7. Foreign Account Tax Compliance Act (FATCA)

FATCA is the acronym for Foreign Account Tax Compliance Act enacted by the US Government as part of the Hiring Incentives to Restore Employment (HIRE) Act, in 2010.The purpose of FATCA is to help Internal Revenue Service (IRS) to identify and collect tax from US Persons (USP) holding financial assets outside US.

This chapter deals with Foreign Account Tax Compliance regulation. It includes the description about functions that would help FCIS to support FATCA.

This chapter contains the following sections:

- Section 7.1, "System Parameters"

- Section 7.2, "Entity FATCA Classification"

- Section 7.3, "Entity FATCA Classification Maintenance"

7.1 System Parameters

The below mentioned table describe the system parameters for the related fields:

Field |

System Parameter |

Maximum Length |

FATCA Classification –Individual |

FATCACATIND |

10 |

FATCA Classification –Corporate |

FATCACATCOR |

10 |

FATCA Classification Reasons |

FATCACATREASON |

10 |

FATCA Effective Date |

FATCAEFFDATE |

10 |

FATCA Individual UH Reporting |

FATCAINDUHLIMIT |

10 |

FATCA Corporate UH Reporting |

FATCACORPUHLIMIT |

10 |

FATCA Verification Time Limit in days |

FATCAVERTMLIMIT |

4 |

FATCA Due Diligence Date |

FATCADUEDELIGENCEDATE |

10 |

FATCA Country Code |

FATCACNTRYCD |

3 |

FATCA Amount Limit |

FATCAAMOUNTLIMIT |

10 |

FATCA WHT Applicable |

FATCAWHTAPPLICABLE |

3 |

FATCA WHT Effective Date |

FATCAWHTEFFDT |

10 |

FATCA WHT Percentage |

FATCAWHTPERCENTAGE |

3 |

Document for individuals |

MASTERDOCIND |

Max |

Document for corporate |

MASTERDOCCORP |

Max |

Category of the documents |

MASTERDOCCAT |

3,2 |

Max % of holding for Corporate UH for the defined directors |

FATCAMINPCNTHLDG |

Max |

The international dialling country code |

INTDIALCODE |

|

7.2 Entity FATCA Classification

This section contains the following topics:

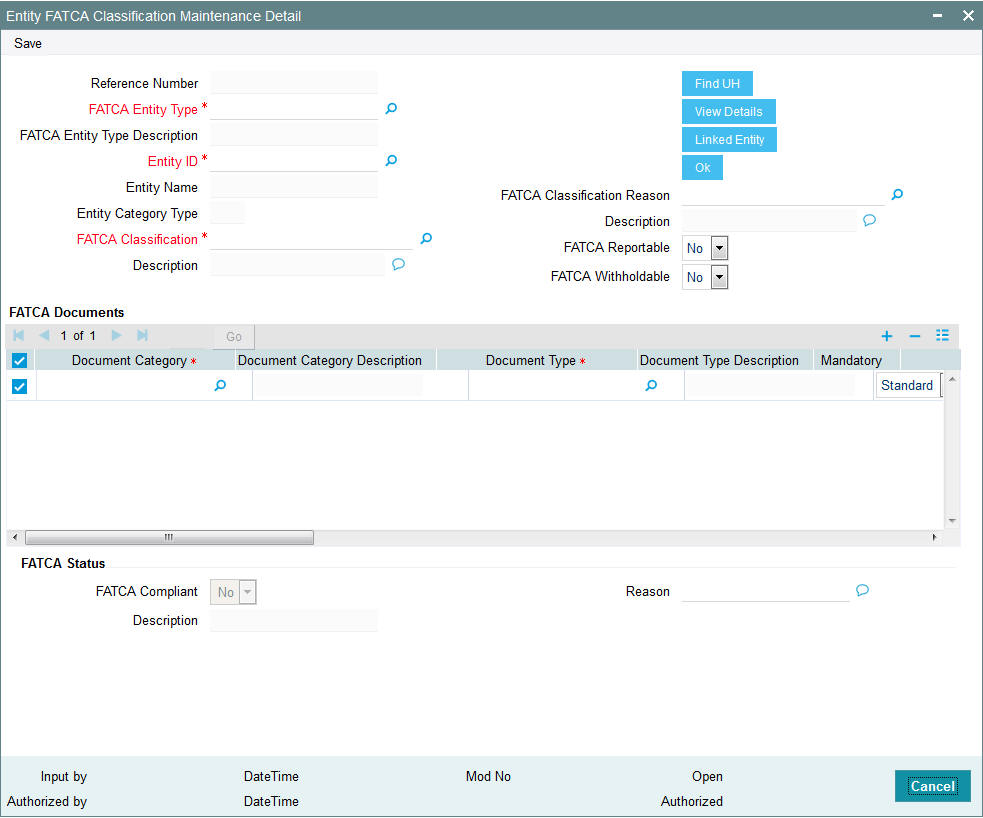

7.2.1 Maintaining Entity FATCA Classification

You can maintain FATCA Classification and record document details in the ‘Entity FATCA Classification Maintenance Detail’ screen. To invoke this screen type ‘UTDFATMT’ in the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

You can capture the following details in this screen:

Reference Number

Display

The system displays the reference number.

FATCA Entity Type

Alphanumeric; 2 Characters; Mandatory

Select the FATCA entity type from the adjoining option list. The options available are:

- Unit Holder

- Broker

- Single Entity

- Nominee

FATCA Entity Type Description

Display

The system displays the description for the selected FATCA entity type.

Entity ID

Alphanumeric; 12 Characters; Mandatory

Select the Entity identification from the adjoining option list.

You can also query for entity ID by clicking ‘Find UH’ button.

Entity Name

Display

The system defaults the entity name from the entity record.

Entity Category Type

Display

The system displays the entity category type.

FATCA Classification

Alphanumeric; 25 Characters; Mandatory

Select the FATCA Classification from the adjoining option list.

Description

Display

The system displays the description for the selected FATCA classification.

FATCA Classification Reason

Alphanumeric; 25 Characters; Mandatory

Select the reason for FATCA classification from the adjoining option list.

Description

Display

The system displays the description for the selected FATCA classification reason.

FATCA Reportable

Optional

Select the FATCA Reportable status for the entity selected from the drop-down list. The list displays the following values:

- Yes

- No

FATCA With holdable

Optional

Select the FATCA with holdable status for the entity selected from the drop-down list. The list displays the following values:

- Yes

- No

FATCA Documents

Document Category

Alphanumeric; 25 Characters; Mandatory

Select the document category from the adjoining option list.

Document Category Description

Display

The system displays the description for the selected document category.

Document Type

Alphanumeric; 25 Characters; Mandatory

Select the type of the document from the adjoining option list.

Document Type Description

Display

The system displays the description for the selected document type.

Mandatory

Optional

You need to indicate whether the document is mandatory or optional. The drop-down list displays the following options:

- Standard - This indicates that the document is mandatory

- Additional - This indicates that the document is optional

Select the appropriate option.

Document ID

Alphanumeric; 25 Characters; Optional

Specify the document identification.

Issue Date

Date Format; Mandatory

Specify the issue date of the received document.

Expiry Date

Date Format; Optional

Specify the expiry date of the received document.

Copy Received

Mandatory

Check this box to indicate that the copy is received.

Original Received

Mandatory

Check this box to indicate that the original is received.

Received Date

Date Format; Optional

Specify the document received date.

Document Reference Number

Alphanumeric; Optional

Specify the document tracking reference number.

Remarks

Alphanumeric; 255 Characters; Optional

Specify remarks, if any.

Chasing Date

Date Format; Optional

Specify the document chasing date.

Document Reference Number

Alphanumeric; 255 Characters; Optional

Specify the document reference number

Document Serial Number

Display

The system displays the document serial number.

Document Upload

Click this button to upload or view the documents.

FATCA Status

FATCA Compliant

Display

The system displays whether you are FATCA compliant.

Description

Display

The system displays the description for the FATACA compliant.

Reason

Alphanumeric; 255 Characters; Optional

Specify remarks, if any.

Click ‘View’ button. The ‘Single Entity Maintenance Detail’ screen is displayed. You can maintain the details of single entity in this screen.

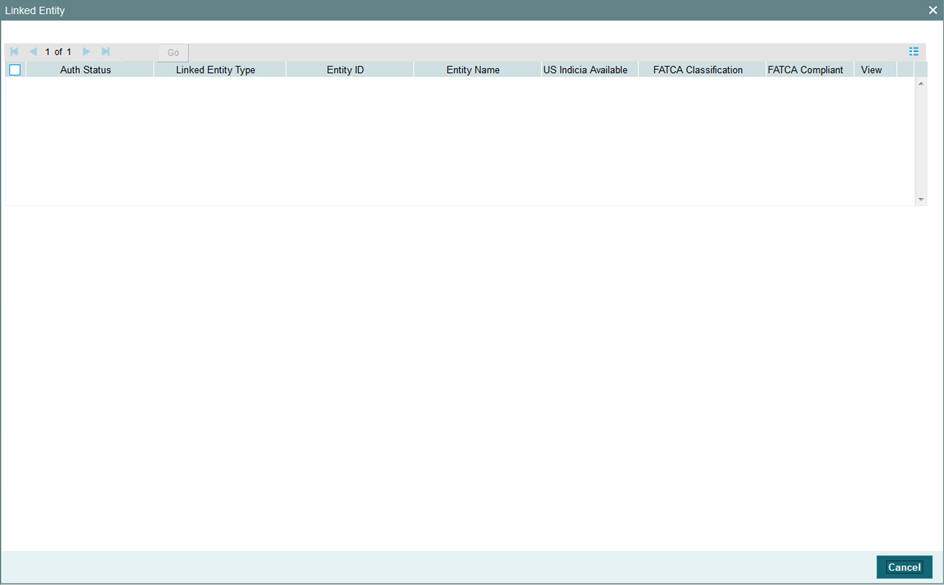

Linked Entity Button

Click on Linked Entity button to view linked entity details.

The system displays the following values:

- Auth Status

- Linked Entity Type

- Entity ID

- Entity Name

- US Indicia Available

- FATCA Classification

- FATCA Compliant

View

Click on ‘View’ to view the details of FATCA Maintenance of a linked entity.

Note

During UT Transaction capture for US Indicia Available Funds, if the FATCA Status of the unit holder or linked entity of a unit holder is:

- Pending, then the system displays a warning message as ‘Maintain FATCA Classification for UH/Linked entity’.

- Recalcitrant, then the system displays warning message as ‘Unit Holder or Linked entities mapped to the Unit Holder is FATCA is recalcitrant’.

During LEP Transaction capture for US Indicia Available Funds, if the FATCA Status of the unit holder or linked entity of a unit holder is:

- Pending, then the system displays a warning message as ‘Maintain FATCA Classification for UH/Linked entity.

- Recalcitrant, then the system displays warning message as ‘Unit Holder or Linked entities mapped to the Unit Holder is FATCA is recalcitrant’.

If the US Indicia is available for one of the customer during the CIF merge, then the customer account to which this account is being merged will also be US Indicia.

7.3 Entity FATCA Classification Maintenance

This section contains the following topics:

- Section 7.3.1, "Viewing Entity FATCA Classification Maintenance"

- Section 7.3.2, "Deleting Entity FATCA Classification Maintenance Details"

- Section 7.3.3, "Modifying FATCA Maintenance Details"

- Section 7.3.4, "Authorizing FATCA Maintenance Details"

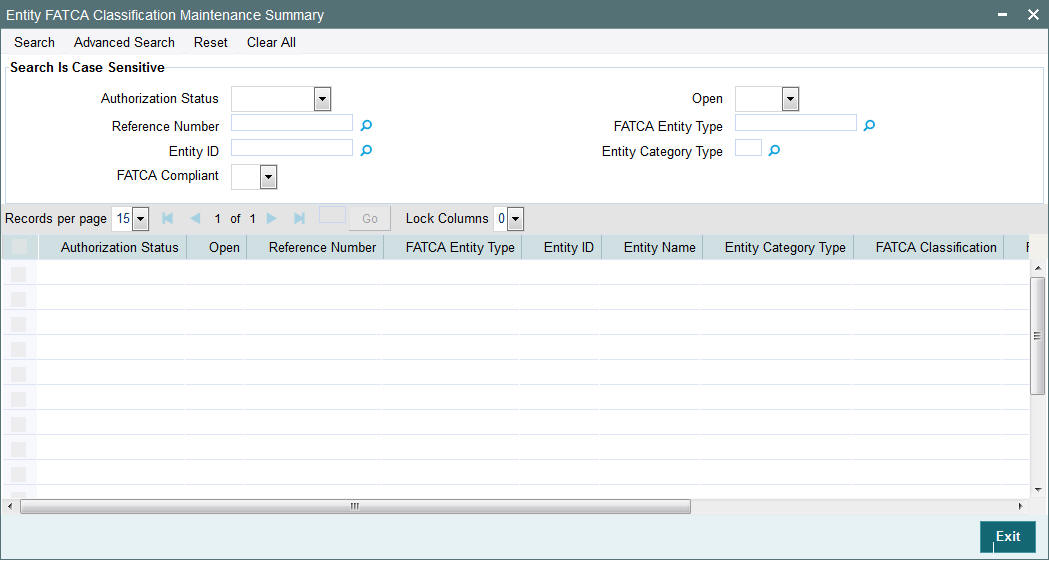

7.3.1 Viewing Entity FATCA Classification Maintenance

You can view, modify, delete and authorize Entity FATCA Classification Maintenance details in the ‘Entity FATCA Classification Maintenance Summary’ screen. You can invoke this screen by typing ‘UTSFATMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can perform the following actions using this screen

You can view previously entered details of Entity FATCA Classification Maintenance Detail in the ‘Entity FATCA Classification Maintenance Summary’ screen, as follows:

- Specify any or all of the following details in the ‘Entity

FATCA Classification Maintenance Summary’ screen:

- The status of the record in the Authorization Status field. If you choose the ‘Blank Space’ option, then all the records that involve the specified Entity FATCA Classification Maintenance Detail are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all the records that involve the specified Entity FATCA Classification Maintenance Detail are retrieved.

- Reference Number

- Entity ID

- FATCA Compliant

- FATCA Entity Type

- Entity Category Type

Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also search the record by using combination of % and alphanumeric value.

7.3.2 Deleting Entity FATCA Classification Maintenance Details

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the ‘Entity FATCA Classification Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete. The ‘Entity FATCA Classification Maintenance Detail’ screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

7.3.3 Modifying FATCA Maintenance Details

You can modify only unauthorized records in the system. To modify a record that you have previously entered:

- Invoke the ‘Entity FATCA Classification Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for modification.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify. The ‘Entity FATCA Classification Maintenance Detail’ screen is displayed.

- Select Edit operation from the Action list and modify the details. After modifying the details, click Save to save the modifications.

7.3.4 Authorizing FATCA Maintenance Details

You can authorize records in the system. To authorize a record that you have previously entered:

- Invoke the ‘Entity FATCA Classification Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for authorization.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to authorize. The ‘Entity FATCA Classification Maintenance Detail’ screen is displayed.

- Select authorize operation from the Action list. The system prompts you to confirm the authorization, and the record is authorized.

7.4 FATCA WHT Repayment

This section contains the following topics:

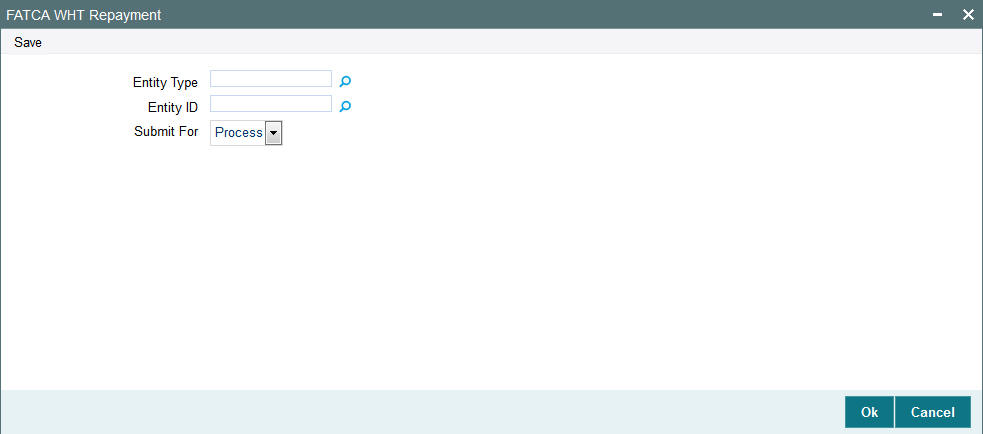

7.4.1 Invoking FATCA WHT Repayment Screen

You can maintain FATCA with holding tax repayment using ‘FATCA WHT Repayment’ screen. You can invoke this screen by typing ‘UTDFATRP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

Entity Type

Alphanumeric; 1 Character; Optional

Specify the entity type. Alternatively, you can select entity type from the option list. The list displays all valid entity types maintained in the system.

Entity ID

Alphanumeric; 12 Characters; Optional

Specify the entity ID. Alternatively, you can select entity ID from the option list. The list displays all valid entity ID maintained in the system.

Submit For

Optional

Select the submit option from the drop-down list. The list displays the following values:

- Process

- Execute