Key Features and Benefits of OIPA solutions

Line-of-business and Product Agnostic

OIPA is highly configurable through XML business rules and designed to be both line of business and product agnostic. It enables insurers to create truly innovative products and riders, from simple to complex, across life, health, unit-linked and annuity products.

Web-based, Modern, Highly Extensible

OIPA is a modern system that is built on open, J2EE-based architecture and can be deployed across numerous technology stacks. The system is Service-Oriented Architecture (SOA)-enabled allowing integration through Web Services with other insurance systems and Web portals to support straight-through processing. The system's browser-based User Interface further promotes ease-of-use by both business and IT users.

Unparalleled, Flexible Rules Configuration

The OIPA streamlined architecture separates the rules, which support business and product logic, from the base code, minimizing the need for heavy IT intervention during the configuration process. Its highly flexibly rules-configuration capability empowers business and technical users to collaboratively configure changes using business rules without the need to customize the system's core code or database structure. This helps shorten product development time cycles, while reducing the cost of configuring products and installing upgrades.

Another key benefit is the ability to reuse rules. Users configure rules once and reuse again for other products reducing development, testing, and maintenance.

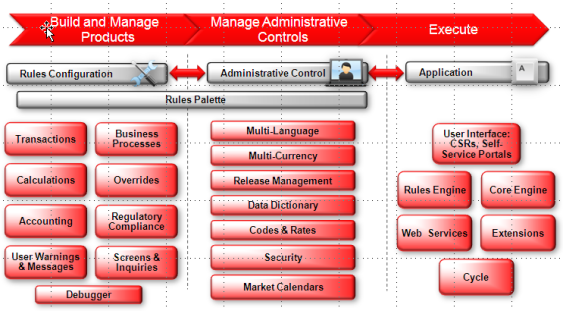

Oracle Insurance Policy Administration for Life, Unit Linking and Annuity is structured to provide competitive advantage through rules-based configuration separated from the base code and data structure.

Powerful Rules Engine

OIPA's rules engine allows business and technical analysts to configure transactions using business rules to support unique and creative product features. For example, an insurer may want to execute a distinct transaction on a policy, such as paying an agent a bonus on every sale. This innovation makes the insurer more attractive to agents and producers. It also promotes consistency and accuracy, reducing the time required for development, testing, and maintenance. Through rules-based configuration, business and technical analysts can create compliant calculations and reusable functions, such as tax withholding, to support state-filed products across life, health and annuities.

Rules Palette

The Rules Palette, a visual configuration tool with drag-and-drop functionality, simplifies rule creation, modification, and debugging. It offers unparalleled flexibility by enabling business and technical analysts involved in configuration to make changes by products, fields, screens, languages, currencies, and more through business rules—while facilitating improved collaboration with business and IT. With it, users can control security rights, rates, funds, and other items through administration tables for a centralized view of fixed and variable data for enhanced flexibility. The integrated Data Dictionary drives a consistent set of field labels and math variables.

Integrated Debugger

OIPA includes an integrated debugger tool within the Rules Palette. The debugger provides full exposure and step-by-step execution of formulas and complex calculations within policy examples (for example, a partial surrender charge or taxable gain). The ability to validate calculations and formulas contributes to reusability and reduced development cycles, testing, and maintenance.

Pre-configured Product Examples

OIPA includes pre-configured product configuration examples for guaranteed level premium term life, variable deferred annuity (without annuitization payout), and unit-linked fund processing. The pre-configured examples help provide a jump start to insurers during the configuration process and may be adapted by an insurer based upon the specific product and /or business requirements.

Product Cloning

OIPA provides the ability for users to quickly "clone" a product and reconfigure it to create a new one, resulting in accelerated speed to market. Users may clone rules from an existing product and reconfigure based on new requirement (for example, add a new secondary guarantee to a life or annuity product).

Corrective Processing

Corrective processing functionality is inherent within the system and is triggered by policy transaction reversals or compliant back-dated transactions. This eliminates the need for manual processing by customer service representatives (CSRs). In contrast, legacy systems are often high-touch and time consuming for CSRs to complete corrective undo and redo processing of policy transactions reversals.

Workflow Queue

OIPA enables users to manually select and process tasks from dashboard which need manual intervention for completing activity processing cycle.

Complete Traceability of Data

OIPA enables insurers to enforce compliance and best practices, reduce manual processing, and provide full visibility into transaction history throughout the policy lifecycle. It provides the ability for users to view the history at transaction and screen detail level to support compliance requirements and market conduct audits. This is available to CSRs or other employees as soon as the transaction has been processed.

Proven Performance – Tested Scalability

The system also is highly scalable to support the evolving business needs of the largest Tier One global insurers. Oracle recognizes that each implementation project is unique and specialized to each customer's requirements with system performance dependent upon the rules configured to support their products and lines of business. Performance tuning is an important phase of each project to meet client expectations.

Release Management

Release management capability with OIPA provides governance of rules migration from development, to testing, to the production environment throughout the product development lifecycle. This promotes consistency and further accelerates time to market for new and adapted products.

Globalization / Localization Support

OIPA includes several features to support internationalization and localization requirements of global and regional insurers, including support for multiple languages, locales and currencies in a single instance of the system.