5. Multi Bank Cash Concentration

Multi Bank Cash Concentration (MBCC) are automated cash management systems for corporations with at-least one third party bank account.

It is an automated means of centralizing balances held at third-party banks of the corporate (In this process liquidity is either transferred to the various TPB accounts or Liquidity is pulled out of various TPB accounts)

It caters to the corporate need to maintain important third-party local bank relationships for rendering truly localized services while optimizing the potential yield from liquidity consolidated with a global concentration bank

This chapter contains the following sections:

- Section 5.1, "Benefits of MBCC"

- Section 5.2, "Features in MBCC"

- Section 5.3, "Sweep Mechanism"

- Section 5.4, "MBCC System Setup"

5.1 Benefits of MBCC

The benefit of MBCC can be listed as below:

- Consolidates Cash balances effectively

- Enhances yield on surplus cash

- Better overview and easier access to group-wide liquidity

- Timely access to information and improved liquidity management

5.2 Features in MBCC

The following features are provided for MBCC in LM:

- Automated movement of funds across multiple third party bank accounts, currencies, banks and geographic regions

- Multi Bank Cash Concentration though SWIFT using MT940\MT941,MT942,MT950

- Flexibility to add or delete accounts in the MBCC structure

- Flexibility of movement at end of day, intra day, weekly (particular day of a week) or Monthly (particular day of a month)

- Flexible sweep types such as Zero / Target / Threshold / Collar balancing / Percentage

- Multi-currency multi bank cash concentration

- For sweeps (both inward and outward) which involve a currency conversion the FX rate would be picked up from maintenance

5.3 Sweep Mechanism

This following steps lists out the sweep mechanism through MT920 requests:

- Mirror account & a linked CASA account for all the third party accounts are created

- MT920 generation frequencies, MT920 start time and end time are defined for each mirror account

- Cut-off time for MT101 generation for sweep ins and cut off time for MT103 generation for sweep outs are defined for each mirror account

- Cut-off time for balance update on the mirror accounts from DDA system (Post recon of MT101 with MT103) to be set.

5.3.0.1 Sweep In

The steps followed for sweep in are as below:

- Account balances from the third party accounts are collected by Generating MT920 (Requesting MT940 or MT941 or MT942) as per the pre-defined frequency parameters and time intervals for each mirror account.

- System will be capable of handling incoming MT940/MT941,MT942,MT950 which need not be in response to an outgoing MT920 i.e. incoming MT940,MT941,MT942,MT950 may or may not be in response to outgoing MT920

- Mirror account balances will be updated by processing the response/incoming MT940,MT941,MT942

- Balances will be updated based on either MT940 (Customer Statement) or MT941 (Balance report) or MT942 (Interim transaction report)

- MT 940: Balance can be updated based on the closing available balance tag of the message and duplicates can be checked based on statement number/sequence number tag.

- MT941: Balance can be updated based on the closing available balance tag of the message and duplicates can be checked based on statement number tag

- When a MT942 (Interim transaction report from the last statement or balance report or the last interim report) is received the current available balance in the external account will be determined

- The same is achieved by taking the balance from the previous MT940 or MT942 and credits are added and debits are subtracted

- If the response/incoming MT940,MT941,MT942 updates a Credit balance in the mirror account, MT101 has to be generated at the cut off time for requesting a sweep-in.

- The processing of MT103 which is received in response to MT101 will update the designated CASA Account

- MT101 generation will cater to the following sweep types on third

party accounts:

- Zero balance sweep

- Target balancing (Fixed)

- Threshold balancing

- Collar balancing

- Percentage sweep

While generating MT101 request for funds, system will take in to consideration the sweep parameters set at the other bank (can be own bank or third party bank) to arrive at the amount. In some cases there can be combination of these parameters at work.

MT |

MT Message |

Purpose |

920 |

Request Message |

Requests the account servicing institution to send an MT 940, 941, 942 or 950 |

940 |

Customer Statement Message |

Provides balance and transaction details of an account to a FI on behalf of the account owner |

941 |

Balance Report |

Provides balance information of an account to a financial institution on behalf of the account owner |

942 |

Interim Transaction Report |

Provides balance and transaction details of an account, for a specified period of time, to a financial institution on behalf of an account owner It is used to transmit detailed and/or summary information about entries debited or credited to the account since: • The last statement or balance report, or • The last interim transaction report (sent in the period since the last statement or balance report). |

950 |

Statement Message |

Provides balance and transaction details of an account to the account owner |

5.3.0.2 Sweep Out

The steps followed for sweep in are as below:

- If the response\ incoming MT940,MT941,MT942 updates a Debit balance in the mirror account, then a MT103 will be generated at the cut off time maintained for a sweep-out to regularize the debit balance on the third party account

- System will follow the sweep parameters set at the account level when arriving at the amount to be transferred via a MT103.

- The sweep parameters can be set as the following as an independent or a combination:

5.4 MBCC System Setup

The following maintenance screens has to be configured to set up multi bank cash concentration structure:

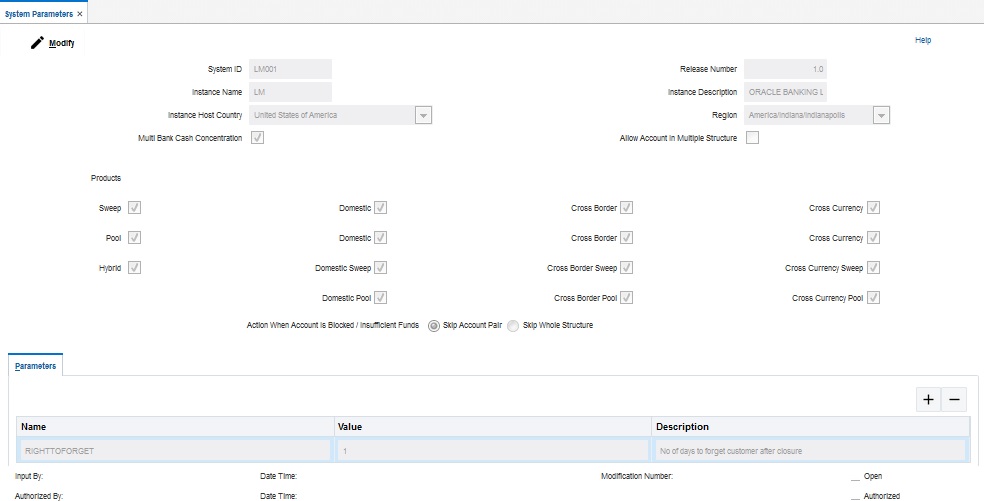

5.4.1 System Set-Up Maintenance Screen

Allow multiple bank, Allow cross-border transaction and Allow cross-currency transaction options must be enabled at system level maintenance screen to allow bank to provide this feature.

System ID

Specify the unique system ID. This is usually a back-end upload.

Release Number

Specify the LM release number. This is usually a back-end upload.

Instance Name

Specify the name of the LM instance. This is usually a back-end upload

Instance Description

Specify a description if any for the instance. This is usually a back-end upload

Instance Host Country

Select the ISO code of the country in which the instance has been installed from the drop down list.

Region

Select the region in which the instance is installed from the drop down list.

Multiple Bank Cash Concentration .

Check this box to allow set up of Multi Bank Cash Concentration Liquidity Structures.

Allow Account In Multiple Structure

Check this box to allow account in Multiple Structure

Products

Select the type of products allowed in the structure. The options are: Physical Sweeping - Check this box to allow only sweep structures in the system Notional Pooling - Check this box to allow only pooling structures in the system

Sweep

Check this box to select domestic/cross border/cross currency in liquidity structures.

Domestic Sweep

Check this box to allow Domestic pairs in sweep liquidity structures.

Cross Border Sweep

Check this box to allow cross border pairs in sweep liquidity structures.

Cross Currency Sweep

Check this box to allow cross currency structures in sweep Liquidity Structures.

Pool

Check this box to select domestic/cross border/cross currency in liquidity structures.

Cross Border Pool

Check this box to allow cross border pairs in pool liquidity structures.

Domestic Pool

Check this box to allow Domestic pairs in pool liquidity structures.

Cross Currency Pool

Check this box to allow cross currency structures in pool Liquidity Structures.

Hybrid

Check this box to select domestic/cross border/cross currency in liquidity structures.

Cross Border Pool Hybrid

Check this box to allow cross border hybrid pairs in pool liquidity structures.

Domestic Pool Hybrid

Check this box to allow Domestic hybrid pairs in pool liquidity structures.

Cross Border Sweep Hybrid

Check this box to allow cross border hybrid pairs in sweep liquidity structures.

Domestic Sweep Hybrid

Check this box to allow Domestic hybrid pairs in sweep liquidity structures.

Cross Currency Pool Hybrid

Check this box to allow cross currency hybrid structures in pool Liquidity Structures.

Cross Currency Sweep Hybrid

Check this box to allow cross currency hybrid structures in sweep Liquidity Structures.

Action When Account Is Blocked / Insufficient Funds

Indicate the action to be taken by the system when an account in the structure is blocked. You can select one the following options:

Skip Account Pair - Skip the account pair and continue with the rest of the structure

Skip Whole Structure - Skip the whole structure

Parameter

Specify any custom parameters specific to the instance. Click '+' to add a row and specify the Parameter, Value and Description of the same.Click '-' to remove a row.

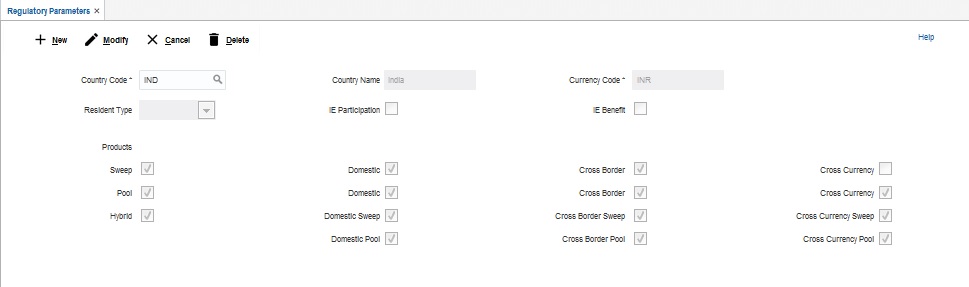

5.4.2 Country Maintenance

The regulatory system must allow corporate to set-up MBCC in the country where liquidity management instance is running.

While defining a MBCC group the system will validate whether multiple bank facility is allowed in particular country

Country Code

Specify the country code of the country for which the compliance is to be set. You can select the relevant country code from the option list. The list displays all the country codes maintained in the system

Country Name

Specify the name of the country.

Currency Code

Input the base currency

Resident Type

Select the account type allowed in the country from the drop down list. The options are:

Resident

Non Resident

Both

Not Applicable.

IE Participation

Check this box to allow the accounts in Interest Enhancement Structure.

IE Benefit

Check this box to allow the accounts in Interest Enhancement Structure.

Sweep

Check this box to select domestic/cross border/cross currency sweep account pairs in the country.

Domestic Sweep

Check this box to allow domestic sweep for the accounts in the country.

Cross Border Sweep

Check this box to allow cross border sweep for the accounts in the country.

Cross Currency Sweep

Check this box to allow cross currency account pairs in the country.

Pool

Check this box to select domestic/cross border/cross currency pool account pairs in the country.

Cross Border Pool

Check this box to allow cross border pool for the accounts in the country.

Cross Currency Pool

Check this box to allow cross currency pool for the accounts in the country.

Domestic Pool

Check this box to allow domestic pool for the accounts in the country.

Hybrid

Check this box to select domestic/cross border/cross currency hybrid account pairs in the country.

Domestic Hybrid Sweep

Check this box to allow domestic hybrid sweep for the accounts in the country.

Cross Border Hybrid Sweep

Check this box to allow cross border hybrid sweep for the accounts in the country.

Cross Currency Hybrid Sweep

Check this box to allow cross currency hybrid sweep account pairs in the country.

Domestic Pool Hybrid

Check this box to allow domestic hybrid pool for the accounts in the country.

Cross Border Pool Hybrid

Check this box to allow cross border hybrid pool for the accounts in the country.

Cross Currency Pool Hybrid

Check this box to allow cross Currency hybrid pools for the accounts in the country.

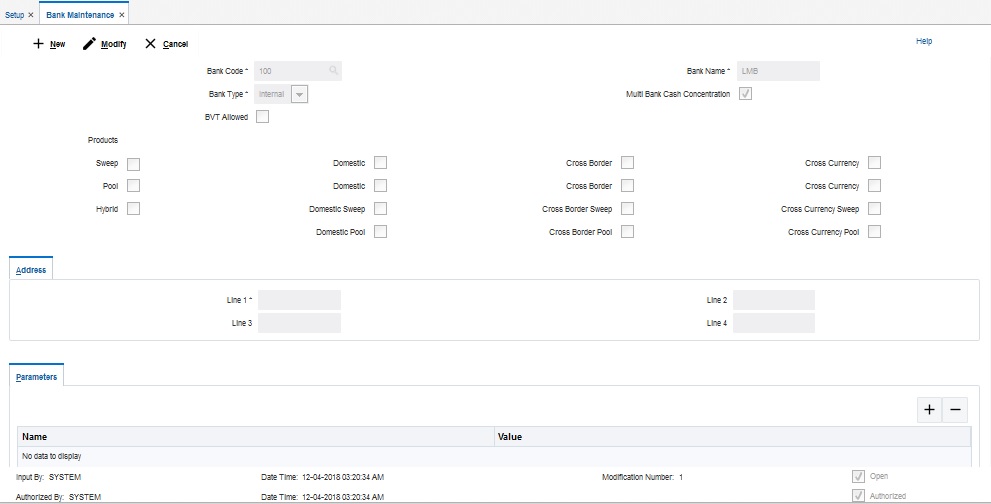

5.4.3 Bank Maintenance

Click ‘Bank Maintenance’ link in Setup screen to define Bank details

.

Bank Code

Specify the bank code. You can select the bank code from the option list.

Bank Name

The system displays the bank name based on the selected bank code.

Bank Type

Select the bank type as ‘Internal’ or ‘External’ from the drop down list.

Multi Bank Cash Concentration

Check this box if the selected banks is to participate in MBCC. If the Bank is internal and this box is selected, it means that the host bank supports MBCC. If the Bank is external and this box is selected, it means that the host bank can create MBCC structures involving these banks

BVT Allowed

Check this box if selected banks allow BVT.

Sweep

Check this box to select domestic/cross border/cross currency sweep account pairs in the Bank.

Domestic Sweep

Check this box to allow domestic sweep for the accounts in the Bank.

Cross Border Sweep

Check this box to allow cross border sweep for the accounts in the Bank.

Cross Currency Sweep

Check this box to allow cross currency account pairs in the Bank.

Pool

Check this box to select domestic/cross border/cross currency pool account pairs in the Bank.

Cross Border Pool

Check this box to allow cross border pool for the accounts in the Bank.

Cross Currency Pool

Check this box to allow cross currency pool for the accounts in the Bank.

Domestic Pool

Check this box to allow domestic pool for the accounts in the Bank.

Hybrid

Check this box to select domestic/cross border/cross currency hybrid account pairs in the Bank.

Domestic Hybrid Sweep

Check this box to allow domestic hybrid sweep for the accounts in the Bank.

Cross Border Hybrid Sweep

Check this box to allow cross border hybrid sweep for the accounts in the Bank.

Cross Currency Hybrid Sweep

Check this box to allow cross currency hybrid sweep account pairs in the Bank.

Domestic Pool Hybrid

Check this box to allow domestic hybrid pool for the accounts in the Bank.

Cross Border Pool Hybrid

Check this box to allow cross border hybrid pool for the accounts in the Bank.

Cross Currency Pool Hybrid

Check this box to allow cross Currency hybrid pools for the accounts in the Bank.

Address

Specify the address of the bank in below fields.

Line 1

Line 2

Line 3

Line 4

Parameter

Specify additional parameters if any. Click '+' to add a row and specify the Parameter, Value of the same. Click '-' to remove a row.

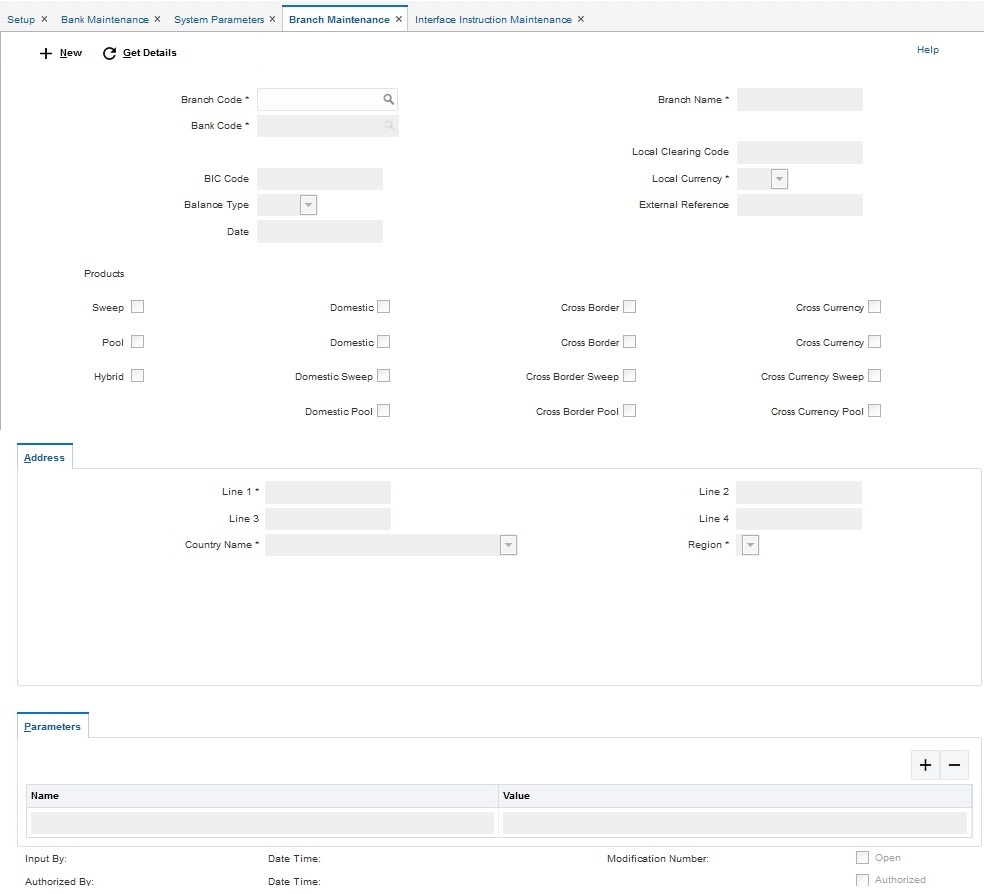

5.4.4 Branch Maintenance

Click ‘Branch Maintenance’ link in Setup screen to define Branch details for created Bank

.

Branch Code

Specify the branch code.

Branch Name

Specify the name of the branch.

Bank Code

Specify the bank code. You can select the bank code from the option list.The list displays all the bank codes maintained in the system.

Local Clearing Code

Specify local clearing code for the selected branch.

BIC Code

Specify BIC code relevant for the branch.

Local Currency

Select the local currency used by the branch from the drop down list.

Balance Type

Select the balance build method as online or offline

External Reference

Specify the External Reference for branch.

Sweep

Check this box to select domestic/cross border/cross currency sweep account pairs in the country.

Domestic Sweep

Check this box to allow domestic sweep for the accounts in the Branch.

Cross Border Sweep

Check this box to allow cross border sweep for the accounts in the Branch.

Cross Currency Sweep

Check this box to allow cross currency account pairs in the Branch.

Pool

Check this box to select domestic/cross border/cross currency pool account pairs in the Branch.

Cross Border Pool

Check this box to allow cross border pool for the accounts in the Branch.

Cross Currency Pool

Check this box to allow cross currency pool for the accounts in the Branch.

Domestic Pool

Check this box to allow domestic pool for the accounts in the Branch.

Hybrid

Check this box to select domestic/cross border/cross currency hybrid account pairs in the Branch.

Domestic Hybrid Sweep

Check this box to allow domestic hybrid sweep for the accounts in the Branch.

Cross Border Hybrid Sweep

Check this box to allow cross border hybrid sweep for the accounts in the Branch.

Cross Currency Hybrid Sweep

Check this box to allow cross currency hybrid sweep account pairs in the Branch.

Domestic Pool Hybrid

Check this box to allow domestic hybrid pool for the accounts in the Branch.

Cross Border Pool Hybrid

Check this box to allow cross border hybrid pool for the accounts in the Branch.

Cross Currency Pool Hybrid

Check this box to allow cross Currency hybrid pools for the accounts in the Branch.

Address

Specify the address of the bank in below fields.

Line 1

Line 2

Line 3

Line 4

Country

Specify the Country

Region

Specify Region

Parameter

Specify additional parameters if any. Click '+' to add a row and specify the Parameter, Value of the same. Click '-' to remove a row.

Interface Details

Specify the Interface details by selecting the System ID from System ID LOV.

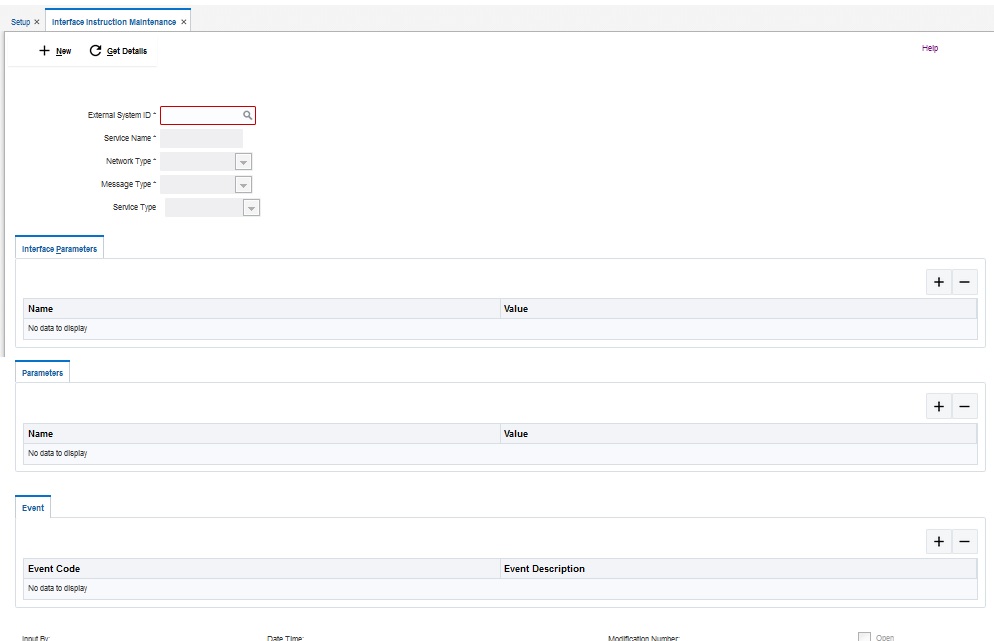

5.4.5 Interface Instruction Maintenance

You can maintain payment parameter values at bank level for all the internal and external banks participating in liquidity management structure. The values captured in this screen will be handed off to payment systems to initiate domestic or cross border sweep.

External System ID

Specify the external system ID for which the instruction is to be set. You can select the relevant external system from the option list. The list displays all the external system id maintained in the system.

Service Name

The system displays the service name for selected external system Id.

Network Type

The system displays network type for the selected external system Id.

Message Type

The system displays message type for the selected external system Id.

Service Type

The system displays Service type for the selected external system Id.

Name

Specify the interface parameter name for interface instruction.

Value

Specify the interface parameter value for interface instruction.

Event Code

Specify the event code for interface instruction.

Event Description

Specify the event description for interface instruction.

Parameter Name

Specify the parameter name.

Parameter Value

Specify the parameter value.Dynamic values are entered as #.

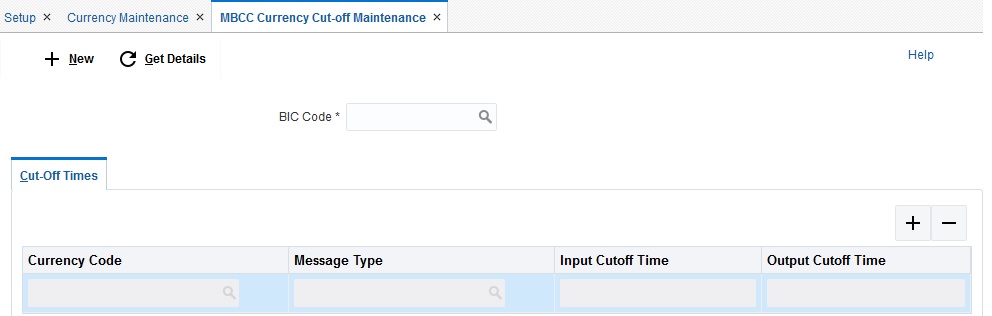

5.4.6 MBCC Currency Cut Off Maintenance

Branch level & Currency level cut off are maintained in here. If the message arrives after the cut-off time, balance will not be considered for upcoming sweep schedule.

Exception messages will be logged separately

.

BIC Code

Select the BIC Code of the branch for which currency cutoffs are to be maintained

Currency

Specify the currency for which the cut off time is to be set. You can select the currency from the option list. The list displays all the currencies maintained in the system

MessageType

Specify the message type to be associated with the currency.You can select the message type from the option list. The list displays all the message type maintained in the system

IncomingCutOfTime

Specify the incoming cut off time for the currency.

OutgoingCutOffTime

Specify the outgoing cut off time for the currency