5. Processing Transactions - II

This chapter contains the following sections:

- Section 5.1, "Mandatory Information for All Transaction Types"

- Section 5.2, "Unit Holder Balances Summary"

- Section 5.3, "Contract Notes for Transactions"

- Section 5.4, "Entering Payment Details for Transactions"

- Section 5.5, "Enrich Exchange Rate Detail"

- Section 5.6, "Payment Clearing Detail"

- Section 5.7, "Transaction Load Override"

- Section 5.8, "Transaction Load Override Summary"

- Section 5.9, "Global Order"

- Section 5.10, "GO Maintenance Summary"

- Section 5.11, "Global Order Confirmation Detail"

- Section 5.12, "Global Order Confirmation Summary"

- Section 5.13, "GO Reconciliation Details"

- Section 5.14, "GO Reconciliation Summary"

- Section 5.15, "Global Order Settlement Details"

- Section 5.16, "Global Order Settlement Summary"

- Section 5.17, "Global Order Status"

- Section 5.18, "Global Order Generation"

- Section 5.19, "Trading Transaction or Global Order Restriction Mapping"

- Section 5.20, "Trading Transaction or Global Order Restriction Mapping Summary"

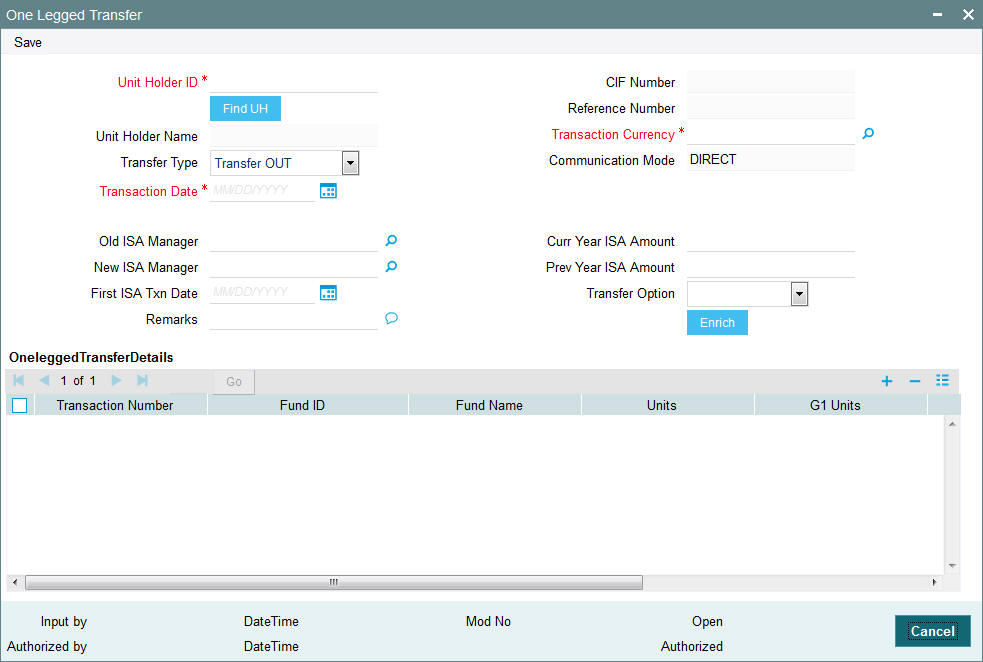

- Section 5.21, "ISA Transfer"

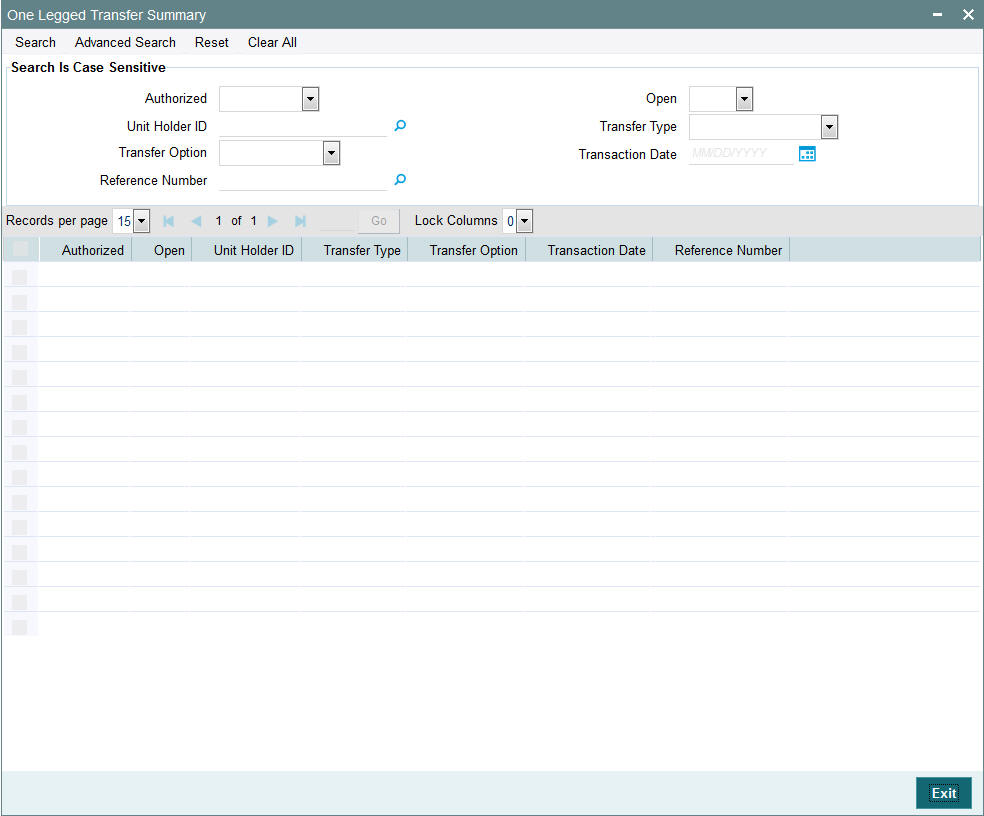

- Section 5.22, "One Legged Transfer Summary"

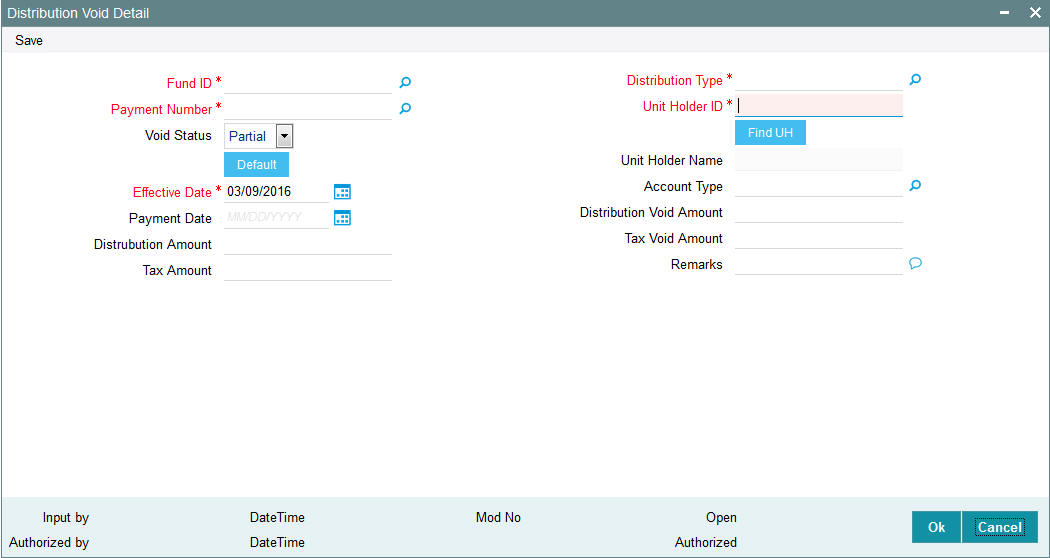

- Section 5.23, "Distribution Void Detail"

- Section 5.24, "Distribution Void Summary"

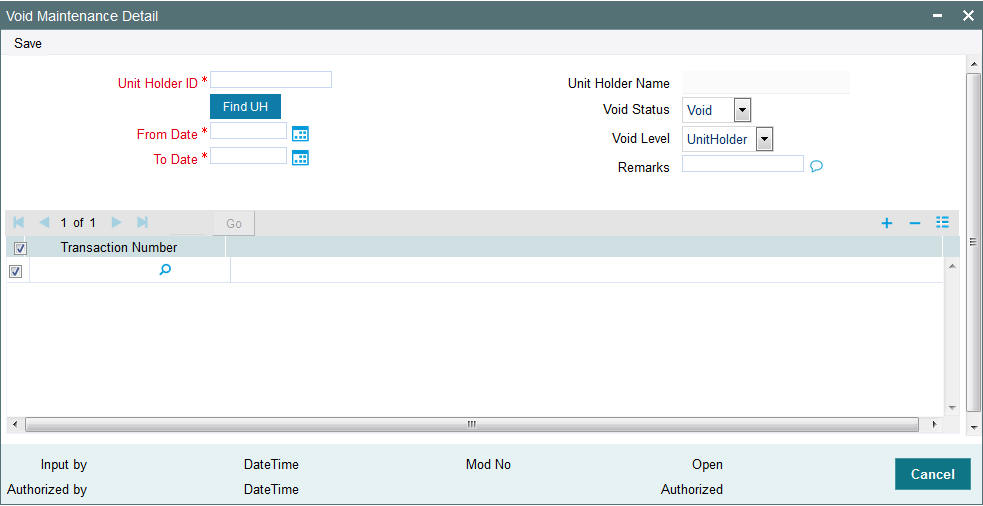

- Section 5.25, "Void Maintenance Detail"

- Section 5.26, "Void Maintenance Summary"

- Section 5.27, "Intra-day Checks for Transactions"

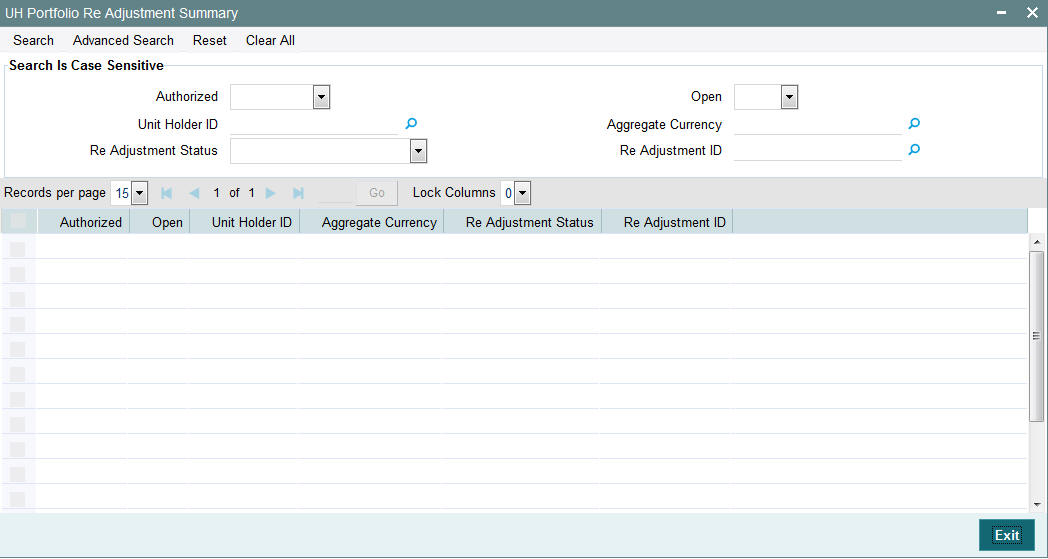

- Section 5.28, "UH Portfolio Readjustment Details"

- Section 5.29, "UH Portfolio Readjustment Summary"

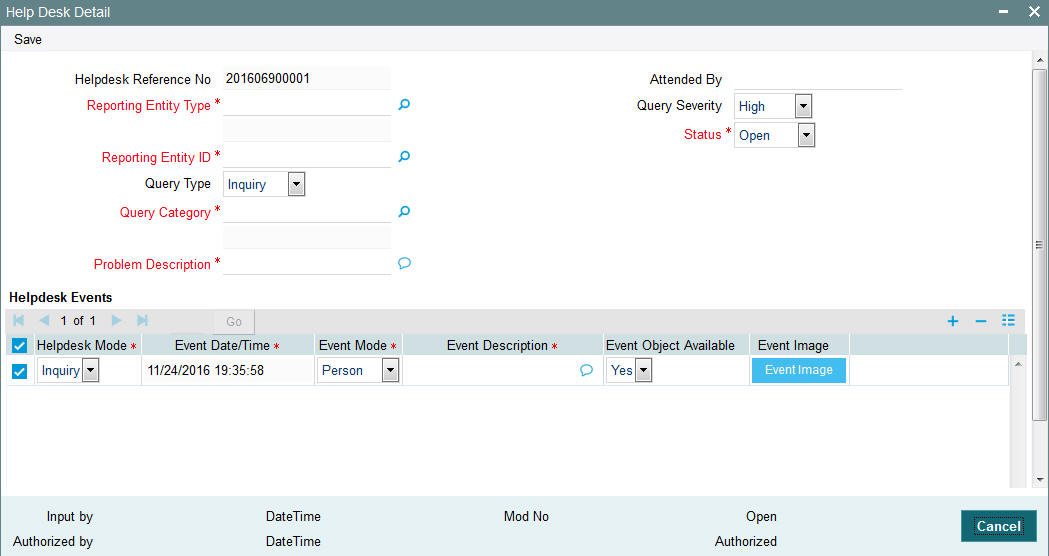

- Section 5.30, "Help Desk Facility"

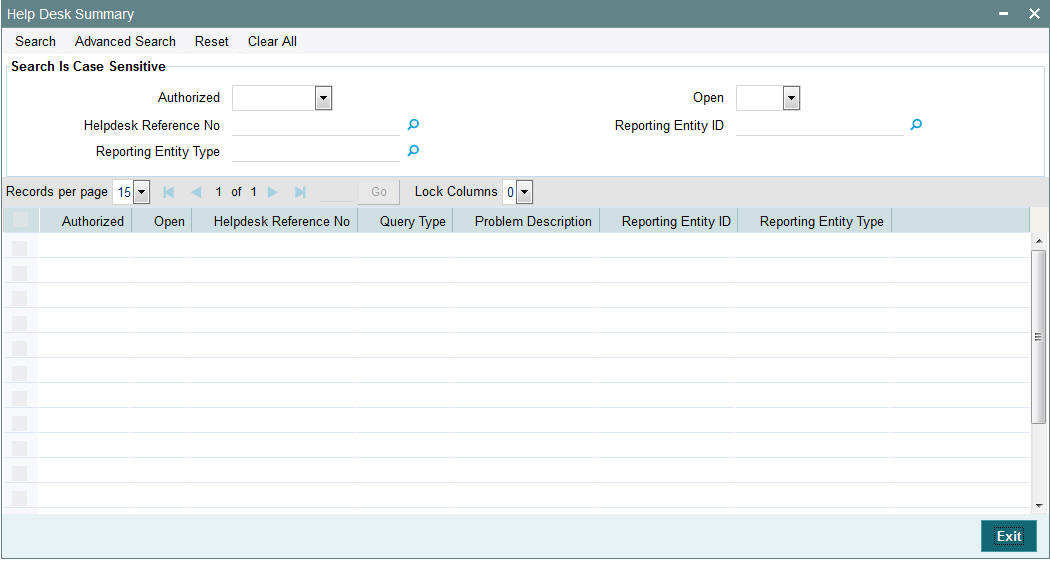

- Section 5.31, "Help Desk Summary"

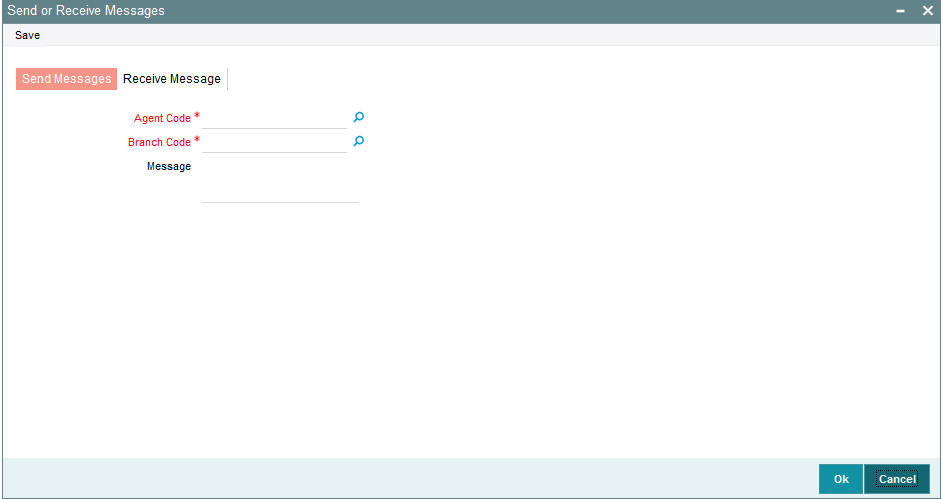

- Section 5.32, "Sending and Receiving Messages"

- Section 5.33, "RTA Transfer Details"

- Section 5.34, "RTA Transfer Summary"

- Section 5.35, "Consolidation of Portfolios"

- Section 5.36, "Batch Update of Transaction Date"

- Section 5.37, "Tracking Cheques"

- Section 5.38, "Cheque Tracking Summary Screen"

- Section 5.39, "Special Discount Maintenance"

- Section 5.40, "Special Discount Summary"

- Section 5.41, "Disable Auto Switch"

- Section 5.42, "Disable Auto Switch Summary Screen"

- Section 5.43, "Block Allowed Transaction Ref Types"

- Section 5.44, "Block Allowed Transaction Ref Types Summary"

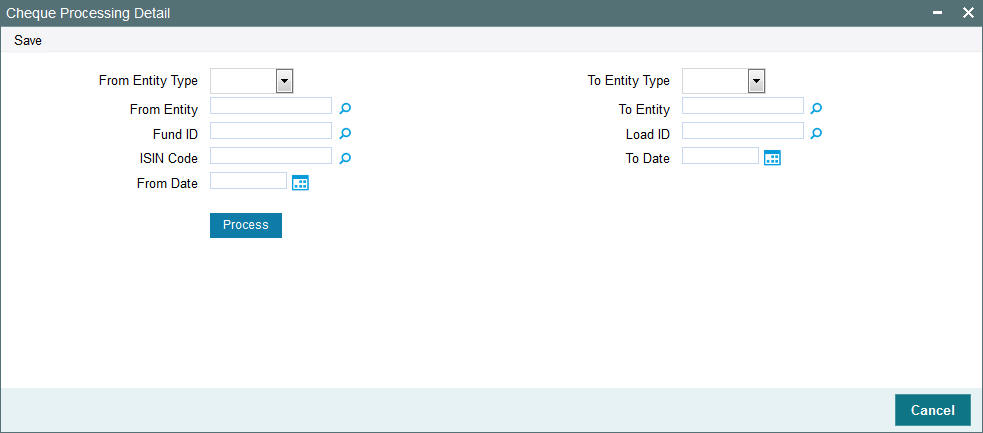

- Section 5.45, "Cheque Processing Detail Screen"

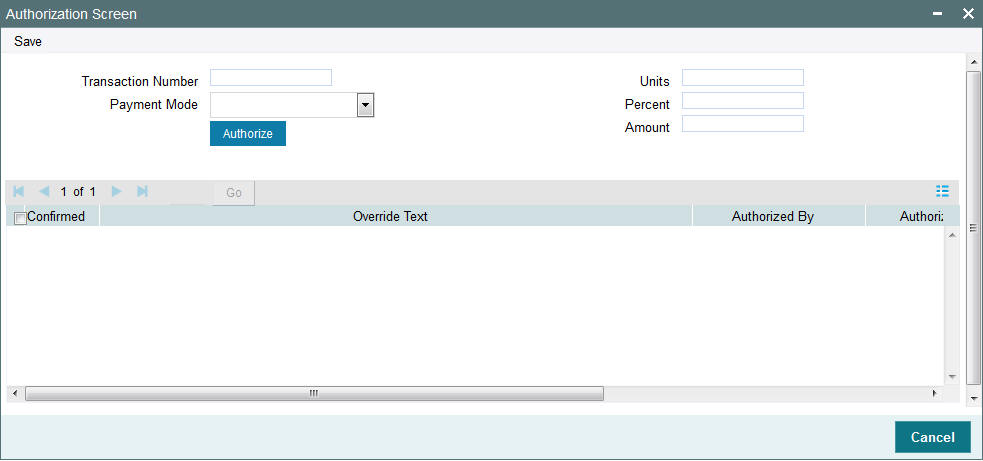

- Section 5.46, "Authorization Screen"

5.1 Mandatory Information for All Transaction Types

The transactions input detailed screen consists of the following sections:

- Client Information

- Transaction Information

- Broker Details

- Payment Details

- Fee Details

- Certificate Details

- Load Override Details

- Allocation Details

- Document Details

The mandatory information you need to supply before saving the transaction is given below as under each section. This is applicable to all transaction types:

Client Information Section

- The CIF Number for the investor, or, if this is not known, the investor number (or Unit Holder ID) in the Investor field.

- The Unit Holder ID for non-CIF investors.

Transaction Information Section

- The date of the transaction, in the Transaction Date field. If you are entering a backdated transaction, the date must be within the backdating limits specified for the fund in the Transaction Processing Rules.

- The fund in which the transaction was requested, in the Fund field. You must also specify the ISIN Code of the fund, in the ISIN Code field.

- The desired mode for the transaction, in the Transaction Mode field.

- The currency for the transaction, in the Transaction Currency field.

- The volume of the transaction, in terms of the selected transaction mode, in the Transaction Value field.

- The mode of communication that was used to request the transaction, in the Communication Mode field.

- The desired mode of payment for the transaction, in the Payment Mode field, for IPO, subscription and redemption transactions.

- Whether the applicable exchange rate that is prevalent at the time of transaction entry, must be overridden, in the Override Exchange Rate? field.

- Whether the transaction is to be initiated by gross amount / units, or net amount, in the Gross / Net field, for IPO, subscription and redemption transactions.

- The exchange rate source to be used, in the Exchange Rate Source field.

- Whether the transaction is an LOI transaction, in the LOI Transaction field.

- The maturity date for the transaction, if any, in the Maturity Date field.

- Whether the fee for the transaction is to be overridden, in the Override Fee field.

- The Price Basis for the transaction

Payment Details Section

- For redemption transactions, all the details in the Payment Details section.

- For IPO and subscription transactions, the payment type in the Payment Type field.

Fee Payment Details Section

- If fees are applicable, then all the details of fee payment, in the Fee Payment Details section.

Certificate Details Section

- The certificate numbers for certificate based transactions.

5.2 Unit Holder Balances Summary

This section contains the following topic:

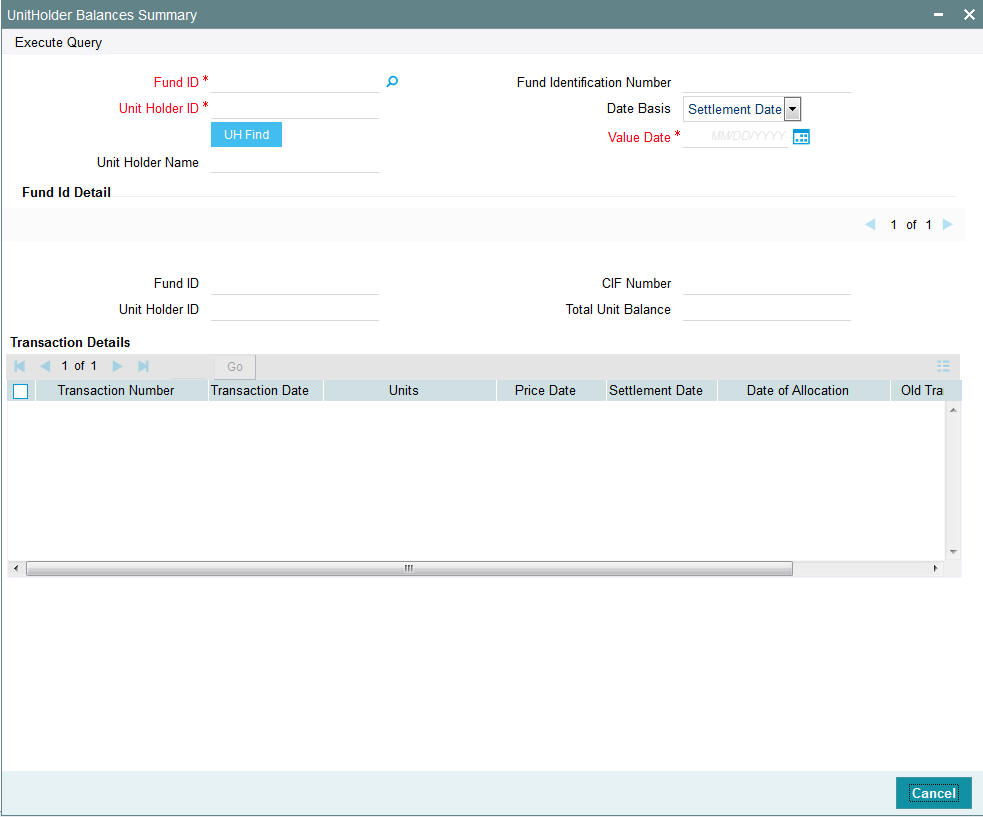

5.2.1 Invoking Unit Holder Balances Summary Screen

In the ‘UnitHolder Balances Summary’ screen, you can query the database to obtain fund-wise balances of unit holders, as of a price date or settlement date. You can invoke this screen by typing ‘UTDUHBAL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

As of a price date or a settlement date, you can view the balances for:

- A specific unit holder in all funds. You must provide the ID of the required unit holder in this case. This is a mandatory field.

- A specific unit holder in a specific fund. You must provide the IDs of both the required fund as well as the unit holder, in this case.

- All unit holders in a specific fund. You must provide the ID of the required fund in this case.

To obtain the required balances for viewing in this screen, you must specify the following information that would be used as search criteria:

Fund ID

Alphanumeric; 6 Characters; Mandatory

Specify the ID of the fund for which you require to view the unit holder balances. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

Fund Identification Number

Display

The system displays the fund identification number.

Unit Holder ID

Alphanumeric; 12 Characters; Mandatory

Specify the ID of the unit holder for which you wish to view fund-wise balances as of the indicated date. You can also query for unit holder ID by clicking on ‘UH Find’ button.

Unit Holder Name

Display

The system displays the name of the selected unit holder ID.

Date Basis

Optional

Select whether you wish to view the balances as of a price date or a settlement date from the drop-down list. The list displays the following values:

- Settlement Date

- Price Date

Value Date

Date Format; Mandatory

Select the value date from the adjoining calendar.

The following details are displayed in the Fund ID Detail portion of the Unit Holder Balances screen:

- ID of the fund for which the unit holder balances are displayed

- CIF of the unit holder whose balances are displayed

- ID of the unit holder

- Total Unit balance of the unit holder in the fund, as of the indicated date

You can view a transaction-wise breakup details for the unit balance, in the Transaction Details section:

- Transaction Number

- Transaction Date

- Units

- Price Date

- Settlement Date

- Date of Allocation

- Old Transaction Number

5.3 Contract Notes for Transactions

Confirmation reports (contract notes) for transactions allocated on a business day may be obtained by printing them through the Confirmation Reports menu item in the Queries menu. You can print the notes as often as required through the Confirmation Reports menu.

The End of Day processes on a given business day also execute an EOD job that prints contract notes in respect of transactions allocated on a given business day. The job checks to see if the contract notes have already been printed from the menu. If so, duplicates will be printed only if the ‘Duplicates Required’ option in the task parameters static information for the job has been enabled and set to ‘Yes’. If the Duplicates Required option has been set to ‘No’, duplicate contract notes are not printed by the EOD job. The Duplicates Required option is configured by the implementers at your installation, according to your requirement in respect of printing of duplicate contract notes.

If the contract notes have not been printed through the Confirmation Reports menu, the EOD job prints the contract notes.

Also, if allowed, as explained above, the EOD job prints transaction contract notes for transactions involving only those unit holders for whom the ‘File’ option has not been set as the preferred mailing mode in the unit holder account details. For transactions involving any unit holders for which the ‘File’ option has been set in the account details, the EOD job suppresses the printing of contract notes.

5.4 Entering Payment Details for Transactions

This section contains the following topics:

- Section 5.4.1, "Payment Incomplete Transactions"

- Section 5.4.2, "Gross Basis and Net Basis Transactions"

5.4.1 Payment Incomplete Transactions

When you enter a transaction request from an investor into the system (in the Transaction Details screens), you can save the transaction without entering any details of payment, in either of the following cases:

- For instance, in the case of a gross basis transaction, you would capture the mode of payment as mandatory information, but the investor need not actually furnish details of any payment instrument at the time of transaction entry.

- In the case of net basis transactions, you would not capture any payment details, as the actual amount of the transaction is not known at the time of transaction entry.

Whenever you do not enter the payment details, the transaction is saved as a payment incomplete transaction.

Further, a payment incomplete transaction can be authorized, and the payment details “completed” or entered subsequently, after authorization.

5.4.2 Gross Basis and Net Basis Transactions

An investor may request either a gross basis or a net basis for processing a transaction, at the time when you enter the request into the system.

5.5 Enrich Exchange Rate Detail

This section contains the following topics:

- Section 5.5.1, "Exchange Rate Enrichment for Exchange Rate Incomplete Transactions"

- Section 5.5.2, "Invoking Enrich Exchange Rate Detail"

- Section 5.5.3, "Performing Bulk Update of Exchange Rate"

- Section 5.5.4, "Authorizing Exchange Rate Enrichments"

5.5.1 Exchange Rate Enrichment for Exchange Rate Incomplete Transactions

When you enter a transaction request from an investor into the system (in the Transaction Details screens), you can save the transaction without specifying an exchange rate, in cases where the exchange rate for the source selected for the transaction has not been uploaded or is unavailable.

Whenever you do not enter the exchange rate, the transaction is saved as an exchange rate-incomplete transaction.

Further, an exchange rate incomplete transaction can be authorized, and the exchange rate “completed” or entered subsequently, after authorization.

Transaction Enrichment

The process of entering the exchange rate for an exchange rate incomplete transaction is known as Exchange Rate Enrichment.

Why must enrichment be performed?

A transaction can only be picked up by the End of Day process for allocation of units only if it is authorized and all necessary details are present in the transaction record. If the exchange rate is not available, the equivalent transaction amount in fund base currency cannot be computed. In the event of the transaction being authorized before the exchange rate details are specified, it must be made “exchange rate-complete” before it can be picked up subsequently for allocation.

When to perform enrichment?

Exchange rate enrichment must be performed as a mandatory procedure before an exchange rate incomplete transaction is allocated.

Exchange rate enrichment must also be performed for authorized transactions generated due to a standing instruction.

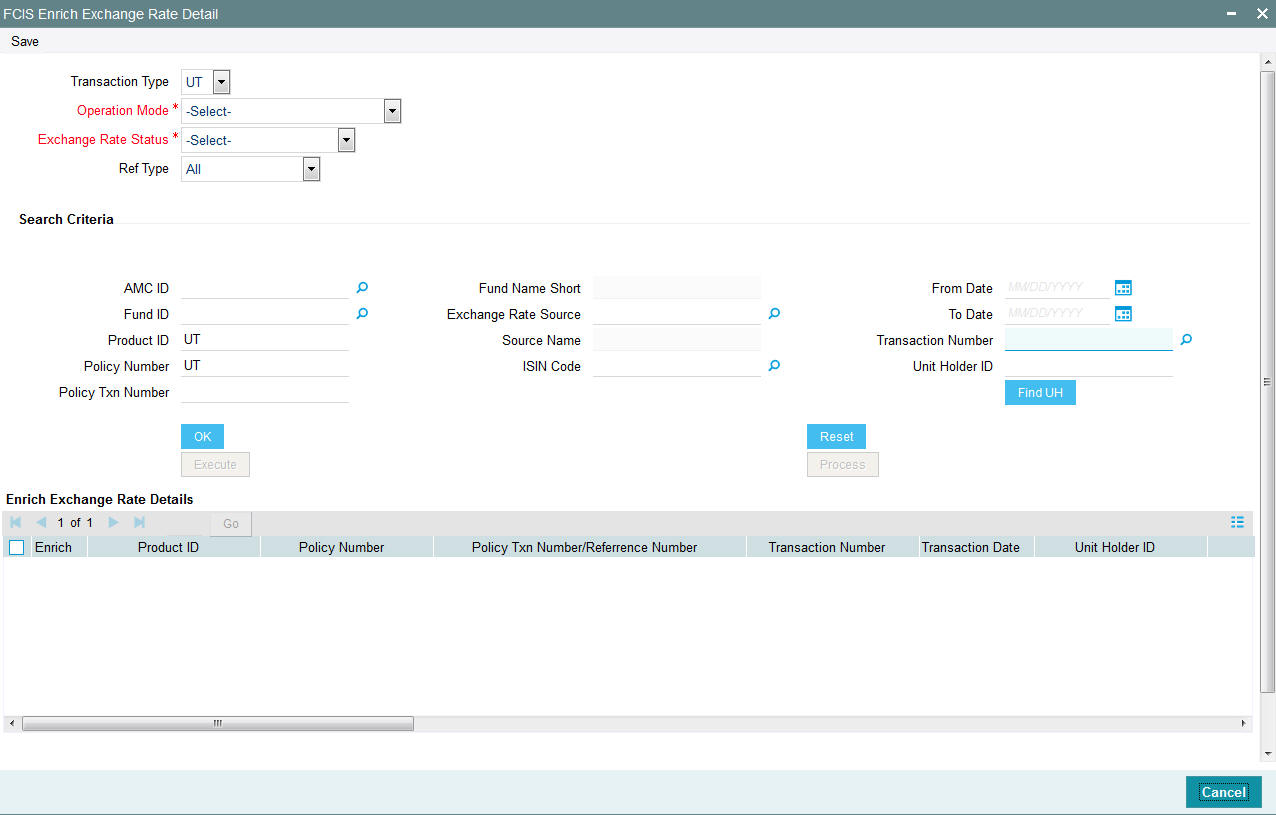

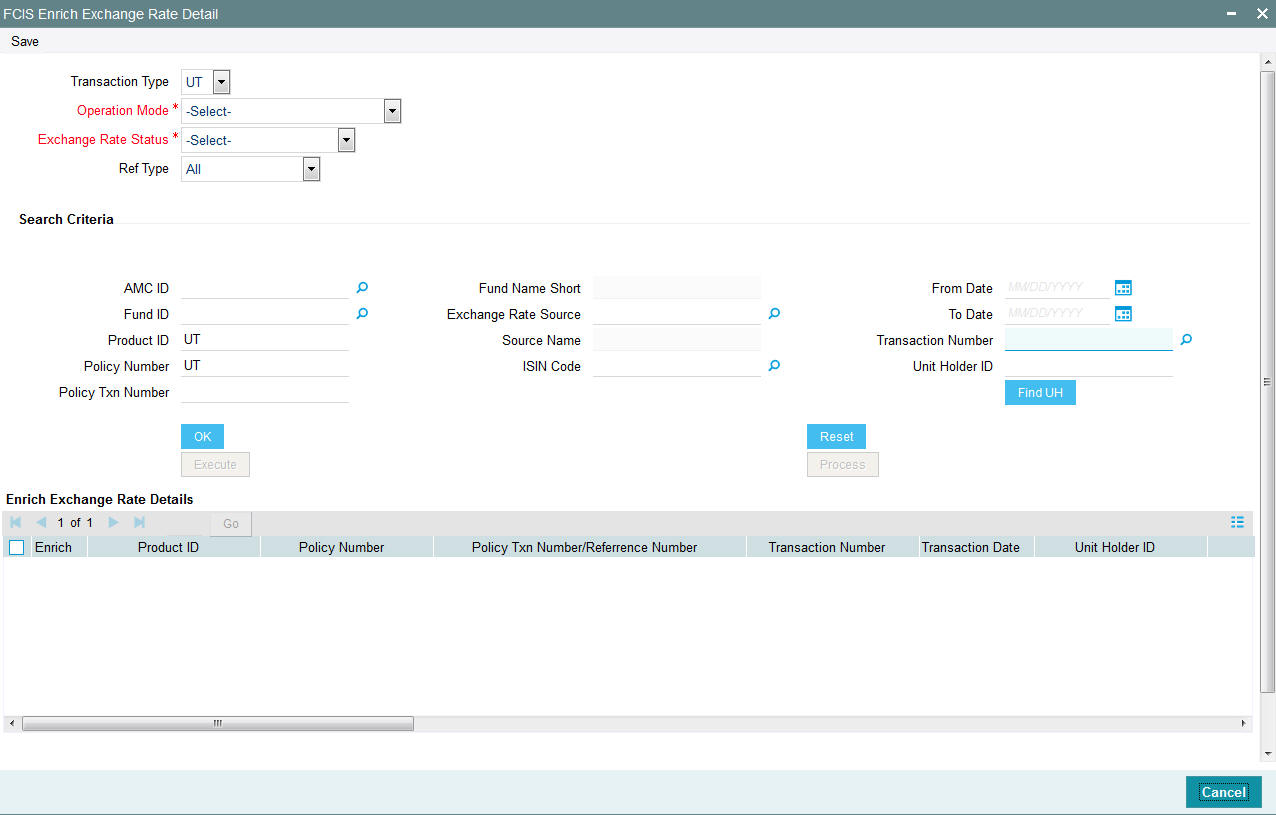

5.5.2 Invoking Enrich Exchange Rate Detail

You can specify the exchange rate for exchange rate incomplete transactions in the ‘FCIS Enrich Exchange Rate Detail’. You can invoke this screen by typing ‘UTDTXNEE’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Enrich the exchange rate details in this screen as follows:

Transaction Type

Optional

Select the type of transaction from the drop-down list. The list displays the following values:

- LEP

- UT

If u choose UT only incomplete UT transactions will be displayed for enrichment. If you choose LEP and mention the ‘Product ID’ and ‘Policy Number’, then all the underlying incomplete UT transactions of the particular policy will be available enrichment.

Operation Mode

Mandatory

Select the mode of operation from the drop-down list. The list displays the following values:

- Enrich Exchange Rate

- Authorize

- Bulk Exchanged Rate Enrichment

- View Enrich Exchange Rate

If you select ‘Enrich Exchange Rate’ or ‘Authorize’ option, then ‘Exchange Rate Status’ and ‘Ref Type’ fields will be disabled. Also ‘Execute’ and ‘Process’ buttons will be disabled.

Exchange Rate Status

Mandatory

Select the exchange rate status from the drop-down list. The list displays the following values:

- Incomplete

- UnAuthorized

- Unauthorized/ Authorized

- Complete

If the transaction for which you are entering the exchange rate is an authorized transaction for which the exchange rate has not been entered, select ‘Incomplete’ option.

Ref Type

Optional

Select the ref type from the drop-down list. The list displays the following values:

- All

- Standing Instruction

- IPO Subscription

- Subscription

- Redemption

- Switch

- Transfer

Search Criteria

AMC ID

Alphanumeric; 12 Characters; Optional

Specify the AMC ID. Alternatively, you can select AMC ID from the option list. The list displays all valid AMC ID maintained in the system.

Fund ID

Alphanumeric; 6 Characters; Optional

Specify the fund ID. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

Fund Name Short

Display

The system displays the short fund name for the selected fund ID.

Product ID

Alphanumeric; 10 Characters; Optional

Specify the product ID. Alternatively, you can select product ID from the option list. The list displays all valid product ID maintained in the system.

This field is enabled only if you have selected ‘Transaction Type’ as ‘LEP’.

Policy Number

Alphanumeric; 16 Characters; Optional

Specify the policy number. Alternatively, you can select policy number from the option list. The list displays all valid policy number maintained in the system.

This field is enabled only if you have selected ‘Transaction Type’ as ‘LEP’.

Policy Txn Number

Alphanumeric; 16 Characters; Optional

Specify the policy transaction number. Alternatively, you can select policy transaction number from the option list. The list displays all valid policy transaction number maintained in the system.

This field is enabled only if you have selected ‘Transaction Type’ as ‘LEP’.

Exchange Rate Source

Alphanumeric; 6 Characters; Optional

Specify the exchange rate source. Alternatively, you can select exchange rate source from the option list. The list displays all valid exchange rate source maintained in the system.

Source Name

Display

The system displays the source name for the selected exchange rate source.

ISIN Code

Alphanumeric; 6 Characters; Optional

Specify the ISIN code. Alternatively, you can select ISIN code from the option list. The list displays all valid ISIN code maintained in the system.

If you specify the fund ID, the system displays ISIN code and vice versa.

From Date

Date Format; Optional

Select the From date from the adjoining calendar.

To Date

Date Format; Optional

Select the To date from the adjoining calendar.

Transaction Number

Alphanumeric; 16 Characters; Optional

Specify the transaction number. Alternatively, you can select transaction number from the option list. The list displays all valid transaction number maintained in the system.

Unit Holder ID

Alphanumeric; 12 Characters; Optional

Specify the unit holder ID.

You can query unit holder ID by clicking ‘Find UH’ button.

Clicking ‘Execute’ button, the system displays the following enrich exchange rate details:

- Enrich

- Product ID

- Policy Number

- Policy transaction number/reference number

- Transaction Number

- Transaction Date

- Unit Holder ID

- Fund ID

- Transaction Mode

- Transaction Currency

- Fund Base Currency

- Source ID

- Override Exchange Rate

- Exchange Rate Applied

- Switch-In-Fund Base Currency

- Switch-In-Source ID

- Switch-In Exchange Rate Applied

- Mod No

- FX Deal Date

- FX Value Date

This button will be enabled only if you have selected ‘Bulk Exchanged Rate Enrichment’ and ‘View Enrich Exchange Rate’ option in ‘Operation Mode’ field.

Click ‘Process’ button to process the exchange rate. This button will be enabled only if you have selected ‘Bulk Exchanged Rate Enrichment’ and ‘View Enrich Exchange Rate’ option in ‘Operation Mode’ field.

After specifying the necessary details, click ‘Ok’ button. This button will be enabled only if you have selected ‘Enrich Exchange Rate’ and ‘Authorize’ option in ‘Operation Mode’ field.

You can reset by clicking ‘Reset’ button. This button will be enabled only if you have selected ‘Enrich Exchange Rate’ and ‘Authorize’ option in ‘Operation Mode’ field.

Click ‘Authorize’ button to authorize the transaction.

5.5.3 Performing Bulk Update of Exchange Rate

Bulk Exchange rate enrichment is performed for authorized but un-allotted transactions in the system. To perform bulk update of exchange rates select ‘Bulk Exchange Rate Enrichment’ in the operation field.

Certain other fields will be displayed in this screen if you choose the operation as ‘Bulk Exchange Rate Enrichment’.

To invoke this screen type UTDTXNEE in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Enrich the exchange rate details in this screen as follows:

- Select the operation mode as ‘Bulk Exchange Rate Enrichment’.

- Select the reference type for which you are performing exchange rate enrichment.

- Select the ID of the fund or the ISIN Code of the fund in which the bulk exchange rate enrichment is being performed, in the Fund ID and the ISIN Code fields.

- The date range when the transaction was processed.

- If the transaction for which you are enriching the exchange rate is an authorized but un-allotted transaction, choose the 'Complete' option in the field Exchange Rate Status

- If the transaction for which you are entering the exchange rate is an authorized transaction for which the exchange rate has not been entered, choose the ‘Incomplete’ option in the Exchange Rate Status field.

- In the Exchange Rate Source field, select the exchange rate source specified for the transaction, and click ‘Process’ button to submit the job to update the exchange rate details.

- Else, click ‘Execute’ button to update the update the exchange rate details.

5.5.4 Authorizing Exchange Rate Enrichments

After you have enriched the exchange rate in the Exchange Rate Enrichment screen, another user must authorize the enrichment for it to be effective in the system database, so that the transaction can be picked up for allocation.

To authorize the enrichment of exchange rate for a transaction, do as follows:

- Select the ID of the fund or the ISIN Code of the fund in which the transaction was entered, in respect of which exchange rate enrichment was done, in the Fund ID and the ISIN Code fields.

- Select the Authorize option in the Operation Mode field, in the Find Records section of the screen.

- Only unauthorized exchange rate enrichment transactions can be authorized. Select the Unauthorized option in the Exchange Rate Status field.

- In the Exchange Rate Source field, select the exchange rate source specified for the exchange rate enriched transaction, and click ‘Ok’ button.

- All exchange rate-enriched transactions that are retrieved according to your specifications are displayed as a list in the Records Matching The Search Criteria grid, in the lower portion of the screen.

- For each transaction for which you want to authorize the exchange rate enrichment, select the row of the transaction in the list grid.

- In the Auth Status field, select the Authorize option to mark the enrichment for authorization.

- After similarly marking as many records as necessary for payment enrichment authorization, click ‘Authorize’ button to effect the authorization.

- Transactions enriched through bulk operation need not be authorized.

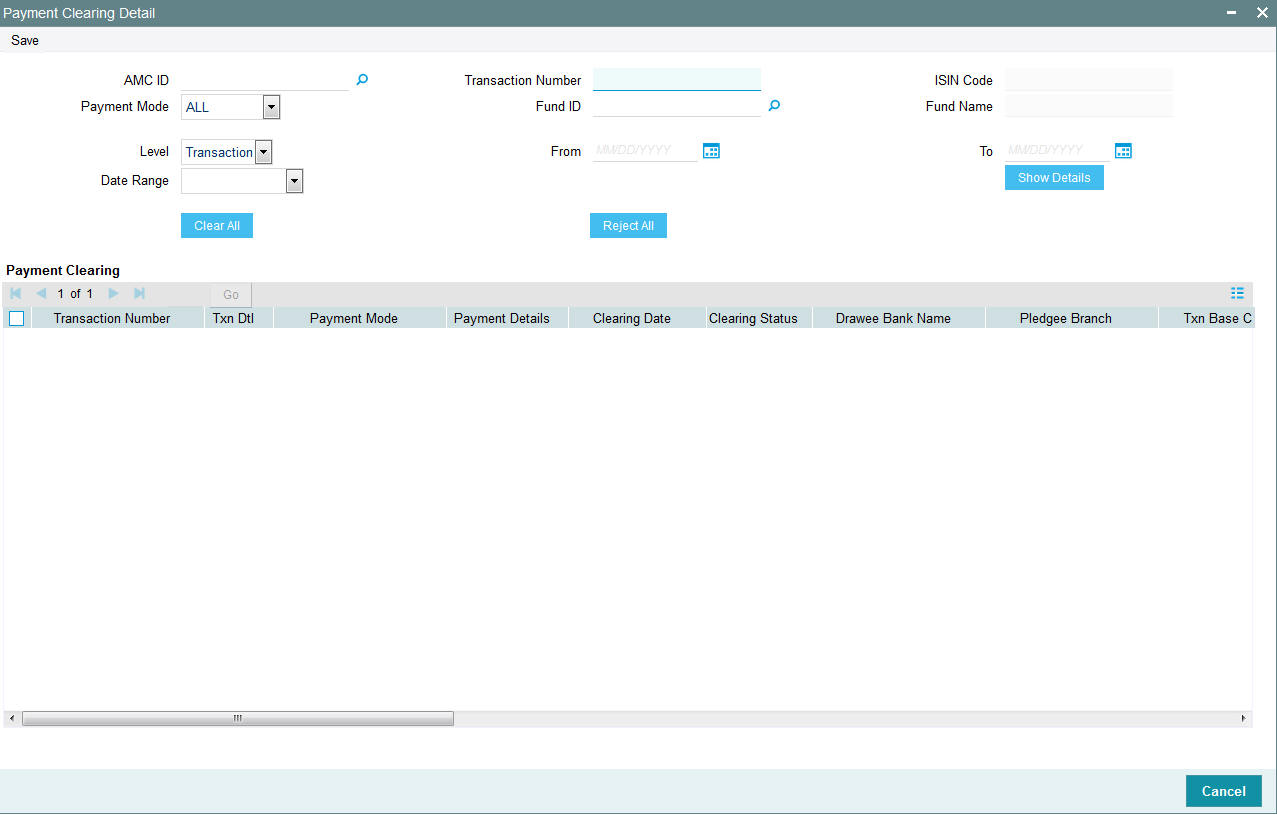

5.6 Payment Clearing Detail

This section contains the following topics:

- Section 5.6.1, "Invoking Clearing Payment Instruments"

- Section 5.6.2, "Updating Clearing Status of Payment Instrument"

- Section 5.6.3, "Payment Clearing Details"

- Section 5.6.4, "Authorizing Clearing Status"

- Section 5.6.5, "Tracking Status of Returned Cheques"

- Section 5.6.6, "Authorizing Tracking Status"

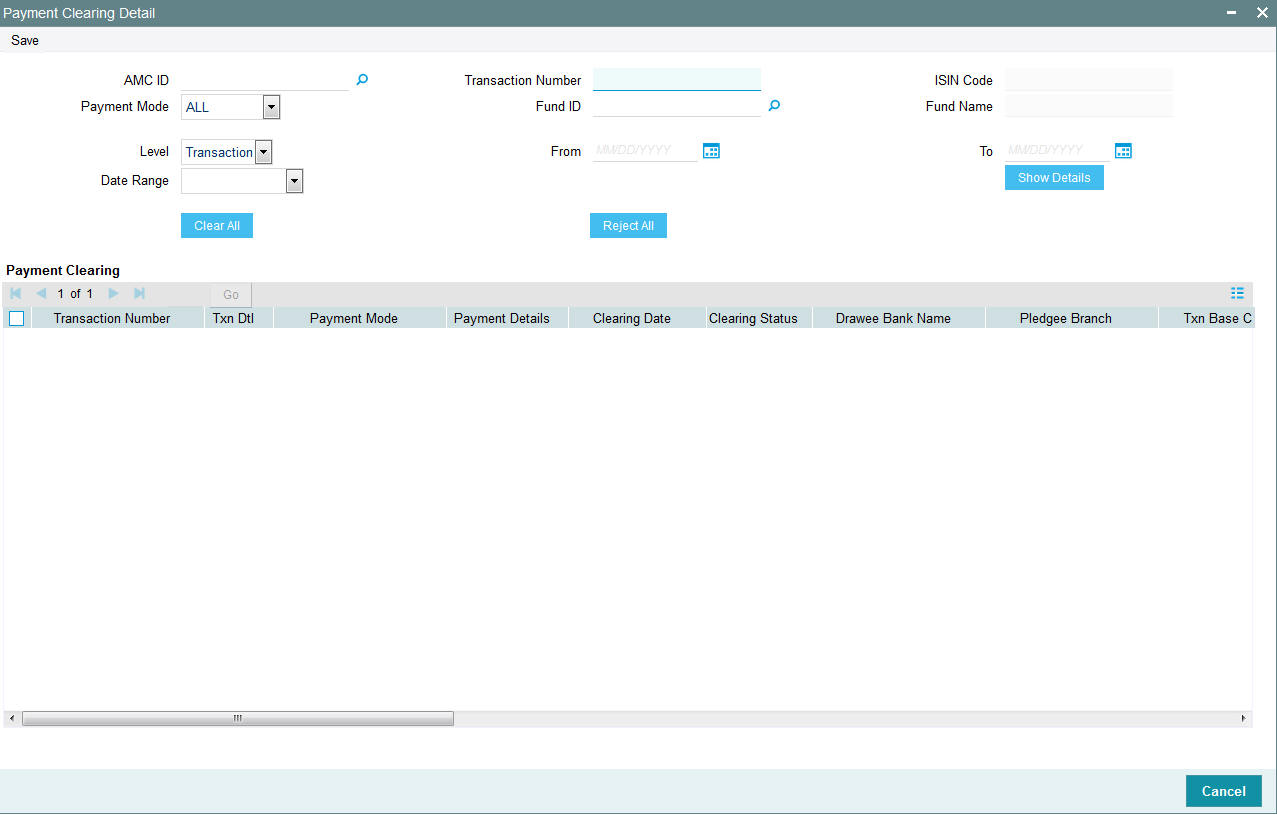

5.6.1 Invoking Clearing Payment Instruments

The system provides the facility to keep track of the clearing status of payment instruments for transactions, or, in the case of LEP (Life and Endowment Products), on a policy level, on an online basis.

To update the clearing status of a payment, use the ‘Payment Clearing Detail’ screen. You can invoke this screen by typing ‘UTDPYCLR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

5.6.2 Updating Clearing Status of Payment Instrument

To update the clearing status of a payment instrument for a transaction in the Payment Clearing screen, do as follows:

AMC ID

Alphanumeric; 12 Characters; Optional

Specify the AMC ID. Alternatively, you can select AMC ID from the option list. The list displays all valid AMC ID maintained in the system.

Payment Mode

Optional

Select mode of payment from the drop-down list, specified for the transaction for which you want to update the clearing status of the payment instrument. The list displays the following values:

- All

- Cheque

- Demand Draft

- Transfer

- Credit Card

Level

Optional

Select transaction level from the drop-down list. The list displays the following values:

- Transaction

- Policy

- Settlement

Date Range

Optional

Select range of dates from the drop-down list that would signify the period between which the transaction date or the allotted date of the transaction would be found. The list displays the following values:

- Transaction date

- Allocation Date

- Payment Date

Transaction Number

Alphanumeric; 16 Characters; Optional

Specify the transaction number.

Fund ID

Alphanumeric; 6 Characters; Optional

Specify the fund ID. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

ISIN Code

Display

The system displays the ISIN code for the selected fund ID.

Fund Name

Display

The system displays the fund name for the selected fund ID.

From

Date Format; Optional

Select the From date from the adjoining calendar.

To

Date Format; Optional

Select the To date from the adjoining calendar.

Click ‘Show Details’ button to view the following payment clearing details:

- Transaction Number

- Transaction Detail

- Payment Mode

- Payment Details

- Clearing Date

- Clearing Status

- Drawee Bank Name

- Pledgee Branch

- Transaction Base Currency

- Instrument Status

- Remarks

- System Reference Number

- Check Status

- Clearing Level

- Auth Status

- Maker ID

- Maker Date Stamp

- Checker ID

- Checker Date Stamp

Click ‘Clear All’ button to clear the instruments displayed. Click ‘Reject All’ button to reject the instrument details. Depending on what you choose, either Clear All or Reject All, the clearing status field under the Payment Clearing grid will display the clearing status

After marking as many instruments as necessary for clearing or rejection, click the Save button to save your changes.

5.6.3 Payment Clearing Details

The following details are displayed in the Payment Clearing screen:

- The transaction number of the transactions with the selected mode of payment or a check number.

- The payment mode used in the specified transaction

- The instrument number of the payment instrument used for the transaction

- The date of the payment instrument.

- The currency of the payment instrument.

- The amount of the payment instrument.

- The bank name and branch name of the bank where the payment instrument was drawn.

5.6.4 Authorizing Clearing Status

After you have updated the clearing status for a transaction payment instrument, another user must authorize the clearing status, for it to be effective in the system data stores.

To authorize a clearing status in the Payment Clearing screen, do as follows:

- In the Selection Criteria section, specify the following details as search parameters to retrieve the transaction records for which the clearing status of payment instruments must be authorized:

- In the Mode field, select the Authorize option.

- In the Level field, select the Transaction option.

- In the Payment Mode field, select the mode of payment specified for the transaction for which you want to authorize the clearing status of the payment instrument. To authorize a specific cleared payment instrument, enter the number of the instrument in the Specific Number field.

- In the Date Range fields, specify a range of dates that would signify the period between which the transaction date or the allotted date of the transaction would be found.

- Click on the Show button. All transactions with payment instruments that match your search criteria are displayed, with the instrument details, in the lower grid portion of the screen, in a list.

- For each payment instrument that you want to authorize the clearing status, select Authorize from the drop down menu in the Auth Status field. Your specification here will mark the clearing status of the instrument for authorization.

- After marking the clearing status of as many instruments as necessary for authorization, click the Authorize button to effect the authorization. Authorization of the payment clearing of a subscription transaction will settle all unsettled redemptions linked to it.

Clearing Status

3 Character, Alphanumeric, Mandatory

Select Clear to mark the check as Cleared. Select Reject to mark the check as Returned / Rejected.

Clearing Date

Date, Mandatory

Specify the date on which the clearing takes place. By default, the clearing date is deemed to be the application date.

Remarks

255 Characters Maximum, Alphanumeric, Mandatory

Specify any relevant remarks regarding the clearing status.

5.6.5 Tracking Status of Returned Cheques

After a transaction has been allocated, the purchase transaction will have a cooling block set, which implies that no units can be redeemed from this transaction’s lots. The cooling block will be removed (transaction will be cooled off) when the status of the instrument is updated as cleared.

You can track the status of the physical instruments using the Payment Clearing screen.

To track the status of a payment instrument for a transaction in the Payment Clearing screen, do as follows:

- In the Selection Criteria section, specify the following details as search parameters to retrieve the transaction records for which the payment instruments must be tracked:

- In the Mode field, select the ‘New’ option.

- In the Level field, select the Settlement option.

- You can search for a record using any of the following criteria:

- Fund ISIN

- Fund ID

- AMC ID

- In the Payment Mode field, select the mode of payment specified for the transaction for which you want to update the status of the payment instrument. Only Cheque, Demand Draft and Money Transfer payment modes are applicable. To clear a specific payment instrument, enter the number of the instrument in the Specific Number field.

- In the Date Range fields, specify a range of dates that would signify the period between which the transaction date, the allotted date or the payment date of the transaction would be found.

- Click on the Show button. All transactions with payment instruments

that match your search criteria are displayed, in the lower grid portion

of the screen in a list.

- All necessary information such as transaction number, payment mode, clearing date, payment currency, payment amount, etc is recorded.

- Click on the Payment Details link to view the Settlement Information screen. The payment details of all legs involved in the transaction is displayed.

- Specify the status of the instrument in the Instrument Status field.

The options are:

- Credit Received - Once this status is selected, system triggers automatic clearing of the associated transaction record and convert provisional units into confirmed units.

- Debit Received - Indicates that information about Cheque rejection is received from Bank.

- Reject Status Awaited - Indicates that information about Cheque rejection has been received at AMC/TA through return of physical instrument.

- Rejected - This means that both; rejected cheque and reject information from the bank have been received. Once this status is updated, system will trigger automatic reversal of the associated transaction record.

- Specify any relevant remarks in the Remarks field.

- After marking as many instruments as for tracking, click the Save button to save your changes.

If you select an Instrument Status for one or all of Instruments for a transaction that results in payment / transaction rejection, system gives the following warning message “This will reject the entire transaction. Do you want to go ahead?”

5.6.6 Authorizing Tracking Status

After you have updated the status of a transaction payment instrument, another user must authorize the instrument status, for it to be effective in the system data stores.

To authorize an instrument status in the Payment Clearing screen, do as follows:

- In the Selection Criteria section, specify the following details as search parameters to retrieve the transaction records for which the status of payment instruments must be authorized:

- From the Actions list, select the Authorize option.

- In the Level field, select the Settlement option.

- In the Payment Mode field, select the mode of payment specified for the transaction for which you want to authorize the status of the payment instrument. To authorize a specific payment instrument, enter the number of the instrument in the Specific Number field.

- In the Date Range fields, specify a range of dates that would signify the period between which the transaction date or the allotted date of the transaction would be found.

- Click on the Show button. All transactions with payment instruments that match your search criteria are displayed, with the instrument details, in the lower grid portion of the screen, in a list.

- For each payment instrument that you want to authorize the status, select Authorize from the drop down menu in the Authorization Status field. Your specification here will mark the status of the instrument for authorization.

- After marking the status of as many instruments as necessary for authorization, click the Authorize button to effect the authorization.

Instrument Status

Alphanumeric, Mandatory

Specify the status of the instrument in the Instrument Status field. The options:

- Credit Received - If this status is selected, system triggers automatic clearing of the associated transaction record and convert provisional units into confirmed units.

- Debit Received - Indicates that information about Cheque rejection is received from Bank.

- Reject Status Awaited - Indicates that information about Cheque rejection has been received at AMC/TA through return of physical instrument.

- Rejected - This means that both; rejected cheque and reject information from the bank have been received. Once this status is updated, system will trigger automatic reversal of the associated transaction record.

Note

If the record is uploaded with the status ‘Debit Received’, the options in the drop-down list are ‘Reject Status Awaited’ and ‘Rejected’.

- If the record is uploaded with the status ‘Reject Status Awaited’, the options in the drop-down list are ‘Debit Received’ and ‘Rejected’.

- If the payment mode is Money Transfer, then the options available are ‘Credit Received’ and ‘Rejected’.

- If the record is uploaded from the Bank Reconciliation screen with the status ‘Credit Received’ or ‘Rejected’, then the record will not be available in the New mode and you will not be allowed to update the instrument status.

In case of uploaded records, system adds the following in the Remarks field:

‘Through Bank Recon Upload When No Action’

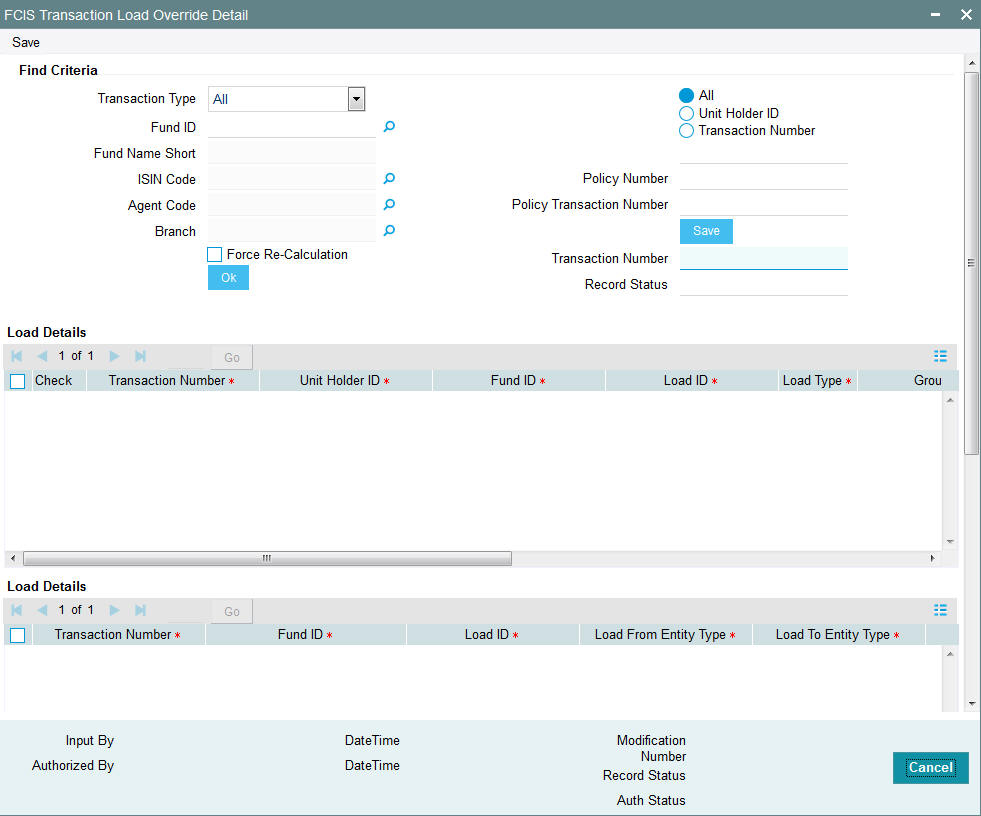

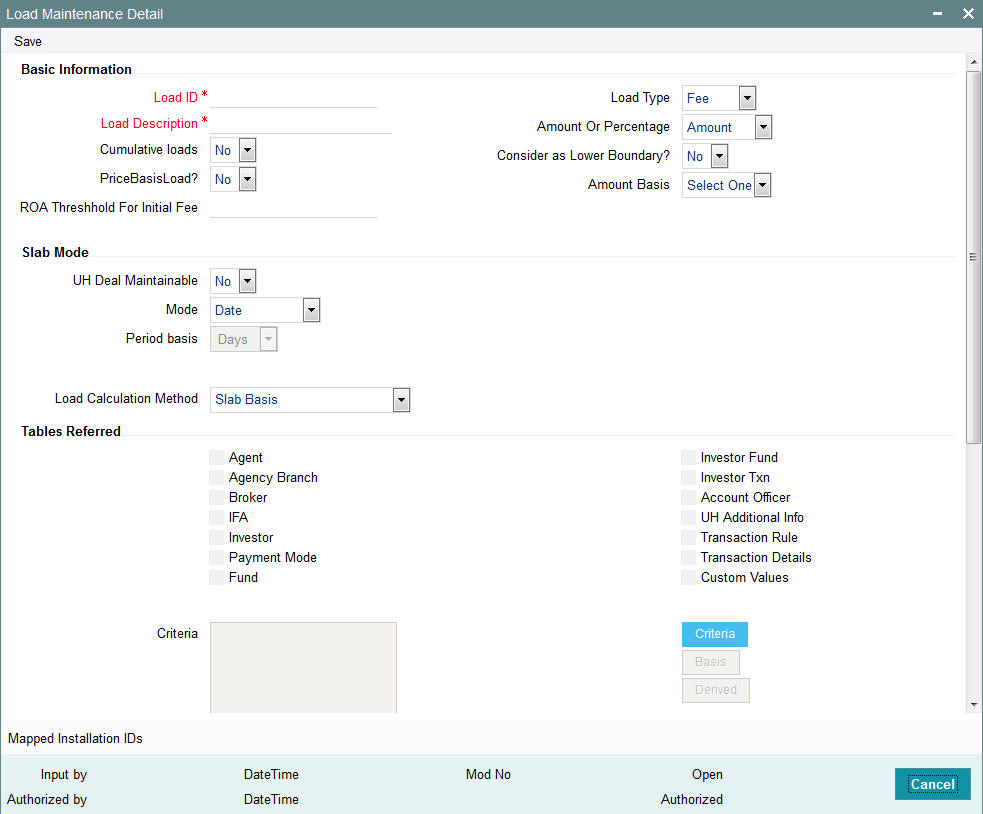

5.7 Transaction Load Override

This section contains the following topics:

5.7.1 Invoking Load Override Details

In FLEXCUBE Investor Services, you have the facility of changing the return value or final amount value of a load (charge) that is applicable for a transaction requested by an investor.

To override such a load, use the ‘FCIS Transaction Load Override Detail’ screen. You can invoke this screen by typing ‘UTDTXNLO’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

To override a load, do as follows:

Retrieve the record of the load that you want to override by specifying search parameters. You can specify any or all of the following to enable the search:

Find Criteria

Transaction Type

Optional

Select the type of transaction from the drop-down list. The list displays the following values:

- All

- IPO Subscription

- Reinv IPO Subscription

- Subscription

- Reinv Subscription

- Redemption

- Switch From

- Transfer

- Block

- Unblock

- Consolidation

- Split

- Reissue

Choose one of the following options and enter the associated number for the selected option in the text box below:

- All

- Unit Holder ID

- Transaction Number

Fund ID

Alphanumeric; 6 Characters; Optional

Specify the fund ID in which the transaction was put through, for which you want to override a load. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

Fund Name Short

Display

The system displays the fund name for the selected fund ID.

ISIN Code

Alphanumeric; 12 Characters; Optional

Specify the ISIN code.

If you have specified Fund ID, then the system displays the ISIN code for the specified fund ID and vice versa.

Agent Code

Alphanumeric; 12 Characters; Optional

Specify the agent code. Alternatively, you can select agent code from the option list. The list displays all valid agent code maintained in the system.

Branch

Alphanumeric; 12 Characters; Optional

Specify the branch code. Alternatively, you can select branch code from the option list. The list displays all valid branch code maintained in the system.

Force Re-Calculation

Optional

Check this box to enable force re-calculation.

Policy Number

Alphanumeric; 12 Characters; Optional

Specify the policy number

Policy Transaction Number

Alphanumeric; 12 Characters; Optional

Specify the policy transaction number.

Transaction Number

Display

The system displays the transaction number.

Record Status

Alphanumeric; 1 Character; Optional

Specify the record status.

When you have specified your criteria, click ‘Save’ button to save the details. Click ‘Ok’ button to view the following details:

Load Details

- Check

- Transaction Number

- Unit Holder ID

- Fund ID

- Load ID

- Load Type

- Group ID

- Transaction Amount

- Load Calculation Method

- Amount Or Percentage

Load Details

The system displays the following Load Details for the selected transaction number:

- Load ID

- Load From Entity Type

- Load to Entity Type

- Transaction Amount

- Transaction Date

- Load To Price

- Load VAT To Price

- Mandatory

- Priority Number

- Free Transaction

- Apply Return Value on

- No of Decimals for Load

- Round of truncate for Load

- Group ID

- To Override

Investor

Display Only

The ID of the unit holder who has made the transaction is displayed here.

Transaction Number

Display Only

In this field, the transaction numbers of the transactions, based on the selection criteria, are displayed

Fund ID

Display Only

The ID of the fund on which the transaction has occurred is displayed here

Original Return Value

Display Only

The original return value percentage of each of the applicable loads before the override is displayed here.

Original Load Amount

Display Only

The original load amount of each of the applicable loads before the override is displayed here, after being calculated based on the return value.

You are allowed to override the following details in this section:

Override Return Value

Numeric, 30 Characters; Optional

Enter a value to override the original Return Value for the given load, for the given transaction. If nothing is entered then the Return Value will be taken as it is for allocation purposes provided the Override Load Amount is not changed. If the Return value specified is a percentage, you can override this percentage too.

If the Load Amount is changed, the change is also reflected in the Load Return Value field.

Override Load Amount

Numeric, 30 Characters; Optional

Enter an amount to override the original Load Amount for the given load, for the given transaction. If nothing is entered then the Load Amount will be taken as it is for allocation purposes provided the Override Return Value is not changed.

If the Load Return Value is changed, the change is also reflected in the Load Amount field.

To Override

Optional

Indicate one of the following to indicate your preference for overriding, from the drop-down list:

- Both

- Return Value

- Load Amount

Derived Load Details

- Check

- Transaction Number

- Unit Holder ID

- Fund ID

- Load ID

- Parent Load ID

- Transaction Amount

You can check against the transaction number for which transaction is done in the check box.,

If the load is criteria based, the criteria will be displayed in the Load Details screen.

If any derived loads are applicable, they are also displayed and can be overridden.

Load Type

Display Only

The type of load, indicating whether it is a fee or an incentive, is displayed here.

Transaction Amount

Display Only

The transaction amount of the given transaction is displayed here.

Calculation Method

Display Only

This field displays the Calculation Method (either Slab, Linear or Weighted) for the particular Load.

Amount/Percent

Display Only

This Field displays whether the Return Value is displayed in Amount or Percentage.

Load Details

Original Return Value

Display Only

The original return value of each of the applicable loads before the override is displayed here, either as a percentage or a load amount.

Click the OK button to save your changes.

The following must be borne in mind at a general level, while carrying out load overrides in this screen:

- Any load that is a tax cannot be overridden. A particular Load is deemed a tax if the fund load mapping record has a value specified for the Apply Return Value On field.

- Interconnected Loads:

- In the system, two loads are deemed to be interconnected loads if the From Entity of the one is the same as the To Entity of the other. After you exercise a Load Override in this screen and attempt to save the override record, the system flashes a warning message if the concerned load is an interconnected one. The message also displays the transaction number and the connected loads. If you choose Yes in this message box, these changes will be reflected during allocation of the transaction.

- Once a load override is saved in this screen, it is removed from the view list. To retrieve it, you must specify the search criteria again.

- If the original load is a percentage based load, and is loaded to price, the original load amount displayed is a per unit figure. The following illustration will make this clear:

Let us suppose that the Transaction Price is 10, and the load percentage is 5%. The amount displayed is as follows:

5% of 10=0.5.per unit.

If the load is not loaded to price, then the actual load amount is displayed here. Considering the same example above, If the transaction amount is 1000 currency units, and the load percentage is 5%, with the load not loaded to price, the load amount displayed is as follows:

5% of 1000=50 currency units.

5.7.1.1 Forcing Recalculation

When you open the load override screen for the first time (i.e., before any load overrides have been performed) and retrieve some load records, the computed load amounts are not displayed in the Amount/Return Value fields in the Txn Load Override screen. This will be so if you have not checked the Force Recalculation? field check box in the main Transaction Load Override screen. To indicate to the system that load computation must be done, you must Select this option. When you do so, the original computed loads, before any overrides, is displayed in the Return Value/Amount fields in the Txn Load Override screen.

After you perform the load overrides and override some or all of the retrieved loads, the overridden load records are saved as unauthorized load overrides. At this stage, when you open the Load Override screen and retrieve the overridden load records by specifying search criteria, you have the following options:

- If you check the Force Re-calculation? check box, the system will compute the loads again, without taking into account the overrides you have performed. The load amounts displayed after this computation are the original, pre-override amounts.

- If you want to revert to the saved load override record and the overridden load values, do not check the Force Recalculation? check box. The overridden load records will be retrieved and displayed.

If a load override that is performed is subsequently authorized, then you will not be able to retrieve it through specifying search criteria.

5.7.1.2 Authorizing load Override

A user other than the one who performed the override must authorize any override of a load.

To authorize a load override, use the Transaction Load Override Authorization screen. You can access this screen by clicking the Summary option in the Txn Load Override menu item in the Transactions Input menu category of the Agency Branch main menu.

When you open this screen, the load overrides that have been exercised, that are pending authorization, are displayed along with their details.

Mark each override you want to authorize by selecting the Authorize option in the Authorize field against the required override row.

After you have marked as many records as necessary for authorization, click the Authorize button to effect the authorization.

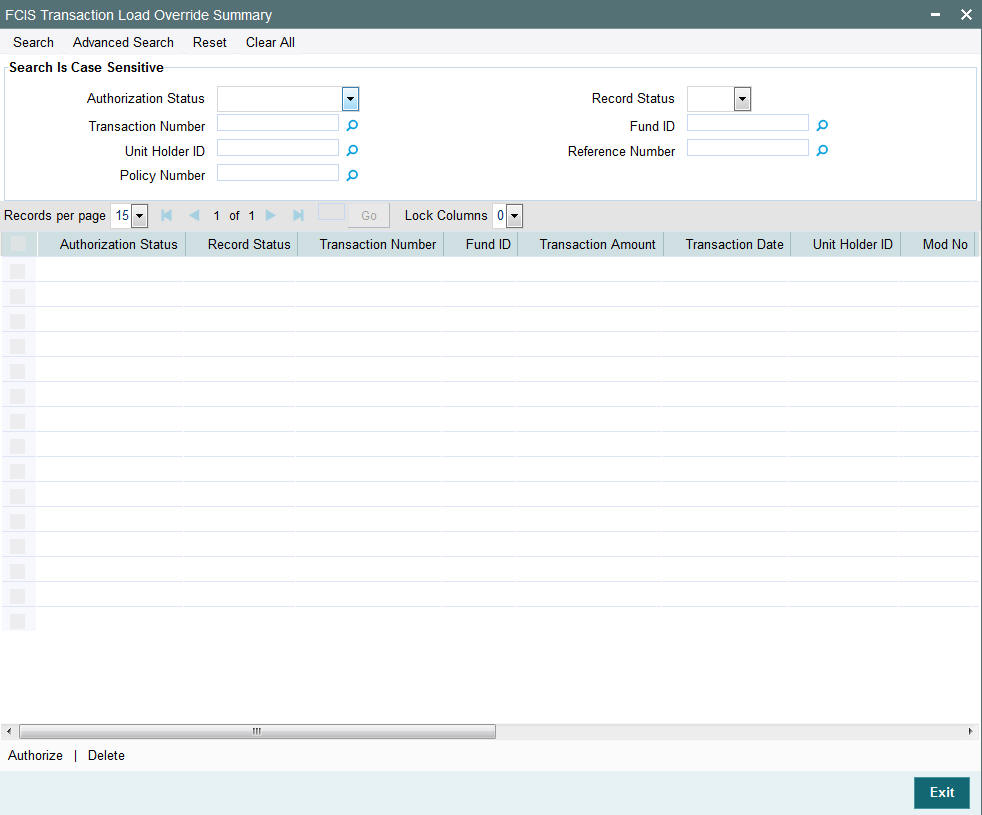

5.8 Transaction Load Override Summary

This section contains the following topics:

- Section 5.8.1, "Retrieving a Record in Transaction Load Override Summary Screen"

- Section 5.8.2, "Editing Transaction Load Override Record"

- Section 5.8.3, "Viewing Transaction Load Override Record"

- Section 5.8.4, "Deleting Transaction Load Override Record"

- Section 5.8.5, "Authorizing Transaction Load Override Record"

- Section 5.8.6, "Amending Transaction Load Override Record"

- Section 5.8.7, "Authorizing Amended Transaction Load Override Record"

5.8.1 Retrieving a Record in Transaction Load Override Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

Invoke the ‘FCIS Transaction Load Override Summary’ screen by typing ‘UTSTXNLO’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button and specify any or all of the following details in the corresponding details.

- The status of the record in the Authorization Status field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Record Status field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Transaction Number

- Unit Holder ID

- Policy Number

- Fund ID

- Reference Number

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Transaction Number

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value

5.8.2 Editing Transaction Load Override Record

You can modify the details of Transaction Load Override record that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the FCIS Transaction Load Override Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorization Status field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The FCIS Transaction Load Override Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

Click Save to save your changes. The FCIS Transaction Load Override Detail screen is closed and the changes made are reflected in the FCIS Transaction Load Override Summary screen.

5.8.3 Viewing Transaction Load Override Record

To view a record that you have previously input, you must retrieve the same in the FCIS Transaction Load Override Summary screen as follows:

- Invoke the FCIS Transaction Load Override Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the unauthorized / Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The FCIS Transaction Load Override Detail screen is displayed in View mode.

5.8.4 Deleting Transaction Load Override Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the FCIS Transaction Load Override Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. The FCIS Transaction Load Override Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

5.8.5 Authorizing Transaction Load Override Record

- An unauthorized FCIS Transaction Load Override record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the FCIS Transaction Load Override Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS Transaction Load Override Detail screen is displayed. Select Authorize operation from the Action List.

When a checker authorizes a record, details of validation, if any, that were overridden by the maker of the record during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the record.

5.8.6 Amending Transaction Load Override Record

After a FCIS Transaction Load Override record is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the FCIS Transaction Load Override Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS Transaction Load Override Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

5.8.7 Authorizing Amended Transaction Load Override Record

An amended FCIS Transaction Load Override record must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module and Agency Branch module.

The subsequent process of authorization is the same as that for normal transactions.

5.9 Global Order

This section contains the following topics:

- Section 5.9.1, "Maintaining Global Order"

- Section 5.9.2, "Invoking Global Order Maintenance Detail Screen"

5.9.1 Maintaining Global Order

Global Order is a process where a distributor bulks their investor’s transactions including Subscriptions, Redemptions and send to the Asset Management Companies or to the Fund Houses as a single Transaction for processing before the funds cut-off time on daily basis. The distributors generally will have an identification number with the fund houses or AMC’s which is called as Nominee Account Number. On receipt of a bulk order or GO from the distributor, the fund house will confirm the units allotted to this distributor or to the Nominee Account. On receipt of confirmation from fund house, distributor will then confirm the global order at his end. If there is any discrepancy in global order, then global order will go through a reconciliation mechanism to address the difference. Once the discrepancy, if any, is resolved, distributor will allocate units to underlying unit holders.

The GO will be grouped according to Fund, transaction type (subscription and redemption), transaction mode (units/amount), Transaction Category (Advised, Execution and Legacy), Account type, Indicator (gross/Net) and transaction date. This is applicable for daily price funds. For non daily price funds, the system will generate separate GO which will not include Transaction date in grouping.

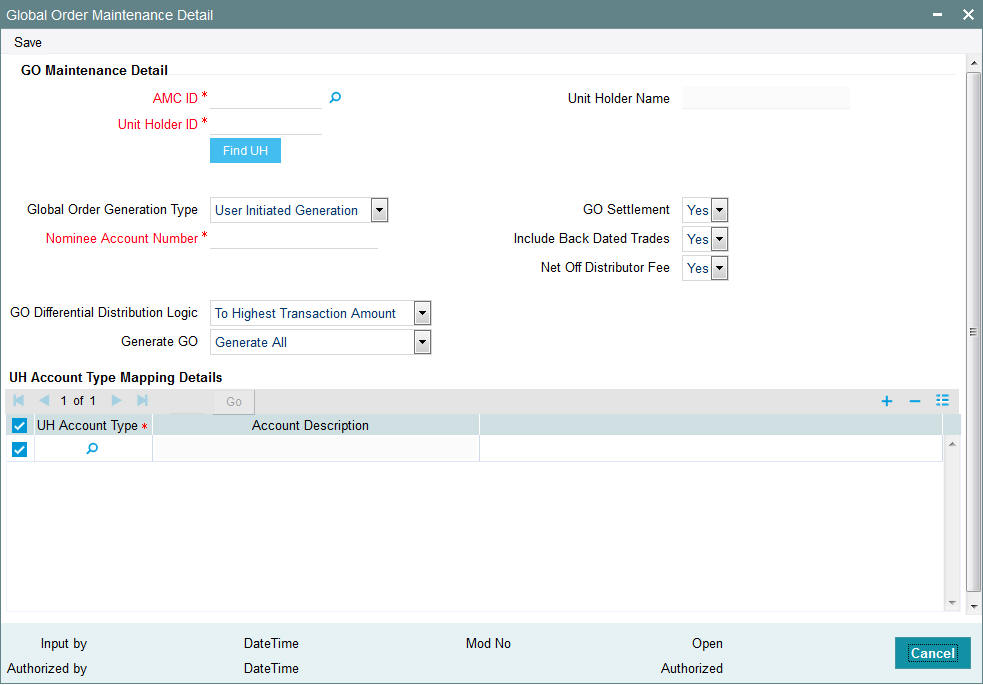

5.9.2 Invoking Global Order Maintenance Detail Screen

You can maintain Global Order set up using ‘Global Order Maintenance Detail’ screen. To invoke this screen, type ‘UTDGOMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select 'New' from the Actions menu in the Application tool bar or click new icon to enter the details of the ‘GO Maintenance Detail’ screen.

AMC ID

Alphanumeric; 12 Characters; Mandatory

Specify the AMC for which the GO is maintained. You can also select the valid AMC ID from the adjoining option list.

Unit Holder ID

Alphanumeric; 12 Characters; Mandatory

Specify the Unit Holder for which the GO is maintained.

You can also query for unit holder ID by clicking ‘Find UH’ button.

Unit Holder Name

Display

The system displays the unit holder name for the selected Unit Holder ID.

Global Order Generation Type

Optional

Select the Global Order generation type from the drop-down list. Following are the options available in the drop-down list:

- User Initiated Generation

- Generation at Cut-off time

GO Settlement

Optional

Select the GO Settlement details from the drop-down list. Following are the options available in the drop-down list:

- Yes

- No

Nominee Account Number

Alphanumeric; 16 Characters; Mandatory

Specify the nominee account number.

Include Back Dated Trade

Optional

Select if back dated trade is included from the drop-down list. Following are the options available in the drop-down list:

- Yes

- No

Net Off Distributor Fee

Optional

Select if distributor fee is netted off or not from the drop-down list. Following are the options available in the drop-down list:

- Yes

- No

GO Differential Distribution Logic

Optional

Select the GO differential distribution logic from the drop-down list. Following are the options available in the drop-down list:

- To Highest Transaction Amount

- Highest Transaction to the Lowest

If you maintain distribution logic as ‘To Highest Transaction Amount’ then the differential units will be adjusted to the transaction which has the highest transaction amount.

If you maintain distribution logic as ‘Highest Transaction Amount to Lowest’ then the system will distribute the difference amount from the highest transaction amount to the lowest in step up units.

Generate GO

Optional

Select if all the GO should be generated or GO as per transaction category should be generated from the adjoining drop-down list. Following are the options available:

- Generate All

- Generate per transaction category

5.9.2.1 UH Account Type Mapping Details

UH Account Type

Alphanumeric; 2 Characters; Mandatory

Specify the UH account type. You can also select the valid account type from the adjoining option list.

Account Description

Display

The system displays the description for the selected UH account type.

Once GO is generated, the system will generate subscription multiple order generation message (SWIFT) /redemption multiple order generation message for subscription/redemption global orders respectively as per the Swift pooling frequency defined in the system.

For non daily priced funds, the system will generate GO as per transaction cut-off date and it will take trade cycle override into account while generating GO.

In case for a trade TBC is different from FBC the system will only pick trades for which exchange rate is available. Exchange rate required to be maintained for the trades where exchange rate is not available. If no exchange rate is available for the trades where TBC is different from FBC then those trades will not be picked for GO.

The system will run a pre EOD batch to check if all trades for a given date have been sent across in a GO which will be based on price date.

5.10 GO Maintenance Summary

This section contains the following topics:

- Section 5.10.1, "Retrieving Global Order Maintenance Record"

- Section 5.10.2, "Viewing Global Order Maintenance Record"

- Section 5.10.3, "Editing Global Order Maintenance Record"

- Section 5.10.4, "Deleting Global Order Maintenance Record"

- Section 5.10.5, "Authorizing Global Order Maintenance Record"

- Section 5.10.6, "Amending Global Order Maintenance Record"

- Section 5.10.7, "Copying Global Order Maintenance Record"

- Section 5.10.8, "Closing Global Order Maintenance Record"

5.10.1 Retrieving Global Order Maintenance Record

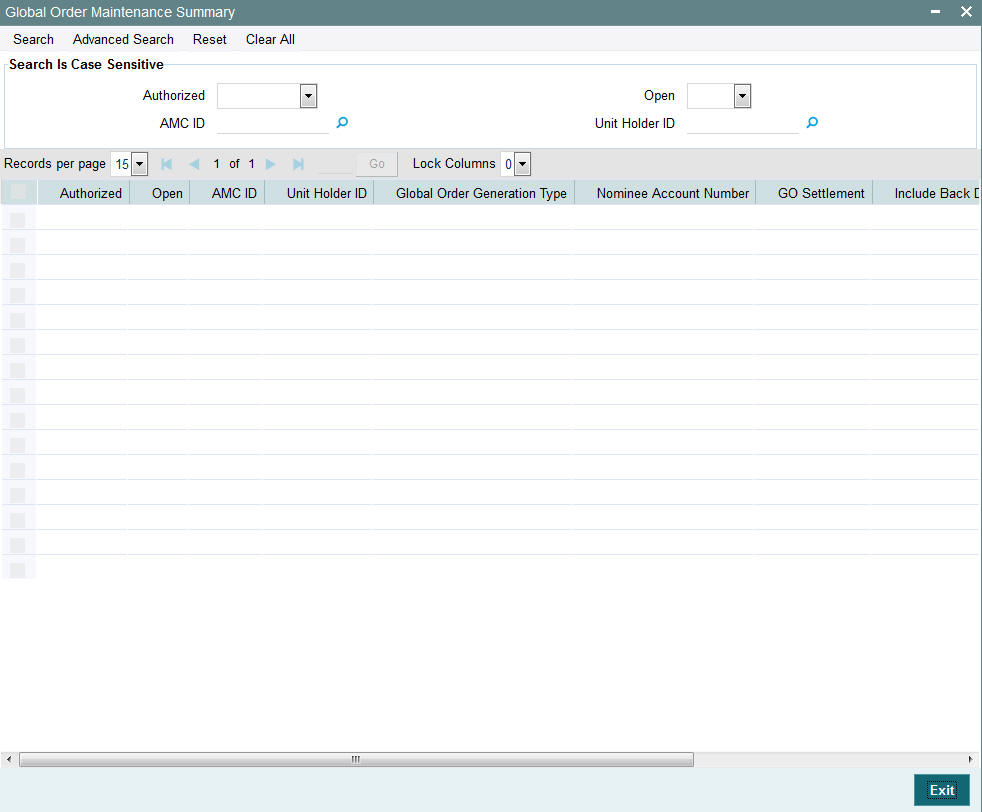

You can view Global Order details using ‘GO Maintenance Summary’ screen. To invoke this screen, type ‘UTSGOMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can retrieve previously entered Global Order Maintenance as follows:

- Invoke the ‘GO Maintenance Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID

- The Unit Holder ID. If you choose the blank space, then all the records are retrieved.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

After retrieving a record, you can perform the following actions in the Global Order Maintenance Detail screen:

- View a Record

- Edit a Record

- Delete a Record

- Authorize a Record

- Amend an Authorized Record

- Close a Record

- Copy a Record

5.10.2 Viewing Global Order Maintenance Record

To view a record that you have previously entered, you must retrieve the same in the ‘Global Order Maintenance Summary’ screen, as follows:

- Invoke the ‘Global Order Maintenance Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID in the ‘AMC ID’ field. If you choose the blank space, then all the records are retrieved.

- The unit holder ID in the ‘Unit Holder ID’ field. If you choose the blank space, then all the records are retrieved.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The ‘Global Order Maintenance Detail’ screen is displayed in the view mode.

5.10.3 Editing Global Order Maintenance Record

You can modify the Global Order details that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the ‘Global Order Maintenance Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID in the ‘AMC ID’ field. If you choose the blank space, then all the records are retrieved.

- The unit holder ID in the ‘Unit Holder ID’ field. If you choose the blank space, then all the records are retrieved.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double-click the record that you want to modify in the list of displayed records. The ‘Global Order Maintenance Detail’ screen is displayed.

- Select Unlock operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The ‘Global Order Maintenance Detail’ screen is closed and the changes made are reflected in the ‘Global Order Maintenance Summary’ screen.

5.10.4 Deleting Global Order Maintenance Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the ‘Global Order Maintenance Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID in the ‘AMC ID’ field. If you choose the blank space, then all the records are retrieved.

- The unit holder ID in the ‘Unit Holder ID’ field. If you choose the blank space, then all the records are retrieved.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double-click the record that you want to delete. The ‘Global Order Maintenance Detail’ screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

Note

The maker of the record can only delete the unauthorized record.

5.10.5 Authorizing Global Order Maintenance Record

Apart from the maker, someone else must authorize an unauthorized global order record deal in the system for it to be processed. To authorize a record:

- Invoke the ‘Global Order Maintenance Summary’ screen from the Browser.

- ‘The status of the transaction in the ‘Authorized’ field. Choose the ‘Unauthorized’ status.

- Click ‘Search’ button to view the records. All the records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Select the Authorization operation from the Action list to authorize the selected record.

5.10.6 Amending Global Order Maintenance Record

After a global order record is authorized, it can be modified using the Unlock operation from Action list. To make changes to a record after authorization:

- Invoke the ‘Global Order Maintenance Summary’ screen from the Browser.

- Select the status of the transaction that you wish to retrieve for amendment. You can only amend only authorized records.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to amend. The ‘Global Order Maintenance Detail’ screen is displayed in the amendment mode. Click the Unlock operation from the Action list to amend the record.

5.10.7 Copying Global Order Maintenance Record

To create a new record with details similar to a previously created record, refer to the following steps:

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID in the ‘AMC ID’ field. If you choose the blank space, then all the records are retrieved.

- The unit holder ID in the ‘Unit Holder ID’ field. If you choose the blank space, then all the records are retrieved.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double-click the record that you want to delete. The ‘Global Order Maintenance Detail’ screen is displayed.

- Click Copy from the action list in the ‘Details’ screen, to create a new record with the same details.

5.10.8 Closing Global Order Maintenance Record

To close an authorized record, refer to the following steps:

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID in the ‘AMC ID’ field. If you choose the blank space, then all the records are retrieved.

- The unit holder ID in the ‘Unit Holder ID’ field. If you choose the blank space, then all the records are retrieved.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double-click the record that you want to delete. The ‘Global Order Maintenance Detail’ screen is displayed.

- Click Close from the action list in the ‘Details’ screen.

You can re-open any closed record at a later point in time.

5.11 Global Order Confirmation Detail

This section contains the following topic:

5.11.1 Invoking Global Order Confirmation Detail Screen

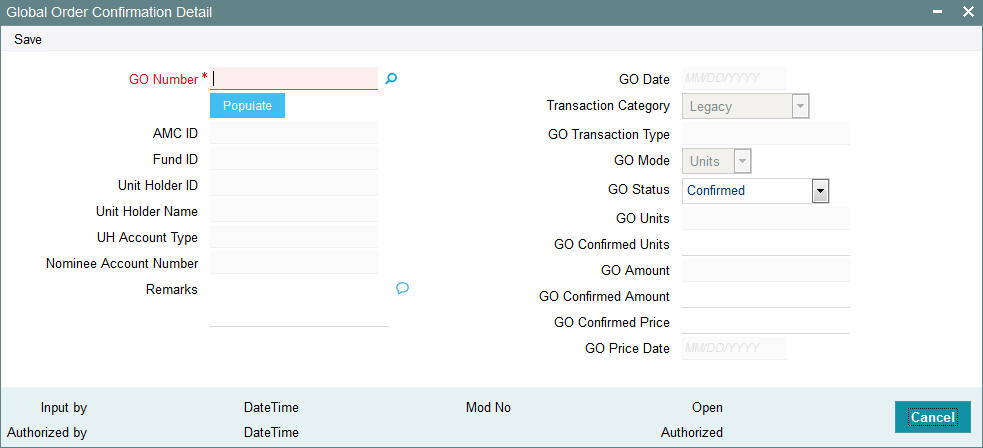

You can specify the price received from the fund house against the GO using ‘GO Confirmation Detail’ screen. the system which provide the details of price uploaded for the Global Orders. To invoke this screen, type ‘UTDGOCNF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select 'New' from the Actions menu in the Application tool bar or click new icon to enter the details of the ‘GO Confirmation Detail’ screen. You can enter the following in this screen:

GO Number

Alphanumeric; 16 Characters; Mandatory

Specify the Global Order number.

If you click on ‘Populate’ button, the following fields are displayed:

AMC ID

Display

The system displays the AMC ID.

Fund ID

Display

The system displays the fund ID.

Unit Holder ID

Display

The system displays the unit holder ID.

Unit Holder Name

Display

The system displays the unit holder name.

UH Account Type

Display

The system displays the UH account type.

Nominee Account Number

Display

The system displays the nominee account number.

Remarks

Alphanumeric; 255 Characters; Mandatory

Specify remarks, if any.

GO Date

Display

The system displays the Global Order date.

Transaction Category

Display

The system displays the transaction category. One of the following values are displayed in this field:

- Legacy

- Advised Business

- Execution Only

GO Transaction Type

Display

The system displays the GO transaction type.

GO Mode

Display

The system displays the GO mode. One of the following values are displayed in this field:

- Unit

- Amount

GO Status

Optional

Select the Global Order status from the drop-down list. Following are the options available in the drop-down list:

- Confirmed

- Rejected

- Pending Confirmation

- Amount Mismatch

- Unit Mismatch

- Price Mismatch

For Amount based order, if confirmation amount is mismatch then system will save record with Status as ‘Amount Mismatch’.

For Unit based order, if confirmation unit is mismatch then system will save record with Status as ‘Unit Mismatch’.

For Amount/ unit based order, if confirmation price is different than the fund price (for transaction date and transaction type combination) then system will save GO with status as ‘Price Mismatch’.

If unit/ amount and confirmation price matches then system will save the GO with confirmed status as ‘GO Confirmed’.

You can change the GO status manually to either GO confirmed or GO rejected in the GO Confirmation screen. All other statuses are defaulted by the system without manual intervention. Once GO is rejected, post confirmation of rejected order and all underlying transactions in the GO will be rejected. These will not be taken up for allocation.

GO Units

Display

The system displays the Global Order units.

GO Confirmed Units

Numeric; 27 Characters; Optional

Specify the Global Order confirmed units.

GO Amount

Display

The system displays the Global Order amount.

GO Confirmed Amount

Numeric; 30 Characters; Optional

Specify the Global Order confirmed amount.

GO Confirmed Price

Numeric; 22 Characters; Optional

Specify the Global Order confirmed price.

The system will consider the confirmation price received against a GO as the fund price for the GO confirmation date.

GO Price Date

Display

The system displays the Global Order price date.

The ‘GO Confirmation Detail’ screen will support all messages received via Swift Messages and will be enabled for any manual confirmation.

If no confirmation is received from the fund house, then GO will not be reversed, however, it will reflect GO status as ‘Pending Confirmation’ in ‘GO Confirmation Detail’ screen

The system will run the pre-EOD batch to check if all GOs generated for the day have been confirmed. The batch will also include unconfirmed GOs for back dated. Only if GO is confirmed, the underlying trades will be allotted.

5.12 Global Order Confirmation Summary

This section contains the following topics:

- Section 5.12.1, "Retrieving Global Order Confirmation Record"

- Section 5.12.2, "Viewing Global Order Confirmation Record"

- Section 5.12.3, "Editing Global Order Confirmation Record"

- Section 5.12.4, "Deleting Global Order Confirmation Record"

- Section 5.12.5, "Authorizing Global Order Confirmation Record"

- Section 5.12.6, "Copying Global Order Confirmation Record"

- Section 5.12.7, "Closing Global Order Confirmation Record"

5.12.1 Retrieving Global Order Confirmation Record

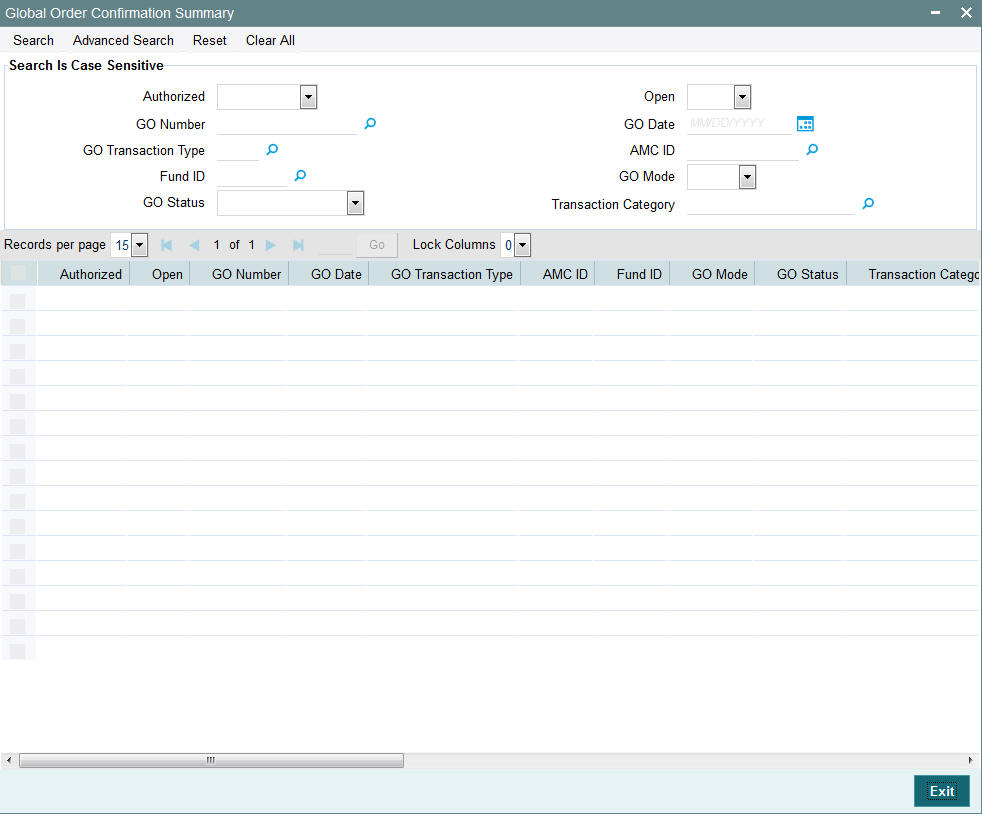

You can view Global Order Confirmation details using ‘GO Confirmation Summary’ screen. To invoke this screen, type ‘UTSGOCNF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button to perform the following operations:

You can retrieve a previously entered Global Order Confirmation Details as follows:

- Invoke the ‘GO Confirmation Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- GO Number

- GO Date

- GO Transaction Type

- AMC ID

- Fund ID

- GO Mode

- GO Status

- Transaction Category. If you choose the blank space, then all the records are retrieved.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

After retrieving a record, you can perform the following actions from the Global Order Confirmation Detail screen:

- View a Record

- Edit a Record

- Delete a Record

- Authorize a Record

- Close a Record

- Copy a Record

5.12.2 Viewing Global Order Confirmation Record

To view a record that you have previously entered, you must retrieve the same in the ‘GO Confirmation Summary’ screen, as follows:

- Invoke the ‘GO Confirmation Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID in the ‘AMC ID’ field. If you choose the blank space, then all the records are retrieved.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The ‘GO Confirmation Detail’ screen is displayed in the view mode.

5.12.3 Editing Global Order Confirmation Record

You can modify the Global Order confirmation details that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the ‘GO Confirmation Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID in the ‘AMC ID’ field. If you choose the blank space, then all the records are retrieved.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The ‘GO Confirmation Detail’ screen is displayed.

- Select Unlock operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The ‘GO Confirmation Detail’ screen is closed and the changes made are reflected in the ‘GO Confirmation Summary’ screen.

5.12.4 Deleting Global Order Confirmation Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the ‘GO Confirmation Summary’ screen from the Browser.

- Specify any or all of the following details in the screen:

- The status of the transaction in the ‘Authorized’ field. If you choose the blank space, then both the authorized and the unauthorized status records will be retrieved for the specified criteria.

- The status of the records in the ‘Open’ field. If you choose the blank space, then all the records are retrieved.

- The AMC ID in the ‘AMC ID’ field. If you choose the blank space, then all the records are retrieved.

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete. The ‘GO Confirmation Detail’ screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

Note

The maker of the record can only delete the unauthorized record.

5.12.5 Authorizing Global Order Confirmation Record

Apart from the maker, someone else must authorize an unauthorized global order confirmation record deal in the system for it to be processed. To authorize a record:

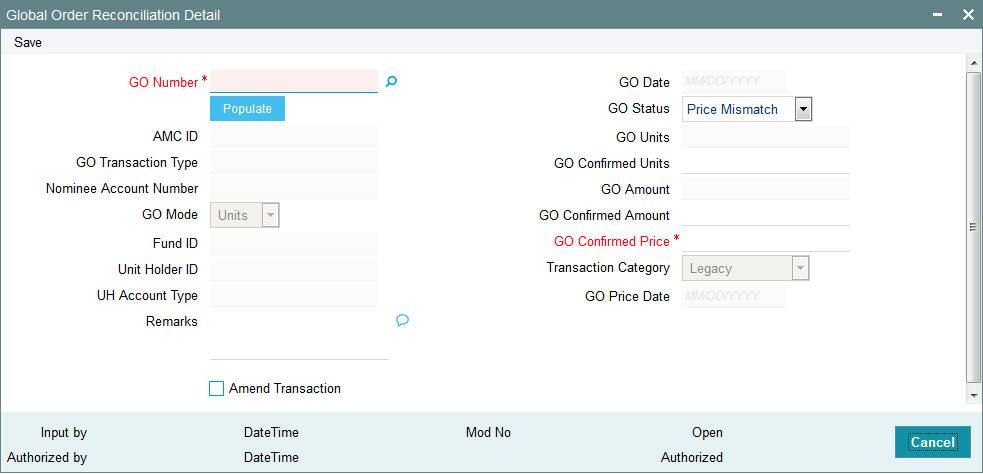

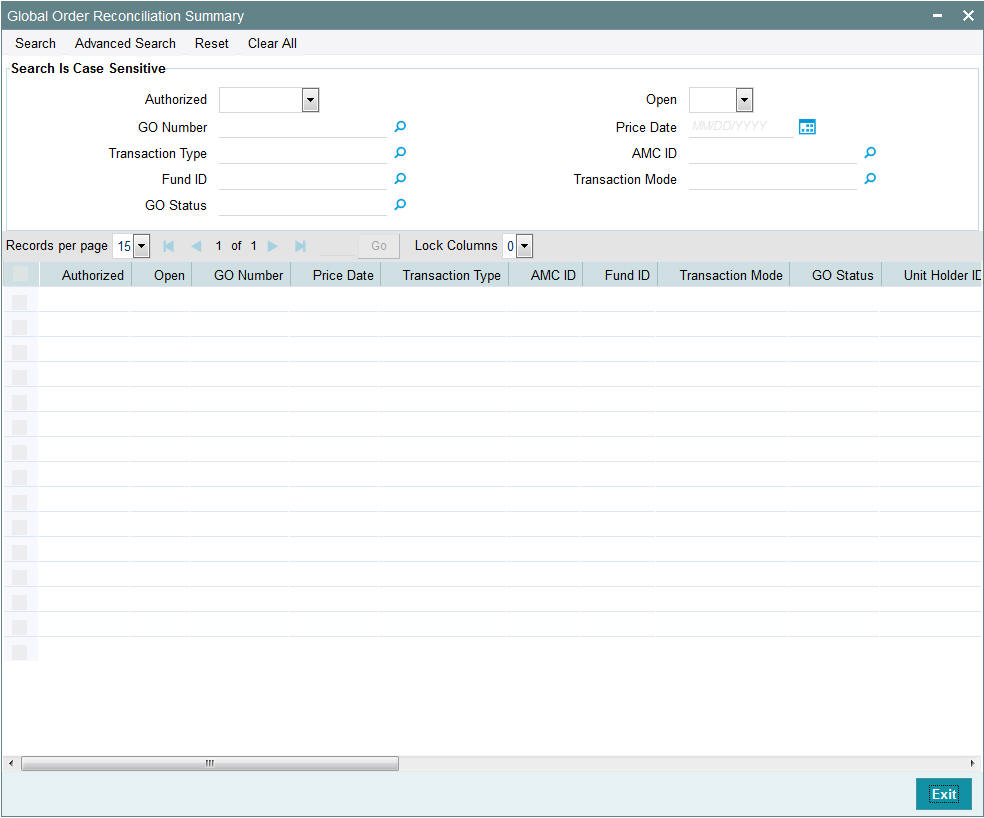

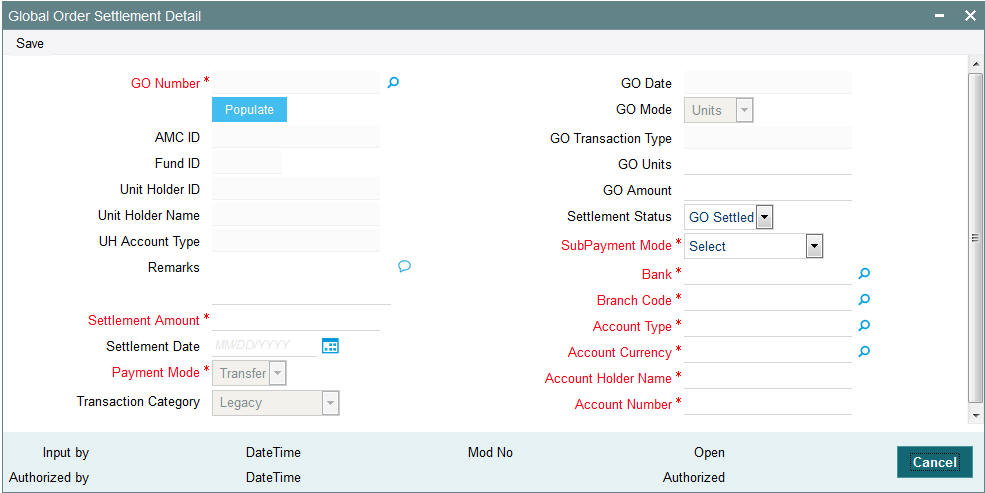

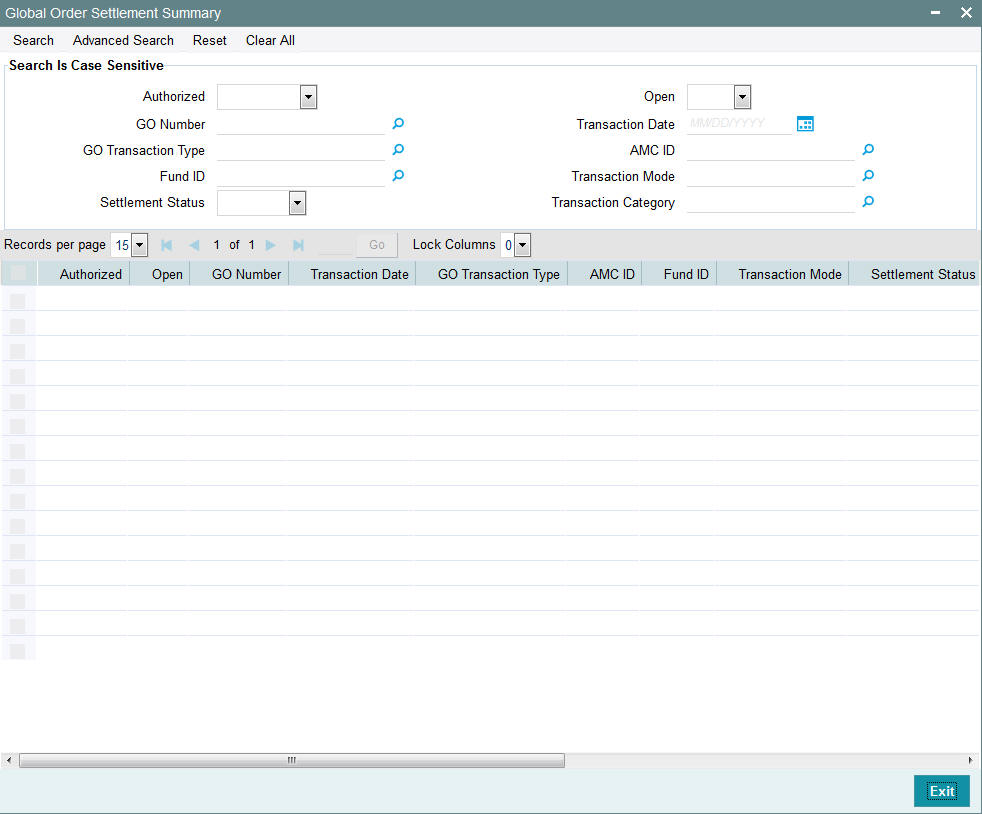

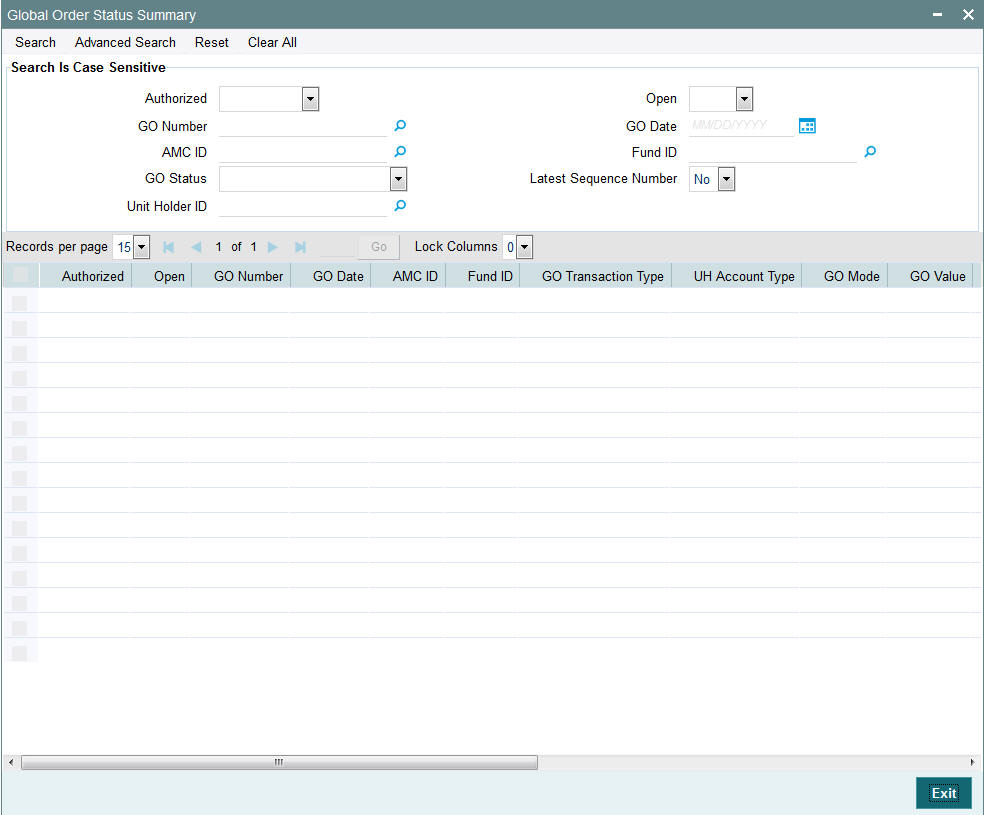

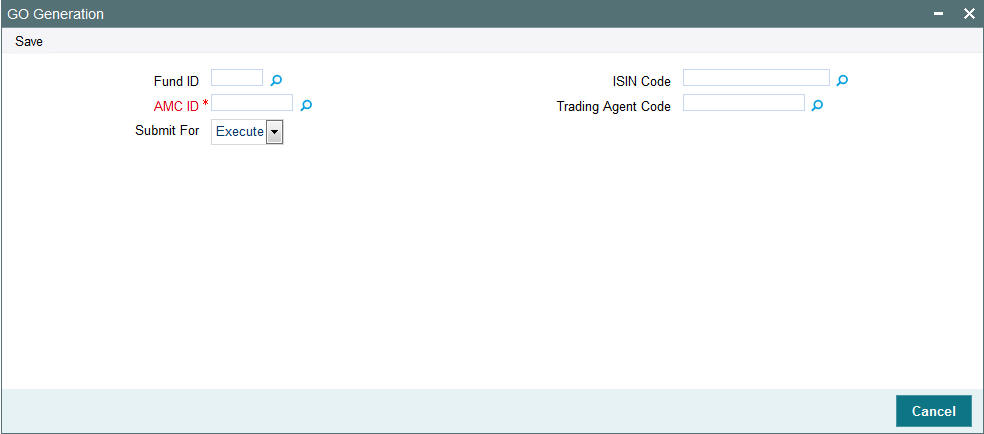

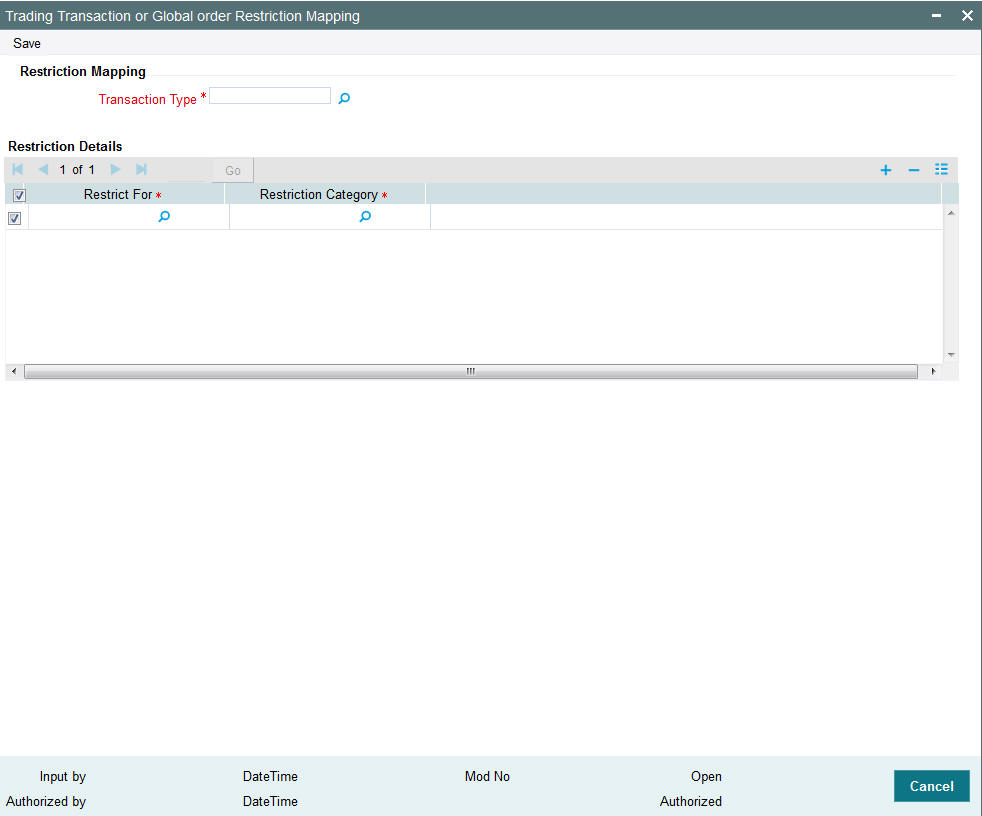

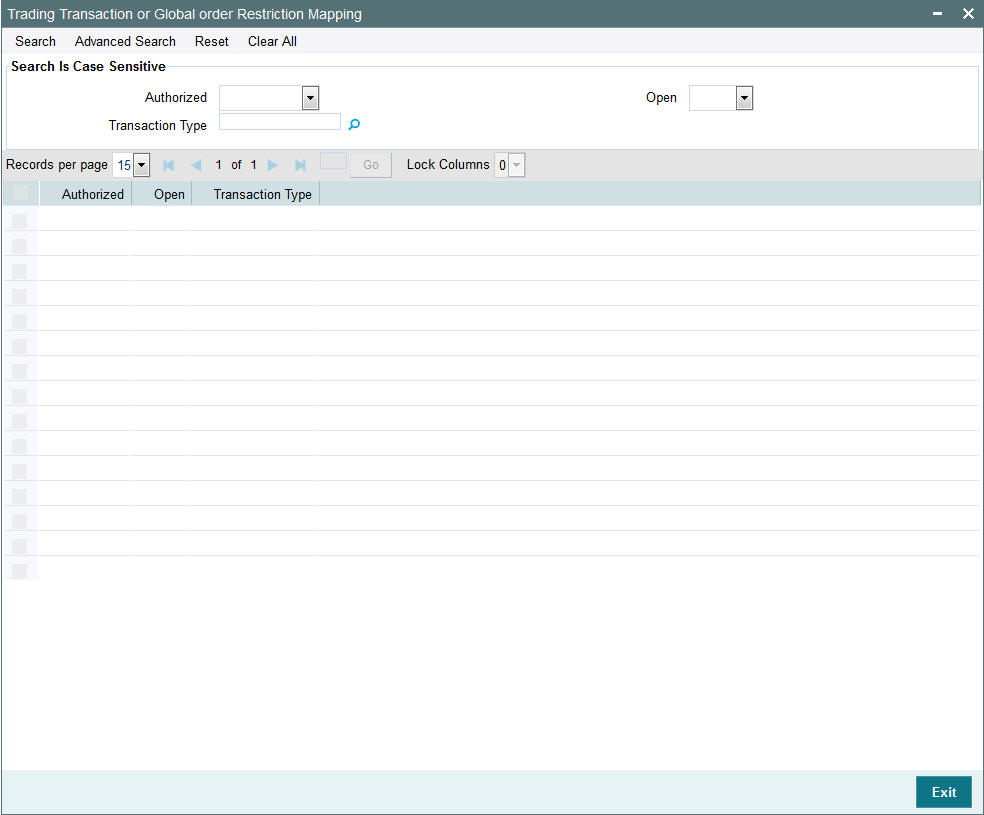

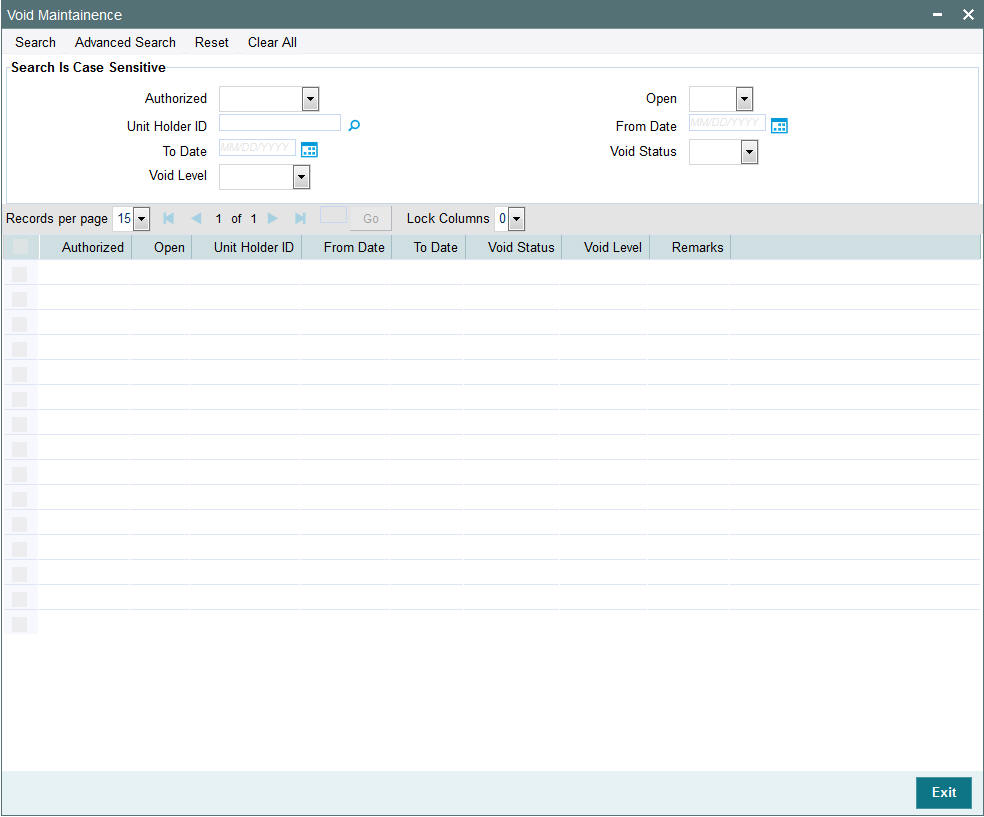

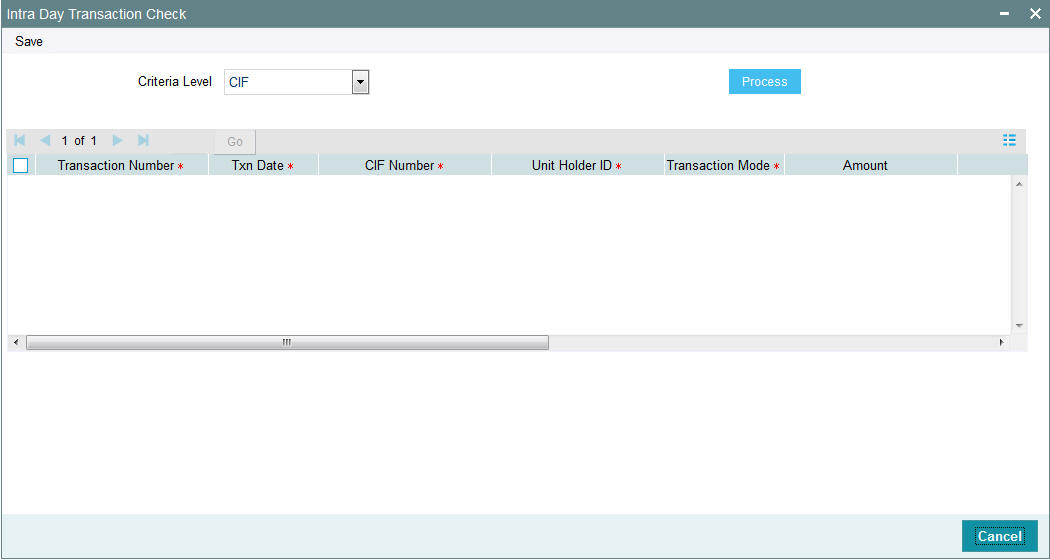

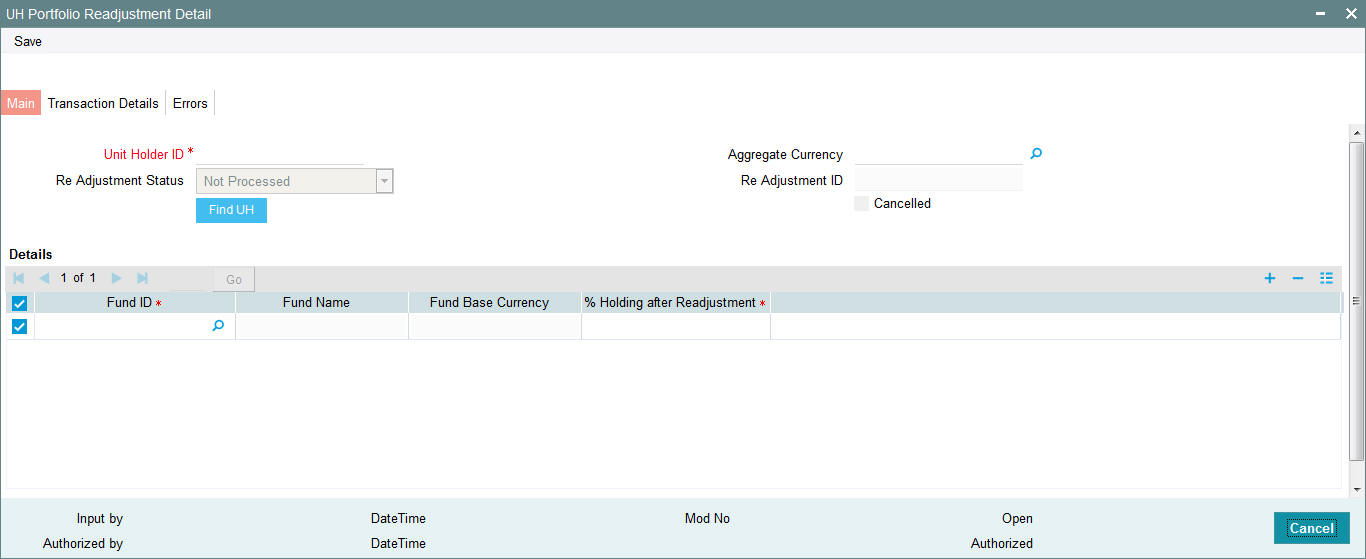

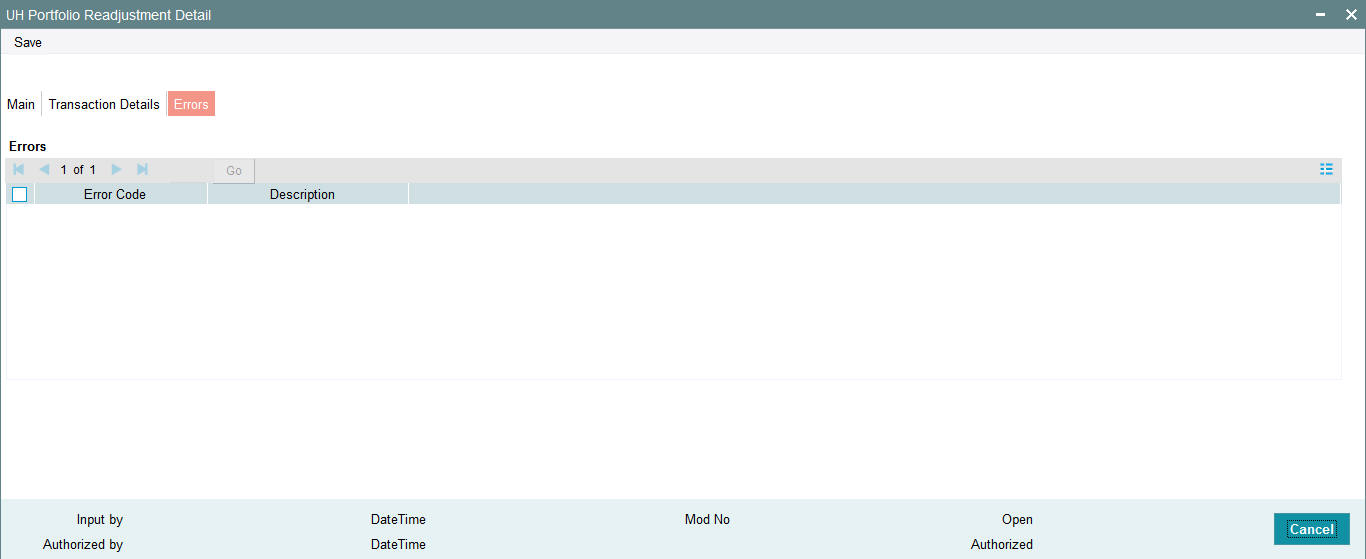

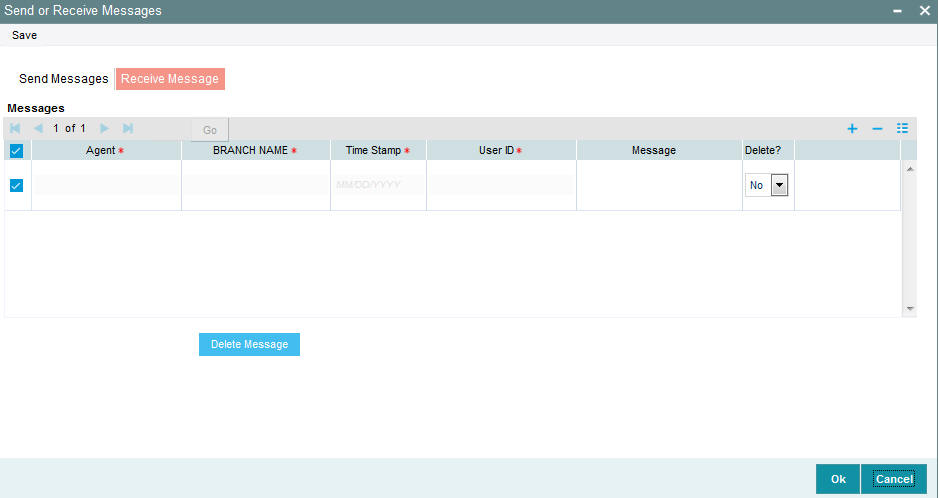

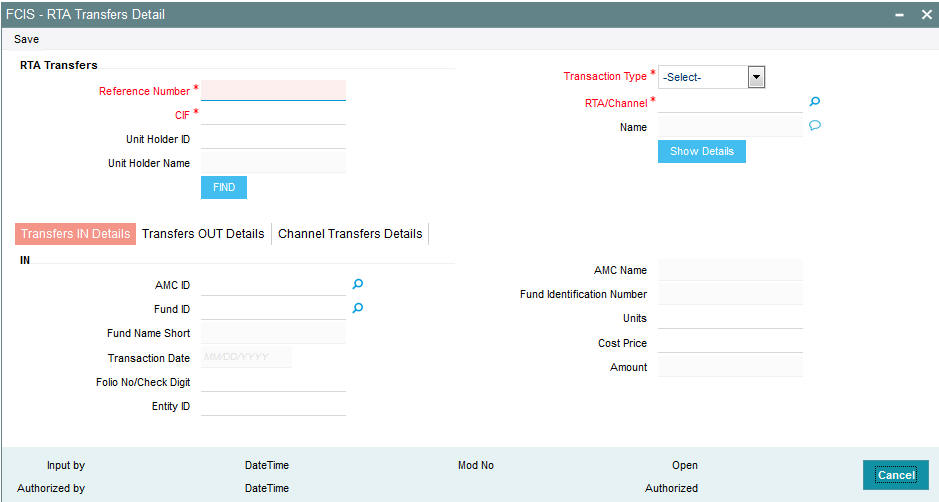

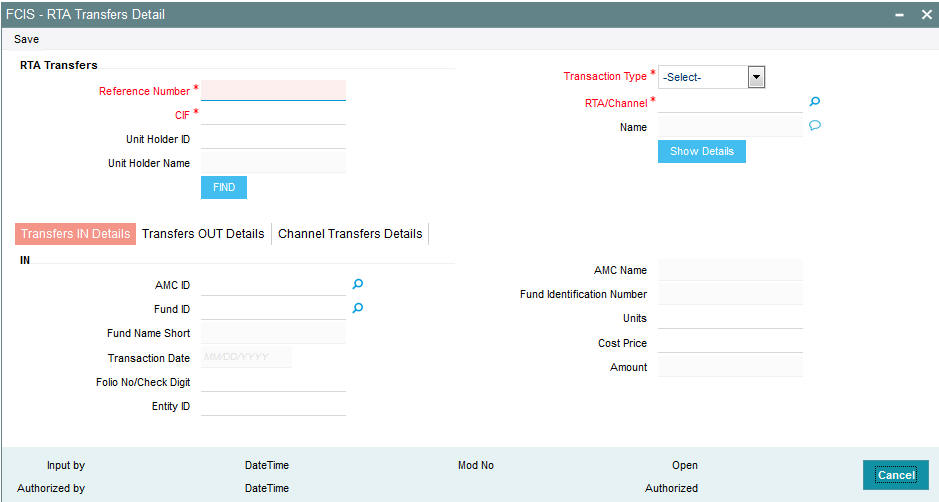

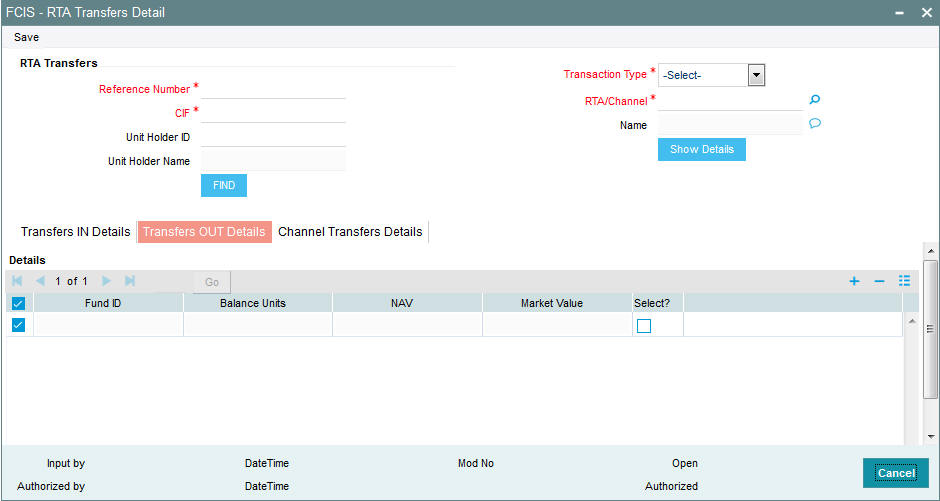

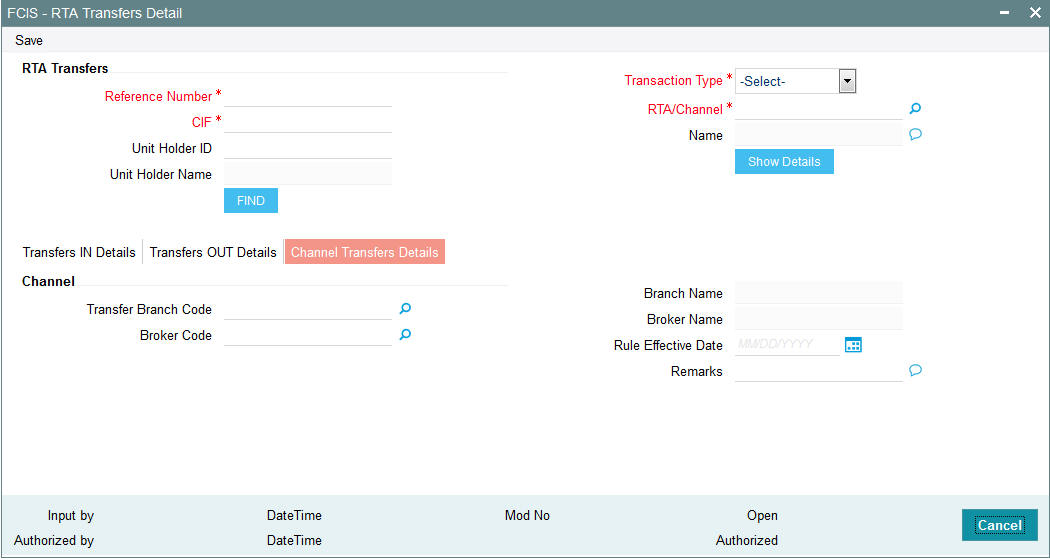

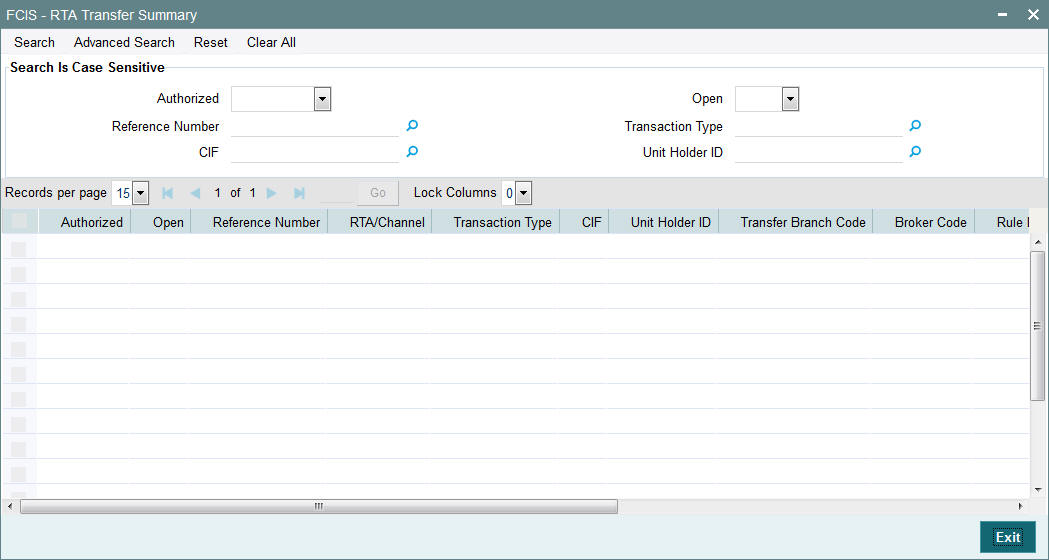

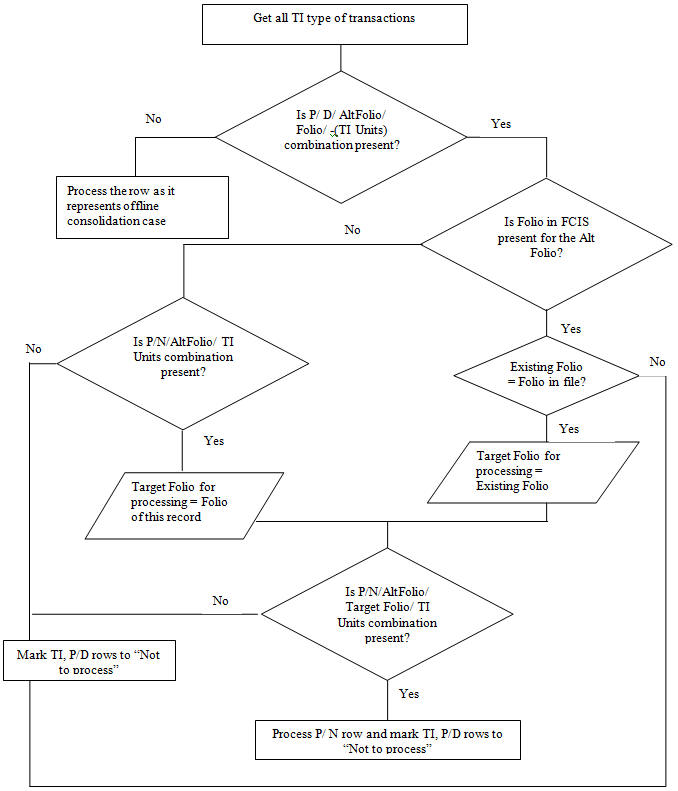

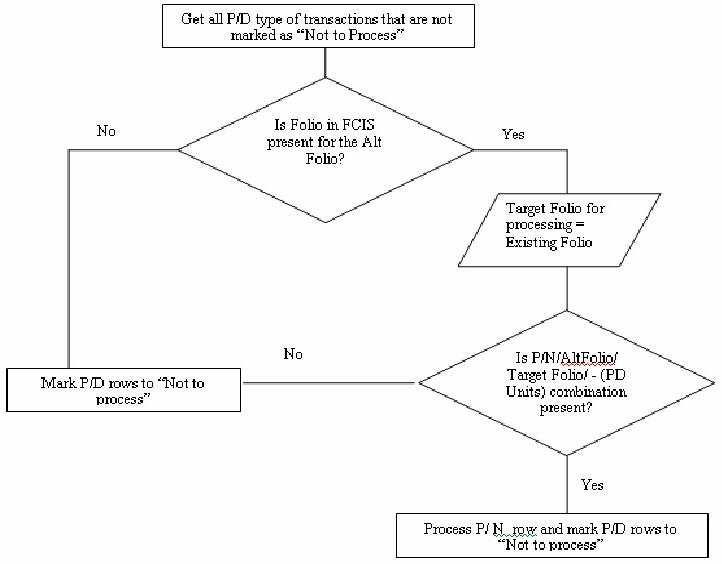

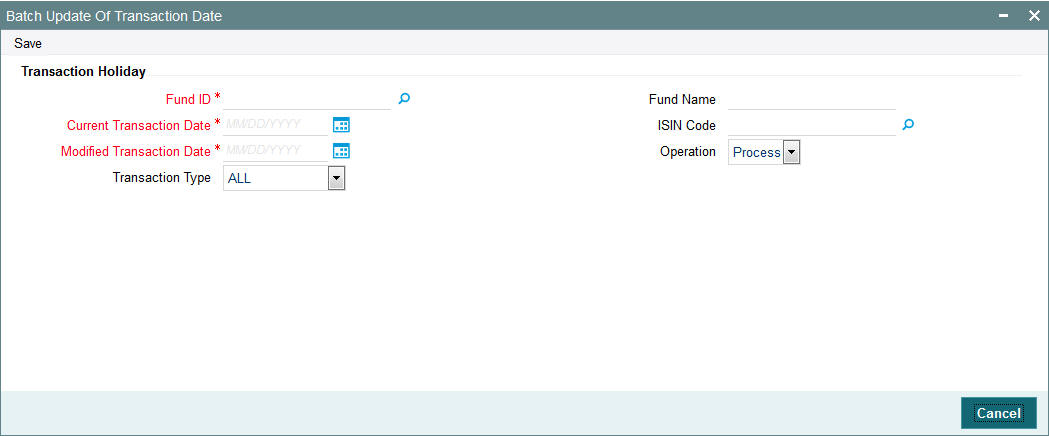

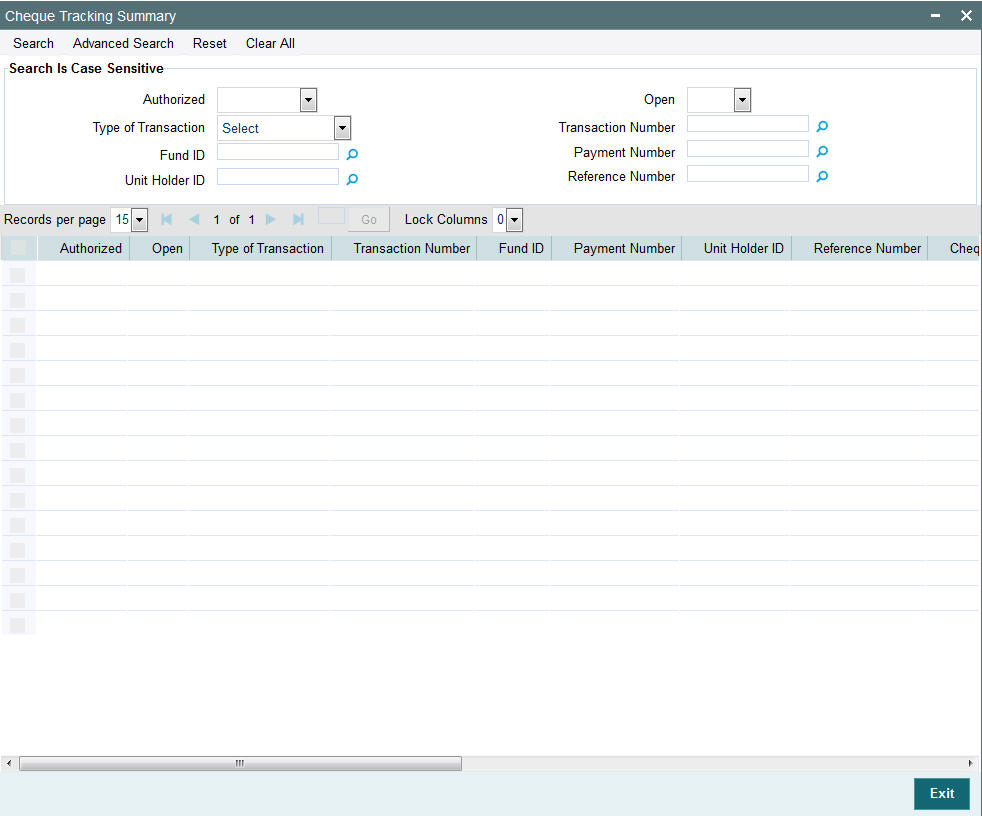

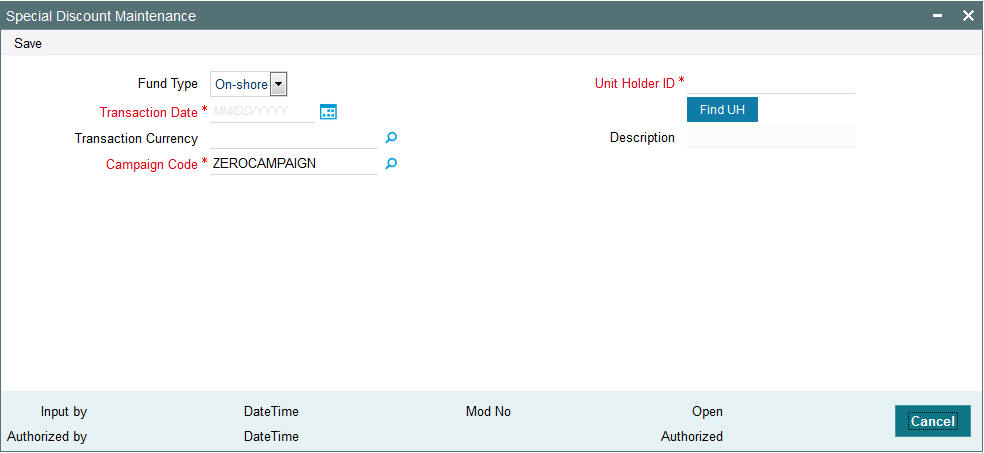

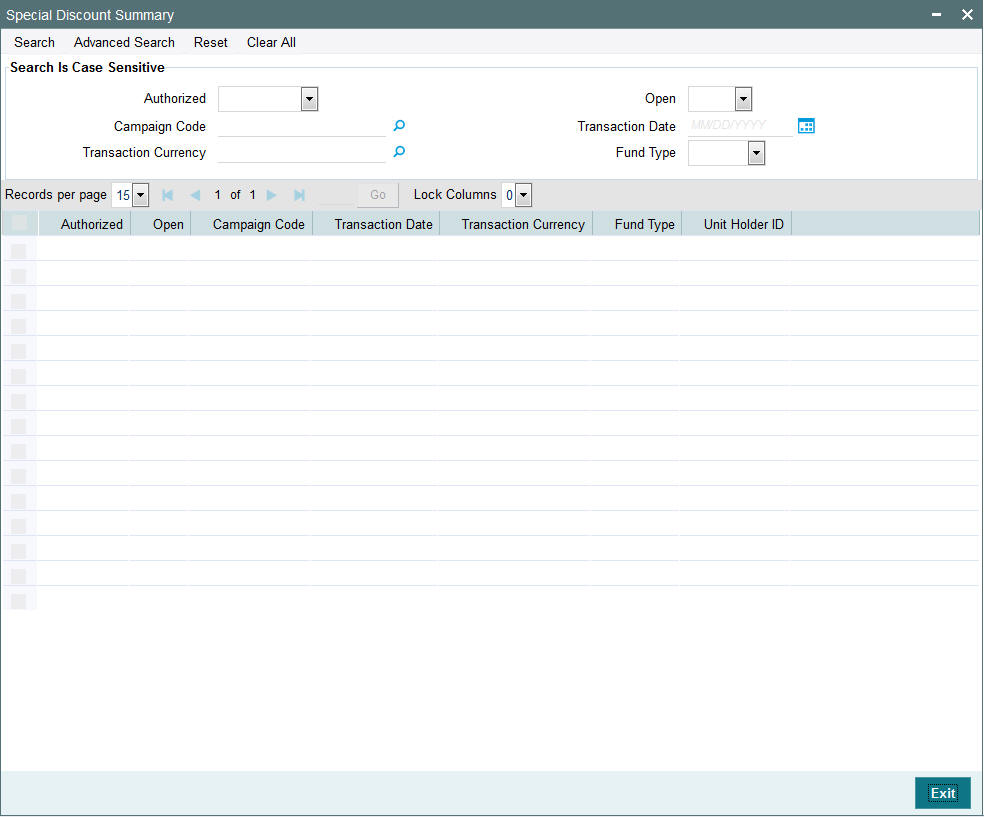

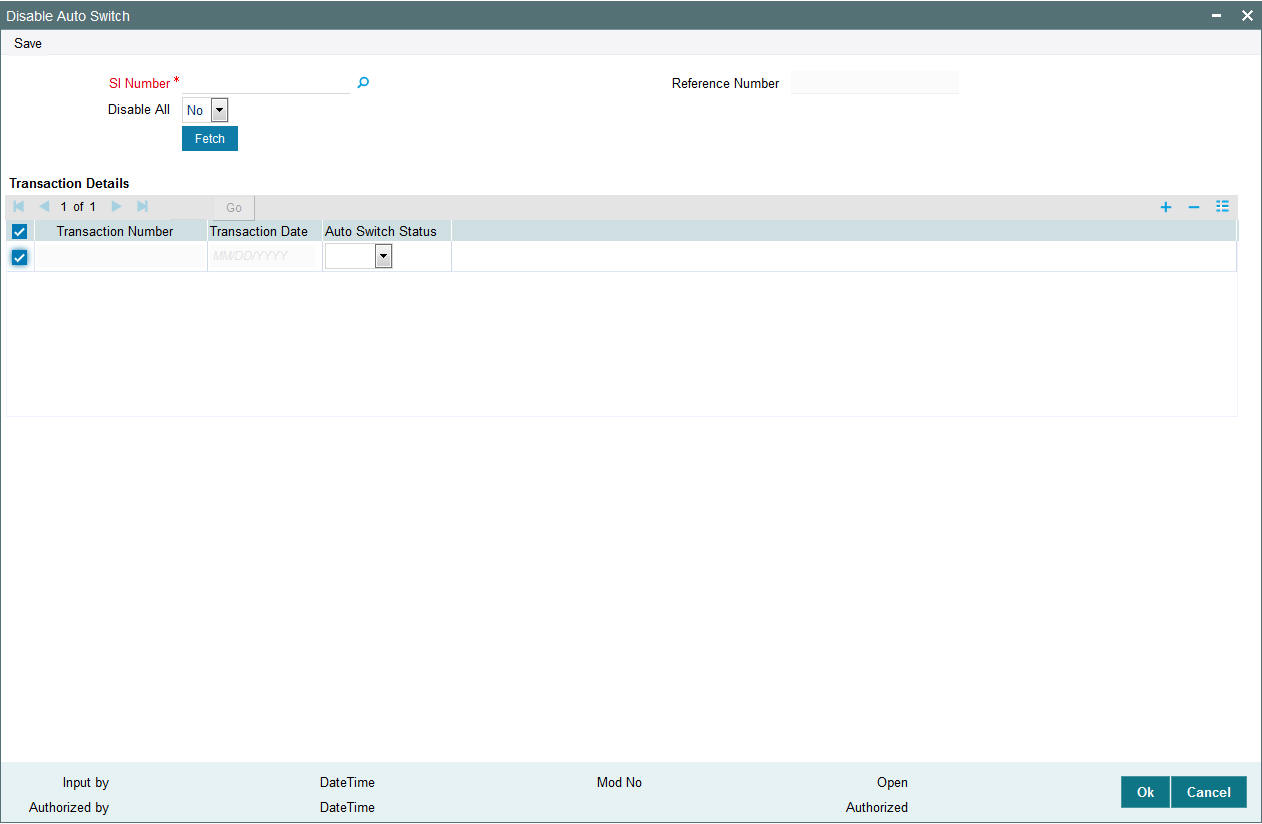

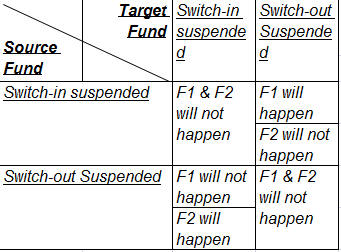

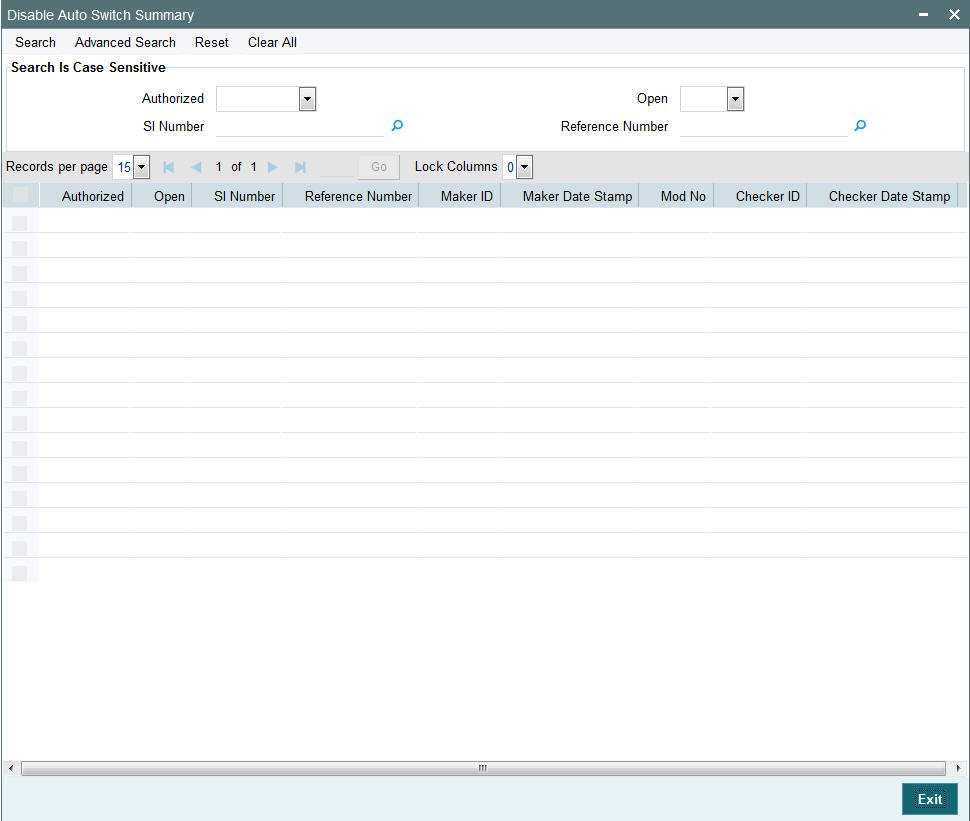

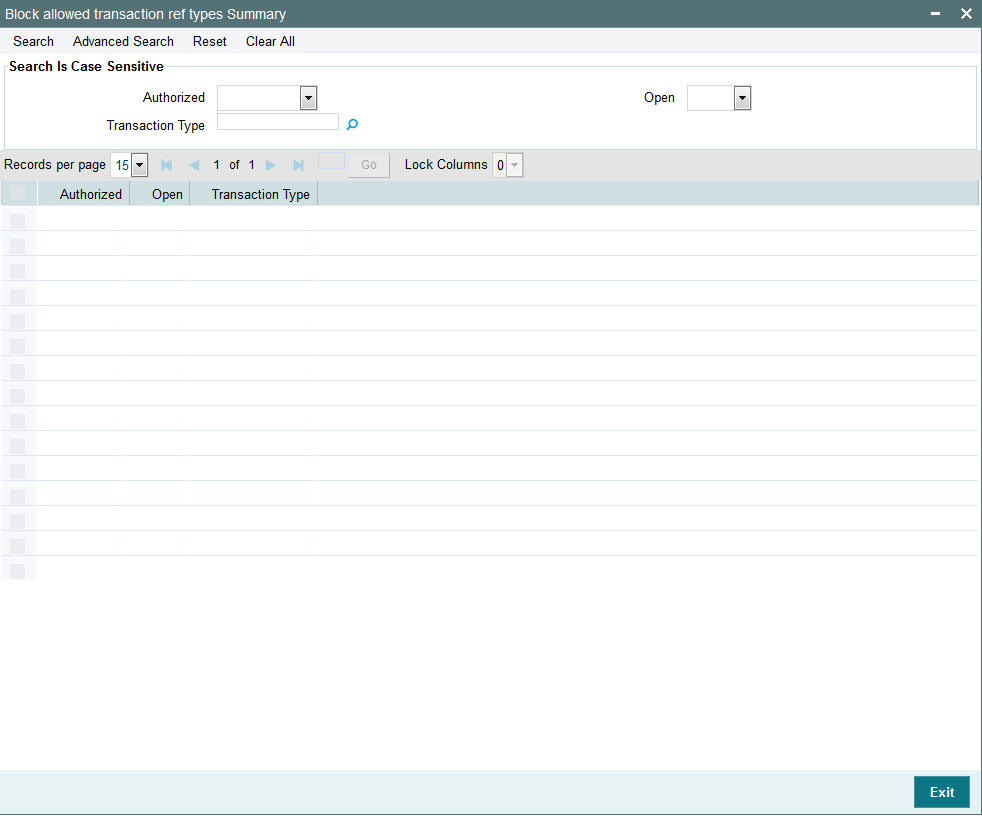

- Invoke the ‘GO Confirmation Summary’ screen from the Browser.