9. Rolling-over a Loan

This chapter contains the following sections:

- Section 9.1, "Introduction"

- Section 9.2, "Features of the Product Roll-over Details Screen "

- Section 9.3, "Specifying Contract Roll-Over Details"

- Section 9.4, "Specifying Details for Normal Rollover"

- Section 9.5, "Specifying Details for Rollover Split"

- Section 9.8, "Authorizing a Manual Roll-Over"

9.1 Introduction

A rollover is the renewal of a loan. Instead of liquidating a loan on maturity, you can roll it over into a new loan. The outstanding principal of the old loan is rolled-over with or without the interest outstanding on it. When a loan is rolled-over (renewed), it is processed in the following manner:

- A new version of the loan with the same contract reference number is initiated

- A new loan with a different contract reference number is initiated

- The original loan could be split into multiple loans as a result of the rollover

- The original loan could be consolidated along with other loans as a result of the rollover

You can rollover a loan that you are processing, provided a rollover is allowed for the product, the loan involves.

For a product with rollover defined, you can specify if loans involving the product should inherit the following:

- The attributes defined for the ICCF components (interest, charges and fees) from the product.

- Those defined for the initial contract. This gains significance, if you changed the attributes that the (initial) contract acquired, from the product. The rolled-over loan will acquire the changed attributes.

- For a product with new version of rollover mechanism, you can click 'Rollover' button and save the contract, only if 'Cont Booking For Addl Amt Only' check is selected before the maturity date. After this, the system fires 'RAMD' event. In addition, entries are posted for additional amount which is rolled over.

In addition, you have to specify the following for a product, defined with rollover:

- Whether it is to be rolled-over along with outstanding interest

- Whether tax has to be applied on the rolled-over loan

- Whether the principal of the rolled-over interest, should be taxed

However, when processing a loan, you can change the attributes that the loan acquires from the product. At the time of contract processing, you can indicate if a rollover is to be automatic or manual. In addition, indicate the maturity type (fixed, call, or notice); the maturity date for a fixed maturity loan and the notice days for a loan with notice type of maturity.

You should also indicate the following:

- Whether only the outstanding principal is to be rolled-over

- Whether the outstanding principal is to be rolled-over with interest

- Whether a special amount is to be rolled-over. If a part of the principal and interest from the old loan has been liquidated and only the outstanding principal - with or without interest, is rolled-over, it is called a special amount.

9.2 Features of the Product Roll-over Details Screen

When defining a product, you have to specify whether loans involving the product can be rolled-over. If rollover has been allowed for a product, all the loans involving the product can, by default, be rolled-over.

Note

However, a loan involving such a product is rolled-over only if it is not liquidated, on its Maturity Date. You can choose not to rollover a loan involving a product with the rollover facility. This can be indicated when processing the loan.

Note

If you want contingent entries to be posted, then select 'Cont Booking For Addl Amt Only' check box. This is applicable only if the 'Rollover Mechanism' is 'New Version' and 'Rollover Method' is 'Normal'. If contingent entries are booked for a contract, the system does not allow VAMI, PYMNT, and REVN events.

The rollover details for the product that you are defining can be specified in the Product Roll-over details screen. Click ‘Rollover Details’ button in the Product Preferences screen to invoke this screen.

The following are the features of the product roll-over details screen.

- Section 9.2.1, "Specifying whether Rollover is Applicable"

- Section 9.2.2, "Specifying the Rollover Mechanism"

- Section 9.2.3, "Specifying the Rollover Method "

- Section 9.2.4, "Mode of roll-over"

- Section 9.2.5, "Roll-over of Interest, Charge and Fee Components"

- Section 9.2.6, "Maturity Date Basis"

- Section 9.2.7, "Updating Credit Limit Utilization"

- Section 9.2.8, "Applying Tax on Roll-Over"

- Section 9.2.9, "Deduct tax on Roll-Over"

- Section 9.2.10, "Contingent Entries for Additional Amount"

- Section 9.2.11, "Applying a Charge on the Roll-Over Amount"

- Section 9.2.12, "Liquidating Overdue Schedules"

- Section 9.2.13, "Interest Rate on Rollover"

- Section 9.2.14, "Indicating the Values to be Re-keyed during Authorization"

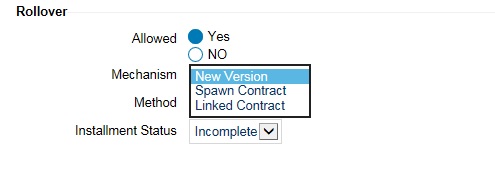

9.2.1 Specifying whether Rollover is Applicable

Select the option ‘Yes’ in the section ‘Rollover’ to indicate contracts booked under this product can be rolled over. Select the option ‘No’ to indicate contracts under this product cannot be rolled over. You can, for a contract, change this preference. This can be done while entering a contract in the OL Contract Online screen.

9.2.2 Specifying the Rollover Mechanism

You can indicate whether rolling over a loan contract using the product must create a new version of the original contract, a spawn contract, or a linked contract.

- Select ‘New Version’ if a new version of the original contract must be created.

- Select ‘Spawn Contract’ if a child contract must be created on rollover.

- Select “Linked Contract’ if a contract needs to be created manually. This contract needs to be booked before the maturity date of the parent rollover contract. The linked contract is taken as a new contract with Rollover-reference-no field of the deal populated with the reference number of the parent contract.The BOOK event fires a NEW event RAMD for the parent contract. No further modifications allowed after RAMD.

9.2.3 Specifying the Rollover Method

If you have indicated the rollover mechanism applicable for contracts using the product in the Rollover Mechanism field as ‘New Contract’ (as in the case of borrower draw down products), then you can use this field to indicate whether a single new contract must be created for the rolled over amount.

Or

Whether the original contract must be split into multiple contracts, or consolidated with other contracts into a single new contract, when rolled over using the rollover operation. Accordingly, select any of the options, ‘Normal’, ‘Split’, or ‘Consolidated’, in this field, as applicable.

If you indicate the ‘Split’ option, you can specify the preferences for the split, when you enter the borrower draw down contract using the product.

If you indicate the ‘Consolidate’ option, you can specify the other draw down contracts with which the original contract must be consolidated into a single contract, when you enter the borrower draw down using the product.

Specifying the maturity basis

You must indicate the tenor basis upon which the maturity days specified for the rolled-over contract will be reckoned, in the Roll By field. The options are Days, Months, Quarters, Semi-annuals, and Years.

9.2.4 Mode of roll-over

For a loan involving a product with rollover facility, you should specify the mode of rollover, automatic, semi-auto, or manual during processing. The mode of rollover also depends on whether the mode of liquidation of the loan is automatic or manual.

9.2.4.1 Impact of Liquidation Mode on Roll-Over

The mode of liquidation of a loan (automatic, semi-auto, or manual) has the following impact when the rollover is carried out:

Auto liquidation and auto roll-over

The old loan is liquidated and a new one initiated on the Maturity Date of the loan. It is processed during the BOD run of the Automatic Contract Update function. If the Maturity Date falls on a holiday then the liquidation and the rollover are processed, as per your holiday handling specifications in the Branch Parameters screen.

- If you specified that processing has to be done today (the last working day before the holiday), then for automatic events, the schedule falling on the holiday, is liquidated today during End of Day processing.

- If you specified that processing has to be done only up to the System Date (today), then only the events scheduled for today (the last working day before the holiday) are processed. The events falling on the holiday are processed on the first working day after the holiday, during Beginning of Day processing.

Auto liquidation (of principal) and manual roll-over

The old loan is liquidated automatically on the Maturity Date. If the loan has to be rolled-over, the instructions should be specified before the Maturity Date. At times the contract is not liquidated because of the lack of funds in the repayment account. In such cases you can give rollover instructions even after the maturity date, saying that the contract has to be rolled-over, as of the maturity date.

Manual liquidation (of principal)

Rollover has to be manual. The loan is not liquidated by the Auto Liquidation function. You can either liquidate it or specify that it has to be rolled-over. This can be specified at any time before or after the Maturity Date of the loan, if the contract has not yet been liquidated.

If you have defined that the loan should be liquidated manually, you cannot roll it over automatically.

When a loan is rolled-over or renewed for interest, charge or fee components, it can assume the following attributes:

- Those of the product involving the loan being rolled-over

- Those of the old loan itself

Semi-auto liquidation

The system processes all the events and waits for instructions from the user to send the necessary messages. The messages are held in the outgoing browser. These messages are payment messages and not advices or notices.

In addition, the system displays only those semi-automatic contracts on which user confirmation is required to send out the messages for that respective event.

The events INIT, LIQD, and ROLL are automatically processed by the system and it processes only the accounting entries. These events appear in the ‘Forward Processing’ screen for the user to confirm whether the messages generated to be sent or not.

If the user confirms the event on the value date, the messages are sent out immediately. Based on the confirmation received from the user, system releases these messages.

9.2.5 Roll-over of Interest, Charge and Fee Components

The interest, charge and fee components of the new (rolled-over) loan can be picked up, either from the old loan or from the product involving the old loan. The following example illustrates this point:

Example

When defining a product you specified that all loans involving it have an interest schedules every month and an annual fee.

Assume that you have processed a loan, involving this product, with the following attributes:

- Interest payment only on Maturity Date

- No fees

When rolling-over this loan, you have two options:

- You can indicate that the interest and fee details specified for the product, are to be applied to the new (rolled-over) loan. In such a case, the new loan have an interest payment schedules every month and an annual fee.

- You can specify that the interest and fee details, defined for the loan being rolled-over (old loan), should be made applicable to the new loan. In this case, the new loan have an interest payment schedule only on Maturity Date and have no annual fee.

9.2.6 Maturity Date Basis

Select the Maturity Date basis for a rolled over contract. Select the option ‘Product’ if you want the tenor of the rolled over contract to be the default tenor maintained for the product. Select the option ‘Contract’ if you want the tenor of the rolled over contract to be the one currently applicable for the contract.

9.2.7 Updating Credit Limit Utilization

This function indicates whether the credit limit utilization is to be updated, when a loan is rolled-over. That is, the interest that has been accrued on a loan is also considered, as a part of the utilized amount for the purpose of risk tracking.

Note

This option applies only if you want to rollover a loan with interest.

9.2.8 Applying Tax on Roll-Over

For tax to be applicable on a rolled-over loan:

- It should be applicable to the product involving the loan

- It should not have been waived for the old loan

You have to indicate whether tax has to be applied, on the rolled-over loan also.

9.2.8.1 Rolling-over with Interest

You have to specify whether the loan that you are rolling-over, should be rolled-over along with the outstanding interest. If you so specify, the principal of the new loan, is the sum of the outstanding principal and the outstanding interest on the old loan. This applies only to loans with a bearing (add-on) method of interest liquidation.

If all the outstanding interest has been paid, then the loan can be renewed without the interest. If not, it is rolled-over with the interest that is still outstanding on it.

A loan is rolled-over with only the main interest that is outstanding. It is that interest component, which you specify as the main interest in the ICCF Product Details screen (this will be displayed in the Contract Main screen). Other interest components and the penalty interest, if there are any, are not rolled-over.

The following example illustrates how this concept works.

Example

Consider the example of Ms Yvonne Cousteau, who has taken a loan of USD 10,000 under the Short Term Loans for Individuals scheme,

- On 1 June 1997

- At 20% interest

- To be liquidated at Maturity, on 31 December 1997

- Ms Cousteau is unable to repay the loan, therefore, you decide to renew it (roll it over into a new loan).

- You have two options:

- You can roll it over without the outstanding interest

- You can roll it over along with the outstanding interest

If you roll it over without interest, the new principal is USD 10,000. The accrued interest on this loan is liquidated. The loan is rolled-over, only if the interest can be liquidated. If there are no funds in the repayment account, there can be no rollover.

If you roll the old loan over (renew it), along with the unpaid interest, the principal of this renewed loan is USD 1, 1167 (USD 10,000 + USD 1,167) as of 31 December 1997. The interest on the new loan is applied on a principal of USD 11,167.

9.2.9 Deduct tax on Roll-Over

When a loan is initiated, tax is applied on the principal of the loan. When this loan is rolled-over or renewed, you have two choices (depending on the tax laws of your Country):

- Apply tax on the principal (outstanding principal + outstanding interest or only the outstanding principal), of the new loan

- Since the principal of the old loan would have already been taxed once, you can choose to waive the tax on the principal of the rolled-over loan. However, if this principal has the outstanding interest from the old loan incorporated, then only the interest portion is taxed.

This option applies only to tax on principal and not to tax on interest.

This field assumes importance, when:

- Tax (for principal as well as interest) has not been waived on the old loan

- Tax, has not been waived on the rolled-over loan

If this tax is not waived for the old loan, it is applied on the new loan. If it is waived on the old loan it is not applied on the renewed loan.

Choose Deduct Tax on Rollover, if tax on the old loan has to be liquidated before it is rolled-over.

9.2.10 Contingent Entries for Additional Amount

Select the ‘Cont. Booking For Addl Amt Only’ check box to indicate contingent entries for the additional rollover amount must be passed when the child rollover contract is booked, for contracts using the product. If you select this check box, contingent entries for the additional rollover amount are passed. If you do not select this option, contingent entries are passed for the total principal amount of the child rollover contract.

9.2.11 Applying a Charge on the Roll-Over Amount

Select the ‘Apply Charge on Rollover Amt’ check box to indicate a charge is applied on the amount being rolled over.

9.2.12 Liquidating Overdue Schedules

Select the ‘Liquidate Overdue Schedules’ check box to indicate schedules for the original deal that are overdue on the day of rollover should be liquidated before the deal is rolled over. If you have selected this check box but the overdue schedules cannot be automatically liquidated, the deal is not rolled over and it is reported as an exception condition in the Daily Exception Report.

9.2.13 Interest Rate on Rollover

Select the ‘Repickup Interest Rate on Rollover’ check box to indicate the interest for the rolled over contract should be picked up again on rollover of the contract. If you do not select this box, the interest for the rolled over contract is the latest interest applicable for the contract.

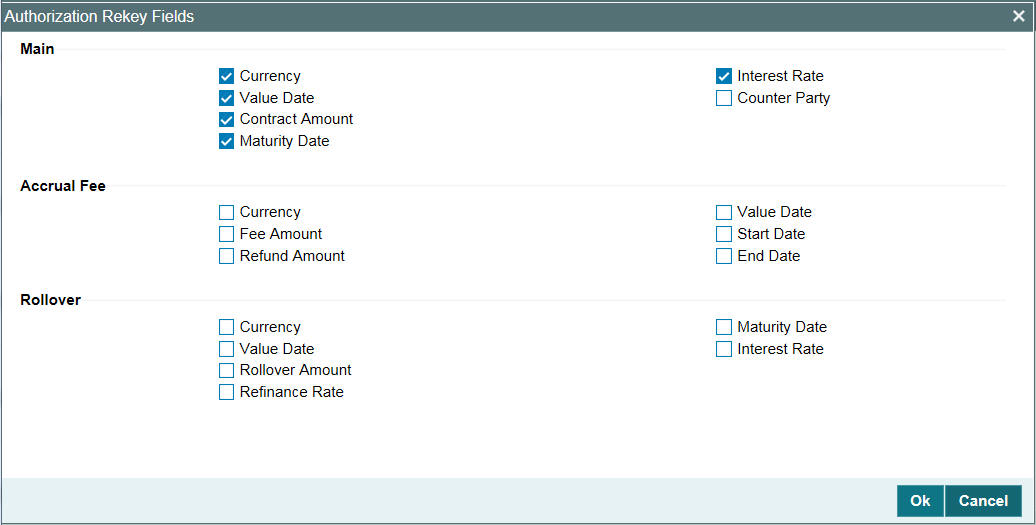

9.2.14 Indicating the Values to be Re-keyed during Authorization

You can specify the fields whose values have to be rekeyed at the time of authorizing rollover contracts. The re-key option serves as a means of ensuring the accuracy of inputs. The fields that have to be rekeyed during the authorization of rollover contracts are specified in the Authorize Rekey Fields screen. Click ‘Rekey Fields’ in the ‘Preferences’ screen to invoke this screen.

In this screen, you can specify any or all of the following re-key fields:

- Currency

- Value Date

- Rollover amount

- Maturity Date

- Interest Rate

- Refinance Rate

9.3 Specifying Contract Roll-Over Details

Instead of liquidating a loan on maturity date, you can renew it into a new contract. As part of rolling over a contract, the original contract should be liquidated and a new contract should be initiated. In Oracle Lending, these two processes are done in a single step.

9.3.1 Rollover Preferences for a Loan Contract

To recall, when a loan is rolled-over (renewed), it is processed in the following manner, depending upon the rollover mechanism and rollover method specified:

- A new version of the loan with the same contract reference number is initiated

- A new loan with a different contract reference number is initiated

- The original loan could be split into multiple loans as a result of the rollover

- The original loan could be consolidated along with other loans as a result of the rollover

The rollover method indicates:

- Whether a single new contract must be created when the original contract is rolled over

- Whether the original contract must be split into multiple contracts when rolled over

- Whether the original contract must be consolidated into one single contract along with other contracts, when rolled over

The rollover method specified for the product used by the contract is defaulted, and you can change it when you enter the contract, if required.

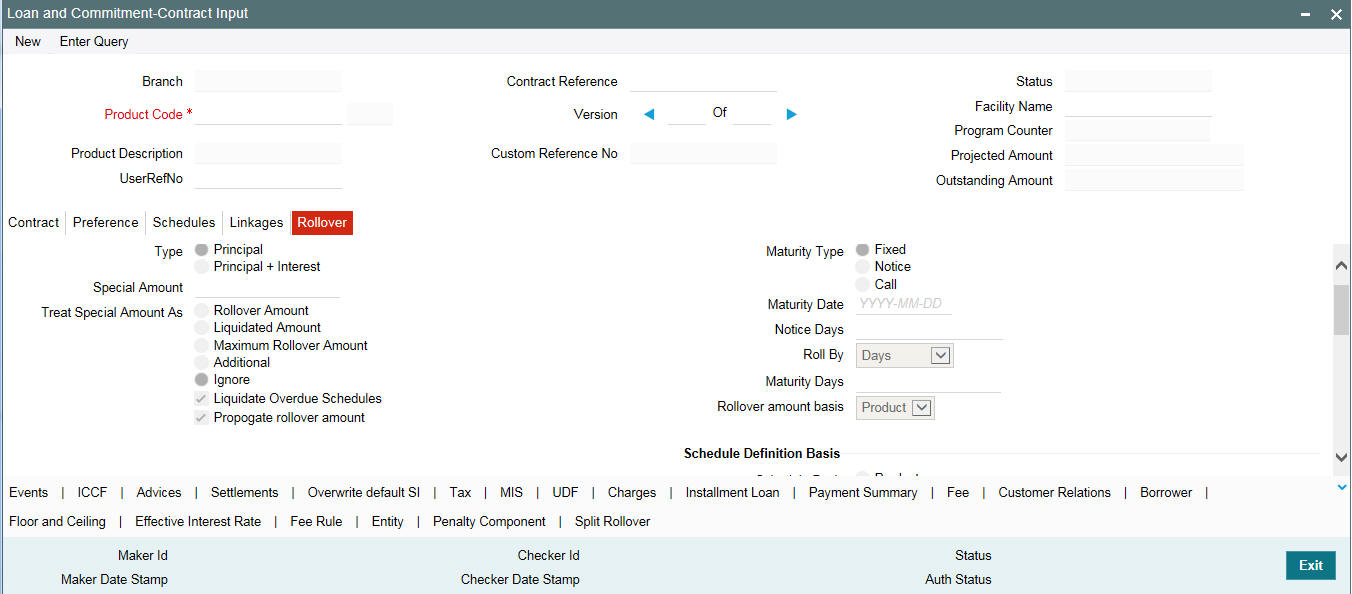

9.4 Specifying Details for Normal Rollover

If you have chosen the rollover method as “Normal”, then you must enter the corresponding details for the rollover, in the Rollover tab in the Loan and Commitment- Contract Input screen.

In the case of normal rollover, the system either creates a new draw down contract with a new contract reference number for the original one being rolled over (if the rollover mechanism specified is ‘New Contract’), or a new version of the original contract, with the same reference number (if the rollover mechanism specified is ‘New Version’).

You can rollover a loan in the ‘Loans and Commitment – Contract Input’ screen. In the ‘Loans and Commitment – Contract Input’ screen, click ‘Rollover’ from menu.

At the time of contract creation, you can maintain/change the rollover instructions. Click ‘Rollover’ tab to rollover a contract maintain/change the rollover instructions. You can specify the rollover instructions for the rolled over contract. After specifying the rollover details, you need to save the contract.

When you rollover the contract, the system completes the rollover process with the specified rollover instructions and a new version is created for the event ROLL.

To authorize the rolled over contract, both the versions created during rollover have to be authorized simultaneously.

By default, a contract is rolledover with all the terms of the original contract. However, you can change certain terms by specifying them in the Rollover Details screen while creating and modifying a contract.

The following are the features of the contract rollover screen:

- Section 9.4.1, "Mode of Roll-Over of a Contract "

- Section 9.4.2, "Manual Rollover"

- Section 9.4.3, "Specifying the Roll-Over Amount"

- Section 9.4.4, "Specifying the Manner in which the Special Amount should be Treated"

- Section 9.4.5, "Updating Credit Limit Utilization"

- Section 9.4.6, "Applying Tax"

- Section 9.4.7, "Specifying whether Charge should be Applied on the Rolled-over Amount"

- Section 9.4.8, "Specifying the Schedule Basis for the rolled over contract"

- Section 9.4.9, "Specifying whether New Components have to be Included"

- Section 9.4.10, "Specifying whether Overdue Schedules should be liquidated"

- Section 9.4.11, "Specifying the Maturity Type"

- Section 9.4.12, "Indicating the Interest Basis for Roll-over"

- Section 9.4.13, "Specifying the Refinancing Rate for the rolled over Contract"

9.4.1 Mode of Roll-Over of a Contract

You can rollover a loan automatically or manually.

Automatic Rollover

The Automatic Contract Update function automatically rolls over a loan on its maturity date, if you have:

- Allowed rollover for the loan at the time of defining the product

- Specified auto, in the Contract Details screen

If you have marked a loan for auto liquidation and auto rollover, the system original loan and creates a new rolled-over loan on the Maturity date of the original loan. This is done by the Automatic Contract Update function during it Beginning of Day run.

If the Maturity Date falls on a holiday, then the liquidation and the rollover are processed as per your holiday handling specifications in the Branch Parameters screen:

- If you have specified that processing has to be done today (the last working day before the holiday), then the automatic events schedule falling on the holiday is liquidated during End of Day processing.

- If you have specified that processing has to be done only up to the System Date (today), then only the events scheduled for today (the last working day before the holiday) will be processed. The events falling on the holiday will be processed on the first working day after the holiday, during Beginning of Day processing.

If the holiday is a month end, then the liquidation and rollover does not cross the month. It is done in the same month, irrespective of the specifications in the Branch Parameters screen.

Note

Since a rolled-over contract is initiated automatically, it is also authorized automatically. The Maker and Authorizer fields of the new contract shows ‘Auto’.

Example

Today’s date |

14 November 1997 |

Next working date |

16 November 1997 (which means 15 November 1997 is a holiday) |

During its BOD run, the Automatic Contract Update function rolls over loans with a maturity date of 14 November 1997.

The processing of the roll-over which falls due on a holiday depends on your holiday handling specifications in the Branch Parameters screen:

- You could have specified that automatic processes scheduled for the holiday(s) are to be carried out on the last working day before the holiday(s). In such a case, the contract is rolled over, during the EOD processing of the Automatic Contract Update function, on 14 November 1997. This function rolls over loans with an End Date of 15 November 1997.

- If you have not specified this, the rollover takes place during the BOD processing of the Automatic Contract Update function. This function rolls over contracts with an End Date of 15 November 1997, during its BOD run on the next working day that is 16 November 1997.

The Activity Journal for the day reports the details of loans that were rolled-over automatically during the day. If a loan that had to be rolled-over was not rolled-over for some reason, it is reported in the Exception Report for the day. The reason for the contract not being rolled-over is also reported in the Exception Report. This report is generated every day, by the Automatic Contract Update function, during its EOD run.

9.4.2 Manual Rollover

You can rollover a loan manually through the Roll-over Details screen. If a loan has to be rolled-over:

- The latest activity on the loan has to be authorized

- It should be past its Maturity Date

- It should not have been liquidated

Choose Rollover from the Processing sub-menu of the Actions Menu when the loan you want to rollover is highlighted in the Contract Summary screen or the Contract Detailed screen. By default, the loan is rolled-over with the same terms as the original loan. However, you can change certain terms through the Roll-over Details Screen while creating and modifying a contract.

- You can apply, on the renewed loan, the interest, charge and fee applicable to the product of the old loan. If these have been changed for the old loan, you have the choice of applying the changed terms (for ICCF components only), of the old loan to the rolled-over loan.

- You can change the Maturity Type (fixed, call or notice); the Maturity Date; and in case of a notice type of maturity, you can change the notice days.

However, the Reference Number of the renewed (or rolled-over) loan is the same as that of the old loan.

9.4.3 Specifying the Roll-Over Amount

When you roll-over a loan you can roll-over:

- The outstanding principal of the loan

You can indicate for the product that a loan is to be rolled-over with interest. Then at the time of loan processing, you can specify that only the outstanding principal has to be rolled-over.

However, only when all the outstanding interest is paid (liquidated manually or automatically), can the loan be renewed without the interest.

- The outstanding principal and the outstanding interest together

If you have specified for the product that only the outstanding principal should be rolled-over, and you find that the outstanding interest has not been liquidated on this particular loan under process. Then you can specify through this screen that the rollover be made along with the outstanding interest.

- An amount that is different from the total of the outstanding principal and the outstanding interest. This is a special amount

The special amount is:

- Less than the outstanding principal + interest. This is because the amount by which it is less is liquidated against the interest and principal of the old loan. The remaining amount is rolled-over.

- The special amount can never be more than the outstanding principal + interest of the old loan. If it is, then you have to initiate a new loan.

Ms Yvonne Cousteau has taken a loan of USD 10,000 under the Short Term Loans for Individuals scheme:

- On 1 June 1997

- At 20% interest

- To be liquidated, at Maturity, on 31 December 1997

Since Ms Cousteau is unable to repay the loan you decide to renew the loan (roll it over).

You have two options:

- You can roll it over without interest

- You can roll it over along with the interest

If you roll it over without interest, the principal of the new loan will be USD 10,000. The accrued interest on this loan is liquidated. If you roll the old loan over (renew it), along with the unpaid interest, the principal of this renewed loan is USD 1, 1167 (USD 10,000 + USD 1,167) as of 31 December 1997.

Ms Cousteau decides to pay back USD 1,000 on 31 December 1997, the Maturity Date of the old loan. A part of the interest is thus, be liquidated. The new outstanding interest (USD 167), will be rolled-over with the outstanding principal USD 10,000 and the principal of the rolled-over loan is USD 10,167. This is what is termed a Special amount. Interest is calculated on this principal for the renewed loan.

Note

If the rollover amount that you enter, is lesser than or greater than the outstanding principal amount of the contract being rolled over, the system displays a configurable override.

9.4.3.1 Multiple Collateral/Pool Linkages to OL Contracts

You can either link a single facility or multiple collateral/pool to an OL contract. For the Collateral/Pool/Facility linkage, you should specify the linked amount and linked %. Based on this contract amount utilization takes place.

On Contract rollover, linkage utilization amount changes depending on the rollover amount.

For more information, refer to Linking OL contract to a facility or multiple collateral/pool section

9.4.4 Specifying the Manner in which the Special Amount should be Treated

If you specified that the principal of the new loan is meant to be a special amount you also have to indicate the manner in which the special amount is to be treated. You can choose any one of the following options:

- Rollover Amount

- Liquidation Amount

- Maximum Rollover Amount

- Ignore

The amount that is rolled-over depends on the treatment that you specify. You can choose not to treat the special amount in a specific manner by choosing to ignore this option.

Rollover Amount

If the outstanding amount is 20,000 and the special amount is given as 25,000 the additional 5000 gets added to the loan.

If the outstanding amount is 30,000 and the special amount is given as 25,000 the additional 5000 gets liquidated.

Note

The Outstanding Amount is the sum of all the components put together.

Liquidation Amount

If the outstanding amount is 20,000 and the special amount is given as 25,000 you are not allowed to rollover.

If the outstanding amount is 30,000 and the special amount is given as 5,000 the additional 5000 gets liquidated and only 25,000 is rolled over

Additional Principal Amount

Additional Principal Amount option can be selected only if the rollover is by special amount.

Note

Individual components are liquidated in the liquidation order.

Maximum Rollover Amount

If the outstanding amount is 20,000 and the special amount is given as 25,000 you can rollover the entire outstanding amount.

If the outstanding amount is 30,000 and the special amount is given, as 25,000 only 25,000 will be rollover and the remaining 5000 is liquidated.

9.4.5 Updating Credit Limit Utilization

When creating a product, you can indicate if credit limit utilization is to be updated at the time of rollover. Your specifications for the product is default to all loans involving the product. When you specify that the credit limit utilization has to be tracked, the interest that has been accrued on a loan is also considered as a part of the utilized amount for the purpose of risk tracking.

While creating a product, you can choose not to update the credit limit utilization at the time of rolling-over loans. However, note that if you have disallowed the updation of utilization, for a product, you cannot choose to update utilization when you rollover loans involving the product.

9.4.6 Applying Tax

When you define a product, you can specify if tax has to be applied on rolled-over loans. For tax to be applicable on a rolled-over loan:

- It should be applicable to the product involving the loan

- It should not have been waived for the old loan

If you have that tax is applicable to the rolled-over loan, then through this screen, you can waive it for the rolled-over contract.

9.4.7 Specifying whether Charge should be Applied on the Rolled-over Amount

When creating a product, you would have indicated if charge is to be applied on loans that are rolled over (involving the product). For charge to be applicable on a rolled over loan:

- It should be applicable to the product involving the loan.

- It should not have been waived for the original loan.

If you indicate that charge is to be applied on rolled over loans involving a product, by default, charge is applied on all loans involving the product. In this screen, you can waive charge altogether for a rolled over loan, by deselecting this field.

9.4.8 Specifying the Schedule Basis for the rolled over contract

If you have defined repayment schedules for a product, they are applied to the loan involving the product, automatically. However, you can change the schedules while processing the loan under the product.

When the loan for which the repayment schedules were changed is rolled over, you can choose to apply the repayment schedules defined for the product or retain the schedules defined for the contract.

9.4.9 Specifying whether New Components have to be Included

You may have added new components to a product after initiating a loan under it. These components that were originally not available for the old loan may be included for the rolled over contract. To do this, you have to select the ‘New Components Allowed’ option for the rolled over contract.

9.4.10 Specifying whether Overdue Schedules should be liquidated

At the time of rolling over a contract with overdue schedules, you may either liquidate the overdue schedules prior to rollover or include the overdue amount (for the schedules not liquidated) as part of the rolled over amount.

Select the ‘Liquidate Overdue Schedules’ option to liquidate the overdue schedules before rolling over a contract.

9.4.11 Specifying the Maturity Type

The Maturity Type, which you have specified for the old loan, apply to the loan being rolled-over, by default. However, you can change the Maturity Type through this screen.

If it is to be changed, you have to specify the new Maturity Type for the rolled-over loan. It could be:

Fixed |

This type of loan has a fixed Maturity Date. For a loan with a fixed maturity date, you enter the changed date on which the loan should be liquidated. |

Call |

The Maturity Date is not fixed. The loan can be liquidated anytime |

Notice |

The loan is liquidated after a certain period of notice. The number of days of notice should be specified in this screen. This is only for information purposes. Whenever a report is generated on a notice type of loan, the notice days are mentioned on it. For a loan with notice type of maturity, you have to enter the Maturity Date, once the notice is issued to the counterparty (customer). |

For a loan maturing at notice, enter the notice period in days. This is only for information purposes. Whenever a report is generated on a notice type of loan, the notice days are mentioned on it. For a loan with notice type of maturity, you have to enter the Maturity Date, once the notice is issued to the counterparty (customer).

Specifying the maturity days

For fixed maturity types, you must specify the number of days to be added to the new value date of the rolled-over contract, to arrive at its maturity date.

Specifying the maturity basis

You must indicate the tenor basis upon which the maturity days specified for the rolled-over contract will be reckoned, in the Roll By field. The options are Days, Months, Quarters, Semi-annuals, and Years.

If you specify the ‘days’ maturity basis, and do not specify the maturity days, the system ‘rounds’ the tenor of the original contract to the nearest maturity days basis. The rounded tenor is considered as the new tenor of the rolled-over contract.

Example

For a loan, the value date of the original contract is 1st April 2001, and the maturity date is 15th March 2002. The maturity basis (Roll By) option is ‘Months’, and no maturity days have been specified.

The maturity date for the rolled over contract is arrived at as follows:

Tenor of the contract = Rounded off (number of months between 15th –March 2002 and 1st April 2001) = 11

Maturity date of the rolled over contract = (15th March 2002 + Tenor) = (15th March 2002 + 11) = 15th February 2003

If the maturity basis for the same contract would have been ‘Months’, and the maturity days is 10, the maturity date of the rolled over contract would be computed as:

Maturity date of rolled over contract = (15th March 2002 + maturity days taken in terms of the maturity basis) = (15th March 2003 + 10 months) = 15th January 2003

9.4.12 Indicating the Interest Basis for Roll-over

The interest basis indicates the manner in which interest for a specific component is calculated. You can select any one of the following as the basis on which the interest rate is picked up.

- Product

- Contract

- User Defined

If you specify that the interest rate maintained at the Product level should form the interest basis then the product level interest rate is made applicable for the component at rollover. Similarly the rate maintained for the contract is made applicable if you specify that the Contract as the interest basis.

If you indicate that the interest basis should be User Defined then you have to specify the appropriate interest rate. The rate that you specify is made applicable to the respective component at rollover.

For more information on interest basis, refer to the Interest User Manual.

9.4.13 Specifying the Refinancing Rate for the rolled over Contract

When a loan that is funded by a pool, is rolled over, you should specify the rate that will be used to arrive at the refinance income on the new contract.

9.4.13.1 Amending Rollover instructions for TD contract by upload

You can amend rollover instructions for TD contract. The system amends the Rollover preferences, special amount preferences, and so on in the Rollover details.

Note

CAMD event is triggered when you upload amendment for rollover instruction

9.5 Specifying Details for Rollover Split

If you have chosen the rollover method as “Split”, then you must enter the corresponding details for the split, in the Split Rollover Details screen. Click ‘Spilt Rollover’ in the Contract Online screen to invoke this screen.

You can only split loan contracts:

- of the same customer

- of the same currency

You can specify the following general rollover details for rollover splits, just as you would for a normal loan contract (as explained in previous sections):

- Rollover amount

- Mode of rollover

- Updating credit limit utilization

- Liquidating overdue schedules

- Applying charges

- Applying tax

9.5.1 Specifying Details for Rolled Over Contracts Created out of the Rollover Split

When you indicate the rollover method as “Split”, the system creates multiple draw down contracts out of the original draw down contract. For each rolled over contract, the system generates a split number.

You must indicate preferences for these rolled over contracts in the Split Rollover Details screen.

You must indicate the following details:

- The amount that can be rolled over to create each of the multiple contracts that will be created as part of the rollover split. You can also indicate how the amount is to be considered, just as you would in the case of a special rollover amount, as explained in previous sections, as for a normal rollover.

- The draw down schedule to which the new contract, created out of the rollover split, would be linked

- Whether the repayment schedules applicable for the rolled over contract created out of the rollover split, must be defaulted from the product used by the original contract, or the original contract itself.

- Whether the rolled over contract created out of the rollover split, is to have a fixed maturity, matures at call or at notice

- For fixed maturity contracts, the maturity date

- For contracts maturing at notice, the applicable notice days

- For fixed maturity type contracts, the number of days to be added to the value date to arrive at the maturity date.

- The refinance rate for the contract split rollover contract

Each of the split contracts inherits the interest components defined for the original contract. All the rate details defined for these interest components, in the original contract, such as the rate type, rate code (for floating rate components) interest basis, margin and spread, are inherited by the split contract.

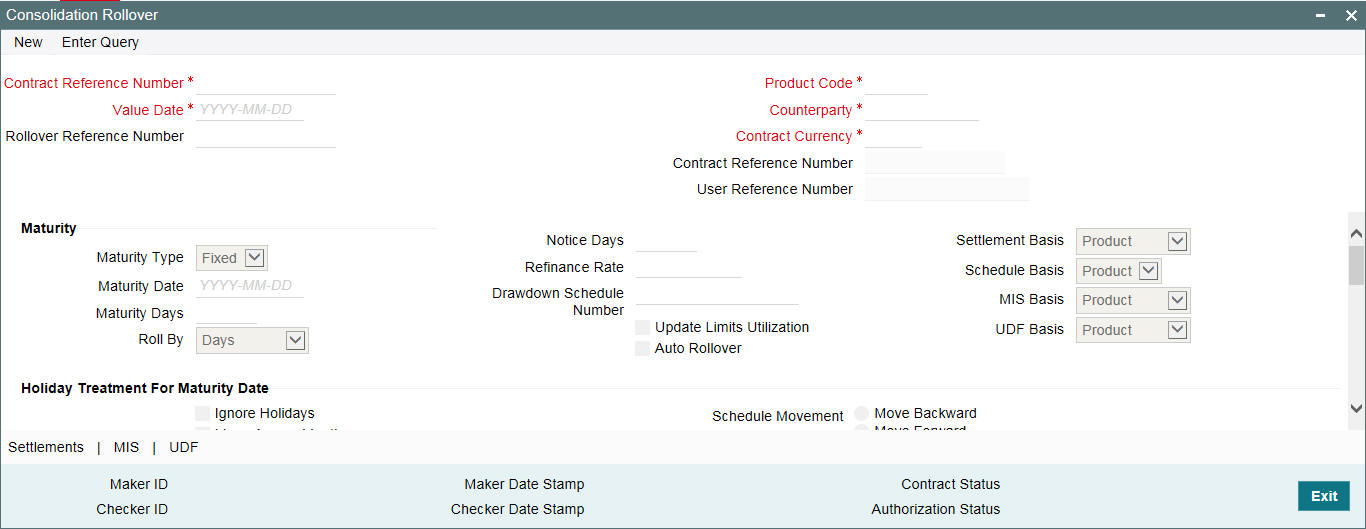

9.6 Specifying Details for Rollover Consolidation

If you have chosen the rollover method as “Consolidation”, then you must enter the corresponding details for the consolidation, in the Consolidation Rollover screen.

You can invoke ‘Consolidation Rollover’ screen by typing ‘OLDCOROL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the reference number of the loan contract (commitment) which you want to consolidate with other loan contracts, as part of the rollover operation.

You can only consolidate loan contracts:

- Of the same customer

- Maturing on the same date

- Of the same currency

When you select the loan reference number, the product code for the loan is displayed. You can select the other loan contracts to be consolidated.

You must specify the following details for the consolidated rolled-over contract:

Maturity Details

You can indicate whether the consolidated contract has a fixed maturity date, or matures at call or notice. For contracts maturing at notice, you can indicate the applicable notice days.

For fixed maturity type contracts, you can specify the maturity date.

For fixed maturity type contracts, you can specify the number of days to be added to the value date to arrive at the maturity date.

Schedule Basis

You can indicate whether the repayment schedules for the consolidated contract must be defaulted from the loan product or from the driver contract.

The Mode of Rollover

You can indicate whether the rollover consolidation must be initiated automatically for the selected contracts. The mode of rollover also depends on whether the mode of liquidation of the loan is automatic or manual. This preference can be set just as you would do for a normal rollover, as explained in previous sections.

Updating Credit Limit Utilization

You can indicate whether the credit limit utilization is to be updated, when the consolidation operation is performed. That is, the interest that has been accrued on a loan is also considered, as a part of the utilized amount for the purpose of risk tracking.

Note

This option applies only if you want to rollover a loan with interest.

Settlement Basis

You can indicate whether settlement details for the consolidated contract must be defaulted from the loan product, or the driver contract

MIS Basis

You can indicate whether MIS details for the consolidated contract must be defaulted from the loan product, or the driver contract,

UDF Basis

You can indicate whether user-defined fields for the consolidated contract must be defaulted from the loan product, or the driver contract.

Refinance Rate

You must indicate the refinance rate for the consolidated contract.

Holiday Treatment

You can indicate whether the system must check for maturity dates of the consolidated contract falling on holidays.

If the holiday check is indicated, you can also specify whether maturity dates falling on holidays must be moved forward to the next working day, or backward to the previous working day. You can also indicate whether the moved maturity date is allowed to cross over months.

Interest Components for the Consolidated Contract

You can define the interest components to be applicable for the consolidated contract.

The interest rate can be defaulted from either the loan product, or the driver contract, or a special rate can be entered. If a special rate is to be entered, you can specify the required rate in the Rate field.

Consolidation Preferences for Driver Contracts

As part of the preferences for the consolidation contract, you can identify contracts from which information such as settlement details, schedules, MIS details and so on, can be defaulted. These contracts are called driver contracts. You can select the contracts to be used as driver contracts, in the Participant Ref No field.

You must specify the following details for the driver contracts:

- How the rolled over amount is reckoned. This could be just the outstanding principal, or outstanding principal together with interest.

- Whether charges are applicable for the consolidated contract

- Whether old schedules for the contracts getting consolidated, must be liquidated

- Whether a special rollover amount is applicable, and how the special amount is to be considered. This preference can be set just as for a normal rollover, as explained in previous sections in this chapter.

9.7 Advices for a Rolled-Over Loan

In the Product Events Definition screen, you can define the events for which advices are to be generated, for loans involving a product. An advice is generated when a loan is rolled-over, if specified to do so, for the product the loan involves. Generation of advices upon rollover, if specified, is as follows:

- When the loan is rolled-over with interest (that is, the entire outstanding amount in the original loan is rolled-over without any component of the original loan being liquidated), the liquidation advice for the original loan is not generated. Instead, a rollover advice, with the details of the liquidation of the original loan and its subsequent rollover into a new loan, is generated.

- When the loan is rolled with an amount, that is not the entire outstanding amount in the original loan, the liquidation advice(s) for the original loan is generated along with the rollover advice.

9.8 Authorizing a Manual Roll-Over

The operations on a loan like input, modification, manual liquidation and manual rollover have to be authorized by a user other than the one who performed the operation. All the loans should be authorized before you can begin the End of Day operations.

When you call such a loan for authorization, the details of the liquidation of the original loan is displayed.

At the time of authorizing rolled over contracts, you need to enter the values for the re-key fields (specified at the product level).