7. Cash Transactions

7.1 Introduction

Teller transactions in the Savings module can be classified into four types:

- Cash transactions

- Instrument transactions

- Term Deposits transactions

- General Ledger transactions

This chapter details all the cash-based transactions that can be performed through this module. You can perform the following types of cash-based transactions:

- Cash deposit and withdrawal

- Closing out an Account with Withdrawal

- Denomination exchange in the same currency

- Bill payments – by cash and against account

- Funds transfer request and stop payment

- Foreign exchange sale and purchase – for walk-in customer

- Telegraphic transfer (TT)

- TT issue – against account, against GL and for walk-in customer

- TT liquidation – against GL, against account and for walk-in customer

- TT inquiry

- Transaction Reversal

- Rental Payments for Safe Deposit Box

This chapter contains the following sections:

- Section 7.2, "Deposit Cash"

- Section 7.3, "Withdraw Cash"

- Section 7.4, "Domestic Cash Transfer"

- Section 7.5, "International Cash Transfer"

- Section 7.7, "Advance By Cash"

- Section 7.6, "Close out Withdrawal by Cash"

- Section 7.8, "Exchanging Denominations "

- Section 7.9, "Pay Bill by Cash"

- Section 7.10, "Pay a Bill against Account"

- Section 7.11, "Pay a Bill by Clearing Cheque"

- Section 7.12, "Pay a Bill by In-house Cheque"

- Section 7.13, "Request for Funds Transfer"

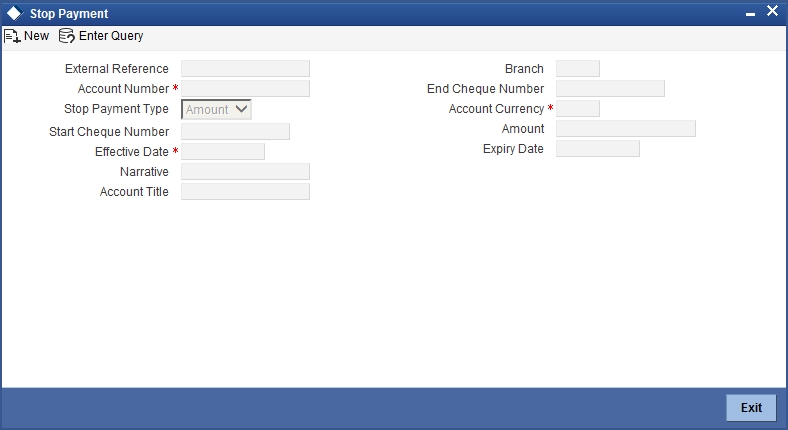

- Section 7.14, "Making a Stop Payment"

- Section 7.15, "Sell Foreign Exchange to a Walk-in Customer"

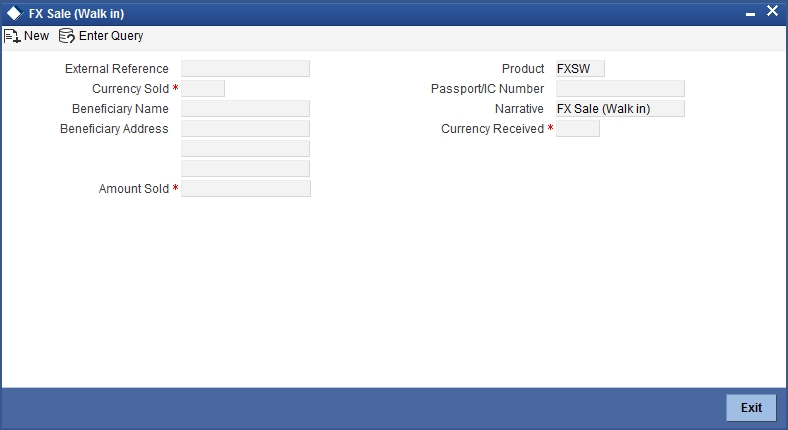

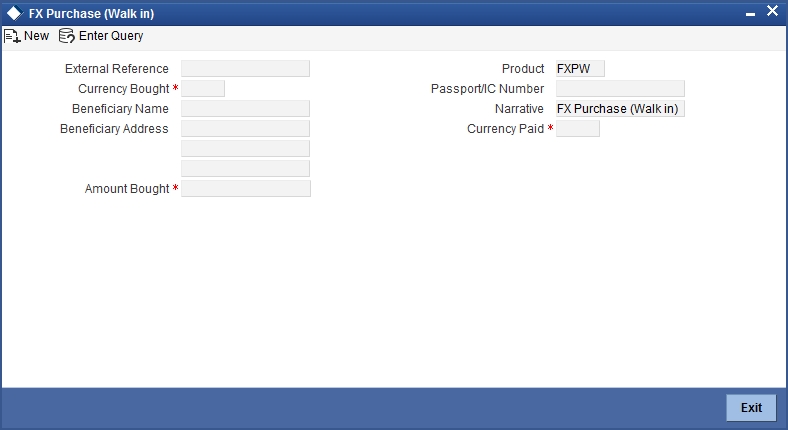

- Section 7.16, "Purchase Foreign Exchange from a Walk-in Customer "

- Section 7.17, "Purchase FX against Account"

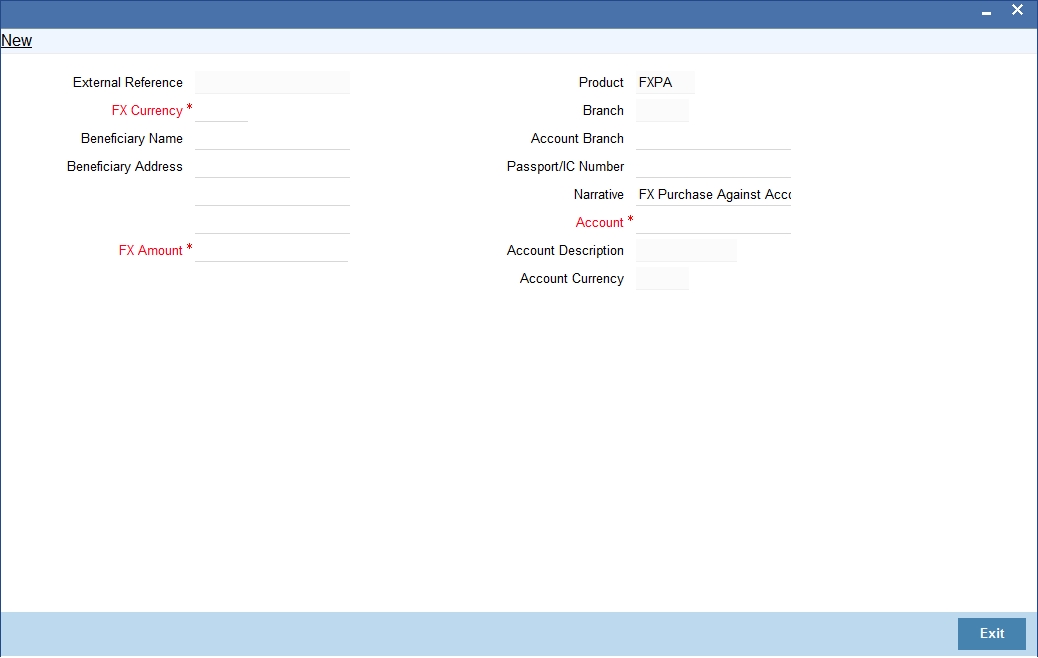

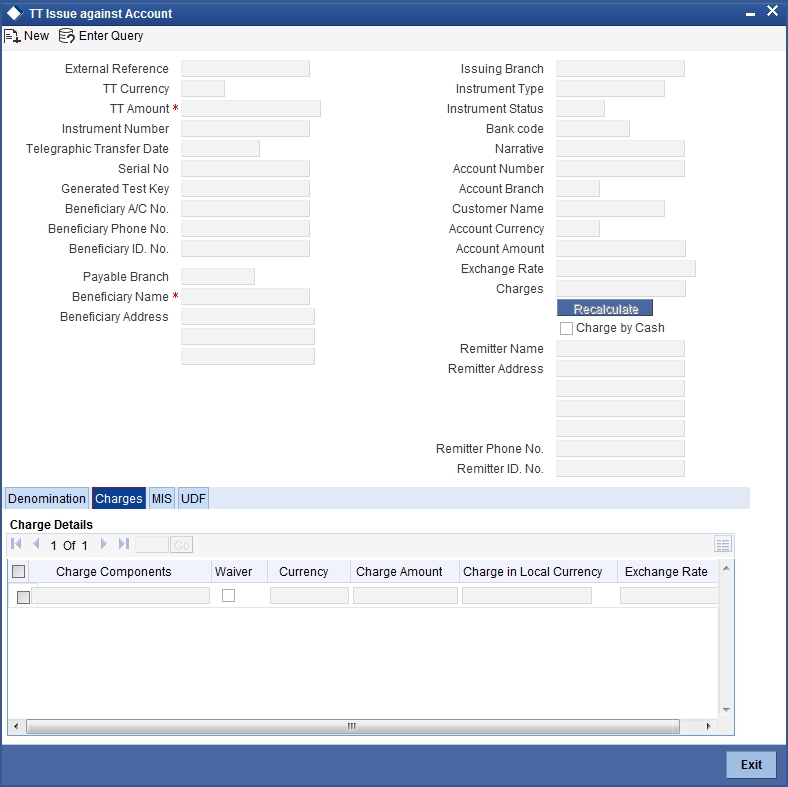

- Section 7.18, "Issue TT against Account "

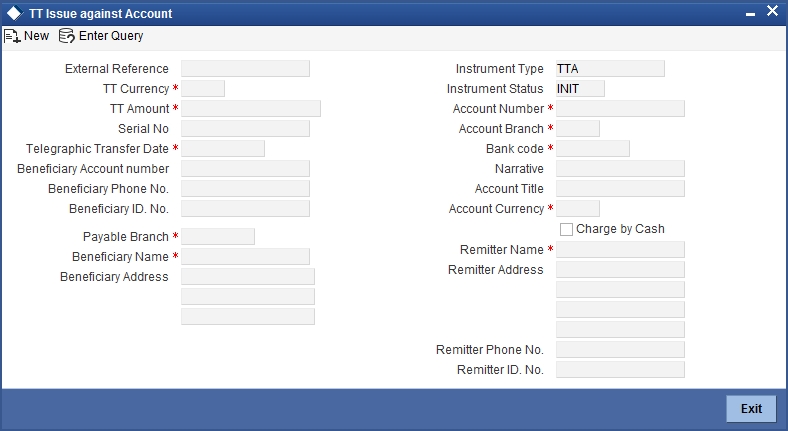

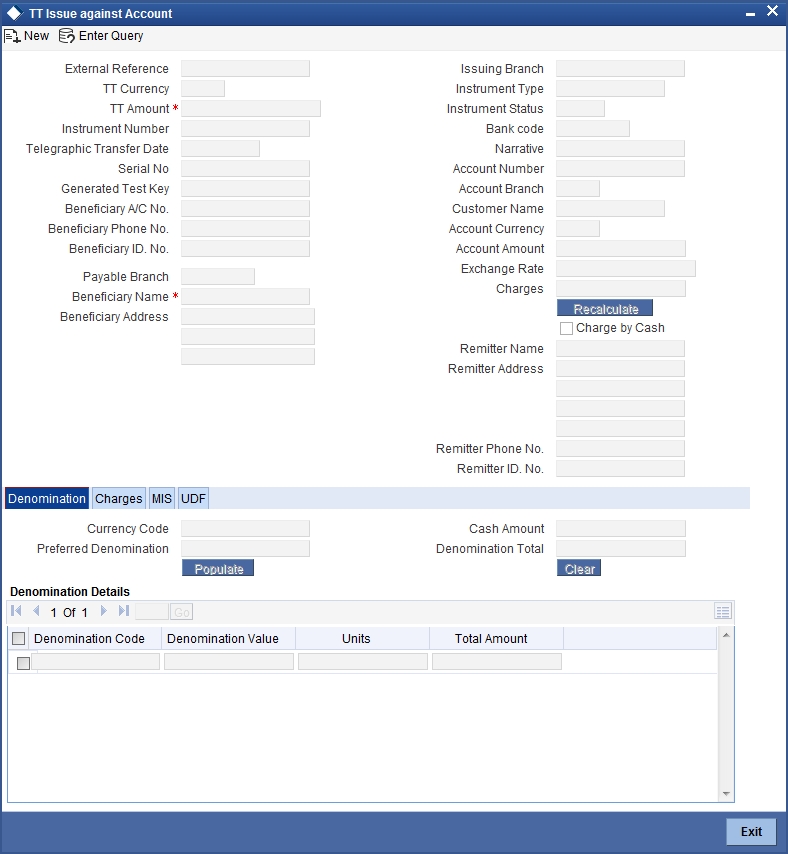

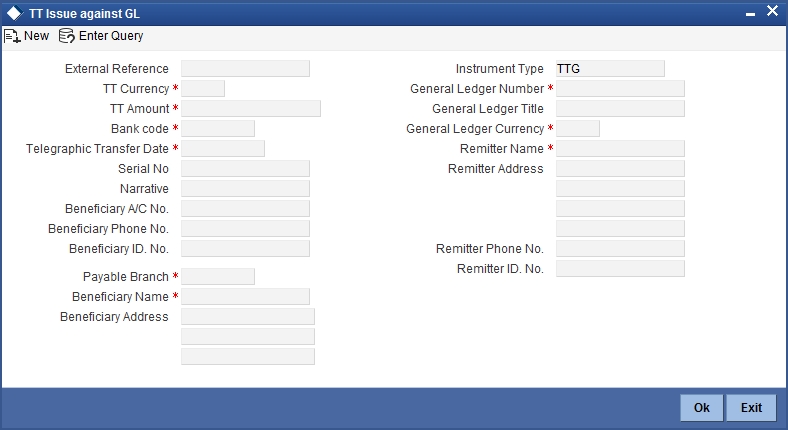

- Section 7.19, "Issue a TT against GL "

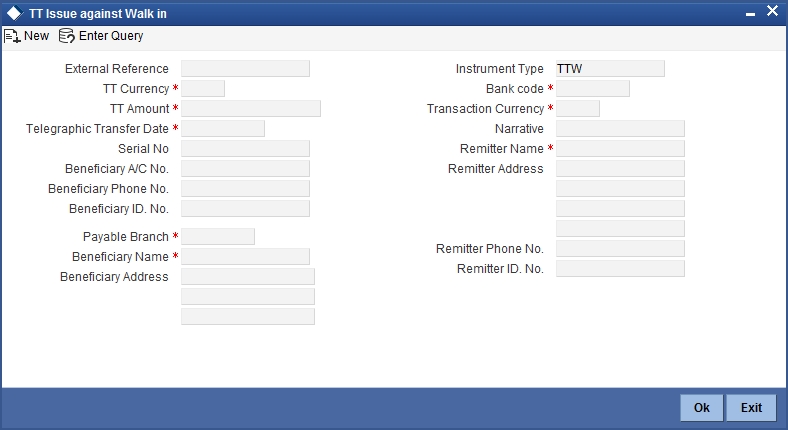

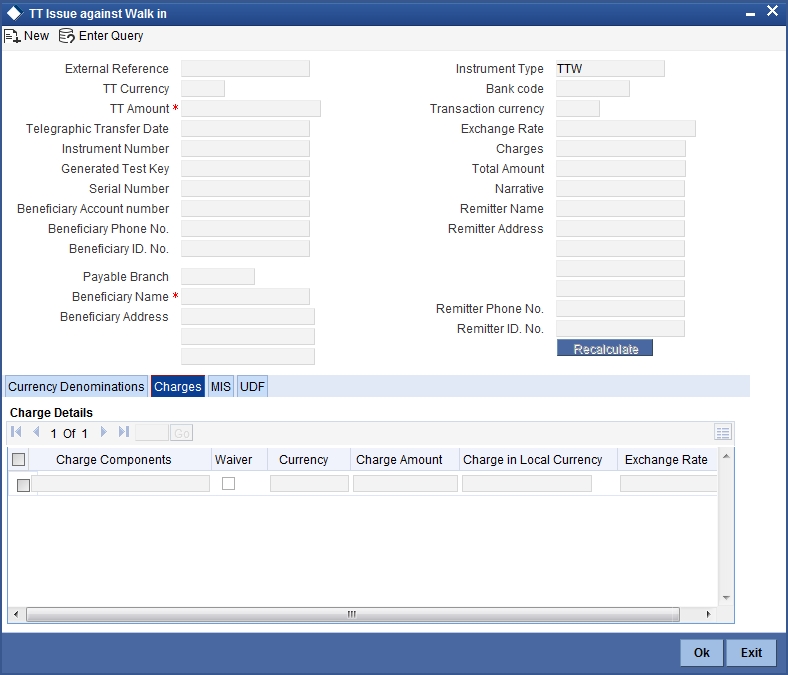

- Section 7.20, "Issue a TT to a Walk-in Customer "

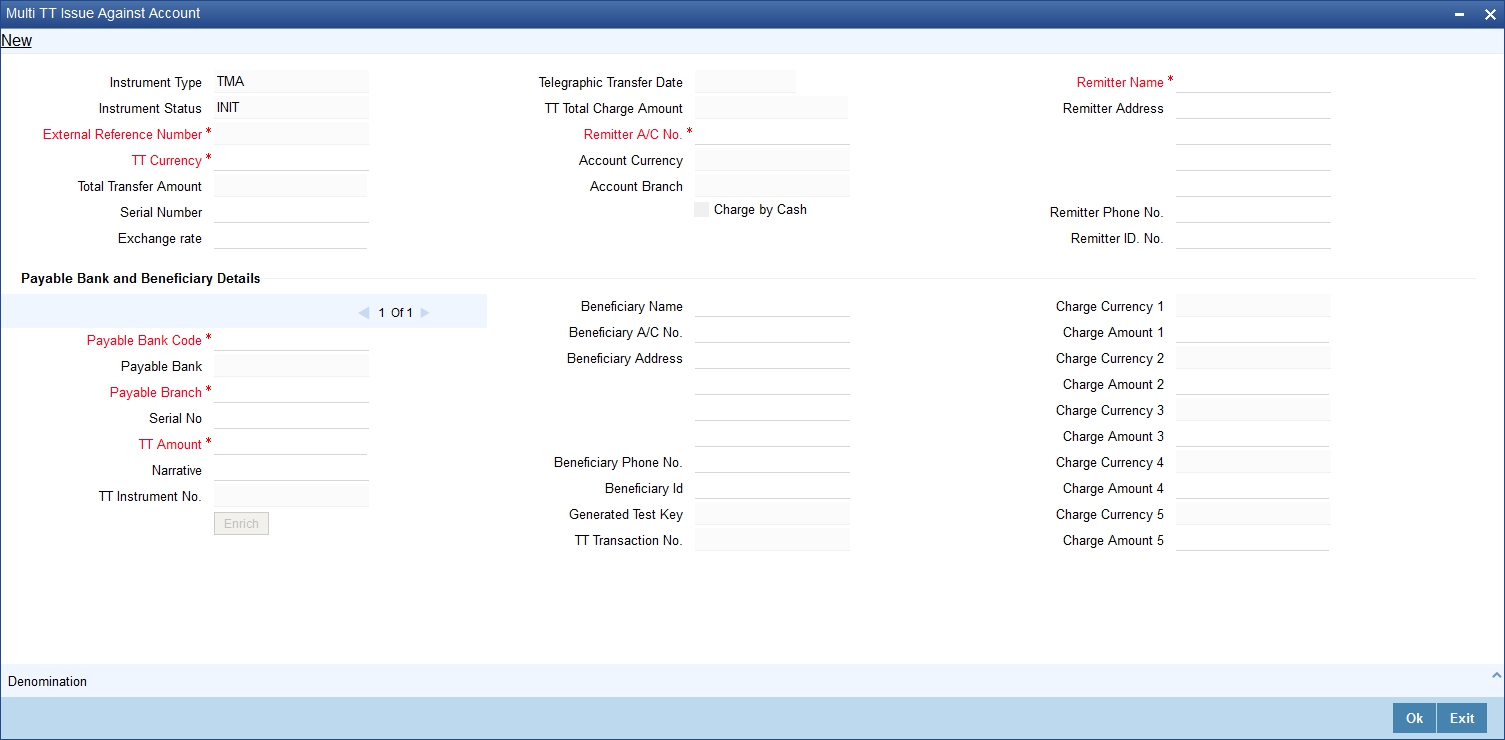

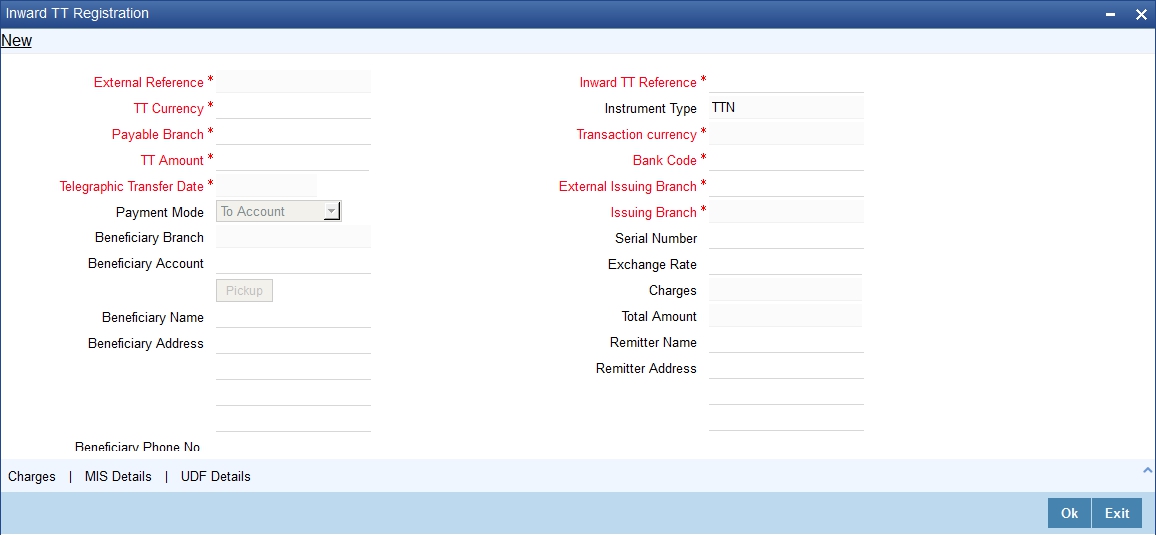

- Section 7.21, "Issuing Multiple TT against Account"

- Section 7.22, "Issuing Multiple TT for Walk In"

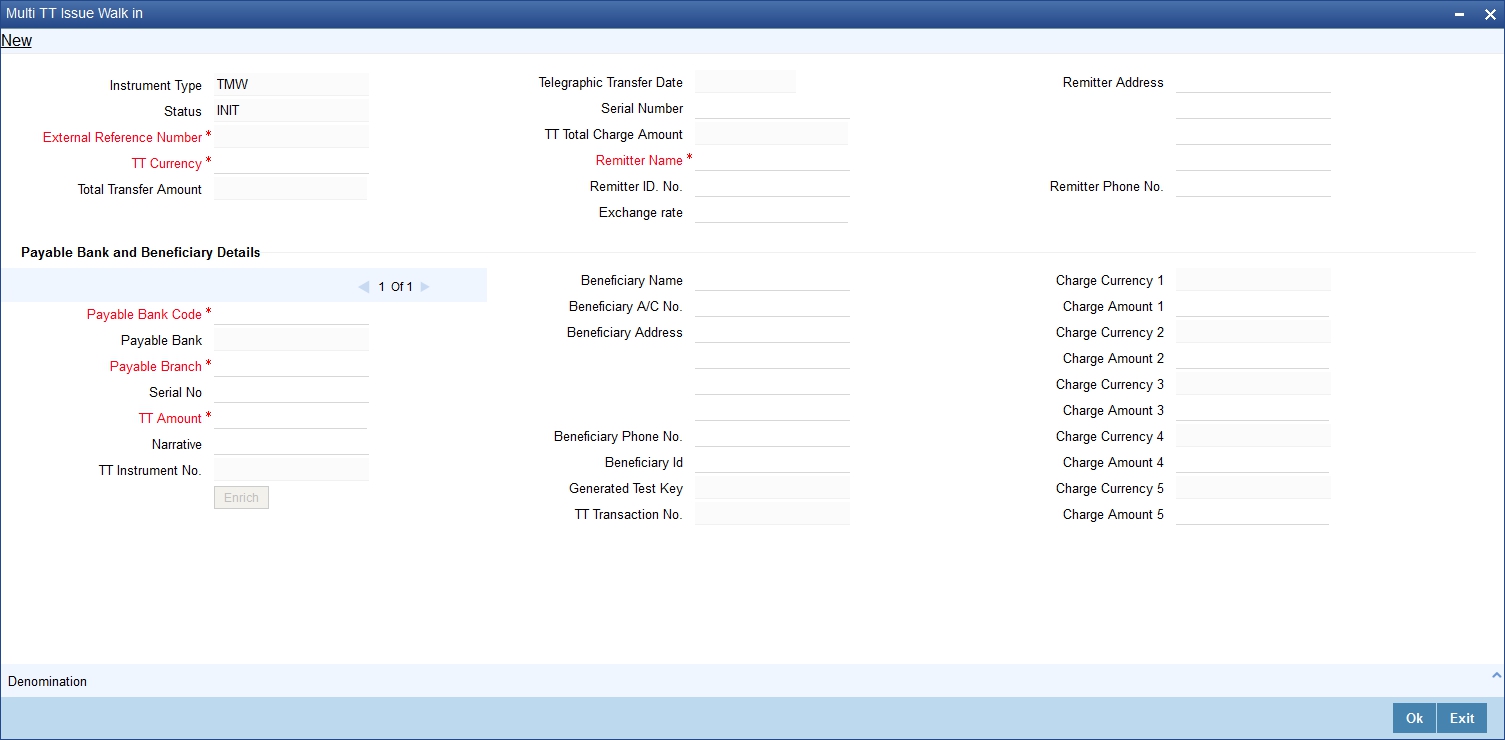

- Section 7.23, "Maintaining TT Test Keys"

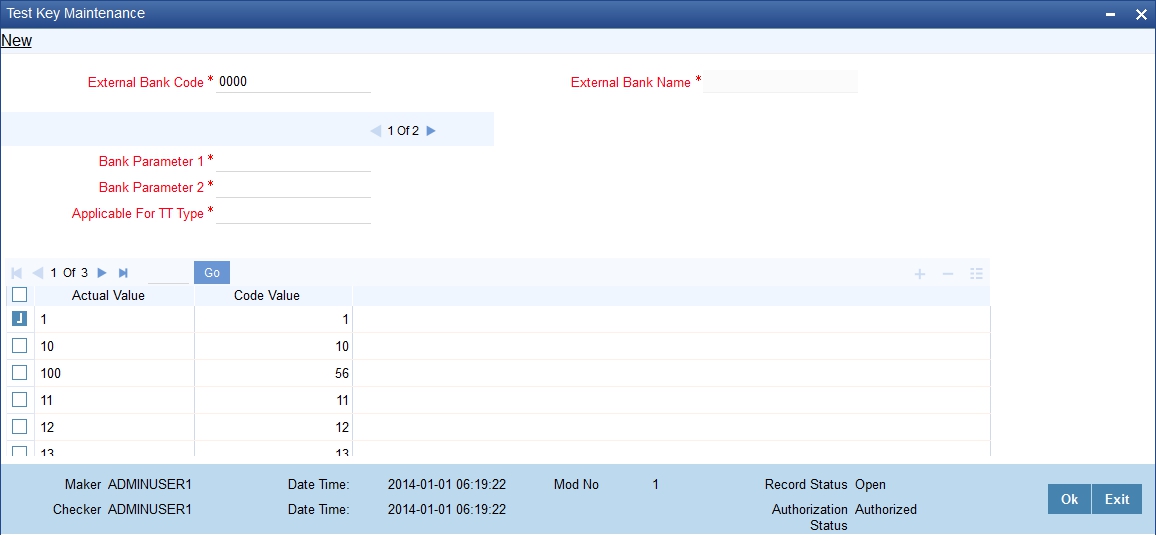

- Section 7.24, "Inward TT Registration"

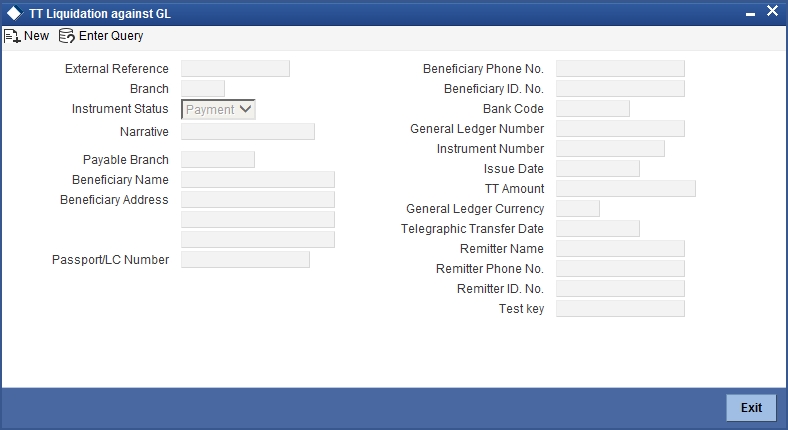

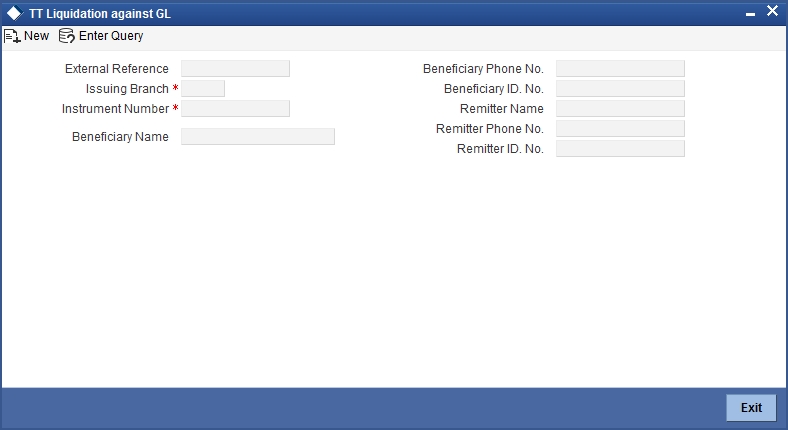

- Section 7.25, "Liquidate a TT against GL "

- Section 7.26, "Liquidate a TT against Account"

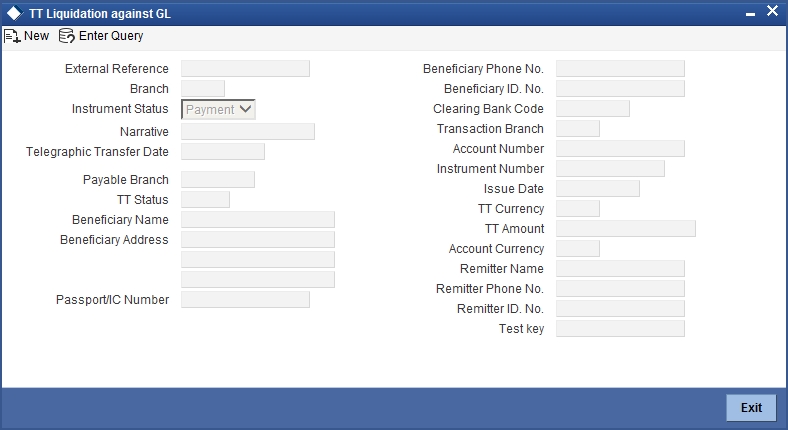

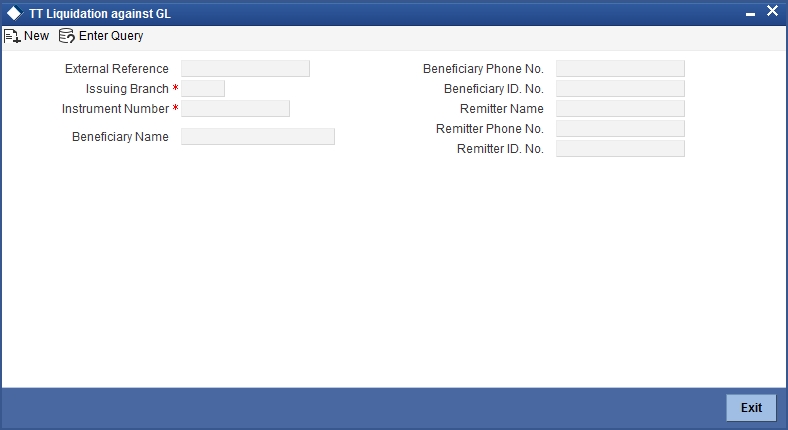

- Section 7.27, "Liquidate a TT for a Walk-in Customer"

- Section 7.28, "Inquiring on a TT Transaction"

- Section 7.29, "Transaction Reversal"

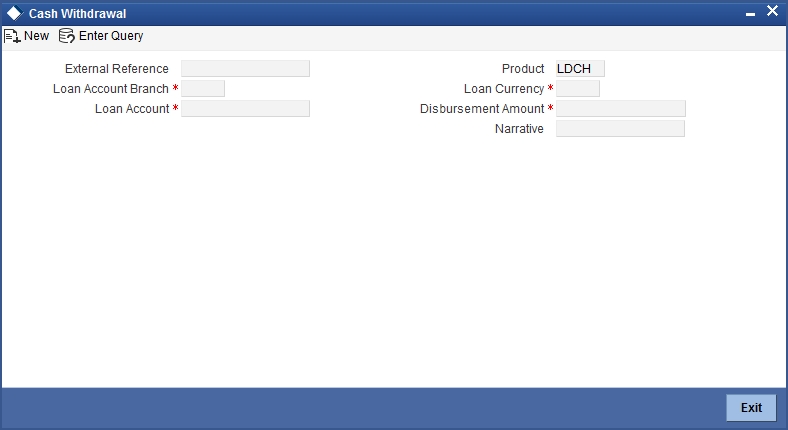

- Section 7.30, "Disbursing Loan Manually By Cash"

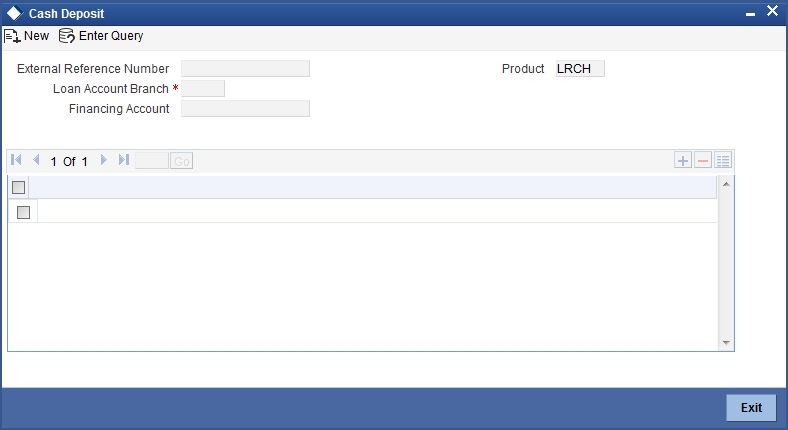

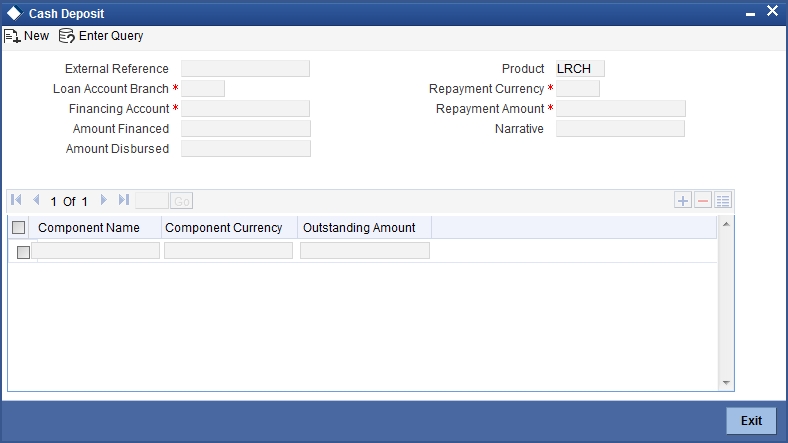

- Section 7.31, "Repaying Loan Manually By Cash"

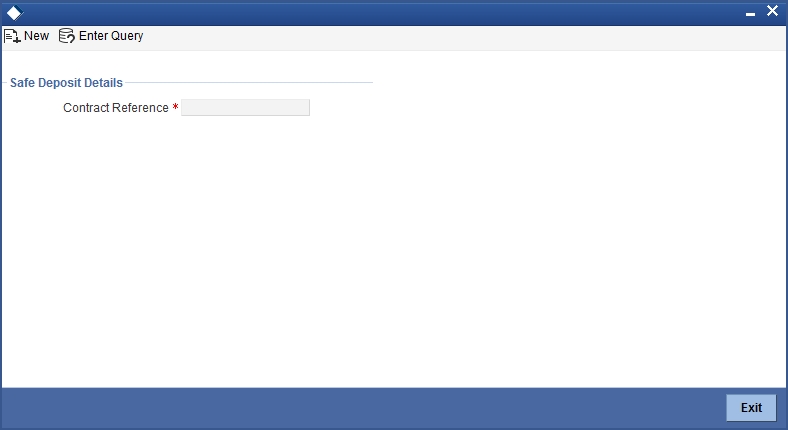

- Section 7.32, "Safe Deposit Box Rentals"

- Section 7.33, "Viewing Availability of Denomination in Till"

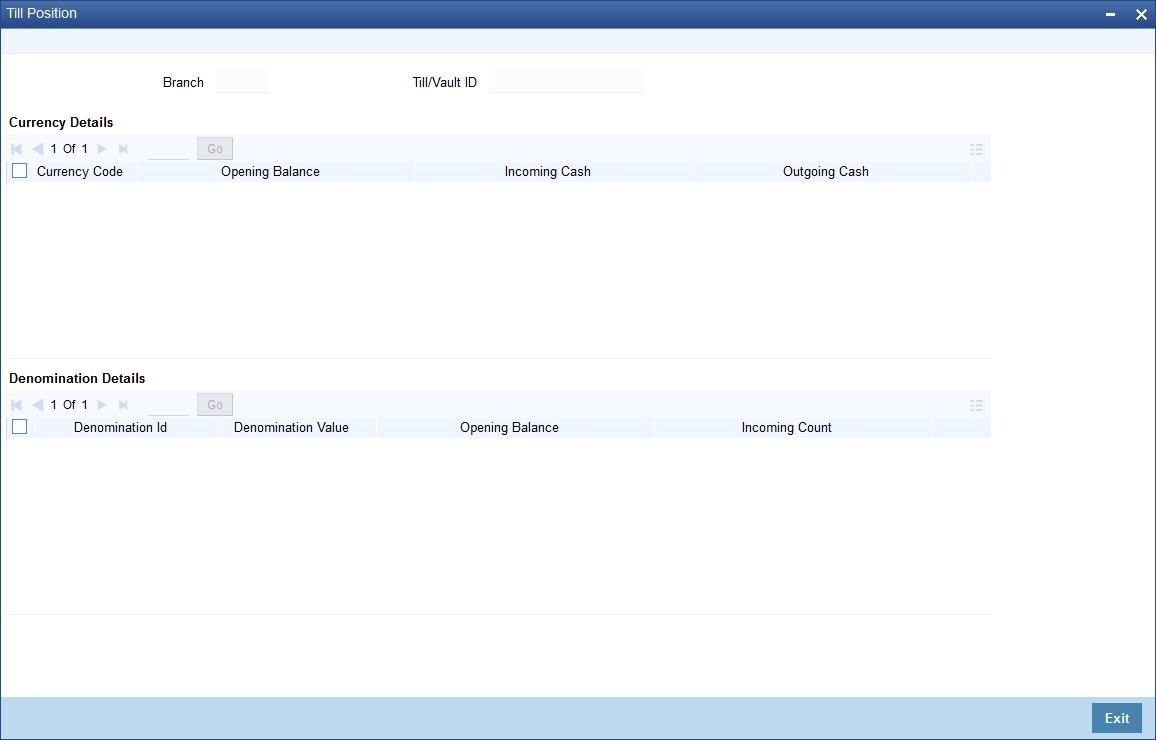

- Section 7.34, "Querying Till Vault Position"

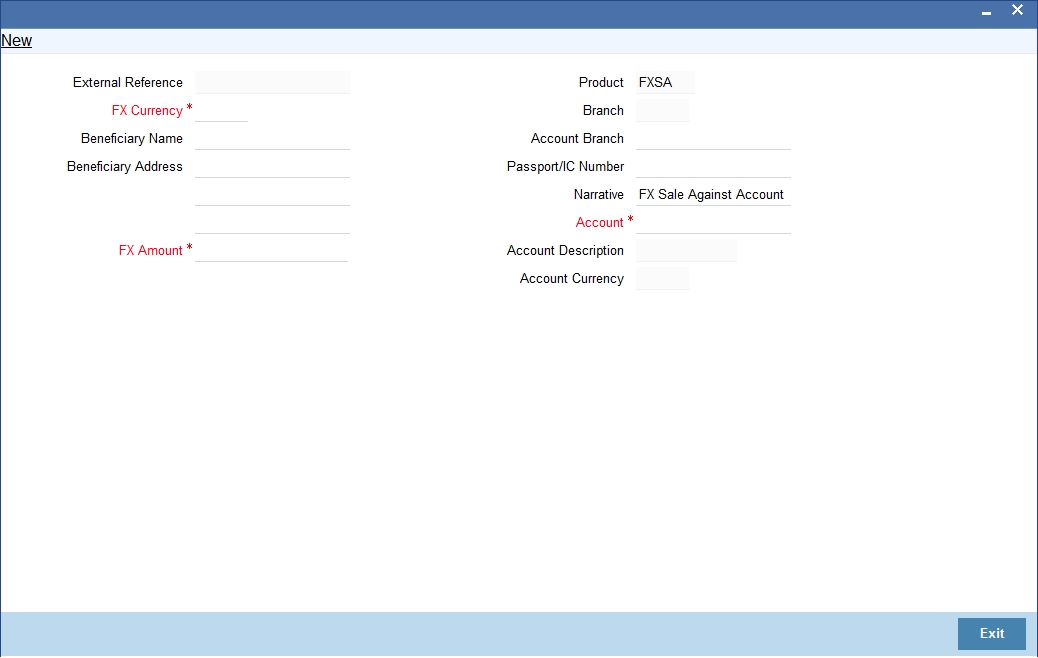

- Section 7.35, "Sell Foreign Currency against CASA Account"

7.2 Deposit Cash

This section contains the following topics:

- Section 7.2.1, "Depositing Cash "

- Section 7.2.2, "Specifying Denomination Details"

- Section 7.2.3, "Specifying Charge Details"

- Section 7.2.4, "Specifying MIS Details"

- Section 7.2.5, "Specifying UDF Details"

- Section 7.2.6, "Specifying Project Details"

- Section 7.2.7, "Authorization Stage"

- Section 7.2.8, "Viewing errors and overrides"

- Section 7.2.9, "Cash Deposit in Two Step Processing"

7.2.1 Depositing Cash

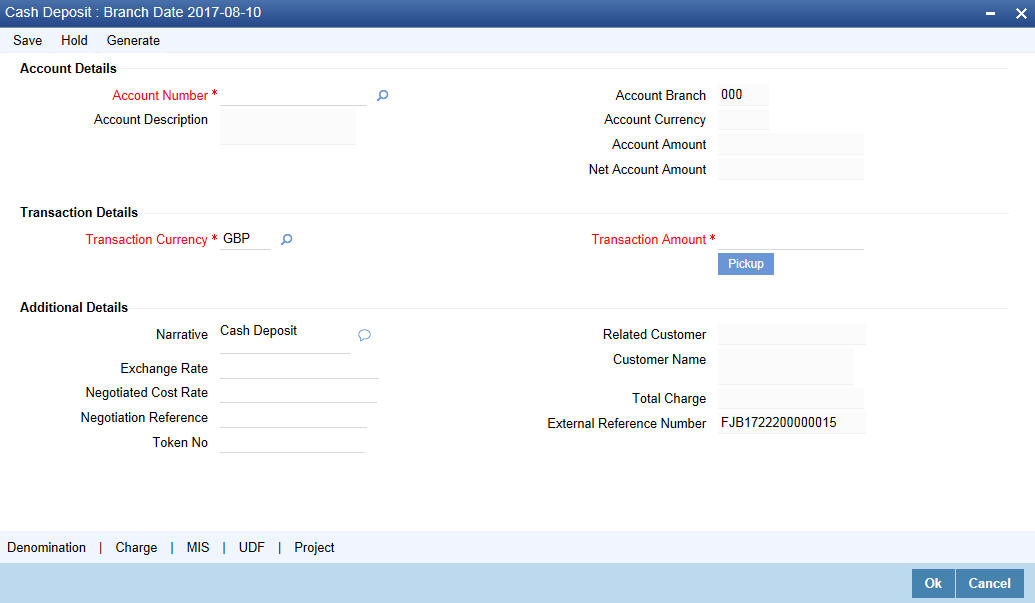

You can capture a cash deposit transaction through the ‘Cash Deposit’ screen. You can invoke this screen by typing ‘1401’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The cash deposit can be done in single step or two step process. The single step process is the single screen approach. For the single step cash deposit, the teller accepts the cash and accounting entries are passed in a single step. In two step process, the teller just collects the information and posts the transaction where no accounting entries are passed. The cashier accepts the cash and then the accounting entries are passed in the second step.

You can also specify Virtual Accounts in this screen. These virtual accounts can be used as a routing account to credit the underlying physical account.

If a virtual account number is specified in this screen, then the F10, F11, and F12 keys will not display any value, however the following error messages will be displayed for each of these keys:

- F10: Customer Image not maintained for this Customer/Account in branch 214

- F11: Customer Account Balance cannot be accessed for this Customer/ Account.

- F12: Customer Signature not maintained for this Customer/Account in branch 214

Click the OK button and you will be able to proceed further with the transaction.

Here the teller can capture the following details:

Account Number

Physical Account Number:

Specify the customer account number into which the cash needs to be deposited. You can also select an account number from the list displayed by clicking on the adjoining option list.

Note

In case of multiple accounts with the same account number, the system will display a list of corresponding account branches to select.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Virtual Account Number

You can also specify a virtual account number in this field. The physical account number is identified based on the Virtual Account Number and Account Currency combination. If there is no physical account available for the combination, then the default physical account number is selected. The account currency changes as per the default physical account number.

Account Branch

The system displays the logged-in branch. If you specify another account number and tab out of the Account Number field, the system displays the corresponding account branch.

Account Description

The system displays the description of the account number chosen.

Transaction Currency

The system displays the local currency. If you specify another account number and tab out of

the Account Number field, the system displays the currency associated with the specified account.

Account Amount

The system displays the transaction amount in terms of account currency.

Total Charge

The system computes the charges applicable for the transaction and displays it here.

Net Account Amount

The system displays the net amount to be credited to the account (in the account currency) after calculating the applicable charges. This amount depends on the charge method – whether inclusive or exclusive.

Related Customer

The system displays the related customer.

Customer Name

The system displays the customer name.

Account Currency

The system displays the currency associated with the account.

For a Virtual Account, the transaction currency is defaulted as the account currency. The physical account number is identified based on the account currency and virtual account number combination. If physical account number is available then the transaction currency remains the same.

If the physical account number is not available, then the default physical account number is selected and the transaction currency changes as per the default physical account number. The account currency changes according to the default physical account number.

Transaction Amount

Specify the amount that should be credited to an account in terms of transaction currency. If the account to be credited is a Trust account, this amount should be within the cash deposit limit defined for the credited account class.

Pickup

Click on pickup to default the data into the Denominations, Charges, MIS, UDF and Project details. It is mandatory to click on ‘Pickup’ button before save.

Exchange Rate

The system displays the exchange rate used to convert the transaction currency into account currency. If the transaction currency is the same as the account currency, the system will display the exchange rate as ‘1’.

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction.

Negotiation Reference

Specify the unique reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also.

Note

Oracle FLEXCUBE books the online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

Token Number

Specify the token number.

Narrative

The system displays ‘Cash Deposit’. You can modify it, if required.

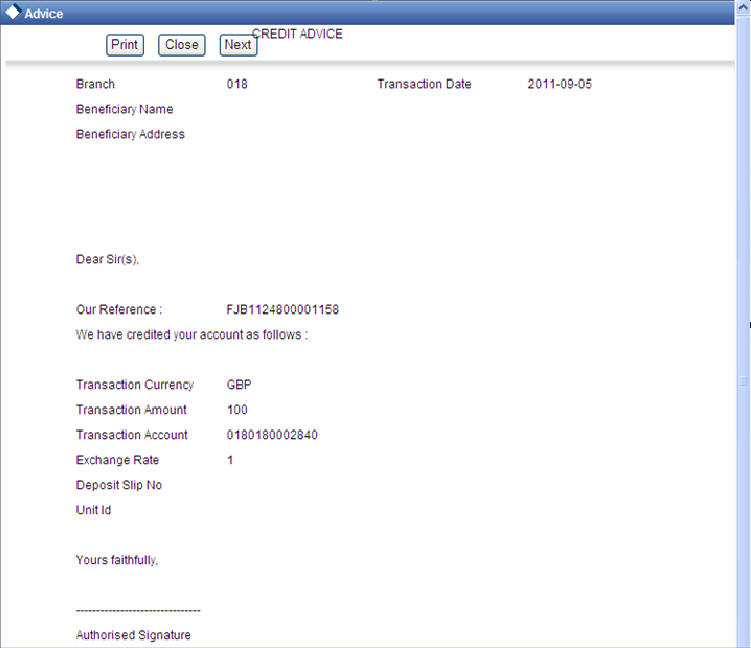

The system generates the advice on click of ‘OK’ button or save after providing all the details.

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Note

You can generate a transaction slip by clicking on ‘Generate’ button after providing account number, transaction amount and clicking on pickup button. It is produced to the customer to sign and confirm the transaction.

Note

When Duplicate Advice Tracker field is checked and you click the EXIT button on the advice generation screen, the system displays a message “Print Successful?”. Click OK button to confirm the successful printing. Every subsequent print of the advices will be considered as duplicate advice. For more information on Duplicate Advice Tracker refer to section “Messaging Branch Parameters Maintenance” in the Core User Manual

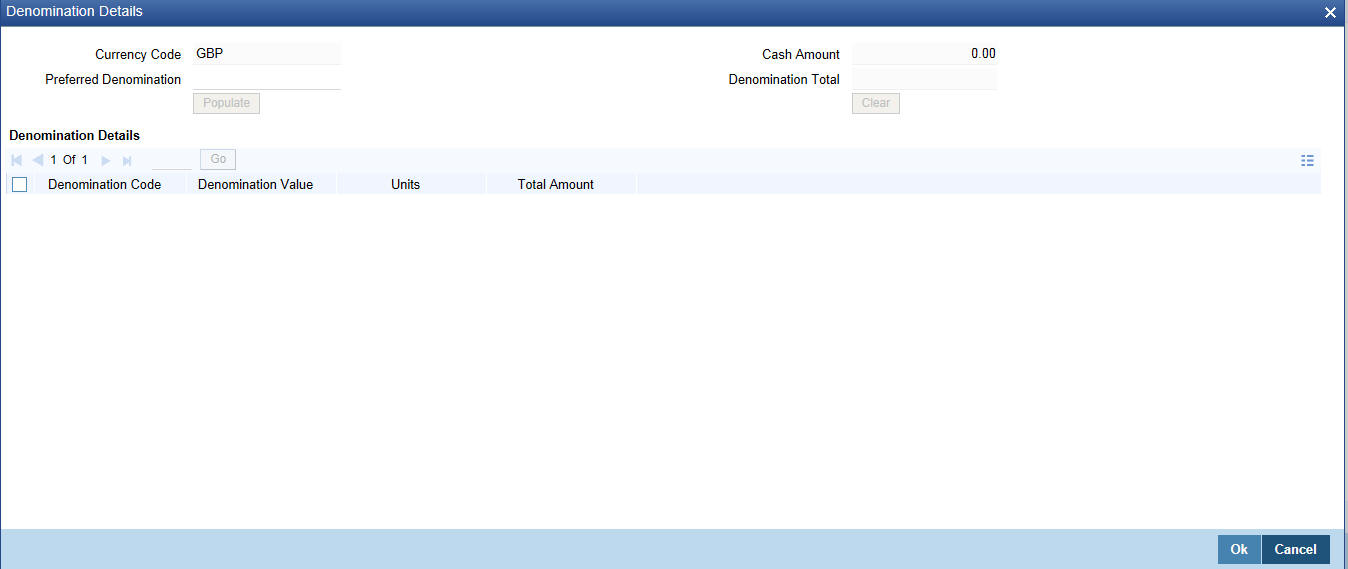

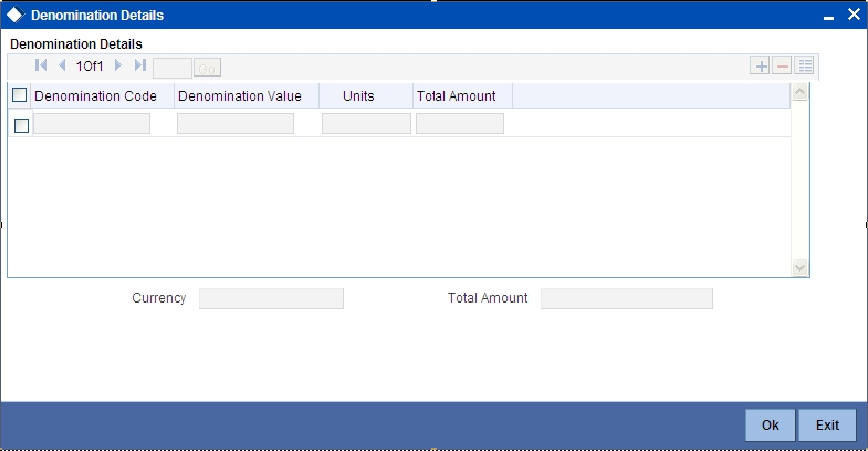

7.2.2 Specifying Denomination Details

In this block, you can capture details of the currency denominations involved in the transaction through the following fields:

Currency Code

The system displays the currency of the account.

Cash Amount

The system displays the amount for which the denominations have to be captured.

Preferred Denomination

Specify the preferred denomination.

Denomination Total

The system displays the total denomination.

Denomination Details

Denomination Code

For every currency, the various denominations are assigned separate denomination codes. These codes are displayed here.

Denomination Value

The system computes the face value of the denomination and displays it. For instance if the denomination code represents a USD 100, the value will be displayed as ‘100’.

Units

Indicate the number of units of the specified denomination. By default, till contents are incremented for inflow transactions like cash deposit. To reverse this default behaviour, you can specify units in negative.

Total Amount

The system computes the denomination value by multiplying the denomination value with the number of units. For instance, if the denomination code represents a USD 100 and the number of units is 10, the denomination amount will be ‘1000’.

Click ‘OK’ to validate the denominations with the cash amount. If you click on ‘Cancel’ then the data specified will not be available.

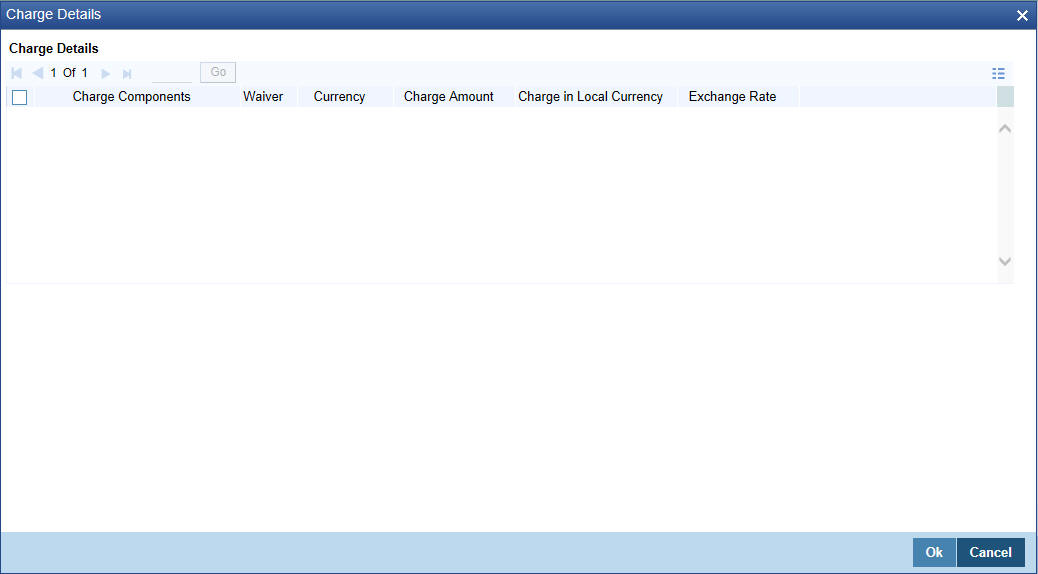

7.2.3 Specifying Charge Details

This block allows you to capture charge related details. Click on ‘Charges’ button to invoke the following screen.

Here you can capture the following details:

Charge Component

The system defaults the charge components applicable to the transaction.

Waiver

You can waive a certain charge for the customer by checking this box against the charge component.

Currency

The system displays the currency in which the charge has to be deducted.

Charge Amount

The system displays the charge amount to be deducted for the corresponding charge component. You can edit the amount.

Charge in Local Currency

In case the transaction currency is different from the local currency, the system will compute the local currency equivalent of the charge and display it here.

Exchange Rate

The exchange rate used for the currency conversion is displayed here. If the charge currency is the same as the transaction currency, the system will display ‘1’ as the exchange rate.

7.2.3.1 Recalculating charges

You can modify the charges by clicking on the charges button. You can edit the charge amount and Click “OK” button. The system displays the new charges in the main screen against ‘Total Charge’, which subsequently updates the changes in ‘Net Account Amount’ too.

7.2.4 Specifying MIS Details

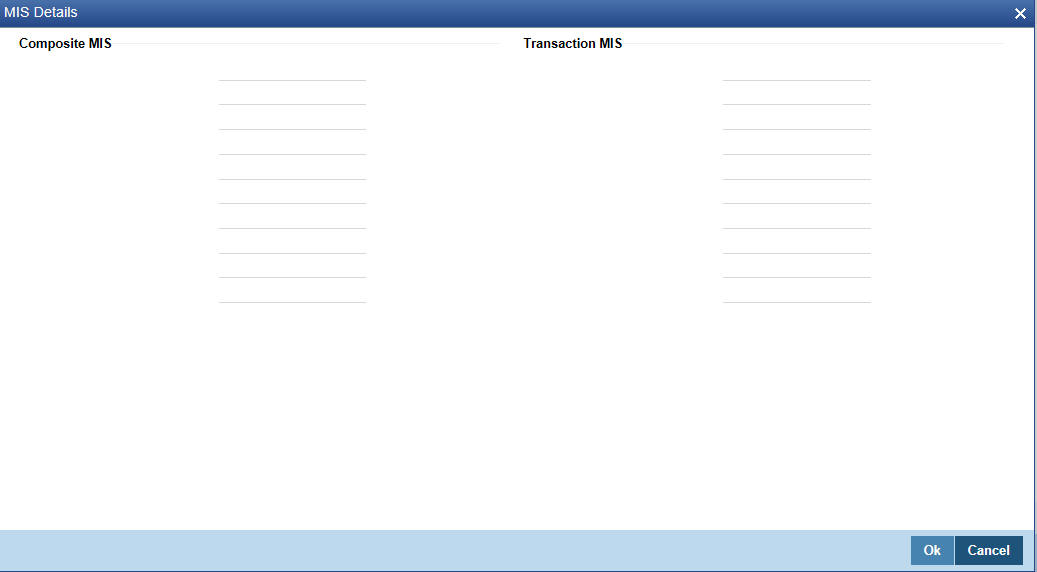

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ button to invoke the following screen:

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to capture the following details:

Transaction MIS

Specify the transaction MIS code.

Composite MIS

Specify the composite MIS code.

Refer the ‘MIS’ User Manual of Oracle FLEXCUBE Host, for further details about MIS.

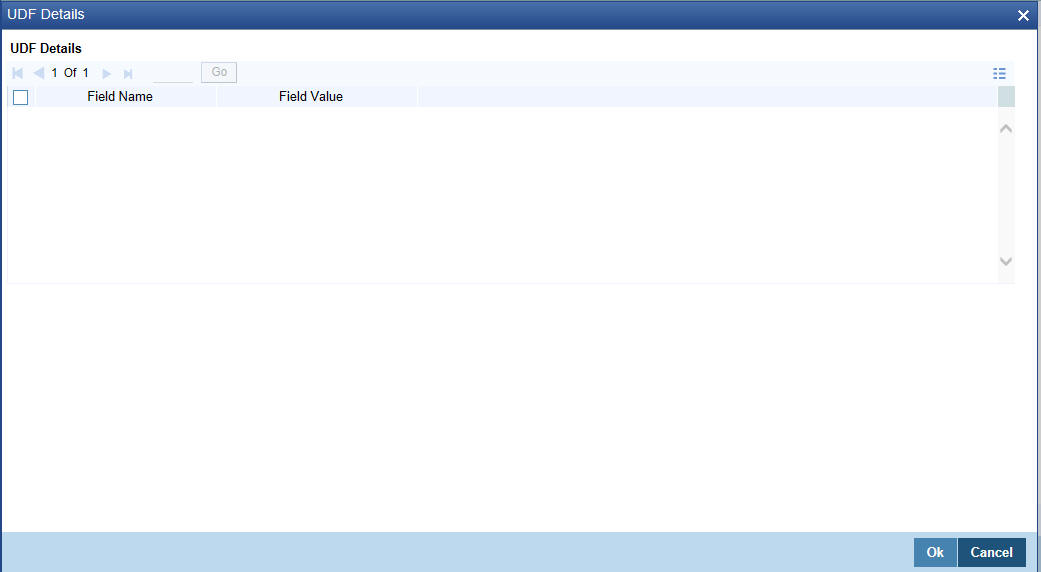

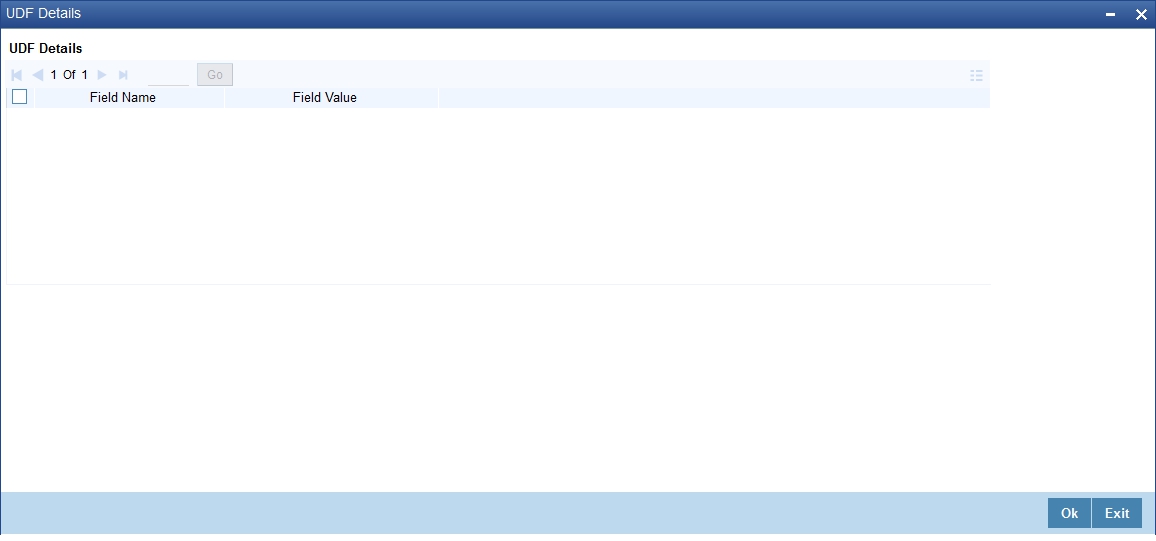

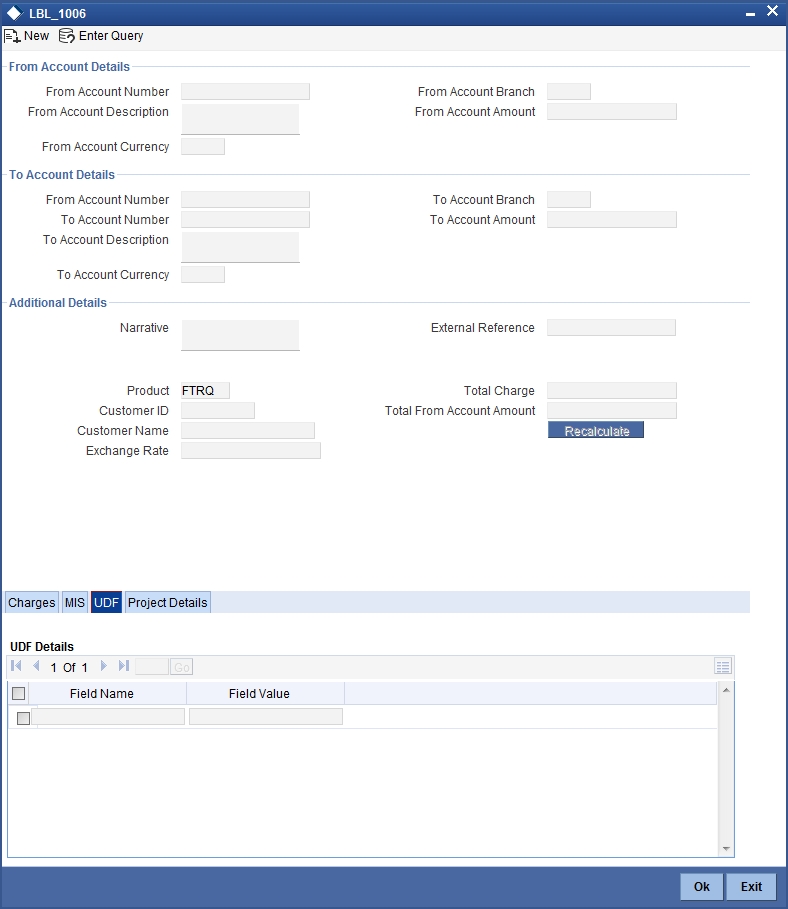

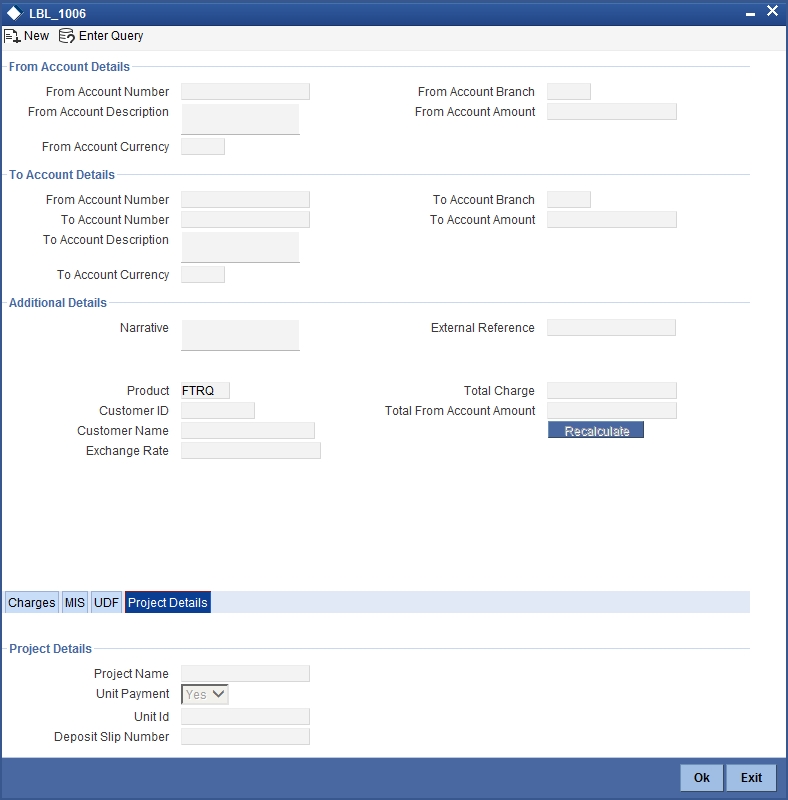

7.2.5 Specifying UDF Details

You can capture the UDF details under ‘UDF’ button.

Field Name

The system displays the various User-Defined Fields (UDFs) that you have maintained for the product in the Host.

Field Value

Specify the value for the each UDF that is displayed.

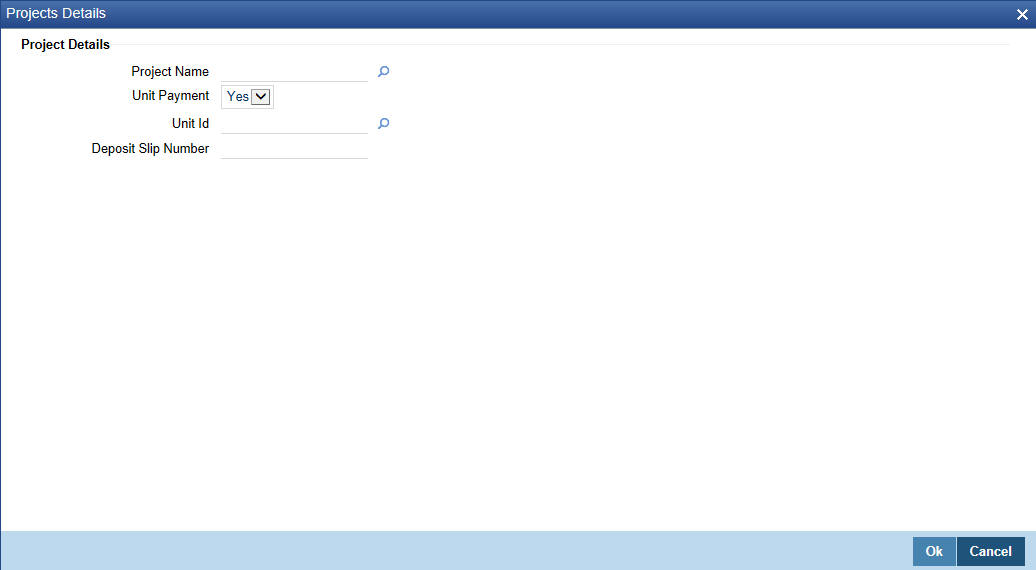

7.2.6 Specifying Project Details

You can capture project details under ‘Project Details’ button. Note that this button will be applicable only if the cash is being deposited in a Trust account.

Specify the following details:

Project Name

Specify the developer project name for which payment is being made. The adjoining option list displays all valid projects maintained in the system. You can select the appropriate one. Input to this field is mandatory.

Unit Payment

Indicate whether the transaction is a unit payment or not by choosing the appropriate value from the adjoining drop-down list. The following values are available:

- Yes

- No

Unit ID

Specify the unit ID of the project. This field will be enabled only if you have selected ‘Yes’ against ‘Unit Payment’. The adjoining option list displays all unit IDs along with the unit holder names corresponding to the project name chosen. You can select the appropriate one.

Deposit Slip Number

Specify the deposit slip number for the payment.

Click save icon to save the transaction. On saving, the system checks whether the account to be credited is a Trust account or not. If it is a Trust account, the system will check whether the deposit amount is within the deposit limit maintained for the transaction currency at the account class level. If the currency-wise limit has not been maintained, it will verify the deposit amount against the deposit limit maintained for the account class. If the deposit amount exceeds the limit, it will display an error message.

Note

- You have to click on ‘Pickup’ button after specifying account number and transaction amount. If you save the transaction without clicking on ‘Pickup’, then the system displays an error message as “Please click on pickup before save”.

- After clicking on ‘Pickup’ button, if you modify the transaction account, transaction currency, transaction amount or exchange rate then you will have to click on ‘Pickup’ again.

- You can click on the OK button after specifying the data in the denomination, charge, MIS, UDF, and project details button for the data to persist. If you close the screen or click on 'Cancel' button after specifying the data, then the data will not persist.

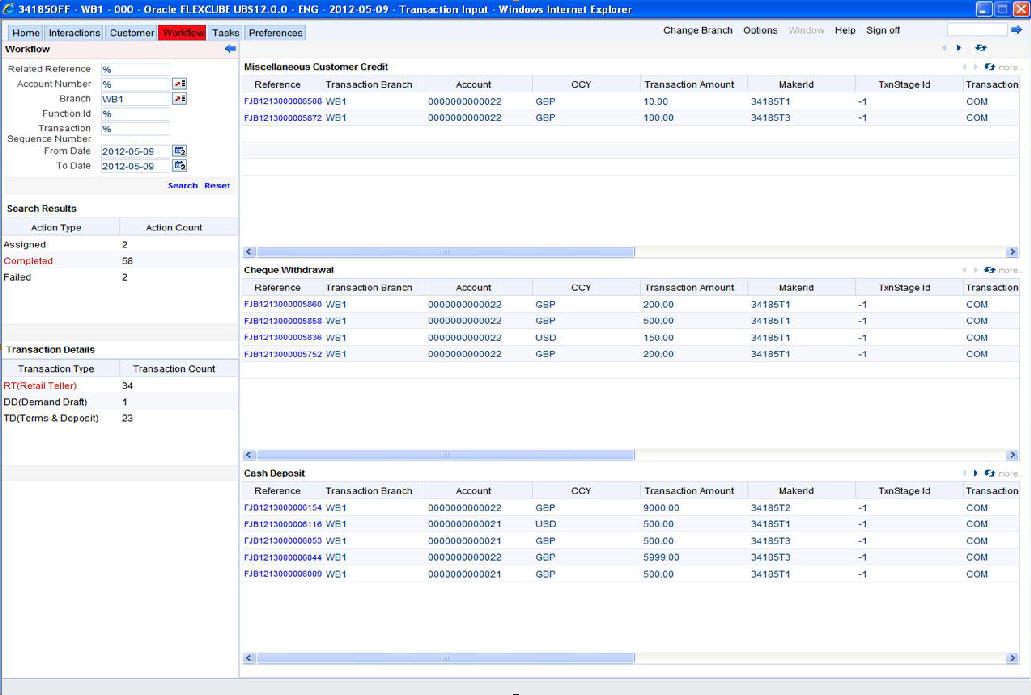

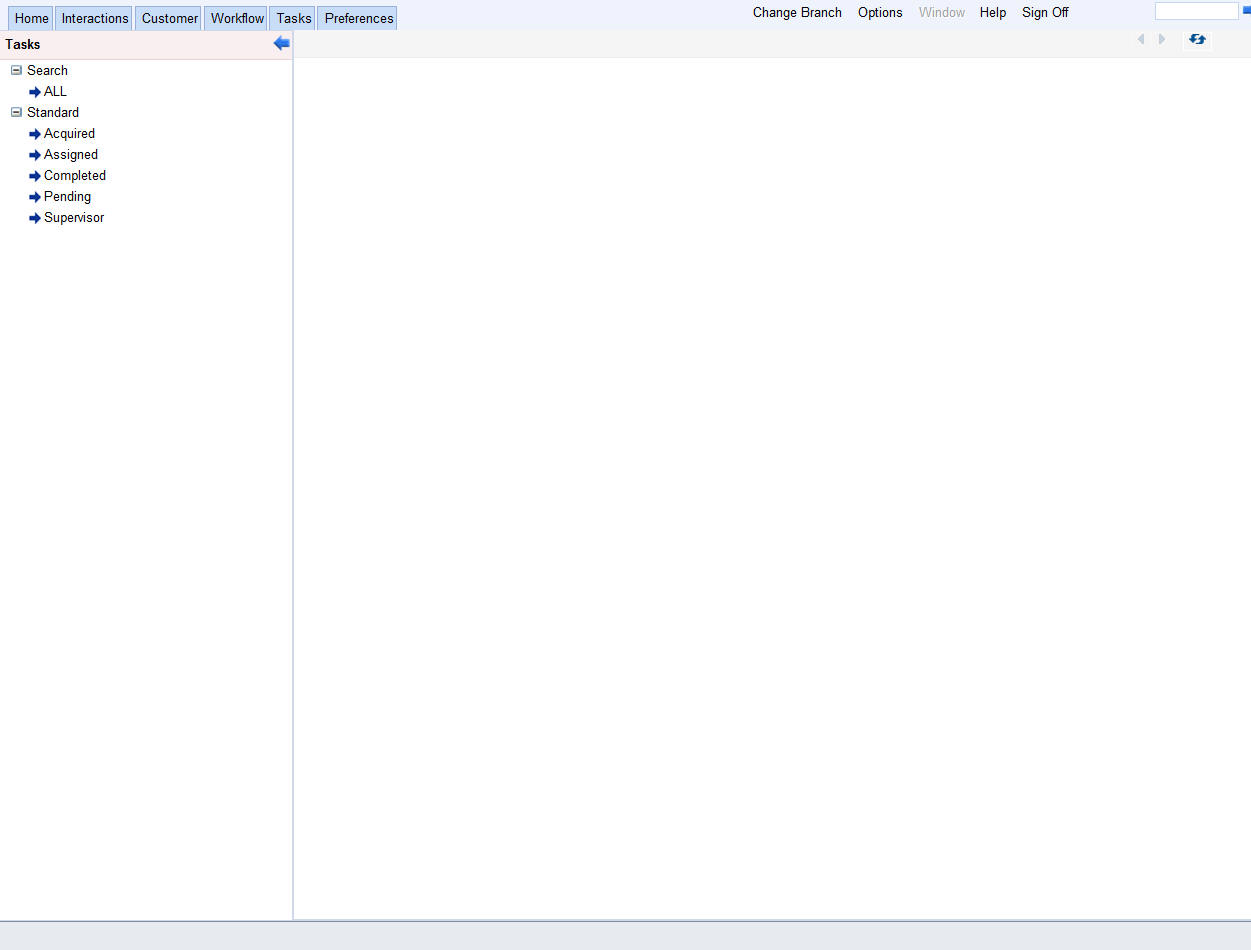

The supervisor can view the transactions pending authorization in his or her task list as shown below. You can view this list by choosing the ‘Workflow’ option in the application.

The person needs to click on the ‘Assigned’ option to view all transactions assigned to you.

In case of auto assign, the transaction will get assigned to all the eligible authorizers as per the assignment criteria maintained at your branch. All these eligible supervisors will be able to view these transactions in their ‘Pending Tasks’ lists. The first authorizer to fetch the transaction from his or her task list will lock the same and then can either approve or reject it. This process is similar to the remote authorization flow described earlier. You can view the tasks that are approved by other supervisors in the ‘Approved’ lists and also you can view the history of authorization in the ‘Auth-History’ lists.

Irrespective of the supervisor’s action (approve or reject), the transaction will be re-assigned to the maker.

You can fetch and see the response from your task list.

7.2.7 Authorization Stage

If the workflow for the transaction is configured as a ‘Dual-control’, the transaction will have to be authorized by a supervisor before it gets saved as an unauthorized transaction (for manual assign) or as an authorized transaction (for auto-assign) in the Host. In case of manual assign, the system prompts you to get the transaction authorized at your branch. Branch authorization can happen in either of the following ways based on the transaction configuration in the workflow:

- Local

- Remote

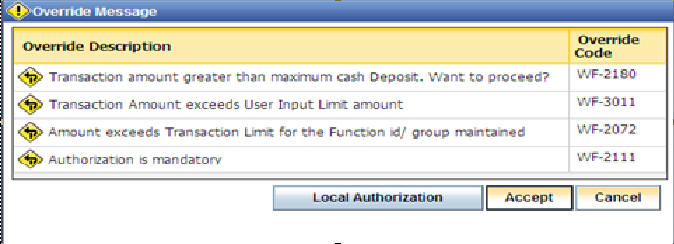

When overrides are raised by the system and have to be approved, the teller will have the option to choose between remote and local authorization. By default remote authorization will be selected. If the teller wants local authorization then the choice has to be made explicitly.

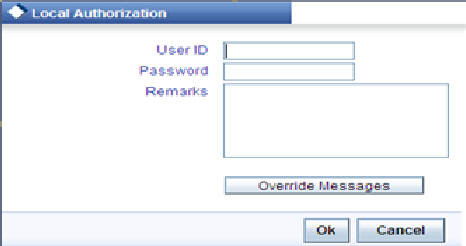

7.2.7.1 Local Authorization

In case of local authorization, the authorizer can allow or cancel the transaction. The following screen is used for local authorization:

The authorizer can only view the transaction details here. He or she will have to enter the following details:

User Id

Specify the user ID of the authorizer.

Password

Specify the password with which he or she can either authorize or reject the transaction.

Remarks

The authorizer can specify some remarks pertaining to the transaction.

Click ‘OK’ button to authorize the transaction. On successful validation of the User ID and password, the transaction will proceed to the next stage as per workflow. The validations for User ID will be same as in Remote Auth. The user credential validation includes ‘Holiday Maintenance’ check also. However, if you click ‘Cancel’ button, the transaction will move to unassigned queue.

You can view the override messages by clicking ‘Override Messages’.

Note

Local Authorization option is not available when user authentication is via Single Sign On (SSO).

7.2.7.2 Remote Authorization

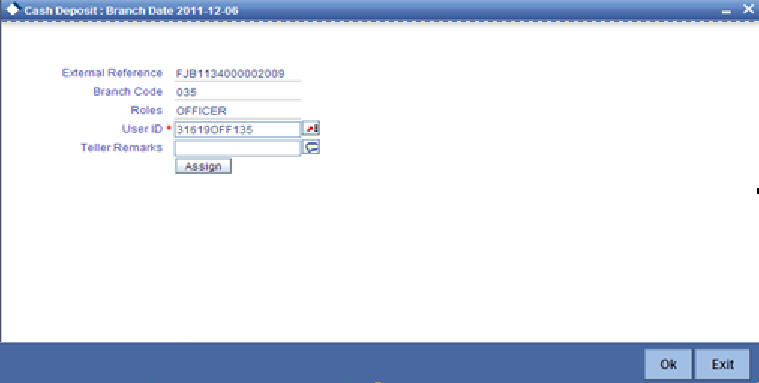

In case of remote authorization, you need to assign the transaction to an authorizer through the following screen:

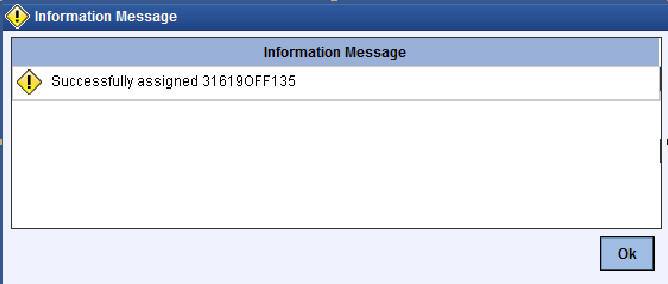

This screen is automatically prompted if the transaction workflow is configured as ‘Remote Authorization’. This assignment can happen either to a particular role or a particular person. In the screen shown above, it is to a particular person. The system displays the message “Successfully Assigned to <USER ID>” on successful assignment.

The supervisor can view the transactions pending his authorization in his or her ‘Assigned Txn’ list. In case of auto assign, the transaction will get assigned to all the eligible authorizers as per the assignment criteria maintained at your branch. All these eligible supervisors will be able to view these transactions in their ‘Pending Tasks’ lists. The first authorizer to fetch the transaction from his or her task list will lock the same and then can either approve or reject it. This process is similar to the remote authorization flow described earlier. You can also view the remarks entered by the teller for that transaction.

Irrespective of the supervisor’s action (approve or reject), the transaction will be re-assigned to the maker. The following screen will be displayed to the supervisor:

You can fetch and see the response from your task list. If the supervisor has approved, you can fetch the transaction from your task list and click save icon to save the transaction for submitting it. Post this, the system will post accounting entries for the transaction and update balances. In case of rejection, the transaction will move to failed queue of the Maker.

7.2.8 Viewing errors and overrides

You can view overrides for the transaction by clicking on the ‘Override Messages’ link on the ‘Remote Authorization’ screen. You need to click on ‘OK’ to close the ‘Overrides’ window and then take appropriate action on the main screen.

7.2.8.1 Submission stage

Submission of the transaction for saving in the Host can happen in two ways:

- Single-step save – wherein the transaction is saves as ‘Auto-authorized’ in the Host.

- Two-step save – wherein the transaction is first saved as ‘Unauthorized’ in the Host and then authorized locally or remotely (as described under ‘Authorization stage’).

After the transaction is successfully saved and the tills are successfully updated, the message “Transaction completed successfully” is displayed.

7.2.9 Cash Deposit in Two Step Processing

During two step processing, the two step role needs to be defined at workflow level.

Role of Teller

The customer approaches the teller for cash deposit. The teller collects the details from the customer and maintains the details like transaction account and transaction amount, specifies the denomination details and checks the charges if anything needs to be modified or waived.The teller then saves the transaction. The accounting entries are not passed at this stage. The teller can choose to open or not open a till at this stage.

Role of a Cashier

The cashier picks the transaction from the pending queue which is saved by the teller. The customer is then called by referring to the token number available in the transaction. The cashier/vault collects the cash from the customer and checks whether the denominations matches with the entry in the system and then saves the record. The cashier’s till gets updated and accounting entries are passed.

The cashier role is performed by CHDP.

Accounting Entry:

Dr/Cr and Account |

Amount |

Dr Cash GL |

Transaction Amount |

Cr Customer A/c |

Transaction amount less the Charges |

Cr Income GL |

Charges |

Dr Income GL |

Tax payable on Charge collected |

Cr Tax payable GL |

Tax payable on Charge collected |

NSF is not applicable when the Charge debit account maintained under the charges tab is a GL.

Note

- You cannot delete the records in 1401 if the first step is completed by the teller.

- Once the teller completes the transaction, it will be in the completed queue and the same record will be available in the pending queue of the cashier. The transaction can be reversed either by teller or cashier.

- If the teller picks the transaction for reversal from the completed queue, then the number of pending records for the cashier will be reduced by one and the number of records in reversal queue gets added up by one for the teller.

- If the cashier picks the transaction for reversal, then the completed queue of the teller gets reduced by one and adds the reversal queue of cashier by one.

- If a token is in use, i.e. one step has been completed by the teller and awaiting for cashier to process, then if same token number is specified, the system displays an error message.

- You cannot amend a transaction after authorization for cash deposit with two step processing. Cash Deposit in two step processing does accounting in second step only. So validations during accounting cannot be achieved.

7.3 Withdraw Cash

This section contains the following topics:

- Section 7.3.1, "Withdrawing Cash"

- Section 7.3.2, "Specifying Denomination Details"

- Section 7.3.3, "Specifying charge details"

- Section 7.3.4, "Specifying MIS details"

- Section 7.3.5, "Specifying UDF Details"

- Section 7.3.6, "Specifying Project Details"

- Section 7.3.7, "Cash Withdrawal in Two Step Processing"

7.3.1 Withdrawing Cash

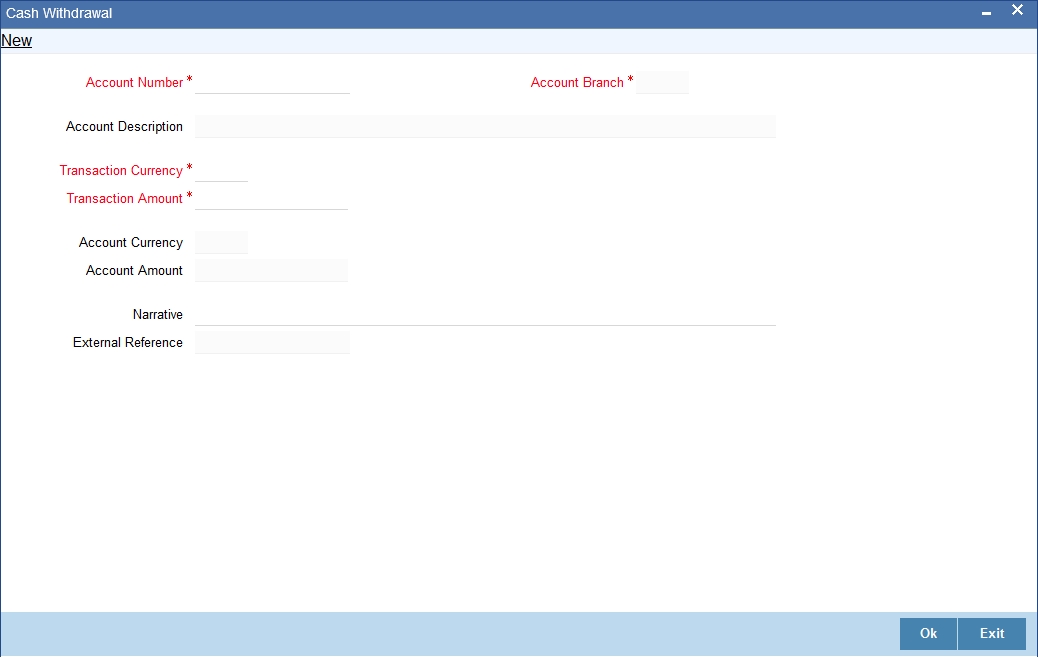

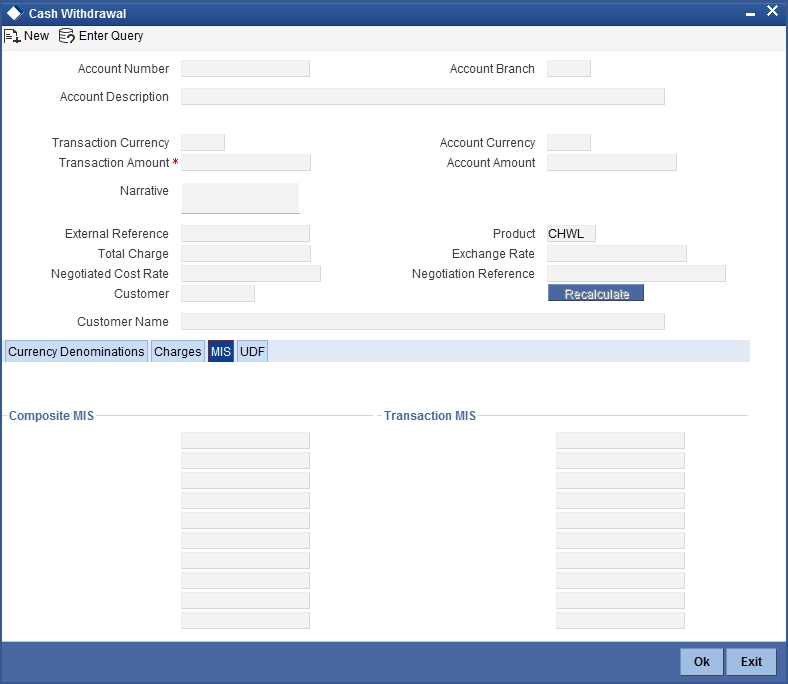

You can capture a cash withdrawal transaction through the ‘Cash Withdrawal’ screen. You can invoke this screen by typing ‘1001’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Note

When you press the ‘Tab’ key, you can move from one field to another based on the order of field alignment. The cash withdrawal can be done in single step or two step process. The single step process is the single screen approach. For the single step cash withdrawal, the teller disburses the cash and accounting entries are passed in a single step. In two step process, the teller just collects the information and posts the transaction. In the first step accounting entries will be passed where the customer accounts will get debited. The cashier accepts the cash and then the accounting entries are passed in the second step. In two step process accounting entries will be passed in steps 1 and 2.

Here the teller can capture the following details:

Account Number

Specify the customer account number into which the cash needs to be deposited. Upon keying the account number, the system will default the Account Number, Account Branch and Account Currency for the corresponding account.

Note

In case of multiple accounts with the same account number, the system will pop-up a list of account numbers with account branch to select.

Account Branch

The system displays the logged-in branch. If you specify another account number and tab out of the Account Number field, the system displays the corresponding account branch.

Account Description

The system displays the description of the account number chosen.

Transaction Currency

The system displays the local currency. If you specify another account number and tab out of the Account Number field, the system displays the currency associated with the specified account.

Account Currency

The system displays the currency of the account.

Transaction Amount

Specify the amount that should be debited from account in terms of transaction currency. If the account to be debited is a Trust account, this amount should be within the cash withdrawal limit defined for the debited account class.

Pickup

Click on pickup to default the data into the Denominations, Charges, MIS, UDF and Project details. It is mandatory to click on ‘Pickup’ button before save.

Account Amount

The system displays the transaction amount in terms of account currency.

Total Charge

The system computes the charges applicable for the transaction and displays it here.

Net Account Amount

The system displays the net amount to be debited from the account (in the account currency) after calculating the applicable charges. This amount depends on the charge method – whether inclusive or exclusive.

Related Customer

The system defaults the related customer.

Customer Name

The system defaults the customer name.

Exchange Rate

The system displays the exchange rate used to convert the transaction currency into account currency. If the transaction currency is the same as the account currency, the system will display the exchange rate as ‘1’.

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction.

Negotiation Reference Number

Specify the unique reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also.

Note

Oracle FLEXCUBE books then online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

Token No

Specify the token number.

Narrative

The system displays ‘Cash Withdrawal’. You can modify it, if required.

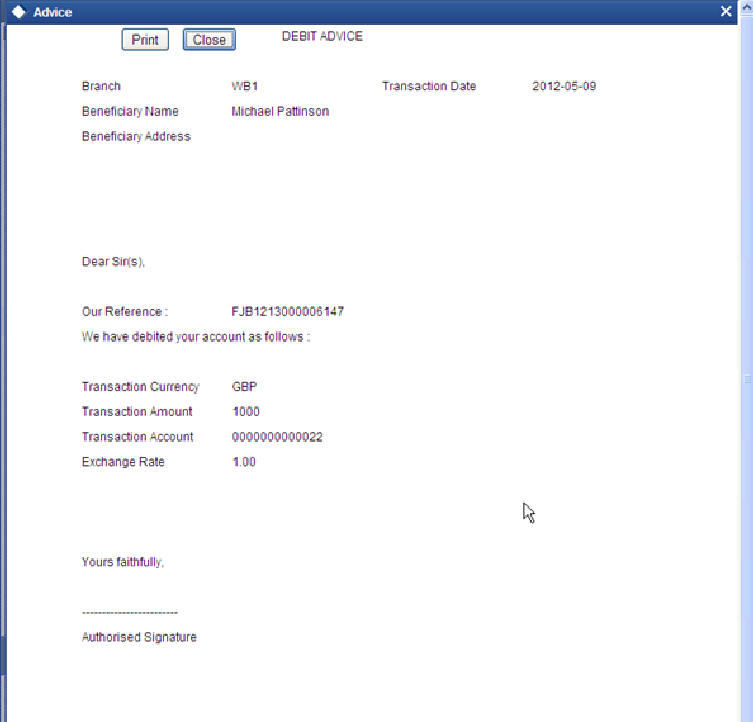

Click OK button or save after providing all details to generate advice with token number.

External Reference Number

The system generates a unique number based on the branch specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Account Amount

You can generate a transaction slip by clicking on ‘Generate’ button after providing account number, transaction amount and clicking on pickup button. It is produced to the customer to sign and confirm the transaction.

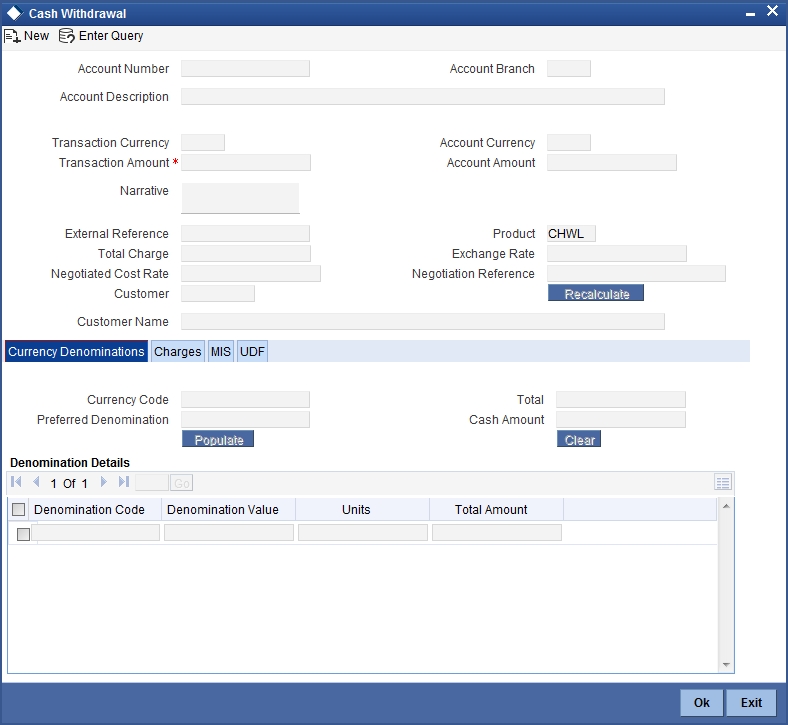

7.3.2 Specifying Denomination Details

In this block, you can capture details of the currency denominations involved in the transaction.

Preferred Denomination

Specify the denomination code that should be preferred. The system processes the transactions with the preferred denominations. If the transaction amount is less than the preferred denomination, the system will use the low valued denomination than the preferred denomination based on the defaulting rule.

If the preferred denomination is not captured, the system will consider the highest available denomination as the preferred denomination.

If the denomination is not available, the system will display ‘Denomination not available’ message.

Click ‘Populate’ button to display the units of currency denomination based on the defaulting rule.

Note

- According to defaulting rule, the system will calculate the total amount in terms of minimum number of currencies. It means that the system divides the total amount into the bigger denominations first. Then the remaining amount into next biggest denomination and so on.

- For the preferred denomination, the ‘Unit’ field will be disabled.

Refer the section titled ‘Specifying denomination details’ under ‘Depositing Cash’ for further details.

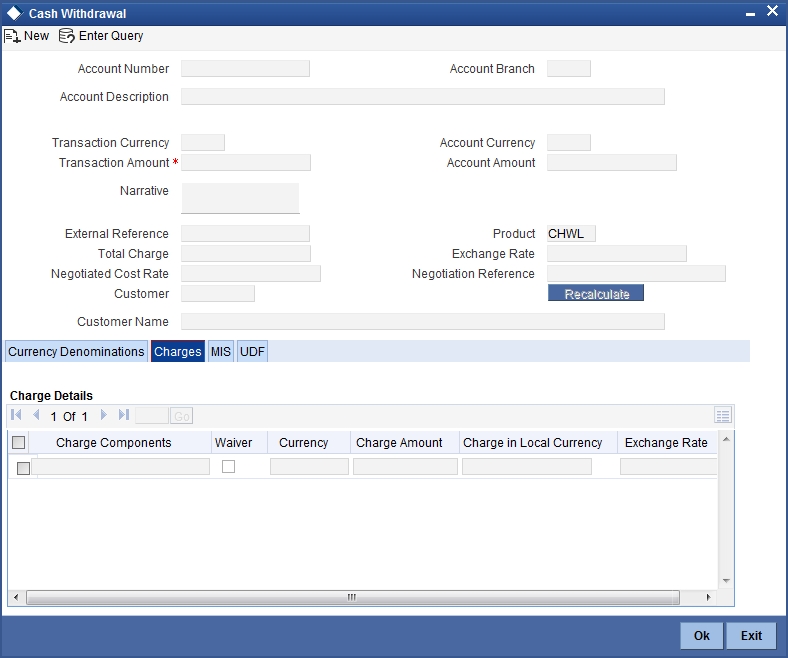

7.3.3 Specifying charge details

This block allows you to capture charge related details. You need to click on the ‘Charges’ button to invoke the following screen.

Refer the section titled ‘Specifying charge details’ under ‘Depositing Cash’ for further details.

7.3.4 Specifying MIS details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ button to invoke the following screen:

Refer the section titled ‘Specifying MIS details’ under ‘Depositing Cash’ for further details.

7.3.5 Specifying UDF Details

You can capture the UDF details under ‘UDF’ button.

Refer the section titled ‘Specifying the UDF details’ under ‘Depositing Cash’ for further details.

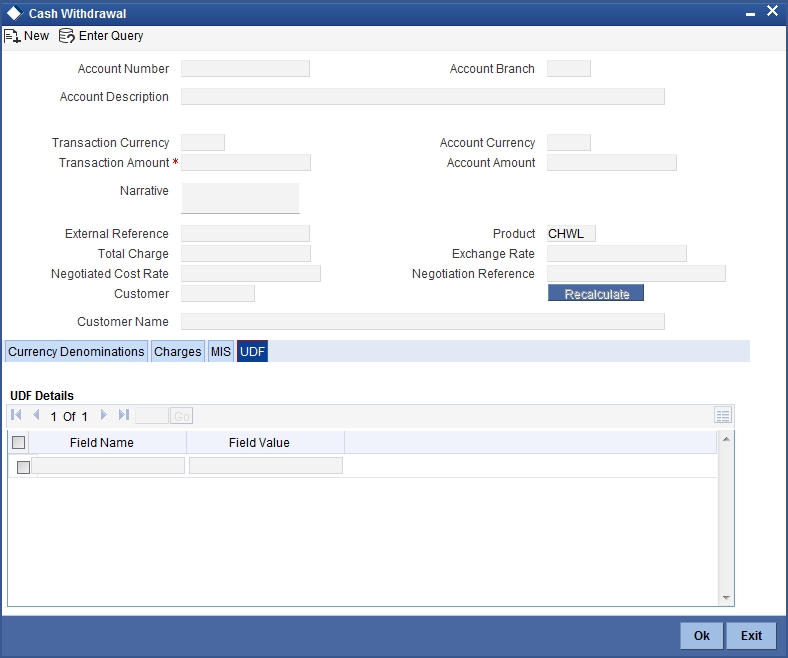

7.3.6 Specifying Project Details

You can capture project details under ‘Project Details’ button. Note that this button will be applicable only if the cash is being deposited in a Trust account.

Specify the following details:

Project Name

Specify the developer project name for which payment is being made. The adjoining option list displays all valid projects maintained in the system. You can select the appropriate one. Input to this field is mandatory.

Unit Payment

Indicate whether the transaction is a unit payment or not by choosing the appropriate value from the adjoining drop-down list. The following values are available:

- Yes

- No

Unit ID

Specify the unit ID of the project. This field will be enabled only if you have selected ‘Yes’ against ‘Unit Payment’. The adjoining option list displays all unit IDs along with the unit holder names corresponding to the project name chosen. You can select the appropriate one.

Deposit Slip Number

Specify the deposit slip number for the payment.

Click save icon button to go to the next stage. The authorization process is similar to cash deposit.

Note

- You have to click on ‘Pickup’ button after specifying account number and transaction amount. If you save the transaction without clicking on ‘Pickup’, then the system displays an error message as “Please click on pickup before save”.

- After clicking on ‘Pickup’ button, if you modify the transaction account, transaction currency, transaction amount or exchange rate then you will have to click on ‘Pickup’ again.

- You can click on the OK button after specifying the data in the denomination, charge, MIS, UDF, and project details button for the data to persist. If you close the screen or click on 'Cancel' button after specifying the data, then the data will not persist.

7.3.7 Cash Withdrawal in Two Step Processing

During two step processing, the two step role needs to be defined at workflow level.

Role of Teller

The customer approaches the teller for cash withdrawal. The teller collects the details from the customer and maintains the details like transaction account and transaction amount, and clicks on ‘Pickup’ button and generates the advice by clicking ‘Generate’ button. It is not mandatory for the teller to specify the denomination as cash is handed over to customer by the cashier. The system validates the total denomination amount with cash amount and does not update the till of the teller irrespective of till being open or closed. The accounting entries are passed at this stage. It is not mandatory for the teller to open the till at step 1.

The teller role is performed by CHWL.

Accounting Entry:

Dr/Cr and Account |

Amount |

Dr Customer A/C |

Txn amount + Charges |

Cr Misc-credit GL |

Txn amount |

Cr Intermediary GL |

Charges |

Role of Cashier

The cashier picks the transaction from the pending queue which is saved by the teller. The customer is then called by referring to the token number available in the transaction. The cashier checks whether the denomination button has got the values by confirming with the customer. If the data persist in the button, the cashier will cross check with the physical denominations in hand. If respective denomination is not available then the cashier will make required changes in the denominations and click ‘OK’ and save the transaction. If the data is not available in the denominations tab, then the cashier should update the denomination details and save the record. The cashier’s till gets updated and accounting entries are passed.

The cashier role is performed by CHW2.

Accounting Entry:

Dr/Cr and Account |

Amount |

Dr Misc-Credit GL |

Txn amount |

Cr Cash GL |

Txn amount |

Dr Intermediary GL |

Charges |

Cr Income GL |

Charges |

Dr Income GL |

Tax payable on Charge |

Cr Tax payable GL |

Tax payable on Charge |

NSF is not applicable when the Charge debit account maintained under the charges tab is a GL.

Note

- You cannot delete the records in 1001 if the first step is completed by the teller.

- Once the teller completes the transaction, it will be in the completed queue and the same record will be available in the pending queue of the cashier. The transaction can be reversed either by teller or cashier.

- If the teller picks the transaction for reversal from the completed queue, then the number of pending records for the cashier will be reduced by one and the number of records in reversal queue gets added up by one for the teller.

- If the cashier picks the transaction for reversal, then the completed queue of the teller gets reduced by one and adds the reversal queue of cashier by one.

- If a token is in use, i.e. one step has been completed by the teller and awaiting for cashier to process, then if same token number is specified, the system displays an error message

By default the cash deposit and cash withdrawal will follow the single screen approach.

Refer the section titled ‘Specifying denomination details’ under ‘Depositing Cash’ for further details.

Refer the corresponding section under ‘Depositing Cash’ for further details.

7.4 Domestic Cash Transfer

This section contains the following topics:

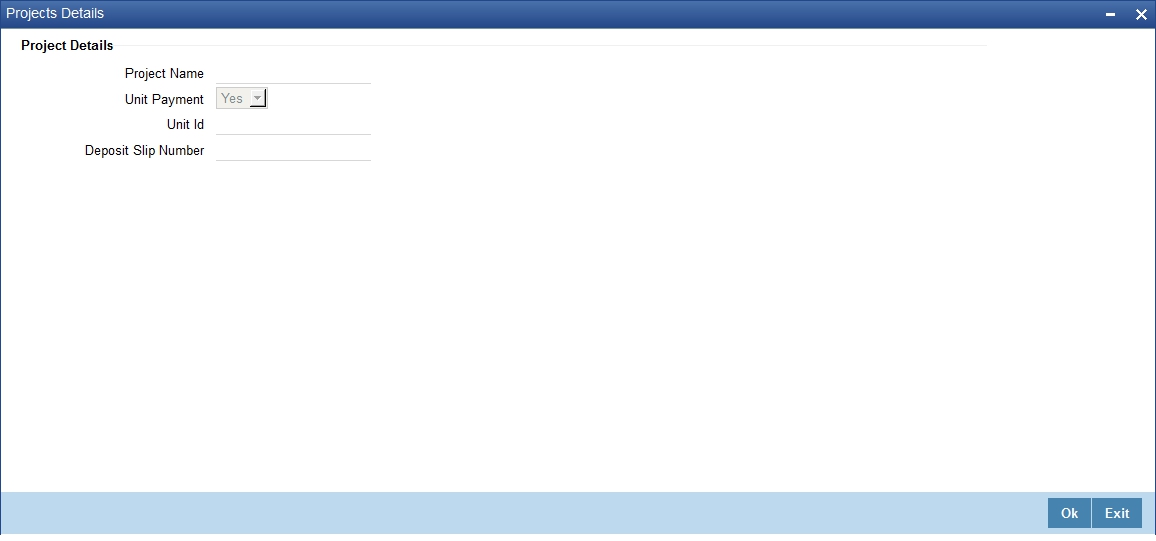

7.4.1 Transferring Cash Domestically

You can capture a domestic cash transfer transaction through the ‘Domestic Cash Transfer’ screen. You can invoke this screen by typing ‘1405’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

7.4.2 Specifying PC Details

You can capture the PC details under ‘PC Details’ tab.

Counterparty Name

Specify the name of the counterparty.

Counterparty Address 1

Specify the address 1 of the counterparty.

Counterparty Address 2

Specify the address 2 of the counterparty.

Counterparty Address 3

Specify the address 3 of the counterparty.

Counterparty Bank Code

Specify the counterparty bank code.

Counterparty Account Number

Specify the external counter party account number.

Counterparty Account Type

Select the counterparty account type from the drop-down list. Following are the options available in the drop-down list: 10 - Savings Bank

- 11 - Current Account

- 12 - Overdraft

- 13 - Cash Credit

- 14 - Loan Account

- 40 - NRE

- 50 - Cash

- 51 - Credit Card

Sender To Receiver Information 1

Specify the sender to receiver information 1.

Sender To Receiver Information 2

Specify the sender to receiver information 2.

Sender To Receiver Information 3

Specify the sender to receiver information 3.

Clearing Network

Specify the clearing network details.

Customer Name

Specify the customer name.

If transaction account has not been entered then you need to enter the walk-in customer name otherwise the system will default the customer name of the transaction account.

Customer Address 1

Specify the customer address 1.

If transaction account has not been entered then you need to enter the address 1 of the walk-in customer otherwise the system will default the customer address.

Customer Address 2

Specify the customer address 2.

If transaction account has not been entered then you need to enter the address 2 of the walk-in customer otherwise the system will default the customer address.

Customer Address 3

Specify the customer address 3.

If transaction account has not been entered then you need to enter the address 3 of the walk-in customer otherwise the system will default the customer address.

Communication Mode

Select the mode of communication to the customer to intimate about the beneficiary account credit. Following are the options available:

- Mobile

Mobile Number/Email ID

Specify the mobile number or the e-mail ID based on the communication mode selected.

If transaction account has been entered then system will default the corresponding customer’s mobile number or e-mail ID.

In the single stage flow, if there is an transaction level override or error during approval then the transaction will be moved to the pending queue. Without save action being initiated, the transaction will not be in pending queue.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save. On pick up, the fields that are currently enabled in the enrich stage will alone be retained as enabled fields.

On authorization of this transaction, the system will automatically create the outgoing payment transaction in PC module for the amount of (Transaction amount – Total Charges). After this process, any operations on branch transaction or outgoing payment transaction will be handled independently.

Refer the section titled ‘Depositing Cash’ for further details.

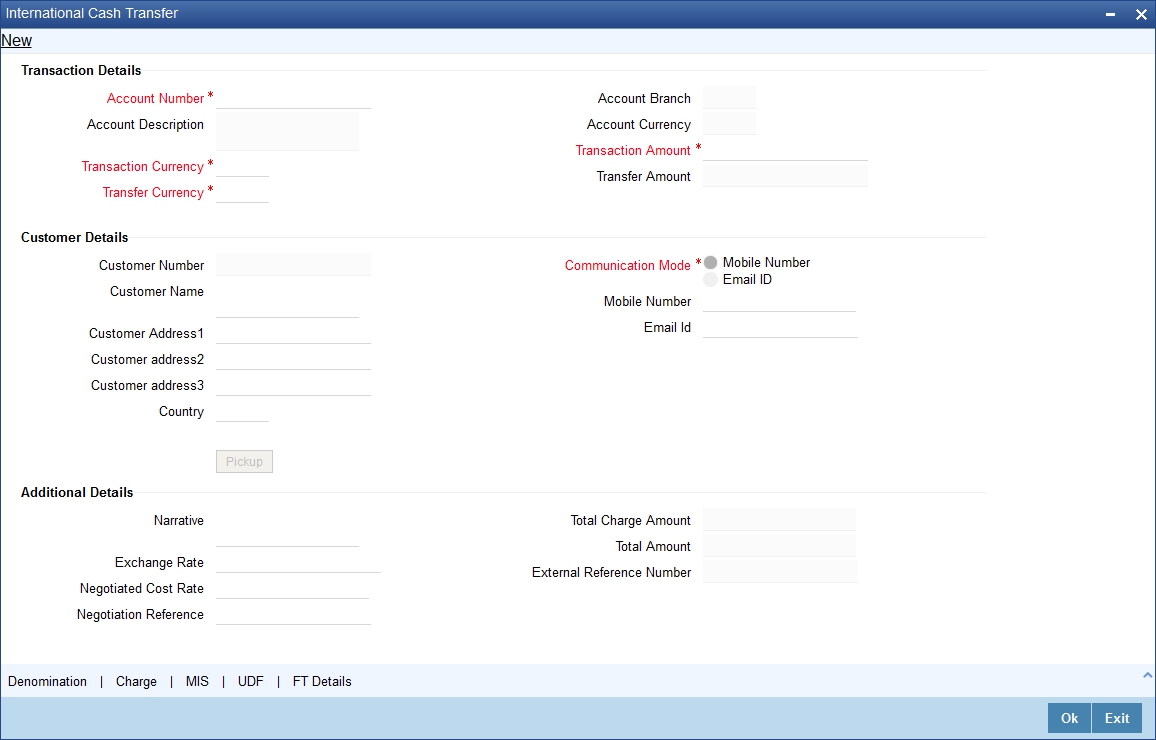

7.5 International Cash Transfer

This section contains the following topics:

- Section 7.5.1, "Transferring Cash Internationally"

- Section 7.5.2, "Denomination Button"

- Section 7.5.3, "Charge Button"

- Section 7.5.4, "MIS Button"

- Section 7.5.5, "UDF Button"

- Section 7.5.6, "FT Details Button"

7.5.1 Transferring Cash Internationally

Oracle FLEXCUBE facilitates international funds transfer by cash. A Walk in customer or an account holder of the Bank can perform the transfer by remitting cash in foreign currency.You can process International Cash Transfer for an account holder or for a walk-in customer, if the Product Code is defaulted as ‘CXTR’ and the FT Transaction check box is selected in the RT Product Preference (DEDRTPRM) screen.

You can process international cash transfer through the ‘International Cash Transfer’ screen. You can invoke this screen by typing ‘1406’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

Transaction Details

Account Number

Specify the account number for the transaction. Alternatively, you can select the account from the option list. The list displays all valid accounts maintained in the system. In case of walk-in customer, this field is left blank.

Account Description

The system displays the description of the account number.

Account Branch

The system displays the branch of the main account of the transaction.

Account Currency

The system displays the currency of the account.

Transaction Currency

Specify the currency of the transaction. Alternatively, you can select the transaction currency from the option list. The list displays all the currencies maintained in the system.

Transfer Currency

Specify the transfer currency in which the amount has to be transferred. Alternatively, you can select the transfer currency from the option list. The list displays all the currencies maintained in the system.

If the customer wants the deposited FCY cash to be transferred in another currency to the Beneficiary account, you need to specify the transfer currency for FT transaction in the ‘Transfer currency’ field. The system converts the transaction amount into the transfer currency and credits it to the beneficiary account using the specified exchange rate.

Transaction Amount

Specify the transaction amount.

Transfer Amount

The system displays the transfer amount based on the transfer currency selected and the derived exchange rate.

Customer Details

Customer Number

The system displays the customer Id. If the customer number is a walk-in customer, the walk-in customer number maintained at the branch parameter level is defaulted.

Customer Name

The system displays the customer name. If the customer number is a walk-in customer, specify the customer name.

Note

If the customer is a Walk-in Customer, you can specify the customer name in the Customer Name field.

Customer Address1

Specify the first line of the customer address.

Customer Address2

Specify the second line of the customer address.

Customer Address3

Specify the third line of the customer address.

Country

Specify the country code of the ordering customer. Alternatively, you can select the country code from the option list. The list displays all the country codes maintained in the system.

Communication Mode

Select the mode of communication for the funds transfer. The options are as follows:

- Mobile Number

- Email ID

Mobile Number

Specify the mobile number of the customer. If you select the mode of communication as ‘Mobile Number’, it is mandatory to specify the mobile number of the customer.

Email ID

Specify the email Id of the customer. If you select the mode of communication as ‘Email ID’, it is mandatory to specify the email Id of the customer.

Additional Details

Narrative

Specify any remarks pertaining to the transaction.

Exchange Rate

The system displays the exchange rate, if the transaction currency and transfer currency are different. This exchange rate used to convert the transaction currency into transfer currency and derive the transfer amount.

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You should specify the rate only when the currencies involved in the transaction are different. Else, it will be a normal transaction.

Negotiated Reference

Specify the unique reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then it is mandatory to specify the negotiated reference number.

Note

Oracle FLEXCUBE books an online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

Total Charge Amount

The system displays the total charge amount of the transaction in the transaction currency.

Total Amount

The system displays the total amount of the transaction. In case of walk-in customer, the total amount would be the total transaction amount with the applicable charges.

If the customer is a walk-in customer, the system displays the charges as the total amount. If the customer is an Account Holder, the system displays the transaction amount as the total amount.

External Reference Number

The system displays the external reference number maintained in the system.

Click ‘Pickup’ button to populate the data such as total Amount, total charge amount in transaction currency, customer number, customer name, and address details. In case of walk-in customer, you need to enter the customer name, address, country code and communication mode. It is mandatory to click ‘Pickup’ button to populate the data in the Denomination, Charge, MIS, UDF and FT Details screens.

After clicking ‘Pickup’ button, if you modify the Transaction Amount, Transaction Amount Currency or Account then it is mandatory to click ‘Pickup’ button before saving the transaction.

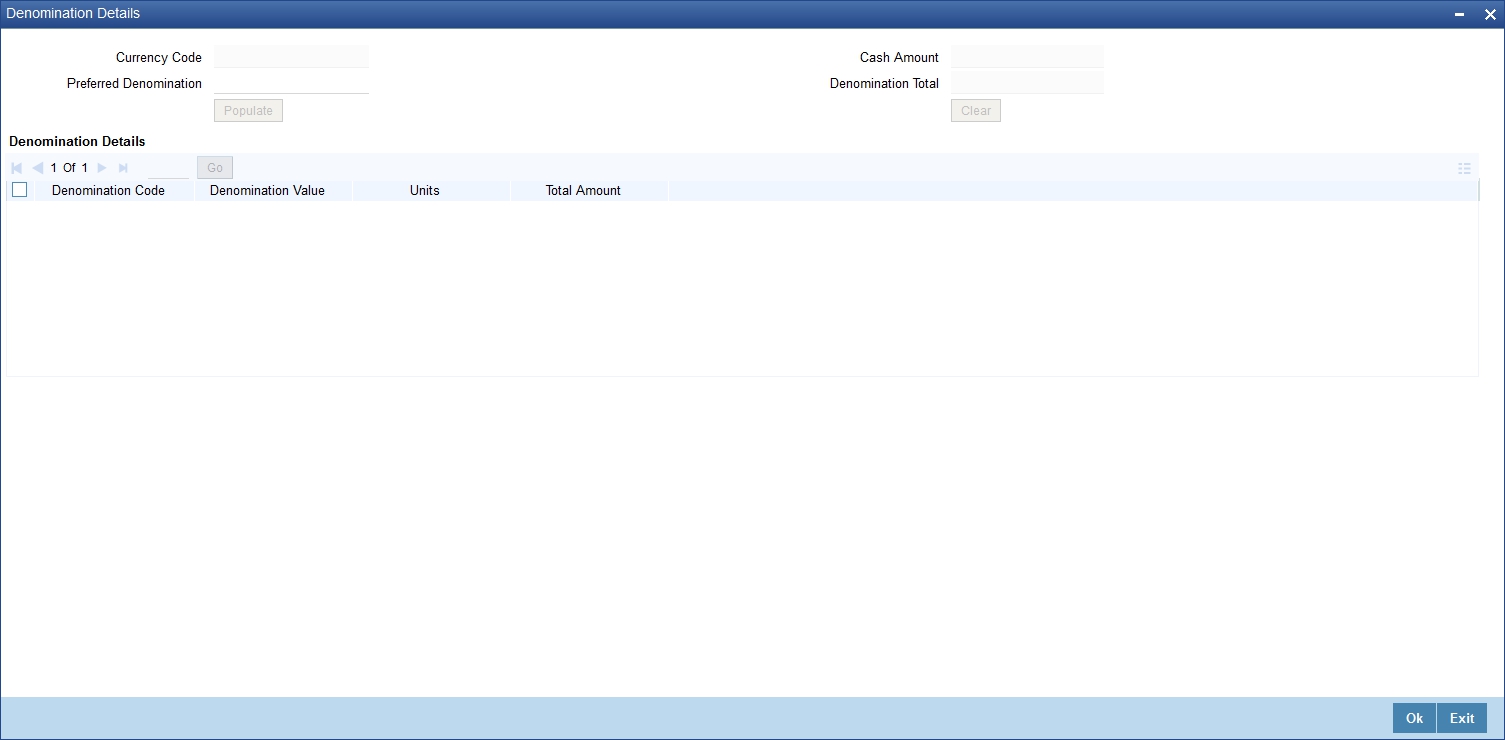

7.5.2 Denomination Button

You can specify the denomination details for the international cash transfer in the ‘Denomination Details’ screen. Click the ‘Denomination’ button to invoke the screen.

For more information on denomination details, refer to the section ‘Specifying Denomination Details’ in chapter ‘Depositing Cash’ in this User Manual.

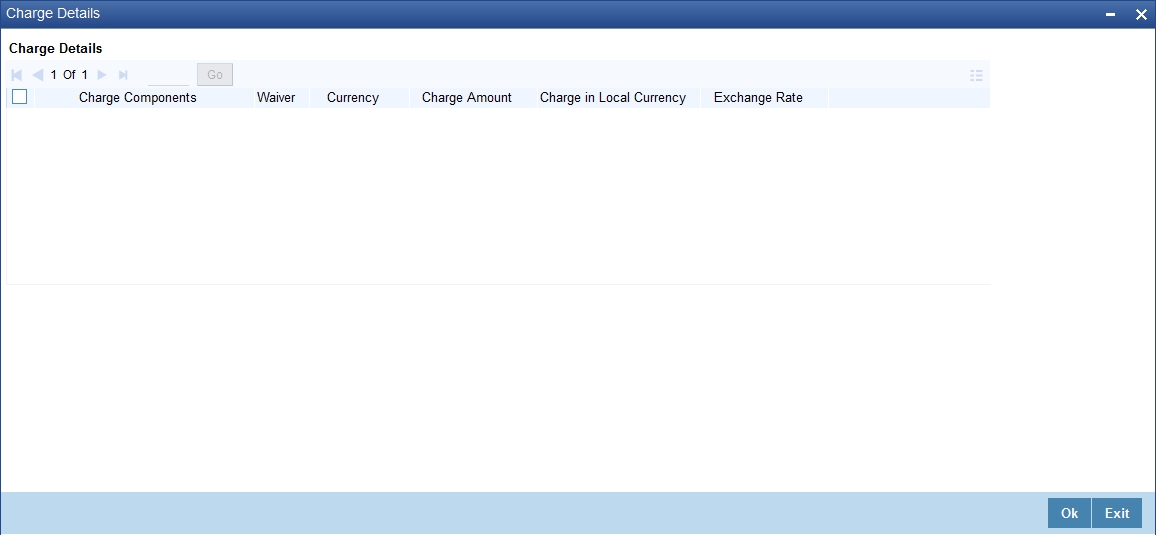

7.5.3 Charge Button

You can capture charge related details in ‘Charge Details’ screen. Click the ‘Charge’ button to invoke the screen.

For more information on charge details, refer to the section ‘Specifying Charge Details’ in chapter ‘Depositing Cash’ in this User Manual.

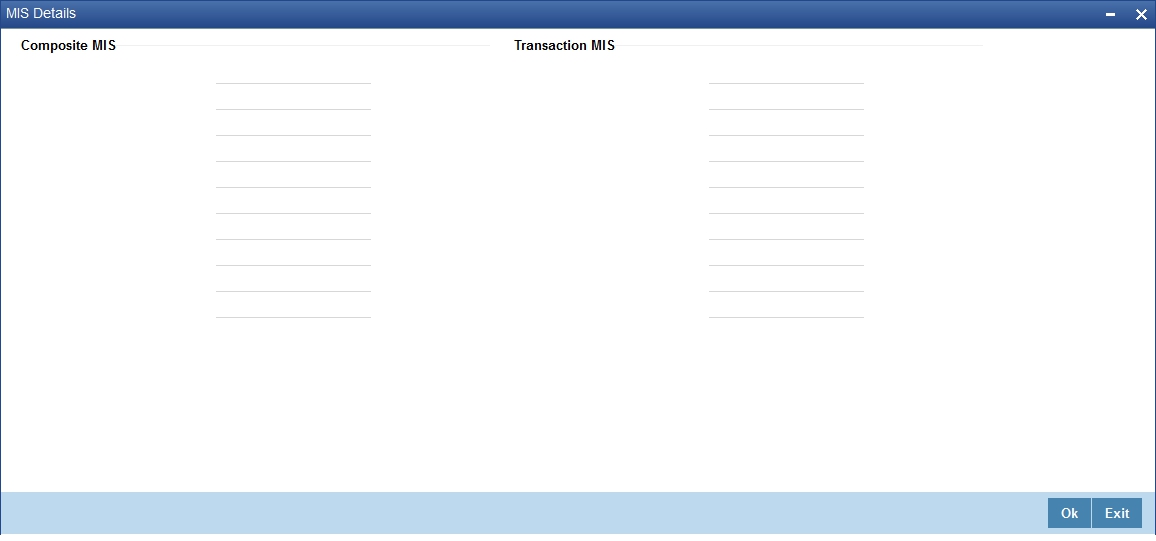

7.5.4 MIS Button

You can capture MIS details in the ‘MIS Details’ screen. Click the ‘MIS’ button to invoke the screen.

For more information on MIS details, refer to the section ‘Specifying the MIS details’ in chapter ‘Depositing Cash’ in this User Manual.

7.5.5 UDF Button

You can capture UDF details in the ‘UDF details’ screen. Click the ‘UDF’ button to invoke the screen.

For more information on UDF details, refer to the section ‘Specifying the UDF details’ in chapter ‘Depositing Cash’ in this User Manual.

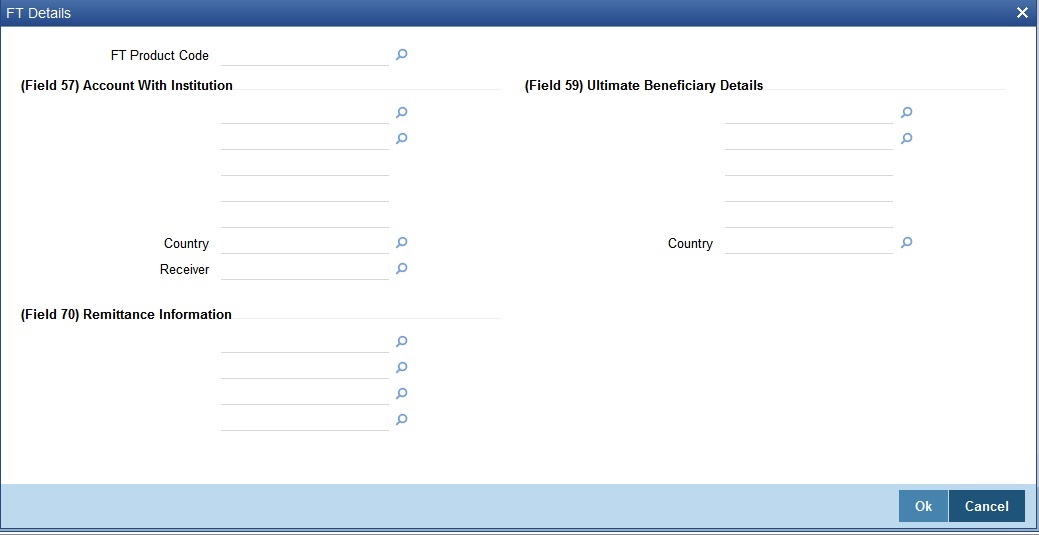

7.5.6 FT Details Button

You can capture Funds Transfer details in the ‘FT Details’ screen. Click the ‘FT Details’ button to invoke the screen.

You can specify the following details here:

FT Product

Specify the FT product code. The system allows only outgoing FT product codes to be specified. Alternatively, you can select the product code from the option list. The list displays all product codes maintained in the system.

(Field 57) Account with Institution

Specify the account with institution details. Alternatively, you can select the account from the option list. The list displays all accounts with institution details maintained in the system.

Country

Specify the country code. Alternatively, you can select the country code from the option list. The list displays all the country codes maintained in the system.

Receiver

Specify the receiver BIC code. Alternatively, you can select the code from the option list. The list displays all the receiver BIC codes maintained in the system.

(Field 70) Remittance Information

Specify the remittance information. Alternatively, you can select the remittance details from the option list. The list displays the remittance details maintained in the system.

(Field 59) Ultimate Beneficiary

Specify the ultimate beneficiary details. Alternatively, you can select the beneficiary from the option list. The list displays all the beneficiary maintained in the system.

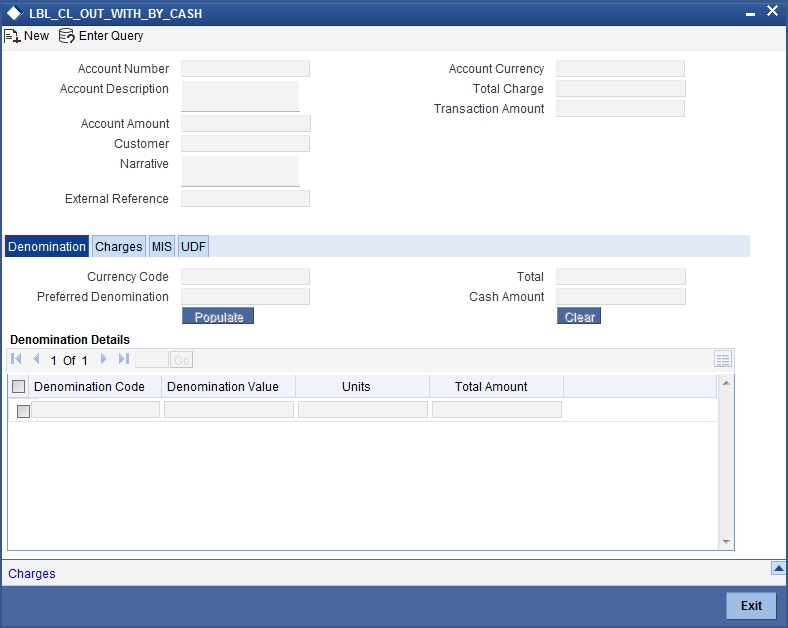

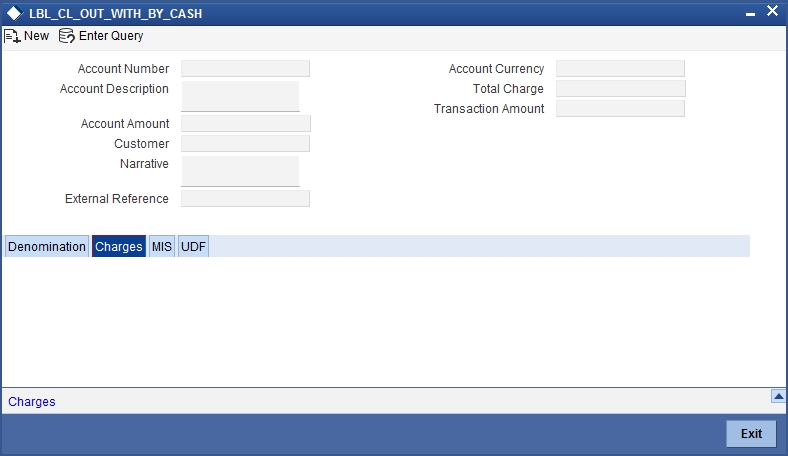

7.6 Close out Withdrawal by Cash

This section contains the following topics:

- Section 7.6.1, "Closing out Withdrawal by Cash"

- Section 7.6.2, "Specifying Charge Details"

- Section 7.6.3, "Specifying the MIS Details"

- Section 7.6.4, "Specifying the UDF details"

7.6.1 Closing out Withdrawal by Cash

You can capture a close out withdrawal transaction through the ‘Close Out Withdrawal by Cash’ screen. You can invoke this screen by typing ‘1301’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can capture the following details:

Account Number

Specify the account number that needs to be closed. The adjoining option list displays all the accounts maintained in the Host. You can select the appropriate account number.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

The current logged-in branch code is displayed here. However, you can modify it. Specify the branch where the customer account which needs to be closed resides.

Account Description

The system displays a brief description on the selected account.

Account Currency

The system displays the account currency here.

Account Amount

The system displays the available amount in the account.

Customer ID

The system displays the customer ID based on the account specified.

Narrative

The system defaults ‘Close Out Withdrawal by Cash’ here. However you can modify this.

External Reference

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

In the single stage flow, if there is an transaction level override or error during approval then the transaction will be moved to the pending queue. Without save action being initiated, the transaction will not be in pending queue.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save. On pick up, the fields that are currently enabled in the enrich stage will alone be retained as enabled fields.

Note

The Close out Withdrawal of Account transactions are processed without any change till the ‘Branch Available’ status is marked as ‘Yes’. If the branch available status is ‘No’ or branch date is ahead of host date, the transactions are not allowed.

Clicking ‘Pickup’ button, the system defaults the following details:

Account Title

The system displays a brief title for the chosen account.

Customer ID

The system displays the customer ID based on the account specified.

Account Currency

The system displays the account currency here.

Account Amount

The system displays the net cash to be disbursed to the customer after deducting the applicable charges.

Note

A transaction slip is generated at the time of input stage completion and is produced to the customer to sign and confirm the transaction.

Enrichment stage - 2

The system displays the following screen on clicking the ‘Proceed’ button.

In addition to the data defaulted from the previous stage, you can capture the following information here:

7.6.1.1 Specifying Denomination Details

This block, you can capture details of the currency denominations involved in the transaction.

Refer the section titled ‘Specifying denomination details’ under ‘Depositing Cash’ for further details.

7.6.2 Specifying Charge Details

This block allows you to capture charge related details. Click on the ‘Charges’ tab and invoke the following screen.

Refer the section titled ‘Specifying charge details’ under ‘Depositing Cash’ for further details.

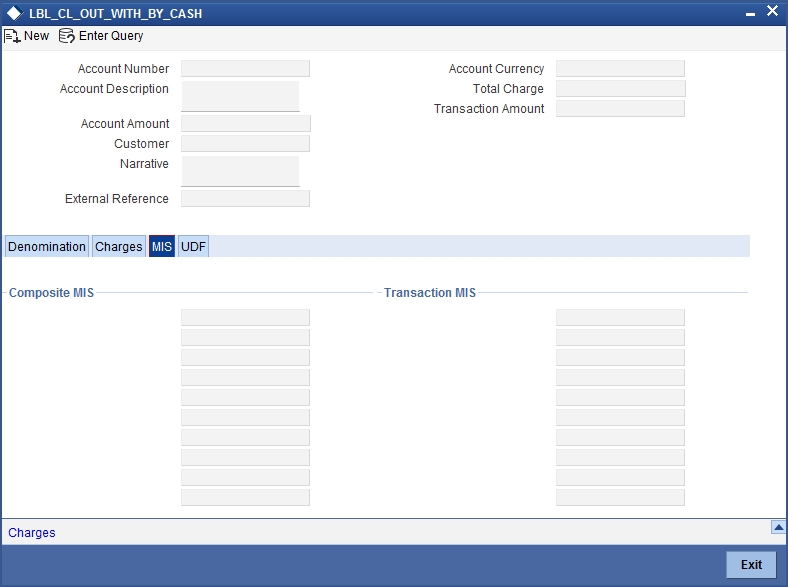

7.6.3 Specifying the MIS Details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the following screen:

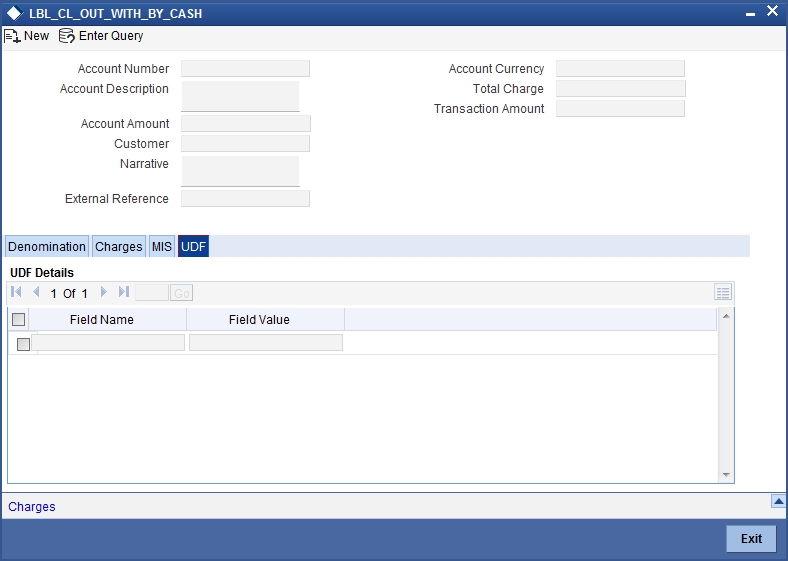

7.6.4 Specifying the UDF details

You can capture these details in the ‘UDF’ tab of the screen.

Specify the following details.

Field Description

The system will display all the User-Defined Fields (UDF) maintained for the product.

Field Value

Specify the value for the required UDFs.

Click save icon to save the transaction. The authorization process is similar to cash deposit.

Refer the corresponding section under ‘Depositing Cash’ for further details.

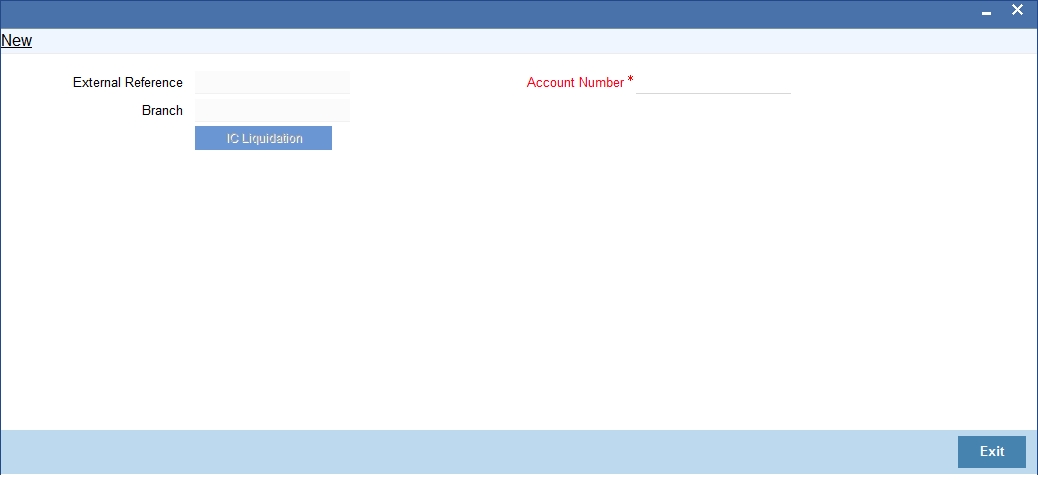

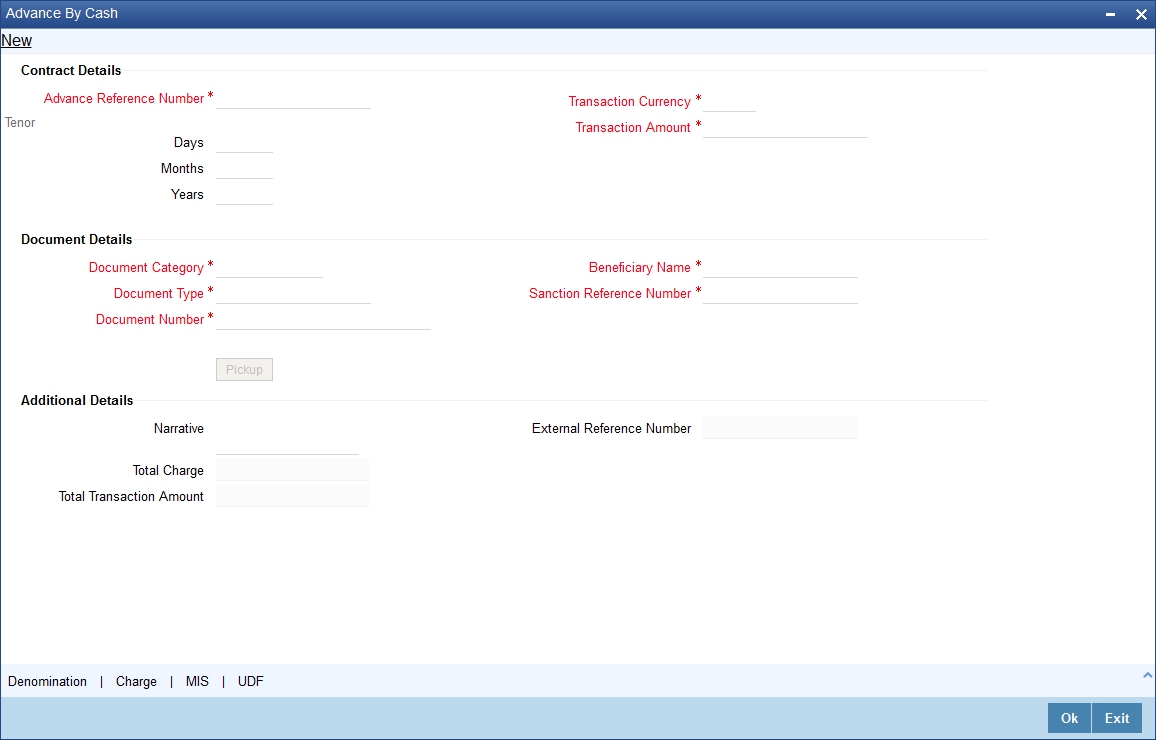

7.7 Advance By Cash

This section contains the following topics:

- Section 7.7.1, "Disbursing Cash Advance"

- Section 7.7.2, "Specifying Denomination Details"

- Section 7.7.3, "Specifying Charge details"

- Section 7.7.4, "Specifying the MIS details"

- Section 7.7.5, "Specifying the UDF details"

7.7.1 Disbursing Cash Advance

You can release cash advances through the ‘Advance By Cash’ screen. When a credit card customer submits a request for advance by cash, you can disburse the cash advances that are maintained in the external system where cash withdrawal from GL is allowed. You can also perform reversal of transaction in this screen.You can invoke this screen by typing ‘1461’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Product type in the Retail Product Parameter Definition screen ‘DEDRTPRM’ should be ‘EC’-External Cash Advance. ARC setup should be done to track denominations and the credit account should be CASH GL. in IFDATMMN an ARC maintenance is created, where the charge type will be percentage and basis will be transaction amount

Contract Details

Advance Reference Number

Specify the advance reference number. For example if the Nature of Advance is Loan the loan account number should be specified and if the Nature of Advance is credit card then the Credit Card number should be specified.

Transaction currency

Specify the currency in which cash advance transaction is initiated. Alternatively you can select the transaction currency code from the option list. The list displays all valid transaction currency maintained in the system.

Transaction Amount

Specify the transaction amount that needs to be sanctioned.

Tenor

You can specify the tenor of the advance in Days/Months/Years

Days

Specify the tenor of advance in days. The range of value that you can specify is “0-30”. If you specify a value beyond permissible range, the system will display an error message.

If you specify the tenor value of date in decimal, then the system displays an error message “Invalid Tenor Value”.

Months

Specify the tenor of advance in months. The range of value that you can specify is “0-11”. If you specify a value beyond permissible range, the system will display an error message

If you specify the tenor value of month in decimal, then the system displays an error message “Invalid Tenor Value”.

Years

Specify the tenor of advance in years.

If you specify the tenor value of year in decimal, then the system displays an error message “Invalid Tenor Value”.

Document Details

Document Category

Specify the category of the document that is uploaded. Alternatively you can select the category of the document from the option list. The list displays all valid document categories maintained in the system.

Document Type

Specify the type of document submitted by the customer. Alternatively you can select the type of document from the option list. The list displays all valid document types maintained for a document category.

Document Number

Specify the document reference number submitted by the customer.

Beneficiary Name

Specify the beneficiary name.

Sanction Reference Number

Specify the approval number obtained from the third party.

When a transaction is reversed and initiated again with the same Sanction Reference Number and application number combination, then the system displays an configurable override message “Sanction Reference Number should be unique”.

Additional Details

Narrative

Specify the remarks about the transaction.

Total Charge

Specify the total charge applicable.

Total Transaction Amount

The system displays the total transaction amount inclusive of all applicable charges.

External Reference Number

The system displays a unique number generated based on the branch specific sequence number generation logic. The Host system identifies a branch transaction with the External reference number.

The following transactions will be performed in this screen:

- Cash Advance (If netting is not present)

- Debit Offset GL

- Credit cash GL

- Charge portion

- Debit GL

- Credit. income GL

You can capture the following details in this screen:

7.7.2 Specifying Denomination Details

You can capture denomination related details in this screen. Click ‘Denomination’ button to invoke this screen.

For more information on denomination details screen, refer to the section ‘Specifying denomination details’ in the chapter ‘Depositing Cash’ in this User Manual.

7.7.3 Specifying Charge details

You can capture charge related details in this screen. Click ‘Charge’ button to invoke this screen.

For more information on charge details screen, refer to the section ‘Specifying charge details’ in the chapter ‘Depositing Cash’ in this User Manual.

7.7.4 Specifying the MIS details

You can capture details pertaining to MIS. Click on the ‘MIS’ button to invoke the screen.

For more information on MIS details screen, refer to the section ‘Specifying the MIS details’ in the chapter ‘Depositing Cash’ in this User Manual.

7.7.5 Specifying the UDF details

You can capture the UDF details in the ‘UDF details’ screen. Click ‘UDF’ button to invoke this screen.

For more information on UDF screen, refer to the section ‘Specifying the UDF details’ in the chapter ‘Depositing Cash’ in this User Manual.

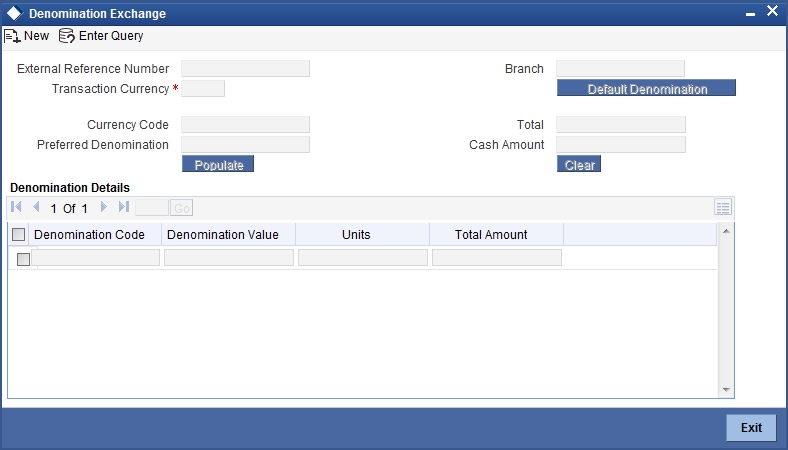

7.8 Exchanging Denominations

A customer may approach your bank to exchange currency denomination. That person may or may not be an actual bank customer (with a valid CIF or customer account). He or she may give you two notes of USD 50 each and ask for 10 notes of USD 10 each. This transaction involves only denomination exchange from your till. The total value in the till will remain the same. Hence there won’t be any accounting entries for this exchange. However, the denomination count in the till will change and hence it needs to be updated. You can capture such a transaction through the ‘Denomination Exchange’ screen. You can invoke this screen by typing ‘DENM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can capture the following details:

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Branch Code

The system displays the current logged-in branch code.

Transaction Currency

Specify the currency in which your customer wishes to exchange denominations. The adjoining option list displays all the currency codes maintained in the system. Choose the appropriate one.

7.8.1 Specifying Denomination Details

This block allows you to capture exact details of the denominations being exchanged.

Currency Code

Specify the currency in which the transaction is being performed. You can select the appropriate code from the adjoining option list.

Denomination Code

Specify the denomination of the currency used in the transaction. For every currency, the various denominations are assigned separate denomination codes. These codes are displayed in the adjoining option list. Choose the appropriate one.

Value

The system computes the face value of the denomination and displays it. For instance if the denomination code represents a USD 100, the value will be displayed as ‘100’.

Units

Indicate the number of units of the specified denomination.

By default, a positive value is considered to be an inflow unit. To reverse this default behaviour and to enter the units for denominations going out, you can specify a negative value. The summation of the total amount should be zero.

If the total value is not zero, the system will display an error message.

Total Amount

The system computes the denomination value by multiplying the denomination value with the number of units. For instance, if the denomination code represents a USD 100 and the number of units is 10, the denomination amount will be ‘1000’.

Click save icon to save the transaction. The authorization process is similar to cash deposit.

Refer the corresponding section under ‘Depositing Cash’ for further details.

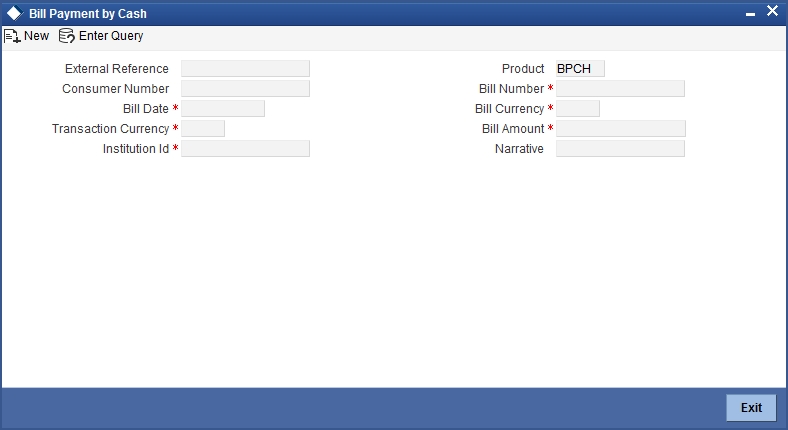

7.9 Pay Bill by Cash

This section contains the following topics:

- Section 7.9.1, "Paying a Bill by Cash"

- Section 7.9.2, "Specifying denomination details"

- Section 7.9.3, "Specifying Charge Details"

7.9.1 Paying a Bill by Cash

This module allows you to undertake cash transactions for payments of all the utility bills. To enter into such transactions, you need to invoke the ‘Bill Payment by Cash’ screen. You can invoke this screen by typing ‘1025’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can capture the following details:

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here.

Product Code

The system displays the code of the retail teller product maintained in the system that will be used for processing the transaction.

Consumer Number

Specify the consumer number for the transaction.

Bill Number

Specify the bill number here.

Bill Date

Specify the date on which the bill has been issued. The adjoining button when clicked invokes a calendar in which you need to double-click on the appropriate date. The chosen date will then be seen in the ‘YYYYMMDD’ format.

Bill Currency

Specify the currency in which the bill should be paid. You can select the appropriate code from the adjoining option list that displays all the currency codes maintained in the system.

Transaction Currency

Specify the currency in which the payment is being made by your customer. You can select the appropriate code from the adjoining option list that displays all the currency codes maintained in the system.

Institution Id

Specify the unique ID corresponding to the institution towards which the bill payment is being made. You can select the appropriate code from the adjoining option list that displays all the institution codes maintained in the system.

Bill Amount

Specify the amount that should be paid towards the bill.

Narrative

You may enter remarks about the transaction here. This is a free format text field.

In the single stage flow, if there is an transaction level override or error during approval then the transaction will be moved to the pending queue. Without save action being initiated, the transaction will not be in pending queue.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save. On pick up, the fields that are currently enabled in the enrich stage will alone be retained as enabled fields.

Clicking ‘Pickup’ button, the system defaults the following details:

Exchange Rate

The system displays the exchange rate used to convert the bill amount in the bill currency to transaction currency. If the transaction currency is the same as the bill currency, the system will display the exchange rate as ‘1’.

Charges

The system computes the charges applicable for the transaction and displays it here.

Total Amount

The system displays the total amount inclusive of the bill amount and the charges.

Note

A transaction slip is generated at the time of input stage completion and is produced to the customer to sign and confirm the transaction.

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction.

Negotiation Reference Number

Specify the unique reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also.

Note

Oracle FLEXCUBE books then online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

7.9.2 Specifying denomination details

In this block, you can capture details of the currency denominations involved in the transaction.

Refer the section titled ‘Specifying denomination details’ under ‘Depositing Cash’ for further details.

7.9.3 Specifying Charge Details

This block allows you to capture charge related details. Refer the section titled ‘Specifying charge details’ under ‘Depositing Cash’ for further details.

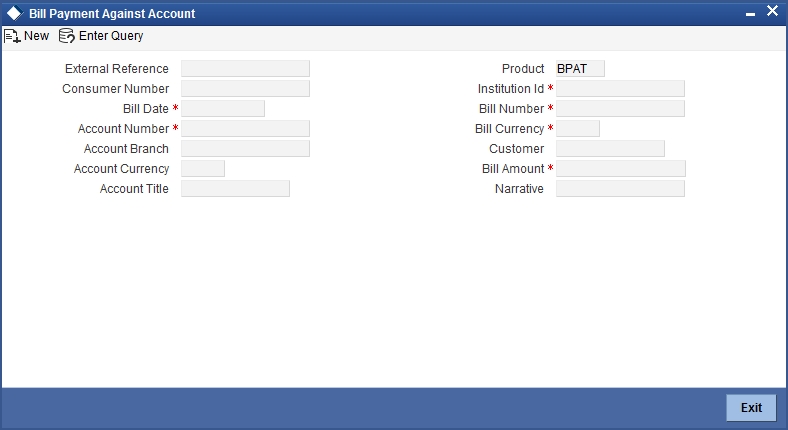

7.10 Pay a Bill against Account

This section contains the following topics:

- Section 7.10.1, "Paying a Bill against Account"

- Section 7.10.2, "Specifying charge details"

- Section 7.10.3, "Specifying the MIS details"

- Section 7.10.4, "Specifying the UDF details"

7.10.1 Paying a Bill against Account

You can capture a bill payment transaction against account through the ‘Bill Payment (Against Account)’ screen. You can invoke this screen by typing ‘1075’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can capture the following details:

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Product Code

The system displays the code of the retail teller product maintained in the system that will be used for processing the transaction.

Bill Number

Specify the bill number here.

Consumer Number

Specify the consumer number for the transaction.

Bill Date

Specify the date on which the bill has been issued. The adjoining button when clicked invokes a calendar in which you need to double-click on the appropriate date. The chosen date will then be seen in the ‘YYYYMMDD’ format.

Institution Id

Specify the unique ID corresponding to the institution towards which the bill payment is being made. You can select the appropriate code from the adjoining option list that displays all the institution codes maintained in the system.

Bill Currency

Specify the currency in which the bill should be paid. You can select the appropriate code from the adjoining option list that displays all the currency codes maintained in the system.

Bill Amount

Specify the amount that should be paid towards the bill.

Account Number

Specify the account number of the customer against which the bill should be paid. You can select the appropriate number from the adjoining option list that displays all the accounts maintained in the system.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

The branch where the chosen account resides is displayed here.

Narrative

You may enter remarks about the transaction here. This is a free format text field.

In the single stage flow, if there is an transaction level override or error during approval then the transaction will be moved to the pending queue. Without save action being initiated, the transaction will not be in pending queue.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save. On pick up, the fields that are currently enabled in the enrich stage will alone be retained as enabled fields.

Clicking ‘Pickup’ button, the system defaults the following details:

Account Currency

The system displays the currency in which the chosen account is maintained.

Customer ID

The system displays the customer ID based on the account specified.

Account Title

The system displays a brief title for the chosen account.

Exchange Rate

The system displays the exchange rate used to convert the bill amount in bill currency to transaction amount in transaction currency. If the transaction currency is the same as the bill currency, the system will display the exchange rate as ‘1’.

Total Charge

The system computes the charges applicable for the transaction and displays it here.

Total Amount

The system displays the total amount inclusive of the bill amount and the charges.

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction.

Negotiation Reference Number

Specify the unique reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also.

Note

Oracle FLEXCUBE books then online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

7.10.2 Specifying charge details

This block allows you to capture charge related details.

Refer the section titled ‘Specifying charge details’ under ‘Depositing Cash’ for further details.

7.10.3 Specifying the MIS details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the following screen:

Refer the section titled ‘Specifying the MIS details’ under ‘Depositing Cash’ for further details.

7.10.4 Specifying the UDF details

You can capture these details in the ‘UDF’ tab of the screen.

Field Description

The system will display all the User-Defined Fields (UDF) maintained for the product.

Field Value

Specify the value for the required UDFs.

Click save icon to save the transaction. The authorization process is similar to cash deposit.

Refer the corresponding section under ‘Depositing Cash’ for further details.

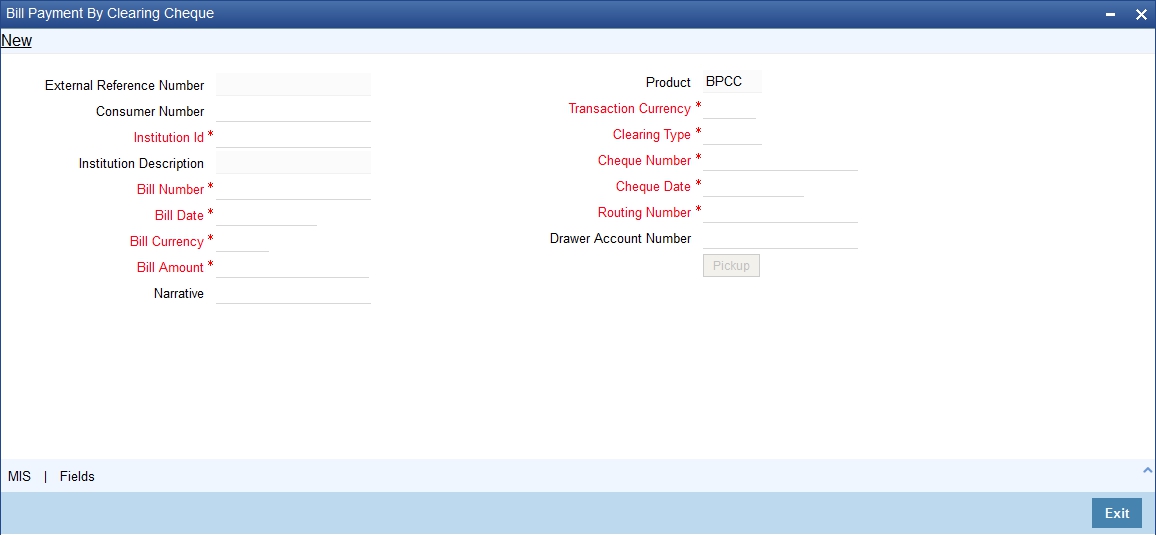

7.11 Pay a Bill by Clearing Cheque

This section contains the following topics:

- Section 7.11.1, "Paying a bill by clearing cheque"

- Section 7.11.2, "Specifying the MIS details"

- Section 7.11.3, "Specifying the Field details"

7.11.1 Paying a bill by clearing cheque

You can undertake other bank cheque transactions for the payment of all the utility bills through ‘Bill Payment By Clearing Cheque’ screen. You can invoke this screen by typing ‘1045’ in the field at the top right corner of the application tool bar and clicking on the adjoining arrow button.

You can capture the following details:

External Reference Number

The system displays the external reference number.The system generates a unique number based on the branch-specific sequence number generation logic and displays it here.

Consumer Number

Specify the consumer number for the transaction.

Institution Id

Specify the unique Id corresponding to the institution towards which bill payment is being made. Alternatively, you can select the institution id from the option list. The list displays all institution code maintained in the system.

Institution description

The system displays the description of the biller institution.

Bill Number

Specify the bill number.

Bill Date

Select the date on which the bill has been issued from the adjoining calendar.

Bill currency

Specify the currency in which the bill should be paid. Alternatively, you can select the currency from the option list. The list displays all bill currency maintained in the system.

Bill Amount

Specify the bill amount.

Narrative

Specify any remarks pertaining to the transaction.

Product

The system displays the utility payment product. The Product ‘BPCC’ will be defaulted for the transaction pertaining to the bill payment for clearing cheques.

Transaction Currency

Specify the currency in which the payment is made by the customer. Alternatively, you can select the transaction currency from the option list. The list displays all transaction currency maintained in the system

Clearing Type

Select the clearing type. Alternatively, you can select the type of clearing from the option list. The list displays all clearing products maintained in the system.

Cheque Number

Specify the cheque number provided by the customer. Alternatively you can select the cheque number from the option list. The list displays all the cheque numbers of the customer maintained in the system.

Cheque Date

Select the date on which cheque has been issued from the adjoining calendar.

If the cheque is issued before three months, the system displays an error message “Cheque is a stale one”.

Routing Number

Specify the routing number. Alternatively you can select the routing number from the option list. The list displays all routing number maintained in the system.

Drawer Account Number

Specify the drawer account number.

Pickup Button

Click on pickup to default the data into the MIS and fields details. It is mandatory to click on ‘Pickup’ button before save.

7.11.2 Specifying the MIS details

You can capture details pertaining to MIS. Click on the ‘MIS’ button to invoke this screen.

For more information on MIS details screen, refer to the section ‘Specifying the MIS details’ in the chapter ‘Depositing Cash’ in this User Manual.

7.11.3 Specifying the Field details

You can capture the UDF details in the ‘UDF details’ screen. Click ‘Fields’ button to invoke this screen.

For more information on UDF screen refer to the section ‘Specifying the UDF details’ in the chapter ‘Depositing Cash’ in this User Manual.

7.12 Pay a Bill by In-house Cheque

This section contains the following topics:

- Section 7.12.1, "Paying a bill by in-house cheque"

- Section 7.12.2, "Specifying Charge details"

- Section 7.12.3, "Specifying the MIS details"

- Section 7.12.4, "Specifying the Field details"

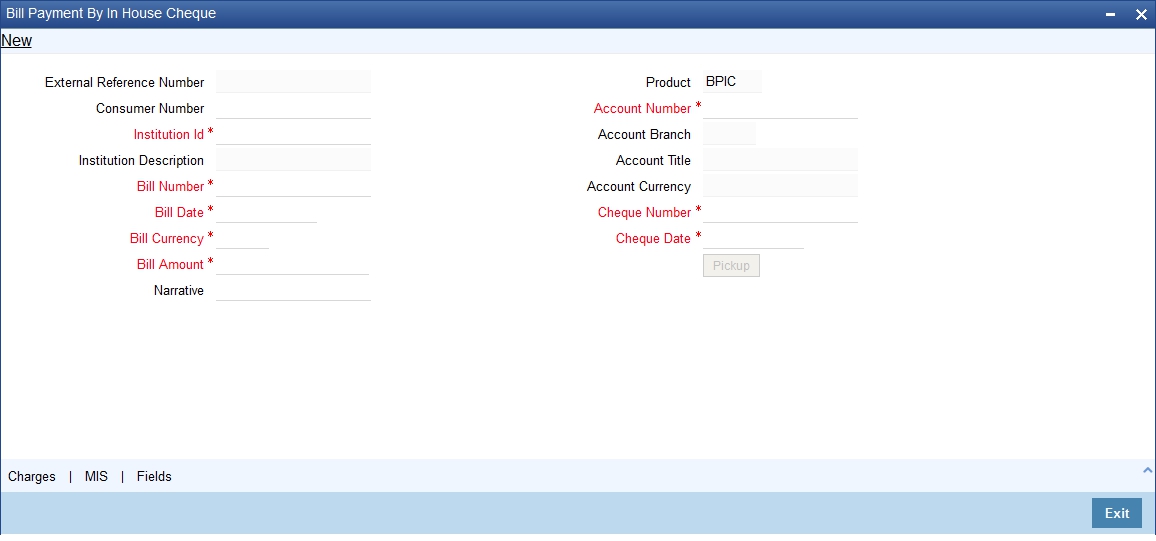

7.12.1 Paying a bill by in-house cheque

You can pay all the utility bills using same bank cheque. You can maintain these transactions, in the ‘Bill Payment By In-house Cheque’ screen. You can invoke this screen by typing ‘1035’ in the field at the top right corner of the application tool bar and clicking on the adjoining arrow button

You can capture the following details:

External Reference Number

The system displays the external reference number.The system generates a unique number based on the branch-specific sequence number generation logic and displays it here.

Consumer Number

Specify the consumer number for the transaction.

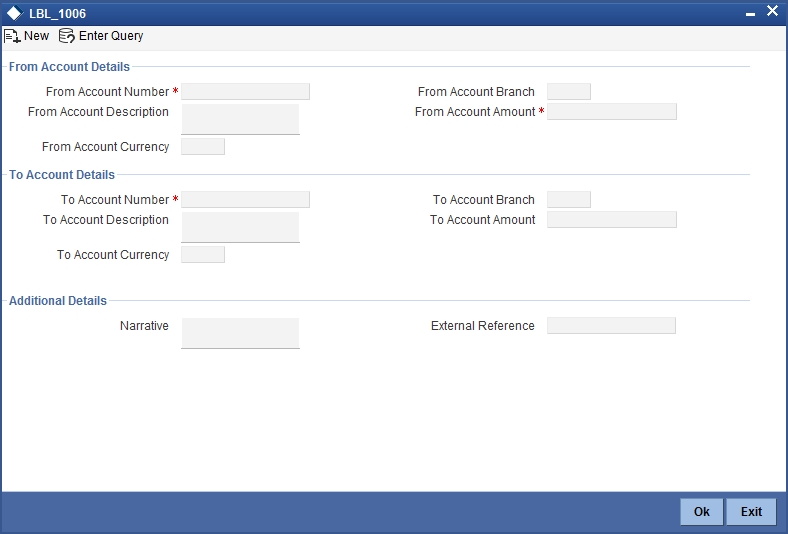

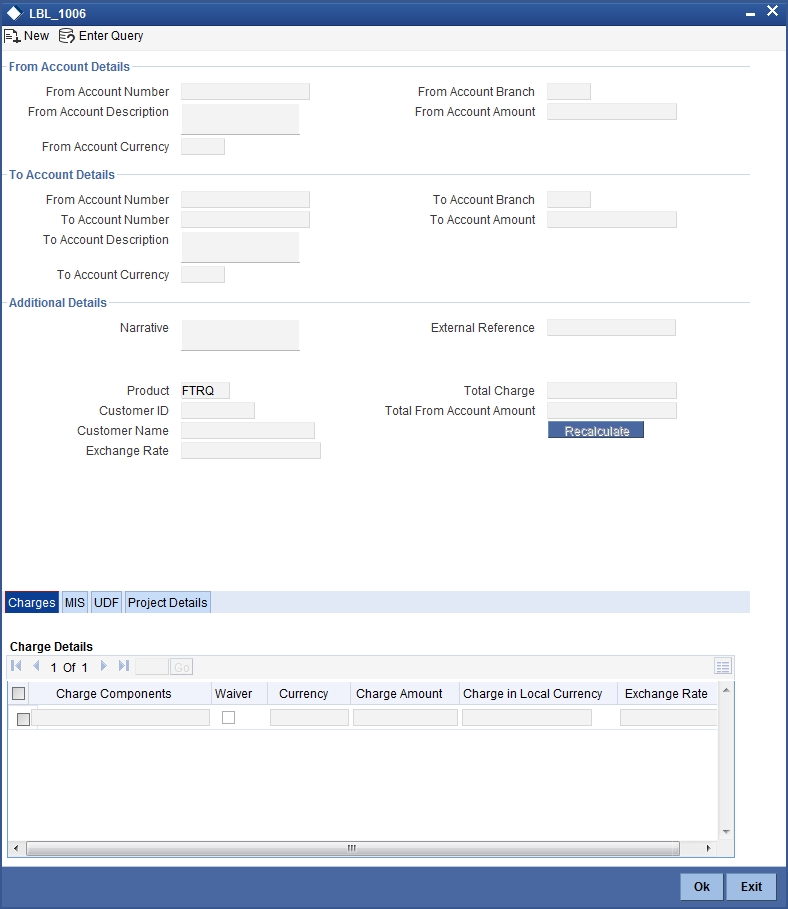

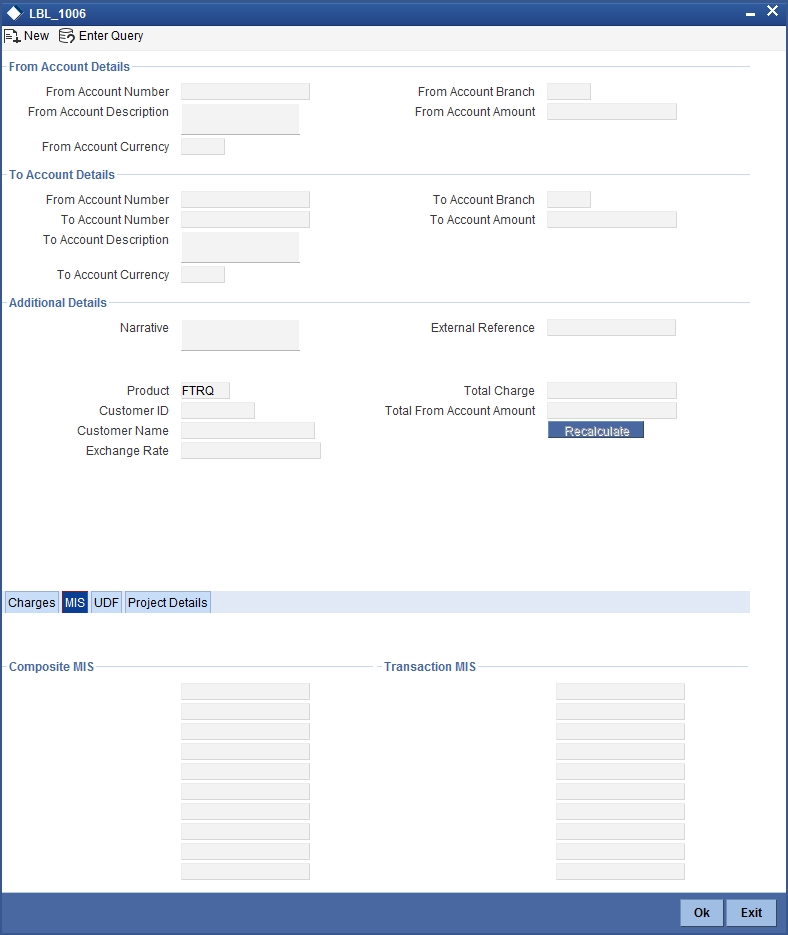

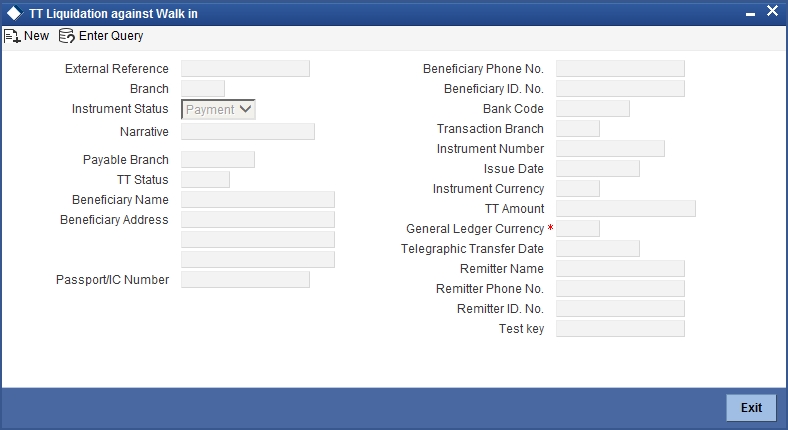

Institution Id