10. Processing a Value Dated Amendment

This chapter contains the following sections:

- Section 10.1, "Introduction"

- Section 10.2, "Making Value Dated Amendments for a Tranche"

- Section 10.3, "Viewing Value Dated Amendment Summary"

- Section 10.4, "Downsizing Tranche for an Investor’s Default"

- Section 10.5, "Upsizing Tranche Amount on a Non-prorata Basis"

- Section 10.6, "Making Value Date Amendments for a Drawdown"

10.1 Introduction

The Value Dated Changes function of Oracle FLEXCUBE enables you to make changes to borrower tranches and borrower drawdowns under a syndication, which impact the financial details and accounting entries. Through this function, you can make changes to an authorized borrower tranche and borrower drawdown before its maturity date.

The changes that are made through this function, takes effect on a date known as the ‘Value Date’, which is why it is known as the ‘Value Dated Changes’ function.

The Value Date could be:

- A past date

- The application date

- A future date

You make value dated changes to borrower tranches in the same manner as you would for a normal commitment or loan contract.

For a detailed description, refer the chapter Making Additional Disbursements and Rate Changes, in the Bilateral Loans User Manual.

Note

Only those aspects that apply specifically to borrower tranches and borrower drawdowns are explained in this chapter.

Any changes that you make to a borrower tranche is automatically applied to the participant leg of the contract.

10.2 Making Value Dated Amendments for a Tranche

Using the ‘Value Dated Changes’ function, you can make changes to different components of a borrower tranche or a borrower drawdown under a tranche:

- The tranche principal amount

- The maturity date

Any changes to any of these components will be automatically applied to the participant leg of the corresponding tranche.

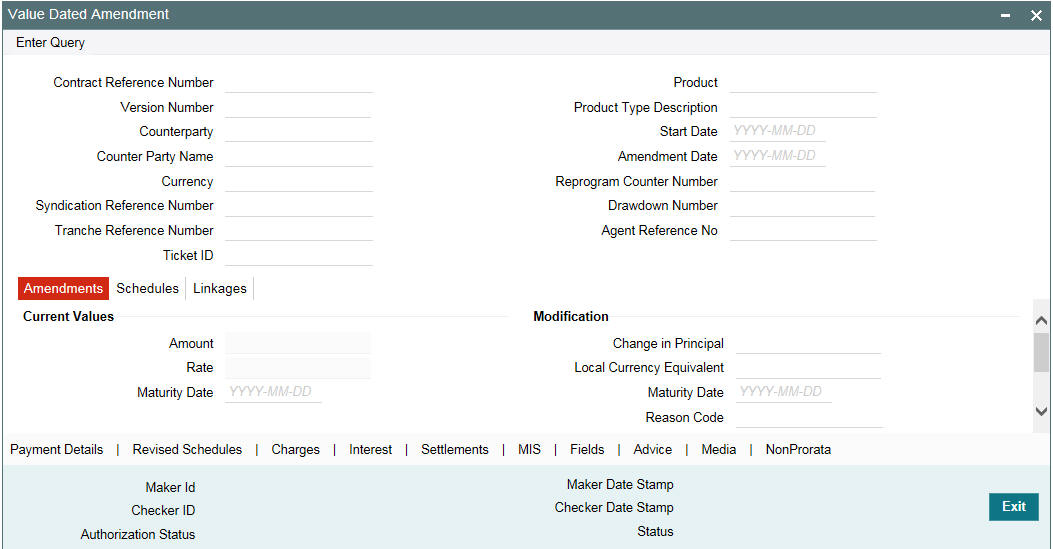

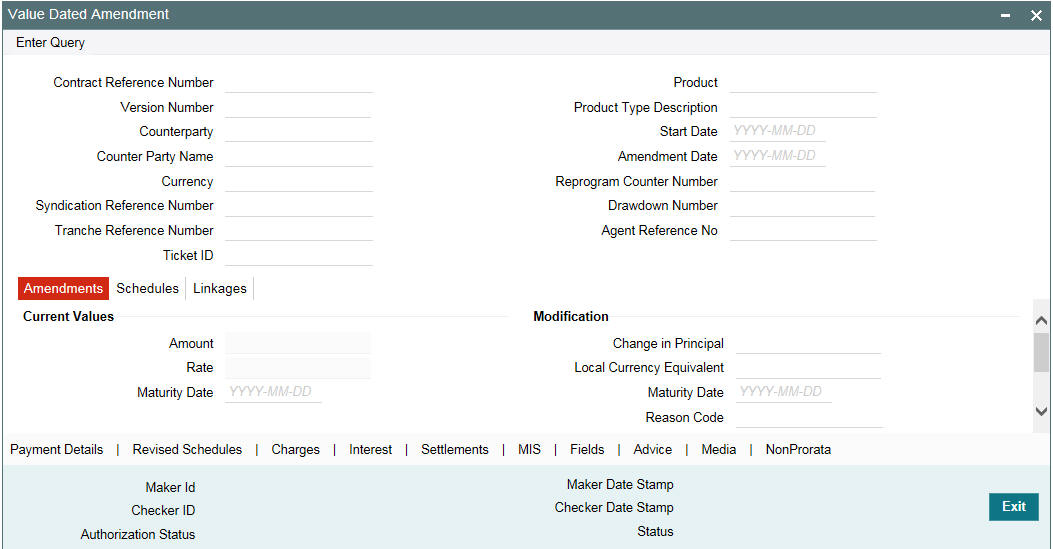

You can enter value-dated changes to a borrower tranche in the ‘LS-Value Dated Amendments’ screen. You can invoke the ‘LS - Value Dated Amendment’ screen by typing ‘LBDVAMND’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The ‘Contract Details’ section of the screen displays the following details:

- Name of the product used in the tranche

- Counterparty Id and Name

- Contract Reference Number

- Start date of the tranche

- Currency of the tranche

- Reference Number of the facility under which the tranche is processed

- Number of drawdowns processed under the tranche

- Reference number of the FpML Contract.

The ‘Amendment’ tab displays the following:

- Current Principal

- Current Maturity Date

To make an amendment, select the reference number of the tranche you want to amend and then select “Unlock’ from the menu to unlock the same.

Specify the following after unlocking the tranche:

Amendment Date

By default, the current system date is displayed as the date of amendment. You can change the date provided the date is:

- Not later than the maturity date of the tranche

- Not earlier than the value date of the tranche

- Not earlier than the last liquidation date of the unutilized fee

- Not earlier than the latest amendment date

After you specify the date, you cannot change it.

Note

The Interest basis gets changed beyond the last payment date you are allowed to calculate the payable receivable amount as required.

The VAMI for Interest Basis change with value date less than or equal to today is allowed but not allowed with value date less than or equal to the previous VAMI value date. This validation is applicable for both Lead and Non Lead(Wrapper) tranches.

10.2.1 Modifying Tranche Principal

You can use the ‘LS- Value Dated Amendments’ screen to:

Increase the tranche principal

When increasing the tranche principal, the system checks for the following:

- The increase does not allow the sum of all tranches (including the increased amount) under the linked facility to exceed the Total Facility amount.

- The increase is not more than the maximum amount allowed for a tranche. This amount is specified at the facility level.

Decrease the Tranche Principal

When decreasing the tranche principal, the system checks for the following:

- The decrease does not result in the principal being less than the sum of all outstanding drawdowns linked to the tranche.

- The decrease is not less than the minimum amount allowed for a tranche. This amount is specified at the facility level.

To change the principal, specify the following:

Change in Principal

Specify the amount by which you want to increase or decrease the tranche principal. If the tranche currency is different from the local currency of the branch, the system displays its equivalent in the local currency.

A change in tranche principal results in recalculation of the Utilization and Non-Utilization Fee. It also alter the Non-Utilized amount under the tranche. An increase in the principal allows you to process new drawdowns under the tranche to the extent of the increased amount. Note that the system considers the margin rates maintained for the participants while calculating the interest due for the participants.

10.2.2 Modifying Maturity Date

Through the ‘LS- Value Dated Amendments’ screen, you can:

Extend the maturity date

When extending the maturity date of the tranche, the system ensures that the new date:

- does not exceed the product end date

- does not exceed the maturity date of the linked facility

- does not exceed the tranche end date defined at the facility level

Reduce the maturity date

When reducing/advancing the maturity date of the tranche, the system ensures that the maturity date:

- Does not go beyond the product end date

- Is not earlier than the start date of the linked facility

- Is not earlier than the start date defined for the tranche at the facility level

- Is not earlier than the value date of the tranche

- Is not earlier than the maturity date of existing drawdowns under the tranche

- Is not earlier than the amendment date

To modify the maturity date, new date in the ‘Modifications’ section of the screen:

Maturity Date

Specify the new maturity date for the tranche as per you requirement, whether you want to extend or reduce the maturity date. Capture the date in ‘DD-MMM-YYYY’ format.

Note that the system considers the margin rates maintained for the participants while calculating the interest due for the participants.

Propagate VAMI to Drawdown

Check this field to propagate the Non pro rata VAMI effect to Drawdown contracts for increase and decrease of principal amount. This box is enabled only for pro-rate tranches with agency type ‘Participation’.

You are allowed do the following in case this field is checked.

- Amendment of the Non Pro rata Value dated amendment beyond the Non Pro rata Value dated amendment.

- Amendment of the Non Pro rata Value dated beyond the Liquidation.

- Liquidation beyond the Non Pro rata Value dated amendment

Note

- This field is enabled after capturing the Non pro rata ratios in the 'Non pro rata' screen and for those pro rata tranches with Agency type ‘Participation’

- Non Pro rata VAMI is not applicable to maturity date change and Interest rate change.

- The system does not allow Future dated Non pro rata VAMI.

- System allows Non Pro-rata VAMI for pro rata tranches with agency type as ‘Lead’ to propagate the non- prorata VAMI effect to drawdown contracts in the ‘Value Dated Amendment’ screen of the tranche

- If the ‘Propagate VAMI to Drawdown’ is checked, then on authorization of Non Prorata value-dated amendment at tranche contract, system triggers the VAMB/VAMI event at the underlying drawdown contracts for propagating the VAMI effect.

- Multiple NPVAMI/VAMI events are allowed on the same date for both the lead and participant.

In case of overdue Drawdown, any variations/mismatches in the Drawdown amounts and Payment schedules, you should address them operationally.

Reason Code

Specify the reason code here. The adjoining option list displays all reason codes maintained in the system. Choose the appropriate one.

10.2.2.1 Amortization Redefine

Re-Amortization process allows you to re-defining the instalment schedules of an amortized contract as if maturity date of the contract has been extended for schedule re-calculation purpose.

Re-Amort Date

Specify a new maturity date greater than the current maturity date for calculating the amotization amount.

Re-Amortization is processed based on current principal outstanding balance. Instalment amount gets re-calculated based on the remaining schedules, and the new tenor, where tenor is considered between the Re-amort value date and the new end date. The installment schedules derived beyond the maturity date gets added up and parked in the bullet schedule, and thus results in high payment amount in the bullet schedule.

Re-amortization request placed in the middle of the cycle also considers the current schedule for re-amortization calculation. Back value dated re-amortization is allowed however the Value date of the re-amortization should not be earlier than the last liquidation date and also it should not be earlier than last re-amortization date.

Re-amortization processing happens during save operation from VAMI screen. You can delete un-authorized entry for a Re-amortization amendment details.

Rate change, CAMD, Principal amount change/maturity date change through VAMI have impact on EMI and the installment amount (and balloon payment on bullet schedule) is calculated based on the Re-Amort date.

10.2.3 Saving Amendment

The amendment becomes effective only after you save the details. To save, click ‘Save’ from the menu. On successful save, the system displays a message to confirm the same.

The ‘Current Values’ section of the ‘Amendments’ tab displays the new values for the tranche.

The details are updated:

- Principal: (Old Principal) +/- (Change in Principal)

- Maturity Date: New Date

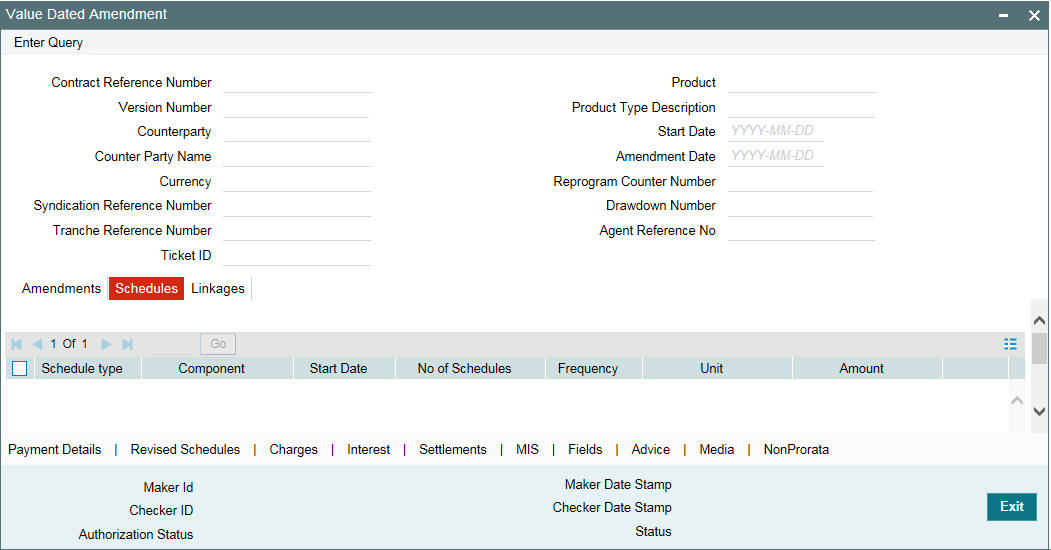

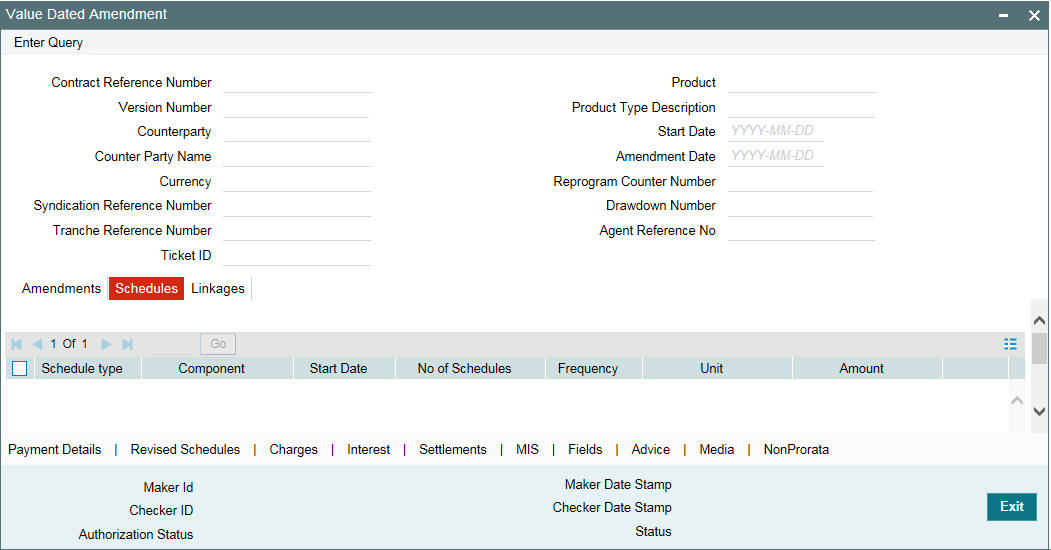

10.2.4 Viewing Schedule Details

After the amendment you can view the existing schedules as well as the one for the principal (for the increased/decreased amount) in the ‘Schedules’ tab of the screen:

10.2.4.1 Impact of Amendment

The system redefines the fee schedules and reduction schedules on increase/decrease of principal/maturity date, as mentioned below:

- If amount is decreased, reduction schedules are redefined on ‘FIFO’ basis

- If amount is decreased, amount gets added as a bullet reduction schedule

- If basis amount for the fee changes, fee repayment schedules are redefined as per the new amount.

- If maturity date is increased and if fee bullet schedule falls on the earlier maturity date, the bullet fee schedule and bullet reduction schedule moves to the new maturity date.

- If maturity date is decreased, one bullet schedule for fee and reduction is inserted with the sum of reduction/fee amount which falls after the new maturity date.

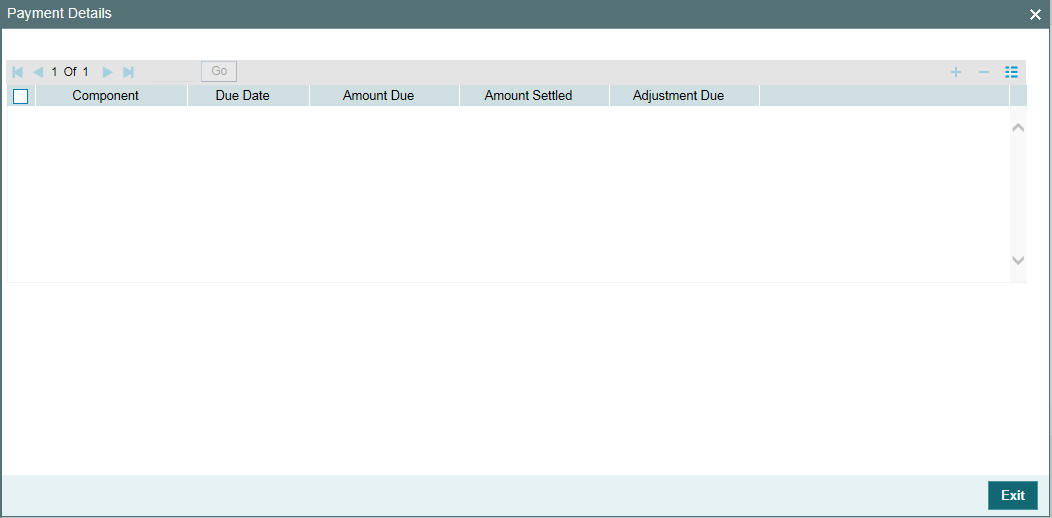

10.2.4.2 Viewing Payment Schedules

You can view the payment schedules in the ‘Schedules’ tab of the screen. To do this, click ‘Payment Details’ tab.

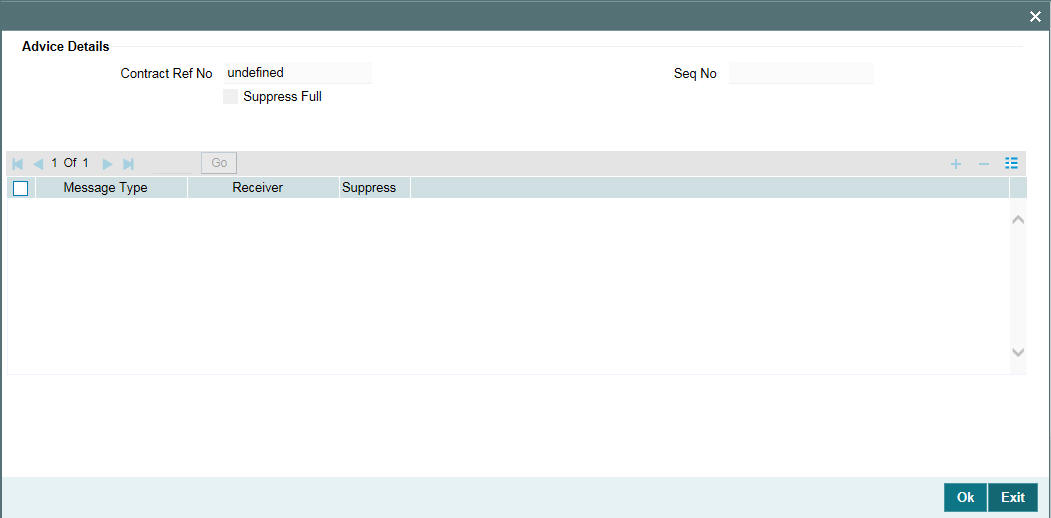

10.2.5 Viewing Advices

You can view the advices generated as part of the value dated amendment (VAMI), in the ‘Advices’ screen. Click ‘Advice’ tab to view the details.

Suppress All

Select this check box to indicate that the system can suppress all the messages.

10.2.6 Viewing Overwrite Settlement Instruction Details

You can maintain settlement instructions for various components such as fees, charges, tax, principal, interest, and so on, using the ‘Overwrite Settlement Instruction Details’ screen. Using this screen, you can post liquidation entries into an Internal GL account instead of the customer account at the time of rollover.

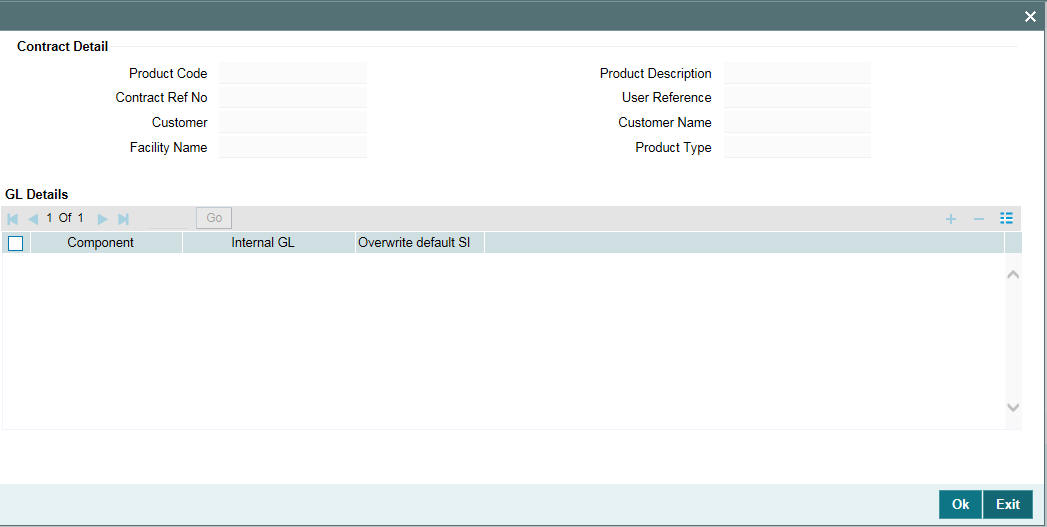

Click ‘Overwrite default SI’ in the ‘LS Value Dated Amendment’ screen to invoke the following:

Component

This screen displays the all the components displayed in the Settlement Message Details screen.

Internal GL

Specify the Internal GL accounts into which you want to post the liquidation entries for the components.

Overwrite default settlement instruction

Select the ‘Overwrite default settlement instruction’ check box to confirm that the liquidation entries should be posted into the Internal GL account. System posts the entries to the Internal GLs only if you check this check box. Otherwise, system posts the entries as per the settlement instructions specified for the component of the contract.

10.2.7 Viewing Settlement Details

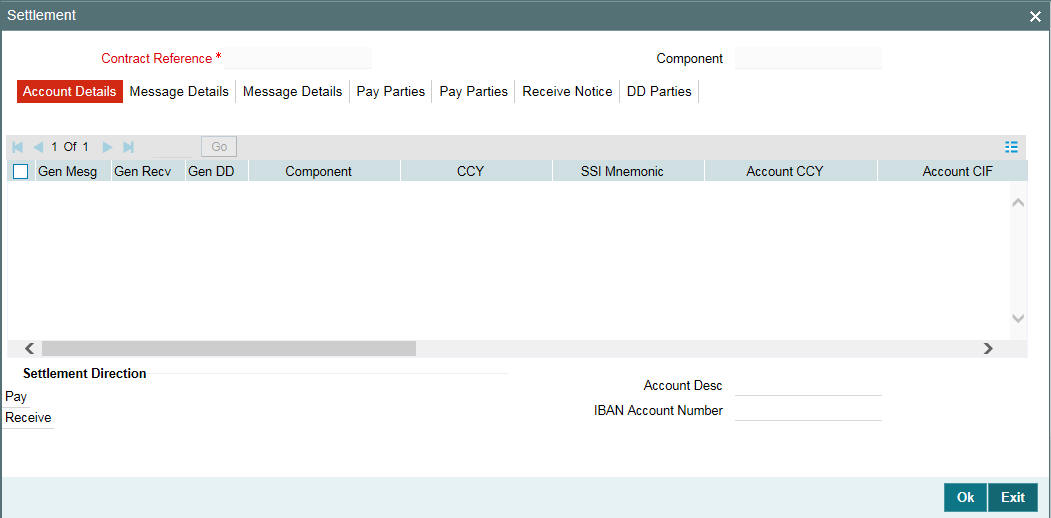

You can view the settlement account details for the amended tranche

in the ‘Settlement Message Details’ screen. Click ‘Settlements’

tab to view the details, as shown below:

For details on the above screen, refer the Settlements User Manual.

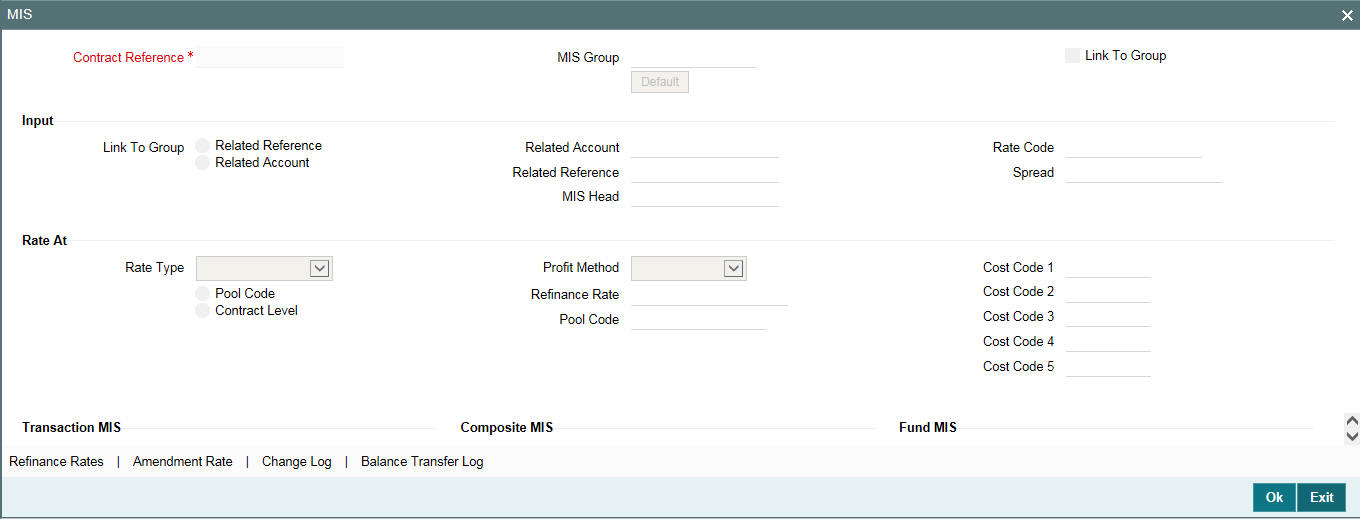

10.2.8 Viewing MIS Details

To view the MIS details for the amended tranche, click ’MIS’ tab.

For more details on this screen, refer the MIS (Management Information System) User Manual.

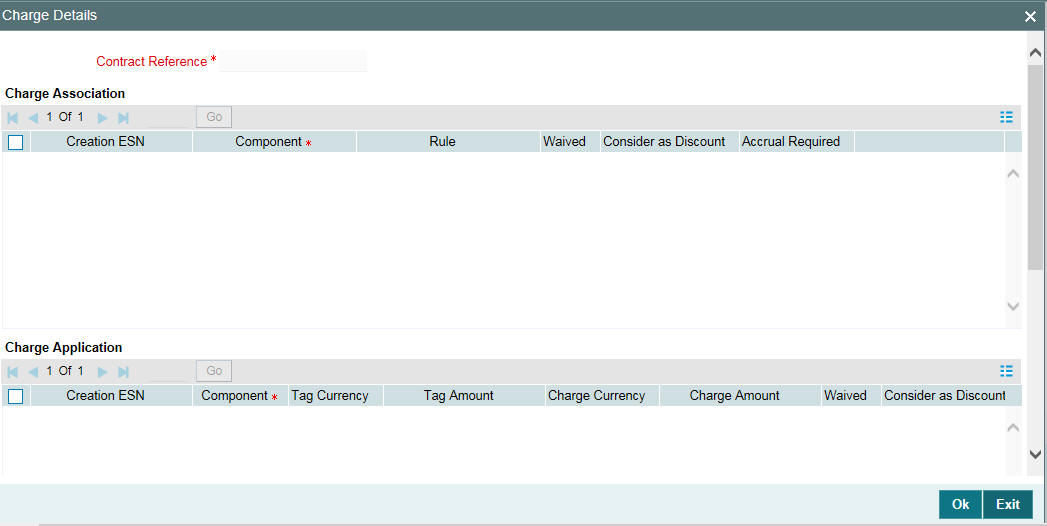

10.2.9 Viewing Charge Details

You can view the charge components associated with the amended tranche in the ‘Contract Charge Details’ section of the screen. Click ‘Charges’ tab in the ‘LS-Value Dated Amendments’ screen to view the details.

For more details on the ‘Contract Charge Details’ screen, refer the Charges User Manual.

10.2.10 Specifying Media for Message Generation

You can specify the media for the message generation in ‘Media

for Message Generation’ screen. You can invoke this screen by clicking

‘Media’. This button is enabled

only if the ‘FpML Type’ option is deselected at the contract

level and the ‘Media Priority’ option is checked at the product

level.

If this button is enabled, then the system will display an override message saying to view the ‘Media for Message Generation’ screen. If not, the system will handoff the message as per the details maintained in the ‘Customer Entity Maintenance’ screen.

For more information on the ‘Media for Message Generation’ screen, refer the section ‘Specifying Media for Message Generation’ in the Loan Syndication Contracts - Part 2’ chapter of this User Manual.

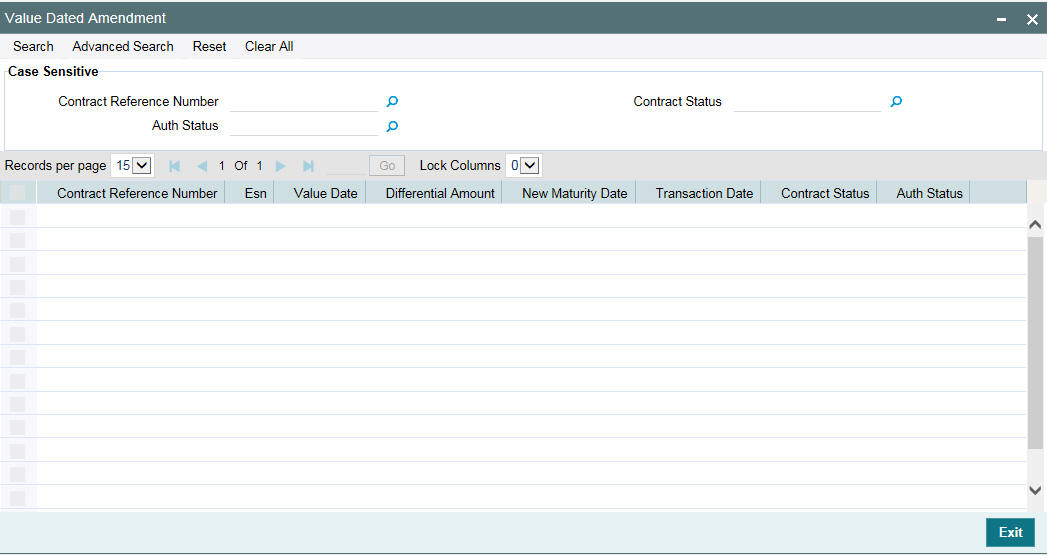

10.3 Viewing Value Dated Amendment Summary

You can view the Value Dated Amendment summary in the ‘LS-Value Dated Amendment Summary’ screen.

You can invoke the ‘Value Dated Amendment’ summary screen by typing ‘LBSVAMND’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The following fields are displayed in the ‘LS-Value Dated Amendment Summary’ screen:

- Contract Reference Number

- Value Dated Amendment Booking Event Seq Number

- Value Date of Amendment

- Transaction Date of Amendment

- Differential Amount

- New Maturity Date

- Event Audit Trial

- Auth Status

10.4 Downsizing Tranche for an Investor’s Default

If there is an investor default in due course of time, you have to manually initiate a tranche downsize to the extent of the defaulting investor’s contribution.

To facilitate this, Non-Prorata VAMI with negative amount is enabled when sighting funds is applicable and the tranche is of lead type.

The non-prorata VAMI will then be propagated to the drawdowns to propagate the revised ratios along with the reduction in drawdown amount.

System will show an override message if the Tranche down size is happening for an investor who has fully funded. System does not capture any information on investor defaulting.

In case of value dated amendment, the VAMI amount is expected to be funded by those investors who have funded completely for the previous disbursement events.

The system throws an override during save of VAMI to state this validation.

10.4.1 Validating Fronting Details

The system performs the following validations while capturing the fronting details for the VAMI event:

- The fronting flag for the unfunded investor cannot be different from the previous VAMI/INIT events. In other words, for the unfunded investor, either the entire amount is fronted across disbursements or the entire amount is not fronted across disbursements.

- If the investor has already funded the disbursements, then he is expected to fund the current VAMI also. In case if the investor is not funding the current disbursement inspite of funding earlier disbursements, the following restrictions are imposed on the transaction activities:

- Payment / Reprice / Rollover / PRAM (with such investor) and tranche downsize (non-prorata VAMI with negative amount) is blocked till the complete funding is made by the unfunded investor for VAMI activity.

- The funding for the pending VAMI events happens together. For example, in case the investor has not funded few of the last disbursements, he cannot fund for only the first VAMI while second VAMI is already in place.

- The system does not allow tranche upsize if any of the underlying drawdowns has not been funded completely.

10.5 Upsizing Tranche Amount on a Non-prorata Basis

Oracle FLEXCUBE allows you to perform a non-prorata type of increase (upsize) of the tranche amount through a value dated amendment. To do this:

- First you to have to specify the amount by which the tranche principal has to be increased. You can specify this amount in the ‘Change in Principal’ field of the ‘LS-Value Dated Amendments’ screen.

- You then have to select the participants who are contributing towards the increase and their ratio of contribution. This is explained in the section below.

10.5.1 Selecting Participants for Tranche Upsize

You can select the participants in the ‘Participant Ratio Details’

screen. Click ‘NonProrata’ tab in the ‘LS - Value

Dated Amendments’ screen to invoke it. In the ‘Non Prorata

Participant Ratio Details’ screen, click ‘List of Values’ button to invoke the ‘Participant

Selection’ screen. The system displays the names of the existing

participants of the tranche as on the value date of the amendment (upsize).

From the existing list of participants, you have to select the participants contributing towards tranche upsize and move them to the ‘Contract Participants’ section of the screen.

For details on the above screen, refer the section titled ‘Specifying participants for the facility’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

After selecting the list of participants, click ‘Ok’ button to save and return to the ‘Participant Ratio Details’ screen. In this screen, you can view the names of the selected participants (in the ‘Component Ratio’ field), as shown below.

You can specify the new ratio as per the participants’ contribution towards the increase. The system allocates the increased amount to the selected participants as per this new ratio.

10.5.1.1 Propagating the Increased Amount to Underlying Drawdowns

For prorata type of tranche, you can propagate the new ratio, as a result of tranche upsize, to the underlying drawdowns. By default, the system checks the ‘Propagate Ratio to Drawdown’ box to facilitate the propagation. You can deselect this option, if required. If not checked, propagation to the underlying drawdowns does not happen and the system converts the tranche to a non-prorata type (the ‘Cascade Participation’ option is unchecked in the ‘LS Tranche Contract Online’ screen).

If you check the ‘Propagate Ratio to Drawdown’ box, the system displays a message to indicate that the new asset ratio is propagated to the underlying drawdowns. This message is displayed when you save the tranche upsize.

Note

- The ‘Propagate Ratio to Drawdown’ is not available for a non-prorata type of tranche.

- You can use the Non-Prorata option only to upsize the tranche amount and not for reduction in the tranche amount.

In addition, the system performs the following activities on tranche upsize:

- On saving, triggers the events VAMI (Value Dated Amendment Initiation) and PRAM (Participant Ratio Amendment) for the tranche. Increase the tranche amount and updates the new asset ratio for the tranche.

- If you have checked the ‘Propagate Ratio to Drawdown’ box, triggers the PRAM event for the underlying drawdowns for propagating the new asset ratio.

- Allows you to book new drawdowns to the extent of increased tranche amount. However, in the new drawdowns, you have to monitor the settlement advice messages since all the participants of the tranche become part of the new drawdowns. Hence, you have to manually perform settlements for the participants who contributed towards tranche upsize.

- Restricts all back valued activities (drawdown initiation, amendment) for a prorata tranche till the value date of the non-prorata tranche upsize.

- You cannot initiate a tranche upsize beyond/after an assignment and another value dated amendment.

10.6 Making Value Date Amendments for a Drawdown

In Oracle FLEXCUBE, you can change values of the following components using the value dated amendment function for a drawdown:

- Increase the drawdown principal

- Modify the interest rate (for fixed rate type)

- Modify the spread (for floating rate type)

- Change the maturity date

You can enter value-dated changes to a borrower drawdown in the ‘LS-Value Dated Amendments’ screen. You can invoke the ‘LS - Value Dated Amendment’ screen by typing ‘LBDVAMND’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The ‘Contract Details’ section of the screen displays the following details:

- Name of the product

- Counterparty Id and Name

- Contract Reference Number

- Start date of the drawdown

- Currency of the drawdown

- Ticket Id (Only if the VAMI is initiated from the trading activity)

- Reference Number of the facility under which the tranche is processed

- Number of drawdowns processed under the tranche

The ‘Amendment’ tab displays the following:

- Current Principal

- Current Maturity Date

To make an amendment, select the reference number of the drawdown you want to amend and then select Unlock from the menu.

10.6.1 Increasing Drawdown Principal

After you unlock the drawdown, you need to specify the following:

Amendment Date

By default, the current system date is displayed as the date of amendment. Once you specify this date, you cannot change it.

Change in Principal

Specify the amount by which you want to increase the drawdown principal. You can indicate this under the ‘Modifications’ section in the ‘LS – Value Dated Amendments’ screen. If the currency of the drawdown is different from the local currency of the branch, system displays its equivalent in the local currency.

When you specify the increase in principal, this amount is blocked at the tranche level from the date of booking.

Note

- For normal and bearing type of drawdowns, the increase in principal amount is added to the bullet payment schedule.

- For amortized type of drawdowns, the increase in principal recalculates the payment schedule of the contract.

- You cannot enter a back dated amendment on or beyond the previous value dated amendment.

- For normal or bearing type of drawdowns, you can enter back value

dated amendments beyond the liquidation date or schedule date only if

the following criteria are satisfied:

- Latest non-prorata payment date

- Last payment date of the prime loan with the option to pay the interest along with the principal prepayment

- For any change in the principal amount, the participant’s share is subsequently change. As a result, the participant’s contracts will get updated based on their share. This is initiated through a VAMI event.

- When the principal amount changes at the drawdown level, Oracle FLEXCUBE recalculates the utilization and non-utilization fees at the tranche level.

- Value dated amendments will not be applicable for swing line contracts

- If the drawdown currency is different from the tranche currency, Oracle FLEXCUBE converts the increase in drawdown amount to the tranche currency. This amount is then validated against the tranche availability amount. This validation will be effective from the value date of the amendment till the maturity date of the drawdown.

- During value dated amendments, you cannot decrease the principal amount.

- Value dated amendments to the principal and interest components are not allowed after the maturity date of the loan.

- Future Value dated amendments will be allowed for Prime draw downs, similar to normal draw downs.

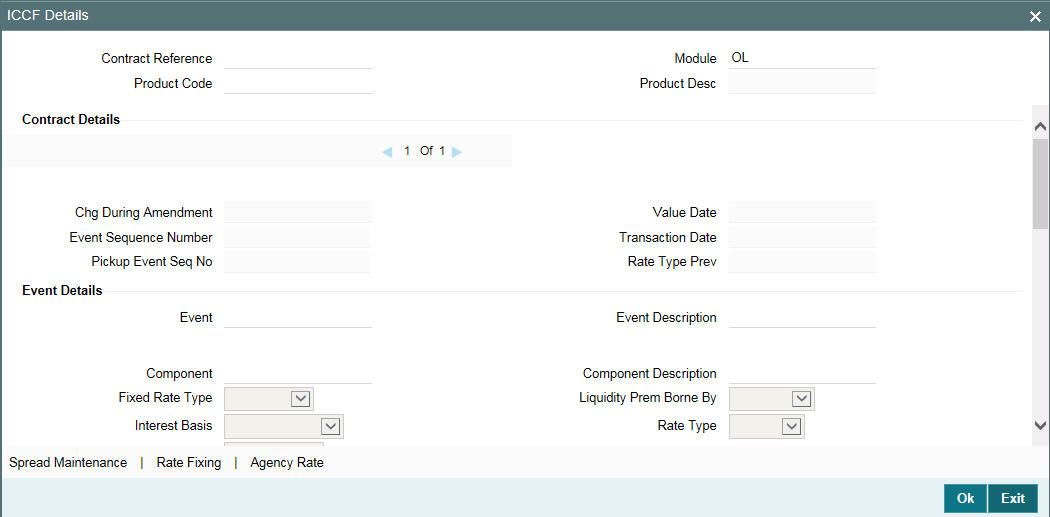

10.6.2 Modifying Interest Rate

You can modify the interest for fixed or floating rate type of drawdowns. To do this, click ‘Interest’ tab (this button is available only if you are performing value dated amendment for a drawdown) in the ‘LS-Value Dated Amendments’ screen. The ‘ICCF Details’ screen is displayed.

Using the above screen, you can select the rate type for which you want to change the interest rate. For floating rate type of drawdowns, you can also change the interest rate code.

For more details on negative rate processing, refer the title ‘Maintaining Loans Parameters Details’ in the chapter ‘Bank Parameters’ in Core Services User Manual.

For more details on this screen, refer the section ‘Specifying Interest Details for a Contract’ in the Interest User Manual.

Note

- You can modify the interest rate only for drawdowns

- You can also change the interest rate/spread on a Value Date prior to the last PRAM (Participant Ratio Amendment)/VAMI date. Any difference in the interest amount as a result of the change is tracked as payables/ receivables.

- If the UDF ‘RATE-VARIANCE’ is maintained as a non-zero value for a tranche contract to which the drawdown is linked, dual authorization is required for rate code changes for floating rate contracts and margin rate changes for borrower drawdowns.

- The system considers the margin rates maintained for the participants while calculating the interest due for the participants.

For more details regarding dual authorization, refer the heading titled ‘Authorizing Overrides’ in the chapter titled ‘Loan Syndication Contracts - Part 1’ of this User Manual.

For more details, refer the heading titled ‘Processing Back Valued Interest/Fee for Payables and Receivables’ in the chapter titled ‘Loan Syndication Contracts- Part 2’ chapter of this User Manual.

10.6.3 Modifying Maturity Date

Specify the new maturity date for the drawdown as per you requirement. You can extend the maturity date to a later date or decrease the maturity date to an earlier date. The date should be specified in the ‘DD-MMM-YYYY’ format.

Note

In the case of cross currency drawdowns for which you have defined revaluation schedules, a change in the maturity date will repopulate the schedules as per the modified maturity date.

For more information on modifying the maturity date for drawdown contracts, refer ‘Modifying Maturity Date’ under the section ‘Making Value Dated Amendments for a Tranche’ in this chapter.

10.6.4 Viewing Schedule Details

After the amendment, you can view the existing schedules as well as the one for the principal (for the increased/decreased amount) in the ‘Schedules’ tab of the screen.

You can view the schedule details of a drawdown contract in this screen.

For more information on the schedule details, refer the section titled ‘Capturing details in the SCHEDULE tab’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.