13. Annual Rest Loans

13.1 Introduction

In Installment Loans the tenor of the loan is divided into periods by defining Unearned Interest Schedules (one period is the interval between two Unearned Interest Schedules). The system first calculates the interest amount for the period that is starting based on the Principal outstanding at the beginning. Subsequently, the interest amount is allocated to all the interest payment schedules within the period.

Let us assume that your bank has to process an Annual Rest Loan with a tenor of 36 months. Oracle Lending processes such loans in the following manner:

- At the start of every 12 month period, the monthly interest installment amount for the next 12 months will be computed based on the outstanding principal at the start of the 12-month period.

- At the start of the 12 month period, the total interest amount for the next 12 months is passed to an Unearned GL (the interest amount is unearned as you will be calculating the interest for a future period). Consequently, the following accounting entries can be passed in Oracle Lending by setting up entries as defined below:

Dr Loan Asset GL

Cr Unearned Interest GL

- On complete payment of monthly installment amount towards principal and interest, the Unearned interest amount can be accrued as shown:

Dr Unearned Interest GL

Cr Interest Income GL

- If the customer makes a prepayment, the entries for the unamortized unearned interest can be reversed as shown:

Dr Unearned Interest GL

Cr Loan Asset GL

- If there is any change in the status of Annual Rest Loans, the reversal of accruals will also involve the reversal of the unearned interest amount that is not accrued. Accordingly entries can be set up as follows:

Dr Unearned Interest GL

Cr Loan GL

- During write-off of Annual Rest Loans, you can reserve a GL for the outstanding principal as shown:

Dr Write-Off GL

Cr GL for Reserve for Doubtful items

- In case your bank recovers the loan amount after write-off, the GL reserved for doubtful items can be debited to the extent of the outstanding principal payment as indicated below:

Dr GL reserved for Doubtful Items

Cr Recovery GL

his section contains the following topics:

- Section 13.1.1, "Specifying the Unearned Interest Calculation Parameters"

- Section 13.1.2, "Specifying the Accounting Roles for Unearned Interest Component"

- Section 13.1.3, "Capturing the unearned interest details at the contract level"

- Section 13.1.4, "Amending the Details of Annual Rest Loans"

- Section 13.1.5, "Processing Accruals"

- Section 13.1.6, "Specifying the Status of Annual Rest Loans"

- Section 13.1.7, "Processing Prepayments of Installment Loans"

13.1.1 Specifying the Unearned Interest Calculation Parameters

For normal loans, you would calculate and collect the interest amount at the same time (for example every month in case of monthly repayment schedules). However, for installment loans, you can specify different frequencies for calculation and payment of the main interest component.

Therefore, as part of processing Annual Rest Loans, Oracle Lending first calculates the unearned interest amount (this interest amount is unearned as you are calculating the interest for a future tenor). Subsequently, the system allocates the interest amount to the payment schedules that you specify for the loan.

These are the steps involved in specifying the calculation parameters for the unearned interest amount:

- Indicating the preferences and schedules for the unearned interest amount at the product level,

- Specifying the unearned interest calculation parameters for an Annual Rest loan contract. The unearned calculation parameters defined at the product level is defaulted to the contracts associated with it. However, Oracle Lending allows you to modify the values of the parameters at the time of contract processing.

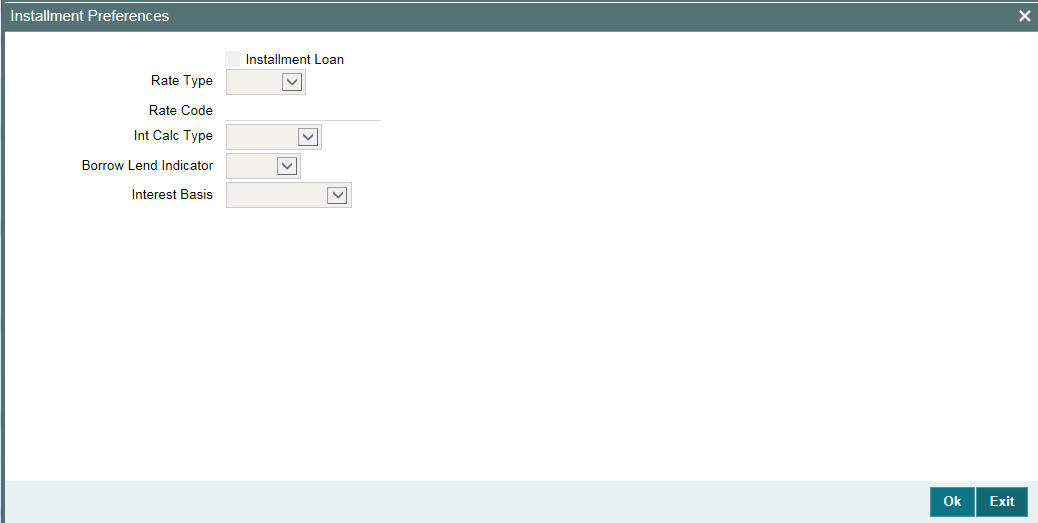

Indicating the preferences for the unearned interest amount

At the time of defining an Annual Rest Loan product, you need to specify

the calculation parameters for the unearned interest amount in the ‘Installment

Preferences’ screen. Click ‘Installments

Details’ in the ‘Loans and Commitments Product Preferences’

screen to specify the calculation parameters for the unearned interest

amount.

In this screen, you need to specify the following details:

- Whether the loan is an installment loan. You can choose this option

only at the time of creating a new loan product. You cannot modify this

selection after you save the product. In addition, you can choose the

installment loan option only if:

- The rate type of the main interest component linked to the product is ‘Special’,

- The payment method is ‘Bearing’

- The repayment schedules are of type ‘Normal’

This is required because, for Annual Rest Loans, the system first calculates the unearned interest amount and then allocate it to the interest payment schedules.

- The rate type for calculating the unearned interest amount. This can be either fixed or floating

- If you have opted for floating rate type, you need to indicate the rate code

- The interest basis method for calculating the unearned interest amount

- The Borrow-Lend indicator of the rate code (in case of Floating Rate)

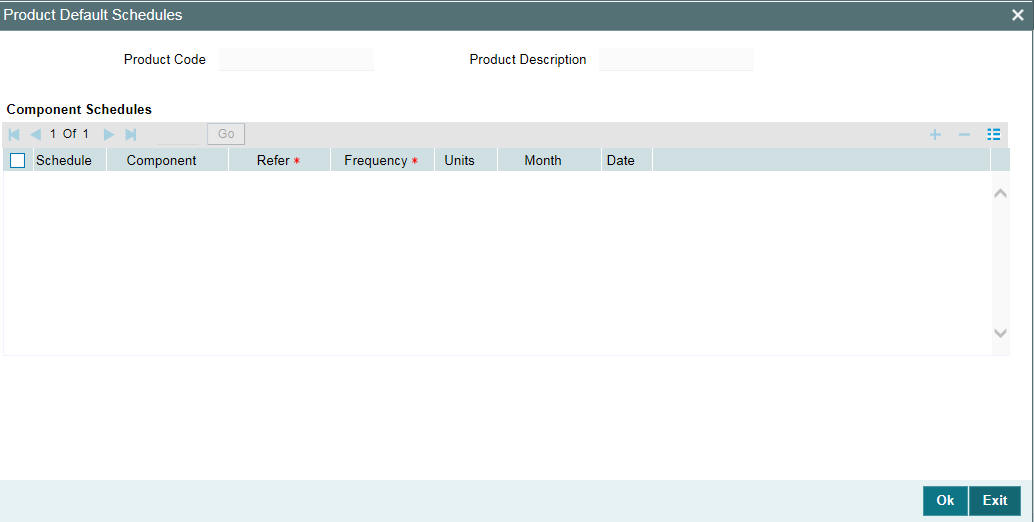

Indicating the schedule preferences

At the time of defining a product, you need to specify the schedule preferences for interest calculation and interest payment for the main interest component. Accordingly, the system calculates the interest amount for the unearned interest calculation schedules and accordingly allocate the calculated interest amount to the interest payment schedules.

Oracle Lending allows you to maintain both normal interest payment schedules and unearned interest calculation schedules for the main interest component. In the ‘Preferences’ screen click ‘Schedules’ to specify the schedule preferences in the ‘Product Default Schedules’ screen.

You can differentiate between the interest payment schedules and unearned interest calculation schedules. Enter ‘U’ for unearned interest calculation schedule and ‘P’ for payment schedules.

Example

Let us assume that you have defined the main interest component MAIN_INT for an installment loan product. At the time of specifying the schedule details, you need to:

- Choose ‘U’ for the main interest component MAIN_INT to specify the interest calculation schedules. Accordingly, the system calculates the unearned interest amount for the specified schedule.

- Choose ‘P’ for the main interest component MAIN_INT to specify the schedule details for interest payment. Accordingly, the system allocates the interest amount calculated (according to the interest calculation preferences) to the payment schedules that you define here for collection of interest.

If you do not specify the schedule preferences for unearned interest, the system defaults a single unearned interest calculation schedule for the entire period of the contract.

13.1.2 Specifying the Accounting Roles for Unearned Interest Component

Oracle Lending provides the following additional roles for the unearned interest component.

- COMPONENT_UIP: Map this accounting role to an Unearned Income/Liability GL

- COMPONENT_UIR: Map this accounting role to a Loan Asset GL

Note

Refer to the section ‘Mapping Accounting Roles to Account Heads’ in the chapter ‘Defining the attributes specific to a loan product’ for further details.

Specifying event-wise accounting entries

Oracle Lending generates the event UIDB (Booking of Unearned Interest amount) to post accounting entries of unearned interest amount.

Oracle Lending also generates the amount tag COMPONENT_UINT for the unearned interest component.

Accounting entries for the event Booking of Unearned Interest Amount (UIDB)

At the time of initiation or liquidation of an Annual Rest Loan, the system checks for unearned interest schedules for which schedule due date is before or same as the initiation or liquidation date. For each such schedule, it checks whether all payment schedules falling on or before the due date have been paid. If all such schedules have been paid, it calculates the interest amount based on the outstanding principal amount and the specified interest rate on the due date of the unearned interest schedule and allocate it to all interest repayment schedules before the next interest calculation due date.

Example

Let us assume that you have disbursed an Annual Rest Loan with the following details:

- Value Date: 1-Jan-2002

- Tenor: 24 months

- Maturity Date: 1-Jan-2004

The interest payment schedules (P) and interest calculation schedule details (U) for the contract are as follows:

Interest Calculation Schedule Due date |

Interest Payment Schedule Due Date |

1-JAN-2002 |

1-APR-2002 1-JUL-2002 1-OCT-2002 |

1-JAN-2003 |

1-APR-2003 1-JUL-2003 1-OCT-2003 |

On 1st January 2002, the system first calculates the unearned interest amount for one year (between 1-JAN-2002 and 1-JAN-2003) and allocate the amount to each payment schedule.

After calculating the unearned interest amount and allocating the amount to the payment schedules, the system passes the following accounting entries during the event UIDB:

Accounting Role |

Amount Tag |

Debit/Credit Indicator |

COMPONENT_UIR This accounting role is mapped to a Loan Asset GL. |

COMPONENT_UINT Oracle Lending provides this amount tag and it contains the unearned interest amount |

Dr |

COMPONENT_UIP This accounting role is mapped to an Unearned Income GL/Discount Liability GL. You need to credit this GL with the unearned interest amount. |

COMPONENT_UINT |

Cr |

Accounting entries for the event LIQD

Accounting Role |

Amount Tag |

Debit/Credit Indicator |

Customer Account |

COMPONENT_LIQD |

Dr At the time of liquidation, you need to collect the interest amount from the customer |

COMPONENT_UIR You would have mapped this accounting role to the Loan Asset GL. |

COMPONENT_LIQD |

Cr |

Accounting Roles for the event ACCR

Accounting Role |

Amount Tag |

Debit/Credit Indicator |

COMPONENT_UIP |

COMPONENT_ACCR |

Dr |

COMPONENT_INC |

COMPONENT_ACCR |

Cr |

13.1.3 Capturing the unearned interest details at the contract level

In Oracle Lending, when you are entering the details of a new contract, the unearned interest schedule details specified at the product level gets defaulted to the contract. Click ‘Schedules’ to view and modify the schedule details of installment loans.

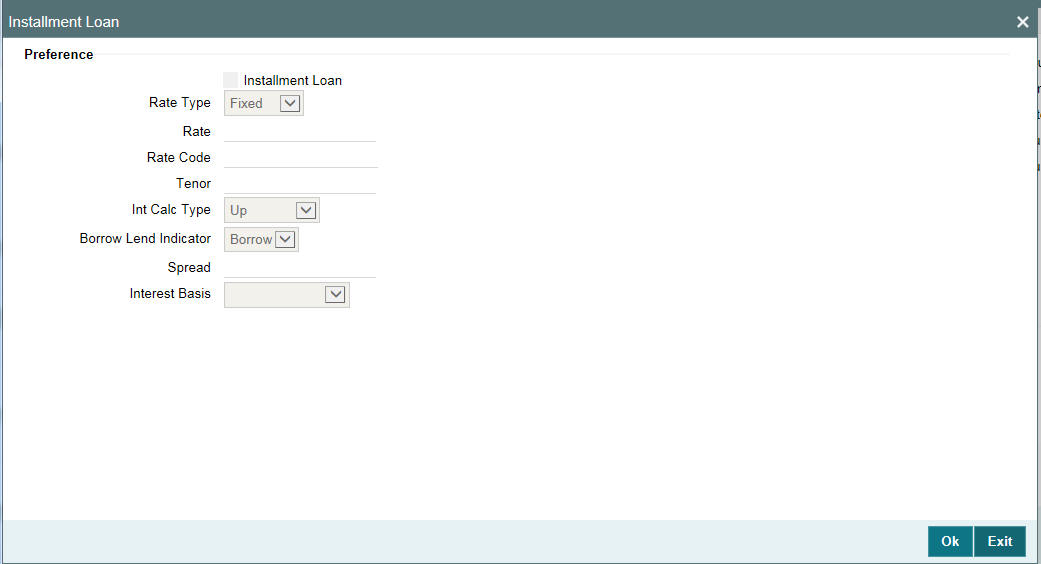

13.1.3.1 Specifying the interest calculation parameters for the contract

In the ‘Loans and Commitment - Contract Input’ screen, click on ‘Installment Loan’ to modify the unearned interest calculation parameters.

The calculation parameters defined for the product gets defaulted to the contract. You can however, modify all the parameters except rate type. If the ‘Rate Type’ is ‘Fixed’, you need to enter the interest rate based on which the system will calculate the unearned interest amount.

After specifying the schedule details and interest calculation parameters, you can view the unearned interest amount details.

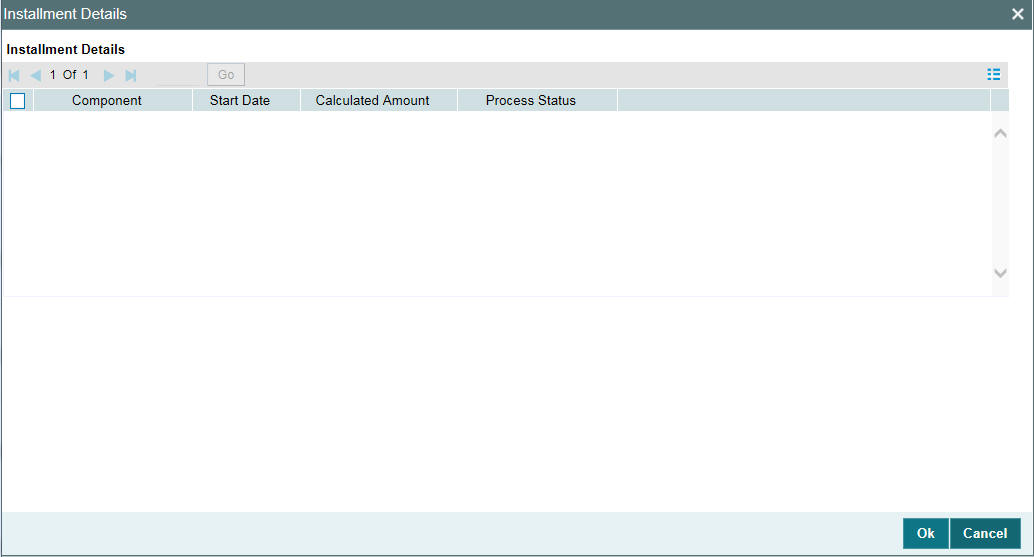

Click ‘Unearned Interest’ to view the schedule details.

The following details are displayed in the screen:

- Component: This will be the main interest component

- Due Date: This indicates the date from which the system will start calculating the unearned interest amount

- Calculated Amount: This amount is calculated from the due date of the current period to the due date of the next period (if the period exists). If there are no more periods, the system calculates on the maturity date of the contract.

- Status: This indicates whether the unearned calculation schedule has been processed

Example

Let us assume that you have disbursed an Annual Rest Loan with the following details:

- Value Date: 1-Jan-2002

- Tenor: 24 months

- Maturity Date: 1-Jan-2004

- Loan Amount: USD 50,000

Unearned Interest Calculation Parameters

- Rate Type: Fixed

- Interest Rate: 5%

- Interest Basis: Actual/360

- Main Interest Component: MAIN_INT

The interest payment schedules (P) and interest calculation schedule details (U) for the contract are as follows:

Interest Calculation Schedule Due date (P) |

Interest Payment Schedule Due Date (I) |

1-JAN-2002 |

1-APR-2002 1-JUL-2002 1-OCT-2002 |

1-JAN-2003 |

1-APR-2003 1-JUL-2003 1-OCT-2003 |

On 1st January 2002, the system first calculates the unearned interest amount for one year (between 1-JAN-2002 and 1-JAN-2003) and allocate the amount to each payment schedule.

Assuming that the current working date of your bank is 15th March 2002, these values are displayed in the ‘Unearned Interest Schedule Details’ screen:

Component: MAIN_INT

Due Date = 1-JAN-2002

Calculated Amount= 50,000x365x5

100x360

=2534.72

The system allocates this amount to the specified interest payment schedules.

13.1.4 Amending the Details of Annual Rest Loans

Oracle Lending applies the following restrictions on the amendment operations on Annual Rest Loans:

- In case you want to change the maturity date of an Annual Rest Loan, you cannot enter a maturity date before the due date of the first unprocessed unearned interest schedule. If there are no unprocessed unearned interest schedules, you cannot change the maturity date of the contract.

Example

Let us assume that for an Annual Rest Loan, the Due Date for calculating

the unearned interest amount is 2-Jun-2002 and the maturity date of the

contract is

2-Jun-2003. In Oracle Lending, you cannot modify the maturity date of

the contract to a date before 2nd June 2002 as this is before the due

date for calculating the unearned interest amount.

You cannot redefine the schedules before the due date of the first unprocessed unearned interest schedule. You cannot amend the schedules of the contract if there are no unprocessed unearned interest schedules.

You cannot make the above-mentioned amendments on Annual Rest Loans since the system calculates the interest payment schedule amounts based on the interest calculation schedules. Therefore, if you make any financial amendments to the loan contract after allocating the interest amounts, it would make the previous allocations invalid.

13.1.5 Processing Accruals

The income on installment loans will be realized only after your bank realizes the amount from the customer. Therefore, Oracle Lending does not allow periodic accruals on installment loan contracts. The system completes the pending accruals only when the customer pays the interest amount.

13.1.6 Specifying the Status of Annual Rest Loans

The status of an installment loan depends on the repayments made on the loan. A repayment could mean a change in status. Each status applicable for a contract is defined in the system. For movement to each status, you can define processing parameters, such as whether further accruals may be stopped, or accruals already made must be reversed out, and if the reporting GL must be changed when the status changes.

You can also process individual statuses and status changes for each schedule defined for a contract. In such a case, for each schedule, the accrued interest amounts on the schedule that has fallen overdue, resulting in a change of status, would be moved to the transfer GL’s defined for the status. You can transfer the outstanding unearned interest amount of the main interest component to a different GL. In case of unearned interest amounts falling overdue, you can specify the following:

- For the accounting role COMPONENT_UIR (which is mapped to a Loan Asset GL), the system would transfer the outstanding unearned interest amount from the Loan Asset GL to a new GL.

- For the accounting role COMPONENT_UIP (which is mapped to a Unearned Income/Liability GL), the system will transfer the outstanding unearned interest amount to a new GL.

13.1.7 Processing Prepayments of Installment Loans

If a customer repays the loan amount before the maturity date, the customer account is debited for the outstanding principal and the outstanding unearned interest amount should be reversed. In such cases, you need to use the interest income GL as the settlement account for the interest amount.

Let us assume that a customer settles the loan amount before the maturity date of the contract. Let us represent the outstanding loan amount as ‘P’ and the outstanding unearned interest amount as ‘I’. Follow the steps given below to handle such prepayments:

- You first need to liquidate the principal amount in the payment screen (Refer to the chapter on ‘Processing Repayments’ for details on specifying the repayment details). The accounting entries that will be passed as a result of this payment are:

Accounting Role |

Amount |

Debit/Credit Indicator |

Customer Account |

P |

Dr |

Loan Asset GL |

P |

Cr |

After liquidating the principal amount, you need to liquidate the unearned interest amount in the ‘Schedule Payment’ screen. For this, you need to use the interest income GL as the settlement account.

Accounting Role |

Amount |

Debit/Credit Indicator |

COMPONENT_INC This indicates the Income GL |

I |

Dr |

COMPONENT_UIR This is mapped to the Loan Asset GL |

I |

Cr |

After passing these entries for the outstanding unearned interest amount, the system then passes the below entries as part of completing pending accruals:

Accounting Role |

Amount |

Debit/Credit Indicator |

COMPONENT_UIP |

I |

Dr |

COMPONENT_INC |

I |

Cr |

Reversal of Outstanding Unearned Interest amount

As stated earlier, the following entries are passed as part of UIDB event:

Debit |

Loan Asset GL |

Unearned Interest Amount |

Credit |

Unearned Interest GL |

Unearned Interest Amount |

If the loan becomes delinquent subsequently, and the outstanding unearned interest amount needs to be reversed, you need to change the status of such a contract to a new one. The system performs this action by posting the following entries:

Debit |

UID GL |

Unearned Interest Amount |

Credit |

Loans Asset GL |

Unearned Interest Amount |

The system passes these accounting entries only if you have maintained the following GL transfer setup for the unearned interest accounting roles in status change

- ComponentUIP: This should be mapped to the loan asset GL

- ComponentUIR: This should be mapped to UID GL

If the interest or principal amount is repaid after a contract status is changed to PDO Accrual, PDO Non-Accrual or Write-Off you can process the payment using the loan payment screen.

You need not change the status of the contract to normal to enter such payments. The system automatically reduces the amount from the PDO Accrual GL or PDO Non-accrual GL, depending on the current status of the contract.