2. General Maintenance

2.1 Introduction

Before you begin any operations in the Islamic Derivatives module you have to maintain certain basic information. This information is necessary for the successful functioning of the module. The information that you need to maintain includes:

- Defining Derivative Types

- Bank and Branch Parameter details

- Revaluation details

- Messaging party details

- Counterparty details

- Limits Processing

Although you maintain this information at the out set before beginning any transactions in this module it is imperative that you periodically review and update this information to reflect the latest changes.

The procedure to maintain these details is documented in the subsequent sections:

This chapter contains the following sections

- Section 2.2, "Derivative Types"

- Section 2.3, "Maintaining Branch Parameters"

- Section 2.4, "Maintaining Counterparty Master Agreement Details"

- Section 2.5, "Maintaining Clearing Houses"

- Section 2.6, "Maintaining Messaging Party Details"

- Section 2.7, "Maintaining Limits Processing Details"

2.2 Derivative Types

This section contains the following topics

2.2.1 Maintaining Derivative Types

The difference between this module and the other modules in Oracle FLEXCUBE is that before you begin to maintain products you are required to define Derivative types. In maintaining derivative types you can broadly classify the derivative instrument as a CCS or IRS.

Additionally you can also capture relevant information about the instrument. For instance indicating whether schedules are allowed or whether profit is to be paid in advance or in arrears and so on.

The advantage of defining Islamic derivative types is that at the time of creating a product you need to specify the code assigned to the derivative type. The basic details you have specified for the derivative type will be automatically inherited by the product and consequently by any contract entered using that product.

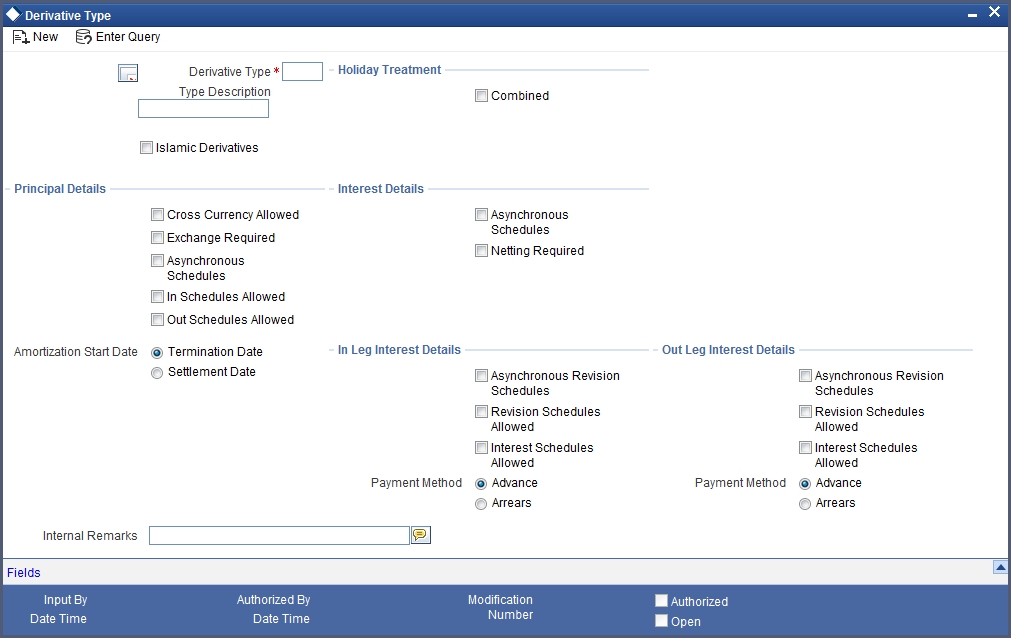

You can invoke ‘Derivative Type Maintenance’ screen by typing ‘DVDDTMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

If you are maintaining details of a new derivative type choose New from the Actions Menu or click ‘New’ icon from the tool bar. The ‘Derivative Type Maintenance detailed’ screen will be displayed without any details.

If you are calling a derivative type maintenance record that has already been defined, choose the Summary option under Derivative Type. From the ‘Summary’ screen, double click a record of your choice to open it.

Derivative Type

The first attribute that you define for the derivative is its type. A type defines the basic characteristics of the instrument. It indicates whether the:

- Deal involves a single currency or two currencies

- Deal involves multiple profit schedules

- Profit will be liquidated in a single payment

By suitably defining a derivative type, you will be able to define the following basic instrument types and their variants:

- Cross Currency Swaps (CCS)

- Profit Rate Swaps (PRS)

Type Description

You can also assign a brief description for the derivative type that you are defining. This description will be associated with the type only for information purposes. Under each Derivative Type you can create any number of products.

Islamic Derivative

Check this option to indicate that the derivative should be used for processing Islamic derivatives like currency and profit rate swaps. If you check this option, the system will validate for synchronous schedules.

Principal Details

As part of specifying the principal details you have to indicate whether two separate currencies can be maintained for both the inward and outward legs of all the contracts linked to the derivative type you are creating. If you choose allow cross currencies for the in and out legs of contracts linked to the derivative type then you have to also indicate whether the contract principal has to be exchanged upon initiation and maturity.

Apart from this you also have to indicate whether multiple schedules can be defined for the principal component. If you choose to define multiple schedules then the frequency of these schedules can be indicated at the time of specifying the product preferences. You can select any one as the frequency for the principal schedules:

- Daily

- Weekly

- Monthly

- Quarterly

- Half-yearly

- Yearly

But if you choose not to define multiple schedules then the principal liquidation for all the contracts linked to this type will be done on contract maturity.

Also the in leg and out leg principal schedules that you define for a contract need not be in sync with each other. You can choose to have asynchronous schedules for both the in and out legs of the contract. You can also indicate whether cross currency transactions should be allowed or not. Additionally, you can also indicate whether an exchange is required for the transactions under this product. However, if the option ‘Islamic Profit Rate Swap’ is checked, you should not check the ‘Cross Currency Allowed’ and ‘Exchange required’ options.

Amortization Start Date

In the case of termination of hedge deals, you have to indicate the date from which the amortization of gains and or losses should start. While terminating swaps, amortization should start as of the termination.

Holiday Treatment

You can indicate the way in which a particular schedule date should be treated if it falls due on a holiday. The holiday movement of the principal, profit and revision schedules for each of the in and out legs can be based on:

- The holiday table maintained for a single financial center or single currency specified at the leg level

- The combination of holiday tables of multiple financial centers/currencies

Select the Combined option in this screen if you want the movement of schedules to be based on the combination of holiday tables maintained for multiple financial centers/currencies at both the legs of the contract. This will be applicable if the holiday treatment (specified at the contract level) is based on the holiday calendars of the currencies or financial institutions involved in the contract.

You specification will be automatically inherited by the product associated with the derivative type and consequently by any contract entered using the respective product.

Profit Details

Netting Required

If two or more accounting entries for an profit schedule payment are to be passed in the same currency on the same Value Date, then in Oracle FLEXCUBE you are allowed to net these entries.

However netting of entries is allowed only in the case of single currency derivative types. If you are maintaining details of a cross currency type you will not be allowed to net entries.

Asynchronous Schedules

Netting for asynchronous schedules is allowed only for derivative types that do not define a cross currency swap. The in leg and out leg payment methods should also be synchronous (both Advance or both Arrears) for selecting the Netting required option for Asynchronous schedules.

In/Out Leg Profit Details

Profit Schedules Allowed for the Leg Type

While maintaining the derivative type you are required to indicate whether contracts linked to the derivative type can have multiple schedules or whether the schedules have to be bulleted.

In Oracle FLEXCUBE you can choose to have multiple schedules for one leg and bullet schedules for the other leg. For instance you can indicate that the in leg schedules have to be bulleted and the out leg schedules have to be multiple. Consequently for all contracts linked to this type the in leg schedules will be bulleted while the out leg can have multiple schedules.

You can also choose to define multiple schedules for both the inward and outward legs and indicate that the frequency of repayment should differ.

Revision Schedules Allowed for the Leg Type

Just as in the case of profit schedules so also revision schedules too can either be multiple or bulleted, depending upon your specification.

A revision schedule is the time period for which a floating profit rate is to be used. Normally this would be the same as the profit schedule but in Oracle FLEXCUBE you are allowed to maintain separate profit and revision schedules. Therefore you have to specify whether the revision schedules defined for the particular (In or Out) leg of the contract need to be in sync with the profit schedules or whether they can be asynchronous. For instance you may like to permit contracts with semi-annual profit payments with quarterly revision in profit rate.

Payment Method

Profit amount repayments for both the inward and outward profit legs can be made either at the start of the profit period or at the end of the profit period. Profit rate swap would require cash-flows to be exchanged at the end of each profit period.

Your choice of the payment method at the derivative type definition level will be defaulted to all the contracts linked to the derivative type. Note that if the option ‘Islamic Profit Rate Swap’ is checked, you should not select the ‘Advance’ option.

Internal Remarks

When creating the derivative type you can capture additional information about the type intended for the internal reference of your bank. Your remarks will not be printed on any correspondence with the customer.

However you can choose to include these remarks in the reports that you generate.

Note

You will not be allowed to change the details of an existing derivative type except change the Description Type and the Internal Remarks.

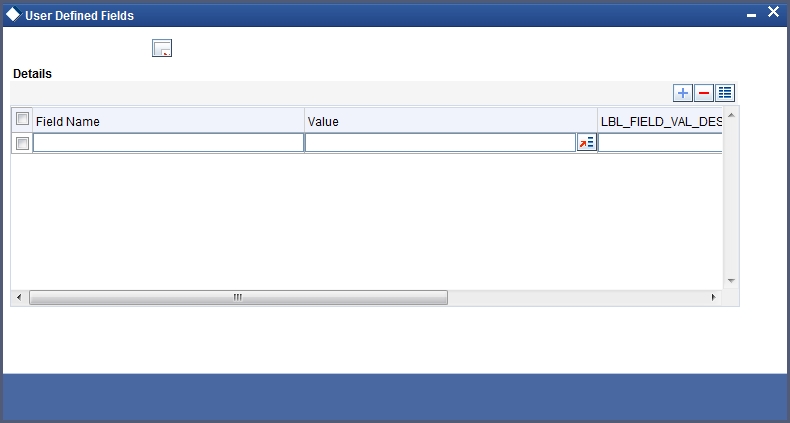

2.2.2 Maintaining User Defined Fields

You can associate values to all the User Defined fields created and attached to the ‘Derivative Type Maintenance’ screen. You can view the list of User Defined fields associated to this screen by clicking ‘Fields’ button in the ‘Derivative Type Maintenance’ screen.

You can enter the value for the UDFs listed here in the ‘Value’ column.

For more details on how to create user Defined fields, refer chapter ‘Creating custom fields in Oracle FLEXCUBE’ in the User Defined Fields User Manual under Modularity.

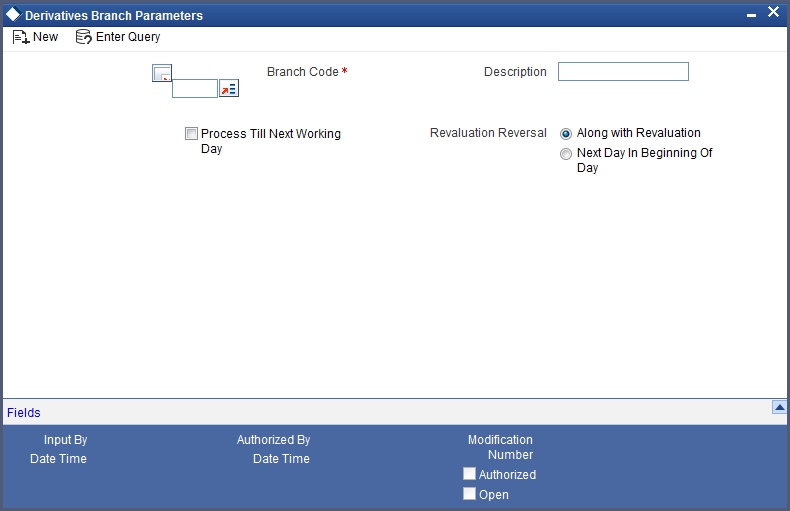

2.3 Maintaining Branch Parameters

You can maintain branch level parameters that govern the processing of Islamic Derivatives in a particular branch of your bank through the ‘Islamic Derivative Branch Parameters Maintenance’ screen. You can invoke this screen by typing ‘IDDBRNPM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Those events, which have to be triggered automatically, will be processed accordingly during batch process. However you are required to indicate how automatic events falling due on a holiday should be processed.

Process till Next Working Day

You have the option to specify whether the batch process should process automatic events falling due on a holiday either

- As part of the EOD process on the last working date before the holiday

- As part of the BOD process on the next working day after the holiday

Revaluation Reversal

As a branch level parameter you can indicate the manner in which deal level reversal of Unrealized Revaluation with Previous Year Adjustment should be processed. The options available are:

- Along with Revaluation - Reversals of entries for a particular revaluation will be performed at the time of the next revaluation

- Next Day in BOD - Select this option to indicate that any revaluation gain/loss should be reversed the very next day during the BOD process. If the BOD processing date happens to be the first day of the financial year, revaluation reversal will be done from the Previous Year Adjustment GL maintained in the Chart of Accounts

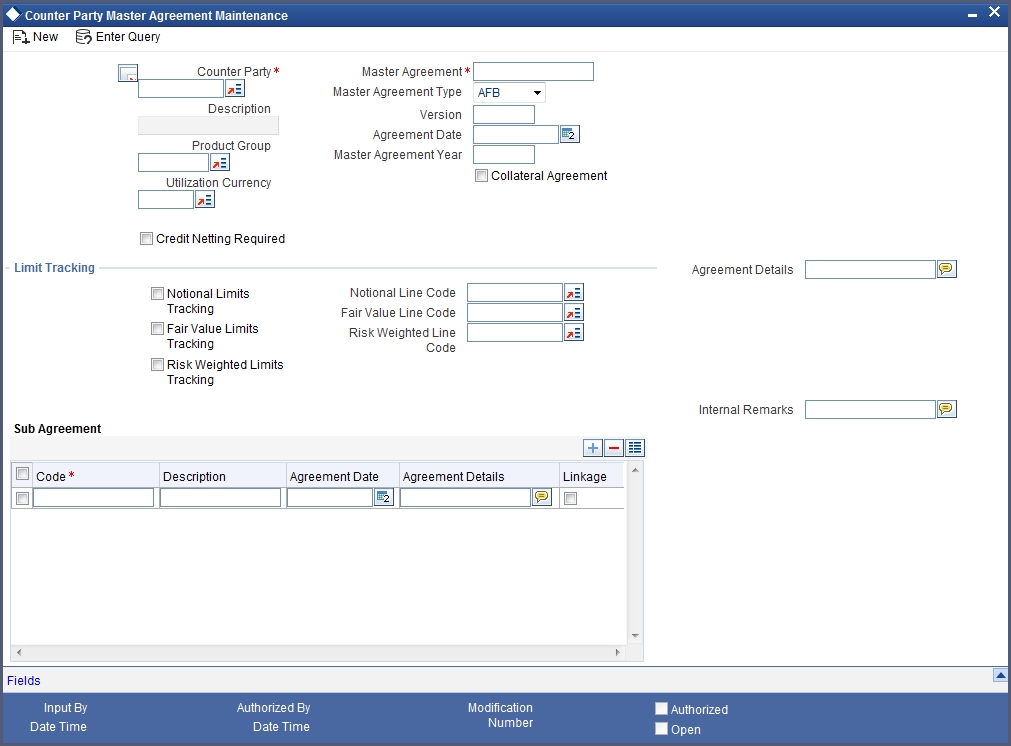

2.4 Maintaining Counterparty Master Agreement Details

Through the Derivatives ‘Counterparty Master Agreement Maintenance’ screen you can enter the details of the master agreement(s) with each counterparty.

You can invoke this screen by typing ‘DVDCPMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

If you are maintaining details of a new master agreement, choose ‘New’ from the Actions Menu or click ‘New’ icon from the tool bar. The ‘Counterparty Master Agreement Maintenance’ screen will be displayed without any details.

If you are calling a master agreement record that has already been defined, choose the Summary option under Counterparty. From the ‘Summary’ screen double click a record of your choice to open it.

Counter Party and Master Agreement code

Each master agreement that you create can be associated with a counter party. You have to indicate the code assigned to the counterparty for which the master agreement is being maintained.

After you specify the customer for who the master agreement is being maintained you have to enter a code to uniquely identify the master agreement. You can follow your own conventions while devising this code.

Master Agreement Type

You can indicate the type of master agreement under which the contract falls. The options available in the option list provided contain a list of standard master agreement types. They are as follows:

- AFB

- BBAIRS

- ISDA

- FRABBA

- OTHERS

A product is a specific service that you offer your customers. In Oracle FLEXCUBE you are required to group together products according to the common attributes that they share. This kind of grouping of products helps you organize information pertaining to the services that you provide. Besides it also simplifies information retrieval.

Maintenance of product groups is done through the ‘Product Group Definition’ screen. You can indicate the product group whose contracts can be linked to the master agreement.

Version

You need to indicate the version number of the master agreement for which you are maintaining details.

Utilization Currency

If you have indicated that Limit Tracking is required then you need to specify the utilization currency. The currency that you specify here will be taken as the credit limit utilization currency for the master agreement.

Agreement Date

Specify the date as of which the master agreement was signed.

One of the main advantages in maintaining a master agreement is the credit netting provision. While defining the master agreement you can indicate whether the positive and negative contract fair values should be netted for the counterparty.

This concept can be explained with the help of an example:

Master Agreement Year

Every master agreement that you define will invariably refer to the Book of Definitions (ISDA Definition).

You have to indicate the year of definition, which is applicable for the master agreement in this field.

Collateral Agreement

You have to indicate whether collateral agreements are applicable for the master agreement.

Note

The system checks this box by default. If you do not want the collateral agreements to become a part of the master agreement, leave this box unchecked.

Limits Tracking Details

You have to indicate whether exposure against the master agreement needs to be tracked for the counterparty limits. If you want to track counterparty limits for exposure against the master agreement then you need to specify the default credit line against which the credit limit utilization of contracts under the master agreement will be tracked.

You can specify whether Notional Limits tracking is required for the Customer and also specify the line code against which the notional limit should be tracked.

If you have indicated that Fair Value Limit tracking is required for the master agreement then you are required to specify the default fair value credit line against which the credit limit utilization of contracts under the master agreement will be tracked.

Additionally, you can specify whether Risk Weighted Limits Tracking is required and also select the line code against which the Risk Weighted Limit should be tracked.

The options Notional Limits Tracking, Fair Value Limits Tracking and Risk Weighted Limits Tracking will be enabled only if the Limits tracking option is selected.

Subsequently you also have to indicate the utilization currency. This currency will be taken as the credit limit utilization currency for the master agreement.

Agreement Details and Internal remarks

After specifying the main details about the master agreement you can summarize the entire agreement and store details about it. This information is basically for the internal reference of your bank and will not be reflected on any customer correspondence.

Additionally you can also capture your own internal remarks about the master agreement that you have created. These remarks too will not be reflected in your correspondence with the customer.

Sub Agreements

With every master agreement that you create you can link one or more sub agreements. Subsequent to creating a sub agreement you can either choose to link it to the master agreement or choose to link it at a future point in time.

Code

Enter a code to identify the sub agreement that you are creating. The code that you enter will have to be a unique code at the counterparty level.

Description

Enter a brief description that will enable you to identify the sub agreement code being maintained quickly. The description that you specify here is for information purposes only and will not be printed on any customer correspondence.

Date

Specify the date as of which the sub agreement was signed.

Agreement Details

You can summarize and capture all the details about the sub agreement. The details that you enter here will not be printed on any customer correspondence.

Linkage

You can check this box to indicate that the sub agreement for which you are maintaining details should be associated with the master agreement.

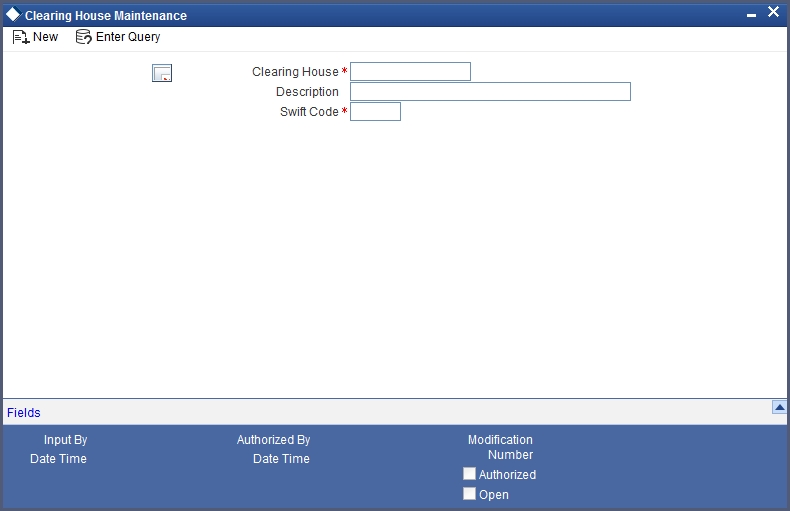

2.5 Maintaining Clearing Houses

You can maintain the details of financial centers through the ‘Clearing House Maintenance’ screen. The reason for maintaining clearing houses or financial centers is that at the time of processing the contract you can indicate that holiday treatment for principal and profit schedules and for rate resets should be according to the holiday calendar of the financial center.

You can invoke this screen by typing ‘STDCLMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

If you are maintaining details of a new financial center choose New from the Actions Menu or click ‘New’ icon from the tool bar. The ‘Clearing House Maintenance’ screen will be displayed without any details.

If you are calling a clearing house record maintenance record that has already been defined, choose the Summary option under Clearing House. In the ‘Summary’ screen double click on a record of your choice.

Clearing House

In Oracle FLEXCUBE you have to assign a unique three-character code to the clearing house that you are maintaining. The code that you assign is used to identify the particular clearing house whenever you link it to a particular contract. You can follow your own convention while devising this code.

Description

In addition to assigning a code you can give it a brief description so that you can identify it easily while retrieving information. The description that you enter is for information purposes only and will not be printed on any customer correspondence.

Swift Code

Specify the SWIFT Code that you wish to maintain for the Clearing House.

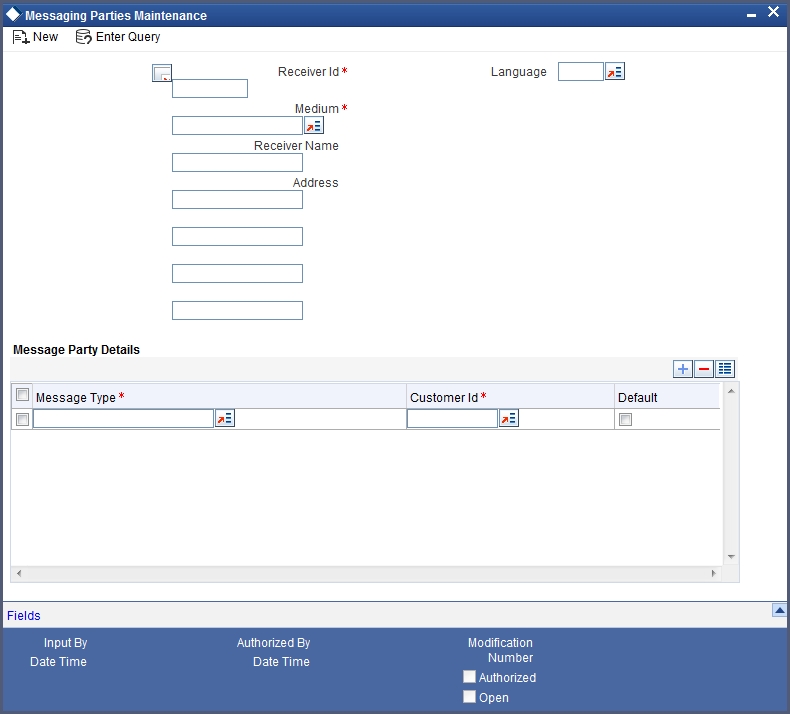

2.6 Maintaining Messaging Party Details

At every stage in the life cycle of a transaction you will need to send various messages to your customer. You need to send these messages to the recipient of the message whom your customer has identified as the receiver of the message.

The ‘Messaging Party Maintenance’ screen will enable you to capture details of the recipients of derivative messages that have to be sent to the various counterparties.

You can invoke this screen by typing ‘DVDMGMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

If you are maintaining details of a new receiver on behalf of the counterparty choose New from the Actions Menu or click ‘New’ icon from the tool bar. The ‘Messaging Party Maintenance’ screen will be displayed.

You can identify the person who is to receive the message on behalf of the counterparty and the medium through which the message should be sent. To do this you have to assign a unique code to the receiver and medium combination. Subsequently you have to capture the name of the receiver.

Receiver Id

This is the code assigned to the receiver of the message. Enter a unique code to identify the receiver of the message.

Medium

Choose the medium through which you wish to send the message. This can be any of the following:

- Telex

- Fax

- SWIFT

Receiver Name

This is the name of the receiver of the message. Enter the name of the party who will receive the message on behalf of the customer.

Address

While maintaining the messaging party details you are required to indicate the mailing address of the receiver of the message. All the messages addressed to the counterparty will be directed to the receiver address that you specify.

During contract input when you indicate the ID of the receiver, the default address specified for the receiver is displayed.

Note

If you specify that the message should be sent through SWIFT then you have to indicate the SWIFT address of the receiver in the first line of the address box before you specify the mailing address.

Language

The message can be sent to the receiver in the language of the receiver. You can choose a language code from the picklist available in this field.

Note

Remember that to send a message to a receiver in a particular language you should have also maintained a message format for the language in the ‘Advice Format Maintenance’ screen.

Message Party Details

Message Type

Your customer can identify more than one receiver as the recipient of messages that you need to send the customer as and when required. Additionally your customer can also instruct you to send specific messages to different receivers.

Customer Identification File

After you select the list of messages that have to be sent to your customer you have to specify the ID assigned to the particular customer for whom you are maintaining recipient details. The picklist available for this field will contain a list of all the CIF ID’s you have maintained through the Customer Information Maintenance file.

Thus every time you send a message to the particular customer it will reach the recipient whom the customer has identified as the official receiver of the message.

For example CHASEBANK is the customer of your bank. CHASEBANK has identified Peter and Yvonne as the recipients of any mail messages that need to be communicated to them. You have also been instructed by CHASEBANK that all cancellation messages should be sent to Peter and all other messages can be sent to Yvonne.

While maintaining Messaging Party Maintenance details you have to enter Peter in the Receiver ID field and Mail as the medium of sending the message. Select DV_CANC_CCS in the Party Type field.

Secondly since CHASEBANK has instructed you to send all cancellation messages to Peter you have to select from the list and associate all possible cancellation messages that may have to be sent to CHASEBANK with Peter’s ID.

While maintaining receiver details you can identify a particular receiver as the default receiver of messages that need to be sent to the customer. All those messages that have been marked for the particular will be sent to the default receiver.

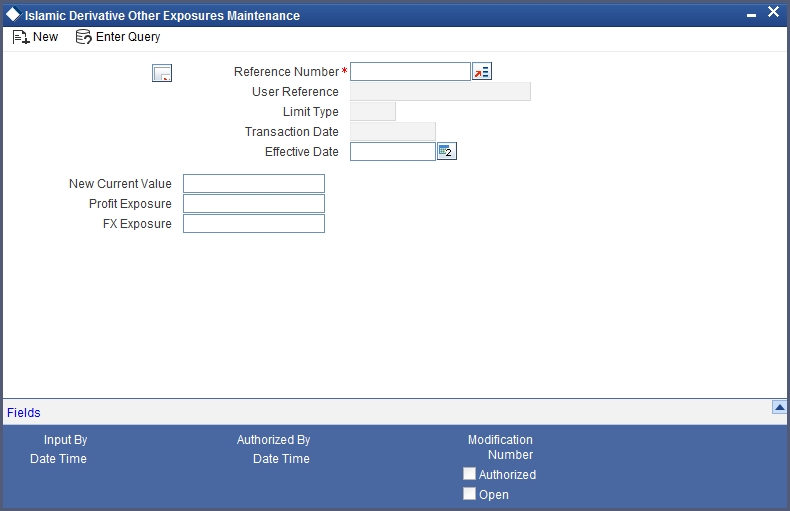

2.7 Maintaining Limits Processing Details

You can track the current value and exposure details of a counterparty using the ‘Islamic Derivatives Other Exposures Maintenance’ screen. You can invoke this screen by typing ‘IDDLMVAL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The system displays the following details in order to track the current value and exposure details of a counter party:

- Reference Number

- User Reference

- Limit Type

- Transaction Date

- Effective Date

- Current Value

- Interest Exposure

- FX Exposure