2. Corporate Loan Origination

2.1 Introduction

The process of loan origination gets initiated when a prospective customer approaches the bank, with a loan account opening request or when the bank approaches a prospective customer, taking lead from its database. In case of a bank–initiated request, the process moves forward only if the prospective customer is interested. The entire process is carried out in multiple stages and on successful completion of each stage, it moves automatically to the next stage.

When the customer approaches the bank for its products and offers, before initiating the loan origination process, the bank can create a mock-proposal which would have the personal details of the customer, the loan offers the customer is interested in as well as the schedules associated with the loan offer. This can be stored as reference in the system to be retrieved when the actual loan process flow is initiated.

Corporate lending process flow uses Oracle BPEL framework with multiple human tasks for workflow stages. The capture and enrichment of information in multiple steps can be dynamically assigned to different user roles, so that multiple users can take part in the transaction. Oracle Business rules are used for dynamic creation of multiple approval stages.

The following details need to be maintained for originating a Corporate Loan:

- Credit rating rules

- Credit ratios

- Override details

- Document checklist and advices

- Application category details

The Corporate Loan origination process flow is composed of following stages:

- Application Entry

- Application Verification

- Internal KYC

- External KYC

- Underwriting

- Loan Approval

- Document Verification

- Manual Retry

The features, maintenances and the different stages in the process flow are explained in detail in the following sections.

This chapter contains the following sections:

- Section 2.2, "Maintaining Loan Prospect Details"

- Section 2.3, "Defining Bank Level Parameters for Lead ID"

- Section 2.4, "Simulating Corporate Loans"

- Section 2.5, "Maintaining Credit Rating Rules"

- Section 2.6, "Credit Ratios"

- Section 2.7, "Maintaining Ratio Details"

- Section 2.8, "Pricing Details"

- Section 2.9, "Stages in Corporate Loan Origination"

- Section 2.10, "Application Entry"

- Section 2.11, "Application Verification"

- Section 2.12, "Internal KYC Review"

- Section 2.13, "External KYC Review"

- Section 2.14, "Underwriting"

- Section 2.15, "Loan Approval"

- Section 2.16, "Document Verification"

- Section 2.17, "Manual Retry"

- Section 2.18, "Auto Closure of Leads"

2.2 Maintaining Loan Prospect Details

You can maintain the details of a prospective borrower or a loan applicant, when the borrower initially approaches the bank enquiring about the various loan products that are being offered.

The following details are captured as part of this maintenance:

- Prospective customer’s personal and location details

- Prospective customer’s employment details

- Requested loan details

This section contains the following topics:

- Section 2.2.1, "Main Tab"

- Section 2.2.2, "Details Tab"

- Section 2.2.3, "Financial Tab"

- Section 2.2.4, "Requested Tab"

- Section 2.2.5, "Document Details"

- Section 2.2.6, "Conversation Details"

- Section 2.2.7, "History Tab"

- Section 2.2.8, "Corporate Tab"

- Section 2.2.9, "Viewing Loan Prospect Summary"

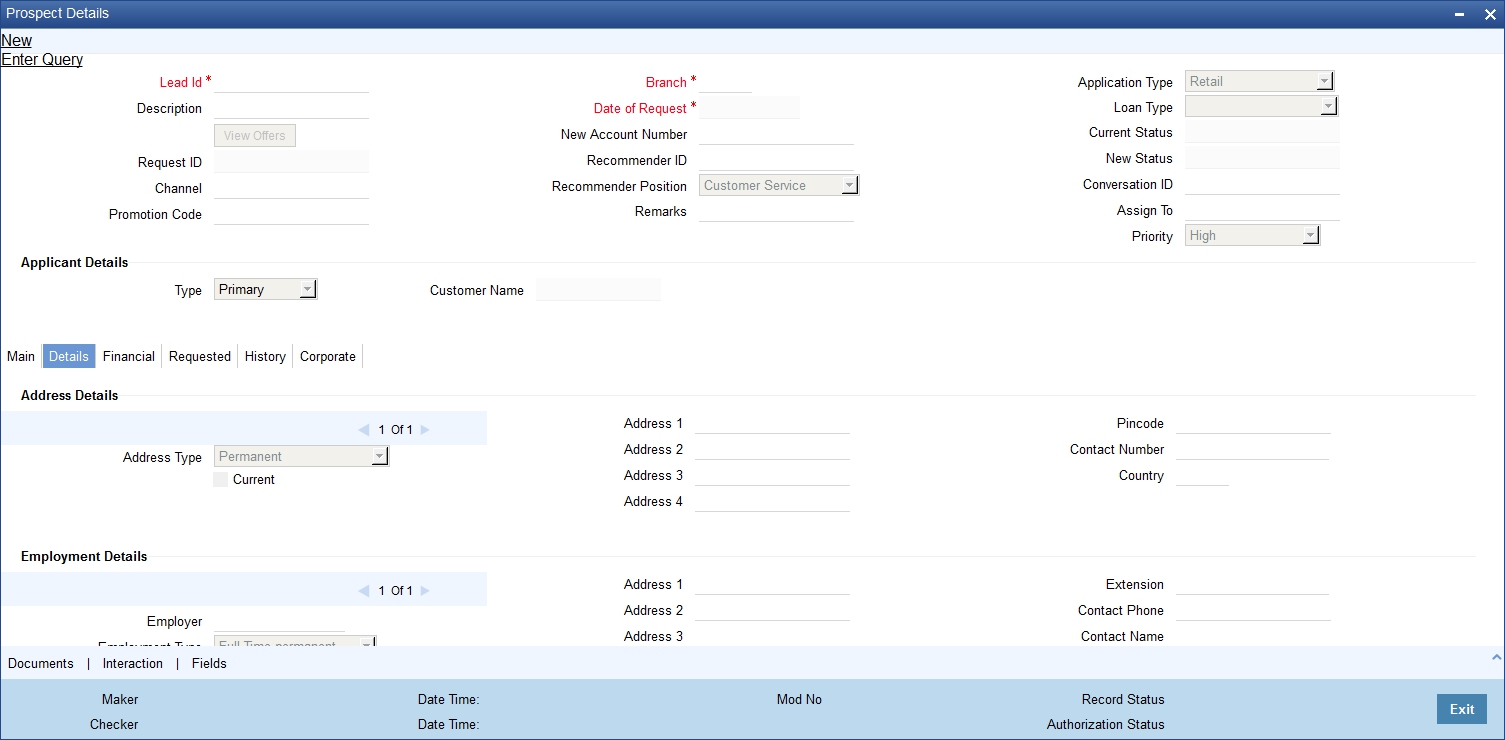

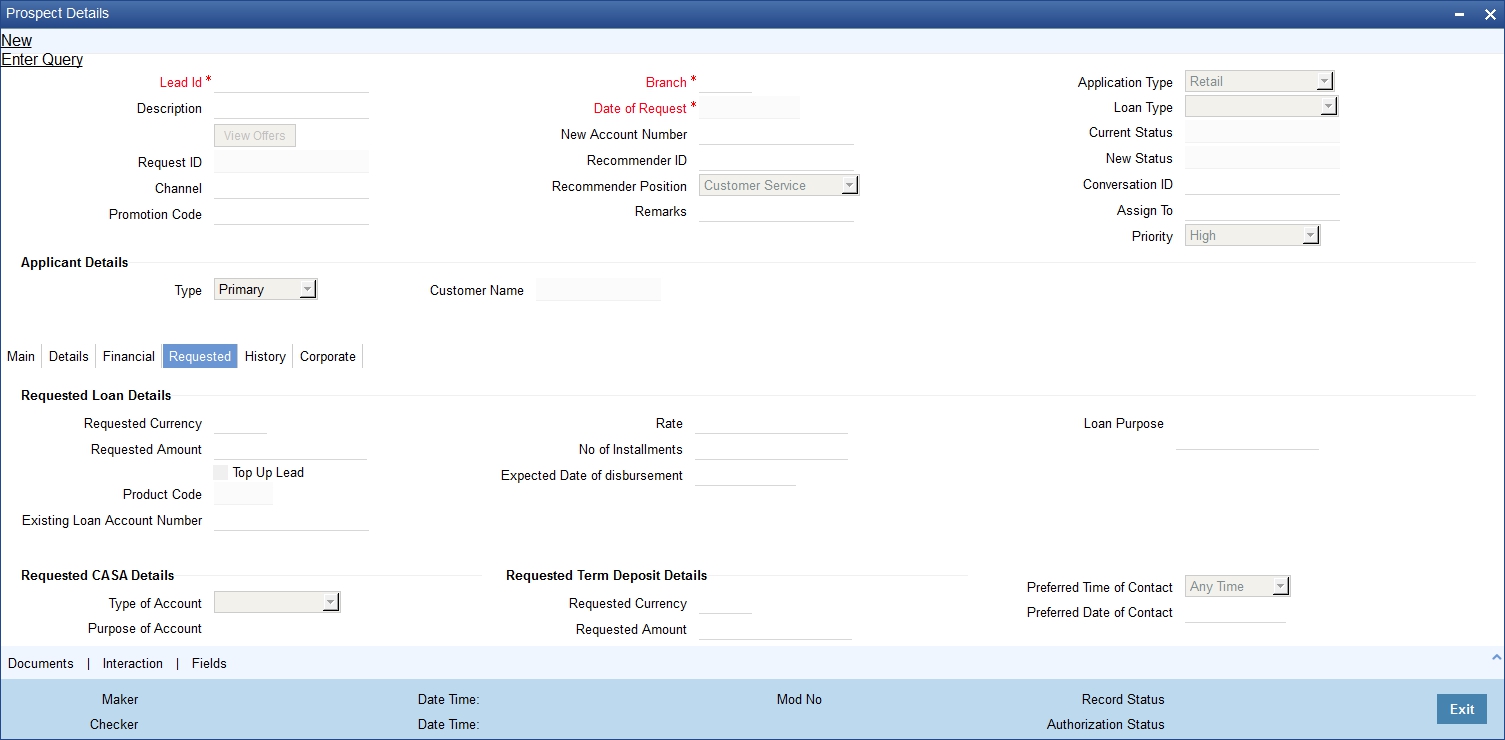

You can maintain the details related to the prospective customer in ‘Prospect Details’ screen. You can invoke this screen by typing ‘ORDLEADM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details in this screen:

Lead Id

Specify a unique identification for the prospective loan customer.

Remarks

Specify remarks if any for the prospective loan customer.

Click on ‘View Offers’ to view the multiple offers in the Loan Simulation screen. The system displays the following information in this screen:

- Enquiry ID

- Enquiry Date

- Request ID

- Request Date

- Branch

- Application Category

- Product Code

- Description

- Status Movement

- User Reference

- Lead ID

Customer Details

- Customer No

- First Name

- Last Name

- Contact Number

Requested Loan Details

- Requested Currency

- Requested Amount

- Promotion ID

- Rate

- Tenor (in months)

- Maximum Allowed Amount - Specify the maximum allowed amount. If the requested loan amount is greater than the maximum allowed amount, the system displays an information message and defaults the maximum allowed amount as requested loan amount.

- Loan Purpose

Request ID

The system displays the request identification of the loan request.

Channel

The system by default displays ‘FLEXCUBE’ as the channel. However, you can modify if needed. The adjoining option list displays a list of valid channels. Select the appropriate one.

Promotion Code

Indicate the promotion code.

Branch

Select the branch code from the adjoining option list.

Date of Request

Specify the date when the prospective customer has made the enquiry about the loan. You can also select the date by clicking the adjoining ‘Calendar’ icon.

New Account Number

The system displays the new account number.

Application Type

Select the application type from the adjoining drop-down list. The available options are:

- Retail

- Corporate

- CASA

- Ijarah

- Istisna

- Mudarabah

- Murabaha

- Musharaka

- Tawarooq

Loan Type

Select the loan type from the adjoining drop-down list. The options available are:

- Vehicle

- Business

- Home

- Personal

- Cash Credit

- Overdraft

- Working Capital Loan

- Term Loan

- Short Term Finance

- Import Loan

- Pre Shipment Loan

Current Status

The system displays the current status of the lead.

New Status

Select the new status from the adjoining option list. It is mandatory to select the new status if the current status is ‘Closed’, ‘Rejected’ or ‘Additional Document Required’.

Conversation ID

Select the conversation ID from the adjoining option list.

Recommender ID

Select the user ID of the employee who is referring the customer from the adjoining option list.

Recommender Position

Select the position of the employee who is referring the customer from the adjoining drop-down list.

Remarks

Specify remarks, if any.

Assign To

Select the user ID of the person who will follow up on the lead.

Priority

Select the priority of follow up on the lead request from the adjoining drop-down

The table shows the status available for lead management of loans.

Lead Status |

Description |

Possible Next Status |

New |

All the leads generated from the channel will have the status as 'New' FCUBS user can see the entire list of leads in the lead summary screen. |

Follow Up Closed Rejected |

Rejected |

When the FCUBS user rejects the lead. When the status is selected as 'rejected', it will be mandatory for the user to select the reason code in the sub screen which will be populated at the save operation. |

Status cannot be changed |

Follow Up |

The FCUBS contacts the prospect for further processing The FCUBS user can edit the details provided by the prospect/customer based on their interaction. |

Additional Documents Required Closed Rejected Offer Generated |

Additional Documents Required |

After speaking to the prospect/customer, FCUBS user informs correct or additional documents required. When the status is selected as 'Closed', it will be mandatory for the user to select the reason code in the sub screen which will be populated at the save operation |

Follow Up Closed Rejected Offer Generated |

Review |

When the prospect/customer uploads corrected or additional documents |

Follow Up Closed Rejected Offer Generated |

Offer Generated |

When the FCUBS user simulates and system generates the offer based on requested details |

Closed Converted |

Closed |

When the FCUBS rejects or closed the lead id When the status is selected as 'Closed', it will be mandatory for the user to select the reason code in the sub screen which will be populated at the save operation |

Status cannot be changed |

Converted |

When the customer accepts one of the generated offers |

Closed |

Application Under process |

When a converted loan lead is saved in the application entry stage of the origination, the system will automatically change the status of the lead in ORDLEADM to “application under process” |

You will not be able to change the status manually after this status. |

Under Process |

When the lead ID is in the follow up stage. |

All status applicable |

Offer Rejected |

When customer rejects all the generated offers. If the new status is changed to OFFER REJECTED, then on save all the offers gets rejected. |

Closed |

2.2.1 Main Tab

You can capture the following personal and geographical details related to a prospective customer:

Sequence Number

The system displays the sequence number.

Type

Select the type of the customer from the adjoining drop-down list.

Existing

Check this box if you are an existing customer.

Local Branch

Select the local branch of an existing customer from the adjoining option list.

Customer No

Select the customer number from the adjoining option list.

Default

Click on default button to default the details on existing customer.

Short Name

Specify the short name of the customer.

Customer Name

Specify the name of the customer.

National Id

Specify the national Id or country code of the customer or select the national Id from the option list provided.

Responsibility

Select the responsibility from the adjoining drop down list.

Liability

Specify the liability for all parties other than primary applicant.

City

The system defaults the city of the customer.

Country

Specify the country of domicile of the customer or select the country code from the option list provided.

Nationality

Specify the country of which the customer is a national or select the country code from the option list provided.

Language

Specify the primary language of the customer or select the language from the option list provided.

Customer Category

Specify the category to which the customer belongs or select the customer category from the option list that displays all valid customer categories.

Financial Currency

Select the financial currency from the adjoining option list.

Mobile Number

Specify the mobile phone number of the prospective customer.

Landline No

Specify the land phone number of the prospective customer.

Home Phone ISD+

Select the area code for the home phone number from the adjoining option list.

Home Phone

Specify the home phone number with area code.

Specify the e-mail Id of the prospective customer.

Fax

Specify the fax number of the prospective customer.

Preferred Date of Contact

Specify the preferred date of contact.

Preferred Time of Contact

Specify the preferred time of contact.

First Name

Specify the first name of the customer.

Middle Name

Specify the middle name of the customer.

Last Name

Specify the last name of the customer.

Salutation

Select the salutation preference of the customer from the drop-down list provided. You can select any of the following options:

- Mr

- Mrs

- Miss

- Dr

Gender

Select the gender of the customer from the drop-down list.

Date of Birth

Specify the date of birth of the customer or select the date by clicking the ‘Calendar’ icon provided.

Mother’s Maiden Name

Specify the customer’s mother’s maiden name.

Marital Status

Select the marital status of the prospective customer from the drop-down list. The following options are available:

- Married

- Unmarried

- Divorcee

Dependents

Specify the number of dependents for the customer.

SSN

Specify applicant’s SSN.

Passport Number

Specify the passport number of the prospective customer.

Passport Issue Date

Specify the date on which the customer’s passport was issued or select the date from by clicking the adjoining ‘Calendar’ icon.

Passport Expiry Date

Specify the date on which the customer’s passport expires or select the date from by clicking the adjoining ‘Calendar’ icon.

Existing Relationship Details

Relationship Type

Specify the relationship type of the customer.

Credit Card Number

Specify the credit card number of the customer

Customer ID/Account Number

Specify the customer identification or account number of the customer.

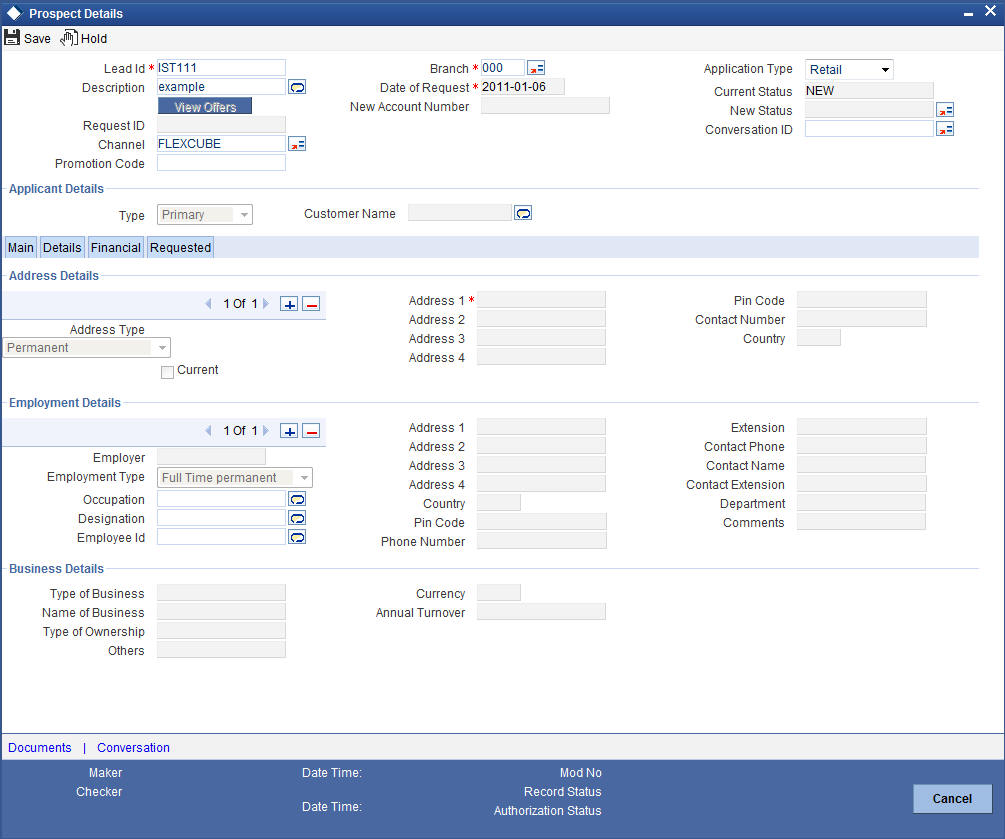

2.2.2 Details Tab

You can capture the address and employment related details of the prospective customer in ‘Details’ tab.

Address Details

Address Type

Select the address type of the customer from the following options provided in the drop-down list:

- Correspondence Address

- Registration

Mailing

Check this box to indicate that the address you specify here is the customer’s mailing address.

Address Line 1 – 4

Specify the address of the customer in four lines starting from Address Line 1 to Address Line 4.

Contact Number

Specify the contact telephone number of the customer.

Pincode

Specify the zip code associated wit the address specified.

Country

Specify the country associated with the address specified.

Employment Details

Employer

Specify the name of the employer of the prospective customer.

Employment Type

Select the customer’s employment type from the drop-down provided. The following options are available:

- Part Time

- Full Time

- Contract Based

Employer

Specify the name of the employer of the prospective customer.

Occupation

Specify the occupation of the prospective customer.

Designation

Specify the designation of the prospective customer.

Employee Id

Specify the employee Id of the prospective customer.

Address Line 1 – 4

Specify the employment address of the customer in four lines starting from Address Line 1 to Address Line 4.

Pincode

Specify the zip code associated with the office address specified.

Country

Specify the country associated with the employment address specified.

Phone Number

Specify the official phone number of the prospective customer.

Extension

Specify the telephone extension number, if any, of the prospective customer.

Contact Phone

Specify the contact phone number of the customer’s contact person.

Contact Name

Specify the name of a contact person at the customer’s office.

Contact Extension

Specify the telephone extension number, if any, associated with contact person.

Comments

Specify comments, if any, related to the customer’s employment.

Department

Specify the department to which the customer belongs.

Business Details

Type of Business

Select the type of business from the adjoining drop-down list.

Name of Business

Specify the name of the company here.

Type of Ownership

Select the type of ownership from the adjoining drop-down list.

Others

Specify if the type of ownership is others.

Currency

Select the currency from the adjoining option list.

Annual Turnover

Specify the annual turnover of the company.

Business Description

Give a brief description on the company.

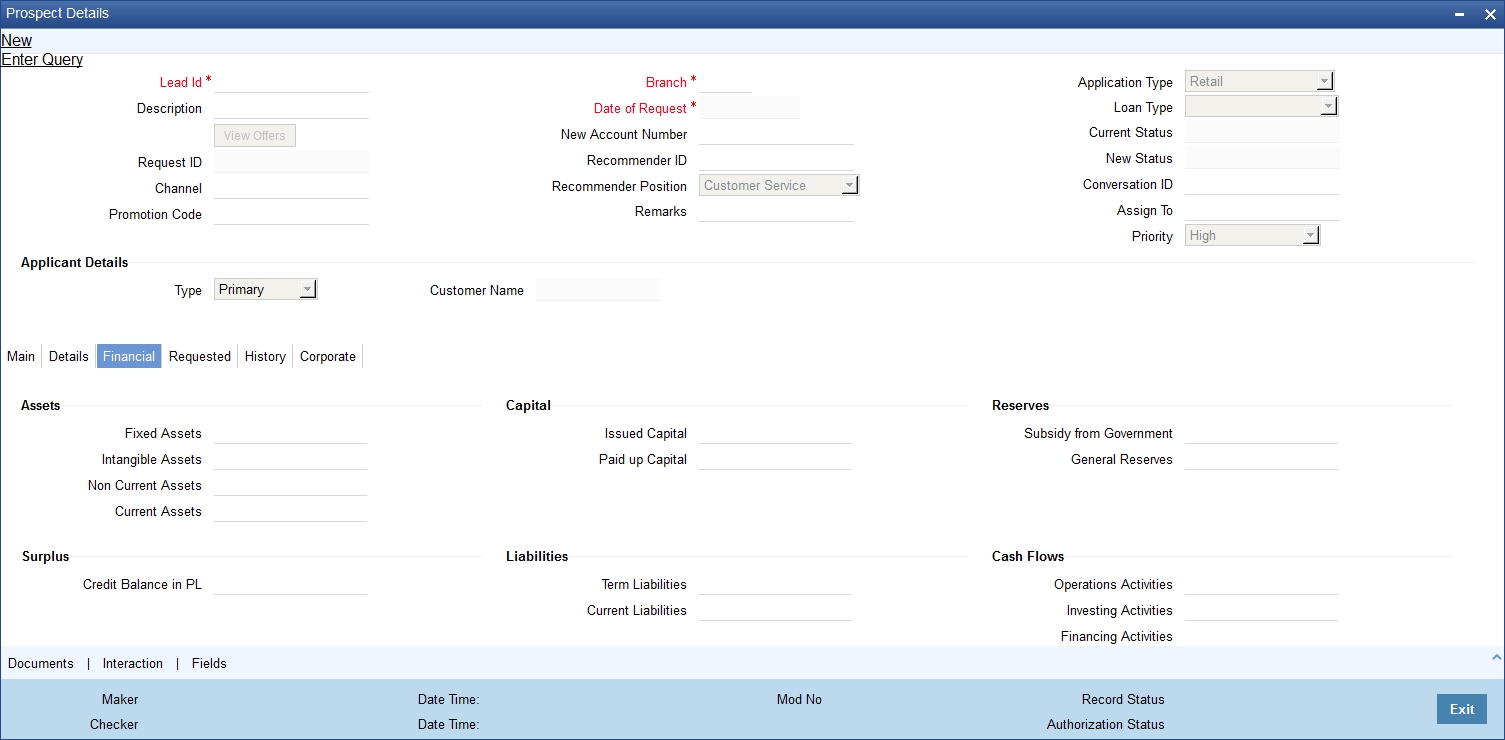

2.2.3 Financial Tab

You can capture the details related to the finance in the ‘Financial’ tab.

Income Details

Income Type

Select the income type from the adjoining option list.

Frequency

Select the frequency of the income of the applicant.

Currency

Select the currency of the income from the adjoining option list.

Amount

Specify the income amount.

The system enables the following fields if the applicant type is ‘Corporate’.

Assets

You can capture the following details corresponding to the loan applicant’s assets:

Fixed Assets

Specify the value associated with the fixed assets of the customer.

Intangible Assets

Specify the value associated with the intangible assets of the customer.

Non Current Assets

Specify the value associated with the non current assets of the customer.

Current Assets

Specify the value associated with the current assets of the customer.

Capital

You can capture the following details corresponding to the loan applicant’s capital:

Issued Capital

Specify the value associated with the issued capital of the customer.

Paid-Up Capital

Specify the value associated with the paid-up capital of the customer.

Reserves

You can capture the following details corresponding to the loan applicant’s cash reserves:

Subsidy from Govt

Specify the value of any subsidies the customer has obtained from the government.

General Reserves

Specify the value associated with any general reserves of the customer.

Surplus

You can capture the following details corresponding to the loan applicant’s surplus income:

Credit Balance in PL

Specify the surplus credit balance, if any, associated with the customer.

Liabilities

You can capture the following details corresponding to the loan applicant’s liabilities:

Term Liabilities

Specify the value associated with the long term liabilities associated with the customer.

Current Liabilities

Specify the value associated with the current liabilities associated with the customer.

Cash Flows

You can capture the following details corresponding to the loan applicant’s cash flows:

Operations Activities

Specify the cash flow value associated with the operation activities of the corporate customer.

Investing Activities

Specify the cash flow value associated with the investing activities of the corporate customer.

Financing Activities

Specify the cash flow value associated with the financing activities of the corporate customer.

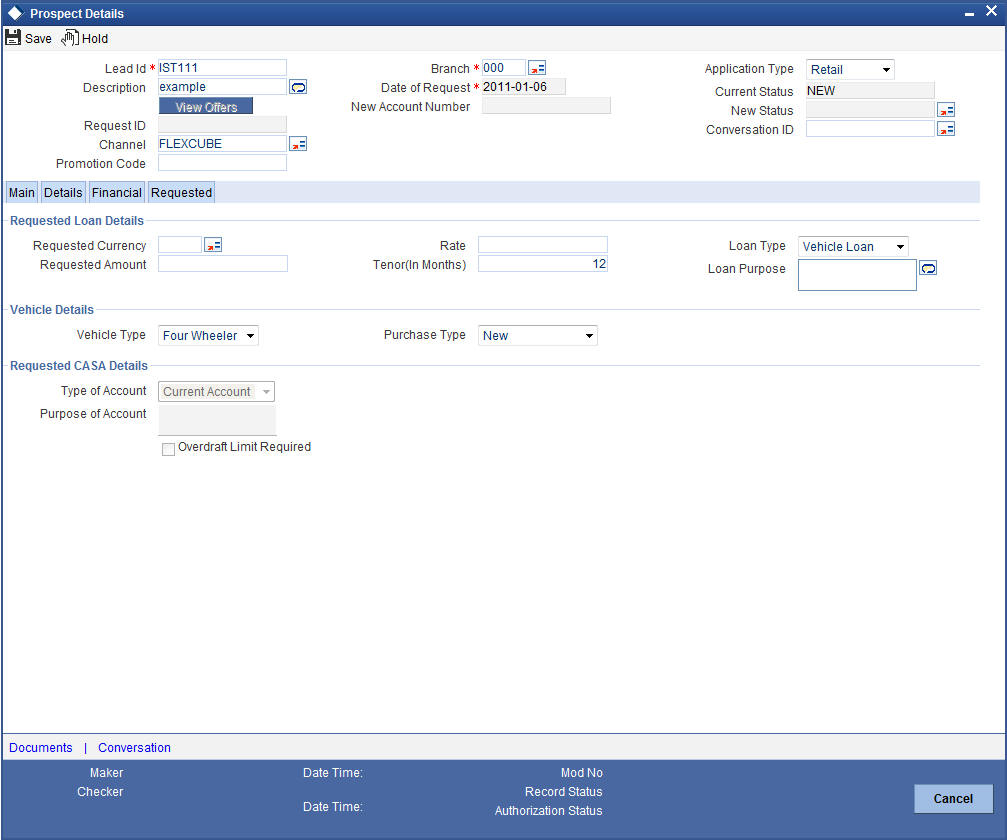

2.2.4 Requested Tab

You can capture the details related to the requested loan in ‘Requested’ tab.

You can capture the following details here:

Requested Currency

Specify the loan currency preference of the customer or select the currency from the option list provided.

Requested Amount

Specify the loan amount requested by the prospective customer.

Tenor (in months)

Specify the preferred loan tenor (in months) of the prospective customer.Rate

Specify the preferred interest rate of the prospective customer.

Loan Purpose

Specify the Purpose of the loan.

Additional Instructions

Specify additional instructions, if any.

Requested Term Deposit Details

Requested Currency

Select the requested currency from the adjoining option list.

Requested Amount

Specify the requested amount.

Tenor (In Months)

Specify the duration of the term deposit in months.

Vehicle Details

Vehicle Type

Select the type of vehicle for which the loan is requested from the adjoining drop-down list.

Purchase Type

Select the purchase type from the adjoining drop-down list.

Requested CASA Details

Type of Account

The system displays the type of account.

Purpose of Account

The system displays the purpose of the account.

Overdraft Limit Required

Check this box if overdraft limit is required.

Credit the Proceeds to

Specify whether the credit should be proceeded to a new account or an existing account. If the proceeds are credited to an existing account, then select the account number from the adjoining option list.

2.2.5 Document Details

Click on ‘Documents’ link to invoke the Documents screen.You can upload the required documents from the external system.

Document Category

Select the document category from the adjoining option list.

Document Reference

Specify the document reference.

Document Type

Select the type of document from the adjoining option list.

Remarks

Specify remarks, if any.

Ratio Upload

Check this box to enable ratio upload.

Upload

Click on ‘Upload’ button to upload the document.

View

Click on ‘View’ button to view the uploaded document.

The document upload from the external system is allowed only when

- the customer submits the loan request from the external system

- the status in the Prospect Details screen is ‘Additional Documents Required’.

- The documents uploaded by the customer through the external system is stored in the Document Management System with a document reference number.

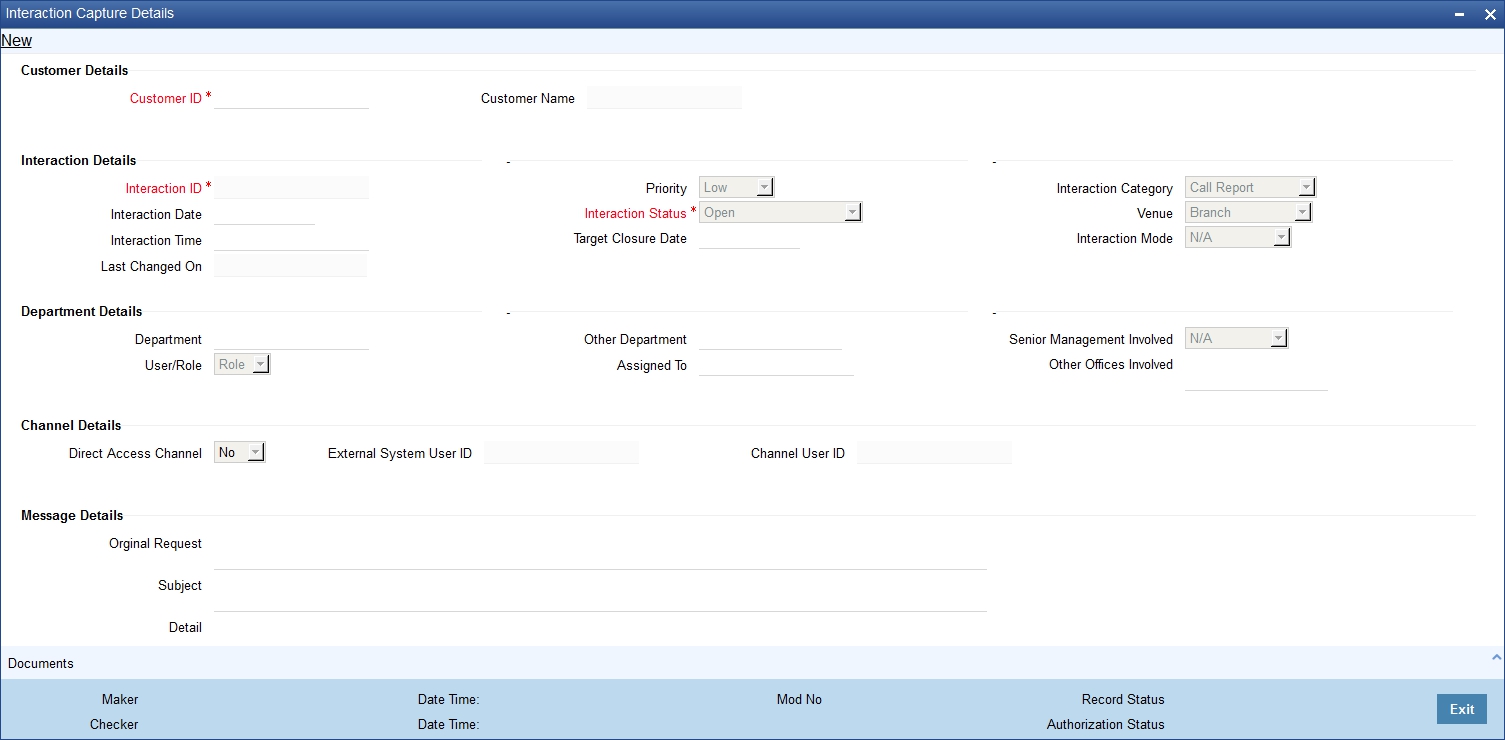

2.2.6 Conversation Details

Click on ‘Conversation’ in the Prospect Detail screen to invoke the ‘Conversation Input’ screen.

The system displays the following details if the conversation ID is selected in the prospect Detail screen.

Customer Details

Customer I D

The system displays the customer ID.

Customer Name

The system displays the name of the customer.

Conversation Details

Conversation ID

The system displays the conversation ID.

Conversation Date

The system displays the conversation date.

Conversation Time

The system displays the conversation time.

Last Changed On

The system displays the date and time when the conversation was last changed.

Priority

The system displays the conversation priority.

Conversation Status

The system displays the conversation status.

Conversation Category

The conversation category is defaulted here.

Venue

The system defaults the venue.

Conversation Mode

The system displays the conversation mode.

Department Details

The system displays the following department details:

- Department

- User/Role

- Other Department

- Assigned To

- Senior Management Involved

- Other Offices Involved

Channel Details

The system displays the following channel details:

- Direct Access Channel

- External System User ID

- Channel User ID

Message Details

The system displays the following message details

- Original Request

- Subject

- Detail

- Documents Presented

- Reply to Customer

- Closure Remarks

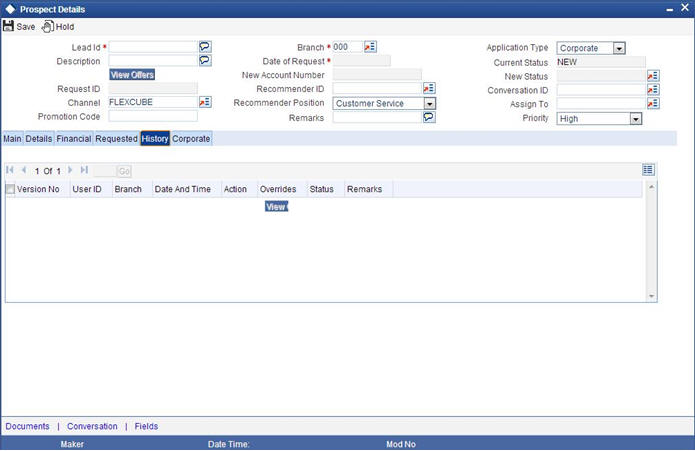

2.2.7 History Tab

You can audit loan details in the History tab of the Prospect Details screen.

Version No.

The system displays the version number of the lead.

User ID

The system displays the user ID of the user who has done the modification.

Branch

The system displays the branch code.

Date and Time

The system displays the date and time of the modification.

Action

The system tracks the action of the user.

Overrides

Click on ‘Overrides’ button to view the override details.

Status

The system displays the lead status at the time of action.

Remarks

The system displays the remarks captured.

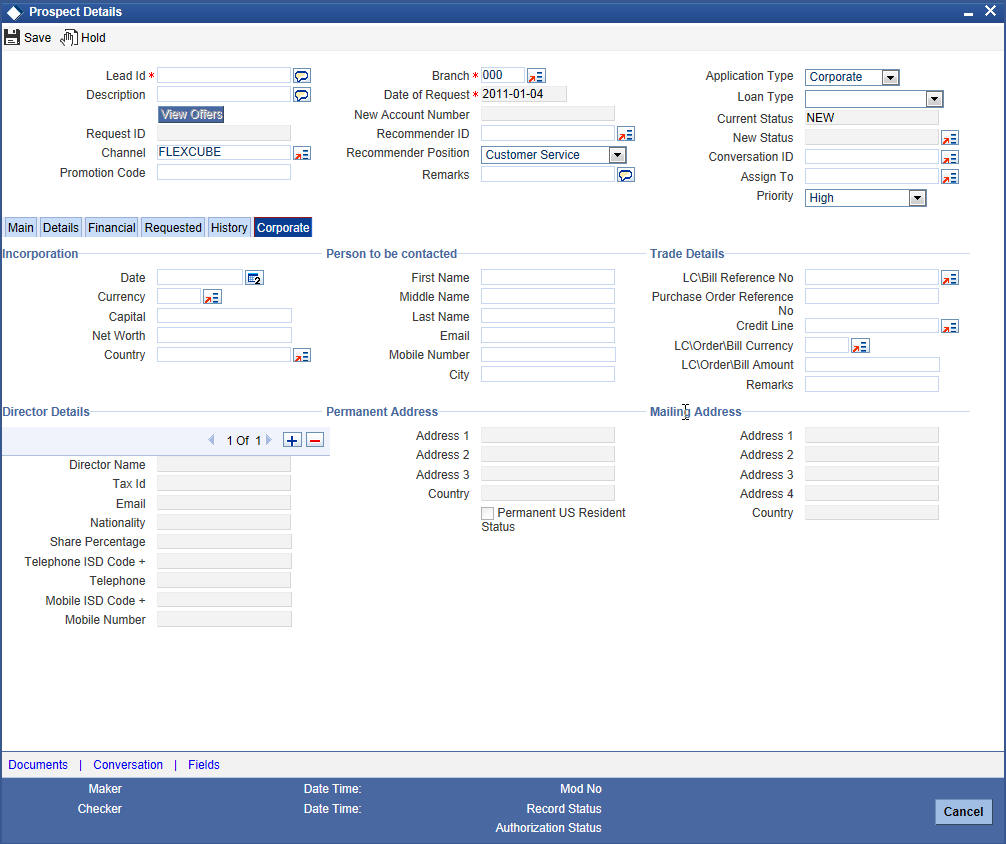

2.2.8 Corporate Tab

You can capture the details related to the corporate in he Corporate tab of the Prospect Details screen.

Incorporation

Date

Specify the date of incorporation from the adjoining calendar.

Currency

Select the currency from the adjoining option list.

Capital

Specify the capital of the corporate.

Net Worth

Specify the net worth of the corporate.

Country

Select the country from the adjoining option list.

Person to be Contacted

First Name

Specify the first name of the contact person.

Middle Name

Specify the middle name of the contact person.

Last Name

Specify the last name of the contact person.

Specify the email Id of the contact person.

Mobile Number

Specify the mobile number of the contact person.

City

Specify the city of the contact person.

Trade Details

LC\Bill Reference No.

Select the reference number of trade instrument from the adjoining option list.

Purchase Order Reference No.

Specify the purchase order reference number.

Credit Line

Specify the facility ID of the customer from the adjoining option list.

LC\Order\Bill Currency

Select the LC\Order\Bill currency from the adjoining option list.

LC\Order\Bill Amount

Specify the order\contract amount.

Remarks

Specify remarks, if any.

Director Details

Director Name

Specify the name of the director of the corporate customer.

Tax ID

Specify the tax identification number (TIN) of the director.

Specify the e-mail ID of the director.

Nationality

Specify the nationality of the director.

Share Percentage

Specify the percentage of share for the key person.

Telephone ISD Code +

Specify the international dialling code for the telephone number of the director. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Telephone

Specify the telephone number of the director.

Mobile ISD Code +

Specify the international dialling code for the mobile number of the director. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Mobile Number

Specify the mobile number of the director.

Permanent Address

Address

Specify the permanent address of the director.

Country

Specify the country associated with the address specified.

Permanent US Resident Status

Check this box to indicate that the corresponding director is a permanent US resident.

Mailing

Address 1 – 4

Specify the mailing address of the customer in Line 1 to Line 4 provided.

Country

Specify the country of the mailing address.

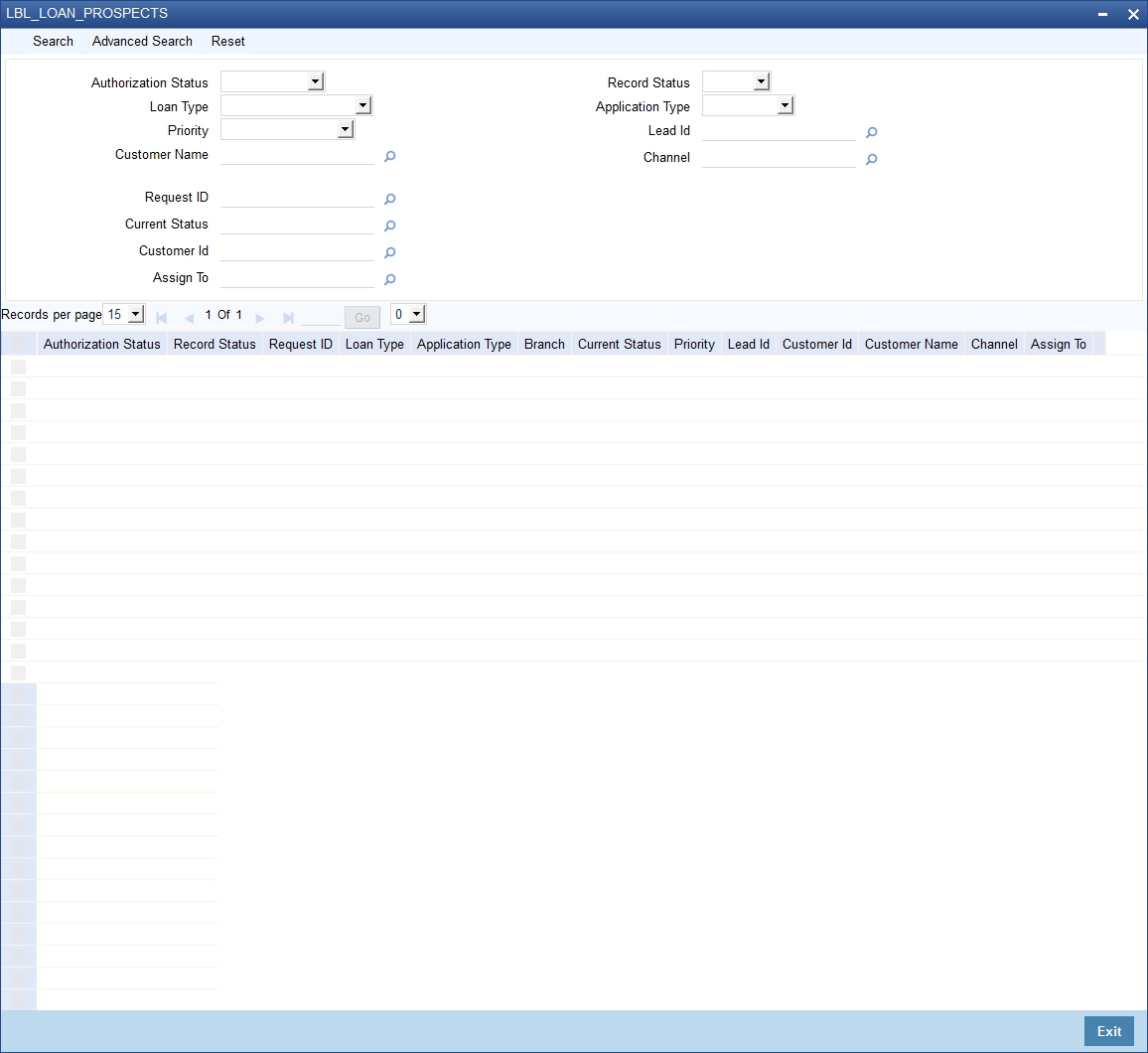

2.2.9 Viewing Loan Prospect Summary

You can view a summary of the prospective loan customers or the borrowers in ‘Loan Prospect Details’ screen. You can also query for a particular record based on desired search criteria.

You can invoke this screen by typing ‘ORSLEADM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify any of the following details to search for a record:

- Authorization Status

- Record Status

- Request ID

- Loan Type

- Application Type

- Branch

- Current Status

- Priority

- Lead Id

- Customer ID

- Customer Name

- Channel

- Assign To

Click ‘Search’ button to search for a record based on the search criteria specified. You can double click a desired record to view the detailed screen.

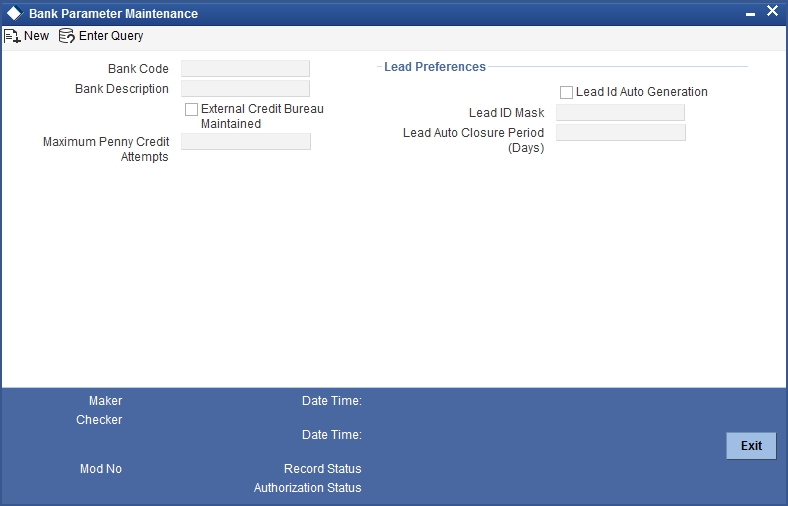

2.3 Defining Bank Level Parameters for Lead ID

You can maintain bank level parameters for lead ID generation and auto closure of leads in the Bank Parameters Maintenance screen. To invoke this screen type ‘ORDBKPMT’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

You can specify the following here:

Bank Code

Select the bank code from the adjoining option list.

Bank Description

Give a brief description on the bank.

External Credit Bureau Maintained

Check this box if external credit bureau is maintained.

Maximum Penny Credit Attempts

Specify the number of attempts made for penny credit.

Lead Preferences

Lead Id Auto Generation

Check this box to indicate that the lead ID should be auto generated. Lead ID should be less than or equal to 16 characters.

Lead mask criteria:

@(BRN): Branch Code, 3 digits

@(CCY): Currency, 3 digits

@(DATE:'): Date, YYDDD, 5 digits

@(SEQ:'): sequence number, 4 digits

@(PRCD):' Process code for lead screen, 4 digits, hard-coded as 'LEAD'

Lead ID Mask

Specify the criteria for the lead ID generation.

Lead Auto Closure Period (Days)

Specify the lead auto closure period in days.

All leads in any status other than the following will be auto closed if they meet the configured closure period:

- ‘Application Under Process’ (i.e. loan leads already in origination work flow)

- ‘Converted’ or ‘Account Opening in progress’

- ‘Origination in Progress’ (i.e. for CASA leads in origination)

The auto closure period will be decided by the bank based on the turnaround time of all other linked processes with the lead and hence will be managed and decided accordingly by the bank.

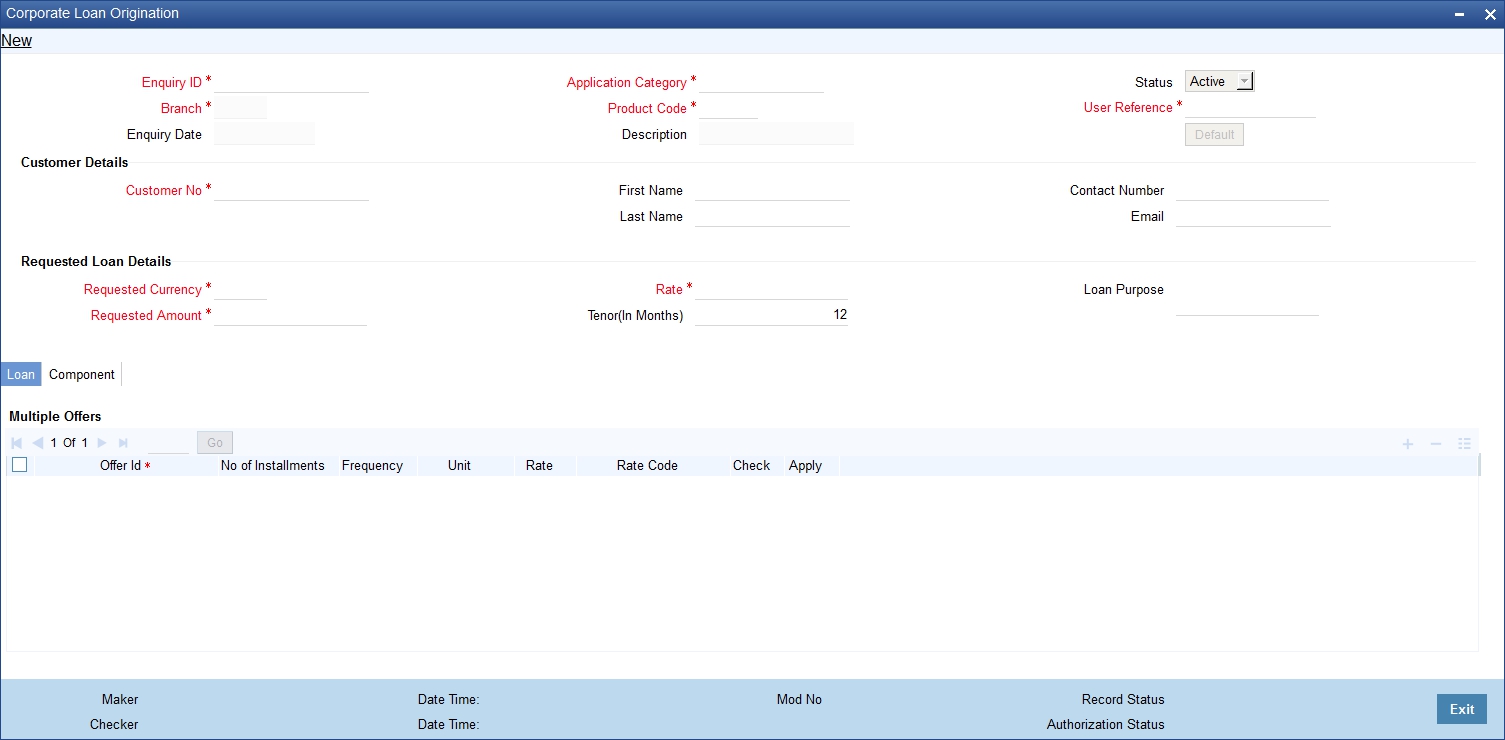

2.4 Simulating Corporate Loans

You can simulate a loan proposal for a customer approaching the bank with enquiries about the loan products offered by the bank. The following details would need to be captured as part of the simulation:

- Personal Details of the Prospect

- Loan offers selected by the Prospect

Based on the product, offers selected and requested details, the system will generate loan and schedule details.

This section contains the following topics:

- Section 2.4.1, "Loan Tab"

- Section 2.4.2, "Component Tab"

- Section 2.4.3, "Viewing Simulated Loan Details"

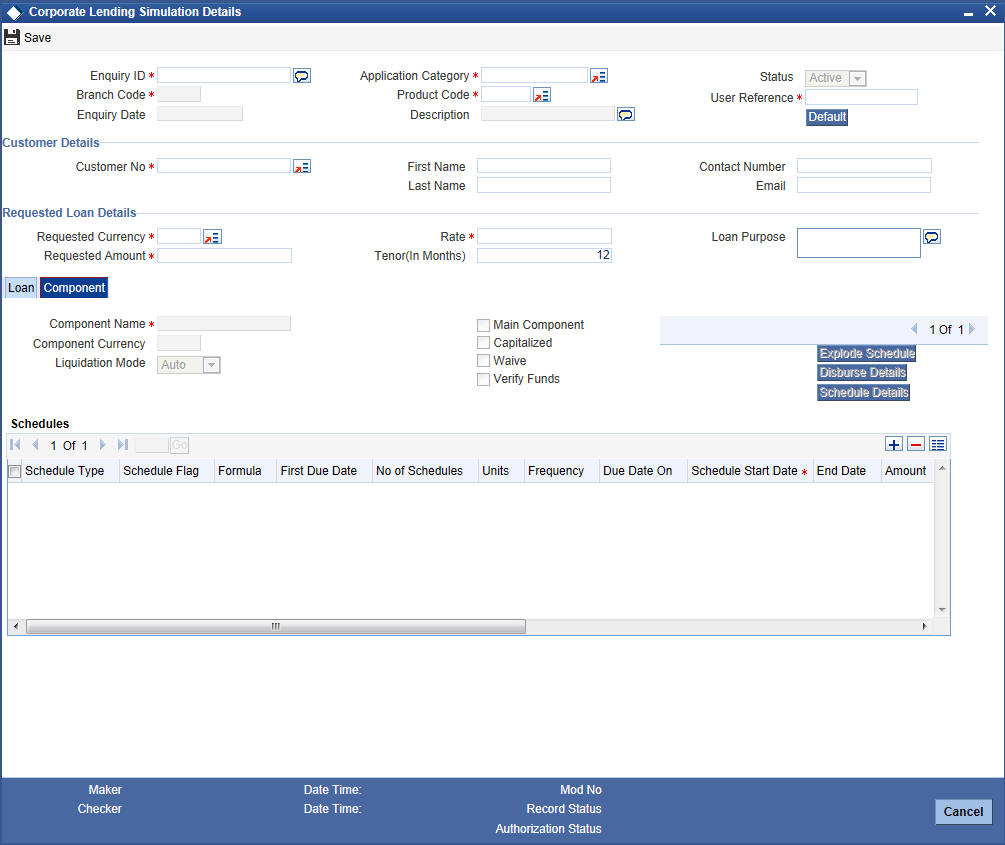

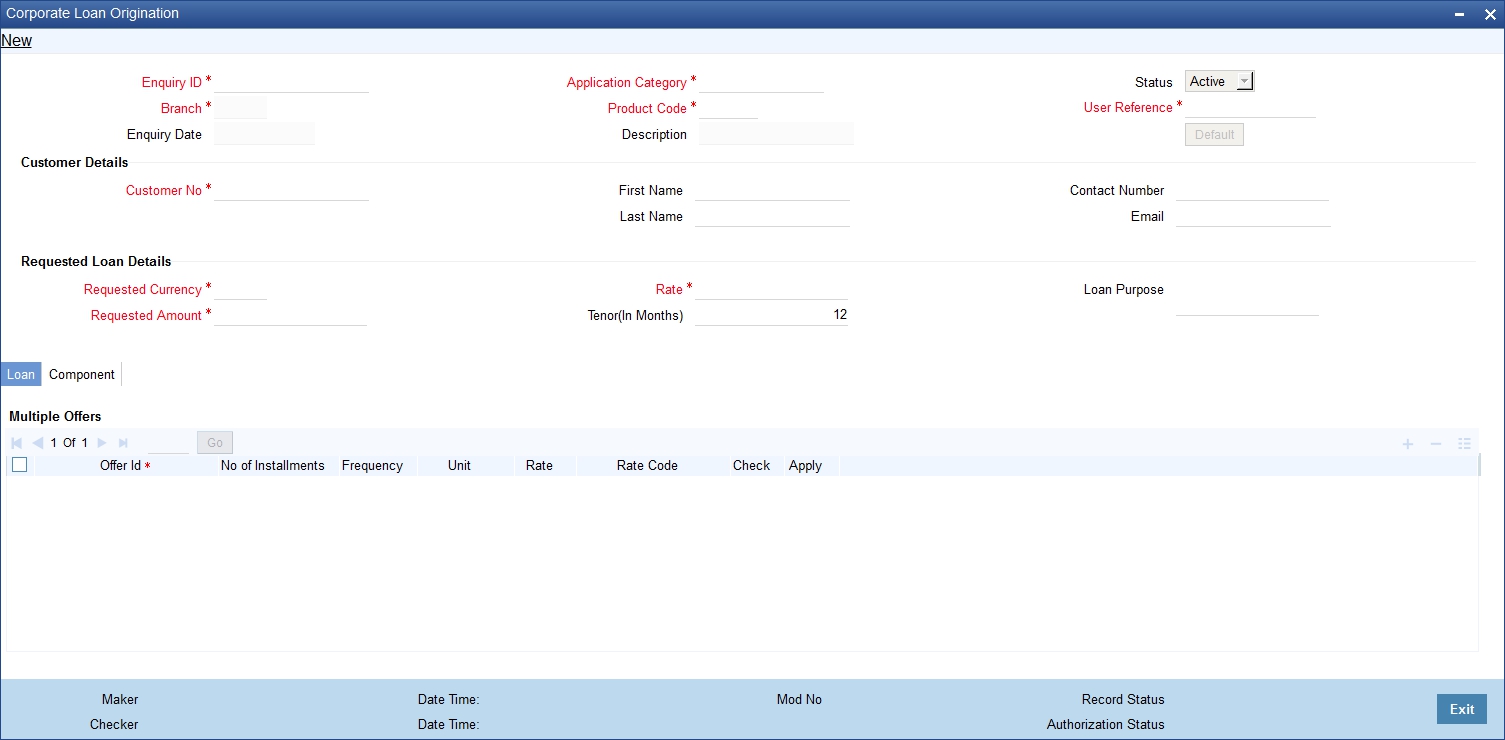

You can enter the required details for the prospective customer in ‘Corporate Loan Simulation Details’ screen. You can invoke this screen by typing ‘ORDCLSIM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

If details are available as part of the maintenance for the prospect in the ‘Prospect Details’ screen, then after you specify the Application category, Product Code and Customer Number in this screen, if you click the ‘Default’ button, the system will populate all loan and schedule details available for the prospect.

When you create a new proposal, the system will generate the Enquiry ID and the Date for the proposal You are required to capture the following details:

Application Category

Specify the application category for the loan enquiry. You can also select it from the adjoining option list.

Product Code

Specify the product code for loan product selected by the customer. You can also select it from the adjoining option list.

Branch Code

Specify the branch code in which the loan will be processed. You can also select it from the adjoining option list.

Customer Details

Specify the following details for the customer:

Customer No

Specify a unique customer number for the prospect who has initiated a loan account for the same product and application category combination.

First Name

Specify the first name of the customer.

Last Name

Specify the last name of the customer.

Contact Number

Specify the number at which the customer can be contacted.

E-mail ID

Specify the e-mail ID of the prospective customer.

Requested Loan Details

You can enter the details requested by the prospect here:

Requested Currency

Specify the loan currency preference of the customer or select the currency from the option list provided.

Requested Amount

Specify the loan amount requested by the prospective customer.

Default Interest rate

Specify the preferred interest rate of the prospective customer.

Tenor (In Months)

Specify the preferred loan tenor (in months) of the prospective customer.

Loan Purpose

Specify the purpose of the loan.

2.4.1 Loan Tab

You can maintain the offers for the customer in the loan tab.

Enter the following details here:

Offer ID

Specify a unique identification for the loan offer being made to the customer.

No of Instalments

Specify the number of instalments associated with the loan.

Units

Select the units based on which the loan disbursement should be carried out. The following options are available in the option list:

- Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

Frequency

Specify the frequency at which the loan disbursement should be carried out.

Rate

Specify the interest rate to be associated with the loan.

Rate Code

Specify the rate code used to derive the interest rate or select the rate code from the option list provided.

Spread

Specify the spread that is applicable for the loan being offered.

Effective Rate

The effective rate of interest gets displayed here, based on the interest and the spread specified.

Check

Select the required offer by clicking the ‘Check’ option.

Click the ‘Apply’ button. The system will default all the details in the ‘Loan Details’ section. When you click the ‘Apply’ button available in the lower section in ‘Loan Details’, the system will populate the schedule details for the offer you have selected.

2.4.2 Component Tab

After the loan details have been displayed by the system or modified as per your requirements, click ‘Apply’. The system will process these details. Click ‘Component’ and the system will display the details of the payment and amortization schedules based on the loan details.

You can specify the following schedule related details:

Compound Days

Specify the number of compound days.

Compound Months

Specify the number of compound months.

Compound Years

Specify the number of compound years.

Years

Select the actual number of days for the year from the adjoining drop-down list. You can select one of the following options:

- 360

- 365

- Actual

Days in Month

Select the number of days that would constitute a month for calculation from the adjoining drop-down list. You can select one of the following options:

- 30 (euro)

- 30 (US)

- Actual

After the loan application has been created in the system, if you select the ‘Enquiry ID’ specified here, the system will default the requested details for the offer selected here in the ‘Corporate Loan Application Entry’ screen (in the ‘Requested’ tab). You can only view the details in the screen. At the Underwriting stage, the system will default the loan details which you can modify (in the ‘Loan’ tab of the ‘Corporate Loan Underwriting Stage’ screen)

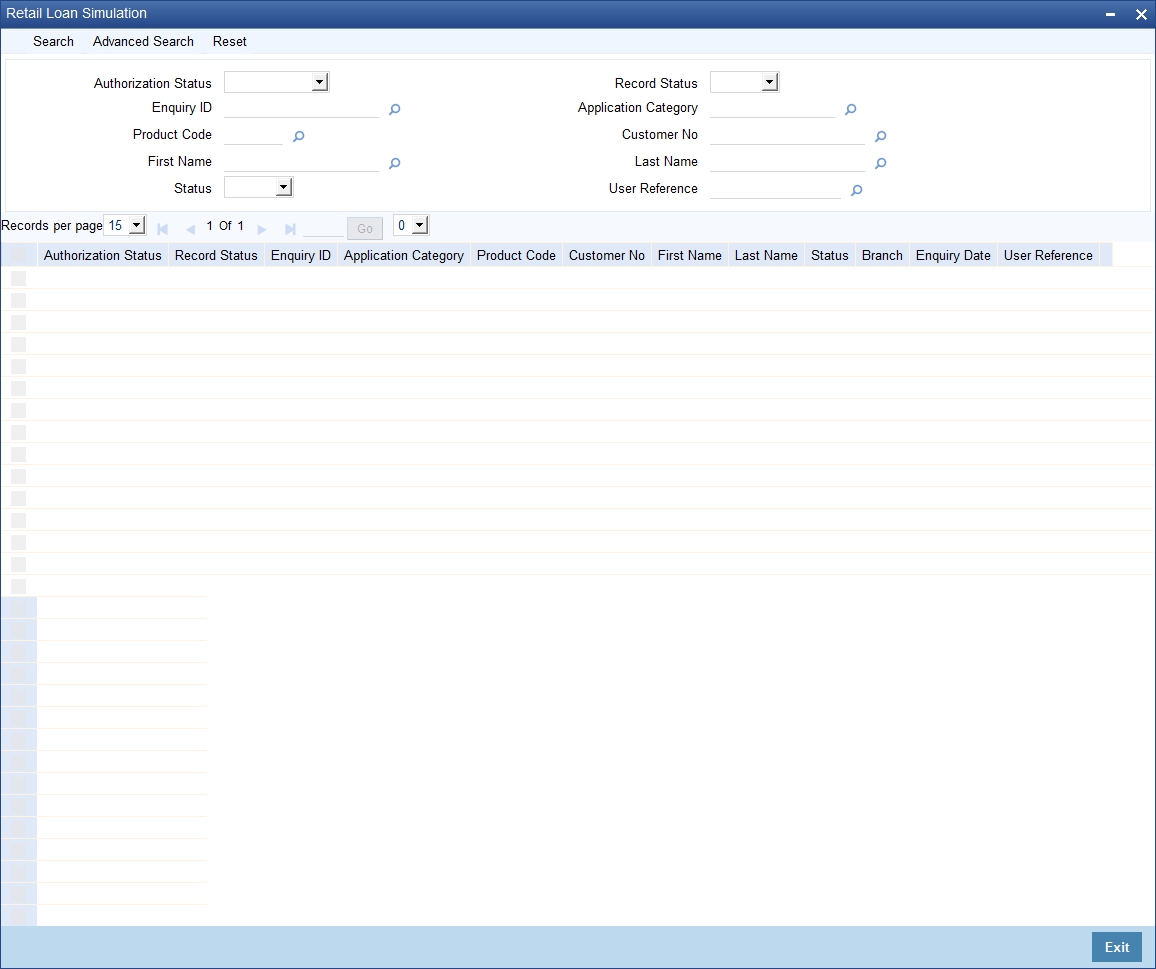

2.4.3 Viewing Simulated Loan Details

You can view a summary of the loans that have been simulated for prospects in ‘Corporate Loan Simulation Summary’ screen. You can also query for a particular record based on desired search criteria.

You can invoke this screen by typing ‘ORSCLSIM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify any of the following details to search for a record:

- Authorization Status

- Record Status

- Enquiry ID

- Customer Number

- First Name

- Last Name

- Contact Number

Click ‘Search’ button to search for a record based on the search criteria specified. You can double click a desired record to view the detailed screen.

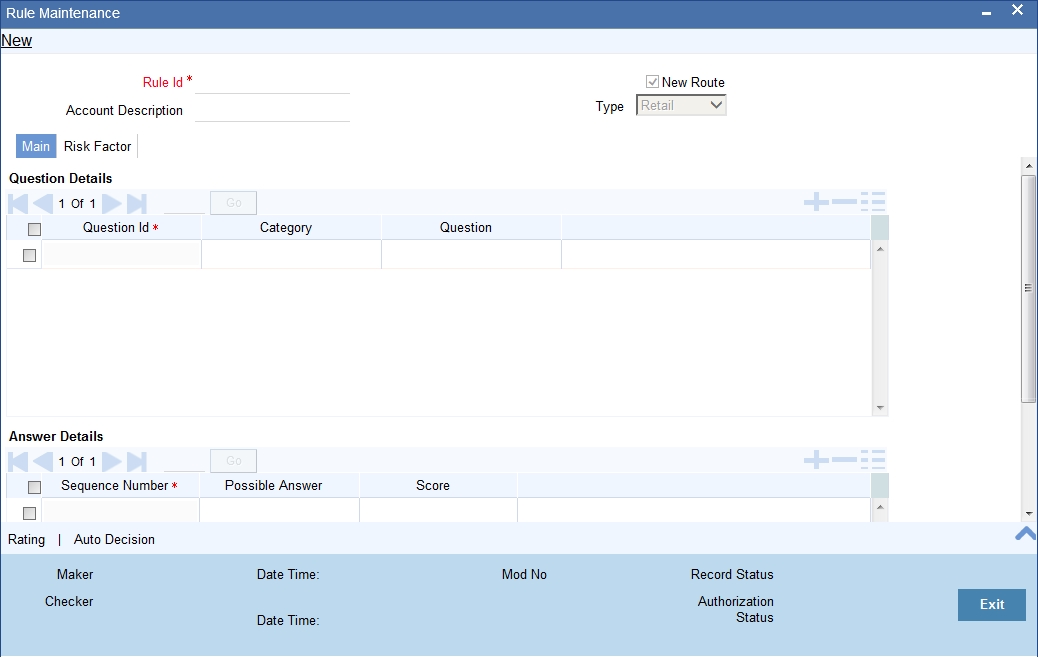

2.5 Maintaining Credit Rating Rules

You can maintain a set of questions along with a possible set of answers with associated scores, to assess the credit rating of a prospective loan customer. You can also calculate the risk factor associated with the loan and arrive at a credit grade based on the scores obtained.

This section contains the following topics:

- Section 2.5.1, "Main Tab"

- Section 2.5.2, "Risk Factor Tab"

- Section 2.5.3, "Specifying Credit Grades"

- Section 2.5.4, "Specifying Auto Decision"

- Section 2.5.5, "Viewing Credit Rule Summary"

You can maintain these details in ‘Rule Details’ screen. You can invoke this screen by typing ‘ORDRULMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.’

You can specify the following details in this screen:

Rule ID

Specify a unique identification for the credit rating rule.

Description

Specify a suitable description for the credit rating rule.

Type

Select the type of the loan from the following options available:

- Retail

- Corporate

2.5.1 Main Tab

You can maintain the following details in this tab:

Question Details

Question ID

The question ID is automatically generated by the system.

Category

Select the category to which the question belongs from the option list provided.

Question

Specify the question to be asked to the prospective customer to derive the credit rating score.

Answer Details

Sequence Number

The sequence number is automatically generated by the system.

Possible Answer

Specify a set of possible answers to be associated with a question.

Score

Specify the score associated with an answer.

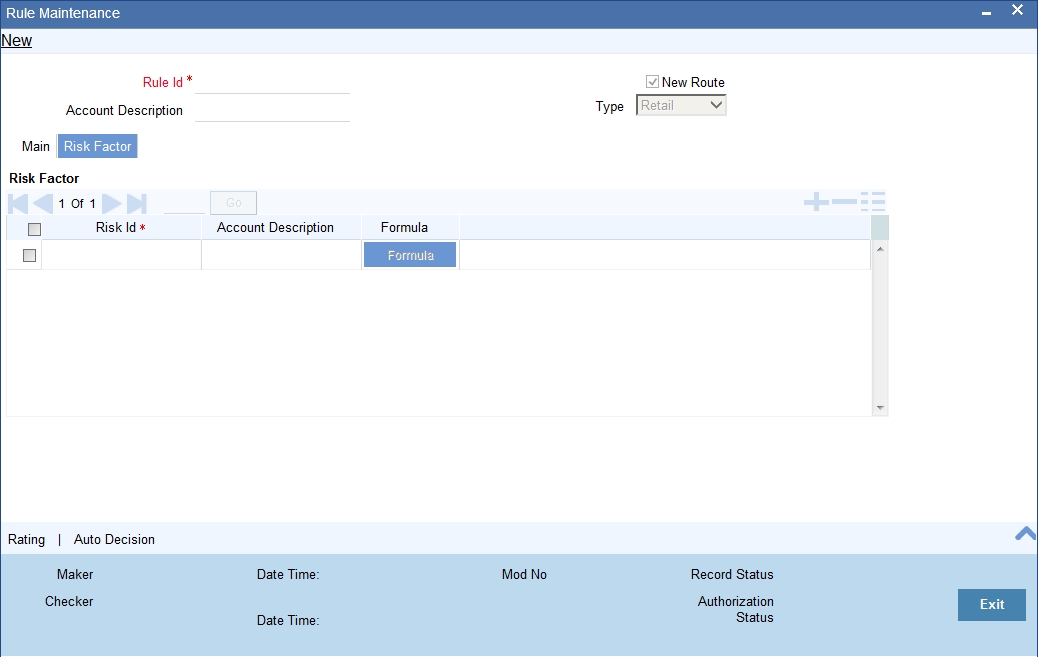

2.5.2 Risk Factor Tab

You can specify the risk details associated with the loan and also indicate the formula for calculating the credit score in this tab.

You can specify the following details here:

Risk ID

Specify a unique identifier for the credit risk being maintained.

Description

Specify a suitable description for the credit risk.

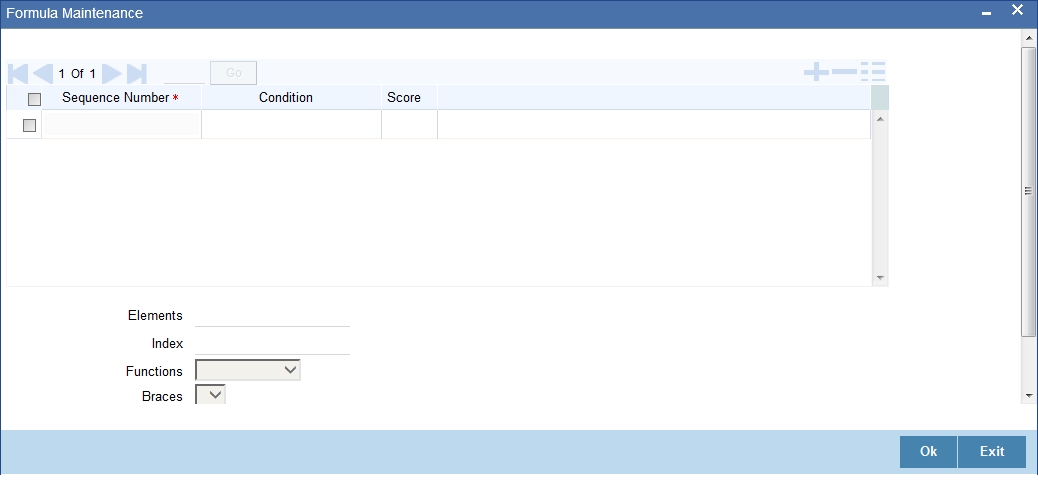

2.5.2.1 Specifying Formula Details

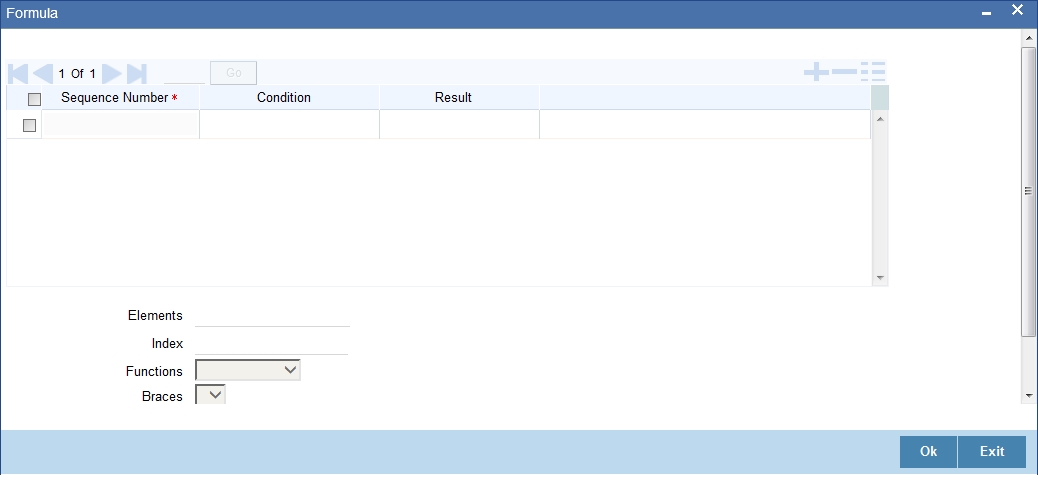

You can specify the formula to calculate the credit score by clicking the ‘Formula’ button corresponding to a credit risk entry in Risk Factor tab. The ‘Formula’ screen is displayed where you can specify the condition for calculating the credit score associated with a risk condition.

You can specify the following details here:

Sequence Number

The sequence number is automatically generated by the system.

Condition

The condition specified using the Elements, Functions, Operators etc. gets displayed here.

Result

Specify the result to be associated with the condition specified.

Elements

Specify the data elements to be used to define the formula for credit score calculation or select the element from the option list provided.

Functions

Select the mathematical function to be used to define the formula from the drop-down list provided.

Braces

Select the opening or the closing brace from the drop-down list provided, to define the credit score calculation formula.

Operators

Select the mathematical operator to be used to define the credit score calculation formula. You can select ‘+’, ‘-‘, ‘*’, or ‘/’.

Logical Operators

Select the logical operator to be used to define the credit score calculation formula. You can select ‘<’, ‘>‘, ‘=’, ‘<>’, ‘>=‘, ‘<=’, ‘AND’ or ‘OR’.

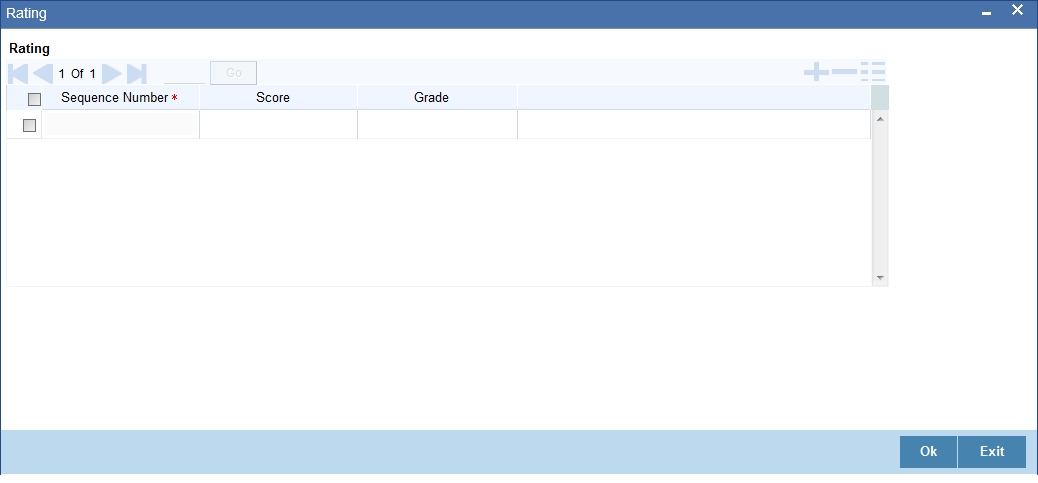

2.5.3 Specifying Credit Grades

You can maintain different credit grades based on the credit scores obtained. Click ‘Rating’ button in Rule Details screens to invoke the ‘Rating’ screen, where you can maintain these details.

You can specify the following details here:

Sequence Number

The sequence number is automatically generated by the system.

Score

Specify the score associated with a credit risk.

Grade

Specify the credit grade based on the score obtained.

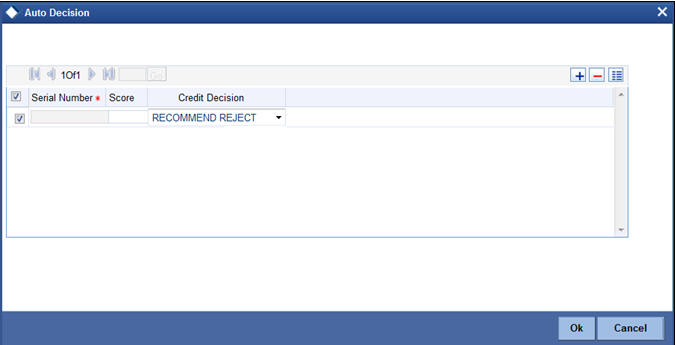

2.5.4 Specifying Auto Decision

You can maintain decisions based on the credit scores obtained to decide applicants eligibility for loan. Click ‘Auto Decision’ button in Rule Details screens to invoke the ‘Auto Decision’ screen, where you can maintain these details.

Serial Number

System generates the unique serial number for each auto decision status.

Score

Specify the maximum credit score for the applicant based on the auto decision.

Credit Decision

Specify the credit decision for the applicant based on the auto decision. You can select any of the following options from the drop-down list provided:

- AUTO APPROVED – Applications proceed to ‘Document Verification’ stage from ‘Underwriting’ stage. If this option is selected, ‘Loan Approval’ stage will be skipped.

- RECOMMEND-APPROVAL – Applications need to be approved manually in ‘Loan Approval’ stage after the ‘Underwriting Stage’.

- RECOMMEND-REJECT – Applications need to be approved manually in ‘Loan Approval’ stage after the ‘Underwriting Stage’.

- AUTO REJECTED – Applications proceed to the ‘Application entry’ stage from ‘Application verification’ stage again.

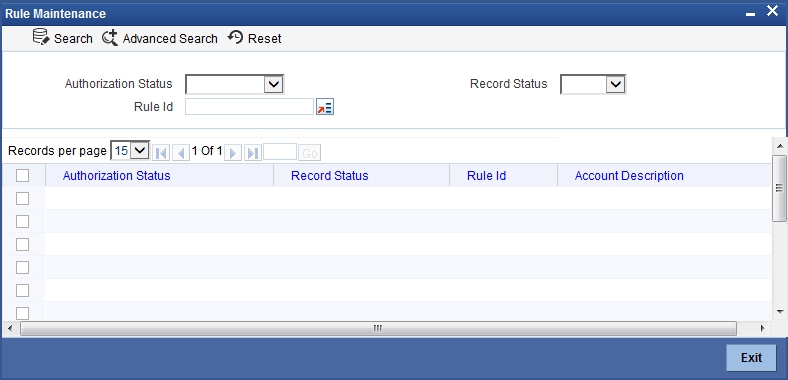

2.5.5 Viewing Credit Rule Summary

You can view a summary of the credit rules in ‘Rule Maintenance’ screen. You can also query for a particular record based on desired search criteria.

You can invoke this screen by typing ‘ORSRULMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify any of the following details to search for a record:

- Authorization Status

- Record Status

- Rule ID

Click ‘Search’ button to search for a record based on the search criteria specified. You can double click a desired record to view the detailed screen.

2.6 Credit Ratios

This section contains the following topics:

- Section 2.6.1, "Maintaining Credit Ratios"

- Section 2.6.2, "Specifying Formula Details"

- Section 2.6.3, "Viewing Credit Ratio Summary"

2.6.1 Maintaining Credit Ratios

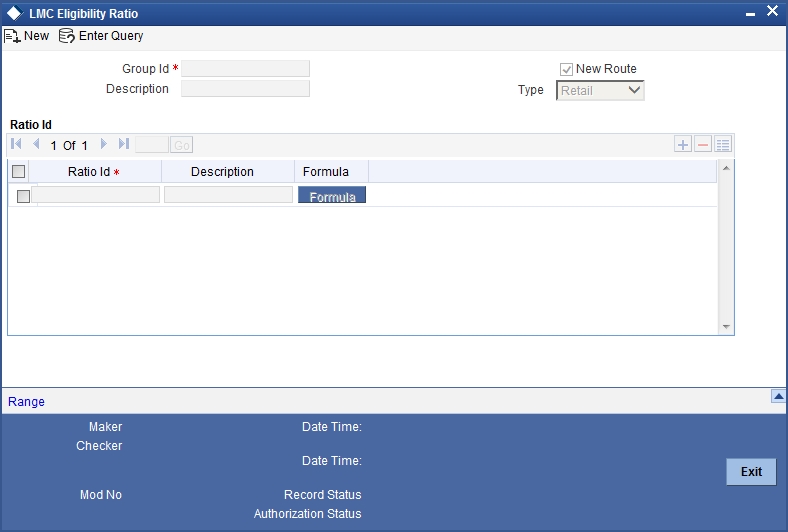

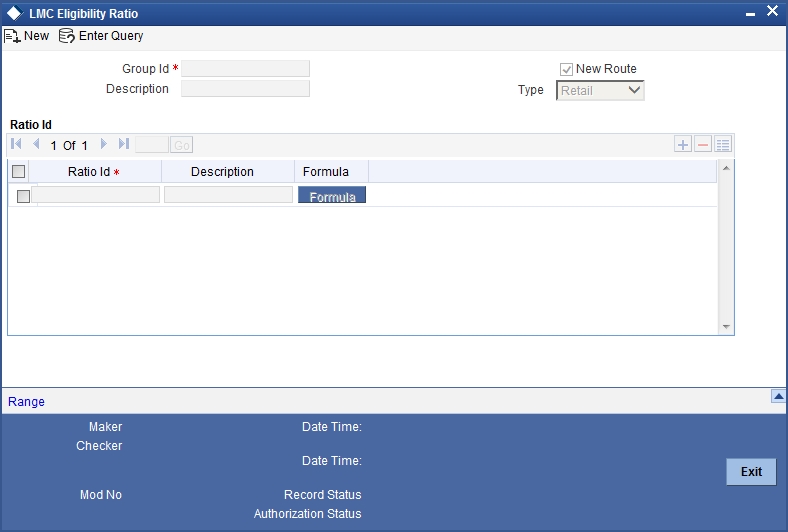

You can maintain the rules to calculate the credit ratios in ‘Credit Ratio Maintenance’ screen. You can invoke this screen by typing ‘ORDRATMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details in this screen:

Group ID

Specify a unique identification code for the ratio group.

Description

Specify a suitable description for the ratio group.

Type

Select the type of the loan from the following options available:

- Retail

- Corporate

Ratio ID

Specify a unique identification for the credit ratio being maintained.

Description

Specify a suitable description for the credit ratio.

2.6.2 Specifying Formula Details

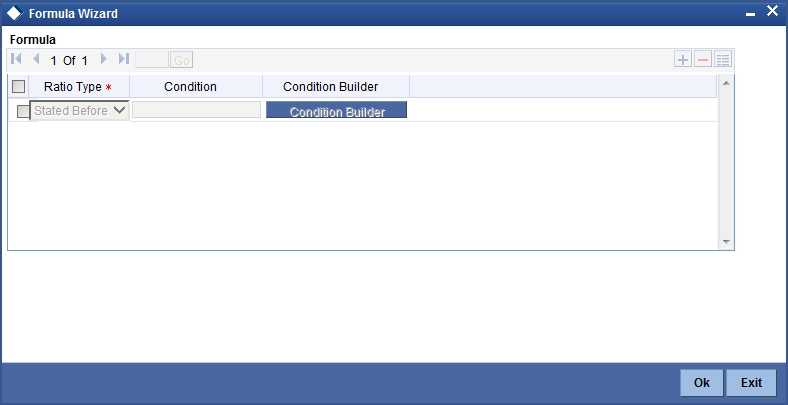

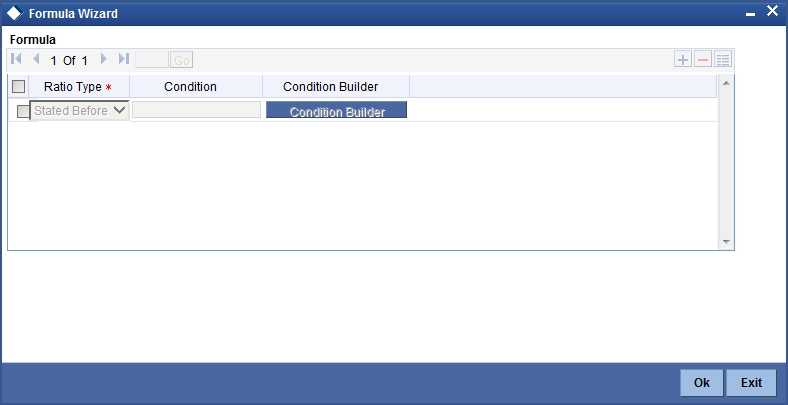

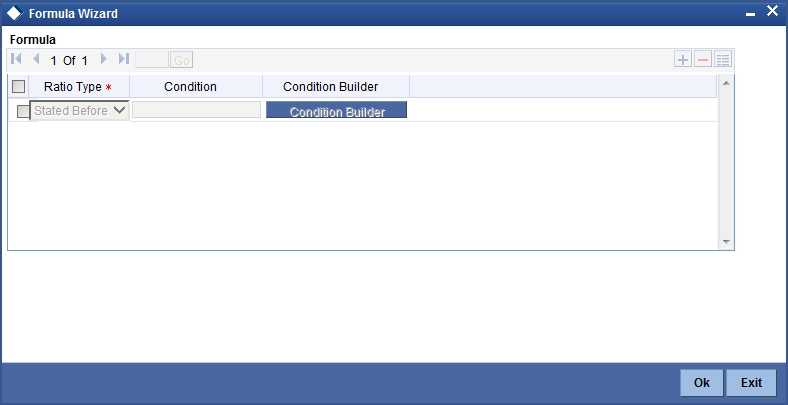

You can specify the formula to calculate the credit ratio by clicking the ‘Formula’ button corresponding to a ratio ID. The ‘Formula’ screen is displayed where you can specify the condition for calculating the credit ratio associated with a ratio ID.

You can specify the following details here:

Ratio Type

Select the type of the ratio being maintained, from the drop down list provided. The following options are available:

- Stated Before

- Stated After

- Actual Before

- Actual After

Condition

The condition specified using the Elements, Functions, Operators etc. gets displayed here.

Elements

Specify the data elements to be used to define the formula for credit ratio calculation or select the element from the option list provided.

Functions

Select the mathematical function to be used to define the formula from the drop-down list provided.

Braces

Select the opening or the closing brace from the drop-down list provided, to define the credit ratio calculation formula.

Operators

Select the mathematical operator to be used to define the credit ratio calculation formula. You can select ‘+’, ‘-‘, ‘*’, or ‘/’.

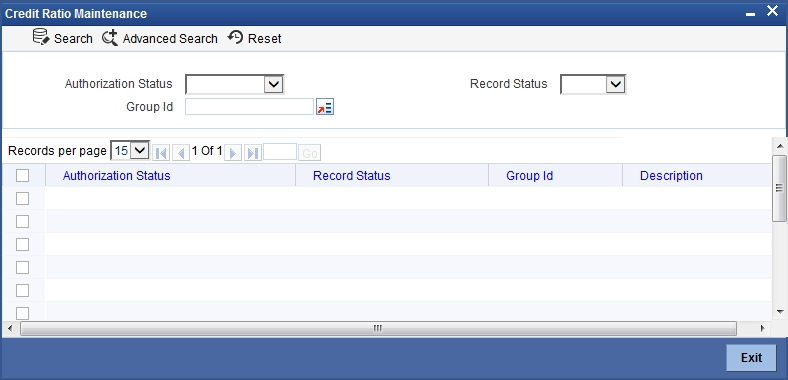

2.6.3 Viewing Credit Ratio Summary

You can view a summary of the credit ratios in ‘Credit Ratio Maintenance’ screen. You can also query for a particular record based on desired search criteria.

You can invoke this screen by typing ‘ORSRATMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify any of the following details to search for a record:

- Authorization Status

- Record Status

- Group ID

Click ‘Search’ button to search for a record based on the search criteria specified. You can double click a desired record to view the detailed screen.

2.7 Maintaining Ratio Details

You can define templates for calculating financial ratios taken from the balance sheet, income statement, statement of cash flows or statement of retained earnings within the product. You can capture the template related details through the ‘Ratio Template Definition’ screen.

You can invoke this screen by typing ‘ORDTEMDF’ in the field at the top-right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details:

Group Id

Specify the group id here.

Description

Specify a brief description of the group id you are maintaining.

Type

Select the credit ratio type from the adjoining drop-down list. This list displays the following values:

- Retail

- Corporate

- Ijarah

- Istisna

- Mudarabah

- Murabaha

- Mushraka

- Tawarooq

Ratio Id

Specify the ratio id here.

Description

Specify a brief description for the ratio id you are maintaining.

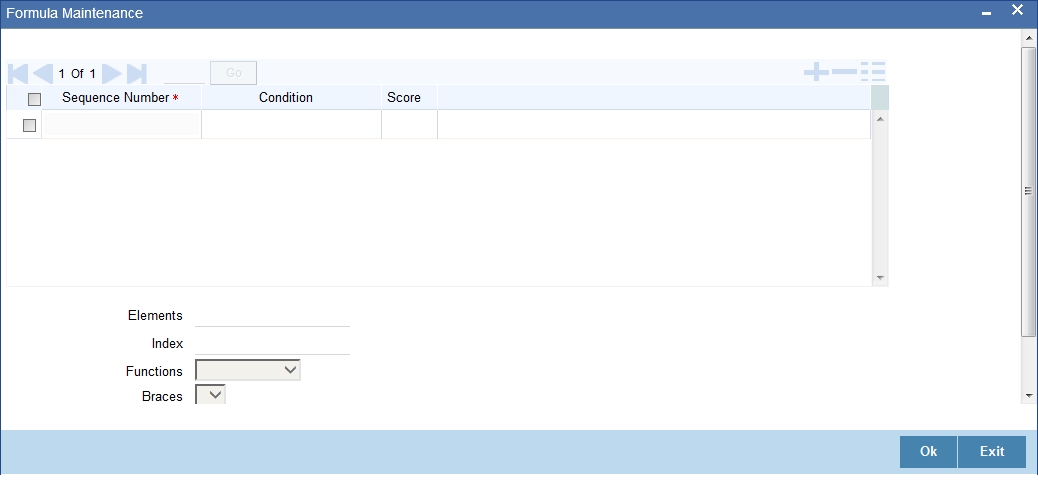

Click the ‘Formula’ button to build the ratio formula.

Specify the following details

Formula

Ratio Type

Select the ratio type from the adjoining drop-down list. This list displays the following values:

- Stated Before

- Stated After

- Actual Before

- Actual After

Condition

Specify the condition here. You can also maintain the condition in the ‘Condition Builder’ screen which is invoked by clicking the ‘Condition Builder’ button.

Specify the following details:

Condition

Specify the condition for the rule here.

Business Rule

Braces

Select the braces from the adjoining drop-down list.

Functions

Select the functions from the adjoining drop-down list.

Elements

Select the elements from the adjoining option list. This list displays all valid elements maintained in the system.

Operators

Select the mathematical operators from the adjoining drop-down list. This list displays the following values:

- Equal To

- Greater Than

- Greater Than or Equal To

- Less Than

- Less Than or Equal To

- Like

- Not Like

- Not Equal To

Logical Operators

Select the logical operators from the adjoining drop down list. This list displays the following values:

- And: Use ‘And’

- Or: Use ‘OR’

Value

Specify the value of the SDE to define the condition. The value may be numeric or alphanumeric, as required for the condition.

After building the condition, click the ‘Insert’ button to insert the same. To remove a condition, click the ‘Clear’ button in the screen.

2.8 Pricing Details

This section contains the following topics:

- Section 2.8.1, "Maintaining Pricing Details"

- Section 2.8.2, "Maintaining Pricing Formula"

- Section 2.8.3, "Maintaining Pricing Offer"

- Section 2.8.4, "Viewing Pricing Details Summary"

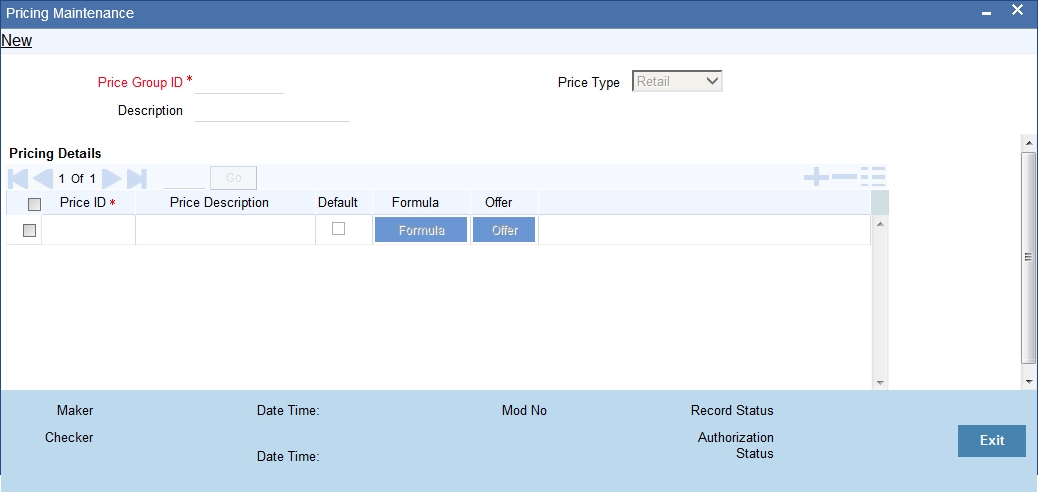

2.8.1 Maintaining Pricing Details

Oracle FLEXCUBE allows you to maintain pricing groups and apply a suitable pricing rule to an application category during corporate loan origination. The pricing rule automatically selects the best matched loan offer for the loan application from the available offers for the application category.

You need to maintain pricing groups and define the price IDs and formulae for the group using ‘Pricing Details’ screen. To invoke the screen, type ‘ORDPRCMT’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Specify the following details:

Pricing Group ID

Specify a unique name to identify the price group.

Description

Specify a brief description of the price group.

Price Type

Specify the price type associated with the price group. You can choose one of the following price types:

- Corporate

- Retail

Pricing Details

Specify the following details.

Price ID

Specify a unique price ID.

This price ID can be applied to a loan at underwriting stage.

Price Description

Specify a brief description of the price ID.

Default

Check this box to set this as the default price ID for the price group that you maintain.

2.8.2 Maintaining Pricing Formula

Click ‘Formula’ button to define the pricing rule for each price ID. You can define the formula using origination system elements in Oracle FLEXCUBE.

Sequence Number

Specify the sequence number.

Condition

Specify the possible data or the data limits here. The supported operators are:

Operator |

Description |

= |

Equals To |

> |

Greater Than |

>= |

Greater Than (or) Equals To |

< |

Less Than |

<= |

Less Than (or) Equals To |

Score

Specify the score for each condition.

Elements

Select the element from the adjoining option list.

If the loan requested details satisfies the condition specified in the pricing maintenance then the corresponding score gets added. If the details do not satisfy the condition then zero will be considered as default score.

Functions

Select the mathematical function to be used to define the formula from the drop-down list provided.

Braces

Select the opening or the closing brace from the drop-down list provided, to define the credit score calculation formula.

Operators

Select the mathematical operator to be used to define the credit score calculation formula. You can select ‘+’, ‘-‘, ‘*’, or ‘/’.

Logical Operators

Select the logical operator to be used to define the credit score calculation formula. You can select ‘<’, ‘>‘, ‘=’, ‘<>’, ‘>=‘, ‘<=’, ‘AND’ or ‘OR’.

Based on the formula and the loan application category, the system automatically applies a price ID to the application. You can apply a different price ID that matches the application only at the Underwriting Stage.

If you change a price ID selected by the system and reapply a different price ID, the system changes the score of the pricing rule. The score determines the price ID to be automatically applied.

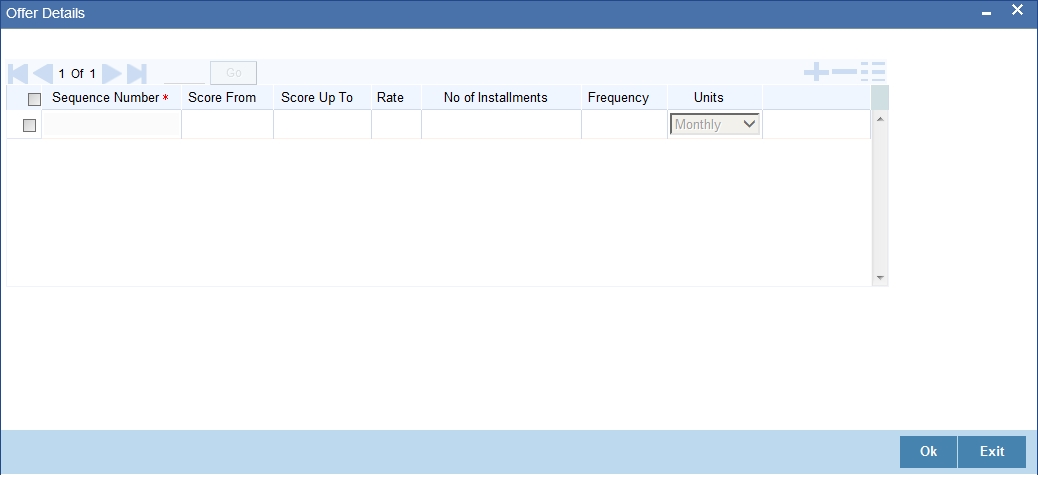

2.8.3 Maintaining Pricing Offer

Click ‘Pricing’ button to define the pricing rule for each price ID for the user to pick up the offer for the loan.

You can specify the following details here:

Sequence Number

System generates the sequence number.

Score From

Specify the start credit score to pick the offer for the loan.

Score Up To

Specify the end credit score to pick the offer for the loan.

Rate

Specify the rate to be picked up for the score.

No of Instalments

Specify the number of instalments for the offer.

Frequency

Specify the frequency of the offer.

Units

Select the frequency unit from the adjoining drop-down list. You can select one of the following:

- Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

- Bullet

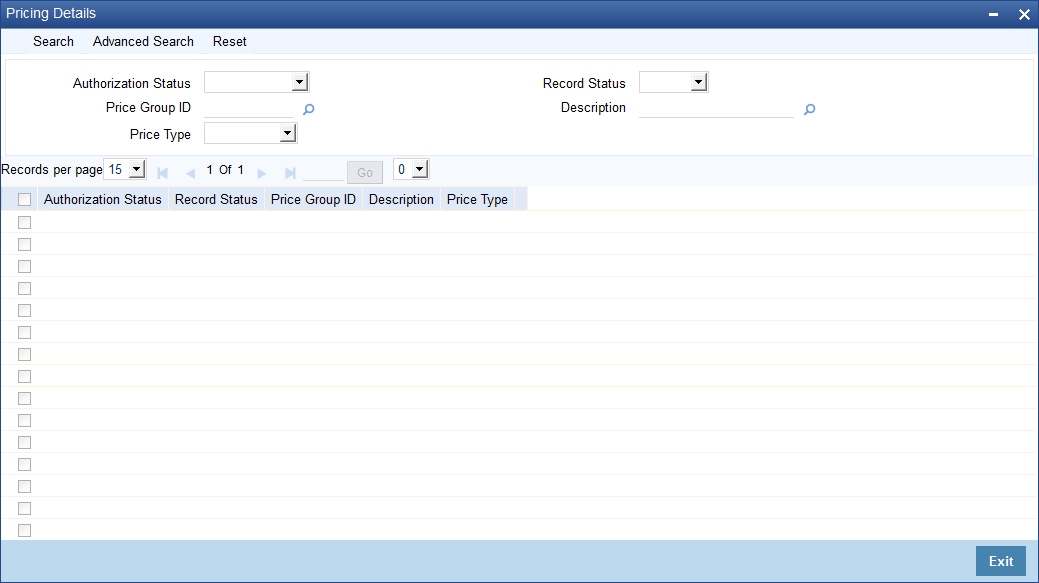

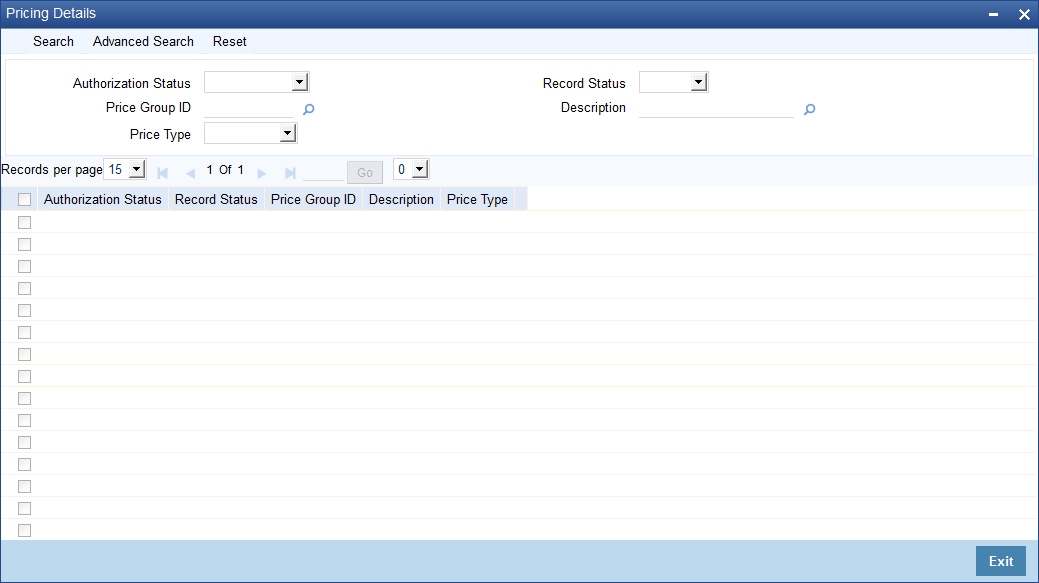

2.8.4 Viewing Pricing Details Summary

You can view the pricing details maintained in the ‘Pricing Details’ screen. To invoke the screen, type ‘ORSPRCMT’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

In this screen, you can base your queries by providing any or all of the following criteria:

- Application Status

- Price Group ID

- Price Type

- Record Status

- Description

Based on the details provided, system displays the following details:

- Authorization Status

- Record Status

- Price Group ID

- Description

- Price Type

2.9 Stages in Corporate Loan Origination

The different stages in corporate lending process flow are designed using Oracle BPEL framework. The process of loan origination consists of several manual as well as system tasks, carried out in a sequential manner. Many users can be involved in the completion of a transaction and at each stage of the process, a user or a group of users, assigned with a task, acquire and work on the relevant transaction.

Oracle Business rules that are embedded help the dynamic creation of multiple approval stages. The different stages and sub-stages in the process flow can be summarized as follows:

- Application Entry

- Information captured in this stage include

- Applicant Information

- Corporate Information

- Directors Information

- Application details

- Requested Loan Details

- Facility Information

- Collateral Details

- Checklist

- Documents

- Application Verification

- Internal KYC

- External KYC

- Underwriting

- Collateral Valuation Information

- Applicant Financial Ratios

- Applicant Credit Score

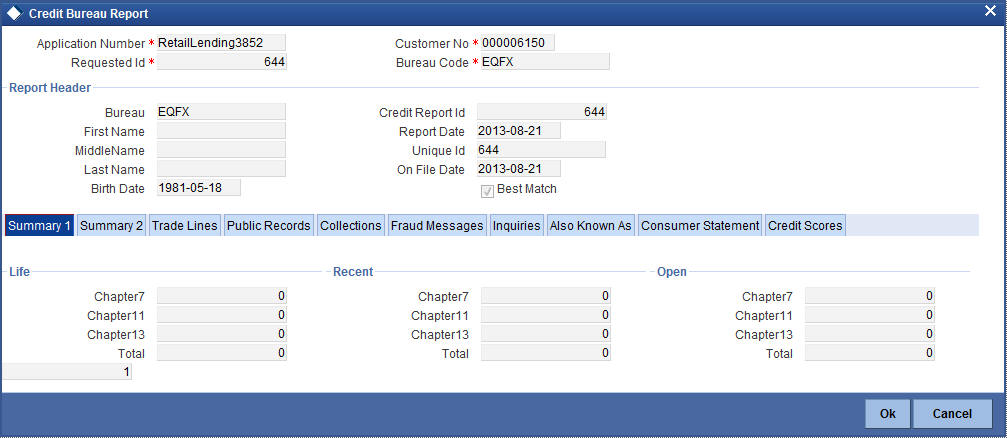

- Applicant Bureau Report

- Loan Offers

- Loan Schedules

- Loan Charges

- Field Investigation

- Document Capture

- Advice Generation

- Loan Approval

- Document Verification

- Information captured during Previous stages are verified

- All documents obtained are verified against checklist

This section contains the following details:

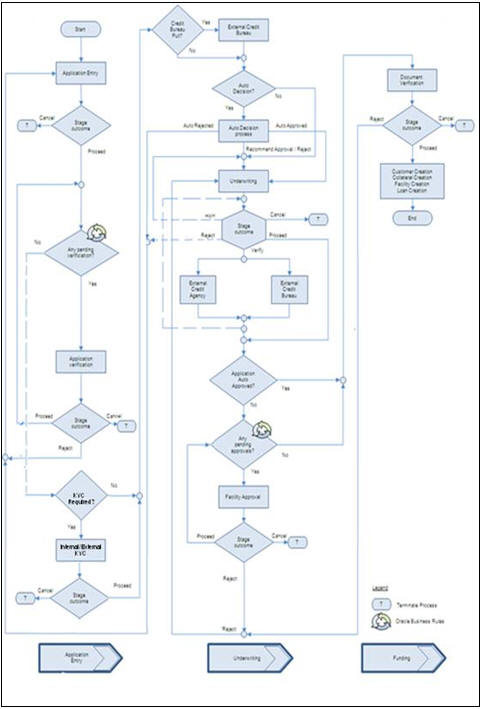

2.9.1 Process Flow Diagram

The process flow diagram given below illustrates the activities carried out during the different stages of the workflow.

The various tasks carried out in these stages will be explained in detail in the subsequent sections.

2.9.2 Process Matrix

The process matrix given below lists out the different stages, the user role handling each stage, the function Ids involved and the exit points for each stage.

Stage |

Stage Title |

Description |

Function ID |

Exit point |

1 |

Application Entry |

The following details are captured as part of this stage Application Details Applicant Details Requested Lending Details Collateral Details Check List User Defined Fields and Comments Document Capture Advice Generation |

ORDCLAPP |

PROCEED, CANCEL |

2 |

Application Verification |

The details captured as part of ‘Application Entry’ stage is verified |

ORDCLVER |

PROCEED, RETURN, CANCEL |

3 |

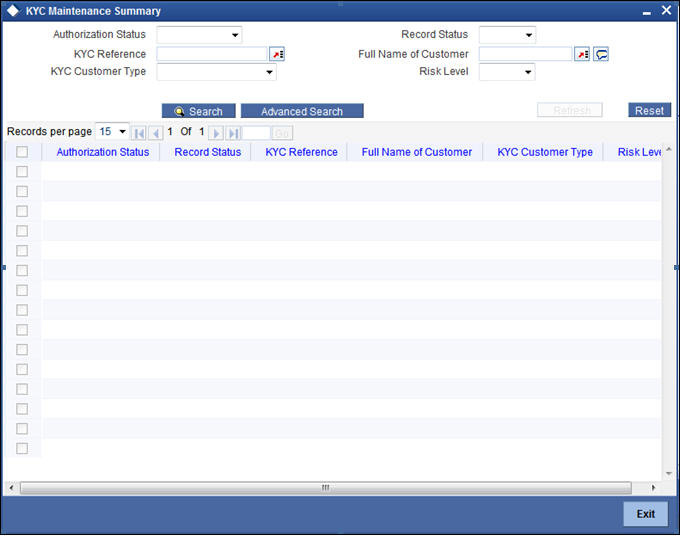

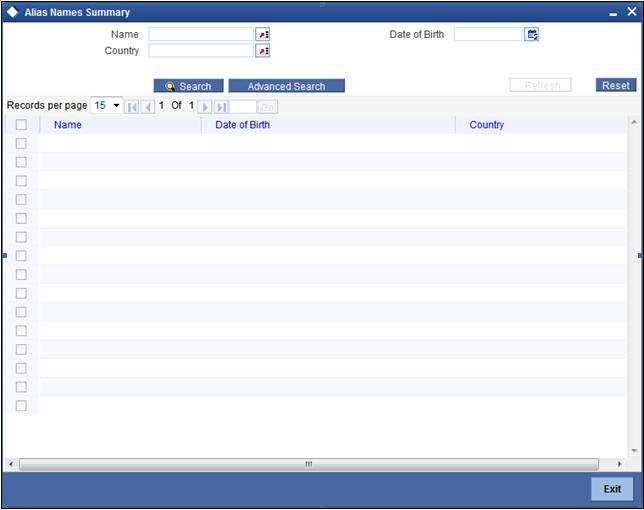

Internal KYC |

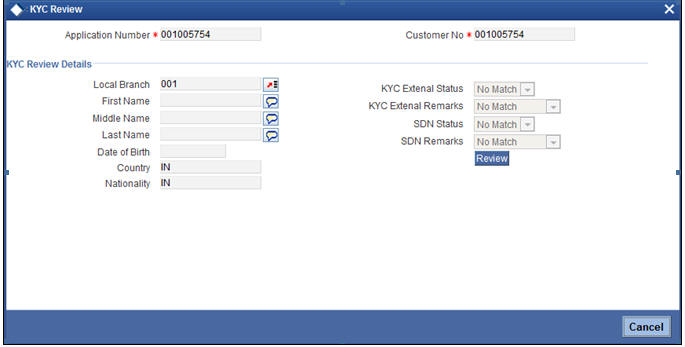

The applicant will be verified for the internal KYC check |

ORDCLIKC |

PROCEED, CANCEL |

4 |

External KYC |

The applicant will be verified for the external KYC check |

ORDCLEKC |

PROCEED, CANCEL |

5 |

Underwriting |

The following details are captured as part of this stage Collateral Valuation Information Applicant Financial Ratios Applicant Credit Score Applicant Bureau Report Loan Offers Loan Schedules Loan Charges Field Investigation Document Capture Advice Generation |

ORDCLUND |

VERIFY PROCEED, RETURN, CANCEL |

6 |

Loan Approval |

Facility Approval |

ORDCLAPR |

PROCEED, RETURN, CANCEL |

7 |

Document Verification |

Document Verification Final Verification Customer Creation Loan Account Creation Advice Generation |

ORDCLDVR |

PROCEED, RETURN, CANCEL |

8 |

Manual Retry |

This stage is optional. Task will be moved to this stage only when the system is unable to create Customer/ Customer Account/ Liability/ Facility/ Collateral/ pool/ Loan. You can make the necessary changes & retry. |

ORDCLMCU |

PROCEED |

The stages are explained in detail in the sections that follow.

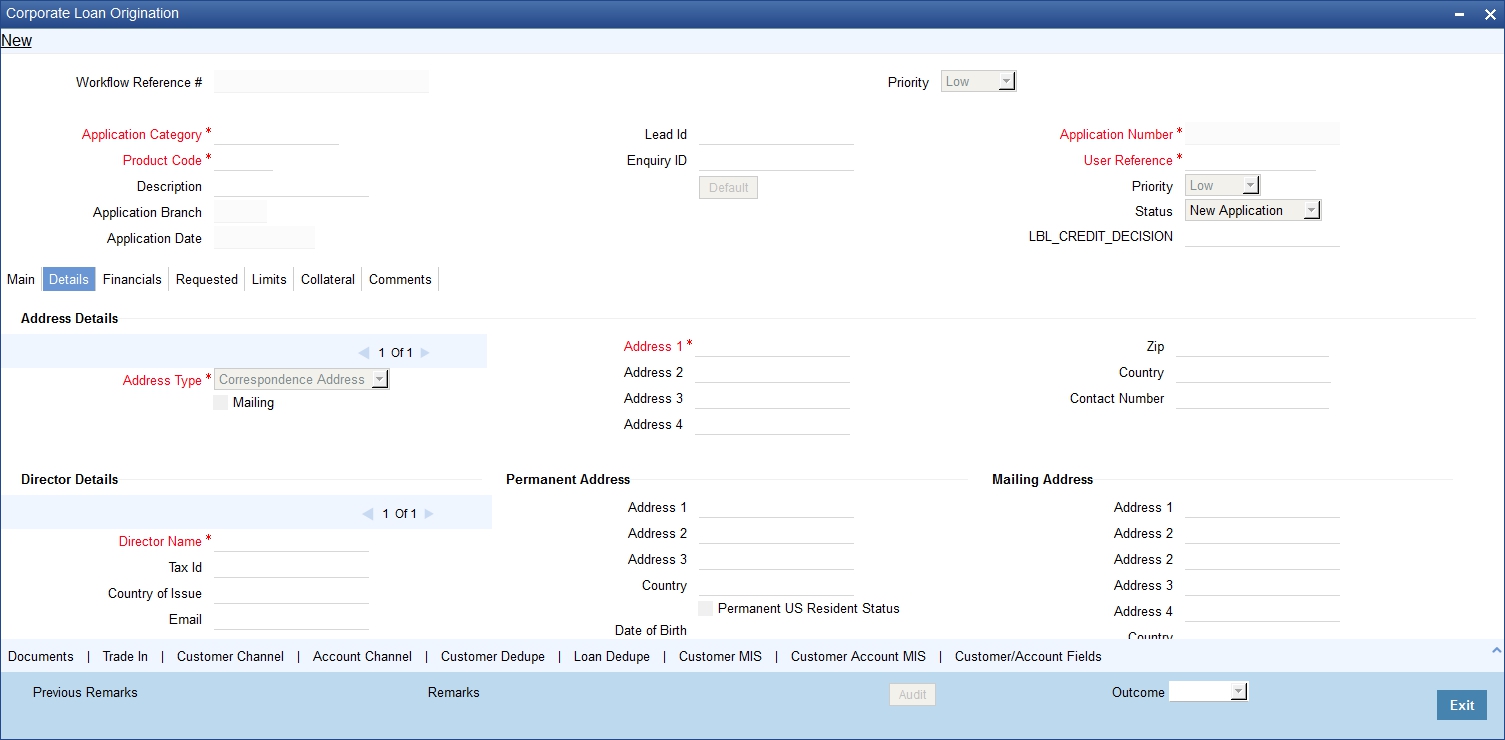

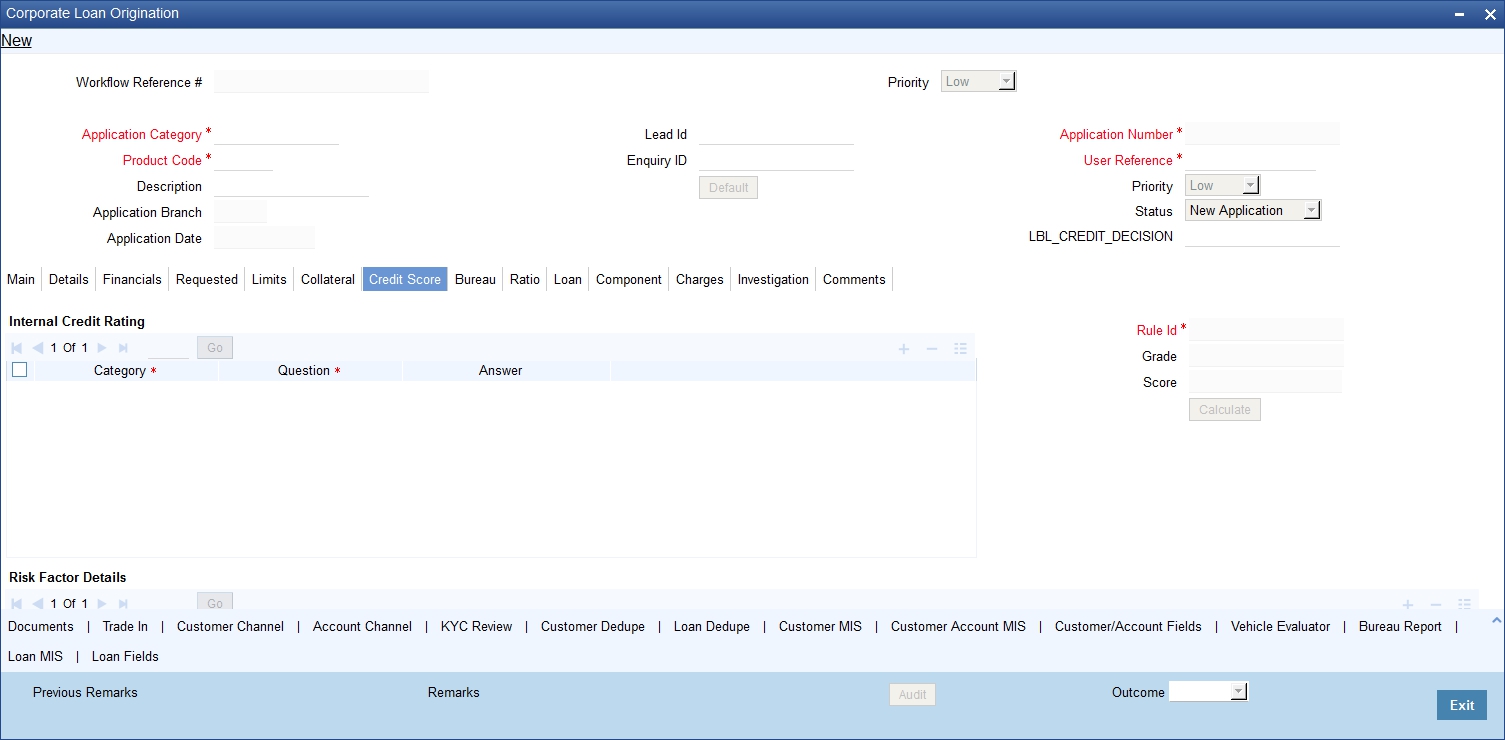

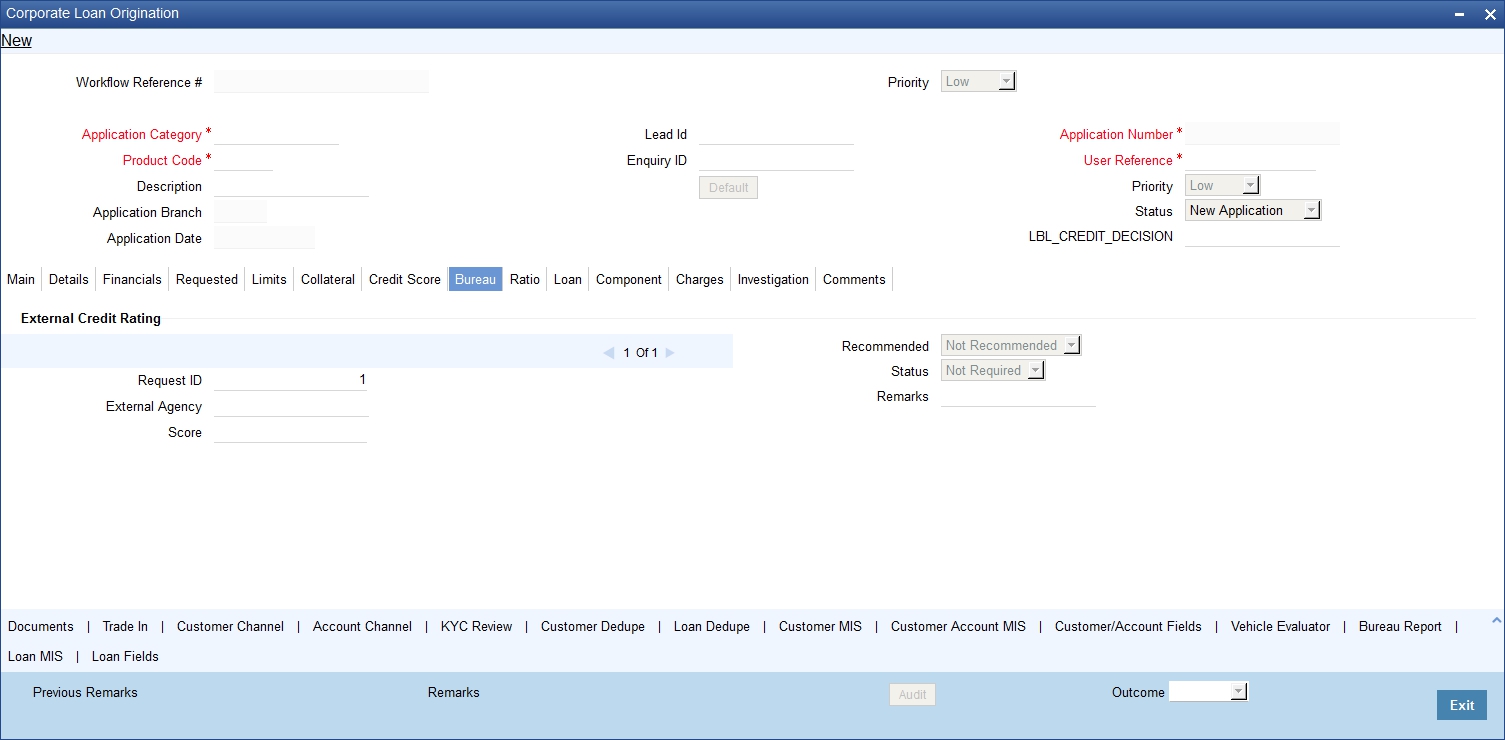

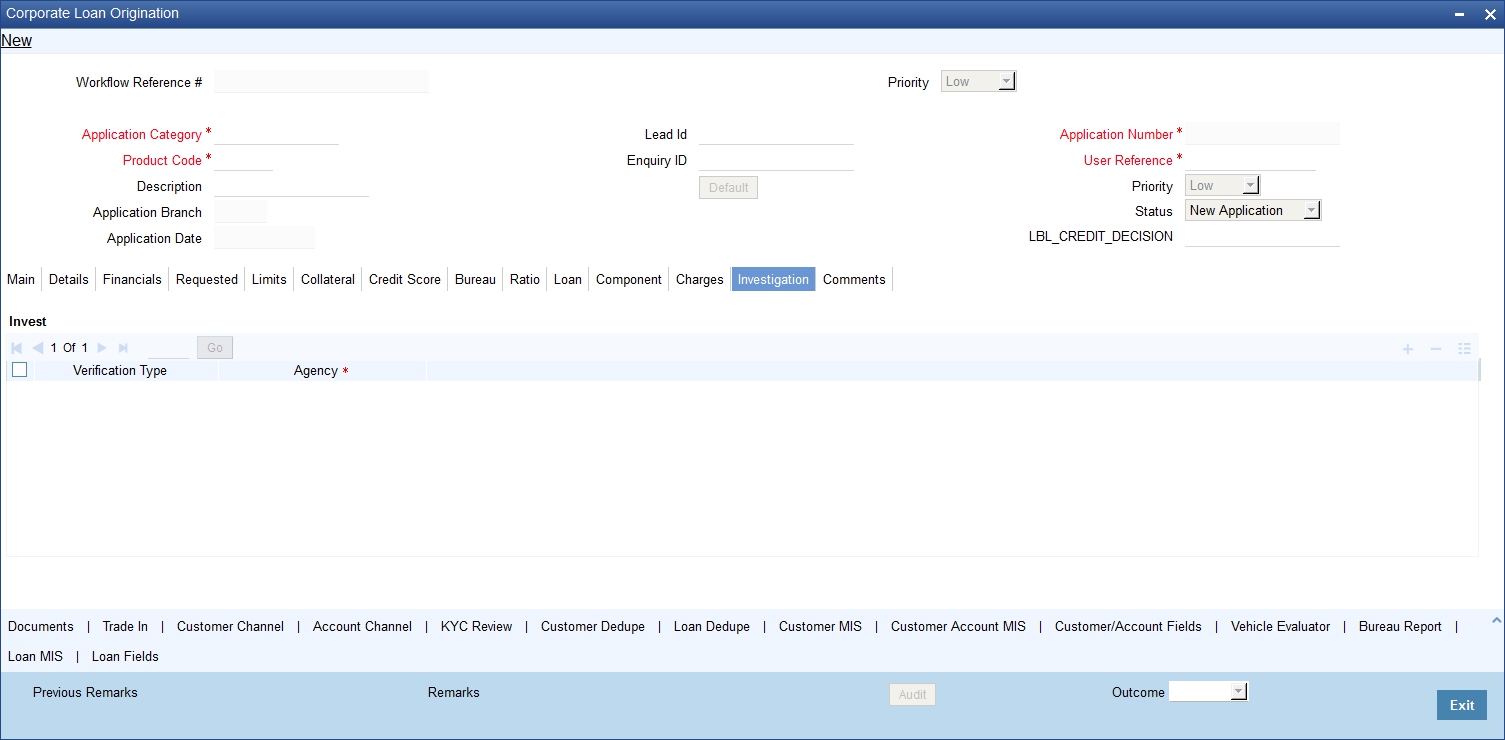

2.10 Application Entry

In this stage, the bank receives an application requesting for the creation of a facility from a prospective borrower/customer. The relevant documents and financial statements are also provided by the customer. If the applicant/borrower does not have an account but intends to open one, the bank also obtains the account opening form and related documents as part of this activity.

The following details are captured in this stage:

- Applicant information

- Applicant contact information

- Director’s information

- Corporate information

- Facility

- Loan details

- Collateral details

Documents obtained from the applicant are also uploaded during this stage.

This section contains the following details:

- Section 2.10.1, "Making Corporate Loan Application Entry"

- Section 2.10.2, "Main Tab"

- Section 2.10.3, "Details Tab"

- Section 2.10.4, "Financials Tab"

- Section 2.10.5, "Limits Tab"

- Section 2.10.6, "Collaterals Tab"

- Section 2.10.7, "Requested Tab"

- Section 2.10.8, "Comments Tab"

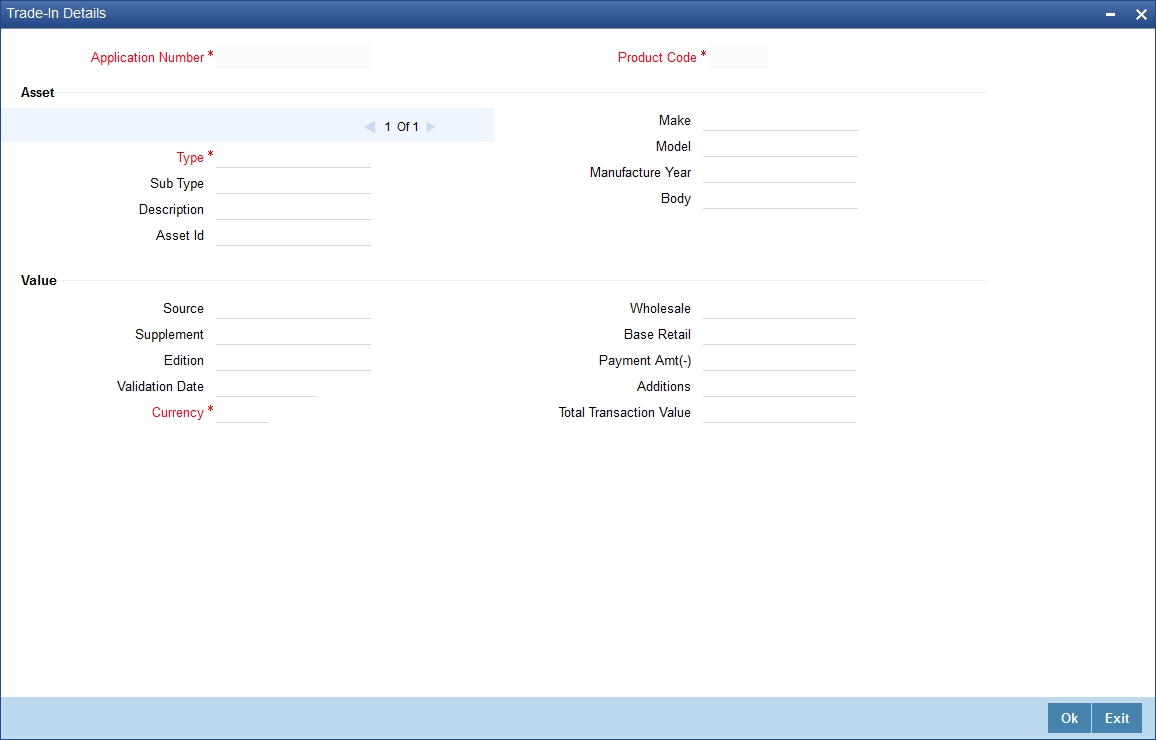

- Section 2.10.9, "Capturing Document Details"

- Section 2.10.10, "Capturing Trade In Details"

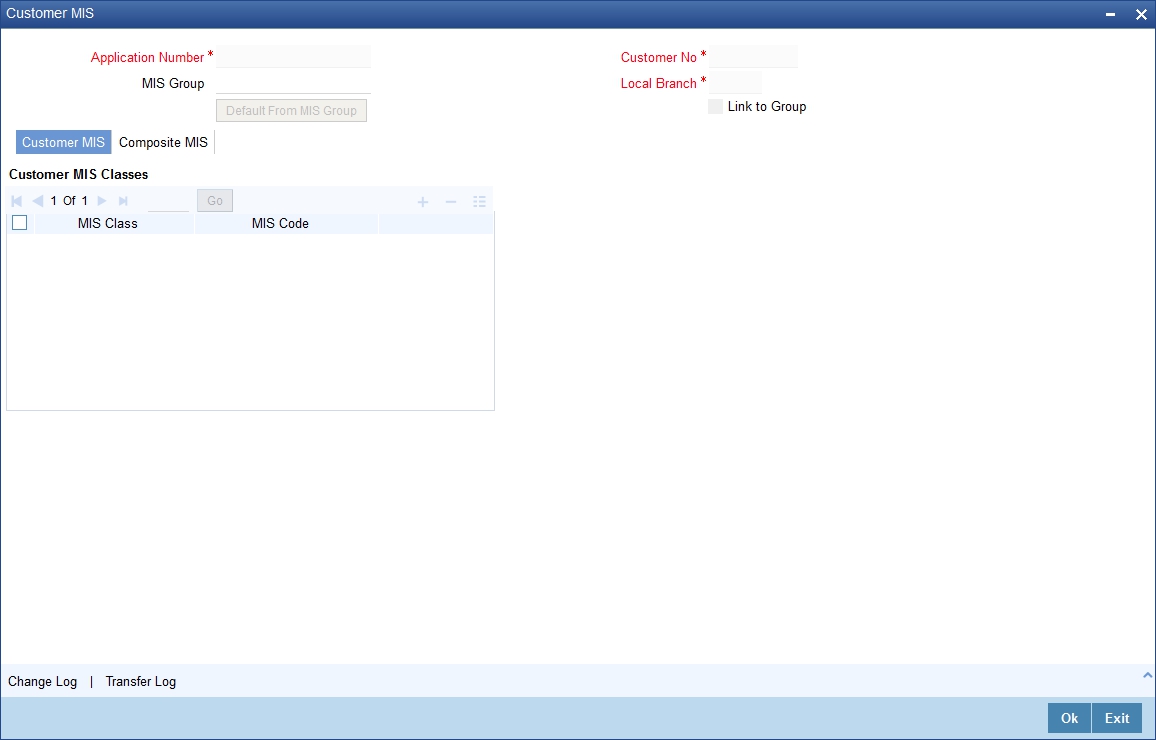

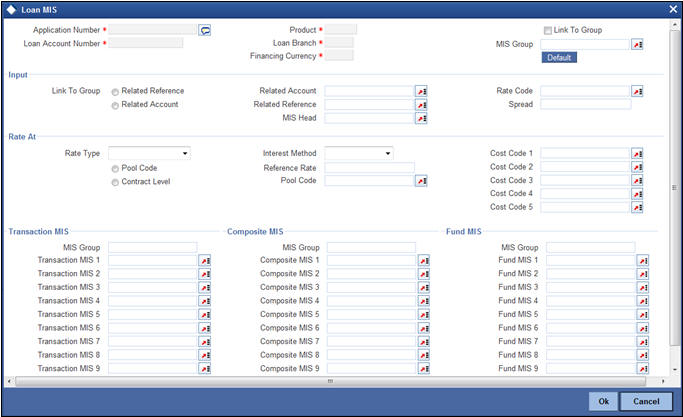

- Section 2.10.13, "Capturing Customer MIS"

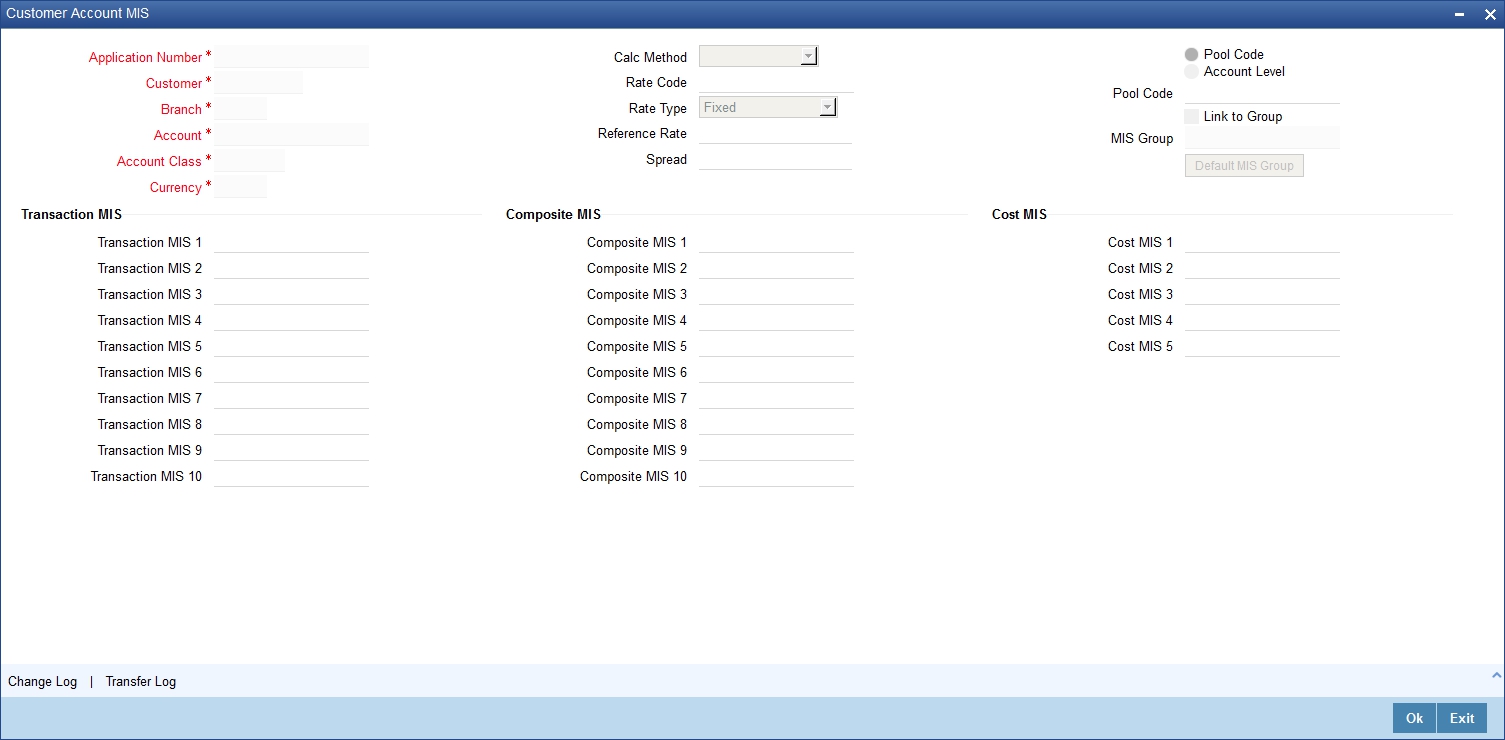

- Section 2.10.14, "Capturing Customer Account MIS"

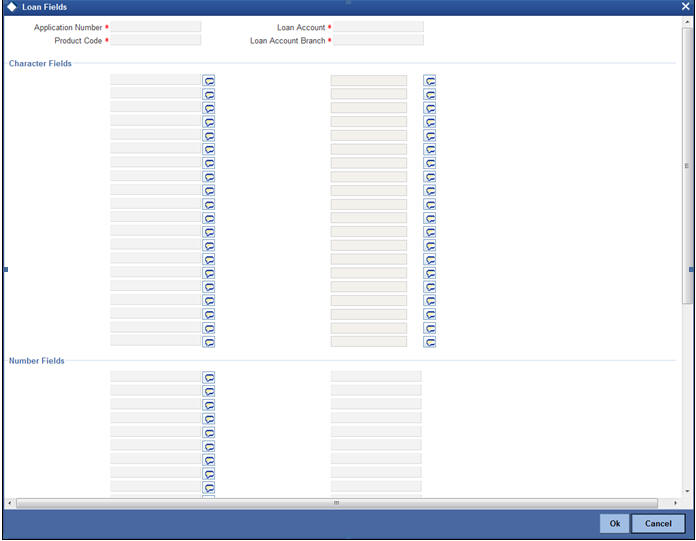

- Section 2.10.15, "Specifying Customer/Account Fields"

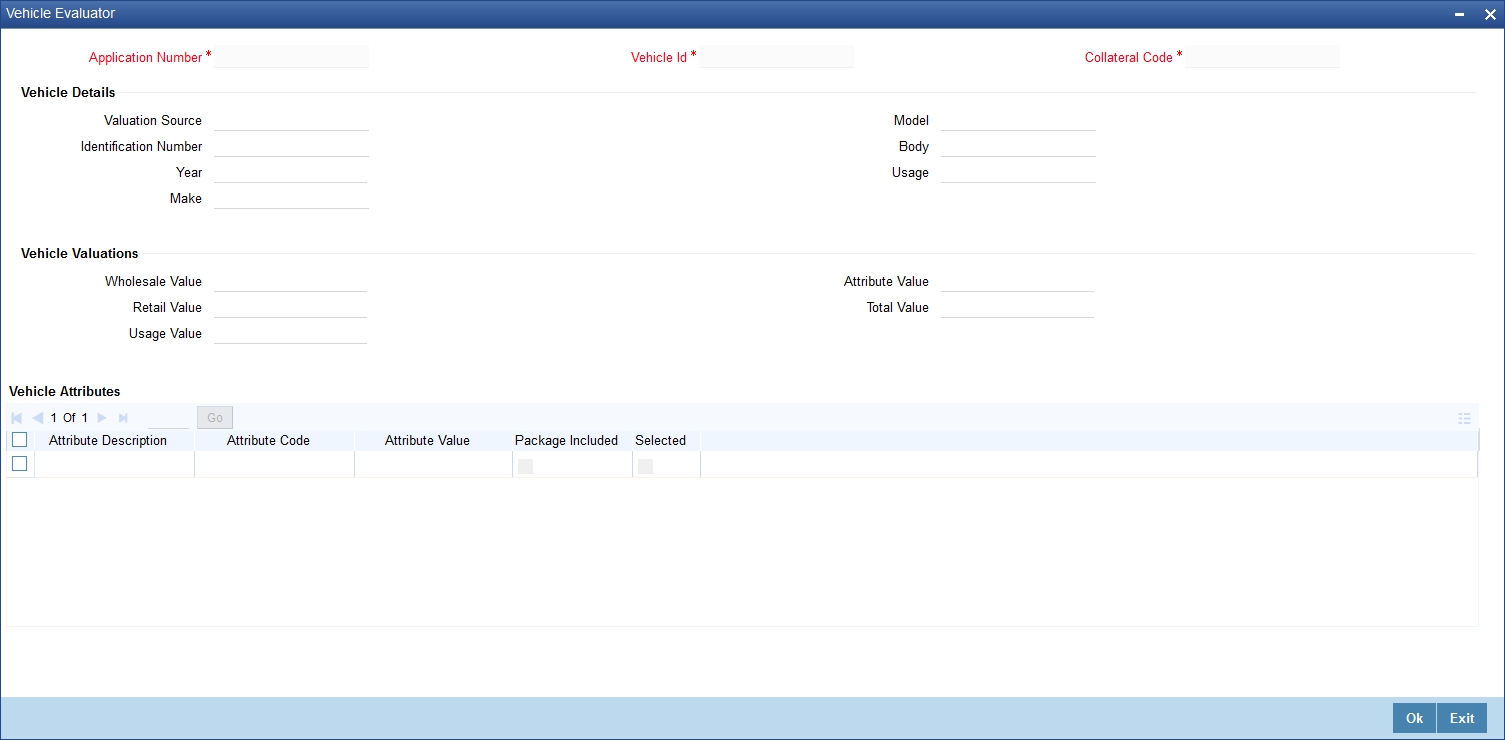

- Section 2.10.16, "Viewing Vehicle Evaluator"

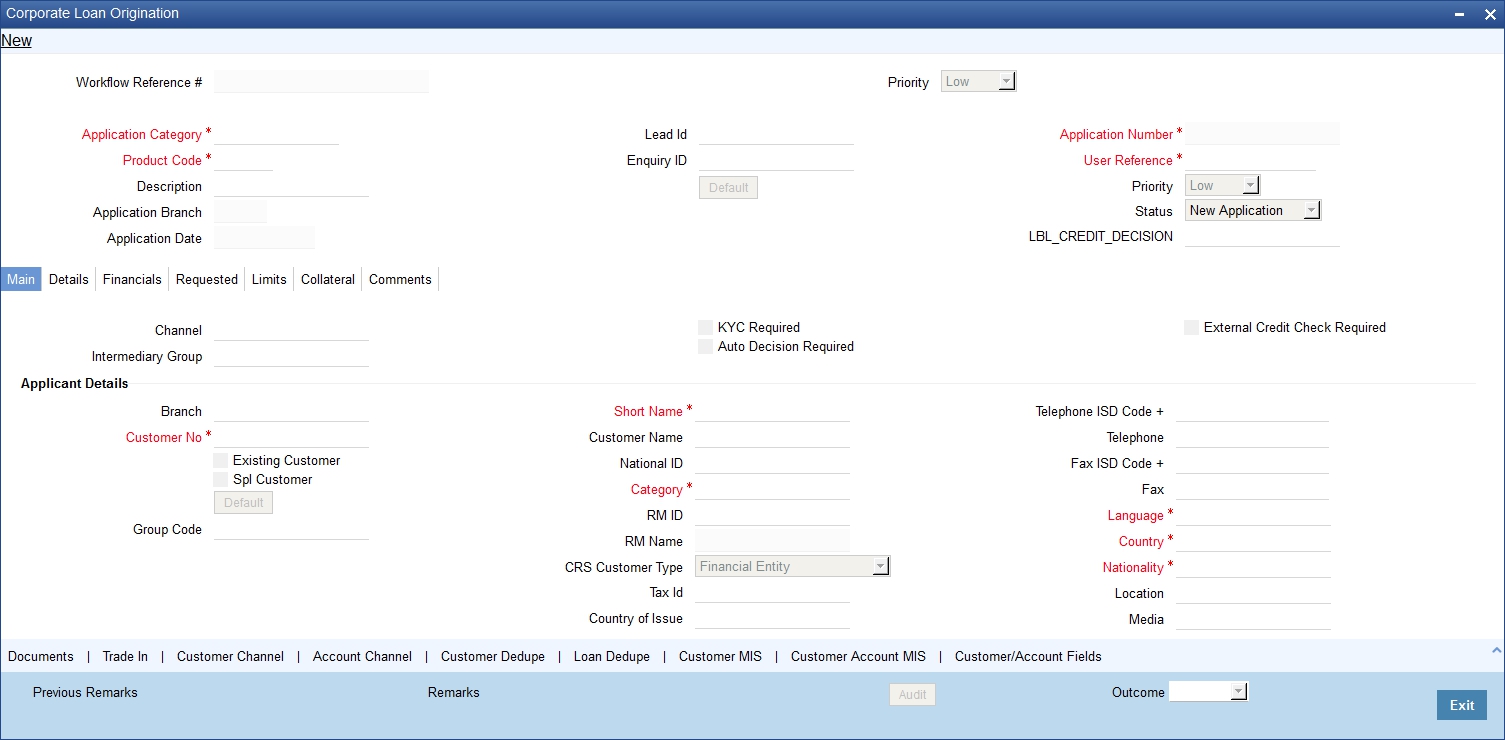

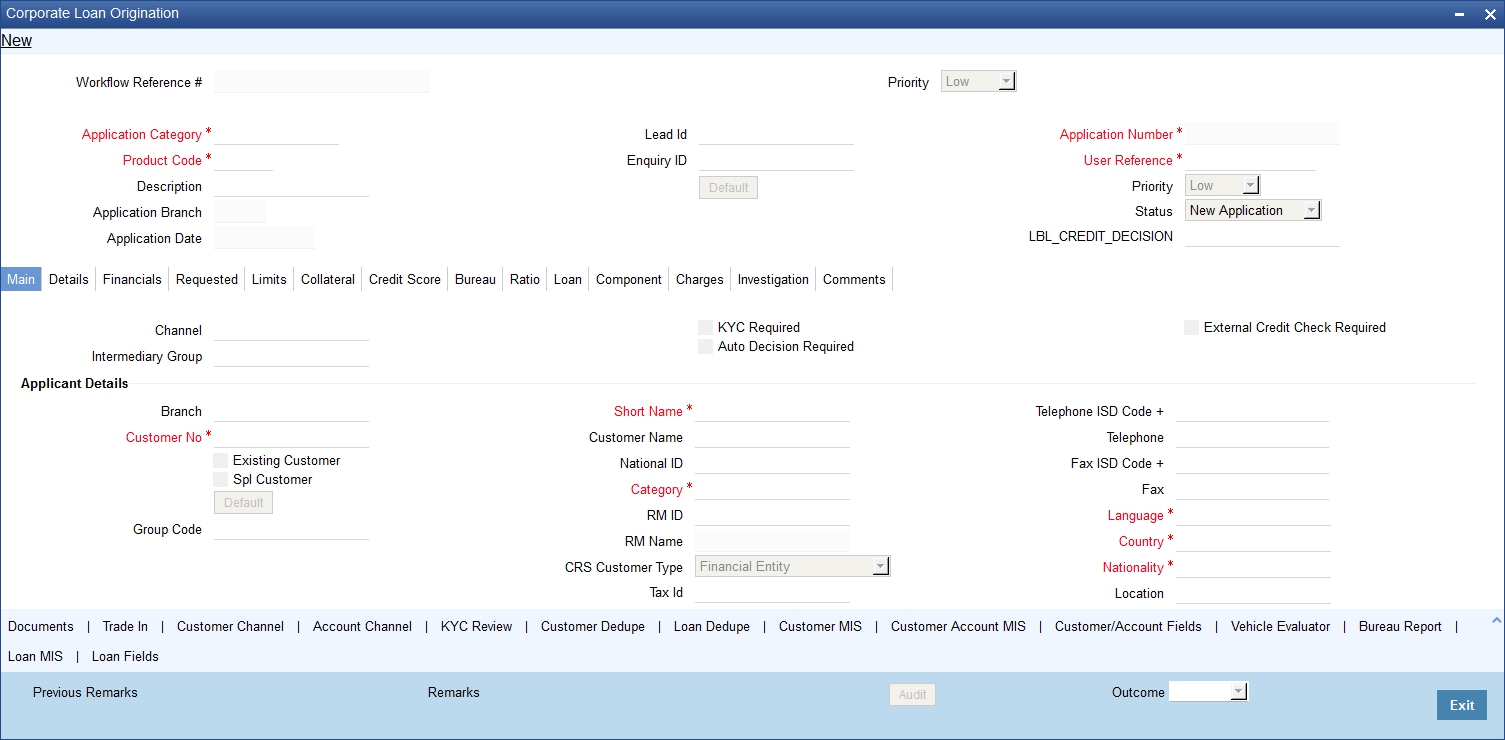

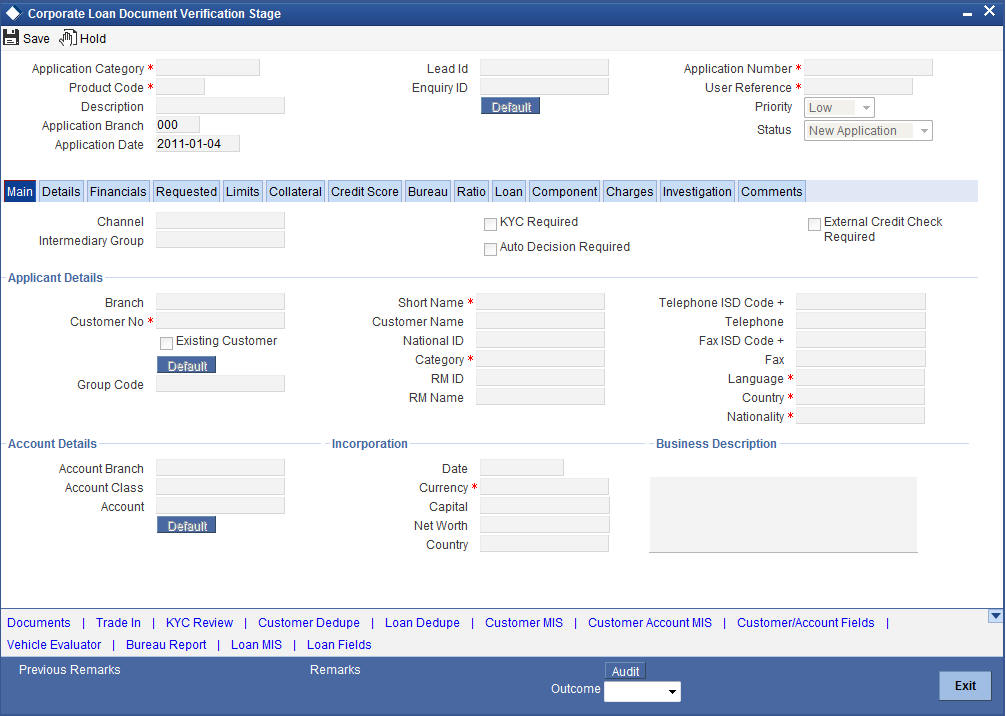

2.10.1 Making Corporate Loan Application Entry

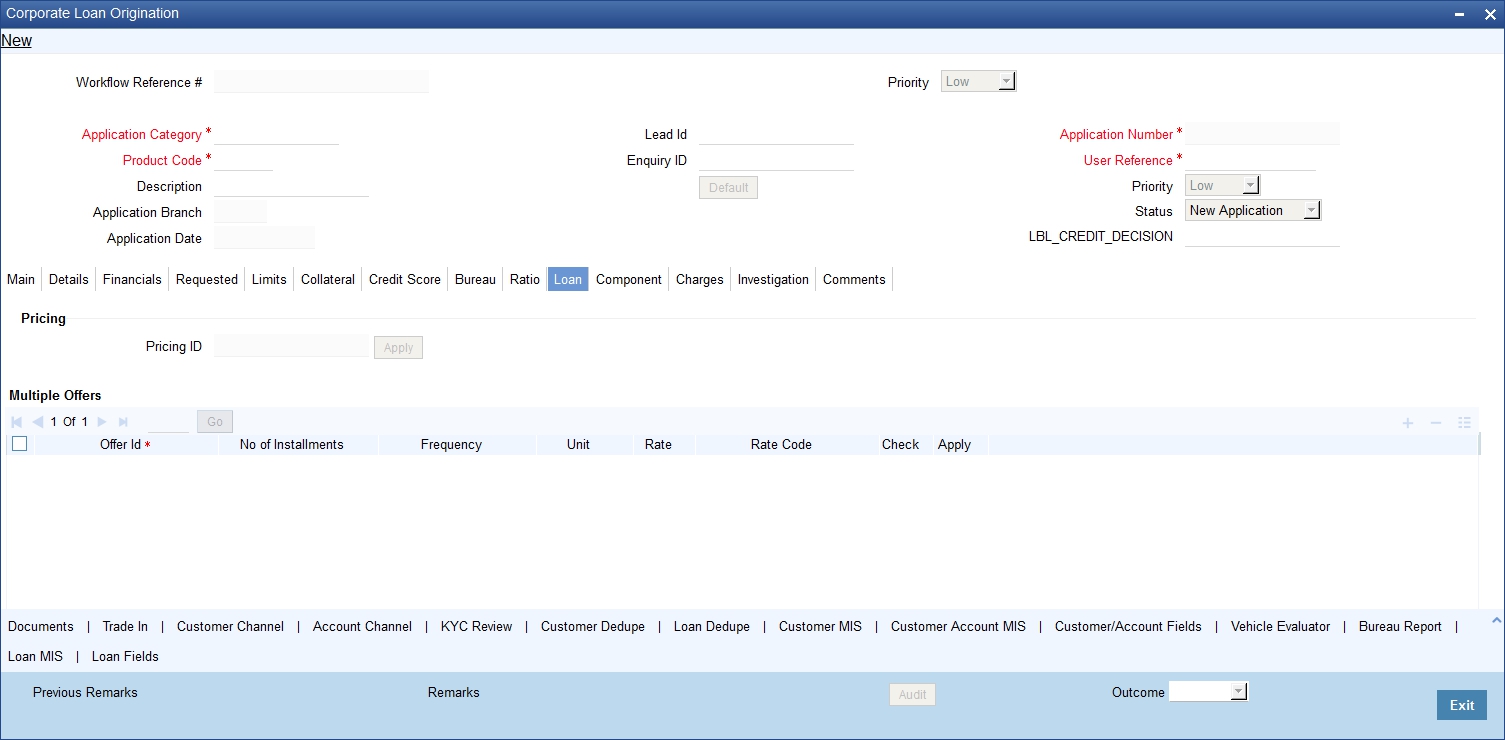

You can key-in the loan application details required in ‘Corporate Loan Application Entry’ screen. You can also invoke this screen by typing ‘ORDCLAPP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The Application Number is automatically generated by the system. You can capture the following details in the main screen:

Application Category

Specify the loan application category to be used or select the application category from the option list.

Product Code

Select the product from the adjacent option list. The list displays only the corporate CL products created in Oracle FLEXCUBE.

Description

System displays the description of the selected product code.

Application Branch

System displays the current branch code.

Application Date

System displays the application date.

Lead ID

Specify a unique identification for the prospective loan customer.

Enquiry ID

Specify an enquiry Id, if you wish to retrieve information on the loan offer selected by the customer. You can also select the ID from the adjoining option list. The list contains all the Enquiry IDs created for the customer as part of the loan simulation process.

Application Number

System displays the application number.

User Reference

Specify the user reference number for the loan application. If you do not specify the reference number, system generates it when you click on the ‘Default’ button.

Priority

Select the priority for the creating export LC from the adjoining drop-down list. This list displays the following options:

- Low

- Medium

- High

Status

The status of the application gets displayed here.

Click ‘Default’ button to default the details related corresponding to the prospective loan customer.

2.10.2 Main Tab

In ‘Main’ tab, you can capture the details associated with the loan applicant. The customer details corresponding to the Application Category specified are displayed here. You can modify these details, if required.

Channel

Specify the channel ID of the originating channel.

Intermediary Group

Specify the identification code of the intermediary group if the customer has been associated with any.

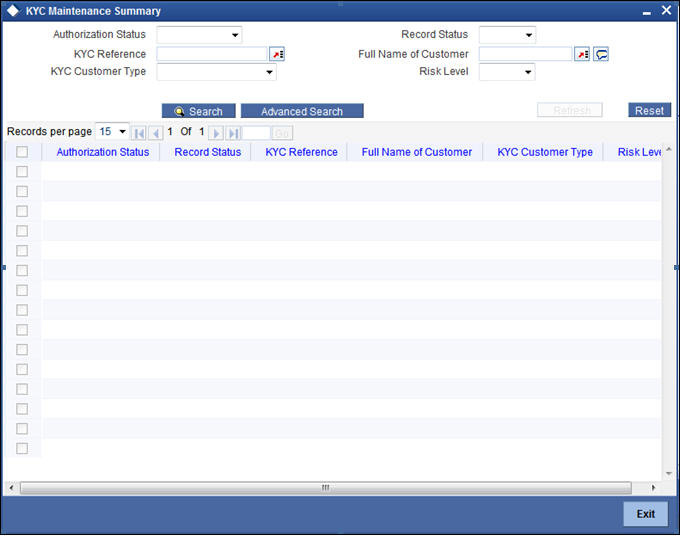

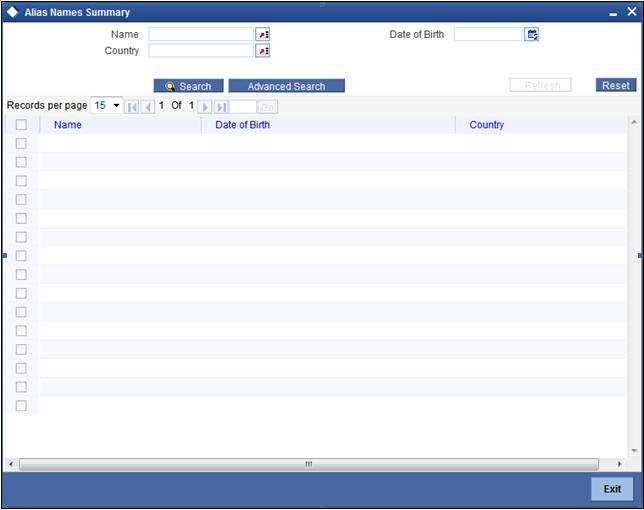

KYC Required

Check this box to indicate that the customer verification is required for this applicant.

If you check this box, the system will evaluate a business rule. Based on that rule, the system initiates internal KYC or External KYC or both during application entry and verification stage.

If you do not check this box, the system then system skips the Internal KYC and External KYC stages after completing the application entry and verification stages.

Auto Decision Required

Check this box to enable auto decision on loan application. If you check this box, based on the applicant credit score – auto decision mapping maintained in ‘Auto Decision’ screen, the system decides whether to approve, reject, recommend approval or recommend rejection of the application.

External Credit Check Required

Check this box to enable external credit bureau service for credit evaluation of the loan applicant.

If you check this box, the system will automatically initiate external credit check. The credit check initiation happens before underwriting stage.

Applicant Details

Existing Customer

Check this box to indicate if the customer applying for the loan is an existing customer of the bank.

Local Branch

Specify the applicant’s home branch.

Account branch

Specify the applicant’s account branch.

Customer No

For existing customers you need to select the customer number from the option list provided.

Group Code

Select the group code from the adjoining option list.

National ID

Specify the national ID.

CRS Customer Type

Select the CRS customer type for which the maintenance is done from the drop-down list. The list displays the following options:

- Individual

- Financial Entity

- Active Non-Financial Entity

- Passive Non-Financial Entity

Tax ID

Specify the tax identification number (TIN) of the customer.

Country of Issue

Specify the country which has issued the tax ID for the customer. Alternatively, you can select the country from the option list.

Additional Tax ID Details

The system displays the following tax details:

- Tax ID

- Country of Issue

Click ‘Default’ button to default the details of existing customers.

Note

For more details on capturing Customer details, refer the chapter titled ‘Maintaining Customer Information Files’ in Core Entities user manual.

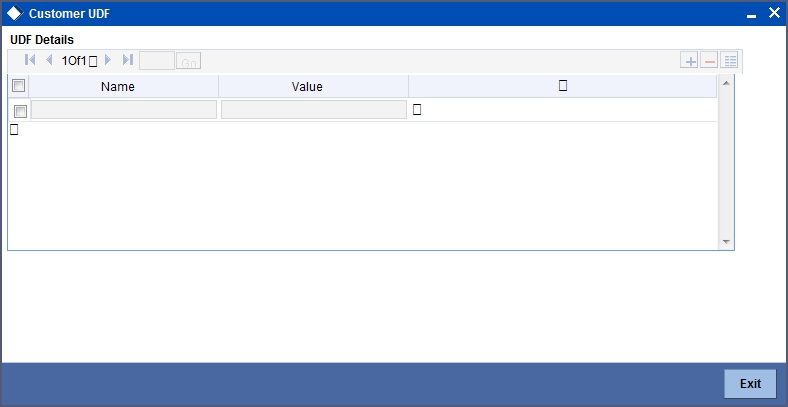

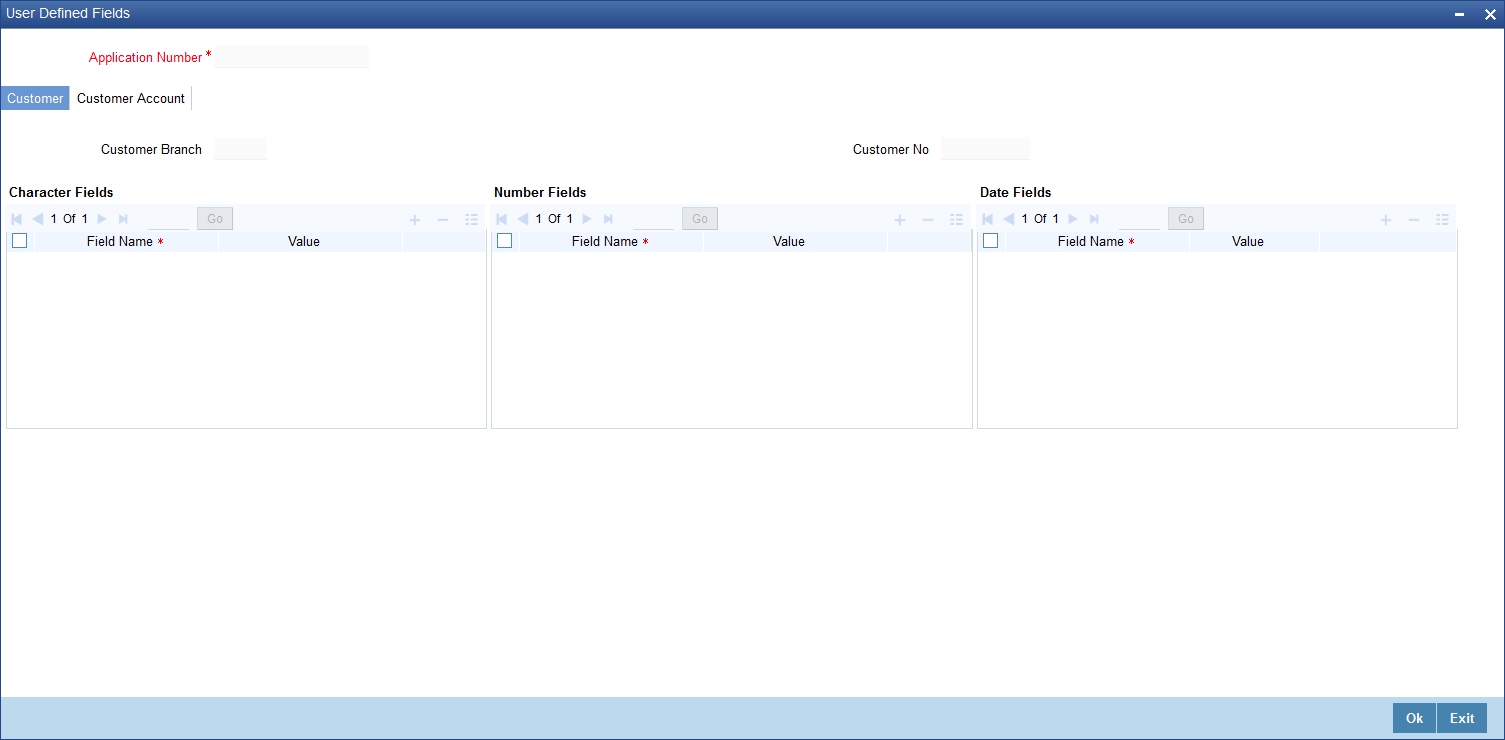

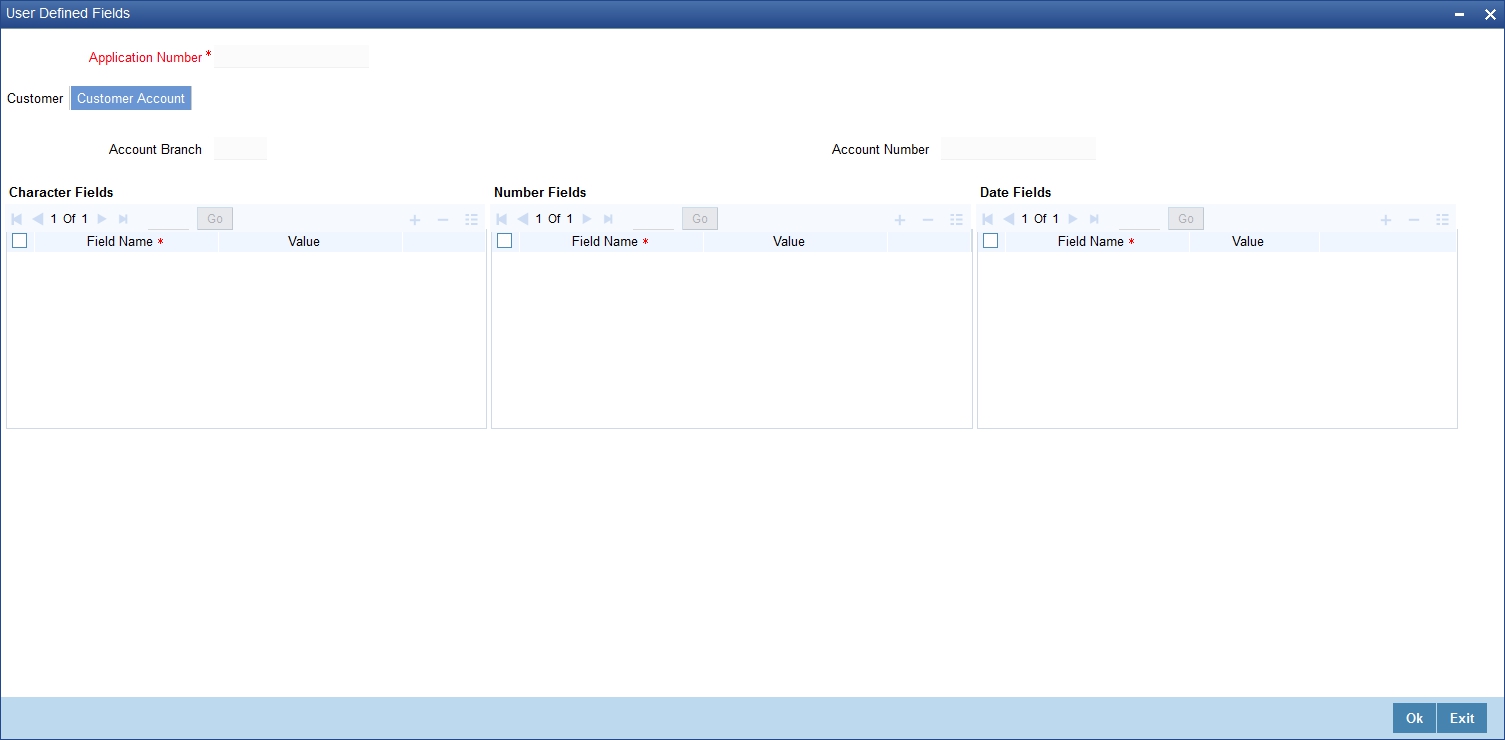

2.10.2.1 Fields

You can capture the user defined field details for the customer, if any by clicking ‘Fields’ button. The ‘Customer UDF’ screen gets displayed where you can maintain the UDF details.

You can specify the following details in this screen:

Name

Specify the name of the UDF being created for the customer.

Value

Specify the value associated with the UDF being created for the customer.

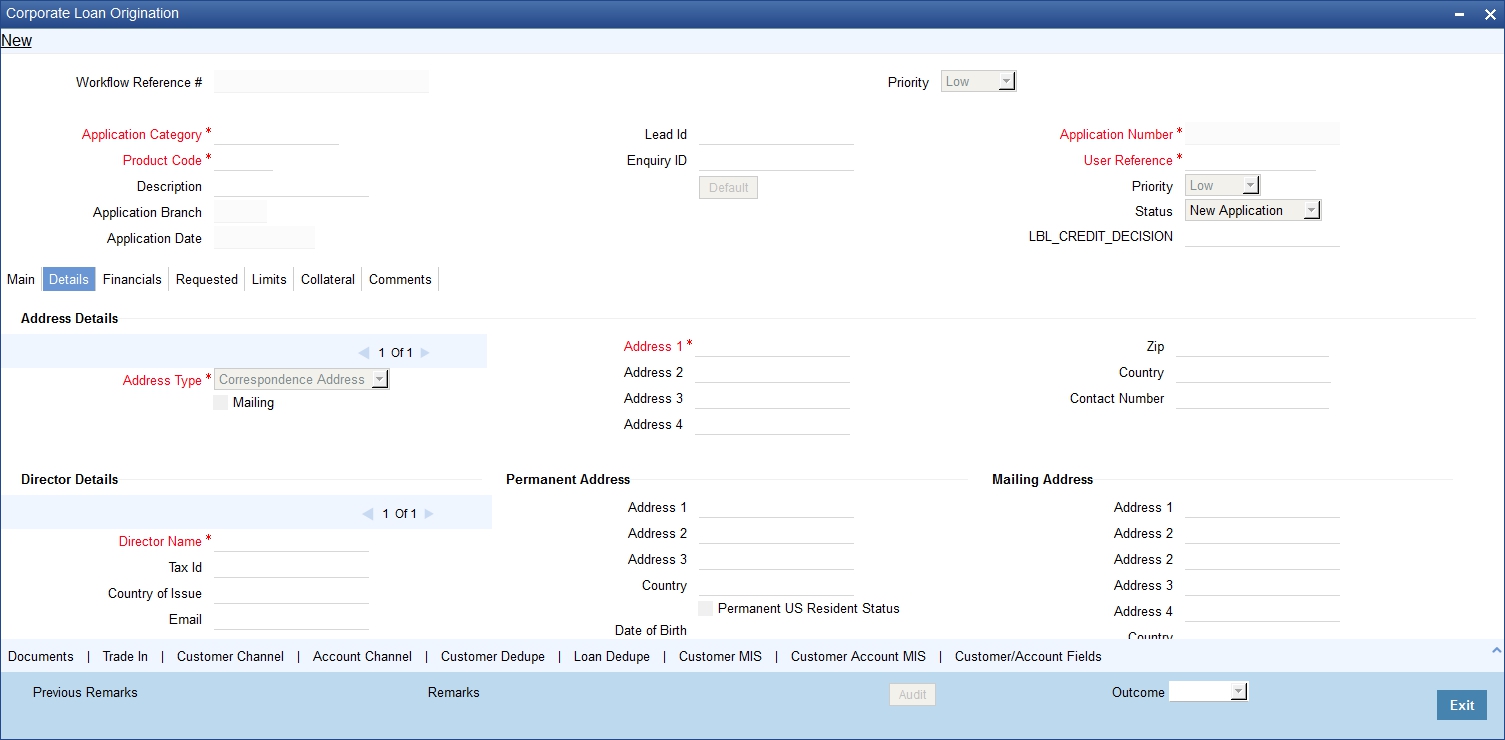

2.10.3 Details Tab

The address and employment related details of the customer corresponding to the Application Category selected are displayed in this tab. You can modify these details if required.

In this screen, you can capture multiple address and employment details, if required.

Note

For more details on capturing address details, refer the chapter titled ‘Maintaining Customer Information Files’ in Core Entities user manual.

You can capture the following additional details related to the Director in this tab:

Director Name

Specify the name of the director of the corporate customer.

Tax ID

Specify the tax identification number (TIN) of the director.

Country of Issue

Specify the country which has issued the tax ID for the customer. Alternatively, you can select the country from the option list.

Specify the e-mail ID of the director.

Nationality

Specify the nationality of the director.

Share Percentage

Specify the percentage of share for the key person.

Telephone ISD Code +

Specify the international dialling code for the telephone number of the director. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Telephone

Specify the telephone number of the director.

Mobile ISD Code +

Specify the international dialling code for the mobile number of the director. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Mobile Number

Specify the mobile number of the director.

Permanent Address

Address

Specify the permanent address of the director.

Country

Specify the country associated with the address specified.

Permanent US Resident Status

Check this box to indicate that the corresponding director is a permanent US resident.

Date of Birth

Specify the date of birth of the director.

Birth Place

Specify the birth place of the director.

Birth Country

Specify the birth country of director.

Type of Ownership

Specify the type of ownership. Alternatively, you can select the ownership type from the option list. The list displays all valid options.

This field is mandatory if CRS customer type is Passive Non-Financial Entity.

Mailing

Line 1 – 4

Specify the mailing address of the customer in Line 1 to Line 4 provided.

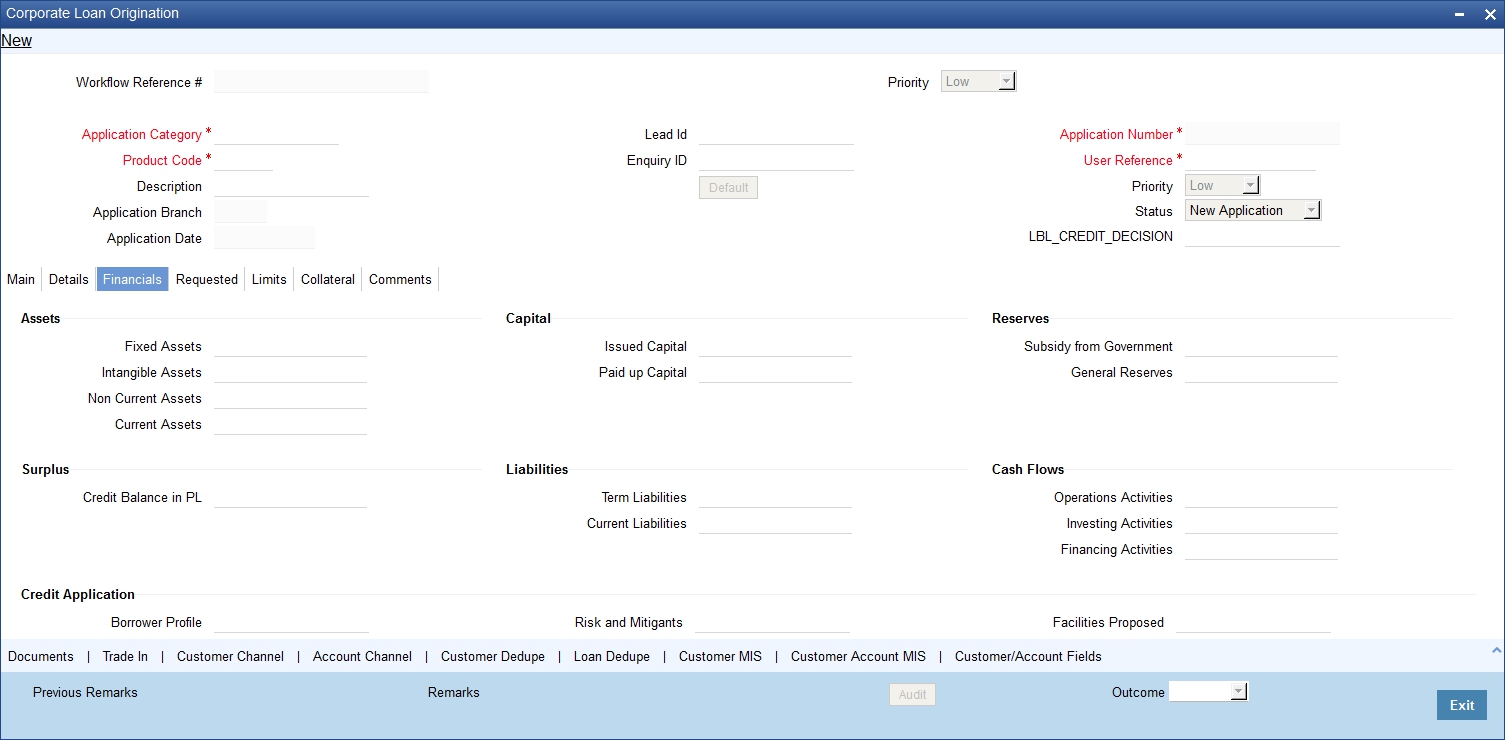

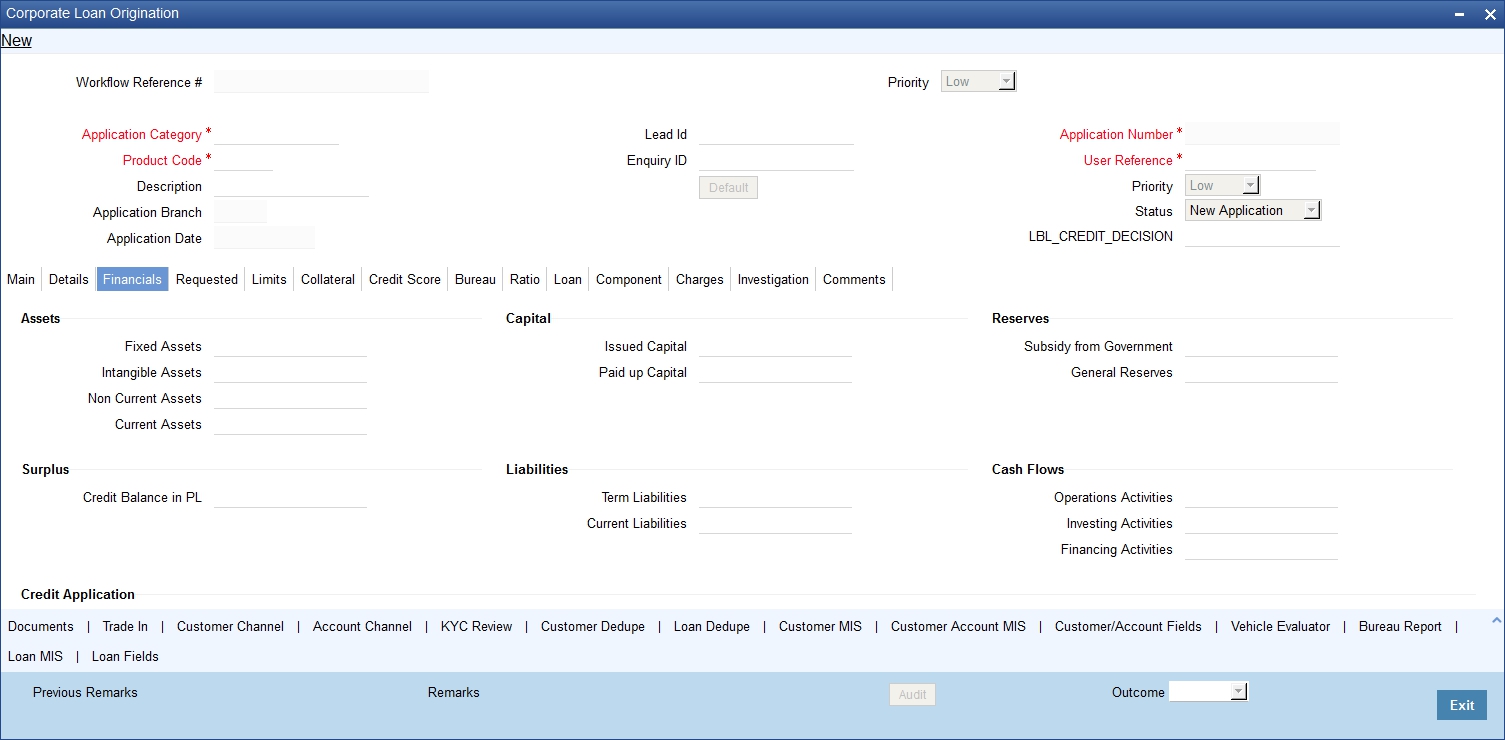

2.10.4 Financials Tab

You can capture the financial details corresponding to the customer in this screen.

You can capture the following details here:

- Assets Details

- Capital details

- Reserves Details

- Surplus Details

- Liabilities Details

- Cash Flows

- Credit Application

Assets

You can capture the following details corresponding to the loan applicant’s assets:

Fixed Assets

Specify the value associated with the fixed assets of the customer.

Intangible Assets

Specify the value associated with the intangible assets of the customer.

Non Current Assets

Specify the value associated with the non current assets of the customer.

Current Assets

Specify the value associated with the current assets of the customer.

Capital

You can capture the following details corresponding to the loan applicant’s capital:

Issued Capital

Specify the value associated with the issued capital of the customer.

Paid-Up Capital

Specify the value associated with the paid-up capital of the customer.

Reserves

You can capture the following details corresponding to the loan applicant’s cash reserves:

Subsidy from Govt

Specify the value of any subsidies the customer has obtained from the government.

General Reserves

Specify the value associated with any general reserves of the customer.

Surplus

You can capture the following details corresponding to the loan applicant’s surplus income:

Credit Balance in PL

Specify the surplus credit balance, if any, associated with the customer.

Liabilities

You can capture the following details corresponding to the loan applicant’s liabilities:

Term Liabilities

Specify the value associated with the long term liabilities associated with the customer.

Current Liabilities

Specify the value associated with the current liabilities associated with the customer.

Cash Flows

You can capture the following details corresponding to the loan applicant’s cash flows:

Operations Activities

Specify the cash flow value associated with the operation activities of the corporate customer.

Investing Activities

Specify the cash flow value associated with the investing activities of the corporate customer.

Loan Activities

Specify the cash flow value associated with the loan activities of the corporate customer.

Credit Application

The details associated with how the corporate customer has deployed his assets need to be captured as part of assessing the risk associated with the loan proposed .You can capture the following details related to the credit application:

Borrower Profile

Specify the details corresponding to the profile of the corporate customer’s customer.

Financial Performance

Specify the details corresponding to the financial performance of the corporate customer’s customer.

Borrower Market Position

Specify the details corresponding to the market position of the corporate customer’s customer.

Risk and Mitigants

Specify the details corresponding to the risk and mitigants associated with the corporate customer’s customer.

Risk Department Mitigants

Specify the inputs from risk department related to the risk mitigants associated with the corporate customer’s customer.

Risk Department Assessment

Specify the risk department’s assessment corresponding the corporate customer’s customer.

Facilities Proposed

Specify the details corresponding to the facilities that have been proposed by the corporate customer.

Approved Facilities

Specify the details corresponding to the facilities that have been approved by the corporate customer.

Recommended

Specify the details corresponding to the facilities that have been recommended by the corporate customer.

Terms and Conditions

Specify the terms and conditions associated with the credit application.

2.10.5 Limits Tab

You can capture the Facility Information in ‘Limits’ tab.

In this screen, specify the following details:

Liability Details

Liability Number

Select the liability number. The adjoining option list displays all valid liability numbers maintained in the system. Select the appropriate one.

Liability Name

Select the liability name. The adjoining option list displays all valid liability names maintained in the system. Select the appropriate one.

Main Liability No

Select the parent liability number. The adjoining option list displays all valid main liability numbers maintained in the system. Select the appropriate one.

Liability Branch

Select the liability branch. The adjoining option list displays all valid liability branch maintained in the system. Select the appropriate one.

Liability Currency

Select the liability currency. The adjoining option list displays all valid liability currency maintained in the system. Select the appropriate one.

Overall Limit

Specify the overall limit.

Line Details

Line Code

Select the line code. The adjoining option list displays all valid liability numbers maintained in the system. Select the appropriate one.

Line Serial

Specify the line serial number.

Main Line Code

Select the main line code. The adjoining option list displays all valid main line codes maintained in the system. Select the appropriate one.

Line Branch

Select the line branch code. The adjoining option list displays all valid branch codes maintained in the system. Select the appropriate one.

Line Currency

Select the line currency code. The adjoining option list displays all valid line currency codes maintained in the system. Select the appropriate one.

Line Amount

Specify the line amount.

Limit Amount

Specify the limit amount.

Collateral Amount

If the collateral is maintained, system displays the collateral amount when you click on ‘Default’ button. Otherwise, system displays the value as ‘zero’.

Effective Line Amount Basis

Select the basis on which the effective line amount is calculated.

Effective Line Amount

System displays the effective line amount based on the specified effective line amount basis,

Availability

Start Date

Specify the start date of the line from the adjoining calendar.

Expiry Date

Specify the expiry date of the line from the adjoining calendar.

Last Available Date

Specify the last availability date for the line from the adjoining calendar.

Remarks

Specify the remarks for the line.

Revolving Line

Check this box to indicate that the revolving line is required.

Pool Details

Pool Code

Select the pool code. The adjoining option list displays all valid pool codes maintained in the system. Select the appropriate one.

Pool Designation

Specify the pool designation.

Pool Currency

Select the pool currency code. The adjoining option list displays all valid pool currency codes maintained in the system. Select the appropriate one.

Pool Amount

System displays the pool amount.

Pool Utilized

System displays the pool amount utilized.

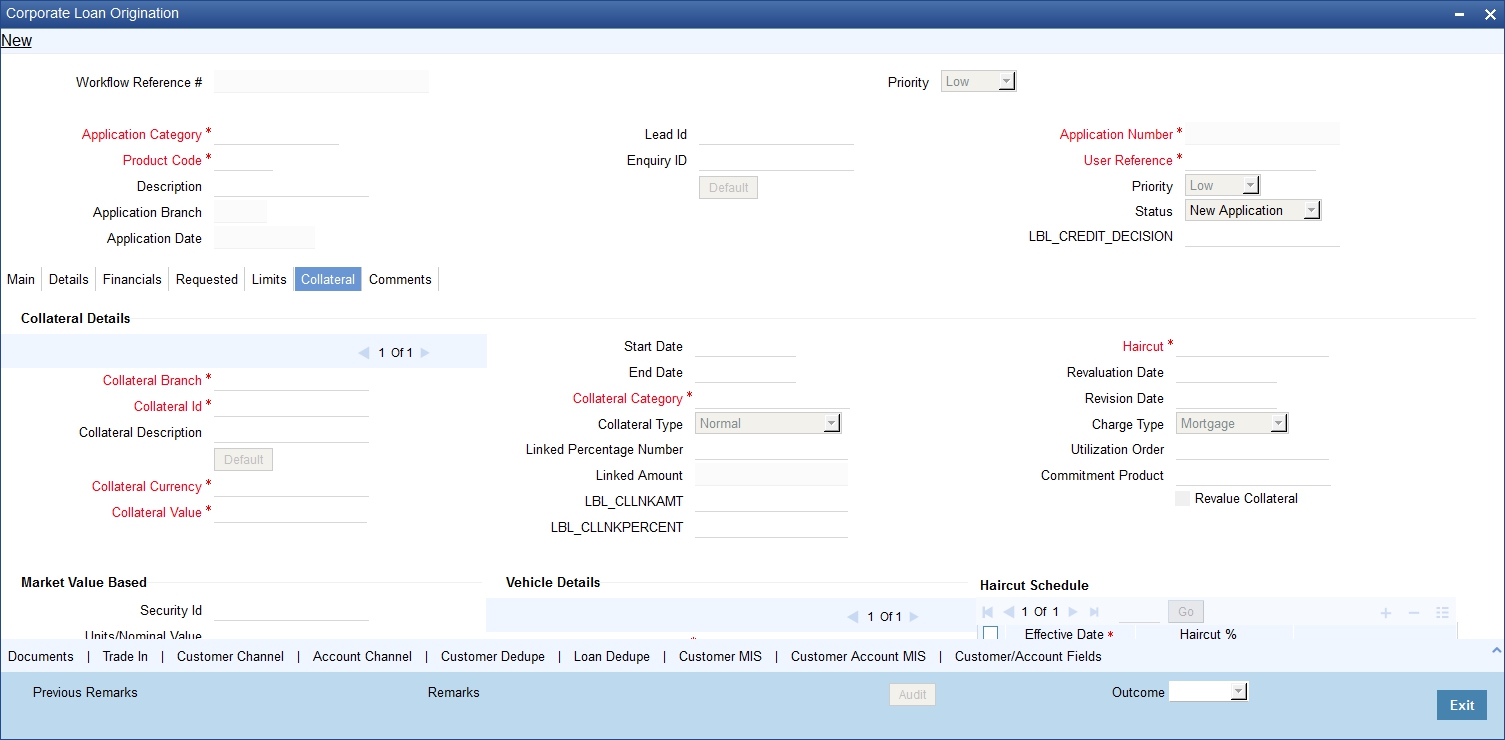

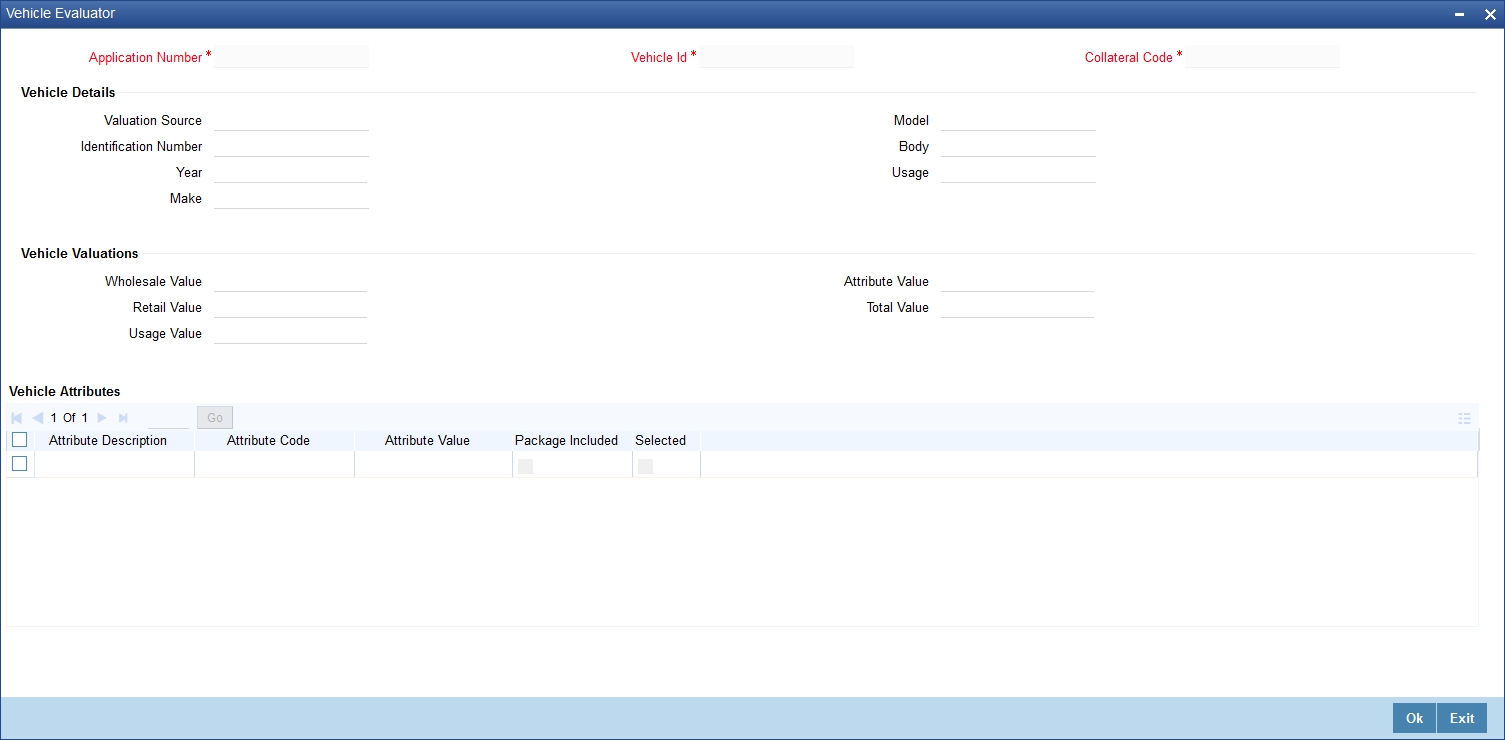

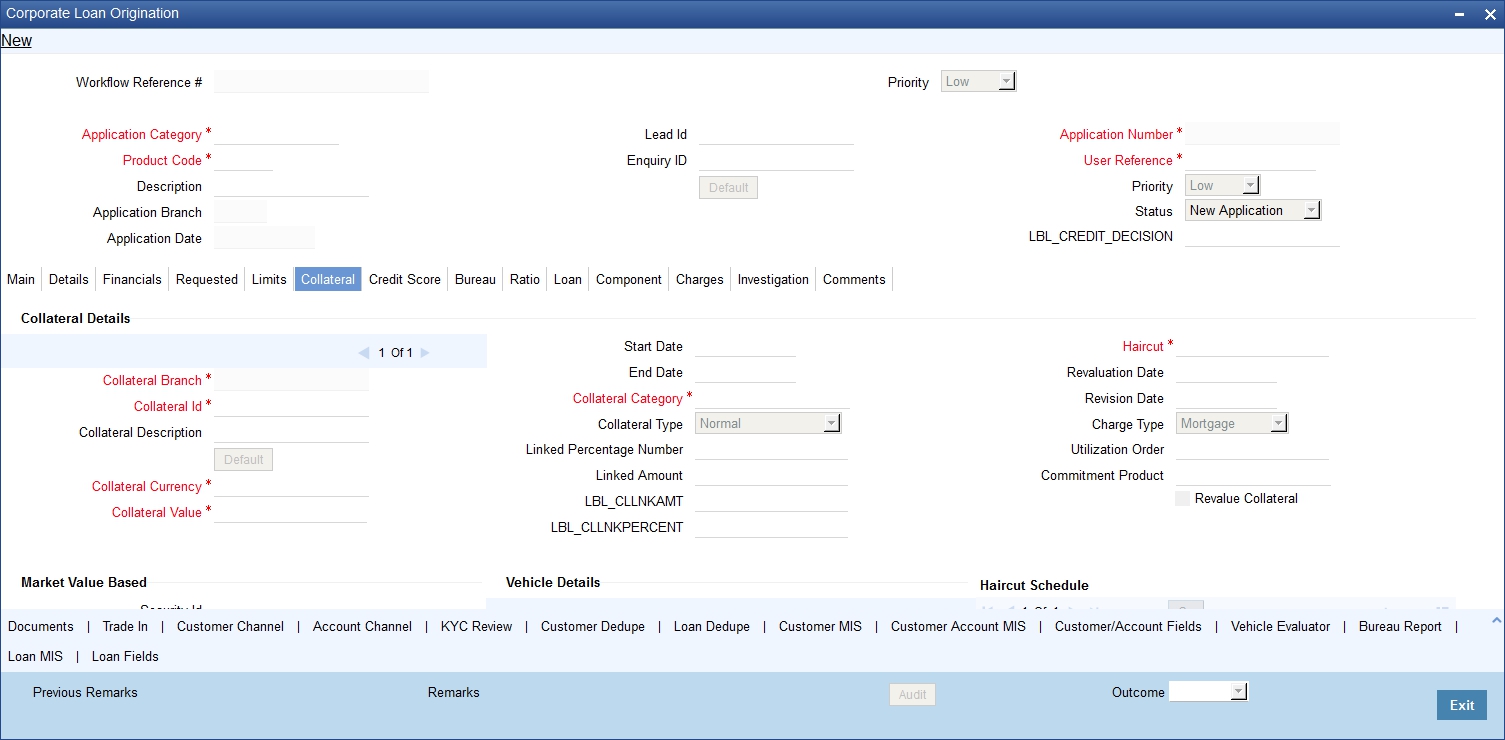

2.10.6 Collaterals Tab

You can capture the details related to the collaterals provided by the customer in this tab.

In this screen, specify the following details to facilitate vehicle evaluation:

Collateral Details

Collateral Branch

Specify the collateral branch.

Utilization Order

Specify the collateral utilization order if any collaterals are linked to the Loan.

Commitment Product

Specify the commitment product if any collaterals are linked to the Loan.

Market Value Based

Security ID

Select the security ID. The adjoining option list displays all valid security IDs maintained in the system. Select the appropriate one.

Number of Units/Nominal Value

Specify the number of units.

Cap Amount

Specify the cap amount.

Guarantor Based

Guarantor ID

Select the Guarantor ID. The adjoining option list displays all valid guarantor IDs maintained in the system. Select the appropriate one.

Rating

The system displays the rating.

Haircut Schedules

Specify the following Haircut Revision Schedule details for any collateral linked to the Loan.

Effective Date

Specify the effective date from the adjoining calendar.

Haircut %

Specify the haircut percentage.

Vehicle Details

You can capture the details of the vehicle which is to be evaluated in the following fields:

Vehicle Number

Specify the registration number of the vehicle.

Year

Specify the year of manufacture for the vehicle.

Make

Specify the make of the vehicle.

Model

Specify the vehicle model.

Body

Specify the vehicle body details.

Usage

Specify the mileage used by the vehicle till date.

These details will be used at the underwriting stage to evaluate the vehicle.

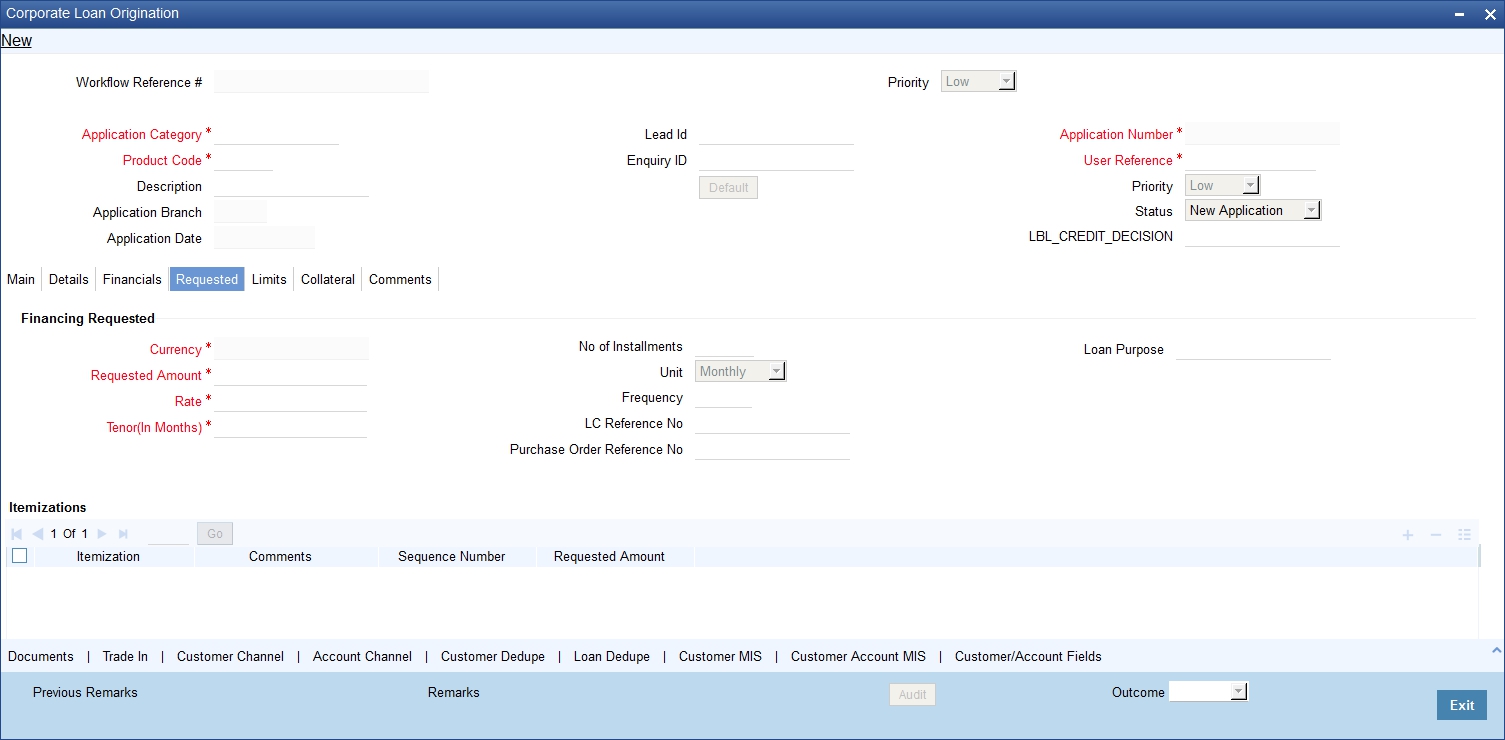

2.10.7 Requested Tab

The details related to the requested loan can be captured in this tab. If you have selected an ‘Enquiry ID’ for the customer, then the requested details that have been stored for the corresponding loan proposal are displayed here.

You can capture the following details here:

Currency

Specify the loan currency preference of the customer or select the currency from the option list.

Requested Amount

Specify the loan amount requested by the prospective customer.

Interest Rate

Specify the preferred interest rate of the prospective customer.

Tenor (in months)

Specify the preferred loan tenor (in months) of the prospective customer.

No of Installments

Specify the requested Number of Loan Instalments/Schedules.

Frequency

Specify the requested Loan Schedule Frequency.

Unit

Specify the requested Loan Schedule Frequency Unit/Basis.

LC Reference No

Select the reference number of the LC instrument from the adjoining option list.

Purchase Order Reference No

Specify the reference number of the trade instrument.

Loan Purpose

Specify the Purpose of the loan.

Itemization

Specify the tenor itemization that is required. For example, you can specify the itemizations like ‘Booking Amount’, ‘Payment’, ‘Interiors’ etc.

Comments

Specify comments, if any, corresponding to the itemization.

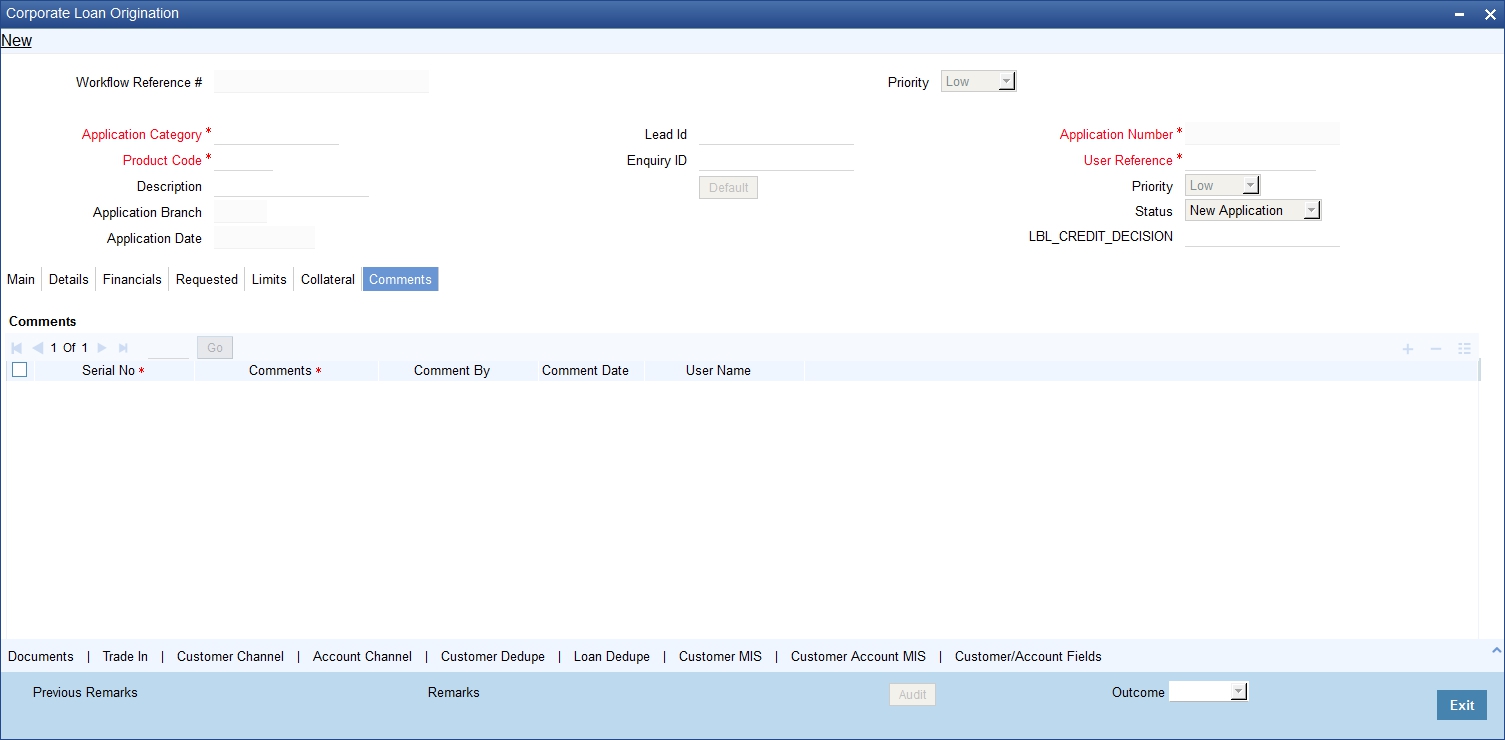

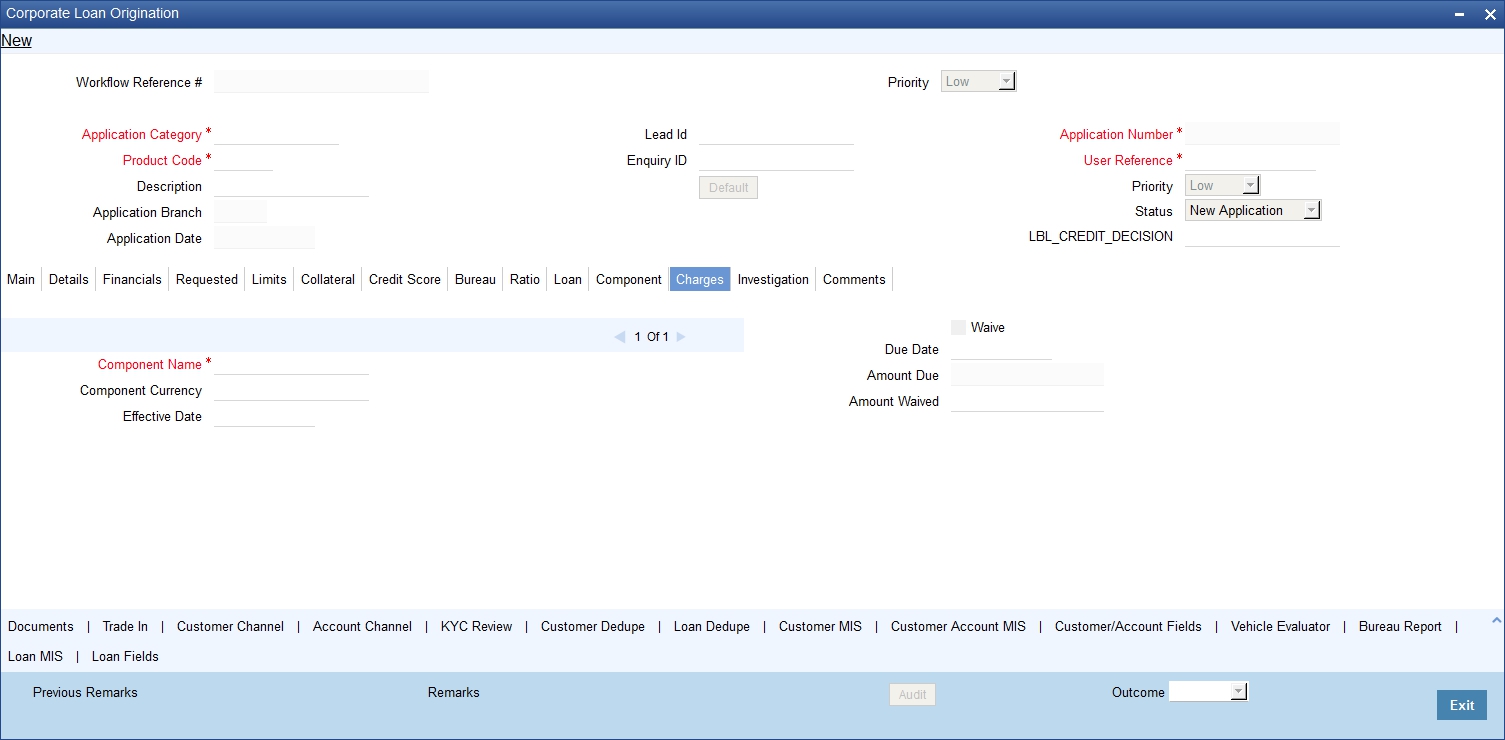

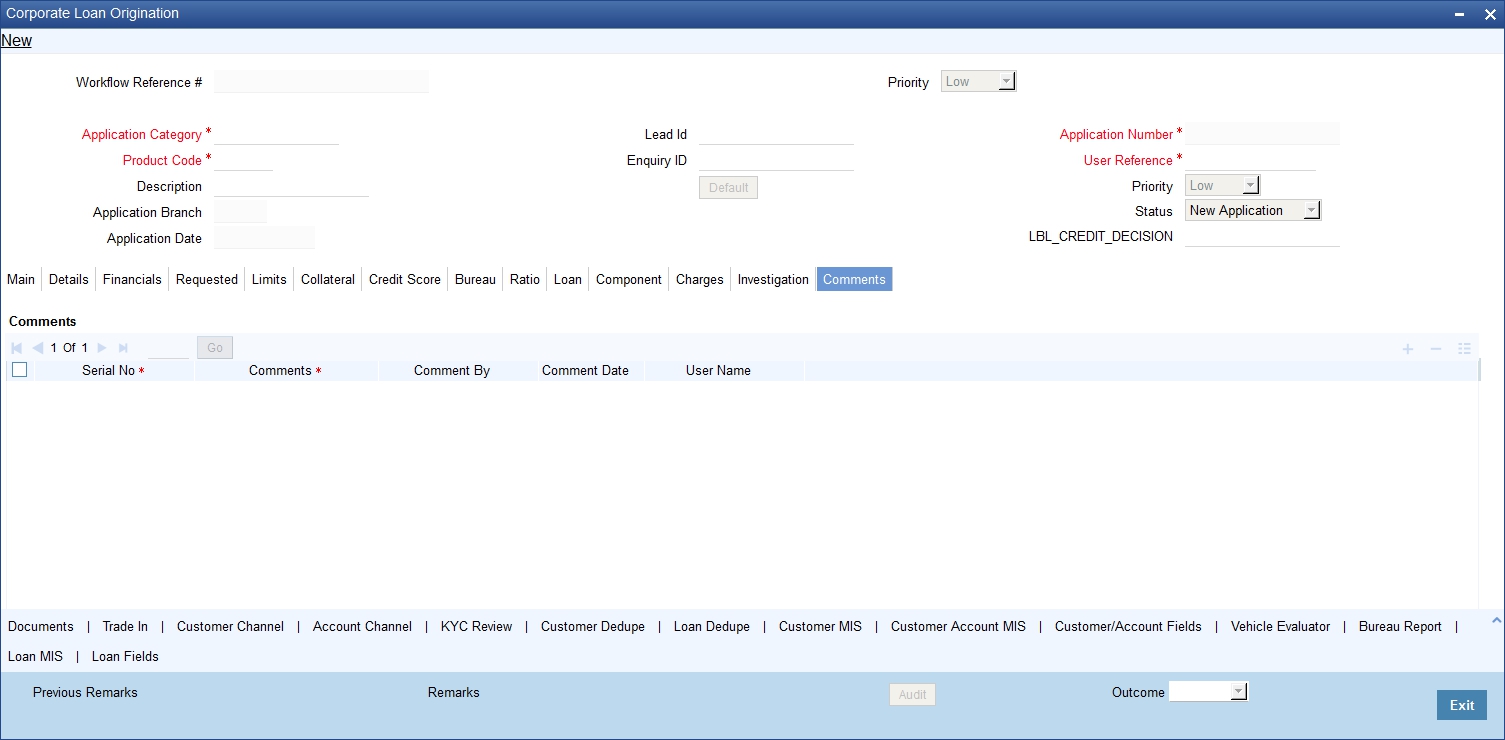

2.10.8 Comments Tab

In this tab, you can specify comments, if any, related to the loan application.

You can specify the following details here:

Sequence Number

The sequence number is automatically generated by the system.

Comments

Specify comments, if any, to be associated with the loan application.

Comment By

System displays the name of the commenter.

Comment Date

The system displays the date on which the comment was added.

2.10.9 Capturing Document Details

You can capture the customer related documents in central content management repository through the ‘Documents’ screen. Click ‘Documents’ button to invoke this screen.

Here, you need to specify the following details:

Document Category

Specify the category of the document to be uploaded.

Document Reference

The system generates and displays a unique identifier for the document.

Document Type

Specify the type of document that is to be uploaded.

Ratio Upload

Check this box to view the calculated financial ratios, which is obtained by uploading the excel sheet (balance sheet, income statement, statement of cash flows etc.).

On clicking the ‘Vertical Analysis’ button, system displays the calculated ratios in ratio tab of underwriting stage.

Upload

Click ‘Upload’ button to open the ‘Document Upload’ sub-screen.

In the ‘Document Upload’ sub-screen, specify the corresponding document path and click the ‘Submit’ button. Once the document is uploaded through the upload button, the system displays the document reference number.

View

Click ‘View’ to view the document uploaded.

In ‘Corporate Loan Origination’ process, ‘Document Upload’ feature is not available in all the stages. Its availability in this process is given below:

Stage Title |

Function Id |

Doc Callform Exists |

Upload(Available/Not Available) |

View(Available/Not Available) |

Application Entry |

ORDCLAPP |

Available |