5. Setting up Load Groups

This chapter contains the following sections:

- Section 5.1, "Load Groups"

- Section 5.2, "Rights of Accumulation"

- Section 5.3, "Load Groups Creation"

- Section 5.4, "Group Load Mapping Summary Screen"

- Section 5.5, "Load Group Characteristics Screen"

- Section 5.6, "Load Group Characteristics Maintenance Summary Screen"

- Section 5.7, "Non-fulfilment of Letter of Intent"

- Section 5.8, "Group Load Mapping "

- Section 5.9, "Load Group Summary Screen"

5.1 Load Groups

The AMC may need to group funds together based on common load and transaction processing characteristics, such as the same loads being applied to transactions in all funds in the group, or applicability of certain preferences maintained for investors.

Such a group of funds, which entail common load or transaction processing characteristics, are called load groups.

This is typical in the case of loads that are cumulative across funds (such as in the case of Rights of Accumulation), and also load patterns for Letter of Intent investors. This is also typical in the case of loads that are applied to funds that form part of a investment product or policy (plan) portfolio.

5.2 Rights of Accumulation

The AMC may give investors benefits based on the history of their investment in the funds of the AMC. This benefit would typically be a fee benefit, such as reduced transaction charges or reduced commissions, and is offered based on the history of investments.

This benefit facility given to the investor is known as the Rights of Accumulation facility.

Investors are given the option of availing of the Rights of Accumulation, at their discretion. Thus, when an investor transacts in a fund of the AMC, the history of the investor’s transactions in the fund is considered when the fee is applied for the transaction, if the investor has chosen to avail of the Rights of Accumulation facility.

The AMC reserves the discretion to interpret the history of investment of each investor on the basis of which, the Rights of Accumulation benefit would be available. Also, the AMC reserves the discretion to identify a single fund or a group of funds for which it would offer the Rights of Accumulation facility to investors, as well as the method of interpretation of investments, to be applicable for each group. The AMC can also specify whether the holdings across all the investors under a CIF account are to be considered for ROA.

Any individual fund for which the AMC designates Rights of Accumulation as applicable are called ROA funds, and any group of such funds is called an ROA group. An investor that opts to avail of the Rights of Accumulation is called an ROA investor. Also, the investor can override the AMC option of availing ROA at a CIF account level.

Interpreting the history of investments

The interpretation of the past investments of an investor in the case of Rights of Accumulation, for any ROA group of funds, would be based on any of the following aspects, at the AMC’ choice:

- Option (1): The total amount invested by the investor in all the funds in an ROA group of the AMC as on the transaction date

- Option (2): The product of the current holdings in all funds of the ROA group and the prevalent NAV for each fund in the ROA group on the transaction date.

- Option (3): The product of the current holdings in all funds of the ROA group and the prevalent subscription price for each fund in the ROA group on the transaction date.

- Option (4): Option (1) or (2), depending upon which of the two values is higher

- Option (5): Option (1) or (3), depending upon which of the two values is higher

- Option (6): The total value of the transactions entered into on the current business day in all individual funds, as well as funds forming part of a load group or a plan or policy portfolio. This option is known as the current day transactions value.

Depending upon the option chosen by the AMC for each ROA group of funds, any new transaction for the investor in the ROA group would take into consideration the value of the past investments, when the slab for loading is considered.

The following example will make this clearer:

For instance, let us suppose that an ROA investor, Mr. Colin White, would like to invest 10000 currency units in the Carey Bugle Growth Fund, which is part of an ROA group of funds known as LGROA, on 02-01-2003.

Before 02-01-2003, he has invested in the LGROA group of funds of which the Carey Bugle fund is a constituent, as follows:

Fund of ROA group (LGROA) |

Present holdings (units) |

Total amount invested in ROA group (TA1) |

Carey Bugle Growth Fund (CBGF) |

10000 |

100000 |

Farley Income Fund (FIF) |

5000 |

50000 |

|

15000 (sum) |

150000 (sum) |

The worth of the holdings in the LGROA group in terms of NAV prevalent on 02-01-2003:

Fund |

Present holdings (units) |

NAV on 02-01-2003 |

Total worth of holdings (TA2) |

CBGF |

10000 |

12 |

120000 |

FIF |

5000 |

12 |

60000 |

|

15000 (sum) |

|

180000 (sum) |

The worth of the holdings in the LGROA group in terms of subscription prices on 02-01-2003:

Fund |

Present holdings (units) |

Subscription price on 02-01-2003 |

Total worth of holdings (TA3) |

CBGF |

10000 |

11 |

110000 |

FIF |

5000 |

12 |

60000 |

|

15000 (sum) |

|

170000 (sum) |

The AMC has chosen Option (4) as the basis for applicability of Rights of Accumulation for the LGROA group. Since the value TA2 is higher than TA1, the value taken for identifying the loading slab for any new transactions for Mr. White in the LGROA group is taken to be TA2.

The load slabs defined for the LGROA group, of which the two funds are a part, are as follows:

Slab |

From Amount |

To Amount |

Return Value (%) |

001 |

0 |

10000 |

5 |

002 |

10000 |

20000 |

4 |

003 |

20000 |

40000 |

3 |

004 |

40000 |

80000 |

2 |

005 |

80000 |

16000 |

1 |

006 |

160000 |

320000 |

0.25 |

Now for Mr. White’s subscription transaction of 10000 currency units on 02-01-2003, the amount considered for identifying the slab, according to the ROA option chosen by the AMC for the LGROA group = Transaction Amount + TA2 = 10000 + 180000 = 190000 currency units.

This would fall in slab 006 for the fund and so, the applicable return value percentage would be 0.25%.

5.3 Load Groups Creation

This section contains the following topics:

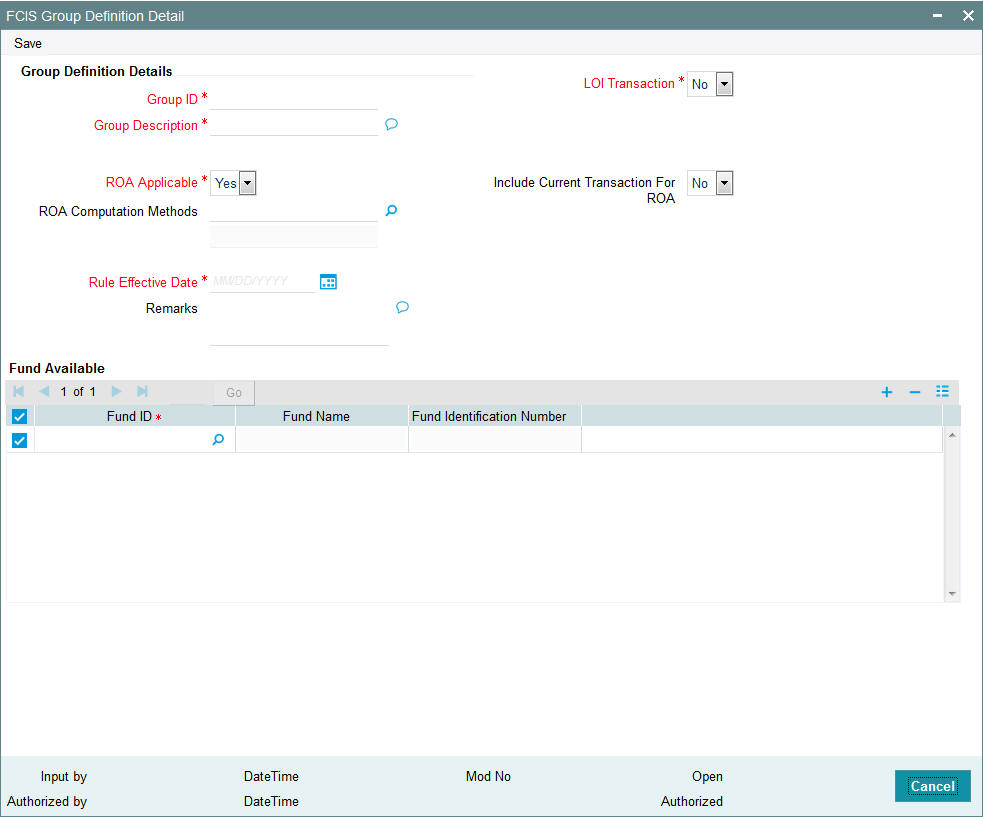

5.3.1 Invoking FCIS Group Definition Screen

In Oracle FLEXCUBE Investor Servicing, you create a load group as follows:

- Give the load group a unique identifier (ID) and identify the funds that will constitute the load group. A fund can be mapped to more than one load group.

- Indicate the load and transaction processing characteristics that would apply to transactions in any of the funds belonging to the group. This includes specifying Letter of Intent (LOI) applicability and Rights of Accumulation (ROA) applicability. If ROA is applicable, you must also specify the method of computation applicable.

- Map any required loads to the group in the Group Load Mapping screen.

- Have the load group authorized by another user.. The Group Definition (Summary) screen can be used for this. This screen can be accessed through the Group Definition (Summary) menu item in the Maintenance menu category in the Fund Manager component.

To create a load group in the system, use the ‘FCIS Group Definition Detail’ screen. You can invoke this screen by typing ‘UTDGRPDF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You must specify the following as mandatory information for the creation of a load group:

- A unique ID for the group and descriptive text qualifying the group, in the Group and Description fields in the screen, respectively.

- The date from which this rule is effective.

- Whether Rights of Accumulation (ROA) would be applicable for investors that invest in the funds identified for the load group. Specify this in the ROA Applicable field.

- If ROA is applicable, you must also specify the ROA computation method that would apply on investment into the group, as well as whether current transactions must be taken into account for ROA computation.

- Whether Letters of Intent (LOI) would be applicable for investors that invest in the funds identified for the load group. Specify this in the LOI Applicable field.

- The funds that would constitute the group, in the Funds Included box. A fund can be mapped to more than one load group.

You can specify the following fields in this screen:

Group ID

Alphanumeric; 6 Characters; Mandatory

Specify a unique alphanumeric identifier for the load group. You will use this ID to set up characteristics for the group.

Group Description

Alphanumeric; 255 Characters; Mandatory

Enter descriptive text, a short phrase that qualifies the group.

LOI Transaction

Mandatory

Choose ‘Yes’ from the drop-down list to indicate the applicability of Letters of Intent for funds in the group.

Choose ‘No’ from the drop-down list if the LOI investors investing in the group cannot avail of the Letter of Intent facility.

ROA Applicable

Mandatory

Choose ‘Yes’ for this option to indicate the applicability of Rights of Accumulation for funds in the group.

Choose ‘No’ if the ROA investors investing in the group cannot avail of the Rights of Accumulation facility.

ROA Computation Method

Numeric; 1 Character; Mandatory if ROA is applicable for the group

Specify the method of interpreting the history of investments, which will be used to arrive at the basis for ROA computation, for any investments by unit holders into the ROA group.

The following methods could be available:

- Amount invested by the investor

- Holdings * NAV as of that date

- Holdings * Subscription Base Price as of that date

- Higher of (1) and (2)

- Higher of (1) and (3)

- Current Day’s Transaction Value

Based on the value selected, the system displays the description in the adjacent field.

Include Current Transactions for ROA

Optional, Applicable only if ROA is applicable for the group

Choose ‘Yes’ for this option to indicate that current transactions are to be taken into consideration when the selected method of interpretation of investments (ROA computation method) is applied on investments into the ROA group.

Rule Effective Date

Date Format; Mandatory

This is the date from which the group definition is effective. It should be later than or the same as the application date. You can select the date from the calendar provided.

Remarks

Alphanumeric; 255 Characters; Optional

Specify remarks, if any.

Fund Available

Fund ID

Alphanumeric; 6 Characters; Mandatory

You can select the funds that you want to designate to be part of the load group. A fund can be mapped to more than one load group.

Fund Name

Display

The system displays the fund name for the selected fund ID.

Fund Identification Number

Display

The system displays the fund identification number.

5.4 Group Load Mapping Summary Screen

This section contains the following topics:

- Section 5.4.1, "Retrieving Record in Group Load Mapping Summary Screen"

- Section 5.4.2, "Editing Group Load Mapping"

- Section 5.4.3, "Viewing Group Load Mapping "

- Section 5.4.4, "Deleting Group Load Mapping "

- Section 5.4.5, "Authorizing Group Load Mapping "

- Section 5.4.6, "Amending Group Load Mapping "

- Section 5.4.7, "Authorizing Amended Group Load Mapping "

- Section 5.4.8, "Copying Attributes"

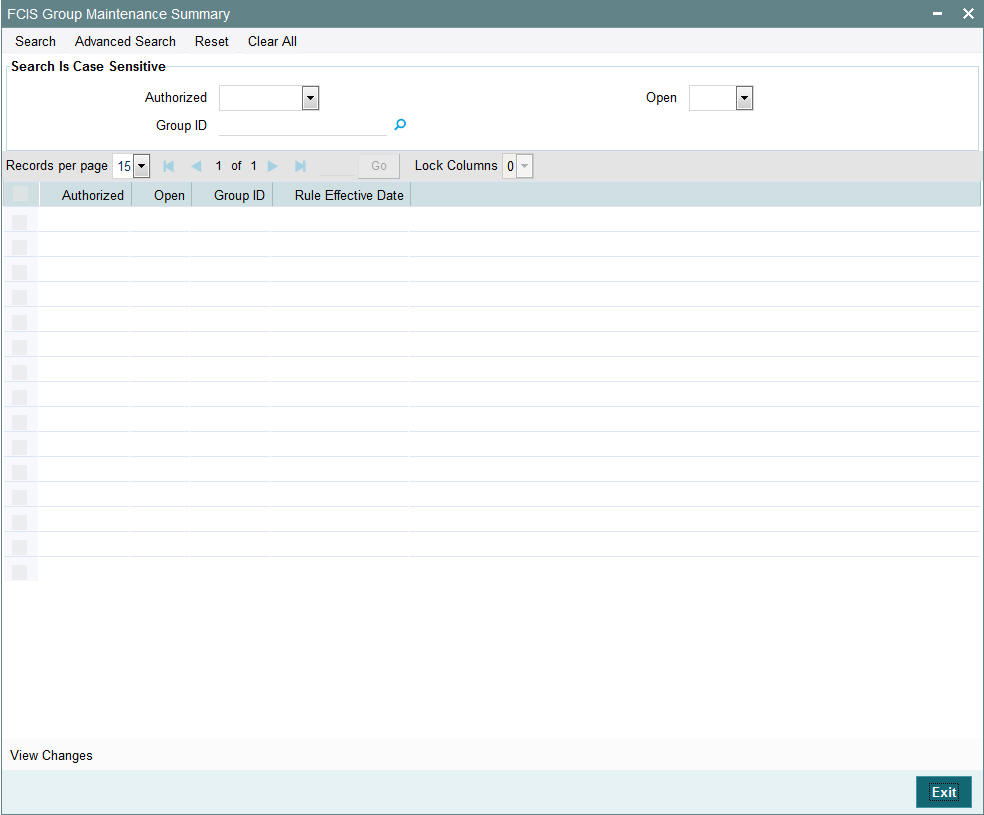

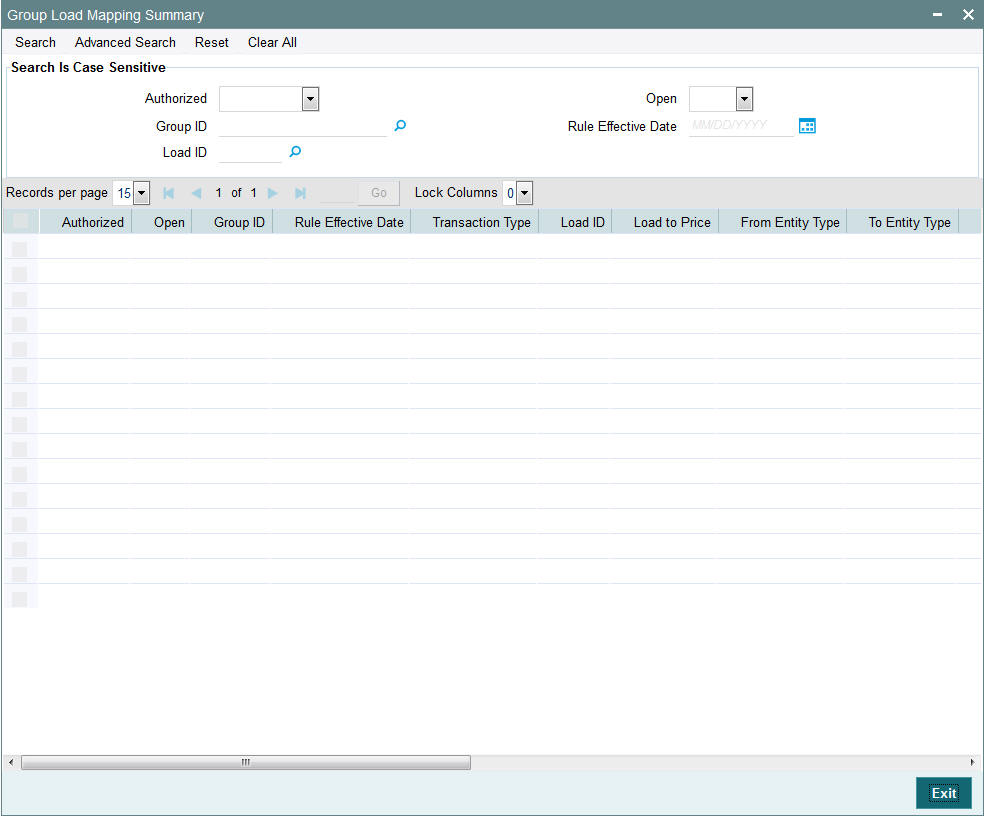

5.4.1 Retrieving Record in Group Load Mapping Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

Invoke the ‘Group Load Mapping Summary’ screen by typing ‘UTSGRPDF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

To perform any operation on a group load mapping record, you must first retrieve the record from the database in the Summary screen.

To retrieve a record for viewing, select View in the Operation field. Specify the Group ID and the Rule Effective Date of the group whose record you want to retrieve, and click OK. (In the Operation field, you must select the operation that you want to perform, before you specify the search criteria.)

All the group mapping records that match your search criteria are displayed in the lower list portion of the screen.

Specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Group ID

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Group ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

Example

You can search the record for Group ID by using the combination of % and alphanumeric value as follows:-

- Search by A%: The system will fetch all the records whose Group ID starts from Alphabet ‘A’. For example, AGC17, AGVO6, AGC74 and so forth.

- Search by %7: The system will fetch all the records whose Group ID ends by numeric value’ 7’. For example, AGC17, GSD267, AGC77 and so forth.

- Search by %17%: The system will fetch all the records whose Group ID contains the numeric value 17. For example, GSD217, GSD172, AGC17 and so forth.

- Search by %: The system will fetch all the records

5.4.2 Editing Group Load Mapping

You can modify the details of a Group Load Mapping that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Group Load Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Group Load Mapping Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Group Load Mapping Detail screen is closed and the changes made are reflected in the Group Load Summary screen.

5.4.3 Viewing Group Load Mapping

To view a record that you have previously input, you must retrieve the same in the Group Load Mapping Summary screen as follows:

- Invoke the Group Load Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Group Load Mapping Detail screen is displayed in View mode.

5.4.4 Deleting Group Load Mapping

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Group Load Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The Group Load Mapping Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

5.4.5 Authorizing Group Load Mapping

An unauthorized Group Load Mapping must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Group Load Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Group Load Mapping Detail screen is displayed. Select Authorize operation from the Action List.

When a checker authorizes a transaction, details of validation, if any, that were over ridden by the maker of the transaction during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the transaction.

5.4.6 Amending Group Load Mapping

After a Group Load Mapping is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the Group Load Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Group Load Mapping Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

5.4.7 Authorizing Amended Group Load Mapping

An amended Group Load Mapping maintenance must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module and Agency Branch module.

The subsequent process of authorization is the same as that for normal transactions.

5.4.8 Copying Attributes

If you want to create a new Group Load Mapping with the same attributes of an existing maintenance, you can copy the attributes of an existing Group Load mapping to a new one.

To copy the attributes:

- Retrieve the record whose attributes the new Group Load mapping should inherit. You can retrieve the record through the Summary screen or through the F7-F8 operation explained in the previous sections of this chapter.

- Click on Copy.

- Indicate the ID for the new Group Load mapping. You can, however, change the details of the new maintenance.

5.5 Load Group Characteristics Screen

This section contains the following topics:

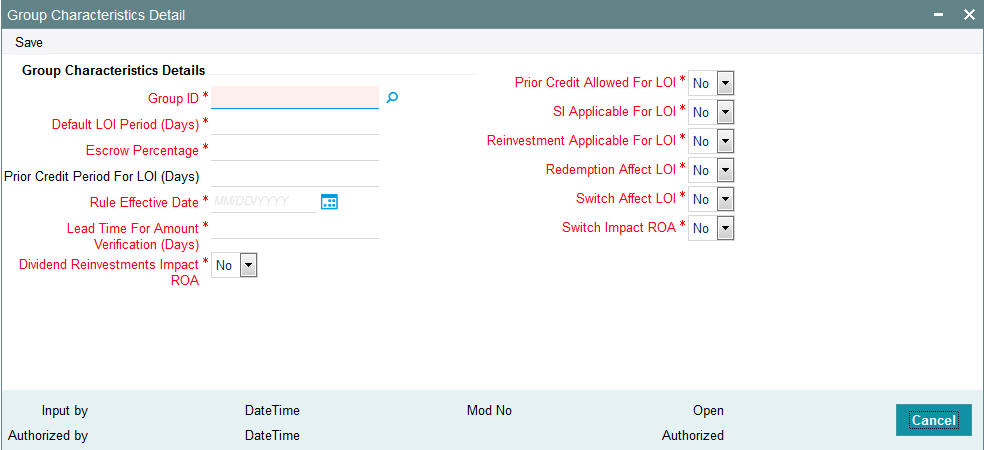

5.5.1 Invoking the Group Characteristics Detail Screen

To specify the load and transaction processing characteristics that would apply to transactions in funds in a load group, use the ‘Group Characteristics Detail’ screen.

Invoke this screen by typing ‘UTDGRPCH’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the group that you are defining.

You can specify any of the following loading parameters that would be applicable for all funds in the group:

- The date from which the characteristics are effective, in the Rule Effective Date field.

- The default period (in days) for the Letter of Intent facility availability. Specify this in the Default LOI Period field.

- The threshold balance percentage of the holdings that must be maintained in an LOI investor account. Redemption for such investors would not be allowed if the holdings in any funds of the load group falls below this percentage as a result of the redemption. This percentage is known as the escrow percentage. Specify this in the Escrow Percentage field.

- For all funds in the group, the applicability of a prior credit period for LOI fulfilment. Indicate this in the Prior Credit Allow field. If allowed, also specify the prior credit period applicable (by default) in the Prior Credit Period field.

- The applicability of redemption and switch transactions affecting the LOI used up amount, for all funds in the group, in the Redemption Affect LOI and Switch Affect LOI fields.

- The applicability of standing instructions for investors investing in the group, in the SI Applicable field.

- The applicability of reinvestments for investors investing in the group, in the Reinvestment Applicable field.

- The lead time, if any, for the verification of amounts for LOI or ROA applicability, that is to apply to all funds in the group. Specify this in the Lead Time for Amount Verification field.

For a fuller discussion of what Letters of Intent are and how an investor can opt to avail of the same, refer the Managing Investor Accounts chapter.

You need to specify the following fields in this screen:

The following fields are available for data entry in the Load Group Characteristics screen:

Group Characteristics Details

Group ID

Alphanumeric; 6 Characters; Mandatory

From the list, select the group of funds for which you are setting up the common load and transaction processing characteristics for transactions.

Default LOI Period (Days)

Numeric; 3 Characters; Mandatory

Specify the default period (in days) for the Letter of Intent facility availability that would apply to all funds in the group.

Escrow Percentage

Numeric; 5 Characters; Mandatory

Specify the escrow percentage that is to apply to LOI investors who transact in the funds of the group.

For LOI investors, the AMC stipulates a certain threshold percentage of holdings that must always be maintained. A redemption transaction due to which the holdings balance in the funds of the group falls below this percentage, will not be accepted. This percentage is called an escrow percentage.

Prior Credit Period for LOI (Days)

Numeric; 3 Characters; Mandatory only if prior credit is allowed.

If prior credit is permitted to investors for fulfillment of LOI in any of the funds in the group, specify the duration (in days) of the period.

Rule Effective Date

Date Format; Mandatory

Specify the date on and following which the load group characteristics you are specifying for the group will be effective.

Lead Time for Amount Verification (Days)

Numeric; 12 Characters; Mandatory

Specify the lead time applicable, if any, for the verification of amounts for LOI or ROA applicability that is to apply to all funds in the group.

Dividend Reinvestments Impact ROA

Mandatory

If you choose ‘Yes’, then the units increased due to dividend reinvestment will also be considered for ROA. The system will consider the Reinvestment Units in terms accumulated units.

Prior Credit Allowed For LOI

Mandatory

Select ‘Yes’ from drop-down list to indicate that a prior credit period is permitted for the fulfilment of LOI amount, for LOI investors.

If you select ‘No’, none of the transactions of an investor earlier than the transaction date, will be reckoned to affect the LOI used up amount.

SI Applicable for LOI

Mandatory

Select ‘Yes’ from drop-down list to indicate that standing instructions are permitted to be accepted for investors transacting in the load group.

Reinvestment Applicable for LOI

Mandatory

Select ‘Yes’ from drop-down list to indicate that reinvestment instructions are permitted to be processed for investors transacting in the load group.

Redemption Affect LOI

Mandatory

Select ‘Yes’ from drop-down list to indicate that redemption transactions can be taken into account for reducing the LOI amount for LOI investors that invest in the load group.

Switch Affect LOI

Mandatory

Select ‘Yes’ from drop-down list to indicate that switch transactions can be taken into account for reducing the LOI amount for LOI investors that invest in the load group.

Switch Impact ROA

Mandatory

If you choose ‘Yes’, the system will take into account the fluctuation of units due to Switch in while computing Accumulated Units.

5.6 Load Group Characteristics Maintenance Summary Screen

This section contains the following topics:

- Section 5.6.1, "Retrieving Record in Load Group Characteristics Maintenance Summary Screen"

- Section 5.6.2, "Editing Load Group Characteristics Maintenance"

- Section 5.6.3, "Viewing Load Group Characteristics Maintenance"

- Section 5.6.4, "Deleting Load Group Characteristics Maintenance"

- Section 5.6.5, "Authorizing Load Group Characteristics Maintenance"

- Section 5.6.6, "Amending Load Group Characteristics Maintenance"

- Section 5.6.7, "Authorizing Amended Load Group Characteristics Maintenance"

- Section 5.6.8, "Copying Attributes"

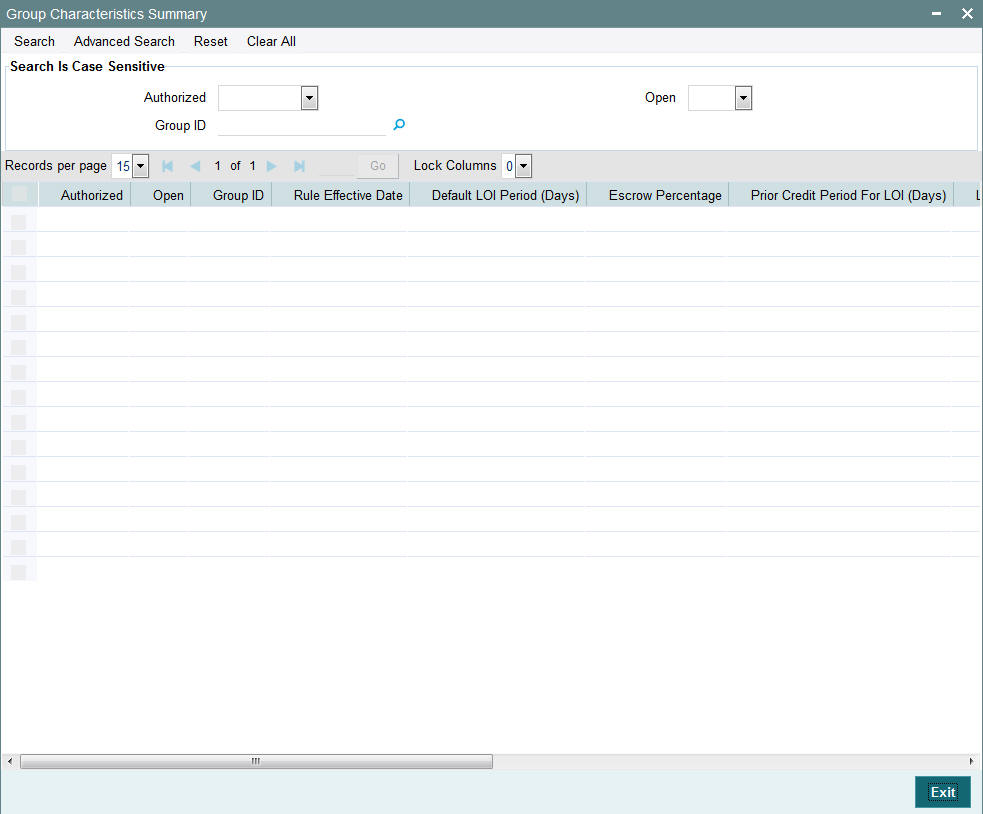

5.6.1 Retrieving Record in Load Group Characteristics Maintenance Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

- Invoke the ‘Group Characteristics Summary’ screen by

typing ‘UTSGRPCH’ in the field at the top right corner

of the Application tool bar and clicking on the adjoining arrow button.

Specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Group ID

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Group ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

Example

You can search the record for Group ID by using the combination of % and alphanumeric value as follows:-

- Search by A%: The system will fetch all the records whose Group ID starts from Alphabet ‘A’. For example, AGC17, AGVO6, AGC74 and so forth.

- Search by %7: The system will fetch all the records whose Group ID ends by numeric value’ 7’. For example, AGC17, GSD267, AGC77 and so forth.

- Search by %17%: The system will fetch all the records whose Group ID contains the numeric value 17. For example, GSD217, GSD172, AGC17 and so forth.

5.6.2 Editing Load Group Characteristics Maintenance

You can modify the details of a Load Group Characteristics Maintenance that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the Load Group Characteristics Maintenance Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Load Group Characteristics Maintenance Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Load Group Characteristics Maintenance Detail screen is closed and the changes made are reflected in the Load Group Characteristics Maintenance Summary screen.

5.6.3 Viewing Load Group Characteristics Maintenance

To view a record that you have previously input, you must retrieve the same in the Load Group Characteristics Maintenance Summary screen as follows:

- Invoke the Load Group Characteristics Maintenance Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Load Group Characteristics Maintenance Detail screen is displayed in View mode.

5.6.4 Deleting Load Group Characteristics Maintenance

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Load Group Characteristics Maintenance Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The Load Group Characteristics Maintenance Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

5.6.5 Authorizing Load Group Characteristics Maintenance

An unauthorized Load Group Characteristics Maintenance must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Load Group Characteristics Maintenance Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Load Group Characteristics Maintenance Detail screen is displayed. Select Authorize operation from the Action List.

When a checker authorizes a transaction, details of validation, if any, that were overridden by the maker of the transaction during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the transaction.

5.6.6 Amending Load Group Characteristics Maintenance

After a Load Group Characteristics Maintenance is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the Load Group Characteristics Maintenance Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. Load Group Characteristics Maintenance Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

5.6.7 Authorizing Amended Load Group Characteristics Maintenance

An amended Load Group Characteristics Maintenance must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module and Agency Branch module.

The subsequent process of authorization is the same as that for normal transactions.

5.6.8 Copying Attributes

If you want to create a new Load Group Characteristics Maintenance with the same attributes as that of an existing maintenance, you can copy the attributes of an existing Load Group Characteristics Maintenance to a new one.

To copy the attributes:

- Retrieve the record whose attributes the new Load Group Characteristics Maintenance should inherit. You can retrieve the record through the Summary screen or through the F7-F8 operation explained in the previous sections of this chapter.

- Click on Copy

- Indicate the ID for the new Load Group Characteristics Maintenance mapping. You can, however, change the details of the new maintenance

5.7 Non-fulfilment of Letter of Intent

This section contains the following topics:

- Section 5.7.1, "Monitoring Fulfilment of Letter of Intent"

- Section 5.7.2, "Invoking Lol Adjust Proc Screen"

5.7.1 Monitoring Fulfilment of Letter of Intent

If an investor does not bring in the investment amount promised in a letter of intent, before the expiry of the letter of intent, it constitutes non-fulfilment, and the AMC can recover the applicable commission that would have been due without the letter of intent.

The system monitors the fulfilment of letters of intent. The following facilities are available in the system:

Prior Warning Report

On the date that marks the beginning of the start of the lead time period for the load group, a prior warning report is generated by the system during the Beginning of Day (BOD) process. This report contains information about those letters of intent that have not been fulfilled as on that date.

For instance, if the letter of intent expires on 15th June 2002 and the lead-time specified for the load group is 10 days, , a BOD process is executed on 5th June 2002 to ascertain whether the investor has satisfied the letter of intent amount agreed upon. This verification is performed for all letters of intent.

The report identifies and displays the following information for each letter of intent for any investor which is unfulfilled as on the date that marks the beginning of the lead time period:

- LOI Number

- LOI start date

- LOI end date (expiry date)

- LOI amount

- Amount fulfilled or used up as on the current date

- Amount remaining unfulfilled as on the current date. This is computed as the difference between the LOI amount and the Amount Used Up as on the current date

- The Load Group to which the fund belongs, for which the LOI has been set up for the investor

- The lead time period specified for the load group

Post-Adjustment Report

In the event of non-fulfilment of a letter of intent, you can obtain a report (known as the post adjustment report) that displays the actual commission that would have been due on any transactions entered into by the investor, had the letter of intent not been applied.

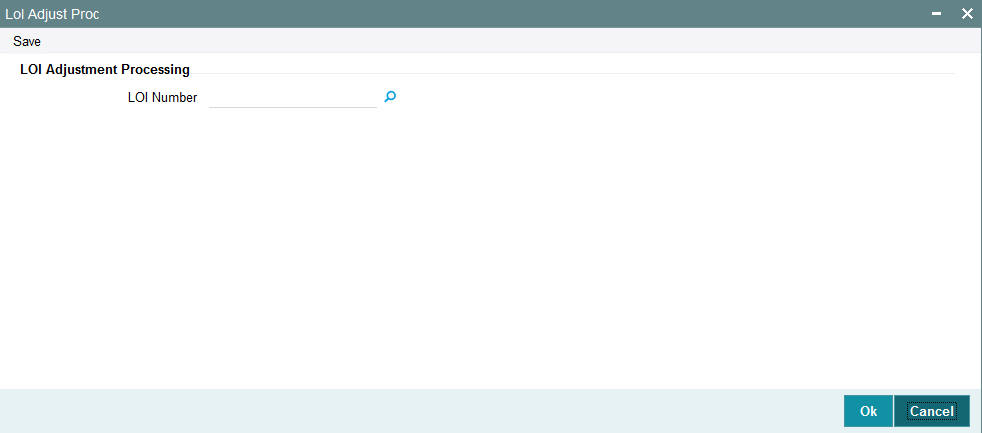

5.7.2 Invoking Lol Adjust Proc Screen

To obtain such a report, you must trigger the computation and storing of the actual commission data, from the system database. You can use the ‘Lol Adjust Proc’ screen for this. You can invoke this screen by typing ‘UTDLOIPR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

LOI Adjustment Processing

LOI Number

Alphanumeric; 25 Characters; Optional

Specify the LOI number of the corresponding letter of intent, on the next business date after the expiry date of the letter of intent.

In this screen, you must specify the LOI number of the corresponding letter of intent, on the next business date after the expiry date of the letter of intent. Click on the Process button to trigger the process of computation and storage. Alternatively, if you do not specify the number, you can trigger the computation of commission data for all such letters of intent that are unfulfilled, after the expiry date.

After you have triggered the computation of commission data, in the LOI Adjustment Processing screen, you can use the LOI Non-Fulfilment menu item in the Batch menu to obtain the actual report.

The report contains details of the actual commission due on each of the transactions without considering the letter of intent. This amount must be recovered from the unit holder by the AMC.

The following details are displayed in the report for each letter of intent for any investor which is unfulfilled as on the next business date after the expiry date:

- LOI Number

- Letter of intent amount agreed (LOI amount)

- Letter of intent amount fulfilled (used up amount)

- ID of the load group to which the fund belongs, for which the LOI was set up for the investor

- The funds in the load group

- Transaction number, for each transaction designated as an LOI transaction

- Commission collected for the transaction

- Actual commission that should have been collected had there been no letter of intent.

- The loss borne by the AMC, which is computed as the difference between the commission collected and commission that should have been collected had there been no LOI.

The commission for each of the LOI transactions entered into during the LOI period is recomputed as if there had been no letter of intent. For each transaction, the actual commission collected and the commission that should have been collected without the LOI is displayed. The sum of the commissions will be subtracted from the actual commission collected and the difference is reported through the report.

5.8 Group Load Mapping

This section contains the following topics:

5.8.1 Invoking Group Load Mapping Screen

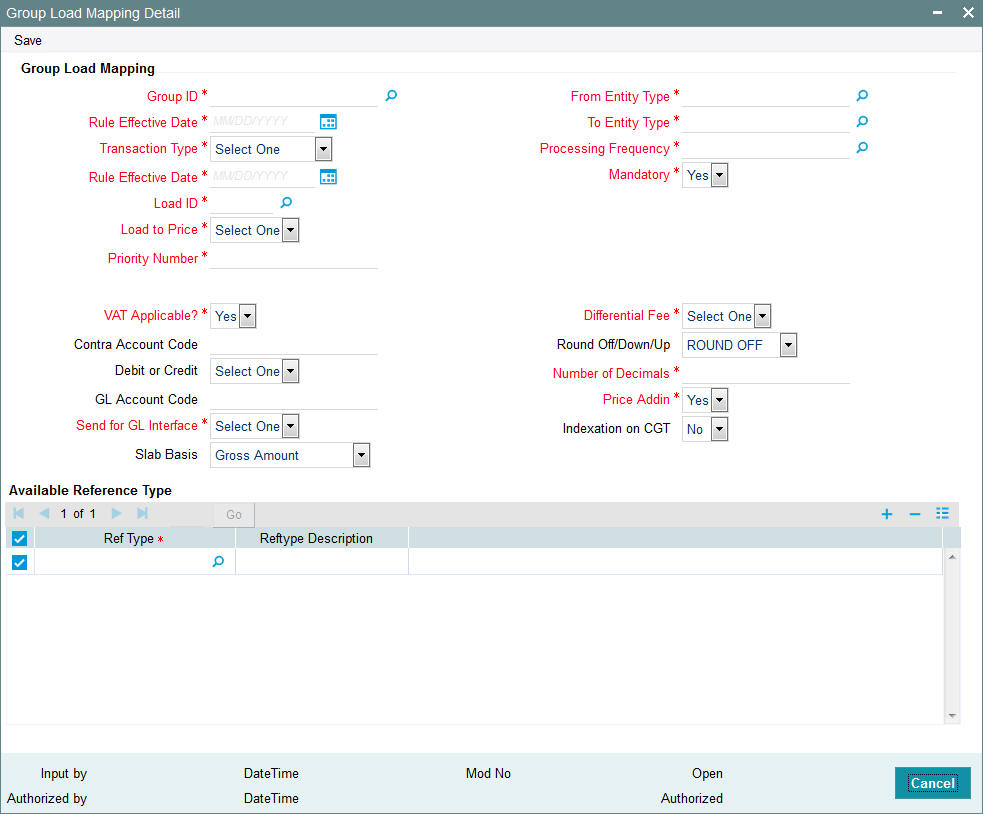

To designate different fees or incentives that are levied during the processing of transactions, as applicable for transactions in funds of specific load groups, use the ‘Group Load Mapping Detail’ Screen.

You can invoke this screen by typing ‘UTDLDGRP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The ‘Group Load Mapping Detail’ screen is displayed.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the group load.

A simple mapping can be done where the appropriate fees or incentives, called loads in the system, may be tagged as applicable to the appropriate transaction types for all funds in the appropriate load groups.

You can also designate the loads as applicable to certain reference types of transactions, such as standing instructions, policy transactions in funds of the load group and so on.

Before you set up a Group Load mapping profile record for a load group, it is desirable to ensure that the following information is already setup in the system:

- Any of the funds in the load group already has an existing, unauthorized Fund Demographics profile record.

- Any of the funds in the load group already has an existing, unauthorized Shares Characteristics profile record.

- Any of the funds in the load group already has an existing, unauthorized Transaction Processing Rules profile record for the appropriate Transaction Type.

- The fees/incentives (Loads) that are to be applied must already have been identified in the system and have existing, authorized profiles as maintained in the Loads Maintenance.

- It must be remembered that, while mapping a load to a reference transaction type, the system does not support the mapping of the Ref Type 68 (Funding Repayment) to any load.

You can specify the following fields in this screen:

Group Load Mapping

Group ID

Alphanumeric; 6 Characters; Mandatory

Select the ID of the load group for which the group load mapping profile is being set up, from the options provided.

Rule Effective Date

Date Format; Mandatory

Specify the Rule Effective Date for the load group for which the group load mapping profile is being set up.

Transaction Type

Mandatory

This is to indicate the transaction type for which the loads are being defined. Select the Transaction Type from the list given in the drop-down list. The list displays the following values:

- IPO Subscription

- Subscription

- Redemption

- Switch From

- Transfer

- Block

- Unblock

- Consolidation

- Split

- Reissue

- Switch To

Rule Effective Date

Date Format; Mandatory

Specify the Rule Effective Date.

Load ID

Numeric; 5 Characters; Mandatory

Specify the name of the Load (fee/incentive) that must be applied for the selected load group. You may make your choice from the options provided in the drop-down list.

Load To Price

Mandatory

Select ‘Yes’ from drop-down list to indicate that this load is to be loaded to the base price.

Priority Number

Numeric; 5 Characters; Mandatory

Enter a value to specify the priority number in case of optional loads.

For a mandatory load, the priority number is set to 0 and for an optional load the priority number should be unique i.e. for a given load group, no more than one load can have the same priority number.

From Entity Type

Alphanumeric; 1 Character; Mandatory

Specify the entity that bears this load.

To Entity Type

Alphanumeric; 1 Character; Mandatory

Specify the entity that will be recipients of the load.

Processing Frequency

Alphanumeric; 1 Character; Mandatory

Specify the processing frequency.

Mandatory

Mandatory

Select Mandatory or Optional to specify whether the load is mandatory or optional, from the drop-down list.

VAT Applicable

Mandatory

Select ‘Yes’ from drop-down list to indicate that the Load to Price is applicable. Therefore VAT Load to Price is dependent on Load to Price.

Contra Account Code

Alphanumeric, 10 Characters; Optional

Specify the code that will be used to identify the second leg of accounting entries for any transaction, in the event of exporting of transaction information to an external system.

Debit or Credit

Optional

Indicate whether the applied load would result in a debit or credit for the funds in the load group from the drop-down list. The list displays the following values:

- Debit

- Credit

This data is captured for information purposes only and has no processing implications in the system database. This is to be used in case of an interface with an Asset Management system where details for calculation of NAV would need to be uploaded.

GL Account Code

Alphanumeric; 10 Characters; Optional

Specify the code that will be used to map this load to its corresponding charge code in the external system.

When transaction information is exported to an external system, if separate books of accounts are to be posted for different loads, this code will be used to identify this load information in the export data.

Send for GL Interface

Mandatory

Select ‘Yes’ from drop-down list to indicate that accounting entries due only to the selected load must be posted to the external asset management system, for the load group.

Slab Basis

Optional

Select the basis on which the slabs will be reckoned for an amount-based load that you are designating as applicable for the load group. You can indicate that the slabs must be reckoned on a gross amount or a net. You can select one of the values from the drop-down list:

- Gross Amount

- Net Amount

- Weighted Average Cost

Differential Fee

Mandatory

Select ‘Yes’ from the drop-down list to indicate that the differential fee in the case of switch transactions for any fund is to be applicable, for the load group.

Round Off/Down/Up

Optional

Select the rounding options for the load amount for the selected transaction type from the drop-down list, for the load group.

- Choose ‘Round Up’ to indicate rounding the value at the precision decimal place to the next higher numeral.

- Choose ‘Round Off’ to indicate normal rounding at the precision decimal.

- Choose ‘Round Down’ to indicate truncation of the value at the precision decimal place.

Example

Let us suppose that the load amount computed for a subscription transaction is 10.561234, and that this value must be rounded to the 3rd decimal place.

If you indicate rounding up, then the value reckoned would be 10.562.

If you indicate rounding off, then, applying normal rounding off rules, the value reckoned would be 10.561.

If you indicate rounding down or truncation, then the value would be truncated as it is, in the 3rd decimal place, and it would be reckoned as 10.561.

Number of Decimals

Numeric; 1 Character; Mandatory

Specify the maximum number of decimals that would be reckoned for rounding precision, for the load amount.

Price Addin

Mandatory

Select ‘Yes’ from drop-down list to indicate that the add-in factor is to be applicable for computing the return value for the load, for the selected transaction type. The add-in factor is used to arrive at the return value for a load, at the time of allocation.

Indexation on CGT

Optional

Select ‘Yes’ from drop-down list to indicate that the indexation of CGT is applicable for the selected transaction type.

For more information, refer the chapter ‘The Allocation Process’ in the Allocation User Manual.

Available Reference Type

Ref Type

Alphanumeric; 2 Characters; Mandatory

Specify the ref type.

Reftype Description

Display

The system displays the description for the selected ref type.

5.9 Load Group Summary Screen

This section contains the following topics:

- Section 5.9.1, "Retrieving Record in Load Group Summary Screen"

- Section 5.9.2, "Editing Load Group Maintenance"

- Section 5.9.3, "Viewing Load Group Maintenance"

- Section 5.9.4, "Deleting Load Group Maintenance"

- Section 5.9.5, "Authorizing Load Group Maintenance"

- Section 5.9.6, "Amending Load Group Maintenance"

- Section 5.9.7, "Authorizing Amended Load Group Maintenance"

- Section 5.9.8, "Copying Attributes"

5.9.1 Retrieving Record in Load Group Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

- Invoke the ‘FCIS Load Group Maintenance Summary’ screen

by typing ‘UTSLDGRP’ in the field at the top right corner

of the Application tool bar and clicking on the adjoining arrow button..

Specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Group ID

- Rule Effective Date

- Load ID

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Group ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

Example

You can search the record for Group ID by using the combination of % and alphanumeric value as follows:-

- Search by A%: The system will fetch all the records whose Group ID starts from Alphabet ‘A’. For example, AGC17,AGVO6,AGC74 and so forth.

- Search by %7: The system will fetch all the records whose Group ID ends by numeric value’ 7’. For example, AGC17, GSD267, AGC77 and so forth.

- Search by %17%: The system will fetch all the records whose Group ID contains the numeric value 17. For example, GSD217, GSD172, AGC17 and so forth.

- Search by %: The system will fetch all the records

5.9.2 Editing Load Group Maintenance

You can modify the details of Load Group Maintenance that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the Load Group Maintenance Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Load Group Maintenance Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Load Group Maintenance Detail screen is closed and the changes made are reflected in the Load Group Maintenance Summary screen.

5.9.3 Viewing Load Group Maintenance

To view a record that you have previously input, you must retrieve the same in the Load Group Maintenance Summary screen as follows:

- Invoke the Load Group Maintenance Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorized field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized or Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Load Group Maintenance Detail screen is displayed in View mode.

5.9.4 Deleting Load Group Maintenance

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Load Group Maintenance Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The Load Group Maintenance Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

5.9.5 Authorizing Load Group Maintenance

- An unauthorized Load Group Maintenance must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Load Group Maintenance Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Load Group Maintenance Detail screen is displayed. Select Authorize operation from the Action List.

When a checker authorizes a transaction, details of validation, if any, that were overridden by the maker of the transaction during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the transaction.

5.9.6 Amending Load Group Maintenance

After a Load Group Maintenance is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the Load Group Maintenance Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Load Group Maintenance Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

5.9.7 Authorizing Amended Load Group Maintenance

An amended Load Group Maintenance must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module.

The subsequent process of authorization is the same as that for normal transactions.

5.9.8 Copying Attributes

If you want to create a new Load Group Maintenance with the same attributes as that of an existing maintenance, you can copy the attributes of an existing Load Group Maintenance to a new one.

To copy the attributes:

- Retrieve the record whose attributes the new Load Group Maintenance should inherit. You can retrieve the record through the Summary screen or through the F7-F8 operation explained in the previous sections of this chapter.

- Click on Copy

- Indicate the ID for the new Load Group Maintenance. You can, however, change the details of the new maintenance.