4. Notional Pooling

OBLM supports notional pooling of accounts for cash concentration benefits. Under notional pooling, balances remain on participating accounts. The bank charges or credits interest on net balance of the pooled accounts thereby mitigating the cost of overdrafts on participant accounts.

Notional Pooling of is a mechanism for calculating interest on the combined credit and debit balances of accounts that a corporate parent chooses to cluster together, without actually transferring any funds. It is ideal for companies with decentralized organizations that want to allow some autonomy to their subsidiaries, including their control over bank accounts.

Pool participant accounts are aggregated for interest compensation purposes. Funds are not physically moved, but are notionally combined. There is no commingling of funds, and the integrity of the individual account position is maintained.

Notional Pooling can be combined within the framework of a global cash concentration structure to provide comprehensive overlay structures to meet even the most complex organization’s needs

Notional pooling can have multi-layered overlays like in country pools sweeping into regional pools which in turn sweep into global pools. This type of structure is provided to mirror the corporate’s regional treasury arrangements.

Once a company earns interest on the funds in a notional pooling account, interest income is usually allocated back to each of the accounts comprising the pool. For tax management reasons the corporate parent usually charges the subsidiaries participating in the pool for some cash concentration administration expenses related to management of the pool. This scenario works best if the corporate subsidiaries are located in high-tax regions where reduced reportable income will result in reduced taxes.

The main downside of notional pooling is that it is not allowed in some countries. It is difficult to find anything but a large multi-national bank that offers cross-currency notional pooling. Instead, it is most common to have a separate notional cash pool for each currency area.

Notional pooling is normally done within one branch so that the bank gets the right of offset on its balance sheet (from the regulators and clients). Else bank has to set aside capital to cover the gross pooled balances

This chapter contains the following sections:

- Section 4.1, "Benefits of Notional Pooling"

- Section 4.2, "Notional Pooling Structures"

- Section 4.3, "Interest Calculation Methods"

- Section 4.4, "Interest Allocation Methods"

- Section 4.5, "Interest Reallocation"

4.1 Benefits of Notional Pooling

The benefit of notional pooling can be listed as below:

- Minimizes interest expense and improves balance sheet for corporate by off-setting debit and credit positions

- Single liquidity position without commingling of funds

- Allows each subsidiary company to take advantage of a single, centralized liquidity position, while still retaining daily cash management privileges

- Preserves autonomy, control and record-keeping

- Benefit from off-setting without movement of funds and saving on administrative costs by avoiding foreign exchange costs

- Avoids inter company loans by avoiding the use of cash transfers to a central pooling account

- Automation of interest reallocation

- Reduction in operating expenses by reducing short term borrowings

- Concentration of balances

- Largely eliminates the need to arrange overdraft lines with local banks

4.2 Notional Pooling Structures

Notional Pooling can take any of the following structures:

- Single currency, Single country

- Single currency, Cross border

- Multi-currency, Single country

- Multi-currency, Cross border

4.3 Interest Calculation Methods

Interest on pool participants can be calculated in the following ways:

- Replacement Interest Payment Method/ Interest Method - System will have interest suppressed at the participant accounts and will make a single payment/charge as required based on the pool header balance

- Advantage Method - Interest is initially calculated without taking the pooling arrangement into account and then a rebate is paid to the group

- Interest Optimization Method (Top up interest payment) - Bank arranges preferential interest rates for participating accounts without fully offsetting credit and debit balances. This option will be used in jurisdictions where full notional pooling is not permitted.Here dual interest rates are applied i.e. Balance of the account is segregated into compensated and non compensated balances and interest rates applied accordingly

- Interest Enhancement Method - This method works by applying preferential pricing across a group of accounts on the basis of predetermined criteria that are typically based on a net aggregate balance threshold.

4.3.1 Interest Method

System will have interest suppressed at the participant accounts and will make a single payment/charge as required based on the pool header balance

For Interest method, we need to set the IC setup. Please follow the below steps:

4.3.1.1 Interest Rule Setup

You can invoke the ‘Interest Rule Setup’ page by clicking on the setup tab in application.

Rule ID

Specify a rule ID.

Rule Description

Specify a description for the rule.

Apply Interest on Account Opening Month

Check this box to apply the interest on the account opening month.

Apply Interest on Account Closing Month

Check this box to apply the interest on the Account Closing month.

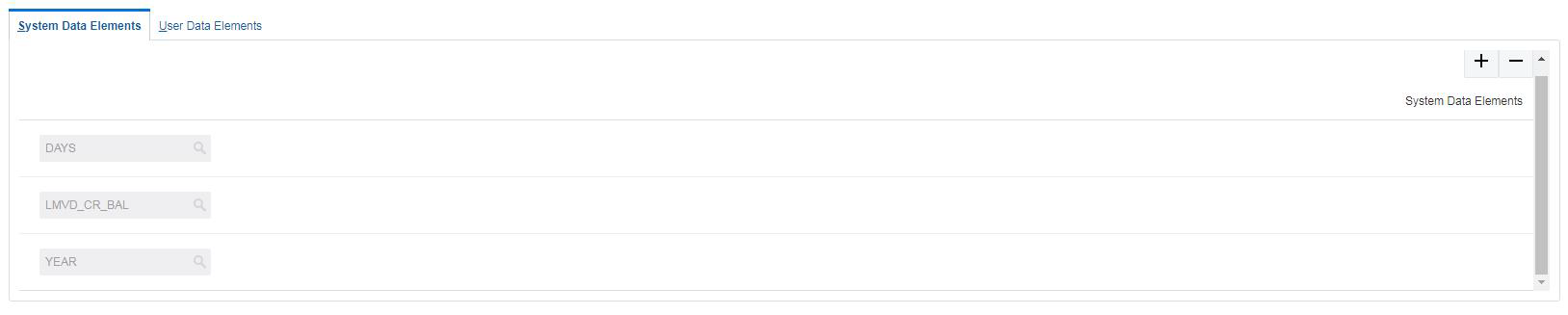

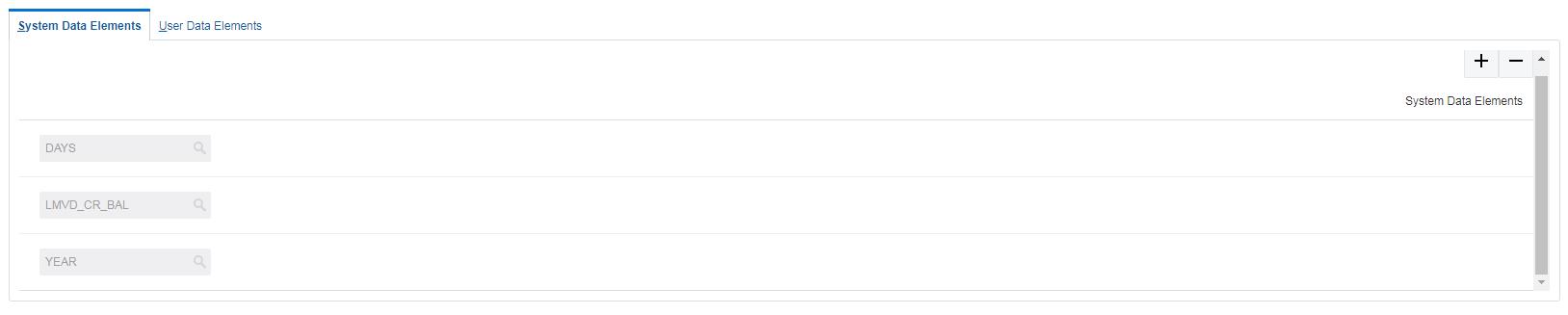

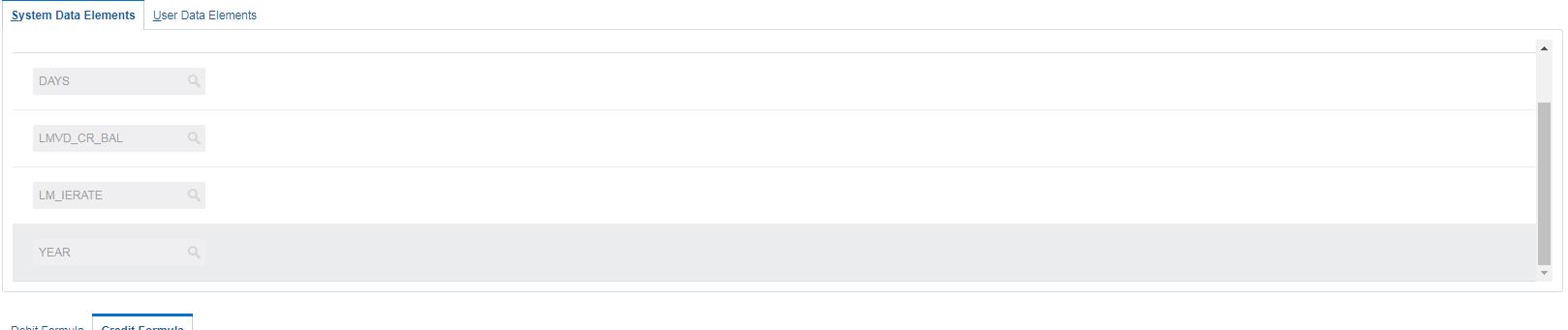

System Data Elements

Click '+' button to add system elements. Specify the system elements like DAYS, LMVD_CR_BAL and YEAR. You can select the system elements from the option list.

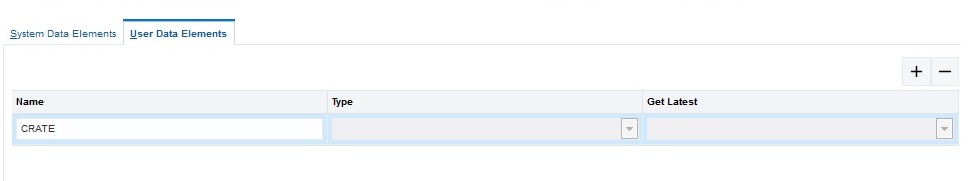

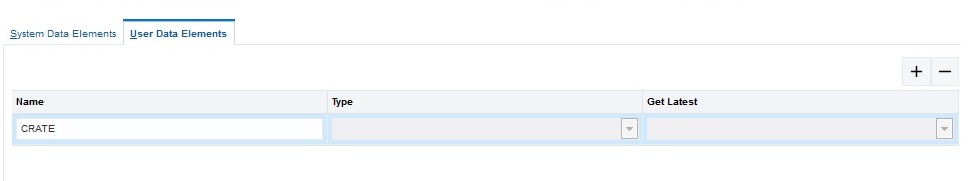

User Elements

Specify a user element.

Name

Specify the user defined name in Textbox

Type

Select the type as “Rate” from the drop down list.

Get Latest

Select the option “Use Current” which is to be used as latest

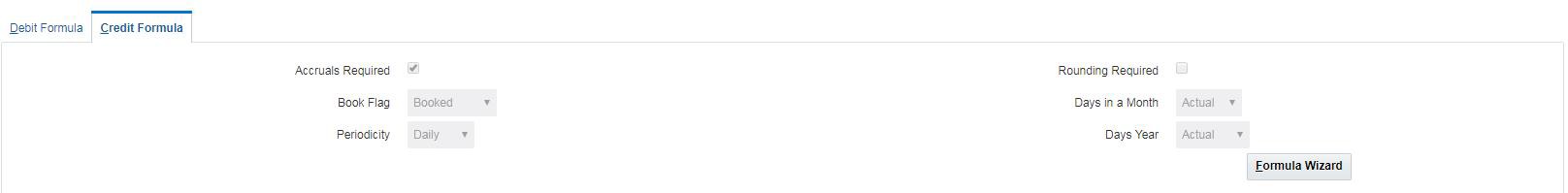

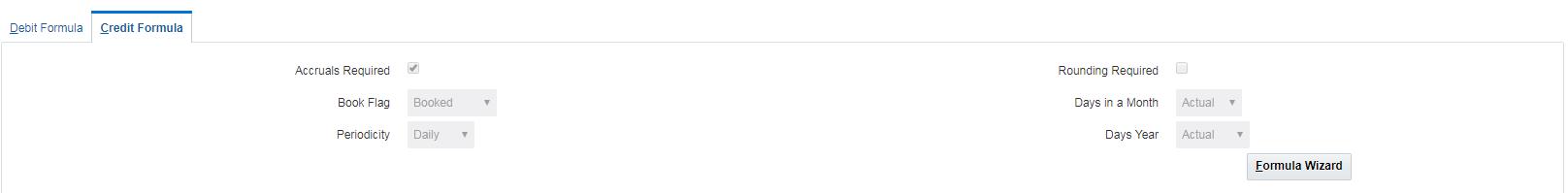

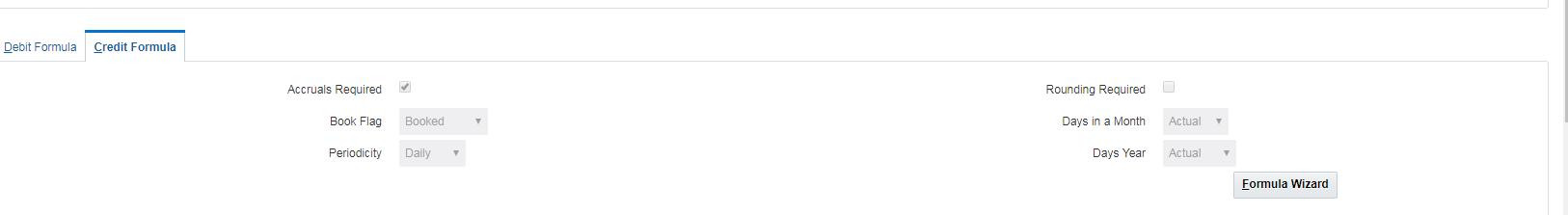

Accruals Required

Check this box if accrual are required.

Rounding Required

Check this box if rounding is required.

Book Flag

Select the book flag “Booked” from the drop down list.

Periodicity

Select the frequency “Daily” from the drop down list.

Days in a Month

Select “Actual” from the drop down list. The options are:

Days Year

Select “Actual” from the drop down list.

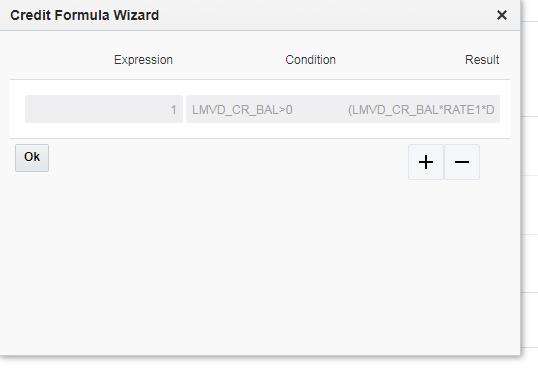

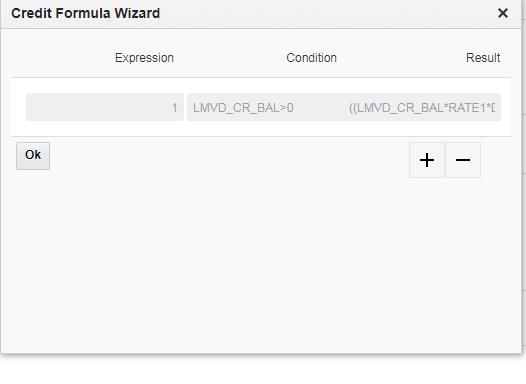

Expression, Condition and Result

Specify the Expression, Condition and Result as mentioned below.

|

Header/ Child |

Condition |

Formula |

Interest Method for sweep |

Header/ Child |

LMVD_DR_BAL<0 |

(LMVD_DR_BAL * RATE1*DAYS)/(YEAR*100) |

(LMVD_CR_BAL>0) AND (LMVD_CR_BAL<=10000) |

(LMVD_CR_BAL * RATE2*DAYS)/(YEAR*100) |

||

(LMVD_CR_BAL>10000) AND (LMVD_CR_BAL<=9999999) |

(LMVD_CR_BAL * RATE3*DAYS)/(YEAR*100) |

||

Interest Method for Pool |

Header |

(LMVD_CR_POOLBAL>0) AND (LMVD_CR_POOLBAL<=10000) |

(LMVD_CR_POOLBAL * RATE4*DAYS)/(YEAR*100) |

(LMVD_CR_POOLBAL>10000) AND (LMVD_CR_POOLBAL<=9999999) |

(LMVD_CR_POOLBAL * RATE5*DAYS)/(YEAR*100) |

||

LMVD_DR_POOLBAL<0 |

(LMVD_DR_POOLBAL*RATE6*DAYS)/(YEAR*100) |

||

Child |

Not Applicable |

Not Applicable |

LMVD_CR_POOLBAL - Credit net pool position

LMVD_DR_POOLBAL - Debit net pool position

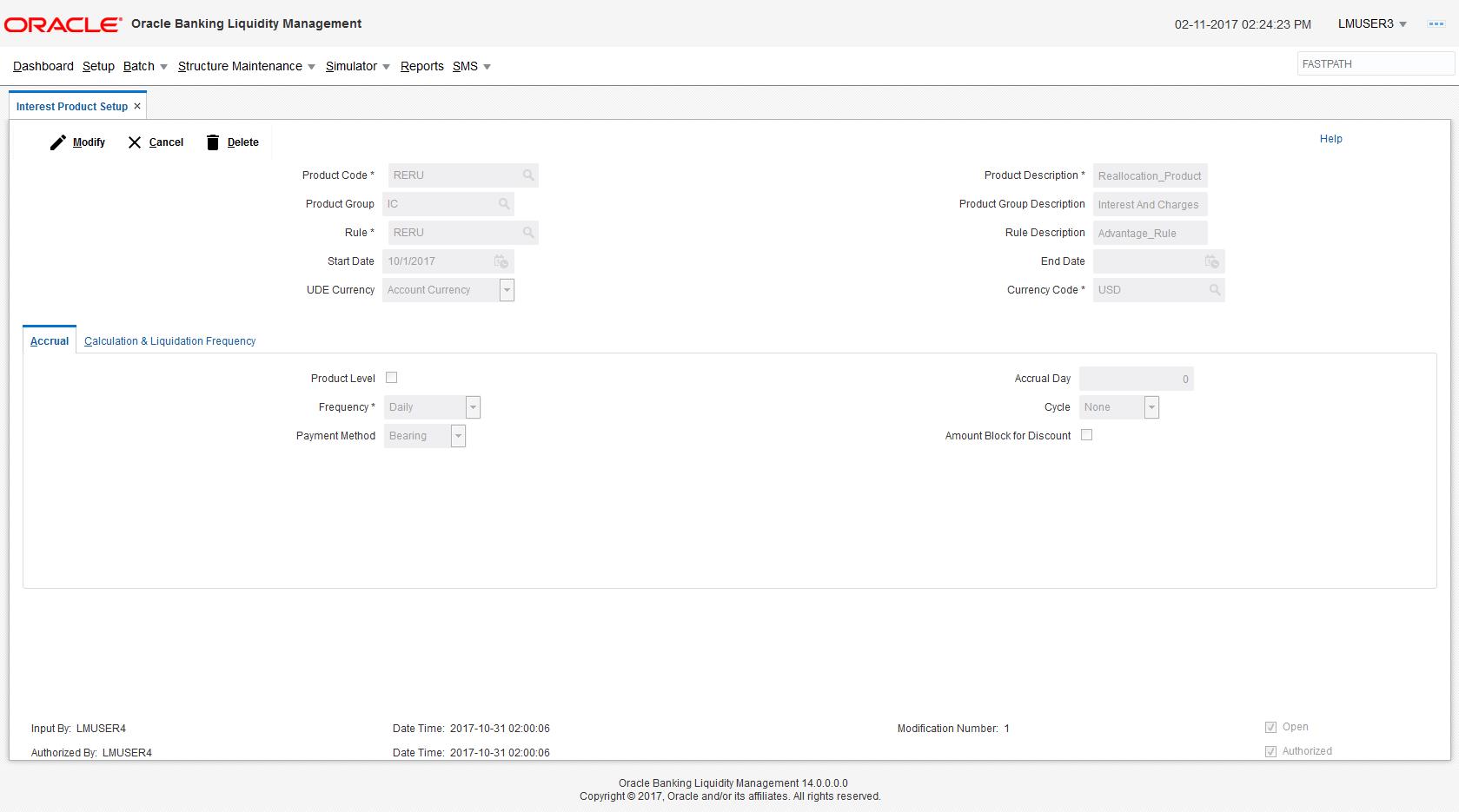

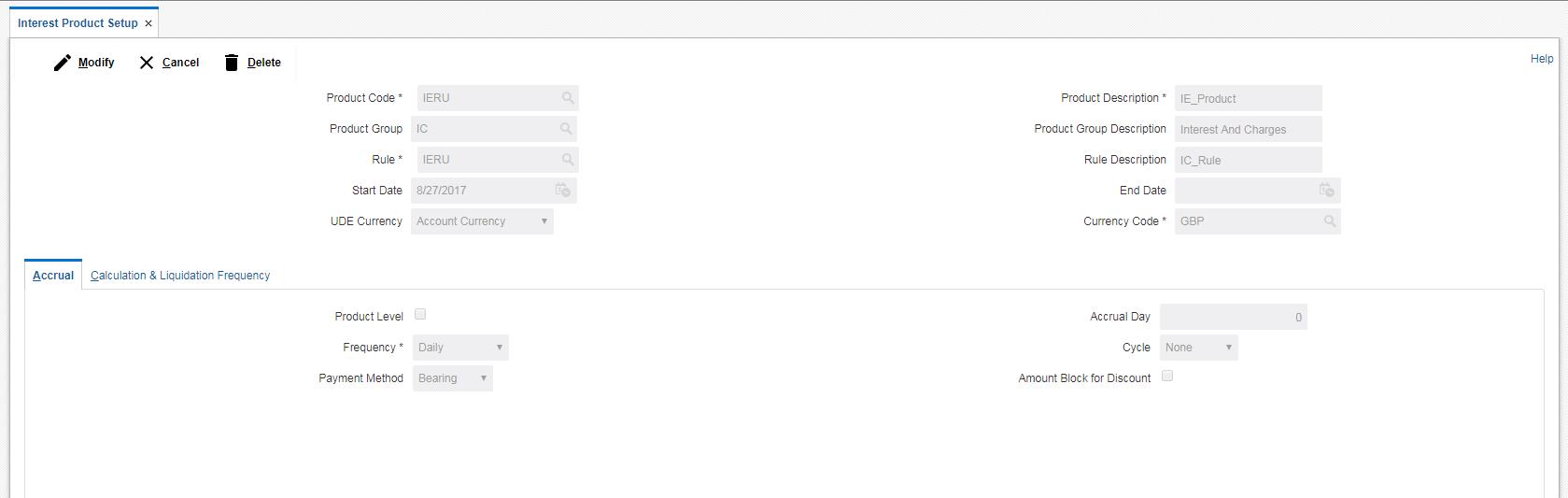

4.3.1.2 Interest Product Setup

You can invoke the ‘Interest Product Setup’ page by clicking on the setup tab in application

Product Code

Specify a product code for the new interest product

Product Description

Specify a description for the new interest product.

Product Group

Specify the product group under which the new product is based. You can select the product group from the option list. The list displays all the product groups maintained in the system

Product Group Description

The system displays the description for the selected product group.

Rule

Specify the rule to be associated with the interest product. You can select the rule from the option list. The list displays all the rules maintained in the system

Rule Description

The system displays the description for the selected rule.

Start Date

Specify the start date of liquidation.

End Date

Specify the date till which the interest product will be active.

UDE Currency

Select the UDE currency to be associated with the product from the drop down list. The options are: Account Currency, Local Currency

Currency

Select the currency from the option list. The list displays all the currencies maintained in the system

Accrual Tab

Product Level

Check this box if the interest accrual is to be done at product level.

Accrual Day

Specify the day the accrual should happen.

Frequency

Select the frequency of accrual “Daily” from the drop down list.

Cycle

Select the cycle for the accrual “None” from the drop down list.

Payment Method

Select the payment method for interest accrual “Bearing” from the drop down list.

Amount Block for Discount

Check this box to block amount for discount.

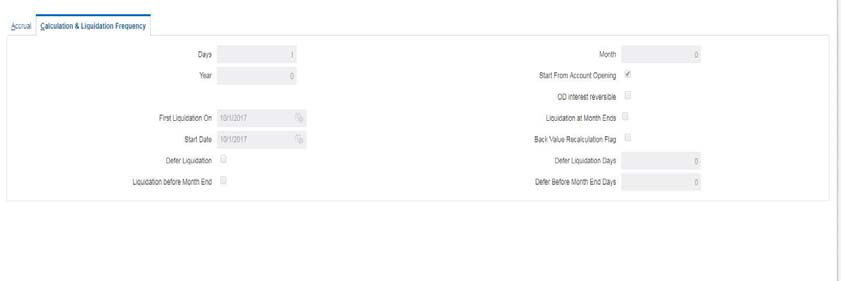

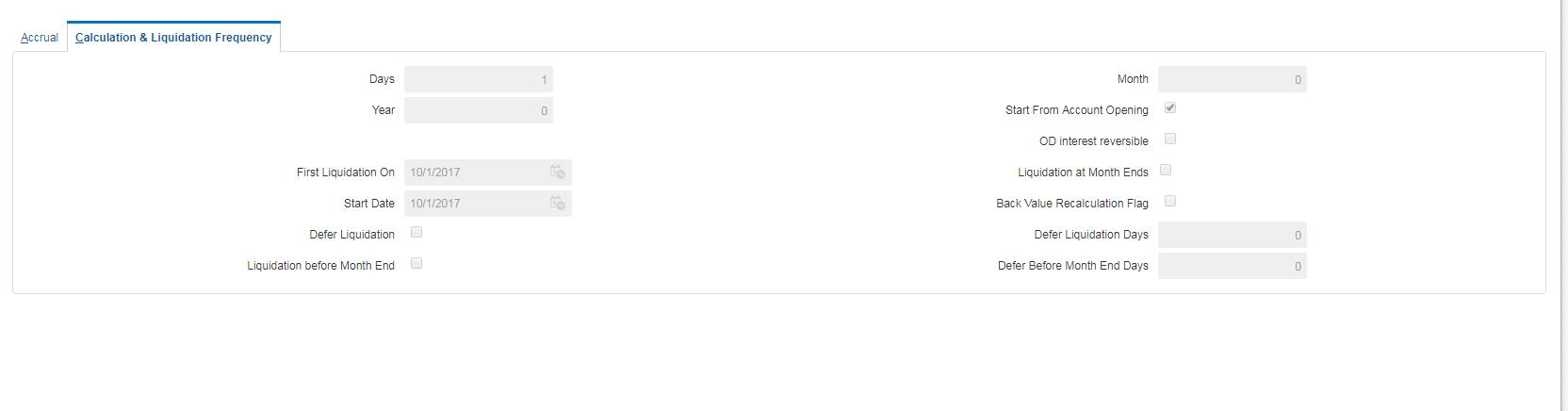

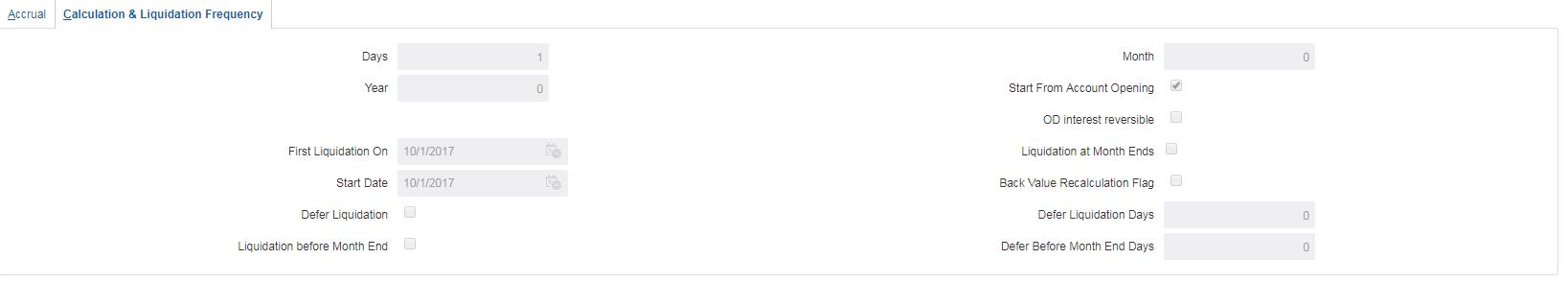

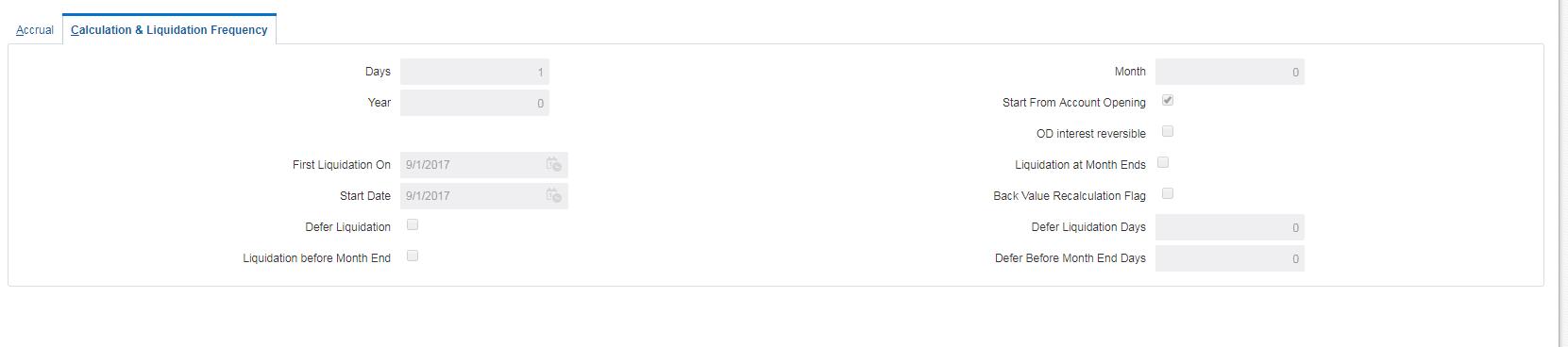

Calculation & Liquidation Frequency

Days

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every 15 days, enter ‘15’. If you want to liqui-date interest every 9 days enter ‘09’.

Month

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every month enter ‘01’. If you want to liqui-date interest every quarter enter ‘03’.

Year

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every year enter ‘01’.

Start From Account Opening

Check this box to start the calculation of liquidation from the start of account opening.

OD interest reversible

Check this box if OD interest is reversible.

First Liquidation On

Specify the date for calculation of first liquidation.

Liquidation at Month Ends

Check this box if liquidation at month ends.

Start Date

Specify the start date of liquidation.

Back Value Recalculation Flag

Check this flag to do Back Value Recalculation

Defer Liquidation

Check this box if you wish to defer the calculation and liquidation of periodic interest on an account for a few days beyond the end date of each interest period.

Defer Liquidation Days

Specify the number of calendar days by which the interest liquidation for a period has to be deferred.

Liquidation Before Month End

For interest liquidation frequencies like monthly, yearly, quarterly cycles specify the specified number of days before the month end when the liquidarion is needed

Defer Before Month End Days

Specify the number of days before the month-end when the interest has to be liquidated

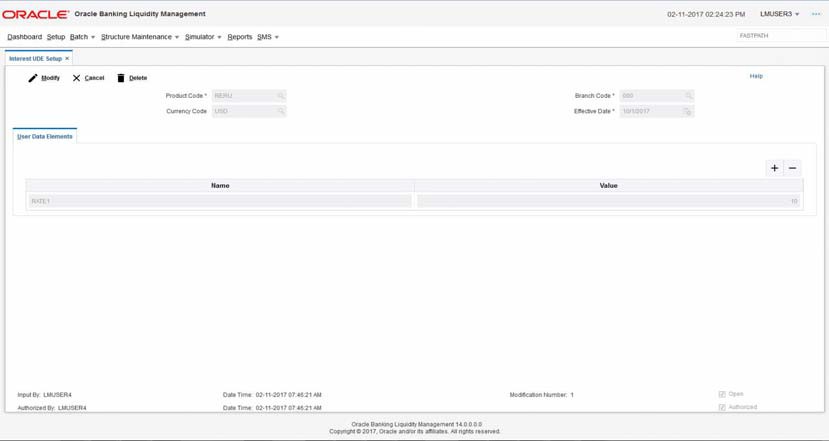

4.3.1.3 Interest UDE Setup

You can invoke the ‘Interest UDE Setup’ page by clicking on the setup tab in application

Product Code

Specify the product code. You can select the product code from the option list. The list displays all the product codes maintained in the system

Branch Code

Specify the branch code. You can select the branch code from the option list. The list displays all the branch codes maintained in the system

Currency Code

Specify the currency code. You can select the currency code from the option list. The list displays all the currency codes maintained in the system

Effective Date

Specify the date from which this will be effective

User Element

Specify the User Element what we have given in Interest Rule setup

User Element Value

Specify User Element Value.

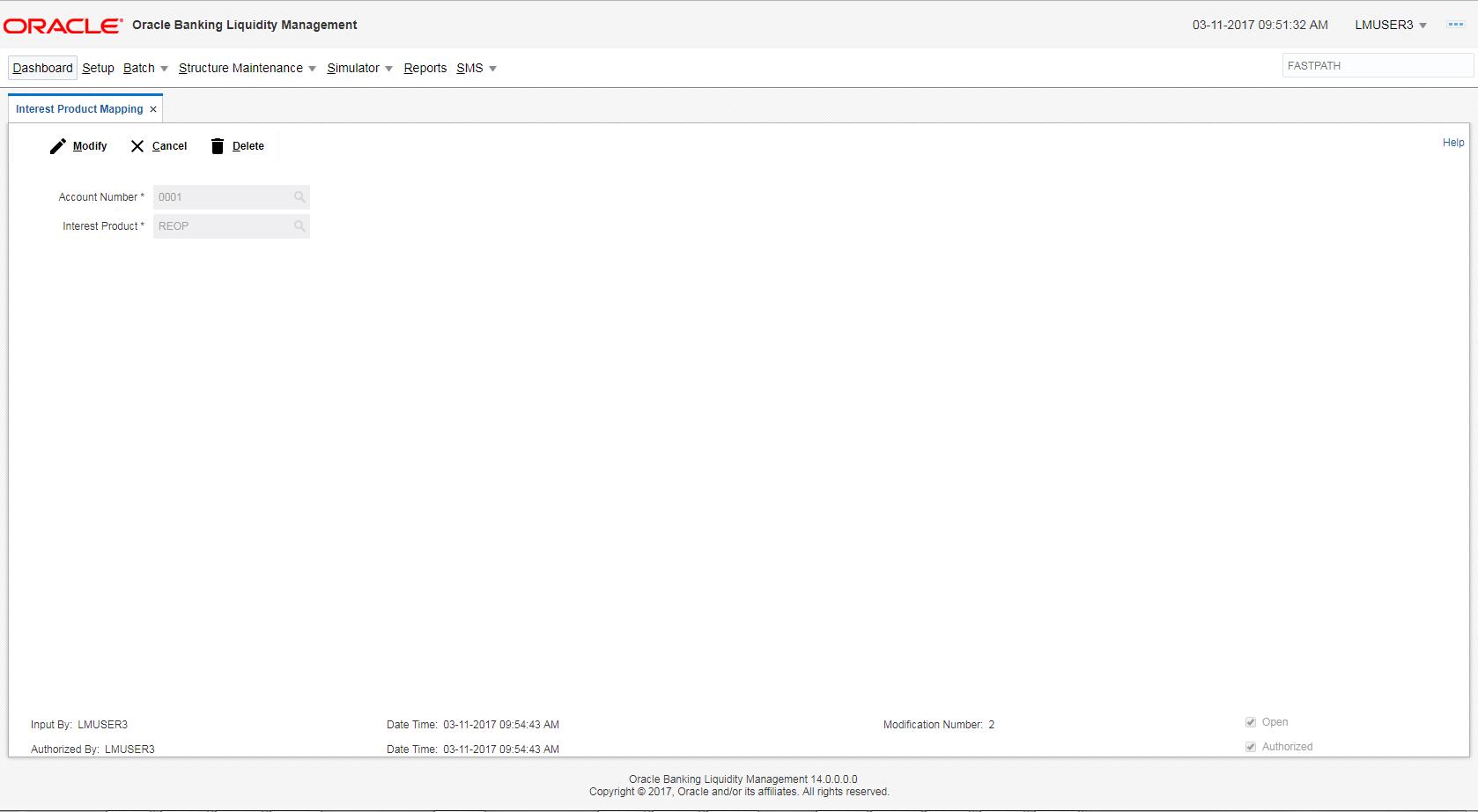

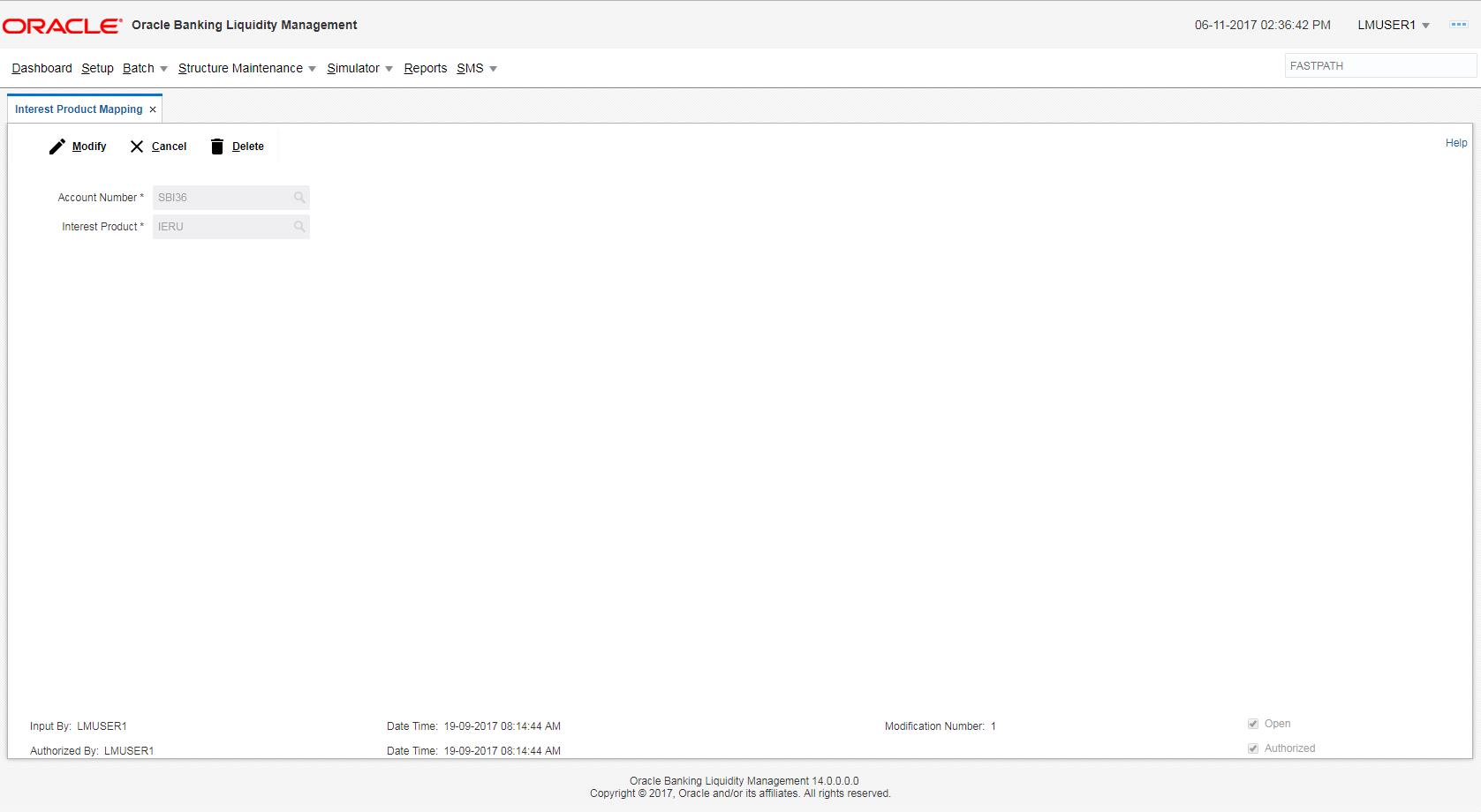

4.3.1.4 Interest Product Mapping

You can invoke the ‘Interest Product mapping’ page by clicking on the setup tab in application

Account Number

Specify the account number to be mapped. You can select the account number from the option list. The list displays all the account numbers maintained in the system.

Interest Product

Specify the interest product. You can select the interest products from the option list. The list displays all the interest products maintained in the system.

4.3.2 Advantage Method

Interest is calculated at each participant account as per their balances with an applicable rate and debits and credits posted to the participants accordingly.

Next interest is calculated based on the pool balance at notional header in notional header currency.

The difference between the interest arrived at the pool level and the summation of interest arrived at the participant level is called the advantage interest (Z-I).

For Advantage method, we need to set the IC setup. Please follow the below steps:

4.3.2.1 Interest Rule Setup

You can invoke the ‘Interest Rule Setup’ page by clicking on the setup tab in application.

Rule ID

Specify a rule ID.

Rule Description

Specify a description for the rule.

Apply Interest on Account Opening Month

Check this box to apply the interest on the account opening month.

Apply Interest on Account Closing Month

Check this box to apply the interest on the Account Closing month.

System Data Elements

Click '+' button to add system elements. Specify the system elements like DAYS, LMVD_CR_BAL and YEAR. You can select the system elements from the option list.

User Elements

Specify a user element.

Name

Specify the user defined name in Textbox

Type

Select the type as “Rate” from the drop down list.

Get Latest

Select the option “Use Current” which is to be used as latest

Accruals Required

Check this box if accrual are required.

Rounding Required

Check this box if rounding is required.

Book Flag

Select the book flag “Booked” from the drop down list.

Periodicity

Select the frequency “Daily” from the drop down list.

Days in a Month

Select “Actual” from the drop down list. The options are:

Days Year

Select “Actual” from the drop down list.

Expression, Condition and Result

Specify the Expression, Condition and Result as mentioned below.

|

Header/ Child |

Condition |

Formula |

Advantage Method |

Header |

LMVD_CR_POOLBAL>0 |

(LMVD_CR_POOLBAL * RATE7*DAYS)/(YEAR*100) |

( LMVD_DR_POOLBAL<0 |

(LMVD_DR_POOLBAL*RATE8*DAYS)/(YEAR*100) |

||

Child |

LMVD_DR_BAL<0 |

(LMVD_DR_BAL*RATE9*DAYS)/(YEAR*100) |

|

(LMVD_CR_BAL>0) AND (LMVD_CR_BAL<=10000) |

(LMVD_CR_BAL * RATE10*DAYS)/(YEAR*100) |

||

(LMVD_CR_BAL>10000) AND (LMVD_CR_BAL<=9999999) |

(LMVD_CR_BAL * RATE11*DAYS)/(YEAR*100) |

LMVD_CR_POOLBAL - Credit net pool position

LMVD_DR_POOLBAL - Debit net pool position

4.3.2.2 Interest Product Setup

You can invoke the ‘Interest Product Setup’ page by clicking on the setup tab in application

Product Code

Specify a product code for the new interest product

Product Description

Specify a description for the new interest product.

Product Group

Specify the product group under which the new product is based. You can select the product group from the option list. The list displays all the product groups maintained in the system

Product Group Description

The system displays the description for the selected product group.

Rule

Specify the rule to be associated with the interest product. You can select the rule from the option list. The list displays all the rules maintained in the system

Rule Description

The system displays the description for the selected rule.

Start Date

Specify the start date of liquidation.

End Date

Specify the date till which the interest product will be active.

UDE Currency

Select the UDE currency to be associated with the product from the drop down list. The options are: Account Currency, Local Currency

Currency

Select the currency from the option list. The list displays all the currencies maintained in the system

Accrual Tab

Product Level

Check this box if the interest accrual is to be done at product level.

Accrual Day

Specify the day the accrual should happen.

Frequency

Select the frequency of accrual “Daily” from the drop down list.

Cycle

Select the cycle for the accrual “None” from the drop down list.

Payment Method

Select the payment method for interest accrual “Bearing” from the drop down list.

Amount Block for Discount

Check this box to block amount for discount.

Calculation & Liquidation Frequency

Days

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every 15 days, enter ‘15’. If you want to liqui-date interest every 9 days enter ‘09’.

Month

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every month enter ‘01’. If you want to liqui-date interest every quarter enter ‘03’.

Year

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every year enter ‘01’.

Start From Account Opening

Check this box to start the calculation of liquidation from the start of account opening.

OD interest reversible

Check this box if OD interest is reversible.

First Liquidation On

Specify the date for calculation of first liquidation.

Liquidation at Month Ends

Check this box if liquidation at month ends.

Start Date

Specify the start date of liquidation.

Back Value Recalculation Flag

Check this flag to do Back Value Recalculation

Defer Liquidation

Check this box if you wish to defer the calculation and liquidation of periodic interest on an account for a few days beyond the end date of each interest period.

Defer Liquidation Days

Specify the number of calendar days by which the interest liquidation for a period has to be deferred.

Liquidation Before Month End

For interest liquidation frequencies like monthly, yearly, quarterly cycles specify the specified number of days before the month end when the liquidation is needed

Defer Before Month End Days

Specify the number of days before the month end when the interest has to be liquidated

4.3.2.3 Interest UDE Setup

You can invoke the ‘Interest UDE Setup’ page by clicking on the setup tab in application

Product Code

Specify the product code. You can select the product code from the option list. The list displays all the product codes maintained in the system

Branch Code

Specify the branch code. You can select the branch code from the option list. The list displays all the branch codes maintained in the system

Currency Code

Specify the currency code. You can select the currency code from the option list. The list displays all the currency codes maintained in the system

Effective Date

Specify the date from which this will be effective

User Element

Specify the User Element what we have given in Interest Rule setup

User Element Value

Specify User Element Value.

4.3.2.4 Interest Product Mapping

You can invoke the ‘Interest Product mapping’ page by clicking on the setup tab in application

Account Number

Specify the account number to be mapped. You can select the account number from the option list. The list displays all the account numbers maintained in the system.

Interest Product

Specify the interest product. You can select the interest products from the option list. The list displays all the interest products maintained in the system.

4.3.3 Interest Optimization Method

Interest to be initially calculated without taking the pooling arrangement into account and then a rebate is to be paid to the group

Bank arranges preferential interest rates for participating accounts without fully offsetting credit and debit balances. This option will be used in jurisdictions where full notional pooling is not permitted.

In this method dual interest rates are applied i.e. Balance of the account is segregated in to compensated and non compensated balances and interest rates applied accordingly

Compensated (Covered) and non compensated (residual) balances are arrived by the following logic

Compensated (Covered) and non compensated (residual) ratios are arrived

Credit |

Net Pool Position (NPP) > 0 |

Net Pool Position (NPP) < 0 |

Coverage Ratio (Compensated Balance) |

Min(Cumulative Credit,

Cumulative Debit)/ |

1 |

Residual Ratio (Non-Compensated Balance) |

1 - Coverage Ratio |

0 |

|

|

|

Debit |

|

|

Coverage Ratio (Compensated Balance) |

1 |

Min(Cumulative Credit,

Cumulative Debit)/ |

Residual Ratio (Non-Compensated Balance) |

1 - Coverage Ratio |

1 - Coverage Ratio |

Post arrival of the Compensated (Covered) and non compensated (residual) balances interest rate is applied using the following formula

For accounts in Credit balance (NPP>0 or NPP<0)

{[Credit Coverage Ratio * Account Balance] * Covered Credit Interest} +

{[Credit Residual Ratio * Account Balance] * Residual Credit Interest}

For accounts in Debit balance (NPP>0 or NPP<0)

{[Debit Coverage Ratio * Account Balance] * Covered Debit Interest} +

{[Debit Residual Ratio * Account Balance] * Residual Debit Interest}

For Optimization method, we need to set the IC product . Please follow the below steps:

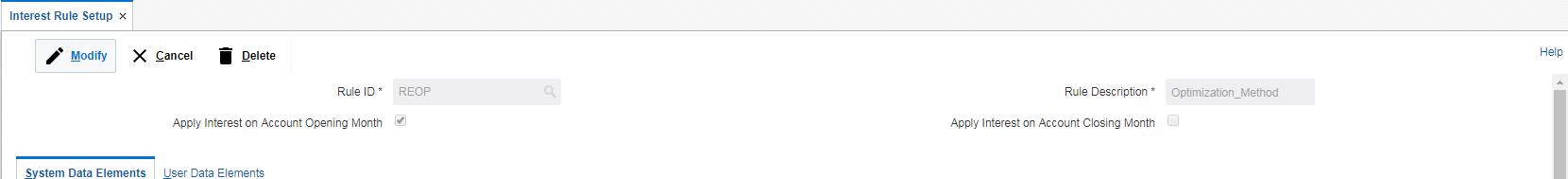

4.3.3.1 Interest Rule Setup

You can invoke the ‘Interest Rule Setup’ page by clicking on the setup tab in application.

Rule ID

Specify a rule ID.

Rule Description

Specify a description for the rule.

Apply Interest on Account Opening Month

Check this box to apply the interest on the account opening month.

Apply Interest on Account Closing Month

Check this box to apply the interest on the account Closing month.

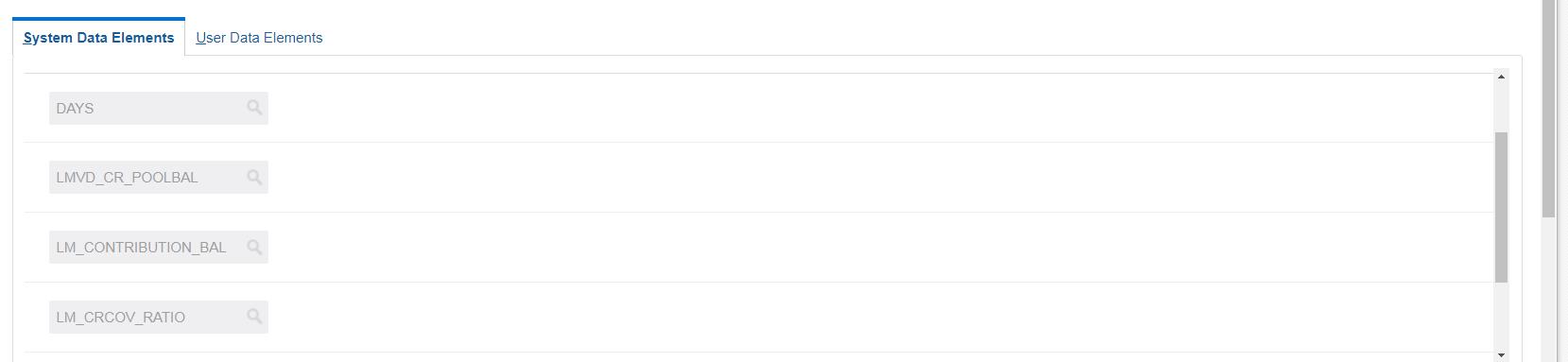

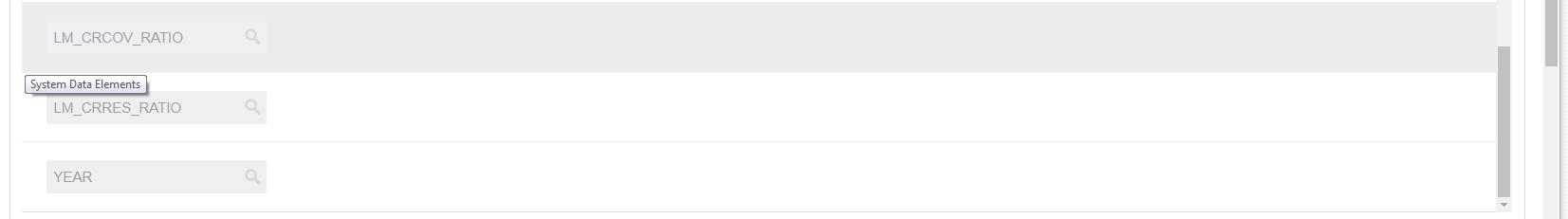

System Data Elements

Click '+' button to add system elements. Specify the system elements like DAYS, LMVD_CR_POOLBAL, LM_CONTRIBUTION_BAL, LM_CRCOV_RATIO, LM_CRRES_RATIO and YEAR. You can select the system elements from the option list.

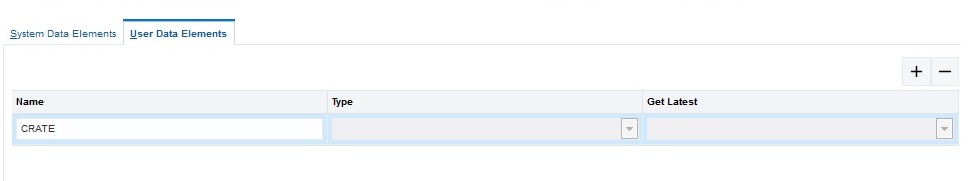

User Elements

Specify a user elements as COVRATE and RESRATE.

Name

Specify the user defined name in Textbox

Type

Select the type as “Rate” from the drop down list.

Get Latest

Select the option “Use Current” which is to be used as latest

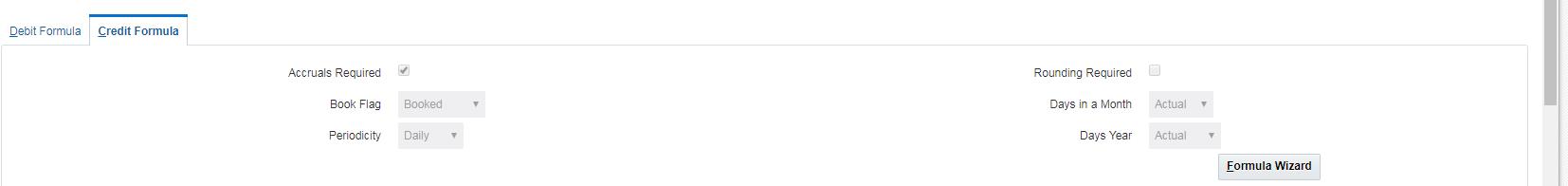

Accruals Required

Check this box if accrual are required.

Rounding Required

Check this box if rounding is required.

Book Flag

Select the book flag “Booked” from the drop down list.

Periodicity

Select the frequency “Daily” from the drop down list.

Days in a Month

Select “Actual” from the drop down list. The options are:

Days Year

Select “Actual” from the drop down list.

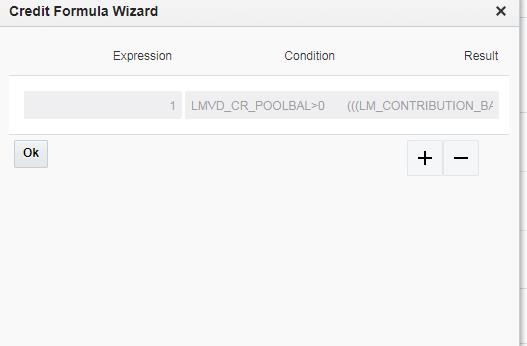

Expression, Condition and Result

Specify the Expression, Condition and Result as mentioned below.

|

Condition |

Formula |

Optimization Method ( Child) |

LM_OPT_POOLBAL>0 AND LMVD_CR_BAL>0 |

(((LMVD_CR_BAL*LM_CRCOV_RATIO*COVRATE*DAYS)/(YEAR*100))+((LMVD_CR_BAL*LM_CRRES_RATIO*RESRATE*DAYS)/(YEAR*100))) |

LM_OPT_POOLBAL<0 AND LMVD_DR_BAL<0 |

(((LMVD_DR_BAL*LM_DRCOV_RATIO*COVRATE*DAYS)/(YEAR*100))+((LMVD_DR_BAL*LM_DRRES_RATIO*RESRATE*DAYS)/(YEAR*100)) |

|

Optimization Method ( Header) |

Not Applicable |

Not Applicable |

LMVD_CR_POOLBAL - Credit net pool position

LMVD_DR_POOLBAL - Debit net pool position

LM_CRCOV_RATIO - Credit coverage Ratio

LM_CRRES_RATIO - Credit Residual Ratio

LM_DRCOV_RATIO - Debit Coverage Ratio

LM_DRRES_RATIO - Debit Residual Ratio

LM_OPT_POOLBAL - Net Pool position

4.3.3.2 Interest Product Setup

You can invoke the ‘Interest Product Setup’ page by clicking on the setup tab in application

Product Code

Specify a product code for the new interest product

Product Description

Specify a description for the new interest product.

Product Group

Specify the product group under which the new product is based. You can select the product group from the option list. The list displays all the product groups maintained in the system

Product Group Description

The system displays the description for the selected product group.

Rule

Specify the rule to be associated with the interest product. You can select the rule from the option list. The list displays all the rules maintained in the system

Rule Description

The system displays the description for the selected rule.

Start Date

Specify the start date of liquidation.

End Date

Specify the date till which the interest product will be active.

UDE Currency

Select the UDE currency to be associated with the product from the drop down list. The options are: Account Currency, Local Currency

Currency

Select the currency from the option list. The list displays all the currencies maintained in the system

Accrual Tab

Product Level

Check this box if the interest accrual is to be done at product level.

Accrual Day

Specify the day the accrual should happen.

Frequency

Select the frequency of accrual “Daily” from the drop down list.

Cycle

Select the cycle for the accrual “None” from the drop down list.

Payment Method

Select the payment method for interest accrual “Bearing” from the drop down list.

Amount Block for Discount

Check this box to block amount for discount.

Calculation & Liquidation Frequency

Days

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every 15 days, enter ‘15’. If you want to liqui-date interest every 9 days enter ‘09’.

Month

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every month enter ‘01’. If you want to liqui-date interest every quarter enter ‘03’.

Year

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every year enter ‘01’.

Start From Account Opening

Check this box to start the calculation of liquidation from the start of account opening.

OD interest reversible

Check this box if OD interest is reversible.

First Liquidation On

Specify the date for calculation of first liquidation.

Liquidation at Month Ends

Check this box if liquidation at month ends.

Start Date

Specify the start date of liquidation.

Back Value Recalculation Flag

Check this flag to do Back Value Recalculation

Defer Liquidation

Check this box if you wish to defer the calculation and liquidation of periodic interest on an account for a few days beyond the end date of each interest period.

Defer Liquidation Days

Specify the number of calendar days by which the interest liquidation for a period has to be deferred.

Liquidation Before Month End

For interest liquidation frequencies like monthly, yearly, quarterly cycles specify the specified number of days before the month end when the liquidarion is needed

Defer Before Month End Days

Specify the number of days before the monthend when the interest has to be liquidated

4.3.3.3 Interest UDE Setup:

You can invoke the ‘Interest UDE Setup’ page by clicking on the setup tab in application

Product Code

Specify the product code. You can select the product code from the option list. The list displays all the product codes maintained in the system

Branch Code

Specify the branch code. You can select the branch code from the option list. The list displays all the branch codes maintained in the system

Currency Code

Specify the currency code. You can select the currency code from the option list. The list displays all the currency codes maintained in the system

Effective Date

Specify the date from which this will be effective

User Element

Specify the User Element what we have given in Interest Rule setup

User Element Value

Specify User Element Value.

4.3.3.4 Interest Product Mapping

You can invoke the ‘Interest Product mapping’ page by clicking on the setup tab in application

Account Number

Specify the account number to be mapped. You can select the account number from the option list. The list displays all the account numbers maintained in the system.

Interest Product

Specify the interest product. You can select the interest products from the option list. The list displays all the interest products maintained in the system.mization method, we need to set the IC product . Please follow the below steps:

4.3.4 Interest Enhancement

Interest Enhancement method works by applying preferential pricing across a group of accounts on the basis of pre-determined criteria that are typically based on a net aggregate balance threshold.

For example, a company with multiple credit balances distributed across its various operating centers may find that individually these balances only qualify for the lowest interest-rate tier payable on credit balances. By contrast, under an interest-enhancement arrangement, the total of these balances is used to enhance the qualifying tier of the individual balances

The accounts participating in the enhancement pool will be attached with an enhancement rate card which has the interest slabs and their corresponding rates. These rates will be applied over and above the base interest rates (applied on to the accounts) to calculate and credit the enhancement rate

In some cases bank may offer premium interest rates in addition to the above (base rate + enhancement rate) for a balances in a specific currency in such cases one more rate card will be attached to that particular currency accounts and interest will be calculated on those accounts with rate as base rate + enhancement rate + premium rate

For Interest Enhancement method, we need to set the IC setup. Please follow the below steps:

4.3.4.1 Interest Rule Setup

You can invoke the ‘Interest Rule Setup’ page by clicking on the setup tab in application.

Rule ID

Specify a rule ID.

Rule Description

Specify a description for the rule.

Apply Interest on Account Opening Month

Check this box to apply the interest on the account opening month.

System Data Elements

Click '+' button to add system elements. Specify the system elements like DAYS, LMVD_CR_BAL, LM_IERATE and YEAR. You can select the system elements from the option list.

User Elements

Specify a user elements as RATE.

Type

Select the type as “Rate” from the drop down list.

Get Latest

Select the option “Use Current” which is to be used as latest

Accruals Required

Check this box if accrual are required.

Book Flag

Select the book flag “Booked” from the drop down list.

Periodicity

Select the frequency “Daily” from the drop down list.

Days in a Month

Select “Actual” from the drop down list. The options are:

Days Year

Select “Actual” from the drop down list.

Expression, Condition and Result

Specify the Expression, Condition and Result as mentioned below.

|

Condition |

Formula |

Interest Enhancement Method |

(LMVD_CR_BAL>0) AND (LMVD_CR_BAL<=10000) AND (LM_IESTRBALTHCCY>=IETHRESHOLDBAL) AND (LM_IECCYTOTALBAL<LM_IECCYTHRESHOLDBAL) |

((LMVD_CR_BAL*RATE12*DAYS)+(LMVD_CR_BAL*LM_IECCYERATE*DAYS))/(YEAR*100) |

(LMVD_CR_BAL>10000) AND (LMVD_CR_BAL<=9999999) AND (LM_IESTRBALTHCCY>=IETHRESHOLDBAL) AND (LM_IECCYTOTALBAL<LM_IECCYTHRESHOLDBAL) |

((LMVD_CR_BAL*RATE13*DAYS)+(LMVD_CR_BAL*LM_IECCYERATE*DAYS))/(YEAR*100) |

|

(LMVD_CR_BAL>0) AND (LMVD_CR_BAL<=10000) AND (LM_IESTRBALTHCCY>=IETHRESHOLDBAL) AND (LM_IECCYTOTALBAL>=LM_IECCYTHRESHOLDBAL) |

(((LMVD_CR_BAL*RATE14)+(LMVD_CR_BAL*LM_IECCYERATE)+(LMVD_CR_BAL*LM_IECCYPRATE))*DAYS)/(YEAR*100) |

|

(LMVD_CR_BAL>10000) AND (LMVD_CR_BAL<=9999999) AND (LM_IESTRBALTHCCY>=IETHRESHOLDBAL) AND (LM_IECCYTOTALBAL>=LM_IECCYTHRESHOLDBAL) |

(((LMVD_CR_BAL*RATE15)+(LMVD_CR_BAL*LM_IECCYERATE)+(LMVD_CR_BAL*LM_IECCYPRATE))*DAYS)/(YEAR*100) |

|

LMVD_DR_BAL <0 AND LM_IESTRBALTHCCY<IETHRESHOLDBAL |

(LMVD_DR_BAL*RATE16*DAYS)/YEAR |

LMVD_CR_BAL - Credit Account Balance

LMVD_DR_BAL - Debit Account Balance

IETHRESHOLDBAL - Structure Level Threshold

LM_IESTRBALTHCCY - Total Structure balance in threshold ccy

LM_IECCYERATE - Enhancement rate as per account's balance

LM_IECCYTHRESHOLDBAL - Currency wise threshold balance

LM_IECCYTOTALBAL - Currency wise total balance for structure

LM_IECCYPRATE - Premium rate as per account's balance

4.3.4.2 Interest Product Setup

You can invoke the ‘Interest Product Setup’ page by clicking on the setup tab in application

Product Code

Specify a product code for the new interest product

Product Description

Specify a description for the new interest product.

Product Group

Specify the product group under which the new product is based. You can select the product group from the option list. The list displays all the product groups maintained in the system

Product Group Description

The system displays the description for the selected product group.

Rule

Specify the rule to be associated with the interest product. You can select the rule from the option list. The list displays all the rules maintained in the system

Rule Description

The system displays the description for the selected rule.

Start Date

Specify the start date of liquidation.

End Date

Specify the date till which the interest product will be active.

UDE Currency

Select the UDE currency to be associated with the product from the drop down list. The options are: Account Currency, Local Currency

Currency

Select the currency from the option list. The list displays all the currencies maintained in the system

Accrual Tab

Product Level

Check this box if the interest accrual is to be done at product level.

Accrual Day

Specify the day the accrual should happen.

Frequency

Select the frequency of accrual “Daily” from the drop down list.

Cycle

Select the cycle for the accrual “None” from the drop down list.

Payment Method

Select the payment method for interest accrual “Bearing” from the drop down list.

Amount Block for Discount

Check this box to block amount for discount.

Calculation & Liquidation Frequency

Days

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every 15 days, enter ‘15’. If you want to liqui-date interest every 9 days enter ‘09’.

Month

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every month enter ‘01’. If you want to liqui-date interest every quarter enter ‘03’.

Year

Specify the liquidation frequency for the Interest product being created. If you want to liquidate interest every year enter ‘01’.

Start From Account Opening

Check this box to start the calculation of liquidation from the start of account opening.

OD interest reversible

Check this box if OD interest is reversible.

First Liquidation On

Specify the date for calculation of first liquidation.

Liquidation at Month Ends

Check this box if liquidation at month ends.

Start Date

Specify the start date of liquidation.

Back Value Recalculation Flag

Check this flag to do Back Value Recalculation

Defer Liquidation

Check this box if you wish to defer the calculation and liquidation of periodic interest on an account for a few days beyond the end date of each interest period.

Defer Liquidation Days

Specify the number of calendar days by which the interest liquidation for a period has to be deferred.

Liquidation Before Month End

For interest liquidation frequencies like monthly, yearly, quarterly cycles specify the specified number of days before the month end when the liquidation is needed

Defer Before Month End Days

Specify the number of days before the month end when the interest has to be liquidated

4.3.4.3 Interest UDE Setup:

You can invoke the ‘Interest UDE Setup’ page by clicking on the setup tab in application

Product Code

Specify the product code. You can select the product code from the option list. The list displays all the product codes maintained in the system

Branch Code

Specify the branch code. You can select the branch code from the option list. The list displays all the branch codes maintained in the system

Currency Code

Specify the currency code. You can select the currency code from the option list. The list displays all the currency codes maintained in the system

Effective Date

Specify the date from which this will be effective

User Element

Specify the User Element what we have given in Interest Rule setup

User Element Value

Specify User Element Value.

4.3.4.4 Interest Product Mapping

You can invoke the ‘Interest Product mapping’ page by clicking on the setup tab in application

Account Number

Specify the account number to be mapped. You can select the account number from the option list. The list displays all the account numbers maintained in the system.

Interest Product

Specify the interest product. You can select the interest products from the option list. The list displays all the interest products maintained in the system.

4.4 Interest Allocation Methods

The interest calculated for notional pooling has to be distributed to the participant accounts. The different allocation models which are supported by LM are as below:

- Central Distribution Model

- Even Distribution Model

- Even Direct Distribution Model

- Percentage Distribution Model

- Fair Share Model

- Reverse Fair Share Model

- Absolute Pro-Rata Model

4.4.1 Central Distribution Model

In this method, the interest\ advantage interest arrived is credited to one central account which can be one of the participant accounts or any other account

4.4.2 Even Distribution Model

In this method, the interest\ advantage arrived is evenly distributed amongst the participant accounts

4.4.3 Even Direct Distribution Model

In this method the Interest reward is evenly spread across all accounts with positive balances.

4.4.4 Percentage Distribution Model

In this method, pre-defined percentage of the interest\ advantage arrived is distributed amongst the participant accounts.

4.4.5 Fair Share Model

In this method, If the net pool position is positive, the interest/advantage interest arrived is distributed amongst the positive contributors in the ratio of their contribution (Both in Interest and Advantage models).

If the net pool position is negative the interest amount is distributed amongst the negative contributors in the ratio of their contribution (Interest model)

If the net pool position is negative, the advantage interest amount is distributed amongst the negative contributors in the ratio of their contribution. For example, the interest calculated at the account level is @10% but the interest calculated at pool level is @8% taking into consideration few positive account contributors (Advantage model)

4.4.6 Reverse Fair Share Model

In this method, if the new pool position is positive, the interest/advantage interest arrived is distributed amongst the negative contributors in the ratio of their contribution (Both in Interest and advantage models)

If the net pool position is negative, the interest amount is distributed amongst the positive contributors in the ratio of their contribution (Interest model)

If the net pool position is negative, the advantage interest amount is distributed amongst the positive contributors in the ratio of their contribution (Advantage model)

4.4.7 Absolute Pro -Rata Model

In this method, absolute balances of all accounts would be considered and interest would be shared proportionately to all accounts.

4.5 Interest Reallocation

Interest reallocation is applicable only to central distribution model of interest allocation. The interest/ advantage interest credited to the central account which would be a treasury account is re-distributed amongst the participant accounts using any of the above discussed allocation models.

In allocation models the debit was to the Bank GL, In re-allocation model the debit will be to the central treasury.

Note

- Interest for the pool is calculated in the base currency of the pool header

- Interest reallocation from the header accounts will be in the account currency

- If the beneficiary account of a notional pool is in a different currency

to that of the pool header, the interest amount posted is converted from

the header account currency to the beneficiary account currency

using the agreed FX rate between the two currencies