16. FpML Messaging

This chapter contains the following sections:

- Section 16.1, "Introduction"

- Section 16.2, "Maintenances Required for FpML"

- Section 16.3, "Handling Initial Validations for FpML Messages"

- Section 16.4, "Notices from Agent to Investors"

- Section 16.5, "Generating Notices Manually"

- Section 16.6, "System generated Messages"

- Section 16.7, "Messages from Markit for Prime Increase"

- Section 16.8, "Messages from Markit for Trade Settlement"

- Section 16.9, "Impact of Markit Trades on Tranches and Drawdowns in LB"

- Section 16.10, "Handling Status for Processing Markit Agency Trade Settlement"

- Section 16.11, "Messages from Markit for Trade Settlement in SLT"

- Section 16.12, "Processing Manual Trade Settlement"

- Section 16.13, "Handling Status for Processing Markit SLT Trade Settlement"

- Section 16.14, "Viewing the Markit Agency Interface Browser"

- Section 16.15, "Transferring Updated Information to Markit"

- Section 16.16, "Viewing FpML Messages"

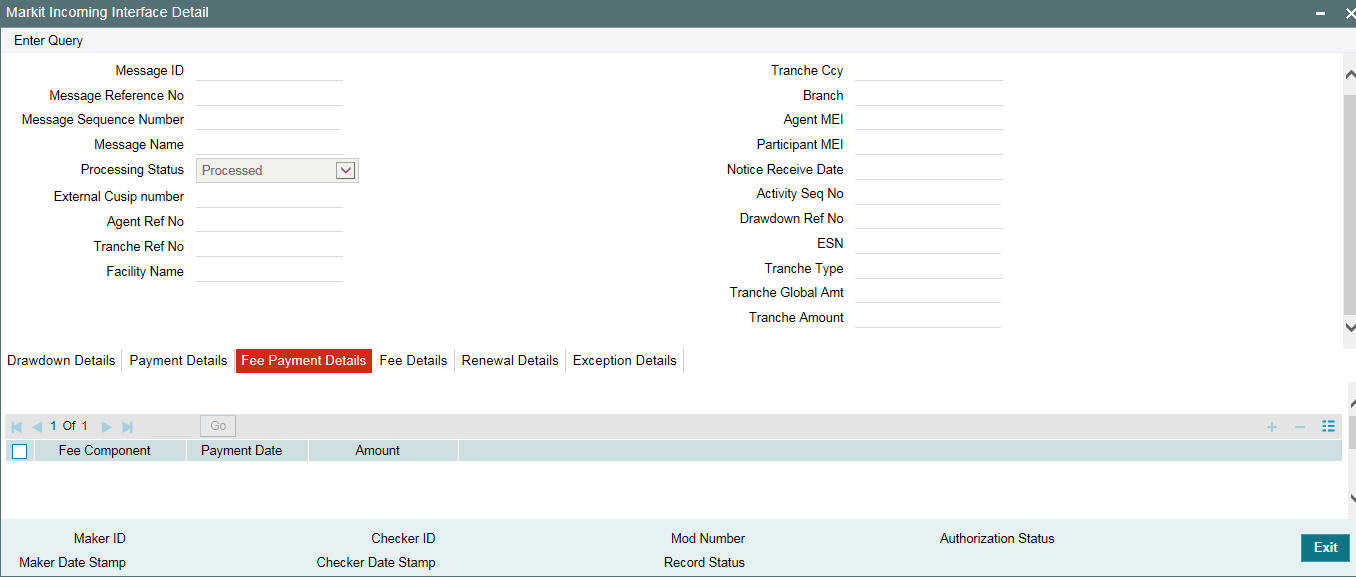

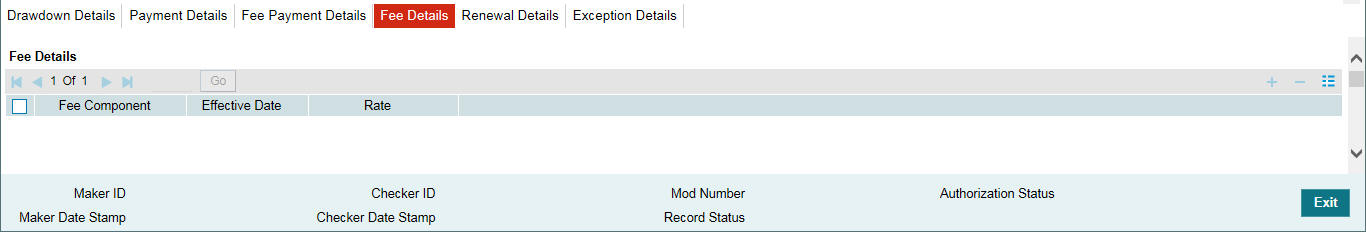

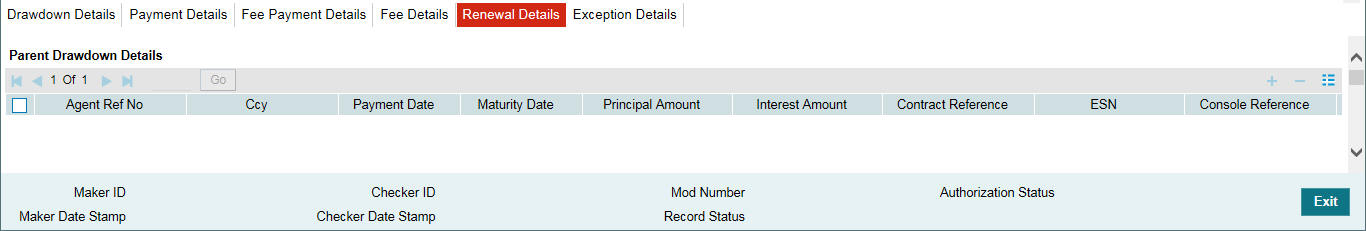

- Section 16.17, "Viewing the Markit Agency Interface Browser"

16.1 Introduction

FpML (Financial products Markup Language) is an XML based message standard used for complex financial products. Oracle FLEXCUBE supports generation of messages (notices) using this format. The messages can be broadly categorized into two groups:

- FpML messages that are sent from the agent to individual participants of a contract.

- FpML messages that are sent to Markit, a Financial Information System that acts as an inventory for all the Agency activities. The messages sent to Markit can be generated by the system or they can be generated manually on an ad-hoc basis.

The system supports FpML messaging for regular back-valued activity, which is not prior to any other activity. This is treated as any other current dated activity message. Any back-valued activity prior to any other event is suppressed by the system.

This chapter discusses these notices, the maintenances required and the validations that the system performs as part of the message processing.

16.2 Maintenances Required for FpML

To generate FpML messages from agent to individual participants, you need to do the following:

- Maintain ‘FpML’ as a media type in the ‘Media Detailed’ screen

- Attach advices that need to be fired for only a specific event to the event at the product participant level

- Select the ‘Send FpML’ option at the customer level in the ‘Customer Entity Details’ screen

- Maintain FpML formats for notices that will be sent using Free Format Messages in the ’Message Format Template Maintenance’ screen

- Specify the FpML format and the message that should use the format in the ‘Format File Maintenance’ screen

- Capture details for messages in the ‘Free Format Messages – Multiple Participants’ screen

To generate FpML messages to Markit, you are required to maintain all the messages that you wish to generate in the ‘Message Type Maintenance’ screen and in the borrower products (tranche/drawdown), you can associate the messages to the events for which the messages should be generated. The messages to Markit are generated when the contract to which the message is attached is saved and it is handed off during authorization of these contracts.

Refer the following for more details on these screens:

- ‘Maintaining Addresses for a Customer’ chapter in the Messaging System User Manual (Customer entity)

- ‘Defining Free Format Messages’ chapter in the Messaging System User Manual (for FpML formats)

- ‘Maintaining Media Types’ chapter in the Messaging System User Manual (for defining FpML media)

- ‘Maintaining Advice Formats’ chapter in the Messaging System User Manual (for details on the FpML format and message linking)

- Loan Syndication Contracts chapter in the Loan Syndication module (for details on free format messages for multiple participants)

16.3 Handling Initial Validations for FpML Messages

As mentioned earlier, there are various types of FpML messages that can be generated. These typically include notices from agent to individual participants, manually-generated notices to Markit, system-generated notices to Markit and updates relating to CUSIP and MEI CODE changes to Markit.

In case of notices generated to Markit, the system ensures that:

- The External CUSIP is not blank if the message is at the borrower tranche level or at the borrower drawdown level

- The External CUSIP for the borrower tranche or drawdown is not blank. In addition, MEICODE at participant level should not be blank. This is applicable for Position Update notice and all bulk notices that have participant details in them. If the MEICODE for a participant is not available, then that participant is excluded from the bulk message.

- For a tranche, Take On Deal Definition/ Take On Facility Definition is generated and handed off along with the Position Update message of Position Statement type

- System checks if multiple participants within a tranche/drawdown have the same MEI code UDF value for outgoing FMPL messages to Markit

- If multiple participants are maintained with same MEI code UDF value, then those participants’ positions are summed up and is sent as one single participant message in the bulk message for outgoing FMPL messages to Markit

- The branch name is the value for participant name (Party Name) for consolidated participant messages. The branch, under which the tranche is booked, is considered as the branch name. The MEI Code of the consolidated participant is displayed in the message id.

- The participant id that is displayed in message id is replaced with the MEI Code of the consolidated participant.

- The following bulk messages display the MEI Code of the consolidated

participant:

- Position Update [positionUpdate] Notice

- On Going Fee [onGoingFee] Notice

- One off Fee [oneOffFee] Notice

- Commitment Adjustment [commitmentAdjustment] Notice

- Amend Contract [amendContract] Notice

- Drawdown [drawdown] Notice

- Repayment [repayment] Notice

- Interest Payment [interestPayment] Notice

- LC Issuance [lcIssuance] Notice

- LC Termination [lcTermination] Notice

- Rollover [rollover] Notice

- Rate Set Notice

If any of the validation fails, the system suppresses the message.

Note

For display of MEI Code of the consolidated participants, note the following:

- For Rate Set notice, one single message is sent with the appropriate rate details for all participants having same MEI code UDF value

- No validations are performed if the participants are self-participants or are not for this consolidation. The entire consolidation is driven by MEI Code UDF.

- MEI Code of the consolidated participant is applicable for outgoing FpML messages to Markit only.

16.4 Notices from Agent to Investors

The following are the notices sent from Agent to Investors which can be generated in the FpML format:

- Drawdown Notice – generated for ‘BOOK’,‘ DNOT’ and ‘VAMB’ events of the drawdown

- Rate Reset Notice - generated for ‘IRFX’ event of the drawdown

- Interest Payment Notice – FpML format message generated as part of Free Format message generation

- Principal Repayment Notice - - FpML format message generated as part of Free Format message generation

- Scheduled Fee Payment Notice - - FpML format message generated as part of Free Format message generation

- Adhoc Fee Payment Notice - - FpML format message generated as part of Free Format message generation

- Split Rollover Notice - generated on ‘RNOT’ event of the drawdown

- Consolidated Rollover Notice - generated on ‘CRNT’ event of the drawdown

- LC Issuance Notice - generated on ‘DNOT’ event of the LC drawdown

- LC Balance Notice – generated as part of any event on the LC drawdown that leads to the LC balance changes (VAMB, LIQD) event in FpML format

- LC Amendment Notice - generated as part of LC drawdown amendment (VAMB) event

- LC Fee Notice - generated as part of LC drawdown fee payment (NOTC) event

- LC Termination Notice - generated as part of LC drawdown termination (VAMI/LIQD) which marks the contract status as liquidated event

- Pricing Change Notice - The pricing change notices are generated

if any of the following changes occur:

- Margin Changes

- LC Drawdown Rate Change

- Fee Rate Change

To generate FpML messages, you need to maintain the Advice format for the FpML notice in ‘Advice Format Maintenance’ screen with the media value specified as ‘FPML’. These advices are in turn attached to the related events at participant product level.

Note

If you want to generate both FpML as well as non-FpML notices for an event, you need to attach both the advices at the product level.

16.4.1 Pricing Change Message

You need to maintain the following details in the ‘Free Format Message Template’ screen:

- Maintain ‘FPML’ as media for the FpML formats.

- The ‘Mapped Fax Template’ field is enabled only if media is ‘FPML’. The fax template code for the corresponding FPML format should be maintained.

Select the ‘MAIL’ template in the ‘MAIL’ tab. On selection of the ‘MAIL’ template, the corresponding FpML template to which the ‘MAIL’ template is mapped is arrived at and the FpML template is updated in the ‘FPML’ tab

Entity details with media as ‘FPML’ is updated in the Entity section of the ‘Free Format Message’ screen for the entities associated with the Contract participants for which the ‘Send FPML’ option is selected. For any participant if there are no entities for which the ‘Send FPML’ option is selected, the FPML tabis disabled and the FPML template will not be populated.

Message Preview or Generate generates the MAIL notices and in addition, generates the FPML notice for all the entities for which the ‘Send FPML’ option is selected.

Pricing change free format message is similar to the automated pricing change notice which is getting generated in the FpML format on Margin changes//Fee rate changes for Tranche contracts.

The factory-shipped templates that are provided for pricing change free format message generation are as follows:

- Fax template for Margin rate change, related event is MRFX

- FpML template for Margin rate change, related event is MRFX

- Fax template for Fee rate change, related event is FRFX

- FpML template for Fee rate change, related event is FRFX

Pricing change notice for Fee Rate or Margin Rate change is generated at the tranche level. During the price change message generation, the system prompts for ‘Schedule date’ (user input date) which should match with Fee/Margin rate maintenance schedule date to pick up the rate. If the date is not matching, the message tags are printed blank.

Note

Fee rate change and Margin rate change free format messages are generated individually.

16.5 Generating Notices Manually

You can manually generate the following notices as and when required from the ‘FpML Adhoc Message’ screen. All the notices are generated for the ZAMG event

Refer the chapter ‘Processing Outgoing Messages’ in the Messaging System User Manual for details of the screen.

16.5.1 Take on Deal Definition

The Take on Deal Definition notice can be generated for tranches that have not yet been sent to MarkIt. The system will ensure that the tranche details are sent only for the first tranche under the deal (facility) and that the tranches are not generated or handed-off more than once. You will be allowed to generate other FpML messages for tranches/ drawdowns only if the Take on Deal /Take On Facility Definition messages have been generated and handed-off to MarkIt.

The message will display ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

Note

Assignment validation details are populated for each tranche in the Take on Deal Definition Notice.

16.5.2 Take on Facility Definition

The Take on Facility Definition notice can be generated for tranches that have not yet been sent to MarkIt. The system ensures that the tranche details that are being sent are not for the first tranche under the deal (facility) and that the tranches are not generated or handed-off more than once. You are allowed to generate other FpML messages for tranches/ drawdowns only if the Take on Deal /Take On Facility Definition messages have been generated and handed-off to MarkIt.

The message display ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

Note

Assignment validation details are populated for each tranche in the Take on Facility Definition Notice.

16.5.3 Position Update of Position Statement Type

The Position Update message which contains the participant position details is generated at the borrower level. For each tranche, the details are grouped for participants for the tranche and sent as a single bulk message. You can manually send this message as a follow-up message for the ‘PositionStatement’ event type when the details of the deal or tranche are sent to Markit for the first time.

This message can be used at a tranche or drawdown level for all the participants under the tranche or drawdown and is generated only after the Take on Deal / Take on Facility notices have been generated and handed-off to Markit.

The message displays ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.5.4 Drawdown Notice

The Drawdown Notice is generated at the borrower level for new drawdown bookings and principal increases on drawdowns. The notice consists of a notice for each participant and a notice for the global details for the borrower.

The message display ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.5.5 Cancel Notice

The Cancel notice is generated to reverse specific notices already sent to Markit and for payment and value-dated amendment reversals.

16.6 System generated Messages

The following messages are generated by system automatically:

16.6.1 Commitment Adjustment Notice

The Commitment Adjustment notice, which is generated at the borrower level, is generated whenever principal is increased or decreased for a tranche. It has all the participant and global details and consist of a message for each participant and a message for global details for borrower. You need to maintain the message for the VAMB event for tranche products to generate the notice for tranche value-dated amendment notice.

If there are no principal changes for the value-dated amendment or if the amendment results in the tranche being decreased to nil principal and the maturity date to less than or equal to today, this notice is suppressed. You can also suppress the generation during value dated amendment if you require. Since the notice is generated only for principal changes done directly on the tranche and not as a result of any drawdown activity, the system does not generate the notice for drawdown payments on non-revolver tranches.

The message display ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.2 Deal Definition Notice

The Deal Definition Notice is generated for tranche amendments on a tranche at the borrower level, if the contract status is updated to ‘Liquidated’. This implies that there is one message for a tranche value-dated amendment for tranche amendment. You need to maintain the message for the event VAMI for tranche products.

You can suppress this notice during value-dated amendment if you want. The system suppresses this message when during value-dated amendments the tranche contract status does not get updated to ‘Liquidated’. This is applicable for both value-dated amendments done manually and those due to SLT-LB STP.

The message display ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.2.1 Deal Definition Notice with all Tranches for Ext Deal CUSIP/ISIN

Deal Definition Notice generated for facility/deal amendment contains details of all the active tranches that have the same Ext Deal CUSIP/ISIN as that of the facility/deal CUSIP, provided Take on Deal/Take on Facility and Position Update for Position Statement type have already been generated for all those tranches.

Deal Definition notice generated for tranche amendment contains details of all the active tranches that have the same Ext Deal CUSIP/ISIN as that of the tranche which being amended, provided Take on Deal/Take on Facility and Position Update for Position Statement type have already been generated for all those tranches.

This notice does not contain details of tranches for which Take on Deal/Take on Facility and Position Update for Position Statement type is not generated. In this case, the notice generation does not fail but excludes such tranches.

Deal Definition notice generation for a facility/deal amendment is suppressed systematically if none of the tranches under the facility/deal have the Ext Deal CUSIP/ISIN same as the facility CUSIP. Deal Definition notice for a facility/deal amendment is suppressed systematically if none of the tranches (with matching CUSIP) have Take on Deal/Take on Facility and Position Update for Position Statement type generated and handed off. This notice is suppressed systematically for a tranche amendment if the tranche does not have Take on Deal/Take on Facility and Position Update for Position Statement type already generated and handed off.

For Deal Definition generation for a tranche amendment, the details in the notice for the current tranche that is amended in Oracle FLEXCUBE contains the latest amended details and all other tranches contain the latest details. In case of facility/deal amendment, the latest details are present in the notice for all the tranches.

Note

This notice does not include details of previously liquidated/reversed tranches.

Deal Definition Notice generation for Tranche - Borrower/Co-borrower

- For all tranche amendments (CAMD event) involving addition of borrowers from the ‘Borrowers’ sub-screen in ‘LB Tranche Contract Online’ screen

- All the latest borrowers are included as list of co-borrowers in this notice

- The attribute for the list of borrowers is named as ‘coBorrower<ExtCUSIP/ISIN>1’, ‘coBorrower<ExtCUSIP/ISIN>2’, ‘coBorrower<ExtCUSIP/ISIN>3’ and so on

- The party id for the co-borrower is the MEI code of the borrower. MEI code is the UDF (MEI CODE FOR INVESTORS) at the customer maintenance. The party name for the co-borrower is the name of the borrower in Oracle FLEXCUBE

- For all tranche amendments involving addition of borrowers/co-borrowers, this notice should be maintained for CAMD event as part of the tranche product setup.

Deal Definition Notice Generation for Facility/Deal - Assignment Fee Details

Deal Definition Notice is generated for all facility amendments (CAMD event) involving addition/amendment/removal of assignment fee details from the ‘Assignment Fees Details’ sub-screen in ‘LB Facility Contract Online’ screen.

For facility/deal - assignment fee details, this notice should be maintained for the CAMD event as part of the facility product setup.

Deal Definition Notice Generation for Tranche - Drawdown Currency

Deal Definition Notice is generated for all tranche amendments (CAMD event) involving addition/removal of currencies from the ‘Currency’ sub-screen in ‘LB tranche Contract Online’ screen.

For tranche - drawdown currency, this notice should be maintained for the CAMD event as part of the tranche product setup.

Deal Definition Notice Generation for Tranche - Maturity Date

Deal Definition Notice is generated for all tranche value dated amendments (VAMI event) involving change to the maturity date of the tranche.

In this scenario, this notice should be maintained for the VAMI event as part of the tranche product setup for the tranche which is getting amended.

Deal Definition Notice Generation for Tranche - Termination Date

Deal Definition Notice is generated for all tranche value dated amendments (VAMI event) involving change to the maturity date of the tranche and resulting in the tranche being liquidated. In this scenario, this notice should be maintained for the VAMI event as part of the tranche product setup for the tranche which is getting amended.

Deal Definition Notice Generation for Tranche - ‘Assignment Validations Applicable’ check box

Deal Definition Notice is generated for all tranche amendments (CAMD event) involving change to the ‘Assignment Validations Applicable’ check box in the ‘LB Tranche Contract Online’ screen. In this scenario, this notice should be maintained for CAMD event as part of the product setup.

Deal Definition Notice Generation for Tranche - ‘Assignment Validations’

Deal Definition Notice is generated for all tranche amendments (CAMD event) involving changes in details maintained in the ‘Assignment Validations‘ sub-screen in the ‘LB Tranche Online’ screen. In this scenario, this notice should be maintained for the CAMD event as part of the tranche product setup.

Deal Definition Notice is not generated if ’New Investor’ check box is amended in the ‘LB Tranche Online’ screen.

Note

Assignment validation details are populated for each tranche in the Deal Definition Notice.

16.6.3 Amend Contract Notice

The Amend Contract Notice is generated at the borrower level with one message for a drawdown amendment for the following event:

- Drawdown Value dated amendment for change in maturity date(VAMB)

The message is a bulk message which consists of a message for each participant and a message for the global details for borrower. You need to maintain the message at the VAMB event for the drawdown product. If the VAMB event is for anything other than changes in maturity date , then the system suppresses the notice generation. You can manually suppress the notice during VAMB.

The message ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.4 Rate Set Notice

The Rate Set Notice is generated at the borrower level with one message for a drawdown/tranche for the following events:

- Drawdown Value dated amendment for interest rate changes (VAMB)

- Drawdown Interest Rate amendment (IRAM)

- Drawdown Margin Rate Revision (MRFX)

- Drawdown Floating Rate Revision (REVN)

- Drawdown Exchange Rate Amendment (ERAM)

- Tranche Fee Rate Revision (FRFX) for non-adhoc (non-USERINPUT) components

Rate Set Notice is a bulk message with borrower global level message and participant details. The bulk message constitutes the following messages grouped together:

- Message for each participant

- Message for the global details for borrower

You need to maintain the message at the VAMB, IRAM, MRFX, REVN and ERAM events for the drawdown product. If the VAMB event is for anything other than changes in interest rate, the system systematically suppresses the notice generation. In addition, you can manually suppress the notice during VAMB but not during IRAM, ERAM, MRFX, FRFX, and REVN events.

If the fee rate change involves fee rate change for multiple fee components, then system generates one message for each fee component for which the rate is changed. Rate set notice for Interest/Margin/Exchange/Fee rate changes is applicable only when Take on Deal/Take on Facility FpML notice and Drawdown notice are generated. Position Update Notice should also be generated if you want to generate the Rate Set Notice.

The message will display ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.5 Repayment Notice

The Repayment Notice is generated at the borrower level for partial or full payments of principal on the drawdown. It is a bulk message for a drawdown payment with all the participant and global details and consist of a message for each participant and a message for the global details for the borrower. You need to maintain the message at the LIQD event for drawdown products.

If the payment is only for the interest, the system will suppress the notice. If the payment is for both interest and principal, then the system will generate the Interest Payment Notice for the interest liquidated and the Repayment Notice for the principal liquidated. You cannot suppress the notice generation manually during drawdown payment. However, by doing a contact amendment in the Drawdown online screen, you can suppress the message. If needed, before making the payment, an amendment can be done to suppress the notice for the termination and then payment can be done.

The message ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.6 Interest Payment Notice

The Interest Payment Notice is generated at the borrower level for full or partial interest payments on the drawdown. It is a bulk message for drawdown interest with all the participants and global details and consist of a message for each participant and a message for the global details for the borrower. You need to maintain the message at the LIQD event for drawdown products.

If the payment is only for the principal, the system suppresses the notice. If the payment is for both interest and principal, then the system generates the Interest Payment Notice for the interest liquidated and the Repayment Notice for the principal liquidated. Or it can bulk the two notices if principal and interest are being paid together.

You cannot suppress the notice generation manually during drawdown payment. However, by doing a contact amendment (CAMD) in the Drawdown online screen, you can suppress the message. If needed, before making the payment, an amendment can be done to suppress the notice for the termination and then payment can be done.

The message ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.7 LC Issuance Notice

The LC Issuance Notice is generated at the borrower level with one bulk message for a LC drawdown with all the participant and global details. It consists of a message for each participant and a message for the global details for the borrower. It is generated for:

- New LC drawdown bookings

- LC Increases because of LC Balance movement (with the LC increase amount)

- LC Decreases because of LC Balance movement (with the LC decrease amount). If the LC decrease amount results in the LC amount being reduced to nil, then the system generates an LC termination notice

To have this message generated, the ‘LC Drawdown’ preference should be selected at the drawdown level. You need to maintain the message for the following events for LC drawdown products:

- BOOK (for new LC drawdown booking)

- VAMB (for LC increases)

- LIQD (for LC decreases)

You should not maintain drawdown notices for the BOOK, VAMB and DNOT events since maintaining this would lead to LC Issuance notices being generated for those drawdowns instead. You can suppress the notice manually for the new LC drawdown bookings but not for the LC increases and decreases. However, by doing a contact amendment (CAMD) in the Drawdown online screen, you can suppress the message. If needed, before making the payment, an amendment can be done to suppress the notice for the termination and then payment can be done.

The message ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.8 LC Termination Notice

The LC Termination Notice is generated at the borrower level with one bulk message containing all the participant and global details. It consists of a message for each participant and a message for the global details for the borrower. It is generated for full payments on LC drawdown.

You need to maintain the message for the LIQD event for LC drawdown product. The message will be generated only if the ‘LC Drawdown’ preference has been selected at the drawdown level and the status of the LC drawdown contract is ‘Liquidated’. If the status is not ‘Liquidated’, then the system will suppress the generation of this message.

You cannot manually suppress the message during LC drawdown payment. However, by doing a contact amendment (CAMD) in the Drawdown online screen, you can suppress the message. If needed, before making the payment, an amendment can be done to suppress the notice for the termination and then payment can be done.

The message ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.9 Ongoing Fee Notice

The Ongoing Fee Notice is generated at the borrower level with one bulk message for a tranche and have all participant and global details. The message consists of one message for each participant and one message for the global details for the borrower. It is generated for:

- Initial fee capture at tranche level for non-adhoc (non USERINPUT type) fee components, either during generation of Position Update notice the first time using adhoc generation screen (systematic generation)

- Fee payment of non-adhoc fee components

The fees which are supported by Markit are:

- LetterOfCredit Fee

- CommitmentFee (fee based on the unfunded portion of the facility)

- UtilizationFee (fee based on the utilized/funded portion of the facility)

- FacilityFee (fee based on the entire commitment of the facility)

- OtherAccruingFee

You are required to map these fees to fee components in Oracle FLEXCUBE to facilitate the generation of notices. To generate the notice for fee details and send it for the first time to Markit, you need to maintain the message for BOOK/FBOK/FAMD event for tranche products. For generation of notice for fee payment, you need to maintain the message for FLIQ event for tranche products. The notice for new booking/fee capture does not include the fee payment details, while the notice generated for fee liquidation will.

If there are non-adhoc fee components added newly as part of fee capture or fee amendment, then the notice is generated for the FBOK/FAMD event. If non-adhoc fee components are defined during tranche booking itself and changes are done during fee amendment, then the system will suppress the notice generation for the FBOK/FAMD event. System suppresses the notice generation for any fee rate changes (FRFX) for non-adhoc fee components.

The system will suppress the notice generation for the adhoc fee components for the BOOK event if adhoc fee components have been captured as part of tranche booking or if there are no non-adhoc fee components for which payment is done as part of the FLIQ event. You can manually suppress the notice generation during tranche booking but not during fee amendment, fee liquidation and fee revision.

The message ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.10 One Off Fee Notice

The One Off Fee notice is generated at the borrower level with one bulk message for a tranche with all participant and global details. The message consists of a message for each participant and a message for the global details for the borrower. It is generated for fee payments of adhoc fee (USERINPUT type) components at tranche level.

The fees which are supported by Markit are:

- TickingFee

- ConsentFee

- AmendmentFee

- AssignmentFee (not in scope currently)

- FacilityExtensionFee

- FundingFee

- BreakageFee

- UpfrontFee

- WaiverFee

- OtherFee

You are required to map these fees to fee components in Oracle FLEXCUBE to facilitate the generation of notices. You need to maintain the message for FLIQ event for the tranche products.

If there are no adhoc fee components in the fee payment, the system suppresses the generation of this notice. You cannot manually suppress the notice generation during fee liquidation.

The message ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.11 Rollover Notice

The Rollover notice is generated at the borrower level with one bulk message for a tranche with all participant and global details. The message consists of a message for each participant and a message for the global details for the borrower. It is generated for the rollover (split or consolidated) or re-pricing (split or consolidated) of drawdowns.

The rollover message contains details of only the rollover. The system sends an increase or decrease as part of rollover or re-pricing as drawdown notice or repayment notice, as is defined for the respective VAMB/LIQD event only at the time of actual rollover, since the changes are triggered only at the time of actual rollover. The system suppresses the drawdown notice for the new child contract as the rollover notice would include a section for the child contract. You are not allowed to manually suppress the notice during rollover or reprice capture.

You need to maintain the message for the actual rollover events – ROLL/CROL/SPTI/MRGI – for the drawdown products. This is maintained at the actual rollover event instead of the usual RNOT/CRNT/SPTB/MRGB events as Markit expects the principal increase/decrease notices as part of the rollover to be sent along with the rollover notice. In addition, Markit requires the child drawdown contract id to be populated in the rollover notice, so that subsequent messages sent for the child contract are applied properly in Markit on the right child drawdown.

The rollover type mentioned in the notice, define the type of rollover done. The possible values are:

- Rollover - One to One rollover

- Split – One to many rollover/reprice

- Combination – Many to one merge reprice/consolidation

- Conversion – One to One reprice

The message ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.12 Reprice Message

Oracle FLEXCUBE supports both Merge Reprice and Split Reprice message generation in FpML format. The FpML formats used for generating messages for Rollover instruction processing is used for generating the FpML notice for Reprice events.

The Split Reprice advice is generated during SPNT event for drawdown contracts. The Reprice message is generated in FpML format for SPNT event. The message generation and handoff processing follows the similar processing of Split Reprice advice.

The Merge Reprice advice is generated during MRGB event for drawdown contracts. The Reprice message is generated in FpML format for MRGB event. The message generation and handoff processing follows the similar processing of Merge Reprice advice.

16.6.13 Drawdown Notice

The Drawdown Notice is generated at the borrower level for new drawdown bookings and principal increases on drawdowns. The notice consists of a notice for each participant and a notice for the global details for the borrower.

For generation for new drawdown bookings, you need to maintain this message at BOOK/DNOT event for drawdown products. For principal increases on drawdown, you need to maintain the message at the VAMB event for drawdown products. For both events, you have the option of suppressing the generation.

Principal increases on the drawdown caused due to rollover with increase and STL-LB STP activities will also result in the generation of the message. You do not have an option to suppress the generation for these operations.

The message ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’Cancel Notice.

The Cancel notice is generated to reverse specific notices already sent to Markit and for payment and value-dated amendment reversals. You need to maintain the messages at the REVP event for drawdown products for payment reversals and the VAMC event for the value-dated amendment reversals for drawdown and tranche. The notice is sent for the message ID of the bulk messages sent for the payment / value-dated amendment – this covers all the underlying messages of the original bulk message.

16.6.14 Position Update of PositionStatement type

The Position Update message which contains the participant position details is generated at the borrower level. For each tranche, the details are grouped for participants for the tranche and sent as a single bulk message. You can send this message for the event ‘Assignment’ when there is a change in participant positions in a tranche. For this you need to maintain the message for the PRAM/PAMI events for tranche only.

This message can be used at a tranche or drawdown level for all the participants under the tranche or drawdown and is generated only after the Take on Deal / Take on Facility notices have been generated and handed-off to Markit.

The message ‘Ext Deal CUSIP/ISIN’ captured at the tranche level for the ‘InstrumentId’ field in ‘Deal Summary’.

16.6.15 Prime Increase Message

The system generates the Prime Increase FpML message for participants when additional borrowing is required for prime loans.

Prime Increase FpML message is generated only for the Drawdown contracts having Main Interest component with Rate Type as ‘FLOATING’. The system does not refer to the preference maintained for the box ‘Prime Loan’ at Drawdown product preference. The system determines the Drawdown as Prime if Floating Rate Type of Main Interest component is attached with the Drawdown.

Prime Increase is a Drawdown Value-Dated Amendment Event (VAMI) in Oracle FLEXCUBE to increase the Drawdown amount (Borrowing amount). The system generates the Prime Increase message during Value Dated Amendment operation.

The Prime Increase message is same as the drawdown message. The latest Drawdown amount including the amount that is increased in the Value Dated Amendment operation is sent in the Prime Increase message. The Prime Increase FpML message is generated for the ‘VAMB’ event

The system sends floatingRateIndex value as Prime/Libor for the Prime Increase message. Agent Ref No will be sent in the Prime Increase message if already available in the system, else Agent Ref No will be sent blank. Message Generation and Handoff processing follows the processing of Drawdown Advice.

16.6.16 Outgoing FPML Changes for Negative Rate

The following outgoing FpML notices sends interest and margin rates in negative if the rates are maintained in negative for the associated contracts.

Individual FpML messages for each participant

Notice Name |

Associated Event |

Remarks |

Systematic / Free format |

Drawdown Notice |

DNOT |

During drawdown booking |

Systematic |

Rate Reset Notice |

IRFX |

During drawdown Interest rate fixing |

Systematic |

Interest Payment Notice |

NOTC |

During Interest payment |

Freeformat |

Split Rollover Notice |

RNOT |

During Split Rollover booking |

Systematic |

Consolidated Rollover Notice |

CRNT |

During consol Rollover Booking |

Systematic |

Pricing Change Notice |

MRFX |

During Margin rate revision at drawdown level. |

Systematic |

Bulk FpML notices (One message with all participant details)

Notice Name |

Associated Event |

Remarks |

Systematic / Free format? |

Drawdown Notice |

DNOT |

During drawdown booking |

Systematic |

Rate Set Notice |

IRAM |

During Interest rate amendment |

Systematic |

VAMB |

During interest rate amendment in VAMI screen |

Systematic |

|

MRFX |

During drawdown Margin rate revision |

Systematic |

|

Interest Repayment Notice |

LIQD |

During full or partial interest payment on drawdown |

Systematic |

Split Rollover Notice |

RNOT |

During Split Rollover booking |

Systematic |

Consolidated Rollover Notice |

CRNT |

During consol Rollover Booking |

Systematic |

16.7 Messages from Markit for Prime Increase

The Prime Increase message is consumed from Markit in the same way the drawdown message is consumed in Oracle FLEXCUBE. The system processes the new Drawdown message as Prime Increase message only when the following conditions are satisfied:

- The FloatingRateIndex value from the Drawdown message is one of the pre-defined floating indexes in the factory-shipped table, for the Drawdown currency and for the Rate ‘PRIME’.

- The Floating Rate type of the Main Interest component is attached with the resolved Drawdown product during the message processing.

- The Agent reference number is already associated with an active Drawdown in Oracle FLEXCUBE.

The checkbox ‘Prime Loan’ at Drawdown product preference is not used to determine the drawdown as Prime Drawdown.

If the agent reference number is already associated with an active Drawdown in Oracle FLEXCUBE, the system performs Prime increase by doing a value dated amendment for Drawdown(VAMI).

If the agent reference number is not associated with any Drawdown in Oracle FLEXCUBE then:

- The system considers it as a new Drawdown contract and will create a drawdown.

- The system does not validate FloatingRateIndex during new Drawdown processing and floatingRateIndex need not be USD-Prime-Reference.

- Also, the Main Interest component for the resolved product need not be ‘FLOAT’ and it can be ‘FIXED’ as well.

If FloatingRateIndex is not USD-Prime-Reference in the Drawdown message and the agent reference number is already associated with an active Drawdown in Oracle FLEXCUBE, the message processing will fail.

‘Agent Ref No’ is displayed in the ‘Value Dated Amendment’ screen. The system consumes and processes value dated amendment (prime increase)

Once the message is received from Markit and is displayed in the incoming interface browser, the system performs the basic validations of External CUSIP/ISIN, Message ID, Notice Date and MEI Code for participant(s) and borrower. These validations are similar to the validations of other messages which are consumed.

If any of the validations fail or the system is unable to process the message, the system logs the following exceptions:

- Based on the drawdown currency and amount, the availability of Tranche

is checked. If there is insufficient availability at the tranche level,

the system marks the processing status as ‘Failed’ by logging

an exception -‘No Availability at Tranche’.

- If manual correction to the Tranche is possible, you can make the necessary changes to the Tranche as part of contract amendment and value dated amendment and change the processing status to ‘Pending’, so that the system can re-pick up the message for processing

- If manual action is possible, a new corrected message has to be received from Markit. This message have the same Message ID as the original message but with corrected information.

- If a matching participant/borrower is not found at the tranche level, then system marks the processing status as ‘Failed’ by logging an exception – ‘Participant/Borrower not found at the tranche’.

- No rate changes are allowed as part of prime increase. Any information on the rates are ignored in the incoming message.

- If the event date (noticeDate) is earlier than the application date,

- The system does not process the contract/event in Oracle FLEXCUBE and marks the processing status of the incoming message as ‘Pending Authentication’.

- You can change the processing status to ‘Pending’/’Processed’, where ‘Pending’ indicates that the system can pick the message for re-processing and ‘Processed’ indicates that no further action is required on the message.

- If the event date (noticeDate) is greater than the application date

for a Drawdown Notice (Prime Increase),

- The system considers the message as an ‘Intent Message’ and mark the processing status as ‘Hold’, irrespective of Effective Date (drawdown value date)

- The system retains the message in the Incoming Browser till the event date. On the event date during the batch, the system updates the processing status as ‘Pending’, so that the job will pick up the incoming message for processing.

- If the event date (noticeDate) is the application date and the effective date is future-dated, the system will process the message to create an uninitiated value-dated amendment and will update the processing status as ‘Processed’.

- The value dated amendment (current/future dated) will be created and auto authorized if there are no overrides requiring dual authorization. If there are any such overrides, the drawdown needs to be manually authorized after dual authorization. The processing status is automatically updated as ‘Processed’.

- If the processing fails, the system updates the processing status as ‘Failed’ and the exceptions are shown in the ‘Exceptions’ sub-screen. You can manually input the value-dated amendment and change the processing status to ‘Processed’.

If the incoming message fails to process due to any data mismatch between the incoming data and Oracle FLEXCUBE, you can use the ‘Enrich’ option for the key important fields.

For the message Prime increase notice, if the notice date is equal to the application date and the effective date is earlier than the application date, the system considers it as a back-dated value-dated amendment and all the back-value checks are applied.

The dual authorization functionality is applicable for these messages and status is updated as ‘Pending Authentication’ after which you have to manually authorize it. Once authorized, the system updates the process status as ‘Processed’.

Exception processing, Re-linking, Clipping of the message is applicable as per the incoming FpML message processing. Only amount increase is allowed as part of prime increase consumption processing.

Incoming messages with Message Name as ‘Drawdown Notice’ and DrawdownEventType as ‘NewDrawdownEvent’ are placed in the Incoming Browser with the processing status as ‘Pending’

The system processes these messages as follows:

- If the External CUSIP/ ISIN in the message is an active Borrower Tranche, the fields in the Incoming Browser are updated with data from the message/tranche contract.

- The system picks the Branch code as the branch under which the tranche is booked.

- MIS pickup is done based on the tranche MIS maintenance during new Drawdown booking. MIS pick is not done during VAMI for Prime Increase incoming message processing.

- If the Message ID is not already processed and the Agent Ref No in the message is not found for any active Borrower Drawdown contract in Oracle FLEXCUBE, the system creates a new Drawdown contract.

- If the Message ID is not already processed and if the Agent Ref No

in the message is found for any active Borrower Drawdown contract in

Oracle FLEXCUBE, a value-dated amendment is booked and VAMB/VAMI events

are fired.

- Markit sends the complete Drawdown Amount after applying Prime increase. Latest Drawdown amount in the system is compared with the amount received in Prime Increase message. Value-dated Amendment is initiated in Oracle FLEXCUBE only when the system amount is lesser than the amount received. VAMI is done only for the differential amount and not for the complete Drawdown amount received from Markit.

- The value- dated amendment is auto-authorized if there are no overrides that require dual authorization.

- The value-dated amendment will be created as unauthorized if there are any overrides that require dual authorization. The processing status is ‘Pending Authentication’ in such cases and the drawdown VAMI have to be manually authorized after dual authorization.

- Based on the Product Set up for messages, automated fax/wire messages attached for VAMB/VAMI events are generated.

- Once the message is successfully processed in Oracle FLEXCUBE as an event and authorized, the system updates the processing status as ‘Processed’.

- If the value-dated amendment is not authorised, while marking the EOTI, the system prompts you to clear pending authorizations.

Note

- Unauthorised transactions are tracked from EOD pending transactions for you to perform authorisation.

- There is no impact on sighting fund tranches as sighting fund functionality is applicable only for lead agents.

16.8 Messages from Markit for Trade Settlement

The following messages are communicated between Markit and Oracle FLEXCUBE for processing trade settlement from Markit for agented deals:

Message |

Description |

Occurrence |

Flow |

Trade Details - Agent View |

Trade details that the agent can use to setup the trade in their system (LB). Trade is consumed in Oracle FLEXCUBE and is populated into the Agency confirmation browser with all the relevant details of the trade. |

Can be received multiple times prior to Settlement/ TradeUpdateNotification |

Markit to Oracle FLEXCUBE |

Trade Status Update Notification |

Markit trade status will be updated in Oracle FLEXCUBE based on the status received. Cancelled/Removed/Suspended |

Can be received only once prior to Settlement and it isoptional |

Markit to Oracle FLEXCUBE |

Submit Agency Update |

Notifies the update to agent to signify final transfer of asset is needed. Trade is marked as closed. |

Can be received only once on Settlement |

Markit to Oracle FLEXCUBE |

Position Update Notice |

This is an inventory message

and this is sent with type as "Assignment". |

Is sent only once on successful processing of SubmitAgencyUpdateNotice in Oracle FLEXCUBE |

Oracle FLEXCUBE to Markit |

16.8.1 Syndicated Loan Trade Notice

The Syndicated Loan Trade Notice message is a trade-related message that is received from agent to set up the trade in Oracle FLEXCUBE. Each Syndicated Loan Trade Notice message contains the following details:

- Unique identifier for the trade

- Buyer/Seller details

- One or more Tranche details for which the trade is effected

- Assignment Fee details

16.8.2 Trade Update Notice

The Trade Update Notice message is an update notification on the trade received from Markit to notify the trade status in Oracle FLEXCUBE. Each Trade Update Notification message contains the following details:

- Unique identifier for the trade

- Update Status

Each Trade Update Notification Message comprises the following primary details:

- tradeID - Unique Trade Id for each Markit trade. It consists of the Markit Trade Id. LQT Ticket Id is also received if the bank is one of the trade counterparty.

- allocationID –This can have the Allocation Id’s of all the allocations under the Trade Id. This can also be blank. Irrespective of the allocation id, all the trades under the Markit TradeID are updated with the appropriate ‘updateStatus‘

- tradeCompletelySettled – This field is not used by Oracle FLEXCUBE for the agented level messages

- updateStatus – The status received is populated as the Markit

Trade Status in the Agency Confirmation Browser. The possible values

for updateStatus are given below

- Suspended

- Cancelled

- Removed

A system job processes all the uploaded messages. Based on the trade id, all the trades corresponding to this message are identified. If the trade id does not exist, then the message is marked as ‘Rejected’.

Confirmation status is updated as ‘Rejected’ for trades, based on this message. You cannot change the confirmation status for rejected trades. Trade Update Notification message is sent only if the trade settlement should be blocked in Markit/Oracle FLEXCUBE.

16.8.3 Processing of Trade Update Notice Message in LB Module

When any Trade Update Notice message with ‘Suspended’ status is processed for a Markit trade id, the trade is enabled and you can process it further.

System consumes the Syndicated Loan Trade Notice message for trade that is suspended. System also consumes this notice any number of times before processing the following messages:

- Submit Agency Update Notice

- Trade Update Notice with Cancelled or Removed status

Markit always sends a Trade Update Notice message for each allocation.

Markit does not send the Syndicated Loan Trade Notice message again for the allocation which is closed.

16.8.4 Processing of Trade Update Notice Message in SLT Module

When any Trade Update Notice message with ‘Suspended’ status is processed for a Markit trade id, the trade is enabled and you can process it further.

After receiving a trade with status as ‘Suspended’, system does not reject but consumes and processes the following messages:

- Trade Match Notice

- Syndicated Loan Trade Allocation

- Settlement Details Notice

- Trade Closed Notice

For unallocated trades, Markit always sends Trade Match Notice and Settlement Details Notice messages together. After processing this Settlement Details Notice message, Trade Match Notice message can be received again. System consumes the Trade Match Notice messages without rejection, and processes them again for the same trade any number of times before Trade Closed Notice or Trade Update Notice is received with ‘Cancelled’ or ‘Removed’ status.

For allocated trades, Markit sends Trade Match Notice and Settlement Details Notice messages together for the parent trade, before the actual allocation. After allocation, Markit sends Settlement Details Notice for the allocated trades after Syndicated Loan Trade Allocation message.

For allocated trades, the following processing takes place:

- If any allocation is closed or settled, Markit does not send Trade Update Notice message with Cancelled/Removed status. After an allocation is closed in the system, system rejects the message if Trade Update Notice is received with Cancelled/Removed status.

- If the Trade Update Notice with the status as ‘Suspended’ is processed in the system after the allocation is closed, then there is no impact on the closed allocation. However, the remaining open allocations are suspended.

- If the Syndicated Loan Trade Allocation message is processed in the system after the allocation is closed, then the revised allocations are processed without impacting the closed allocations.

If a new Trade Match Notice is received with ‘replacedTradeIdentifier’, then the trade mentioned in ‘replacedTradeIdentifier’ is marked as ‘Cancelled’ and the trade received as part of the Trade Match Notice is treated as a new trade. If any allocation is closed under a trade, then there is no impact on the closed trade as part of new trade processing.

If Trade Match Notice is received again for an existing Markit trade Id, then the old allocations are removed from the system and closed allocation(s), if any, are retained. New allocation received as part of Syndicated Loan Trade Allocation is used for further processing. If any of the allocation is closed, then new allocation message should also contain details of closed allocation along with new allocation.

After an allocation is closed under a trade, if Markit sends Trade Match Notice with ‘replacedTradeIdentifier’ and Syndicated Loan Trade Allocation with new allocations, then:

- ‘Markit Trade Status’ for Closed allocation of old trade remains as ‘Settled’

- System does not process closed allocations received as part of the new trade. However, the new allocation which is closed is marked as ‘Settled’ and linkage details are logged against the new allocation in the Exception screen.

After receiving new Syndicated Loan Trade Allocation message for SLT, new Syndicated Loan Trade Notice Agent should be sent again for agency. Settlement is not done in LB until the matched Markit trade is settled in SLT.

Trade Update Notice is received at Markit trade id level and not at individual allocation level. System does not validate the allocation ids sent by Markit in the Trade Update Notification but marks all allocations (for allocated trades) under the Markit Trade Id as Suspended/Cancelled/Removed.

Trade Update Notice message with status as ‘Suspended’ can be received multiple times before Trade Closure

Trade Update Notice with status as ‘Cancelled or ‘Removed’ can be received after receiving Trade Update Notice with status as ‘Suspended’

16.8.5 Submit Agency Update Notice

The Submit Agency Update Notice message is the closure message for a trade that has already been received from Markit to notify that the trade is closed in Markit and settlement can be initiated systematically in Oracle FLEXCUBE.

The Submit Agency Update Notice message contains the following details:

- Unique identifier for the trade

- Effective date of transfer

- Trade details (same as the trade details received as part of the Syndicated Loan Trade Notice Agent message)

Each Submit Agency Update Notice Message comprises the following primary details:

- tradeID – Unique Trade Id for each Markit trade (consists of Markit Trade Id). LQT Ticket Id is also received if the bank is one of the trade counterparty.

- allocationID – Unique Trade Id for each allocation. This is blank if it’s not an allocated trade. This id is not used for agency trade settlement processing and is used for information purpose only.

- effectiveDate – Actual settlement date, which is the effective date for the transfer(assignment/PRAM) to be triggered in the system. Value date is updated with this date for all the trades under this TradeID.

A system job processes all the uploaded messages. On receipt of this message when system is in online mode during intra-day, the trade is marked as ‘Closed’ in the system and the position update message is sent to Markit, based on the following:

- Based on the trade id, all the trades corresponding to this message are identified.

- To ensure there is not short sell, the seller’s position is

validated as follows and if the validations are not met, system rejects

the trade confirmation status:

- The seller’s total current position is arrived by consider the existing position of the seller in the tranche and the trades that are pending for processing, but are confirmed/closed.

- The trade amount is less than the computed total current position.

- For the Buyer/Seller irrespective of new/existing participant in

the system, the tax rules validation is done to verify the following

and the trade is rejected if the validations are not successful:

- At least one open tax rule is maintained for the buyer and seller. Tax rule maintained with ‘ALL’ customer is not considered.

- The expiry date of the tax rule is greater than the trade value date.

- The following sighting fund validations are done for trades from

Markit

- Fronting details should be captured for all drawdowns

- Buyer/Seller should be funded for all the past events

- Trade value date should not be before the latest actual receipt date for the buyer/seller

- Buyer/Seller should have funded the entire amount for all past events

- The change to allow trade to proceed if there are unfunded future events (future dated drawdown) and all past events are funded, are also applicable for Markit/Clearpar trades.

- If the validation fails for any one particular trade under a tranche, then the individual trades for all the tranches under the particular Markit Trade Id are marked with the confirmation status as ‘Rejected’.

- The exception details are updated appropriately to notify the rejection and the error reason.

- Once the trade is marked as ‘Closed’ in the system, the Position Update Notice message is generated and sent to Markit.

If this message is received when the system is in batch mode, then message is processed as follows:

- The message is consumed by the Java adapter, which would be running even when the system is in batch mode

- Java adapter logs the details of the messages in a system table

- System does not process the messages till it resumes to online mode

- Once the batch is completed, a system job initiates Markit message processing which picks up all the unprocessed messages and initiates the validation/process.

- Effectively the processing of all the agency messages received during batch mode happens once the system is online.

The message processing is successful only when the validations are successful and the Position Update message is handed off to Markit. The following details are updated in the system on successful processing of the Submit Agency Update Notice message:

- Confirmation Status is updated as ‘Closed’

- Process Status is updated with Handoff

- Markit Trade status is updated as ‘Closed’

- Postion update message status will be ‘Handoff’

- Message status will be ‘Processed’

If the message processing fails, then the following details are updated in the system:

- Confirmation Status is updated as ‘Rejected’

- Process Status is ‘Extraction’

- Markit Trade status is ‘Closed’

- Position update message status is ‘Pending/Failed’

- Message status is ‘Rejected’

If the buyer/seller/SLT trade is not resolved, then the trade is rejected. You can enrich the trade by selecting the buyer/seller/SLT trade manually. Combination of Markit trade ID and Ext CUSIP/tranche reference number should be selected to fetch a single record. On enriching the buyer/seller, system does the following:

Buyer/Seller is defaulted to all other trades under that Markit trade ID. If bank counterparty is involved, then you should resolve SLT trade for all trades under that Markit trade ID. If resolution of SLT trade can be done for all records, closure processing takes place status is updated accordingly. If System could not resolve SLT trade reference number for any of the trades, then the resolved SLT trade reference numbers remain with the tranches and status fields are not changed. If bank counterparty is not involved, then closure processing takes place and the status fields are changed accordingly.

Enrichment is allowed for SLT trade only if bank counterparty is involved in the trade. On enriching the SLT trade reference number, system carries out validations/resolution is done based on buyer/seller and for all other tranches trade reference number under Markit trade ID.

16.8.6 Position Update Notice

Once all the trades for a Markit Trade Id are marked as ‘Closed’, system sends the Position Update Notice message to Markit for all such trades. Once this message is generated successfully, you can view the message in the ‘FpML Message Browser’. Position update message for a Markit Trade ID will not be allowed to generate/ handoff from this Browser. If message generation fails, it should be generated after user marks for reprocessing from Markit Agency Interface Browser

One bulk Position Update message is generated for all the tranches(facilities) under the Markit Trade Id.

Position Update message for a CUSIP/ISIN is sent only if the Original Take-on Facility/Take-On Deal message was already sent to Markit along with Initial Position Update message. If Take-On deal/facility message is not sent to Markit for a CUSIP/ISIN under a Markit Trade id, then the Position Update message for all the CUSIP/ISIN’s under the Trade ID will not be sent to Markit.

Position Update message would consists of the following primary fields;

- Buyer/Seller

- dealSummary – Summary of the facility (Deal) in Oracle FLEXCUBE with the External CUSIP/ISIN

- transferState – Defaulted as ‘Closed’

- effectiveDate – Effective date of the trade, same as the effective date received in the Submit Agency Update message

- knowledgeDate –defaulted with the ‘Effective Date’

- facilityPortfolioPositions – This field will have multiple

values for each of the tranches for which the trade from Markit was sent,

similar to the ‘multi Facility Trade Details’ sent in the

Trade element of the ‘Syndicated Loan Trade Notice Agent’

message.

- tradeId –Markit trade id received from the original message

- facilitySummary – Includes the CUSIP/ISIN for the tranche

- commitedPosition – System populates the tranche position for the participant, post the effect of the current trade

- fundedPosition – System populates the total drawdown outstanding position for the participant, post the effect of the current trade

- committedTransferAmount – System populates the trade amount for the tranche

- transferAmount – System populates the committedTransferAmount

- changeEvent –Defaulted as ‘Assignment’

Appropriate Position Update message status is updated in Markit Agency Interface Browser. This status indicates whether or not system has sent the Position Update message to Markit successfully for a Markit Trade id.

System does not initiate Consolidation and Trade Processing until the position update message is generated and handed-off to Markit successfully.

Note

- If the ‘Ext Deal CUSIP/ISIN’ for all Tranches under the facility is same, then ‘InstrumentId’ in the FpML message will display ‘Ext Deal CUSIP/ISIN’ from Tranche.

- If ‘Ext Deal CUSIP/ISIN’ for any of the Tranche under the facility is different or null, then ‘InstrumentId’ in FpML message will display CUSIP from Facility.

16.9 Impact of Markit Trades on Tranches and Drawdowns in LB

Since the Position Update message is sent to Markit before the ‘Participant Transfer’ is actually processed in LB Tranche, there is an impact on processing of events in the LB module. When the actual Participant Transfer is triggered in LB tranche as a result of message from Markit, the generation of Position Update message is suppressed during participant transfer.

For the tranches for which Markit messages have been received for trade processing and the Position Update message has been handed off to Markit, system does not allow processing of any events which could send FpML messages to Markit (based on the product event advice setup) till the actual Participant Transfer is done on the tranche. The following table lists the screens where this validation is done and processing is blocked:

Sl. No |

Screen Name |

Blocking events |

1 |

Borrower Tranche Input |

To block Reversal |

2 |

Messaging Processes- FpML Adhoc Message |

To block the generation of position update message for the external CUSIP/ISIN |

3 |

Borrower Drawdown Input |

To block new Drawdown booking /Reversal |

4 |

Fee Liquidation |

To Block new FLIQ |

5 |

Fee Amendment |

To Block FAMD |

6 |

Fee Rule Maintenance |

To block Fee rule maintenance |

7 |

Interest Rate Fixing |

To block IRAM(Interest Rate Amendment) |

8 |

Participant Transfer |

To block Any new participant Transfer |

9 |

Value Dated Amendment |

To block any amendment and also reversal |

10 |

Repricing |

To block new Repricing for a contract |

12 |

Draft Transfer |

To block any new participant transfer for the contract |

13 |

Manual Payment |

To block new payment and payment reversal |

14 |

Consol Rollver Input |

To block rollover for a contract |

15 |

Trade Settlement |

To block any settlement which will change the participant ratio for the corresponding external CUSIP |

16 |

Ticket Settlement |

To block any settlement which will change the participant ratio for the corresponding external CUSIP |

In scenarios, where there is a necessity to process a particular event on a tranche or on its underlying Drawdowns and the actual automatic participant transfer (assignment) is still pending processing, the processing of Participant Transfer can be done manually from the ‘Pending Trade Processing Queue’ for the tranche.

16.10 Handling Status for Processing Markit Agency Trade Settlement

Following are the various statuses handled for processing Markit Trades and Agency Trade Settlement in the system:

- Message status

- Markit Trade status

- Confirmation Status

- Process Status

- Position Update message status

- Participant Transfer Process status

These messages have been explained in detail in the following sections.

16.10.1 Message Status

Details on Message Status are given below:

- This status indicates whether the system has successfully processed a Markit message or not

- This status is updated and tracked for each Markit message and also for the individual Oracle FLEXCUBE tranche under a Trade Id.

- This status is for agency trade settlement for Markit trades

- This status is also updated and tracked for Clearpar trades

16.10.2 Markit Trade Status

Details on Markit Trade Status are given below:

- This status indicates the Markit trade status in the Markit System.

- This status is updated and tracked for each Markit message and also for the individual Oracle FLEXCUBE tranche under a Trade Id

- This status is for agency trade settlement for Markit trades

16.10.3 Confirmation Status

Details on Confirmation Status are given below:

- This status indicates whether the Clearpar/Markit Trade is closed or pending to be closed in the system.

- This status is updated only after closure message is received from Markit. Until then the default status will be ‘Pending Closure’.

- This status is updated and tracked for each individual Oracle FLEXCUBE tranche for a Trade Id.

- This status is used for Markit Trade settlement processing.

16.10.4 Process Status

Details on Process Status are given below:

- This status indicates whether the Clearpar/Markit Trade is settled in system or not, that is, the Participant Transfer is successful in the system or not.

- This status is updated only after closure message is received and also after confirmation status is updated as ‘Closed’. The default status is ‘Extraction’.

- This status is updated and tracked for the individual Oracle FLEXCUBE tranche under a Trade Id

- This status is used for Markit Trade settlement processing

16.10.5 Position Update Message Status

Details on Position Update Message Status are given below:

- This status indicates that the Position Update message is generated/Handed off to Markit.

- This status is updated only after closure message successfully processed in the system.

- This status is updated and tracked for each Markit Trade id

- This status is for agency trade settlement for Markit trades

16.10.6 Participant Transfer Process Status

Details on Position Update Message Status are given below:

- This status indicates that Participant Transfer is processed in Agency for the tranches under the Markit Trade ID. Default status will be ‘Unprocessed’.

- If Participant Transfer is processed for all tranches under the Markit Trade ID, status is updated as ‘Fully Processed’.

- If Participant Transfer is in ‘Failed’ status for all tranches under the Markit Trade ID, then status is updated as ‘Failed’.

- If Participant Transfer fails for any of the tranches and is processed for a few tranches, then system updates the status as updated as ‘Partially Processed’.

16.11 Messages from Markit for Trade Settlement in SLT

The messages received from Markit are mainly for identifying the workflow, displaying the funding memo and enabling the user for initiating SLT trade settlement.

The following messages are communicated from Markit to Oracle FLEXCUBE for processing trade settlement from in SLT module:

Message |

Description |

Occurrence |

Flow |

Trade Match Notification |

Markit sends successful match message to both buyer and seller of the trade. System consumes this message and populates it in the Trade settlement Queue to do a trade match |

Can be received multiple times prior to Settlement |

Markit to Oracle FLEXCUBE |

Trade Allocation Message |

Allocation definition structure. |

Can be received multiple times prior to Settlement |

Markit to Oracle FLEXCUBE |

Trade Status Update Notification |

Possible Trade Status from Markit:

|

Can be received only once prior to Settlement |

Markit to Oracle FLEXCUBE |

Settlement Details |

Settlement details for

a Secondary trade. |

Can be received multiple times prior to Settlement |

Markit to Oracle FLEXCUBE |

Trade Closed |

Notification of trade closing for counterparties from Markit |

Can be received only once on closure of the trade in Markit |

Markit to Oracle FLEXCUBE |

The FpML message from Markit would be parsed by the Java adapter. If ‘Markit Trade Settlement Allowed’ box is deselected in ‘Loans Parameters’ screen, then Markit messages are not processed in the system. However, if this check box is selected, then all the Markit messages are uploaded by the Java adapter the system.

16.11.1 Trade Match Notice

Trade Match Notice message is the first message received from Markit to initiate SLT trade settlement process in Oracle FLEXCUBE.

Each Trade Match Notice message consists of the following primary details:

- Markit Trade ID - Unique Identifier for the trade

- LQT Ticket ID - Ticket Id sent by Loans QT while booking SLT trade in the system. Multiple SLT trades can be booked in one Ticket Id

- Trade details - Trade Type, Document Type, Trade counterparties, and assignment Fee details

- Facility details

Each message from Markit can have trade details of multiple trades under one facility. The following details are the same across all the trades (CUSIP/ISINs) under the message:

- LQT Ticket ID

- Trading counterparties, buyer and seller

- Trade Date, Expected Settlement Date

- Trade Type – Primary / Secondary

- Assignment Fee Details

- Trading Association – LSTA / LMA

- DocumentationType – Par / Distressed

- FormOfPurchase – Assignment, Assignment-Only

- AccrualSettlementType – Flat / SWOA

The following primary details are sent from Markit to Oracle FLEXCUBE as part of Trade Match Notice message:

Markit Fields |

Description |

Party |

MEI code of the buyer and seller |

Approval |

Approval Type, status and approver details. These are used by the system for user information only. No processing impact |

replacedTradeIdentifier |

This indicates the old Markit trade that is being replaced by the current Markit trade. The replaced Trade Identifier should be a valid Markit Trade ID that was previously consumed by Oracle FLEXCUBE |

Product Type |

It is always ‘SyndicatedLoanTradeNotice’ |

TradeID |

Unique Trade Id for each Markit trade. It consists of two Id’s, Markit Trade Id and LQT Ticket Id which is the Ticket Id of the SLT trade |

SellerTradingParty |

Reference to the Party who sells the position |

BuyerTradingParty |

Reference to the Party who buys the position |

TradeDate |

Trade Date |

ExpectedSettlementDate |

Expected Settlement Date of all the trades under this Markit Trade ID |

TradingAssociation |

LSTA / LMA. Applicable for all the Trades under a Markit TradeID |

DocumentationType |

Par/ Distressed. Applicable for all the Trades under a Markit TradeID |

FormOfPurchase |

Assignment or Assignment-Only Applicable for all the Trades under a Markit TradeID. Any other type of FormOfPurchase results in the trade being in unmatched status in Oracle FLEXCUBE. Participation trades are out of scope of this FS |

AccrualSettlementType |

Flat or SWOA. Applicable for all the Trades under a Markit TradeID. Any other type of AccrualSettlementType results in the trade being in rejected in Oracle FLEXCUBE. |

TradeType |

Primary/Secondary. Applicable for all the Trades under a Markit TradeID |

AssignmentFeeDetails |

Wrapper Element. Assignment Fee Remitter and Assignment Fee Paid By. Applicable for all the Trades under a Markit TradeID |

Deal Summary |

Wrapper Element. Includes CUSIP/ISIN and Value Date of the facility. Facility will be unique for all the Tranches in TradeMatchNotice |

MultiFacilityTradeDetails |

Wrapper Element. Contaisn the details of the traded amount for each Tranche. Contain the facilityTradeDetails element that occurs multiple times, for each of the tranche under the Markit trade id |

FacilityTradeDetails |

Wrapper Element and is repeated for every tranche under the Markit trade id |

FacilitySummary |

Wrapper Element. Consists of instrumentid and original commitment(tranche) amount with currency |

multiFacilityTradeDetails-> facilityTradeDetails-> facilitySummary -> instrumentId |

CUSIP/ISIN of the tranche, based on which the Tranche is identified in Oracle FLEXCUBE |

multiFacilityTradeDetails -> facilityTradeDetails -> tradedCommitmentAmount |

Trade amount with currency |

TradePrice |

Trade Price |

System resolves the details from ‘Markit SLT interface Browser’ and populates the details in the ‘Markit Trade Settlement queue’. For each trade from Markit, the details of the trades are resolved and detailed validations are done based on the following:

- Counterparty from Markit trade, that is,. Buyer/Seller in Oracle

FLEXCUBE are identified by matching the Markit details with the MEICODE

UDF of the customers in the Oracle FLEXCUBE.

- The trade is rejected if MEICODE UDF is not found in the system.

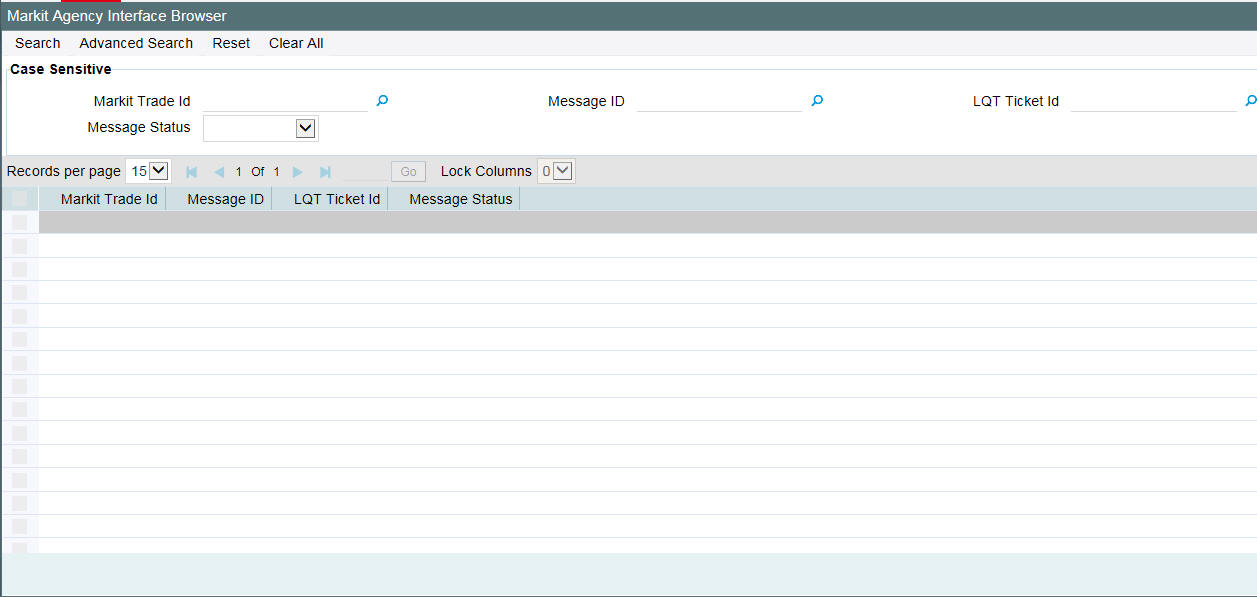

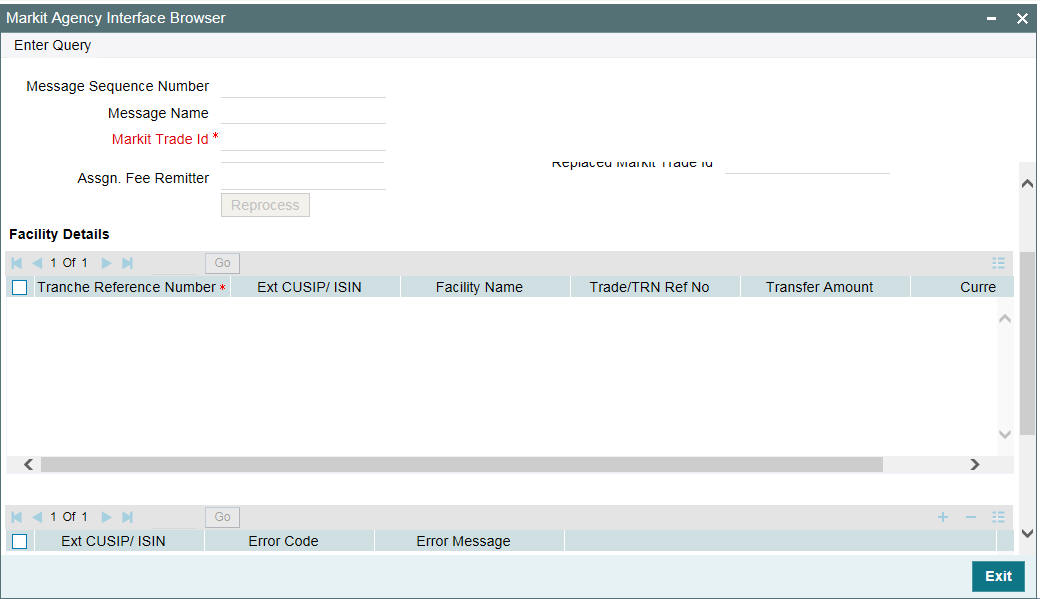

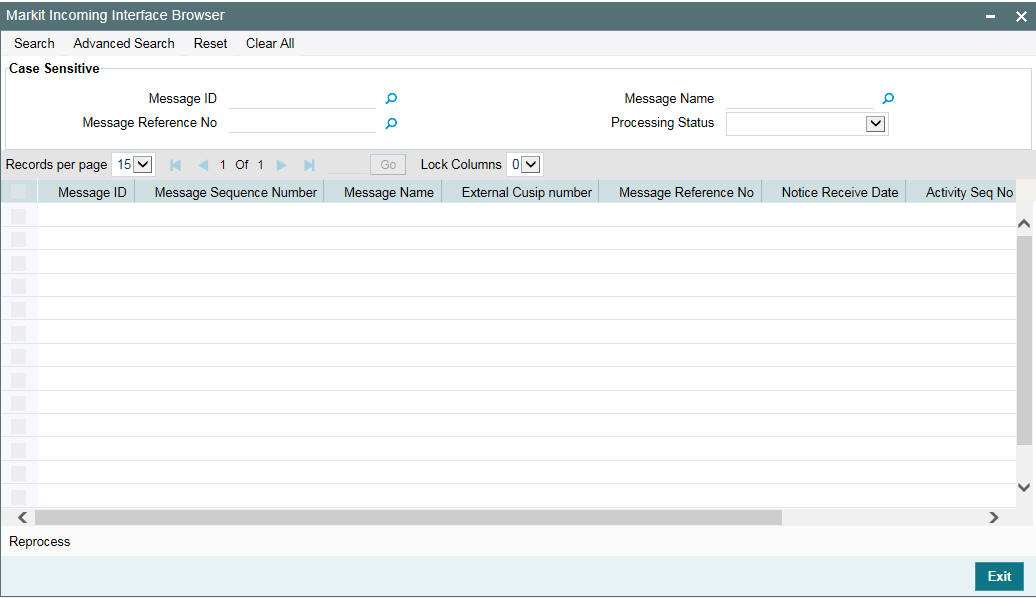

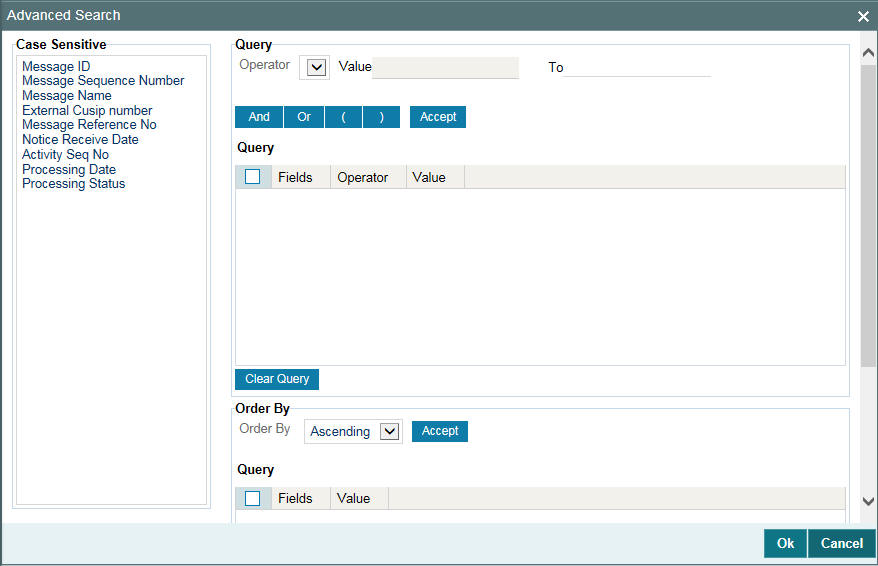

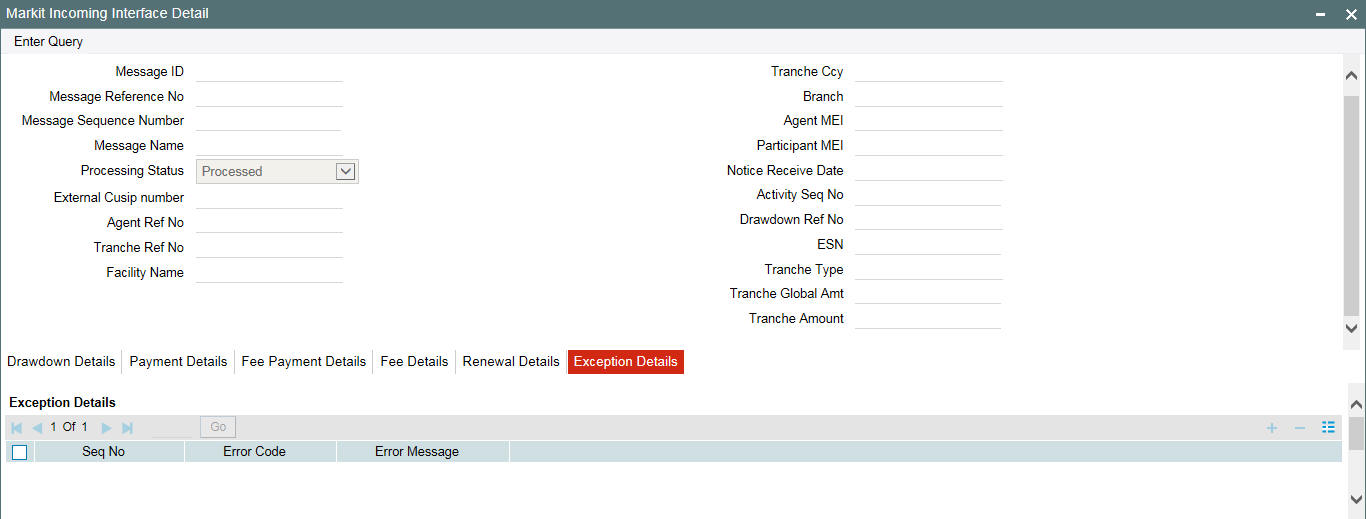

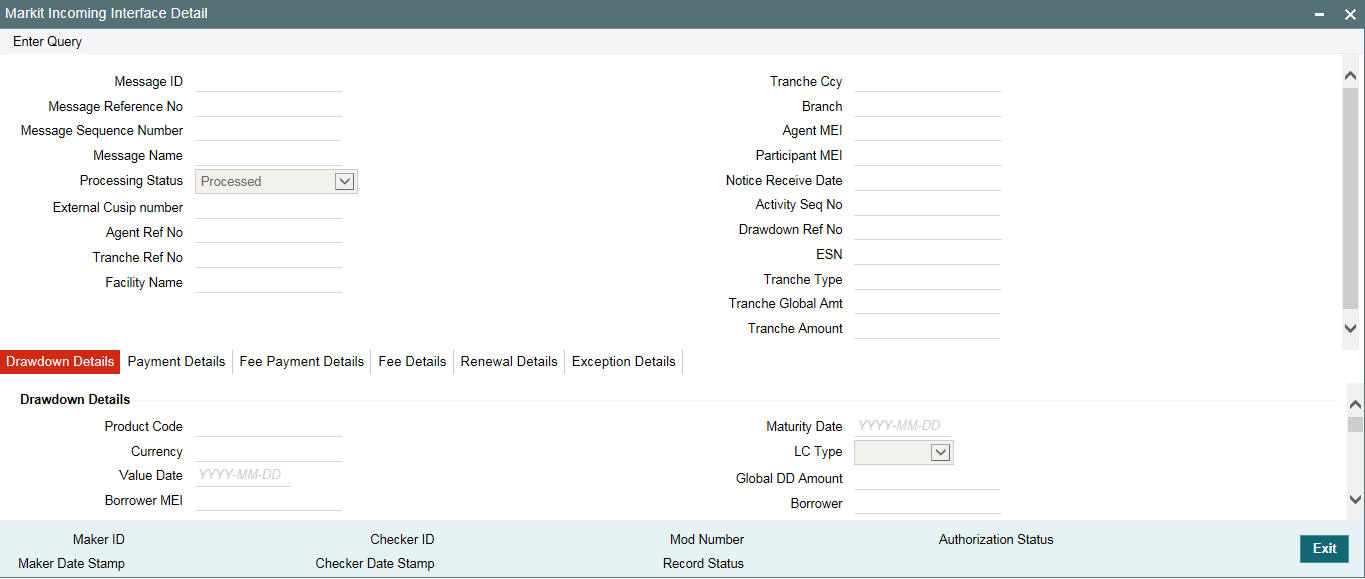

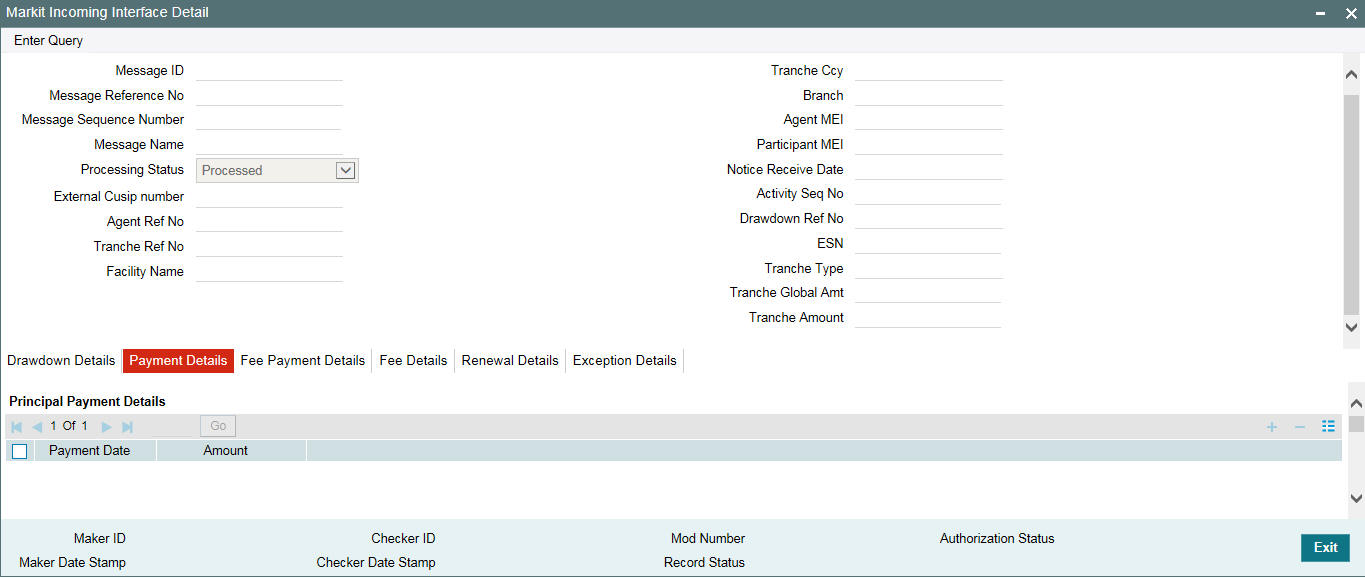

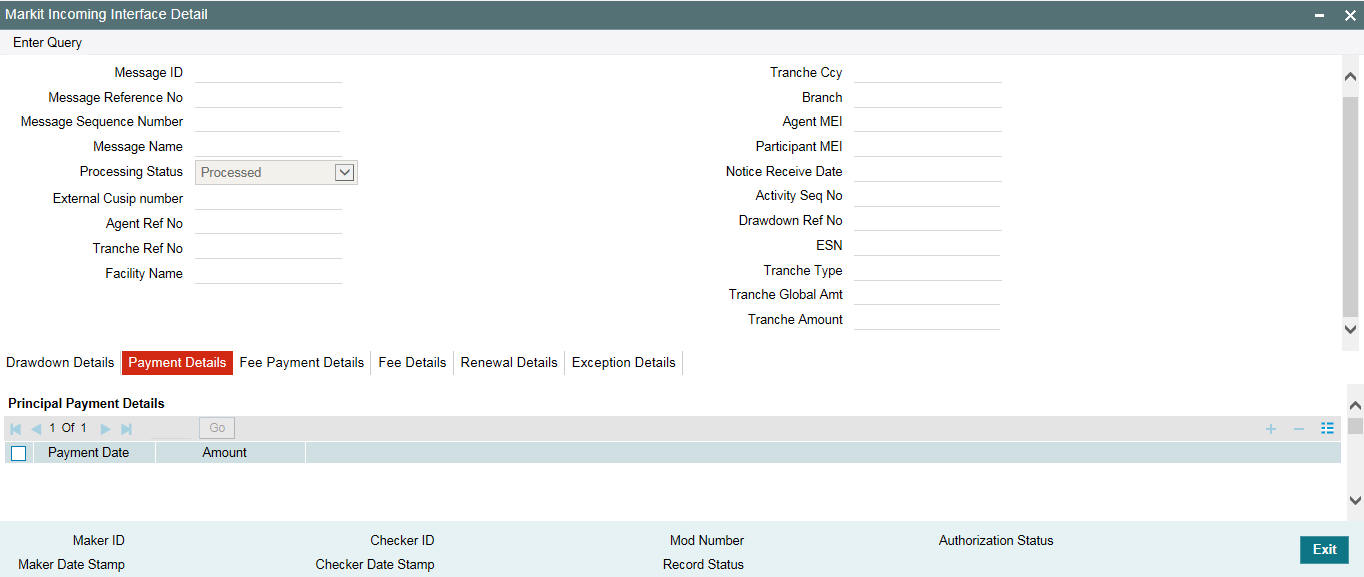

- Trade is ‘Unmatched’ if MEICODE UDF is found and Buyer /Seller is resolved. However, the trade matching fails.