4. Other Fund Activities

This chapter contains the following sections:

- Section 4.1, "Entities with Funds Association"

- Section 4.2, "Fund Entity Mapping Summary Screen"

- Section 4.3, "Agency Branch Backdating Setup"

- Section 4.4, "Fund Agency Backdating Limit Summary Screen"

- Section 4.5, "Restrictions for Switch Transactions"

- Section 4.6, "Fund Switch Restrict Summary Screen"

- Section 4.7, "Pseudo Switch Lag Maintenance"

- Section 4.8, "Pseudo Switch Lag Summary"

- Section 4.9, "Fund Price"

- Section 4.10, "Fund Price Maintenance Summary Screen"

- Section 4.11, "Fund Preference Maintenance"

- Section 4.12, "Fund Preference Summary Screen"

- Section 4.13, "Short Trade Counter Details Screen"

- Section 4.14, "Investor Fund Risk Rating Mapping"

- Section 4.15, "Investor Fund Risk Mapping Summary"

- Section 4.16, "Adhoc Prices"

- Section 4.17, "Adhoc Price Dates Maintenance Summary Screen"

- Section 4.18, "Pricing Preference Indication"

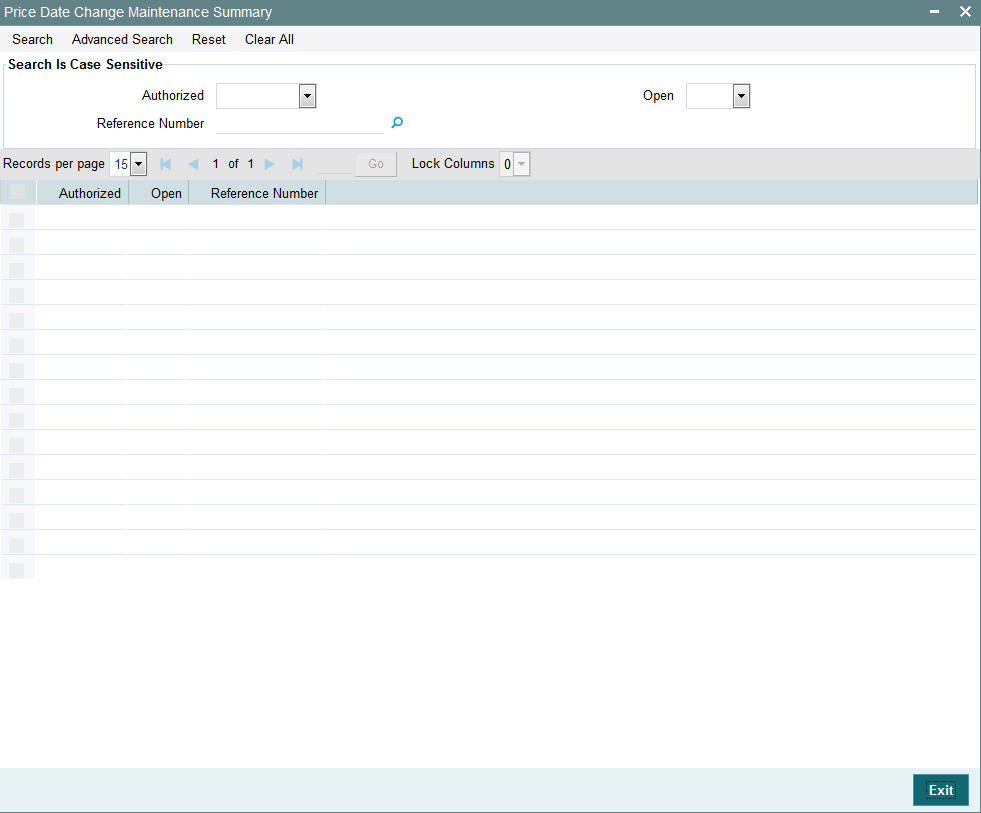

- Section 4.19, "Price Date Change Summary Screen"

- Section 4.20, "Non Availability of Fund Price"

- Section 4.21, "Fund Price Holiday Maintenance Summary Screen"

- Section 4.22, "Fund CPMF Preferences"

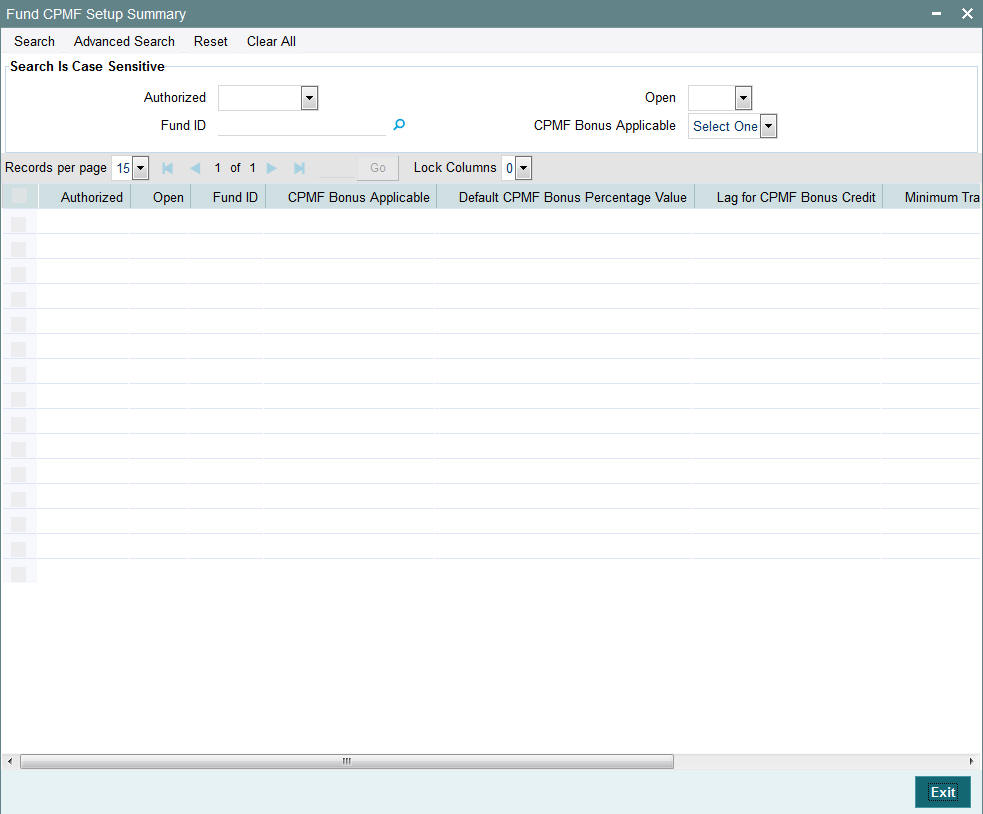

- Section 4.23, "Fund CPMF Summary Screen"

- Section 4.24, "Fund Account Set Up"

- Section 4.25, "Fund Account Summary Screen"

- Section 4.26, "Funds to Products Mapping"

- Section 4.27, "Wrap Fund Maintenance"

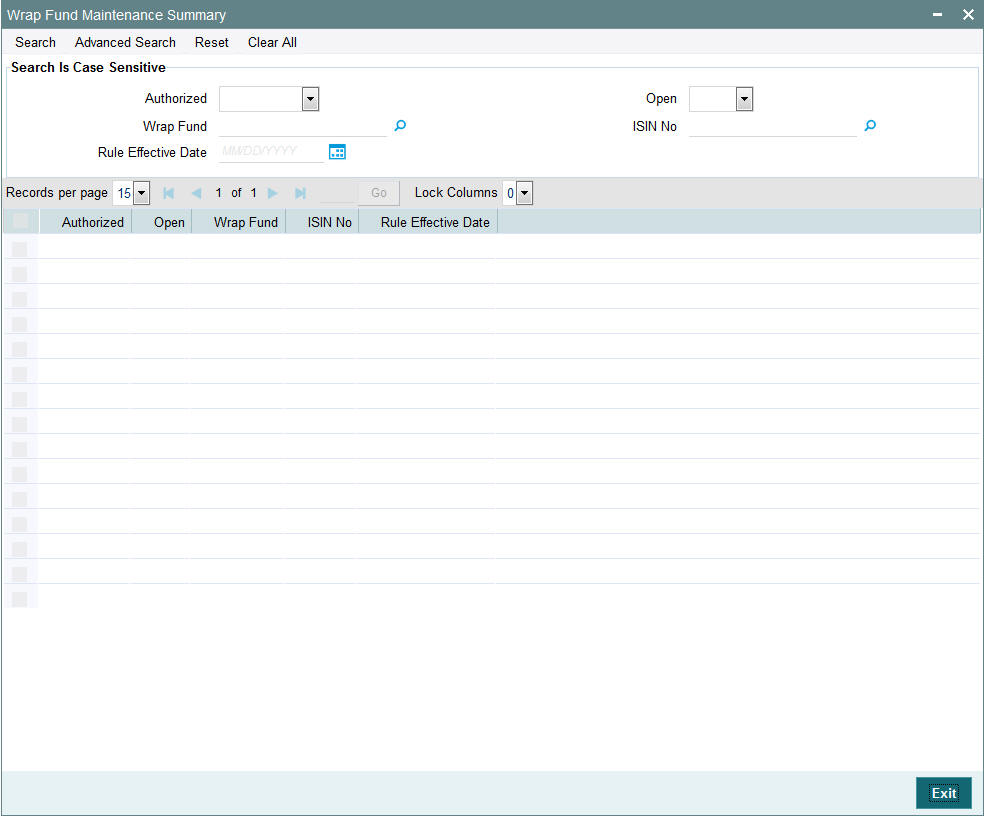

- Section 4.28, "Wrap Fund Summary Screen"

- Section 4.29, "Access Restrictions"

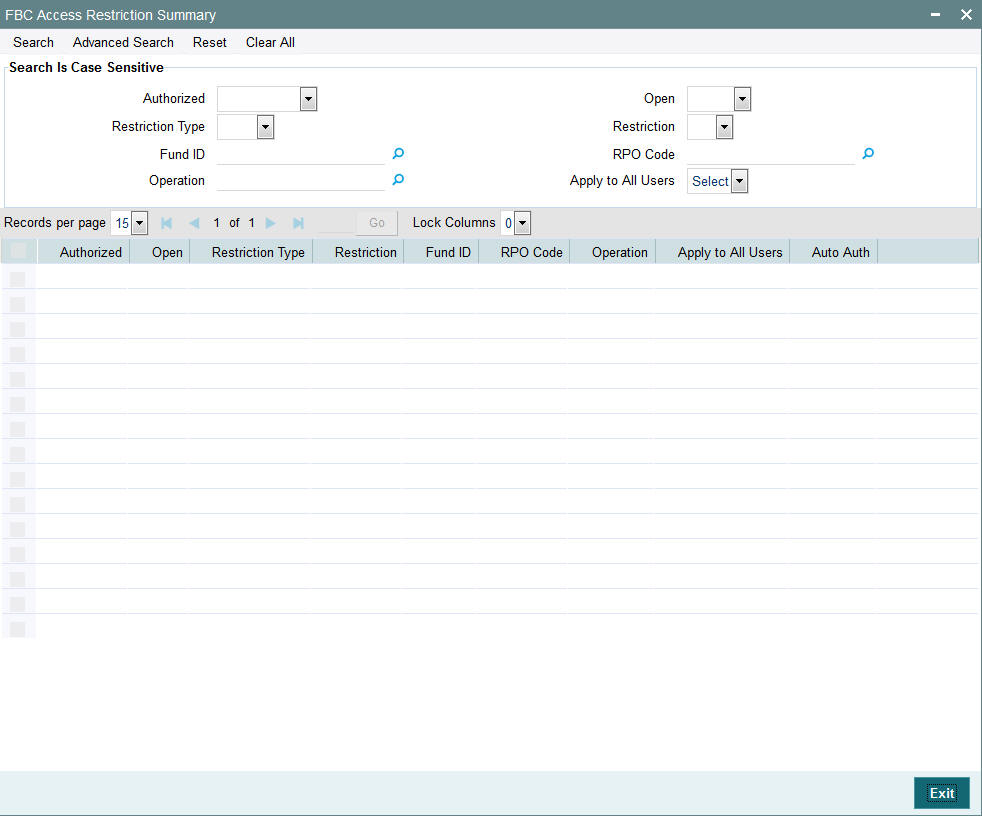

- Section 4.30, "FBC Access Restriction Summary Screen"

- Section 4.31, "Corporate Actions for Fund"

- Section 4.32, "Corporate Actions Summary Screen"

- Section 4.33, "Corporate Actions Processing"

- Section 4.34, "Bank Reconciliation"

- Section 4.35, "Bank Reconciliation Summary Screen"

- Section 4.36, "Performance Fee for Hedge Funds"

- Section 4.37, "Override Trade Cycles Date For Funds"

- Section 4.38, "Override Trade Cycle Date Summary Screen"

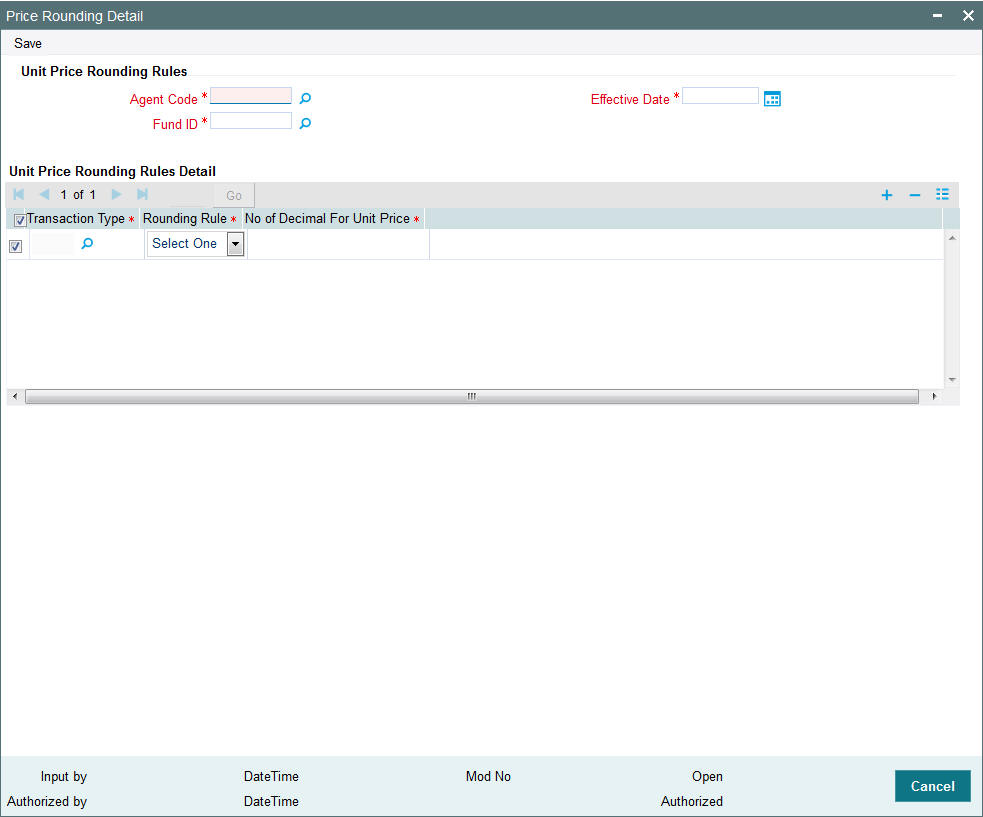

- Section 4.39, "Price Rounding Detail"

- Section 4.40, "Unit Price Rounding Summary"

4.1 Entities with Funds Association

This section contains the following topics:

- Section 4.1.1, "Associating Entities with Funds"

- Section 4.1.2, "Invoking Fund Entity Mapping Detail Screen"

4.1.1 Associating Entities with Funds

This screen can be used to associate entities with a fund. You can maintain either a list of ‘restricted’ entities, or an ‘allowed’ list.

If you maintain a restrictive list as ‘Yes’, only the entities that you maintain in the list in the Fund Entity Maintenance screen for a fund are restricted from transacting in the selected fund. If you maintain a restrictive list as ‘No’, only the entities that you maintain in the list in the Fund Entity Maintenance screen are allowed to transact in the selected fund. If you maintain neither a restrictive nor an allowed list, all entities of a type are allowed to transact in the fund.

Agents

In the case of agents, mapping can be carried out for only those Agents and their branches as have been created using the Agent and Agency Branch screens. Only those agents and their branches that have been mapped to a fund as part of an ‘allowed’ list will be able to accept transactions related to that particular fund. Agents and their branches maintained as a ‘restrictive’ list will not be able to accept transactions for the fund.

Distributor agents can also be mapped to the fund. This would be required in a scenario where the Distributor markets certain funds of the AMC, or in cases where a service agent performs back office processing for an AMC as well as a Distributor.

Customer Categories

Your AMC may wish to restrict investment in a fund based on investor categories, allowing only investors of certain categories to invest. Also, your AMC may wish to restrict or allow use of a fund to certain unit holders. You can maintain lists of such allowed / restricted investor categories (or unit holders) in the Fund Entity Maintenance screen in the Fund Manager component of the system.

At the transaction entry or upload (including adjustment transactions), standing instructions entry or upload, or income distribution setup, the unit holders in a restricted list or belonging to the restricted categories cannot be specified. For an allowed list, at the transaction entry or upload (including adjustment transactions), standing instructions entry or upload, or income distribution setup, the unit holders in the allowed list or belonging to the allowed categories can be specified.

If you maintain neither a restrictive nor an allowed list, all customers are allowed to transact in the fund.

CIFs

You might need to restrict certain CIFs from a restricted category from transacting in a fund. You can maintain such restrictions in the Fund Entity Maintenance screen.

You can disallow CIFs belonging to a restricted category (a restrictive list); or, you might require maintaining a list of CIFs that are allowed to transact in a fund (a positive list).

The system checks the CIF number specified for any transaction that is entered in the Transaction Detail screens as well as in the Standing Instructions Detail screen, to see if any restrictions have been maintained that would entail disallowing the specified CIF from transacting into the fund. The restrictions, if any, applicable at the following levels, would be enforced:

- Unit Holder Account

- CIF

- Investor Category

Check Vendors

Using this screen, you can also associate a check vendor that is maintained as an entity in the system, with those funds for which the vendor is designated to print check books that are requested by investors availing the check writing facility.

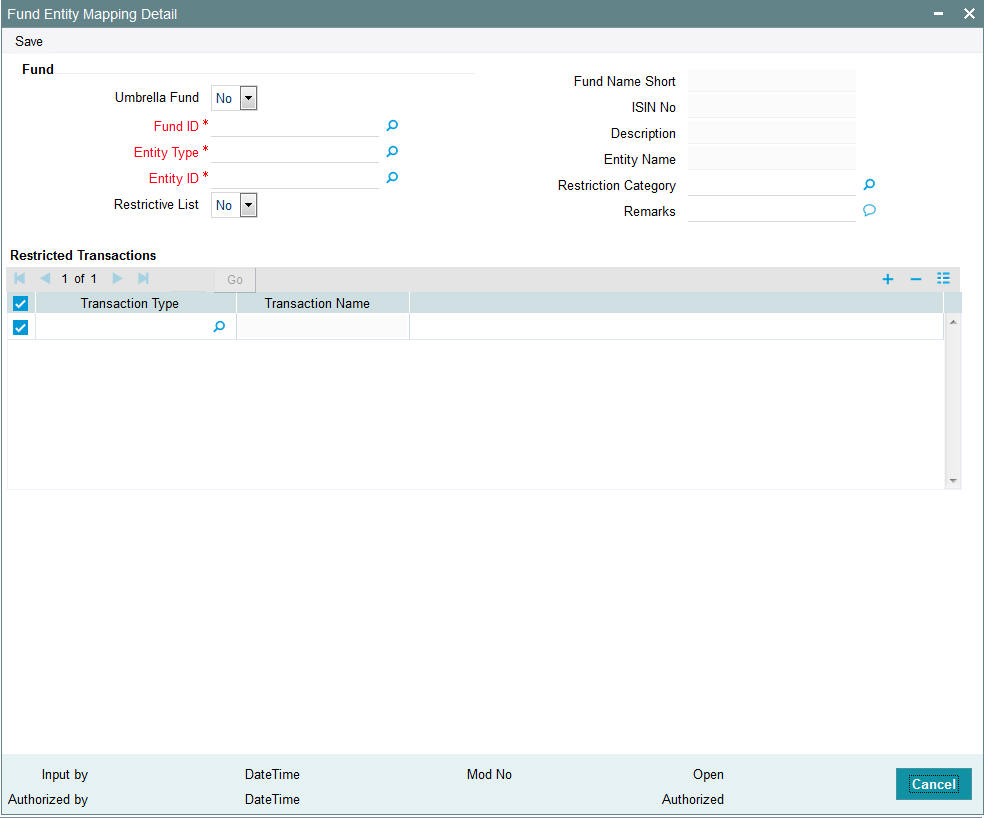

4.1.2 Invoking Fund Entity Mapping Detail Screen

To map entities to a fund, use the ‘Fund Entity Mapping Detail’ screen. You can invoke this screen by typing ‘UTDFNENT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The ‘Fund Entity Mapping Detail’ screen is displayed.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the fund and entity that you wish to map.

You can only map entities to a fund for which the latest rule is effective, and all fund rules have been authorized.

When you enter a fund entity mapping in this screen, you can save it by selecting the save option from the action menu.

You can specify the following fields in this screen:

Fund

Umbrella Fund

Optional

Select ‘Yes’ from the drop-down list if the fund for which you wish to maintain the fund entity association is an umbrella fund.

Fund ID

Alphanumeric; 6 Characters; Mandatory

Select the fund for which you want to map entities, from the options provided. If you specify the fund, the ISIN Code of the selected fund is displayed in the ISIN Code field. You can also map all the funds to an entity by selecting ‘All’ option from the option list.

If you have selected the ‘All’ option, then any new fund created in the system will be automatically mapped to this entity. You will not be able to map individual fund to this entity. Similarly, if individual fund is mapped to an entity, then the system will not allow you to map all the funds to the same entity.

Fund Name Short

Display

The system displays the description for the selected fund ID.

ISIN Code

Display

The system displays the ISIN Code for the selected fund ID.

Entity Type

Alphanumeric; 2 Characters; Mandatory

You can use this field to indicate the type of entity that is to be associated with the selected fund. You can associate any of the following entities:

- Agent

- Investor

- Individual Investor Categories

- Corporate Investor Categories

- Check Vendor

- Clearing Agent

- CIF Number

- Broker

- ISA Manager

If you are maintaining a restrictive / positive list of CIFs that you wish to disallow / allow to transact into the specified fund, you must select the CIF Number option in this field.

If you select the CIF Number option, you can also specify the appropriate restriction category and any remarks, in the Restriction Category and Remarks fields.

Description

Display

The system displays the description for the selected entity type.

Entity ID

Alphanumeric; 12 Characters; Mandatory

Select the code of the entity that is to be allowed to operate this fund, from the options provided. It could be an agent, or a check vendor who is designated to print check books that are requested by investors availing the check writing facility; it could also be a unit holder, individual or corporate investor category, or a clearing agent.

Entity Name

Display

The system displays the name of the selected entity ID.

Restrictive List

Optional

Use this field to indicate whether you are maintaining a list of ‘allowed’ entity associations for the fund, or a ‘restrictive’ one. Select ‘Yes’ from the drop-down list to indicate a restricted list; leave it unchecked to indicate an allowed list.

If you maintain a ‘restrictive list’, only the entities that you specify are restricted from transacting in the selected fund. If you maintain an ‘allowed’ list, only the entities that you specify are allowed to transact in the selected fund.

Based on the installation setup, the system validates Broker fund mapping in one the following ways:

- If any broker or brokerage is mapped to a fund and the restrictive list value is selected as ‘No’, then only those brokers and the sub-brokers are allowed to transact in the fund. If any broker or brokerage is mapped to a fund and the restricted list is listed as ‘Yes’, then all the brokers apart from the disallowed list are allowed to in the fund, unless you map the sub-brokers of the disallowed brokers to a particular fund.

- If any broker or brokerage is mapped to a fund and the restrictive list value is selected as ‘No’, then only those brokers are allowed to transact in the fund, the sub-brokers are not allowed to transact in the mapped fund. If any broker or brokerage is mapped to a fund and the restricted list is listed as ‘Yes’, then all the brokers apart from the disallowed list are allowed to transact in the fund, even the sub-brokers of disallowed parent broker are allowed.

Restriction Category

Alphanumeric; 2 Characters; Optional

If you are maintaining a restrictive / positive list of CIFs that you wish to disallow / allow to transact into the specified fund, you can select the appropriate restriction category in this field.

Remarks

Alphanumeric; 255 Characters; Optional

If you are maintaining a restrictive / positive list of CIFs that you wish to disallow / allow to transact into the specified fund, you can specify any appropriate remarks in this field.

Restricted Transactions

Transaction Type

Alphanumeric; 2 Characters; Optional

Specify the transaction type. Alternatively, you can select transaction type from the option list. The list displays all valid transaction type maintained in the system.

Transaction Name

Display

The system displays the description for the selected transaction type.

4.2 Fund Entity Mapping Summary Screen

This section contains the following topics:

- Section 4.2.1, "Retrieving Record in Fund Entity Mapping Summary Screen"

- Section 4.2.2, "Editing Fund Entity Mapping"

- Section 4.2.3, "Viewing Fund Entity Mapping "

- Section 4.2.4, "Deleting Fund Entity Mapping "

- Section 4.2.5, "Authorizing Fund Entity Mapping "

- Section 4.2.6, "Amending Fund Entity Mapping "

- Section 4.2.7, "Authorizing Amended Fund Entity Mapping "

- Section 4.2.8, "Copying Attributes"

4.2.1 Retrieving Record in Fund Entity Mapping Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

- Invoke the ‘Fund Entity Mapping Summary’ screen by typing

‘UTSFNENT’ in the field at the top right corner

of the Application tool bar and clicking on the adjoining arrow button.

Specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Fund ID

- Entity Type

- Entity ID

- Custom Values Setup

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Fund ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

Example

You can search the record for Fund ID by using the combination of % and alphanumeric value as follows:-

- Search by A%: The system will fetch all the records whose Fund ID starts from Alphabet ‘A’. For example, AGC17, AGVO6, AGC74 and so forth.

- Search by %7: The system will fetch all the records whose Fund ID ends by numeric value’ 7’ For example, AGC17, GSD267, AGC77and so forth.

- Search by %17%: The system will fetch all the records whose Fund ID contains the numeric value 17. For example, GSD217, GSD172, AGC17 and so forth.

4.2.2 Editing Fund Entity Mapping

You can modify the details of Fund Entity Mapping that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the Fund Entity Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Fund Entity Mapping Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Fund Entity Mapping Detail screen is closed and the changes made are reflected in the Fund Entity Summary screen.

4.2.3 Viewing Fund Entity Mapping

To view a record that you have previously input, you must retrieve the same in the Fund Entity Mapping Summary screen as follows:

- Invoke the Fund Entity Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Fund Entity Mapping Detail screen is displayed in View mode.

4.2.4 Deleting Fund Entity Mapping

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Fund Entity Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The Fund Entity Mapping Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

4.2.5 Authorizing Fund Entity Mapping

An unauthorized Fund Entity Mapping must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Fund Entity Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Fund Entity Mapping Detail screen is displayed. Select Authorize operation from the Action List.

When a checker authorizes a transaction, details of validation, if any, that were overridden by the maker of the transaction during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the transaction.

4.2.6 Amending Fund Entity Mapping

After a Fund Entity Mapping is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the Fund Entity Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Fund Entity Mapping Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

4.2.7 Authorizing Amended Fund Entity Mapping

An amended Fund Entity Mapping maintenance must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module and Agency Branch module.

The subsequent process of authorization is the same as that for normal transactions.

4.2.8 Copying Attributes

If you want to create a new Fund Entity Mapping with the same attributes of an existing maintenance, you can copy the attributes of an existing Fund Entity mapping to a new one.

To copy the attributes:

- Retrieve the record whose attributes the new Fund Entity mapping should inherit. You can retrieve the record through the Summary screen or through the F7-F8 operation explained in the previous sections of this chapter.

- Click on Copy.

- Indicate the ID for the new Fund Entity mapping. You can, however, change the details of the new maintenance.

4.3 Agency Branch Backdating Setup

This section contains the following topics:

4.3.1 Invoking the Agency Branch Backdating Limit Setup Screen

This fund rule facilitates the maintenance of the back dating limits for a particular transaction type for an agency branch in a fund. The backdating limit applicable for every transaction type can also be specified in the Transaction Processing Rules profile for the fund, but if it is necessary to handle exceptions for a few agency branches for specific transaction types, the same can be maintained here. The information entered here will then supersede the information in the Transaction Processing Rules profile for the fund, and for that agency branch.

To set up the backdating options for a transaction type for a fund, use the ‘Fund Agency BackDating Limit Setup Detail’ screen. You can invoke this screen by typing ‘UTDFALMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the backdating limits that you wish to maintain.

Before you set up an Agency Branch Backdating limits profile record for a fund, it is desirable to ensure that the following information is already setup in the system:

- The fund already has an existing, unauthorized Fund Demographics profile record.

- The fund already has an existing, unauthorized Shares Characteristics profile record.

- The fund already has an existing, unauthorized Transaction Processing Rules profile record for the concerned transaction type.

You can specify the following fields in this screen:

Fund ID

Alphanumeric; 6 Characters; Mandatory

The Fund ID is a unique identification for each Fund as defined in Fund Demographics. Choose the fund from the list for which the Agency Branch backdating is being set up.

ISIN Code

Alphanumeric; 12 Characters; Optional

Select the ISIN Code of the fund for which you want to set up agency branch backdating, from the options provided. If you specify the ISIN Code of a fund, the ID of the fund is displayed in the Fund field and vice versa.

Fund Name Short

Display

The system displays the description for the selected fund ID.

Agency Details

Agent Code

Alphanumeric; 12 Characters; Mandatory

Enter the code of the agent who is allowed to operate this fund and for whom backdating is to be done.

Agency Branch Code

Alphanumeric; 12 Characters; Mandatory

Enter the branch code of the specified Agent for whom backdating is to be done.

Transaction Type

Alphanumeric; 2 Characters; Mandatory

Enter the Transaction Type for which backdating is to be done.

Backdating Period

Numeric; 22 Characters; Mandatory

Enter the number of days allowed in Backdating for that Agency Branch for the transaction type specified above.

4.4 Fund Agency Backdating Limit Summary Screen

The section contains the following topics:

- Section 4.4.1, "Retrieving Record in Fund Agency Backdating Limit Summary Screen"

- Section 4.4.2, "Editing Fund Agency Backdating Limit"

- Section 4.4.3, "Viewing Fund Agency Backdating Limit"

- Section 4.4.4, "Deleting Fund Agency Backdating Limit"

- Section 4.4.5, "Authorizing Fund Agency Backdating Limit"

- Section 4.4.6, "Amending Fund Agency Backdating Limit"

- Section 4.4.7, "Authorizing Amended Fund Agency Backdating Limit"

- Section 4.4.8, "Copying Attributes"

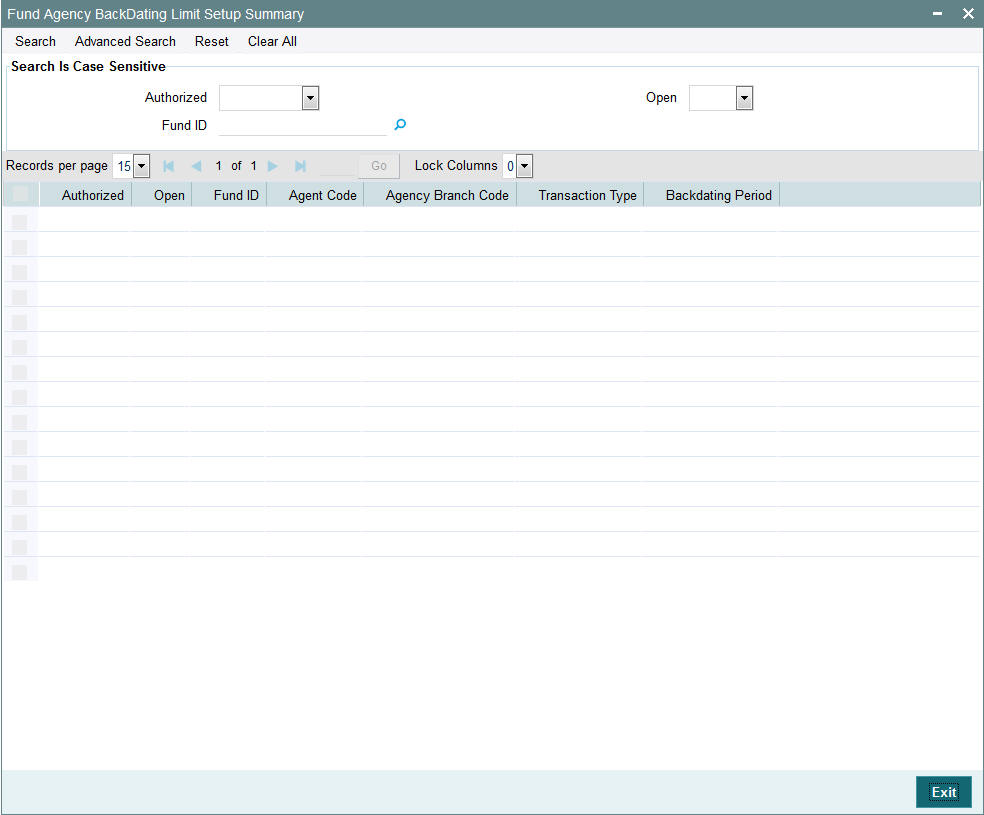

4.4.1 Retrieving Record in Fund Agency Backdating Limit Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

Invoke the summary screen and specify any or all of the following details in the corresponding fields:

- You can invoke the Fund Agency BackDating Limit Setup Summary’

screen by typing ‘UTSFALMT’ in the field at the top right corner

of the Application tool bar and clicking on the adjoining arrow button..

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Fund ID

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Fund ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

Example

You can search the record for Fund ID by using the combination of % and alphanumeric value as follows:-

- Search by A%: The system will fetch all the records whose Fund ID starts from Alphabet ‘A’. For example, AGC17, AGVO6, AGC74 and so forth.

- Search by %7: The system will fetch all the records whose Fund ID ends by numeric value’ 7’. For example, AGC17, GSD267, AGC77 and so forth.

- Search by %17%: The system will fetch all the records whose Fund ID contains the numeric value 17. For example, GSD217, GSD172, AGC17 and so forth.

4.4.2 Editing Fund Agency Backdating Limit

You can modify the details of Fund Agency Backdating Limit that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the Fund Agency Backdating Limit Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorization Status field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Fund Agency Backdating Limit Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Fund Agency Backdating Limit Detail screen is closed and the changes made are reflected in the Fund Agency Backdating Limit Summary screen.

4.4.3 Viewing Fund Agency Backdating Limit

To view a record that you have previously input, you must retrieve the same in the Fund Agency Backdating Limit Summary screen as follows:

- Invoke the Fund Agency Backdating Limit Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Fund Agency Backdating Limit Detail screen is displayed in View mode.

4.4.4 Deleting Fund Agency Backdating Limit

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Fund Agency Backdating Limit Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The Fund Agency Backdating Limit Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

4.4.5 Authorizing Fund Agency Backdating Limit

An unauthorized Fund Agency Backdating Limit must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Fund Agency Backdating Limit Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Fund Agency Backdating Limit Detail screen is displayed. Select Authorize operation from the Action List.

When a checker authorizes a transaction, details of validation, if any, that were overridden by the maker of the transaction during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the transaction.

4.4.6 Amending Fund Agency Backdating Limit

After a Fund Agency Backdating Limit is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the Fund Agency Backdating Limit Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Fund Agency Backdating Limit Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

4.4.7 Authorizing Amended Fund Agency Backdating Limit

An amended Fund Agency Backdating Limit must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module and Agency Branch module.

The subsequent process of authorization is the same as that for normal transactions.

4.4.8 Copying Attributes

If you want to create a new Fund Agency Backdating Limit with the same attributes of an existing one, you can copy the attributes of an existing Fund Agency Backdating Limit to a new one.

To copy the attributes:

- Retrieve the record whose attributes the new Fund Agency Backdating Limit should inherit. You can retrieve the record through the Summary screen or through the F7-F8 operation explained in the previous sections of this chapter.

- Click on Copy

- Indicate the ID for the new Fund Agency Backdating Limit. You can, however, change the details of the new maintenance.

4.5 Restrictions for Switch Transactions

This section contains the following topics:

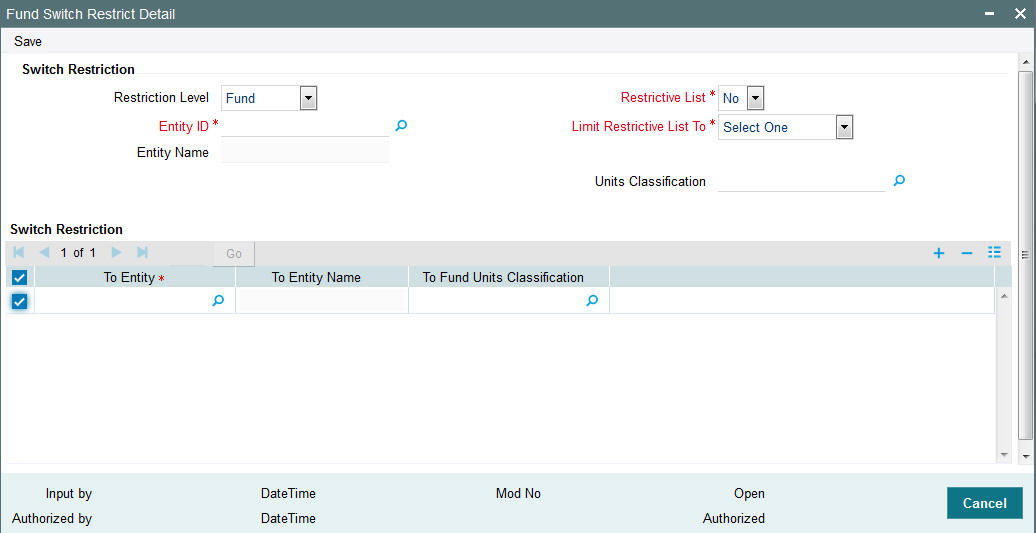

4.5.1 Invoking the Fund Switch Restrict Detail Screen

Switch transactions are governed by the switching policy indicated for the AMC. Accordingly, switch transactions could either be allowed between funds within the AMC, or between funds within the same fund family.

In the case of Distributors, no switching logic might be indicated.

For a fund, you might require to disallow switch transactions into a few selected funds (a restrictive list); or, you might require maintaining a list of funds into which switch transactions are allowed (a positive list).

Typically, a restrictive list could be required if the switching logic indicated for the AMC entails no restrictions on switch transactions.

You can maintain such restrictive or positive lists for a fund in the ‘Fund Switch Restrict Detail’ screen. You can invoke this screen by typing ‘UTDFNSWR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the lists on switch transactions.

Before you maintain switch restrictions in the Fund Switch Restrictions screen, you must ensure that:

- The switching logic for the AMC has been maintained, in the Single Entity Maintenance.

- Authorized fund rules have been maintained for the requisite funds.

Maintenance of switch restrictions is not a fund rule, and can be done after the fund rules have been maintained.

Note

For a fund, you cannot maintain both a positive as well as a restrictive list.

You can specify the following fields in this screen:

Switch Restriction

Restriction Level

Optional

Select the restriction level from the drop-down list. The list displays the following values:

- Fund

- Fund Family

- Legal Entity

- Fund Type

Entity ID

Alphanumeric; 12 Characters; Mandatory

Specify the entity ID. Alternatively, you can select the entity ID form the option list. The list displays all valid entity ID maintained in the system.

Entity Name

Display

The system displays the entity name for the selected entity ID.

Restrictive List

Mandatory

For a fund, you might require to disallow switch transactions into a few selected funds (a restrictive list); or, you might require maintaining a list of funds into which switch transactions are allowed (a positive list)

You can indicate that you are maintaining a restrictive list, by choosing ‘Yes’ from the drop-down list. To indicate that the list is a positive list, choose ‘No’ from the drop-down list.

If you indicate a restrictive list, switch transactions into any of the selected funds in the list will not be allowed. If you indicate a positive list, switch transactions are allowed only into any of the selected funds in the list. For a fund, only a restrictive list OR a positive list can be maintained, not both.

Limit Restrictive List To

Mandatory

If you have indicated a restrictive list, you can indicate the range of funds for which the restrictive list applies from the drop-down list. The list displays the following values:

- No Restriction

- Fund Family

- AMC

- Legal Entity

- Units Classification

Indicating the range of funds in this field is dependant on the switching logic applicable for the AMC (also in the case of Distributors), as given below:

- If the restrictions are being maintained for a Distributor, and no

restrictions have been indicated for switch transactions, you can indicate

whether the restricted list would be applicable for switch transactions

involving:

- All funds (select ‘No Restrictions’ in this field)

- Funds within the same AMC

- Funds within the same fund family

- Legal Entity

- Units Classification

- If the switching logic for the AMC is ‘Switch Within Funds of AMC’, the ‘Within AMC’ option is selected in this field and cannot be changed. The restrictive list will only be applicable for funds within the AMC.

- If the switching logic for the AMC is ‘Switch Within Funds of Fund Family’, the ‘Within Fund Family’ option is selected in this field and cannot be changed. The restrictive list will only be applicable for funds within the same fund family.

This field is not applicable for positive lists; the switching logic of the AMC is defaulted here and cannot be changed.

Units Classification

Alphanumeric; 1 Character; Optional

Specify the units classification details. Alternatively, you can select units classification code from the option list. The list displays all valid unit classification code maintained in the system.

Units Classification Description

Alphanumeric; 60 Characters; Optional

Specify the units classification description.

Switch Restriction

To Entity

Alphanumeric; 12 Characters; Mandatory

Select the To Entity ID into which switch transactions from the selected ‘from fund’ are disallowed (if you are maintaining a restrictive list) or allowed (if you are maintaining a positive list). When the restrictive / positive list is applied, the fund you select here is considered the ‘To Fund’.

To select the fund, you can either indicate the Fund ID or the ISIN Code of the fund. When you select the fund, the short name of the fund is also displayed.

The funds available for selection in this field depend on the option selected in the Limit Restricted Funds To field:

- If the ‘No Restriction’ option has been chosen, all valid funds in the system are available for selection in this field.

- If ‘Within AMC’ has been chosen, all funds belonging to the AMC of the ‘from fund’ are available for selection

- If ‘Within Fund Family’ has been chosen, all funds belonging to the fund family of the ‘from fund’ are available for selection

To Entity Name

Display

The system displays the To Entity name for the selected To Entity ID.

To Fund Units Classification

Alphanumeric; 1 Character; Optional

Specify the To funds units classification details. Alternatively, you can select To funds units classification from the option list. The list displays all valid To fund units classification code maintained in the system.

Units Classification Description

Alphanumeric; 60 Characters; Optional

Specify the units classification description.

How Restricted / Positive Lists Work

The following example illustrates how restricted lists for switch transactions would be applied.

Example

For the Royal Trust AMC, no restrictions for switch transactions have been indicated in the switching logic (the Switching Logic in the Entity Maintenance is ‘No Restrictions’). The following funds are maintained:

Fund |

AMC |

Fund Family |

Fund 1 |

Royal Trust AMC |

Growth Funds |

Fund 2 |

Carling Finance AMC |

Equity Funds |

Fund 3 |

Elton Trueblood AMC |

Equity Funds |

Fund 4 |

Carling Finance AMC |

Growth Funds |

Fund 5 |

Carling Finance AMC |

Equity Funds |

The switch restriction lists are maintained as follows:

Fund |

Restrictive / Positive List |

Limit Restricted List To |

Restricted / Allowed Funds |

Fund 1 |

Restrictive |

No Restrictions |

Fund 2 (Restricted) |

Fund 2 |

Restrictive |

Within AMC |

Fund 4 (Restricted) |

Fund 3 |

Restrictive |

Within Fund Family |

Fund 5 (Restricted) |

Fund 4 |

Positive |

No Restrictions |

Fund 1 (Allowed) |

The lists would apply as follows:

From Fund |

To Funds Allowed |

To Funds Disallowed |

Fund 1 |

All funds except Fund 2 |

Fund 2 |

Fund 2 |

Fund 5 |

Fund 4 |

Fund 3 |

Fund 2 |

Fund 5 |

Fund 4 |

Fund 1 |

All funds except Fund 1 |

4.6 Fund Switch Restrict Summary Screen

This section contains the following sections:

- Section 4.6.1, "Retrieving Record in Fund Switch Restrict Summary Screen"

- Section 4.6.2, "Editing Fund Switch Restrict Record"

- Section 4.6.3, "Viewing Fund Switch Restrict Record"

- Section 4.6.4, "Deleting Fund Switch Restrict Record"

- Section 4.6.5, "Authorizing Fund Switch Restrict Record"

- Section 4.6.6, "Amending Fund Switch Restrict Record"

- Section 4.6.7, "Authorizing Amended Fund Switch Restrict Record"

- Section 4.6.8, "Copying Attributes"

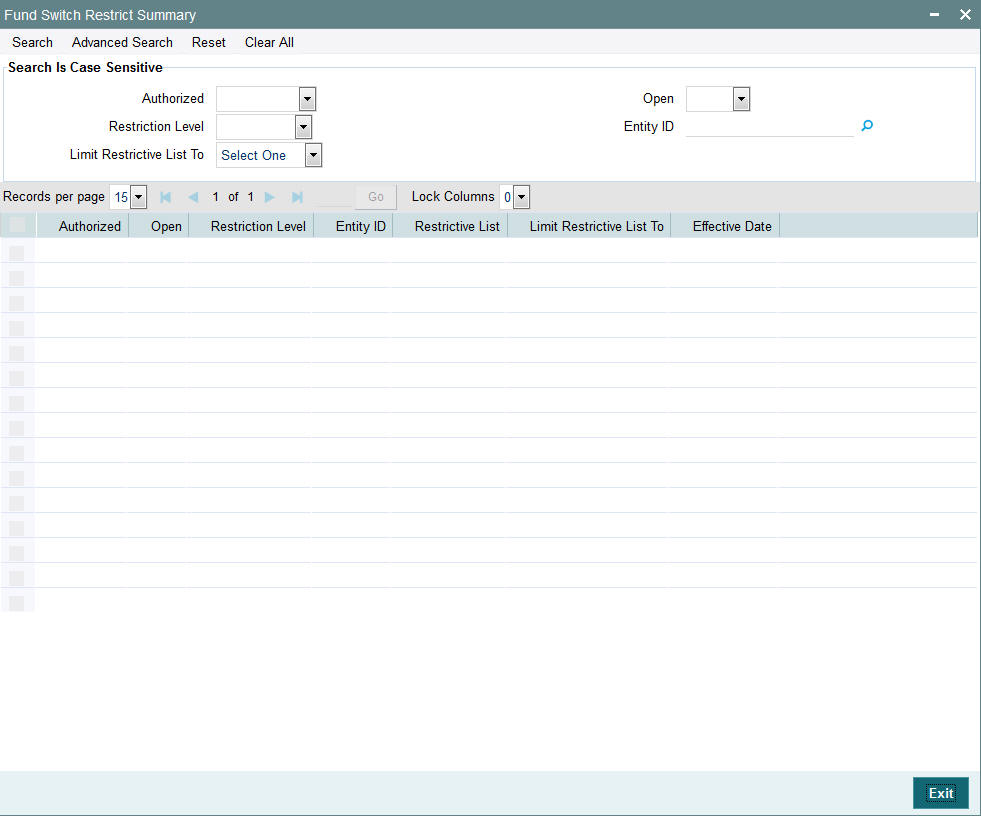

4.6.1 Retrieving Record in Fund Switch Restrict Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

Invoke the summary screen and specify any or all of the following details in the corresponding fields:

- You can invoke this screen by typing ‘UTSFNSWR’ in the field at the top right corner

of the Application tool bar and clicking on the adjoining arrow button.

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Restriction Level

- Entity ID

- Limit Restrictive List To

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Entity ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

Example

You can search the record for Fund ID by using the combination of % and alphanumeric value as follows:-

- Search by A%: The system will fetch all the records whose Entity ID starts from Alphabet ‘A’. For example, AGC17, AGVO6, AGC74 and so forth.

- Search by %7: The system will fetch all the records whose Entity ID ends by numeric value’ 7’. For example, AGC17, GSD267, AGC77 and so forth.

- Search by %17%: The system will fetch all the records whose Entity ID contains the numeric value 17. For example, GSD217, GSD172, AGC17 and so forth.

4.6.2 Editing Fund Switch Restrict Record

You can modify the details of a Fund Switch Restrict record that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the Fund Switch Restrict Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorization Status field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Fund Switch Restrict Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Fund Switch Restrict Detail screen is closed and the changes made are reflected in the Fund Switch Restrict Summary screen.

4.6.3 Viewing Fund Switch Restrict Record

To view a record that you have previously input, you must retrieve the same in the Fund Switch Restrict Summary screen as follows:

- Invoke the Fund Switch Restrict Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorized field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Fund Switch Restrict Detail screen is displayed in View mode.

4.6.4 Deleting Fund Switch Restrict Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Fund Switch Restrict Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. . The Fund Switch Restrict Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

4.6.5 Authorizing Fund Switch Restrict Record

- An unauthorized Fund Switch Restrict record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Fund Switch Restrict Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Fund Switch Restrict Detail screen is displayed. Select Authorize operation from the Action List.

When a checker authorizes a transaction, details of validation, if any, that were overridden by the maker of the transaction during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the transaction.

4.6.6 Amending Fund Switch Restrict Record

After a Fund Switch Restrict record is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the Fund Switch Restrict Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Fund Switch Restrict Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

4.6.7 Authorizing Amended Fund Switch Restrict Record

An amended Fund Switch Restrict record must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module and Agency Branch module.

The subsequent process of authorization is the same as that for normal transactions.

4.6.8 Copying Attributes

If you want to create a new Fund Switch Restrict record with the same attributes of an existing maintenance, you can copy the attributes of an existing Fund Switch Restrict record to a new one.

To copy the attributes:

- Retrieve the record whose attributes the new Fund Switch Restrict record should inherit. You can retrieve the record through the Summary screen or through the F7-F8 operation explained in the previous sections of this chapter.

- Click on Copy.

- Indicate the ID for the new Fund Switch Restrict maintenance. You can, however, change the details of the new maintenance.

4.7 Pseudo Switch Lag Maintenance

This section contains the following topics:

- Section 4.7.1, "Maintaining Pseudo Switch Lag Maintenance"

- Section 4.7.2, "Invoking Pseudo Switch Lag Maintenance Screen"

4.7.1 Maintaining Pseudo Switch Lag Maintenance

You can maintain the lag for the combination of two funds or for two Fund Families. You can derive Pseudo switch date based on cut off time. fund cut off time, then the system will derive the transaction date of Switch Out fund based on Switch Out fund cut off time and the transaction date of Switch In fund based on Switch In fund cut off time.

The transaction date will be derived based on the application received date and time recorded at the transaction level.

For Non Daily pricing frequency funds, in case when derived transaction date falls on a holiday and trade is received before cut-off time then the system will arrive previous or next working day of current transaction cut-off day cycle depending on holiday rule is prior or after. If trade is received after cut-off time then the system should arrive previous or next working day of next cycle transaction cut-off day depending on holiday rule is prior or after.

If the Pseudo switch lag is maintained for the funds and between the families of those funds then the system will give precedence to the Fund. If there is no pseudo switch lag maintenance for the fund then the system will consider the lag maintained for the fund family.

Based on the maintenance at AMC level, the to fund/fund family can be within the AMC or across AMC

Settlement of Pseudo Switch In leg Transaction will be automatic when Switch Out leg is settled manually either through ‘Switch Screen’ or via ‘Confirm Redemption Screen’.

If Switch Out leg transaction is settled using ‘Switch’ screen, then the system will automatically initiate the settlement process for subscription (Switch In Leg) transaction.

If Switch Out leg transaction is settled using ‘Confirm Redemption’ screen, then the system will automatically initiate the settlement process for subscription (Switch In Leg) transaction.

If you try to manually settle the Switch IN leg transaction, then the system will display an error message as ‘The Switch IN leg Transaction cannot be settled manually since Auto Switch In Settlement is turned ON’.

Also the system will allow settlement of Switch OUT only when Switch out leg is allotted. If you try settlement before the allocation, then the system will display an error message as ‘Settlement of Switch OUT cannot be allowed before allocation’.

If ‘Auto Settle Switch Transactions’ field is checked, then only the system will perform the above validations.

You can use ‘Pseudo Switch Lag Maintenance’ screen to maintain the lag maintenance at Fund or Fund Family level. As per the maintenance, the transaction date of switch in transaction will be derived in the respective calendar maintained. The system derives Price date and settlement date based on the fund level lag maintenances. If in Pseudo switch lag maintenance, switch lag option is selected as Settlement Date and Switch Lag as 2, then the system will derive pseudo switch in leg transaction date as (out leg Settlement Date) + 2.

Example for Pseudo switch-in transaction date derivation

Example 1

The system will use Pseudo Switch Lag Maintenance screen for the following setup for switch in transaction date derivation logic (Assumption is No fund holiday for the month November):

Fund Preference Switch-in Generation Level |

Switch Out Fund |

Switch In Fund |

Switch Lag Option |

Switch Lag |

Calendar Basis |

Settlement |

FundA |

FundB |

Settlement Date |

2 |

Actual |

FundB |

FundC |

Price Date |

2 |

Actual |

|

FundD |

FundA |

Transaction Date |

3 |

System |

With the above maintenance, pseudo switch in transaction date will be as follows:

Switch Out Fund ID |

Switch In Fund ID |

Switch Out Txn Date |

Switch Out Price Date |

Switch Out Settlement Date |

Switch In Txn Date |

Switch in Generation on |

FundA |

FundB |

7-Nov-16 |

8-Nov-16 |

9-Nov-16 |

11-Nov-16 |

9-Nov-16 |

FundB |

FundC |

7-Nov-16 |

8-Nov-16 |

9-Nov-16 |

10-Nov-16 |

9-Nov-16 |

FundD |

FundA |

7-Nov-16 |

8-Nov-16 |

8-Nov-16 |

10-Nov-16 |

8-Nov-16 |

Example 2

The following examples cover the following cases:

- Switch-out transaction with payment lag and price lag

- Switch-in transaction date derived based on switch-out price date/Settlement date

Fund Level setup

Fund ID |

Transaction Date |

Price Lag |

Payment Lag |

Fund A |

T |

T+1 |

T+5 |

Fund B1 |

T |

T+1 |

T+5 |

Fund B2 |

T |

T+1 |

T+5 |

Fund C |

T |

T+1 |

T+5 |

In Fund Preference Level, Switch-in Generation Level = Allotment

Pseudo Switch Lag Maintenance

Switch Out Fund |

Switch In Fund |

Switch Lag Option |

Switch Lag |

Calendar Basis |

Fund A |

Fund B1 |

Price Date |

0 |

Fund Calendar |

Fund A |

Fund B2 |

Price Date |

0 |

Fund Calendar |

Fund A |

Fund C |

Settlement Date |

0 |

Fund Calendar |

Pseudo Switch in Transaction attributes as follows:

From Fund |

To Fund |

Transaction |

Transaction Date |

Price Date |

Settlement Date |

Fund Holiday |

Fund A |

Fund B1 |

PS-Out |

30-Oct |

31-Oct |

4-Nov |

|

PS-In |

31-Oct |

1-Nov |

5-Nov |

|

||

Fund A |

Fund B2 |

PS-Out |

30-Oct |

31-Oct |

4-Nov |

|

PS-In |

31-Oct |

2-Nov |

6-Nov |

1-Nov |

||

Fund A |

Fund C |

PS-Out |

30-Oct |

31-Oct |

4-Nov |

|

PS-In |

4-Nov |

5-Nov |

9-Nov |

|

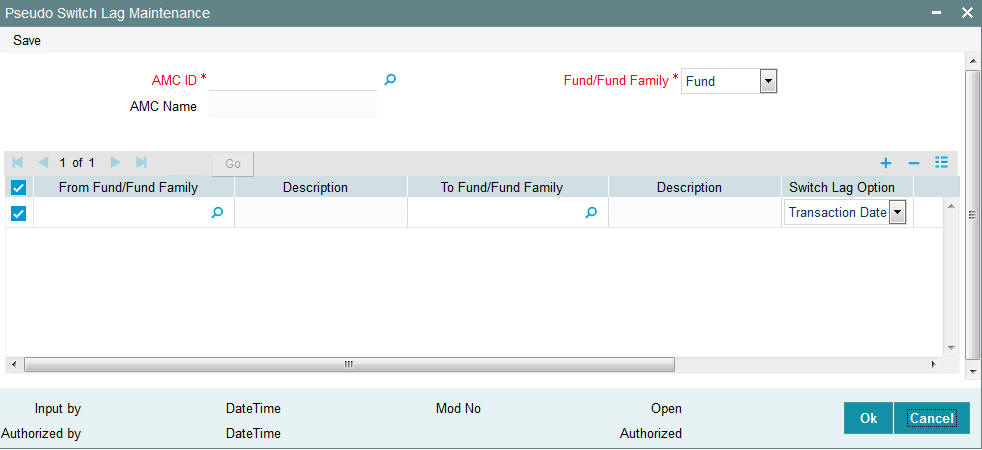

4.7.2 Invoking Pseudo Switch Lag Maintenance Screen

You can maintain the lag for the combination of two funds or for two Fund Families using ‘Pseudo Switch Lag Maintenance’ screen. You can invoke this screen by typing ‘UTDSWLAG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

AMC ID

Alphanumeric; 12 Characters; Mandatory

Specify the AMC ID. Alternatively, you can select the AMC ID from the option list. The list displays all valid AMC ID maintained in the system.

AMC Name

Display

The system displays the description for the selected AMC ID.

Fund/Fund Family

Mandatory

Select the fund or fund family from the drop-down list. The list displays the following values:

- Fund

- Fund Family

From Fund/Fund Family

Alphanumeric; 6 Characters; Optional

Specify the from fund or fund family details. Alternatively, you can select the from fund or fund family details from the option list. The list displays all valid from fund or fund family details maintained in the system.

Description

Display

The system displays the description for the selected from fund or fund family.

To Fund/Fund Family

Alphanumeric; 6 Characters; Optional

Specify the To fund or fund family details. Alternatively, you can select the To fund or fund family details from the option list. The list displays all valid To fund or fund family details maintained in the system.

Description

Display

The system displays the description for the selected To fund or fund family.

Switch Lag Option

Optional

Select the switch lag option from the drop-down list. The list displays the following values:

- Transaction Date

- Settlement Date

- Price Date

- Dealing Date

Switch Lag

Alphanumeric; 2 Characters; Optional

Specify the switch lag details.

Calendar Basis

Optional

Select the calendar basis from the drop-down list. The list displays the following value

- Actual Calendar

- System Calendar

- AMC Calendar

- Fund Calendar

During Transaction Upload Process, the Switch Transaction date will be calculated as follows:

- If the maintenance is done for the Fund/ Fund family for From and To leg, then it should arrive the transaction date for To leg according to the maintenance irrespective of UPLOADCUTOFFTIME being on or off

- If there is no pseudo switch lag maintenance and PSINCUTTIME and UPLOADCUTOFFTIME is off, then the default trade date is taken which is based on the Out settlement date. The To Price Date is arrived based on the to transaction date

- If there is no pseudo switch lag maintenance and PSINCUTTIME is ON and UPLOADCUTOFFTIME is off then the IN leg trade date will be derived depending on whether the transaction has been created before or after switch in fund cut off time and in leg transaction date will be derived accordingly and The To Price Date is arrived based on the to transaction date

- If there is no pseudo switch lag maintenance and PSINCUTTIME is ON and UPLOADCUTOFFTIME is ON, then the IN leg trade date will be derived depending on cut off time mentioned in upload file is before or after switch in fund cut off time and in leg transaction date will be derived accordingly and The To Price Date is arrived based on the to transaction date.

4.8 Pseudo Switch Lag Summary

This section contains the following topics:

- Section 4.8.1, "Retrieving Pseudo Switch Lag Record"

- Section 4.8.2, "Viewing Pseudo Switch Lag Record"

- Section 4.8.3, "Editing Pseudo Switch Lag Record"

- Section 4.8.4, "Deleting Pseudo Switch Lag Record"

- Section 4.8.5, "Authorizing Pseudo Switch Lag Record"

- Section 4.8.6, "Amending Pseudo Switch Lag Record"

4.8.1 Retrieving Pseudo Switch Lag Record

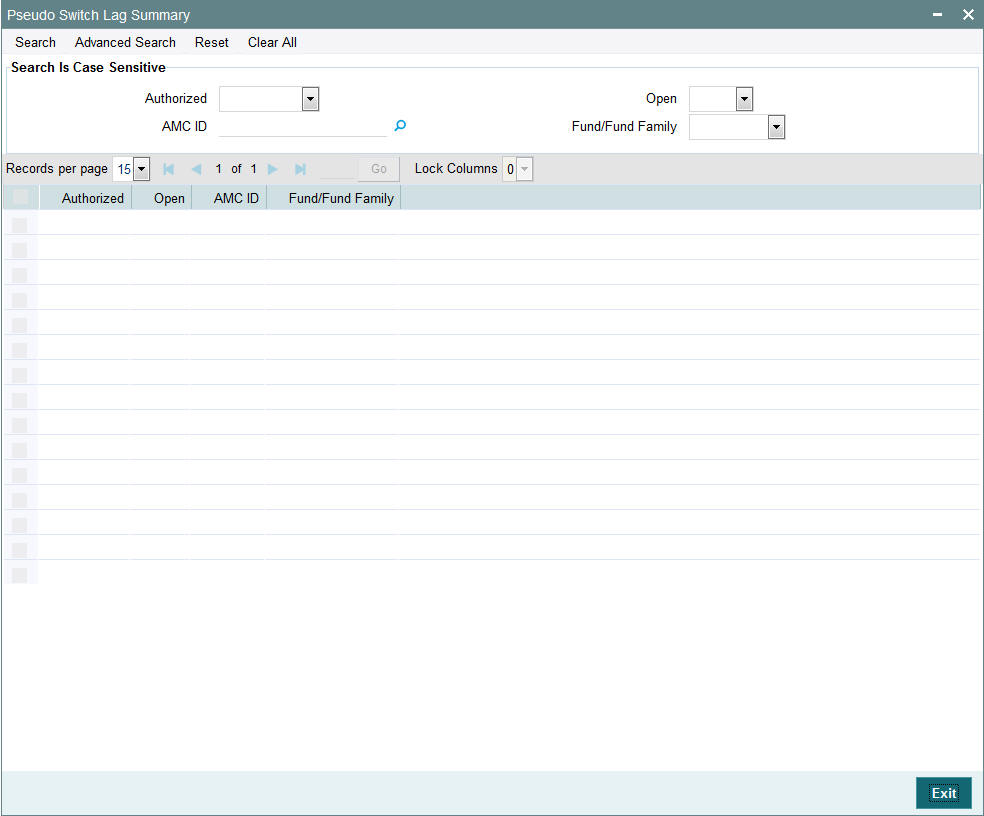

You can view pseudo switch lag details using ‘Pseudo Switch Lag Summary’ screen. To invoke this screen, type ‘UTSSWLAG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can retrieve previously entered Pseudo Switch Lag as follows:

- Invoke the ‘Pseudo Switch Lag Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- AMC ID

- Fund or Fund Family

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

4.8.2 Viewing Pseudo Switch Lag Record

To view a record that you have previously entered, you must retrieve the same in the ‘Global Order Maintenance Summary’ screen, as follows:

- Invoke the ‘Pseudo Switch Lag Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID in the ‘AMC ID’ field. If you choose the blank space, then all the records are retrieved.

- The Fund/Fund Family

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The ‘Pseudo Switch Lag Detail’ screen is displayed in the view mode.

4.8.3 Editing Pseudo Switch Lag Record

You can modify the Pseudo Switch Lag that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the ‘Pseudo Switch Lag Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID in the ‘AMC ID’ field. If you choose the blank space, then all the records are retrieved.

- The Fund/Fund Family

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double-click the record that you want to edit in the list of displayed records. The ‘Pseudo Switch Lag Detail’ screen is displayed.

- Select Unlock operation from the Action list to edit the record. Edit the necessary information.

- Click Save to save your changes. The ‘Pseudo Switch Lag Detail’ screen is closed and the changes made are reflected in the ‘Pseudo Switch Lag Summary’ screen.

4.8.4 Deleting Pseudo Switch Lag Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the ‘Pseudo Switch Lag Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID in the ‘AMC ID’ field. If you choose the blank space, then all the records are retrieved.

- The Fund/Fund Family

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double-click the record that you want to delete. The ‘Pseudo Switch Lag Detail’ screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

Note

The maker of the record can only delete the unauthorized record.

4.8.5 Authorizing Pseudo Switch Lag Record

Apart from the maker, someone else must authorize an unauthorized Pseudo Switch Lag deal in the system for it to be processed. To authorize a record:

- Invoke the ‘Pseudo Switch Lag Summary’ screen from the Browser.

- ‘The status of the transaction in the ‘Authorized’ field. Choose the ‘Unauthorized’ status.

- Click ‘Search’ button to view the records. All the records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Select the Authorization operation from the Action list to authorize the selected record.

4.8.6 Amending Pseudo Switch Lag Record

After a Pseudo Switch Lag record is authorized, it can be modified using the Unlock operation from Action list. To make changes to a record after authorization:

- Invoke the ‘Pseudo Switch Lag Summary’ screen from the Browser.

- Select the status of the transaction that you wish to retrieve for amendment. You can only amend only authorized records.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to amend. The ‘Pseudo Switch Lag Detail’ screen is displayed in the amendment mode. Click the Unlock operation from the Action list to amend the record.

4.9 Fund Price

This section contains the following topics:

- Section 4.9.1, "Invoking the Fund Price Maintenance Screen"

- Section 4.9.2, "Fund Base Currency Details Tab"

- Section 4.9.3, "Additional Information Tab"

- Section 4.9.4, "Fund Price Currency Details Button"

4.9.1 Invoking the Fund Price Maintenance Screen

The Real NAV for the fund for a specific date must be declared, according to the frequency specified for this declaration.

To set up the fund prices, use the ‘Fund Price Detail’ screen. You can invoke this screen by typing ‘UTDFPRIC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The ‘Fund Price Detail’ screen is displayed.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the new fund price.

After you have set up and authorized a fund, you may enter the Fund Price on the Next Price Declare Date that you have specified in the General Operating Rules. Subsequently, you can enter the Fund Price according to the price declare frequency that you have specified in the General Operating Rules for the fund.

You can specify the following fields in this screen:

Fund ID

Alphanumeric; 6 Characters; Mandatory

Select the fund for which the price is being set, from the options provided.

Effective Date

Date Format; Mandatory

Specify the effective date.The price entered in this screen is effective from the system date.

Fund Base Currency

Display

When the fund is selected, the Fund Base Currency for the selected fund is picked up from the Fund Demographics profile and displayed here.

ISIN Code

Display

The system displays the ISIN Code of the selected fund ID

NAV Computation

You need to select the option based on which the Fund Price is to be calculated. The following options are available for calculation of Fund Price:

Net Asset Value

Optional

If you choose this option, you must specify the Real NAV per unit, and the system will compute the fund price per transaction, based on whether the fund is formula-based.

Total Assets

Optional

If you choose this option, you must specify the Total Assets, and based on the outstanding units, the system computes the net asset value.

Formula Builder

Optional

If you choose this option, you must specify values for all the user input fields, and the system computes the Net Asset Value.

Real NAV/Lot

Numeric; 22 Characters; Mandatory

Enter the Real NAV per Unit for the period when the price is being set.

This is applicable only if NAV is selected in the Total assets/ NAV / Formula Builder option. If Total Assets is selected, then this is calculated by the system.

If entered, the system validates this value against the fluctuation limits set for the selected transaction type, in the selected fund, in the Transaction Processing Rules. If the limit is exceeded, an override is sought while saving the price.

Floor Price

Numeric; 22 Characters; Mandatory

Enter the Floor Price for the fund. The floor price is to indicate the lowest price that the fund can offer. Based on the loads, if the net transaction price happens to be lower than this floor price then, the floor price would be considered as net transaction price. This will typically be in case of a redemption or a switch transaction.

FI Outstanding Units

Display

The system displays the number of Foreign Investors’ Outstanding Units for the fund that is also calculated by the system. The units displayed prior to allocation are of the previous period and post-allocation, the Foreign Investors’ units will form the balance for the effective day.

The Foreign Investors Outstanding Units should always be below the figure of one hundred trillion, at any point of time.

Outstanding Units

Display

This displays the number of Total Outstanding Units for the fund that is calculated by the system. The units displayed prior to allocation are of the previous period. Post-allocation, the outstanding units will become the balances for the effective day.

The Total Outstanding Units should never exceed or be equal to the figure of ten thousand trillion, at any point of time.

Reflect in Trading

Optional

Select ‘Yes’ option from drop-down option if you wish to make this fund price applicable for an investor who maintains a trading account under this fund.

Swinging Price Basis

Display

The system displays whether mid/offer/bid price is applied for the fund.

Swinging Price

Numeric; 30 Characters; Optional

Specify the swinging price which is applied for allocating transactions.

The Swinging Price Basis and Swinging Price fields are populated on running the Mini EOD for swinging price computation, only if the fund is swinging or semi swinging price basis fund. For non swinging/non semi swinging fund these fields will be blank.

NAV Lot

Numeric; 22 Characters; Optional

Enter the NAV lot amount.

Total Net Assets

Display

The system displays the Total Net Asset Value or Fund Corpus for the fund. This is applicable only if Total Assets is selected in the Total Assets / NAV / Formula Builder option. If NAV is selected then this is calculated by the system.

This should never exceed or be equal to the figure of ten thousand trillion, at any point of time.

No. Of Unit Holders

Display

This displays the Total Number of unit holders holding a balance in the fund. This number will be the actual number for any given effective date. This is also calculated by the system.

Declared NAV/Lot

Numeric; 22 Characters; Mandatory

Specify the declared NAV per lot.

Ceiling Price

Numeric; 22 Characters; Mandatory

Enter the Ceiling Price for the fund. The Ceiling price is to indicate the highest price that the fund can offer. Based on the loads, if the net transaction price happens to be greater than the Ceiling Price then, the Ceiling Price would be considered as the net transaction price. This will typically be in case of a subscription or IPO transaction.

The Floor Price should be less than the Fund Price and the Ceiling Price should be greater than the Fund Price i.e., Fund Price should be between Floor Price and the Ceiling Price.

Amend Transactions

Optional

This option allows you to reverse and recreate transactions affected by amending the Fund Price or merely updating the price. Only after you select this option, the transactions included during authorization of the Fund Price are affected.

The system will not reverse and recreate the transactions if any underlying child transaction has been created from the old transaction.

The details specified below are displayed if the related fund is a ‘Hedge Fund’.

High Water Mark (HWM)

Numeric; 22 Characters; Optional

Specify the high water mark, as per the price date.

Hurdle Rate

Numeric; 22 Characters; Optional

Specify the hurdle rate as per the price date.

HWM + Hurdle

Numeric; 22 Characters; Optional

Specify the sum of High Water Mark (HWM) and the hurdle rate, rounded based on the price rounding method.

After specifying the necessary details, clicking ‘Ok’ button.

4.9.2 Fund Base Currency Details Tab

You can maintain fund base currency details by clicking ‘Fund Base Currency Details’ tab in ‘Fund Price Detail’ screen.

After specifying the mandatory details, click ‘Ok’ button. The system displays the following details:

Transaction Details

- Effective Date

- Transaction Type

- Base Price

- Base Price Constant

- Allocation Vs. Register Capital

Fund Price Components

- Component Description

- Component Value

Click ‘Compute’ button to process the request.

4.9.3 Additional Information Tab

Additional Information Details

Label Code

Display

The system displays the label of the additional information field.

Field Value

Display

The system displays the value in this field.

Based on the entity add info mapping, all mapped additional information is displayed here.

4.9.4 Fund Price Currency Details Button

You can maintain fund price currency details by clicking ‘Fund Price Currency Button’ tab in ‘Fund Price Detail’ screen. You can capture the various price details for Fund Price Currency’s for various transaction types and component details for a COE fund in this screen..

The system will validate if the price is maintained for the fund in fund price currencies. if not the system will display an error message as ‘Prices for all currencies are not maintained. Do you wish to continue?’

During the pre EOD, the system will check if price in FPC have been maintained for the day. If the price in currency of expression is not found, then the transaction entered in currency of expression will not be allotted.

The Units will be allocated using respective currency of expression or fund price if the transaction is done in currency of expression. If the transaction is done in fund base currency then the allocation will take place by taking the fund price captured in fund base currency. If the transaction is done in a currency which is other than FBC or currency of expression then the allocation of units will be done using exchange rate of FBC.

For project allocation, the system will take the latest available price and show the project allocation. For menu allocation if the price is not available then system will not allocate the transactions.

NAV Correction for fund price currencies

The system will be impacted for NAV corrections for fund price currencies. In case the NAV is corrected for fund price currency, for instance, if GBP and the amend transaction is set to Yes, then all the transactions will be corrected with the new NAV price for the fund price currency (GBP). In case the amend transaction is set to No, the system will not correct the new price at transaction level.

For more details on field explanation, please refer ‘Fund Price Currencies Button’ section in Fund Rule’ screen in this User Manual.

4.10 Fund Price Maintenance Summary Screen

This section contains the following topics:

- Section 4.10.1, "Retrieving Record in the Fund Price Maintenance Summary Screen"

- Section 4.10.2, "Editing Fund Price Record"

- Section 4.10.3, "Viewing Fund Price Record "

- Section 4.10.4, "Deleting Fund Price Record"

- Section 4.10.5, "Authorizing Fund Price Record"

- Section 4.10.6, "Amending Fund Price Record "

- Section 4.10.7, "Authorizing Amended Fund Price Record"

- Section 4.10.8, "Copying Attributes"

4.10.1 Retrieving Record in the Fund Price Maintenance Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

- Invoke the ‘Fund Price Summary’ screen by typing ‘UTSFPRIC’ in the field at the top right corner

of the Application tool bar and clicking on the adjoining arrow button.

.

Specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorization Status field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Fund ID

- Effective Date

- Declared NAV/Lot

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Fund ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

Example

You can search the record for Fund ID by using the combination of % and alphanumeric value as follows:-

- Search by A%: The system will fetch all the records whose Fund ID starts from Alphabet ‘A’. For example, AGC17, AGVO6, AGC74 and so forth.

- Search by %7: The system will fetch all the records whose Fund ID ends by numeric value’ 7’. For example, AGC17, GSD267, AGC77 and so forth.

- Search by %17%: The system will fetch all the records whose Fund ID contains the numeric value 17. For example, GSD217, GSD172, AGC17 and so forth.

4.10.2 Editing Fund Price Record

You can modify the details of Fund Price record that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the Fund Price Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Fund Price Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Fund Price Detail screen is closed and the changes made are reflected in the Fund Price Summary screen.

4.10.3 Viewing Fund Price Record

To view a record that you have previously input, you must retrieve the same in the Fund Price Summary screen as follows:

- Invoke the Fund Price Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Fund Price Detail screen is displayed in View mode.

4.10.4 Deleting Fund Price Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

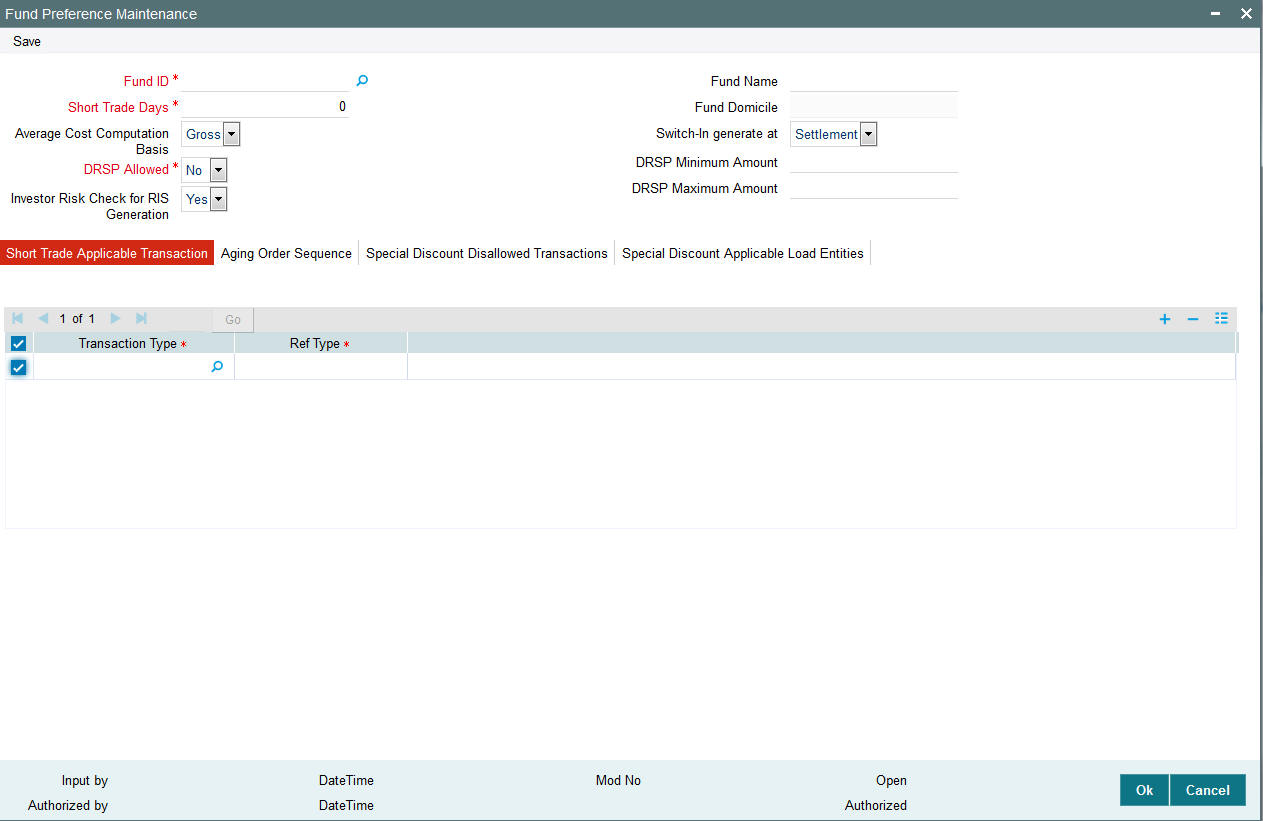

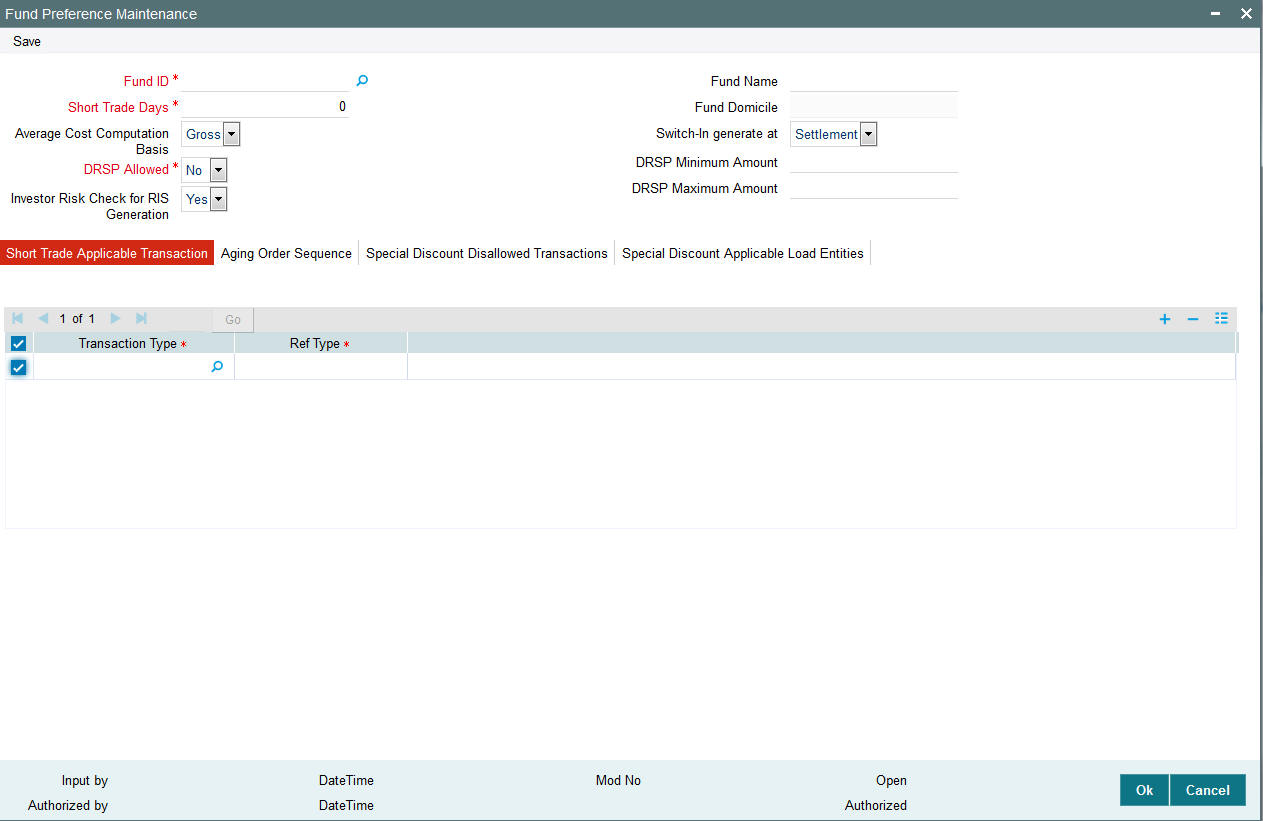

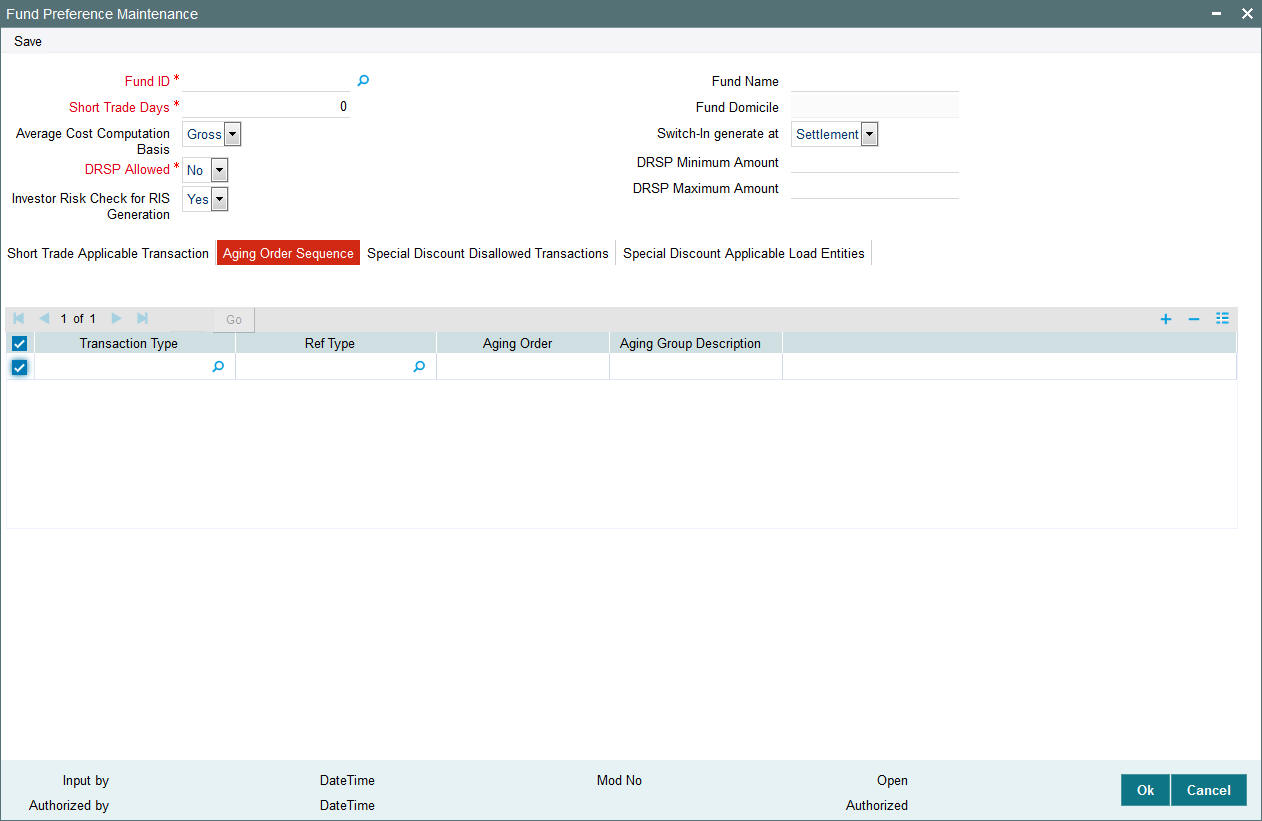

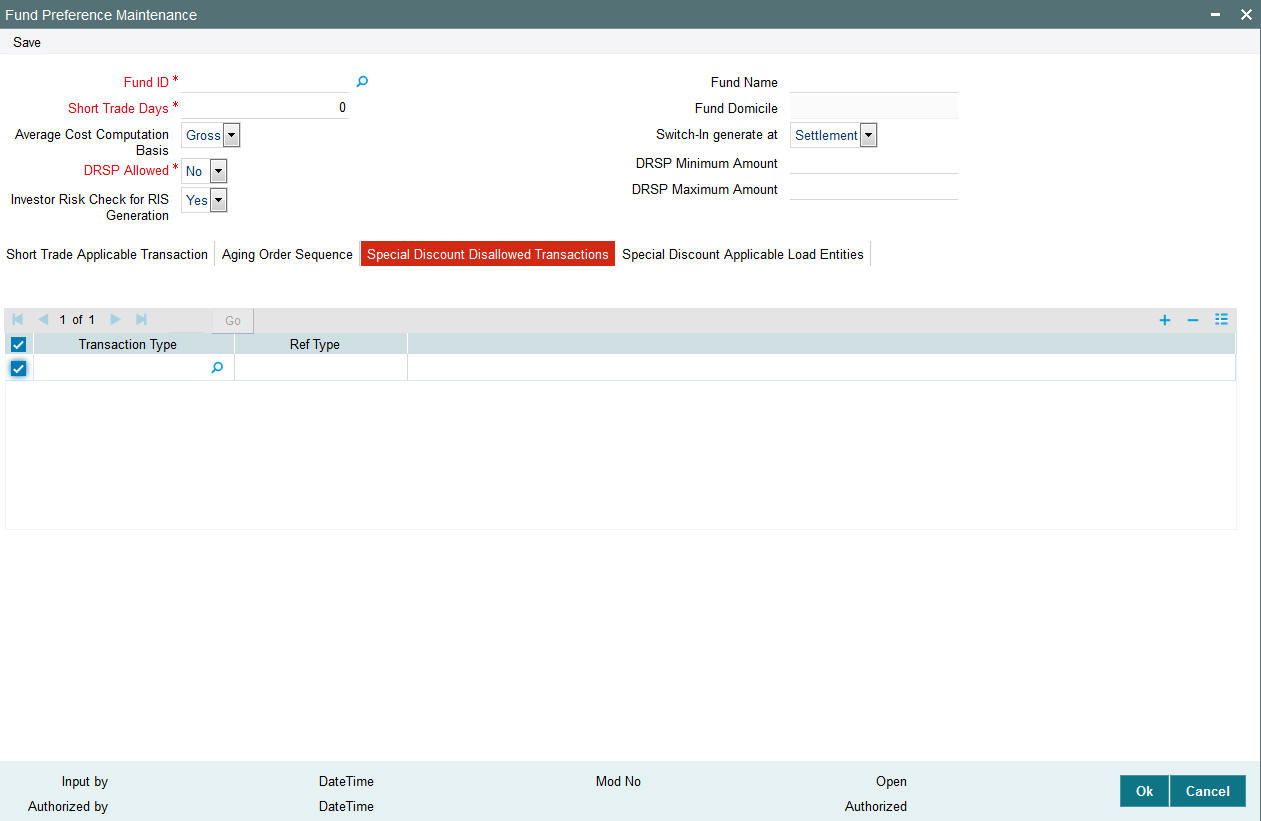

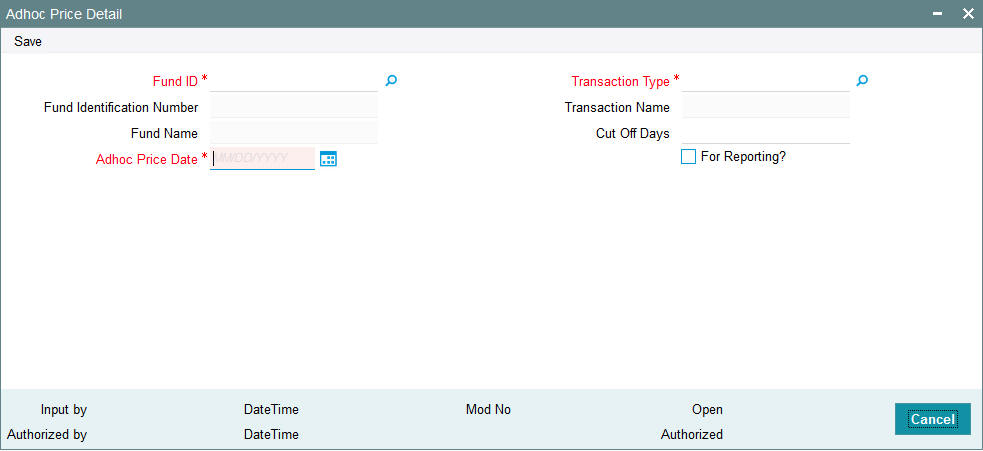

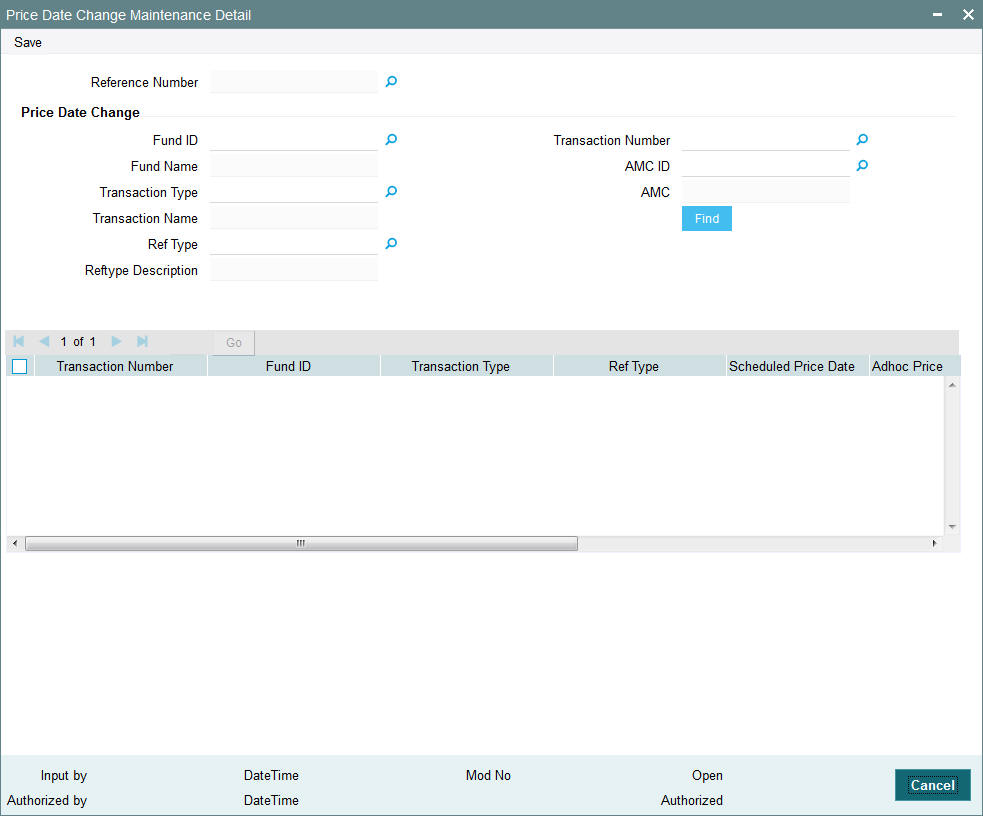

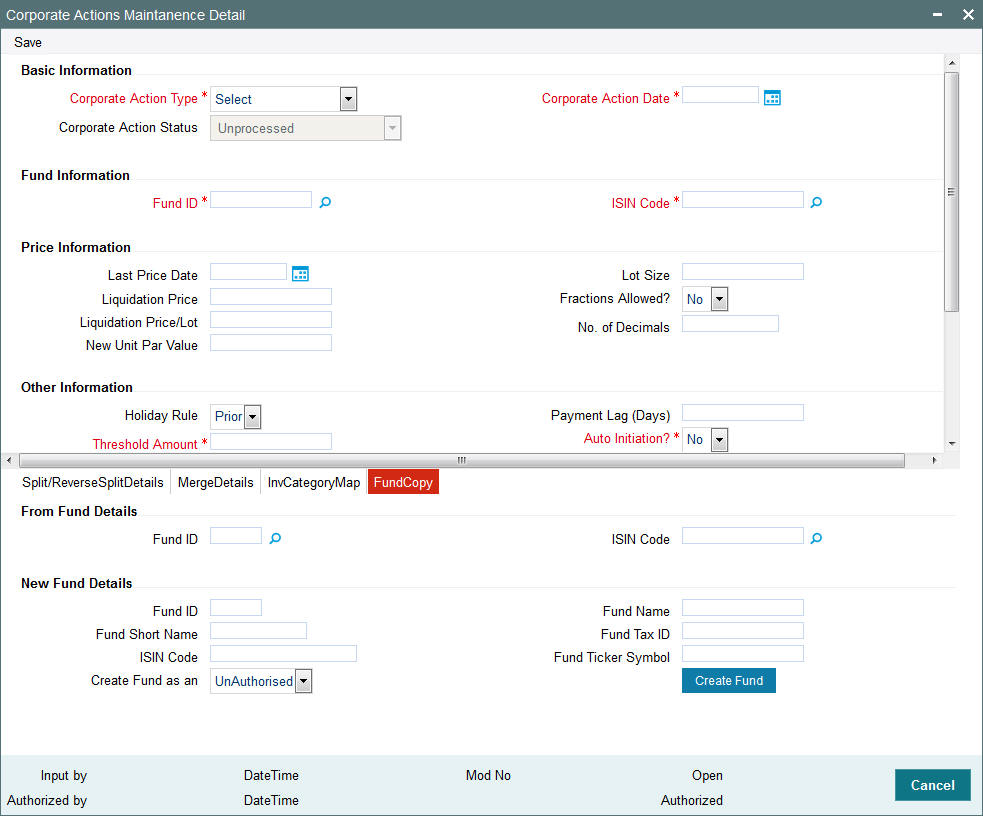

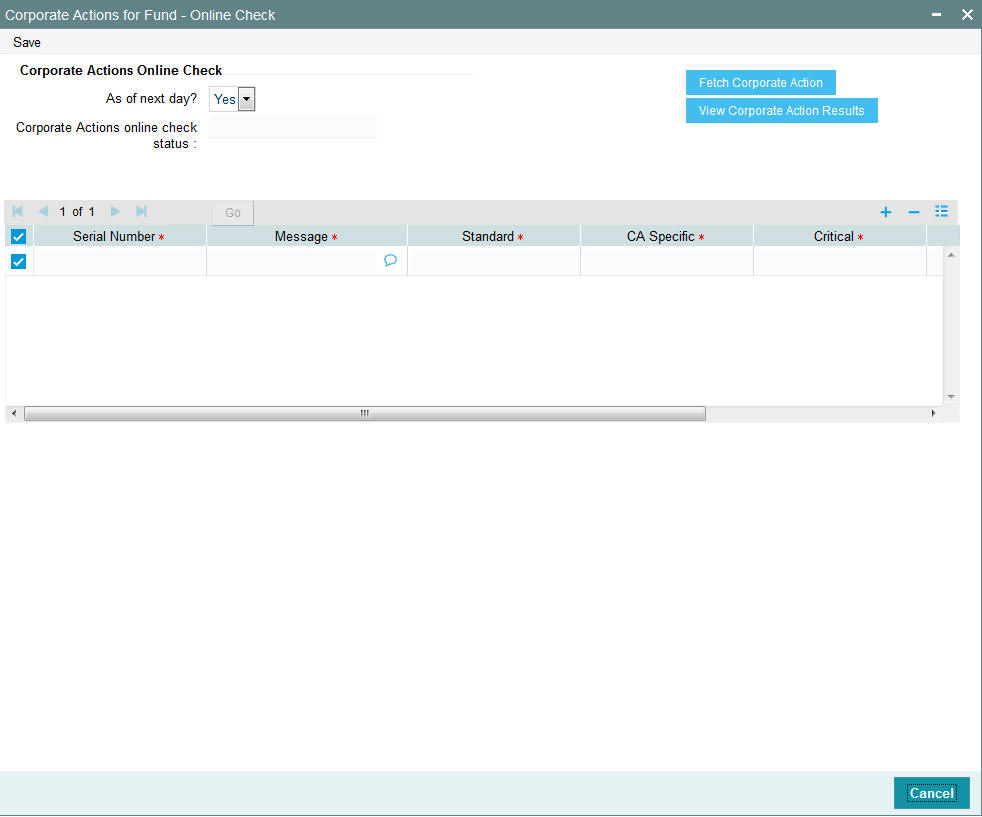

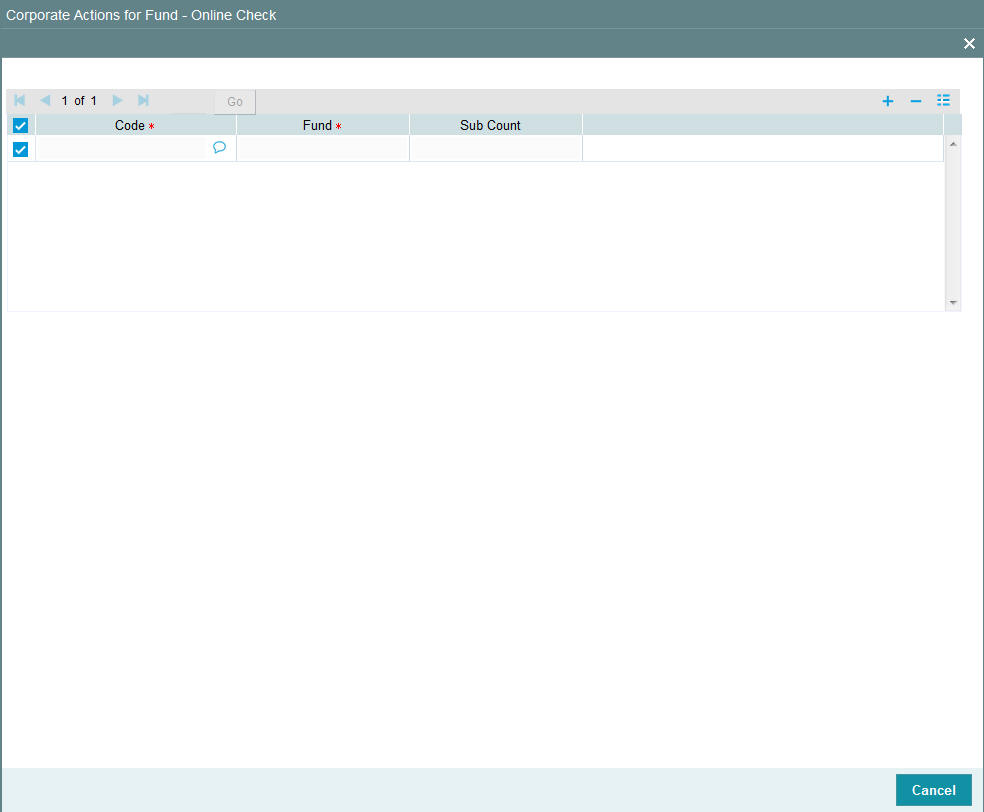

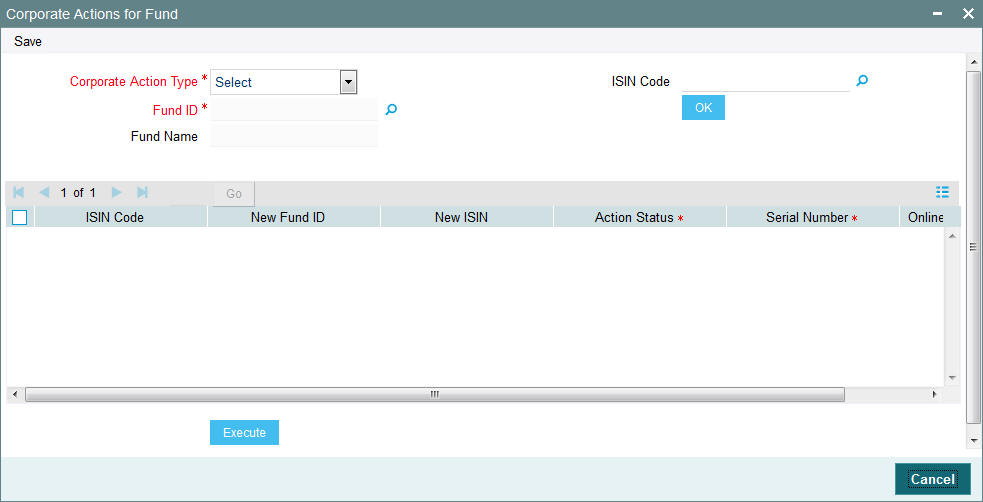

- Invoke the Fund Price Summary screen from the Browser.