4. Appendix A - Reporting for Capital Gains Tax

This chapter contains the following sections:

4.1 Capital Gains Tax

This section contains the following topics:

- Section 4.1.1, "Processing Capital Gains Tax"

- Section 4.1.2, "Maintenance for Capital Gains Tax Computation"

- Section 4.1.3, "Computation of Capital Gains Tax"

- Section 4.1.4, "Weighted Average Unit Cost approach for computing Capital Gain / Loss"

- Section 4.1.5, "Computation of EUSD Average Cost/Capital Gain"

- Section 4.1.6, "Computation of Capital Gains for Redemption"

- Section 4.1.7, "Computation of Capital Gains for Transfers"

- Section 4.1.8, "Reporting in Respect of Capital Gains Calculations"

- Section 4.1.9, "Generating Capital Gains Detailed Report"

- Section 4.1.10, "Capital Gains Summary Report"

4.1.1 Processing Capital Gains Tax

The gains made by an investor over investments attract taxation, and the tax applied is called the Capital Gains Tax.

Oracle FLEXCUBE Investor Servicing provides the facility to compute and deduct capital gains tax on a unit holder’s gains. Reporting on the computation of the tax, at each transaction level, is also available.

In case transactions are reversed or backdated, appropriate reversal and adjustment transaction entries are initiated and processed, along with adjustments to the gain. A history of transactions, with the appropriate reversals and adjustments, can be obtained as a report.

4.1.2 Maintenance for Capital Gains Tax Computation

To set up the processing of capital gains tax in the system, you must do the following:

- Set up the capital gains tax as a load in the Load Definition screen. The frequency of processing for the tax must be ‘Post-allocation’.

- Associate the load with the funds for which capital gains tax processing must be done, in the Fund Load Maintenance profile for each fund.

- In the Entity Maintenance record for the AMC or Distributor, specify the effective date following which capital gains computations must be performed.

- If any expressions for the NAV have been defined in the Fund Formula Maintenance record for a price component for a fund, you can indicate the component that must be excluded in the calculations for capital gains tax, as desired.

4.1.3 Computation of Capital Gains Tax

The computation of capital gains tax applicable on transactions on a fund is triggered as part of the allocation process after the fees; price and units calculations in respect of the transaction are completed.

4.1.4 Weighted Average Unit Cost approach for computing Capital Gain / Loss

The system uses the Weighted Average Unit Cost approach for calculation of capital gains. By this approach, the ‘gain’ (upon which the tax may be applied) is computed based on the weighted average unit cost for the unit holder.

The Weighted Average Unit Cost (WAUC) is computed for each transaction that results in an inflow (i.e., subscription, switch–to or transfer–to), but not for a transaction that results in an outflow (redemption, switch-from or transfer-from). The gains are computed based on the WAUC, for each outflow transaction.

The computations of WAUC begin from the effective date for capital gains calculations maintained for the entity (AMC or Distributor) in the Entity Maintenance.

Note

It must be remembered that this feature of capital gains computation is only available if your installation has specifically requested for it.

Some important terms

The following terms must be taken into consideration to understand the process of WAUC or gain calculation for a transaction:

- An ‘original transaction’ is a normal transaction entered and allocated in the system on any date.

- A ‘reversal transaction’ is a transaction in which the amount, units or percentage applied for in an original transaction is amended to zero, on a date later than the allocation date of the original transaction.

- A ‘backdated transaction’ is one that is entered with a transaction date being earlier than the allocation date.

- A ‘dependant transaction’ is a transaction entered for a unit holder and fund, for which the transaction date is earlier than that of a reversal or backdated transaction for the same unit holder / fund combination.

- An ‘adjustment transaction’ is an original transaction for which the WAUC or the gain / loss has been recalculated because the transaction was ‘dependant’ on a reversal or backdated transaction.

From the effective date following which capital gains computation is to be done, the WAUC on every inflow transaction and the gain on every outflow transaction is computed. The system also facilitates the processing of the effect of reversed and backdated transactions on the WAUC and the gain.

A counter is also maintained by the system to identify the order in which transactions are allotted.

Definitions

The following empirical expressions are employed in the computation:

For WAUC,

W(i) = ( W(i-1) * B(i-1) + A(i) ) / ( B(i) )

If transaction (i) is an outflow transaction, W(i) = W(i-1)

Capital Gain / Loss is calculated only on outflow transactions. If the transaction (i) is an outflow transaction,

G(i) = (U(i) * W(i-1) )- A(i) + C(i)

If the transaction (i) is an inflow transaction, then G(i) = 0.

Where,

Variable |

Variable Definition |

(i) |

A counter maintained by the system to identify the order in which transactions are allotted. It is incremented by 1 each time a transaction is allotted, and in the order in which transactions are allotted in the system. |

W(i) |

WAUC corresponding to the ’i’th transaction. For instance, W(3) indicates the WAUC corresponding to the third transaction allotted. |

W(i-1) |

This is computed by summing up the WAUC for transaction (i-1), taking into account the original transaction and any subsequent adjustments due to backdated and / or reversal transactions. |

B(i) |

The unit balance after the allocation of the ’i’th transaction. It is calculated according to the order in which transactions are allotted. |

A(i) |

The transaction amount in the ’i’th transaction. This would be Amount Applied, or Switch Amount, Transfer Amount, or Redemption Amount, depending upon the transaction type. For the transaction modes ‘units’ or ‘percentage’, it is calculated. |

W(0) |

The WAUC corresponding to the start of capital gains calculations, i.e., the effective date for capital gains calculations. This could default to zero, but there could be an upload of starting WAUC through the Bulk Upload functions. |

B(0) |

The unit balance at the start of capital gains calculations (the effective date). If the 1st original transaction occurs after the effective date, this unit balance is zero. If the 1st original transaction occurs before the effective date, this is the sum of units allocated and confirmed for all transactions before the effective date. |

G(i) |

The Capital Gain (or Loss) corresponding to the ’i’th transaction. A Capital Loss occurs when G(i) is negative. |

U(i) |

The number of units allotted on the ’i’th Transaction. |

C(i) |

The excluded price component factor. It is calculated as (sum of excluded price components) * (number of units allotted in the ’i’th transaction) |

Recalculation of WAUC and Capital Gain / Loss for original and dependant transactions

Reversal and backdated transactions have the effect of causing a recomputation of WAUC and Capital Gain / Loss for any original or dependant transactions that have been entered or allocated after the transaction date of the reversal or backdated transaction.

The recomputation involves initiating adjustment transactions to offset the effect of the reversal or backdating on the WAUC or the Capital Gain / Loss.

The process of recalculation can be summarized in the following steps:

- Reconstruction of the transaction history with the backdated or reversal transactions

- Calculation of an opening unit balance and opening WAUC for the reconstructed transaction history

- Calculation of the Gain / Loss and WAUC for the reconstructed transactions

- Calculation of the adjustment in Gain / Loss and WAUC in respect of each backdated or reversal transaction

- Steps 1-4 are repeated for each backdated and reversal transaction on the application date.

- Calculation of Gain / Loss and WAUC in respect of transactions with transaction date being the application date

The reconstruction of the transaction history will have the following information:

Information head |

Remarks |

Transaction Number |

For an “Original Transaction”, this is the transaction number of the “Original Transaction” For a “Reversal Transaction”, this is the transaction number of the “Reversal Transaction” that is being reversed. For an ‘Adjustment Transaction’ this is the transaction number of the ‘Original Transaction’ which is being adjusted, not the transaction number of the associated ‘Reversal’ or ‘Backdated Transaction. |

Linked Transaction Number (LTN) |

For an “Original Transaction”, this is null. For a “Reversal Transaction” this is null. For an “Adjustment Transaction” this is the transaction number of the “Reversal Transaction” or “Backdated Transaction” that is associated with that “Original Transaction”. |

Old Transaction Number (OTN) |

For an “Original Transaction” that has been reversed, this is the transaction number of the “Original Transaction”. For a “Reversal Transaction” this is the transaction number of the “Original Transaction” that is being reversed. For all other transaction types, this is null |

Unit Holder ID (UH ID) |

This is the Unit Holder ID associated with the “Transaction Number”, above |

Fund ID |

This is the Fund ID associated with the “Transaction Number”, above |

Transaction Type Description |

For an “Original Transaction” this would be Subscription, Switch In, Transfer To, Redemption, Switch Out or Transfer From. For a “Reversal Transaction” this would be the Transaction Description of the Original Transaction concatenated with the word “Reversal”. For instance, “Subscription Reversal” For an “Adjustment Transaction” this should be the Transaction Description of the “Original Transaction” concatenated with the word “Adjustment”, for instance, “Redemption Adjustment”. |

Transaction Amount (Amount) |

This is the gross transaction amount associated with the “Transaction Number”, above. It will be positive for inflow transactions and reversals of outflow transactions, and negative for outflow transactions and reversal of inflow transactions. |

Effective Unit Price (Price) |

This is the effective transaction price, calculated as (Amount) / (Units), as the Transaction Base Price is stored with the transaction where the fees are mapped as a load to amount. For a reversal transaction, this should be the unit price of the transaction being reversed. |

Confirmed Units Allotted (Units) |

This is the number of confirmed units allotted associated with the “Transaction Number”, above. These are the units switched out of the From Fund for Switch Out transactions and the units switched into the To Fund for Switch In transactions. For Reversal Transactions, this will have the same value but opposite sign of the Original Transaction’s units. The Amount must be positive for inflow transactions and reversals of outflow transactions, and negative for outflow transactions and reversal of inflow transactions. |

Unit Balance (Balance) |

This is the unit balance after allocation of the current record. |

Weighted Average Unit Cost (WAUC) |

For Original Transactions, this is the WAUC calculated according to the definition described above. |

Excluded Price Components |

This is the excluded price component factor. It is computed as (Sum of excluded price components) * (units allotted), and the absolute value is considered. If the sum of excluded price components falls below zero, it is defaulted to zero. |

Weighted Average Gain or Loss (Gain) |

This is gain or loss for the transaction, calculated according to the rules described above. |

Transaction Date (Value Date) |

This is the transaction date corresponding to the “Transaction Number” transaction. |

Date Allotted |

The date on which the “Transaction Number” transaction is allocated. |

WAUC Adjustment (WAUC Adj) |

For an “Original Transaction” this value is zero. For an Adjustment Transaction, this is the WAUC of the Adjusted / Reversed transaction, less the WAUC of the Original Transaction, less the sum of all prior WAUC adjustments in respect of the Transaction Number of the current record. |

Gain or Loss Adjustment (Gain Adj) |

For an Original Transaction this value is zero. For an Adjustment Transaction, this is the Gain or Loss calculated on the Adjustment Transaction, less the Gain or Loss on the Original Transaction, less the Gain or Loss Adjustment on all previous transactions where the Transaction Number is the Transaction Number for the Adjustment Transaction, and Transaction Number <> Linked Transaction Number. |

Entry Date and Time |

This is the server date and time, at which the record is inserted into the database. |

Record Indicator |

This will be “NML” for normal transactions, “ADJ” for Adjustments and “REV” for Reversals. For Reversals, this code will be “NML” for the Original Transaction. |

4.1.5 Computation of EUSD Average Cost/Capital Gain

To comply with EUSD (European Union Savings Directive), average cost/capital gain must be computed. EUSD came into effect on 1st July, 2005. For transactions recorded after 1st July, 2005, the Weighted Average Unit Cost approach is applicable for the computation of capital gains. However, for transactions recorded prior to 1st July, 2005, the average cost is the first NAV after 1st July, 2005.

For every transaction done by the unitholder, system tracks the average cost on the TIS (Taxable Income for the Subscription), maintained as part of fund price formula. During redemption, the difference between the TIS for the redemption’s price date and the TIS average cost is the basis on which the gain is computed.

The following expression is used to compute gain:

Gain = Minimum of (TIS Component for the price day – TIS WAC) and (Unit cost or NAV – EUSD WAC)

Unit cost is used for all computations of EUSD WAC and EUSD Gain. However, if the transaction does not have any load (other than the CGT load) then the NAV is used instead of the unit cost.

Even if one of the components is less than or equal to 0, capital gain is treated as 0. The following example illustrates this:

4.1.6 Computation of Capital Gains for Redemption

The unit holders, without the joint holders, system will apply the tax on entire capital gain depending on the tax applicability if the RECOVERCGT is checked at Unit holder level.

The unit holders, having joint holders, system will split the Capital gain proportionately amongst all the holders and apply the tax depending on the tax applicability of RECOVERCGT selected as a part of Unit holder/Joint holder set up at Unit holder/Joint holder level.

4.1.7 Computation of Capital Gains for Transfers

If ‘Change of Beneficial Ownership’ and ‘RECOVERCGT’ boxes are checked during Transfer transaction as part of Unit holder/Joint holder and if the set up is 1, then system will apply tax on capital gain.

If Change of Beneficial Ownership option is not selected, during Transfer transaction, then system will not apply tax on capital gain.

The tax calculation will be done as follows:

- On transaction unitization date

- Calculation details will be stored separately for each unit holder/ joint holder for information and reporting purposes.

- Settlement Amount at transaction level will reflect the tax deduction

- Capital gains balance check taking place with unit holder fund holdings will not consider provisional holdings in the fund.

4.1.8 Reporting in Respect of Capital Gains Calculations

You can obtain a report of the recalculations of Gain / Loss and the WAUC, in respect of each transaction, in the following format:

Information head |

Remarks |

Transaction Number |

For an “Original Transaction”, this is the transaction number of the “Original Transaction” For a “Reversal Transaction”, this is the transaction number of the “Reversal Transaction” For an “Adjustment Transaction” this is the transaction number of the “Original Transaction” which is being adjusted, not the transaction number of the associated “Reversal” or “Backdated” Transaction. |

Linked Transaction Number (LTN) |

For an “Original Transaction”, this is null. For a “Reversal Transaction” this is the transaction number of the Reversal Transaction. For an “Adjustment Transaction” this is the transaction number of the “Reversal Transaction” or “Backdated Transaction” that is associated with that specific “Original Transaction”. |

Old Transaction Number (OTN) |

For an “Original Transaction” that has been reversed, this is the transaction number of the “Original Transaction”. For a “Reversal Transaction” this is the transaction number of the “Original Transaction” that is being reversed. For all other transaction types, this is null |

Unit Holder ID (UH ID) |

This is the Unit Holder ID associated with the “Transaction Number”, above |

Fund ID |

This is the Fund ID associated with the “Transaction Number”, above |

Transaction Type Description (Txn Type) |

For an “Original Transaction” this would be Subscription, Switch In, Transfer To, Redemption, Switch Out or Transfer From. For a “Reversal Transaction” this would be the Transaction Description of the Original Transaction concatenated with the word “Reversal”, for example, “Subscription Reversal” For an “Adjustment Transaction” this should be the Transaction Description of the “Original Transaction” concatenated with the word “Adjustment”, for example, “Redemption Adjustment”. |

Transaction Amount (Amount) |

This is the gross transaction amount associated with the “Transaction Number” above. For Reversal Transactions, this amount would be equal in value to that of the Original Transaction, but opposite in sign The Amount must be positive for inflow transactions and reversals of outflow transactions, and negative for outflow transactions and reversal of inflow transactions. For “Adjustment Transactions”, the amount must be changed zero. |

Effective Unit Price (Price) |

The price will be the same as the price used in the calculation above to reconstruct the Transaction History. Note that the price cannot be calculated here, as for Adjustment Transactions, the amount and units are both changed to zero. |

Confirmed Units Allotted (Units) |

These are the confirmed units allotted associated with the “Transaction Number”, above. These are the units switched out of the From Fund for Switch Out transactions and the units switched into the To Fund for Switch In transactions. For Reversal Transactions, this would take the same value but opposite sign of the Original Transaction’s units. The Units must be positive for inflow transactions and reversals of outflow transactions, and negative for outflow transactions and reversal of inflow transactions. For “Adjustment Transactions”, the units must be changed to zero. |

Weighted Average Unit Cost (WAUC) |

For Original Transactions, this is the WAUC calculated according to the definition described in this document. For Reversal or Adjusted Transactions, this is the adjusted WAUC calculated from the reconstructed transaction history. |

Excluded Price Components |

This is the excluded price component factor. It is computed as (Sum of excluded price components) * (units allotted), and the absolute value is considered. If the sum of excluded price components falls below zero, it is defaulted to zero. |

Weighted Average Gain or Loss (Gain) |

For an Original Transaction, this is the gain or loss for the transaction, calculated according to the rules described in this document. For an Adjustment or Reversal transaction, this would be the Gain or Loss Adjustment associated with that transaction. |

Transaction Date (Value Date) |

This is the transaction date corresponding to the “Transaction Number” transaction. |

Date Allotted |

The date on which the “Transaction Number” transaction is allocated. |

WAUC Adjustment (WAUC Adj) |

For an “Original Transaction”, this value is zero. For a Reversal Transaction or an Adjustment Transaction, this is the WAUC of the Adjusted / Reversed transaction, less the WAUC of the Original Transaction, less the sum of all prior WAUC adjustments in respect of the Transaction Number of the current record. |

Entry Date and Time |

This is the server date and time at which the record is inserted into the Transaction History Reconstruction Table. |

Record Indicator |

This will be “NML” for Normal Transaction, “ADJ” for Adjustments and “REV” for Reversals. For Reversals this code will be “NML” for the Original Transaction. |

The following reports may be obtained:

- Weighted Average Gain or Loss Detail Report

- Weighted Average Gain or Loss Detail Report

Weighted Average Gain or Loss Summary Report

This report is obtained for every Unit Holder ID, Fund Base Currency and Fund ID combination, from the details in the report format explained above. The following details are presented:

- Unit Holder ID

- Fund Currency

- Fund Name (Long Name)

- Opening Weighted Average Cost – The Opening Weighted Average Cost is calculated as (Opening Unit Balance) * (Opening Weighted Average Unit Cost). The Opening Unit Balance is the unit balance of the transaction where the Entry Date is immediately prior to the “From Date” parameter. The Opening Weighted Average Unit Cost is the Weighted Average Unit Cost of same transaction.

- Inflows – This is the sum of the “Amount” values for inflow transactions added to the sum of the “Amount” values in respect of reversal of inflow transactions. The “Amount” values for reversals of inflow transactions are considered negative, and the “Amount” for Adjustment Transactions is zero. This sum is calculated for transactions where the entry date of the transaction is between the user-entered From and To dates.

- Outflows – This is the sum of the “Amount” values for outflow transactions added to the sum of the “Amount” values in respect of reversal of outflow transactions. The “Amount” values for reversals of outflow transactions are considered negative, and the “Amount” for Adjustment Transactions is zero. This sum is calculated for transactions where the entry date of the transaction is between the user-entered From and To dates.

- Gain or Loss – This is the sum of the Gain or Loss for all transactions where the “Entry Date” is between the user-entered From and To dates.

- Closing WA Cost – The Closing Weighted Average Cost is calculated as (Opening WA Cost) + (Inflows) – (Outflows) + (Gain or Loss)

- Check – The check is to ensure that the Closing WA Cost, as calculated above, balances with the Weighted Average Unit Cost. The check is calculated as (Closing WA Cost) – (Weighted Average Cost associated with the last transaction where the “Entry Date” is less that or equal to the To Date) * (Unit Balance as at the To Date, calculated by “Entry Date”)

Weighted Average Gain or Loss Report

This report is obtained for every Unit Holder ID, Fund Base Currency and Fund ID combination, from the details in the report format explained above. Totals are presented for amount, units and gain for each fund, and also for all funds of the same currency. The following details are displayed for the reconstructed transaction history:

- Unit Holder ID

- Fund Base Currency

- Fund ID

- Transaction Number

- Transaction Type

- Amount

- Price

- Units

- WAUC

- Gain

- Value Date

- WAUC Adjustment

- Entry Date

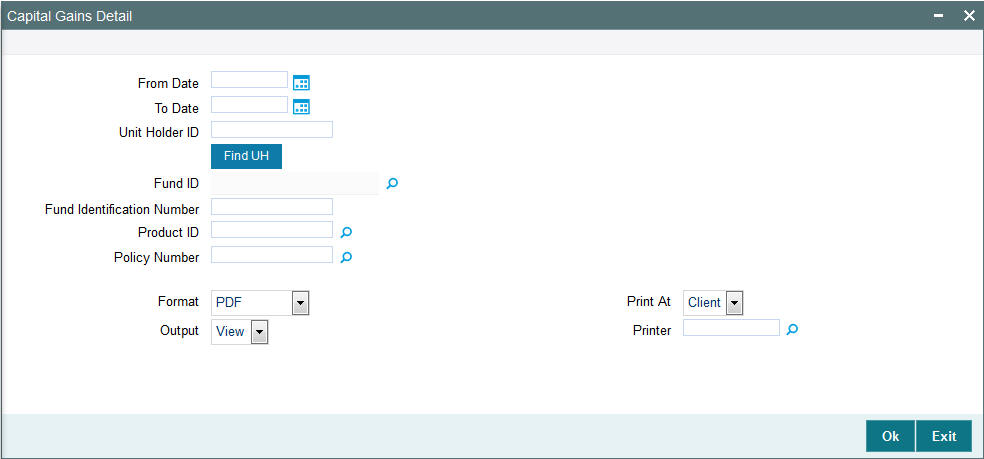

4.1.9 Generating Capital Gains Detailed Report

You can generate capital gains details for a unit between a date range for a fund or product using ‘Capital Gains Detail’ screen. You can invoke this screen by typing ‘UTR00150’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

From Date and To Date

Date Format; Optional

Select the dates that specify the period between which you want to view the capital gains details.

Unit Holder ID

Alphanumeric; 12 Characters; Optional

Specify the ID of the unit holder for whom the capital gains is to be fetched.

You can also select unit holder ID by selecting ‘Find UH’ button.

Fund ID

Alphanumeric; 6 Characters; Optional

Specify the fund ID. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

Fund Identification Number

Display

The system displays the fund identification number for the selected fund ID.

Product ID

Alphanumeric; 10 Characters; Optional

Specify the product ID. Alternatively, you can select product ID from the option list. The system displays all valid product ID maintained in the system.

Policy Number

Alphanumeric; 16 Characters; Optional

Specify the policy number. Alternatively, you can select policy number from the option list. The system displays all valid policy number maintained in the system.

Format

Optional

Select the format from the drop-down list. The list displays the following values:

- HTML

- Excel

- Excel (.xlsx)

- RTF

Output

Optional

Select the output from the drop-down list. The list displays the following values:

- View

- Spool

Print At

Optional

Select the printing location from the drop-down list. The list displays the following values:

- Client

- Server

Printer

Alphanumeric; 15 Characters; Optional

Specify the printer details from adjoining option list.

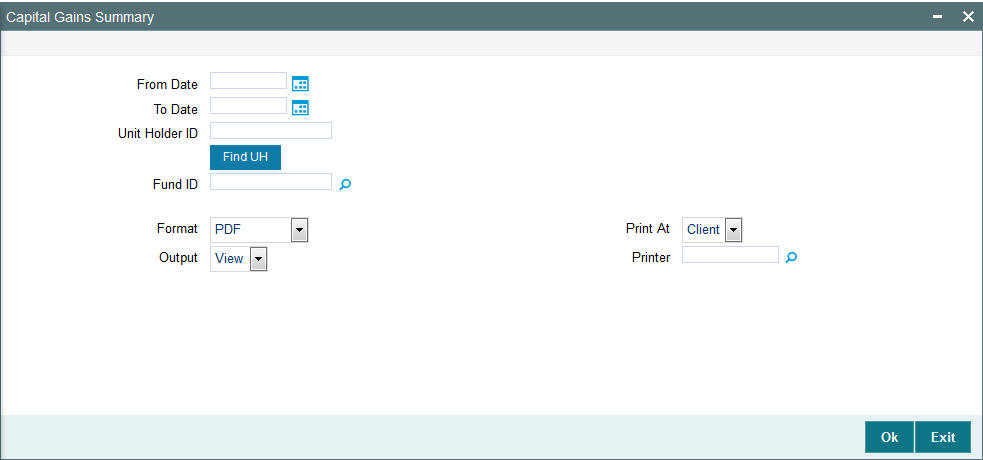

4.1.10 Capital Gains Summary Report

You can generate capital gains summary report for a unit between a date range for a fund or product using ‘Capital Gains Summary’ screen. You can invoke this screen by typing ‘UTR00151’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

From Date and To Date

Date Format; Optional

Select the dates that specify the period between which you want to view the capital gains details.

Unit Holder ID

Alphanumeric; 12 Characters; Optional

Specify the ID of the unit holder for whom the capital gains is to be fetched.

You can also select unit holder ID by selecting ‘Find UH’ button.

Fund ID

Alphanumeric; 6 Characters; Optional

Specify the fund ID. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

Format

Optional

Select the format from the drop-down list. The list displays the following values:

- HTML

- Excel

- Excel (.xlsx)

- RTF

Output

Optional

Select the output from the drop-down list. The list displays the following values:

- View

- Spool

Print At

Optional

Select the printing location from the drop-down list. The list displays the following values:

- Client

- Server

Printer

Alphanumeric; 15 Characters; Optional

Specify the printer details from adjoining option list.