2. Islamic Bills and Collections - An Overview

2.1 Introduction

A bill, as an instrument of international trade, is the most commonly used method for a seller to be paid through banking channels. Besides credit risk considerations, bills are the customary business practice for trade and a particularly important fee-earning service for any bank.

The Islamic Bills and Collections (IBC) module supports the processing of all types of Islamic bills, both domestic and international. It handles the necessary activities during the entire lifecycle of an Islamic bill once it is booked.

This section contains the following topics

- Section 2.2, "Features"

- Section 2.3, "Operations you can Perform on a Islamic Bill"

- Section 2.4, "Profit and Charge Liquidation"

2.2 Features

In an effort to empower your bank in handling a high volume of credit and to enable you to provide superior services to the customers of your bank, Oracle FLEXCUBE provides you with the following features:

- The Islamic Bills and Collections module supports the processing

of all types of international and domestic bills like:

- Incoming Bills under LCs

- Incoming Bills not under LCs

- Outgoing Bills under LCs

- Outgoing Bills not under LCs

- Incoming Collections

- Outgoing Collections

- Usance or Sight Bills

- Documentary or Clean Bills

- You can create a new product or copy the details of an existing Islamic bill on to a new one and modify it to suit your requirements. This renders the input of the details of a bill faster and easier.You have the flexibility to create and customize a product to suit almost any requirement under a bill. The bills associated with the product will bear characteristics that you define for it.

- The IBC module is designed to handle the profit, charges, or fees related to a bill and record amendments to the original terms of the bill.

- The IBC module actively interacts with the Islamic LC module of Oracle FLEXCUBE. This enables easy retrieval of information for bills drawn under an Islamic LC that was issued at your bank. Most of the details maintained for the Islamic LC will be defaulted to the bill when you indicate the reference number of the Islamic LC involved in the bill. This eliminates the need to re-enter the details of the Islamic LC all over again.

- The Central Liability sub-system automatically controls the booking of a bill against the credit lines assigned to the customer before the bookings are made. Oracle FLEXCUBE also supports tracking your bank’s exposure for a bill to several parties.

- You have the option to automate periodic processes such as:

- The application of floating profit rates to the components of a bill as and when they change

- The movement of a bill from a given status to another

- Accrual of profit due to a bill

- Liquidation of bills on the liquidation date that you indicate

- Generation of tracers on the due date

These will be processed as part of the batch processes run at BOD or EOD. The system automatically calculates the date on which the events should take place, based on the frequency and the date specified for the bill.

- The module also supports automated follow-up and tracer facility for payments and acceptance. Tracers can be automatically generated at an indicated frequency until a discrepancy is resolved.

- When a repayment against the bill, is not made on the due date, you may want to do an aging analysis for the bill. You can define the number of days that the bill should remain in a given status, the sequence in which a bill should move from one status to another and also indicate the direction of movement (forward or reverse). You can follow-up on the repayment of a bill by generating reports which detail the status of aging bills.

- Depending on the processing requirements of your bank, you can define and store the standard documents, clauses, and instructions and free format texts. These details can be incorporated and printed onto the output document of the bill, by entering the relevant code. This eliminates entering the details of standard components of a bill every time you need to use them.

- Islamic Bills can be carried over several stages during the day. After a bill has been entered, it can be verified and authorized on-line before further processing.

- Information services for managerial and statistical reporting such as on-line transactions, status report and the immediate retrieval of information of the bills processed at your bank can be generated.

- Oracle FLEXCUBE's Graphic User Interface (GUI) facilitates ease of input. Option lists are provided wherever possible. This makes the module both efficient and easy to use.

- The media supported include Mail, Telex and SWIFT

- The Islamic BC module supports and handles the following functions:

- Open/Amend a bill

- The authorization of bill contracts

- The reversal and liquidation of profit and charges

- Customer inquiries

- The generation of tracers and advices

- The generation and printing of reports

- On-line help - indicates that you can invoke global help by making use of the Help option in the Menu bar. You can also invoke on-line context sensitive help, which is made available to you, if you strike the hot key <F1> while in the application. A window pops up displaying information associated with the field from which you invoked it.

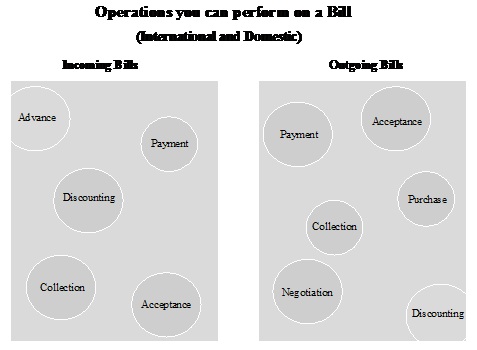

2.3 Operations you can Perform on a Islamic Bill

The operations that you can perform on an Islamic bill depend on the trade finance product type you are processing. Further, the messages and advices that are generated for the bill are determined by the operation you perform on the bill. The profit, charges or fees can be different for each operation that you perform on the bill.

In Oracle FLEXCUBE, all types of bills are classified in to two categories. They are:

- Import Bills

- Export Bills

All types of incoming bills (international and domestic) financed by your bank are termed Import bills. Similarly, all outgoing bills (international and domestic) financed by your bank are termed Export bills.

The operations that you can perform on an Islamic bill have been diagrammatically represented below:

The system allows you to effect a change of operation for the following operation types:

- Acceptance to Advance (automatic facility provided)

- Acceptance to Discount

- Collection to Purchase

For instance, while processing an acceptance bill, which needs to be discounted, you need not enter a new bill to discount the bill. You need to just amend the operation type from acceptance to discount.

The SWIFT Messages that can be Generated for an Import Bill

The messages that are generated for an Import bill depend on the operation you perform on the bill. The following are the SWIFT messages that are supported for an Import bill.

Description |

SWIFT Code |

Acknowledgement |

MT 410 |

Acceptance Advice |

MT 412 |

Payment tracer |

MT420 |

Acceptance tracer |

MT 420 |

Advice of Payment for a Collection bill |

MT 400 |

Advice of fate (principal and acceptance) |

MT 422 |

Refusal Advice (payment and accept) |

MT 734 |

Discharge Advice |

MT 732 |

Tracers that are generated |

MT 420 |

Authorization to pay, accept or negotiate |

MT 752 |

Advice of Payment for import bills under LC |

MT 756 |

The SWIFT Messages that can be Generated for an Export Bill

The messages that are generated for an Export bill depend on the operation you perform on the bill. The following are the SWIFT messages that are supported for an Export bill.

MT 400 – Advice of Payment for a Collection Bill

Description |

SWIFT code |

Acknowledgement |

MT 410 |

Acceptance Advice |

MT 412 |

Payment tracer |

MT420 |

Acceptance tracer |

MT 420 |

Refusal Advice (payment and accept) |

MT 734 |

Discharge Advice |

MT 732 |

Amendment of instruction |

MT 430 |

Reimbursement claim |

MT 742 |

Discrepancy Requirement |

MT 750 |

Tracers that are generated |

MT 420 |

2.4 Profit and Charge Liquidation

The IBC module has a flexible mechanism for raising, tracking and controlling the profit that you collect and the charges that you levy. These may be on a cash or account receivable basis. They can be collected either in advance or in arrears and can be accrued or non- accrued.

Profit can be collected either as a rate or as a flat amount. Standard Profit rates can be defined for each bill type. Changes that you effect to fields like the base date, exchange rate or account numbers require reversal entries. The system generates reversal entries for the corrected amount, account, rate etc.