4. Product

Each of the Life and Endowment Products that the Life and Endowment Company provides to the Policy Holders must be defined in the Oracle FLEXCUBE Investor Servicing (FCIS) system. The Policy Holders buy policies in any of these products depending upon their need and requirements.

Note

Products can be defined through the Fund Manager component only.

The Product Maintenance screen allows you to capture the generic characteristics of the Product you wish to maintain. The next section gives you step-by-step instructions to do the same.

This chapter contains the following sections:

- Section 4.1, "Product Definition"

- Section 4.2, "Product Summary Screen"

- Section 4.3, "Product and Transaction Sub Type"

- Section 4.4, "Product Transaction Sub Type Mapping Summary"

- Section 4.5, "Product Annual Annuity Limit Mapping"

- Section 4.6, "Product Annual Annuity Limit Summary"

4.1 Product Definition

This section contains the following topics:

- Section 4.1.1, "Creating and Saving Product"

- Section 4.1.2, "Invoking Screen"

- Section 4.1.3, "Product Details Tab"

- Section 4.1.4, "Additional Investments Tab"

- Section 4.1.5, "Bank Details Tab"

- Section 4.1.6, "Withdrawals Tab "

- Section 4.1.7, "Portfolio Mapping Tab"

- Section 4.1.8, "Premium and Annuity Details Tab"

- Section 4.1.9, "Loan and Funding Details Tab"

- Section 4.1.10, "Income Distribution Rule Tab"

- Section 4.1.11, "Transaction Currency Tab"

- Section 4.1.12, "Regulations Tab"

- Section 4.1.13, "Regulation 28 Parameters Tab"

4.1.1 Creating and Saving Product

The following are the steps you need to follow to define a Product. Each of these steps is explained in detail in subsequent sections.

- Invoke the Product Maintenance screen.

- Enter information in the Product Maintenance screen.

- Save the information entered.

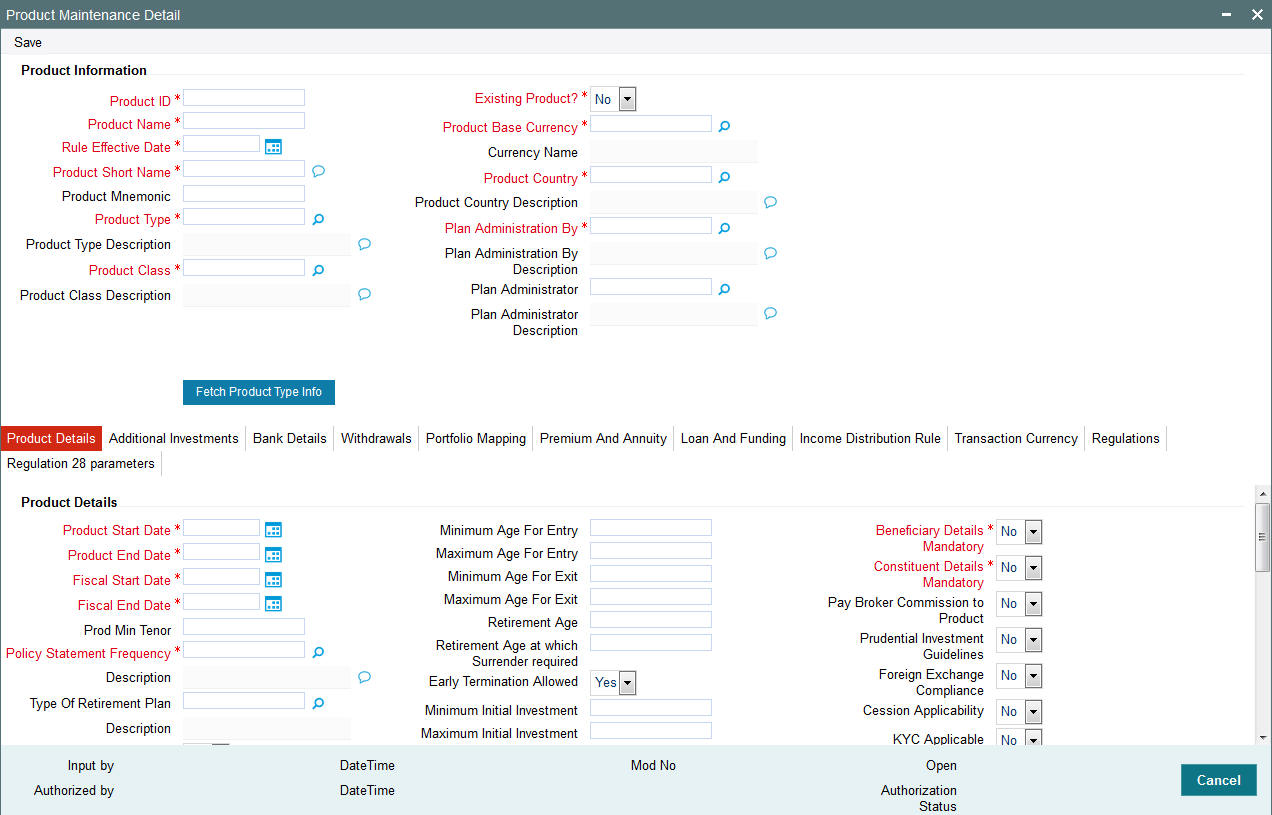

4.1.2 Invoking Screen

Invoke the ‘Product Maintenance Detail’ screen by typing ‘LEDPROD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the Product.

Product Information

Product ID

Alphanumeric; 10 Characters; Mandatory

Specify a unique identification for the product that is being defined through this screen. This identification will be used whenever subsequent reference is made to this product in the system. The ID you enter can contain a maximum of 4 characters.

Product Name

Alphanumeric; 60 Characters; Mandatory

Give the Product ID a description which will help you identify the same easily.

Rule Effective Date

Date Format; Mandatory

Specify the date from which the Product profile definition will become effective for all transactions in this product.

By default, this date is displayed as the next working day in the system.

Product Short Name

Alphanumeric; 20 Characters; Mandatory

Specify a short name for the product.

Product Mnemonic

Alphanumeric; 10 Characters; Optional

Specify a mnemonic for the product. The mnemonic is typically used as an identifier to run queries or to generate reports regarding the product.

Product Type

Alphanumeric; 4 Characters; Mandatory

The various Product Types you have already maintained through the Product Type Maintenance screen will be available for selection in the option list. Select the Product Type that is applicable to the Product.

Product Type Description

Display

The system displays the description for the selected product type.

Product Class

Alphanumeric; 4 Characters; Mandatory

The Product Classes that you have specified through the System Parameters screen will be available for selection in the option list.

Product Class Description

Display

The system displays the description for the selected product class.

Existing Product?

Mandatory

Select ‘Yes’ to indicate that the product is an existing product. For an existing product, the Product Start Date is earlier than the application date. If any existing business products need to be entered into the system, this field facilitates easy conversion of the same.

Product Base Currency

Alphanumeric; 3 Characters; Mandatory

Select the currency that the Product will use, from the options provided in the option list. The currency that you choose for the product will be the reference currency for all the fields identified as part of the Product.

Currency Name

Display

The system displays the name of the currency for the selected product base currency.

Product Country

Alphanumeric; 3 Characters; Mandatory

Select the country where the product will operate, from the options provided in the option list. When the system computes the withholding tax applicable on annuity payments in this Product, the base country information that is specified here is taken into consideration.

Product Country Description

Display

The system displays the description for the selected product country code.

Plan Administration By

Alphanumeric; 3 Characters; Mandatory

Select the entity that will administer the plan. The option list includes all the options that you have maintained in the System Parameters Maintenance screen for the Parameter Code POLICYCODE.

Refer to the chapter ‘Maintaining System Parameters’ in the ‘Security’ User Manual for further information on the System Parameters Maintenance.

Plan Administration By Description

Display

The system displays the description of the selected plan administration by details.

Plan Administrator

Alphanumeric; 60 Characters; Optional

Select the administrator for the entity that you have chosen. The option list includes all the entities that you have maintained in the Single Entity Maintenance screen.

Refer to the chapter ‘Maintaining Reference Information’ in the ‘Reference Information’ User Manual for further information on the Single Entity Maintenance screen.

Plan Administrator Description

Display

The system displays the description for the selected plan administrator ID.

After specifying the necessary details, click ‘Fetch Product Type Info’ button to fetch the product type information.

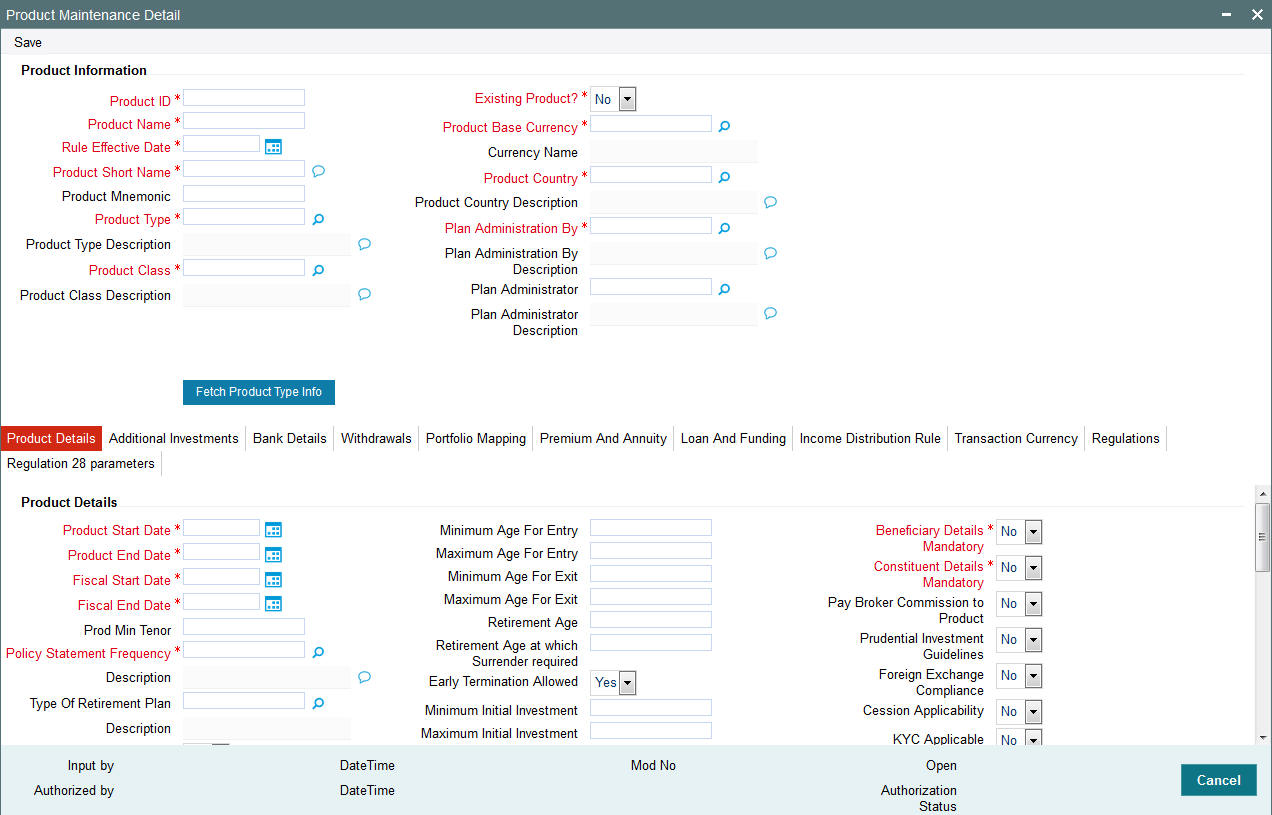

4.1.3 Product Details Tab

Click ‘Product Details’ tab to enter the details.

Product Start Date

Date Format, Mandatory

Specify the date on and beyond which the Product is available for transactions by the Policy Holders.

Note

This date must not be earlier than the Application Date, except if the Product is an existing one.

Product End Date

Date Format, Mandatory

Specify the date on and beyond which the Product is not available for transactions by the Policy Holders.

Note

This date must not be earlier than the Application Date and the Maturity Date of a policy.

Fiscal Start Date

Date Format; Mandatory

Specify the date on which the fiscal year begins.

Fiscal End Date

Date Format; Mandatory

Specify the date on which the fiscal year ends.

Prod Min Tenor

Numeric; 3 Characters; Mandatory and Enabled only if Maturity Date Basis for Product Type is ‘Minimum Tenor’

Specify the minimum age for policies in this Product, in terms of number of years. The age, in number of years, is referred to as the ‘term’ of the Product, and is considered from the Start Date of the Product.

Note

This field will be enabled only if you have selected the option ‘Minimum Tenor’ against the field ‘Maturity Date Basis’ for the Product Type, in the Product Type Maintenance screen.

Policy Statement Frequency

Alphanumeric; 1 Character; Mandatory

Specify the frequency at which policy statements must be generated for a Policy Holder who has subscribed to a policy in this Product.

Description

Display

The system displays the description for the selected description.

Type of Retirement Plan

Alphanumeric; 1 Character; Optional

Specify the type of retirement plan.

Note

This field will be applicable to those Product Types for which you have selected the option ‘Yes” against the field ‘IRA Applicable’.

Description

Display

The system displays the description for the selected type of retirement plan.

Cash Management Account Applicability

Optional

Select ‘Yes’ if you want to make the Cash Management Account feature available in this product, else select ‘No’.

If you have chosen this option, you need to also specify your choices for CMA Fund, Restrict CMA for Initial Investments and Redeem Periodic Fee from CMA Fund. This lays the rules for the operation of the CMA Fund.

CMA Fund

Alphanumeric; 6 Characters; Optional

Specify a fund to be the CMA fund. You can select from the option list.

Description

Display

The system displays the description for the selected CMA applicability.

Restrict CMA for Initial Investment

Optional

Select ‘Yes’ if you wish to restrict initial investments for the CMA Fund. Else select ‘No’.

Redeem Periodic Fee from CMA Fund

Optional

Select ‘Yes’ if you want the system to treat the specified CMA fund, as the preferred fund for periodic fee redemptions. Else select ‘No’.

If you have chosen this option, then system would treat CMA Fund as preferred fund for periodic fee redemptions, provided no preferred fund is selected at Policy Level.

CGT Applicable

Mandatory

Select ‘Yes’ from the drop-down list if CGT is applicable.

Generate Redemption for CGT

Mandatory

Select ‘Yes’ from the drop-down list to generate redemption for CGT.

CGT Reporting Currency

Alphanumeric; 3 Characters; Optional

Specify the currency in which the capital gains and capital gains tax amount should be reported. The capital gains and capital gains tax amount, which is computed at the fund level in the fund base currency, will be converted in terms of the reporting currency using the default exchange rate. If you do not maintain a reporting currency, the system will convert the capital gains and capital gains tax amount only in terms of the product and policy base currency.

Minimum Age for Entry

Numeric, 3 Characters; Optional

The minimum age before which a Policy Holder cannot subscribe to a policy under a Product of this Product Type, will be displayed.

Maximum Age for Entry

Numeric, 3 Characters; Optional

Specify the maximum age after which a Policy Holder cannot subscribe to a policy under a Product of this Product Type.

Minimum Age for Exit

Numeric, 3 Characters; Optional

Specify the minimum age before which a Policy Holder cannot close a policy under a Product of this Product Type.

Maximum Age for Exit

Numeric, 3 Characters; Optional

Specify the maximum age after which a Policy Holder is not allowed to have holdings in the Product.

Note

The age limits that you have specified for the Product Type through the Product Type Maintenance screen will be displayed in the above fields. You will be allowed to change the same for a Product if, for the Product Type, you have selected the option Override Age Limit.

Retirement Age

Numeric, 3 Characters; Optional and Enabled only if Maturity Date Basis for Product Type is ‘Retirement Age’

Specify the age that will be considered as retirement age for Policy Holders under this product. After this age, the Policy Holders with policies in this Product will become eligible for retirement benefits, if any.

This field will be enabled only if, for the Product Type, in the Product Type Maintenance screen:

- You have selected the option ‘Yes’ against the field ‘Retirement Features Supported?’

- You have selected the option ‘Retirement Age’ against the field ‘Maturity Date Basis’

Retirement Age at which Surrender required

Alphanumeric; 3 Characters; Optional

Specify the age at which the Policy Holder must surrender the policy.

Early Termination Allowed?

Optional

A policy in a Product can be terminated earlier than the Maturity Date of the Product. Select ‘Yes’ if such a termination is desired to be applied to policies in this Product.

Minimum Initial Investment

Numeric, 18 Characters; Optional

Specify the minimum amount that a Policy Holder has to contribute to hold a policy in this Product at the time of policy creation.

Maximum Initial Investment

Numeric, 18 Characters; Optional

Specify the maximum amount that a Policy Holder can invest while making an initial investment in a policy in this Product.

Note

The Policy Holder can top up the policy later if additional investment is allowed for the Product. The same can be indicated through the screen that is invoked when you click on the Additional Investments link. The same is explained in subsequent sections.

Maximum Annual Contribution

Numeric, 18 Characters; Optional

This field is locked for non retirement products.

ROA Applicable

Optional

Select ‘Yes’ from drop-down list if Rate of accumulation is applicable for a product.

The initial administrator and broker will use the market value at policy level to derive the fee return value. the Fee is calculated based on the gross amount of the individual transaction value.

For an ROA function to be applicable, a cumulative load would be setup and mapped in the Load Product.

ROA Computation Method

Alphanumeric; 1 Character; Optional

Select the appropriate method to calculate the right of accumulation from the option list. The ROA may be calculated on the basis of:

- Amount invested in the policy by the policy holder

- Holdings of the customer as on that date

- Holdings subscription price as on that date

- The current days transaction value

Description

Display

The system displays the description for the selected ROA computation method.

Include Current TXN for ROA

Optional

Select whether the current transaction should be considered for calculating ROA.

Include Reinvestment for ROA

Optional

Indicate whether the reinvestments affect the ROA calculation from the drop-down list.

Switch Impact ROA

Optional

Indicate whether switch transactions affect ROA computation from the drop-down list.

Beneficiary Details Mandatory

Mandatory

Select if beneficiary details are mandatory or not from the drop-down list.

During product amendment system checks if there are any policies associated to the product in which case you will not be allowed to select ‘No’.

Note

If you select ‘Yes’, it is mandatory to specify beneficiary details in the policy maintenance screen.

Constituent Details Mandatory

Mandatory

If you select ‘Yes’, it is mandatory to specify constituent details in the ‘Policy Maintenance’ screen.

Pay Broker Commission to Product

Optional

Select ‘Yes’ if pay broker commission is set to the product from the drop-down list.

Prudential Investment Guidelines

Optional

Indicate if you need to define the rules for Prudential Investment guidelines. You can either select Prudential Investment Guidelines or Foreign Exchange compliance.

Foreign Exchange Compliance

Optional

Indicate if you are defining rules for Foreign exchange compliance.

You can define rules by selecting either Prudential Investment Guidelines or Foreign Exchange Compliance. The rules are defined on the number of investment components available or also a combination of these investment components. There is no restriction placed on the number of components which can be selected to define a rule.

For example you can specify two components for a rule; for a rule sequence 1, you can define two components, with a threshold percentage within 0-100 =

Rule ID |

Description |

Components selected for the rule |

Operator (<, >, ≤, ≥, =) |

Threshold percentage (0 – 100%) |

Rule1 |

PIG Compliance-Total Cash |

CA1; CA2 |

≤ |

100 |

Rule 2 |

FOREXCOMPLIANCE |

CA2; EQ2; PR2 |

≤ |

15 |

Cession Applicability

Optional

Indicate whether you want to allow policies associated with this product for policy cession maintenance.

Refer to the chapter “Policy Cession Maintenance” in the LEP User Manual for details.

KYC Applicable

Optional

If you select ‘Yes’, the transaction limit will be checked at the time of capture of Policy Transactions.

Note

System level existing workflow of KYC would still be applicable irrespective of the status selected.

Remarks

Alphanumeric; 255 Characters; Optional

You may enter remarks on the Product, if necessary.

Tax Aggregation Allowed

Optional

Check if tax aggregation is applicable for the product.

WAC Method

Optional

Select WAC method from the drop-down list. The list display the following values:

- Regular WAC

- Life WAC

If you select Life WAC, Base Cost is not provided while capturing a transaction, then the system will calculate Weighted Average Cost (WAC) as follows:

LIFE WAC = ((No of units in the fund before inflow) * (WAC before inflow) + (No of units in the inflow for fund) * (Unit Price of inflow)) / (Total Units in Fund)

Where,

Unit price = (Net investment amount) / number of units purchased

Net Investment amount = Gross investment amount – all Fee except the ones which are paid to AMC

The net investment amount will not exclude any Fee for which To Entity is AMC. The system will deduct any other fee (apart from those where To Entity is AMC) from the gross investment amount to arrive at the net investment amount.

Total units in Fund = (No of units in the fund) + (No of units in the inflow for the fund)

If you select a product with WAC method as LIFE WAC, and if a Switch transaction is done within the same Fund Family and Base Cost is not provided while capturing the transaction then the system will calculate WAC as follows:

Life WAC = ((No of units rolling over) * (WAC in ‘From’ Fund) + (No of units in the ‘To’ fund) * (WAC in ‘To’ Fund)) / (Total Units in ‘To’ Fund)

Where Total units in ‘To’ Fund = (No of units rolling over into To Fund) + (No of units in the ‘To’ fund)

The system will calculate Capital Gain or Loss as follows:

Gain / Loss = Units surrendered / redeemed from Fund* ((Price of fund on the date of Redemption / Surrender) – WAC for fund)

If there is a gain then Capital Gain Tax has to be deducted.

To deduct the capital Gain Tax, a separate Load will be mapped under Product load mapping as post allocation load. If the Slab basis is selected as weighted average then this load will be applied on the Gain portion and tax will be deducted and only the net amount will be paid to the customer.

Tax Deductible Contributions Allowed?

Optional

This field will be enabled only if, for the Product, you have selected the option IRA Enabled. Select ‘Yes’ to indicate tax deductible contributions are allowed for the IRA Product.

WHT Applicable

Mandatory

Select the option to indicate withholding tax needs to be calculated on the reinvested income from the policies in this Product. The options in the drop-down are as follows:

- Reinvestment

- Dividend Payout

- Annuity

- Reinvestment + Dividend

- Reinvestment + Annuity

- Annuity + Dividend

- Reinvestment + Dividend +Annuity

Reinvest IRA Income?

Optional

Select the option ‘Yes’ to indicate the income from IRA Plan is to be reinvested in the same plan. Select the option ‘No’ to indicate the income is to be paid out to the Policy Holder.

Note

This field will be applicable to those Product Types for which you have selected the option ‘Yes’ against the field ‘IRA Applicable’.

Auto Clear Prov Bal

Mandatory

Indicate whether 100% outflow transactions based on the product should include provisionally allotted units. You can specify any of the following options:

- Option not allowed: Provisionally allotted units should not be considered while processing 100% outflow transactions.

- Allowed – Default checked: Provisionally allotted units should be considered while processing 100% outflow transactions by default.

- Allowed – Default unchecked: Provisionally allotted units will not be considered while processing 100% outflow transactions by default. However, you can check this option while performing transactions.

Auto Clear Reinvestments

Mandatory

Indicate whether 100% outflow transactions based on the product should include freeze held and reinvestment units. You can specify any of the following options:

- Option not allowed: Freeze held/reinvestment units should not be considered while processing 100% outflow transactions.

- Allowed – Default checked: Freeze held/reinvestment units should be considered while processing 100% outflow transactions by default.

- Allowed – Default unchecked: Freeze held/reinvestment units will not be considered while processing 100% outflow transactions by default. However, you can check this option while performing transactions.

Refer the section ‘Annexure for CMA’ in the chapter ‘Policy’ in this User Manual for details on the operation of Cash Management Account.

4.1.3.1 Calculating Capital Gain Tax

Capital Gain Tax (CGT) calculations are applicable only for Funds. Since the fund prices are declared gross of CGT, the system will deduct CGT by the Life Company when a CGT event occurs, that is, when sale of units happens which can be due to surrender/ disinvestments or switches. The system will calculate CGT as follows:

Capital Gain Tax = (Gains or Profit – Proportionate Loss from other Funds) * Tax Rate

Where,

Gain or Profit = Units Sold * (Price as of Disinvestment Date - WAC)

WAC = Weighted Average Cost

Post Unitiation, CGT fee will be computed and deducted for all outflows based on the CGT load mapping. If there is any loss, CGT will be zero and losses will be carry forwarded to offset against any future profit/gain. Transaction level losses will be added to the Carry Forwarded losses at policy level if any, and proportionately deducted from the profit/Gain of the other funds.

The system will run a batch at EOD to compute the total gain on a policy outflow (post unitization) and generate a follow on CGT redemption transaction to the extent of capital gains Tax due to a Policy holder. Losses will get logged in Policy Gain/Loss table. Follow on transaction will deduct units to recover any gains tax calculated at the Policy Level.

The system will use the preferred fund of the Unitholder for withdrawal of units to deduct the CGT. If there is no sufficient balance in that fund for that unitholder, then the system will use the latest portfolio percentage and generate a policy withdrawal on pro-rata basis.

Note

Follow on transaction to deduct CGT is applicable only for LEP transactions. For UT the system will limit only to calculate the capital gains

The system will record the CGT amount that is due for outflow transactions. Even if CGT transaction generation fails, the system will calculate and log the CGT amount due on the outflow transaction which can then be used for further processing manually.

In case of 100% surrenders, the capital gains amount due by the policy holder will be netted off from the settlement amount of underlying UT transactions. If surrender amount is less than the capital gains tax amount, then system will block EFT and carry forward the capital gains.

The system will map standard post allocation load with 0% return value to the product to compute gain/loss. If the policy transaction under consideration is a 100% surrender then the system will recover the tax from settlement amount.

The system should reduce the system derived settlement amount to the extent of tax recovered.

The above process will consider the gain/loss computed/carried forward up to and including the current 100% surrender in consideration. The system will recover the tax amount from the settlement amount of funds which resulted in gain only.

If the settlement of such funds is insufficient then the system will recover proportionately from all funds involved in 100% surrender.

If all the UT transactions are in loss then the system will recover proportionately from the portfolio funds.

If the CGT redemption transaction is reversed then the gain will not be reversed.

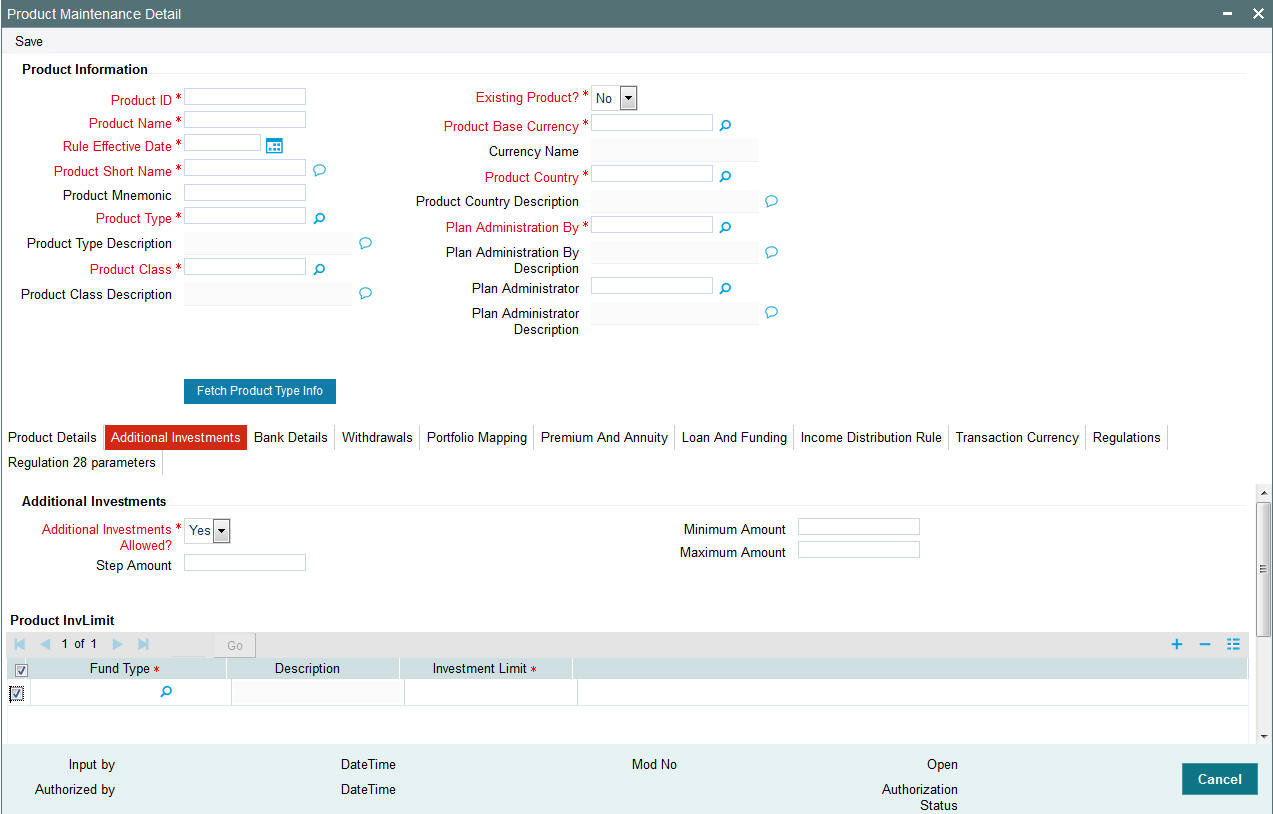

4.1.4 Additional Investments Tab

Click ‘Additional Investments’ tab to enter the details.

Additional Investments

Additional Investments Allowed?

Mandatory

Select ‘Yes’ option to indicate the Policy Holder can make an additional investment in a policy in this product.

Note

The other fields in this screen will be enabled only if you select this option.

Step Amount

Numeric; 18 Characters; Optional

Enter a value that indicates the steps of initial investment amount in which a Policy Holder can invest to subscribe to a policy in this Product.

For instance, it could be that some products support only steps of 500 currency units while some other will support steps of 100 currency units.

Minimum Amount

Numeric; 18 Characters; Optional

Specify the minimum additional investment amount.

Maximum Amount

Numeric; 18 Characters; Optional

Specify the maximum amount to which an additional investment can be made.

Product InvLimit

In the Investment Limit section, you can enter information in the following fields:

Fund Type

Alphanumeric; 6 Characters; Mandatory

Select the funds from the option list in which the Policy Holder can make an additional investment.

You can specify the details of more than one fund by clicking add icon, which adds a field wherein you can choose another fund.

Description

Display

The system displays the description for the selected fund type.

Investment Limit

Numeric; 3 Characters; Mandatory

For each fund, specify the ratio in which the additional investment is allowed to be made.

Note

- The sum total of the ratio you enter, should add up to 100.

- When a Policy Holder makes an additional investment in a policy, the system will calculate the holding in the funds belonging to the fund type for which you have specified an investment limit. If the current holdings plus the new investment exceed the investment limit you have specified, the system will not allow the Policy Holder to make an additional investment in funds belonging to this fund type.

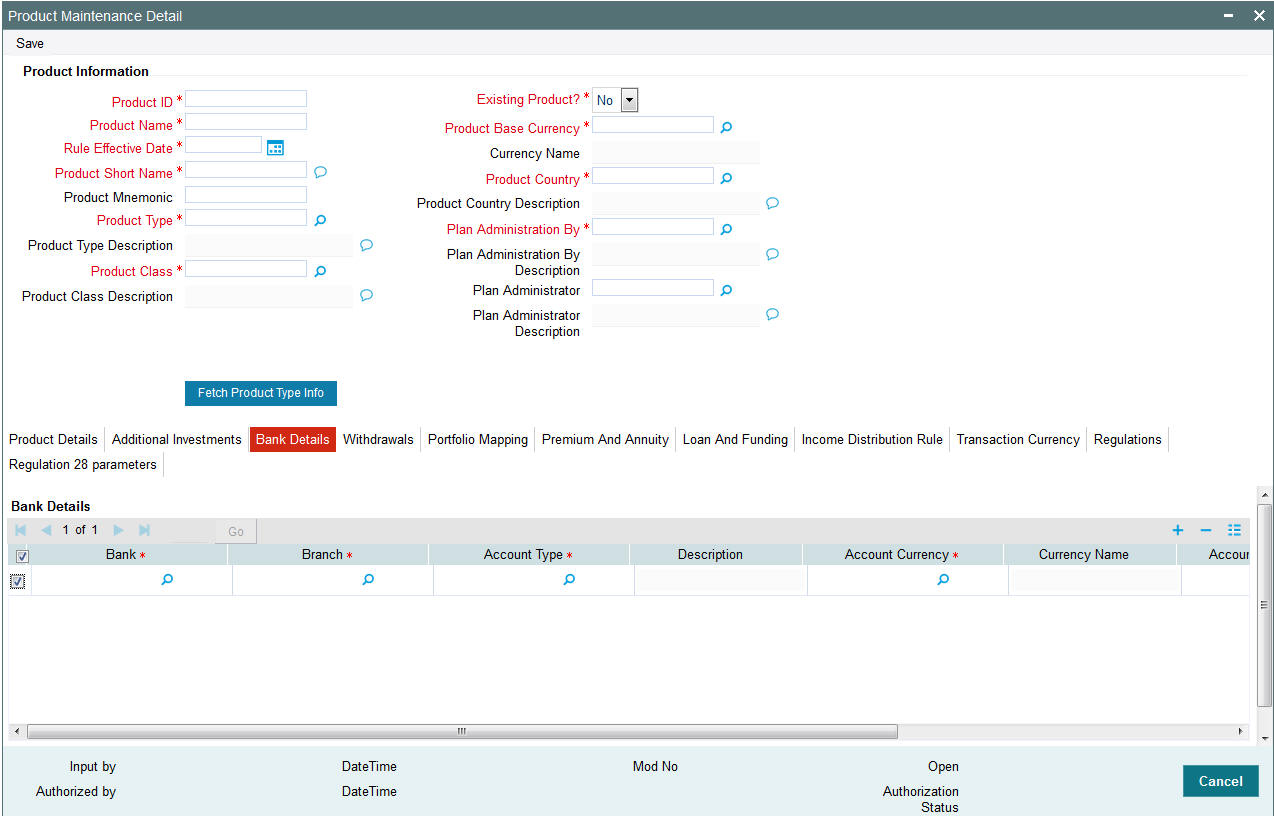

4.1.5 Bank Details Tab

In certain cases, the proceeds of payments such as collection of management fees, surrender at a policy level to handle exceptional situations like death, and so on, may need to be made to a default product bank account and not to the Policy Holder bank account. Several bank accounts can be associated with a product.

Note

This section is mandatory. You will have to enter information in all fields.

Click ‘Bank Details’ tab to enter the details.

Bank Details Section

Bank

Alphanumeric; 12 Characters; Mandatory

Select the name of the bank where the Product account resides, from the option list.

Branch

Alphanumeric; 12 Characters; Mandatory

Select the name of the branch of the bank where the Product account resides, from the option list.

Account Type

Alphanumeric; 1 Character; Mandatory

Select the type of the Product account from the option list.

Description

Display

The system displays the description for the selected account type.

Account Currency

Alphanumeric; 3 Characters; Mandatory

Select the currency of the Product account from the option list.

Currency Name

Display

The system displays the name of the currency for the selected account currency code.

Account Number

Alphanumeric; 16 Characters; Mandatory

Specify the account number of the Product account.

IBAN

Alphanumeric; 40 Characters; Optional

Specify the IBAN (International Bank Account Number) of the account holder.

Default Bank

Mandatory

Select this option to indicate this is the default bank account. You will need to specify one default bank account for every currency.

Note

You can specify the details of more than one bank by clicking add icon, which adds a field wherein you can choose another bank.

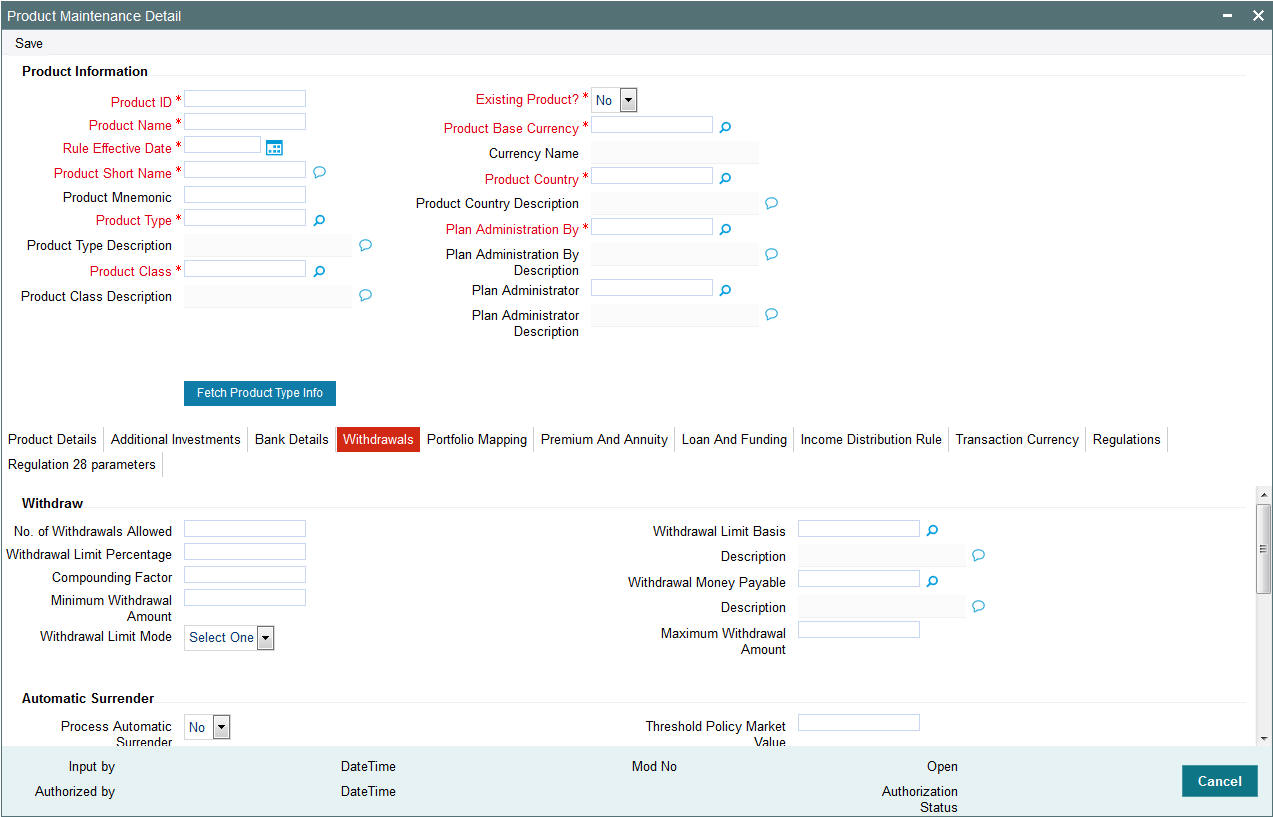

4.1.6 Withdrawals Tab

The information you enter in this screen will be applicable only for the minimum tenor that you have specified in the ‘Product Maintenance’ screen. Once the policy has matured, these details will not be valid.

Click ‘WithDrawals’ tab to enter the details.

Withdraw

No. of Withdrawals Allowed

Numeric; 5 Characters; Optional

Specify the number of partial surrender transactions that can be performed by the Policy Holder during the tenor of the policy. You have to mention the number above zero to select the applicable transaction sub types.

Withdrawal Limit Percentage

Numeric; 5 Characters; Optional

This field will be enabled if you have specified the Withdrawal Limit Mode as Percentage. Specify the maximum percentage of holdings that the Policy Holder is allowed to withdraw.

Compounding Factor

Numeric; 5 Characters; Optional

This field will be enabled if you have specified the Withdrawal Limit Mode as Percentage and the Withdrawal Limit Basis as Compounded Contribution. Specify the compounding factor to be used in calculations.

Minimum Withdrawal Amount

Numeric; 18 Characters; Optional

This field will be enabled if you have specified the Withdrawal Limit Mode as Amount. Specify the minimum amount that a Policy Holder can be withdrawn from the holdings.

Withdrawal Limit Mode

Optional

Select withdrawal limit mode from the drop-down list. The list displays the following values:

- Percentage

- Amount

Select the option ‘Percentage’ to indicate the withdrawal details will be specified in terms of the percentage of holdings. Select the option ‘Amount’ to indicate the withdrawal details will be specified in terms of the withdrawal amount.

Withdrawal Limit Basis

Alphanumeric; 1 Character; Optional

This field will be enabled if you have specified the Withdrawal Limit Mode as Percentage. Specify the applicability of the withdrawal percentage. The percentage you have specified might apply to the Contribution Amount, Compounded Contribution or Market Value.

Description

Display

The system displays the description for the selected withdrawal limit basis.

Withdrawal Money Payable

Alphanumeric; 1 Character; Optional

Specify whether the withdrawal money is payable to the customer, administrator or product account.

Description

Display

The system displays the description for the selected withdrawal money payable

Maximum Withdrawal Amount

Numeric; 18 Characters; Optional

This field will be enabled if you have specified the Withdrawal Limit Mode as Amount. Specify the maximum amount that a Policy Holder can be withdraw from the holdings.

Automatic Surrender

Process Automatic Surrender

Optional

Indicate whether a policy should be automatically surrendered if the market value of the policy goes below a threshold amount or not from the drop-down list.

Consequently, when you do surrender, by default, the money will be transferred to the unitholder's bank account. But, here, the money will be transferred to the bank account of the product and not to the unitholder.

Threshold Policy Market Value

Alphanumeric; 15 Characters; Optional

You will be allowed to enter the threshold policy market value, if you have selected ‘Yes’ for Automatic Surrender. If the policy market value reaches less than the amount that you specify here, the system will automatically trigger a 100% policy withdrawal transaction.

Adjustment Transaction Sub Types

Specify the applicable transaction sub types for the adjustment withdrawal. If you do not specify it, then all outflow transactions would affect withdrawal counter at policy level.

Adjustment Transaction Type

Alphanumeric; 25 Characters; Mandatory

Specify the adjustment transaction type.

Applicable Adjustment Transaction Type Description

Display

The system displays the description for the selected adjustment type.

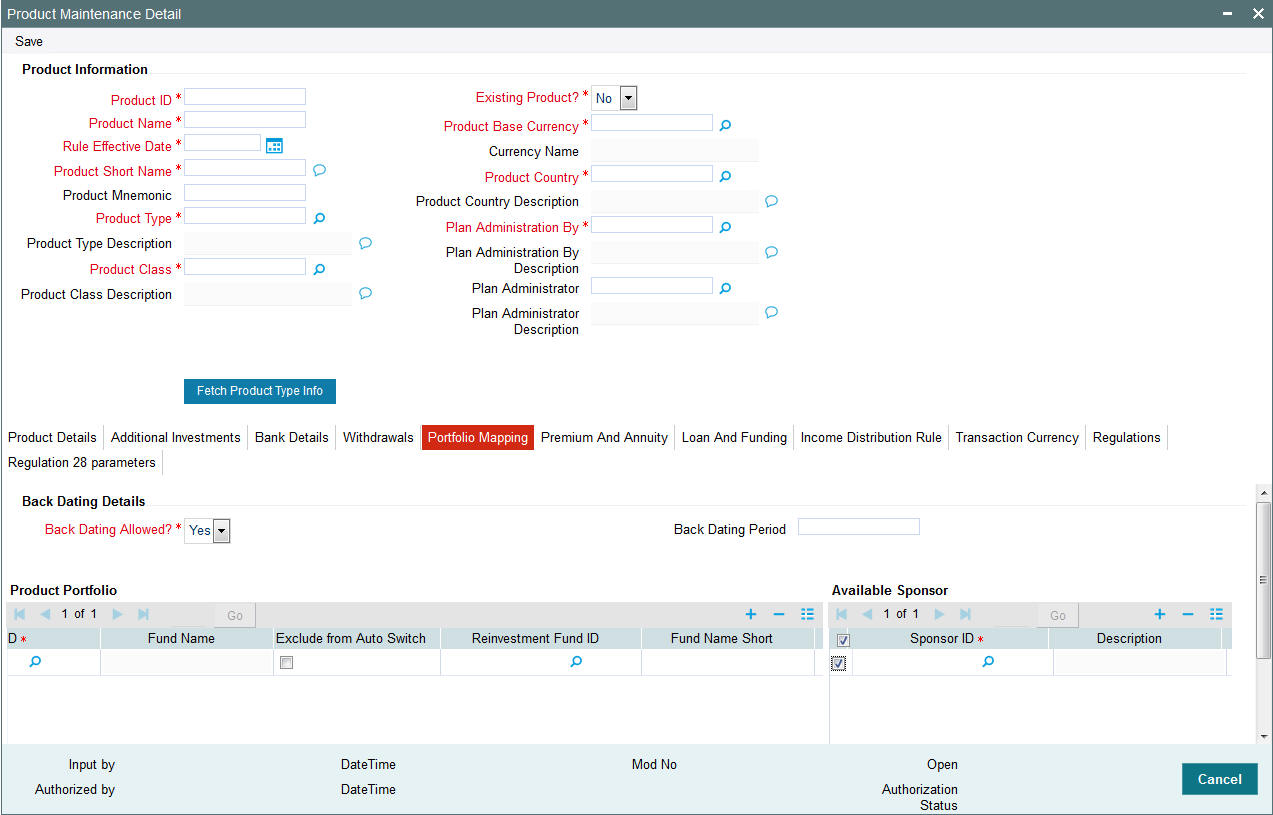

4.1.7 Portfolio Mapping Tab

You will need to maintain the Product Portfolio details. A Product Portfolio contains the funds that are mapped to the Product and available to customers for investing when they take a policy in that Product.

Note

This section is mandatory. You will have to enter information in all fields.

Click ‘PortFolio Mapping’ tab to enter the details.

Back Dating Details

Back Dating Allowed?

Mandatory

Select ‘Yes’ option to indicate back dating is allowed for transactions carried out for policies under this product from the drop-down list. You will be allowed to change this option for a fund under the product.

Back Dating Period

Alphanumeric; 3 Characters; Optional

This field will be enabled if you have specified that back dating is allowed for transactions under this product. Specify the number of days by which the transaction can be back dated.

Product Portfolio

Fund ID

Alphanumeric; 6 Characters; Mandatory

Specify the fund ID by selecting the values from the option list.

Fund Name

Display

The system displays the Fund Name of the selected Fund ID.

Exclude from Auto Switch

Optional

Check this box to exclude the portfolio from auto switch.

Reinvestment Fund ID

Alphanumeric; 6 Characters; Mandatory

Specify the reinvestment fund ID. Alternatively, you can select the reinvestment fund ID from the option list. The list displays all valid reinvestment fund ID maintained in the system.

Fund Name Short

Display

The system displays the fund name for the selected reinvestment fund ID.

Available Sponsor

Sponsor ID

Alphanumeric; 12 Characters; Mandatory

Specify the sponsor ID.

Description

Display

The system displays the description for the selected sponsor ID.

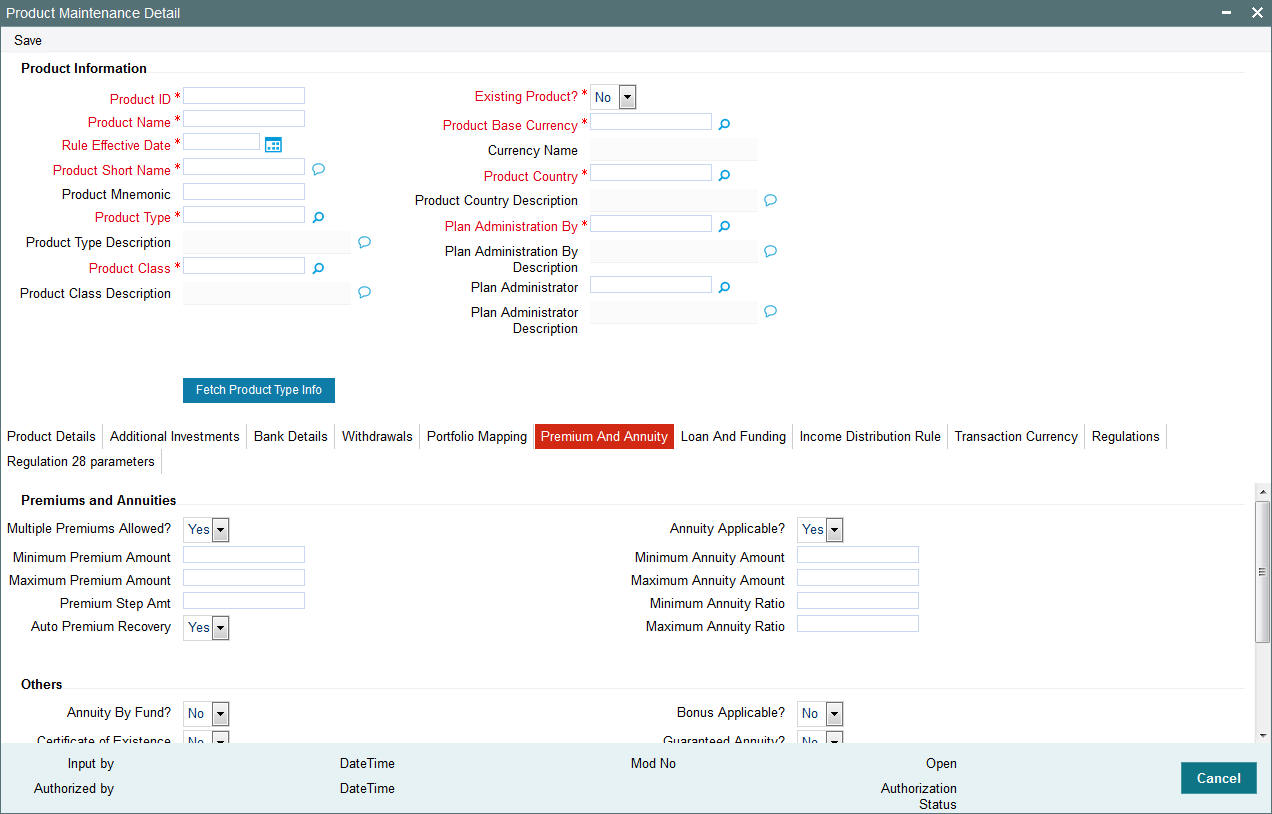

4.1.8 Premium and Annuity Details Tab

You will be able to see this link only if you have chosen a product type for which the option ‘Premium and Annuity Applicable?’ is set to ‘Yes’.

Click ‘Premium and Annuity’ tab to enter the details.

Premiums and Annuities

Multiple Premiums Allowed?

Optional

You can select ‘Yes’ from the drop-down list, if multiple premiums are allowed on the Product.

Minimum Premium Amount

Numeric; 18 Characters; Optional

Specify the minimum premium amount that the Policy Holder needs to pay.

Maximum Premium Amount

Numeric; 18 Characters; Optional

Specify the maximum premium amount that the Policy Holder needs to pay.

Premium Step Amt

Numeric; 18 Characters; Optional

Specify the step amount for payment of premium. The premium amount will be a multiple of the step amount.

Auto Premium Recovery

Optional

If you select ‘Yes’, the system will automatically generate all pending premium transactions if one of the following cases is applicable:

- The premium payment that has stopped, becomes ‘Active’ again

- Premium payments are not made, the status of the same is marked ‘PUP’ by the AMC. Once the premium payment is made, the AMC changes the status to ‘Active’

If you select ‘No’, then no pending premium transactions are generated.

Annuity Applicable?

Optional

An annuity is a deferred payment made to the Policy Holder over a period, for lump-sum payments or premium payments received from the Policy Holder. You can select ‘Yes’ if annuities are applicable to this product.

Note

The next few fields Minimum Annuity Amount, Maximum Annuity Amount, Minimum Annuity Ratio and Maximum Annuity Ratio are enabled only if you have selected the option ‘Annuity Applicable?’

Minimum Annuity Amount

Numeric; 18 Characters; Optional

Specify the minimum amount to be paid out as annuity to the Policy Holder for any policy in the Product.

Maximum Annuity Amount

Numeric; 18 Characters; Optional

Specify the maximum amount allowed to be paid out as annuity to the Policy Holder for any policy in this Product.

Minimum Annuity Ratio

Numeric; 3 Characters; Optional

Specify the ratio of annuity to the net investment amount. This will determine the lower limit of annuity amount payable in a policy.

Note

This will be used for the 5/20 validation during Batch functions.

Refer to the chapter Batch Functions in this User Manual for further information on the 5/20 validation.

Maximum Annuity Ratio

Numeric; 3 Characters; Optional

Specify the ratio of annuity to the net investment amount. This will determine the upper limit of annuity amount payable in a policy.

Note

This will be used for the 5/20 validation during Batch functions.

Refer to the chapter Batch Functions in this User Manual for further information on the 5/20 validation.

Others

Annuity By Fund?

Optional

Select whether annuities are paid out for on the basis of the funds in the Product from the drop-down list.

Certificate of Existence Applicable

Optional

You can select ‘Yes’ from the drop-down list to indicate the Policy Holder needs to produce a certificate of existence.

Life Cover Applicable

Optional

Select ‘Yes’ from the drop-down list to indicate whether the Policy Holder has an option to opt for a life cover while subscribing to this Product.

Annuity Tax Computation Basis

Optional

If the Withholding Tax Applicable for Annuity is selected, you can select the annuity tax computation basis from the drop-down list as Policy or Policy Holder.

If the maintenance for Annuity Tax Basis at the product level is at policy holder, the gross annualized amount for all policies pertains to the Policy Holder gets added up for a Product. If it is at Policy level, gross annualized amount of the Policy level would be taken.

Bonus Applicable?

Optional

Select ‘Yes’ to indicate this Product declares a bonus.

Guaranteed Annuity?

Optional

Select ‘Yes’ from drop-down list to indicate annuity is guaranteed on a policy in this Product.

Life Cover Amount

Numeric; 18 Characters; Mandatory if ‘Life Cover Applicable’ box is checked

Specify the amount to be paid by the Policy Holder as a fee for obtaining the life cover for any policy held by him in this Product.

Note

This field is enabled only if you have selected the option ‘Life Cover Applicable’.

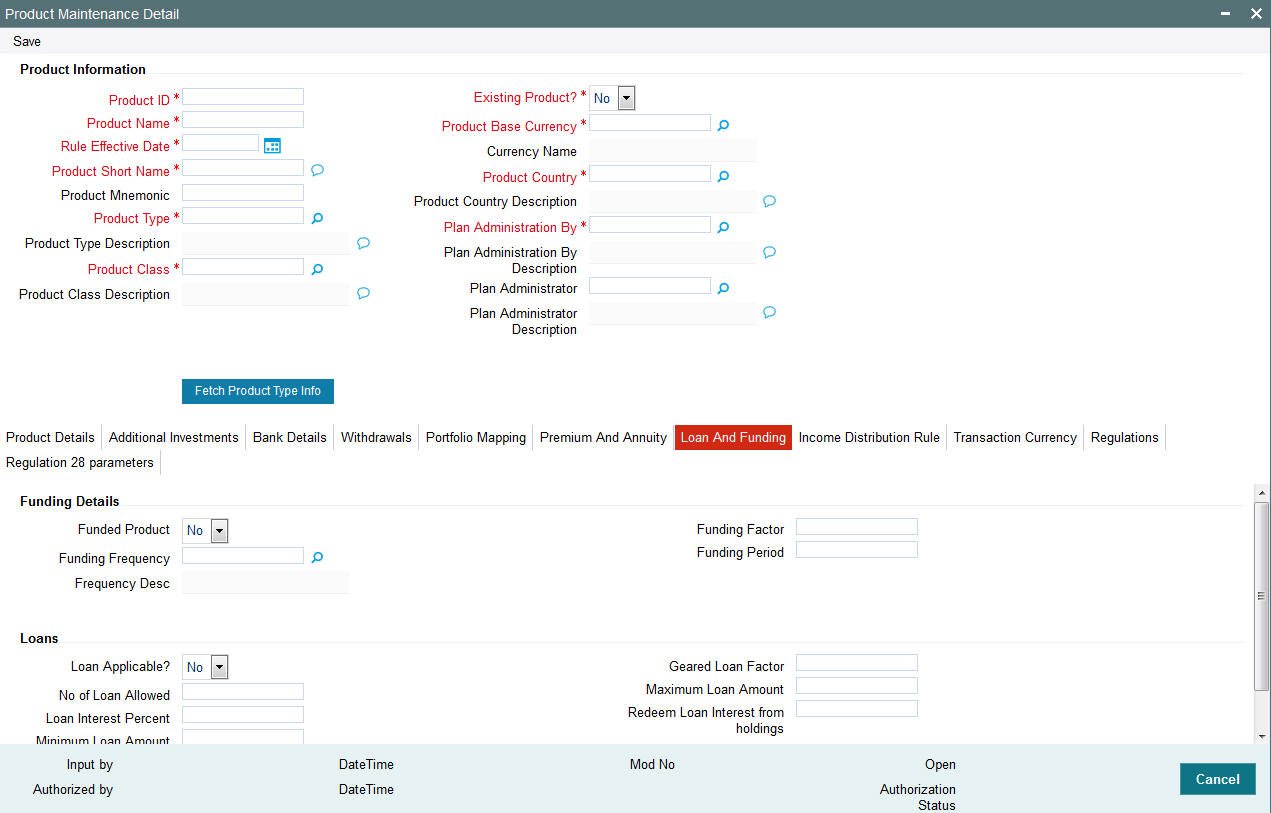

4.1.9 Loan and Funding Details Tab

You will be able to see this link only if, for the product, you have selected the option ‘Yes’ against the field ‘Funding Features Supported?’, in the ‘Product Type Maintenance’ screen.

The funding rules that you specify in this screen, are valid only till the maturity date of the product.

Click ‘Loan and Funding’ tab to enter the details.

Funding Details

Funded Product

Optional

Select whether the Product is a funded product or not from the drop-down list, wherein a portion of the initial investment and subsequent top-ups, if any, will be retained.

Funding Frequency

Alphanumeric; 1 Character; Mandatory if ‘Funded Product’ is ‘Yes’

Specify the frequency at which the funded amount will be repaid to the investor.

Note

You cannot change the funding frequency for a policy.

Frequency Desc

Display

The system displays the description for the selected funding frequency.

Funding Factor

Numeric; 5 Characters; Mandatory if ‘Funded Product’ is ’Yes’

Specify the funding factor that is applicable to policy transactions in this Product. This must be expressed as a percentage and cannot exceed one hundred percent.

Note

You will be allowed to change this at the policy creation level for the initial contribution and then at the transaction level for top ups.

Funding Period

Numeric; 3 Characters; Mandatory if ‘Funded Product’ is ‘Yes’

Specify the duration of the repayment period, at the end of which the entire funded amount will be paid back to the investor.

Note

You can change the same for a policy.

Loans

Loan Applicable?

Optional

Select ‘Yes’ if Loan is applicable, else ‘No’.

Geared Loan Factor

Numeric; 5 Characters; Optional

Enter the geared loan factor.

No of Loan Allowed

Numeric; 5 Characters; Optional

Enter the number of loans allowed.

Loan Interest Percent

Numeric; 5 Characters; Optional

Enter the loan interest percent.

Minimum Loan Amount

Numeric; 18 Characters; Optional

Enter the minimum loan amount.

Maximum Loan Amount

Numeric; 18 Characters; Optional

Enter the maximum loan amount.

Redeem Loan Interest from holdings

Numeric; 1 Characters; Optional

Enter the redeem loan interest from holdings.

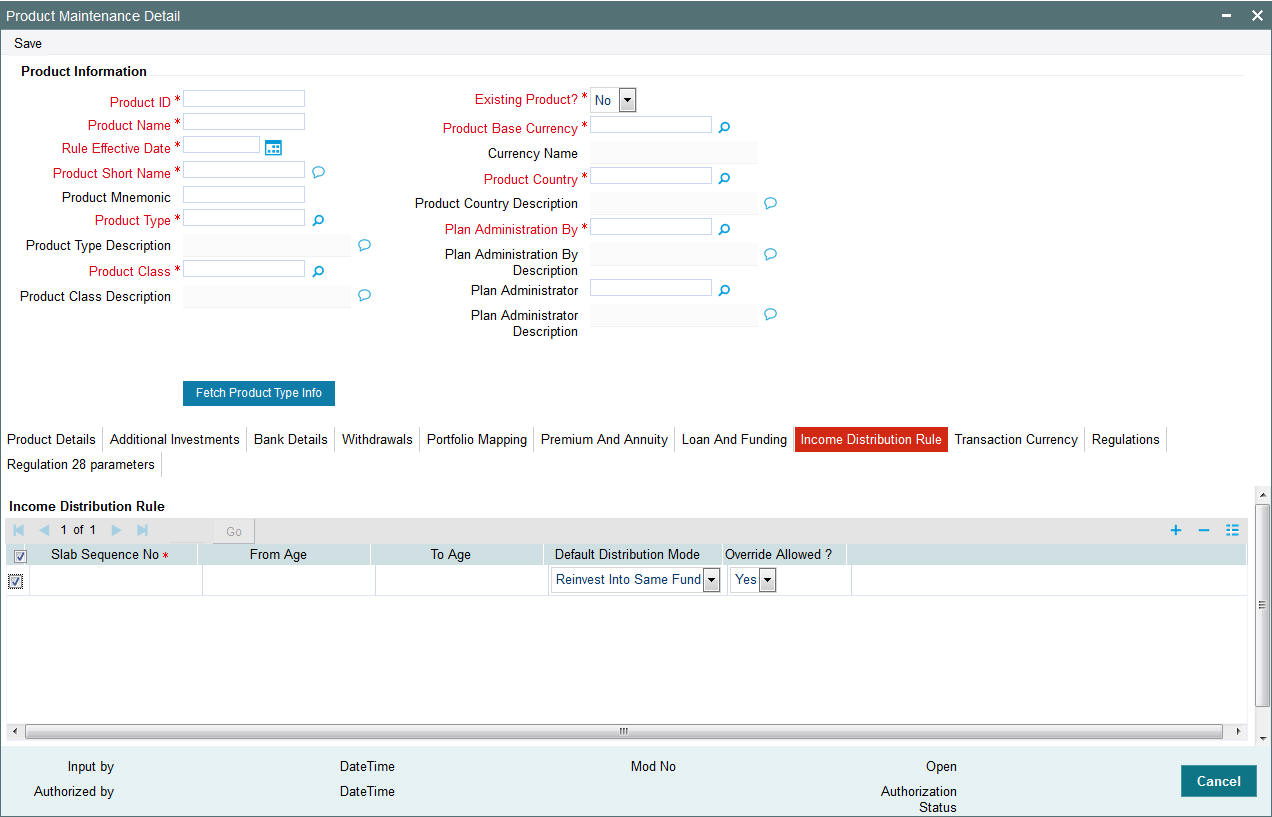

4.1.10 Income Distribution Rule Tab

You will be able to see this link only if, for the product, you have selected the option ‘No’ against the field ‘Reinvest IRA Income?’. As you have specified that the IRA income should not be reinvested, you will need to specify the income distribution. You are allowed to specify different distribution modes depending on the age of the Policy Holder.

Click ‘Income Distribution Rule’ tab to enter the details.

Income Distribution Rule

Slab Sequence No

Numeric; 5 Characters; Mandatory

Specify the sequence of the age slab.

From Age and To Age

Numeric; 4 Characters; Optional

Specify the ages between which the distribution mode you select will be applicable.

Default Distribution Mode

Optional

Select whether the dividend income distributed will be reinvested or paid out from the drop-down list. The option you select will be valid between the ‘From Age’ and ‘To Age’ you have specified. The options available in the drop-down list are as follows:

- Reinvestment into same Fund

- Payout

Override Allow

Optional

If you select the option ‘Yes’, you will be allowed to override the distribution mode that you have specified, for the Policy Holder, through the ‘Income Distribution SetUp’ screen.

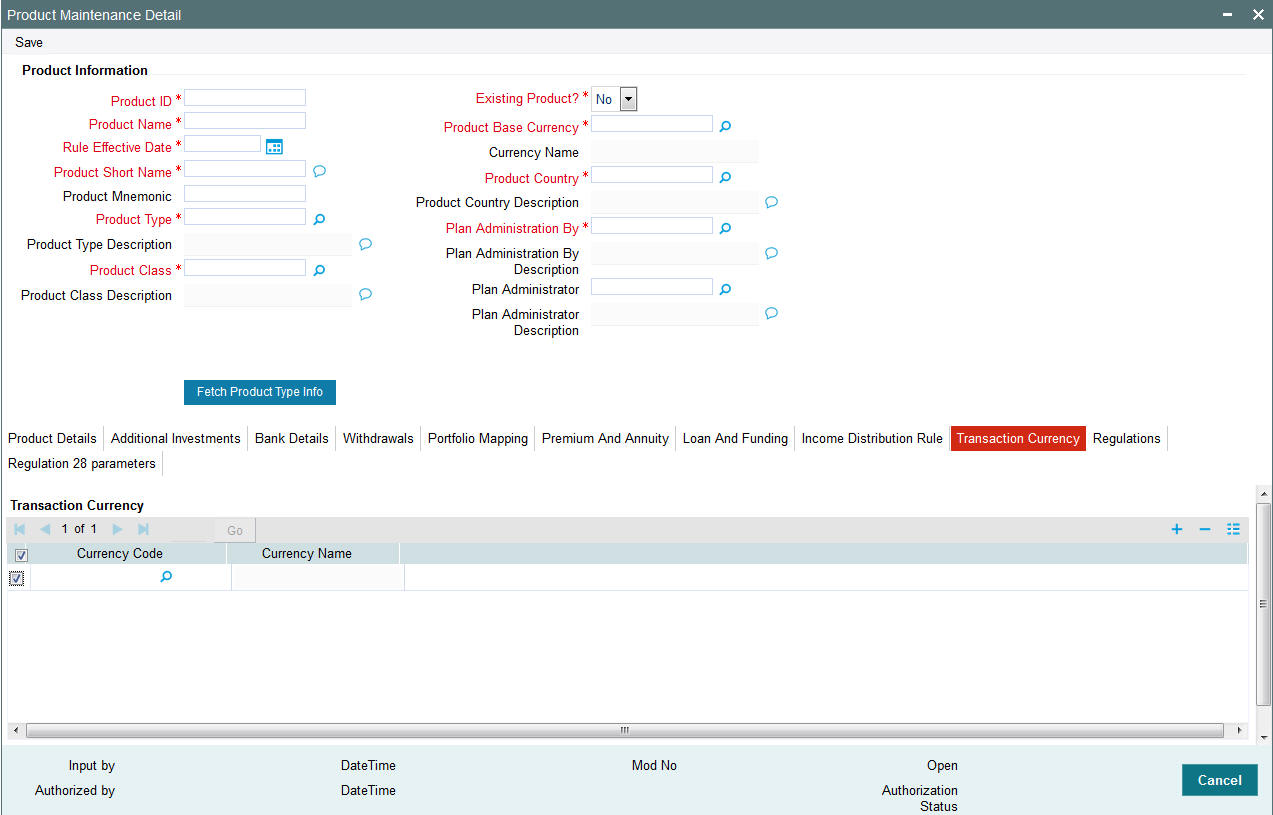

4.1.11 Transaction Currency Tab

An LEP product can support multiple currencies. The base currency of the policy can be any of the currencies supported by the product. If the product and policy base currencies are different and if the load is maintained at product level, the policy transaction amount in product base currency is used to derive the load slab. You also need to maintain product base currency in the transaction currency list.

You can maintain the list of currencies supported by the product in ‘Transaction Currency’ tab.

You can specify the following details in this screen:

Currency Code

Alphanumeric; 3 Characters; Optional

Specify the currency supported by the LEP product or select the currency from the option list provided.

Currency Name

Display

The name corresponding to the currency code selected previously gets displayed here.

Saving the information entered

When you have entered all the mandatory information, click ‘Ok’ button.

The system displays the confirmation message as “Record Successfully Saved ”.

This indicates the record has been saved. Click ‘Ok’ button.

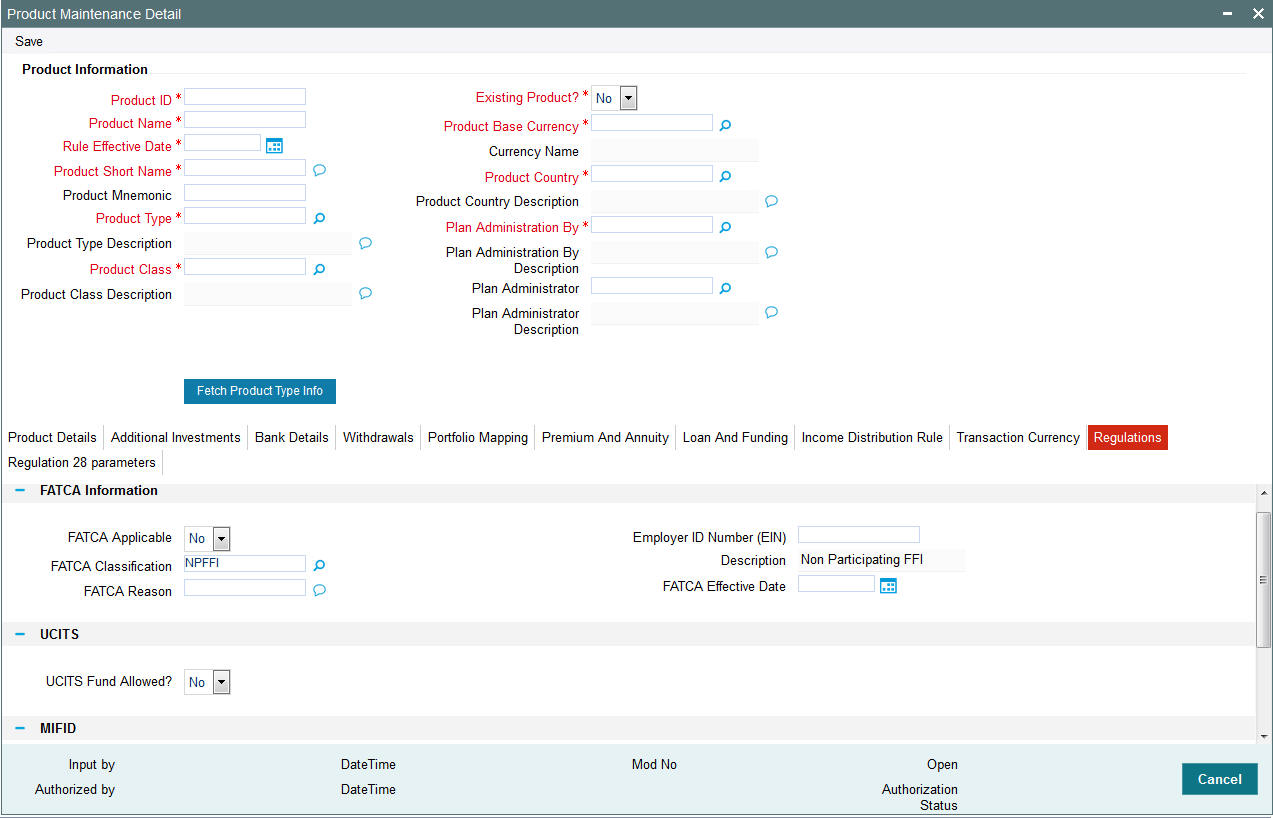

4.1.12 Regulations Tab

In this section you can capture the details regarding Foreign Account Tax Compliance Act. Click on ‘FATCA Information’ tab to maintain the details.

You can specify the following information:

FATCA Applicable

Optional

Select Yes or No to indicate whether FATCA is applicable. However, the system defaults the value ‘No’.

FATCA Classification

Alphanumeric; 25 Characters; Optional

Select the classification of FATCA from the adjoining option list.FATCA Classification is mandatory if FATCA Applicable is ‘Yes’.

Description

Display

The system displays the description for the selected FATCA classification ID.

FATCA Reason

Alphanumeric; 255 Characters; Optional

Specify the reason for FATCA classification.

Employer ID Number (EIN)

Alphanumeric; 50 Characters; Optional

Specify the employer ID number. The Employer ID Number is mandatory if the FATCA Applicable is ‘Yes’.

FATCA Effective Date

Date Format; Optional

Specify the FATCA Effective Date if FATCA is applicable.

FATCA Effective Date cannot be lesser than the product rule effective date.

UCITS

UCITS Fund Allowed?

Optional

Select if UCITS is allowed or not from the adjoining drop-down list. Following are the options available:

- Yes

- No

If you select ‘Yes’, during the portfolio mapping, you can select UCITS funds as part of portfolio. If you select ‘No’, then during portfolio mapping, the system will not allow you to select a UCITS fund. The system will display an error message as ‘The product does not allow UCITS funds’.

Once the product is authorised ‘UCITS Fund’ field is non amendable.

MIFID

MIFID Product

Optional

Select if the product is scoped under MIFID regulation or not from the drop-down list. The list displays the following values:

- Yes

- No

Product Risk Level

Numeric; 2 Characters; Optional

Specify the risk profile of the product. Alternatively, you can select the product risk level maintained in the system. The system displays all valid product risk level maintained in the system.

Target Market

Alphanumeric; 255 Characters; Optional

Specify the country code of the Country to which the product is sold as part of MIFID regulation. Alternatively, you can select the country code maintained in the system. The system displays all valid country code maintained in the system.

Investment Horizon

Optional

Select the investment objective from the drop-down list. The list displays the following values:

- Long Term

- Medium Term

- Short Term

Product Risk Level Description

Display

The system displays the description for the selected product risk level.

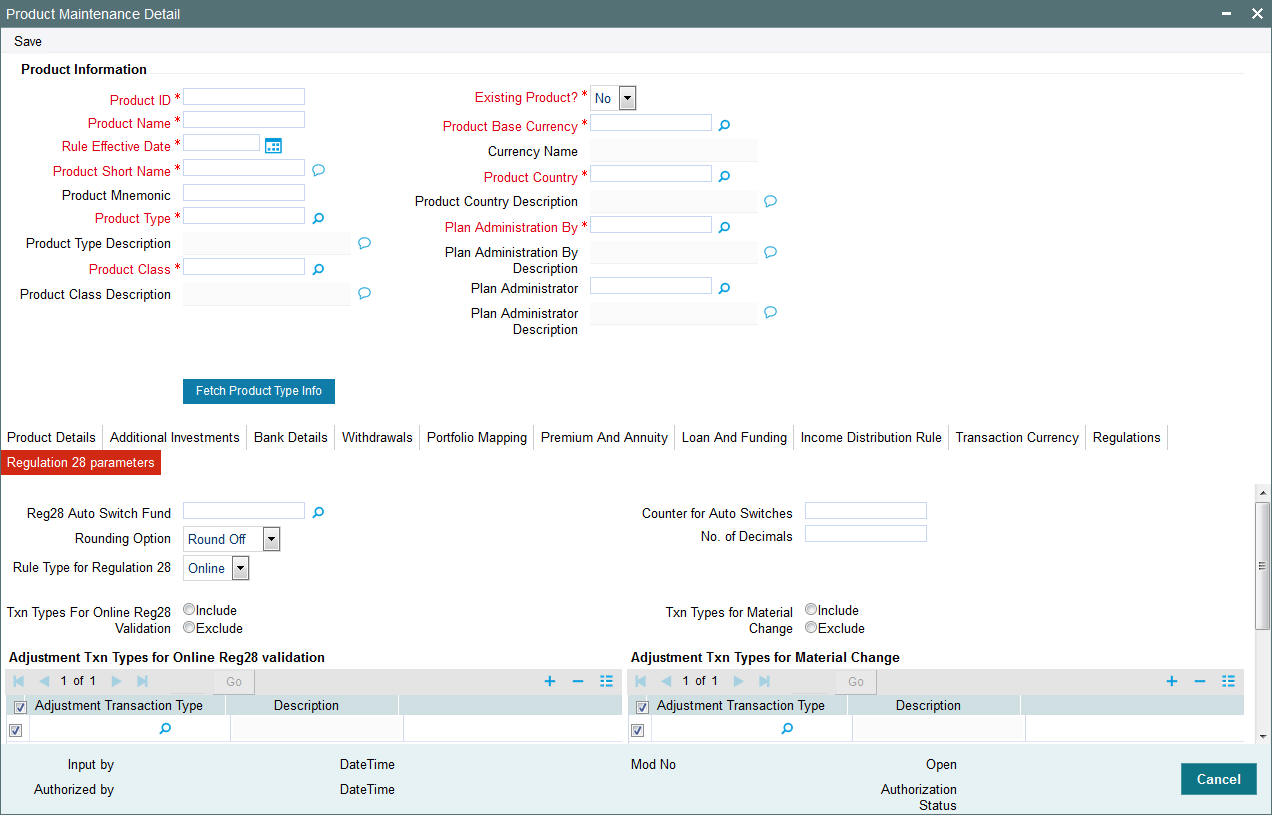

4.1.13 Regulation 28 Parameters Tab

In this section you can capture the details regarding regulation 28 parameters. Click on ‘Regulation 28 Parameters’ tab to maintain the details. This tab is enabled only if product is PIGS compliant product.

You can specify the following details:

Reg28 Auto Switch Fund

Alphanumeric; 6 Characters; Mandatory if Product is PIGS compliant

Specify the Regulation 28 Auto Switch Fund details to map specific fund (switch in) for Auto re-balancing of client portfolio to enable policy to be PIGS compliant. Alternatively, you can select Reg28 Auto Switch Fund from the option list. The list displays all valid Reg28 Auto Switch Fund details maintained in the system.

Rounding Option

Optional

Select the rounding option from the drop-down list. The list displays the following values:

- Round Off

- Round Up

- Round Down

Rule Type for Regulation 28

Optional

Select the Rule Type for Regulation 28 from the drop-down list. The list displays the following values:

- Online - If this option is maintained, the system will use AML batch rule for validating Reg 28 compliance

- Batch - If this option is maintained, the system will use IML online rule for validating Reg 28 compliance

Counter for Auto Switches

Numeric; 10 Characters; Mandatory if Product is PIGS compliant

Specify the number of unsuccessful Regulation 28 compliance check to run a contract before auto switch is initiated.

No. of Decimals

Numeric; 10 Characters; Mandatory

Specify the number of decimal places allowed.

Txn Types For Online Reg28 Validation

Optional

Select the transaction types for online Reg28 validation. The options are as follows:

- Include

- Exclude

Txn Types for Material Change

Optional

Select the transaction types for material change. The options are as follows:

- Include

- Exclude

Adjustment Txn Types for Online Reg28 validation

Adjustment Transaction Type

Alphanumeric; 3 Characters; Optional

Specify the Adjustment Transaction Type. Alternatively, you can select the Adjustment Transaction Type from the option list. The list displays all valid Adjustment Transaction Type maintained in the system.

Description

Display

The system displays the description for the selected Adjustment Transaction Type.

Adjustment Txn Types for Material Change

Adjustment Transaction Type

Alphanumeric; 3 Characters; Optional

Specify the Adjustment Transaction Type. Alternatively, you can select the Adjustment Transaction Type from the option list. The list displays all valid Adjustment Transaction Type maintained in the system.

Description

Display

The system displays the description for the selected Adjustment Transaction Type.

4.2 Product Summary Screen

This section contains the following topics:

- Section 4.2.1, "Invoking the Product Summary Screen"

- Section 4.2.2, "Retrieving Product in Product Screen"

- Section 4.2.3, "Editing Product"

- Section 4.2.4, "Viewing Product"

- Section 4.2.5, "Deleting Product"

- Section 4.2.6, "Authorizing Product"

- Section 4.2.7, "Amending Product"

- Section 4.2.8, "Authorizing Amended Product"

4.2.1 Invoking the Product Summary Screen

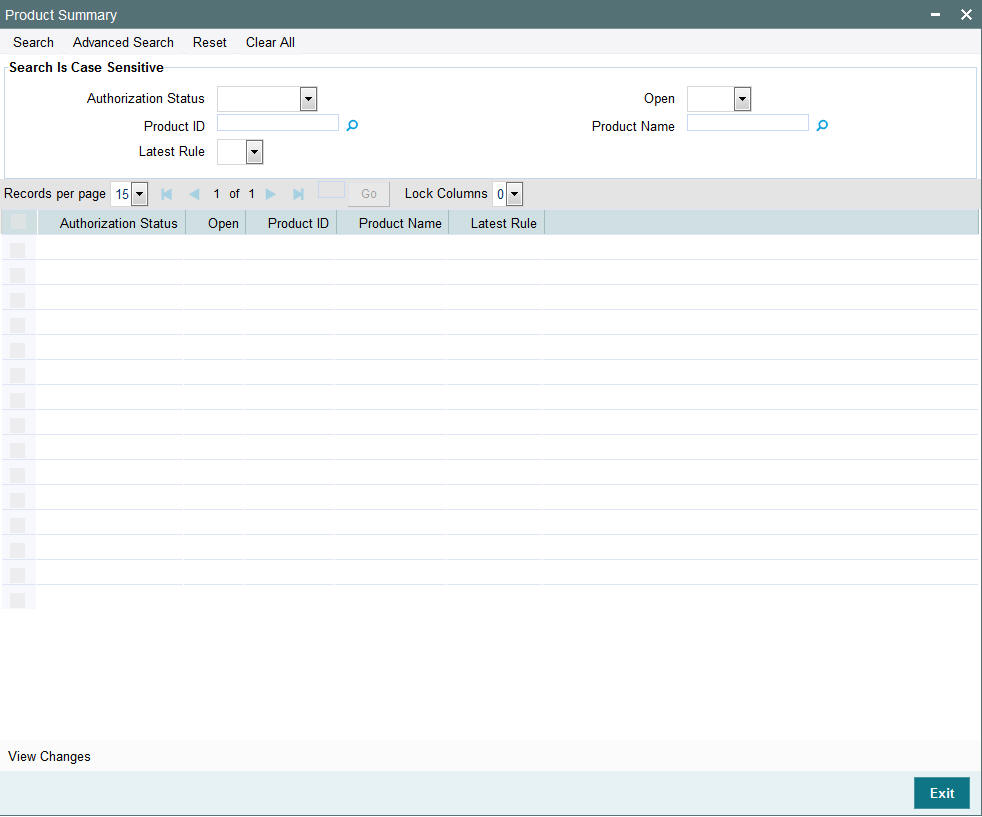

You can invoke the ‘Product Summary’ screen by typing ‘LESPROD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

4.2.2 Retrieving Product in Product Screen

You can retrieve a previously entered record in the Summary screen, as follows:

- Specify any or all of the following details in the Product Summary screen:

- Select the status of the record in the Authorization Status field. If you choose the “Blank Space” option, then all the records are retrieved.

- Select the status of the record in the Open field. If you choose the “Blank Space” option, then all the records are retrieved.

- Product ID

- Product Name

- Latest Rule

After you have specified the required details, click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by doing query in the following manner:

- Press F7

- Input the Product ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

4.2.3 Editing Product

You can modify the details of a record that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Product Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorization Status field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option from the drop down list.

- Specify any or all of the details of the record in the corresponding fields on the screen to retrieve the record that is to be modified. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Product Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Product Detail screen is closed and the changes made are reflected in the Product Summary screen.

4.2.4 Viewing Product

To view a Product you have previously entered, you must retrieve the same in the Product Summary screen, as follows:

- Invoke the Product Summary Screen from the Browser.

- Select the status of the Product Type that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the records in the corresponding fields on the screen, and click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records, in the lower portion of the screen. The Product screen is opened in view mode.

4.2.5 Deleting Product

You can delete only unauthorized records in the system.

To delete a record that you have previously entered, you must retrieve the same in the Product Summary screen, as follows:

- Invoke the Product Summary screen from the browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details of the record in the corresponding fields on the screen, and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records, in the lower portion of the screen. The Product Detail screen is opened in View mode.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

4.2.6 Authorizing Product

An unauthorized record must be authorized in the system for it to be processed.

To authorize a record, you must first retrieve the same in the Product Summary screen.

- Invoke the Product Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the Unauthorized option from the drop down list.

- Specify any or all of the details of the record in the corresponding fields on the screen. Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Product Detail screen is opened in View mode.

- Select Authorize operation from Action list.

When the checker authorizes a record, details of validations, if any, that were overridden by the maker of the record during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the transaction.

4.2.7 Amending Product

After a record is authorized, it can be modified using the Unlock operation from Action list. To make changes to a record after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the Product Summary screen from the Browser.

- Select the status of the record that you wish to retrieve for amendment. You can only amend records that are authorized.

- Specify any or all of the details of the record in the corresponding fields on the screen. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to amend. The Product screen will be displayed in Amendment mode. Click the Unlock operation from the Action list to amend the record.

- Amend the necessary information. Click the Save button to save your changes.

4.2.8 Authorizing Amended Product

An amended product must be authorized for the amendment to be made effective in the system.

Authorization of amended records can only be done from Fund Manager Module and Agency branch Module. The process of authorization is subsequently the same as that for normal transactions.

4.3 Product and Transaction Sub Type

This section contains the following topics:

4.3.1 Mapping Product and Transaction Sub Type

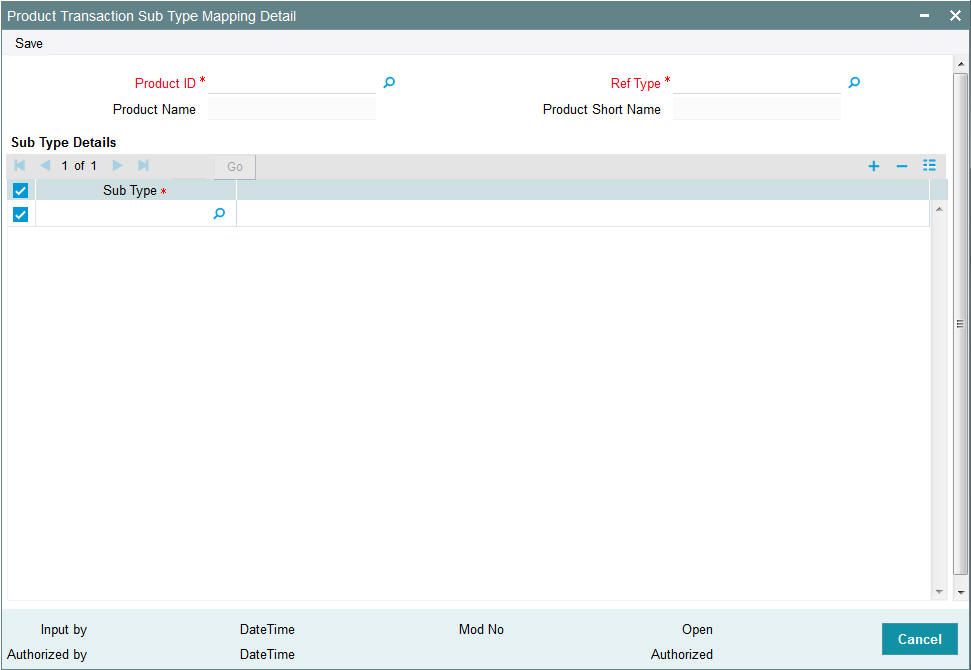

The ‘Product Transaction Sub Type Mapping Detail’ screen as shown in the screenshot allows you to link available sub type codes, maintained under transaction sub type maintenance to a particular product, such as Redemption, Subscription.

4.3.2 Invoking Screen

Invoke the ‘Product Transaction Sub Type Mapping Detail’ screen by typing ‘LEDPRSUB’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the Product Transaction Sub Type Mapping.

Product ID

Alphanumeric; 10 Characters; Mandatory

Specify the product identity number.

Ref Type

Alphanumeric; 2 Characters; Mandatory

Specify the transaction type for which the Transaction sub type is mapped or linked from the transaction sub type maintenance screen.

Product Name

Display

The Product name of the product for which transaction sub type is mapped is defaulted once the Product ID is selected.

Product Short Name

Display

The short name attributed to the Product is defaulted once you have selected the Product ID.

4.3.2.1 Sub Type Mapping Section

Sub Type

Alphanumeric; 3 Characters; Mandatory

If you have activated Product Transaction sub type mapping then the sub types applicable for particular transaction types are defaulted/ populated from available transaction sub types maintained as part of Product Transaction sub type screen. Otherwise the sub types are populated from Transaction sub type screen.

For system generated transaction sub types FLEXCUBE defaults the values entered.

4.4 Product Transaction Sub Type Mapping Summary

This section contains the following topics:

- Section 4.4.1, "Invoking Product Transaction Sub Type Mapping Summary"

- Section 4.4.2, "Retrieving Product Transaction Sub Type Mapping "

- Section 4.4.3, "Editing Product Transaction Sub Type Mapping"

- Section 4.4.4, "Viewing Product Transaction Sub Type Mapping"

- Section 4.4.5, "Deleting Product Transaction Sub Type Mapping"

- Section 4.4.6, "Authorizing Product Transaction Sub Type Mapping"

- Section 4.4.7, "Amending Product Transaction Sub Type Mapping"

- Section 4.4.8, "Authorizing Amended Product Transaction Sub Type Mapping"

4.4.1 Invoking Product Transaction Sub Type Mapping Summary

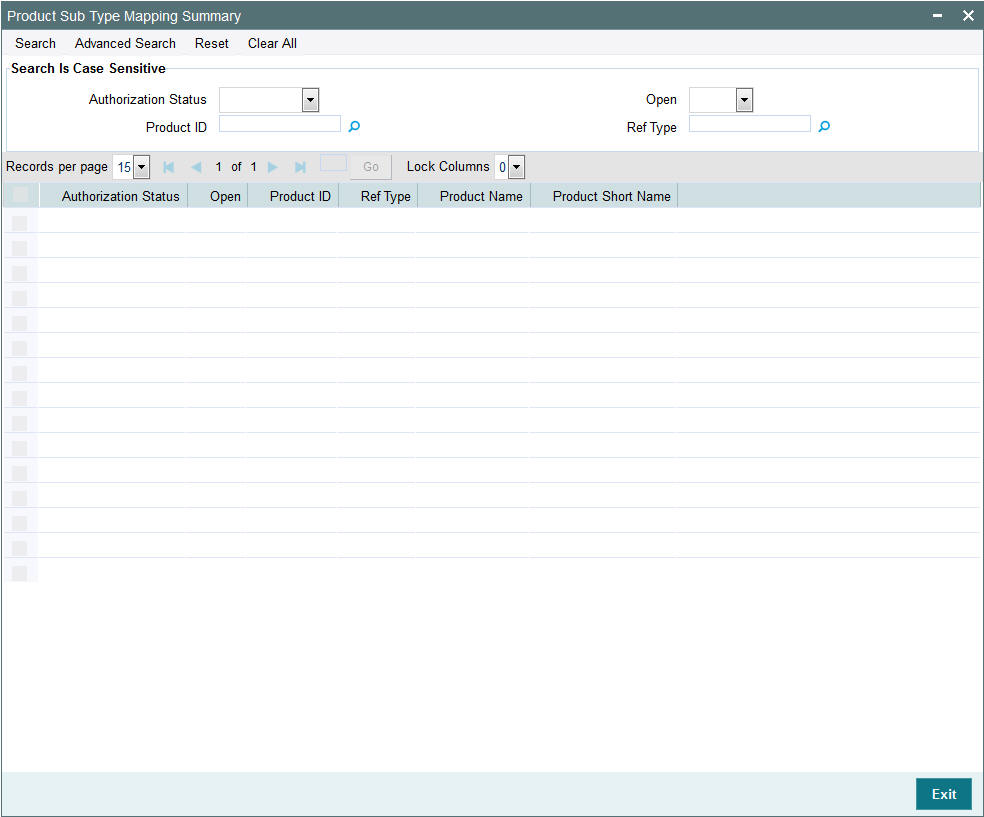

Invoke the ‘Product Sub Type Mapping Summary’ screen, by typing ‘LESPRSUB’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

4.4.2 Retrieving Product Transaction Sub Type Mapping

You can retrieve a previously entered record in the Summary screen, as follows:

- Invoke the Product Transaction Sub Type Mapping Summary screen from the Browser.

- Select the status of the record in the Authorization Status field. If you choose the “Blank Space” option, then all the records are retrieved.

- Select the status of the record in the Open field. If you choose the “Blank Space” option, then all the records are retrieved.

- Product ID

- Ref Type

After you have specified the required details, click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by doing query in the following manner:

- Press F7

- Input the Product ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

4.4.3 Editing Product Transaction Sub Type Mapping

You can modify the details of a record that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Product Transaction Sub Type Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorization Status field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option from the drop down list.

- Specify any or all of the details of the record in the corresponding fields on the screen to retrieve the record that is to be modified. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Product Transaction Sub Type Mapping Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Product Transaction Sub Type Mapping Detail screen is closed and the changes made are reflected in the Product Transaction Sub Type Mapping Summary screen.

4.4.4 Viewing Product Transaction Sub Type Mapping

To view a Product Transaction Sub Type Mapping you have previously entered, you must retrieve the same in the Product Transaction Sub Type Mapping Summary screen, as follows:

- Invoke the Summary Screen from the Browser.

- Select the status of the Product Transaction Sub Type Mapping that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the records in the corresponding fields on the screen, and click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records, in the lower portion of the screen. The Product Transaction Sub Type Mapping screen is opened in view mode.

4.4.5 Deleting Product Transaction Sub Type Mapping

You can delete only unauthorized records in the system.

To delete a record that you have previously entered, you must retrieve the same in the Product Transaction Sub Type Mapping Summary screen, as follows:

- Invoke the Product Transaction Sub Type Mapping Summary screen from the browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details of the record in the corresponding fields on the screen, and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records, in the lower portion of the screen. The Product Transaction Sub Type Mapping Detail screen is opened in View mode.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

4.4.6 Authorizing Product Transaction Sub Type Mapping

An unauthorized record must be authorized in the system for it to be processed.

To authorize a record, you must first retrieve the same in the Product Transaction Sub Type Mapping Summary screen.

- Invoke the Product Transaction Sub Type Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the Unauthorized option from the drop down list.

- Specify any or all of the details of the record in the corresponding fields on the screen. Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Product Transaction Sub Type Mapping Detail screen is opened in View mode.

- Select Authorize operation from Action list.

When the checker authorizes a record, details of validations, if any, that were overridden by the maker of the record during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the transaction.

4.4.7 Amending Product Transaction Sub Type Mapping

After a record is authorized, it can be modified using the Unlock operation from Action list. To make changes to a record after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the Product Transaction Sub Type Mapping Summary screen from the Browser.

- Select the status of the record that you wish to retrieve for amendment. You can only amend records that are authorized.

- Specify any or all of the details of the record in the corresponding fields on the screen. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to amend. The Product Transaction Sub Type Mapping screen will be displayed in Amendment mode. Click the Unlock operation from the Action list to amend the record.

- Amend the necessary information. Click the Save button to save your changes.

4.4.8 Authorizing Amended Product Transaction Sub Type Mapping

An amended Product Transaction Sub Type Mapping must be authorized for the amendment to be made effective in the system.

Authorization of amended records can only be done from Fund Manager Module and Agency branch Module. The process of authorization is subsequently the same as that for normal transactions. .

4.5 Product Annual Annuity Limit Mapping

This section contains the following topics:

- Section 4.5.1, "Maintaining Product Annual Annuity Limit Mapping Details"

- Section 4.5.2, "Invoking Product Annual Annuity Limit Detail Screen"

4.5.1 Maintaining Product Annual Annuity Limit Mapping Details

You can define different lower and upper annual annuity income percentage boundary of a client request per product based on the following criteria:

- Client Age: The upper and lower boundaries can be different based on the client’s age.

- Client Health Status: If age is a parameter for the given product

and Policy Start date and if a client suffers from ill health, the same

rules apply as if the client was in the highest age bracket.

- If client is healthy, then system will apply the appropriate % between minimum and maximum age range, post deriving the bracket in which client’s age falls into. However, the minimum % cannot be higher than his/her previous requested %.

- If client is ILL, then system will apply the appropriate % between minimum and maximum age range, post deriving the bracket as if the client was in the highest age bracket. However, the minimum % cannot be higher than his/her previous requested %.

- Policy Start Date: The original boundaries that were in place at

the time of the creation of the Policy apply even if the boundaries have

since changed (except for when the client elects to move to a lower percentage

than the initial lower bound). Hence, the client’s Policy Start

date stipulates the allowable lower and upper boundaries. For instance,

if a client has taken out a Policy on 1 Jan 2000 when the range was 5%

to 20% and the range has changed on 1 Mar 2007 to 2.5% to 12%, the client

may still choose a percentage between 5% and 20% today. (except for the

case shown below).

- If a new upper and lower boundary is declared, and the new lower boundary is lower than the lower boundary for the Policy Start date, product and age, the client may elect to select a percentage in the new range that is lower than the original lower boundary, but then the client may not revert back to the higher percentages associated with the earlier Policy start date. For instance, if a client has taken out a Policy on 1 Jan 2000 when the range was 5% to 20% and the range has changed on 1 Mar 2007 to 2.5% to 12%, and the client elects a percentage of 3% on 1 April 2007, the client may not revert back to a percentage greater than 12% and less than 20% on the next anniversary date, say, on 20% on 1 April 2008.

To drive annuity ranges, the system will compare ‘Effective Start Date’ and ‘End Date’ with rule effective date of the policy if annuity is already generated. Also, policy start date should be less than the effective end date.If the annuity is not generated till date then the system will compare Effective Start date and End Date with policy start date.

4.5.2 Invoking Product Annual Annuity Limit Detail Screen

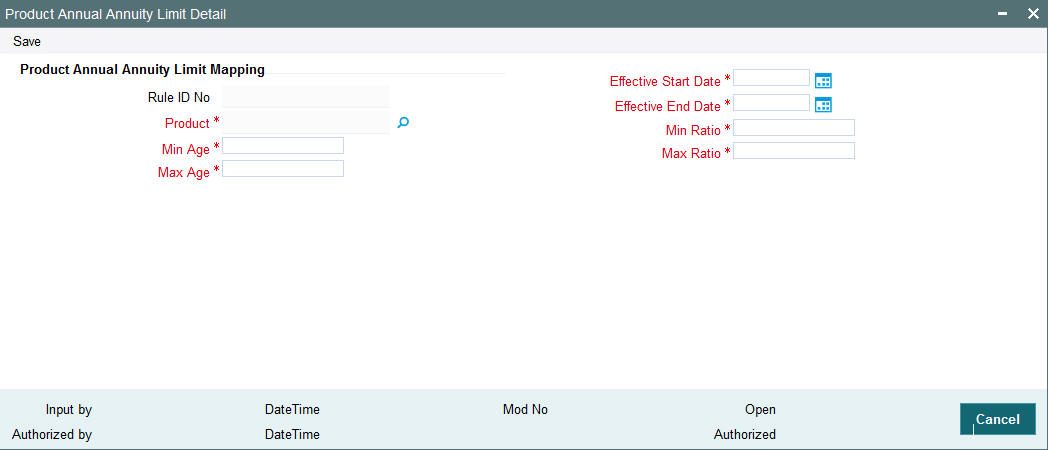

You can define lower and upper annuity income percentage using ‘Product Annual Annuity Limit Detail’ screen. You can invoke this screen by typing ‘LEDPAALM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

Product Annual Annuity Limit Mapping

Rule ID No

Display

The system displays the rule ID for the maintenance.

Product

Alphanumeric; 10 Characters; Mandatory

Specify the product ID. The adjoining option list displays all valid product ID maintained in the system. You can choose the appropriate one.

Min Age

Numeric; 3 Characters; Mandatory

Specify the minimum age for the unit holder.

Max Age

Numeric; 3 Characters; Mandatory

Specify the maximum age for the unit holder.

Effective Start Date

Date Format; Mandatory

Specify the effective start date for the maintenance.

Effective End Date

Date Format; Optional

Specify the effective end date for the maintenance.

Min Ratio

Numeric; 5 Characters; Mandatory

Specify the minimum ratio for the maintenance.

Max Ratio

Numeric; 5 Characters; Mandatory

Specify the maximum ratio for the maintenance.

4.6 Product Annual Annuity Limit Summary

This section contains the following topics:

- Section 4.6.1, "Retrieving a Record in Product Annual Annuity Limit Summary Screen"

- Section 4.6.2, "Editing Product Annual Annuity Limit Record"

- Section 4.6.3, "Viewing Product Annual Annuity Limit Record"

- Section 4.6.4, "Deleting Product Annual Annuity Limit Record"

- Section 4.6.5, "Authorizing Product Annual Annuity Limit Record"

- Section 4.6.6, "Amending Product Annual Annuity Limit Record"

- Section 4.6.7, "Authorizing Amended Product Annual Annuity Limit Record"

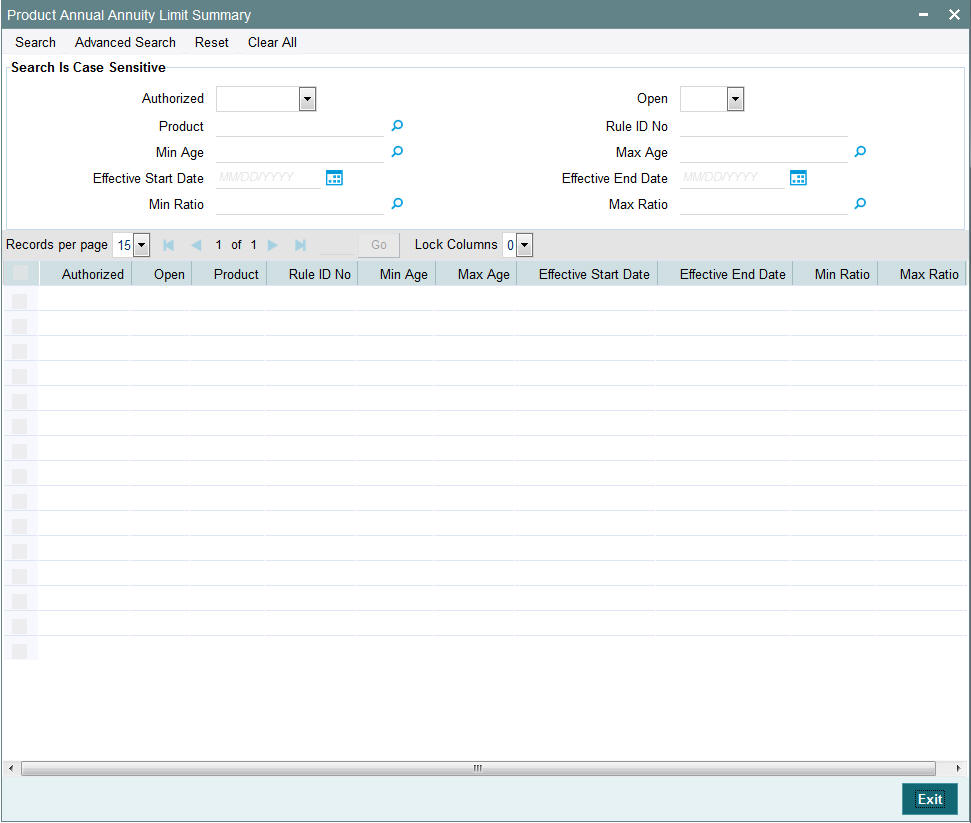

4.6.1 Retrieving a Record in Product Annual Annuity Limit Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

Invoke the ‘Product Annual Annuity Limit Summary’ screen by typing ‘LESPAALM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button and specify any or all of the following details in the corresponding details.

- The status of the record in the Authorized Status field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Product

- Minimum Age

- Effective Start Date

- Minimum Ratio

- Rule ID Number

- Maximum Age

- Effective End Date

- Maximum Ratio

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Product

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value

4.6.2 Editing Product Annual Annuity Limit Record

You can modify the details of Product Annual Annuity Limit record that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the Product Annual Annuity Limit Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorization Status field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Product Annual Annuity Limit Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

Click Save to save your changes. The Product Annual Annuity Limit Detail screen is closed and the changes made are reflected in the Product Annual Annuity Limit Summary screen.

4.6.3 Viewing Product Annual Annuity Limit Record

To view a record that you have previously input, you must retrieve the same in the Product Annual Annuity Limit Summary screen as follows:

- Invoke the Product Annual Annuity Limit Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the unauthorized / Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Product Annual Annuity Limit Detail screen is displayed in View mode.

4.6.4 Deleting Product Annual Annuity Limit Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Product Annual Annuity Limit Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The Product Annual Annuity Limit Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

4.6.5 Authorizing Product Annual Annuity Limit Record

An unauthorized Product Annual Annuity Limit record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Product Annual Annuity Limit Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Product Annual Annuity Limit Detail screen is displayed. Select Authorize operation from the Action List.

When a checker authorizes a record, details of validation, if any, that were overridden by the maker of the record during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the record.

4.6.6 Amending Product Annual Annuity Limit Record

After a Product Annual Annuity Limit record is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the Product Annual Annuity Limit Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Product Annual Annuity Limit Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes

4.6.7 Authorizing Amended Product Annual Annuity Limit Record

An amended Product Annual Annuity Limit record must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module and Agency Branch module.

The subsequent process of authorization is the same as that for normal transactions.