5. Processing an Islamic Derivatives Contract

5.1 Introduction

You can capture the details of the contract through the ‘Contract Input Details’ screen. Before we proceed to discuss the details of the ‘Islamic Derivatives Contract Input’ screen, we shall briefly recall the workflow in the Derivatives module.

First of all you need to maintain the basic information that is necessary for the successful functioning of the module. This information includes the maintenance of:

- Derivative Types

- Bank and Branch Parameter details

- Revaluation details

- Messaging party details

- Counterparty details

- Profit, Tax and Charge class details

The next step in the process is the creation of products for the Islamic Derivatives module. Products help you group together or categorize contracts, which share broad similarities. You have to associate a derivative type with each of the products that you create. Thus the product inherits all the attributes of the type. Subsequently you associate the various profit, charge and tax classes with the product.

Under each product that you define, you can enter specific contracts for this module. By default, a contract inherits the attributes of the product to which it is associated. This means that you do not have to define the attributes that default from the product every time you input a contract involving the product. However you can change some of the attributes to suit the product you are defining.

This chapter contains the following sections

- Section 5.2, "Islamic Derivative Contract Input Screen"

- Section 5.3, "Uploade Contracts for Amendment"

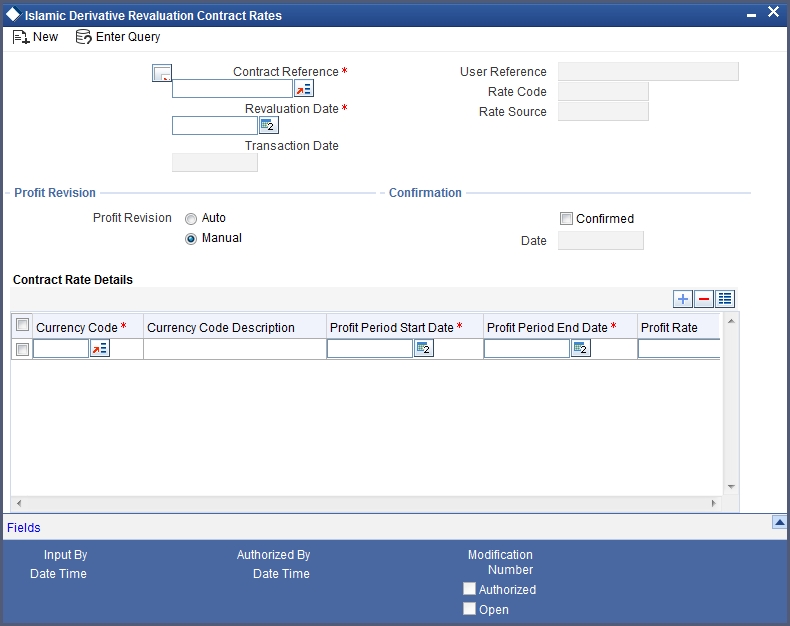

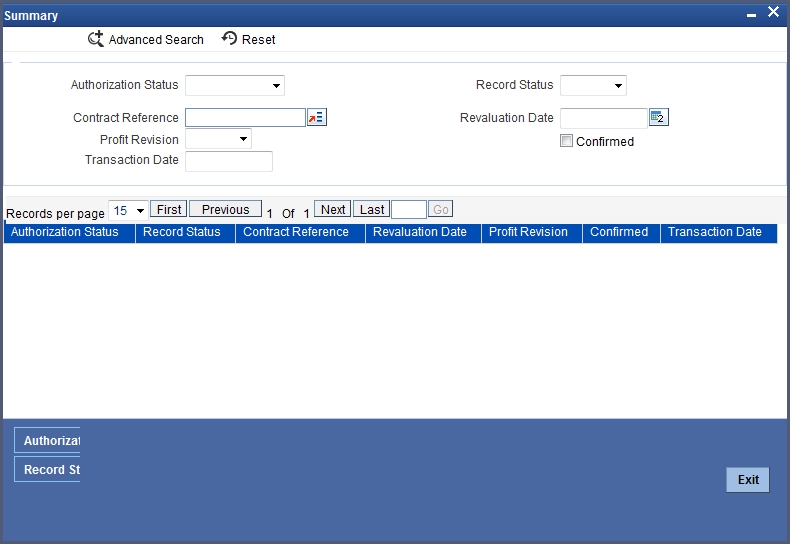

- Section 5.4, "Revaluation Contract Rates"

- Section 5.5, "Reassign Contracts"

5.2 Islamic Derivative Contract Input Screen

This section contains the following topics

- Section 5.2.1, "Maintaining the Islamic Derivative Contract Input Screen"

- Section 5.2.2, "Main Details tab"

- Section 5.2.3, "Maintaining Principal Schedule Details"

- Section 5.2.4, "Maintaining Holiday Treatment Details"

- Section 5.2.5, "Defining Principal Schedules"

- Section 5.2.6, "Viewing Schedule Details"

- Section 5.2.7, "Maintaining Profit Details"

- Section 5.2.8, "Contract Rate Revision"

- Section 5.2.9, "Indicating Commodity Details"

- Section 5.2.10, "Indicating other Details of the Derivative Contract"

- Section 5.2.11, "Limits Processing"

- Section 5.2.12, "Processing Brokerage on a Contract"

- Section 5.2.13, "Specifying Advices for the Contract"

- Section 5.2.14, "Viewing Event Details"

- Section 5.2.15, "Selecting the User Defined Fields"

- Section 5.2.16, "Levying Charges for a Transaction"

- Section 5.2.17, "Maintaining Settlement Instruction Details"

- Section 5.2.18, "Levying Tax on a Contract"

- Section 5.2.19, "Saving the Details of a Contract"

- Section 5.2.20, "Generating Payment Messages on Authorization "

- Section 5.2.21, "Viewing different versions of a Contract"

5.2.1 Maintaining the Islamic Derivative Contract Input Screen

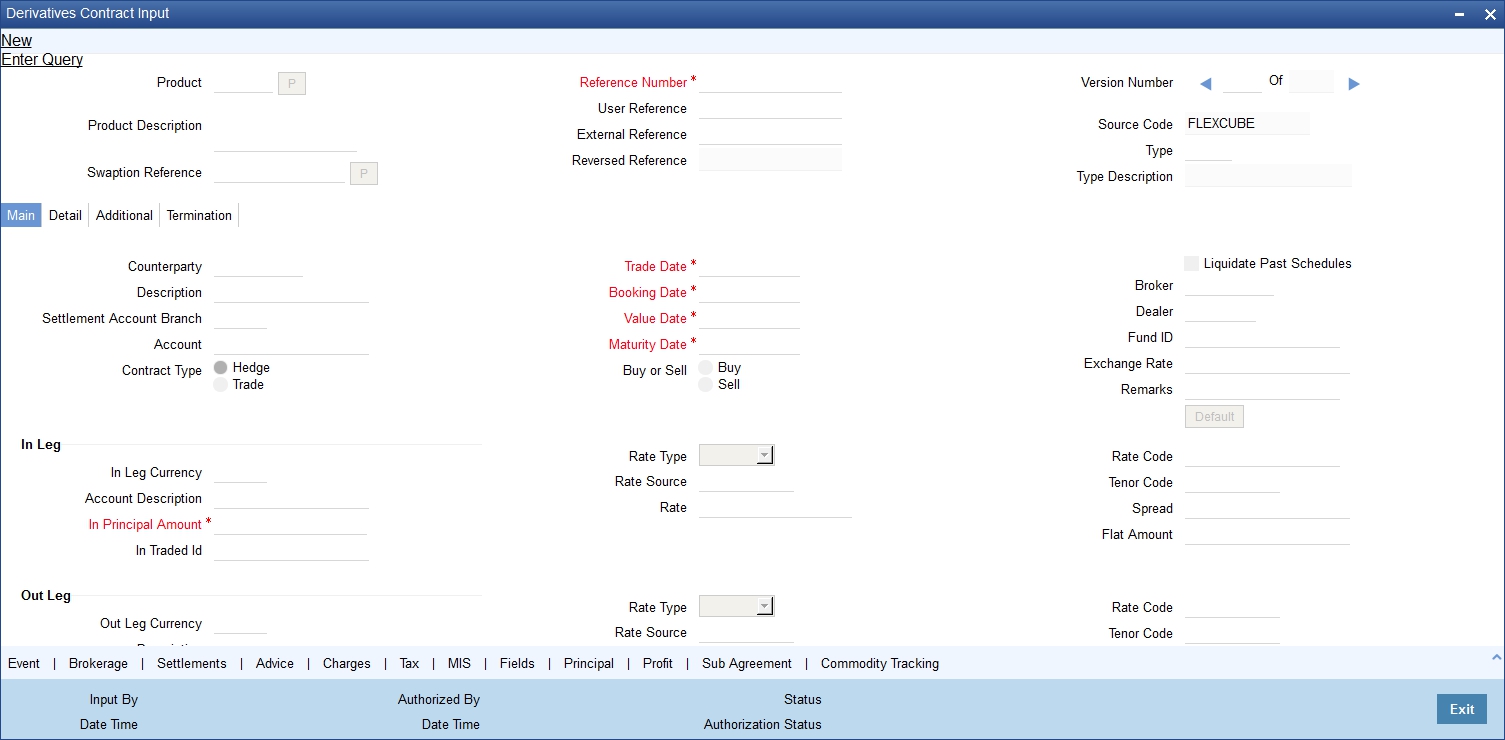

You can invoke the ‘Derivative Contract Input’ screen from the Application Browser. To enter the details of a new contract choose New from the Actions Menu or click ‘New’ icon from the tool bar. You can invoke this screen by typing IDDTRONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

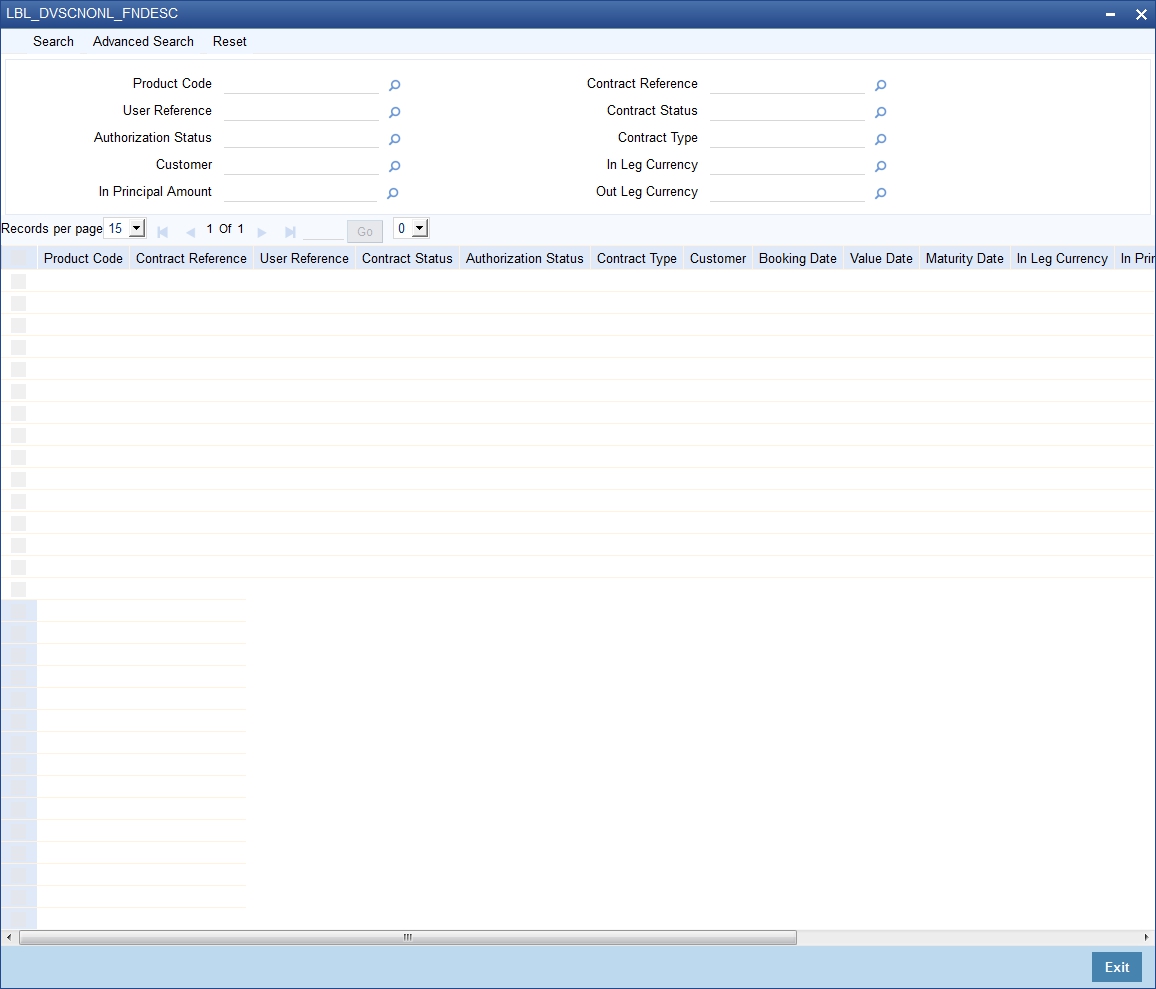

If you are calling a contract that has already been created, choose the Contract Input Summary option. The details of all the contracts that you entered earlier will be displayed in a tabular form. From the ‘Summary’ screen, you can open an existing deal by double clicking it.

The ‘Contract On-line’ screen contains a header, footer, and a body of fields that capture information specific to the contract that you are maintaining. You need to capture these details in addition to the attributes that the contract acquires as a result of being linked to the product.

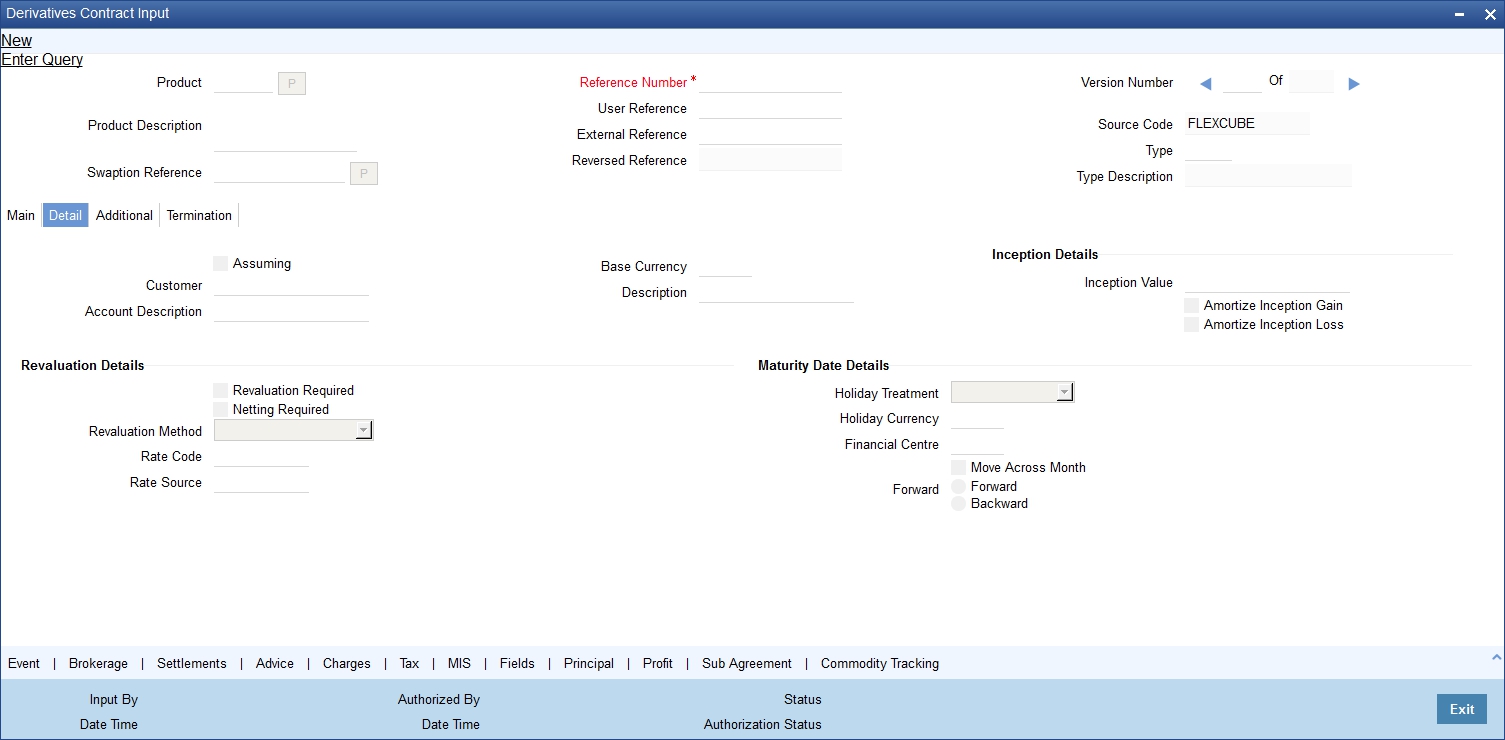

The body of fields, in this screen, is divided into two tabs. Firstly you need to capture the main details of the derivative contract such as the Contract Type, Counterparty and the In and Out Leg profit and principal details. You can specify the Contract Principal Schedules for both the in and out legs separately by clicking ‘Principal’ button. Click ‘Profit’ button to indicate the profit details for both the legs of the contract. Click ’Commodity’ button to track the commodity details for both the legs of the contract.

Next you can start capturing additional information relating to the derivative such as the Revaluation details, Inception and Termination details and so on by moving to the Detail tab.

Besides the existing fields in the ‘Derivative Contract On-line’ screen, you will also notice a vertical array of buttons. Clicking on an button launches a screen that captures details specific to an attribute, Settlement Message details, for example.

These buttons are briefly described below:

Field |

Description |

Brokerage |

Click this button to indicate brokerage details applicable to the contract. |

Advice |

Click on this button to enter the leg advices. You can view suppress and prioritize the advices that are to be generated for each leg of the transaction. |

Event |

Click this button to view details of the events and accounting entries that the contract involves. The screen also displays the overrides that were encountered for the contract. |

Fields |

Click this button to invoke the ‘User Defined Fields’ screen. You can indicate the user-defined fields for which information needs to be captured. |

Charges |

This button invokes the Charge service of Oracle FLEXCUBE. On invoking this function you will be presented with a screen where the charge rate, amount, and the waive charge parameters can be specified. |

MIS |

Click on this button to enter the transaction MIS details. |

Settlements |

Click this button to invoke the ‘Settlement’ screens. Based on the details that you enter in the ‘Settlement’ screens, the contract will be settled. The details of these screens have been discussed in the Settlements manual. |

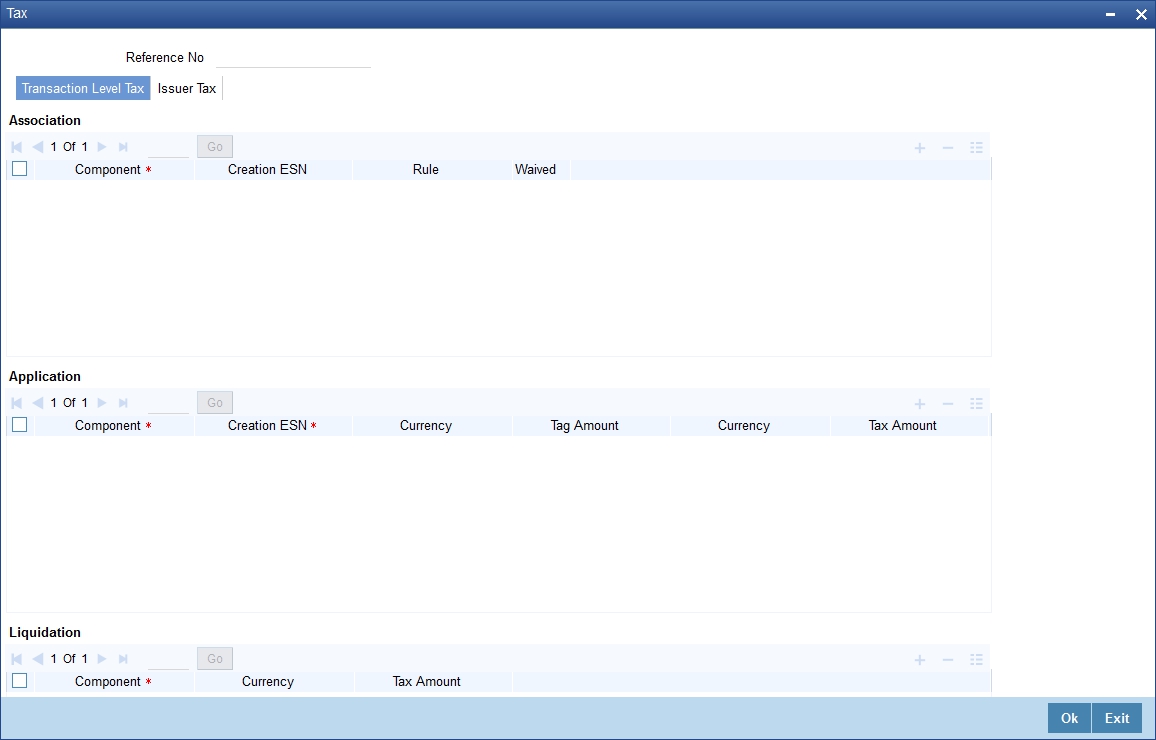

Tax |

This button invokes the Tax services. The application of tax on a deal is discussed under the head Levying tax on a contract. |

Sub Agreement |

Click this button to invoke the ‘Sub Agreement’ screen. You can either choose to link the sub agreement to the master agreement or choose to link it at a future point in time. |

Principal |

Click this button to invoke the principal schedule details for the in and out legs of the contract. This is possible only if you have specified so for the derivative type linked to the contract. |

Interest |

Click this button to indicate the profit schedule, profit revision schedule and accrual related details for every contract that you process |

Commodity Tracking |

Click this button to maintain principal and profit schedules for the in and out legs of the contract |

Through the ‘Islamic Derivatives Contract Input’ screen, you can process all types of derivative contracts.

Product

You can enter the details of a contract using a derivative product. Based on the type of contract you are entering, you can select a product from the option list available at the Product field.

Once you link a product with a contract, the attributes defined for the product and consequently the derivative type associated with the product will be inherited by the contract automatically. You are allowed to change a few of these details such as revaluation details, the in and out leg profit details, before saving the contract.

Reference Number

In Oracle FLEXCUBE, reference numbers are generated automatically and sequentially by the system. This number tag is used to identify the contract you are entering, it is also used in all the accounting entries and transactions related to this contract. Hence the system generates a unique number for each contract.

The contract reference number is a combination of a three-digit branch code, a four-character product code, a five-digit Julian Date and a four-digit serial number. The Julian Date has the following format:

’YYDDD’

Here, YY stands for the last two digits of the year and DDD for the number of day (s) that has/have elapsed in the year.

User Reference

You can enter a reference number for the contract. A contract will be identified by this number in addition to the Contract Reference No. generated by the system. This number should be unique and cannot be used to identify any other contract. By default, the Contract Reference Number generated by the system will be taken as the User Reference No.

External Reference

If the transaction is being uploaded from an external source, you can specify the identification for the transaction in the external source, as the external reference number.

Reversed Reference

The reference number of the contract that is being reversed and rebooked is displayed here.

Source Code

You have to indicate the source from which contracts have to be uploaded.

Type

The type of derivative, It will get defaulted once you select the product

Type Description

This is the description associated with the derivative type

5.2.2 Main Details tab

Counterparty

When you are entering the details of a derivative contract you should specify the customer with whom the derivative contract is being entered into. Specify the code of an authorized customer who falls into a category allowed for the product linked to the contract.

Settlement Account Branch

You might want to settle these components in an account existing at a branch other than the one where the contract was initiated. Therefore you have to indicate the branch code of the branch where the account resides. Subsequently indicate the account number of the settlement account.

If Settlement Instructions have been defined for the customer, the settlement accounts will be picked up from those instructions. While entering the details of the contract, you can change the Settlement Instructions for the derivative contract.

Note

- If a settlement account has been specified in the settlement instructions for the customer, and a different account has been specified for the derivative contract, the account specified for the contract will take precedence

- If you have specified Debit or Credit settlement accounts that use

an account class that is restricted for the product, an override is sought

Account

You have to specify the settlement account if Settlement Instructions have not been defined for the customer. The settlement account that you specify is the account through which the various components linked to the contract get settled.

Contract Type

All derivative contracts must be designated at inception either as Trade or as Hedge contracts. At the time of product definition you would have indicated whether the product being defined is meant for trade deals or hedge deals. When you associate a contract with a product the specification you made for the product will be defaulted to the contract. You can however change this specification.

The specification you make for the Contract Type will determine the accounting entries that will be passed for processing the particular contract. The system will identify all trade contracts and revalue them according to the revaluation preferences you have specified. For hedge type of contracts profit accruals will be carried out at periodic intervals.

In addition you also have to indicate whether the contract is a Buy type or Sell type of contract.

Booking Date

The date on which the deal details were entered is displayed here. This defaults to the system date (today’s date). This date is for information purposes only. The accounting entries are passed as of the Value Date of the deal (initiation date of the deal).

Value Date

If you are entering the details of a profit/cross currency swap you have to indicate the date on which the swap takes effect. The accounting entries for the initiation of the deal will be passed as of the value date. The tenor of the deal will begin from this date and all calculations for profit and all the other components based on tenor will be made from this date onwards.

The system defaults to today’s date. You can also enter the Value Date of your choice here, and it can be any one of the following:

- Today’s date

- A date in the past

- A date in the future

The Value Date should not be earlier than the Start Date or later than the End Date of the product involved in the deal.

If the liquidation date for any of the deal components falls before today’s date, the liquidation entries (as defined by you for the product) will be passed if you have specified the same for the product.

While maintaining the details of a swap you have to indicate the date on which the swap matures.

Buy or Sell

You need to indicate whether the contract is a Buy type or Sell type of contract.

You can choose to liquidate past schedules of back dated contracts. If you specify that back dated schedules should be liquidated the system will liquidate these schedules irrespective of the availability of funds.

Note

The entries associated with each event (initiation and liquidation in this case) will be passed only if they have been defined for the product. Further, the accounts used will be the ones defined for each entry.

Broker

If you are processing a deal that involves brokerage, indicate the ID of the broker through whom the deal was brokered. Click on the option list and select a broker code. The list will contain a list of valid brokers with whom you can enter deals.

You will be allowed to enter details of a broker only if brokerage is allowed for the product to which the deal is associated.

Dealer

Select the name of the dealer involved in the transaction.

Exchange Rate

While maintaining details of Cross Currency Swaps you are required to indicate the Exchange Rate for exchange of principal. The rate that you indicate will be used for determining the Out leg amount for the initial exchange in principal, given the In Leg amount.

Note

The exchange rate that you indicate will be validated against the exchange rate variance limits (Override Limit, Stop Limit) that you have specified at the time of defining the product. If the exchange rate variance exceeds the Override Limit the system will display an appropriate override message. If the rate variance exceeds the Stop Limit then you will not be allowed to save the contract until you change the rate.

Remarks

Free format information pertaining to the details of the contract can be captured in this field. The remarks that you enter here will not be reflected in any of the advices sent to the customer.

You can capture the relevant information in the window that gets displayed. Once you capture the necessary information click the OK button.

Default Details

At the time of input of a contract in different currencies, after you have specified the currency and amount of the first leg and the currency of the second leg, you must click ’Default’ button. The system then displays the equivalent amount for the second leg in the currency specified for that leg.

In case of contracts with both legs in the same currency, you can use the Default button or manually input the amount and currency for both legs.

Note

If you wish to specify the Principal and Profit details for a contract, you must use ‘Default’ button irrespective of whether both legs of a contract are in the same currency or in different currencies. The system displays an error if you try to access the ‘Principal’ and ‘Profit’ screens without having visited ‘Default’ button.

In/Out leg Details

As part of maintaining the In and Out leg details of the contract, you are required to indicate the currency, amount,

Currency and Amount

You are required to indicate the currency in which profit amount should be calculated for both the inward as well as the outward legs of the contract. You can select the currency code from the option list available.

In addition you are also required to indicate the principal amount (Actual/ Notional) for both the legs of the contract. The amount that you specify will be taken in the currency indicated for the particular leg of the contract.

Rate Type

The profit paid on both the legs of the contract can either be a fixed amount or an profit rate that changes periodically. For special cases you are also allowed to maintain a flat amount.

If you specify that the profit rate for either of the legs is Fixed then you have to indicate the rate of profit for the particular leg of the contract. When the rate type is floating you have to indicate the rate code based on which the profit rate should be calculated. Similarly when the rate type is special you have to indicate the flat amount that is to be used to calculate profit.

Rate Code

If the contract involves a product defined with floating profit, this is the Rate Code that links the contract to the Floating Rate table. As is the case with the Rate Type so also the Rate Code linked to the product will be displayed in this field. You can choose to change it.

Rate Source

For all contracts with a floating profit rate leg, apart from specifying the Rate Code you are also required to indicate the Rate Source. The rate source that you indicate here (such as Telerate, Reuters) will be used to pick up the floating rate for the outward/inward leg of the contract.

Tenor Code

The tenor code refers to the tenor of the floating rate code and currency combination that is to be associated with this leg of the contract.

Once you select the Rate Code, the code assigned to the tenor linked to the particular Rate Code will be displayed in this field. You can choose to change it by selecting another code from the available option list.

Spread (on a floating profit rate)

When the Rate Type of the particular leg of a contract is floating you can choose to specify a spread that is to be applied over the rate maintained in the ‘Floating Rate’ screen.

The Spread that you enter should be greater than or equal to the Minimum Spread and less than or equal to the Maximum Spread defined for the product that the contract involves.

If the spread you apply happens to be greater than the Maximum Spread, then the Maximum Spread will be applied on the rate. On the other hand, if it is less than the Minimum Spread defined for the product, the Minimum Spread will be picked up.

Rate

If you specify that the profit rate for this leg of the contract is ‘Fixed’, then you have to enter the actual rate of profit.

Flat Amount

If you have indicated the Rate Type is Special for this leg of the contract then you need to specify the Flat Amount.

Trader Identification

Specify the trader identification details for both the in leg and out leg of the contracts.

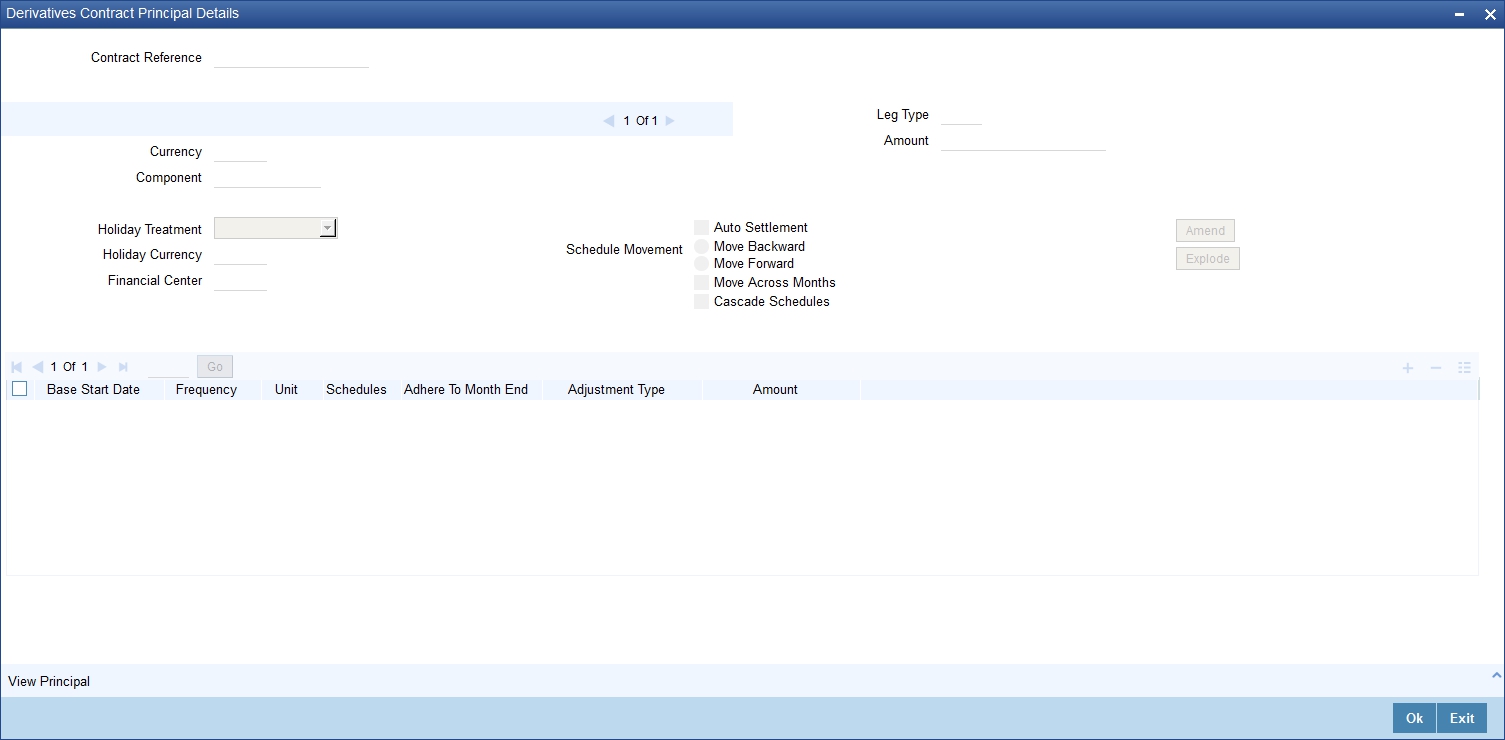

5.2.3 Maintaining Principal Schedule Details

You have to maintain the principal schedule details for the in and out legs of the contract only if you have specified so for the derivative type linked to the contract.

While defining the details of a particular leg (either in leg or out leg) click ‘Principal’ button. The ‘Contract Principal Schedule’ screen will be displayed.

In this screen you can specify the holiday treatment, the holiday movement and the frequency of the principal schedules.

5.2.4 Maintaining Holiday Treatment Details

Holiday Treatment

In Oracle FLEXCUBE, a schedule date falling due on a holiday can be treated in any of the following ways:

- Ignore the holiday - In which case the holiday will be ignored and the schedule date will be retained on that day

- Choose to follow the Local holiday - The holiday will be treated as per your specifications in the ‘Branch Holiday Maintenance’ screen

- Choose to follow the Currency holiday - The movement of schedules will be based on the holiday calendars maintained for all the currencies that you have specified for the contract in the ‘Holiday Currency’ screen (explained in detail in the subsequent section)

- Indicate that the holiday treatment should be governed by the Financial Center – In such a case, the movement of schedules will be based on the holidays maintained for the financial institutions involved in the contract (multiple financial institutions are also maintained in the ‘Holiday Currency’ screen)

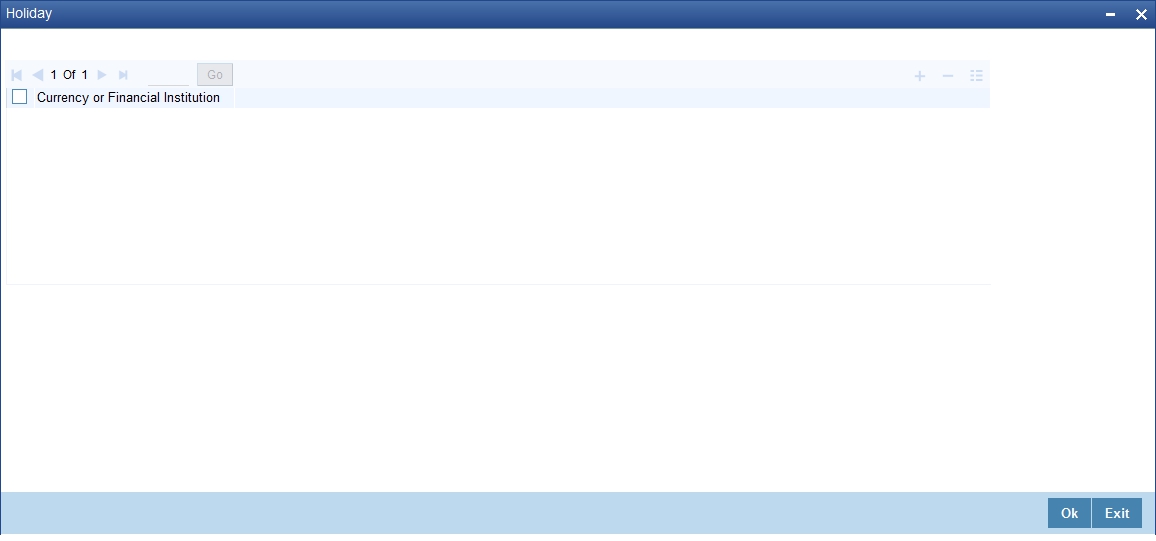

Holiday Currency and Financial Centre

If you choose to follow either the currency holiday or the holiday calendar maintained for the financial center, you need to specify the currencies/ financial institutions that are involved in the contract. In the event, a schedule date of a component falls due on a holiday, the system computes the next schedule date based on the combination of holiday calendars maintained for all the currencies/ financial institutions that you have specified for the contract (whether principal, profit or revision). Therefore, in effect, the next schedule date for a component will be a working day in all the calendars involved in the contract.

Multiple Currencies/Financial Institutions

Click ‘Holiday’ button to invoke the ‘Holiday Currency’ screen to indicate the currencies or the financial institutions (depending on your selection of the holiday treatment) involved in the contract. This option is enabled only if you have selected the ‘Combined’ option for the Derivative Type involved in the contract.

Click Add button to select a currency /financial institution from the option list. If you wish to delete a currency/financial institution, click delete button on the screen.

The following example illustrates the procedure for combined holiday processing as handled by Oracle FLEXCUBE:

Auto Settlement

The principal exchange schedules can either be settled automatically or manually.

Check this box to indicate whether the principal settlement has to be done automatically as of the settlement date. Else you will have to do it manually.

Holiday Movement

Move Backward/Forward

Occasionally the preferred holiday treatment, the branch holiday, the currency holiday or the holiday governed by the financial center may, in turn, fall on a holiday. In such a situation you have to indicate the movement of the schedule date. Whether it is to be moved forward to the next working day or whether it should be moved backward to the previous working day.

This concept can be easily explained with the help of an example:

Cascade Schedules

The question of cascading schedules arises only if:

- You have specified that a schedule falling due on a holiday has to be moved forward or backward

- The schedule has been defined with a definite frequency

If you have indicated that schedules should be cascaded, the schedule date for the next payable schedule will depend on how the schedule date was moved for a holiday. The following example illustrates how this concept of cascading schedules functions:

5.2.5 Defining Principal Schedules

Start Date

Enter the date on which the particular principal schedule should start.

Frequency

In addition to indicating the holiday treatment you also need to specify the periodicity or the frequency of the schedules for each principal component. You can indicate that the frequency of schedules can either be Periodic or Bullet.

If you choose to have bullet schedules for a particular component, liquidation for the component will be done only as of the Maturity Date. In the case of periodic schedules you have to specify whether the frequency should be daily, weekly, monthly, quarterly, half-yearly or yearly.

Frequency Unit

In addition to specifying the frequency of schedules you are also required to indicate the number of units of the frequency. The number of units that you indicate will determine the actual schedule frequency.

For instance for a particular schedule you want to have a bi-weekly frequency. The list of choices available for the Frequency field does not have this option. In the Frequency field indicate the option Daily. Enter 2 as the Frequency Unit, the particular schedule will be due once in every two weeks.

No of Schedules

For a particular Frequency and Frequency Unit combination you can choose to have a number of schedules depending on how many you want to define for the particular component.

For instance, for a particular schedule you have indicated that the Frequency should be Weekly and the Frequency Unit as 2. Subsequently you indicate that the Number of Schedules as 12. This particular schedule will be run once in every two weeks, twelve times.

Adhere to the Month End

When the principal exchange frequency is in terms of a month you can choose to indicate whether the schedules should be liquidated as of the last working day of the month or whether it should strictly follow the defined schedule.

Adjustment Type

Periodic schedule repayment of the principal amount will always bring about a readjustment in the principal amount. It either increases or decreases the amount that is to be repaid to the counterparty.

Therefore while defining principal schedules you have to indicate whether liquidation of the particular schedule results in the Increase or Decrease of the actual amount.

Amount

Since the periodic schedule repayment of the principal amount either increases or decreases the amount to be repaid to the counterparty, you have to indicate the amount by which the principal is being changed.

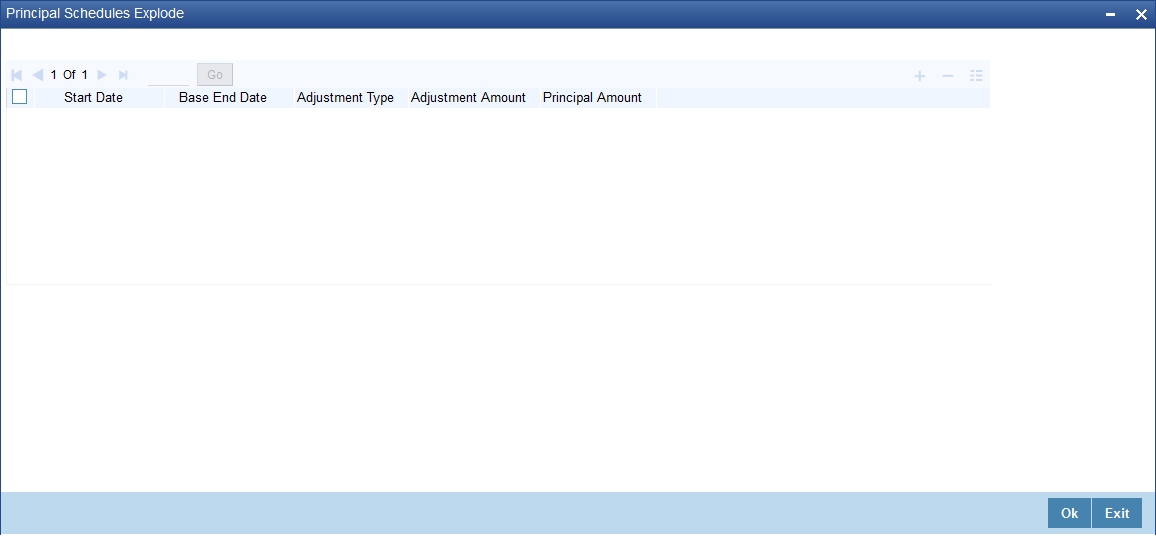

5.2.6 Viewing Schedule Details

Click ’Explode’ button to view the details of all the schedules for the contract.

Note

You can change the details of existing schedules by clicking ‘Amend‘ button.

5.2.7 Maintaining Profit Details

Just as you maintain principal schedule details for the in and out legs of the contract so also you are required to indicate the profit schedule, profit revision schedule and accrual related details for every contract that you process.

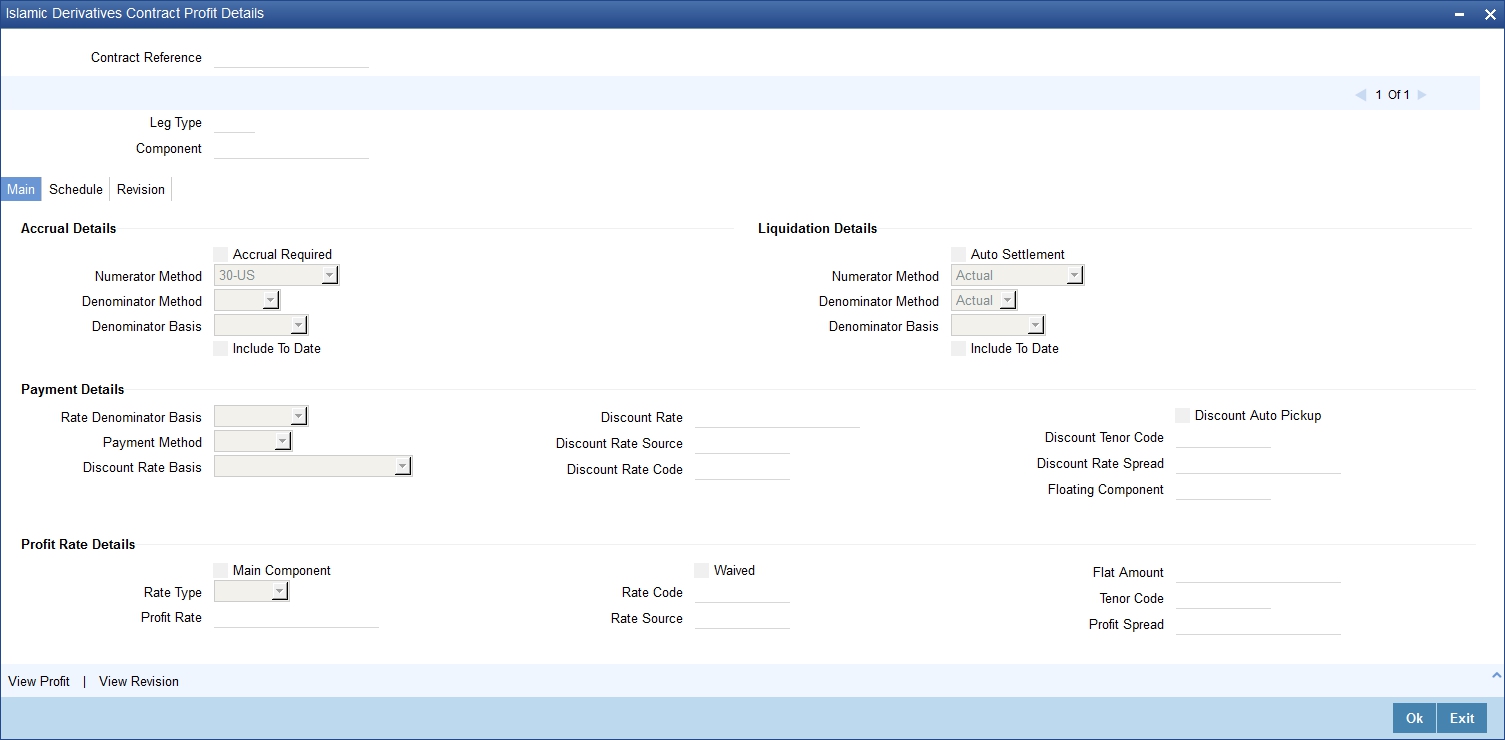

Click ‘Profit ’ button while maintaining details of either the in leg or the out leg. The ‘Derivative Contract Interest Details’ screen will be displayed.

As a result of linking a product to a contract all the product specific preferences defined at the product level will be inherited by the contract. These preferences include the profit accrual preferences, liquidation preferences and the schedules for the various profit and revision profit components.

Note

Except for the profit accrual frequency, which you have defined at the product level you will be allowed to modify all the other preferences (accrual as well as liquidation) to suit the contract you are processing.

5.2.7.1 Main Details tab

Accrual and Liquidation Details

Accrual Required

You can choose not to accrue profit for a particular contract although you have indicated this preference at the product level.

For instance when you are processing a trade deal profit accrual details are not required since trade deals are always revalued. In the ‘Profit Details’ screen you can indicate that profit accrual is not required for the specific contract by disabling the option.

However if indeed profit accrual is required for the contract you are processing and you merely want to change the accrual related details such as the profit calculation method, the basis on which profit is to be calculated for the accrual period, you will be allowed to do so.

The accrual function when run as part of the batch process run at EOD, calculates the accrual amount and passes accrual accounting entries for the accruable profit components of a derivative contract. The function will pick up derivative contracts for processing on the following criterion:

- Active and authorized contracts which are yet to be liquidated

- Contracts whose accrual date falls on the current processing date or contracts whose accrual date falls between the current processing date and the next working date

The date on which accrual is due for a contract is calculated based on the accrual date and accrual frequency defined for the product associated with the contract. .

If the accrual date of a bill falls on a holiday, the accruals are done as per your holiday handling specifications for automatic processes.

Denominator Basis

You need to indicate the basis on which the denominator has to be computed. The options available are:

- Per annum

- Per period

Auto Settlement

When setting up a product you specify the whether the mode of liquidation should be automatic or manual for the different components of contracts linked to that product. By default, all derivatives involving the product will inherit this definition. However, you can change the mode of liquidation, from automatic to manual, or vice versa, while processing a contract.

Include To Date

While calculating profit for the accrual period you have to indicate whether you would like to take into account the last day in an accrual period, for arriving at the accrual days both for the in and out legs of the contract.

Similarly you have to indicate whether the last day in a liquidation period should be considered for liquidation.

Refer the Chapter ‘Defining Attributes specific to Derivative Products’ for details on Numerator and Denominator Methods

Payment Details

Rate Denominator Basis

You need to indicate the basis on which rate denominator has to be computed. The options available are:

- Per annum

- Per period

Note

If you are specifying in leg details then indicate the in leg rate denominator basis. While defining out leg details indicate the out leg rate denominator basis.

Payment Method

You can indicate the method in which profit components for both the in as well as the out legs of the contract should be paid. You can indicate one of the following:

- Arrears - Profit is liquidated at the end of each profit period

- Advance - Profit is paid at the start of each profit period

Discount Rate Basis

When you decide to pay profit in Advance, you have to indicate the basis on which the profit rate should be picked up to compute the discounted amount. You can select any one of the following options:

- Direct Input

- Contract Floating Component

- Other Floating Component

If you select the first option then you have to manually enter the rate at which profit is to be discounted. When the discount rate basis is the Floating Component you have to specify the Floating Component based on which profit is to be discounted

If your choice to discount the rate basis is the Other Floating Component, you have to indicate the rate source linked to the rate, the tenor associated with the rate, as well as the spread that is to be applied over the rate maintained in the ‘Floating Rates’ screen. Based on these parameters the discount rate will be calculated.

Discount Rate

Specify the rate at which profit is to be discounted, if the discount rate basis is Direct Input.

Floating Component

Indicate the Floating Component based on which profit is to be discounted, if you have indicated that the discount rate basis is Contract Floating Component.

Discount Auto Pickup

Check this box to indicate whether the discount rate should be automatically picked up by the system from the ‘Floating Rates’ screen depending on the other parameters you have specified such as the discount rate source, rate code, tenor code and the rate spread.

Discount Rate Source

If your choice for the discount rate basis is the Other Floating Component, then you have to indicate the Rate Source linked to the Rate Code based on which the discount rate is to be calculated.

Discount Tenor Code

If your choice for the discount rate basis is the Other Floating Component, then you have to indicate the tenor code associated with the rate Code based on which the discount rate is to be calculated.

Discount Rate Spread

For the floating component you can specify the Spread that you want to apply over the rate maintained in the Floating Rates screen.

Note

The Spread you apply should always be greater than or equal to the Minimum Spread and less than or equal to the Maximum Spread defined for the product involved in the contract. If the spread happens to be greater than the Maximum Spread, then the Maximum Spread will be applied on the rate. On the other hand, if it is less than the Minimum Spread defined for the product, the Minimum Spread will be picked up.

For a floating rate, the spread will be applied over the market rate applicable for the day.

Profit Rate Details

Rate Type

The profit rate type paid on derivative settlements can be any one of the following types:

- Fixed

- Floating

- Special

Profit Rate

When you maintain a fixed profit rate for a particular component of the profit leg of a contract it is necessary that you specify the rate.

Flat Amount

When the profit rate is special you have to indicate the Flat Amount. Moreover if the derivative you are processing happens to be a commodity type of derivative instrument you have to indicate whether the flat amount specified is per unit of the derivative.

Waiver

Check this box if you would like to waive this component. Else leave this box unchecked.

Rate Source

Indicate the Source from which the Rate Code is to be taken. The Rate Code pick list is populated depending on your selection of the rate source.

Rate Code

If the Rate Type you have specified is ‘Floating’, then indicate the Rate Code that is to be associated(from the ‘Floating Rates’ screen) with the profit leg of the contract.

Tenor Code

Once you specify the Rate Code, you have to indicate the Tenor Code that is to be linked to the particular Rate Code.

Profit Spread

You can choose to apply a spread over and above the rate maintained in the Floating Rates screen.

This Spread should be greater than or equal to the Minimum Spread and less than or equal to the Maximum Spread defined for the product that the contract involves.

If the spread you apply happens to be greater than the Maximum Spread, then the Maximum Spread will be applied on the rate. On the other hand, if it is less than the Minimum Spread defined for the product, the Minimum Spread will be picked up.

Main Component

In Oracle FLEXCUBE you can define any number of tenor based profit components for every contract that you process. Therefore it is essential that you identify one profit component as the Main Component. This component will be used for amortization purposes.

Note

For the main component the Rate Type will be defaulted from the ‘Contract Input Maintenance’ screen. For all the other components the Rate type that you indicate will determine whether the particular in or out leg profit component (depending on which leg details you are specifying) is fixed, floating or special.

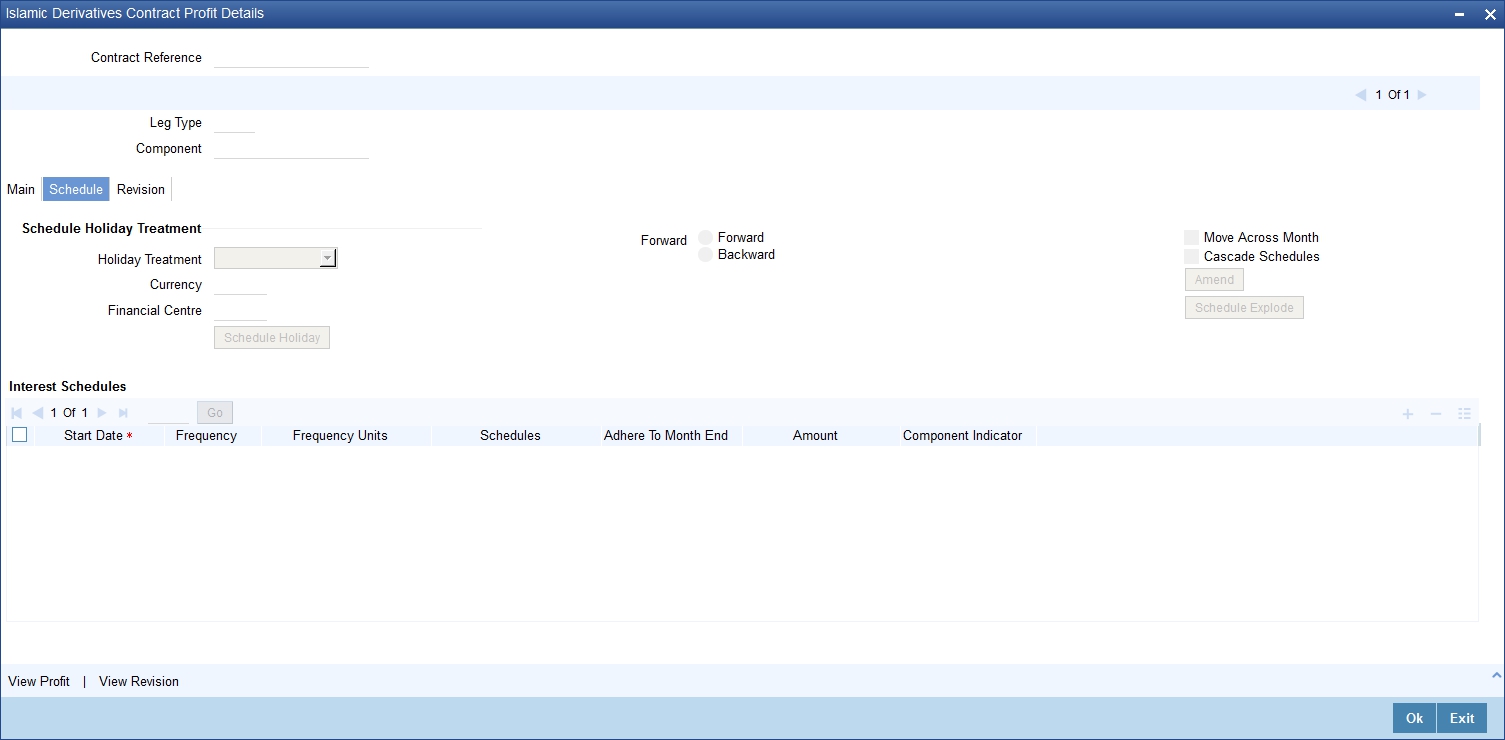

5.2.7.2 Schedule Details tab

The schedule preferences that you specify at the time of creating the product like the frequency of schedules, the unit of frequency and so on, will be defaulted to the contract. You will be allowed to change these preferences for the contract you are processing.

Profit liquidation process will pass netted entries for in leg and out leg schedules only if the in leg profit liquidation date matches with the out leg liquidation date. To facilitate netting for asynchronous schedules netting amount tags should be separately maintained at the product level.

Please refer to the Annexure A – Accounting Entries and Advices manual for details on maintaining the netting amount tags.

Note

Netting for Asynchronous schedules is possible only for Profit Rate Swaps (IRAs) and for CCS.

Schedule Holiday Treatment

You have to specify the holiday treatment that has to be followed when schedules fall due on a holiday. The holiday treatment method has been explained at length in the earlier section on Indicating Principal Schedule Details.

Profit Schedules

Start Date

Enter the date on which the particular profit schedule should start.

Frequency

If you want to define periodic profit schedules, you should indicate the frequency of the schedules for a particular profit component. From the option list provided, you can select one of the following by clicking on the option:

- Daily

- Weekly

- Monthly

- Quarterly

- Half-yearly

- Yearly

- Bullet

Note

You can choose to have a bullet schedule for a particular profit component in which case liquidation for the component will happen only as of the Maturity Date.

Frequency Units

You can specify the number of units of the frequency in this field. The number that you specify here will determine the actual schedule frequency.

For instance for a particular schedule you want to have a bi-weekly frequency. The option list available for Frequency does not have this option. In the Frequency field, indicate the option ‘Weekly’ and in the Frequency Unit field if you enter 2, the particular schedule will be due every once in two weeks.

No Of Schedules

For a particular Frequency and Frequency Unit combination you can choose to have a number of schedules depending on how many you want to define for the particular profit component.

For instance, for a particular schedule you have indicated that the Frequency should be Weekly and the Frequency Unit as 2. Subsequently you indicate that the Number of Schedules as 12. This particular schedule will be run once in two weeks twelve times.

Adhere To Month End

If the profit liquidation schedule is in terms of a month, you can choose to indicate whether the schedule days should adhere to Month-Ends.

Check this box to indicate that profit schedules should adhere to month ends.

Amount

If the profit schedules you are defining are for a special type of profit component then you have to indicate the profit amount for the particular special component.

Compounding Indicator

Check this box to indicate that the profit amount should not be repaid but should be added on to the principal amount at the end of the contract period.

Leave it unchecked to indicate that the profit repayment should be liquidated on the schedule end date.

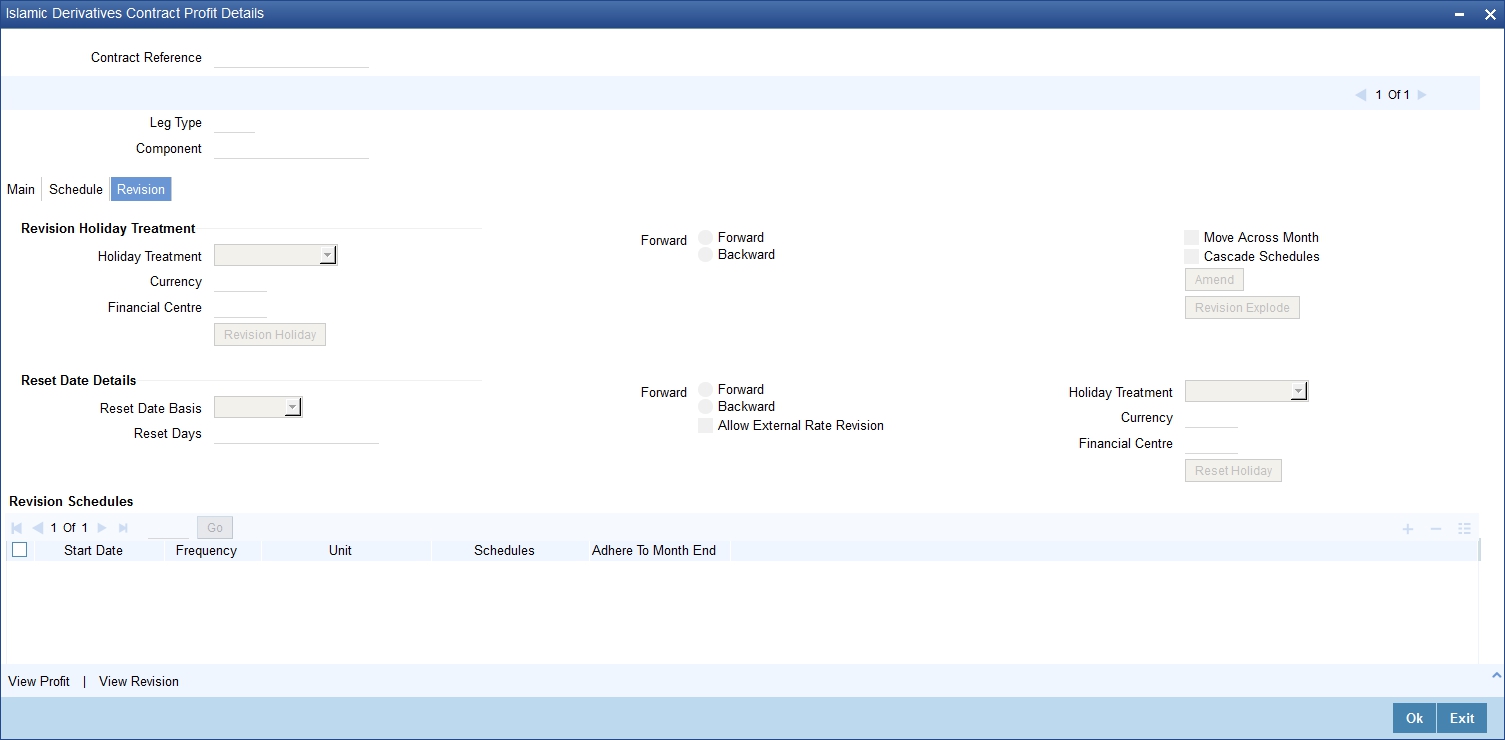

5.2.7.3 Revision Details Tab

The revision schedules are maintained in the ‘REVISION’ tab of the screen.

Revision Holiday Treatment

You have to specify the holiday treatment that has to be followed when schedules fall due on a holiday. The holiday treatment method has been explained at length in the earlier section on Indicating Principal Schedule Details Holiday Treatment

Reset Date Details

Reset Date Basis

Since the floating profit rates are entirely dependent on the market conditions you can periodically reset the floating rate for each profit component over the tenor of the contract.

For this purpose you need to specify the date basis on which profit rates should be reset. The following options are available:

- Start Date - The rate will be refreshed as of the start date of the schedule depending in the reset movement and the reset days

- End Date - The rate will be refreshed as of the start date of the schedule depending in the reset movement and the reset days indicated

- Other - You can also specify any other date basis as the reset date basis

Reset Date Movement

After you specify the basis on which rate should be reset you have to indicate whether the reset movement should be backward or forward from the schedule Start/ End Date or any other date.

Allow External Rate Revision

Checking this option indicates that for a contract, you can allow rate revision based on the rates uploaded from an external system. If the option is checked but no rate is uploaded for the contract, the rate would be picked up from the maintenance.

Reset Days

For the reset basis and reset date movement specified you have to indicate the number of days before or after the start/end or any other date that should be used to determine the rate reset date.

Note

If a particular reset date falls on a holiday then you are required to indicate the way in which the holiday should be treated.

Revision Schedules

Start Date

Specify the date on which the particular profit revision schedule should start

Frequency

If you want to define periodic profit revision schedules, you should indicate the frequency of the revision schedules for a particular profit component. The options are:

- Daily

- Weekly

- Monthly

- Quarterly

- Half-yearly

- Yearly

- Bullet

Note

If you prefer to keep the revision schedules as bullet then the particular profit component will be liquidated only as of the Maturity Date.

Frequency Units

You can specify the number of units of the frequency in this field. The number that you specify here will determine the actual schedule frequency.

For instance for a particular schedule you want to have a bi-weekly frequency. The option list available for Frequency does not have this option. In the Frequency field indicate the option weekly and in the Frequency Unit field if you enter 2, the particular schedule will be due every once in two weeks.

No of Schedules

For a particular Frequency and Frequency Unit combination you can choose to have a number of schedules depending on how many you want to define for the particular revision component.

For instance, for a particular schedule you have indicated that the Frequency should be Weekly and the Frequency Unit as 2. Subsequently you indicate that the Number of Schedules as 12. This particular schedule will be run every two weeks twelve times.

Adhere To Month End

If the profit revision schedule is in terms of a month, you can choose to indicate whether the schedule days should adhere to Month-Ends by checking this option.

5.2.8 Contract Rate Revision

During rate revision, the system picks up the floating rate applicable on the contract. If the ‘Related Component’ (spread) is not zero, the profit rate of the related component is also picked up as part of rate revision. This floating rate along with the spread is then compared with Cap or Floor rate depending on the Profit Type specified for the contract, to arrive at the final rate.

The manner in which the system determines the final rate for each of the four profit types is given below:

- For Profit Type ‘Cap’, if the total floating rate arrived at by the system plus profit rate of related component is greater than Cap Rate, the final rate is taken as the Cap Rate minus profit rate of related component, if the same is specified. If related component is not selected, the final rate will be Cap Rate minus the spread part. Rate of related component cannot be more than the Cap Rate.

- For Profit Type ‘Floor’, if the total floating rate is less than the Floor Rate and if Related Component is specified, the final rate will be taken as Floor Rate minus profit rate of the Related Component. If Related Component is not maintained, final rate will be the Floor Rate minus the spread component.

- If Profit Type is ‘Corridor’ then, final rate will lie between the Floor Rate and Cap Rate. If the final rate is above Cap Rate, then final rate is decided as in the case explained for Cap profit type (where spread is zero). Similarly, if the final rate is below Floor Rate, final rate is decided as explained for the Floor profit type above.

- If the profit type is ‘Normal’, both final rate as well as the spread will be taken as it is. Also, Related Component will not be applicable in this case.

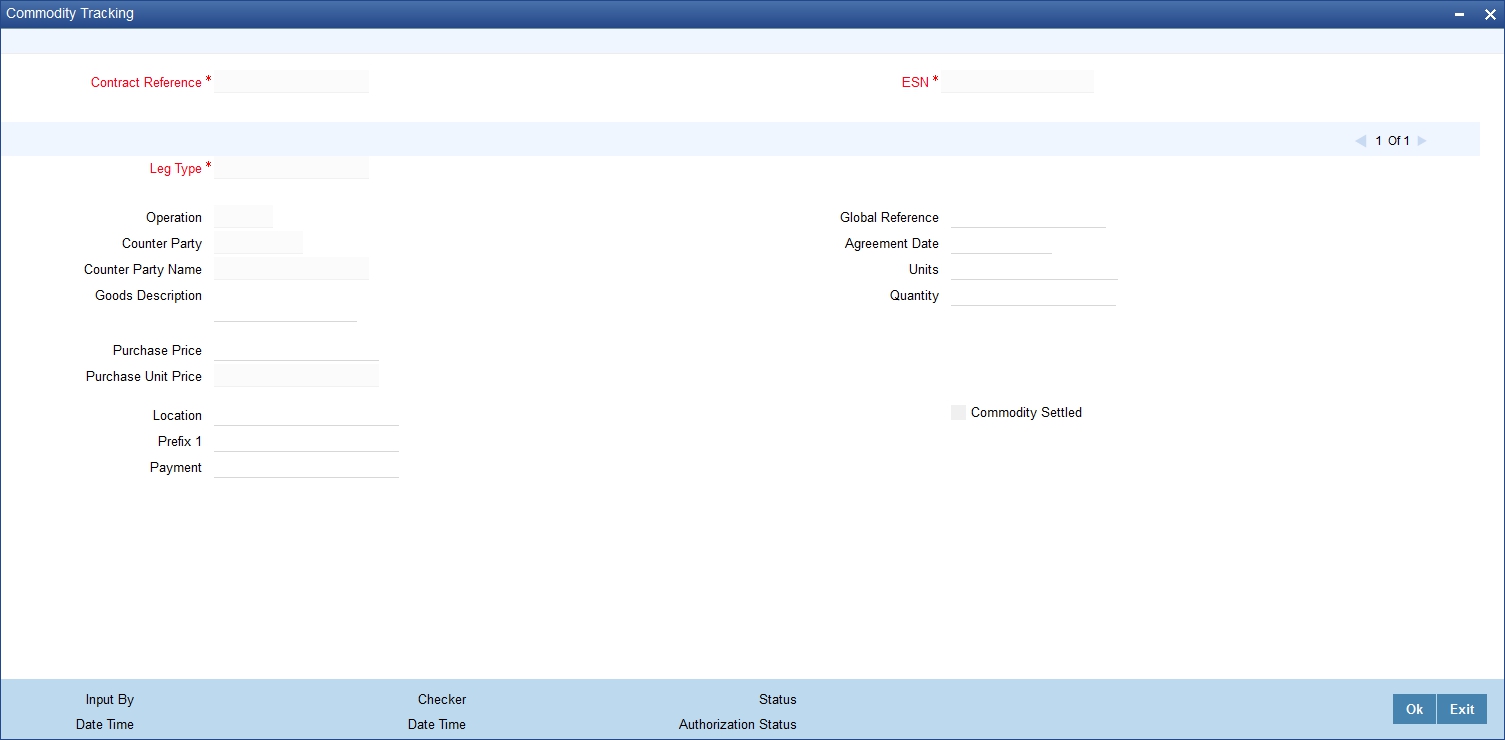

5.2.9 Indicating Commodity Details

You can maintain principal and profit schedules for the in and out legs of the contract. Similarly, you can indicate commodity details for every contract that you process. You can also invoke this screen by typing ‘IDDCOTRK’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Click ‘Commodity’ button in the ‘Islamic Derivative Contract Input’ screen. The ‘Commodity Tracking’ screen will be displayed.

You can capture the following details:

Contract Reference

The system displays the contract for which commodity details are being input.

Event Sequence Number

The system displays the event sequence number

Leg Type

The system displays the commodity details for the in and out leg.

Counterparty

The system displays the counterparty details of the contract.

Operation

The system displays commodity operation details based on the contract type and the commodity tracking status.

Goods Description

Specify the description of the goods bought.

Global Agreement Reference

Specify the agreement reference number associated with the transaction.

Global Agreement Date

Specify the date of the agreement associated with the contract.

Quantity

Specify the quantity of commodity to be purchased.

Price

The system displays the principle amount of the transaction as the purchase price of the commodity, by default.

Unit Price

The system derives the unit price based on the purchase price and the quantity of the commodity.

Location

Specify the place where the sales and purchase of the commodity occurs.

Title

Specify the title for the commodity purchased.

Payment Instrument

Specify the details of the payment instruments.

Commodity Settled

Check this option to indicate that the commodity has been sold or purchased.

5.2.9.1 Operations on the Record

The following operations are allowed for the commodity tracking screen:

- Unlock

- Save

5.2.10 Indicating other Details of the Derivative Contract

Once you enter the essential details of the derivative contract you have to enter the additional details that are required to process the contract. Click on ‘Detail’ tab that corresponds to Detail.

Assuming

If the contract you are processing has been assumed from another counterparty you are required to indicate so before you begin to specify the other details. Uncheck the box if you are processing a fresh contract.

Customer

If the counterparty from whom you are assuming the contract is a customer of your bank, indicate the name of the customer. When the counterparty is not in any way connected to your bank you need not specify the name.

Base Currency

Since you can maintain different currencies for both the in and out legs of the contract, you have to identify one single currency as the Base Currency of the contract. The base currency you specify will be used to compute the contract fair value to be used for revaluation purposes.

Revaluation Details

Revaluation is typically applicable to trade deals. The revaluation preferences that you made at the product level will be defaulted to the contract. You may change these preferences while processing the contracts.

If indeed revaluation is required for the contract being processed, it will be done according to revaluation method that you choose.

Note

Each of the revaluation methods have been thoroughly explained in the chapter on Defining the Fair Price revaluation methods.

Netting Required

This field indicates whether contracts with positive and negative MTM values can be netted for computing credit limit utilization.

After you specify the MA Code the other details linked to the code such as Limits Tracking Required, Netting Required and so on get defaulted to the contract.

Note

At the MA level if you have indicated that Netting is required and while entering the details of the contract you decide that netting is not required for that particular contract, then you will be allowed to uncheck this box.

However at the MA level if you have specified that netting is not required, then you will not be allowed to change this default at the time of entering the contract details.

Similarly, the way in which revaluation entries should be passed, whether at the leg level or at the contract level will also be defaulted from the ‘Product Preference’ screen.

At the product level if you have specified that revaluation netting is not required then you will not be allowed to change this at the contract level. However at the product level if you have indicated that revaluation netting is required, then you can change this to ‘Not Required’ at the contract level.

Rate Code

If you indicate that the revaluation should be based either on the Contract Specific Rate or on the Branch Specific Rate, then you have to indicate the Rate Code which should be used for the same purpose.

Rate Source

This is the Rate Source to which the Rate Code belongs. Select from the option list and indicate the Rate Source to which the Rate Code is to be linked.

Maturity Date Details

Holiday Treatment

As part of specifying the maturity date details you have to select the holiday handling treatment if the Maturity Date were to fall due on a holiday. You can specify that the holiday should be treated according to on of the following:

- Ignore the holiday

- Branch Holiday

- Currency Holiday

- Financial Center

Holiday Movement

You can also choose to move the maturity date falling due on a holiday either forward or backward to the next or the previous working day respectively. If not, the maturity date will be kept in the same month, on the last or first working day of the month, depending on whether the maturity date is over the month-end or the beginning of the month.

Holiday CCY

If you have specified that the Holiday Treatment should be as per your specifications in the Currency Holiday Calendar then you have to indicate the currency for which the holiday table should be checked.

Financial Centre

If you have indicated that the Holiday Treatment should be governed by the holiday calendar of the Financial Center then you have to indicate the code assigned to the Financial Center.

Inception Details

Inception Value

The inception value refers to the value of the contract at inception. This is applicable only in the of trade deals. You can either choose to amortize the gain/loss at inception or you can choose to ignore the same.

Note

Your preference at the product level regarding the amortization of inception gain and/or loss will be will be made applicable to the contract as well. However if you do not want to allow amortization for inception gain/loss for this particular contract you will be allowed to do so.

Termination Details

Termination Type

When you are terminating a particular contract you have to indicate whether it s a normal termination or whether the contract is going to be assigned to another counterparty. In the latter case, you have to indicate the counterparty to whom the contract is to be assigned.

Note

This would not be applicable when you are entering a new contract.

Counterparty

If the contract is to be assigned to counterparty then you can indicate the ID of the counterparty to whom the contract is to be assigned.

Termination Value and Currency

If there has been any gain or loss due to termination you have to indicate the gain or loss in value by specifying a positive or negative amount and the currency in which the termination gain or loss should be settled.

You can either choose to amortize the termination gain/loss or you can choose to ignore the same.

Termination Date

You must specify the Termination Date. Termination can either be back-valued, current dated or future-valued. The date that you specify should adhere to the following conditions:

- For IRS/CCS contracts the termination date can be anywhere between the Booking Date (inclusive) and Maturity Date (exclusive). Any deviation from these conditions will result in an error message

- If you are specifying a back-dated termination for an IRS/CCS contract, ensure that the termination date is not greater than the most recent schedule settlement date that has been executed

- The termination date is defaulted as the System date. You can modify this date. Ensure that you do not leave this field blank

- When you save the contract after specifying the Termination Date, DTRB event is triggered. No accounting entries are passed for this event. The contract status remains active after DTRB and a new version is created

- If the DTRB event has been triggered for a contract, you cannot terminate the contact again

- For a back-valued termination, or termination on application date, the Termination event (DTER) is triggered along with the event DTRB when you save the contract. The SGEN for Termination is fired on authorization

- For future-dated termination, the termination event (DTER) is triggered during EOD/BOD on the respective date

- Settlement Message generation (SGEN) is triggered for the termination event (DTER). Therefore you must maintain the Payment Message for settlement message generation at DTER. If the settlement message generation batch has not been executed, then SGEN will trigger along with DTER

Note

Your specification in the ‘Product Preferences’ screen about the amortization of termination gain/loss the will be defaulted on to the contract. At the product level if you have set this preference as No then you will not be allowed to change this to Yes at the contract level. However, if you have set the preference as Yes then you can change this to No at the contract level

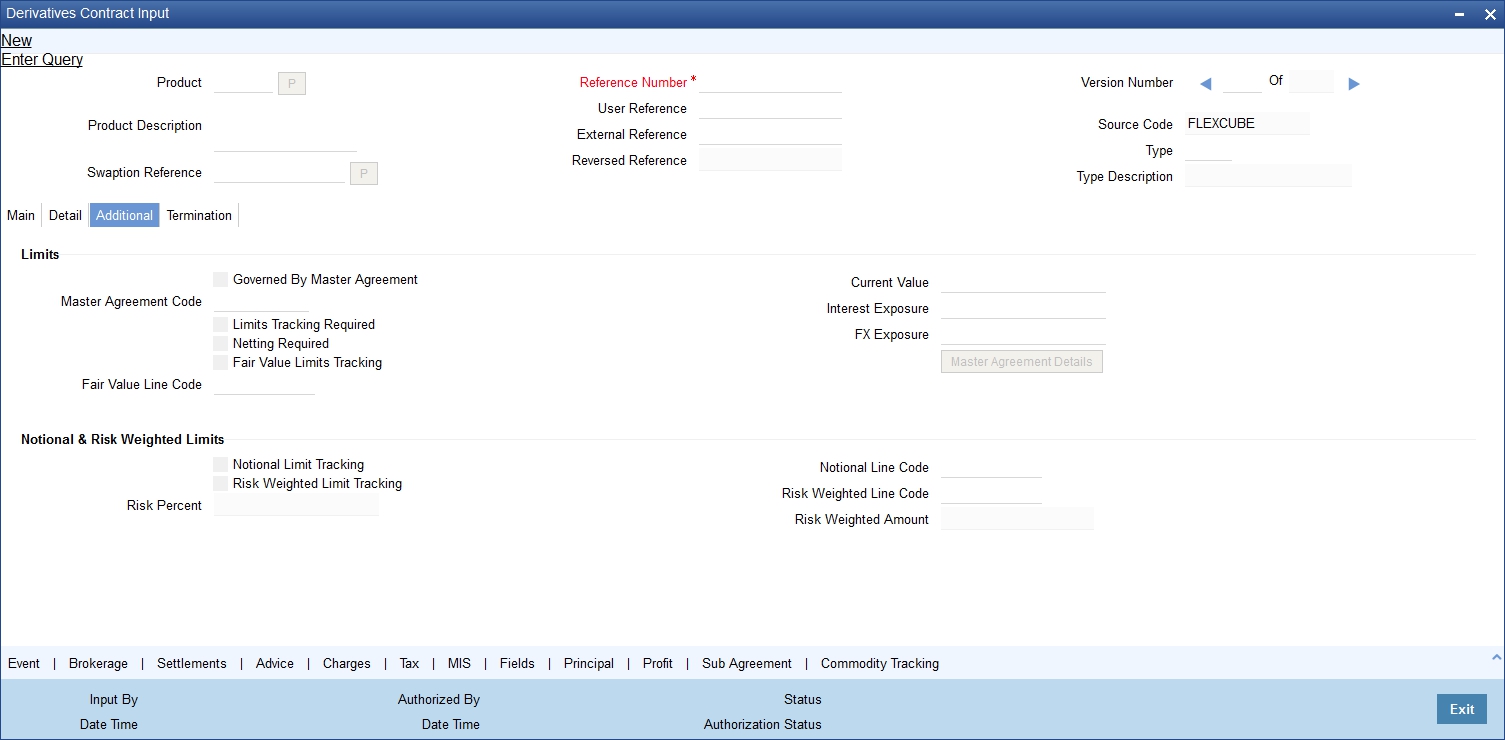

5.2.10.1 Additional Details tab

Once you enter the essential details of the derivative contract you have to enter the additional details that are required to process the contract. Click on ‘Additional’ tab that corresponds to Detail.

Limits

Governed By Master Agreement

Check this box to indicate that the contract for which you are capturing details comes under the purview of a master agreement that exists between your bank and the counterparty.

MA Code

If you have specified that the contract is governed by a master agreement then you have to indicate the code assigned to the Master Agreement in the Master Agreement Maintenance screen.

After you choose the MA Code, the other details linked to the MA code, such as Limits Tracking Required, Netting Required and so on will get defaulted to the contract.

Note

If you input the MA Code, click ‘MA Details’ button. The system displays the related details for the MA code specified.

Limits Tracking Required

At the MA level if you have indicated that limit tracking is required and while entering the details of the contract you decide that tracking is not required then you will be allowed to uncheck this box.

However at the MA level if you have specified that limit tracking is not required then you will not be allowed to change this default at the time of entering the contract details.

Fair Value Line Code

This field is the Line Code for the Fair Value Limits tracking and will be defaulted from the master agreement maintenance once the master agreement is chosen.

This field is mandatory if the Fair Value Limits Tracking option is checked.

Current Value

The Current Value represents the current Mark-to-Market value of the contract. This value will change as and when the contract is revalued.

When you are entering a contract you may enter the inception value in this field. This will be taken as the current value of the contract.

FX Exposure

The likely increase in value in a contract during the contract tenor may be attributed to two factors:

- Profit Exposure - Exposure to fluctuation in profit rates

- FX Exposure - Exposure to fluctuations in exchange rates only when foreign currency is involved

Specify the profit and FX Exposure amounts.

Notional & Risk Weighted Limits

You can specify whether Limit Tracking is required for the particular contract. The fields Fair Value Limit Tracking, Notional Limits Tracking and Risk Weighted Limits Tracking will be enabled only if Limit Tracking option is enabled. If the contract is governed by a Master agreement then if any of the three fields (Fair Value Limit Tracking, Notional Limits Tracking and Risk Weighted Limits Tracking) are checked in the Master Agreement, the Limit Tracking Required option will be checked at contract level.

The fields Notional Limits Tracking, Notional Line Code, Risk Weighted Limits Tracking and Risk Weighted Line Code are defaulted from the Master agreement maintenance if the contract comes under the preview of a Master agreement.

The Notional Line Code and Risk Weighted Line Code are mandatory if the Notional Limits Tracking and Risk Weighted Limits Tracking options are enabled, respectively.

For the line code, all valid lines for the counterparty and the product will be displayed in the option list.

On saving the contract, all the three lines selected will be validated for any restrictions based on product and currency. Oracle FLEXCUBE will also ensure that all line codes selected are distinct from each other.

Risk % and Risk Weighted amount will be calculated and shown in the screen as soon as the Risk Weighted Limits Tracking option is selected. These fields will be recalculated if the value date or the maturity date is amended.

Risk Weighted Amount will be calculated as follows:

Risk percent will be computed by comparing the tenor (Maturity date – Value date) of the contract with the tenor slabs in risk percent maintenance. Risk category used for comparison will be the risk category defined in customer maintenance for the counterparty of the derivatives and options contract. Product used for comparison will be the product for the contract. If there is no risk maintenance for the particular category and product, product will be replaced by ‘ALL’ and risk percent for contract tenor, customer category and product ‘ALL’ will be arrived at. Module used for find out the risk percent will be ‘DV’ for Islamic Derivatives.

Various combinations possible for find out risk percentage in order of preference are:

DV + Customer Category + Product

DV + Customer Category + ALL

An error message will be raised if Risk Weighted Limit Tracking is checked and risk percentage cannot be arrived at.

Risk percent, once arrived at, will be stored and the contract level and will be used to compute the risk weighted amount for limit tracking. Any future amendment of risk percentage in risk percentage maintenance will not affect the risk weighted amount of the contract and it will remain the same throughout the life cycle of the contract.

Limits Utilization for the Notional Amount and the Risk Weighted amount will be done against the in leg currency for IRS and CCS.

5.2.11 Limits Processing

Limit tracking for Notional Contract amount will be carried out on the in leg principal. For risk weighted limit tracking, notional amount will be multiplied with the risk percent for finding out the risk weighted amount and limit tracking will be done on this amount.

If credit netting is checked during contract input and the contract is governed by a master agreement, then the limit tracking will be done against a single reference number. This reference number will be the master agreement code of the master agreement for the counterparty of the contract.

5.2.12 Processing Brokerage on a Contract

When capturing the details of a contract that involves brokerage, you will have to specify the brokerage details applicable to the contract. To recall, you have already specified the name of the broker through whom the contract was brokered in the ‘Islamic Derivatives Contract Input’ screen. The details specified for the broker including the brokerage rule linked to the broker, is defaulted. However, you can change some details, like - whether brokerage should be booked in advance, in arrears or whether it should be waived altogether.

Click ‘Brokerage’ button to define the brokerage details that are applicable to the contract leg you are processing. You will be allowed to enter details of a broker only if brokerage was allowed for the product to which the contract is associated.

The code assigned to the broker through whom the deal was brokered is displayed along with the broker’s name.

If the brokerage payable currency is the same as the brokerage paid currency, then the same amounts (brokerage paid and brokerage payable) are displayed against the currencies. You have the option to change these currencies.

While you cannot input the brokerage payable amount, the brokerage paid amount can be changed.

The following brokerage details are displayed:

- The brokerage liquidation status. If it has been liquidated, the liquidation reference number is also displayed

- The rule code and description that has been linked to the broker

Indicating when brokerage should be booked

You can indicate preferences as to when the brokerage applicable to the contract should be linked. The options available are:

- No Booking

- Advance

- Arrears

The preference specified for the broker will be displayed. You can change it in this screen, say, from advance to arrears or vice-versa.

You have a third option. That is, of waiving brokerage. If you opt for no booking, no accounting entries will be passed for brokerage for this deal.

Note

If you invoke the ‘Contract Brokerage Details’ screen for operations like delete, change, authorize, liquidate and detailed view, this screen will only display brokerage details. You can change brokerage details for a deal only if you have clicked the Modify option from the Actions Menu.

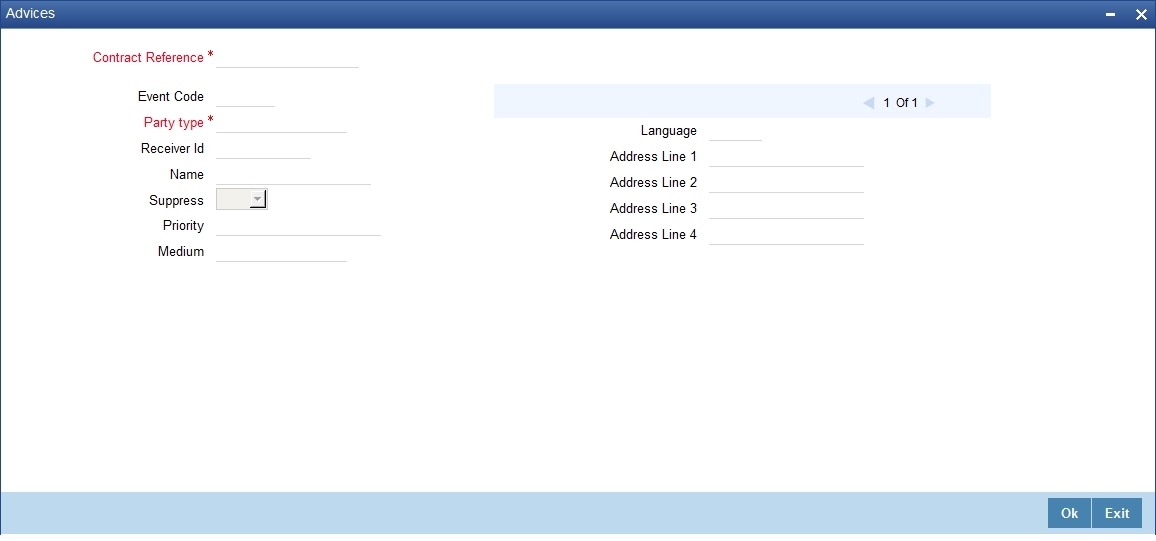

5.2.13 Specifying Advices for the Contract

Click ‘Advice’ button from the ‘Islamic Derivatives Contract Input Details’ screen. The ‘Events Advices’ screen is displayed. To recall, the advices that can be generated for the events that occur during the life-cycle of a contract are defined for the product to which the contract is associated.

The details of the advices applicable for an event are displayed in the ‘Advices’ screen.

Party Type

The party type to whom a specific advice should be sent is picked up automatically based on the type of contract you are entering and the parties specified in the contract.

The address of the party who is the recipient of the message will be picked up by default, based on the media and address maintenance for the party. You can change either of them.

For a payment message by SWIFT, you also have the option to change the priority of the message.

Receiver ID

Specify the Customer to whom the Advice is being dispatched.

Suppress

By default, all the advices defined for a product will be generated for contracts involving it. If any of the advices are not applicable to contract you are processing, you can suppress its generation.

Priority

For a payment message by SWIFT, you also have the option to change the priority with which the message should be generated. By default, the priority of all advices is marked as Normal.

You have the option to prioritize a payment message to one of the following options:

- Normal

- Medium

- High

Medium

The medium through which an advice is transmitted and the corresponding address will be picked up based on the address and media maintained for the customer who is the recipient of the message.

You can, however, change either of these while processing the contract. Typically, if changed, both of them will be changed.

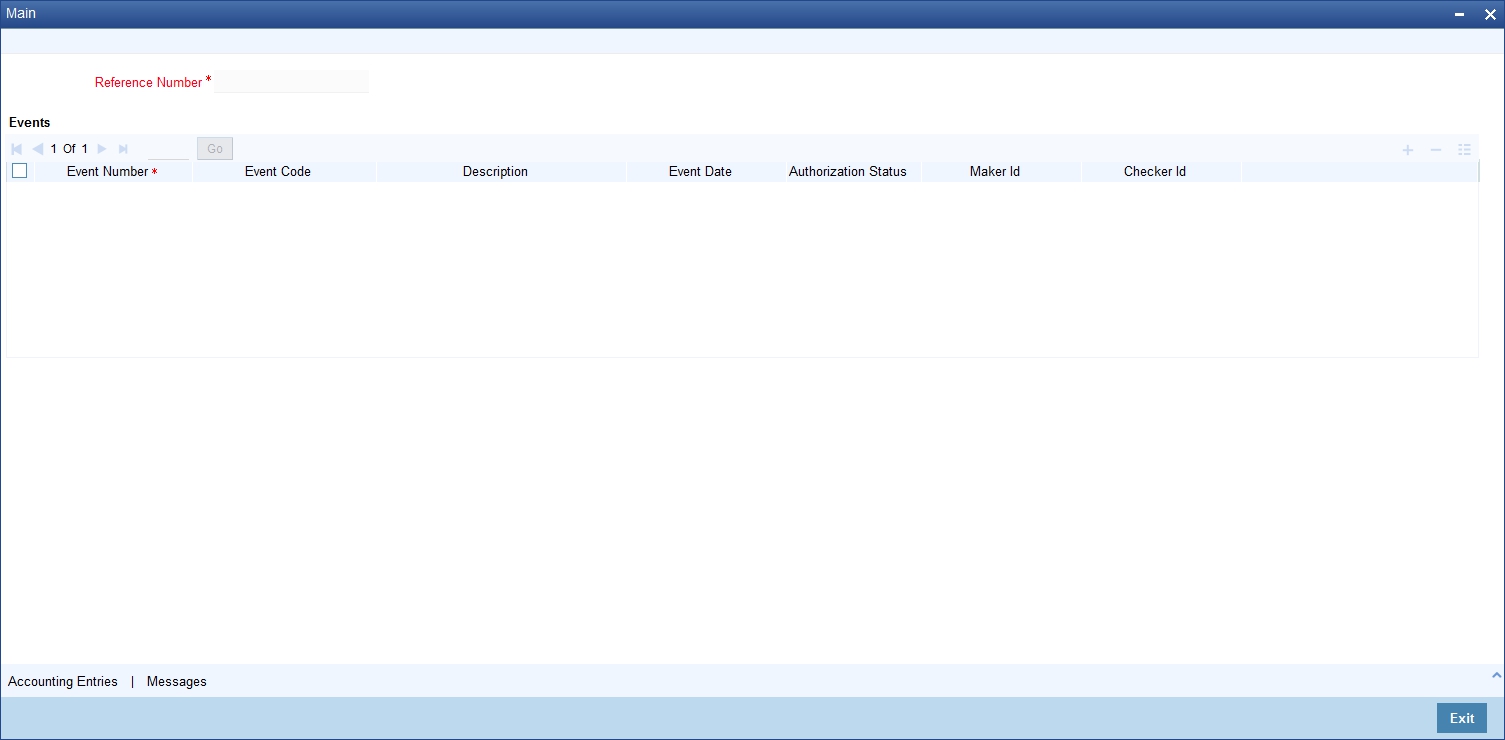

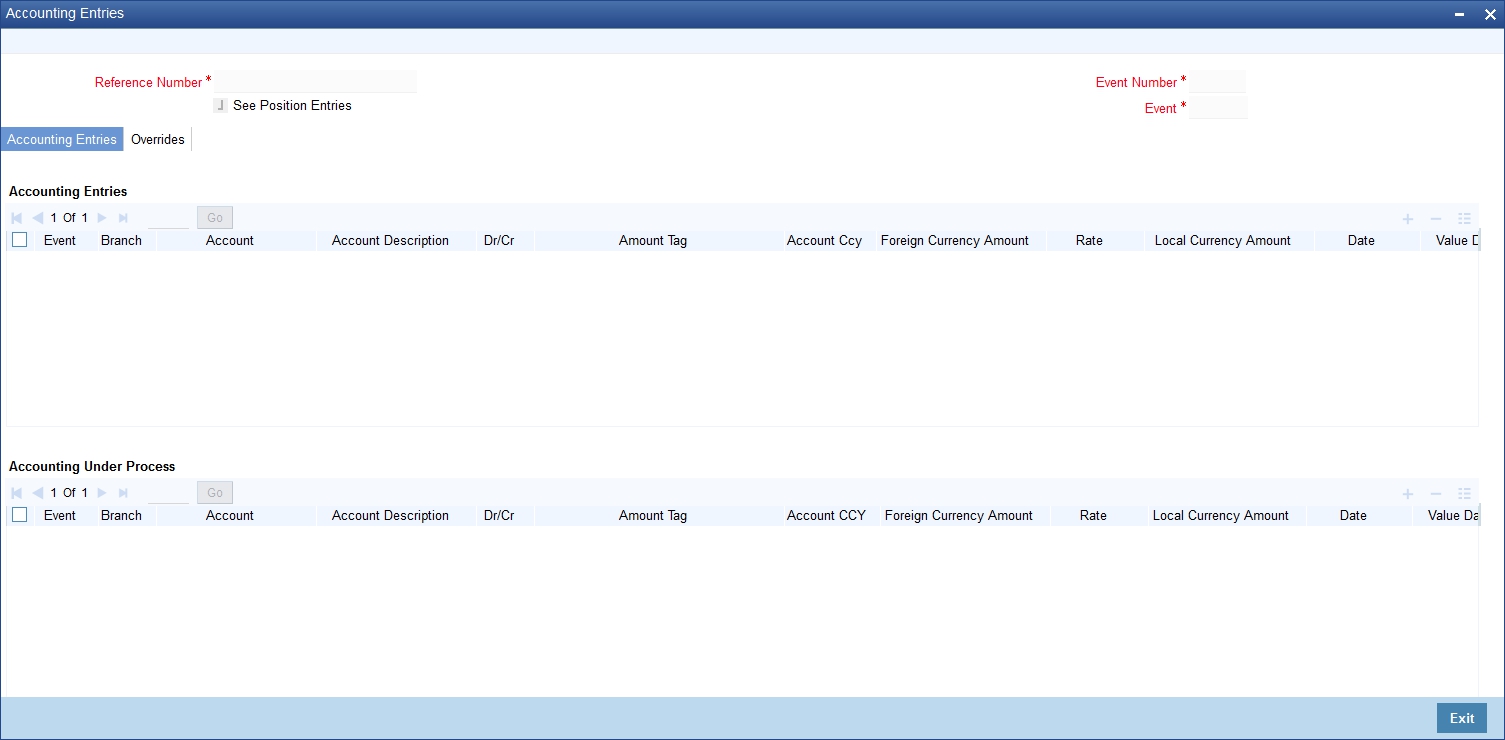

5.2.14 Viewing Event Details

Click ‘Event’ button from the ‘Contract Input Details’ screen, to view details of events involved in the transaction.

The details of events that have already taken place for the transaction leg will be displayed, along with the date on which the event took place.

You can view the accounting entries details for a specific event by choosing the event and clicking on ‘Accounting Entries’ button.

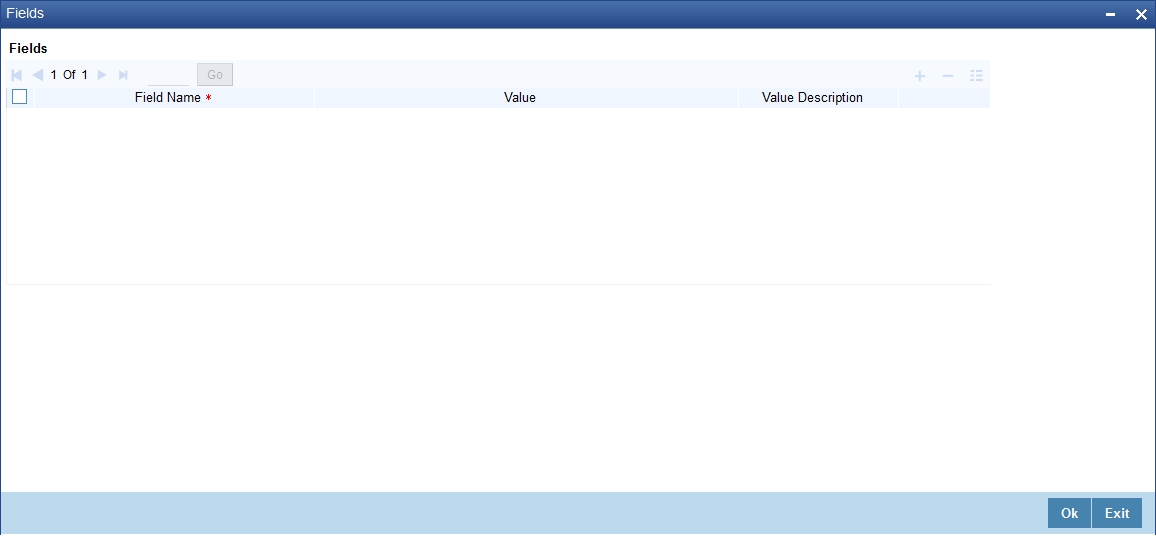

5.2.15 Selecting the User Defined Fields

The user-defined fields that have been linked to the product will be defaulted to the contract. You need to capture the relevant information pertaining to these fields. Click ‘Fields’ button in the ‘Contract Input’ screen. The ‘User Defined Fields’ screen will display fields for which information needs to be captured.

For more details on how to create user Defined fields, refer chapter ‘Creating custom fields in Oracle FLEXCUBE’ in the User Defined Fields User Manual under Modularity.

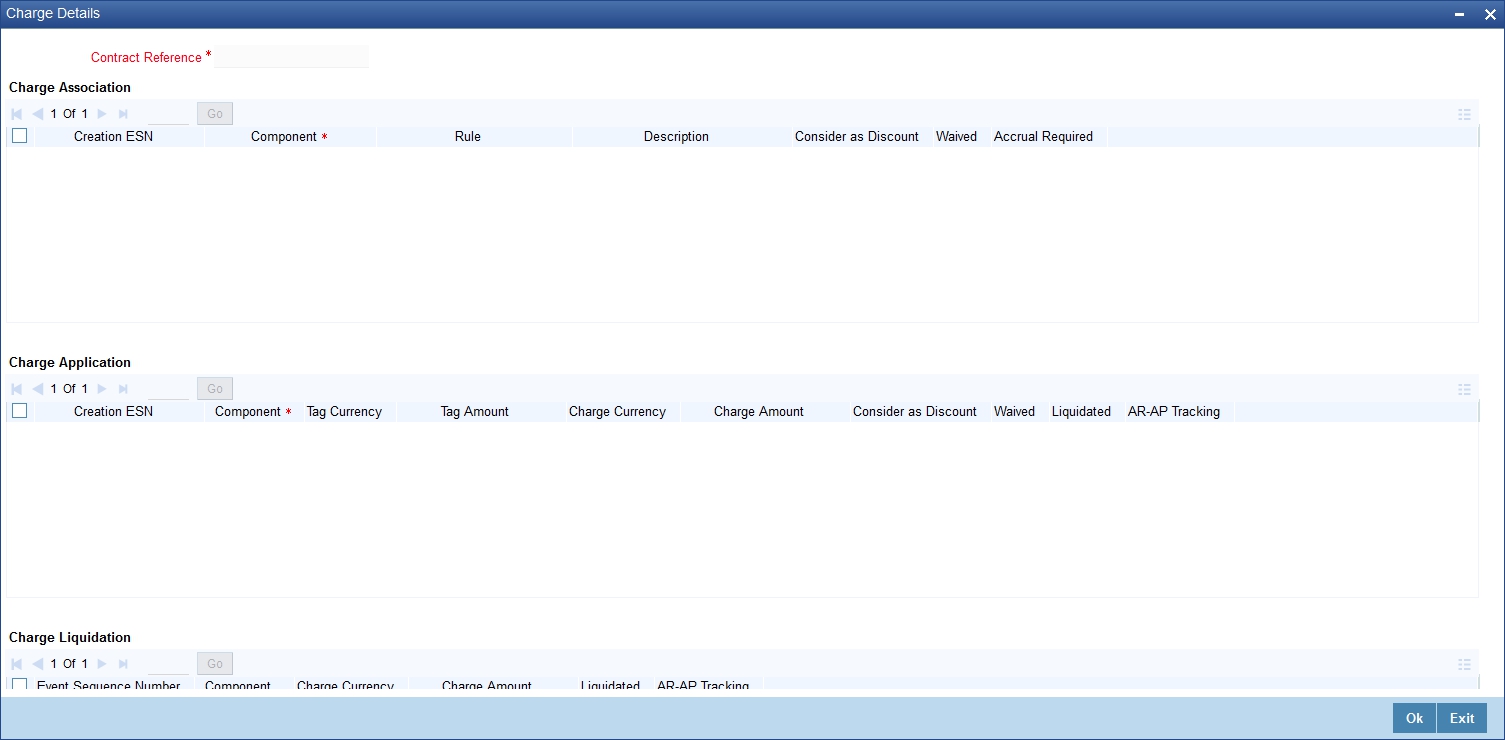

5.2.16 Levying Charges for a Transaction

For each leg of the transaction you can specify the charges that you levy. Charges are applicable only the for customer legs of a transaction.

The characteristic feature of a charge is that it is always booked in advance and is not accrued, as a charge is collected only when it is due.

To recall, you have defined the attributes of a charge by defining a Charge Rule in the ‘ICCF Rule Definition’ screen. A rule identifies the basic nature of the charge. You have further defined a Charge class in the ‘Charge Class Maintenance’ screen where you have enriched the attributes of a rule. We shall refer to these classes as components.

Each charge component in turn is linked to a product. All the charge components linked to a product are defaulted to the contracts associated with it. Thus each time you enter a contract, you need not specify when and how charges should be collected.

However, while capturing the details of a transaction, you can choose to associate a component to the transaction. Further, you can modify some of the attributes defined for the applicable component.

From the ‘Islamic Derivatives Contract Input Detail’ screen, click ’Charges’ button. The ‘Contract Charge Details’ screen is displayed.

The reference number of the transaction leg for which you are defining charge details is displayed. The screen will contain a list of all the charge components applicable to the transaction leg.

Charge Association

All the charge components applicable to the transaction leg you are processing will be displayed together with the rule that is linked to the component.

In this section of the screen you can:

- Change the charge rule linked to the component

- Disassociate a charge component from the transaction leg

Changing the charge rule linked to a component

The rule that is linked to a charge component is displayed next to the component. Choose a new rule to link to the component from the option list., A list of all the charge rules maintained will be displayed. Select the appropriate rule from the option list . The new rule will be made applicable to the charge component.

Disassociating a charge component from the transaction leg

You can disassociate a charge component from the transaction leg. In the Association section of the ‘Contract Charge Details’ screen, click against the waive option positioned next to the component.

In this case, the charge component is attached to the transaction leg but is not calculated.

Charge Application

In the application section of the screen, you can indicate the charge components that should be applied to the transaction leg. The list of components that is displayed depends on the charge components that you have associated to the transaction leg. The following details of the component are also displayed:

- The basis component on which the charge is levied

- The currency of the basis amount

- The basis amount

- The charge amount

- The currency in which the charge amount is defined

You can change the charge amount that is calculated using the class applicable to the component.

Waiving a charge on a transaction leg

You also have the option to waive the component for the transaction leg that you are processing. If, for some reason you want to waive the charge on the transaction you are processing, you can do so by checking against the waiver option in the application section of the screen. The charge will be calculated but not applied.

Note

You can waive a charge only if it is yet to be liquidated.

5.2.16.1 Viewing Charge Liquidation

When a charge component that is applied to a transaction is liquidated, the relevant accounting entries are passed. The ‘Contract Charge Details’ screen displays:

- The charge components that have already been liquidated

- The amount that was liquidated

- The currency in which it was liquidated

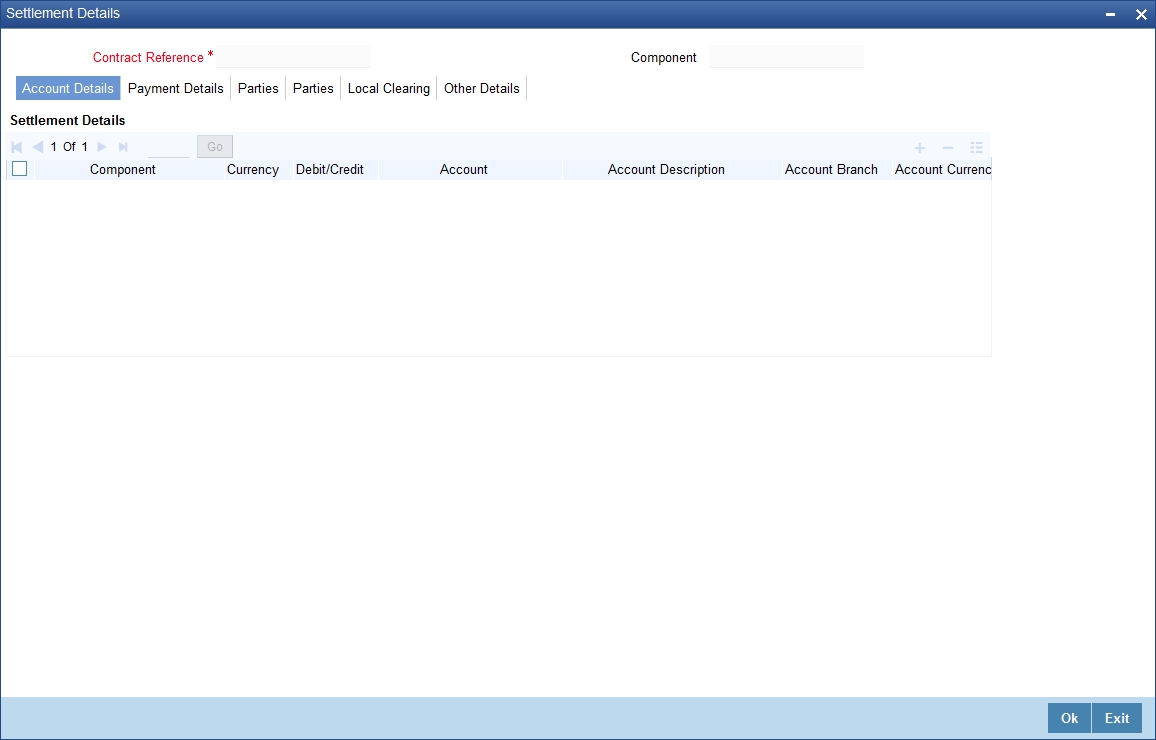

5.2.17 Maintaining Settlement Instruction Details

In order to capture the details of a contract successfully you have to capture the following details as well.

- The accounts to be debited for charges, if there are any

- The accounts to be debited for profit that the contract involves

- The method in which the contract is to be settled - whether it is an instrument or a Message (as in a SWIFT or TELEX message)

- Details about the route through which the money settlement should take place

The information that is related to the settlement method and route applicable for a transfer is referred to as Settlement Instructions.

The Settlement Instructions are captured through four different screens. Click ‘Settlements’ button in the ‘Contract Input Details’ screen to invoke the ‘Settlement Instructions’ screen. Through the four screens you can capture the following information:

- Account details (details about the accounts involved in the contract that have to be either debited or credited in your branch)

- Message details

- Party details (details about the various parties involved in the

contract)

5.2.17.1 Account Details tab

For the various components involved in a transaction like charges etc you have to specify the account details in this screen. These details include the component, the currency in which it is paid, the payment account and its currency, the branch of your bank to which the account belongs, the exchange rate (in the case of the component currency being different from the account currency).

Depending on the component, the system will also display whether the account involved in an entry has to be debited or credited:

- P indicates you credit (Pay to) the account involved

- R indicates you debit (Receive from) the account involved

5.2.17.2 Message Details tab

A transaction can be settled either in the form of an instrument (a Demand Draft, a Manager’s Check or a Check) or a Message (a SWIFT, TELEX or Mail message to be sent to the receiver). The details regarding the instrument or message have to be specified in the ‘Message Details’ screen.

The message details that you specify here are applicable only for SWIFT. The type of SWIFT message that is generated depends on the parties involved in the contract.

Depending on the method in which you want to settle the transaction, you should input either Instrument or Message details.

Specifying Instrument Details

For a transaction that is being settled through an instrument, you should specify the type of instrument being used. It could be Manager’s Check, Check or a Demand Draft. You should also specify the number that will identify the instrument. This number will be printed on the instrument.

If the settlement is through an instrument, you cannot specify party details for the transaction.

Specifying Message Details

For a SWIFT message, you have to specify:

- Whether a Cover has to be sent to the Reimbursement Bank, along with the payment message to the receiver

- Bank to bank payment details, (these can be in the form of instructions or additional information to any of the parties involved in the transaction)

- Information from the sender to the receiver

5.2.17.3 Party Details tab

To effect a transaction, you may have to pass on funds through a series of banks before it actually reaches the ultimate beneficiary. Through the two ‘Parties’ screens you can capture details of all the parties that will be involved in settlement of the transaction.

These screens contain fields that explore the possible routes in which the transaction components can be transferred.

Intermediary Reimbursement Institution

An Intermediary Reimbursement Institution is the financial institution between the Sender’s Correspondent and the Receiver’s Correspondent, through which the reimbursement of the transaction will take place.

Intermediary

The Intermediary in a transaction refers to the financial institution, between the Receiver and the Account With Institution, through which the transaction component must pass.

The Intermediary may be a branch or affiliate of the Receiver or the account with Institution, or an entirely different financial institution. This field corresponds to field 56a of SWIFT.

Here you can enter either the:

- ISO Bank Identifier Code of the bank

- Name and address of the Bank

Receiver’s Correspondent

The Receiver’s Correspondent is the branch of the Receiver or another financial institution at which the funds will be made available to the Receiver. This field corresponds to field 54a of SWIFT. You can enter one of the following:

- ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

Account With Institution

An Account With Institution refers to the financial institution, at which the ordering party requests the Beneficiary to be paid. The Account With Institution may be a branch or affiliate of the Receiver, or of the Intermediary, or of the Beneficiary Institution, or an entirely different financial institution.

This field corresponds to field 57a of SWIFT. You can enter one of the following:

- ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

- Other identification codes (for example, account number)

Ordering Institution

The Ordering Institution is the financial institution, which is acting on behalf of itself, or a customer, to initiate the transaction. This field corresponds to 52a of SWIFT.

In this field you can enter one of the following:

- The ISO Bank Identifier Code of the Ordering Institution

- The branch or city of the Ordering Institution

- The Name and address of the Bank

Ordering Customer

The Ordering Customer refers to the ordering customer of the transaction. Here you can enter the name and address or the account number of the Customer, ordering the transaction. This field corresponds to field 50 of SWIFT. You will be allowed to enter details in this field only if you have initiated a customer transfer (MT 100 and MT 202).

Beneficiary Institution

Here, you can enter details of the institution in favor of which the payment is made. It is in reality the bank that services the account of the Ultimate Beneficiary. This field corresponds to field 58a of SWIFT.

You will be allowed to make entries into this field only for Bank Transfers (when the remitter and beneficiary of the transfer are financial institutions - MT 100 or MT 202). Here you can enter either:

- The ISO Bank Identifier Code of the Beneficiary Institution

- The Name and Address of the Beneficiary Institution

Ultimate Beneficiary

The Ultimate Beneficiary refers to the Customer to whom the transaction amount is to be paid. This field refers to field 59 of SWIFT. You can make entries into this field only for a customer transfer (MT 100 and MT 202).

The number of banks involved in the transfer would depend on the:

- Relationships and arrangements between the sending and receiving banks

- Customer instructions

- Location of parties

- The banking regulations of a country

Refer to the Settlements User Manual of Oracle FLEXCUBE for more details.

5.2.18 Levying Tax on a Contract

The tax details specified for the product to which the contract is associated will be automatically applied to the contract. However, while processing a contract, you can waive the application of tax on the contract.

You can invoke the contract ‘Tax Details’ screen by clicking ’Tax’ button from the ‘Contract On-line’ screen.

Refer to the Tax User Manual of Oracle FLEXCUBE for more details.

5.2.19 Saving the Details of a Contract

Enter valid inputs into all the mandatory fields; or you will not be able to save the contract. After you have made the mandatory entries, save the contract by either clicking ‘Save’ icon in the toolbar or selecting Save from the Actions menu.

On saving the contract, your User Id will be displayed in the Entry By field at the bottom of the screen. The date and time at which you saved the deal will be displayed in the Date/ Time field.

A contract that you have entered should be authorized by a user bearing a different login ID, before the EOD is run. Once the contract is authorized, the ID of the user who authorized the contract will be displayed in the Auth By field. The date and time at which the deal is authorized will be displayed in the Date/ Time field positioned next to the Auth By field.

The current status of the contract is also displayed in the field Deal Status. The field will display one of the following: active, closed, expired, reversed, cancelled, and on hold.

5.2.20 Generating Payment Messages on Authorization

During the authorization of the contract, the system generates payment messages by applying the floating profit rate at that point of time.

The system handles the payment messages in two different ways: