2. Back Data Propagation

Back Data Propagation refers to the process of including data that has been left out and correcting data that has been erroneously entered and can be performed for both UT and LEP transactions. This is done by replaying all the transactions for the Unit Holder that have taken place since the date of the propagation transaction and which have an impact on the unit holder balance and client contribution. Based on the correct (or complete) information that is input through the propagation record, the system will re-compute dividends, broker commissions, capital gains tax and its recovery, annuity and periodic fees.

This chapter contains the following sections:

- Section 2.1, "Back Data Processing"

- Section 2.2, "Propagating Back Data for UT"

- Section 2.3, "FCIS UT Back Data Propagation Summary"

- Section 2.4, "UT Transactions Creation"

- Section 2.5, "FCIS UT Propagate Transaction Summary"

- Section 2.6, "Back Data Propagation for LEP"

- Section 2.7, "FCIS LEP Back Data Propagation Summary"

- Section 2.8, "Propagate Transaction Detail"

- Section 2.9, "FCIS LEP Propagate Transaction Summary"

- Section 2.10, "Annuities and Premium Transactions"

- Section 2.11, "FCIS LEP Propagate SI Summary"

- Section 2.12, "Processing Transactions"

- Section 2.13, "First Verification"

- Section 2.14, "Back Data Transactions Authorization"

- Section 2.15, "Running Debugs for Propagation"

- Section 2.16, "Propagation Jobs"

- Section 2.17, "Impact of Propagation"

- Section 2.18, "Back Data Propagation Details"

2.1 Back Data Processing

Propagation of back data is a process wherein the system simulates all the relevant transactions for a Unit Holder from the date of propagation till current date, This is done by simulating the incomplete or incorrect transactions in a separate schema known as the report schema. For the simulation, the transaction details need to be entered in the normal or business schema and then selected for data propagation. The system will then access the latest version of the transaction that is being propagated from the main tables in the business schema and update information accordingly. The updated information will be stored in the tables of the report schema and can be viewed from the business schema.

Propagation can be done for multiple transactions at the same time, for instance if you wish, you can modify a transaction and at the same time select another transaction for deletion. Each time propagation happens, the system will generate a unique reference to identify the process and store it along with the data in the business schema. This reference will be used to retrieve the propagation data for the corresponding transaction from the report data stores after propagation.

The following transactions can be propagated:

- UT Transactions

- IPO

- Subscription

- Redemption

- Normal Switch and Pseudo switch

- Transfer

- SI transactions

- LEP Transactions:

- Policy Initial Investment

- Top up

- Premium

- Annuity

- Policy switches

- Recurring switches

- Surrender

Note

- If the transaction is unavailable in the main tables of the business schema, the system will check for its existence in the archives (of the business schema) and display an error message if the transaction cannot be traced in either of these.

- The propagation will be only a simulation in the report schema. You will not be allowed to correct data or input data missed out in the business schema.

- You cannot perform multiple operations on the same transaction

- If, after a transaction has been entered in the business schema, there is an NAV correction, the system will consider the corrected NAV for propagation

The following details will be stored in the report data stores for the propagated transactions:

- Total confirmed units before propagation

- Total confirmed units after propagation

- Total Provisional units before propagation

- Total Provisional units after propagation

- Net profit

- Net Loss

2.2 Propagating Back Data for UT

This section contains the following topics:

2.2.1 Invoking the FCIS UT Back Data Propagation Detail

You can create a transaction that has not been input for a unit holder, delete existing erroneous data and modify certain details for an existing record in the ‘FCIS UT Back Data Propagation Detail’ screen. You can invoke by typing ‘UTDROPUT' in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

To modify or delete a transaction, you can specify the required operation, the original transaction number and change the details or delete the transaction through the ‘UT Back Data Propagation’ screen. To create a new record however, you are required to enter a new and unique transaction number along with the other details of the transaction in the ‘UT Propagate Transaction Detail’ screen. Subsequently, you need to select the new transaction number in the ‘UT Back Data Propagation’ screen to propagate the new record.

You can enter the following details here:

Basic Information

Propagation Reference Number

Display Only

The system generates a unique number for each propagation process.

Unit Holder ID

Alphanumeric; 12 Characters; Mandatory

Specify the UH for which the propagation is being done, You can use the ‘UH Find’ button to select the required UH.

Unit Holder Name

Display Only

The system displays the name of the selected UH.

Propagation Date

Display Only

The system displays the application date here.

Specifying Transaction Information Details

Operation

Mandatory

Select from the adjoining drop-down list, the kind of propagation operation that is to be done. The options are:

- New

- Modify

- Delete

The data that you are required to enter from here on depends on the type of operation you have selected.

Old Transaction Number

Alphanumeric; 16 Characters; Mandatory only if Operation is ‘Delete’

Specify the transaction number of the transaction that you wish to delete or modify. You can also select the transaction number from the adjoining option list. The list contains the reference numbers of all authorized transactions.

New Transaction Number

Alphanumeric; 16 Characters; Mandatory for New Operation

Specify a new unique transaction number for a transaction that you wish to create. You can also select the transaction number from the adjoining option list. The list contains the reference numbers for all the transactions that were created in the ‘FCIS UT Propagate Transaction Detail’ screen.

Transaction Currency

Alphanumeric; 3 Characters; Mandatory only if Operation is ‘Modify’

Specify the currency in which the new transaction is to be reckoned.

Transaction Mode

Mandatory only if Operation is ‘Modify’

Select, from the adjoining drop-down list, the mode of transacting. The options are:

- Amount

- Percent

- Units

Amount Applied

Numeric; 30 Characters; Mandatory if Transaction Mode is ‘Amount’

If the transaction mode is amount, specify the amount for the transaction.

Percent

Numeric; 5 Characters; Mandatory if Transaction Mode is ‘Percent’

If the transaction mode is percent, specify the percentage.

Units

Numeric; 27 Characters; Mandatory if Transaction Mode is ‘Units’

If the transaction mode is units, specify the number of units for the transaction.

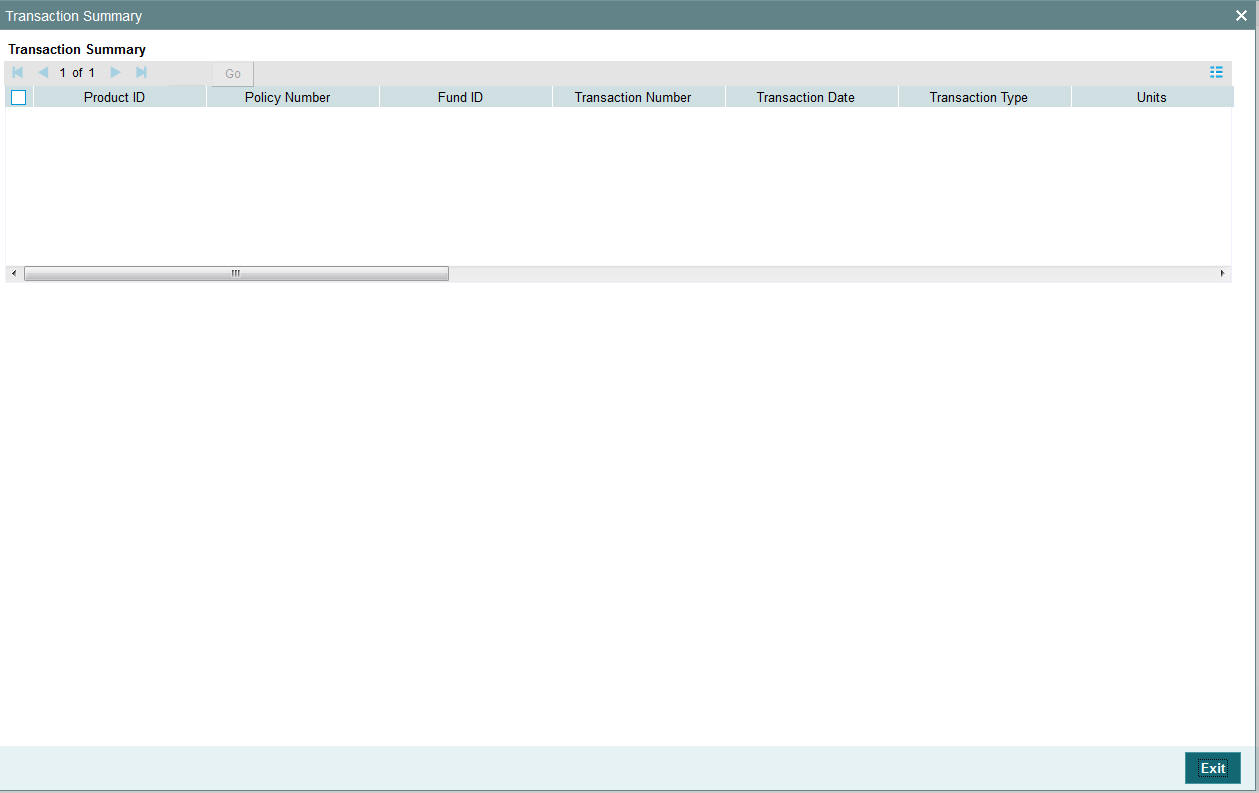

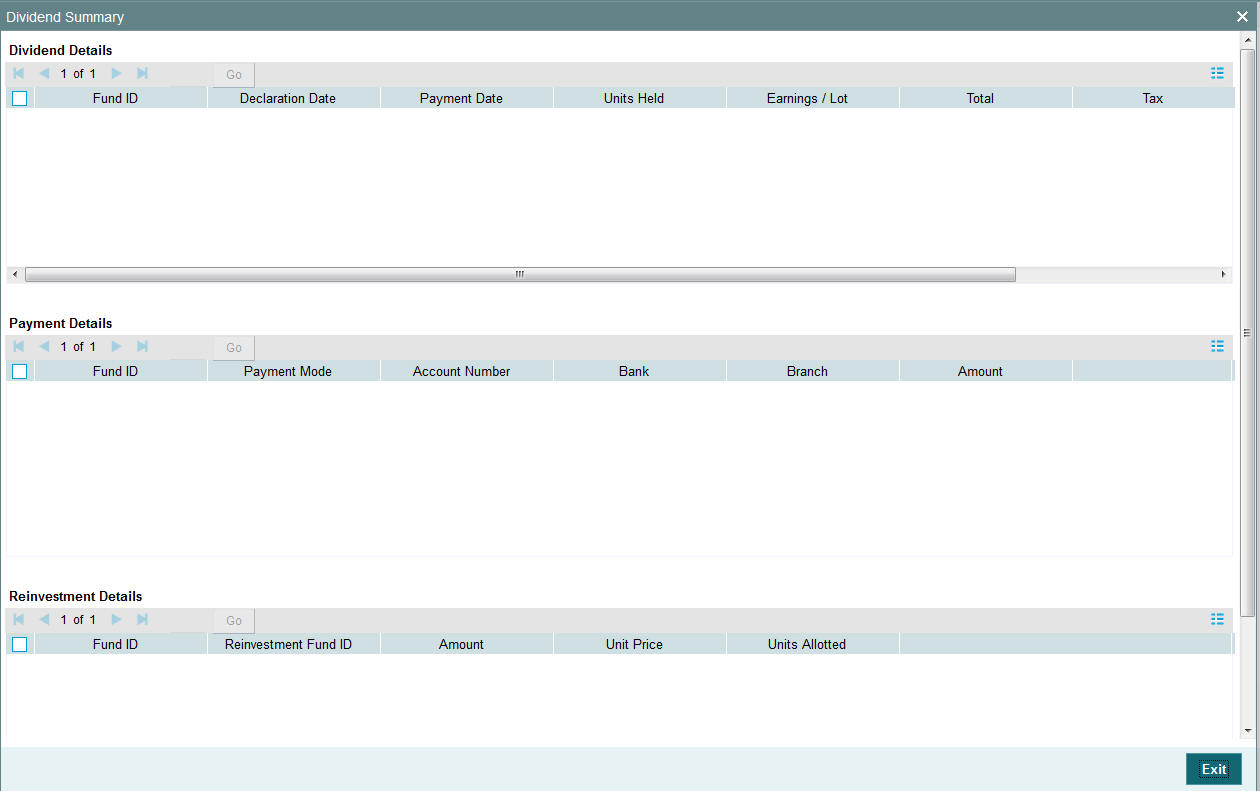

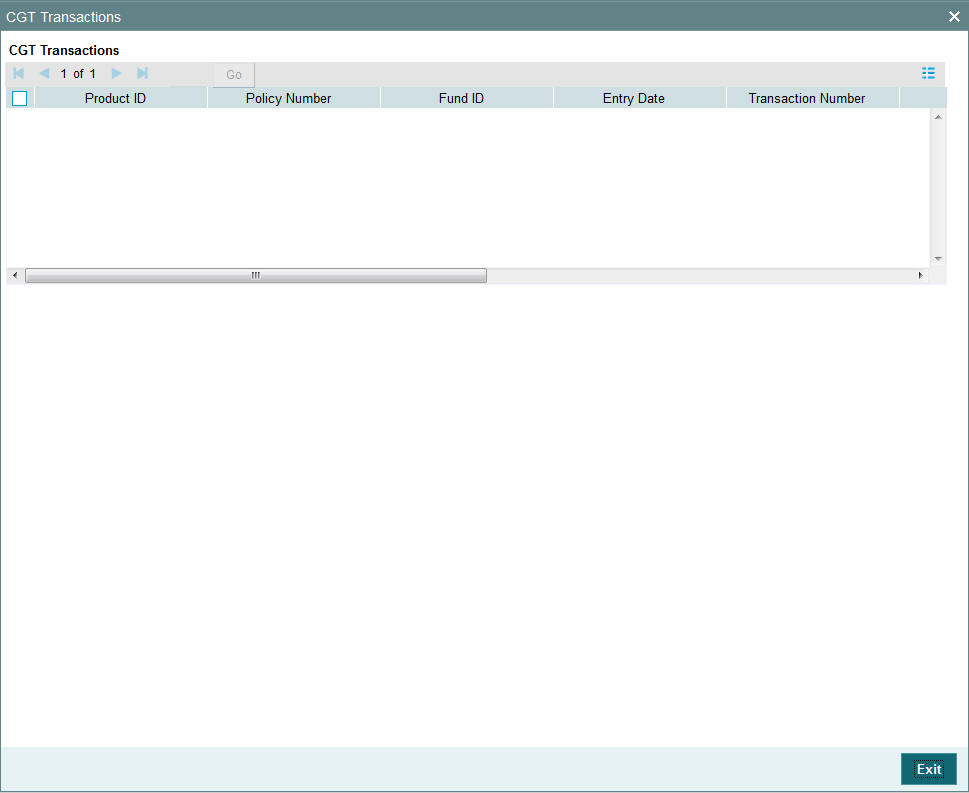

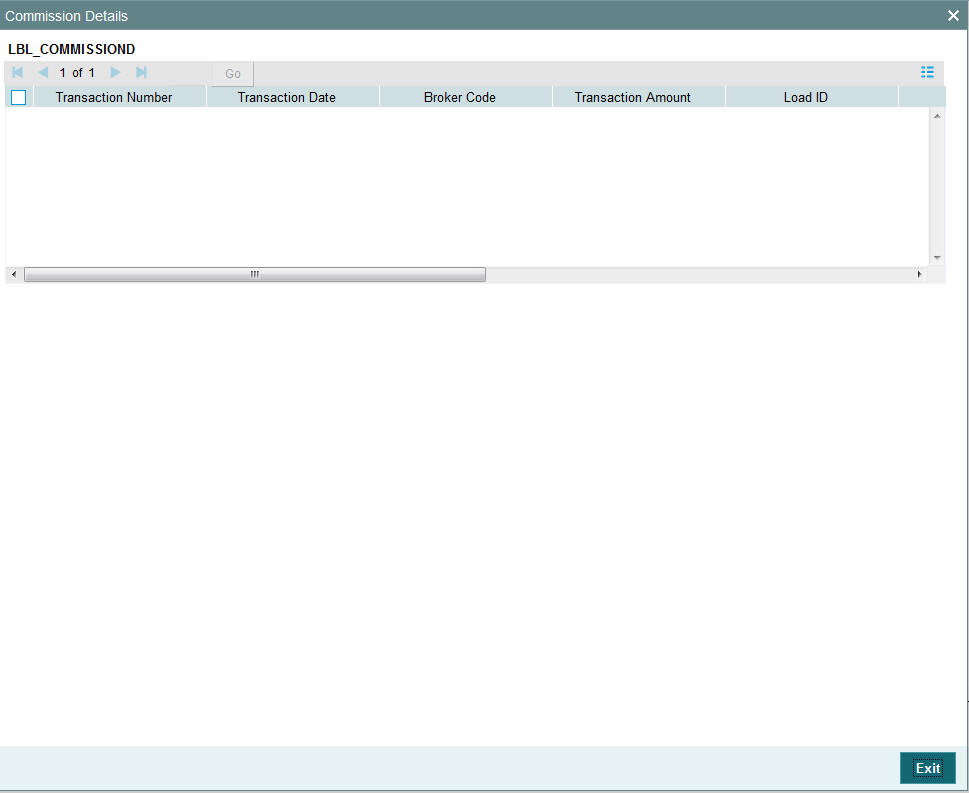

After entering the requisite details, click ‘Save’. The system will propagate the transactions (and commissions) as per the operation specified and generate a detailed report. If any of the following transactions have taken place during the data propagation period, the system will take these into account along with the original data for reiteration:

- Dividend payout or re-investment transaction

- Applicable loads

- Periodic fees

- SI Transactions

2.3 FCIS UT Back Data Propagation Summary

This section contains the following topics:

- Section 2.3.1, "Retrieving Record in FCIS UT Back Data Propagation Summary screen"

- Section 2.3.2, "Viewing an FCIS UT Back Data Propagation Record"

- Section 2.3.3, "Authorizing an FCIS UT Back Data Propagation Record"

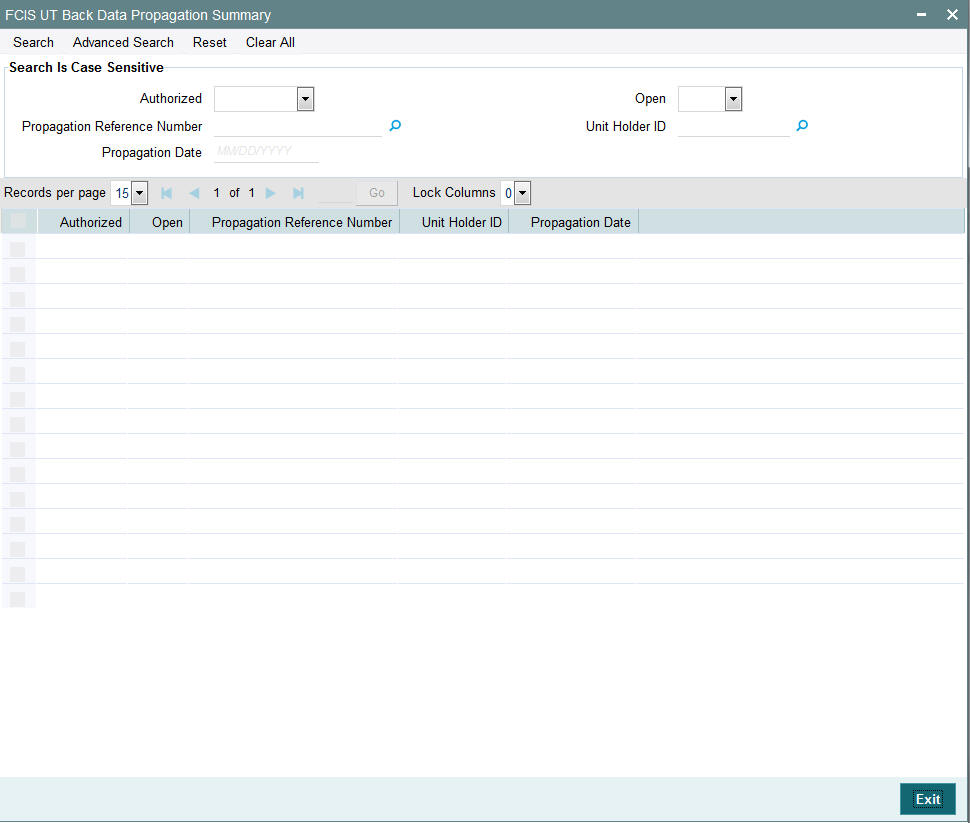

2.3.1 Retrieving Record in FCIS UT Back Data Propagation Summary screen

You can retrieve a previously entered record in the Summary Screen, as follows:

- Invoke the ‘FCIS UT Back Data Propagation Summary’ screen

by typing ‘UTSROPUT' in the field at the top right corner of

the Application tool bar and clicking on the adjoining arrow button.

.

Specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Propagation Reference Number

- Unit Holder ID

- Propagation Date

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Propagation Reference Number

- Press F8

2.3.2 Viewing an FCIS UT Back Data Propagation Record

To view a record that you have previously input, you must retrieve the same in the FCIS UT Back Data Propagation Summary screen as follows:

- Invoke the FCIS UT Back Data Propagation Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The FCIS UT Back Data Propagation screen is displayed in View mode.

2.3.3 Authorizing an FCIS UT Back Data Propagation Record

An unauthorized FCIS UT Back Data Propagation record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the FCIS UT Back Data Propagation Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS UT Back Data Propagation screen is displayed. Select Authorize operation from the Action List.

2.4 UT Transactions Creation

This section contains the following topics:

- Section 2.4.1, "Creating UT Transactions"

- Section 2.4.2, "Transaction Information Tab"

- Section 2.4.3, "Settlement Details Tab"

- Section 2.4.4, "Intermediary Tab"

- Section 2.4.5, "KYC Details Tab"

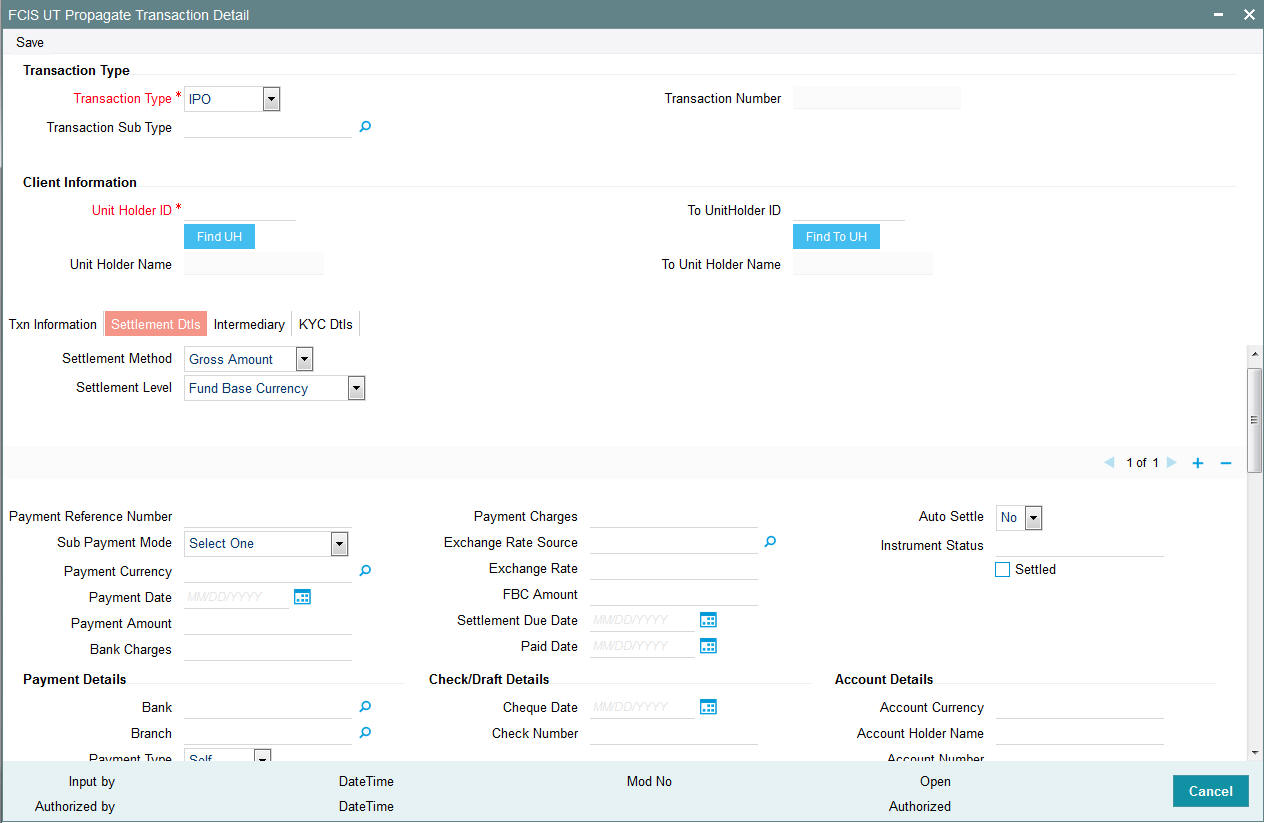

2.4.1 Creating UT Transactions

If you wish to create a record that has been missed out, you can do so in the ‘FCIS UT Propagate Transaction Detail’ screen. You can invoke the screen by typing ‘UTDPRTXN' in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

Enter the following details here:

Transaction Type

Transaction Type

Mandatory

Select, from the adjoining drop-down list, the kind of transaction you want to create. The options are:

- IPO

- Subscription

- Redemption

- Switch

- Transfer

Transaction Number

Display Only

The system generates and displays a unique transaction number.

Transaction Sub Type

Alphanumeric; 1 Character; Optional

Specify the sub-type for the transaction.

Client Information

Unit Holder ID

Alphanumeric; 12 Characters; Mandatory

Specify the unit holder for the transaction. You can select the required unit holder ID by clicking the ‘Find UH’ button.

Unit Holder Name

Display Only

The system will display the name of the unit holder selected.

To UnitHolder ID

Alphanumeric; 12 Characters; Optional (Only for Transfer Transactions)

Specify the unit holder to whom the units are being transferred. You can select the required unit holder ID by clicking the ‘Find UH’ button.

To Unit Holder Name

Display Only

The system will display the name of the unit holder selected.

2.4.2 Transaction Information Tab

In this section, you can enter the basic details for the transaction along with the exchange rates to be used.

You can specify the following details:

Transaction Date

Date Format; Mandatory

Select the date format from the adjoining calendar.

Fund ID

Alphanumeric; 6 Characters; Mandatory

Specify the fund ID. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

Transaction Currency

Alphanumeric; 6 Characters; Optional

Specify the transaction currency. Alternatively, you can select transaction currency code from the option list. The list displays all valid transaction currency code maintained in the system.

To Fund ID

Alphanumeric; 6 Characters; Optional

Specify the To fund ID. Alternatively, you can select To fund ID from the option list. The list displays all valid To fund ID maintained in the system.

Fund Identification Number

Display

The system displays the fund identification number based on the fund ID selected.

Fund Name

Display

The system displays the fund name for the selected fund ID.

Gross or Net

Optional

Select gross or net from the drop-down list. The list displays the following values:

- Gross

- Net

Transaction Category

Optional

Select the transaction category from the drop-down list. The list displays the following values:

- Legal

- Advised Business

- Execution Only

Communication Mode

Optional

Select the communication mode from the drop-down list. The list displays the following values:

- Direct (In Person)

- Check Writing

- Internet

- Registered Investment Advisor

- Registered Dealer

- Savings Plan

- SWIFT

- Telephone

Transaction Mode

Optional

Select the transaction mode from the drop-down list. The list displays the following values:

- Units

- Amount

- Percent

Units

Numeric; 12 Characters; Optional

Specify the units.

Amount

Numeric; 30 Characters; Optional

Specify the amount.

Percent

Numeric; 2 Characters; Optional

Specify the percent.

Payment Mode

Alphanumeric; 2 Characters; Optional

Specify the payment mode.

Payment Mode Description

The system displays the description for the selected payment mode.

Subscription Fund ID

Alphanumeric; 12 Characters; Optional

Specify the subscription fund ID.

Delivery Option

Optional

Select the delivery option from the drop-down list. The list displays the following values:

- Investment Account

- Clearing Account - Against Payment

- Clearing Account - Free of Payment

- Delivery to Custodian

- Physical Delivery

- PUEV

Click ‘Enrich’ button to enrich the transaction details.

Exchange Rate Details

Source ID

Alphanumeric; 6 Characters; Mandatory

Specify the source ID. Alternatively, you can select source ID from the option list. The list displays all valid source ID maintained in the system.

Amount Applied

Numeric; 30 Characters; Optional

Specify the amount applied.

FX Deal Date

Date Format; Optional

Select FX deal date from the adjoining calendar.

Exchange Rate Applied

Numeric; 21 Characters; Optional

Specify the exchange rate applied.

Override Exchange Rate

Optional

Select if the exchange rate is overridden or not from the drop-down list. The list displays the following values:

- Yes

- No

FX Value Date

Date Format; Optional

Select the FX value date from the adjoining calendar.

Click ‘Calculate’ button to calculate the exchange amount.

2.4.3 Settlement Details Tab

In this section, you can capture the details of settlement and payment made for the transaction in the case of IPO, subscription and redemption transactions. Payment Details link is displayed on selecting any Payment Mode other than ‘Cash’ and ‘Against Payment’. Click the Payment Details link to invoke the Settlement Information screen.

You can specify the following details:

Settlement Method

Optional

Select the settlement method from the drop-down list. The list displays the following values:

- Gross Amount

- Net of Agent Fees

- Net of All Fees

- Net of FM Fees

Settlement Level

Optional

Select the settlement level from the drop-down list. The list displays the following values:

- Fund Base Currency

- Transaction Base Currency

Payment Reference Number

Alphanumeric; 50 Characters; Optional

Specify the payment reference number.

Sub Payment Mode

Optional

Select the sub payment mode from the drop-down list. The list displays the following values:

- Demand Draft

- Pay Order

- Against Payment

- Inkind Payment

- CMA Cheque

- Broker Cheque

- Cashier Cheque

- Foreigner Cheque

- Government Cheque

- Other Institution Cheque

- Local Cheque

- Out of Town Cheque

- Payroll Deduction

- Cheque

- Reserve Bank Cheque

- Debit Card

- Credit Card

- Advice

- CMA Transfer

- Direct Debit

- Money Transfer

- Telegraphic Transfer

- Wire Transfer

- Cash

Payment Currency

Alphanumeric; 3 Characters; Optional

Specify the payment currency. Alternatively, you can select payment currency code from the option list. The list displays all valid payment currency code maintained in the system.

Payment Date

Date Format; Optional

Select the payment date from the adjoining calendar.

Payment Amount

Numeric; 30 Characters; Optional

Specify the payment amount.

Bank Charges

Numeric; 30 Characters; Optional

Specify the bank charges.

Payment Charges

Numeric; 30 Characters; Optional

Specify the payment charges.

Exchange Rate Source

Alphanumeric; 6 Characters; Optional

Specify the exchange rate source. Alternatively, you can select exchange rate source ID from the option list. The list displays all valid exchange rate source maintained in the system.

Exchange Rate

Numeric; 15 Characters; Optional

Specify the exchange rate.

FBC Amount

Numeric; 30 Characters; Optional

Specify the FBC amount.

Settlement Due Date

Date Format; Optional

Select the settlement due date from the adjoining calendar.

Paid Date

Date Format; Optional

Select the paid date from the adjoining calendar.

Auto Settle

Optional

Select if the transaction is auto settled or not from the drop-down list. The list displays the following values:

- Yes

- No

Instrument Status

Alphanumeric; 30 Characters; Optional

Specify the instrument status.

Settled

Optional

Select this box if the transaction is settled.

Payment Details

Bank

Alphanumeric; 12 Characters; Optional

Specify the bank details. Alternatively, you can select bank details from the option list. The list displays all valid bank details maintained in the system.

Branch

Alphanumeric; 12 Characters; Optional

Specify the branch details. Alternatively, you can select branch details from the option list. The list displays all valid branch details maintained in the system.

Payment Type

Optional

Select the payment type from the drop-down list. The list displays the following values:

- Self

- Third Party

- Broker

Broker

Alphanumeric; 12 Characters; Optional

Specify the broker details. Alternatively, you can select broker details from the option list. The list displays all valid broker details maintained in the system.

Check/Draft Details

Cheque Date

Date Format; Optional

Select the cheque date from the adjoining calendar.

Check Number

Alphanumeric; 16 Characters; Optional

Specify the cheque number.

Card Details

Credit Card Ref No

Alphanumeric; 16 Characters; Optional

Specify the credit card reference number.

Card Number

Alphanumeric; 16 Characters; Optional

Specify the card number.

Account Details

Account Currency

Alphanumeric; 3 Characters; Optional

Specify the account currency code.

Account Holder Name

Alphanumeric; 30 Characters; Optional

Specify the account holder name.

Account Number

Alphanumeric; 16 Characters; Optional

Specify the account number

Account Type

Alphanumeric; 1 Character; Optional

Specify the account type.

IBAN

Alphanumeric; 40 Characters; Optional

Specify the IBAN details.

Third Party Details

Third Party Address

Alphanumeric; 255 Characters; Optional

Specify the third party address.

Third Party Reference

Alphanumeric; 255 Characters; Optional

Specify the third party reference.

Third Party US State

Alphanumeric; 1 Character; Optional

Specify the third party US state.

Third Party Zip Code

Alphanumeric; 1 Character; Optional

Specify the third party zip code.

Unit Holder Details

Payment Address Details

Alphanumeric; 255 Characters; Optional

Specify the payment address details.

Inkind Details

Inkind Payment Details

Alphanumeric; 255 Characters; Optional

Specify the inkind payment details.

Fund Bank Details

ISIN Code

Alphanumeric; Optional

Specify the ISIN code.

Fund Base Currency

Alphanumeric; 3 Characters; Optional

Specify fund base currency.

Fund ID

Alphanumeric; 3 Characters; Optional

Specify the fund ID.

Bank

Alphanumeric; 12 Characters; Optional

Specify the bank details.

Branch

Alphanumeric; 12 Characters; Optional

Specify the branch code.

Description

Alphanumeric; 255 Characters; Optional

Specify the branch details.

Account Currency

Alphanumeric; 3 Characters; Optional

Specify the account currency.

Account Number

Alphanumeric; 16 Characters; Optional

Specify the account number.

Account Name

Alphanumeric; 100 Characters; Optional

Specify the account name.

Direct Debit Applicable

Alphanumeric; 1 Characters; Optional

Specify the direct debit applicable.

Close Account

Alphanumeric; 1 Characters; Optional

Specify the close account details.

IBAN

Alphanumeric; 40 Characters; Optional

Specify IBAN details.

Routing Bank Detail

SWIFT Format

Optional

Select SWIFT format from the drop-down list. The list displays the following values:

- MT103

- MT202

Bank Charged

Optional

Select the bank charged from the drop-down list. The list displays the following values:

- Beneficiary

- Remitter

- Share

Beneficiary Details

Beneficiary

Alphanumeric; 35 Characters; Optional

Specify the beneficiary details.

Beneficiary Code

Alphanumeric; 24 Characters; Optional

Specify the beneficiary code.

Beneficiary IBAN

Alphanumeric; 40 Characters; Optional

Specify the beneficiary IBAN code.

Beneficiary Add1

Alphanumeric; 35 Characters; Optional

Specify the beneficiary address details.

Beneficiary Add2

Alphanumeric; 35 Characters; Optional

Specify the beneficiary address details.

Beneficiary Add3

Alphanumeric; 35 Characters; Optional

Specify the beneficiary address details.

Beneficiary BIC Code

Alphanumeric; 24 Characters; Optional

Specify the beneficiary BIC code.

Beneficiary Acct No

Alphanumeric; 24 Characters; Optional

Specify the beneficiary address details.

Beneficiary Info

Alphanumeric; 100 Characters; Optional

Specify the beneficiary information.

Intermediary Details

Intermediary

Alphanumeric; 35 Characters; Optional

Specify the beneficiary details.

Intermediary Code

Alphanumeric; 24 Characters; Optional

Specify the beneficiary code.

Intermediary IBAN

Alphanumeric; 40 Characters; Optional

Specify the beneficiary IBAN code.

Intermediary Add1

Alphanumeric; 35 Characters; Optional

Specify the beneficiary address details.

Intermediary Add2

Alphanumeric; 35 Characters; Optional

Specify the beneficiary address details.

Intermediary Add3

Alphanumeric; 35 Characters; Optional

Specify the beneficiary address details.

Intermediary BIC Code

Alphanumeric; 24 Characters; Optional

Specify the beneficiary BIC code.

Intermediary Acct No

Alphanumeric; 24 Characters; Optional

Specify the beneficiary address details.

Intermediary Info

Alphanumeric; 100 Characters; Optional

Specify the beneficiary information.

Further Credit Details

Further Credit Name

Alphanumeric; 35 Characters; Optional

Specify the further credit name.

Further Credit Acct No

Alphanumeric; 35 Characters; Optional

Specify the further credit account number.

Reference

Reference1

Alphanumeric; 35 Characters; Optional

Specify the reference details.

Reference2

Alphanumeric; 35 Characters; Optional

Specify the reference details.

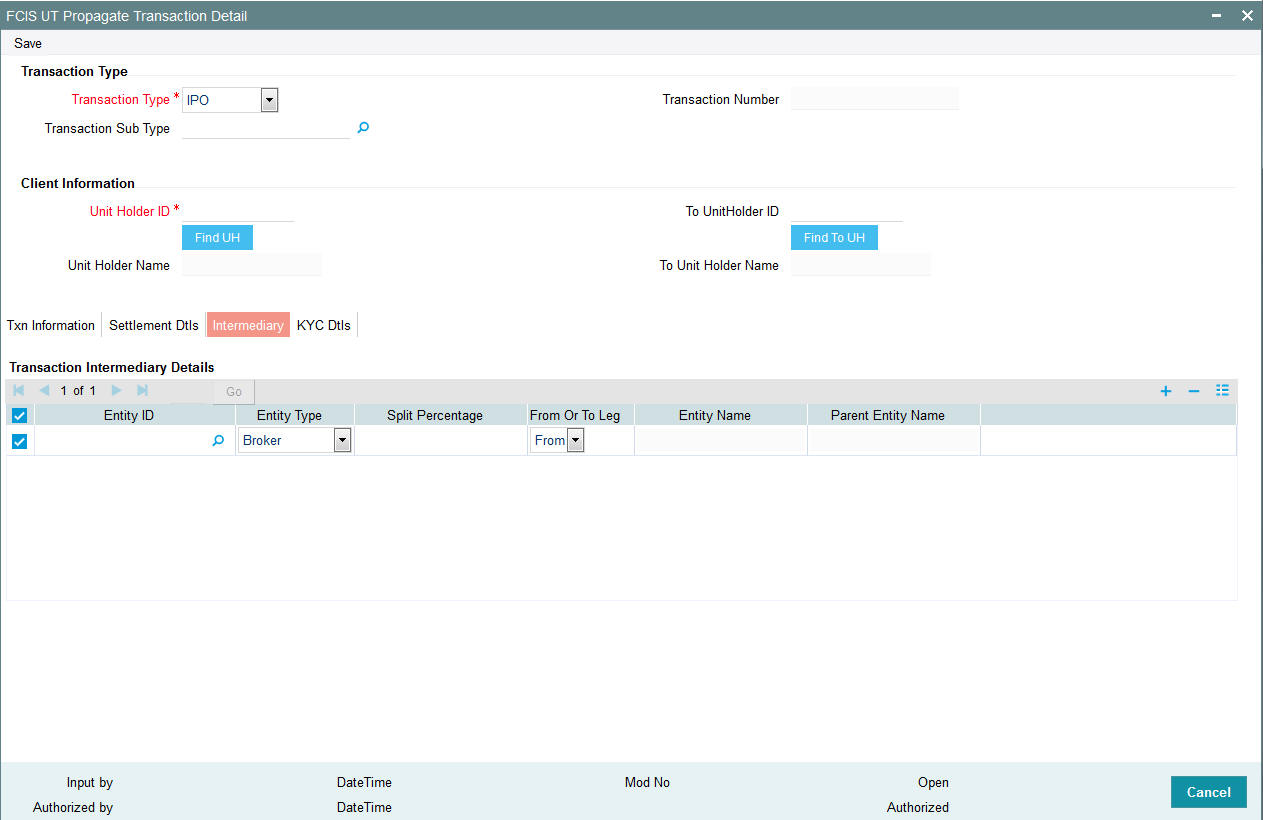

2.4.4 Intermediary Tab

If a broker has been identified as an intermediary for the transaction, then you must identify the same in this section, along with the commission percentage split for the broker.

If brokers are designated as mandatory for the fund in which the transaction is being put through, then you must specify at least one broker as mandatory information in this section. If brokers are not mandatory for the fund, and you do not specify any broker in this section, then the system reckons the broker as DIRECT and designates the same as the default broker.

You can specify the following details:

Transaction Intermediary Details

Entity ID

Alphanumeric; 12 Characters; Optional

Specify the entity ID. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

Entity Type

Optional

Select the entity type from the drop-down. The list displays the following values:

- Agent

- Agent Branch

- Account Officer

- IFA

- Broker

Split Percentage

Numeric; 5 Characters; Optional

Specify the split percentage.

From Or To Leg

Optional

Select if From or To Leg from the drop-down list. The list displays the following values:

- From

- To

Entity Name

Display

The system displays the entity name for the selected entity ID.

Parent Entity Name

Alphanumeric; 50 Characters; Optional

Specify the parent entity name.

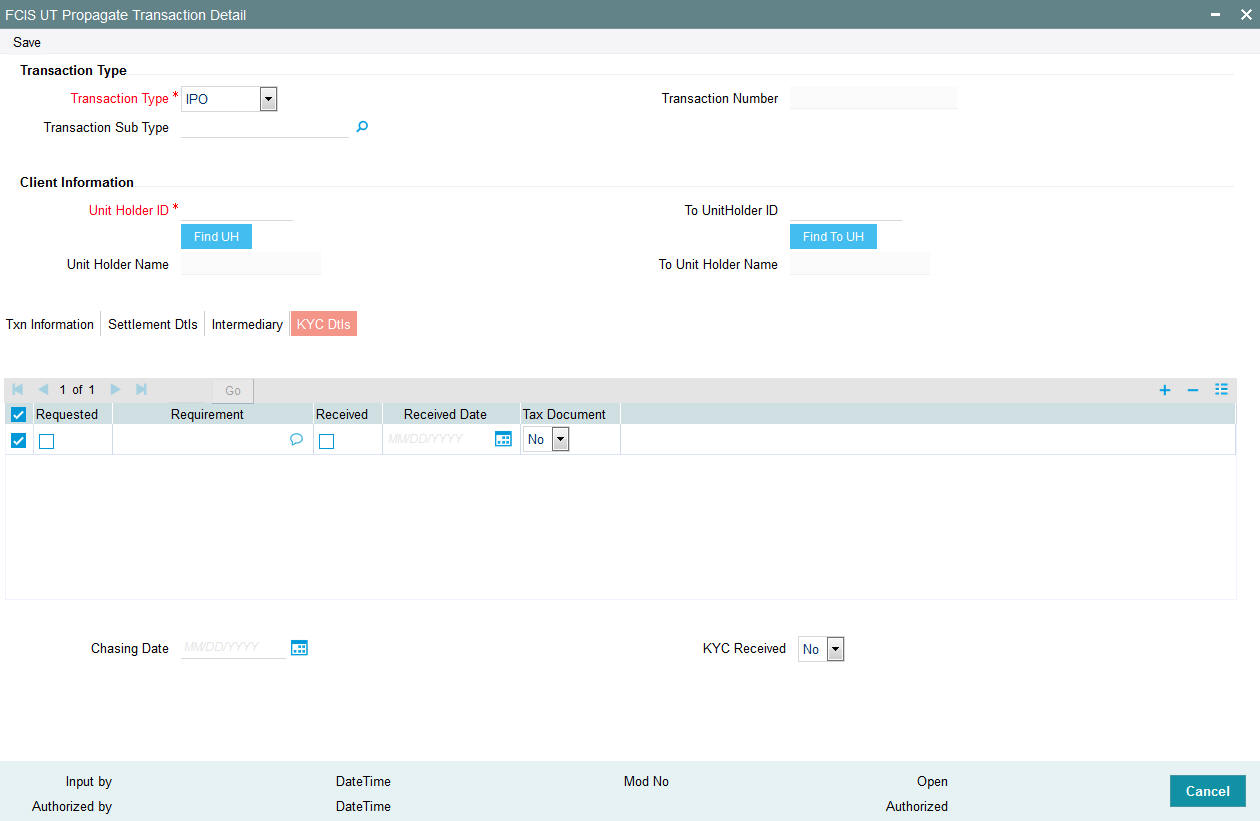

2.4.5 KYC Details Tab

You need to specify the list of required KYC documents for this transaction. System allows you to save the transaction even if the unit holder has not submitted all the required KYC documents. However, you will not be allowed to perform the completion operation on that transaction unless all the required documents have been received from the investor.

This feature will be available only if your installation has requested for it.

You can specify the following details:

Requested

Optional

Check this box if KYC details are requested.

Requirement

Alphanumeric; 255 Characters; Optional

Specify the required details.

Received

Optional

Check this box if KYC details are received

Received Date

Date Format; Optional

Select the received date from the adjoining option list.

Tax Document

Optional

Select if tax document is required or not from the drop-down list. The list displays the following values:

- Yes

- No

Chasing Date

Date Format; Optional

Select the chasing date from the adjoining option list.

KYC Received

Optional

Select if KYC is received or not from the drop-down list. The list displays the following values:

- Yes

- No

You can also modify details of a newly created record, delete and authorize a record through this screen. Modification, however, will be allowed only if the record has not been selected for data propagation in the ‘UT Back Data Propagation’ screen.

Note

- If you put in a new transaction for transfer, the system will consider this transaction to recalculate the holdings of the Unitholder only. It will not automatically re-compute the unit balances of the unit holder to whom the transfer is being done (the To Unit Holder). Also, it will store the updated information for only the ‘To Unit Holder’ in the report schema tables.

- In case of a switch transaction, it will re-calculate the unit holder balances in both the ‘To Fund’ as well as the ‘From Fund’ and store details of both in the report schema tables.

- If there has been a merger or a split for a fund specified in a propagation transaction, the system will re-calculate the holdings for the propagation period.

2.5 FCIS UT Propagate Transaction Summary

This section contains the following topics:

- Section 2.5.1, "Retrieving Record in FCIS UT Propagate Transaction Summary screen"

- Section 2.5.2, "Editing an FCIS UT Propagate Transaction Record "

- Section 2.5.3, "Viewing an FCIS UT Propagate Transaction Record"

- Section 2.5.4, "Deleting an FCIS UT Propagate Transaction Record"

- Section 2.5.5, "Authorizing an FCIS UT Propagate Transaction Record"

- Section 2.5.6, "Amending an FCIS UT Propagate Transaction Record"

- Section 2.5.7, "Authorizing an Amended FCIS UT Propagate Transaction Record"

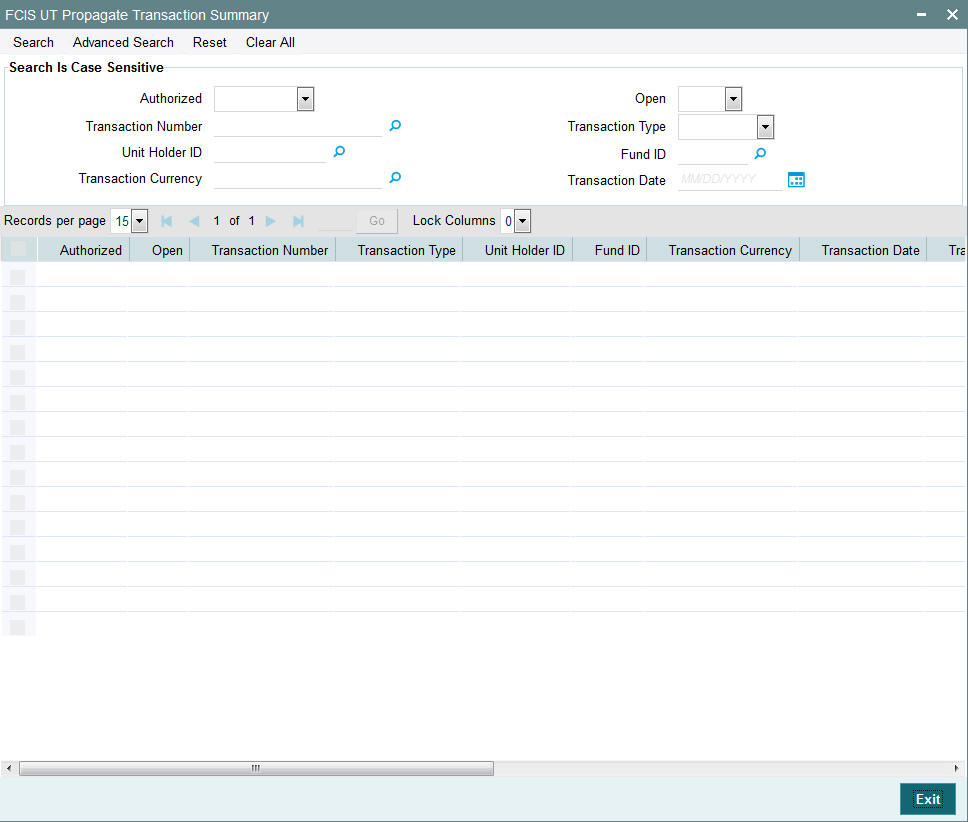

2.5.1 Retrieving Record in FCIS UT Propagate Transaction Summary screen

You can retrieve a previously entered record in the Summary Screen, as follows:

Invoke the ‘FCIS UT Propagate Transaction Summary’ screen by typing ‘UTSPRTXN' in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Transaction Number

- Transaction Type

- Unit Holder ID

- Fund ID

- Transaction Currency

- Transaction Date

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Transaction Number

- Press F8

You can perform Edit, Delete, Amend, Authorize operations by selecting the operation from the Action list.

2.5.2 Editing an FCIS UT Propagate Transaction Record

You can modify the details of an FCIS UT Propagate Transaction record that you have already entered into the system, provided it has not been subsequently authorized and if it has not been attached to any propagation. If the transaction has been propagated, then you will not be allowed to modify it.

You can perform this operation as follows:

- Invoke the FCIS UT Propagate Transaction Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The FCIS UT Propagate Transaction screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The FCIS UT Propagate Transaction screen is closed and the changes made are reflected in the FCIS UT Propagate Transaction Summary screen.

2.5.3 Viewing an FCIS UT Propagate Transaction Record

To view a record that you have previously input, you must retrieve the same in the FCIS UT Propagate Transaction Summary screen as follows:

- Invoke the FCIS UT Propagate Transaction Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The FCIS UT Propagate Transaction screen is displayed in View mode.

2.5.4 Deleting an FCIS UT Propagate Transaction Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the FCIS UT Propagate Transaction Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The FCIS UT Propagate Transaction screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

2.5.5 Authorizing an FCIS UT Propagate Transaction Record

An unauthorized FCIS UT Propagate Transaction record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the FCIS UT Propagate Transaction Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS UT Propagate Transaction screen is displayed. Select Authorize operation from the Action List.

2.5.6 Amending an FCIS UT Propagate Transaction Record

After an FCIS UT Propagate Transaction record is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the FCIS UT Propagate Transaction Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS UT Propagate Transaction screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

2.5.7 Authorizing an Amended FCIS UT Propagate Transaction Record

An amended FCIS UT Propagate Transaction record must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module.

The subsequent process of authorization is the same as that for normal records.

2.6 Back Data Propagation for LEP

This section contains the following topics:

2.6.1 Propagating Back Data for LEP

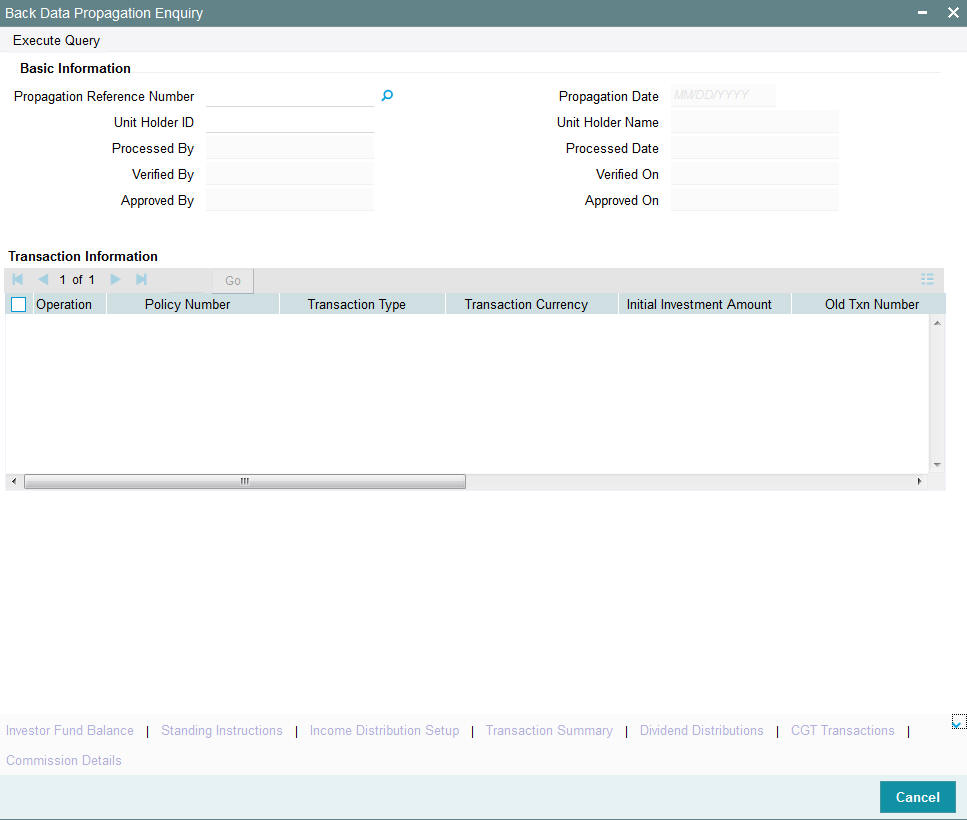

You can create transactions that have not been input for a policy holder, delete existing erroneous data and modify certain details for an existing record in the ‘FCIS LEP Back Data Propagation’ screen. You can invoke by typing ‘LEDROPLE' in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

To modify or delete a transaction, you can specify the required operation, the original transaction number and change the details or delete the transaction through the ‘FCIS LEP Back Data Propagation’ screen. To create a new record however, you are required to enter a new and unique transaction number along with the other details of the transaction in the ‘FCIS LEP Propagate Transaction Detail’ screen. Subsequently, you need to select the new transaction number in the ‘FCIS LEP Back Data Propagation’ screen to propagate the new record.

You can enter the following details here:

Basic Information

Propagation Reference Number

Display

The system generates a unique number for each propagation process.

Unit Holder ID

Alphanumeric; 12 Characters; Mandatory

Specify the UH for which the propagation is being done. You can use the ‘UH Find’ button to select the required UH.

Unit Holder Name

Display Only

The system displays the name of the selected UH.

Propagation Date

Display Only

The system displays the application date here.

Transaction Information

Operation

Optional

Select from the adjoining drop-down list, the kind of propagation operation that is to be done. The options are:

- New

- Modify

- Delete

The data that you are required to enter from here on depends on the type of operation you have selected.

Policy Number

Alphanumeric; 16 Characters; Mandatory only if the Operation is Modify

Specify the policy number for which you want to propagate back data. You can also select the policy number from the adjoining option list. The list contains the reference numbers of all authorized policies.

Transaction Type

Optional

Select, from the adjoining drop-down list, the type of transaction to be propagated. The options are:

- Policy Initial Investment

- Topup

- Switch

- Surrender

- Annuity

- Premium

- Recurring Switch

Initial Investment Amount

Numeric; 30 Characters; Mandatory if Transaction Type is ‘Policy Initial Investment’

Enter the initial investment amount for the policy.

Old Transaction Number

Alphanumeric; 16 Characters; Mandatory if Operation is ‘Delete’

Enter the transaction number of the transaction that you wish to delete or modify.

New Transaction Number

Alphanumeric; 16 Characters; Mandatory if Operation is ‘New’

Specify a new unique transaction number for a transaction that you wish to create. You can also select the transaction number from the adjoining option list. The list contains the reference numbers for all the transactions that were created in the ‘FCIS LEP Propagate Transaction Detail’ screen.

Transaction Currency

Alphanumeric; 3 Characters; Mandatory if Operation is ‘Modify’

Specify the currency in which the new transaction is to be reckoned.

Transaction Mode

Mandatory if Operation is ‘Modify’

Select, from the adjoining drop-down list, the mode of transacting. The options are:

- Amount

- Percent

- Units

Amount Applied

Numeric; 30 Characters; Mandatory if Transaction Mode is ‘Amount’

If the transaction mode is amount, specify the amount for the transaction.

Percent

Numeric; 5 Characters; Mandatory if Transaction Mode is ‘Percent’

If the transaction mode is percent, specify the percentage.

Units

Numeric; 27 Characters; Mandatory if Transaction Mode is ‘Units’

If the transaction mode is units, specify the number of units for the transaction.

Transaction Category

Optional

Select the transaction category from the drop-down list. The list displays the folloing values:

- Legacy

- Advised Business

- Execution Only

After entering the requisite details, click ‘Save’. The system will propagate the transactions (and commissions) as per the operation specified and generate a detailed report. If any of the following transactions have taken place during the data propagation period, the system will take these into account along with the original data for reiteration:

- Dividend payout or re-investment transaction

- Annuity, recurring switches, recurring premium or surrender transactions

- Applicable loads

- Annuity Journals

- Periodic fees

- CGT Recovery Transactions

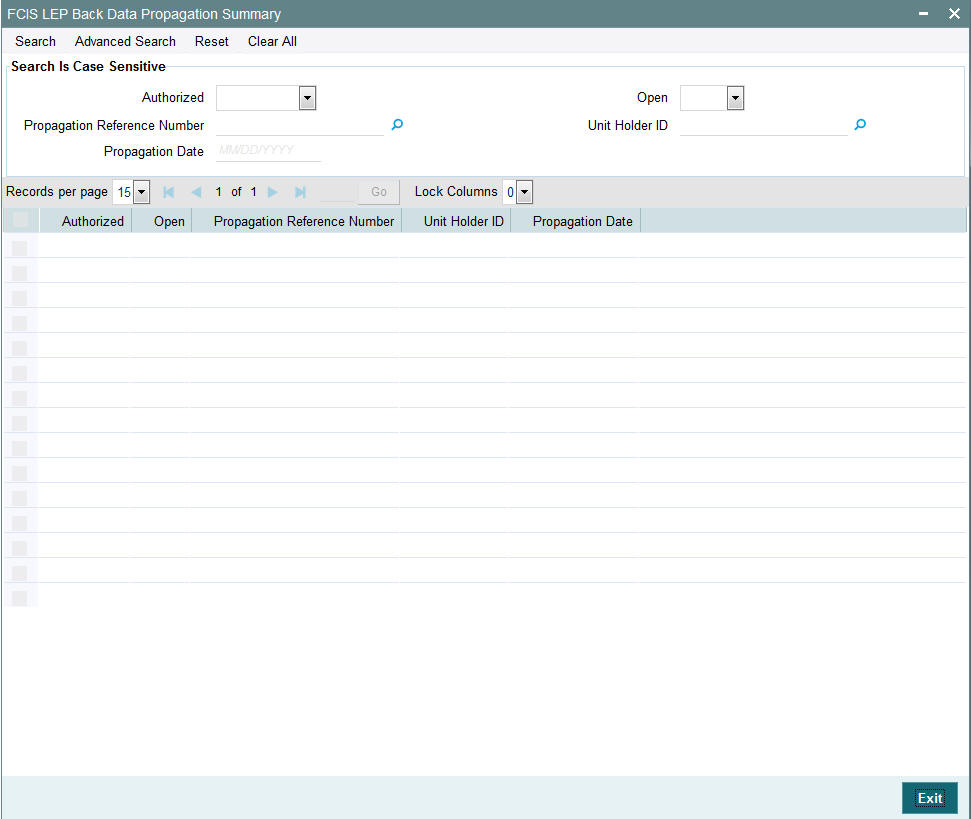

2.7 FCIS LEP Back Data Propagation Summary

This section contains the following topics:

- Section 2.7.1, "Retrieving Record in FCIS LEP Back Data Propagation Summary screen"

- Section 2.7.2, "Viewing an FCIS LEP Back Data Propagation Record"

- Section 2.7.3, "Authorizing an FCIS LEP Back Data Propagation Record"

2.7.1 Retrieving Record in FCIS LEP Back Data Propagation Summary screen

You can retrieve a previously entered record in the Summary Screen, as follows:

Invoke the ‘FCIS LEP Back Data Propagation Summary’ screen by typing ‘LESROPLE' in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Propagation Reference Number

- Unit Holder ID

- Propagation Date

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Propagation Reference Number

- Press F8

2.7.2 Viewing an FCIS LEP Back Data Propagation Record

To view a record that you have previously input, you must retrieve the same in the FCIS LEP Back Data Propagation Summary screen as follows:

- Invoke the FCIS LEP Back Data Propagation Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The FCIS LEP Back Data Propagation screen is displayed in View mode.

2.7.3 Authorizing an FCIS LEP Back Data Propagation Record

An unauthorized FCIS LEP Back Data Propagation record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the FCIS LEP Back Data Propagation Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS LEP Back Data Propagation screen is displayed. Select Authorize operation from the Action List.

2.8 Propagate Transaction Detail

This section contains the following topics:

- Section 2.8.1, "Invoking LEP Propagate Transaction Detail"

- Section 2.8.2, "Transaction Details Tab"

- Section 2.8.3, "Asset Allocation Tab"

- Section 2.8.4, "Payment Details Tab"

- Section 2.8.5, "Broker Details Tab"

2.8.1 Invoking LEP Propagate Transaction Detail

You can invoke the ‘LEP Propagate Transaction Detail’ screen by typing ‘LEDPRTXN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

Policy Transaction

Policy Number

Alphanumeric; 16 Characters; Mandatory

Specify the policy number. Alternatively, you can select the policy number from the option list. The list displays all valid policy number maintained in the system.

Policy Holder ID

Display

The system displays the policy holder ID for the selected policy number.

Policy Txn Number

Display

The system displays the policy transaction number.

Transaction Type

Mandatory

Select the transaction type from the drop-down list. The list displays the following values:

- Topup

- Surrender

- Switch

2.8.2 Transaction Details Tab

Select ‘Transaction Details’ tab in the ‘LEP Propagate Transaction Detail’ screen to invoke the screen:

Transaction Date

Date Format, Mandatory

Specify the date for the transaction.

Transaction Currency

Alphanumeric; 3 Characters; Mandatory

When different currencies have been used in payment details, then you are required to enter the transaction currency.

Transaction Amount

Numeric, 30 Characters; Mandatory

Specify the investment amount of the transaction.

Txn Type

Alphanumeric; 2 Characters; Optional

Select the Transaction Type. Alternatively, you can select transaction type from the option list. The list displays all valid transaction type maintained in the system.

Phase In To Be Cancelled

Alphanumeric; 16 Characters; Optional

You could choose to cancel all, none or specific IDs of the active Phase-In setup.

Include Interest in Investment

Optional

Select, from the adjoining drop-down list, if the interest earned on the initial investment should be considered along with the initial investment for investment in the policy.

If you select ‘Yes’, the interest amount will be included in the investment and a single transaction will be generated for both. You need to manually add the interest amount calculated in the settlement details to the transaction amount of the particular currency in the asset allocation details.

If you select ‘No’, the interest amount will be generated as a separate UT transaction.

Interest Amount

Numeric; 18 Characters; Optional

Specify the interest amount based on the interest calculation days and interest rate provided.

Transaction Entry Date

Date Format, Mandatory

The Transaction Entry Date signifies the date on which the transaction is entered into the system. By default, the application date is displayed in this field, and it cannot be altered.

Transaction Mode

Mandatory

Select the transaction mode from the drop-down list. The list displays the following values:

- Amount

- Unit

- Percent

Top Up Inclusive

Optional

Select if the transaction is an inclusive top up transaction or not from the drop-down list.The list displays the following values:

- Yes

- No

When a top up is inclusive, the top up amount is considered immediately for the next annuity payment. If it is an exclusive top up, the top up amount is not considered for annuity payments till after the first anniversary date.

PortFolio Switch

Optional

Select if portfolio switch is considered or not from the adjoining drop-down list. The list displays the following values:

- Yes

- No

Portfolio Surrender

Optional

Select if portfolio surrender is considered or not from the adjoining drop-down list. The list displays the following values:

- Yes

- No

Surrender Money Payable

Alphanumeric; 1 Character; Optional

Specify the surrender money payable details.

Refer to the chapter “Maintaining System Parameters” for further information on the System Parameters Maintenance screen.

Transaction Category

Mandatory

Select the transaction category from the adjoining drop-down list. Following are the options available:

- Legal

- Advised Business

- Execution Only

Exchange Rate Details

Amount Applied

Numeric; 30 Characters; Optional

Specify the amount calculated based on the exchange rate specified.

Source ID

Alphanumeric; 6 Characters; Optional

Specify the source from which the exchange rate is obtained or select the source ID from the option list provided.

Exchange Rate Applied

Numeric; 21 Characters; Optional

Specify the exchange rate applied.

Override Exchange Rate

Optional

Select the option to indicate if you wish to override the exchange rate that gets defaulted. Select ‘Yes’ to indicate that you wish to override the exchange rate and ‘No’ to indicate otherwise.

Click ‘Calculate’ button to calculate the amount using the exchange rate specified. The interest amount associated with the policy transaction also gets converted to policy base currency based on the exchange rate specified.

2.8.3 Asset Allocation Tab

Capture the fund-wise pattern of distribution of the investment amount in the Asset Allocation Details section of this tab. If the initial contribution that you enter is in different currencies, you need to mention the currency-wise details here. Click the ‘Asset Allocation’ tab to enter the asset allocation details for the transaction.

Fund ID

Alphanumeric; 6 Characters; Mandatory

All the funds mapped for the selected product are displayed in the option list. Select the required funds.

Fund Name

Display

The system displays the fund name for the selected fund ID.

Fund Base Currency

Display

The system displays the fund base currency details.

Transaction Currency

Alphanumeric; 3 Characters; Optional

Specify the transaction currency for the initial contribution. If many currencies have been mentioned in the settlements, then you are required to enter the amount for individual currencies. You can specify a transaction currency only if the transaction is amount-based.

Transaction Amount

Numeric, 30 Characters; Mandatory

Specify the portion of the transaction amount that is to be invested in each of the selected funds. If different currencies have been mentioned in settlements, then you can specify only the transaction amount.

Exchange Rate Source

Alphanumeric; 6 Characters; Optional

The system will display the exchange source maintained at the default set-up in system parameters. You can change it by selecting the required exchange rate source from the adjoining option list. This will be used by the system to convert the transaction amount in terms of fund base currency.

Override Exchange Rate

Optional

Select ‘Yes’ if you wish to change the exchange rate that is displayed here. If you select ‘Yes’, however, you need to specify the exchange rate to be used for the transaction in the ‘Exchange Rate Applied’ field. Select ‘No’ if you wish to retain the exchange rate that is displayed by the system.

Exchange Rate Applied

Numeric; 21 Characters; Optional

The system will default the exchange rate available for the currency based on the exchange source specified. If you have elected to override the exchange rate, you need to enter the exchange rate to be used here. If exchange rate is not available, then the system will generate the transactions as incomplete ones. Such transactions can be enriched later through the ‘Policy Transaction Enrichment Screen’.

FX Deal Date

Date format; Optional

Specify the FX deal date.

FX Value Date

Date format; Optional

Specify the FX Value date.

WAC

Numeric; 30 Characters; Optional

Enter the Weighted Average Cost.

Ratio

Numeric, 11 Characters; Optional

Specify the portion of the units that are to be invested in each of the selected funds.

The latest investment ratio applicable for the Policy is displayed here when the form is opened. These values can be amended, and you can specify the required percentages.

Auto Clear Provisional Balance

Mandatory

Select if provisional balance should be automatically cleared or not from the drop-down list. The list displays the following values:

- Yes

- No

Auto Clear Reinvestments

Mandatory

Select if reinvestment details should be automatically cleared or not from the drop-down list. The list displays the following values:

- Yes

- No

2.8.4 Payment Details Tab

Capture the details of payments made by the Policy Holder towards processing of the transaction in this tab. Click the ‘Payment Details’ tab to enter the payment details for the transaction.

Payment Details

Payment Mode

Optional

Select the mode through which the payment is made by the Policy holder. This could be any one of the following, as applicable:

- Cash

- Cheque

- Demand Draft

- Money Transfer

Clearing Date

Date Format, Optional

Specify the Clearing Date of the payment.

Payment Type

Mandatory

Select the payment type from the drop-down list. The list displays the following values:

- Self

- Product

- Third Party

- Beneficiary

Bank Code

Alphanumeric; 12 Characters; Optional

Select the Bank code from the option list.

Account Number

Alphanumeric; 16 Characters; Optional

Specify the number of the transfer account.

Check Number

Alphanumeric; 16 Characters; Optional

Enter the cheque number of the cheque /draft number of the demand draft by which the payment is being made.

Identification Number

Alphanumeric; 50 Characters; Mandatory

Specify the identification number.

Address Line 1

Alphanumeric; 255 Characters; Optional

Specify the address of the customer.

Transferee Number

Alphanumeric; 16 Characters; Optional

Specify the transferee number.

Payment Date

Date Format; Mandatory

Specify the date on which the initial investment was done. You can deposit the amount in different currencies and on different dates.

Payment Currency

Alphanumeric; 3 Characters; Optional

Enter the currency in which the initial investment is being done. The initial amount can be deposited in multiple currencies.

Payment Amount

Numeric; 30 Characters; Mandatory

Enter the initial investment amount being paid in the particular currency.

Ratio

Numeric; 5 Characters; Optional

Specify the ratio.

Branch Code

Alphanumeric; 12 Characters; Optional

Select the Branch code from the option list.

Account Type

Alphanumeric; 1 Character; Optional

Select the account type of the transfer account.

Account Currency

Alphanumeric; 3 Characters; Optional

Specify the transaction currency.

Check Date

Date Format, Optional

Enter the cheque date of the cheque /draft number of the demand draft by which the payment is being made.

Contact Name

Alphanumeric; 100 Characters; Optional

Specify the contact name.

Address Line 1

Alphanumeric; 255 Characters; Optional

Specify the address of the customer.

IBAN

Alphanumeric; 40 Characters; Optional

Specify the IBAN (International Bank Account Number) of the account holder.

Exchange Rate Details

Source ID

Alphanumeric; 6 Characters; Optional

Specify the source ID from the adjoining option list.

Exchange Rate Applied

Numeric; 21 Characters; Optional

Specify the exchange rate applied.

Transaction Currency Amount

Numeric; 30 Characters; Optional

Specify the transaction currency amount.

Override Exchange Rate

Optional

Select the exchange rate is overridden or not from the drop-down list. The list displays the following values:

- Yes

- No

FX Deal Date

Date Format; Optional

Select FX deal date from the adjoining calendar.

FX Value Date

Date Format; Optional

Select the FX value date from the adjoining calendar.

If exchange rate details are not available for any settlement when the transaction or policy is entered, the system will not generate a UT transaction. Once all the settlement details have been enriched in the ‘Policy Transaction Exchange Rate Enrichment’ screen and the ‘FCIS Enrich Exchange Rate Detail’ screen, the system will compute the transaction amount and generate the UT transaction. If it is not enriched, then the system will pick the exchange rate during EOD and generate the UT transaction.

Interest Details

When you click the ‘Enrich’ button in the ‘Transaction Detail’ tab, if the investment amount has been deposited prior to the transaction date, the system will calculate and display the interest on the payment amount in the ‘Policy Information’ tab. The interest will be calculated from the date of payment till the transaction date.

When you click ‘Calculate Interest’ button in the ‘Settlement Details’ screen, the system will calculate and display the interest amount in the ‘Interest Amount’ field in the same screen.

Interest Rate

Numeric; 30 Characters; Optional

Enter the rate of interest that is to be used to calculate interest amount for the particular currency. Alternatively, you can maintain the interest rate in the ‘Interest Rate Maintenance’ screen. If you do not maintain an interest rate, the system will take it as null.

Interest Amount

Numeric; 30 Characters; Optional

Specify the interest amount.

Interest Amount in Transaction Currency

Numeric; 30 Characters; Optional

Specify the interest amount in terms of the transaction currency.

Interest Calc. Days

Numeric; 30 Characters; Optional

Specify the number of days for which interest calculation has to be done for a policy top-up based on the payment date and transaction date.

Basis Days

Optional

Select the interest basis days, based on which the interest will be calculated. The options available are:

- 360 days

- 365 days

2.8.5 Broker Details Tab

Click the ‘Broker Details’ tab to enter details of brokers for the transaction.

Broker Code

Alphanumeric; 9 Characters; Mandatory

Specify the Broker Mapped for the Policy from the option list.

Broker Name

Display

Upon selection of the broker code, the system displays the name of the selected broker code.

Split Percentage

Percentage Format, Mandatory if you select any broker in the Intermediary field.

Specify the percentage of the commission that the selected broker is entitled to receive on any transactions put through for the investor.

This percentage must not exceed one hundred percent.

Note

If you specify more than one broker in this section, the split percentages for all brokers, when summed up, must not exceed or fall below one hundred percent.

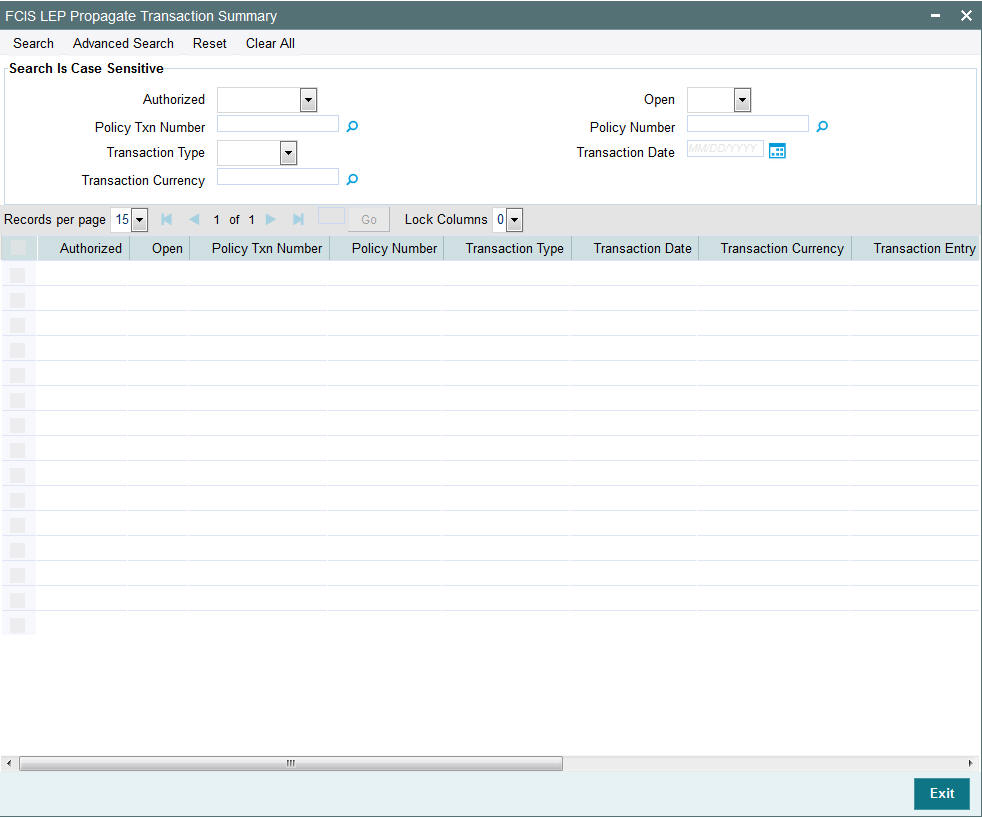

2.9 FCIS LEP Propagate Transaction Summary

This section contains the following topics:

- Section 2.9.1, "Retrieving Record in FCIS LEP Propagate Transaction Summary screen"

- Section 2.9.2, "Editing an FCIS LEP Propagate Transaction Record "

- Section 2.9.3, "Viewing an FCIS LEP Propagate Transaction Record"

- Section 2.9.4, "Deleting an FCIS LEP Propagate Transaction Record"

- Section 2.9.5, "Authorizing an FCIS LEP Propagate Transaction Record"

- Section 2.9.6, "Amending an FCIS LEP Propagate Transaction Record"

- Section 2.9.7, "Authorizing an Amended FCIS LEP Propagate Transaction Record"

2.9.1 Retrieving Record in FCIS LEP Propagate Transaction Summary screen

You can retrieve a previously entered record in the Summary Screen, as follows:

Invoke the ‘FCIS LEP Propagate Transaction Summary’ screen by typing ‘LESPRTXN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Policy Txn Number

- Policy Number

- Transaction Type

- Transaction Date

- Transaction Currency

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Policy Txn Number

- Press F8

You can perform Edit, Delete, Amend, Authorize operations by selecting the operation from the Action list.

2.9.2 Editing an FCIS LEP Propagate Transaction Record

You can modify the details of an FCIS LEP Propagate Transaction record that you have already entered into the system, provided it has not been subsequently authorized and if it has not been attached to any propagation. If the transaction has been propagated, then you will not be allowed to modify it.

You can perform this operation as follows:

- Invoke the FCIS LEP Propagate Transaction Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The FCIS LEP Propagate Transaction screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The FCIS LEP Propagate Transaction screen is closed and the changes made are reflected in the FCIS LEP Propagate Transaction Summary screen.

2.9.3 Viewing an FCIS LEP Propagate Transaction Record

To view a record that you have previously input, you must retrieve the same in the FCIS LEP Propagate Transaction Summary screen as follows:

- Invoke the FCIS LEP Propagate Transaction Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The FCIS LEP Propagate Transaction screen is displayed in View mode.

2.9.4 Deleting an FCIS LEP Propagate Transaction Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the FCIS LEP Propagate Transaction Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The FCIS LEP Propagate Transaction screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

2.9.5 Authorizing an FCIS LEP Propagate Transaction Record

An unauthorized FCIS LEP Propagate Transaction record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the FCIS LEP Propagate Transaction Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS LEP Propagate Transaction screen is displayed. Select Authorize operation from the Action List.

2.9.6 Amending an FCIS LEP Propagate Transaction Record

After an FCIS LEP Propagate Transaction record is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the FCIS LEP Propagate Transaction Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS LEP Propagate Transaction screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

2.9.7 Authorizing an Amended FCIS LEP Propagate Transaction Record

An amended FCIS LEP Propagate Transaction record must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module.

The subsequent process of authorization is the same as that for normal records.

2.10 Annuities and Premium Transactions

This section contains the following topics:

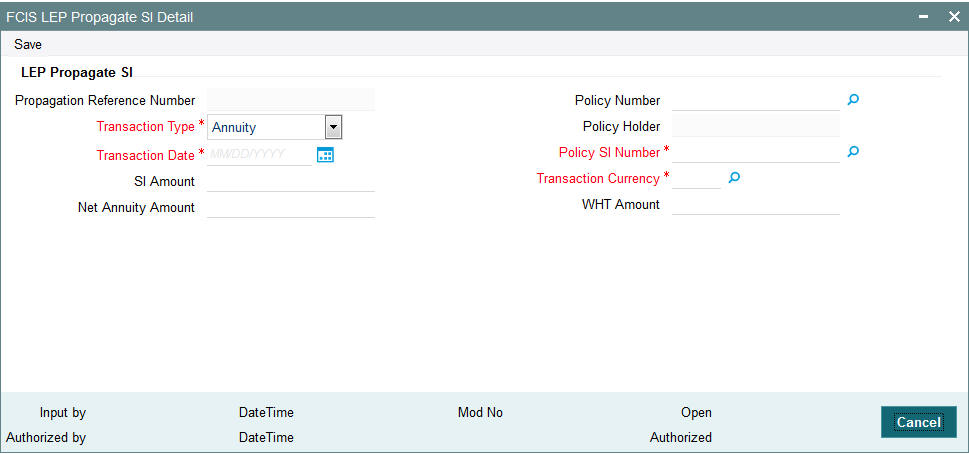

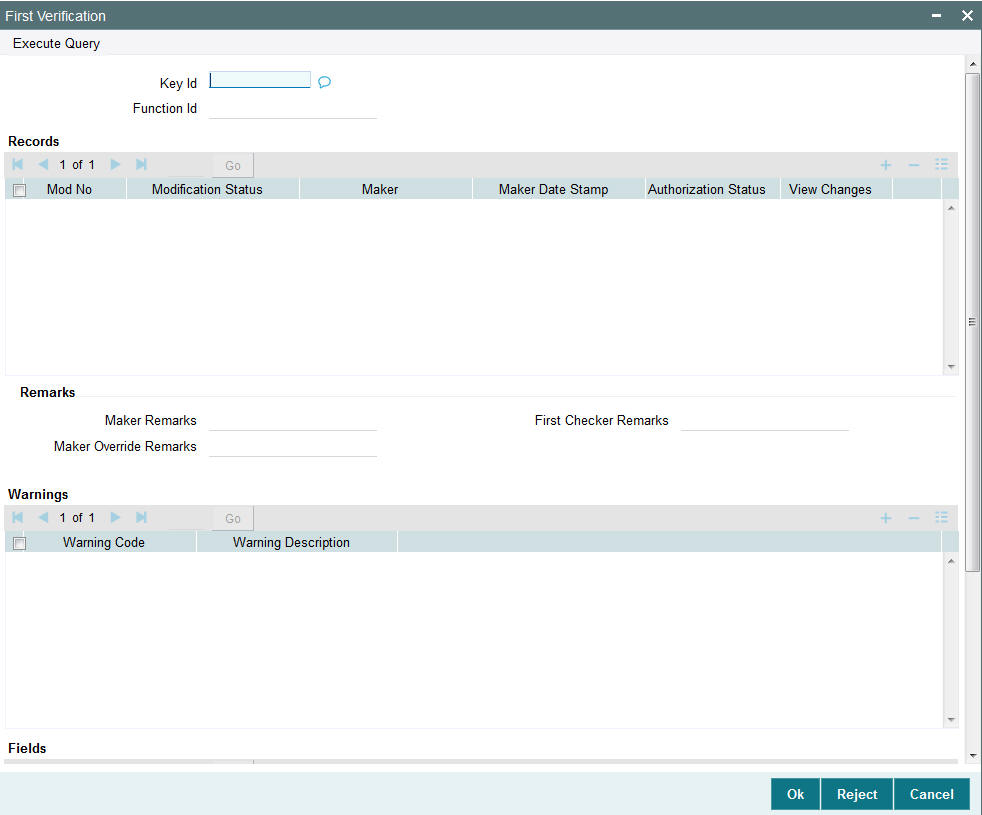

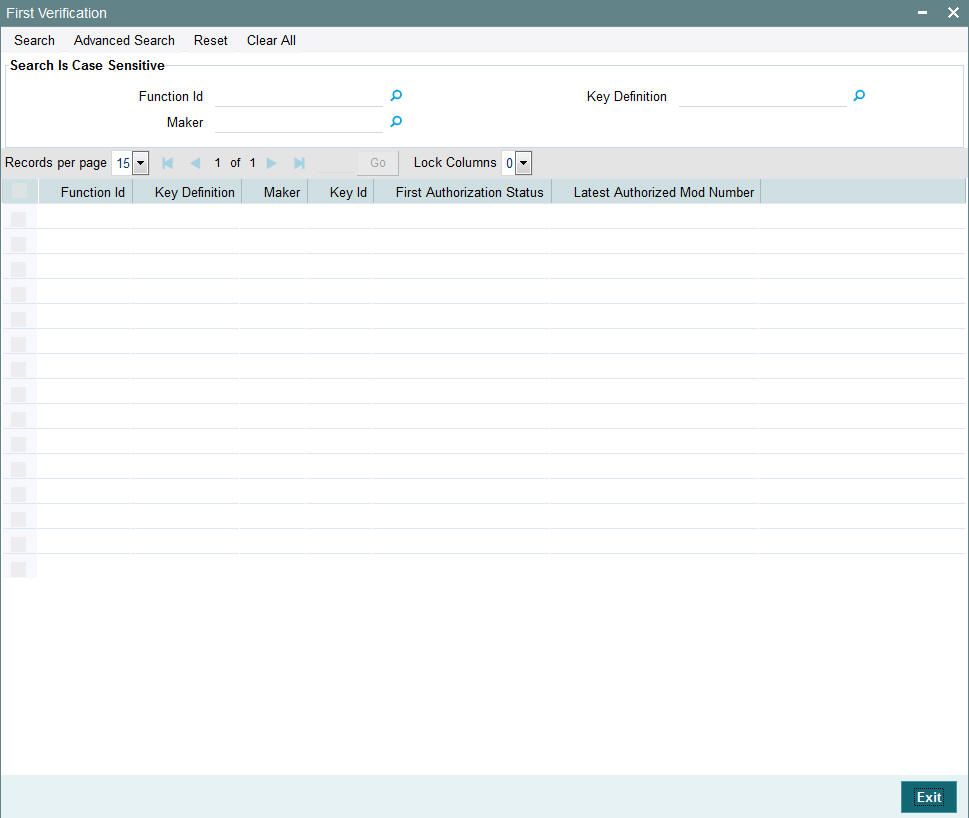

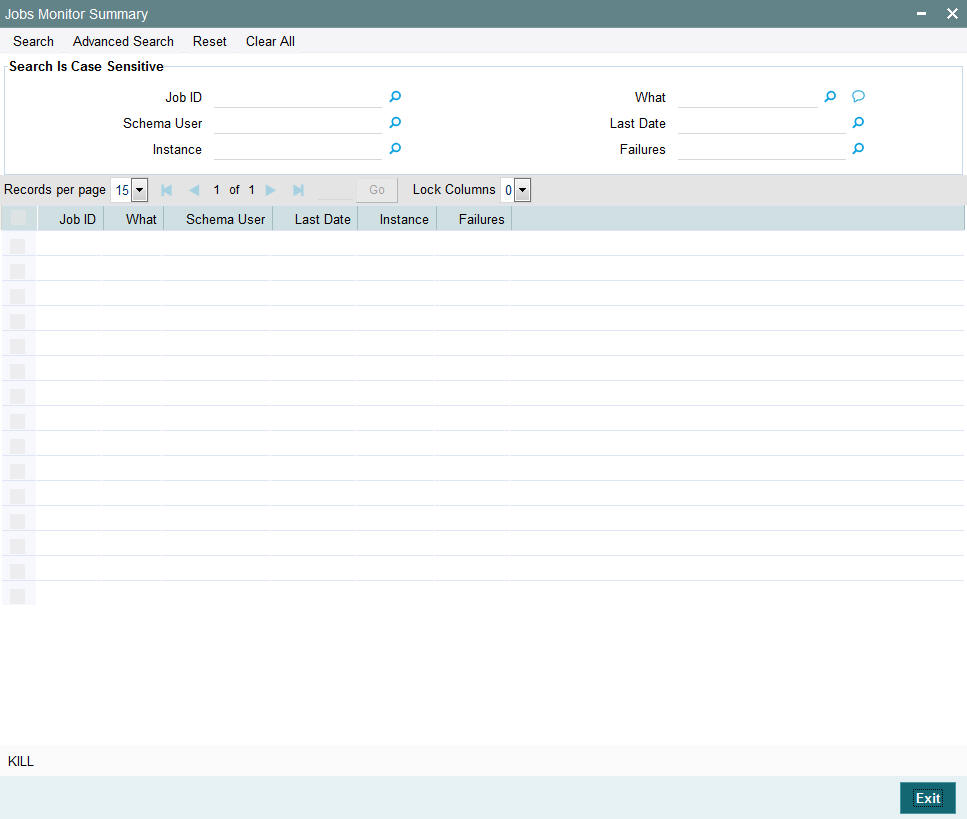

2.10.1 Creating Annuities and Premium Transactions

Similar to the way policy transactions are entered in the system, annuities and premium related transactions can be entered for propagation in the ‘FCIS LEP Propagate SI Details’. You can invoke this screen by typing ‘LEDPROSI’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

Enter the following details:

LEP Propagate SI

Propagation Reference Number

Display

The system displays the propagation reference number.

Transaction Type

Mandatory

Select, from the adjoining drop-down list, the transaction type. You have the following options:

- Annuity

- Recurring Premium

- Recurring Switch

Transaction Date

Date Format; Mandatory

Select the date of transaction from the adjoining option list.

SI Amount

Numeric; 30 Characters; Optional

This is the value for which the SI will be generated.. You can give either SI amount or Net Annuity amount and WHT amount. If SI amount alone is entered system will compute the WHT amount if applicable. If SI amount is given, Net annuity amount and WHT amount should not be specified.

Net Annuity Amount

Numeric; 15 Characters; Optional

You can enter either SI amount or Net Annuity amount and WHT amount. If Net annuity amount and WHT amount are entered, the system will generate an SI with Net annuity amount and a WHT redemption transaction for the WHT amount.

Policy Number

Alphanumeric; 16 Characters; Optional

Enter the policy number for which SI should be generated.

Policy Holder

Display

The system will display the Unitholder of the policy.

Policy SI Number

Alphanumeric; 16 Characters; Mandatory

You need to choose the policy SI maintenance for which an adhoc SI to be generated

Transaction Currency

Alphanumeric; 3 Characters; Mandatory

Enter the transaction currency for the SI transaction.

WHT Amount

Numeric; 15 Characters; Optional

You can enter either SI amount or Net Annuity amount and WHT amount. If Net annuity amount and WHT amount is entered, the system will generate an SI with Net annuity amount and a WHT redemption transaction for the WHT amount.

2.11 FCIS LEP Propagate SI Summary

This section contains the following topics:

- Section 2.11.1, "Retrieving Record in FCIS LEP Propagate SI Summary screen"

- Section 2.11.2, "Editing an FCIS LEP Propagate SI Record "

- Section 2.11.3, "Viewing an FCIS LEP Propagate SI Record"

- Section 2.11.4, "Deleting an FCIS LEP Propagate SI Record"

- Section 2.11.5, "Authorizing an FCIS LEP Propagate SI Record"

- Section 2.11.6, "Amending an FCIS LEP Propagate SI Record"

- Section 2.11.7, "Authorizing an Amended FCIS LEP Propagate SI Record"

2.11.1 Retrieving Record in FCIS LEP Propagate SI Summary screen

You can retrieve a previously entered record in the Summary Screen, as follows:

Invoke the ‘FCIS LEP Propagate SI Summary’ screen by typing ‘LESPROSI’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Propagation Reference Number

- Transaction Type

- Transaction Date

- Policy SI Number

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Propagation Reference Number

- Press F8

You can perform Edit, Delete, Amend, Authorize operations by selecting the operation from the Action list.

2.11.2 Editing an FCIS LEP Propagate SI Record

You can modify the details of an FCIS LEP Propagate SI record that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the FCIS LEP Propagate SI Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The FCIS LEP Propagate SI screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The FCIS LEP Propagate SI screen is closed and the changes made are reflected in the FCIS LEP Propagate SI Summary screen.

2.11.3 Viewing an FCIS LEP Propagate SI Record

To view a record that you have previously input, you must retrieve the same in the FCIS LEP Propagate SI Summary screen as follows:

- Invoke the FCIS LEP Propagate SI Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The FCIS LEP Propagate SI screen is displayed in View mode.

2.11.4 Deleting an FCIS LEP Propagate SI Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the FCIS LEP Propagate SI Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The FCIS LEP Propagate SI screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

2.11.5 Authorizing an FCIS LEP Propagate SI Record

An unauthorized FCIS LEP Propagate SI record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the FCIS LEP Propagate SI Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS LEP Propagate SI screen is displayed. Select Authorize operation from the Action List.

2.11.6 Amending an FCIS LEP Propagate SI Record

After an FCIS LEP Propagate SI record is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the FCIS LEP Propagate SI Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS LEP Propagate SI screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

2.11.7 Authorizing an Amended FCIS LEP Propagate SI Record

An amended FCIS LEP Propagate SI record must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module.

The subsequent process of authorization is the same as that for normal records.

2.12 Processing Transactions

You can propagate different combinations of transactions and operations in the back data propagation and transaction screens. The workflow for each combination of transaction and operation is detailed in the table below:

Transaction |

Operation |

Scenario |

Workflow |

Policy Initial Investment |

Modify Only initial investment amount modification would be supported. |

Policy captured with wrong initial investment amount. |