8. Post Dated Cheques (PDC) Management

It is a standard banking practice in some countries to request post-dated checks for the retail Lease repayments. When Lease are sanctioned, the lending institution collects post-dated checks in advance from the Lease recipient - at times for the full tenor of the Lease. The main reason for the practice of seeking post dated checks by banks is that it is far quicker for the banks to recover money that is due in a cheque dishonor case than in a regular civil case for recovery of Lease dues.

Post dated checks can also be used for payment in the realization for the Lease. Security checks are used only when the account becomes non-performing.

Managing accounts using post dated checks is very complex and important, as it has significant bearing on the servicing operations. If the PDCs due for clearing are not sent as required, the repercussions are huge. The lending institution loses its payment from the customer and may levy penalties such as late fees and insufficient funds charges which can lead to customer dissatisfaction. Hence, the utmost care should be taken while servicing the Lease accounts using PDC. The PDC process begins with the sorting of checks received from various account holders. They are segregated by Lease product and location before being vaulted in conduits at the centralized location or PDC center. This sorting enables the lending institution to quickly retrieve the PDCs with relevant date and send them for clearing.

The Post Dated Cheques screen is opened from the Servicing master tab’s Post Dated Cheques link and contains the following tabs in its link bar:

- PDC Entry

- PDC Maintenance

- PDC Search

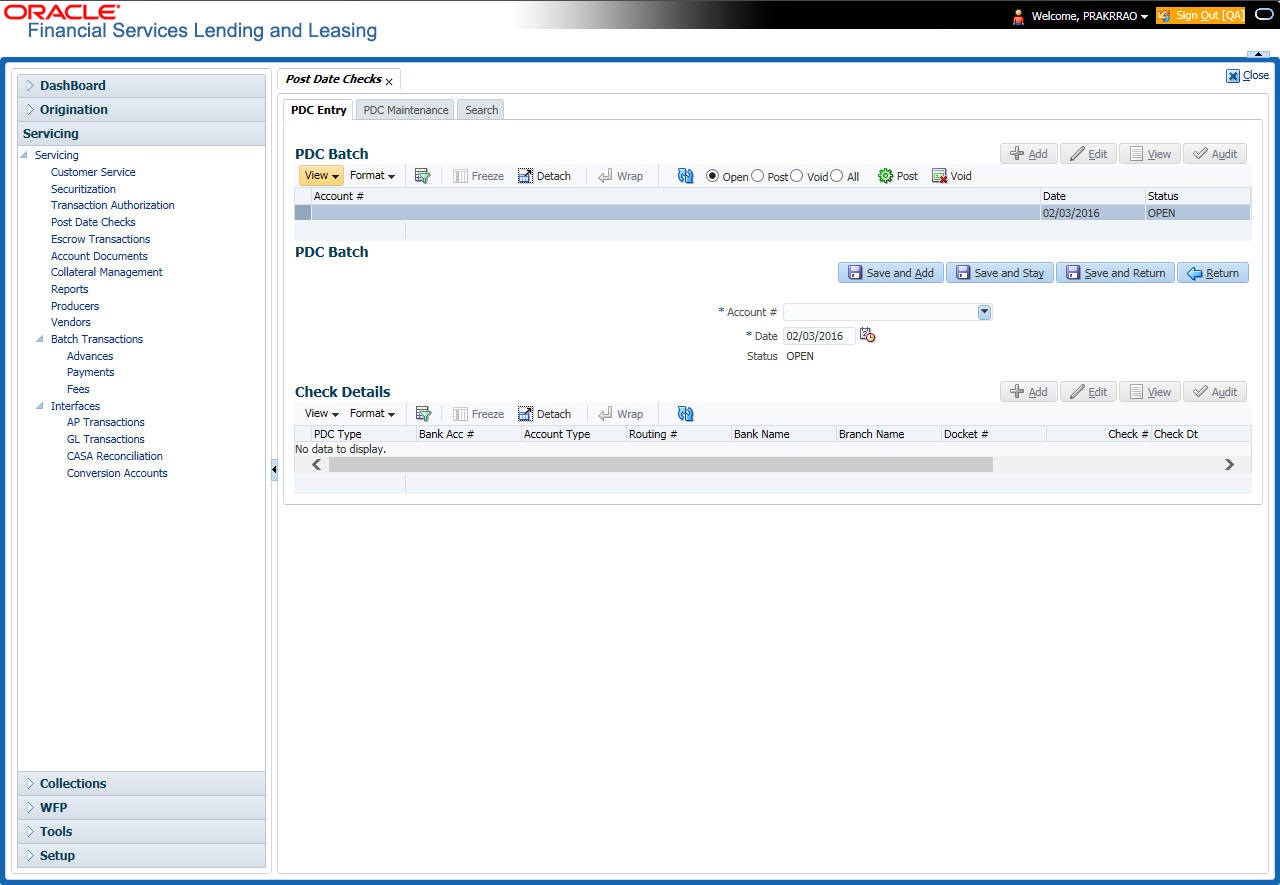

8.1 PDC Entry Tab

The PDC Entry link opens the PDC Entry screen which enables you to record details about the post dated checks collected from customer.

When post dated check is processed by the PDC batch, the status changes to PROCESSED. All the processed checks will then be picked by the Payment Batch and processed. After this, the system posts s payment transaction on the Payment screen’s Payment Entry tab.

The View Options section enables you to view PDC batches by status (Open, Post, Void, and All). You can choose whether the PDCs from the customer are for a single Lease account or for multiple Lease accounts in the same bank. Once you enter the Lease account number of the customer in the PDC Batch section, The system displays all Lease accounts pertaining to the customer.

The information has to be captured to facilitate the inward sorting i.e. sorting the cheques by Lease product group and location and then vaulting them in boxes placed in the vaults at the PDC center and subsequently send them for clearance on the day the payment is due. Usually the PDCs are sent for clearance a few days before the actual due date.

Information maintained here can be viewed at Customer Service > Account Details > Contract Information > PDC sub tab.

After the batch has been created, click POST in Action section to post the batch of PDCs to Lease account. You can also click VOID in the Action section to cancel the PDC entry on a Lease account.

To view the PDC Entry section

- On the Oracle Financial Services Lending and Leasing Application home screen, click the Servicing > Servicing > Post Dated Cheques > PDC Entry.

- On the PDC Entry screen’s View Options section, select the type of PDC batch you want to view.

If you choose:

System displays in the PDC Batch section:

Open

All batches with open status.

Post

All batches with post status.

Void

All batches with void status.

All

All batches, regardless of the status.

- In this section, you can perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Account |

Select the account number. |

Date |

Specify the date. |

Status |

View the status. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- In the Check Details section, you can perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

PDC Type |

Select the post dated check type, Security checks or post dated checks for payment. |

Bank Acc # |

Specify the account number, on which the cheque is drawn. |

Account Type |

Specify the type of the account |

Routing # |

Specify routing number of the cheque. It is the number printed on cheque, also called MICR number (Magnetic Ink Character Recognition). |

Bank Name |

Specify the bank name of the customers cheque |

Branch Name |

Specify the Branch name of the customers cheque |

Docket # |

Specify the docket number where post dated checks are supposed to be stored |

Check # |

Specify the starting cheque number |

Check Dt |

Select the check date. In case there are multiple checks being deposited that have sequential serial numbers, the date of the first cheque in the series would be entered in the date field. The remaining cheque dates would be anniversary dates based on the frequency set up. For example, the cheque range could be from 111 to 180. If date on first cheque-111 is October 12, 2003 and the frequency is set to Monthly, the next cheque would be picked up for processing on November 12, 2003. |

Check Amt |

Specify the appropriate cheque amount. |

Status |

Specify if there are any additional status of the PDC. |

Comments |

Specify any remarks for the details. |

Once the PDC batch is posted, an entry appears in Post Dated Checks section on the Customer Service screen’s Payment Mode tab, with OPEN status.

The status changes to PROCESSED when post dated check is sent for clearance on the pre-processing day and the payment is received. At that time, a payment transaction is posted on the Payments screen’s Payment Entry screen.

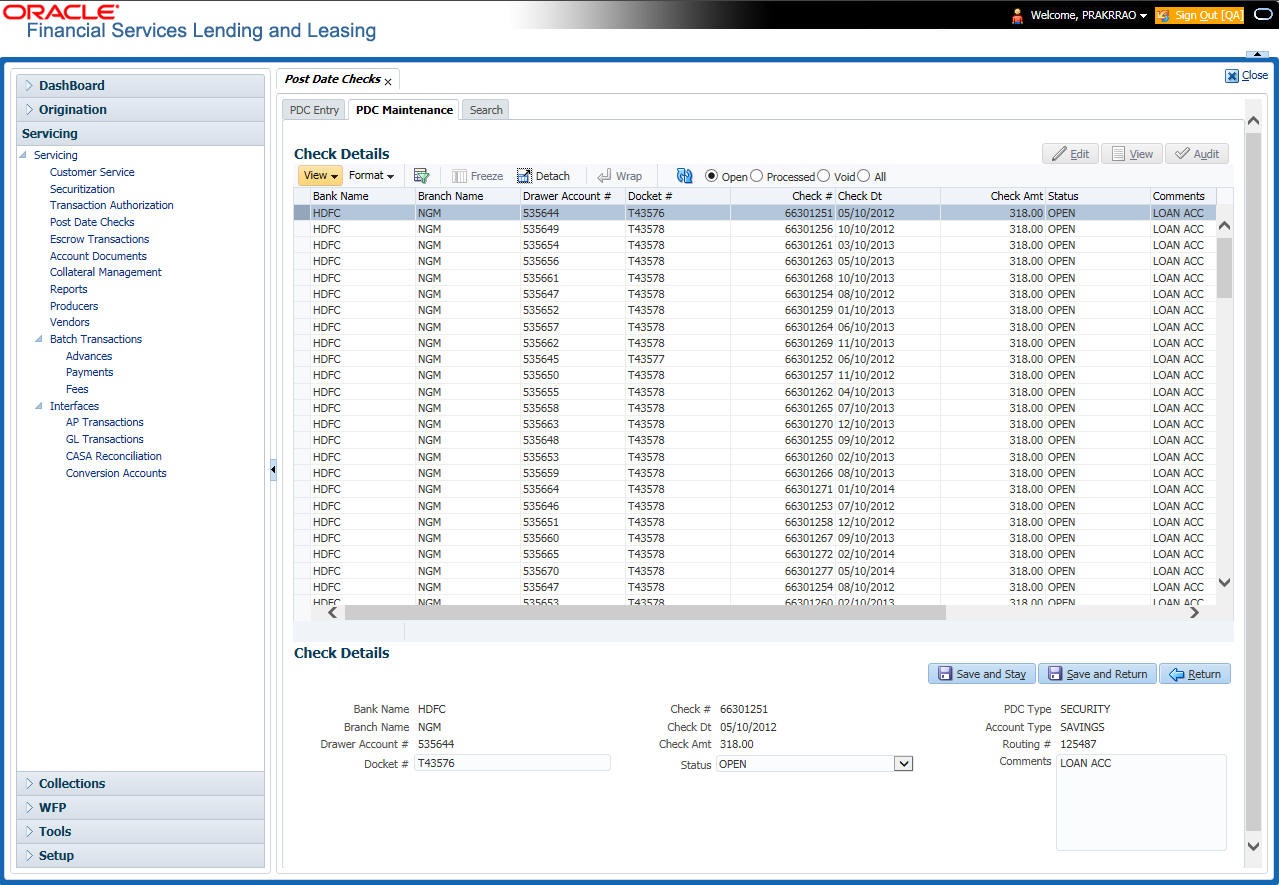

8.2 PDC Maintenance Tab

The PDC Maintenance tab opens the PDC Maintenance screen which enables you to modify check details for a specific account. You can either use view options to filter the PDC details by status or search the details using Query By Example option. The Edit button enables you to modify docket number, change status, and to add comments.

To view the PDC Maintenance screen

- On the Oracle Financial Services Lending and Leasing Application home screen, click the Servicing > Servicing > Post Dated Cheques > PDC Maintenance tab.

- On the PDC Maintenance screen’s View Options section, select the type of PDC entry you want to view in the PDC Maintenance section.

If you choose:

The system displays in the PDC Batch section:

Open

All entries with open status.

Processed

All entries with post status.

Void

All entries with void status.

All

All entries, regardless of status.

- In this section, you can perform any of the Basic Operations mentioned in Navigation chapter.

- A brief description of the fields is given below.

Field:

Do this:

Bank Name

View the bank name for which check is provided.

Branch Name

View the bank’s branch name.

Drawer Account #

View the bank account number.

Docket #

Edit/view the location number where checks have been stored.

Check#

View the check number.

Check Dt

View the check date.

Check Amt

View the check amount.

Status

Select to change or view the cheque’s current status.

PDC Type

View the check type (Payment or Security).

Account Type

View the bank account type.

Routing #

View the bank’s routing number.

Comments

Specify or view any comments associated with the record.

- Perform any of the Basic Actions mentioned in Navigation chapter.

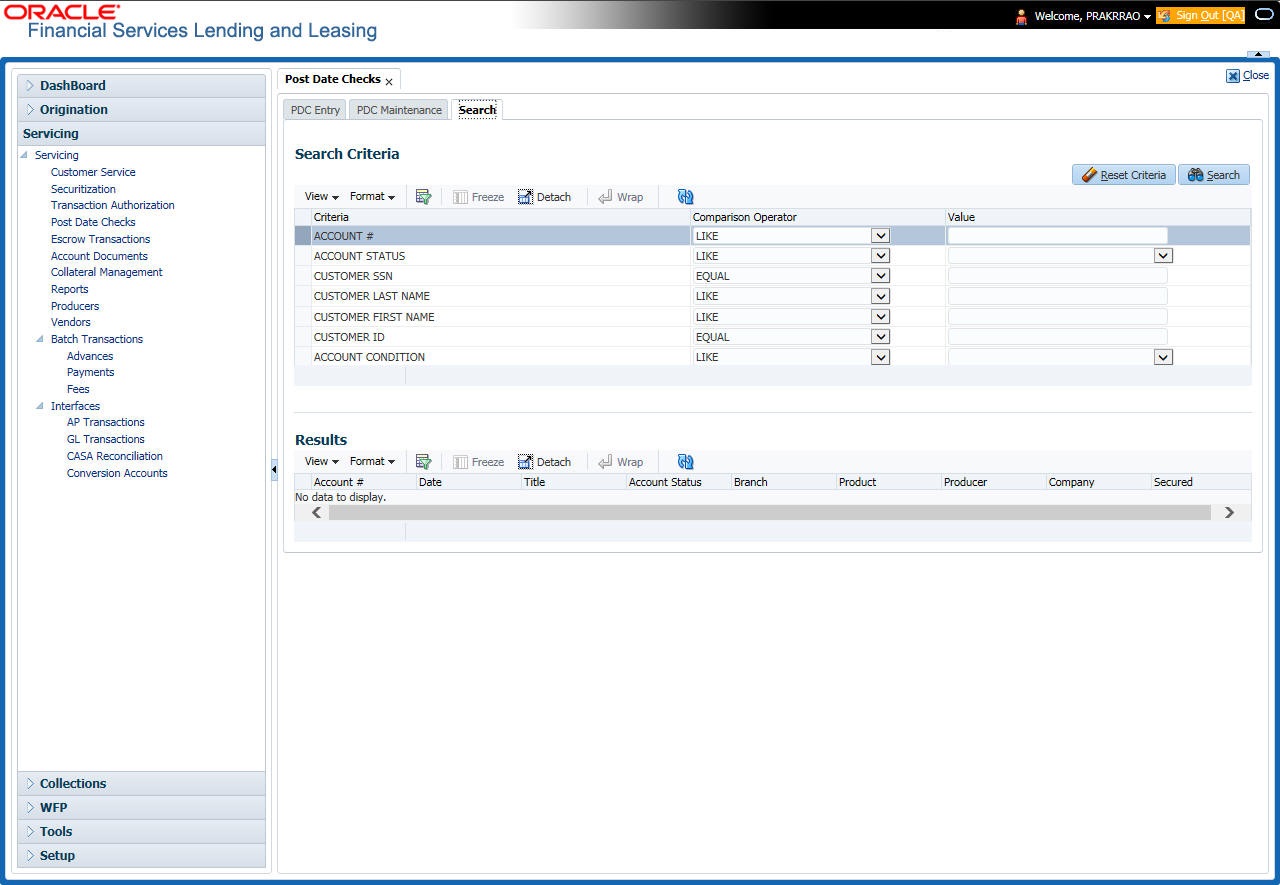

8.3 Search Tab

The Search tab opens Search screen. On Search screen, the Search Criteria section enables you to locate an account or group of accounts. The Results section displays details of the Lease account. This is a useful alternative to using the Customer Service screen to search for account information.