10. Making Additional Disbursements and Rate Changes

This chapter contains the following section:

- Section 10.1, "Introduction"

- Section 10.2, "Navigating to the Schedule Definition screen"

- Section 10.4, "Tracking Payables and Receivables"

10.1 Introduction

Any change to the terms of a loan, which affects its financial details and the accounting entries, can be made through the Value Dated Amendment function of Oracle Lending. Through this function you can make changes to authorized loans on any day before the Maturity Date of the loan.

The changes to the terms of a loan, notified through this function, take effect on a date referred to as the “Value Date”. That is why the changes brought about by this function are called Value Dated Amendment.

A Value Date could be:

- Today

- A date in the future

- A date in the past

Using the Value Dated Amendment function, you can make changes to the various components of a loan such as:

- Additional disbursement of Principal

- The interest rate or amount

- The fees

- The Maturity Date

When you make a value dated amendment, only the accrual entries are passed by the Value Dated Amendment function. All the other accounting entries are passed by the Automatic Daily function.

If the value date is a date in the past, it should not be beyond the last payment date for any component.

You should ensure that a contract - on which you plan to make backdated changes - does not have amortized schedules.

In addition, a value date in the future cannot be beyond the Maturity Date of the loan. If it has to be beyond the Maturity Date of the loan, you have to first postpone the Maturity Date of the loan so that your proposed future value date falls before the new maturity date. Only after this change is authorized can you fix a value date in the future for the loan.

The system defaults to today’s date.

Note

If a contract is pending for authorization in any screen and if you try to unlock in OLDVAMND to do changes, then an error message “Unauthorized amendments exist for contract in ‘function id’ “appears.

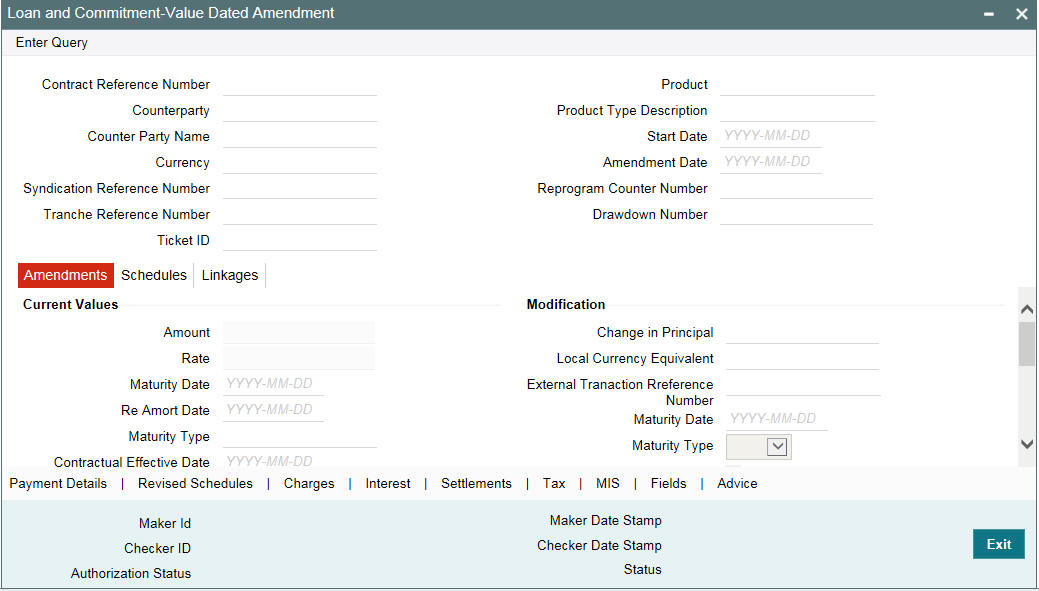

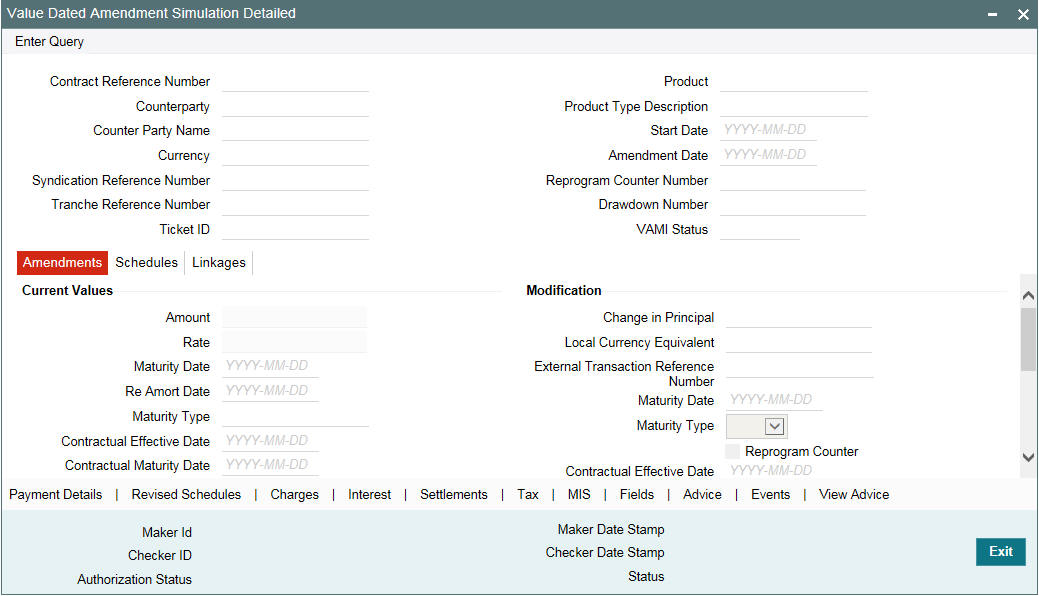

You can invoke the ‘Loan and Commitment - Value Dated Amendment’ screen by typing ‘OLDVAMND’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Enter the reference number of the loan to which you want to make amendments. The main details of the loan is displayed in the screen.

Note

The ‘Ticket Id’ field is displayed only when the individual SLT trades get handed off to LS and then to LD (Origination). If the setup is to consolidate all the trades across the tickets for a CUSIP, the ticket Id is not displayed for any trade.

You can make an additional disbursement through the Value Dated Amendment function.

If you increase the principal amount, the increased amount is put into the last principal payment schedule. You, then, have to authorize the schedule, which the system has redefined to maturity. Only then you can define new schedules, as per your requirement, through the Contract Schedules screen.

For a loan, you can increase the principal through the Value Dated Amendment function. If you want to decrease the principal, you have to treat it as a repayment.

Note

VAMI reversal is allowed only for principal increase and not supported for interest rate or maturity date changes.

You can make payment on the value date and amendment can be done on the value date of the contract.

If a discount accrual component is attached to the contract and if there is a change in the amount due, then the IRR is recomputed.

For back value dated VAMI beyond the liquidation date, the IRR is recomputed, if there is a change in the amount due. The catch up YACR is due to the recomputation posted online, provided if there is a fee liquidation done prior to the VAMI.

The tier based spread is recomputed on payment of principal on the value date and on value dated amendment provided if there is a change in the principal amount.

If there is a VAMI beyond the liquidation date with the value date as value date of the contract, then the principal amount to be increased is adjusted in the bullet schedule and the interest amount is recomputed. The amount to be settled is adjusted based on the net amount paid (Total paid - Total amount reversed - Refund amount) depending on the parameter selected at the product level.

Value date amendment is not allowed for rate type change of capitalized type loans.

You can either link a single facility or multiple collateral/pool to an OL contract. For the Collateral/Pool/Facility linkage, you should specify the linked amount and linked %. Based on this contract amount utilization takes place.

In OLDTRONL, if you alter the Contract Amount, and on Save of the contract amendment, the system does the following:

- Reverses the Utilization that has happened

- Alters and updates the utilization amount for the amended contract amount.

For more information, refer to Linking OL contract to a facility or multiple collateral/pool section

Value Dated Amendment beyond Rate Revision/Rate fixing Date

You can do value dated amendment beyond rate revision/rate fixing date. Only principal Increase and Spread change are allowed as part of this amendment.

Note

During value added amendment, you can change any interest component to floating and give the rate fixing days during amendment.

Schedule Amendment of Non-Liquidated Past Schedules

You can amend the repayment schedules if the schedule due date is in the past.

Amendment beyond Liquidation Date

Amendment beyond liquidation date can be done both for commitments and loans.

Spread Change Beyond Liquidated Schedules

You can change the spread for a effective date beyond a liquidated schedule, however it calculates the interest only from the last liquidation date.

Changes are done to re-compute the interest, from the effective date of the Spread provided the Spread type is Slab/Tier. If the Spread type is flat, then the spread can be changed from Value Dated Amendment Screen.

Based on the re-computation, if the amount due (interest to be liquidated) for a schedule changes, then based on the net interest paid (Amount paid-refund amount-amount reversed) the schedules are adjusted automatically.

Note

For a commitment, you can also decrease the principal amount as only contingent entries are passed.

Negative Value Dated Amendment

You can reduce loan balance in case of an HFS transfer by selecting the ‘HFS Transfer’ check box. The system then posts the corresponding accounting entries as per the product set-up for HFS transfer.

Negative VAMI for Loan reduces CoC balances such as contra and write off, along with HFI loan position.

10.1.1 Changing the Maturity Date

Enter the new Maturity Date in the screen.

When you change the Maturity Date or the Principal of a loan:

- If you have advanced the Maturity Date, the schedules falling due after the new Maturity Date is redefined to the Maturity Date.

- If you have postponed the Maturity Date, the schedules that have not been liquidated and which fall due before the new maturity Date is redefined to the new Maturity Date.

You have to authorize the change in Maturity Date, before you redefine the schedules according to your requirements, through the Contract Schedules screen.

When you extend the Maturity Date of a loan, the time code of the credit line to which the contract is linked should be beyond the new Maturity Date. If not, the system seeks an override.

The new Maturity Date is applicable to the loan from the Value Date of the contract. You can also change the maturity date of the active commitment after its maturity date.

Note

- The system recalculates the fee schedules on the maturity date, if there are any such fee schedules and if they are not liquidated, and shifts them to new maturity date.

- The system allows the commitment reductions (VAMI with decrease in amount) for the existing maturity date even after crossing the maturity date of the Commitment.

- The system does not allow change in maturity date and change in commitment reduction in the same instance through this screen.

- On changing the maturity date of the commitment, the bullet schedule is shifted to the new maturity date if its not liquidated.

10.1.2 Enabling the Reprogramming Counter

Whenever any event (loan disbursement, value dated amendment, schedule changes, and so on.) in the life-cycle of a loan contract results in a negative cash flow for a bank, you have to enable the reprogramming counter by selecting the check box positioned next to the Reprogram Counter field.

10.1.3 Capturing details of amendments to loan agreements

You can record whether there has been any amendment to the loan agreement after it was initiated. If you record that there has been an amendment, you also have to specify the date on which such an amendment was made.

The details that you mention here is incorporated in the amendment confirmation advice that is sent to the customer.

The details pertaining to agreement amendment that you mention in the LD – Value Dated Amendments screen are automatically incorporated in the new version of the contract in the LD Contract Online screen.

10.1.3.1 Indicating the Schedule Definition

LIFO

Select this field to indicate that the system should start the principal adjustment from the bullet schedule. You can perform Non Pro rata VAMI (LIFO) for the agency VAMI activities.

Pro – Rata

Select this field to indicate that the system should do the principal adjustment pro-rata basis for the unpaid schedules using the pro-rata factor in case of overdue loans. You can perform Pro rata VAMI for the assignment activities (Pro-Rata Factor = (New-principal-outstanding / Old-Principal-outstanding).

Note

- In case of normal Loans, the principal adjustment happen pro-rata basis for the schedules after the value date of the Pro-Rata VAMI (Pro-Rata Factor = (New-principal-outstanding as on VAMI value date/ Old-Principal-outstanding as on VAMI value date).

- In case of Pro-Rata Option you can do the following:

- The Value dated Amendment beyond the Value dated Amendment

- The Value dated Amendment beyond the Liquidation

- The Liquidation beyond the Value dated Amendment

- You have to operationally handle any discrepancies in the Loan/Commitment amounts or schedules due to the back valued activities.

- The possible activities which may result in the position or schedule

mismatch are as follows:

- Pro-Rata VAMI beyond another Pro-Rata VAMI or payment or customer VAMI

- Borrower VAMI beyond Pro-Rata VAMI or payment

- Any back valued activities beyond the prepayment with the interest

- Payment/Prepayment beyond Pro-Rata VAMI

- Pro-Rata VAMI with the overdue principal schedules

Reason Code

Specify the reason code here. The adjoining option list displays all reason codes maintained in the system. Choose the appropriate one.

10.2 Navigating to the Schedule Definition screen

The schedule changes, which have come about as a result of value-dated changes, can be done through the Value Dated Amendments screen. For example, if the schedule change has come about following a change in the maturity date, you have to do this through this screen. Click on ‘Schedules’ in this screen.

This section contains the following topics:

- Section 10.2.1, "Applying Rate Revision Schedules"

- Section 10.2.2, "Making Changes in Interest"

- Section 10.2.3, "Making Changes in Interest Rate Type "

- Section 10.2.4, "Making Changes in Maturity Type "

- Section 10.2.5, "Making Changes in Special Rate Type"

- Section 10.2.6, "Amortization after a Value Dated Amendment"

- Section 10.2.7, "Making Changes in Fees"

- Section 10.2.8, "Settlement instructions"

- Section 10.2.9, "Specifying Linkages"

- Section 10.2.10, "Deleting Value Dated Amendments"

10.2.1 Applying Rate Revision Schedules

When you change the rate applied on a fixed rate contract through the Value Dated Amendments screen, you can also apply the rate revision schedules to the contract. In the Schedules tab of the LD Value Dated Amendments screen, any interest rate revision schedules defined for the contract are displayed. You can make these schedules effective by clicking on the “Apply” button.

10.2.2 Making Changes in Interest

Through the Value Dated Amendment function, you can make changes to the maturity date, the principal and specify a new value date for the loan.

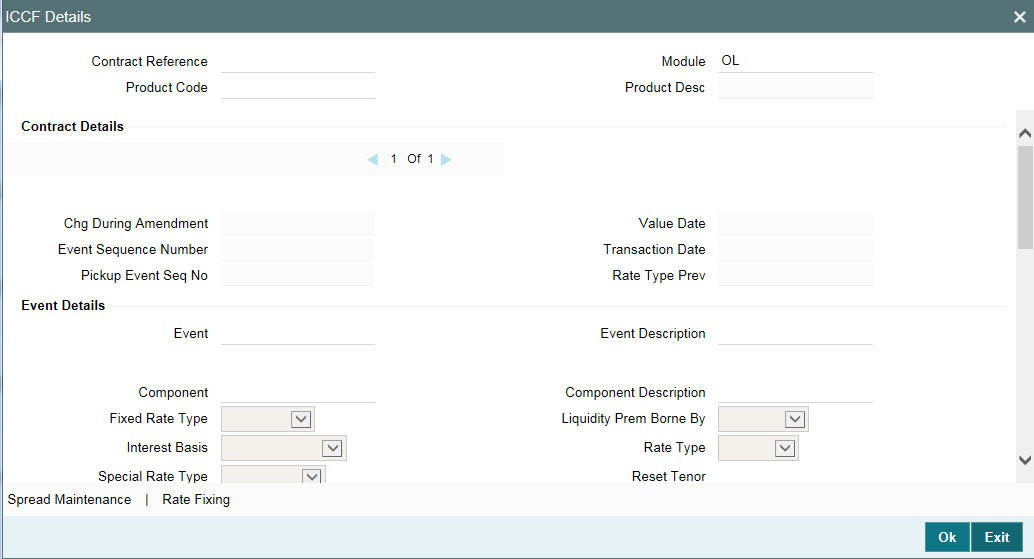

However, if you want to change the interest rate, the rate code, the

spread or the interest amount, you have to invoke the Contract ‘ICCF

Details ‘screen of the ICCF module through the ‘Loan and

Commitment Value Dated Amendments’ screen. Click the’Interest’ to invoke this screen.

You can make Value Dated Amendments only to the following components in the Contract ICCF screen.

Interest Rate

Enter the new interest rate. However, you cannot:

- Change the interest rate if you have defined zero interest for the loan

- Change the interest type

For fixed rate contracts, you can change the rate applied by specifying a new rate.

Note

You can change the interest rate or the schedule only when a back valued change does not affect schedules that have even one of the components (Interest/Charges) partly/fully liquidated.

Rate Code

If a floating type of interest has been defined, enter the new rate code.

Spread

Enter the new spread here.

Interest amount

Enter the new interest amount.

Acquired interest

If the loan was already initiated when it was input, the interest amount that has been accrued should be entered here. The amount is taken into account by the system during the next liquidation cycle. You can make changes to the acquired interest through this screen.

Waiver

The attributes of an interest component that have been defined for a product will be applied on a contract involving the product. If, for some reason you do not want to apply the interest component for the contract you are processing, you can do so by checking this field. The interest is calculated but it is not applied on the contract.

For back valued changes in interest rate the system will take corrective action. Accruals are redone till the last accrual date. In addition, in case of a back valued change, the value date should not be beyond the last liquidation date.

Note the following:

Note

- A fee can be changed only for a commitment.

- If the UDF ‘RATE-VARIANCE’ is maintained as a non-zero value for a commitment contract to which the loan is linked, dual authorization is required for rate and spread changes for fixed rate contracts and rate code and spread changes for floating rate contracts.

For more details regarding dual authorization, refer to the ‘Dual Authorization’ section in this User Manual.

10.2.3 Making Changes in Interest Rate Type

In this screen, you can change the ‘Rate Type’ after a contract is authorized. You can change it either from ‘Floating’ to ‘Fixed’ or from ‘Fixed’ to ‘Floating’. But you cannot change it to ‘special’ or from ‘Special’ to any other rate type (‘Floating’ or ‘Fixed’).

If the rate type is changed to ‘Fixed’ then the field Fixed Rate Type always be defaulted to ‘User Input’ and cannot modify the same. In addition, the field User Rate gets enabled and you can input the appropriate rate. If the rate type is changed to ‘Floating’ then the fields Code Usage and Floating Rate Code gets enabled for modification. The field Code Usage can be modified to ‘Auto’ or ‘Periodic’.

If Code Usage is changed to ‘Periodic’ then the field Revision Method gets enabled for modification. The Revision Method can be modified to ‘Automatic’ or ‘manual’. The change in the rate type is effective from the value date of value dated amendment. Depending on the rate type, appropriate rate is used by the system for interest calculation. The interest rate changes are applicable only for “Main Component.

10.2.4 Making Changes in Maturity Type

The field ‘Maturity Type’ in the ‘Current Values’ section is the existing maturity type for the loan. You need to select ‘Maturity Type’ in the ‘Modification’ section as the maturity type of the loan which is effective after the value dated amendment:

Fixed -> Fixed Maturity Type of Loans

Call -> Demand Loans

Whenever the maturity type is modified from ‘Fixed’ to ‘Call’ the ‘Maturity Date’ field gets nullified and disabled. As part of VAMI, following operations are done:

- The ‘Auto Extension’, which is applicable for demand loans, gets updated as “Y” for the latest version of the loan.

- All the outstanding future dated payment schedules are deleted and system creates only bullet payment schedule for both Interest and Principal.

All the future dated rate revision schedules are also deleted from the system. Users can do contract amendment (CAMD) to define the future payment/revision schedules as per their requirement.

Whenever the maturity type is modified from ‘Call’ to ‘Fixed’ the ‘Maturity Date’ field is enabled and it is mandatory to input maturity date. As part of VAMI, following operations are done:

- The ‘Auto Extension’, which is applicable for demand loans, is updated as “N” for the latest version of the loan.

- All the outstanding future dated payment schedules are deleted and system creates only the bullet payment schedule for both Interest and Principal.

- The schedule date for these bullet schedules is the new maturity date captured as part of VAMI

The schedule date for these bullet schedules will be the new maturity date captured as part of VAMI. All the future dated rate revision schedules gets deleted from the system. Users can do contract amendment (CAMD) to define the future payment/revision schedules as per their requirement.

Note

- The maturity type change is not applicable if the loan has FAS91 type of Fees.

- The rate type and maturity type change is applicable only for normal, bearing type of loans.

- The rate type and maturity type change is not applicable for Agency type of loans.

- In case a future-dated VAMI is captured for maturity type change then further VAMIs is not allowed till the former VAMI is processed successfully.

- In case of Maturity type Change VAMI, only Maturity type Change can be done, no other type of VAMI is possible at the same instance.

- The interest rate type change and maturity type change (from Fixed to Call) is not applicable after the maturity date.

- The maturity type change is not allowed, if the contract has any partial interest payment for the bullet schedule.

For more information on the ICCF Details screen, refer to the Interest User Manual.

10.2.5 Making Changes in Special Rate Type

For late payment charge component attached to the contract, system displays the values of the following fields from the contract ICCF details screen:

- Rate Type

- Special Rate Type

- Accrual Required

- Rate or Interest Amount

During VAMI operation, if ’Amendment Date’ is the same as the current date, then you can modify the ‘Special Rate Type’ (fixed rate or flat amount) applicable to late payment charge component.

For active contracts, you cannot edit the following fields during VAMI operation for late payment charge components:

- Rate Type

- Special Rate Type

- Accrual Required

For uninitiated contracts, you can modify the value of ‘Special Rate Type’ from the contract ICCF Details screen.

Based on the value of ‘Special Rate Type’, system either enables ‘Rate’, ‘Interest Amount’ for amendment. The amended value is applicable only to future schedules where late payment charges are to be calculated. Thus back/future value dated change is not allowed for late payment charge components.

During VAMI operation, if ‘Amendment Date’ of the VAMI is the not the same as the current date, then system does not allow any change in the fixed rate/flat amount applicable to the late payment charge component. When you modify the late payment charge rate/amount, save the changes and exit the ICCF Details screen, system gives the following error message:

‘For special rate type Amount/Rate change should be current dated.’

In this case, you should cancel the change and re-input the VAMI operation.

Back value dated amendments that result in a change in the basis amount of the late payment charge will result in recalculation of late payment charges. If the previously calculated late payment charge has been partially paid, then system tracks only the additional amount as due. If recalculation results in an overpayment for late payment charge, then system stores the overpaid amount against the schedule which can be adjusted using the ‘Pay/Receive Liquidation’ screen.

10.2.6 Amortization after a Value Dated Amendment

You can make a value dated amendment in the interest rate for a loan with amortized schedules. The change can be with a value date of today, or a date in the future. Back dated changes cannot be made on a loan with amortized schedules.

If the change affects the schedule, the schedules are amortized again with the changed terms.

Note

Only the Principal and Interest schedules are redefined. The Fee schedules are not redefined.

10.2.7 Making Changes in Fees

The schedule that falls due immediately after the value-dated change have a slightly different amount (that is, not the Equated Installment). This is because an adjustment has to be made if the period for which the interest is calculated has two different rates. The subsequent schedules are amortized at the new rates.

Fee rates can be changed only if the contract is a commitment. The fee rate can also be changed in case of a future dated loan that is yet to be initiated and the Value Date has to be the same as the Initiation Date of the loan.

For example, for a loan, the new draw-down fees are applicable only if the loan is a future valued loan that is yet to be initiated.

10.2.8 Settlement instructions

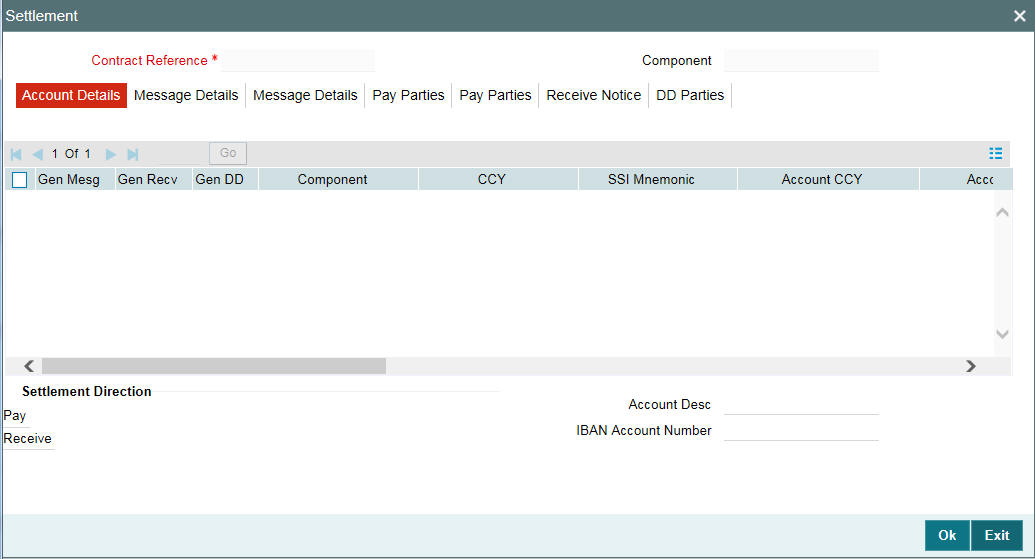

If you want to make changes to the settlement accounts and the currency conversion rates, you have to invoke the ‘Loans and Commitment - Contract Input’ screen and go to the ‘Settlements’ screen by clicking the ‘Settlements’.

For more information, refer to the Settlements User Manual.

10.2.8.1 Amending Settlement instructions for TD contract by upload

The system amends the settlement instructions which are defaulted as a part of maintenance and the settlement accounts which are defaulted component (Amount Tag) wise.

Note

CAMD event is triggered when you upload amendment for settlement instruction.

10.2.9 Specifying Linkages

Similarly, if there is a change in linkages brought about by value-dated changes, then you have to do it through this screen. For instance, if you have increased the principal, there may now be an uncovered amount which you may wish to link to a deposit, an account or a commitment.

10.2.10 Deleting Value Dated Amendments

You can delete the value-dated changes that you have made on a loan provided:

- The change is yet to be authorized

- In case of a future value dated amendment) the change has not yet been effected

All the value-dated changes have to be authorized before the End of Day operations begin.

All future Value Dated Amendment is applied by the automatic contract update program when the changes are due. If the value date of the change is earlier than, or the same as today’s date, the changes will take effect immediately.

To delete value-dated amendments, call the contract on which you have

made Value Dated Amendment (that are still to be authorized) through

the Value Dated Amendment screen by entering the contract reference number.

The details of the contract is displayed. Choose delete from the Actions

Menu or click ‘Delete’on the

toolbar. The value-dated changes are deleted.

10.2.10.1 Reversing Value Dated Amendments

You can reverse Value Dated Amendment Booking

(VAMB) and Value Dated Amendment Initiation (VAMI) using ‘Value

Dated Amendment Reversal’ screen. To invoke this screen, click

‘Reverse’ in the ‘Loans

and Commitment – Value Dated Amendments’.

Exclude From Statement

Select this field to not allow VAMI and its reversal appear in the loan statement.

Remarks

You may add remarks in this field.

Note

The system allows this reversal only if the VAMI reversed is the latest event of the Contract. If subsequent events are executed post VAMI, then you should reverse all the events post VAMI before reversing the VAMI.

Authorizing Value Dated Amendments

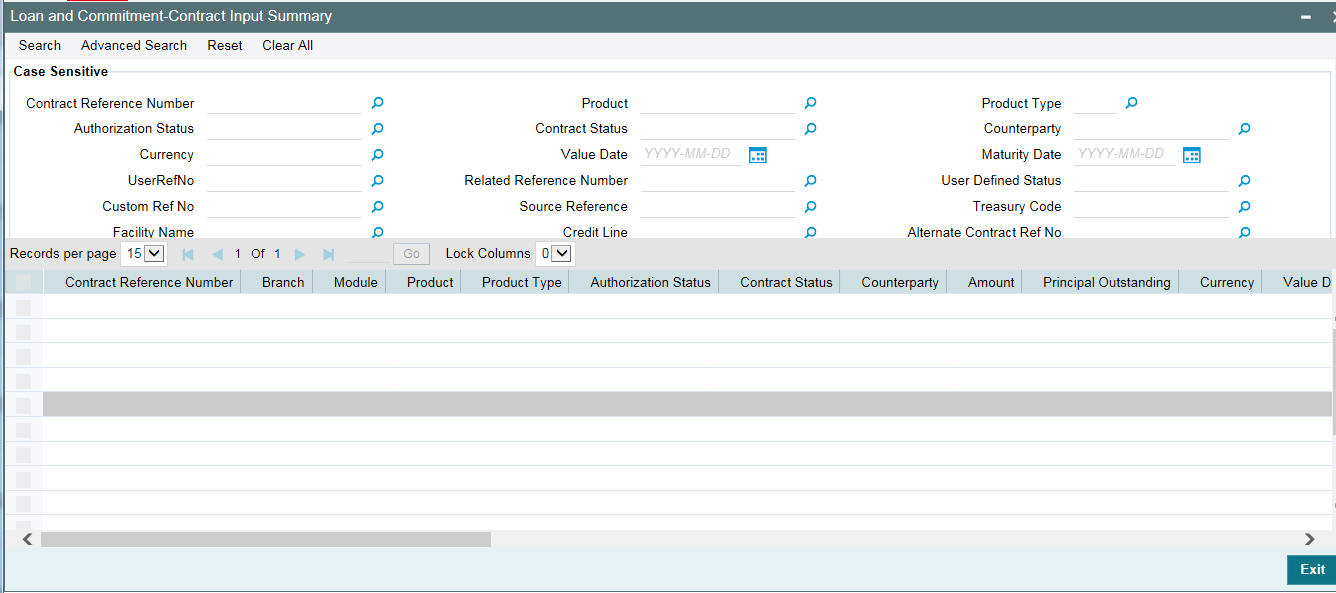

In Oracle Lending, you can authorize the value-dated amendments made on Loan contracts through the ‘Loans and Deposit Contract Summary’ screen.

You can invoke the ‘Loans and Commitment - Contract Input Summary’ screen by typing ‘OLSTRONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The authorization status of all unauthorized contracts is marked as ‘U’. The following stages of the contracts might be unauthorized:

- Contract Input

- Value dated amendments

- Payments made towards the contracts

To authorize the unauthorized contracts, double-click on the contract in the ‘Loans and Deposits Contract Summary’ screen. The screen that is displayed depends on the stage of the contract that is unauthorized.

- If booking or initiation is unauthorized, the ‘Contract Online’ screen is displayed.

- If a value dated amendment is unauthorized, the ‘LD-Value Dated Amendments’ screen is displayed.

- If the payment of a contract is unauthorized, the ‘LD Schedule Payment’ screen is displayed.

In the screen that is displayed (based on the unauthorized stage)

click ‘Authorize’ to authorize

the contract.

If you double click on a contract for which the authorization status is marked as ‘A’, the ‘Contract Online’ screen is displayed.

10.2.11 Reduction of CoC balances for HFI Contracts

The system reduces HFI balances on a pro-rata basis during VAMI event due to HFS transfer, if the box ‘HFS Transfer’ in the ‘Value Dated Amendment’ screen is checked. It computes pro-rata reduction of the following balances for individual loans based on the VAMI amount:

- Pro-rata reduction of write-off

- Pro-rata reduction of contra interest

- Pro-rata release

- of FAS 114 funded reserve

CoC balances are not applicable for LC loans. The box ‘HFS Transfer’ is not applicable for commitment VAMI.

You need to manually reduce FAS 114 unfunded reserve on a prorate basis during HFI to HFS transfer as part of internal HFI Sell trade processing.

10.3 Simulating VAMI

The value dated amendment simulation screen is similar to ‘Loan and Commitment - Value Dated Amendment’ screen. Once the VAMI is saved in this screen, you can view the revised schedules and view the advice.

Value Dated Amendment simulation is used to view the impact on repayment schedules, tenor and maturity date after the VAMI.

You can invoke the ‘Value Dated Amendment Simulation Detailed’ screen by typing ‘OLDVAMSI’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

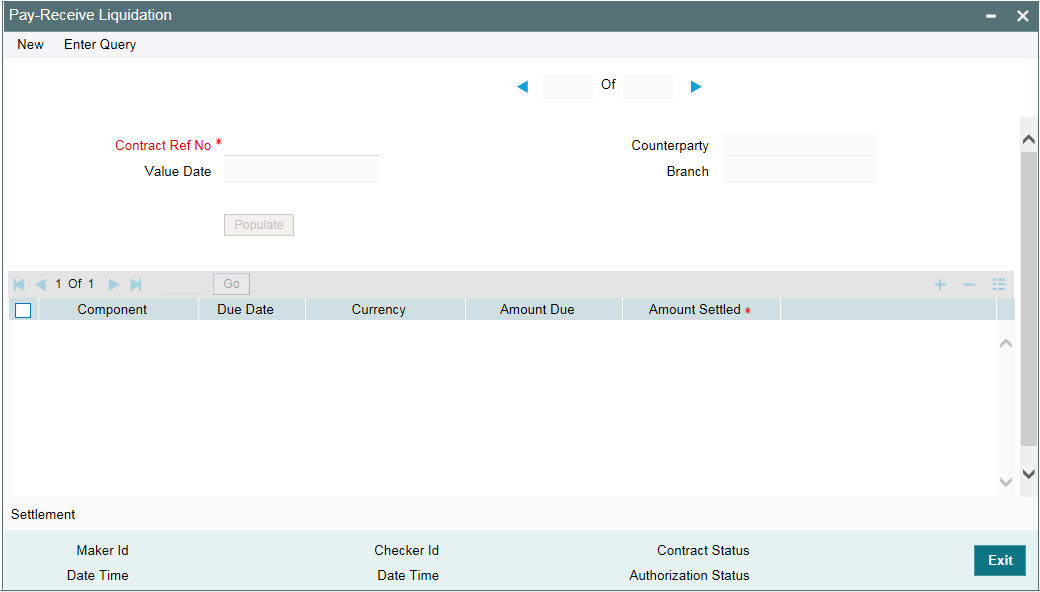

10.4 Tracking Payables and Receivables

You can track and liquidate the differences in the settled amount using ‘Pay – Receive Liquidation’ screen.

You can invoke the ‘Pay - Receive Liquidation’ screen by typing ‘OLDPRLIQ’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Note

In case of any Pro Rata VAMI beyond any Payment, it may result in the change in the settlement amount for the settled schedules. These differences in the settled schedules (both positive and negative) you can track under the payable and receivables and can settle the differences to the Pay-Receive Liquidation option.

Contract Reference Number

Specify the contract reference number whose list of components you want to display in this screen.

The following fields are displayed

- Department

- Branch

- Counterparty

- Component

- Due Date

- Amount Due

- Currency

Value Date

Specify the value date of the payment for the selected component. The value date of the payment can be either backdated or current dated.

Amount Settled

Specify the amount to be liquidated for the selected component.

Note

- You are allowed to reverse the payment manually.

- You are allowed to delete the payment and delete the reversal of payment before authorization of the activity.