3. Managing Investor Accounts

This chapter contains the following sections:

- Section 3.1, "Customer Information"

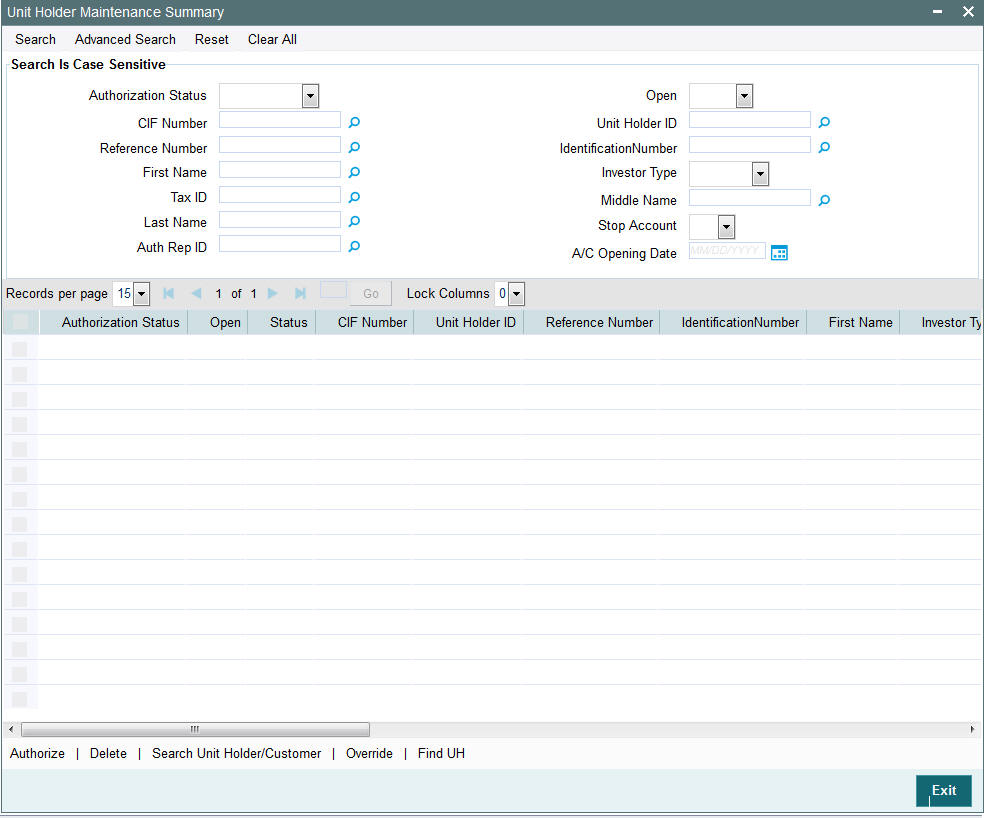

- Section 3.2, "Unit Holder Maintenance Details Screen"

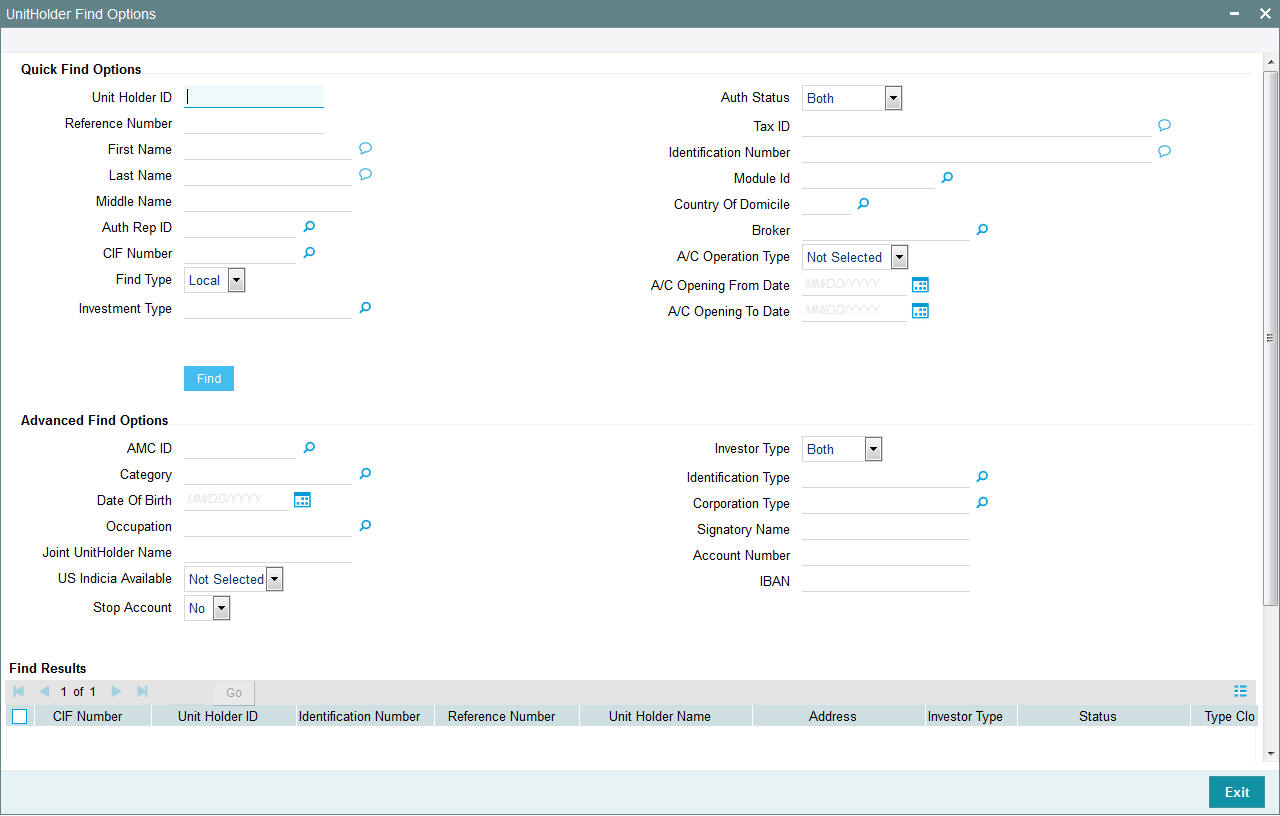

- Section 3.3, "Unit Holder Maintenance Summary Screen"

- Section 3.4, "Unit Holder Find Options"

- Section 3.5, "UH Category Parameter Screen"

- Section 3.6, "UH Category Parameter Summary Screen"

- Section 3.7, "Account Type Maintenance Details Screen"

- Section 3.8, "Account Type Maintenance Summary Screen"

- Section 3.9, "Financial Intelligence Centre Act (FICA)"

- Section 3.10, "Escheatment Tracking"

- Section 3.11, "Export of Unit Holder Information"

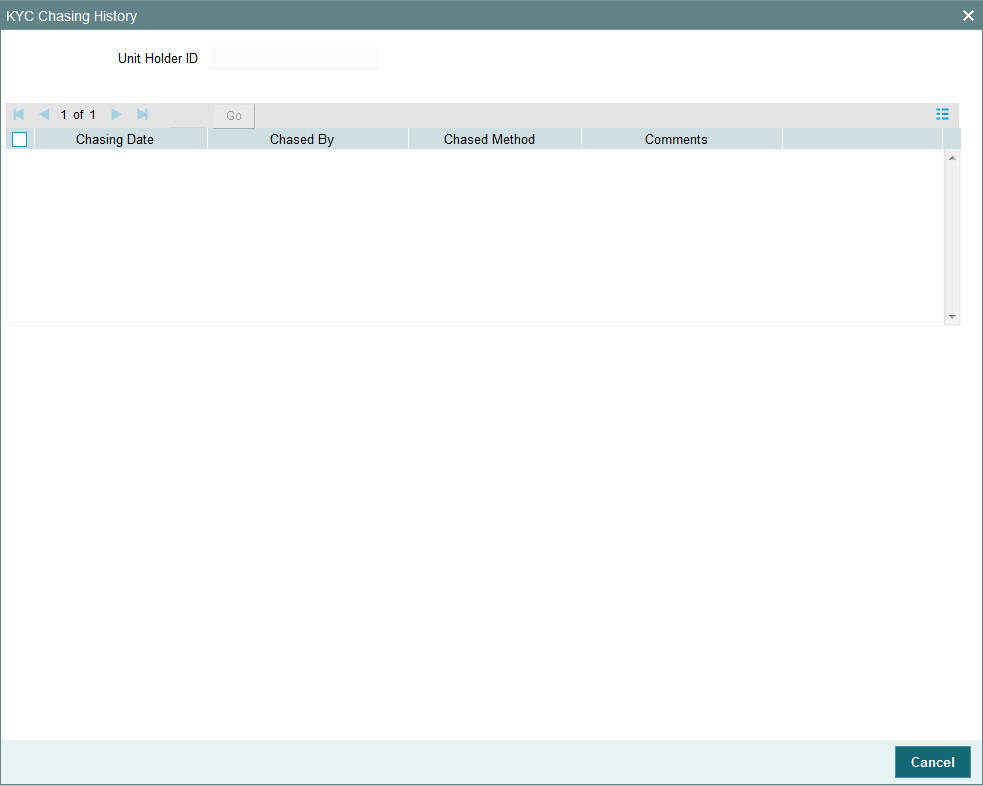

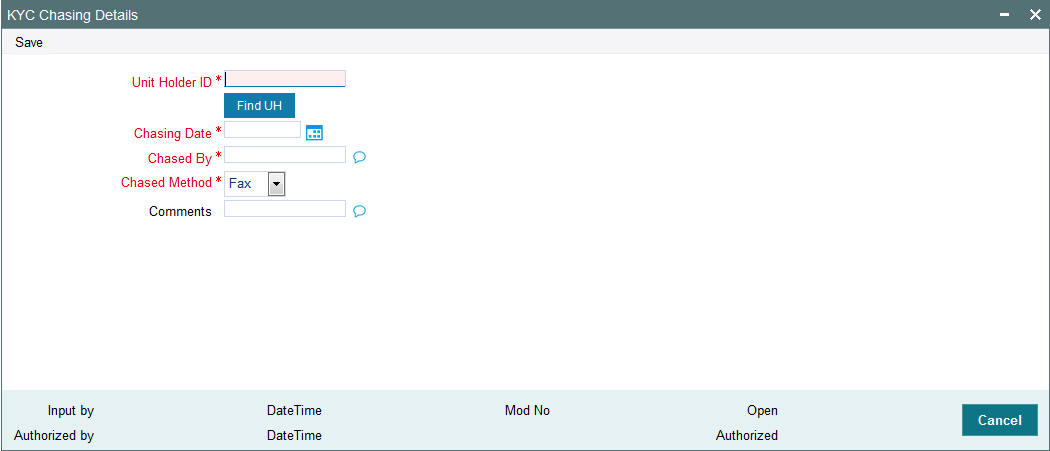

- Section 3.12, "KYC Chasing Details"

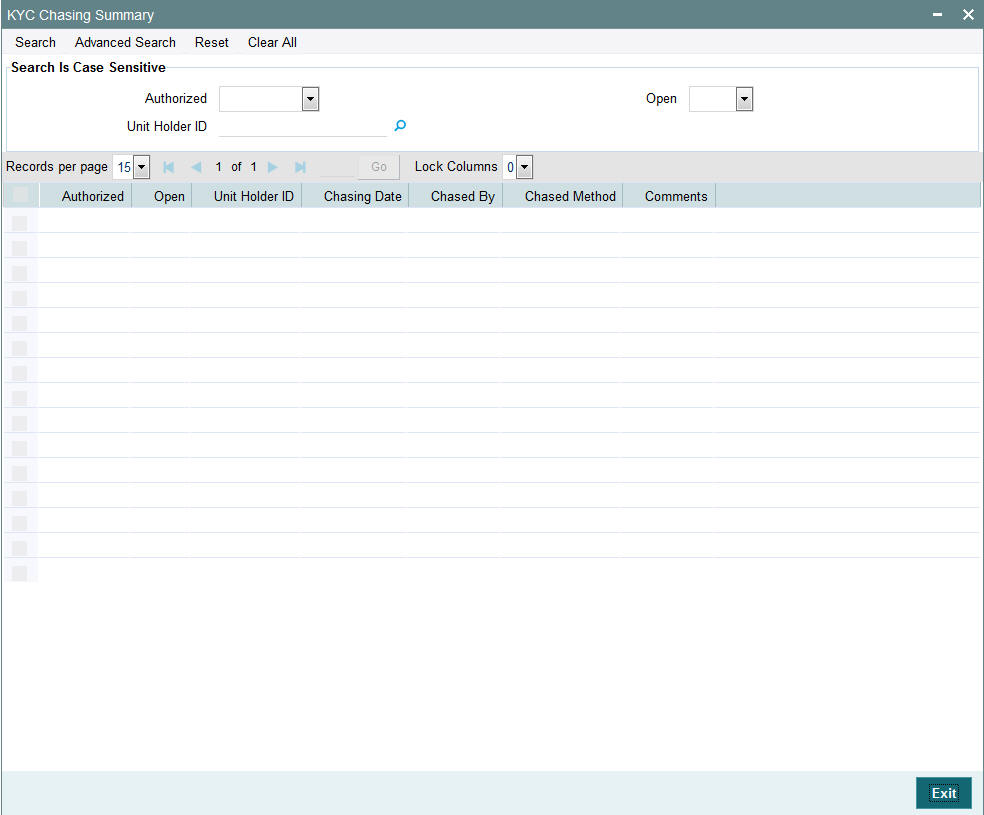

- Section 3.13, "KYC Chasing Summary"

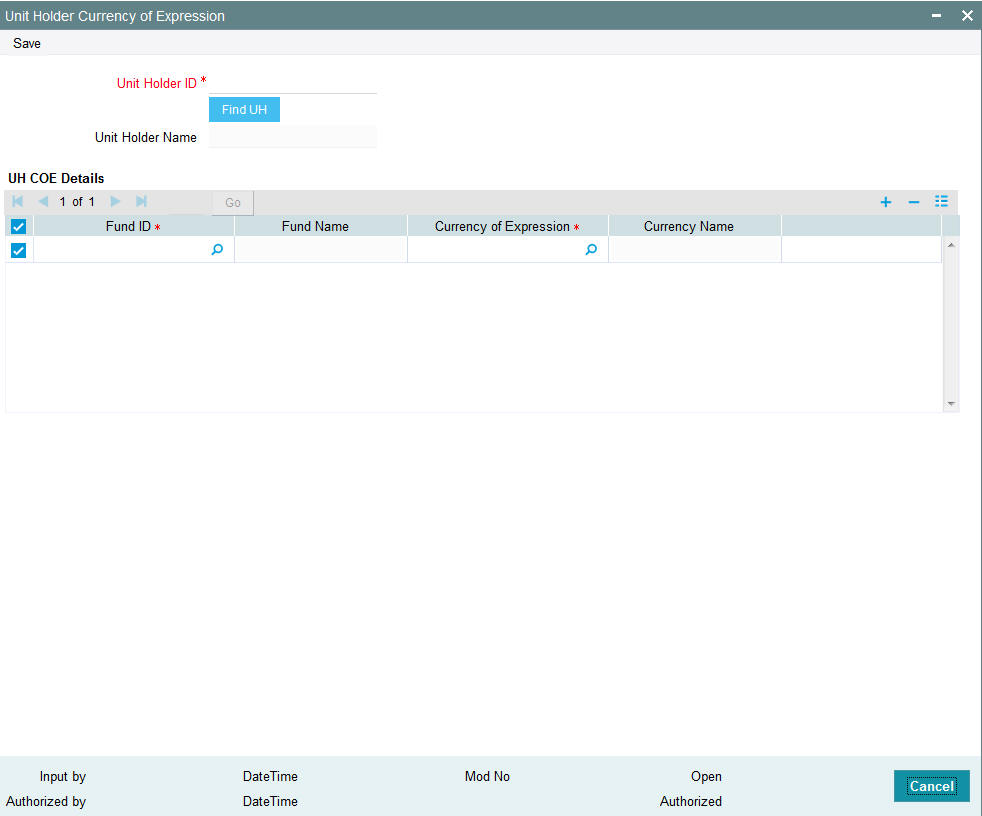

- Section 3.14, "Unit Holder Currency of Expression"

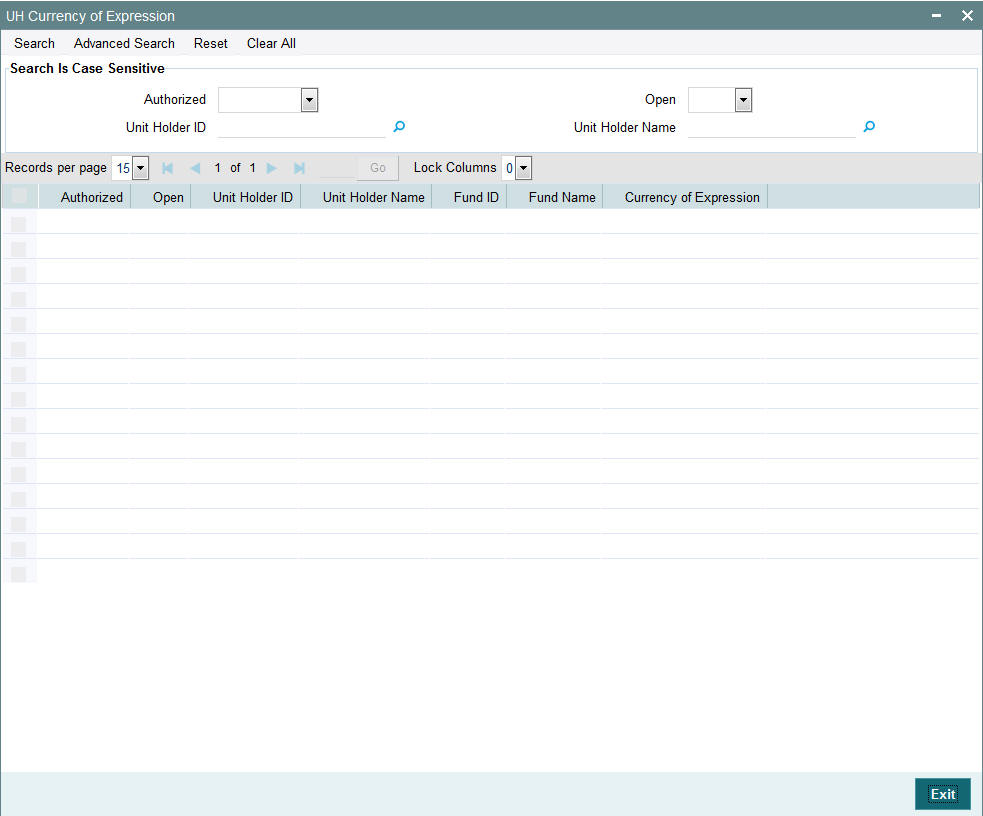

- Section 3.15, "Unit Holder Currency of Expression Summary"

3.1 Customer Information

This section contains the following topics:

- Section 3.1.1, "Maintaining Customer Information"

- Section 3.1.2, "Maintaining Investor Accounts"

- Section 3.1.3, "Identifying Unit Holder Account in System"

- Section 3.1.4, "Specifying Mandatory Information for New Account"

- Section 3.1.5, "Defaulting of Information for CIF Unit Holder Accounts"

- Section 3.1.6, "Specifying Additional Information for New Account"

- Section 3.1.7, "Choosing Template for Automatic Replication"

- Section 3.1.8, "Maintaining Stop Status on Unit Holder Account"

- Section 3.1.9, "Maintaining IRS Notifications on Unit Holder Account"

- Section 3.1.10, "Saving New Account"

3.1.1 Maintaining Customer Information

Each individual or company that transacts with your bank becomes your customer. In the Oracle FLEXCUBE Investor Servicing (FCIS) system, a customer information file (or CIF) is maintained for each customer.

A customer may desire to invest in the funds of the AMC, and have an investment account. In such a case, an investment account known as a unit holder account is maintained for such customers. A customer can have more than one investment account.

A customer account or a CIF account is created in the FC-IS system in either of the following ways:

- At installations where the Oracle FLEXCUBE Corporate (FCC) and Oracle FLEXCUBE Retail (FCR) applications are also present, an interface is defined between either (or both) of these applications and FC-IS. The CIF account for the customer is created in either of these applications. Whenever a CIF account is authorized with investment details in either FCC or FCR systems, the interface propagates the details of the CIF account to the FC-IS system, where an initial, single unit holder account is created for the CIF account. The unit holder ID created in FC-IS will be identical to the account number in FCC. Subsequently, any number of unit holder accounts may be created in FC-IS for the CIF account. If a CPNJ number is linked to a CIF in FCC, then a unitholder of the type ‘Corporate’ will be created in FCIS for that customer. Similarly, if a CPF number is linked to a CIF in FCC, then a unitholder of the type ‘Individual’ will be created in FCIS for that customer. Any modification to the customer account details in FCC will be propagated to FCIS.

- At installations where FCC and FCR are both not present, a CIF account for a customer can be created in FC-IS through the Customer Maintenance menu in the Browser. An initial, single unit holder account is created for the CIF account. Again, subsequently, any number of unit holder accounts may be created in FC-IS for the CIF account. Edition and Amendment (through Information Change) of the unit holder accounts can only be performed through the FC-IS system.

For a fuller discussion of how CIF accounts are created in FC-IS system, refer the chapter “Maintaining Customer Information”

After a CIF account is created along with a single, initial unit holder account, in either of the ways described above, you can create any number of unit holder accounts for the CIF account in the FC-IS system.

3.1.2 Maintaining Investor Accounts

Any individual or company that invests capital in any investment avenue with a view to receive greater returns and appreciation of invested capital is known as an investor.

When an investor invests in a mutual fund or any of the funds floated by an AMC, the fund gives the investor a certain number of investment units that are indicative of the investor’s stake in the fund money pool. The investor is known as a unit holder and is said to have holdings in the fund.

In Oracle FLEXCUBE Investor Servicing, all details regarding each unit holder that invests in the AMC are maintained in the system database, in the account created for the unit holder. This account is known as the unit holder account, and it is the single repository in the system database from where any information regarding the unit holder can be queried for, retrieved as well as updated.

Though a single account can be typically created for each unit holder, multiple accounts can also be maintained for Customer Information File (CIF) customers of your bank or AMC.

This chapter deals with all aspects of the creation and maintenance of unit holder and CIF unit holder accounts in the FC-IS system.

After you open a unit holder account for a new investor, you can perform any of the following maintenance operations:

- Authorize the account

- Make changes to the account in any way

- Close the account

- Query the database for any information regarding the account at any time

- Set up different investment preferences for the investor, as and when requested

Whenever an investor requests for a transaction, the system uses the unit holder account as the identification for the investor, while putting the transaction through. The effect of the transaction on the balance holdings of the investor in a fund is also reflected in the account.

3.1.3 Identifying Unit Holder Account in System

The unit holder account that is maintained for an investor in the system database can be uniquely identified in the system by the following two identifiers:

The Reference Number

The reference number is a unique alphanumeric identifier for the account. It could be the serial number that is given on the application form through which the investor has invested in the AMC. It could also be any alphanumeric value given by the AMC or the investor, to identify the account.

The reference number can be used to query the database for information regarding the account.

The Unit Holder ID (or Number)

Like the reference number, the unit holder ID is also a unique alphanumeric identifier for the account. Either you can specify the unit holder ID or it can be generated by the system when you create the account and enter all the necessary details into the system. The unit holder ID has a generation logic that can be defined by the AMC for each of its branches. Thus, the unit holder ID is the most important identifier for the account in the system.

Like the reference number, the unit holder ID can also be used to query the database regarding the account.

Before you begin to set up any new unit holder accounts for investors that are desirous of investing in the funds of the AMC, you must ensure that the following static information sets have already been set up and entered into the system database and the required authorizations done:

- All necessary CIF accounts have been created in the system, either through the interface with FCC or FCR, or through the Customer Maintenance.

- All reference data that is typically defined in the Data Entry menu item in the Fund Manager component. This includes:

- All static information such as required entities (agents, branches, agency branches, brokers, AMCs, registrars, trustees), countries, corporation types, investor categories, occupation types, identification types, banks and their branches, mode of payment types, currencies, additional information heads, fee categories and subcategories.

- Authorized funds with all the necessary fund rules, agency branches, brokers, countries of domicile, account types, currencies and so on.

For a detailed account of this information, refer to the Fund Manager.

3.1.4 Specifying Mandatory Information for New Account

In the UH New Account Detail screen, you must specify the following details about the investor as mandatory information when you are creating a new unit holder account:

- The CIF Number of the customer for whom the unit holder account is being created, in the CIF Number field. This is mandatory information for all unit holder accounts.

Note

If you wish to copy the unit holder details from that of an existing unit holder account, use the Copy UH link alongside the CIF Number field.

- For a non-CIF investor, the reference number for the unit holder account, in the Reference Number field.

- The ID of the AMC/ Distributor, the funds of which the investor has chosen to invest in, in the AMC ID field.

- The type of investor for whom the account is being created, (either Individual or Corporate) in the Investor Type field.

- The date on which the account is to be created, in the Account Opening Date field. By default, this is deemed by the system to be the application date, but you can specify an earlier date.

- The option of dealing with the AMC either through self or an authorized representative. If dealing through an authorized representative, specify the same in the Dealing Type field, and select an authorized representative, as mandatory information, in the Auth Rep ID field. If you are maintaining a depositary as a unit holder, you must select ‘Depositary’ as the dealing type.

- For individual investors, specify the following details as mandatory information:

- The name of the investor. You must specify at least the first name of the investor in the First Name field.

- The Fee Category in the Fee Category field.

- The gender of the investor, in the Sex field.

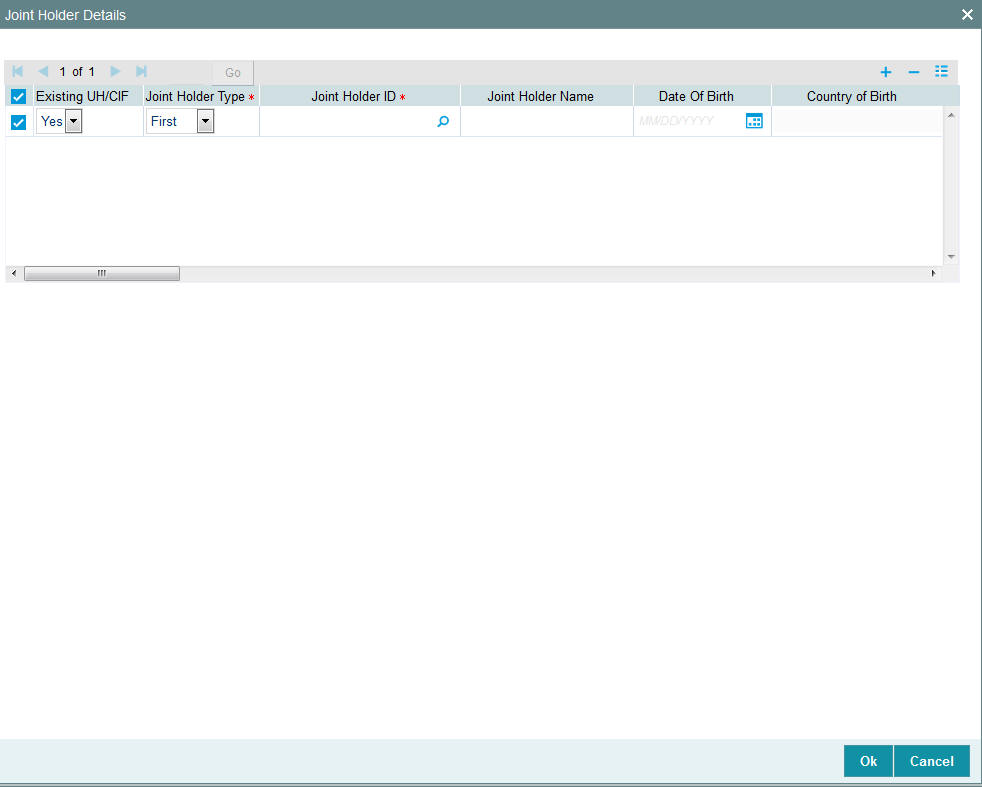

- The option chosen by the investor of operating the account either singly or as a joint account, in the Account Operation Type field. If the account is to be a joint account, you must specify the name of at least one of the joint unit holders, in the Joint CIF Details section. In this screen you can specify the Joint Holder’s ID, Joint Type and Address details. Once authorized, this field cannot be modified.

- For corporate investors, specify the following details as mandatory information:

- The name of the company, in the Company Name field.

- The type of corporation, in the Corporation Type field.

- The contact address of the investor, in the Address field under the Default Address header.

- The type of identification, number of the identification document and its place of issue provided by the investor, in the fields Identification Type, Identification Number and Place of Issue respectively. Once authorized, these fields cannot be modified.

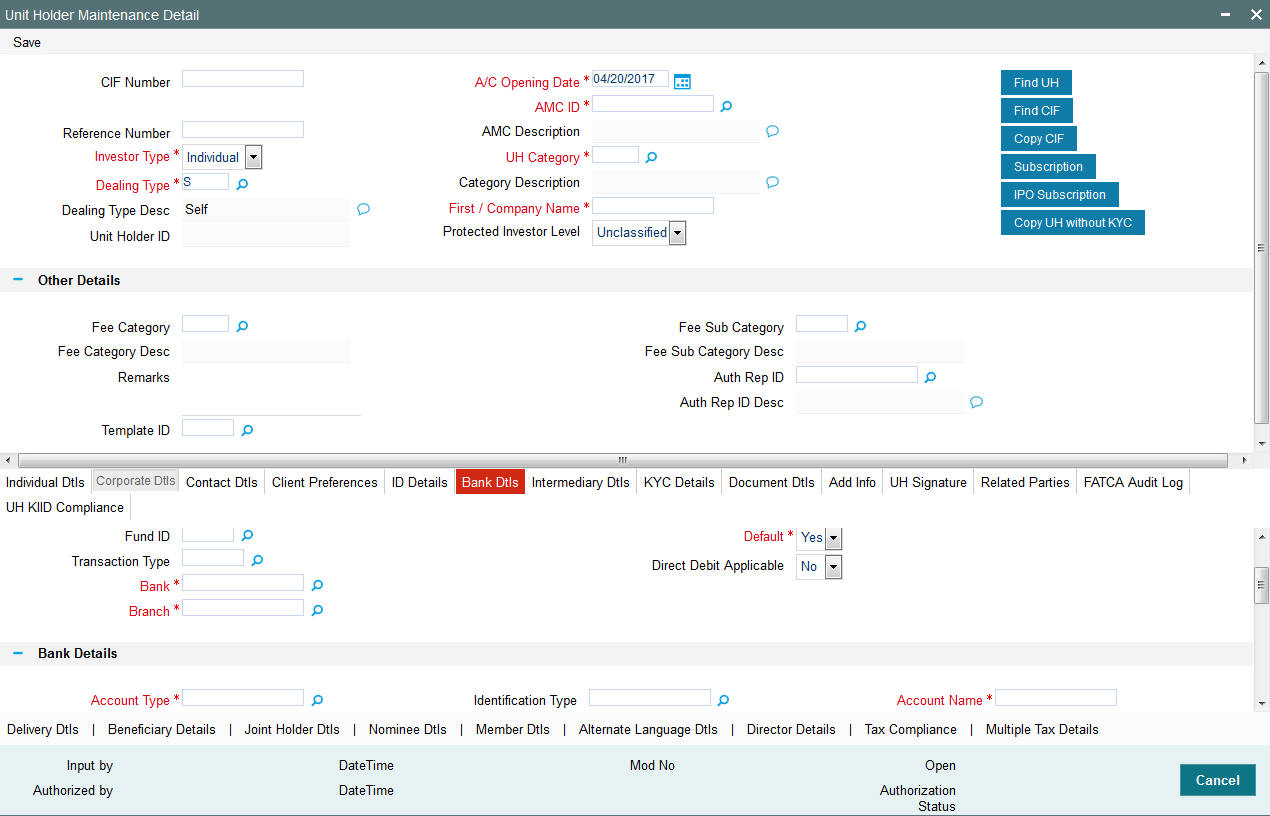

- Specifying the details of a bank account for an investor is not mandatory. If you wish to indicate them, any number of bank accounts can be designated, for each currency. You can also indicate a default bank account for each currency. During transaction entry, the payment bank account to be used for the unit holder will be picked up based on the transaction currency. The default bank account defined for the unit holder, for the transaction currency, is used.

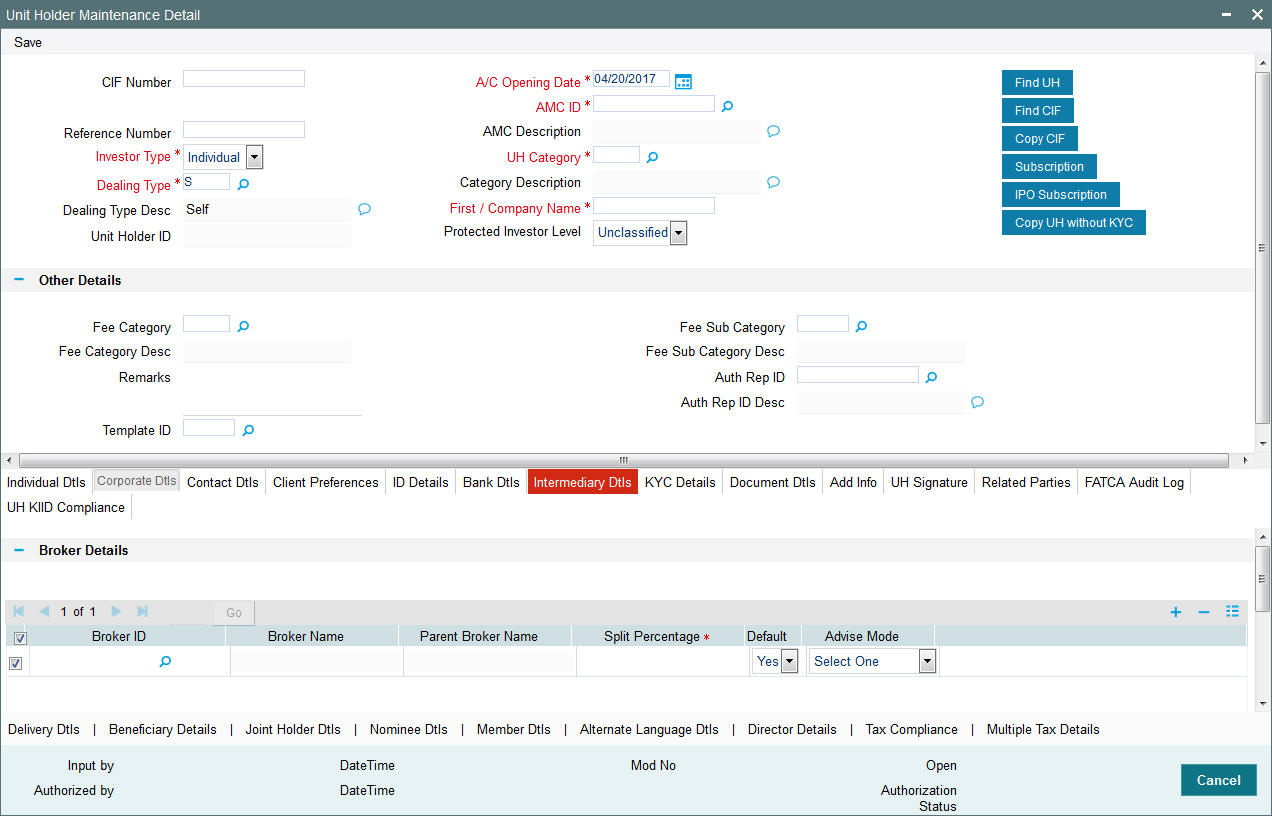

- The code of at least one intermediary designated for the investor, in the Intermediary field in the Intermediary Details section. You must also specify the commission percentage that the intermediary is to receive, in the Split Percent field. The sum of all split percentages for the specified intermediaries must not exceed one hundred percent. The broker details and the split percentages are used as default information during the entry of transactions for the investor.

3.1.5 Defaulting of Information for CIF Unit Holder Accounts

As mentioned earlier, when a CIF account is authorized in either FCC or FCR at an installation, a single, initial unit holder account is created in FC-IS for the CIF account. The following information is defaulted for the unit holder account in FC-IS:

- The account operation type is deemed to be single.

- The dealing type for the unit holder is deemed to be ‘Self’.

- The account is deemed for an initial investor.

- For corporate investors, the minimum number of corporate signatories is deemed by default to be 1.

- The unit holder is not deemed to be a minor.

- The account is created as an open and enabled account and not as a closed one.

- The account is created without a specification for YTD account statements.

- The account is created as an unauthorized account in the FC-IS system.

- The ID assigned to the unit holder in the FC-IS system will be identical to the FCC account number.

- The FCC account details will be the default bank details of the of unit holder account in FC-IS.

- The identification number submitted by the unit holder.

These default specifications cannot be changed when the first, initial unit holder account is created for the CIF account in the FC-IS system. To change any of these details, an information change must be done. However, you cannot change the defaulted identification number.

Subsequently, after the creation of the first, initial unit holder, whenever you create another unit holder account for the CIF in FC-IS in the UH New Account screen, the specifications that were used as defaults for the creation of the first account, as shown above, are defaulted again. However, these can be changed at the time of creation of a new unit holder. Depending on the specifications at the FCC installation, you can add the FCC account details as unit holder account bank details in FC-IS or create another unit holder account for the CIF in FC-IS.

Whenever an FCC account undergoes number modification, FC-IS will perform an information change to the unit holder account record. On FCC account closure, the status of the unit holder account will be changed to ‘Pending for Closure’ and no outflows will be allowed from the account.

3.1.6 Specifying Additional Information for New Account

After you have specified all the mandatory information, you are ready to save your specifications so that the account can be entered into the database.

You can, additionally, specify any of the following information as applicable before you actually save the record:

- Any personal details for an individual investor, such as the name of the father or spouse, the date of birth, the marital status, and any beneficiary designated for the investor. You can also specify whether the investor is a minor and also specify the designated guardian for the same.

- To make these specifications, click the Individual Details link in the screen, and enter the details in the corresponding fields.

- For a corporate investor, the name of a contact person as well as authorized signatories for the company.

- To make these specifications, click the Corporate Details link in the screen, and enter the details in the corresponding fields.

- Any contact details such as alternative addresses, city, state, zip code, as well as telephone or fax numbers, and E-mail IDs, if any.

- To make these specifications, click the Contact Details link in the screen, and enter the details in the corresponding fields.

- If you designate that tax is deemed to be deducted at source for the unit holder, the tax details applicable for the investor, such as the tax ID, tax circle and tax category. You can specify the PAN of the investor.

- To make these specifications, click the Identification Details link in the screen, and enter the details in the corresponding fields.

- Preferences opted for by the investor, concerning any or all of the

following:

- Currency, both for transactions and for account statements

- Frequency of receiving account statements

- The nationality, country of domicile, language and resident status

- Preferred mode of mailing

- Default mode of receiving redemption payments

- Applicability of Rights of Accumulation benefits

- Registration details

- Applicability of making redemption and switch requests over telephone

- Applicability of indexation for the computation of capital gains income

- KYC Details

- To make these specifications, click the Client Preferences link in the screen, and enter the details in the corresponding fields.

- You can also indicate whether check writing facility is allowed for the investor, and specify the signatories for check writing. The investor can avail of check book facility in any fund in which the investor holds unit balances.

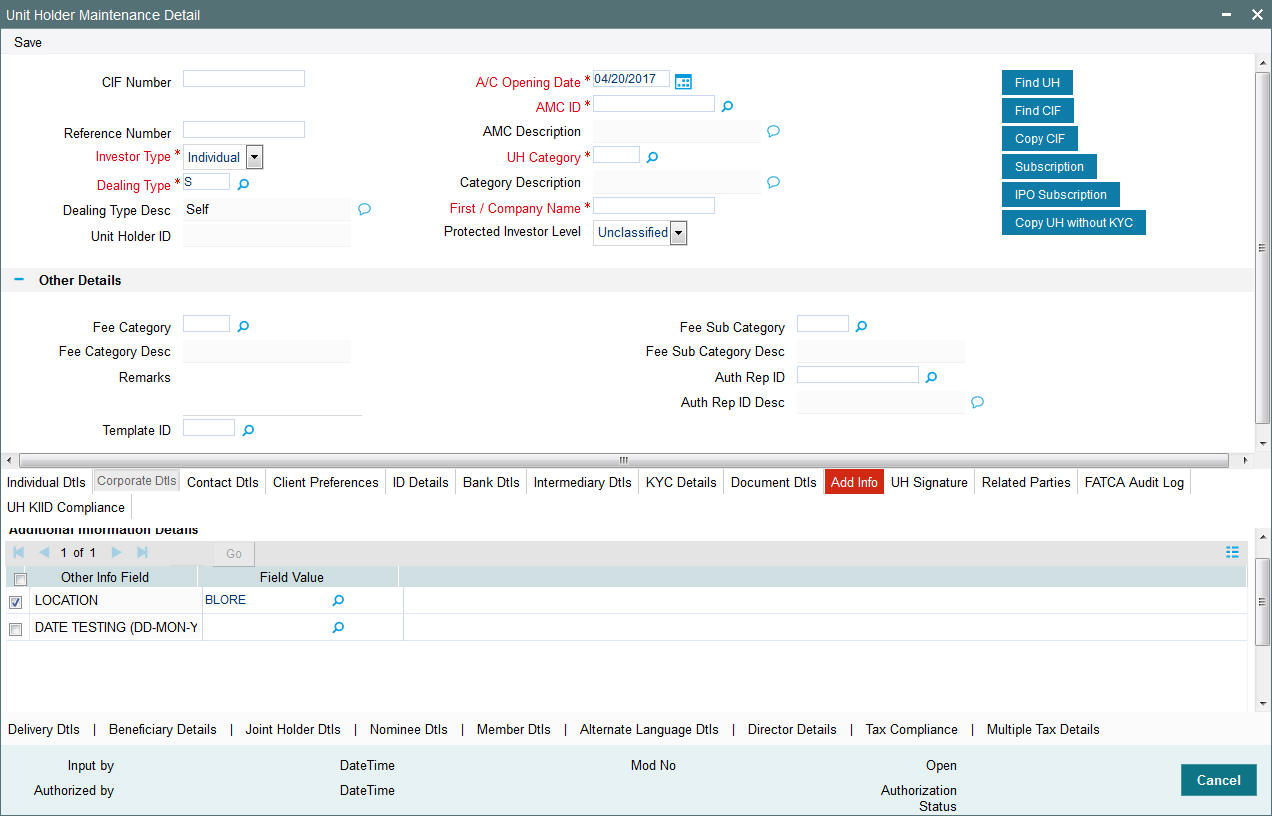

- Any additional information under the heads defined for the AMC. Click the Additional Information link in the screen, and enter the details in the corresponding fields.

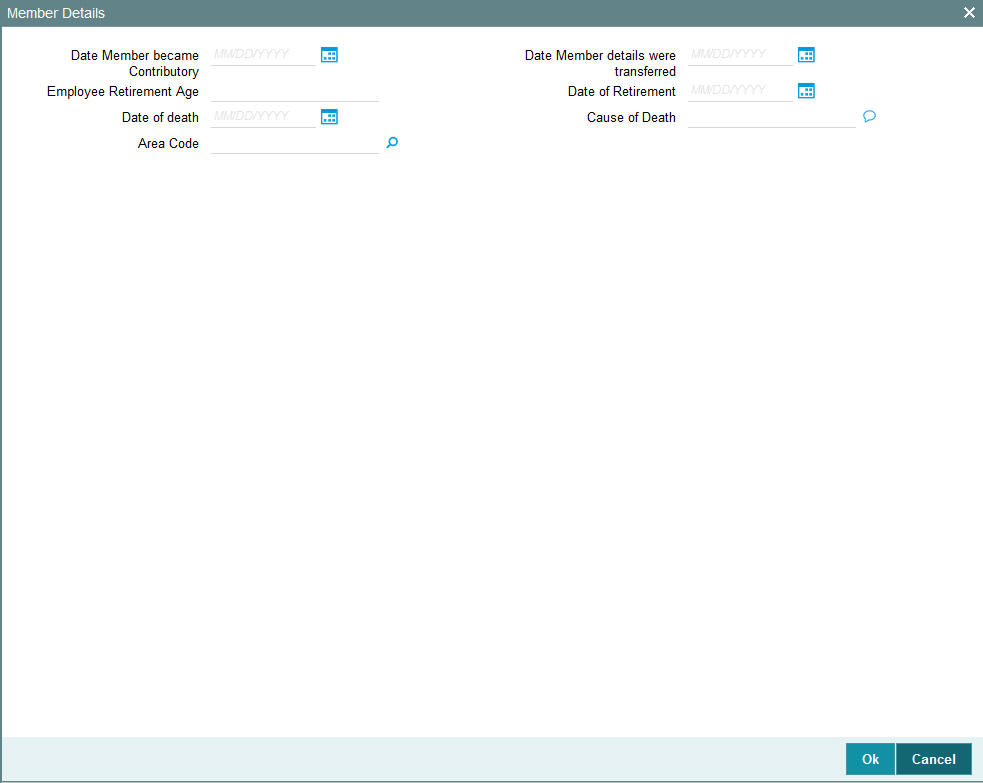

- If the account is a retirement type of account, additional details for the individual investor, such as the retirement age, date of retirement and if the investor has expired; the date and cause of death.

To make these specifications, click the Member Details link in the screen, and enter the details in the corresponding fields.

3.1.7 Choosing Template for Automatic Replication

Modifications made to a unit holder account under a CIF, through an Information Change operation, might require to be replicated to all unit holder accounts under the CIF. Oracle FLEXCUBE Investor Servicing provides the facility of configuring the system so that automatic replication could be achieved, through automatic replication templates.

When an information change to a unit holder account under a CIF is authorized, a template for automatic replication could be chosen. Any changes that have been made through Information Change, to any of the fields defined in the template, are replicated to all unit holder accounts belonging to the CIF, when the Information Change is authorized. The replication occurs at the level defined for the template – CIF level (changes made to CIF fields are replicated) or Identification Type level (changes made to Identification Type fields are replicated)

Template ID

Optional

Select the automatic replication template that is to be used for replication of changes made to the unit holder account through Information Change, to all unit holder accounts belonging to the CIF.

Any changes that have been made through Information Change, to any of the fields defined in the template, are replicated to all unit holder accounts belonging to the CIF, when the Information Change is authorized. The replication occurs at the level defined for the template – CIF level (changes made to CIF fields are replicated) or Identification Type level (changes made to Identification Type fields are replicated)

3.1.8 Maintaining Stop Status on Unit Holder Account

A stop could be placed on a unit holder account for a number of reasons. Such a stop typically results in restrictions being placed on the account, in terms of inflows and outflows, with regard to the following events:

- Any inflow and outflow transactions

- Standing instructions

- Tax deduction

- Dividend payment

A unit holder account can be rendered as restricted in an operation through a stop, due to any of the following:

- An IRS notification on the account. This could be due either to non-payment of tax, or incorrect reporting of the Tax ID.

- An Stop Code being assigned to the account, for escheatment tracking.

Specifying a Stop Instruction

You can place a stop on an account in the system by performing an information change and specifying the following information in the Client Preferences field:

- The IRS Notification assigned to the account, if any, in the IRS Notification field

- The Stop Code assigned to the account, if any, in the Stop Code field.

- The date of release of the account from the stop status.

For details, refer the sections Maintaining IRS Notifications and Escheatment Tracking, found later in this chapter.

When you specify this information, the system marks the account with a ‘stop’ status. The Stop Account box in the Client Preferences section is checked, and the stop account code is assigned by the system, using the information provided.

The Stop Account Code

When you specify a stop instruction through an information change, the system automatically assigns a 20-character code that indicates the stop instruction status of the account, known as the Stop Account Code. Any account that has a stop account code assigned to it due to a stop instruction, is restricted in operation.

To recall, an account can be rendered restricted in operation due to any of the following:

- An IRS notification on the account. This could also be for notifications such as Sections 54E (A) or 54E (B)

- An Stop Code being assigned to the account

Both IRS notifications as well as Stop Codes can be assigned to an account through an information change.

The stop account code consists of 20 characters or ‘bits’. Each character denotes a restriction on any of the following operations:

- Bit 1 is for IPO Subscription Transactions. Bit 2 is for Redemption Transactions.

- Bit - 13 for Redemption Payment Restrictions

- Bit - 14 for Dividend Payment Restrictions

- Block and unblock transactions (Bit 3)

- Standing instructions (Bit 4)

- Tax deduction (Bit 5)

- Dividend payment (Bit 6)

- Subscription transactions (Bit 7)

- Switch Out transactions (Bit 8)

- Transfer Out transactions (Bit 9)

- Switch In transactions (Bit 10)

- Transfer transactions (Bit 11)

- Dividend payment (Bit 12)

Each character could have a value of 0,1 or 2. The values are interpreted as follows:

Stop account bit position |

Interpretation |

||

When bit value = 0 |

When bit value = 1 |

When bit value = 2 |

|

1 |

Allow all IPO Subscription Transactions |

Stop all IPO Subscription Transactions |

Warning |

2 |

Allow all Redemption Transactions |

Stop all Redemption Transactions |

Warning |

3 |

Unblock all transactions |

Block all transactions |

Warning |

4 |

Pause all standing instructions |

||

5 |

Deduct all dividend tax |

||

6 |

Dividend reinvestment only |

||

7 |

Allow all subscription transactions |

Stop all subscription transactions |

Warning |

8 |

Allow all Switch Out transactions |

Stop all Switch Out Transactions |

Warning |

9 |

Allow all Transfer Out transactions |

Stop all Transfer Out transactions |

Warning |

10 |

Allow all Switch In transactions |

Stop all Switch In transactions |

Warning |

11 |

Allow all Transfer In transactions |

Stop all Transfer In transactions |

Warning |

12 |

Dividend payout only. The 6th bit will take precedence over the 12th bit if the value of both is specified as 1. |

||

The remaining 8 characters in the stop account code are not currently used, and are reserved for future usage.

3.1.9 Maintaining IRS Notifications on Unit Holder Account

An IRS notification is typically issued on a unit holder account in the event of non-payment of tax or due to incorrect reporting of the Tax ID.

You can capture the IRS notification by performing an information change on the unit holder account. In the Client Preferences section, select the notification that is applicable, in the IRS Notification field.

If the notification pertains to an incorrect reporting of Tax ID, select it from the drop down list. If the notification pertains to non-payment of tax, select the option ‘Under Reporting’. When this notification is chosen, all outflows from the account are frozen, but inflows due to standing instructions are allowed. Also, dividend is compulsorily reinvested, and tax is compulsorily deducted, regardless of the TDS setup.

3.1.10 Saving New Account

After you have specified all the information that is mandatory for the account, (and any further information, if any, as applicable) click the Save link at the bottom of the Detail screen to save your specifications. The system validates all the information and saves the record into the database. The unit holder ID for the account is generated and displayed if you have not specified it. In case you have input the unit holder ID, the system validates it.

Along with the confirmation details, links to Subscription and IPO transaction screens are also displayed. If you invoke the transaction screens directly from here, the new Unit holder ID will be defaulted in the transaction screens. Transactions thus saved will be unauthorized and have to be manually authorized. However, if the user has Auto -Authorization roles enabled when a new Unit holder is created and when a transaction is done, both, Unit holder record and transaction will be authorized automatically.

The unit holder account has now been created successfully in the system database. You can now perform any of the following operations:

- Accept a transaction request for the investor immediately and enter it into the system, without authorizing the account.

- Edit any of the details that you have specified for the account, before it is authorized.

- You can have a different user authorize the account.

3.2 Unit Holder Maintenance Details Screen

This section contains the following topics:

- Section 3.2.1, "Invoking Unit Holder Maintenance Details Screen"

- Section 3.2.2, "Individual Dtls Tab"

- Section 3.2.3, "Corporate Dtls Tab"

- Section 3.2.4, "Contact Dtls Tab"

- Section 3.2.5, "Client Preferences Tab"

- Section 3.2.6, "ID Details Tab"

- Section 3.2.7, "Bank Dtls Tab"

- Section 3.2.8, "Intermediary Dtls Tab"

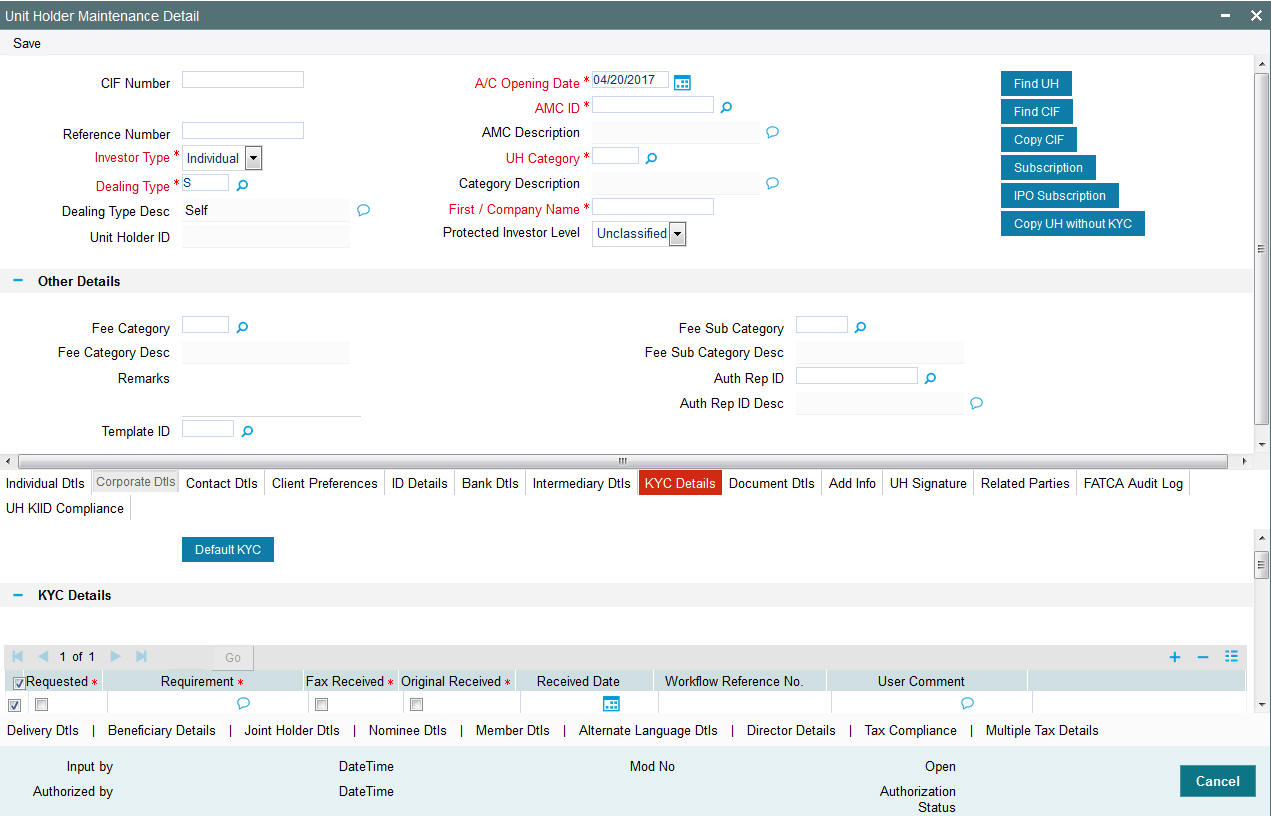

- Section 3.2.9, "KYC Details Tab"

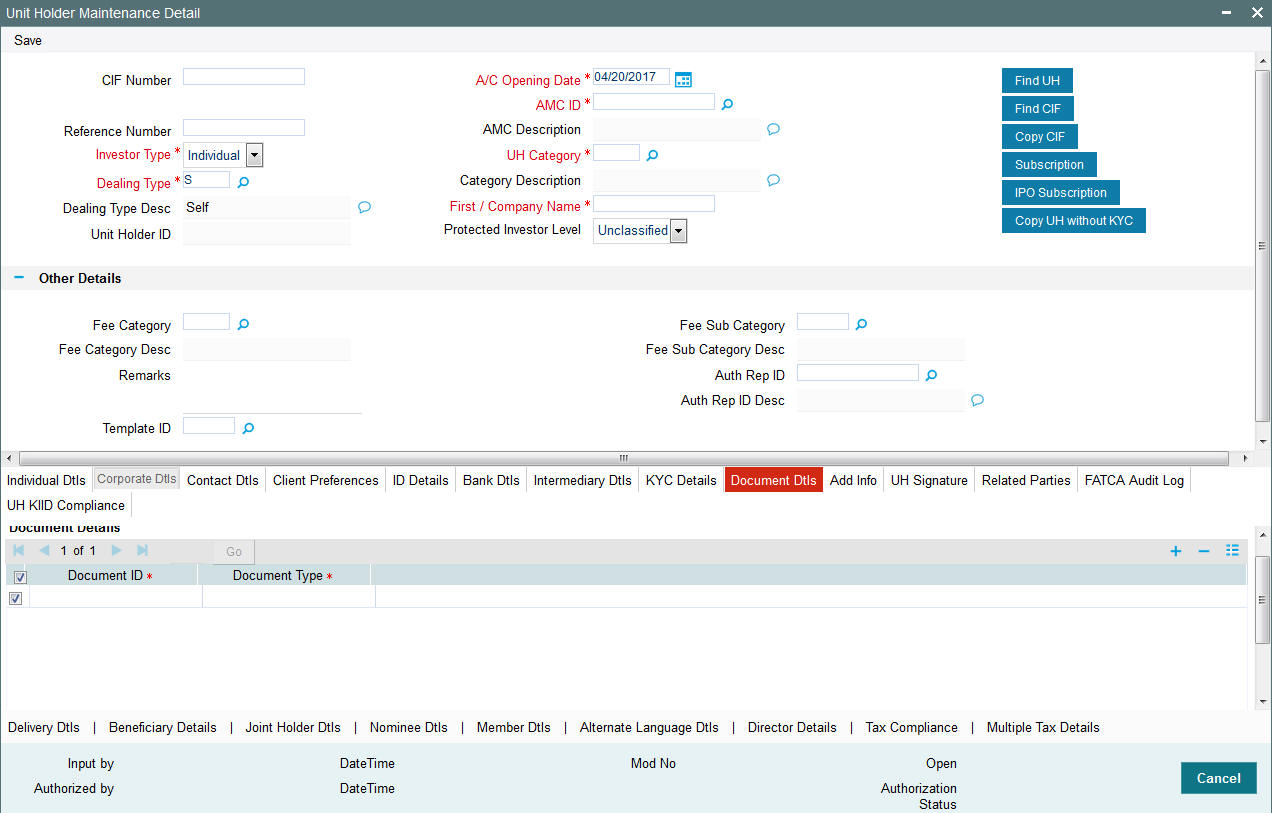

- Section 3.2.10, "Document Dtls Tab"

- Section 3.2.11, "Add Info Tab"

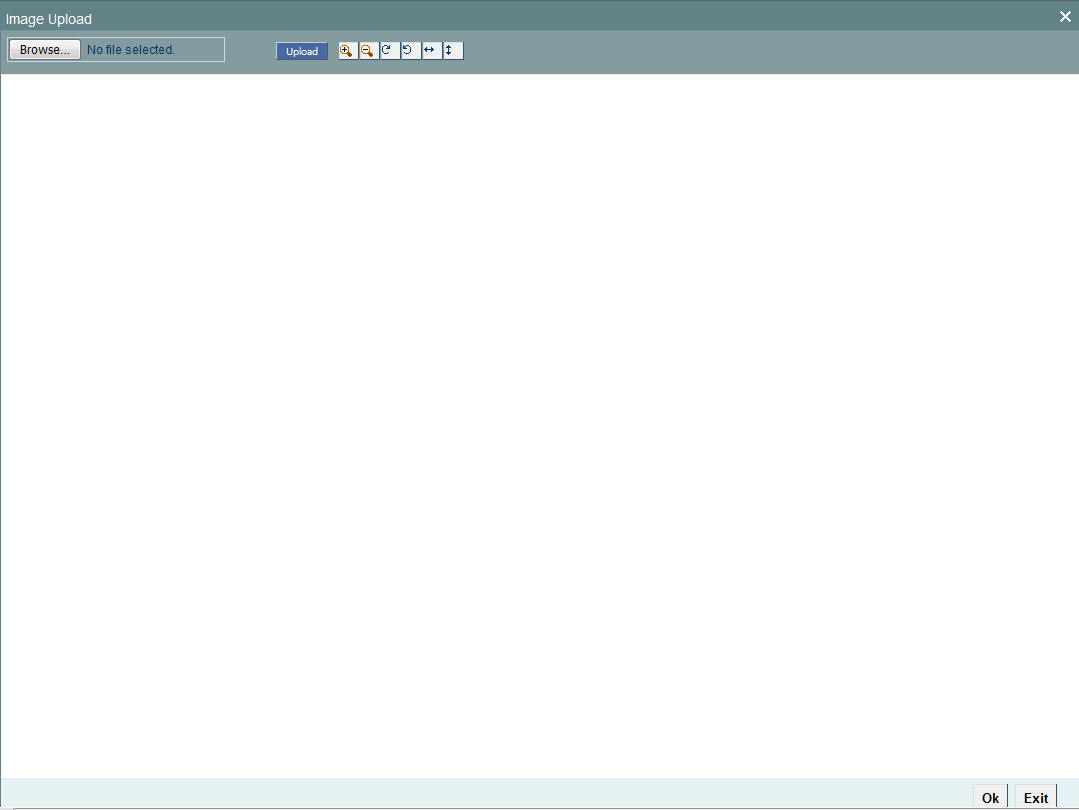

- Section 3.2.12, "UH Signature Tab"

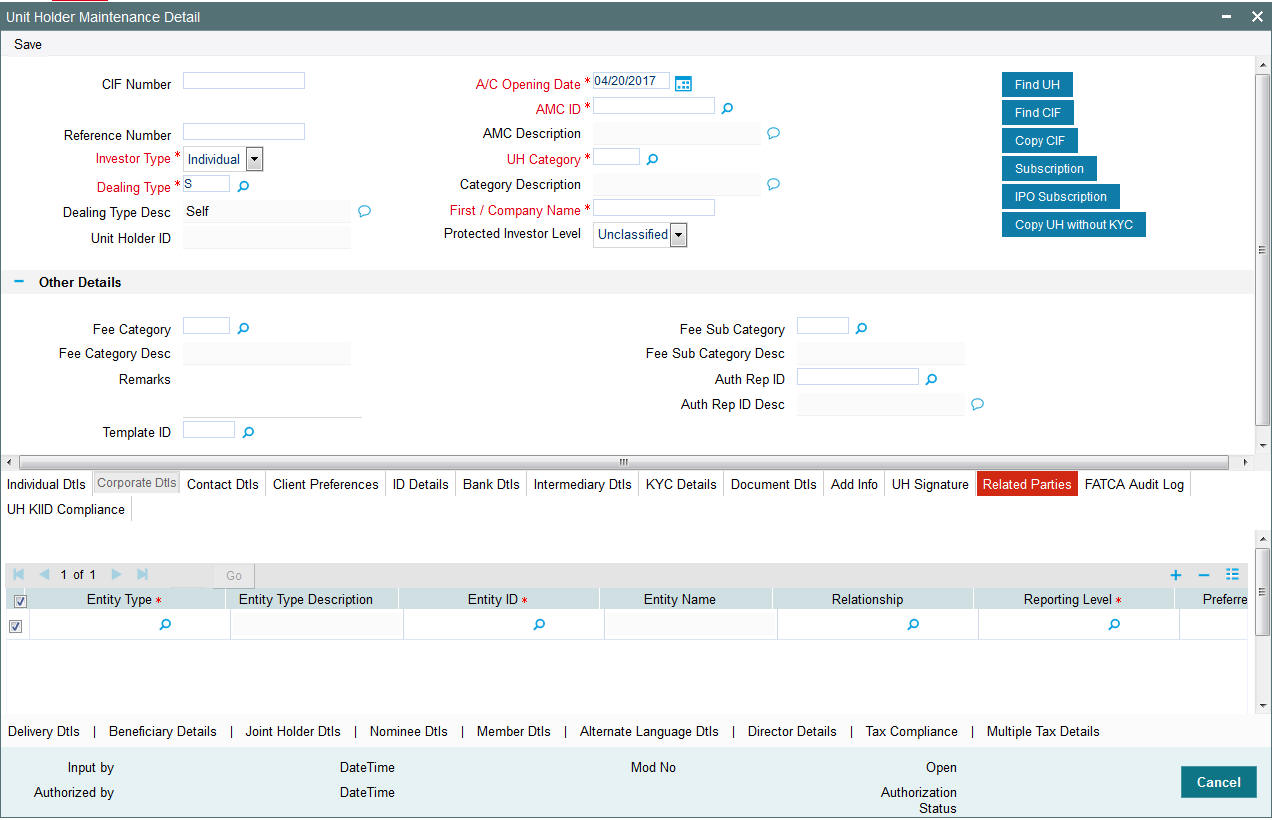

- Section 3.2.13, "Related Parties Tab"

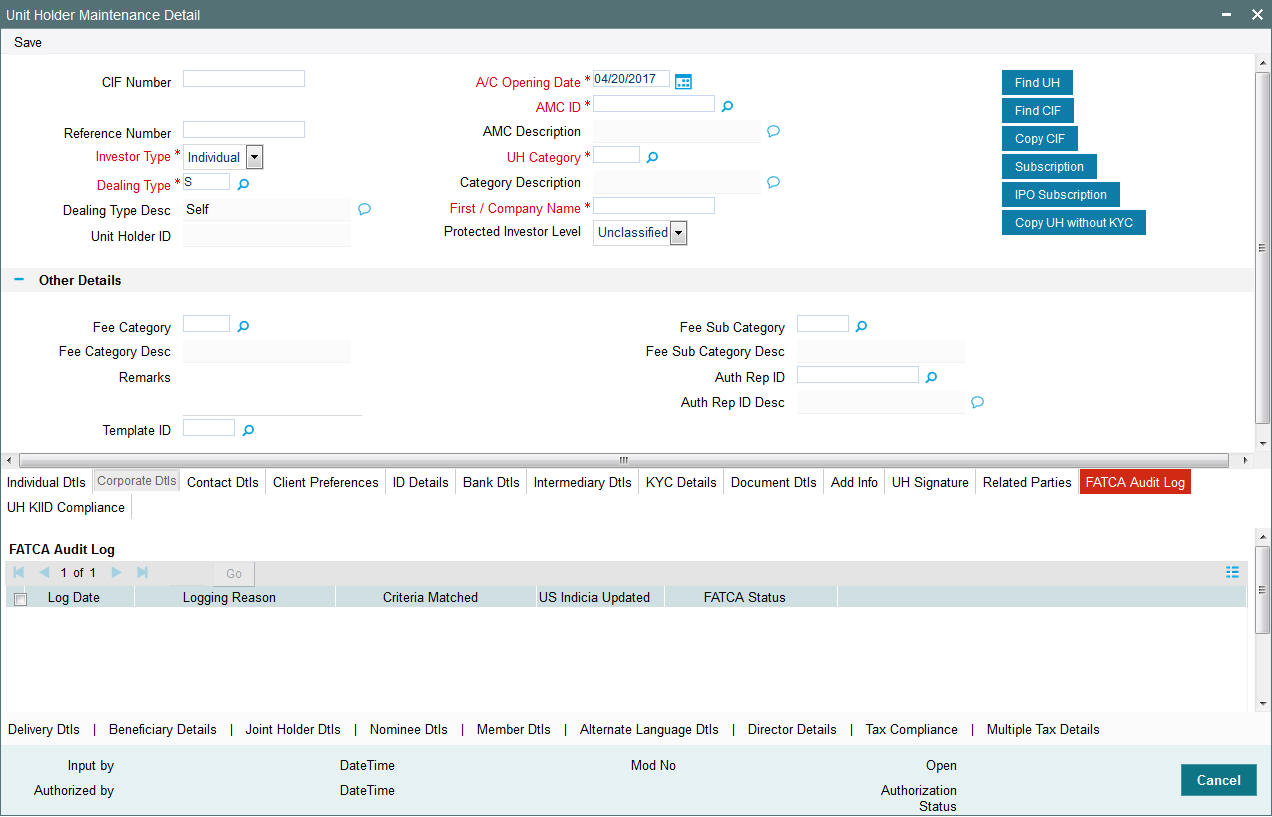

- Section 3.2.14, "FATCA Audit Log Tab"

- Section 3.2.15, "UH KIID Compliance Tab"

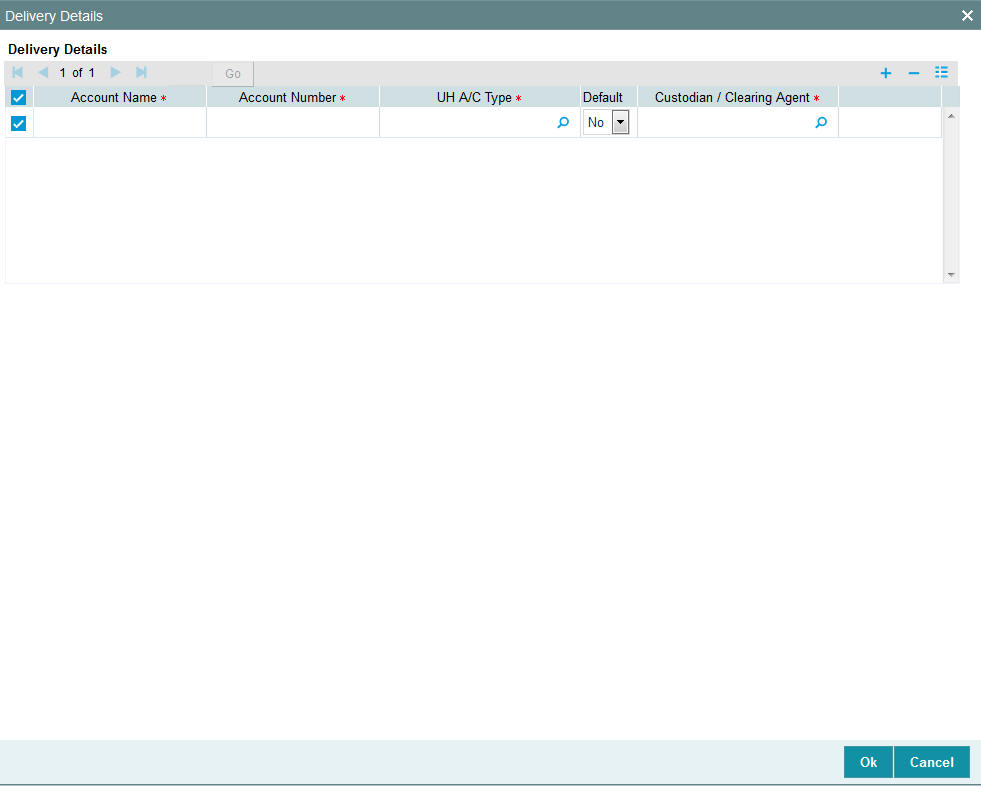

- Section 3.2.16, "Delivery Dtls Button"

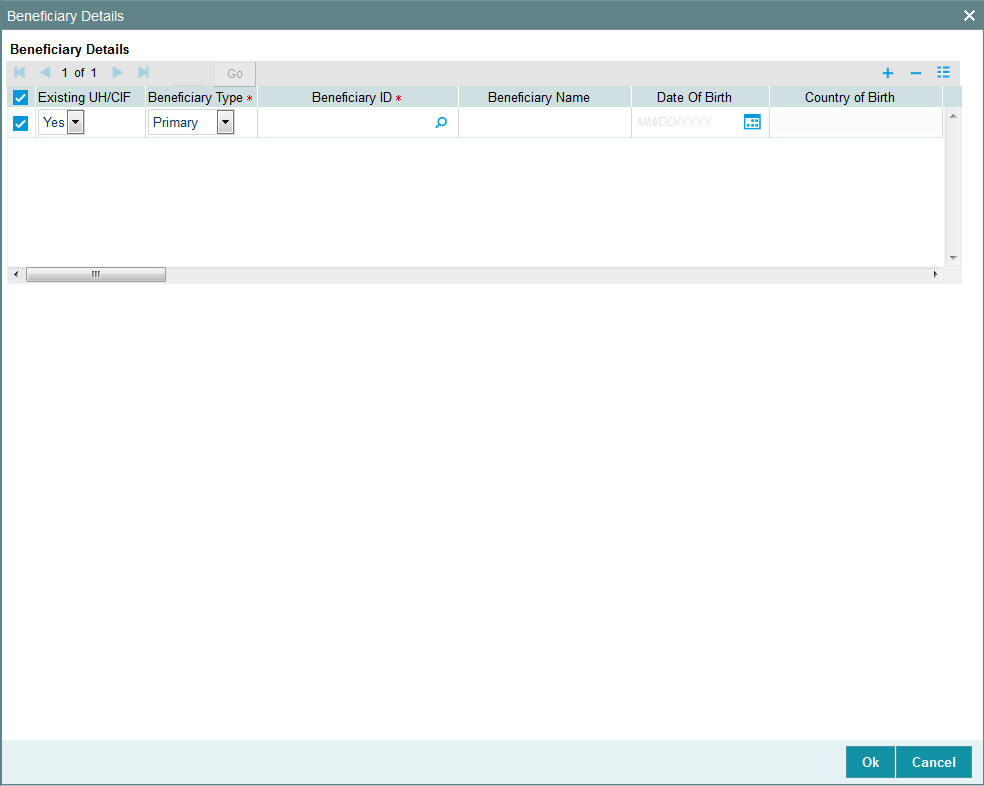

- Section 3.2.17, "Beneficiary Dtls Button"

- Section 3.2.18, "Joint Holder Dtls Button"

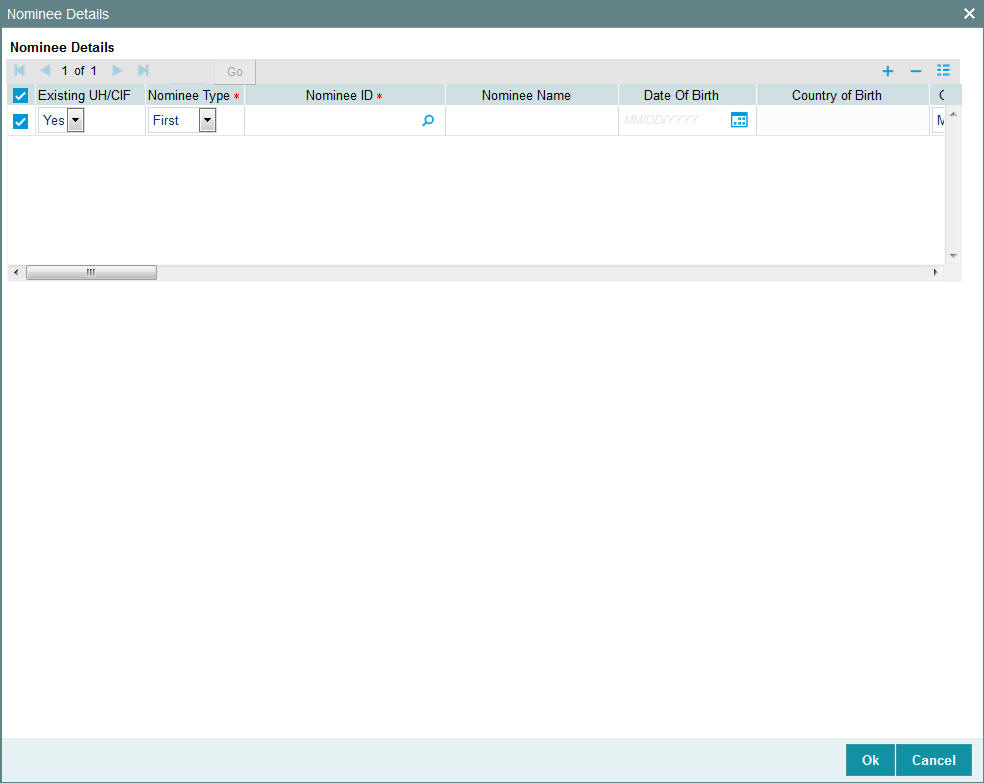

- Section 3.2.19, "Nominee Dtls Button"

- Section 3.2.20, "Member Dtls Button"

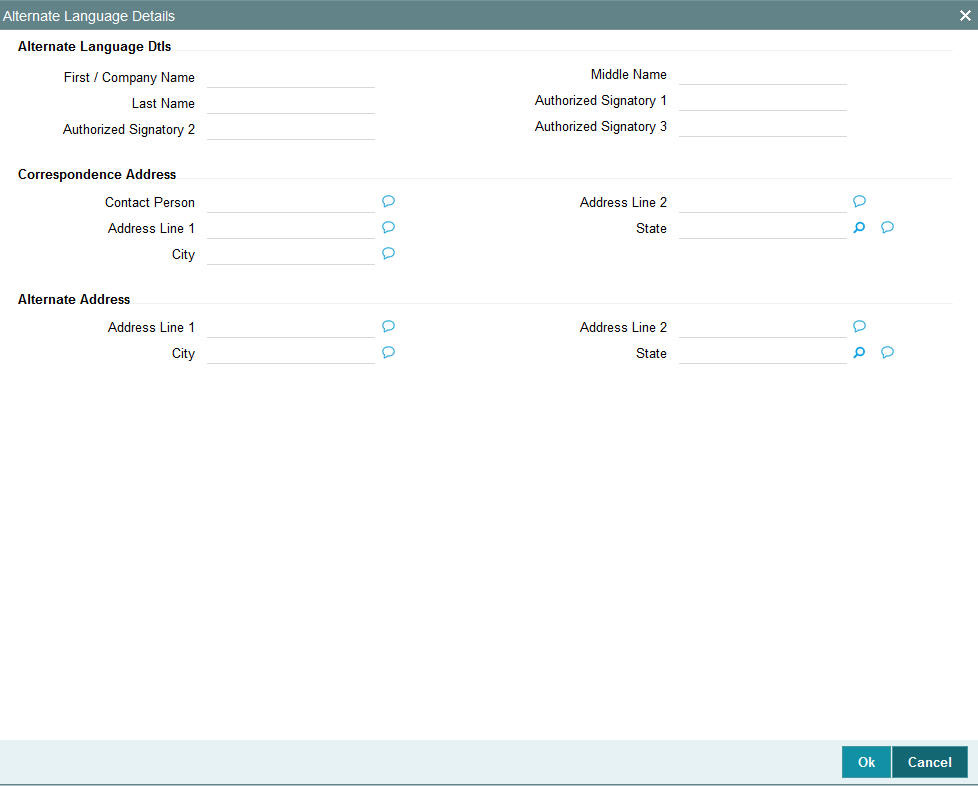

- Section 3.2.21, "Alternate Language Dtls Button"

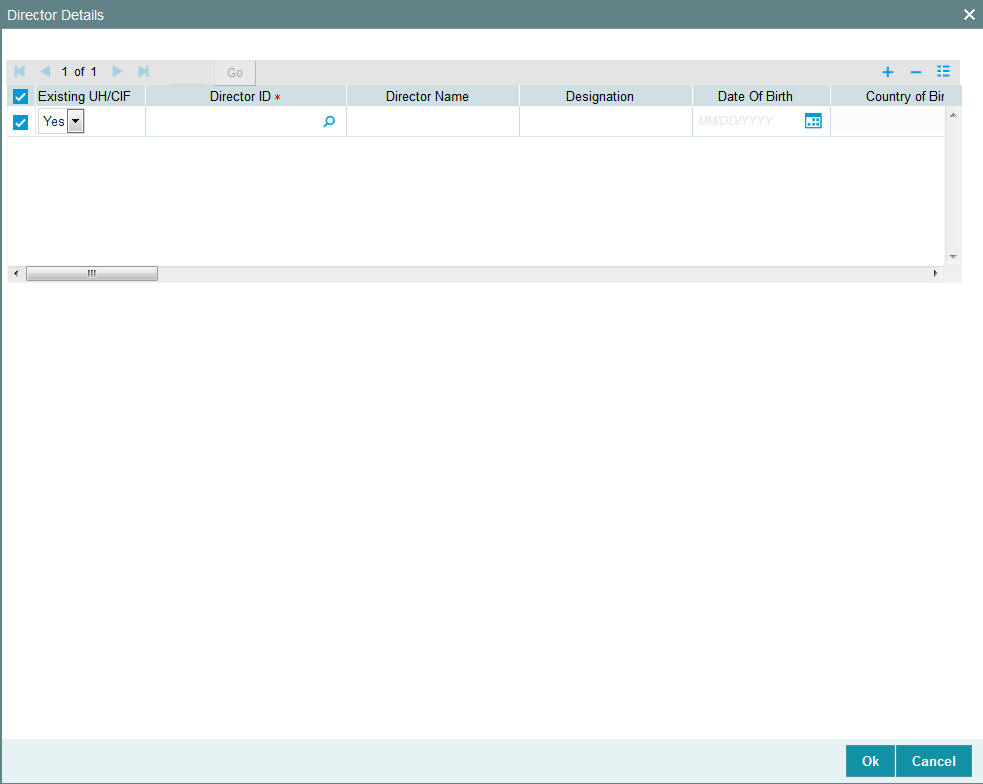

- Section 3.2.22, "Director Details Tab"

- Section 3.2.23, "Tax Compliance Button"

- Section 3.2.24, "Multiple Tax Details Button"

3.2.1 Invoking Unit Holder Maintenance Details Screen

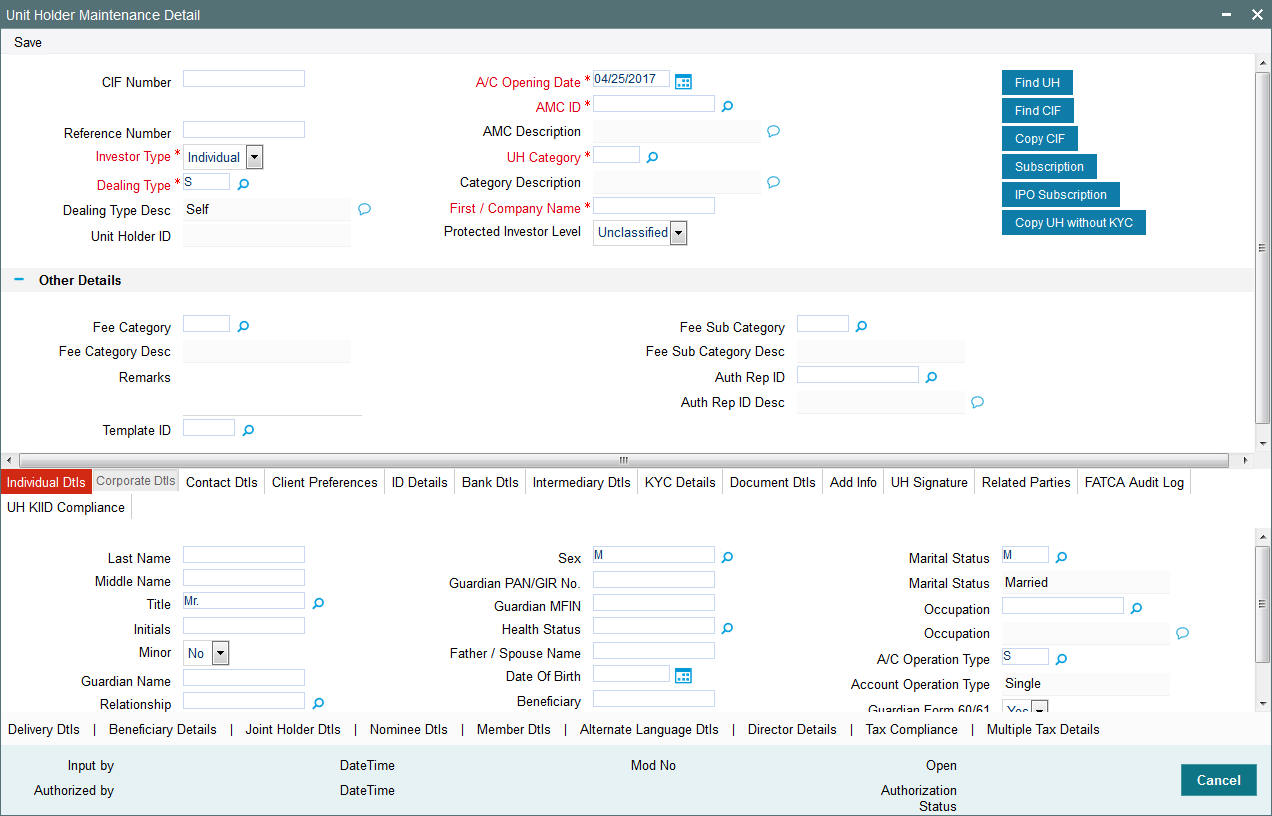

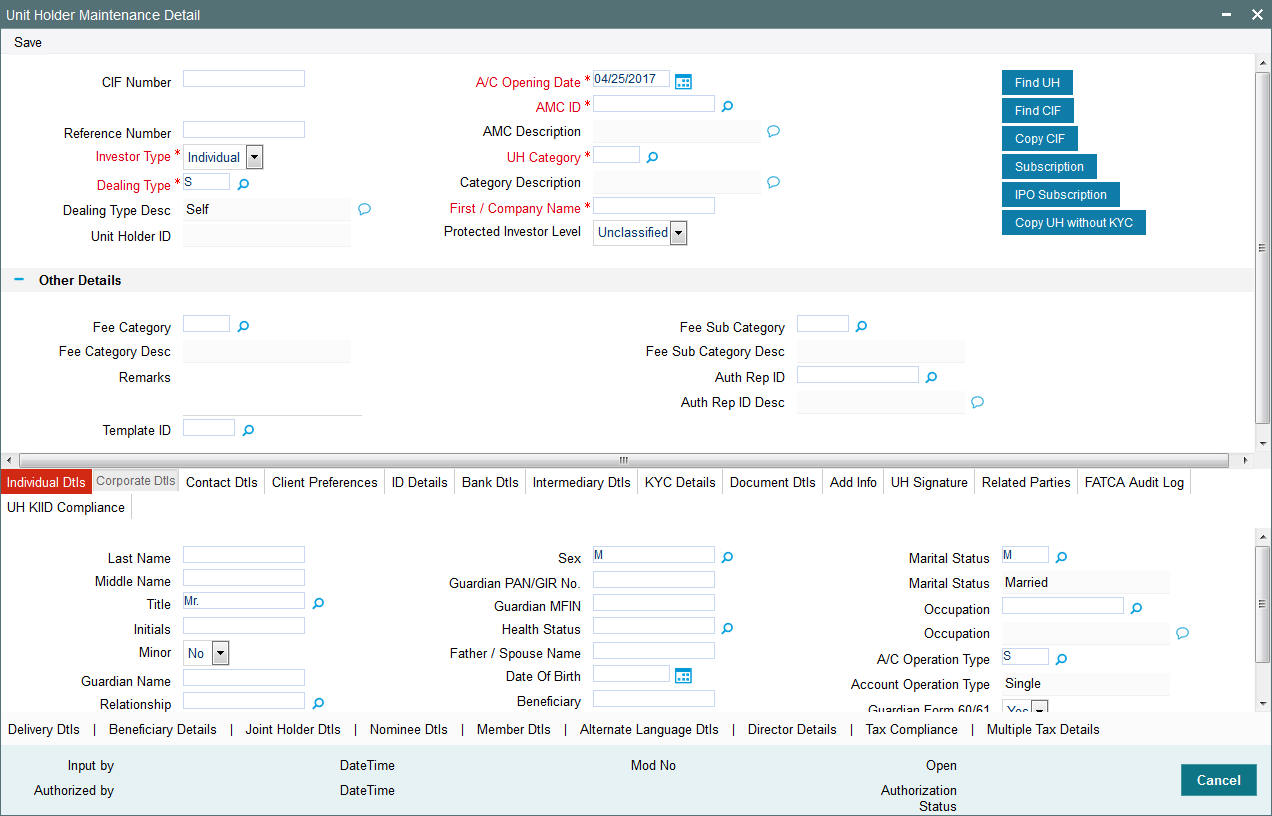

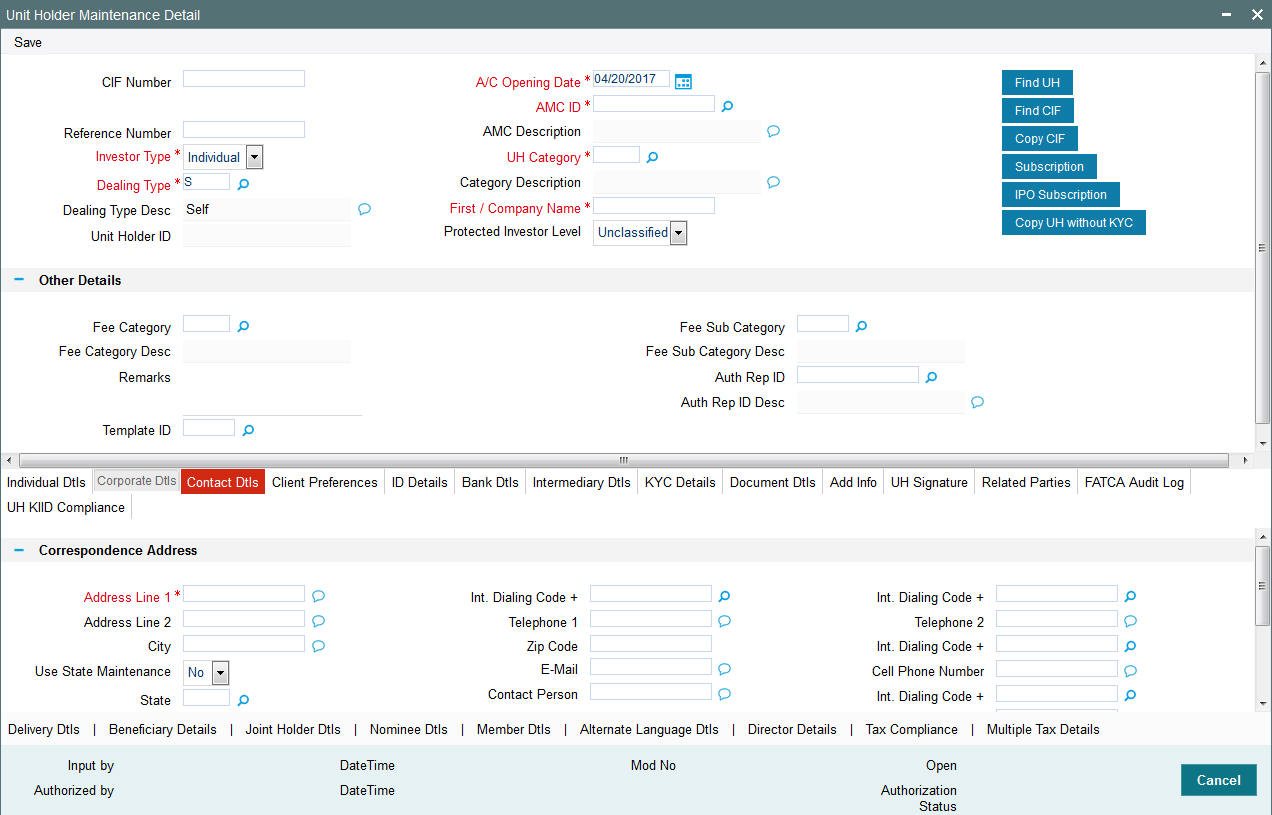

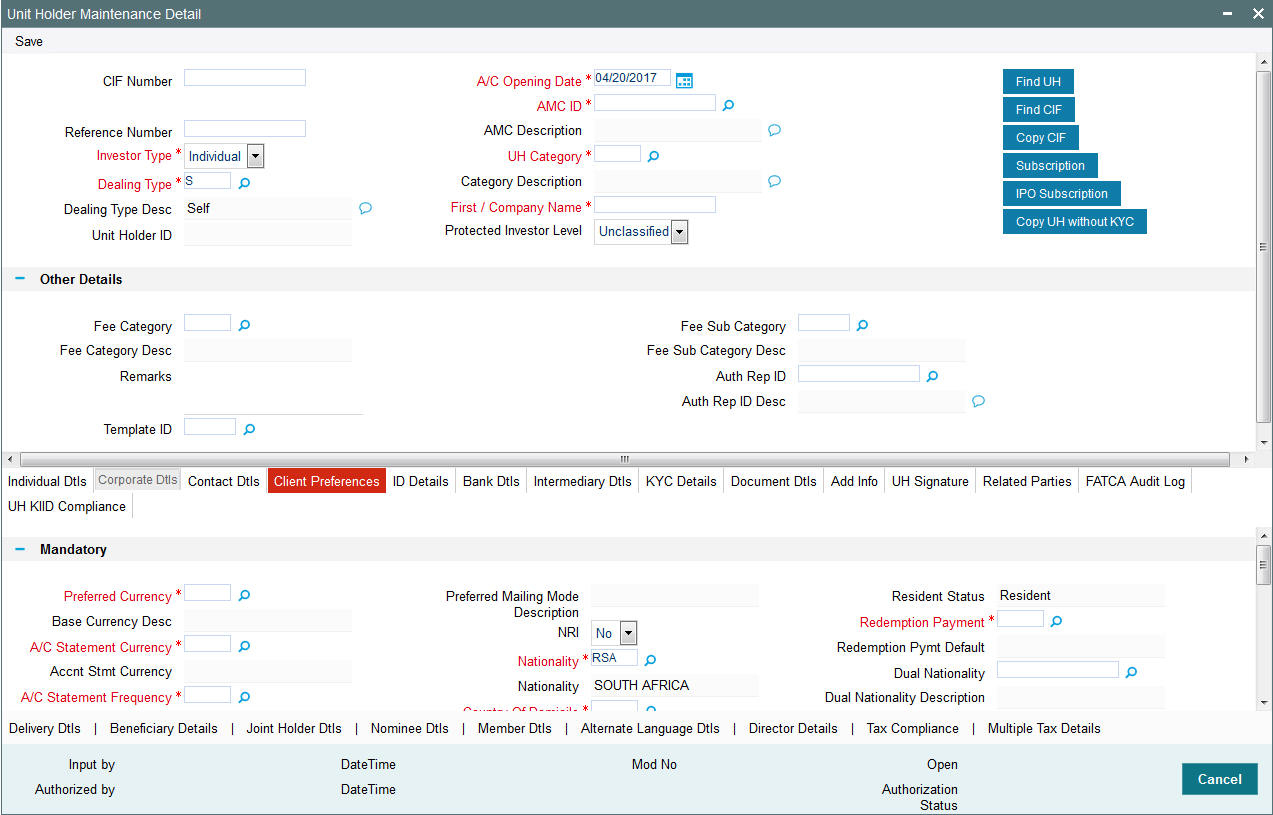

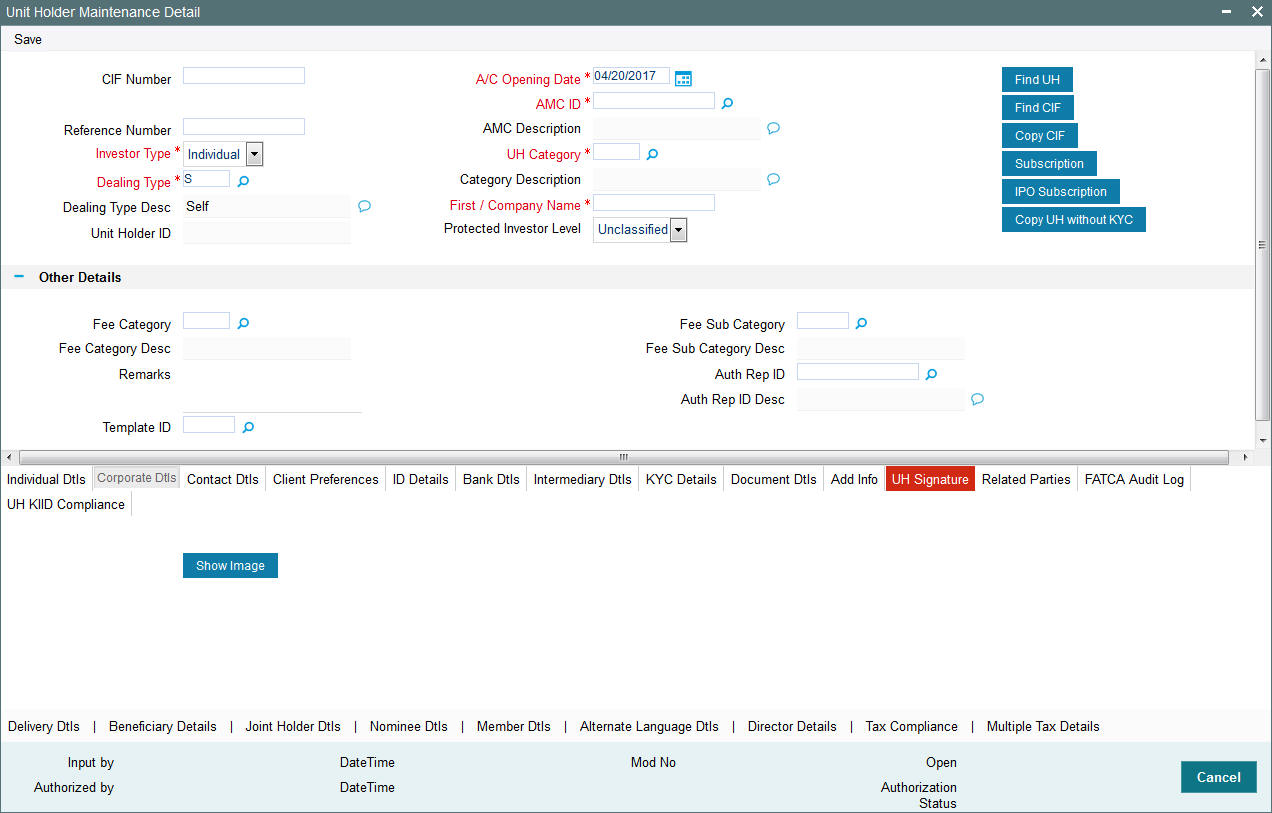

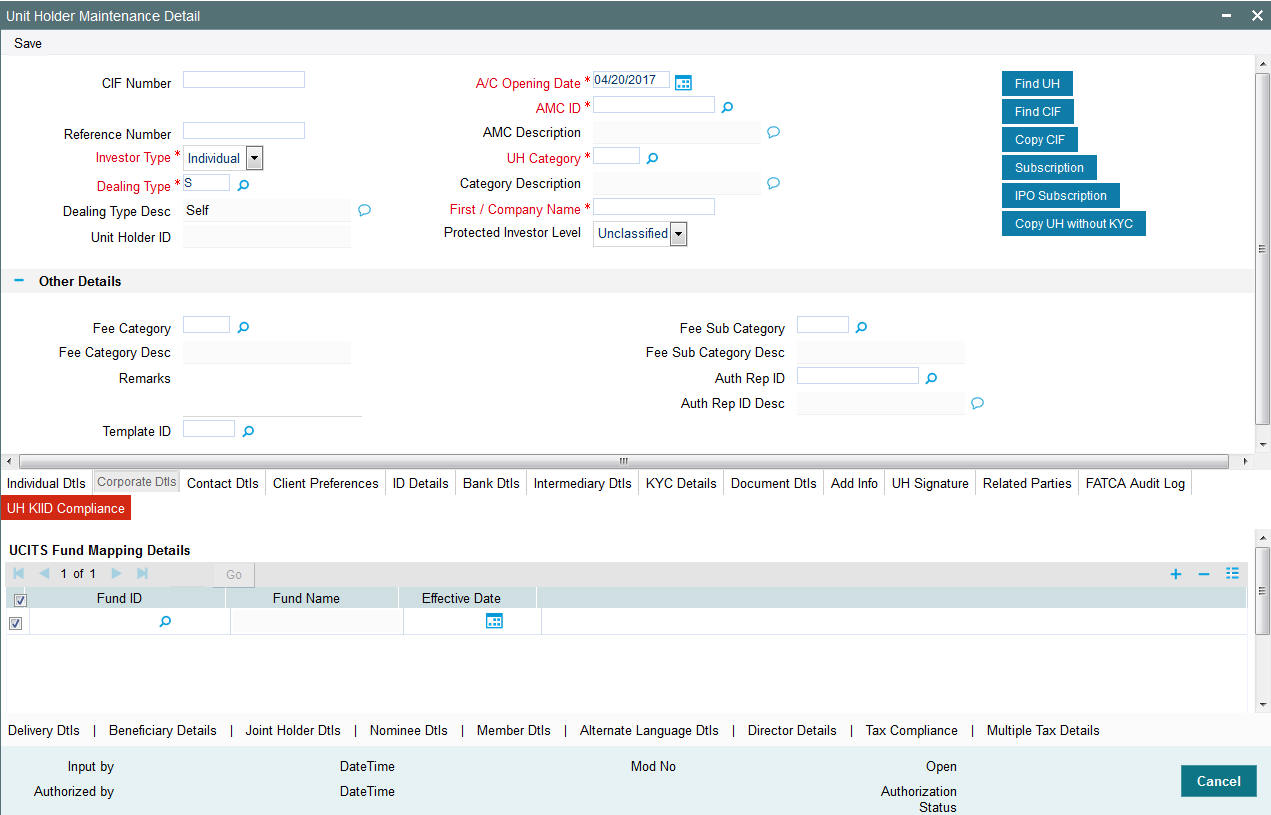

To create a new unit holder account in the FC-IS system for an investor, use the ‘Unit Holder Maintenance Detail’ screen. You can invoke this screen by typing ‘UTDUH’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the Unit Holder Maintenance Detail screen, you create the account by:

- Specifying information that will form a profile of the investor. This includes, first, all the mandatory information that is required, and then, any further specifications you might want to make.

Note

You can also copy the details of an existing unit holder, and then modify the copied details as required, by using the Copy UH link.

- Saving your specifications.

Select ‘New’ from the Actions menu in the Application toolbar or click new icon to enter the details of the Unit Holder Maintenance screen. The Unit Holder Maintenance Detail screen has the following fields for data entry:

CIF Number

Alphanumeric; 9 Characters; Optional

Specify the CIF number of the customer for whom you are creating a unit holder account.

You can also query for CIF number by clicking ‘Find UH’ button.

When you specify the CIF Number, the name of the corresponding CIF customer is retrieved from the database and displayed alongside the field. Also, the default information from the initial unit holder account created for the CIF account is displayed in the fields of this screen. You can override any of these if necessary, and make necessary specifications.

Reference Number

Alphanumeric; 12 Characters; Optional

Specify the reference number.

Investor Type

Mandatory

Select the type of investor from the drop-down list. the list displays the following values:

- Individual

- Corporate

Dealing Type

Alphanumeric, 1 Character; Mandatory

Indicate whether the investor wishes to deal with the AMC either directly (as self) or through a designated authorized representative, by choosing the appropriate option from the option list.

If you choose the authorized representative option here, then you must specify the ID of the designated authorized representative in the Auth Rep ID field as mandatory information for the account.

If you are maintaining a depositary as a unit holder in the system, you must select the dealing type as ‘Depositary’.

Dealing Type Desc

Display

The system displays the description for the selected dealing type.

Unit Holder ID

Display

The system displays the unique number assigned to each unit holder account.

In case you have input the unit holder ID, the system checks if:

- The number of characters in the value input is less than 12

- The value specified is unique

- The last 2 characters (which are the check digits) of the value input are valid using the check digit algorithm for generating unit holder ID.

If you input the last two characters as ‘04’, the system displays an error message and you are required to input a new value for the unit holder ID.

In the case of system-generated ID, the automatic generation of unit holder ID takes place after you have specified all mandatory details for a new account, and clicked the Save button at the bottom of the Client Information Section (or at the bottom of the Detail screen).

All your specifications are validated, and upon successful validation, the generated unit holder ID for the account is displayed.

The logic governing the generation of unit holder ID’s would have been defined for the agency branch where you have created the account, in the agency branch maintenance record.

This field is not visible when you are creating a new account in the Detail screen. If you are viewing, editing, deleting or amending a previously created unit holder record, then the ID of the account is displayed here, and is non-editable.

If the unit holder account is being created for a CIF account in FCC, then the unit holder number will be identical to the FCC account number.

Note

You should define the following System Parameters to enable the generation and validation of unit holder ID:

- WEIGHTFACTOR

- MODULAR

- UHPREFIX

A/C Opening Date

Date Format, Mandatory

Specify the date on which you are creating the account.

The application date is displayed here by default, and will be reckoned as the opening date for the account if you do not specify any other date in this field. You can specify an earlier date, if necessary.

AMC ID

Alphanumeric; 12 Characters; Mandatory

Select the code of the AMC/ Distributor in whose funds the investor wishes to invest, from the list provided. You capture this information for the purpose of identifying the AMC/ Distributor to which the unit holder belongs, and in whose database the unit holder account will reside.

AMC Description

Display

The system displays the description for the selected AMC ID.

UH Category

Alphanumeric; 2 Characters; Mandatory

Specify the unit holder category.

Category Description

Display

The system displays the description for the selected UH category.

First / Company Name

Alphanumeric; 105 Characters; Mandatory

Enter the First or Company name.

Protected Investor Level

Optional

Select protected investor level from the drop-down list. The list displays the following values:

- Classified

- Unclassified

Other Details

Fee Category

Alphanumeric; 3 Characters; Optional

From the list provided, select the fee category to be deemed applicable for the investor whose account you are creating.

Fee Category Desc

Display

The system displays the description for the selected fee category.

Remarks

Alphanumeric; 255 Characters; Optional

Specify any narrative, or descriptive text, if any, concerning the account.

Template ID

Alphanumeric; 6 Characters; Optional

Specify the template ID. Alternatively, you can select template ID from the option list. The list displays all valid template ID maintained in the system.

On modify operation, if the template ID is given a overrride message as ‘Auto-information change will happen for underlined unitholders for CIF/ Identification based on the template ID’ will be shown and on authorization informations will be replicated. On New operation, if the template ID is given, the system display an error message as 'Template ID should be entered only during modification'.

In this field, indicate the reasons for which the account is being created, if necessary.

Fee Sub Category

Alphanumeric, 6 Characters; Optional

From the list provided, select the fee subcategory to be deemed applicable for the investor whose account you are creating.

Fee Sub Category Desc

Display

The system displays the description for the selected fee category.

Auth Rep ID

Alphanumeric; 12 characters; Mandatory only for unit holders dealing through authorized representative

For investors dealing through authorized representative, select the ID of the preferred representative using the list button alongside.

Auth Rep ID Desc

Display

The system displays the description for the selected fee category.

Click ‘Find CIF’ button to search for CIF number.

Click ‘Subscription’ button to input ‘Subscription Transaction’ details.

Click ‘IPO Subscription’ button to input ‘IPO Subscription’ details.

The Copy CIF Button

If you wish to copy the unit holder details from that of an existing unit holder account, click the Copy CIF button alongside the CIF Number field. The Unit Holder Find screen is opened, and you can select the unit holder whose details you wish to copy. When you have selected the required unit holder, the details of the selected account are written into the respective fields in the UH New Account Detail screen. You can make changes to the copied details, if required, and save your changes to create the unit holder account. This feature can only be invoked in the New Mode.

While creating a unit holder account using the Copy UH link, the system will not copy the KYC details. You need to provide new KYC details as per category selected.

Copy UH Without KYC button

This button will be enabled upon query operation. If you click this the system will copy the previous unit holder along with KYC details. When the KYC details are copied from the parent UH the ‘All requested KYC documentation has been received’ field will be defaulted to “No”.

If you want to copy the UH but not KYC details of the previous UH then click ‘Copy UH without KYC’. The system will not copy the KYC from the parent UH.

3.2.2 Individual Dtls Tab

In this section, specify the personal details for individual investors. You can access it by clicking ‘Individual Dtls’ tab.

Note

After you have specified the details in this section for an individual investor, all your specifications will be lost if you change the investor type from “Individual’ to ‘Corporate’.

Click ‘Individual Dtls’ tab to enter the details.

Last Name

Alphanumeric; 105 Characters; Optional

Specify the last name.

Middle Name

Alphanumeric; 105 Characters; Optional

Specify the middle name of the individual investor.

Title

Alphanumeric; 15 Characters; Optional

Select the applicable title for the name of the individual investor from the list provided. If you do not find the option you are looking for in the list, maintain the same in the System Parameters Maintenance Screen.

For further information refer to the chapter “Maintaining System Parameters”.

Initials

Alphanumeric; 10 Characters; Optional

The system uses the first character in the First Name and Middle Name of the Unit Holder and displays it as Initials. You can however, change the initials if required.

Example

Consider the investors with names ‘Lee-Ann Burrows’ and ‘Shawn David James Burrows’.

The table below illustrates how the system arrives at the Initials for the above two names:

First Name |

Middle Name |

Last Name |

Initials |

Lee-Ann |

|

Burrows |

L |

Shawn |

David James |

Burrows |

SDJ |

Minor

Optional

Select ‘Yes’ to indicate that the investor is a minor. If so, you must specify the following as mandatory information for such an investor:

- The date of birth for the same, in the Date of Birth field.

- The name of the designated guardian, in the Guardian field.

- The relationship of the designated guardian with the investor, in the Relationship field.

Guardian Name

Alphanumeric; 105 Characters; Optional

Specify the name of the designated guardian for the minor investor.

Relationship

Alphanumeric; 70 Characters; Optional

Specify the relationship between the designated guardian and the minor investor.

Description

Display

The system displays the description for the selected relationship status.

Sex

Alphanumeric; 1 Character; Optional

Indicate the gender of the individual investor by choosing either the Male or Female option, as applicable.

The default option displayed in this field is Male, and will be considered to be the gender of the investor if you do not select an option.

Guardian PAN/GIR No.

Alphanumeric; 15 Characters; Optional

Enter PAN/ GIR number.

Guardian MFIN

Alphanumeric; 15 Characters; Optional

In case the unit holder is a minor and the client country parameter is set to “SHOWPANINFO” for your bank, specify the MFIN details of the unit holder’s guardian here.

Health Status

Alphanumeric; 1 Character; Optional

Specify the health status. Alternatively, you can select health status from the option list. The list displays all valid health status maintained in the system.

Father/ Spouse Name

Alphanumeric; 105 Characters; Optional

Specify the name of the father or spouse of the individual investor.

Date of Birth

Date Format; Optional (Mandatory for minor investors)

Specify the date of birth of the investor. Although you need not specify this as mandatory information for non-minor investors, it is recommended that you do so.

You must specify the date of birth as mandatory information for investors that are minors.

Beneficiary

Alphanumeric; 105 Characters; Optional

Specify the name of the preferred beneficiary of the individual investor.

Marital Status

Alphanumeric; 1 Character; Optional

Indicate the marital status of the individual investor by choosing either the Single or Married option, as applicable.

The default option displayed in this field is Single, and will be considered to be the marital status of the investor if you do not select an option.

Marital Status

Display

The system displays the description for the selected marital status.

Occupation

Alphanumeric; 1 Character; Optional

Indicate the occupation of the individual investor by selecting the applicable option from the list provided.

Occupation

Display

The system displays the occupation description for the selected occupation code.

A/c Operation Type

Alphanumeric; 1 Character; Optional

Indicate the manner in which the investor wishes to operate the account, from the options in the list provided.

The investor may choose to operate the account in any of the following ways:

- Single

- Joint

- Either or Survivor

If you choose the Joint option, then you must specify the name of at least one of the preferred joint unit holders in the Joint CIF Details section in this screen, you are also allowed to specify the details of the joint account holders in the Joint UnitHolder Details screen which can be invoked by clicking the Joint UnitHolder Details hyperlink which appears once the Joint option is selected. You can modify the account operation type after authorization.

Account Operation Type

Display

The system displays the type of account operation.

Guardian Form 60/61 Available?

Optional

If you want Guardian Form 60/61 to be available, select ‘Yes’. Else select ‘No’.

3.2.3 Corporate Dtls Tab

In this section, specify the company details for corporate investors. You can access it by clicking ‘Corporate Dtls’ tab..

Authorized Signatory 1, 2 and 3

Alphanumeric; 105 Characters; Optional

Specify the names of any authorized signatories that must be deemed as valid for the company.

Minimum No of Signatories

Numeric; 22 Characters; Optional

Specify the minimum number of signatories.

Corporation Type

Alphanumeric; 3 Characters; Optional

Select the type of the corporation that the company is to be deemed, from the list provided.

Description

Display

The system displays the description for the selected corporation type.

Country of Incorporation

Alphanumeric; 3 Characters; Optional

Specify the incorporation country from the adjoining option list.

Note

After you have specified the details in this section for a corporate investor, all your specifications will be lost if you change the investor type from ‘Corporate’ to “Individual’.

Description

Display

The system displays the description for the selected country code.

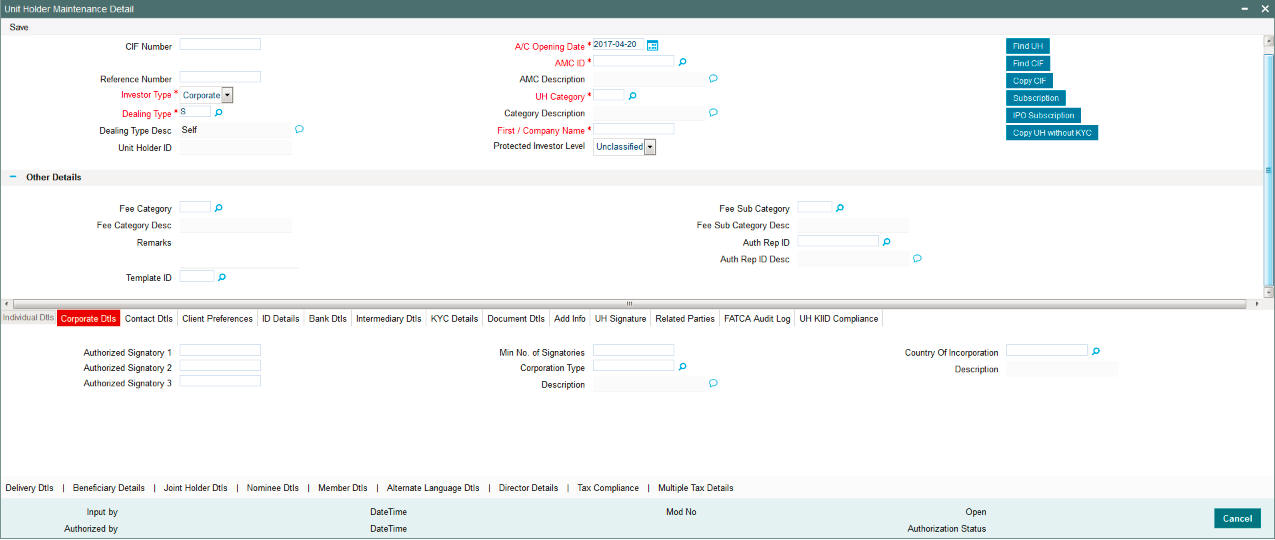

3.2.4 Contact Dtls Tab

In this section, specify the means of communication with the investor for whom you are creating the account. You can access this section by clicking ‘Contact Dtls’ tab.

You can specify at least two addresses, and designate one as the default mailing address to be used for correspondence with the investor, and the other as the alternate address. Specify the default address under the Default Address head, and the alternate address under the Alternate Address head.

You can also maintain the SWIFT Address for the unit holder, in the SWIFT Address tab.

Correspondence Address Section

The following fields comprise the correspondence address information, in the Correspondence Address section:

Address Lines 1-2

Alphanumeric; 105 Characters; Mandatory

Specify the default postal address that is to be used for correspondence with the investor.

City

Alphanumeric; 105 Characters; Optional

Specify the name of the city of residence of the investor. You can select the city from the drop down list provided. The available options depend on the values defined at the params maintenance. If the city is not available in the list, you can specify the city in the field provided alongside.

The list of cities available in the system will be a one time upload into the system.

Use State Maintenance

Optional

You can select one of the two values from the drop-down list:

- Yes

- No

If you select ‘Yes’, then only the system can accept US state code in ‘State’.

If you select ‘No’, then system can accept any value for ‘State’.

By default, the system displays ‘No’.

State

Alphanumeric; 80 Characters; Optional

Specify the state in which the city of residence of the investor is located. You can select the state of residence from the drop down list provided. The available options depend on the values defined at the params maintenance. If the state is not available in the list, you can specify the city in the field provided alongside.

Country

Alphanumeric; 3 Characters; Optional

Select the country in which the investor is domiciled, from the drop-down list.

When you specify the address of the investor, the country (if any) indicated in the address is displayed here by default

Int. Dialing Code +

Alphanumeric; 10 Characters; Optional

Specify the international dialling code.

Telephone 1

Alphanumeric; 60 Characters; Optional

Enter the contact telephone numbers of the investor.

Zip Code

Alphanumeric; 10 Characters; Optional

Specify the zip code of the specified city of residence of the investor.

Alphanumeric; 255 Characters; Optional

Specify the Email address of the investor.

Contact Person

Alphanumeric; 160 Characters; Optional

For corporate investors, enter the name of the contact person at the unit holder office.

Int. Dialing Code +

Alphanumeric; 10 Characters; Optional

Specify the international dialling code.

Telephone 2

Alphanumeric; 60 Characters; Optional

Enter the contact telephone numbers of the investor.

Int. Dialing Code +

Alphanumeric; 10 Characters; Optional

Specify the international dialling code.

Cell Phone Number

Numeric; 60 Characters; Optional

Specify the cell phone number of the investor.

Int. Dialing Code +

Alphanumeric; 10 Characters; Optional

Specify the international dialling code.

Fax Number

Numeric; 60 Characters; Optional

Specify the fax number of the investor.

Alternate Address Section

The Alternate Address section captures the same details as the Correspondence Address tab (as detailed above). However, you can specify a date range within which the alternate address would be in effect:

Address Line 1-2

Alphanumeric; 105 Characters; Mandatory

Specify the default postal address that is to be used for correspondence with the investor.

City

Alphanumeric; 105 Characters; Optional

Specify the name of the city of residence of the investor. You can select the city from the drop down list provided. The available options depend on the values defined at the params maintenance. If the city is not available in the list, you can specify the city in the field provided alongside.

The list of cities available in the system will be a one time upload into the system.

Use State Maintenance

Optional

You can select one of the two values from the drop-down list:

- Yes

- No

If you select ‘Yes’, then only the system can accept US state code in ‘State’.

If you select, ’No’, then system can accept any value for ‘State’.

By default, the system displays ‘No’.

State

Alphanumeric; 80 Characters; Optional

Specify the state in which the city of residence of the investor is located. You can select the state of residence from the option list provided. The available options depend on the values defined at the params maintenance. If the state is not available in the list, you can specify the city in the field provided alongside.

Country

Alphanumeric; 3 Characters; Optional

Select the country in which the investor is domiciled, from the option list.

Zip Code

Alphanumeric; 10 Characters; Optional

Specify the zip code of the specified city of residence of the investor.

Effective From Date

Date Format, Optional

Specify the date that marks the beginning of the period for which the specified alternate address is in effect.

Effective To Date

Date Format, Optional

Specify the date that marks the end of the period for which the specified alternate address is in effect.

Alphanumeric; 255 Characters; Optional

Specify the E-mail address of the investor.

Int. Dialing Code +

Alphanumeric; 10 Characters; Optional

Specify the international dialling code.

Telephone 1

Alphanumeric; 60 Characters; Optional

Enter the contact telephone numbers of the investor.

Int. Dialing Code +

Alphanumeric; 10 Characters; Optional

Specify the international dialling code.

Telephone 2

Alphanumeric; 60 Characters; Optional

Enter the contact telephone numbers of the investor.

Int. Dialing Code +

Alphanumeric; 10 Characters; Optional

Specify the international dialling code.

Fax Number

Alphanumeric; 60 Characters; Optional

Enter the fax number of the investor.

SWIFT Address Section

The following fields comprise the SWIFT address information, in the SWIFT Address section:

Address Lines 1-2

Alphanumeric; 105 Characters; Optional

Enter the SWIFT address of the investor. You can enter up to 4 lines of address information.

City

Alphanumeric; 105 Characters; Optional

Specify the city of the SWIFT address for the investor.

Country

Alphanumeric; 3 Characters; Optional

Specify the country of the SWIFT address for the investor.

Country Name

Display

The system displays the name of the country for the selected country code.

BICCODE

Alphanumeric; 16 Characters; Optional

Specify the Bank Identifier Code (BIC) of the investor.

3.2.5 Client Preferences Tab

In this section, you specify any preferences indicated by the investor for the purpose of investment and transaction processing. You can access this section by clicking ‘Client Preference’ tab.

Mandatory Section

Preferred Currency

Alphanumeric; 3 Characters; Optional

From the list, select the currency in which the investor prefers to transact with the AMC.

The preferred currency is the currency in which the investor or unit holder prefers to make any payments involving transactions or receive any dividend income payments. The currency you select here will be deemed as the default currency for all payments from or to the investor. If the ‘Payment Mode’ chosen is ‘Transfer’, the system allows you to successfully save the unit holder details only if you maintain a bank account for the preferred currency or multi-currency.

You can also choose ‘Fund Base Currency’ (FBC) as your preferred currency (for unit holders only). In this case, you will be allowed to proceed with saving unit holder details without maintaining an account for ‘FBC’.

You can save transactions for unit holders with ’FBC’ as preferred currency, but these transactions will be marked incomplete. You can complete such transactions by specifying unit holder Bank details for the unit holder and for the transactions (in the ‘Payments Details’ section).

The system processes payments on the basis of the currency for each fund for the ‘FBC’ option. In case an account exists for the FBC, the system picks it up for payments or else it picks up the default multi-currency account for the unit holder. If neither is available, the system displays an error message.

The investor can, if need be, choose to transact in a currency different from the one you specify here, for any transaction.

Note

When you specify the country in which the investor is domiciled, in the Country of Domicile field, the currency associated with the specified country is retrieved from the Country Currency Maintenance record in the system and displayed in this field by default. If you do not select any currency here, then the displayed default currency will be deemed as the preferred currency for the investor.

Base Currency Desc

Display

The system displays the description for the selected base currency.

A/C Statement Currency

Alphanumeric; 3 Characters; Optional

Select the currency for account statements for the investor, from the drop-down list.

If you do not make any selection, this will be deemed as the account statement currency for the unit holder.

Accnt Stmt Currency

Display

The system displays the account statement currency for the selected account statement currency.

A/C Statement Frequency

Alphanumeric; 1 Character; Mandatory

From the list, select the frequency at which the investor wishes to receive periodic statement of accounts from the AMC – this could be monthly, daily, yearly, half-yearly, biweekly, quarterly or weekly.

Account Statement Frequency

Display

The system displays the account statement frequency.

A/C Type

Alphanumeric; 2 Characters; Optional

From the list, specify whether the account is to be a Voluntary account or a Retired account. Once authorized, this field cannot be modified.

Account Type

Display

The system displays the type of account for the selected account type.

Preferred Mailing Mode

Alphanumeric; 2 Characters; Mandatory

From the list, select the mailing mode in which the investor prefers to receive correspondence from the AMC.

If you wish to suppress the printing of contract notes in respect of the unit holder during execution of End of Day processes, you must select the ‘File’ option in this field.

Preferred Mailing Mode Description

Display

The system displays the description for the selected preferred mailing mode.

NRI

Optional

Select if the investor is NRI or not from the drop-down list. The list displays the following values:

- Yes

- No

Nationality

Alphanumeric; 15 Characters; Mandatory

From the list, select the nationality of the investor for whom you are creating the account.

When you specify the country in which the investor is domiciled, in the Country of Domicile field, the nationality of the specified country is displayed in this field by default. If you do not make any selection in this field, then the displayed default nationality will be deemed as the nationality of the investor.

Nationality

Display

The system displays the nationality description.

Country of Domicile

Alphanumeric; 3 Characters; Mandatory

From the list provided, select the country where the investor is domiciled.

If you do not make a selection, then this default country of domicile is reckoned for the investor account in the database.

Country Of Domicile Description

Display

The system displays the description for the selected country of domicile.

Preferred Language

Alphanumeric; 12 Characters; Mandatory

From the list, select the language preferred by the investor for correspondence and communication.

Preferred Language Desc

Display

The system displays the description for the selected preferred language.

Resident Status

Alphanumeric; 1 Character; Mandatory

Indicate whether the investor resides in the selected country of domicile or not, by selecting either the Resident or the Non-Resident option.

Resident Status

Display

The system displays the description for the selected resident status.

Redemption Payment

Alphanumeric; 1 Character; Optional

Select the default mode of payment that is to be used for paying out the proceeds of any redemption transactions for the investor.

The two modes of payment supported in the system are Check and Transfer.

Redemption Pymt Default

Display

The system displays the description for the selected redemption payment.

Dual Nationality

Alphanumeric; 3 Characters; Optional

Select the dual nationality from the adjoining option list.

Dual Nationality Description

Display

The system displays the description for the selected dual nationality.

Substantial Stay in US

Optional

Indicate your substantial stay in US from the adjoining drop-down list. The options available are:

- Yes

- No

Investor Risk Level

Numeric; 3 Characters; Optional

Select the investor risk level from the option list. Alternatively, you can select Investor Risk Level from the option list. The system displays all valid investor risk status maintained in the system.

If investor with any risk level (including null) tries to invest in a fund with Restricted fund as ‘Yes’, then the system will display warning message as ‘Fund is restricted for investment from selected transaction type/ref type combination’. The error message will be displayed based on ‘Restriction applicable’ field, based on ref types mapped into ‘Fund Restriction’ screen.

Note

You can configure Fund risk level and investor risk level at param maintenance for FUNDRISKPROFILE and INVRISKPROFILE param codes respectively. The system will validate the fund risk for an investor in ‘Investor Fund Risk Rating Mapping’ screen.

This validation is also applied to electronic deals (bulk upload/SWIFT/gateway), light weight screens and bulk transaction screens.For light weight screen and bulk upload, the warning/ error messages will be logged and cannot be viewed on the screen.

The warning messages will be generated during the ‘Save’, ‘Edit’ and ‘Modify’ operations for the transactions captured manually.

If the SI ref type is mapped, the system will generate warning message on the RSP transaction while saving.

During authorization, the warning messages will appear for confirmation and the checker will have to accept the warnings to complete the transaction authorization.

Note

The above validations are also applicable for transactions that are uploaded through FCIS Bulk Upload, SWIFT and gateway services.(Create/ Modify for IPO Subscription/ Subscription/ Switch/ Transfer).

Investor Risk Level Description

Display

The system displays the description for the selected investor risk level.

Risk Expiry Date

Date Format; Optional

Select the expiry for the risk rating captured for the UH from the adjoining calendar.

When investor or guardian of minor account reaches 70 years old, the system will automatically update investor risk level to ‘10’ [‘conservative/ low’] and expiry date field will not be updated.

This check and risk profile updating will be handled by a BOD batch job. This job will be sequenced before SI generation job. Age at which the risk profile defaults to 10 is configurable in ‘Parameter Maintenance Screen’ with Param Code as ‘RISKPROFILEEXPIRYAGE’. This job for resetting risk profile can be scheduled as part of mini EOD for the required AMC's also.

When expiry date is crossed, the system will consider the investor risk level as ‘10’ [Low] irrespective of the investor risk level maintained. The system will not update the investor risk level field to ‘10’ [Low] in this case.

Latest Assessment Date

Date Format; Optional

Select the date on which investor risk profile was last assessed from the adjoining calendar.

Optional

Check Writing Facility

Optional

You can use this field to indicate that the investor is allowed to avail check writing facility on any funds of the AMC in which the investor holds unit balances.

Typically, in money market funds, investors could be issued deposit slips for subsequent purchases. They could also write checks to any external entity/ individual, which are reckoned as redemption from the investor account, when produced by the external entity individual, to the AMC.

Telephone Redemption

Optional

Select ‘Yes’ to indicate that telephonic requests from the investor for redemption transactions must be accepted.

Telephone Switch

Optional

Select ‘Yes’ to indicate that telephonic requests from the investor for switch transactions must be accepted.

Note

If you select both Telephone Redemption and Telephone Switch fields as ‘Yes’, then the system will accept redemption and switch transaction requests with ‘telephone’ as the means of purchase.

Registration Type

Alphanumeric; 2 Characters; Optional

For investors requesting NSCC or Wire Order transactions, indicate whether the registration of certificates issued, if any, must be in the investor’s name (Individual Name) or registration name specified for the broker dealer (Street Name).

Registration Type Desc

Display

The system displays the description for the selected registration type.

Place of Birth

Alphanumeric; 80 Characters; Optional

Enter the place of birth of the investor. This is mandatory if you have not specified the Tax ID.

Dispatch Date

Date Format; Optional

Enter the dispatch date.

Trail Commission Preference

Optional

Select the trail commission preference from the drop-down list. The list displays the following values:

- Payout

- Reinvestment

Preferred Fund ID

Alphanumeric; 6 Characters; Optional

The fund you select in this field will be the one from which management fee will be recovered and into which any incentives will be credited.

When an incentive is being credited, the system will first consider the fund you have selected here, in the field ‘Preferred Fund’. If you have selected a fund here, the incentive will be credited into this fund. If you have not selected a fund, the incentive will be credited into the fund for which a fund-load mapping has been done.

Consider the following cases during the redemption of a fee:

Case 1 – Periodic Fee maintained at the product level

If the periodic load is maintained at the product level, redemption will happen from the fund indicated here, only if the fund has sufficient balance. If the fund does not have sufficient balance, the system will consider the funds that you have selected through the Management Fee Applicability screen. For further information on the Management Fee Applicability screen, refer to the chapter Management Fee in the LEP User Manual.

Case 2 – Period Fee maintained at the fund level

If the periodic load is maintained at the fund level, the redemption will happen in the following manner:

The system will first consider the fund you have selected here, in the field ‘Preferred Fund’. If there is sufficient balance, the redemption will happen from this fund. If the balance is not sufficient, or you have not selected a fund (this field being optional), the system will consider the fund for which a fund-load mapping has been done. If there is sufficient balance in this fund, the redemption will be carried out from this fund. If, in this fund, the balance is not sufficient, the system will carry out the redemption from any other fund that the Unit Holder has invested into, in the appropriate ratio.

The funds, from which the fee amount is redeemed, may not be in the same currency. If the funds have different base currencies, the mid rate will be used as the exchange rate to arrive at the amount to be redeemed, in the fee currency.

Note

If the fee needs to be accrued in a certain currency, the transaction will need to be generated in the same currency. Hence, if the base currency of a certain fund is not that particular currency and it does not allow any transaction in that currency, the fund will not be considered for redemption of the fee amount. This can be illustrated with the following example:

Example

The base currency of the fund where the fee is accrued is RAND. After apportioning, the system will generate a redemption transaction in three funds with base currency and the restrictions as follows:

F1: Base Currency – RAND; Allowed Currencies: RAND, USD and GBP

F2: Base Currency – USD; Allowed Currencies: USD, INR and GBP

F3: Base Currency – GBP; Allowed Currencies: USD and GBP

In this case since the fee is accrued in RAND, the redemption transactions need to be generated in RAND. In the above case, F2 does not allow a RAND transaction. The system in such a case will raise an error.

Transaction Delivery Preferences

Alphanumeric; 1 Character; Optional

Select the transaction delivery preferences from the option list.

Cert Delivery Preference

Display

The system displays the certificate delivery details for the selected transaction delivery preferences.

Registration Name

Alphanumeric; 50 Characters; Optional

For street name registrations, specify the registration name to be displayed on the certificates. Typically, this is the dealer name of the corresponding broker dealer.

Pay by FEDWIRE / ACH

Optional

Select ‘Yes’ to indicate that payment by FEDWIRE or ACH is to be accepted for the investor.

Apply Indexation on CGT?

Optional

You can use this field to indicate whether indexation is to be applied on capital gains tax computation, for the investor. Select this option to indicate application of indexation. Leave it unchecked to indicate that indexation is not applicable.

To indicate application of indexation, you must also specify it as applicable for the capital gains load, when you associate the load with a fund in the Fund Load Setup. Indexation is applied only if it is specified both in this Unit Holder New Account screen (for the investor’s profile) as well as in the Fund Load Setup, for the fund.

Country of Birth

Alphanumeric; 3 Characters; Optional

From the list, select the country of birth of the investor. This is mandatory if you have not specified the Tax ID.

Country of Birth Description

Display

The system displays the description for the selected country code.

Returned Date

Date Format; Optional

Enter the returned date.

All Signatories Sign Required

Mandatory if check writing is allowed

For joint accounts in which the unit holder is availing the check-writing facility, use this field to indicate whether the signatures of all joint unit holders must be required on issued checks.

ROA Investor

Optional

Select ‘Yes’ to indicate that the investor prefers to avail of the Rights of Accumulation facility.

Country Type

Alphanumeric; 1 Character; Optional

Specify the country type. The adjoining option list displays all valid county codes maintained in the system. You can choose the appropriate one.

Country Type Description

Display

The system displays the description for the selected country type code.

Campaign Code

Alphanumeric; 6 Characters; Optional

You can link the campaign to the unit holder. Specify the campaign to be mapped. You can also select the campaign code from the option list. The campaign codes with the start and the end date in between the unit holder account opening date is displayed in the option list. You can modify the campaign even after the authorisation.

Stop Account

IRS Notification on A/C

Alphanumeric; 10 Characters; Mandatory

Specify IRS notification details on account. The adjoining option list displays all valid IRS Notification ID maintained in the system. You can choose the appropriate one.

IRS Notification

Display

The system displays the description for the selected IRS Notification ID.

Stop Code

Alphanumeric; 25 Characters; Optional

Specify the stop code. The adjoining option list displays all valid stop code maintained in the system. You can choose the appropriate one.

If multiple Stop codes are mapped to the Unit Holder, the highest Stop Account Restriction will be consider for the Unit Holder Status and the system will display the warning message as ‘Unit Holder is mapped with the Stop Account code’ at transaction level.

Stop Code Description

Display

The system displays the description for the selected stop code.

Stop Account Reason

Alphanumeric; 255 Characters; Optional

Specify the reason for stopping an account.

Stop Account Effective Date

Date Format; Optional

Specify the effective date to stop an account.

The Stop Code effective date can be a future dated. However, the system will validate only those Stop codes which has the effective date less than or equal to the application date and lesser than release date for current transactions. The system will not validate the Stop codes which has effective date greater than the application date.

For backdated transactions,

- In case of single Stop Code for the UH, the system will pick up the Stop account restriction applicable for that period of time. However, in case of multiple Stop codes, based on the transaction type (whether IPO, Subscription, Redemption etc), the system will check each bit for the respective Stop codes available for that time and will take the highest preference stop account restriction.

- For both single and multiple Stop codes, the system will pick up the stop account restriction if the transaction date is greater than or equal to the Stop Account effective date but less than the Stop Account release date.

The system will not allow you to add any Stop Code effective date for the backdated and display an error message as ‘Stop Code effective date cannot be a backdated’.

Stop Account Release Date

Date Format; Optional

Specify the stop account release date.

Note

Stop code will remain available in the system and will not be made to null

Stop Account

Optional

Select stop account status from the adjoining drop-down list. Following are the options available:

- Yes

- No

Stop Account Restrictions

Display

The stop account restrictions box gets populated with according to the stop code mapped to UH.

Client Communication Restrictions

Contract Notes

Optional

Select if contract notes are applicable or not from the adjoining drop-down list. Following are the options available:

- Applicable

- Not Applicable

Account Statement

Optional

Select if account statement is applicable or not from the adjoining drop-down list. Following are the options available:

- Applicable

- Not Applicable

Communication Mode Restrictions

Communication Mode

Alphanumeric; 2 Characters; Optional

Specify the communication mode. The adjoining option list displays all valid communication mode maintained in the system. You can choose the appropriate one.

For Communication Mode, the system will restrict the Param value to the length of 2 characters.

The system will validate the applicable communication mode in UH screen against the communication mode in the transaction screen.

Communication Mode Description

Display

The system displays the description for the selected communication mode.

Restriction

Optional

Select if restriction is applicable or not from the adjoining drop-down list. Following are the options available:

- Applicable

- Not Applicable

Once the communication mode is restricted, the system will not allow you to enter the trades using the specific communication mode including Uploads and will display an error message as ‘The communication mode is restricted for the UH’.

If you try to map the restricted communication mode again to the UH then the system will display an error message as ‘Communication mode is already restricted for the UH’.

If you try to capture the transaction for the UH where the defined communication mode is restricted, then the system will display an error message as ‘Communication mode is restricted for the UH’.

Beneficiary Payout

You can direct redemption and dividend proceeds to beneficiaries by specifying the following preferences:

Redemption Payout

Optional

Check this option to indicate that the proceeds of a redemption transaction should be transferred to the beneficiaries mentioned. If you select this option, you need to maintain a minimum of one beneficiary along with the percentage to be awarded for the beneficiary in the ‘Beneficiary Dtls’ screen. It is also essential that the beneficiary be an existing Unit Holder and not a third party beneficiary.

Dividend Payout

Optional

Check this option to indicate that dividends should be transferred to the beneficiaries specified. If you select this option, you need to maintain a minimum of one beneficiary along with the percentage to be awarded for the beneficiary in the ‘Beneficiary Dtls’ screen. It is also essential that the beneficiary be an existing Unit Holder and not a third party beneficiary.

When you have multiple beneficiaries for a payout (dividend or redemption), you can amend the percentage to be given to each, as and when required. If the total percentage awarded to the beneficiaries does not add up to 100%, the remaining payout will be done to the primary unit holder. The amount paid out to the beneficiary will be net of withholding tax, which will be derived on the basis of the tax for the Unitholder – Beneficiary Country combination.

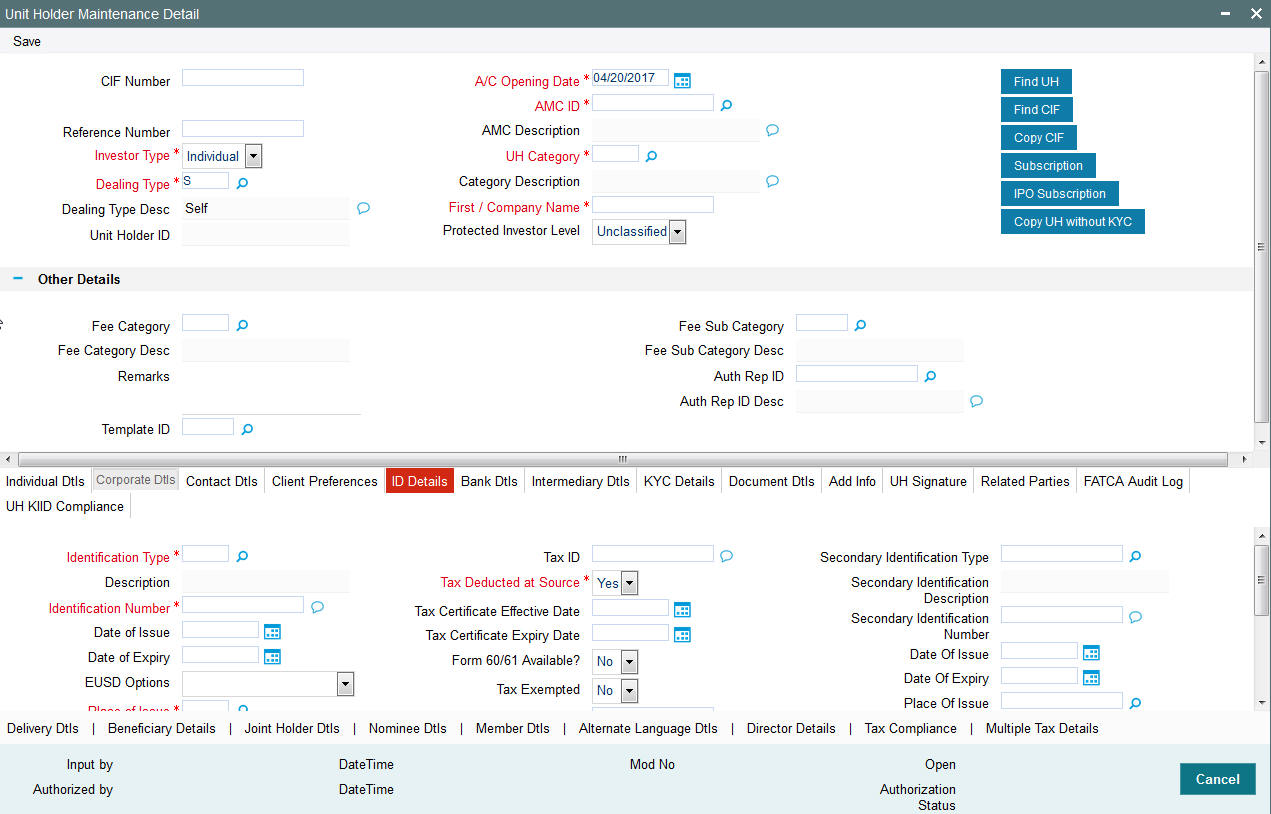

3.2.6 ID Details Tab

In this section, you specify details of any identification provided by the investor. You also indicate the applicability of tax being deducted at source for the investor and the required tax details.

Click ‘ID Details’ tab to enter the details.

Identification Type

Alphanumeric; 20 Characters; Mandatory

From the list, select the type of identification that is being provided by the investor. The identification type is the mode in which the unit holder will furnish an identification document or proof, and could be a Personnel ID, License, Birth Certificate, etc. This is used for identifying the unit holder during all subsequent transactions.

You can capture ‘NRIC Number’ as the identification type for a unit holder account. If you have selected NRIC Number as the Identification Type for the account, you can specify the applicable NRIC Number as the Identification Number. Once authorized, this field cannot be modified.

Description

Display

The system displays the description for the selected identification type.

Identification Number

Alphanumeric; 50 Character; Mandatory

Specify the number or ID of the identification document or proof that is furnished by the unit holder. Once authorized, this field cannot be modified.

Date of Issue

Date Format, Optional

Specify the date of issue of the identification document or proof that is furnished by the unit holder.

The date of issue that you specify here must not be later than the date of opening the account.

Date of Expiry

Date Format; Optional

Specify the date of expiry of the identification document or proof. It must be later than the date of issue and the application date.

EUSD Option

Optional

Select the EUSD (European Union Savings Directive) option from the drop-down list. The list displays the following values:

- With Holding Tax

- Exchange of Information

- Tax Exemption Certificate

Note

If EUSD option is not applicable at the segment level, then you will not be allowed to specify any option here.

Place of Issue

Alphanumeric; 3 Characters; Mandatory

From the option list, select the place of issue of the identification type. Once authorized, this field cannot be modified.

Place of Issue

Display

The system displays the description for the selected place of issue.

UH BIC Code

Display

The system displays the Bank Identification Code (BIC) of the unit holder, in case of financial institutional unit holders.

Recover CGT?

Optional

Select ‘Yes’ option, if the tax on capital gain has to be deducted from the transaction (Redemption, Transfer and Switch).

FATCA Classification

Display

If the ID selected is an existing entity in the system then system displays FATCA Classification type.

Description

Display

The system displays the description of FATCA classification.

Tax ID

Alphanumeric; 50 Characters; Optional (Mandatory if tax is specified to be deducted at source)

Specify the tax identification number or tax ID for the investor.

You can use this field to capture the PAN Number of the unit holder. For any transactions entered into by the unit holder in any fund, which involve volumes that exceed the Minimum Amount for Tax ID specified in the fund rules, the system validates the availability of the PAN Number.

Tax Deducted at Source

Mandatory

Select ‘Yes’ to indicate that tax must be deducted at source for the investor.

If you select ‘Yes’ at source, then you must specify the following mandatory information:

- The tax ID of the investor, in the Tax ID field.

- The tax circle that corresponds to the investor, in the Tax Circle field.

- The tax category that corresponds to the investor, in the Category field.

Tax Certificate Effective Date

Date Format; Optional

Specify the date from when the tax certificate is effective.

Tax Certificate Expiry Date

Date Format; Optional

Specify the date on which the tax certificate expires. It is mandatory for you to specify the expiry date if you chosen ‘Tax Exemption Certificate’ as the EUSD option.

Form 60/ 61 Available?

Optional

If form 60/ 61 is available, select ‘Yes’. Else select ‘No’.

Tax Exempted

Optional

You can use this field to indicate that the investor is the recipient of a special exemption from tax. Check this box to indicate such an exemption. If you have maintained any tax details for such an investor, they will be disabled, and not used.

Tax Circle

Alphanumeric; 15 Characters; Optional (Mandatory if tax is specified to be deducted at source).

Specify the tax circle to which the unit holder belongs.

MFIN

Alphanumeric; 15 Characters; Optional

Specify the MFIN details of the unit holder, provided the client country parameter is set to “SHOWPANINFO” for your bank. You will however not be allowed to enter the MFIN details if the unit holder is a minor.

US Indicia Available

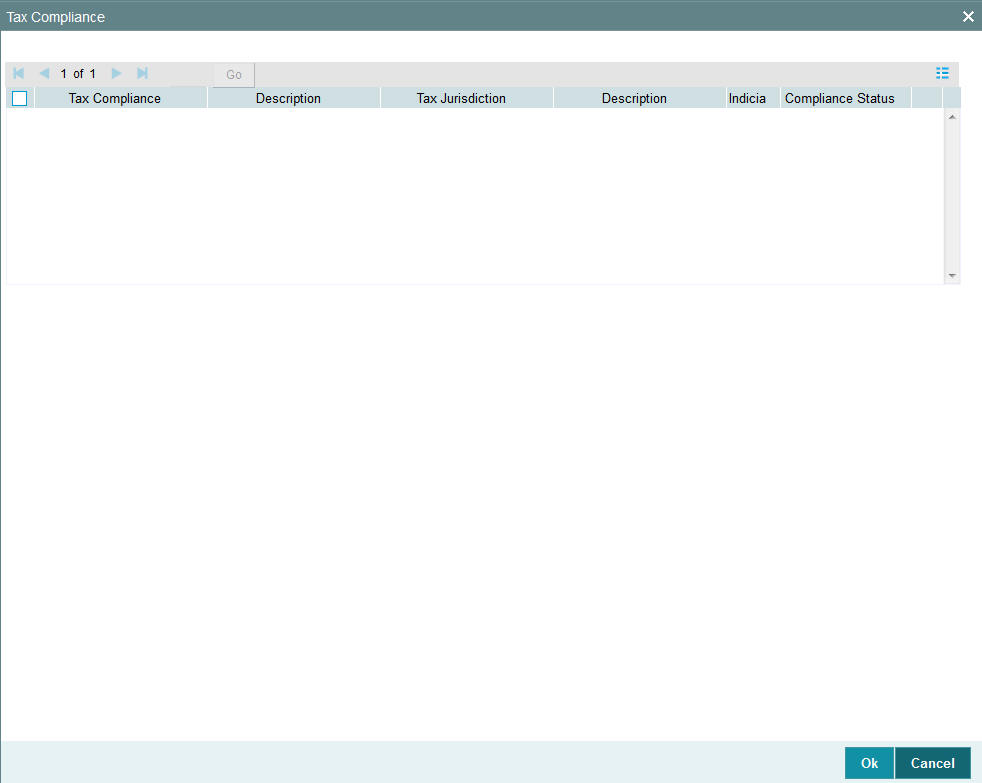

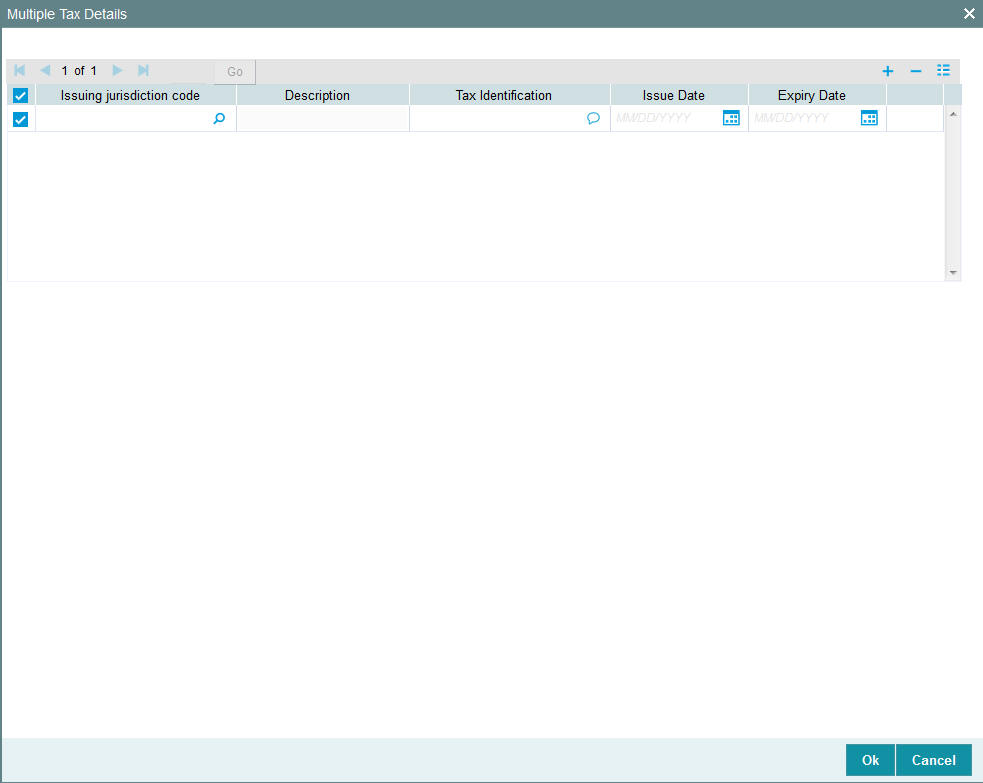

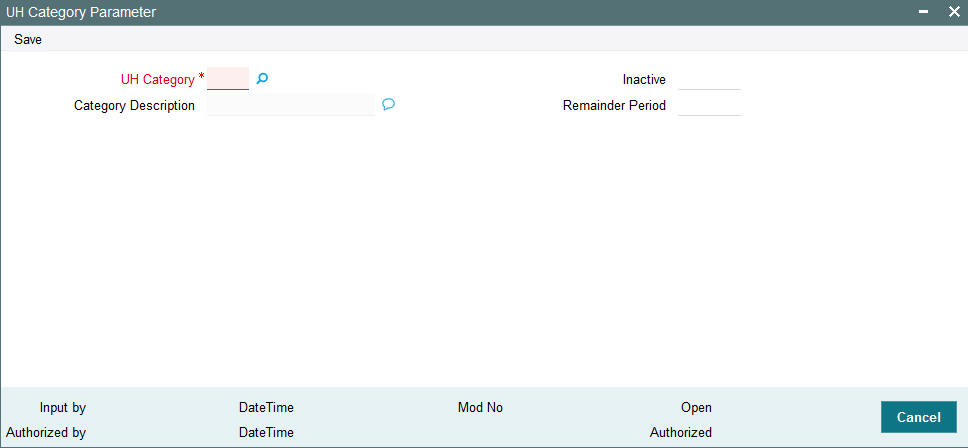

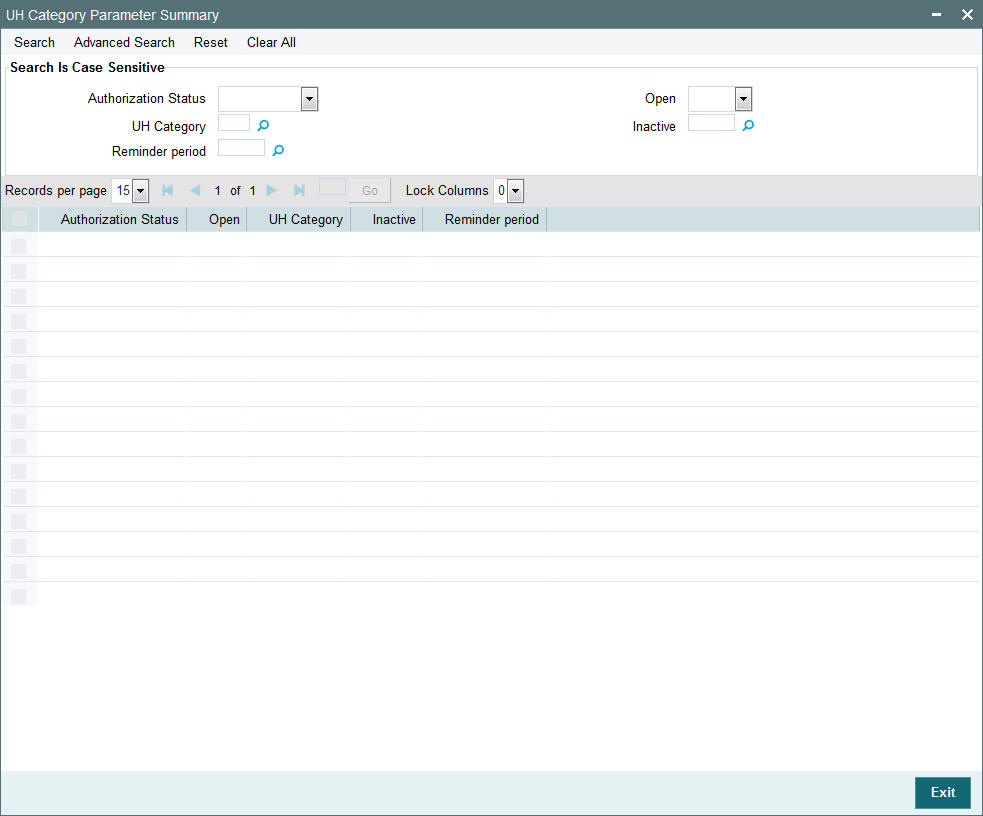

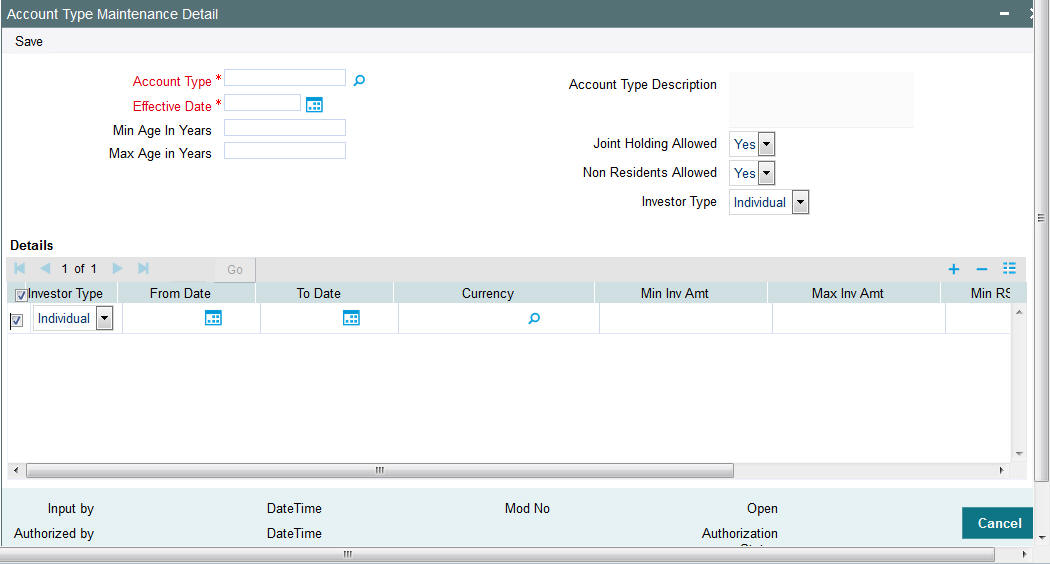

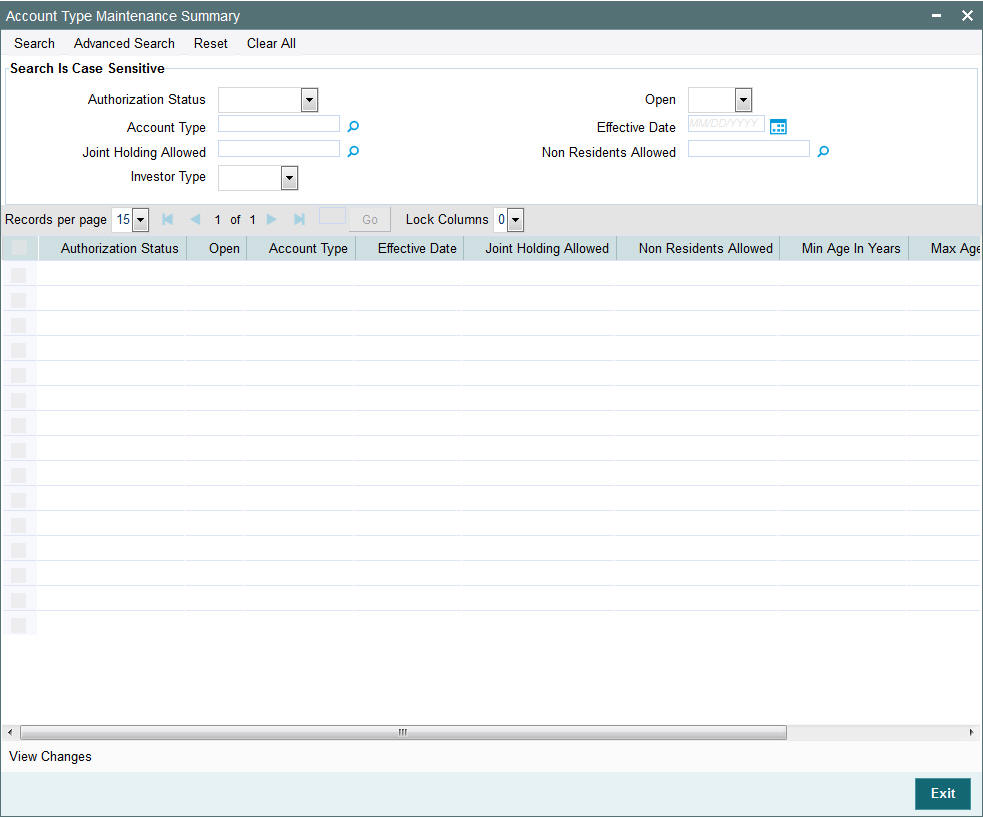

Display