7. Defining Discount Accrual Fee Classes

The chapter contains the following sections:

- Section 7.1, "Introduction"

- Section 7.2, "Defining a Discount Accrual Fee class"

- Section 7.3, "Events and Accounting Entries for Discount Accrual"

- Section 7.4, "Specifying Status Change Details for Discount Accrual"

- Section 7.5, "Processing for Internal Rate of Return Calculation"

7.1 Introduction

In Oracle Lending, you can define the different types of charges or fees that apply on a product as “classes”. A charge class is a specific type of charge component (For example, ‘Charges for amending the terms of a loan’).

When defining a product, you merely have to attach the required classes. In this manner, a contract processed under a particular product acquires the classes (components) associated with the product.

A discount accrual fee class can be made applicable for loans and bills processed in Oracle Lending. To apply a discount accrual fee, you should first define attributes for each of the components.

Steps involved in processing discount accrual fees

The following steps are involved in processing discount accrual fees:

- Defining discount accrual fee classes

- Associating discount accrual fee classes with a product

7.2 Defining a Discount Accrual Fee class

A discount accrual fee class specifies the accrual parameters for interest, charges and fees.

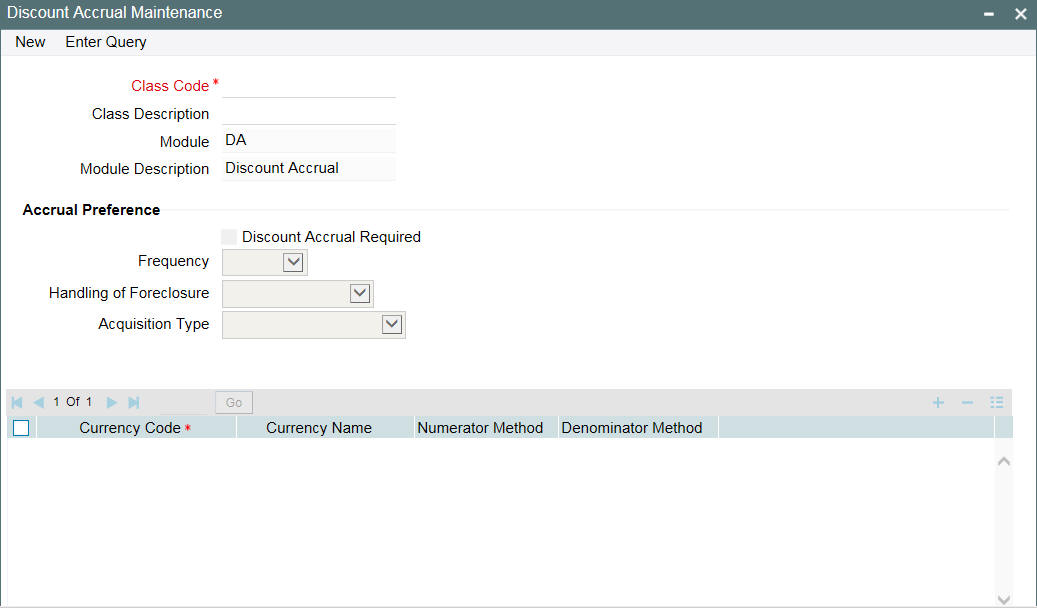

You can define the attributes of a discount accrual fee class in the ‘Discount Accrual Preference Class Maintenance’ screen.

You can invoke the ‘Discount Accrual Maintenance’ screen by typing ‘OLDACRCL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Before defining the attributes of a discount accrual fee class, you should assign the class a unique identifier, called the Class Code and briefly describe the class. A description would help you easily identify the class.

When building a discount accrual fee class, you define certain attributes such as:

- Whether Discount accrual should be performed for the class

- The frequency at which discount accrual should be performed. This can be either Daily or Monthly. For monthly accruals, the discount accrual is done on the last day of the month.

- How foreclosures in respect of the contracts using the class, must be handled. You can opt for complete accruals, or refund

- The acquisition type for the class. You can specify any of the following

options:

- Par

- Par/Discount

- Par/Premium

- Par/Discount/Premium

- The day count methods for each currency using the class. You can define the day count methods for both the numerator and the denominator.

7.2.1 Associating Discount Accrual Components to Products

After building discount accrual fee classes you can associate the class with loans or bills products. Click the ’Discount Accrual’ in the ‘Product Definition’ screen. The ‘Discount Accrual Preference Association’ screen is invoked.

To associate discount accrual fee class with a product, click ‘Default From Class’ in the ‘Discount Accrual Preference Association’ screen. Select the appropriate discount accrual fee class from the list of classes.

The attributes defined for the discount accrual fee class defaults to the product. You have the option to modify the attributes defined for the class, to suit the requirement of the product you are creating.

Alternatively, you can choose to define the discount accrual details for the product.

Note

- If the Acquisition type is different from what is maintained at Discount Accrual Class level then system gives an error and the contract does not save.

- You are allowed to change acquisition type during the life cycle of the contract on the basis of the maintenance done at the product level.

7.3 Events and Accounting Entries for Discount Accrual

While defining the accounting entries for the Loans and Bills modules you must identify the events and accounting entries that are required for discount accrual fee accounting. One of these is the YTM based Discount Accrual (YACR) event. It is meant to indicate the periodic discount accruals for the contract.

The Accounting Roles that should be associated with the event YACR are:

Accounting Role |

Description |

Acquisition Type |

Product Type |

EIMDISCRIA |

Effective Interest Based Discount To Be Accrued |

Discount |

Asset |

EIMDISCINC |

Effective Interest Based Discount Accrued Till Date |

Discount |

Asset |

EIMPREMPIA |

XX? |

Premium |

Asset |

EIMPREMEXP |

|

Premium |

Asset |

EIMINTADJREC |

|

Par |

Asset |

EIMINTADJINC |

|

Par |

Asset |

EIMDISCPIA |

|

Discount |

Liability |

EIMDISCEXP |

|

Discount |

Liability |

EIMPREMRIA |

|

Premium |

Liability |

EIMPREMINC |

|

Premium |

Liability |

EIMINTADJPAY |

|

Par |

Liability |

EIMINTADJEXP |

|

Par |

Liability |

The Amount Tags for the YACR event:

Amount Tag |

Description |

EIMDISC_ACCR |

Net Discount Accrual amount for the processing day |

EIMDISC_ADJ |

Discount Accrual Refund Amount |

The following entries should be maintained for the YACR event:

Accounting Role |

Amount Tag |

Dr/Cr Indicator |

EIMDISCRIA |

EIMDISC_ACCR |

Debit |

EIMDISCINC |

EIMDISC_ACCR |

Credit |

Note

The account head mapped to the accounting role ‘EIBDISCOUNT_RIA’ and account heads mapped to the subsystem specific RIA (Received in Advance) accounting roles should be maintained as the same account. For discount accrual, you must also maintain the following accounting set-up for the Charge Liquidation (LIQD/INIT/VAMI/ROLL/CAMD) event. This is in addition to the normal accounting set-up that you would define for the charge liquidation event.

Accounting Role |

Description |

component_RIA* |

Charge amount Received in Advance |

Charge comp_RIA |

Charge amount Received in Advance |

<Charge Comp>PIA |

Charge amount Paid in Advance |

<Fee Comp>RIA |

Fee Amount Received in Advance |

* The component is replaced by the appropriate Charge Rule.

Amount Tag |

Description |

component_DISC* |

Charge Amount to be discounted |

<Charge comp>_DISC(Existing Tag) |

Charge Discount Amount |

<Charge Comp>_PREM |

Charge Premium Amount |

<Fee Comp>_DISC |

Fee Discount Amount |

* The component is replaced by the appropriate Charge Rule.

You should maintain the following for the normal accounting entry setup for LIQD event:

Amount Tag |

Description |

EIMDISC_ADJ - (Existing Tag) |

Discount Accrual Refund Amount |

EIMPREM_ACCR |

Net Premium Accrual amount for the processing day |

EIMINTADJ_ACCR |

Interest Adjustment Amount |

EIMPREM_ADJ |

Premium Accrual Refund Amount |

You should maintain the following accounting roles for setting up accounting entries for the YACR event:

Along with the normal accounting entry setup for the LIQD event, you must also maintain the following accounting entries:

Accounting Role |

Amount Tag |

Dr/Cr Indicator |

EIMDISCRIA |

EIMDISC_ADJ |

Debit |

CUSTOMER |

EIMDISC_ADJ |

Credit |

EIMDISCRIA |

EIMDISC_ADJ |

Debit |

CUSTOMER |

EIMDISC_ADJ |

Credit |

CUSTOMER |

EIMPREM_ADJ |

Debit |

EIMPREMPIA |

EIMPREM_ADJ |

Credit |

EIMPREMRIA |

EIMPREM_ADJ |

Debit |

CUSTOMER |

EIMPREM_ADJ |

Credit |

CUSTOMER |

EIMDISC_ADJ |

Debit |

EIMDISCPIA |

EIMDISC_ADJ |

Credit |

The following entries should be maintained for the liquidation event.

Accounting Role |

Amount Tag |

Dr/Cr |

<Charge rule>_RIA |

<Charge rule>_DISC |

Credit |

CUSTOMER |

<Charge rule>_DISC |

Debit |

<Charge rule>_INC |

<Charge rule>_LIQD |

Credit |

CUSTOMER |

<Charge rule>_LIQD |

Debit |

CUSTOMER |

<Charge rule>_DISC |

Debit |

<Charge rule>_RIA |

<Charge rule>_DISC |

Credit |

CUSTOMER |

<Charge rule>_PREM |

Credit |

<Charge rule>_PIA |

<Charge rule>_PREM |

Debit |

CUSTOMER |

<Charge rule>_PREM |

Debit |

<Charge rule>_RIA |

<Charge rule>_PREM |

Credit |

CUSTOMER |

<Charge rule>_DISC |

Credit |

<Charge rule>_PIA |

<Charge rule>_DISC |

Debit |

You should maintain the following accounting entries for the YACR event:

Accounting Role |

Amount Tag |

Dr/Cr |

EIMDISCRIA |

EIMDISC_ACCR |

Debit |

EIMDISCINC |

EIMDISC_ACCR |

Credit |

EIMPREMEXP |

EIMPREM_ACCR |

Debit |

EIMPREMPIA |

EIMPREM_ACCR |

Credit |

EIMINTADJREC |

EIMINTADJ_ACCR |

Debit |

EIMINTADJINC |

EIMINTADJ_ACCR |

Credit |

EIMPREMRIA |

EIMPREM_ACCR |

Debit |

EIMPREMINC |

EIMPREM_ACCR |

Credit |

EIMDISCEXP |

EIMDISC_ACCR |

Debit |

EIMDISCPIA |

EIMDISC_ACCR |

Credit |

EIMINTADJEXP |

EIMINTADJ_ACCR |

Debit |

EIMINTADJPAY |

EIMINTADJ_ACCR |

Credit |

7.4 Specifying Status Change Details for Discount Accrual

Discount accruals in respect of a loan or a bill could result in status changes. You must maintain the following details as part of status maintenance for loans and bills, for discount accruals:

- Whether discount accruals should be stopped or reversed

- The transfer GLs for discount accrual

You can specify the following roles as part of the transfer GLs:

Accounting Role |

Description |

EIMDISCRIA |

Effective Interest Based Discount To Be Accrued |

EIMDISCINC |

Effective Interest Based Discount Accrued Till Date |

Note

The accounting roles for discount accrual are available to indicate the transfer GL as part of status change.

7.4.1 Processing for Contract Status Change

The impact of status change of contracts on Transfer of Balances, Stop Accruals and Reverse Accruals is as follows:

Transfer of Balances

The following balances are transferred to new GL:

- Premium TBA – Premium Accrued

- Discount TBA – Discount Accrued

- Interest Adjustment Accrued Already + Interest Adjustment Accrued

Stop of Accruals

YACR does not pass any entries.

Reverse of Accruals

The following balances are reversed:

- Premium Accrued

- Discount Accrued

- Interest Adjustment Accrued Already + Interest Adjustment Accrued

7.5 Processing for Internal Rate of Return Calculation

This section contains the following topics:

- Section 7.5.1, "Recalculation of IRR with new effective date"

- Section 7.5.2, "Computation of Net Present Value based on Acquisition Type"

- Section 7.5.3, "Computation of Net Discount Accrual Amount for a Processing Day"

- Section 7.5.4, "Discount Accrual Processing - an Example"

The Acquisition Type specified at the Discount Accrual Preference Class Maintenance is recognized during IRR calculation and stored in the IRR tables. During contract save, the acquisition type is derived using the following logic:

Product |

Inflow/Outflow |

Acquisition Type |

Asset* |

Inflow>Outflow |

Discount |

Asset |

Inflow<Outflow |

Premium |

Asset |

Inflow=Outflow |

Par |

Liability* |

Inflow>Outflow |

Premium |

Liability |

Inflow<Outflow |

Discount |

Liability |

Inflow=Outflow |

Par |

The following information is stored for every IRR Effective Date when the IRR calculation/recalculation happens and also during the Discount Accrual Batch:

- O/S Principal

- O/S Bearing Interest Accrual

- Discounted Interest TBA

- Premium TBA

- Discount TBA

- Expense Fee TBA

- Income Fee TBA

- Interest Adjustment Accrued Already

- Premium Accrued Till Date

- Discount Accrued Till Date

7.5.1 Recalculation of IRR with new effective date

In case of Bearing contracts, IRR recalculation is done using a new effective date, during the following events:

Contract Amendment without Schedule Re-definition:

- VD Increase of Principal

- VD Amendment of Maturity Date

- VD Amendment of Interest Rate

- Floating Interest Rate Revision

- Partial Prepayment – Principal

- Partial Prepayment – Interest

Rollover:

- New Charge on the following Events

- CAMD

- VAMI

- LIQD – Partial Prepayment

- ROLL

- Upfront Fee Amendment

In case of Discounted contracts, IRR recalculation is done using a new effective date, during the following events:

Contract Amendment without Schedule Re-definition:

- Partial Prepayment – Principal

- Rollover

- New Charge

- CAMD

- ROLL

- LIQD – Partial Prepayment

- Upfront Fee Amendment

Note

- In case of both Bearing and Discounted contracts, IRR is calculated with the currently active effective date during Contract Amendment with Schedule Re-definition event

- IRR Re-calculation is undone during Reversal of Partial Prepayment

- In case IRR Re-calculation has happened for any un-reversed event with IRR Effective Date >= Payment Value Date, then IRR Re-calculation is done as of the earliest IRR Effective Date.

- IRR Re-calculation does not happen in following cases:

- Full Prepayment

- Regular Payment

- Overdue Payment

- Reversal of Full Prepayment

- Reversal of Regular Payment

- Reversal of Overdue Payment

- In case of Bearing and Discounted contracts, the following actions

are allowed prior to the currently active IRR Effective Date, provided

there is no future un-reversed charge or upfront fee cash flow with Due

Date > New IRR Effective Date:

- Schedule Re-definition

- VD Increase of Principal

- VD Amendment of Interest Rate

- VD Amendment of Maturity Date Change

- Floating Interest Rate Revision

- Principal Prepayment

- Interest Prepayment

- Up-front Fee Amendment

- IRR calculation is done during the event BOOK instead of INIT in future-dated contracts

- Cash Flow for Charge Components being Liquidated in BOOK or INIT is Populated with Due Date = Value Date.

- For Charge Components with Charge Currency <> Contract Currency and Cash Flow Due Date = Value Date, the Charge Amount in Contract Currency during BOOK event is frozen.

- In case Charge Currency <> Contract Currency AND Contract Currency = Settlement Account Currency, the Charge Amount in Contract Currency frozen during BOOK would be used to pass Accounting Entries during INIT for the Charge Amount to the Settlement Account also.

- New Charge during Contract Amendment with Schedule Re-definition is Disallowed wherein the currently active IRR Effective Date < Today.

- New Charge used as Prepayment Penalty during LIQD Event is allowed in case of Partial & Full Prepayment only

- In case of Full Prepayment, %LIQD Amount Tag is populated instead of %DISC or %PREM Amount Tag

- Catch-Up of DA Accrual during various events namely, Amendment, Rate Revision, Liquidation, Rollover, Reversal of Prepayment, and so on similar to Catch-Up of Interest Liquidation in LD, BC is done.

- During Full Pre-payment, YACR passes outstanding accrual unconditionally

to ensure the following without any NPV Calculation:

- Premium Accrued = Premium TBA

- Discount Accrued = Discount TBA

- Interest Adjustment = 0

- During foreclosure of the contract the same processing as that of Discount is followed for Premium that is either ‘Complete pending accrual’ or ‘Refund’ happens based on the flag at discount accrual class level

- In case of Par case there is no Refund. Pending accruals are completed.

- EIM are not supported for the following types of Contracts

- Negative Interest Contracts

- Call and Notice Type of Contracts

- For Charge components marked as “Consider as Discount” and denominated in a Charge Currency <> Contract Currency, the %DISC Amount Tag is posted into the %RIA Head in Contract Currency.

- In case Charge Currency <> Contract Currency AND Contract Currency = Settlement Account Currency, the Exchange Rate input in Settlements Screen is used to convert Charge Amount to Contract Currency.

- EIM is supported for Commitments also. IRR is recalculated whenever the commitment is linked to Loan Contracts. In case of revolving commitments IRR is recalculated if Commitments are delinked from loan contracts.

- PYCYCM handling is done during YACR event. Previous Year, Current Year, and Current month Accruals are passed separately.

- The following Rollover types are supported:

- New Version

- Spawned

- Linked

7.5.2 Computation of Net Present Value based on Acquisition Type

The NPV calculation is different for different acquisition types.

If the acquisition type is Discount:

NPV = O/S Principal

+O/S Bearing Interest Accrued*

+O/S Acquired Interest

+ (Expense Fee TBA –Expense Fee Accrued)

- (Income Fee TBA –Income Fee Accrued)

- (Discounted Interest TBA – Discounted Interest Accrued)*

- (Discount TBA – Discount Accrued)

If Acquisition type is Premium:

NPV = O/S Principal

+O/S Bearing Interest Accrued*

+O/S Acquired Interest

+ (Expense Fee TBA –Expense Fee Accrued)

- (Income Fee TBA –Income Fee Accrued)

- (Discounted Interest TBA – Discounted Interest Accrued)*

+ (Premium TBA – Premium Accrued)

If Acquisition type is Par

NPV = O/S Principal

+O/S Bearing Interest Accrued*

+O/S Acquired Interest

+ (Expense Fee TBA –Expense Fee Accrued)

- (Income Fee TBA –Income Fee Accrued)

- (Discounted Interest TBA – Discounted Interest Accrued)*

+ (Interest Adjustment Accrued Already + Interest Adjustment Accrued)

Note

- The values suffixed with the asterix mark* are mutually exclusive.

- ‘O/S Bearing Interest Accrued’ is for bearing type of contracts

- ‘Discounted Interest TBA – Discounted Interest Accrued’ is for discounted type of contracts

- While computing IRR, the system ensures that IRR values less than or equal to zero are not allowed during IRR Calculation/Recalculation

- Cash flows as of every IRR effective date are stored whenever IRR calculation/recalculation happens

7.5.3 Computation of Net Discount Accrual Amount for a Processing Day

The net discount accrual amount for a processing day is computed as follows:

- All future cash flows are discounted to the processing day using the IRR effective as of the processing day, and the net present value (NPV) of the contract as of the processing day is obtained

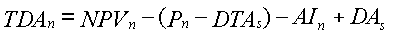

- The till date discount accrual amount is computed using the following expression:

Where,

- TDAn represents the Till Date Discount Accrual for nth Accrual Date,

- NPVn , the Net Present Value of the contract as of nth Accrual Date,

- Pn, the Outstanding Principal of the contract as of nth Accrual Date

- DTAs, the Discount to be accrued as of current IRR Effective Date

- AIn, the Current Period Accrued Interest as of nth Accrual Date,

- DAs, the Discount Accrued as of current IRR Effective Date

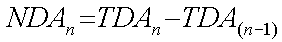

The difference between the ‘Till date discount accrual’ amount as of the previous processing day and the ‘Till date discount accrual’ amount as of the current processing day is the ‘Net Discount accrual’ amount that is realized as income as of the processing day. The expression used would be

Where,

- NDAn represents the Accrual for nth Accrual Date,

- TDAn, the Till Date Discount Accrual for nth Accrual Date and

- TDAn-1, the Till Date Discount Accrual for n-1th Accrual Date

7.5.4 Discount Accrual Processing - an Example

Let us consider a Loan contract with following parameters

Loan Amount |

USD 1,000,000 |

Value Date |

01-Jan-2003 |

Maturity Date |

01-Jan-2004 |

Interest Rate |

12% |

Commission Rate |

6% |

Commission Value Date |

01-Jan-2003 |

Interest Repayment Frequency |

Monthly (Month Ends) |

Principal Repayment Frequency |

Bullet |

Interest Basis |

Actual/365 |

Discount Accrual Day count Numerator Method |

Actual |

Discount Accrual Day count Denominator method |

365 |

Interest Payment Method |

Bearing |

IRR |

20.30% |

The projected cash flow for the contract would be:

Due Date |

Component |

Amount (USD) |

01-Jan-2003 |

Principal |

-1,000,000 |

01-Jan-2003 |

Commission |

60,000 |

01-Feb-2003 |

Interest |

10,191.78 |

01-Mar-2003 |

Interest |

9,205.48 |

01-Apr-2003 |

Interest |

10,191.78 |

01-May-2003 |

Interest |

9,863.01 |

01-Jun-2003 |

Interest |

10,191.78 |

01-Jul-2003 |

Interest |

9,863.01 |

01-Aug-2003 |

Interest |

10,191.78 |

01-Sep-2003 |

Interest |

10,191.78 |

01-Oct-2003 |

Interest |

9,863.01 |

01-Nov-2003 |

Interest |

10,191.78 |

01-Dec-2003 |

Interest |

9,863.01 |

01-Jan-2004 |

Interest |

10,191.78 |

01-Jan-2004 |

Principal |

1,000,000 |

If the Discount Accrual Processing Date is 15-Feb-2003, the processing for discount accrual is as follows:

Step 1

NPV of the contract is computed as of 15-Feb-2003 by discounting the future cash flows as shown below:

Due Date |

Amount |

(di-d1)/D |

1+IRR |

(1+IRR)^( (di-d1)/D) |

Discount CF |

01-Mar-03 |

9205.48 |

0.038 |

1.203 |

1.0071 |

9140.46 |

01-Apr-03 |

10191.78 |

0.123 |

1.203 |

1.023 |

9962.22 |

01-May-03 |

9863.01 |

0.205 |

1.203 |

1.0387 |

9495.54 |

01-Jun-03 |

10191.78 |

0.29 |

1.203 |

1.0551 |

9659.27 |

01-Jul-03 |

9863.01 |

0.373 |

1.203 |

1.0713 |

9206.78 |

01-Aug-03 |

10191.78 |

0.458 |

1.203 |

1.0882 |

9365.53 |

01-Sep-03 |

10191.78 |

0.542 |

1.203 |

1.1054 |

9219.70 |

01-Oct-03 |

9863.01 |

0.625 |

1.203 |

1.1224 |

8787.80 |

01-Nov-03 |

10191.78 |

0.71 |

1.203 |

1.1401 |

8939.02 |

01-Dec-03 |

9863.01 |

0.792 |

1.203 |

1.5755 |

8520.56 |

01-Jan-04 |

1010191.78 |

0.877 |

1.203 |

1.1759 |

859105.75 |

|

|

|

|

|

951402.94 |

The NPV of the Contract as of 15-Feb-2003 = USD 951,402.94

Step 2

IRR Start date = 01-Jan-2003

Outstanding Principal as of 12-Feb-2003 = USD 1,000,000

Discount to be accrued as of 01-Jan-2003 = USD 60,000

Accrued Interest as of 15-Feb-2003 = USD 4602.74

Discount Accrued as of 01-Jan-2003 = USD 0.00

Previous process till date = 14-Feb-2003

Till Date Accrual as of 14-Feb-2003 (TDAn-1) = USD 6647.43

TDAn = 951402.94 – (1000000-60000)-4602.74+0

TDAn = 6800.2

Net Discount Accrual = TDAn – TDAn-1

Net Discount Accrual = 6800.20 – 6647.43

Net Discount Accrual = 152.77