Valuation Overview

Valuation is the calculation of a policy’s worth. When OIPA performs valuation, it calculates the policy’s current fund and deposit values.Policies that accumulate cash value, such as variable annuity or unit linked, are the only types of policies that are subject to valuation calculations. Term policies do not accumulate cash value, so there is no value to calculate.

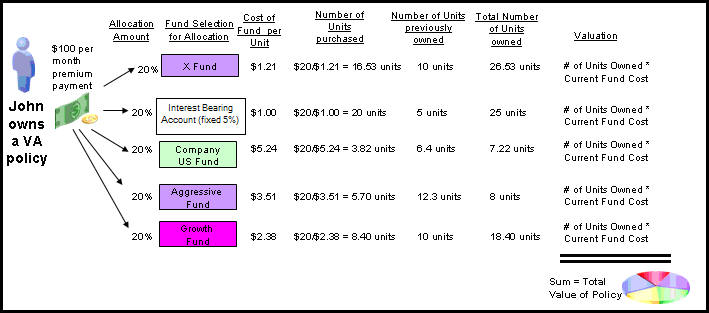

The calculation of a policy’s value is determined by the type of funds in the policy. A policy owner invests money in a policy by making deposits into specific fund(s). The value of a policy depends on the amount in the funds, the type of funds the policy owner has elected to purchase and the funds' performance in the marketplace. The policy owner may move money out of funds or transfer between funds, which will also affect the policy’s value.

The movement of money in and out of a policy requires complex calculations and logic. The OIPA system offers an agile environment that can support the various configuration scenarios needed to manage a wide array of valuation requirements and fund types.

There are two different methods of configurating valuation: traditional and Point-in-Time. When traditional valuation is used, all policy valuation calculations are made using all data from the inception of the fund. When Point-in-Time valuation is used, policy valuation calculations are made using values from the last processed valuation, rather than from inception. Since traditional valuation must recalculate all valuation data each time valuation is processed, it is much more resource intensive than Point-in-Time valuation.

| Important | A plan that uses traditional valuation with fixed or variable funds can be converted to use Point-in-Time valuation. The only exception involves unit linked funds. They are not supported at this time. |

| Important | The interest rates retrieved during fixed fund valuation must be maintained and accessible from AsRate and AsRateGroup tables. These cannot be delegated to external resources or customized implementation. |

Simplified Valuation Diagram

Valuation and Unit Linked Funds

Unit linked funds require a special type of valuation.

When configuring valuation the following areas should be considered:

-

Funds

-

Allocations

-

Transactions

-

Assignments

-

Any additional rules to enhance processing