12. Re-pricing

This chapter contains the following sections:

- Section 12.1, "Introduction"

- Section 12.2, "Capturing Split Re-Price Instructions"

- Section 12.3, "Processing Split Re-Pricing"

- Section 12.4, "Capturing Consolidation Re-Price Instructions"

- Section 12.5, "Processing Consolidated Re-Pricing"

- Section 12.6, "Reversing Re-Price Instructions"

12.1 Introduction

Oracle FLEXCUBE allows you to re-price fixed rate contracts to floating rate contracts and vice-versa. Re-pricing is very similar to the rollover operation. The difference being that you can initiate a rollover only on the maturity date whereas you can perform re-pricing on any date between the value date and maturity date of the contract (value date inclusive). The following two options are available for re-pricing:

- Split re-pricing – In this case, you re-price the parent contract into new child contracts

- Merger Re-pricing – In this case, you re-price one or more child contracts into a single parent contract.

You have to adhere to the following rules for both types of re-pricing:

- Use ‘Re-Price Suspense GL’ (selected in the Branch Parameters – Preferences’ screen) for settlement of re-price transactions

- Re-price only the principal of the contract and not interest

- Use different products for parent and child contracts during re-pricing but all products have to be under the same tranche

12.2 Capturing Split Re-Price Instructions

When you re-price a contract, the amount is taken from the parent contract into the ‘Re-Price Suspense GL’ (specified in the ‘Preferences’ sub-screen of the ‘Branch Parameters – Detail’ screen) before moving it to the child contract.

You can re-price a transaction (or part amount) into a new transaction or multiple transactions through the ‘Re-Price Transaction (Split Details)’ screen.

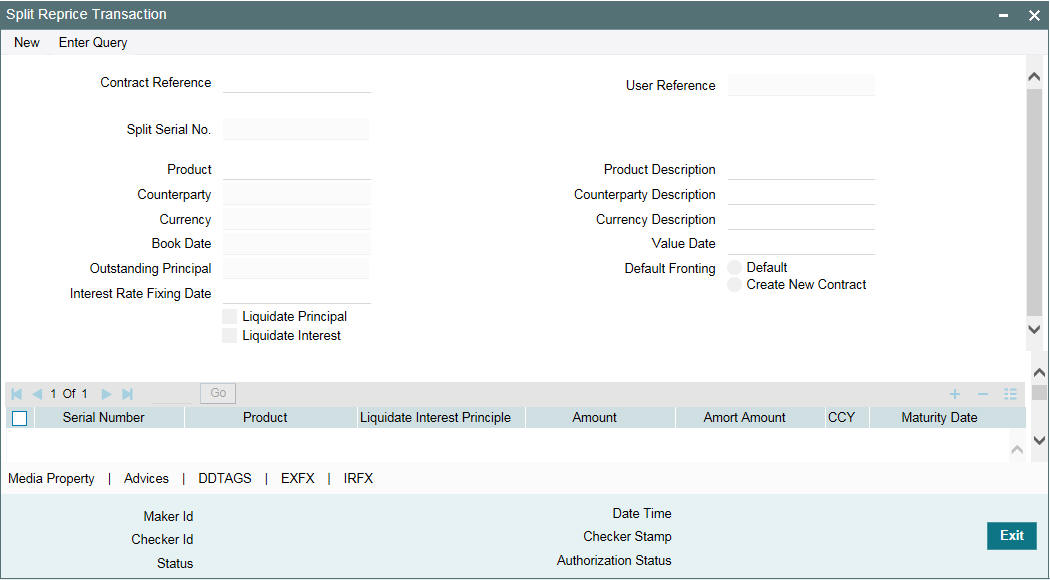

You can invoke the ‘Split Reprice Transaction’ screen by typing ‘LBDREPRS’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The current system date is displayed as the ‘Book Date’ (you are not allowed to change this date) and ‘Value Date’ of split re-pricing.

In addition, you have to specify the following:

Contract Ref No

Select or enter the reference number of the contract to be re-priced. When you enter the reference number, the following details are displayed for the parent contract:

- User Reference Number

- Product and associated description

- Counterparty

- Currency of the contract

- Outstanding Principal

The Split Serial No. gives you the number of split transactions carried out on the parent contract till date. It starts with one and increments by 1 for every subsequent split transaction.

Note

- You can re-price only those contracts that have no overdue schedules

- The advices to the customer on account of re-pricing are sent from the parent contract

Value Date

By default, the system displays the current date. You can change this date provided the new date is less than the maturity date or greater than or equal to the value date of the contract.

Liquidate Principal

By default, the system selects this check box if the total amount of the child contracts is less than the outstanding principal balance. It instructs the system to liquidate the outstanding principal for the parent contract at the time of re-pricing. You can deselect this check box, if required.

Liquidate Interest

By default, this check box is deselected. If you select this check box, the system liquidates the outstanding interest for the parent contract at the time of re-pricing, if interest payment schedule exists on that day. If you do not check this box, the interest remains with the parent. On the event of complete liquidation of principle or re-price amount more than the principle outstanding also you can select or deselect the Liquidate Interest check box.

Interest Rate Fixing Date

The system displays the interest Rate Fixing Date.

In the case of prime loans, this box is not applicable and prime interest liquidation happens to the extent of the re-price amount and principle if any.

Transfer Unamortized Fee

Select this check box to transfer all the unamortized fees to the child contract. Amortization starts from EOD of the Global Application date.

Default Fronting

Indicate if the fronting detail has to be defaulted for the increase in amount during rollover / reprice. You can select one of the following options:

- ‘Default Fronting’ - select this option to default the front/fund details from the latest disbursement

- ‘Create New Contract’ – select this option to create a new contract for the increase in amount without the default front/fund details

On selecting the ‘Default Fronting’ option, the front/fund details is defaulted from the past disbursement events to the new disbursement event (VAMB/VAMI) which is triggered as part of reprice processing. System generates BPMT to the borrower for the fronted/funded investor’s portion and proceed with the reprice processing.

On selecting the ‘Create New Contract’ option, the system defaults the front/fund details to the new disbursement event (VAMB/VAMI) which will be triggered as part of reprice processing, but the BPMT event is not fired based on these default options. Further, as part of Reprice processing, one of the child contractsare created for the increase in amount without any default fronting/funding options. In the split child contract, for the increased amount, the funding details are captured and borrower payment is also be sent from this child contract.

12.2.1 Specifying Child Contract Details

In the ‘Child Re-Price Transaction (Split)’ section of the screen, you can specify the following details of the child contracts.

Product

Select the product under which the child contract is to be created during re-pricing.

Liqd Int on Prepayment

The system allows you to check this option only if the product you select is defined as a ‘Prime Loan’ product (in the ‘Loans Syndication – Borrower Product Preferences’ screen). If selected, the system liquidates the interest component along with the principal either on the frequency-based schedule date or at the time of principal prepayment. In case of the latter, system calculates interest only on the principal prepaid.

Amount

Specify the transaction amount for the split/child contract. After you specify the amount, the system displays the following information:

- CCY- The currency of all child contracts is same as that of the parent contract. You are not allowed to change the same.

- Total Split Amount - The total amount of all child contracts

Note

The sum total of the transaction amounts of all the child contracts can be less than, equal to, or greater than the outstanding principal amount of the parent contract. If the total amount of the child contracts (at the time of re-pricing) is greater than the outstanding principal balance, the system automatically initiates a VAMI (value dated amendment on the re-price date) on the parent contract for the differential amount. Thus, the difference amount is added to the principal amount before the system proceeds with re-pricing.

Amort Amount

Specify the amort amount for the child contracts.

Amort Amount is enabled only if the child product is amortization type and the “Allow user input installment” and ‘User Input Installment’ is selected at the product level. The system validates this value and displays an error message if the field value is null.

Pre-EMI main Interest component schedule is not defaulted to Child contracts even if parent contract has ‘Allow pre-amortization interest’ checked. Split Reprice is supported only for Amortization contracts having Principal and Main Interest component amount as part of Amortization constant. If Escrow impounding components or any other non main interest component exists and they are not part of the Amortization constant, Split reprice is allowed.

Impound components are copied from child product and special amount is not be copied from parent contract. For Tax/ Insurance/ ESCROW components, definition of special component related details for the child products are not supported.

Maturity Date

Enter the date of maturity for the child contract. Child contract generated from the parent contract can have any maturity date but not greater than the maturity date of the tranche and not less than the value date of the re-price.

Child Ref No

The system displays the reference number of the child/re-priced contract. For current and back dated split instructions, the reference number is generated on authorization of the split instructions. For future dated instructions, the reference number is generated either on the re-price value date or on the child contract creation date (through the ‘Partial Split Instruction Processing’ screen), which ever occurs first.

Consider for Split

Select this check box to specify the split that should be considered for the new contract created for the increase in amount without the default front/fund details.

It is mandatory to select this option for one of the splits if ‘Create new contract’ option is selected.

Note

- On selecting the 'Default Fronting' option, the 'Consider for Split' is disabled.

Example

Case 1: Split reprice instruction is captured as follows:

Split No |

Reprice Amount |

Consider for Split |

1 |

12M |

Y |

On completing the reprice processing, it is as follows:

Split No |

Reprice Amount |

Consider for Split |

Child Contract |

1 |

2M |

Y |

C2 |

2 |

10M |

N |

C3 |

The split for 12M is internally split into 2M (increase in amount) and 10M (12M-2M). Child contracts C2 and C3 are created for 2M and 10M, respectively. For C3, all the participants are treated as fronting (defaulted from parent contract C1). For C2, there is not any default fronting. User have to capture the fronting values manually using the payment processing browser.

Case 2: Split reprice instruction is captured as follows:

Split No |

Reprice Amount |

Consider for Split |

1 |

10M |

N |

2 |

2M |

Y |

On completing the reprice processing, it is as follows:

Split No |

Reprice Amount |

Consider for Split |

Child Contract |

1 |

10M |

N |

C2 |

2 |

2M |

Y |

C3 |

Child contracts C2 and C3 are created for 10M and 2M respectively. For C2, all the participants are treated as fronting (defaulted from parent contract C1). For C3, there is not any default fronting. User have to capture the fronting values manually using the payment processing browser.

Case 3: Split reprice instruction is captured as follows:

Split No |

Reprice Amount |

Consider for Split |

1 |

7M |

N |

2 |

5M |

Y |

On completing the reprice processing, it is as follows:

Split No |

Reprice Amount |

Consider for Split |

Child Contract |

1 |

7M |

N |

C2 |

2 |

2M |

Y |

C3 |

3 |

3M |

N |

C4 |

The second split for 5M is internally split into 2M (increase in amount) and 3M (5M-2M). Child contracts C2, C3 and C4 are created for 7M, 2M and 3M respectively. For C2 and C4, all the participants are treated as fronting (defaulted from parent contract C1). For C3, there is not any default fronting. User have to capture the fronting values manually using the payment processing browser.

Rate Type

Select the nature of the rate for computing interest for the child contract. The options available are:

- FIXED

- SPECIAL

- FLOATING

When you select the ‘Rate Type’, the system displays the name of the component(s), if any of the above type is associated with the product.

Reset Tenor

This indicates the tenor for the component. The tenor of the parent contract defaults for the child contract. You can specify a different tenor for the same, if required.

Rate Code

If there are components with ‘Rate Type’ as ‘Floating’, select a rate code to be applied to the child contract. The option list displays all valid rate codes maintained in the system. Select the appropriate code from this list. The system picks up the rate maintained for the selected rate code and displays it in the ‘Base Rate’ field.

Interest Basis

The system defaults the value from the component at the parent contract level and you are allowed to amend the value while capturing Re-price instruction.

The interest for each currency is calculated using the interest basis, which you select:

- 30 Euro / 360

- 30 US / 360

- Actual / 360

- 30 Euro / 365

- 30 US / 365

- Actual / 365

- 30 Euro / Actual

- 30 US / Actual

- Actual / Actual

- 30(Euro)/365.25

- 30(US)/365.25

- Actual/365.25

- Working Days/252

- Working Days/360

Base Rate

The base rate for the component of the child contract is displayed here. If the rate type of the component is ‘Fixed’ and the ‘Fixed Rate Type’ is ‘User Input’, you can amend the rate. In the case of ‘Floating’ rate type, system displays the rate applicable for the selected ’Rate Code’.

In addition, the system displays the following:

- Margin Rate - The sum total of the margin component values

- Rate – The final rate that the system arrives at based on the component ‘Base Rate’ plus ‘Margin Rate’ that you specify.

The margin, if maintained for the interest components defined for the selected borrower drawdown product (in the ‘Interest Definition’ screen), defaults in the ‘Product Component’ section of the screen. The following details are displayed:

- Name of the margin component

- Margin Basis whether tranche or drawdown

- Basis Amount Tag

- Margin Rate

Note

You can change the default rate only for components with ‘Basis Amount Tag’ as ‘User Input’.

Remarks

You can capture any additional information/remarks for the split transaction.

12.3 Processing Split Re-Pricing

During split re-pricing, in case there are residual interest and principal on the parent contract (in case of partial re-price), the system liquidates the same in the parent contract if you select the ‘Liquidate Principal’ and ‘Liquidate Interest’ boxes. If you do not select , the amount is retained in the parent contract.

Note

- If the parent contract is a prime loan for which you have checked both ‘Liquidate Interest’ and ‘Liquidate Interest on Prepayment’, the system liquidates the interest that is accrued till date (the date when the re-pricing is done).

- The system posts the accounting entries for the principal and interest liquidation at re-price for the SPTI (Split Transaction Initiation) event triggered for the parent contract.

The system creates the child contracts with the same currency as that of the parent contract. However, if drawdown currency is different from the linked tranche currency, you have the option to fix exchange rate for each child contract.

For details, refer the section titled ‘Fixing exchange rate for child contracts’ in this chapter.

You cannot perform a back dated re-pricing beyond the:

- Latest PRAM date

- Last payment date

- Last value dated amendment date

- Re-price value date

12.3.0.1 Automatic Rate Set Process for Future Dated Split Re-Price

The system processes the SPIX on the Rate Fixing Date. The Interest rate is picked from Daily LIBOR Rate for the Rate fixing date for Drawdown currency and for Interest Rate Period and Rate Code. The SPIX gets processed online once the Job starts processing and also when the rate maintenance available for the Rate fixing date

If the flag ‘Auto Auth Rate Fixing Events’ is ‘Yes’ at loans parameters screen, then SPIX gets auto-authorized with maker/checker as SYSTEM

If the flag ‘Auto Auth Rate Fixing Events’ is ‘No’, then SPIX will not be authorized. The Maker Id for SPIX event is SYSTEM. You are allowed to authorize this event from ‘Split Re-Price Transaction’ Screen.

You to manually amend the interest rate through Interest Rate Amendment screen (IRAM), if further amendments required for the Re-priced Drawdown interest components. The job fails the SPIX event if rate maintenance is not available for the day. Appropriate exception is logged saying rate maintenance is not available.

12.3.1 Generating Child Contracts for Future Dated Re-Pricing

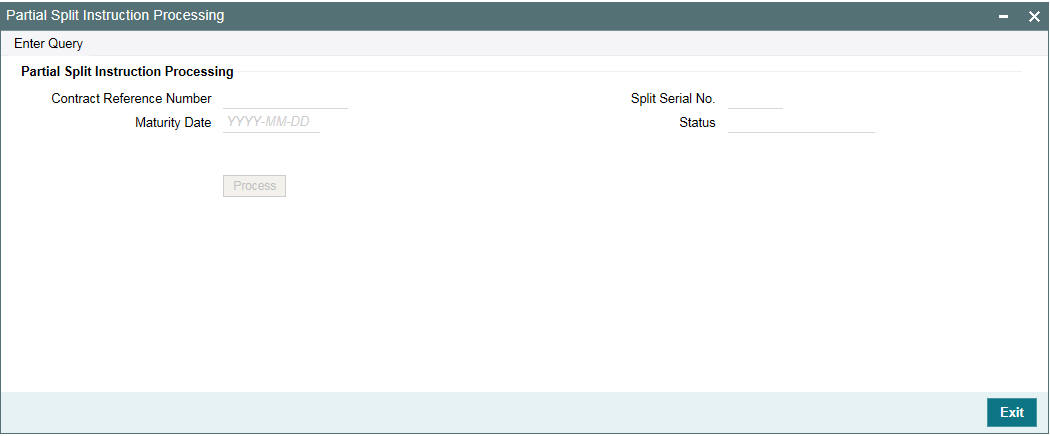

In the case of future dated re-pricing, FLEXCUBE allows you to create child contracts in advance, that is,. before the value date of the split. You can create the child contracts through the ‘Partial Split Instruction Processing’ screen. You can invoke the ‘Partial Split Instruction Processing’ screen by typing ‘LBDPARSP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen, the system displays all future dated parent contracts for which child contracts are yet to be created. You can select the contracts for which you wish to create the child contracts in advance. Check the box against each record to select a contract.

Click ‘Ok’ to generate

the child contracts for the selected parent contracts.

Note

If you opt for forward dated re-pricing, the system restricts other events (which may change the payment schedules – Liquidation, Value Dated Amendment, PRAM, Split/Merge Re-price, and so on), for the parent contract till the re-pricing is complete. However, for pro-rata tranche contracts, you can do a participant transfer between the Booking and Initiation dates.

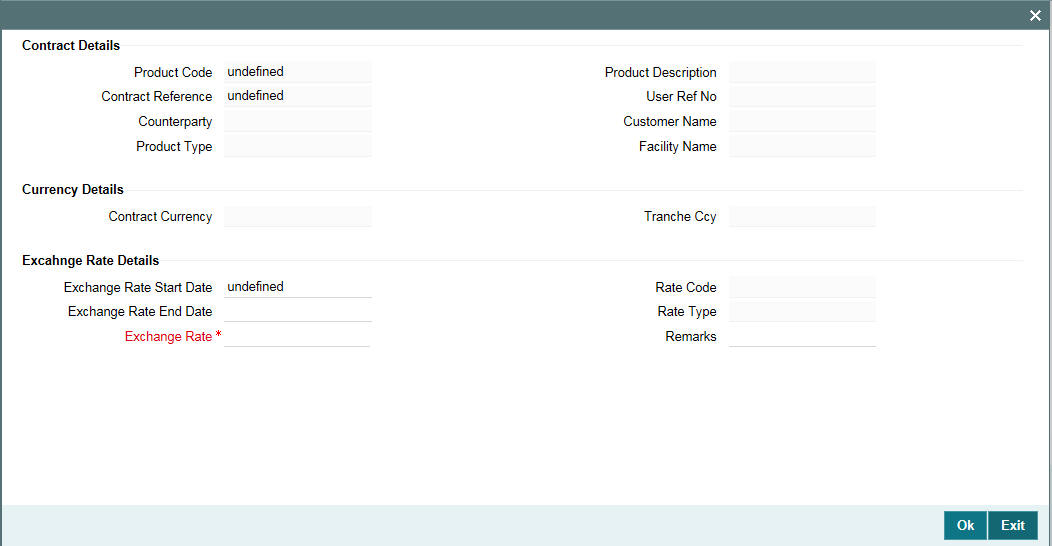

12.3.2 Fixing Exchange Rate for Child Contracts

If drawdown currency is different from the linked tranche currency, you have the option to fix exchange rate for each child contract. You can do this through the ‘Exchange Rate Fixing’ screen. Click ‘Exchange Rate Fixing’ button in the ‘Re-Price Transactions (Split Details)’ screen.

For more details on the above screen, refer the section titled ‘Fixing exchange rate for drawdown currency’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

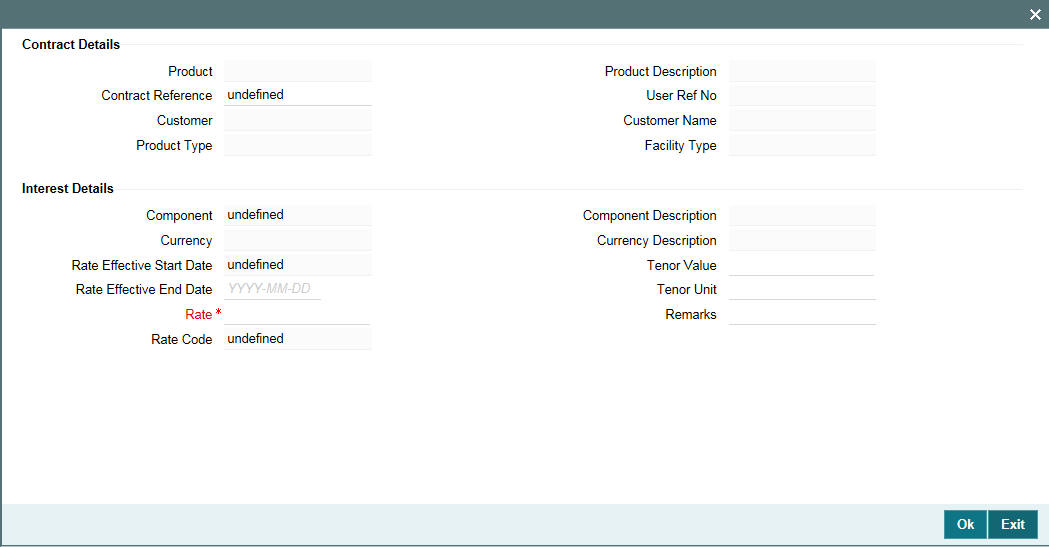

12.3.3 Fixing Interest Rate for Child Contracts

If you have checked the ‘Rate Fixing Required’ box for the interest component at the product level (in the ‘Interest Definition’ screen), you can fix the interest rate for such components in the child contracts, at the time of re-pricing. To do this, click ‘Interest Rate’ button in the ‘Re-Price Transactions (Split Details)’ screen.

For details on the above screen, refer the section titled ‘Fixing interest rate after drawdown booking’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

12.3.4 Authorizing Override for Split Re-Pricing

If the UDF ‘RATE-VARIANCE’ is maintained as a non-zero value for a tranche contract to which the drawdown is linked, dual authorization is required.

For more details, refer the section ‘Authorizing Overrides’ in the chapter titled ‘Loan Syndication Contracts - Part 1’ of this User Manual.

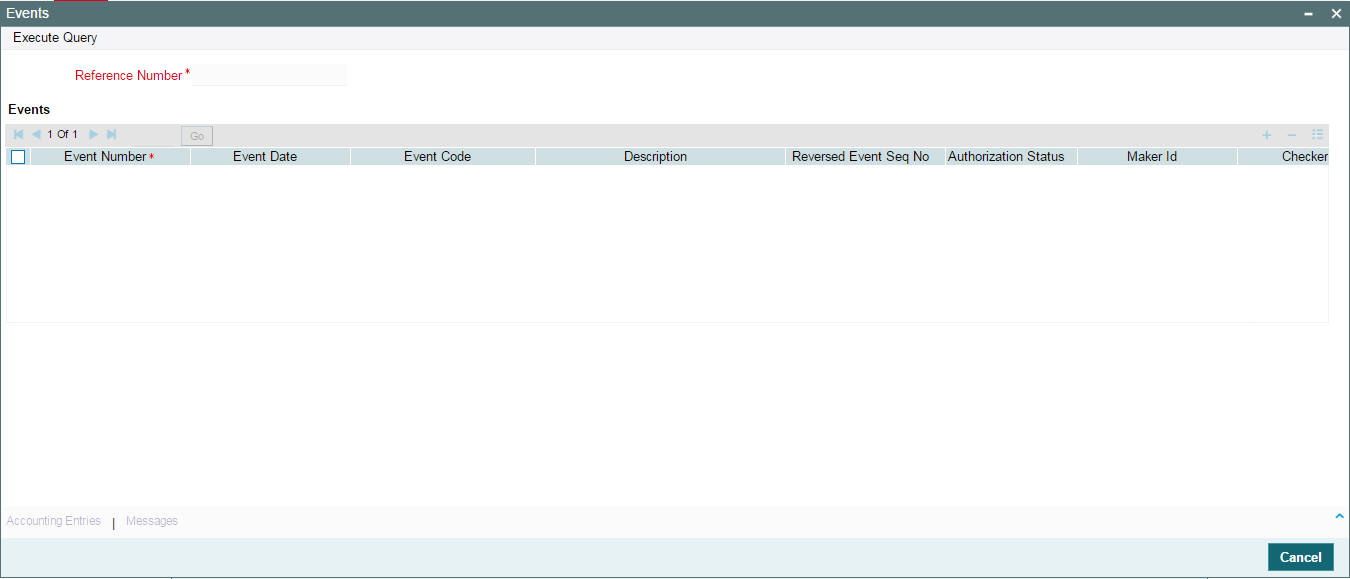

12.3.5 Viewing Event Details

You can view the events, accounting entries and advices generated for contract in the ‘Event Log Details’ screen. Click Events’ to invoke this screen.

For more information on the ‘Event Log Details’ screen, refer the section ‘Viewing events for the facility’ in the ‘Loan Syndication Contracts’ chapter this User Manual.

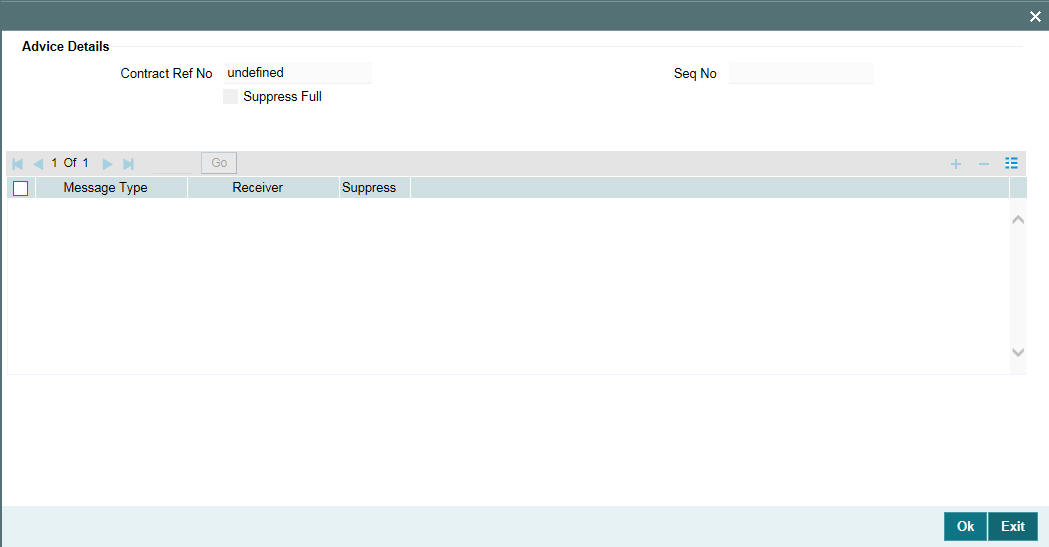

12.3.5.1 Viewing Advices

Similarly, you can view the advices generated for contract. To do

this, click ‘Advices’ tab

in the ‘Re-Price Transaction (Split Details)’ screen. The

system displays the ‘Advices’ screen, as shown below.

12.3.6 Specifying Media for Message Generation

You can specify the media for the message generation in ‘Media

for Message Generation’ screen. You can invoke this screen by clicking

‘Media’ button. This button

is enabled only if the ‘FpML Type’ option isdeselected at

the contract level and the ‘Media Priority’ option is selected

at the product level.

If this button is enabled, then the system will display an override message saying to view the ‘Media for Message Generation’ screen. If not, the system handoffs the message as per the details maintained in the ‘Customer Entity Maintenance’ screen.

For more information on the ‘Media for Message Generation’ screen, refer the section ‘Specifying Media for Message Generation’ in the Loan Syndication Contracts - Part 2’ chapter of this User Manual.

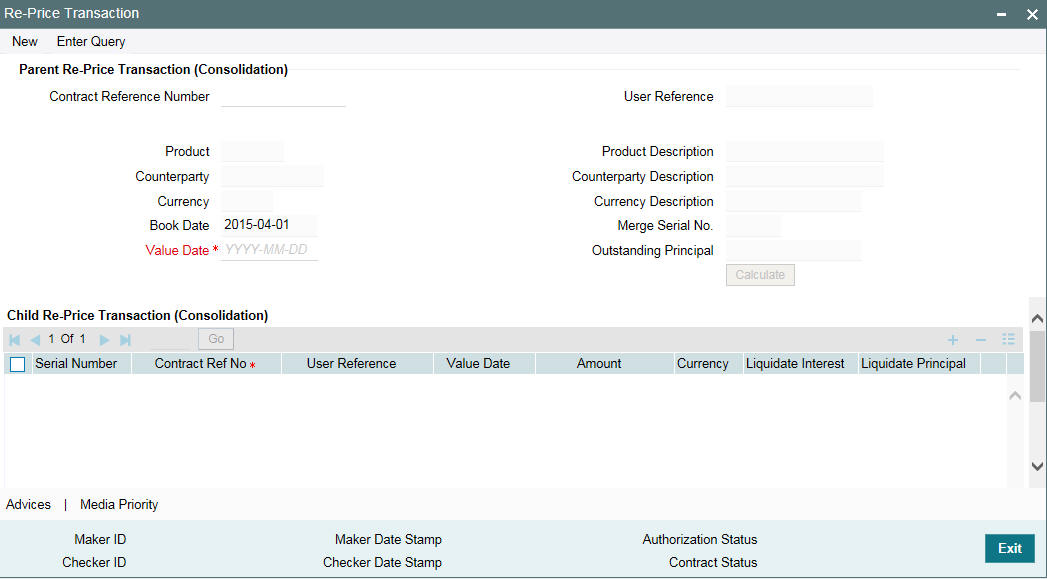

12.4 Capturing Consolidation Re-Price Instructions

You can consolidate one or more re-priced child contracts with a parent contract. The same can be done through the ‘Re-Price Transaction (Consolidation Details)’ screen. You can invoke the ‘Re-Price Transaction’ screen by typing ‘LBDREPRC’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Note

You cannot capture split/merge reprice instructions for the same contract if any reprice is pending for the process.

The current system date is displayed as the ‘Book Date’ (you are not allowed to change this date) and ‘Value Date’ for consolidated re-pricing. In addition, you have to specify the following details:

Contract Ref No

Select the reference number of the parent contract into which the selected child contracts (in the ‘Child Re-Price Transaction’ section of the screen) are to be consolidated. When you enter the reference number, the following details of the selected parent contract is also displayed:

- User Reference Number

- Product and Description

- Counterparty

- Currency

- Outstanding principal

The ‘Merge Serial No.’ gives you the number of merge transactions carried out on the parent contract.

Value Date

By default, the system displays the current date as the merger value date. You can change this date provided the new date is less than the maturity date or greater than or equal to the value date of the parent contract. The system allows current dated, forward dated or back dated merger re-pricing. However, back dated merge re-pricing cannot be beyond the:

- Latest PRAM

- Last payment date

- Last value dated amendment date

- Re-price value date

12.4.1 Specifying Child Contract Details for Consolidation

In the ‘Child Re-Price Transaction (Consolidation)’ section of the screen, you can specify the following details of the child contracts that have to be consolidated to the selected parent contract.

Contract Ref No

Select the reference number of the child contract that is to be merged with the parent contract. The option list displays the reference number of all the non-LC type of drawdowns which are eligible for merge reprice contracts. Contracts which satisfy the following conditions are displayed in the option list:

- Contracts which are under the same tranche of parent contract

- Contracts for which reprice value date lies between Value date and maturity date (including maturity date

- Contracts which have same currency and same borrower as thatof parent contract

Upon selection of the child contract, the following details are displayed:

- User Reference Number

- Value date of the contract

- Transaction Amount

- Currency of the contract

Amount

The amount of the child contract which is re-priced and consolidated with the parent contract is displayed here. This is the outstanding principal amount of the child contract. The amount can be less than or equal to the outstanding principal.

The system displays the sum total of the merged amount in the ‘Total Merge Amount’ field.

Currency

The currency of the child contract is displayed here. You can merge only those child contracts that have the same currency as the parent contract.

Liquidate Interest

By default, this box is deselected. If you select this check box, the system liquidates the outstanding interest for the child contract at the time of re-pricing, if interest payment schedule exists on that day. If you do not select this check box, the interest remains with the child.

Note

If the child contract is prime loan, the system liquidates the interest which has been accrued till date (the re-price value date) irrespective of the ‘Liquidate Interest’ option.

Liquidate Principal

By default, the system selects this check box if the total amount of the child contracts is less than the outstanding principal balance. It instructs the system to liquidate the outstanding principal for the child contract at the time of re-pricing. You can deselect this check box, if required.

Remarks

You can capture additional remarks for the consolidation transaction, if required.

12.5 Processing Consolidated Re-Pricing

During consolidation re-pricing, the amount is taken from the child contract into the ‘Re-Price Suspense GL’ (specified in the ‘Preferences’ sub-screen of the ‘Branch Parameters – Detail’ screen) before moving it to the parent contract.

Note

- You cannot merge child contracts for more than the principle outstanding amount of those contracts. Merge reprice can happen for those contracts which have the same no of active participants with the same participant ratios.

- The system processes all future dated re-pricing entries on BOD of the value date of re-price.

- Re-pricing can be processed only if the balance is zero in all the linked escrow accounts for the contract. Thus during re-pricing, balances in the escrow account is not automatically transferred to the new contract.

12.5.1 Authorizing Override for Consolidated Re-Pricing

If the UDF ‘RATE-VARIANCE’ is maintained as a non-zero value for a tranche contract to which the drawdown is linked, dual authorization is required.

For more details, refer the section ‘Authorizing Overrides’ in the chapter titled ‘Loan Syndication Contracts - Part 1’ of this User Manual.

12.6 Reversing Re-Price Instructions

You can reverse a forward split/consolidation re-price instructions before the value date of re- price. To reverse the split instructions for which the system has already processed the child contracts, you have to first reverse the child contracts before you reverse the re-price instructions maintained for the parent contract. You cannot reverse the instructions if the underlying split child contracts are active.

For the list of events and sample accounting entries, refer ‘Appendix A – Events, Advices and Accounting Entries for Loan Syndication Products’ of this User Manual.

12.6.0.1 Account Entries

As part of Re-price, SPTI event is triggered in the parent contract. Only the Principal and Interest Liquidation entries get posted.

Accounting Role |

Dr. / Cr. |

Amount Tag |

SYN_POOL |

Cr. |

INTEREST_LIQD |

CUSTOMER |

Dr. |

INTEREST_LIQD |

SYN_POOL |

Cr. |

PRINCIPAL_LIQD |

CUSTOMER |

Dr. |

PRINCIPAL_LIQD |

SYN_POOL |

Cr. |

PRINCIPAL_SPTI |

CUSTOMER |

Dr. |

PRINCIPAL_SPTI |

The entries triggered for fee as part of INIT in the child contract for inheriting the unamortized fee is mentioned below.

Accounting Role |

Dr. / Cr. |

Amount Tag |

CUSTOMER |

Cr. |

PRINCIPAL |

SYN_POOL |

Dr. |

PRINCIPAL |

ROLL_WASH |

Cr. |

PRINCIPAL_ROIN |

SYN_POOL |

Dr. |

PRINCIPAL_ROIN |

12.6.0.2 Rate Setting

To set the rate setting rules for the Split Re-Price Instructions, click the ‘Rate Setting’ button in the ‘Split Re-Price Instructions’ screen and invoke the ‘Rate setting’ screen.

Specify the following details.

Contract Details

Product code

The system displays the product code.

Contract Ref number

The system displays the contract ref number.

User ref number

The system displays the user ref number.

Customer

The system displays the customer name.

Facility name

The system displays the facility name.

Split Details

Split number

The system displays the split number.

Principal roll amount

The system displays the principal roll amount.

Interest roll Amount

The system displays the Interest roll amount.

Roll Product

The system displays the roll product.

Total roll amount

The system displays the total roll amount.

Maturity date

The system displays the maturity date.

Interest rate rounding rules

Rounding rule

Select the rounding rule from the adjoining drop down list. Select one of the options listed below:

- Down

- Upto

- No rounding

- Manual

Rounding Unit

The rounding unit enables only if the you have selected the ‘rounding rule’ as ‘Down’ and ‘Upto’ .

Interest rate period

Select one of the interest rate periods from the options given.

Note

Once all the Rate setting rules are maintained and when you come out of ‘Rate Setting Rule screen’ by clicking OK button (Green tick), following override message is displayed displayed

- If the Interest Rate Rounding Rule is ‘Manual’, then the message is ‘Rounding Rule is manual. Auto Rate Fixing will not be done’

- If Interest Rate Rounding Rule is not ‘Manual’, then the message is ‘Rounding Rule is maintained. Auto Rate Fixing will be done and rate will be defaulted’. This message appears only for the future dated events / contracts

- You are allowed to change the Rounding Rule by clicking ‘Cancel’ button in the override message