2. Processing Cheque Book Requests

An investor could avail the use of cheque books for a fund. You can maintain details of cheque books requested by an investor, as well as the status of individual checks in a cheque book that has been issued.

This chapter contains the following sections:

- Section 2.1, "Cheque Book Requests"

- Section 2.2, "Send Details of Cheque Book Requests "

- Section 2.3, "Receive Details of Printed Cheque Books "

- Section 2.4, "Make Changes to Cheque Book Requests"

- Section 2.5, "Statuses for Individual Cheque"

- Section 2.6, "Cheque Writing Status Detail"

- Section 2.7, "Cheque Writing Status Summary"

2.1 Cheque Book Requests

This section contains the following topics:

- Section 2.1.1, "Processing Cheque Book Requests"

- Section 2.1.2, "Before Entering Cheque Book Request"

- Section 2.1.3, "Entering Cheque Book Request in Cheque Book Request Screen"

2.1.1 Processing Cheque Book Requests

To maintain details of requested cheque books and update the status of checks in each issued cheque book, use the ‘Cheque Book Request Detail’ screen. You can invoke this screen by typing ‘UTDCHKRQ’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

2.1.2 Before Entering Cheque Book Request

Only those investors, for whom the cheque writing facility has been allowed in their account profiles, can avail the use of cheque books for a fund. Also, rules for the cheque writing facility must also be maintained for the fund for which the cheque books has been requested by the investor.

Typically, cheque books requested by investors for a fund are printed by external agencies known as cheque vendors that enter into an agreement with the AMC, to print the cheques on the investor’s behalf. You must maintain a record for each cheque vendor with whom the AMC has entered into such an agreement, as an entity in the Entity Maintenance, in FCIS. You must also associate each cheque vendor with the funds for which the vendor can print cheques. You do this in the Fund Entity screen.

2.1.3 Entering Cheque Book Request in Cheque Book Request Screen

To enter a cheque book request in the Cheque Book Request screen, you must specify the following details:

Specifying the unit holder

You must specify the unit holder who has requested the use of a cheque book. Only those unit holders, for whom cheque writing is allowed, as part of their account profiles, may avail the use of a cheque book.

Specifying the fund

You must specify the fund for which the unit holder has requested the use of a cheque book. Rules for cheque writing should already have been maintained for such a fund.

Specifying the cheque vendor

You must also specify the cheque vendor who will print the cheque books on behalf of the investor. Only those cheque vendors associated with the selected fund for which the cheque book is being requested, can be specified.

Specifying cheque book details

You must also specify the details of the cheque book being printed, such as the number of the cheque book, the currency in which it is being issued and any remarks.

Specifying the status of a cheque book request

When a new cheque book request is being filled in, in this screen, you must mark the status of the cheque book as ‘Cheque book Applied’. The interface that you have defined for exporting details for cheque book requests to the designated vendors, when executed, will only pick up those requests whose status is ‘Cheque book Applied’. After the interface is successfully executed, the status of the requests processed is automatically marked as ‘Sent to Vendor’.

After a cheque book request has been sent to the designated cheque vendor, if there is any discrepancy reported by the vendor while downloading the cheque book request, you must manually change the status to ‘Discrepancy Noticed’, by either editing or amending the request.

When the details of cheque books printed and issued against each request are received from the vendors and uploaded into the system, the status of all issued cheque books is marked as ‘Cheque Status Maintained’. In this status, the details of all cheques that are part of the issued cheque book are maintained in the system.

When all cheques in the cheque book have been used up, the status of the book is marked as ‘Cheque Book Exhausted’. You will need to either edit or amend the record to mark this status. In this status, all cheques contained in the book are marked ‘Invalid’.

If, for any reason, the cheque book stands cancelled, and you have received notification to that effect, you must edit or amend the cheque book request and mark the status as ‘Cancelled’. In this status, all cheques contained in the book are marked ‘Invalid’.

You can also monitor the status of individual cheques in the cheque book, through the Cheque Status Summary screen.

You can specify the following fields in this screen:

Unit Holder ID

Alphanumeric; 12 Characters Maximum; Mandatory

In this field, you can indicate the unit holder for whom the cheque book request is being entered. You can use the ‘Find UH’ button to view a list of unit holders for whom the cheque writing facility has been allowed in their account profiles, and select the required unit holder from this list.

You cannot enter a cheque book request for a unit holder for whom the cheque writing facility is not allowed, in the account profile.

Fund ID

Alphanumeric; 6 Characters; Mandatory

In this field, you can indicate the fund for which the unit holder made the cheque book request. You cannot enter a cheque book request for a unit holder in a fund for which rules for cheque writing facility have not been defined.

When you specify the ID of the fund, the ISIN Code of the fund is displayed in the ISIN Code field.

ISIN Code

Alphanumeric; 25 Characters; Optional

Select the ISIN Code of the selected fund. If you specify the ISIN Code of a fund, the ID of the fund is displayed in the Fund field.

Entity ID

Alphanumeric; 12 Characters; Mandatory

Indicate the cheque vendor to whom the cheque book request will be sent for printing. You can select the list of cheque vendors associated with the selected fund, select the required vendor from the option list.

Entity Name

Display

The name of the vendor that you select is displayed in the Entity Name field.

Cheque Book Details

Cheque Book Number

Alphanumeric; 16 Characters; Mandatory

Specify the number of the cheque book that has been requested. This is the identification for the cheque book in the system. The number you specify here must not be used to identify any other cheque book in the system, for the same unit holder and fund combination.

Cheque Currency

Alphanumeric; 3 Characters; Optional

In this field, you can indicate the currency in which the cheque amounts will be expressed, on a cheque issued from the requested cheque book. All currencies allowed for the selected fund (in the Fund Transaction Currency Rule) are displayed in the option list.

Status

Alphanumeric; 50 Characters; Optional

This field is used to assign a status to a cheque book. The individual cheque in the book may have different statuses, which are different from the status of the cheque book. You can choose the status of the cheque book that is being requested from the drop-down list. The list contains statuses defined to be applicable to cheque books, in the System Parameters.

The following statuses are possible for a cheque book:

- Cheque Book Applied: You must mark this status when a cheque book request is entered for the first time in this screen. This is the only status you can assign when you are entering a new request in this screen.

- Sent to Vendor: The system automatically marks this status for all cheque book requests that are sent to the designated vendor for printing.

- Discrepancy Noticed: You can mark this status when a vendor reports a discrepancy in a cheque book request, while processing it. You can only mark this status by editing or amending the cheque book request with the status ‘Sent to Vendor’.

- Cheque Status Maintained: The system automatically marks this status when the file containing details of printed and issued cheque books is received from the vendor and uploaded into the system. In this status, details of each cheque in the cheque book are maintained in the system.

- Cheque Book Exhausted: You can mark this status when all the cheques in a cheque book have been used up. In this status, all cheques in the book are marked ‘Invalid’. You can only mark this status by editing or amending the cheque book request with the status ‘Cheque Status Maintained’.

- Cancelled: You can mark this status when notification is received that the cheque book stands cancelled. In this status, all cheques in the book are marked ‘Invalid’. You can only mark this status by editing or amending the cheque book request.

Remarks

Alphanumeric; 200 Characters; Optional

You can specify any relevant narrative regarding the requested cheque book in this field.

2.2 Send Details of Cheque Book Requests

To send details of cheque book requests entered into the system through the Cheque Book Request screen to the designated cheque vendors, you must define an interface, through the Interface Definition facility.

The interface, when executed on a given business day, sends all authorized cheque book requests with status ‘Cheque book Applied’, received during the day, as an export file, to the designated cheque vendors.

You must manually execute the interfaces on each business day. If you fail to do so, the pre-end of day cheques performed by the system prompts you to do so. To execute the interfaces, use the Online Execution of Interfaces menu option.

2.3 Receive Details of Printed Cheque Books

To upload details of cheque books printed by vendors against requests received, you must define an interface, through the Interface Definition facility. The cheque books are uploaded as authorized records.

The interface, when executed on a given business day, uploads all authorized cheque books printed by vendors against requests received during the day, from an import file sent by the vendors.

You must manually execute the interfaces on each business day. If you fail to do so, the pre-end of day cheques performed by the system prompts you to do so. To execute the interfaces, use the Online Execution of Interfaces menu option.

2.4 Make Changes to Cheque Book Requests

This section contains the following topics:

- Section 2.4.1, "Invoking the Cheque Book Request Summary Screen"

- Section 2.4.2, "Retrieving a Cheque Book Request Record"

- Section 2.4.3, "Editing a Cheque Book Request Record"

- Section 2.4.4, "Viewing a Cheque Book Request Record"

- Section 2.4.5, "Deleting a Cheque Book Request Record "

- Section 2.4.6, "Authorizing a Cheque Book Request Record"

- Section 2.4.7, "Amending a Cheque Book Request Record"

- Section 2.4.8, "Authorizing a Cheque Book Request Record"

2.4.1 Invoking the Cheque Book Request Summary Screen

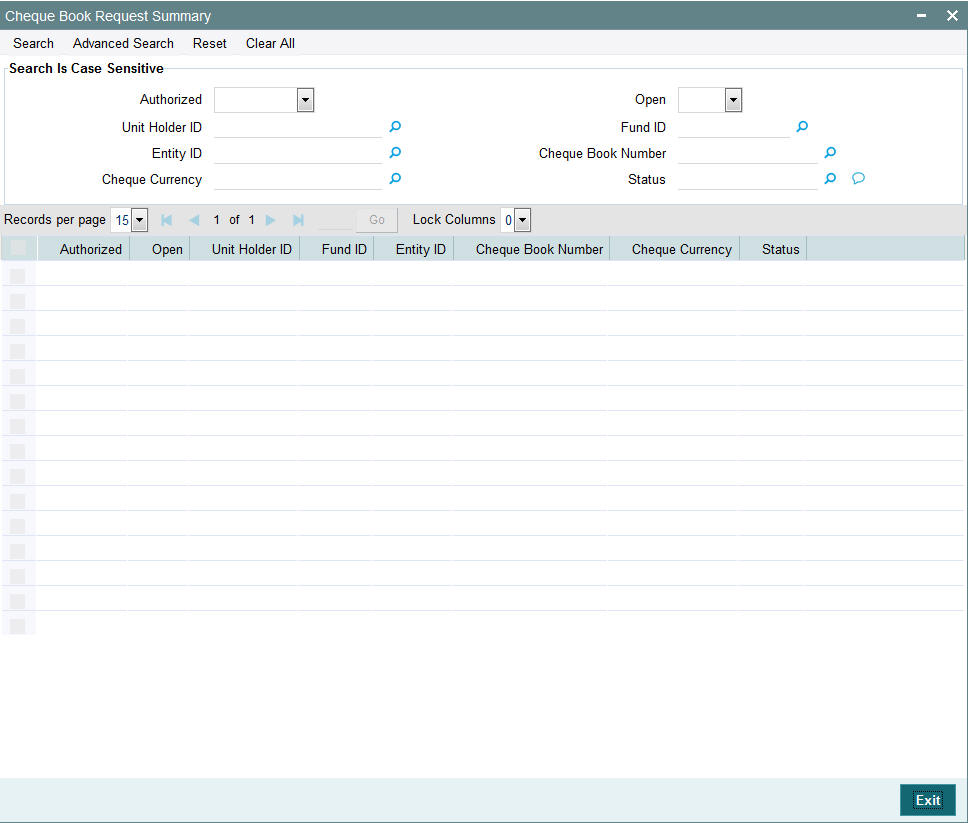

If a cheque book request has been entered incorrectly, you can make changes to the details of the request, through the ‘Cheque Book Request Summary’ screen.

You can invoke this screen by typing ‘UTSCHKRQ’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can make changes both before the request is authorized, and also after.

You can change the following details:

- Cheque Book Number

- Cheque vendor

- Cheque book status

- Cheque book issue currency

In the summary screen, you can select a cheque book request for which you want to make changes, by specifying any or all of the following details:

- The ID of the unit holder who requested the cheque book

- The ID and ISIN Code of the fund for which the cheque book request was made

- The cheque vendor to whom the cheque book request was sent for printing

- The number of the cheque book

The following operations are possible in through the Cheque Book Request Summary screen:

2.4.2 Retrieving a Cheque Book Request Record

You can retrieve a previously entered record in the Summary Screen, as follows:

In the Browser, select Cheque Book Request menu and click on Summary, specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Unit Holder ID

- Fund ID

- Entity ID

- Cheque Book Number

- Cheque Currency

- Status

Click 'Search' to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input Fund ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

Example

You can search the record for Fund ID by using the combination of % and alphanumeric value as follows:-

- Search by A% :- System will fetch all the records whose Fund ID starts from Alphabet ‘A’. For example, AGC17,AGVO6,AGC74 etc.

- Search by %7 :- System will fetch all the records whose Fund ID ends by numeric value’ 7’. For example, AGC17,GSD267,AGC77 etc.

- Search by %17%:- System will fetch all the records whose Fund ID contains the numeric value 17. For example, GSD217,GSD172, AGC17 etc.

2.4.3 Editing a Cheque Book Request Record

You can modify the details of a cheque book request record that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Cheque Book Request Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click 'Search'. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Cheque Book Request Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Cheque Book Request Detail screen is closed and the changes made are reflected in the Cheque Book Request Summary screen.

2.4.4 Viewing a Cheque Book Request Record

To view a record that you have previously input, you must retrieve the same in the Cheque Book Request Summary screen as follows:

- Invoke the Cheque Book Request Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorized field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click 'Search'. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Cheque Book Request Detail screen is displayed in View mode.

2.4.5 Deleting a Cheque Book Request Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Cheque Book Request Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click 'Search'. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The Cheque Book Request Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

2.4.6 Authorizing a Cheque Book Request Record

An unauthorized Cheque Book Request record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Cheque Book Request Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click 'Search'. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Cheque Book Request Detail screen is displayed. Select Authorize operation from the Action List.

When a checker authorizes a transaction, details of validation, if any, that were overridden by the maker of the transaction during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the transaction.

2.4.7 Amending a Cheque Book Request Record

After a Cheque Book Request record is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the Cheque Book Request Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click 'Search'. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Cheque Book Request Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

2.4.8 Authorizing a Cheque Book Request Record

An amended Cheque Book Request record must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module and Agency Branch module.

The subsequent process of authorization is the same as that for normal transactions.

2.5 Statuses for Individual Cheque

This section contains the following topics:

2.5.1 Monitoring Statuses for Individual Cheque

A unit holder who uses the cheque writing facility could issue cheques to third parties for a transaction.

The bank at which the cheque is presented communicates with the AMC and sends the cheque details to the AMC. A redemption transaction is initiated for the unit holder who issued the cheque, in the fund for which the cheque was issued.

The used cheque details are typically sent to the AMC as a file, the contents of which may be uploaded into the system. You must define an interface that will upload the details from the file and also automatically trigger the generation of redemption transactions based on the cheque details.

Each cheque in an issued cheque book will pass through different statuses in the cycle of issue through clearing. To monitor the status of a cheque in the system, use the Cheque Status Summary screen.

The active status

When a cheque book is printed and issued against a request, and the details of the cheque book sent by a vendor are uploaded into the system, each cheque in the issued cheque book is marked with the ‘active’ status. This means that the cheque is now available to the unit holder to be issued to a third party for a transaction.

A stop payment instruction could be issued on an active cheque. An active cheque could also be rendered lost, if the unit holder misplaces it, or a third party to whom it is issued, misplaces it before presenting it at the bank.

You can manually change the status of active cheques in a cheque book as ‘Stop Payment Issued’, ‘Lost’, or ‘Inactive’, as deemed necessary, by amending the cheque status in the Cheque Status Summary Screen.

A change in status of the original cheque book request could also affect the status of an active cheque in the cheque book. For instance, if the original request is marked with ‘Cancelled’ status, then all cheques in the cheque book would automatically be marked ‘Invalid’.

The ‘Used’ status

Any cheque that has been issued by a unit holder, for which the details have been received by the AMC from the bank or clearing house, and uploaded into the system, is automatically marked as ‘Used’.

For such cheques, redemption transactions are generated when you execute the interface that you have defined, through the Online Execution of Interfaces option. If the transaction is generated successfully, the status of the ‘Used’ cheque is marked as ‘Redemption Cleared’.

If the redemption transaction fails to be generated successfully, the status of the ‘Used’ cheque is marked as ‘Redemption Failed’.

If the redemption transaction generated for the cheque is amended, the status of the used cheque is marked as ‘Redemption Amended’.

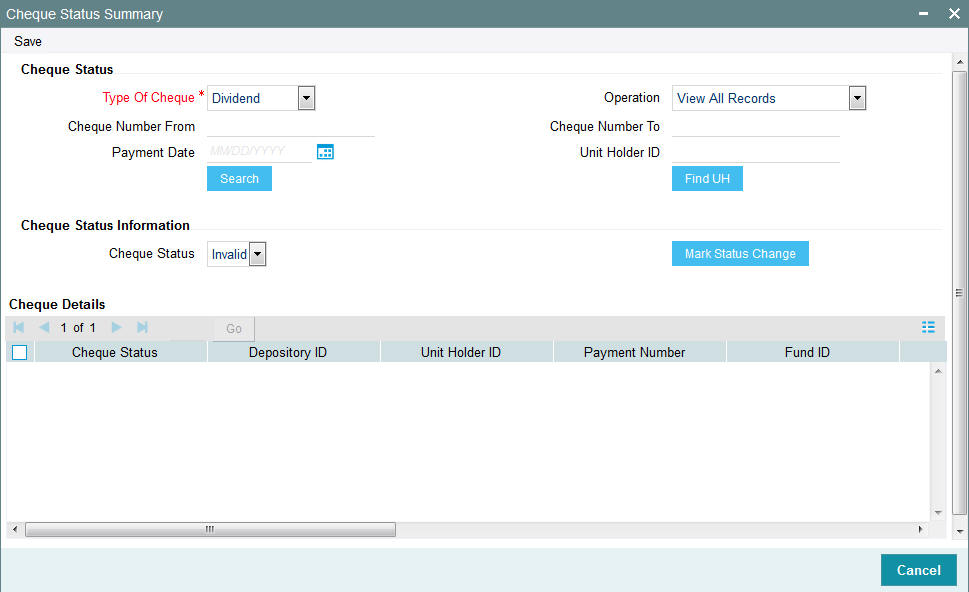

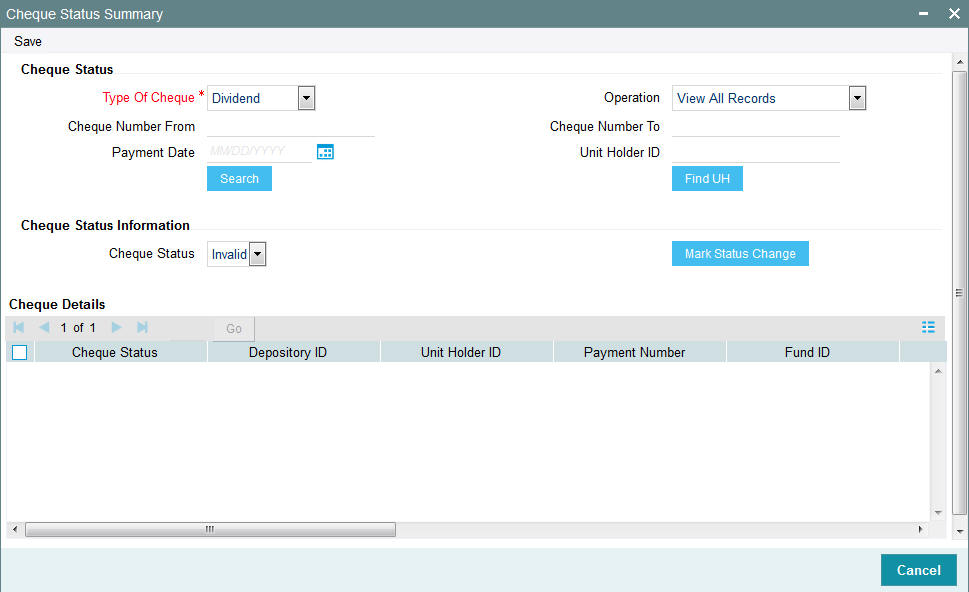

Selecting a cheque in the Cheque Status Summary screen

To recall, you can effect manual status changes on an active cheque, in the Cheque Status Summary screen. You can also view the status of active or used cheques. You can invoke this screen by typing ‘UTDCHKST’ in the field at the top right corner of the Application tool bar and click the adjoining arrow. The screen is displayed below:

You can manually change the status of an active cheque to ‘Stop Payment Issued’ or ‘Lost’, through this screen.

To select a cheque in this screen, you must specify the following details that the system will use to identify and retrieve the cheque record:

- The number of the cheque

- The ID of the unit holder who issued the cheque

- The ID of the fund for which the cheque was issued, and the ISIN Code for the fund.

- The number of the redemption transaction that was generated for the cheque

- The status of the cheque

You could also specify the number of the cheque book that contained the cheque issued, as well as the ID of the cheque vendor who printed the cheque book.

If you do not select any criteria for the search, all the records are displayed.

The following details are displayed for each cheque:

- The ID of the unit holder that has issued the cheque

- The ID of the fund for which the cheque has been issued

- The ID and name of the cheque vendor

- The number of the cheque book

- The number of the cheque

- The date on which the cheque was assigned the present status

- The currency in which the cheque book was issued

- The transaction number corresponding to the redemption payment made against the cheque

Selecting the operation

To change the status of an active cheque in the Cheque Status Screen, select ‘Amend’ as the operation. The amended record will be saved as an unauthorized record, which you must authorize to make the change effective. To authorize a cheque status amendment, choose ‘Authorize’ as the operation.

To view the status of a cheque, select ‘View’ as the operation.

When you have specified all the details for selecting the cheque and the operation you want to perform, click on ‘OK’ Button. The cheques that match the details you have specified are displayed in the lower list portion of the screen.

In this screen, the details of the cheque you have selected are displayed in View Mode. If you have selected an operation to change the status of the cheque, the Cheque Status field is enabled, with the current status displayed, and you can select the required status by choosing from the options in the drop-down list.

If the operation you have selected is ‘View’, then none of the details in the Cheque Status screen can be changed, including the Cheque Status. The latest status of the cheque is displayed here.

You can specify the fields in the Cheque Status Summary Screen:

Cheque Status Section

The following fields are available in this screen:

Type of Cheque

Mandatory

Specify the type of cheque for which you wish to view details or change the status.

The type can be any of the following:

- Redemption

- Dividend

- Fee /Incentive

- Bonus

Operation

Mandatory

Select the type of operation you wish to perform from the drop-down list:

You can:

- View all records

- View Status Change Records

- Mark Status Change

Note

The field 'Cheque Status' and the button 'Mark Status Change' are enabled only if the type of operation is 'Mark Status Change'

Cheque Number From

Alphanumeric; 16 Characters; Optional

Enter the cheque number from which you wish to perform the operation specified.

Cheque Number To

Alphanumeric; 16 Characters; Optional

Enter the Cheque number till which you require the operation you have specified.

Payment Date

Date Format; Optional

Specify the payment date of the cheque(s).

Unit Holder ID

Alphanumeric; 12 Characters; Optional

Specify the unit holder ID if you want view details/ make changes only for a specific unit holder.

Use the 'UH Find' button to search for the specific unit holder.

Click 'OK' after having specified all the relevant details. The system displays all the relevant details in the 'Cheque Status Details' section.

Cheque Status Information Section

Cheque Status

Optional

The current status of the selected cheque is displayed here. It could be any of the following:

- Lost: Indicates that information has been received from the unit holder that the cheque has been misplaced.

- Invalid: Indicates that the original cheque book that contained this issued cheque has been marked with the status ‘Cancelled’ or ‘Cheque Book Exhausted’.

Click on the 'Mark Status Change' button to apply the status change to the given cheque.

Cheque Details Section

The system displays the following cheque details:

- Cheque Status

- Depository ID

- Unit Holder ID

- Payment Number

- Fund ID

- Cheque Number

- Cheque Date

- Drawee Bank

- Drawee Branch

- Cheque Amount

- Transaction Number

2.6 Cheque Writing Status Detail

This section contains the following topic:

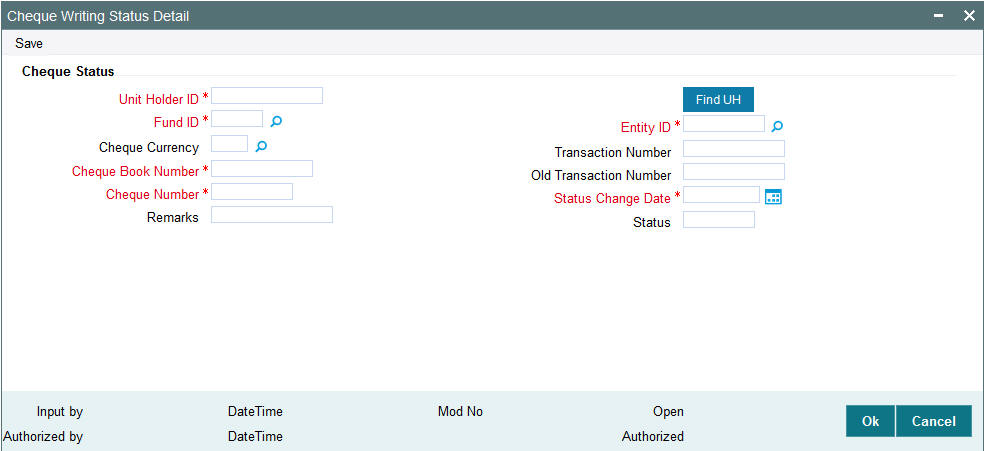

2.6.1 Invoking Cheque Writing Status Detail Screen

You can maintain cheque writing status using ‘Cheque Writing Status Detail’ screen. You can invoke this screen by typing ‘UTDCHWST’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

Cheque Status

Unit Holder ID

Alphanumeric; 16 Characters; Mandatory

Specify the unit holder ID. You can also query for unit holder ID by clicking ‘Find UH’ button.

Fund ID

Alphanumeric; 6 Characters; Mandatory

Specify the Fund ID. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

Cheque Currency

Alphanumeric; 3 Characters; Mandatory

Specify the cheque currency. Alternatively, you can select cheque currency code from the option list. The list displays all valid cheque currency code maintained in the system.

Cheque Book Number

Alphanumeric; 16 Characters; Mandatory

Specify the cheque book number.

Cheque Number

Alphanumeric; 12 Characters; Mandatory

Specify the cheque leaf number.

Remarks

Alphanumeric; 255 Characters; Optional

Specify remarks, if any.

Entity ID

Alphanumeric; 12 Characters; Mandatory

Specify the entity ID. Alternatively, you can select entity ID from the option list. The list displays all valid entity ID maintained in the system.

Transaction Number

Alphanumeric; 16 Characters; Mandatory

Specify the transaction number.

Old Transaction Number

Alphanumeric; 16 Characters; Mandatory

Specify the old transaction number.

Status Change Date

Date Format; Mandatory

Select the status change date from the adjoining calendar.

Status

Alphanumeric; 50 Characters; Optional

Specify the status of the cheque.

2.7 Cheque Writing Status Summary

This section contains the following topics:

- Section 2.7.1, "Retrieving a Record in Cheque Writing Status Summary Screen"

- Section 2.7.2, "Editing Cheque Writing Status Record"

- Section 2.7.3, "Viewing Cheque Writing Status Record "

- Section 2.7.4, "Deleting Cheque Writing Status Record"

- Section 2.7.5, "Authorizing Cheque Writing Status Record "

- Section 2.7.6, "Amending Cheque Writing Status Record "

- Section 2.7.7, "Authorizing Amended Cheque Writing Status Record "

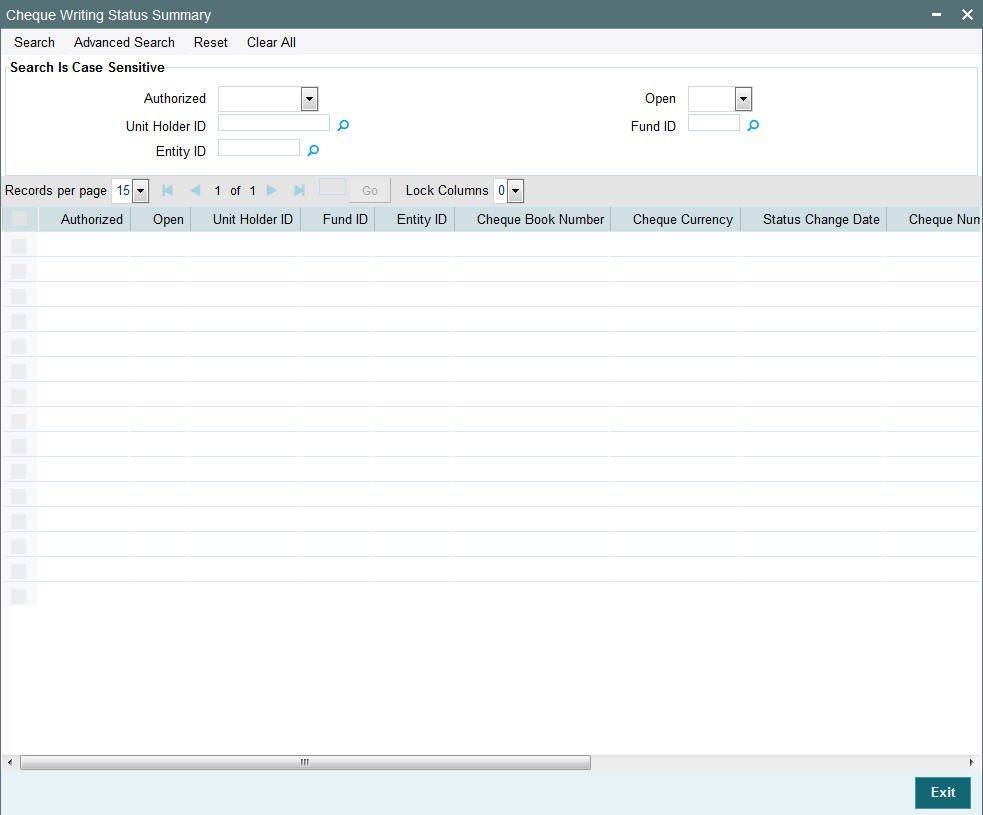

2.7.1 Retrieving a Record in Cheque Writing Status Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

- Invoke the ‘Cheque Writing Status Summary’ screen by

typing ‘UTSCHWST’ in the field at the top right corner

of the Application tool bar and clicking on the adjoining arrow button

and specify any or all of the following details in the corresponding

details.

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Unit Holder ID

- Entity ID

- Fund ID

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Fund ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

For example:

You can search the record for Fund ID by using the combination of % and alphanumeric value as follows:-

- Search by A%:- System will fetch all the records whose Fund ID starts from Alphabet ‘A’. For example:- AGC17,AGVO6,AGC74 etc.

- Search by %7:- System will fetch all the records whose Fund ID ends by numeric value’ 7’. For example: AGC17, GSD267, AGC77 etc.

- Search by %17%:- System will fetch all the records whose Fund ID contains the numeric value 17. For example: GSD217, GSD172, AGC17 etc.

2.7.2 Editing Cheque Writing Status Record

You can modify the details of Cheque Writing Status record that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the Cheque Writing Status Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Cheque Writing Status Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

Click Save to save your changes. The Cheque Writing Status Detail screen is closed and the changes made are reflected in the Cheque Writing Status Summary screen.

2.7.3 Viewing Cheque Writing Status Record

To view a record that you have previously input, you must retrieve the same in the Cheque Writing Status Summary screen as follows:

- Invoke the Cheque Writing Status Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorized field. You can also view all records that are either unauthorized or authorized only, by choosing the unauthorized / Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Cheque Writing Status Detail screen is displayed in View mode.

2.7.4 Deleting Cheque Writing Status Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Cheque Writing Status Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The Cheque Writing Status Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

2.7.5 Authorizing Cheque Writing Status Record

- An unauthorized Cheque Writing Status record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Cheque Writing Status Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Cheque Writing Status Detail screen is displayed. Select Authorize operation from the Action List.

When a checker authorizes a record, details of validation, if any, that were overridden by the maker of the record during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the record.

2.7.6 Amending Cheque Writing Status Record

After a Cheque Writing Status record is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the Cheque Writing Status Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Cheque Writing Status Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes

2.7.7 Authorizing Amended Cheque Writing Status Record

An amended Cheque Writing Status record must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module and Agency Branch module.

The subsequent process of authorization is the same as that for normal transactions.