4. Defining Products for Loan Syndication

This chapter contains the following sections:

- Section 4.1, "Introduction"

- Section 4.2, "Products for Loan Syndication"

- Section 4.3, "Creating a Borrower Tranche/Drawdown Product"

- Section 4.4, "Creating Borrower Facility Products"

- Section 4.5, "Creating Participant Products"

- Section 4.6, "Setting Preferences for Participant Products"

- Section 4.7, "Specifying Preferences for Syndication Products"

- Section 4.8, "Saving a Loan Syndication Product"

4.1 Introduction

This chapter discusses the manner in which you can define attributes specific to products which are to be used to process loan syndication contracts, whether on the borrower side or the participant side.

A product is a specific service, scheme or utility that you make available to customers of your bank. For instance, the facility of a syndication contract between your bank and other banks or financial institutions, for the purpose of pooling funds to disburse loans are specific service you could offer. This service can be thought of as a product.

Similarly, the facility of availing loans through a drawdown, from any of the tranches under the syndication, is another specific service that you offer to customers. This could also be thought of as a product.

4.1.1 Product Type

The first attribute of a product is the Product Type, which categorizes the product. It also indicates its nature and the kind of contracts that could be entered against the product. For instance, a borrowing line commitment contract would be entered against a borrowing line type of product.

4.1.2 Contracts

A contract is a specific agreement or transaction entered into between two or more entities. A customer who approaches your bank to avail of any of the services offered by your bank enters into a contract with your bank. In the case of a borrower facility contract, the entities involved in a contract are the borrowing customer and the participants for any tranche of the agreement. Similarly, any specific loans (drawdowns) disbursed by your bank under a tranche in the borrower facility contract are also contracts.

In Oracle FLEXCUBE, a contract is entered into the system against a product. For instance, a drawdown under a tranche in a borrower facility contract is entered into the system against a borrower leg drawdown loan product.

When Oracle FLEXCUBE processes the contract, it applies all the attributes and specifications made for the product against which the contract was entered. You can enter more than one contract against a product.

4.2 Products for Loan Syndication

Products for borrower side contracts

When you define products for the processing of borrower tranches and drawdown loans under a borrower facility contract, you would need to do so at two levels:

- Products that contain attributes and preferences by which all commitments (and the resulting drawdown loans) under borrower tranches of borrower facility contracts are processed.

- Product with attributes and preferences for processing the main level syndication agreement (facility) contracts with the borrowers.

Products for Participant Contracts

You also need to define products containing attributes and preferences for processing participant facility, tranche or drawdown (deposit) contracts that are created under the related borrower facility, tranche or drawdown (loan) contracts.

4.2.1 Products for Borrower Tranches and Drawdowns

At the second level, for the borrower tranche contracts under a main borrower facility contract, you need to define a commitment type of product for the borrowing customer.

The commitment contract for the borrower at tranche level is processed in the same manner as a normal commitment contract in Oracle FLEXCUBE. In addition, for the actual borrower drawdowns in a borrower tranche under a borrower facility contract, you would need to define a loan type of product for a loan advanced to the borrowing customer (drawdown)

The loan contract at drawdown level for the borrowing customer is processed in the same manner as normal loans in Oracle FLEXCUBE. The process in which the loan is disbursed (or the borrowing customer avails the loan principal) under a borrower facility contract depends upon many factors. The most important factor is the nature of the requirement of the borrowing customer. The other factor is the identification of the participants who would share the load of funding the borrowing.

Under a syndication contract, the borrower may need to avail the loan principal in many tranches. Under each tranche, the borrower may avail the total tranche amount through a specified number of drawdown loans.

The deployment of the total syndication amount in as many tranches is done according to the requirement of the borrower. Similarly, the deployment of the tranche amount, in a specified number of drawdown loans is also decided by the requirement of the borrower. Each tranche amount as well as each drawdown loan may have different processing attributes with regard to components such as interest, fees, tax applicable and so on, and these attributes would be arranged to suit the borrower’s requirement.

Accordingly, you will need to define borrower tranche products with specific attributes to process borrower tranche contracts with specific requirements. Similarly, you will need to define borrower drawdown products with specific attributes to process borrower drawdown loans with specific requirements. Consider the example given below:

Example

Facility Product

One of your customers, Mrs. Catherine Crenshaw, has approached you for a loan of 100000 USD and entered into a syndication contract with your bank. The agreement is booked on 1st June 2000, and the end date, by which all components of the borrowed amount will be repaid, to be 1st June 2001.

For the purpose of processing the syndication contract, you can create a facility product. Let us assume you have created a facility product SYN1 for this purpose, and you have entered the agreement as a contract under it.

Tranche Products

Mrs. Crenshaw proposes to avail the total loan principal in the following manner:

- Total syndicated loan principal: 100000 USD, in two tranches, with a total tenor of six months

- Portion of loan desired in the first tranche: 50000 USD

- Portion of loan desired in the next tranche: 50000 USD

To meet the borrowing requirement of the first tranche, your bank has identified the Far East Bank of Commerce and Gold Crest Bank to create a pool of funds to disburse the tranche amount. This arrangement forms the first tranche under the syndication contract.

You need to define products for the tranche contracts of the borrower, and commitments for the two participants. You need to define products with the specific attributes required for each tranche.

For instance, for the tranches, you would need to create products for the tranche contracts. You could create the following products:

- BSFT, for tranche borrower commitment contracts

- PSFT, for tranche borrowing line participant contracts. These products could have similar attributes as the product BSFT

To meet the borrowing requirement of the second tranche, your bank has again approached the Far East Bank of Commerce and Gold Crest Bank to create a pool of funds to disburse the tranche amount. This arrangement forms the second tranche under the syndication contract.

Drawdown Products

Let us suppose that Mrs. Crenshaw proposes to avail the actual drawdown loans from each tranche in the following pattern:

Tranche One

- 15000 USD on 30th June

- 20000 USD on 31st July

- 15000 USD on 31st August

Tranche Two

- 20000 USD on 30th September

- 20000 USD on 31st October

- 1000 USD on 30th November

You need to define products for the drawdown loan contracts of the borrower and the participants of the tranche, and deposit contracts for the two participants. You need to define products with the specific attributes required for each drawdown loan.

For instance, for drawdown loans under the tranches, you would need to create the following products:

- BDFT, for drawdown borrower loan contracts

- PDFT, for drawdown participant deposit contracts. These products can have similar attributes as BDFT

This pattern of product definition enables your bank to process the different types of contracts under the facility contract with Mrs. Crenshaw.

4.2.2 Borrower Facility Product

At the first level, you must define a borrower facility product for borrower facility contracts. The example given below will illustrate this.

Example

Your bank has decided to make available the facility of entering into a loan syndication contract with customers. You can define a product for this facility. Let us assume that the product you define has been given the code SYN1. Now, any syndication facility contracts that are entered into by your bank with any borrowing customer can be processed against this product.

You can define more than one syndication facility product. For instance, you can define a general syndication product, and a special syndication product.

Let us suppose that you have entered into a syndication contract with one of your customers, Mr. John Baldwin. After identifying the participants for a tranche under this contract, you want the participants in a tranche to fulfill their commitments five days in advance, before each drawdown schedule under the tranche falls due. You could define a general syndication facility product to enter a contract of this nature, specifying the required number of notice days as five.

Your bank has also entered into an agreement with one of your corporate customers, Equinox Consultants. Let us suppose that, for this contract you do not need to notify the participants in advance of a schedule. You could define a special syndication facility product to enter agreements of this nature, with the number of notice days as zero.

4.3 Creating a Borrower Tranche/Drawdown Product

When you define a borrower facility product, you must specify the corresponding borrower tranche and drawdown products to be used for borrower tranche or drawdown contracts that will be processed under the parent borrower facility contract that uses the borrower facility product.

You must also specify the participant product that is used to process participant contracts that are created from borrower facility contracts that use the borrower facility product.

Therefore, it becomes necessary for you to create participant products and borrower tranche and drawdown products before creating borrower facility products.

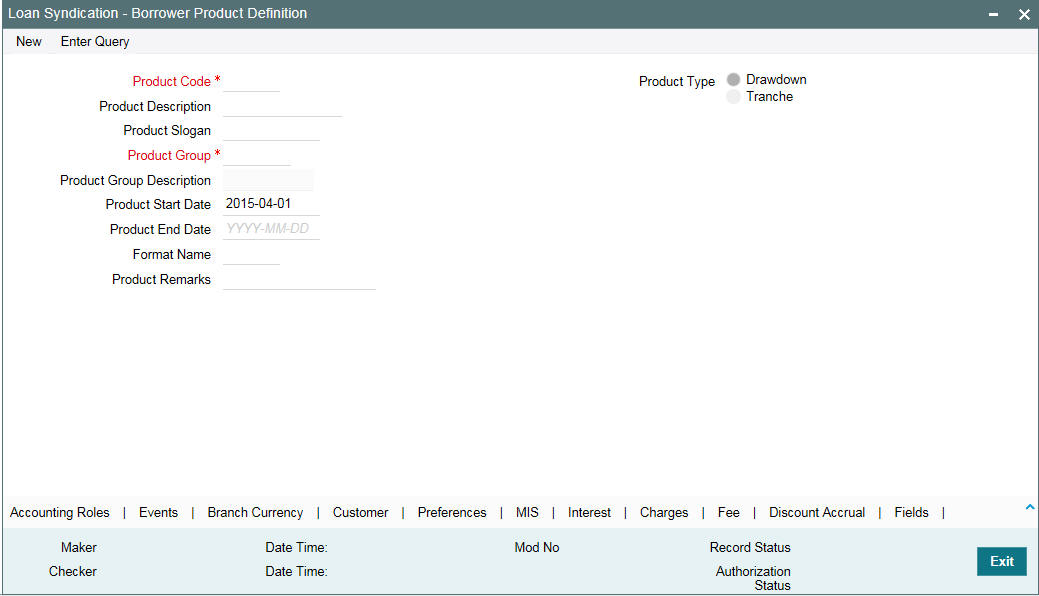

To create a borrower tranche or drawdown loan you can specify the basic details such as the Product Code, Group, Description, and so on in the ‘Loans Syndication – Borrower Product Definition’ screen. You can invoke the ‘Loan Syndication - Borrower Product Definition’ screen by typing ‘LBDPRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

For any product you create in Oracle FLEXCUBE, you can define generic attributes, such as branch, currency, and customer restrictions, interest details, and so on., by clicking on the appropriate icon in the horizontal array of icons in this screen.

The tabs provided in the screen are used for the following purposes:

Tabs |

Description |

Accounting Roles |

Defining Accounting Roles and Heads for a product |

Events |

Defining Events and for maintaining Accounting Entries and Advices for each event |

Branch Currency |

Maintaining a list of allowed/disallowed branches and currencies for a product |

Customer |

Maintaining a list of allowed/disallowed customer categories for a product |

Preferences |

Maintaining attributes specific to a product |

MIS |

Maintaining MIS details |

Interest |

Maintaining Interest details for a product |

Charges |

Maintaining Charge details for a product |

Fee |

Specifying fee details for a product |

Discount accrual |

Specifying discount accrual preferences |

Fields |

Making User Defined Fields (UDFs) applicable to a product |

Diary Events |

Associating diary events with the product |

Party Type |

Associating party types with the product |

Change Log |

Maintains list of modification details made for a product |

Note

Only the specifications exclusive to the Tranche/Drawdown product is explained in this chapter.

For information on the generic attributes of a product, refer the following Oracle FLEXCUBE User Manuals:

- Products

- MIS

- Interest

- Charges and Fees

- Tax

- User Defined Fields and

- Settlements

For a borrower tranche/drawdown product, in addition to these generic attributes, you can specifically define other attributes.

4.3.0.1 Defining the Borrower Product Type

You can define the generic attributes specific to a borrower tranche/drawdown product in the ‘Loans Syndication – Borrower Product Definition’ screen.

Type

The product type is the first attribute that you specify for a borrower tranche or drawdown product. It indicates the category under which the product can be placed, and the type of contract that will be processed against the product.

Each borrower product that you define could be placed under any of the following categories:

- Drawdown: To process the actual borrower drawdowns under a borrower tranche, you need to select the drawdown type of product

- Tranche: For processing a tranche under a facility contract, you need to define a tranche type of product

4.3.1 Specifying Preferences for Tranche/ Drawdown Products

Preferences are options that you can use to define specific attributes for a product, which is applied automatically to contracts that are entered and processed against the product.

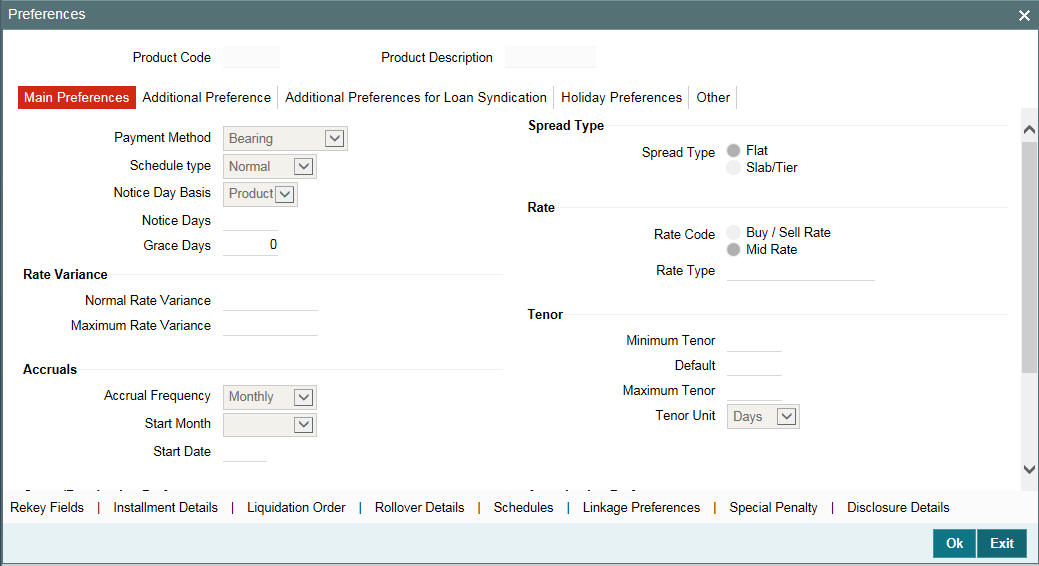

You set up preferences for a borrower tranche/drawdown product in the Loans Syndication – Borrower Product Preferences screen. Invoke this screen by clicking ‘Preferences’ in the ‘Loans Syndication – Borrower Product Definition’ screen.

You set up the general preferences for a borrower tranche or drawdown product in the ‘Loan Syndication – Borrower Product Preferences’ screen in the same manner as you would for a normal commitment product or loans, depending upon the product type you have specified in the ‘Loans Syndication – Borrower Product Definition’ screen.

Refer the Bilateral Loans User Manual for a detailed description.

This section explains aboutthose preferences that you need to set specifically for borrower tranche or drawdown products under a borrower facility contract. Such preferences include the revaluation details, which you can specify in the main LB Product – Preferences screen, and also those pertaining specifically to loan syndication, which you can specify in the ‘Additional Preferences for LB’ screen.

Note

To indicate Forward Processing is applicable to the borrower tranche or drawdown product during the events INIT and LIQD, select the option ‘Semi-Auto’ against the fields ‘Initiation Mode’ and ‘Liquidation Mode’, respectively. The system processes the two events before the scheduled date, but hold the messages till the spot date or value date. The messages are held in the Forward Processing Queue.

For details on Forward Processing, refer to the ‘Capturing Forward Event processing details’ in the chapter ‘Reference Information for Loan Syndication’.

Notice Days

You can indicate whether the notice days applicable for borrower drawdown contracts using the product must be defaulted from the product preferences, or from the parent tranche or facility contract.

The notice days refers to the number of days before a schedule payment date, a payment notice is to be sent to the borrowing customer, for the borrower drawdown contract. This would apply to ad-hoc fee, interest and principal schedules, and defined for the contract.

4.3.1.1 Specifying Details for Drawdown Revaluation

Oracle FLEXCUBE facilitates periodic revaluation of drawdowns if the drawdown currency is different from the tranche currency. The revaluation preferences you maintain as part of additional product preferences defaults here.

For details on revaluation preferences, refer the heading titled ‘Specifying revaluation preferences for drawdown products’ in this chapter.

4.3.1.2 Specifying LC Fee Details

Oracle FLEXCUBE gives you the option to define LC type of drawdown products. You have to specify the following to define such a product:

LC Drawdown

You have to select this option to create an LC type of drawdown product. All drawdowns processed using the product is referred to as an LC Drawdown.

This attribute defaults to all drawdowns processed under the product. You cannot change this specification at the contract level.

LC Type

If you are defining a LC type of drawdown product, you have to specify the type of LC also. Select a type from the following available options:

- Standby LC

- Commercial LC

Note

You can select the type of LC only if you have checked the ‘LC Drawdown’ option. The type you select for the product will default to all drawdowns processed with the product. However, you may change the LC type at the drawdown level, if required.

4.3.1.3 Specifying Other Preferences

Prime Loan

Oracle FLEXCUBE enables you to pay the interest applicable on the principal. This is applicable only if you select the ‘Prime Loan’ check box. You also need to select the ‘Liquidate Interest on Prepayment’ check box at the contract level (in the ‘Drawdown Contract Online’ screen) to liquidate the interest component.

Note

If you do not select the ‘Liquidate Interest on Prepayment’ check box at the contract level, the system treats the prepayment against a Prime Loan as normal prepayment, where the principal alone is liquidated even if the interest schedules are due or overdue.

You can pay the interest component along with the principal either on the frequency-based schedule or at the time of principal prepayment. In case of the latter, interest is calculated only on the principal prepaid. Onselecting the ‘Prime Loan’ check box, Oracle FLEXCUBE allows you to define only a bullet schedule for the principal component.

Note

At the time of amendment of the product, you cannot change the value of the ‘Prime Loan’ check box.

Assignment Validations Applicable

Select this check box if the assignment validations are applicable at the product level.

If this field is deselected, then you cannot amend this field at the contract level.

Note

Based on the product level selected, the system defaults this field to the Tranche online.

Suppress Advices

Select this check box to indicate advices should be suppressed for all contracts booked under this product (say for example, an LC product). If you check this box for a drawdown product, all the advices are suppressed for contracts booked under the drawdown product. The advices being generated for the tranche contract is also suppressed for such drawdowns.

For those products for which you have selected the box ‘Suppress Advice’:

- You have to maintain settlements through internal GLs

- Forward processing will not be applicable

Int/Fee Distribution

You can indicate the method in which the interest and fee components have to be distributed among the participants when an assignment is executed before the liquidation date.

- Lender of Actuals – if you select this option, Interest and fee liquidation schedules are distributed among the participants based on the old participant ratio for the period before the Participant Ratio Amendment Date (PRAM Value Date) and the new ratio for the period after the PRAM value date.

- Lender of Records - If you select this option, the Interest and fee liquidation components are distributed among the participants based on the ratio existing at the time of liquidation.

Note

This option is applicable to both fee and interest components.

Sighting Funds Applicable

Select this check box to indicate that sighting funds is applicable for the Borrower drawdown product.

Note

Compensatory component is not available for schedule definition. The Main interest component schedules are internally considered for the Compensatory component.

Floor/Ceiling Restricted to Base Rate

Select this check box if you want to maintain floor and ceiling only for base rate.

Media Priority

Select this check box to indicate that the media priority is required for the Borrower drawdown product.

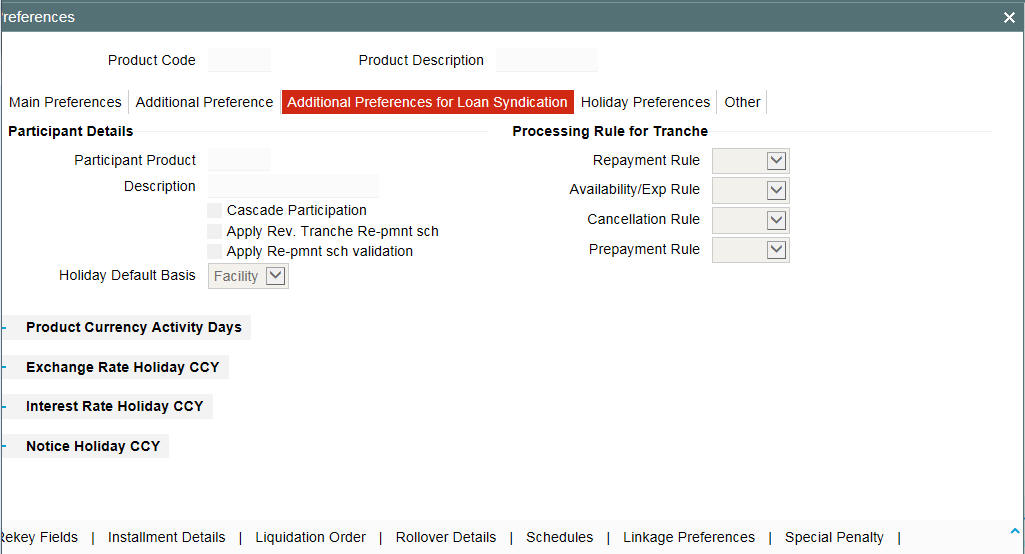

4.3.1.4 Specifying Additional Preferences for Loan Syndication

You can specify the following additional details regarding syndication, for borrower tranche or drawdown products, in the ‘Additional Preferences for Loan Syndication’ screen.You can invoke this screen by clicking the ‘ Additional Preferences for Loan Syndication’ button in the ‘LB Product – Preferences’ screen:

Capture the following information in this screen:

Participant Product

For a borrower tranche product, the corresponding participant product to be used for participant borrowing line contracts that are created under the borrower tranche contracts that use the product is displayed in this screen. The linkage is established when you define the participant product.

For a borrower drawdown product, the corresponding participant drawdown to be used for participant drawdown contracts that are created under the borrower drawdown contracts that use the product is displayed in this screen. The linkage is established when you define the participant product.

Cascading Participation

For a borrower tranche product, you can indicate whether any changes to participants in respect of a borrower tranche contract that uses the product, must be propagated to all related active drawdown contracts.

For a borrower drawdown product, you can specify that the participants should be propagated to the contract using the product, by selecting the check box ‘Cascade Participation’. The preference you specify for the product can be changed at the contract level.

Apply Rev. Tranche Re-prmnt sch

Select this check box to indicate that prepayment on the tranche repayment schedule is applicable for revolving tranches. If this check box is selected, then system enables the ‘Tranche Schedules’ button in the ‘Tranche Online’ screen for revolving tranches. If you select this check box for a tranche product having active tranches, then you should define the tranche repayment schedules manually for underlying active tranche contracts.

Note

- By default, this check box is deselected. You can modify this check box only after authorization of the tranche product definition.

- This check box is applicable only for the tranche product.

Apply Re-prmnt validation

Select this check box to indicate that system should validate sum of processed and unprocessed repayment schedule amounts against the transfer availability of the tranche. In addition to this, the following validations are also applicable for the tranche product:

- For revolving tranches, the tranche repayment schedules should be maintained based on the global amount.

- Future schedules should be redefined in case of value dated amendment of revolving tranches for principal amount/maturity date.

By default, this check box is deselected. You can modify this check box only after product maintenance is authorized.

Holiday Default Basis

For a borrower product, you can indicate whether the holiday treatment (for schedule dates and maturity date) applicable to tranche or drawdown contracts using the product must be defaulted from the parent borrower facility product; or from the borrower tranche or drawdown product.

In the Holiday Default Basis field, select ‘Facility’ to indicate that the holiday treatment specified in the borrower facility product is applicable, or select ‘Product’ to indicate that the holiday treatment from the borrower tranche or drawdown product is applicable.

4.3.1.5 Specifying the Processing Rule for Tranche

You have to specify the processing rule for the following:

Repayment Rule

Select the repayment rule for the tranche product. You have the following options:

- FIFO

- LIFO

- PRORATA

You can change this preference for the contract.

Availability / Exp Rule

Select the expiry rule for the tranche product. You have the following options:

- FIFO

- LIFO

- PRORATA

You can change this preference for the contract.

Cancellation Rule

Select the expiry rule for the tranche product. You have the following options:

- FIFO

- LIFO

- PRORATA

You can change this preference for the contract.

Prepayment Rule

Select the expiry rule for the tranche product. You have the following options:

- FIFO

- LIFO

- PRORATA

You can change this preference for the contract.

4.3.1.6 Specifying the Product Currency Activity Days

Ccy

Select the currency for which you are defining preferences.

Exchange Rate Fixing Days and Time

For borrower tranche products, you can specify the number of days before the drawdown date (defined in the drawdown schedule), the exchange rate must be fixed, for contracts wherein the drawdown currency is different from tranche currency.

Indicating Interest Rate Fixing Days

For borrower tranche products, you can specify the number of days before the drawdown date (defined in the drawdown schedule), the interest rate must be fixed. You can specify the applicable number of days for each required currency.

DD Notification Days and Time

For borrower tranche products, you can specify the number of days before the drawdown date that the customer needs to inform the bank of a new drawdown or reset of interest rate.

Exchange Rate Holiday Currency

The holiday preferences of the currency you select here is applied to calculate the exchange rate fixing days or date.

Interest Rate Holiday Currency

The holiday preferences of the currency you select here is applied to calculate the interest rate fixing days or date.

Notice Holiday Currency

The holiday preferences of the currency you select here is applied to calculate the notice rate fixing days or date.

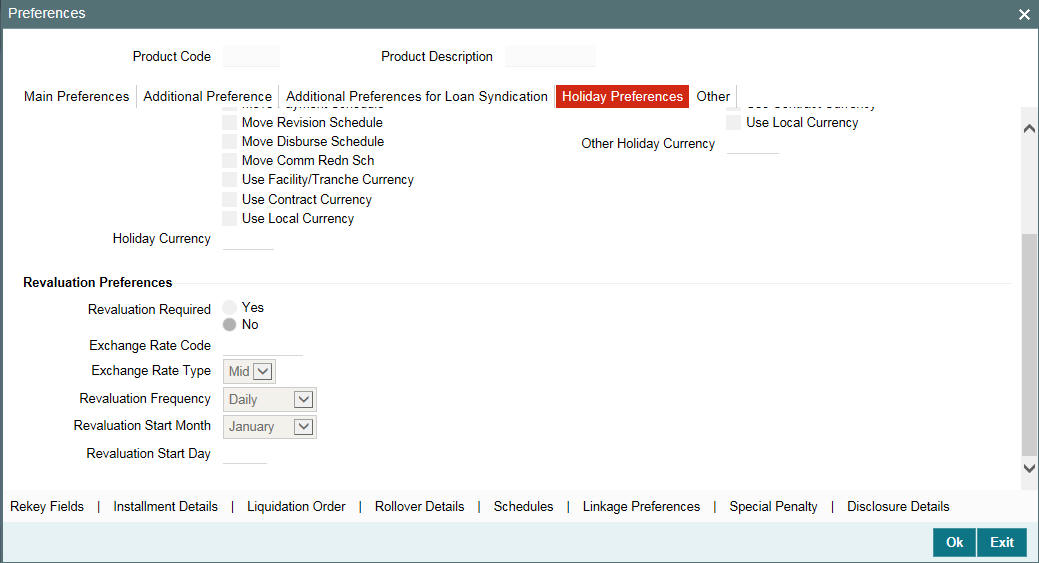

4.3.1.7 Specifying Holiday Preferences for All Schedules

Schedule dates for a contract could fall on holidays defined for your branch or on holidays defined for the currency of the contract. In the Product Preferences, you can specify whether the system should check for schedule dates falling on holidays, and how such schedule dates must be handled. These specifications would default to any borrower facility contract using the product, and also to underlying borrower tranche or drawdown contracts that are opened under the facility contract.

Note

You can change the holiday parameters for schedules through amendment at tranche/drawdown contract online screens, if required. You can specify that:

- Holidays must be ignored

- Checks must be made for schedule dates falling on holidays

If you specify that checks must be made, you can also specify the corresponding treatment for schedule dates falling on holidays.

4.3.1.8 Holiday Treatment Type

The Holiday Treatment Type is the parameter that defines how the system checks for schedule dates falling on holidays. You can specify one of the following options:

Include Branch Holiday

Select this check box to indicate that you want the system to check whether a schedule date falls on a local holiday defined for the branch. You cannot specify a check for currency holidays, if you choose this option.

The system checks the holiday table for your branch. If it encounters a contract entered in your branch, with a schedule date falling on a branch holiday, the holiday is handled according to the holiday-handling preferences you specify.

Use Facility Currency

If you choose this option, the system checks whether the schedule date falls on a holiday defined for the currency of the facility (borrower) contract, if this currency is different from the holiday currency you have indicated.

Use Local Currency

If you choose this option, the system checks whether the schedule date falls on a holiday defined for the local currency, if this currency is different from the holiday currency, facility currency and contract currency you have indicated.

Holiday Ccy

If the system must check whether the schedule date falls on a holiday defined for the currency of the contract, you must specify the code of the holiday currency.

Further, you have the following options to specify the specific currency for which the check must be done:

- Facility Currency

- Local Currency

The system checks the holiday table for the currencies you have specified. If it encounters a contract using any of the specified currencies, with a schedule date falling on a holiday for any of the currencies, the holiday is handled according to the holiday-handling preferences you specify.

4.3.1.9 Holiday-handling Preferences for Schedule Dates

If you have specified that the system check for schedule dates falling on holidays, you must also specify the treatment for schedule dates encountered by the system that do fall on holidays. The following preferences can be set:

Moving the Schedule Date Backward or Forward

You can indicate whether the schedule date falling on a holiday must be moved forward to the next working day, or backward to the previous one.

Moving Across Months

If you have indicated either forward or backward movement, and the moved schedule date crosses over into a different month, you can indicate whether such movement is allowable; it will be allowable only if you indicate so in the ‘Move Across Months’ field.

Cascading Schedules

If one schedule has been moved backward or forward in view of a holiday, cascading schedules would mean that the other schedules are accordingly shifted. If you do not want to cascade schedules, then only the schedule falling on a holiday is shifted, as specified, and the others remain as they were.

4.3.1.10 Holiday Processing on Commitment Reduction Schedules

Select the ‘Move Comm Redn Sch’ check box to indicate the holiday processing rule should be applied on commitment schedules. This is applicable only to tranche products.

4.3.1.11 Holiday Processing on Repayment Schedules

Select the ‘Move Payment Sch’ check box to indicate the holiday processing rule should be applied on repayment schedules. This is applicable only to drawdown products.

4.3.1.12 Holiday Processing on Interest Rate Revision Schedules

Select the ‘Move Revision Sch’ option to indicate the holiday processing rule should be applied interest rate revision schedules. This is applicable only to drawdown products.

4.3.1.13 Specifying Holiday Preferences for Maturity and Value Dates

The maturity date for a contract could fall on holidays defined for your branch. In the Product Preferences, you can specify whether the system should check for maturity dates falling on holidays, and how such dates must be handled. These specifications would default to any borrower facility contract using the product, and also to underlying borrower tranche or drawdown contracts that are opened under the facility contract. You can specify that:

- Holidays must be ignored OR

- The maturity date falling on a holiday must be moved according to the holiday-handling preferences that you specify

4.3.1.14 Holiday Treatment Type

The Holiday Treatment Type is the parameter that defines how the system checks for maturity dates falling on holidays. You can specify one of the following options:

Include Branch Holiday

Select this check box to indicate that you want the system to check whether a maturity date falls on a local holiday defined for the branch. You will not be able to specify a check for currency holidays, if you choose this option.

The system checks the holiday table for your branch. If it encounters a contract entered in your branch, with a maturity date falling on a branch holiday, the holiday is handled according to the holiday-handling preferences you specify.

Use Facility/Tranche Currency

If you select this check box, the system checks whether the maturity date falls on a holiday defined for the currency of the facility (borrower)/tranche contract, if this currency is different from the holiday currency you have indicated.

Use Local Currency

If you select this check box, the system checks whether the maturity date falls on a holiday defined for the local currency, if this currency is different from the holiday currency, facility currency and contract currency you have indicated.

Holiday Ccy

If the system must check whether the maturity date falls on a holiday defined for the currency of the contract, you must specify the code of the holiday currency. Further, you have the following options to specify the specific currency for which the check must be done:

- Facility Currency

- Local Currency

The system checks the holiday table for the currencies you have specified. If it encounters a contract using any of the specified currencies, with a maturity date falling on a holiday for any of the currencies, the holiday is handled according to the holiday-handling preferences you specify.

4.3.1.15 Holiday-handling Preferences for Maturity Dates

If you have specified that the system check for maturity dates falling on holidays, you must also specify the treatment for maturity dates encountered by the system that do fall on holidays.

The following preferences can be set:

Moving the Maturity Date Backward or Forward

You can indicate whether the maturity date falling on a holiday must be moved forward to the next working day, or backward to the previous one.

Moving across months

If you have indicated either forward or backward movement, and the moved maturity date crosses over into a different month, you can indicate whether such movement is allowable; it is allowable only if you indicate so in the ‘Move Across Months’ field.

4.3.1.16 Specifying Revaluation Preferences for Drawdown Products

Oracle FLEXCUBE facilitates periodic revaluation of drawdowns based on the preferences you maintain here and this is applicable only if the drawdown currency is different from the tranche currency. The new exchange rate, post revaluation, is used to convert the transaction amount from the drawdown currency into its equivalent in the tranche currency.

You can specify revaluation preferences in the ‘Holiday Preferences’ tab. Click ‘Holiday Preferences’ tab in the ‘Additional Preferences for Loans Syndication’ screen.

The product code and description is displayed in this screen. You can specify the following revaluation preferences:

Reval Reqd

By default, revaluation is applicable for a drawdown product and the option ‘Yes’ is selected. In this case, you have to specify the following additional preferences as mandatory information:

Exchange Rate Code

You must select the code for the exchange rate that must be used to convert the drawdown amount from the drawdown currency to its equivalent in the tranche currency. The option list displays the rate codes maintained in the ‘Currency Rates Maintenance’ screen.

By default, the rate code you select here will be applicable to all drawdowns. At the time of capturing drawdown details, if the drawdown currency is different from the tranche currency and the default ‘Exchange Rate Code’ is not maintained for the currency pair involved, system displays an error message.

Exchange Rate Type

You must also specify the type of exchange rate that must be used to convert the drawdown amount from the drawdown currency to the tranche currency. The options available are:

- Buy

- Mid

- Sell

On the revaluation schedule dates, arrived at abased on the Frequency, Start Month, and Start Day, Oracle FLEXCUBE picks up the exchange rate defined for the selected ‘Exchange Rate Code’ and ‘Exchange Rate Type’ combination, corresponding to the currency pair involved in the conversion, to convert the amount in the drawdown currency into its equivalent in the tranche currency.

Frequency

This refers to the frequency or periodicity of revaluation. The options available are:

- Daily

- Monthly

- Half-Yearly

- Quarterly

- Yearly

Start Month and Start Day

For the frequency you select, you must also specify the month and the date for commencing the revaluation process.

Note

If Reval Required is ‘Yes’ for the drawdown product, the same defaults to all drawdowns processed with the product. You can, however, change the preferences at individual drawdown levels. But, if ‘Reval Required’ is ‘No’ for the product, you cannot change it to ‘Yes’ at the drawdown level and revaluation is not applicable for cross currency drawdowns.

For details on specifying revaluation preferences for a drawdown, refer the heading titled ‘Capturing details in the ‘CONTRACT’ tab’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

4.3.1.17 Specifying the Special Penalty Components

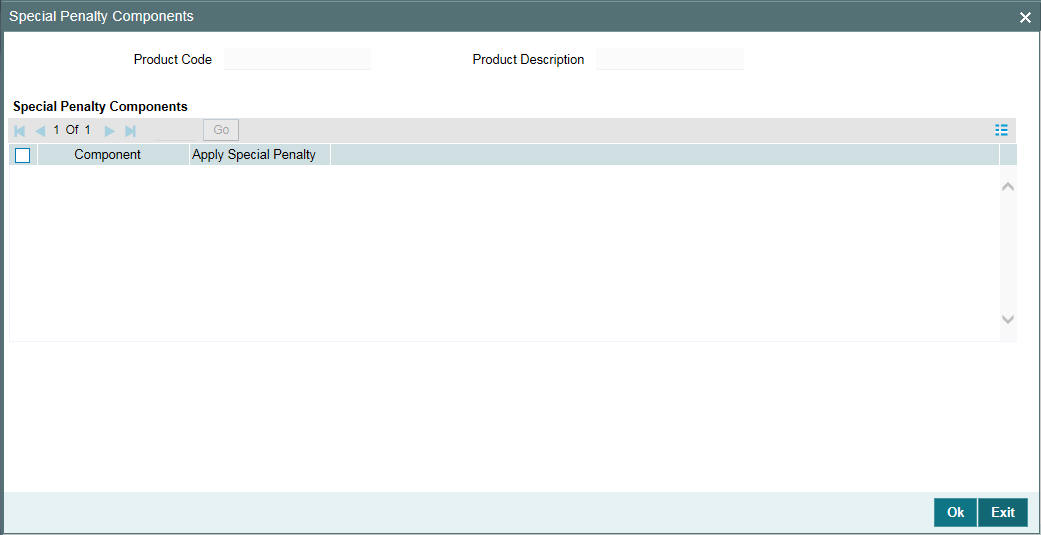

You can select components to which late payment charges are applicable using the ‘Special Penalty Components’ screen. To invoke this screen, click the ‘Special Penalty’ in ‘Loans Syndication – Product Preferences’ screen.

Specify the following details:

Product Details

System displays the product code and a brief description of the product.

Component

By default, system displays all components defined in the ‘Interest’ screen for the loan product. For commitment products, system defaults all components defined in the ‘Interest’ and ‘Fee’ screens (with exception of the generic component ‘PRINCIPAL’). However, you can specify the components and check the ‘Apply Special Penalty’ box for which late payment charges are applicable.

You can amend the components list for a product by unlocking the product maintenance. This amendment does not impact the list of late payment charge components defined for existing contracts under this product. The change is also not impacted late payment charges already calculated based on the list of components defined at contract level.

While calculating the basis amount for late payment charges, system does not consider the excluded components even if they remain unpaid after expiry of grace period.

If you recalculate the already calculated late payment charges due to back value dated change of interest rate or principal, then during recalculation system considers the latest late payment charge components at the contract level. Therefore, the late payment charges are recalculated considering the changed rate but not the changed list of components at the product level.

Apply Special Penalty

Select this check box to indicate that system should apply special charges to the penalty component.

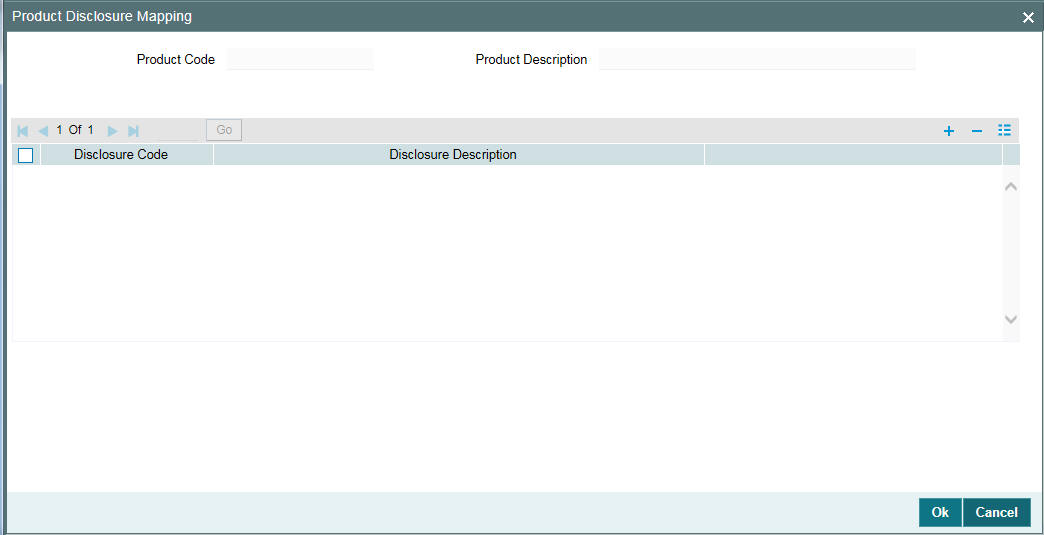

4.3.2 Mapping the Disclosure Code to a Product

Once you have defined the disclosure codes, you can specify the codes applicable to each product using the ‘Product Disclosure Mapping’ screen. To access this screen, click ’Disclosure Details’ in the ‘Additional Preferences for Loan Syndication’ tab.

On invoking this screen, system displays the product details. If you have opened the above screen from a drawdown, the system display details of the drawdown product.

Disclosure Code

You can select the disclosure code that you want to map to the product from the list of values.

Disclosure Description

On selecting the disclosure code, the corresponding description is displayed. This defaults from the ‘Disclosure Maintenance’ screen.

To add or delete a disclosure code from the list, click ‘Add Row’ or ‘Delete Row’ buttons, respectively. Once you add a disclosure code, it can be associated with all future contracts booked with a product.

Note

You can delete a disclosure code only if it is not linked to any contracts within the product.

For more information on maintaining Disclosure Codes, refer the section ‘Maintaining Reporting Requirements’.

4.3.3 Specifying Generic Attributes for a Tranche/Drawdown Product

After specifying all the basic details of a borrower tranche/drawdown product, you can indicate certain specific attributes for the product. Each of these attributes can be defined in the corresponding screen that you can invoke from the Tranche / Drawdown Product Definition main screen, by clicking the appropriate icons. Attributes with common characteristics are grouped together in common screens, simplifying the process of defining them.

For further information on the generic attributes that you can define for a product, refer the following Oracle FLEXCUBE User Manuals:

- Products

- Interest

- Charges and Fees

- Tax

- User Defined Fields

- Settlements

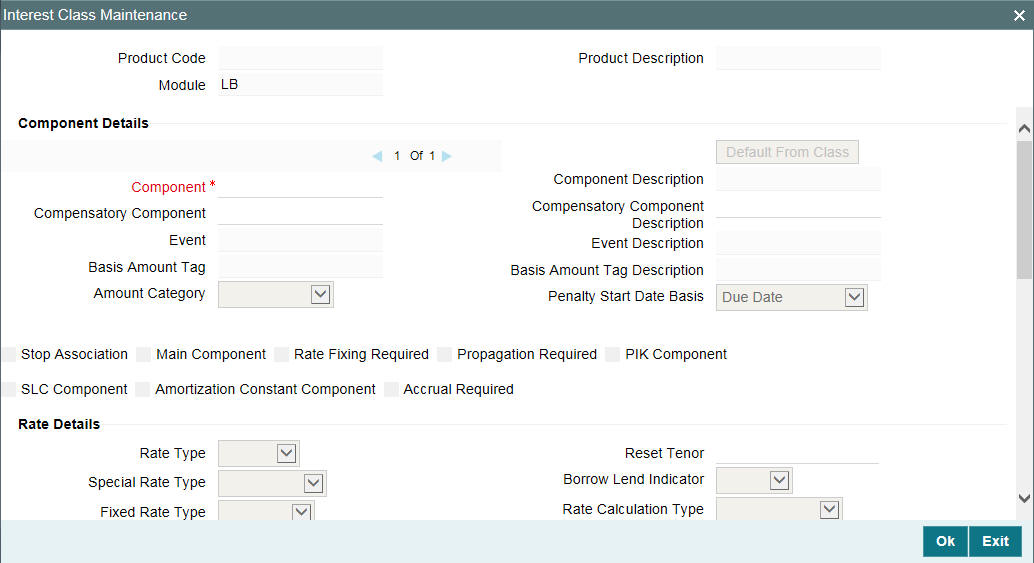

4.3.4 Defining Interest Components for Borrower Tranche/Drawdown Products

You must indicate the applicability of interest components, for borrower contracts using the product. You can use the ‘Interest Class Maintenance’ screen for this. Click ‘Interest’ in the Tranche/Drawdown Product Definition screen to invoke the ‘Interest Definition’ screen.

In this screen, you associate interest components in the same manner as you would for a normal commitment or loans product. Only information specific to the LS Module is explained here.

Rate Fixing Required

You can fix the interest rate for a component if you check this option. The system arrives at the Interest rate fixing date for the drawdown currency based on the Interest rate fixing days maintained at the tranche level and the holiday validation currencies specified for the drawdown currency.

Note

Rate fixing is applicable for an interest component with the following attributes:

- Rate Type: Fixed

- Fixed Rate type: User input

This is done through the ‘Rate Fixing Details’ sub-screen invoked from the ‘ICCF Details’ screen of the ‘Drawdown Contract Online’ screen.

PIK Component

This value defaults from the associated interest class. You can modify this, if required.

If you select this option, you need to specify the Rate Type as ‘Fixed’ and Fixed Rate Type as ‘User Input’.

Note

- You can link only a PIK margin component to the PIK interest component and only one PIK interest component is allowed to be linked at the drawdown product level

- You can specify only bullet schedule for PIK interest component

- You can not select the main interest component as the PIK component

- Basis amount category can not be overdue for a PIK component

For more details on this screen, refer the heading titled ‘Fixing interest rate for the drawdown’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

Compensatory Component

Specify the name and description of the compensatory component.

Note

- You are allowed to specify compensatory name and description only if ‘Sighting Funds Applicable’ field is selected at ‘Loans Syndication – Borrower Product Preferences’ screen. And this is enabled only for the main interest component.

- On specifying this, the system internally creates the compensatory component by defaulting all the parameters from the main interest component except ‘Propagation required’ which is defaulted as ‘No’. The compensatory component is computed independently at the borrower and investor levels. Hence the ‘Propagation required’ is set to ‘No’ for this component.

- The compensatory component is available at the participant product even though ‘Propagation Required’ is set to No.

SLC Component

Select this field to default schedules for SLC component from the main interest component. The base rate is SLC fee rate and you can modify this rate as part of value dated amendment, if required.

The margin and spread sub components from the main interest components are defaulted to SLC component as well.

Note

- SLC fee component has to be maintained as another interest component at the DD product level.

- The Final ALL In Rate for the SLC Interest component will be SLC FEE Rate + (Margin + Spread) from the Main Interest

- SLC fee component is not settled on participant side, However, it is available to facilitate Tax amount

- For enabling ‘SLC Component’, it is mandatory that you

have to select the field; ‘Propagation Reqd’ and upon checking

‘SLC Component’, the system disables the following fields.

- Main component

- Rate Fixing Reqd

- PIK Component

Amortization Constant Component

Select this check box to indicate that the component is amortization constant component.

You can select this flag only if the schedule type is ‘Amortization’ and user input installment flag is checked. For main interest component, this flag is checked and disabled for products with schedule type ‘Amortization’ and user input installment flag checked.

For Amortization Constant, along with the Main Interest component and the Principal, the below components are considered:

INS_COMP1 -- Insurance component (Escrow Impounding component)

TAX_COMP1 - Tax component(Escrow Impounding component)

SERVFEE – Servicer Fee – applicable only for Agency (Interest component for Servicer Fee)

ESCROW 3 – An escrow impounding component (Escrow Impounding component)

4.3.4.1 Specifying Billing Notice Preferences

You can specify the following billing preferences for the interest component in this screen:

Billing Notice Required

Select this check box to indicate that you would like to send a billing notice for the interest component.

No of Days

Specify the number of days prior to the billing date that the billing notice needs to be sent.

4.3.4.2 Defining Margin Components

You can also associate margin components with an interest component here. Select the margin component from the option list which contains margin components you have defined through the ‘Margin Definition’ screen. Once you select a margin component, the Description, Margin Basis, and Basis Amount Tag are displayed.

You are allowed to enter a default margin rate if the ‘Margin Basis’ is ‘Drawdown’.

For details about associating interest components for a product, refer the Interest manual. The preferences specific to borrower tranche or drawdown products are explained in this section.

4.3.4.3 Indicating Propagation of Interest Components to Participant Contracts

Interest component classes for specific application to borrower tranche or drawdown contracts can be propagated to participant contracts resulting from the borrower contracts. You can build this preference into interest classes that you define specifically for borrower tranche or drawdown products. During definition of the class, this preference can be indicated, by selecting the Propagation Reqd check box in the ‘Interest Class Maintenance’ screen.

Note

This check box is active only for interest components of the LS module. For all other modules the box is deactivated.

Click the PIK Component check box to indicate that you want to calculate the interest based on the PIK margin.

In the Product ‘Interest Class Maintenance’ screen, when you are associating the interest components for the borrower tranche or drawdown product, you can choose an interest class for which the propagation to participants option has been indicated in the class definition, if required. If so, the Propagation Reqd check box is selected.

You can change this specification and deselect the Propagation Reqd check box, if you want to indicate that interest class propagation to participants is not applicable. Alternatively, if you have chosen an interest class for which propagation to participants has not been indicated, you can select the Propagation Reqd box to indicate propagation of interest class to participants, if required.

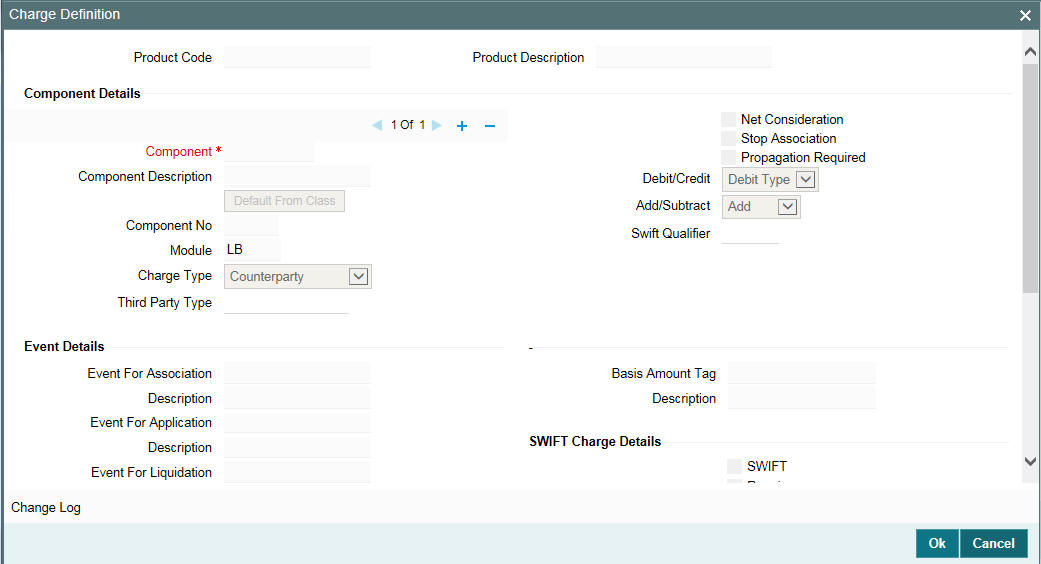

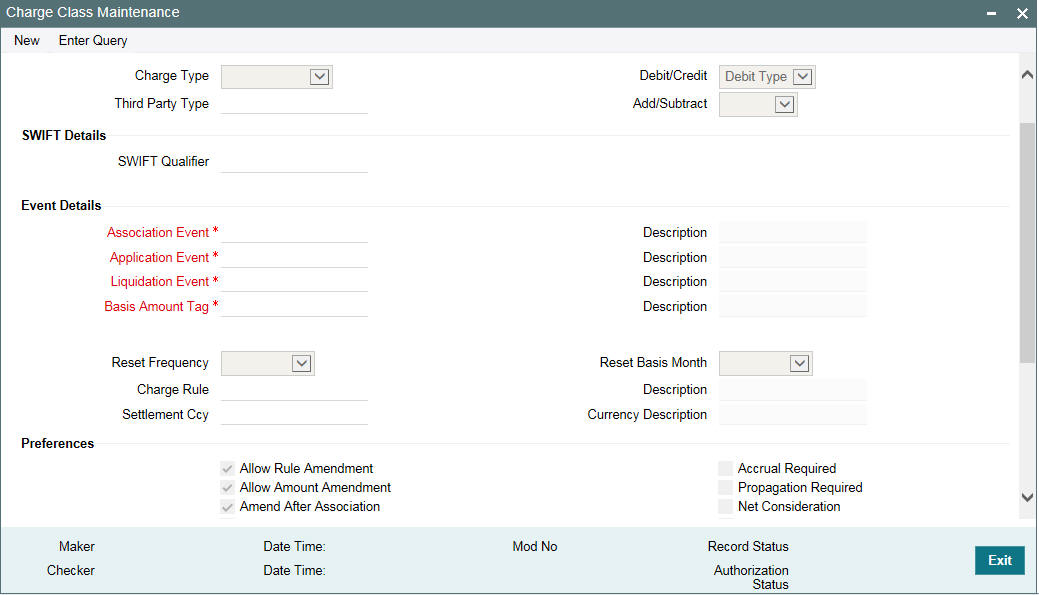

4.3.5 Charge Components for Borrower Tranche/ Drawdown Products

You must indicate the applicability of charge components, for borrower contracts using the product. You can use the ‘Charge Definition‘screen. Click ‘Charges’ in the Tranche / Drawdown Product Definition screen to invoke the ‘Charge Definition’ screen.

In this screen, you associate charge components in the same manner as you would for a normal commitment or loans product.

For details about associating charge components for a product, refer the Charges and Fees manual. The preferences specific to borrower tranche or drawdown products are explained in this section.

4.3.5.1 Indicating Propagation of Charge Components to Participant Contracts

When you collect the charges from the borrower, you can choose to pass the charges to the participants of the tranche or drawdown contract. To indicate this you have to click the ‘Propagation Required’ check box in the ‘Charge Class Maintenance’ screen (LFDCHGCE).

Note

This check box is active only for charge components of the LS module. For all other modules the box is deactivated.

Refer the Charges and Fees manual for further details on this screen.

In the product Charge Definition screen, when you are associating the interest components for the borrower tranche or drawdown product, you can choose a charge class for which the propagation to participants option has been indicated in the class definition, if required. If so, the Propagation Reqd check box is required.

You can change this specification and deselect the Propagation Reqd check box, if you want to indicate that charge class propagation to participants is not applicable. Alternatively, if you have chosen a charge class for which propagation to participants has not been indicated, you can select the Propagation Reqd check box to indicate propagation of charge class to participants, if required.

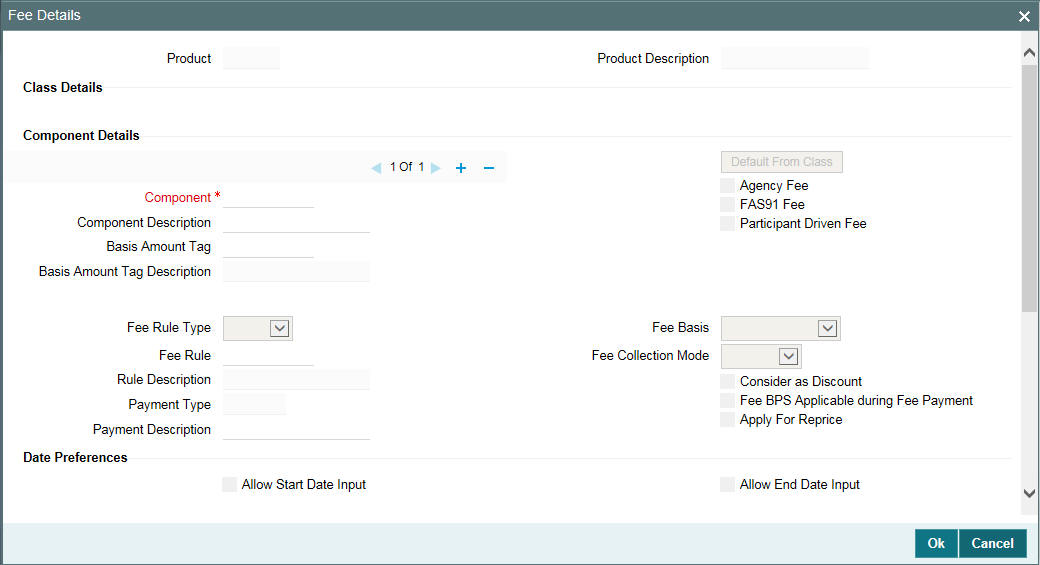

4.3.6 Specifying Fee Components for a Borrower Product

You must indicate the applicability of fee components for borrower contracts. You can use the Fee Definition screen for this. Click the ‘Fee’ in the ‘Tranche/Drawdown - Product Definition’ screen to invoke the ‘Fee Details’ screen.

The fee is applicable to borrowers only.

You have the option of associating a Fee Class to the components, in which case, the attributes of the class is defaulted to the component. To do the same, click the ‘Default From Class’ button.

The fee details maintained for the fee class in 'Fee Class Maintenance' (LFDFEECL) screen gets defaulted.

System defaults the parameters of the selected fee component. However, you can change the parameters according to your requirements.

In this screen, you associate fee components applicable for the product you are defining. Specify the following in this screen:

Component

Enter the fee component you are maintaining details for.

Description

Enter a description for the fee component.

Basis Amount Tag

When defining fees, you can select the applicable amount tag on which the fee is to be calculated from the option list given.

The following amount tags are available for a Tranche product:

- User Input – adhoc fee

- Outstanding – to collect fee on the outstanding portion of the tranche

- COMMERCIAL_LCOS – to collect fee as a percentage of the outstanding amount of all the ‘Commercial LC’ type of drawdowns linked to the tranche.

- STANDBY_LCOS - to collect fee as a percentage of the outstanding amount of all the ‘Standby LC’ type of drawdowns linked to the tranche.

- ISSUER1_LCOS up to ISSUER10_LCOS – to compute fee on the outstanding amount of all the LC drawdowns for a given issuer. This fee, referred to as the issuance fee, is paid only to the bank that issues the LC. You have to define an LC Issuance Fee component to be associated with each of these ten basis amount tags.

Note

Since issuance fee is not distributed across all the participants, the same is not displayed in the ‘Participant Ratio Details’ screen. The participant who is identified as the issuer of the LC is entitled to 100% of this fee.

- Utilized – to collect fee on the utilized portion of the tranche

- Unutil – to collect fee on the unutilized portion of the tranche

The following example illustrates the difference between utilized and unutilized basis amount tags with reference to ‘Revolving’ and ‘Non-Revolving’ tranches:

Example

In the case of a non-revolving tranche, the unutilized amount does not take into consideration the repayments made by the customer under any of the draw-downs under the tranche.

A customer has three draw-downs of USD 100,000 each, under a tranche of USD 500,000 of which:

- Draw-down 1 has been repaid

- Draw-down 2 has a total outstanding of USD 72,500

- Draw-down 3 has no repayments

In this case:

- Outstanding amount : USD 172,500 (DD2-72500; DD3-100,000)

- Utilization amount : USD 300,000

- Non-utilization amount : USD 200,000

In the case of a revolving tranche, the utilization or non-utilization amount takes into consideration the repayments made by the customer under any of the draw-downs under the tranche.

Considering the same example as above, in this case:

Outstanding amount is : USD 172,500 (DD2-72500; DD3-100,000)

Utilization amount is : USD 172,500

Non-Utilization amount is : USD 327,500 (500,000 – 172,500)

Agency Fee

If, for the fee component that you have selected, you have selected the box ‘Agency Fee’, the income on the component is meant for the leading agent alone. It does not get propagated to the participants.

Note

If you check the box Agency Fee, the box ‘Participant Propagation Required’ is disabled.

FAS91 Fee

Select this check box to perform FAS91 computations. The system validates if:

- The ‘Agency Fee’ check box is selected

- The ‘Basis Amount Tag’ is maintained as USER INPUT

- The ‘Fee Collection Mode’ is ADVANCE

- The ‘Accrual Required’ box is checked

Participant Driven Fee

If you select this check box, the system allows you to define an individual fee amount for each participant.

Note

- If you check this option, you are not allowed to select the ‘Agency Fee’ option

- System performs the following validations on checking the ‘Participant

Driven Fee’ box:

- The ‘Basis Amount Tag’ is maintained as USER INPUT

- The ‘Fee Collection Mode’ is ADVANCE

- It is mandatory to check the ‘Participant Propagation’ check box at the product level

- The Accrual Parameters are disabled

Fee Rule Type

Select the Fee Rule Type applicable from the option list. You have the options ICCF and Margin. The rules are applicable depending on the rule type you select.

Fee Rule

Select the rule applicable from the option list given. The option list includes Fee Rules that you have defined in the Fee Rule Maintenance screen.

Fee Basis

The Fee Basis indicates the method in which a given fee schedule amount has to be calculated. The values in the drop-down list are:

- 30(Euro)/360

- 30(US)/360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/365.25

- 30(US)/365.25

- Actual/365.25

- Working Days/252

- Working Days/360

For more information on fee basis, refer to Charges and Fees User Manual.

Fee Collection Mode

While defining fees, you can specify whether the fee is to be collected in advance or in arrears.

Payment Type

The system displays the payment type.

Fee BPS Rate Applicable

Select this check box to indicate that BPS rate is applicable to the payment type.

Note

‘Payment Type’ and ‘Fee BPS Rate Applicable’ options are enabled only if ‘Basis Amount Tag’ is ‘USERINPUT’.

Following are the Accounting Roles and Amount Tags when the fee is collected in advance:

At Fee Collection (FLIQ)

|

Dr/Cr |

Accounting Role |

Amount tag |

Amount |

As of the Fee Inception Date (FLIQ) |

Dr |

Customer |

<COMPONENT>_LIQD (Advance fee component) |

Balance for the fee basis amount tag* Fee Rate * Accrual Basis * No. of. Days |

Cr |

Fee In Advance |

<COMPONENT>_LIQD (Advance fee component) |

Balance for the fee basis amount tag * Fee Rate * Accrual Basis * No. of. Days |

At Fee Accrual (FACR)

|

Dr/Cr |

Accounting Role |

Amount tag |

Amount |

Daily Accrual (FACR) |

Dr |

Fee In Advance |

<COMPONENT>_ACCR |

Liquidated Fee Amount / No.of.Days |

Cr |

Income |

<COMPONENT>_ACCR |

Liquidated Fee Amount / No.of.Days |

Description of the Amount Tags

The following table gives the description of the amount tags:

Amount Tag |

Description |

CUSTOMER |

Borrower |

<COMPONENT>_LIQD |

Advance Fee Component Liquidated |

<COMPONENT>_ACCR |

Advance Fee Component Accrued |

Following are the Accounting Roles and Amount Tags when the fee is collected in arrears:

At Fee Accrual (FACR):

Accounting Role |

Dr. / Cr. |

Amount Tag |

Component_REC |

Dr. |

Component_FACR |

Component_INC |

Cr. |

Component_FACR |

At Fee Collection (FLIQ):

Accounting Role |

Dr. / Cr. |

Amount Tag |

CUSTOMER |

Dr. |

Component_LIQD |

Component_REC |

Cr. |

Component_LIQD |

Description of the amount tags

The following table gives the description of the amount tags

Amount Tag |

Description |

Component_REC |

Fee Component Receivable |

Component_INC |

Fee Component Income |

CUSTOMER |

Borrower |

Component_LIQD |

Fee Component Liquidated |

Component_FACR |

Fee Component Accrued |

4.3.6.1 Specifying Liquidation Preferences

Liquidation Mode

Select the liquidation mode for the fee components under this fee class. You have the following options:

- Auto Liquidation - Select this option to indicate the fee is to be liquidated automatically

- Deferred Auto Liquidation - Select this option to indicate the fee is to be liquidated automatically, but the automatic liquidation is to be deferred. You can specify the number of days after the Schedule Date that the fee is to be liquidated in the field ‘No. of Days’ in this screen.

- Manual Liquidation - Select this option to indicate the fee is to be liquidated manually

- Semi-Auto – Select this option to indicate the fee is to be liquidated semi-automatically. If you select this option, forward processing is applicable to this fee. The fee liquidation event is processed, but the message is held in the Forward Processing Queue. Forward Processing has been explained in the chapter Reference Information for Loan Syndication. Refer to the same for more information.

No of Days

If you have selected the option ‘Deferred Auto Liquidation’, you have to specify the number of days by which the liquidation is to be deferred, in this field.

4.3.6.2 Billing Notice Preferences

Billing Notice Required

When liquidation is due, you can choose whether or not you would like to send a notice to the concerned customer. Select this check box to indicate you would like to send a notice.

No. of Days

Enter the number of days prior to liquidation that the notice is to be sent out.

4.3.6.3 Accruals Preferences

Accrual Required

Select this check box to indicate accrual is required.

Accrual Method

If you have selected the ‘Accrual Required’ check box, you have to select the accrual method. You can accrue a fee using the straight line or discount accrual method.

Accrual Frequency

Specify the accrual frequency. The frequency can be one of the following:

- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

Accrual Frequency Units

Specify the units of accrual frequency here. If, for example, you select the frequency of accrual as ‘Monthly’, and specify the frequency units as ‘5’, the accrual once in five months.

4.3.6.4 Other Preferences

Allow Rule Amendment

Select this check box to indicate the fee rule can be amended.

Allow Amount Amendment

Select this check box to indicate the user at the transaction level, based on the margin or ICCF rule linked to the fee class can amend the fee amount calculated. This field is applicable only for advance types of fee collection.

Stop Association

Select this check box to indicate the fee component should not be associated with the product henceforth.

Participation Propagation Reqd

While entering fee details, you have the option of passing the fee collected from the borrower to the participant of a facility, tranche or drawdown contract.

Select ‘Participant Propagation Reqd’ check box, if you want to transfer the fee to the participant. If you do not select this check box, fees collected from the borrower is not passed to the participant.

4.3.6.5 Date Preferences

Allow End Date Input

If you select this check box, you can enter the date on which the system has to stop the accrual of fee amount, in the LS Contract Online screen.

This date can be lesser than, or equal to the Maturity Date. If you do not select this check box, the Maturity Date of the contract is defaulted as the end date for accrual.

Allow Start Date Input

If you select this check box, you can enter the date on which the system has to start the accrual of fee amount, in the LS Contract Online screen.

This date can be greater than, or equal to the Value Date. If you do not select this check box, the Value Date of the contract is defaulted as the start date for accrual.

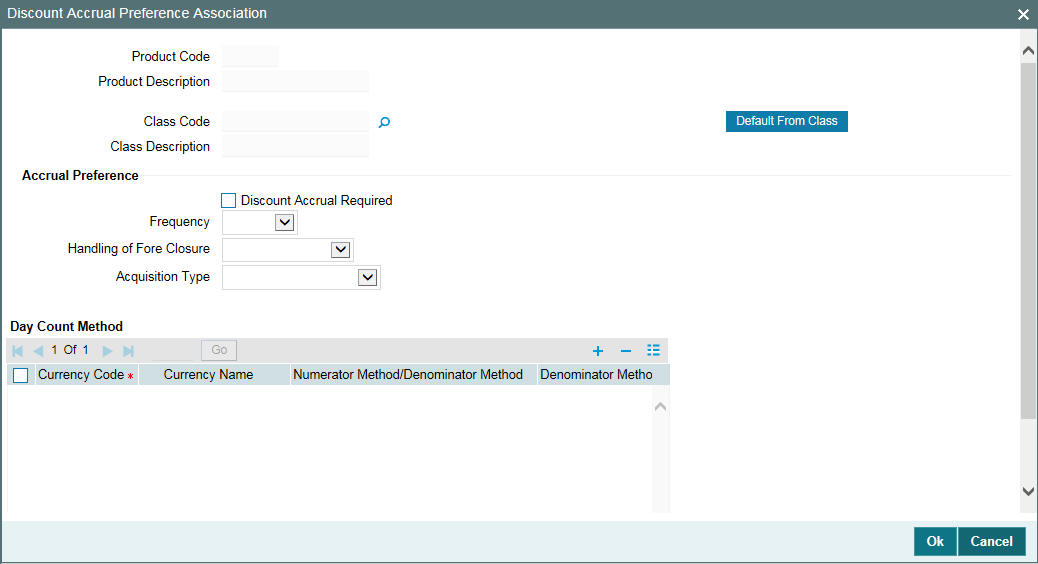

4.3.7 Defining Discount Accrual Preference

After building discount accrual fee classes you can associate the class with loans or bills products. Click the ‘Discount Accrual’ in the Product Definition screen. The ‘Discount Accrual Preference Association’ screen is displayed.

To associate discount accrual fee class with a product, click the ‘Default From Class’ in the Discount Accrual Preference Association screen. Select the appropriate discount accrual fee class from the list of classes that you would have maintained through the Discount Accrual Preference Class Maintenance.

For further information on the Discount Accrual Preference Class Maintenance screen, refer to the chapter ‘Defining Discount Accrual Fee Classes’ in the Bilateral Loans User Manual.

The attributes defined for the discount accrual fee class defaults to the product. You have the option to modify the attributes defined for the class, to suit the requirement of the product you are creating.

Alternatively, you can choose to define the discount accrual details for the product.

Note

- (If the Acquisition type is different from what is maintained at Discount Accrual Class level then the system gives an error and contract does not save.)

- You are allowed to change acquisition type during the life cycle of the contract on the basis of the maintenance done at the product level

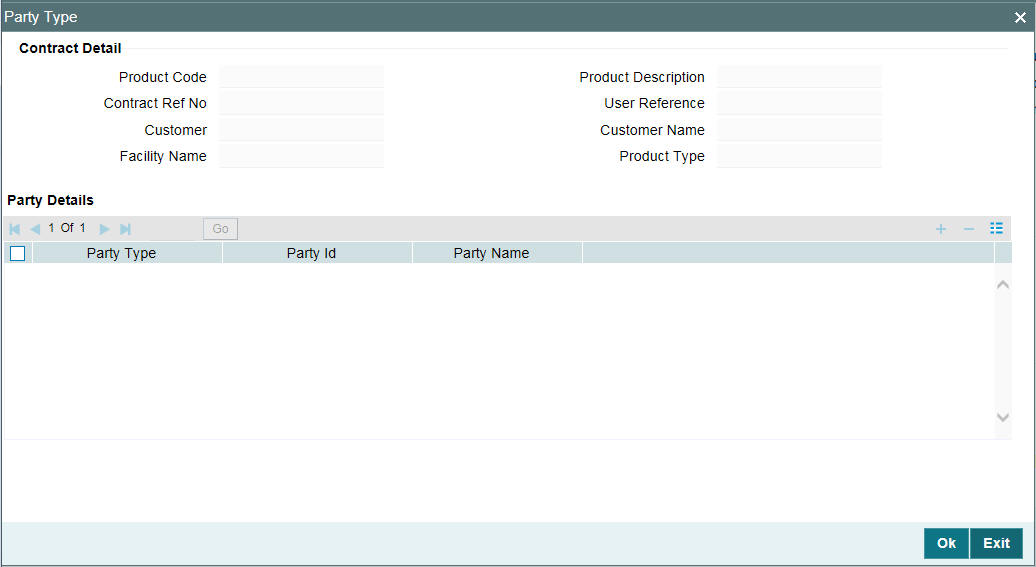

4.3.8 Associating Parties

You can also specify the different types of entities or parties that would be applicable for the borrower tranche or drawdown product in the Party Association screen. Click ‘Party Type’ in the Tranche/Drawdown Product Definition screen to invoke the Party Association screen.

For each party type that you associate in this screen, you can specify:

- Whether more than one party belonging to the associated type may be specified for contracts using the product

- Whether specification of at least one party belonging to the product is mandatory for contracts using the product

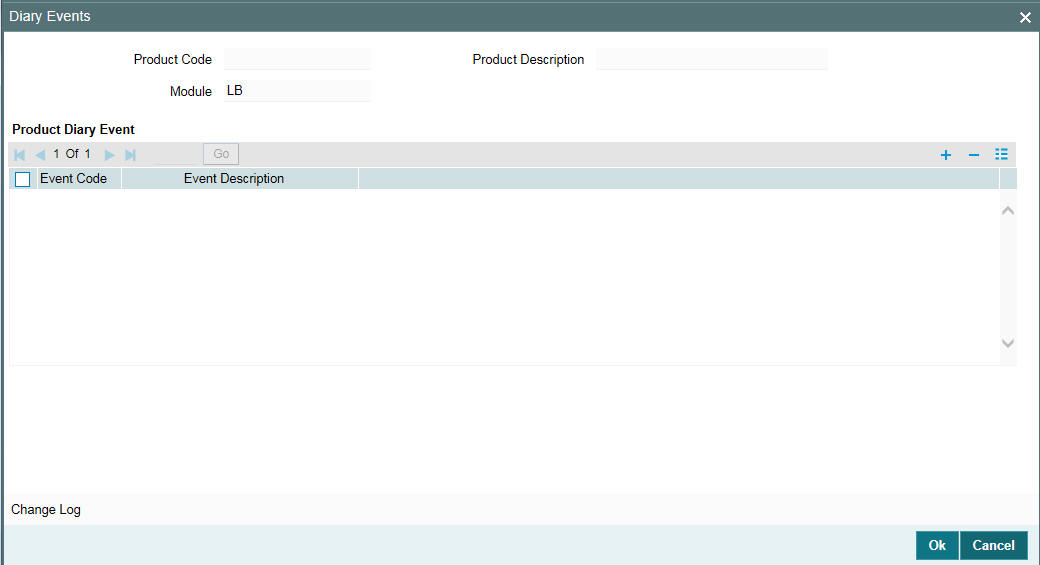

4.3.9 Associating Diary Events

In the Diary Event Association screen, you can also specify the different diary events that would need to be processed for borrower tranche or drawdown contracts using the borrower tranche or drawdown product. Click ‘Diary Events’ in the Tranche / Drawdown Product Definition screen to invoke the ‘Diary Events’ screen.

In this screen, select the code of the diary event that you want to associate with the product, in the Event Code field.

4.3.10 Maintaining UDFs

You can maintain the UDFs pertaining to the loan using the ‘Product User Defined Fields’ screen. To invoke this screen, click the ‘Fields’ on the Application toolbar of the ‘Loan Syndication -Borrower Product Definition’ screen.

In this screen, you can maintain the UDF ‘PAYOFF-FEE’ attached to tranche/drawdown products which is used to determine the flat fee amount.

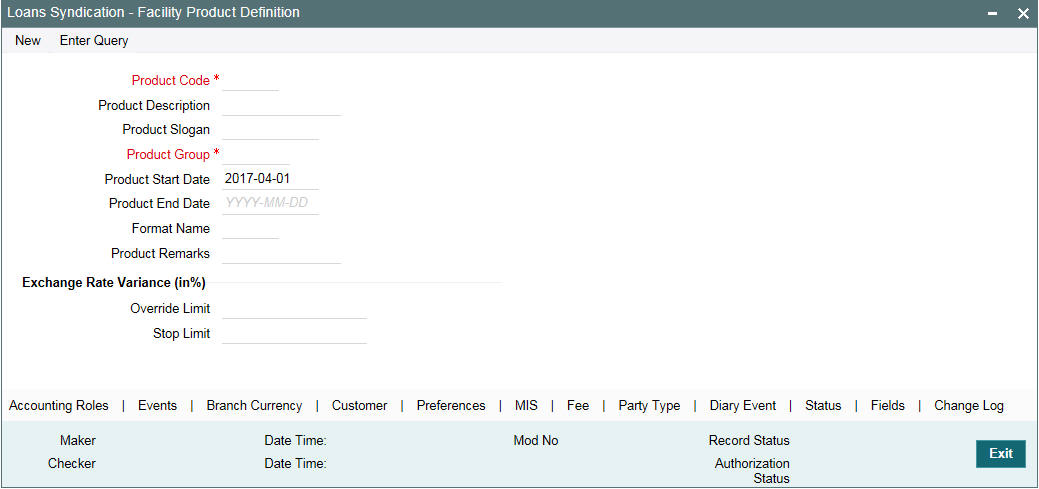

4.4 Creating Borrower Facility Products

After you have created products to process borrower side contracts in respect of a syndication agreement, such as borrower tranches and drawdowns, as well as products for participant side contracts, you must define products that would be used to process the main syndication agreement (facility) contract with the borrower. Such products are called borrower facility products.

To create a borrower facility product, you can specify the basic details such as the Product Code, Group, Description, and so on in the Loan Syndication – Facility Product Definition screen. You can then use the other product definition screens to set up preferences for the product.

You can invoke the ‘Loan Syndication - Facility Product Definition’ screen by typing ‘FCDPRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the basic details for the product, such as the Product Code, Description, Group and life-span, in the same manner as you specified for the tranche/drawdown product.

4.4.1 Defining Generic Attributes of a Loan Syndication Product

After specifying all the basic details of a product, you can indicate certain specific attributes for the product. Each of these attributes can be defined in the corresponding screen that you can invoke from the Loan Syndication Product Definition main screen, by clicking the appropriate icons. Attributes with common characteristics are grouped together in common screens, simplifying the process of defining them.

You can define generic attributes, such as branch, currency, and customer restrictions by clicking on the appropriate tabs. For a borrower facility product, in addition to these generic attributes, you can specifically define other attributes. These attributes are discussed in detail in the following sections.

For further information on the generic attributes that you can define for a product, please refer the following Oracle FLEXCUBE User Manuals:

- Products

- User Defined Fields

- Settlements

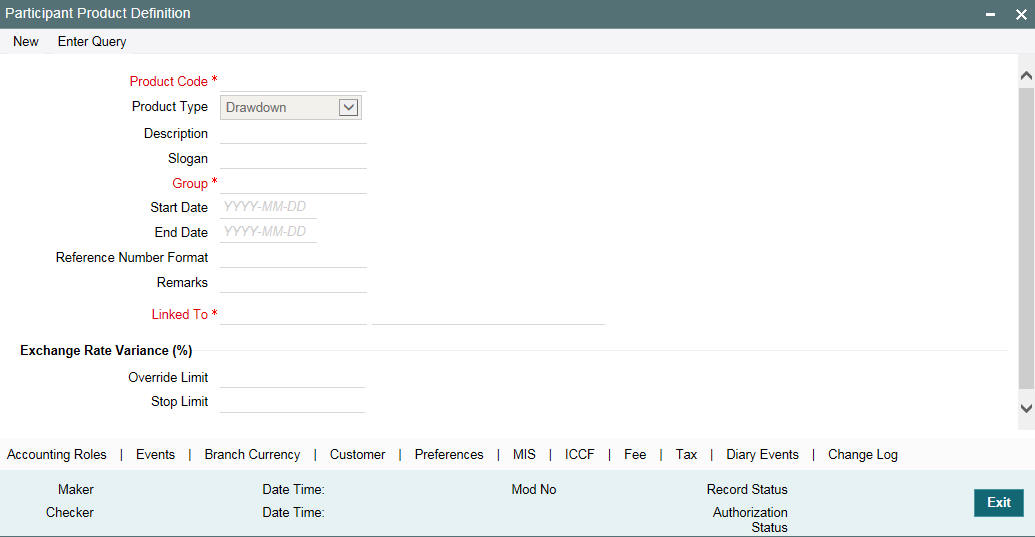

4.5 Creating Participant Products

You can create participant products only after you have defined the borrower products (for processing borrower facility, tranche and drawdown contracts).

Subsequently, when you define a borrower facility product for processing borrower facility contracts, you have to associate the borrower tranche product and the borrower drawdown product participant tranche product and the participant drawdown product to be used for processing the corresponding participant contracts that would be created under the borrower facility contracts.

You must define the products to be used for participant facility, tranche and drawdown contracts that will be created for participants under a borrower facility contract. This can be done through the Product – Creation screen.

You can invoke the ‘Participant Product Definition’ screen by typing ‘LPDPRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Click ‘New’ to create participants products. In the ‘Product – Creation’, you have to specify the following details:

Participant Product Type

Select the product type of the participant product you are creating, from the option list. The options available are:

- Facility

- Tranche

- Drawdown

Linked Borrower Product

Select the borrower product with which you to want to link the participant product being created.

New Product Code

Give the participant product a unique code by which it can be easily identified. The code can be combination of alphabets and numbers and should consist of at least one alphabet.

Click ‘Ok’ to proceed with product creation. The ‘Loans Syndication – Participant Product Definition’ screen is displayed.

4.5.1 Defining Generic Attributes of a Participant Product

After specifying all the basic details of a participant product, you can indicate certain specific attributes for the product. Each of these attributes can be defined in the corresponding screen that you can invoke from the Loan Syndication – Participant Product Definition main screen, by clicking the appropriate icons. Attributes with common characteristics are grouped together in common screens, simplifying the process of defining them.

You can define generic attributes, such as branch, currency, and customer restrictions by clicking on the appropriate icon in the horizontal array of icons in this screen. For a participant product, in addition to these generic attributes, you can specifically define other attributes. These attributes are discussed in detail in this section.

For further information on the generic attributes that you can define for a product, please refer the following Oracle FLEXCUBE User Manuals:

- Products

- User Defined Fields

- Settlements

4.5.2 Specifying the Product Type

The product type is the first attribute that you specify for a participant product. It indicates the category under which the product can be placed, and the type of contract that is processed against the product.

Each participant-level product that you define could be used to process any of the following types of contracts that are created under a corresponding borrower contract, as applicable at each level:

- Facility products, for processing participant facility contracts that are created under corresponding borrower facility contracts

- Tranche products, for processing participant tranche contracts that are created under corresponding borrower tranche contracts

- Drawdown products, for processing participant drawdown contracts that are created under corresponding borrower drawdown contracts

- Collateral Online, for creating and posting collateral online contract for each tranche

- Collateral Settlements, for creating and posting collateral settlement contract for each tranche

You can select the required product type in the Product Type field, in the Loan Syndication – Participant Product Definition screen.

Note

If you have selected the product type as ‘Collateral Online’ or ‘Collateral Settlements’, the following are disabled:

- Override Limit and Stop Limit fields

- Preference, ICCF, Fee, Tax, and Dairy Event buttons

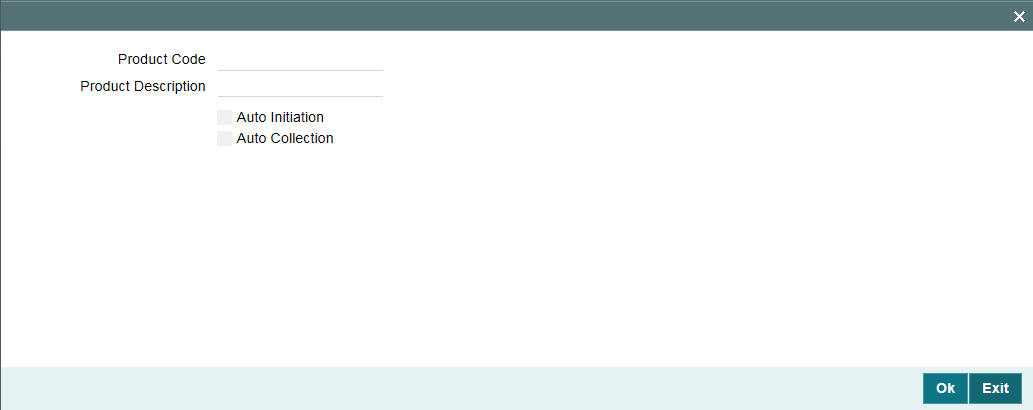

4.6 Setting Preferences for Participant Products

Preferences are those options you can use to specify attributes for a product. These attributes are picked up and applied automatically to any contracts involving the product.

For instance, for participant contracts using a participant facility product, you can define whether collection from the participants towards a drawdown must be initiated automatically; or whether the amount repaid by the borrower must be disbursed automatically to participants.

Click ‘Preferences’ to specify certain preferences unique to the product. The ‘Loans Syndication - Participant Product Preferences’ screen is invoked, where you can specify your preferences.

You can capture the following information in this screen:

Auto Initiation

You can indicate whether collection from the participants towards a borrower drawdown must be initiated automatically. Your specification is inherited by all participant contracts using the participant product.

Auto Collection

You can indicate whether the amount repaid by the borrower must be disbursed automatically to the respective participants. Your specification is inherited by all participant contracts using this product.

Note

- If you have selected the product type as ‘Collateral Online’ or ‘Collateral Settlements’, ‘Preferences’ tab is disabled.

4.6.1 Specifying Tax Details for a Participant Product

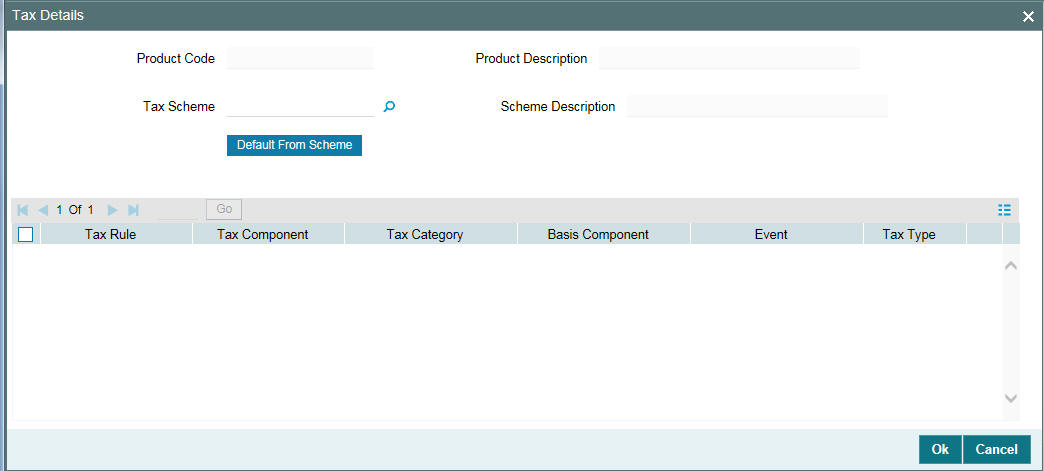

Click ‘Tax’ to link tax components with the participant product. The following screen is invoked:

Specify the following details in this screen:

Tax Scheme

A tax scheme is made applicable to a product when it is linked to the product. Select the applicable scheme from the list. The tax schemes maintained through the ‘Tax Scheme Maintenance’ screen are available in the option list provided.

When you select a scheme, the following defaults:

- Tax Rules linked to the scheme

- Tax component for each rule

Tax Category

You can specify tax category for each tax rule that is linked to a tax scheme. The categories defined through the ‘Tax Category Maintenance’ are available in the option list provided. Select the appropriate one from this list.

Basis Component

Tax can be applied on the basis of any component that is taxable according to the laws in your country. This component is called the Basis Component. The method of tax application defined for the Tax Rule is applied on this component.

Event

You should specify the event upon which the tax is to be applied. For instance, if you specify that the tax be to be applied at the time the fess is collected from the customer, then the entries for tax are passed when the fee component is liquidated.

Tax Type

The type of tax, decides the bearer of the tax. It could be the bank or the customer. A customer bears withholding type of tax and the tax component is debited to the customer’s account. The bank bears an expense type of tax and the tax component is booked to a tax expense account.

Note

If you have selected the product type as ‘Collateral Online’ or ‘Collateral Settlements’, ‘Tax’ is disabled.

4.7 Specifying Preferences for Syndication Products

Preferences are those options you can use to specify attributes for a product. These attributes are picked up and applied automatically to any contracts involving the product. For instance, for contracts under a borrower facility syndication product, you can define when intimation must be sent to participants to fulfill their commitments towards a scheduled drawdown.

Click ‘Preferences’ to specify certain preferences unique to the product. The Borrower Facility Product - Preferences screen is invoked, where you can specify your preferences.

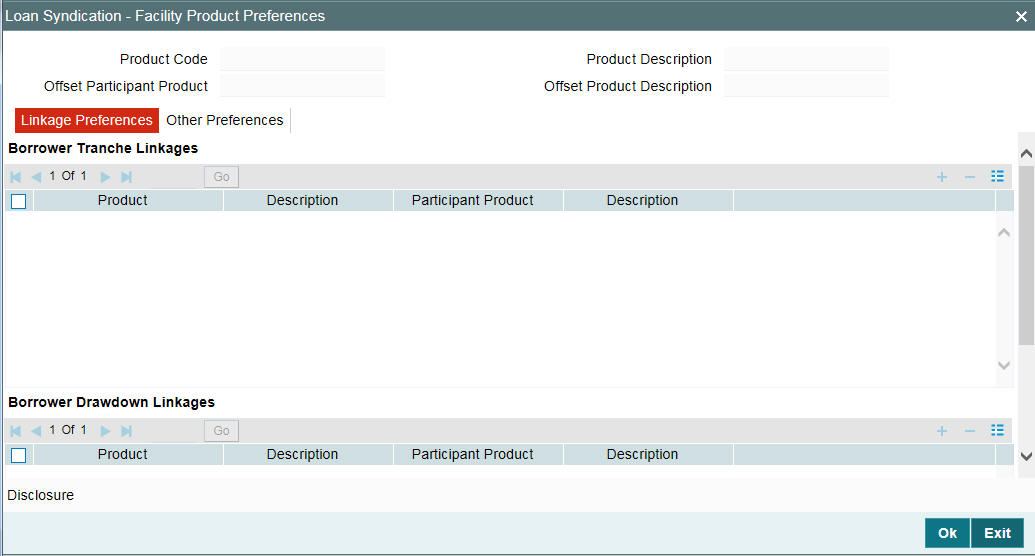

4.7.1 Mapping Products for Borrower and Participant Contracts

You can associate several tranche products to a facility product. To each of the tranche products, you can associate several drawdown products. Each time you initiate a borrower tranche or drawdown contract under the Facility contract, you have the option of selecting one of the tranche or drawdown products you have associated with the facility product under which you have booked a contract. The system then defaults the attributes of the product to the contract.

Note

This feature allows you to associate any LC product (which can be treated like a drawdown product) with other drawdown products under a tranche. The participant product that is linked to the borrower facility product while defining the participant product is displayed as the ‘Offset Participant Product’.

Example

Let us assume that you are maintaining a borrower facility product called SYN2. You have associated the following products with this product:

Tranche Products

- Borrower tranche product - BT02

- Participant facility product – PT02

Drawdown products

- Borrower drawdown (loan) product - BD02

You are initiating a borrower tranche contract under a main syndication contract involving the syndication product SYN2. Automatically, the system defaults the product codes and attributes of:

- BT02 for the borrower tranche contract

- PT02 for the participant tranche contract

Similarly, the product codes and attributes of BD02 and PT02 are defaulted for the corresponding drawdown contracts under each tranche.

4.7.2 Specifying Whether SGEN is Required

Select this check box to indicate that the generation of messages is required.

The SGEN event is for the generation of messages notifying your customer that payment is due before SGEN number of days. If this box is deselected, this event is not fired and no such notification messages get generated by Oracle FLEXCUBE.

4.7.3 Specifying the Rekey Options

You can specify those values in a borrower facility contract that must be keyed in when a user is authorizing it.

You can use the rekey feature to ensure that the right contract is being authorized. It requires the authorizer to key in the values of certain fields during authorization. You can select the fields for which the values must be entered, in the Auth Rekey Fields option in the Loan Syndication Product Preferences screen.

The user that authorizes a contract cannot be the same user that entered the contract.

All operations on a syndication contract, as well as the tranche contracts and the drawdown loan contracts under a tranche of the agreement contract, must be authorized before the End of Day procedures are begun at the branch.

Click ‘Disclosure’ in the ‘Loans Syndication - Facility Product Preferences’ to invoke the ‘Product Disclosure Mapping’ screen.