5. Processing Funds Transfer

5.1 Introduction

A Funds Transfer (FT) contract is a transaction whereby funds are moved from the account of one party (called the remitter) to another party (called the beneficiary). Such movement of funds may involve a sequence of events, but is treated as one contract.

For example, if a customer of Berliner Bank, instructs them to pay Pounds Sterling to Midland bank, London into the account of Mr. Silas Reed. The sequence of the events that will follow, to effect the transfer can be considered an FT contract.

An FT Contract would therefore require information on:

- Who is the remitter?

- What is the transfer amount and currency?

- Is it a cross currency transfer?

- Are any intermediate banks involved in the transfer?

- What route should the transfer follow before it actually reaches the beneficiary?

- When is it to be settled?

- Details of the beneficiary (name, account number etc.)

- The mode of reimbursement

- The method of transfer

- The type of transfer (incoming, outgoing or internal)

Under each Product that you have defined, you can enter specific FTs based on the needs of your customer. Each of these will constitute a contract. While products are general and serve to classify or categorize funds transfers, contracts are customer specific and represent the actual funds transfers that you are involved in. The attributes that you define for a product will be inherited by all contracts linked to the product. While some of these attributes (for instance the exchange rate) inherited from a product can be changed when a contract is entered involving the product, there are some attributes (such as accounting treatment) that cannot be changed when the contract is entered.

This chapter contains the following sections:

- Section 5.2, "Entering Details of Funds Transfer"

- Section 5.3, "Specifying FT Contract Details"

- Section 5.4, "Description of FT Contract Details Screen"

- Section 5.5, "Funds Transfer"

- Section 5.6, "Viewing Settlement Route of Transfer"

- Section 5.7, "Viewing Details of Transfer Events"

- Section 5.8, "Specifying Advices for Transfer"

- Section 5.9, "Selecting User Defined Fields"

- Section 5.10, "Generating Charge Claim Advice"

- Section 5.11, "Specifying Customer Cover Details"

- Section 5.12, "Viewing OFAC Check Response"

- Section 5.13, "Capturing MIS Details"

- Section 5.14, "Viewing Change Log"

- Section 5.15, "Specifying Settlement Details"

- Section 5.16, "Viewing All Messages"

- Section 5.17, "Specifying Project Details"

- Section 5.18, "Viewing Duplication details"

- Section 5.19, "Generation of MT 210 for Funds Transfer Contract"

- Section 5.20, "Generation of MT900 and 910"

- Section 5.21, "Checks for Generation of MT103+ Messages"

- Section 5.22, "Currency Cut-off Checks for Funds Transfer Transaction"

- Section 5.23, "Funds Transfers with Blacklisted BIC Codes"

- Section 5.24, "Operations that you can perform on contracts"

- Section 5.25, "View Different Versions of Contract"

- Section 5.26, "Multi-level Authorization of a Contract"

- Section 5.27, "Transaction Queues (Transaction Status) Management"

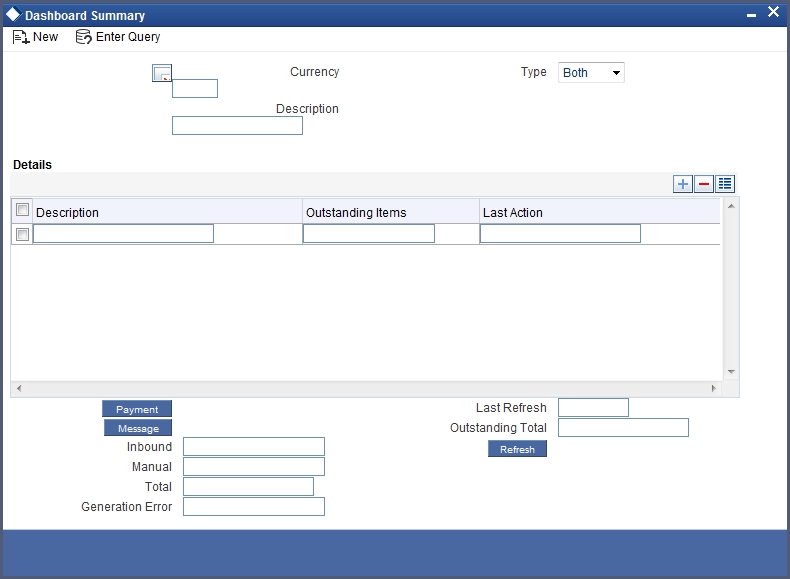

- Section 5.28, "Summary Dash Board for Funds Transfer Transactions"

- Section 5.29, "Examples on how to Enter Details of FT Contracts"

- Section 5.30, "Authorize Bulk FT Contracts"

- Section 5.31, "Maintaining MT101 Agreements with Ordering Customer"

- Section 5.32, "MT101 Transaction Input Screen"

5.2 Entering Details of Funds Transfer

Through the screens that follow in this section you can initiate all the three major types of FT’s (incoming, outgoing and internal).

You can choose to enter the details of a transfer either by:

- Copying contract details from an existing contract and changing only the details that are different for the contract you are entering.

- Using your keyboard or the option lists that are available at the various fields to enter the details of an FT afresh.

To enter the details of a contract, you need to just enter a product code and a few details about the beneficiary and the remitter. Depending on the product code that you select, many of the fields will be defaulted. You can over write some of these defaults to suit the FT that you are processing. After specifying the details, you can save the record. In case of internal transfer when you are saving the records, the system checks whether the accounts mentioned in the ‘from’ and ‘to’ leg of the transaction belong to the same netting group or not. If they belong to the same netting group, the accounting entries will not be posted. Instead the transaction will be logged for the netting batch. The system will automatically place an amount block on the debit account. However, for the credit account, the amount will be reflected only after the netting batch.

On authorisation, the transaction will be made available for the netting batch if logged for netting batch.

Refer the section ‘Maintaining Netting Group’ in the chapter ‘Accounts for Inter-Branch Transactions’ in the Core Services User Manual for further details about netting.

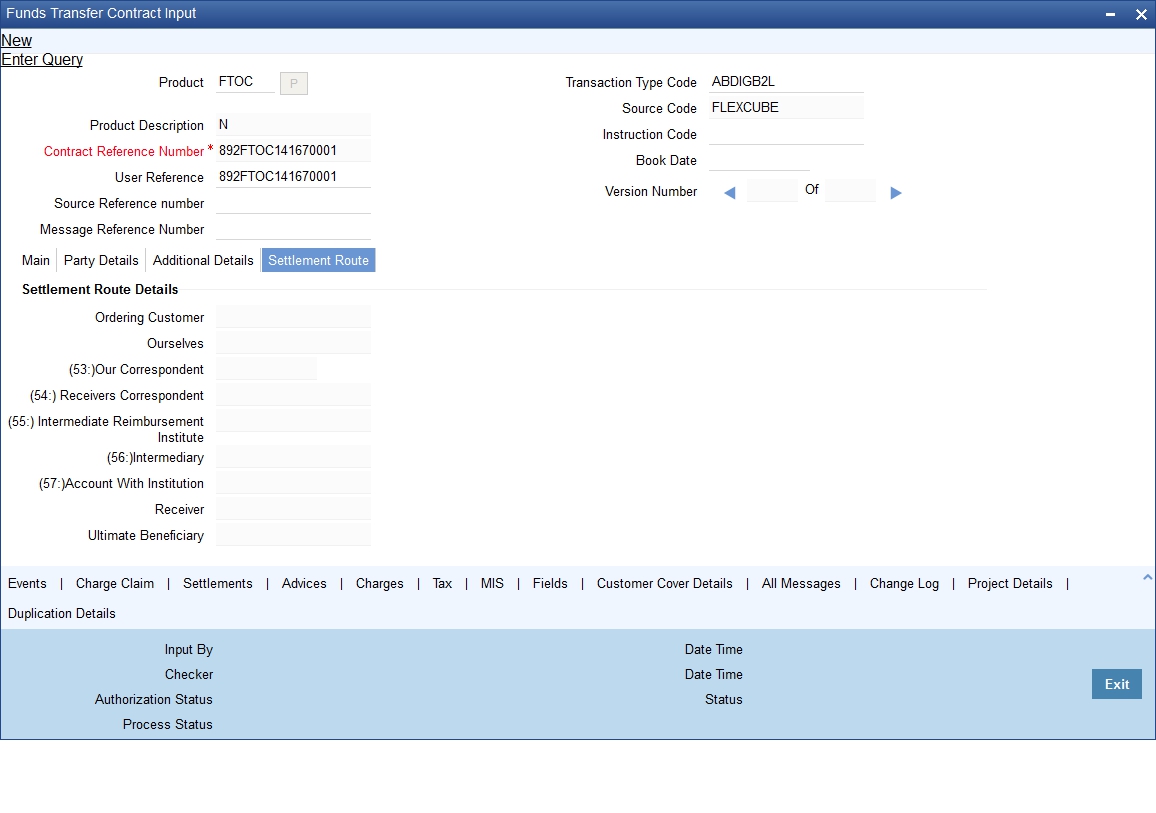

5.3 Specifying FT Contract Details

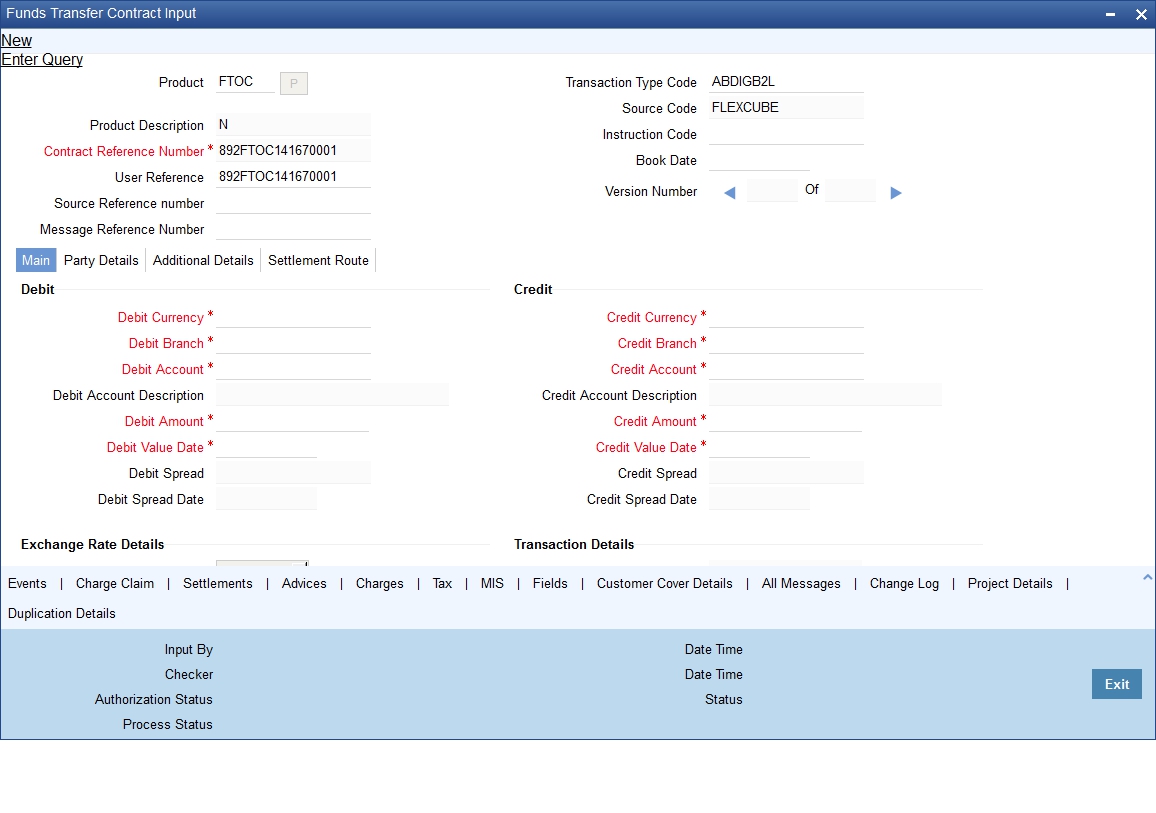

You can invoke the ‘FT Contract Details’ screen by typing ‘FTDTRONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Click the ‘New’ button on the application toolbar.

Enter valid inputs into all the mandatory fields, or you will not be able to save the contract. After you have entered all the details of a funds transfer, save the contract. To save a contract, Select ‘Save’ from the Actions menu in the Application tool bar or click save icon.

At the time of saving a funds transfer contract, the contract details should be passed on to the FATCA accounts and obligations maintenance. The details should be passed on if the customer who will be the beneficiary of the funds transfer has a reportable FATCA classification and if the product code used to book the funds transfer contract is present in the FATCA products, account class and instruments maintenance.

If you have multi branch operation rights, you can create new transactions for a different branch. However, the system will not allow you to query or authorize a transaction which is already created in another branch.

5.4 Description of FT Contract Details Screen

The FT Contract Detailed screen as it appears, contains a header and a footer containing fields that are specific to the contract you are entering. Besides these, you will also notice four tabs and a vertical array of icons, along the lines of which you can enter details of a transfer. Contract details are grouped into various screens according to the similarities they share.

Product

This is the product that is involved in the contract you are entering. Enter the code of an authorized product defined through the Product definition table. Select the product code of the product to which you want the contract to be linked. The contract will inherit all the attributes of the product you have selected.

To facilitate fast input, you need to input the product code. Click ‘P’ button placed next to the Product Code field. The system displays the details of primary keys. Depending on the product code, the system defaults the values against many fields.

The default values will be displayed in the screens that correspond to the four tabs on the ‘Funds Transfer Contract Input’ screen.

Product Description

Based on the product you have chosen, the system displays the description of the product.

Contract Reference Number

As you click ‘P’ button, the system generates the reference number sequentially. This number tag is used to identify the FT contract you are entering, it is also used in all the accounting entries and transactions related to this contract. Hence the system generates a unique number for each contract.

The contract reference number is a combination of a three-character branch code, a four-character product code, a five-digit Julian Date and a four-digit serial number. The Julian Date has the following format:

‘YYDDD’

Here, YY stands for the last two digits of the year and DDD for the number of day (s) that has/have elapsed in the year.

For example,

January 31, 1998 translates into the Julian date: 98031. Similarly, February 5, 1998 becomes 98036 in the Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those elapsed in February (31+5 = 36).

User Reference

Enter a reference number for the contract. The contract will be identified by this number in addition to the ‘Contract Reference No’ generated by the system. This number should be unique and cannot be used to identify any other contract. By default, the Contract Reference No. generated by the system will be taken as the User Reference No.

Source Reference Number

This is the reference number of the source from which the FT contract was uploaded.

Message Reference Number

This is a unique message identification number that will be used to identify an incoming message coming from an external system. This is defined as the ICN number. On upload of an incoming message into Oracle FLEXCUBE, this number, given by the external system, will be stored in Oracle FLEXCUBE and passed on to the contract generated as a result of the incoming message. If the incoming message results in an outgoing message, the ICN number will be linked to the outgoing message also.

This number will help you in creating a relationship between the incoming message, the resultant contract in Oracle FLEXCUBE, and the outgoing message, if any.

For instance, if an incoming MT103 results in an FT transaction, then ICN number of the incoming MT103 will be linked to the FT contract generated due to the upload of the incoming payment message.

If an Incoming message results in an outgoing contract (outgoing message), Oracle FLEXCUBE will store the External reference number (ICN Number) at the following levels.

- Incoming Message Level

- Contract Level (Resulted due to the Incoming message)

- Outgoing message (As a result of the above contract)

The external reference number will also double up as the related reference number in Field 21 of the bank transfer message or MT 202. In the Funds Transfer Contract Details screen, this field will be enabled for Bank Transfer Type product. The value will be validated for ‘/’ at the start, ‘/’ at the end or ‘//’ in the value.

The following tags under MT 202 message will support a clearing code ‘PL’:

- 52A, 52D

- 56A, 56D

- 57A, 57D

- 58A, 58D

The details of these messages will be stored in data store and will be used during message validation.

Note

This field should not have ‘/’ at the start or end or ‘//’ in the value.

Transaction Type Code

Specify the transaction type code.

Source Code

The system displays the source code of the source from which the FT contract was uploaded.

Instruction Code

Select the instruction code from the adjoining option list.

Book Date

Specify the date of booking.

Version Number

Select the version number

5.4.1 Body of Screen

The FT Contract Screen is designed to contain four tabs along the lines of which you can enter details of the contract. The four tabs are:

Main |

Click this tab to enter vital details of a contract. This screen, along with its fields, has been detailed under the head Processing a Funds Transfer. |

Other Details |

Click this tab to set the preferences and specify other details. The details of this tab have been explained under the head ‘Capturing Other Details’. |

Settlement Details |

Click this tab to specify the details pertaining to regulatory reporting and envelope. You can specify the details on this screen if you have checked the option ‘Remit Messages’ in ‘Product Preferences’ screen. |

Settlement Route |

Click this tab to view a screen which depicts the route that a transfer will take before it actually reaches the ultimate beneficiary. The details of this screen have been detailed under the head Viewing the settlement route of a transfer. |

On the contract detailed screen you will notice a vertical toolbar. The buttons on this toolbar enable you to invoke a number of functions that are vital to the processing of a transfer. These buttons have been briefly enlisted below.

Settlement |

Click this button to invoke the Settlement screens. A transfer is settled based on the settlement details that you specify. This has been discussed in the Settlements manual. |

MIS |

Click this icon to define MIS details for the transfer |

Charges |

This button invokes the Charges, Commissions and Fees (ICCF) service. On invoking this function you will be presented with a screen where the ICCF rate, amount, currency, waive charge Y/N parameter can be specified. In the Charges and Fees manual you will find the entire procedure for maintaining charge rules. It also deals with the linking of a charge scheme to a product and the application of the scheme on a transfer. |

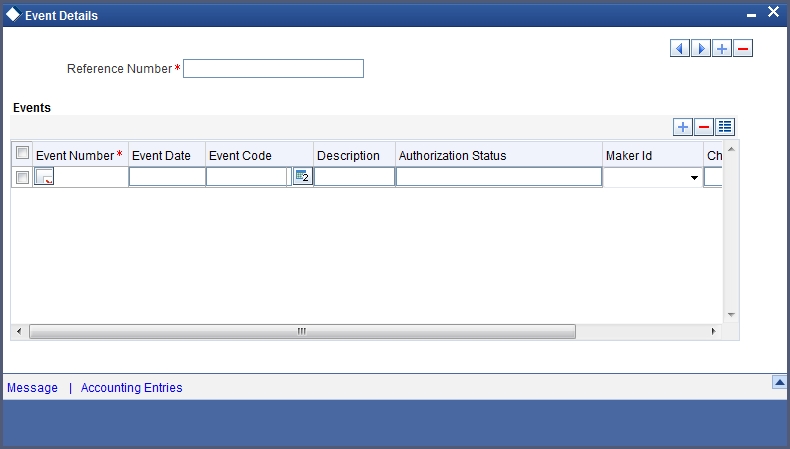

Events |

Click this button to view details of the events in the life cycle of the transfer you are processing. |

Tax |

This button invokes the Tax services. On invoking this function you can define the tax scheme that is applicable to the transfer. The Processing Tax manual details the entire procedure of maintaining tax rules and schemes. It also deals with the linking of a tax scheme to a product and the application of the scheme on a transfer. |

Advices |

Click on this button to suppress or prioritize the advices that are to be generated for a contract. The details of the advices screen have been detailed under the head ‘Specifying advices for a transfer’. |

Fields |

Click on this icon to invoke the User Defined Fields screen. |

Charge Claim |

Click this button to specify details for the generation of a Charge Claim Advice (MT 191). |

Change Log |

If a contract has more than one version, you can use this screen to identify the details that have been changed. |

Customer Cover Details |

Click this button to specify or view all details related to the new COV format of customer cover. |

All Messages |

Click this button to view all messages generated for a particular contract. |

Project Details |

Click this button to capture project details if the beneficiary account is a Trust account. |

Duplication Details |

Click this button to view the details of duplicate contracts. |

After you have made the required mandatory entries and saved the record, your User ID will be displayed at the bottom of the screen. The date and time at which you save the contract will be displayed in the Date Time field.

A user bearing a different User ID should authorize a contract that you have entered before the EOD is run. Once the contract is authorized the Id of the user who authorized the contract will be displayed. The status of the contract will be marked as Authorized.

Click ‘Exit’ button to exit the screen. You will return to the Application Browser.

5.5 Funds Transfer

This section contains the following topics:

- Section 5.5.1, "Processing Funds Transfer"

- Section 5.5.2, "Specifying Details for Debit Leg of Transfer"

- Section 5.5.3, "Specifying Details for Credit Leg of Transfer"

- Section 5.5.4, "Specifying Party Details"

- Section 5.5.5, "Capturing Additional Details"

- Section 5.5.6, "Note on Rate Pickup and Message Generation"

- Section 5.5.7, "Limit Amounts for Cross Currency Transactions for Default of Exchange Rates"

- Section 5.5.8, "How Limits are applied when Transaction is Entered"

- Section 5.5.9, "Exchange Rate for Cross Currency Transactions"

- Section 5.5.10, "Internal Remarks"

- Section 5.5.11, "Capturing Payment Details"

- Section 5.5.12, "Specifying Upload Details"

5.5.1 Processing Funds Transfer

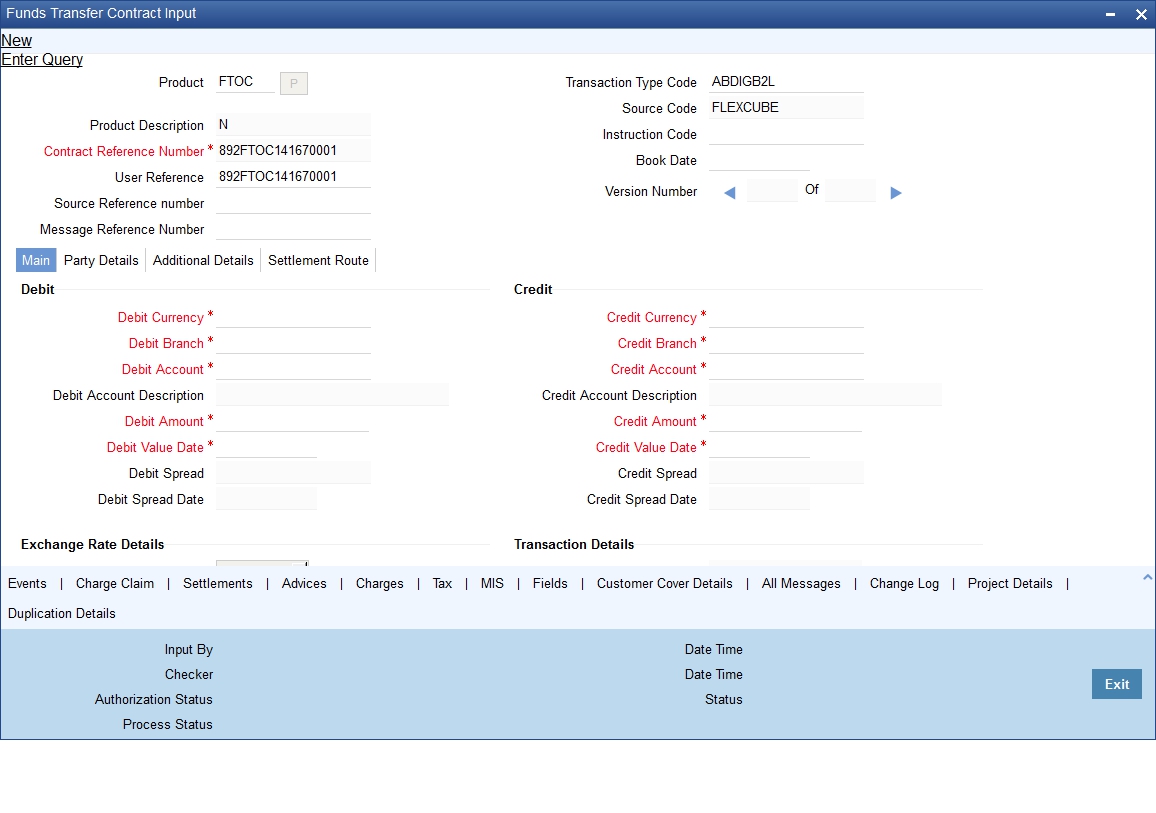

While defining a product, you have defined a broad outline that will be applicable to all transfers involving it. While processing a transfer, you need to enter information that is specific to the transfer. This information is captured through the Funds Transfer Contract Input – Main screen. From the Funds Transfer Contract Input screen, click the tab titled Main to define important contract details.

The entries that you make to the various fields on this screen depend on whether the funds involved in the contract are incoming, outgoing, or internal. Details of information that can captured through the ‘FT Contract Main’ screen have been detailed below.

5.5.2 Specifying Details for Debit Leg of Transfer

Debit Currency

Specify the currency of the remitter’s account. You can choose a valid currency code from the list of values that is available.

If you do not specify the debit currency, the currency of the account entered in the Remitter Account field will be taken as the debit currency for the transfer. However, if you indicate only the GL of the remitter account and not the account itself in the account field, input into the currency field becomes mandatory.

Debit Branch

If the account of the remitter is in a branch different from your branch, enter the code of that branch. Choose a branch code from the adjoining option list.

This field will be defaulted with the branch code of your bank.

Note

If you have specified an account that uses an account class that is restricted for the product, an override is sought.

Debit Account

Specify the account number of the remitter i.e., the account to be debited for the transfer amount. This account number should exist in the list of accounts maintained for the branch you had specified in the ‘Branch’ field.

If you are processing an incoming transfer, enter the account of the bank from which your bank has received funds (typically this will be your nostro account in the currency of the transfer). If it is an outgoing transfer, specify the account of the Ordering customer (the ordering customer of your bank). If the remitter is your bank itself, you can specify just the GL of the account. The appropriate account will be picked up by the system, in the currency of the transfer (the currency you specified in the currency field).

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Debit Account field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Debit Account Description

The description corresponding to the debit account selected is displayed here. If the debit account number keyed in has only one value matching it in the option list, then system will not open the option list on tab out and the description of the debit account will be automatically displayed.

Debit Amount

In this field, enter the amount that is being transferred. This amount is taken to be in the same currency indicated in the previous field. In the case of incoming transfers, this will be the transfer amount indicated in the event definition by the amount tags TFR_AMT. In the case of outgoing transfers, the amount that you enter here will be corresponding to the amount tag AMT_EQUIV, since in an outgoing transfer the actual transfer amount is the amount that is being transferred to the Beneficiary.

On saving the transaction after entering all the required details in the system, the system validates the value of the debit amount against the following:

- Product transaction limit

- User Input limit

If the transaction currency and the limit currency are different, then the system converts the amount financed to limit currency and checks if the same is in excess of the product transaction limit and user input limit. If this holds true, the system indicates the same with below override/error messages:

- Number of levels required for authorizing the transaction

- Transaction amount is in excess of the input limit of the user

Debit Value Date

This is the date on which the debit leg of the funds transfer becomes effective, i.e., the value date with which the remitter’s account is debited. This date must be earlier than or same as the credit date.

If you do not enter a debit value date, the system defaults the system date (today’s date).

The generation time of an outgoing transfer effected directly in the FT module, through settlements of any other module or on account of a straight through process should be checked against the cut-off time defined for the currency involved in the transfer.

If the system time at the time of message generation for Outgoing transfers is beyond the cut-off time, the value date of the transfer is amended according to the number of days to be added.

Debit Spread

The system displays the number of spread days maintained in the ‘Value Date Spread Detailed’ screen for a customer, product and currency.

Debit Spread Date

The system displays the debit spread date for product, customer and currency in this field. It is derived after adding the spread days to the debit value date maintained in ‘Value Date Spread Details’ screen.

5.5.3 Specifying Details for Credit Leg of Transfer

Credit Currency

Specify the currency in which the beneficiary is to be credited. If you do not enter a credit currency, the currency of the account entered in the ‘Credit Account’ field will be defaulted.

It is mandatory for you to enter a credit currency if you have indicated a GL as the credit account. You can choose a valid currency from the list of values available for this field.

Credit Branch

Enter the branch to which you are crediting funds (i.e.) the branch into which you are crediting the transfer amount, on behalf of the Ultimate beneficiary. You can select a valid branch code from the adjoining option list.

Note

If you have specified an account that uses an account class that is restricted for the product, an override is sought.

Credit Account

This is the account that will be credited with the transfer amount. For an outgoing transfer it refers to the next bank in the chain (typically your nostro in that currency), for the movement of funds. Depending on the settlement route the funds will in turn be transferred to the next bank in the chain before the ultimate beneficiary is paid. For an incoming transfer this will be ultimate beneficiary’s account in your bank. If you specify a Trust account in this field, you will have to specify project related details in the ‘Project Details’ sub-screen by clicking ‘Project Details’ button. If you do not capture project details, the system will display an error message while saving.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Credit Account field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Credit Account Description

The description corresponding to the credit account selected is displayed here.. If the credit account number keyed in has only one value matching it in the LOV, then system will not open the LOV on tab out and the description of the credit account will be automatically displayed.

Credit Amount

Indicate the amount that is to be credited to the beneficiary account. If you are effecting an outgoing cross currency transfer, you need to only enter the credit amount; the other component of the transfer, that is, the debit amount will be derived based on the exchange rate that you specify.

In the case of incoming transfers, the amount that you enter in this field will correspond to the amount tag AMT_EQUIV (the equivalent amount in the remitter’s account currency), while in the case of outgoing transfers, the amount that you enter here will be corresponding to the amount tag TFR_AMT (representing the actual amount that is being remitted.

On saving the transaction after entering all the required details in the system, the system validates the value of the debit amount against the following:

- Product transaction limit

- User Input limit

If the transaction currency and the limit currency are different, then the system converts the amount financed to limit currency and checks if the same is in excess of the product transaction limit and user input limit. If this holds true, the system indicates the same with below override/error messages:

- Number of levels required for authorizing the transaction

Transaction amount is in excess of the input limit of the user

Credit Value Date

This is the value date with which the Beneficiary’s account is to be credited. The credit value date is in reality the value date (transaction date) of the transfer. This date must be later than or equal to the debit date.

The system defaults the value date as explained below:

- For incoming and internal transfers the default is the system date

- For outgoing transfers the default date is the system date + spot

days as defined in the currency table in the Core Services module of

Oracle FLEXCUBE.

Transfer Type

Remitter

Beneficiary

Internal Transfer

For an internal transfer, it is mandatory for you to enter details of remitter of the funds.

The remitter in this case can be a customer or a bank.

For an internal transfer, it is mandatory for you to enter details of beneficiary of the funds. The beneficiary of an internal transfer can be a customer or a bank.

Incoming Transfer

For an incoming transfer the remitter of the funds is always a bank. Once the debit leg currency is chosen the system will default the nostro account maintained in that currency as the debit account.

The beneficiary in the case of an incoming transfer can be either a bank or a customer.

Outgoing Customer Transfer

For outgoing transfers, it is mandatory for you to enter details of remitter of the funds. The remitter in this case is almost always a customer. However if you input a bank as the remitter of such a transfer, then the system will seek an override. If you input a GL as the remitter, then it is mandatory for you to enter the details of the Ultimate beneficiary.

If it is a Nostro, then it is mandatory for you to enter the details of the Ultimate beneficiary.

The system automatically default s the nostro maintained in that currency in the credit account field once you enter the credit leg currency.

Outgoing Bank Transfer

If you are entering an outgoing bank transfer, input into this field is mandatory.

In the case of Outgoing Bank Transfers, the remitter can be either a bank or a GL. If you enter a GL in this field then input into the ‘By Order Of’ field becomes mandatory.

In this case the beneficiary must be a bank or a Managers Check Payable.

Outgoing Own A/C Transfer

In case of Outgoing Own A/C transfer, the remitter account has to be a ‘Nostro’ Account. It is also mandatory to maintain the mapping of this Nostro account with the external account.

The beneficiary account also needs to be a Nostro account but with a different Bank than that of the remitter

Credit Spread

The system displays the number of spread days maintained for a customer, product and currency as specified in the ‘Value Date Spread Detailed’ screen.

Credit Spread Date

The system displays the credit spread date for product, customer and currency in this field. It is derived after adding the spread days to the credit value date maintained in ‘Value Date Spread Details’ screen.

IBAN for the debit and credit accounts

The IBAN or International Bank Account Number is a unique account number that is used to identify a customer’s account in a financial institution internationally.

International Bank Account Numbers in your bank are generated in the format of the account mask that you specify in the IBAN Masks section of the Branch Parameters.

You may need to provide the IBAN for the debit and credit accounts involved in a funds transfer transaction.

Debit IBAN

In this field, indicate the IBAN corresponding to the debit account that you have entered for the transaction.

Credit IBAN

In this field, indicate the IBAN corresponding to the credit account that you have entered for the transaction.

Virtual Account

Specify the virtual account number in this field. Based on your input in the ‘Virtual Account Code’ field and ‘Credit Currency’ fields, the physical account is populated in the ‘Credit Account’ field. If no physical account is mapped to the virtual account, then the default physical account linked to the virtual account is derived.

Virtual Account Name

The account name of the virtual account number is displayed in this field.

5.5.3.1 Specifying Exchange Rate Details

The system ascertains the CIF ID based on the debit (for outgoing customer transfers) or credit account (for incoming customer transfers) that you specify. This, along with your specification of the Currency Pair and the Value Date for the transaction, enables the System to automatically assign the exchange rate that is to be used for the FT deal, if currency conversion is involved.

The Exchange Rate applicable for the transaction = Base Rate +/- Customer Spread (depending on whether it is a Buy or a Sell).

The Base Rate is derived from the Mid Rate and the Buy/Sell Spreads that you maintain for the currency pair in the exchange rate maintenance table. The system displays the rate type based on the specifications defined in the product to which the contract is linked.

Similarly, the spread that you have maintained for the specified Counterparty, Currency Pair and Tenor combination in the Customer Spread Maintenance screen is picked up and applied for the customer involved in the deal. The tenor for an FT contract is zero (0) – therefore, you need to maintain Customer Spread for zero tenor in the Customer Spread Maintenance screen.

If spread details for a specific counterparty (for the currency pair) are unavailable, the System looks for the customer spread maintained for the wildcard ALL entry. If even that is not available, then the Customer Spread defaults to zero.

The method of spread definition – whether percentage or points – as well as the spread code are displayed based on the specifications defined for the product to which the contract is linked.

Note

For a customer availing any Relationship Pricing scheme, the customer specific exchange rate gets defaulted here, on clicking the ‘Enrich’ button.

FX Contract Reference

Specify the FX Contract Reference number you need to link to the FT contract, for the currency pair. The adjoining option list displays a list of valid FX contract reference number. Select the appropriate one.

If you specify the FX Contract Reference number, you will not be allowed to specify Rate Date and Rate Serial. You cannot Link FX Contract to the FT contract, if 'Split Dr/Cr Liquidation' check box is checked at FT product level

Rate Reference

The Rate Reference for the currency pair can be selected from the option list provided. If you specify the Rate Reference, you will not be allowed to specify Rate Date and Rate Serial.

Rate Date

Rate Date is used for picking up the exchange rate for the currency pair involved in the transaction and is applicable only in the case of cross currency transactions.You need to specify the Rate Date for the currency pair. The Rate Date must be less than or equal to the application date. If you specify Rate Date and Rate Serial, you will not be allowed to specify Rate Reference.

Rate Serial

You can specify the Rate Serial for the Rate Date you have entered. All the rate serials existing for the selected Rate Date will appear for selection. Select a Rate Serial from the option list provided. If you have specified Rate Date and Rate Serial, you cannot specify Rate Reference.

Validations for the Rate Date, Rate Serial and Rate Reference

You cannot specify Rate Date and Rate Serial and Rate Reference simultaneously. You can specify either Rate Reference or Rate Serial and Rate Date. To choose Rate Reference, select from the option list provided. This list will show all active spot FX contracts for the same currency pair as the FT transaction. The currency pair is determined based on the product type of the FT.

Upon choosing the FX contract, the system will default the Exchange Rate of the FX deal as the Base Rate as well as the Exchange Rate for this FT contract. If the Rate Reference is chosen, then no Spread will be applied to the Exchange Rate. The System will take the Exchange Rate of the FX contract as it is. There will not be any variance validation in this case.

If you specify the Rate Date and Rate Serial, then system will look into the Exchange Rate Maintenance and get the rate for the combination. If the Rate Serial number is not present, the system will throw up an error saying the Rate for the Serial Number does not exist. If the Rate Serial Number and Rate Date are entered, then the base rate will be defaulted with the Rate for this combination. In addition to this, the Customer Spread and Product Spread will be applied and the Exchange Rate will be arrived at.

The Rate Serial will be used only if the transaction amount is less than the limit defined for a currency pair. The Funds Transfer Contract Input will default the Rate only if the transaction amount is less than the maximum amount defined for the Rate Code maintained at the FT product level. If the amount is more than the specified amount, then the system will not default the Rate. Instead, it will force you to enter the Rate. If you enter the Rate, the system will not add the Customer Spread, as this will be the final Exchange Rate for the contract.

The rate variance validation will also be done only if the Transaction Amount is less than the Maximum Amount defined for the Rate Code maintained at the FT product level. If the amount is more than the specified amount, the system will not perform rate variance validation. Instead, there will be an override to specify that the transaction amount is greater than the maximum amount for rate variance check.

For more details on customer specific exchange rates, refer the section titled ‘Specifying Pricing Benefit Details’ in Relationship Pricing user manual.

5.5.3.2 Specifying Transaction Details

Local Currency Equivalent

The system displays the local currency equivalent of the transfer amount.

Charge Bearer

There are obvious costs involved in transferring funds from one location to another. You need to indicate who will actually bear these service charges. You can select an option from the option list that is available. The options available are:

- Remitter — All Charges

- Beneficiary — All Charges

- Remitter — Our Charges

This specification is inherited from the specification involving the product used by the contract. It can be changed for a specific FT only if such a change is allowed in the preferences for the product.

Message As Of

Specify the date as of when the messages are to be generated.

Rate As Of

Specify the date as of when exchange rates should be picked up and applied to the components of a transfer.

Accounting As Of

Specify the date as of when accounting entries are posted.

Message Date

Specify the message date.

Accounting Date

Specify the date on which the accounting entries are posted.

Rate Pickup Date

Specify the date on which rate is picked up.

5.5.3.3 Specifying Other Details

Receiver

Indicate the name of the receiver or receiving institution that receives the message regarding the transfer of funds, if it is different from the Account with Institution.

For incoming FT contract created through STP, the receiver will be updated based on the debit account

5.5.3.4 Enriching FT Contract

In case of an outgoing FT contract, specify the credit amount and click the ‘Enrich’ button. The system displays the debit amount. Similarly, in case of an incoming FT contract, you need to specify the debit amount. The system will display the credit amount on clicking ‘Enrich’ button.

Each time you modify the transaction details such as Debit Account, Credit Account, Exchange Rate, Debit Value Date, Credit Value Date or Transaction Amount, you need to click ‘Enrich’ button before saving the modification.

Note

If you do not click ‘Enrich’ button before saving the record, the system will validate the data with the corresponding values as per the product, settlements and customer spread maintenance. If the values specified on this screen do not match those in the maintenances, the system will overwrite the values entered by you.

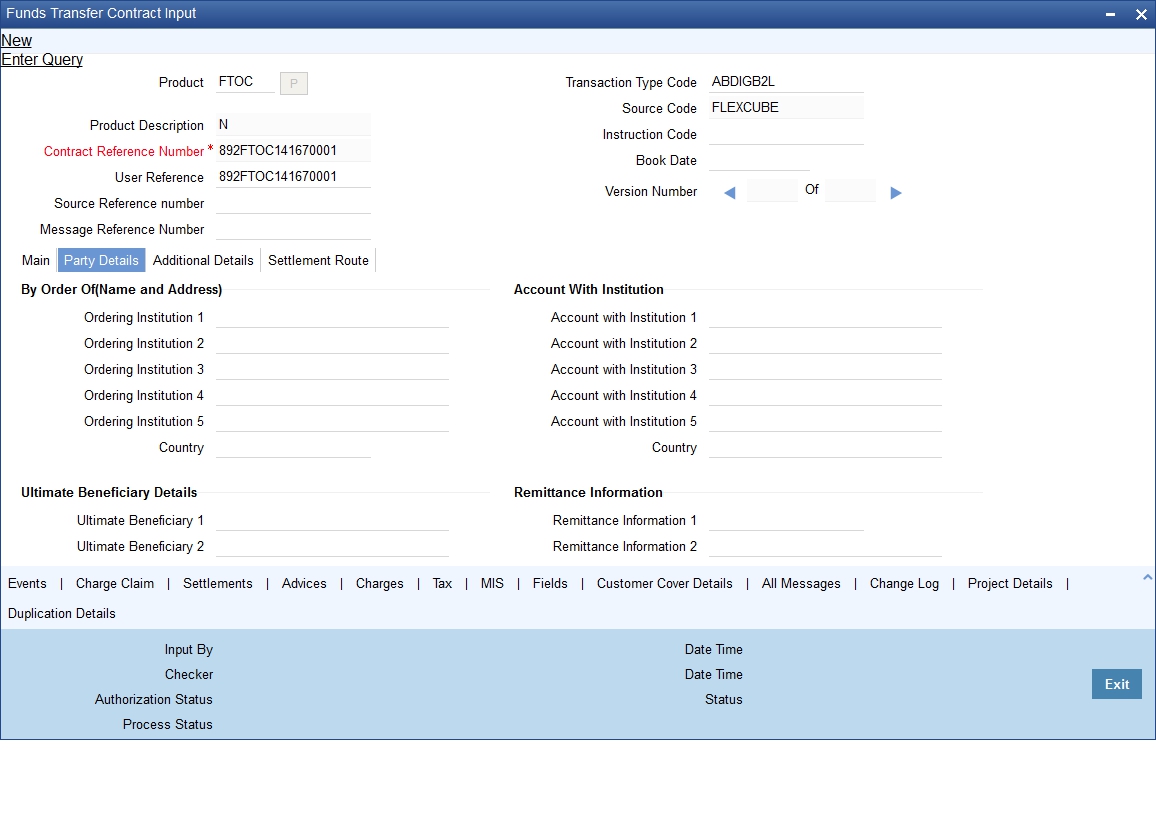

5.5.4 Specifying Party Details

Click ‘Party Details’ tab to invoke the following screen.

Here you can enter the following details:

5.5.4.1 Specifying Name and Address of Ordering Customer (By Order Of)

Indicate the name and address of the ordering customer or institution of the transfer in the field ’By Order Of‘. Input into this field depends on the type of transfer that has been initiated. You can also choose the BIC of the customer from the adjoining option list that displays all the BIC maintained in Oracle FLEXCUBE. The details that you enter will be used to determine the settlement route of the transfer and in the SWIFT messages that are generated for the transfer.

This field corresponds to field 50 in the MT 103/MT 103+ message that will be generated for the customer transfer. Here you can specify up to 4 lines (each of 35 characters) indicating the ordering customer’s name and address or BIC. The details in this field will be defaulted automatically once you enter the debit account in the case of an outgoing transfer. For instance, the IBAN of the customer will be fetched from customer account and defaults the same as the first line of Ordering Customer. Note that for an outgoing MT102, MT103, MT103+ and MT210 the first line should have number 1 present for option F. The customer’s name will be defaulted in the second line and the address on the third.

Country

Specify the country of the ordering customer/institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

5.5.4.2 Specifying Account with Institution

Indicate the institution where the beneficiary’s account is to be credited with the amount of the funds transfer. This is known as the account with institution. This field corresponds to Field 57 of the payment message.

Country

Specify the country of the beneficiary’s account with institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

5.5.4.3 Specifying Details of Ultimate Beneficiary of Transfer

Indicate the name and address of the ultimate beneficiary of the transfer. The ultimate beneficiary can be a customer or institution depending on the type of transfer that you have initiated.

For incoming or internal transfers, you can select the ultimate beneficiary from the option list. If you have maintained settlement instructions for the ultimate beneficiary the transfer will be routed through the default settlement route. This field corresponds to Field 59 of the customer transfer messages (MT 103/103+) and field 58 in case of a bank transfer. When you choose the credit account (in the case of an incoming transfer) the details of the ultimate beneficiary (like IBAN) will be defaulted automatically by the system. While saving the contract, System will Validate Ultimate beneficiary (59) for a valid IBAN account number. IBAN validation will be done in the below cases for both Ordering Customer and Ultimate beneficiary. The system will consider the IBAN valid only if:

- The first character is ‘/’

- The second and third characters represent a valid country code

- Both Sender’s and receiver’s countries should be for Mandatory IBAN Check

Country

Specify the country of the ultimate beneficiary. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Note

The country information is captured to enable Mantas to analyze the transactions for possible money laundering activities.

For more details on Mantas, refer 'Mantas' interface document.

5.5.4.4 Capturing Remittance Information

You can specify the sender to receiver information of the transfer by selecting the appropriate value from the adjoining option list. The details that you enter will be populated in field 70 of the payment message MT 103. The following values are available in the option list:

- //

- /INV/

- /IPI/

- /RFB/

- /ROC/

- /TSU/ - The code placed between slashes ('/') must be followed by the invoice number, a slash ('/') and the amount paid.

Apart from the values provided in the list, you can also specify a valid ISO11649 creditor reference number in the Remittance Information field.

Validations

System validates the specified reference number and displays the error message, if found wrong as ‘Invalid Value for field Remittance Information’.

The Creditor Reference Number, if specified, should adhere to the following:

- First 2 characters should be ‘RF’.

- ‘RF’ should be followed by 2-digit check digit.

- The total length of the Creditor Reference Number should not exceed 25 characters.

If Creditor Reference Number is specified in any of the remittance information fields, then during message generation the system ignores rest of the remittance information.

5.5.4.5 Specifying Beneficiary Advice Preferences

For outgoing remittances, you can indicate the mode of sending advice to beneficiary here. The details specified in Ultimate Beneficiary Maintenance get defaulted here. You can modify these values, if required.

Fax Number

Specify the fax number of the ultimate beneficiary for whom you are maintaining details.

Mobile Number

Specify the mobile number of the ultimate beneficiary for whom you are maintaining details.

Email Address

Specify the email address of the ultimate beneficiary for whom you are maintaining details.

Note

You can specify only one of the options among fax number, mobile number and e-mail address.

The system generates the beneficiary advice based on the details specified here, during contract initiation or during the batch for future dated remittances. ‘BEN_ADV’ message type is used for generating the advice. The advice generated contains the following tags:

- FAX/Email Address

- Order By(50)

- Beneficiary (59)

- Payment Details (70)

- Value date

- Currency

- Amount (Credit Amount)

- Amount in words

- Originating bank/branch address

Note

- Generic Interface is used to send out the beneficiary advice via fax or mobile.

- The advice will not be generated if beneficiary details are not specified

For more details on Ultimate Beneficiary maintenance, refer the section titled ‘Maintaining Ultimate Beneficiary details’ in Settlements user manual.

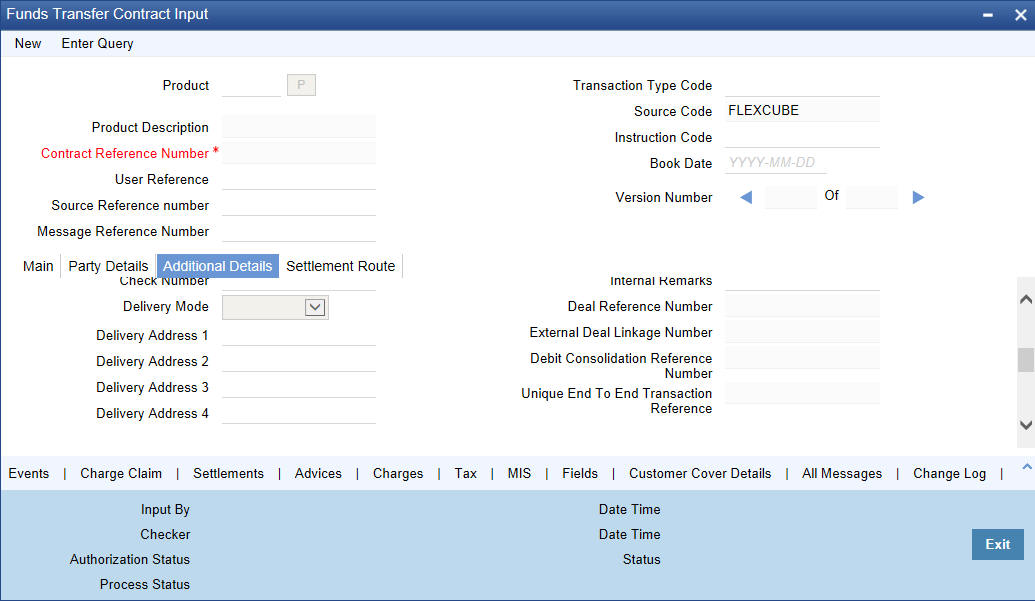

5.5.5 Capturing Additional Details

Capture more information with regard to the product from ‘Funds Contract Transfer Input – Other Details’ screen. From the ‘Funds Transfer Contract Input’ screen, click the tab titled ‘Additional Details’ to invoke the following screen.

5.5.5.1 Indicating Preferences

Oracle FLEXCUBE allows you to indicate your preferences. You can check the boxes corresponding to the following fields as required.

Override Overdraft

The Override Overdraft field is applicable to future dated contracts. This field is defaulted based on the specifications you made in the Process overdraft for Autobook field on the product preference screen.

The Autobook function automatically liquidates future dated funds transfer contracts. There could be a situation where a customer requests you transfer an amount that actually exceeds the balance in his account. In this field you can specify whether such future dated contracts, can be processed when it is picked up by the autobook function, despite the overdraft. If you check against this field the system will allow overdrawing and process such contracts.

Otherwise the auto book function will skip the contract with an error message. You can view all the contracts that are not processed by the Autobook function because of the overdraft in the FT Exception Report.

Remit Message

This is defaulted from the product level. If you wish to send the envelope contents, you need to check this box.

The following validations will be carried out in Oracle FLEXCUBE if the ‘Remit Message’ box is checked:

- The Sender and Receiver are Remit members

- Envelope contents are mandatory

- If the ‘Remit Message’ box is checked, the value of the Transfer Type will be ‘CUST_TRANSFER’

- An override message is displayed if payment details are maintained

The remit message will be displayed in the message in Block 119 as 119:REMIT.

Our Correspondent Required

If the transfer is routed through a correspondent bank, you can indicate so, by selecting this option.

After Rate Refresh

To recall, you have specified the exchange rates to be used and indicated when they are to be applied to the components of the transfer. You have the option to indicate that the rates should be picked up only after the rates have been refreshed and authorized for the day.

Check against this field to indicate that the standard rate as of as of a future date can be applied to the transfer only after the rates have been refreshed and authorized for the day. Leave it unchecked to indicate otherwise.

If you have checked against this field, the exchange rate is picked up by the same method mentioned for the standard rate, except that the rate as of booking, spot or value is picked up only after the rate refresh has been completed and has been authorized.

When you run the Rate Update function, all contracts that require a rate update will be displayed. It is from this screen that you can allow the refreshed rates to be applied to the components of the transfer.

Refer to the chapter titled Automatic Processes for details of the rate update function.

Uploaded

If the contract has been uploaded from the Oracle FLEXCUBE FT gateway interface then the field marked Uploaded will be automatically checked to indicate that the contract has come from an external system. For details, refer the section ‘Specifying upload details’ in this chapter.

5.5.5.2 Specifying Check Details

Indicating the Manager’s Check number

This is the identifying number of the Manager’s check that you issue for outgoing transfers by check. This number should be unique across contracts and is used as a reference for outgoing transfers.

For transfer types involving a Manager’s Check, the beneficiary account field will be defaulted with the Manager’s Check payable account defined for the product.

Note

It is mandatory for you to enter a manager’s check number if you have checked against Instrument Number Required in the Product Preferences screen. On the other hand, you will not be allowed to make entries into this field, if the Managers check allowed field is unchecked in the FT Product Preference Screen.

Indicating a customer check number

If you are processing an outgoing transfer and need to debit a check into a customer account, you should indicate the identifying number of the check being used in the transfer.

The check number that you enter will have to match number validations in the check book details table maintained in the Current Account and Savings Account (CASA) module of Oracle FLEXCUBE.

Delivery Mode

Select the mode of delivery of the cheque book from the adjoining drop-down list. This list displays the following values:

- Courier

- Branch

Note

If the delivery mode is ‘Courier’, then you will need to specify the delivery address.

Delivery Address 1

Specify the address to which the cheque book should be delivered. The adjoining option list maintains all valid addresses maintained in the system. You can choose the appropriate one.

Delivery Address 2- 4

Specify the address to which the cheque book should be delivered.

5.5.5.3 Specifying Regulatory Reporting Details

Specify the regulatory reporting details.

5.5.5.4 Specifying Multi Credit Transfer Details

Enabling Multi Credit transfer

You cannot enable or disable the Multi Credit Transfer option. It is defaulted from the product/branch level and cannot be changed by you at the contract level. This option will be enabled for ‘Multi. Customer Transfer’ and ‘Multi Financial Institution Transfer’ type of payments only and will not be enabled for other normal products.

Multi Credit Reference Number

You can assign a Multi Credit Reference number to a specific contract by clicking the option list to choose from the list of Multi Credit Reference Numbers that are pending closure. During contract save, the system validates the above-mentioned fields with existing contracts and if the current transfer/transaction is identical to an existing contract it is pooled together with the existing contract and it also assumes the same ‘Consol Account Reference ’ number as the existing one. [Only Consolidation Pool pending closure, will be considered] In case the above fields are not identical or if the number of contracts in the Pool exceeds 10, the system generates a new ‘Consol Account Reference’. In case you do not specify any ‘Multi Credit Ref No’ the system would generate a ‘Consol Account Reference’ for the first time.

Note

Processed Consolidation Pools will not be considered for matching.

If grouping is done by the system, based on grouping criteria then ‘Multi Credit Ref No’ would be NULL and ‘Consol Account Reference’ would be used to consolidate accounting entries. In case you are doing the consolidation by yourself, the ‘Multi Credit Ref No’ would be the Reference Number given by you and ‘Consol Account Reference’ would be used to consolidate Accounting Entries.

All Multi Financial Institution Transfer contracts would have Messaging, Accounting and Rate as of booking date only. The ‘After Rate Refresh’ field will not be enabled for such contracts.

Amendment of Contract will be allowed only if Message has not been generated. If any of the above mentioned fields used for grouping are changed, the contract would be tracked against a different consolidation pool depending on the new values.

During the contract authorization, payment messages will be generated in suppressed stage. Message generation happens after the individual queue is closed.

If you close a Consolidation Record by means of the Close Button or the Close option from the menu, the consolidation record is liquidated. The system generates MT102, MT203 or MT201 for multi customer credit transfer, multi credit bank transfer or multi credit own account bank transfer respectively. Further, consolidated accounting entries are posted. Generation of MT102 and MT203 provides for the generation of consolidated cover messages. One cover per each MT102/MT203 is sent along with the consolidated amount.

During closure of consolidated record, the system triggers CINT (Consolidation Event for both Messaging and Accounting) event.

Consol Account Reference Number

The consol account reference number is system-generated. This number is the reference that facilitates consolidation of the various transfers of a customer, based on the grouping criteria. It facilitates passing Consolidated Accounting entry to the Beneficiary Account/Settlement Account.

The following items are checked for consolidating transfers across the system:

- Product Code

- Settlement Account

- Receiver

- Currency

- Credit Value Date

- Bank Operation code

- Sender Correspondent

- Receiver Correspondent – Line1 to 5

- Sender to Receiver Info (Tag 72) – Line1 to 6

- Message Date

- Multi Credit Ref. No

- Consol Account Reference

All transactions that have identical above-mentioned fields/items are validated and consolidation happens if intermediary party [tag 56] is not mentioned in any of the transaction.

The systems checks whether the beneficiary of the message is MT102/ MT203 enabled and also if ‘Multi Credit Transfer’ flag is enabled at the BIC level. If the field is not enabled, the system will generate an error message.

Consolidation Status

The system indicates whether the consolidated contracts for a given multi credit reference number are pending closure (P) or closed (C).

Note

The Multi transfer message is generated upon the closure of the reference number. However upon the authorization of each individual contract, the corresponding payment message is in the generated status. But the status of the Suppress Flag is ‘Y’ for the same. Hence the Job which processes the outgoing message does not process these messages.

Debit Consolidation Reference Number

The system displays the contract reference number of the consol internal FT contract created for customer debit consolidation.

- For incoming and outgoing Existing MT102 message, processing will be extended to handle MT102+ format.

- For outgoing MT102+, flag field 119 will be populated with STP in the third user header block.

- For incoming MT102+ flag, field 119 will be checked for code STP in the third User header block. If value is STP then MT102+ validations will be done before uploading transactions.

For processing outgoing MT102+, the following validations are done:

- Ordering Institution and AWI are used with letter option A.

- Sending Institution is not used.

- Bank Operation Code contains codes ‘CREDIT’ and ‘SPAY’

- Sender to Receiver Information.

- Contains INS in the beginning and followed by a valid BIC.

- Contain codes ‘REJT’ and ‘RETN’

- Must not contain ERI information.

- Must contain Account field or Beneficiary Customer

- MT102+ will not be generated on booking or authorization of a transaction. It will be generated from Outgoing Consolidation screen similar to MT102.

If with the above validation, you check the option ‘Generate MT102+’ in addition to ‘Multi Credit Transfer ’ in the following screen, MT102+ will be processed

- Funds Transfer Branch Parameters

- BIC

- FT Product

You can generate MT 102 and MT102+ message from Queue called ‘Funds Transfer Multi Customer Summary’ where Consolidation of individual MT102s is done.

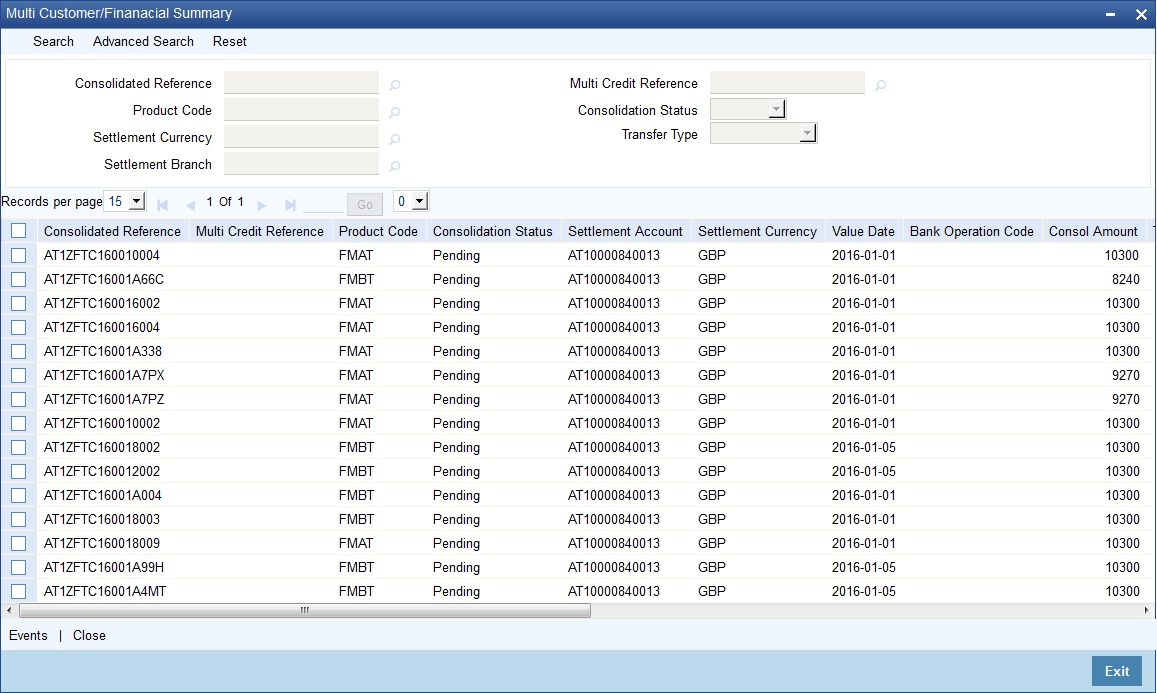

You can invoke the screen by entering ‘FTSTCONS’ in the field at the top right corner of the Application toolbar and clicking the adjoining arrow button.

In this screen, you can query on record based on the following criteria:

- Consolidated Reference

- Product Code

- Consolidation Status

- Multi Credit Reference number

- Settlement Currency

- Settlement Branch

This Queue gives the summary of all the consolidated transactions. Drill down gives the Summary screen of the FT contract.

Close of the Consolidation Record initiated through the Close Button or Close option from the menu liquidates and creates MT102 and consolidate accounting is also passed. Events called ‘CINT’ (Consolidation Event for both Messaging and Accounting) get triggered during closure of consolidated record.

Generation of MT102 would also generate Consolidate Cover message if required with consolidated amount i.e. one cover per MT102 would be send with consolidate amount if cover is required.

MT203 size restrictions

- MT203 will be generated only if there are more than one transaction

to consolidate

- If only one message is consolidated, MT202 is generated. Similarly, if only one message is consolidated for MT103, system generates MT102.

- Maximum number of transactions for a MT102/MT203 is limited to ten i.e. a maximum of ten transactions (FT Contracts) will be allowed to be consolidated in a single pool. This restriction is based on the parameter ‘MT102_TXN_LIMIT’ setup in CSTB parameters.

- If multiple pools have been created because of size restrictions, any subsequent amendment, deletion, reversal of contracts in these pools will not result in the re alignment of the pools.

5.5.5.5 Specifying Other Details

External Deal Linkage Number

Select the deal reference number of the related external deal from the option list provided. The option list contains system generated reference numbers for all external deals.

The exchange rate, Dr amount, Dr account, Dr currency, Cr amount and Cr currency get defaulted on selecting the external deal reference number.

Note

This is applicable only for outgoing remittance transactions.

Deal Reference Number

The deal reference number associated with the selected deal linkage number gets displayed here.

On initiating this transaction, the amount block maintained against this deal reference number gets released. The amount blocks associated with future dated contracts are released when the corresponding batches are run.

If the contract is deleted or reversed, the amount block gets reinstated with the expiry date as the expiry date maintained in External Deal linkage screen.

Note

- The amount block released corresponds to the debit leg of the transaction and the expiry date of the amount block defaults to the debit leg value date of the contract.

- Only one amount block can be linked to an FT contract.

- The contract amount should be equal to the amount block maintained in the system.

- The debit value date of the contract should be less than or equal to the expiry date of the deal.

For more details on external deal maintenance, refer section titled ‘External Deal Maintenance’ in Core Services user manual.

Unique End to End Transaction Reference

The system displays tag 121 value of category 1 and 2 SWIFT messages.

5.5.5.6 Specifying Envelope Details

Specify the envelope content.

5.5.5.7 Reversal of Outgoing Multi Credit Customer Transfers

In case of reversal of outgoing multi credit transfer, the system passes accounting entries based on the status of MT102 generation.

Scenario 1 - MT102 Not Generated

If MT102 is not generated, the system will pass the following accounting entries during reversal process.

Dr/Cr |

Account |

Description |

Dr. |

Remitter |

With –ve Transaction Amount |

Cr. |

MT102 Suspense |

With –ve Transaction Amount |

Once these entries are passed, the system will adjust the total consolidated amount and remove the corresponding contract from the consolidation queue.

Scenario 2 - MT102 Already Generated

If MT102 is already generated, during reversal, the system will display an override ‘Message has already been generated’. If you choose ‘OK’, the system will proceed with the reversal operation. The following accounting entries will be passed in this case.

Dr/Cr |

Account |

Description |

Dr. |

Remitter |

With –ve Transaction Amount |

Cr. |

MT102 Suspense |

With –ve Transaction Amount |

Dr/Cr |

Account |

Description |

Dr. |

MT102 Suspense |

With –ve Transaction Amount |

Cr. |

Cr. Beneficiary |

With –ve Transaction Amount |

On reversal of an individual transaction, the corresponding CINT event will also be reversed. The system will recalculate the consolidation pool amount.

Closure of consolidation pool is allowed for authorized transactions only. If you attempt to close an unauthorized transaction, the system will display an error message.

While marking EOTI, if there are pending consolidated transactions in MT102 consolidation queue, the system will display a configurable override message. You can choose to proceed or cancel.

5.5.5.8 Indicating when Settlement Messages should be Generated

Indicate the day or date on which Settlement messages related to the transfer should be generated. You can select an appropriate date from the option list that is available.

The options available are:

- As of Booking date

- As of Spot date

- As of Value date

- As of Debit Value Date

- As of Credit Value Date

- As of Instruction Date

If the transfer you are processing is associated with a product, the message generation specifications you made for the product is defaulted. You can change the values that are defaulted if required.

Message as of Booking Date

If you specify ‘Booking Date’, settlement messages will be generated as of the date you enter the contract after the contract is authorized.

Message as of Spot Date

For each currency that your bank deals with, you would have also specified a spot date in the Currency Definition Maintenance table of the Core Services module.

If you choose ‘Spot Date’, messages will be generated spot days depending on the spot date you have maintained for the currency involved in the transfer.

Message as of Value Date

If you specify value date, messages will be generated on the day the transfer becomes effective.

You can enter a value date of your choice. However, it should be one of the following:

- Today’s date

- A date in the past

- A date in the future

You can enter a date in the future only if future value dating is allowed for the product to which the transfer is associated. The Value Date (transfer initiation date) should not be earlier than the Start Date or later than the End Date of the product involved in the transfer.

Message as of Debit Value Date

If you choose this option, the messages will be generated, as on the value date, with which the remitter account will be debited, will be used for the transfer. This would be earlier than the credit value date.

Message as of Credit Value Date

If you choose this option, the messages will be generated on the value date with which the beneficiary account will be credited, will be used for the transfer. The credit value date is in reality the value date (transaction date) of the transfer.

Messages can be generated only after the exchange rate for the contract has been fixed. Thus, based on the rate pick up code that you specify, you will have to match the options for message generation.

For normal contracts (as of booking date) messages will be generated only after authorization. In the case of Future Valued transfers messages will be generated as of spot date.

Message Date

This is the actual date on which the messages are to be generated. This date is computed on the basis of the input in the ‘Message as of Field’ in the ‘Contract – Others’ screen.

5.5.5.9 Specifying when Accounting Entries must be passed

For the contract, you can specify whether accounting entries must be passed on the date of message generation (if message generation is indicated on booking date) or on the debit value date of the transaction.

If you indicate that accounting entries must be passed on the date of message generation, the entries related to the contract will be passed on the date of message generation. If message generation is indicated on booking date, and you have indicated that accounting entries are to be posted on the debit value date of the transaction, the messages are generated on the booking date, and the accounting is deferred to the debit value date.

The accounting date

When you make your specification in the Accounting As Of field, the system arrives at the date on which accounting entries will be posted, and displays it in the Accounting Date field on the FT Contract Online screen. If you select ‘Message Date’, the date on which messages are generated is taken as the accounting date. If you select ‘Debit Value Date’, the debit value date of the transaction is taken as the accounting date.

You can only specify the Accounting As Of date if:

- Message generation is indicated to be on the booking date (the option chosen in the Message As Of field is ‘Booking Date’). If message generation is indicated on any date other than the booking date (that is, if the option in the Message As Of field is not ‘Booking Date’), the default option in the ‘Accounting As Of’ field is ‘Message Date’, (that is, accounting entries will be passed only on the date of message generation), and it cannot be changed.

- If message generation before accounting is allowed for the product used by the contract. If allowed, and if the contract involves a customer for whom the facility of message generation before passing of accounting entries has been set in respect of FT transactions, in the Customer Information Maintenance, the preference is defaulted to the contract, and you can change the default if required.

For the messages as of specific dates, you can choose accounting as of specific dates as listed in the table below.

Message as of |

Accounting as of |

Booking Date |

Message Date or Debit Value Date |

Value Date |

Message Date |

Spot Date |

Message Date |

Debit Value Date |

Message Date |

Credit Value Date |

Message Date |

Instruction Date |

Message Date |

If the parameter ‘SGEN_PARAM’ in CSTB_PARAM is set as ‘Y’, the process will be as discussed below.

Message as of’’ is set to ‘Booking Date’. Suppose that ‘Accounting as of’ is chosen as ‘Debit Value Date’.

The system will trigger ‘BOOK’ event on the booking date of the contract.

On authorization of the FT contract, the system will trigger SGEN event and generate settlement messages linked to INIT event or LIQD event. For a contract, if you have checked the option ‘After Rate Refresh’, this happens during End of Day operations. INIT and LIQD events are triggered based on the Debit Value Date. For these events, the system will not generate settlement messages.

5.5.5.10 Indicating Date on which Rates should be picked up

You need to specify the date as of when exchange rates should be picked up and applied to the components of a transfer.

If the transfer you are processing is associated to a product, the preferences you stated for the product will be defaulted. You can change the values that are defaulted.

In the case of a contract that is liquidated as of the booking date, the rates will also be picked up as of the booking date.

For future valued transfers, you can specify the rate pick up date as of booking date, value date or spot date. You can select one of the following options:

Rate as of Booking Date

If you specify that the rates should be picked up as of the ‘Booking Date’, the exchange rates prevailing as of the date you enter the contract is used to compute the components of the transfer.

The spread that you specify for the transfer will be applied to the exchange rates that are picked up.

Rate as of Spot Date

Specify that exchange rates can be picked up as of spot days only for future dated funds transfers.

To recall, for each currency that your bank deals with, you have also specified a spot date in the Currency Definition Maintenance table of the Core Services module.

The spread that you specify for the transfer will be applied to the exchange rates to compute the components of the transfer.

We shall examine an example wherein the ‘rate as of’ is specified as Spot Date:

A customer of your bank approaches you on 1 March 1998 (the booking date) to initiate a cross currency transfer for US $ 10,000. Assume the offset currency of the transfer to be INR. Also assume that you had maintained the spot days for USD to be 2 days in the Currency Definition table of the core services module.

The transfer is to be initiated on 5, March, 1998 (the Value Date). It is therefore a future dated transfer.

Booking Date - 01/03/96

Value Date - 05/03/96

Contract Currency - USD

Contract Amount - 1000 $

Spot Days maintained for USD -2

In this case the exchange rates to be applied to the transfer will be picked up from the currency table on 3, March, 1997, Spot days (2 days) before the Value date of the transfer.

Rate as of Value Date

If you specify ‘Value date’ then the rates to be used to process the transfer amount will be picked up on the day the transfer is effected. The accounting entries for the contract will be passed as of this date.

Enter a value date of your choice. In which case, it should be one of the following:

- Today’s date

- A date in the past

- A date in the future. You can enter a date in the future only if Future Dating has been allowed for the product to which this contract is linked.

The Value Date (transfer initiation date) should not be earlier than the Start Date or later than the End Date of the product involved in the transfer.

Indicating that exchange rates will be ‘User Input’

If you do not want to make the standard exchange rates applicable to a transfer you can choose ‘User Input’ from the option list.

In this case, the exchange rate that you enter in the exchange rate field of the Contract Main screen is picked up to compute the components of the transfer.

Indicating that exchange rates are not applicable

If you are processing a transfer wherein the currency that is remitted is the same, as the currency that is credited, you can indicate that exchange rates are not applicable to the transfer.

Rate as of Instruction Date

If you chose this option, the rate as of the date on which the customer placed his instruction will be taken. This is similar to booking date.

Rate as of Debit Value Date

If you choose this option, the exchange rate as on the value date with which the remitter account will be debited, will be used for the transfer. This may be earlier than the credit value date.

Rate as of Credit Value Date

If you choose this option, the exchange rate as on the value date with which the beneficiary account will be credited, will be used for the transfer.

Rate Pickup Date

This is the actual date on which the rate is picked up. This date is computed based on the input given in the ‘Rate as of’ field on the ‘Contract Other’ screen.

Social Security Number

If you are processing a funds transfer on behalf of a customer of your bank, the Social Security Number of the customer involved in the transaction will be defaulted from the CIF Maintenance details screen. However, if you are initiating the funds transfer for a walk-in customer you will have to capture the walk-in customer’s SS Number.

Note

Each outgoing customer type of transfer initiated by an individual type of customer can be tracked against the customer’s SS number. If the value of debits within a specific customer account exceeds USD 2500, with-in a seven-day working period the system notifies you of the same with an override message.

For example,

Let us assume that on the 24th of September 2001, Mrs. Wendy Klien a customer of your bank initiates an outgoing FT for USD 2000. Since all weekends are considered as holidays at your bank, while processing the transfer all debits against her account for six working days preceding the 24th i.e., up to the 16th September will be tracked against her SS number.

Again, on the 1st of October 2001, she initiates another outgoing transfer, which necessitates a deduction of USD 700 on her account. While processing the transfer the system checks for all debits up to the 21st of September.

An amount of USD 2000 has already been tracked against her SS number on the 24th of September. However, since the current debit exceeds the maximum limit of USD 2500 for a running seven-day working period the transfer will be processed only if your confirm the override.

5.5.6 Note on Rate Pickup and Message Generation

The Rate pickup and message generation codes that you specify for a transfer need to be combined in a fashion to facilitate the following flow of events:

- Rate pickup

- Message Generation

Accounting entries will be passed and then messages will be generated. All the possible combinations between the rate pickup and the message generation codes have been explored and detailed below.

Note

If message generation has been indicated to occur before accounting is done for a contract, the accounting entries are posted on the Accounting As Of date. This could be either the date of message generation or the debit value date of the transaction, as explained in the earlier section.

Standard rate as of booking date - Message as of Spot Date

If you select this combination:

- The amounts will be converted using the rates available in the currency table (on the booking date). The spread will be applied to the rate, based on the spread code you specify.

- Messages will be generated Spot days before the settlement date.

Rate as of Spot - Message as of Spot

If you choose this combination:

- The contracts with this combination will not be processed in the same manner as a normal contract. The Autobook function (a batch process explained in the chapter 7) run either at EOD or BOD, automatically picks up the exchange rates as of spot days before settlement date and applies this rate to the components of the transfer and also passes accounting entries.

- Messages will also be generated by the autobook function on the spot date.

Rate and Message as of Value Date

If you choose this combination the transfer amount will be converted based on;

- The rates that will be picked up on the value date and

- Messages will be generated on the value date.

Rate as of Booking Date - Message as of Booking Date

If you select this combination, the system converts the transfer and commission amount based on the:

- Rates that are available in the Currency table at the time of contract input

- Messages will be generated after the contract is authorized

Rate as of Spot Date - Message as of Booking Date

In this example the rate date is later than the message date and hence this would not be allowed by the system. The message generation in Oracle FLEXCUBE happens along with the accounting and therefore, the rate pick-up date must be on or before the message generation date.

5.5.7 Limit Amounts for Cross Currency Transactions for Default of Exchange Rates

Typically, the exchange rates applicable for cross currency funds transfer transactions is defaulted by the system depending upon the preference indicated in the product preferences, for the product involving the transaction.

In your bank, for high-value cross currency transactions, you may want the user to manually enter the exchange rate involved, rather than let the system automatically pick up a default rate during transaction input. You can define such a preference to be applicable to cross currency transactions involving:

- a currency pair

- a specific product, or all products

- a specific module, or all modules

- a specific branch, or all branches

- a specific Rate Code

The transaction amount limit, above which the exchange rate must be entered, for a high value transaction, could be defined in terms of any currency pair where the currency of the transaction is currency1 in the CCY pair defined in the maintenance.

To ensure that users manually enter exchange rates for high-value cross currency transactions in Oracle FLEXCUBE, you must specify the limit amounts that must be validated against for each currency pair, product, module and branch combination. You can use the Exchange Rate Limits screen to specify the limits.

When you have specified these limits, the system automatically validates the amount each transaction for the currency pair, product, module and branch combination, and accordingly, if the limits are exceeded, enforces the manual entry of exchange rates.

In case, the limit between ccy1 and ccy2 is given in ccy2, the system will automatically convert the transaction amount to an amount in ccy 2 using standard mid rate and check against the limit amount for manual entry of exchange rates.

5.5.8 How Limits are applied when Transaction is Entered

Whenever a cross currency funds transfer or teller transaction is entered, Oracle FLEXCUBE checks for appropriate limits, in the Exchange Rate Limits Maintenance. If no limits are maintained for the currency, product, module and branch combination, then no limits are applied.

The example given below illustrates how the system identifies the appropriate limit from the Exchange Rate Limit Maintenance.

For example,

You have maintained the following amount limits for cross currency teller and funds transfer transactions in your bank, in the Exchange Rate Limit Maintenance:

Number |

Branch |

Module |

Product |

currency1 |

Currency 2 |

Limit Ccy |

Rate Type |

Limit amount |

1 |

001 |

DE |

PRD1 |

USD |

GBP |

GBP |

Standard |

25000 |

2 |

001 |

FT |

PRD2 |

USD |

INR |

USD |

Spot |

40000 |

3 |

ALL |

FT |

PRD3 |

GBP |

USD |

GBP |

Forward |

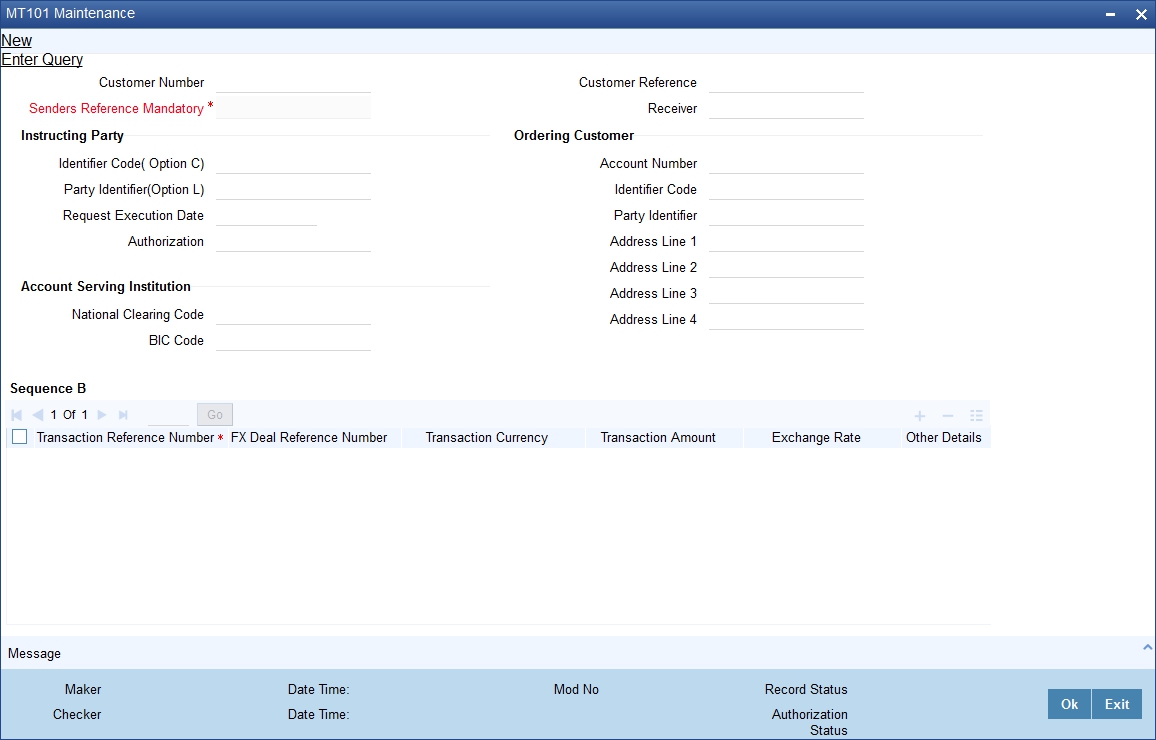

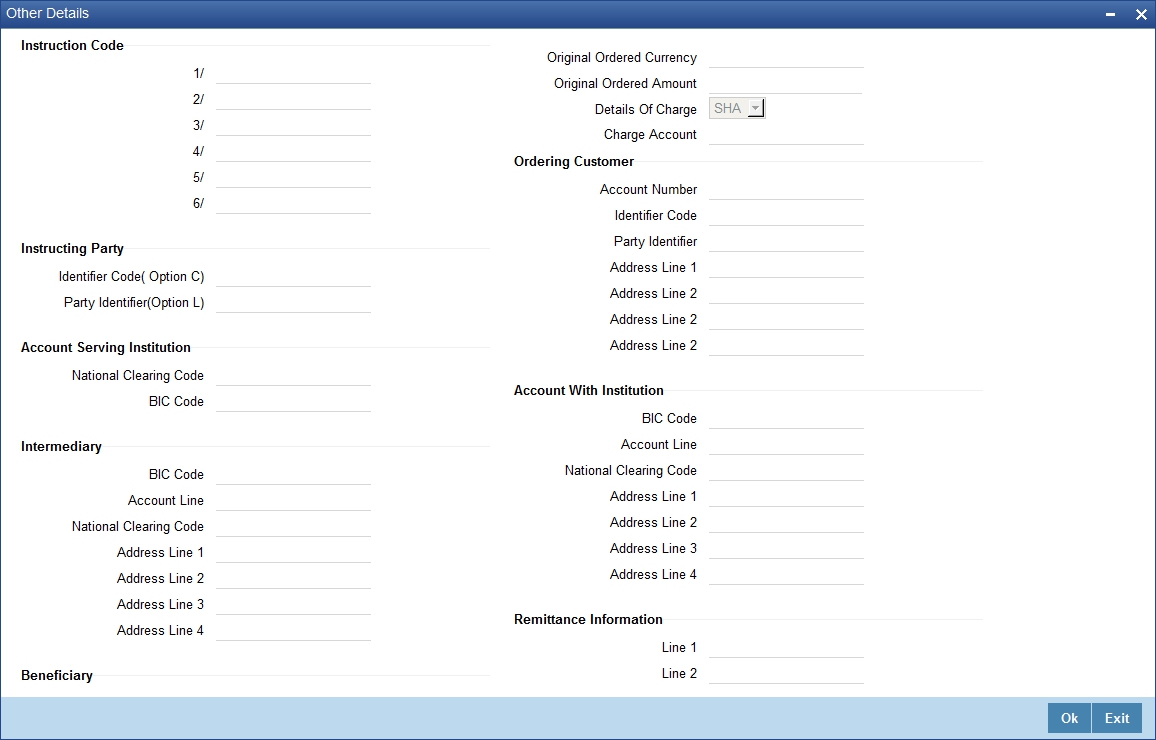

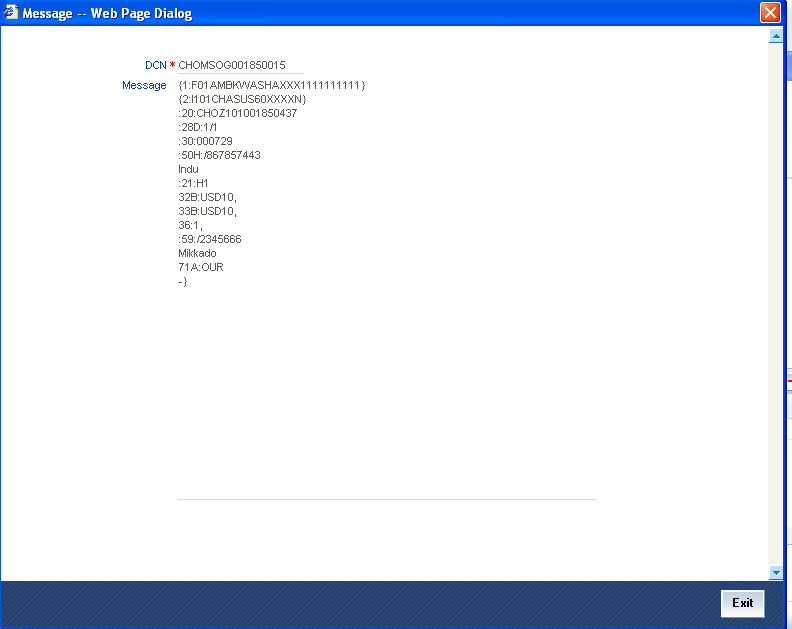

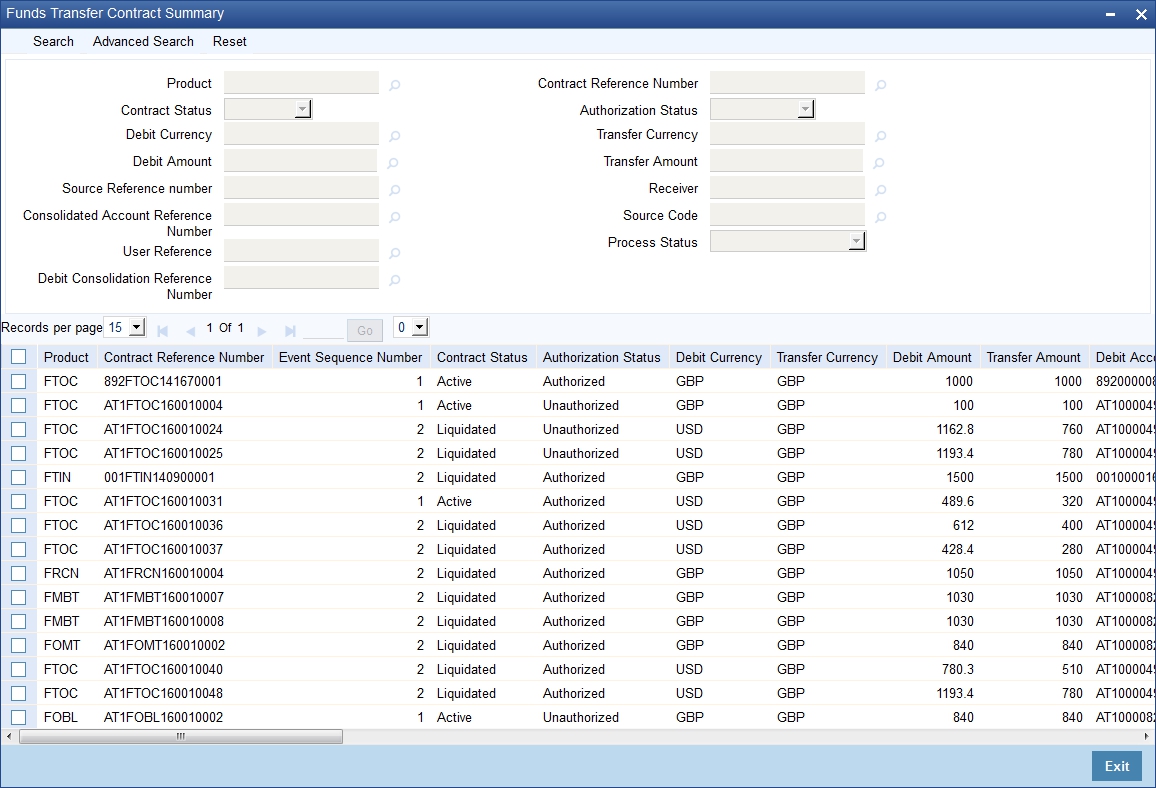

20000 |