6. Processing Upfront Fee Accruals

This chapter contains the following sections:

- Section 6.1, "Introduction"

- Section 6.2, "Applying a Fee"

- Section 6.3, "FASB Fees Amortization Using Straight Line Method"

- Section 6.4, "Liquidating Fee Components"

- Section 6.5, "Transferring Memo Interest to FAS91 Fee"

6.1 Introduction

A fee is a payment that you levy on your customer in exchange for advices or services rendered by your bank. While processing contracts in Oracle Lending, you can choose to accrue fee components at the time of booking the contract. The upfront fee involved in a contract is accrued by the system over the tenor of the contract.

In Oracle Lending, you can define the manner in which fees that apply on a product should be accrued. The following are the two methods by which you can opt to calculate the fee accrual amount:

- Straight Line Method

- Yield Basis Method

Straight Line method of calculating the accrued fee amount

In this method of fee accrual, the fee amount is equally spread over the tenor from the fee calculation start date to the fee calculation end date of the loan or commitment.

The example given below illustrates the Straight Line method of calculating accruals wherein the fee amount is equally spread across between the Start and End date for fee calculation.

Example

Consider a loan with the following details:

- Value Date: 01-Jan-2002

- Accrual Start Date: 01-Jan-2002

- Fee Amount: USD 365,000

- Accrual Frequency: Monthly

Let us assume that the current working date of your bank is 28th February 2002.

Therefore, the previous accrual date is 31st January 2002 as the accrual frequency is ‘Monthly’.

The fee accrual amount as of 01-Jan-2002 (which is the previous accrual date) = USD 31,000 (for 31 days between 1st January 2002 and 31st January 2002).

On 28th February 2002 (which we have assumed as the current working date of your bank), the system calculates the gross fee amount that has to be accrued as: USD 31,000 (previous accrued amount) + USD 28,000 (fee amount accrued for 28 days for the month of February) = USD 59,000.

Note

For contracts where a Principal amount has not been specified the Upfront Fee details can be maintained. Accruals takes place only on straight line basis.

Yield Basis method of calculating accrued fee amount

In the Yield Basis method of fee accrual, accruals are done based on the balance and the repayment schedules of the contract.

Example

Case1: Yield Basis method of accrual for loan contracts

Assume that your bank has disbursed a loan with the following details:

- Value Date: 1-Jan-2002

- Maturity Date: 1-Jan-2003

- Principal: 1,000,000.00

- Currency: USD

- Fee Amount: 2000

- Fee Currency: USD

The detail of the loan contract is diagrammatically represented as shown:

|

1,000,000 |

400000

|

|

1-Jan-02 1-Jul-02 1-Jan-03 |

|

According to the above illustration, the loan contract has a repayment schedule on 1st July 2002 and we are assuming that the customer has repaid USD 6,00,000 of the loan amount and therefore the outstanding balance is USD 4,00000.

Oracle Lending calculates the fee accrual amount for the above loan contract as follows:

Start Date |

End Date |

Basis Amount |

No of Days |

Total Accrual Amount |

Daily Avg Accrual Amount |

1-Jan-02 |

1-Jul-02 |

1000000 For loans, the basis amount is always the expected principal balance. |

181 |

2000x The denominator is called the ‘Yield Factor’ and is always the sum of (No of Days x Basis Amount) for both loans and commitments. |

1,421.84/181= 7.85549544 |

1-Jul-02 |

1-Jan-03 |

400000 This is the expected balance as we are assuming that the customer has paid back USD 600000. |

184 |

2000x =578.16 |

578.16/184= |

Case 2: Yield Basis method of accrual for revolving type of commitments with utilized facility amount

Let us assume that your bank has processed a revolving commitment with the following details:

- Value Date: 1-Jan-2002

- Maturity Date: 1-Jan-2003

- Commitment Amount: 1,800,000.00

- Currency: USD

- Fee Amount: 2,000

- Fee Currency: USD

Details of the loan linked to the above commitment

- Value Date: 1-Mar-2002

- Maturity Date: 1-Sep-2002

- Principal Amount: 1,000,000.00

- Currency: USD

The details of the commitment are diagrammatically represented below:

|

1,000,000 Outstanding Amount

|

400,000 |

1-Jan-02 1-Mar-02 1-Jun-02 1-Sep-02 1-Jan-03

In the above representation, the shaded area represents the outstanding amount of the commitment and non-shaded area represents the amount utilized by the customer.

With reference to the above illustration, we are assuming that the schedules for the commitment are on 1st march 2002, 1st June 2002 and 1st September 2002. Further, we assume that the utilized amount between 1st September 2002 and 1st January 2003 is USD 400,000.

Keeping these details in view, system calculates the fee accrual amount as shown below:

Start Date |

End Date |

Basis Amount |

No of Days |

Total Accrual Amount |

Daily Avg Accrual Amount |

1-Jan-02 |

1-Mar-02 |

0.00 Basis Amount = Utilized Amount |

59 |

0.0 |

0.00 |

1-Mar-02 |

1-Jun-02 |

1,000,000.00 |

92 |

2,000x[1,000,000x92] |

1,428.57/92 |

1-Jun-02 |

1-Sep-02 |

400,000.00 (We are assuming that this is the utilized amount) |

92 |

2,000 x [400,00x92] |

571.43/92= |

1-Sep-02 |

1-Jan-03 |

0.00 |

122 |

0.00 |

0.00 |

6.2 Applying a Fee

Given below is the sequence of steps you need to follow to apply and process fees levied on a contract:

- Maintain a Fee Rule through the Fee Rule – Definition screen

- Define the attributes of a Fee Rule through the Fee Rule Maintenance screen

- Once you have defined the attributes of a Fee Rule, you have two

options:

- Define a Fee Class through the Fee Class screen. If you define a Fee Class, you can associate it with a Product directly (through the Loans and Deposits Fee screen) and the Product inherits all the attributes of the Fee Class.

- Do not define a Fee Class, instead, associate a Fee Rule directly with a Product and define the other properties through the Loans and Deposits Fee screen.

- The contracts booked under various products, inherit the properties of the product. For each contract, you can add, edit or remove fee components through the Fee Components screen.

- Enter schedules for the fee components through the Fee Schedules screen

- Liquidate the fee components through the Fee Liquidation screen

6.2.1 Associating the Component with the Product

After defining a fee component, you need to link the fee component to a product in Oracle Lending. Consequently, you can collect and accrue fees on all contracts associated with that product.

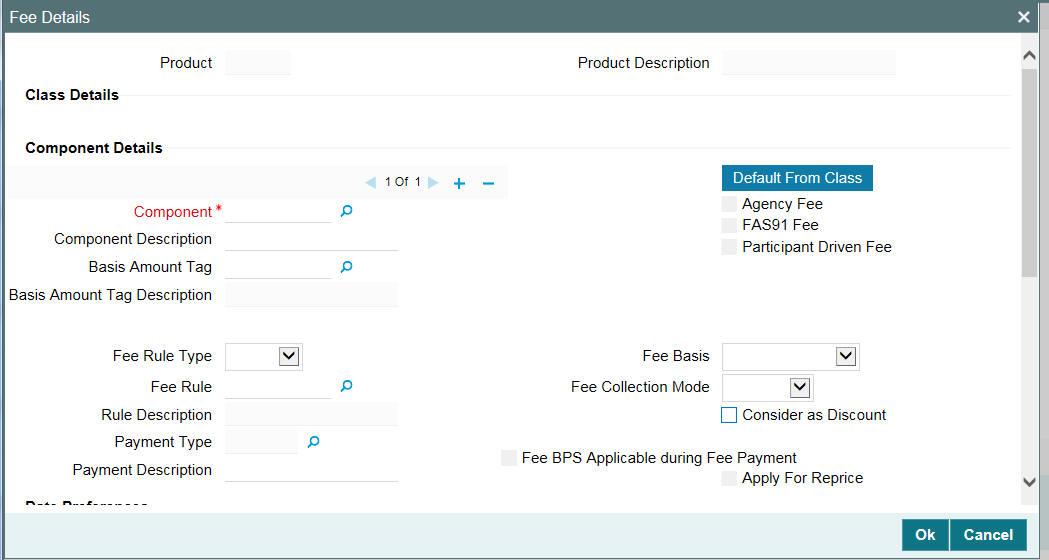

Click ’Fee’ n the Product Definition screen to invoke this screen.

Click ‘Add Row’

to add fee components. Click ‘Default

From Class’ to associate the required fee component with the product.

System defaults the parameters of the selected fee component. However,

you can change the parameters according to your requirements.

6.2.2 Specifying the Accounting Roles

For each of the fee component that you associate with the product, Oracle Lending generates the following accounting roles:

- COMPONENT_FIA: You can use this accounting role to map to a Liability GL for the unearned fee income

- COMPONENT_FIN: You can use this accounting role to map to an Income GL for the fee earned

For more information on accounting role to head mapping, refer to the Product Definition User Manual.

6.2.3 Specifying Discount Accrual

For the fee component you associate with product you can specify if the component is considered for discount accrual. Discounted Accrual is applicable for both Fixed and Floating type of Fixed Maturity type Loan and Advance type of User Input fees. The discount accrual selected here for the product gets defaulted to the contract level.

Select ‘Consider as Discount’ check box for applying discount accrual to the component.

6.2.4 Specifying Re-Price

Among the fee components you associate with product one of the fee components can be used to transfer the unamortized fee amount in the contract to the child contract. Applying for Re-price has no impact on the schedules of the fees.

Select ‘Consider as Discount’ and ‘Apply Reprice’ check box for transferring the unamortized amount of the contract to another child contract. While transferring the amount system shows an error if both the options are not selected for the component.

Specifying the events

In addition to the various events that are available, you need to associate the following events for processing the fee components in Oracle Lending:

- Event FELR

This event is triggered whenever you associate a new upfront fee component with a contract or when you amend the financial details of a fee component.

You can define relevant accounting entries that need to be passed during this event. This is discussed in the subsequent sections of this manual.

- Event FACR

The accrual entries for the fee amount is passed when this event is triggered. You can specify the relevant accounting entries that need to be passed during this event. This is discussed in the subsequent sections of this manual.

You should maintain the following set up for charges if the option ‘Consider as Discount’ has been selected:

Event of association |

Event of Application |

Event of Liquidation |

BOOK |

BOOK |

INIT |

BOOK |

VAMB |

VAMI |

BOOK |

CAMD |

CAMD |

BOOK |

LIQD |

LIQD |

BOOK |

ROLL |

ROLL |

Specifying the accounting entries for the associated fee components

For every event associated with the product, you can specify the accounting entries that need to be posted to the respective GL’s. Oracle Lending provides the following amount tags for each of the fee component associated with the product.

- COMPONENT_LIQD: You can use this amount tag to pass entries at the time of collecting a new fee or an additional fee from the customer. This amount tag contains the fee liquidation amount.

- COMPONENT_DECR: This amount tag contains the fee refund amount. This amount tag is used to pass an accounting entry if you want to refund a fee amount

- COMPONENT_ACCR: This amount tag contains the fee amount that is accrued

Specifying event-wise accounting entries

You can specify the accounting entries that need to be posted to the respective GL’s during each event that is associated with the product. As discussed earlier, the events that are associated for processing fee accruals are FELR and FACR. These are the accounting entries that you need to pass during each of these events.

Accounting entries for the event FELR

During collection of a new upfront fee, you need to pass the following accounting entries:

Accounting Role |

Amount Tag |

Debit/Credit Indicator |

CUSTOMER |

COMPONENT_LIQD This contains the fee liquidation amount that is collected as new fee. |

Dr |

COMPONENT_FIA This is the accounting role, which is mapped to an Unearned Income GL/ Liability GL. At the time of collecting a fee, you can credit the Unearned Income GL. You can credit the actual Income GL at the time of fee accrual. |

COMPONENT_LIQD |

Cr |

If your bank is refunding the fee amount to the customer, you need to pass the following accounting entries:

Accounting Role |

Amount Tag |

Debit/Credit Indicator |

COMPONENT_FIA This is the accounting role which is mapped to a Liability GL. |

COMPONENT_DECR This contains the fee refund amount |

Dr |

CUSTOMER |

COMPONENT_DECR |

Cr |

Accounting entries for the event FACR

This event is triggered as part of accrual processing of the upfront fee components associated with the product. This event is triggered as part of LD automatic daily batch for those contracts that have been set up for up-front fee accrual. The accounting entries that you need to pass during this event are shown below:

Accounting Role |

Amount Tag |

Debit/Credit Indicator |

COMPONENT_FIA This is the accounting role which is mapped to a Liability GL. |

COMPONENT_ACCR This contains the fee amount being accrued |

Dr |

COMPONENT_FIN This accounting role is mapped to an Income GL. You can credit this GL with the fee amount. |

COMPONENT_ACCR |

Cr |

Specifying the advices

Your bank might want to generate messages on collection of a new fee or during fee refund operation (Event FELR). Accordingly, Oracle Lending generates a Debit Payment Advice if you are collecting a new fee. In case of fee refund operation, the system generates a Credit Payment Advice.

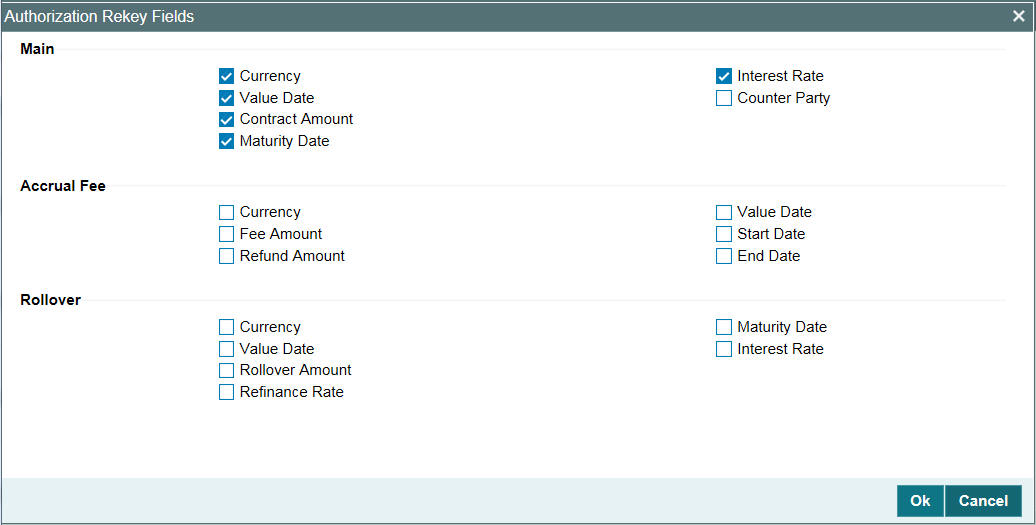

Indicating the values of the fee amount to be rekeyed during authorization

You can specify the parameters of the fee whose values have to be rekeyed at the time of authorizing a fee input for a particular contract. To invoke this screen, click ’Rekey Fields’ in the ‘Product Preferences’ screen.

You can specify any or all of the following as re-key fields:

- Fee Currency

- Fee amount

- Refund Amount

- Value Date

- Fee Calculation Start Date

- Fee Calculation End Date

Specifying the status of an upfront fee

In Oracle Lending, the status of a fee component depends on the payments made towards the fee amount. For movement to each status, you can define processing parameters, such as whether further accruals of the fee component has to be stopped, or fee related accruals already made must be reversed out, and if the reporting GL must be changed when the status changes.

You can transfer the overdue accrued fee amount to a different GL. In case of fee components falling overdue, you can specify the following:

- For the accounting role COMPONENT_FIA (which is mapped to a Unearned Income/Liability GL), you can specify that the amount in the Unearned Income/Liability GL be transferred to another GL.

- For the accounting role COMPONENT_FIN (which is mapped to an Income GL), you can specify that the amount in the Income GL be transferred to another GL.

6.2.5 Processing Lock-ins

In a structured finance business scenario, your bank may encounter a situation wherein you agree upon a commitment and allow the customer to borrow/repay any amount any number of times within a pre-defined period. At the end of the period, you can consolidate the unsettled loans into a single loan and agree upon a payment schedule. This is referred to as ‘Lock-in’. Till the lock-in takes place, the unsettled amount as of a given date is not predictable as the customer might return a loan or borrow an additional amount. Therefore, Oracle Lending uses only the Straight-line method of accrual for such contracts. However, after lock-in takes place, you can instruct the system to accrue the fee amount based on yield basis method.

If you want to change the method of accrual from Straight-line method to Yield Basis method after lock-in, it is advisable to transfer the fee amount from the commitment contract to the loan contract. This is because, in Oracle Lending, status control is available only for loans. If you want to track the fee amount (that is if you do not want status control), you can change the accrual method to yield basis for the commitment contract only and the system accordingly accrue the fee amount based on yield basis method.

6.2.6 Generating Fee Accrual reports

You can generate reports to view the accrual details of the upfront fee components for loans and commitments. The report displays the following:

- Contract Reference Number

- Fee component

- Previous Accrual Date

- Till Date Accrual

- Outstanding Accrual

For more information on report generation, refer to Generating Reports User Manual.

6.3 FASB Fees Amortization Using Straight Line Method

Oracle Lending facilitates transfer of unamortized fees to the child contract. You have to select the accrual method as ‘Straight Line’ to accrue the fee using straight line method. To accrue the fee using straight line method, you have to select the accrual method as ‘Straight Line’ in the ‘Loans and Commitments Fee’ screen.

Click ‘Fee’ in the Product

Definition screen to invoke this screen.

You have to maintain the fee rule at the product level for computing the fee. To transfer the unamortized straight line fee to the child contract, you have to select both ‘Apply for Re-price’ and ‘Accrual Required’ option.

For the fee component you associate with product you can specify if the component is considered for straight line accrual. Straight line accrual selected here for the product gets defaulted to the contract level.

Select ‘Accrual Required’ check box for applying straight line accrual. The accrual method should be selected as ‘Straight Line’ for the fee to be accrued using straight line method.

You are allowed to attach multiple fee components to the product. For the fee component which you associate with product, you have to specify if the component is considered for straight line accrual. The straight line accrual is selected for the product to get defaulted to the contract level.

During transfer, the system checks if the unamortized fee component has selected for both ‘Apply for Re-price’ and ‘Accrual Required’ before transferring the amount from parent contract to child. An error message throws up otherwise and the system does not save the transaction.

For arrear or advance type of fee, the ‘Daily Straight Line’ accrual is calculated based on the number of days between the start date and end date.

Example

Let us assume the following:

- Arrear/Advance Fee Calculated – 1000

- Start Date – 01-Apr-2005

- End Date – 01-May-2005

- No of Days – 30

The Daily Straight Line is calculated based on the number of days between the start date and end date. Therefore the Accrual Amount is 33.333.

6.3.1 Maintaining Fee Rule Details

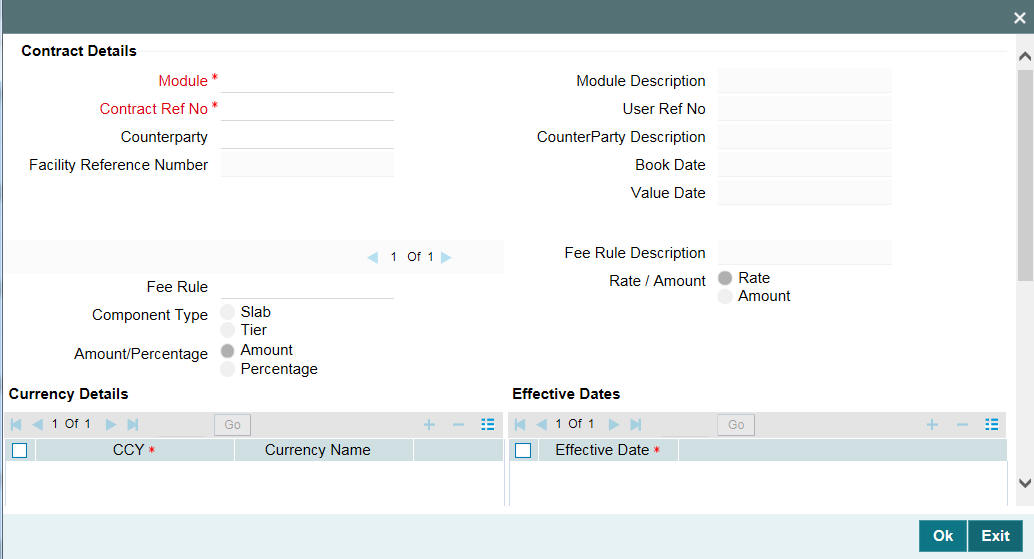

You can invoke ‘Fee Rule Maintenance’ screen by clicking ‘Fee Rule’ from the ‘Loan and Commitment- Contract Input’ (OLDTRONL) screen. You can define the slab ranges and the fee amount or rate for each slab for each of the fee components like ‘Loan Fee’ and ‘Commitment Fee’.

6.3.2 Associating Fee at Contract Level

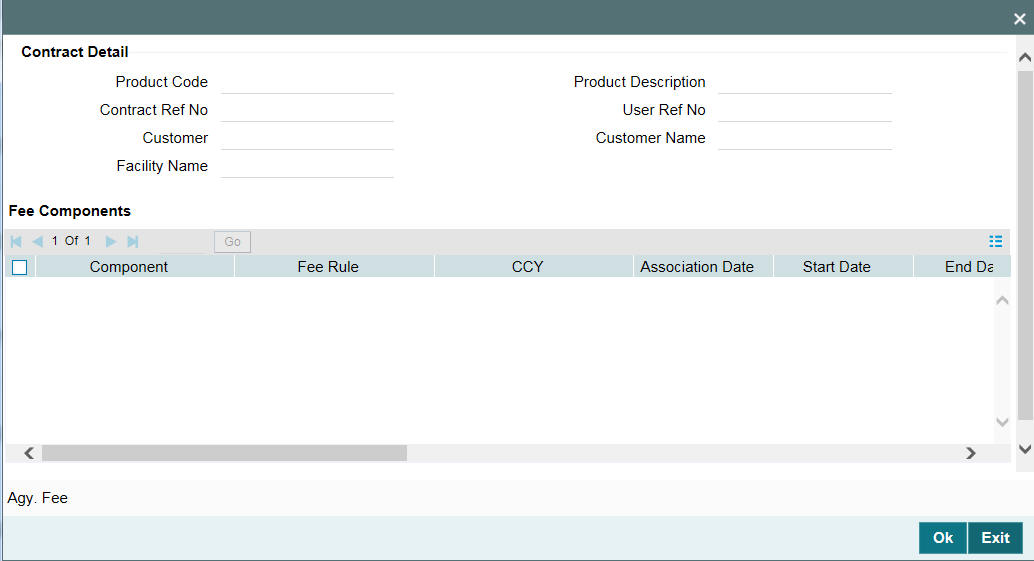

You can associate the fee by clicking the ‘Fee’ button in the Loan and Commitment- Contract Input’ (OLDTRONL) screen.

For more information on contract details, refer to Disbursing a Loan chapter in this User Manual.

On clicking the ‘Fee’, the ‘Fee Component’ screen is displayed.

Here, the system defaults the loan fee, unused fee and commitment fee components which are maintained at the product level with which this contract is associated.

The system defaults the following details:

- Fee Component

- Fee Rule

- Currency

- Association Date

- Start Date

- End Date

- Component Status

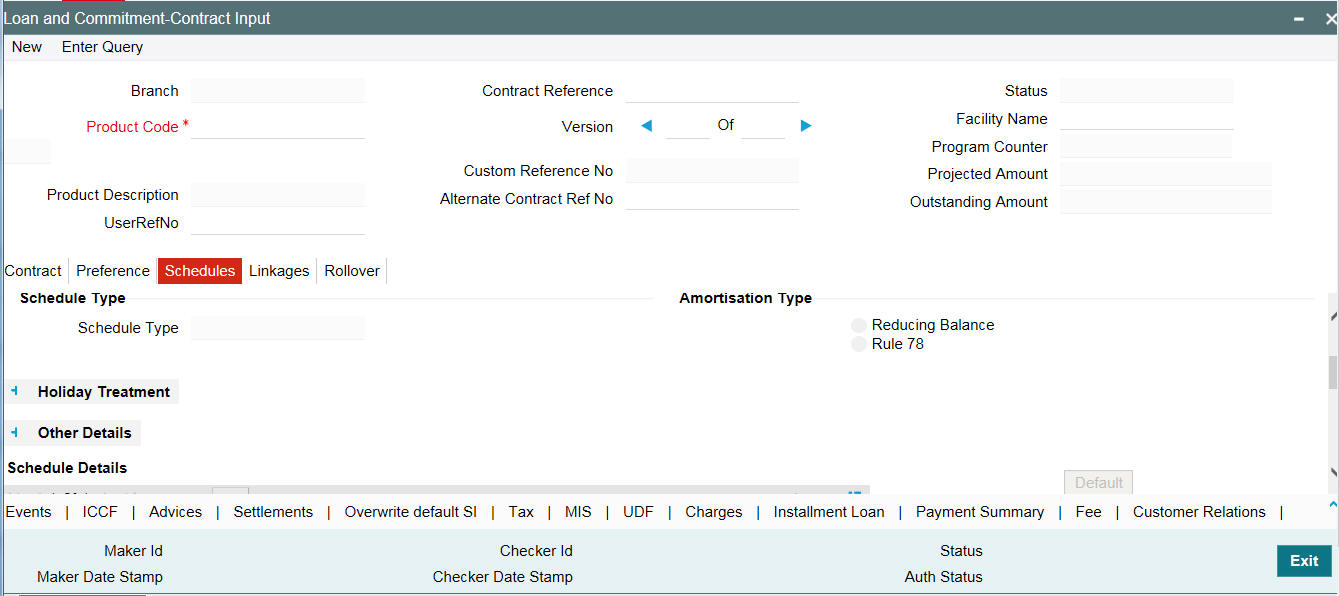

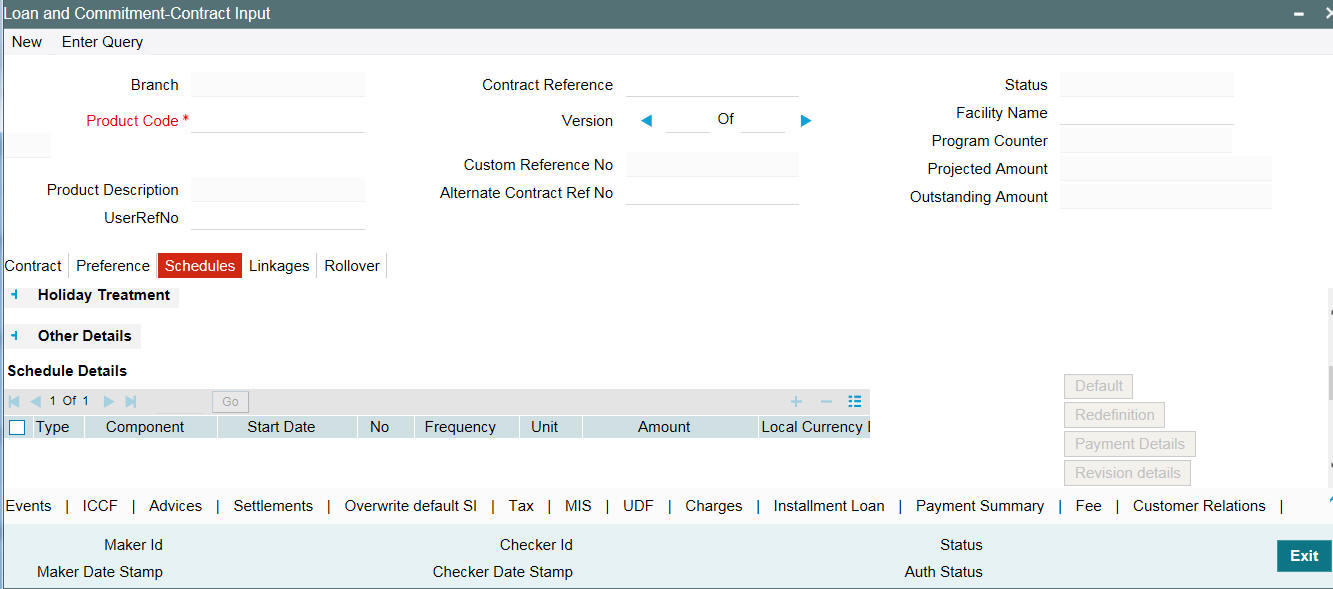

You can define the fee payment schedules in the Loan and Commitment- Contract Input’ (OLDTRONL) screen under ‘Schedules’ tab.

Here the fee payment schedules are defined under Schedule Details as seen above.

You are allowed to amend the above preferences in future through the ‘Fee Amendment’ screen.

You can amend fee schedules in ‘Schedules Details’ tab.

Here you can amend the schedules of a particular component of a contract if required.

The system posts the following entries in case of Fee Liquidation:

- Fee collected in Advance

- At Fee Collection ( FLIQ):

Accounting Role

Dr / Cr

Amount Tag

CUSTOMER

Dr.

Component_LIQD

Component_RIA

Cr.

Component_LIQD

- At Fee Accrual (FACR):

Accounting Role

Dr / Cr

Amount Tag

Component_RIA

Dr.

Component_ACCR

Component_INC

Cr.

Component_ACCR

- Component_RIA - Fee Component Received in Advance

- Component_INC - Fee Component Income

- CUSTOMER - Borrower

- Component_FLIQ - Fee Component Liquidated

- Component_FACR - Fee Component Accrued.

- At Fee Collection ( FLIQ):

- Fee collected in arrears

- At Fee Accrual (FACR):

Accounting Role

Dr. / Cr.

Amount Tag

Component_REC

Dr.

Component_ACCR

Component_INC

Cr.

Component_ACCR

- At Fee Collection (FLIQ)

Accounting Role

Dr. / Cr.

Amount Tag

CUSTOMER

Dr.

Component_LIQD

Component_REC

Cr.

Component_LIQD

- Component_REC - Fee Component Receivable

- Component_INC - Fee Component Income

- CUSTOMER - Borrower

- Component_LIQD - Fee Component Liquidated

- Component_ACCR - Fee Component Accrued

- At Fee Accrual (FACR):

6.4 Liquidating Fee Components

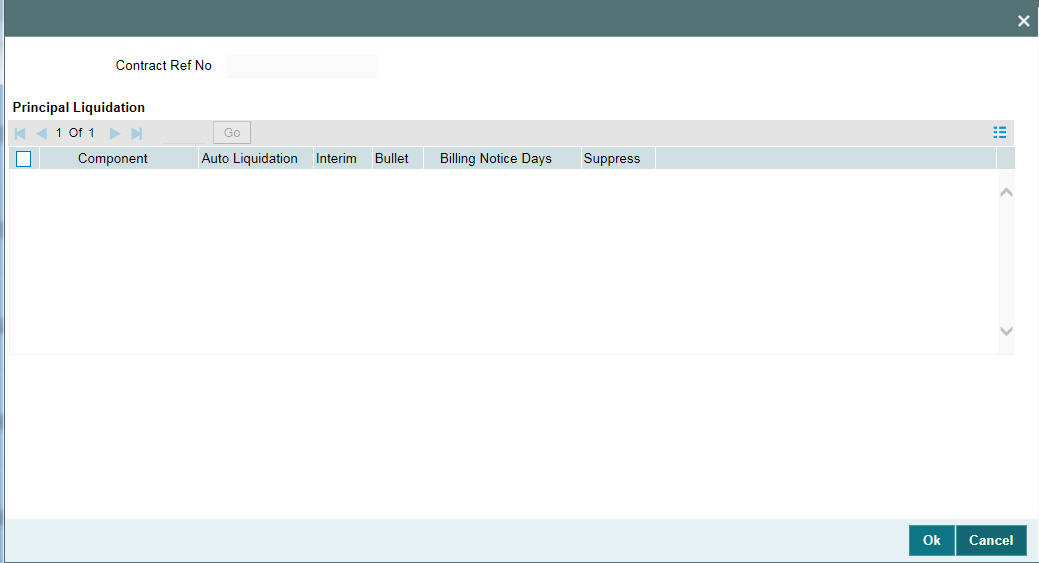

You can manually liquidate the fee schedules defined for fee components in the ‘Fee Liquidation’ screen. You can liquidate even future dated schedules through this screen. You can invoke this screen by clicking ‘Liquidation Order’ available in the Schedules tab.

6.5 Transferring Memo Interest to FAS91 Fee

When the status of a loan contract status changes from non-performing to performing, the system performs FAS91 fee liquidation for the commitment contract after processing status change for the underlying loan contract. Fee Liquidation (FELR) event is registered at the commitment contract for the deferred interest component with effective date as status change date. The fee liquidation amount that is moved from the Memo GLs to the Real GLs during status change is tracked as the deferred interest amount for FELR event.

Oracle Lending processes fee liquidation as under for batch and online status change:

As mentioned before, in case of manual status change, FELR event is registered at the commitment contract level individually for each loan contract, when the status change happens.

In case of automatic status change for a loan contract wherein ‘Propagate Status to loan’ box is not checked for the linked commitment, FELR event is registered at the commitment contract level individually for each loan contract, when the status change happens during the day. If there is a systematic status change during end of day batch process for multiple loans under a commitment contract, then one single consolidated FELR event is registered at the commitment contract by summing up the memo interest across all the loans under a commitment that were changed from non-performing to performing.

If ‘Propagate Status to Loan’ check box is selected for the commitment and its status is changed to ‘Performing’, then all underlying loan contracts which are in ‘Non-performing’ status is systematically moved to ‘Performing’ status during End of Day. For such status change for the loan contracts, one single consolidated FELR event is registered at the commitment contract by summing up the memo interest across all the loans that have changed from ‘Non-performing’ to ‘Performing’. If loans under the commitment are booked with multiple currencies, then memo interest for foreign currency loans are converted into commitment currency.

6.5.1 Restarting Amortization Fee Accrual

When a commitment changes from ‘Performing’ to ‘Non-performing’, un-amortization fee accrual stops. When the status of the commitment changes to ‘Performing’, the system does an amortization of fees as though the fees were received on the date of the status change. This process of amortization restart happens in the following steps:

- The system computes the outstanding fee amount for each component as Total Fee Liquidation Amount - Total Fee Refund Amount - Till Date Accrual.

- The system refunds the outstanding fee amount (Unamortized).

- The system liquidates the outstanding fee amount (Unamortized) with start date as status change date and end date as old fee end date.

The aforementioned process is performed for each individual amortization fee component, including FAS 91 fee, Marks Fee, and Deferred Interest Fee component.

The system performs the following validations for each fee component after commitment status change:

- Status change date should be less than the fee end date

- Status change date should be less than the commitment maturity date

If any one of the above validation fails, then system does not perform amortization fee accrual restart for that component. In such cases, the system catches up the accrual for the component for the non-performing period during the status change from ‘Non-performing’ to ‘Performing’.

After the systematic refund and liquidation, the actual accrual process begins for each amortization fee component of performing commitment, by taking into account the current outstanding fee amount.

6.5.1.1 Reversal of Fee Payment

You can initiate fee payment reversal using ‘Fee Payment Reversal’

screen. To invoke this screen, click ‘Reverse’

in the ‘Fee Liquidation’ screen.

When you initiate the fee payment reversal, you can exclude it from loan statement.

Exclude From Statement

Select this field to not allow the fee payment and its reversal appear in the Loan Statement.

Remarks

You may add remarks, if you wish to, in this field.

6.5.2 Associating the Accrual Fee Component

After defining a fee component, you need to link the fee component to a product in Oracle Lending.

Click ‘Accrual Fee Details’ in the ‘Product Definition’ screen to invoke the ‘Accrual Fee Input’ screen.

Click ‘Add row’ to add fee components. Click ‘Default From Class’ to associate the required fee component with the product. System defaults the parameters of the selected fee component. However, you can change the parameters according to your requirements.

You need to specify the following details:

Accrual Method

Specify the accrual method from the adjoining drop-down list. This list displays the following values:

- Straight Line

- Yield

- Flat Amount.

Basis Amount

Select the basis amount on which the fee component should be calculated from the adjoining drop-down list. This list displays the following values:

- Expected balance

- Expected Outstanding Facility

- Expected utilized Facility

Fee Type

Specify the fee type from the adjoining drop-down list. This list displays the following values:

- Income

- Expense

Payment Method

Specify the fee type from the adjoining drop-down list. This list displays the following values:

- Discounted

- Bearing

Allow Method Amendment

Select this check box to indicate that the amendment method is allowed for the accrual fee component.

Allow End Date input

Select this check box to indicate that the fee component (if applicable for the product involved in the contract) cease to be associated with a contract on the contract ‘End Date.

CLP Buy Price Diff

Select this check box to indicate that the difference between the PAR price (100%) and actual buy price is booked as fee against that component.

Note

- For the Commitments associated with the CLP positions, system maintains separate Income and Expense type of amortization FEE components to handle the amortization FEE amount computed based on the price difference between the Buy Price and Par value (100%). In case of premium price quotation for the Buy trades, expense type of amortization FEE is created and Income type is used for Discount Price quotation.

- These Income and Expense components should be unique for a commitment product. Such Amortization FEE components are identified by flag “CLP Buy Price Diff”. In a CLP commitment product, system allows one income and one expense type of Amortization FEE components with the flag “CLP Buy Price Diff”

Asset Transfer Marks

Select this option to indicate that the amortization fee component is of the asset transfer marks type. This is defaulted to the component level when details of the amortization fee are being entered.

Accrual Required

You have the option to accrue the fee earned on syndication contracts. To do this, you have to check this option.

Consider as Discount

Select this check box to indicate that the discount accrual to the component is applied.

Deferred Interest Component

Select this check box to indicate that this component should represent deferred interest. When the loan status changes to ‘Performing’ from ‘Non-performing’, the system checks the value of the backend parameter ‘ALLOW_REPERFORMING_LOAN_FUNC’. If the value of this parameter is ‘Y’, the system performs memo interest reversal. Amortization fee liquidation is done on deferred fee interest component for the memo interest amount that is moved to Real GL as part of the reversal.

Note that you can maintain only one deferred interest component for a product.

The system posts the following accounting entries:

For normal amortization FEE component of income type:

Accounting Role |

Dr / Cr |

Amount Tag |

CUSTOMER |

Dr. |

Component_LIQD |

FEE_Received_In Advance |

Cr. |

Component_LIQD |

For normal amortization FEE component of expense type:

Accounting Role |

Dr / Cr |

Amount Tag |

CUSTOMER |

Cr. |

Component_LIQD |

FEE_Paid_In Advance |

Dr. |

Component_LIQD |

For amortization FEE components of Income type (CLP Buy Price Diff):

Accounting Role |

Dr / Cr |

Amount Tag |

SLT-PREM-DISC |

Dr. |

Component_LIQD |

FEE_Received_In Advance |

Cr. |

Component_LIQD |

For amortization FEE component of expense type (CLP Buy Price Diff):

Accounting Role |

Dr / Cr |

Amount Tag |

SLT-PREM-DISC |

Cr. |

Component_LIQD |

FEE_Paid_In Advance |

Dr. |

Component_LIQD |