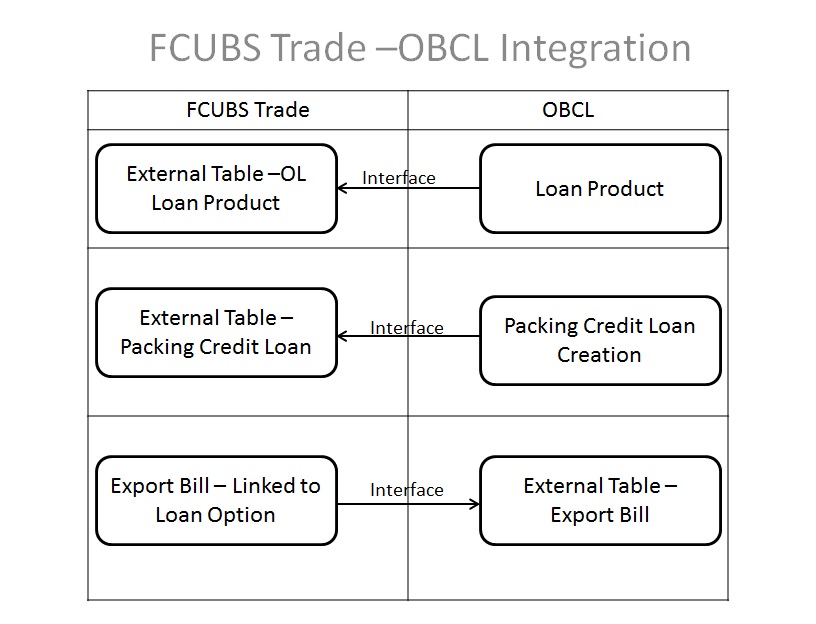

2. FCUBS Trade -OBCL Integration

The integration between FCUBS trade and OBCL enables banks to do the following:

- Packing credit loan is liquidated on purchase of export bill

- On liquidation of import bill, loan is created

- Loan is created as collateral of shipping guarantee

- Link to loan

Loan product created in OBCL to be provided to FCUBS. If a product is closed in OBCL it has to be informed to FCUBS. Loan product enabled with 'Advance By Loan' option created in OBCL to be provided to FCUBS.

FCUBS provides API integration to OBCL. OBCL invokes the API to store the data at external table in FCUBS.

This chapter contains the following sections:

2.1 Scope

This section describes the activities that take place in each system and its impact on the other.

This section contains the following topics:

- Section 2.1.1, "Integration Scope with FCUBS Co-deployed with OL"

- Section 2.1.2, "Integration Scope without FCUBS Co-deployed with OL"

2.1.1 Integration Scope with FCUBS Co-deployed with OL

Co-deployment and communication would be in asynchronous mode between FCUBS Trade and OBCL.

2.1.2 Integration Scope without FCUBS Co-deployed with OL

Standalone deployment, communication would be in asynchronous mode between FCUBS Trade and OBCL.

2.2 Prerequisites

This section contains the following topics:

2.2.1 Prerequisites in Oracle FLEXCUBE Oracle Lending

The prerequisites for this integration are as follows:

- Loan product enabled with 'Advance By Loan' option created in OBCL to be provided to FCUBS.

- Packing credit loan created in OBCL to be provided to FCUBS. Outstanding amount to be updated in FCUBS on payment, amendment or any other event that occurs in loan contract. In case of loan closure, the status has to be updated in FCUBS.

- Export bill contract with ‘Linked to Loan’ option created in FCUBS to be provided to OBCL.

2.3 Integration Process

This section contains the following topics:

- Section 2.3.1, "Linkage of Packing Credit Loan in to Export Bills"

- Section 2.3.2, "Loan Creation during Import Bill Liquidation"

- Section 2.3.3, "Loan creation as a collateral of shipping guarantee issuance"

- Section 2.3.4, "Link to a Loan"

2.3.1 Linkage of Packing Credit Loan in to Export Bills

The following steps take place while processing the export bill with packing credit loan attached.

- Packing credit loans created in OBCL is provided to FCUBS. The same is available at external table in FCUBS with PACKING_CREDIT field as ‘Y’.

- Packing credit loans can be linked during purchase or discount of Export Bills / Liquidation of Export Collection Bills.

- Multiple Packing Credit Loans can be linked to a bill. Sum of linked

loan amount should not be greater than the purchase amount.

- For packing credit loan, multiple loans can be attached. If any loan/loans payment gets failed and for other successful loan payments (loans for which payment is successful), the loan reversal entries are passed. A new packing credit BC contract should be created with the correct loan details.

- Full outstanding loan only can be linked to a bill.

- On Save of Export Bill, request to liquidate Packing Credit Loan is logged in staging table. Necessary accounting entry is posted on save of Export Bill.

- Status field is introduced in BC Contract Master to indicate status of loan request processing.

- System picks and posts the payment request to OBCL. Payment request to be processed in OBCL and successful process payment is auto-authorized. Status of response received from OBCL to be logged in staging table.

- In case of success response, the system updates authorization status. For auto-authorization, you need to authorize the bill manually.

- In case of failure response, you have to manually delete the operation.

- The above steps are applicable during liquidation of collection bills also.

This section contains the following topics:

- Section 2.3.1.1, "Product Creation"

- Section 2.3.1.2, "Linkage of Packing Credit Loan in to Export Bills"

2.3.1.1 Product Creation

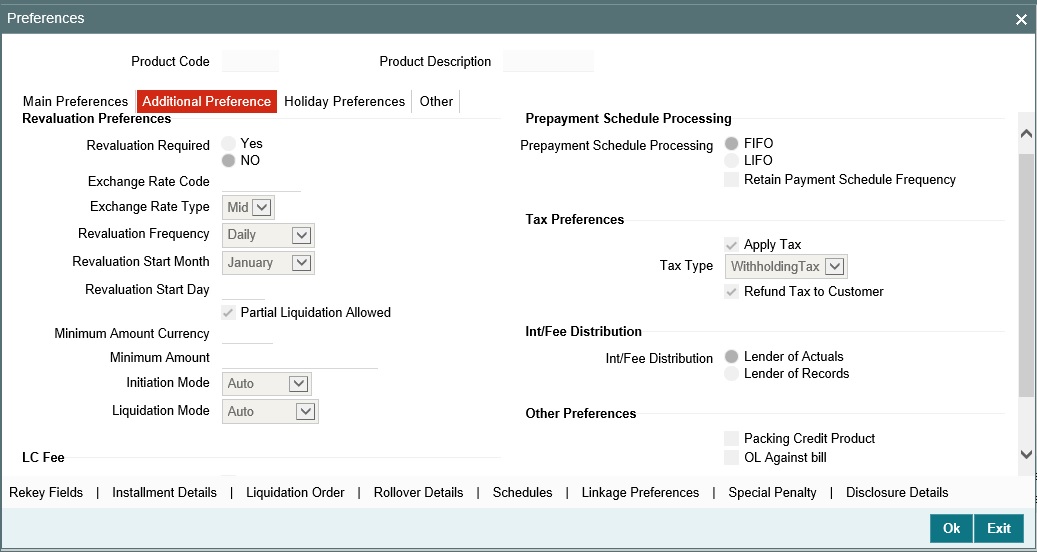

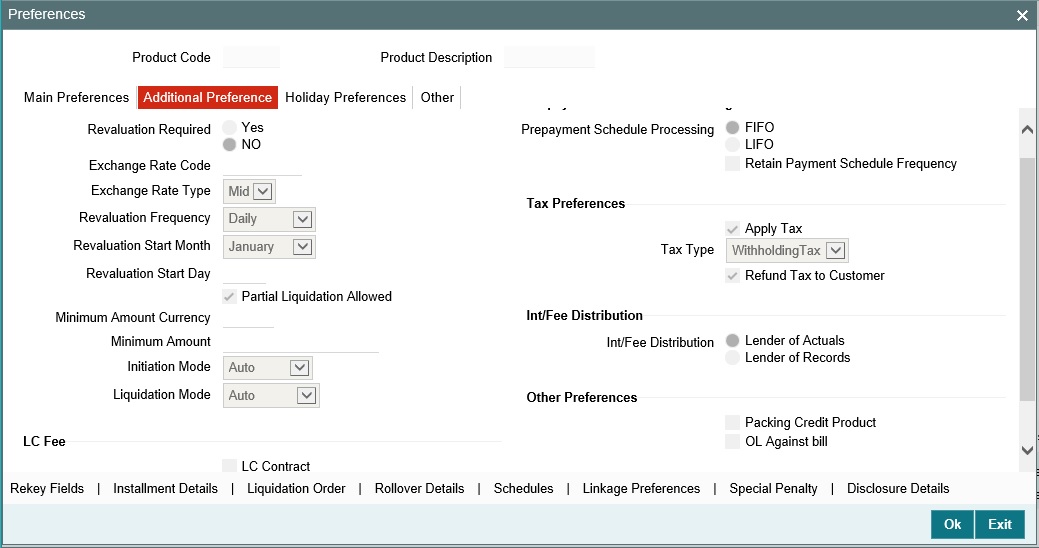

In Loans and Commitment Product Definition’( OLDPRMNT) screen, under Additional Preferences tab, the ‘Packing Credit Product’ check box should be selected.

2.3.1.2 Linkage of Packing Credit Loan in to Export Bills

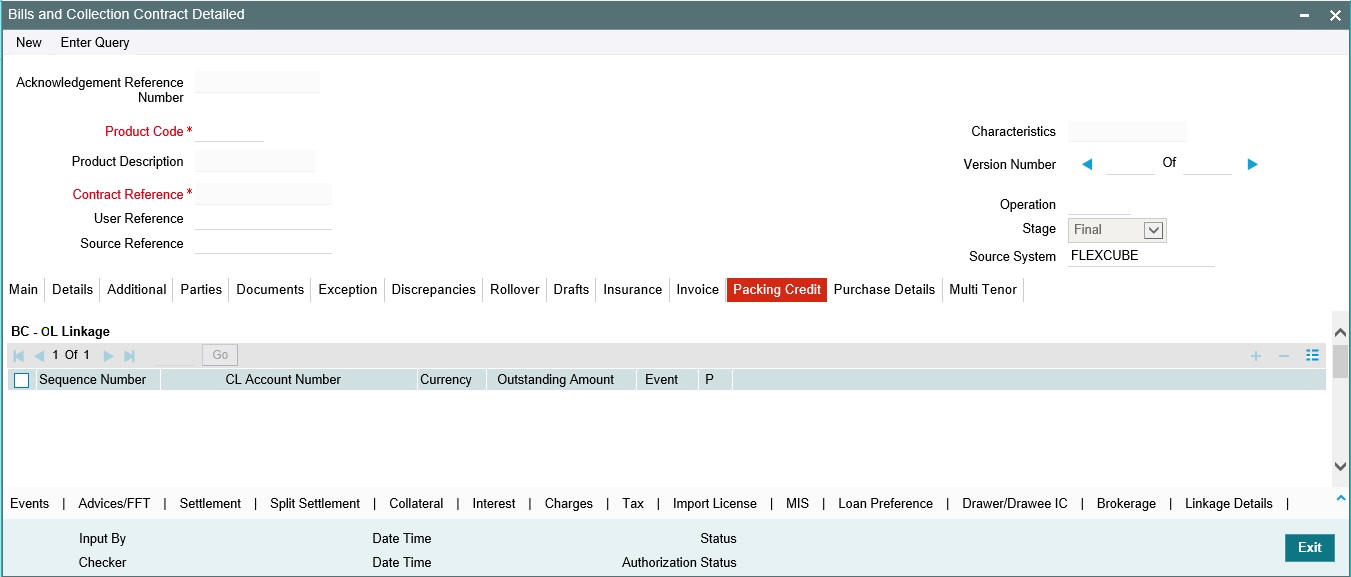

In Bills and Collections Contract Detailed ( BCDTRONL) screen, under Packing Credit tab, Packing credit loans can be linked during purchase or discount of Export Bills /Liquidation of Export Collection Bills.

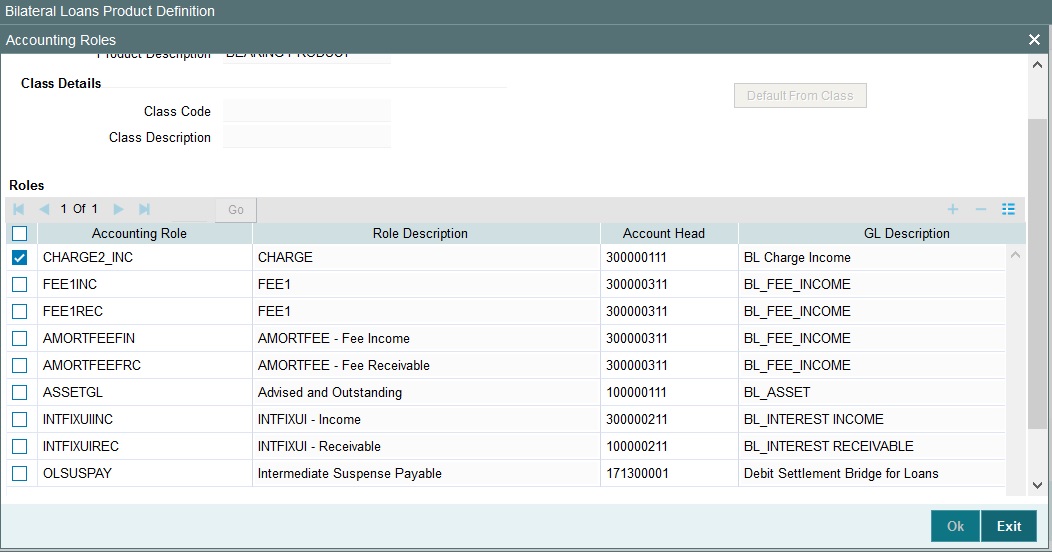

Accounting role should be configured at the product level using Bride GL. For LIQD event, debit leg should refer to Bridge GL ACC role.

2.3.2 Loan Creation during Import Bill Liquidation

The following steps take place while creating a loan during import bill liquidation.

- Import bills created for products with ‘Advance by Loan’ option selected.

- During liquidation of import bills, partial or full liquidation, details for loan liquidation to be logged in staging table.

- Branch Code, Loan Product, Loan amount, Loan currency, Counterparty, Value Date, and Maturity Date

- Loan amount is Bill liquidation amount minus Cash collateral in Bills, Collateral from LC and available amount in settlement account

- Loan currency to be local currency

- Counterparty of the Import Bill

- Value date to be liquidation date

- Maturity date to be value date + tenor

- Request to create loan to be generated and exposed to OBCL. Response of loan creation to be received and logged in staging table. Loan should be authorized.

- Bill can be authorized on successful creation of loan.

- If loan could not be created successfully, bill needs to be deleted.

This section contains the following topics:

2.3.2.1 Product Creation

- Loan products created in OBCL to be made available in FCUBS. The same is available at external table in FCUBS. Loan product enabled with 'Advance By Loan' option created in OBCL to be provided to FCUBS.

- Product creation of import bill is enhanced to capture loan products created in OBCL.

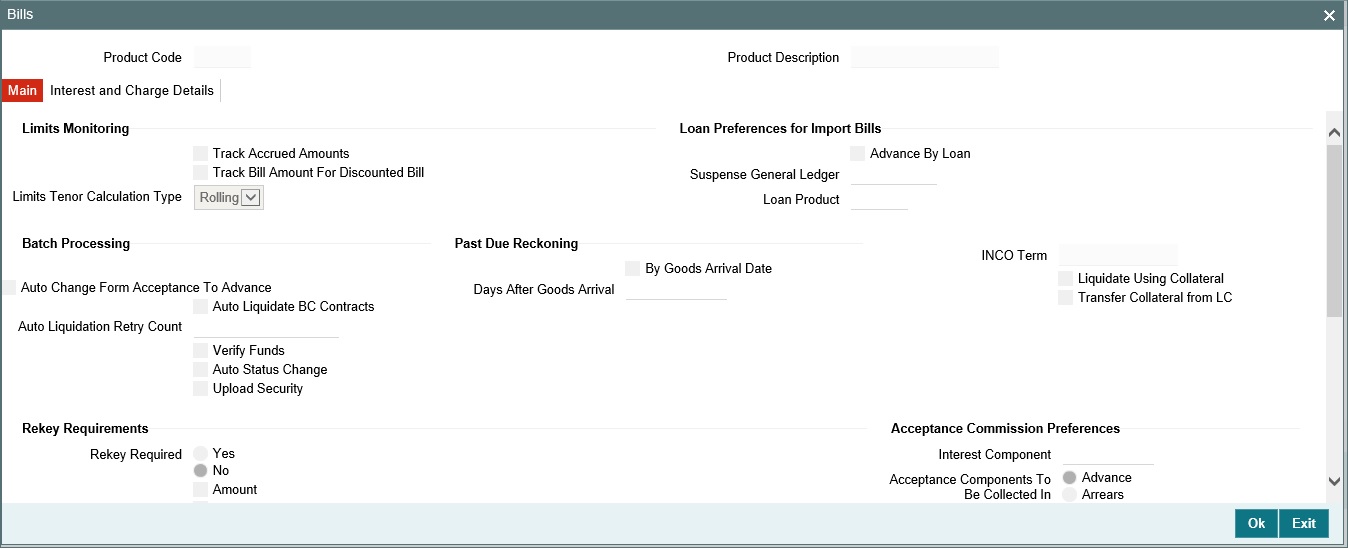

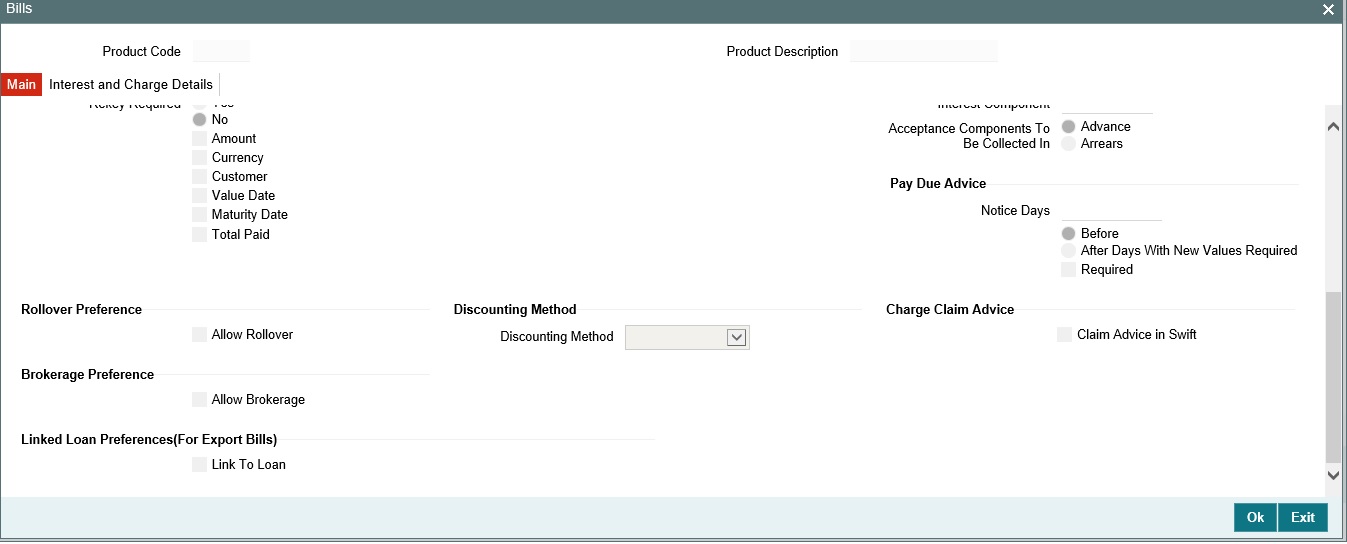

In Bills and Collections Product Definition (BCDPRMNT) screen, the loan products are displayed in ‘Loan Product’ option in ‘Loan Preferences for Import Bills in Preferences’ section.

2.3.2.2 Import Bill Processing

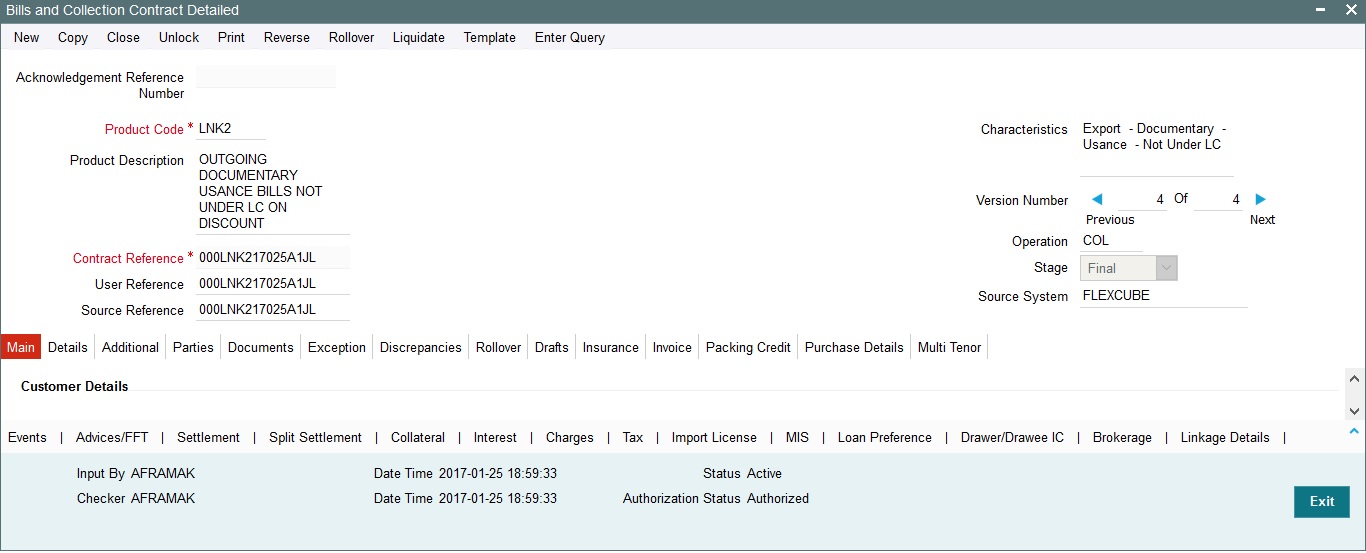

In Bills and Collections Contract Detailed (BCDTRONL) screen, book a contract and click 'Liquidate' option and then 'Save’ the contract.

2.3.3 Loan creation as a collateral of shipping guarantee issuance

The following steps take place while creating a loan as a collateral of shipping guarantee issuance.

- During creation of shipping guarantee, details for loan creation

are logged in staging table.

- Branch Code, Loan Product, Loan amount, Loan currency, Counterparty, Value Date, Maturity Date,

- Suspense GL

- Loan amount is the amount provided in split settlement for loan creation.

- Loan currency to be local currency

- Counterparty of the shipping guarantee

- Value date to be value date of shipping guarantee

- Maturity Date to be value date + tenor

- Suspense GL is the Bridge GL maintained at product maintenance

- Status field is introduced in LC Contract Master to indicate status of loan request processing.

- The system saves shipping guarantee in FCUBS and then posts the loan creation request to OBCL.

- Request to create loan to be generated and exposed to OBCL.

- Response of loan creation to be received and logged in staging table. Loan should be authorized.

- On receiving success response

- In case of auto-auth, the system updates authorization status in shipping guarantee automatically.

- In case of non auto-auth, you need to authorize the transaction manually. If you try to delete the shipping guarantee, the system displays an error message as the loan is authorized.

In case of failure response, you need to manually delete the shipping guarantee.

This section contains the following topics:

2.3.3.1 Product Creation

Loan products created in OBCL to be made available in FCUBS. The same is available at external table in FCUBS.

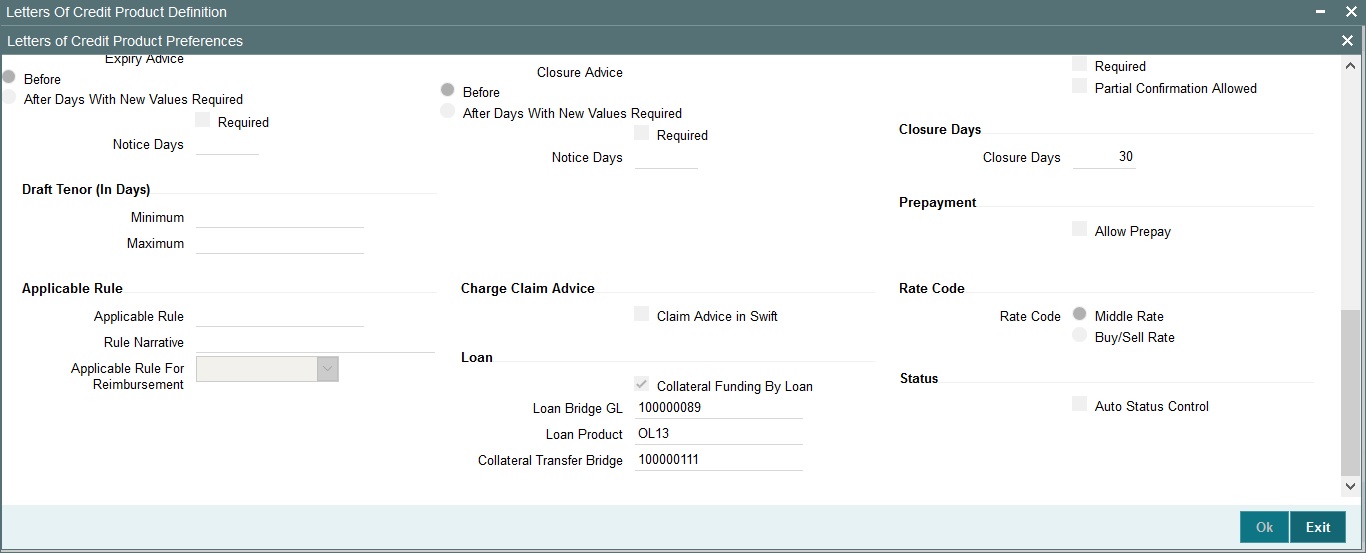

In Letters of Credit Product Definition ( LCDPRMNT) screen, the loan products are displayed under Loans section. For creating a shipping guarantee loan product, ensure to select ‘Collateral Funding By Loan’ check box.

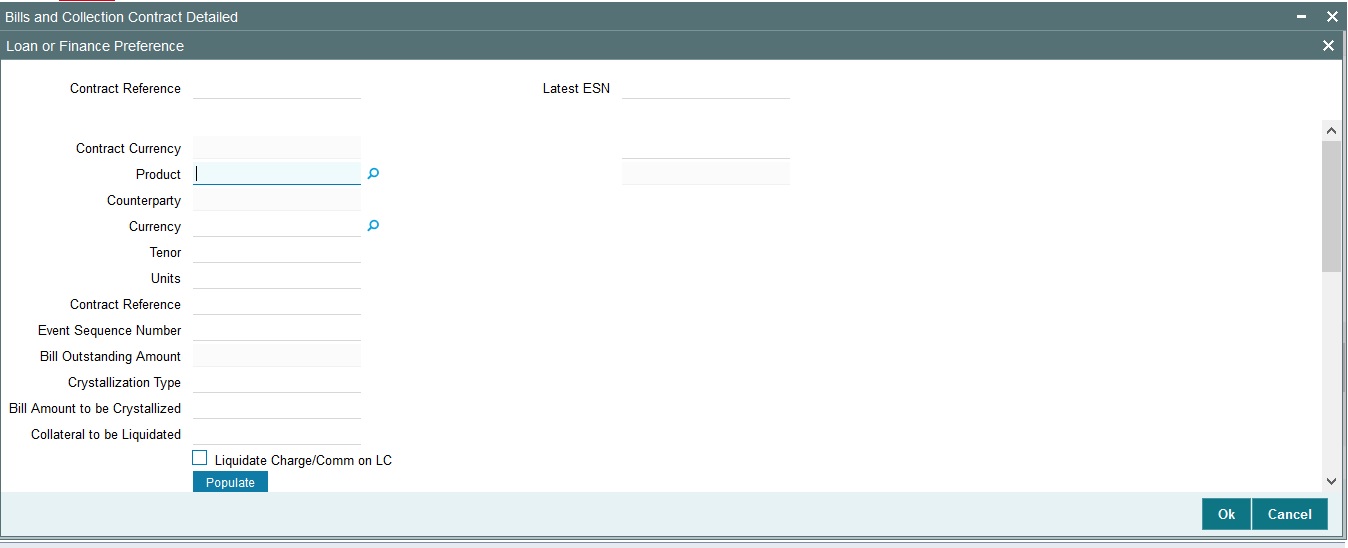

In Loan or Finance Preference (BCCTRPRF) screen, ‘Product’ and ‘Module’ must be ‘OL’.

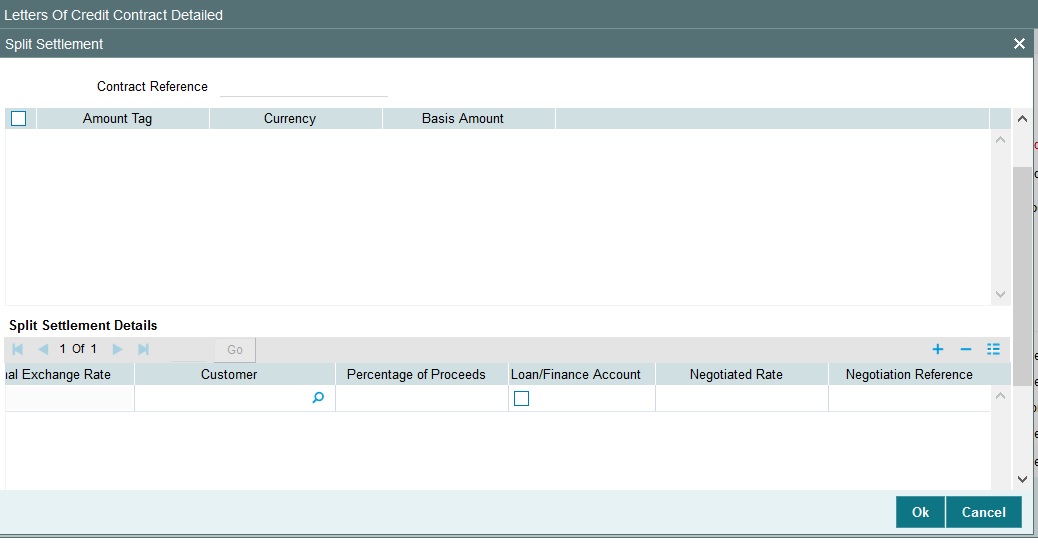

2.3.3.2 Processing shipping guarantee issuance

In ‘Letters of Credit Contract Detailed’ screen (LCDTRONL), ensure to select 'Loan/Finance' check box and map the Bridge GL.

Note

The Bridge GL for OL and BC should be same as maintained in the product.

2.3.4 Link to a Loan

The following steps take place while linking a loan.

- Export Bill Products created in FCUBS with ‘Link to Loan’ option selected. Export Bills created for these products to be provided to OBCL.

- During Loan creation in OBCL with ‘CL Against Bill’ selected, export bill to be allowed for linkage. On successful linkage of export bill in OBCL, request to be sent to FCUBS to trigger BLNK event for the bill. Request to be processed in FCUBS.

- During Reversal of Loan in OBCL, request to be sent to FCUBS to trigger BLRV event. Request to be processed in FCUBS.

- Loan can be settled in OBCL, before liquidation of the Bill. There is no impact on linked bill.

- On liquidation of Bill in FCUBS, request to be sent to OBCL to update Bill due amount.

- In OBCL, value date of the loan cannot be less than Bill value date and cannot be greater than Bill maturity date.

- The sum total of all loan amount financed must be greater than Bill Outstanding Amount

Export Bills contract should be created for the products with Link to Loan as ‘Y’ and it should be provided to OBCL.

This section contains the following topics:

2.3.4.1 Product Creation

Loan products created in OBCL to be made available in FCUBS. The same is available at external table in FCUBS.

In Loans and Commitment Product Definition (OLDPRMNT) screen, under ‘Additional Preferences’ tab, ‘OL Against Bill’ option should be selected.

Product creation of import bill is enhanced to capture Loan Products created in OBCL.

Export Bill Products should be created in FCUBS - BCDPRMNT screen with ‘Link to Loan’ option selected.

2.3.4.2 Processing Link to a Loan

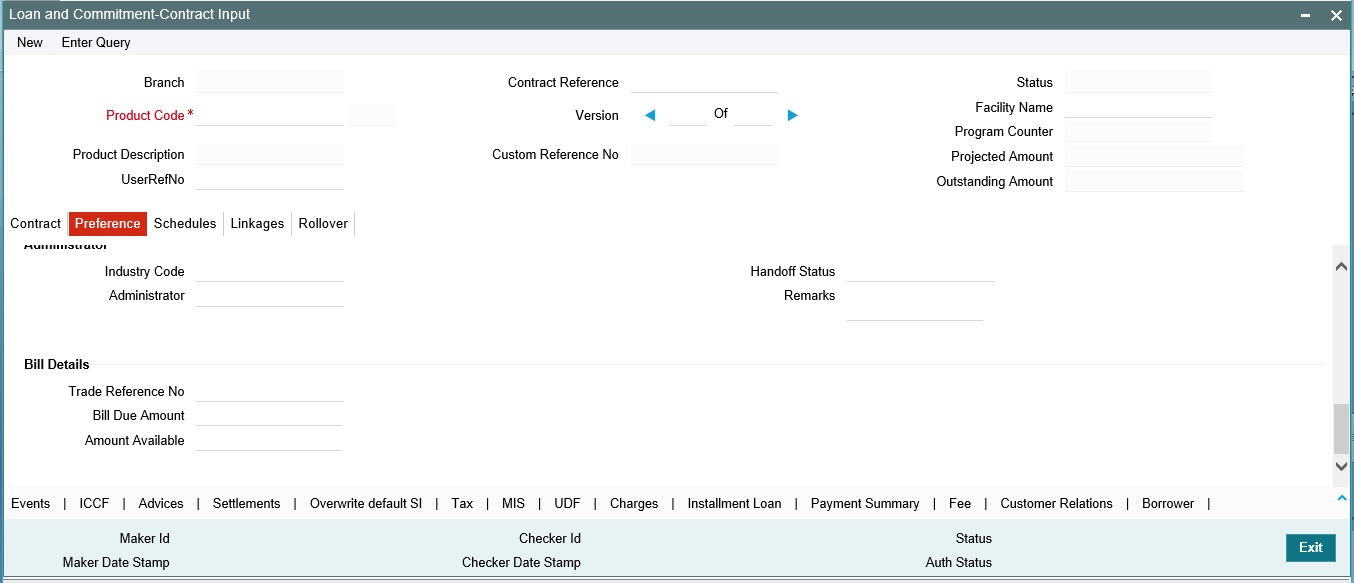

During loan creation in OBCL, in Loan and Commitment - Contract Input ( OLDTRONL) screen, under Preferences tab, ensure that ‘OL Against Bill’ check box is selected. Export bill is allowed for linkage in ‘Trade Reference No’ field.

On successful linkage of export bill in OBCL, request is sent to FCUBS to trigger BLNK event for the bill. This request is processed in FCUBS.