4. Dashboards

4.1 Introduction

The credit appraisal management dashboard provides various information to the relationship managers, risk officers and bank management. The key features of the dashboard are as follows.

- Easy access for relationship managers to the applications mapped to his/her ID.

- Enhanced capability for risk officers to do risk analysis for the applications being processed

- Access for bank managers to view logically categorized applications for easy analysis and processing

You can view the following Dashboards based on the ‘User Role’ you are mapped to:

- Relationship manager dashboards

- Covenant renewals dashboard

- Risk office dashboards

Each ‘User Role’ would not require all of the above, hence the system enables grouping of these Dashboards based on the ‘User Role’.

The following sections explain, in detail, the features associated with each Dashboard, the groups, and the ‘User Role’ associated with each group.

This chapter contains the following sections:

- Section 4.2, "Relationship Manager Dashboard"

- Section 4.3, "Covenant Renewals Dashboard"

- Section 4.4, "Risk Officer Dashboard"

4.2 Relationship Manager Dashboard

This section contains the following topics:

- Section 4.2.1, "Viewing Relationship Manager Dashboard"

- Section 4.2.2, "Application Status Tracking"

- Section 4.2.3, "Over Utilized Applications"

- Section 4.2.4, "Document Missing Applications"

- Section 4.2.5, "Applications Pending Acceptance"

- Section 4.2.6, "Customer Portfolio"

- Section 4.2.7, "Relation Manager Dashboard on Monetary aspect"

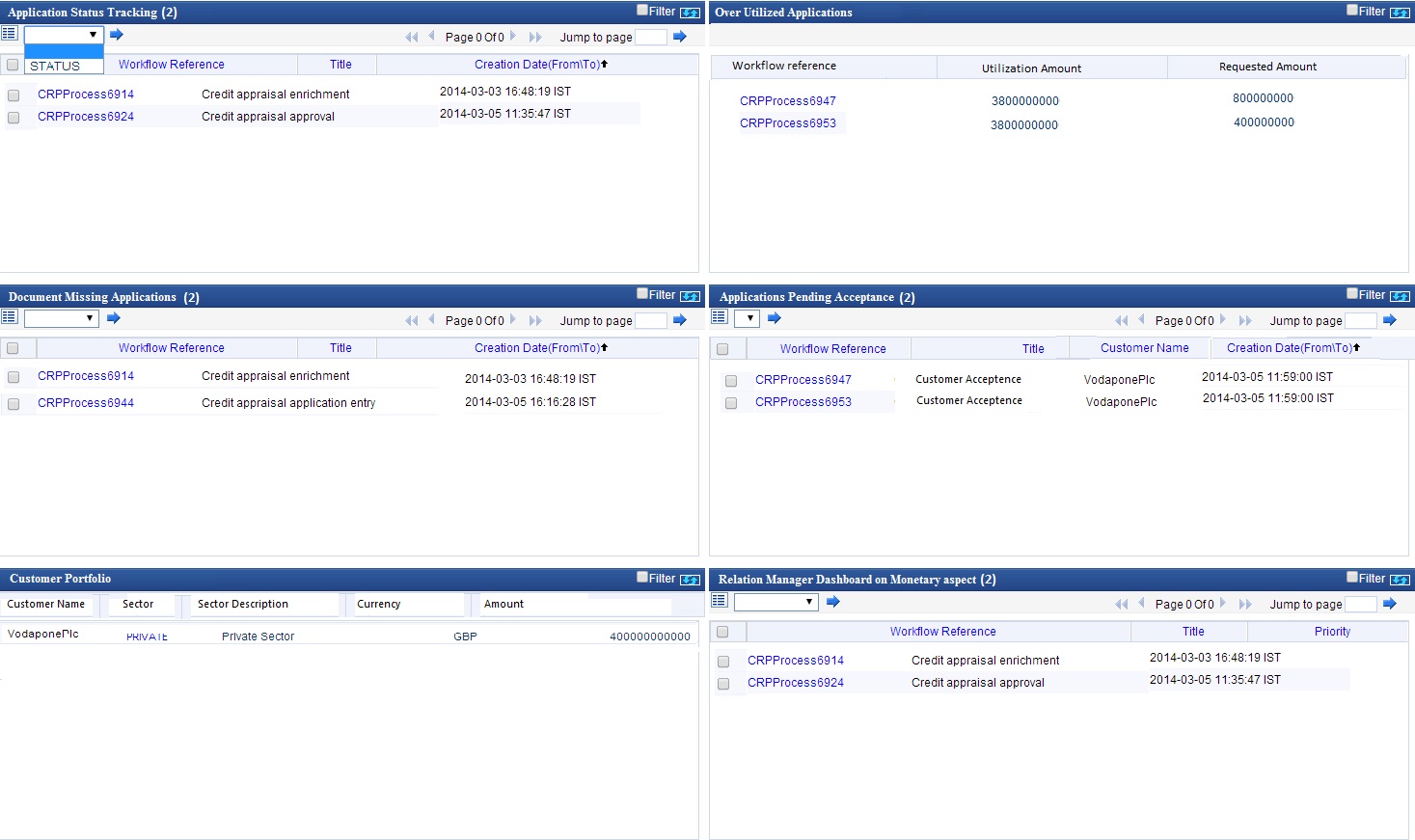

4.2.1 Viewing Relationship Manager Dashboard

In the Relationship Manager Dashboard, the relationship managers can analyse the in-flight credit applications which are mapped to his/her RM ID and track the current status of the applications.

Various dashboards for relationship managers are discussed under the following headings.

4.2.2 Application Status Tracking

In this dashboard, the Relationship Manager can view and track the stage by stage flow of the applications which are mapped to his/her RM ID.

In this dashboard, you can view the following details of each application:

- Workflow reference number

- Title

- Creation date (From/To)

This dashboard has an action ‘Status’, using which you can track the current status of an application.

4.2.3 Over Utilized Applications

This dashboard displays the applications which have reached the threshold limit. An application is listed under this head when the utilization amount has crossed the overall limit.

You can view the following details for each application:

- Application reference number

- Utilization amount

- Requested amount

4.2.4 Document Missing Applications

Applications which are returned with an outcome ‘Documents Missing’ are listed in this dashboard. Relationship managers can communicate the details of missing mandatory documents to the customers for applications associated with their RM ID.

You can view the following details for each application:

- Workflow reference number

- Title

- Creation date (From/To)

4.2.5 Applications Pending Acceptance

This dashboard displays the applications pending for acceptance from customer. Based on this information, the relationship managers can act and get the customer responses for such applications.

You can view the following details for each application:

- Workflow reference number

- Title

- Customer name

- Creation date (From/To)

4.2.6 Customer Portfolio

This dashboard displays the customer specific split of applications along with the overall limit amount and requested amount.

In this dashboard, you can view the following details:

- Customer name

- Sector

- Sector description

- Currency

- Amount

4.2.7 Relation Manager Dashboard on Monetary aspect

The Total number of applications the RM has processed/converted/completed successfully for the current month, for which he can claim monetary benefit, will be displayed in this dashboard.

You can view the following details for each application:

- Workflow reference number

- Title

- Priority

4.3 Covenant Renewals Dashboard

This section contains the following topics:

- Section 4.3.1, "Viewing Covenant Renewals Dashboard"

- Section 4.3.2, "Facility Covenant Renewal"

- Section 4.3.3, "Collateral Covenant Renewal"

4.3.1 Viewing Covenant Renewals Dashboard

In the Covenant Renewals Dashboard, you can view the following dashboards.

- Facility covenant renewal

- Collateral covenant renewal

4.3.2 Facility Covenant Renewal

In this dashboard, you can view the set of facility covenants that are nearing revision date. For each facility covenant, the following details are displayed in the dashboard.

- Liability number

- Line code

- Serial number

- Covenant name

- Covenant description

- Covenant reference number

- Revision date

4.3.3 Collateral Covenant Renewal

In this dashboard, you can view the list of collateral covenants that are nearing revision date and need to be renewed. For each collateral covenant, you can view the following details:

- Collateral code

- Liability number

- Covenant reference number

- Covenant name

- Description

- Revision date

4.4 Risk Officer Dashboard

This section contains the following topics:

- Section 4.4.1, "Viewing Risk Officer Dashboard"

- Section 4.4.2, "Applications to be Approved"

- Section 4.4.3, "Potential Applications for Approval"

- Section 4.4.4, "Escalated Applications"

- Section 4.4.5, "Application Status Tracking"

- Section 4.4.6, "Productivity Dashboard"

- Section 4.4.7, "Applications from External Channels"

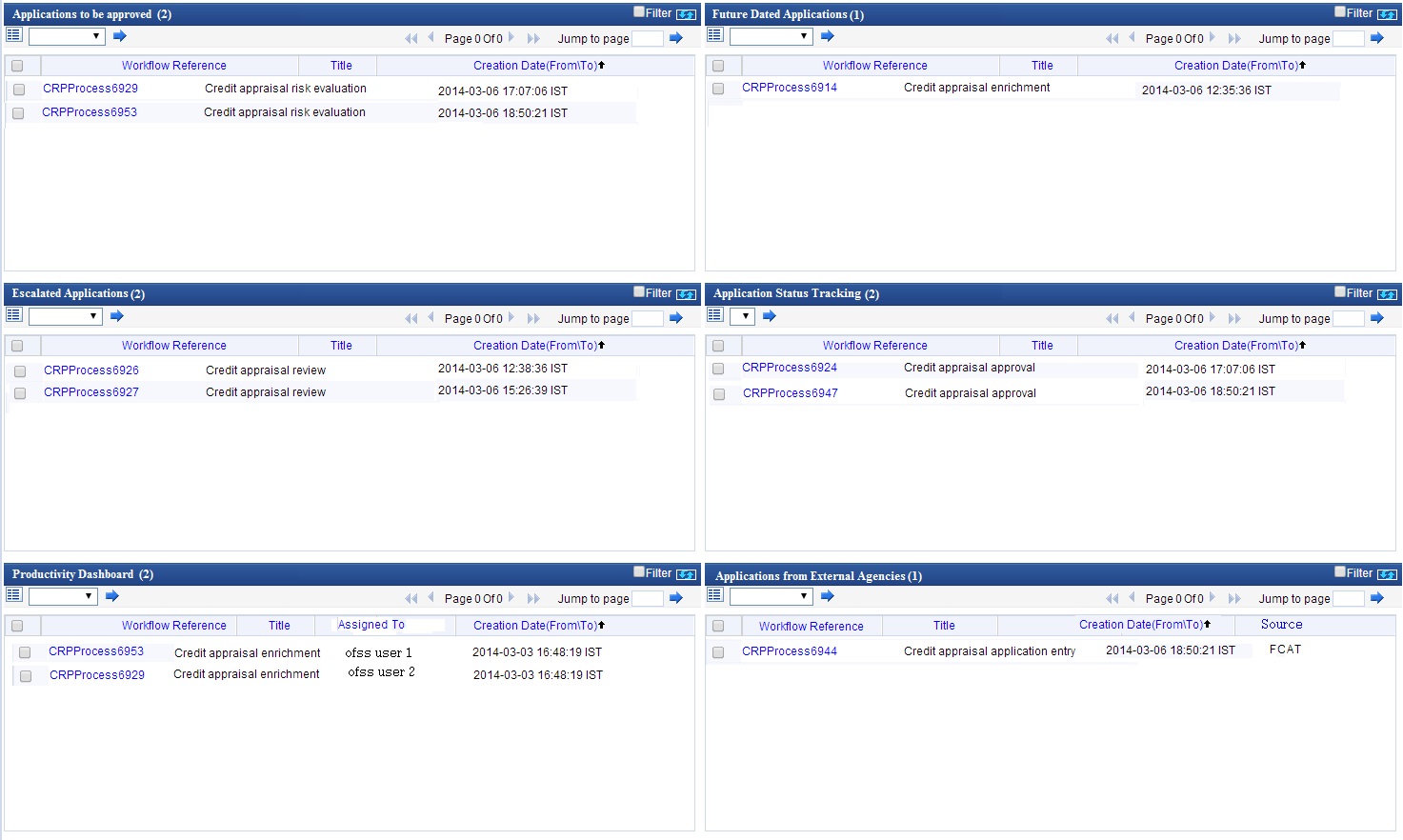

4.4.1 Viewing Risk Officer Dashboard

The risk officer dashboards provide the details of applications that helps the risk officers of the bank to swiftly act upon potential risks. This dashboard enables risk officers to perform a credit analysis and evaluate the risks involved in each incoming application.

Various dashboards for risk officers are discussed under the following headings.

4.4.2 Applications to be Approved

The applications pending in risk evaluation stage are listed in this dashboard. The Risk Manager can analyse the applications and approve the ones that he/she thinks fit.

You can view the following details for each application:

- Workflow reference number

- Title

- Creation date (From/To)

4.4.3 Potential Applications for Approval

Applications in the previous stage of the risk evaluation will be listed in this dashboard. Risk managers can view the stage by stage flow of these applications.

You can view the following details for each application:

- Workflow reference number

- Title

- Creation date (From/To)

4.4.4 Escalated Applications

This dashboard displays all applications that are escalated to the risk manager. The risk manager can analyse the applications and act upon them.

Applications are either manually escalated using ‘Escalate’ button in the Task-List dashboard, or pre-configured to get escalated automatically after a specific period.

You can view the following details for each application:

- Workflow reference number

- Title

- Creation date (From/To)

4.4.5 Application Status Tracking

In this dashboard, the risk manager can track the stage by stage flow of the applications that are analysed and approved previously.

You can view the following details for each application:

- Workflow reference number

- Title

- Creation date (From/To)

This dashboard has an action ‘Status’, using which you can track the current status of an application.

4.4.6 Productivity Dashboard

In this dashboard, the risk manager can view the details of applications and users who are subordinates of the risk manager. Such details enables the risk manager to supervise and take necessary actions to speed up the applications that are long pending with the subordinates.

You can view the following details for each application:

- Workflow reference number

- Title

- Assigned to

- Creation date (From/To)

4.4.7 Applications from External Channels

This dashboard displays applications initiated from external channels. Based on the information available in this dashboard, the risk manager can act swiftly on such applications.

You can view the following details for each application:

- Workflow reference number

- Title

- Creation date (From/To)

- Source