Chart of Accounts and Disbursements

Disbursements are removals of money from the administration system's accounts into outbound accounts or accounts for downstream systems. The accounting may actually be accomplished as the money is moved out of a policy (non-disbursement activity) or may be delayed until the disbursement is executed.

High Level Steps to Configuring Disbursements

Chart of Accounts plays an important role in disbursement processing. Entities and accounts must be set up in order for OIPA to properly track disbursements. There are also several screens and transactions that need to be configured to support disbursements. The main components of disbursement configuration are outlined below.

- Configure the DisbursementScreen, DisbursementApprovalScreen and DisbursementSearchScreen.

- Create the necessary policy level transactions to spawn a disbursement transaction that triggers the removal of money from the policy.

- Configure any necessary client level disbursement transactions to remove money from suspense accounts.

- Create a separate CoA for each disbursement status that will be supported. View details for disbursements on the CoA wizard. Available statuses are:

- Active = 01

- Recoverable = 12

- Pending = 02

- PendingShadow = 34

- Recovered = 27

- TaxableOffset = 28

- Unrecovered = 44

- Create CoA Entities for transactions that initiate a disbursement. This is only needed if the processing of the transaction has accounting implications.

-

Determine if transaction processing will be used as a means to update disbursement status. If the answer is Yes, then a transaction must be configured to perform this. The DisbursementUpdate rule should be configured and attached to this transaction. CoA Entity must also exist to trigger accounting if this option is configured in DisbursementUpdate. View prototype example

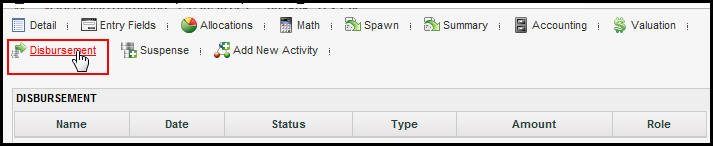

View Disbursement Information in OIPA

When a disbursement activity is processed, the resulting account information can be viewed from the Activity Results window. From the Activity screen, click the Activity Detail icon to the left of the processed activity. This will open the Activity Results window. A Disbursement link is provided at the top of the window. All disbursement details can be viewed from that link.

Disbursement Link in Activity Result Window in OIPA

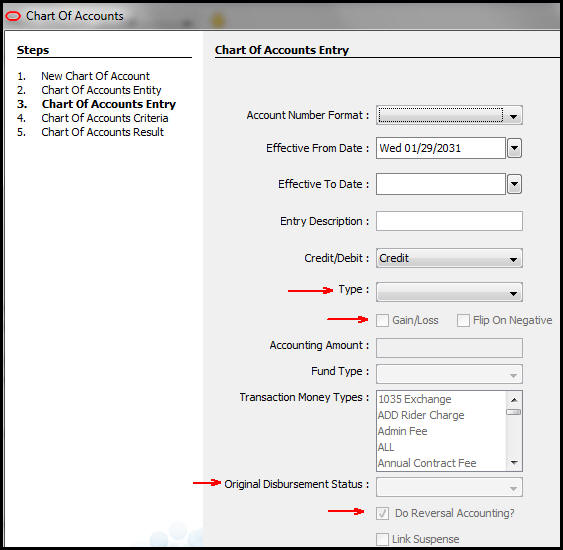

CoA and Disbursement Detail

The disbursement status is originally pending. If the disbursement activity was reversed the status would be recovered. In some versions the status may be Pending Shadow.

The Entry Detail section of the CoA creation wizard has specific fields that are associated with setting-up disbursement accounts.

-

Type - Select disbursement when account is a type of disbursement.

-

Gain Loss/Negative – If setting up a type of account that is either ByFund or Total Fund, check this box to indicate that accounting will only happen if there is a gain or loss to funds. For example, a FundTransfer activity may use this selection or it could be used in the reversal/recycle of an activity that would result in a difference of the amount because of the fluctuation in market fund value.

-

Flip on Negative - This checkbox is no longer needed as now all negative accounting is handled in the OIPA code.

-

Original Disbursement Status - Activities generally have an active and pending status, but for a disbursement activity that sends money out to a client, there is a chance the money may not be received by the client. This field is used to track the status of the money in case an adjustment needs to be made. The status names in this field are pulled from AsCodeDispursementStatus.

-

Pending – Select for forward accounting. This is the status when an activity is processed for the first time.

-

Recoverable – Select for reverse accounting. For example, if overpayment or recovery of payment, such as broker commission of a policy, that was surrendered. Money is not always recovered.

| Important | If this is selected then specific configuration using the disbursement element tag in the transaction is required. The disbursement element tag has an attribute called recoverable that needs to be set to Yes. |

-

Recovered – Select if the insurance company gets the money back. Most commonly used when a disbursement transaction is reversed or recycled.

-

Do Reverse Accounting – Check if you need to capture the accounting information when reversing the disbursement activity. This is usually always selected, as collecting information for reverse accounting is necessary.

Accounting Detail Reversal

If the Do Reversal Accounting check box is selected, then when a reversal is processed it will be viewable via the Accounting Detail (Reversal) section. This applies when a disbursement activity was reversed or recycled. The reversal accounting status is not viewable via the OIPA application. You will need to query the database. If the status is pending, you will not see the Accounting Detail (Reversal) section at all. It only displays when the status is active.

Disbursement Fields on CoA Wizard Step Three