3. Policy

After the products are defined in the system, you can accept requests for creating policies in the products, for Policy Holders. A Policy Holder can buy policies in any of the active products defined in the system. A Policy, therefore, essentially is an investment into the underlying portfolios of the Product, and the creation of a Policy lays down the profile or guidelines of the desired pattern of investment by a Policy Holder into a Product.

Note

Policies can be created through the Agency Branch component only.

The Policy Maintenance screen allows you to capture the details of a Policy. The next section gives you step-by-step instructions to do the same.

This chapter contains the following sections:

- Section 3.1, "Policy Creation"

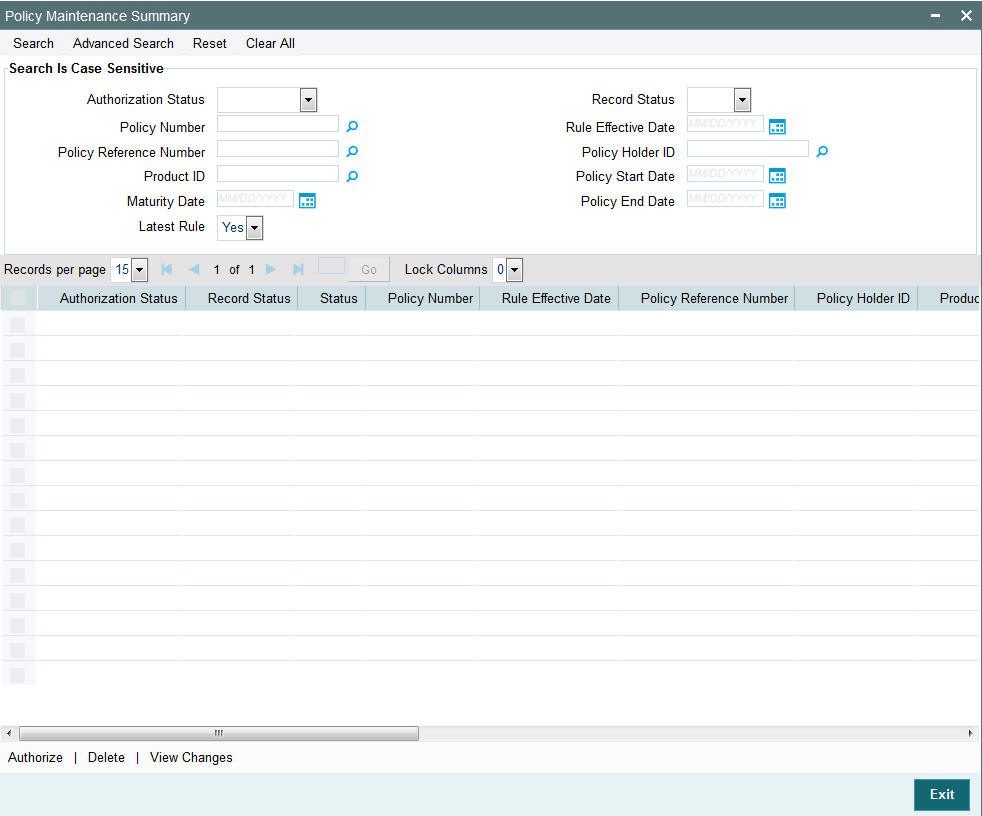

- Section 3.2, "Policy Maintenance Summary Screen"

- Section 3.3, "Ratio Percentage Maintenance"

- Section 3.4, "Policy Transaction Enrichment"

- Section 3.5, "Interest Rate Details Maintenance"

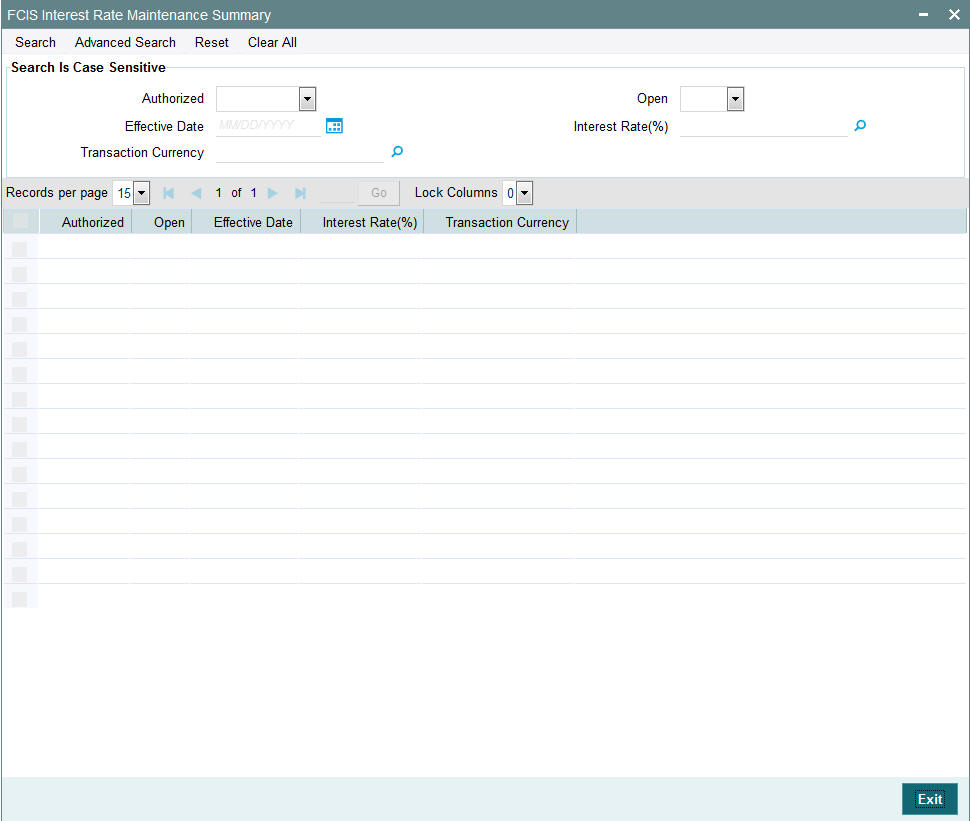

- Section 3.6, "Interest Rate Maintenance Summary Screen"

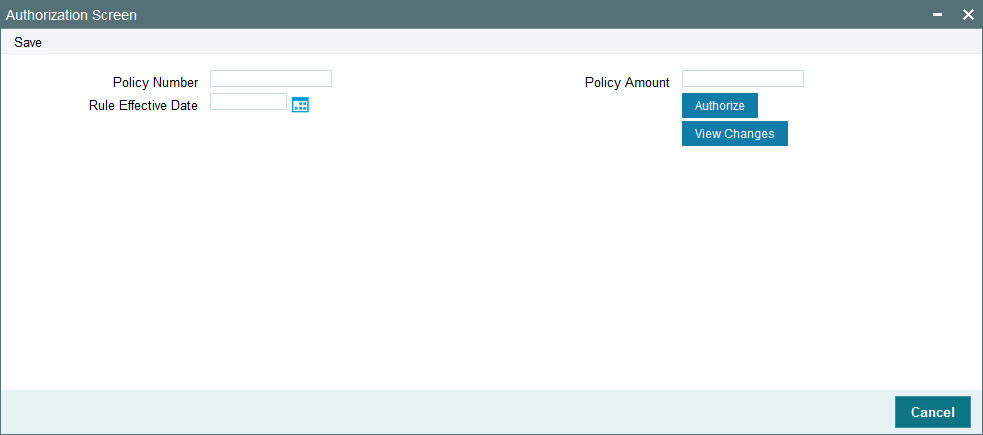

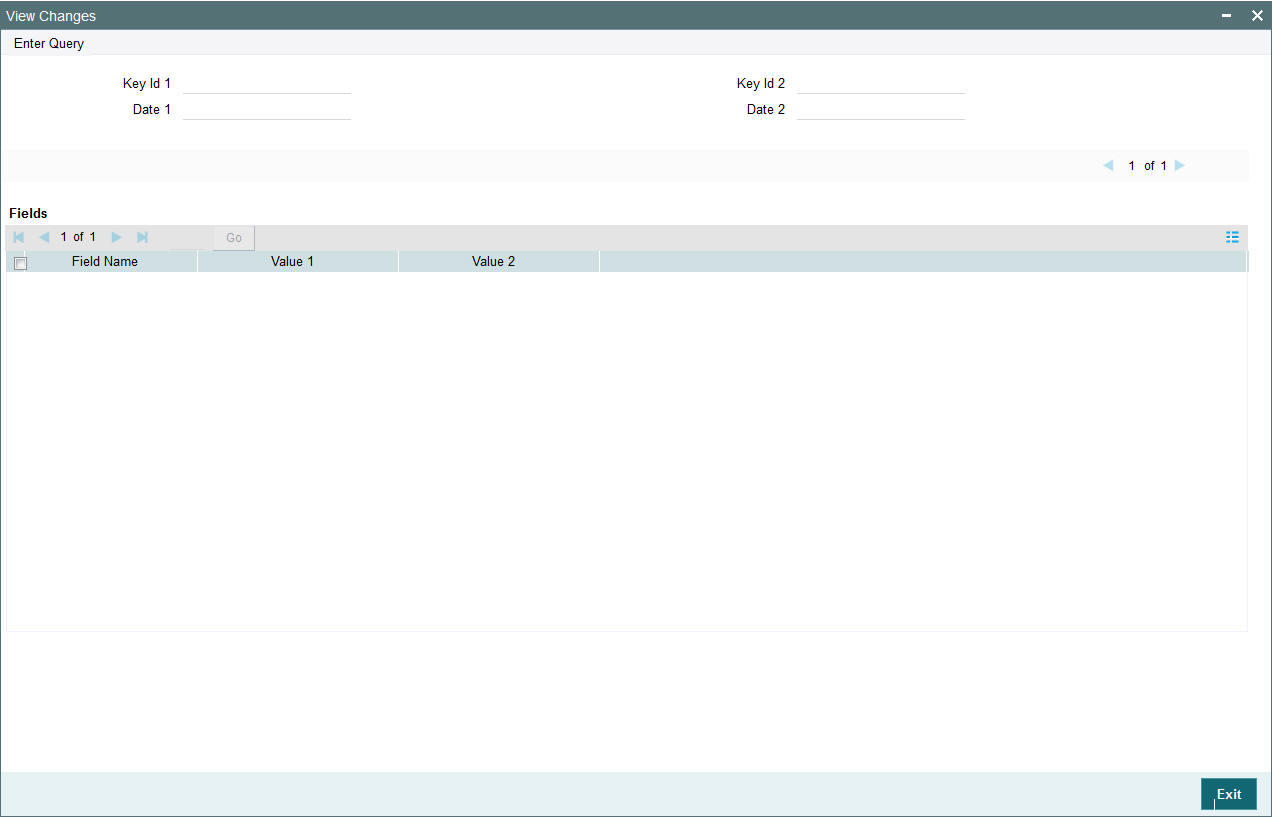

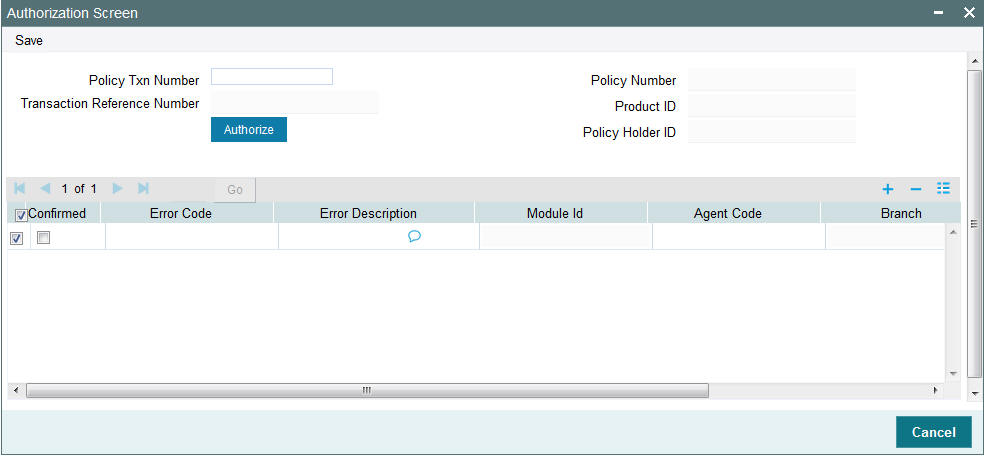

- Section 3.7, "Authorization Screen"

- Section 3.8, "Policy Authorization"

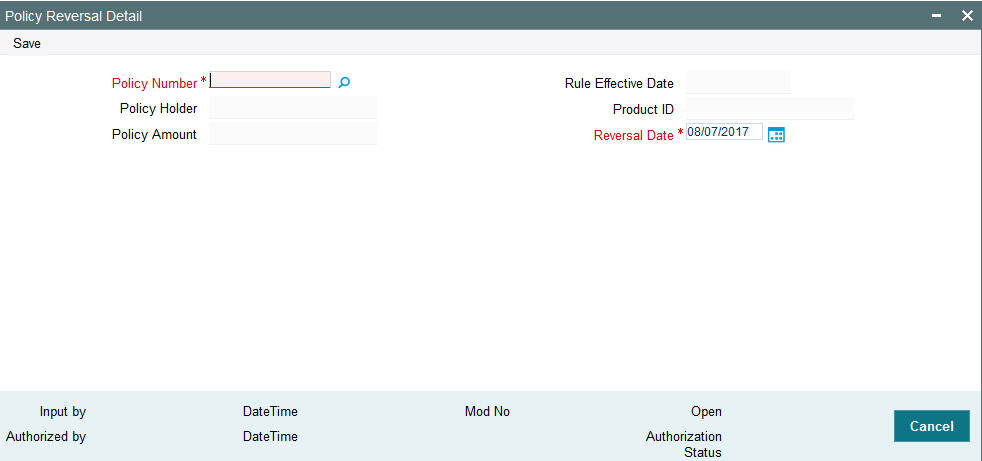

- Section 3.9, "Policy Reversal Detail"

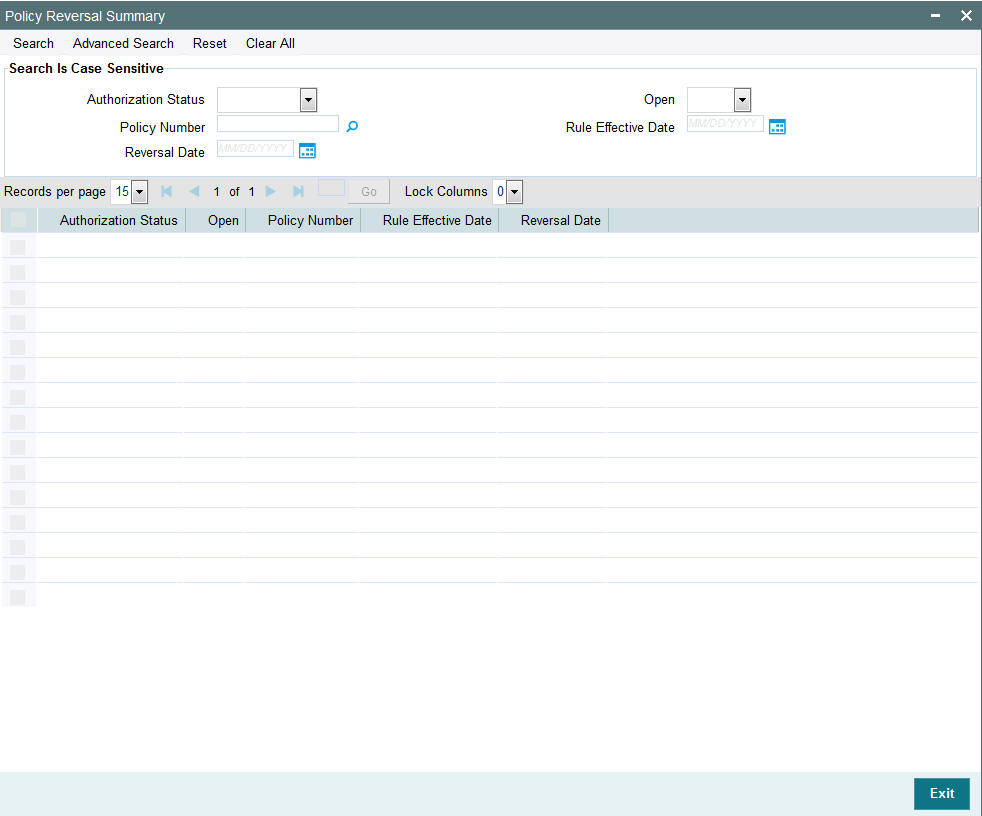

- Section 3.10, "Policy Reversal Summary"

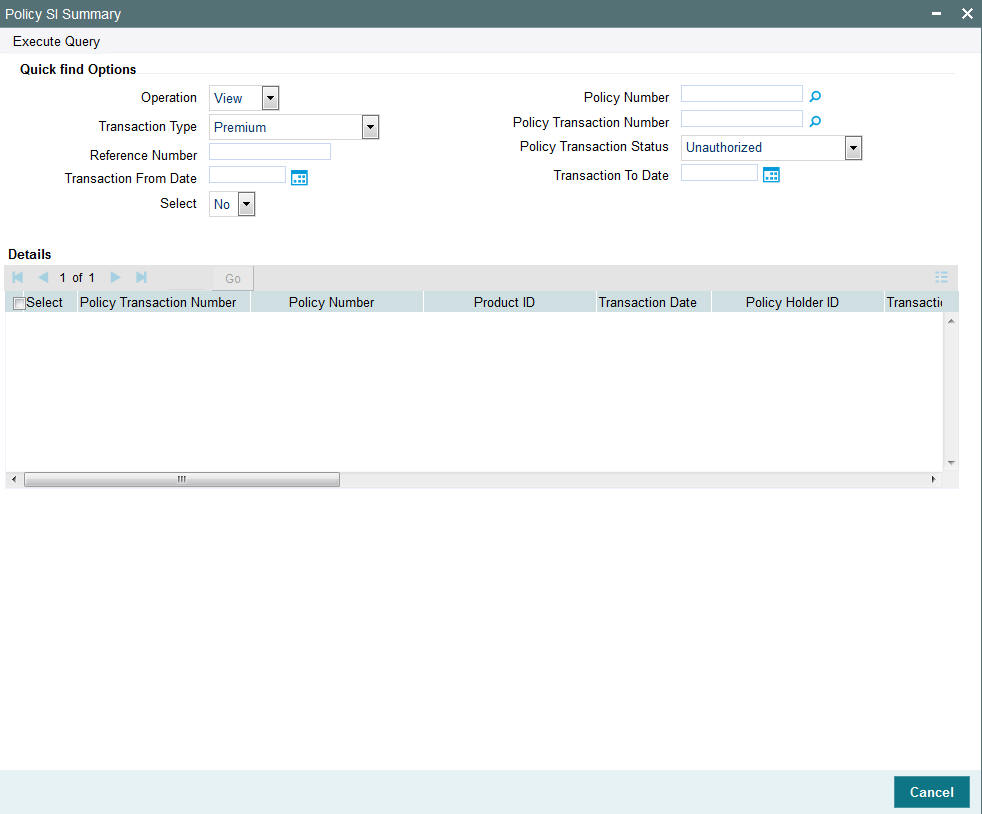

- Section 3.11, "Policy SI Summary"

3.1 Policy Creation

This section contains the following topics:

- Section 3.1.1, "Invoking Policy Maintenance Detail Screen"

- Section 3.1.2, "Policy Information Tab"

- Section 3.1.3, "Policy Details Tab"

- Section 3.1.4, "Additional Details Tab"

- Section 3.1.5, "Intermediary Details Tab"

- Section 3.1.6, "Beneficiary Details Tab"

- Section 3.1.7, "Constituent Details Tab"

- Section 3.1.8, "Projected Return Value Details Tab"

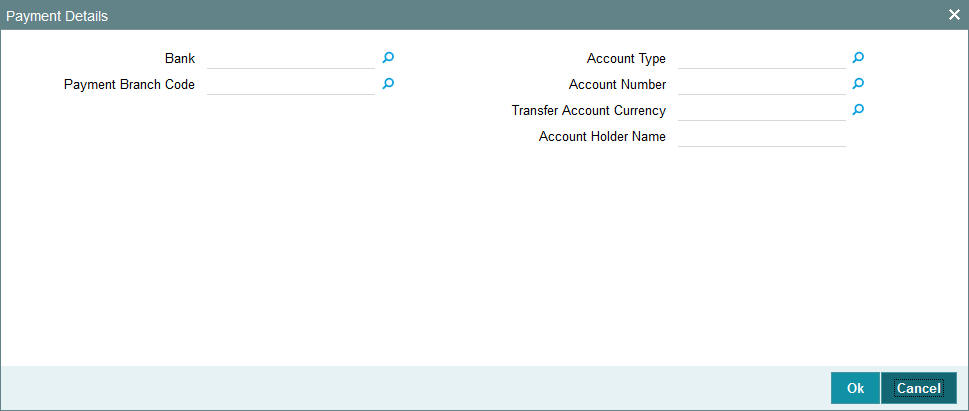

- Section 3.1.9, "Payment Details Button"

- Section 3.1.10, "Asset Allocation Button"

- Section 3.1.11, "Premium Details Button"

- Section 3.1.12, "Annuity Details Button"

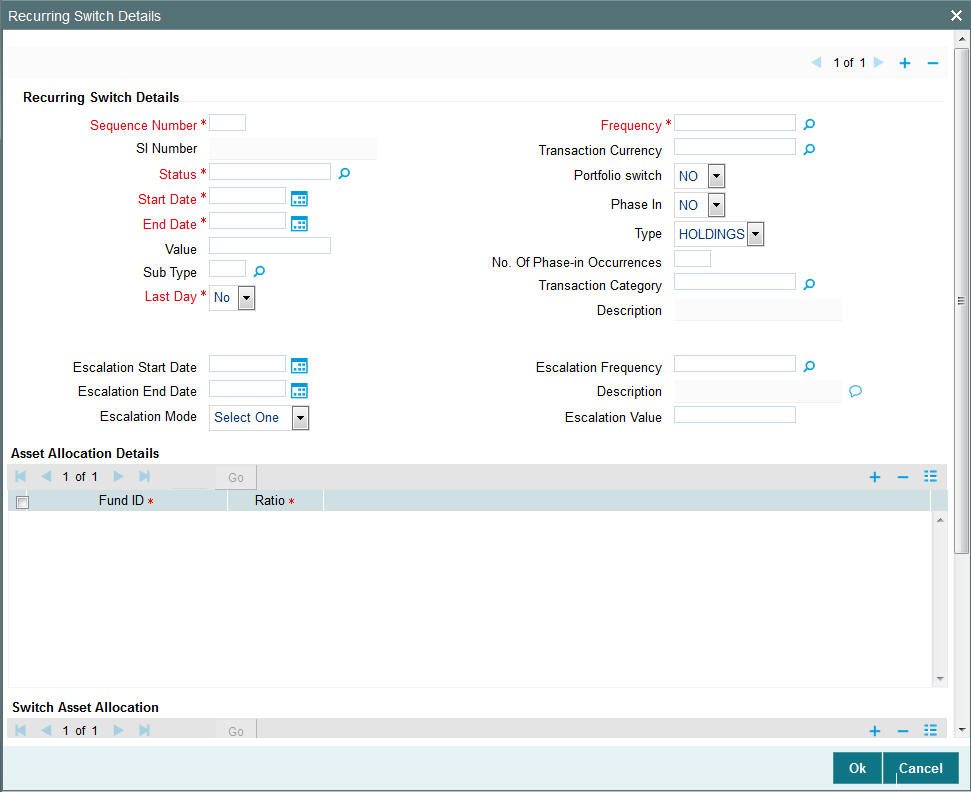

- Section 3.1.13, "Recurring Switch Details Button"

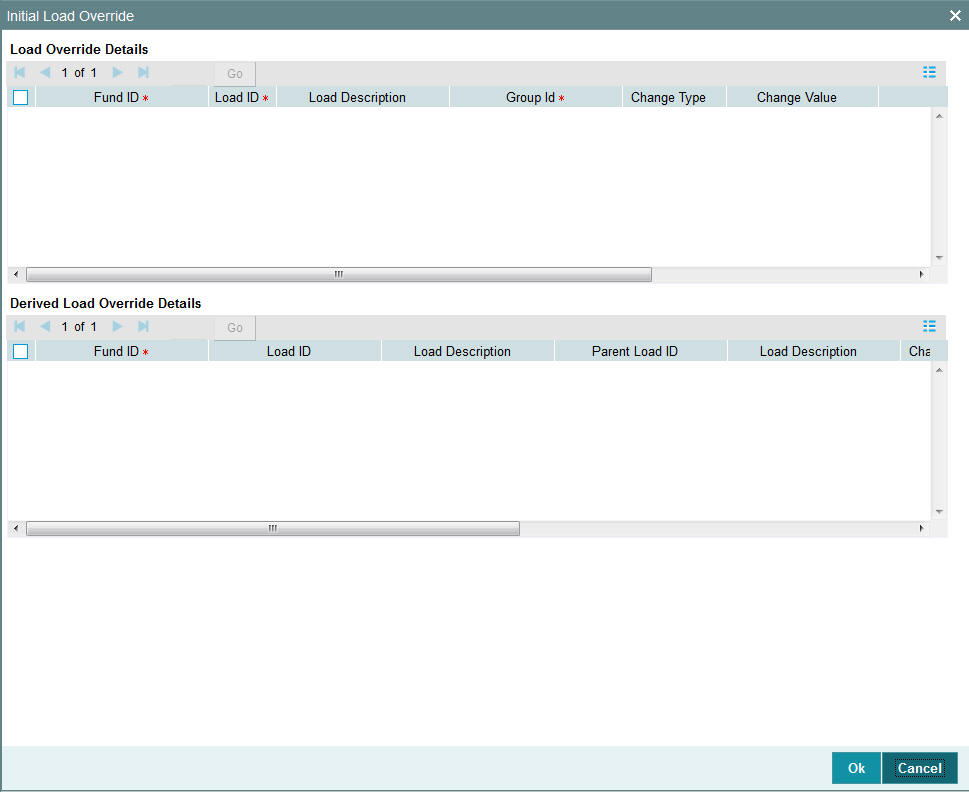

- Section 3.1.14, "Initial Load Override Button"

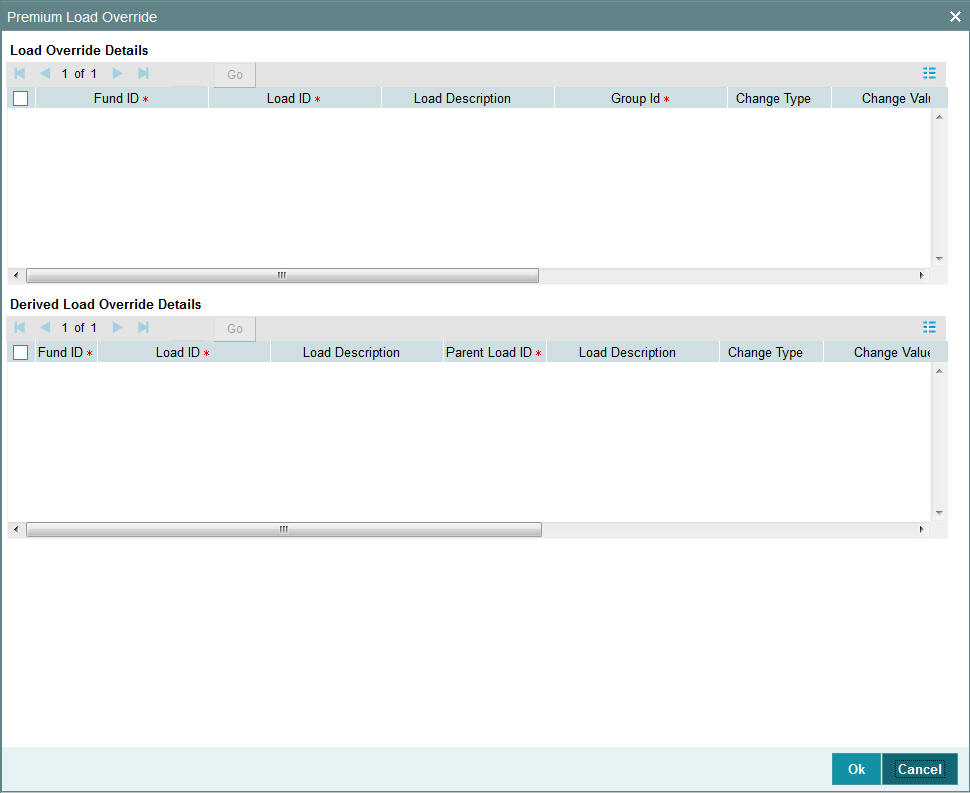

- Section 3.1.15, "Premium Load Override Button"

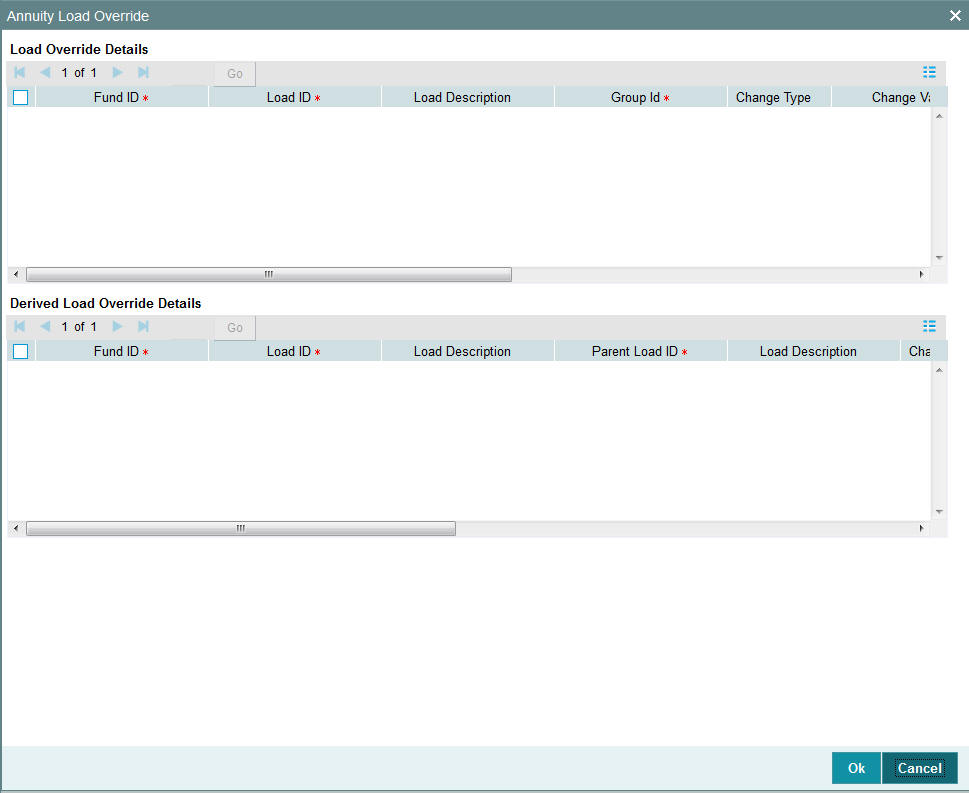

- Section 3.1.16, "Annuity Load Override Button"

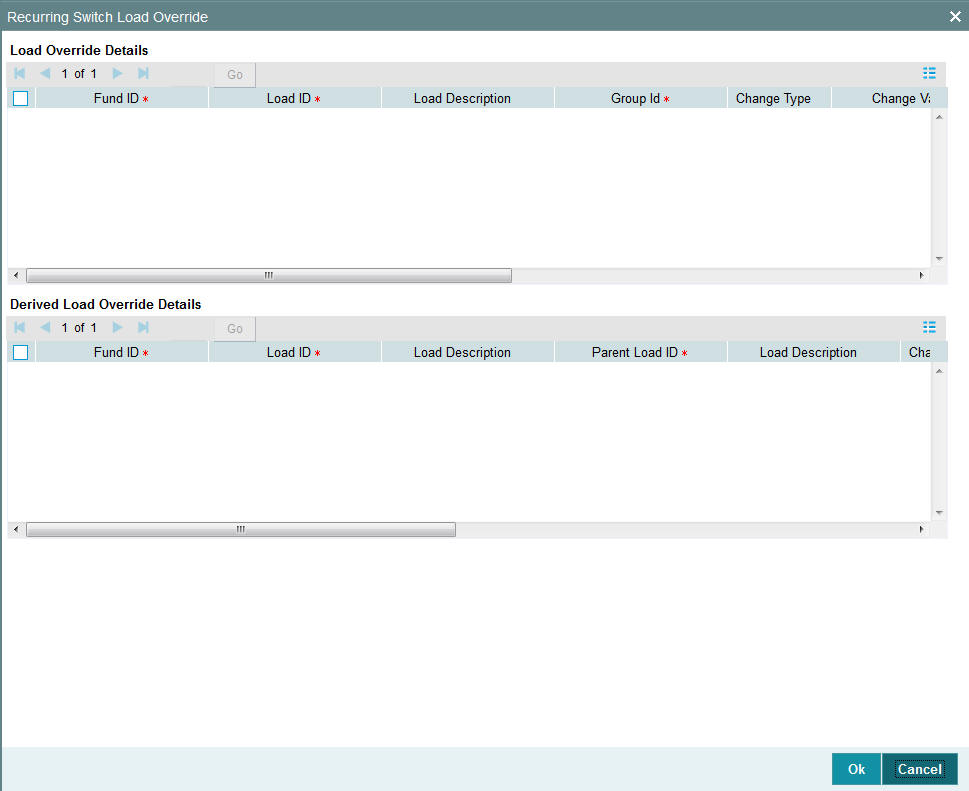

- Section 3.1.17, "Recurring Switch Load Override Button"

- Section 3.1.18, "Add Info Button"

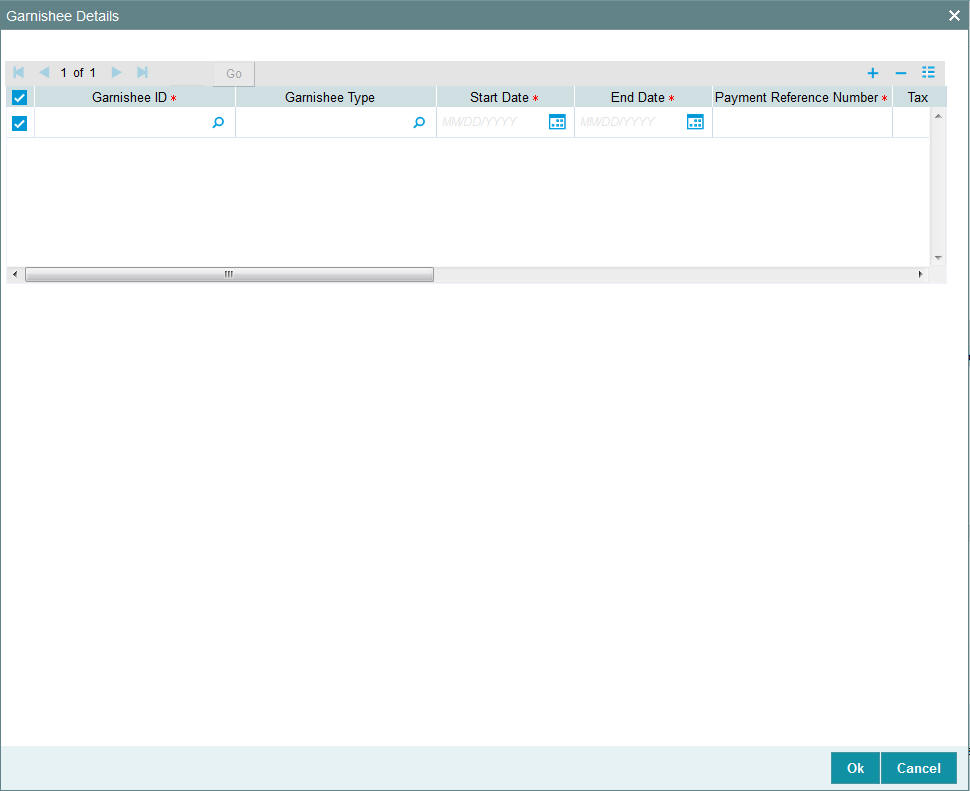

- Section 3.1.19, "Garnishee Details Button"

- Section 3.1.20, "Saving Information Entered"

- Section 3.1.21, "Creating Future-dated Rules for Policies"

- Section 3.1.22, "Processing Back Data Propagation for Transactions"

3.1.1 Invoking Policy Maintenance Detail Screen

Following are the steps you need to follow to create a Policy. Each of these steps is explained in detail in subsequent sections.

Note

Any investor, who desires to invest in any of the Products by purchasing a Policy in a product, can invest only if he is a valid Unit Holder with an account in the system. Therefore, you must first set up a Unit Holder account for the Policy Holder in the system.

Refer to the chapter ‘Managing Investor Accounts’ for further information.

- Invoke the Policy Maintenance screen

- Enter information in the Policy Maintenance screen.

- Save the information entered.

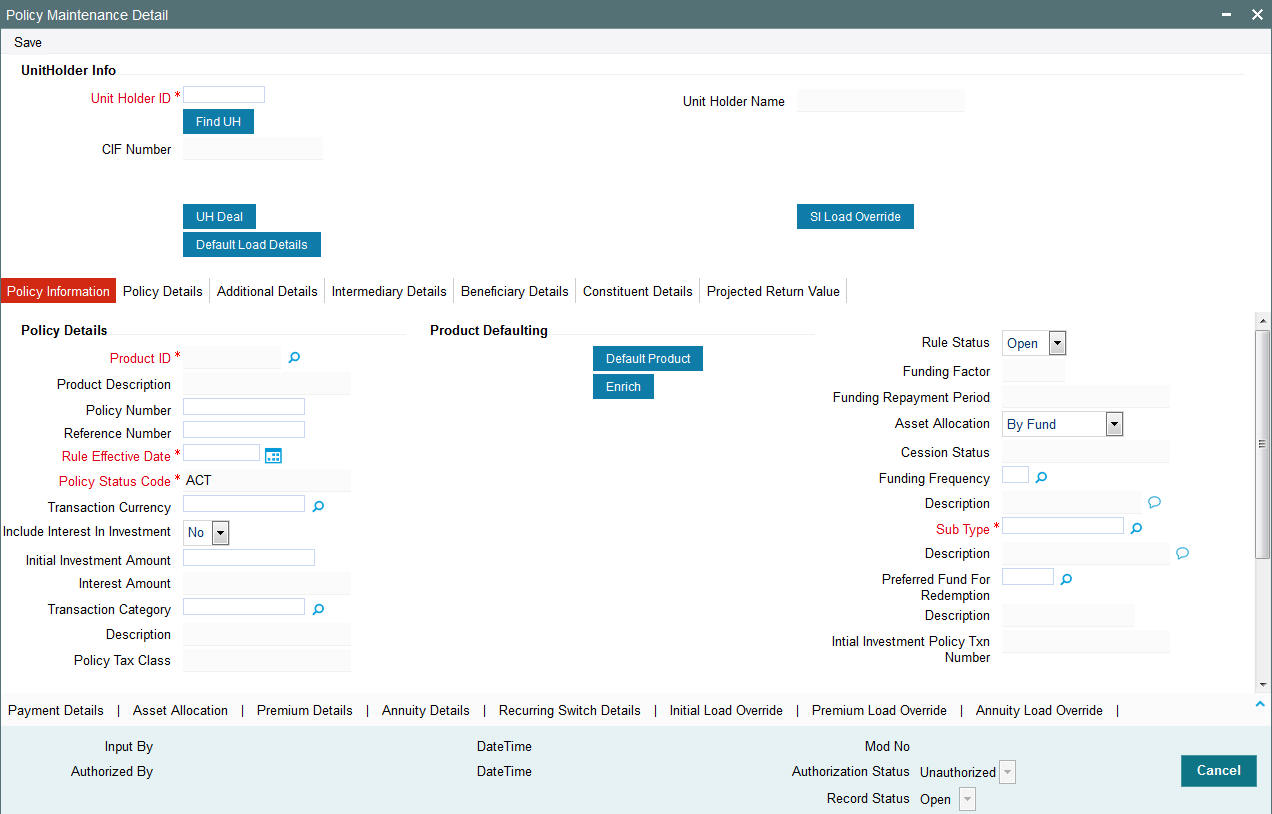

You can invoke the ‘Policy Maintenance Detail’ screen by typing ‘LEDPLAN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the Policy Maintenance.

You can specify the following fields in this screen:

Unit Holder ID

Alphanumeric; 12 Characters; Mandatory

Enter the Unit Holder ID of the Policy Holder. System allows you to create a policy for unauthorized Unit Holder IDs. However, a policy can be authorized only if the policy holder has been authorized in the system.

You can also search for unit holder ID by clicking ‘Find UH’ button.

Unit Holder Name

Display

System will default Unitholder Name for the selected Unit Holder ID.

CIF Number

Display

The system displays the CIF Number of the Policy Holder.

Note

- You have the option of using the Find Options screen to enter the CIF Number and Unit Holder ID. This screen is invoked when you click on the option list.

- Once you have entered the Unit holder ID, the CIF Number and the Unit Holder Name will get updated.

3.1.2 Policy Information Tab

Specify the following details in this section:

Policy Details

Product ID

Alphanumeric; 10 Characters; Mandatory

Select the product in which the Policy Holder wants to buy the Policy. The option list includes all valid and active Products.

Product Description

Display

The system displays the description of the selected product.

Policy Number

Alphanumeric; 16 Characters; Optional

Specify the Policy Number at the time of policy creation. The system validates the value input for its uniqueness. The policy number cannot, however, be changed during subsequent edit or amend operations.

When a Policy Holder subsequently contributes into this Policy that has been created, the same Policy number has to be specified, and the Policy must be an active, valid Policy for the transactions to be accepted.

Reference Number

Alphanumeric; 16 Characters; Optional

Specify a unique initial identification for this Policy. The Reference Number is the initial identification that you give to a Policy, before the Policy Number is generated.

You can invoke the Policy or retrieve it through the Find Form using this Reference Number for subsequent inquiries and transactions.

Rule Effective Date

Date Format, Mandatory

Specify the date from which the Policy will be effective. The format will be the one that has been maintained for your user ID in the ‘My Dash Board User’ setting date format.

Policy Status Code

Mandatory

By Default Policy Status will be 'ACT' on New Mode.

Transaction Currency

Alphanumeric; 3 Characters; Optional

Specify the transaction currency for the policy. If you do not maintain this value, the system will default this value at the time of saving the maintenance. The transaction currency maintained at the fund level will be default if all the transaction currencies for the fund are the same. If various currencies have been maintained at the fund level, then the system will default the policy base currency as the policy transaction currency.

Include Interest in Investment

Optional

Select, from the adjoining drop-down list, if the interest earned on the initial investment should be considered along with the initial investment for investment in the policy.

If you select ‘Yes’, the interest amount will be included in the investment and a single transaction will be generated for both. You need to manually add the interest amount calculated in the settlement details to the transaction amount of the particular currency in the asset allocation details.

For instance, if the interest amount is USD 1000 and the transaction amount is USD 100000, then you are required to add USD 1000 to the transaction amount for the currency USD in the asset allocation details.

If you select ‘No’, the interest amount will be generated as a separate UT transaction.

Initial Investment Amount

Numeric; 18 Characters; Optional

You have the option of entering the initial amount to be invested in the policy. If the product is a single premium product (the box ‘Multiple Premiums Allowed?’ is not checked while creating a product), and you enter an amount here, the system will generate a transaction for this amount.

You will be allowed to change the initial investment amount, interest amount and the asset allocation details for a policy that has been authorized as long as it has not been allocated. When you modify the details, the system will reverse the existing initial investment transaction and create a new policy transaction for the modified amount. You can modify the policy any number of times till policy allocation.

If transactions like allocation, premium, annuity, recurring switch, top-ups, and surrender have been generated for the policy, the system will not allow you to modify the initial investment amount.

Consider the following cases:

Case 1

The product is a multiple premium product; you enter the initial investment amount and premium details. The Start Date for the premiums is a system date when the policy is authorized.

When the policy is Authorized, a transaction will be created on the date mentioned for the initial investment amount you have entered.

Case 2

The product is a multiple premium product; you enter the initial investment amount and premium details. The Start Date for the premiums is the System Date. When the policy is saved:

- A transaction will be created for the initial investment amount you have entered.

- A transaction will also be generated for the first premium amount, at EOD.

Case 3

The product is a multiple premium product; you do not enter any initial investment amount, but only the premium amount. The Start Date for the premiums is the System Date.

When the policy is Authorized, an initial investment transaction will be generated with the premium amount.

Case 4

The product is a multiple premium product; you do not enter any initial investment amount, but only the premium amount. The Start Date for the premiums is a future date.

When the policy is Authorized, an initial investment transaction will be generated on the date specified, with the premium amount.

Note

In a scenario as described under Case 4, you will be allowed to amend the premium amount till the date specified. You will, however, not be allowed to enter an initial investment amount after you authorize a policy.

Case 5

The product is a multiple premium product; you do not enter either the initial investment amount or the premium amount. No transaction will be generated on saving the policy. An initial investment transaction will be generated only if you enter any premium details at a later stage.

Note

The initial investment amount and premium amounts are independent of each other. This means that changing the initial investment will not change the premium amount and vice versa.

Let us say, for example, you have not entered the initial investment amount and have entered only the premium amount. You now wish to enter an initial investment amount. You may do so before the policy is authorized, and in doing so, the premium amount you have entered will not be affected. Similarly, if you change the premium amount, the initial investment amount will not be affected.

Interest Amount

Display

The system computes the interest amount based on the interest calculation days and interest rate provided by you in the Interest Calculation Screen (explained below).

Transaction Category

Alphanumeric; 1 Character; Optional

Specify the type of transaction. Alternatively, you can select transaction category from the option list. The list displays all valid transaction category code maintained in the system.

If the transactions captured are for MIFID funds/ products, the transaction category ‘Advised and execution only’ will be applicable (if fund/ product is MIFID regulated). For MIFID funds/ products related transactions; the defaulting of transaction category to legacy will not be applicable, only if MIFID fund/ Product is selected as ‘Yes’ at fund and product level.

In the transaction screen, the transaction category will be based on ‘RDRTXNCATEGORY’ PARAM maintenance.

For products if the risk level for a product is defined and risk profile for a UH is maintained during LEP transactions (plan initial investment, premiums, plan switch, plan top up) the system will perform the risk checks for LEP transactions, considering the product level risk and UH risk profile along with risk expiry date.

If ‘MIFID fund/ product’ is selected as ‘Yes’, the transaction applicable are IPO subscriptions, subscription, switch, Standing instructions and transfer In, plan initial investment, premiums, plan switch, plan top up. For MIFID funds; ‘Transaction Category’ at the transaction level will be classified as either ‘Advised Business’ or ‘Execution Only Business’.

The SI transactions (subscriptions and switches, includes premiums and recurring switches) escalations will be categorized as ‘Advised Business’ or ‘Execution Only Business’. If you amend the SI, the system displays the warning message as ‘Transaction category amended for the SI’. The next SI will reflect the changed category.

If you change the ‘Transaction Category’ for a MIFID transaction during edit or amend operation, then the system displays the warning message as ‘Default Transaction Category has been overridden. Do you want to continue?’

Description

Display

The system displays the description for the selected transaction category.

Policy Tax Class

Display

The system displays the tax class of a Policy. The system will default this value from ‘Product Tax Class Maintenance’ screen.

If a UH Category gets modified, post authorisation the system will automatically change at EOD all the underlying policy Tax Class to new policy tax class (based on the new UH Category and Product combinations). The system will also update the SI’s with new tax class fund ID’s and generates 100% switch transactions from the old policy tax class funds.

Product Defaulting

Click ‘Default Product’ button to default the product values.

Rule Status

Optional

Select the rule status from the drop-down list. The list displays the following values:

- Open

- Closed

Funding Factor

Numeric; 5 Characters; Optional

The funding factor that is applicable to Policy transactions in this Product, which would have been set up at product-definition level, is displayed here. You can override this value at this stage. This must be expressed as a percentage and cannot exceed one hundred percent.

Funding Repayment Period

Numeric; 3 Characters; Optional

The duration of the repayment period, at the end of which the entire funded amount will be paid back to the investor, which would have been specified for this product, is displayed here. You can change the same for the Policy.

Asset Allocation

Optional

The asset allocation for the Policy can be specified either by the sponsor of the product, or by the Policy Holder. The drop-down list contains two options – ‘By Fund’ and ‘By Policy Holder’. Select the required option.

Cession Status

Display

When Policy Holders exercise the option of ‘ceding’ their policies on either a temporary or a permanent basis, the ceded Policy will be designated a ‘Cession ID’ and ‘Cession Status’ in the system. The Cession Status for this Policy is displayed here.

Typically, at the time of Policy creation, the newly created Policy does not have a Cession ID or Cession Status, and this field is blank, and locked. Subsequently, whenever this Policy record is viewed, any changes to Cession Status will be displayed in this field.

Funding Frequency

Alphanumeric; 1 Character; Optional

The frequency at which the funded amount will be repaid to the investor, which would have been set up at the time of Product definition, is displayed here. It cannot be changed at this stage.

Description

Display

The system displays the description of the specified funding frequency.

Sub Type

Alphanumeric; 3 Characters; Mandatory

Specify the sub transaction type.

Description

Display

The system displays the description of the specified sub type.

Preferred Fund for Redemption

Alphanumeric; 6 Characters; Optional

You can select or amend the redemption fund during the creation or amendment of the policy.

If you maintain adequate balance to recover periodic fees in ‘Preferred Fund for Redemption’, system will redeem entire periodic fees from the preferred fund.

If you do not maintain adequate balance ‘Preferred Fund for Redemption’ system will follow the present logic to recover the periodic fees.

Note

For a CMA applicable Product, system would treat CMA Fund as preferred fund for periodic fee redemptions, provided no preferred fund is selected at Product level.

The system will consider Policy level Preferred fund for redemption

and if this is not available then at unit holder level, the system will

consider the ratio of funds, i.e. same

as monthly ongoing fee transaction generation.

Refer the section ‘Cash Management Account’ in this chapter for more details on the operation of the Cash Management Account.

Description

Display

The system displays the description of the specified preference for fund redemption.

Initial Investment Policy Txn Number

Display

The system displays the transaction number of the initial investment policy.

Exchange Rate Details

The exchange rate details that are defaulted here or that you modify here will be used to convert the policy transaction amount as well as the interest on initial investment amount into the policy base currency.

Amount Applied

Display

The system displays the transaction amount in terms of the policy base currency.

Source ID

Alphanumeric; 6 Characters; Optional

You can select the source ID required from the adjoining option list. If you do not specify any, the system will default the source ID when you save the policy.

FX Deal Date

Date Format; Optional

Enter the deal date for exchange rate.

FX Value Date

Date Format; Optional

Enter the value date for the exchange rate.

Exchange Rate Applied

Numeric; 21 Characters; Optional

Specify the exchange rate to be used to convert the transaction amount from transaction base currency to policy base currency, if you have chosen to override the exchange rate.

Override Exchange Rate

Optional

Select ‘Yes’ if you wish to change the exchange rate that is displayed here. If you select ‘Y’, however, you need to specify the exchange rate to be used for the transaction in the ‘Exchange Rate Applied’ field. Select ‘No’ if you wish to retain the exchange rate that is displayed by the system.

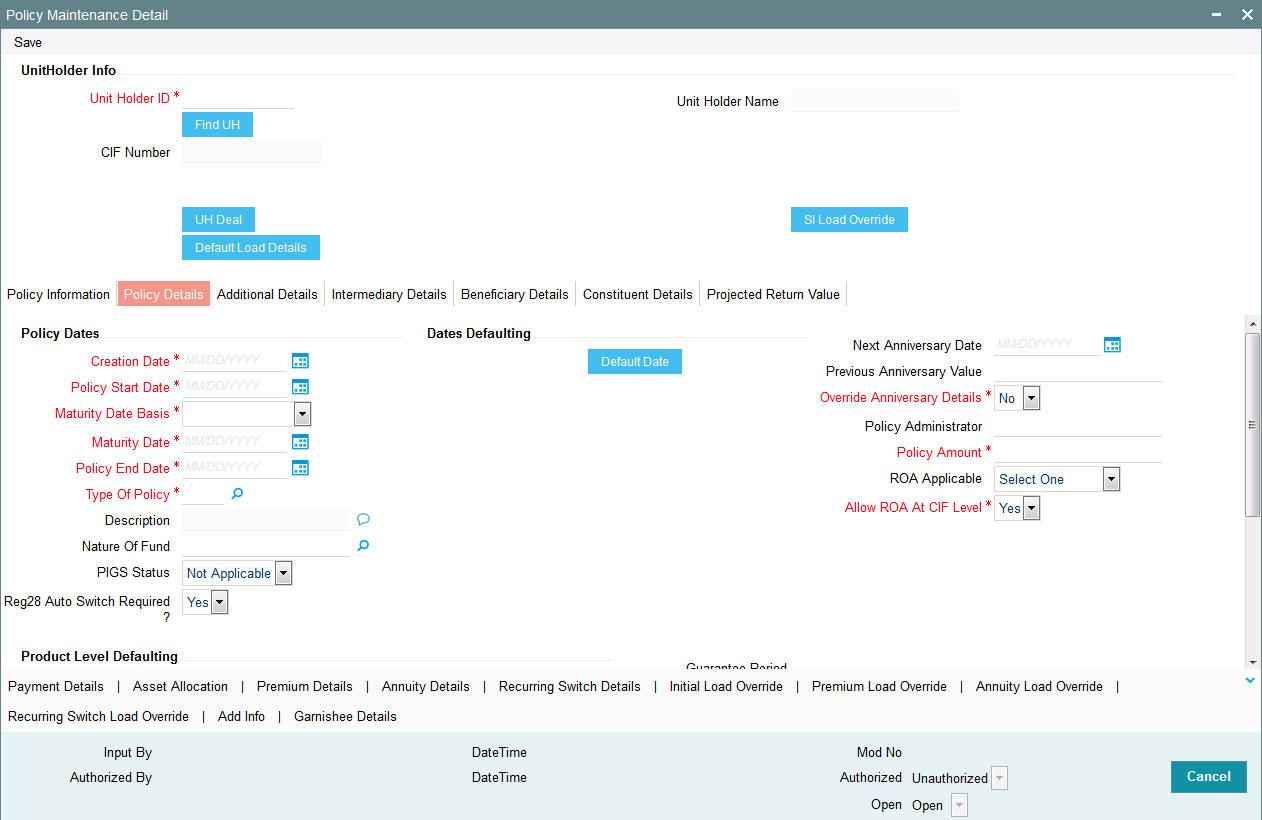

3.1.3 Policy Details Tab

Click ‘Policy Details’ tab, to invoke the Policy Detail section:

Policy Dates

Creation Date

Date Format; Mandatory

This signifies the date on which Policy record was entered into the system.

Policy Start Date

Date Format, Mandatory

Specify the date from which the Policy is available for transactions.

The Policy Start Date can be a past date if backdating is allowed for the product (if you have selected the option ‘BackDating Allowed?’ in the Product Maintenance screen), but it must not be earlier than the Product Start Date.

Maturity Date Basis

Mandatory

The option you select here, will decide on what basis the maturity date will be calculated.

You have the following two options:

- Retirement Age

- Minimum Tenor

You can select the option ‘Retirement Age’ only if you have selected the option ‘YES’ against the field ‘Retirement Features Supported’. In such a case, the maturity date will be calculated on the basis of the age of retirement you will specify at the Product level.

If you select the option ‘Minimum Tenor’, the maturity date will be calculated on the basis of the minimum tenor you will specify at the Product level.

Maturity Date

Date Format, Mandatory

When the Start Date of the Policy is specified, the system computes the maturity date for the Policy by adding the Minimum Tenor that has been specified at the product level for all policies, to the Policy Start Date, and defaults the computed date in this field. You can change this date.

The concept of a Maturity Date enables the AMC to keep track of premature closures of policies that take place, so that the applicable exit fees may be levied.

A Policy that has matured continues to exist in the product for all activities, but no transactions will be accepted into the Policy after the Policy End Date.

Policy End Date

Date Format, Mandatory

Specify the date beyond which the Policy should cease to be active. This date must not be earlier than the application date or the Policy Start Date.

Type of Policy

Alphanumeric; 2 Characters; Optional

Specify whether the Policy being created is a new Policy, a rollover from an existing Policy or whether the customer is transferring retirement assets.

Transfer-in option is applicable for fresh investment. If Balance Transfer-in is chosen from the drop down list the policy asset allocation will be enhanced to capture the unit transferred in each fund and WAC. The system will generate unit based transaction for such an initial investment.

Note

The option list includes the option ‘Accelerated Annuity’. If you select this option, in case of death of a policy holder, the policy will be transferred to a new policy opened in the name of the beneficiary .The initial amount of the new policy will be the maturity amount of the old one and the entire maturity proceed will be paid out over number of occurrences and frequency (maintained in the annuity tab).

Description

Display

The system displays the description of the selected policy type.

Nature of Fund

Alphanumeric; 3 Characters; Optional

Specify the nature of the fund based on param maintenance. The adjoining option list displays all valid accounts maintained in the system. You can choose the appropriate one.

The combination of product and the nature of the fund will then determine if PIGS rules can be applied while capturing the contributions and switches for the policy. Once applied, the system will apply PIGS rules for all transactions under the policy.

Policy PIGS Status

Optional

Select the contract status from the adjoining drop-down list. Following are the options available:

- Grandfathered

- Regulated

- Not Applicable

Policy PIGS Status is applicable only for those products for which PIGS and FOREX compliance is true.

If Policy start date is greater than or equal to PIGSREGDATE and product is PIGS compliant (with appropriate Nature of fund), then the system will mark the contract status as regulated.

If PIGSREGDATE is null then all Policy PIGS status will be by default Grandfathered. The system will display an warning message if you select ‘Regulated’ option.

If nature of fund is not mapped, Contract status will be derived based on PIGS compliance status at product level and PIGSREGDATE.

You can change PIGS status from Regulated to Grandfathered manually for policy which policy start date greater than or equal to PIGSREGDATE.

For policies with Grandfathered status, the system will not change policy status automatically to Regulated on material change before PIGSREGDATE.

If you change policy status manually to Regulated before PIGSREGDATE, then the system will not validate for material change and policy will continue to be in Regulated status.

Validating PIGS and FOREX

The system will automatically mark any contract created in system after PIGSREGDATE as Regulated. However, you can change it manually.

For premiums, the system will consider any change in Status, Start Date, End Date, Value, Frequency and Transaction, and Escalation details/Asset Allocation as material change and will mark the policy as ‘Regulated’.

For recurring switches the system will consider any change in Status, Start Date, End Date, Value, Frequency, number of phase in occurrences and Transaction category, and Escalation details/Asset Allocation as Material change will mark he policy as ‘Regulated’.

The following transactions are considered as material changes and will change the contract status from ‘Grandfathered’ to ‘Regulated’:

- Top up transactions / additional investments

- Unit Transfers

- User initiated Switch transactions

- Standing instruction, i.e. a new debit order, regular switch or phase in transaction

- The following amendments to debit orders, regular switches:

- Change in amount

- Frequency change

- Changes to the selected funds for either the debit order, phase in or regular switch.

- Adding an escalation value to an existing Standing Instruction

- Increasing the escalation value of an existing Standing Instruction considering the escalation frequency.

- The creation of a new Phase in transaction will change the status of the Grandfathered contracts to Regulated.

The following system generated transactions are not considered as material changes, and will not alter the ‘Grandfathered’ status to ‘Regulated’:

- Fund Merge transactions

- Reinvested Distributions

- Bonus payments

- Fees

- CMA switch transactions

- Redemptions / Withdrawals do not alter the ‘Grandfathered’ status as the funds under management will be reduced.

- Existing premiums (in the form of existing debit orders, regular switches, phase in and annuities).

The following amendments to debit orders and regular switches:

- Change in Bank details linked to a standing instruction (debit order or annuity payment) is not considered a material change

- Any changes to annuity payments will not affect the ‘Grandfathered’ status

- The amendment or cancellation of a Phase In will not change the status to Regulated

- The creation of a new Phase In will change the status.

If a transaction, for which the status is changed from Grandfathered to Regulated, is reversed or cancelled, then the system will automatically change the status back to ‘Grandfathered’.

The system will not check ‘Grandfathered’ contracts for asset limit compliance, when contract is amended to add or modify recurring debit orders or recurring switches. However, if a Top-up and switch transaction causes a contract to lose its ‘Grandfathered’ status, then that transaction will not be subjected to Regulation 28 compliance checks.

The following transactions will be checked for Regulation 28 compliance:

- New investments

- Top up transactions

- Switches

- Partial redemption

- 100% redemptions are not checked for compliance.

- Creation of a new recurring debit order

The Regulation 28 online checks will check compliance during the creation of a recurring debit order. For instance, if the debit order itself is validated, and the current value in the client’s portfolio is not taken into account, then that contract will be ‘non-compliant’. The system will only validate if the actual debit order instruction has passed Regulation 28 validation.

If a contract has failed compliance during a Quarterly monitoring run, and the contract is marked as ‘Non-compliant’, then the system will not allow the creation of new recurring debit orders.

The new investments and top up transactions must be checked for Regulation 28 compliance, taking into account the current market value of the contract as well.

On capturing a transaction, the system will aggregate the asset allocation for each selected fund on a weighted average basis and check the same against the Regulation 28 asset limits. If the aggregate position is not compliant, then the system will display a warning message.

The system will run Policy PIGS Status Updation batch as part of the EOD to amend the PIGS status of Grand Fathered contracts which had a material change transaction for the day. This batch will also change PIGS status for policy which may have been amended with a future effective date.

Reg28 Auto Switch Required?

Optional

Select if Reg28 auto switching is required or not from the drop-down list. The list displays the following values;

- Yes

- No

This field is mandatory for PIGS compliant product.

Processing Auto Switch

Auto Switch functionality is applicable only for Regulated contracts where Auto switch required is marked as ‘Yes’ at Policy level.

Once the maximum number of unsuccessful runs for auto switch is reached during quarterly compliance checking process, the system will check the contract against Actual components and update the serial number if the contract is non compliant. If the contract is compliant against AML, then the serial number will be updated to 0.

If a policy is failed consecutively for defined number of times, then the system will run auto switch as part of the following quarter. For instance, if the maximum non-compliance count is 4, auto switch will takes place as part of 5th quarter. In such cases, auto switch process shall pickup all the contracts whose current count is more than 4 and continue with the processing of auto switch.

The system will run ‘Policy – Reg28 Auto-Switch Generation’ batch to pick up all non-complaint contracts against the AML components for successive nth time i.e. maximum number of unsuccessful runs plus one, i.e N+1 times. The system will validate these contracts for Regulation 28 against rule with latest balance.

If the contract is complaint against rule maintained and latest balance then the contract will be marked as complaint and Serial Number will be updated to ‘0’.

If the contract is not compliant against this IML and latest balance then the batch will generate Auto-Switch forcing the contract to be Regulation 28 compliant by ‘Sell by Margin’ method. This Batch will also run on the same day as the current quarterly process.

You can maintain IML batch rule for Auto switch to take place. If IML batch rule is not maintained, system will mark the contract as ‘Compliant’ and the Serial number will be updated as 0 and policy will be marked as ‘Policy is compliant with IML’. In IML Batch rule, each rule can have only 1 component.

While determining the latest market value, for switch transactions, both the out and in leg must be allotted before they can be included in the market value calculation. The latest available prices will be used in the calculation. The system will evaluate the computed IML component values against latest IML rule to check whether contract is compliant or not.

If the contract is compliant against IML components then the system will mark the contract as ‘Compliant’ and the Serial number will be updated as 0 and will be marked as ‘Policy is compliant with the IMLs’ in data store as well.

If the contract is not compliant against IML, then system will take the Rule which has maximum breach. The breach is defined as the Portfolio’s IML limit less the asset limit.

The system will derive the required variable based on the Rule. It will derive the Sell% (excluding funds based on maintenance) after applying the formula.

The system will rebalance the portfolio by keeping the excluded funds values constant and by switching the amount from the eligible funds to Auto Switch fund.

The system will check to see whether the rebalanced portfolio passes Regulation 28 validation using IMLs. (Switch transaction calculated against Rule 10 must be included)

If Contract is compliant then system:

- Marks the contract as compliant by updating the serial number to 0 and update the remarks in the data store will be updated as ‘Policy is compliant with the IMLs’ against this contract.

- Creates a switch transaction as per the sell amount derived from respective funds into Money Market fund.

If the contract is still not compliant, then system will repeat re-balancing steps until contract is compliant. The system will generate only one switch transaction per contract. The switch transactions will generate 2 Adjustment Transaction Types, namely, LHO (for Switch Out leg) and LHI (for Switch In leg) during this process.

The system will track all the computed variables, values etc used in calculation of Switch generation with the iteration number for reconciliation and reporting purposes. You can also exclude funds for Reg 28 auto switch rebalancing while selecting funds in ‘Portfolio Mapping’ screen.

Dates Defaulting

Next Anniversary Date

Date Format; Optional

Specify the Anniversary Date for the annuity payment.

Previous Anniversary Value

Numeric; 30 Characters; Optional

Specify the preceding anniversary amount.

Note

Post authorization, you will be allowed to amend the ‘Anniversary Value’ and the ‘Previous Anniversary Value’ fields provided the ‘Override Anniversary Date?’ option has been checked.

Override Anniversary Details?

Mandatory

Select if anniversary details has to be overridden or not from the drop-down list. The list displays the following values:

- Yes

- No

When you enter the Start Date of the Policy in the Policy Details section of this screen, the system defaults the Anniversary Date to a date that is exactly one year after the Start Date.

Policy Administrator

Alphanumeric; 60 Characters; Optional

Specify the plan administrator details.

Policy Amount

Numeric; 30 Characters; Mandatory

Specify an indicative amount for which the Policy is taken in the product. The system does not perform any validation against this amount, and it is used only for information purposes.

ROA Applicable

Optional

Indicate whether a Rate of accumulation is applicable for the policy from the drop-down list. The list displays the following values:

- Policy Level

- Policy Holder Level

- Across Product

The initial administrator and broker will use the market value at policy level to derive the fee return value. The fee is calculated based on the gross amount of the individual transaction value.

You can select the applicable ROA for policy and policy holder. On selecting the Right of accumulation for Policy, an accumulation rate is applied on the policy, being created. On selecting Unit holder, the Right of Accumulation is applicable for all the policies mapped to the particular Unitholder.

For an ROA function to be applicable, a cumulative load would have to be setup and mapped in the Load Product.

Allow ROA at CIF Level

Optional

Indicate if ROA is to be allowed at CIF level or not by choosing from the drop-down list.

Product Level Defaulting

Statement Frequency

Alphanumeric; 1 Character; Mandatory

Specify the frequency at which the Policy statement must be mailed to the Policy Holder for this Policy.

Note

This frequency overrides the frequency specified for the Product.

Description

Display

The system displays the description of the specified statement frequency.

Policy Base Currency

Alphanumeric; 3 Character; Mandatory

Specify the base currency to be associated with the policy or select the policy base currency from the option list provided. All currencies maintained in the system get displayed in the option list.

While saving the record, the system validates whether the selected currency is supported by product and saves the record on successful validation.

Description

Display

The system displays the description of the specified policy base currency.

Life Cover Applicable

Mandatory

This field indicates whether or not the Policy Holder has an option to opt for a life cover while subscribing to this product. Select ‘Yes’ or ‘No’ from the drop-down list.

Life Cover Amount

Numeric; 30 Characters; Optional

Specify the amount to be paid by the Policy Holder as a fee for obtaining the life cover for any Policy held by him in this product.

Proof of Existence Certificate

Mandatory

Select whether or not the Policy Holder will need to produce a certificate of existence.

Guarantee Period

Numeric; 3 Characters; Optional

Specify the guarantee period.

Take on Annuity Amount

Numeric; 30 Characters; Optional

Enter the take-on annuity amount here. The annuity details will be calculated by the system based on the amount you enter here and not the annuity percentage, till the first anniversary. The annuity details will be taken into consideration after the first anniversary.

Number of Withdrawals Allowed

Numeric; 5 Characters; Optional

Specify the number of withdrawals allowed.

Withdrawal Counter

Display

This field displays the number of withdrawals taken by the policy holder. It will be displayed irrespective of the product to which the policy belongs.

System will update the Withdrawal counter at policy level after doing a withdrawal transaction, and also validates with the No. of withdrawals allowed at Policy level.

Example

If you enter the Start Date of the Policy as 3rd June 2005, the Anniversary Date will be defaulted to 3rd June 2006.

If you wish to change the Anniversary Date of the annuity payment, check the box ‘Override Anniversary Date’.

This field is enabled only if the ‘Override Anniversary Date?’ option has been checked

Retirement Age

Numeric; 3 Characters; Optional (Enabled only if Maturity Date Basis for Product is ‘Retirement Age’)

Specify the age that will be considered as retirement age for Policy Holders under this product. After this age, the Policy Holders will become eligible for retirement benefits, if any.

Note

This field will be enabled only if, for the Product, in the Product Maintenance screen:

- You have selected the option ‘Yes’ against the field ‘Retirement Features Supported?’

- You have selected the option ‘Retirement Age’ against the field ‘Maturity Date Basis’

Life Expectancy

Numeric; 3 Characters; Optional

User can enter life expectancy.

Policy Term (Years)

Numeric; 3 Characters; Optional

You can enter the policy term.

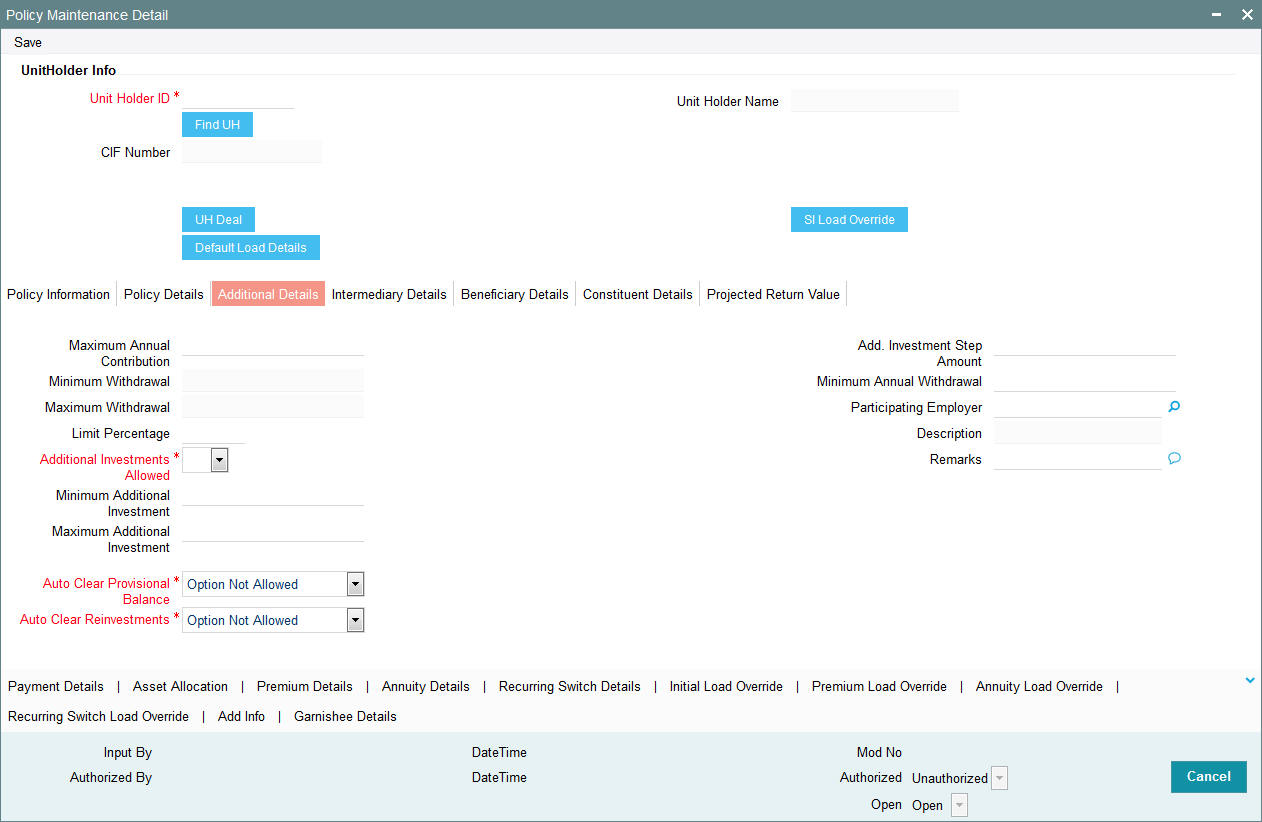

3.1.4 Additional Details Tab

Click ‘Additional Details’ tab, to invoke the Additional Details section:

Maximum Annual Contribution

Numeric, 30 Characters; Optional

Specify the maximum amount that the Policy Holder can invest annually in a Policy in this Product. This amount includes top ups, if any. The amount displayed is the amount specified for the Product. You can change the same for the Policy.

Minimum Withdrawal

Numeric, 30 Characters; Optional

This field will be enabled if you have specified the Withdrawal Limit Mode as Amount. Specify the minimum amount that a Policy Holder can be withdraw from the holdings.

Maximum Withdrawal

Numeric, 30 Characters; Optional

This field will be enabled if you have specified the Withdrawal Limit Mode as ‘Amount’. Specify the maximum amount that a Policy Holder can be withdraw from the holdings.

Limit Percentage

Numeric; 5 Characters; Optional

This field will be enabled if you have specified the Withdrawal Limit Mode as ‘Percentage’. Specify the maximum withdrawal in terms of a percentage, that a Policy Holder can be withdraw from the holdings.

Additional Investments Allowed

Mandatory

This option indicates whether or not the Policy Holder can make an additional investment in a Policy. The option you have specified for the Product will be defaulted here.

Note

You will be allowed to uncheck this box if it is checked. You will, however, not be allowed to check this box if it is unchecked

Minimum Additional Investment

Numeric, 30 Characters; Optional

Specify the minimum additional investment amount that a Policy Holder should make (if the option ‘Additional Investments Allowed’ has been selected for the Policy Holder).

Maximum Additional Investment

Numeric, 30 Characters; Optional

Specify the maximum additional investment amount that a Policy Holder should make (if the option ‘Additional Investments Allowed’ has been selected for the Policy Holder).

Add. Investment Step Amount

Numeric, 30 Characters; Optional

Specify the step amount for an additional investment.

Minimum Annual Withdrawal

Numeric, 30 Characters; Optional

If the withdrawals are allowed at the Product level then the minimum amount that customer needs to withdraw annually can be specified here while creating a Policy. This will override the amount set at the Product level. The amount set at the product level will be shown here after user selects the Product.

Participating Employer

Alphanumeric; 12 Characters; Optional

Specify the underlying policyholders’ employer. The option list displays all participating employers linked to the chosen product.

Description

Display

The system displays the name of the selected participating employer.

Remarks

Alphanumeric; 255 Characters; Optional

Specify remarks, if any.

Auto Clear Provisional Balance

Mandatory

This field indicates whether 100% outflow transactions include provisionally allotted units. The option specified for the product, in the Product Maintenance screen, will be defaulted. However, you can change the defaulted option. You can specify any of the following options:

- Option not allowed: Provisionally allotted units should not be considered while processing 100% outflow transactions.

- Allowed – Default checked: Provisionally allotted units should be considered while processing 100% outflow transactions by default.

- Allowed – Default unchecked: Provisionally allotted units will not be considered while processing 100% outflow transactions by default. However, you can check this option while performing transactions.

Auto Clear Reinvestments

Mandatory

This field indicates whether 100% outflow transactions include freeze held and reinvestment units. The option specified for the product, in the Product Maintenance screen, will be defaulted. However, you can change the defaulted option.

You can specify any of the following options:

- Option not allowed: Freeze held/reinvestment units should not be considered while processing 100% outflow transactions.

- Allowed – Default checked: Freeze held/reinvestment units should be considered while processing 100% outflow transactions by default.

- Allowed – Default unchecked: Freeze held/reinvestment units will not be considered while processing 100% outflow transactions by default. However, you can check this option while performing transactions.

Refer to the chapter “Maintaining System Parameters” for more details.

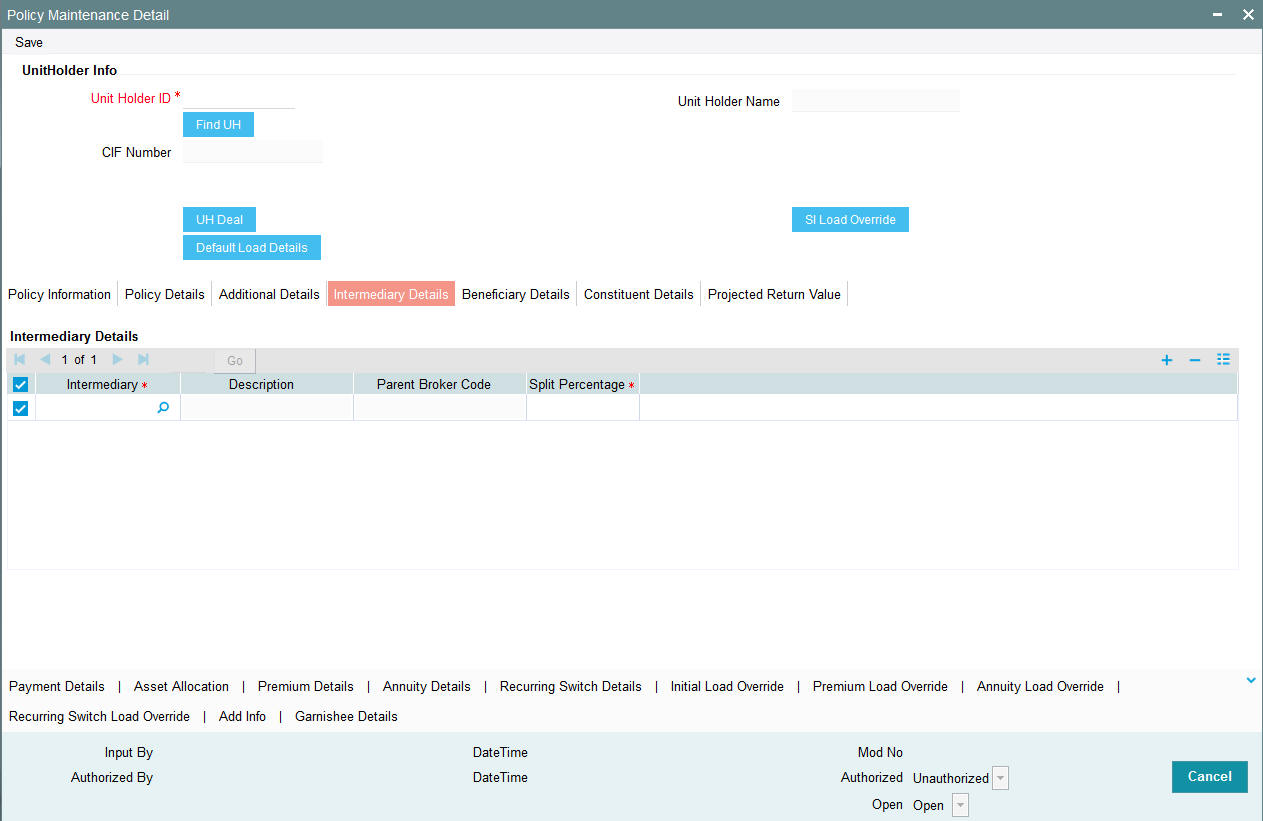

3.1.5 Intermediary Details Tab

You will need to capture details of the intermediaries attached to the initial investment. When you click ‘Intermediary Details’ link, the screen is invoked:

The default intermediary details maintained for the unit holder involved in the transaction are displayed here. However, you can change the defaulted values.

Intermediary

Alphanumeric; 12 Characters; Optional

From the list, select the broker preferred by the Policy Holder.

Description

Display

The system displays the description for the selected intermediary code.

Parent Broker Code

Display

The system will display the parent broker code once the intermediary code is chosen.

Split Percentage

Numeric; 22 Characters; Mandatory

Specify the percentage of the commission that the selected broker is entitled to receive on any transactions put through for the investor.

This percentage must not exceed one hundred percent.

Note

If you specify more than one broker in this section, the split percentages for all brokers, when summed up, must not exceed or fall below one hundred percent.

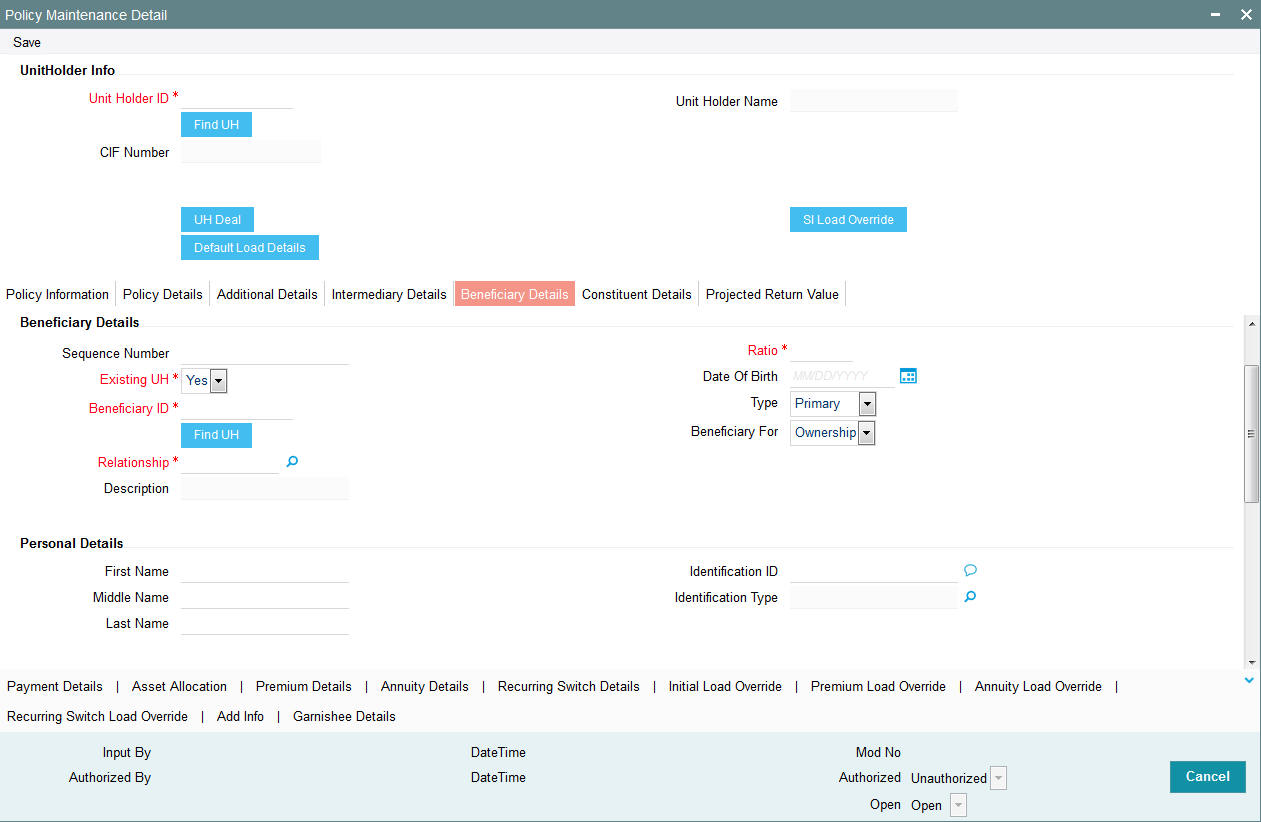

3.1.6 Beneficiary Details Tab

In this section, you must specify the details of one or more beneficiaries, if any, for the Policy Holder. A beneficiary could be an existing Unit Holder in the system or could be an external entity.

When you click ‘Beneficiary Details’ link, the screen is invoked:

It is mandatory for you to maintain beneficiary details only if the option ‘Beneficiary Details Mandatory’ has been checked for the underlying product.

Beneficiary Details

Sequence Number

Display

The system displays the sequence number.

Existing UH

Mandatory

Select ‘Yes’ for existing Unit Holder. Else ‘No’.

Beneficiary ID

Alphanumeric; 12 Characters; Mandatory

If the beneficiary is an existing Policy Holder, you can invoke the same from the option list. Else, specify the same.

You can also search for beneficiary ID by clicking ‘Find UH’ button.

Relationship

Alphanumeric; 40 Characters; Mandatory

Specify the relationship of the beneficiary with the Policy Holder.

Description

Display

The system displays the description for the selected relationship code.

Ratio

Numeric; 5 Characters; Mandatory

Specify the percentage of the Policy Holder’s holdings that belongs to the beneficiary. The ratio should sum up to 100.

Date of Birth

Date Format; Optional

Enter the date of birth of the beneficiary.

Type

Optional

Specify whether the beneficiary is a primary or secondary holder from the drop-down list.

Beneficiary For

Optional

Select ‘Ownership’ or ‘Proceeds’ from the drop-down list.

Personal Details

First Name

Alphanumeric; 100 Characters; Optional

Specify the first name of the beneficiary.

Middle Name

Alphanumeric; 40 Characters; Optional

Specify the middle name of the beneficiary.

Last Name

Alphanumeric; 40 Characters; Optional

Specify the last name of the beneficiary.

Identification ID

Alphanumeric; 50 Characters; Optional

Specify the identification details.

Identification Type

Alphanumeric; 3 Characters; Optional

Select the identification type from the option list.

Address Details

Address

Alphanumeric; 255 Characters; Optional

Specify the address of the beneficiary.

City

Alphanumeric; 50 Characters; Optional

Specify the city name of the beneficiary.

Zip Code

Alphanumeric; 10 Characters; Optional

Specify the zip code of the beneficiary.

State or Country

Alphanumeric; 40 Characters; Optional

Specify the state or country name of the beneficiary.

Phone Number

Alphanumeric; 20 Characters; Optional

Enter the phone number of the beneficiary.

Fax Number

Alphanumeric; 20 Characters; Optional

Enter the fax number of the beneficiary.

E-Mail ID

Alphanumeric; 255 Characters; Optional

Enter the e-mail ID of the beneficiary.

Account Details

Bank

Alphanumeric; 12 Characters; Optional

Specify the bank code of the beneficiary’s bank. You can select the same from the option list, if the bank code is a valid code in the system.

Branch

Alphanumeric; 12 Characters; Optional

Specify the branch of the selected beneficiary bank.

Bank Name

Display

The system displays the name of the selected bank code.

Branch Name

Display

The system displays the name of the selected branch code.

Account Type

Alphanumeric; 1 Character; Optional

Specify the account type.

Account Number

Alphanumeric; 16 Characters; Optional

Specify the account number.

Account Currency

Alphanumeric; 16 Characters; Optional

Specify the account currency.

IBAN

Alphanumeric; 40 Characters; Optional

Specify the IBAN (International Bank Account Number) of the account holder.

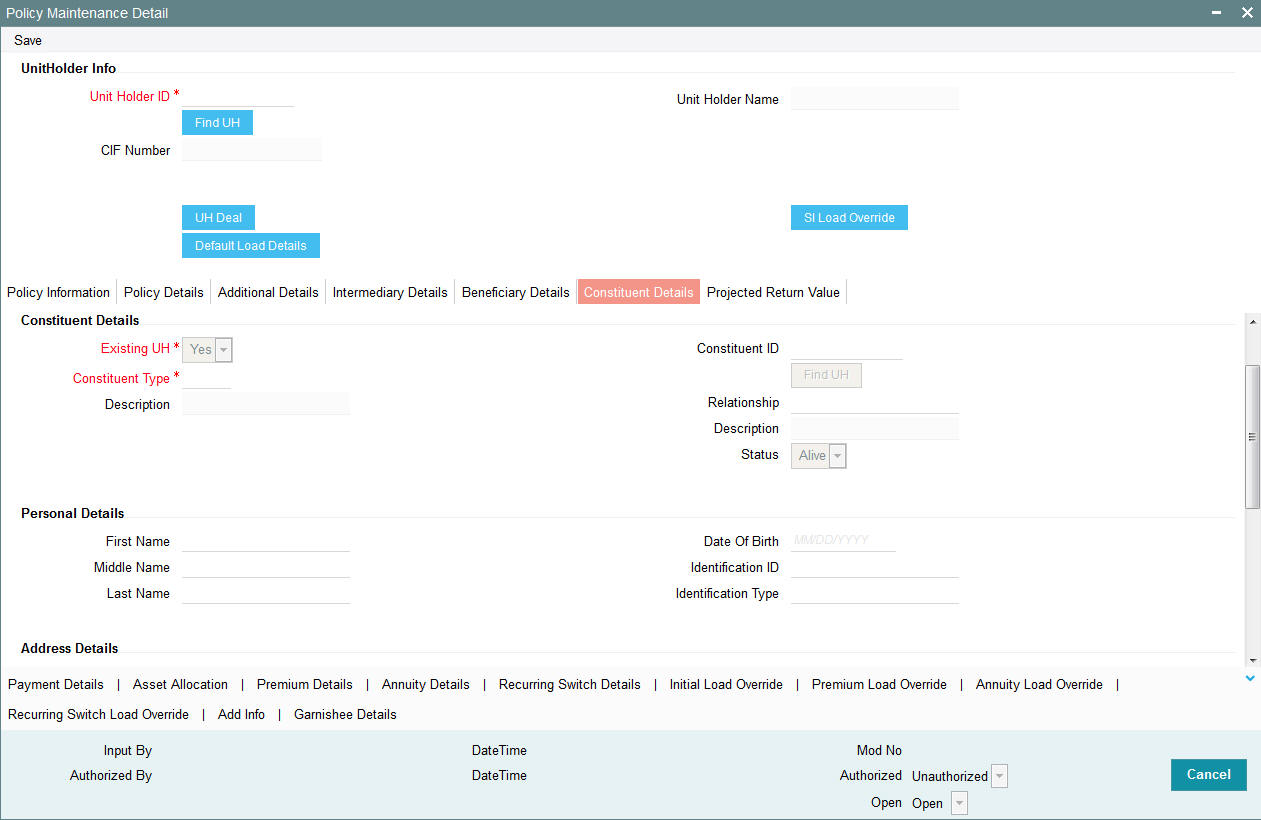

3.1.7 Constituent Details Tab

When you click ‘Constituent Details’ link, the screen is invoked:

It is mandatory for you to maintain constituent details only if the option ‘Constituent Details Mandatory’ has been checked for the underlying product.

Constituent Details

The constituent details are given below:

Existing UH

Mandatory

Select ‘Yes’ for existing Unit Holder. Else ‘No’.

Constituent Type

Alphanumeric; 3 Characters; Mandatory

Select all the stakeholders of the Policy from the option list.

Description

Display

The system displays the description for the selected constituent type.

Constituent ID

Alphanumeric; 12 Characters; Mandatory

Specify the ID of the constituent from the option list. You can either select a valid Unit Holder in the system or enter a Constituent ID.

You can also select constituent ID by selecting ‘Find UH’ button.

Relationship

Alphanumeric; 40 Characters; Mandatory

Select the relationship of the constituent to the Policy Holder from the option list.

Description

Display

The system displays the description for selected relationship code.

Status

Mandatory

Select the status ‘Alive’ or ‘Dead’ from drop-down list.

Personal Details

First Name

Alphanumeric; 100 Characters; Optional

Specify the first name of the constituent holder.

Middle Name

Alphanumeric; 40 Characters; Optional

Specify the middle name of the constituent holder.

Last Name

Alphanumeric; 40 Characters; Optional

Specify the last name of the constituent holder.

Date Of Birth

Date Format; Optional

Select the date of birth of constituent holder from the adjoining calendar.

Identification ID

Alphanumeric; 50 Characters; Optional

Specify the identification details.

Identification Type

Alphanumeric; 3 Characters; Optional

Select the identification type from the option list.

Address Details

Address

Alphanumeric; 255 Characters; Optional

Specify the address of the constituent holder.

City

Alphanumeric; 50 Characters; Optional

Specify the city name of the constituent holder.

Zip Code

Alphanumeric; 10 Characters; Optional

Specify the zip code of the constituent holder.

State or Country

Alphanumeric; 40 Characters; Optional

Specify the state or country name of the constituent holder.

Phone Number

Alphanumeric; 20 Characters; Optional

Enter the phone number of the constituent holder.

Fax Number

Alphanumeric; 20 Characters; Optional

Enter the fax number of the constituent holder.

E-Mail ID

Alphanumeric; 255 Characters; Optional

Enter the e-mail ID of the constituent holder.

Account Details

Bank

Alphanumeric; 12 Characters; Optional

Specify the bank code of the constituent holder’s bank. You can select the same from the option list, if the bank code is a valid code in the system.

Branch

Alphanumeric; 12 Characters; Optional

Specify the branch of the selected constituent holder’s bank.

Bank Name

Display

The system displays the name of the selected bank code.

Branch Name

Display

The system displays the name of the selected branch code.

Account Type

Alphanumeric; 1 Character; Optional

Specify the account type.

Account Number

Alphanumeric; 16 Characters; Optional

Specify the account number.

Account Currency

Alphanumeric; 16 Characters; Optional

Specify the account currency.

IBAN

Alphanumeric; 40 Characters; Optional

Specify the IBAN (International Bank Account Number) of the account holder.

3.1.8 Projected Return Value Details Tab

In this section, you can override or alter the value of any load (including derived loads, if any) mapped to the selected fund and applicable for the transaction type, which is to be computed at the time of allocation. The frequency of computation for such loads would be "allocation".

Click on the ‘Projected Return Value’ tab to invoke the screen:

This section is only enabled for funds that have allocation time loads mapped to them as applicable for the transaction type.

Projected Return Value

Policy Number

Display

System displays the Policy Number.

Transaction Number

Display

System displays the Transaction Number.

Transaction Date

Display

System displays the Transaction Date.

Fund ID

Display

System displays the Fund ID.

Policy Holder

Display

System displays the Policy Holder.

Load ID

Display

System displays the Load ID.

Transaction Type

Display

System defaults the Transaction Type.

Ref Type

Display

System defaults the Reference Type.

Projected Return Value

Display

The System populates the return value from the load setup.

If there are criteria based loads, the criteria is evaluated during UT transaction generation and it will be used during allocation.

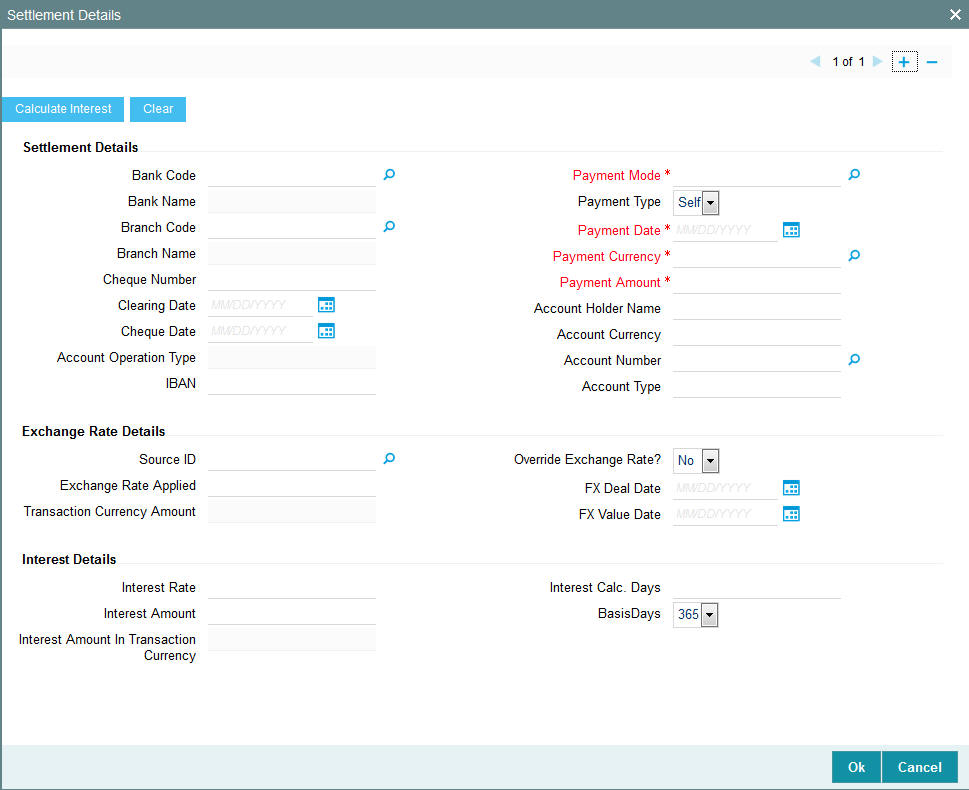

3.1.9 Payment Details Button

The Settlement Details screen is invoked when you click on this button.

Bank Code

Alphanumeric; 12 Characters; Optional

Specify the bank code from which the transfer of payment is being made.

Bank Name

Display

The system displays the name of the bank for the specified bank code.

Branch Code

Alphanumeric; 12 Characters; Optional

Specify the branch from which the transfer of payment is being made.

Branch Name

Display

The system displays the name of the branch for the selected branch code.

Cheque Number

Alphanumeric; 16 Characters; Optional

Specify the cheque number.

Clearing Date

Date Format; Optional

Select the date of clearing from the adjoining calendar.

Cheque Date

Date Format; Optional

Select the date of cheque from the adjoining calendar.

Account Operation Type

Display

The system displays the type of account operation.

IBAN

Alphanumeric; 40 Characters; Optional

Specify the IBAN (International Bank Account Number) of the account holder.

Payment Mode

Alphanumeric; 1 Character; Optional

Specify the mode of payment.

Payment Type

Optional

Select the type of payment from the drop-down list. The list displays the following values:

- Self

Payment Date

Date Format; Mandatory

Specify the date on which the initial investment was done. You can deposit the amount in different currencies and on different dates.

Payment Currency

Alphanumeric; 3 Characters; Mandatory

Enter the currency in which the initial investment is being done. The initial amount can be deposited in multiple currencies.

Payment Amount

Numeric; 30 Characters; Mandatory

Enter the initial investment amount being paid in the particular currency.

Account Holder Name

Alphanumeric; 100 Characters; Optional

Specify the account holder name.

Account Currency

Alphanumeric; 3 Characters; Optional

Specify the account currency of the account number from which the transfer of payment is being made.

Account Number

Alphanumeric; 16 Characters; Optional

Specify the account number from which the transfer of payment is being made.

Account Type

Alphanumeric; 1 Character; Optional

Specify the account type from which the transfer of payment is being made.

Exchange Rate Details

When you click the ‘Enrich’ button in the ‘Policy Information’ tab, the system will default the following exchange rate details for each settlement:

Source ID

Alphanumeric; 6 Characters; Optional

Specify the source ID.

Exchange Rate Applied

Numeric; 21 Characters; Optional

Specify the exchange rate applied. ID.

Transaction Currency Amount

Display

The system displays the transaction currency amount.

Override Exchange Rate

Optional

Select if exchange rate has to be overridden or not from the drop-down list. The list displays the following values:

- Yes

- No

FX Deal Date

Date Format; Optional

Select the FX deal date from the adjoining calendar.

FX Value Date

Date Format; Optional

Select the FX value date from the adjoining calendar.

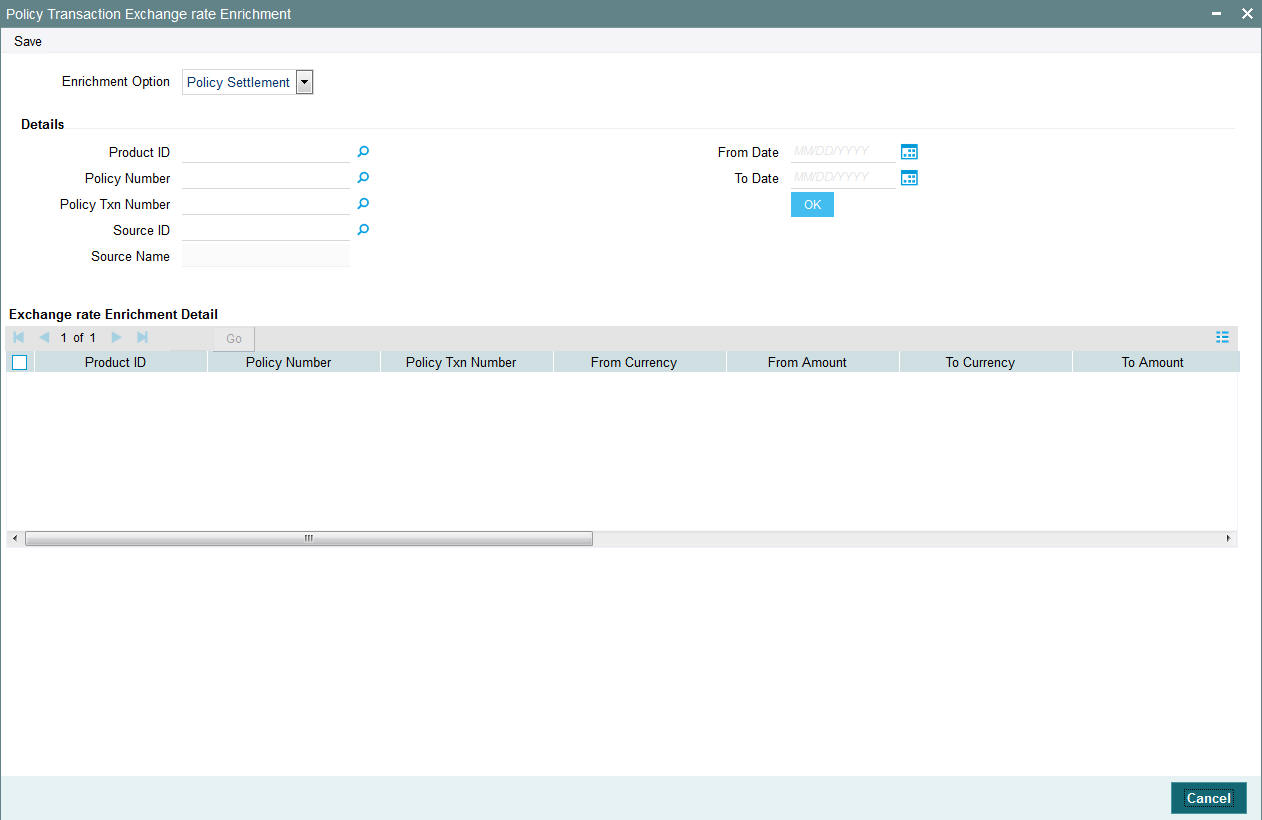

If exchange rate details are not available for any settlement when the transaction or policy is entered, the system will not generate a UT transaction. Once all the settlement details have been enriched in the ‘Policy Transaction Exchange Rate Enrichment’ screen and the ‘FCIS Enrich Exchange Rate Detail’ screen, the system will compute the transaction amount and generate the UT transaction. If it is not enriched, then the system will pick the exchange rate during EOD and generate the UT transaction.

Interest Details

When you click the ‘Enrich’ button in the ‘Policy Information’ tab, if the initial investment amount has been deposited prior to the policy start date, the system will calculate and display the interest on the payment amount in the ‘Policy Information’ tab. The interest will be calculated from the date of payment till the transaction date.

When you click ‘Calculate Interest’ button in the ‘Settlement Details’ screen, the system will calculate and display the interest amount in the ‘Interest Amount’ field in the same screen.

Interest Rate

Numeric; 12 Characters; Optional

Enter the rate of interest that is to be used to calculate interest amount for the particular currency. Alternatively, you can maintain the interest rate in the ‘Interest Rate Maintenance’ screen. If you do not maintain an interest rate, the system will take it as null.

Interest Amount

Numeric; 12 Characters; Optional

Specify the interest amount.

Interest Amount in Transaction Currency

Display Only

The system computes and displays the interest amount in terms of the transaction currency.

Interest Calc. Days

Numeric; 12 Characters; Optional

Specify the number of days for which interest calculation has to be done for a policy based on the policy start date and payment date.

Basis Days

Optional

Select the interest basis days, based on which the interest will be calculated. The options available are:

- 360

- 365

Click ‘Calculate Interest’ button to calculate the interest rate.

When you click the ‘Clear’ button, the interest-related details will be cleared.

3.1.10 Asset Allocation Button

The initial contribution towards the Policy can be directed into any number of mapped funds for the product, and annuity is paid out to the Policy Holder from any of these funds. The ratio of contributions received into the Policy to the annuity payouts for each of the mapped funds of the product, as specified at the time of Policy creation are displayed here. The initial contribution that you enter can be in different currencies. In this case, you need to mention the currency-wise details here.

Note

The asset allocation details that you specify here will be applicable to only the initial contribution towards the policy, and not the annuity and premium payments.

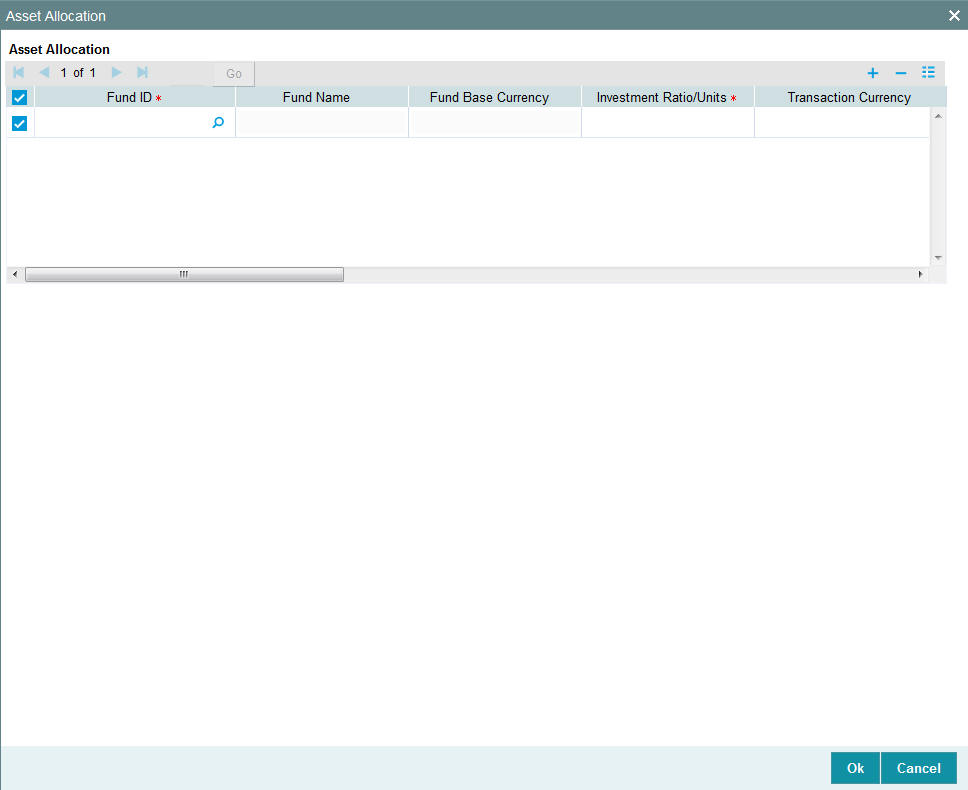

When you click ‘Asset Allocation’ button, the screen is invoked:

Enter information in the following fields:

Fund ID

Alphanumeric; 6 Characters; Mandatory

All the funds mapped for the selected product are displayed in the option list. Against each of these funds, you can specify the investment ratio and the annuity ratio.

Fund Name

Display

The system displays the name of the selected fund ID.

Fund Base Currency

Display

The system displays the fund base currency for the selected fund ID.

Investment Ratio/Units

Numeric; 27 Characters; Mandatory

For each fund that is displayed, specify the ratio of investment or the number of units to be made in the fund out of the total contribution towards the Policy. The sum total of the investment ratio should add up to 100.

If there are many currencies specified as part of settlements, then the system will not allow you to enter a ratio. Instead you need to enter the transaction currency and transaction amount for each currency. The system will compute and display the ratio based on the currency and amount details provided. To calculate the ratio, the transaction amounts will be

If the settlements are maintained in only one currency, then you can enter either the ratio or the transaction amount.

Note

If the type of policy is 'Balance Transfer-in' the number of units being transferred-in are mentioned and not the ratio of investment.

Transaction Currency

Alphanumeric; 3 Characters; Optional

Specify the transaction currency for the initial contribution. If many currencies have been mentioned in the settlements, then you are required to enter the amount for individual currencies. You can specify a transaction currency only if the transaction is amount-based.

Transaction Amount

Numeric; 18 Characters; Optional

Specify the transaction amount for the currency selected. If different currencies have been mentioned in settlements, then you can specify only the transaction amount. The system will default the ratio. If all the currencies in settlements are the same, then you can specify either the transaction amount or the ratio.

Note

- If you have checked the ‘Include Interest in Investment’ box, then the total of settlement and interest amounts for each currency needs to be equal to the asset allocation transaction amount for the currency.

- If the ‘Include Interest in Investment’ box has not been checked, then sum of currency wise settlement amount should be equal to the asset allocation transaction amount for the currency.

WAC

Numeric; 30 Characters; Optional

Specify the take-on WAC here. This will be used as the opening WAC in respective funds. CGT computation for initial investment transaction will be based on the take-on WAC

Note

WAC is mandatory in case of Balance Transfer-In type of policy.

Exchange Rate Source

Alphanumeric; 6 Characters; Optional

The system will display the exchange source maintained at default set-up in system parameters. You can change it by selecting the required exchange rate source from the adjoining option list. This will be used by the system to convert the transaction amount in terms of fund base currency.

Override Exchange Rate?

Optional

Select ‘Yes’ if you wish to change the exchange rate that is displayed here. If you select ‘Yes’, however, you need to specify the exchange rate to be used for the transaction in the ‘Exchange Rate Applied’ field. Select ‘No’ if you wish to retain the exchange rate that is displayed by the system.

Exchange Rate

Numeric; 21 Characters; Optional

The system will default the exchange rate available for the currency based on the exchange source specified. If you have elected to override the exchange rate, you need to enter the exchange rate to be used here. If exchange rate is not available, then the system will generate the transactions as incomplete ones. Such transactions can be enriched later through the ‘Policy Transaction Enrichment Screen’.

FX Deal Date

Date format; Optional

The system will default the starting date of the policy here. You can change it if required.

FX Value Date

Date format; Optional

The system will default the starting date of the policy here. You can change it if required.

KIID Compliant

Optional

Select if the policy is KIID compliant or not from the adjoining drop-down list. Following are the options available:

- Yes

- No

3.1.11 Premium Details Button

In this section, enter the details of the premium payment and the frequency at which the premium payments will be made.

You can enter the details for more than one premium.

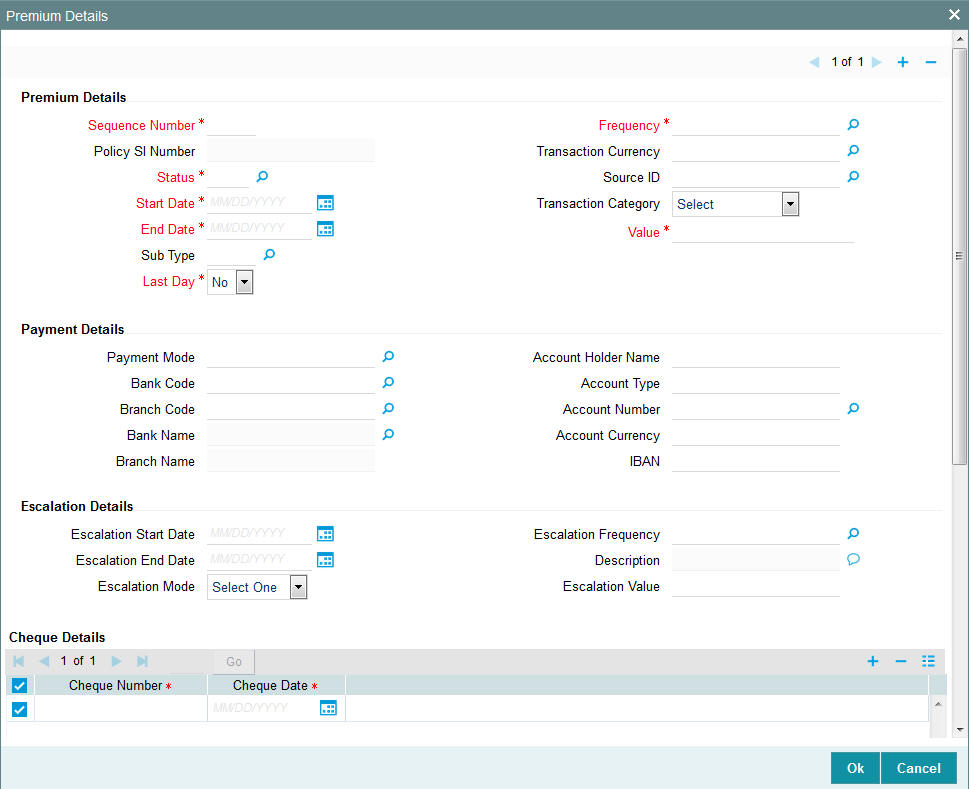

When you click on the ‘Premium Details’ button, the screen is invoked:

Enter information in the following fields:

Premium Details

Sequence Number

Numeric; 3 Characters; Mandatory

You can enter the sequence number.

Policy SI Number

Display

This number is generated by the system. It represents the number of premium payments between the Start Date and End Date specified for the premium payment.

Status

Alphanumeric; 1 Character; Mandatory

Select the status of the standing instruction for premium payment from the option list.

Note

If you select the status ‘STOP’, escalation will not be applied on the premium.

Transactions will not be generated for SIs on premiums whose status is ‘STOP’. It is possible for you to change the status of such SIs to ‘ACTIVE’ during amendment of the policy.

During amendment of a policy, you can change the status of an active SI, to ‘Paused’, ‘Stopped’ or ‘Cancelled’.

During amendment of an SI marked ‘Not Started’, you can change all details except the status of the SI. You will be allowed to delete the SI.

During amendment of an active SI:

- Escalation End Date can be amended only it is greater than the System Date

- Escalation Start Date and Escalation Frequency can be amended only if escalation has not been applied on the policy

Start Date

Date Format, Mandatory

Specify the date, beginning from which, the first premium payment is to be made for this Policy. Subsequent to this payment, premium payments will be made according to the premium frequency specified for the Policy.

Note

The Premium Start Date must not be equal to and earlier than the Policy Start Date.

End Date

Date Format, Mandatory

Specify the date on which the last premium payment will be made.

Note

The premium period of premium SIs cannot overlap.

Sub Type

Alphanumeric; 3 Characters; Optional

Specify the sub type.

Last Day

Mandatory

Select the last day from the drop-down list. The list displays the following values:

- Yes - If you select ‘Yes’, then the system will consider it as month-end order and the transaction get processed on the last day of the month.

- No - If you select ‘No’, then the system will consider it as date based instruction and the transaction will get processed on the exact date mentioned.

In case the SI date happens on a holiday, the system will consider the next working day for LEP transaction.

For a non-leap year, the system will consider 28th as the last day of the month for February, else the system will consider 29th as last day of the month for February.

This field is applicable for monthly, quarterly, half-yearly and Yearly frequencies.

This field will indicate if the SI is a date based SI or end of frequency (frequency could be monthly, quarterly, half-yearly and Yearly). If you have selected as ‘Yes’, then the system will process the subsequent SI on the last day of the frequency selected. If you have selected as ‘No’, then the system will process as per the given date. If it is the last date of any month, you need to select ‘Last Day’ field as ‘Yes’.

You can select ‘Yes’ only if the Premium start date is selected as 31st of any month. For the other dates which are not a valid last days of the month, you need to select ‘No’.

If you select 30th January as Start date and select ‘Last Date’ field as ‘Yes’, then the system will display an error message as ‘Premium Start Date is not month end, Last Day cannot be selected as Yes’

If you have selected a valid month end date, for instance, 28th of Feb (not a Leap Year) then the system will allow you to save the record without any error message.

Frequency

Alphanumeric; 1 Character; Mandatory

Specify the frequency at which the premium payments will be made, for this Policy, by the Policy Holder.

Transaction Currency

Alphanumeric; 3 Characters’ Optional

Specify the transaction currency.\

Source ID

Alphanumeric; 6 Characters; Optional

Specify the source ID.

Transaction Category

Alphanumeric; 1 Character; Optional

Select the transaction category from the adjoining drop-down list. Following are the options available:

- Legal

- Advised Business

- Execution Only

Description

Display

The system displays the description for the selected transaction category.

Value

Numeric, 30 Characters; Mandatory

Specify the amount paid by the Policy Holder as the premium amount for the Policy.

Payment Details

Payment Mode

Alphanumeric; 2 Characters; Optional

Select the mode of the premium payment.

You have the following options:

- Cheque

- Transfer

Bank Code

Alphanumeric; 12 Characters; Optional

Specify the bank code from which the transfer of payment is being made. The adjoining option list displays valid bank codes maintained in the system. You can choose the appropriate one.

Branch Code

Alphanumeric; 12 Characters; Optional

Specify the branch from which the transfer of payment is being made.

Bank Name

Display

The system displays the name of the bank for the selected bank code.

Branch Name

Display

The system displays the name of the branch for the selected branch code.

Account Holder Name

Alphanumeric; 100 Characters; Optional

Specify the account holder name.

Account Type

Alphanumeric; 1 Character; Optional

Specify the account type from which the transfer of payment is being made.

Account Number

Alphanumeric; 16 Characters; Optional

Specify the account number from which the transfer of payment is being made.

Account Currency

Alphanumeric; 3 Characters; Optional

Specify the account currency of the account number from which the transfer of payment is being made.

IBAN

Alphanumeric; 40 Characters; Optional

Specify the IBAN (International Bank Account Number) of the account holder.

Escalation Details

Enter escalation information in the following fields:

Escalation Start Date

Date Format, Optional

Specify the date from which escalation will commence. This date must be earlier than the End Date of the Policy, and must be later than the Premium Start Date.

Escalation End Date

Date Format, Optional

Specify the date from which the escalation must cease to be applied on the annuity. This date must be later than the Premium Start Date. If the Premium Escalation Start Date has been specified, then the End Date is mandatory and must be specified.

Escalation Mode

Optional

Annuity payments can be escalated periodically as a pre-defined percentage, amount or market value. Select the mode from the drop-down list.

Escalation Frequency

Alphanumeric; 1 Character; Optional

Select the frequency at which the escalation is to be applied, from the values in the drop-down list. If the Start Date has been specified, the frequency is mandatory and must be specified.

Description

Display

The system displays the description for the selected escalation frequency.

Escalation Value

Numeric; 30 Characters; Optional’

Specify the escalation amount that is to be applied.

Cheque Details

Enter the check details in the following fields:

Cheque Number

Alphanumeric; 16 Characters; Mandatory

Enter the cheque number of the cheque by which the premium is being paid.

Cheque Date

Date Format, Mandatory

Enter the cheque date of the cheque by which the premium is being paid.

Asset Allocation

Fund ID

Alphanumeric; 6 Characters; Mandatory

Specify the fund ID. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

Fund Name

Display

The system displays the name of the selected fund ID.

Ratio

Numeric; 6 Characters; Mandatory

Specify the percentage of asset allocation.

3.1.12 Annuity Details Button

As mentioned earlier, this section is available only if, for the product you have chosen, you have selected the option ‘Annuity Applicable?’ in the Premium and Annuities section of the Product Maintenance Details screen.

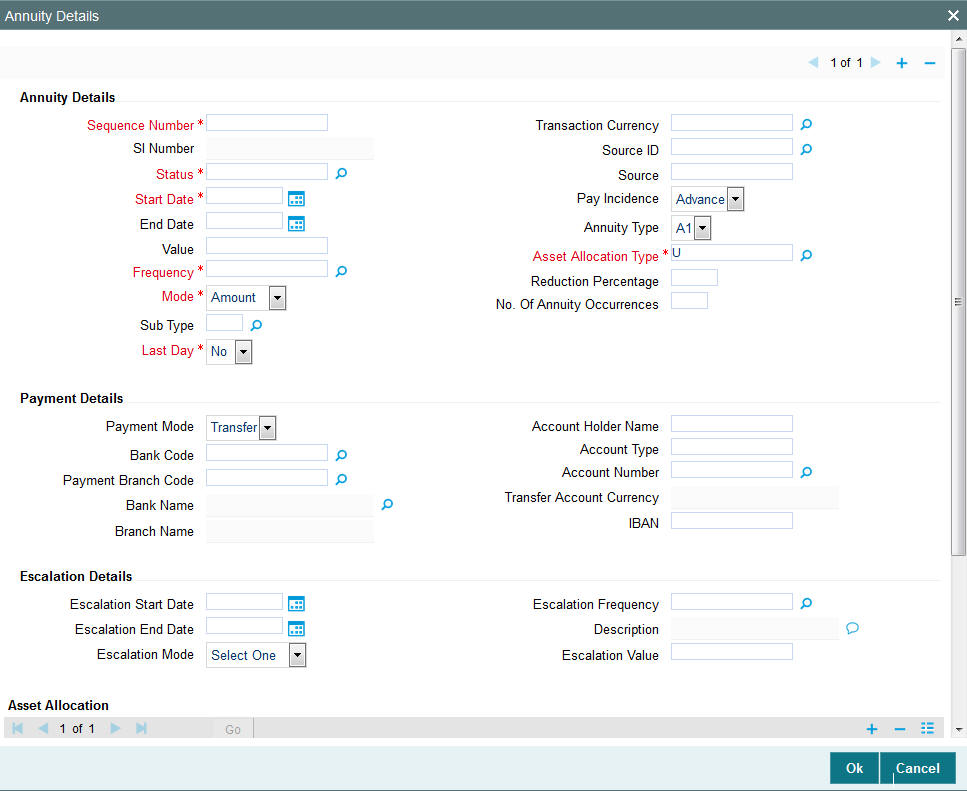

If, for the product you have chosen, annuity details are applicable, the ‘Annuity Details’ screen is invoked when you click on the Annuity Details tab:

Annuity Details

Sequence Number

Numeric; 22 Characters; Optional

You can enter the sequence number.

SI Number

Display

When you save the details of the Policy you are entering, the Standing Instructions or SI Number will be generated by the system and displayed.

Status

Alphanumeric; 1 Character; Mandatory

Select the status of the standing instruction of the annuity payment from the option list. The options are:

- A-Active

- C-Cancel

- N-Not Started

- P-Pause

- S-Stop

Note

If you select the status ‘STOP’, escalation will not be applied on the annuity.

Transactions will not be generated for SIs on annuities whose status is ‘STOP’. It is possible for you to change the status of such SIs to ‘ACTIVE’ during amendment of the policy.

During amendment of a policy, you can change the status of an active SI, to ‘Paused’, ‘Stopped’ or ‘Cancelled’. However, if you have checked the box ‘Phase-In’, you will not be allowed to select the options ‘Paused’ and ‘Stopped’.

During amendment of an SI marked ‘Not Started’, you can change all details except the status of the SI. You will be allowed to delete the SI.

During amendment of an active SI:

- Escalation End Date can be amended only it is greater than the System Date

- Escalation Start Date and Escalation Frequency can be amended only if escalation has not been applied on the policy

Start Date

Date Format, Mandatory

Specify the date, beginning from which, the annuity payment is to be made for this Policy. Subsequent to this payment, annuity payments will be made according to the annuity frequency specified for the Policy.

Note

The Annuity Start Date must not be equal to and earlier than the Policy Start Date.

End Date

Date Format, Optional

Specify the date on which the last annuity payment is to be made for this Policy. This date must not be the same as the Annuity Start Date.

Note

The annuity period for annuity SIs cannot overlap.

Value

Numeric, 30 Characters; Optional

The amount that is to be paid as annuity to the Policy Holder over a time period in definite intervals / frequencies against the initial investment towards this Policy in this Product is displayed here. You can change this amount at this stage.

Note

The is not applicable if the type of policy is 'Accelerated Annuity'

If the value specified here is a percentage, it must be within the Annuity Minimum Ratio and the Annuity Maximum Ratio specified at product level.

Note

If you have selected the option ‘Amount’ against the field Mode, the value you enter will be the annuity amount to be paid in the frequency specified. If you have selected the option ‘Percentage’, the percentage value of the policy annuity amount will be calculated and paid in the frequency specified.

The same is illustrated with the following example:

Case 1

The Mode is ‘Amount’. Value is 1000 currency units. Frequency is Monthly. In this case, 1000 currency units will be paid to the policy holder every month.

Case 2

The Mode is ‘Percentage’. Value is 10%. Frequency is Monthly. In this case, 10% of the policy anniversary amount will be paid to the policy holder in that year.

Frequency

Alphanumeric; 1 Character; Mandatory

Specify the frequency at which annuity payments must be made for this Policy.

Mode

Mandatory

Annuity payments can be made either as a percentage of the net investment amount or as a flat amount. Accordingly, select the appropriate mode from the drop-down list. The options are as follows:

- Amount

- Annual %

Note

This is not applicable if the type of policy is 'Accelerated Annuity'.

Sub Type

Alphanumeric; 3 Characters; Optional

Specify the sub type.

Last Day

Mandatory

Select ‘Yes’ to maintain annuity details to the last day of a month from the drop-down list. The list displays the following values:

- Yes

- No

If you select ‘Yes’, then the system will process the transaction on the last day of the month irrespective of dates mentioned.

If you select ‘No’ then the system will consider SI date maintained.

If SI date happens on a holiday, then the system considers the next working day for LEP.

For non-leap year, the system will consider 28th as the last day of the month for February. For leap year, the system will consider 29th as the last day of the month for February.

Transaction Currency

Alphanumeric; 3 Characters; Optional

Specify the code of the transaction currency. The adjoining option list displays all valid currency codes along with their description. You can choose the appropriate one.

Source ID

Alphanumeric; 6 Characters; Optional

Specify the source ID.

Source

Alphanumeric; 20 Characters; Optional

Specify the source details.

Pay Incidence

Optional

The payment incidence for an annuity payment sets up the actual payout incidence within the specified frequency for the annuity payment. Select the pay incidence from the drop-down list. The list displays the following values:

- Advance

- Arrear

Annuity Type

Optional

Select the desired annuity type that is to be applicable for this Policy, from the options provided in the drop-down list.

For information purposes only, the annuitant has the option of specifying the type of annuity that should accrue. The four types provided are as follows:

- A1: In this type, the annuity is a single life annuity payable until the death of the annuitant.

- A2: In this type, the annuity is a joint life and last survivor annuity and is payable until the last death of both annuity and spouse, that is, while at least one of the annuitant or spouse is alive.