2. Suspense and Statutory Accounts and Trading

Oracle FLEXCUBE Investor Servicing (FC-IS) provides the AMC with the facility to automate the trading on units and the management of trading accounts such as the statutory accounts and suspense accounts.

Typically, the AMC trades on units to generate profit and dividend earnings on units in its possession.

This chapter contains the following sections:

- Section 2.1, "Few Basic Terms"

- Section 2.2, "Trading Transactions"

- Section 2.3, "Trading Functions in FC-IS System"

- Section 2.4, "Unit Holder Trading Account Mapping Screen"

- Section 2.5, "Unit Holder Trading Account Mapping"

- Section 2.6, "Trading Transaction Maintenance"

- Section 2.7, "Trading Maintenance Summary"

2.1 Few Basic Terms

You need to understand a few terms in connection with trading on units clearly before you use the FC-IS system to automate the same:

Trading Box

The trading box refers to the number of units that are available at any given point of time for the AMC, to do trading. The units in the trading box could be the result of any (or both) of two transactional sources:

- Units arising due to the trading done by the AMC itself

- Units arising due to inflow and outflow resulting from investors’ transactions in the fund.

A trading box, therefore, has no physical existence as an actual entity, but is a term used to identify the pool of trading units held by the AMC and available for trading at any given point of time.

Any transaction that results in an increment in the number of units in the trading box may be considered as an “in” transaction, and any transaction that results in depletion in the number of units in the trading box may be considered as an “out” transaction.

Statutory Account

This account is maintained by the AMC according to the regulatory requirements. It is used by the AMC very much like a reserve account where the AMC can “park” a specified percentage of the units held by it. This specified percentage is by no means constant and the AMC can use the units held in this account for trading purposes, and also generate dividend earnings on them.

The statutory account is, therefore, a unit holder account in the system where the AMC can station some of the units held in its possession at any given point of time.

Suspense Account

This account is maintained by the AMC to differentiate its own holdings from the units arising due to inflows or outflows from investor transactions. One of the reasons for this differentiation is to facilitate the generation of dividend earnings for the AMC on its holdings.

The suspense account is, therefore, a unit holder account in the system where the AMC actually transfers all its holdings at a given point in time for the purpose of gaining income earnings on them.

When a dividend is declared and processed by the AMC, or when an income distribution process is initiated, all its outstanding holdings in a fund must be transferred to the suspense account so that either income distribution earnings or dividend earnings may be availed of by the AMC.

2.2 Trading Transactions

During the course of trading on holdings, the AMC may do any or all of the following transactions:

- Creation

- Liquidation

- Management Transfer transactions -

- Management Transfer Out to Statutory Account (MTOST)

- Management Transfer Out to Suspense Account (MTOSU)

- Management Transfer In from Statutory Account (MTIST)

- Management Transfer In from Suspense Account (MTISU)

- Net Settlement In (NSI) transactions

- Net Settlement Out (NSO) transactions

Note

Global Order transactions can also be entered by an AMC. The system also services these transactions. However, the global order feature is only available if you installation has specifically requested for it. An exhaustive note on global order transactions may be found in the Annexure. This chapter only discusses the transaction types mentioned above.

Creation

Creation of units by the AMC is a result of a management decision to “buy” a certain amount of units from the trustees. The units that are bought are either sold to the unit holders at a more favourable price to generate profit, or kept in the suspense account, or both. .

Creation of units by the AMC is a typical activity when it is desirous of generating earnings on favourable movement of fund prices.

A creation transaction will have the effect of incrementing the number of units in the trading box, and is considered an “in” transaction.

Liquidation

Liquidation of units by the AMC is a result of a management decision to sell part of its holdings to the trustee, and may occur for any of two reasons:

- To minimize losses on its holdings due to unfavourable movement of fund prices

- To generate earnings out of an abundance of units in the trading box and a favourable price for liquidation.

A liquidation transaction will have the effect of depleting the number of units in the trading box, and is considered an “out” transaction.

Net Settlement

The net number of units that are settled due to the different transactions that occur on a business day is referred to as the Net Settlement for the day. This consists of the following two components:

- The net number of units flowing into the trading box due to redemption, switch-out, amended switch-in and amended subscription (or initial public offering) transactions. This is called the Net Settlement In or NSI.

The NSI transaction has the effect of incrementing the number of units in the trading box, and is considered an “in” transaction.

- The net number of units flowing out to the trading box due to subscription, initial public offering, switch-in, reinvestment, amended switch-out and amended redemption transactions. This is called the Net Settlement Out or NSO.

The NSO transaction has the effect of depleting the number of units in the trading box, and is considered an “out” transaction.

The AMC ensures that the trading box never goes into a negative or a zero position where the net settled units due to “out” transactions exceed the number of available units in the box.

Movement of Units to and from Statutory Account or Suspense Account

Any movement of units from or to the statutory account or suspense account, due to management trading decisions, from the trading box, will result in any of the following transactions, as applicable:

Management Transfer out to Statutory Account (MTOST)

This activity is a result of a management decision to transfer part of the AMC’s holdings from the trading box to the statutory account.

The MTOST transaction has the effect of depleting the number of units in the trading box, and is considered an “out” transaction.

Management Transfer out to Suspense Account (MTOSU)

This activity is a result of a management decision to transfer part of the AMC’s holdings from the trading box to the suspense account.

The MTOSU transaction has the effect of depleting the number of units in the trading box, and is considered an “out” transaction.

Management Transfer in from Statutory Account (MTIST)

This activity is a result of a management decision to transfer part of the AMC’s holdings from the statutory account to the trading box.

The MTIST transaction has the effect of incrementing the number of units in the trading box, and is considered an “in” transaction.

Management Transfer in from Suspense Account (MTISU)

This activity is a result of a management decision to transfer part of the AMC’s holdings from the suspense account to the trading box.

The MTISU transaction has the effect of incrementing the number of units in the trading box, and is considered an “in” transaction.

Trading – Graphical Work-flow View

The following diagram graphically depicts the movement of trading units and the different components of the trading system.

2.3 Trading Functions in FC-IS System

This section contains the following topics:

- Section 2.3.1, "Operating Trading Functions in FC-IS System"

- Section 2.3.2, "Triggering Net Settlement Transactions"

2.3.1 Operating Trading Functions in FC-IS System

You can automate the trading process of the AMC by using the following screens in the FC-IS system:

- The UH Mapping (Detail and Summary) screens in the Trading menu in the Browser.

- The Trading Transaction Maintenance (Detail and Summary) screens in the Trading Txn Maintenance menu in the Browser.

For the purpose of enquiry, the following reports are also available:

- The Fund Gross Settlement report

- The Trading Enquiry report

- The Trading Profit/Loss report

You can access all these reports through the Reports menu in the Browser.

When you operate the trading functions of the AMC through the FCIS system, it is recommended that you perform following processes:

- Set up the unit holders that are to be linked to the statutory and the suspense account for the AMC in the system, using the Unit Holder New Account screen. Authorize them and accept the information in the Registrar component.

- Link the unit holders that you have set up to the desired account type, statutory or suspense account, using the Unit Holder Trading Account Mapping Detail screen.

- Obtain the information about the trading position of the AMC through the Fund Gross Settlement report. The gross volume or settlement due to the transactions occurring on any certain business day can be learned from this report.

- To initiate any of the trading transactions, use the Trading Transaction Maintenance Detail screen.

- Authorize any initiated trading transactions using the Trading Transaction Maintenance Summary Authorization screen. The transactions are allocated as soon as they are authorized in the system.

2.3.2 Triggering Net Settlement Transactions

Though you can use the Trading Maintenance screen to initiate any of the trading transactions, the Net Settlement Transactions NSO and NSI cannot be initiated through this screen. These transactions are automatically triggered by the End of Day process at the end of each working day, and the impact of these transactions is reflected immediately in the accounting and the balance in the trading box for the next working day.

2.4 Unit Holder Trading Account Mapping Screen

This section contains the following topics:

- Section 2.4.1, "Invoking the UH Mapping Maintenance Detail Screen"

- Section 2.4.2, "Operations in this Screen"

- Section 2.4.3, "Checks and Controls"

- Section 2.4.4, "Designating Unit Holder Account as Statutory or Suspense Account"

- Section 2.4.5, "Fields in UH Mapping Maintenance Screen"

2.4.1 Invoking the UH Mapping Maintenance Detail Screen

You can use this screen to designate a unit holder account that has been set up in the system as the statutory account or the suspense account for the AMC, for the purposes of trading. When you associate an existing unit holder account in this screen as the statutory account or the suspense account, the system maps the unit holder ID and the account type and will debit or credit the unit holdings in this account with the impact of all subsequent trading transactions.

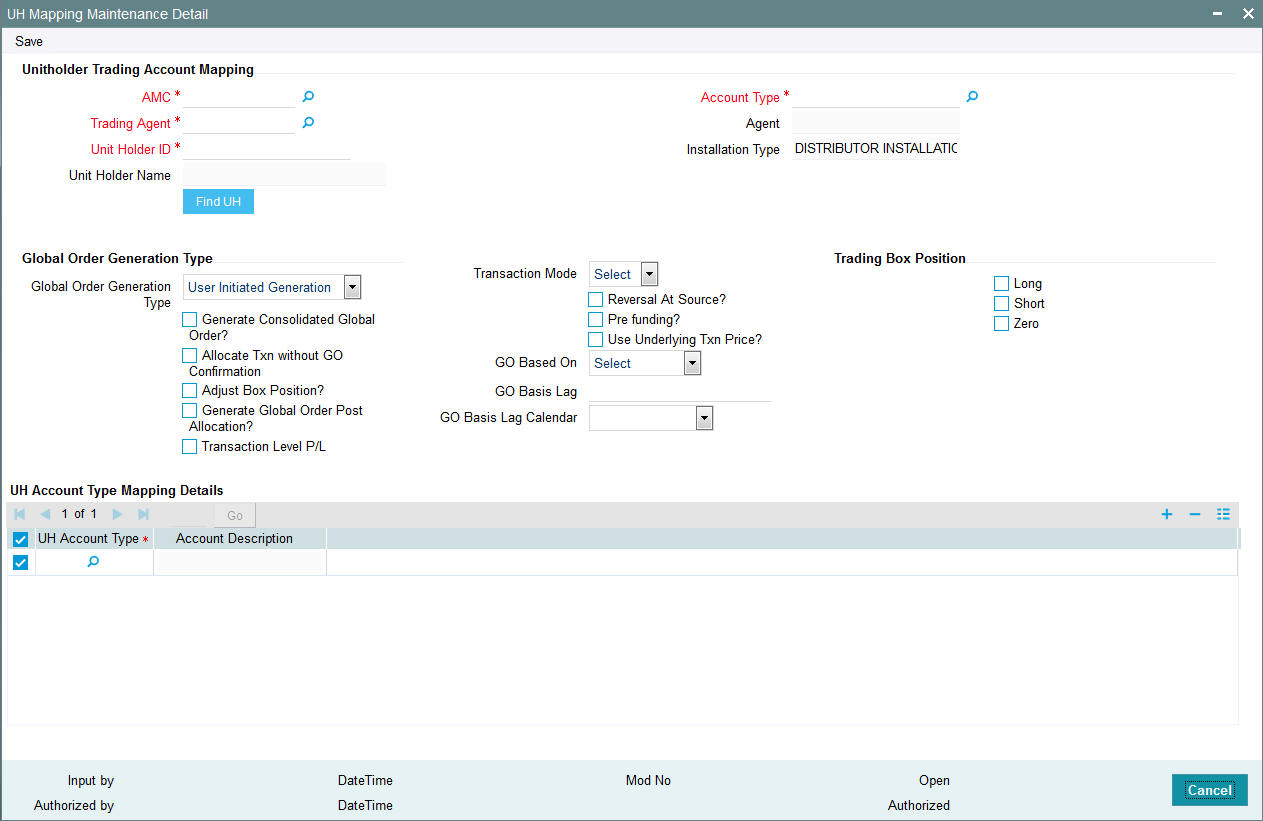

Invoke the ‘UH Mapping Maintenance Detail’ screen by typing ‘UTDUHTRD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

2.4.2 Operations in this Screen

When you have designated a unit holder account as the statutory or suspense account in this screen, you can subsequently

- Edit the mapping by changing the unit holder ID, the AMC ID or the account name.

- Delete the mapping, if necessary

You must remember that if trading has occurred after you have designated the statutory or suspense account in this screen and the trading has impacted either account, and there are holdings in either account, you cannot edit or delete the mapping in this screen.

2.4.3 Checks and Controls

- Before you designate a unit holder account as the statutory or suspense account, it is recommended that you must already have set up the desired investor as a unit holder, and subsequently authorized the unit holder account and accepted the same in the Registrar component.

- For an AMC, you can only designate one unit holder account as the statutory or suspense account.

2.4.4 Designating Unit Holder Account as Statutory or Suspense Account

To designate a unit holder account as statutory or the suspense account in this screen, specify the following details:

- AMC ID

- Account Name

- Unit Holder ID

- Click the Save button to save your specifications, or click the Cancel button to cancel your specifications and start again.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the UH Mapping Maintenance screen.

2.4.5 Fields in UH Mapping Maintenance Screen

Unit holder Trading Account Mapping

AMC

Alphanumeric, 12 Characters; Mandatory

Select the AMC for which you are designating the statutory or suspense unit holder account.

Trading Agent

Alphanumeric, 12 Characters; Mandatory

Select the trading agent from the option list.

Agent

Display

The system displays the agent name for the selected trading agent.

Account Type

Alphanumeric, 2 Characters; Mandatory

Select the account that you are designating for the AMC. It could be either a statutory account or suspense account.

Unit Holder ID

Alphanumeric, 12 Characters; Mandatory

Specify the ID of the unit holder account that you want to designate as the statutory or the suspense account, as applicable.

You can also search for unit holder ID by clicking ‘Find UH’ button. The Find Unit Holder screen is opened, and you can retrieve the required unit holder number by specifying suitable search criteria.

Unit Holder Name

Display

When you specify the ID of the unit holder account that you want to designate as the statutory or suspense account, the name of the corresponding unit holder is displayed here.

Installation Type

Display

The system displays the installation type.

Global Order Generation Type

Global Order Generation Type

Optional

Select global order generation type from the drop-down list. The list displays the following values:

- User Initiated Generation

- Generation at Cut-off Time

- Generation in EOD

- Generation in Mini-EOD

Generate Consolidated Global Order?

Optional

Check this box if consolidated global order has to be generated.

Allocate Txn without GO Confirmation

Optional

Check this box to allocate transaction without global order confirmation.

Adjust Box Position?

Optional

Check this box to adjust the box position.

Generate Global Order Post Allocation?

Optional

Check this box to generate the global order post allocation.

Transaction Level P/L

Optional

Check this box to consider transaction level P/L details.

Transaction Mode

Optional

Select the mode of transaction from the drop-down list. The list displays the following values:

- Amount

- Unit

- Both

Reversal At Source?

Optional

Check this box if transaction has to be reversed at source.

Pre funding?

Optional

Check this box if pre-funding is required.

Use Underlying Txn Price?

Optional

Check this box to use underlying transaction price.

GO Based On

Optional

Select if Global Order is based on Allocation date or input date from the drop-down list.

GO Basis Lag

Numeric; 3 Characters; Optional

Specify the global order basis lag.

GO Basis Lag Calendar

Optional

Select the type of global order basis lag calendar from the drop-down list. The list displays the following values:

- System Calendar

- Fund Calendar

- Actual Calendar

Trading Box Position

Select the appropriate trading box position by checking the following boxes:

- Long

- Short

- Zero

UH Account Type Mapping Details

UH Account Type

Alphanumeric; 2 Characters; Mandatory

Specify the UH account type. The adjoining option list displays all the valid UH account types maintained in the system. You can select the appropriate one.

Account Description

Display

Upon selection of the UH account types, the system displays the account description of the specified account.

2.5 Unit Holder Trading Account Mapping

This section contains the following topics:

- Section 2.5.1, "Invoking the Unit Holder Mapping Maintenance Summary Screen"

- Section 2.5.2, "Retrieving Record in Payment Clearing Summary Screens"

- Section 2.5.3, "Editing Transaction"

- Section 2.5.4, "Viewing Transaction"

- Section 2.5.5, "Deleting Transaction"

- Section 2.5.6, "Authorizing Transactions"

- Section 2.5.7, "Amending Transaction"

- Section 2.5.8, "Authorizing Amended Transactions"

- Section 2.5.9, "Copying Attributes of Transaction"

2.5.1 Invoking the Unit Holder Mapping Maintenance Summary Screen

After you have maintained a unit holder trading account mapping, you must have another user authorize it so that it would be effective in the system.

Before the mapping is authorized, you can edit it as many times as necessary. You can also delete a transaction before it is authorized.

After authorization, you can only make changes to a mapping through an amendment.

The ‘Unit Holder Mapping Maintenance Summary’ screen can be used for the following operations on mappings:

- Retrieval for viewing

- Editing unauthorized mappings

- Deleting unauthorized mappings

- Authorizing mappings

- Amending authorized mappings

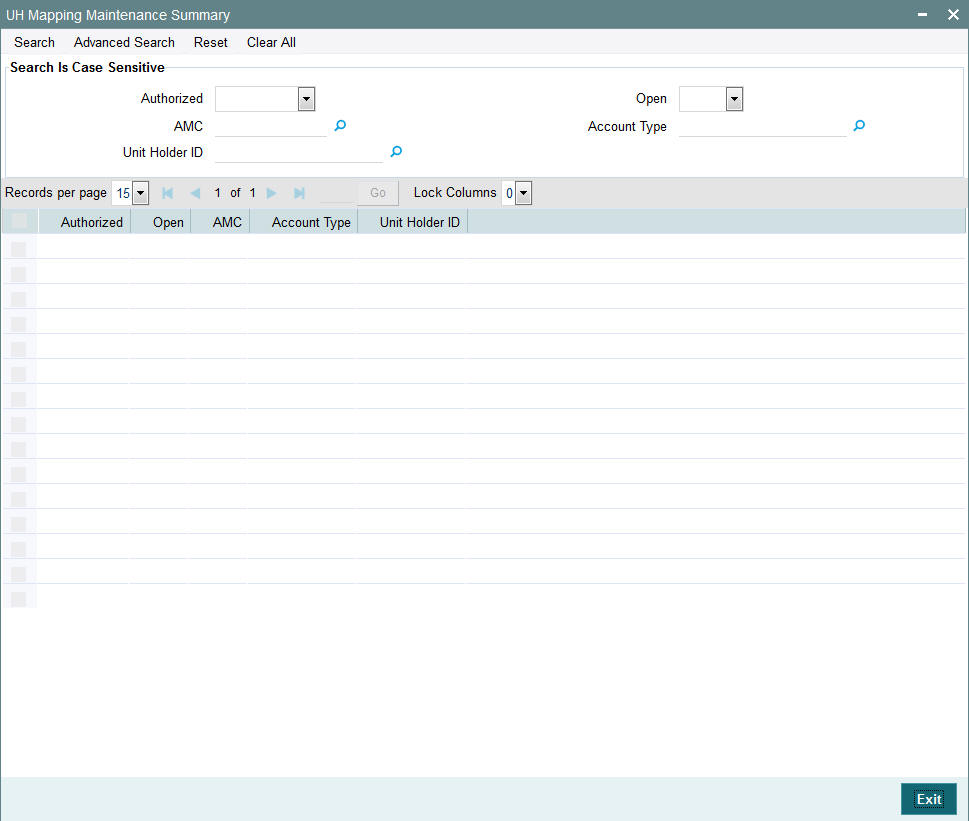

You can invoke the ‘Unit Holder Mapping Maintenance Summary’ screen by typing ‘UTSUHTRD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

2.5.2 Retrieving Record in Payment Clearing Summary Screens

You can retrieve a previously entered record in the UH Mapping Summary screen, as follows:

- In the browser, select Trading menu and click on UH Mapping Summary,

specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the “Blank Space” option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the “Blank Space” option, then all the record are retrieved.

- The AMC, in the AMC field.

- The type of account, in the Account Type field.

- The ID of unit holder, in the Unit Holder ID field.

- After you have specified the required details, click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by doing query in the following manner:-

- Press F7

- Input the Unit Holder ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting from the Action list.

You can also search the record using a combination of % and alphanumeric value.

For example

You can search the record for Unit Holder ID by using the combination of % and alphanumeric value as follows:-

- Search by A%: The system will fetch all the records whose Unit Holder ID starts from Alphabet ‘A’. Ex: AGC17, AGVO6, AGC74 and so forth.

- Search by %7: The system will fetch all the records whose Unit Holder ID ends by numeric value’ 7’. Ex: AGC17, GSD267, AGC77 and so forth.

- Search by %17%: The system will fetch all the records whose Unit Holder ID contains the numeric value 17. Ex: GSD217, GSD172, AGC17 and so forth.

2.5.3 Editing Transaction

You can modify the details of a transaction that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the UH Mapping screen from the Browser.

- Select the status of the transaction that you want to retrieve for modification in the Authorization Status field. You can only modify records of transactions that are unauthorized. Accordingly, choose the unauthorized option from the drop down list.

- Specify any or all of the details of the transaction in the corresponding fields on the screen to retrieve the transaction that is to be modified. All unauthorized transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed transactions. The UH Mapping Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information

- Click Save to save your changes. The UH Mapping Detail screen is closed and the changes made are reflected in the UH Mapping Summary screen.

2.5.4 Viewing Transaction

To view a transaction that you have previously entered, you must retrieve the same in the UH Mapping Summary screen, as follows:

- Invoke the UH Mapping Summary Screen from the Browser.

- Select the status of the transaction that you want to retrieve for viewing in the Authorization Status field. You can also view all transactions that are either unauthorized or authorized only, by choosing the Unauthorized / Authorized option.

- Specify any or all of the details of the transaction in the corresponding fields on the screen, and click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you want to view in the list of displayed transactions, in the lower portion of the screen. The UH Mapping Detail screen is opened in view mode.

2.5.5 Deleting Transaction

You can delete only unauthorized transactions in the system.

To delete a transaction that you have previously entered, you must retrieve the same in the UH Mapping Summary screen, as follows:

- Invoke the UH Mapping Summary screen from the browser.

- Select the status of the transaction that you want to retrieve for deletion.

- Specify any or all of the details of the transaction in the corresponding fields on the screen, and click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you want to delete in the list of displayed transactions, in the lower portion of the screen. The UH Mapping Detail screen is opened in view mode.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

2.5.6 Authorizing Transactions

An unauthorized transaction must be authorized in the system for it to be processed.

To authorize a transaction, you must first retrieve the same in the UH Mapping Summary screen.

- Invoke the UH Mapping Summary screen from the Browser.

- Select the status of the transaction that you want to retrieve for authorization. Typically, choose the unauthorized option from the drop down list.

- Specify any or all of the details of the transaction in the corresponding fields on the screen. Click ‘Search’ button. All transactions with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you wish to authorize. The UH Mapping screen is opened in view mode.

- Select Authorize operation from Action list.

When the checker authorizes a transaction, details of validations, if any, that were overridden by the maker of the transaction during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the transaction.

2.5.7 Amending Transaction

After a transaction is authorized, it can be modified using the Unlock operation from Action list. To make changes to a transaction after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the UH Mapping Summary screen from the Browser.

- Select the status of the transaction that you wish to retrieve for amendment. You can only amend records of transactions that are authorized.

- Specify any or all of the details of the transaction in the corresponding fields on the screen. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you want to amend. The Transaction screen will be displayed in Amendment mode. Click the Unlock operation from the Action list to amend the transaction.

- Amend the necessary information. Click the Save button to save your changes.

2.5.8 Authorizing Amended Transactions

An amended transaction must be authorized for the amendment to be made effective in the system. Authorization of amended transactions can be done from Fund Manager Module and Agency branch Module.

2.5.9 Copying Attributes of Transaction

If you want to create a new transaction having the same attributes of an existing transaction, you can copy the attributes of the existing transaction to the new transaction.

To copy the attributes of an existing transaction to a new transaction:

- Retrieve the transaction whose attributes the new transaction should inherit. You can retrieve the transaction through the UH Mapping Summary screen or through the F7-F8 operation which are explained in the previous section.

- In the UH Mapping Detail screen, click on ‘Copy’ Action.

- Indicate the ID for the new transaction. You can however change the details of the new transactions if required.

As mentioned earlier, if the designated account has been impacted by subsequent trading, and has holdings, then you cannot edit or delete the mapping in this screen.

2.6 Trading Transaction Maintenance

This section contains the following topics:

- Section 2.6.1, "Invoking the Trading Transaction Maintenance Screen"

- Section 2.6.2, "Checks and Controls"

2.6.1 Invoking the Trading Transaction Maintenance Screen

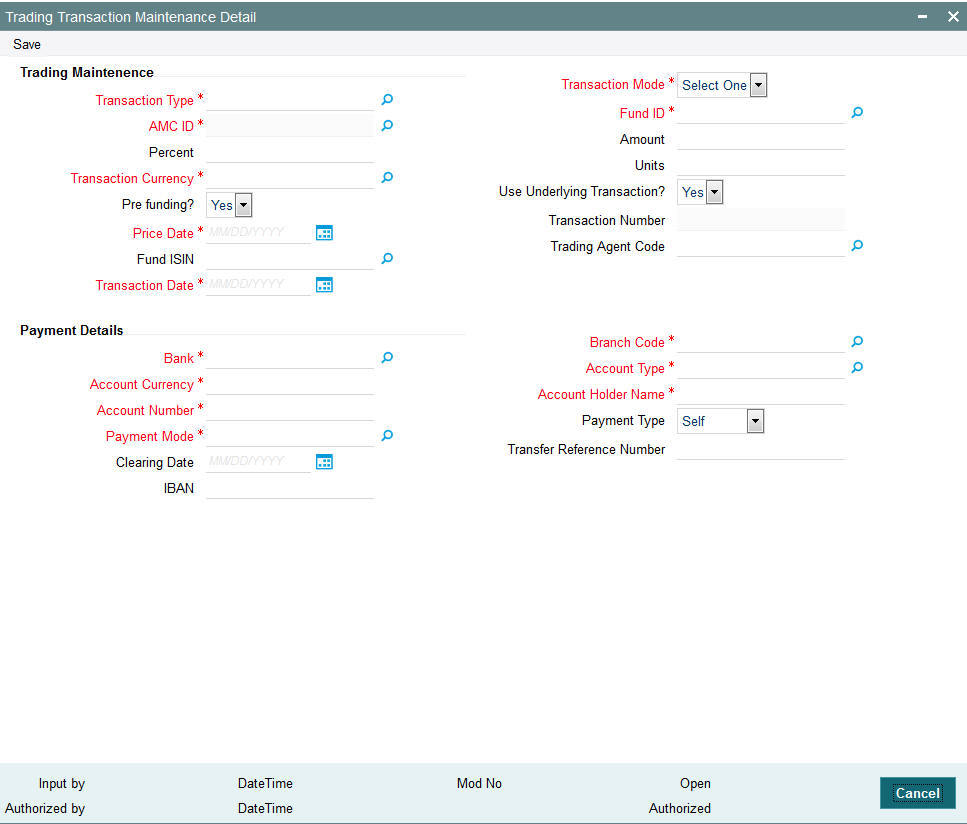

You can use this screen to initiate any of the trading transactions in the system. You can invoke the ‘Trading Transaction Maintenance’ screen by typing ‘UTDTRDTX’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

2.6.2 Checks and Controls

Before initiating trading transactions in this screen, it is recommended that you must already have

- Identified and marked the funds for which the trading functions must be allowed. When you set up the General Operating Rules for each fund in the General Operating Rules screen, you must check the Maintain Trading Box field. This indicates to the system that trading functions are allowable for the fund. Subsequently, all the fund rules pertaining to the fund must be authorized

- You can only initiate trading transactions in this screen for all such funds for which the trading functions are allowable.

- Set up the unit holders that are to be linked to the statutory and the suspense account for the AMC in the system, authorized them and accepted the information in the Registrar component.

- Linked the unit holders that you have set up to the desired account type, statutory or suspense account, using the Account Unit Holder Information screen.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the Trading Transaction Maintenance screen.

You can specify the following fields in this screen:

Trading Maintenance

Transaction Type

Alphanumeric; 2 Characters; Mandatory

Select the type of trading transaction that you are initiating through this screen.

Transaction Mode

Mandatory

Select the mode in which the volume of the transaction must be reckoned and the transaction put through from the drop-down list. The list displays the following values:

- Amount: The volume of the transaction is specified in terms of an amount. Select this mode for creation and liquidation transactions. It is not allowable for the management transfer transactions.

- Units: The volume of the transaction is specified in terms of the number of units requested. Select this mode for liquidation transactions and the management transfer transactions. It is not allowable for creation transactions.

- Percentage: The volume of the transaction is specified as a specific percentage of the holdings already held in the specified fund in the trading box. Select this mode, if applicable, only for liquidation transactions. It is not allowable for any other transaction types.

When you select the transaction mode in this field, you must specify the actual volume of the transaction in the selected mode in the Amount, Units or Percentage field, as applicable.

AMC ID

Alphanumeric; 12 Characters; Mandatory

Select the ID of the AMC that is initiating the trading transaction from the option list.

Fund ID

Alphanumeric; 6 Characters; Mandatory

Select the ID of the fund in which the AMC is desirous of initiating the trading transaction, from the drop down list. When you specify the ID of the fund, the ISIN Code of the fund is displayed in the ISIN Code field.

Percent

Numeric; 5 Characters; Mandatory if the selected Transaction Mode is “Percentage”

Indicate the percentage of the holdings of the investor that is to be deemed as the volume of this transaction.

Units

Numeric; 27 Characters; Mandatory if the selected Transaction Mode is “Units”

Indicate the number of units requested in the transaction.

Amount

Numeric; 27 Characters; Mandatory if the selected Transaction Mode is “Amount”

Indicate the amount involved in the transaction.

Transaction Currency

Alphanumeric; 3 Characters; Mandatory

Select the currency in which the transactions will be initiated. When you select a fund in the Fund Name field, the fund transaction currencies that are allowable for transactions into the selected fund are displayed in the drop down list in this field, from the Fund Transaction Currency fund rule record that has been maintained for the selected fund.

Pre funding?

Optional

Select ‘Yes’ or ‘No’ from the drop-down list to specify whether pre-funding is required or not for UH Mapping. The list displays the following values:

- Yes

- No

Use Underlying Transaction?

Optional

Select ‘Yes’ or ‘No’ from the drop-down list to specify whether underlying transaction can be used for UH Mapping or not.

Price Date

Date format; Mandatory

Indicate the date on which the desired price that is to be reckoned for allocation of the transaction was prevalent. You can specify a past date, but not a future date. If you specify a past date, it must be a date on which the desired authorized fund price was prevalent.

Transaction Number

Display

The system displays the transaction number.

FUND ISIN

Alphanumeric; 12 Characters; Optional

Select the ISIN Code of the selected fund. If you specify the ISIN Code of a fund, the ID of the fund is displayed in the Fund field.

Trading Agent Code

Alphanumeric; 12 Characters; Optional

Select the trading agent code from the option list.

Transaction Date)

Date Format; Mandatory

Select the date on which the transaction is initiated into the system from the adjoining calendar.

You can only initiate trading transactions on the application date, and you cannot initiate trading transactions on a future date or a past date.

Payment Details

Bank

Alphanumeric; 12 Characters; Mandatory

Specify the bank name of the customer.

Branch Code

Alphanumeric; 12 Characters; Mandatory

Specify the branch code of the customer.

Account Currency

Alphanumeric; 3 Characters; Mandatory

Specify the account currency code used by the customer.

Account Type

Alphanumeric; 1 Character; Mandatory

Specify the account type.

Account Number

Alphanumeric; 16 Characters; Mandatory

Specify the account number of the customer.

Account Holder Name

Alphanumeric; 100 Characters; Mandatory

Specify the account holder name.

Payment Mode

Alphanumeric; 1 Character; Mandatory

Specify the mode of payment.

Payment Type

Optional

Select the type of payment from the drop-down list. The list displays the following values:

- Self

- Third Party

Clearing Date

Date Format; Optional

Select the clearing date from the adjoining calendar.

Transfer Reference Number

Alphanumeric; 20 Characters; Optional

Specify the transfer reference number.

IBAN

Alphanumeric; 40 Characters; Optional

Specify the IBAN (International Bank Account Number) of the account holder.

By default, the price date is reckoned to be the application date. In such a case, the prevalent price as on the application date need not be available at the time of initiating the trading transaction in this screen, but it must be available when the authorization of the trading transaction is done.

2.7 Trading Maintenance Summary

This section contains the following topics:

- Section 2.7.1, "Invoking the Trading Maintenance Summary Screen"

- Section 2.7.2, "Retrieving Transaction "

- Section 2.7.3, "Editing Transaction"

- Section 2.7.4, "Viewing Transaction"

- Section 2.7.5, "Deleting Transaction"

- Section 2.7.6, "Authorizing Transactions"

- Section 2.7.6, "Authorizing Transactions"

- Section 2.7.8, "Authorizing Amended Transactions"

2.7.1 Invoking the Trading Maintenance Summary Screen

After you have initiated a trading transaction, you must have another user authorize it so that it would be effective in the system.

Before the transaction is authorized, you can edit it as many times as necessary. You can also delete a transaction before it is authorized.

After authorization, you can only make changes to a transaction through an amendment.

The ‘Trading Transaction Maintenance Summary’ screen can be used for the following operations on transactions:

- Retrieval for viewing

- Editing unauthorized transactions

- Deleting unauthorized transactions

- Authorizing transactions

- Amending authorized transactions

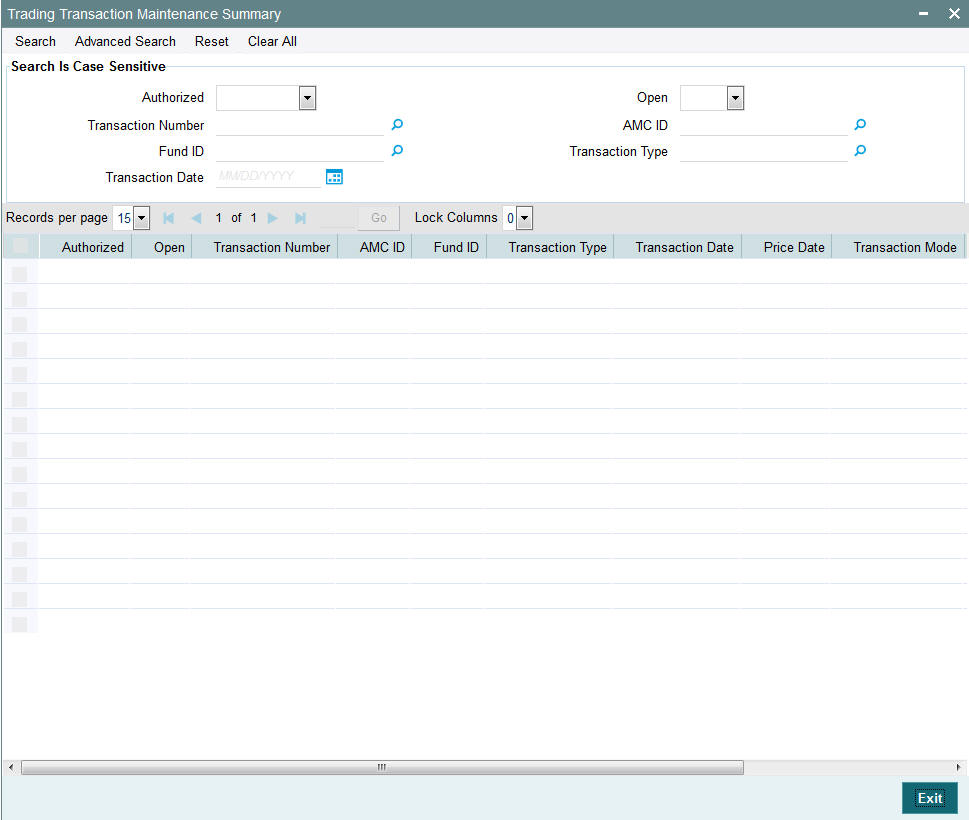

Invoke the ‘Trading Transaction Maintenance Summary’ screen by typing ‘UTSTRDTX’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

2.7.2 Retrieving Transaction

You can retrieve a previously entered transaction in the Trading Transaction Maintenance Summary screen, as follows:

- In the browser, select Trading screen and click on Trading Transaction

Maintenance Summary, specify any or all of the following details in

the corresponding fields:

- The status of the transaction in the Authorized field. If you choose the “Blank Space” option, then all the transactions are retrieved.

- The status of the Transaction in the Open field. If you choose the “Blank Space” option, then all the transactions are retrieved.

- The number of the transaction, in the Transaction Number field.

- The ID of AMC, in the AMC ID field.

- The ID of the fund, in the Fund ID field.

- The type of transaction, in the Transaction Type field.

- The date of transaction, in the Transaction Date field.

After you have specified the required details, click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual transaction detail from the detail screen by doing query in the following manner:-

- Press F7

- Input the Fund ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

For example

You can search the record for Fund Id by using the combination of % and alphanumeric value as follows:-

- Search by A%: The system will fetch all the records whose Fund Id starts from Alphabet ‘A’. Ex: AGC17, AGVO6, AGC74 and so forth.

- Search by %7: The system will fetch all the records whose Fund Id ends by numeric value’ 7’. Ex: AGC17, GSD267, AGC77 and so forth.

- Search by %17%: The system will fetch all the records whose Fund Id contains the numeric value 17. Ex: GSD217, GSD172, AGC17 and so forth.

2.7.3 Editing Transaction

You can modify the details of a transaction that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Trading Transaction Maintenance Summary screen from the Browser.

- Select the status of the transaction that you want to retrieve for modification in the Authorization Status field. You can only modify records of transactions that are unauthorized. Accordingly, choose the unauthorized option from the drop down list.

- Specify any or all of the details of the transaction in the corresponding fields on the screen to retrieve the transaction that is to be modified. All unauthorized transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you want to modify in the list of displayed transactions. The Transaction Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information

- Click Save to save your changes. The Trading Transaction Maintenance Detail screen is closed and the changes made are reflected in the Trading Transaction Maintenance Summary screen.

2.7.4 Viewing Transaction

To view a transaction that you have previously entered, you must retrieve the same in the Trading Transaction Maintenance Summary screen, as follows:

- Invoke the Trading Transaction Maintenance Screen from the Browser.

- Select the status of the transaction that you want to retrieve for viewing in the Authorization Status field. You can also view all transactions that are either unauthorized or authorized only, by choosing the Unauthorized / Authorized option.

- Specify any or all of the details of the transaction in the corresponding fields on the screen, and click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you want to view in the list of displayed transactions, in the lower portion of the screen. The Trading Transaction Maintenance Detail screen is opened in view mode.

2.7.5 Deleting Transaction

You can delete only unauthorized transactions in the system.

To delete a transaction that you have previously entered, you must retrieve the same in the Trading Transaction Maintenance Summary screen, as follows:

- Invoke the Trading Transaction Maintenance Summary screen from the browser.

- Select the status of the transaction that you want to retrieve for deletion.

- Specify any or all of the details of the transaction in the corresponding fields on the screen, and click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you want to delete in the list of displayed transactions, in the lower portion of the screen. The Trading Transaction Maintenance Detail screen is opened in view mode.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

2.7.6 Authorizing Transactions

An unauthorized transaction must be authorized in the system for it to be processed.

To authorize a transaction, you must first retrieve the same in the Trading Transaction Maintenance Summary screen.

- Invoke the Trading Transaction Maintenance Summary screen from the Browser.

- Select the status of the transaction that you want to retrieve for authorization. Typically, choose the unauthorized option from the drop down list.

- Specify any or all of the details of the transaction in the corresponding fields on the screen. Click ‘Search’ button. All transactions with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you wish to authorize. The Trading Transaction Maintenance screen is opened in view mode.

- Select Authorize operation from Action list.

When the checker authorizes a transaction, details of validations, if any, that were overridden by the maker of the transaction during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the transaction.

2.7.7 Amending Transaction

After a record is authorized, it can be modified using the Unlock operation from Action list. To make changes to a record after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the Trading Transaction Maintenance Summary screen from the Browser.

- Select the status of the record that you wish to retrieve for amendment. You can only amend records of transactions that are authorized.

- Specify any or all of the details of the record in the corresponding fields on the screen. All record with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to amend. The Trading Transaction Maintenance screen will be displayed in Amendment mode. Click the Unlock operation from the Action list to amend the record.

- Amend the necessary information. Click the Save button to save your changes.

2.7.8 Authorizing Amended Transactions

An amended transaction must be authorized for the amendment to be made effective in the system. Authorization of amended transactions can be done from Fund Manager Module and Agency branch Module.

2.7.8.1 Checks and Controls

Before you authorize a trading transaction, you must already have entered the fund prices for that business day and authorized the same.

To authorize a trading transaction in this screen,

- Select ‘Authorize’ in the Operation field

- Select the type of transaction that you must authorize, in the Transaction Type field.

- When you select the transaction type, the system retrieves all transactions

of the selected type that are pending authorization, and displays the

details in the lower grid portion of the screen. The following details

are displayed for each transaction:

- The number of the transaction, the date of the transaction and the mode of the transaction.

- The ID and ISIN Code of the fund in which the transaction was initiated.

- The ID of the user that has entered the transaction into the system, and the date on which this was done (in the Maker ID and Maker Date fields)

- The authorization status of the transaction is displayed as U, indicating that it is an unauthorized transaction.

- Highlight the row of the retrieved unauthorized transaction that you must authorize in the lower grid portion of the screen.

- Specify the volume of the transaction in the Amount, Units or Percentage fields, according to the mode of the transaction.

- In the Operation field, mark the transaction either for authorization by selecting “A”, or rejection, by selecting “R”.

- Similarly mark as many transactions for authorization or rejection by repeating steps 3 – 5.

- When you have finished, choose the Save option to save your changes. The transactions are now authorized.