8. Instrument Transactions

As you may recall, the Savings module allows you to perform different types of transactions. This chapter details the various instrument-based transactions that can be performed through this module. You can perform the following types of instrument-based transactions:

- Cheque transactions

- Cheque deposit and withdrawal

- Cheque deposit to GL

- Cheque book request

- In-house cheque deposit

- Cheque return

- Traveller’s Cheque (TC) transactions

- TC sale and purchase - against account and for walk-in customer

- TC sale against GL

- Demand Draft (DD) transactions

- DD sale against account

- DD liquidation – against GL, against account and for walk-in customer

- DD issue – to walk-in customer and against GL

- DD inquiry

- DD reprint

- Banker’s Cheque (BC) transaction

- BC sale – against account and against clearing

- BC issue – against GL and for walk-in customer

- BC liquidation – against account and against GL

- BC inquiry

- BC reprint

This chapter contains the following sections:

- Section 8.1, "Withdraw Cash against a Cheque"

- Section 8.3, "Deposit a Cheque into a GL"

- Section 8.4, "Deposit an In-house Cheque "

- Section 8.5, "Tracking a Cheque Return"

- Section 8.6, "Bulk Cheque Return"

- Section 8.7, "Querying Cheque Status"

- Section 8.9, "Issue a TC against an Account"

- Section 8.10, "Issue a TC against a GL"

- Section 8.11, "Issue a TC to a Walk-in Customer"

- Section 8.12, "Purchase a TC against an Account"

- Section 8.13, "Purchase a TC from a Walk-in Customer"

- Section 8.14, "Issue a DD Issue against an Account"

- Section 8.15, "Issue DD against Cheque"

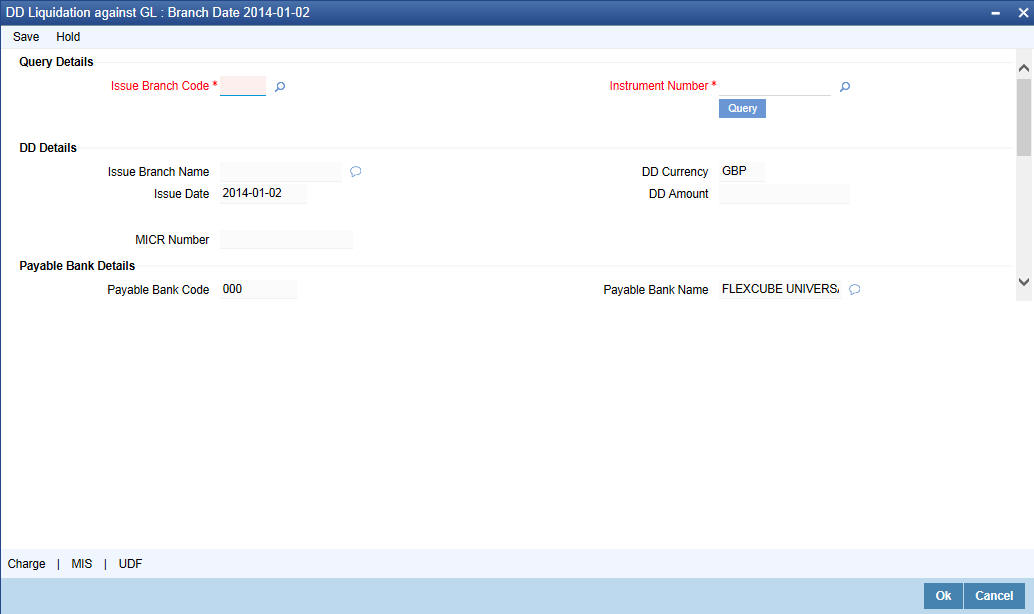

- Section 8.16, "Liquidating a DD against a GL"

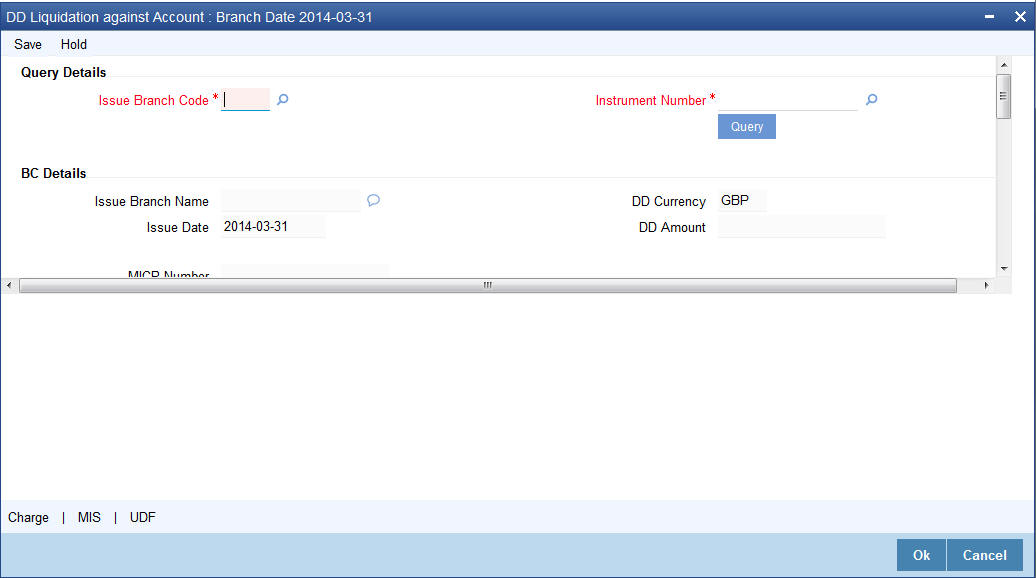

- Section 8.17, "Liquidate a DD against an Account"

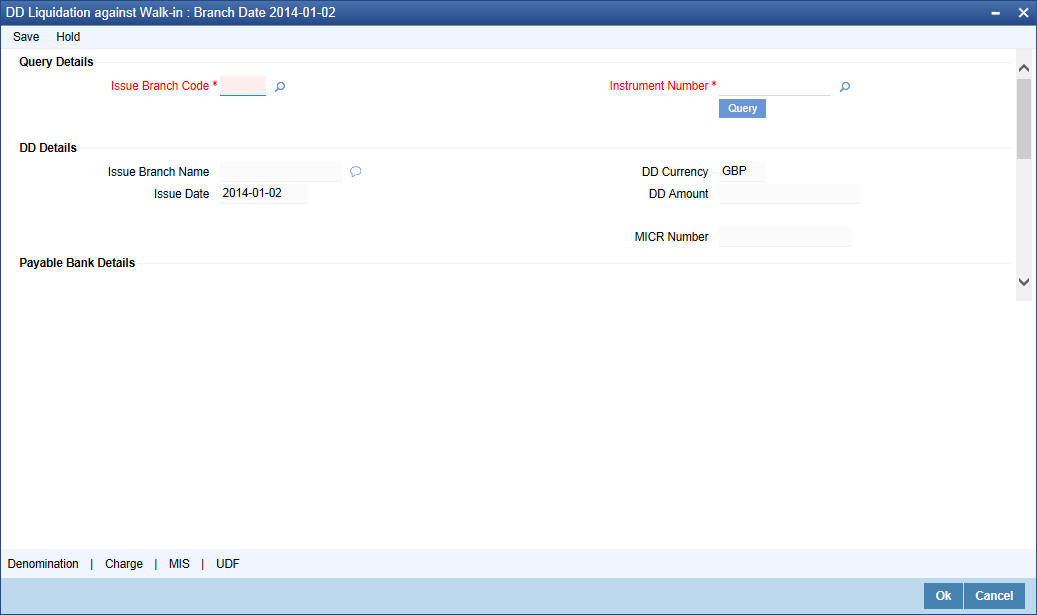

- Section 8.18, "Liquidate a DD for a Walk-in Customer"

- Section 8.19, "Issue a DD to a Walk-in Customer"

- Section 8.20, "Issue a DD against a GL"

- Section 8.21, "Inquiring on a DD Transaction"

- Section 8.22, "Re-validate DD Instrument"

- Section 8.23, "Reprint/ Reissue of DD"

- Section 8.24, "Duplicate DD Instrument"

- Section 8.25, "Issue a BC against an Account"

- Section 8.26, "Issue BC against Cheque"

- Section 8.27, "Close Account by BC"

- Section 8.28, "Close Account"

- Section 8.29, "Issue a BC against a GL"

- Section 8.30, "Issue a BC to a walk-in customer"

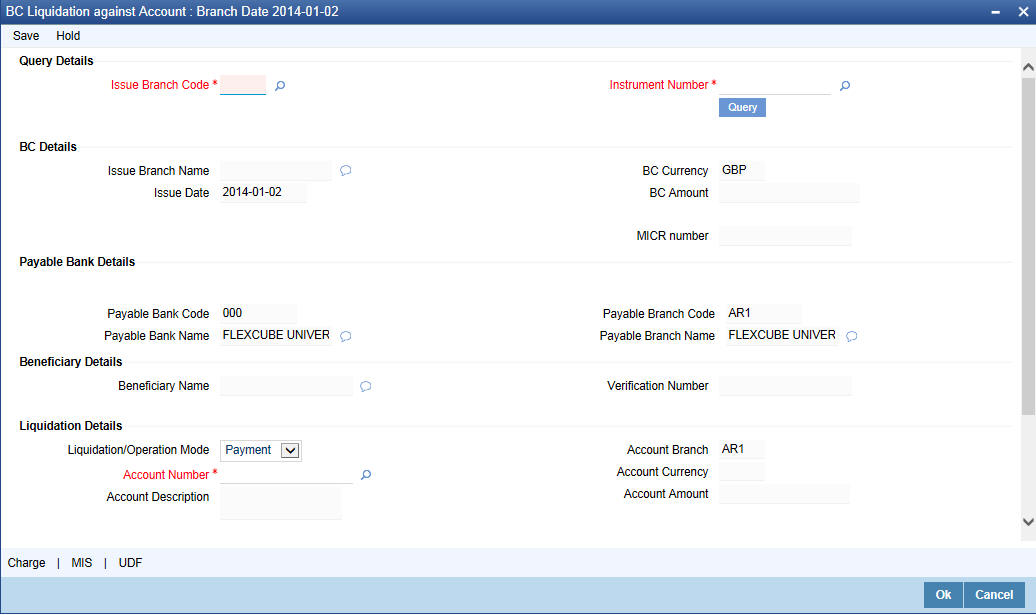

- Section 8.31, "Liquidate a BC against an account"

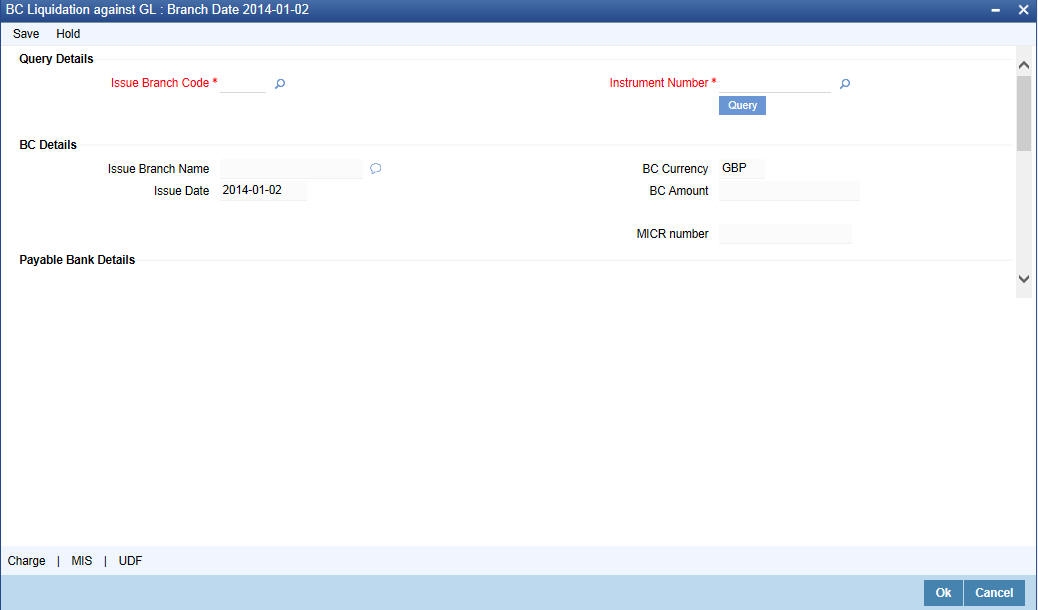

- Section 8.32, "Liquidate a BC against a GL"

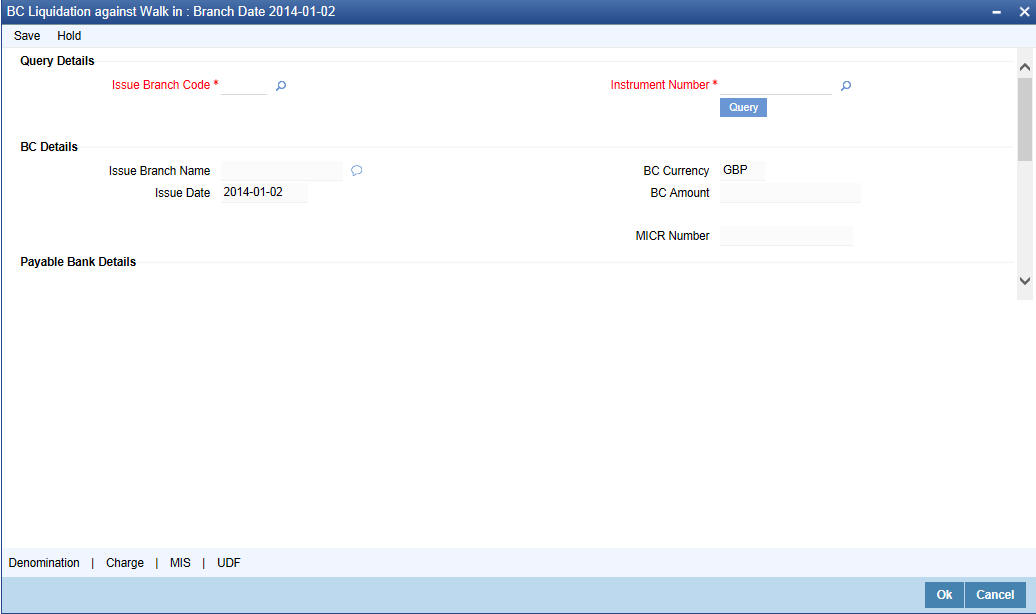

- Section 8.33, "Liquidate a BC for a walk-in customer"

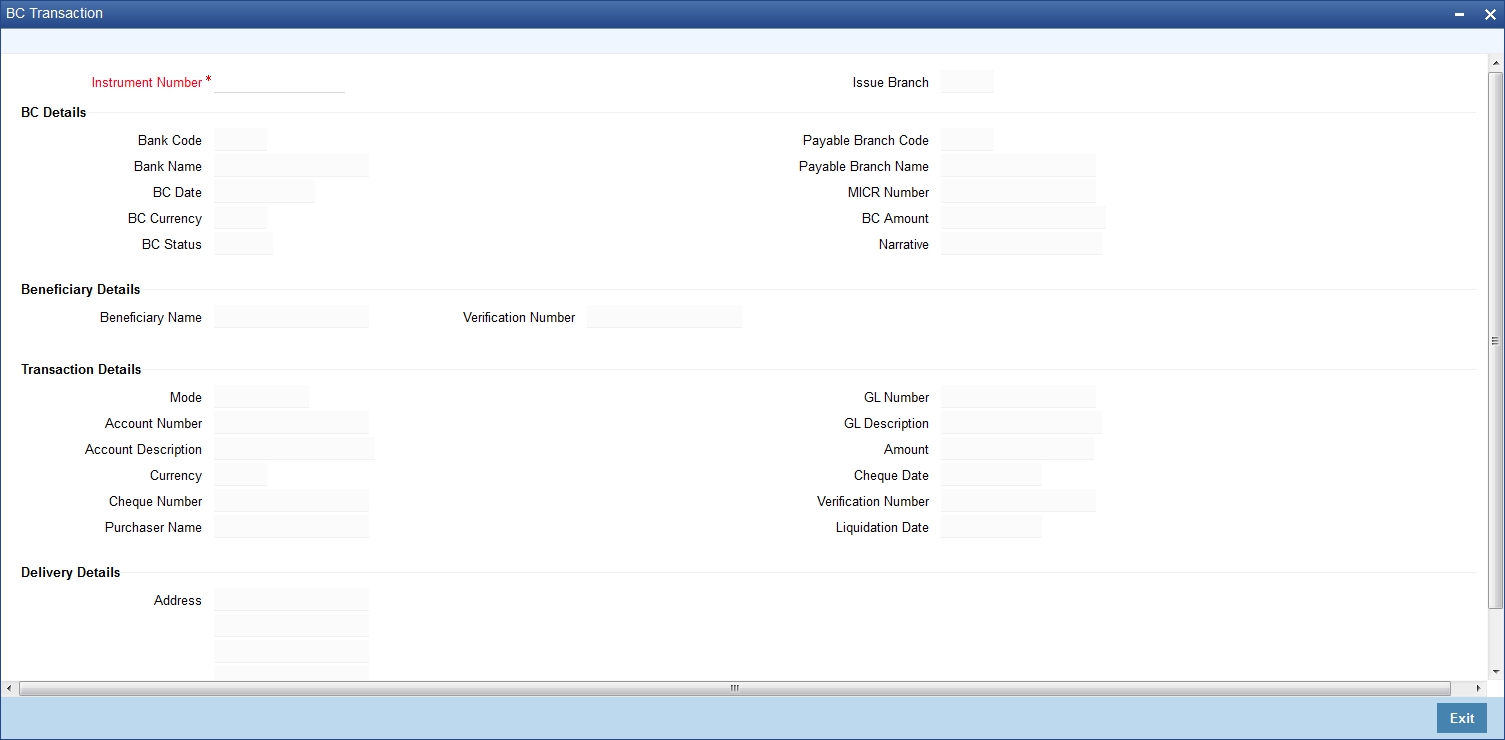

- Section 8.34, "Inquiring on a BC Transaction"

- Section 8.35, "Re-validate BC Instrument"

- Section 8.36, "Reprint / Reissue Banker’s Cheque"

- Section 8.37, "Duplicate BC Instrument"

- Section 8.38, "Reversing BC/DD Liquidation"

8.1 Withdraw Cash against a Cheque

This section contains the following topics:

- Section 8.1.1, "Withdrawing Cash against a Cheque"

- Section 8.1.2, "Specifying Denomination Details"

- Section 8.1.3, "Specifying Charge Details"

- Section 8.1.4, "Specifying MIS Details"

- Section 8.1.5, "Specifying UDF details"

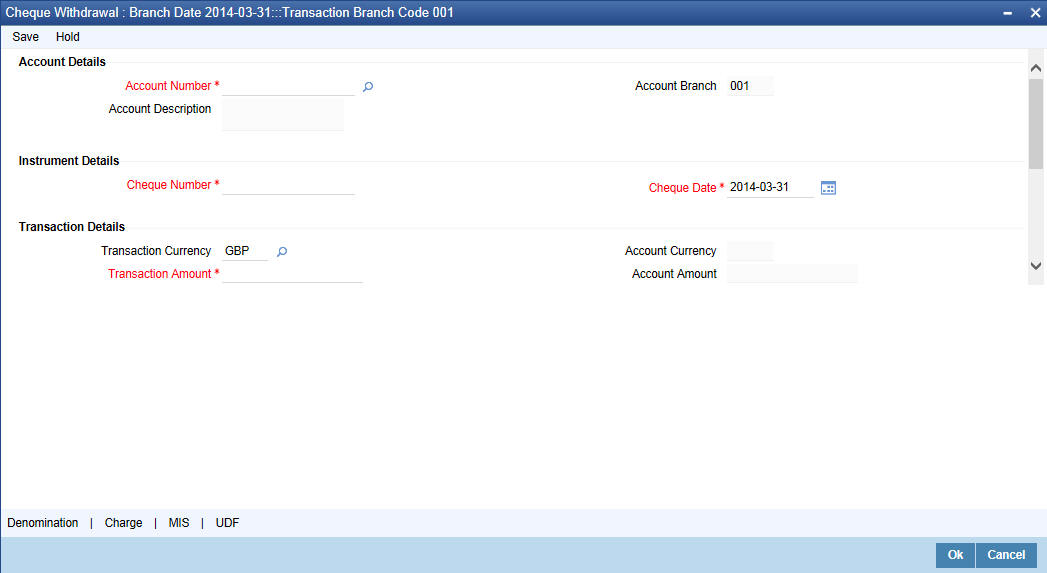

8.1.1 Withdrawing Cash against a Cheque

Your customer can withdraw money from his/her account by issuing a cheque on the account. You can capture such a transaction through the ‘Cheque Withdrawal’ screen. You can invoke this screen by typing ‘1013’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can capture the following details:

Account Number

Specify the customer account into which the cash needs to be deposited.

Note

In case of multiple accounts with the same account number, the system will display a list of account numbers with account branches to select.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

The system displays the logged-in branch. If you specify another account number and tab out of the Account Number field, the system displays the corresponding account branch.

Account Description

Enter a brief description on the account.

Cheque Number

Specify the MICR number displayed on the cheque leaf.

Cheque Date

Specify the date displayed on the cheque leaf.

Transaction Currency

The system displays the local currency. If you specify another account number and tab out of the Account Number field, the system displays the currency associated with the account.

Transaction Amount

Specify the amount that should be debited from another account in terms of transaction currency. If the account to be debited is a Trust account, this amount should be within the cash withdrawal limit defined for the debited account class.

Account Currency

The system displays the logged-in currency. If you specify another account number and tab out of the Account Number field, the system displays the currency associated with the account.

Account Amount

The system displays the transaction amount. You cannot modify it..

Narrative

The system displays ‘Cheque Withdrawal’. You can modify it, if required.

In the single stage flow, if there is an transaction level override or error during approval then the transaction will be moved to the pending queue. Without save action being initiated, the transaction will not be in pending queue.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save.

External Reference Number

The system generates and displays a unique number based on the branch-specific sequence number generation logic. The Host system identifies a branch transaction with the external reference number.

Clicking ‘Pickup’ button, the system defaults the following details:

Account Description

The system displays a brief title for the chosen account.

Account Currency

The system displays the currency of the customer account.

Exchange Rate

The system displays the exchange rate used to convert the transaction currency into account currency. If the transaction currency is the same as the account currency, the system will display the exchange rate as ‘1’.

Total Charge

The system calculates the charges applicable to the transaction and displays the amount here.

Account Amount

The system displays the amount to be debited from the account (in the account currency) after calculating the applicable charges. The system adds the charge amount from the transaction amount and displays the net value.

Customer ID

The system displays the customer ID based on the account that is specified.

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction.

Negotiation Reference Number

Specify the reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, you need to specify the negotiated reference number also.

Note

Oracle FLEXCUBE books the online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

Reject Code

Specify the Reject Code. The adjoining option list displays the list of all the reject codes maintained in the system. You can choose the appropriate one.

Note

If you reject a cheque without giving the reject code then that cheque can be reused. However, if you enter the reject code then the cheque will be rejected.

8.1.2 Specifying Denomination Details

In this block, you can capture details of the currency denominations involved in the transaction through the following fields:

Currency Code

The system displays the currency of the account.

Denomination Code

The system defaults the denomination code as maintained in the ‘Denomination Maintenance’ screen.. For every currency, the various denominations are assigned separate denomination codes..

Denomination Value

The system computes the face value of the denomination and displays it. For instance if the denomination code represents a USD 100, the value will be displayed as ‘100’.

Units

Indicate the number of units of the specified denomination. By default, till contents are decremented for outflow transactions like cash withdrawal. To reverse this default behavior, you can specify units in negative.

Total Amount

The system computes the denomination value by multiplying the denomination value with the number of units. For instance, if the denomination code represents a USD 100 and the number of units is 10, the denomination amount will be ‘1000’.

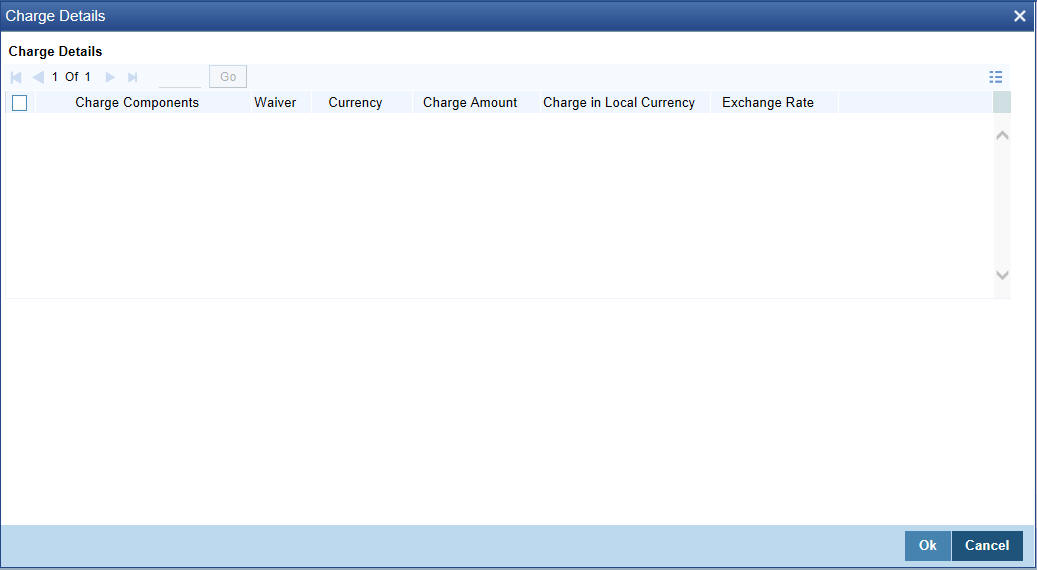

8.1.3 Specifying Charge Details

This block allows you to capture charge related details. Click on the ‘Charges’ tab and invoke the following screen.

Here you can capture the following details:

Charge Component

The system displays the charge component that is levied on the transaction.

Waiver

This option is unchecked by default, thereby indicating that the charge needs to be levied. However, you can check this option to waive the charge. If you check this option, you will have to click the ‘Recalculate’ button to re-compute the net amount to be credited to the account.

Charge Currency

The system displays the currency in which the charge has to be levied.

Charge Amount

The system displays the charge amount in the charge currency. However you can change it. You will then have to recalculate the charge and net transaction amount.

Charge in LCY

In case the transaction currency is different from the local currency, the system will compute the local currency equivalent of the charge and display it here.

Exchange Rate

The exchange rate used for the currency conversion is displayed here. If the charge currency is the same as the transaction currency, the system will display ‘1’ as the exchange rate.

Charge Currency

The system displays the currency in which the charge has to be levied.

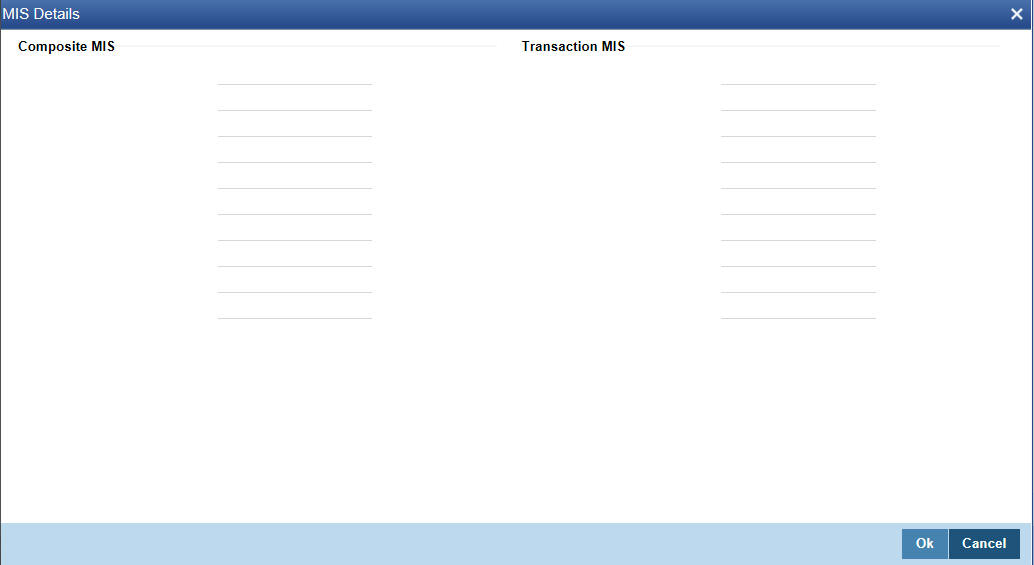

8.1.4 Specifying MIS Details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the following screen:

You can capture the following details here:

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to capture the following details:

Transaction MIS

Specify the transaction MIS. The adjoining option list displays a list of transaction MIS codes maintained in the system. You can choose the appropriate one.

Composite MIS

Specify the composite MIS. The adjoining option list displays a list of composite MIS codes maintained in the system. You can choose the appropriate one.

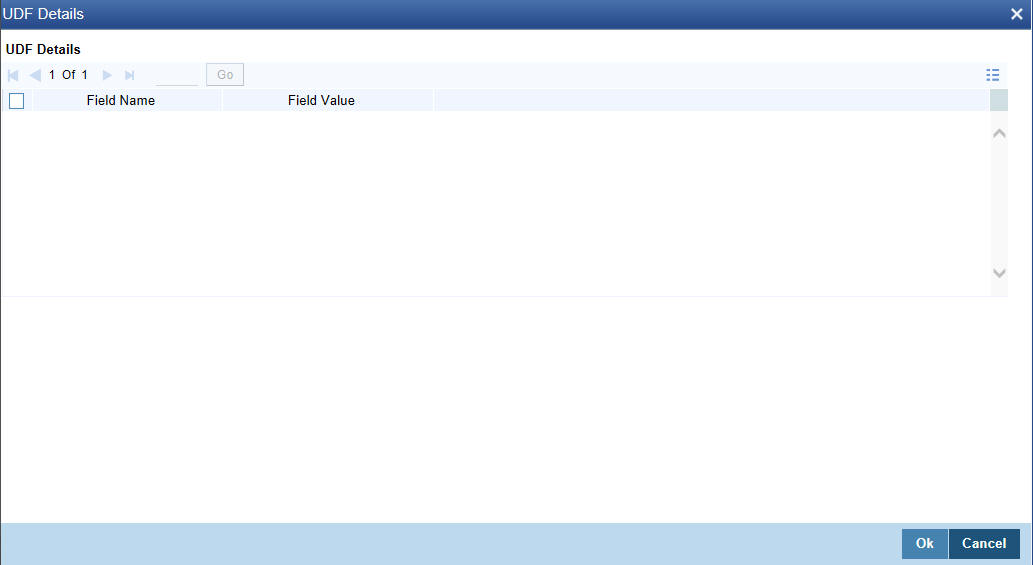

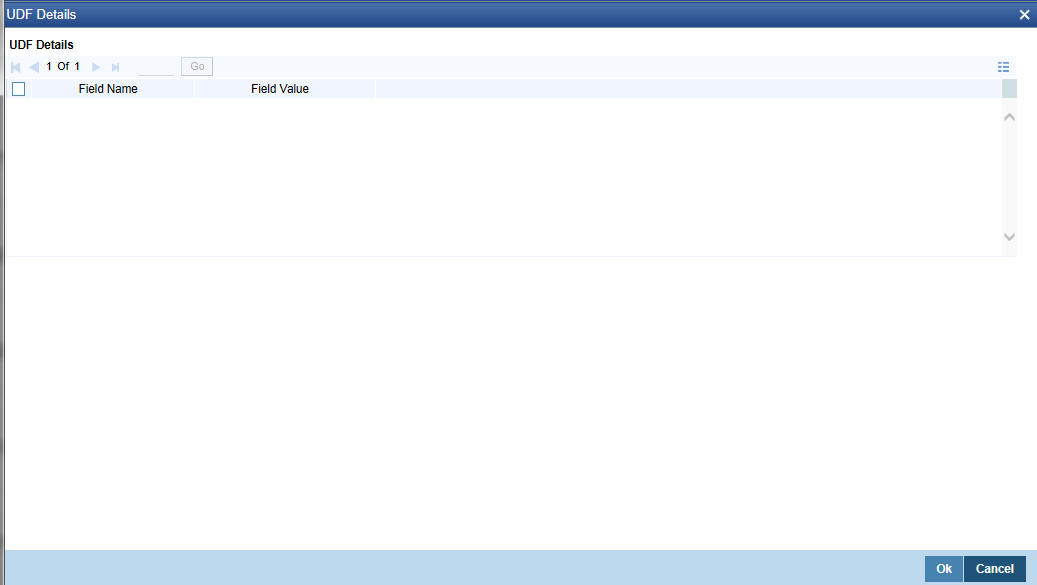

8.1.5 Specifying UDF details

You can capture these details in the ‘UDF’ tab of the screen.

UDF Name

The system displays the various User-Defined Fields (UDFs) that you have maintained for the product in the Host.

UDF Value

Specify the value for the each UDF that is displayed.

Note

The MIS-related fields displayed here are based on the MIS configuration done at the Host.

Refer the ‘MIS’ User Manual of Oracle FLEXCUBE Host, for further details about MIS.

Click save icon to save the transaction.

The system displays overrides on a separate window. You can either accept or reject the overrides and proceed with saving the transaction. If you click ‘Reject’ button, the screen will remain in the enrichment stage for you to make changes to charge elements. Then if you click ‘Save’, the system will initiate reversal of the transaction without reversing the charges.

The authorization process is similar to that of cash deposit.

Note

Depending on the ‘Display Type’ selected for customer / account in ‘Instruction Maintenance’ screen, the instruction will be displayed the time of saving the input stage and authorizing the transaction.

For more details about viewing customer / account instructions, refer the section titled ‘Viewing Customer / Account Instructions on ‘F6’ Key-Press’ and Viewing Customer / Account Instruction Details in Override Screen’ in this user manual.

Refer the corresponding section under ‘Depositing Cash’ in the chapter ‘Cash Transactions’ of this User Manual for further details.

Refer the chapters titled ‘Transaction Workflow’ and ‘Common Operations’ in this User Manual for details on the dual-control operations and the authorization process respectively.

8.2 Depositing a Cheque

The In-house cheques will deposit using the existing Outward Clearing Data Entry screens if Customer float days are greater than zero for the product or if sufficient funds are not available during cheque deposited from existing LOCH screen. If the in-house cheques are initiated using Outward Clearing Data Entry screen, the system will follow the regular life cycle of inward clearing contract creation and return handling like other normal clearing cheques.

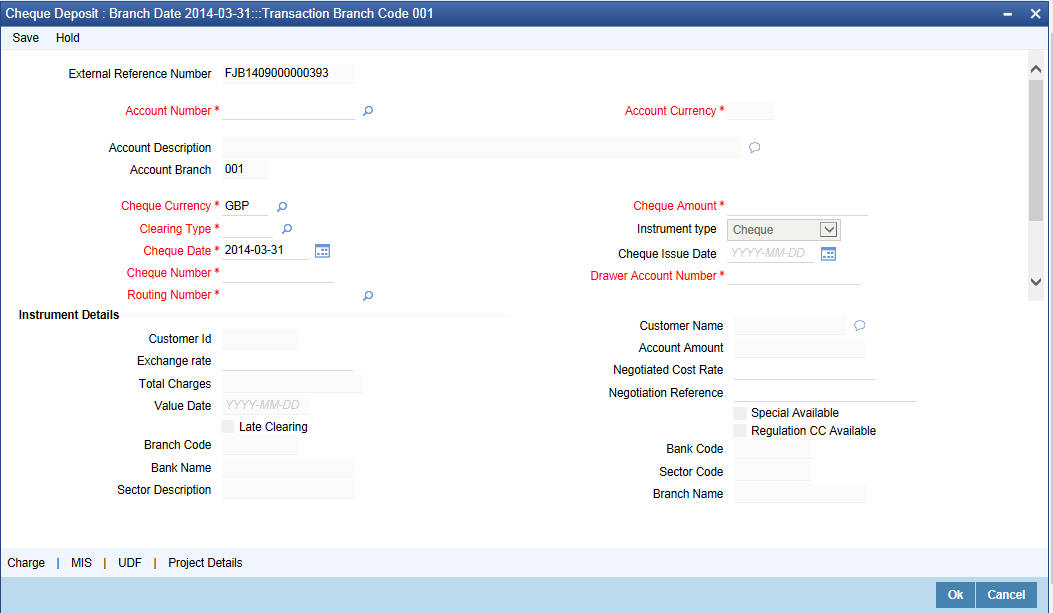

You can deposit a cheque into your customer’s account through the ‘Cheque Deposit’ screen. You can invoke this screen by typing ‘6501’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can capture the following details:

External Reference

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Account Number

Specify the customer account number into which the cash needs to be deposited.

Note

In case of multiple accounts with the same account number, the system will display a list of account numbers with account branches to select.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Currency

The system displays the currency associated with the account.

Account Description

The system displays the description of the account number chosen.

Account Branch

The system displays the logged-in branch. If you specify another account number and tab out of the Account Number field, the system displays the corresponding account branch.

Cheque Currency

The system displays the local currency. If you specify another account number and tab out of the Account Number field, the system displays the currency associated with the account.

Cheque Amount

Specify the amount that needs to be deposited to the account; in terms of local currency.

Clearing Type

Specify the product that is maintained in the system for the transaction. The adjoining drop-down list displays the outward and inward clearing products. For example:

- CLEARING OF CHEQUE-LOOC

- CLEARING OF CHEQUE-NAOC

Cheque Issue Date

To specify the issue date of the cheque, click on the adjoining calendar icon and select the appropriate date.

Note

If the difference between the ‘Cheque issue date’ and the ‘Cheque Date’ is greater than the ‘Cheque Stale Days’ maintained at the ‘Branch Parameters Maintenance’ screen, an error message will be displayed stating that the cheque is a stale one. However, a stale cheque validation would not be done if the field ‘Cheque Stale days’ is not maintained at the ‘Branch Parameters Maintenance’ screen.

Cheque Number

Specify the MICR number displayed on the cheque.

Drawer Account Number

Specify the account number on which the cheque is drawn.

Routing Number

Specify the routing number for cheque clearance. .The adjoining option list displays all routing numbers along with the Branch codes and Bank Codes. You can select the appropriate one.

Narrative

The system defaults the narrative as 'Cheque Deposit - Cheque no - Cheque Number – Drawer A/c Number - Account Number'. Once you specify the ‘Cheque Number’ and ‘Drawer Account Number’, the system replaces the field values respectively on tabbing out from the field.

Clicking ‘Pickup’ button, the system displays the following details:

Instrument Details

Customer ID

The system displays the customer ID based on the account specified.

Exchange Rate

The system displays the exchange rate used to convert the transaction currency into account currency. If the transaction currency is the same as the account currency, the system will display the exchange rate as ‘1’.

Account Amount

The system displays the cheque amount in terms of account currency.

Total Charges

The system calculates the charges applicable to the transaction and displays the amount here.

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction.

Negotiation Reference Number

Specify the reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also.

Late Clearing

The system indicates whether the cheque has been cleared on the same day or is marked for late clearing.

Regulation CC Available

Check this box to indicate that the ‘Reg CC’ facility is available for the transaction.

Special Available

Check this box to indicate that the ‘special availability’ facility is available for the transaction.

Bank Code

The system displays the clearing bank code based on the routing number.

Bank Name

The system displays the name of the clearing bank based on the routing number.

Branch Code

The system displays the branch code of the clearing bank, based on the routing number.

Branch Name

The system displays the branch in the clearing bank, based on the routing number.

Sector Code

The system displays the sector code of the clearing bank, based on the routing number.

Sector Description

The system displays the description of the sector.

Note

Oracle FLEXCUBE books the online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

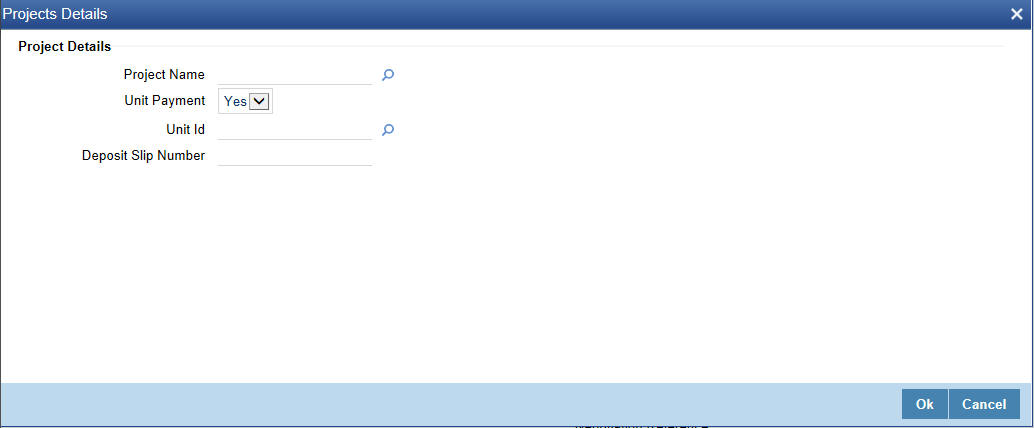

8.2.1 Specifying Project Details

You can capture project details under ‘Project Details’ tab. Note that this tab will be applicable only if the cheque is being deposited into a Trust account.

Specify the following details:

Project Name

Specify the developer project name for which payment is being made. The adjoining option list displays all valid projects maintained in the system. You can select the appropriate one. Input to this field is mandatory.

Unit Payment

Indicate whether the transaction is a unit payment or not by choosing the appropriate value from the adjoining drop-down list. The following values are available:

- Yes

- No

Unit ID

Specify the unit ID of the project.The adjoining option list displays all unit IDs along with the unit holder names corresponding to the project name chosen. You can select the appropriate one.

If you specify the Project Name, the system will display the Unit Ids in the list of values here.

Deposit Slip Number

Specify the deposit slip number for the payment.

Click save icon to go to the next stage.

Refer the sections titled ‘Authorization stage’ and ‘Submission stage’ under ‘Withdrawing Cash against a Cheque’ for details on the authorization and submission.

8.2.2 Specifying Charge Details

Charges Details sub screen allows you to capture charge related details for the transaction. Refer the section titled ‘Specifying charge details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.2.3 Specifying MIS Details

MIS Details sub-screen allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the MIS Details screen.

Refer the section titled ‘Specifying the MIS details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.2.4 Specifying UDF Details

You can capture the UDF details under ‘UDF’ tab. Click the tab button ‘UDF’. The system displays the following details:

Click to save the transaction.

The approver can fetch this transaction for his/her task list and authorize it. The authorization process is similar to that of cash deposit.

Note

Depending on the ‘Display Type’ selected for customer / account in ‘Instruction Maintenance’ screen, the instruction will be displayed at the time of saving the input stage and authorizing the transaction.

Refer the corresponding section under ‘Depositing Cash’ in the chapter ‘Cash Transactions’ of this User Manual for further details.

Refer the chapters titled ‘Transaction Workflow’ and ‘Common Operations’ in this User Manual for details on the authorization process.

8.3 Deposit a Cheque into a GL

This section contains the following topics:

- Section 8.3.1, "Depositing a Cheque into a GL"

- Section 8.3.2, "Specifying Charge Details"

- Section 8.3.3, "Specifying MIS Details"

- Section 8.3.4, "Specifying UDF Details"

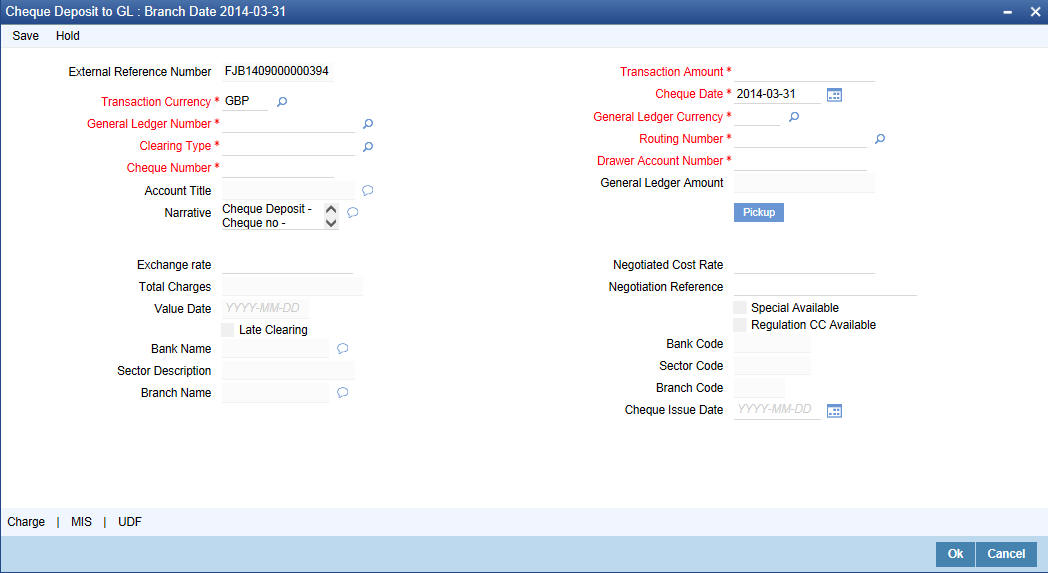

8.3.1 Depositing a Cheque into a GL

Your customer can deposit a cheque into a GL. You can capture this transaction through the ‘Cheque Deposit to GL’ screen. You can invoke this screen by typing ‘6520’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can capture the following details:

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Transaction Amount

Specify the amount that needs to be deposited into the GL.

Transaction Currency

The system defaults the account currency as the transaction currency. However, you can modify it. The adjoining option list displays all the currency codes maintained in the system. You can select the appropriate one.

Cheque Date

The system defaults the system date as the cheque date. However, you can edit it from the adjoining calendar.The chosen date will then be seen in the ‘YYYYMMDD’ format.

General Ledger Number

Specify the GL into which the cheque is being deposited. The adjoining option list displays all the GL codes maintained in the system. You can select the appropriate one.

General Ledger Currency

Specify the currency of the GL into which the customer is depositing a cheque. The adjoining option list displays all the currency codes maintained in the system. You can select the appropriate one.

Clearing Type

Specify the product that is maintained in the system for the transaction. The adjoining drop-down list displays the outward and inward clearing products. For example:

- CLEARING OF CHEQUE-LOOC

- CLEARING OF CHEQUE-NAOC

Select the appropriate one.

Routing Number

Specify the routing number for cheque clearance.

Cheque Number

Specify the MICR number displayed on the cheque.

Drawer Account Number

Specify the account on which the cheque is drawn.

General Ledger Amount

The system adds the charges to the transaction amount and displays the total amount that will be credited to the GL.

Account Title

On specifying the account number, the corresponding account title (description) is displayed.

Narrative

The system defaults the narrative as 'Cheque Return - Cheque no - Cheque Number - Reject Reason'. Once you specify the 'Cheque Number' and 'Reject Reason', the system replaces the field values respectively on tabbing out from the field.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Exchange Rate

The system displays the exchange rate used to convert the transaction currency into GL currency. If the transaction currency is the same as the GL currency, the system will display the exchange rate as ‘1’.

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction.

Total Charges

The system displays the service charges applicable to the transaction.

Negotiation Reference Number

Specify the reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also.

Note

Oracle FLEXCUBE books the online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

Regulation CC Available

Check this box to indicate that the ‘Reg CC’ facility is available for the transaction.

Special Available

Check this box to indicate that the ‘special availability’ facility is available for the transaction.

Late Clearing

The system indicates whether the cheque has been cleared on the same day or is marked for late clearing.

Refer the section titled ‘Specifying instrument details’ and ‘Capturing instrument details’ under ‘Depositing a Cheque’ for further details about maintaining instrument details for this transaction.

Bank Name

The system displays the name of the clearing bank based on the routing number.

Branch Name

The system displays the branch in the clearing bank, based on the routing number.

Sector Code

The system displays the sector code of the clearing bank, based on the routing number.

8.3.2 Specifying Charge Details

Charge Details sub-screen allows you to capture charge related details for the transaction. Click on the ‘Charge Details’ tab to view the Charge Detailsscreen.Refer the section titled ‘Specifying charge details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.3.3 Specifying MIS Details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the MIS Details screen.Refer the section titled ‘Specifying the MIS details’ under ‘Withdrawing Cash against a Cheque’ for further details.

Click save icon to save the transaction.

The approver can fetch this transaction for his/her task list and authorize it. The authorization process is similar to that of cash deposit.

8.3.4 Specifying UDF Details

You can capture the UDF details under ‘UDF’ tab. Click the tab button ‘UDF’. The system displays the following details:

Refer the corresponding section under ‘Depositing Cash’ in the chapter ‘Cash Transactions’ of this User Manual for further details.

Refer the chapters titled ‘Transaction Workflow’ and ‘Common Operations’ in this User Manual for details on the authorization process.

8.4 Deposit an In-house Cheque

This section contains the following topics:

- Section 8.4.1, "Depositing an In-house Cheque"

- Section 8.4.2, "Specifying Charge Details"

- Section 8.4.3, "Specifying MIS Details"

- Section 8.4.4, "Specifying UDF Details"

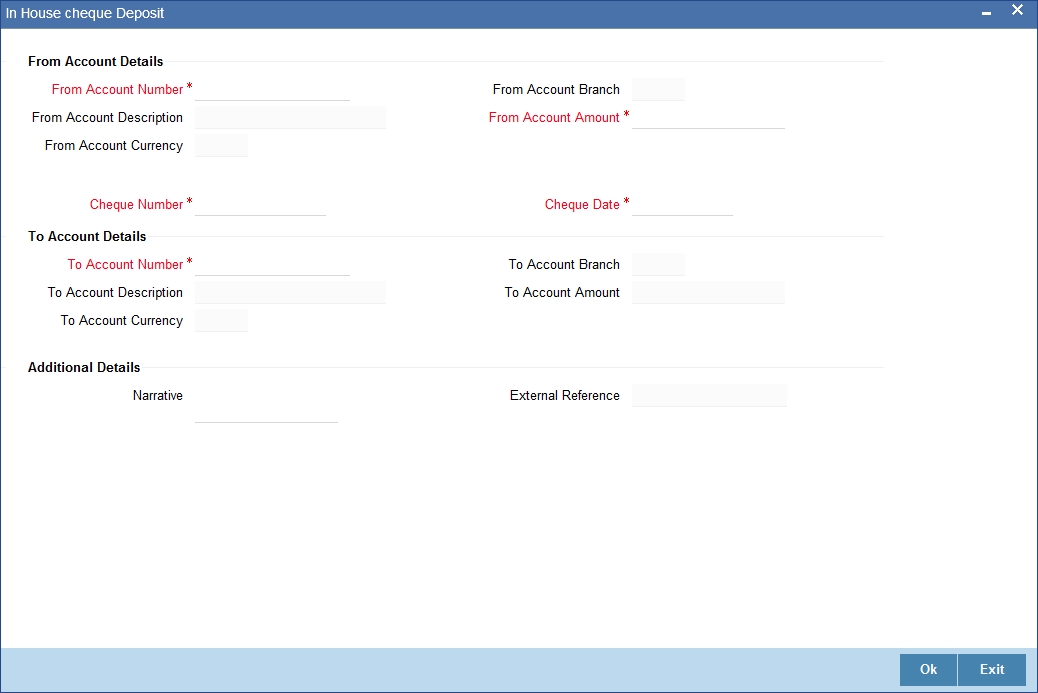

8.4.1 Depositing an In-house Cheque

You can capture deposit transactions for cheques issued by your bank to your customers through the ‘In House Cheque Deposit’ screen. You can invoke this screen by typing ‘LOCH’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can capture the following details:

From Account Details

From Account Number

Specify the drawer account number. The adjoining option list displays all the accounts maintained in the logged-in branch. You can choose the appropriate one.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the From Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

From Account Branch

The system displays the current logged in branch. This means that you will be able to specify an account that resides in the current branch only.

From Account Description

The system displays the description of the account number chosen.

From Account Currency

The system displays the currency of the drawer account.

From Account Amount

Specify the transferrable amount in the currency associated with the From Account.

Cheque Number

Specify the cheque number.

Cheque Date

Specify the cheque date from the adjoining calendar.

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Product

The system displays the code of the retail teller product that will be used in the Host for processing the transaction.

To Account Number

Specify the beneficiary account that needs to be credited with the cheque amount. The adjoining option list displays all the accounts maintained across different branches in the Host. You can choose the appropriate one. However, the option list will display the values only on specifying the ‘to account branch’ field.

If you have already specified the branch codes for the beneficiary account in the ‘To Account Branch’ field, the option list will display only those accounts that belong to the chosen branch.

To Account Branch

Specify the branch where the beneficiary account resides. The adjoining option list displays all the branch codes maintained in the system. You can choose the appropriate one.

To Account Currency

The system displays the currency of the beneficiary account.

Amount

Specify the amount for which the cheque has been drawn.

Narrative

Here, you can enter remarks for the transaction.

Cheque Number

Specify the number on the cheque that has been drawn.

Cheque Date

The system defaults the cheque date. However, you can modify it by clicking the adjoining button and selecting from the calendar.

Cheque Issue Date

Specify the issue date of the cheque. You can click on the adjoining calendar icon and select the appropriate date.

Note

If the difference between the ‘Cheque issue date’ and the ‘Cheque Date’ is greater than the ‘Cheque Stale Days’ maintained at the ‘Branch Parameters Maintenance’ screen, an error message stating that the cheque is a stale one will be displayed. However, stale cheque validation would not be done if the field ‘Cheque Stale days’ is not maintained at the ‘Branch Parameters Maintenance’ screen.

In the single stage flow, if there is an transaction level override or error during approval then the transaction will be moved to the pending queue. Without save action being initiated, the transaction will not be in pending queue.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save.

Clicking ‘Pickup’ button, the system defaults the following details:

Customer ID

The system displays the drawer customer’s CIF based on the value in the ‘From Account’ field.

From Amount

The system displays the amount debited from the beneficiary account.

To Amount

The system displays the amount credited to the beneficiary account.

Exchange Rate

The system displays the exchange rate for the transaction if the cheque currency and the transaction currency are not the same.

Reject Code

Specify the Reject Code. The adjoining option list displays the list of all the reject codes maintained in the system. You can choose the appropriate one.

Note

If you reject a cheque without giving the reject code then that cheque can be reused. However, if you enter the reject code then the cheque will be rejected.

8.4.2 Specifying Charge Details

This block allows you to capture charge related details for the transaction.

Refer the section titled ‘Specifying charge details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.4.3 Specifying MIS Details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the MIS Details screen.Refer the section titled ‘Specifying the MIS details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.4.4 Specifying UDF Details

You can capture the UDF details under ‘UDF’ tab. Click the tab button ‘UDF’ to view the UDF Details screen. Refer the section titled ‘Specifying the MIS details’ under ‘Withdrawing Cash against a Cheque’ for further details.

Click save icon to save the transaction. On saving, the system checks whether the accounts mentioned in the ‘from’ and ‘to’ leg of the transaction belong to the same netting group or not. If they belong to the same netting group, the entries will not be posted. Instead the transaction will be logged for the netting batch. On authorisation, the transaction will be made available for the netting batch if logged for netting batch.

Refer the section ‘Maintaining Netting Group’ in the chapter ‘Accounts for Inter-Branch Transactions’ in the Core Services User Manual for further details about netting.

The approver can fetch this transaction for his/her task list and authorize it. The authorization process is similar to that of cash deposit.

The system displays overrides on a separate window. You can either accept or reject the overrides and proceed with saving the transaction. If you click ‘Reject’ button, the screen will remain in the enrichment stage for you to make changes to charge elements. Then if you click ‘Save’, the system will initiate reversal of the transaction without reversing the charges.

Refer the corresponding section under ‘Depositing Cash’ in the chapter ‘Cash Transactions’ of this User Manual for further details.

Refer the chapters titled ‘Transaction Workflow’ and ‘Common Operations’ in this User Manual for details on the authorization process

8.5 Tracking a Cheque Return

This section contains the following topics:

8.5.1 Invoking Cheque Return Screen

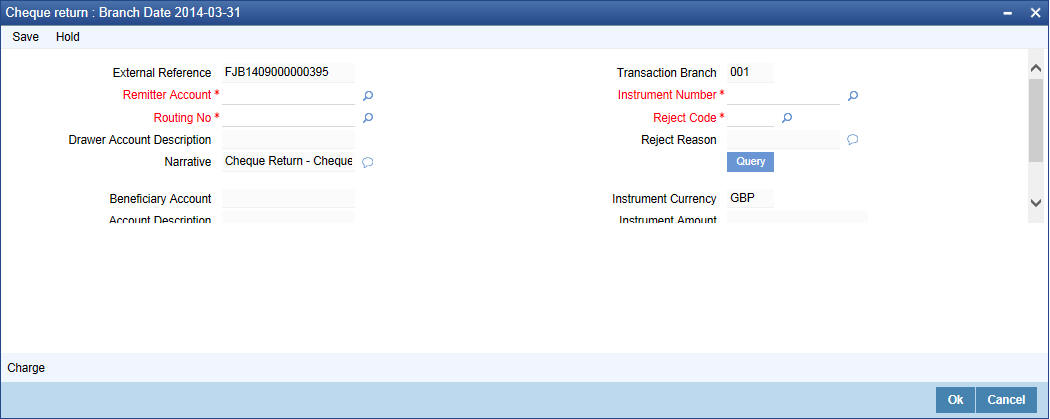

A cheque transaction may not be successfully completed for want of funds in the drawer account or if the drawer account is invalid. You can cancel a cheque issued on such an account through the ‘Cheque Return’ screen. You can invoke this screen by typing ‘6560’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can capture the following details:

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Transaction Branch

The current logged branch code is displayed here.

Remitter Account

Specify the remitter account number. Alternatively, you can select remitter account number from the option list. The list displays all valid remitter account number maintained in the system.

Instrument Number

Specify the instrument number. Alternatively, you can select instrument number from the option list. The list displays all valid instrument number maintained in the system.

Reject Code

Specify the reject code. Alternatively, you can select reject code from the option list. The list displays all valid reject code maintained in the system.

Reject Reason

The system displays the reason for the selected reject code.

Drawer Account Description

The system displays the description of the specified drawer account number based on the details maintained at ‘Customer Account Maintenance’ level.

Routing No

Once the drawee account number is specified, you can select the routing number from the adjoining option list. Alternately, you can choose a routing number along with the Branch codes and Bank Codes from the adjoining list and view the corresponding cheque number and account number.

Narrative

The system defaults the narrative as 'Cheque Return - Cheque no - Cheque Number - Reject Reason'. Once you specify the 'Cheque Number' and 'Reject Reason', the system replaces the field values respectively on tabbing out from the field.

After specifying the mandatory details, click ‘Query’ button, to display the following values:

- Beneficiary Account

- Account Description

- Cheque Return Amount

- Charge Amount

- Instrument Currency

- Instrument Amount

- Value Date

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Drawee Accounts Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

8.5.2 Charge Button

System displays the following details under ‘Charge Details’ section:

- Charge Component

- Charge Currency

- Charge in Local Currency

- Exchange Rate

Waiver

Check this box to waive the charge.

Charge Amount

System displays the calculated charge amount here. You can amend this, if required.

Note

If you reject a cheque without giving the reject code then that cheque can be reused. However, if you enter the reason code then the cheque will be rejected.

In the single stage flow, if there is an transaction level override or error during approval then the transaction will be moved to the pending queue. Without save action being initiated, the transaction will not be in pending queue.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save. On pick up, the fields that are currently enabled in the enrich stage will alone be retained as enabled fields.

Refer the chapters titled ‘Transaction Workflow’ and ‘Common Operations’ in this User Manual for details on the authorization process.

8.6 Bulk Cheque Return

This section contains the following topics:

- Section 8.6.1, "Cheque Return Batch"

- Section 8.6.2, "Maintaining Function Input Details"

- Section 8.6.3, "Triggering Cheque Return Processing Batch"

8.6.1 Cheque Return Batch

You can process the cheque return in bulk using an intraday batch in Oracle FLEXCUBE. For this, you need to first maintain the batch as an intraday batch in the system.

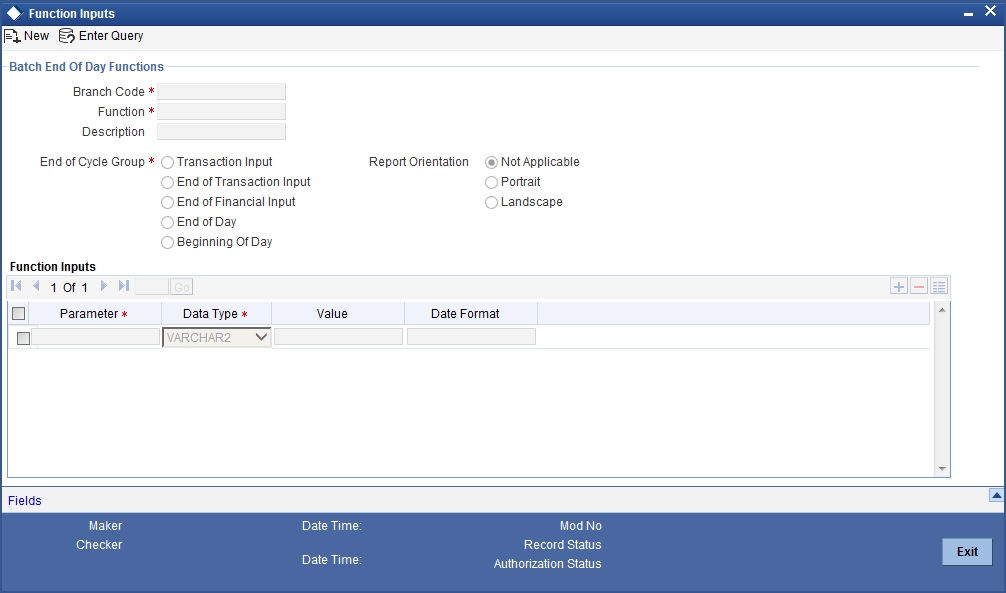

8.6.2 Maintaining Function Input Details

You need to maintain the required batch program in 'Batch EOD Function Input' screen. To invoke this screen, type BADEODFE’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

Specify the following details:

Function ID

Specify CGREJECT. This is the function ID for running the intraday batch for cheque return.

End of Cycle Group

Select ‘Transaction input’.

Report Orientation

Select ‘Not Applicable’.

Function Input

You need to map the following parameters.

Parameter |

Data Type |

Value |

ACTION CODE |

VARCHAR2 |

RETURN |

EXTERNAL SYSTEM |

VARCHAR2 |

Name of the external system for which the cheque returns are being uploaded |

FUNCTION ID |

VARCHAR2 |

6560 |

Once you have specified the details, save the maintenance.

For further information on this screen, refer to the section 'Specifying Data Values for EOD Functions' in chapter ‘Automated End of Cycle Operations’ of the Automated End of Day user manual.

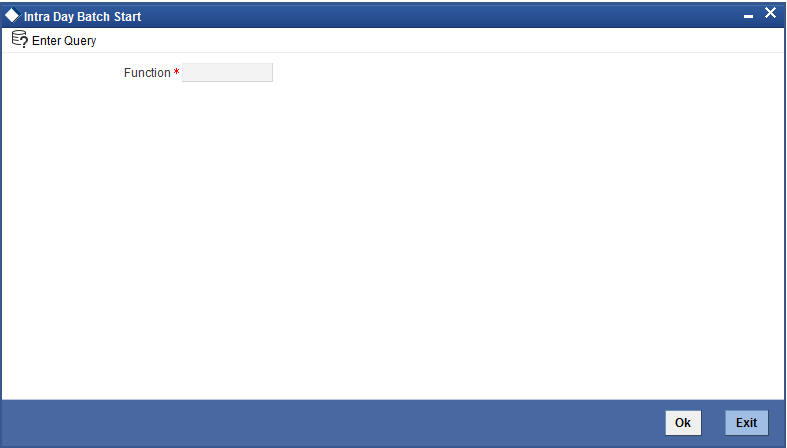

8.6.3 Triggering Cheque Return Processing Batch

You can invoke 'Intra Day Batch Start' screen by typing 'BABIDBAT' in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Select the function ID of the batch to be executed. Click 'OK' button. The system triggers the batch process.

The batch will pick up the unprocessed cheque return records and start processing the records one by one.

Before passing the cheque return record to the main processing routine, the system validates the entered data against the data stored in the database. If the entered data does not match with the data stored in the database, the system logs the error and proceeds to the next record.

You can input the charge component and charge amount/waiver for a cheque return. The charge component thus entered must be maintained in the ‘Arc Maintenance’ screen for the charge product mapped to the clearing product of the cheque being returned. The charge product, which should be an RT product, is mapped to the clearing product using the screen ‘Online Charge Product Maintenance’ (STDCHGMN). If it is not maintained, then the system will log appropriate error for the particular cheque return and proceed to the next cheque return record.

If you do not input any charge component for the cheque, then the system will check if any charge component has been maintained in 'Arc Maintenance' screen for the charge product mapped to the clearing product. If it is maintained, then system will pick that charge component and amount and process the record.

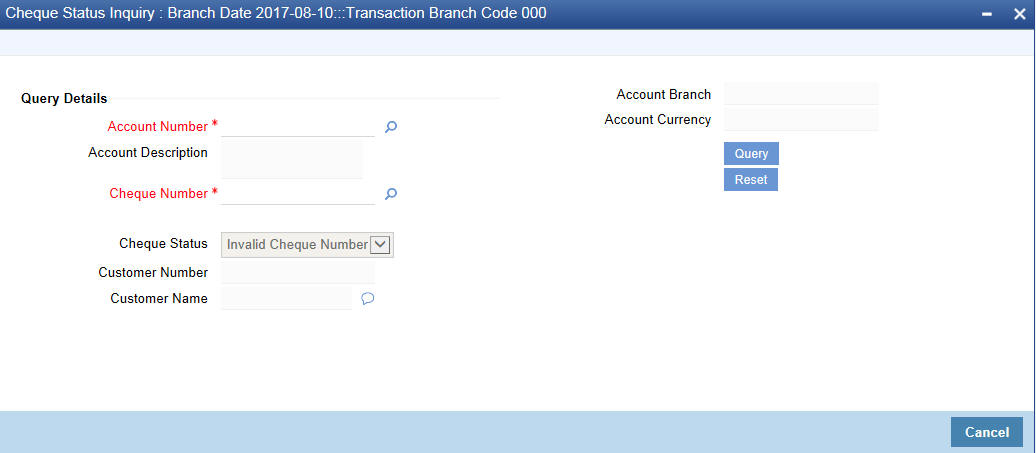

8.7 Querying Cheque Status

You can query the details of a cheque by specifying the customer’s account number and cheque number in the ‘Cheque Status Inquiry’ screen. You can invoke this screen by typing ‘CQIN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can capture the following details:

Account Number

Specify the account number. The adjoining option list displays all the valid account numbers maintained in the account branch selected. You can choose the appropriate one.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

Specify the branch code. The adjoining option list displays all the valid branch codes maintained in the system. You can choose the appropriate one.

Account Description

The system displays a brief description on the account.

Account Currency

The currency of the chosen account is displayed here.

Cheque Number

Specify the cheque number. The adjoining option list displays all the valid cheque numbers maintained in the account number selected. You can choose the appropriate one.Click ‘Reset’ button once you specify the account number and cheque number. The following details will be displayed in the screen:

- Account Title

- Customer Number

- Account Currency

- Cheque Status

Note

Validation will be done to check if the account number specified is a valid number.

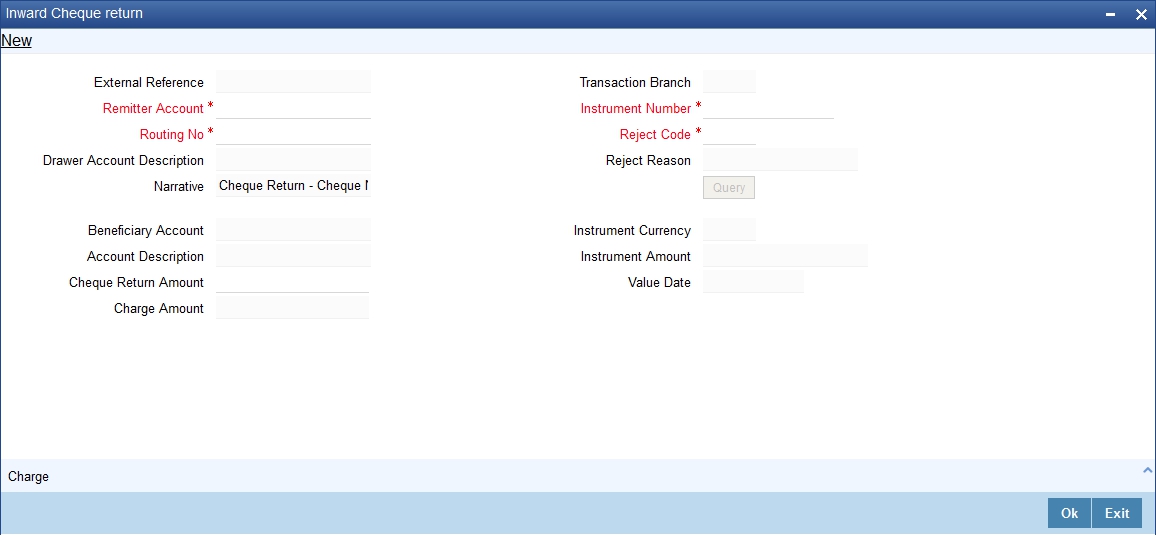

8.8 Inward Cheque Return

This section contains the following topic:

8.8.1 Invoking Inward Cheque Return Screen

In case of handling returns for successfully processed Inward clearing transactions, the system will first reverse the entries that got passed as part of Inward clearing transaction and pass the newly introduced reject entries as part of REVR event. You can return successfully processed inward clearing transactions using ‘Inward Cheque Return’ screen. You can invoke this screen by typing ‘6570’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

External Reference

The system displays the external reference number based on the branch specific sequence number by which the host identifies the branch transaction.

Remitter Account

Specify the drawer account number, Alternatively, you can select remitter account from the option list. The list displays all valid drawer account number maintained in the system.

Routing No

Specify the routing number. Alternatively, you can select routing number from the option list. The list displays all valid routing number maintained in the system.

Drawer Account Description

The system displays description for the specified remitter account.

Transaction Branch

The system displays the current logged in branch details.

Instrument Number

Specify the cheque number that needs to be tracked to return. Alternatively, you can select instrument number from the option list. The list displays all valid instrument number maintained in the system.

Reject Code

Specify the reject code. Alternatively, you can select reject code from the option list. The list displays all valid reject code maintained in the system.

Reject Reason

Specify the reason for reject.

Narrative

Specify the details about the cheque number and the reject reason for the cheque return.

Beneficiary Account

The system displays the beneficiary details specified for the cheque.

Account Description

The system displays the description of the beneficiary account number.

Cheque Return Amount

The system displays the amount of cheque returned.

Charge Amount

The system displays the charge applicable for the charge return.

Instrument Currency

The system displays the currency of the instrument.

Instrument Amount

The system displays the amount of the instrument.

Value Date

The system displays the value date of the instrument.

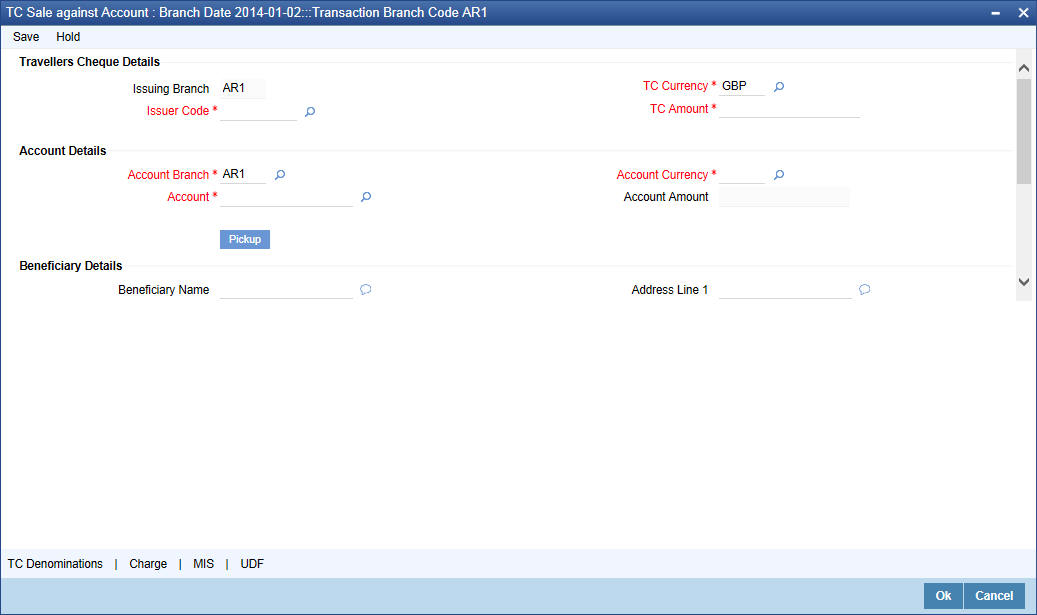

8.9 Issue a TC against an Account

This section contains the following topics:

- Section 8.9.1, "Selling a TC against an Account"

- Section 8.9.2, "Specifying TC Denomination Details"

- Section 8.9.3, "Specifying Charge Details"

- Section 8.9.4, "Specifying MIS Details"

- Section 8.9.5, "Specifying UDF Details"

8.9.1 Selling a TC against an Account

You can issue a Traveller’s Cheque (TC) for your customer against his/her savings account. In order to capture this transaction, you need to invoke the ‘TC Sale (Against A/C’) screen by typing ‘1009’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here, you can capture the following details:

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Issuing Branch

The current logged – in branch is displayed.

Instrument Type

The instrument type corresponding to a TC issued to customers against their savings account is displayed here.

Instrument Status

The system displays the event that is triggered for the transaction. This corresponds to the status of the instrument.

Issuer Code

Specify the issuer code to validate the TC details for sale from the adjoining option list.

Account Branch

Specify the branch in which the customer account is maintained for issuing the TC from the adjoining option list.

Account

Specify the customer account against which you are issuing the TC. The adjoining option list displays all the accounts maintained in the system. Select the appropriate one.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Currency

The account currency of the specified customer account is displayed here.

TC Currency

The transaction currency of the specified customer account is displayed here.

TC Amount

Specify the amount for which the TC is being issued.

Narrative

Here, you can enter remarks about the transaction.

Click the save icon to go to the next stage.

In the single stage flow, if there is an transaction level override or error during approval then the transaction will be moved to the pending queue. Without save action being initiated, the transaction will not be in pending queue.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save. Clicking ‘Pickup’ button, the system defaults the following details:

Related Customer ID

The customer identification number of the payment initiator is displayed here based on the chosen account number.

Customer Name

The customer name pertaining to the related customer ID is displayed here.

Exchange Rate

The system displays the exchange rate used to convert the transaction currency into account currency. If the transaction currency is the same as the account currency, the system will display the exchange rate as ‘1’.

Total Charge

The system computes the charges applicable for the transaction and displays it here.

Beneficiary Name

Specify the beneficiary name.

Beneficiary Address

Specify the beneficiary address.

Account Amount

The system displays the amount to be debited from the account (in the account currency) after calculating the applicable charges. This amount depends on the charge method – whether inclusive or exclusive.

Recalc

Click ‘Recalc’ button to update amount/charge details.

8.9.2 Specifying TC Denomination Details

In this block you can enter the TC denomination details through the following fields:

TC Description

Select the TC denomination from the adjoining option list. The list displays all the TC denominations maintained in the branch system.

TC Denomination

The number of available units in the denomination is displayed.

Currency

The TC Currency is displayed here.

Count

Enter the number of TCs against each denomination in Count.

Series

Select the TC series from the option list.

Start Number

Specify the starting serial number of TC against each denomination and press TAB.

The following details are displayed:

End Number

The system displays ending serial number of TCs against each denomination based on the TC count you have specified.

TC Amount

The system displays the TC amount based on the value of denomination and the number of TCs against that denomination.

System Count

The count of denominations available in the system is displayed.

8.9.3 Specifying Charge Details

This block allows you to capture charge related details. Click on the ‘Charges’ to invoke the Charge Details screen.Refer the section titled ‘Specifying charge details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.9.4 Specifying MIS Details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the MIS Details screen.

Refer the section titled ‘Specifying MIS details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.9.5 Specifying UDF Details

This block allows you to capture details pertaining to UDF. Click on the ‘UDF’ tab to invoke the UDF Details screen.

Refer the section titled ‘Specifying the UDF details’ under ‘Withdrawing Cash against a Cheque’ for further details.

Click save icon to save the transaction.

The approver can fetch this transaction for his/her task list and authorize it. The authorization process is similar to that of cash deposit.

Note

Depending on the ‘Display Type’ selected for customer / account in ‘Instruction Maintenance’ screen, the instruction will be displayed at the time of saving the input stage and authorizing the transaction.

For more details about viewing customer / account instructions, refer the section titled ‘Viewing Customer / Account Instructions on ‘F6’ Key-Press’ and Viewing Customer / Account Instruction Details in Override Screen’ in this user manual.

Refer the corresponding section under ‘Depositing Cash’ in the chapter ‘Cash Transactions’ of this User Manual for further details.

Refer the chapters titled ‘Transaction Workflow’ and ‘Common Operations’ in this User Manual for details on the authorization process.

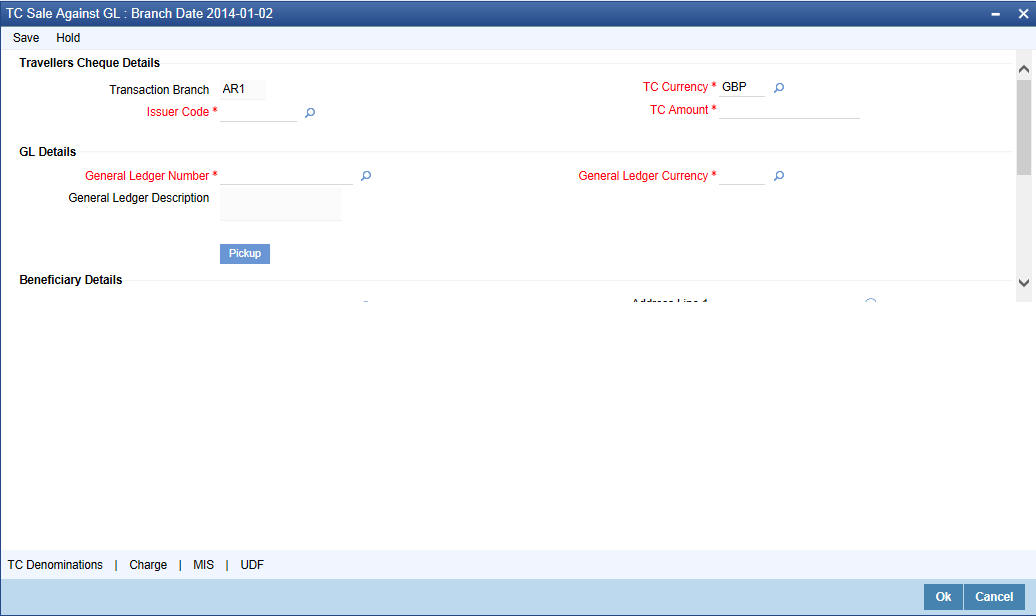

8.10 Issue a TC against a GL

This section contains the following topics:

- Section 8.10.1, "Selling a TC against a GL"

- Section 8.10.2, "Specifying TC Denomination Details"

- Section 8.10.3, "Specifying Charge Details"

- Section 8.10.4, "Specifying MIS Details"

- Section 8.10.5, "Specifying UDF Details"

8.10.1 Selling a TC against a GL

You can issue a Traveller’s Cheque (TC) for your customer against General Ledger account. In order to capture this transaction, you need to invoke the ‘TC Sale (Against GL)’ screen by typing ‘8205’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here, you can capture the following details:

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Issuer Code

Specify the issuer code to validate the TC details for sale from the adjoining option list.

Branch

The current logged – in branch is displayed.

Instrument Type

The instrument type corresponding to a TC issued against GL account is displayed here.

Instrument Status

The system displays the event that is triggered for the transaction. This corresponds to the status of the instrument.

TC Currency

Specify the currency of the TC.

General Ledger Currency

Specify the currency of the GL against which the TC is being issued. The adjoining option list displays all the currency codes maintained in the system. Choose the appropriate one.

TC Amount

Specify the amount for which the TC is being issued.

General Ledger Number

Specify the GL against which you are issuing the TC. The adjoining option list displays all the GL accounts maintained in the system. Select the appropriate one.

GL Description

The system displays the description of the GL account number chosen.

Narrative

Here, you can enter remarks about the transaction.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save. Clicking ‘Pickup’ button, the system defaults the following details:

Customer Number

The customer identification number of the payment initiator is displayed here based on the chosen account number.

Exchange Rate

The system displays the exchange rate used to convert the TC currency into GL account currency. If the TC currency is the same as the account currency, the system will display the exchange rate as ‘1’.

Total Charge

The system computes the charges applicable for the transaction and displays it here.

Total Amount

The system displays the amount to be debited from the account (in the account currency) after calculating the applicable charges. This amount depends on the charge method – whether inclusive or exclusive.

Beneficiary Name

Specify the name of the beneficiary in whose favour the TC is being drawn.

Beneficiary Address

Specify the address of the beneficiary.

Recalc

Click ‘Recalc’ button to update amount/charge details.

8.10.2 Specifying TC Denomination Details

In this block you can enter the TC denomination details.

Refer the section titled ‘Specifying TC Denomination Details’ under ‘Selling a TC against an Account’ for further details.

8.10.3 Specifying Charge Details

This block allows you to capture charge related details. Click on the ‘Charges’ to invoke the Charge Details screen.

Refer the section titled ‘Specifying charge details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.10.4 Specifying MIS Details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the MIS Details screen.

Refer the section titled ‘Specifying MIS details’ under Withdrawing Cash against a Cheque’’ for further details.

8.10.5 Specifying UDF Details

This block allows you to capture details pertaining to UDF. Click on the ‘UDF’ tab to invoke the UDF Details screen:

Refer the section titled ‘Specifying the UDF details’ under Withdrawing Cash against a Cheque’’ for further details.

Click save icon to save the transaction.

The approver can fetch this transaction for his/her task list and authorize it. The authorization process is similar to that of cash deposit.

Refer the corresponding section under ‘Depositing Cash’ in the chapter ‘Cash Transactions’ of this User Manual for further details.

Refer the chapters titled ‘Transaction Workflow’ and ‘Common Operations’ in this User Manual for details on the authorization process.

8.11 Issue a TC to a Walk-in Customer

This section contains the following topics:

- Section 8.11.1, "Selling a TC to a Walk-in Customer"

- Section 8.11.2, "Specifying TC Denomination Details"

- Section 8.11.3, "Specifying Currency Denomination Details"

- Section 8.11.4, "Specifying Charge Details"

- Section 8.11.5, "Specifying MIS Details"

- Section 8.11.6, "Specifying UDF Details"

8.11.1 Selling a TC to a Walk-in Customer

You can sell a TC to any walk-in customer through the ‘TC Sale (Walk-In)’ screen. You can invoke this screen by typing ‘8204’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here, you can capture the following details:

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Branch

The current logged – in branch is displayed.

Issuer Code

Specify the issuer code to validate the TC details for sale from the adjoining option list.

Instrument Type

The instrument type corresponding to a TC issued to walk-in customers is displayed here.

Instrument Status

The system displays the event that is triggered for the transaction. This corresponds to the status of the instrument.

Transaction Date

Enter the date of issue of the TC. This is deemed to be the application date by default, and can be changed if necessary.

TC Currency

Specify the currency in which the TC is being issued.

Account Currency

The system defaults the branch currency as the account currency. However you can change it. The adjoining option list displays all the currency codes maintained in the system. You can select the appropriate code.

TC Amount

Specify the amount for which the TC is being issued.

Narrative

Here, you can enter remarks about the transaction.

In the single stage flow, if there is an transaction level override or error during approval then the transaction will be moved to the pending queue. Without save action being initiated, the transaction will not be in pending queue.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save. On pick up, the fields that are currently enabled in the enrich stage will alone be retained as enabled fields.

Clicking ‘Pickup’ button, the system defaults the following details:

Exchange Rate

The system displays the exchange rate used to convert the TC currency into transaction currency. If the TC currency is the same as the transaction currency, the system will display the exchange rate as ‘1’.

TC Amount in A/C Currency

Specify the TC amount in the TC currency.

Total Charge

The system computes the charges applicable for the transaction and displays it here.

Actual Amount

The system adds the charge amount to the TC amount and displays the total transaction amount.

Recalc

Click ‘Recalc’ button to update amount/charge details.

8.11.2 Specifying TC Denomination Details

Click ‘TC Denominations’ to enter the TC denomination details.

Refer the section titled ‘Specifying TC Denomination Details’ under ‘Selling a TC against an Account’ for further details.

8.11.3 Specifying Currency Denomination Details

Click ‘Currency Denominations’, to capture details of the currency denominations involved in the transaction.

Refer the section titled ‘Specifying denomination details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.11.4 Specifying Charge Details

This block allows you to capture charge related details. Click on the ‘Charges’ to invoke the Charge Details screen:

Refer the section titled ‘Specifying charge details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.11.5 Specifying MIS Details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the MIS Details screen.

Refer the section titled ‘Specifying MIS details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.11.6 Specifying UDF Details

This block allows you to capture details pertaining to UDF. Click on the ‘UDF’ tab to invoke the UDF Details screen. Refer the section titled ‘Specifying the UDF details’ under ‘Withdrawing Cash against a Cheque’ for further details.

Click save icon to save the transaction.

The approver can fetch this transaction for his/her task list and authorize it. The authorization process is similar to that of cash deposit.

Refer the corresponding section under ‘Depositing Cash’ in the chapter ‘Cash Transactions’ of this User Manual for further details.

Refer the chapters titled ‘Transaction Workflow’ and ‘Common Operations’ in this User Manual for details on the authorization process.

8.12 Purchase a TC against an Account

This section contains the following topics:

- Section 8.12.1, "Purchasing a TC against an Account"

- Section 8.12.2, "Specifying TC Denomination Details"

- Section 8.12.3, "Specifying Charge Details"

- Section 8.12.4, "Specifying MIS Details"

- Section 8.12.5, "Specifying UDF Details"

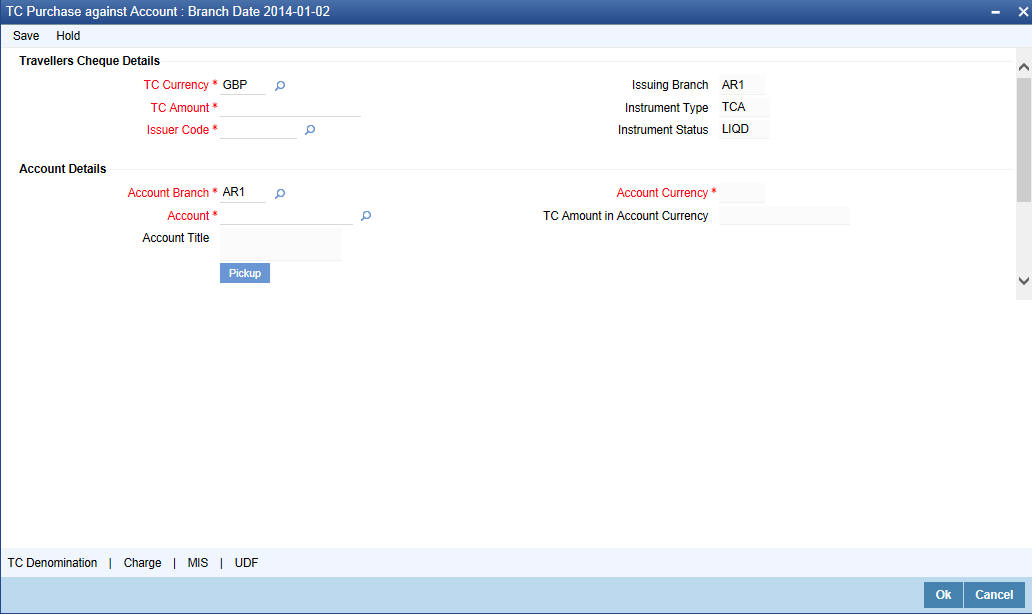

8.12.1 Purchasing a TC against an Account

You can purchase a TC through the ‘TC Purchase (Against A/C)’ screen. You can invoke this screen by typing ‘1409’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here, you can capture the following details:

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Issuing Branch

The current logged – in branch is displayed.

Account Number

Specify the customer account against which you are purchasing the TC. The adjoining option list displays all the accounts maintained in the system. Select the appropriate one.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

Specify the Branch in which the customer account needs to be selected for issuing the TC. The adjoining option list displays all the branches maintained in the system. Select the appropriate one.

TC Currency

Specify the currency of the TC.

TC Amount

Specify the amount as indicated on the TC instrument being purchased.

Issuer Code

Specify the issuer code to validate the TC details for sale from the adjoining option list.

Account Currency

The transaction currency of the chosen customer account is displayed here.

Narrative

Here, you can enter remarks about the transaction.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save. Clicking ‘Pickup’ button, the system defaults the following details:

Related Customer ID

The system displays the customer ID based on the account specified.

Customer Name

Customer name pertaining to the Related customer ID will be defaulted and displayed here.

TC Amount in A/C Currency

Specify the TC amount in the TC currency.

Exchange Rate

The system displays the exchange rate used to convert the TC currency into account currency. If the TC currency is the same as the account currency, the system will display the exchange rate as ‘1’.

Total Charge

The system computes the charges applicable for the transaction and displays it here.

Total Amount

The system deducts the charge amount from the TC amount and displays the total transaction amount.

In case you change the TC amount, you will have to click the ‘Recalc’ button to re-compute the total transaction amount and the total amount.

8.12.2 Specifying TC Denomination Details

In this block you can enter the TC denomination details.

Refer the section titled ‘Specifying TC Denomination Details’ under ‘Selling a TC against an Account’ for further details.

8.12.3 Specifying Charge Details

This block allows you to capture charge related details. Click on the ‘Charges’ to invoke the Charge Details screen. Refer the section titled ‘Specifying charge details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.12.4 Specifying MIS Details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the MIS Details screen.

Refer the section titled ‘Specifying MIS details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.12.5 Specifying UDF Details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the UDF Details screen.

Refer the section titled ‘Specifying the UDF details’ under ‘Withdrawing Cash against a Cheque’ for further details.

Click save icon to save the transaction.

The approver can fetch this transaction for his/her task list and authorize it. The authorization process is similar to that of cash deposit.

Note

Depending on the ‘Display Type’ selected for customer / account in ‘Instruction Maintenance’ screen, the instruction will be displayed at the time of saving the input stage and authorizing the transaction.

For more details about viewing customer / account instructions, refer the section titled ‘Viewing Customer / Account Instructions on ‘F6’ Key-Press’ and Viewing Customer / Account Instruction Details in Override Screen’ in this user manual.

Refer the corresponding section under ‘Depositing Cash’ in the chapter ‘Cash Transactions’ of this User Manual for further details.

Refer the chapters titled ‘Transaction Workflow’ and ‘Common Operations’ in this User Manual for details on the authorization process.

8.13 Purchase a TC from a Walk-in Customer

This section contains the following topics:

- Section 8.13.1, "Purchasing a TC from a Walk-in Customer"

- Section 8.13.2, "Specifying TC Denomination Details"

- Section 8.13.3, "Specifying Currency Denomination Details"

- Section 8.13.4, "Specifying Charge Details"

- Section 8.13.5, "Specifying MIS Details"

- Section 8.13.6, "Specifying UDF Details"

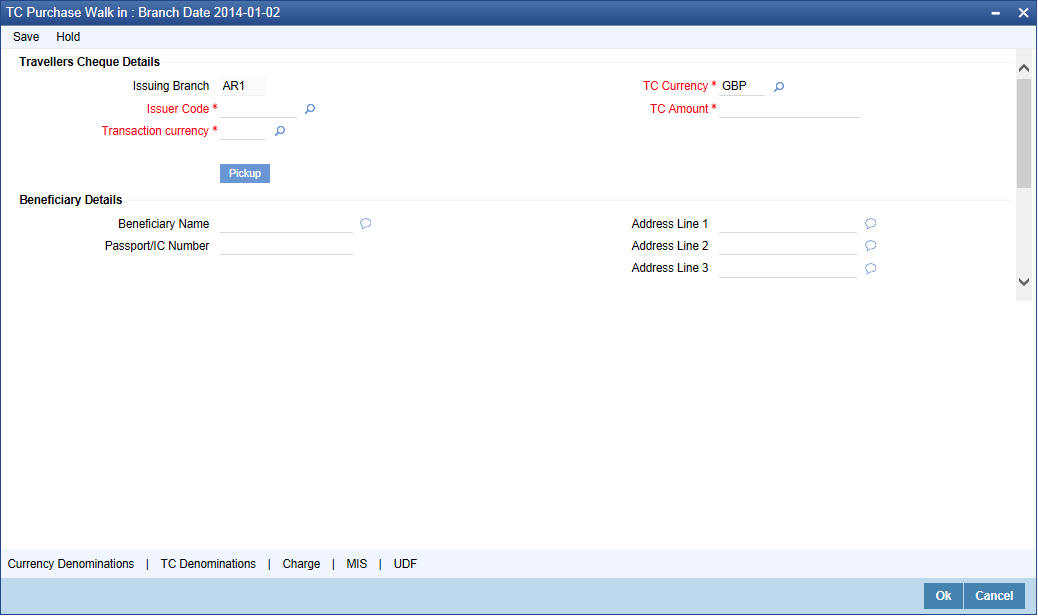

8.13.1 Purchasing a TC from a Walk-in Customer

You can liquidate a TC from a walk-in customer and give him/her the equivalent amount in cash. In order to capture such a transaction, invoke the ‘TC Purchase (Walk - In)’ screen. You can invoke this screen by typing ‘8003’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here, you can capture the following details:

External Reference Number

The system generates a unique number based on the branch-specific sequence number generation logic and displays it here. The Host system identifies a branch transaction with the external reference number.

Issuing Branch

The current logged – in branch is displayed.

Issuer Code

Specify the issuer code to validate the TC details for sale from the adjoining option list.

Instrument Type

The instrument type corresponding to a TC issued against GL account is displayed here.

Instrument Status

The system displays the event that is triggered for the transaction. This corresponds to the status of the instrument.

TC Currency

Specify the currency of the TC.

Account Currency

The system defaults the branch currency as the account currency. However you can change it. The adjoining option list displays all the currency codes maintained in the system. You can select the appropriate code.

TC Amount

Specify as indicated on the TC instrument being purchased.

Narrative

Here, you can enter remarks about the transaction.

Beneficiary Name

Specify the name of the beneficiary of the transaction.

Beneficiary Address

Specify the address of the beneficiary of the transaction.

In the single stage flow, if there is an transaction level override or error during approval then the transaction will be moved to the pending queue. Without save action being initiated, the transaction will not be in pending queue.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save.

Clicking ‘Pickup’ button, the system defaults the following details:

Exchange Rate

The system displays the exchange rate used to convert the TC currency into transaction currency. If the TC currency is the same as the transaction currency, the system will display the exchange rate as ‘1’.

Related Customer ID

System displays the customer ID applicable to walk-in customers.

Total Charge

The system computes the charges applicable for the transaction and displays it here.

Total Amount

The system displays the amount to be debited from the account (in the account currency) after calculating the applicable charges. This amount depends on the charge method – whether inclusive or exclusive.

Beneficiary Name

Specify the beneficiary name.

Beneficiary Address

Specify the beneficiary address.

Passport/IC Number

Specify the customer’s passport number or any other identification number.

In case you change the TC amount, you will have to click the ‘Recalc’ button to re-compute the total transaction amount and the total amount.

8.13.2 Specifying TC Denomination Details

In this block you can enter the TC denomination details.

Refer the section titled ‘Specifying TC Denomination Details’ under ‘Selling a TC against an Account’ for further details.

8.13.3 Specifying Currency Denomination Details

In this block, you can capture details of the currency denominations involved in the transaction.

Refer the section titled ‘Specifying denomination details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.13.4 Specifying Charge Details

This block allows you to capture charge related details. Click on the ‘Charges’ to invoke the Charge Details screen.

Refer the section titled ‘Specifying charge details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.13.5 Specifying MIS Details

This block allows you to capture details pertaining to MIS. Click on the ‘MIS’ tab to invoke the MIS Details screen.

Refer the section titled ‘Specifying MIS details’ under ‘Withdrawing Cash against a Cheque’ for further details.

8.13.6 Specifying UDF Details

This block allows you to capture details pertaining to UDF. Click on the ‘UDF’ tab to invoke the UDF Details screen.

Refer the section titled ‘Specifying the UDF details’ under ‘Withdrawing Cash against a Cheque’ for further details.

Click save icon to save the transaction.

The approver can fetch this transaction for his/her task list and authorize it. The authorization process is similar to that of cash deposit.

Refer the corresponding section under ‘Depositing Cash’ in the chapter ‘Cash Transactions’ of this User Manual for further details.

Refer the chapters titled ‘Transaction Workflow’ and ‘Common Operations’ in this User Manual for details on the authorization process.

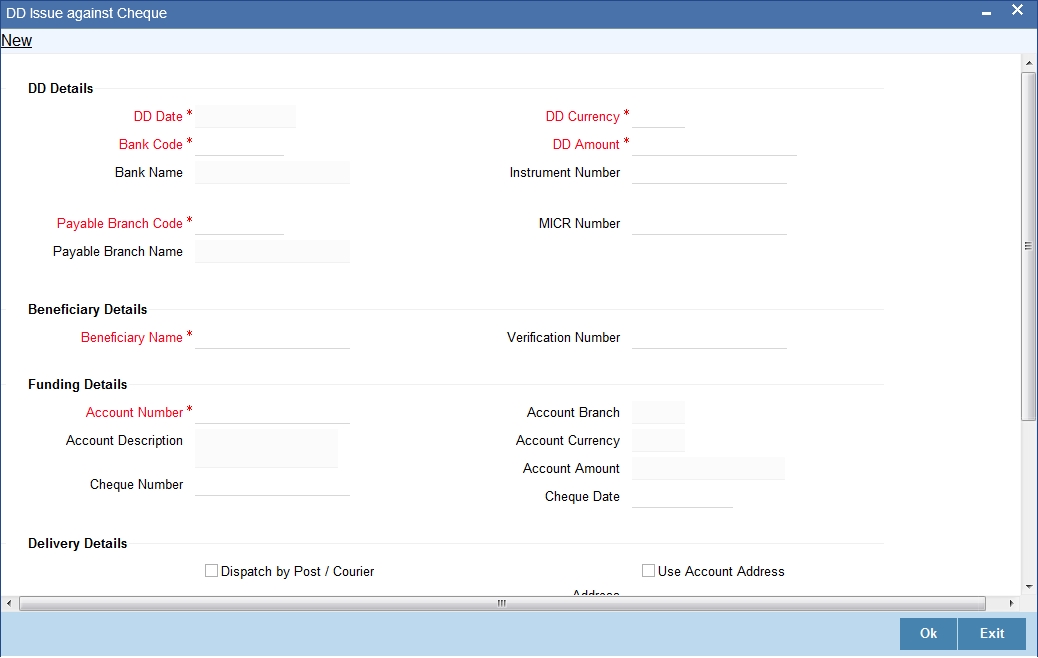

8.14 Issue a DD Issue against an Account

This section contains the following topics:

- Section 8.14.1, "Selling a DD Issue against an Account"

- Section 8.14.2, "Specifying Charge Details"

- Section 8.14.3, "Specifying MIS Details"

- Section 8.14.4, "Specifying UDF Details"

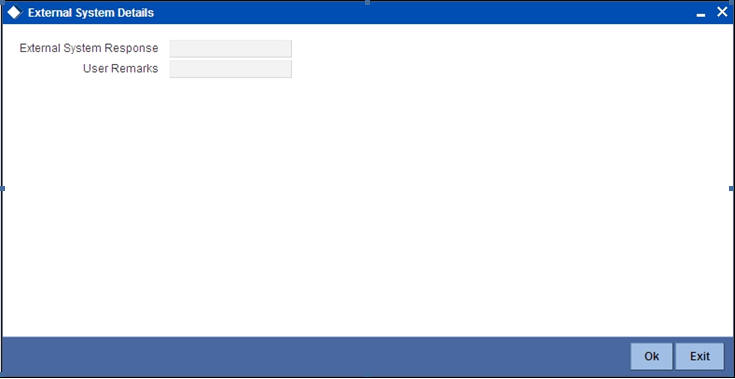

- Section 8.14.5, "Viewing OFAC Check Response"

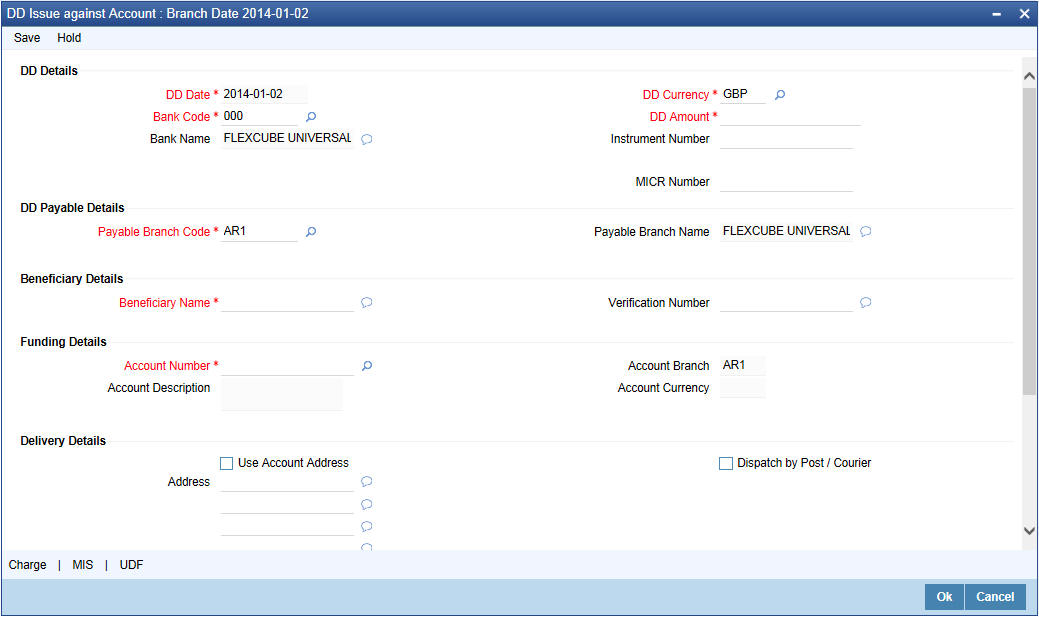

8.14.1 Selling a DD Issue against an Account

You can issue a Demand Draft (DD) for your customer against his/her savings account. In order to capture this transaction, you need to invoke the ‘DD Issue Against Account’ screen by typing ‘1014’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can capture the following details:

DD Details

DD Date

The date of DD issue is displayed here.

Bank Code

Specify the code of the bank that is issuing the DD. The adjoining option list displays all the bank codes maintained in the system. Select the appropriate one.

Bank Name

The system displays the name of the bank.

Payable Branch Code

Specify the branch code at which the DD should be encashed or redeemed. The adjoining option list displays all the branches maintained in the system. Select the appropriate one.

Payable Branch Name

The system displays the name of the branch.

DD Currency

Specify the currency of the DD.

DD Amount

Specify the amount for which the DD is being drawn.

Instrument Number

Specify the instrument number. On save, system validates the instrument number.

If the instrument number is available then the system moves the transaction to the enrich stage.

If the instrument number is not available then the system raises an error message as “Instrument number entered is not valid”

If the instrument number is not specified the system defaults the least instrument number which is available for the branch and the instrument type.

MICR Number

Specify the MICR number of the cheques.

Beneficiary Details

Beneficiary Name

Specify the name of the beneficiary in whose favour the DD is being drawn.

Verification Number

Specify the customer’s verification number.

Funding Details

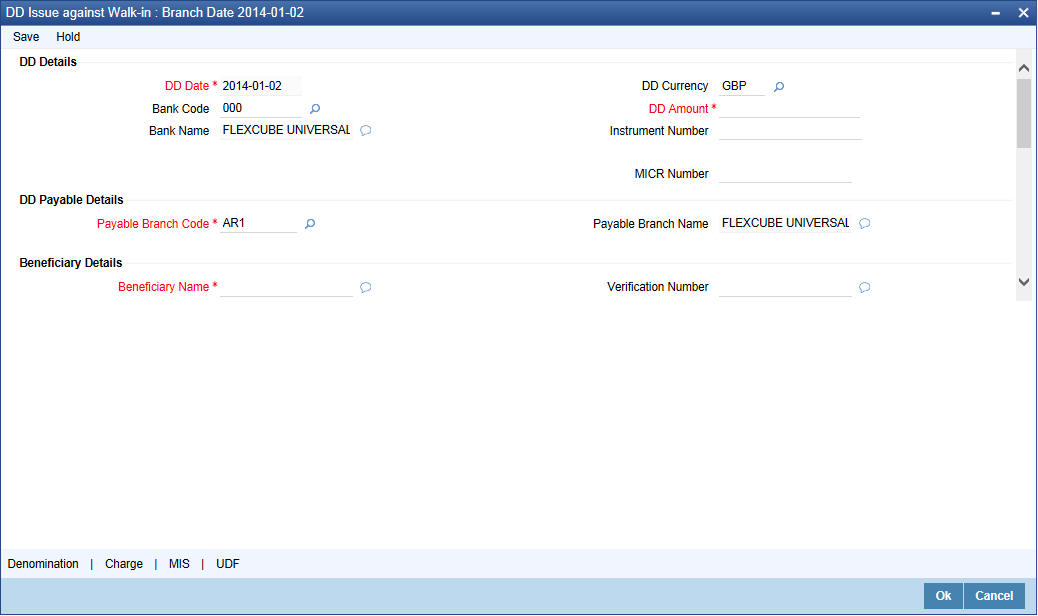

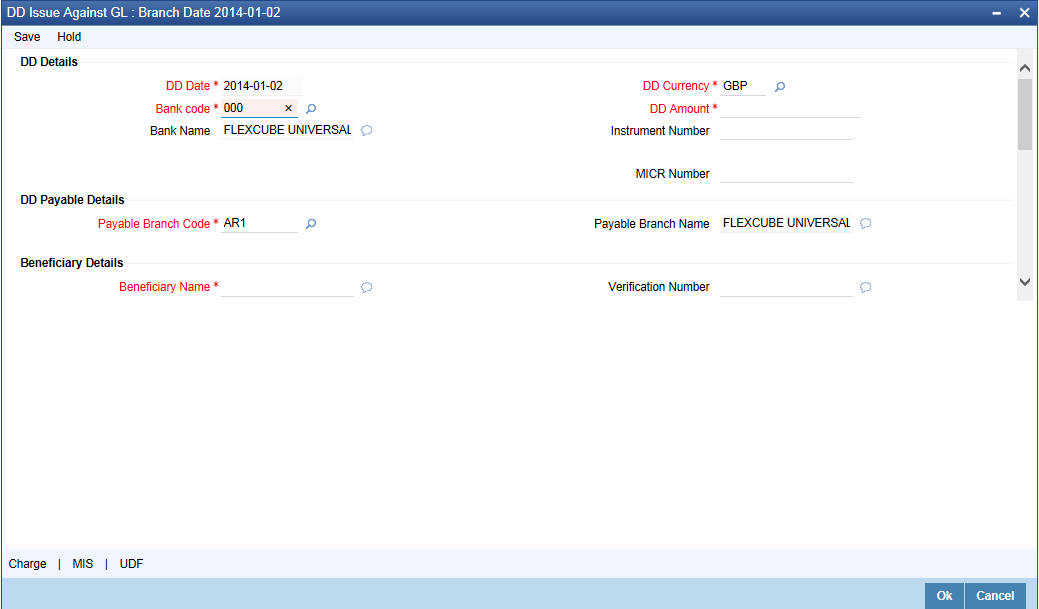

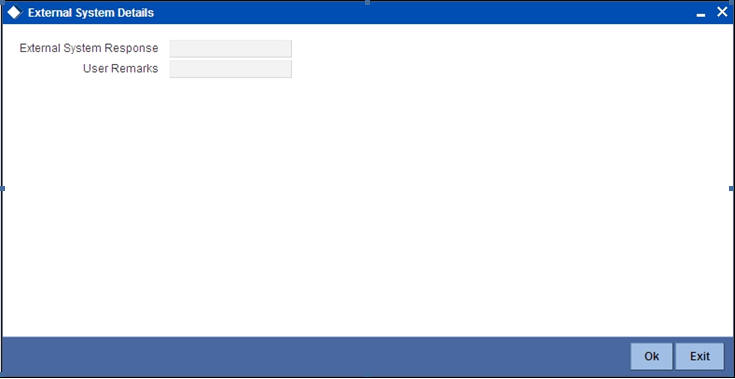

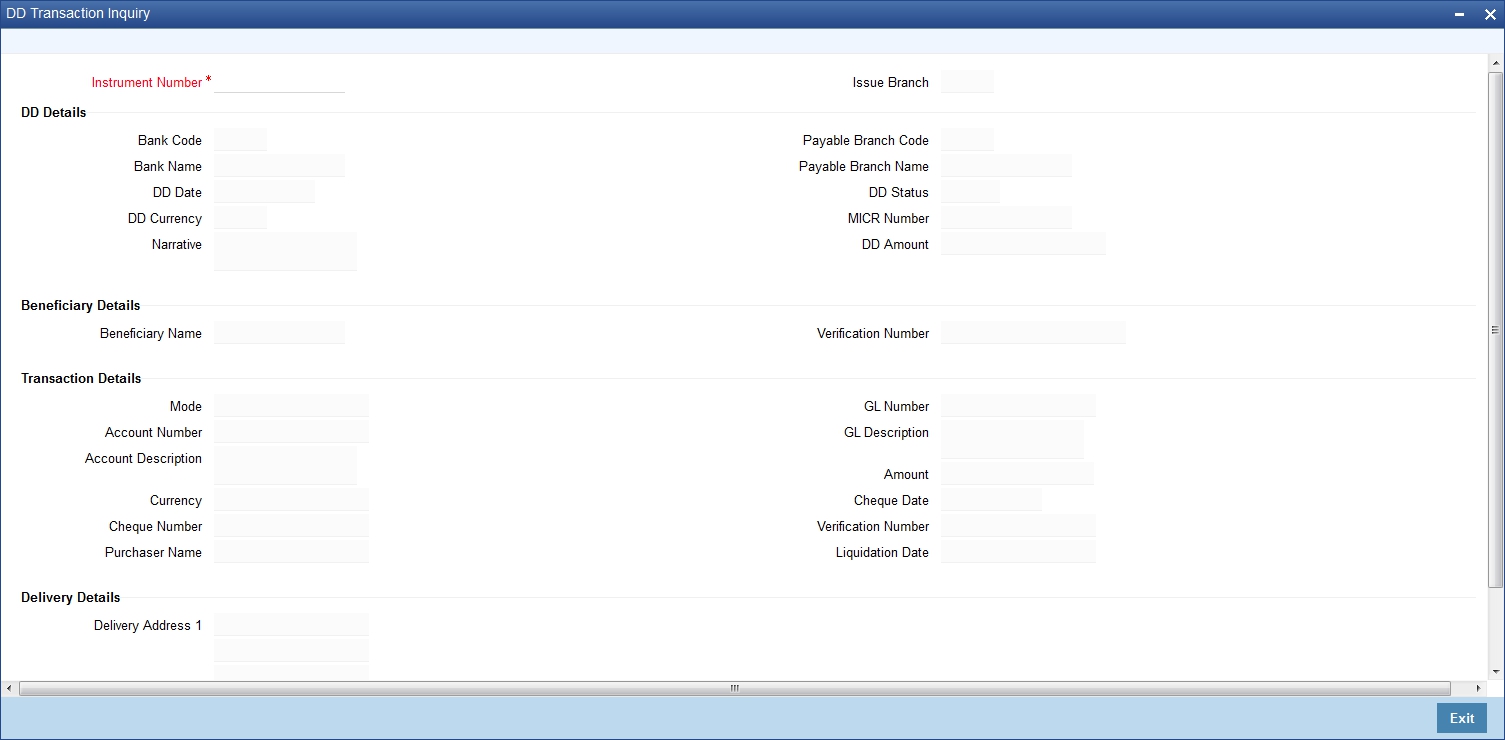

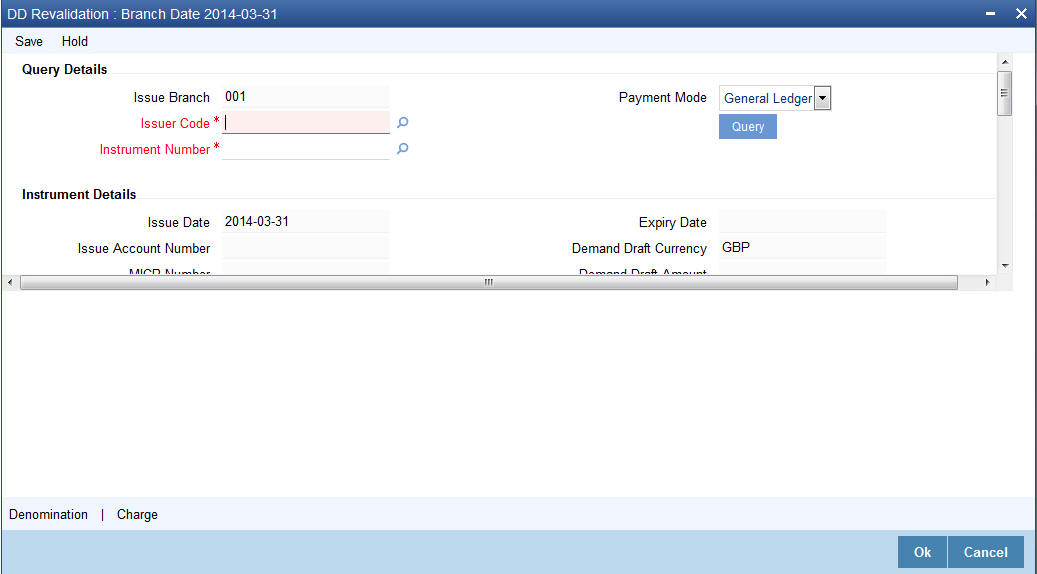

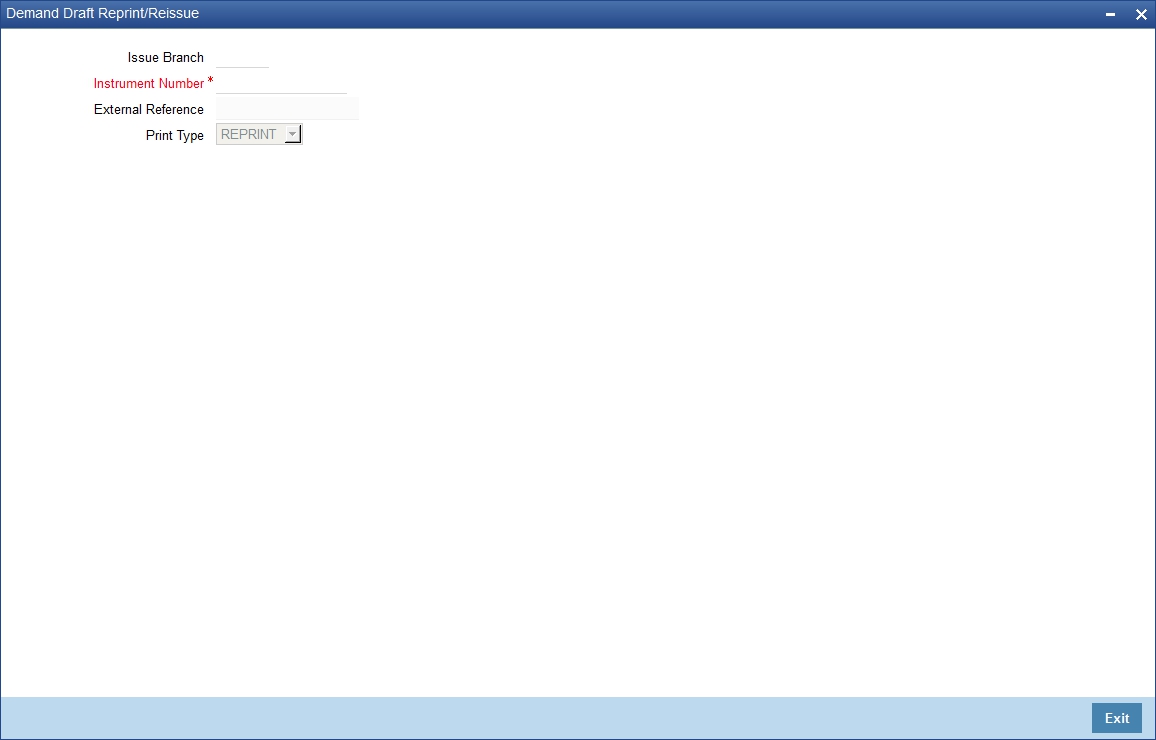

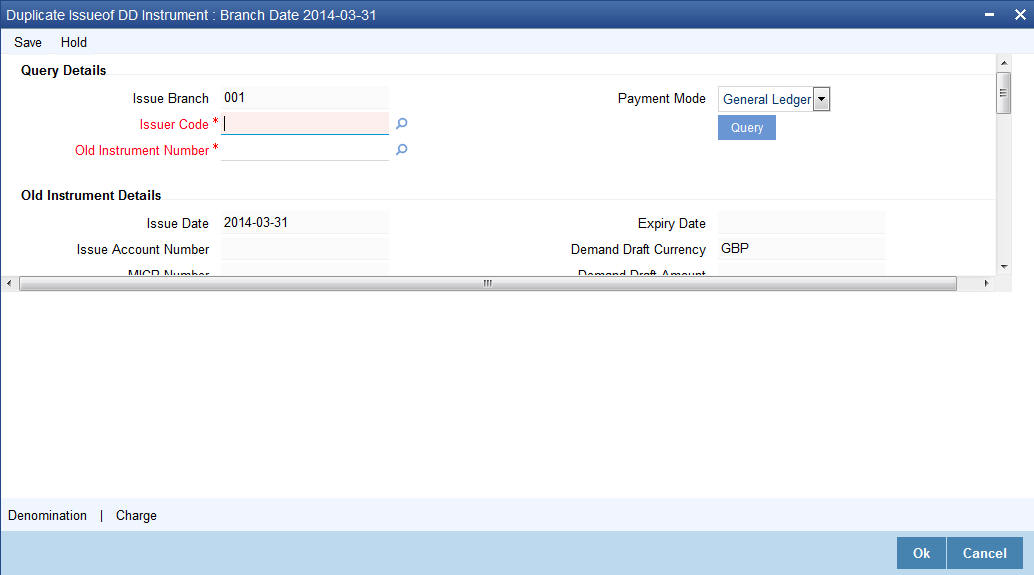

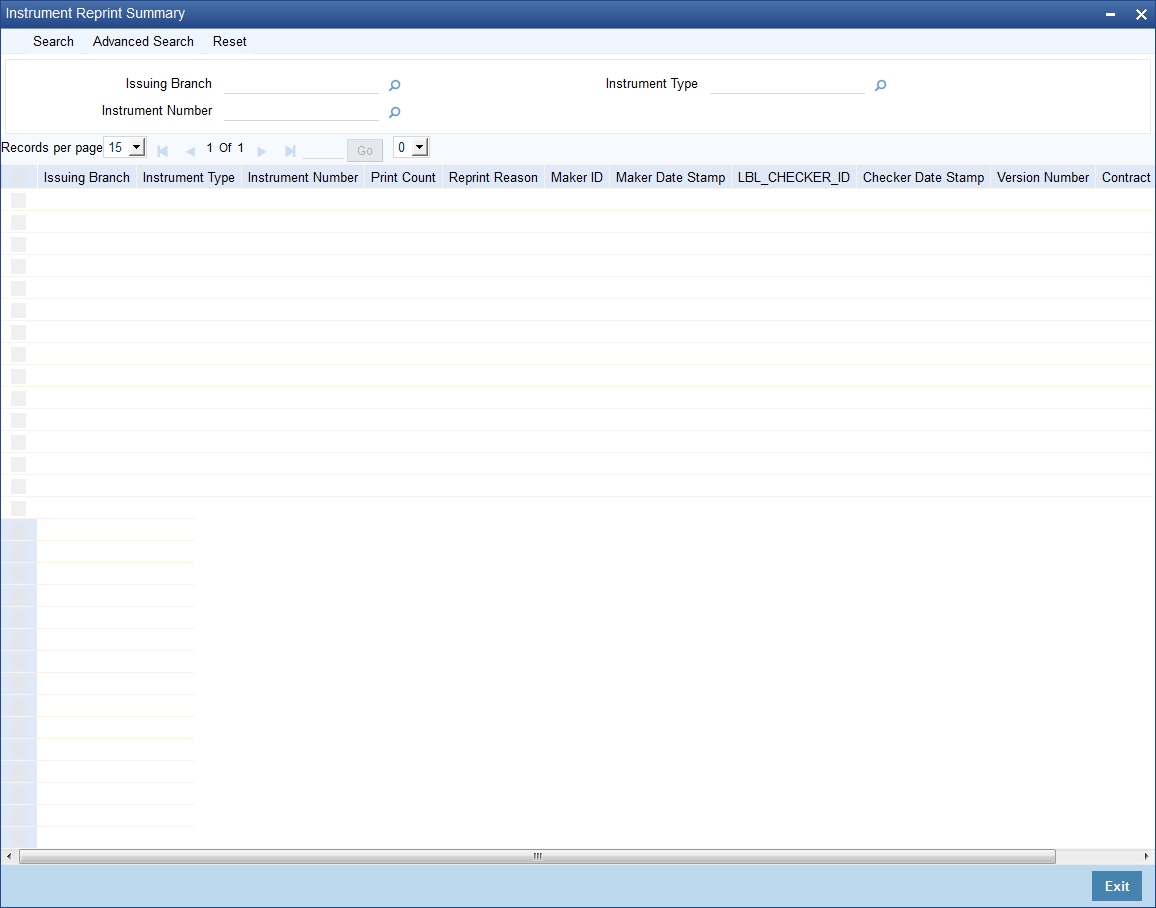

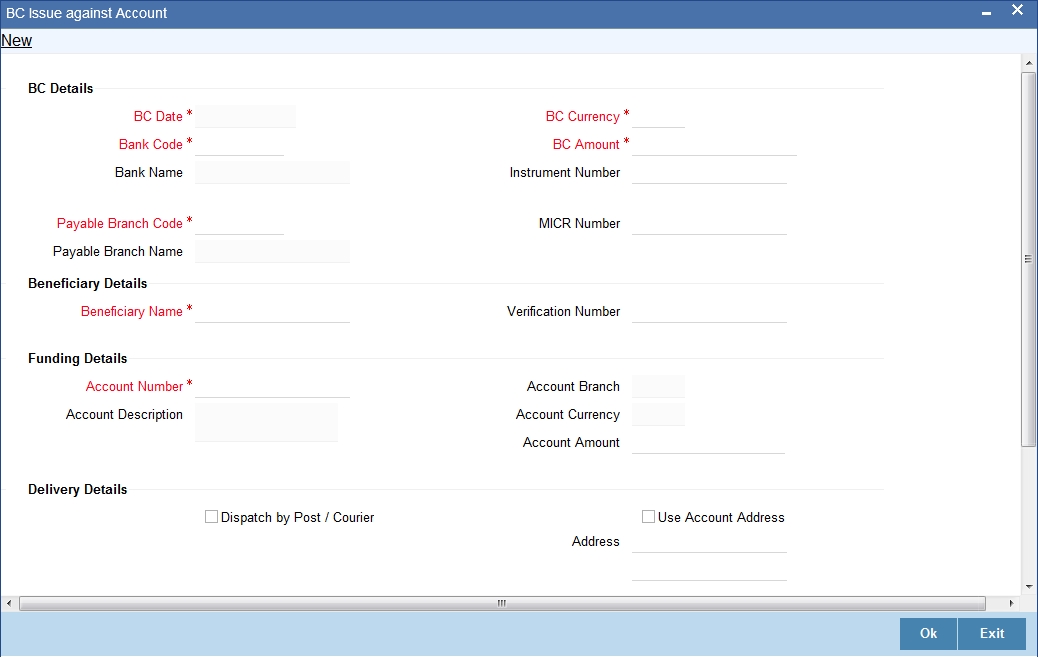

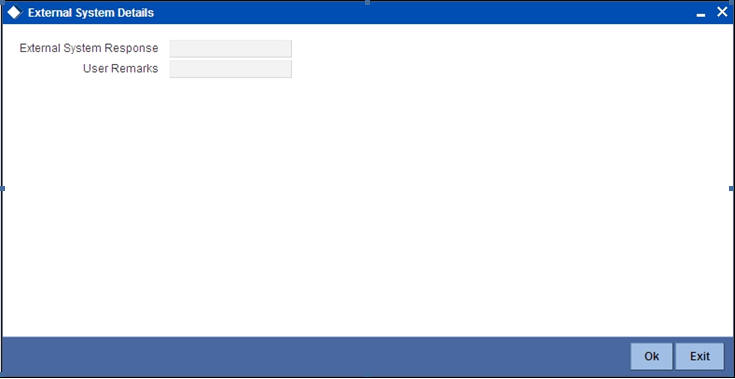

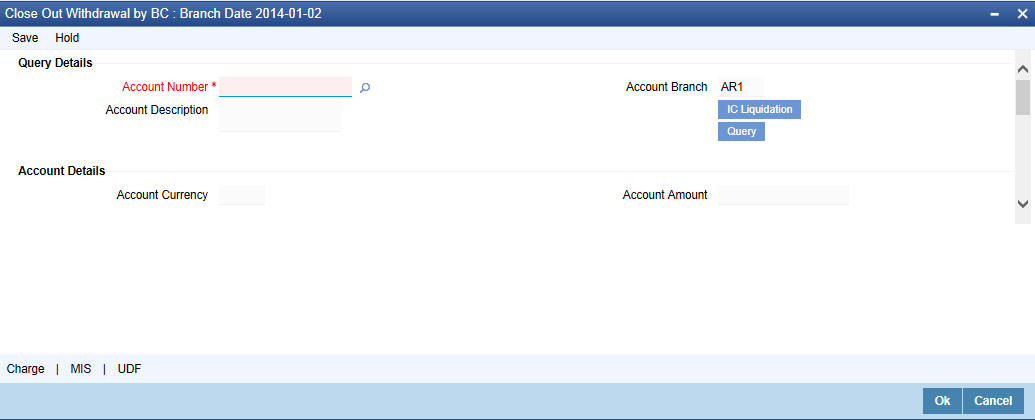

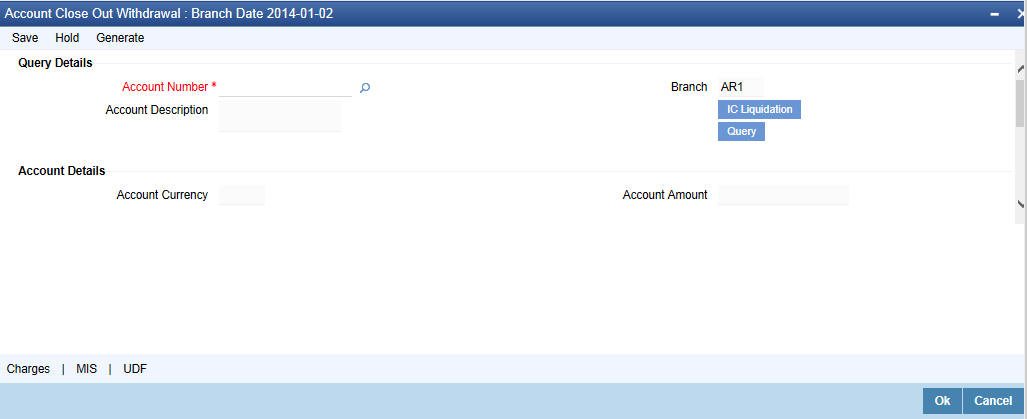

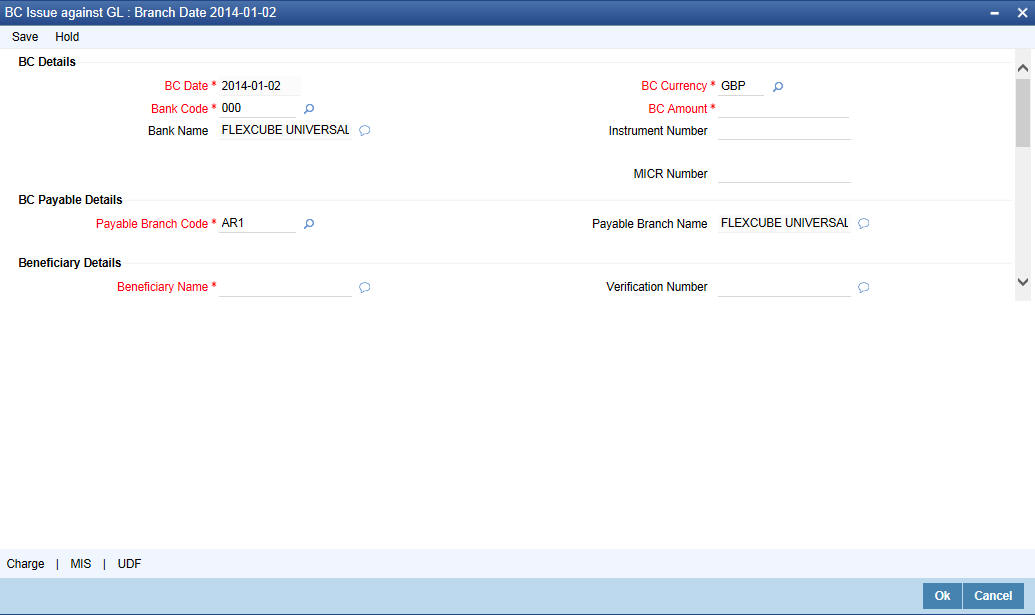

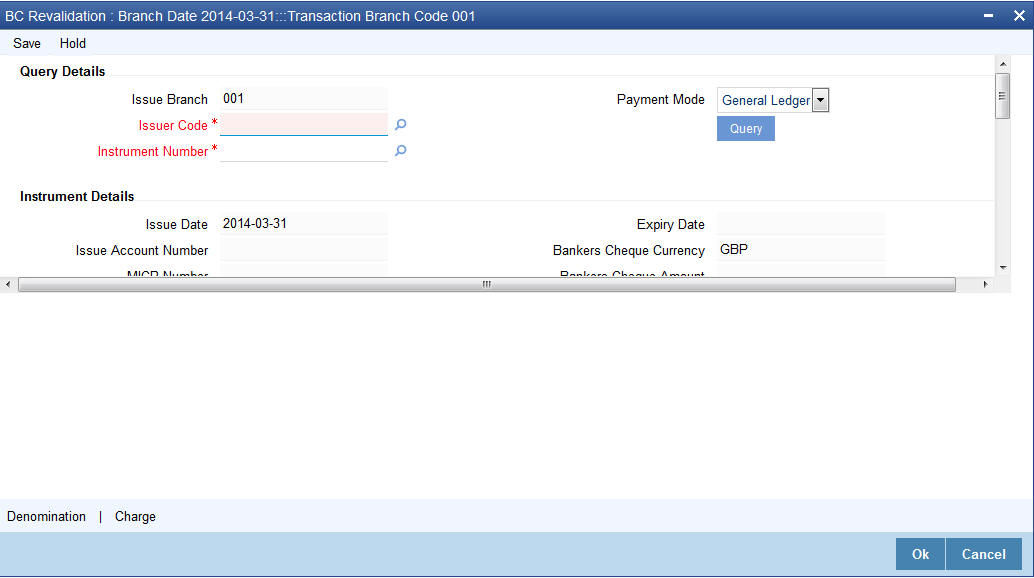

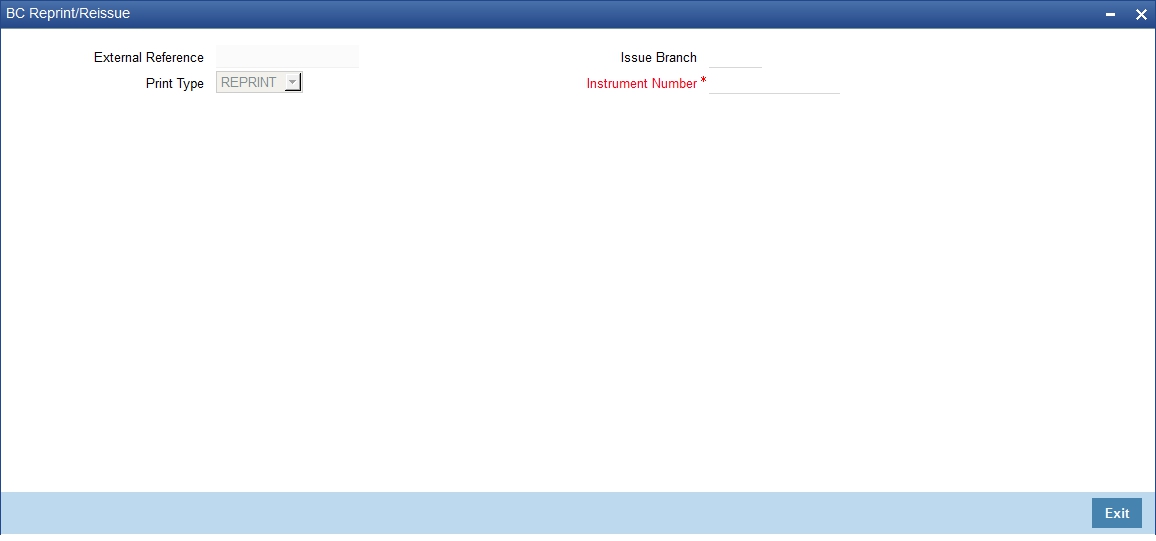

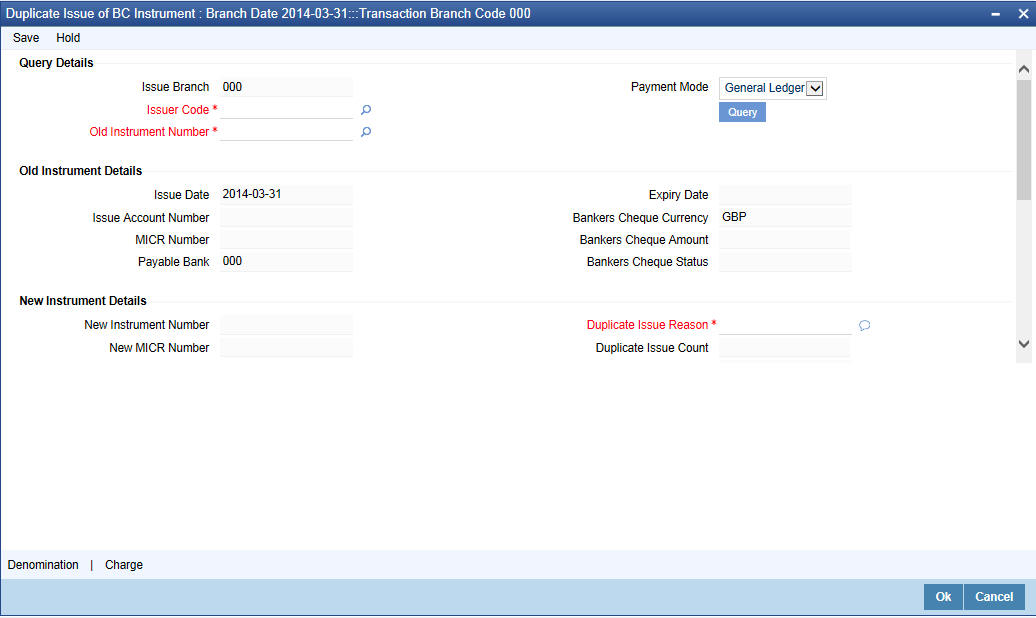

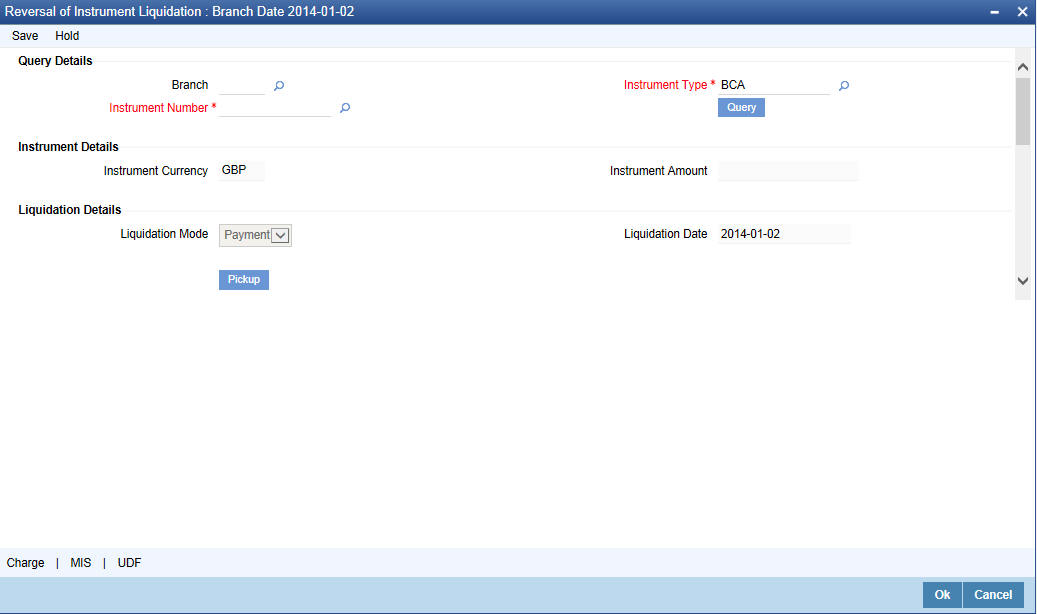

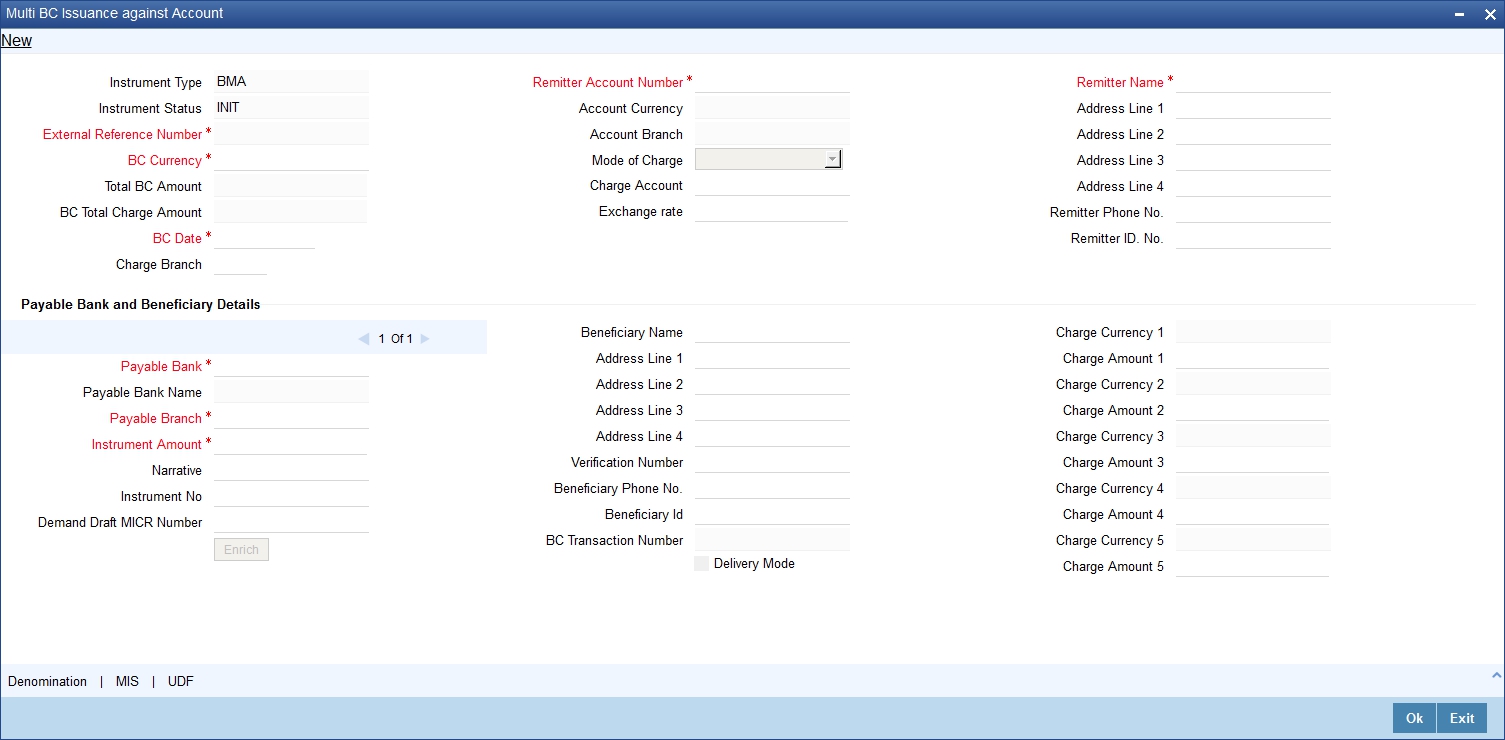

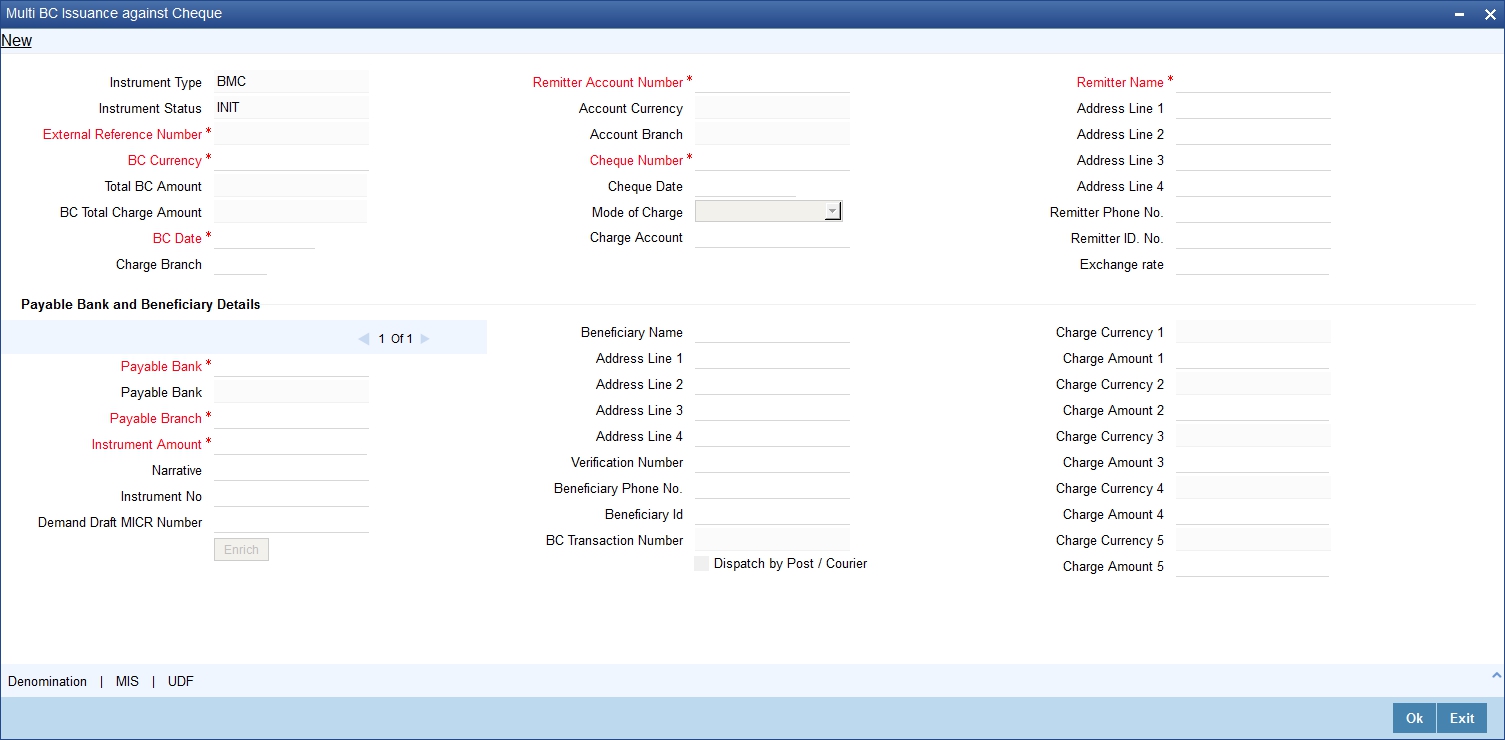

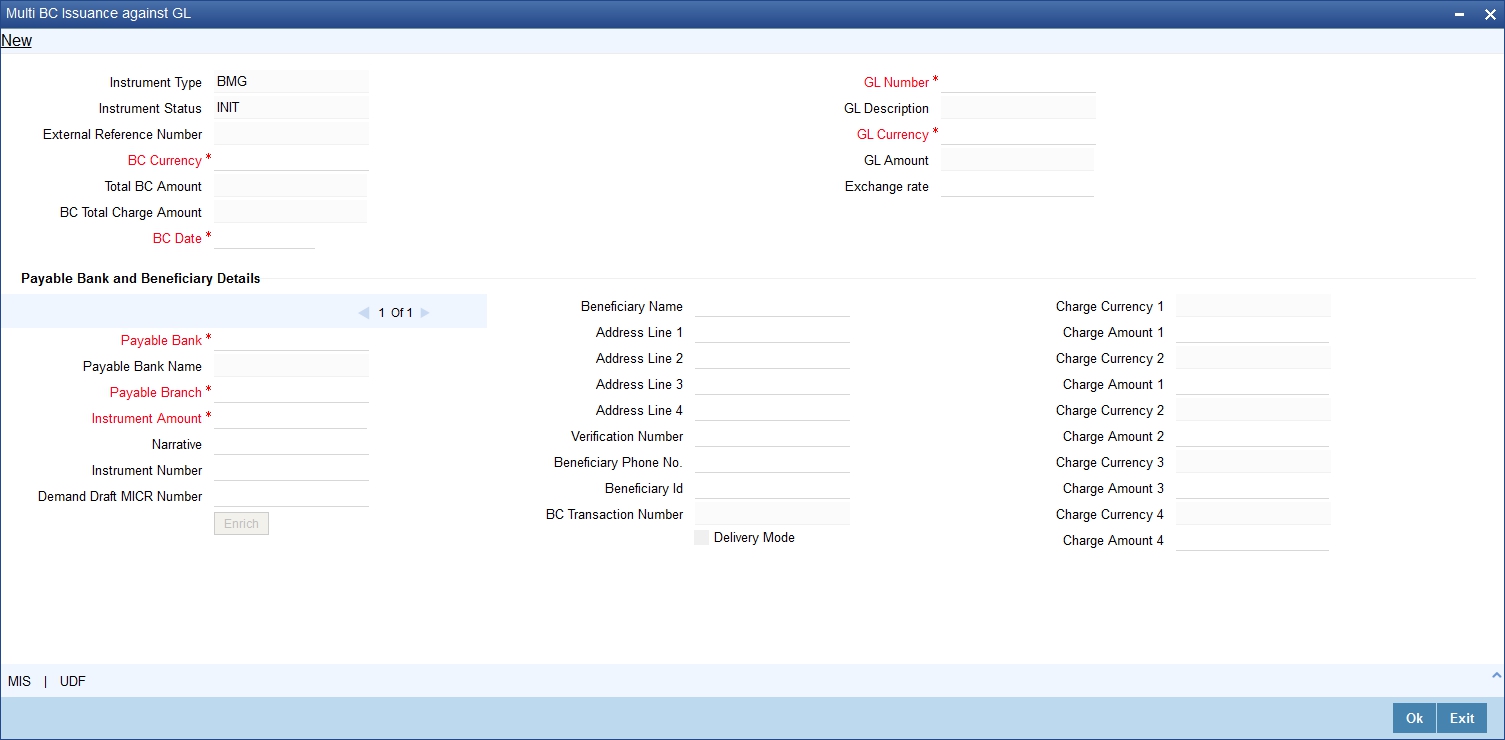

Account Number