5. Operations

5.1 Introduction

You can process commission payment/charge collection at defined frequency level for every intermediary based on the transactions. You can also pay commission/collect charge to/from the intermediary at a pre-defined frequency specified for every intermediary product. Hierarchy distribution of the commission is done based on the hierarchy percentage maintained at intermediary product level.

After settlement is done, the system generates an intermediary statement based on the product maintenance displaying details of computation and the settlement amount.

This chapter explains the processing for computing commission.\

This chapter contains the following sections

5.2 Commission

This section contains the following topics:

- Section 5.2.1, "Commission Processing"

- Section 5.2.2, "Settlement of Commission Between Intermediaries"

- Section 5.2.3, "Viewing Intermediary System Data Elements"

- Section 5.2.4, "Actions Allowed"

- Section 5.2.5, "Viewing SDE Summary "

- Section 5.2.6, "Viewing Calculated Commission"

- Section 5.2.7, "Actions Allowed"

- Section 5.2.8, "Viewing Commission Calculation Summary"

5.2.1 Commission Processing

As part of the End of Day (EOD) processing, the system computes System Data Elements (SDEs) for the Intermediaries across products. Calculation of SDEs is done for intermediaries based on the branch-level parameter ‘Daily SDE Computation’. If the branch parameter is checked, the system will do daily computation of SDEs for all intermediaries irrespective of whether the settlement is due on application date or not. If it is not checked, the system will compute SDEs only if settlement processing is due on the said date.

Consider the following example:

Assume a transaction with the following details:

- SDE - LOAN_DISBURSED_AMT

- Batch Processing Date - 01 February, 2009

- Last Settlement Date for the intermediary product - 01 January, 2009

The batch will calculate the total amount disbursed for the intermediary between last settlement date, i.e 01 January, 2009 and processing date i.e. 01 February, 2009. This amount will be used for computation of the SDE and then logged into a data store for processing.

Subsequent to SDE calculation, the system does the following:

- Calculation of amount for all the rules for the product (say INP1)

- Assume the following figure is calculated rule-wise:

RUL1: 200 (Commission)

RUL2: 100 (Charge/Penalty)

- Netting the amount across all the rules

- For above scenario, the accounting should be as under

RUL1

Accounting Role |

Amount Tag |

Debit/Credit |

Expense |

200 |

Dr |

Intermediary |

200 |

Cr |

RUL2

Accounting Role |

Amount Tag |

Debit/Credit |

Intermediary |

100 |

Dr |

Income |

100 |

Cr |

In the above scenario, netting will be done as under:

Accounting Role |

Amount Tag |

Debit/Credit |

Expense |

200 |

Dr |

Income |

100 |

Cr |

Intermediary |

100 |

Cr |

- Processing settlement with the intermediary based on netted amount

- The system posts settlement entries as per the netted. The settlement with the intermediary is based on the intermediary set-up. If CASA is the settlement mode maintained for the intermediary, settlement will happen using the CASA maintained. If External Account is the settlement mode maintained, then settlement will happen using a PC transaction.

The system performs the following validations:

- For every product-intermediary combination, a liquidation reference number is generated. The sequence is based on the product code. The entries are passed when the INLQ event defined at the product level is triggered.

- If the settlement mode of the intermediary is CASA, settlement will be processed with the CASA (both debit/credit).The corresponding debit/credit advice will get generated for the intermediary based on the product set-up and the netted amount. If the netted amount to the intermediary is a credit, credit advice will get generated. If the netted amount is a debit, debit advice will get generated.

- If the settlement mode of the intermediary is ‘External Account’,

the system will check for the following:

- If the transaction is a credit to the intermediary, settlement will get processed using a PC transaction based on the maintenance at intermediary level and the category maintained at the intermediary branch level.

- If the transaction is a debit to the intermediary, settlement will get processed using the settlement account/branch maintained for the intermediary.

5.2.2 Settlement of Commission Between Intermediaries

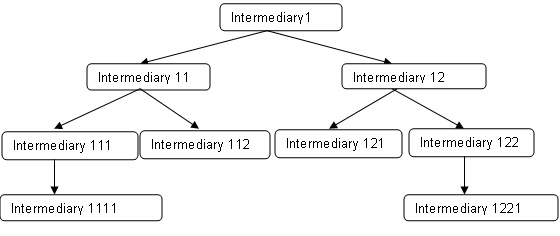

Oracle FLEXCUBE supports commission settlement between intermediaries in a hierarchical way. The system computes the hierarchy amount payable to the parent intermediary for each intermediary based on the intermediary maintenance. The following diagram illustrates the hierarchical structure that can be maintained for intermediaries.

The computation happens till the level specified at the intermediary level. If the level is immediate, calculation will happen only till the immediate parent level; otherwise it will happen till the root level. This computation will happen product-wise for the intermediary.

5.2.3 Viewing Intermediary System Data Elements

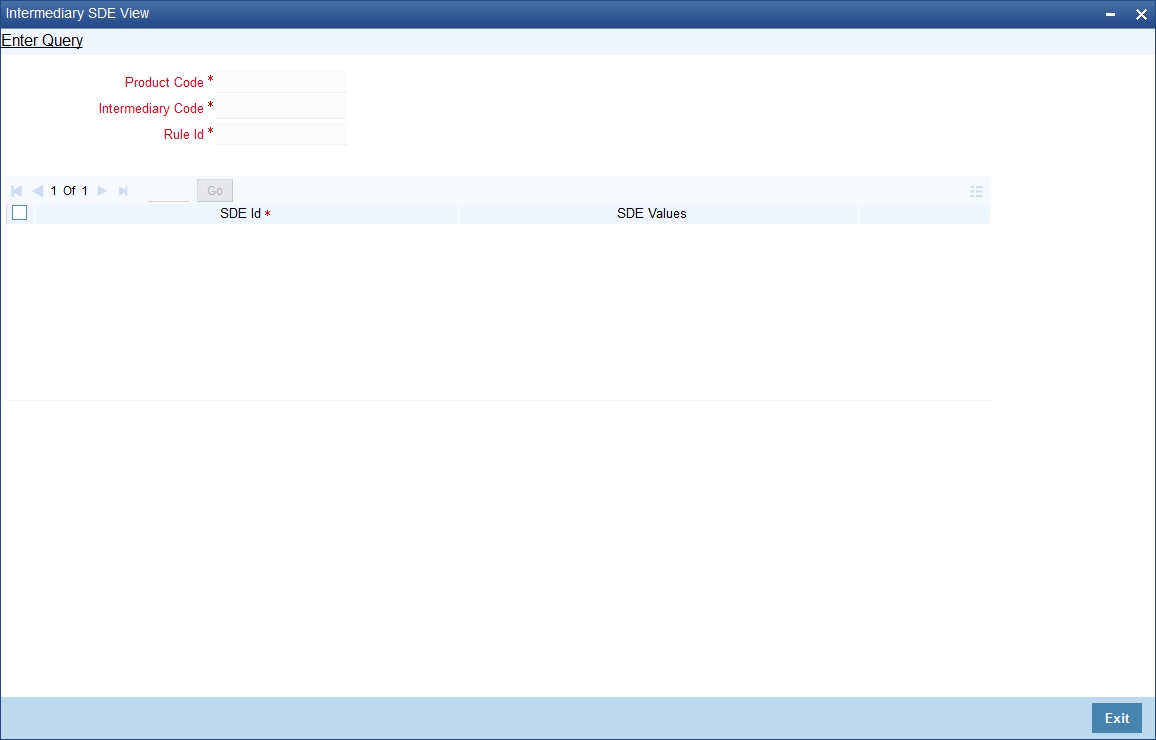

Fore a given product, you can view all SDE values for the current liquidation cycle, through the ‘Intermediary SDE View’ screen. You can invoke this screen by typing ‘INDSDVAL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can capture the following details.

Product Code

Specify the product for which you want to view SDEs. The adjoining option list displays all valid Intermediary products maintained in the system. You can select the appropriate one.

Intermediary Code

Specify the Intermediary code for which you want to view SDEs. The adjoining option list displays all valid Intermediary codes maintained in the system. You can select the appropriate one.

5.2.4 Actions Allowed

You can perform the following action on a record:

- Query

Refer the Procedures User Manual for details about each action.

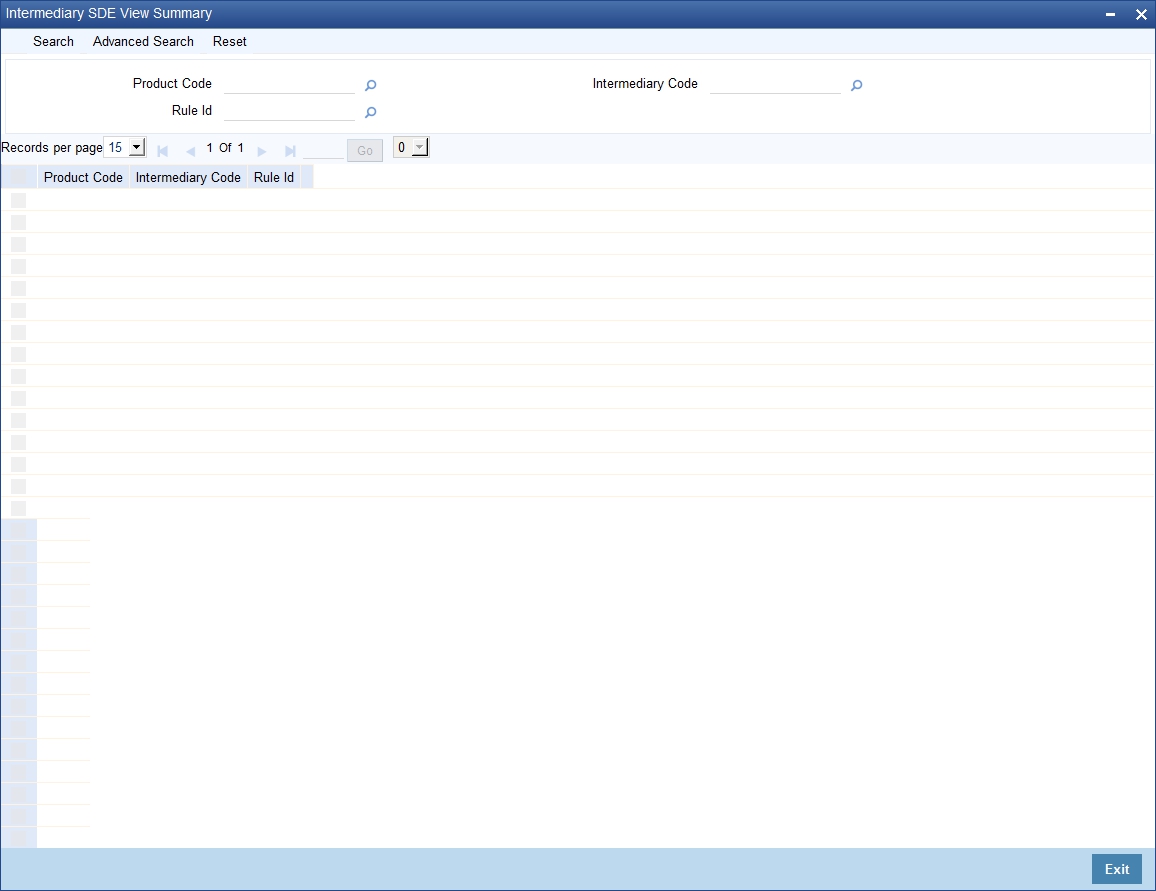

5.2.5 Viewing SDE Summary

You can view a summary of all SDEs for different product-intermediary combinations, through the ‘Intermediary SDE View Summary’ screen. You can invoke this screen by typing ‘INSSDVAL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query based on all or any of the following criteria:

- Product Code

- Intermediary Code

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Product Code

- Intermediary Code

- SDE

- SDE Value

5.2.6 Viewing Calculated Commission

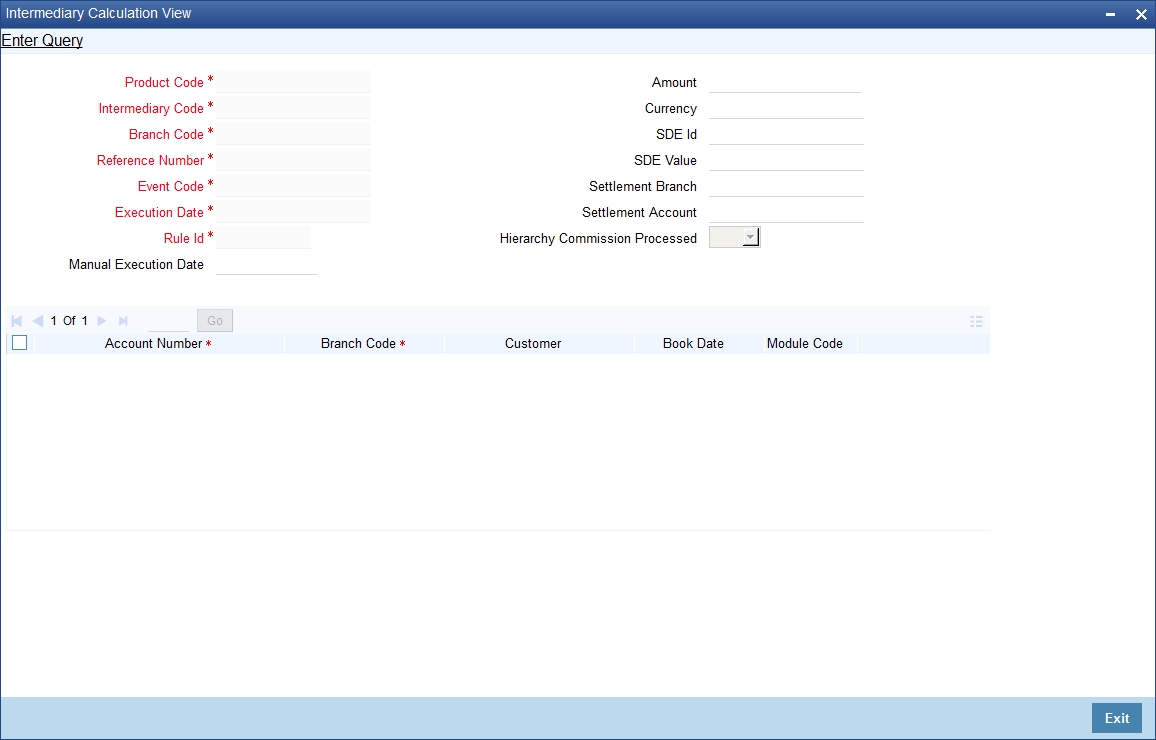

You can view all the accounts considered for commission/charge calculation across intermediary products for a given execution date, using the ‘Intermediary Calculation View’ screen. You can invoke this screen by typing ‘INDIVIEW’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details.

Product Code

Specify the intermediary product code for which you want to view commission calculation.

Intermediary Code

Specify the intermediary code for which you want to view commission calculation.

Branch Code

Specify the branch code under which transactions should be considered for commission calculation view.

Reference Number

Specify the contract reference number for which you want to view commission calculation.

Event Code

Specify the event code for which you want to view commission calculation.

Execution Date

Specify the date of automatic transaction execution based on which you want to view commission calculation.

Rule ID

Specify the intermediary rule based on which you want to view commission calculation.

Manual Execution Date

Specify the date of manual transaction execution based on which you want to view commission calculation.

Amount

Specify the transaction amount based on which you want to view commission calculation.

Currency

Specify the transaction currency based on which you want to view commission calculation.

SDE ID

Specify the SDE ID based on which you want to view commission calculation.

SDE Value

Specify the SDE value based on which you want to view commission calculation.

Settlement Branch

Specify the settlement branch code based on which you want to view commission calculation.

Settlement Account

Specify the settlement account based on which you want to view commission calculation.

Hierarchy Commission Processed

Indicate the hierarchy commission processing status by choosing one of the following options from the adjoining drop-down list:

- Yes

- No

Click Single View icon. This screen displays the following details of accounts considered for commission calculation:

- Reference Number

- Branch Code

- Customer ID

- Book Date

- Module Code

5.2.7 Actions Allowed

You can perform the following action on a record:

- Query

Refer the Procedures User Manual for details about each action.

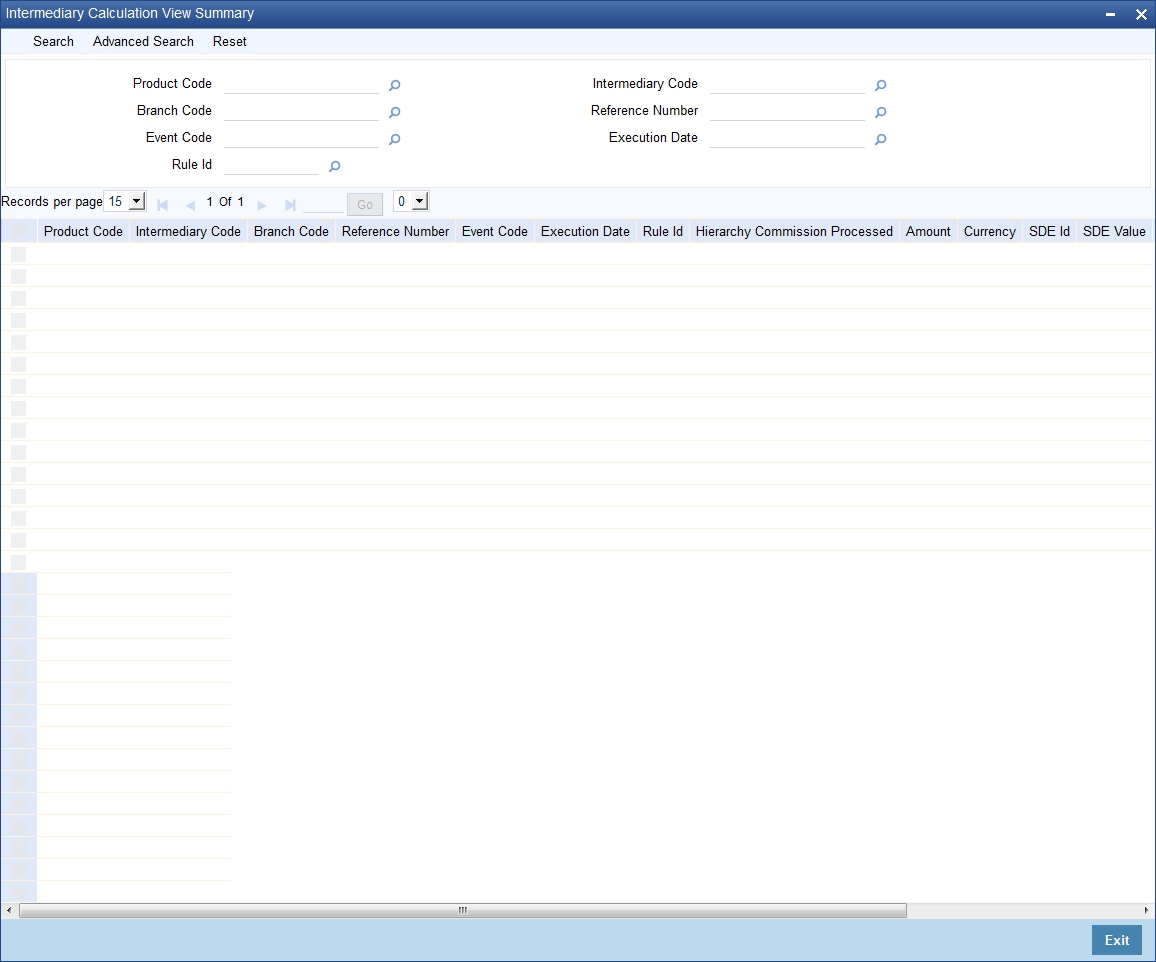

5.2.8 Viewing Commission Calculation Summary

You can view summary of all commission calculation through the ‘Intermediary Calculation View Summary’ screen. You can invoke this screen by typing ‘INSIVIEW’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query on records based on any or all of the following criteria:

- Product Code

- Branch Code

- Event Code

- Rule ID

- Intermediary Code

- Reference Number

- Execution Date

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Product Code

- Branch Code

- Event Code

- Rule ID

- Intermediary Code

- Reference Number

- Execution Date

- Rule ID

- Hierarchy Commission Processed

- Amount

- Currency

- SDE ID

- SDE Value

- Settlement Branch

- Settlement Account

5.3 Intermediary Commission

This section contains the following topics:

- Section 5.3.1, "Liquidating Intermediary Commission Manually"

- Section 5.3.2, "Actions Allowed"

- Section 5.3.3, "Viewing Manual Liquidation Summary"

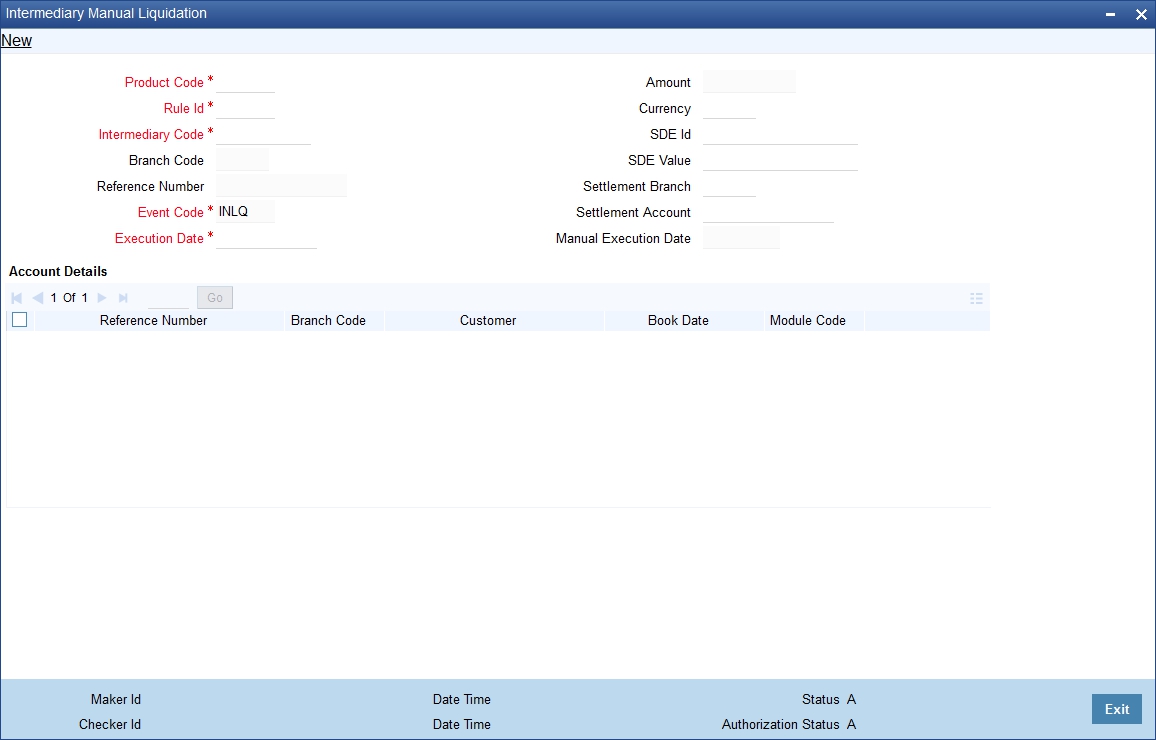

5.3.1 Liquidating Intermediary Commission Manually

As mentioned before, commission calculation and liquidation can be automated as part of the EOD batch. However, you can also manually liquidate commission or charge for the failed settlements in the batch, through the ‘Intermediary Manual Liquidation’ screen. You can invoke this screen by typing ‘INDMPMCL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details.

Product Code

Specify the intermediary product code for which you want to liquidate commission. The adjoining option list displays all valid product codes maintained in the system. You can select the appropriate one.

Rule ID

Specify the intermediary rule based on which you want to liquidate commission. The adjoining option list displays all valid rule IDs maintained in the system. You can select the appropriate one.

Intermediary Code

Specify the intermediary code for which you want to liquidate commission. The adjoining option list displays all valid intermediary codes maintained in the system. You can select the appropriate one.

Branch Code

The system displays the current logged-in branch code.

Reference Number

Specify the contract reference number for which you want to view liquidate commission. The adjoining option list displays all transactions linked to the intermediary. You can select the appropriate one.

Event Code

Specify the event code for which you want to liquidate commission.

Execution Date

Specify the date of automatic transaction execution based on which you want to liquidate commission, using the adjoining calendar.

Amount

Specify the commission amount that you want to liquidate.

Currency

Specify the currency based on which you want to liquidate commission.

SDE ID

Specify the SDE ID based on which you want to liquidate commission.

SDE Value

Specify the SDE value based on which you want to liquidate commission.

Settlement Branch

Specify the settlement branch code based on which you want to liquidate commission.

Settlement Account

Specify the settlement account based on which you want to liquidate commission.

Manual Execution Date

Specify the date of manual transaction execution based on which you want to liquidate commission, using the adjoining calendar.

Click Single View icon. This screen displays the following details of accounts considered for commission liquidation:

- Reference Number

- Branch Code

- Customer ID

- Book Date

- Module Code

5.3.2 Actions Allowed

You can perform the following actions on a record:

- New

- Delete

- Unlock

- Save

- Auth (Authorise)

- Reverse

- Execute

- Query

Refer the Procedures User Manual for details about each action.

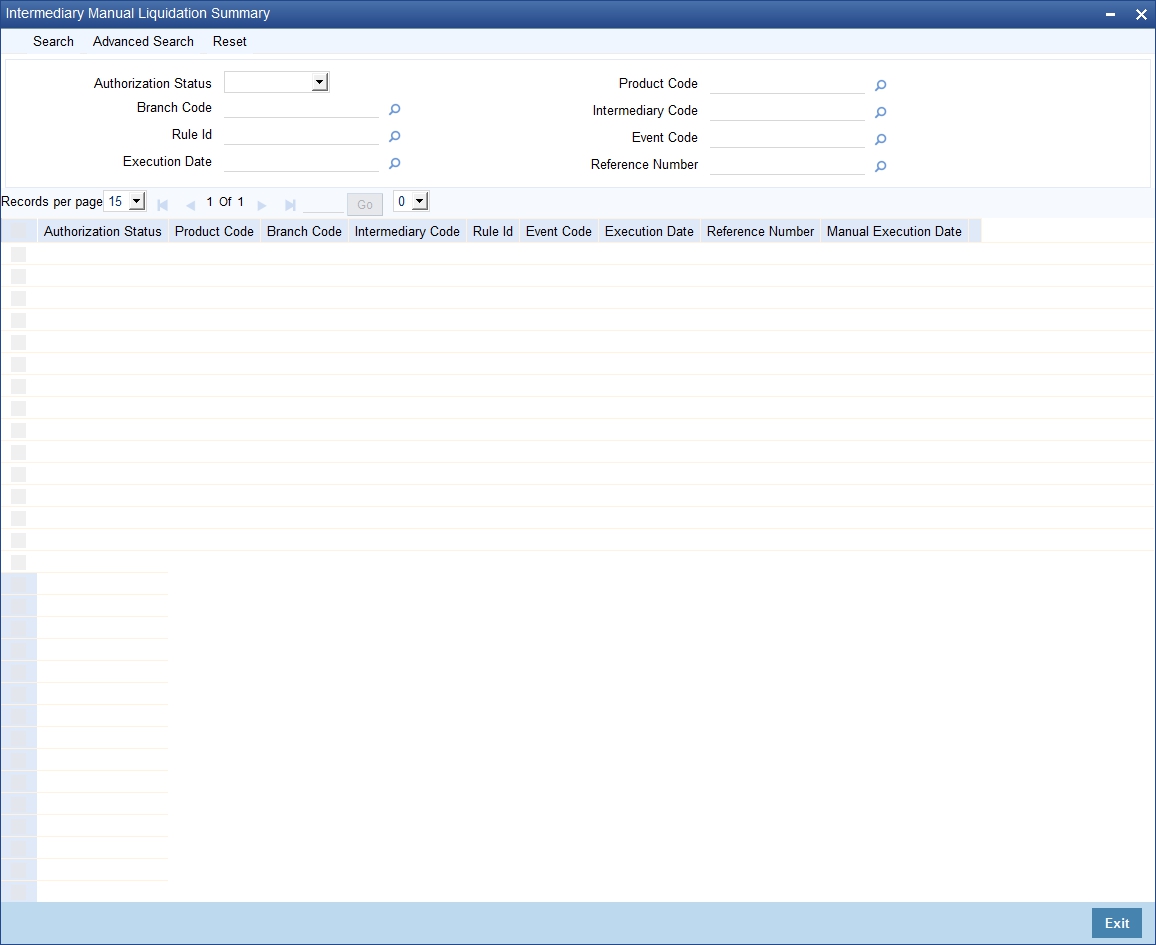

5.3.3 Viewing Manual Liquidation Summary

You can view summary of all manual liquidations through the ‘Intermediary Manual Liquidation Summary’ screen. You can invoke this screen by typing ‘INSMPMCL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query based on all or any of the following criteria:

- Authorized

- Branch Code

- Rule ID

- Execution Date

- Product Code

- Intermediary Code

- Event Code

- Reference Number

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Authorized

- Product Code

- Branch Code

- Intermediary Code

- Rule ID

- Event Code

- Execution Date

- Reference Number