2. Securitization of Loans - An Overview

2.1 Introduction

Securitization is the process of transformation of non-tradable assets into tradable securities. It is a structured finance process that distributes risk by aggregating debt instruments in a pool and issues new securities backed by the pool.

When a bank or financial institution is in need of additional capital to finance a new facility, to raise the fund, instead of selling the assets, the financial institution decides to sell the portion of the loan to a Trustee named as Special Purpose Vehicle (SPV) and collect the fund up front and remove the loan asset from the balance sheet of the institution. SPV holds the asset as collateral in balance sheet and issues bonds to the investors. It uses the proceeds from those bond sales to pay the originator for the assets.

This chapter contains the following sections:

2.2 Securitization Process Flow

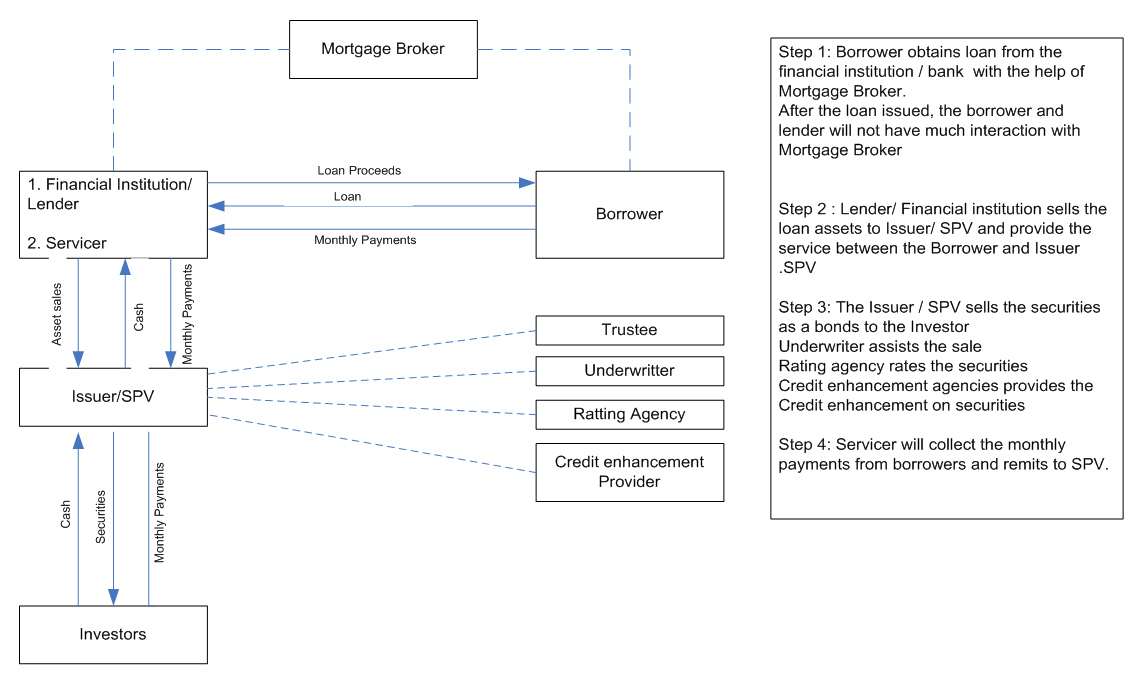

The detailed securitization process with typical components has explained with typical components in the diagram below:

The roles and responsibilities of various components involved in the securitization structure are explained below:

- Borrower – An Individual or organization which obtains loan from financial institution / bank and pays the monthly payments.

- Mortgage Broker - Acts as a facilitator between a borrower and the lender. The mortgage broker receives fee income upon the loan's closing.

- Issuer - A bankruptcy-remote Special Purpose Entity (SPE) formed to facilitate a securitization and to issue securities to investors.

- Lender - An entity that underwrites and funds loans that are eventually sold to the SPE for inclusion in the securitization. Lenders are compensated by cash for the purchase of the loan and by fees. In some cases, the lender might contract with mortgage brokers. Lenders can be banks or non-banks.

- Servicer - The entity responsible for collecting loan payments from borrowers and for remitting these payments to the issuer for distribution to the investors. The servicer is typically compensated with fees based on the volume of loans serviced. The servicer is generally obligated to maximize the payments from the borrowers to the issuer, and is responsible for handling delinquent loans and foreclosures

- Trustee - A third party appointed to represent the investors' interests in a securitization. The trustee ensures that the securitization operates as set forth in the securitization documents, which may include determinations about the servicer's compliance with established servicing criteria.

- Securitization Documents - The documents create the securitization and specify how it operates. One of the securitization documents is the Pooling and Servicing Agreement (PSA), which is a contract that defines how loans are combined in a securitization, the administration and servicing of the loans, representations and warranties, and permissible loss mitigation strategies that the servicer can perform in event of loan default.

- Underwriter - Administers the issuance of the securities to investors.

- Credit Enhancement Provider - Securitization transactions may include credit enhancement (designed to decrease the credit risk of the structure) provided by an independent third party in the form of letters of credit or guarantees.

Note

Not all securitizations are identical. For example, the lender and the servicer are sometimes the same entity, or in other arrangements brokers may not play a role.

Securitization takes the role of the lender and breaks it into separate components. Unlike the more traditional relationship between a borrower and a lender, securitization involves the sale of the loan by the lender to a new owner--the issuer--who then sells securities to investors. The investors are buying ‘bonds’ that entitle them to a share of the cash paid by the borrowers on their mortgages. Once the lender has sold the mortgage to the issuer, the lender no longer has the power to restructure the loan or make other accommodations for its borrower. That becomes the responsibility of a servicer, who collects the mortgage payments, distributes them to the issuer for payment to investors, and if the borrower cannot pay, action is taken to recover cash for the investors. The servicer can only do what the securitization documents allow it to do. These contracts may constrain the servicer's flexibility to restructure the loans

For example, suppose that a financial institution has processed 10 housing loans under the total worth of 5,000,000 USD (each loan for 500,000USD). The Maximum Tenor for the loan is 20 Years and aggregated Monthly Installment for the housing loan is 50,000USD.

In order to overcome the financial crisis, the financial institution decided to sell the loan assents and raise capital. It sold the loan assets to an SPV for 7,000,000 USD and got the profit of 2,000,000 USD.

Once the contract has been signed after the legal verification, the financial institution becomes the service provider for borrowers and SPV. It transfers the monthly payments / interest / charges / Fees / Prepayment / penalty charges directly to SPV as per the agreement.