7. RD Operations

7.1 Introduction

This chapter contains the following sections:

7.2 Payment Details

This section contains the following topics:

- Section 7.2.1, "Capturing Payment Details"

- Section 7.2.2, "Viewing Accounting Entries"

- Section 7.2.3, "Specifying UDF Values"

- Section 7.2.4, "Viewing Payment Summary "

7.2.1 Capturing Payment Details

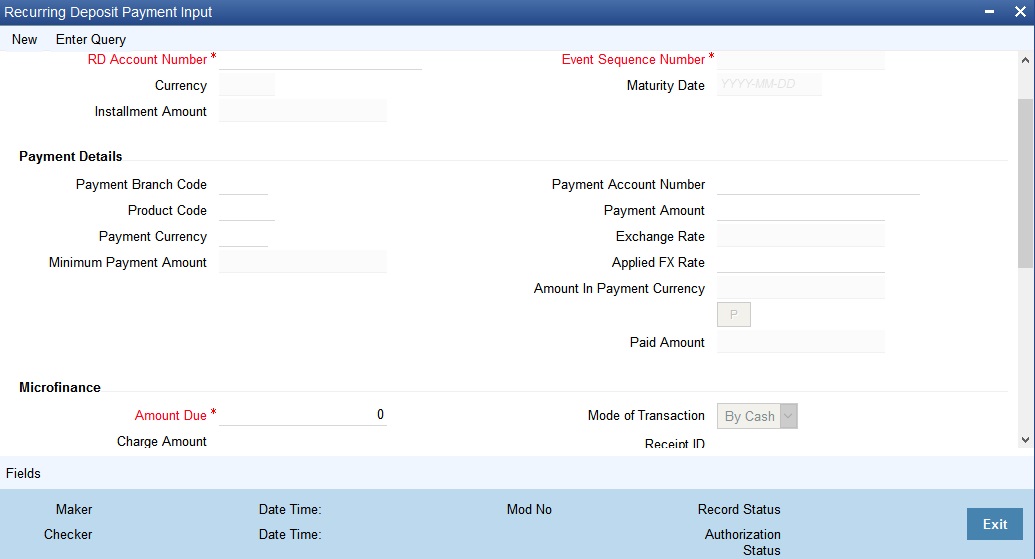

You have the option of allowing manual receipt of instalments. Invoke the ‘Recurring Deposits Payment Input’ screen from the Application by typing ‘ICDRDPMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

On invoking this screen, all the outstanding and future installments are displayed. You can choose to pay any multiple of the installment amount. To do this, the system will clear all the overdue amounts first and then allocate the amounts to current and future installments.

Type of Payment

Normal Payment

Select this option to indicate the payment as a normal RD payment. When this option is selected ‘Recurring Deposit’ and ‘Flexible Recurring Deposit’ account fields are displayed.

Top up Payment

Select this option to indicate the payment as a top-up payment. If this option is selected then only Flexible Recurring Deposit account fields are displayed.

RD Account Details

Specify the following details.

Branch Code

Specify the branch where the RD resides. The adjoining option list displays all valid branch codes maintained in the system. You can select the appropriate one.

Transaction Date

The system displays the date on which the transaction is initiated.

RD Account Number

Specify the RD Account Number. You can also choose the appropriate one from the option list. The option list displays the deposit type of accounts maintained in the system.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the RD Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Maturity Date

The system display the maturity date of the RD, on specifying the recurring deposit account.

Installment amount

The system displays the installment amount for the RD, on specifying the recurring deposit account.

CCY

The system displays the currency for the RD, on specifying the recurring deposit account.

Payment Details

Specify the following details.

Payment Branch Code

Specify the code assigned to the branch in which the payment is to be made. The adjoining option list displays all valid branch codes maintained in the system. You can select the appropriate one.

Product Code

Specify the retail teller product with combination of ARC maintenance. You have to ensure that the retail teller product is enabled for RD payments by checking the field ‘RD Payments allowed’ at the teller product level maintenance-preferences screen.

Payment Account Number

Specify the payment account number used for manual payment for the RD. The adjoining option list displays all valid savings account and current accounts maintained in the system. You can select the appropriate one.

Exchange Rate

Specify the exchange rate, if the account currency is different from the currency in which the payment amount is expressed.

Applied FX Rate

The FX rate entered by the user.

In the followiing scenarios the Applied FX rate should be equal to the Original FX rate:

- If the Deposit Account Currency and the Pay-In/Out Account Currency are same.

- If the Rate Type/Rate code combination is not maintained at the account class for a Pay-In/Out Mode. In this case the sysytem considers the STANDARD Rateas the default and the MID Rate code as the existing rate type.

Amount In Payment Currency

Click the P button to generate the paid amount in the specified currency.

Payment Currency

Specify the currency in which the payment is being made. The adjoining option list displays all valid currency codes maintained in the system. You can select the appropriate one.

Payment Amount

Specify the amount deposited as payment. Here you can specify the installment amount or the complete deposit amount in multiples of the a installment amount.

Minimum Payment Amount

The system displays the installment amount indicating the minimum amount that can be deposited in the RD account.

After entering the RD accounts payment details, click ‘P' button. The system then calculates the paid amount and displays them in the respective fields.

Paid Amount

The paid amount.

Microfinance

Amount Due

The amount due.

Charge Amount

The charge amount.

Mode of Transaction

The mode of transaction such as cash or through the customer’s bank account.

Receipt ID

The ID of the recipt received after the payment.

RD Account Payments

On click of ‘P’ button, along with paid amount, the system calculates the due days, due date, instalment amount and RD contract status.

Due Date

The system displays due date of the installment

Installment Amount

The system displays installment amount.

Payment Date

Specify payment date for the RD. Normally, the payment date is the same as the transaction date. You can change the date and click ‘P’ button to automatically populate the update ‘Due Date’ and ‘Instalment Amount’.

Due Days

The system displays overdue days in case payment is overdue.

7.2.2 Viewing Accounting Entries

Click ‘Events’ button in the ‘Recurring Deposits Payment Input’ screen and view accounting entries.

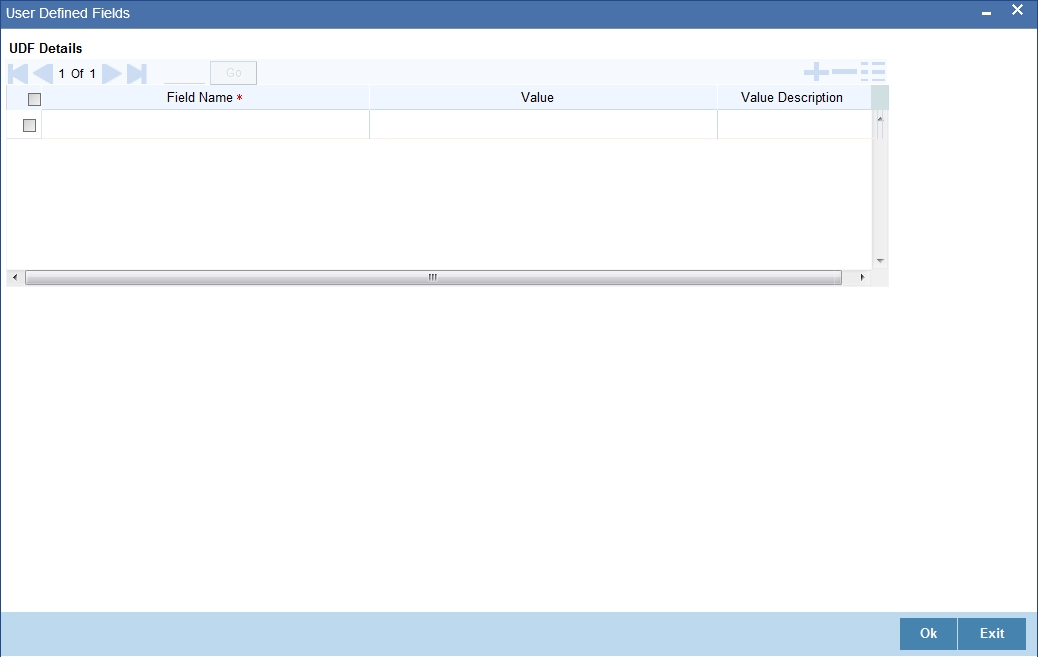

7.2.3 Specifying UDF Values

All User Defined Fields (UDFs) linked to the function ID ‘ICDRDPMT’ are displayed in the ‘User Defined Fields’ screen. Invoke this screen by clicking ‘Fields’ button on the ‘Recurring Deposit Payment Input’ screen.

Here you can specify values for each UDF.

Refer the User Manual titled ‘User Defined Field’ for details about defining UDFs.Click ‘Fields’ button on the ‘TD Accounts Maintenance’ screen and invoke the ‘User Defined Fields’ screen.

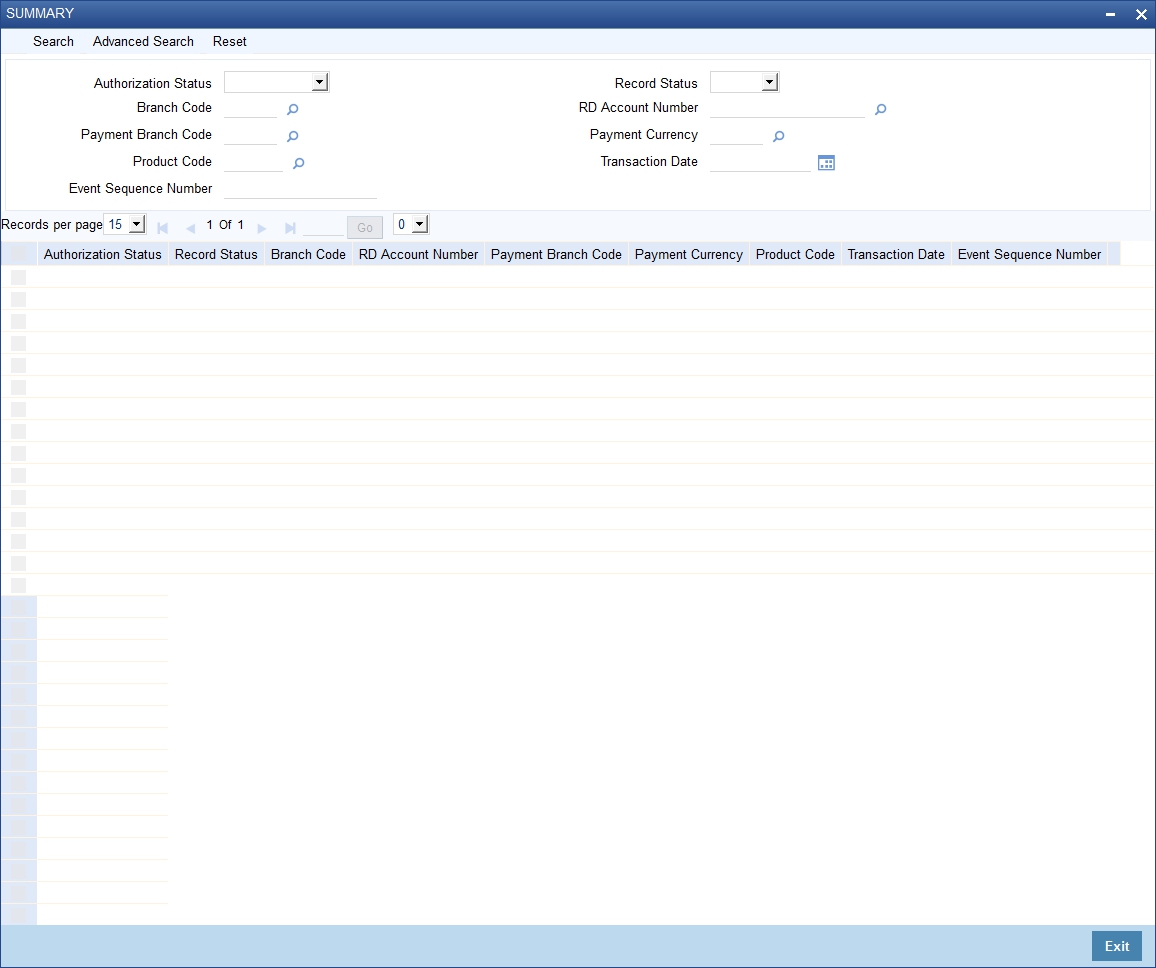

7.2.4 Viewing Payment Summary

You can view summary of all RD payments using the ‘Recurring Deposit Payment Summary’ screen. To invoke this screen, type ‘ICSRDPMT’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

You can query on records based on any one or all of the following criteria:

- Authorization Status

- Record Status

- Branch Code

- RD Account Number

- Payment Branch Code

- Payment Currency

- Product Code

- Transaction Date

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Authorization Status

- Record Status

- Branch Code

- RD Account Number

- Payment Branch Code

- Payment Currency

- Product Code

- Transaction Date

Double click on a record to invoke the detailed screen for that record.

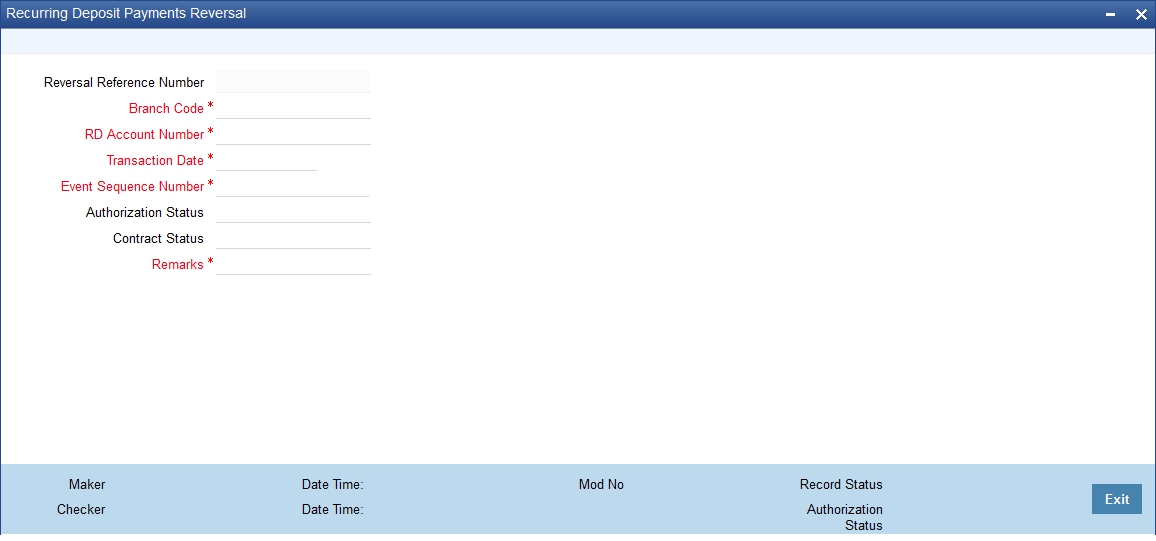

7.3 Reversing Payment

You can reverse the payments made to the RD account rather the installment amounts to the recurring deposit account. Invoke the ‘Recurring Deposit Payments Reversal’ screen from the application browser. You can also invoke this screen by typing ‘ICDRDREV’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can capture the following details.

Branch Code

Specify the code assigned to the branch in which the payment is to be made. You can also choose the branch code from the adjoining option list.

RD Account Number

Specify the recurring account number for which the installments are to be collected. The system displays the recurring deposit accounts that are in open and authorized status in the adjoining option list. You can choose the appropriate one from this list.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the RD Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Transaction Date

The system displays the transaction date for which reversal is supposed to be initiated.

Auth Status

The system displays the authorization status.

Contract Status

The system displays the contract status.

Reversal of a payment transaction can be done from this screen. When a transaction is reversed, the system updates the contract status as ‘V’ (Reversed).