3. Maintaining Reference Information

Before you begin to use the Oracle FLEXCUBE Investor Servicing system (FCIS), you must ensure that all data that will eventually be used by the system to help you operate funds has been set up in the system. You must prepare the system to recognize this data and process it the way you want it to. Therefore, you must ensure that the following activities are done:

- Setting up System Parameters

- Setting up Reference Information, including entities

- Setting up Currencies and capturing Exchange Rates

- Setting up Funds

- Setting up miscellaneous maintenance functions

Only after these maintenance activities are completed, can you actually set up your unit holders and accept transactions for the funds. The maintenance activities that fall under each of the categories mentioned above are available as menu items in the Maintenance Menu Item of the Fund Manager component.

This chapter deals with the first category, the maintenance of reference information.

This section contains the following topics:

- Section 3.1, "Reference Information Setup"

- Section 3.2, "Fund Types"

- Section 3.3, "Fund Type Maintenance Summary Screen"

- Section 3.4, "Entities"

- Section 3.5, "Single Entity Maintenance (Summary) Screen"

- Section 3.6, "Entity Mapping Detail"

- Section 3.7, "Entity Mapping Summary"

- Section 3.8, "Relationship Maintenance Detail"

- Section 3.9, "Income Distribution Setup (IDS) Options"

- Section 3.10, "Income Distribution Setup Summary"

- Section 3.11, "Payment Details for Entities"

- Section 3.12, "FCIS Entity Payment Maintenance Summary Screen"

- Section 3.13, "Consent Maintenance Detail"

- Section 3.14, "Consent Maintenance Summary"

- Section 3.15, "Agents Setup"

- Section 3.16, "Agency Branches Setup"

- Section 3.17, "AMC Setup"

- Section 3.18, "Distributors Setup"

- Section 3.19, "Bank Details Maintenance"

- Section 3.20, "Unit Holder Bank Verification Summary"

- Section 3.21, "Setting up ISA Fund Managers"

- Section 3.22, "Withholding Tax"

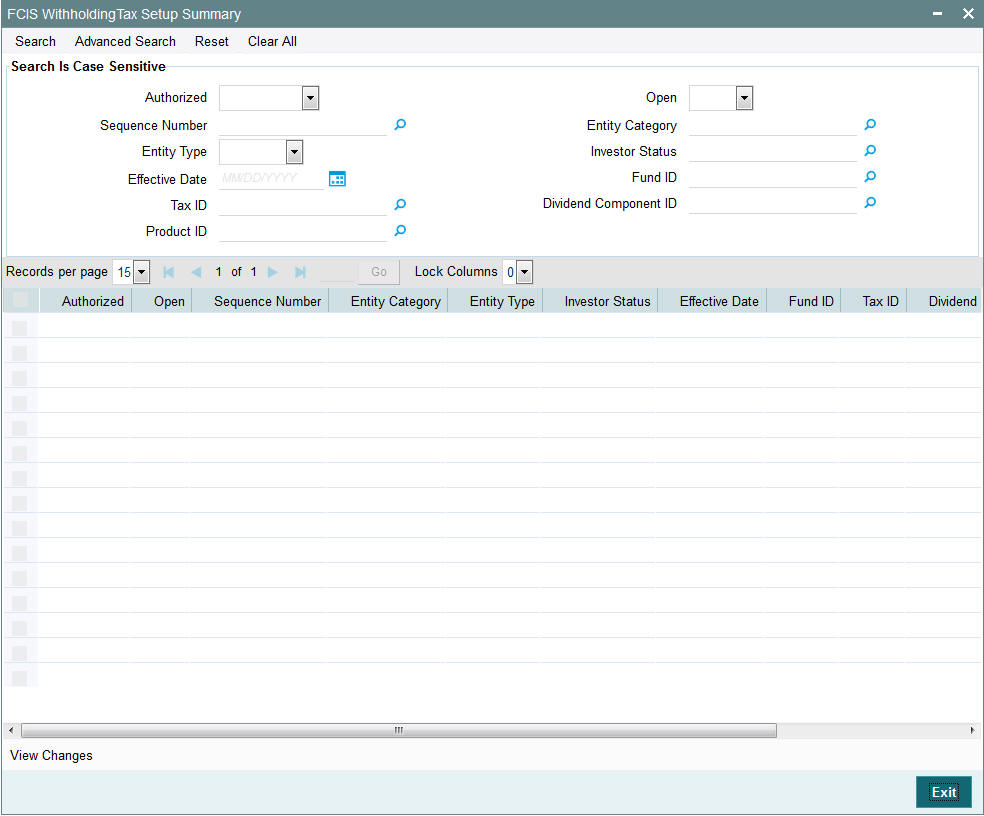

- Section 3.23, "Withholding Tax Setup Summary Screen"

- Section 3.24, "UH Dividend Component Override"

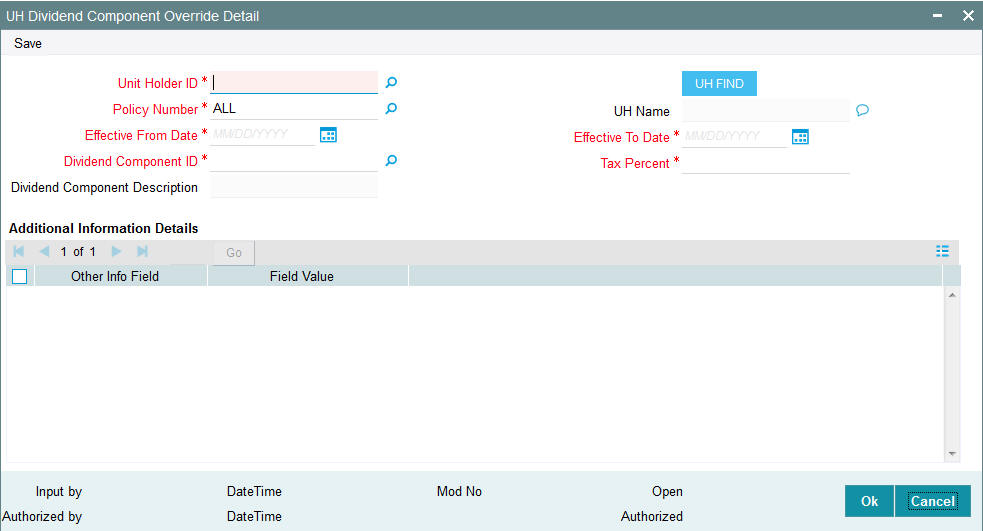

- Section 3.25, "Holidays Maintenance"

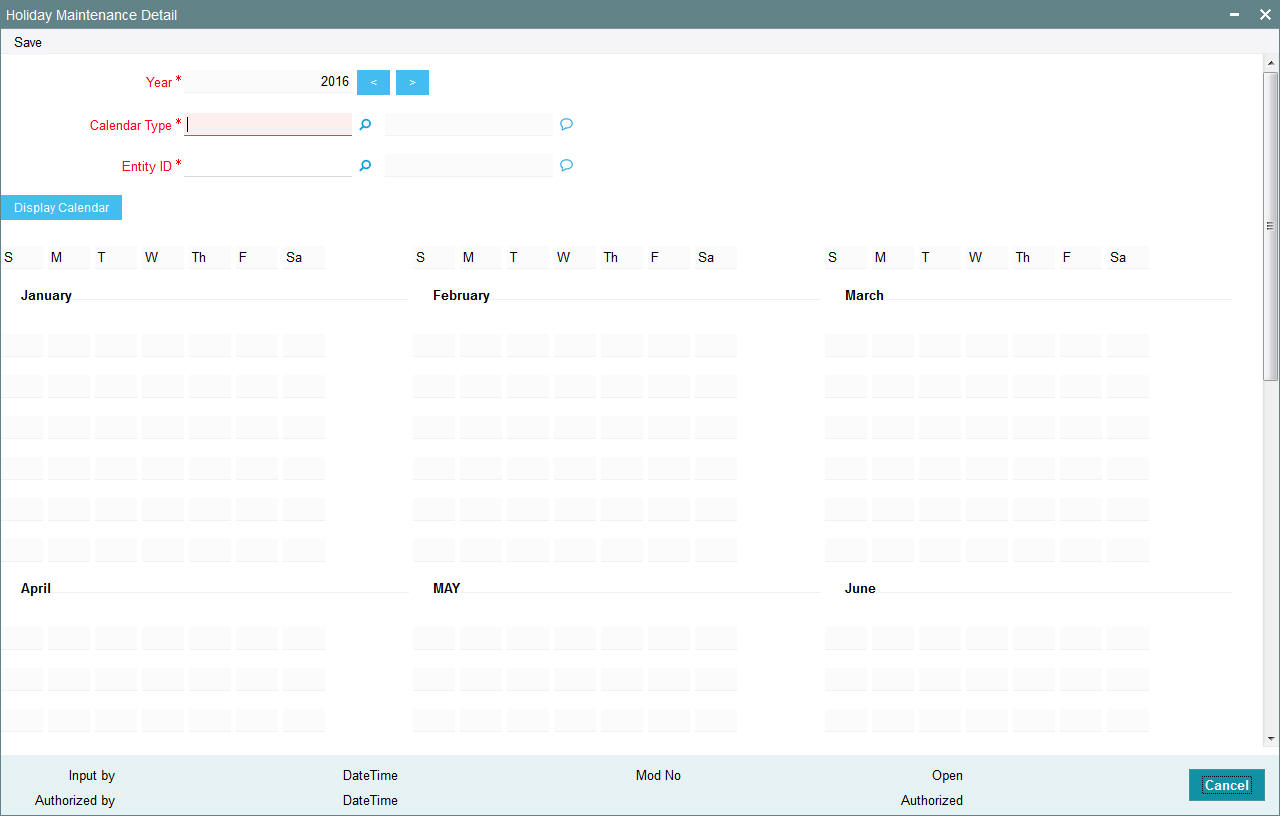

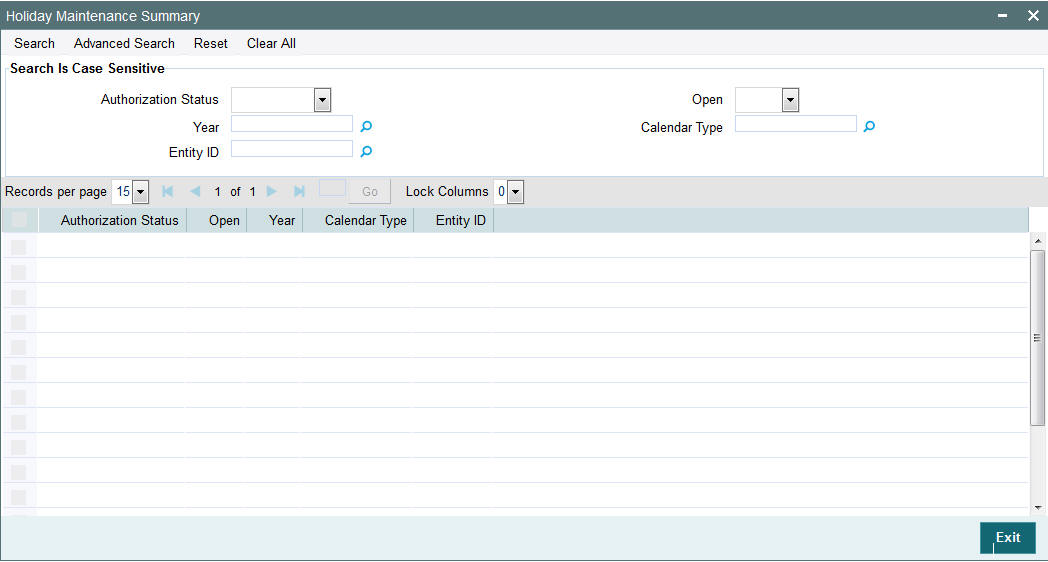

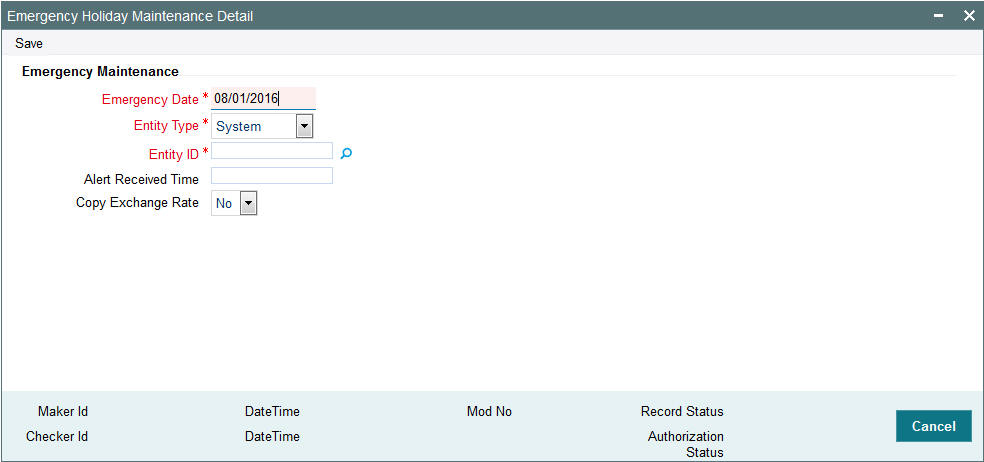

- Section 3.27, "Emergency Holiday Maintenance"

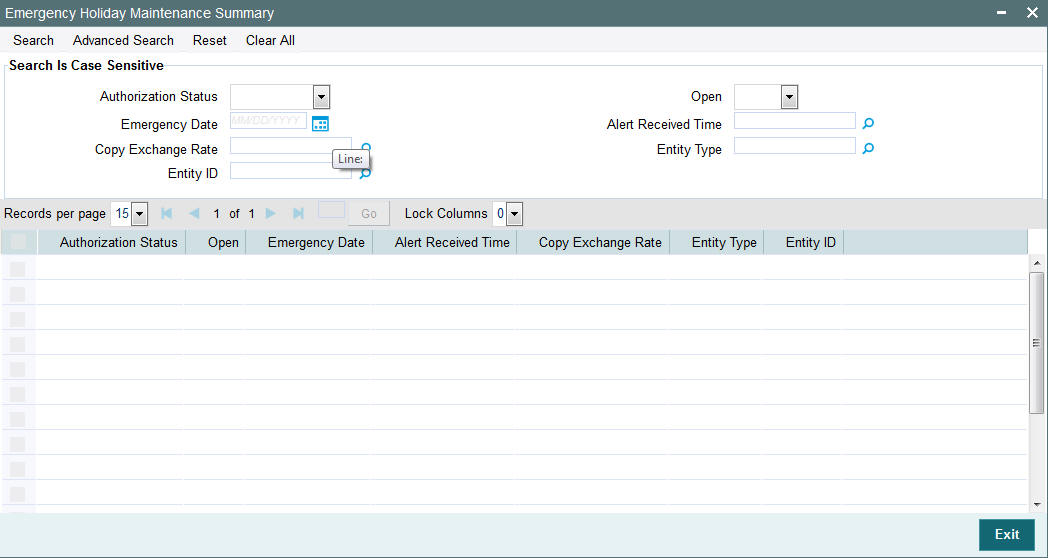

- Section 3.28, "Emergency Holiday Maintenance Summary"

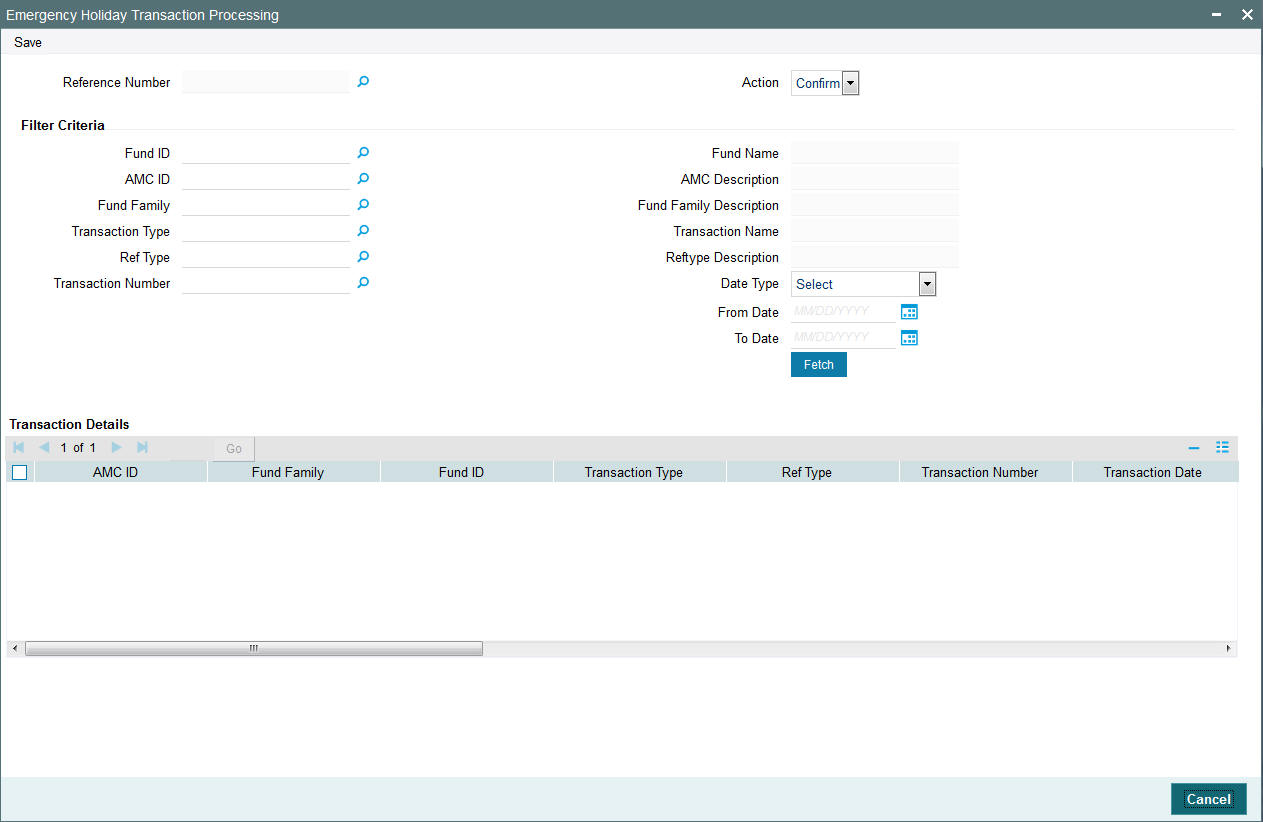

- Section 3.29, "Emergency Holiday Transaction Processing"

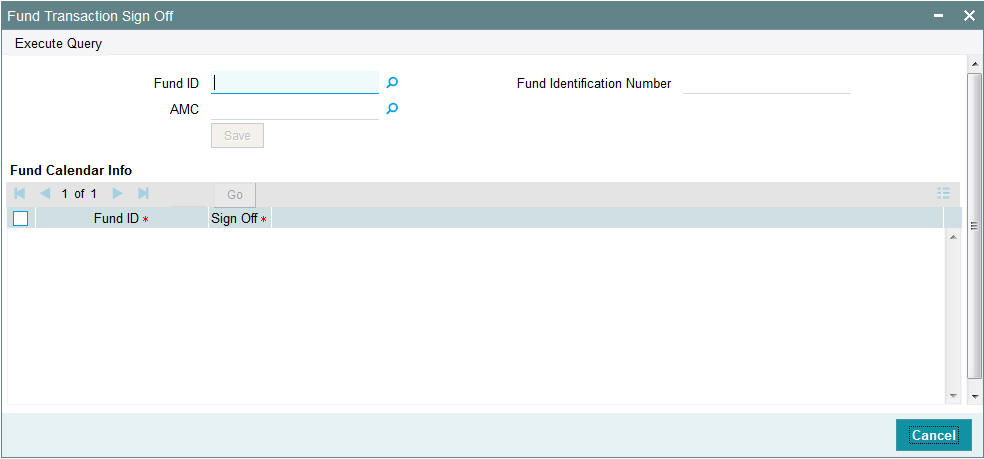

- Section 3.30, "Fund Transaction Sign Off Screen"

- Section 3.31, "Mode of Payment"

- Section 3.32, "Mode of Payment Detail Summary Screen"

- Section 3.33, "Static Maintenance for Switch Transactions"

- Section 3.34, "Switch Privilege List Setup Summary Screen"

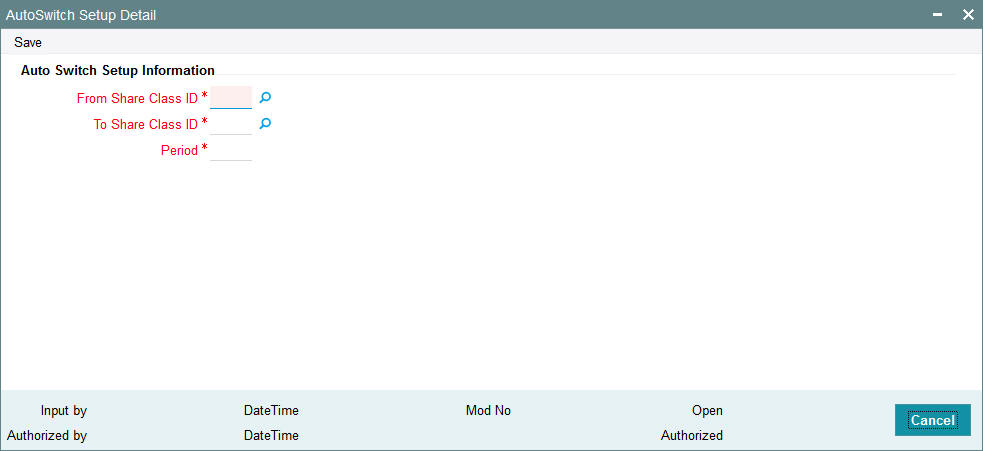

- Section 3.35, "Period Definition for Allowing Automatic Switch"

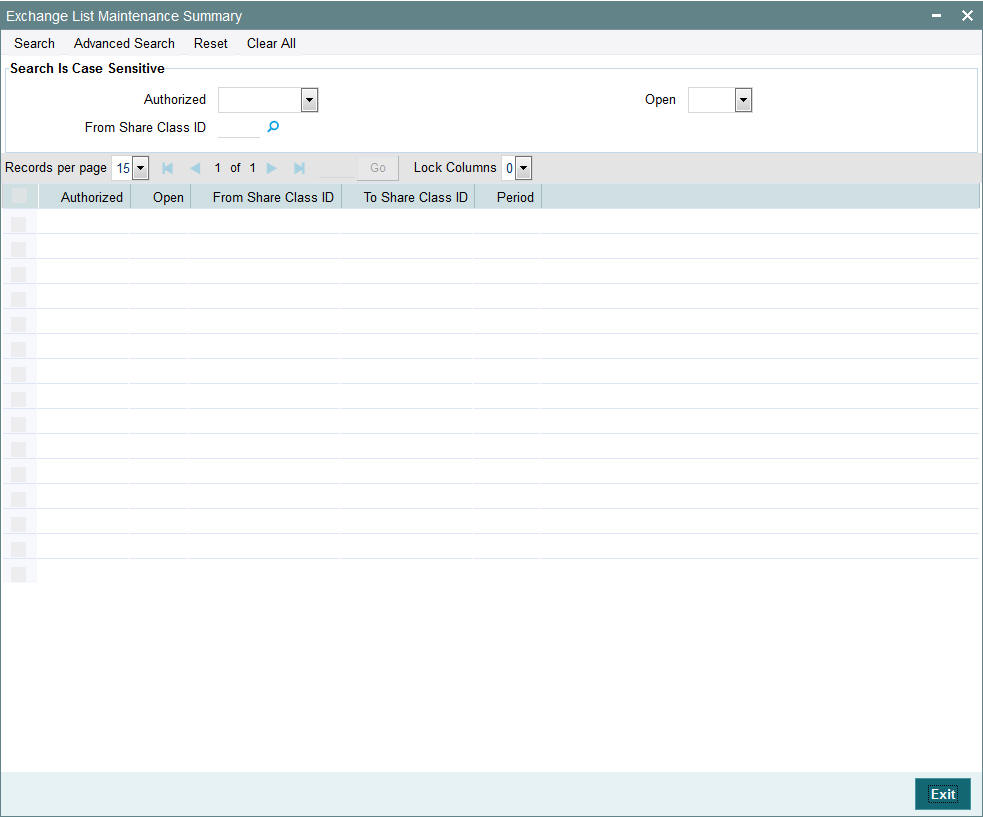

- Section 3.36, "Exchange List Maintenance Summary Screen"

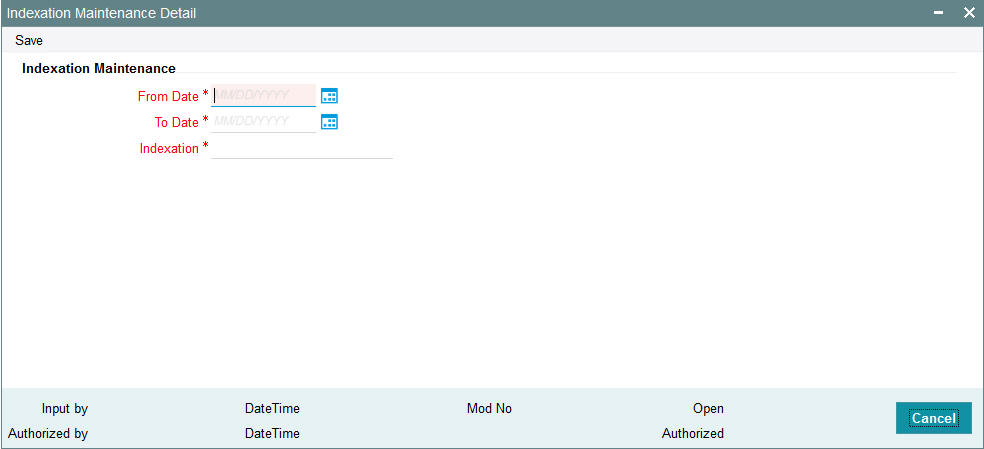

- Section 3.37, "Indexation Values"

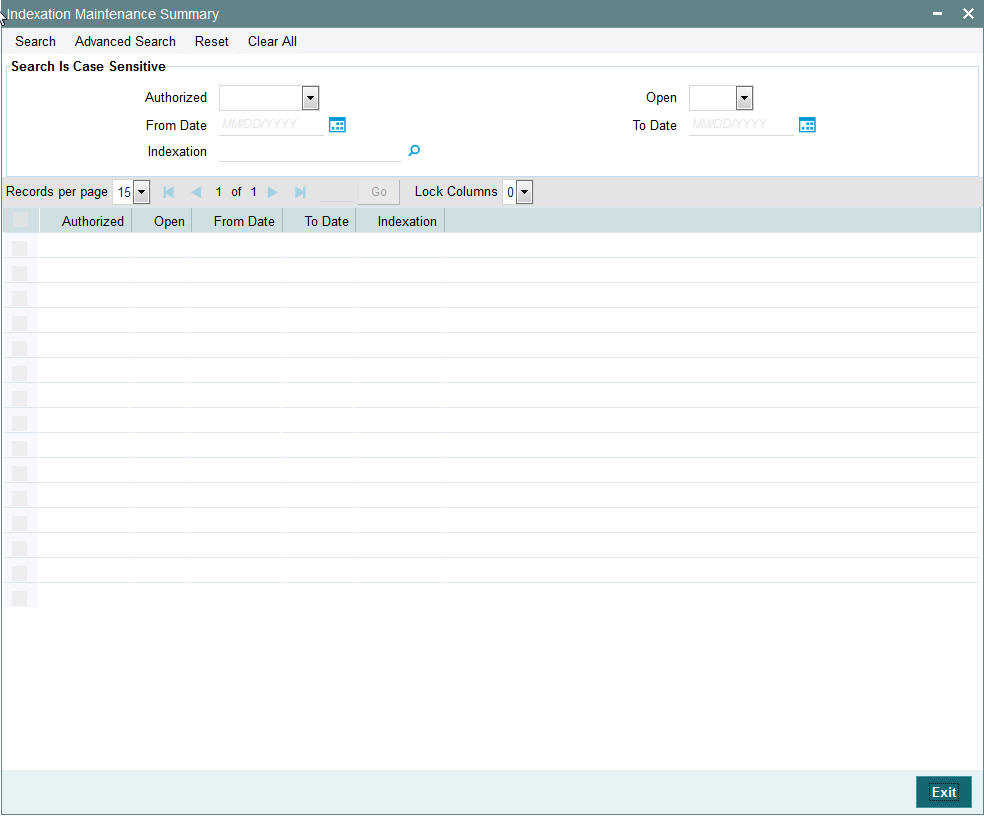

- Section 3.38, "Indexation Summary Screen"

- Section 3.39, "Collection Centers and Payout Accounts"

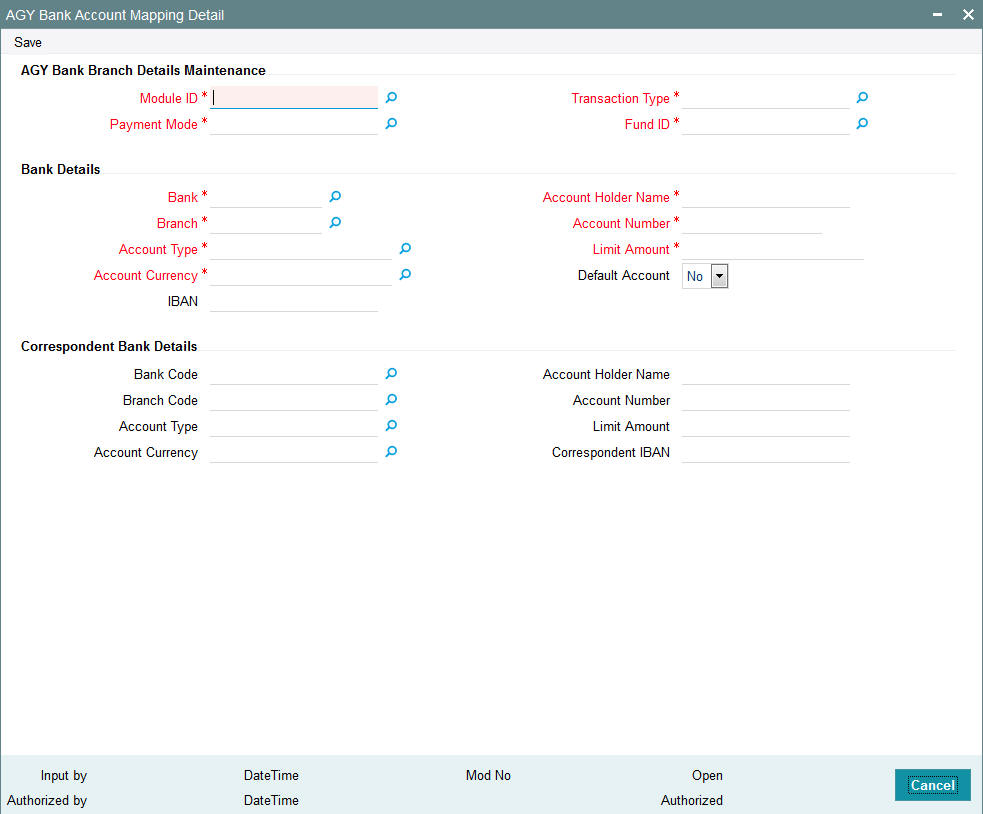

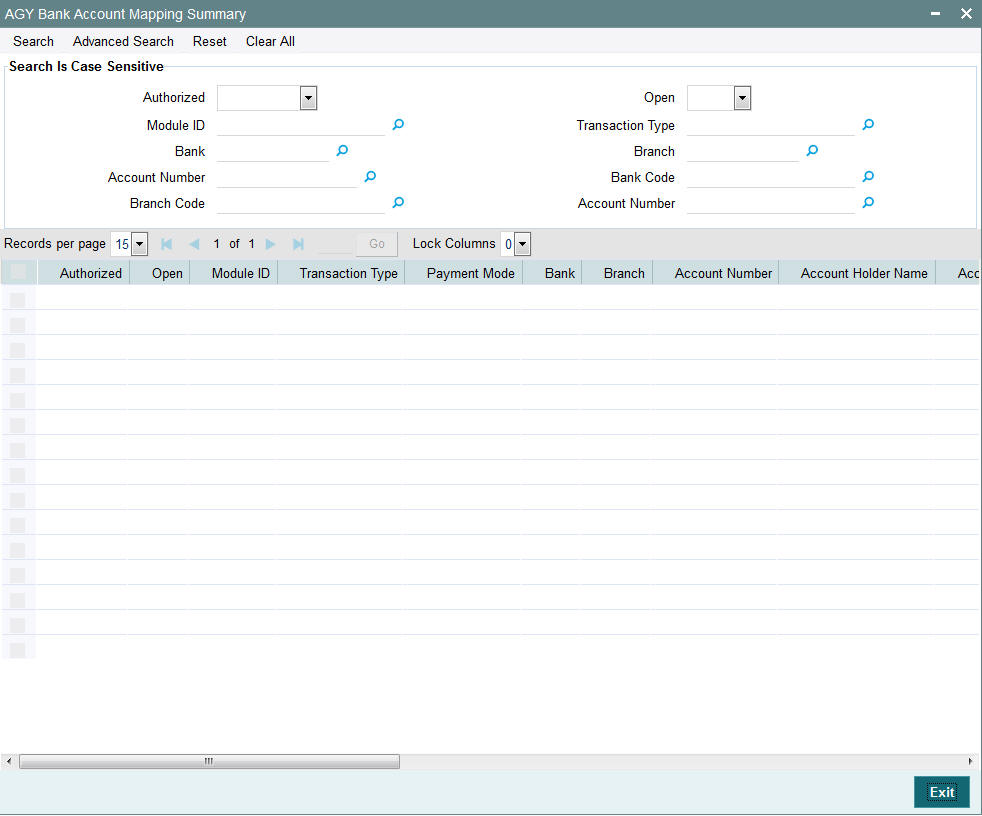

- Section 3.40, "AGY Bank A/C Mapping Summary Details Screen"

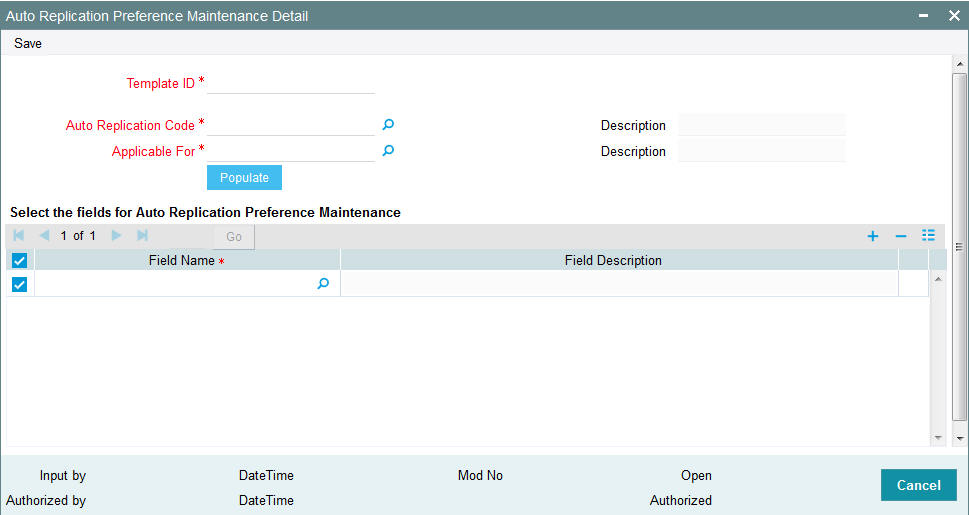

- Section 3.41, "Replication of Changes"

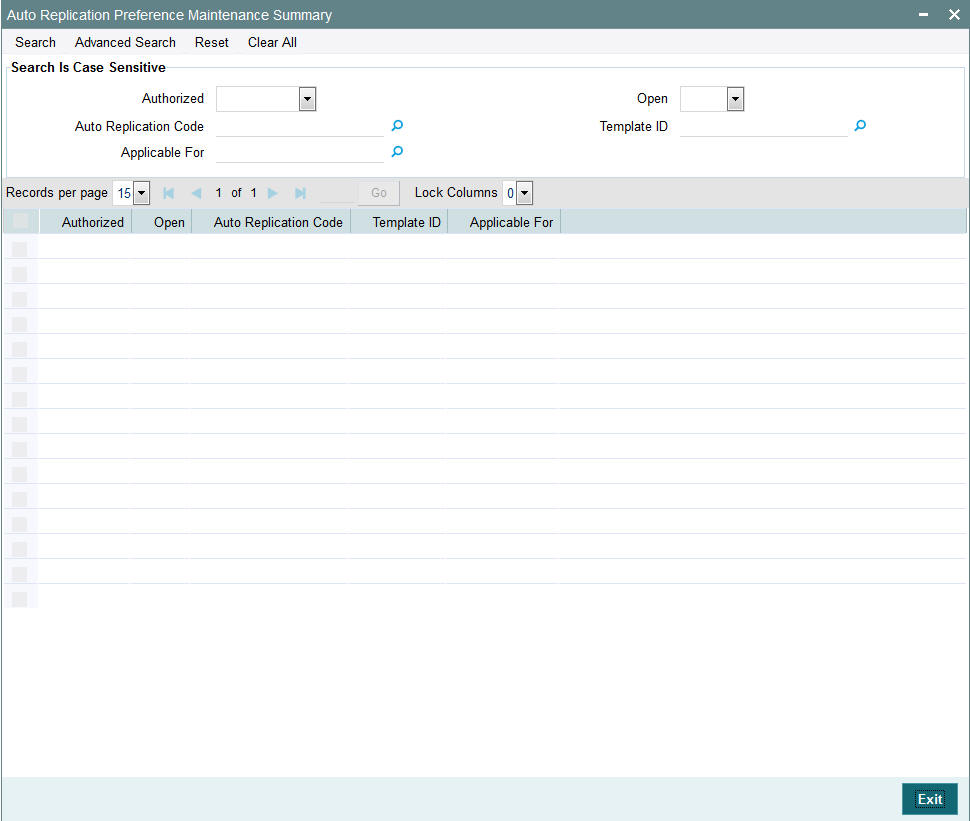

- Section 3.42, "Auto Replication Preference Maintenance Summary"

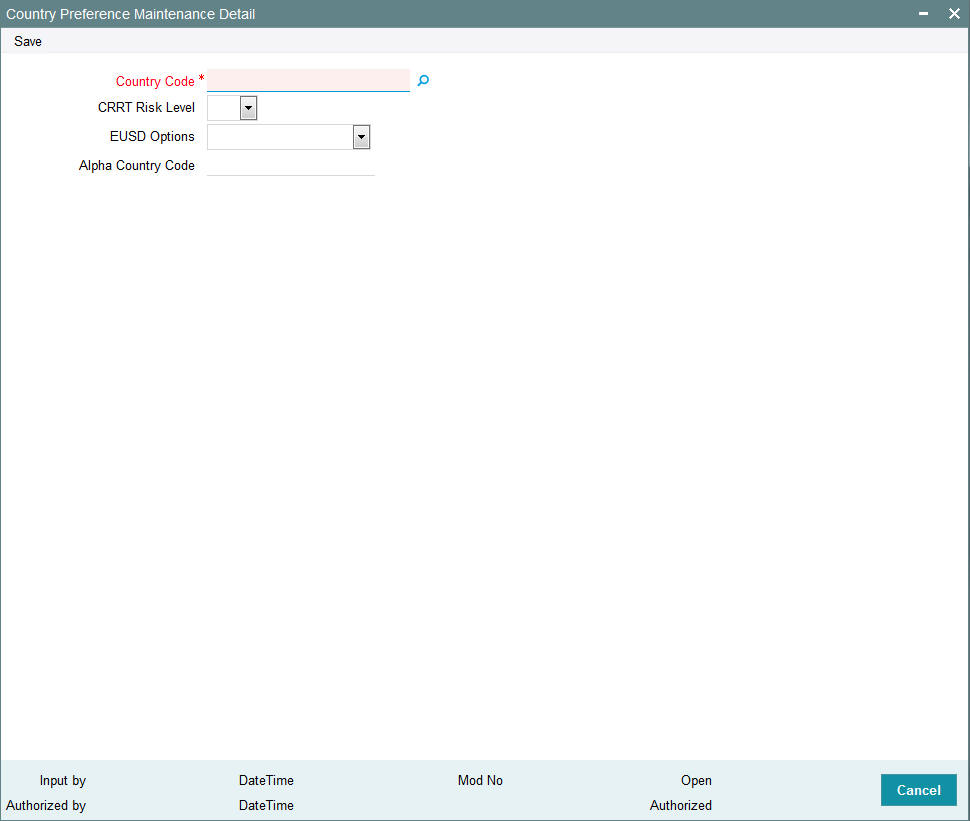

- Section 3.43, "Preferences for Country"

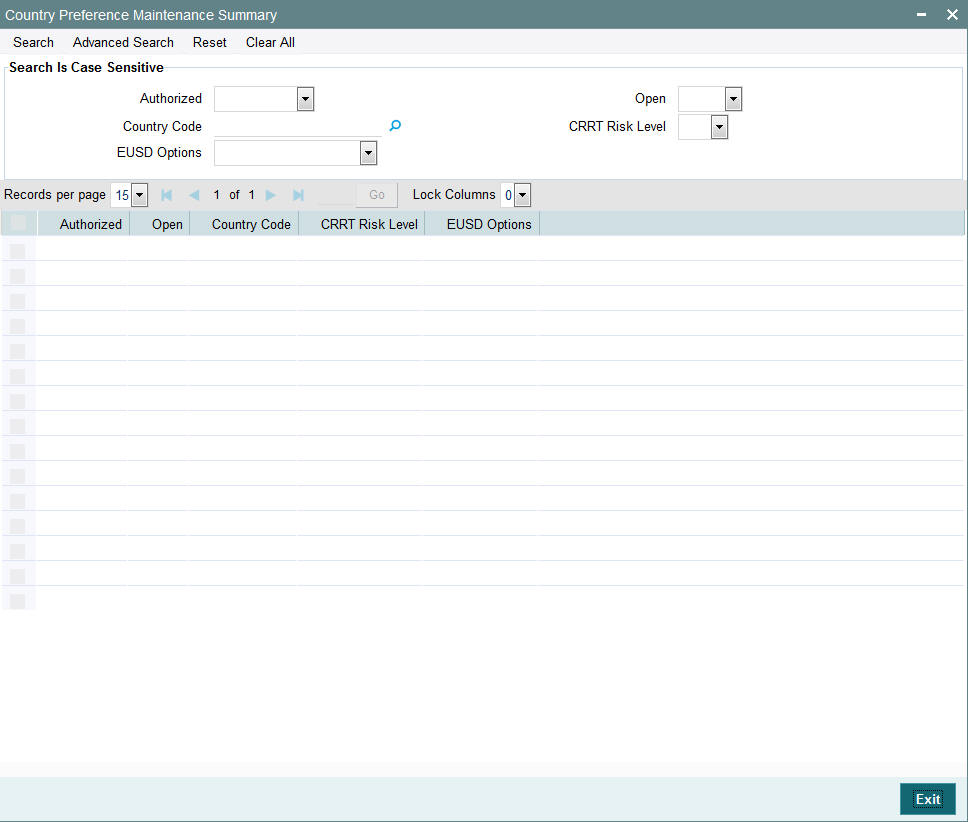

- Section 3.44, "Country Preference Maintenance Summary Screen"

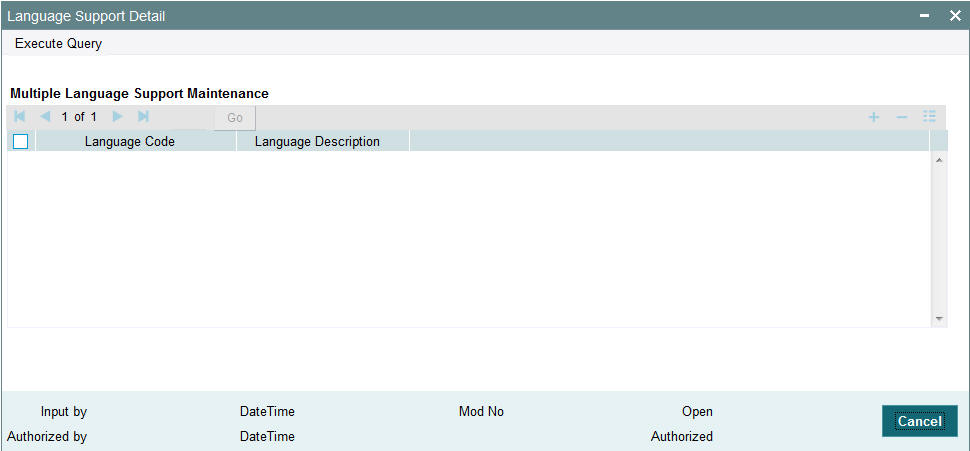

- Section 3.45, "Multiple Languages Maintenance"

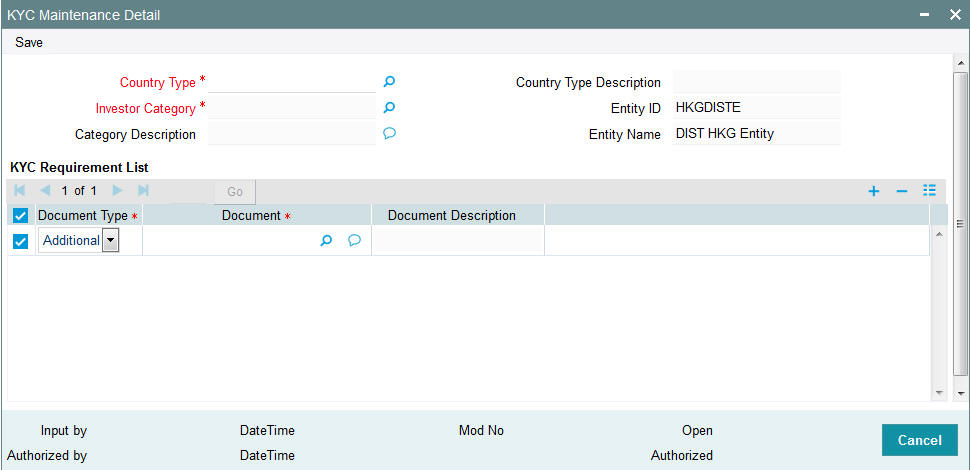

- Section 3.46, "KYC/ AML Maintenance"

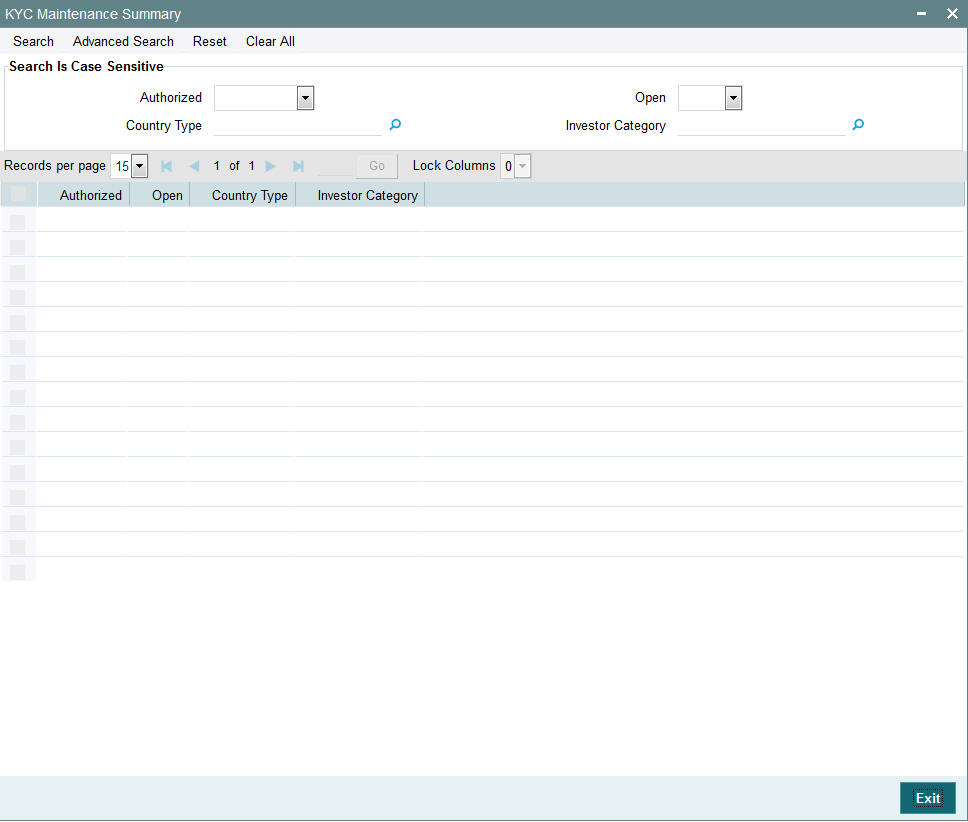

- Section 3.47, "KYC Maintenance Summary Screen"

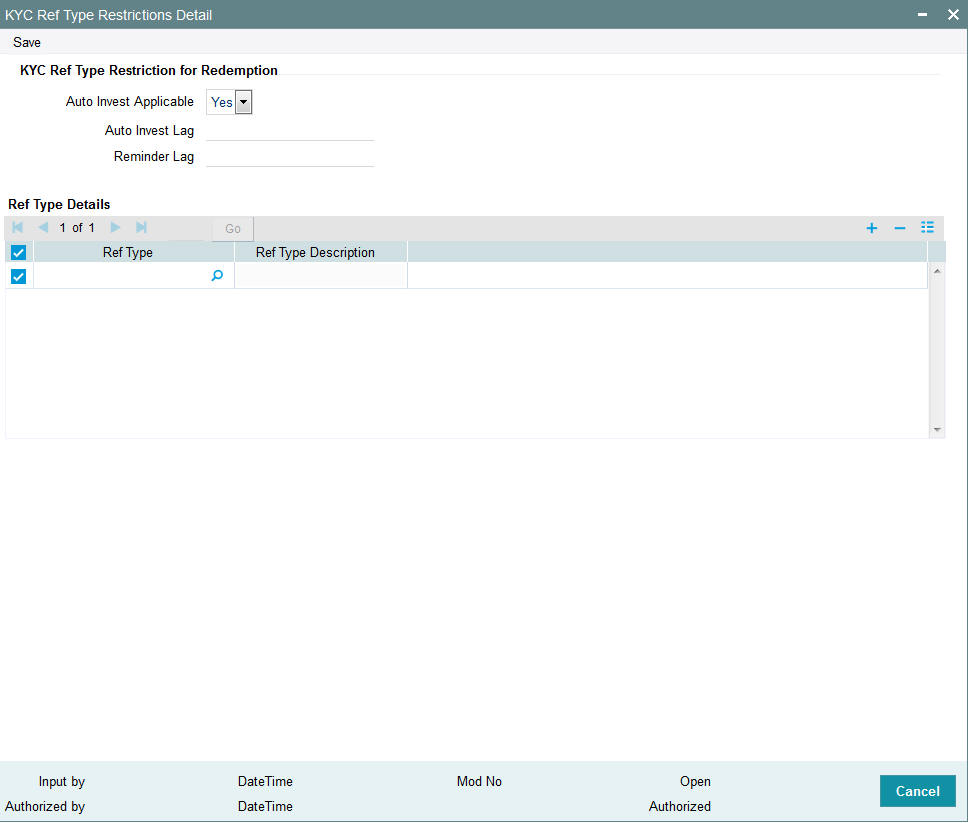

- Section 3.48, "KYC Ref Type Restrictions"

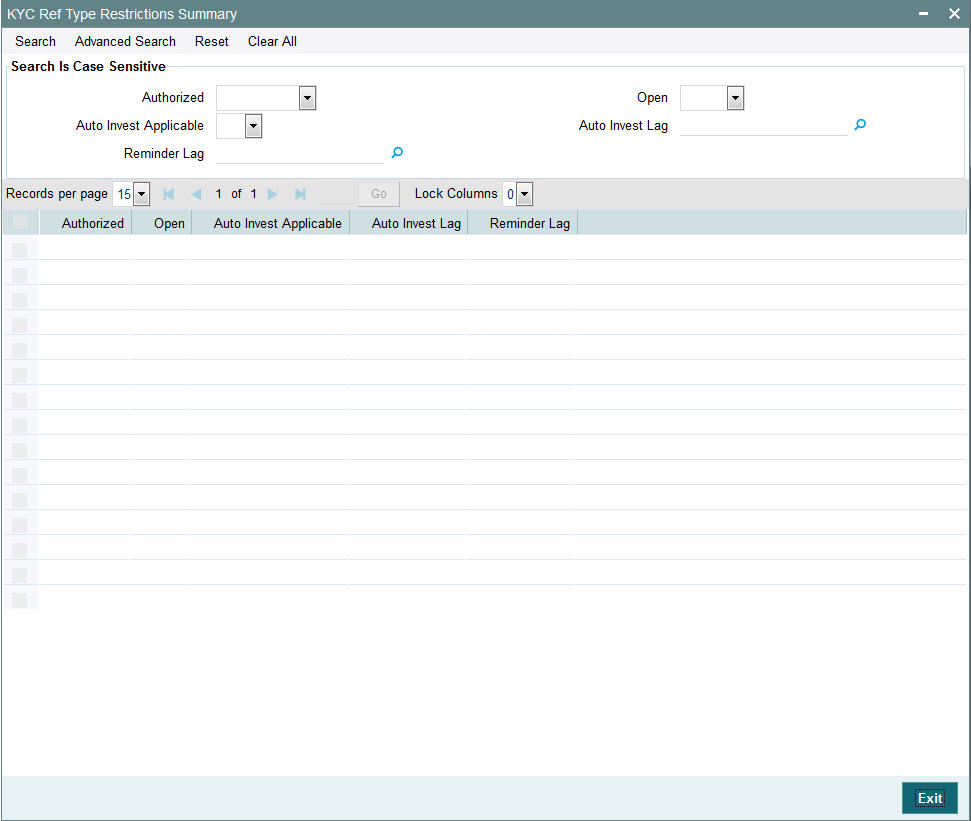

- Section 3.49, "KYC Ref Type Restrictions Summary Screen"

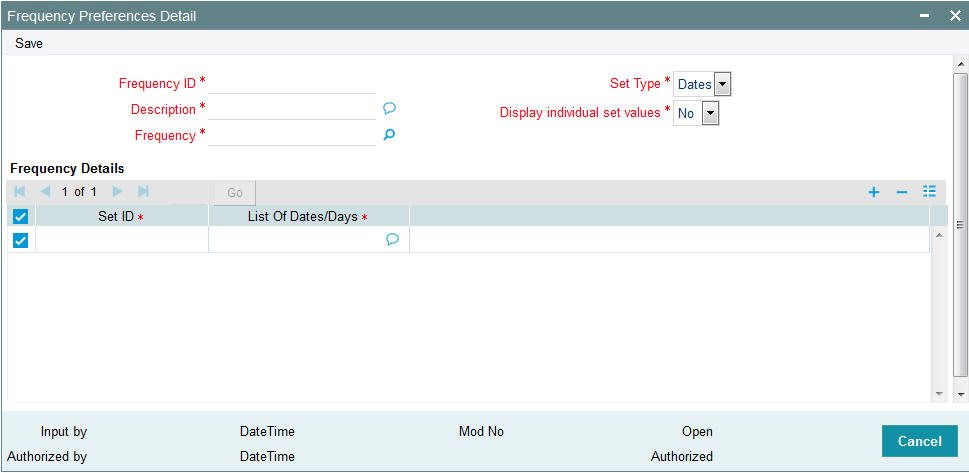

- Section 3.50, "SIP/ SWP/ STP Rules"

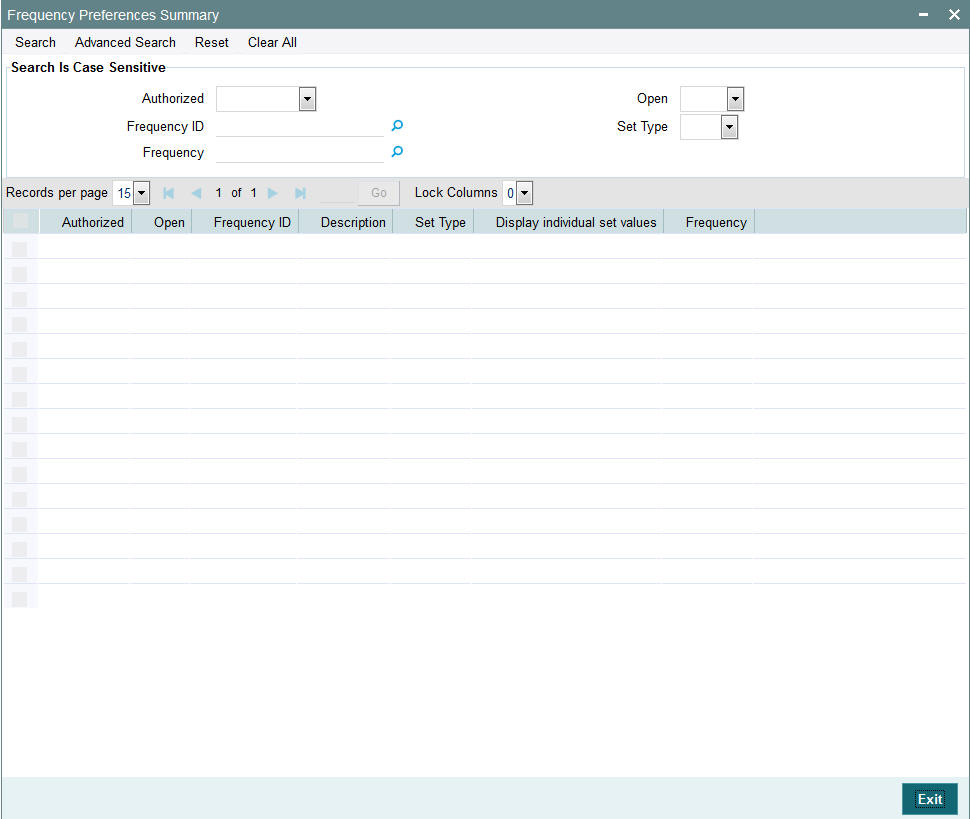

- Section 3.51, "Frequency Preferences Summary Screen"

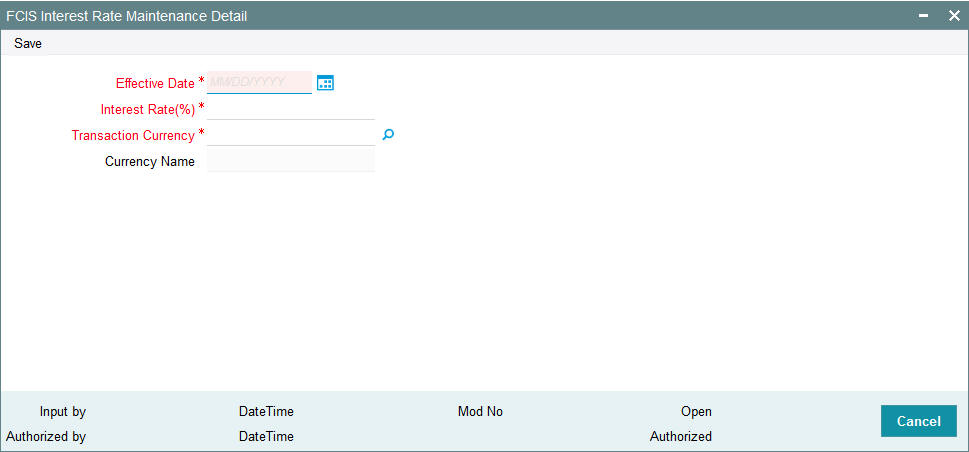

- Section 3.52, "Interest Rate Details"

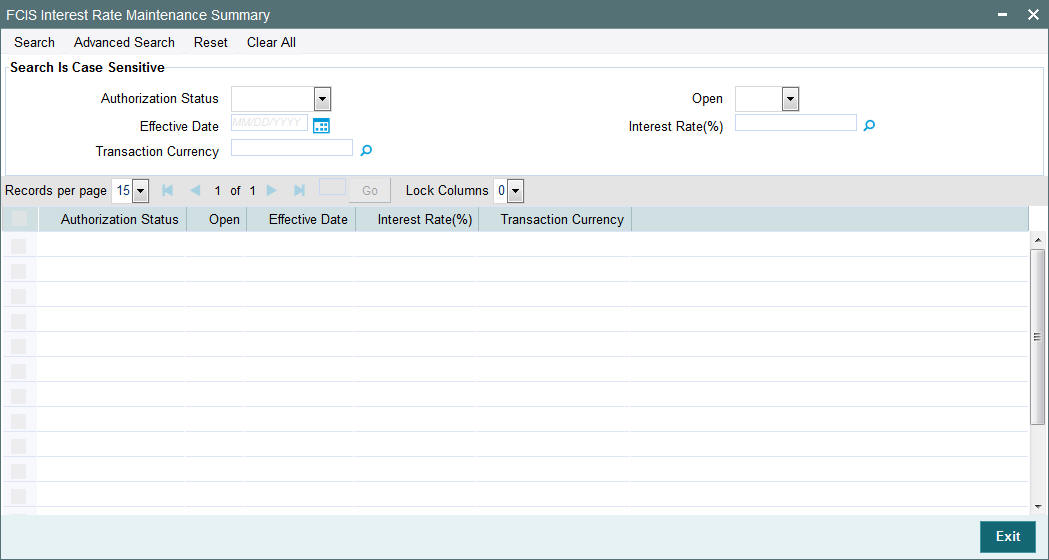

- Section 3.53, "Interest Rate Summary Screen"

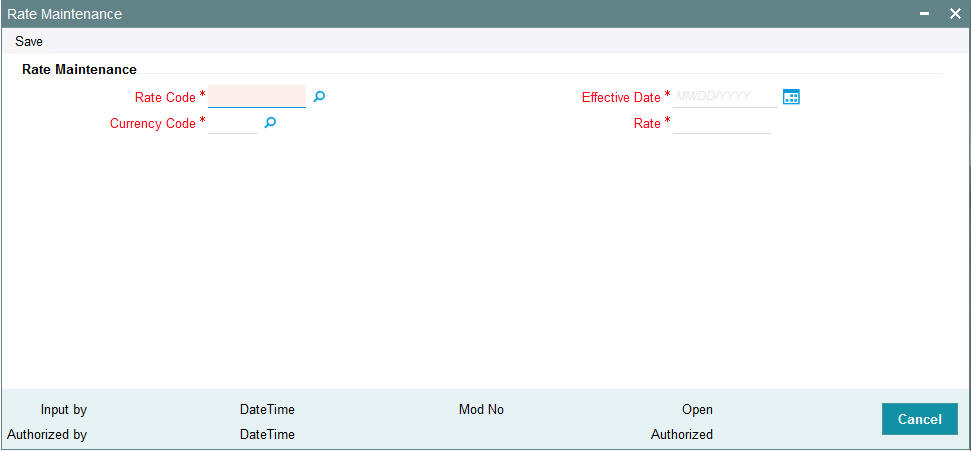

- Section 3.54, "Rate Details for Hedge Funds"

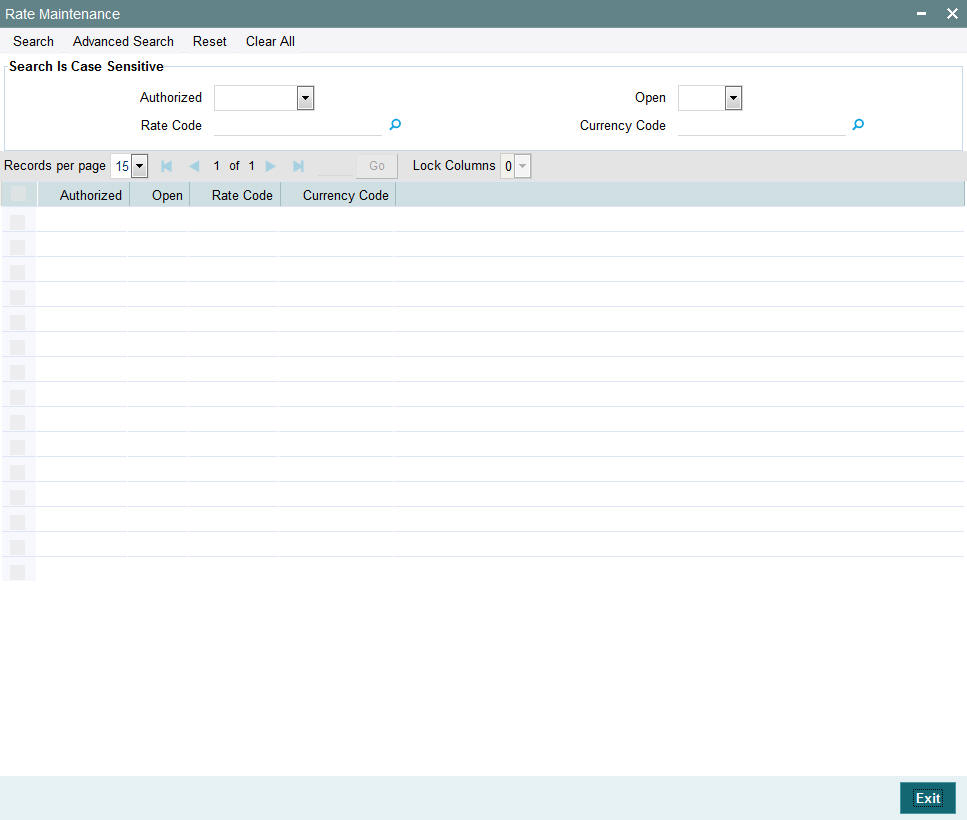

- Section 3.55, "Rate Maintenance Summary Screen"

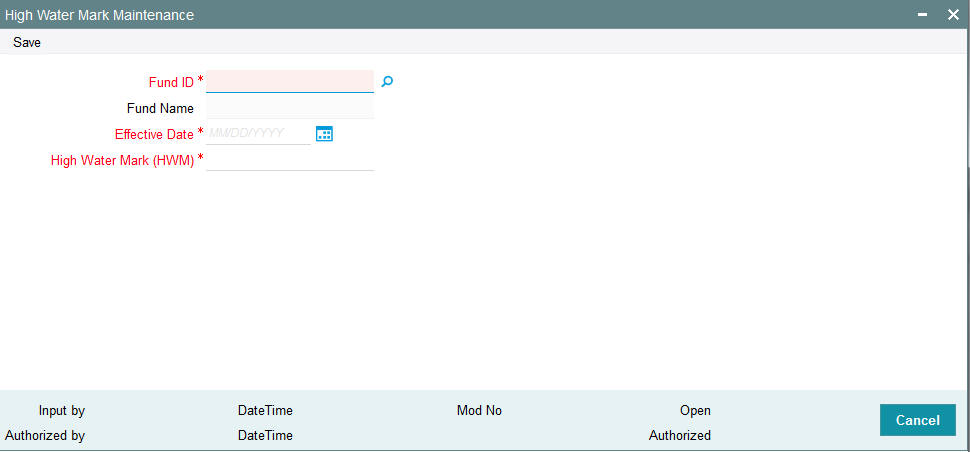

- Section 3.56, "High Water Mark Details"

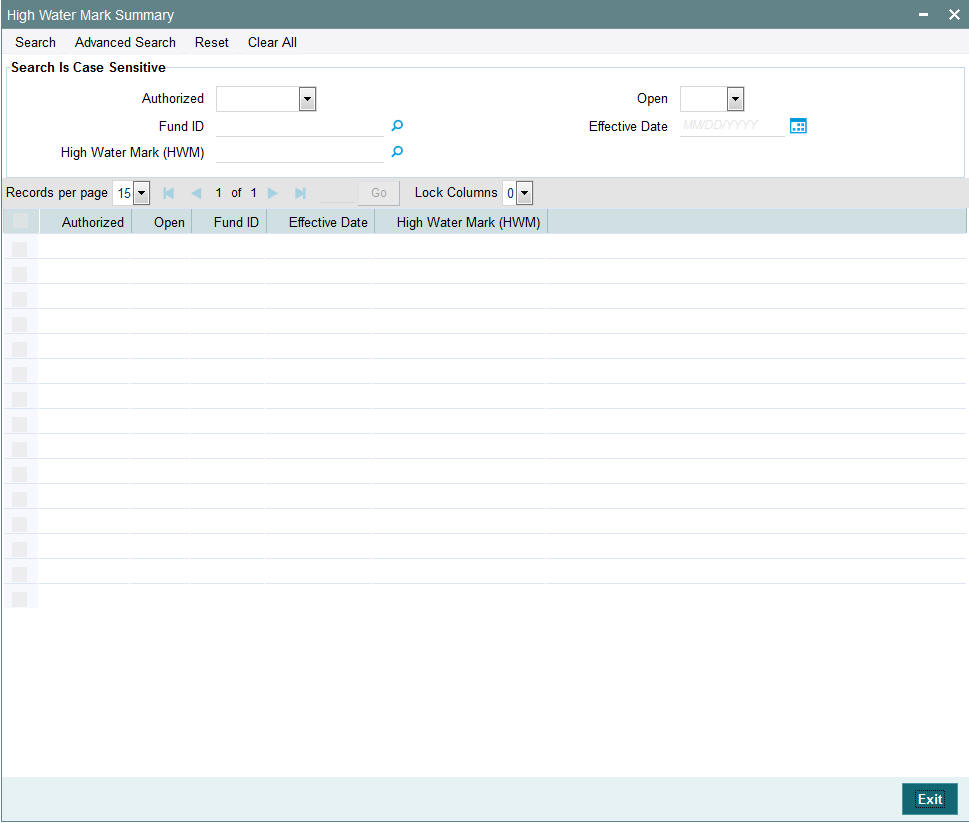

- Section 3.57, "High Water Mark Summary Screen"

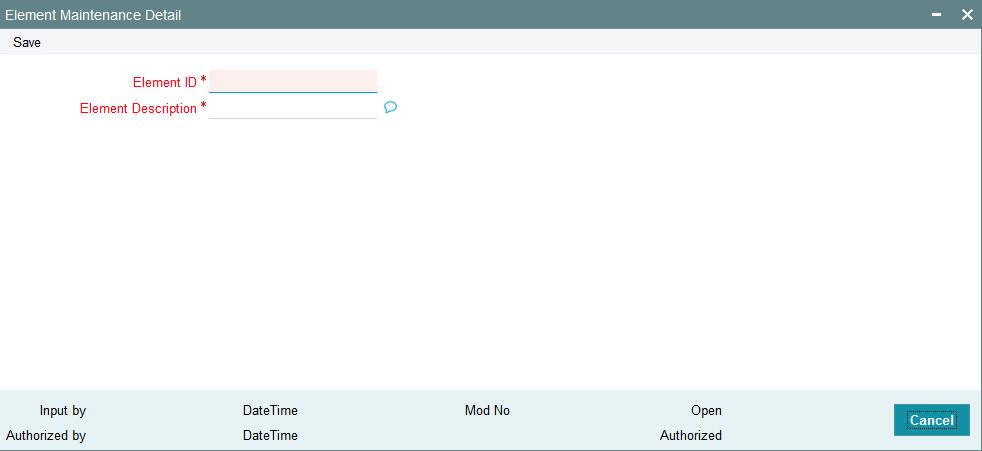

- Section 3.58, "Data Elements"

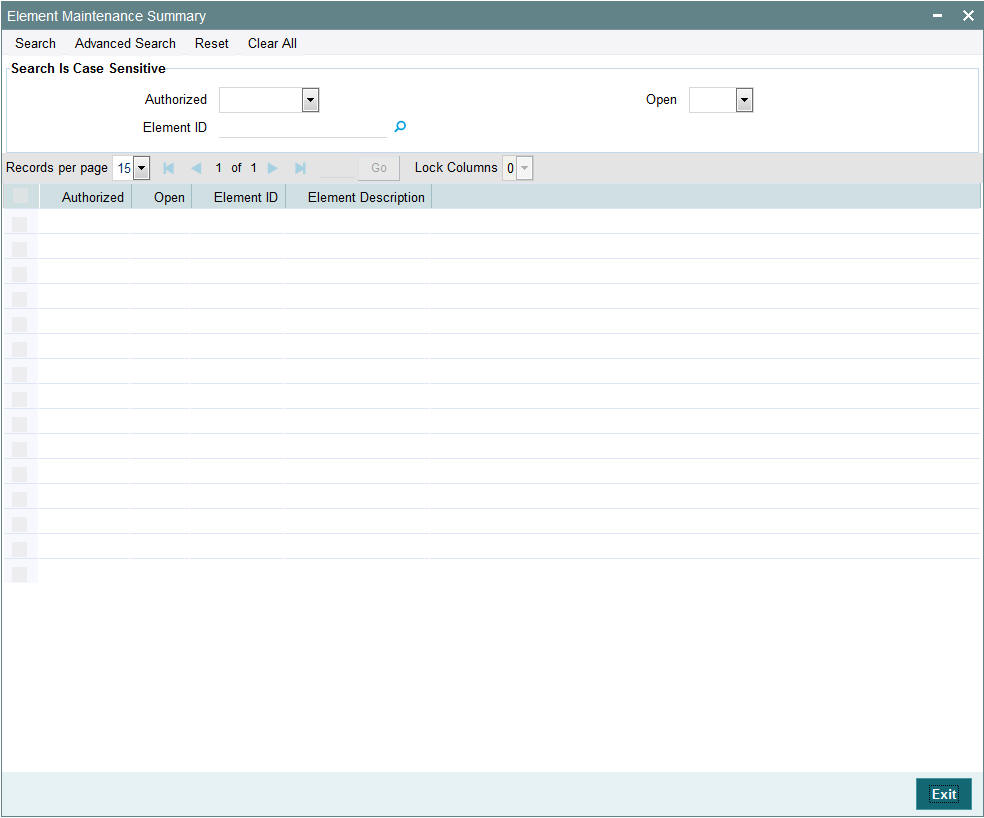

- Section 3.59, "Element Maintenance Summary Screen"

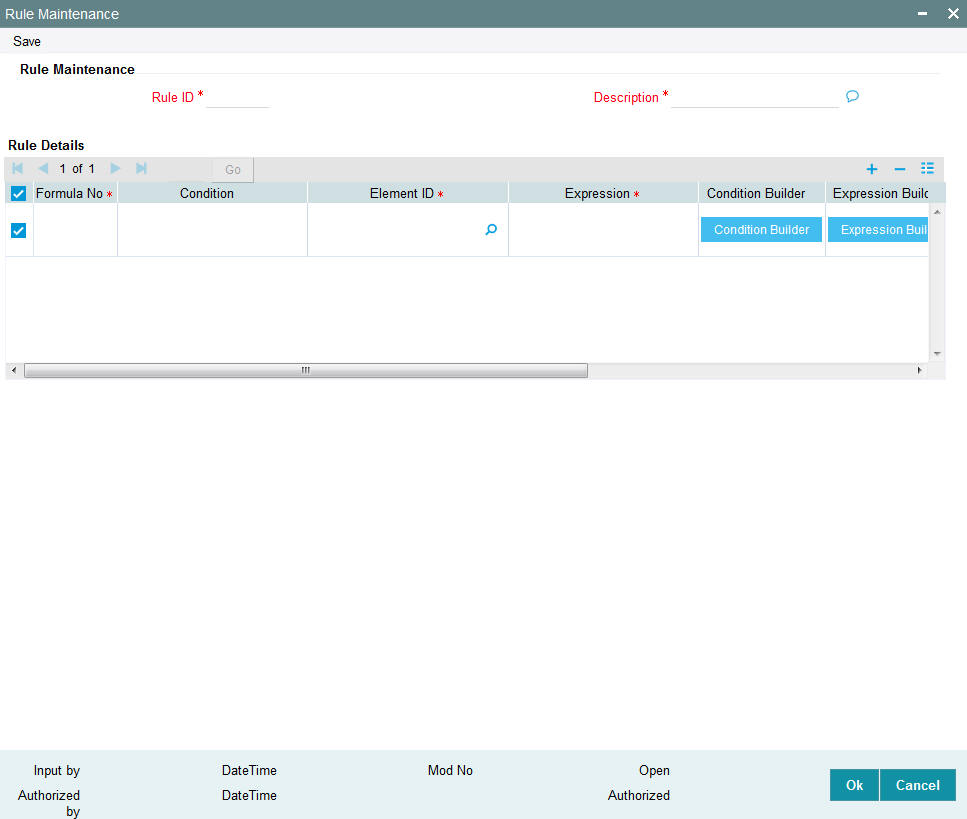

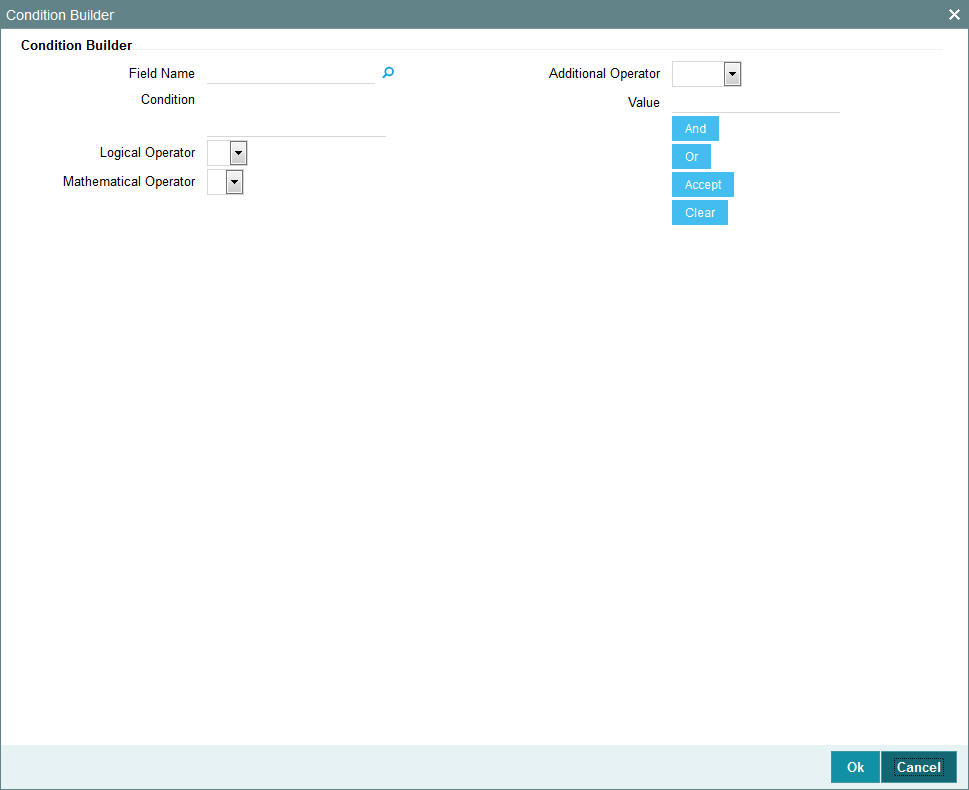

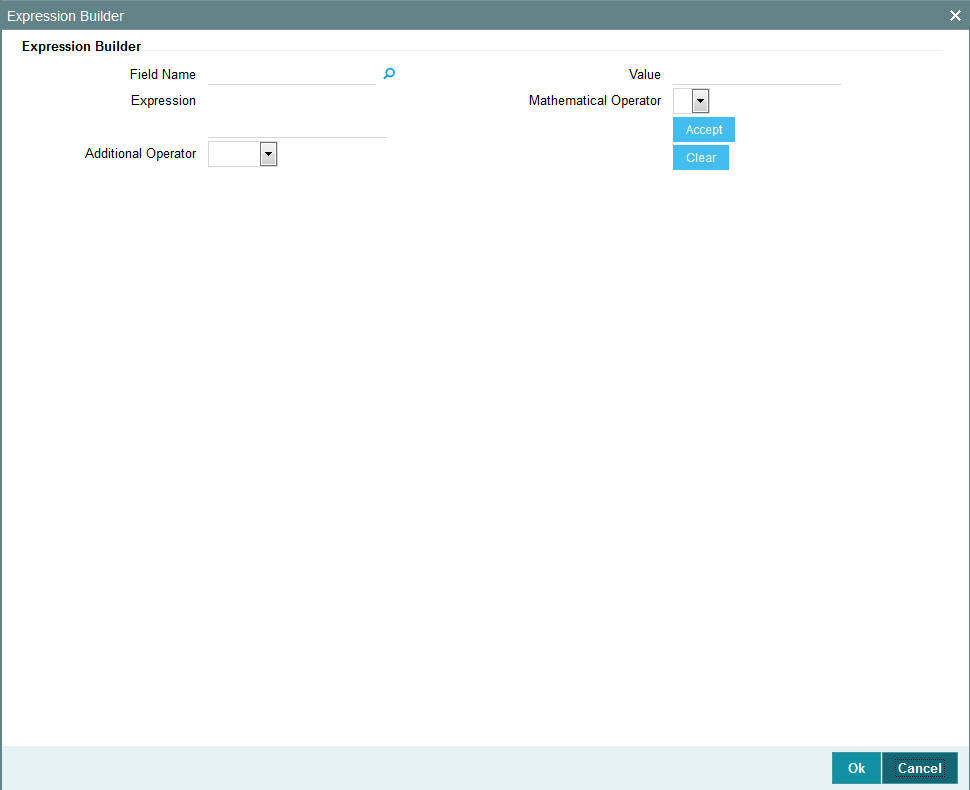

- Section 3.60, "Rules for Performance Fee Calculation"

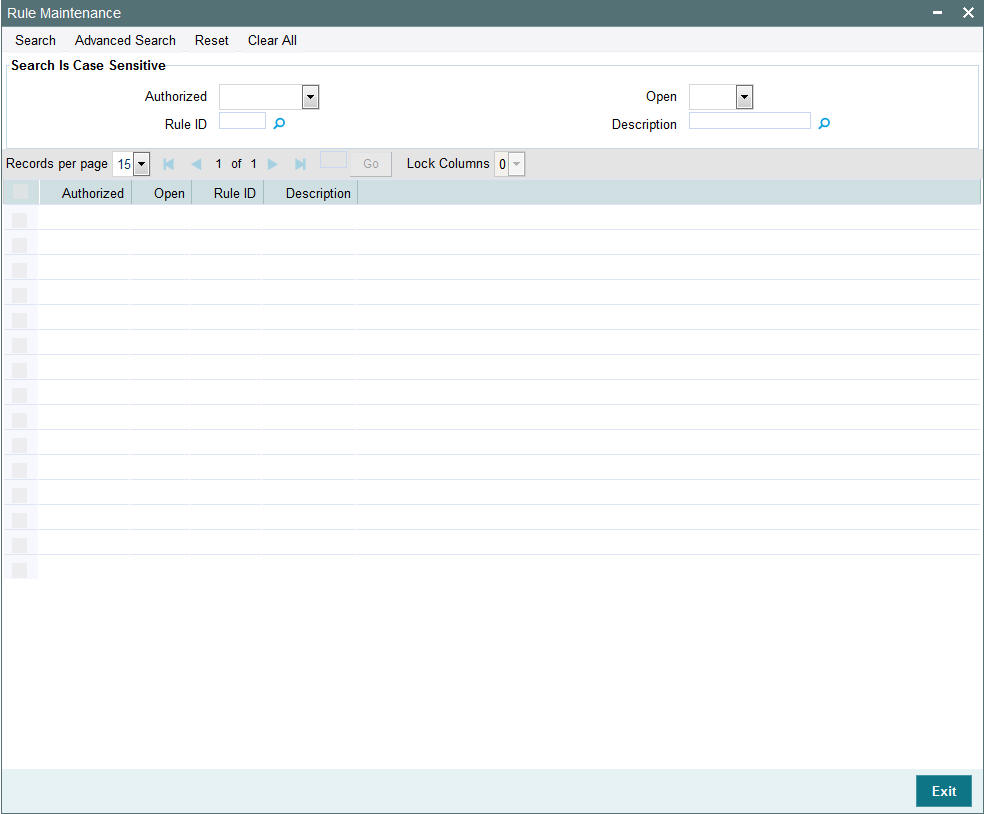

- Section 3.61, "Rule Maintenance Summary"

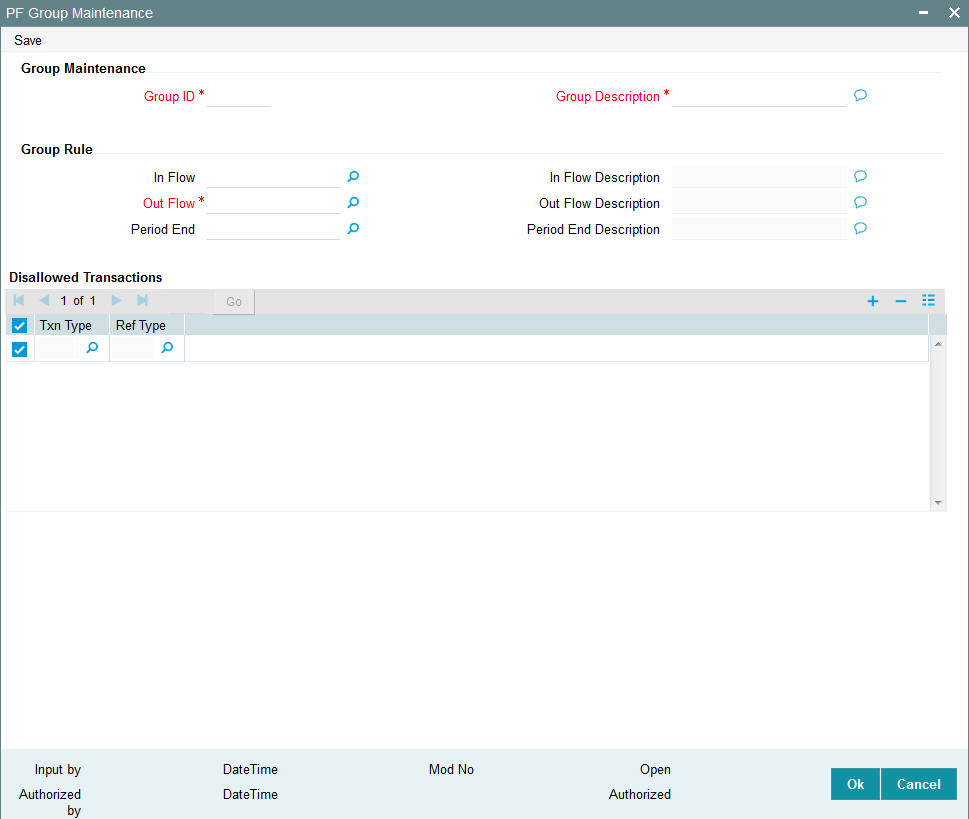

- Section 3.62, "Group Rule Mapping"

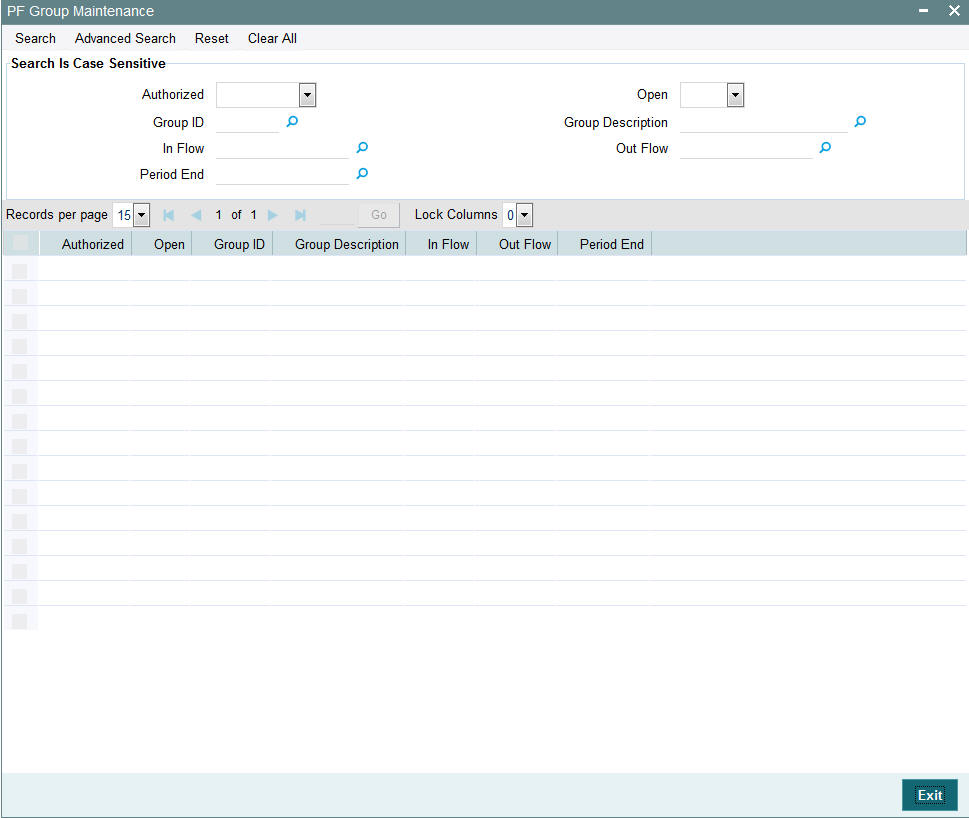

- Section 3.63, "PF Group Maintenance Summary Screen"

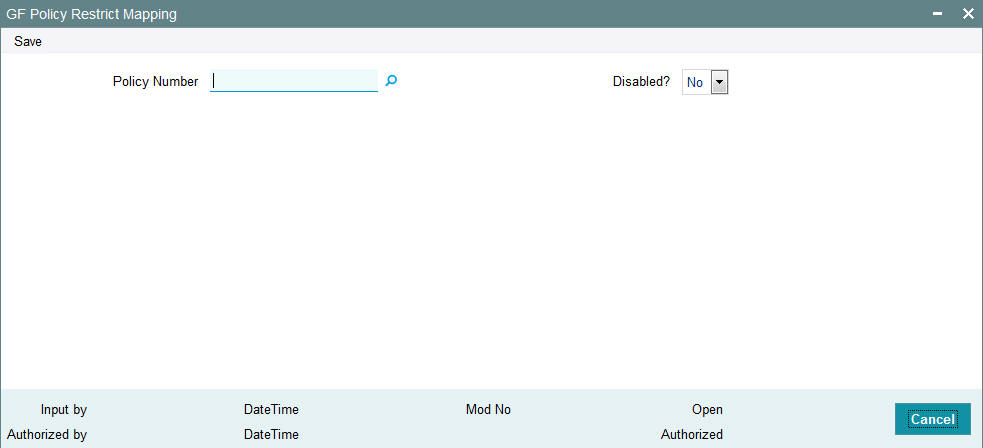

- Section 3.64, "Policy Restrictions for Guaranteed Funds"

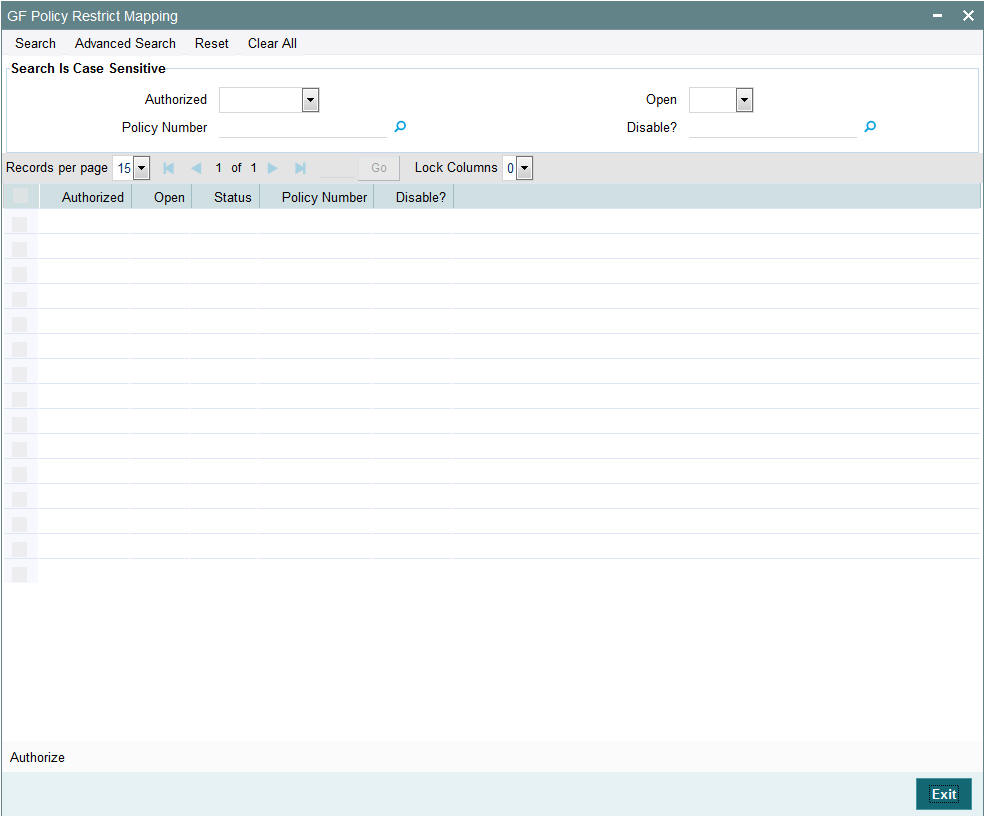

- Section 3.65, "GF Policy Restrict Mapping Summary Screen"

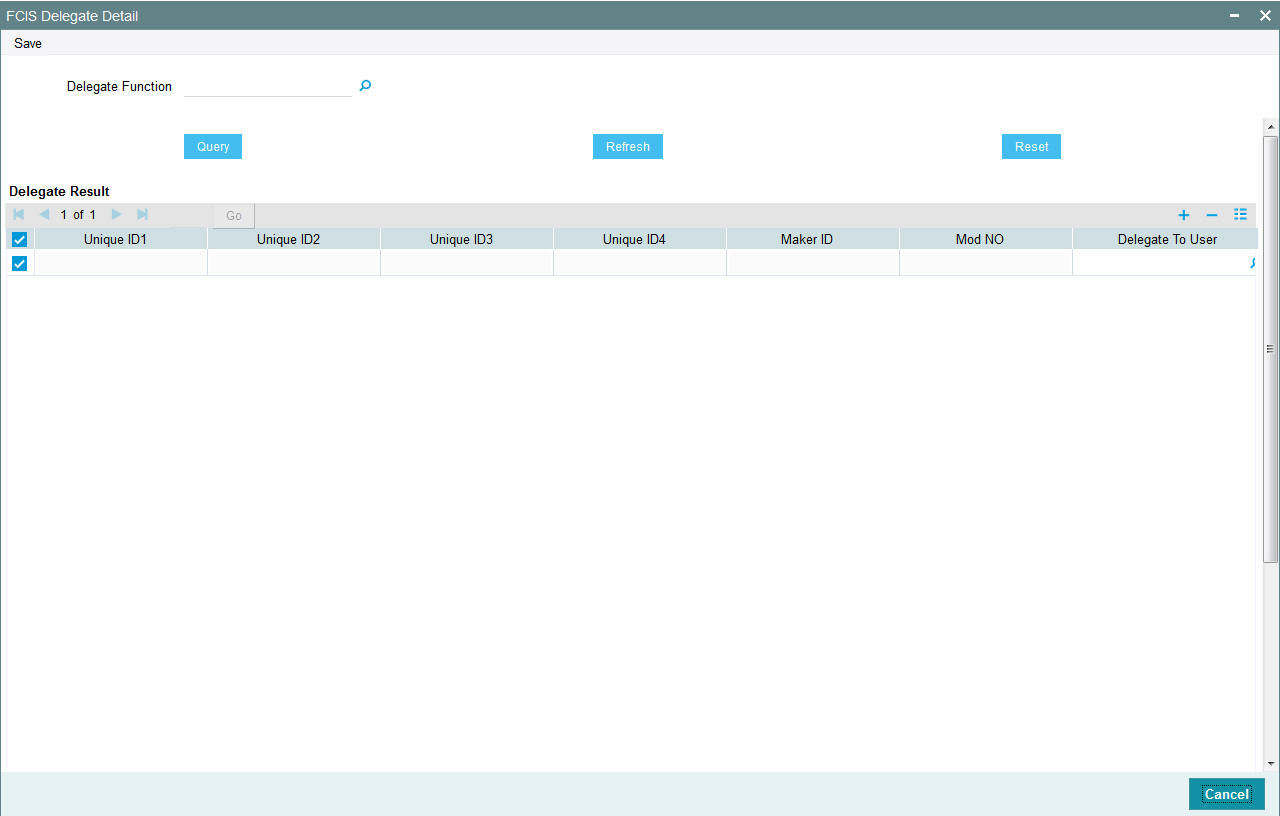

- Section 3.66, "Delegate Detail at Fund Price"

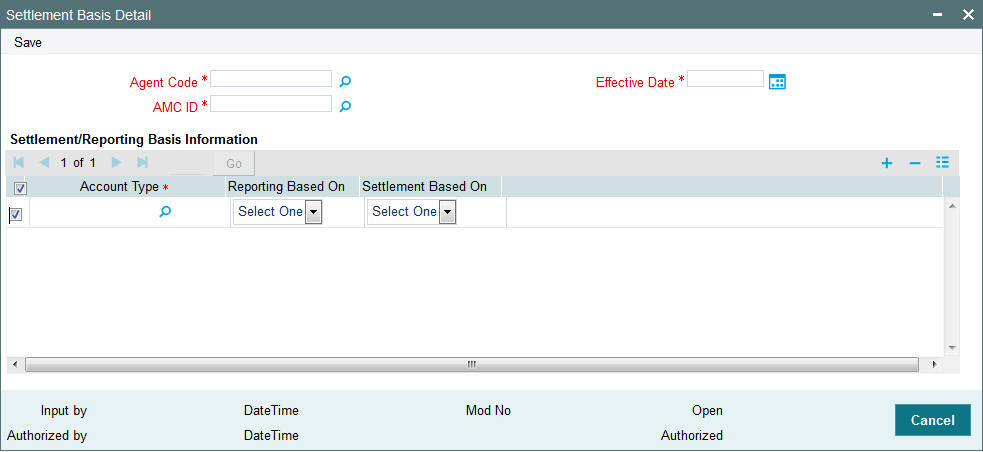

- Section 3.67, "Settlement Basis Detail"

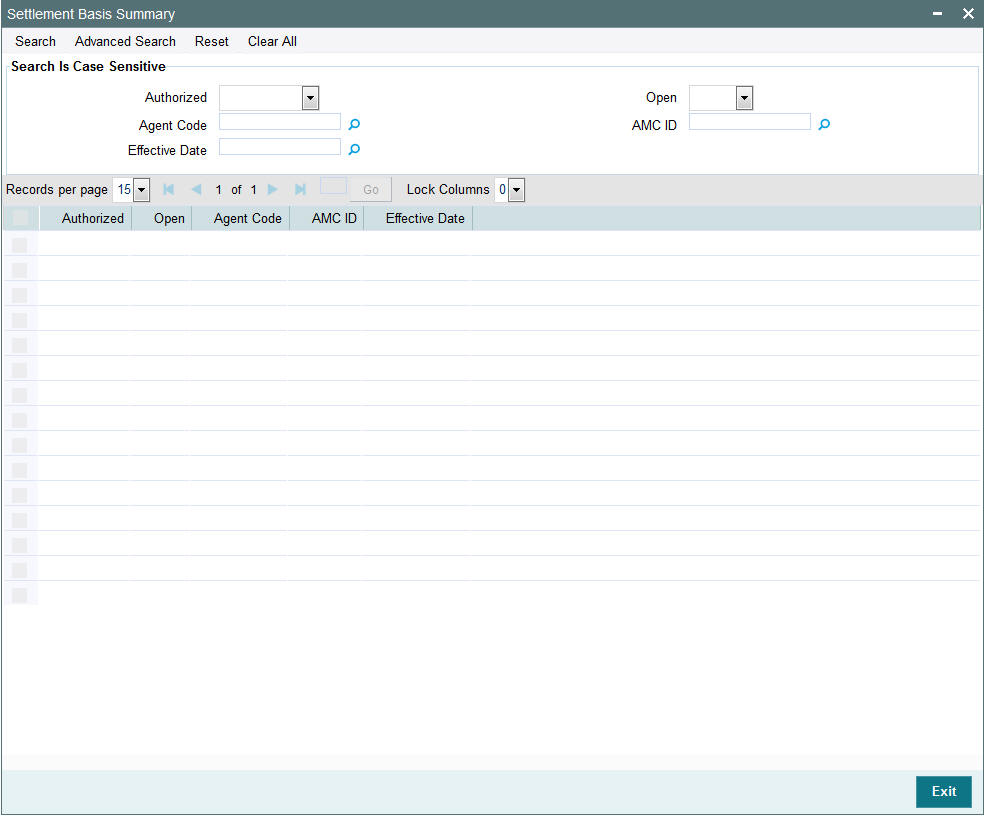

- Section 3.68, "Settlement Basis Summary"

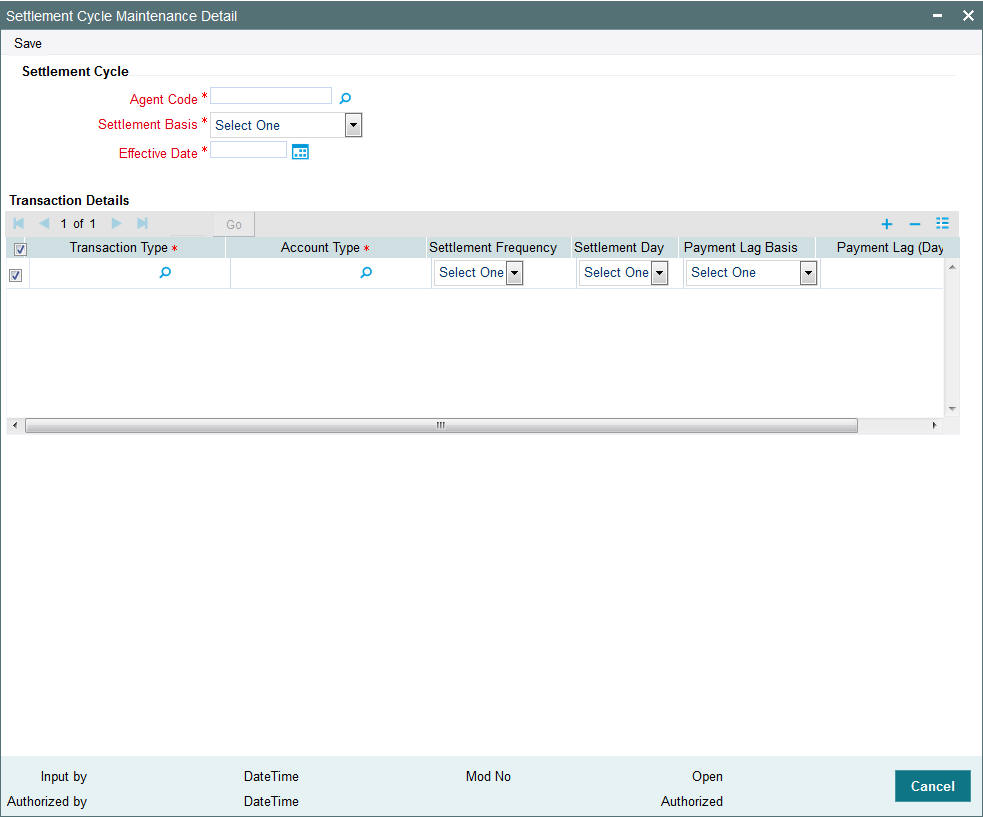

- Section 3.69, "Settlement Cycle Maintenance Detail"

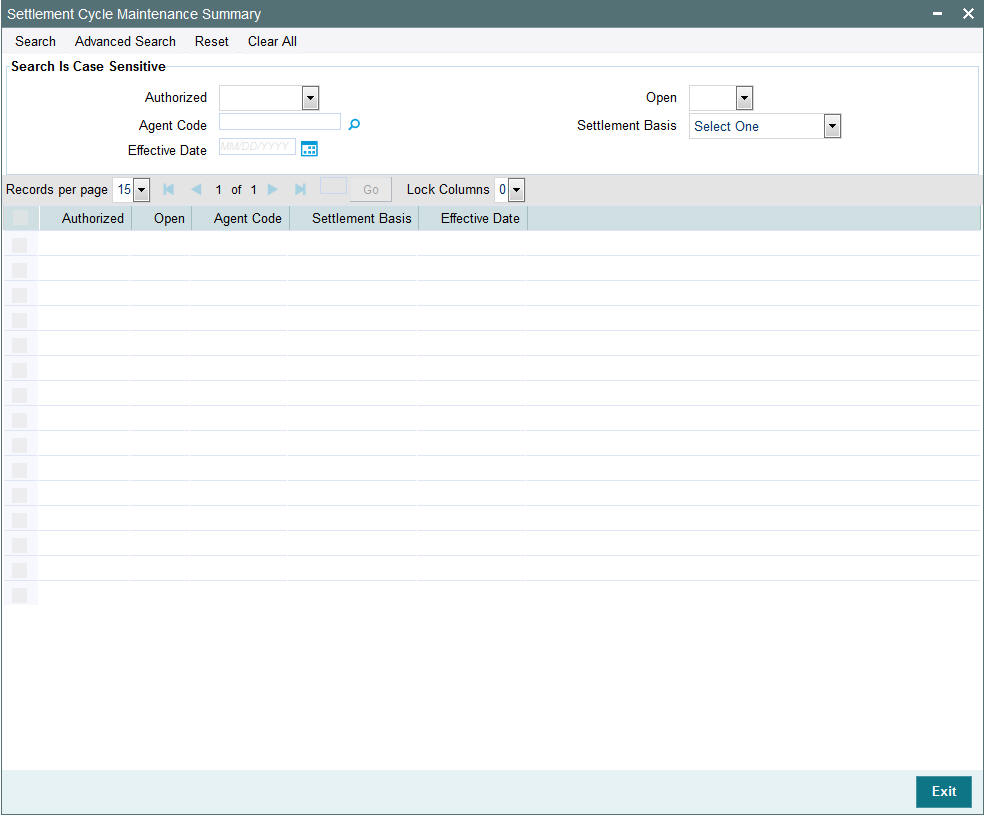

- Section 3.70, "Settlement Cycle Maintenance Summary"

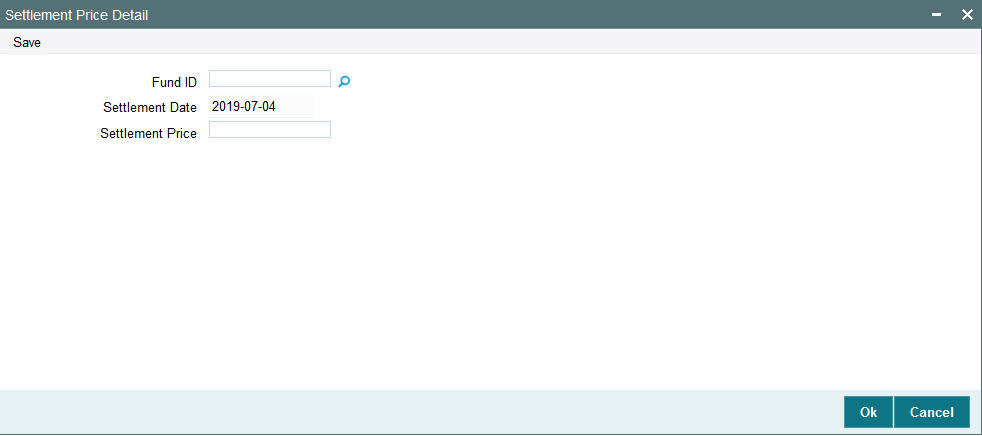

- Section 3.71, "Settlement Price Detail"

- Section 3.72, "Succession Price Detail"

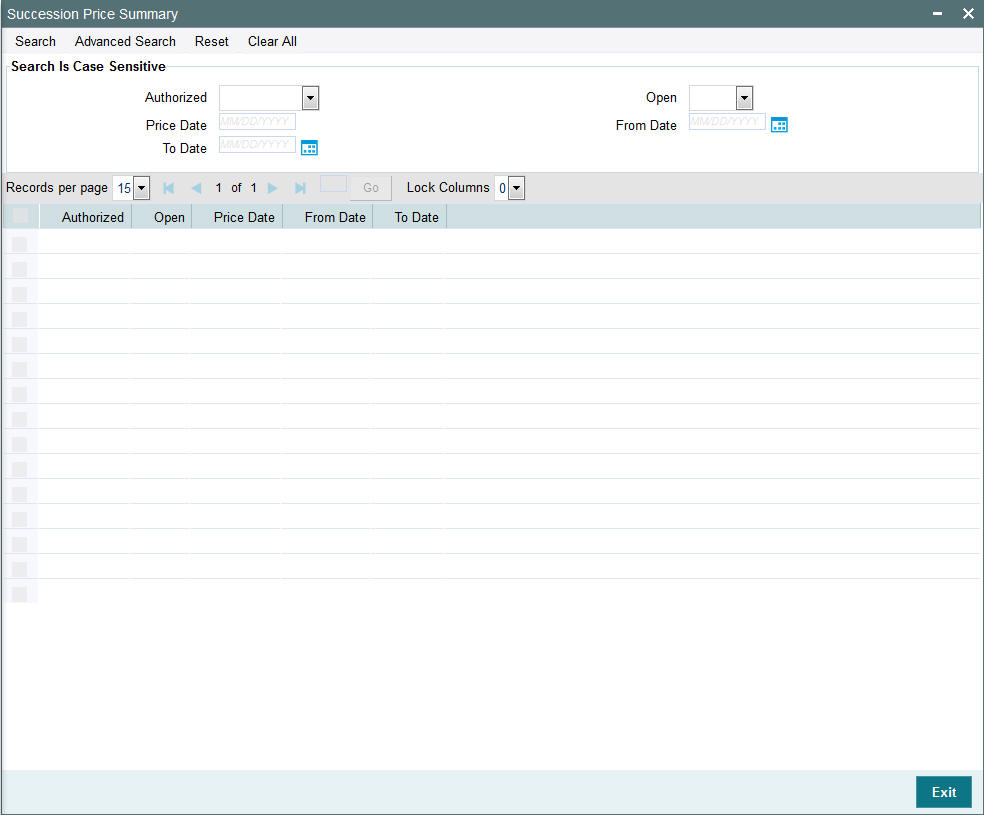

- Section 3.73, "Succession Price Summary"

3.1 Reference Information Setup

Information that is static and will need to be set up only the first time, and subsequently altered very little or not at all, constitutes reference information. This includes:

- Entities that the AMC would transact with, such as agents, agency branches, banks, bank branches, registrars, trustees, bulk clients, check vendors, underwriters and custodians. You can also maintain different AMC’s as entities.

- The different values for static system parameters, such as countries, identification, corporation and occupation types, account types, investor categories, fee categories, and so on.

- Currency information, such as the different currencies, exchange rate sources and pair currencies. On a daily basis, you can also capture the prevalent exchange rates.

- Tax processing information that would be applicable to investor categories, country tax laws, cash dividends, brokers and funds floated by the AMC.

- The different fees, incentives or loads that would apply to transactions of investors in the funds of the AMC. This includes fees such as contingent deferred sales charge (CDSC), trailing commissions and ongoing management fees.

- The holiday calendar for the AMC, and the holiday calendar for the fund, if required.

This chapter deals with setting up the following reference information:

- Fund Types

- Entities

- Withholding Tax

- Modes of Payment

- Holidays

- Static maintenance for switch transactions

- Indexation values for capital gains tax

3.2 Fund Types

This section contains the following topics:

3.2.1 Setting up Fund Types

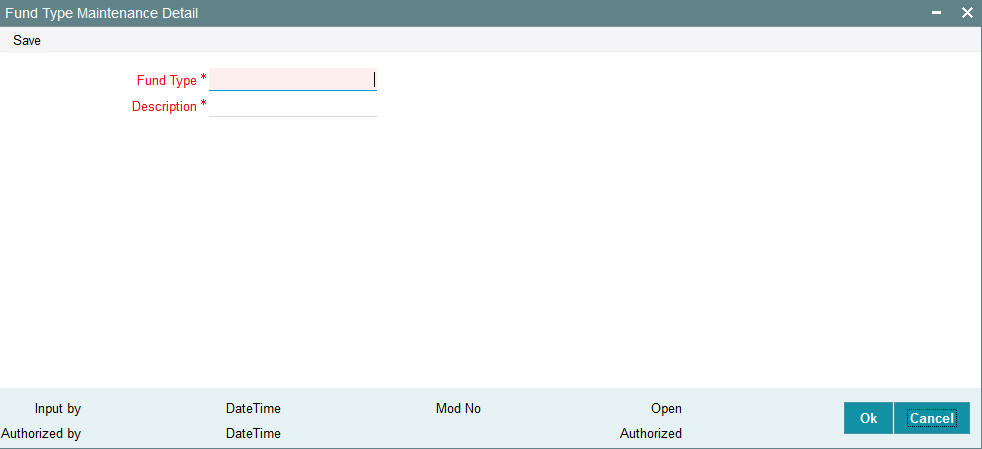

Before any fund may be set up in the system, the types of funds that can be maintained must be set up in the ‘Fund Type Maintenance Detail’ screen. You can invoke the ‘Fund Type Maintenance Detail’ screen by typing ‘UTDFNTYP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The ‘Fund Type Maintenance Detail’ screen is displayed. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the Fund Type.

Fund Type

Numeric; 38 Characters; Mandatory

Specify an identification for the fund type that you wish to set up.

Description

Alphanumeric; 20 Characters; Mandatory

Enter a brief description for the fund type.

3.3 Fund Type Maintenance Summary Screen

This section contains the following topics:

- Section 3.3.1, "Invoking the Fund Type Maintenance Summary Screen"

- Section 3.3.2, "Retrieving Fund Type in Summary Screen"

- Section 3.3.3, "Editing Fund Type"

- Section 3.3.4, "Viewing Fund Type"

- Section 3.3.5, "Deleting Fund Type"

- Section 3.3.6, "Authorizing Fund Types"

- Section 3.3.7, "Amending Fund Types"

- Section 3.3.8, "Authorizing Amended Fund Types"

- Section 3.3.9, "Copying Attributes"

3.3.1 Invoking the Fund Type Maintenance Summary Screen

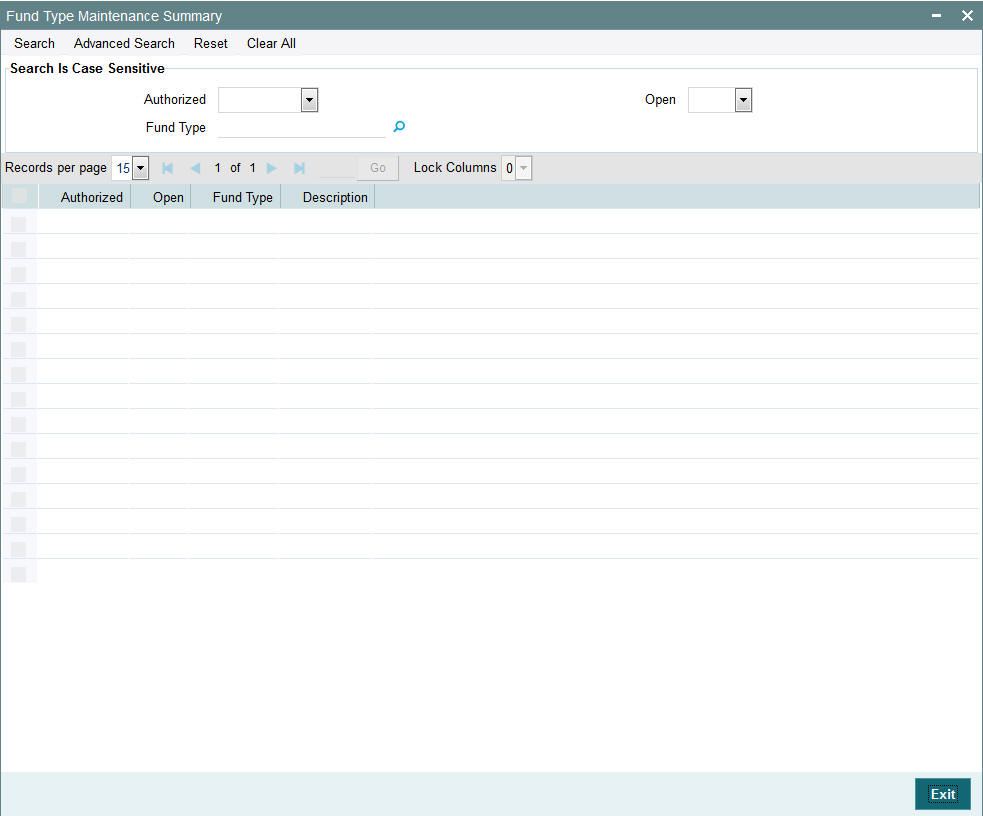

You can use the ‘Fund Type Maintenance Summary’ screen to:

- Edit an existing fund type

- View existing fund types

- Delete an existing fund type

- Authorize a fund type

- Amend an authorized fund type

You can invoke the ‘Fund Type Maintenance Summary’ screen by typing ‘UTSFNTYP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

3.3.2 Retrieving Fund Type in Summary Screen

You can retrieve a previously entered fund type in the Summary screen, as follows:

- Invoke the Fund Type Summary screen and specify the following:

- The status of the fund type in the Authorized field. If you choose the “Blank Space” option, then all the fund types are retrieved.

- The status of the fund type in the Open field. If you choose the “Blank Space” option, then all the fund types are retrieved.

- The Fund Type

- After you have specified the required details, click ‘Search’ button. All Fund Types with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve the individual fund type detail from the detail screen by doing query in the following manner:-

- Press F7

- Input the Fund Type

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

For example, you can search the record for Fund Type or Fund Type description by using the combination of % and alphanumeric value as follows:-

- Search by M%: The system will fetch all the records whose Fund Type description starts from Alphabet ‘M’. For example, Mutual Fund.

- Search by %7 : The system will fetch all the records whose Fund Type ends by numeric value’ 7’ For example, 217,267,77 and so forth.

- Search by %17%: The system will fetch all the records whose Fund Type contains the numeric value 17. For example, 3217, 2172 and so forth.

3.3.3 Editing Fund Type

You can modify the details of a fund type that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Fund Type Summary screen from the Browser.

- Select the status of the fund type that you want to retrieve for modification in the Authorization Status field. You can only modify records of fund types that are unauthorized. Accordingly, choose the Unauthorized option from the drop-down list.

- Specify any or all of the details of the fund type in the corresponding fields on the screen to retrieve the fund type that is to be modified.

- Click ‘Search’ button. All unauthorized fund types with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the fund type that you want to modify. The Fund Type Maintenance screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save the changes. The Fund Type Maintenance screen is closed and the changes made are reflected in the Fund Type Summary screen.

3.3.4 Viewing Fund Type

To view a fund type that you have previously entered:

- Invoke the Summary Screen from the Browser.

- Select the status of the fund type that you want to retrieve for viewing in the Authorization Status field. You can also view all fund types that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the fund type in the corresponding fields on the screen.

- Click ‘Search’ button. All fund types with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the fund type that you want to view in the list of displayed fund types. The Fund Type Maintenance screen is opened in view mode.

3.3.5 Deleting Fund Type

You can delete only unauthorized fund types in the system.

To delete a fund type:

- Invoke the Fund Type Summary screen from the Browser.

- Select the status of the fund types that you want to retrieve for deletion.

- Specify any or all of the details of the fund type in the corresponding fields on the screen.

- Click ‘Search’ button. All fund types with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the fund type that you want to delete. The Fund Type Maintenance Detail screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

3.3.6 Authorizing Fund Types

An unauthorized fund type must be authorized in the system for it to be processed.

To authorize a fund type:

- Invoke the Fund Type Summary screen from the Browser.

- Select the status of the fund type that you want to retrieve for authorization. Typically, choose the Unauthorized option from the drop down list.

- Specify any or all of the details of the fund type in the corresponding fields on the screen.

- Click ‘Search’ button. All fund types with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the fund type that you wish to authorize. The Fund Type Maintenance screen displayed. Select Authorize operation from Action.

When the checker authorizes a fund type, details of validations, if any, that were overridden by the maker of the transaction during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the fund type.

3.3.7 Amending Fund Types

After a fund type is authorized, it can be modified using the Unlock operation from Action list. To make changes to a fund type after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the Fund Type Summary screen from the Browser.

- Select the status of the fund type that you wish to retrieve for amendment. You can only amend records of fund types that are authorized.

- Specify any or all of the details of the fund type in the corresponding fields on the screen.

- Click ‘Search’ button. All fund types with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the fund type that you want to amend. The Fund Type Maintenance screen is displayed in Amendment mode.

- Click the Unlock operation from the Action list to amend the fund type.

- Amend the necessary information. Click the Save button to save the changes.

3.3.8 Authorizing Amended Fund Types

An amended fund type must be authorized for the amendment to be made effective in the system.

The process of authorization is subsequently the same as that for normal transactions.

3.3.9 Copying Attributes

If you want to create a Fund Type having the same attributes of an existing Fund Type, you can copy the attributes of an existing fund type to a new fund type.

To copy the attributes:

- Retrieve the fund type whose attributes the new fund type should inherit. You can retrieve the record through the Summary screen or through the F7- F8 operation which is explained in the previous sections of this chapter.

- Click on ‘Copy’ in the Actions list.

- Indicate the ID for the new Fund Type. You can however change the details of the Fund Type if required.

3.4 Entities

This section contains the following topics:

- Section 3.4.1, "Setting up Entities"

- Section 3.4.2, "Invoking Single Entity Maintenance Detail"

- Section 3.4.3, "Basic Information Tab"

- Section 3.4.4, "Other Information Allowed"

- Section 3.4.5, "Correspondence Address Tab"

- Section 3.4.6, "Bank Details Tab"

- Section 3.4.7, "Alternate Language Details Tab"

- Section 3.4.8, "CPF Account Types Tab"

- Section 3.4.9, "Default Broker Details Tab"

- Section 3.4.10, "Additional Information Tab"

- Section 3.4.11, "Related Parties Tab"

- Section 3.4.12, "Swift Message Type Button"

- Section 3.4.13, "Mapped Installation IDs Button"

3.4.1 Setting up Entities

Each business entity that the AMC interacts with in the course of managing investment can be profiled in the FC-IS system with a unique profile. You can use the Single Entity Maintenance screen to set up the following entities in the system:

- Agency Branches

- Agents

- AMC

- Banks

- Bank Branches

- Bulk Clients

- Registrars

- Trustees

- Check Vendors

- Underwriters

- Custodians

- Clearing Agents

- Account and Valuation Agents

- Independent Financial Advisors (IFA)

- Participating Employer

- Account Officers

- Paying Agent

- Cash Management Account

- ISA (Individual Savings Account) Manager

- Legal Entity

Note

AMCs can only be maintained at Distributor installations. At an AMC installation, the profile of the logged in AMC can be viewed in the Single Entity screen, but a new profile cannot be created.

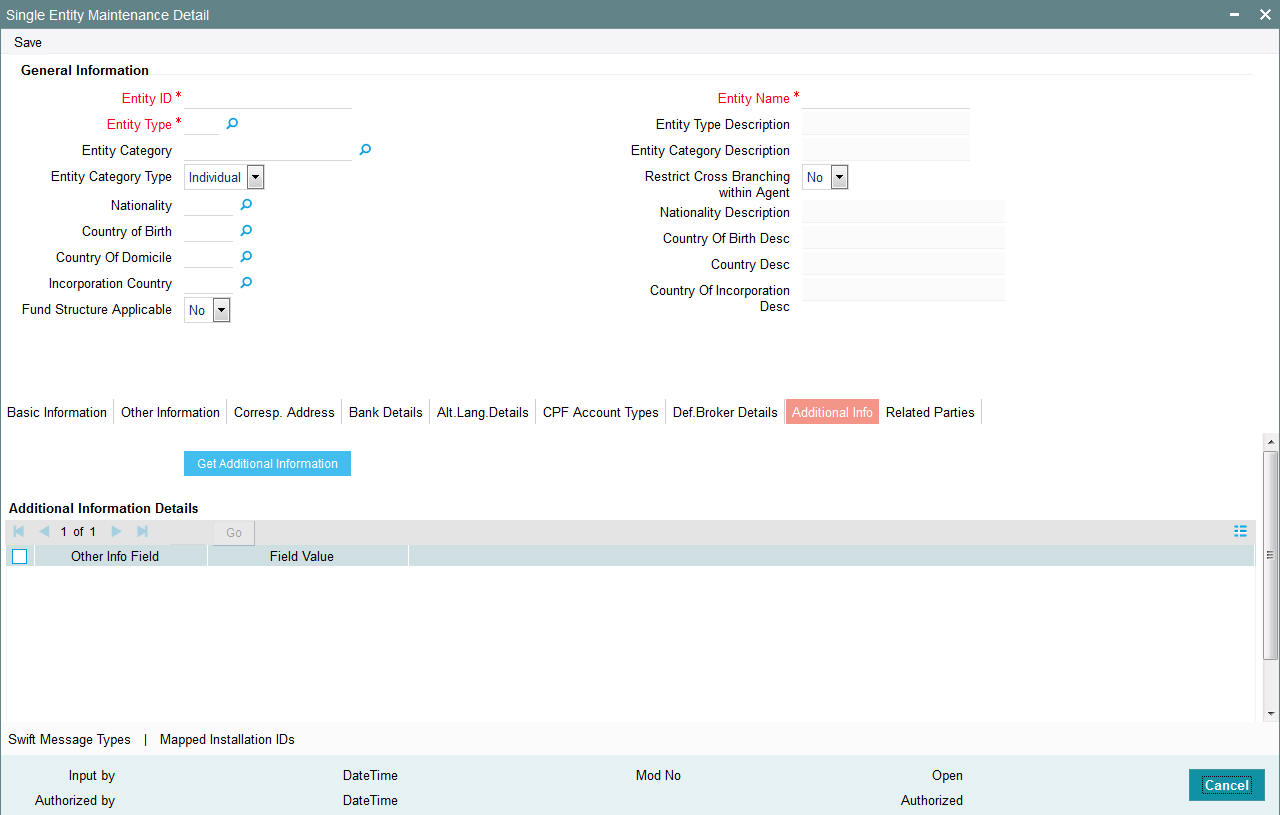

3.4.2 Invoking Single Entity Maintenance Detail

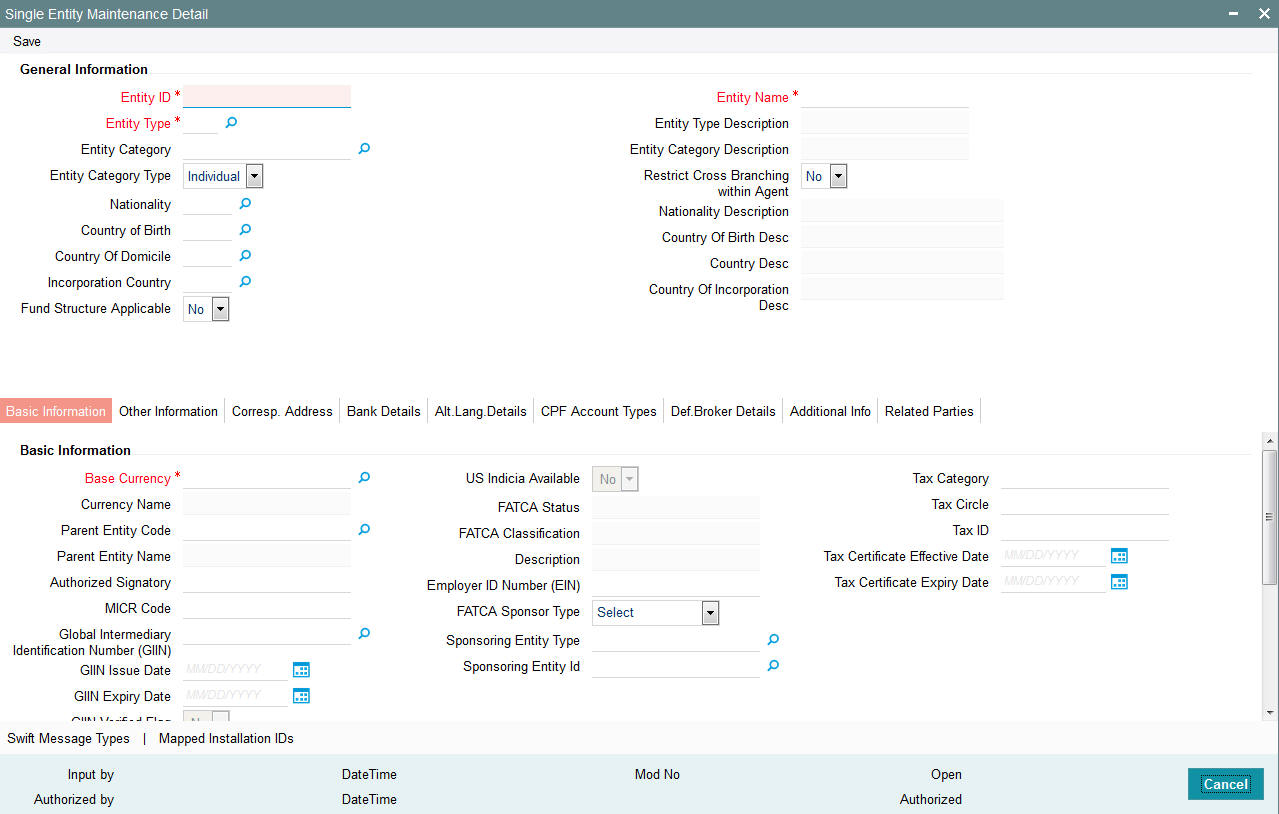

You can invoke the ‘Single Entity Maintenance Detail’ screen by typing ‘UTDENTMN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The ‘Single Entity Maintenance Detail’ screen is displayed. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the entity.

You can specify the following details:

Entity ID

Alphanumeric; 12 Characters; Mandatory

The Entity ID is a unique Identification for an entity in the system. Any detail regarding an entity is obtained by using the entity ID for reference. The ID you specify here must be unique and not already in use for any other entity in the system.

Entity Name

Alphanumeric; 60 Characters; Mandatory

Specify the name (or description) of the entity being set up in the system.

Entity Type

Alphanumeric; 1 Character; Mandatory

Specify the type of entity being set up. This could be any of the following:

- Agency Branch

- Agent

- AMC

- Bank

- Bank Branch

- Bulk Client

- Registrar

- Trustee

- Check Vendor

- Underwriter

- Custodian

- Clearing Agent

- Account and Valuation Agent

- Independent Financial Advisors (IFA)

- Participating Employer

- Paying Agent

- Cash Management Account

- Fund Manager

Entity Type Description

Display

The system displays description for the specified entity type here based on the details maintained in the system.

Entity Category

Alphanumeric; 2 Characters; Optional

Specify whether the entity being maintained belongs to the Individual or Corporate categories. This specification is optional; if specified, you must also select the appropriate category in the Entity Category field.

Entity Category Description

Display

The system displays the description for the selected entity category.

Entity Category Type

Optional

Select type of entity category from the drop-down list. The list displays the following values:

- Individual

- Corporate

Restrict cross branching within agent

Optional

Select Yes Cross Branching is allowed at this branch. By enabling this, the agency branch will be allowed to view details, perform transactions pertaining to the unit holders created by the other agency branches in the system. If this field is not clicked, the agency branch will be able to view details and transact for the unit holders created by him only.

Nationality

Alphanumeric; 3 Characters; Optional

Select the nationality from the adjoining option list.

Nationality Description

Display

The system displays the description of the selected nationality code.

Country of Birth

Alphanumeric; 3 Characters; Optional

Select the country of birth from the adjoining option list.

Country Of Birth Desc

Display

The system displays the description of the selected country of birth code.

Country of Domicile

Alphanumeric; 3 Characters; Optional

Select the country of domicile from the adjoining option list.

Country Of Domicile Desc

Display

The system displays the description of the selected country of domicile code.

Incorporation Country

Alphanumeric; 3 Characters; Optional

Select the Incorporation country from the adjoining option list.

Country Of Incorporation Desc

Display

The system displays the description of the selected country of incorporation code.

Fund Structure Applicable

Optional

Select if fund structure is applicable or not from the adjoining drop-down list. Following are the options available:

- Yes

- No

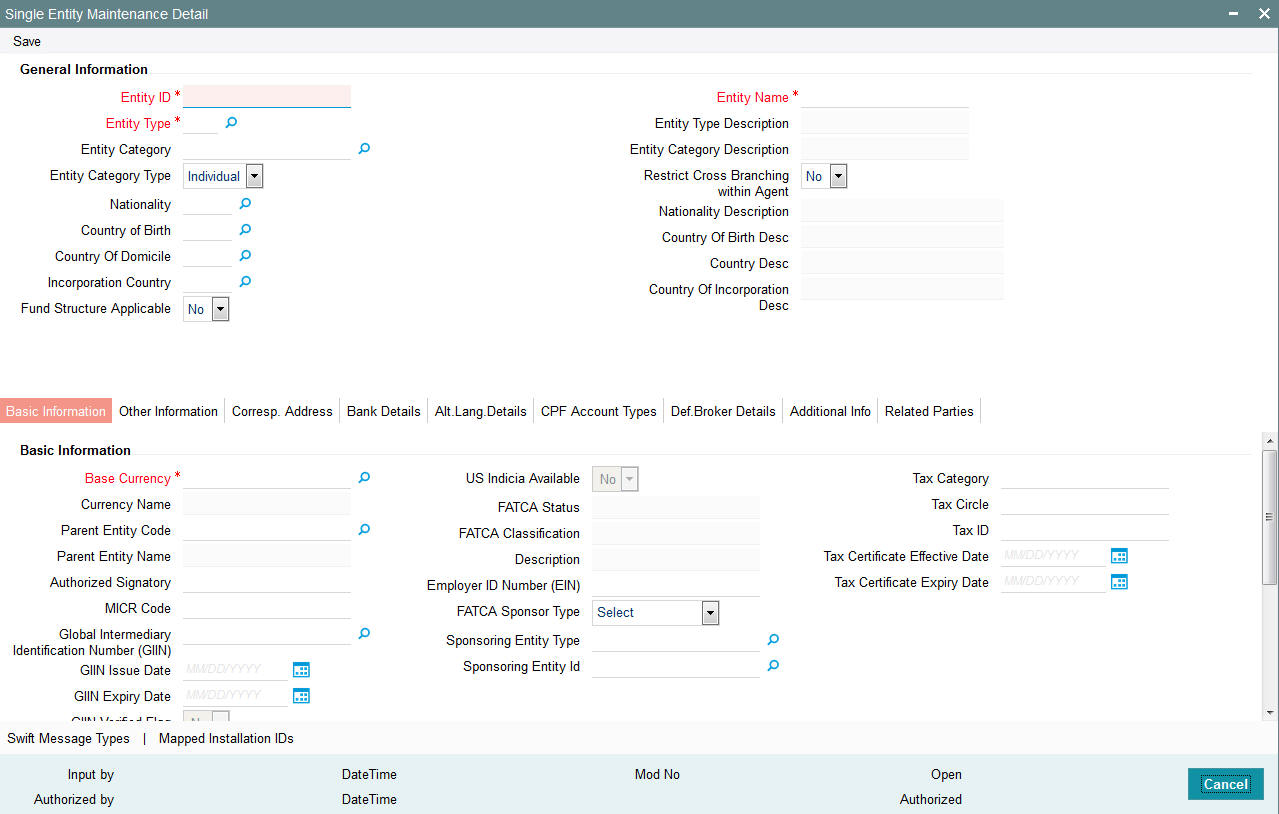

3.4.3 Basic Information Tab

The following window is displayed:

Base Currency

Alphanumeric; 3 Characters; Mandatory

Select the base currency of the entity, from the drop down list. This is the currency in which the entity normally transacts.

Currency Name

Display

The system displays the name of the currency for the selected base currency.

Parent Entity Code

Alphanumeric; 12 Characters; Optional

Specify the parent entity code. The adjoining option list displays all valid parent entity code maintained in the system. You can choose the appropriate one.

This is applicable only for specific entity types.

Parent Entity Name

Display

The system displays the name for the selected parent entity code.

Authorized Signatory

Alphanumeric; 70 Characters; Optional

Enter the name of the Authorized Signatory at the office of the AMC.

MICR Code

Alphanumeric; 12 Characters; Optional

Specify MICR code of the specified Bank here. This code is applicable for both Bank and Bank Branch entity.

Global Intermediary Identification Number (GIIN)

Alphanumeric; 30 Characters; Optional

You can select or specify the GIIN from the adjoining option list.

GIIN Issue Date

Date Format; Optional

Specify the GIIN issue date.

The GIIN issue date cannot be greater than the application date.

GIIN Expiry Date

Date Format; Optional

Specify the GIIN expiry date.

The GIIN expiry date cannot be lesser than the GIIN issue date.

GIIN Verified Flag

Display

System displays the GIIN verified flag based on the GIIN. If you specify the GIIN then, GIIN verified flag gets displayed as ‘No’. If you select the GIIN then, GIIN verified Flag gets displayed as ‘Yes’.

Electronic Dealing Allowed

Optional

Check this box to enable specific AMC / Legal Entity for electronic dealing trades.

This field will be available for the entity types AMC / Legal Entity.

Default Agency Branch

Optional

Check this box to default the agency branch code.

US Indicia Available

Display

The system defaults US Indicia Available as Yes or No depending on the following:

- The nationality is US

- The country of birth is US

- The country of domicile is US

- The country of incorporation is US

- The country of correspondence or alternate address is US

- The country code of the telephone number is 01

- The country code of the bank branch address is US

FATCA Status

Display

The system displays the FATCA Status based on the FATCA maintenance.

FATCA Classification

Display

The system displays the FATCA classification type.

Description

Display

The system displays the description for the selected FATCA classification.

Employer ID Number

Alphanumeric; 50 Characters; Optional

Specify the employer ID number.

FATCA Sponsor Type

Optional

Select the FATCA sponsor type from the adjoining drop down list. The values are:

- Sponsoring Entity

- Sponsored

If you select ‘Sponsoring Entity’, you need to specify the sponsoring entity type and sponsoring entity ID.

If you select ‘Sponsored’, you need not to specify the sponsoring entity type and sponsoring entity ID.

Sponsoring Entity Type

Alphanumeric; 1 Character; Optional

Specify the sponsoring entity type. You can also select the valid entity type from the adjoining option list.

Sponsoring Entity ID

Alphanumeric; 12 Characters; Optional

Specify the sponsoring entity for the FATCA entity type. You can also select the valid entity ID from the adjoining option list.

Tax Category

Alphanumeric; 12 Characters; Optional

Specify the tax category.

Tax Circle

Alphanumeric; 15 Characters; Optional

Specify the tax circle country details.

Tax ID

Alphanumeric; 50 Characters; Optional

Specify the tax identification.

Tax Certificate Effective Date

Date Format; Optional

Specify the date from which the tax certificate is effective.

Tax Certificate Expiry Date

Date Format; Optional

Specify the expiry date of the tax certificate.

Week

Check the appropriate box to indicate the day in a week. The options are as follows:

- Sunday

- Monday

- Tuesday

- Wednesday

- Thursday

- Friday

- Saturday

3.4.4 Other Information Allowed

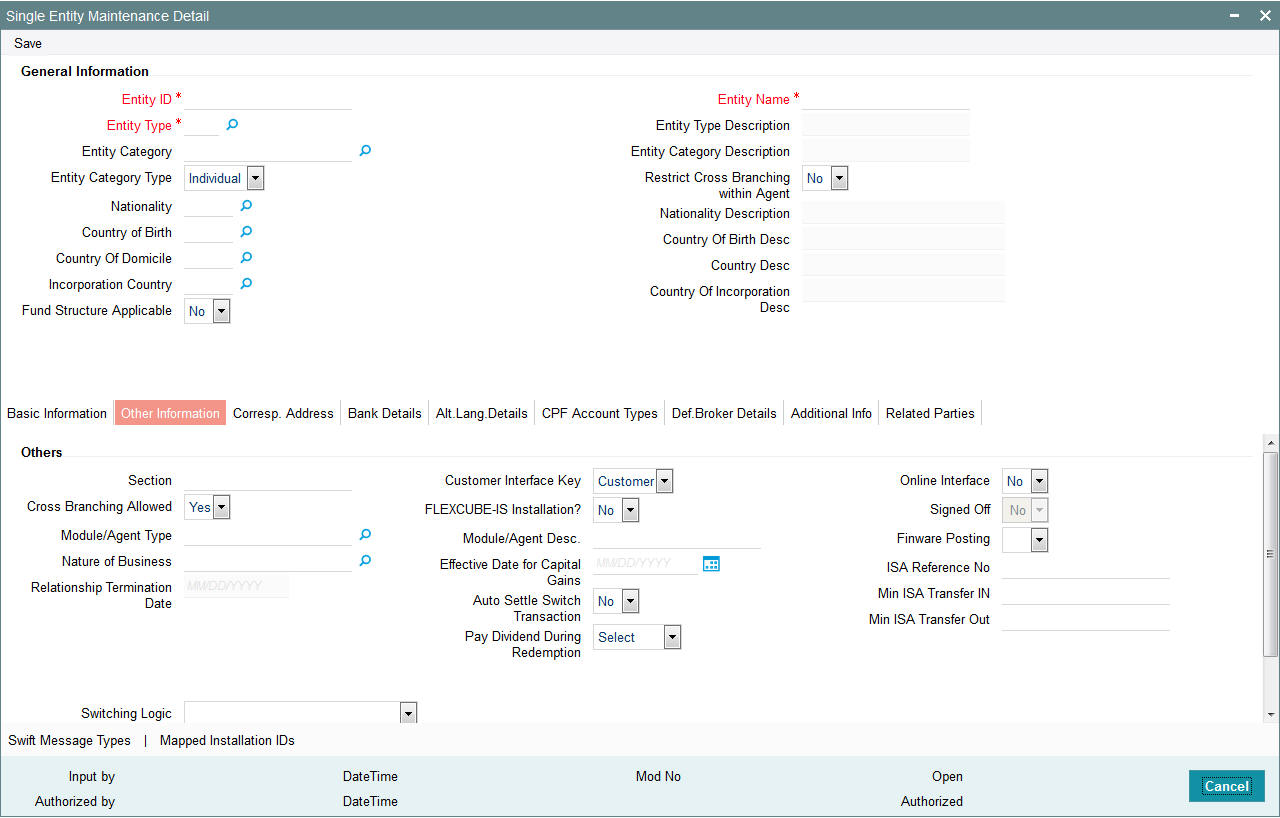

Clicking ‘Other Information’ tab in the ‘Single Entity Maintenance Detail’ screen, the following window is displayed:

Others

Section

Alphanumeric; 40 Characters; Optional

Specify any descriptive text about or qualification for the AMC being maintained.

Cross Branching Allowed

Optional

Select ‘Yes’ if you want to allow cross branching for the specified entity ID from the adjoining drop-down list. If you need to disallow cross branching, then select ‘No’ from the adjoining drop-down list.

This field is applicable only for Agency Branch entity type. It indicates whether Cross Branching is allowed or not in given agency branch. If you select ‘Yes’, Cross branching is True for a agency branch, Unit holders that are created in other agency branches are allowed to view and transact in this agency branch.Otherwise this agency branch is allowed to view and transact only for the unit holders that are created in the agency branch.

Module/Agent Type

Alphanumeric; 3 Characters; Optional

Select the type of the Module that is being set up.

Nature of Business

Alphanumeric; 1 Character; Optional

Specify the business avenues supported by the AMC. This option is only available for entities where the entity type is AMC.

Relationship Termination Date

Display

The system displays the relationship termination date.

Customer Interface Key

Optional

This facility is to be used if customer information from an installation of Oracle FLEXCUBE Corporate (FCC) is to be imported into the FC-IS system using the bulk interface facility, for the creation of unit holder accounts.

The customer interface key determines the level at which unit holder account creation must take place in the FC-IS system, for a given Customer Information File (CIF) in Oracle FLEXCUBE Corporate – either at CIF level or at a customer account level. Accordingly, you can indicate either of the following two options:

- For each CIF, a corresponding unit holder may be created in the FC-IS system. For this option, choose CIF from the drop down list in this field.

- For each CASA (Customer Access System Account) account in a CIF, a corresponding unit holder may be created in the FC-IS system. For this option, choose Account from the drop down list in this field.

The FC-IS system will create corresponding unit holder accounts when the customer information is imported from FCC, according to option you exercise in this field.

Note

If you select either FCR or FCC as the Bulk Client Type, then you must specify the Customer Interface Key as mandatory information.

FLEXCUBE-IS Installed

Optional

Select ‘Yes’ from the drop-down list to check if Oracle FLEXCUBE Investor Servicing is installed at the Agency Branch.

Module/Agent Desc

Alphanumeric; 60 Characters; Optional

The system displays description for the specified agent type.

Effective Date for Capital Gains Calculations

Date Format, Mandatory

Specify the date on which capital gains calculations must begin, for the AMC. This feature is only available if your installation has specifically requested for it.

It is mandatory for you to specify the effective date if EUSD average cost is to be computed.

Auto Settle Switch Transaction

Optional

Select if switch in transactions needs to be auto settled or not from the adjoining drop-down list. Following are the options available:

- Yes

- No

This field is enabled only for AMC entity type.

While saving, If ‘Fund Structure Applicable’ and ‘Auto Settle Switch Transaction’ fields are selected as ‘Yes’ for other Entity types (apart from AMC), then the system will display the warning message as ‘Selected field (fund structure applicable/Auto settle switch transaction) not applicable for the entity type’.

Pay Dividend During Redemption

Optional

Select pay dividend during redemption status from the drop-down list. The list displays the following values:

- 100% Only

- ALL

Online Interface

Optional

Select ‘Yes’ to utilize the created Bulk Client as online interface from the adjoining drop-down list, if you have maintained ‘Entity Type’ as ‘Bulk Client’. This field is not applicable for other entity types.

Signed Off?

Display

This indicates whether the given Agent has signed off for the day. This is not used at setup time, but used only for EOD purposes. by default, when you set up an agent, the agent record is set up with the status ‘signed on’, which means this field has a ‘No’ value.

Finware Posting

Optional

Choose ‘Yes’ if you wish to allow FINWARE posting.

ISA Reference Number

Alphanumeric; 5 Characters; Optional

Specify ISA reference number.

Min ISA Transfer IN

Numeric; 18 Characters; Optional

Specify the minimum ISA that is validated during the transfer in.

Min ISA Transfer Out

Numeric; 18 Characters; Optional

Specify the minimum ISA that is validated during the transfer out.

Switching Logic

Optional

Select the type of logic to be enforced by the AMC in accepting switch transactions from the drop-down list. The list displays the following values:

- Switch transactions restricted to fund family: In this case, switch transactions will be accepted only if the From and To funds are part of the same fund family. Cross-fund family switching is not allowed.

- Switch transactions within AMC: In this case, switch transactions are accepted across fund families so long as both families belong to the same AMC.

- No Restrictions

For distributor installations, the switching logic will not be applicable.

Unit Holder Generation Logic

Optional

Click on the drop-down menu and choose any one of the options available as follows:

- AGT&BRN&SERIAL

- SERIAL&AMC/DIST&CHK

- SERIAL&AGT&CHK

- No Logic

- Reference Number

- AJF Generation Logic

- Ctry(1)&Busi(1)&FMG/DIST&A-Z(1)&NUM(5) stands

- InstallationId(4)&(A-Z)(1)&Num(7)

This option enables multiple AMC branches to opt for different unit holder ID generation logic. Therefore the UH Generation Logic field will be a valid value from UH generation table for a specific AMC, service provider, or a distributor.

- The first option i.e., AGT&BRN&SERIAL&CHK stands for the Agent Code, Branch Code, Serial Number and Check Digit.

- The second option i.e., SERIAL&AMC&CHK stands for the Serial Number, AMC ID (or Distributor ID) and Check Digit.

- The third option i.e., SERIAL&AGT&CHK stands for the Serial Number, Agent Code and Check Digit.

- The fourth option i.e., LEADINGZERO&SERIAL stands for Leading Six Zeros and a running Serial Number.

- The fifth option i.e., Unit Holder ID is assigned with User entered Unit Holder Reference Number.

- The sixth option i.e., AJF Generation Logic

- The seventh option i.e, Ctry(1)&Busi(1)&FMG/DIST(4)&A-Z(1)&NUM(5) stands for Country Code, Business Type, AMC ID (or Distributor ID), a running Serial character and running Serial Number.

- The eight option i.e., <Installed Entity ID/ 4 characters segment code> + Sequence Type + Running Serial No

Note

The above option is applicable only for service provider installations.

3.4.5 Correspondence Address Tab

As part of correspondence details, you can capture correspondence address, alternate address and SWIFT address. Click ‘Corresp Address’ tab to maintain the correspondence details.

Contact Information

Address Type

Mandatory

Select the type of address from the drop-down list. The list displays the following values:

- Correspondence Address

- Alternate Address

- Swft Address

Address Lines 1-2

Alphanumeric; 80 Characters; Optional (Address Line 1 is Mandatory)

Enter the address of the entity being set up in the system.

City

Alphanumeric; 80 Characters; Optional

Enter the city where the entity is located. You can select the city from the drop down list provided. The available options depend on the values defined at the params maintenance. If the city is not available in the list, you can specify the city in the field provided alongside.

State

Alphanumeric; 80 Characters; Optional

Enter the State where the City is located. You can select the state from the drop down list provided. The available options depend on the values defined at the params maintenance. If the state is not available in the list, you can specify the city in the field provided alongside.

US State

Optional

Select ‘Yes’ option from drop-down list to indicate that the specified state is a US (United States) state.

Zip Code

Alphanumeric; 10 Characters; Optional

Enter the Zip Code of the Address of the entity being set up.

Country

Alphanumeric; 3 Characters; Mandatory

Select the country in which the entity is based, from the drop-down list. If the Address type is SWIFT Address, enter the country of the SWIFT address for the entity.

Int. Dialing Code +

Alphanumeric; 10 Characters; Optional

Specify the international dialling code.

Telephone 1

Alphanumeric; 60 Characters; Optional

Enter the telephone number of the entity who is being set up in the system.

Int. Dialing Code +

Alphanumeric; 10 Characters; Optional

Specify the international dialling code.

Telephone 2

Alphanumeric; 60 Characters; Optional

Enter the telephone number of the entity who is being set up in the system.

Fax Number

Alphanumeric; 120 Characters; Optional

Enter the fax number of the entity who is being set up in the system.

Alphanumeric; 255 Characters; Optional

Specify the Email address of the entity being set up.

Contact Person

Alphanumeric; 70 Characters; Optional

Enter the name of the contact person at the entity’s offices.

Int. Dialing Code +

Alphanumeric; 10 Characters; Optional

Specify the international dialling code.

Cell Phone Number

Alphanumeric; 60 Characters; Optional

Specify the cell phone number of the entity being set up.

Effective From Date

Date Format; Optional

This is applicable if the Address Type is Alternate Address.

Specify the date that marks the beginning of the period for which the specified alternate address is in effect.

Effective To Date

Date Format; Optional

This is applicable if the Address Type is Alternate Address.

Specify the date that marks the end of the period for which the specified alternate address is in effect.

BIC Code

Alphanumeric; 12 Characters; Optional

Specify the Bank Identifier Code (BIC) of the entity.

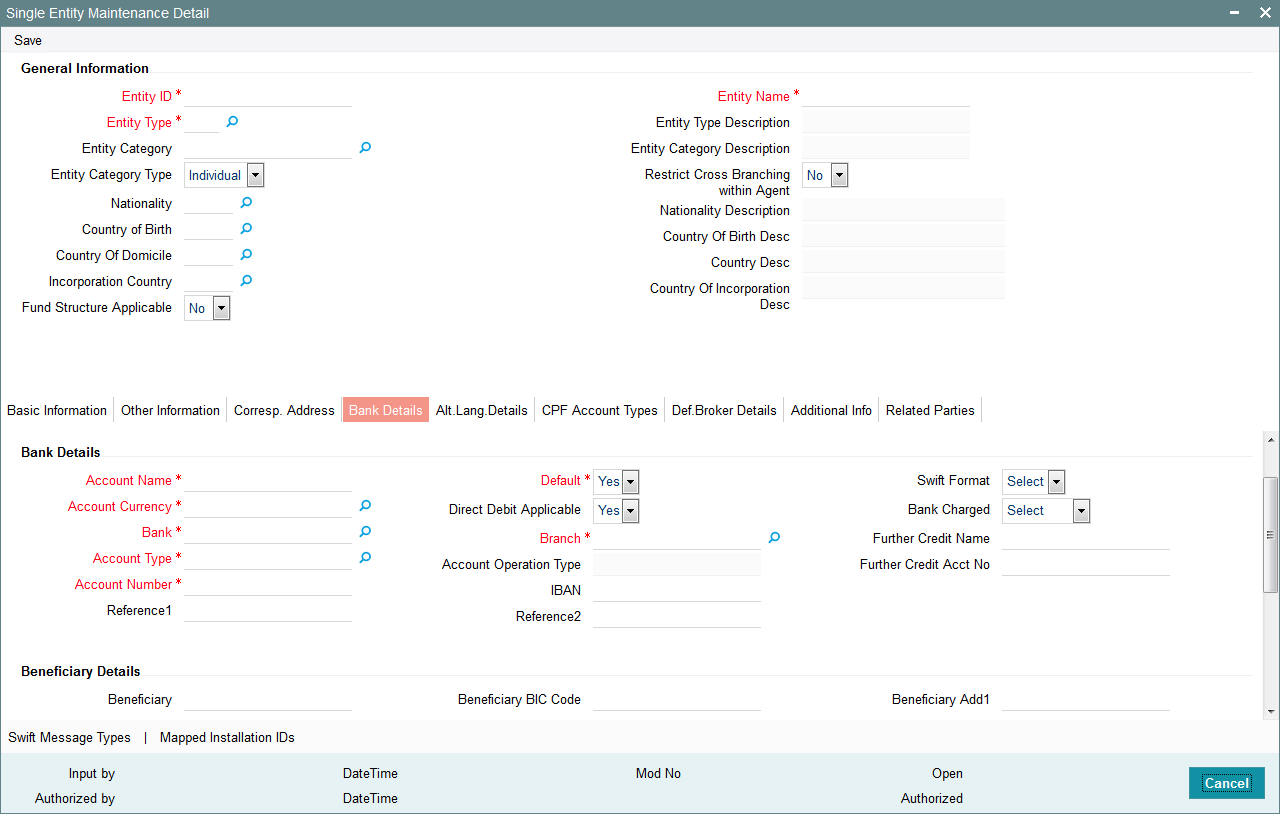

3.4.6 Bank Details Tab

You can capture details of bank accounts held by the entity, with multiple accounts in foreign currencies, if required. These are the settlement details that would be used for settlement of payment to the entities. You must designate one default account for each currency, which would be deemed to be the default settlement account in the selected currency, for the entities.

Bank details can be captured for all entities other than Bank Branches, and are optional for all entities except AMCs and Distributors. For Banks, you can capture the details of Correspondent Banks as part of the bank details.

Commission payments for an entity are made to the default settlement account designated in the Income Distribution Setup (IDS) record maintained for the entity. If no IDS have been maintained, the default bank account designated in the entity details record is considered as the default settlement account.

You can capture the following details for each entity bank account:

- Bank and branch in which the account resides

- Account number

- Account name and the owner of the account

- Account currency

- Whether direct debits are allowed for the account

- Whether the account is the default account for the entity

Click ‘Bank Details’ tab to capture the bank details in the Bank Details section in the Single Entity Maintenance screen.

Bank Details

Account Name

Alphanumeric; 100 Character; Mandatory

Specify the name in which the entity holds the specified bank account.

Account Currency

Alphanumeric, 3 Characters; Mandatory

From the list, select the currency that the specified bank account uses. You can maintain any number of accounts in each currency; however, you must designate one default bank account for each currency.

Bank

Alphanumeric; 12 Characters; Mandatory

From the list, select the name of the bank in which the account is held.

Account Type

Alphanumeric; 1 Character; Mandatory

From the list, select the nature of the account held by the entity.

The list provides all account types that have been set up in the Account Type Maintenance records.

Account Number

Alphanumeric; 16 Characters; Mandatory

Specify the number of the account held by the entity in the selected bank.

Reference 1

Alphanumeric; 35 Characters; Optional

Enter the first reference

Default

Optional

Select ‘Yes’ from drop-down list to identify the bank account that is to be reckoned as the default bank account for the entity in the system, for the selected currency.

Direct Debit Applicable

Optional

You can use this field to indicate whether direct debits may be raised in respect of the bank account you are defining for the entity. Select ‘Yes’ to indicate that direct debits are allowed; leave it unchecked to indicate that they are not.

Branch

Alphanumeric; 60 Characters; Mandatory

From the list, select the name of the branch of the bank in which the account is held.

Account Operation Type

Display

The system displays the description of account operation type.

IBAN

Alphanumeric; 40 Characters; Optional

Specify the IBAN (International Bank Account Number) of the account holder.

Reference2

Alphanumeric; 35 Characters; Optional

Specify the second reference

Swift Format

Optional

Indicate one of the following swift formats from the drop-down list:

- MT103

- MT102

Bank Charged

Optional

Indicate one of the following from the drop-down list:

- Beneficiary

- Remitter

- Share

Further Credit Name

Alphanumeric; 35 Characters; Optional

Specify the further credit name.

Further Credit Acct No

Alphanumeric; 35 Characters; Optional

Specify the further credit account number.

Beneficiary Details

Beneficiary

Alphanumeric; 35 Characters; Optional

Enter the beneficiary Details.

Beneficiary Acct No

Alphanumeric; 24 Characters; Optional

Specify the account number of the beneficiary.

Beneficiary Info

Alphanumeric; 100 Characters; Optional

Specify the information about the beneficiary.

Beneficiary BIC Code

Alphanumeric; 24 Characters; Optional

Specify the BIC code of the beneficiary.

Beneficiary Code

Alphanumeric; 24 Characters; Optional

Specify the code of the beneficiary.

Beneficiary IBAN

Alphanumeric; 40 Characters; Optional

Specify the beneficiary IBAN.

Beneficiary Add1

Alphanumeric; 35 Characters; Optional

Specify the first line of beneficiary address.

Beneficiary Add2

Alphanumeric; 35 Characters; Optional

Specify the second line of beneficiary address.

Beneficiary Add3

Alphanumeric; 35 Characters; Optional

Specify the third line of beneficiary address.

Intermediary Details

Intermediary

Alphanumeric; 35 Characters; Optional

Specify the intermediary details.

Intermediary Acct No

Alphanumeric; 24 Characters; Optional

Specify the account number of the intermediary.

Intermediary Info

Alphanumeric; 100 Characters; Optional

Specify the information about the intermediary.

Intermediary BIC Code

Alphanumeric; 24 Characters; Optional

Specify the BIC Code of the intermediary.

Intermediary Code

Alphanumeric; 24 Characters; Optional

Specify the code of the intermediary.

Intermediary IBAN

Alphanumeric; 40 Characters; Optional

Specify the intermediary IBAN.

Intermediary Add 1

Alphanumeric; 35 Characters; Optional

Specify the first line of beneficiary intermediary.

Intermediary Add 2

Alphanumeric; 35 Characters; Optional

Specify the second line of beneficiary intermediary.

Intermediary Add 3

Alphanumeric; 35 Characters; Optional

Specify the third line of beneficiary intermediary.

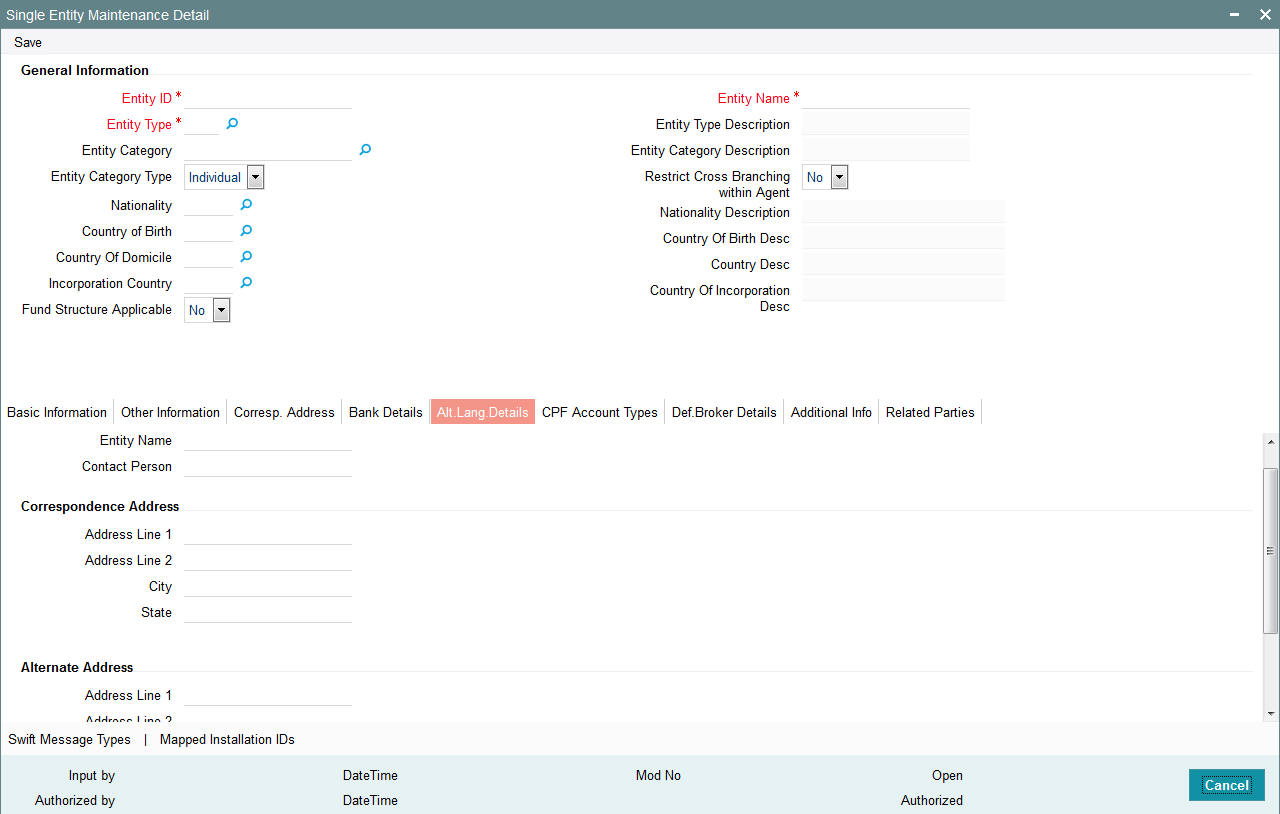

3.4.7 Alternate Language Details Tab

The system allows you to capture entity details in an alternate language of your desire. These fields are captured for information purposes only and no processing would be done on them. Click ‘Alt Lang Details’ tab to maintain the alternate language details.

You can maintain the following information in an alternate language provided you have captured the information in the default language.

Entity Name

Alphanumeric; 60 Characters; Optional

Specify the name of the entity being set up in the system.

Contact Person

Alphanumeric; 70 Characters; Optional

Enter the name of the contact person at the entity’s offices.

Correspondence Address

Address Lines 1-2

Alphanumeric; 80 Characters; Optional

Enter the default postal address that is to be used for correspondence with the entity being set up in the system.

City

Alphanumeric; 80 Characters; Optional

Enter the city where the entity is located.

State

Alphanumeric; 80 Characters; Optional

Enter the State where the City is located.

Alternate Address

Address Lines 1-2

Alphanumeric; 80 Characters; Optional

Enter the alternate postal address that is to be used for correspondence with the entity being set up in the system.

City

Alphanumeric; 80 Characters; Optional

Enter the city where the entity is located.

State

Alphanumeric; 80 Characters; Optional

Enter the State where the City is located.

3.4.8 CPF Account Types Tab

Each Fund is explicitly defined for the eligibility of a specific investment type (Like CPFOA Approved? CPFSA Approved? etc) and only on this basis, transactions like Subscription, Redemption, Switch can be processed for specific investment types on these Funds. Also, the approval date and the corresponding Fund ID as identified for that investment account type is captured for each of the fund in the system.

Only the agent banks that are approved by the CPF board or any other relevant authority are allowed to maintain these accounts for its customers.

The Account Type for the unit holder bank details should be of same type as UH Account Type for a CPF Account. The number of bank details to be captured for the CPF Account will be restricted to only one account. Also it will be mandatory to specify at least one account.

Unit holder upload will capture of CPF account types and also validate the account type with bank details. For non-CPF account types, the system will check that bank details maintained for the unit holder is not a CPF account type.

You can specify the following information on Central Provident Fund (CPF) account types:

Account Type

Alphanumeric; 2 Characters; Mandatory

Specify the account type. Alternatively, you can select account type from the option list. The list displays all valid account type maintained in the system.

Account Type Description

Display

Enter the CPF account type description.

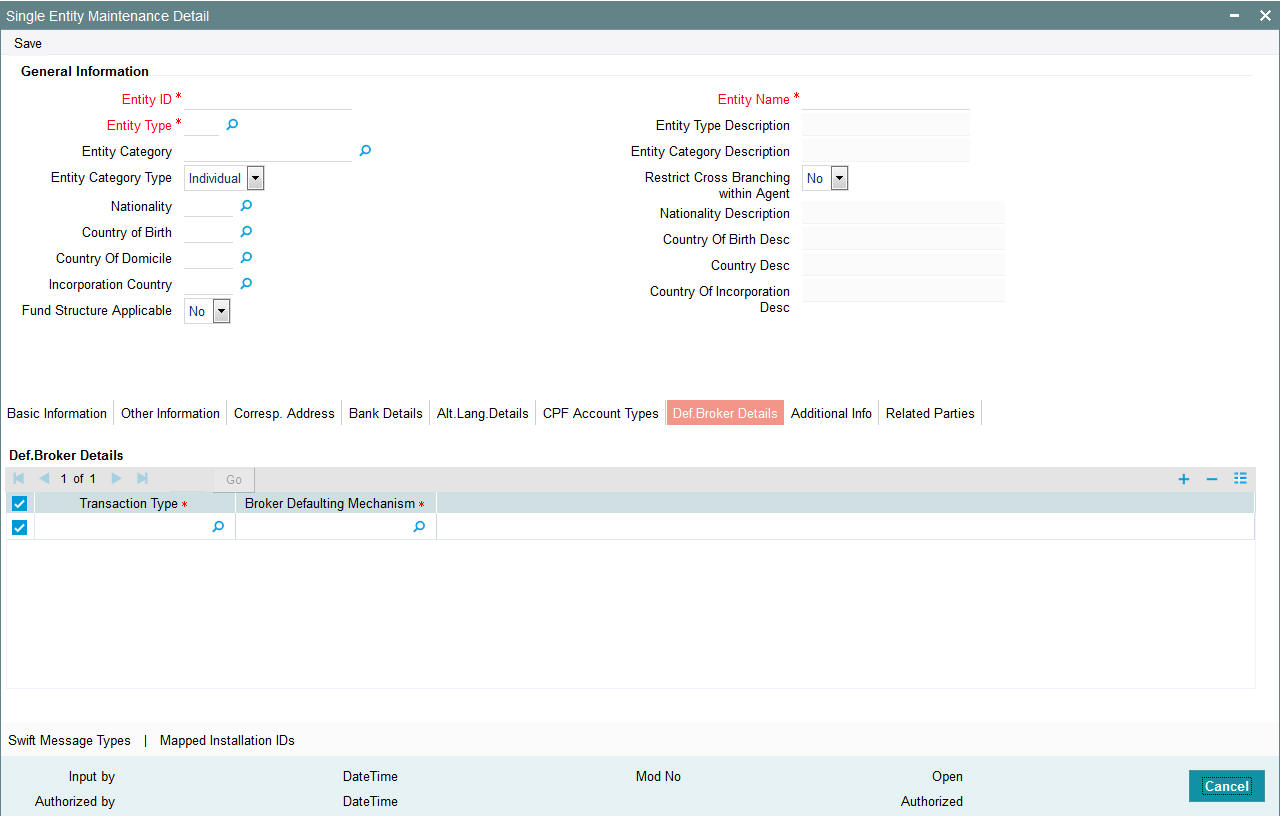

3.4.9 Default Broker Details Tab

Click ‘Def.Broker Details’ tab to enter the defaulting broker details.

Transaction Type

Alphanumeric; 20 Characters; Mandatory

Indicate the type of transaction for which you are specifying the broker details defaulting preferences. You can specify the defaulting preferences for IPO Subscription, Subscription, Redemption, Switch, Transfer and Reinvestment type of transaction.

Broker Defaulting Mechanism

Alphanumeric; 3 Characters; Optional

Specify the defaulting preferences for broker details for the AMC. The following options are available in the list:

- No Defaulting – Broker details will not be defaulted to DIRECT

- Last Transaction Broker – If the user does not have any transaction

in that fund, then system looks for the immediate last transaction (based

on the authorized time stored with the system). If the user has not done

any transaction, system will default the default intermediary of the

unit holder.

While defaulting, if one of the Brokers is disabled, system will default from the unit holder. If the broker is disabled at the unit holder level as well then system will default to DIRECT - Split Percentage – This is applicable only Reinvestment type of transactions. System tracks the holdings per broker. During re-investment generation, system will use these brokers as the reinvestment transaction’s intermediaries with the appropriate ratio.

- While defaulting, if one of the Brokers is disabled, system will default from the unit holder. If the broker is disabled at the unit holder level as well then system will default to DIRECT.

- Default Broker – Broker maintained at the unit holder will be defaulted

If the broker is disabled at the unit holder level as well then system will default to DIRECT.

Note

You can view the ‘Defaulting of Broker Details Section’ provided the client country parameter ‘TXNBROKERS’ is set to True for the installation in your bank.

3.4.10 Additional Information Tab

The system displays the following values:

- Other Info Field - The system displays the additional info data type, maintained as Date, which is mapped to an entity (agent).

- Field Value

Default date format (DD-MON-YYYY) is mentioned in ‘Other Info’ field label for date data type while defaulting.

Click ‘Get Additional Information’ button in the screen. Any additional info like bank details will be maintained.

After saving the above listed details in the single entity maintenance screen, click on the Exit button.

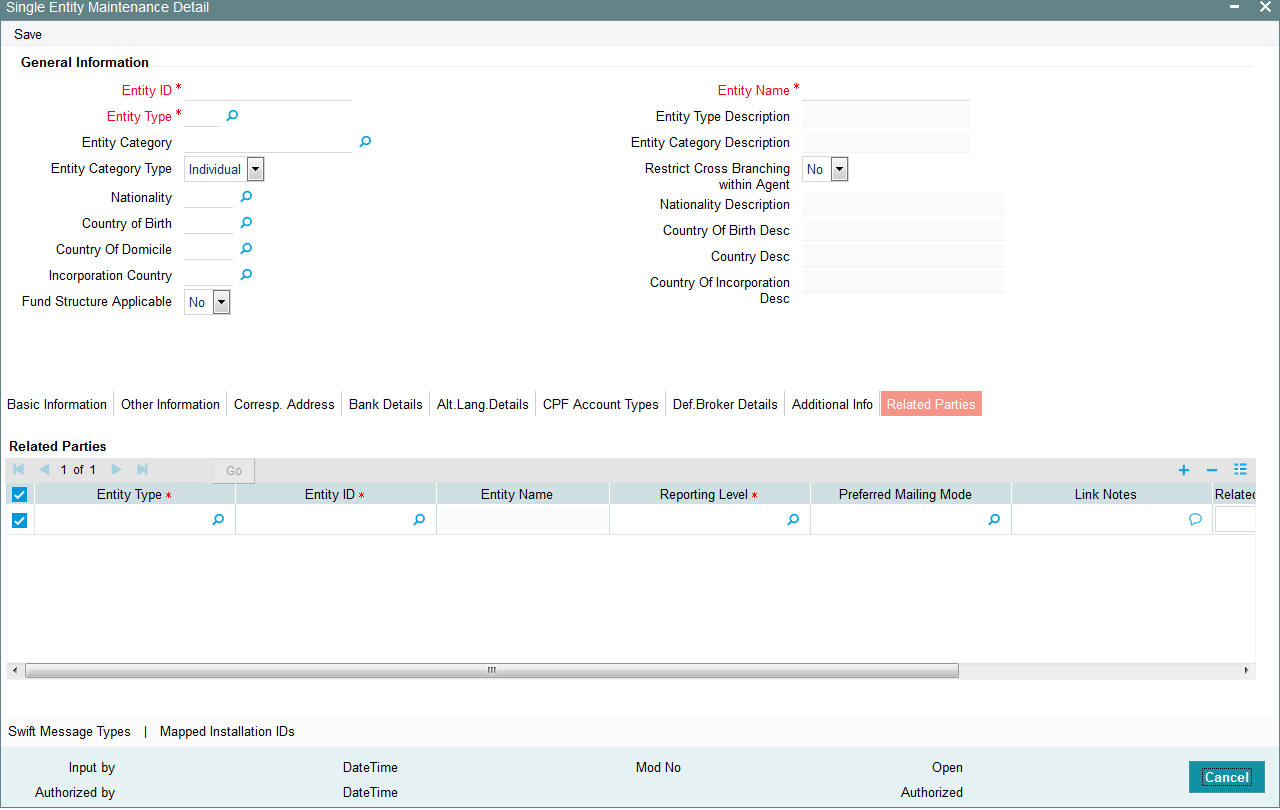

3.4.11 Related Parties Tab

Click ‘Related Parties’ tab to specify the details.

You can specify the following details:

Entity Type

Alphanumeric; 2 Characters; Mandatory

Select the entity type. Alternatively, you can select entity type from the option list. The list displays all valid entity type maintained in the system.

The system will allow you to add a related Party only for the Agent Entity Type.

Entity ID

Alphanumeric; 12 Characters; Mandatory

Select the entity ID from the option list. These entities are based on the Entity Type chosen.

Entity Name

Display

The entity name gets displayed on selection of entity ID.

Reporting Level

Alphanumeric; 1 Character; Mandatory

Select the reporting level from the list. The following are the reporting levels:

- A: All Reports

- C: Contract notes and trade acknowledgement

- V: Valuations and statements

- N: No Reporting

By default, the system defaults Reporting Level as ‘ALL’.

Preferred Mailing Mode

Alphanumeric; 1 Character; Optional

Select the preferred mailing mode from the list. The following are the preferred mailing modes:

- Fax

- SWIFT

Link Notes

Alphanumeric; 255 Characters; Optional

The link notes stores free format text which is used to explain the reason for linking the entity with the unit holder.

Note

Related Parties are captured for informational purpose only and no processing impact is associated.

Related Party Level

Mandatory

Select the related party level from the adjoining drop-down list. Following are the options available:

- All

- Fund

- Fund Family

- Legal Entity

- AMC

Related Party Value

Alphanumeric; 12 Characters; Mandatory

Specify the related party value. The adjoining option list displays all valid related party values maintained in the system. You can choose the appropriate one.

If you select ‘All’ in ‘Related Party Level’ field, then you need to select ‘All’ from the adjoinin option list in ‘Related Party Value’ field as well. The system will not allow any more records to be added if ALL has been selected in the ‘Related Party Level’ field for a particular entity ID and entity type combination.

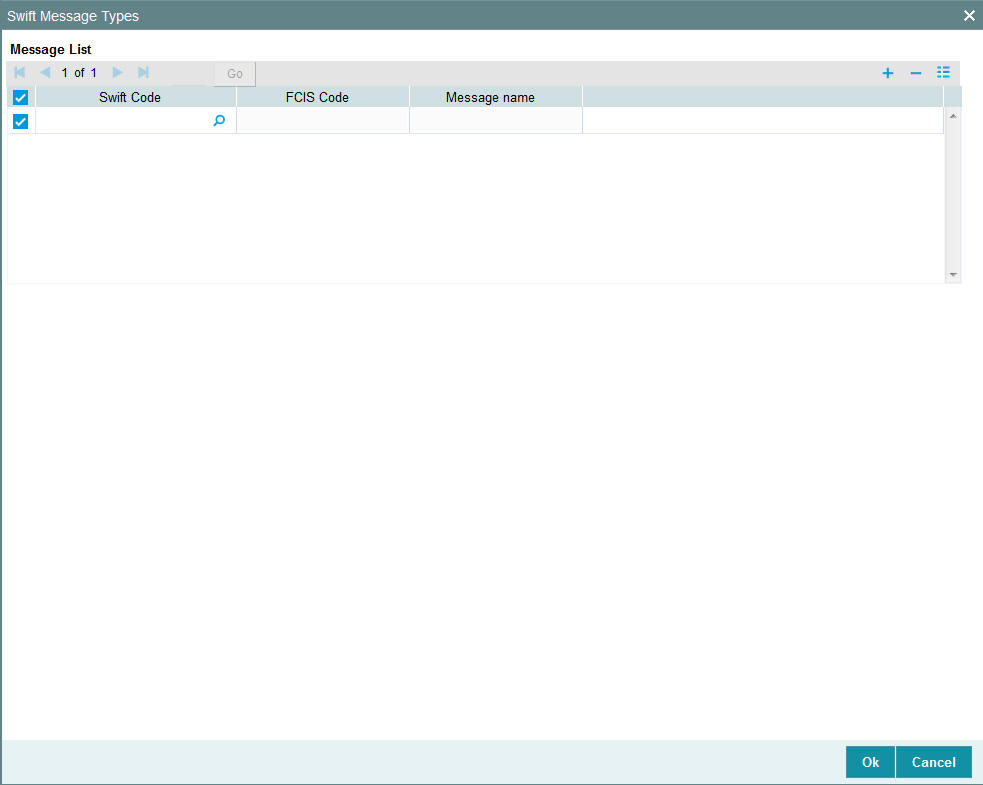

3.4.12 Swift Message Type Button

Clicking ‘Swift Message Type’ button to specify the list of SWIFT messages allowed for that given AMC.

You can specify the following details:

Swift Code

Alphanumeric; 30 Characters; Optional

Specify the swift code. Alternatively, you can select the swift code from the option list. The list displays the following values:

FCIS Code

Display

The system displays the FCIS code based on the Swift code selected.

Message Code

Display

The system displays the message code based on the swift code selected.

The ‘Swift Message Type’ screen is enabled only if you have checked ‘Electronic deal box in ‘Basic Information’ tab.

3.4.13 Mapped Installation IDs Button

Click ‘Mapped Installation IDs’ button to view the mapped installation IDs.

You can view the following details:

- Entity ID

- Entity Type

- Installation ID

- Module ID

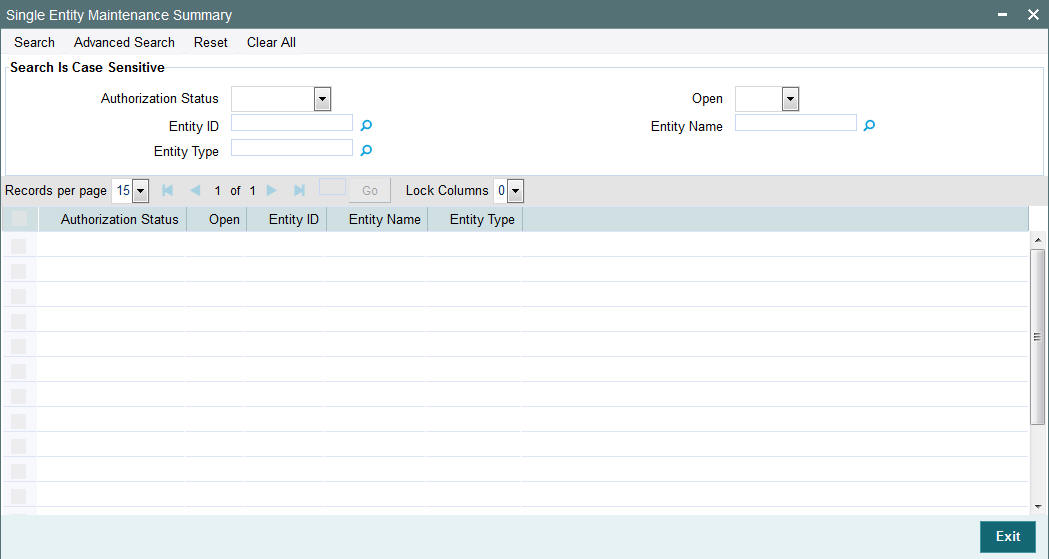

3.5 Single Entity Maintenance (Summary) Screen

This section contains the following topics:

- Section 3.5.1, "Invoking the Single Entity Maintenance Summary Screen"

- Section 3.5.2, "Retrieving Entity in Summary Screen"

- Section 3.5.3, "Editing Entity"

- Section 3.5.4, "Viewing Entity"

- Section 3.5.5, "Deleting Entity"

- Section 3.5.6, "Authorizing Entities"

- Section 3.5.7, "Amending Entities"

- Section 3.5.8, "Authorizing Amended Entities"

3.5.1 Invoking the Single Entity Maintenance Summary Screen

After you have set up an entity of any type in the system, you must have another user authorize the record so that it would be effective in the system.

Before the entity record is authorized, you can edit it as many times as necessary. You can also disable an entity before the entity record is authorized.

After authorization, you can only make changes to the entity details through an amendment.

The ‘Single Entity Maintenance Summary’ screen can be used for the following operations on entities:

- Retrieval for viewing

- Editing unauthorized records

- Disabling unauthorized entities

- Authorizing entities

- Amending authorized entities.

Invoke the ‘Single Entity Maintenance Summary’ screen by typing ‘UTSENTMN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

3.5.2 Retrieving Entity in Summary Screen

You can retrieve a previously entered entity as follows:

- Invoke the Entity Maintenance Summary screen and specify the following:

- The status of the entity in the Authorization Status field. If you choose the “Blank Space” option, then all the entities are retrieved.

- The status of the entity in the Open field. If you choose the “Blank Space” option, then all the entities are retrieved.

- The Entity ID

- Entity Type

- Entity Name

- Click ‘Search’ button after you have specified the required details, all entities with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual entity detail from the Detail screen by doing query in the following manner:-

- Press F7

- Input any parameter in the screen

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

For example, you can search the record for Entity ID by using the combination of % and alphanumeric value as follows:-

- Search by D%:- System will fetch all the records whose Entity ID starts from Alphabet ‘D’. For example, Direct.

- Search by %7:- System will fetch all the records whose entity ID Type ends by numeric value’ 7’. For example, AGENT7.

- Search by %17%:- System will fetch all the records whose Entity ID contains the numeric value 17. For example, AGENT17.

3.5.3 Editing Entity

You can modify the details of an entity that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Single Entity Summary screen from the Browser.

- Select the status of the entity that you want to retrieve for modification in the Authorization Status field. You can only modify records of entities that are unauthorized. Accordingly, choose the Unauthorized option from the drop down list.

- Specify any or all of the details of the entity in the corresponding fields on the screen to retrieve the entity that is to be modified.

- Click ‘Search’ button. All unauthorized entities with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the entity that you want to modify. The Single Entity Maintenance screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save the changes. The Single Entity Maintenance screen is closed and the changes made are reflected in the Single Entity Summary screen.

3.5.4 Viewing Entity

To view an entity that you have previously entered:

- Invoke the Single Entity Summary Screen from the Browser.

- Select the status of the entity that you want to retrieve for viewing in the Authorization Status field. You can also view all entities that are either unauthorized or authorized only, by choosing the Unauthorized / Authorized option.

- Specify any or all of the details of the entity in the corresponding fields on the screen.

- Click ‘Search’ button. All entities with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the entity that you want to view. The Single Entity Maintenance screen is displayed in view mode.

3.5.5 Deleting Entity

You can delete only unauthorized entities in the system. To delete an entity:

- Invoke the Single Entity Summary screen from the Browser.

- Select the status of the entity that you want to retrieve for deletion.

- Specify any or all of the details of the entity in the corresponding fields on the screen.

- Click ‘Search’ button. All entities with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the entity that you want to delete. The Single Entity Maintenance Detail screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

3.5.6 Authorizing Entities

An unauthorized entity must be authorized in the system for it to be processed. To authorize an entity:

- Invoke the Single Entity Summary screen from the Browser.

- Select the status of the entity that you want to retrieve for authorization. Typically, choose the Unauthorized option from the drop down list.

- Specify any or all of the details of the entity in the corresponding fields on the screen.

- Click ‘Search’ button. All entities with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the entity that you wish to authorize. The Single Entity Maintenance screen displayed. Select Authorize operation from Action.

When the checker authorizes an entity, details of validations, if any, that were overridden by the maker of the transaction during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the entity.

3.5.7 Amending Entities

After an entity is authorized, it can be modified using the Unlock operation from Action list. To make changes to an entity after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the Single Entity Summary screen from the Browser.

- Select the status of the entity that you wish to retrieve for amendment. You can only amend records of entities that are authorized.

- Specify any or all of the details of the entity in the corresponding fields on the screen.

- Click ‘Search’ button. All entities with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the entity that you want to amend. The Single Entity Maintenance screen is displayed in Amendment mode.

- Click the Unlock operation from the Action list to amend the entity.

- Amend the necessary information. Click the Save button to save the changes.

3.5.8 Authorizing Amended Entities

An amended entity must be authorized for the amendment to be made effective in the system.

The process of authorization is subsequently the same as that for normal process.

Copying Attributes

If you want to create an entity having the same attributes of an existing entity, you can copy the attributes of an existing entity to a new entity.

To copy the attributes:

- Retrieve the entity whose attributes the new entity should inherit. You can retrieve the record through the Summary screen or through the F7- F8 operation which is explained in the previous sections of this chapter.

- Click on ‘Copy’ in the Actions list.

- Indicate the ID for the new Entity. You can however change the details of the entity if required.

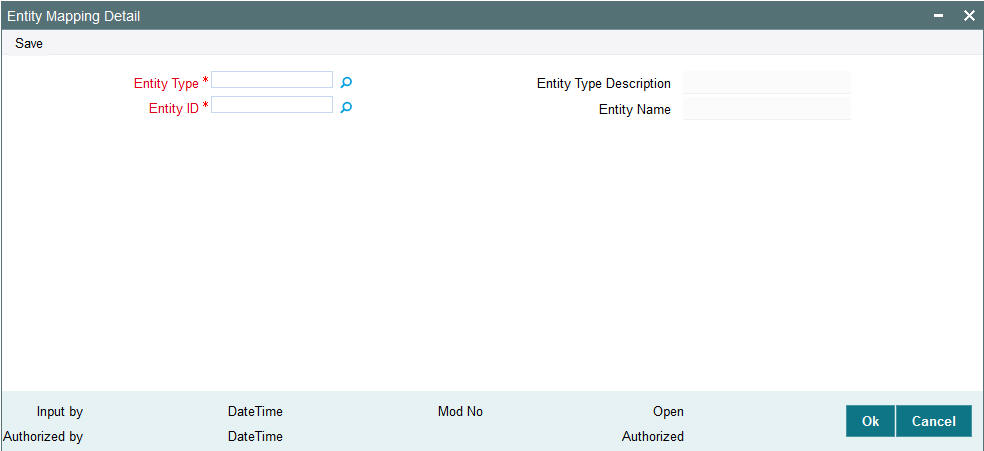

3.6 Entity Mapping Detail

This section contains the following topics:

3.6.1 Invoking Entity Mapping Detail Screen

You can map entity details using ‘Entity Mapping Detail’ screen. You can invoke this screen by typing ‘UTDENTMP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

Entity Type

Alphanumeric; 1 Character; Mandatory

Specify the entity type. Alternatively, you can select entity type from option list. The list displays all valid entity type maintained in the system.

Entity Type Description

Display

The system displays the description for the selected entity type.

Entity ID

Alphanumeric; 12 Characters; Mandatory

Specify the entity ID. Alternatively, you can select entity ID from option list. The list displays all valid entity ID maintained in the system.

Entity Name

Display

The system displays the description for the selected entity ID.

3.7 Entity Mapping Summary

This section contains the following topics:

- Section 3.7.1, "Retrieving Entity Mapping Record in Summary Screen"

- Section 3.7.2, "Editing Entity Mapping Record"

- Section 3.7.3, "Viewing Entity Mapping Record"

- Section 3.7.4, "Deleting Entity Mapping Record"

- Section 3.7.5, "Authorizing Entity Mapping Record"

- Section 3.7.6, "Amending Entity Mapping Record"

- Section 3.7.7, "Authorizing Amended Entity Mapping Record"

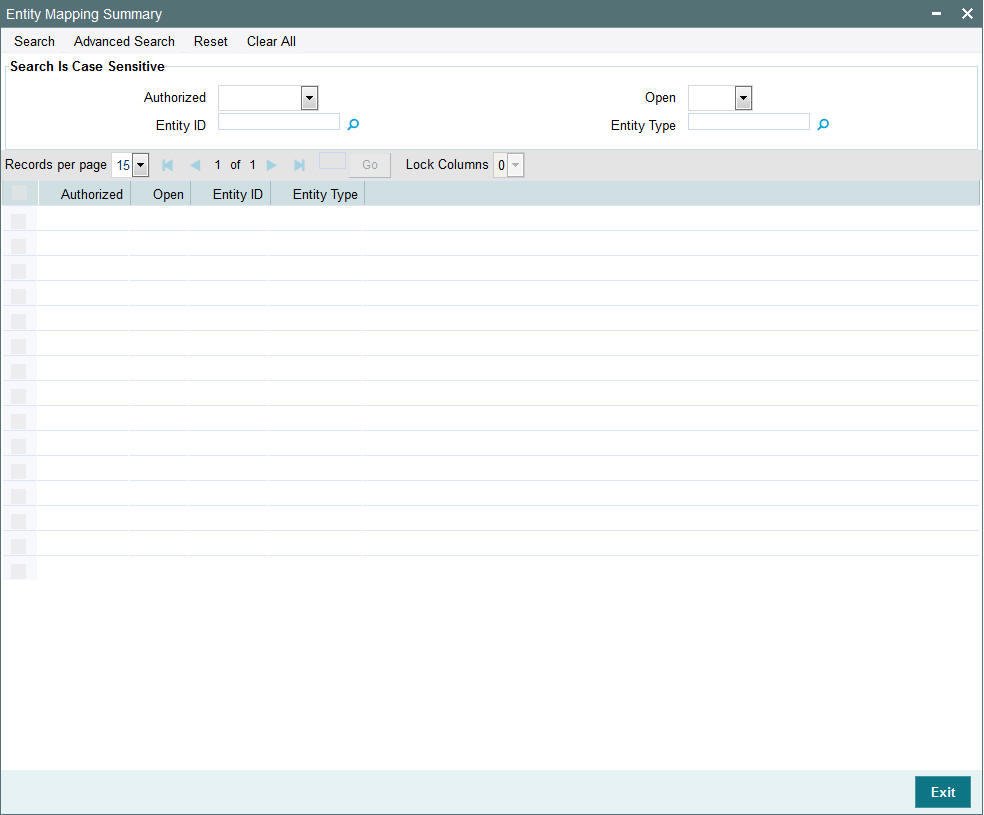

3.7.1 Retrieving Entity Mapping Record in Summary Screen

You can invoke the ‘Entity Mapping Summary’ screen by typing ‘UTSENTMP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can retrieve a previously entered Entity Mapping records in the Summary screen, as follows:

- Invoke the Entity Mapping Summary screen and specify the following:

- The status of the entity ID in the Authorized field. If you choose the “Blank Space” option, then all the entity IDs are retrieved.

- The status of the entity ID in the Open field. If you choose the “Blank Space” option, then all the entity IDs are retrieved.

- Entity ID

- Entity Type

- After you have specified the required details, click ‘Search’ button. All Entity Mapping records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve the Entity Mapping records from the detail screen by doing query in the following manner:-

- Press F7

- Input the Entity ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

For example, you can search the record for Entity ID by using the combination of % and alphanumeric value as follows:-

- Search by M%: The system will fetch all the records whose Entity ID starts from Alphabet ‘M’. For example, Mutual Fund.

- Search by %7 : The system will fetch all the records whose Entity ID ends by numeric value’ 7’ For example, 217,267,77 and so forth.

- Search by %17%: The system will fetch all the records whose Entity ID contains the numeric value 17. For example, 3217, 2172 and so forth.

3.7.2 Editing Entity Mapping Record

You can modify the details of a Entity Mapping record that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Entity Mapping Summary screen from the Browser.

- Select the status of the Entity Mapping records that you want to retrieve for modification in the Authorized field. You can only modify Entity Mapping records that are unauthorized. Accordingly, choose the Unauthorized option from the drop-down list.

- Specify any or all of the details of the Entity Mapping records in the corresponding fields on the screen to retrieve the entity ID type that is to be modified.

- Click ‘Search’ button. All unauthorized Entity Mapping records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the Entity Mapping records that you want to modify. The Entity Mapping Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save the changes. The Entity Mapping Detail screen is closed and the changes made are reflected in the Entity Mapping Summary screen.

3.7.3 Viewing Entity Mapping Record

To view a Entity Mapping records that you have previously entered:

- Invoke Entity Mapping Summary Screen from the Browser.

- Select the status of the Entity Mapping records that you want to retrieve for viewing in the Authorized field. You can also view all Entity Mapping records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the Entity Mapping records in the corresponding fields on the screen.

- Click ‘Search’ button. All Entity Mapping records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the Entity Mapping records that you want to view in the list of displayed Entity Mapping records. The Entity Mapping Detail screen is opened in view mode.

3.7.4 Deleting Entity Mapping Record

You can delete only unauthorized Entity Mapping records in the system.

- Invoke the Entity Mapping Summary screen from the Browser.

- Select the status of the Entity Mapping records that you want to retrieve for deletion.

- Specify any or all of the details of the Entity Mapping records in the corresponding fields on the screen.

- Click ‘Search’ button. All Entity Mapping records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the stop code type that you want to delete. The Entity Mapping Detail screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

3.7.5 Authorizing Entity Mapping Record

An unauthorized Entity Mapping records must be authorized in the system for it to be processed.

To authorize a Entity Mapping records:

- Invoke the Entity Mapping Summary screen from the Browser.

- Select the status of the Entity Mapping records that you want to retrieve for authorization. Typically, choose the Unauthorized option from the drop-down list.

- Specify any or all of the details of the entity ID type in the corresponding fields on the screen.

- Click ‘Search’ button. All Entity Mapping records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the Entity Mapping records that you wish to authorize. The Entity Mapping Detail screen displayed. Select Authorize operation from Action.

When the checker authorizes Entity Mapping records, details of validations, if any, that were overridden by the maker of the transaction during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the stop code.

3.7.6 Amending Entity Mapping Record

After a Entity Mapping records is authorized, it can be modified using the Unlock operation from Action list. To make changes to a Entity Mapping records after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the Entity Mapping Summary screen from the Browser.

- Select the status of the Entity Mapping records that you wish to retrieve for amendment. You can only amend records of Entity Mapping records that are authorized.

- Specify any or all of the details of the Entity Mapping records in the corresponding fields on the screen.

- Click ‘Search’ button. All Entity Mapping records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the Entity Mapping records that you want to amend. The Entity Mapping Detail screen is displayed in Amendment mode.

- Click the Unlock operation from the Action list to amend the Entity Mapping records.

- Amend the necessary information. Click the Save button to save the changes.

3.7.7 Authorizing Amended Entity Mapping Record

An amended Entity Mapping records must be authorized for the amendment to be made effective in the system. The process of authorization is subsequently the same as that for normal transactions.

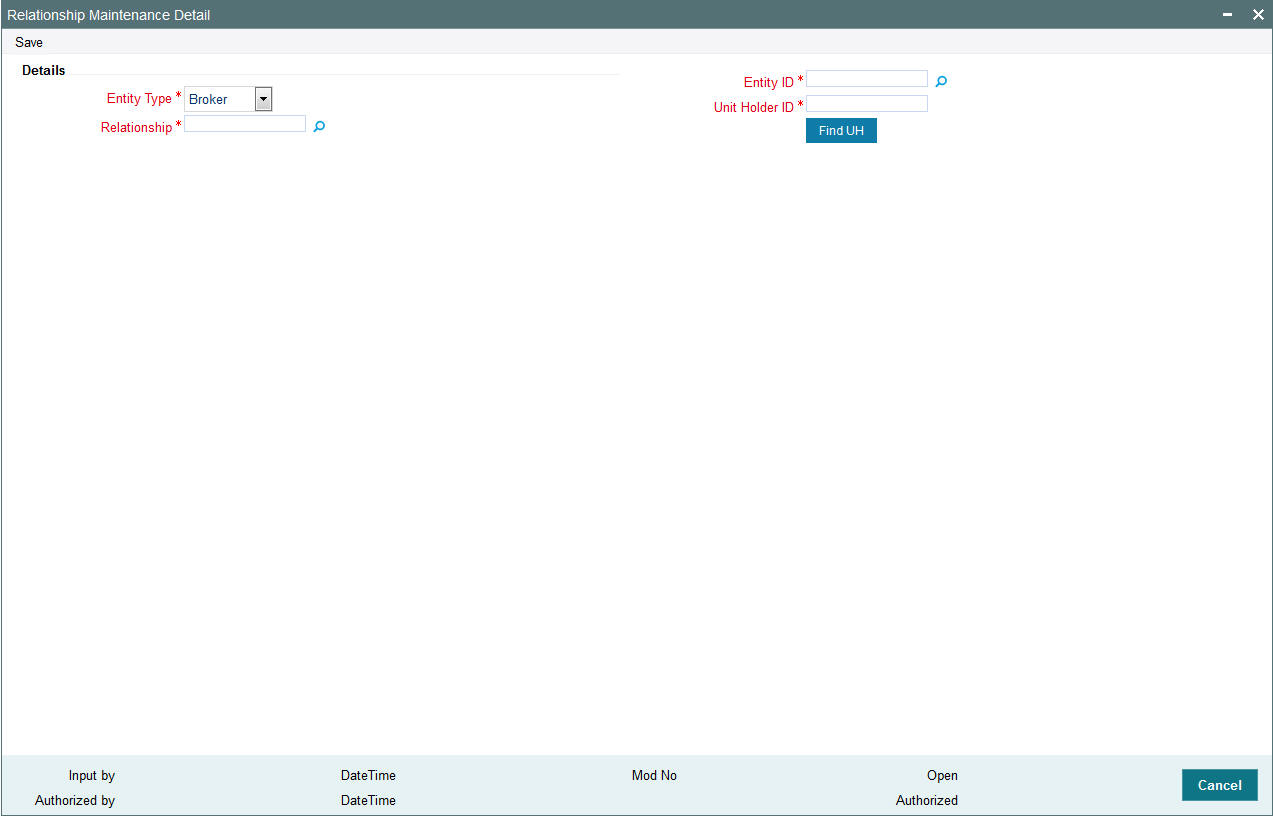

3.8 Relationship Maintenance Detail

This section contains the following topics:

3.8.1 Invoking Relationship Maintenance Detail Screen

You can maintain relationship detail using ‘Relationship Maintenance Detail’ screen. You can invoke this screen by typing ‘UTDENTRL’ in the field at the top right corner of the Application tool bar.

You can specify the following details:

Details

Entity Type

Mandatory

Select the type of entity from the drop-down list. The list displays the following values:

- Broker

- Unit Holder

Relationship

Alphanumeric; 2 Characters; Mandatory

Specify the relationship status. Alternatively, you can select relationship status from the option list. The list displays all valid relationship status maintained in the system.

Entity ID

Alphanumeric; 12 Characters; Mandatory

Specify the entity ID. Alternatively, you can select entity ID from the option list. The list displays all valid entity ID maintained in the system.

Unit Holder ID

Alphanumeric; 12 Characters; Mandatory

Specify the unit holder ID.

You can also query for unit holder ID by clicking ‘Find UH’ button.

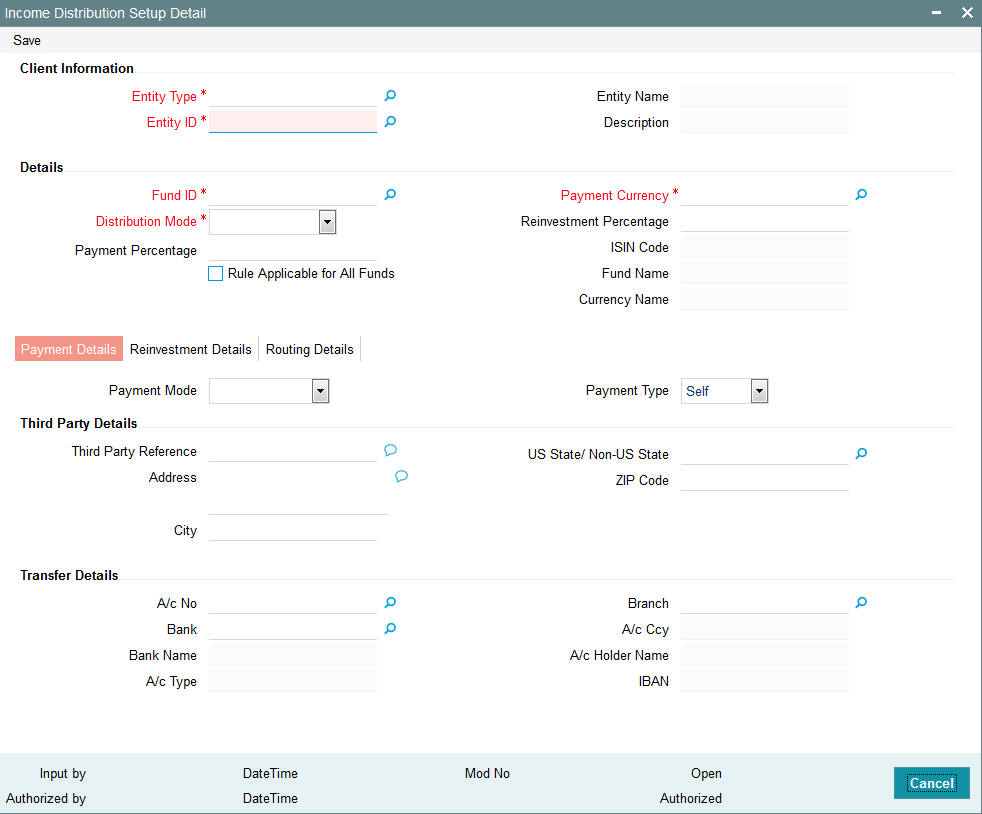

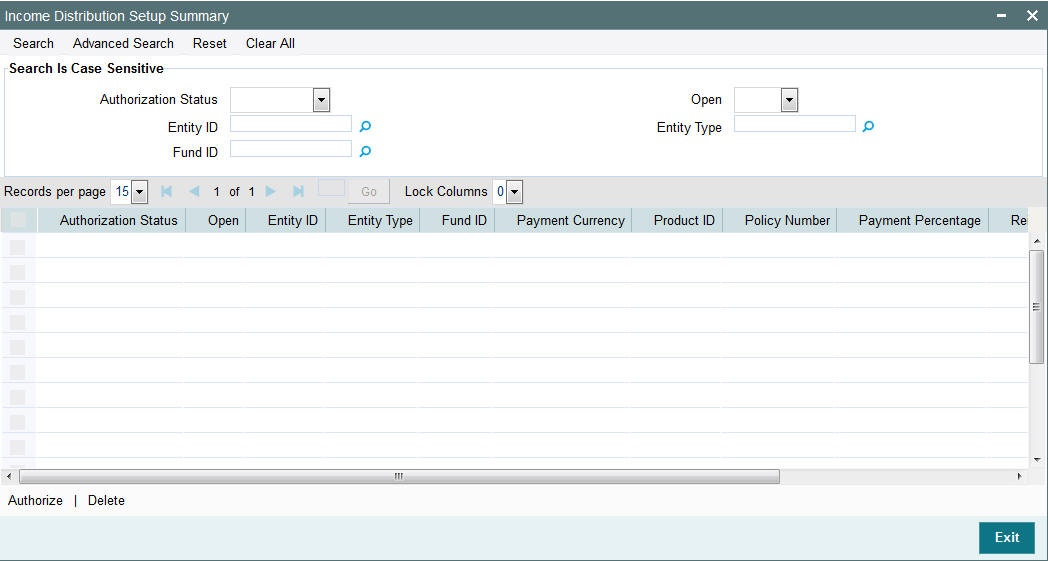

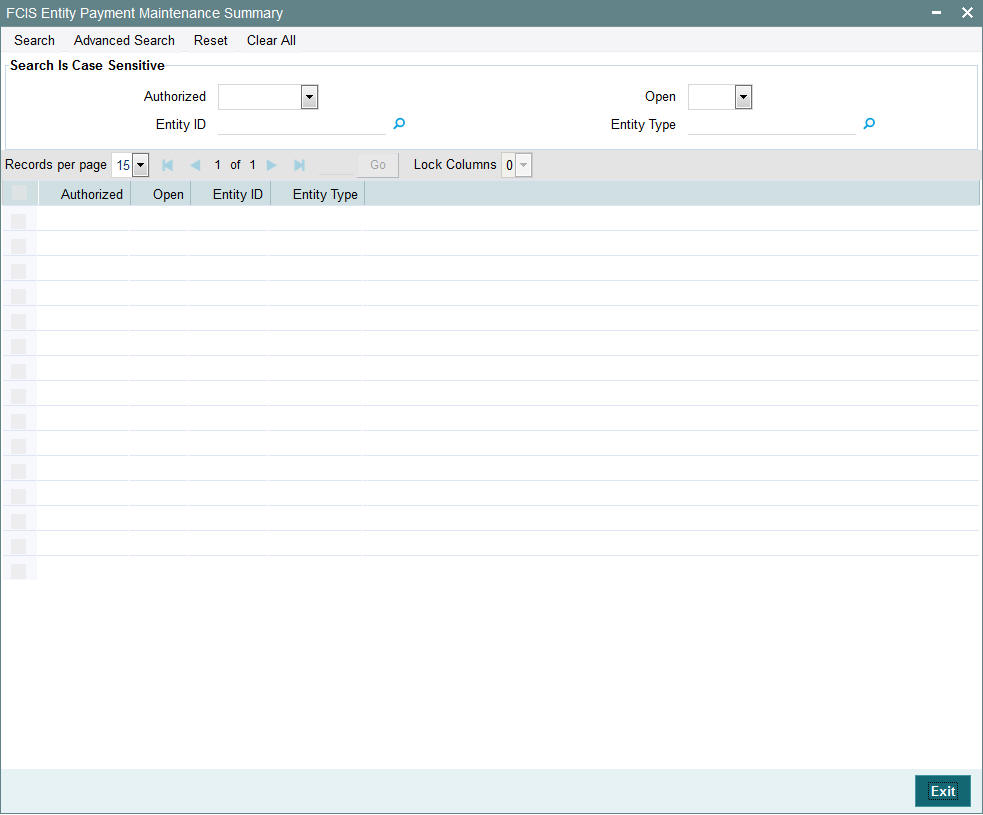

3.9 Income Distribution Setup (IDS) Options

This section contains the following topics:

- Section 3.9.1, "Maintaining Income Distribution Setup (IDS) Options"

- Section 3.9.2, "Payment Details Tab "

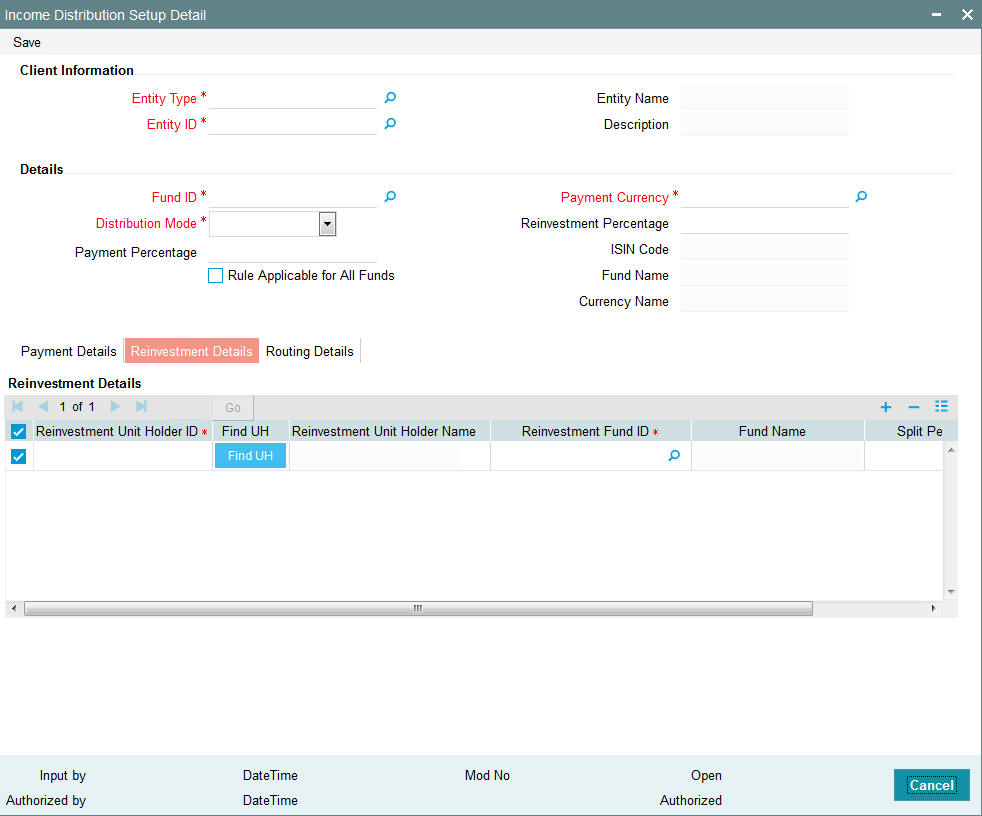

- Section 3.9.3, "Reinvestment Details Tab"

- Section 3.9.4, "Routing Details Tab"

3.9.1 Maintaining Income Distribution Setup (IDS) Options

The different entities involved in transactions in funds of the AMC avail of earnings resulting from their involvement. For instance, an intermediary (such as a broker) derives commission earnings from the transactions in the funds of the AMC.

Each of the entities could opt for any of the following ways of using earnings from transactions:

- Receive the entire earnings, dividend or commission, as payment, either entirely through checks or account transfer.

- Not receive the earnings by way of payment, but invest the earnings back into the funds of the AMC. This is known as reinvestment. Also, the reinvestment could be made into a designated unit holder account too.

- Receive a portion of the earnings by way of payment, and reinvest the remaining portion.

The pattern chosen by the entity to use earnings is known as the Income Distribution Setup pattern or the IDS pattern for the entity.

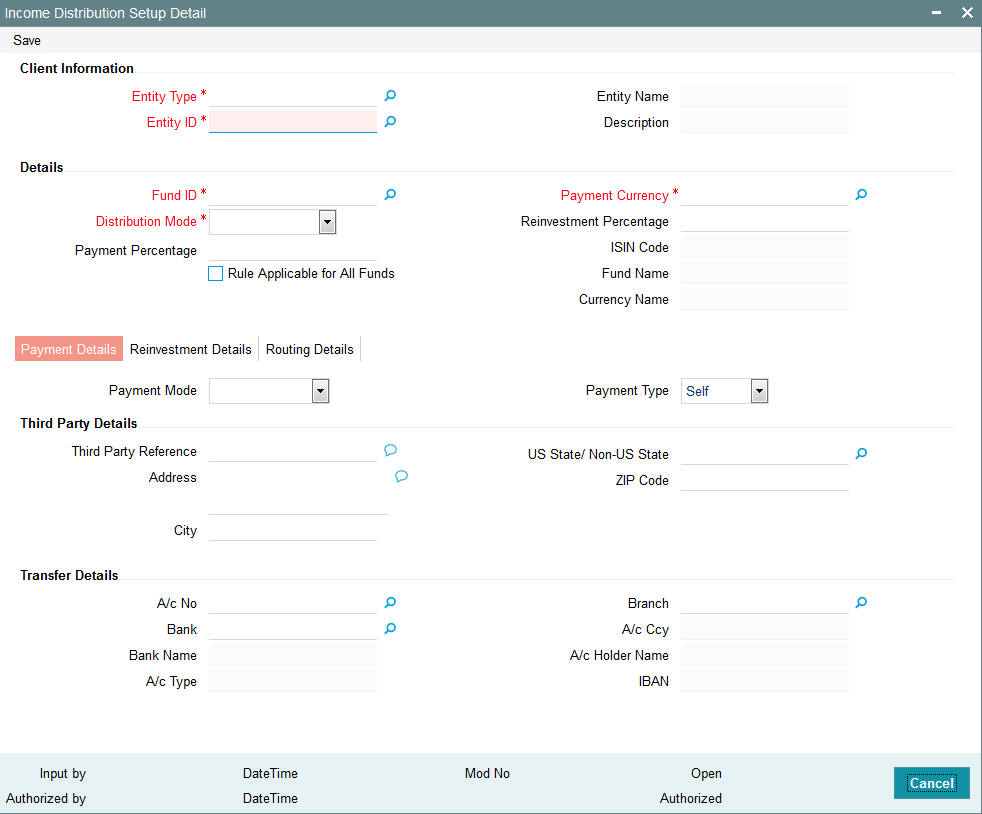

You can capture this pattern for any entity in the Oracle FLEXCUBE Investor Servicing system, in the ‘Income Distribution Setup Detail’ screen. You can invoke this screen by typing ‘UTDBRIDS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details.

In this screen, you set up the IDS pattern by:

- Specifying the type of entity for which the IDS options are being maintained.

- Indicating the entity for which the option is being set up, by specifying the entity ID.

- Specifying the fund for which the option is applicable, in the Fund ID field. You can also specify the ISIN Code for the fund. The option you will set up will be applied only for dividend earnings on the fund you select here. If you wish to set up income distribution options to be applicable for all funds, you can do so by setting the ‘Rule Applicable for All Funds’ option (this option is available for all entity types except brokers and unit holders)

- Specifying the mode of distribution, in the Distribution Mode field. For brokers, distribution by payment or reinvestment, or both, can be set. For all other entities, only distribution by payment can be set.

- For brokers, specifying the percentages that represent the portions of dividend earnings to be paid and reinvested, as desired by the broker, in the Payment Percentage and Reinvestment Percentage fields.

- For brokers, specifying the payment details for the paid portion, in the Payment Details section, and the reinvestment details, for the reinvestment portion, in the Reinvestment Details section.

- For entities other than brokers, specifying the payment details for commission payments, in the Payment Details section.

- Save your changes.

Client Information

In this section, select the code of the broker for whom you are creating an income distribution setup record.

Entity Type

Alphanumeric; 1 Character; Mandatory

Select the type of entity for which you are setting up Income Distribution options from the option list. You can select any of the following entity types, as applicable:

- Accounting and Valuation Agent

- Agent

- Agency Branch

- AMC

- Broker

- Bulk Client

- Check Vendor

- Clearing Agent

- Custodian

- Distributor

- IFA

- Registrar

- Trustee

- Underwriter

- Product Administrator

For entities other than brokers, the IDS options that you set up in this screen are applicable for commission payments only, and only the ‘Payment’ distribution mode can be set.

Entity Name

Display

Based on your selection for Entity ID, the system displays the corresponding Entity Name.

Entity ID

Alphanumeric; 12 Characters; Mandatory

Specify the ID of the entity for whom you are creating the income distribution options in this screen. The name of the entity that you select is displayed alongside the field.

Description

Display

The system displays description of the specified entity here based on the details maintained at ‘Single Entity Maintenance’ level.

Details

In this section, you can indicate the fund, the income earnings from which will be distributed according to the IDS options you are creating for the selected entity. You can also indicate the manner in which the income must be distributed.

For all entity types other than brokers and unit holders, you can define IDS options to be applicable for all funds. Specific IDS options for individual funds can still be defined for the entity even if IDS options have been defined to be applicable for all funds, and these specific options will supersede the option defined for all funds.

Fund ID

Alphanumeric; 6 Characters; Mandatory

Select the ID of the fund from which the selected entity derives income, which will be distributed according to the IDS options you are creating in this screen.

If the selected entity receives income from many funds, then you must create the IDS options for the income from each fund in this screen as applicable, if so requested by the entity.

When you specify the ID of the fund, the ISIN Code of the fund is displayed in the ISIN Code field.

Note

The ALL option is defaulted in this field and cannot be changed if the ‘Rule Applicable for All Funds’ option has been chosen. In such a case, the IDS options being defined would be applicable for income earned by the selected entity from all funds. Also, if specific options need to be defined for an individual fund, they can be defined separately. Such specific options, if defined for an individual fund, would take precedence (only for income earnings from the fund for which they are defined) over options defined for ALL funds.

ISIN Code

Display

The system displays the ISIN Code for the selected fund.

Note

The ALL option is defaulted in this field and cannot be changed if the ‘Rule Applicable for All Funds’ option has been chosen. In such a case, the IDS options being defined would be applicable for income earned by the selected entity from all funds. Also, if specific options need to be defined for an individual fund, they can be defined separately. Such specific options, if defined for an individual fund, would take precedence (only for income earnings from the fund for which they are defined) over options defined for ALL funds.

Fund Name

Display

The system displays name of the specified fund ID based on the details maintained at ‘Fund Maintenance’ level.

Currency Name

Display

The system displays name of the specified payment currency based on the details maintained at ‘Currency Maintenance’ level.

Distribution Mode

Mandatory

From the drop-down list, indicate the manner in which the selected entity prefers to avail of income earned in the selected fund. The list displays the following values:

- Full Payment: Choose this option to indicate that the entity prefers to receive the entire income derived from an income distribution cycle in the selected fund as a payment.

Note

For commission payments for entities other than brokers, the distribution mode is considered to be ‘Full Payment’ by default. This option is selected and cannot be changed.

Further, the entity can choose to avail of payment either in the form of a check, or an account transfer.

- Full Reinvestment: Choose this option to indicate that the entity prefers to reinvest the entire income derived from an income distribution cycle in the AMC back into the funds of the AMC. This option is available only for brokers and not for other entity types.

Further, the entity can choose to have the income reinvested either in the entity’s own default unit holder account or the account of another unit holder. In the latter case, the unit holder in whose account the reinvestment is proposed (i.e., the Reinvestment Unit Holder) must belong to the same AMC as the source entity.

- Both: Choose this option to indicate that the entity prefers to have the income derived from an entire income distribution cycle in the selected fund divided into two portions, receive one portion as payment, and reinvest the remaining portion. This option is available only for brokers and not for other entity types.

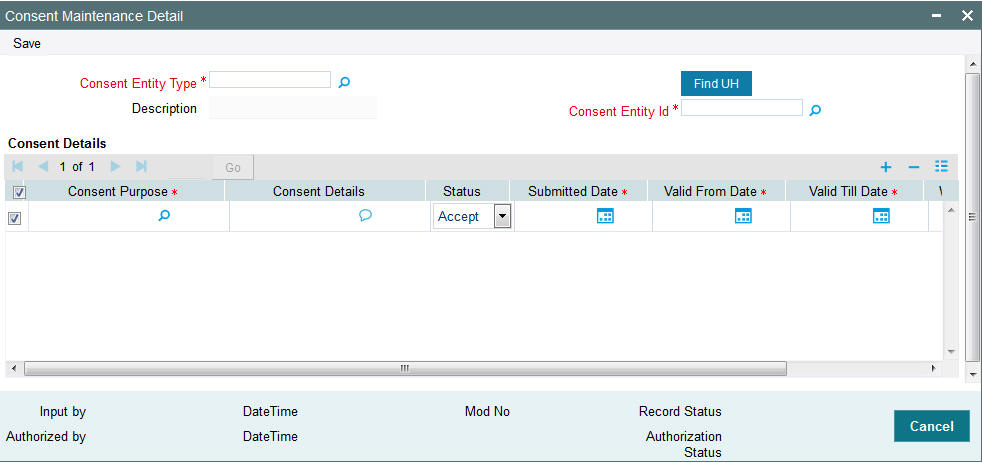

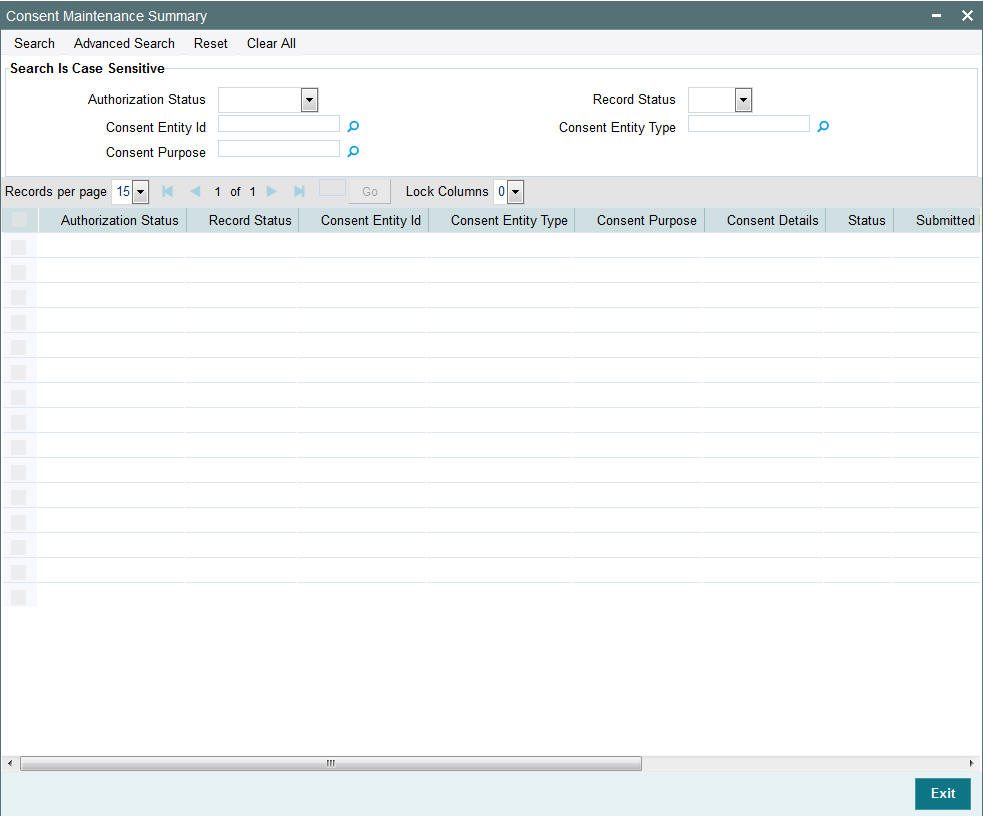

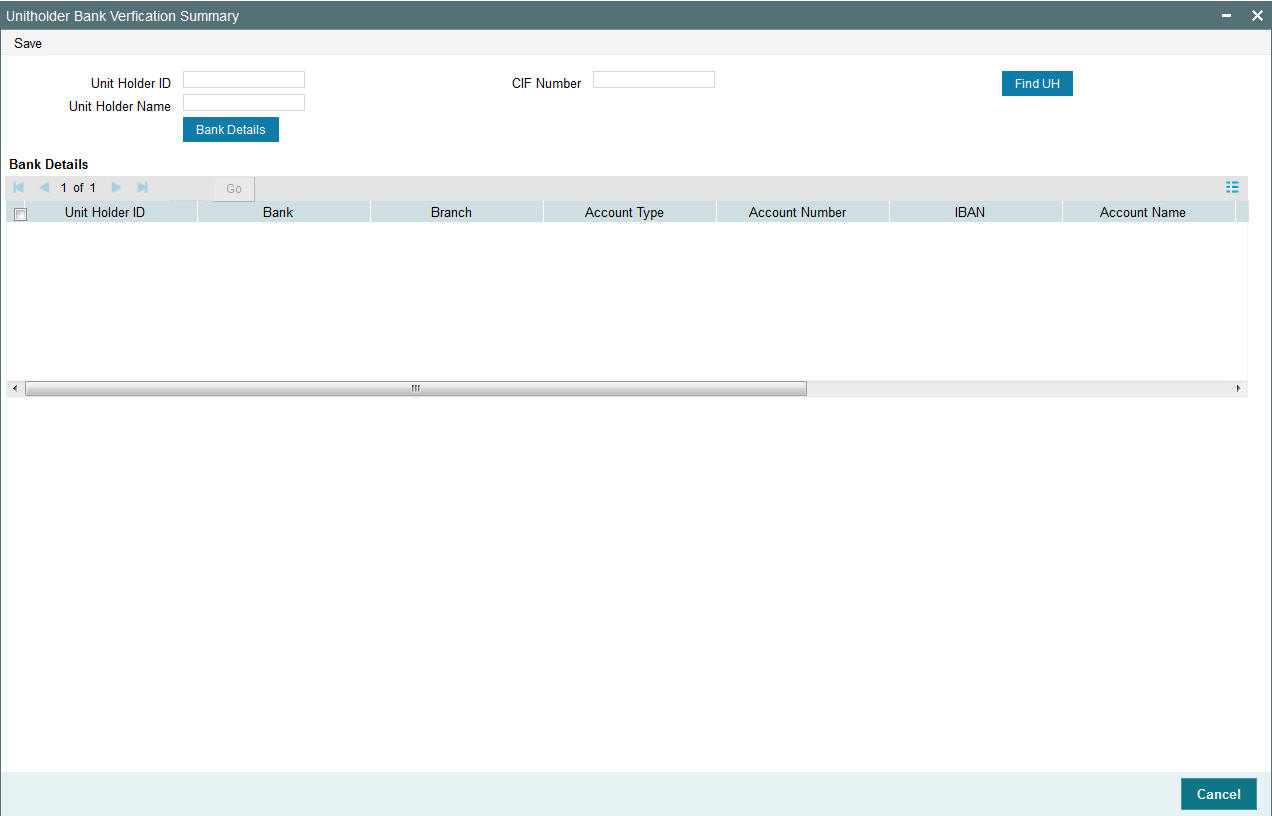

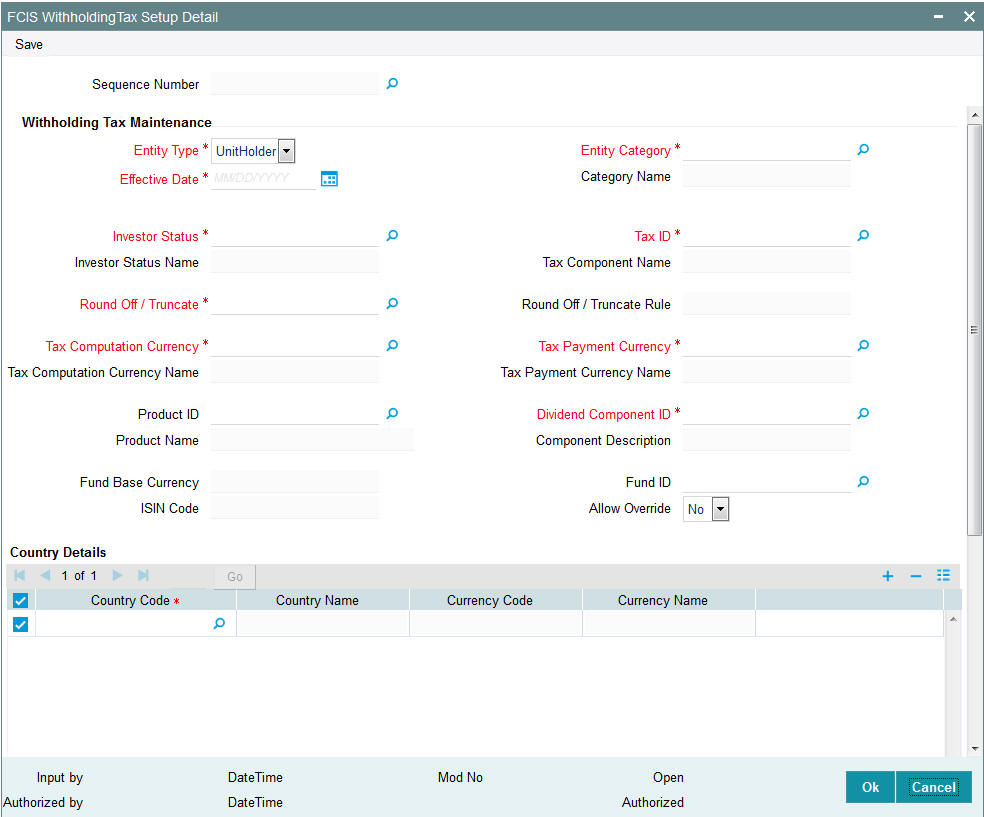

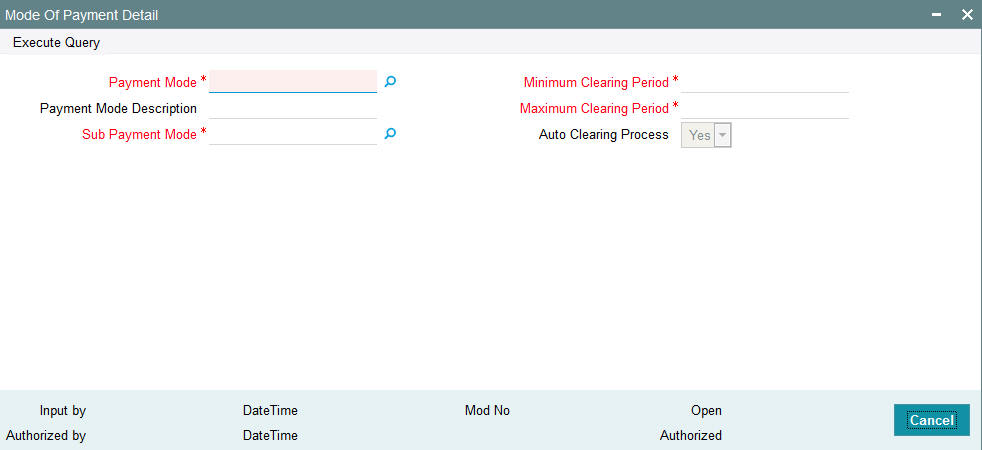

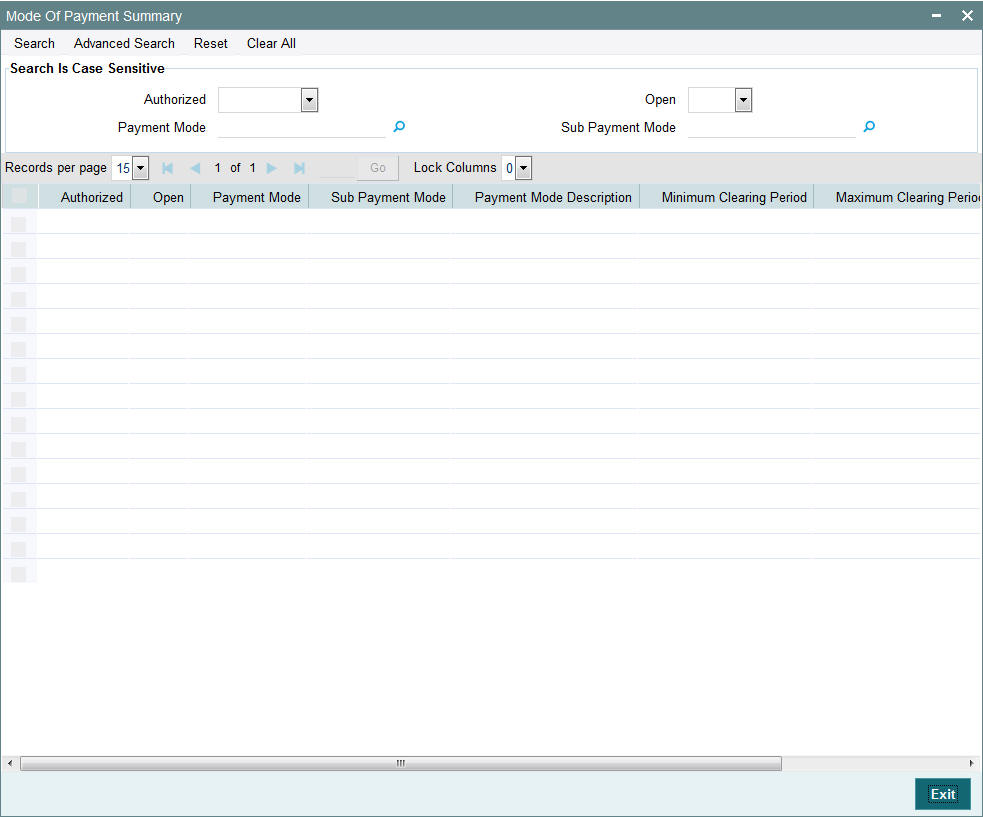

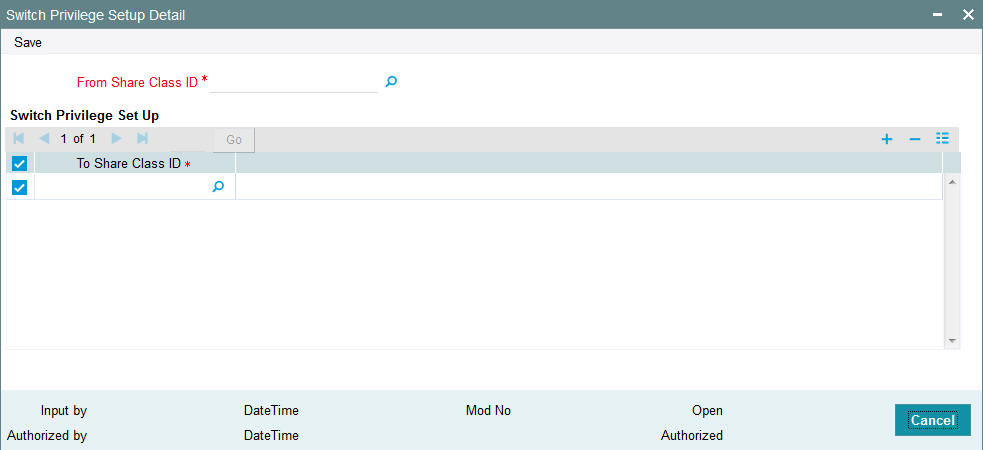

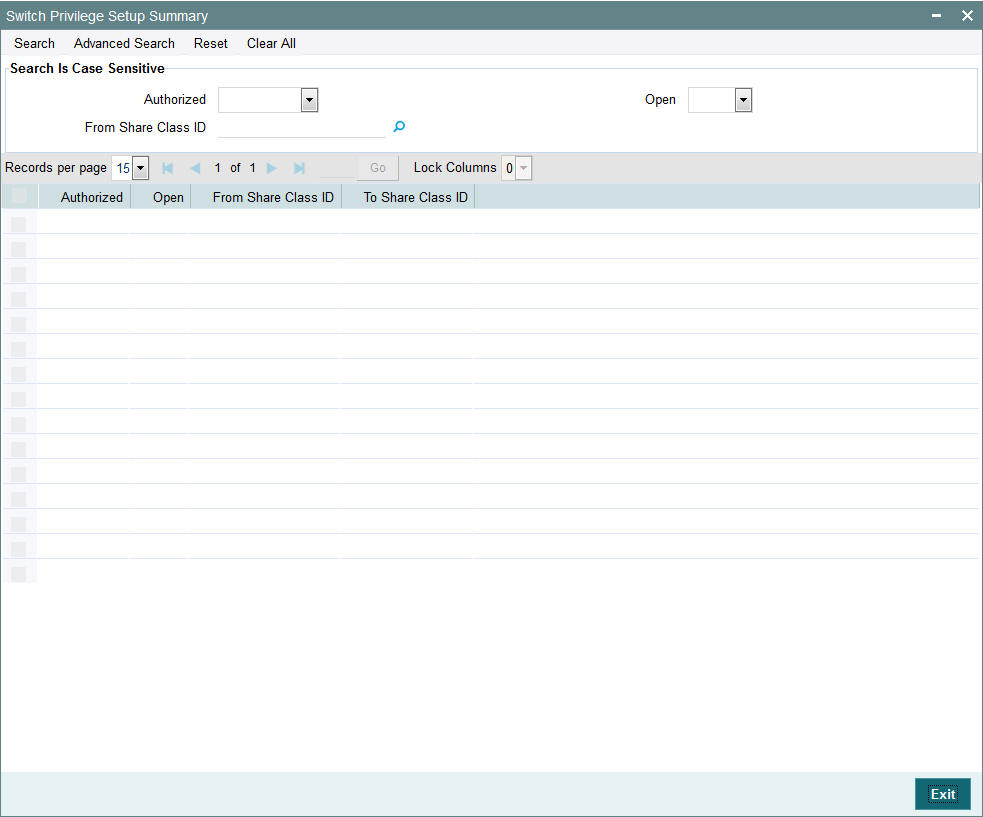

Note