6. Loan Syndication Contracts - Part 2

This chapter contains the following sections:

- Section 6.1, "Processing a Drawdown"

- Section 6.2, "Capturing Drawdown Details"

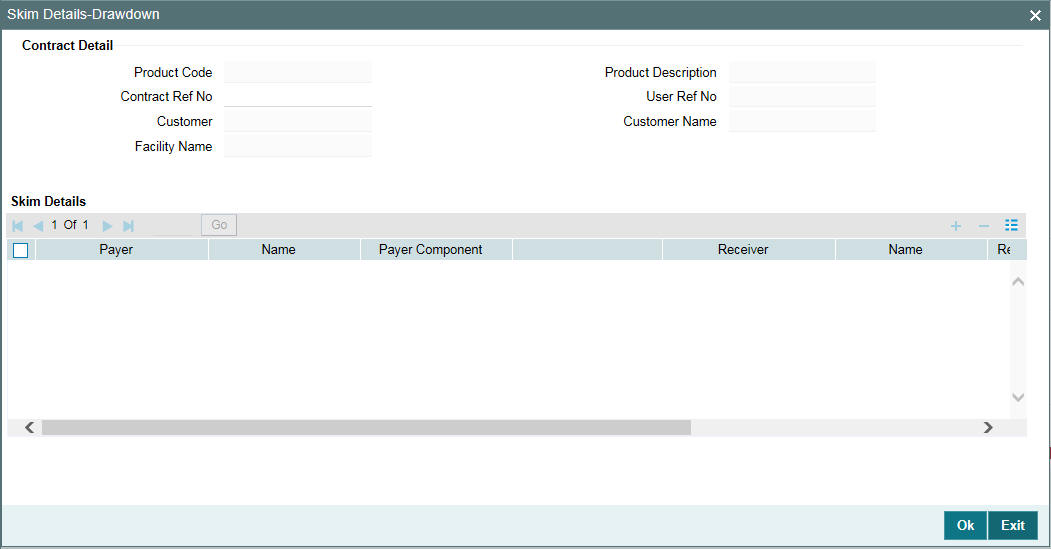

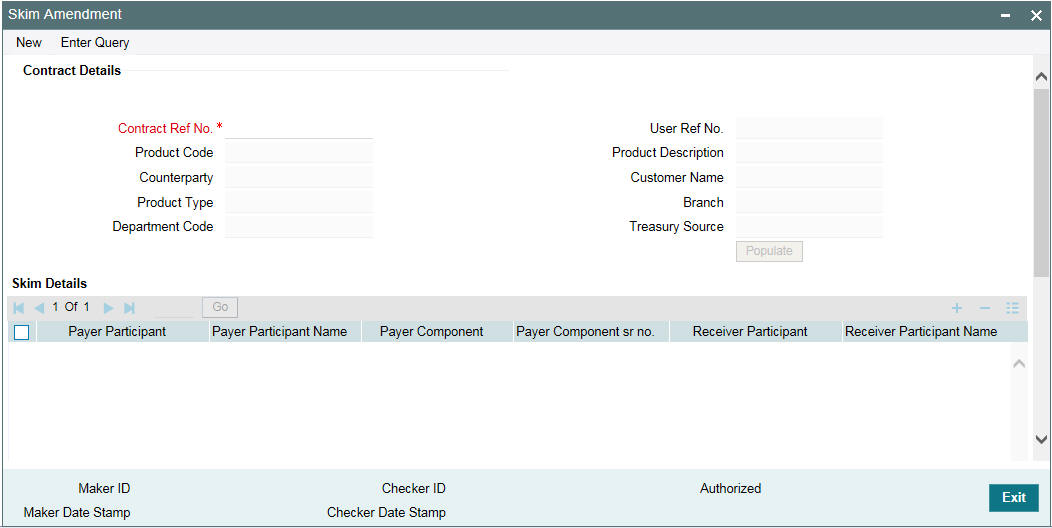

- Section 6.3, "Amending Drawdown SKIM Details"

- Section 6.4, "Processing Future Value Dated Payments"

- Section 6.5, "Processing Revaluation of Drawdowns"

- Section 6.6, "Allowing Back Valued Activities on a Drawdown Beyond the Trade Date"

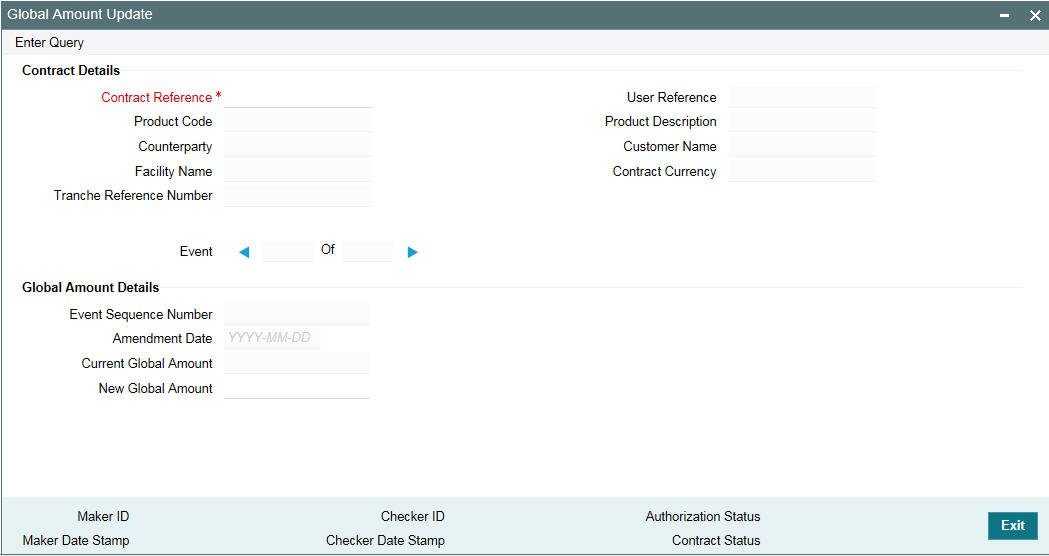

- Section 6.7, "Amending Global Amount for a Contract"

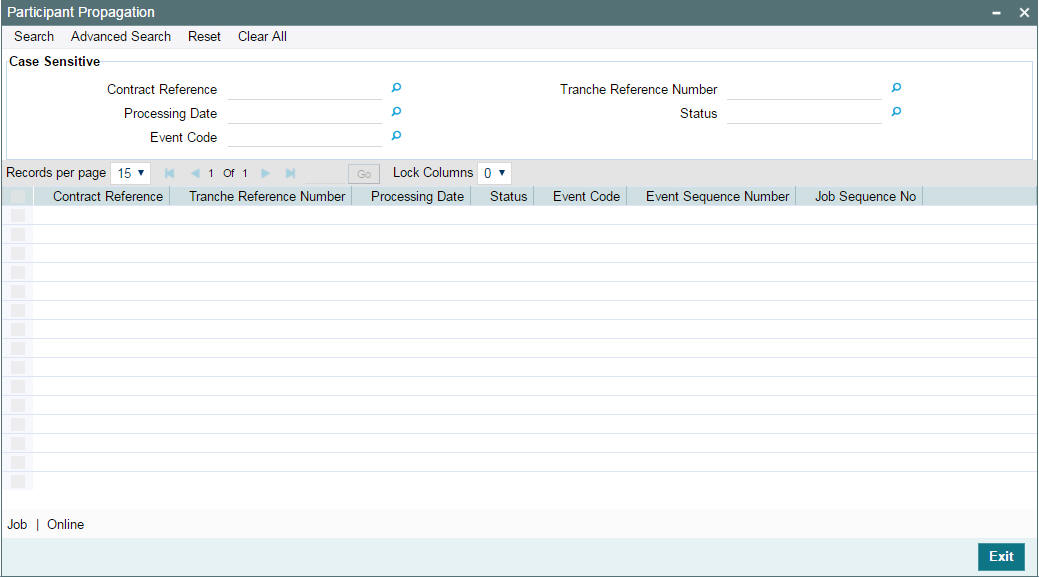

- Section 6.8, "Processing Participant Contracts"

- Section 6.8, "Processing Participant Contracts"

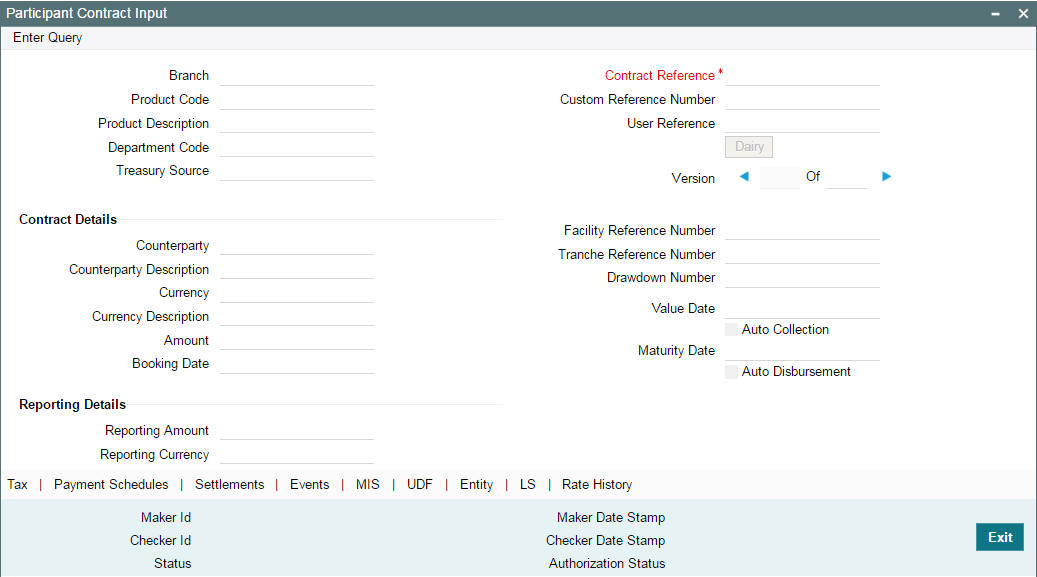

- Section 6.9, "Viewing Participant Contracts"

- Section 6.10, "Modifying Participant Details"

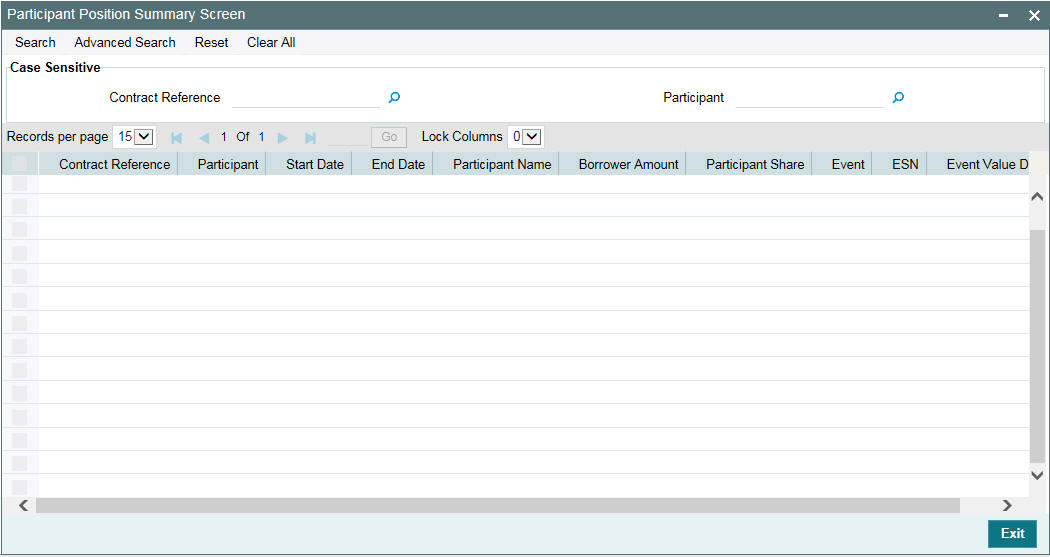

- Section 6.11, "Participant Position Summary"

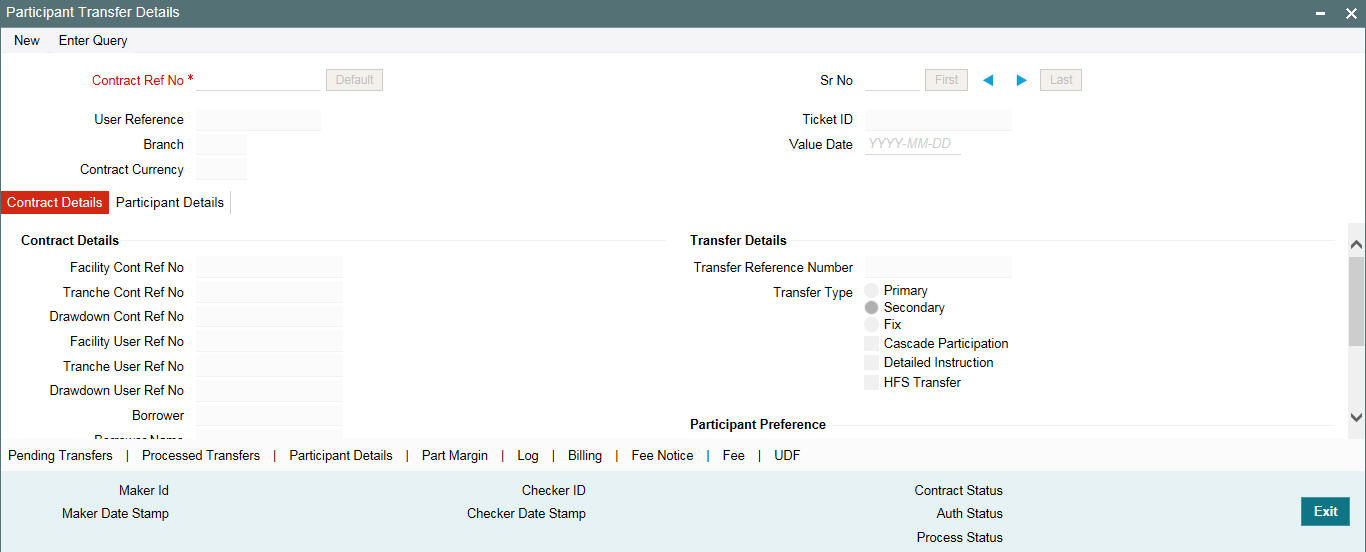

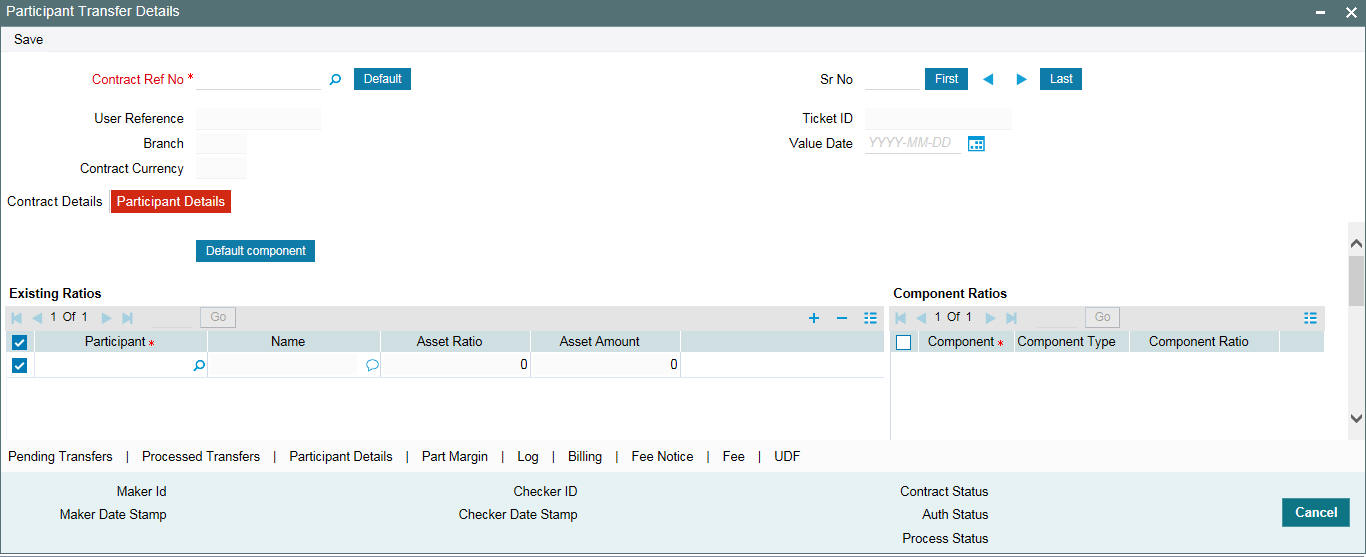

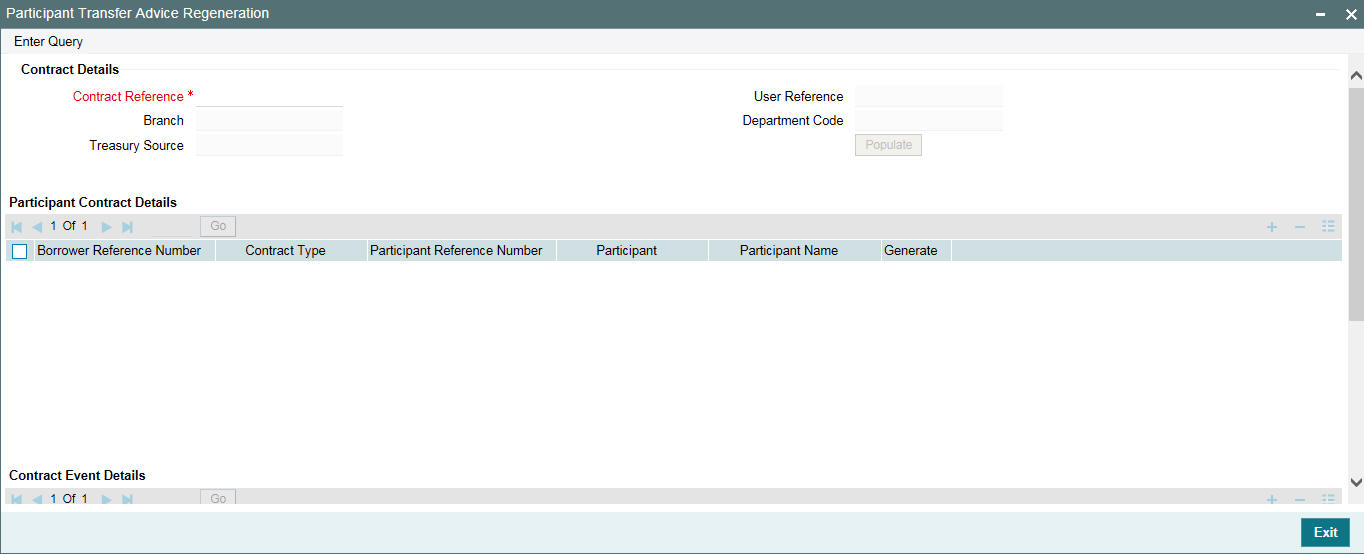

- Section 6.12, "Transferring Participant Assets "

- Section 6.13, "Processing Sighting Fund Rollover/Reprice"

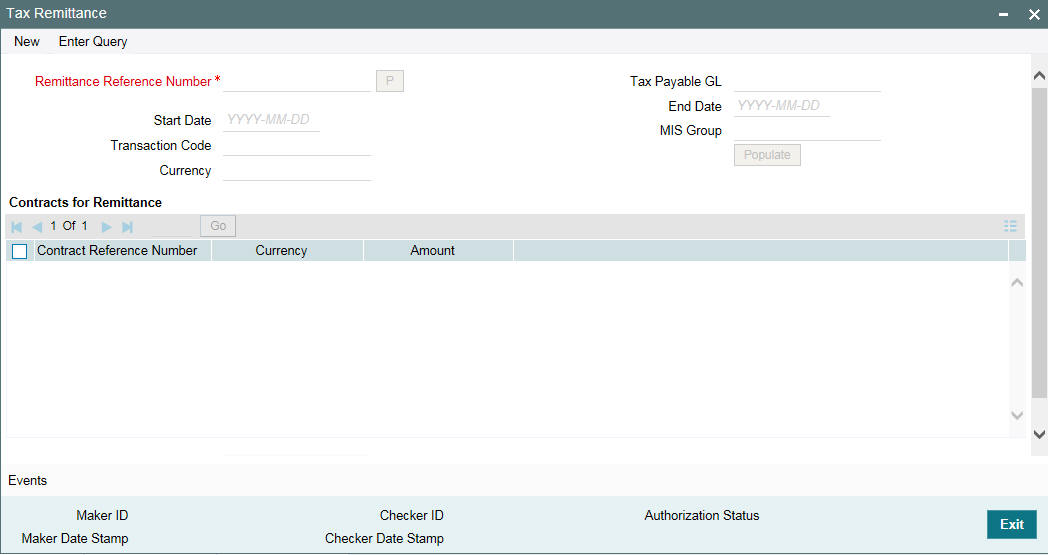

- Section 6.14, "Remitting Withheld Tax"

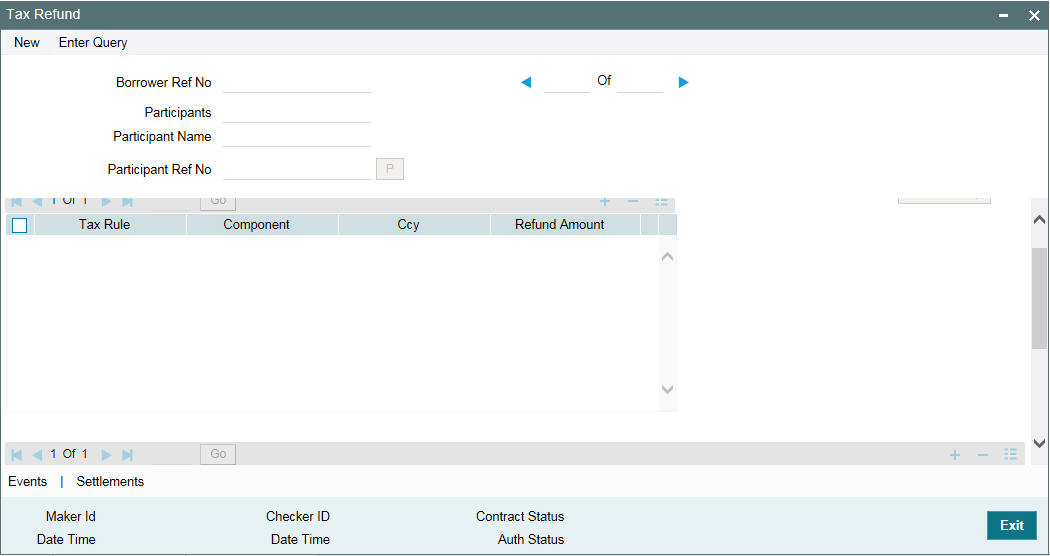

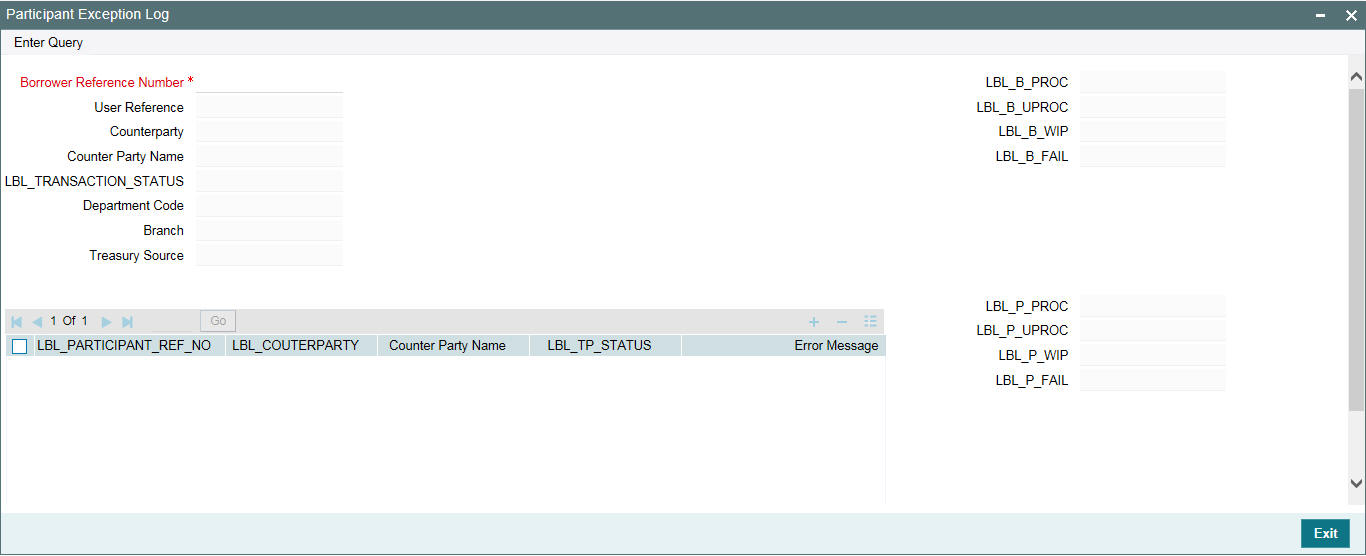

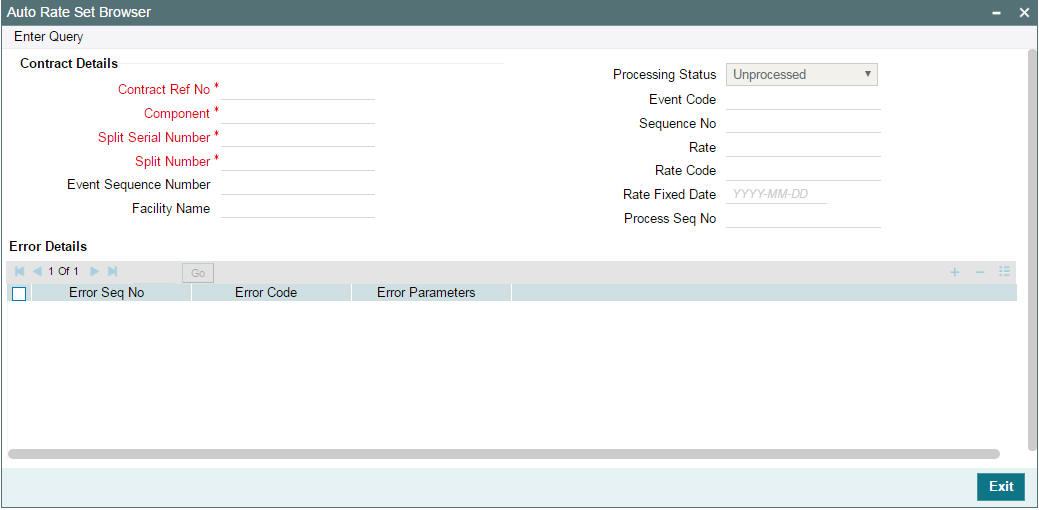

- Section 6.15, "Refunding Withheld Tax"

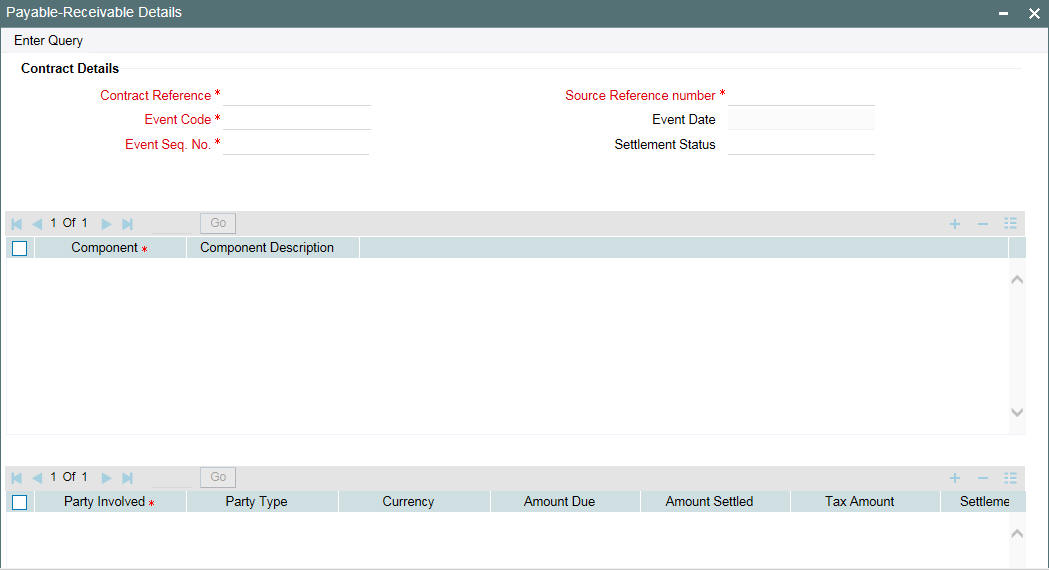

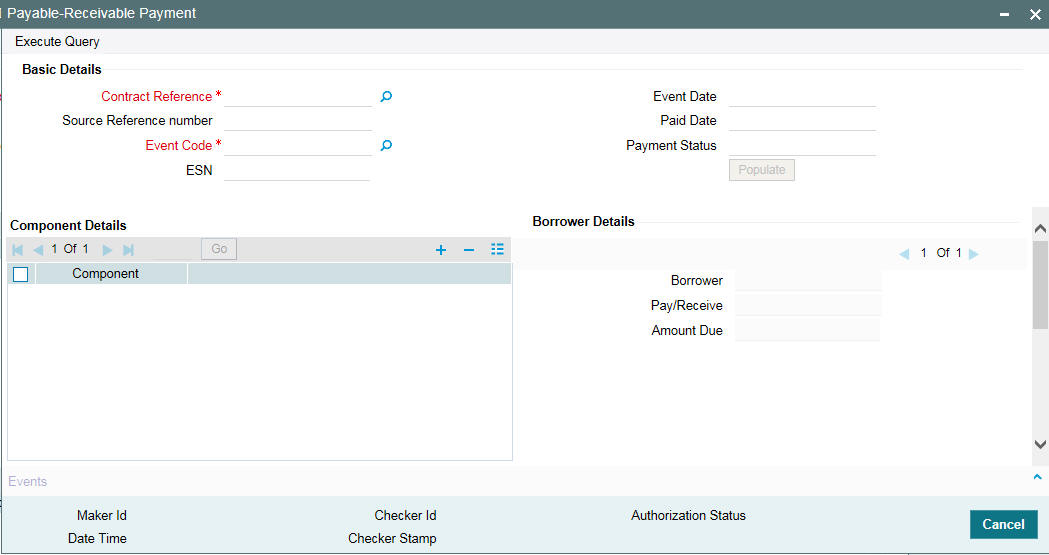

- Section 6.16, "Processing Back Valued Interest and Fee for Payables and Receivables "

- Section 6.17, "Viewing Borrower/Participant Contract Processing Status"

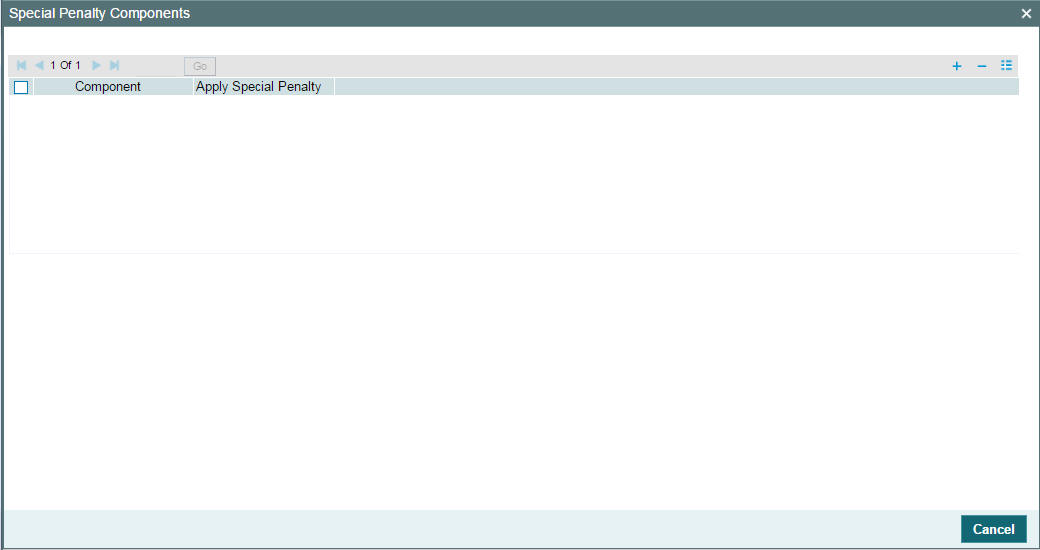

- Section 6.18, "Maintaining Special Penalty Component Waiver Details"

- Section 6.19, "Viewing the Waiver Details of Special Penalty Components"

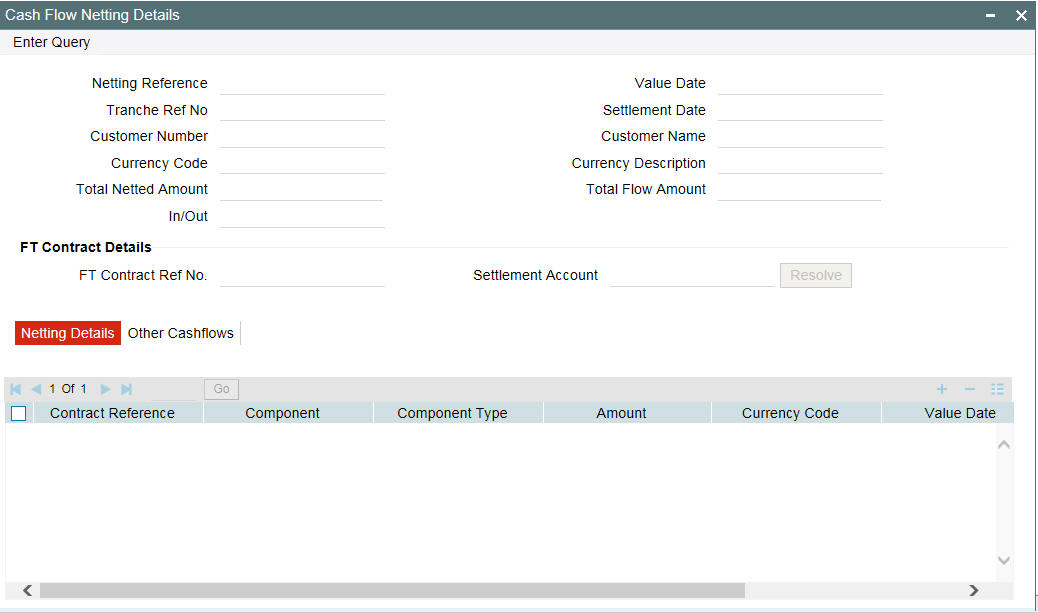

- Section 6.20, "Netting Cash Flows for a Tranche"

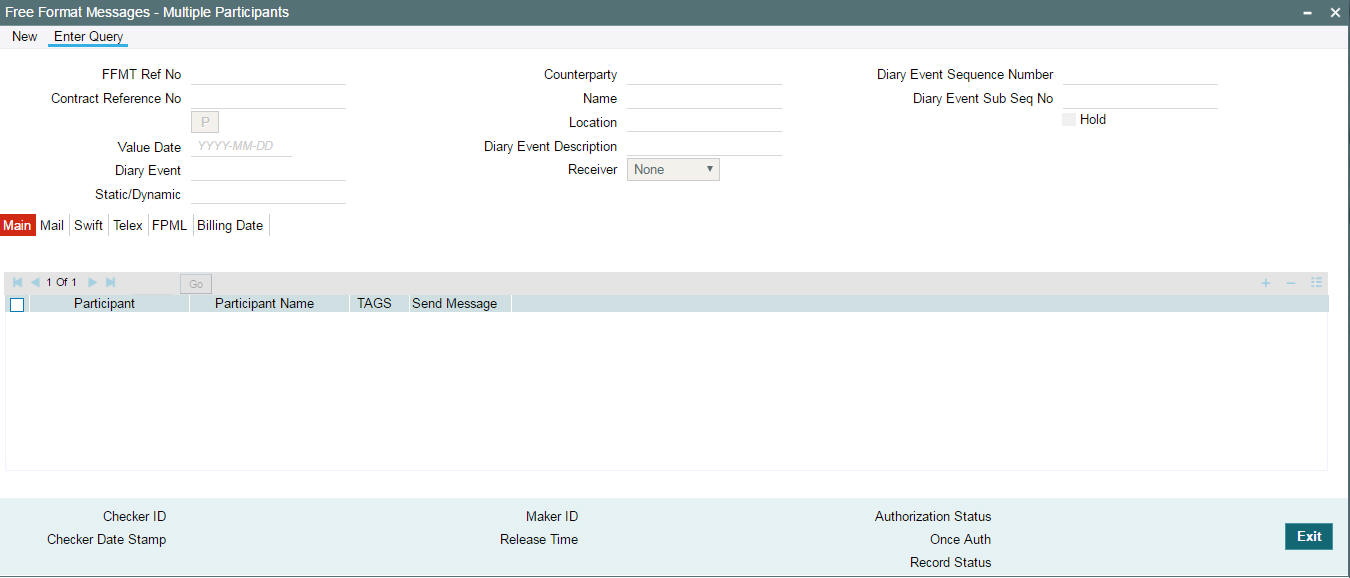

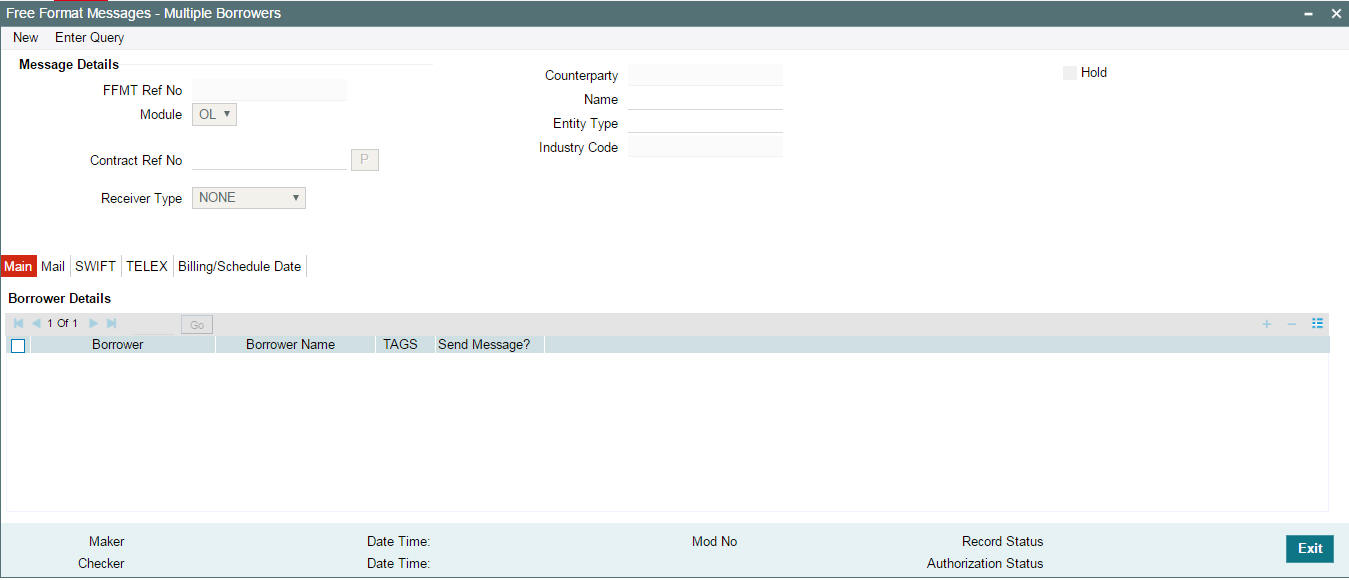

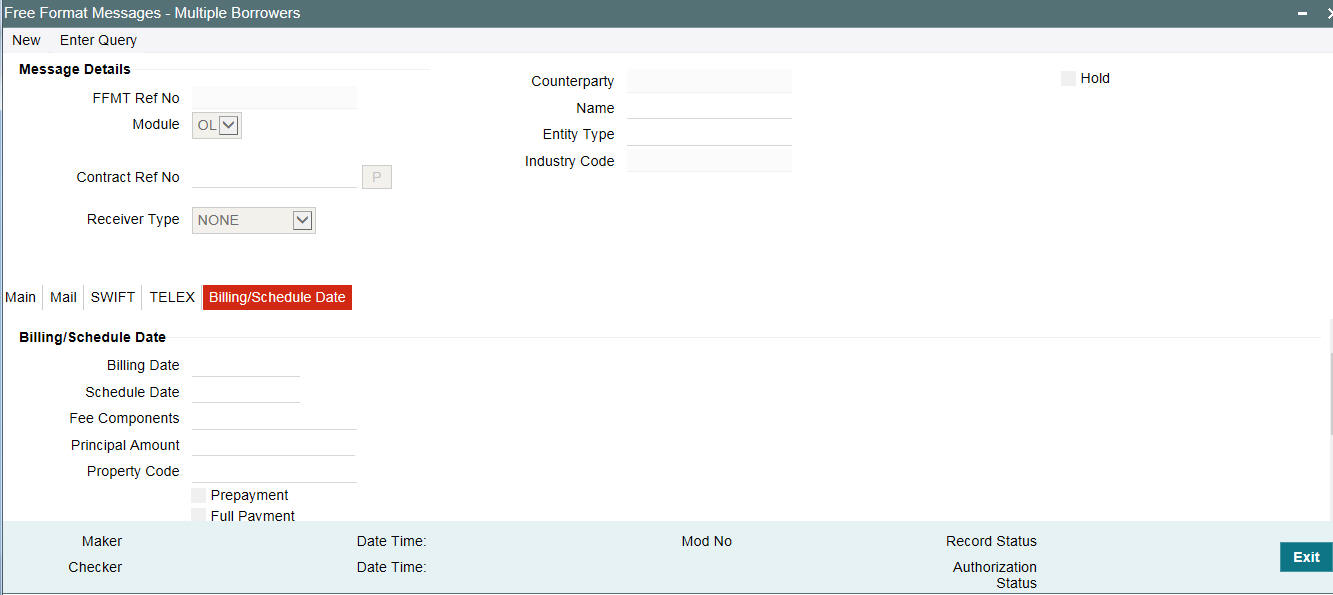

- Section 6.21, "Free Format Messages for Loan Syndication Contracts"

- Section 6.22, "Processing the Release of Payment Messages"

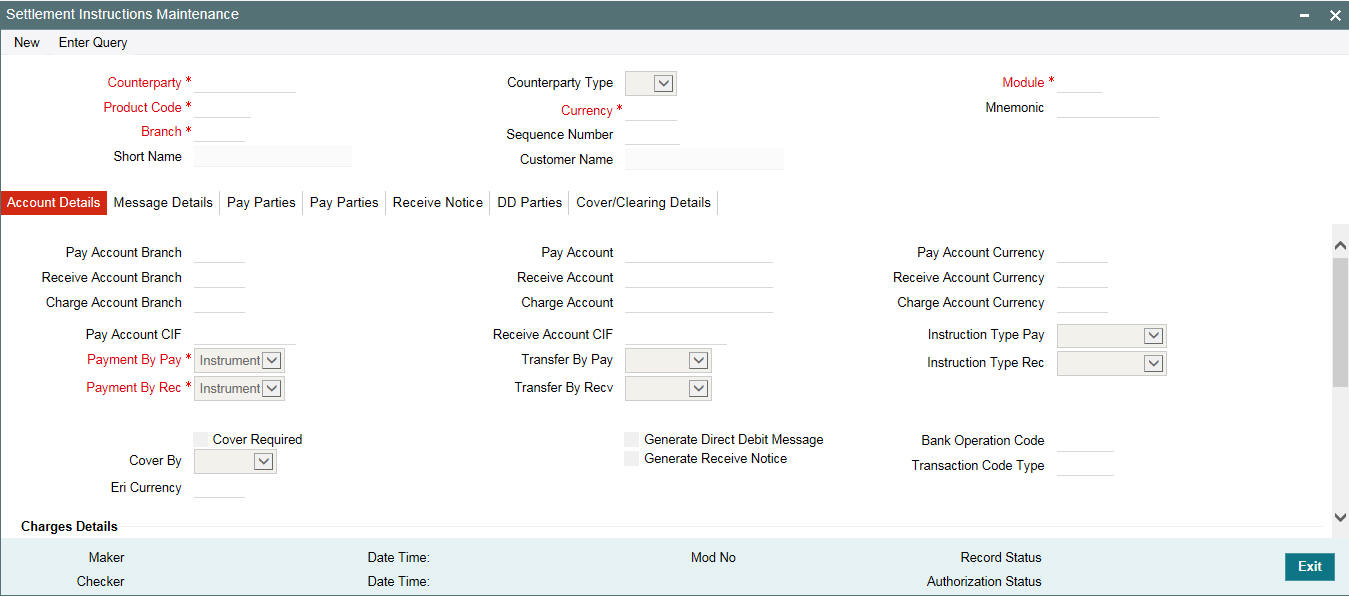

- Section 6.23, "Settlement Instruction Maintenance Information"

- Section 6.24, "Viewing Syndication Contracts"

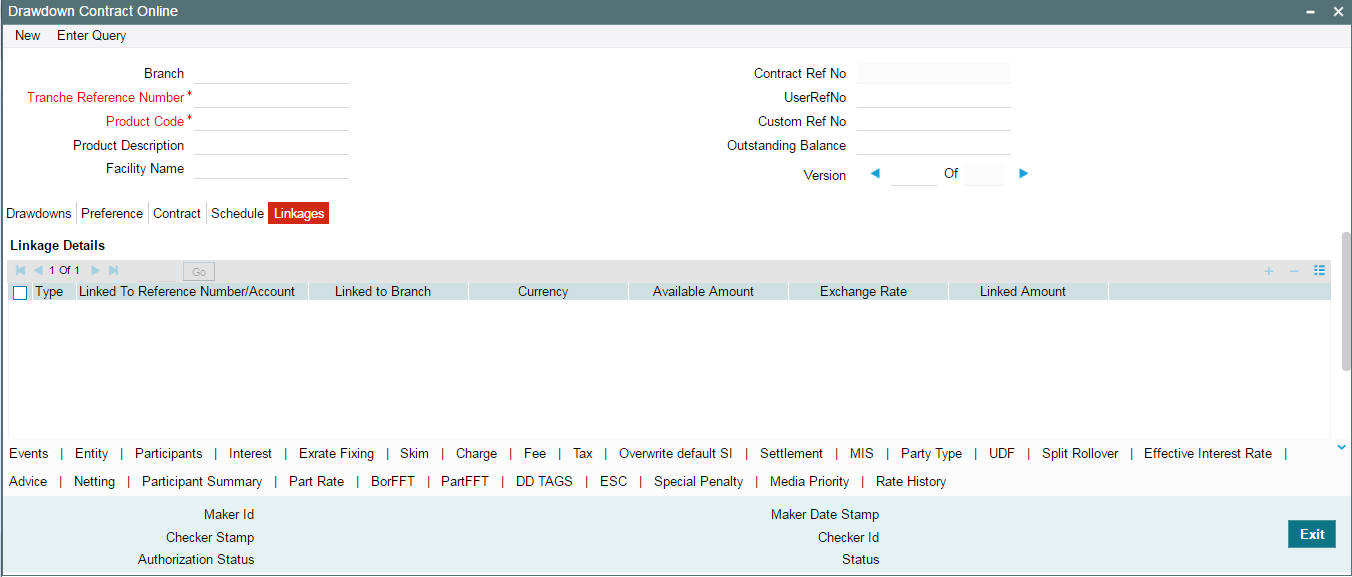

6.1 Processing a Drawdown

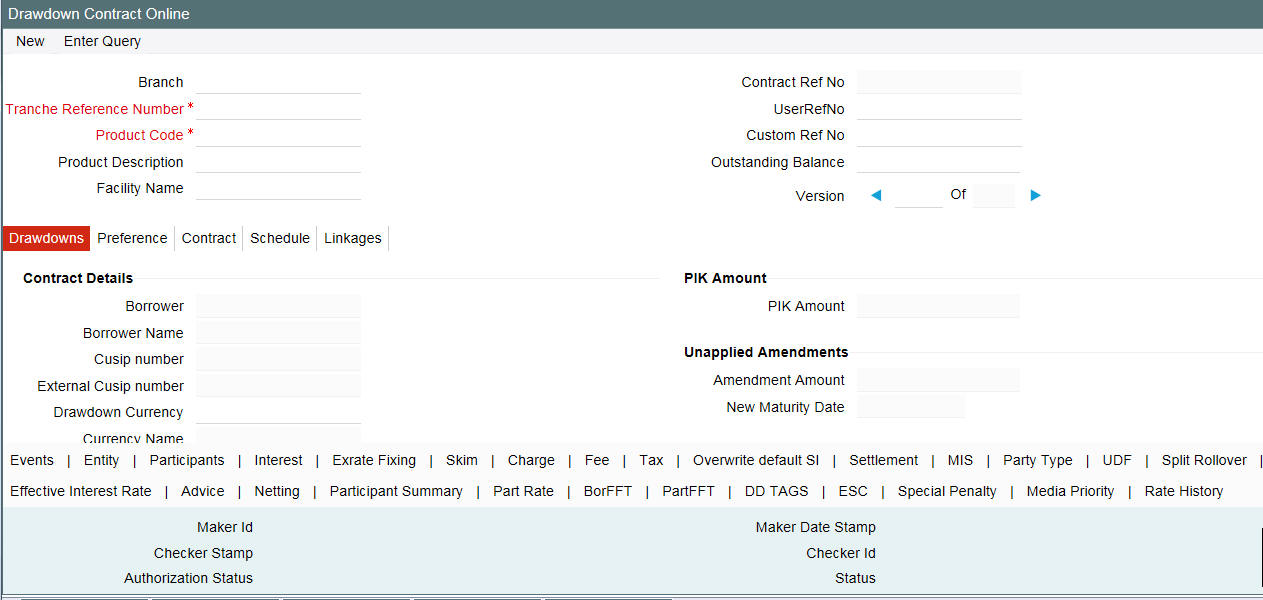

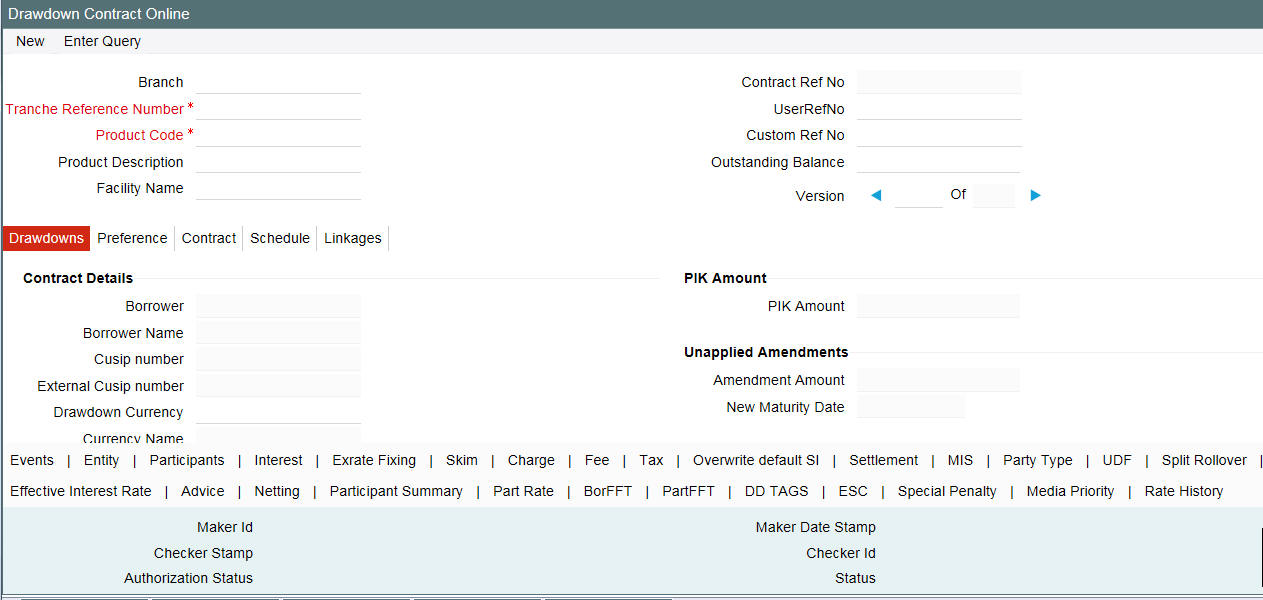

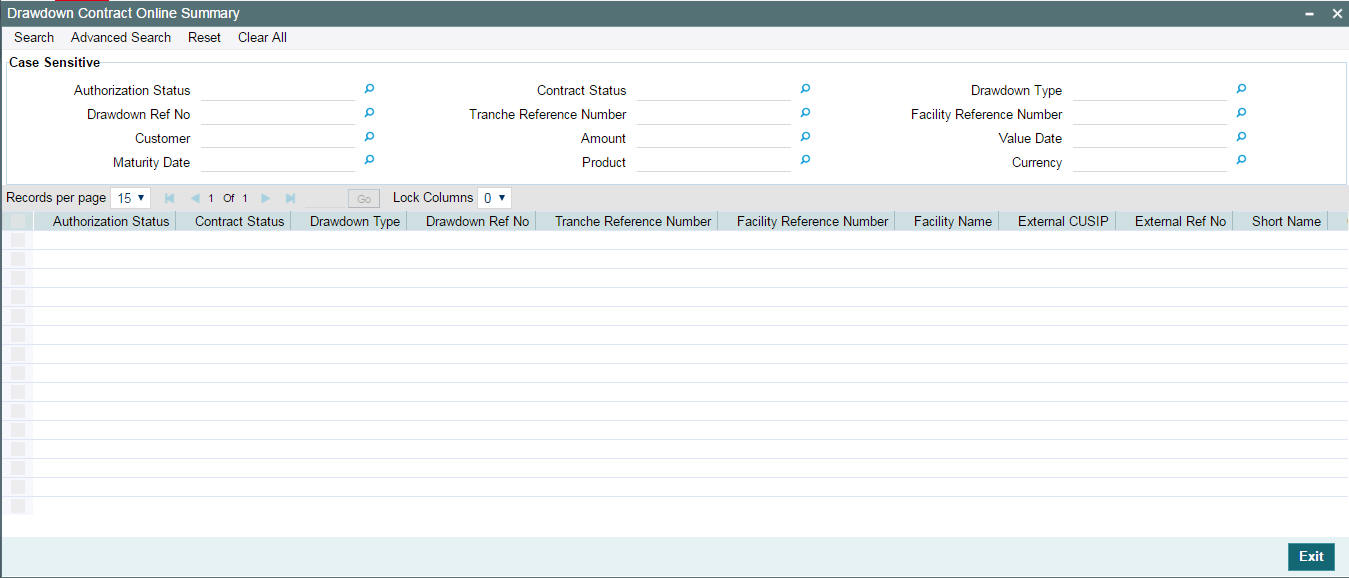

You can process a drawdown contract in the ‘Drawdown Contract Online’ screen. TYou can invoke the ‘DrawDown Online’ screen by typing ‘LBDDDONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen is displayed with details of an existing drawdown contract, as shown below.

When you are capturing a new drawdown, Oracle FLEXCUBE validates the following:

- The current outstanding under the tranche including the new drawdown

should be within the tranche current limit amount.

If there is LC drawdown increase or decrease in principal movements, LC drawdown VAMI using an LC Issuer is validated against the LC Sublimits defined at the tranche level.

You can capture a drawdown contract either by:

- Copying the details from an existing contract

- Associating a product

For more details, refer the heading ‘Entering the facility details’ in this chapter.

6.1.1 A description of the ‘Drawdown Contract Online’ Screen

You can capture the following in for a drawdown:

- The main facility contract under which the drawdown is being entered

- The product under which the contract is processed

- A unique user reference number for the contract

- The counterparty (customer) and currency

- Value date and maturity date

- Transaction Amount, and so on

You capture information pertaining to the drawdown in the following tabs of the screen:

- DrawDown

- Preference

- Contract

- Schedule

- Linkages

In addition, a vertical toolbar provided in the screen, may be used to invoke other sub-systems meant to capture important information for the drawdown.

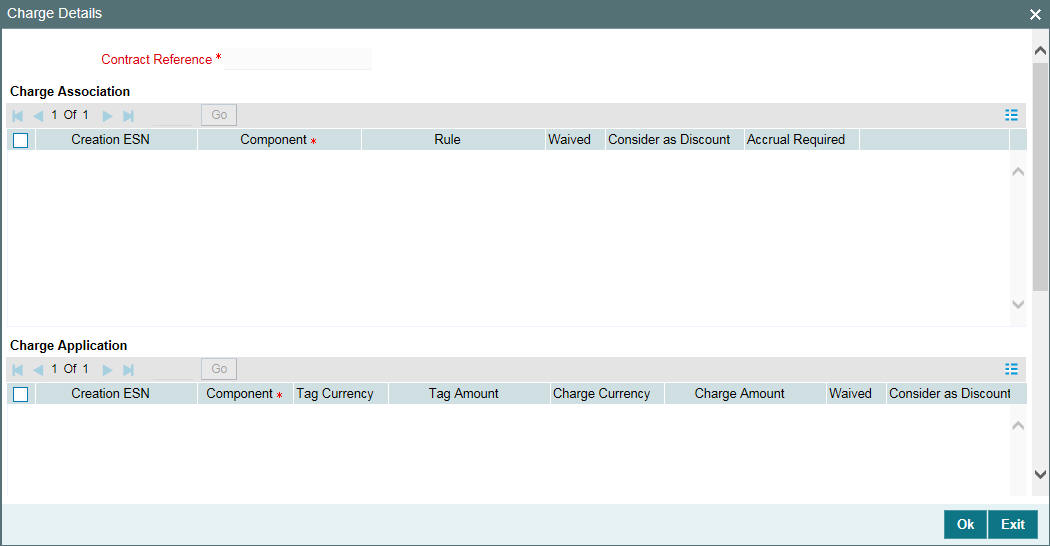

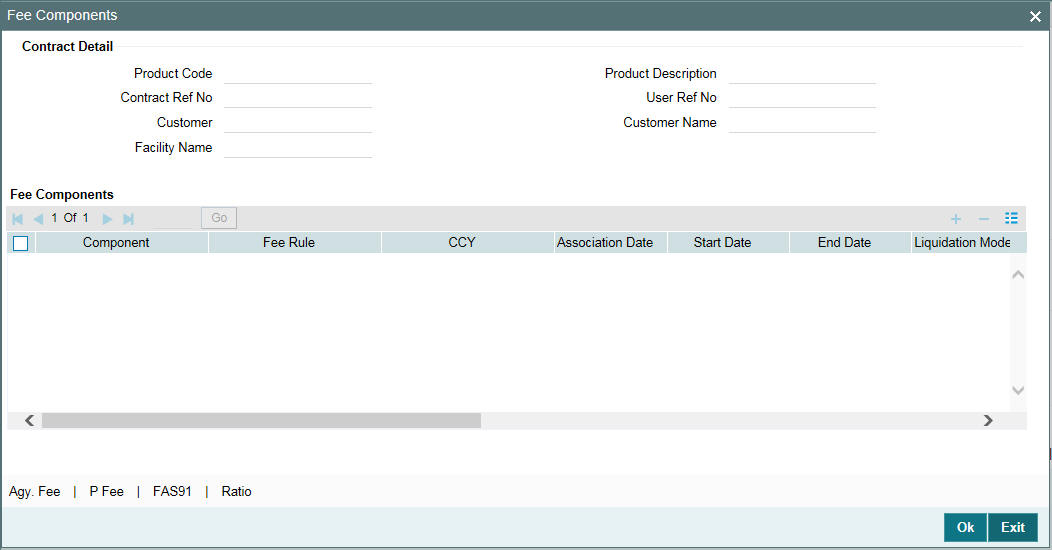

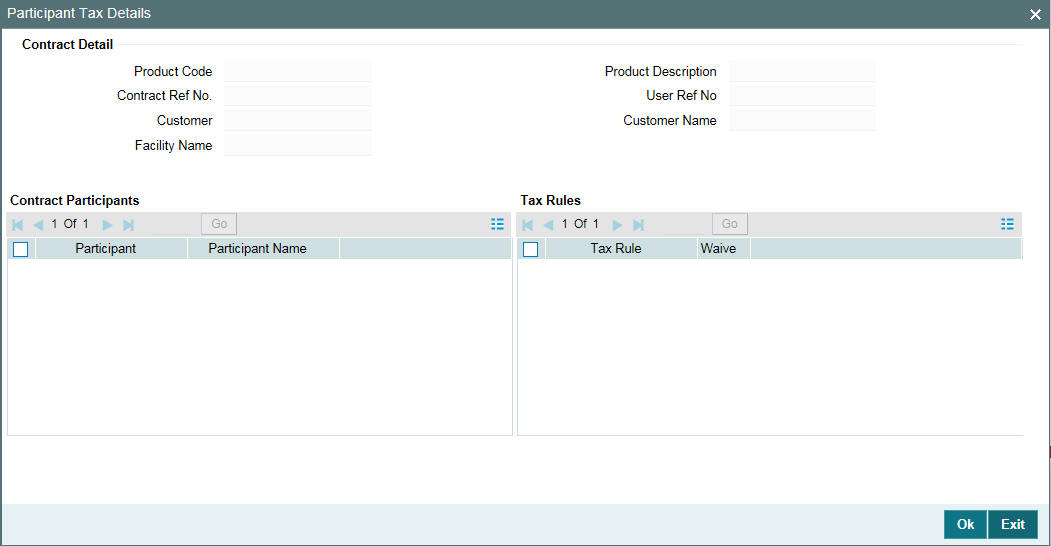

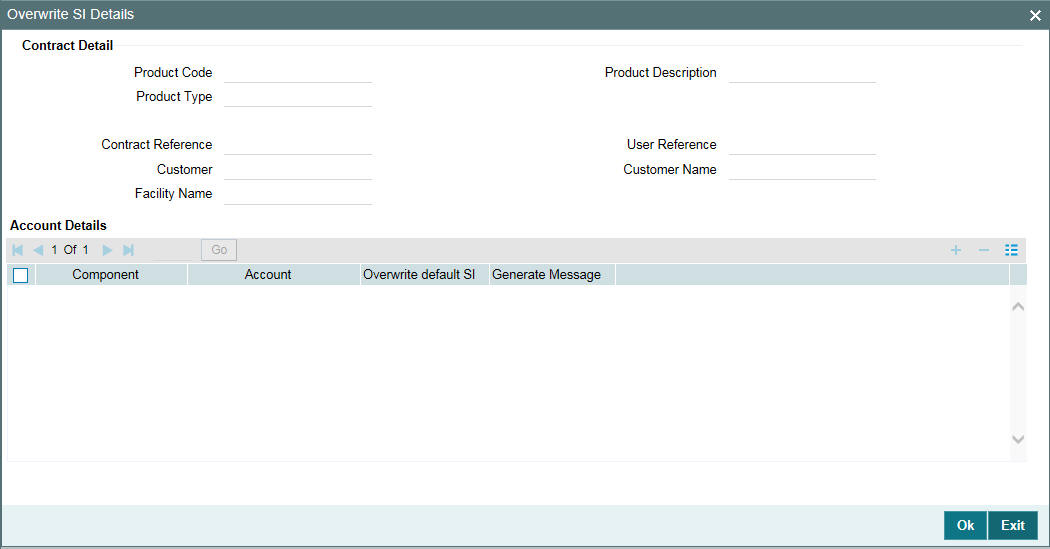

These buttons are same as the ones available for the ‘LB Tranche Contract Online’ screen, except for the following:

‘Entity’ |

Click this tab to view/modify the entity details for the drawdown |

‘Exrate Fixing |

Click this tab to fix the exchange rate for a cross currency drawdown |

‘Interest’ |

Click this tab to view the interest and margin components |

Split Rollover |

Click this tab to specify the spilt rollover details if applicable for the drawdown |

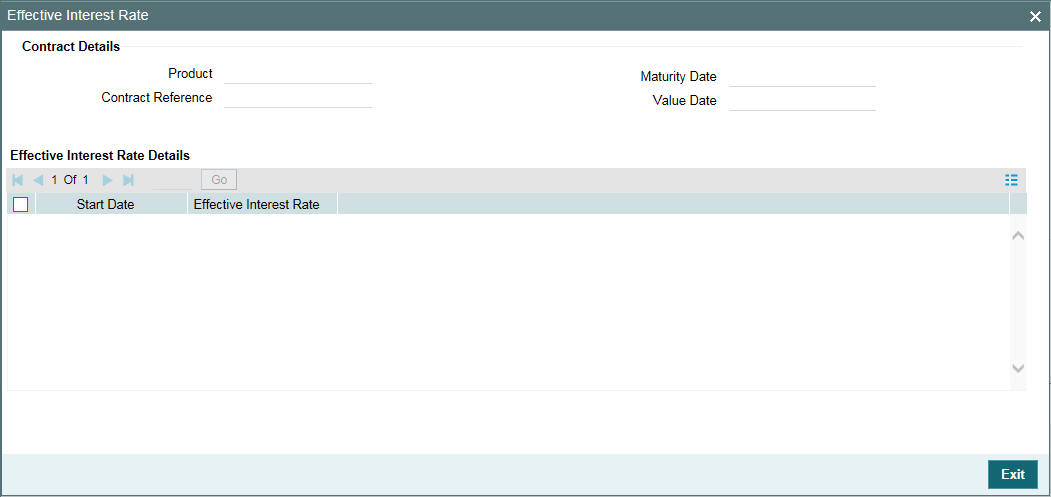

‘Effective Interest Rate’ |

Click this tab to view the Effective Interest (EI) rates for the drawdown |

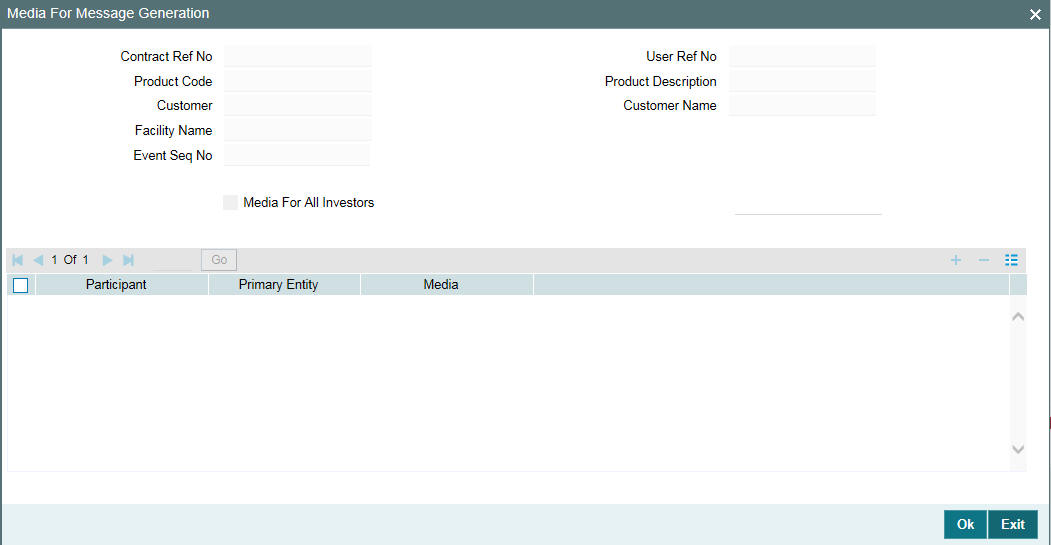

‘Media Priority’ |

Click this tab to specify the media for message generation |

6.2 Capturing Drawdown Details

To capture a new drawdown, click New from the menu.

The ‘Drawdown Type’ is displayed as ‘New’. The contract inherits the details of the template. Alternatively, you can also select the following details to capture a new drawdown:

Branch

Branch for which the drawdown is processed. You can process inter-branch contracts too.

Tranche Ref No

You have to select the reference number of the tranche under which you want to book a drawdown. The option list displays all active and authorized Tranche contracts. When you select the tranche, the system also displays the Tranche User Reference Number and the tranche borrower. In addition, the reference number of the borrower facility contract is also displayed.

Note

When you select a tranche, you have to ensure that all existing drawdowns under the tranche are authorized. If there are unauthorized drawdowns under the selected tranche, the system displays a message to indicate the same when you click the ‘Ok’ button. You are required to select another tranche or authorize the unauthorized drawdown (s) before you proceed.

Agent Ref No

The system displays the FpML Contract Identification number. However, you can modify it.

Borrower

By default, the borrower specified for the selected tranche is displayed here. You can specify a different borrower, if required. The option list displays all the borrowers specified for the tranche.

Drawdown Product

Select the drawdown product you want to use for the drawdown. The option list displays all the drawdown products associated with the tranche under which the drawdown is being processed. The following information defaults to the ‘DRAWDOWN’ tab of the screen (based on the preference defined for the underlying DD product and the tranche):

- Facility Reference Number and Tranche Reference Number

- Drawdown No

- Tranche Amount and Currency

- Customer code and name

- CUSIP No - This is mandatory during Tranche contract input

- Booking Date: This is the date on which the drawdown is captured in the system. This is equal to the current system date and you cannot change it. This date is only for information purposes. The actual accounting entries are passed only as of the Value Date of the drawdown.

- Drawdown Date, Original Start Date and Maturity Date defaults based on the tranche under which the drawdown is being processed.

- Drawdown Type – New

- SSI Pickup At – Component/Currency so on

- Administrator, Agreement Title and Remarks

In the header section of the screen, you have to specify the following:

User Reference Number

The reference number is the identification that you specify for the borrower drawdown. You can specify any identification number. In addition to the Contract Reference Number generated by the system, this number is also be used to retrieve information about the drawdown.

By default, the Contract Reference Number generated by the system is considered to be the User Reference Number for the drawdown.

Custom Ref No

You can capture a unique reference number for the drawdown. This number is used to identify the drawdown in the system. You can also query the drawdown based on this number. The reference number can consist of a maximum of 16 alphanumeric characters.

6.2.1 Capturing Details in the ‘Drawdowns’ and Preferences Tab

You can change some of the default values for a drawdown. You can also capture additional information specific to a drawdown in the ‘Drawdowns’ tab of the screen.

The details that default and those that you can change are discussed below:

External CUSIP/ISIN

Internal and External CUSIP/ISIN is defaulted from the tranche for new drawdowns and cannot be changed at the drawdown level.

If there is a change in the External CUSIP at the tranche level, it gets propagated to the drawdowns for the tranche. The updated details for the drawdown are sent to Markit, a financial system that acts as an inventory for all agency activities, through FpML messages.

Refer the chapter ‘FpML Messaging’ for more details on the updation process

For more information on Internal and External CUSIP Number refer section ‘Capturing Contract Details’ in this chapter.

Currency

You have to select the currency for the drawdown. The option list displays the currencies allowed for the tranche. If the drawdown currency is different from the tranche currency, the system displays the following message:

Exchange Rate needs to be fixed!

The ‘Exchange Rate Fixing Date’ displays the current system date (booking date of the drawdown).

Note

If the drawdown currency is different from the tranche currency and the ‘Exchange Rate Code’ that defaults from the product is not maintained for the currency pair (tranche and drawdown currencies), the system displays an error message.

For more details on exchange rate fixing, refer the heading ‘Fixing exchange rate for the DD currency’ in this chapter.

Amount

Specify the amount being availed by the customer through the drawdown. This amount should be between the minimum and maximum DD amount specified at the tranche level. When you capture the amount, system displays its equivalent in the tranche currency (‘Amount in Tranche Ccy’ field). The sum of all drawdown amounts must not exceed that of the borrower tranche, total facility amount, and global LC sublimit at the tranche level.

Note

- Collateral net available amount is included in the validation for drawdown amount.

- New borrowings are allowed only if the drawdown amount is less than or equal to ((Least of Net Available Collateral Amount for the Drawdown Value Date and Tranche Amount) – (Total Outstanding)).

- If the Borrower is classified, the drawdown amount entered here requires dual-authorization.

- LC drawdown (Issuance) amount for a borrower should not exceed the LC Sublimit defined for the borrower for that currency and the participant.

- The sum of all drawdown amounts are calculated based on the value date of the transaction.

Example

In our first example of the facility contract with Mr. Robert Carr, the drawdown schedules requested by him for the first tranche were as follows:

Portion of loan desired in the first tranche: 50000 USD.

- 20000 USD on 30th January

- 15000 USD on 29th February

- 15000 USD on 31st March

For each drawdown that you enter, you would specify the required amount as specified above.

PIK Margin

The PIK amount carried forward from the parent contract during rollover gets displayed here.

Unapplied Amount

The total uninitiated amount for an increase in drawdown principal for each value dated amendment is displayed here.

New Maturity Date

The unapplied maturity date for a value dated amendment is displayed here.

Drawdown Date

By default, the drawdown date is equal to the value date of the tranche. You can change the date to any date within the tranche period. In addition, the date should be later than the start date of the drawdown product. The date should be captured in ‘DD-MMM-YYYY’ format. The system displays an override if the specified drawdown falls on a holiday of the local currency. The system generates SWIFT messages to be sent to the participants before the drawdown date, intimating them to fulfill their commitment contracts.

Example

In our first example of the facility contract with Mr. Robert Carr, the drawdown schedules requested by him were as follows:

Portion of loan desired in the first tranche: 50000 USD.

- 20000 USD on 30th January

- 15000 USD on 29th February

- 15000 USD on 31st March

Portion of loan desired in the second tranche: 50000 USD.

- 20000 USD on 30th April

- 15000 USD on 31st May

- 15000 USD on 30th June

When you enter this schedule into the system, the drawdown dates you would specify are 30th January, 28th February, 31st March, 30th April, 31st May and 30th June.

Original Start Date

By default, the original start date of the tranche is applicable to the drawdown. You can specify a different date provided the new date is not earlier than the tranche original start date and not later than the tranche maturity date.

Maturity Date

By default, the tranche maturity date is applied. You can change the maturity date such that it is earlier than the tranche maturity date and less than or equal to the drawdown date. If the drawdown is completely paid ahead of the maturity date, then the maturity date is automatically be changed to the date of the drawdown paid.

DD Notice Date

This date is displayed based on the notification days maintained for the DD currency at the tranche level (in the ‘Currency Details’ screen). The notification date is arrived at using the notification holiday processing rules maintained for the tranche.

For details on maintaining notification days and holiday processing rules, refer the heading ‘Specifying currency details for the tranche’ in this chapter.

In case of current dated or back dated drawdowns, the booking date gets defaulted here. You can change the date beyond the booking date but less than or equal to the value date (if the value date and booking date are different). The system displays an override if the notification date is less than the current application date.

Int Rate Fixing Date

The interest fixing date for the DD currency is displayed based on the ‘Interest rate fixing days’ defined for the tranche and the list of holiday currencies maintained for each currency allowed for the tranche.

The interest rate fixing date is the date (prior to the drawdown date) as of which the interest rate is fixed for a new drawdown or for the new rate fix period. If you change the drawdown currency or the drawdown date, the system re-computes the interest rate fixing date and displays the same here.

Exch Rate Fixing Date

Similarly, the exchange rate fixing date for the drawdown currency is displayed based on the ‘Exchange rate fixing days’ defined for the tranche and the list of holiday currencies maintained for each currency allowed for the tranche. Exchange rate fixing for the new drawdown or the new rate fix period is done on this day.

For details on maintaining exchange rate and interest fixing days and holiday processing rules, refer the heading ‘Specifying currency details for the tranche’ in this chapter.

Special Amount

Specify the special amount disbursal, if any.

Note

- For new drawndown, if you enter the negative value in this field, an override message will be displayed.

- If the separate payment message is to be sent for the special amount, the message netting should be set to ‘No’ in the ‘Accounting Entry Definition’ screen of the drawdown product for INIT event.

Industry Code

Specify the industry code. The adjoining option list displays all industry codes maintained in the system. You can choose the appropriate one.

Global DD Amount

The Global Drawdown amount is computed and populated during new drawdown booking based on the Tranche, Global Tranche, and Drawdown amounts. The Global Drawdown Amount is computed as follows:

Global Drawdown Amount = (Global Tranche Amount / Tranche Amount) * Drawdown Amount.

You can amend this amount only for non-lead drawdowns and only if the corresponding Tranche has ‘Cascade Participation’ set to ‘No’. You cannot amend this amount if the underlying Tranche has ‘Cascade Participation’ set to ‘Yes’. The latest Global Amount as on the date of handoff is used for handoff of the Commitment Reduction to the Loans QT system.

However, only those Drawdown Global Amounts, with cascade participation set to N, can be amended using the new screen Global Amount Update/Amendment screen.

Note

The Global Drawdown amount cannot be updated during drawdown amendments.

Drawdown Type

This indicates whether you are defining a new drawdown or renewing an existing drawdown. For a new drawdown, ‘New’ is displayed and you cannot change it.

Renewal Type

The ‘Rollover Method’ you specify for the drawdown product will default here. You can change it at the drawdown level. Specify the manner in which the drawdown should be renewed/rolled over. The options available are:

- Normal: A single new contract is created for the amount you want to rollover.

- Consolidated: Several drawdowns are consolidated into a single new drawdown.

- Split: You can split the original drawdown into multiple drawdowns.

Note

Irrespective of the type of renewal you select here, the system allows you to capture instructions for any one of the renewal types mentioned above. Depending on the type of instructions you capture, the system automatically updates the ‘Renewal Type’ with the latest value when you save the instructions.

Split Message Type

You can select this message type only if the ‘Renewal Type’ is specified as ‘Split’. The message types available are:

- Individual: Select this option to indicate that messages are to be sent only for the individual drawdown schedule being defined.

- Consolidated: Select this option to indicate that messages are to be sent for all drawdown schedules created as a result of the split.

INIT Mode

This specification defaults from the tranche. You can change it for the drawdown, if required. This will indicate the mode of initiating the drawdown in the system. The following options are available:

- Auto: If you select this option, the system automatically initiate the contract on the Value Date. The event ‘INIT’ is fired on this date.

- Semi-Auto: You can select this option to indicate that forward processing is applicable to the borrower drawdown contract during the INIT event. The system processes the events, but hold the messages associated with the event.

For more details on this screen, refer the heading ‘Specifying participant details for the tranche’ in this chapter.

Suppress B.V Fixing Advice

You can check this option to stop the generation of payment messages when back valued schedules for a back-dated drawdown (with initiation date before today’s date) is liquidated.

Ancillary Drawdown

Oracle FLEXCUBE allows you to process Ancillary drawdowns under a tranche. Check this option to indicate that you want to process an Ancillary Drawdown.

This check box is enabled under the following conditions:

- If the drawdown product selected has the ‘Suppress Advices’ option maintained at the product level

- If the tranche contract is of revolving type

A pro-rata tranche is converted to a ‘Non-Cascade’ type once you save the drawdown and it remains as Non-Cascade even on repayment of the drawdown. You can send out participant FFT messages to all the lenders in the syndicate in case of ancillary drawdowns and amendments of the same. You need to maintain a separate advice template for this which you can choose in the FFT screen.

Note

- You can have multiple ancillaries under a tranche.

- You cannot perform back value dated ancillary drawdowns.

Swing Line Drawdown

You can check this option while booking the new drawdown to identify a swing line drawdown. You cannot make any changes to this during the amendments of the drawdown at the contract level.

For more information on swing line refer to Loan Syndication – An Overview chapter.

Note

If you process a swing line drawdown under a tranche for which the ‘Cascade Participation’ option is checked, the system automatically converts the tranche into a non-cascade participation type.

Further, it triggers the event ‘CASC’ to indicate this conversion.

Bidding Contract

You can select this check box to specify whether the contract is of competitive bidding type.

Note

You can process a bidding contract under tranches for which the ‘Cascade Participation’ option is not checked.

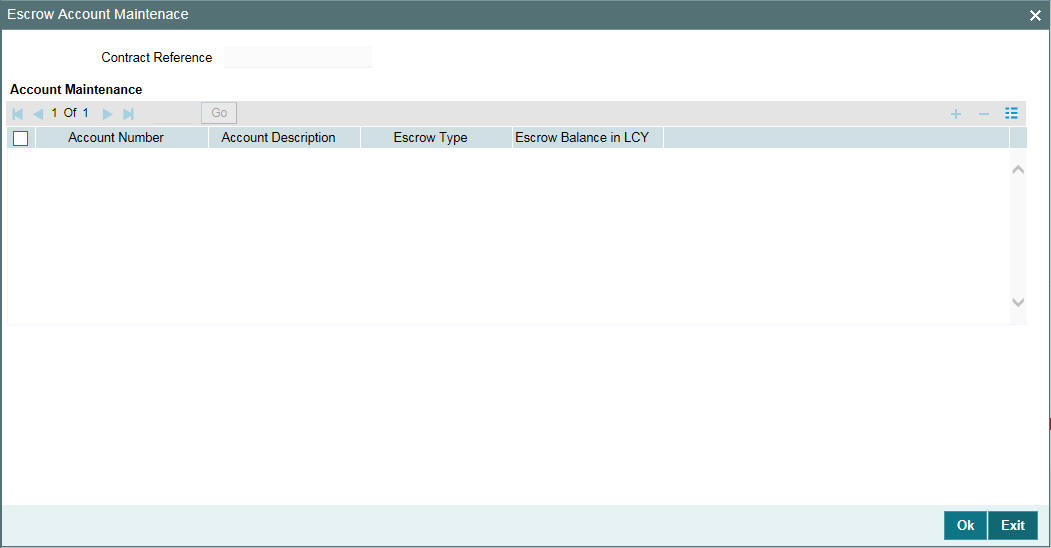

Sighting Funds Applicable

The value for this field is defaulted from the corresponding tranche and you are not allowed to modify this value.

Note

- If the field is selected, then the system does the following validations:

- INIT mode and RENEWAL mode cannot be SEMI-AUTO.

- Liquidation mode is Manual.

- Liquidate Back valued Schedules are set to ‘No’.

- You are not allowed to do any action that result in cascade conversion (swing line, ancillary or non-prorata drawdown).

- You are not allowed to define schedules for the compensatory component. They are defaulted based on the schedules for main interest component.

Liqd Interest on Prepayment

Select this check box to indicate if interest should be liquidated as part of prepayment. This check box is enabled only for Prime contracts.

In other words, you can liquidate an interest component for a contract on prepayment, only if you have selected this check box and also the ‘Prime Loan’ check box for a product in the ‘Loan Syndication – Borrower Product Preferences’ screen.

If this check box is selected, Oracle FLEXCUBE allows you to define only a bullet interest schedule. Otherwise, you can define a frequency-based schedule.

Note

- Prime contracts are Normal or Bearing type.

- Swing line contracts are not applicable for Prime contracts.

- You cannot amend the participant ratio for back valued contracts beyond the last prepayment date if the ‘Liqd Interest on Prepayment’ is checked.

- You can amend the ‘Liqd Interest on Prepayment’ check box, if required, before the first payment for the drawdown contract.

- System allows partial liquidation of interest only for Prime drawdown contracts. This enables you to make partial payment of the interest and fee components.

- Skim is not applicable for prime drawdown contracts.

- At the tranche level, system does not support auto repayment schedule for prime loans. Hence, for prime contracts, the ‘Auto Repayment Schedule’ check box in the Tranche Contract Online screen should be deselected.

- Liquidation of interest is not allowed if the option ‘Partial Prepayment Allowed’ has been selected.

FpML Type

Select this check box to indicate that the FpML type is required for the DrawDown contract.

If you have selected this box, the system does the following:

- Generate the FpML messages for the primary entity provided all the required maintenances and validations are available and satisfied. However, for non-primary entities, it generates the messages based on the media order maintained in the ‘Customer Entity Maintenance’ screen.

- Generate the message with the next priority media maintained in the ‘Customer Entity Maintenance’ screen if any FpML maintenance is not available for the message or participant does not have ‘Send FpML’ chosen at the entity level.

- Generate the message irrespective of the media order maintained in the ‘Customer Entity Maintenance’ screen in case if all FpML maintenance is available and ‘Send FpML’ is chosen at the entity level

If you have not selected this check box and the ‘Media Priority’ option is selected at the product level, then ‘Media Priority’ tab is enabled.

For more information, refer the section ‘Specifying Media for Message Generation’ in this chapter.

Partial Prepayment Allowed

Select this check box to indicate that for drawdown products, partial prepayment is allowed.

Note

Partial prepayment is allowed only for drawdown products where,

- ‘Sighting Funds Applicable’ option has not been selected

- Schedule Type is ‘Normal’

- ‘Lender of Records’ option has been selected

LC Type

This specification defaults from the product. You may change it at the contract level, if required. The available types are:

- Standby LC

- Commercial LC

Note

You can select the type of LC only if the ‘LC Drawdown’ option is checked for the drawdown.

If you check the ‘LC Drawdown’ option for the product, the same defaults to all drawdowns and you cannot amend it at the drawdown level.

LC Issuer

If the drawdown is an LC type of drawdown, you have to select the issuer of the LC as mandatory information. The option list displays the names of participants you have identified as issuers of LC. This is done at the tranche level.

The LC Issuance Fees is paid to the participant who is identified as the issuer of LC. This fee is computed on the outstanding amount of all the LC drawdowns for the selected issuer.

For more details on this, refer the heading titled ‘Identifying participants as issuers of LC’ in this chapter.

Int/Fee Distribution

System displays the method in which the interest and fee components are distributed among the participants when an assignment is executed before the liquidation date. The distribution type is classified into - ’Lender of Actuals’ type and ’Lender of Record’ type.

This is defaulted from the tranche level.

SSI Pickup At

This option defaults from the tranche. You can opt for a different value for the drawdown, if required. This indicates the basis for picking up the SSI (Standard Settlement Instructions) Mnemonic for the drawdown.

The available options are:

- Currency: If you select this option, the system allows you to select the SSI Mnemonic for each allowable currency for each participant in the ‘Participant Ratio Details’ screen. The SSI Mnemonic selected is applicable to all the components for the drawdown participant.

- Component: This option allows you to select the SSI Mnemonic for each component defined for each participant of the drawdown. This is done in the ‘Participant Ratio Details’ screen.

For more details on this screen, refer the heading ‘Specifying drawdown participant details’ in this chapter.

Billing Notice Days

This defaults from the drawdown product. You can change default value, if required.

This indicates the number of working days before the repayment due date when a billing notice should be generated, to be sent to a customer as a reminder of the payment.

PIK Rollover with capitalization

Select this check box to indicate that the PIK rollover with capitalization is allowed for the contract. You can amend this value after the Rollover is removed\reversed. You cannot amend the value if the interest component linked to Tranche PIK margin component is having non- zero rate.

Interest Payment Propagation

Select the interest payment for the drawdown from the below two options:

- Cash

- Normal

Cash payment can be processed as part of manual payment, split rollover and consolidated rollover processing. The field value for the child contract gets defaulted from parent contract during split rollover processing. During consol rollover processing, the value gets defaulted to child contract from the driver contract.

You cannot book drawdown booking with ‘Interest Payment Propagation’ as ‘Cash’ if below mentioned existing flags are checked for drawdown contract

- Partial Prepayment Allowed

- Liquidate Interest on Prepayment

You cannot book drawdown under lead tranche with ‘Interest Payment Propagation’ as ‘Cash’.

After the drawdown is authorized, amendment of interest payment propagation is allowed under the below validations:

- If cash interest payment is processed in partial or full for a drawdown with Interest Payment Propagation as ‘Cash’ and if the payment is active, then amendment from ‘Cash’ to ‘Normal’ is not allowed and system provides an appropriate error message. Amendment from ‘Cash’ to ‘Normal’ is allowed upon reversal of all active cash payments.

- You cannot amend from ‘Normal’ to ‘Cash’ if ‘Partial Prepayment Allowed’ is selected at contract level; if interest payment exists on drawdown then, the system does not allow to deselect the flag 'Liqd int on prepayment’.

- You can amend from 'Normal' to 'Cash' to allow user to deselect the flag 'Liqd interest on prepayment' even if an active interest payment exists. If the flag is selected then amendment from ‘Normal’ to ‘Cash’ does not allowed.

- If user performs amendment from ‘Normal’ to ‘Cash’ and then capture split rollover instruction with cash interest payment as part of same CAMD then user is not allowed to change back the value from ‘Cash’ to ‘Normal’ during the amendment.

For the drawdowns under lead tranches, the value is ‘Normal’ always. All the existing lead and non lead tranches, the ‘Interest Payment Propagation’ gets updated as ‘Normal’.

Named Agent

System defaults the value of the named agent maintained in the tranche contract online screen, while booking a new drawdown, in this field.

System also displays the name of the named agent adjacent to the Named Agent field.

Agreement/Administrator/Internal Remarks

These details gets default from the tranche contract and may be changed at the drawdown level.

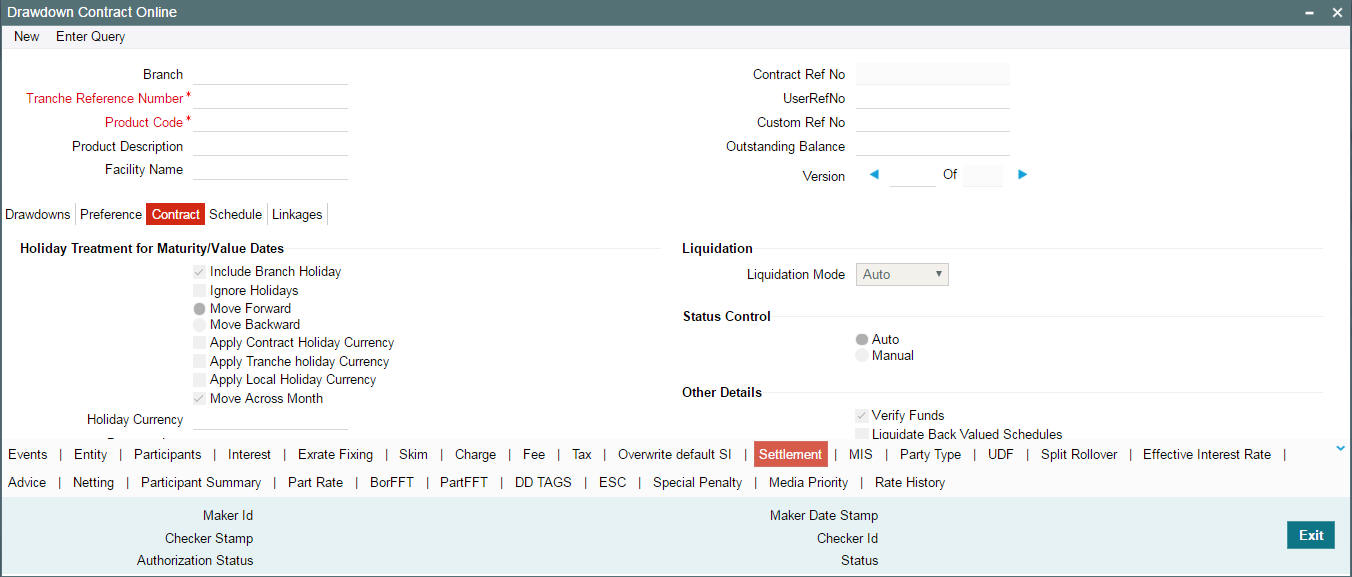

6.2.2 Capturing Details in the ‘Contract’ Tab

You can capture the other contract details in the ‘Contract’ tab of the screen.

The following contract details applicable for drawdowns are explained below:

Liquidation

Mode of liquidation of interest and fee components associated with the drawdown defaults from the drawdown product.

At the drawdown level, you can change the mode to any one of the following methods:

- Auto: The system automatically liquidates the schedule during EOD on the schedule due date of the component.

- Manual: In this mode, you have to liquidate the components manually through the ‘Contract Payment’ screen. Fee components should be liquidated through the ‘Fee Liquidation’ screen.

For more details on ‘Contract Payment’ screen, refer the heading ‘Processing Repayments Manually’ in the ‘Processing Repayments’ chapter of this User Manual.

For more details on ‘Fee Liquidation’ screen, refer the heading ‘Liquidating Fee Components’ in the ‘Processing Charges and Fees’ chapter of this User Manual.

- Component: If you choose this option as the mode of liquidation, the system automatically liquidates the components as per the order you maintain in the ‘Component Liquidation Order’ screen at the product level. The order is maintained as part of specifying product preferences.

- Semi-Auto: If you choose this option, the message that should get generated during liquidation (Event: LIQD) will be kept on hold. The messages are available in the ‘Outgoing Message Browser’ with status ‘Hold’. You need to use the ‘Events for Forward Processing’ screen to release the messages.

For more details on this screen, refer the heading ‘Forward processing of events’ in this chapter.

Status Control

The statuses - for example, Active, Past Due Obligation, Non-Accrual Basis, and Write-Off , and so on. defined for the product in the ‘Status Maintenance’ screen is applicable for the drawdown. You have to indicate the mode of status change for a drawdown.

The options are:

- Auto – If you select this option, system automatically moves the drawdown from one status to the other based on the criteria maintained for status change (in the ‘Status Maintenance’ screen).

- Manual - If you select this option, user intervention is required to move the drawdown from one status to the other.

For details on the ‘Status Maintenance’ screen, refer the heading titled ‘Maintaining status rules for a syndication product’ in the ‘Reference Information for Loan Syndication’ chapter of this User Manual.

Limit Line

When you are entering a borrower drawdown, specify the credit line under which exposure would be tracked, if required. The credit lines selected for the drawdown customer (borrower) is displayed in the option list provided.

Amortization Type

You need to specify the amortization applicable to the drawdown only if the schedule type is ‘Amortized’. The following options are available:

- Reducing Balance: The reducing balance method is used for calculating interest on the reduced principal/outstanding balance for each repayment schedule. The principal repayment would be the difference between the equated monthly installment and the interest, for each schedule.

- Rule of 78: This method is used to determine how much of each monthly payment is paid towards interest and how much is paid towards the principal component. First, you will compute the total interest on the original principal amount. Then, you will divide this interest amount equally into n parts, where n is the number of schedules and divide the loan principal amount also into n equal parts, so that each equal installment is basically a sum of the two. Subsequently, you will apply the rule of 78 to calculate how much of the EMI goes towards interest and principal.

Examples:

Case 1: Reducing balance

Assume that you have disbursed a drawdown with the following details:

- Principal – 10,000 USD

- Interest Rate – 10%

- Interest Calculation Method – Actual/360

- Start Date - 12/1/2000

- End Date - 11/30/2001

- Days in the year – 364

Based on the reducing balance method, the interest, principal and the EMI is as follows:

Sl. No |

Interest |

Principal |

EMI |

Outstanding Bal |

1 |

86.11 |

$793.05 |

$879.16 |

$9,206.95 |

2 |

79.28 |

$799.88 |

$879.16 |

$8,407.07 |

3 |

65.39 |

$813.77 |

$879.16 |

$7,593.30 |

4 |

65.39 |

$813.77 |

$879.16 |

$6,779.53 |

5 |

56.50 |

$822.66 |

$879.16 |

$5,956.88 |

6 |

51.30 |

$827.86 |

$879.16 |

$5,129.02 |

7 |

42.74 |

$836.42 |

$879.16 |

$4,292.60 |

8 |

36.96 |

$842.20 |

$879.16 |

$3,450.40 |

9 |

29.71 |

$849.45 |

$879.16 |

$2,600.95 |

10 |

21.67 |

$857.49 |

$879.16 |

$1,743.46 |

11 |

15.01 |

$864.15 |

$879.16 |

$879.31 |

12 |

6.11 |

$873.05 |

$879.16 |

$6.26 |

The interest for the first schedule is computed on the loan principal (10,000) for the first month (31 days) using the following formula:

(10000 * 10 * 31) / (100*360)

Interest for the subsequent schedules are computed on the outstanding principal for each schedule.

Case 2: Rule of 78

Consider the drawdown details mentioned in case 1.

Total interest on the loan = (10000 * 10 * 364) / (100*360) = 1011.11

Interest for each schedule = 1011.11/12 = 84.26

Principal for each schedule = 10000/12 = 833.33

EMI = 833.33 + 84.26 = 917.59

First month’s interest = 12/78 times $1011.11 = 155.56

(78 is the sum of integers from 1 to 12)

Therefore, principal for the first month = 917.59 – 155.56 = 762.03. The interest, principal, and EMI due for each schedule is as follows:

Sl. No |

Interest |

Principal |

EMI |

1 |

155.56 |

762.03 |

917.59 |

2 |

142.59 |

775.00 |

917.59 |

3 |

129.63 |

787.96 |

917.59 |

4 |

116.67 |

800.92 |

917.59 |

5 |

103.70 |

813.89 |

917.59 |

6 |

90.74 |

826.85 |

917.59 |

7 |

77.78 |

839.81 |

917.59 |

8 |

64.81 |

852.78 |

917.59 |

9 |

51.85 |

865.74 |

917.59 |

10 |

38.89 |

878.70 |

917.59 |

11 |

25.93 |

891.66 |

917.59 |

12 |

12.96 |

904.63 |

917.59 |

Total |

1011.11 |

9999.97 |

11011.08 |

User Defined Status

If you have not checked the ‘Schedule Level’ status processing for the drawdown product (as part of product preferences), you have to specify the drawdown status here. For a new drawdown, the default status is ‘NORM’ (Normal). You cannot change the status of any of the schedules in this case. You can select from a list of user-defined statuses maintained for the drawdown product (in the ‘Status Maintenance’ screen).

If you have defined schedule-level status processing for the drawdown product, you cannot change the status of the contract in this field. You can change the status of any of the schedules, as required, and the status of the contract is determined as the worst status among the individual statuses of the schedules.

6.2.2.1 Specifying Holiday Treatment for Maturity/Value Date of the Drawdown

In this section of the screen, you can specify the holiday treatment preferences for value date and maturity date falling due on holidays defined for the branch. The holiday treatment details maintained for the drawdown product defaults to the drawdown. You can change your preferences for the drawdown.

For more details on the options available, refer the heading ‘Specifying Additional Preferences for Loan Syndication’ in the ‘Defining Products for Loan Syndication’ chapter of this User Manual.

6.2.2.2 Viewing the Agency Type

The agency type of the transaction (Lead or participation) is defaulted from LB Tranche Contract Online and you are not allowed to change it during Drawdown contract booking or Amendment.

- Lead - Your bank is the lead agent for the syndication transaction.

- Participation - Your bank is one of participant in the syndication transaction.

6.2.2.3 Specifying ‘Other’ Details

Following details have to be captured in the ‘Other Details’ section of the screen:

Verify Funds

When the system debits the borrower’s repayment account for liquidation (repayment), you can specify that the availability of funds for liquidation of the various components of the drawdown has to be ascertained before liquidation is done.

Check this option if you want the availability of funds to be checked before automatic liquidation is done. By default, this option is selected.

Liquidate Back Valued Schedules

If you have specified, while defining the product, that for a back-dated tranche or drawdown loan contract (which has an initiation date which falls before today’s date), with schedules prior to today’s date, the schedules have to be liquidated when the drawdown is initiated, the same will apply to the drawdown you are processing. However, through this field, you can choose not to liquidate back valued schedules by leaving this field blank.

6.2.2.4 Specifying Loan Statement Details

The following loan statement details may be maintained:

Statement Type

You can specify if a loan statement needs to be generated for the drawdown. If loan statements are to be generated, you can specify the type of statement you want to generate. The options are:

- Summary

- Detailed

If you do not want to generate loan statement, select the ‘None’ option.

Cycle/On

If loan statements have to be generated for the drawdown, you have to indicate the frequency of statement generation. You can set the frequency to any one of the following options:

- Annual

- Semi-Annual

- Quarterly

- Monthly

- Fortnightly

- Weekly

- Daily

Based on the frequency that you specify, you can also indicate the month/weekday for the generation of the statement. Thus, if you have set the loan statement generation frequency to Annual, Semi-Annual, or Quarterly, you have to indicate the month in which the first statement is to be generated.

Similarly, if you have indicated that statement generation is to be on a fortnightly or weekly basis, you should specify the day of the week on which the statement is to be generated. For instance, if you indicate that a weekly generation should be done on Thursday, the statement is generated every week on Thursdays.

When the frequency is set to monthly, then by default, the statement is generated on the last day of every month. You can also select a different day from the drop-down menu.

6.2.2.5 Specifying Rollover Details

The rollover applicability is explained below:

Rollover (Yes/No)

While setting up the drawdown product, if you specified that drawdowns involving the product should be automatically rolled-over, then all drawdowns involving the product is rolled-over on their respective maturity dates. This feature is called auto rollover. If rollover is specified for the product, the same is applicable for the drawdowns.

If you do not want to rollover the drawdown, you can select the ‘No’ option. However, if rollover is not allowed for the product, you cannot opt for rollover at the drawdown level.

Note

This option is set to ‘No’ and is disabled if the option ‘Partial Prepayment Allowed’ has been selected.

Count

If rollover is applicable for the drawdown, the system displays the rollover count in this field. For a drawdown that has been rolled-over, this count indicates the number of times it has been rolled-over.

6.2.2.6 Specifying the Rounding Details

The drawdown contract inherits the currency-wise rounding rules defined for interest components, in the interest class associated with the drawdown product (as defined in the ‘Interest Class Definition’ screen).

Int Period Basis

This field indicates how the system must consider the tenor basis upon which interest is computed over a schedule or interest period. You can select the required option from the drop down list.

- Include Frm Dt: For all schedules, the period considered for interest calculation would include the start date and exclude the end date. Therefore, the drawdown value date is considered for interest calculation while the maturity date is excluded.

- Include To Dt: In this case, the period considered for interest calculation excludes the drawdown start date and include the end date.

- Include Frm & To Dt: The period considered for interest calculation includes both the value date and the maturity date.

- Exclude Frm & To Dt: The period considered for interest calculation excludes both the value date and the maturity date.

Rounding Rule

Indicate the currency rounding rule that must be applied to round off interest amounts in the selected currency, for the main interest component. The following options are available in the drop down list:

- Truncate

- Up

- Down

- Round Near

Decimals

This indicates the number of digits after the decimal place, to which interest amount in the specified currency, is to be truncated. This specification can only be made for the rounding option ‘Truncate’. If you do not specify a value here, the system uses the number of decimals defined for the drawdown currency (in the ‘Currency Definition’ screen).

The number of decimals specified in this field cannot exceed the number of allowed decimal places defined for the specified currency (in the ‘Currency Definition’ screen).

Units

This field indicates the lowest possible measure in which interest amounts can be considered in the specified drawdown currency. This value cannot be less than the rounding unit for the specified currency (as maintained in the ‘Currency Definition’ screen). If not specified, the system picks up the rounding unit maintained for the drawdown currency.The following details default to screen and you cannot change them:

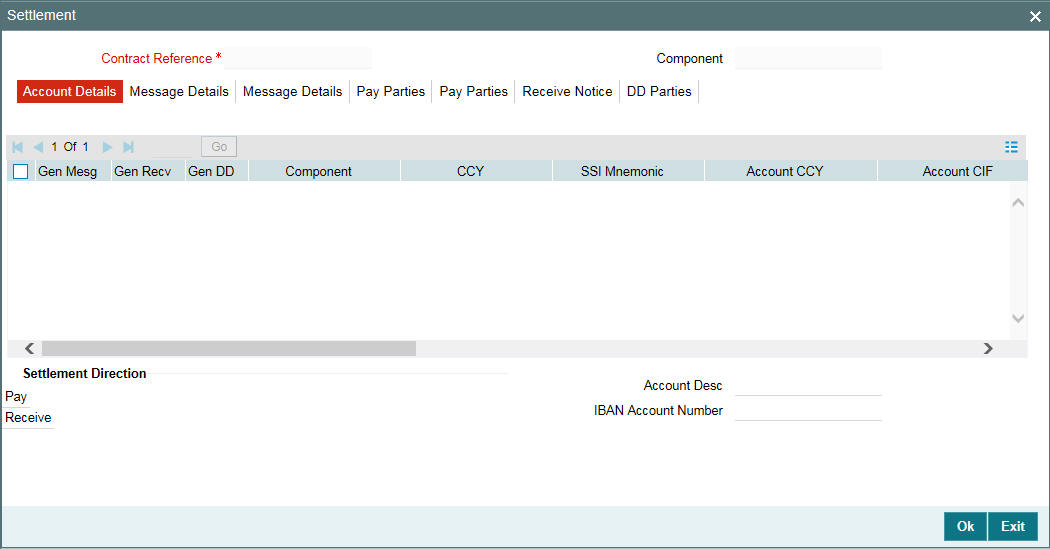

- Settlement details for the borrower – Settlement (Cr/Dr) Branch, Account and Currency.

- Payment Method: Bearing, Discounted or True Discounted as defined for the drawdown product.

- Schedule Type: Normal, Capitalized or Amortized, as defined for the drawdown product.

- Reporting Currency details: The equivalent of the drawdown amount in the reporting currency and the outstanding amount gets updated as and when repayments are made.

For more details on the ‘Currency Definition’ screen, refer the ‘Currency Maintenance’ chapter of the CS (Core Services) User Manual.

6.2.2.7 Specifying Revaluation Preferences

If Reval Reqd is ‘Yes’ for the drawdown product, the same defaults to the drawdown processed with the product. You can, however, change the preferences for a specific drawdown. But, if ‘Reval Reqd’ is ‘No’ for the product, you cannot change it to ‘Yes’ at the drawdown level and revaluation will not be applicable for such drawdowns. The following preferences become mandatory if revaluation is applicable:

Exchange Rate Code

This indicates the code for the exchange rate that must be used to convert the drawdown amount from the drawdown currency to its equivalent in the tranche currency. The option list will display the rates codes maintained for the currency pair (tranche and drawdown currencies) involved in the conversion. During revaluation, system picks up the exchange rate maintained for the selected rate code and rate type corresponding to the currency pair.

Exchange Rate Type

This refers to the type of exchange rate that must be used to convert the drawdown amount from the drawdown currency to the tranche currency. The available options are:

- Buy

- Mid

- Sell

Frequency

This is the frequency or periodicity at which automatic revaluation should be performed. The options available are:

- Daily

- Monthly

- Half-Yearly

- Quarterly

- Yearly

Start Month and Start Day

For the frequency selected, you must also specify the month and the date according to which the system commences the revaluation process.

6.2.2.8 Viewing Revaluation Schedules

If Reval Reqd is ‘Yes’, Oracle FLEXCUBE creates the revaluation schedules based on the Frequency, Start Month and Start Day you specify as part of the revaluation preferences for the drawdown. The system also takes into account the holiday preferences in the ‘Holiday Treatment for Schedule’ section of the ‘SCHEDULE’ tab to arrive at the schedule dates.

The following ‘Contract Details’ are displayed in this screen:

- Product Code

- Contract Reference Number

- User Reference Number

- Customer

The following ‘Revaluation Schedules’ details are displayed in the Contract tab for each schedule:

- Schedule Date: This is the date on which revaluation occurs. For instance, if you have a drawdown initiated on 1-Dec-06 with the Revaluation Frequency as ‘Monthly’ and Start Day as 15. The revaluation schedules would be 15-Dec-06, 15-Jan-07, and so on.

- Rate Code and Rate Type: These correspond to the Exchange Rate Code and Exchange Rate Type respectively that is used to convert the amount in the drawdown currency to its equivalent in the tranche currency.

- Status: This indicates the status of the revaluation process as on

the revaluation schedule date and can display any one of the following

values for a schedule:

- Processed: Indicates a successful revaluation process

- Skipped: Indicates a skip in the process as a result of the revaluation date falling before the current rate fixing end date. Also applicable if the revaluation schedule is in the past for back valued drawdowns.

- Failed: Indicates a failure in applying revaluation due to reasons such as non-availability of the rate or if the new rate results in lack or insufficient availability of funds.

- Unprocessed: Applicable for all future schedules

- Applied Date: Indicates the date on which the revaluation was successfully applied. For instance, say that revaluation fails on 15-Jan-07 as a result of the drawdown amount exceeding the tranche available amount, after conversion with the new rate. On 16-Jan-07, during BOD batch, Oracle FLEXCUBE will try to perform a reval using the rate available on 16-Jan-07. If revaluation succeeds, the Applied Date would be 16-Jan-07.

- Applied Rate: This is the rate that was applied for revaluation i.e. the rate using which the amount in the drawdown currency was converted to its equivalent in the tranche currency.

- Remarks: Displays the remarks such as reasons for success, failure, and so on.

Note

- Auto revaluation is initiated on the schedule dates as part of automatic batch processes run during the EOD operations at your branch. The BOD batch process takes up only the failed schedules and will not include the schedules due on that date.

- If you change the maturity date of the drawdown through a VAMI (Value Dated Amendment Initiation), the system repopulates the revaluation schedules in accordance with the new maturity date.

For more details on revaluation, refer the heading titled ‘Processing revaluation of drawdowns’ in this chapter.

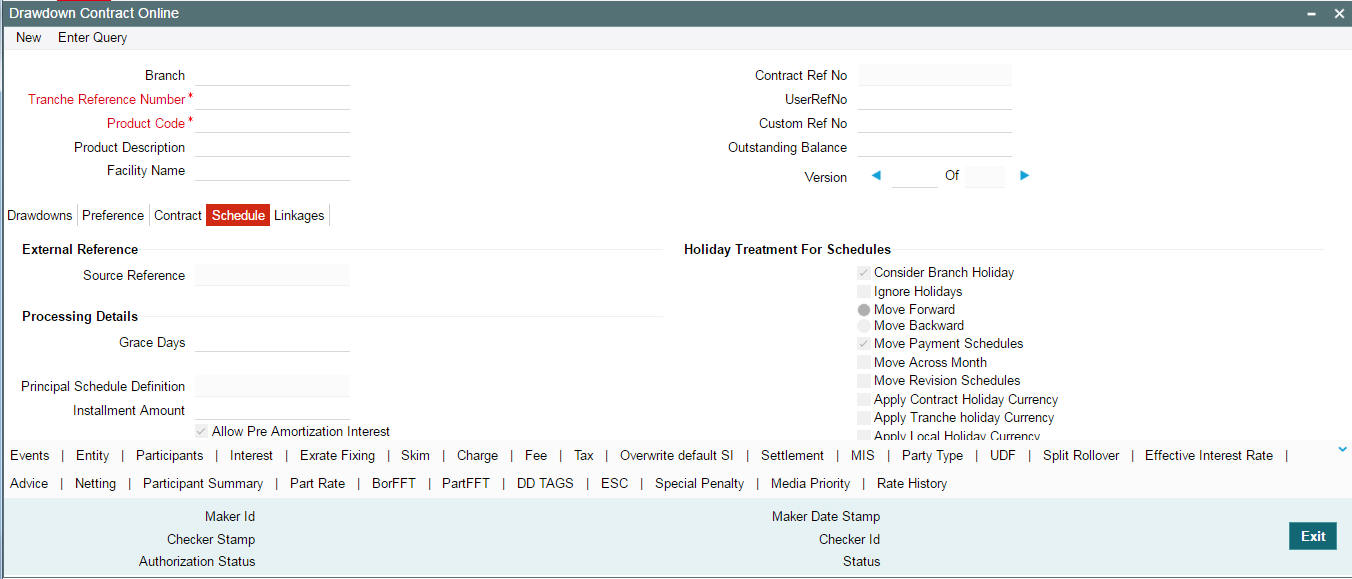

6.2.3 Capturing Details in the Schedule tab

You can capture the details pertaining to the drawdown schedule in the ‘SCEHDULE’ tab.

The information available in this screen is discussed below:

6.2.3.1 Specifying Holiday Treatment for Schedules

The holiday treatment you specified for the DD product defaults to the drawdown. However, you can change the details, if required.

Note

The system redefines the future schedule dates for Principal, Fees, and Interest components based on the changes made.

For details on the available options, refer the heading ‘Specifying Additional Preferences for Loan Syndication’ in the ‘Defining Products for Loan Syndication’ chapter of this User Manual.

6.2.3.2 Processing Rules

Grace Days

For drawdown contract, system defaults the value maintained for ‘Grace Days’ at the borrower drawdown product level. However, you can edit the default value of grace days during contract input or contract amendment. During contract amendment, the amended value is applicable only to future calculations of late payment charges. While saving the drawdown, system displays the following override message:

‘Grace Days for drawdown is defaulted from the tranche contract, do you wish to continue?’

You can accept the override message by clicking the ‘Ok’ button to continue with the save process. In this case, system defaults the value for grace days from linked borrower tranche contract. If you reject the override, then system defaults the value of ‘Grace Days’ from the drawdown product.

6.2.3.3 Specifying Repayment Schedule Details

The repayment schedule definition for the drawdown is based on the repayment processing rule specified at the tranche level. The available rules are:

- FIFO (First In First Out)

- Pro-rata

- LIFO (Last In First Out)

For more information on the above rules, refer the heading ‘Specifying processing rules for the tranche’ in this chapter.

Further, it also depends on the ‘Auto Repay Schedule’ option defined for the tranche (in the ‘Schedule’ tab of the ‘LB Tranche Contract Online’ screen).

- If this option is checked, the rule specified at the tranche level is applied for defining the repayment schedules for the drawdowns processed under the tranche. In this case the ‘Principal Schedule Definition’ is marked as ‘AUTO’ (in the ‘Schedule Details’ section of the ‘Schedule’ tab) and you cannot change it. However, you can amend the schedules, if required. If amendments are made, auto scheduling will not happen for further drawdowns.

- If the option is not checked, the schedules defined for the DD product is applied for drawdowns under the tranche. For such drawdowns, the ‘Principal Schedule Definition’ is marked as ‘MANUAL’ (in the ‘Schedule Details’ section of the ‘Schedule’ tab) and you cannot change it. In this case also, you can amend the schedules, if required. However, if you make amendments, auto scheduling does not happen for further drawdowns.

Note

The drawdown repayment schedules are determined by the reduction schedules only for drawdowns with the following attributes which are defined as part of drawdown product preferences.

- Payment Type - Bearing

- Schedule Type – Normal

The repayment schedule details include the following:

Type

In the ‘Schedule Details’ section of the screen, you can define the following types of schedules:

- P: Repayment schedules

- R: Interest rate revision schedules (for interest components of type ‘Floating’ and ‘Periodic’)

- F: Interest rate revision schedules (for interest components of type ‘Fixed’)

Component

In this field, you have to specify the component for which the schedule is being defined. All components - the principal and other components, depending upon your association with the drawdown product will be available in the form of an option list. You have to define schedules for each of them.

When defining repayment schedules for specific loans, the amount of repayment needs to be specified only for the principal. The interest, commission and fee amounts are calculated by the system, automatically, depending on the repayment date and amount of the principal.

Note

For amortized schedules, you cannot define schedules for the principal. The component is displayed as ‘AMORTISE’. You should specify the frequency of amortization.

Start Date

This is the date on which the first repayment or rate revision becomes due for the schedule being defined. Subsequent dates will be calculated based on this date and the frequency you specify in the next field. Any repayment or rate revision schedule date falling on a holiday is handled as per the holiday treatment specifications you define.

This date should be the same or later than the Value Date and same or earlier than the Maturity Date of the drawdown.

No.

Based on the frequency and the unit of frequency, you have to specify the number of schedules for the component. For instance, if you want the schedules to fall due once a month for 12 months, then you need to specify the following details:

- Frequency: Monthly

- Unit: 1

- No: 12

Frequency

This indicates the frequency/interval at which the schedules fall due. The available frequencies are:

- Daily

- Weekly

- Monthly

- Quarterly

- Half-yearly

- Yearly

- Bullet: One bullet schedule is automatically defined for each component based on the drawdown available amount.

Note

You can specify only bullet schedule for PIK interest component. PIK margin maintained at the ‘Margin Maintenance’ screen is automatically picked up for the PIK margin component.

Unit

Unit of frequency identifies the number of occurrences within a frequency, for example, . Unit ‘2’ and Frequency ‘Monthly’ means bimonthly frequency that is, the schedule occurs once in 2 months. Similarly, if you want a payment every 15 days you have to specify the frequency as ‘Daily’ and enter the units as ‘15’.

Amount

When defining repayment schedules, the amount of repayment needs to be specified only for the principal. This is the amount by which the available amount under the drawdown is reduced as per the frequency.

The system calculates the interest and fee amounts automatically, depending on the repayment date and amount of the principal. However, for drawdowns with special interest, you also have to provide the interest amount. Similarly, if a fee or a charge has been defined as an amount, you also have to specify the amount.

Note

- If you specify amortized schedules, the system automatically does the amortization according to the frequency that you have defined.

- You can define as well as redefine Back Value dated Interest Schedule while amending the schedule for the Drawdown contract.

- You can specify Back Value dated Interest Schedule only for unliquidated Interest Schedules.

- You are allowed to change the Interest schedule beyond the last interest liquidated schedule.

- For Prime drawdowns, you will not be allowed to define a new or redefine an existing interest schedule beyond the last Interest/Principal prepayment date.

6.2.3.4 Specifying the Amortize Details

You can specify the following details related to amortize contracts

Installment Amount

Specify the installment amount for amortized contracts. This option is available only for the contract using the product which has the ‘Allow user input installment’ flag is checked.

The system performs the following validations to this field:

- Amount should be greater than zero and less than the contract amount.

- The computed Interest amount of any of the amortize schedule should not exceed the Installment amount.

- Bullet schedule have non-zero principal schedule based on the user input installment amount during new contract booking. This is not validated during contract amendment.

Installment amount captured is same for all schedules and it may differ if:

- EMI computation function for amortized loan is modified to pass the upfront EMI you entered.

- Main interest component amount of each installment is computed based on the principal balance.

Principal is derived as Principal = user input installment– Interest component. Allow

Pre-Amortization Interest

Select this check box to indicate that the system should calculate the pre-amortization interest.

- If ‘Allow pre-amortization interest’ flag is checked

at the contract level:

- Main Interest component has to be maintained at the product default schedules.

- Schedule default for standalone Main interest component is blocked.

- Defaulted Amortize schedules are deleted.

- Main interest component schedule is allowed to maintain as the first schedule before the amortize schedules. Multiple schedules are not allowed for this component.

- Only one schedule for main interest component is allowed before first amortize schedule. Components other than main interest component is not allowed to define before amortize schedules.

- Redefinition of schedules is allowed. Overlapping of pre-EMI interest and Amortise schedules are not allowed and amortise schedules is not allowed on or before the pre-EMI interest schedule.

- On redefinition of schedules, pre-EMI interest schedule date is considered as the amortization computation start date.

- Redefinition of pre-EMI interest schedules is allowed on Contract Amendment provided there is no Paid Amortization schedule that exists in the contract.

- For userinput installment amortization contracts, Interest and Principal Breakup of the Amortization schedules will undergo a change. However the Amortization amount will be intact.

- In case of System derived amortization, the redefinition of Pre-EMI Interest schedule will change the amortization amount

- If this flag is not selected at the contract level, main interest component or any other component schedules are not allowed to maintain before the Amortise schedule.

- This flag is applicable for both User Installment and System derived Amortization contracts.

- On copying of contracts this flag value is not copied and it is defaulted as unchecked.

6.2.3.5 Viewing Drawdown Payment Schedule Details

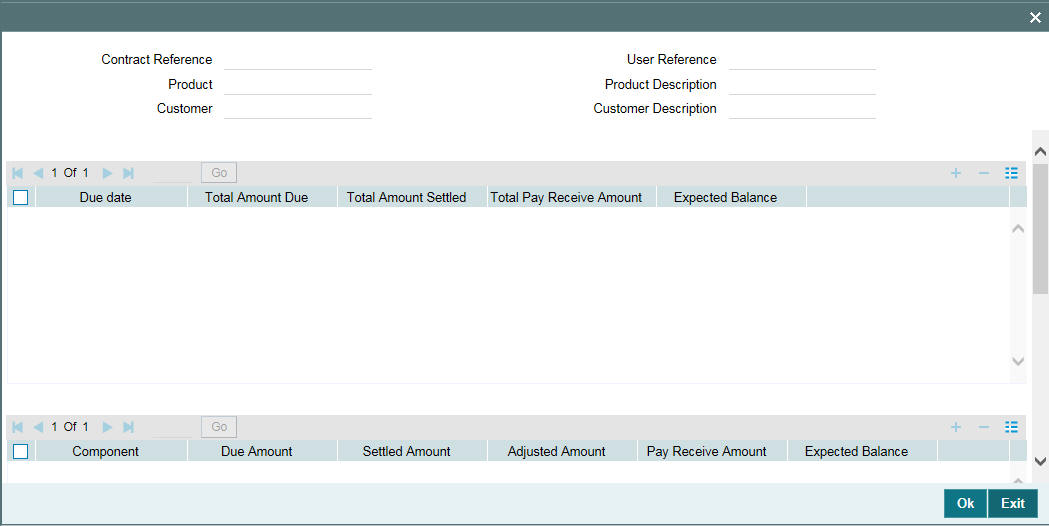

Based on the payment schedules captured for the components, Oracle FLEXCUBE computes the schedules and the amount payable for each schedule in the ‘Payment Schedule Details’ screen.

Click ‘Payment Details’ button from the ‘Schedule’ tab

6.2.3.6 Viewing Drawdown Revision Schedule Details

To view the rate revision schedules, click the ‘Revision Schedule’ button. The ‘Revision Schedule

Details’ screen appears.

The following details are displayed in this screen:

- The name of the interest component that has undergone a revision

- The revision date

- Whether the revision is applied

6.2.3.7 Viewing Rate History Details

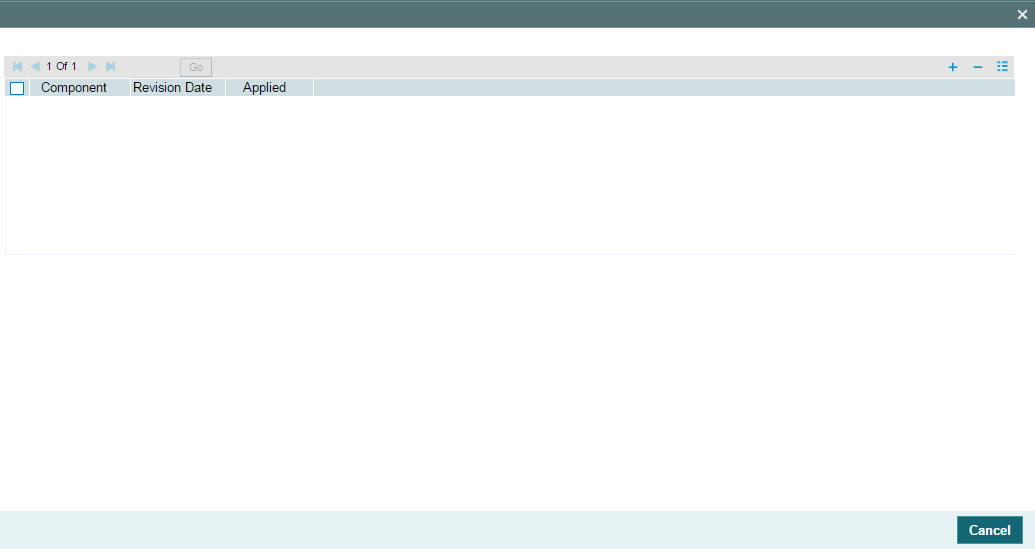

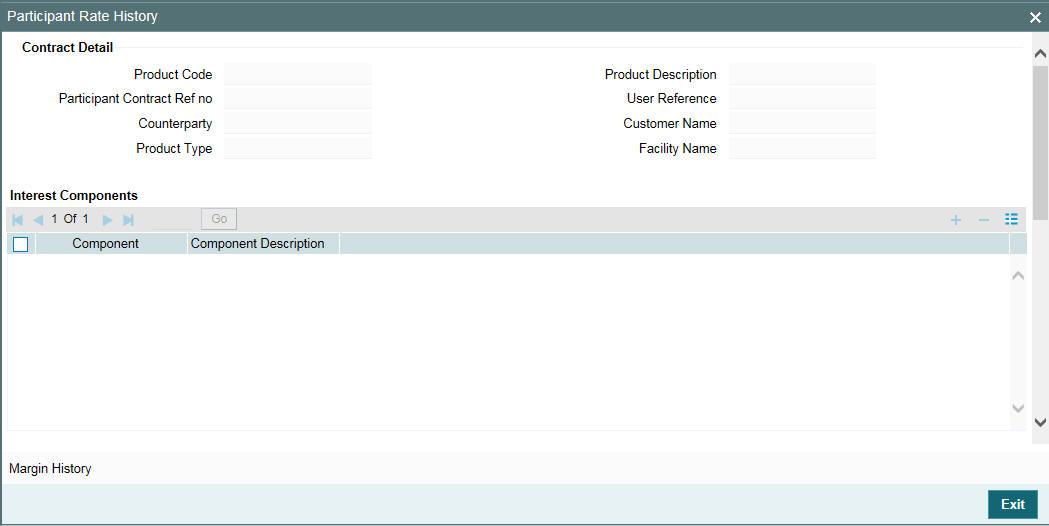

You can view the Interest rate and margin rate history for each drawdown in the ‘Rates History’ screen. This screen holds the history of interest rate and margin changes that have happened for the drawdown. Click ‘Rate History’ tab to invoke this screen.

In this screen,

you have to select the interest component to view the corresponding interest

and margin details. To view the margin rates for the components, click

the ‘Margin History.

6.2.3.8 Viewing Linkage Details for the Drawdown

In the ‘Linkage Details’ section of the screen, you can view the details of the tranche under which the drawdown is processed. The following details are displayed here:

- The linkage type is ‘C’. This indicates that a commitment contract or tranche is associated with the drawdown

- The reference number of the tranche to which the drawdown is linked

- The tranche currency

- Amount available under the tranche (after deducting the new drawdown amount)

- Exchange rate applied on the drawdown. This is required if the drawdown currency is different from the tranche currency

- The amount linked to the tranche. The drawdown amount is displayed here

- The total linked and unlinked amount under the tranche

6.2.3.9 Schedule Adjustments on Interest Rate Revision

In the Instance of Rate change, differential amount will be adjusted against the Bullet schedule without modifying the existing Installment constant amount. On ‘REVN’ or ‘VAMI’ either increase or decrease in the rate increases or decreases the bullet schedule amount without affecting EMI or Tenor. As a result, the EMI of the bullet schedule can be less or more than the other schedules.

The main interest component amount of each installment is re-computed in usual way based on the principal balance and the new rate. The prevailing EMI (EMI present in the current schedule of the transaction – System doesnot consider EMIs of previous schedules) will be kept constant.

The iteration of reducing Principal balance with above Principal component of EMI continues until the bullet schedule is reached. The last EMI have the remaining Principal amount and the interest as the EMI.

In case of user input installment amortise schedule type contracts, On Rate revision or Margin Rate Fixing, if the sum of Interest and Special Component’s amount exceeds the existing Amortization amount, exception is logged for those contracts in batch.

6.2.3.10 Schedule Adjustments on Prepayment

The following schedule adjustments are performed for prepayment:

- Original installment amount is retained on prepayment. Outstanding schedules for principal component gets reduced starting with bullet schedule (LIFO process) and interest amount gets re-computed accordingly.

- If the pre-payment amount is enough to cover the bullet and prior schedules, then amount due for these schedules become zero without changing the maturity date.

Note

‘Liqd int on prepaid principal’ flag is not applicable for any kind of payment of amortization contracts. Payment value date should fall on a schedule date of the Interest (AMORTISE component in case of Amortise schedule type Drawdowns) to do full prepayment of the contract.

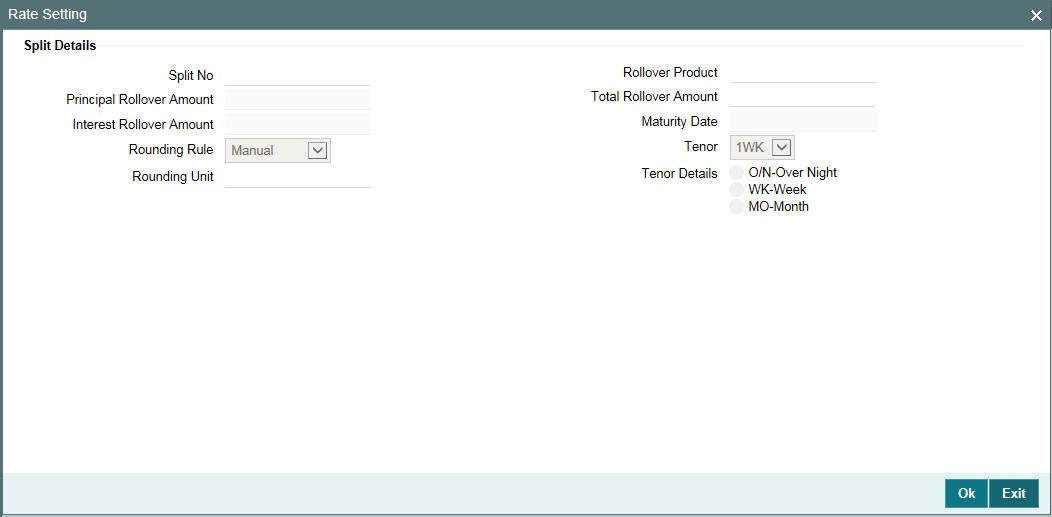

6.2.4 Capturing Details in the ‘Split Rollover’ Tab

You can rollover a drawdown only if you have checked the ‘Allow Rollover’ option for the drawdown product used to process the drawdown. If this option is not selected, the following message is displayed when you attempt to visit the ‘ROLLOVER’ tab:

Rollover not allowed

For details on rollover and information on the ‘ROLLOVER’ tab, refer the ‘Rolling-over a drawdown’ chapter of this User Manual.

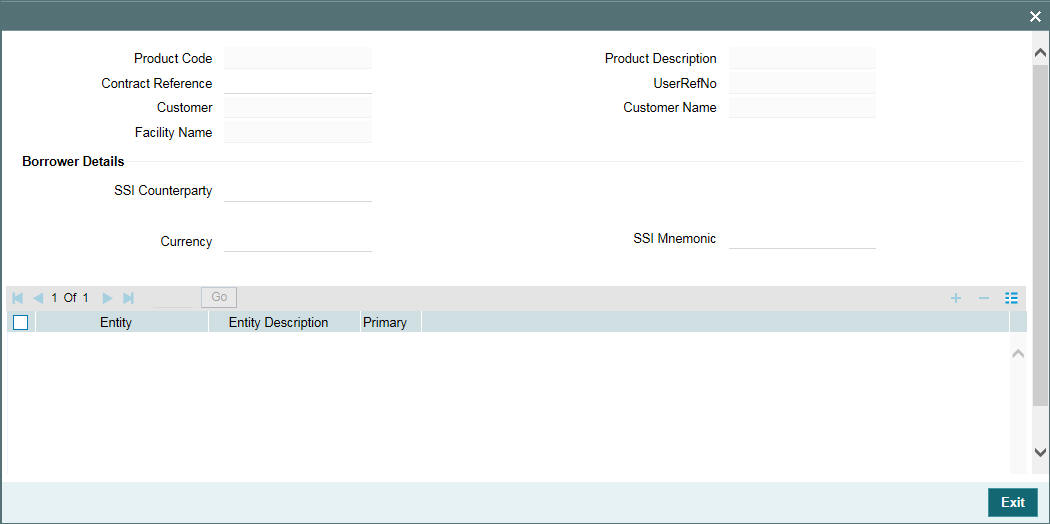

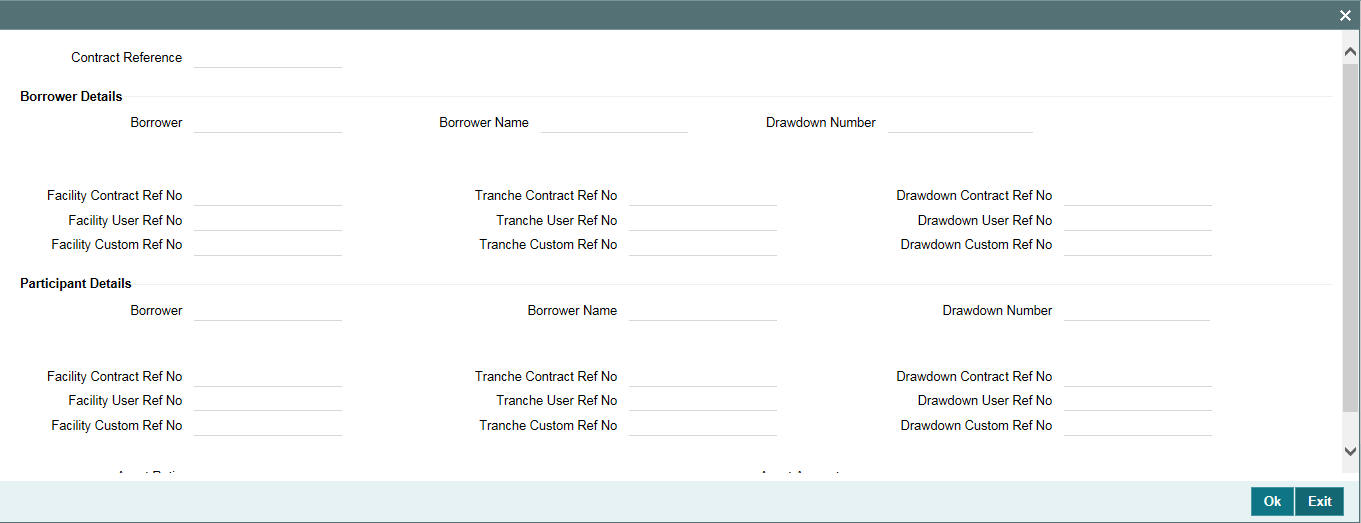

6.2.5 Specifying Drawdown Entity Details

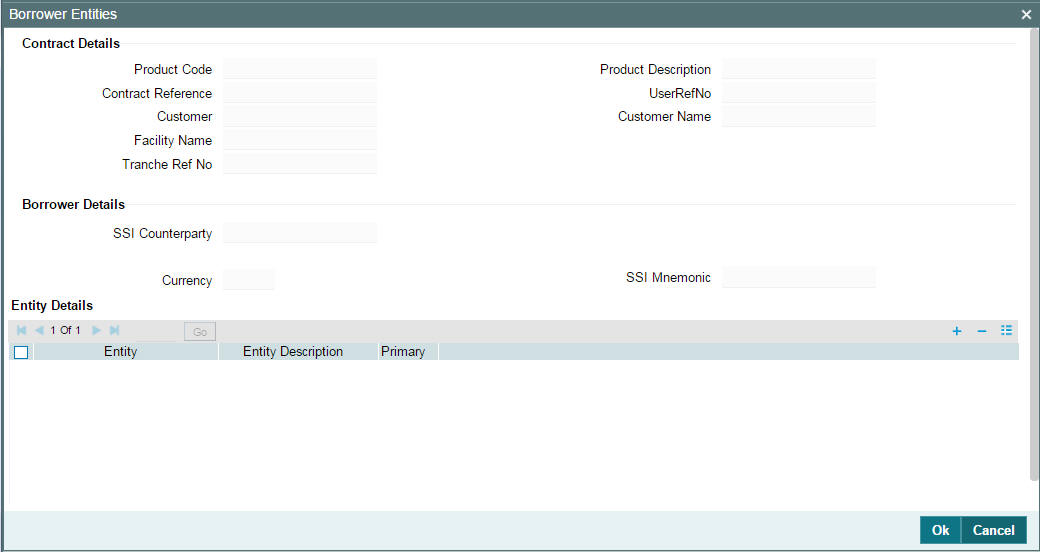

You can view the borrower entity details in the ‘Borrower Entities’ screen. These details default from the tranche associated with the drawdown. Click the ‘Entity’ tab to invoke this screen.

You can modify only the following parameters:

SSI Counterparty

By default, the drawdown borrower is displayed here. You can change the counterparty if the borrower requests to process the settlements through another account. The option list displays the names of all the customers maintained in Oracle FLEXCUBE.

SSI Mnemonic

SSI Mnemonics are maintained in the ‘Settlement Instructions’ screen for a Counterparty, Module, Currency, Product and Branch combination. The same is available for the counterparty/borrower of the drawdown. The Mnemonic selected here obtains the settlement details for the borrower of the contract and the same defaults to the ‘Settlement Message Details’ screen.

If you do not select the SSI Mnemonic, system defaults the SSI Mnemonic for the counterparty and contract currency when you exit the screen.

Note

Note the following:

- If you do not specify the Branch as ‘ALL’ for local currency contracts and participant transfers in the ‘Settlement Instruction Maintenance’ screen, the System displays the following error message.

Select the appropriate ssi mnemonic applicable for the selected currency

- If you do not specify the Branch as ‘Transaction’ for foreign currency contracts and participant transfers in the ‘Settlement Instruction Maintenance’ screen, the System displays the above mentioned error message.

6.2.6 Specifying Drawdown Participants

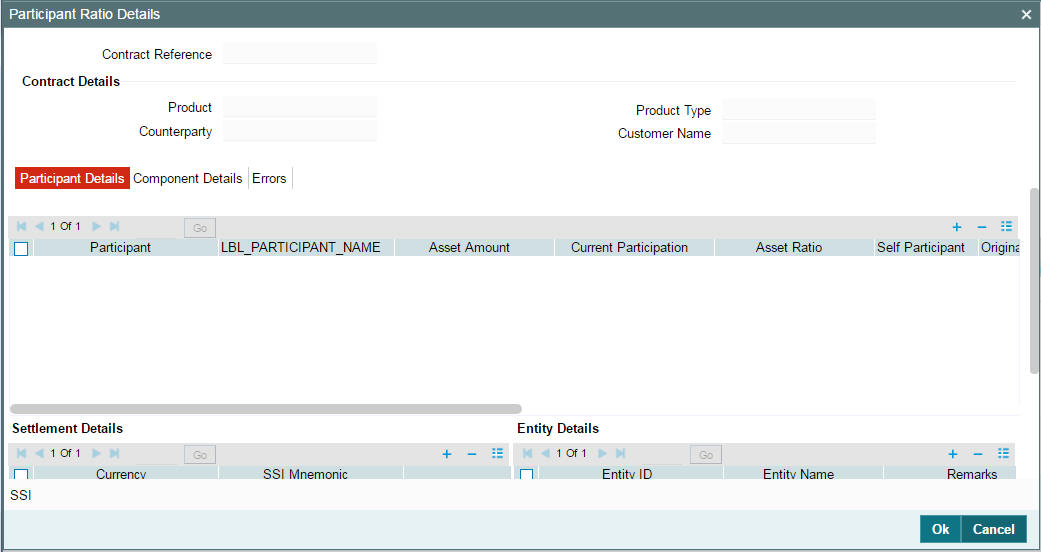

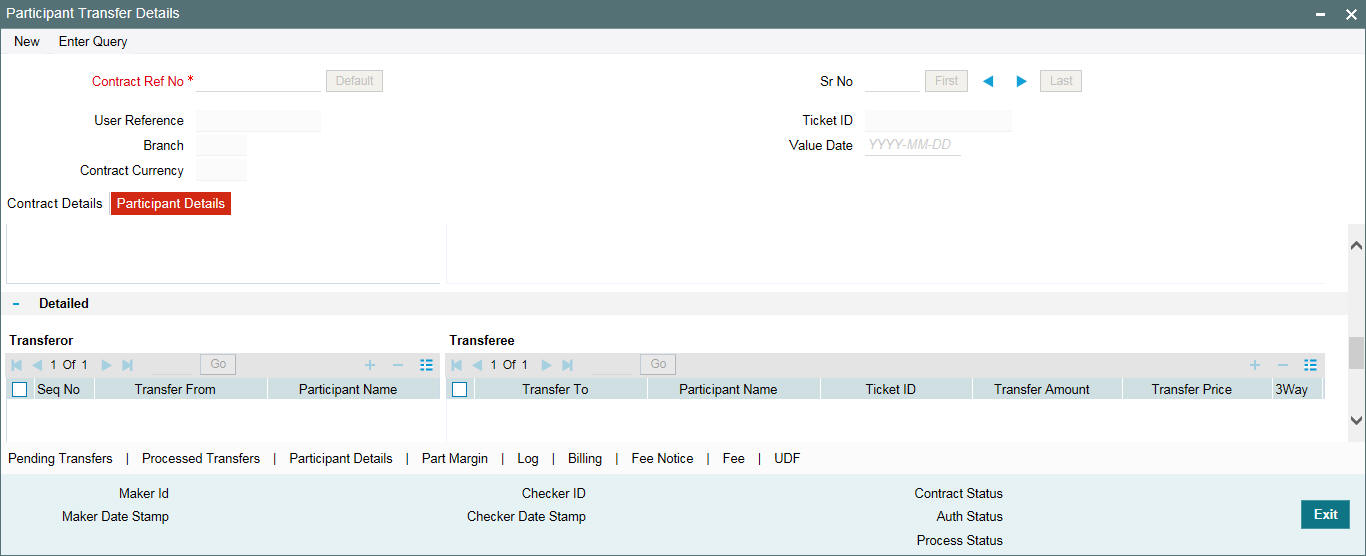

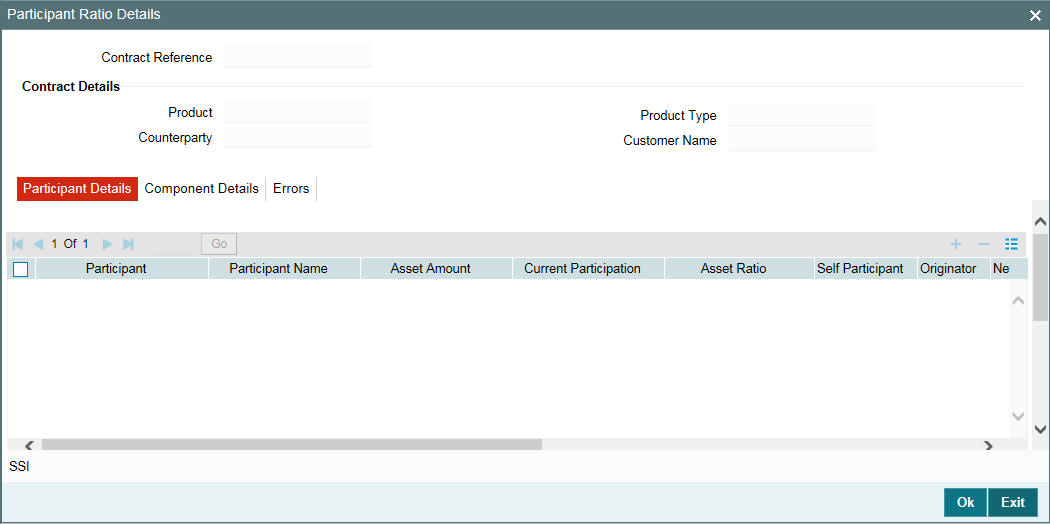

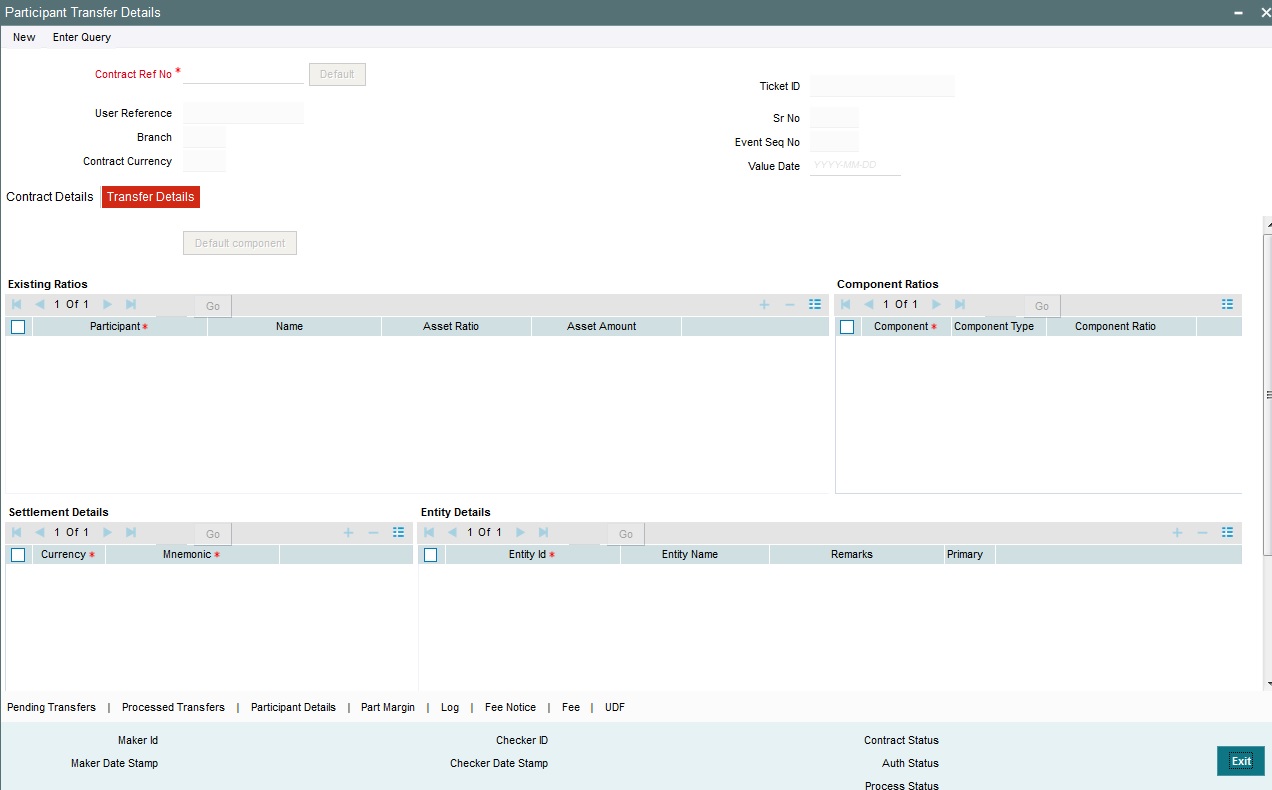

You must also identify the participants who contribute to the amount being disbursed under the drawdown. A borrower drawdown contract inherits the participant details defined for the borrower tranche under which it is entered. You can make changes to the defaulted participant details when you enter a borrower drawdown. To view the details in the ‘Participant Ratio Details’ screen, you have to click the ‘Participants’ tab.

Based on the drawdown amount, the system computes the contribution of each participant towards the drawdown as per the ‘Asset Ratio’ maintained for the tranche.

You can change the default participant details in this screen. Upon change of participants, the system automatically convert a ‘Cascade Participation’ type of tranche to a ‘Non Cascade Participation’ type. The ‘CASC’ event is triggered to indicate the change in the attribute and the ‘Cascade Participation’ option for the underlying tranche (in the ‘CONTRACT’ tab of the ‘LS Tranche Contract Online’ screen) is deselected. If changing the participant details is possible, you can specify the following details for each participant, for the drawdown schedule:

- The name of the participant

- The ID of the participant

- Contribution of the participant to the drawdown schedule for the tranche contract, known as the asset ratio or asset amount. You can specify the participant contributions either as an amount or a percentage. If specified as amounts, the sum of all contributions must not be greater than the tranche borrower commitment contract amount. If a percentage is specified, the sum of percentages for all participants must not exceed one hundred percent. Asset sharing ratio of participants is possible only if their contribution does not exceed the availability amount.

For example, let us assume a tranche amount of USD 10 million. The Asset Sharing Ratio (ASR) for various participants can be calculated as follows:

Participant |

Asset amount in USD |

ASR in % |

CITIBANK |

2,000,000 |

20 |

BARCLAYS |

2,000,000 |

20 |

NATWEST |

3,000,000 |

30 |

HSBC |

3,000,000 |

30 |

At the drawdown level, you can choose to change the asset sharing ratio of the participants in the following manner, if required.

Let us assume that the first drawdown amount is USD 4 million. The Asset Sharing Ratio (ASR) for this amount is as follows:

Participant |

Asset amount in USD |

ASR in % |

CITIBANK |

1,200,000 |

30 |

BARCLAYS |

400,000 |

10 |

NATWEST |

1,600,000 |

40 |

HSBC |

800,000 |

20 |

When you change the ASR for a drawdown under the tranche, the ASR at the tranche level will remain the same. However, at the time of a second drawdown, the ASR at the drawdown level displays the availability ratio instead of the tranche asset sharing ratio.

Note

The original asset sharing ratio is displayed only at the Tranche level.

The availability ratio after the first drawdown is as follows:

Participant |

Asset amount in USD |

ASR in % |

Availability amount |

Availability ratio in % |

CITIBANK |

2,000,000 |

20 |

800,000 |

13.33 |

BARCLAYS |

2,000,000 |

20 |

1,600,000 |

26.67 |

NATWEST |

3,000,000 |

30 |

1,400,000 |

23.33 |

HSBC |

3,000,000 |

30 |

2,200,000 |

36.67 |

The availability amount is computed on the following basis:

The availability amount could vary for revolving and non-revolving tranche.

For revolving tranche contracts, the available amount will be calculated as follows:

For non-revolving tranche contracts, you can compute the available amount in the following manner:

You can change the asset sharing ratio for participants on a non proportionate basis using the ‘Contract Payment’ screen.

For more information on this, refer the section ‘Processing Repayments Manually’ in the ‘Processing Repayments’ chapter of this User Manual.

- If the components levied on the contract are in different currencies, you have the option of selecting a Settlement Sequence Number for each currency. The system uses this number to obtain the settlement details for the participant.

- Whether the arranger bank is also a participant in the syndication (self participant)

- Interest, charge and ad-hoc fee components levied on the contract, the receivables from which are due to the participant (you can only specify those components marked for propagation to participants in the product preferences of the borrower tranche product used by the contract)

- Proportion of income from the interest, charge and ad-hoc fee components, which is due to the participant, will be defaulted from the tranche contract. If, for the product, you have checked the box ‘Cascade Participation’ in the ‘Additional Preferences for LS’ screen, you will not be able to change the income sharing ratio for fee components. You will not be allowed to change the income sharing ratio of interest components whether or not you have checked the box ‘Cascade Participation’.

- Entities for the participant, to whom notices and advices related

to the contract, are sent. A primary entity must be designated. The messages

to all entities other than the primary entity contains the text ‘COPY-AVOID

DUPLICATION’ on them. This text is present in the following notices

- Drawdown notices to banks

- Renewal notices to banks

- Rate fix notices to banks

For details on fields available in this screen, refer the heading ‘Maintaining participant details for the tranche’ in this chapter.

In addition to the above, you can do the following through this screen:

- Upload the participant details through the ‘Upload From File’ option

- Download the participant details through the ‘Download From File’ option

- Specify entity details for each participant

For details on the above procedures, refer the following headings in this chapter:

- Uploading participant details

- Downloading participant details

- Maintaining entity details for a facility participant

6.2.7 Viewing Participant Margin Details

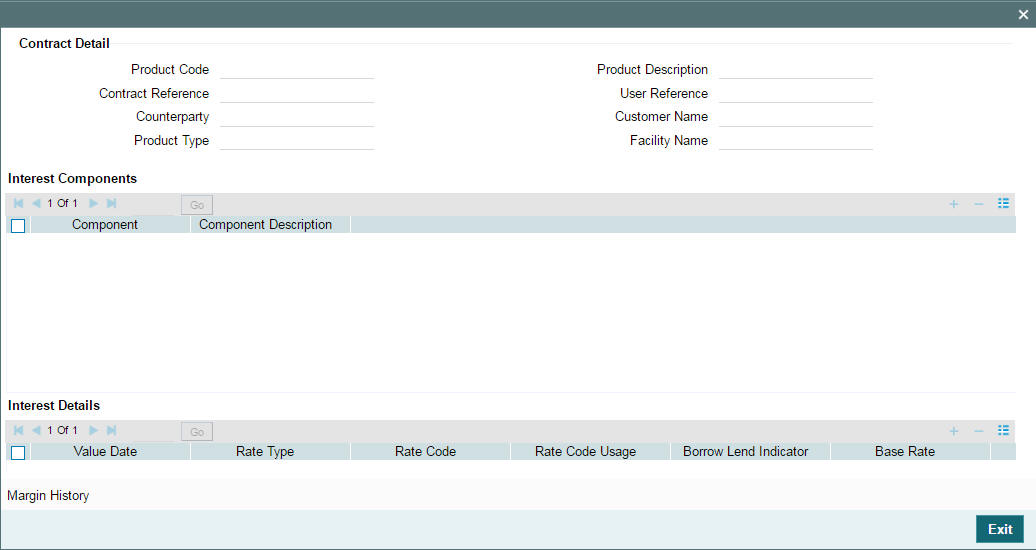

You can view margin details maintained for participants of the drawdown contract, using the ‘Participant Rate Summary’ screen. To view this screen, you have to click the ‘Part Rate’ tab.

Here you can view the following details.

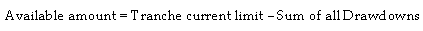

Participant Details

The system displays the following participant details:

- Participant Drawdown Ref no

- Participant Facility Ref no

- Participant Tranche Ref no

- Customer

- Ccy

- Amount

- Borrower Contract Ref no

Interest Components

The system displays the following component details.

- Component

- Component Description

Interest Details

The system displays the following interest details.

- Value Date

- Rate Type

- Rate Code

- Borrow/Lend

- Base Rate

- Spread

- Margin

- Adjustment Rate

- Final Rate

Margin Details

The system displays the following margin details.

- Margin Component

- Margin Rate

- Margin Basis

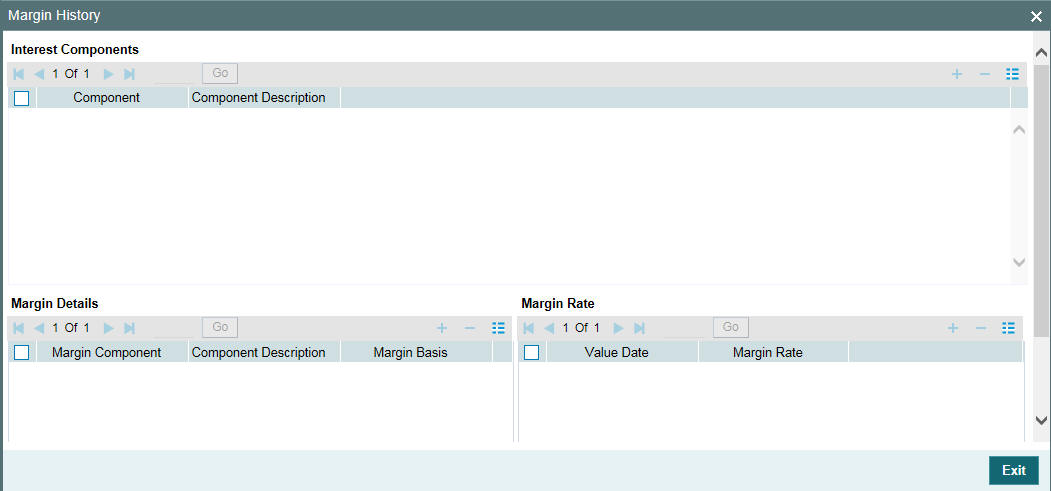

6.2.7.1 Viewing Margin History

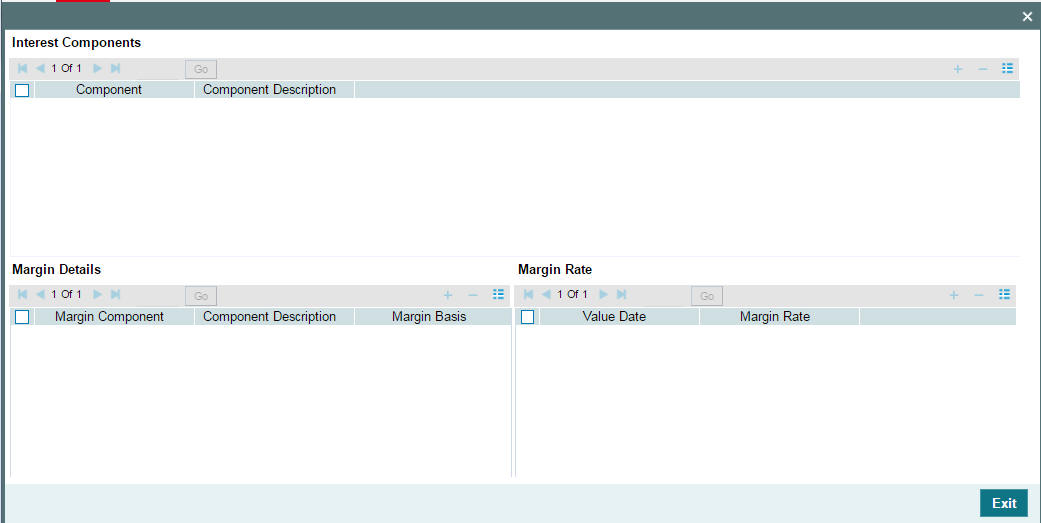

You can view margin details of all participants including the margin history by clicking the ‘Margin History’ button on the ‘Participant Rate Summary’ screen.

The system displays the following details.

Participant Details

The system displays the following participant details:

- Participant Drawdown Ref no

- Participant Facility Ref no

- Participant Tranche Ref no

- Customer

- Ccy

- Amount

- Borrower Contract Ref no

Margin History Interest Component

The system displays the following component details.

- Component

- Component Description

Margin Details

The system displays the following margin details.

- Margin Component

- Margin Rate

- Margin Basis

Margin Rates

The system displays the following margin rate details.

- Value Date

- Margin Rate

- Final Rate

The margin rate maintained for the individual participant is considered while calculating the interest due on the participant side, during contract booking. This is applicable for current dated/back dated/forward dated drawdown bookings.

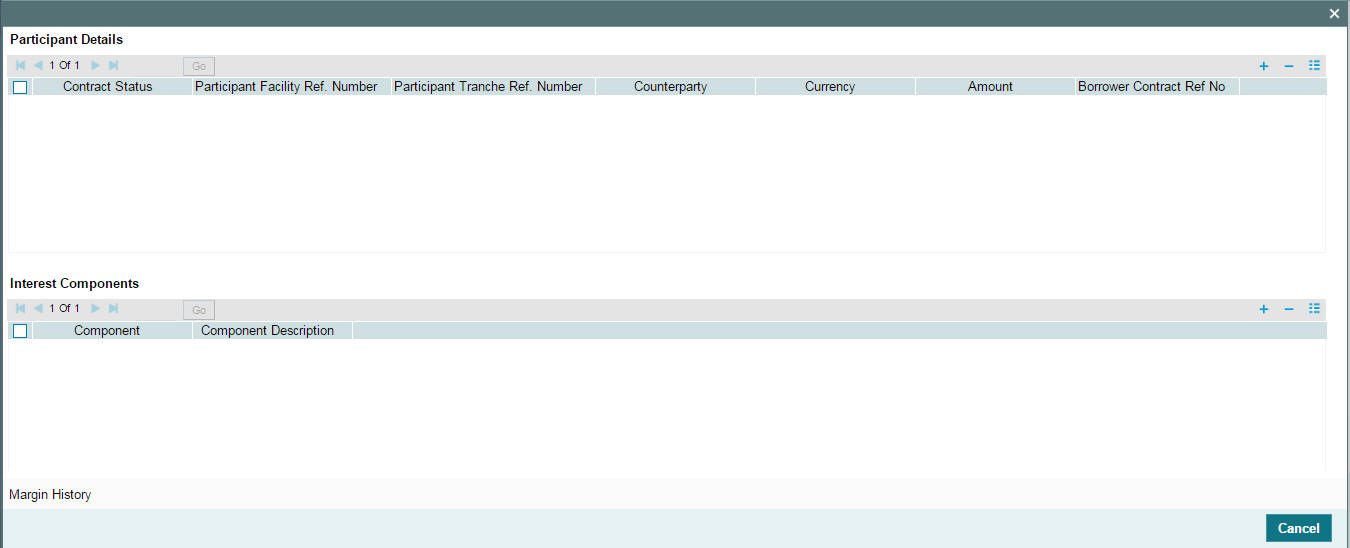

6.2.8 Fixing Exchange Rate for Drawdown Currency

You will need to fix the exchange rate for drawdowns only if the drawdown currency is different from the tranche currency. The exchange rate fixing days refers to the number of business days before the value date of the drawdown or the new rate fix period. Exchange rate fixing for the new drawdown or the new rate fix period is done on this day.

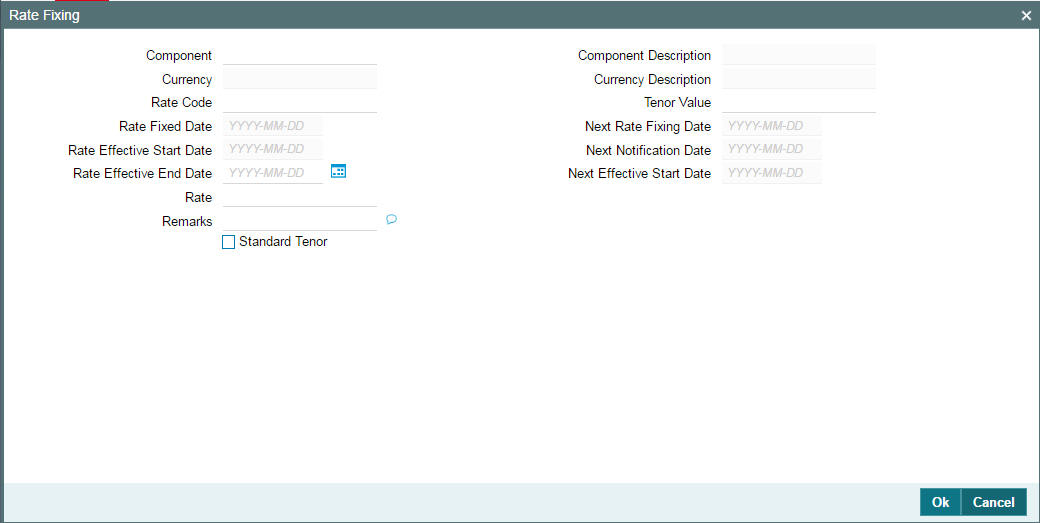

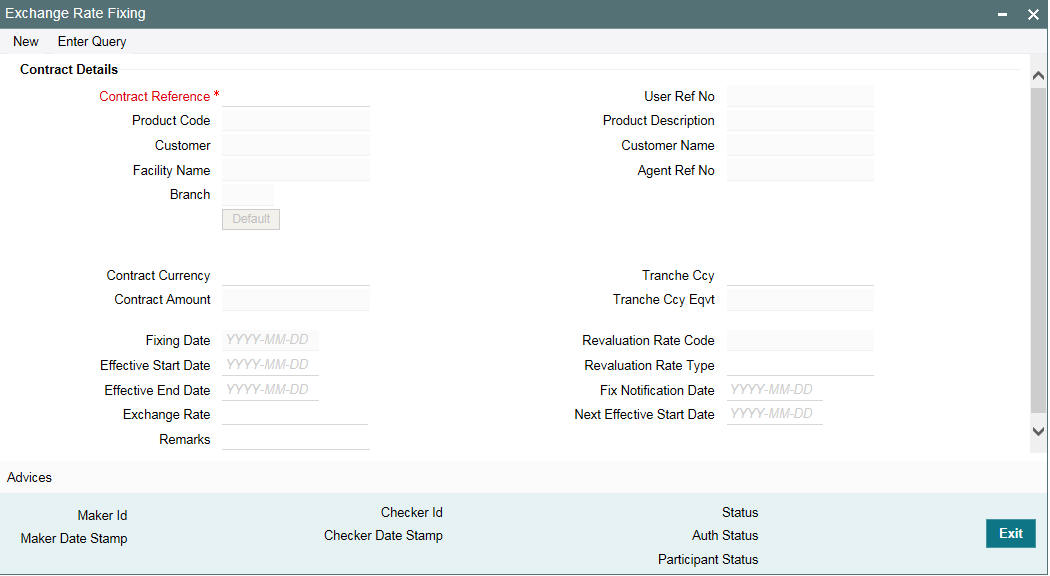

To fix the exchange rate for the drawdown currency, click ‘Exrrate Fixing’ tab. The ‘Exchange Rate Fixing’ screen is displayed, as shown below:

The system arrives at the exchange rate fixing date for the drawdown currency based on the exchange rate fixing days maintained at the tranche level and the holiday validation currencies specified for the drawdown currency.

For more details, refer the heading ‘Specifying currency details for the tranche’ in this chapter.

You can specify the following details in this screen:

Effective End Date

You have to specify an end date for the new rate to be effective in the system. The start date will be equal to the drawdown date. You have to capture the date in ‘DD-MMM-YYYY’ format.

Exchange Rate

The default exchange rate is displayed here. The system picks up this rate from the ‘Currency Rates Maintenance’ screen. You can change the rate, if required. You can enter upto 15 decimal points.

Remarks

You can also capture additional information, if required. This is used only for information purposes.

Note

It is not mandatory for you to fix the exchange rate before you fix the interest rate.

6.2.8.1 Saving the New Exchange Rate

Click ‘Ok’ button to save and exit the screen. When you save the drawdown, the system triggers the ‘EXFX’ event with the exchange rate fixing notice. For future dated drawdowns, you need to fix the exchange rate before the value date of the drawdown.

Subsequently, you have to manually fix the exchange rate for the drawdowns. You have to fix the rate for the next period before the end of the current period. However, if you do not do the rate fixing for the subsequent periods, Oracle FLEXCUBE applies the latest fixing rate for the rest of the period.

Note

- It is mandatory to fix the exchange rate before you initiate a cross currency drawdown in Oracle FLEXCUBE.

- If you do not fix the exchange rate when booking a new drawdown, system applies the default exchange rate for converting the drawdown amount to the tranche amount to validate the tranche availability. When the exchange rate fixing happens, Oracle FLEXCUBE revalidates the tranche available amount and raise the exceptions, if any.

- You also have the option to fix the exchange rate after booking a drawdown.

For more information, refer the heading ‘Fixing Exchange Rate after drawdown booking’ in this chapter.

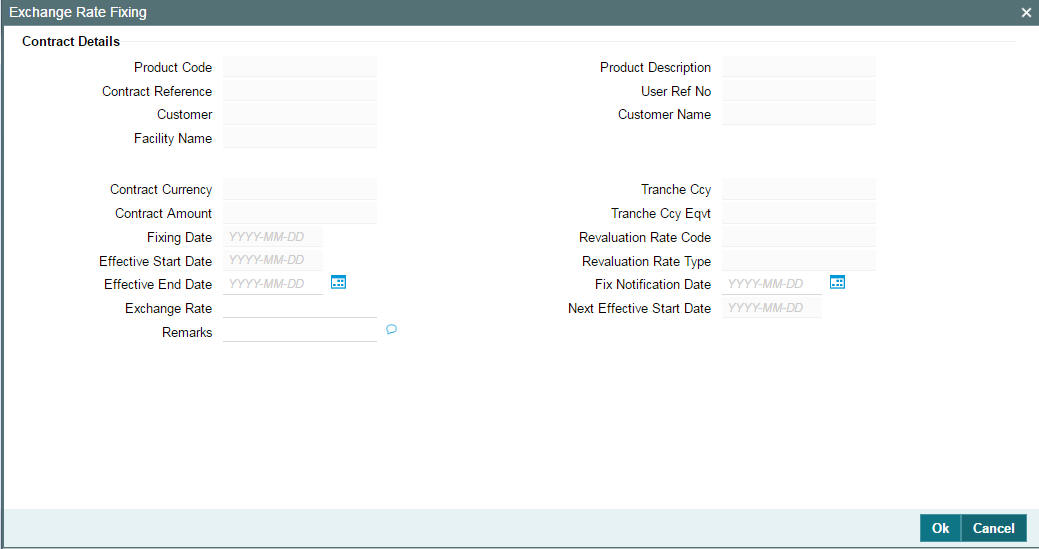

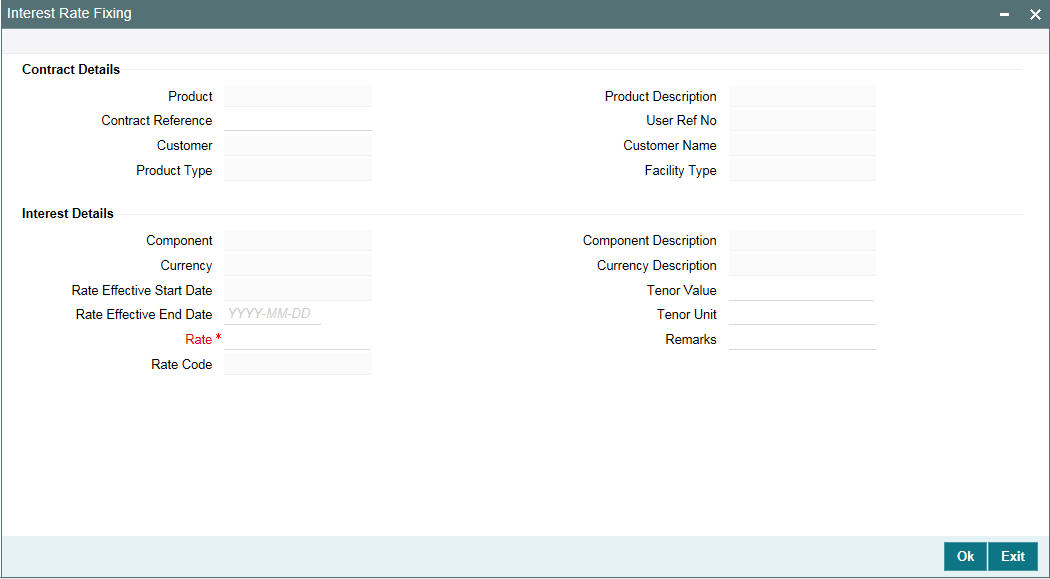

6.2.9 Specifying Drawdown Interest Details

You can view the interest and margin components, if applicable to the drawdown, in the ‘ICCF Details’ screen. These details default from the tranche under which the drawdown is being processed. Click ‘Interest’ tab to invoke this screen.

6.2.9.1 Amending Interest Basis

The interest basis defaults from the product level. However, you can change the default value anytime during the lifecycle of the contract except for contracts with interest capitalization type of renewal instructions. When you change the day basis, the system re-computes the schedule interest amount from the start date of the component. The amendment becomes applicable from the value date of the contract. Note that the system considers the margin rates maintained for each participant while re-computing the interest.

The interest for each currency is calculated using the interest basis, which you select:

- 30 Euro / 360

- 30 US / 360

- Actual / 360

- 30 Euro / 365

- 30 US / 365

- Actual / 365

- 30 Euro / Actual

- 30 US / Actual

- Actual / Actual

- 30(Euro)/365.25

- 30(US)/365.25

- Actual/365.25

- Working Days/252

- Working Days/360

Note the following:

- If the interest distribution type is defined as ‘Lender of Actual’ (in the ‘LS Tranche Contract Online’ screen) and if there are any liquidated repayment schedules, the system updates the payable/receivable of the respective liquidated payment schedule as a result of change in interest basis.

- You cannot amend the Interest Basis for ‘Lender of Record’ type of distribution if there are liquidated schedules for the same component.

You can use the navigation buttons -

to view the interest components associated with the drawdown.

Amortization Constant Component

The default value from the product gets defaulted here. The check box is selected if this is an amortization constant component. You cannot change it in the contract level.

Compensatory Component