10. Time Deposit Transactions

10.1 Introduction

Any deposit with a fixed term or tenor is referred to as a time deposit. In Oracle FLEXCUBE, these kinds of deposits are also referred to as term deposits.

With the time deposits (TD) module of Oracle FLEXCUBE, accounting, collateral tracking, rollover handling and accounting, and tracking of unclaimed deposits are completely automated. This means your staff can remain focused on customer service.

Opening a time deposit account in Oracle FLEXCUBE is similar to opening a current or savings account (CASA). At the time of opening a TD account, payments can be made in one of three modes. The initial payment can be made by cash, account transfer or GL transfer.

Similarly, you can redeem a TD account in one or combination of the following:

- By Cash

- By Bankers Cheque

- By Account Transfer

- By GL Transfer

- By Transfer Other Bank’s Account

- By Child TD

- By Loan Payment

- By Demand Draft

Each of these transactions has been discussed in detail in the following sections.

This chapter contains the following sections:

- Section 10.2, "Open a TD Account for Multi Mode Pay In"

- Section 10.3, "Opening a TD Account for Multi Mode Pay Out"

- Section 10.4, "Topping-up a TD"

- Section 10.5, "Open a Islamic TD Account for Multi Mode"

- Section 10.6, "TD Redemption"

- Section 10.7, "Close Out Withdrawal by Multi Mode"

10.2 Open a TD Account for Multi Mode Pay In

This section contains the following topics:

- Section 10.2.1, "Opening a TD Account for Multi Mode Pay In"

- Section 10.2.2, "Specifying Term Deposit Details"

- Section 10.2.3, "Specifying Interest Details"

- Section 10.2.4, "Specifying joint account holder details"

- Section 10.2.5, "Specifying the dual currency deposit details"

- Section 10.2.6, "Specifying the Check List Details"

- Section 10.2.8, "Capturing the Pay-Out Parameters"

- Section 10.2.9, "Specifying Child TD Details"

- Section 10.2.10, "Capturing Pay-Out Parameters"

- Section 10.2.11, "Specifying Denominated Deposit Details"

10.2.1 Opening a TD Account for Multi Mode Pay In

The TD accounts use account class of ‘deposit’ type. You can create TD accounts like any other CASA accounts. You have to deposit the amount into the account at the time of account creation. There are three pay-in options during account creation, they are:

- Pay in by transfer from GL

- Pay in by transfer from Savings Account

- Pay in by Cash (Only from Savings Module)

- Pay in by Cheque

Note

- Pay-in option can be single or a combination of the three.

- In case of pay-in by cheque, the TD should be entirely funded by a single cheque. Multi mode, combining multiple cheques or part payment by cheque and the rest by other modes, is not allowed.

- During save, the account opening dates would be updated as expected value date of the cheque transaction based on the float days maintained at ARC maintenance level.

- If the pay-in option once selected from the Main tab cannot be changed after save.

- Pay-in details of the cheque to be entered in the ‘Pay-in Details’ multi grid. You cannot modify it. The pay-in option will be read only after first stage save.

- Pay-in option as cheque is not applicable to discounted TDs.

You are allowed to fund the TD using multiple pay-in modes. Any combination of the 3 pay-in modes is possible. You can specify the TD funding amount percentage-wise or in absolute.

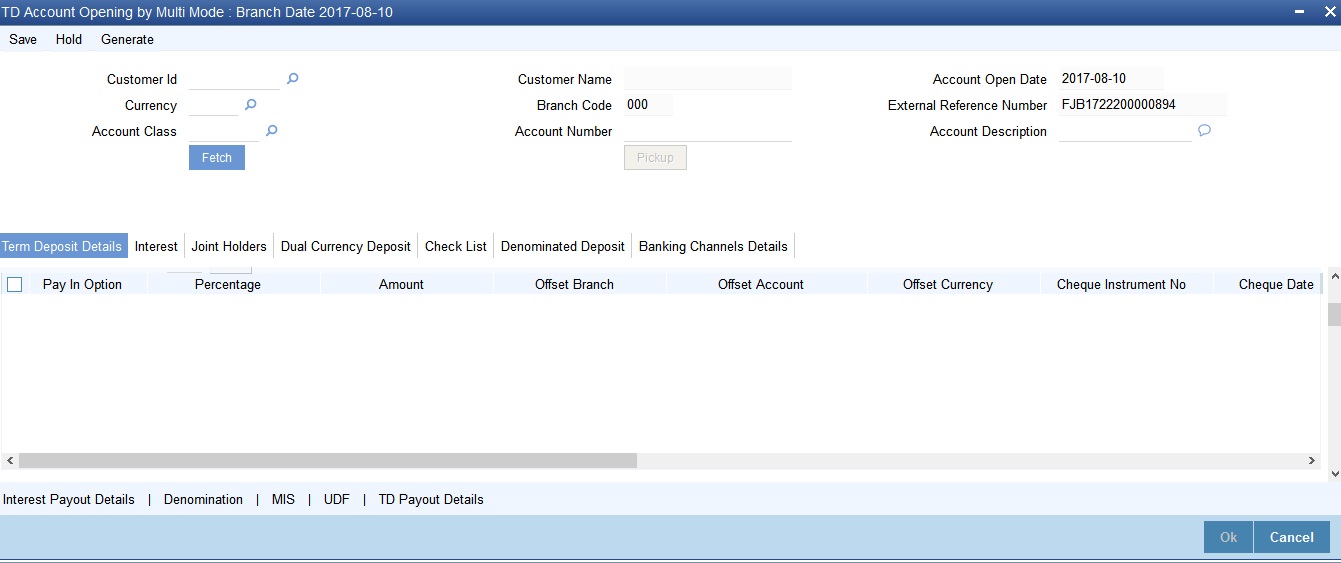

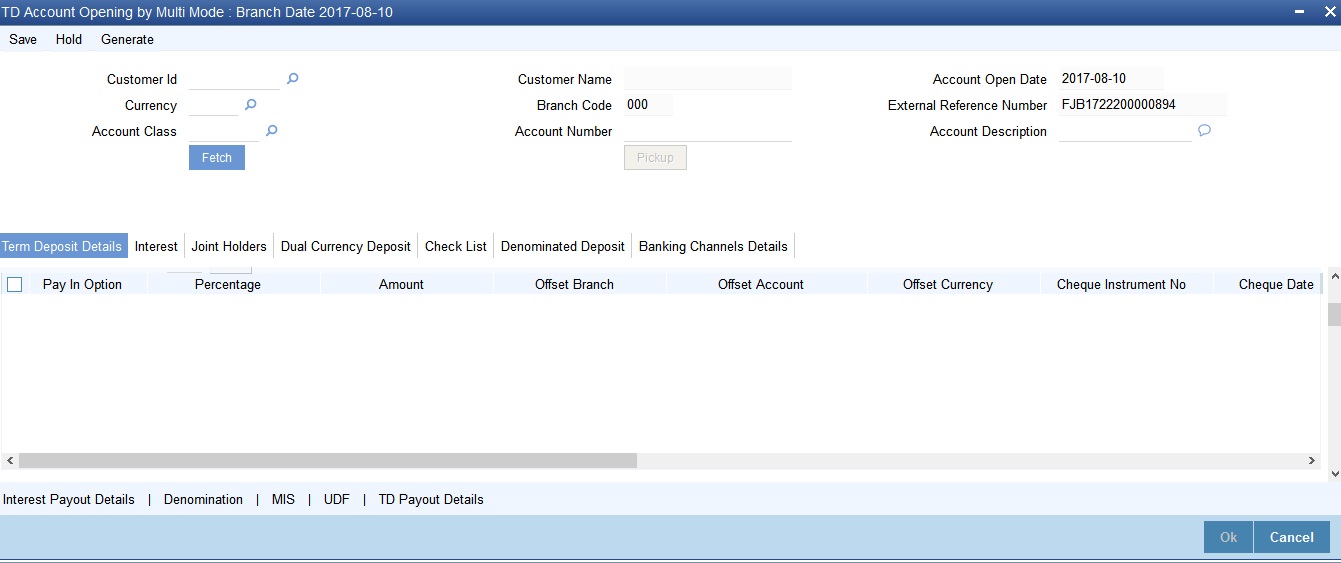

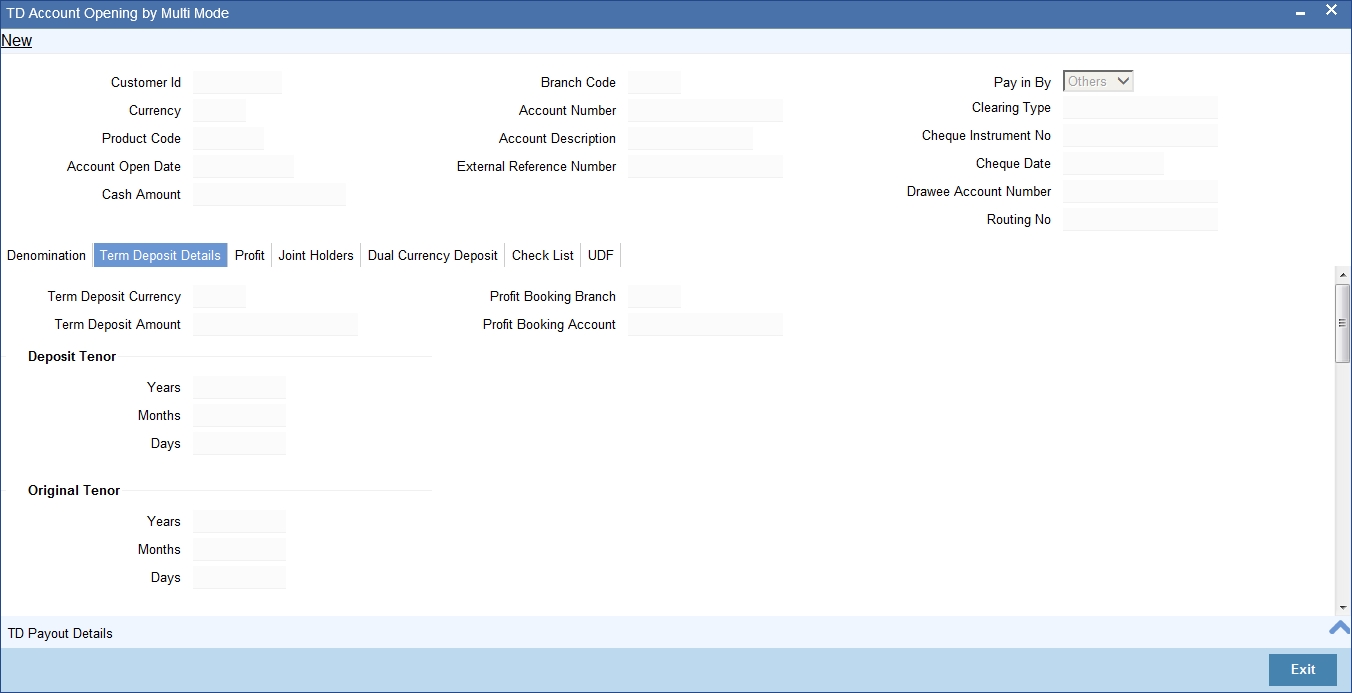

You can open TD accounts with Multi Mode Pay-In options using the ‘TD Account Opening by Multi Mode’ screen. You can invoke this screen by typing ‘TDMM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button

The following details can be entered in this screen:

Customer ID

Select the customer for whom the TD account is to be opened.

Customer Name

The system defaults the customer name.

Branch Code

The current logged in branch is defaulted here.

Currency

Specify the currency to be associated with the TD account. Alternatively, you can also select the currency from the adjoining option list. All the currencies maintained in the system will be available for selection in the option list.

Account Class

Specify the account class to which the particular account belongs. You can select the appropriate account class from the option list that displays all ‘deposit’ type of account classes maintained in the system. Account classes that have surpassed their end date (expired) will not be displayed in the option list..

External Reference Number

The system defaults the generated sequence number for the transaction here.

Account Description

System displays the customer name for the selected account number.

Account Number

Specify the account number of the deposit account.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

In the single stage flow, if there is an transaction level override or error during approval then the transaction will be moved to the pending queue. Without save action being initiated, the transaction will not be in pending queue.

On clicking Pickup button, the system populates the values in all the callforms of the screen and clicking pickup button is mandatory if you make any changes to the Transaction amount and exchange rate after first pickup.

Once you click ‘Pickup’ button once, then on amendment of xrate, amount, charge, pickup will be mandatory before save. On pick up, the fields that are currently enabled in the enrich stage will alone be retained as enabled fields.

On clicking the ‘P’ button, the system validates and ensures for minimum mandatory data entry. If the data entry is found alright, the following details are displayed:

Account No

The system displays the number assigned to the TD account.

Maturity Date

The system calculates and displays the maturity date based on the value date and the tenor you specify for the deposit.

Next Maturity Date

The next maturity date is the default maturity date of the deposit if it is rolled over. It is computed by the system using the tenor and maturity date specified, by adding the tenor to the maturity date.

10.2.2 Specifying Term Deposit Details

Click on ‘Term Deposit Details’ block to capture term deposit related details.

You need to capture the following details here:

Specifying Term Deposit Pay In Options

Pay-in By

Select the pay-in option from the adjoining option list. The list displays the following value:

- Cheque

- Others

If you select the pay-in option as ‘Cheque’, the other options will be unavailable. Similarly, if you select the pay-in option as ‘Others’, the cheque option will be unavailable.

Note

- If the pay-in option once selected from the main tab, it cannot be changed after account class defaults.

- Pay-in details of the cheque entered in the ‘Main’ tab will be automatically displayed in the ‘Pay-in Details’ multigrid. You cannot modify them.

If the pay-in option ‘Cheque’ is selected, you must specify the following details:

Pay-In Option

Select the pay-in mode from the drop-down list. The options available are:

- Account

- GL

- Cash

Note

Only Account option can be multiple.

Percentage

Specify the amount that funds the TD by the pay-in mode selected in percentage.

Amount

Specify the amount that funds the TD. If you have specified the percentage, then the system computes the amount.

Note

When Amount and Percentage options are provided, amount takes precedence and percentage is ignored.

Offset Branch

The system populates the branch code of the account from which fund is transferred to TD account.

Offset Account

Specify the account number/ GL from which the fund is transferred to TD account. This field returns the branch code if the account is selected and NULL is returned if GL is selected. If Pay-In mode is GL, then the system displays only GL’s and if the Pay-In mode is Account then only accounts are displayed in the option list.

Note

- The customer account number, pay-in account number and payout account number needs to use different CASA account numbers. An override message “Book TD with single or joint, provide the IB, Pay-in and Payout as different customer” is displayed.

- In case of pay-in of add funds through GL, you need to select the GL maintained in ‘Term Deposit Pay In Parameters Maintenance’ (STDTDPAY) screen. If you do not specify an offset GL account, then on save, the system defaults the GL maintained in STDTDPAY screen.

Offset Currency

Specify the currency of the TD.

Cheque Instrument No

Specify the cheque instrument number.

Cheque Date

Specify the date of issue of the cheque.

Clearing Type

Specify the clearing type for the transaction. The adjoining option list displays a list of the clearing types maintained in the system. You can select the appropriate one.

Drawee Account Number

Specify the drawee account number.

Routing No.

Specify the Routing number.

Account Open Date

The system displays the value date of opening the deposit account. This will be the term deposit interest start date.

Original FX Rate

Specify the FX rate picked up by the system.

Applied FX Rate

Specify the FX rate entered by the user.

In the following scenarios the Applied FX rate should be equal to the Original FX rate:

- If the Deposit Account Currency and the Pay-In/Out Account Currency are same.

- If the Rate Type/Rate code combination is not maintained at the account class for a Pay-In/Out Mode. In this case the system considers the STANDARD Rate as the default and the MID Rate code as the existing rate type.

Offset Amount

Specify the amount paid for the term deposit account, in the account currency.

Note

The system will validate for the following:

- The deposit amount should be equal or greater than minimum booking amount maintained at the ‘Deposits Cluster Maintenance’ screen, else the system will display the error message as “the deposit amount is less than the minimum booking amount”.

- The deposit amount should be a multiple of the booking unit maintained at the ‘Deposits Cluster Maintenance’ screen, else the system will display the following error message as “the deposit amount must be in multiples of booking unit”.

Deposit Tenor

The system displays the tenor of the deposit account. This is the difference between the interest start date and maturity date. In case of a change in the maturity date, the system updates the deposit tenor accordingly.

However, the system allows you to specify a different tenor for payout term deposits. You can indicate the deposit tenor for the payout TD by selecting one of the following options:

- Account Class Tenor - If you select this option, then system defaults the account class deposit tenor for the payout TD during payout TD creation.

- Account Tenor - If you select this option, then the original deposit tenor of the parent TD is considered as the deposit tenor for the payout TD. By default, this option is selected.

- Independent Tenor - If you select this option, then you can specify the tenor to be considered for deposit in terms of years, months and days.

Note

System validates that the deposit tenor is within the minimum and maximum tenor allowed for the account class. If this validation fails, then system displays the error message, “Rollover tenor does not fall in the range of minimum and maximum tenor allowed”.

You can modify the default tenor during the following:

- Deposit account opening

- Any time before maturity during the life cycle of the deposit

- On rollover of the deposit

If you specify the tenor, the system computes the maturity date. System calculates the maturity date for the payout deposit based on the redemption date of the original deposit and tenor. Once the record is authorized, you cannot amend the tenor.

If the maturity date computed by the system falls on a holiday, then it will adjust the maturity date as per the holiday treatment maintenance at Account Class level and the update the new tenor accordingly.

The deposit tenor is represented in terms of years, months and days. For example, if the deposit tenor is 185 days, it should be represented as 0 years, 6 months and 5 days. You need to specify the values in the appropriate fields.

Years

This indicates the number of years in the deposit tenor.

Months

This indicates the number of months in the deposit tenor.

Days

This indicates the number of days in the deposit tenor.

Original Tenor

This indicates the original tenor of the deposit. This is the tenor specified at account which is arrived before the holiday movement.

The original tenor is represented in terms of years, months and days. For example, if the deposit tenor is 185 days, it should be represented as 0 years, 6 months and 5 days. The following details are displayed:

Years

This indicates the number of years in the original tenor.

Months

This indicates the number of months in the original tenor.

Days

This indicates the number of days in the original tenor.

Maturity Date

Specify the maturity date of the term deposit.

Account Description

The system displays the customer’s complete name. You can modify it, if required.

Interest Payout Frequency

The system displays the payout frequency of the interest.

Term Deposit Pay Out Details

Interest Booking Account

The system displays the TD booking amount.

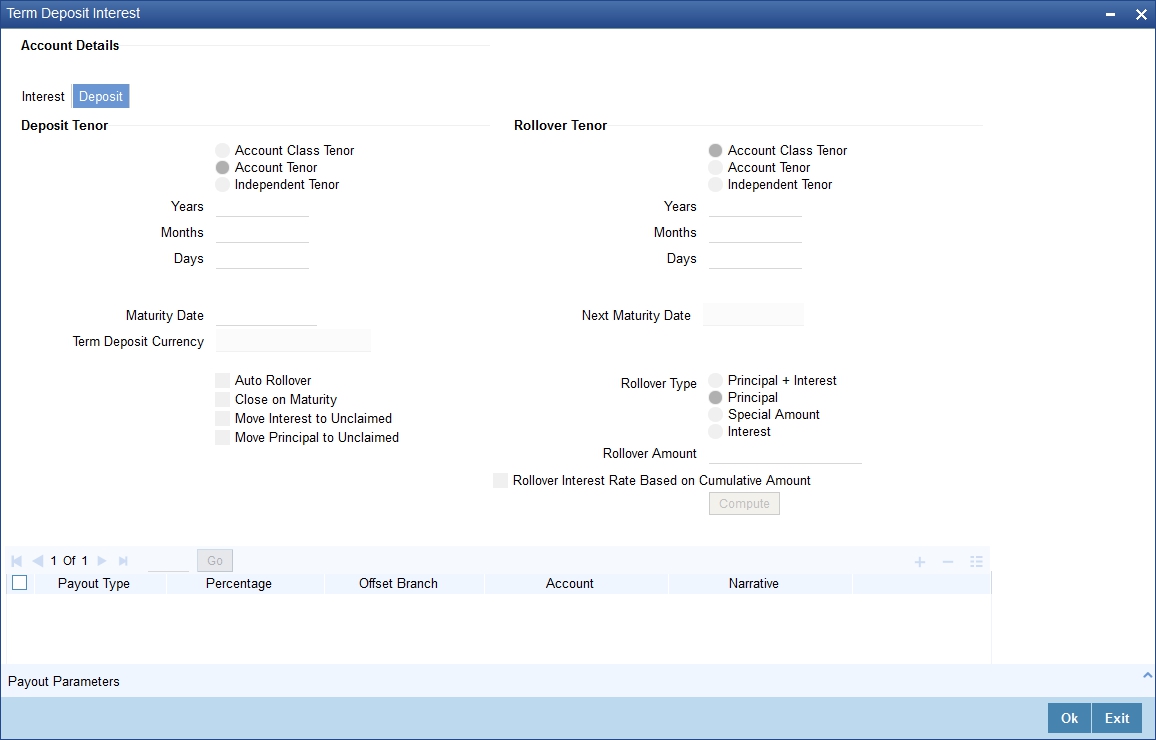

Auto Rollover

Check this box to automatically rollover the deposit you are maintaining. If you check this box, then you need to specify the rollover tenor.

Rollover Type

Select the rollover type from the drop down list. Here you can set the terms and conditions for rollover, as follows:

- Principal - If You select ‘Principal’ option then On Maturity date System will do rollover with Only Principle amount irrespective to the Interest booking account.(i.e. if Interest booking account is given as TD account then on maturity date Interest amount will be first liquidated to TD account and settled to the Payout details maintained for the TD account).

- Principal + Interest - If You Select ‘Principal +Interest’ option then Interest booking account should be always TD account. On maturity date P+I amount will Rollover.

- Special Amount - If you select ‘Special Amount’ option then System will do rollover with Specified amount irrespective to the Interest booking account. (during Second rollover system will do rollover with the same amount by settling the New interest amount to TD payout amount)

- Interest - If you select ‘Interest’ option then Interest booking account should be always TD account. On maturity date Principle amount will be settled to payout option

Note

- This field is applicable only if you have opted for auto rollover.

- System will validate for the deposit amount if the ‘Rollover Type’ is ‘Special’.

Rollover Amount

If a special amount is to be rolled over, specify the amount (less than the original deposit amount). The amount specified here will be reckoned in the account currency.

Rollover Tenor

If ‘Auto Rollover’ box is checked, then you can indicate the rollover tenor for the TD account. You can select one of the following options:

- Account class tenor - If you select this, the rollover tenor in days, months and years is set to null. You cannot modify this. The system will not display the next maturity date, as the account class default tenor is subject to change. During rollover, the default account class tenor at the time of rollover will be taken.

- Account tenor - This is the default value. If this option is selected, the system populates the original tenor of the parent TD as the rollover tenor. The system displays the tenor in days, months and years. You cannot modify this. The next maturity date will be populated by adding the account tenor to the maturity date of child TD.

- Independent tenor - If you select this, you can specify the tenor to be considered for deposit in terms of years, months and days. The default value of the independent tenor will be null. The next maturity date will be populated by adding the independent tenor to the maturity date of child TD.

The tenor specified should be within the minimum and maximum tenor specified at account class. The tenor in months cannot be greater than 11 months. If tenor months are specified, then tenor days cannot be greater than 30 days.

The account tenor is defaulted as the deposit and rollover tenor for the child TD after the account class is populated.

Years

Specify the number of years in the rollover tenor.

Months

Specify the number of years in the rollover tenor.

Days

Specify the number of years in the rollover tenor.

Next Maturity Date

On selecting the rollover for the TD account, the system defaults the next maturity dates from the previous tenor of the deposit.

System calculates the next maturity date based in the current maturity date and the rollover tenor maintained at the account level. System calculates the next maturity date based on the changes to the maturity date due to holiday treatment

Computed Amount

The system populates the computed TD amount when you click the ‘Compute Button’. However, you are not allowed to amend it.

Note

While saving, the system validates the ‘Computed TD Amount’ against the ‘TD Amount’ keyed in.

Maturity Amount

The system displays the maturity amount, when you click on the ‘Compute’ button. This interest rate is based on the TD booking amount and the accrued interest till maturity.

Note

Maturity amount will be based on the capitalized interest (P + I), if the booking account and the interest liquidation account are the same and the interest payout details are not provided.

Refer the chapter ‘Annexure B - IC Rule Set-up’ in this user manual for details about the formula.

Move interest to Unclaimed

Check this box to move the interest amount to the unclaimed GL mapped at the IC product in the accounting role ‘INT_UNCLAIMED’ on Grace period End date. If you select this option, then you will have to check the box ‘Move Principal to Unclaimed’.

Note

- If you have selected auto rollover, then this field will not be applicable.

- Funds will be moved to unclaimed GLs only if the maturity options have not been specified. If an account matures and no action is taken (closure or roll-over) within the grace period, then the funds are moved to the unclaimed GLs on the EOD of the last day of the grace period (maturity date + grace days).

Move Principle to Unclaimed

Check this box to move the principal amount to the unclaimed GL mapped at the IC product in the accounting role ‘PRN_UNCLAIMED’ on Grace period End date. If you select this option then only principle amount will be moved to unclaimed and Interest will be settled to TD payout. If You select both ‘Move Interest to Unclaimed’ and ‘Move Principle to Unclaimed’ then TD amount (i.e. P+I will be moved to Unclaimed GL, irrespective to the TD payout Details).

Add Funds

Check this box to add additional funds for rollover.

Add Amount

Specify the additional amount to be considered for rollover in TD account currency.

Note

If you select Rollover Type as ‘Principal’, ‘Principal+Interest’ or ‘Interest’, then you need to check ‘Add Funds’ checkbox and specify the additional amount in ‘Add Amount’ field.

If you specify the additional amount, then it is mandatory to update the ‘Add Pay in’ details. Otherwise, the system will display an error message on save.

If you select Rollover Type as ‘Special Amount’, then based on the rollover amount, the system updates ‘Add Funds’ checkbox and ‘Additional Amount’ field. If Rollover Amount is more than the Maturtiy Amount (P+I), then system displays the additional amount (Add Amount = Rollover Amount - Maturity Amount) in Add Amount field. ‘Add Funds’ checkbox will be checked automatically.

For Rollover Type, ‘Special Amount’, ‘Add Funds’ and ‘Add Amount’ fields are editable and are populated on ‘Save’.

If the user specifies higher amount, the ‘Add Funds’ gets updated as ‘Yes’ and ‘Add Amount’ will be updated as the difference between special rollover amount and TD maturity amount (P+I) on Save of TD booking. The additonal amount field will not be updated on subsequent events in the TD. Any difference amount after rollover will be transferred to the principal payout account.

If TD Rollover Type is ‘Special Amount’ and Rollover amount specified is lower than TD amount, the difference will be paid out.

Term Deposit Payout Details

Payout Type

Select the pay-out mode from the drop-down list. The options available are:

- Bankers Cheque - BC

- Payments – PC

- Accounts

- General Ledger - GL

- Term Deposit - TD

- Demand Draft

Percentage

Specify the amount of pay-out in percentage.

Offset Branch

The system populates the branch code of the account for pay-out.

Account

Specify the account number/ GL for pay-out.

Account Title

Specify the account title.

Narrative

Specify the description for pay-out.

Payout Component

Select the payout component from the options given below. The options available are:

- Principal

- Interest

Note

For payout component as ‘Interest’, pay-out through TD is not supported.

Goal Account Details

Goal Reference Number

The goal reference number as received from the channels are displayed in this field.

Target Amount

The goal amount is defaulted in this field.

Term Deposit Additional Funds Pay in Option

Select the Payin Details for debiting the additonal amount for rollover from the drop down list. The list displays the following values:

- GL - In case of pay-in of add funds through GL you need to select the GL maintained in Term Deposit Pay In Parameters Maintenance (STDTDPAY) screen. If you do not specify an offset GL account, then on save, the system defaults the GL maintained in STDTDPAY screen to be placed here.

- Account - In case of pay-in from savings account, it is mandatory to specify the offset account. If it is not specified, the system displays an error on saving the TD account. If the pay-in account specified is disallowed for the TD product, then on saving the account, the system displays an error message. The account specified is debited at the time of rollover of TD.

Note

In case of pay-in of add funds through GL, you need to select the GL maintained in ‘Term Deposit Pay In Parameters Maintenance’ (STDTDPAY) screen. If you do not specify an offset GL account, then on save, the system defaults the GL maintained in STDTDPAY screen.

Percentage

Specify the percentage of payout for each payout option specified.

Amount

Specify the amount to be transferred to TD.

Offset Branch

The system displays the branch code of the account to which fund is transferred from TD account.

Offset Account

Specify the account number/ GL to which the fund is transferred in the event of TD account rollover.

If pay in option for additional funds is ‘Account’, then it is mandatory to specify the offset account. Otherwise, the system will display an error message when you try to save,

If the offset account does not have sufficient funds, then the system displays an override message on save. Before rollover date, customer has to operationally ensure that sufficient funds are available in offset account. Otherwise rollover will fail.

If offset account has any limits attached to it, then on save, the system displays an override message. Override message is generic for both TD opening and additional funds rollover payin.

Click ‘Pickup’ button.

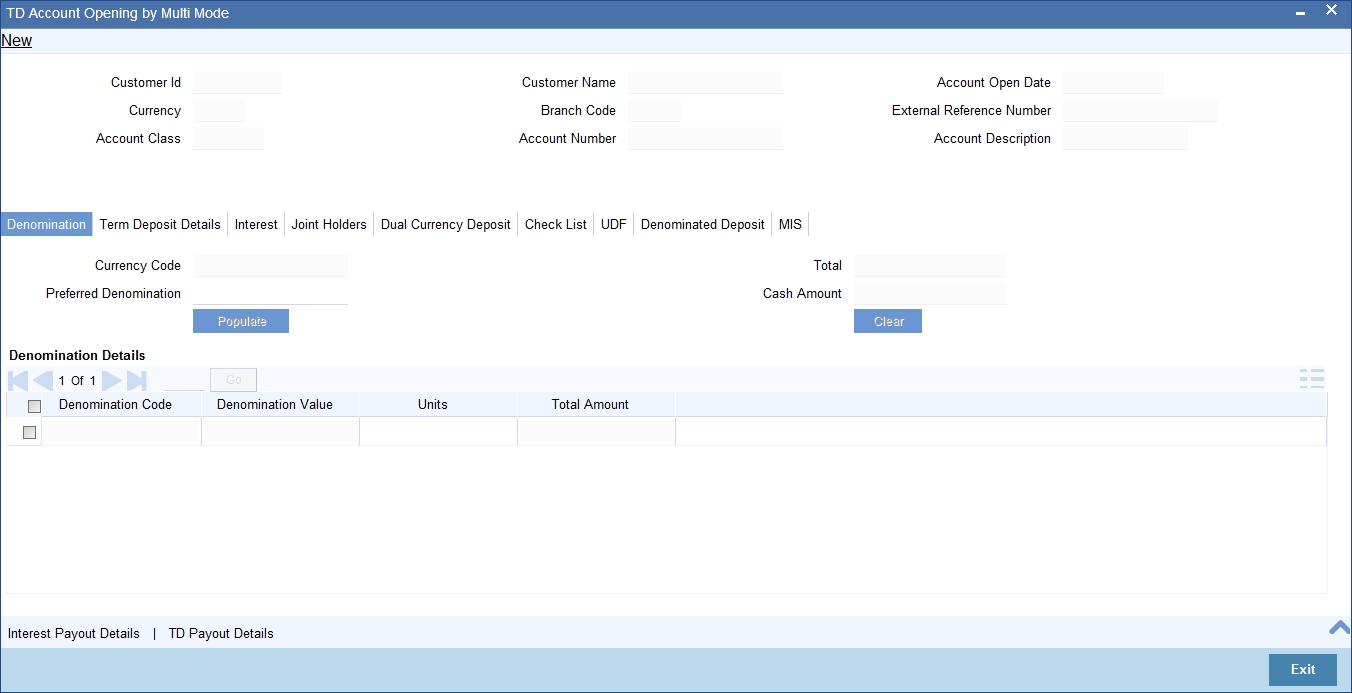

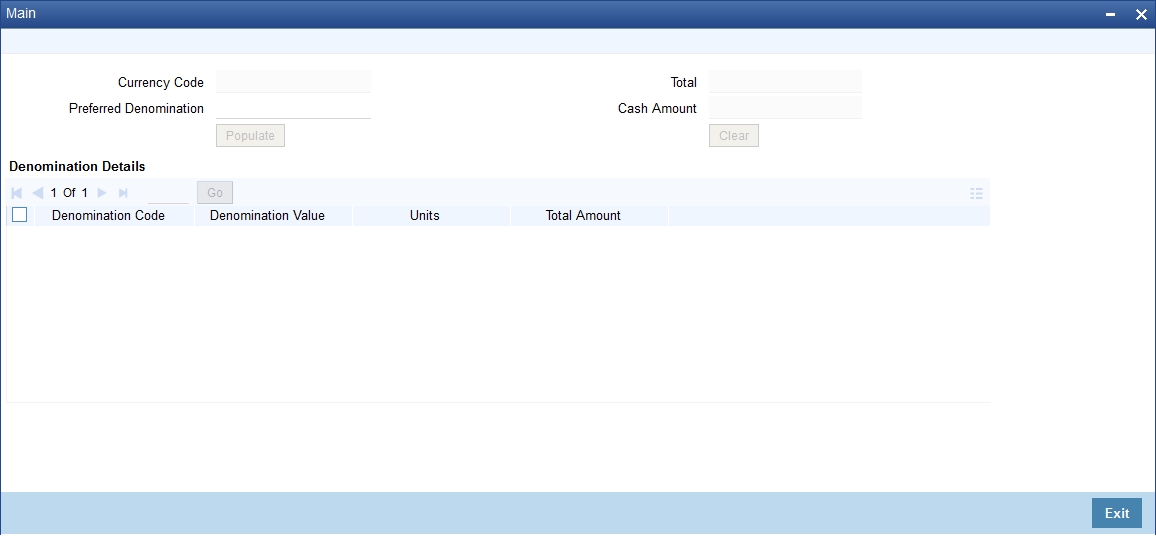

10.2.2.1 Denomination Details

Select Pay-In mode as cash to enable denomination tab.

Note

Pay in by Cash is not applicable to Rollover with additional funds.

Currency Code

The system displays the currency of the account.

Preferred Denomination

Specify the denomination code that should be preferred. The system processes the transactions with the preferred denominations. If the transaction amount is less than the preferred denomination, the system will use the low valued denomination than the preferred denomination based on the defaulting rule.

If the preferred denomination is not captured, the system will consider the highest available denomination as the preferred denomination.

If the denomination is not available, the system will display ‘Denomination not available’ message.

Click ‘Populate’ button to display the units of currency denomination based on the defaulting rule.

Note

According to defaulting rule, the system will calculate the total amount in terms of minimum number of currencies. It means that the system divides the total amount into the bigger denominations first. Then the remaining amount into next biggest denomination and so on.

A transaction slip is generated at the time of input stage completion and is produced to the customer to sign and confirm the transaction.

After Pickup, you can generate Input slip advice by clicking ‘Generate’ button.

Confirmation Received

Check this box to indicate if the confirmation is received.

An override message is displayed if the box remains unchecked “Has the customer signed the slip?”.

Denomination Code

For every currency, the various denominations are assigned separate denomination codes. These codes are displayed here.

Denomination Value

The system computes the face value of the denomination and displays it. For instance if the denomination code represents a USD 100, the value will be displayed as ‘100’.

Units

Indicate the number of units of the specified denomination. By default, till contents are incremented for inflow transactions like cash deposit. To reverse this default behaviour, you can specify units in negative.

Total Amount

The system computes the denomination value by multiplying the denomination value with the number of units. For instance, if the denomination code represents a USD 100 and the number of units is 10, the denomination amount will be ‘1000’.

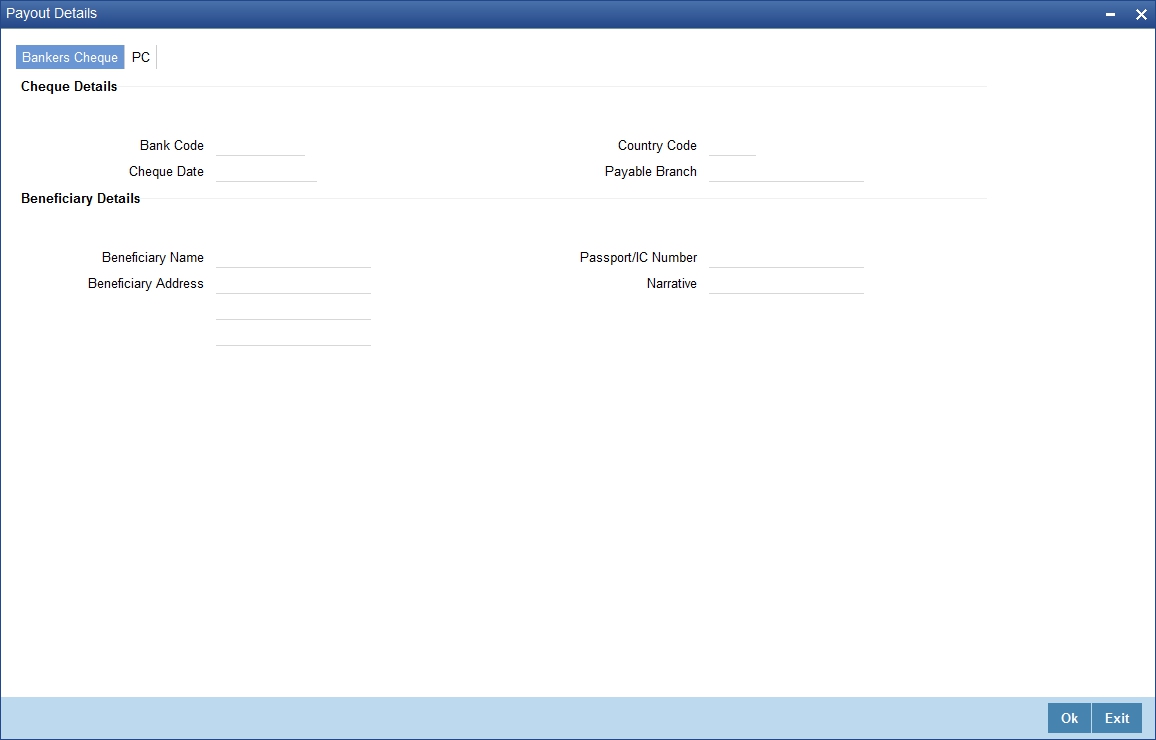

10.2.2.2 Capturing Interest Payout Details for Banker’s Cheque / DD and PC

You can capture interest payout details for Banker’s Cheque / DD and PC in the ‘Term Deposit Interest Payout Details’ screen.

You can capture the following details:

Branch Code

The system displays the branch code.

Account

The system displays the account number.

Currency

The system displays the currency of the account.

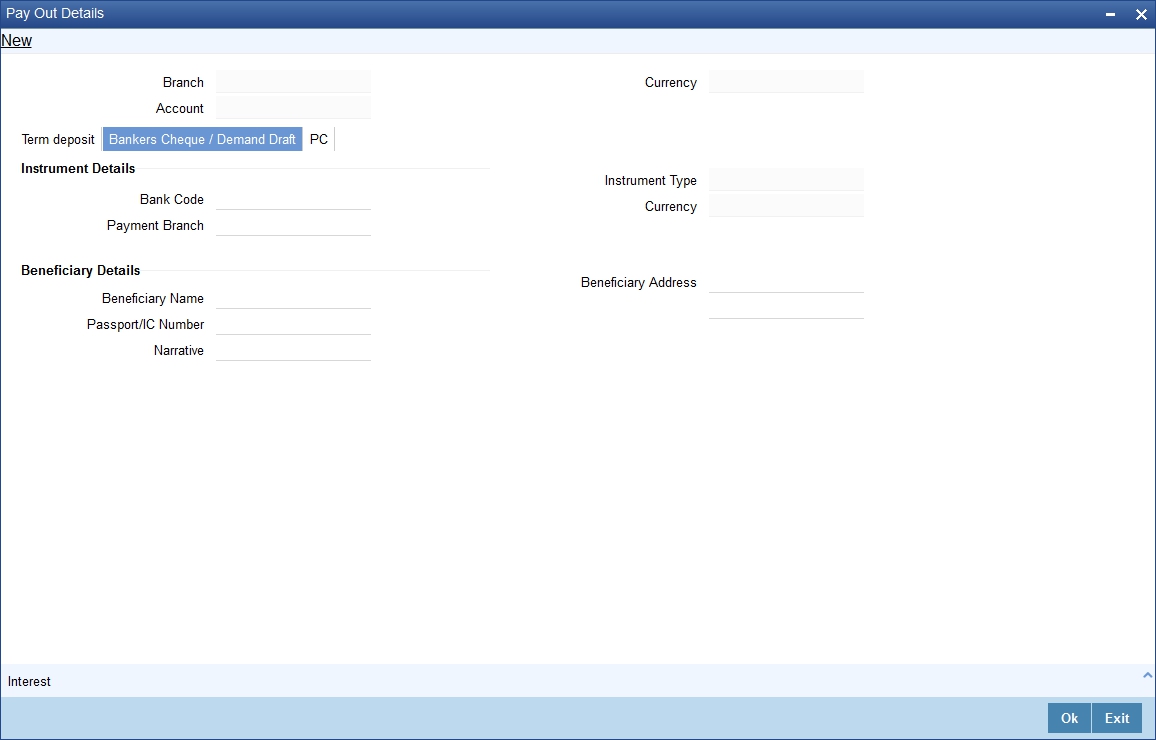

10.2.2.3 Banker’s Cheque / DD Tab

On invoking the ‘Term Deposit Interest Payout Details’ screen, this tab is displayed by default. You can specify the following details:

Cheque /DD Details

You can specify the following cheque or DD details here:

Bank Code

Specify the bank code. The adjoining option list displays all the bank codes maintained in the system. You can choose the appropriate one.

Payable Branch

Specify the branch from which the interest is payable. The adjoining option list displays all the bank codes maintained in the system. You can choose the appropriate one.

Instrument Type

The system displays the instrument type.

Currency

The system displays the currency.

Beneficiary Details

You can specify the following beneficiary details here:

Beneficiary Name

Specify the beneficiary name.

Passport Number

Specify the passport number of the beneficiary.

Narrative

Enter a brief description of the beneficiary.

Beneficiary Address

Specify the beneficiary address.

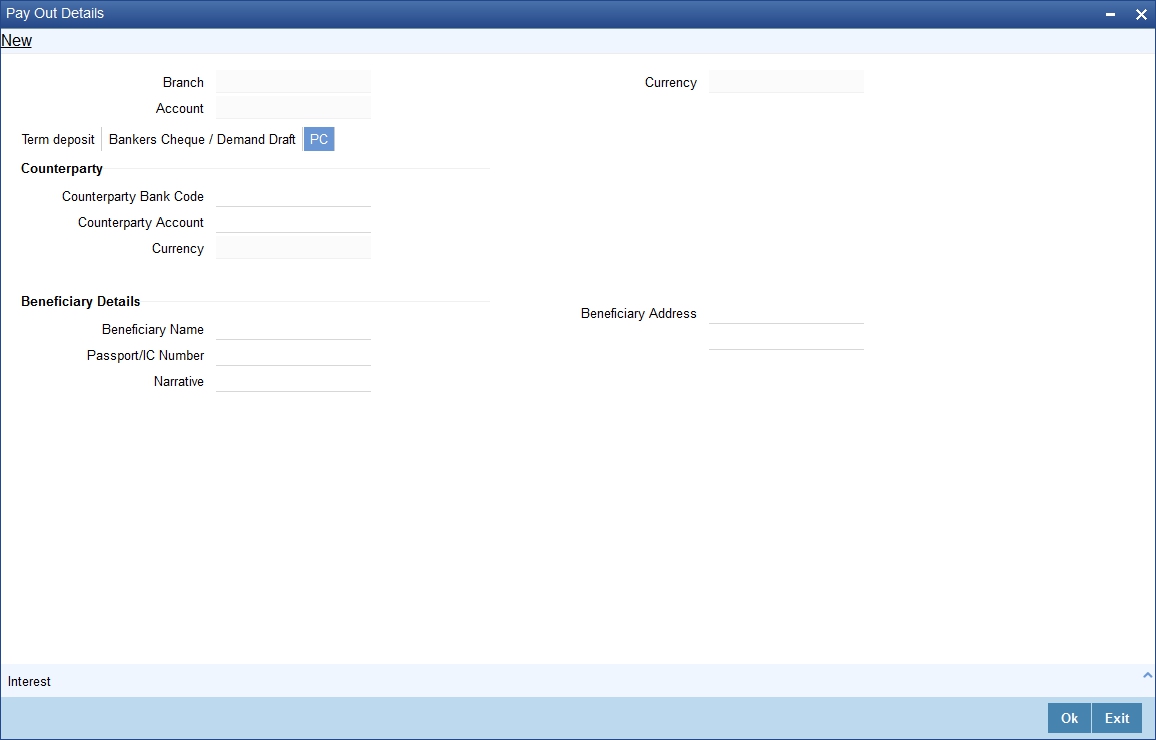

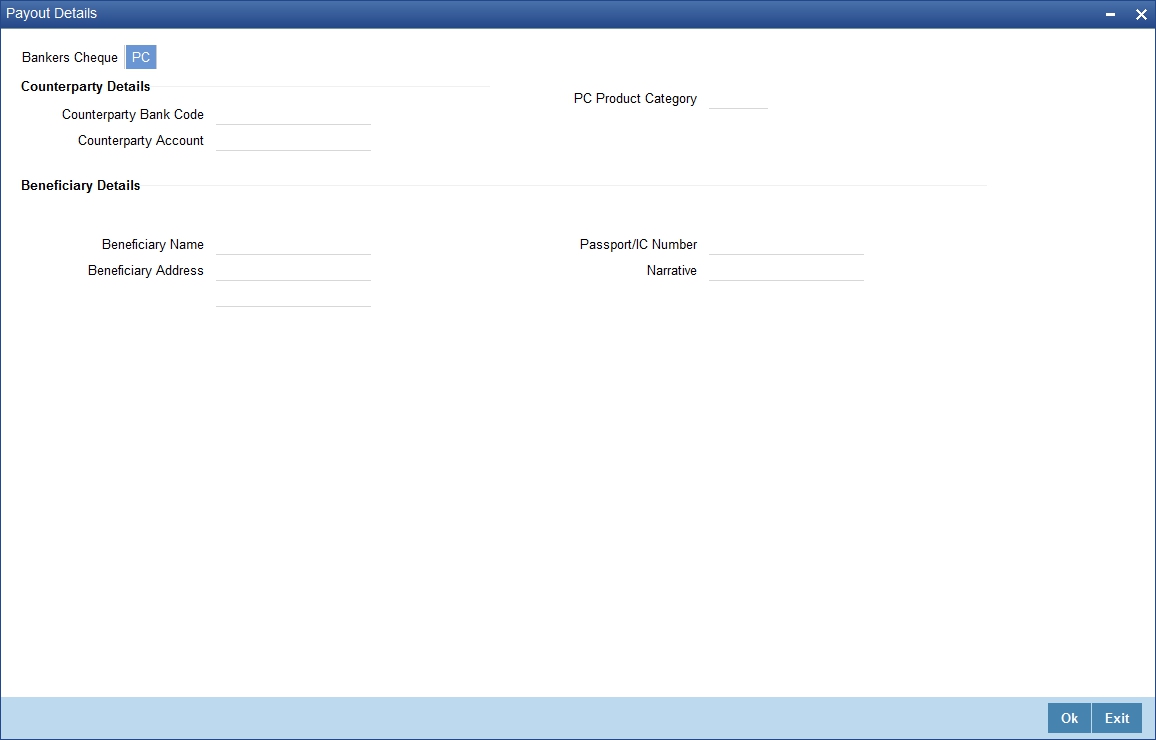

10.2.2.4 PC Tab

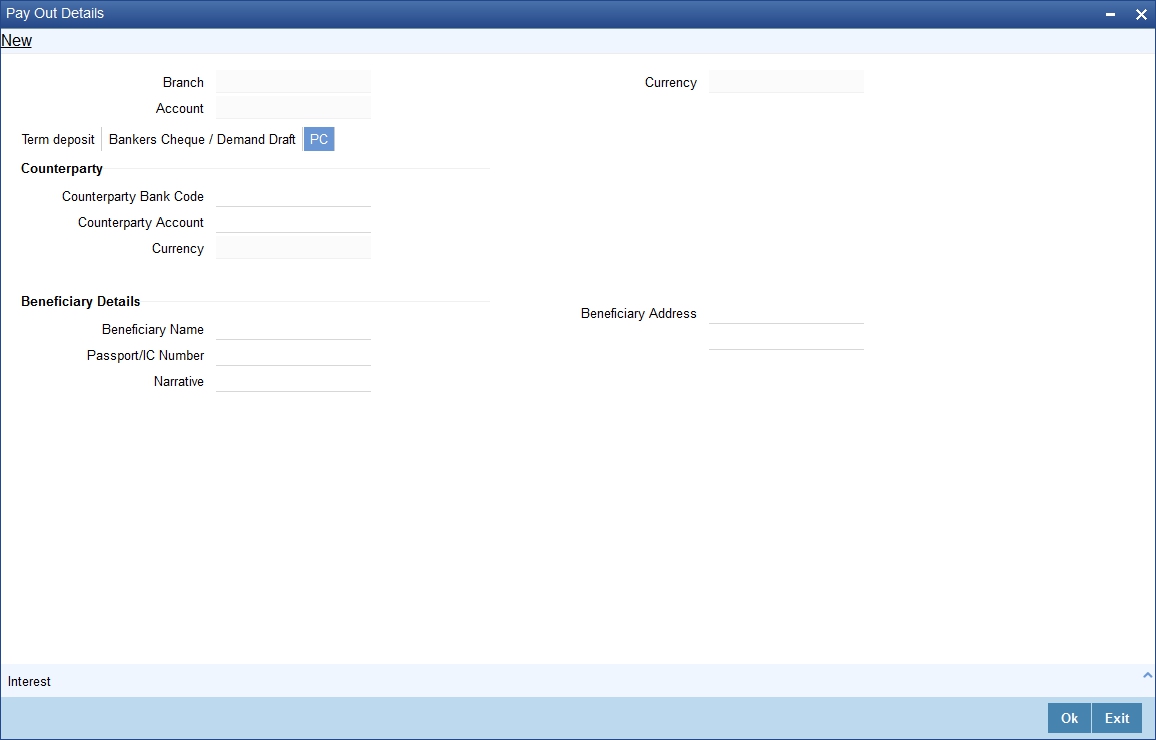

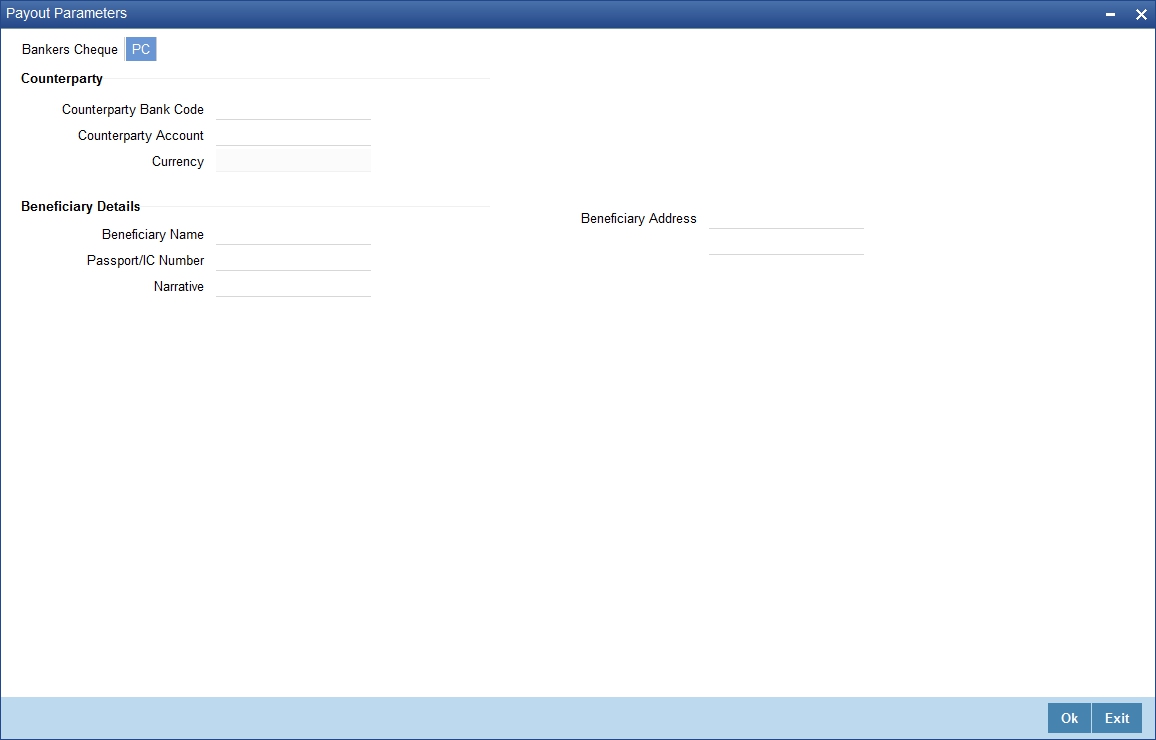

Click ‘PC’ tab on the ‘Term Deposit Interest Payout Details’ screen. The following screen will be displayed.

Counterparty

You can specify the following counterparty details here:

Counterparty Bank Code

Specify the counterparty bank code. The adjoining option list displays all the counterparty bank codes maintained in the system. You can choose the appropriate one.

Counterparty Account

Specify the counterparty account. The adjoining option list displays all the counterparty bank codes maintained in the system. You can choose the appropriate one.

Currency

The system displays the instrument currency.

Beneficiary Details

You can specify the following beneficiary details here:

Beneficiary Name

Specify the beneficiary name.

Passport Number

Specify the passport number of the beneficiary.

Narrative

Enter a brief description of the beneficiary.

Beneficiary Address

Specify the beneficiary address.

Note

The system supports the following payout options for interest payout:

- Account

- General Ledger

- Bankers Cheque

- Demand Draft

- Payments and Collections

- If payout details are maintained for interest component then interest liquidation happens on the basis of payout details maintained for interest component. However, if payout details are not maintained for interest component then interest liquidation happens on the basis of interest book account specified.

- If payout type is chosen as Account or GL for interest component then interest liquidation happens on the basis of offset account mentioned in the ‘Term deposit payout details’ multi grid. If payout type is chosen as Demand Draft /Banker’s Cheque or Payments and Collections for interest component then interest liquidation happens on the basis of payout details maintained in the ‘Interest Payout Details’ sub screen.

- Interest payout through as Demand Draft /Banker’s Cheque or Payments and Collections happens through the same bridge GL used for principal payout.

- The system does not support payout option as Term Deposit.

- Interest payout is not supported if rollover type is interest or principal and interest. For Interest rollover type interest liquidation will be done based on the interest book account.

- For discounted deposits if payout details are maintained for interest component, then the system will display the error message as “Payout details for Interest component should not be entered for Discounted Deposits”.

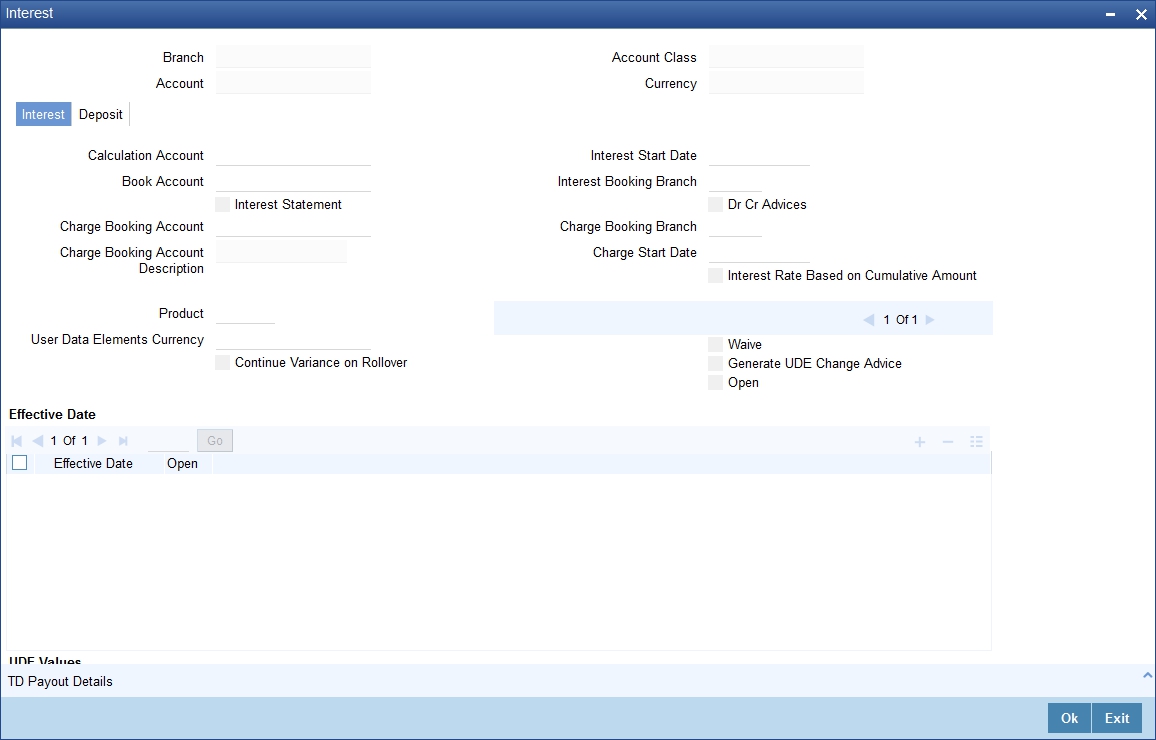

10.2.3 Specifying Interest Details

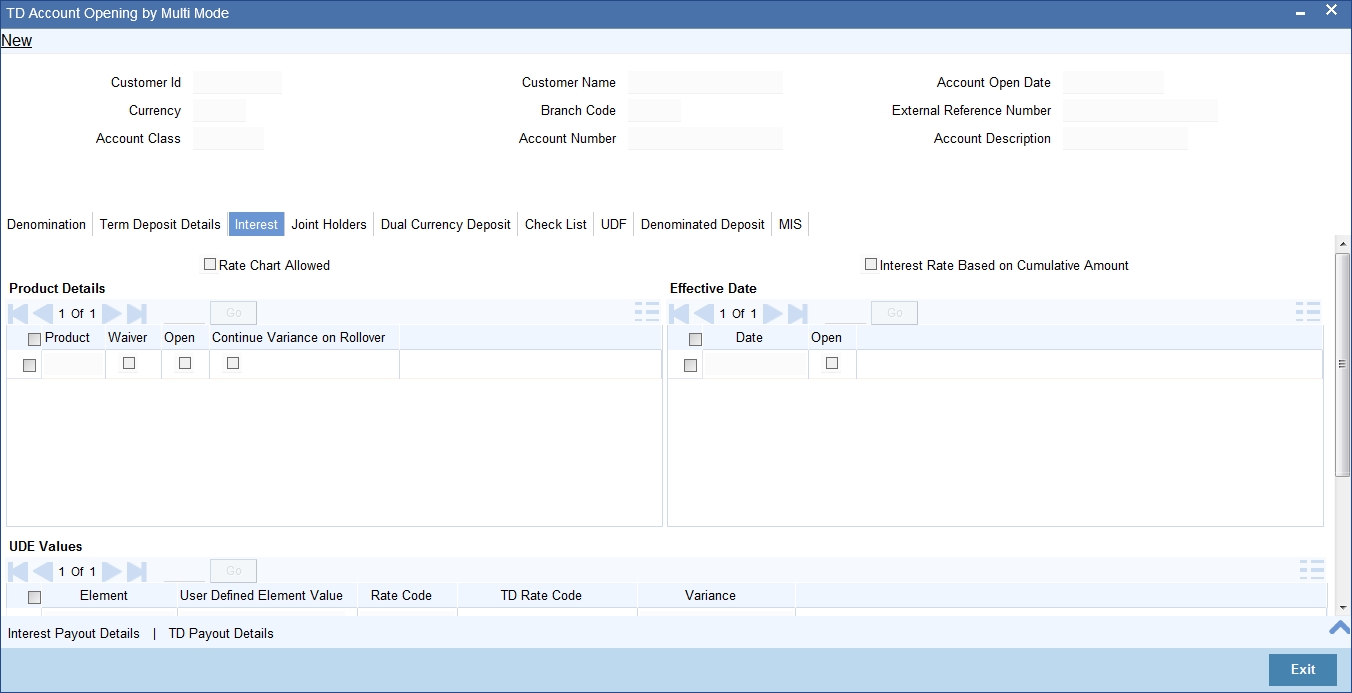

This block allows you to capture interest related details. Click on the ‘Interest tab to invoke the following screen.

Rate Chart Allowed

The system defaults this preference from account class and it indicates that the system should calculate TD interest based on the LDMM float rate maintained in the ‘LD MM Floating Rate input’ screen (CFDFLRTI), If this box is checked, then system will pick interest rates based on different tenors, minimum amount, currency and effective date for a TD.

Interest Rate Based on Cumulative Amount

Check this box to indicate that the system should arrive at the interest rate of a new deposit using the cumulative amount of other active deposits, under the same account class, customer, and currency.

The cumulation of the amount for arriving at the interest rate is done at the account level during the save of the below events:

- Deposit account opening

- Any interest rate change to the deposit - floating rate deposits, rate change on interest liquidation, and rate change on rollover

Note

- When cumulating the amount of the deposits system considers the current deposit balance of all the deposits along with the new deposit amount.

- For backdated deposit opening, all the active deposits as of the current system date are considered to arrive at the cumulative amount, if the ‘Interest Rate Based on Cumulative Amount’ box is checked.

- The interest rate derived is applied only to the new deposit to be opened and there will be no changes done to the deposits which are used for arriving at the interest rate.

Refer the section ‘Calculating Interest Rate Based on Base Amount’ in ‘Terms and Deposits’ User Manual for details about arriving at interest rate based on cumulative amount.

Continue Variance on Rollover

The system defaults it based on the Interest and Charges product. However, user can modify this. If you modify this, during save the system prompts that “Continue variance on Rollover Flag is modified”.

Check this box to enable continued variance on rollover. If you check this, then the system will default account variance as current value to the rollover deposit for the next cycle.

If you do not check this, then the account variance will not be carried forward to next rollover cycle.

TD Rate Code

Specify the rate code to be used for TD calculation. The adjoining option list displays all rate codes maintained using the ‘LD MM Floating Rate Input’ screen (CFDFLTRI). You can select the appropriate one. You can use TD rate code only when ‘Rate Chart Allowed’ is enabled for the Account class linked to product and for defining TD Rate code rule UDE Type should be maintained as ‘Rate as Rate Code’ for interest rate pickup for the account.

Note

You can Define either Rate code or TD rate code not both.

UDE Values

Variance

Specify the variance in the interest rate. This is the variance alone. This value can be modified at anytime.

For more information on Floating Rate, refer ‘Maintaining Floating Interest Rates’ under ‘Retail Lending’ User Manual.

Refer the section titled ‘Specifying interest details’ under ‘Opening a TD by account transfer’ for further details.

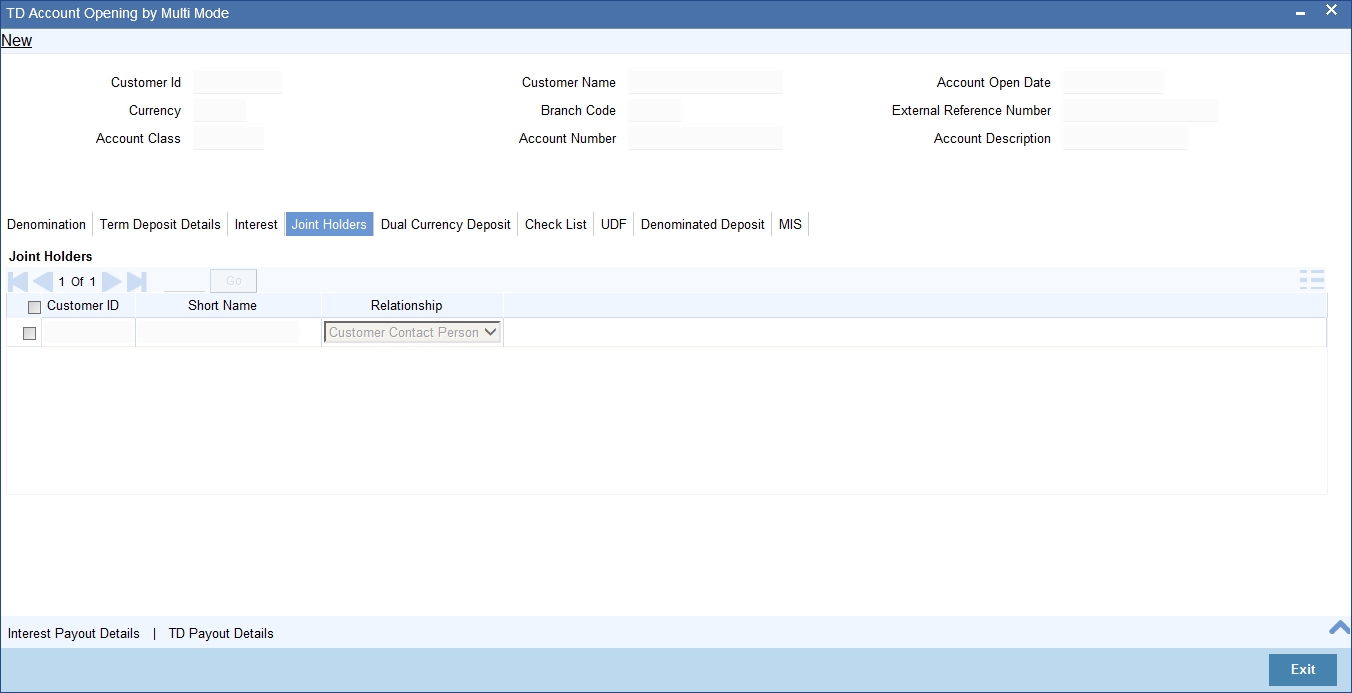

10.2.4 Specifying joint account holder details

In case of joint accounts, you need to specify the details of the joint holder.

Refer the section titled ‘Specifying Joint Account Holder details’ under ‘Opening a TD by account transfer’ for further details.

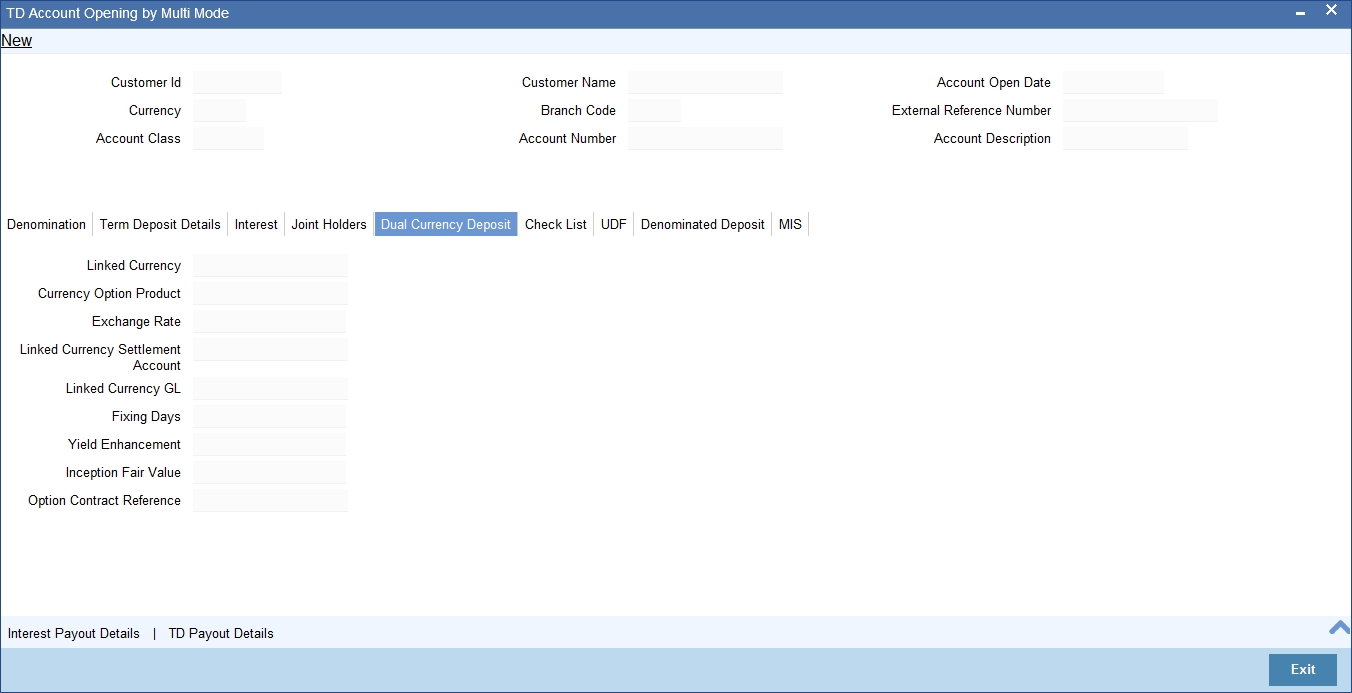

10.2.5 Specifying the dual currency deposit details

In this tab, you can capture dual currency deposit details involved in the transaction. Click on the ‘Dual CCY Deposit’ tab to capture the details:

The following details are captured in this screen:

Linked Currency

This option is defaulted from the Account Class. However you can modify this value.

CCY Option Product

This option is defaulted from the Account Class. However you can modify this value.

Exchange Rate

Specify the exchange rate.

Linked Currency Settlement Account

Specify the account of the linked currency’s settlement.

Linked Currency GL

Specify the account of the linked currency’s GL.

Fixing days

This option is defaulted from the Account Class. However you can modify this value, which is the number of days from TD maturity date before which the Exchange Rate has to be fixed.

Yield Enhancement

Specify the additional yield percentage in this option.

Inception Fair Value

Specify the market value of the option contract at inception. This is defaulted from the Linked Option Contract.

The following options are mandatory if the Linked Currency is specified:

- CCY Option Product

- Exchange Rate

- Linked CCY’s Settlement A/c

- Linked CCY’s GL A/c

- Yield Enhancement

- Inception Fair Value

For more details on handling dual currency deposits, refer section ‘Capturing Details for Dual Currency Deposit’ in the chapter ‘Maintaining Customer Accounts’ in Core Entities User Manual.

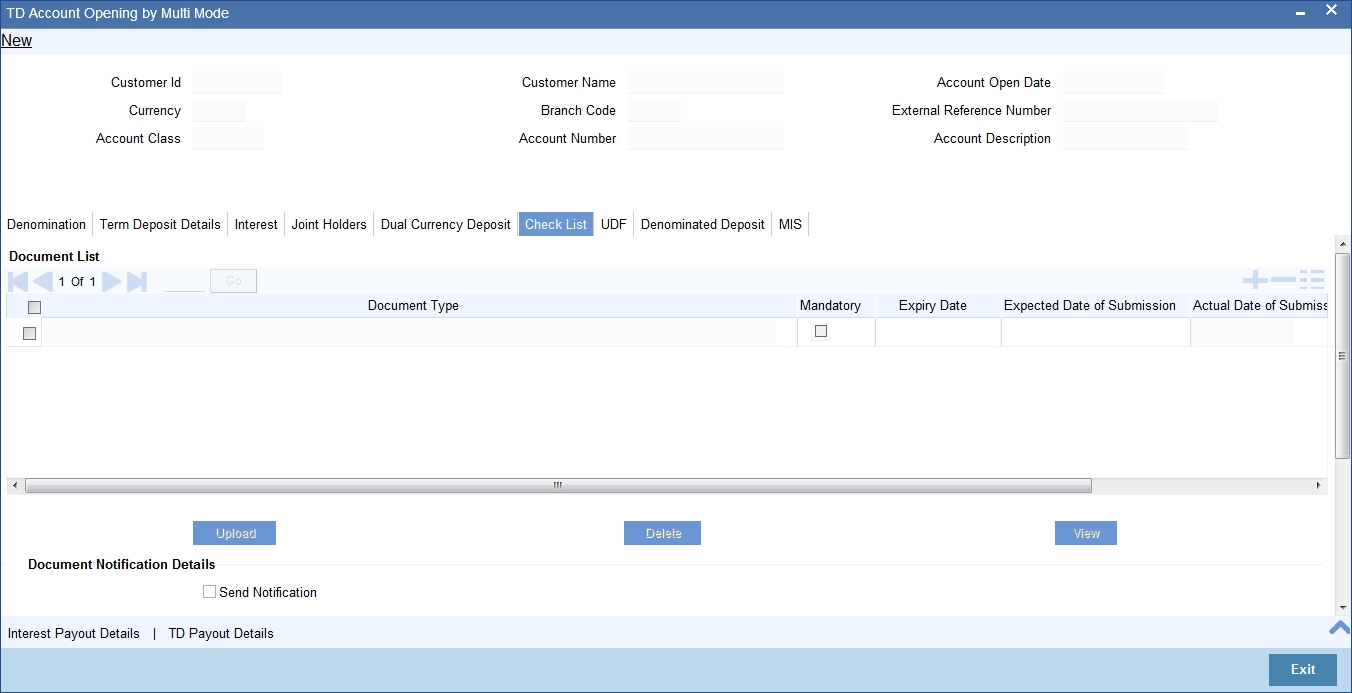

10.2.6 Specifying the Check List Details

In this tab, you can capture document check list details involved in the transaction. Click on the ‘Check List’ tab to capture the details:

You need to specify the following details:

Document Type

Specify the document type. The adjoining option list displays all the document types that are maintained in the system. You can select the appropriate one.

Mandatory

Check this box to indicate that the document specified here is mandatory.

Expiry Date

Specify the expiry date of the document provided by the customer.

Note

- Expiry date will always be greater than ‘Expected Date of Submission’ and ‘Actual Submission Date’.

- Expected Date of Submission will always be greater than current date

Expected Date of Submission

System displays the expected date on which the customer is accepted to submit the required documents.

Actual Date of Submission

Specify the actual date on which customer has submitted the required documents.

Document Reference

System defaults the document reference here.

Checked

Check this box to indicate that the received documents are acknowledged.

Note

You cannot save and authorize an account if the mandatory documents are not confirmed as ‘Checked’.

Upload

Click on this button to upload the selected document type.

Delete

Click on this button to delete the selected document.

View

Click on this button to view the selected document.

Document Notification Details

System defaults notification details from the ‘Account Class Maintenance’ screen.

Send Notification

This check box indicates whether to send notifications or reminders for not submitting the mandatory documents.

Reminder Frequency (Notification)

System defaults the frequency of notification to be sent. The frequency can be one of the following:

- Daily

- Weekly

- Monthly

- Quarterly

- Half yearly

- Yearly

Note

Notification will be sent only if,

- The check box ‘Send Notification’ is checked in Account Class Maintenance’ screen.

- The account status is active and authorized.

- The mandatory documents are not submitted.

Notifications will be sent based on the frequency specified.

First notification will be sent on the expected date of submission or expiry date.

If notification date falls on a holiday then system will send the notification on next working day.

Days (Reminder)

System defaults the number of days left for the expiry or submission due date of the documents for sending the reminder.

System will send the following reminders:

- Reminder prior to the submission due date of the document.

- Reminder prior to the expiry date of the document.

- Overdue notifications after the due date if the document is not submitted based on the frequency.

- Notifications after the expiry date if the document is not submitted after the expiry date.

Note

Reminder will be sent only if,

- The mandatory documents are not submitted.

- The account status is active and authorized.

Reminder will be sent only once.

If reminder date falls on a holiday then system will send the notification on next working day.

Reminder will be sent prior the number of days specified at the account level from expected date of submission or the expiry date.

If there are more than one notifications or reminders of the same message type for which the notification schedule date falls on the same day for the same account, a single notification will be sent which will have the details of all the related documents.

Remarks 1 to 10

Specify the additional information, if required.

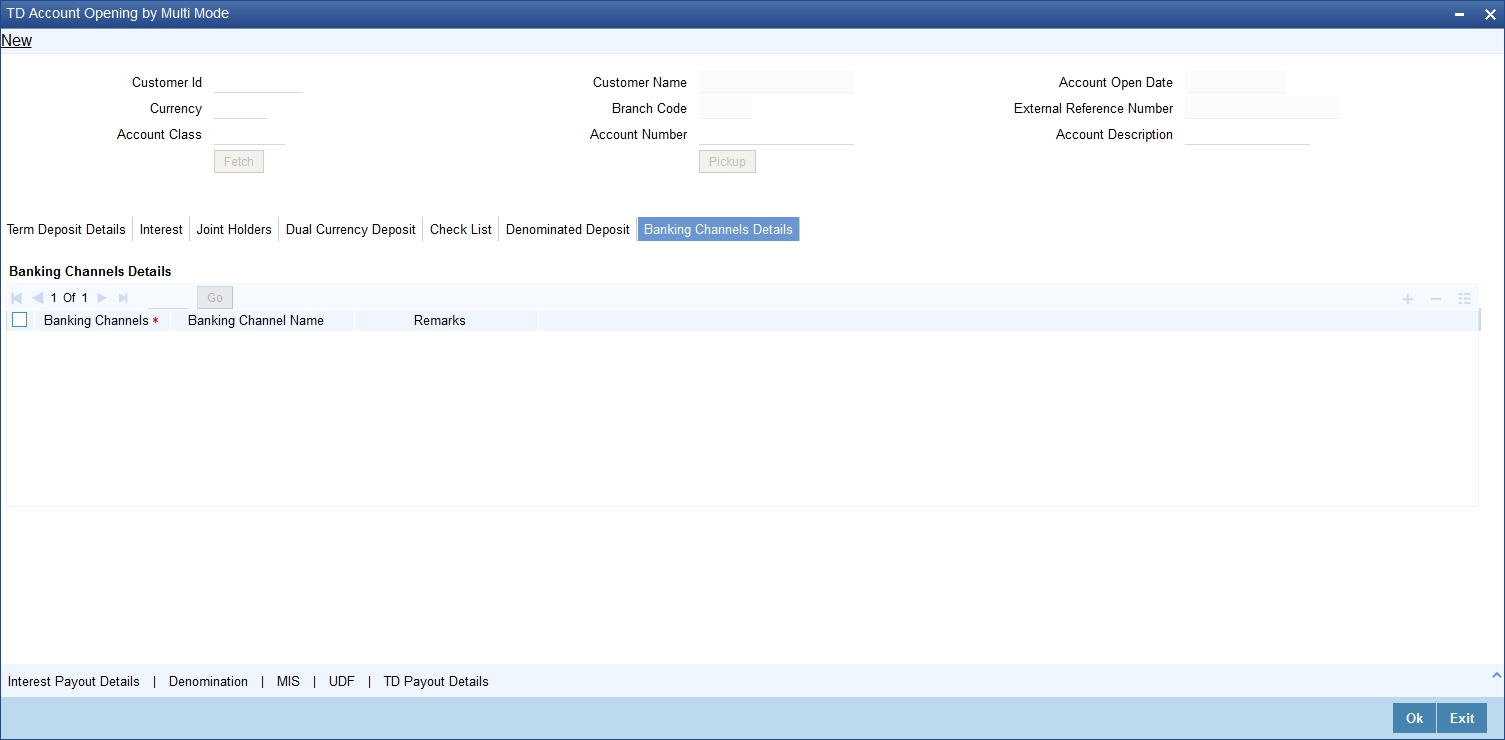

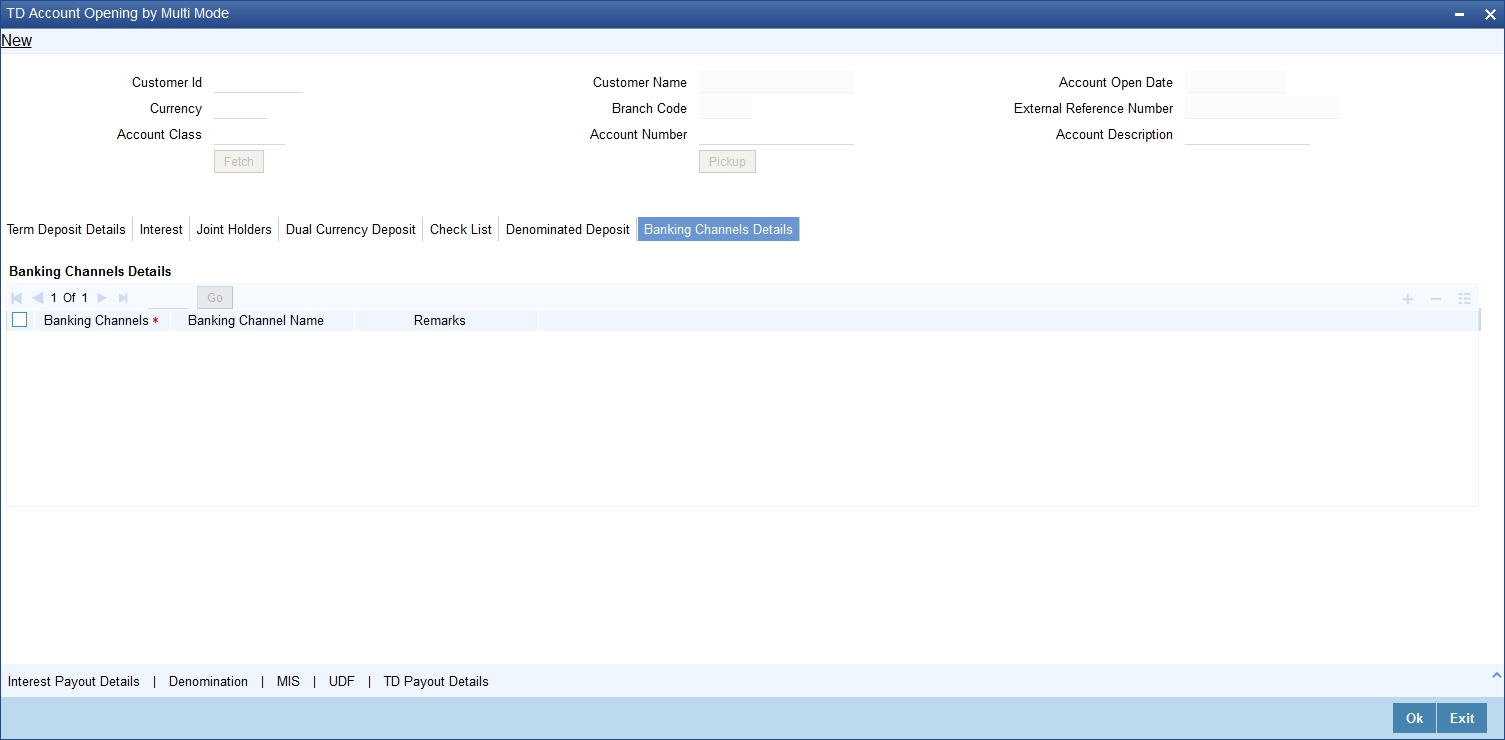

10.2.7 Banking Channels Details Tab

The system defaults the common channel information captured at CIF and account class levels during TD account creation.

Specify the following details:

Banking Channels

Specify the banking channels code. Alternatively, you can select the list of channels from the option list. The list displays the channels maintained in the system.

Banking Channel Name

The system displays the name of the banking channel.

Remarks

Specify remarks for the banking channel subscription.

Note

- While populating the channels to the Customer Account screen, the system populates only the channels which are allowed in primary CIF and Account Class. The system defaults the remarks maintained at customer level to the account. You can modify it.

- You can delete the channels which need not be allowed at the customer account level, but you cannot add the channels which are disallowed at the customer or account class level. The system will display only those channels which are available in both CIF and account class levels.

- You can add channels which are mapped at both CIF and Account Class levels. You cannot delete a channel at CIF/Account Class level, which is already mapped to accounts (authorized or unauthorized) belonging to the CIF/Account Class. The system checks only for active accounts. You can delete the channels from customer/account class level only if the account is closed. During reopen of the account, the system validates whether the account is modified after reopening.

- When an account is created automatically from Customer Creation screen, the channels maintained at both Customer and Account Class is defaulted to the account. If no maintenance is performed at CIF/account class levels for channels, the system does not populate any channels at account.

- When account class transfer happens during batch, the system deletes the existing channels attached to the account and repopulates from the new Account Class and Customer.

During authorization of the account, the system does not repopulate the channel details. While authorizing primary party change, the system defaults the existing channels which are attached to the account and repopulates from the new Customer and Account Class. You can modify the channel information from the main screen for Customer Account Creation.

During save, the system defaults the channel details from Customer and Account Class of the account. You can modify the details in the Account Creation screen (STDCUSAC).

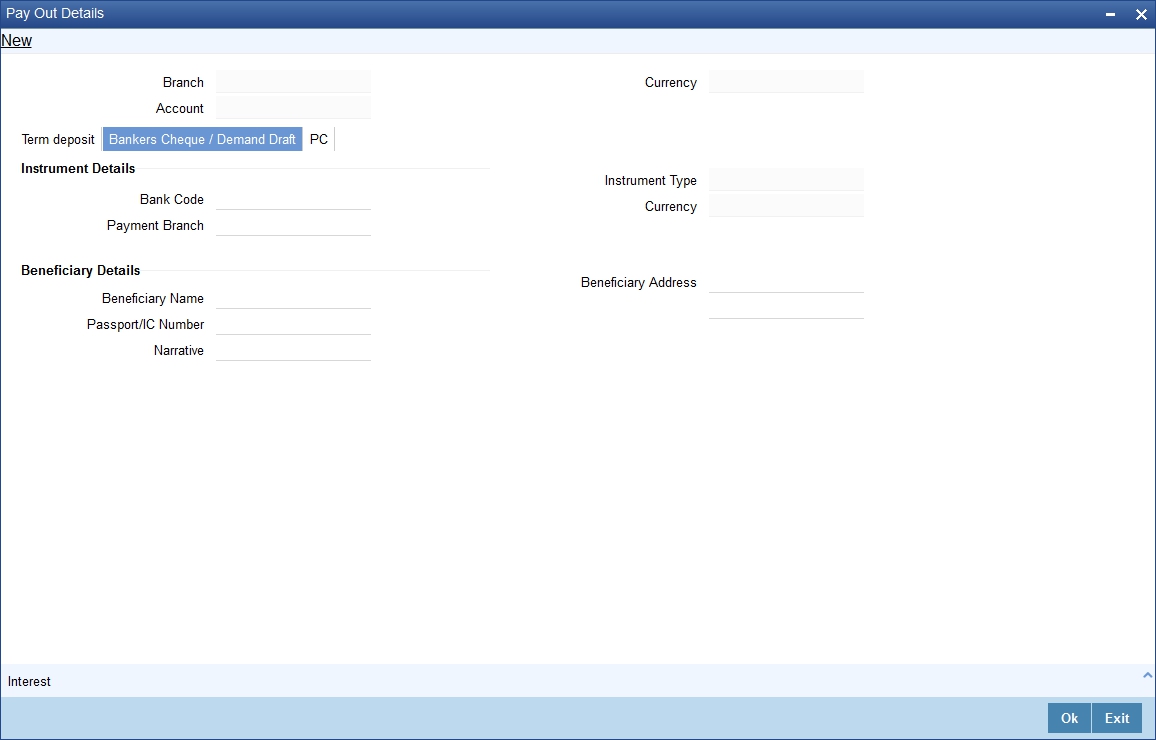

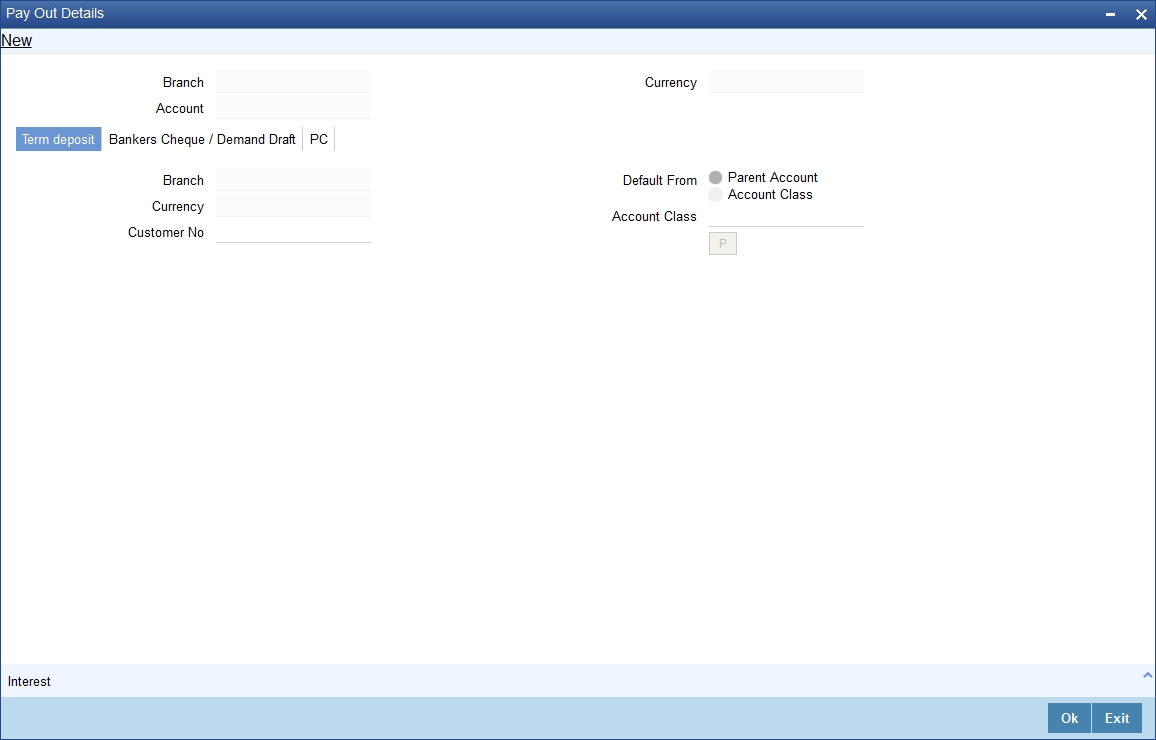

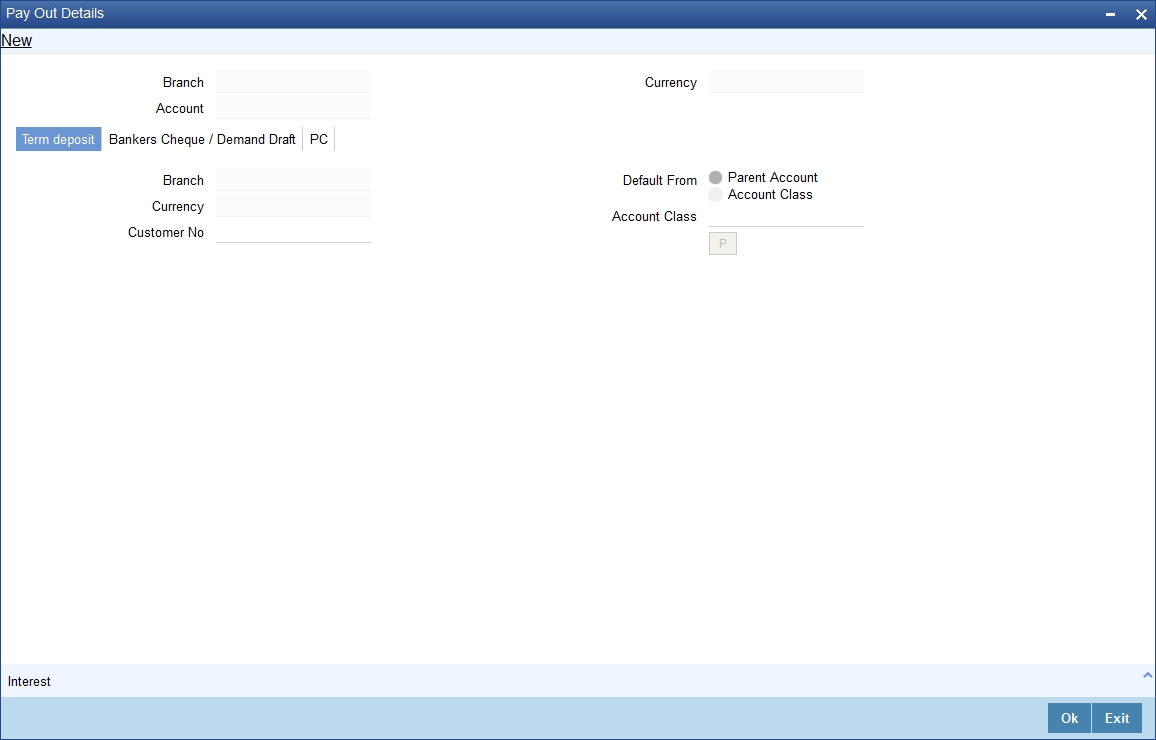

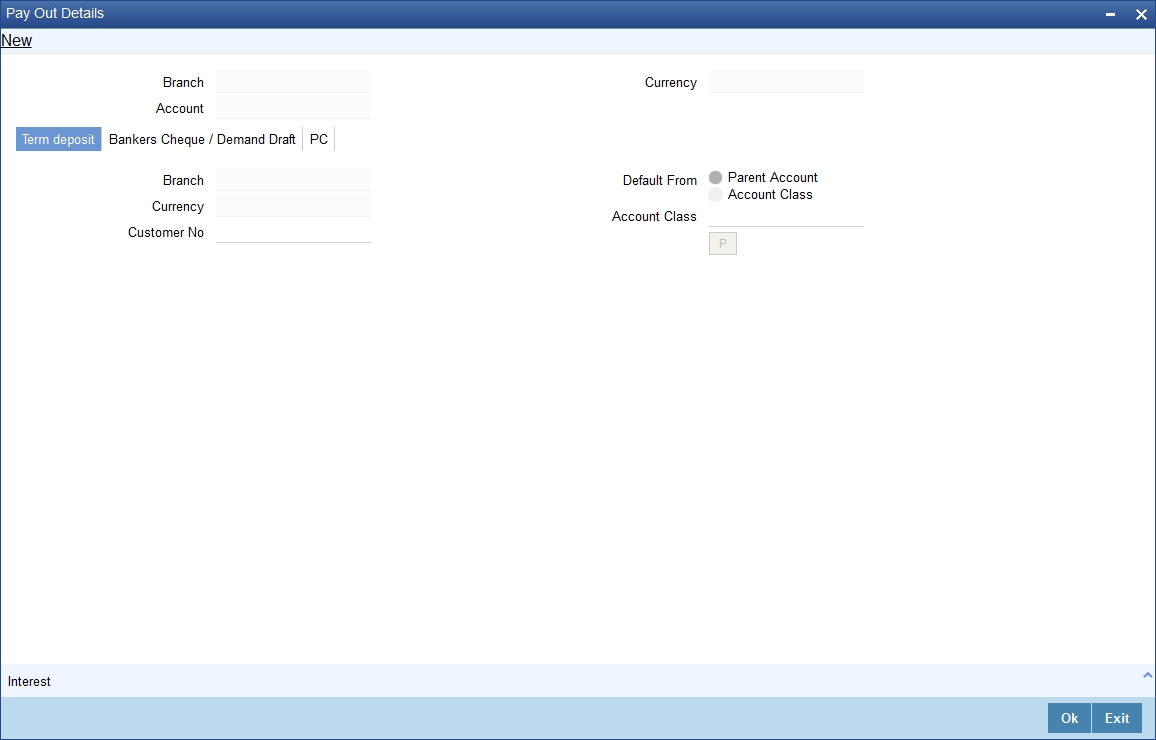

10.2.8 Capturing the Pay-Out Parameters

You can capture the parameters for automatic pay-out by clicking on the ‘TD Payout Details’ button.

The following details are captured here:

Branch Code

The system defaults the branch code.

Account Number

Specify the account number.

Currency

Specify the currency.

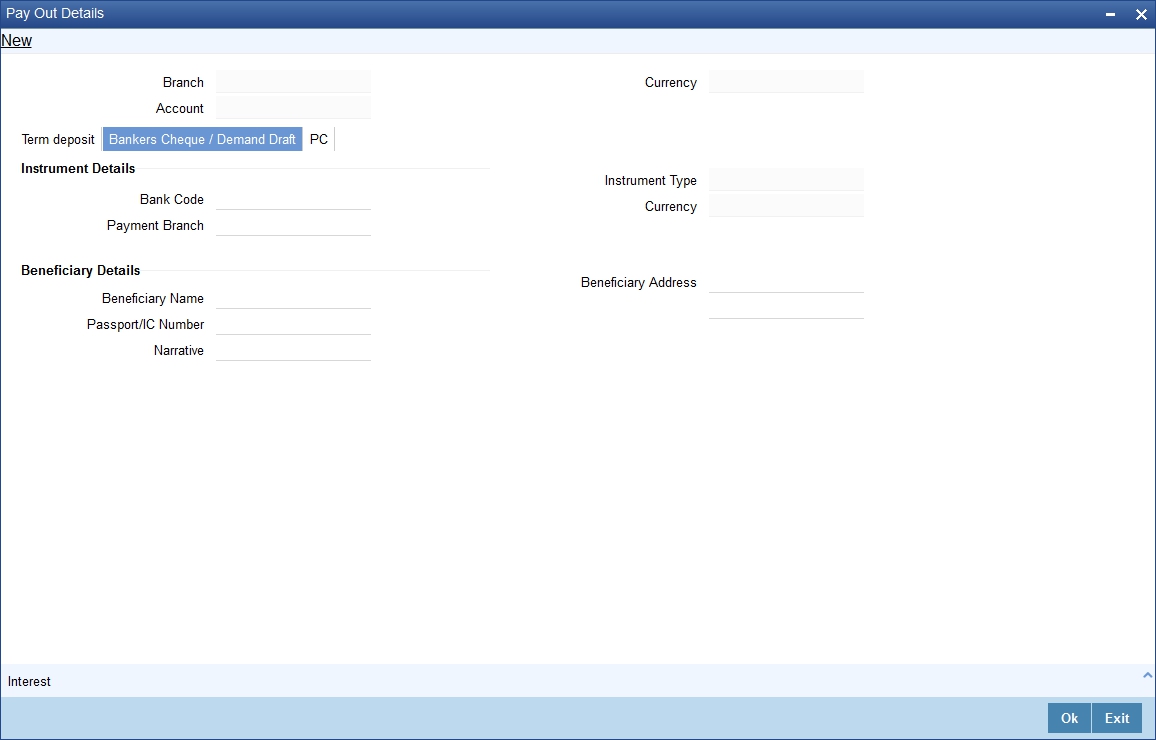

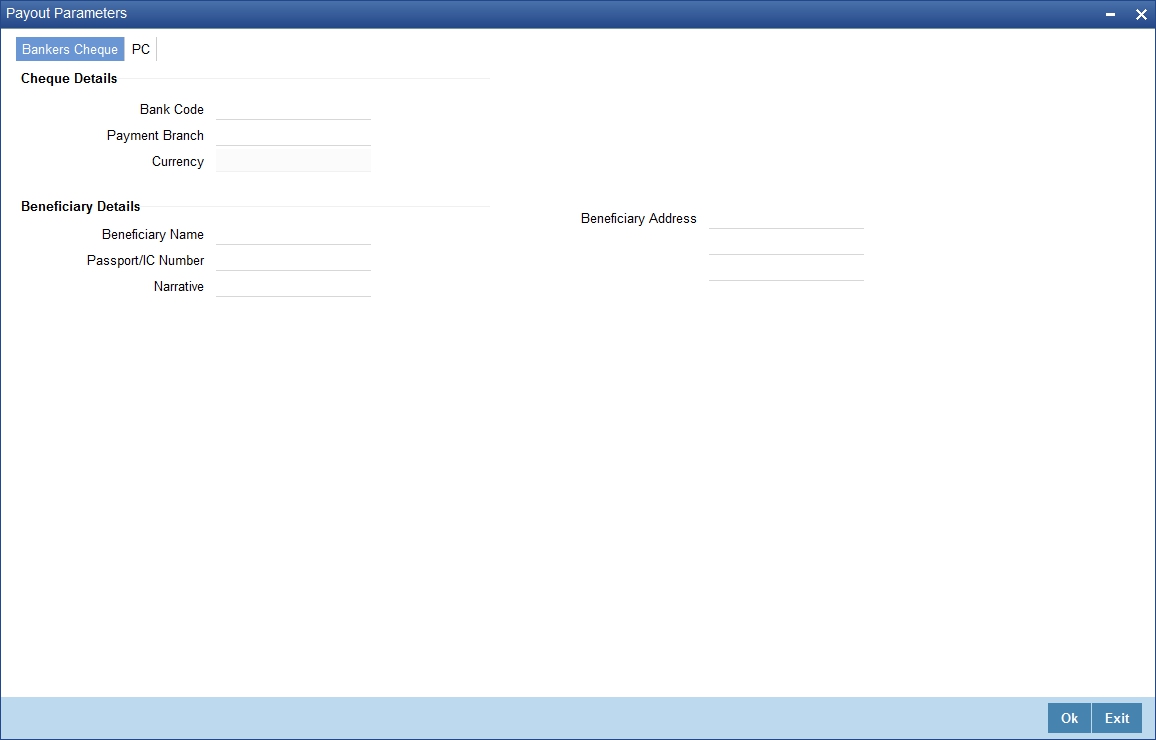

10.2.8.1 Specifying Bankers Cheque Details

To capture the details for pay-out through Bankers Cheque, click on the Bankers Cheque tab.

Bank Code

Specify the bank code of the Bankers cheque.

Payable Branch

Select the payable branch from the adjoining option list. The list displays all the payable branch linked to the selected bank code.

Cheque Currency

Specify the currency of the cheque for the pay-out.

Beneficiary Name

Specify the name of the beneficiary for the pay-out.

Passport/IC Number

Specify the passport number of the beneficiary for the pay-out.

Beneficiary Address

Specify the address of the beneficiary for the pay-out.

Narrative

Specify the description for the pay-out.

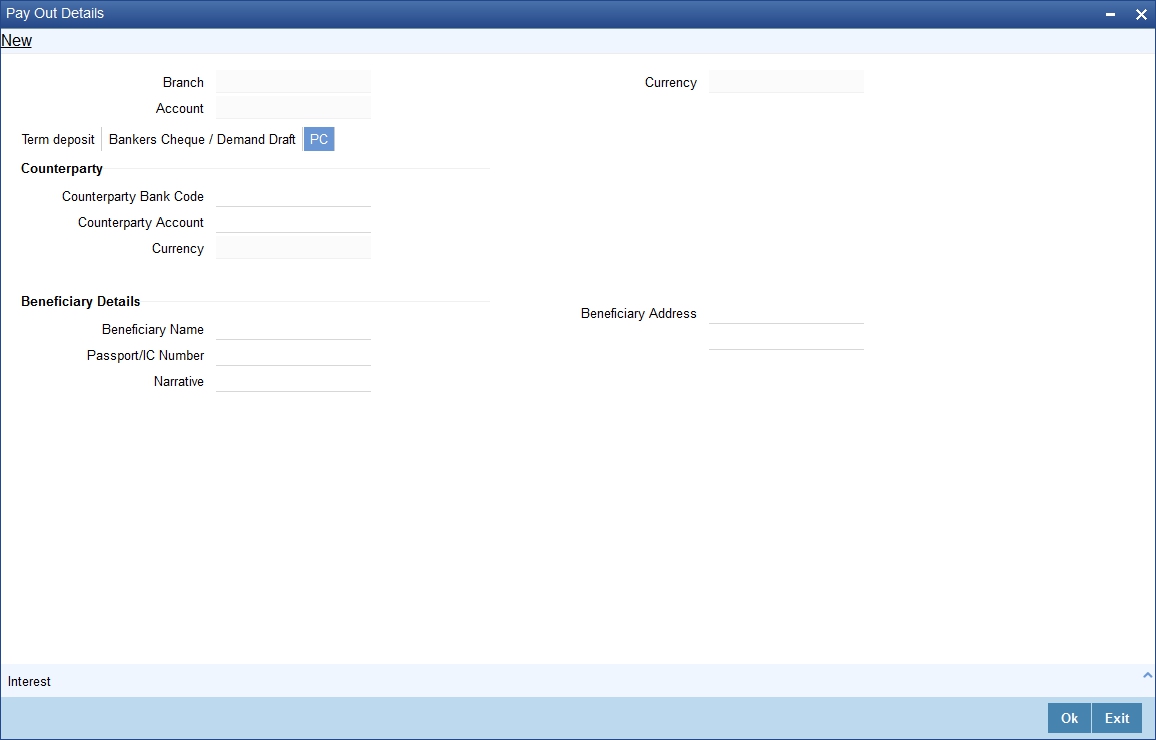

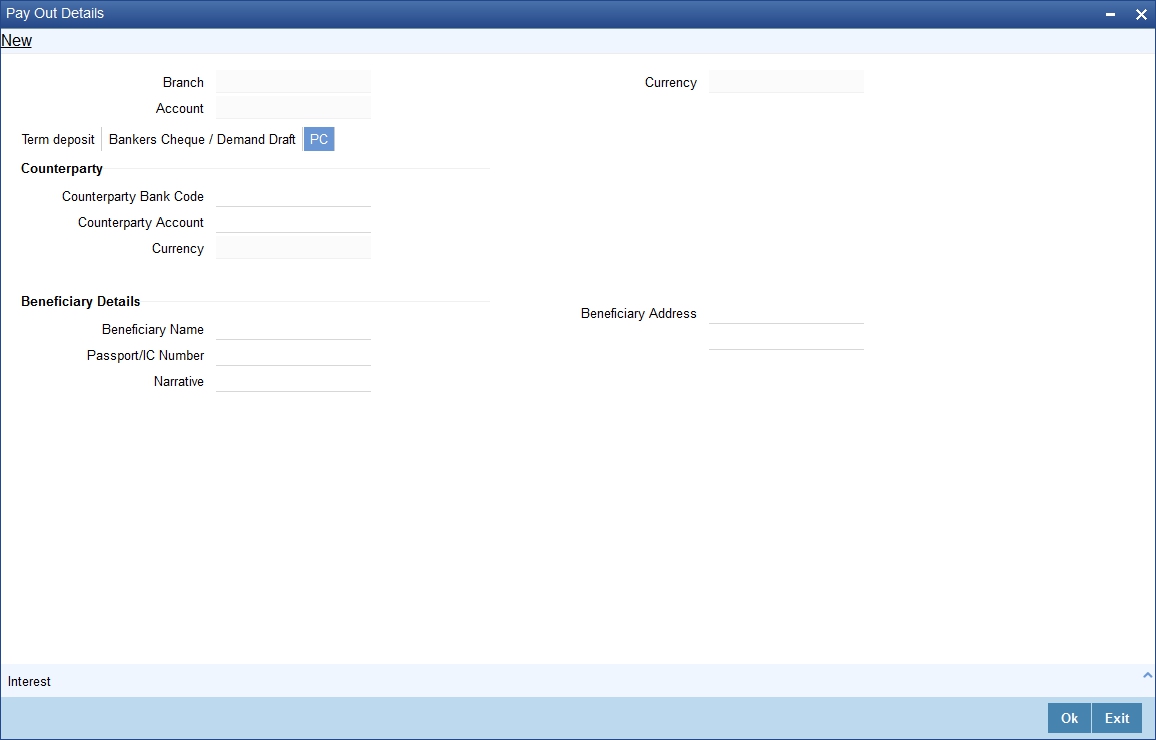

10.2.8.2 Specifying PC Details

To capture the pay-out details thought transfer to other bank account, click on the ‘PC’ tab.

The following details are captured here:

Counter Party Bank Code

Specify the bank code of the counter party for the pay-out.

Counter Party Account

Specify the account number of the counter party for the pay-out.

Currency

Specify the currency of the counter party for the pay-out.

Beneficiary Name

Specify the name of the beneficiary for the pay-out.

Passport/IC Number

Specify the account number of the beneficiary for the pay-out.

Narrative

Specify the description for the pay-out.

Beneficiary Address

Specify the address of the beneficiary for the pay-out.

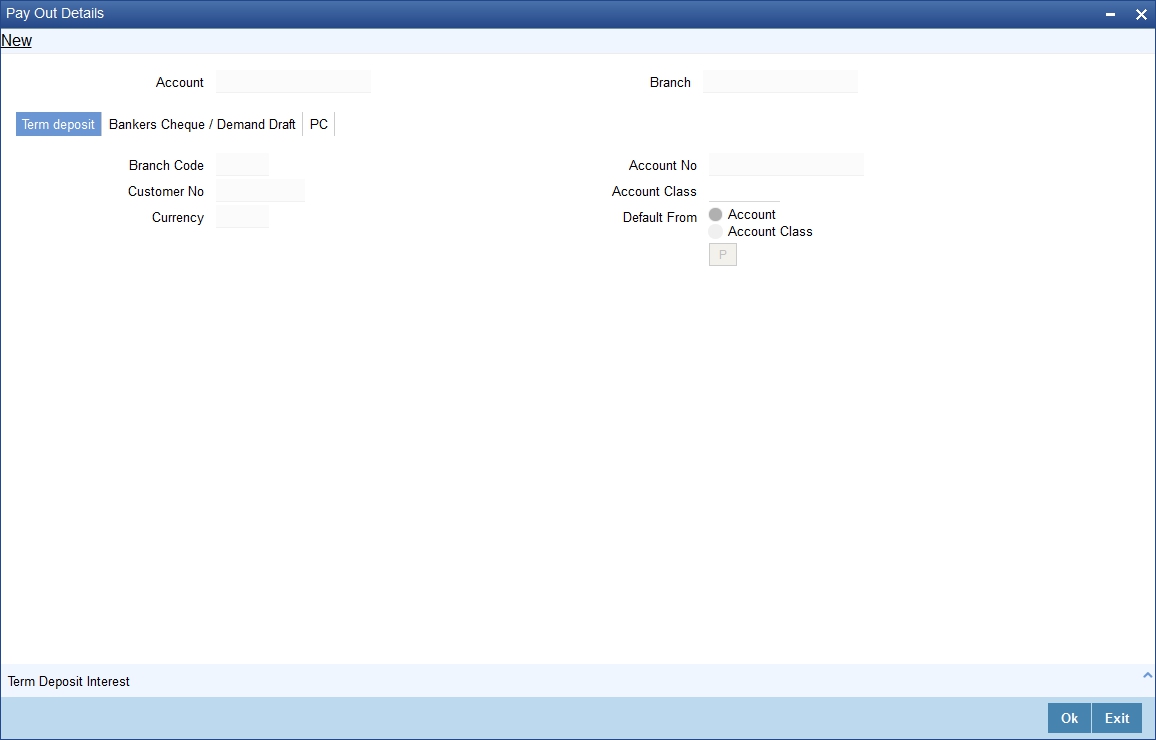

10.2.8.3 Specifying Term Deposit Details

To capture the details for opening a new TD as a part of pay-out, click on the Term Deposit tab.

The following details are captured here:

Branch Code

The system defaults the branch code.

Currency

The system defaults the currency.

Customer Number

The system defaults the customer number.

Default From

Select the ‘Default From’ option to default the details from either the parent account TD account or account class. The options available are:

- Account

- Account Class

Account Class

Specify the account class. If you have selected the ‘Default From’ as Account Class, then you have to specify the Account Class mandatorily. Else you can leave it blank.

Note

If you select the ‘Default From’ as Account, then on clicking of ‘P’ button, the system defaults the interest and deposit details from the parent TD account. Or if you select the ‘Default From’ as Account Class, then on clicking of ‘P’ button, the system defaults the interest and deposit details from the account class selected.

10.2.9 Specifying Child TD Details

The Child TD parameters are similar to the Parent TD, except the child will not have the option to create a new TD as part of Pay-out. You can capture the details of child TD that is created by payout by clicking on the ‘Interest’ button. I

You need to capture the following details here:

Account Details

Specify the account number of the Child TD.

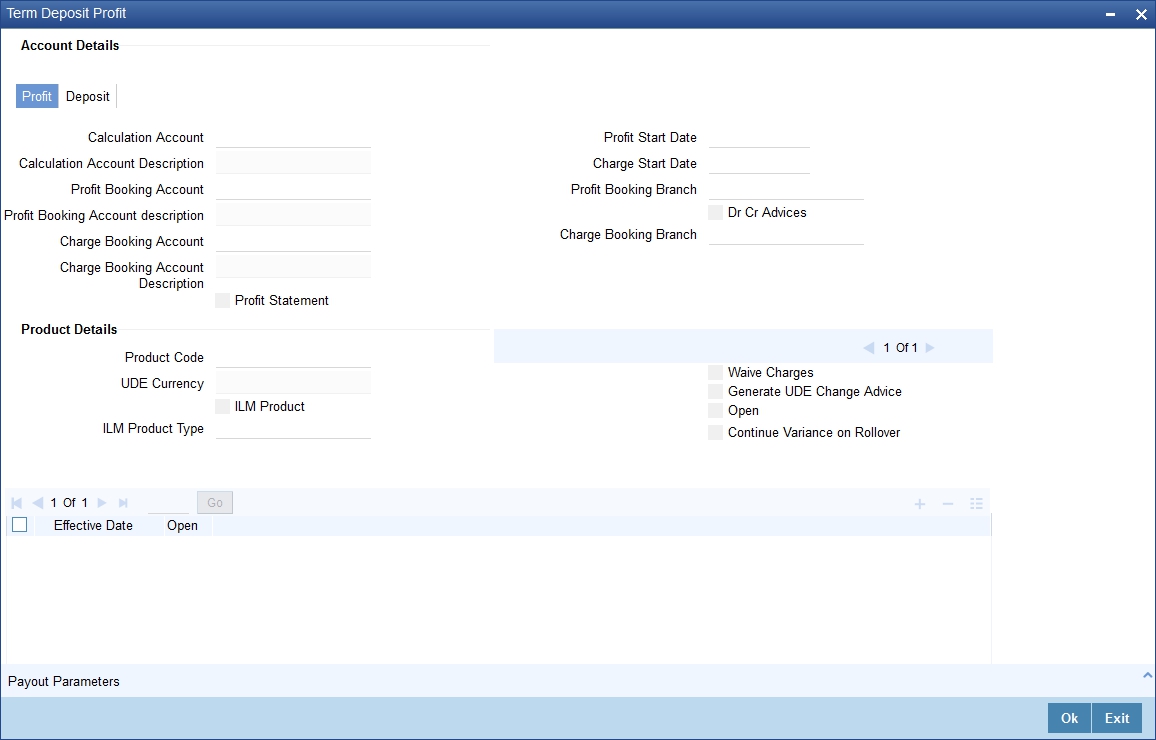

10.2.9.1 Capturing Interest Details

Calculation Account

Select the calculation account of the Child TD from the option list.

Interest Statement

Check this box to generate an interest statement for the account. The Interest Statement will furnish the values of the SDEs and UDEs and the interest rule that applies on the account.

Charge Booking Account

Select the charge booking branch from the option-list available. You have an option of booking interest/charge to a different account belonging to another branch. The accounts maintained in the selected booking branch are available in the option-list provided. The system liquidates the Interest/Charge into the selected account.

Interest Start Date

Select the interest start date from the option list.

Charge Start Date

Select the charge start date from the option list.

Interest Booking Branch

Select the interest booking branch from the option list.

Dr/Cr Advices

Check this box to indicate that the system must generate payment advices when interest liquidation happens on an account. The advices are generated in the existing SWIFT or/and MAIL format.

Charge Booking Branch

Select the charge booking branch from the option-list available. You have an option of booking interest/charge to a different account belonging to another branch. The accounts maintained in the selected booking branch are available in the option-list provided. The system liquidates the Interest/Charge into the selected account.

Product Code

Specify the product code.

UDE Currency

Specify the UDE Currency defined for the product.

Integrated LM Product

Check this box to indicate the product is an Integrated LM product.

IL Product Type

Specify the IL product type.

Waive Charges

Check this box to waive of a particular interest or charges that has been specified.This is not applicable for TD account.

Generate UDE Change Advice

Check this box to generate the UDE change advice.

Open

Check this box to make the product applicable again. More than one product may be applicable on an account class at the same time. You can temporarily stop applying a product on an account class by ‘closing’ it. You can achieve this by un-checking the box ‘Open’. The product will cease to be applied on the account class.

Effective Date

Specify the effective date ‘Effective Date’ of a record is the date from which a record takes effect.

Open

Specify the open records with different Effective Dates if the values of UDEs vary within the same liquidation period.

UDE ID

Specify the UDE ID for the account.

UDE Value

Specify the values for a UDE, for different effective dates, for an account. When interest is calculated on a particular day for an account with special conditions applicable, the value of the UDE corresponding to the date will be picked up.

Rate Code

Specify the rate code for the account. TD Rate code is not supported for child TD currently.

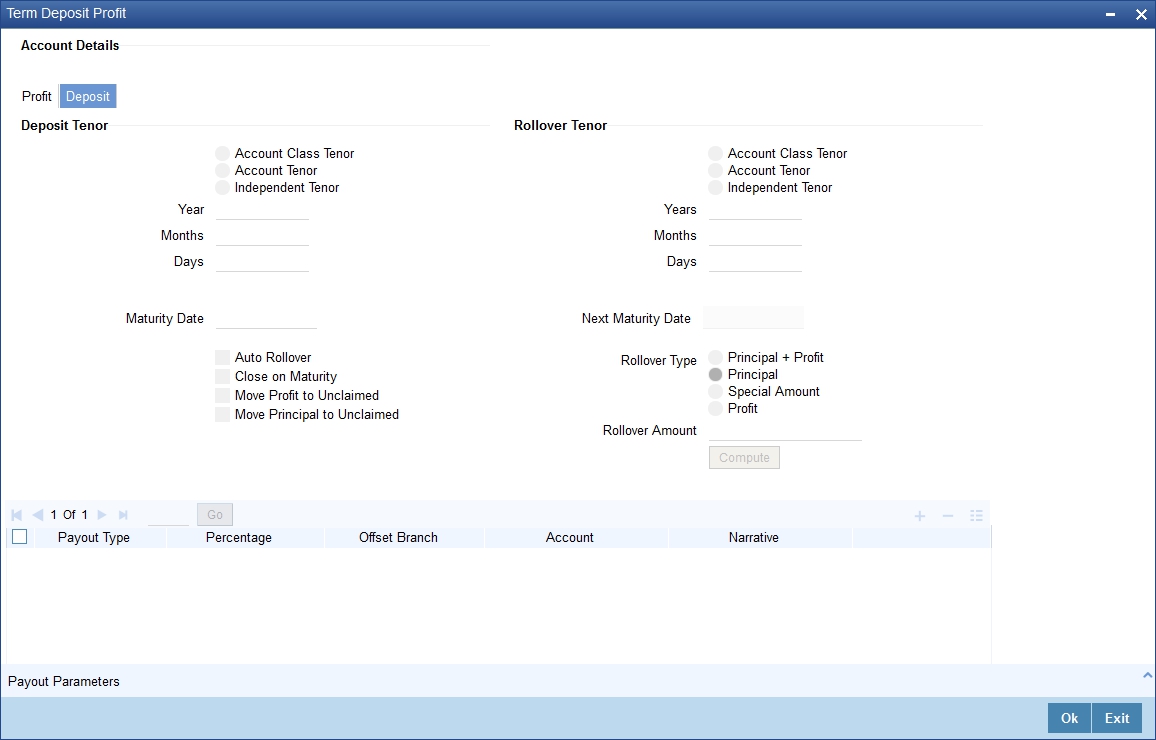

10.2.9.2 Capturing Details for Deposit

Click on the ‘Deposit’ tab to specify the deposit details.

You need to capture the following details here:

Maturity Date

The system defaults the maturity dates from the default tenor from the account class. However, you can modify this date. On this date the term deposit account gets.

Next Maturity Date

On selecting the rollover for the TD account, the system defaults the next maturity dates from the previous tenor of the deposit.

Deposit Tenor

The system calculates the tenor of the deposit account to the difference between Interest start date and Maturity date and displays it. In case of change in maturity date, the system changes the value of this field.

Years

This indicates the number of years in the deposit tenor.

Months

This indicates the number of months in the deposit tenor.

Days

This indicates the number of days in the deposit tenor.

Auto Rollover

Check this field to automatically rollover the deposit you are maintaining. You have to indicate ‘Rollover Type’ on selecting this option.

Close on Maturity

Check this box to close the term deposit account on maturity date and transfer the amount to the principal liquidation account. If you select this option, the principal liquidation account should be an account other than the term deposit account.

Move Interest to Unclaimed

Check this box to move the interest amount to the unclaimed GL mapped at the IC product in the accounting role ‘INT_UNCLAIMED’ on Grace period End date. If you select this option, then you will have to check the box ‘Move Principal to Unclaimed’.

Move Principal to Unclaimed

Check this field to move the principal amount to the unclaimed GL mapped at the IC product in the accounting role ‘PRN_UNCLAIMED’ on Grace period End date. If you select this option then only principle amount will be moved to unclaimed and Interest will be settled to TD payout. If You select both ‘Move Interest to Unclaimed’ and ‘Move Principle to Unclaimed’ then TD amount (i.e. P+I will be moved to Unclaimed GL, irrespective to the TD payout Details).

Interest Rate Based on Cumulative Amount

Check this box to indicate that the system should arrive at the interest rate of a new deposit using the cumulative amount of other active deposits, under the same account class, customer, and currency.

Refer the section ‘Calculating Interest Rate Based on Base Amount’ in ‘Terms and Deposits’ User Manual for details about arriving at interest rate based on cumulative amount.

Rollover Type

You can indicate rollover type as hereunder:

- Principal - If You select ‘Principal’ option then On Maturity date System will do rollover with Only Principle amount irrespective to the Interest booking account.(i.e. if Interest booking account is given as TD account then on maturity date Interest amount will be first liquidated to TD account and settled to the Payout details maintained for the TD account).

- Principal + Interest - If You Select ‘Principal +Interest’ option then Interest booking account should be always TD account. On maturity date P+I amount will Rollover.

- Special Amount - If you select ‘Special Amount’ option then System will do rollover with Specified amount irrespective to the Interest booking account. (during Second rollover system will do rollover with the same amount by settling the New interest amount to TD payout amount)

- Interest - If you select ‘Interest’ option then Interest booking account should be always TD account. On maturity date Principle amount will be settled to payout option

Rollover Amount

If a special amount is to be rolled over, you have to specify the amount (less than the original deposit amount) in the Rollover Amount field.

10.2.9.3 Specifying Term Deposit Pay-Out Details

Payout Type

Select the pay-out mode from the drop down list. The options available are:

- Bankers Cheque - BC

- Transfer to Other bank - PC

- Transfer to GL – GL

- Transfer to Savings Account – AC

Note

- For Dual Currency Deposits you are allowed to select only ‘GL’ and ‘Savings Account’ options as the pay-out mode. You can either select GL or Savings Account but not both. You can select only one GL or one Savings account and not multiple GLs or accounts in either case.

Percentage

Specify the amount of redemption in percentage.

Offset Branch

Specify the branch code of the account for redemption.

Account Number

Specify the account number/ GL for redemption.

Narrative

Specify the description for the redemption.

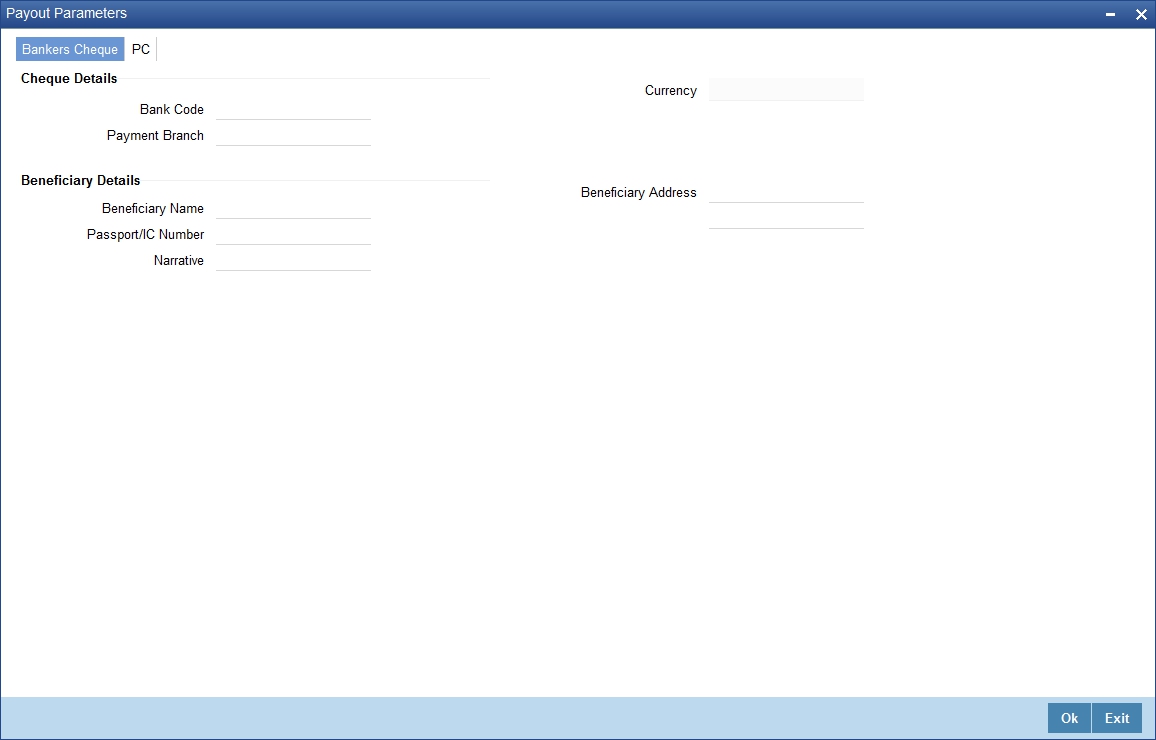

10.2.10 Capturing Pay-Out Parameters

You can capture the parameters for automatic pay-out by clicking on the ‘Pay-Out Parameters’ button. To capture the details for pay-out through Bankers Cheque, click on the Bankers Cheque tab.

The following details are captured here:

10.2.10.1 Specifying Bankers Cheque Details

Bank Code

Specify the bank code of the Bankers cheque.

Payable Branch

Select the payable branch from the adjoining option list. The list displays all the payable branch linked to the selected bank code.

Cheque Currency

Specify the currency of the cheque for the pay-out.

Beneficiary Name

Specify the name of the beneficiary for the pay-out.

Passport/IC Number

Specify the passport number of the beneficiary for the pay-out.

Beneficiary Address

Specify the address of the beneficiary for the pay-out.

Narrative

Specify the description for the pay-out.

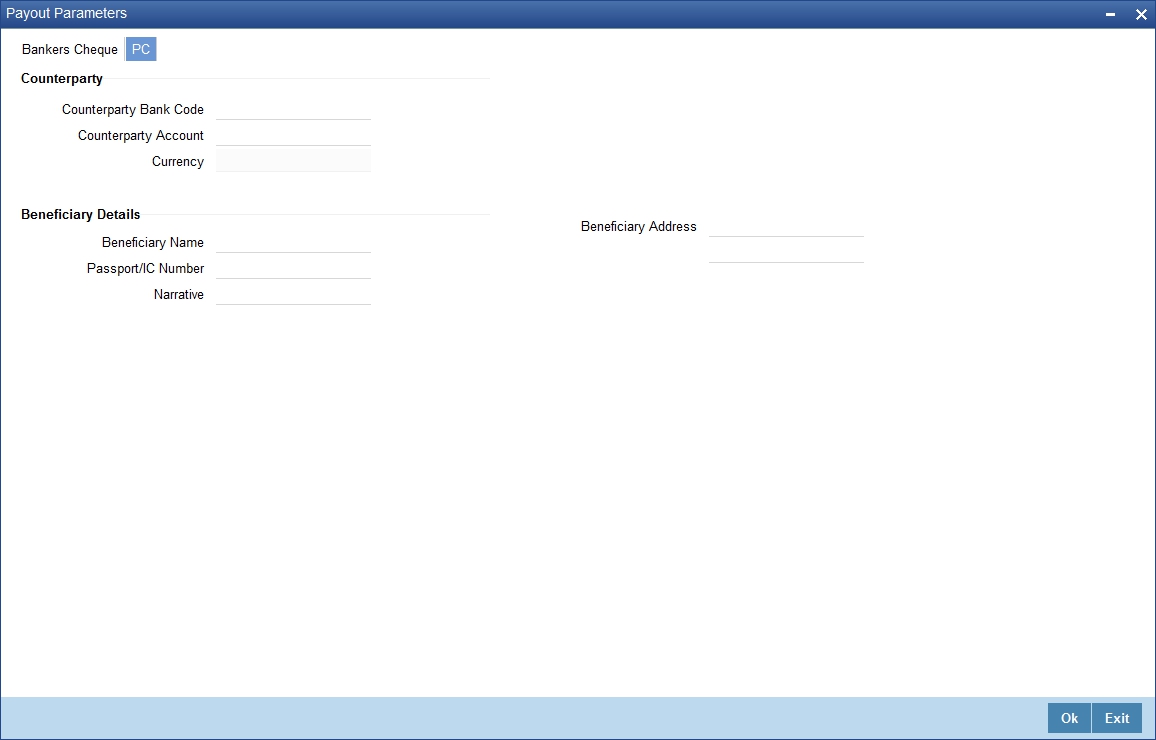

10.2.10.2 Specifying PC Details

To capture the pay-out details thought transfer to other bank account, click on the PC tab.

The following details are captured here:

Counterparty Bank Code

Specify the bank code of the counter party for the pay-out.

Counterparty Account

Specify the account number of the counter party for the pay-out.

Currency

Specify the currency of the counter party for the pay-out.

Beneficiary Name

Specify the name of the beneficiary for the pay-out.

Passport/IC Number

Specify the account number of the beneficiary for the pay-out.

Narrative

Specify the description for the pay-out.

Beneficiary Address

Specify the address of the beneficiary for the pay-out.

10.2.11 Specifying Denominated Deposit Details

Click ‘Denominated Deposit’ button on ‘TD Account Opening by Multi Mode’ screen to invoke the ‘Denominated Deposit’ screen.In this screen you can capture details regarding the denominated deposit.

Denomination Id

Select the denomination id from the adjoining option list. The list displays all denomination codes allowed at the account class level.

Denomination Description

The description of the selected denomination id is displayed here.

Denomination Value

The denomination value of the selected denomination id is defaulted here.

Units

Specify the number of units of the specified denomination.

Total Amount

The system computes the total amount by multiplying the denomination value with the number of units. For instance, if the denomination code represents a USD 100 and the number of units is 10, then the denomination amount will be ‘1000’.

After entering all the above details, click ‘Populate’ button. The following details are displayed:

Denomination Allocation Pending Amount

This indicates the amount for which the denomination is yet to be allocated.

Certificate Allocation Pending Amount

This indicates the amount for which the certificate is yet to be allocated.

Term Deposit Amount

The indicates the deposit amount.

While saving the transaction, if you had modified the interest rate at TD account level for TD booking or for creating Payout TD, the system displays configurable override messages.

These overrides are displayed during subsequent modifications of the interest rate. You can also configure overrides for Dual Authorization to be displayed at Contract and Maintenance level in the ‘Override Maintenance’ screen.

For more information about configuring overrides, refer to the section ‘Override Maintenance’ in the chapter ‘Configuring Overrides’ in the Core Services User Manual.

10.3 Opening a TD Account for Multi Mode Pay Out

Oracle FLEXCUBE facilitates to create a new term deposit as a part pay-out. It allows pay out to an account in other bank. Withdrawal (Pay Out) of funds from TD account is called Redemption. When full funds are redeemed, it results in account closure. If the funds are redeemed partially, then the TD account remains open.

The following are the pay out options available during account creation:

- Pay out by Demand Draft

- Pay out by Bankers Check

- Pay out by transfer to GL

- Pay out by transfer to own bank Savings Account

- Pay out by transfer to Other Bank’s Account

- Pay out resulting in a new TD

Note

Pay-out option can be single or a combination of the six. Combination of Bankers Check and Demand Draft is not allowed.

You can perform TD redemption using multiple pay-out modes. The system allows any combination of the above pay-out modes.

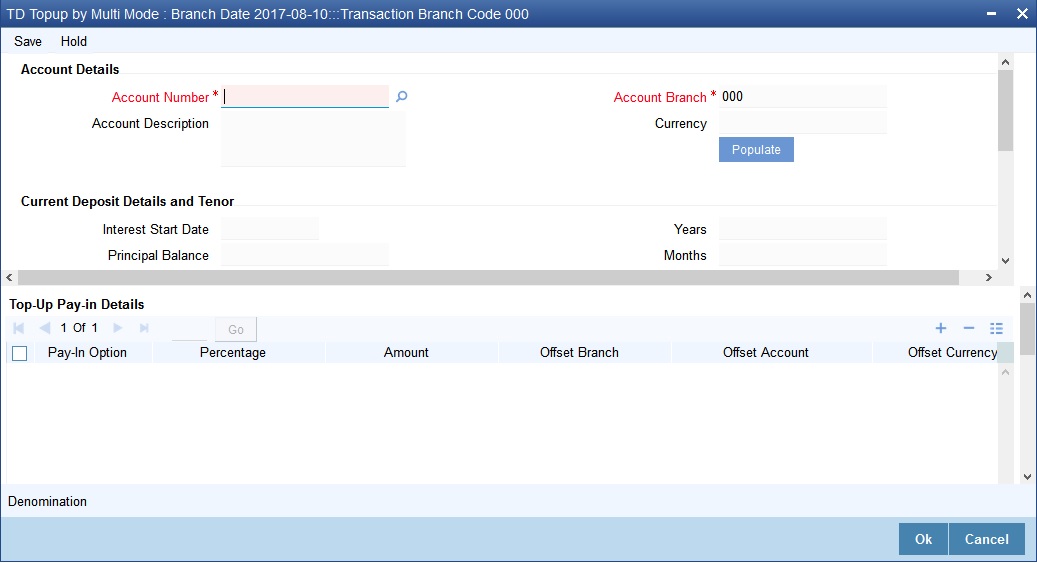

10.4 Topping-up a TD

You can top-up a TD by adding funds to an existing active term deposit.The top-up can be done anytime after the opening date of the TD or anytime before the maturity date of the TD. Top-up input and approval is restricted to only those users who have sufficient rights assigned to their user roles. Limit for input and limit for approval defined at the role level for the user is applicable for the top-up transactions.

You are allowed to do multiple top-ups to the same account in a single day provided the minimum and maximum booking amount and the maximum amount for the deposit account is not breached.The top-up amount must not exceed the limit of minimum and maximum amount allowed for the deposit. If the deposit amount after top-up exceeds the maximum amount system displays the error message: “Deposit amount after top-up should not cross the maximum amount limit allowed for the deposit”. On top up, the deposit amount including top up amount is validated against the min-max limits at deposit cluster level and account class level. If the top-up amount crosses the maximum booking amount for the deposit currency, then the top-up is not allowed. The top-up amount is validated against the top-up units specified for each Ccy at account class.

The top-up amount is validated against the top-up units specified for each Ccy at account class. If top-up is not in multiples of top-up units system displays the following error message:

"Top-Up amount should be given in the Multiples of Top-Up units"

The rate pick-up happens on top-up, based on the interest rate option defined for top-up at account class. The rate will be applicable from the value date of top-up.

The funding of top-up amount can be through multiple modes such as Account, GL, and cash and its combination.

You can top-up a TD using the ‘TD Top-up By Multi Mode’ screen. You can invoke this screen by typing ‘TDTP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The following details are captured here:

Account Number

Select the account number from any branch from the adjoining option list.

On the click of ‘P’ button the following details related to the selected account is populated in the screen.

Account Description

The description of the selected TD account is displayed here. You cannot modify this.

Account Branch

The branch code where the selected TD account is available is displayed here. You cannot modify this.

Currency

The currency of the selected TD account is displayed here. You cannot modify this.

Customer Name

The name of the customer holding the TD account is displayed here.

Customer No

The code of the customer holding the TD account is displayed here.

Top-up Reference Number

A system generated reference number for the top-up transaction is displayed here.

Current Deposit Details

Interest Start Date

The date from which the interest on the TD account should be calculated is displayed here. You cannot modify this.

Principal Balance

The principal balance amount of the term deposit is displayed here. You cannot modify this.

Maturity Amount

The amount available on the maturity of the TD account is displayed here.

Maturity Date

The maturity date of the TD account is displayed here.You cannot modify this.

Deposit Tenor

The deposit tenor details of the TD are displayed here.

Years

The tenor of the TD account in years is displayed here.You cannot modify this.The tenor of the TD account in years is displayed here.You cannot modify this.

Months

The tenor of the TD account in months is displayed here.You cannot modify this.

Days

The tenor of the TD account in days is displayed here.You cannot modify this.

Top-up of Term Deposit Details

The top-up details of the TD are captured here.

Top-up Amount

Specify the top-up amount for the TD.

Value Date

Select the date on which the top-up on the TD has to be effective.The top-up value date can be a back-dated or current date. Future dated top-up is not allowed.

Note

- Top-up can be back-dated to the date of last financial transaction like pay-in, interest liquidation, redemption, maturity, rollover, and top-up of funds.

- If top-up is made back-dated before last financial transaction system displays the following error message: "Top up can be back value dated only up to the value date of the last financial transaction”.

- Top- up value date cannot fall on a holiday. If back-dated top-up date is a holiday system displays the following error message: "Top- up value date is holiday"

Remitter Name

Specify the name of the remitter in this field.

Narrative

Enter remarks about the top-up transaction, if any.

Top-Up Pay-in Details

The pay-in details for the TD top-up is captured here.

Pay-in Option

Select the funding option from the adjoining drop-down list. The following options are available for selection in the drop-down list:

- Account

- GL

- Cash.

Percentage

Specify the percentage of top-up amount that has to be funded through the selected funding option.

Amount

Specify the top-up amount that has to be funded through the selected funding option.

Note

In case of multiple pay in modes, the sum of amounts in multiple payins should match the top up amount entered.

Offset Account

Select the offset account for passing the accounting entries.

Offset Branch

The branch where the selected offset account is available is displayed here.

Offset Currency

Specify the currency of the TD.

Original FX Rate

Specify the FX rate picked up by the system.

Applied FX Rate

Specify the FX rate entered by the user.

In the following scenarios the Applied FX rate should be equal to the Original FX rate:

- If the Deposit Account Currency and the Pay-In/Out Account Currency are same.

- If the Rate Type/Rate code combination is not maintained at the account class for a Pay-In/Out Mode. In this case the system considers the STANDARD Rates the default and the MID Rate code as the existing rate type.

Offset Amount

Specify the amount paid for the term deposit account, in the account currency.

After entering above details click’ Compute’ button.The system will compute the deposit details after top-up and display it.

Deposit Details After Top-up

The following details are captured here:

Principal Balance

The principal balance amount of the term deposit after top-up is displayed here. You cannot modify this.

Interest Rate

The new interest rate to be applied on the top-up deposit, which is maintained at the account class level, is displayed here.

Maturity Amount

The amount that you will get on maturity of the top-up deposit is displayed here.

Click ‘Pickup’ button. It is mandatory, as when you click ‘Pickup’ button, the system populates Charges and Denomination details.The system validates if all the mandatory details are specified. This button will be disabled after the first click.

10.5 Open a Islamic TD Account for Multi Mode

This section contains the following topics:

- Section 10.5.1, "Opening a Islamic TD Account for Multi Mode"

- Section 10.5.2, "Specifying Term Deposit Details"

- Section 10.5.3, "Specifying Profit Details"

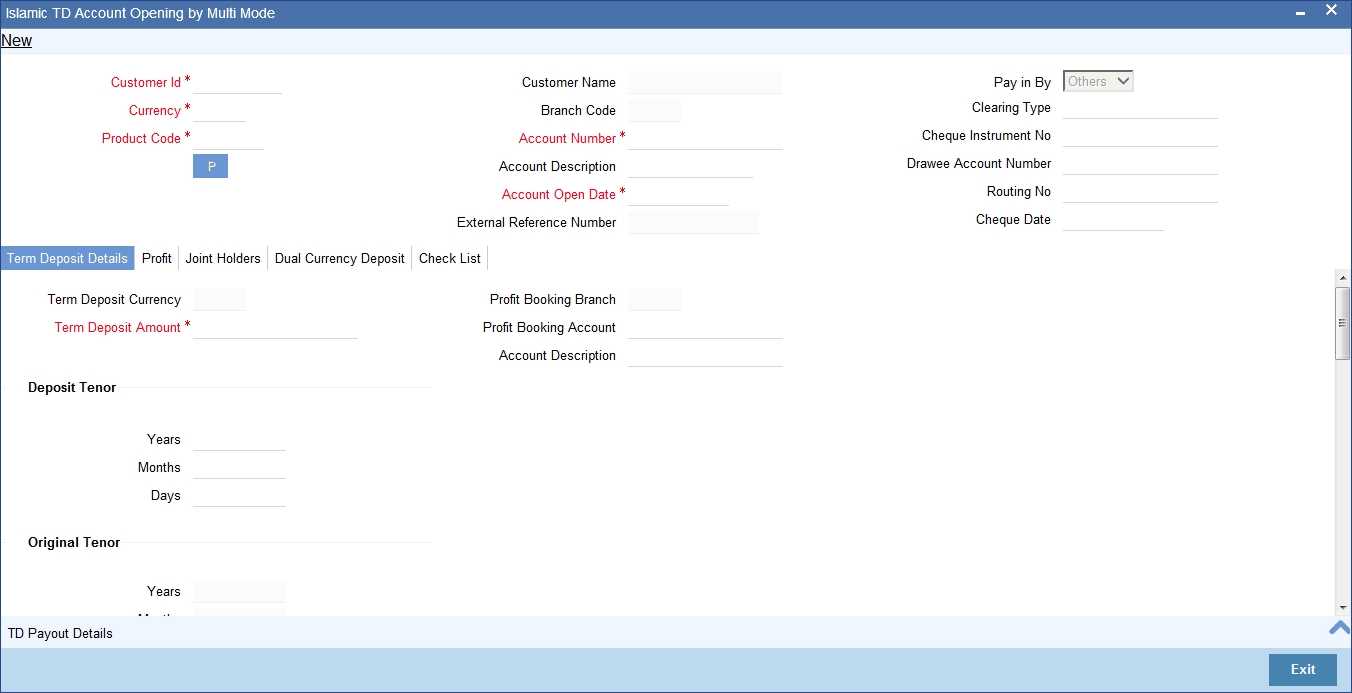

10.5.1 Opening a Islamic TD Account for Multi Mode

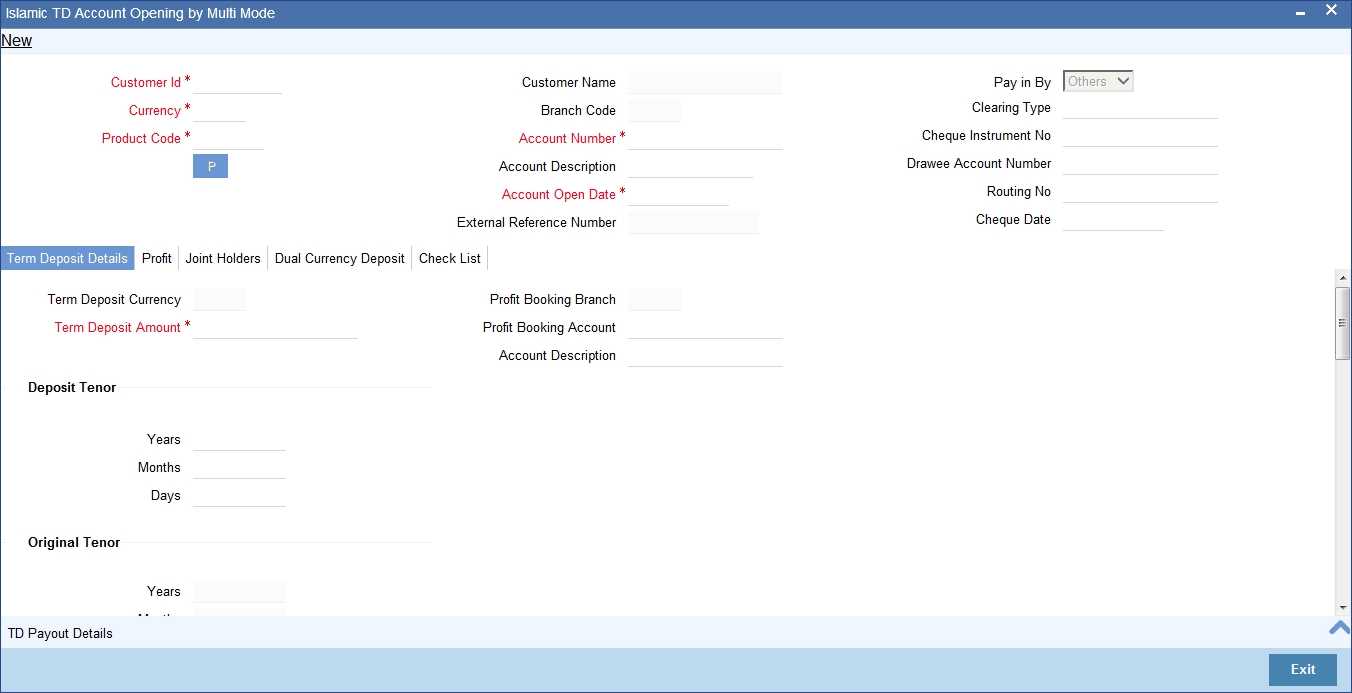

You can open TD accounts with Multi Mode Pay-In options using the ‘Islamic TD Account Opening by Multi Mode’ screen. You can invoke this screen by typing ‘IPTDMM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

For details about the fields in the screen refer ‘Opening a TD Account for Multi Mode Pay In’ section of this chapter.

Enrichment stage

After specifying the parameters, click the ‘P’ button, the system validates and ensures for minimum mandatory data entry. If the data entry is found alright, the following screen will be displayed:

Note

Customer account number, pay in account number, and payout account number should have different CASA account numbers. The following override message is displayed:

“Book TD with Single or Joint, Provide the IB, Pay-in and Payout Account as different customer”.

10.5.2 Specifying Term Deposit Details

Specify the following details:

Profit Booking Branch

Specify the profit booking branch for the customer.

Profit Booking Account

Specify the profit booking account for the customer.

For details about the fields and the tabs in the screen refer ‘Opening a TD Account for Multi Mode Pay In’ section of this chapter.

10.5.2.1 Specifying Term Deposit Pay Out Details

Click ‘TD Payout Details tab in ‘Islamic TD Account Opening by Multi Mode’ screen to maintain payout details.

10.5.2.2 Specifying Bankers Cheque Details

10.5.2.3 Specifying PC Details

For details about the fields and the tabs in the screen refer ‘Specifying Term Deposit Pay out Details’ section of this chapter.

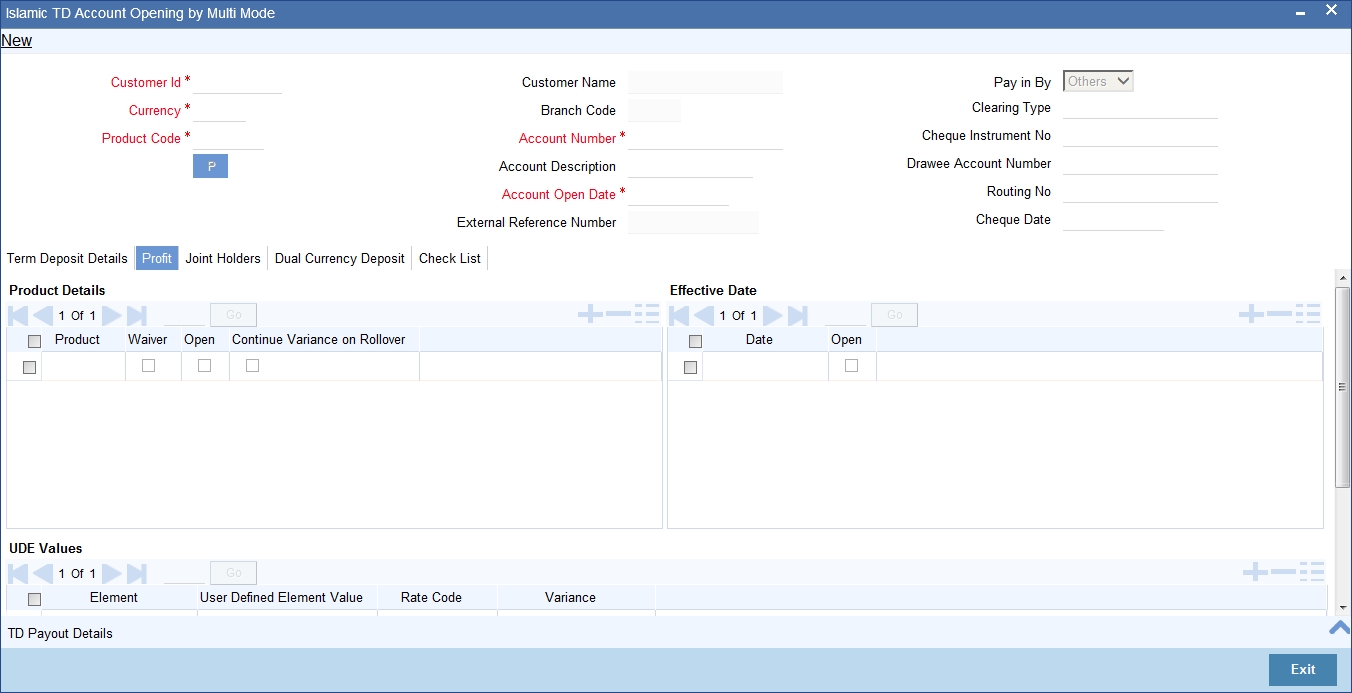

10.5.3 Specifying Profit Details

This block allows you to capture profit related details. Click on the ‘Profit’ tab to invoke the following screen:

You can specify the following details:

Profit Start Date

Select the profit start date from the option list.

Profit Booking Branch

Select the profit booking branch from the option list.

Profit Booking Account

Specify the profit booking account for the customer.

Integrated LM Product

Check this box to indicate the product is an Integrated LM product.

IL Product Type

Specify the IL product type.

For details about the fields and the tabs in the screen refer ‘Capturing Interest Details’ and ‘Capturing Details for Deposit’ sections of this chapter.

While saving the transaction, if you had modified the interest rate at TD account level for TD booking or for creating Payout TD, the system displays configurable override messages.

These overrides are displayed during subsequent modifications of the interest rate. You can also configure overrides for Dual Authorization to be displayed at Contract and Maintenance level in the ‘Override Maintenance’ screen.

For more information about configuring overrides, refer to the section ‘Override Maintenance’ in the chapter ‘Configuring Overrides’ in the Core Services User Manual.

10.5.4 Banking Channels Button

The system defaults the common channel information captured at CIF and account class levels during TD account creation.

Specify the following details:

Banking Channels

Specify the banking channels code. Alternatively, you can select the list of channels from the option list. The list displays the channels maintained in the system.

Banking Channel Name

The system displays the name of the banking channel.

Remarks

Specify remarks for the banking channel subscription.

Note

- While populating the channels to the Customer Account screen, the system populates only the channels which are allowed in primary CIF and Account Class. The system defaults the remarks maintained at customer level to the account. You can modify it.

- You can delete the channels which need not be allowed at the customer account level, but you cannot add the channels which are disallowed at the customer or account class level. The system will display only those channels which are available in both CIF and account class levels.

- You can add channels which are mapped at both CIF and Account Class levels. You cannot delete a channel at CIF/Account Class level, which is already mapped to accounts (authorized or unauthorized) belonging to the CIF/Account Class. The system checks only for active accounts. You can delete the channels from customer/account class level only if the account is closed. During reopen of the account, the system validates whether the account is modified after reopening.

- When an account is created automatically from Customer Creation screen, the channels maintained at both Customer and Account Class is defaulted to the account. If no maintenance is performed at CIF/account class levels for channels, the system does not populate any channels at account.

- When account class transfer happens during batch, the system deletes the existing channels attached to the account and repopulates from the new Account Class and Customer.

During authorization of the account, the system does not repopulate the channel details. While authorizing primary party change, the system defaults the existing channels which are attached to the account and repopulates from the new Customer and Account Class. You can modify the channel information from the main screen for Customer Account Creation.

During save, the system defaults the channel details from Customer and Account Class of the account. You can modify the details in the Account Creation screen (STDCUSAC).

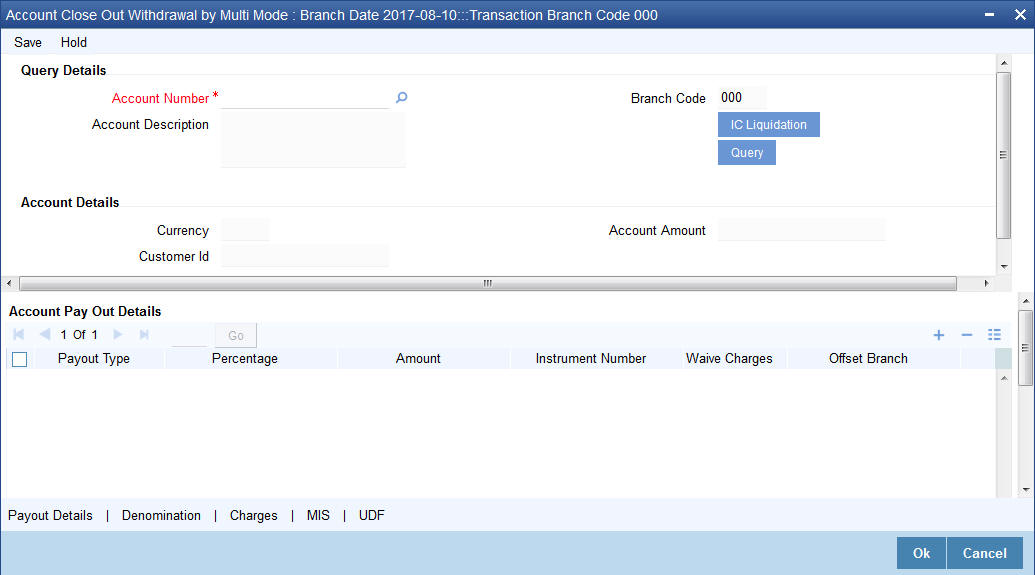

10.6 TD Redemption

This section contains the following topics:

- Section 10.6.1, "Manual Pay-Out TD Redemption"

- Section 10.6.2, "Capturing the Pay-Out Parameters"

- Section 10.6.3, "Specifying Child TD Details"

- Section 10.6.4, "Capturing Pay-Out Parameters Details"

10.6.1 Manual Pay-Out TD Redemption

You can redeem a Term Deposit for multi mode pay out using ‘Multimode Deposit Redemption’ screen.

Note

For denominated deposits, payout to a child TD using the same denominated deposit account class or any other denominated deposit account class will be restricted. This restriction will be applicable during opening, redemption, maturity processing or amendments. System will do a validation for this and if the validation fails an error similar to ‘Payout to term deposit using denominated deposit account class is not allowed for this denominated deposits’ is displayed.

You can invoke ‘Multimode Deposit Redemption’ screen. by typing ‘1317’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The following details are displayed:

Account Details

Account Number

Specify the TD account which is to be pre-closed. The option list displays all valid account numbers applicable across any branch. Choose the appropriate one.

Note

In case of multiple accounts with the same account number, the system will displays a list of account numbers with account branches to select.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

The system displays the logged-in branch. If you specify another account number, the system displays the corresponding account branch.

Account Currency

The system displays the currency of the logged-in account. If you specify another account number and tab out of the Account Number field, the system displays the corresponding account currency.

Account Description

The system displays the description of the account.

Redemption Details

The redemption proceeds is settled using the appropriate pay out modes

- If payout mode is ‘Cash’ the till corresponding to the

branch where TD is redeemed should be considered for the contra entries.

The cash GL/Till update happens in the logged in branch. - The corresponding inter branch transactions is created by the system.

Any charges, as a part of a transaction, will be collected in the logged in branch.

Redemption Mode

Select the Redemption mode from the following options:

- Partial Redemption

- Full Redemption.

Redemption Amount

Specify the Redemption Amount if you have selected the Redemption Mode as ‘Partial Redemption’.

System displays the principal amount as ‘Redemption Amount’ if you have selected the Redemption Mode as ‘Full Redemption’.

Customer Id

Specify the customer identification number.

Cash Amount

Specify the cash amount.

External Reference

The system generates and displays a unique reference number for the transaction. The host identifies the transaction with the external reference number.

Waive Penalty

Check this box to waive the penalty for redeeming the term deposit.

Note

This is applicable only for full redemption and not for partial redemption.

Waive Interest

Check the box to waive the interest for redeeming the term deposit.

Note

This is applicable only for full redemption and not for partial redemption.

Default Maturity Instructions

Check this box to default the principal payout instructions in the Term Deposit Payout Details grid.

Note

The instructions to payout the principal are specified during TD creation.

Amount Details

Principal Amount

The system displays the amount paid at the time of term deposit booking, when you click on the ‘Compute’ button.

Interest Amount

The system defaults the rate of Interest at which the interest amount is calculated.

Tax Amount

The system displays the amount to be deducted towards tax.

Interest Rate

The system displays the current interest rate applicable after partial/full redemption when you click on the ‘Compute’ button.

Maturity Amount

The system displays the current maturity amount after partial/full redemption.

Total Payout Amount

The system displays the total payout amount.

Refer the chapter ‘Annexure B - IC Rule Set-up’ in this user manual for details on calculating principal and interest amount during term deposit redemption.

Specifying the Term Deposit Payout Details

Payout Mode

Select the pay-out mode from the following options:

- Bankers Check

- Payments

- Cash

- Accounts

- General Ledger

- Term Deposit

- Demand Draft

- Loan Payment

Percentage

Specify the amount of redemption in percentage.

Redemption Amount

Specify the amount of redemption in absolute.

Offset Branch

Specify the branch code of the account for redemption.

Offset Account

Specify the account number/ GL for redemption.

Narrative

Specify the description for the redemption

Instrument Number

Specify the instrument number to be issued.

Waive Charges

Check this box to waive charges for pay-out BC issuance.

Original FX Rate

Specify the FX rate picked up by the system.

Applied FX Rate

Enter the user entered FX rate.

In the following scenarios the Applied FX rate should be equal to the Original FX rate:

- If the Deposit Account Currency and the Pay-In/Out Account Currency are same.

- If the Rate Type/Rate code combination is not maintained at the account class for a Pay-In/Out Mode. In this case the system considers the STANDARD Rates the default and the MID Rate code as the existing rate type.

Fcy Amount

Specify the Fcy amount.

Note

The customer number, pay-in account number, and payout account numbers should use different CASA account numbers. The following override message is displayed to ensure that the account numbers are different:

“Do Redemption with differ customer A/C CIF”

Clicking ‘Query’ button, the system validates if all the mandatory details are specified. This button will be disabled after the first click.

Specifying Denomination Certificate Details

Click ‘Denominated Deposits’ tab to capture denominated deposit certificate details:

Select All

Check this box to select all certificates for the account.

Certificate Number