19. Maintaining a Security

19.1 Introduction

In Oracle FLEXCUBE, you have to maintain all securities that you deal in. In other words, you can only enter into deals involving securities that you have maintained in the system. Maintaining a security involves various operations. They include specification of the following:

- Issuer details

- The Market of Issue

- The relevant dates (the Tear-off Date, the Start of Interest Date, etc.)

- The Price details

- The coupon details

When you enter into a deal, the details defined for a security will automatically be picked up. A security is maintained in the Security Definition screen, which is invoked from the Application Browser.

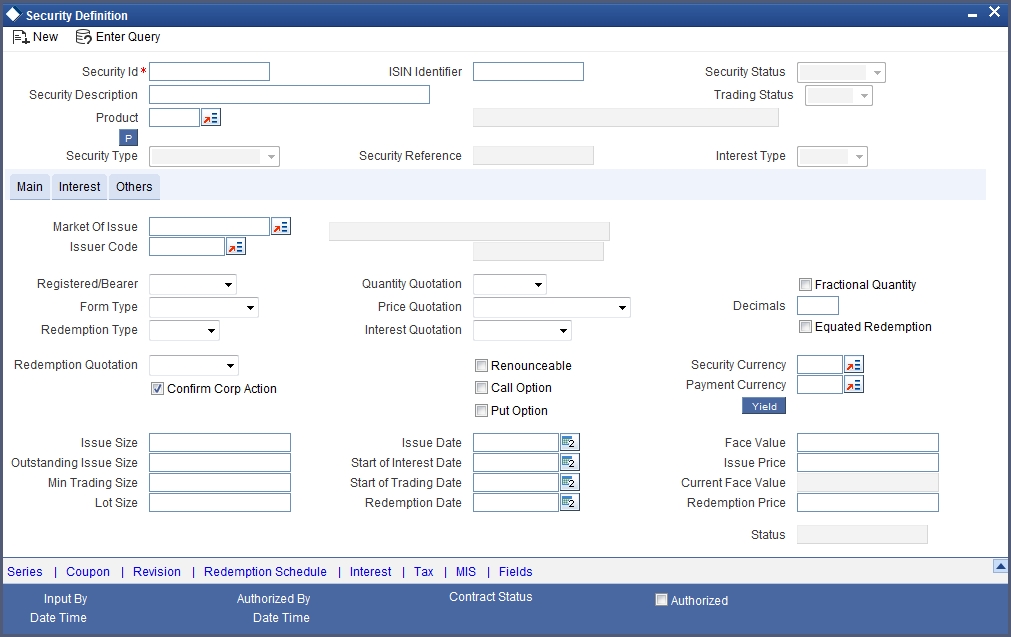

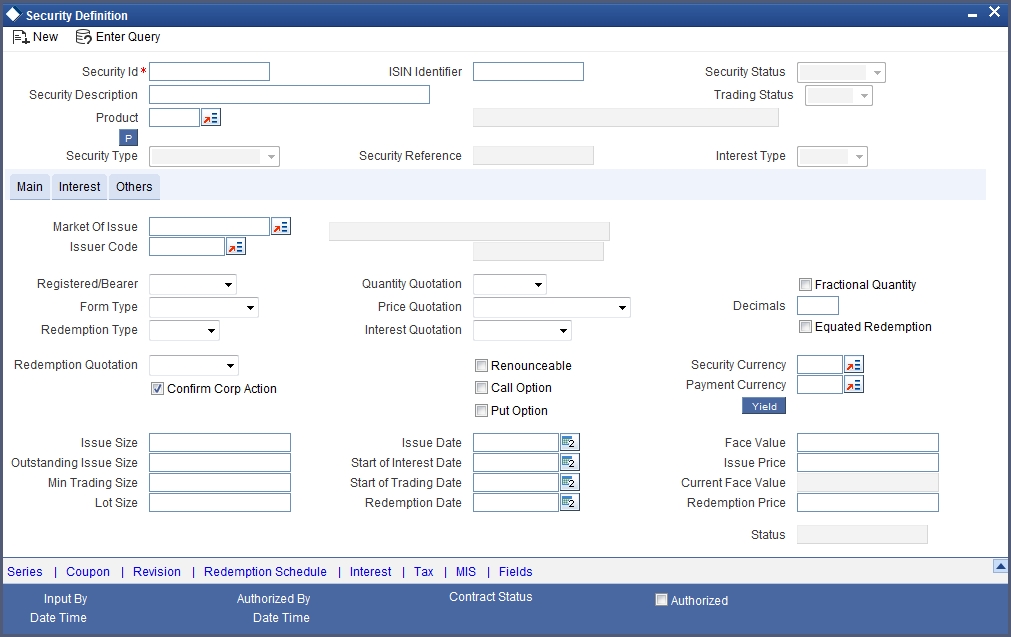

You can invoke the ‘Securities Instrument Definition’ screen by typing ‘SEDTRONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

This chapter contains the following sections:

- Section 19.2, "A description of the Security Instrument Definition Screen"

- Section 19.3, "Details of a Security"

- Section 19.4, "Interest Method for Computing Coupon Interest"

- Section 19.5, "Uploading Security Instruments for Amendment"

- Section 19.6, "Bulk Upload- Security Instruments & Market Security Price"

- Section 19.7, "Reassigning Securities Deal Contract"

19.2 A description of the Security Instrument Definition Screen

The Securities Definition screen contains a header, a footer and a body of fields that capture information specific to the security that you are defining. The body of fields, in this screen, is divided into three tabs.

The three tabs are:

Tabs |

Description |

Main |

Click this tab to enter the essential attributes of a security. |

Interest |

Click this tab to enter the interest details specific to the security that you are maintaining. |

Others |

Click this tab to enter additional information relating to the security that you are maintaining. |

Also displayed on the screen is an array of icons. Clicking on an icon launches its screen. Details specific to an attribute can be captured on the screen.

These buttons are briefly described below:

Buttons |

Description |

Series |

Click on this icon to invoke the Series details screen. If the redemption type of a bond is Series, you can enter the series details in this screen. |

Coupon |

Click on this icon to indicate the coupon details for the bond that you are maintaining. |

Revision |

For bonds defined with floating interest, and an asynchronous, periodic interest rate revision, you can define Revision details. Click on this icon to invoke the Revision Schedules screen. |

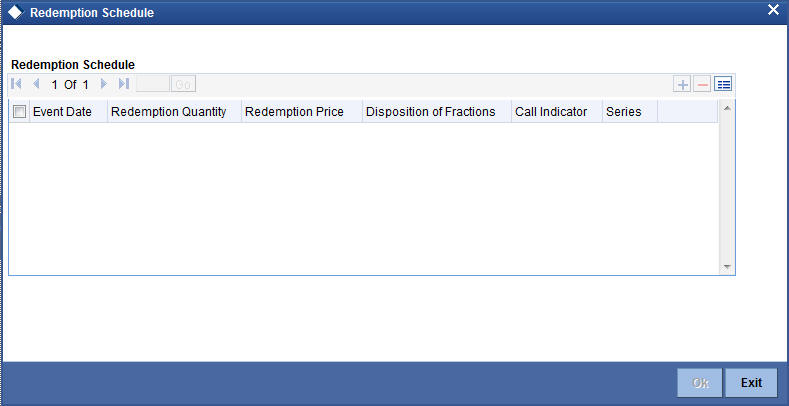

Redemption Schedule |

Click this icon to define redemption schedules for a security (with Quantity Redemption) that you are maintaining. |

Interest |

This button invokes the Interest service of Oracle FLEXCUBE. You can define interest details for a security in this screen. |

Tax |

This icon invokes the Tax services |

MIS |

Click this icon to define MIS details for the security. |

Fields |

Click this icon to invoke the User Defined Fields details screen. |

19.3 Details of a Security

This section contains the following topics:

- Section 19.3.1, "Entering and Saving the Details of a Security"

- Section 19.3.2, "Identifying a Security"

- Section 19.3.3, "Entering the Main Details"

- Section 19.3.4, "Identifying the Market and the Issuer"

- Section 19.3.5, "Specifying the material of a security"

- Section 19.3.6, "Specifying Redemption Quotation Method"

- Section 19.3.7, "Indicating Corporate Action Preference"

- Section 19.3.8, "Capturing Trade-Related Information"

- Section 19.3.9, "Specifying Type of Price Quotation"

- Section 19.3.10, "Capturing Information Specific to the Security Type"

- Section 19.3.11, "Indicating Banker’s Acceptance"

- Section 19.3.12, "Specifying Currencies"

- Section 19.3.13, "Specifying Relevant Dates"

- Section 19.3.14, "Specifying Price Details"

- Section 19.3.15, "Entering Interest Details for a Bond"

- Section 19.3.16, "Opting for Automatic Initiation of Corporate Actions"

- Section 19.3.17, "Indicating a Revaluation Price Code"

- Section 19.3.18, "Indicating the Collateral Type"

- Section 19.3.19, "Specifying the Market for Revaluation"

- Section 19.3.20, "Specifying the Yield Calculation Parameters for a Security"

19.3.1 Entering and Saving the Details of a Security

A security can be maintained in the Security Definition screen, which is invoked from the Application Browser.

In the Securities Definition screen, you can maintain details of the different kinds of securities that you deal in. They include Bonds, Zero Coupon Bonds, Treasury Bills, Equities, Rights, and Warrants. When dealing in a security, the details that you specified in this screen will be picked up automatically.

A security must be maintained under a Security Product, created by the Head Office. For instance, if your bank has defined a Short Term Zero Coupon Bonds security product, you would maintain all short-term zero coupon bonds that you deal in under this product.

A security inherits all the attributes defined for the product under which it is maintained. This enables efficient maintenance of security.

At the time of saving a deal, the customers portfolio balances for the security of the deal will be taken and the balance in security currency will be computed and inserted in the FATCA accounts and obligations screen.

If the deal is closed or liquidated completely, then the corresponding row in FATCA accounts and obligations maintenance will be archived. If you delete the deal before authorization, then you should also delete corresponding entry in FATCA accounts and obligations maintenance.

19.3.2 Identifying a Security

Security Reference Number

In Oracle FLEXCUBE, reference numbers are generated automatically and sequentially, by the system. This number tag is used to identify the security that you are maintaining. It is also used in all the accounting entries generated by transactions involving the security. Thus, the system generates a unique number for each security.

The security reference number is a combination of a three-digit branch code, a four-character product code, a five-digit Julian Date, and a four-digit serial number.

The Julian Date has the following format:

YYDDD

Here, YY stands for the last two digits of the year and DDD for the number of day (s) that have elapsed in the year.

For example, 31 January 1999 translates into the Julian date: 99031. Similarly, 05 February 1999 becomes 99036 in the Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those elapsed in February (31+5 = 36).

Security Id

You can identify a security that you are maintaining, with a unique identifier and a brief description. The identifier is referred to as the Security ID. A security will be identified by this number in addition to, the Security Reference No., generated by the system.

Description

The description that you specify is for information purposes only, and will not be printed on any customer correspondence.

ISIN (International Security Identification Number) Identifier

You can enter the ISIN reference, allotted to the security that you are maintaining. In the SWIFT messages that you generate, this number will identify a security.

Security Type

The securities that you deal in can be broadly classified into the following types:

- Bonds

- Zero Coupon Bonds

- Equities

- Rights

- Warrants

You can maintain a security of a particular type, only under products defined for the type. For instance, you can only maintain bonds, under a product defined for Bonds.

The attributes that can be defined for a security depend on the Security Type. For example, if the security type is indicated as Bond, you can also define details relating to interest.

Trading Status

This field is generated by the system, that states whether the trade is Active or Closed (Suspended).

Security Status

This field is generated by the system, that states whether the security is of Primary type (new issue) or Secondary type.

Interest Type

This is a auto populated field. This is populated by the system based on the security product preferences specified. The value can be:

- Fixed

- Floating

Product Code

You can associate every security that you maintain with a Security Product that you have maintained in the Security Product Definition screen.

When you associate a security with a security product, it acquires the attributes defined for the product. This means, you do not have to define the attributes of a security, all over again, when maintaining it.

On choosing a product, you can view the type of security that you can associate with the product. The Security Type field displays this information. For instance, you can associate a bond that you are maintaining only with a product created for ‘Security Type: Bond’.

Description

In the adjacent field, you can view a brief description of the product (with which you have chosen to associate the security that you are maintaining).

19.3.3 Entering the Main Details

In the Main section of the Security Definition screen, you can maintain the basic details that mark for a security. They include details such as its face value, its tear-off date, start of interest date and expiry date.

The following are some of the basic details that you can indicate for a security:

- The Market of Issue

- The Issuer ID

- The price details

- The relevant dates (Tear-off, Start of Interest, etc.)

- The quantity, price and interest quotation methods

- The currency of the security

- If there are Call and Put options associated with the security

- The Redemption Quotation (whether percentage, factor, or cashflow)

- The type of redemption (whether in quantity, series, or bullet)

- If you can trade the security in fractional quantities

- The minimum quantity in which the security can be traded

Note

Security will acquire, by default, all the attributes defined for the product under which it is maintained. These default attributes can be changed to suit a particular security.

19.3.4 Identifying the Market and the Issuer

For a security, you can identify a Market of Issue. Only a market that you have maintained in the Markets Maintenance screen can be specified.

All securities maintained under a product, by default, will also be associated with the market specified, for the product. When maintaining a security, however, you can identify a unique market for the security.

An issuer of securities should have a valid CIF record, in the Core module of Oracle FLEXCUBE. When maintaining a security, you should identify the issuer. Your CIF specifications for the issuer, such as Limits, will automatically be picked up, for the security.

19.3.5 Specifying the material of a security

When maintaining a security, identify the manner in which it can be held, and the material of the security.

The holder of a security can be one of the following:

- Registered

- Bearer

Securities can be in different formats:

Option |

Description |

Scrip-based |

Issued in a paper format |

Dematerialized |

In an electronic format |

Immobilized |

Securities in lieu of which proxies are traded |

Combination |

Issued in one or more of the above formats |

19.3.6 Specifying Redemption Quotation Method

The Redemption Quotation Method can be specified in the following ways:

- Percentage – In this case, the quantity to be redeemed is expressed in percentage.

- Factor – In this case, the quantity to be redeemed is expressed in fraction.

- Cashflow – Here, the quantity to be redeemed is expressed as an actual cash flow. This represents the amount per face value that will be received on the redemption date. The cashflow includes the coupon and the redemption amount.

Note

The Redemption Quotation types ‘Factor’ and ‘Cashflow’ are applicable only for the quantity redemption type securities.

19.3.7 Indicating Corporate Action Preference

The ‘Confirm Corp Action’ box indicates whether the redemption and coupon schedules should be created as a confirmed corporate action or not. By default, this checkbox will be checked. However, you can uncheck it to indicate that all redemption and coupon schedules should be created in the corporate action maintenance as ‘unconfirmed’.

19.3.8 Capturing Trade-Related Information

You can define the minimum quantity in which a security should be traded. Enter the specification in the Lot Size field.

Preferences defined for the product, under which you maintain the security, will default to this screen. These default attributes can be changed.

The Quantity Quotation method

Securities can be quoted in terms of:

- Units (500 units of a security)

- Nominal (securities worth USD 5000)

Specify the quantity quotation method for every security you maintain. A security maintained under a product acquires the quotation method specified for the product.

If you choose the Units Quotation option, you may also indicate whether the security can be traded in fractional units. Specify the fractional units in the Decimals field. Deals entered in fractional units of the security will be validated against the decimal value that you specify.

19.3.9 Specifying Type of Price Quotation

The method in which price is quoted, is a feature of the market where a security is traded. Each market may use a particular price quotation method. The price of a security can be quoted in the following ways:

Price - in this method, the total price of the security is quoted. The total price can be expressed as:

(Face Value ± Premium or Discount) + Accrued Interest (if the interest quotation method is Flat)

% Price - the price is quoted as a percentage, as follows:

% Price = (Market price / Face value) x 100

% Discount - in this case, the price is quoted based on the discount percentage at which the security is bought or sold.

% Premium - in this case, the price is quoted on the basis of the premium percentage at which the security is bought or sold.

Premium - here, the price is quoted on the basis of the premium at which the security is bought or sold. That is, the differential between the face value of the bond and the price at which it is bought or sold.

Discount - the price is quoted on the basis of the discount at which the security is bought or sold. That is, the differential between the face value of the bond and the price at which it is bought or sold.

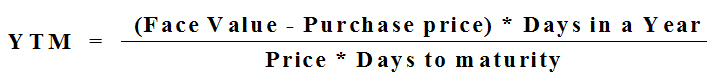

YTM - the price is quoted based on its yield to maturity.

The yield on a discounted instrument is measured by its yield to maturity (YTM). YTM is the yield on a security, calculated from the purchase date to its maturity. The YTM keeps changing with the market price. In case the market price increases above the straight discounted price, YTM would decrease and vice versa.

The price using this quotation method is calculated thus:

Based on the deal quantity and the price quotation method, the deal amount is determined. Irrespective of the price quotation method that is used, the net result is the same.

The price quotation specifications defined for the product, under which the security is maintained, will default in this screen. However, this quotation method can be specific for a security.

19.3.10 Capturing Information Specific to the Security Type

You can capture information that is specific to the type of security you are maintaining.

If the Security Type is bond

You can indicate, if Call and Put options are available for the bond that you maintain in this screen.

The issuer of a bond may also offer the option of converting the bond into shares or equities. Such bonds are referred to as Convertible bonds. Choosing the Convertible option can capture this information.

You can also indicate if the bonds would be Redeemable, and if so, the mode of redemption. An issuer can redeem bonds in three ways:

- Series

- Quantity

- Bullet

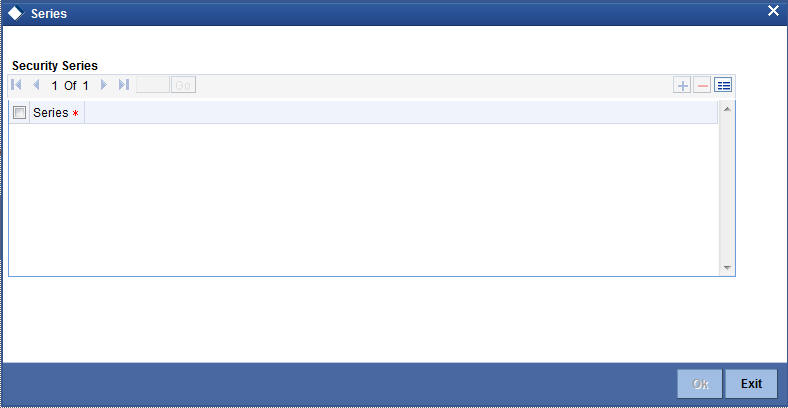

For bonds with the Redemption Type defined as Series, you can specify the Series details in the Security Definition - Series screen.

This screen is invoked by clicking ‘Series’ button.

The actual (series) redemption dates can be specified, in the Security Definition – Redemption Schedules screen.

For bonds with the Redemption Type, defined as Quantity and Series, you can specify the redemption details in the Security Definition - Redemption Schedules screen. This screen is invoked by clicking on the ‘Redemption Schedule’ button.

Specify the date(s) of redemption (in the Event Date field) and the quantity of redemption (in terms of a percentage/fraction/actual cashflow). If the redemption mode is series, specify the series that should be redeemed on an Event Date. If the redemption quotation is ‘Cashflow’, you should ensure that the quantity is not less than the interest for the period. Redemption price will be derived based on redemption quotation type. If the Redemption quotation is ‘Factor’, then the redemption price will be derived as follows:

Where

- Fn is the redemption factor of the nth redemption schedule

- Fn-1 is the redemption factor of n-1th redemption schedule (this value will be 1 for the first redemption schedule)

- RPn is the redemption price of the nth redemption schedule

- FV0 is the original face value of the security

Note

The factor for the final redemption date will be zero. During modification of redemption schedules, the system will validate whether the cumulative factor of all redemption schedules (previous period factor – current period factor) is equal to one or not. The factor for each redemption schedule cannot be greater than one.

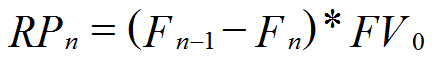

If the Redemption quotation is ‘Cashflow’, then the redemption price will be derived as follows:

Where

- CFn is the cash flow of nth redemption schedule

- Cn is the actual coupon cashflow for the nth coupon period

- RPn is the redemption price of the nth redemption schedule

In case the Redemption Quotation is ‘Percentage’, the system will allow you to define the percentage as zero for any intermediate schedule. However, it will validate whether the sum of all percentages is equal to 100 or not.

At the time of instrument definition for Factor/Cashflow type of securities, if the Factors/Cashflows are unknown, the final redemption price will be the initial face value. At any point in time, if the factor values/cash flows for redemption date(s) are specified, then the final redemption price will be calculated as the Face value – sum of redemption price of the intermediate schedules. If the total redemption price across all schedules is not equal to the initial face value for Factor/Cashflow type of securities, the system will display an error message upon saving the record.

Note

For Collateral Debt Obligations (CDOs), the sum of intermediate cash flows cannot be greater than the face value.

If the Security Type is equity

The issuer of equity can grant a holder voting rights. This information can be captured when maintaining a security, with the Security Type, Equity.

If the Security Type is Right or Warrant

Rights and Warrants can be renounced. You can capture this information when maintaining rights and warrants.

19.3.11 Indicating Banker’s Acceptance

You can indicate whether or not you intend to use the security you are defining for a Banker’s Acceptance deal. If this option is checked, it implies that you can fund the issuer of the security through a loan contract or a money market placement deal. You can also trade in the security on your own behalf.

The value for this field defaults based on your specification in the Security – Product Preferences screen. If the default value is ‘Yes’, you can change it to ‘No’, but not the other way round.

The quantity quotation for this security has to be ‘Nominal’ if the Banker’s Acceptance option is enabled.

Refer to the Deal Online chapter of this User Manual for details on processing Banker’s Acceptances.

19.3.12 Specifying Currencies

When maintaining a security, specify the currency in which it is issued. You can also indicate the currency in which, the issuer of the security (that you are maintaining) pays corporate actions, such as Coupon Payment. The currencies can be selected from the picklists available.

19.3.13 Specifying Relevant Dates

You can capture the dates that are relevant to a security being maintained. The following are the dates that you should specify:

- The Issue/Tear-off Date

- The Start of Interest Date

- The Start of Trading Date

- The Redemption/Expiry/Maturity Date

The Start of Interest Date and the Start of Trading Date that you specify should be greater than the Issue Tear-off Date.

In case you want to extend the redemption date of the security after it is authorized, indicate a new redemption date in the Redemption/Expiry Date field. Once you extend the redemption date, you need to maintain a new coupon schedule for the newly extended period (between the previous redemption date and the new redemption date). In case you do not maintain a coupon schedule for the period, the system will, by default, apply the bullet schedule for the new period.

Note

No back dated buy/sell deal input or reversal of a deal is allowed before the transaction date of the security extension.

On extension of the security, YTM for all deals will be recomputed and the Discount/Premium accrual will be completed till the extension date (using the old redemption date). Discount/Premium accrual for only the unaccrued part will be done using the new redemption date after extension.

Additionally, you can also maintain a new interest revision schedule for the extended period.

19.3.14 Specifying Price Details

You must specify the following price details for a security:

- The Initial Face Value

- The Issue Price

- The Redemption Price

Initial Face Value

This is the actual unit face value of the security you are maintaining, as of the Issue Date. This price is also referred to as the par value of the security.

Issue Price

An issuer can offer a security at a premium or at a discount with respect to the par value, on the Issue Date. You can capture the offer price (the purchase price), or the Issue Price for a security that you are maintaining.

Note

- You must capture the Issue Price of Zero Coupon Bonds

- The issue price of Zero Coupon Bonds must be lower than the Redemption

price

Current Face Value

This is a system generated value, giving the current Face value of the security. This is same as the Initial Face Value but may differ in case of split or reduction of face value by the issuer to increase the capital base.

When viewing the details of bonds, defined with quantity redemption, you can view the face value as of the current system date.

Redemption Price

The price at which an issuer redeems a security is referred to, in Oracle FLEXCUBE, as the Redemption Price. Enter the Redemption Price of the security, when defining it in this screen.

19.3.15 Entering Interest Details for a Bond

When maintaining a bond, you must define its interest details.

The Interest Quotation Method

The Interest Quotation Method for a bond can be:

- Flat

- Plus Accrued

When the interest component is included in the market price of a security, the quotation method is referred to as Flat. A flat price of a security is also referred to as the Dirty Price.

When the interest component is excluded from the market price of a security, the quotation method is referred to as Plus Accrued.

Specifying the Coupon Frequency

You can indicate if the coupons due for a bond are periodic. Choose the Periodic option, to indicate that the coupon is periodic. Coupons for a bond will be calculated according to the periodicity that you specify.

For an interest-bearing bond, with a periodic coupon, you must indicate the Coupon Frequency.

The coupon frequency can be:

- Weekly

- Monthly

- Once in two months

- Quarterly

- Once in four months, etc

If you indicate that the coupon frequency is weekly, you should also indicate the day on which the coupon is due. For instance, you can have a bond with a weekly coupon that is due on Wednesdays.

If the coupon frequency is in terms of a month, you can indicate that the coupon days should adhere to Month-Ends.

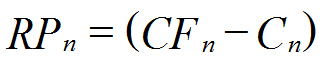

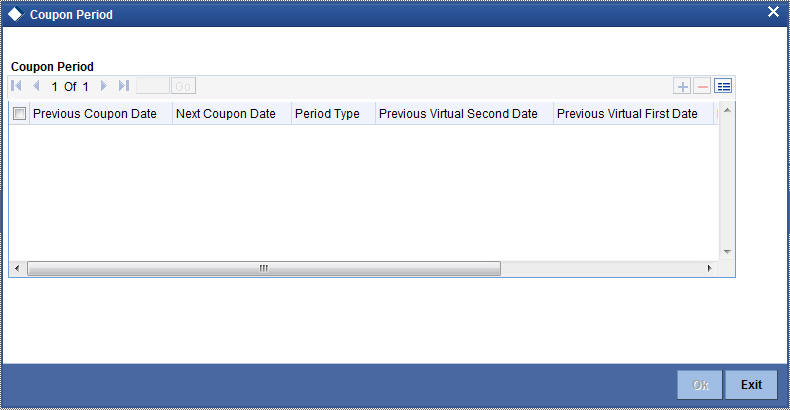

You can define the actual coupon schedules in the Securities Definition – Coupon Schedules screen. You can invoke this screen by clicking the ‘Coupon’ button.

In this screen, you can specify the first coupon due date (Base Start Date) and the last coupon due date (Base End Date). If you choose the Continuous option, the system calculates all intermediate coupon due dates, based on the frequency specified. If you specify a weekly frequency, you must also specify the Week Day. You can also choose to adhere to month-ends. For Discrete / Irregular coupon schedule definition, you will have to set the coupon dates.

For continuous coupon schedules, to introduce an intermediate coupon date, click add icon. Enter the intermediary Coupon Date, in the Base Start Date field, and choose the Discrete option.

Even if the coupon schedules are defined to be continuous, you have the flexibility to amend the coupon payment dates.

Click ‘ZOOM’ button in the Coupon Schedule screen to invoke details of the coupon periods:

You can enter your coupon date amendments in this screen, provided the amended dates do not violate the limit set at the product level.

During coupon date amendment, if you change the NCD (next coupon date) of one schedule, then you should also change the PCD (previous coupon date) of the next schedule accordingly. If you do not, the system will prompt you with a warning, but will not automatically update the PCD of a schedule when the NCD of the previous schedule is changed.

After authorization, coupon dates can only be amended under the following conditions:

- You can amend only the NCD for the current period, provided that there are no active deals after the record date;

- For future periods, you can amend both the NCD and the PCD, provided that there are no active deals in that period.

Any such amendment of PCD/NCD will be subject to the validations as mentioned above.

Specifying Holiday Treatment for Coupon Payments

The holiday treatment that you have specified as part of Product Preferences is inherited by the security. You can change this treatment for the particular security that you are defining. You can also amend it at any point of time – the amended parameters will take effect for subsequent coupon events.

Irrespective of the holiday treatment specified by you, the system will not perform any holiday adjustment if, in the Product Event Accounting Entries Maintenance, you select ‘No’ as the Holiday Treatment parameter. A more detailed explanation is available in the Products manual.

For details of holiday treatment of coupon payments, refer to the chapter on Securities Products in this manual.

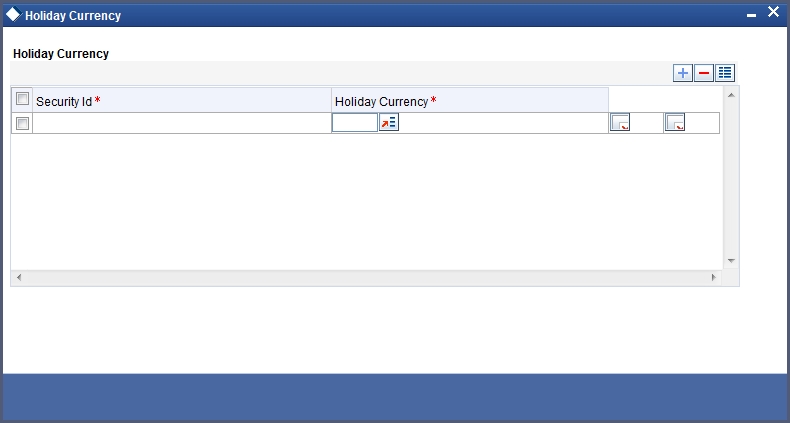

Using the Holiday Calendar Currency list

If the issuer currency and the security currency are not the same, then you might wish to have coupon events fall on days which are common working days for both currencies.

For example, the bank (issuer currency = EUR) issues a USD-denominated bond (security currency = USD), for which one of the coupon payments falls due on a Saturday (a holiday for both EUR and USD). In addition, the following Monday is a holiday for USD.

You have chosen ‘Forward’ as the holiday treatment option for processing of coupon events.

Then, subject to the holiday treatment preferences that you maintain the coupon payment is processed with a value date of the following Tuesday, which is the next common working day for both currencies.

For any security, you can maintain a list of currencies whose holiday calendars are to be consulted by the system in determining common working days. Click ‘H’ button to invoke the following list:

Use the option list against each field to select a currency whose holiday calendar you wish to be included in the computation of common working days.

If one of the currencies maintained in this list is the local currency of the branch, then the system will use the branch holiday calendar to determine the common working days.

For example, suppose that the branch currency is GBP and the security issuer currency is USD. You have maintained both GBP and USD in the holiday calendar currency list. Oracle FLEXCUBE will use the USD holiday calendar and the holiday calendar of the branch for determining the common working day.

Specifying the Interest Rate Revision Frequency

You can revise the interest rates for bonds with floating interest. This revision frequency can be different from the coupon frequency. This is referred to as Asynchronous (interest rate) Revision.

Asynchronous revision can be:

- Periodic

- Non-periodic

As part of interest specifications, you can indicate Interest Rate Revision details. By default, interest rates will be revised according to the coupon frequency, defined for a bond. To revise interest rates at a different frequency, choose the Allow Asynchronous Revision option.

If the asynchronous revision of rates is periodic, click on the Periodic Revision option, and specify the Revision Frequency. For a frequency that is weekly, you should indicate the day on which the revision is due. (For instance, you could indicate that the interest rates for securities should be revised every Monday.) If the revision frequency is in terms of a month, you can indicate that the revision days should adhere to Month-Ends.

The implication of this option is explained in the following example.

Assume the Issue Date of the security (with floating interest and an asynchronous rate revision) is 01 January 2000 and the Maturity Date is 31 December 2000.

You have specified that the interest rate revision frequency is quarterly. If you choose the Adhere to Month End option:

The rate revisions for this security would be due on the following dates:

- 31 March 2000

- 30 June 2000

- 30 September 2000

- 31 December 2000

If you do not choose the Adhere to Month End option:

The rate revisions for this security would be due on the following dates:

- 31 March 2000

- 30 June 2000

- 30 September 2000

- 30 December 2000

If the interest rates for a security should be revised on a non-periodic basis, you should leave the Periodic Revision option blank.

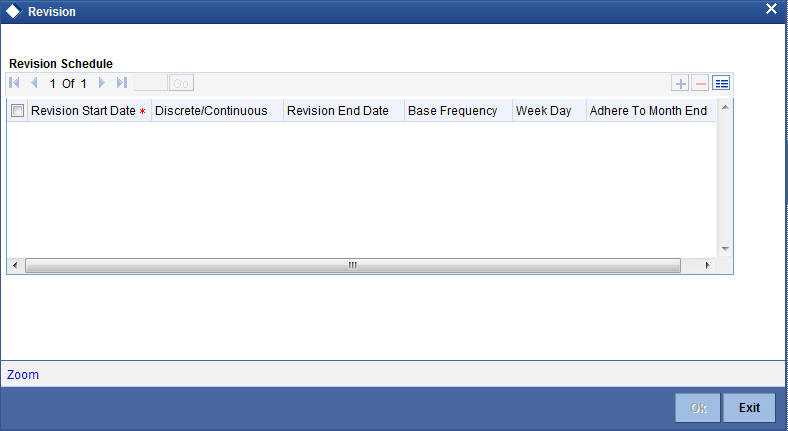

You can capture the actual revision details for a security, with non-periodic rate revision, in the Security Definition – Revision Schedules screen.

You can invoke this screen by clicking the ‘Revision’ button.

In this screen, specify the first revision due date (Base Start Date) and the last revision due date (Base End Date). If you choose the Continuous option, the system calculates all intermediate revision due dates, based on the frequency specified. If you specify a weekly frequency, you must also specify the Week Day. You can also choose to adhere to month-ends.

To introduce an intermediate revision date, click add icon. Enter the intermediary Revision Date in the Base Start Date field and choose the Discrete option.

Exempting interest for the ex period

For Purchase Deals and Sell Deals booked in the Ex Period, you can specify whether you want to calculate the interest. If you check this box, the system will not apply interest for such deals. In addition, the system accrues the holdings as of the ex date and will not pass any interest related accounting entries related to the deals booked in the Ex period.

In case you do not opt for zero interest facility, the system accrues the actual holdings during the accrual period including the buy/sell deals booked in the Ex period.

The system defaults the value maintained in the Market Definition screen. You can choose to change this value, if required. However, you will not be allowed to change this value if the security is already authorized.

19.3.16 Opting for Automatic Initiation of Corporate Actions

Check against the option Auto Initiation of Corporate Action, to indicate that corporate actions for a security should be automatically initiated. If you choose this option, corporate actions for a security will be initiated automatically on the due dates specified (as part of the corporate actions for a security).

If you do not choose this option, you will have to manually initiate all corporate actions required for the security.

19.3.17 Indicating a Revaluation Price Code

Every security that you deal in must be associated with a Price Code. A Price Code identifies the price of a security in a specific market.

To ascertain the value of a security in a market, with reference to the prevailing rates, you need to constantly revalue the security. When defining a security, specify the Price Code that you would like to use, to revalue the security. The value of a security in a market will be determined with respect to the current rates for the corresponding price code.

19.3.18 Indicating the Collateral Type

A customer can offer you securities as collateral against a liability. In the Central Liability module of Oracle FLEXCUBE, you can categorize different types of securities into Collateral Types. For example, Government Bonds can be defined as one type of collateral, and Corporate Bonds as another type.

When maintaining a security, specify its Collateral Type.

19.3.19 Specifying the Market for Revaluation

You must indicate the market, which will determine the number of spot days to be used for arriving at the revaluation date while revaluing the security using the effective interest method.

19.3.20 Specifying the Yield Calculation Parameters for a Security

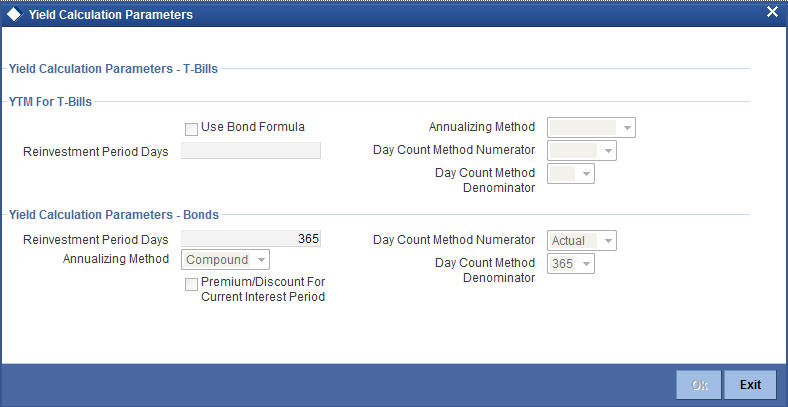

For each Security, the Yield Calculation Parameters are defaulted from the market of issue depending on whether it is a Bond or a T-Bill. You will be allowed to modify these details for a specific Security. Click ‘Yield’ button in the Security Definition screen. The Yield Calculation Parameters screen is displayed.

19.3.20.1 Specifying YTM method for T-Bills

The basis for YTM calculation for T-Bills can either be:

- Simple interest

- Effective (Compound) interest

If you enable the Use Bond Formula option, YTM is calculated using the effective interest formula (typically used for bonds).

For Bonds and for T-Bills with the effective interest method of YTM calculation, you need to specify the following details:

Reinv Period Days

The effective interest formula assumes that coupon payments are reinvested at the same rate as the yield of the T-Bill/Bond till the maturity of the security. You have to specify this period in terms of days.

Annualizing Method

For Bonds and for T-Bills with effective interest you need to specify the annualizing method. This is the method by which the System computes the periodic YTM from the deal YTM, which is annualized.

The options available are:

- Simple

- Compound

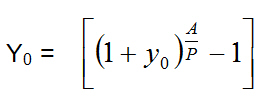

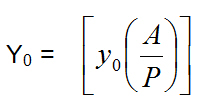

If the Annualizing method is Compound, the relationship between the periodic YTM and the deal YTM is computed as follows:

If the Annualizing method is Simple, it is computed as follows:

Where

- y0 is the Periodic YTM

- Y0 is the Deal YTM

- A is the Day Count Method – Denominator

- P is the Period of Reinvestment. If Null, defaulted to A/n

Apart from these details you need to specify the Day Count Denominator and Numerator methods for all Bonds and T-Bills.

Day Count Method Numerator

Indicate the day count numerator, which is to be used to arrive at the number of days for yield calculation. The options available are:

- 30 Euro

- 30 US

- Actual

Day Count Method Denominator

Select the day count method to be used while calculating yield from the adjoining drop-down list. This list displays the following values:

- 360

- 365

- 364

Note

Values of Day Count Method Denominator maintained in ‘Yield Calculation Parameters’ screen are used in Yield calculation of T-Bills and Bonds.

Premium/Discount for Current Interest Period

Check this option to specify that the premium or discount should be accrued only for the current period. This option will be applicable only if the security is a Floating Rate Bond.

Note

- This option will be disabled if the bank level parameter COMMON_YLD_ACCR is set to ‘Y’.

- Asynchronous revision cannot be enabled if the Premium/Discount for

Current Interest Period is checked and vice versa.

19.3.20.2 Processing Bonds and T-bill based on the YTM parameters

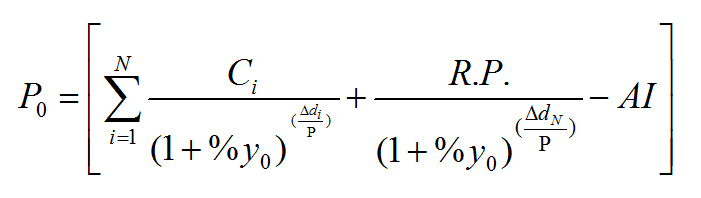

While processing a Bond, if the Price quote is not by ‘Yield to Maturity’, the YTM is computed based on the formula given below:

Where:

- P0 is the Purchase price of the Bond

- N is the Total number of coupons

- Ci is the Coupon payment for coupon i

- y0 is the Periodic YTM

- Y0 is the Annualized YTM

- A is the Day Count Method – Denominator

- n is the Coupons in a Year

- P is the Period of Reinvestment. If Null, defaulted to A/n

- R.P. is the Redemption Price

- AI is the Accrued Interest

- pdi is the Coupon Date – Value Date

- pdN is the Redemption Date – Value Date

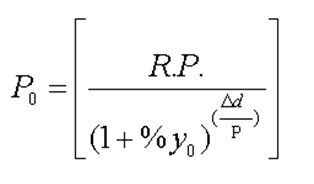

The formula used to calculate the yield given price – for T-Bills (provided you have enabled the Use Bond Formula option), will be

Where:

- P0 is the Purchase price of the T-Bill

- R.P. is the Redemption Price

- y0 is the Periodic YTM

- pd is the Redemption Date – Value Date

- A is the Day Count Method – Denominator

The following example explains the computation of YTM for T-Bills, using the formula mentioned above.

Purchase Price |

USD 90 |

Redemption Price |

USD 100 |

Day count method Numerator |

Actual |

Day count method Denominator |

365 |

Reinvestment Period |

183 days |

Redemption Date |

30-June-2003 |

Purchase Value Date |

31-Jan-2003 |

Annualizing Method |

Simple |

Applying the formula the periodic YTM is calculated as follows:

90 = (100/((1+y0)^(((30-June-2003)-(31-Jan-2003))/183)))

y0 = ((100/90)^ (183/((30-June-2003)-(31-Jan-2003)))) – 1

y0 = 0.1372 or 13.72%

Annual YTM is computed using the relationship given above.

Y0 = 0.14*(365/183)

Y0 = 0.2736 or 27.36%

Refer to the Batch Processing Chapter of this manual for detailed information on End-of-Day processing for Securities with YTM as the as method of accruing Discount or Premium

19.4 Interest Method for Computing Coupon Interest

Apart from the above-mentioned method for calculating the interest, you can also use the ACT/ACT–ISMA Interest Method and ACT/ACT–FRF Interest Method.

ACT/ACT–ISMA Interest Method

The ACT/ACT–FRF Interest Method is applied for periodic coupons using the following coupon:

Coupon Interest = Nominal x (Coupon Rate/Number of Coupons) x (Number of elapsed Days/ Number of days in coupon period)

For ACT/ACT–ISMA, you need to maintain the following parameters:

- Numerator Method – Any of the option in the list

- Denominator Method – Actual

- Denominator Basis – Per Annum

- Rate Denomination Basis – Per Coupon Period

Specify denominator method for calculating the accrual and liquidation amount as follows:

Denominator Method

Select the denominator method from the adjoining drop-down list. This list displays the following values:

- 360

- 365

- 364

The values of Denominator Method maintained in ‘Securities Instrument Definition’ screen are used for accrual and liquidation Interest amount calculation for Bonds for a given security.

366 Basis

While maintaining the Interest related details in the Security Definition screen, you need to specify the whether the system should use leap year or leap date for calculating the interest.

- Leap Year (Y) – Indicates that the system will compute the interest based on the number of calendar days in the year.

- Leap Date (D) – Indicates that the system will use the ACT/ACT–FRF Interest Method to compute the interest.

Note

This field is enabled only if the Denominator Basis value is Per Annum and the Denominator Method is ACTUAL.

ACT/ACT–FRF Interest Method

In ACT/ACT–FRF Interest Method, the Numerator will be the actual number of days between two coupon dates and the denominator will be 366 under the following cases:

- If 29th February falls between the duration of two coupon dates (i.e. previous coupon date and next coupon date)

- If the previous coupon date and the next coupon date fall in different years (annual frequency, next coupon dates in immediate subsequent year of previous coupon date)

- If the coupon schedule is not periodic and spreads across multiple years. The system will apply 366 as the denominator for all the years for computing the day count even if one instance of 29th February falls in between the coupon dates.

19.5 Uploading Security Instruments for Amendment

From an external system, you can upload Securities that require amendment in Oracle FLEXCUBE. The system will distinguish between the new and the ones that require amendment based on the action code of the uploaded record. For an instrument requiring amendment, the action code will be ‘AMND’. If the action code is ‘AMND’, Oracle FLEXCUBE will first check whether the instrument exists in the system or not. If it does not exist in the system, an error message will be displayed to notify that the instrument cannot be amended.

The Security ID provided by the external system has to same if it is a new instrument or if it is an amendment to an existing one.

When you upload a new instrument, the external security Id number will be displayed in the ‘Security ID’ field for that instrument. The Security ID will be the basis for checking whether the instrument exists or not.

The upload for security amendment will trigger the ‘AMND’ event. The same event is triggered even when you make the amendment in the ‘Securities Definition’ screen itself.

The fields that can be amended for a Security are as follows:

- ISIN Identifier

- Description

- Redemption/Expiry Date

- Outstanding Issue Size

- Payment Currency

At the time of uploading a securities instrument, if only the Security Id and Product is provided and the source preference has ‘Put on Hold’ on Exception then the instrument will be uploaded with status Hold. Subsequently, any user can modify the same. If the instrument is created from the front end and kept on hold only then can the same user modify the instrument.

If the instrument is created having a market code whose country code is different, then the country code of the home branch in which the instrument is created will be treated as ‘Foreign Market Instrument’. Otherwise, the instrument will be treated as ‘Local Security Instrument’.

In Oracle FLEXCUBE the following batch functions will be created to handle triggering of notification:

- Notification for Local Instrument Changed

- Notification for Securities Coupon Revision Announcement

- Notification for Local Market Security Price

This batch function will log a notification into the Database queue. This will in turn be picked up by the Gateway and will be sent to the external system.

During batch handoff for security instrument, only the Local Security Instrument will be handed off and not the Foreign Market Instrument.

19.6 Bulk Upload- Security Instruments & Market Security Price

Using Bulk upload, more than one security instrument or market security price can be uploaded. If during upload if any one of the instrument or security price has error then the whole upload will be rejected. The instrument and security price cannot be uploaded through the same XML simultaneously. If the same instrument which has been uploaded successfully is uploaded again, an error will be thrown but in case of security price the upload will go through. If for the same security price a different data is being sent, then it would amend the existing security price with the new information. Once the upload is successful, all the records will be auto authorized irrespective of maintenance done at the source preference.

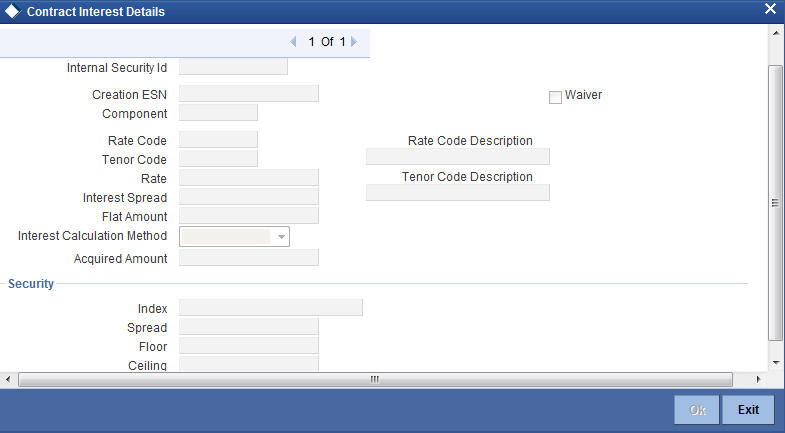

19.6.1 Specifying Contract Interest Details

Numerous interest rates can be defined for a contract through the ‘Contract Interest Details’ screen. To invoke this screen, click ‘Interest’ button in the ‘Securities instrument Definition‘ screen.

Specify the following details:

Security Id

You can identify a security that you are maintaining, with a unique identifier. The identifier is referred to as the Security ID. Specify the security id.

Creation ESN

Event sequence number gets displayed by the system.

Component

Component gets displayed by the system.

Waiver

Check this box to indicate that interest on the contract should be waived.

Rate Code

While processing a contract, you need to indicate this code to make the rate applicable to the contract. Specify a valid rate code to identify the rate you are defining. The adjoining option list displays all the valid rate code maintained in the system. You can select the appropriate one.

Tenor Code

Specify a valid tenor code to identify the tenor for which this rate code should be applicable. The adjoining option list displays all the valid tenor code maintained in the system. You can select the appropriate one.

Spread

Specify the spread.

Rate

Specify the interest rate.

Flat Amount

Specify the flat amount.

Acquired Amount

Specify the acquired amount.

Interest Method

The method in which the number of days are to be calculated for interest, charge, commission or fee components and whether their application is tenor based is displayed here based on the specification you made at the product level. However, you can change it. The following are the options available in the drop-down list:

- 30(Euro)/360

- 30(US)/ 360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/364

- 30(US)/ 364

- Actual/364

Index

Specify the index of the security.

Spread

Specify the spread of the security.

Floor

Specify the lower limit of the security.

Ceiling

Specify the upper limit of the security.

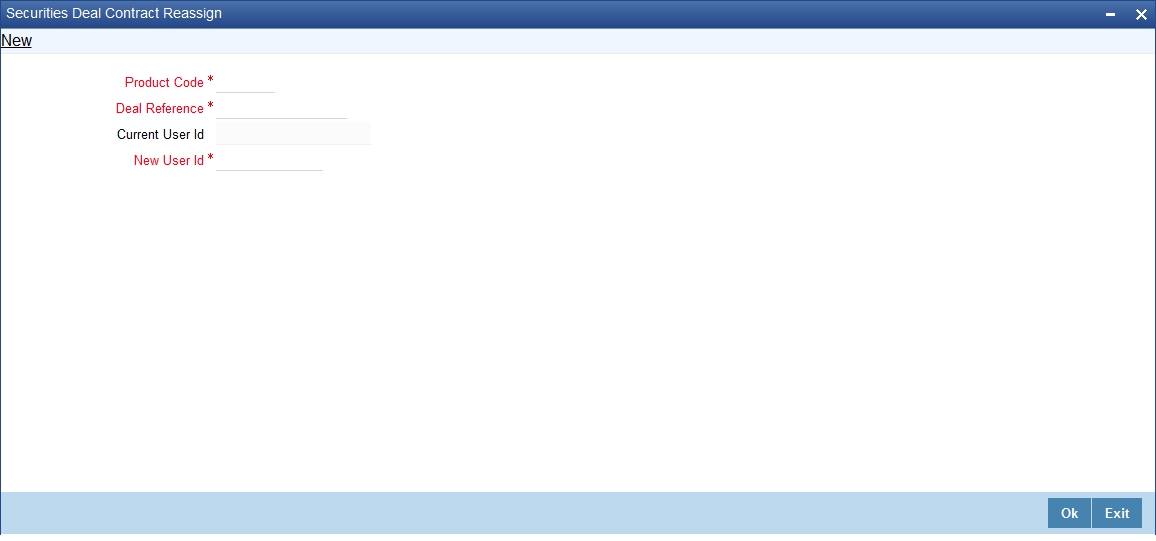

19.7 Reassigning Securities Deal Contract

You can reassign the securities deal contracts in 'Security Deal Contract Reassign' screen. To invoke the screen, type 'SEDXREAS' in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Product Code

Select the code of the product from the adjoining option list.

Deal Reference

Select the deal reference number from the adjoining option list.

Current User Id

Specify the identification of the current user.

New User Id

Select the user identification from the adjoining option list.