9. Rolling over a Drawdown

This chapter contains the following sections:

- Section 9.1, "Introduction"

- Section 9.2, "Defining Product Rollover Preferences "

- Section 9.3, "Specifying Contract Rollover Details"

- Section 9.4, "Rollover Netting Payment Messaging Process"

- Section 9.5, "Reversing Rollover Instructions"

- Section 9.6, "Defining Advices for Rolled Over Drawdowns"

- Section 9.7, "Processing Non-Prorata Rollovers"

9.1 Introduction

A rollover is the renewal of a borrower drawdown under a borrower tranche of a borrower facility. Instead of liquidating a drawdown on maturity, you can roll it over into a new drawdown. The outstanding principal of the old drawdown is rolled-over with or without the interest outstanding on it. You also have the option to increase the principal when rolling over a drawdown.

You can rollover a drawdown you are processing, provided rollover is allowed for the drawdown product involved in the drawdown.

When a drawdown is rolled over, it can be processed in the following manner, depending upon your specification:

- A new drawdown with a different contract reference number is initiated

- The original drawdown could be split into multiple drawdowns as a result of the rollover.

- The original drawdown could be consolidated along with other drawdowns as a result of the rollover.

For a borrower drawdown, typically, a new drawdown would be required to be initiated on rollover, and further, a split or consolidation may be required.

9.2 Defining Product Rollover Preferences

When defining a borrower drawdown product, you have to specify whether drawdowns involving the product can be rolled-over. To enable this, you have to check the ‘Allow Rollover’ option as part of maintaining product preferences. If rollover has been allowed for a product, all the drawdowns involving the product can, by default, be rolled-over.

Note

However, a drawdown involving such a product will be rolled-over only if it is not liquidated, on its Maturity Date. You can choose not to rollover a drawdown involving a product with the rollover facility. This can be indicated when processing the drawdown.

The rollover details for the borrower drawdown product that you are

defining can be specified in the ‘Rollover Details’ screen.

To invoke this screen, you have to click ‘Rollover

Details’ button in the ‘Borrower Product Preferences’

screen.

You define the rollover preferences for a borrower drawdown product in the same manner as you would for a normal loan product.

Note

Only those preferences that you would define specifically for loan syndication borrower drawdown products are explained in this chapter.

You can capture the following details in this screen:

Rollover Mechanism

When defining rollover mechanism for a loans syndication product, the default rollover mechanism will be ‘Spawn Contract’ and you cannot change this specification. This creates a new drawdown on rollover.

Rollover Method

You have to indicate the method that you want to employ to rollover the drawdown. You can choose from the following methods:

- Normal: If you choose this option, a single new contract is created for the amount you wish to rollover. In this case, you can capture the rollover details for a drawdown in the ‘ROLLOVER’ tab of the ‘Drawdown Contract Online’ screen.

- Split: If you select this option, you can split the original drawdown into multiple drawdowns. You can capture the preferences for split rollover in the ‘SPLIT ROLLOVER’ screen which you can invoke from the ‘Drawdown Contract Online’ screen.

- Consolidated: You can opt for this if you want to consolidate a drawdown with other drawdowns into a single new drawdown. You can capture the preferences in the ‘Consolidation Rollover’ screen available in the Application Browser.

Each of the above rollover types are discussed later in this chapter.

Maturity Date Basis

Select the basis on which the system should arrive at the maturity date of the rolled over drawdown. The options available are:

- Product: Select this option if you want the maturity date of the rolled over drawdown to be drawn up based on the default tenor maintained for the drawdown product.

- Contract: Select the option if you want the tenor of the original drawdown to be applied on the rolled over drawdown

Rollover Mode

You can select the rollover mode from the drop-down list. The options are:

- Auto: If you select this option, the system automatically rollovers the drawdown on the maturity date as per the preferences maintained for rollover.

- Semi-Auto: Select this option to indicate that ‘Forward Processing’ is applicable during roll-over. The system processes the event ‘ROLL’ before the schedule date but l hold messages till the value date, for manual release. The messages are held in the ‘Forward Processing Queue’.

Forward Processing has been explained in the chapter ‘Reference Information for Loan Syndication’. Refer to the same for more information

Cont Booking for Addl Amt Only

You have to select this option if you wan to rollover the drawdown for an additional amount only.

Apply Charge on Rollover Amt

You can select this option to indicate that charge is to be applied on drawdowns that are rolled over. However, for charge to be applicable on a rolled over drawdown:

- It should be applicable to the product involving the drawdown

- It should not have been waived for the original drawdown (one that is being rolled over).

Liquidate Overdue Schedules

You can select this option to liquidate the overdue schedules, if any, before rolling over a drawdown.

Repickup Interest Rate on Rollover

You may select this option to instruct the system to reapply the interest rate for the rolled over drawdown. If not selected, the interest rate applied for the original drawdown is used for the new drawdown as well.

9.2.1 Impact of Liquidation Mode on Rollover

Rollover is applicable for both ‘Manual’ and ‘Automatic’ modes of liquidation. When the liquidation mode is ‘Manual’, system allows you to specify the rollover instructions. On saving the same, the rollover option is changed to auto and an override message gets displayed.

The mode of liquidation of a drawdown has the following impact when rollover is carried out:

Auto Liquidation and Auto Rollover

The original drawdown is liquidated and a new one initiated on the maturity date of the drawdown. It is processed as a part of the BOD process by the Automatic Contract Update function. If the maturity date falls on a holiday, the liquidation and the rollover is processed as per the holiday handling specifications maintained in the ‘Branch Parameters’ screen.

- If you have specified that processing has to be done today (the last working day before the holiday), then for automatic events, the schedule falling on the holiday, is liquidated today during End of Day processing.

- If you have specified that processing has to be done only up to the System Date (today), then only the events scheduled for today (the last working day before the holiday) will be processed. The events falling on the holiday are processed on the first working day after the holiday, during Beginning of Day processing.

9.3 Specifying Contract Rollover Details

Instead of liquidating a borrower drawdown loan on maturity date, you can renew it into a new borrower drawdown loan contract, or split it into multiple borrower drawdown contracts, or consolidate it into a single new borrower drawdown contract along with other borrower drawdowns. As part of rolling over a contract, the original contract should be liquidated and a new contract should be initiated. In FLEXCUBE, these two processes are done in a single step.

A borrower drawdown inherits the rollover preferences defined for the borrower drawdown product it uses. By default, the rollover mechanism is ‘Spawn Contract’ and you cannot change it. This indicates that rolling over the contract creates a new drawdown.

The rollover method indicates:

- whether a single new drawdown must be created when the original drawdown is rolled over (Normal Rollover)

- whether the original drawdown must be split into multiple drawdowns when rolled over (Split Rollover)

- whether the original drawdown must be consolidated into one single drawdown along with other drawdown, when rolled over (Consolidation Rollover)

Note

The following are applicable for rollover, irrespective of the rollover method you opt:

- The system does not allow partial interest rollover

- Rollover is allowed only if the interest rate is fixed till the maturity date for the original drawdown.

- You cannot reverse a drawdown for which consolidation rollover instructions are maintained.

- SKIM and Fee components are not propagated to the rolled over drawdown. If required, you can add the components after the new drawdown is created on the rollover date.

- The drawdown count increases to the extent of rolled over drawdowns.

- You are not allowed to specify the rollover instructions if the future dated schedules are present in the drawdown.

- The system displays the name of the facility in the rolled over child contract.

- After you save the instructions for ‘Normal’ and ‘Split’

rollover, system triggers the ‘CAMD’ event. For consolidation

rollover instructions, system triggers the ‘RBOK’ event.

The following advices are generated for these events:

- BORR_ROLL_ADV (for the borrower side)

- PART_ROLL_ADV (for the participant side)

- Amendment Advice is generated when you amend the rollover instructions

- Once rollover gets initiated on the maturity date, system triggers the ‘ROLL’ event for the original drawdown.

- Initiation of the child drawdown does not happen if you have not fixed the interest rate/exchange rate for the child drawdown.

- Utilized/Unutilized portion of tranche gets affected to the extent of rolled over amount less the outstanding principal amount. The system calculates the Utilization/Non-Utilization fee based on this.

- An event “RNET”, for passing the netted accounting entries and for the netted payment message generation (in case of current dated instructions) is fired along with ROLL event.

- An event RMNT is fired which have the message generated based on currency settlement days, if future dated rollover instruction is captured.

- As part of RNET event the actual entries are passed against customer account which will be offset with the Netting suspense GL.

Note

Irrespective of the type of renewal you select in the ‘DRAWDOWN’ tab of the ‘Drawdown Contract Online’ screen, the system allows you to capture instructions for any one of the renewal types – Normal, Split, or Consolidation. Depending on the type of instructions you capture, the system automatically updates the ‘Renewal Type’ with the latest value when you save the instructions.

9.0.0.2 Fixing Exchange Rate for Rollover

If the drawdown currency is different from the tranche currency, you need to fix the applicable exchange rate for the rolled over drawdown. You can do this through the ‘Exchange Rate Fixing’ screen.

For more details on this screen, refer the section titled ‘Fixing exchange rate for drawdown currency’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

9.0.0.3 Specifying the Maturity Date Preferences

For arriving at the maturity date of the rolled over drawdown, you can specify the following:

Maturity Date

You can capture the maturity date of the rolled over drawdown here. If you do not specify the maturity date, the system arrives at the maturity date based on the ‘Roll By’ value and the ‘Maturity Days’ specified for the drawdown.

If you do not select any options here, system displays the maturity date based on the ‘Maturity Date Basis’ maintained at the product level (in the ‘Rollover Details’ screen).

Maturity Days

You have to specify the number of days that is to be added to the value date of the new split drawdown to arrive at the maturity date of the drawdown.

Roll By

Indicate the tenor basis upon which the maturity days specified for the rolled-over contract will be reckoned. The options are:

- Days

- Months

- Quarters

- Semi-annuals

- Years

9.3.0.1 Specifying Interest Basis Details

The interest components and the associated details defined for the drawdown will be applicable for the rolled over drawdown as well. However, you can amend the following details:

Rate Type

You have to indicate the nature the interest applicable for the rolled over drawdown. The options available are:

- Fixed: If you choose this option, the interest rate is fixed and it is based on the ‘Fixed Rate Type’ you specify (explained below)

- Floating: If this option is chosen, the rate is floating in nature and it is picked up based on the ‘Floating Rate Code’ you select (explained below).

Fixed Rate Type

This option is applicable only if you select the ‘Rate Type’ as ‘Fixed’. The system picks up the rate based on the option you select here. The options available are:

- Standard: If you select this option, system picks up the rate based on the ‘Fixed Rate Code’ you select for the component.

- Treasury: If you select this option, system picks the appropriate rate based on your maintenance in the ‘Treasury Floating Rate Maintenance’ screen.

For more details on the above screen, refer the heading ‘Maintaining treasury floating rates’ in the ‘Loans Treasury Operations’ chapter of the OPS User Manual.

User Input: If you select this option, you have to specify the applicable interest rate in the ‘Rate’ field.

Fixed Rate Code

You have to select the applicable fixed rate code if:

- Rate Type is ‘Fixed

- Fixed Rate Type is ‘STANDARD’

The option list displays the rates codes maintained through the ‘Standard Rates Maintenance’ screen. You can select a code from this list. System picks up the appropriate rate based on the effective date and the drawdown currency.

For more information on maintaining standard rate codes and rates, refer the sections ‘Maintaining Standard Rate Codes’ and ‘Maintaining Standard Rates’ in the ‘Processing Auto Deposits’ chapter of the OD (Overnight Deposits) User Manual.

Floating Rate Code

You have to select the applicable floating rate code if the ‘Rate Type’ is ‘Floating’. The rate codes maintained through the ‘Floating Rate Code Definition’ screen is available in the option list provided. The system picks up the rate based on the rate code you select here.

For more details on maintaining floating rate codes, refer the heading ‘Applying Floating Interest Rate’ in the ‘Processing Interest’ chapter of the Interest User Manual.

Rate

You have to specify the interest rate if:

- Rate Type is ‘Fixed’

- Fixed Rate Type is ‘User Input’

However, if you have selected the ‘Rate Fixing Required’ for the interest component at the drawdown product level (in the ‘Interest Definition’ screen), you have to specify the rate in the ‘Rate Fixing Details’ screen.

For more details on this screen, refer the heading titled ‘Fixing interest rate for the drawdown’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

For more details on negative rate processing, refer the title ‘Maintaining Loans Parameters Details’ in the chapter ‘Bank Parameters’ in Core Services User Manual.

Spread

If you have indicated the ‘Rate Type’ as ‘Floating’ for the rolled over drawdown and also specified the applicable ‘Floating Rate Code’, you can indicate the spread applicable for the rate.

Margin Rate

When you select an interest component, the margin components, if defined for the interest component, will default in the ‘Margin Details’ section of the ‘ROLLOVER’ tab. You can amend the margin rate ONLY for those margin components for which the ‘Basis Amount Tag’ is User Input’. The new rate is applied for the rolled over drawdown.

If rollover is performed after Margin Rate amendment, on the same day, then the system applies the margin change for the participants based on the margin maintained for individual participant. Similarly, if forward dated rollover is captured and margin amendment is done before the rollover effective date, margin is applied as part of end of day margin batch. The system considers the margin rates maintained for the individual participants while calculating participant interest.

Remove Rollover Instructions

After capturing the rollover instructions for the drawdown, if you do not want to rollover the drawdown, you have the option to remove the instructions maintained. You have to select this option to remove the rollover instructions.

9.3.0.2 Identifying the Rolled Over Drawdown

After the system rolls over the drawdown on the maturity date of the original drawdown, a new drawdown is created in the system. After the successful creation of the new drawdown, the system displays the reference number of the rolled over drawdown in the ‘Rollover Contract Reference No’ field (in the ‘ROLLOVER’ tab) of the original drawdown.

9.3.0.3 Viewing Errors

In case of any failure in the system while generating the rollover drawdowns due to exceptions like excess utilization of the borrower and participant limit, system logs an exception and stop the rollover processing. In this case, you have to capture the child drawdowns manually after adjusting the limits.

You can view the errors message details in the ’ROLLOVER ERROR’ screen. Click “View Error’ button to invoke this screen.

The following details are displayed in this screen:

- Date and time when the error was encountered

- Error Code

- Description of the error

- Log Printed

9.3.0.4 Viewing Events

You can view the event details associated to a normal rollover. These events occur on the rollover date.

Click ‘Events’ tab to invoke the ’Event Log Details’ screen.

For more information on the ‘Event Log Details’ screen, refer to the section ‘Viewing events for the facility’ in the ‘Loan Syndication Contracts’ chapter of the Loan Syndication (LS) User Manual.

9.3.1 Specifying Details for ‘Split’ Rollover

You can capture instructions for a split rollover in the ‘Split Rollover Details’ screen (LBCSPROL) . Click ‘Spilt Roll’ in the ‘Drawdown Contract Online’ screen to invoke this screen.

Note

This section explains only those features that are specific to split rollover. The preference applicable for ‘Normal’ rollover will be applicable for ‘Split’ rollover as well.

When you indicate the rollover method as ‘Split’, the system creates multiple drawdowns out of the original drawdown. For each rolled over contract, the system generates a split number. After specifying the details for the first split drawdown, click ‘Add Row’ button to specify details for the next drawdown.

The defaulted value for the Netting Option will be No Netting.

Default Fronting

Indicate if the fronting detail has to be defaulted for the increase in amount during rollover / reprice. You can select one of the following options:

- ‘Default Fronting’ - select this option to default the front/fund details from the latest disbursement

- ‘Create New Contract’ – select this option to create a new contract for the increase in amount without the default front/fund details

On selecting the ‘Default Fronting’ option, the front/fund details is defaulted from the past disbursement events to the new disbursement event (VAMB/VAMI) which is triggered as part of rollover processing. System generates BPMT to the borrower for the fronted/funded investor’s portion and proceed with the rollover processing.

On selecting the ‘Create New Contract’ option, the system defaults the front/fund details to the new disbursement event (VAMB/VAMI) which is triggered as part of rollover processing, but the BPMT event will not be fired based on these default options. Further, as part of Rollover processing, one of the child contracts are created for the increase in amount without any default fronting/funding options. In the split child contract, for the increased amount, the funding details are captured and borrower payment is also sent from this child contract.

You have to specify the following split in the ‘Split Details’ section of the screen:

Amount

You have to specify the amount that can be rolled over to create each of the multiple drawdowns as part of the rollover split. This amount depends on the ‘Rollover Amount Type’ you select. The rollover amount type can be any one of the following:

- Principal - In this case, the system rolls over the outstanding principal as displayed in the ‘Total Outstanding Amount’ field. In addition, the system also allows you to amend the outstanding amount. You can specify the amended amount in the ‘Principal Roll Amt’ field (by default, the outstanding amount is displayed here). This amount can be either greater than or lesser than the outstanding principal amount. This is treated as a special amount rollover.

- Principal + Interest – In this case, the system rolls over the outstanding principal along with the interest component. The ‘Total Outstanding Amount’ displays the sum of outstanding principal and interest. The system also displays the interest amount to be capitalized in the ‘Interest Rollover Amount’ field. If you amend the outstanding principal amount in the ‘Principal Roll Amt’ field, the system adds the interest to the principal rollover amount to arrive at the total amount to be rolled over and displays the same in the ‘Total Roll Amt’ field.

Note

In the case of split renewals, the system apportions the interest amount against each split contract in the same ratio as the principal split break up.

PIK Roll amount gets updated if the PIK Rollover with capitalization is checked for parent contract.

Liquidate Principal

By default, the system selects this box. It instructs the system to liquidate the outstanding principal on rollover. If you have chosen the automatic mode of liquidation, the system does not allow you to deselect this check box. You can amend this option only if the following criteria are met:

- If liquidation mode is defined as ‘Manual’ and

- If residual principal component is due for liquidation

Liquidate Interest

By default, this check box is deselected. If you select this box, the system liquidates the outstanding interest on rollover. If you have chosen the automatic mode of liquidation, the system automatically selects this box and does not allow you to change this preference. You can amend it only if:

- If the liquidation mode defined as ‘Manual’ and

- If residual interest component is due for liquidation

The following example illustrates the manner in which the system handles liquidation of interest and principal components when you select/deselect the above options.

Rollover Netting

You have to specify the rollover netting indicating parameter here.

The options are:

- No Netting

- Principal Increase + Interest

The value defaulted is No Netting.

If any of the netting option is selected, then the Liquidate Principal and Liquidate Interest boxes are selected and disabled.

Rollover Product

Oracle FLEXCUBE allows you to select a product for the new rolled-over/child contract. The option-list displays the drawdown products defined in the linked tranche (under which the drawdown being rolled over is booked). As mentioned above, if the product you select is a ‘Prime Loan’ product, you have the option to check ‘Liquidate Interest on Prepayment’ box. If checked, whenever your customer makes a prepayment towards the rolled over loan, the system also liquidates the interest on the amount prepaid.

Schedule Basis

You have to specify the basis on which the system should compute the repayment schedules for the rolled over drawdown. The options are:

- Product: The repayment schedules defined for the product l becomes applicable to the rolled over drawdown.

- Contract: The repayment schedule specified for the original drawdown is applicable to the rolled over drawdown.

- Auto: The system defines the repayment schedules based on the reduction schedule defined for the tranche under which the drawdown is rolled over.

Interest Parameter Basis

Specify the basis on which the interest components should be applied for the rolled over drawdown. The options are:

- Product

- Contract

MIS Basis

Here, you have to specify whether the MIS details for the rolled over drawdown should default from the product level or applied from the original drawdown.

UDF Basis

In this field, you can indicate whether user-defined fields (UDFs) for the rolled over drawdown must default from the drawdown product or the original drawdown that is being rolled over.

Settlement Basis

In this field, you can indicate the basis on which the system should pick up the settlement details for the rolled over drawdown. The options are:

- Product

- Contract

Holiday Parameter Basis

You have to specify the basis for holiday processing if schedules, value date and maturity date of the rolled over drawdown fall due on holidays. The options are:

- Product: Holidays will be processed based on the parameters defined for the drawdown product.

- Contract: The holiday processing rules maintained for the original drawdown becomes applicable to the rolled over drawdown.

PIK Rollover Amount

If the product you have selected has an associated PIK component, then the calculated PIK margin amount for that contract gets displayed here.

Note

- If the selected product has no associated PIK component, then the field name will be displayed as ‘Interest Rollover Amount’ instead of ‘PIK Rollover Amount’.

- There will not be any additional tranche utilization due to the capitalization of the PIK amount.

- When a child contract is rolled over, only the PIK margin calculated for the child contract gets displayed in this field.

- While capturing the rollover instructions for a parent contract with PIK margin, only drawdown products with PIK margin component will be available for selection.

Cash Interest Amount

Specify the interest amount to be liquidated for the borrower which should be lesser than or equal to the outstanding interest of parent drawdown.

This field is disabled during Principal+Interest Rollover (P+I) and enabled only for drawdown contracts under prorata non-lead tranches and the propagation value for the drawdown should be ‘Cash’. Maturity Date

You can capture the maturity date of the rolled over drawdown here. If you do not specify the maturity date, the system will arrive at the maturity date based on the ‘Roll By’ value and the ‘Maturity Days’ specified for the drawdown.

If you do not select any options here, system will display the maturity date based on the ‘Maturity Date Basis’ maintained at the product level (in the ‘Rollover Details’ screen).

Maturity Days

You have to specify the number of days that is to be added to the value date of the new split drawdown to arrive at the maturity date of the drawdown.

Roll By

Indicate the tenor basis upon which the maturity days specified for the rolled-over contract is reckoned. The options are:

- Days

- Months

- Quarters

- Semi-annuals

- Years

This value you specify here is used in combination with the value specified for ‘Maturity Days’. For instance, if the ‘Maturity Days’ is ‘90’ and the ‘Roll By’ is ‘Days’, then the system adds 90 days to the rolled over drawdown value date to arrive at the maturity date of the rolled over drawdown.

Note

- Rate fixing and exchange rate fixing are applicable as per the explanation provided for normal rollover.

- For products with associated PIK component, the calculated PIK margin amount gets displayed in ‘PIK Rollover Amount’.

Consider for Split

Select this check box to specify the split that should be considered for the new contract created for the increase in amount without the default front/fund details.

It is mandatory to select this option for one of the splits if ‘Create new contract’ option is selected.

Note

On selecting the 'Default Fronting' option, the 'Consider for Split' is disabled.

Example

Case 1: Split rollover instruction is captured as follows:

Split No |

Rollover Amount |

Consider for Split |

1 |

12M |

Y |

On completing the rollover processing, it will be as follows:

Split No |

Rollover Amount |

Consider for Split |

Child Contract |

1 |

2M |

Y |

C2 |

2 |

10M |

N |

C3 |

The split for 12M is internally split into 2M (increase in amount) and 10M (12M-2M). Child contracts C2 and C3 are created for 2M and 10M, respectively. For C3, all the participants are treated as fronting (defaulted from parent contract C1). For C2, there is no default fronting. User have to capture the fronting values manually using the payment processing browser.

Case 2: Split rollover instruction is captured as follows:

Split No |

Rollover Amount |

Consider for Split |

1 |

10M |

N |

2 |

2M |

Y |

On completing the rollover processing, it is as follows:

Split No |

Rollover Amount |

Consider for Split |

Child Contract |

1 |

10M |

N |

C2 |

2 |

2M |

Y |

C3 |

Child contracts C2 and C3 are created for 10M and 2M respectively. For C2, all the participants are treated as fronting (defaulted from parent contract C1). For C3, there is no default fronting. User have to capture the fronting values manually using the payment processing browser.

Case 3: Split rollover instruction is captured as follows:

Split No |

Rollover Amount |

Consider for Split |

1 |

7M |

N |

2 |

5M |

Y |

On completing the rollover processing, it is as follows:

Split No |

Rollover Amount |

Consider for Split |

Child Contract |

1 |

7M |

N |

C2 |

2 |

2M |

Y |

C3 |

3 |

3M |

N |

C4 |

The second split for 5M is internally split into 2M (increase in amount) and 3M (5M-2M). Child contracts C2, C3 and C4 are created for 7M, 2M and 3M respectively. For C2 and C4, all the participants are treated as fronting (defaulted from parent contract C1). For C3, there is no default fronting. User will have to capture the fronting values manually using the payment processing browser.

In case of rollover with capitalization of interest, and if ‘Create New Contract’ option is selected, the split rollover amount (principal + interest rollover amount) captured for the split marked for ‘Consider for split’, should exactly match with the increase in amount.

9.3.1.1 Identifying Split Drawdowns

As part of split rollover one drawdown results into multiple drawdowns. After successful creation of new drawdowns, the system displays the reference number of the newly created drawdowns in the ‘Roll Contract Ref No’ field (in the ‘SPLIT ROLLOVER’ screen) of the original parent drawdown.

Note

- Participants and Participant ratios in the split drawdowns remain same as the parent drawdown

- Sum of the principals of the split drawdowns will be less than or equal to the outstanding principal of the parent drawdown

9.3.1.2 Authorizing Override for Split Drawdowns

If the UDF ‘RATE-VARIANCE’ is maintained as a non-zero value for a tranche contract to which the drawdown is linked, dual authorization is required.

For more details, refer the section ‘Authorizing Overrides’ in the chapter titled ‘Loan Syndication Contracts - Part 1’ of this User Manual.

9.3.1.3 Split Rollover with Increase in Principal Amount

Oracle FLEXCUBE allows you to do the rollover of the special amount exceeding the current outstanding amount of the parent contract. During the rollover process, system checks if the sum of the split amount exceeds the outstanding amount of the parent. System initiates a value dated amendment process to increase the principal amount to the extent of the additional amount to be disbursed to the borrower. This value date of the amendment will be the rollover date.

Accounting entries for value dated amendment for borrower is as in the table below:

Amount Tag |

Debit / Credit |

Account |

PRINCIPAL_INCR |

Debit |

SYND_POOL |

PRINCIPAL_INCR |

Credit |

Customer |

Accounting entries for value dated amendment for participant is as in the table below:

Amount Tag |

Debit / Credit |

Account |

PRINCIPAL_INCR |

Credit |

Customer |

PRINCIPAL_INCR |

Debit |

SYND_POOL |

Example

If the outstanding amount at the time of rollover is USD 100,000 and Sum of Split Amount USD 150,000.

Oracle FLEXCUBE passes the value dated amendment for USD 50,000 value dating the maturity date of the parent contract.

Note

When the rollover is captured with increase (by increasing utilization for the child contract) then, the system will re-calculate the PIK amount and same will be displayed in the PIK Amount in both split rollover and consol rollover.

9.0.0.4 Rate Setting

To set the rate setting rules for the Splitrollover, click the ‘Rate Setting’ button in the ‘Splitrollover’ screen and invoke the ‘Rate setting’ screen.

Contract Details

Product code

The system displays the product code.

Contract Ref number

The system displays the contract ref number.

User ref number

The system displays the user ref number.

Customer

The system displays the customer name.

Facility name

The system displays the facility name.

Split Details

Split number

The system displays the split number.

Principal roll amount

The system displays the principal roll amount.

Interest roll Amount

The system displays the Interest roll amount.

Roll Product

The system displays the roll product.

Total roll amount

The system displays the total roll amount.

Maturity date

The system displays the maturity date.

Interest rate rounding rules

Rounding rule

Select the rounding rule from the adjoining drop down list. Select one of the options listed below:

- Down

- Upto

- No rounding

- Manual

Rounding Unit

The rounding unit enables only if the you have selected the ‘rounding rule’ as ‘Down’ and ‘Upto’ .

Interest rate period

Select one of the interest rate periods from the options given.

Note the following

Once all the Rate setting rules are maintained and when you come out of ‘Rate Setting Rule screen’ by clicking OK button (Green tick), following override message is displayed

- If the Interest Rate Rounding Rule is ‘Manual’, then the message is ‘Rounding Rule is manual. Auto Rate Fixing will not be done’

- If Interest Rate Rounding Rule is not ‘Manual’, then the message is ‘Rounding Rule is maintained. Auto Rate Fixing will be done and rate will be defaulted’. This message appears only for the future dated events / contracts

- You are allowed to change the Rounding Rule by clicking ‘Cancel’ button in the override message

9.3.2 Specifying Details for ‘Consolidation’ Rollover

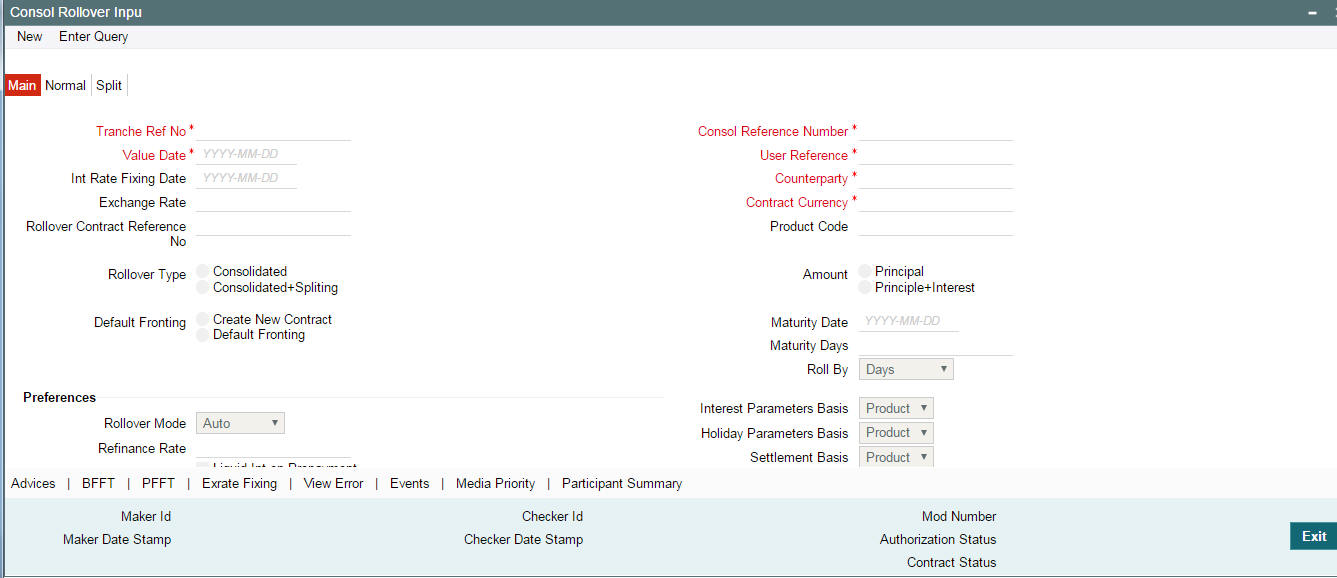

You can capture instructions for a consolidation rollover in the ‘Consolidation Rollover’ screen. You can also define split instructions as part of capturing normal consolidation instructions. You can invoke the ‘Consolidation Rollover’ screen by typing ‘LBDCOROL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Note

This section explains only those features that are specific to consolidation rollover.

To specify consolidation details for a new drawdown, select New from the menu.

Rollover Netting allows you to capture the netting option for Consol Rollover. The available options are:

- Net Principal Decrease + Interest (Net the Principal decrease and Interest for rollover )

- Net Principal Increase + Interest(Net the Principal increase and interest for rollover )

- Net Interest for Rollover

- No Netting

Note

- The default value will be “No Netting”

- Netting will not be applicable for the Principal Increase or Principal decrease

- If any of the netting option other than “No Netting” is selected then the “Liqd Principal” and “Liqd Interest” will be checked and disabled.

- In case of Consol Rollover the netting will happen only for the driver contract.

The consolidation details to be captured in this screen are explained below:

9.3.2.1 Selecting parameters for consolidation

You can select the child drawdowns for consolidation rollover only if the child drawdowns:

- Fall under the same tranche contract

- Use the same drawdown product

- Of the same counterparty

- Are in the same currency

- Mature on the same date

Tranche Ref No

You have to select the reference number of the tranche under which you wish to consolidate drawdowns, as part of the rollover operation. The option list displays all active and authorized tranches maintained in Oracle FLEXCUBE. Select the tranche of your choice from this list.

Product Code

You have to select the drawdown product based on which the system selects the drawdowns for consolidation. The option list displays the drawdown products associated with the tranche product under which the selected tranche is processed.

Note

Upon selection of the product, the system generates a ‘Contract Reference No’ which may be used as a reference to view the consolidation instructions captured in the screen.

Counterparty

You have to select the counterparty of the drawdowns that have to be consolidated as part of rollover. The option list displays the list of all active customers of the branch.

Contract Ccy

You have to select the currency of the drawdowns that have to be consolidated as part of rollover. The option list displays the allowable currencies for the tranche. Select a currency from this list.

Value Date

Another parameter for selecting the drawdowns for consolidation is the value date. In effect, this date refers to the maturity date of the child drawdowns that have to be consolidated as part of rollover. In addition to the same combination of counterparty, product, and currency, the child drawdowns should also have the same maturity date for consolidation to occur.

Rollover Type

You have to indicate the type of rollover you wish to perform. The available options are:

- Consolidated – In this case, all selected drawdowns with the same combination of Tranche + Drawdown Product + Counterparty + Currency + Maturity Date is consolidated into a single contract upon rollover.

- Consolidated + Split – In this case, the system first consolidates the selected drawdowns as per the consolidation instructions and then splits the net result of consolidation as per the split instructions. You can capture the split instructions in the ‘Split’ tab of the ‘Consolidation Rollover’ screen.

Default Fronting

Indicate if the fronting detail has to be defaulted for the increase in amount during rollover / reprice. You can select one of the following options:

- ‘Default Fronting’ - select this option to default the front/fund details from the latest disbursement

- ‘Create New Contract’ – select this option to create a new contract for the increase in amount without the default front/fund details

In consolidation rollover, if ‘Create New Contract’ option is selected, then the system will internally treat it as consol + split and do the rollover processing.

9.3.2.2 Specifying Consolidation Preferences

After selecting the combination of counterparty, product, currency and value date for drawdown selection, you have to capture the following in the ‘Consol Details’ section of the screen:

Child Contract Ref No

You have to select the child drawdowns that have to be consolidated as part of rollover. The option list displays all drawdowns with the same combination of counterparty, product, currency and maturity date that you select. Select a drawdown from this list.

Click the ‘Add Row’ button

to select the next drawdown from the list.

Principal Roll Amt

The system displays the outstanding principal that can be rolled over for each child drawdown. You can amend the outstanding principal, if required. This amount can be either greater than or lesser than the outstanding principal amount. The system treats this as a special amount rollover.

In the case of ‘Principal + Interest’ rollover, in addition to displaying the outstanding principal, the system displays the interest to be capitalized for each drawdown in the ‘Interest Roll Amt’ field. You cannot amend this amount.

PIK Roll amount gets updated if the PIK Rollover with capitalization is checked for parent contract. The system validates if all the parent contracts should have the same value for ‘PIK Rollover with capitalization’. An appropriate error will be displayed during save of the consol rollover.

Cash Interest Amount

Specify the interest amount to be liquidated for each parent contract at the borrower level and the cash interest amount can be lesser than or equal to the outstanding interest of parent drawdown.

Driver Contract

From the list of child drawdowns selected for consolidation, you have to designate one of them as the ‘Driver Contract’. The consolidated drawdown (generated upon rollover) inherits the preferences (information such as settlement details, schedules, MIS details and so on) of the driver contract you select here.

Note

- You can select only one of the child drawdowns as the driver drawdown.

- You can define the rollover amount to be greater than the total outstanding amount of the driver child drawdown.

- For other contracts that are being rolled over, you cannot specify a rollover amount greater than the outstanding amounts of the respective drawdowns.

- If the rollover amount you specify is greater than the outstanding amount of the driver contract, the system triggers a value date amendment (VAMI) on the driver contract to indicate an increase in the principal, before actual rollover occurs.

- If you choose consolidation with the split option for rollover, you cannot define the rollover amount to be greater that the total outstanding amount even for the driver contract.

PIK Rollover Amt

Calculated PIK margin amount for the specified child drawdown contract gets displayed here.

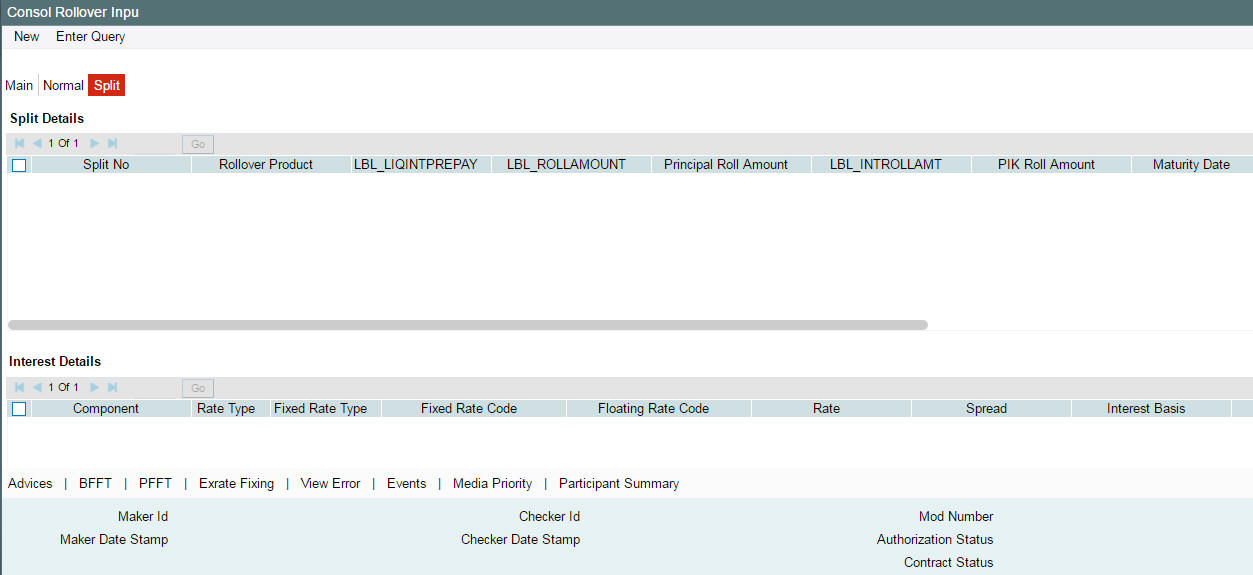

9.3.2.3 Capturing Split Instructions for a Consolidation Rollover

You can define split instructions for a consolidation rollover only if you select the ‘Rollover Type’ as ‘Consolidation + Split’. You can specify the split instructions in the ‘Split’ tab of the ‘Consolidation Rollover’ screen.

For more details on this screen, refer the section titled ‘Specifying details for ‘Split’ rollover’ in this chapter.

If you capture split instructions as part of consolidation rollover, the system first consolidates the selected child drawdowns and then splits the same as per the split instructions you define. The system further ensures that the sum of the split is equal to the consolidated amount.

Principal Roll Amt

Specify the principal roll amount if the contracts with flag ‘PIK Rollover with capitalization’ as checked are being consolidated. The system displays Interest Roll Amt as sum of interest and PIK Roll Amt of parent contract in case of P+I rollover with PIK Margin Component. You cannot change the PIK Roll Amount. You can update the respective margin rate to achieve the desired PIK amount before capturing the rollover.

Note

- If you choose ‘Consolidation + Split’, you cannot increase the rollover amount to be greater than the outstanding principal even for the driver contract.

- The system displays the ‘Consol Ref No’ in the Notice and Rate Fixing Advices to indicate that the advices are generated for the split rollover captured as part of consolidation rollover instructions.

9.3.2.4 Identifying the Consolidated Drawdown

As part of consolidation rollover, many drawdowns will merge to result into a single drawdown. After successful creation of the new drawdown, the system displays the reference number of the newly created drawdown in the ‘Rollover Contract Ref No’ field of the ‘Consolidation Rollover’ screen, where you initially captured the consolidation rollover preferences for the tranche.

9.3.2.5 Authorizing Override for Consolidated Drawdowns

If the UDF ‘RATE-VARIANCE’ is maintained as a non-zero value for a tranche contract to which the drawdown is linked, dual authorization is required.

For more details, refer the section ‘Authorizing Overrides’ in the chapter titled ‘Loan Syndication Contracts - Part 1’ of this User Manual.

9.0.0.5 Viewing Participant Summary Details

You can view the reference numbers of the participant side contracts

that get initiated as a result of rollover. To view the details, click

‘Part Summary’button.

This screen displays the following details:

- Contract reference numbers of the participant side contracts

- The counterparty for each contract

Through this screen, you can also view the events and advices generated

for the each participant. To do this, click

‘Events’ button.

For more information on the ‘Event Log Details’ screen, refer the section ‘Viewing events for the facility’ in the ‘Loan Syndication Contracts’ chapter this User Manual.

9.3.2.6 Viewing Events

Similarly, you can view the events and advices for the borrower drawdown. To do this, click ‘Events’ button in the ‘Consolidation Rollover’ screen. The system displays the ‘Event Log Details’ screen, as shown above.

9.3.2.7 Rate Setting

To set the rate setting rules for the consolidation Rollover, click the ‘Rate Setting’ button in the ‘Consolidated Drawdowns’ screen and invoke the ‘Rate setting’ screen, as shown below:

Specify the following details.

Contract Details

Product code

The system displays the product code.

Contract Ref number

The system displays the contract ref number.

User ref number

The system displays the user ref number.

Customer

The system displays the customer name.

Facility name

The system displays the facility name.

Split Details

Split number

The system displays the split number.

Principal roll amount

The system displays the principal roll amount.

Interest roll Amount

The system displays the Interest roll amount.

Roll Product

The system displays the roll product.

Total roll amount

The system displays the total roll amount.

Maturity date

The system displays the maturity date.

Interest rate rounding rules

Rounding rule

Select the rounding rule from the adjoining drop down list. Select one of the options listed below:

- Down

- Upto

- No rounding

- Manual

Rounding Unit

The rounding unit will be enable only if the you have selected the ‘rounding rule’ as ‘Down’ and ‘Upto’.

Interest rate period

Select one of the interest rate periods from the options given.

Note

Once all the Rate setting rules are maintained and when you come out of ‘Rate Setting Rule screen’ by clicking OK button (Green tick), following override message is displayed.

- If the Interest Rate Rounding Rule is ‘Manual’, then the message is ‘Rounding Rule is manual. Auto Rate Fixing is not done’

- If Interest Rate Rounding Rule is not ‘Manual’, then the message is ‘Rounding Rule is maintained. Auto Rate Fixing is done and rate is defaulted’. This message appears only for the future dated events / contracts

You are allowed to change the Rounding Rule by clicking ‘Cancel’ button in the override message

9.3.2.8 Viewing Advices

Similarly, you can view the advices for the borrower drawdown. To do this, click ‘Advices’ button in the ‘Consolidation Rollover’ screen. The system will display the ‘Advices’ screen, as shown below.

9.0.0.2 Specifying Media for Message Generation

You can specify the media for the message generation in ‘Media

for Message Generation’ screen. You can invoke this screen by clicking

‘Media Priority’ button.

This button will be enabled only if the ‘FpML Type’ option

is unchecked at the contract level and the ‘Media Priority’

option is checked at the product level.

If this button is enabled, then the system will display an override message saying to view the ‘Media for Message Generation’ screen. If not, the system will handoff the message as per the details maintained in the ‘Customer Entity Maintenance’ screen.

During Rollover, the last maintenance of the parent contract will be defaulted to child contract.

For more information on the ‘Media for Message Generation’ screen, refer the section ‘Specifying Media for Message Generation’ in the Loan Syndication Contracts - Part 2’ chapter of this User Manual.

9.3.3 Capturing Back-Dated Renewals

ORACLE FLEXCUBE allows you to capture both current dated and back dated rollover instructions for drawdown contracts. However, the system allows you to capture rollover instructions even after the maturity date only if the contract is not already rolled over but still active.

When you capture back dated or current valued rollover instruction, the system creates the child contracts online when the rollover instructions are authorized.

9.3.4 Generating Child Contracts for Future Dated Rollovers

In the case of future dated rollovers, ORACLE FLEXCUBE allows you to create the rollover child contracts in advance i.e. before the rollover date. You can use the ‘Rollover Child Processing’ (LBSPAROL)screen to generate the child contracts.

In this screen, the system displays all future dated rollover contracts for which child contracts are yet to be created. You can select the contracts for which you wish to create the child contracts in advance. Check the box against each record to select a contract.

Click ‘Ok’ to generate the child contracts for the selected parent contracts.

Note

- The system generates the advices only for the parent contract

- The system allows you to capture re-price instructions or prepayment instructions on the value date of the child contracts. You can capture the instructions in the ‘Contract Payment’ screen.

For details on the ‘Contract Payment’ screen, refer the section titled ‘Processing repayments manually’ in the Processing Repayments’ chapter of this User Manual.

9.3.5 Rolling Over with Interest Capitalization

Oracle FLEXCUBE allows you to perform a Principal + Interest type of rollover for all Normal, Split, Consolidation and Consol + Split methods of rollover. For this, you have to select the Rollover Amount as ‘Principal + Interest’ in the following screens, depending on the type of rollover you wish to initiate:

- ‘Rollover’ tab of the ‘Drawdown Contract Online’ screen

- ‘Split Rollover’ screen

- ‘Consolidation Rollover’ screen

If the tranche under which the rolled over drawdown is booked is of non-revolving type, the system initiates a value dated amendment in the tranche to the extent of the capitalized interest. Also, for rollover with interest capitalization, you cannot create the child contracts in advance. The child contracts are created during rollover processing, on the rollover date.

When you capture rollover instructions with interest capitalization, the system performs the following validations:

- Allows capitalization of interest only for drawdowns under a pro-rata tranches

- Does not allow capitalization of interest if the drawdown has a PIK component

- Does not allow capitalization of interest if you have checked ‘Liquidate Interest on Prepayment’ option for the drawdown.

- In case of ‘Lender of Actuals’ method of interest distribution, does not allow capitalization if there are PRAMs (Assignments/Trade) present in the corresponding tranche.

- Allows renewals with interest in case of ‘Lender of Record’ method of interest distribution even if there are PRAMs (assignments) present in the corresponding tranche.

Further, the system also blocks the following activities in the drawdown, if you are capturing P + I instructions:

- Assignments at the linked tranche level where ‘Lender of Actuals’ option is checked (in the ‘LB Tranche Contract Online’ screen).

- Rate Revision for the drawdown

- Margin Revision for the drawdown

- Value Dated Amendment

9.3.6 Capturing Rollover and Re-Price Instructions for Future Dated Payments

You can capture partial/full principal Renewal/Re-price instructions even if there are pending forward payments due for liquidation. The Principal amount considered for renewal, in this case, will be the effective outstanding principal amount, considering the impact of the forward dated payment processing.

Note

- Rollover with Interest capitalization (P+I rollover) is not allowed if there are any future dated payments due for liquidation.

- You can not capture the forward dated payment instructions for contracts for which Rollover/Renewal instructions are already captured. In such cases, you need to reverse/remove the Rollover/Re-price instruction and then capture the forward dated payment instructions.

- If you reverse a future dated payment, after capturing the Rollover/Re-price instruction the Rollover/Re-price amount does not change. On the value date of the Rollover/Re-price, the System rolls over/re-prices the captured rollover/re-price amount. The remaining future dated payment reversal amount will be liquidated based on the ‘Liqd Int’ or ‘Liqd Principal’ options defined as part of Rollover/Re-price instruction capturing.

- System allows only one active future dated payment at any point of time

9.3.7 Validations for a Rollover/Reprice Instruction

The system performs the following validations when capturing a rollover/reprice instruction.

- The merge reprice is allowed only if the list of unfunded (along with the fronting option) investors is same across the contracts being merged and that of the parent contract.

- The Consol rollover is allowed only if the list of unfunded (along with the fronting option) investors is same across the contracts being consolidated.

- P+I rollover (Interest capitalization) is not allowed if any of the investors has pending funding in the last interest period.

- Incase of rollover or reprice with the increase in amount, VAMI considers the existing investor status (funded/unfunded along with fronting value) from the previous disbursement event.

- The funding/fronting parameters are defaulted from the previous disbursement event of the parent to the child contract.

- The funding activity is tracked at the child contract for the repriced/rolled over amount.

- The funding activity is tracked at the parent contract for the residual amount after reprice/rollover.

9.4 Rollover Netting Payment Messaging Process

The Rollover netting payment message will be generated online/batch based on the settlement days and can be changed as part of the rollover instruction amendment before the payment message is handed off. Once the message is generated, the system does not allow you to make any changes to the netted cash flow by means of any activities such as rate revision, margin revision, and so on.

The payment message is routed through the forward processing, if the component liquidation is Semi-Auto.

For the normal and split rollovers, the netted entries are passed for the parent contract and will be passed for the SSI details of the driver contract in RNET event for the consolidated rollover

All the other non- netted cash flows follow the existing process flows.

9.5 Reversing Rollover Instructions

You can reverse the rollover instructions for a contract even if the child contract has been generated for the same. To reverse the rollover instruction for which the system has already processed the child contract, you have to first reverse the child contract itself before you reverse the rollover instructions maintained for the parent contract.

However, the system does not perform any cross validation to ensure that you reverse the rollover instructions if you reverse the child contract that has already been processed. In case you do not reverse the rollover instructions, the system rolls over the parent contract on the value date of the rollover based on the instructions captured. However, in this case, it does not create any child contract. You have to manually create the child contract (through the ‘Drawdown Contract Online’ screen) for such rollovers.

Note

- You may reverse the rollover instruction and re-process the child contract any number of times before the value date of rollover.

- The system triggers the VAMB event for the parent contract to indicate an increase in principal on rollover. When you reverse such instructions, the system also reverses the balances to the extent of the increase (VAMB amount). However, it does not trigger any event to indicate such a reversal.

- When you reverse a partially processed child contract, the system does not reverse the VAMB amount.

- When you reverse a consolidated rollover instruction, the system triggers the CREV event in the parent contract to indicate the same.

9.6 Defining Advices for Rolled Over Drawdowns

In the ‘Product Events Definition’ screen, you can define the events for which advices are to be generated, for drawdowns involving the product. An advice is generated when a drawdown is rolled over. As mentioned, you can rollover a drawdown only if the ‘Allow Rollover’ option is selected for the drawdown product it involves.

Generation of advices upon rollover, if specified, as follows:

- When the drawdown is rolled over with interest (that is, the entire outstanding amount in the original drawdown is rolled over without any component of the original drawdown being liquidated), the liquidation advice for the original drawdown is not generated. Instead, a rollover advice, with the details of the liquidation of the original drawdown and its subsequent rollover into a new drawdown, is generated.

- When the drawdown is rolled with an amount, that is not the entire outstanding amount in the original drawdown, the liquidation advice(s) for the original drawdown is generated along with the rollover advice.

9.7 Processing Non-Prorata Rollovers

You can process non-prorata payments on the maturity date of the drawdown if:

- the drawdown is not a ‘Prime’ loan

- a non-prorata payment is processed on the maturity date

For details on processing a non-prorata payment, refer the section titled ‘Processing Non-Prorata payments’ in the ‘Processing Repayments’ chapter of this User Manual.

After you process non-prorata payments, the system allows you to capture renewal instructions for that non-pro rata drawdown for the remaining principal amount. The system rolls over the non-prorata drawdown as per the revised asset ratio (arrived at when you save the non-prorata payment). This is the ratio that is available when you capture the instructions for the non-prorata drawdown.

Note

- The system does not allow interest capitalization for non-pro rata drawdowns

- Non-pro rata renewal is allowed for all renewal types (Normal, Split, Consolidation and Consolidation + Split.