8. Setting up Loads

This chapter contains the following sections:

- Section 8.1, "Loads"

- Section 8.2, "Load Maintenance Screen"

- Section 8.3, "Load Maintenance Summary Screen"

- Section 8.4, "Load Mapping"

- Section 8.5, "Across Schemas Load Mapping Summary"

- Section 8.6, "Exchange Rate Source Mapping for Different Schemas"

- Section 8.7, "Exchange Rate Source Mapping Summary"

- Section 8.8, "Trailing Fees"

- Section 8.9, "Payment Groups"

- Section 8.10, "Payment Group Maintenance Summary"

- Section 8.11, "Periodic Load Screen"

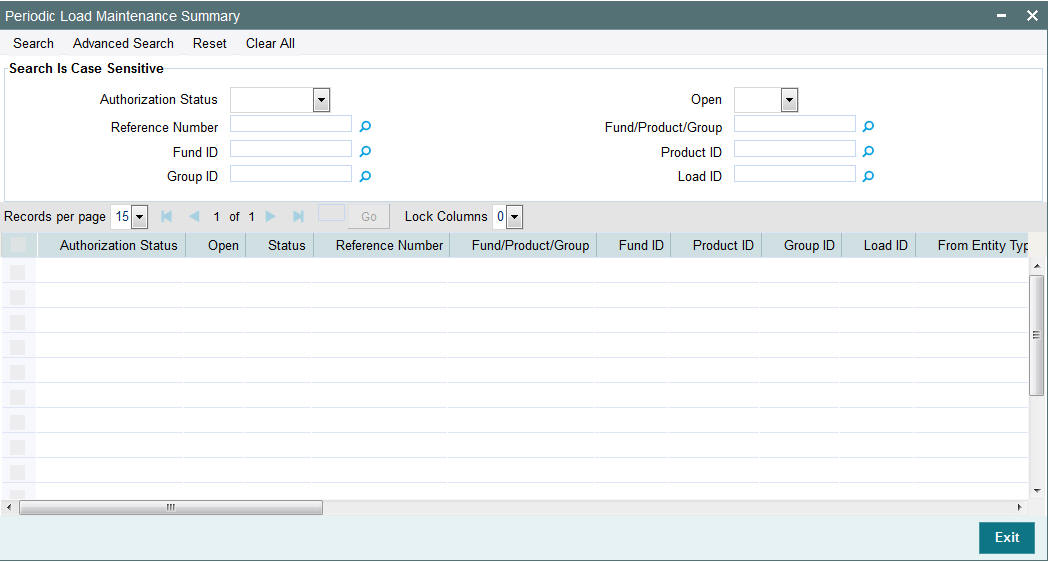

- Section 8.12, "Periodic Load Maintenance (Summary) Screen"

- Section 8.13, "Computation of Trailing Fees"

- Section 8.14, "Methodologies of Trailer Commission Computation"

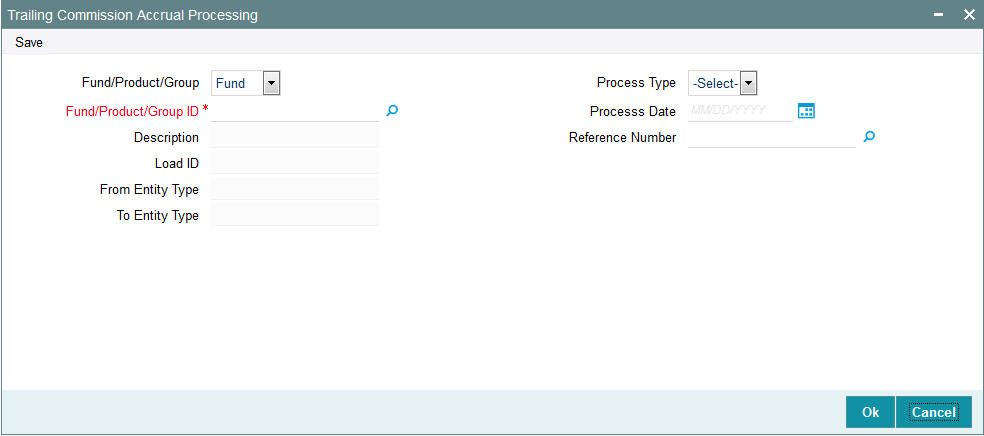

- Section 8.15, "Trailer Commission Processing"

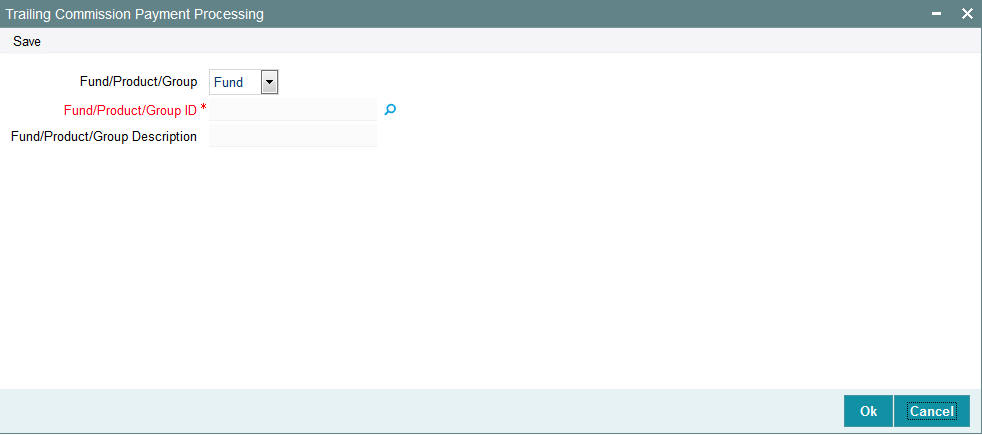

- Section 8.16, "Processing Payment of Trailer Commission"

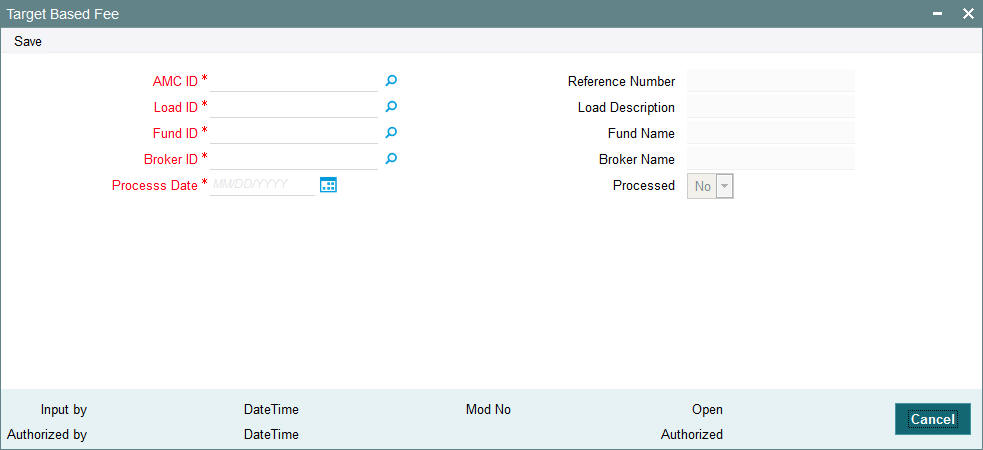

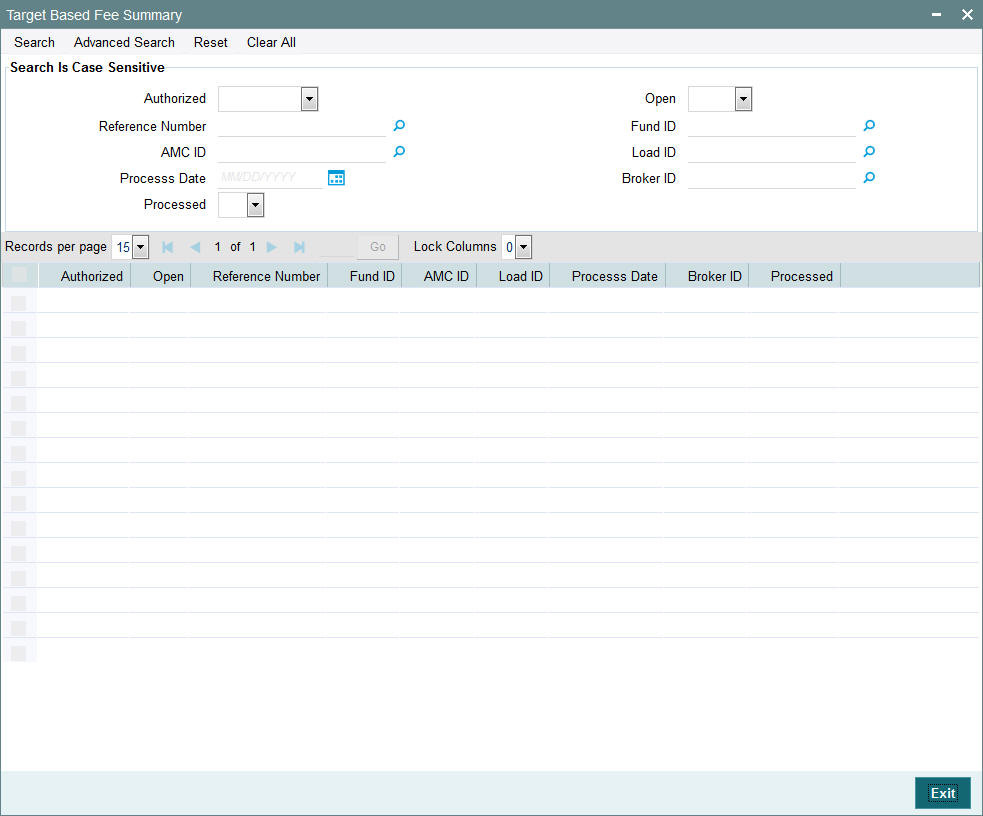

- Section 8.17, "Target Based Fee"

- Section 8.18, "Target Based Fee Summary Screen"

- Section 8.19, "Entity Commission"

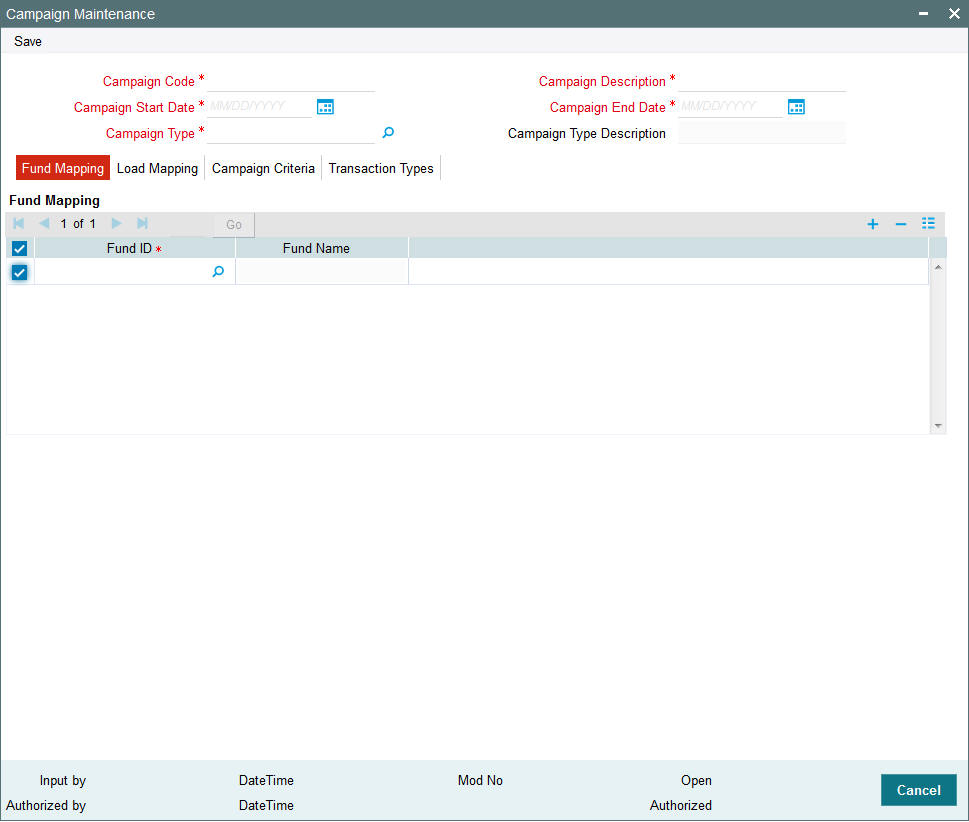

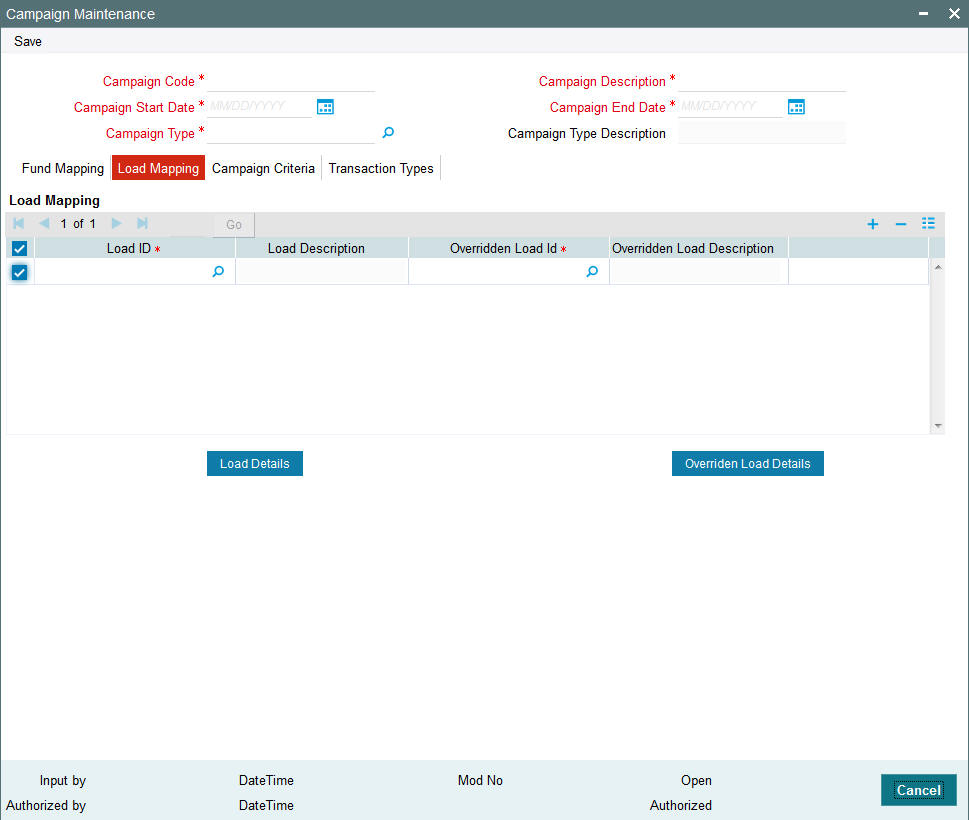

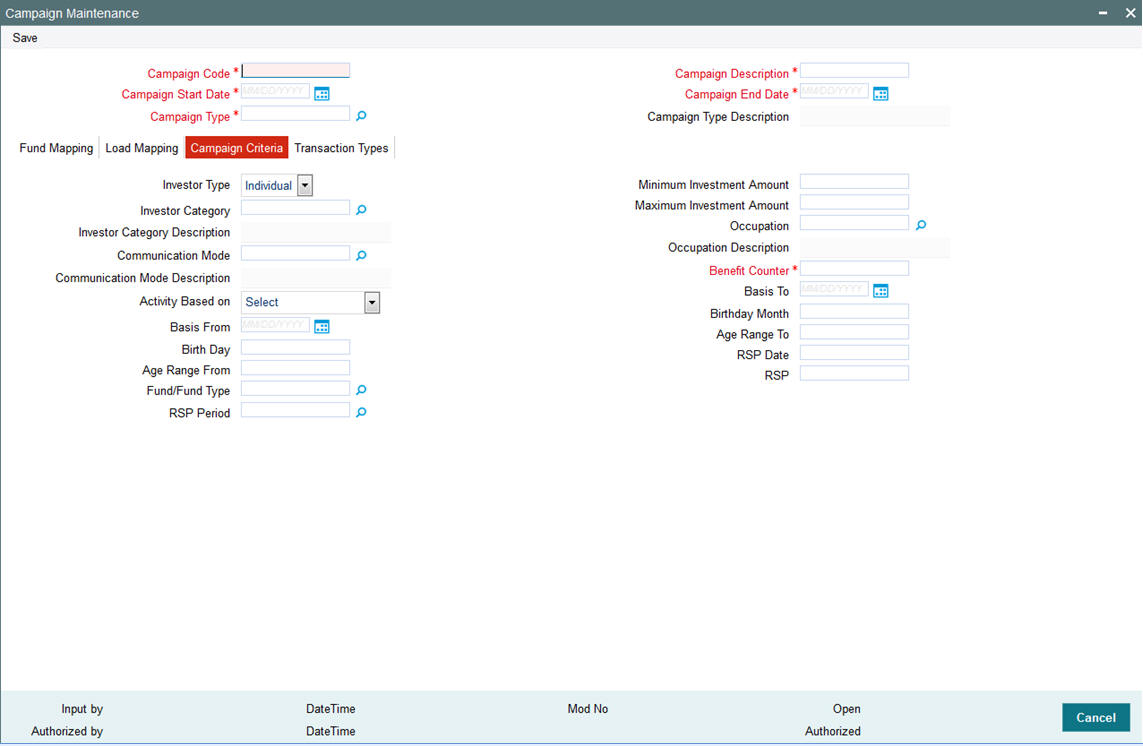

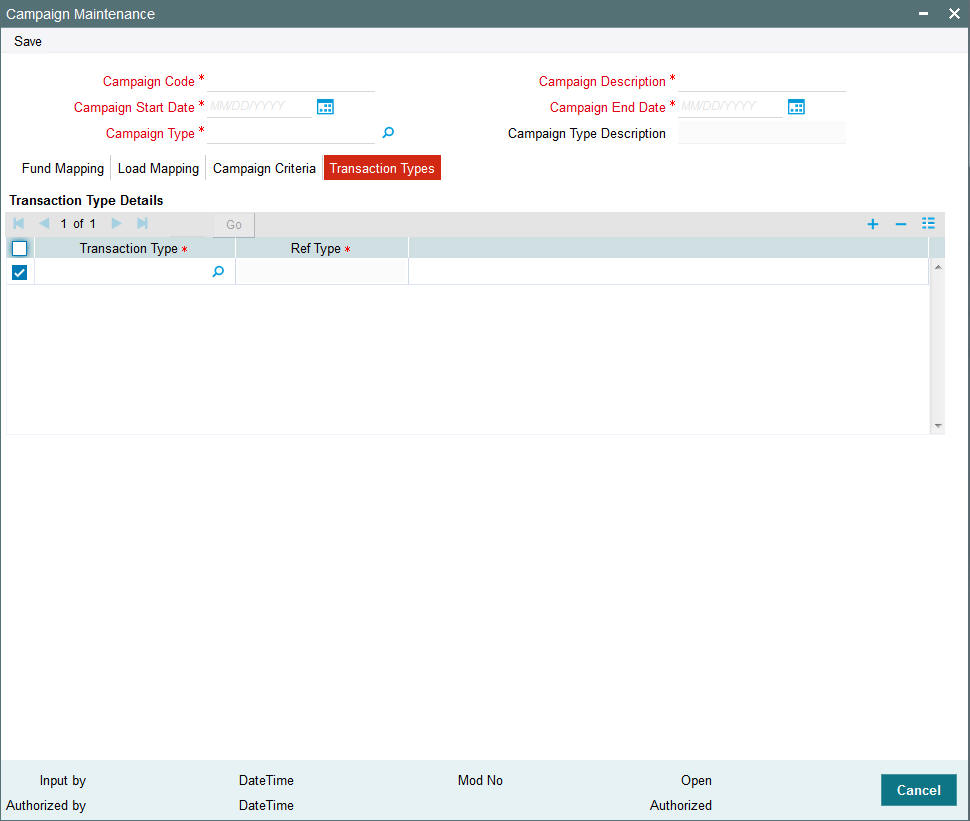

- Section 8.20, "Campaign Maintenance"

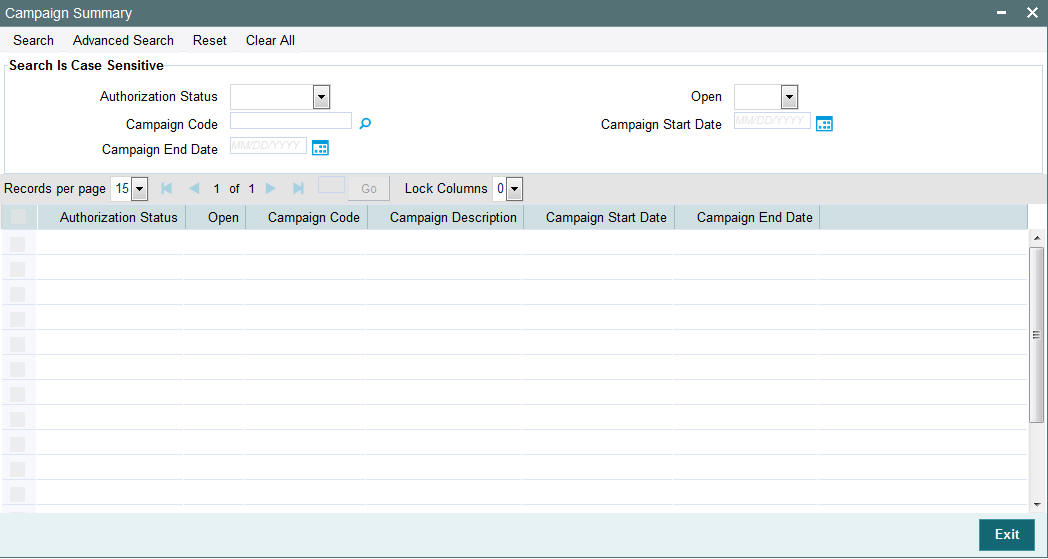

- Section 8.21, "Campaign Summary Screen"

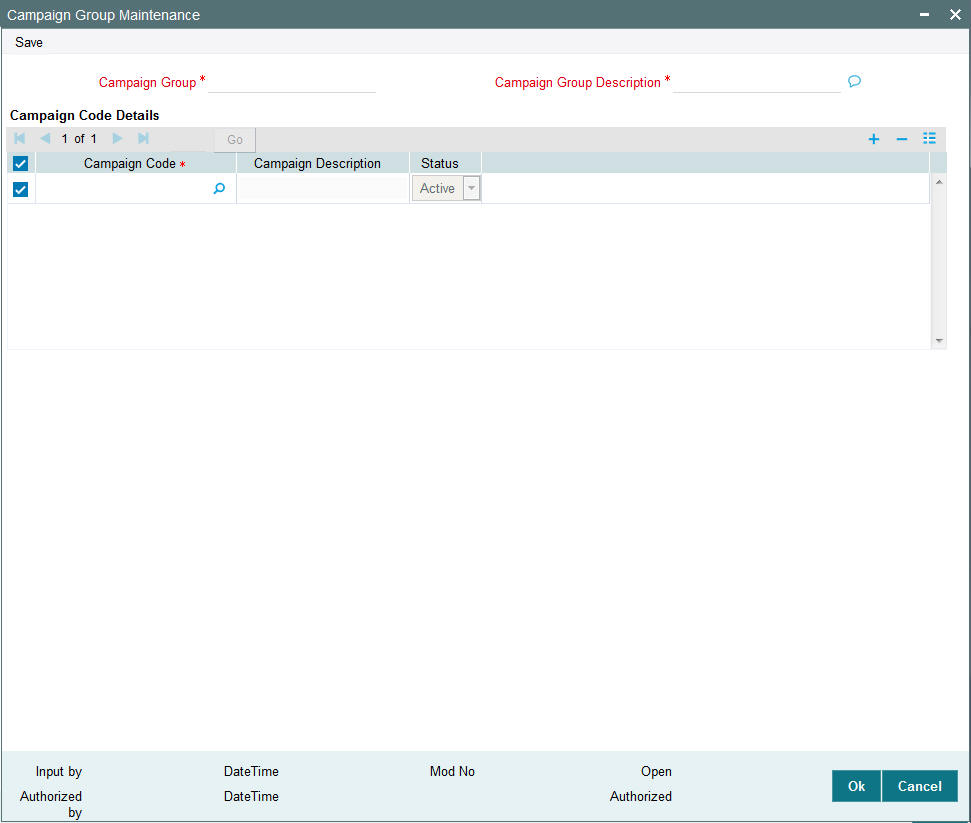

- Section 8.22, "Campaign Group Maintenance"

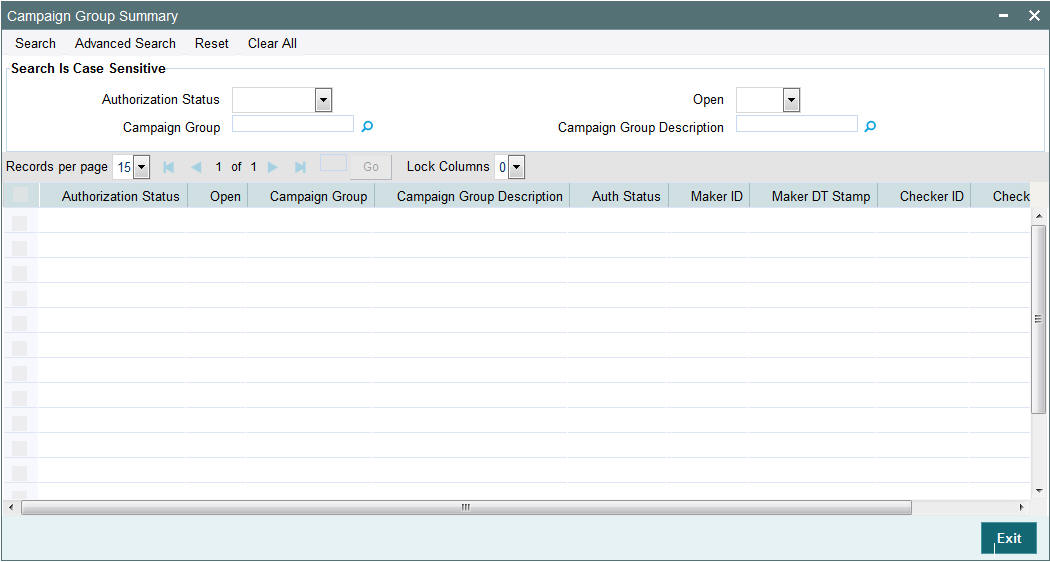

- Section 8.23, "Campaign Group Summary"

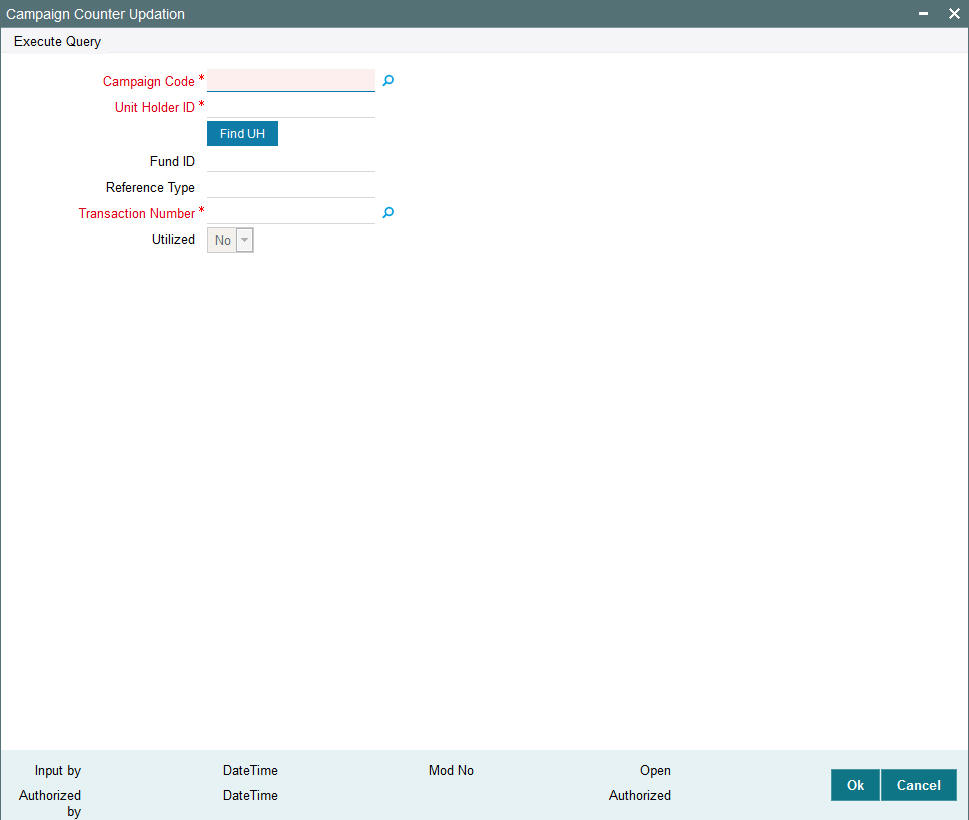

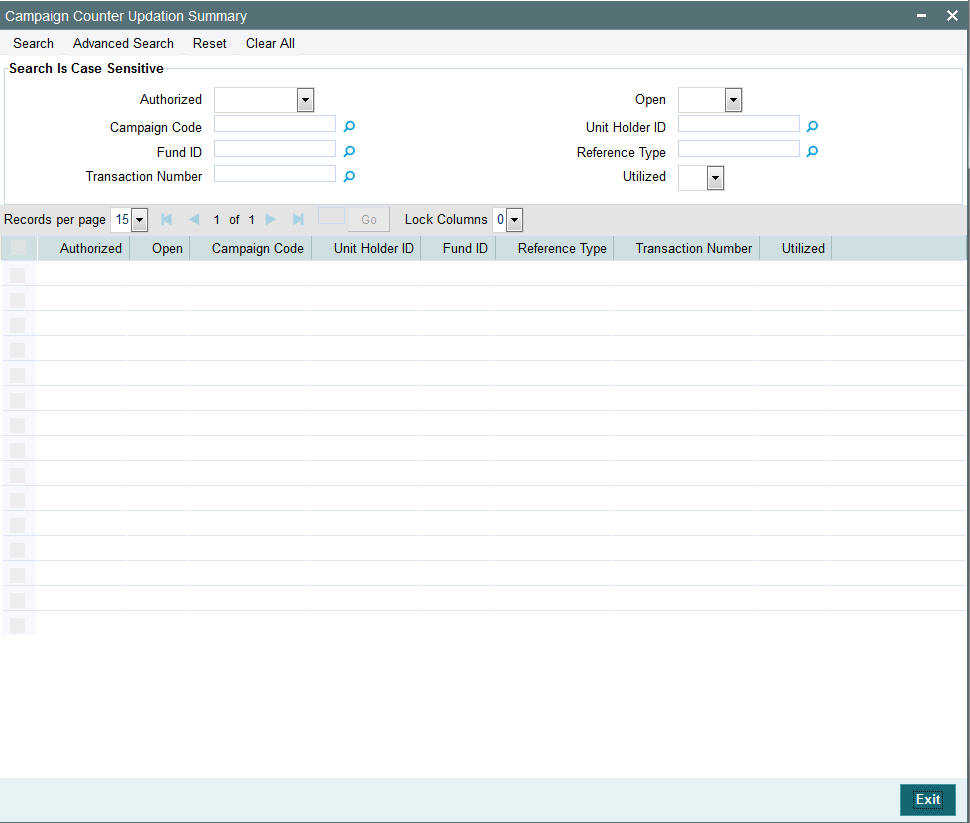

- Section 8.24, "Campaign Counter Updation"

- Section 8.25, "Campaign Counter Updation Summary"

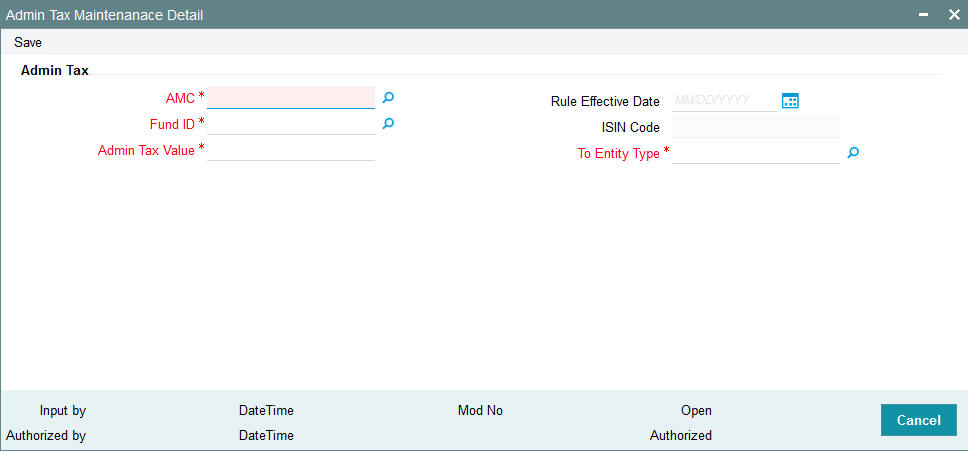

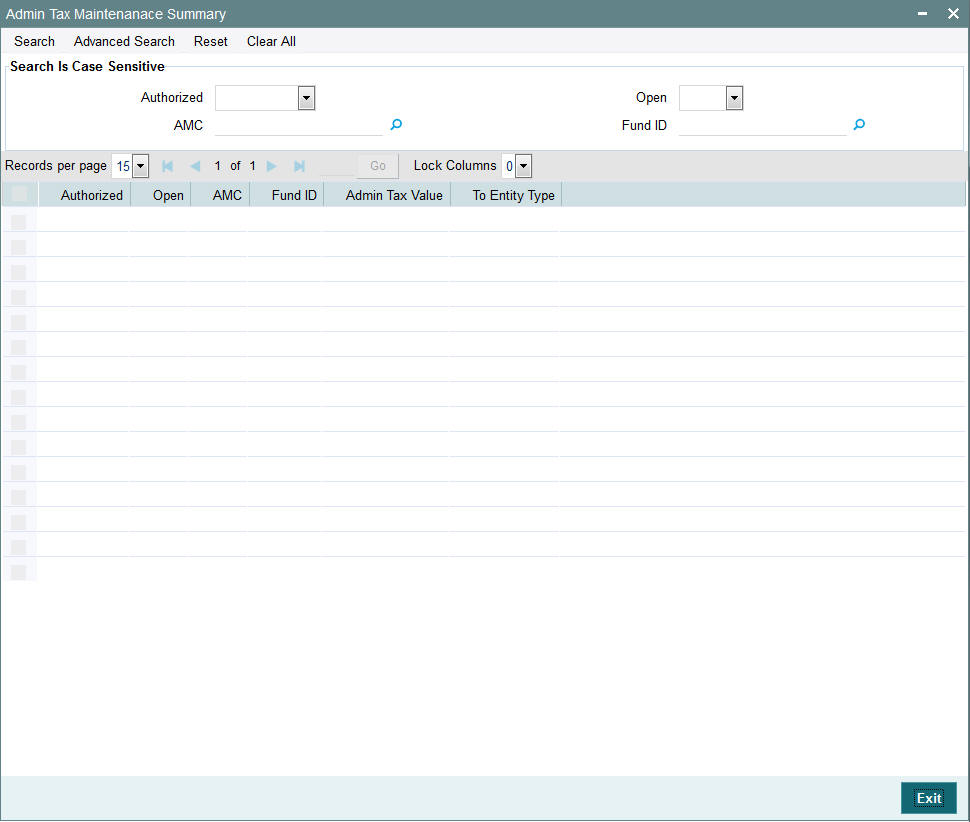

- Section 8.26, "Admin Tax Maintenance"

- Section 8.27, "Admin Tax Maintenance Summary"

8.1 Loads

This section contains the following topics:

- Section 8.1.1, "Types of Loads"

- Section 8.1.2, "Parameters that form Basis for Applying Load"

- Section 8.1.3, "Setting up Loads in System"

8.1.1 Types of Loads

When an investor transacts in an AMC, the AMC may charge the investor a certain fee for any or all of the transactions requested. On the other hand, the AMC may give the investor an incentive for reasons of continued loyalty, or for initial investment. These fees or incentives are identified as loads.

A load involves payment by one entity to another. Any entity that makes the payment is known as the “From” entity, and any entity that receives such payment is known as the “To” entity. Accordingly, there are two basic types of loads, from which all other loads derive:

- Fees: Any payment for transaction charges that investors make to the AMC are fees. .

- Incentives: An AMC sometimes makes a special preference in terms of charges for initial investors and for those investors that have transacted with the AMC over a considerable period of time. These preferences are known as incentives.

For instance, an AMC may stipulate that for the first 10 investors that invest in a newly floated fund, a differential favourable price would be applied. This is an incentive.

The recipient (or the “To” entity) of an incentive could be a unit holder, a broker or another entity.

A broker may also be required to pay a fee to the AMC for services rendered, such as commission processing and payment, reinvestment processing and so on. If the unit holder is not any of the involved parties then that load is a commission. (that is, the “From” or “To” entities are not unit holders).

8.1.2 Parameters that form Basis for Applying Load

Fees, incentives and commissions may be based on many different parameters, or combinations of these parameters, depending upon the requirements of the AMC.

While transacting, the AMC may attach loads to any transaction, be it a fee, incentive or a commission, which may be computed and applied on the basis of any of the following parameters:

Date

For instance, for any transaction request that is accepted on a certain date or a certain period bounded by any two dates, an incentive may be applied on the amount of the transaction, as follows:

Consider a slab as follows:

Slab |

From Date |

To Date |

Return Value |

0-10000 |

15-10-2000 |

15-12-2000 |

5% |

Here the slab value may be reckoned as an amount or a number of units.

This means that for all transactions requested after 15-10-2000 and before 15-12-2000, for a volume that lies within the slab, the percentage of the load (incentive) applied is 5%. In such a case, for a transaction coming in on 15-10-2000, if the transaction amount is 5000 Rand, then the investor would be given an incentive amounting to an additional 250 Rand (5/100 * 5000) worth of units in the fund.

In the same case, if the load were a fee, then the investor would be given only 4750 Rand {5000 - (5/100 * 5000)} worth of units in the fund.

Generally, this is an early bird incentive in case of an IPO or subscription transaction period.

A load can also be applied based on a certain number of days, months or years that the unit holder remains in the fund. For instance,

Load |

Period |

Return Value |

L45 |

45 Days |

5% |

L4M |

4 Months |

4% |

L1Y |

1 Year |

3% |

Let us suppose that a certain unit holder has entered into transactions with the AMC in the following manner:

Transaction Reference Number |

Transaction Type |

Transaction Amount |

Transaction Date |

T1 |

Subscription |

1000 |

3-1-2001 |

T2 |

Subscription |

2000 |

3-4-2001 |

T3 |

Redemption |

3000 |

3-7-2001 |

For the redemption transaction on 3-7-2001, the load based on period is explained below. The load for this transaction is based on the period that has elapsed between the original subscription transaction and the redemption transaction through which the units resulting from the original transaction are redeemed.

Note

The three loads in this example are to be reckoned as separate loads. A single load cannot have slabs based on all three parameters - days, months and years.

Load applied based on the subscription transaction T1:

The number of days between the transaction T1 and T3 = Difference in days between 3-7-2001 and 3-1-2001 = 180 days. This period falls in the slab for load L1Y, above, and the load applied will be 3% of the transaction amount:

Load = 3/100 * 3000 = 90

Load applied based on the subscription transaction T2:

The number of days between the transaction T2 and T3 = Difference in days between 3-7-2001 and 3-4-2001 = 90 days. This period falls in the slab for load L4M, above, and the load applied will be 4% of the transaction amount:

Load = 4/100 * 3000 = 120

Therefore, the total load amount applied for the redemption transaction T3 is 90+120 = 210.

Note

Both the loads applied as shown in the example above are based on periods, and also on the original subscription transaction(s) that have generated the units being redeemed, in a subsequent redemption transaction. These loads have no other basis than these two factors. Since they are based on the period for which the unit holder has continued with the fund, they are known as aging loads.

Loading based on aging policy

In the example given above, the units value considered for the redemption transaction T3 could also be dependent on the aging policy designated for the fund. If the aging policy is designated to be FIFO (first-in, first-out), the aging would apply as follows:

Out of the 3000 units being redeemed, 1000 units would be aged to 180 days (as corresponding to the first subscription transaction T1).

Therefore, the load for the redemption of these 1000 units would be calculated as follows:

3/100 * 1000 = 30

The remaining 2000 units would be aged to 90 days (as corresponding to the first subscription transaction T2).

Therefore, the load for the redemption of these 2000 units would be calculated as follows:

4/100 * 2000 = 80

Therefore, the total loading for T3, with an ageing policy of FIFO, would be 30+80 = 110.

Amount

For each amount slab, the AMC could charge a fee. This would be an amount-based load.

Units

Similarly, as with amount-based loads, the AMC could charge a fee for each slab of units.

Date and Amount

The fee charged could also be operable within a date range, and an amount range.

Period and Amount

The fee could be charged on each amount slab based on a certain number of days, months or years that the unit holder remains in the fund.

Note

If the lower boundary is to be inclusive, then a transaction value of 1000 currency units would be reckoned as falling in the slab 002 for any of the loads. If not, as in this case, then the transaction value of 1000 currency units would be reckoned as falling in the slab 001 for any of the loads.

Let us suppose that a certain unit holder has entered into transactions with the AMC in the following manner:

Transaction Reference Number |

Transaction Type |

Total Transaction Amount |

Transaction Date |

T1 |

Subscription |

1000 |

3-1-2001 |

T2 |

Subscription |

2000 |

3-4-2001 |

T3 |

Redemption |

3000 |

3-7-2001 |

For the redemption transaction on 3-7-2001, the load based on period and amount is explained below, assuming that the ageing policy for the fund is designated to be FIFO (first-in, first-out). The load for this transaction is based on the period that has elapsed between the original subscription transaction and the redemption transaction through which the units resulting from the original transaction are redeemed. It also takes into account the amount being redeemed.

Load applied based on the subscription transaction T1:

The number of days between the transaction T1 and T3 = Difference in days between 3-7-2001 and 3-1-2001 = 180 days. This period falls in the period slab for load L1Y, above, and the number of units falls in the units slab 001 for L1Y. The return value for the load applied will be 75 currency units.

Load applied based on the subscription transaction T2:

The number of days between the transaction T2 and T3 = Difference in days between 3-7-2001 and 3-4-2001 = 90 days. This period falls in the period slab for load L4M, above, and the number of units falls in the units slab 002 for L1Y. The return value for the load applied will be 100 currency units.

Therefore, the total load amount applied for the redemption transaction T3 is 75+100 = 175 currency units.

Note

Both the loads applied as shown in the example above are based on periods and amounts, and also on the original subscription transaction(s) that have generated the units being redeemed, in a subsequent redemption transaction. These loads have no other basis than these two factors. Consequently, they are known as aging loads.

Date and Units

The fee charged could also be operable within a date range, and a units range.

Period and Units

A load can also be applied based on a certain number of days, months or years that the unit holder remains in the fund. For instance,

Load |

Period |

Slab |

From Units |

To Units |

Return Value |

Lower Boundary Inclusive |

L45 |

45 days |

001 |

0 |

1000 |

5% |

No |

|

|

002 |

1000 |

2000 |

4% |

No |

L4M |

4 months |

001 |

0 |

1000 |

4% |

No |

|

|

002 |

1000 |

2000 |

3% |

No |

L1Y |

1 year |

001 |

0 |

1000 |

3% |

No |

|

|

002 |

1000 |

2000 |

2% |

No |

Let us suppose that a certain unit holder has entered into transactions with the AMC in the following manner:

Transaction Reference Number |

Transaction Type |

Transaction Amount |

Transaction Date |

T1 |

Subscription |

1000 |

3-1-2001 |

T2 |

Subscription |

2000 |

3-4-2001 |

T3 |

Redemption |

3000 |

3-7-2001 |

For the redemption transaction on 3-7-2001, the load based on period is explained below. The load for this transaction is based on the period that has elapsed between the original subscription transaction and the redemption transaction through which the units resulting from the original transaction are redeemed.

Load applied based on the subscription transaction T1:

The number of days between the transaction T1 and T3 = Difference in days between 3-7-2001 and 3-1-2001 = 180 days. This period falls in the slab for load L1Y, above, and the load applied will be 3% of the transaction amount:

Load = 3/100 * 3000 = 90

(Here again, if the aging policy is FIFO, only 1000 units would be aged, and the load would be 3/100 * 1000 = 30)

Load applied based on the subscription transaction T2:

The number of days between the transaction T2 and T3 = Difference in days between 3-7-2001 and 3-4-2001 = 90 days. This period falls in the slab for load L4M, above, and the load applied will be 4% of the transaction amount:

Load = 4/100 * 3000 = 120

(Here again, if the aging policy is FIFO, only 2000 units would be aged, and the load would be 4/100 * 2000 = 80)

Therefore, the total load amount applied for the redemption transaction T3 is 90+120 = 210.

If the aging policy is FIFO, the total load amount would be 30 + 80 = 110.

Note

Both the loads applied as shown in the example above are based on periods, and also on the original subscription transaction(s) that have generated the units being redeemed, in a subsequent redemption transaction. These loads have no other basis than these two factors. Since they are based on the period for which the unit holder has continued with the fund, they are known as aging loads.

Loading based on aging date

Ageing for period based loads is calculated based on the ageing date specified at the time of setting up a fund. It can be the dealing date, transaction date or the confirmation date. Period is calculated using the following formula:

Period = Transaction/Dealing date/Price date of the redemption Link transaction date of the corresponding subscription transaction.

Here, the link transaction date of the subscription is the date of inflow for the redemption.

8.1.3 Setting up Loads in System

The Oracle FLEXCUBE Investor Servicing system provides the facility of setting up the pattern according to which you can process loads.

To configure the system to process a load, you must:

- Initiate the load in the system, with all its parameters, in the Load Maintenance (Detail) screen. You can access this screen from the Maintenance menu category of the Fund Manager component. At this time, you must also create any derived loads or basis loads, as applicable, for the load.

- Have another user authorize this load, in the Load Maintenance Find (Summary) screen. This screen may be accessed from the Maintenance menu category of the Fund Manager component. When a load is authorized, all the derived and basis loads (if any) that you have created for the load are also authorized simultaneously.

- At this point, you can edit any details for the load, including details of any derived or basis loads that you have created for the load.

- Map this load to be applied on transactions in the desired funds, in the Fund Load Setup screen. You can access this screen through the Fund Demographics screen, from the Fund Rules (Detail) option in the Maintenance menu category of the Fund Manager component.

- You can also map the load to be applicable for a group of funds defined as a load group. You can do this through the Group Load Mapping screen, accessing it through the Maintenance menu category of the Fund Manager component.

- Authorize the fund (with all its fund rules) in the Fund Rule Find (Summary) screen. You can access this screen from the Maintenance menu category of the Fund Manager component.

Refer the chapters on Setting up Funds and Authorization, respectively, in this user manual for more information on the Fund Load Setup screen and the authorization of a fund.

Note

- After you create a load in the Load Maintenance screen, you can edit the details as many times as possible, as long as the load is not authorized. During editing, you can define any new derived loads or basis loads, or edit any previously created loads.

- After a load is authorized, you can edit the details, provided the load is not already mapped to a fund or a load group, through the Fund Load Setup or Group Load Mapping screens. If you do edit an authorized load under these constraints, your changes will be saved as unauthorized changes. These must be subsequently authorized to be reflected in the database.

- After a load is authorized and then subsequently mapped to a fund or a load group, you cannot edit any of the load details.

8.2 Load Maintenance Screen

This section contains the following topics

8.2.1 Creating Load

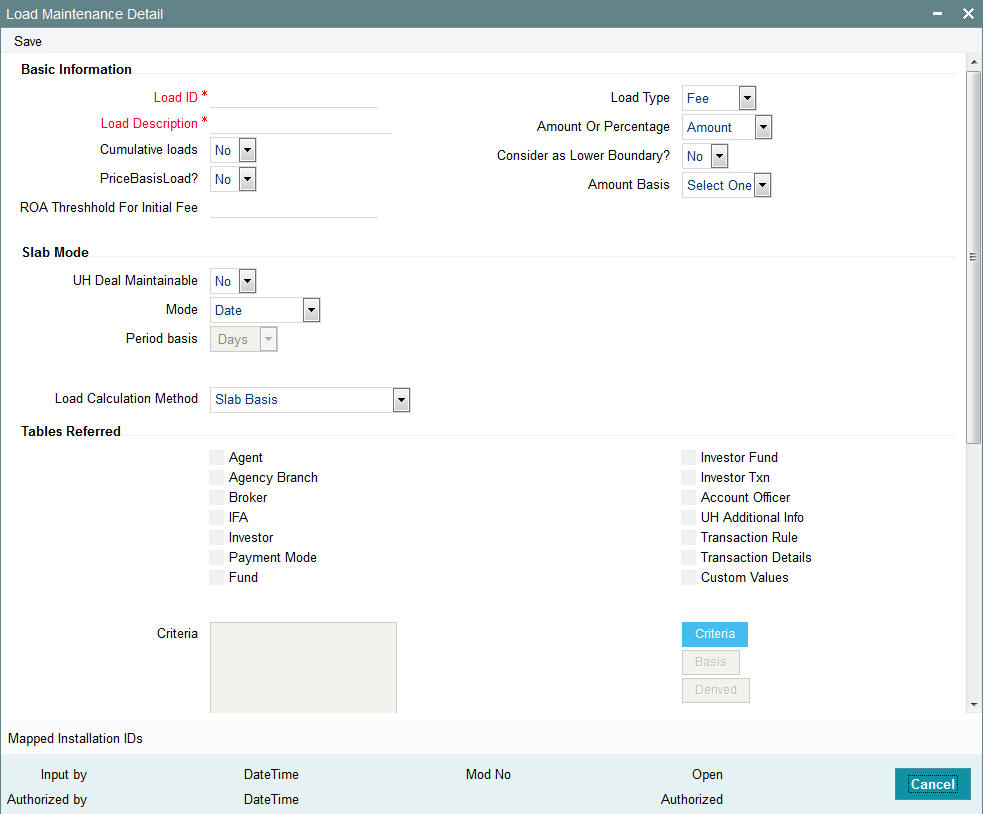

To create a load in the system, use the ‘Load Maintenance Detail’ screen. You can invoke this screen by typing ‘UTDLOADM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the load details.

In this screen, you create a load as follows:

- Specify the basic parameters on the basis of which the load will be applied and computed, in the main Load Maintenance (Detail) screen. These include the following mandatory information:

- A unique identifier for the load, in the Load ID field.

- Descriptive or narrative text qualifying the load, in the Description field.

- Whether the load is fee or an incentive, in the Load Type field. The system deems the load as a fee or an incentive based on the fund load mapping for a fund.

- Whether the return value of the load is arrived at based on an amount or a percentage, in the Amount or Percentage field.

- Whether the load being defined is a price basis load, in the Price Basis Load field.

- The applicable slab type for the load, in the Slab Mode section.

- The basis upon which the period is reckoned, in the Period Basis field.

- The method of calculation to be used for the load, in the Load Calculation Method field.

- Whether a deal can be maintained for a unit holder based on the load, in the UH Deal Maintainable field.

- Whether the load is a cumulative load, in the Cumulative Loads field.

- Whether the lower boundary of a slab is inclusive for the slab, in the Consider as Lower Boundary field.

- Click OK to save your changes.

- Specify the details of slabs for the load and their boundaries in the Load Details section, in the lowest portion of the screen. Setting up slab details for a load is mandatory. When you have set up the slabs, you need to save the changes.

- If you are not setting up a criteria-based load, basis load or derived load, you can save the load in the main Load Definition screen at this stage.

- If you are setting up a criteria-based load, basis load or derived load, click the appropriate button as follows:

- If the load is a basis load, click the Basis link. The Basis Definition screen is opened, and you can set up the load.

- If the load is a derived load, click the Derived link. The Derived Load screen is opened, and you can set up the derived load in this screen.

- If the load is based on criteria, then click the Criteria link. The Query Builder is opened, and you can set up the criteria for the load.

In each of the screens, you must save your changes. The system closes the screen and returns you to the main Load Definition screen, where you must save the load record again.

Note

When you create a load for the first time in this screen, it is advisable that you set up any criteria-based loads, derived loads or basis loads simultaneously.

After a load is authorized, no changes are possible to the load details, i.e., you cannot subsequently set up derived, basis or criteria-based loads, if it has been already mapped to a fund or a group.

To support benefit plans for investors based on successful deduction counter, the system will setup load based on deduction counter.

You can specify the following information in this screen:

Basic Information Section

Load ID

Numeric; 5 Characters; Mandatory

Specify a unique alphanumeric identifier for the load. Do not specify the ID of an existing load here.

Load Description

Alphanumeric; 60 Characters; Mandatory

Enter some descriptive or narrative text, qualifying the load. It should describe the purpose for which the load has been set.

Cumulative Loads

Optional

Select yes to indicate that the load is cumulative in nature. If you check this box, it will be applied based on the static options set up for processing cumulative loads for the AMC. This type of a load is applicable for funds for which the Rights of Accumulation (ROA) facility is applicable.

Price Basis Load

Optional

You can use this field to indicate whether the load being defined is a price basis load, that is, whether the load could be an inherent fee or incentive in respect of fund prices for which price bases other than the NAV and Transaction Base Price components are used.

Note

Any loads that have been defined as price basis loads are only used as the indicator for computing load values, and are not picked up during evaluation of criteria. That is, the other load details specified for such loads, such as the return value, slabs and so on, are not taken into consideration. The difference between the Transaction Base Price and the Price Basis defined for the transaction is considered as an inherent fee or incentive, during allocation.

For instance, if the Price Basis for a transaction is ‘Offer Price’, and Transaction Base Price is 1.009 and the Offer Price is 1.060, the difference (1.06-1.009 = 0.051, without currency rounding) is considered as the inherent fee (since the TBP is less than the offer price). If the offer price were less than the TBP, the difference between the two is considered an inherent incentive.

ROA Threshold for Initial Fee

Numeric; 22 Characters; Mandatory

Specify a threshold for initial fees for ROA based loads. The system compares the value specified with the cumulative AUM of the client to determine what a client should be charged by way of initial fees.

If the cumulative AUM exceeds the threshold value maintained, the system considers the Cumulative AUM for load slab pick up basis.

If the cumulative AUM is lower than the Threshold value maintained, the system considers the transaction value for load slab pick up basis.

Load Type

Optional

Indicate whether the load is to be applied and processed as a fee or an incentive, by choosing the appropriate value from the drop-down list. The list displays the following values:

- Fee

- Incentive

Amount or Percentage

Optional

Indicate whether the return value for the load is a flat Amount or a Percentage of the Base Price/Transaction Amount, by choosing the appropriate value from the drop-down list. The list displays the following values:

- Amount

- Percentage

Consider as Lower Boundary?

Optional

Select Yes to indicate that a slab basis value (either amount or units or period or date) that is a boundary value separating slabs, must be considered as the lower boundary of a slab.

Amount Basis

Optional

Select whether the load return value is to be applied on the fund capital from the drop-down list. The list displays the following values:

- Net

- Gross

This specification is applicable only for Loaded to Price (LTP) loads. Select the Gross option to indicate that the load return value is to be applied on the fund capital. If not, select the Net option.

Slab Mode

UH Deal Maintainable

Optional

Select ‘Yes’ from drop-down list to indicate whether maintaining any deal based on the load would be permitted for unit holders. The list displays the following values:

- Yes

- No

Mode

Optional

Indicate the parameter, upon which basis the slabs for the load will be defined from the drop-down list. The list displays the following values:

- Date

- Period

- Date Amount

- Period Amount

- Amount

- Units

- Date Units

- Period Units

- Deduction Counter

Period Basis

Optional

Indicate the basis upon which the period specified for period-based loads must be interpreted, by choosing the appropriate option from the drop-down list. The list displays the following values:

- Days

- Months

- Years

This information is mandatory for slab modes based on Period, Period and Amount or Period and Units.

Load Calculation Method

Optional

From the list, select the option that indicates the method by which the load must be computed. The following methods of calculation are available:

- Slab Basis

- Linear Interpolation

- Weighted Average

- Progressive Weighted Average

Refer the chapter Managing Investor Accounts in the Agency Branch User Manual for more

information on deals for unit holder.

Tables Referred

You can define a single criterion for a single load. Criteria can be based on any one of the ten parameters given under the Tables Referred section. You can check the relevant boxes from the following list:

- Agent

- Agency Branch

- Broker

- IFA

- Investor

- Payment Mode

- Fund

- Investor Fund

- Investor Transaction

- Account Officer

- UH Additional Info

- Transaction Rule

- Transaction Details

- Custom Values

Criteria

Click ‘Criteria’ button to specify criteria for criteria-based loads. The Query Builder is opened, and you can specify the required criteria.

The criteria could be based on the parameters given. Choose one from the list box and select an Operator like (=, >, <) and enter the value you want to assign. The system will validate the specified criteria and the load will be applied only on successful validation of the same.

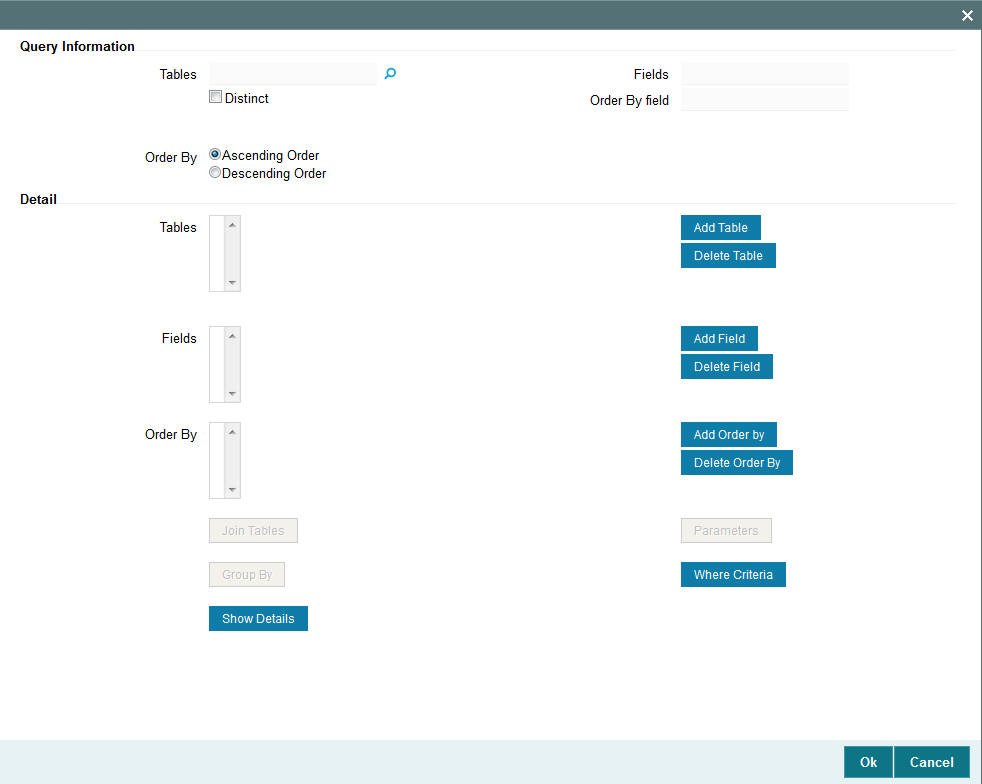

You can specify the following details:

Query Information

Tables

Alphanumeric; 35 Characters; Optional

Specify table details to query.

Distinct

Optional

Check this box for distinct query.

Fields

Display

The system displays the fields value.

Order By field

Display

The system displays the order by field value.

Order By

Optional

Select order by option by selecting one of the following options:

- Ascending Order

- Descending Order

Detail

Click ‘Add Table’ button to add the table information inside Tables field. You can delete the same by clicking ‘Delete Table’ button.

Click ‘Add Field’ button to add the field information inside Fields field. You can delete the same by clicking ‘Delete Field’ button.

Click ‘Add Order By’ button to add the field information inside Fields field. You can delete the same by clicking ‘Add Order By’ button.

Click ‘Join Tables’ button to join the 2 tables.

Click ‘Group By’ button to group the tables.

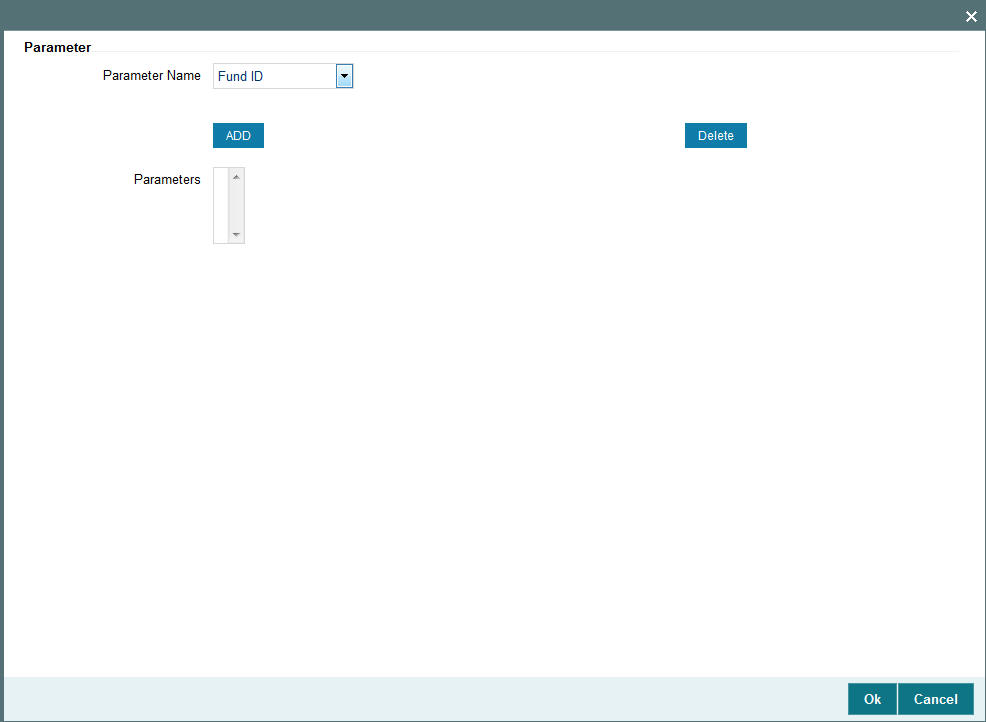

Click ‘Parameters’; button to input the following details:

Parameter

Parameter Name

Optional

Select the name of the parameter from the drop-down list. The list displays the following options:

- Fund ID

- Unit Holder ID

- Load ID

- Transaction Type

- Transaction Date

- Transaction Amount

- Transaction Units

- MOP

- To Unit Holder ID

- To Fund ID

- Broker Code

- Parent Broker Code

- Agent Code

- Branch

- From Date

- To Date

After selecting the required parameters name click ‘ADD’ button to add these details to ‘Parameters’ field. You can delete the added parameters by selecting the same and clicking ‘Delete’ button.

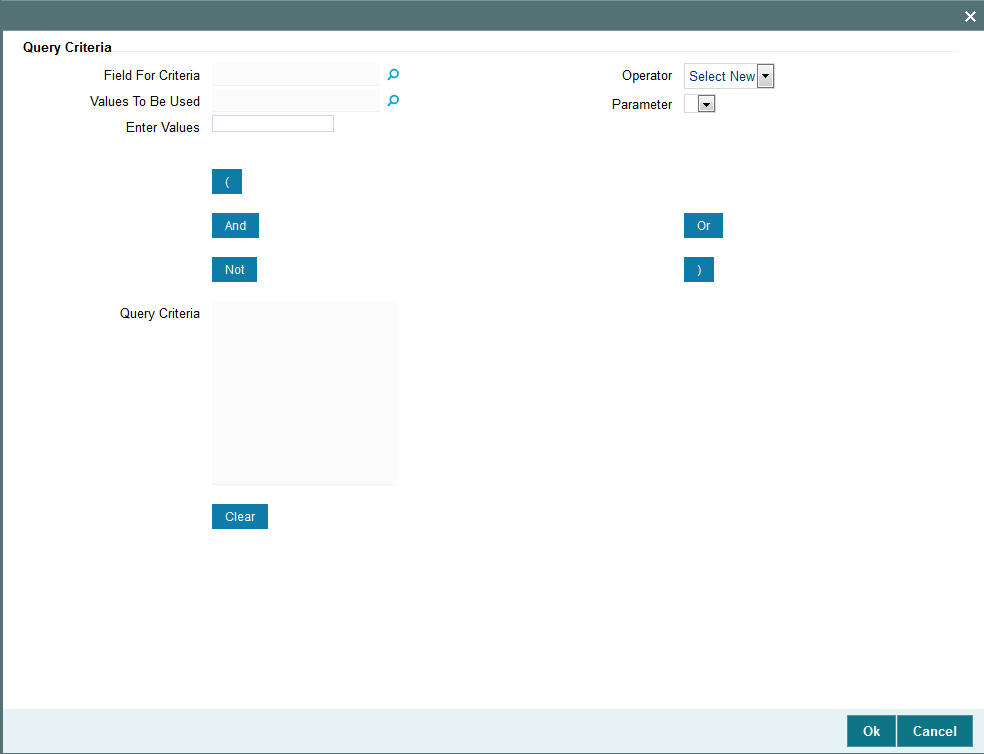

Click ‘Where Criteria’ button to input the query details.

Query Criteria

Field For Criteria

Alphanumeric; 50 Characters; Optional

Specify the field for criteria.

Operator

Optional

Select operator details from the drop-down list. The list displays the following values:

- =

- <>

- <=

- <

- >=

- >

- Like

- Not Like

Values To Be Used

Alphanumeric; 1 Character; Optional

Specify the values to be used.

Parameter

Optional

Select the parameter details.

Enter Values

Alphanumeric; 6 Characters; Optional

Specify the values to be entered to query.

Click one of the following expressions button to add it in the Query Criteria field:

- (

- And

- Or

- Not

- )

Click ‘Clear’ button to clear the specified details.

Click ‘Show Details’ button to view the criteria entered.

Requirement for fee based on communication mode and /or investor account classification /category will be handled via criteria based load in load maintenance using the following table:

Table Name to be used in criteria |

Column Name to be used in ‘Where’ clause |

TRANSACTIONDETAILS |

TRANSACTIONDETAILS.COMMUNICATIONMODE |

INVESTOR |

INVESTOR.UNITHOLDERCATEGORY |

You need to maintain criteria based load to apply short trade penalty for the applicable outflow transactions.

Following are the 2 separate loads to be used for short trade period transactions and transactions with short trade units:

- For Short Trade Period, select the following options:

- In Mode field, select ‘Period’

- In Period Basis field, select ‘Days’

- In ‘Criteria’ field’, specify the transaction details table and short trade units column., i.e., for short trade period, specify where TRANSACTIONDETAILS.SHORTTRADEUNITS = '0

- For Short Trade Units, select the following options:

- In Mode field, select ‘Date’

- In ‘Criteria’ field’, specify the transaction details table and short trade units column, i.e., for short trade units, specify where TRANSACTIONDETAILS.SHORTTRADEUNITS <> '0'

Load Details

After you have set up the basic parameters for a load in the main Load Definition screen, you must set up the details of any applicable slabs and any criteria for the load, before you actually save the load into the system database.

To do so, scroll down to the Load Details section at the lowest portion of the Load Maintenance screen. Here, you can specify the following information for each slab that you want to define for the load:

For loads with the Slab Mode ‘Date’, ‘Date and Amount’, or ‘Date and Units’

- Specify the lower and upper date boundaries for each slab, in the From Date and To Date fields.

- Specify the lower and upper amount or units boundaries for each slab, in the From Amount and To Amount fields, or the From Units and To Units fields, as applicable.

- Specify the applicable return value for each slab in the Return Value field.

- Specify the floor and ceiling values, if any.

- Save your specifications.

For loads with the Slab Mode ‘Period’, ‘Period and Amount’, or ‘Period and Units’

- Specify the lower and upper period boundaries for each slab, in the From Period and To Period fields.

- Specify the lower and upper amount or units boundaries for each slab, in the From Amount and To Amount fields, or the From Units and To Units fields, as applicable.

- Specify the applicable return value for each slab in the Return Value field.

- Specify the floor and ceiling values, if any.

- Save your specifications.

Load setup for short trade period and units are as follows:

transactiondetails.ShorttradeloadAppl = ‘Y’ for short trade units and short trade period

In case of Pseudo Switch, if From Fund ID and To Fund ID is of same Fund Family, then ‘transactiondetails.ShorttradeloadAppl’ will be set to ‘N’

In case of Pseudo Switch, if From Fund ID and To Fund Id is of different fund Family then ‘transactiondetails.ShorttradeloadAppl’ will be set to ‘Y’

For all other transaction type ‘transactiondetails.ShorttradeloadAppl’ will be set to ‘Y’.

Load set up for Short Trade Period:

- Criteria for the Load applicable for Short trade period is “transactiondetails.shorttradeunits = 0” and transactiondetails.ShorttradeloadAppl = ‘Y’

- Load Details for the Load applicable for Short trade period will be from Period 0 and To Period 7

- To Period 7, the number of days as decided by the business for the fund maintained in Fund Preference Maintenance (UTDFPMNT). It will be calendar days

- Return value will be 10%

- The system maps the load for all applicable fund with Based on Income Short Trade selected as Period (T).

Load set up for Short Trade Units

- Criteria for the Load applicable for Short trade units is “transactiondetails.shorttradeunits <> 0” and transactiondetails.ShorttradeloadAppl = ‘Y’

- Load Details for the Load applicable for Short trade Date will be from 01/01/1900 and To 12/31/2999.

- Return value will be 10%

- The system maps the load for the applicable fund with Based on Income Short Trade selected as Units (U).

Slab Sequence No

Display

This number is generated by the system for each slab in the order of entry of the slab details. The sequence number begins with 1. You can set up multiple slabs for every load.

From Date

Date Format; Mandatory only for date-based loads

For date-based loads (i.e., the slab mode you selected for the load in the main Load Definition screen is either Date, Date and Amount or Date and Units), specify the date on and following which the slab is applicable.

Any transaction date higher than this date is reckoned as part of the slab.

If you have designated the lower boundary as inclusive the load by checking the Consider as Lower Boundary check box in the main Load Definition screen, then any transaction date that is equal to the date you specified here is also reckoned as part of the slab.

To Date

Date Format; Optional

For date-based loads (i.e., the slab mode you selected for the load in the main Load Definition screen is either Date, Date and Amount or Date and Units), specify the date up to which the slab is applicable.

Specifying the To Date is optional. If not specified, the system defaults the same, based on the system High Date Value maintained in the Defaults Maintenance.

From Amount

Numeric, 12 Characters; Mandatory for all loads with Slab Mode as Amount, Date and Amount or Period and Amount only

Specify the lower amount boundary for the slab. Any amount higher than this amount is reckoned as part of the slab.

If you have designated the lower boundary as inclusive the load by checking the Consider as Lower Boundary check box in the main Load Definition screen, then any transaction amount that is equal to the amount you specified here is also reckoned as part of the slab.

To Amount

Numeric; 30 Characters; Optional

Specify the upper amount boundary for the slab. Any amount lower than this amount is reckoned as part of the slab.

Specifying the To Amount is optional. If not specified, the system defaults the same, based on the system High Amount Value maintained in the Defaults Maintenance.

From Units

Numeric; 27 Characters; Mandatory for all loads with Slab Mode as Units, Date and Units or Period and Units only

Specify the lower units boundary for the slab. Any number of units higher than this value is reckoned as part of the slab.

If you have designated the lower boundary as inclusive the load by checking the Consider as Lower Boundary check box in the main Load Definition screen, then a number of units applied that is equal to the value you specified here is also reckoned as part of the slab.

To Units

Numeric; 27 Characters; Optional

Specify the upper units boundary for the slab. Any number of units lower than this value is reckoned as part of the slab.

Specifying the To Units is optional. If not specified, the system defaults the same, based on the system High Units Value maintained in the Defaults Maintenance.

From Period

Numeric; 22 Characters; Mandatory only for period-based loads

For period-based loads (that is, the slab mode you selected for the load in the main Load Definition screen is either Period, Period and Amount or Period and Units), specify the beginning of the period in which the slab is applicable.

Any period higher than this is reckoned as part of the slab.

If you have designated the lower boundary as inclusive the load by checking the Consider as Lower Boundary check box in the main Load Definition screen, then any period that is equal to this specified here is also reckoned as part of the slab.

The period you specify here will be interpreted by the basis you have specified in the Period Basis field in the main Load Definition screen. For instance, if you enter a value ‘1’, then it will be deemed as 1 day of the period basis is ‘Days’, 1 month if the period basis is ‘Months’ and 1 year if the period basis is ‘Years’.

To Period

Numeric; 22 Characters; Optional

For period-based loads (i.e., the slab mode you selected for the load in the main Load Definition screen is either Period, Period and Amount or Period and Units), specify the end of the period in which the slab is applicable.

The period you specify here will be interpreted by the basis you have specified in the Period Basis field in the main Load Definition screen. For instance, if you enter a value ‘1’, then it will be deemed as 1 day of the period basis is ‘Days’, 1 month if the period basis is ‘Months’ and 1 year if the period basis is ‘Years’.

Specifying the To Period is optional. If not specified, the system defaults the same, based on the system High Period Value maintained in the Defaults Maintenance.

From Counter

Numeric; 22 Characters; Optional

Specify the range value applicable for mode deduction counter.

To Counter

Numeric; 22 Characters; Optional

Specify the range value applicable for mode deduction counter.

Return Value

Numeric; 30 Characters; Mandatory

Enter the load value applicable for the slab. This is the value that will be applied if the load is applicable for any transaction.

If the return value is indicated to be a percentage of the base price / transaction amount then the value entered should not be greater than one hundred percent.

Floor Value

Numeric; 22 Characters; Optional

Specify the minimum amount that must be paid for this load. If the computation of the load returns a value that is lower than this figure, then the applicable load considered is this figure.

Ceiling Value

Numeric; 30 Characters; Optional

Specify the maximum amount that must be paid for this load. If the computation of the load returns a value that is higher than this figure, then the applicable load considered is this figure.

UH Deal Ceiling Value

Numeric; 30 Characters; Optional

You can specify the UH deal ceiling value either in terms of amount or in terms of percentage.

Refer to the section “Arriving at the Load Return Value and Load Amounts” in the chapter

‘The Allocation Process’ in Volume IV of Fund Manager User Manual for details.

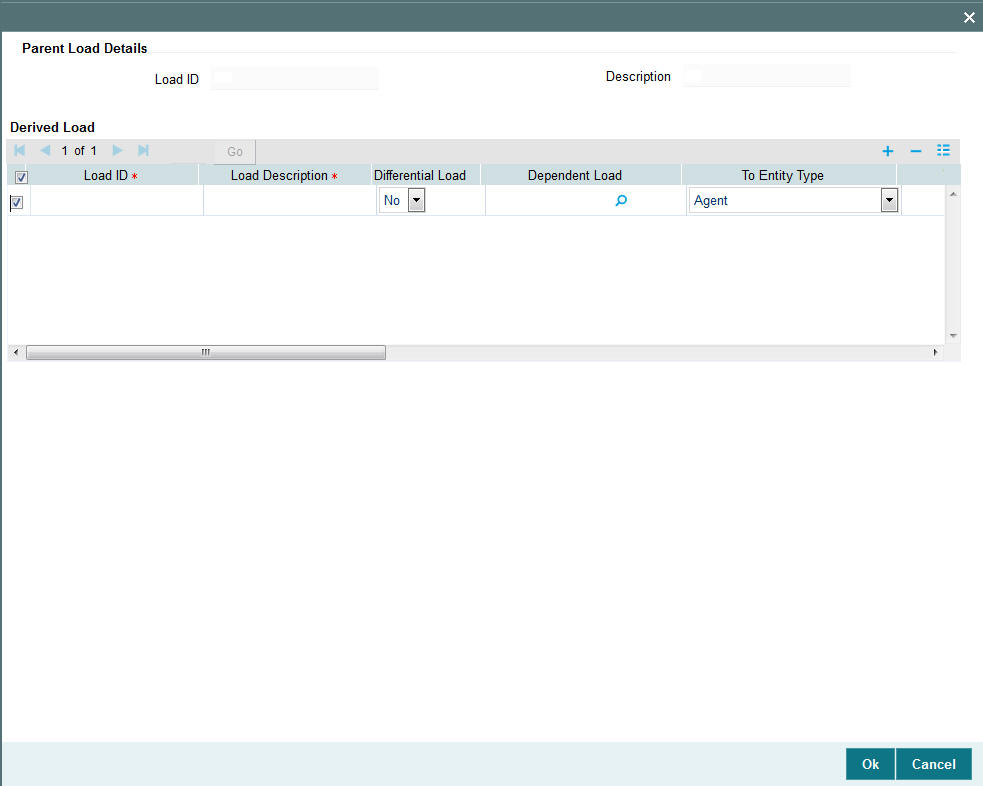

8.2.2 Derived Button

A load can be defined not only on the basis of the parameters, but also ‘deriving’ from (or dependant on) another load. Such loads are termed as derived loads.

In a typical AMC scenario, for example, the charges that are collected from an investor could constitute the parent load and the particulars, that are dependent on the initial collected charges, could be the derived loads. These could comprise broker charges, VAT component, and so on.

In the Oracle FLEXCUBE Investor Servicing system, you can define loads based on other loads. This means that you can map any load that you set up to a parent load. A tree - structure with multiple levels is therefore possible for loads. The lowest level loads are called Parent Loads, and all other loads will be defined as loads that are dependent on these loads. The loads that are dependent are called derived loads.

Derived loads could also be defined to effect fee and commission sharing between a Distributor and the other intermediaries in the hierarchy, for a transaction.

After you have created a load in the Load Definition screen, you can create a derived load that is dependent on the main load.

To do so, click ‘Derived’ button. The ‘Derived Load Set Up’ screen displays, and you can set up the derived load in this screen.

The following fields are available for data entry in the Derived Load Set Up screen:

Load ID

Display Only

The ID of the Load to which the derived load that is being set up should be mapped, is displayed here, from the Load Definition screen. This is the parent load.

Description

Display

The system displays the description of the load ID.

Derived Load Section

In this section, you may specify the parameters for a new derived load. Once you tab out of the last field in the row, (i.e. the Criteria field), the record is saved automatically.

Load ID

Numeric; 5 Characters; Mandatory

Specify a unique alphanumeric identifier for the derived load. This ID must not be the ID of a load already existing in the system database.

Load Description

Alphanumeric; 60 Characters; Mandatory

Enter some descriptive or narrative text, qualifying the derived load. It should describe the purpose for which the load has been set.

Differential Load

Optional

Select the differential load status from the drop-down list. The list displays the following values:

- Yes

- No

Dependent Load

Alphanumeric; 6 Characters; Mandatory

Specify the dependent load.

To Entity Type

Optional

From the drop-down list, select the type of entity that will be the recipient of the derived load. The load setup must be applicable for the entity type you select in this field. The list displays the following values:

- Agent

- Broker

- Bulk Client

- Distributor

- Fund

- Bank Branch

- Bank

- Clearing Agent

- AMC

- Agency Branch

- Policy

- Check Vendor

- Registrar

- Custodian

- Trustee

- Investor

- Accounting and Valuation Agent

- Underwriter

- Transaction

- Fund Price

To Entity ID

Alphanumeric; 12 Characters; Optional

Specify the ID of the entity to which this load is payable. This must be the ID of a valid entity in the system, and the load setup must be applicable for this entity type.

Cap to Parent Load Amount

Optional

Select Yes to indicate that the derived load amount is to be capped to the parent load amount. If selected as Yes then the sum of derived load amounts cannot be greater than the parent load amount. If not, the net derived amount can be negative (that is, the resultant front end load for a particular entity could be negative).

This specification is used for derived loads that are set up for the purpose of fee/commission sharing between the AMC and the Distributors.

Amount Basis

Optional

In this field, you can indicate whether the derived load is a percentage of the parent load amount, or whether it is derived based on the transaction amount. Select either Gross or Net to indicate that the derived load is to be derived based on the transaction amount; leave this field blank to indicate that the derived load is a percentage of the parent load amount.

This specification is used for derived loads that are set up for the purpose of fee/ commission sharing between the AMC and the Distributors.

Return Percentage

Numeric; 22 Characters; Optional

Enter the load percentage that is applicable for this derived load. This value must be greater than zero and less than one hundred.

Mandatory

Optional

Select Yes to indicate that the derived load is to be processed as a mandatory load. If you select No then the derived load is deemed to be an optional load.

A mandatory derived load will be applied (or processed) based on the criteria setup for this load.

An optional derived load will be applied based on the priority you assign to it, depending upon the priority number you specify in the Priority No. field in this screen.

Priority No.

Numeric; 22 Characters; Optional

Specify the priority number that will indicate the priority of application for the derived load.

Criteria

Alphanumeric; 12 Characters; Optional

Specify any criteria that determine how this load is to be applied.

To specify the criteria, click the Criteria link. The Query Builder is opened and you can specify an SQL statement, by the directives of which the load will be processed.

Click ‘Criteria’ button to invoke Criteria screen.

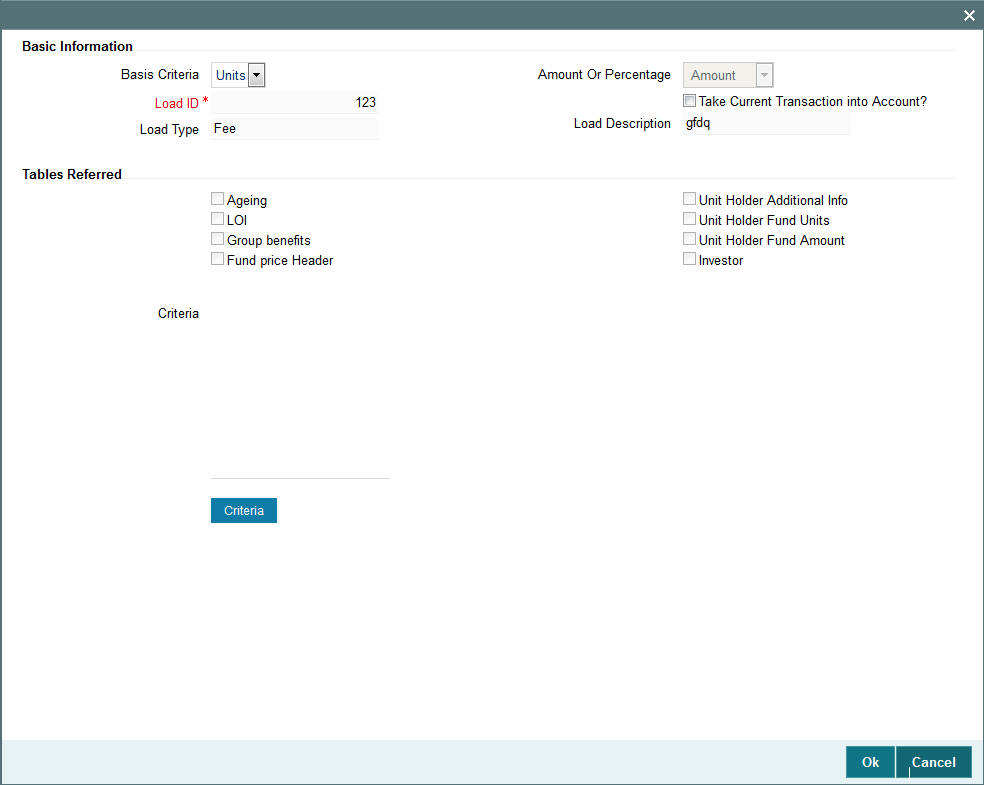

8.2.3 Basis Button

The basis of application of a load is not restricted only to the following parameters:

- Date

- Period

- Amount

- Units

- Date and Amount

- Date and Units

- Period and Amount

- Period and Units

A load may also be applied based on any other parameter that can be defined as a basis. Such a definition is called a basis definition and the load defined on such a basis is called a basis load.

The following example will make this clear:

Basis definitions are usually defined based on a number of holdings units, or a period of time, in days.

In Oracle FLEXCUBE Investor Servicing, you can create a basis definition for any load, through the Basis Definition screen, after you have created a load in the Load Definition screen.

To do so, click ‘Basis’ button. The Basis Load screen is opened, and you can set up the basis load in this screen.

Note

- You cannot build a basis definition more than once on the same load.

- You can build a basis definition using either the units or period as a basis parameter. It is not possible to build a basis definition using amount as a basis parameter in this screen.

- Basis definitions can be built only on Period and Units as parameters.

Basis Information

Basis Criteria

Optional

In this section, you can set up the criteria that will characterize this basis definition. Depending upon whether the basis is reckoned on a number of units or a number of days click the Criteria link and then use the Query Builder to make your specification. To do so, click the Criteria link. The Query Builder is opened.

The criteria that you set up through the Query Builder must return a single value. Once you have saved your specification and closed the Query Builder, the SQL statement corresponding to the desired criteria appears in the Criteria box, and the tables that have been referred in the execution of the criteria are clicked in the Tables Referred Box.

Load ID

Display

The ID of the load that you specified in the Load Definition screen, for which you are creating a basis definition, is displayed here.

Load Type

Display

The type of the load for which you are creating a basis definition is displayed here, from the Load Definition screen.

Amount Or Percentage

Display

The system displays if load is amount or percentage.

Take Current Transaction into Account

Optional

Check this box to indicate the basis definition you are making in this record must take any current transactions into account while computing the return values. By default, this box is not checked.

Load Description

Display

The system displays the load description.

Tables Referred

Display Only

After you have saved your criteria specification in the Query Builder, and closed the same, the SQL statement corresponding to the desired criteria appears in the Criteria box, and the tables that have been referred in the execution of the criteria are clicked in this Box.

Criteria can be based on any one of the eight parameters given under the Tables Referred section. They can be any of the following - Ageing, LOI, Group Benefits, Fund Price Header, Unit Holder Additional Info, Unit Holder Fund Units, Unit Holder Fund Amount, and Investor.

Note

The dynamic packages will get recreated on unlock, save and authorization.

8.3 Load Maintenance Summary Screen

This section contains the following topics:

- Section 8.3.1, "Invoking the Load Maintenance Summary Screen"

- Section 8.3.2, "Retrieving Load"

- Section 8.3.3, "Editing Load Maintenance Details"

- Section 8.3.4, "Viewing Load Maintenance Details"

- Section 8.3.5, "Deleting Loads"

- Section 8.3.6, "Authorizing Loads"

- Section 8.3.7, "Amending Loads"

- Section 8.3.8, "Authorizing Amended Loads"

- Section 8.3.9, "Copying Attributes"

- Section 8.3.10, "Maintaining Fees Applicable on Periodic Basis"

- Section 8.3.11, "Processing Load and Commission"

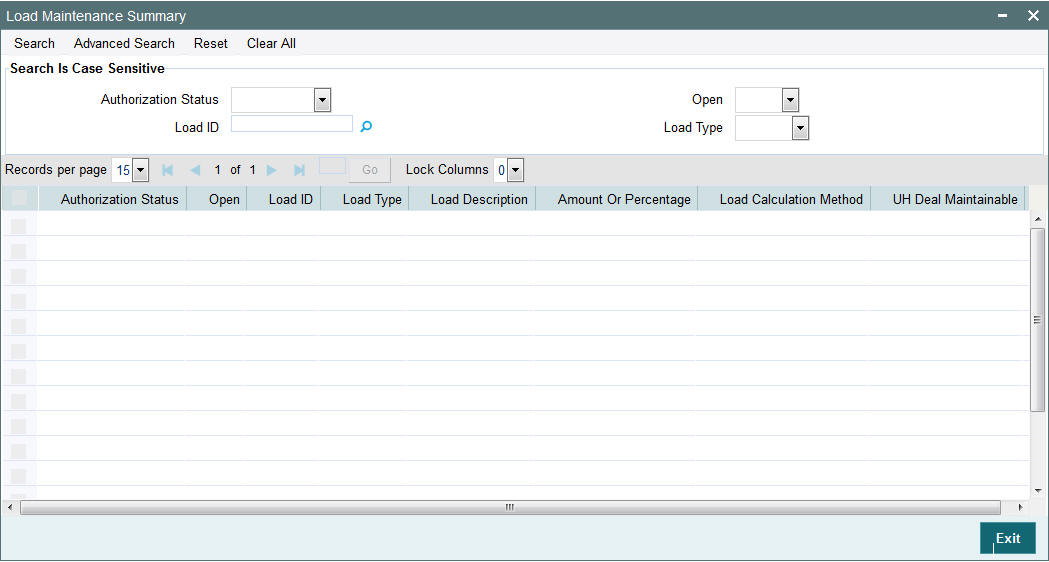

8.3.1 Invoking the Load Maintenance Summary Screen

After you have set up a load, you must have another user authorize it so that it would be effective in the system.

Before the load is authorized, you can edit it as many times as necessary. You can also delete a load before it is authorized.

After authorization, you can only make changes to a load (or any components such as derived or basis loads) through an amendment.

The ‘Load Maintenance Summary’ screen can be used for the following operations on loads:

- Retrieval for viewing

- Editing unauthorized loads

- Deleting unauthorized loads

- Authorizing loads

- Amending authorized loads

You can invoke the ‘Load Maintenance Summary’ screen by typing ‘UTSLOADM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

8.3.2 Retrieving Load

To retrieve a previously entered load:

- Invoke the Load Maintenance Summary screen and specify the following:

- The authorization status of the load maintenance records in the Authorization Status field. If you choose the “Blank Space” option, then all the records are retrieved.

- The status of the load maintenance records in the Open field. If you choose the “Blank Space” option, then all the records are retrieved.

- The Load ID

- Load Type

- Click ‘Search’ button after you have specified the required details,. All records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve an individual Load ID from the Detail screen by doing query in the following manner:-

- Press F7

- Input any parameter in the screen

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

Example

You can search the record for Load ID by using the combination of % and alphanumeric value.

- Search Load Description by C%: The system will fetch all the records whose Load ID starts from Alphabet ‘C’. For example, Common Load

- Search Load ID by %5: The system will fetch all Load ID which end by 5. For example: 5415

8.3.3 Editing Load Maintenance Details

You can modify the details of a load that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Load Maintenance Summary screen from the Browser.

- Select the authorization status of the load records that you want to retrieve for modification in the Authorized field. You can only modify records of loads that are unauthorized. Accordingly, choose the Unauthorized option from the drop down list.

- Specify any or all of the search parameters.

- Click ‘Search’ button. All unauthorized loads with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the load that you want to modify. The Load Maintenance Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save the changes. The Load Maintenance Detail screen is closed and the changes made are reflected in the Load Maintenance Summary screen.

8.3.4 Viewing Load Maintenance Details

To view the load maintenance details that you have previously entered:

- Invoke the Load Maintenance Summary Screen from the Browser.

- Select the status of the load maintenance records that you want to retrieve for viewing in the Authorization Status field. You can also view all load maintenance records that are either unauthorized or authorized only, by choosing the Unauthorized / Authorized option.

- Specify any or all of the other search parameters.

- Click ‘Search’ button. All load maintenance records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the load that you want to view. The Load Maintenance Detail screen is displayed in view mode.

8.3.5 Deleting Loads

You can delete only unauthorized loads in the system. To delete a load:

- Invoke the Load Maintenance Summary screen from the Browser.

- Select the status of the load that you want to retrieve for deletion.

- Specify any or all of the other search parameters for retrieving the records.

- Click ‘Search’ button. All loads with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the load that you want to delete. The Load Maintenance Detail screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

8.3.6 Authorizing Loads

When a load is authorized, any derived or basis loads that have been created for the load are also authorized in the database, simultaneously.

After a load is authorized, you can designate that it must be applicable either to a single fund or a group of funds (a load group). You can indicate this mapping in the Fund Load Setup screen (for a single fund) or the Group Load Mapping screen (for a load group)

An unauthorized load must be authorized in the system for it to be processed. To authorize a load:

- Invoke the Load Maintenance Summary screen from the Browser.

- Select the status of the load that you want to retrieve for authorization. Typically, choose the Unauthorized option from the drop down list.

- Specify any or all search parameters of the load for retrieving the records.

- Click ‘Search’ button. All loads with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the load that you wish to authorize. The Load Maintenance Detail screen displayed. Select Authorize operation from Action.

When the checker authorizes a load, details of validations, if any, that were overridden by the maker of the load during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the load.

8.3.7 Amending Loads

After a load is authorized, it can be modified using the Unlock operation from Action list. To make changes to an after authorization, you must invoke the Unlock operation which is termed as Amend Operation. If a load is attached to a fund, then the system will not allow amendment of load details.

- Invoke the Load Maintenance Summary screen from the Browser.

- Select the status of the load records that you wish to retrieve for amendment. You can only amend records of loads that are authorized.

- Specify any or all other search parameters for retrieving the records.

- Click ‘Search’ button. All loads with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the load that you want to amend. The Load Maintenance Detail screen is displayed in Amendment mode.

- Click the Unlock operation from the Action list to amend the load.

- Amend the necessary information. Click the Save button to save the changes.

8.3.8 Authorizing Amended Loads

After a load is authorized in the Load Authorization screen, you can make changes to any of the details of the load, provided the authorized load has not already been designated as applicable for a fund or load group.

If the load has already been mapped to a fund or a load group in the Fund Load Setup screen or the Group Load Mapping screen, you cannot amend the load.

Provided amendment is possible for the load, you can modify the slab details, any derived or basis loads. If there are no derived loads or basis loads created for the load, you can set up these during amendment.

When you amend an authorized load (provided editing is possible), the changes you make will be saved as unauthorized changes in the database. You must subsequently authorize the record of the load again, so that the changes are effected as authorized in the database.

An amended load must be authorized for the amendment to be made effective in the system. The process of authorization is the same as that of normal authorization process.

8.3.9 Copying Attributes

If you want to create a load having the same attributes of an existing load, you can copy the attributes of an existing load to a new load.

To copy the attributes:

- Retrieve the load whose attributes the new load should inherit. You can retrieve the record through the Summary screen or through the F7- F8 operation which is explained in the previous sections of this chapter.

- Click on ‘Copy’ in the Actions list.

- Indicate the new Load ID. You can however change the details of the load if required.

8.3.10 Maintaining Fees Applicable on Periodic Basis

Some fees or incentives are periodic in nature, that is, they may not be processed each time a transaction is requested or allocated, but they are paid on a periodic basis.

For instance, trailing commission paid to brokers is typically applicable over a period, irrespective of whether any transactions have been entered. Similarly, a management fee charged by an AMC can be applicable on a monthly basis, or a any other frequency, irrespective of whether any transactions have occurred or not.

8.3.11 Processing Load and Commission

In case of transactions done in currency of expression, the load amount during the transaction allocation will be calculated in currency of expression as well as in FBC. If a trade is in FBC; commission will be calculated in FBC. The system internally computes the gross amount and net amount in Fund base currency; these fields are mandatory fields that are to be computed as part of core allocation process.

In case of slab based load, the slab amounts will be held in FBC. The transaction amount in currency of expression will be exchanged to FBC by taking the COE conversion factor and the value will be matched against the slab to get the proper applicable load.

The system will calculate the Normal Average Cost and Weighted Average Cost in Fund Base Currency. The gain will be calculated in Fund Base Currency. The Withholding Tax (EUSD) will be calculated in Fund Base Currency

The maintained fund formula for that fund will be applicable to all the prices in all allowed currency of expression for the Fund along with FBC. For instance, the formula maintained for OFFER component as OFFER = NAV+3%of NAV (or the formula maintained can be NAV+2). The formula will be considered to derive the OFFER price component in FBC and other maintained Fund Price currencies for that fund using the NAV entered for respective currencies. This will be similar for other price components maintained in Fund Formula.

The price calculation method must be identical for each transaction currency within each share class. Trailer commission will be calculated in FBC.

In case of load held as amount, the system will apply the COE conversion factor and also the floor, ceiling and return value held in FBC will also use COE currency factor. All the amount values maintained in Load maintenance will be in FBC and the system will use CEO conversion factor for amount based load.

8.4 Load Mapping

This section contains the following topics:

8.4.1 Mapping Loads

For criteria load mapping, the dynamic package will generate in the new schema upon authorization. You can map loads created in other schemas using ‘Load Mapping Detail’ screen. Using this screen during mapping operation, the system will display all the loads across schemas stored globally and not only those created in that particular schema. This will avoid re-entry and duplication of data. The workflow is as follows:

- Assume operations in two countries Bermuda and Luxembourg, where a fund manager FUNMGR operates. You need to login and choose the module Fund manager of Bermuda (probably represented as FMGBDAAMC) and create a Load ID 1080’.

- You should open Fund Manager module of LUX (probably represented as FMGLUXAMC) and do a map operation of load maintenance in the ‘Across Schemas Load Mapping’ screen. Select this load record and click ‘Save’ button.

- The system will enable the LUX schema/segment also to see the Load ID in the respective LOBs of Loads after the record is authorized.

- Upon mapping the load, the system will allow you to map the load created in different schema.

Within the same installation if duplication of data needs to be avoided, then you can use the mapping details to map the load created in one schema into the other.

Loads will be available in the Schema in which they are created similar to Entity Maintenance. The loads will not be defaulted/displayed in all other schemas.

Only authorized Load records will be available for mapping in the ‘Across Schemas Load Mapping’ screen. You can map the loads created across schemas in the schema in which you have logged in by using the new ‘Across Schemas Load Mapping’ screen.

You can view only the loads which are mapped to the current module from the detail screen.

Amendment and Modification of load is limited only to the Parent schema in which the load is created. However, Loads will not be allowed for any modification or amendment if it is mapped in the system in any other schemas.

For Criteria Load mapping, on authorization of the load using the ‘Load Mapping’ (UTDLOAMP) screen, the system will generate the dynamic package.

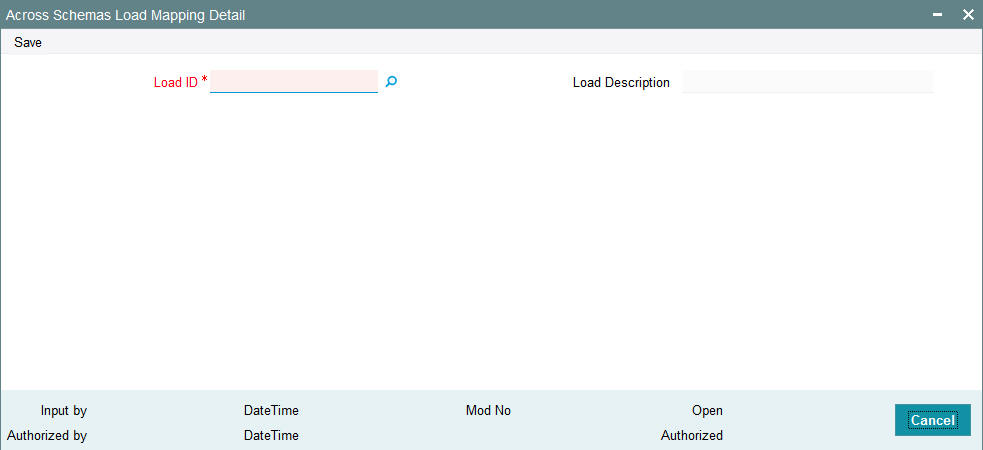

8.4.2 Invoking Across Schema Load Mapping Screen

You can invoke the ‘Across Schemas Load Mapping Detail’ screen by typing ‘UTDLOAMP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details:

Load ID

Numeric; 5 Characters; Mandatory

Specify the load ID across schema will be available for mapping. Alternatively, you can select the load ID from the option list. The list displays all valid load ID maintained in the system.

Load Description

Display

The system displays the description for the selected load ID.

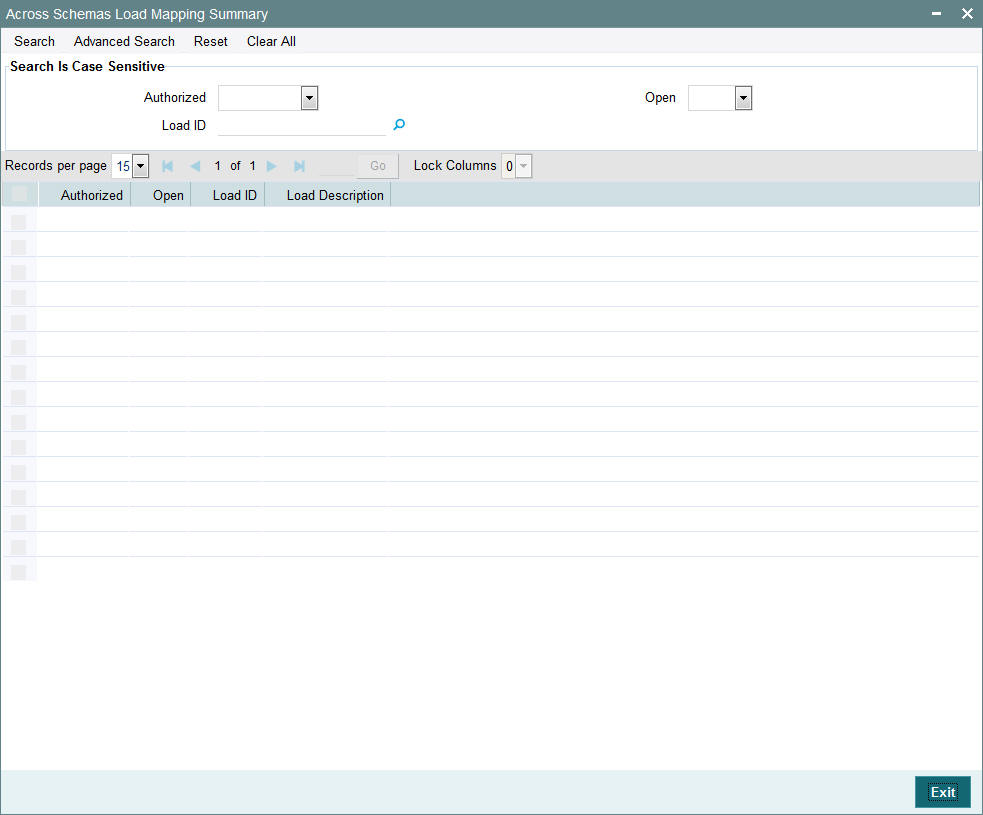

8.5 Across Schemas Load Mapping Summary

This section contains the following topic:

- Section 8.5.1, "Invoking Across Schemas Load Mapping Summary Screen"

- Section 8.5.2, "Retrieving Across Schemas Load Mapping Details"

- Section 8.5.3, "Authorizing Across Schemas Load Mapping Details"

8.5.1 Invoking Across Schemas Load Mapping Summary Screen

You can invoke ‘Across Schemas Load Mapping Summary’ screen by typing ‘UTSLOAMP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

8.5.2 Retrieving Across Schemas Load Mapping Details

To retrieve a previously entered load mapping details:

- Invoke the Across Schemas Load Mapping Summary screen and specify the following:

- The authorization status of the entity in the Authorized field. If you choose the “Blank Space” option, then all the records are retrieved.

- Open

- Load ID

Click ‘Search’ button after you have specified the required details, all records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve an individual load mapping detail from the Detail screen by doing query in the following manner:

- Press F7

- Input any parameter in the screen

- Press F8

You can perform Authorize operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

Example

You can search the record for load mapping by using the combination of % and alphanumeric value.

- Search by A%: The system will fetch all the records whose Load ID starts from Alphabet ‘A’. For example, ACCB.

- Search by %7: The system will fetch all the records whose Load ID has 7. For example: ACT7

8.5.3 Authorizing Across Schemas Load Mapping Details

An unauthorized load mapping record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Across Schemas Load Mapping Summary screen from the Browser.

- Select the status of the load mapping record that you want to retrieve for authorization. Typically, choose the unauthorized option from the drop-down list.

- Specify any or all of the search parameters of the load Mapping in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the load mapping record that you wish to authorize. The Across Schemas Load Mapping Detail screen displayed. Select Authorize operation from Action.

8.6 Exchange Rate Source Mapping for Different Schemas

This section contains the following topics:

- Section 8.6.1, "Mapping Exchange Rate Source"

- Section 8.6.2, "Invoking Exchange Rate Source Mapping Screen"

8.6.1 Mapping Exchange Rate Source

You can use exchange rate in other schemas only when it is mapped. The system will display all the exchange rate source across schemas stored globally and not only those created in that particular schema.

For instance, assume operations in two countries Bermuda and Luxembourg, where a fund manager FUNMGR operates. You need to login and choose the module Fund manager of Bermuda (probably represented as FMGBDAAMC) and create an Exchange Rate Source ‘Reuter’.

You open Fund Manager module of LUX (probably represented as FMGLUXAMC) and do a map operation of exchange rate maintenance in the Exchange Rate Source Mapping screen. You need to select this source record and click ‘Save’ button.The system will enable the LUX schema/segment also to see the Exchange Rate Source (Reuter) in the respective LOBs of Exchange rates after the record is authorized.

Upon mapping the exchange rate source, you can map the source created in different schema. Once the exchange rate source is mapped into the schema, the same will be available for mapped schema across all applicable functions.

Exchange rate source will be available in the Schema in which they are created similar to Entity Maintenance. The source will not be defaulted/displayed in all the schemas.

You can map only authorized exchange rate source records in the ‘Exchange Rate Source Mapping’ screen. You can also map the Exchange Rate Sources created across schemas in the schema in which you are logged in by using this screen.

You can view Exchange Rate Sources which are mapped to the current module from the detail screen.

Amendment and Modification of exchange rate source is limited only to the Parent schema in which the source is created. However, exchange rate sources will not be allowed for any modification or amendment if it is mapped in the system in any other schema.

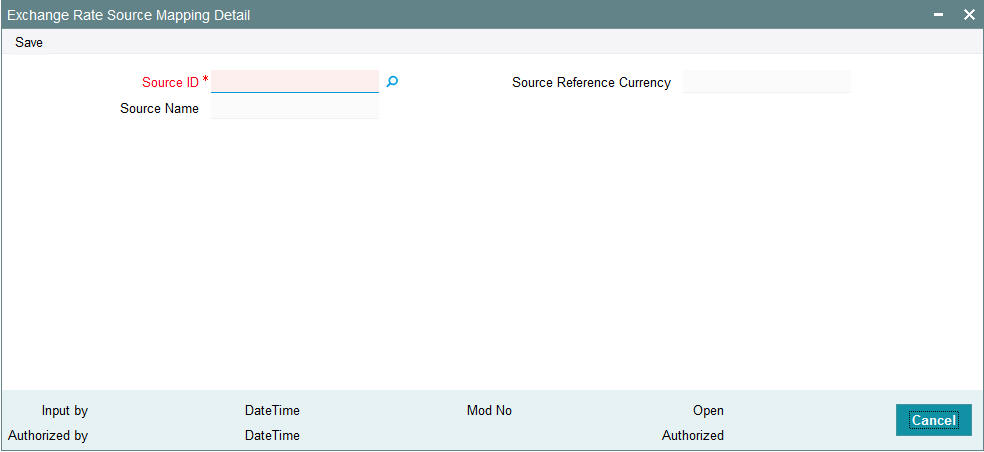

8.6.2 Invoking Exchange Rate Source Mapping Screen

You can invoke the ‘Exchange Rate Source Mapping Detail’ screen by typing ‘UTDEXRMP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details:

Source ID

Alphanumeric; 6 Characters; Mandatory

Specify the source ID across schema will be available for mapping. Alternatively, you can select the source ID from the option list. The list displays all valid source ID maintained in the system.

Source Name

Display

The system displays the source name for the selected source ID.

Source Reference Currency

Display

The system displays the source reference currency code.

8.7 Exchange Rate Source Mapping Summary

This section contains the following topic:

- Section 8.7.1, "Invoking Exchange Rate Source Mapping Summary Screen"

- Section 8.7.2, "Retrieving Exchange Rate Source Mapping Details"

- Section 8.7.3, "Authorizing Exchange Rate Source Mapping Details"

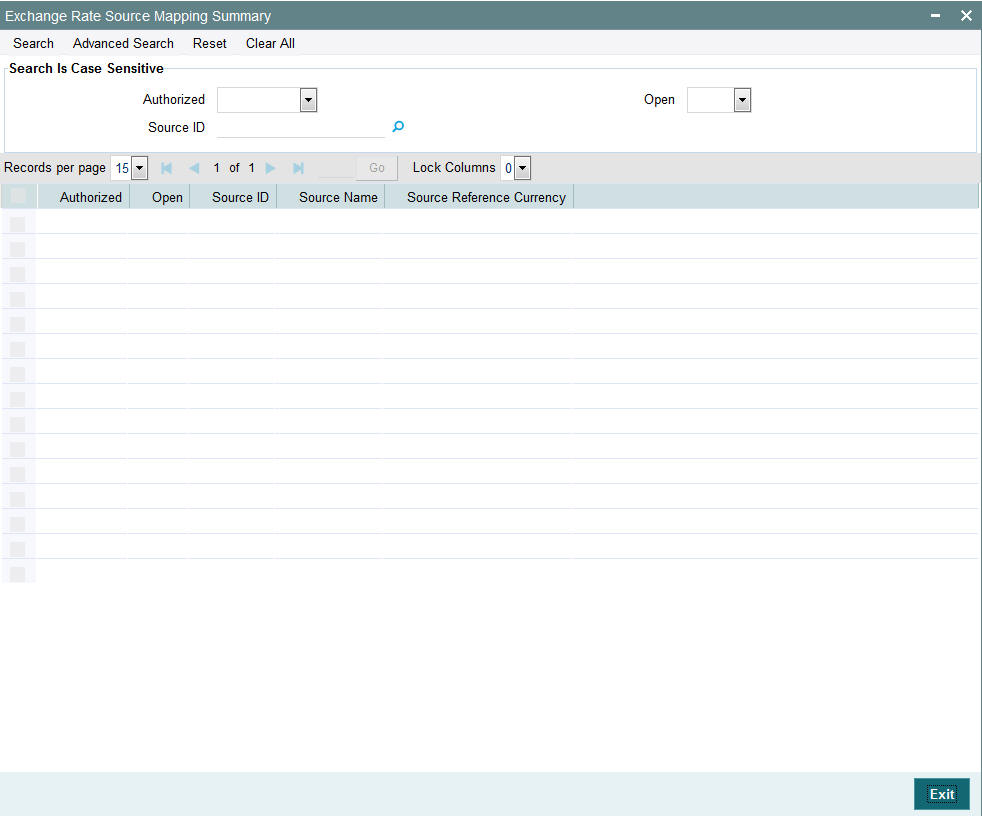

8.7.1 Invoking Exchange Rate Source Mapping Summary Screen

You can invoke ‘Exchange Rate Source Mapping Summary’ screen by typing ‘UTSEXRMP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

8.7.2 Retrieving Exchange Rate Source Mapping Details

To retrieve a previously entered load mapping details:

- Invoke the Exchange Rate Source Mapping Summary screen and specify the following:

- The authorization status of the entity in the Authorized Status field. If you choose the “Blank Space” option, then all the records are retrieved.

- Open

- Source ID

Click ‘Search’ button after you have specified the required details, all records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve an individual source mapping detail from the Detail screen by doing query in the following manner:

- Press F7

- Input any parameter in the screen

- Press F8

You can perform Authorize operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

Example

You can search the record by using the combination of % and alphanumeric value.

- Search by A%: The system will fetch all the records whose Source ID starts from Alphabet ‘A’. For example, ACCB.

- Search by %7: The system will fetch all the records whose Source ID has 7. For instance: ACT7

8.7.3 Authorizing Exchange Rate Source Mapping Details

An unauthorized source mapping record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Exchange Rate Source Mapping Summary screen from the Browser.

- Select the status of the source mapping record that you want to retrieve for authorization. Typically, choose the unauthorized option from the drop-down list.

- Specify any or all of the search parameters of the Source Mapping in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the source mapping record that you wish to authorize. The Exchange Rate Source Mapping Detail screen displayed. Select Authorize operation from Action.

8.8 Trailing Fees

A trailing fee is defined as the commission or incentive that is paid, normally by the fund, to unit holders, brokers, agents, agency branches, account officer or IFA for the continued loyalty of the unit holders to the fund. Here the term loyalty refers to the fact that unit holders who are allocated units hold them for a certain minimum period of time, which in turn results in the fund manager being able to project cash flows and investments with a greater degree of accuracy.

The fee is calculated based on the holdings of the investor, using any of the following methods:

- Quarterly Average Holding

- Average Holdings

- Average Units

- Latest Balance

A minimum period can also be set, for which the balances must be held, before a trailing fee can be applied.

FCIS provides the facility to compute trailer commission at any level i.e. Agent, Agency Branch, Account officer or IFA. The commission sharing will be applicable below the level at which trailer commission is computed. For instance, if trailer commission is computed at Agency branch level, commission sharing on flat percentage will be applicable to all levels below agency branch.

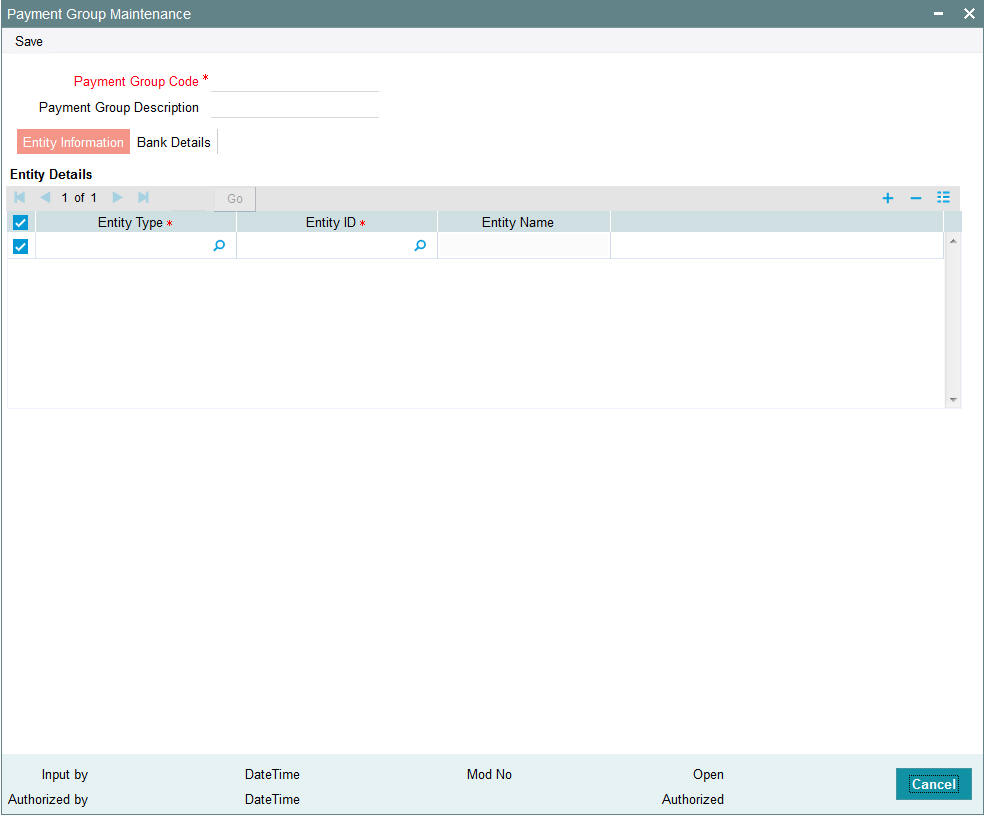

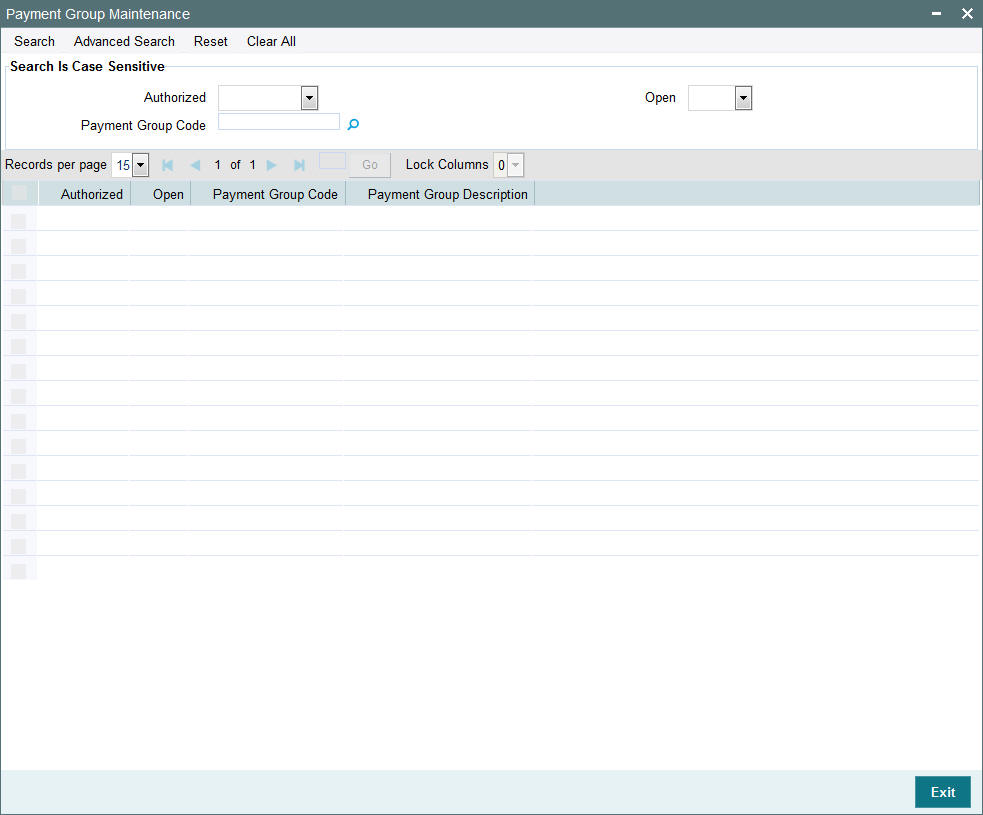

8.9 Payment Groups

This section contains the following topics

- Section 8.9.1, "Maintaining Payment Groups"

- Section 8.9.2, "Entity Information Tab"

- Section 8.9.3, "Bank Details Tab"

- Section 8.9.4, "Ongoing Management Fees"

8.9.1 Maintaining Payment Groups

To support different trailing fee rate across the different groups, you can maintain payment groups for the unit holder/ agent/ agency branch separately using ‘Payment Group Maintenance’ screen. You can invoke this screen by typing ‘UTDPAYGP’ in the field at the top right corner of the Application tool bar and click the adjoining arrow.

In this screen you can maintain the following details:

Payment Group Code

Alphanumeric; 6 Characters; Mandatory

Specify the code to identify the payment group.

Payment Group Description

Alphanumeric; 6 Characters; Optional

Specify the description of the payment group.

8.9.2 Entity Information Tab

Entity Type

Alphanumeric; 1 Character; Mandatory

Specify the type of entity. You can also select the entity type from the option list provided. The list consists of all the valid and authorized entities type. You can also link multiple entities of same type to the payment group. However, if a entity is already mapped to a payment group, then you cannot map it again to a different payment group.

Entity ID

Alphanumeric; 12 Characters; Mandatory

Specify the type of entity ID. You can also select the ID from the option list provided. The list consists of all the valid and authorized entities.

Entity Name

Display

Base on the ID selected, the name of the entity is displayed.

8.9.3 Bank Details Tab

Click the ‘Bank Details’ tab to specify the bank details for the payment group.

You can maintain the following in this screen:

Bank

Alphanumeric; 12 Characters; Mandatory

Specify the name of the bank for receiving the payment. You can also select the bank from the option list provided. The list consists of all the valid bank names maintained in the system.

Branch

Alphanumeric; 12 Characters; Mandatory

Specify the branch of the bank. You can also select the branch name from the option list provided. The list consists of all the valid bank branches maintained in the system.

Account Type

Alphanumeric; 1 Character; Mandatory

Specify the type of account. You can also select the account type from the option list provided. The list consists of all the valid and authorized account types maintained in the system.

Account Type Description

Display

Account description is displayed based on the account type selected.

Account Number

Alphanumeric; 16 Characters; Mandatory

Specify the account for receiving the payment.

IBAN

Alphanumeric; 40 Characters; Optional

Specify the IBAN of the account holder.

Account Name

Alphanumeric; 100 Characters; Mandatory

Specify the name of the account holder.

Account Currency

Alphanumeric; 3 Characters; Mandatory

Specify the account currency. You can also select the currency from the option list provided. The list consists of all the valid and authorized currencies maintained in the system.

Default

Mandatory

Select ‘Yes’ option to set this bank account as the default account to receive the payments. You shall set at least one account as default for each of the currency.

Direct Debit Allowed

Optional

Select ‘Yes’ option to debit the account directly.

Click the ‘Bank Details’ button in the ‘Payment Group Maintenance’ screen to maintain the additional bank details.

In this screen, you can maintain the following details:

SWIFT Format

Optional

Select the SWIFT format from the drop-down list for receiving the payments. The drop-down list consists of the following SWIFT message formats:

- MT103

- MT202

Bank Charged

Optional

Select the bank to be charged. Select any of the following options:

- Beneficiary

- Remitter

- Share

Beneficiary

Alphanumeric; 35 Characters; Optional

Specify the beneficiary of the payment group.

Beneficiary Add1 - 3

Alphanumeric; 35 Characters; Optional

Specify the beneficiary address.

Beneficiary IBAN

Alphanumeric; 35 Characters; Optional

Specify the beneficiary IBAN.

Beneficiary BIC Code

Alphanumeric; 24 Characters; Optional

Specify the BIC of the beneficiary.

Beneficiary Acct No

Alphanumeric; 24 Characters; Optional

Specify the beneficiary account number.

Beneficiary Code

Alphanumeric; 24 Characters; Optional

Specify the beneficiary code.

Beneficiary Info

Alphanumeric; 100 Characters; Optional

Specify any other information of the beneficiary.

Intermediary

Alphanumeric; 35 Characters; Optional

Specify the intermediary of the payment group.

Intermediary Add1 - 3

Alphanumeric; 35 Characters; Optional

Specify the intermediary address.

Intermediary IBAN

Alphanumeric; 40 Characters; Optional

Specify the beneficiary IBAN.

Intermediary BIC Code

Alphanumeric; 24 Characters; Optional

Specify the BIC of the intermediary.

Intermediary Acct No

Alphanumeric; 24 Characters; Optional

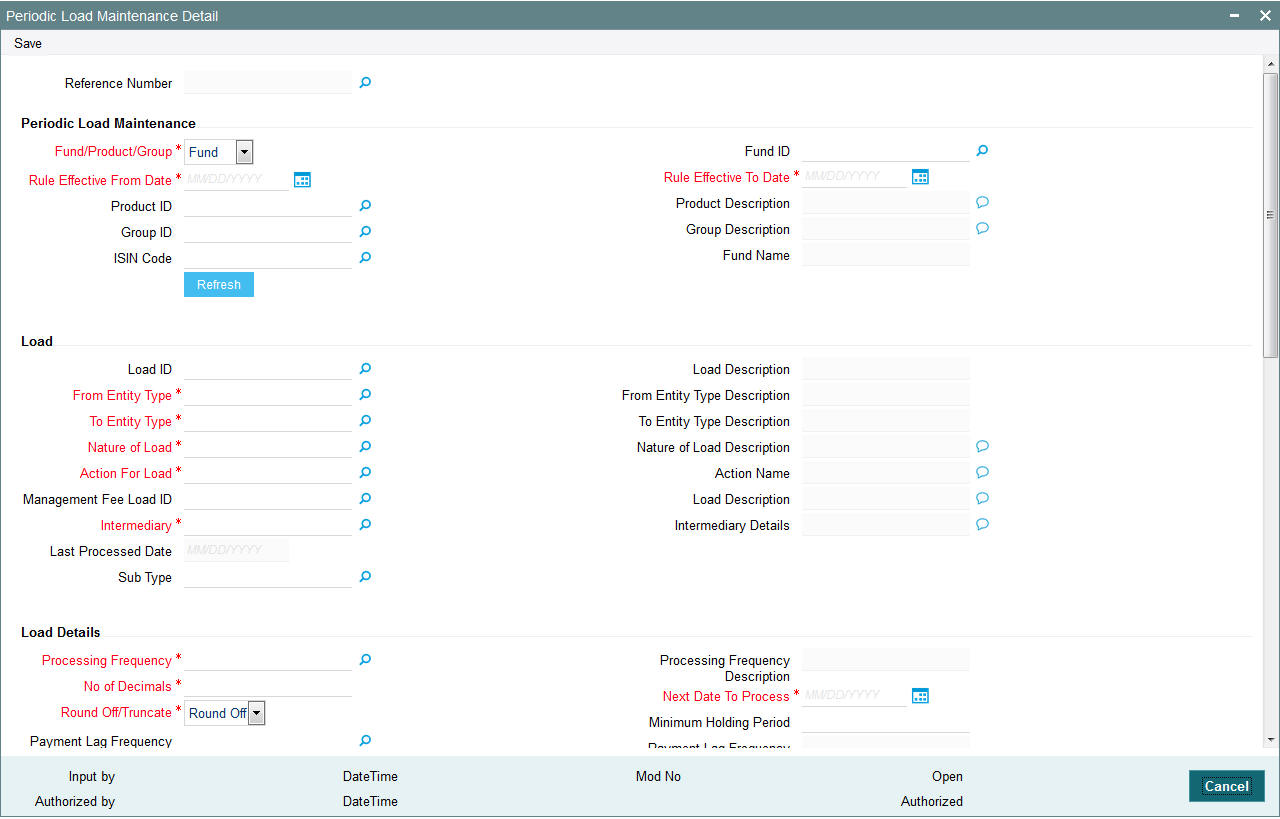

Specify the intermediary account number.