16. Reports

16.1 Introduction

This chapter contains the following sections:

- Section 16.2, "Savings Insignificant Balance Accounts Report"

- Section 16.3, "Blocked Accounts Report"

- Section 16.4, "Account Balance Listing Report"

- Section 16.5, "Saving Accounts Opened Today Report"

- Section 16.6, "Saving Accounts Closed Today Report"

- Section 16.7, "Flat File - Cheque Book Requested Report"

- Section 16.8, "Savings Large Balance Movements Report"

- Section 16.9, "Accounts Dormant Next Month Report"

- Section 16.10, "Savings Account Dormant Today Report"

- Section 16.11, "Re-validated Instruments Report"

- Section 16.12, "Reissued Instrument Report"

- Section 16.13, "Duplicate Instrument Issued Report"

- Section 16.14, "Savings Overline/TOD Report"

- Section 16.15, "Daily Overline/TOD Txn Report"

- Section 16.16, "Large Debit Balance Report"

- Section 16.17, "Intra bank Transfer Report"

- Section 16.18, "Flat File Cheque Book Requested Report"

- Section 16.19, "Signatory Details Report"

- Section 16.20, "Daily Processed Transactions Report"

To generate any of these reports choose Reports in the Application Browser. Choose Savings under it. A list of all the reports in Savings module will be displayed. You can choose to view or print the report.

The time and the operator who generated the report will be displayed.

16.2 Savings Insignificant Balance Accounts Report

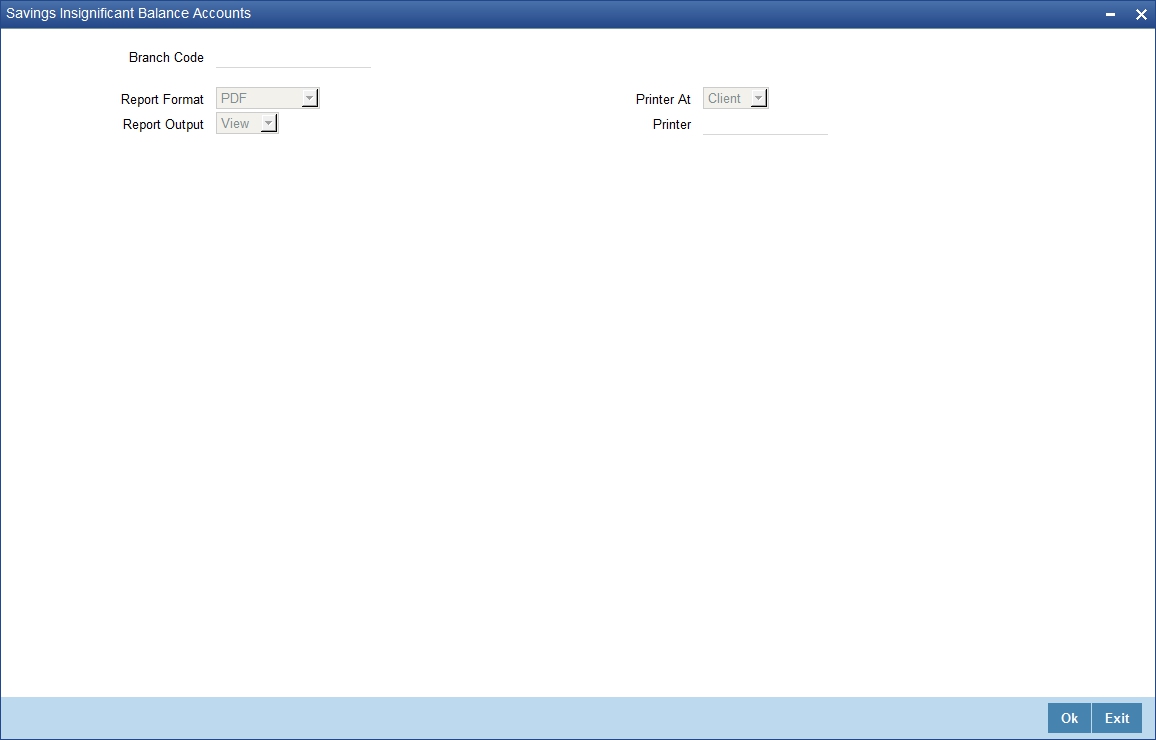

This is an exception report that lists out the customer accounts having insignificant balances. The branches can decide to either close these accounts, or to follow up with the customers for proper maintenance of the accounts. Branches can define the threshold amount of insignificant balance at product level. The threshold limit is defined in the minimum balance in the currency preferences in account class. Banks can levy service charges if minimum balance prescribed by the bank is not maintained. You can choose to print or view the report in pdf format.

You can invoke ‘Savings Insignificant Balance Accounts’ screen by typing ‘SVRIBACC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details here:

Branch Code

Select the branch code from the adjoining option-list. The list displays all valid branch codes. The list will not include any closed branches.

Click ‘OK’ button to generate the report. Click ‘Exit’ to return to the Reports Browser.

16.2.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The contents of the report are discussed under the following heads:

Header

The Header carries the title of the report, branch code, report run date and time, user ID, module code and the page number of the report.

Body of the report

The generated report will have the following information:

Field |

Description |

Branch Code |

This indicates the branch code |

Product |

This indicates the product |

Description |

This gives a brief description on the account class |

Account Number |

This indicates the account number |

Currency |

This indicates the currency |

Last Credit Amount |

|

Last Credit Date |

This indicates the date of previous credit |

Last Debit Amount |

This indicates the Debit Details |

Last Debit Date |

This indicates the date of previous debit |

Account Balance |

This indicates the balance amount in the account |

16.3 Blocked Accounts Report

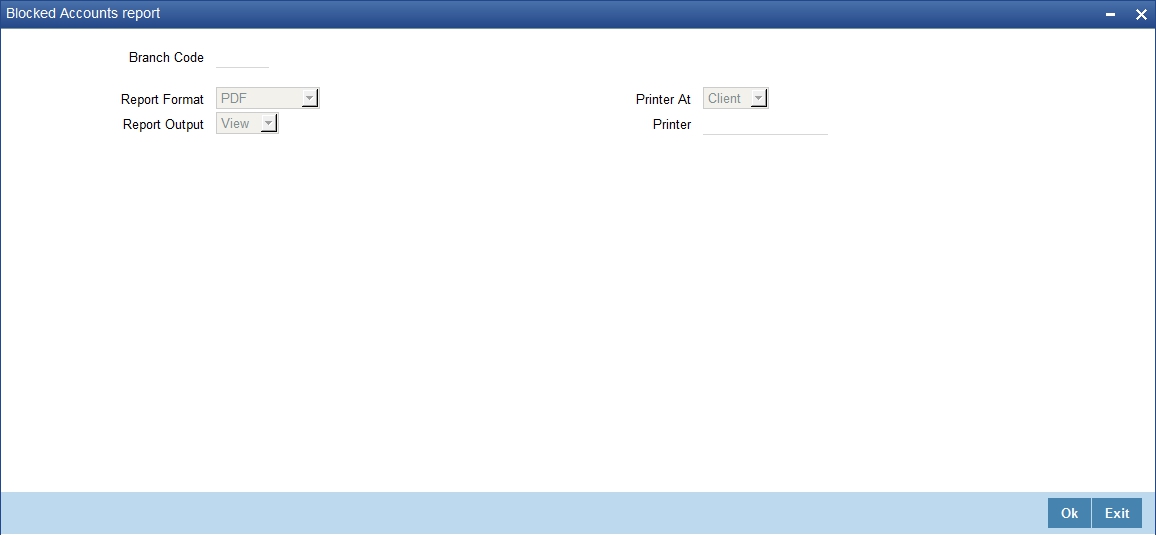

This report lists all the blocked customer accounts with reasons for blocking. This report is generated by the branch and is used for verification purposes.

Blocking of accounts are generally necessitated on receipt of any attachment/order from legal or regulatory authorities. These account blocks are removed at revocation of the legal order.

You can invoke ‘Blocked Accounts’ screen by typing ‘SVRBACCL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details here:

Branch Code

Select the branch code from the adjoining option-list. The list displays all valid branch codes. The list will not include any closed branches.

Click ‘OK’ button to generate the report. Click ‘Exit’ to return to the Reports Browser.

16.3.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The contents of the report are discussed under the following heads:

Header

The Header carries the title of the report, branch code, report run date and time, user ID, module code and the page number of the report.

Body of the report

The generated report will have the following information:

Field |

Description |

Account Number |

This indicates the account number |

Customer ID |

This indicates the customer ID |

Customer Name |

This indicates the name of the customer |

Currency |

This indicates the Currency |

Balance Amount |

This indicates the balance amount |

Date |

This indicates the date on which the account is blocked |

16.4 Account Balance Listing Report

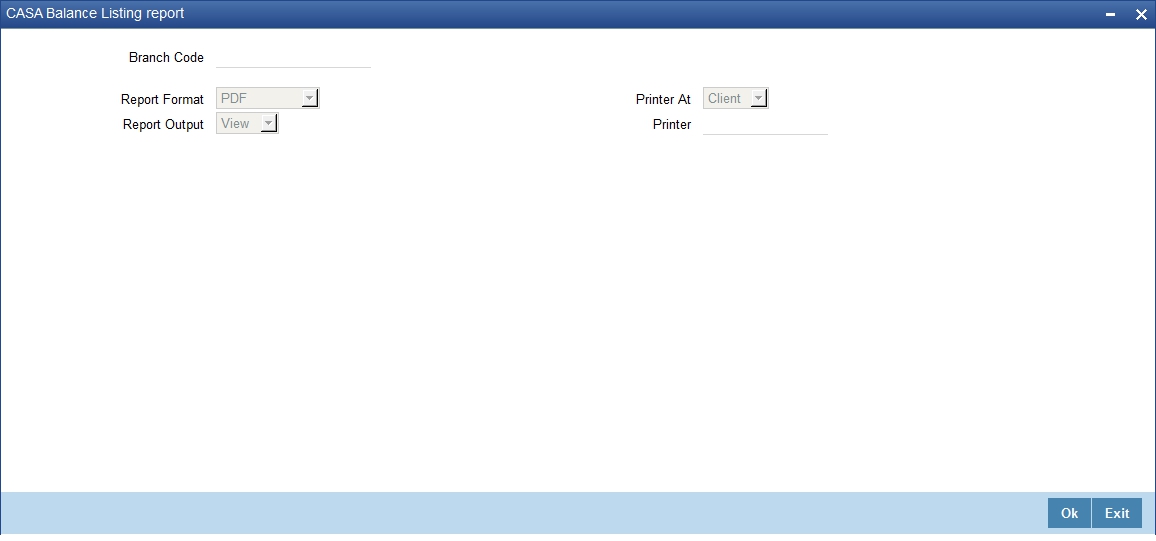

This report lists the balance break-up of all CASA accounts for a given branch and product. The status of the accounts like regular, dormant, restricted, etc. is also provided in the report.

You can invoke ‘CASA Balance Listing’ screen by typing ‘SVRCABLI’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details here:

Branch Code

Select the branch code from the adjoining option-list. The list displays all valid branch codes. The list will not include any closed branches.

Click ‘OK’ button to generate the report. Click ‘Exit’ to return to the Reports Browser.

16.4.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The contents of the report are discussed under the following heads:

Header

The Header carries the title of the report, branch code, report run date and time, user ID, module code and the page number of the report.

Body of the report

The generated report will have the following information:

Field |

Description |

Account Class |

This indicates the account class |

Description |

This gives a brief description on the account |

Currency |

This indicates the currency of the transaction |

Account Number |

This indicates the account number |

Customer ID |

This indicates the customer identification number |

Customer Name |

This indicates the name of the customer |

Account Status |

This indicates the status of the account |

Book Balance |

This indicates the book balance |

Available Balance |

This indicates the balance available |

Un-cleared Amount |

This indicates the uncleared amount |

Accrued Interest |

This indicates the accrued interest |

Hold Amount |

This indicates the hold amount |

Accrued Till |

This indicates the accrued till |

Last Interest |

This indicates the last interest |

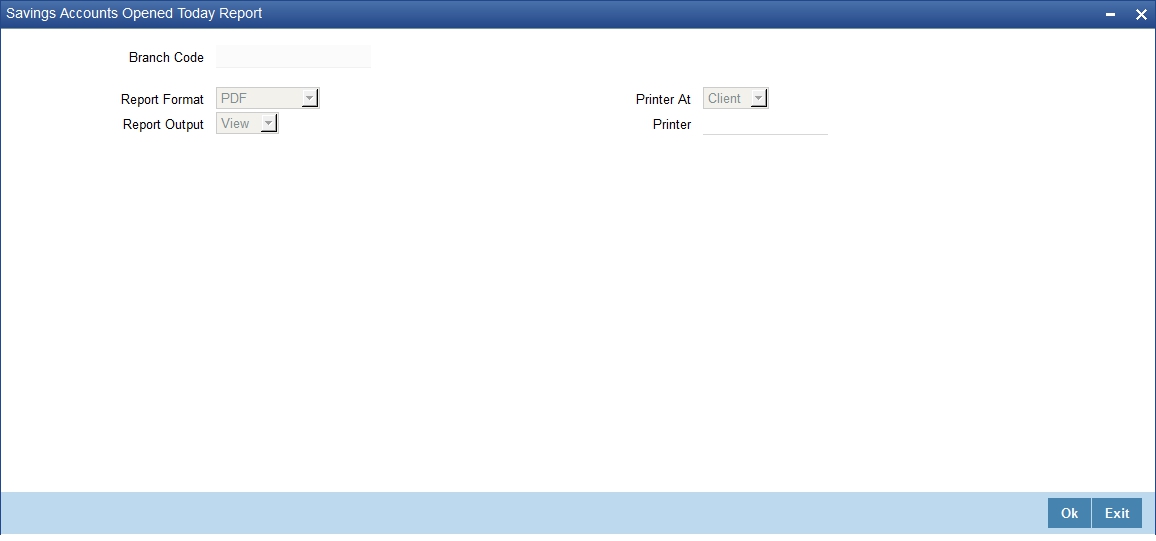

16.5 Saving Accounts Opened Today Report

This report lists the details of accounts opened on the current day, along with the details of initial payment. The data in this report which is grouped product-wise and user-wise along with the details of the initial amount received forms an essential part of account monitoring process and analysis. This report is generated at EOD on a daily basis. You can invoke ‘Saving Accounts Closed Today Report’ screen by typing ‘SVRAOREP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Branch Code

The system displays the current branch code. You can generate the report specific to this branch.

16.5.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The contents of the report are discussed under the following heads:

Header

The Header carries the title of the report, branch code, report run date and time, user ID, module code and the page number of the report.

Body of the report

The generated report will have the following information, grouped by account class and currency:

Field |

Description |

Account Class |

This indicates the account class. Details of saving accounts opened during the day under this account class are displayed below. |

Currency |

This indicates the currency of transaction |

Customer Number |

This indicates the Customer Number |

Customer Name & Address |

This indicates the name of the customer and the address of the customer |

Account Number |

This indicates the account number |

ACY Opening Bal |

This indicates the Opening Balance in Account currency |

Available Balance |

This indicates the available balance |

Teller |

This indicates the Teller ID |

Supervisor |

This indicates the Supervisor name |

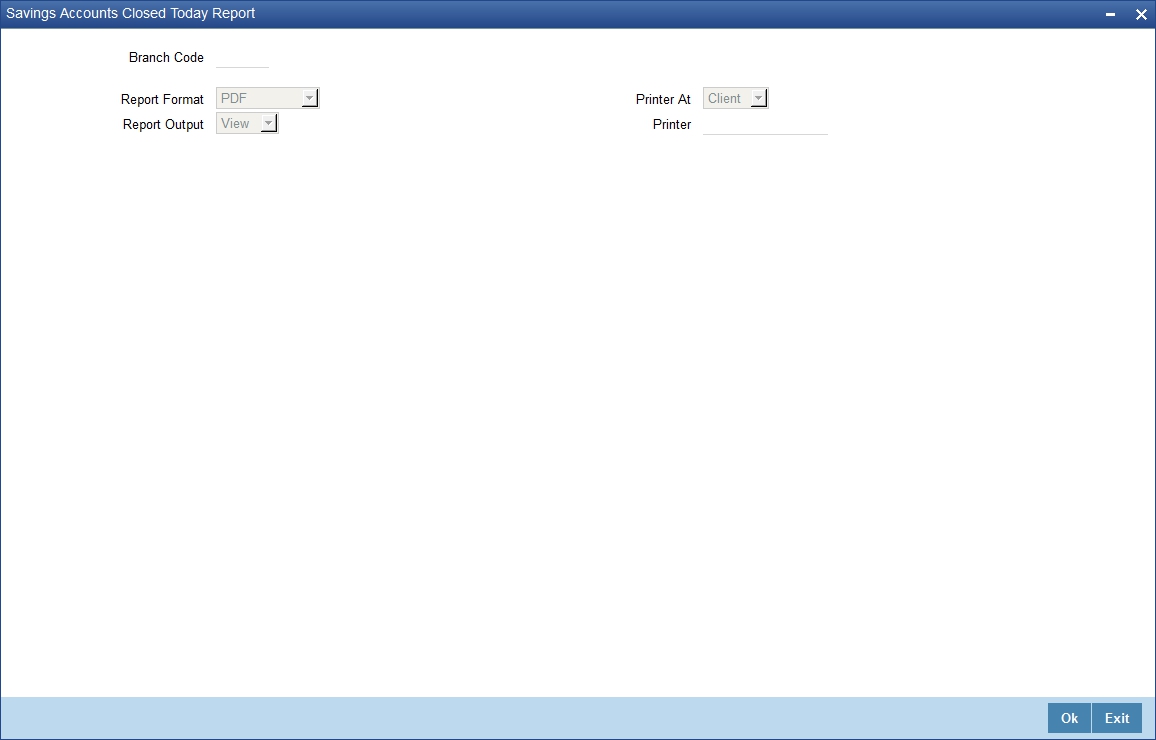

16.6 Saving Accounts Closed Today Report

This report lists the CASA accounts that have been closed in the day, per product per currency per branch. While closing the accounts, interest is charged or applied to the account based on the credit/debit balance on the account. This report is generated at EOD on a daily basis. You can invoke ‘Saving Accounts Closed Today Report’ screen by typing ‘SVRACREP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Branch Code

You can generate this report for a specific branch code. Select the branch code from the option list.

16.6.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The contents of the report are discussed under the following heads:

Header

The Header carries the title of the report, branch code, report run date and time, user ID, module code and the page number of the report.

Body of the report

The generated report will have the following information:

Field |

Description |

Account Class |

This indicates the account class. Details of all savings accounts closed during the day under this Account Class are displayed below. |

Account No |

This indicates the account number of the customer |

Currency |

This indicates the currency of the transaction |

Customer Name |

This indicates the name of the customer |

Closing Balance as |

This indicates the Closing Balance |

Transaction Date |

This indicates the date of transaction |

Teller ID |

This indicates the Teller id |

Supervisor |

This indicates the Supervisor name |

16.7 Flat File - Cheque Book Requested Report

Bank issues cheque books to a customer after the request is initiated. A flat file is generated at EOD for issue of personalized cheque books to customers. The cheque books can also be issued in a centralized environment.

This report provides details of flat file used for cheque book request purpose. This report is generated at EOD on a daily basis.

16.7.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The contents of the report are discussed under the following heads:

Header

The Header carries the title of the report, branch code, report run date and time, user ID, module code and the page number of the report.

Body of the report

The generated report will have the following information:

Field |

Description |

Account Number |

This indicates the account number of the customer |

Branch Name |

This indicates the name of the branch |

Customer Full Name |

This indicates the full name of the customer |

Cheque Start No. |

This indicates the starting cheque number |

Cheque End No. |

This indicates the ending cheque number |

No. of Cheques |

This indicates the number of cheques |

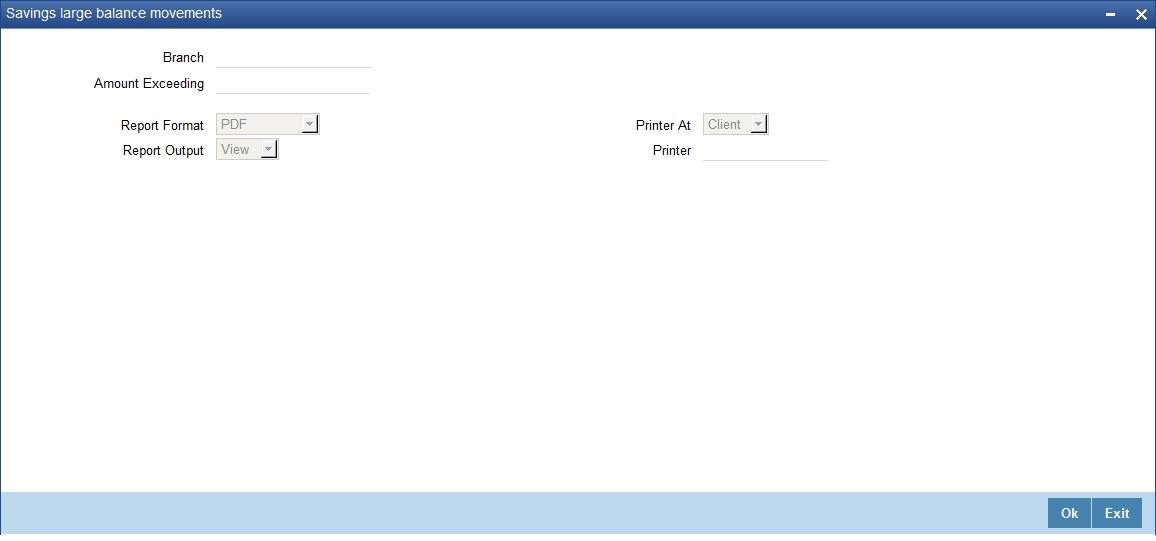

16.8 Savings Large Balance Movements Report

This is an exception report of large balance movements in CASA. The bank sets up an alert at the product level to report accounts with large debit/credit balance movement. This alert would result in an automatic exceptional report at the end of the day. The transactions carried during the day would result in increase or decrease in available balance. When an account balance movement has reached the threshold defined, this exceptional report is generated by the system.

The Threshold amount is defined as the user parameter in the Batch EOD Input (BADEODFN). This report is generated at EOD on a daily basis. You can invoke ‘Savings Large Balance Movements Report’ screen by typing ‘SVRLBALM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

16.8.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The contents of the report are discussed under the following heads:

Header

The Header carries the title of the report, branch code, report run date and time, user ID, module code and the page number of the report.

Body of the report

The generated report will have the following information:

Field |

Description |

Account Class |

This indicates the account class |

Description |

This indicates the description |

Account Number |

This indicates the account number of the customer |

Officer ID |

This indicates the id of the Officer |

Transaction No |

This indicates the transaction number |

Dr/Cr |

This indicates whether the transaction is a debit or a credit |

Balance Movement |

This indicates the Balance Movement in CASA |

Available Balance |

Balance Available |

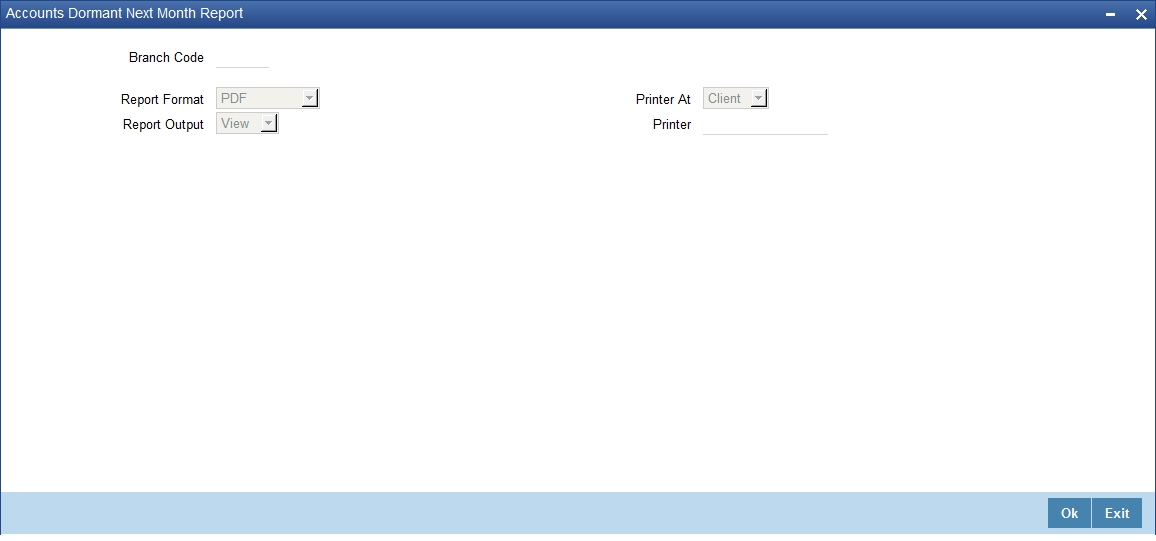

16.9 Accounts Dormant Next Month Report

This report lists the CASA accounts product-wise and currency-wise that will remain dormant from the coming month onwards. In the absence of any customer initiated transaction in an account for a period defined at the product level, the account is moved to the dormancy state. From dormancy the status is changed to unclaimed deposit after a specific period.

This report is generated at EOD on a monthly basis. You can invoke ‘Accounts Dormant Next Month Report’ screen by typing ‘SVRDOREP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

16.9.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The contents of the report are discussed under the following heads:

Header

The Header carries the title of the report, branch code, report run date and time, user ID, module code and the page number of the report.

Body of the report

The generated report will have the following information:

Field |

Description |

Branch Code |

This indicates the branch code |

Account Number |

This indicates the Account Number |

Account Description |

This gives a brief description on the account |

Account class code |

This indicates the account class code |

Customer Number |

This indicates the customer number |

Currency |

This indicates the currency of the transaction |

Current Balance |

This indicates the current balance |

Last Debit Amount |

This indicates the last amount debited |

Last Debit Date |

This indicates the last debit date |

Last Credit Amount |

This indicates the last credited amount |

Last Credit Date |

This indicates the last credit date |

Last Transaction Date |

This indicates the last transaction date |

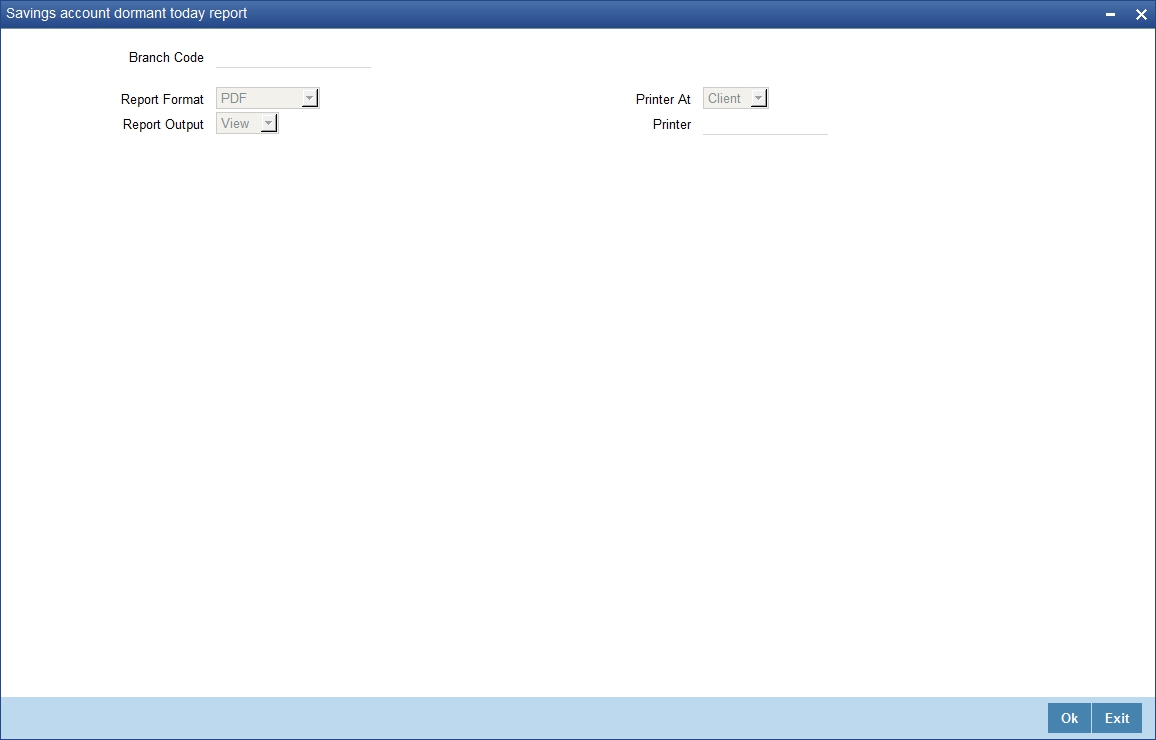

16.10 Savings Account Dormant Today Report

This report lists all Current and Savings accounts that have been marked dormant in the day per product per currency per branch.

The period for which an account is inactive, after which the status moves to dormancy, is set-up at the product level in terms of days, months etc. When there are no customer initiated transactions in an account for the period defined at the product level, the account is moved to the dormancy state.

This report is generated at EOD on a daily basis. You can invoke ‘Savings Account Dormant Today Report’ screen by typing ‘SVRADREP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Branch Code

You can generate this report for a specific branch code. Select the branch code from the option list.

16.10.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The contents of the report are discussed under the following heads:

Header

The Header carries the title of the report, branch code, report run date and time, user ID, module code and the page number of the report.

Body of the report

The generated report will have the following information:

Field |

Description |

Account Number |

This indicates the Customer Account Number |

Account Name |

This indicates the Customer Account Name |

Current Balance |

This indicates the current balance in the customer account. |

Dormancy Date |

This indicates the date of dormancy |

Date of Transaction (Date Last Dr and Date Last Cr) |

This indicates the last date on which there was a transaction in the account. |

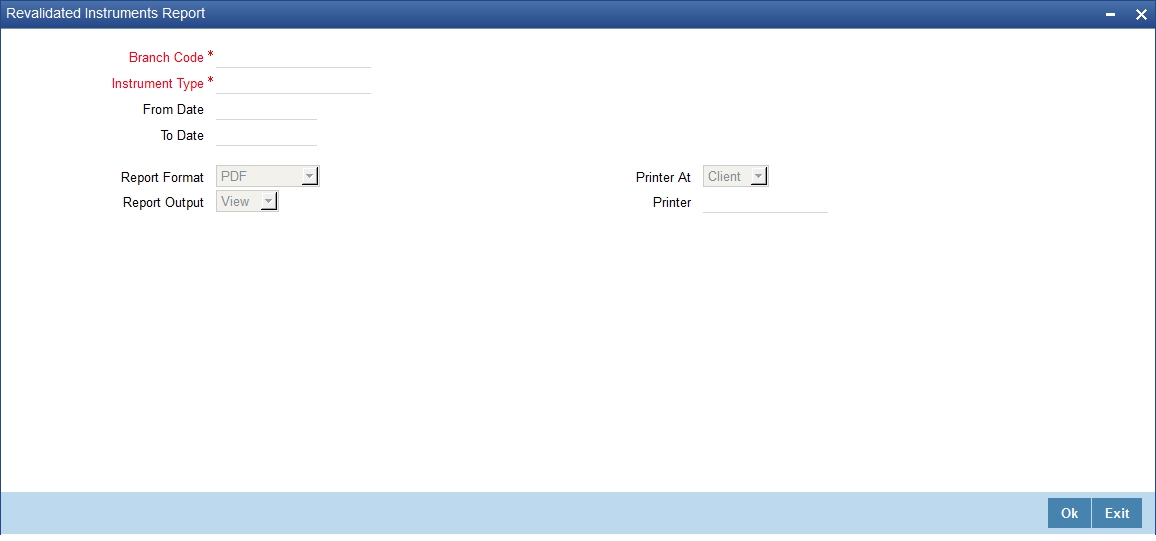

16.11 Re-validated Instruments Report

This report lists the details of the revalidated DD / BC instruments for the specified period.

You can invoke ‘Revalidated Instruments Report’ screen by typing ‘RTRREVL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You need to specify the following details:

Branch Code

Select the branch code from the option list.

Instrument Type

From the drop-down list, select ‘DD’ or ‘BC’ as an instrument type to get the list of DD or BC instruments revalidated for the period chosen. Select ‘All’ to list both DD and BC instruments for the period chosen.

From Date

System defaults the current date here; however you need to specify the date from which the report should be generated.

To Date

System defaults the current date here; however you need to specify the date till which the report should be generated.

Depending on the details provided in the above screen, system generates the report when you click ‘Ok’ button.

16.11.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report.

Header

The Header carries the title of the report, branch code, report run date and time, user ID, module code and the page number of the report.

The generated report will have the following information:

Field |

Description |

Issue Date |

Issue date of the instrument |

Re-validated Date |

Re-validated date of the instrument |

Re-validated Period |

Re-validated period of the instrument |

Payable Bank/Branch |

At which bank/branch it is payable |

Original Expiry Date |

Expiry date of the instrument before re-validation |

Instrument Amount |

Instrument amount |

Instrument Currency |

Currency of the instrument |

Expiry Date |

Expiry date of the Instrument after re-validation |

Contract Reference Number |

Contract reference number of the instrument transaction |

Maker-Id |

Maker id of the re-validated transaction |

Checker-Id |

Authorizer of the re-validated transaction |

Payment Mode |

Payment mode selected for charge. |

Instrument Number |

The reference number of the instrument |

Beneficiary Name |

Name of the Beneficiary. |

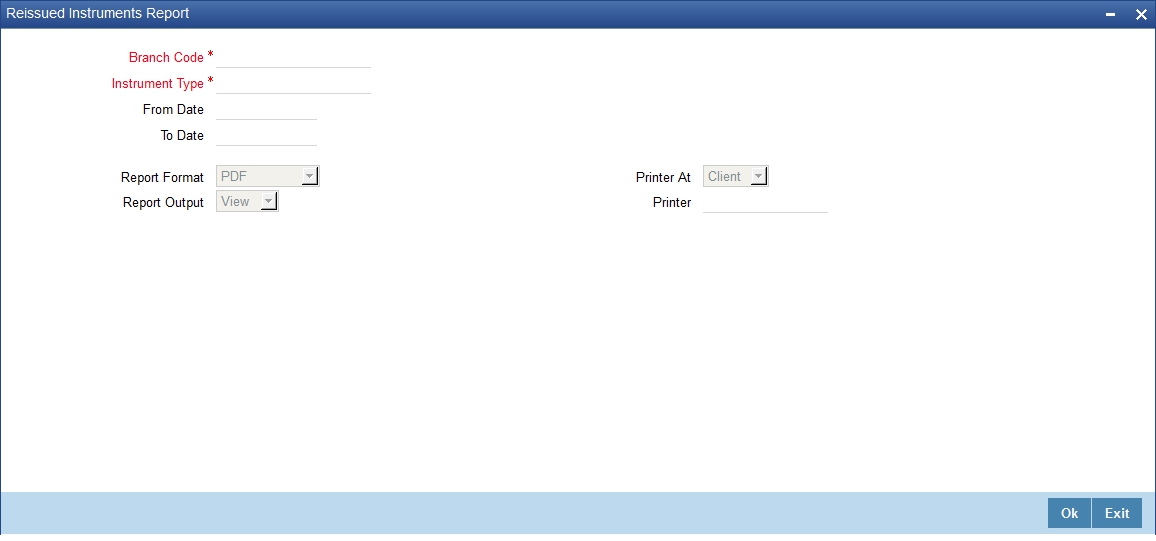

16.12 Reissued Instrument Report

This report lists the details of the reissued DD / BC instruments for the specified period.

You can invoke ‘Reissued Instruments Report’ screen by typing ‘RTRRISU in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You need to specify the following details:

Branch Code

Select the branch code from the option list.

Instrument Type

From the drop-down list, select ‘DD’ or ‘BC’ as an instrument type to get the list of DD or BC instruments reissued for the period chosen. Select ‘All’ to list both DD and BC instruments for the period chosen.

From Date

System defaults the current date here; however you need to specify the date from which the report should be generated.

To Date

System defaults the current date here; however you need to specify the date till which the report should be generated.

Depending on the details provided in the above screen, system generates the report when you click ‘Ok’ button.

16.12.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report.

Header

The Header carries the title of the report, branch code, report run date and time, user ID, module code and the page number of the report.

Body

The generated report will have the following information:

Field |

Description |

Issue Date |

Issue date of the instrument |

Beneficiary Name |

Name of the beneficiary |

Reissued Date |

Re-validated date of the instrument |

Reissue Reason |

Reason for reissue of the instrument |

Expiry Date |

Expiry date of the Instrument after re-validation |

Instrument Amount |

Instrument amount |

Instrument Currency |

Currency of the instrument |

Payable Bank/Branch |

At which Bank/Branch it is payable. |

Contract Reference Number |

Contract reference number of the instrument transaction |

Maker Id |

Maker id of the re-validated transaction |

Maker Date Stamp |

Date on which the transaction is created |

Checker Id |

Authorizer of the reissue transaction |

Checker Date Stamp |

Date on which the reissue transaction is authorized |

Old Instrument Number |

The original instrument number |

New Instrument Number |

The new instrument number generated |

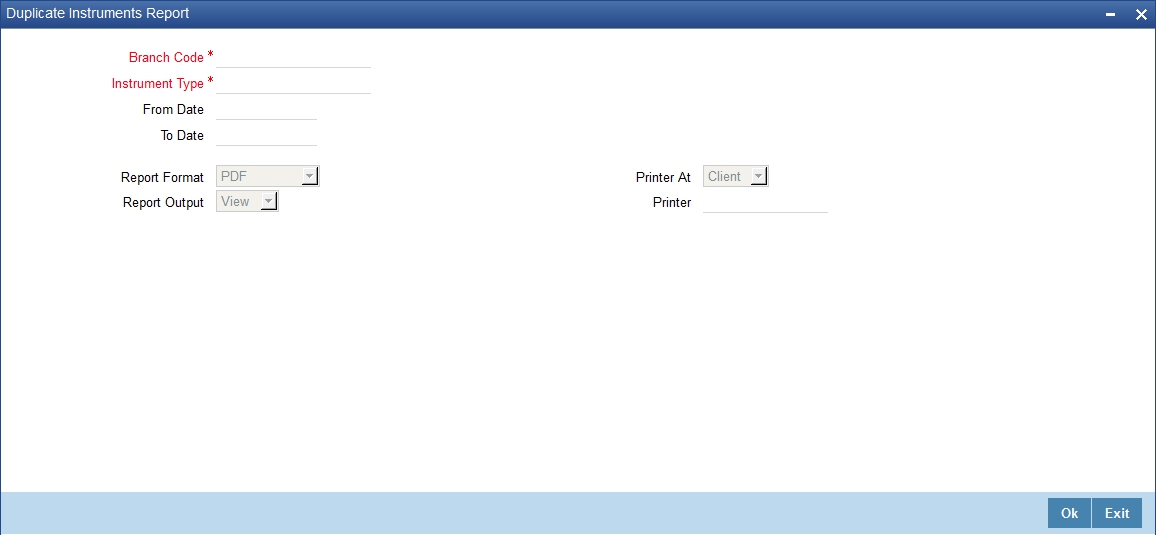

16.13 Duplicate Instrument Issued Report

This report lists the details of the duplicate issuance of DD / BC instruments for the specified period.

You can invoke ‘Duplicate Instruments issued Report’ screen by typing ‘RTRDISU’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You need to specify the following details:

Branch Code

Select the branch code from the option list.

Instrument Type

From the drop-down list, select ‘DD’ or ‘BC’ as an instrument type to get the list of duplicate issued DD or BC instruments for the period chosen. Select ‘All’ to list both DD and BC instruments for the period chosen.

From Date

System defaults the current date here; however you need to specify the date from which the report should be generated.

To Date

System defaults the current date here; however you need to specify the date till which the report should be generated.

Depending on the details provided in the above screen, system generates the report.

16.13.1 Contents of the Report

The selection options that you specified while generating the report are printed at the beginning of the report.

The contents of the report are discussed under the following heads:

Header

The Header carries the title of the report, information on the branch code, the date and time, the branch date, the user id, the module name and the page number of the report.

Body

The generated report will have the following information:

Field |

Description |

Issuing Branch |

Issuing branch of the instrument |

Issue Date |

Issue date of the duplicate instrument |

Issue Reason |

Reason for issue of the duplicate instrument |

Expiry Date |

Expiry date of the Instrument |

Instrument Amount |

Instrument amount |

Instrument Currency |

Currency of the instrument |

Instrument Date |

Instrument date |

Contract Reference Number |

Contract reference number of the instrument transaction |

Old Instrument Number |

This will be original instrument number, which has been cancelled. |

New Instrument Number |

This will be new instrument number generated. |

Beneficiary Name |

Name of the beneficiary |

Maker ID |

This is the user ID of the maker of the record |

Checker ID |

This is the user ID of the authorizer of the record |

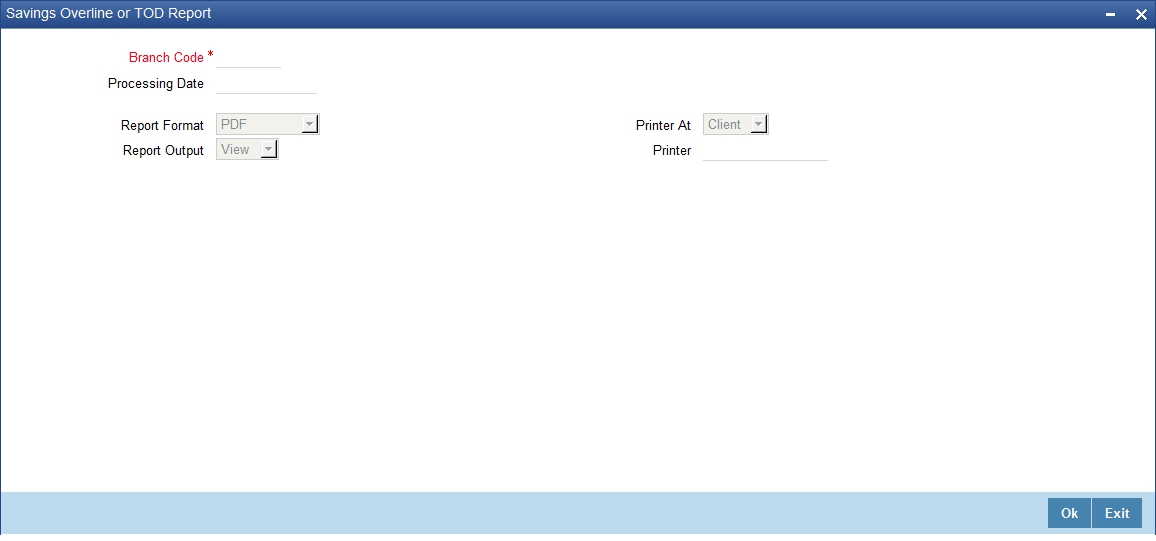

16.14 Savings Overline/TOD Report

When Current and Savings accounts are drawn above the overdraft limit sanctioned, then the system moves to overline status. Temporary overdrafts (TOD), on an ad-hoc basis, may also be sanctioned for the selected accounts, by an appropriate bank official when a customer requires. In such cases, you can generate a ‘Savings Overline/TOD Report’ at EOD with details of overline amount, overline days and credit risk rating description, for proper follow up of these accounts and to regularize the same. The details are listed based on the product type.

You can invoke ‘Savings Overline/TOD Report’ screen by typing ‘STROVODR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated, from the adjoining option list.

Processing Date

Specify a date when the TOD was processed in the specified branch from the adjoining calendar.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to view the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

16.14.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Savings Overline/TOD Report is as follows:

Header

The Header carries the title of the report, information on the branch code, the date and time, the branch date, the user id, the module name and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Account No |

Indicates Customer Account Number |

Maker ID |

Indicates Maker ID |

Acc Desc |

Indicates the account description |

Account Current Balance |

Indicates Account Current Balance |

Current Overline Days |

Indicates Current Overline Days |

Month To Date Days |

Indicates Month-to-Date Days |

Year To Date Days |

Indicates Year-to-Date Days |

Acc. Ccy |

Indicates Account Currency |

Limit Ccy |

Indicates Limit Currency |

Overline Amount |

Indicates Overline Amount |

Last Debit Date |

Indicates Last Debit Date |

Last Debit Amt |

Indicates Last Debit Amount |

Last Credit Date |

Indicates Last Credit Date |

Last Credit Amt |

Indicates Last Credit Amount |

Temp OD Limit |

Indicates Temp OD Limit |

Uncleared Funds Limit |

Indicates Uncleared Funds Limit |

Note

Since the Over Draft date is updated in EOD batch, the date provided as input should be a date previous to the current date. If a date is not provided, all overline accounts will be listed in the report. At least a single overline account should have 100% customer account linkage.

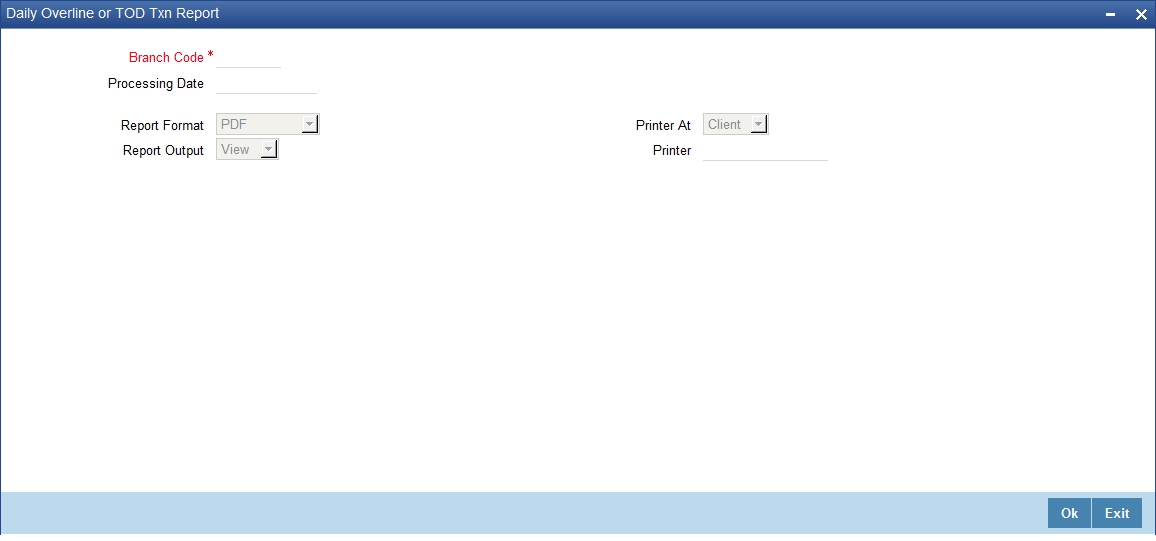

16.15 Daily Overline/TOD Txn Report

Banks provide Overline/TOD facility on a temporary basis to selected customers. You can generate ‘Daily Overline/TOD Txn Report’ to provide details of current and savings account with such facilities, to follow-up at the earliest. This report provides information on daily overline and TOD based on the branch and account.

You can invoke ‘Daily Overline/TOD Txn Report’ screen by typing ‘STROVTOD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated, from the adjoining option list.

Processing Date

Specify a date when the TOD was processed in the specified branch from the adjoining calendar.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to view the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

16.15.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Daily Overline/TOD Txn Report is as follows:

Header

The Header carries the title of the report, information on the branch code, the date and time, the branch date, the user id, the module name and the page number of the report.

Body of the Report

The following details are displayed branch-wise as body of the generated report:

Field Name |

Field Description |

Account No |

Indicates Customer Account Number |

Acc Desc |

Indicates Account Description |

Customer Name |

Indicates the name of the customer |

Last Credit Date |

Indicates Last Credit Date |

Txn Date |

Indicates Txn Date |

Txn Amt |

Indicates Txn Amount |

Txn CCY |

Indicates Txn CCY |

Limit CCY |

Indicates Limit Currency |

Dr/Cr |

Indicates Debit Credit Indicator |

Txn Desc |

Indicates the transaction description |

Total OD Limit |

Indicates the total OD limit |

Balance |

Indicates Account Opening Balance |

Note

- Since the Over Draft date is updated in EOD batch, the date provided as input should be a date previous to the current date. If a date is not provided, all over line accounts will be listed in the report.

- At least a single line should be mapped with 100% customer_account_linkages.

16.16 Large Debit Balance Report

Oracle FLEXCUBE facilitates generation of ‘Large Debit Balance Report’ at EOD with details of CASA accounts which have exceeded the threshold limit. The details are grouped based on the account class and currency.

16.16.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Large Debit Balance Report is as follows:

Header

The Header carries the title of the report, information on the branch code, the date and time, the branch date, the user id, the module name and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Account Class |

Indicates Account Class |

Currency |

Indicates Currency |

Threshold Amount |

Indicates Threshold Limit maintained at product and currency level |

Account Number |

Indicates Account Number whose balance has reached threshold limit |

Account Name |

Indicates Account description |

Customer Id |

Indicates Customer ID |

Customer Name |

Indicates Customer Name |

Customer Telephone No |

Indicates Customer Mobile Number |

Available Balance |

Indicates Account available balance |

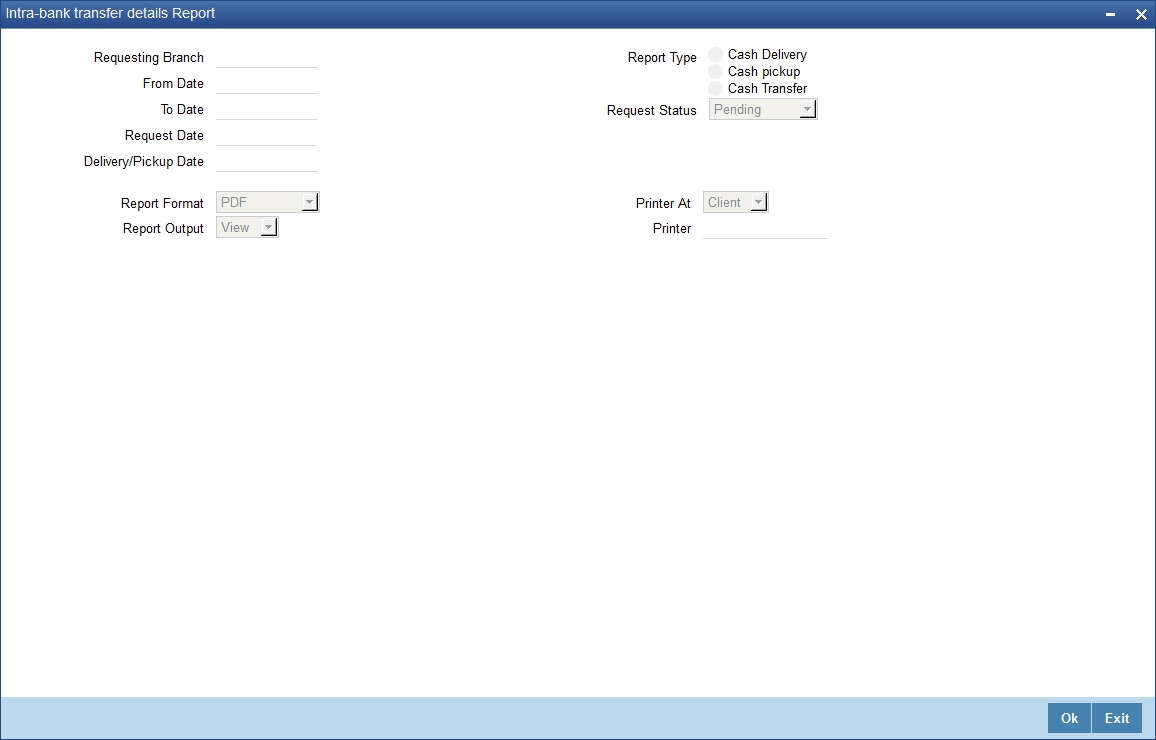

16.17 Intra bank Transfer Report

Oracle FLEXCUBE facilitates generation of the following reports from the ‘Intra Bank Transfer Report’ screen:

- List of all Advance requests received in branch

- List of all Interbank cash transfer done in branch

- List of pending transfer request arrived at branch

You can invoke this screen by typing ‘RTRIBTXD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated, from the adjoining option list.

From Date

Specify the date from which the report should be generated.

To Date

Specify the date to which the report should be generated.

Report Type

Select the type of report from the following options:

- Advance Request

- Completed transfers

- Pending transfers

16.17.1 Contents of the Report

The selection options that you specified while generating the report are printed at the beginning of the report.

The contents of the report are discussed under the following heads:

Header

The Header carries the title of the report, information on the branch code, the date and time, the branch date, the user id, the module name and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Reference No |

Intra bank reference number |

Description |

Description of the intraday transfer |

From Branch |

Branch code of transfer branch |

From Vault |

Vault of the transfer branch |

To Branch |

Branch code of transfer |

To Vault |

Vault of branch to which it is transferred |

Transit GL |

Transit GL code |

Sender User |

User (Teller) who initiated send operation |

Receiver User |

User(Teller) who initiated receive operation |

Denomination Code |

Denomination code |

Denomination Value |

Denomination value |

Unit |

Units |

Total Amount |

Total amount of transfer |

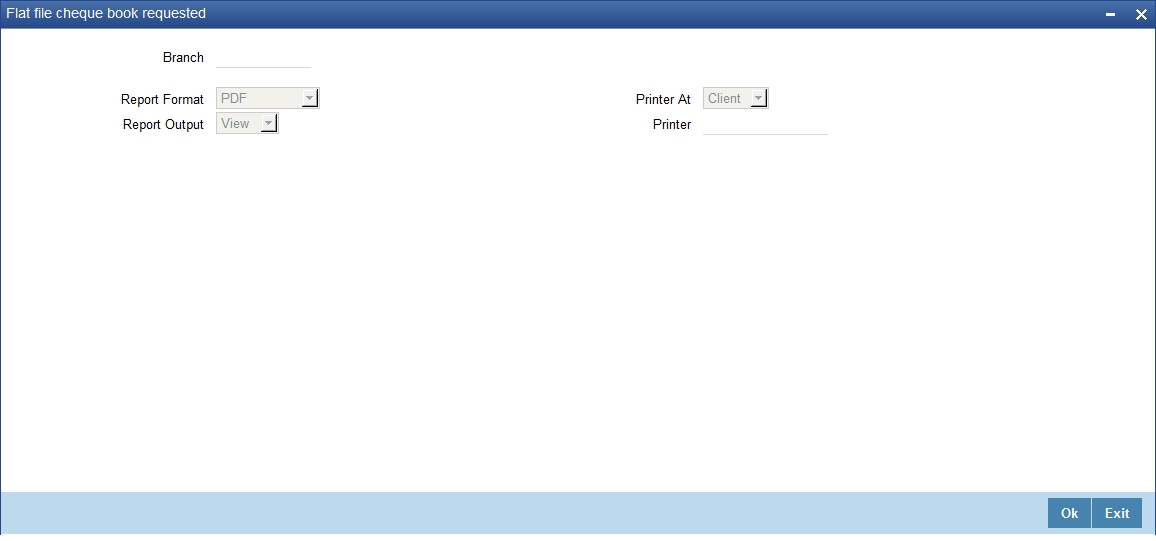

16.18 Flat File Cheque Book Requested Report

You can invoke ‘Flat File Cheque Book Requested Report’ screen by typing ‘SVRREPRT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch

Specify a valid code of the Branch in which report is being generated, from the adjoining option list.

16.18.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Daily Overline/TOD Txn Report is as follows:

Header

The Header carries the title of the report, information on the branch code, the date and time, the branch date, the user id, the module name and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Account Number |

Indicates Customer Account Number |

Customer Full Name |

Indicates the full name of the customer |

Cheque Start Number |

Indicates the start number of the cheque |

Cheque End Number |

Indicates the end number of the cheque |

Number of Cheques |

Indicates the number of cheques |

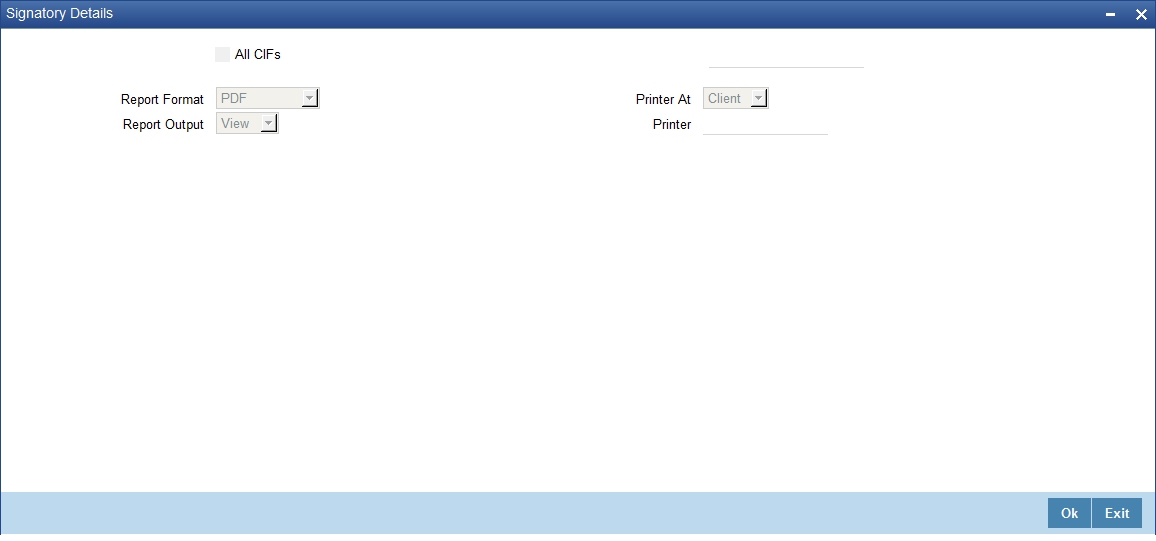

16.19 Signatory Details Report

You can invoke ‘Signatory Details’ screen by typing ‘SVRSIG in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

16.19.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Daily Overline/TOD Txn Report is as follows:

Header

The Header carries the title of the report, information on the branch code, the date and time, the branch date, the user id, the module name and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Customer Number |

Indicates the customer number |

Account Number |

Indicates the Account Number |

Currency |

Indicates the currency |

Signature |

Displays the signature |

CIF Sig Id |

Indicates the CIF Signature |

Approval Limit |

Indicates the limit of approval |

Type |

Indicates the type |

Solo |

Indicates whether the signatory is solo |

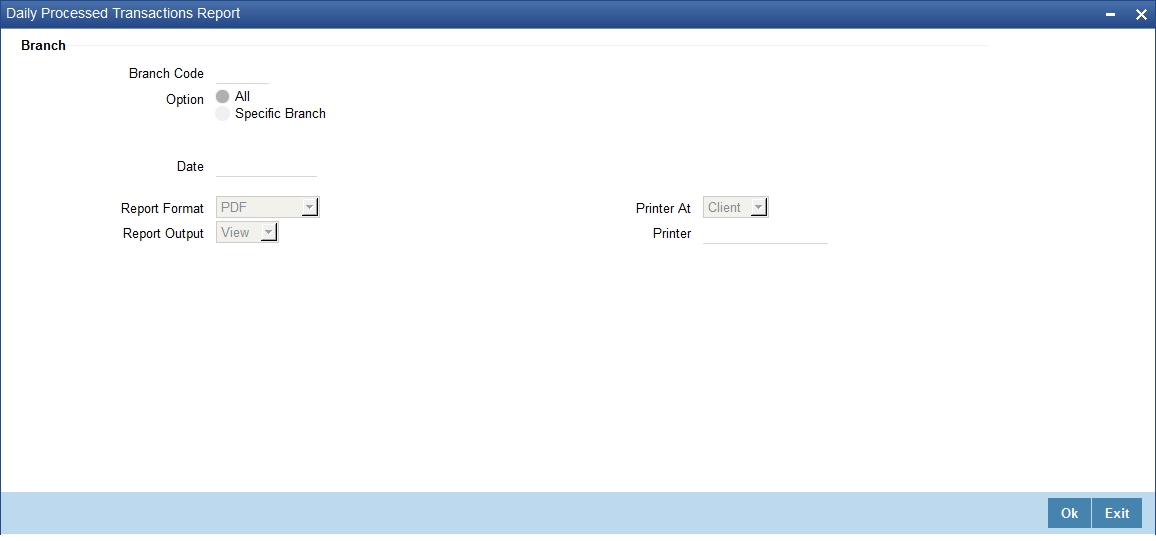

16.20 Daily Processed Transactions Report

You can invoke ‘Daily Processed Transactions Report’ screen by typing ‘CORDLPRT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

You can generate the report for a specific branch or for all the branches. If you select ‘All’, the system will generate the report for all the branches. If you select ‘Specific Branch’, you need to specify the branch code.

Select a valid branch code from the option list. The system will generate the report for the selected branch.

Specify the report options and click ‘OK’ button to generate the report.

Note

The daily processed transactions report displays only transactions related to customer account and does not list any walk-in cash transactions.

16.20.1 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report.

Header

The header of the report will contain the name of the report, branch code, branch name, branch date, user ID of the user who generated the report, module code, date and time of running the report and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Transaction Number |

The transaction number |

Transaction Code |

The code that identifies the type of transaction |

Transaction Amount |

The amount involved in the transaction |

Customer Type |

The type of customer involved in the transaction |

Account Number |

The account number |

Booking Date |

The date of transaction booking |

Value Date |

The transaction value date |

Charge |

The applicable charge |

Rate |

The applicable rate |

Title of Accounts |

This indicates the title of the accounts |

Maker ID |

The user ID of the maker of the transaction |

Maker Date Stamp |

The date and time of the transaction |

Checker ID |

The user ID of the checker who authorized the transaction |

Checker Date Stamp |

The user ID of the checker who authorized the transaction |