10. Common Reporting Standard

This chapter contains the following sections:

- Section 10.1, "Common Reporting Standard"

- Section 10.2, "PARAM Maintenance"

- Section 10.3, "Tax Compliance Setup"

- Section 10.4, "Tax Compliance Setup Summary"

- Section 10.5, "Tax Compliance Source Country Maintenance"

- Section 10.6, "Tax Compliance Source Country Maintenance Summary"

- Section 10.7, "Tax Compliance Document Maintenance"

- Section 10.8, "Tax Compliance Document Maintenance Summary Screen"

- Section 10.9, "Tax Compliance Classification Document Maintenance"

- Section 10.10, "Tax Compliance Classification Document Maintenance Summary"

- Section 10.11, "Third Party Maintenance Detail"

- Section 10.12, "Third Party Entity Maintenance Summary"

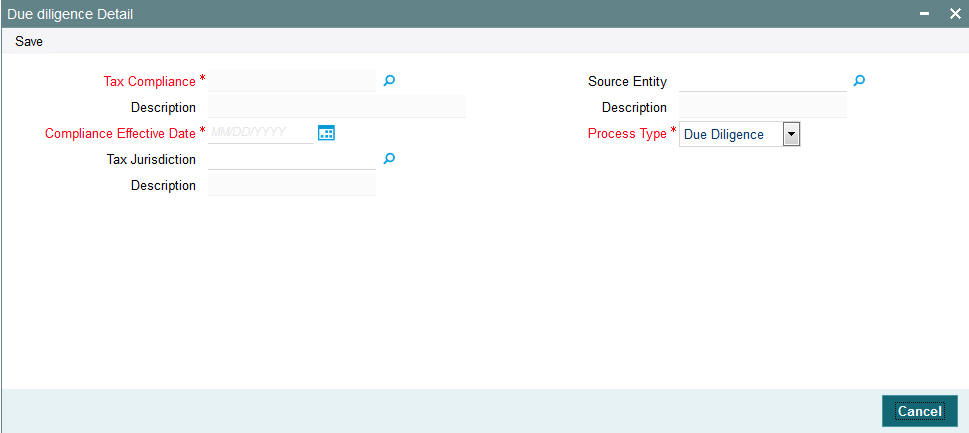

- Section 10.13, "Due Diligence Detail"

10.1 Common Reporting Standard

The Common Reporting Standard (CRS), formally referred to as the Standard for Automatic Exchange of Financial Account Information, is an information standard for the Automatic Exchange Of Information (AEOI), developed in the context of the Organization for Economic Co-operation and Development (OECD). The legal basis for exchange of data is the Convention on Mutual Administrative Assistance in Tax Matters and the idea is based on the USA Foreign Account Tax Compliance Act (FATCA) implementation agreements.

On May 6, 2014, Forty-seven countries tentatively agreed on a ‘Common Reporting Standard’, an agreement to share information on resident’s assets and incomes automatically in conformation with the standard. Until now, the parties to most treaties which are in place for sharing information have shared information upon request, which has not proved effective in preventing tax evasion. The new system will automatically and systematically transfer all the relevant information. This agreement is informally referred to as GATCA (the Global version of FATCA), but ‘CRS is not just an extension of FATCA’.

Endorsing countries included all OECD countries, as well as Argentina, Brazil, China, Colombia, Costa Rica, India, Indonesia, Latvia, Lithuania, Malaysia, Saudi Arabia, Singapore, and South Africa. In September 2014, the G-20, at its meeting in Cairns, Australia, issued the G20 Common Reporting Standard Implementation Plan as part of its official resources.

On 29 October 2014, 51 jurisdictions signed an agreement to automatically exchange information based on Article 6 of the Convention on Mutual Administrative Assistance in Tax Matters. This agreement specifies the details of what information will be exchanged and when, as set out in the Standard. China, Hong Kong and more than 80 countries have agreed to become signatories.

10.2 PARAM Maintenance

This section contains the following topics:

10.2.1 Maintaining PARAM Codes

Following PARAM codes support Common Reporting Standard:

Param Code |

Param description |

Max Length (Param Value) |

Maintainable |

Param Value-Param Text (Examples of List of Values) |

COMPLIANCECODES |

The regulatory rule applicable e.g. Common Reporting Standard |

10 |

Yes |

CRS- Common Reporting Standard |

COMPLIANCECLASSIND |

Classification individual |

10 |

Yes |

RIA-Resident Individual Account FIA-Foreign Individual Account NRIA-Non Resident Individual Account |

COMPLIANCECLASSCORP |

Classification –Corporate |

10 |

Yes |

FI- Financial Institution NFI- Non reportable FI NFE- Non Financial Entity PNFE- Passive NFE |

COMPLIANCECLASSREASON |

Classification Reasons |

10 |

Yes |

1.RES-Resident 2.ARUSP-Auth Rep is a resident 3. BIRTH-Country of Birth 4. NA-Not applicable |

MASTERDOCIND |

Document for individuals |

Max |

Yes |

Self Certification or KYC documents |

MASTERDOCCORP |

Document for corporate |

MAX |

Yes |

Self certification or KYC documents |

MASTERDOCCAT |

Category of the documents |

MAX |

Yes |

Address Proof ID Identification Self certification |

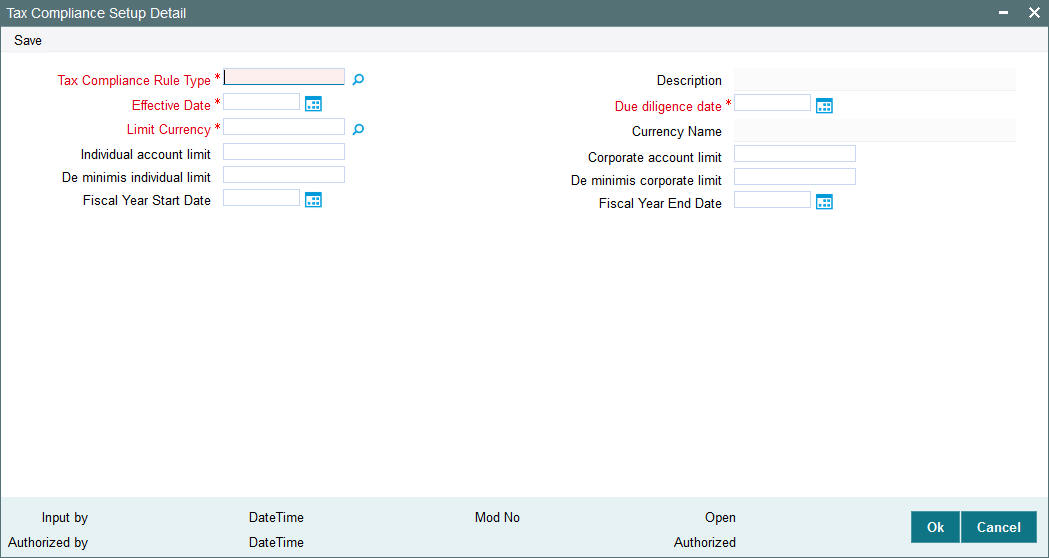

10.3 Tax Compliance Setup

This section contains the following topics:

10.3.1 Invoking Tax Compliance Setup Screen

You can capture tax compliance type, limit maintenance, limit currency details etc. You can also maintain the financial calendar year for reporting account balance.

As part of reporting requirement, you need to submit the account balance as on a calendar year for high value reportable accounts. The financial start and end date field will define the calendar year followed for the reporting.

You can define the rule effective date, due diligence date, individual account limit, corporate account limit and calendar year to be followed for reporting using ‘Tax Compliance Setup Detail’ screen. You can invoke this screen by typing ‘UTDTCS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

Tax Compliance Rule Type

Alphanumeric; 10 Characters; Mandatory

Specify the tax compliance codes applicable based on rules maintained at PARAMS. Alternatively, you can select tax compliance code from the option list. The list displays all valid tax compliance maintained in the system.

Description

Display

The system displays the description for the selected tax compliance code.

Effective Date

Date Format; Mandatory

Select the effective date for the tax rule to be applicable in the system from the adjoining calendar.

Due Diligence Date

Date Format; Mandatory

Select the due diligence date for the rule being implemented.

Limit Currency

Alphanumeric; 3 Characters; Mandatory

Specify the limit currency in which the tax rule type is applicable.

Currency Name

Display

The system displays the name of the currency for the selected limit currency code.

Individual Account Limit

Numeric; 18 Characters; Optional

Specify the account balance value for individual account.

Corporate Account Limit

Numeric; 18 Characters; Optional

Specify the account balance value for corporate accounts.

De minimis Individual Limit

Numeric; 18 Characters; Optional

Specify the de-minimis limit for individual account.

De-minimis Corporate Limit

Numeric; 18 Characters; Optional

Specify the di-minimis limit for corporate accounts.

Fiscal Year Start Date

Date Format; Mandatory

Specify the financial year start date for reporting the account balances of the reportable account.

Fiscal Year End Date

Date Format; Mandatory

Specify the financial year end date for reporting the account balances of the reportable account.

Note

Once the financial year start and end date are authorized, you cannot change these values. The system will do the incremental date change.

You can create only one Tax compliance type in the system, for instance, for Compliance type selected as Common Reporting Standard, the system will not allow one more tax compliance type for common reporting standard.

Once saved and authorized, you cannot delete or change the Tax rule and effective date.

The rule will be applicable across UT and LEP income for a UH and reportable country. The unit holder income reportable will be for confirmed units which include blocked units as well.

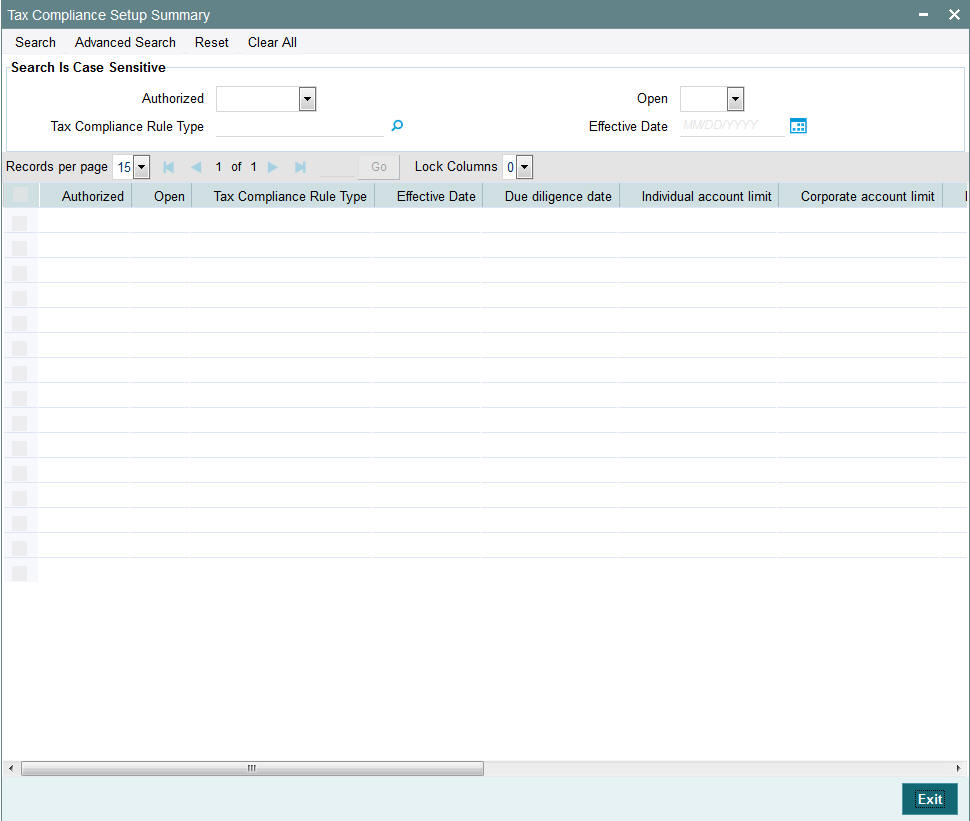

10.4 Tax Compliance Setup Summary

This section contains the following topics:

- Section 10.4.1, "Retrieving Tax Compliance Record"

- Section 10.4.2, "Editing Tax Compliance Record"

- Section 10.4.3, "Viewing Tax Compliance Record"

- Section 10.4.4, "Authorizing Tax Compliance Record"

- Section 10.4.5, "Amending Tax Compliance Records"

- Section 10.4.6, "Authorizing Amended Tax Compliance Details"

10.4.1 Retrieving Tax Compliance Record

You can view Tax compliance details using ‘Tax Compliance Setup Summary’ screen. You can invoke this screen by typing ‘UTSTCS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can retrieve a previously entered tax compliance record in the Summary screen, as follows:

- Invoke Tax Compliance Setup Summary screen and specify the following:

- The authorization status of the entity in the Authorized field. If you choose the “Blank Space” option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the “Blank Space” option, then all the record are retrieved.

- Tax Compliance Rule Type

- Effective Date

- After you have specified the required details, click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve an individual tax compliance detail from the Detail screen by doing query in the following manner:

- Press F7

- Input Tax Compliance Rule Type

- Press F8

You can perform Edit, Amend, Authorize operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

For example, you can search the record for tax compliance code by using the combination of % and alphanumeric value.

- Search by A%: The system will fetch all the records whose Tax Compliance Rule Type starts from Alphabet ‘A’. For example, ACCB.

- Search by %7: The system will fetch all the records whose Tax Compliance Rule Type has 7. For example: ACT7

10.4.2 Editing Tax Compliance Record

You can modify the details of the tax compliance details that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Tax Compliance Setup Summary screen from the Browser.

- Select the authorization status of the tax compliance records that you want to retrieve for modification in the Authorization Status field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option from the drop-down list.

- Specify any or all of the search parameters of the tax compliance in the corresponding fields.

- Click ‘Search’ button. All unauthorized tax compliance records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify. The Tax Compliance Setup Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save the changes. The Tax Compliance Setup screen is closed and the changes made are reflected in the Summary screen.

10.4.3 Viewing Tax Compliance Record

To view the tax compliance record that you have previously entered:

- Invoke the Tax Compliance Setup Summary Screen from the Browser.

- Select the authorization status of the tax compliance records that you want to retrieve for viewing in the Authorization Status field. You can also view all tax compliance records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the search parameters.

- Click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view. The Tax Compliance Setup Detail screen is displayed in view mode.

10.4.4 Authorizing Tax Compliance Record

An unauthorized tax compliance record must be authorized in the system for it to be processed. To authorize a tax compliance record:

- Invoke the Tax Compliance Setup Summary screen from the Browser.

- Select the status of the Tax Compliance Setup record that you want to retrieve for authorization. Typically, choose the unauthorized option from the drop-down list.

- Specify any or all of the search parameters of the Tax Compliance Setup in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the Tax compliance record that you wish to authorize. The Tax Compliance Setup screen displayed. Select Authorize operation from Action.

When the checker authorizes an tax compliance record, details of validations, if any, that were overridden by the maker of the record during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the tax compliance record.

10.4.5 Amending Tax Compliance Records

After a tax compliance is authorized, it can be modified using the Unlock operation from Action list. To make changes to a tax compliance record after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the Tax Compliance Setup Summary screen from the Browser.

- Select the status of the tax compliance records that you wish to retrieve for amendment. You can only amend records of tax compliance that are authorized.

- Specify any or all of the search parameters.

- Click ‘Search’ button. All tax compliance records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the tax compliance record that you want to amend. The Tax Compliance Setup screen is displayed in Amendment mode.

- Click the Unlock operation from the Action list to amend the tax compliance parameters.

- Amend the necessary information. Click the Save button to save the changes.

10.4.6 Authorizing Amended Tax Compliance Details

An amended tax compliance record must be authorized for the amendment to be made effective in the system.

The process of authorization is the same as that of normal authorization process.

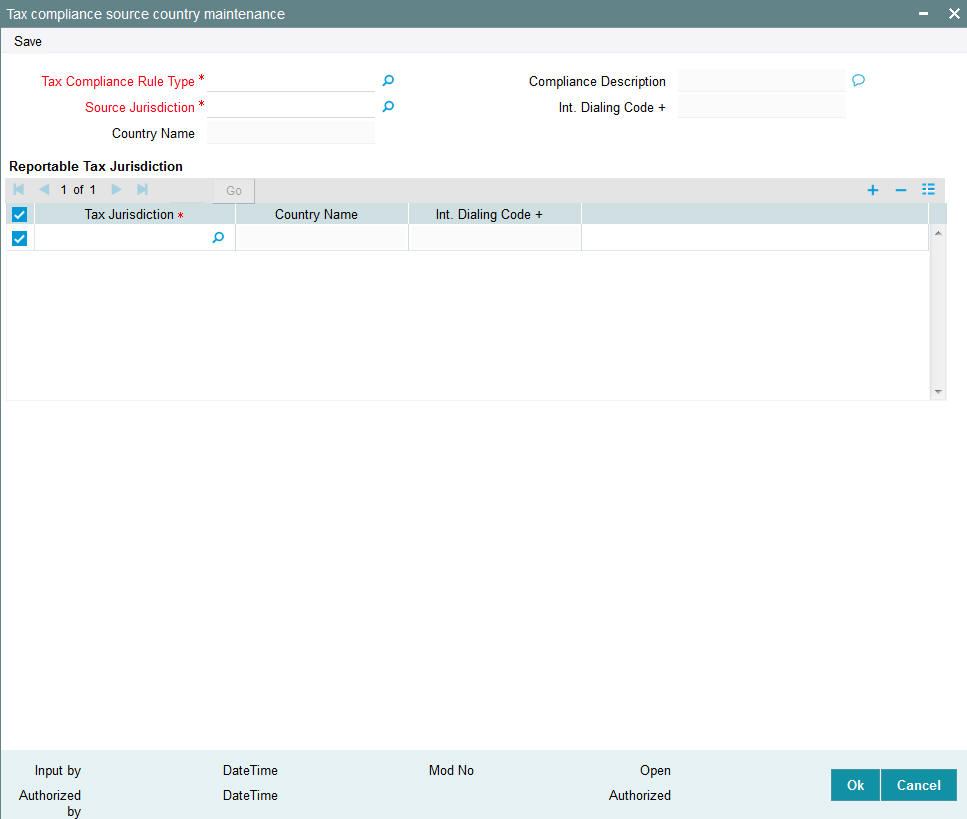

10.5 Tax Compliance Source Country Maintenance

This section contains the following topics:

10.5.1 Invoking Tax Compliance Source Country Maintenance Screen

You can maintain source country and the respective reportable countries for a rule type using ‘Tax Compliance Source Country Maintenance’ screen. For instance, for a Rule type Common Reporting standard, you can maintain a source country for an LOB with multiple reportable countries.

You can invoke ‘Tax Compliance Source Country Maintenance’ screen by typing ‘UTDTCSCM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

Tax Compliance Rule Type

Alphanumeric; 10 Characters; Mandatory

Specify the tax compliance rule type based on rules maintained at PARAMS. Alternatively, you can select tax compliance code from the option list. The list displays all valid tax compliance code maintained in the system.

Compliance Description

Display

The system displays the description for the selected tax compliance code.

Source Jurisdiction

Alphanumeric; 3 Characters; Mandatory

Specify the source jurisdiction code. Alternatively, you can select source jurisdiction code from the option list. The list displays all valid source jurisdiction code maintained in the system.

Int. Dialing Code +

Display

The system displays the international dialling code based on the source jurisdiction code maintained. For instance, if you have selected source jurisdiction code as India, then the system will display international dialling code as 91.

Country Name

Display

The system displays the name of the country for the selected source jurisdiction code.

Reportable Tax Jurisdiction

Tax Jurisdiction

Alphanumeric; 3 Characters; Mandatory

Specify the tax jurisdiction code. Alternatively, you can select tax jurisdiction code from the option list. The list displays all valid tax jurisdiction code maintained in the system.

Country Name

Display

The system displays the name of the country for the selected source jurisdiction code.

Int. Dialing Code +

Display

The system displays the international dialling code based on the source jurisdiction code maintained. For instance, if you have selected source jurisdiction code as India, then the system will display international dialling code as 91.

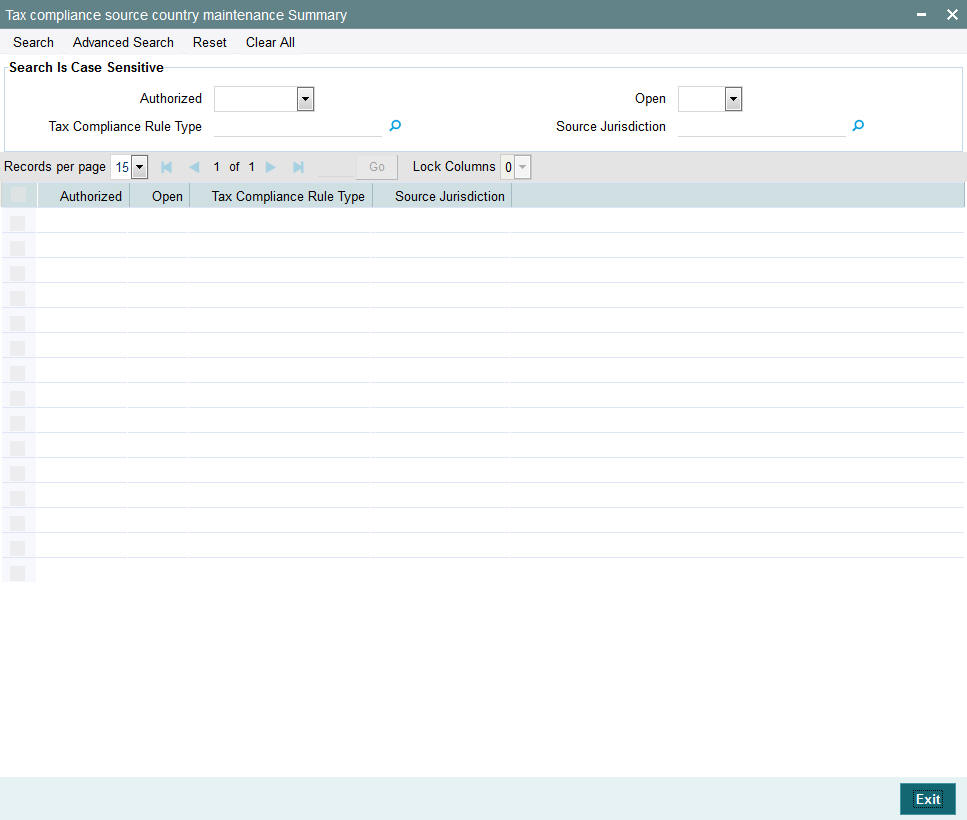

10.6 Tax Compliance Source Country Maintenance Summary

This section contains the following topics:

- Section 10.6.1, "Retrieving Tax Compliance Source Country Record"

- Section 10.6.2, "Editing Tax Compliance Source Country Record"

- Section 10.6.3, "Viewing Tax Compliance Source Country Record"

- Section 10.6.4, "Deleting Tax Compliance Source Country Record"

- Section 10.6.5, "Authorizing Tax Compliance Source Country Record"

- Section 10.6.6, "Amending Tax Compliance Source Country Records"

- Section 10.6.7, "Authorizing Amended Tax Compliance Source Country Details"

10.6.1 Retrieving Tax Compliance Source Country Record

You can view Tax compliance source country details using ‘Tax Compliance Source Country Maintenance Summary’ screen. You can invoke this screen by typing ‘UTSTCSCM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can retrieve a previously entered tax compliance source country record in the Summary screen, as follows:

- Invoke Tax Compliance Source Country Maintenance Summary screen and

specify the following:

- The authorization status of the entity in the Authorized field. If you choose the “Blank Space” option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the “Blank Space” option, then all the record are retrieved.

- Tax Compliance Rule Type

- Source Jurisdiction

- After you have specified the required details, click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve an individual tax compliance detail from the Detail screen by doing query in the following manner:

- Press F7

- Input any parameter in the screen

- Press F8

You can perform Edit, Delete, Amend, Authorize operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

For example, you can search the record for tax compliance code by using the combination of % and alphanumeric value.

- Search by A%: The system will fetch all the records whose Tax Compliance Rule Type starts from Alphabet ‘A’. For example, ACCB.

- Search by %7: The system will fetch all the records whose Tax Compliance Rule Type has 7. For example: ACT7

10.6.2 Editing Tax Compliance Source Country Record

You can modify the details of the tax compliance source country details that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Tax Compliance Source Country Maintenance Summary screen from the Browser.

- Select the authorization status of the tax compliance source country records that you want to retrieve for modification in the Authorization Status field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option from the drop-down list.

- Specify any or all of the search parameters of the tax compliance source country in the corresponding fields.

- Click ‘Search’ button. All unauthorized tax compliance source country records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify. The Tax Compliance Source Country Maintenance Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save the changes. The Tax Compliance Source Country Maintenance screen is closed and the changes made are reflected in the Summary screen.

10.6.3 Viewing Tax Compliance Source Country Record

To view the tax compliance source country record that you have previously entered:

- Invoke the Tax Compliance Source Country Maintenance Summary Screen from the Browser.

- Select the authorization status of the tax compliance source country records that you want to retrieve for viewing in the Authorization Status field. You can also view all tax compliance records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the search parameters.

- Click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view. The Tax Compliance Source Country Maintenance Detail screen is displayed in view mode.

10.6.4 Deleting Tax Compliance Source Country Record

You can delete only unauthorized records in the system. To delete a tax compliance source country record:

- Invoke the Tax Compliance Source Country Maintenance Summary screen from the Browser.

- Select the status of the tax compliance records that you want to retrieve for deletion.

- Specify any or all of the search parameters.

- Click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the tax compliance record that you want to delete. The Tax Compliance Source Country Maintenance Detail screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

10.6.5 Authorizing Tax Compliance Source Country Record

An unauthorized tax compliance source country record must be authorized in the system for it to be processed. To authorize a tax compliance record:

- Invoke the Tax Compliance Source Country Maintenance Summary screen from the Browser.

- Select the status of the Tax Compliance Source Country Maintenance record that you want to retrieve for authorization. Typically, choose the unauthorized option from the drop-down list.

- Specify any or all of the search parameters of the Tax Compliance Source Country in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the Tax compliance source country record that you wish to authorize. The Tax Compliance Source Country Maintenance screen displayed. Select Authorize operation from Action.

When the checker authorizes an tax compliance record, details of validations, if any, that were overridden by the maker of the record during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the tax compliance record.

10.6.6 Amending Tax Compliance Source Country Records

After a tax compliance source country is authorized, it can be modified using the Unlock operation from Action list. To make changes to a tax compliance source country record after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the Tax Compliance Source Country Maintenance Summary screen from the Browser.

- Select the status of the tax compliance source country records that you wish to retrieve for amendment. You can only amend records of tax compliance source country that are authorized.

- Specify any or all of the search parameters.

- Click ‘Search’ button. All tax compliance source country records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the tax compliance source country record that you want to amend. The Tax Compliance Source Country Maintenance screen is displayed in Amendment mode.

- Click the Unlock operation from the Action list to amend the tax compliance source country parameters.

- Amend the necessary information. Click the Save button to save the changes.

10.6.7 Authorizing Amended Tax Compliance Source Country Details

An amended tax compliance source country record must be authorized for the amendment to be made effective in the system.

The process of authorization is the same as that of normal authorization process.

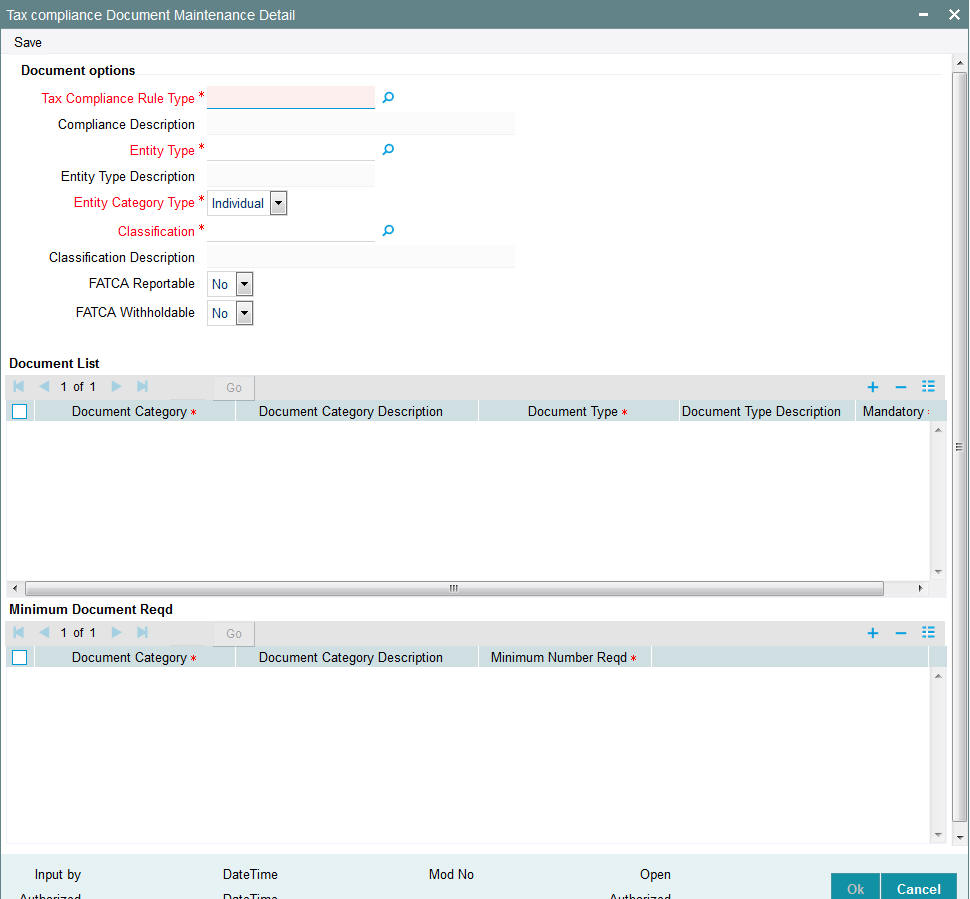

10.7 Tax Compliance Document Maintenance

This section contains the following topics:

10.7.1 Invoking Tax Compliance Document Maintenance Screen

You can maintain the list of tax compliance Document details in the ‘Tax Compliance Document Maintenance Detail’ screen. To invoke this screen type ‘UTDFATDT’ in the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

You can specify the following in this screen:

Document Options

Tax Compliance Rule Type

Alphanumeric; 10 Characters; Mandatory

Specify the tax compliance rule type. Alternatively, you can select Tax compliance rule type from the option list. The list displays all valid tax compliance rule type maintained in the system.

Compliance Description

Display

The system displays the description for the selected tax compliance rule type.

Entity Type

Alphanumeric; 2 Characters; Mandatory

Specify the FATCA entity type. Alternatively, you can select entity rule from the option list. The list displays all valid entity type maintained in the system.

Entity Type Description

Display

The system displays the description for the selected entity type.

Entity Category Type

Mandatory

Select the entity category type from the drop-down list. The list displays the following values:

- Individual

- Corporate

Classification

Alphanumeric; 25 Characters; Mandatory

Select the FATCA Classification. Alternatively, you can select entity rule from the option list. The list displays all valid entity type maintained in the system.

Classification Description

Display

The system will display the description based on the selected FATCA Classification.

FATCA Reportable

Optional

FATCA Reportable gets defaulted from the FATCA document maintenance for the entity selected. You can change the value from ‘Yes’ to ‘No’, but vice versa is not allowed.

The system defaults FATCA Reportable as ‘No’.

FATCA Withholdable

Optional

FATCA With holdable gets defaulted from the FATCA document maintenance for the entity selected. You can change the value from ‘Yes’ to ‘No’, but vice versa is not allowed.

The system defaults FATCA With holdable as ‘No’.

Document List

Document Category

Alphanumeric; 25 Characters; Mandatory

Select the category of the document. Alternatively, you can select document category from the option list. The list displays all valid document category maintained in the system.

Document Category Description

Display

The system displays the document category description based on the selected document category.

Document Type

Alphanumeric; 25 Characters; Mandatory

Select the type of document. Alternatively, you can select document type from the option list. The list displays all valid document type maintained in the system.

Document Type Description

Display

The system displays the document type based on the selected document type.

Mandatory

Mandatory

Select if the document is mandatory or optional from the drop-down list. The list displays the following values:

- Standard - This indicates that the document is mandatory

- Additional - This indicates that the document is optional

Select the appropriate option.

Minimum Document Reqd

Document Category

Alphanumeric; 25 Characters; Mandatory

Select the document category. Alternatively, you can select document category from the option list. The list displays all valid document category maintained in the system.

Document Category Description

Display

The system displays the document category description based on the selected document category.

Minimum Number Reqd

Numeric; 22 Characters; Mandatory

Specify the minimum number of the standard documents that is required.

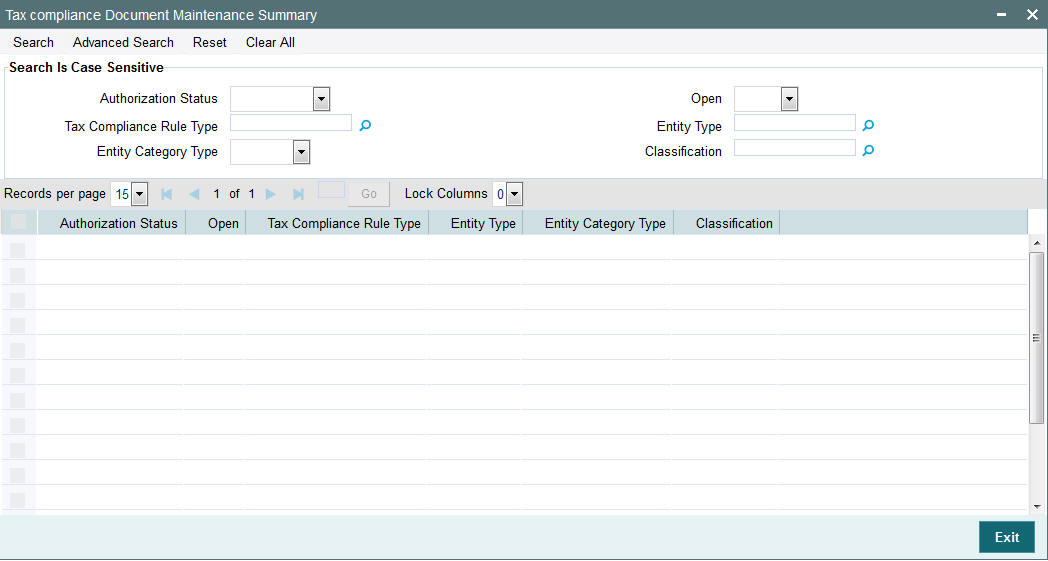

10.8 Tax Compliance Document Maintenance Summary Screen

This section contains the following topics:

- Section 10.8.1, "Retrieving Tax Compliance Document Maintenance Details"

- Section 10.8.2, "Modifying Tax Compliance Document Maintenance Details"

- Section 10.8.3, "Authorizing Tax Compliance Document Maintenance Details"

10.8.1 Retrieving Tax Compliance Document Maintenance Details

You can view tax compliance document Maintenance details using ‘Tax Compliance Document Maintenance Summary’ screen. You can invoke this screen by typing ‘UTSFATDT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can perform the following actions using this screen

You can view previously entered details of Tax compliance document Maintenance in the ‘Tax Compliance Document Maintenance Summary’ screen, as follows:

- Specify any or all of the following details in the ‘Tax Compliance

Document Maintenance Summary’ screen:

- The status of the record in the Authorization Status field. If you choose the ‘Blank Space’ option, then all the records that involve the specified Tax compliance document Maintenance are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all the records that involve the specified tax compliance document Maintenance are retrieved.

- Tax Compliance Rule Type

- Entity Type

- Entity Category Type

- Classification

Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also search the record by using combination of % and alphanumeric value.

10.8.2 Modifying Tax Compliance Document Maintenance Details

You can modify authorized or unauthorized records in the system. To modify a record that you have previously entered:

- Invoke the ‘Tax Compliance Document Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for modification.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify. The ‘Tax Compliance Document Maintenance Detail’ screen is displayed.

- Select Edit operation from the Action list and modify the details. After modifying the details, click Save to save the modifications.

10.8.3 Authorizing Tax Compliance Document Maintenance Details

You can authorize records in the system. To authorize a record that you have previously entered:

- Invoke the ‘Tax Compliance Document Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for authorization.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to authorize. The ‘Tax Compliance Document Maintenance Detail’ screen is displayed.

- Select authorize operation from the Action list. The system prompts you to confirm the authorization, and the record is authorized.

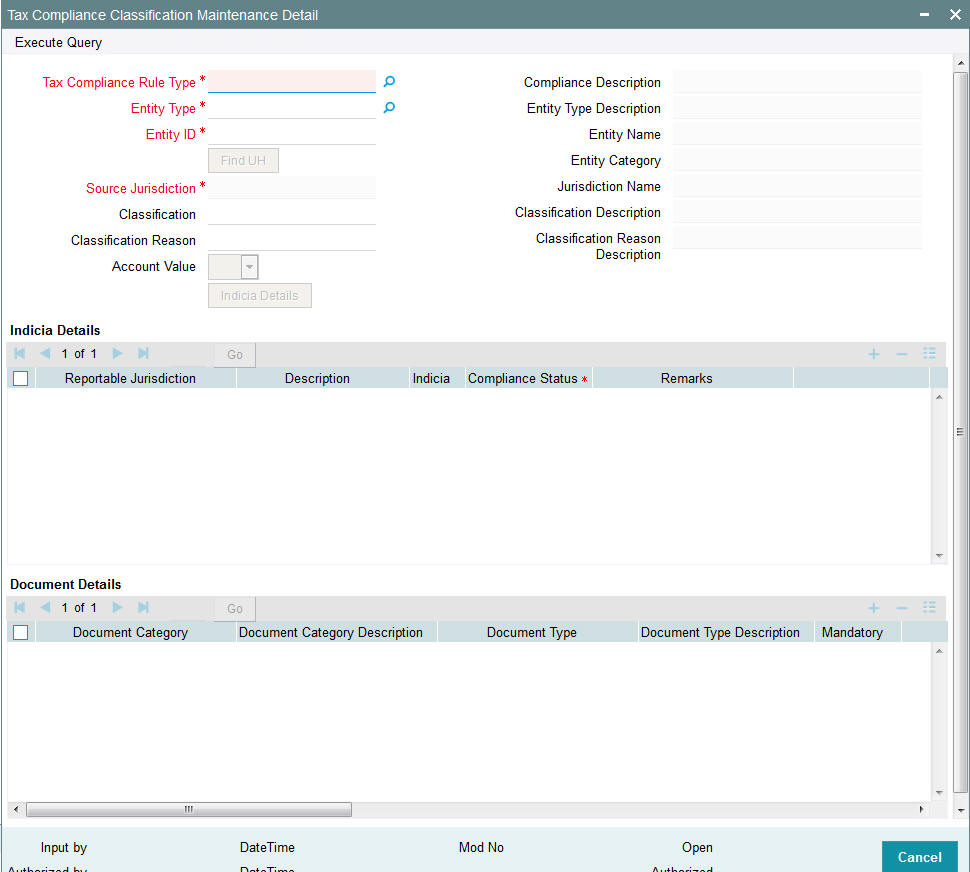

10.9 Tax Compliance Classification Document Maintenance

This section contains the following topics:

10.9.1 Invoking Tax Compliance Classification Document Maintenance Screen

You can maintain Tax compliance Classification Maintenance and record document details for Unit Holder. You can mark the documents collected in the system, classify the entity in the system and also map the indicia to the UH

The Tax compliance Classification Maintenance Screen will be available as part of AGY for UH only.

You can maintain tax compliance classification maintenance record using ‘Tax Compliance Classification Maintenance Detail’ screen. You can invoke this screen by typing ‘UTDCOMCL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

Tax Compliance Rule Type

Alphanumeric; 10 Characters; Mandatory

Specify the tax compliance rule type. Alternatively, you can select tax compliance rule type from the option list. The list displays all valid tax compliance rule type maintained in the system.

Compliance Description

Display

The system displays the description for the selected tax compliance rule type.

Entity Type

Alphanumeric; 2 Characters; Mandatory

Specify the entity type. Alternatively, you can select entity type from the option list. The list displays all valid entity type maintained in the system.

Click ‘Find UH’ button to select the entity type holder in the system.

Entity Type Description

Display

The system displays the description of the selected entity type.

Entity ID

Alphanumeric; 20 Characters; Mandatory

Specify the entity ID to be classified.

Entity Name

Display

The system displays the name of the specified entity ID.

Entity Category

Display

The system displays the category of the specified entity ID.

Source Jurisdiction

Alphanumeric; 3 Characters; Mandatory

Specify the source jurisdiction code.

Jurisdiction Name

Display

The system displays the name of the specified jurisdiction code.

Classification

Alphanumeric; 25 Characters; Optional

Specify the classification details. Alternatively, you can select classification code from the option list. The list displays all valid classifications maintained in the system.

Classification Description

Display

The system displays the description for the selected classification code.

Classification Reason

Alphanumeric; 255 Characters; Optional

Specify the classification reason. Alternatively, you can select classification reason from the option list. The list displays all valid classification reasons maintained in the system.

Classification Reason Description

Display

The system displays the description for the selected classification reason.

Account Value

Optional

Select the value of an account from the drop-down list. The list displays the following values:

- Low

- High

Click ‘Indicia Details’ button to specify indicia and document details.

Indicia Details

Reportable Jurisdiction

Alphanumeric; 3 Characters; Optional

Specify the reportable jurisdiction details for which Indicia are found. Alternatively, you can select reportable jurisdiction details from the option list. The list displays all valid reportable country list maintained as part of tax rule maintenance.

Description

Display

The system displays the description for the selected reportable jurisdiction.

Indicia

Optional

Select the indicia status from the drop-sown list. The list displays the following values:

- Yes

- No

The indicia identification will be based on the criteria defined and this is identified on save for new accounts and for pre existing accounts through due diligence process.

Compliance Status

Mandatory

Select if the account has to be reported to the reportable jurisdiction or not from the drop-down list. The list displays the following values:

- Reportable

- Non Reportable

If a UH with no indicia trigger is classified the values will be blank.

Remarks

Alphanumeric; 255 Characters; Optional

Specify remarks, if any.

Document Details

Document Category

Alphanumeric; 25 Characters; Optional

Specify the document category such as address proof, ID proof. Alternatively, you can select document category from the option list. The list displays all valid document categories maintained in the system.

Document Category Description

Display

The system displays the description for the selected document category.

Document Type

Alphanumeric; 25 Characters; Optional

Specify the document type such as passport details. Alternatively, you can select document type from the option list. The list displays all valid document type maintained in the system.

Document Type Description

Display

The system displays the description for the selected document type.

Mandatory

Optional

Select if the document category to be defined as standard set or additional set of document from the drop-down list. The list displays the following values:

- Standard

- Additional Documents

Document ID

Alphanumeric; 25 Characters; Optional

Specify the document identification number.

Issue Date

Date Format; Optional

Select the issue date from the adjoining calendar.

Expiry Date

Date Format; Optional

Select the expiry date from the adjoining calendar.

Copy Received

Optional

Check this box if the copy is received.

Original Received

Optional

Check this box if the original document is received.

Received Date

Date Format; Optional

Select the date when the documents were received from the adjoining calendar.

Remarks

Alphanumeric; 255 Characters; Optional

Specify remarks, if any.

Document Reference Number

Alphanumeric; 255 Characters; Optional

Specify the document reference number.

Click ‘Upload’ button to upload all the required set of documents.

Post authorization of the Unit holder, the unit holder will be available for ‘Tax Compliance Classification Document Maintenance’. Based on the documents submitted by the Unit holder, you can classify the unit holder accordingly.

Once the Unit holder is classified in ‘Tax Compliance Document Classification Maintenance’ screen, if you update any details as Reportable status then the same is updated back to the Tax Compliance tab in UH maintenance screen.

If you identify new Indicia and Tax jurisdiction along with system identified details then the new details will also be added as part of UH (Tax compliance sub screen).

Once the Indicia is identified by the system and classified, the system will not derive indicia status again. The Tax classification document maintenance will be the final status. In case new Indicia is to be added or deleted, you can do the same through this maintenance (Tax Compliance Classification Document Maintenance (UTDCOMCL)) only.

In case indicia is identified /not identified and in case classification is done for the UH (through Tax compliance classification document maintenance (UTDCOMCL)) upon UH amendment indicia will not be system derived.

Once indicia is identified you can change the Compliance Status.

Following table explains the indicia attribute and the corresponding field mapped to the system that trigger indicia for a Unit Holder:

Individual Accounts (New)

Indicia attributes |

Field at UH |

Tab |

Function ID |

Logic |

Residence address/ mailing address |

Country Field (correspondence country field) |

Contact Details TAB |

UTDUH |

If the country field and telephone no (Tel 1, Tel 2, Cell phone number, Fax number) is one of the reportable jurisdiction country then indicia is triggered for the UH. |

Resident of reportable jurisdiction |

Domicile Country |

Client preference TAB |

UTDUH |

If the country of domicile is one of the reportable jurisdiction then indicia is triggered for the UH |

Effective POA granted to a person with an address in reportable jurisdiction |

Auth Rep ID (if an auth rep is mapped to an UH then the country code of auth rep is to be checked for) |

Country code field in the Auth rep maintenance |

UTDATREP |

If the country code mapped at Auth rep maintenance is one of the reportable jurisdiction then indicia is triggered for the UH |

Telephone of a reportable jurisdiction or no telephone numbers in participating country |

International dialing codes (All four country codes Tel 1, Tel 2, Cell phone number, Fax number) |

Contact Details TAB |

UTDUH |

If anyone of the international dialing code maintained is the dialing code of the reportable jurisdiction then indicia to be triggered for the UH

and

if anyone of the international dialing code maintained is that of a source/ participating jurisdiction then indicia should not be triggered |

Bank details of a reportable jurisdiction |

bank branch country code |

Single entity maintenance- Bank branch maintenance |

UTDTPMN |

If the bank branch country code is one of the reportable jurisdiction then the UH which is mapped with that bank branch will be triggered with indicia. |

Linked Entity- Joint/Nominee (TIN and Date of birth and place of birth) |

Issuing jurisdiction |

Multiple Tax id details |

UTDUH |

If the issuing jurisdiction of the Tax id is one/all of the reportable jurisdiction then indicia is triggered for the UH |

Nominee/Joint |

Correspondence address country field and tax issuing jurisdiction |

Nominee/Joint holder- if they are third party mapped |

UTDUH |

If the UH being mapped at joint holder/nominee is a third party then; the correspondence address country code field or Tax issuing jurisdictions fields are one of the reportable jurisdiction maintained then indicia is triggered for the UH |

NA |

Nominee/Joint holder- if its and existing UH in the system |

UTDUH |

If the UH mapped is an existing UH in the system and has indicia triggered then the same indicia triggers will be applicable for the UH. If an existing CIF is being mapped then the county of domicile to trigger indicia. |

Entity Accounts (New accounts)

Indicia attributes |

Field at UH |

TAB |

Function ID |

Logic |

Residence address/ mailing address |

Country Field (correspondence country field) |

Contact Details TAB |

UTDUH |

If the country field telephone no (Tel 1, Tel 2, Cell phone number, Fax number) is one of the reportable jurisdiction country then indicia is triggered for the UH |

Resident of reportable jurisdiction |

country of incorporation |

Corporate Details TAB |

UTDUH |

If the country of incorporation is one of the reportable jurisdiction then indicia is triggered for the UH |

Telephone of a reportable jurisdiction or no telephone numbers in participating country |

International dialing codes (All four country codes Tel 1, Tel 2, Cell phone number, Fax number) |

Contact Details TAB |

UTDUH |

If anyone of the international dialling code maintained is the dialling code of the reportable jurisdiction then indicia to be triggered for the UH

And

if anyone of the international dialling code maintained is that of a source/ participating jurisdiction then indicia should not be triggered |

Bank details of a reportable jurisdiction |

bank branch country code |

Single entity maintenance- Bank branch maintenance |

UTDTPMN |

If the bank branch country code is one of the reportable jurisdiction then the UH which is mapped with that bank branch will be triggered with indicia. |

Linked Entity- director (TIN and Date of birth and place of birth) |

Issuing jurisdiction |

Multiple Tax id details |

UTDUH |

The Tax ID issuing jurisdiction is one of the reportable jurisdiction then indicia is triggered for the UH- only if the director is marked as controlling person |

Director |

Correspondence address country field and tax issuing jurisdiction |

Director- if its and existing UH/CIF in the system |

UTDUH |

If the UH being mapped as director is a third party then; the correspondence address country code field or Tax issuing jurisdictions fields are one of the reportable jurisdiction maintained then indicia is triggered for the UH. If the UH mapped is an existing Uh in the system and has indicia triggered then the same indicia triggers will be applicable for the UH. If an existing CIF is being mapped then the county of incorporation to trigger indicia.- only if the director is marked as controlling person |

For a corporate account (UH) created, if you map one or all of the director as existing UH in the system there will be no check, if the linked UH is an individual UH in the system. If you map a corporate UH as one of the director then there will be no check and this will be operationally controlled process in the system.

Similarly for a individual account(UH) created, if you map one or all of the joint/Nominee as existing UH in the system there will be no check, if the linked UH is an individual UH in the system. If you map a corporate UH as one of the director then there will be no check and this will be operationally controlled process in the system.

For a corporate account(UH) created, if you map one or all of the director as external entity (Third party) in the system there will be no check if the linked third party is an individual entity in the system. If you map a corporate third party as one of the director then there will be no check and this will be operationally controlled process in the system.

Similarly for an individual account (UH) created; if you map one or all of the external entity (Third party) in the system there will be no check, if the linked third party is an individual entity (third party) in the system. If you map a corporate third party as one of the director then there will be no check and this will be operationally controlled process in the system.

If a unit holder created does not have any indicia triggering attributes except the linked UH (which can be a nominee, joint holder or director for a corporate UH); and if the linked UH has indicia triggered for multiple jurisdictions then the main UH will be triggered with indicia for all the jurisdictions.

If you map UH as joint holder/nominee and if indicia is selected as ‘Yes’ then; the correspondence address country code field (including the International dialling code)/ Tax issuing jurisdictions/ country of birth field are one of the reportable jurisdiction maintained then indicia is triggered at the main UH.

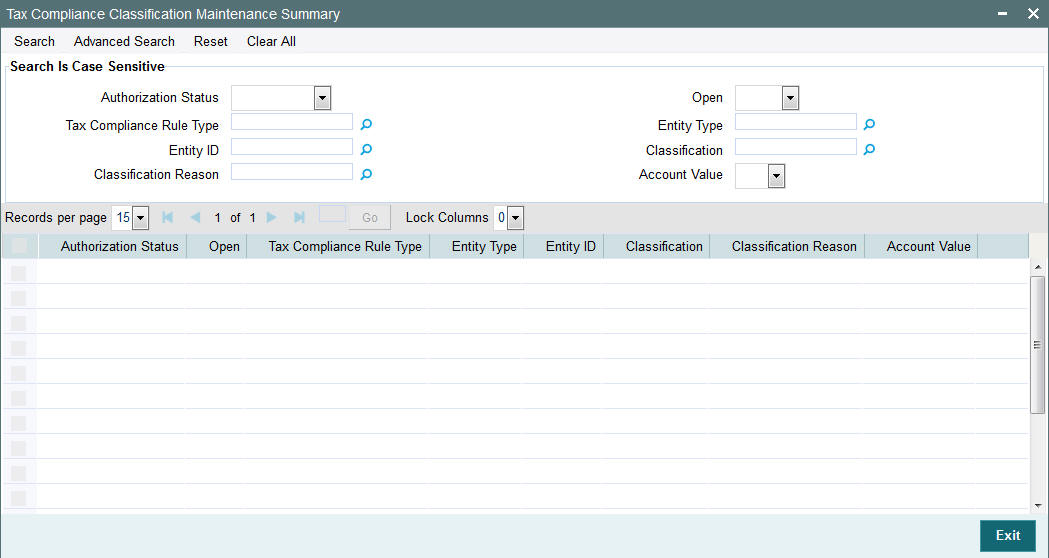

10.10 Tax Compliance Classification Document Maintenance Summary

This section contains the following topics:

- Section 10.10.1, "Retrieving Tax Compliance Classification Document Maintenance Details"

- Section 10.10.2, "Deleting Tax Compliance Classification Document Maintenance Details"

- Section 10.10.3, "Editing Tax Compliance Classification Document Maintenance Details"

- Section 10.10.4, "Authorizing Tax Compliance Classification Document Maintenance Details"

- Section 10.10.5, "Amending Tax Compliance Classification Document Maintenance Details"

- Section 10.10.6, "Authorizing Amended Tax Compliance Classification Document Maintenance Details"

10.10.1 Retrieving Tax Compliance Classification Document Maintenance Details

You can view tax compliance classification document Maintenance details using ‘Tax Compliance Classification Document Maintenance Summary’ screen. You can invoke this screen by typing ‘UTSCOMCL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can view previously entered details of Tax compliance classification document Maintenance in the ‘Tax Compliance Classification Document Maintenance Summary’ screen, as follows:

- Specify any or all of the following details in the ‘Tax Compliance

Classification Document Maintenance Summary’ screen:

- The status of the record in the Authorization Status field. If you choose the ‘Blank Space’ option, then all the records that involve the specified Tax compliance document Maintenance are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all the records that involve the specified tax compliance document Maintenance are retrieved.

- Tax Compliance Rule Type

- Entity ID

- Classification Reason

- Entity Type

- Classification

- Account Value

Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also search the record by using combination of % and alphanumeric value.

10.10.2 Deleting Tax Compliance Classification Document Maintenance Details

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the ‘Tax Compliance Classification Document Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete. The ‘Tax Compliance Classification Document Maintenance Detail’ screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

10.10.3 Editing Tax Compliance Classification Document Maintenance Details

You can modify only unauthorized records in the system. To modify a record that you have previously entered:

- Invoke the ‘Tax Compliance Classification Document Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for modification.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify. The ‘Tax Compliance Classification Document Maintenance Detail’ screen is displayed.

- Select Edit operation from the Action list and modify the details. After modifying the details, click Save to save the modifications.

10.10.4 Authorizing Tax Compliance Classification Document Maintenance Details

You can authorize records in the system. To authorize a record that you have previously entered:

- Invoke the ‘Tax Compliance Classification Document Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for authorization.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to authorize. The ‘Tax Compliance Classification Document Maintenance Detail’ screen is displayed.

- Select authorize operation from the Action list. The system prompts you to confirm the authorization, and the record is authorized.

10.10.5 Amending Tax Compliance Classification Document Maintenance Details

After a tax compliance classification document is authorized, it can be modified using the Unlock operation from Action list. To make changes to a tax compliance classification document after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the ‘Tax Compliance Classification Document Maintenance’ Summary screen from the Browser.

- Select the status of the tax compliance classification document that you wish to retrieve for amendment. You can only amend records of documents that are authorized.

- Specify any or all of the details of the tax compliance classification document in the corresponding fields on the screen.

- Click ‘Search’ button. All tax compliance classification document with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the document that you want to amend. The Tax Compliance Classification Document Maintenance screen is displayed in Amendment mode.

- Click the Unlock operation from the Action list to amend the fund type.

- Amend the necessary information. Click the Save button to save the changes.

10.10.6 Authorizing Amended Tax Compliance Classification Document Maintenance Details

An amended stop code must be authorized for the amendment to be made effective in the system.

The process of authorization is subsequently the same as that for normal transactions.

10.11 Third Party Maintenance Detail

This section contains the following topics:

- Section 10.11.1, "Invoking Third Party Maintenance Detail Screen"

- Section 10.11.2, "Basic Information Tab"

- Section 10.11.3, "Correspondence Address Tab"

- Section 10.11.4, "Bank Details Tab"

- Section 10.11.5, "Alternate Language Details Tab"

- Section 10.11.6, "Additional Info Tab"

- Section 10.11.7, "Tax Details Tab"

- Section 10.11.8, "Mapped Installation IDs Button"

10.11.1 Invoking Third Party Maintenance Detail Screen

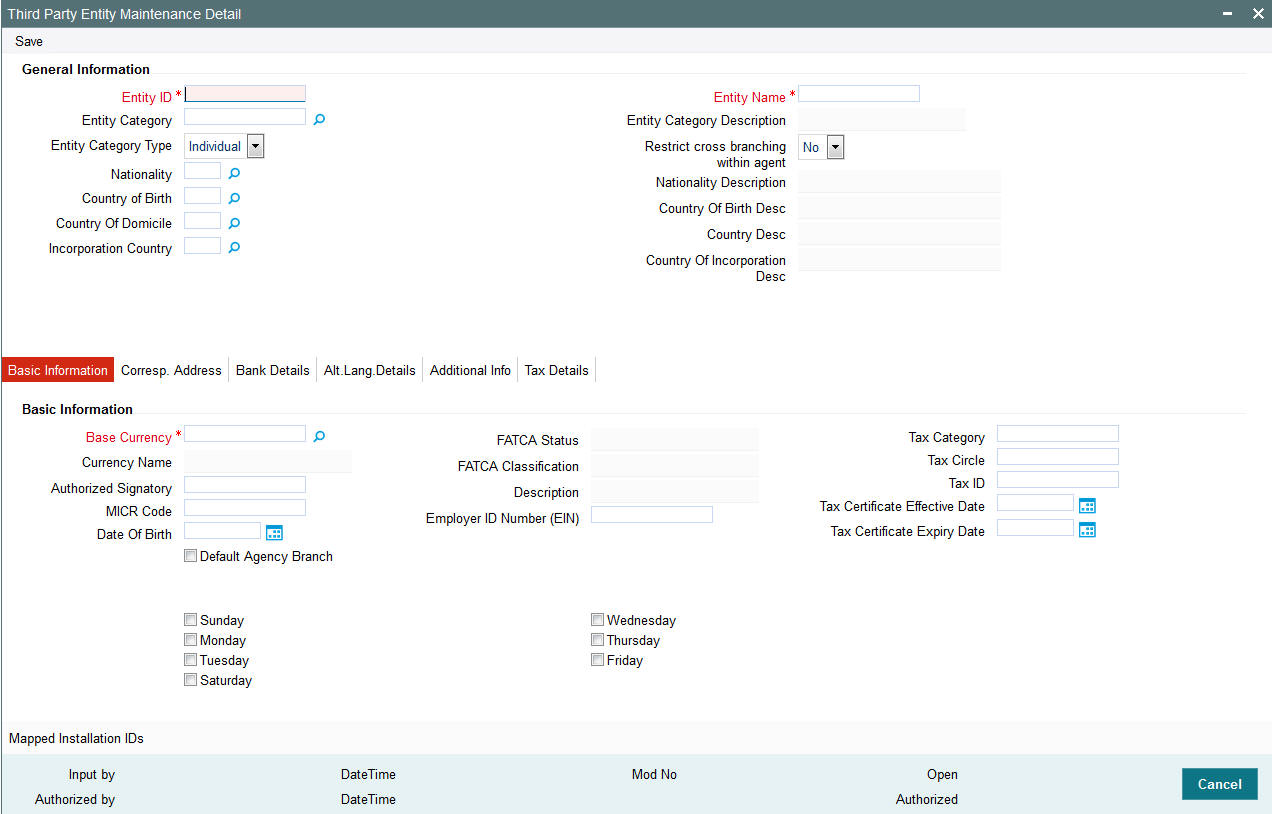

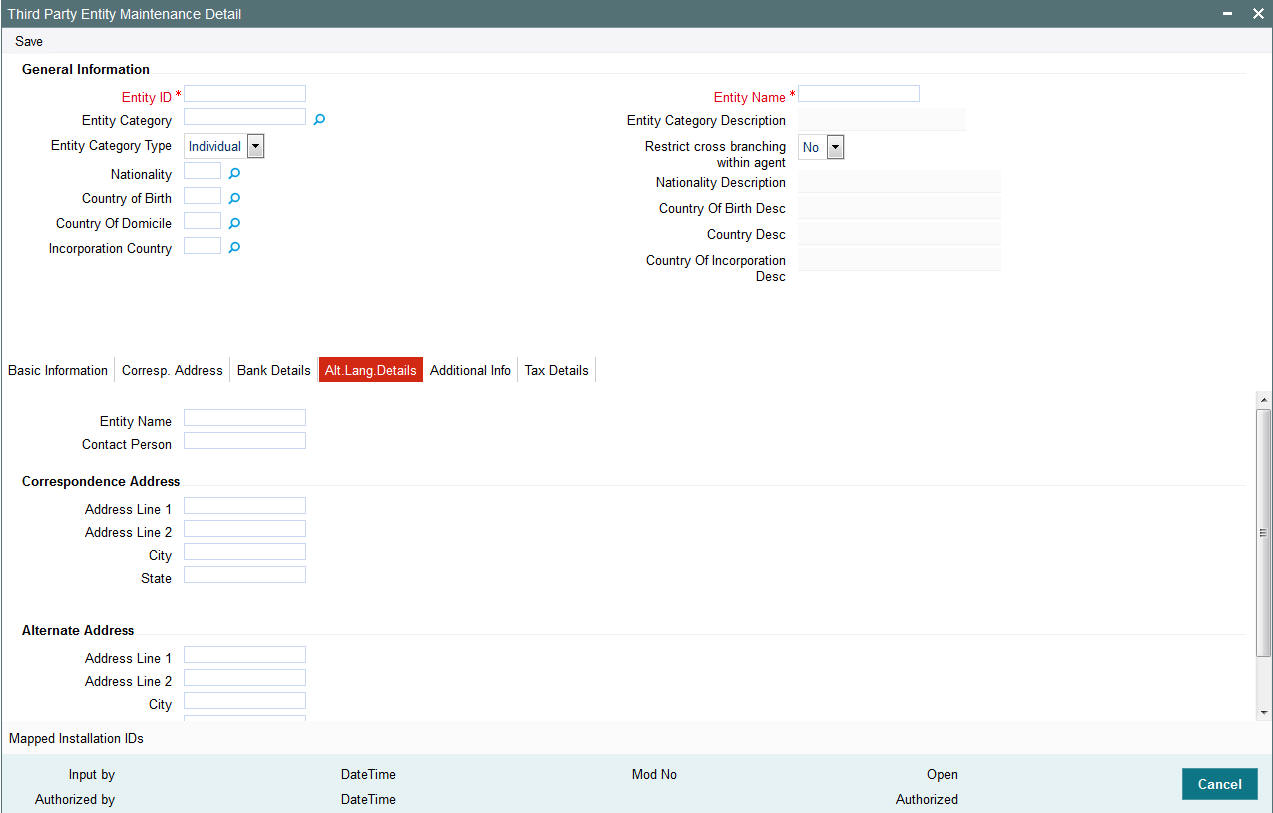

You can map the joint holder/ Nominee/ Director/ Beneficiary at UH maintenance using ‘Third Party Maintenance Detail’ screen if ‘UH/CIF’ field is selected as ‘No’ in ‘Unit Holder Maintenance screen (Joint/ Director/ Nominee/ Beneficiary sub screen). The third party entity can be a Joint Holder/ Nominee/ Director that is outside the system. This third party entity can be an individual or a corporate.

Note

The ‘Third Party Maintenance Detail’ screen is available at Agency Branch module.

You can invoke ‘Third Party Maintenance Detail’ screen by typing ‘UTDTPMN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

Entity ID

Alphanumeric; 12 Characters; Mandatory

The Entity ID is a unique Identification for an entity in the system. Any detail regarding an entity is obtained by using the entity ID for reference. The ID you specify here must be unique and not already in use for any other entity in the system.

Entity Name

Alphanumeric; 60 Characters; Mandatory

Specify the name (or description) of the entity being set up in the system.

Entity Category

Alphanumeric; 2 Characters; Optional

Specify the category to which the entity belongs. Alternatively, you can select entity category from the option list. The list displays all valid entity category maintained in the system.

Entity Category Description

Display

The system displays the description for the selected entity category.

Entity Category Type

Optional

Select whether the entity being maintained belongs to the Individual or Corporate categories from the drop-down list. The list displays the following values:

- Individual

- Corporate

Restrict Cross Branching within Agent

Optional

Select if cross branching within agent is restricted or not from the drop-down list. The list displays the following values:

- Yes

- No

Nationality

Alphanumeric; 3 Characters; Mandatory

Select the nationality of the customer. Alternatively, you can select nation code from the option list. The list displays all valid nation codes maintained in the system.

Nationality Description

Display

The system displays the description for the selected nation code.

Country of Birth

Alphanumeric; 3 Characters; Mandatory

Select the country of birth of the customer. Alternatively, you can select country code from the option list. The list displays all valid country code maintained in the system.

Country Of Birth Desc

Display

The system displays the description for the selected country code.

Country of Domicile

Alphanumeric; 3 Characters; Mandatory

Select the country of domicile of the customer. Alternatively, you can select country code from the option list. The list displays all valid country code maintained in the system.

Country Desc

Display

The system displays the description for the selected country code.

Incorporation Country

Alphanumeric; 3 Characters; Optional

Select the Incorporation country code of the customer. Alternatively, you can select country of incorporation code from the option list. The list displays all valid country code maintained in the system.

Country Of Incorporation Desc

Display

The system displays the description for the selected country of incorporation code.

10.11.2 Basic Information Tab

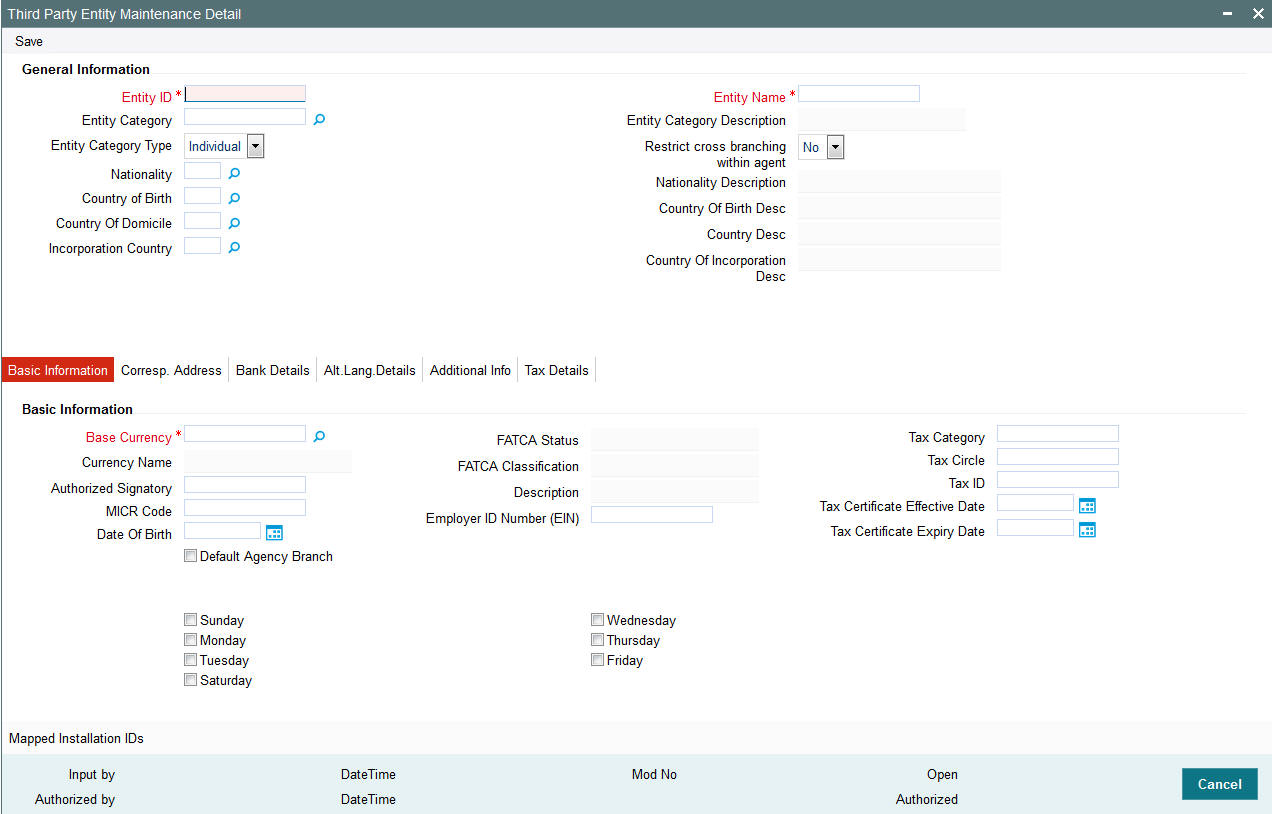

Click ‘Basic Information’ tab in ‘Third Party Entity Maintenance Detail’ screen.

Base Currency

Alphanumeric, 3 Characters; Mandatory

Select the base currency of the entity. Alternatively, you can select base currency code from the option list. The list displays all valid base currency code maintained in the system.

This is the currency in which the entity normally transacts.

Currency Name

Display

The system displays the name of the currency for the selected currency code.

Authorized Signatory

Alphanumeric; 70 Characters; Optional

Enter the name of the Authorized Signatory at the office of the AMC.

MICR Code

Alphanumeric; 12 Characters; Optional

Specify MICR code of the specified Bank here. This code is applicable for both Bank and Bank Branch entity.

Date of Birth

Date Format; Optional

Select the date of birth details for an individual entity being created from the adjoining calendar.

Default Agency Branch

Optional

Check this box to default the agency branch code.

FATCA Status

Display

The system displays the FATCA Status based on the FATCA maintenance.

FATCA Classification

Display

The system displays the FATCA classification type.

Description

Display

The system displays the description for the selected FATCA classification type.

Employer ID Number (EIN)

Alphanumeric; 50 Characters; Optional

Specify employee identification number.

Tax Category

Alphanumeric; 10 Characters; Optional

Specify the tax category details.

Tax Circle

Alphanumeric; 15 Characters; Optional

Specify the tax circle country details.

Tax ID

Alphanumeric; 50 Characters; Optional

Specify the tax identification.

Tax Certificate Effective Date

Date Format; Optional

Specify the date from which the tax certificate is effective.

Tax Certificate Expiry Date

Date Format; Optional

Specify the expiry date of the tax certificate.

Week

Check the appropriate box to indicate the day in a week. The options are as follows:

- Sunday

- Monday

- Tuesday

- Wednesday

- Thursday

- Friday

- Saturday

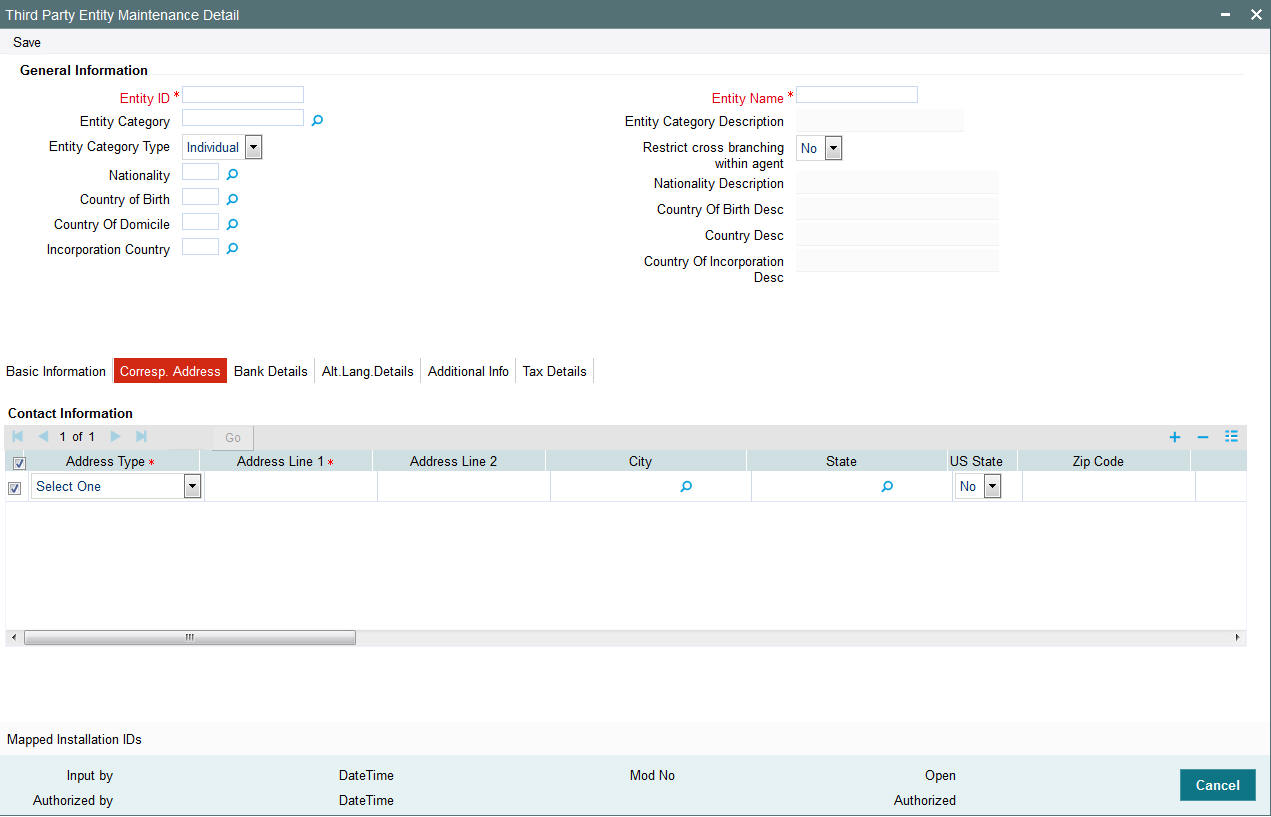

10.11.3 Correspondence Address Tab

As part of correspondence details, you can capture correspondence address, alternate address and SWIFT address. Click ‘Corresp Address’ tab to maintain the correspondence details.

You can specify the following details:

Address Type

Mandatory

Select the address type from the drop-down list. The list displays the following values:

- Correspondence Address

- Alternate Address

- SWIFT Address

Address Lines 1-2

Alphanumeric; 80 Characters; Optional (Address Line 1 is Mandatory)

Enter the address of the third party entity being set up in the system.

City

Alphanumeric; 80 Characters; Optional

Enter the city where the entity is located. You can select the city from the drop down list provided. The available options depend on the values defined at the params maintenance. If the city is not available in the list, you can specify the city in the field provided alongside.

State

Alphanumeric; 80 Characters; Optional

Specify the State where the City is located. Alternatively, you can select state code from the option list. The list displays all valid state code defined at the params maintenance.

If the state is not available in the list, you can specify the city in the field provided alongside.

US State

Optional

Select if the specified state is a US (United States) state or not from the drop-down list. The list displays the following values:

- Yes

- No

Zip Code

Alphanumeric; 10 Characters; Optional

Enter the Zip Code of the Address of the entity being set up.

Country

Alphanumeric, 3 Characters; Mandatory

Specify the country in which the entity is based. Alternatively, you can select country code from the option list. The list displays all valid country code maintained in the system.

If the Address type is SWIFT Address, enter the country of the SWIFT address for the entity.

Int. Dialing Code +

Numeric; 10 Characters; Optional

Specify the international dialling code. Alternatively, you can select international dialling code from the option list. The list displays all valid international dialling code maintained in the system.

Telephone 1

Alphanumeric; 60 Characters; Optional

Specify the telephone number.

Int. Dialing Code +

Numeric; 10 Characters; Optional

Specify the international dialling code. Alternatively, you can select international dialling code from the option list. The list displays all valid international dialling code maintained in the system.

Telephone 2

Alphanumeric; 60 Characters; Optional

Specify the alternative telephone number.

Int. Dialing Code +

Numeric; 10 Characters; Optional

Specify the international dialling code. Alternatively, you can select international dialling code from the option list. The list displays all valid international dialling code maintained in the system.

Fax

Alphanumeric; 120 Characters; Optional

Specify the fax number of the third party entity who is being set up in the system.

Alphanumeric; 255 Characters; Optional

Specify the E-mail address of the third party entity being set up.

Contact Person

Alphanumeric; 70 Characters; Optional

Specify the name of the contact person at the entity’s offices.

Int. Dialing Code +

Numeric; 10 Characters; Optional

Specify the international dialling code. Alternatively, you can select international dialling code from the option list. The list displays all valid international dialling code maintained in the system.

Cell Phone Number

Alphanumeric; 60 Characters; Optional

Specify the cell phone number of the third party entity being set up.

Effective From Date

Date Format; Optional

This is applicable if the Address Type is Alternate Address.

Specify the date that marks the beginning of the period for which the specified alternate address is in effect.

Effective To Date

Date Format; Optional

This is applicable if the Address Type is Alternate Address.

Specify the date that marks the end of the period for which the specified alternate address is in effect.

BIC Code

Alphanumeric; 12 Characters; Optional

Specify the Bank Identifier Code (BIC) of the entity.

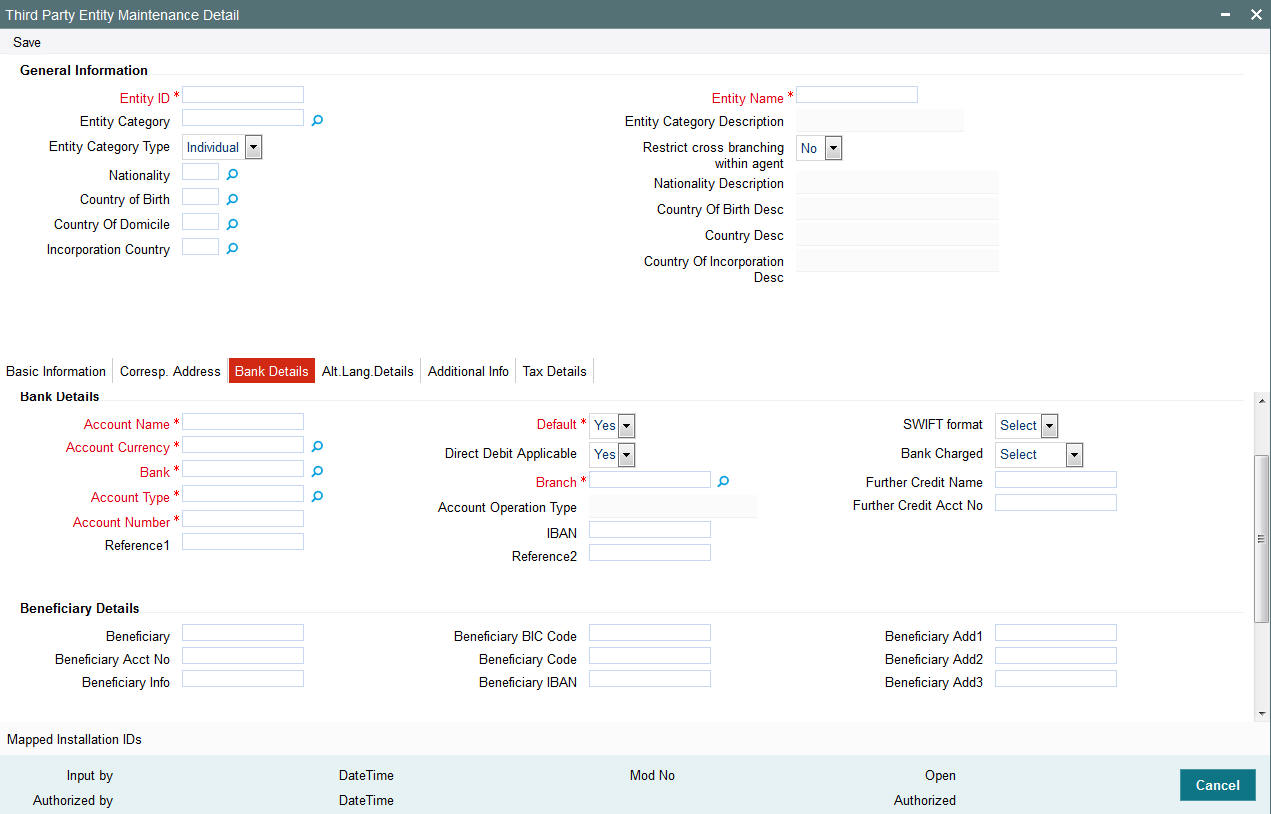

10.11.4 Bank Details Tab

Click ‘Bank Details’ tab in ‘Third Party Entity Maintenance’ screen

You can specify the following details:

Account Name

Alphanumeric; 100 Characters; Mandatory

Specify the account holder name.

Account Currency

Alphanumeric; 3 Characters; Mandatory

Specify the account currency code.

Bank

Alphanumeric; 12 Characters; Mandatory

Specify the bank code.

Account Type

Alphanumeric; 1 Character; Mandatory

Specify the account type.

Account Operation Type

Display

The system displays the type of account operation.

Account Number

Alphanumeric; 16 Characters; Mandatory

Specify the account number.

Reference1

Alphanumeric; 35 Characters; Optional

Specify the reference details.

Default

Mandatory

Select default status from the drop-down list. The list displays the following values:

- Yes

- No

Direct Debit Applicable

Optional

Select if direct debit is applicable or not from the drop-down list. The list displays the following values:

- Yes

- No

Branch

Alphanumeric; 12 Characters; Mandatory

Specify the branch details.

IBAN

Alphanumeric; 40 Characters; Mandatory

Specify the IBAN details.

Reference2

Alphanumeric; 35 Characters; Optional

Specify the reference details.

SWIFT format

Optional

Select SWIFT format from the drop-down list. The list displays the following values:

- MT103

- MT202

Bank Charged

Optional

Select the bank charged details from the drop-down list. The list displays the following values:

- Beneficiary

- Remitter

- Share

Further Credit Name

Alphanumeric; 35 Characters; Optional

Specify the further credit name.

Further Credit Acct No

Alphanumeric; 35 Characters; Optional

Specify the further credit account number.

Beneficiary Details

Beneficiary

Alphanumeric; 35 Characters; Optional

Specify the beneficiary details.

Beneficiary Acct No

Alphanumeric; 24 Characters; Optional

Enter beneficiary Account Number.

Beneficiary Info

Alphanumeric; 100 Characters; Optional

Enter beneficiary information.

Beneficiary BIC Code

Alphanumeric; 24 Characters; Optional

Enter beneficiary BIC Code.

Beneficiary Code

Alphanumeric; 24 Characters; Optional

Enter beneficiary code.

Beneficiary IBAN

Alphanumeric; 40 Characters; Optional

Specify the beneficiary IBAN details.

Beneficiary Address1-3

Alphanumeric; 35 Characters; Optional

Enter beneficiary address.

Intermediary Details

Intermediary

Alphanumeric; 35 Characters; Optional

Enter the intermediary details.

Intermediary Acct No

Alphanumeric; 24 Characters; Optional

Enter intermediary Account Number.

Intermediary Info

Alphanumeric; 100 Characters; Optional

Enter intermediary information.

Intermediary BIC Code

Alphanumeric; 24 Characters; Optional

Enter intermediary BIC Code.

Intermediary Code

Alphanumeric; 24 Characters; Optional

Enter intermediary code.

Intermediary IBAN

Alphanumeric; 40 Characters; Optional

Enter intermediary IBAN details.

Intermediary Address 1-3

Alphanumeric; 35 Characters; Optional

Enter intermediary address.

10.11.5 Alternate Language Details Tab

Click ‘Alt. Lang. Details’ tab in ‘Third Party Entity Maintenance’ screen.

You can specify the following details:

Entity Name

Alphanumeric; 60 Characters; Optional

Specify the name of the entity.

Contact Person

Alphanumeric; 70 Characters; Optional

Specify the contact person details.

Correspondence Address

Address Line 1 - 2

Alphanumeric; 80 Characters; Optional

Specify the address details.

City

Alphanumeric; 80 Characters; Optional

Specify the city name.

State

Alphanumeric; 80 Characters; Optional

Specify the state name.

Alternate Address

Address Line 1 - 2

Alphanumeric; 80 Characters; Optional

Specify the address details.

City

Alphanumeric; 80 Characters; Optional

Specify the city name.

State

Alphanumeric; 80 Characters; Optional

Specify the state name.

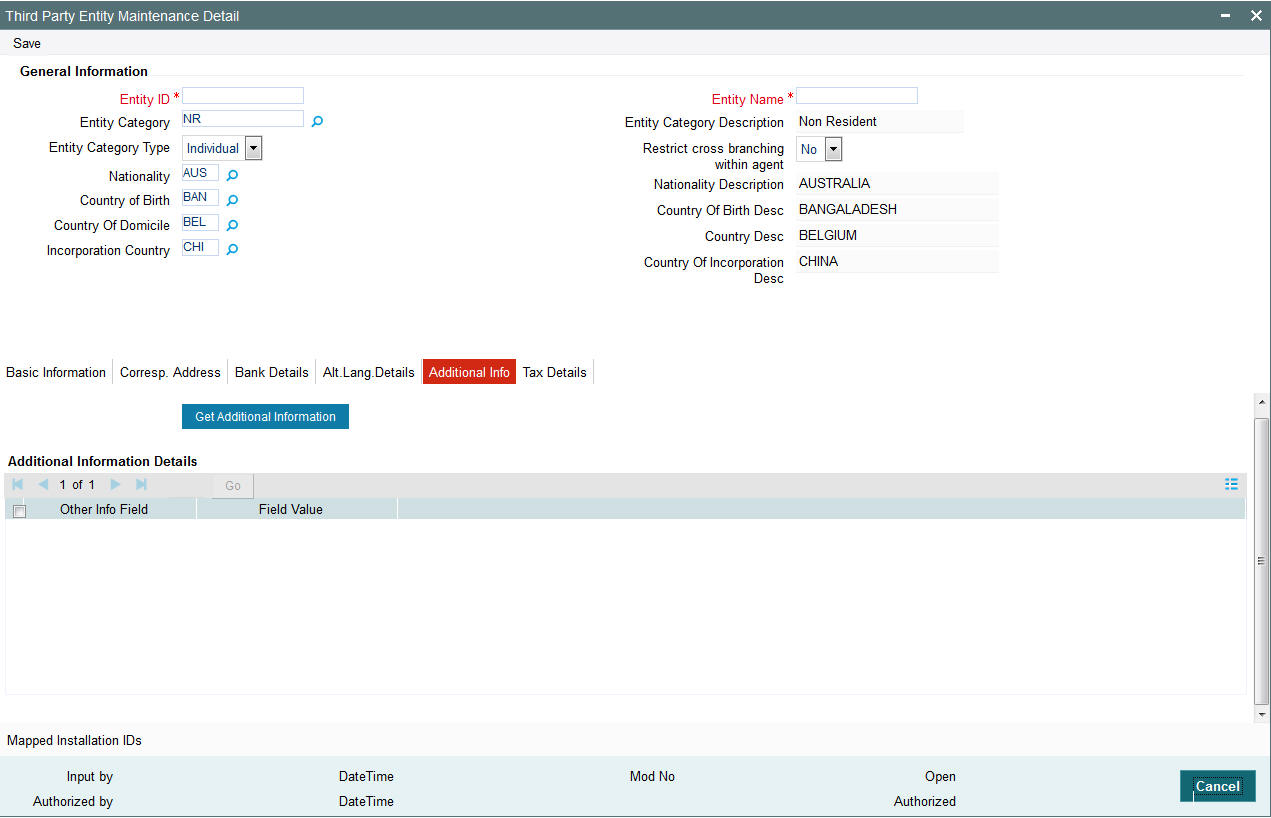

10.11.6 Additional Info Tab

Click ‘Additional Info’ tab in ‘Third Party Entity Maintenance’ screen.

Click ‘Get Additional Information’ button to view additional information details as follows:

- Other Info Field

- Field Value

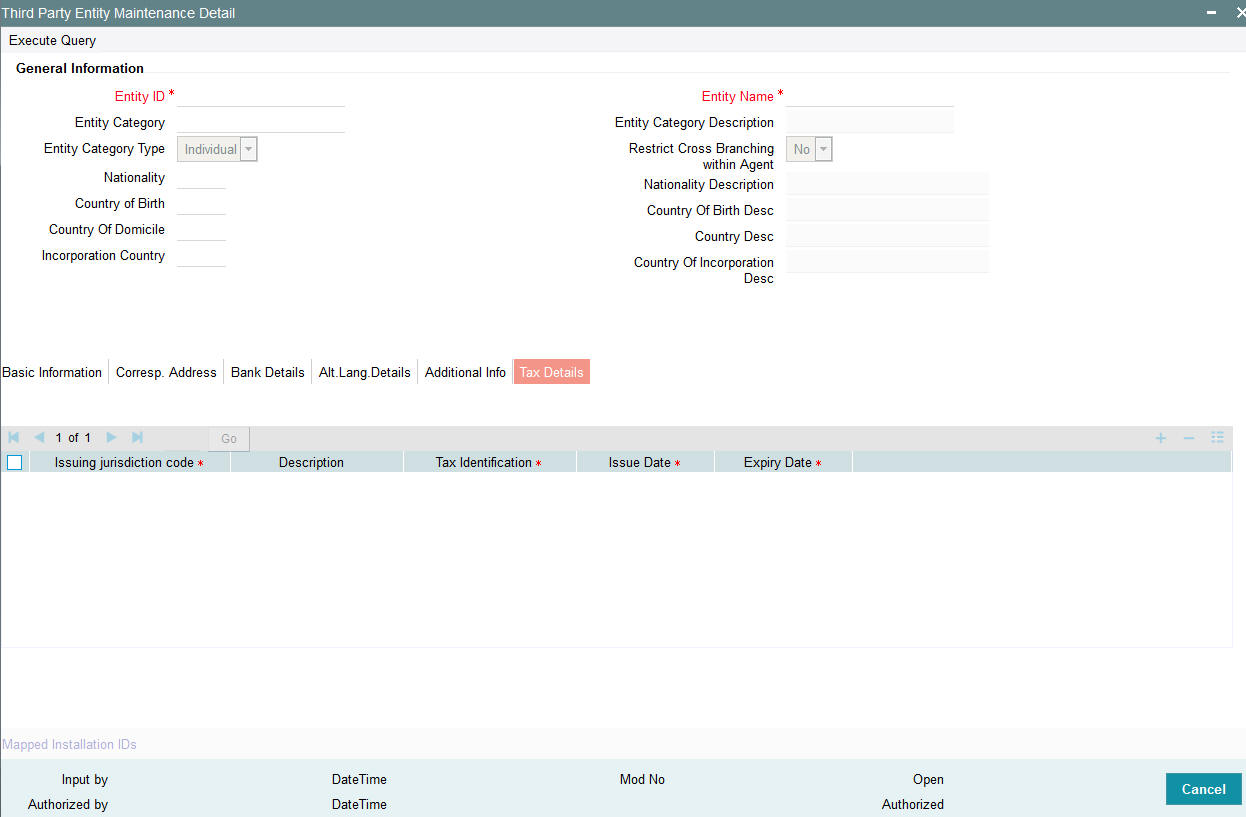

10.11.7 Tax Details Tab

Click ‘Tax Details’ tab in ‘Third Party Entity Maintenance’ screen.

You can specify the following details:

Issuing Jurisdiction Code

Alphanumeric; 3 Characters; Optional

Specify the country code of the issuing country. Alternatively, you can select the country code from the option list. The list displays all valid country code maintained in the system.

Description

Display

The system displays the description for the selected country code.

Tax Identification

Alphanumeric; 50 Characters; Optional

Specify the tax identification number of the unit holder.

Issue Date

Date Format; Optional

Specify the issue date of the tax ID.

Expiry Date

Date Format; Optional

Specify the expiry date of the tax ID.

10.11.8 Mapped Installation IDs Button

Click ‘Mapped Installed IDs’ button in ‘Third Party Entity Maintenance’ screen.

You can view the following details:

- Entity ID

- Entity Type

- Installation ID

- Module Id

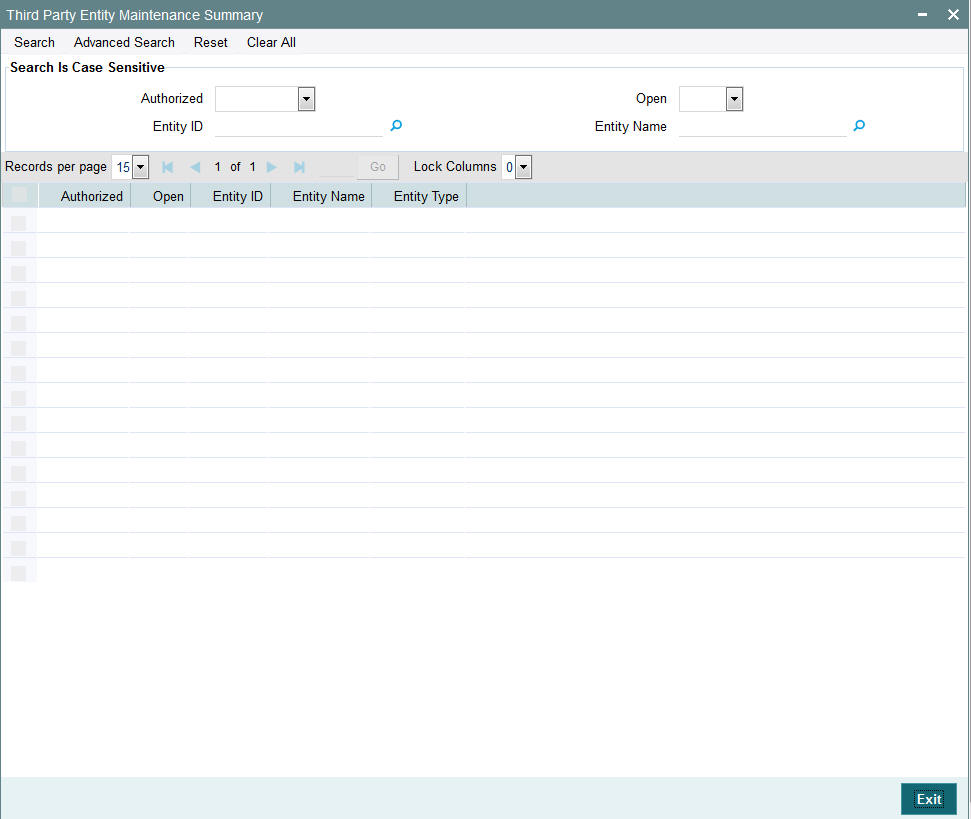

10.12 Third Party Entity Maintenance Summary

This section contains the following topics:

- Section 10.12.1, "Retrieving an Third Party Entity Record"

- Section 10.12.2, "Editing an Third Party Entity Record"

- Section 10.12.3, "Viewing an Third Party Entity Maintenance Record"

- Section 10.12.4, "Delete an Third Party Entity Maintenance Record"

- Section 10.12.5, "Authorizing an Third Party Entity Maintenance Record"

- Section 10.12.6, "Amending an Third Party Entity Maintenance Record"

- Section 10.12.7, "Authorizing an amended Third Party Entity Record"

10.12.1 Retrieving an Third Party Entity Record

You can invoke the ‘Third Party Entity Maintenance Summary’ screen by typing ‘UTSTPMN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

To retrieve a previously entered third party entity record:

- Invoke the Third Party Entity Maintenance Summary screen and specify

the following:

- The authorization status of the third party entity record in the Authorized field. If you choose the “Blank Space” option, then all the records are retrieved.

- The status of the third party entity records in the Open field. If you choose the “Blank Space” option, then all the records are retrieved.

- Entity ID

- Entity Name

- After you have specified the required details, click 'Search'. All records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve an individual third party entity rate detail from the Detail screen by doing query in the following manner:

- Press F7

- Input the Entity ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

10.12.2 Editing an Third Party Entity Record

You can modify the details of a third party entity record that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Third Party Entity Maintenance Summary screen from the Browser.

- Select the authorization status of the records that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option from the drop down list.

- Specify any or all of the search parameters for retrieving the records.

- Click 'Search'. All unauthorized third party entity records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify. The Third Party Entity Maintenance Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save the changes. The Third Party Entity Maintenance Detail screen is closed and the changes made are reflected in the Third Party Entity Maintenance Summary screen.

10.12.3 Viewing an Third Party Entity Maintenance Record

To view the third party entity details that you have previously entered:

- Invoke the Third Party Entity Maintenance Summary Screen from the Browser.

- Select the authorization status of the third party entity records that you want to retrieve for viewing in the Authorized field. You can also view all the third party entity records that are either unauthorized or authorized only, by choosing the Unauthorized / Authorized option.

- Specify any or all of the search parameters for retrieving the records.

- Click 'Search'. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view. The Third Party Entity Maintenance screen Detail is displayed in view mode.

10.12.4 Delete an Third Party Entity Maintenance Record

You can delete only unauthorized records in the system. To delete an third party entity record:

- Invoke the Third Party Entity Maintenance Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the search parameters in the corresponding fields on the screen.

- Click 'Search'. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete. The Third Party Entity Maintenance Detail screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

10.12.5 Authorizing an Third Party Entity Maintenance Record

An unauthorized third party entity record must be authorized in the system for it to come into effect. To authorize an third party entity record:

- Invoke the Third Party Entity Maintenance Summary screen from the Browser.

- Select the status of the third party entity record that you want to retrieve for authorization. Typically, choose the unauthorized option from the drop down list.

- Specify any or all of the search parameters in the corresponding fields on the screen.

- Click 'Search'. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Third Party Entity Maintenance screen displayed. Select Authorize operation from Action.

When the checker authorizes an third party entity details, details of validations, if any, that were overridden by the maker of the third party entity details during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the maintenance.

10.12.6 Amending an Third Party Entity Maintenance Record

After an third party entity record is authorized, it can be modified using the Unlock operation from Action list. To make changes to an third party entity record after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the Third Party Entity Maintenance Summary screen from the Browser.

- Select the status of the record that you wish to retrieve for amendment. You can only amend records that are authorized.

- Specify any or all of the search parameters in the corresponding fields on the screen.

- Click 'Search'. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to amend. The Third Party Entity Maintenance Detail screen is displayed in Amendment mode.

- Click the Unlock operation from the Action list to amend the record.

- Amend the necessary information. Click the Save button to save the changes

10.12.7 Authorizing an amended Third Party Entity Record

An amended third party entity record must be authorized for the amendment to be made effective in the system. The process of authorization is the same as the process of normal authorization.

10.13 Due Diligence Detail

This section contains the following topics:

10.13.1 Invoking Due Diligence Detail Screen

You can maintain due diligence details using ‘Due Diligence Detail’ screen. You can invoke this screen by typing ‘UTDDUDEL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

Tax Compliance

Alphanumeric; 4 Characters; Mandatory

Specify the tax compliance details. Alternatively, you can select tax compliance details from the option list. The list displays all valid tax compliance details maintained in the system.

Description

Display

The system displays the description for the selected tax compliance details.

Compliance Effective Date

Date Format; Mandatory

Select the compliance effective date to process the due diligence from the adjoining calendar.

The default value will be effective date maintained in the Tax compliance setup maintenance. You should not specify the date less than the effective date and greater than the application date.

The system will pick all accounts opened on or before the date input here. It will be applicable for all process type. For due diligence process the date cannot be less than the effective date and greater than the application date.

For Diminimis process, the date cannot be less than the due diligence date maintained as part of Tax compliance setup and not greater than the application date.