7. Transaction Authorization

Transaction Authorization enables you to validate transactions (which have the Authorize property enabled) that were entered on the Customer Service screen’s Maintenance screen by a different Oracle Financial Services Lending and Leasing user. You can view these transactions on the Transaction Authorization screen before they are posted. This process is referred to as ‘Maker-Checker’, as one Oracle Financial Services Lending and Leasing user enters (or ‘makes’) the transaction on Maintenance screen and another validates (or ‘checks’) the transaction on the Transaction Authorization screen. As an example, the checker might review transactions to determine if the transaction will increase the credit limit to an acceptable level or decrease the payment to an unacceptable level.

Type |

Description |

Maker |

The person who posts (or makes) transaction on the Maintenance screen. |

Checker |

The person who checks the details entered by the maker and either accepts or rejects the transaction in the Transaction Authorization screen. |

While defining transaction code, the maker and checker responsibilities can be defined using the access type field available under access grid sub tab. Maker-Checker concept applies only to manual transactions, and not the automated ones.

7.1 Transaction Authorization screen

The Transaction Authorization screen displays the transactions posted on Customer Services screen that requires authorization.

On the Customer Service screen, follow the process for posting transactions on the Maintenance screen and clicking Post. If the Authorization check box is selected for the transaction on the Administration screen’s Transaction tab (i.e. Setup > Administration > User > Access > Transaction tab), rather than being posted, the transaction receives a status of WAITING FOR APPROVAL and the message “Transaction in Waiting for Approval” appears on the Results section.

A checker can use the Authorization screen to view transactions with the status waiting for approval, then approve or reject the transactions. As a checker you can view all the transactions listed within/under your hierarchy, but can authorize or reject only those transactions which qualify the conditions defined for authorization. The same user who initiated the request cannot authorize the transaction even though that user might have the checker responsibility.

The maker uses the Authorization screen to view the transactions posted with a status of POSTED, Error or Reject.

- Posted transactions are those which have been approved by the checker.

- Transactions with an Error status are those which have invalid business rules such as the parameter value is incorrect or has a back dated date and so on.

- Transactions with a REJECT status are those which have been rejected by the checker.

In both statuses (Error or Reject), the maker can modify the transaction and re-post it for the checker to review.

To authorize or reject a transaction the Authorization screen

- On the Oracle Financial Services Lending and Leasing Application home screen, click the Servicing > Servicing > Transaction Authorization > Authorization.

- In the Transaction Authorization screen you can click on the following options to filter the Transactions:

- Checker - To display all transactions within/under logged-in Checker’s hierarchy for authorization and having status as ‘Waiting For Approval’.

- Maker - To display data in descending order of date in the below order:

- Waiting For Approval

- Rejected

- Error

- Posted

- Both - To display all records with Checker responsibility and having status as Rejected, Error and Posted.

- Click one of the following to limit the display of transactions in the Transaction section according to when the transaction was posted:

Click:

The system displays:

1 Day

The transactions posted within the last one day.

2 Day

The transactions posted within the last two days.

5 Day

The transactions posted within the last five days.

All Days

The posted transactions.

The system displays transactions entered on the Maintenance screen with status as error or waiting for approval. If you want to view all transactions with only ERROR status, select View Failed check box.

To Authorize or Reject Transactions

- In the Transactions section, select the required transaction. The transaction parameters are displayed in ‘Parameters’ section and processing details are displayed in ‘Transaction Processing Details’ section.

- Click Edit. You can perform any of the Basic Actions mentioned in Navigation chapter.

- To Authorize the transaction, click Authorize in the ‘AuthRej’ section.

- To Reject the transaction, click Reject in the ‘AuthRej’ section.

- Add a comment and your decision regarding the transaction in the ‘Comments’ column.

- In the Action section, click Post.

Based on comment input, the system authorizes or rejects the transaction and removes it from the Transaction section.

You can view the transaction result on the Transaction Authorization screen’s Authorization History screen.

The results of the decision can be viewed on the Customer Service screen’s Maintenance screen.

The system user who posted the transaction on the Customer Service screen’s Maintenance screen and received a waiting for approval status can open the Authorization screen, click Maker in the Query section and view all the transaction they posted that have a status of POSTED, error or reject.

- If the transaction has a status of Error or Reject, make the required changes to the original transaction on the Authorization screen and click Post in the Action section.

- If you click the Void in Action section, the system removes the transaction from the Transaction Authorization screen.

Note

If the transaction remains unauthorized beyond the number of days specified in the system parameter “AUTH_TXN_VOID_LIMIT”, then the transaction is marked as “void”. The daily batch job checks for inactivity of authorization transactions against this parameter.

7.2 Authorization History tab

The Authorization History screen displays the all the transactions with a status of Open, Void, Error, Posted, waiting for approval, and reject. Aged transactions will not be displayed. The Search Criteria section enables you to select the transactions you want to view in the Results section.

To search for accounts using the Authorization History screen

- On the Oracle Financial Services Lending and Leasing home screen, click the Servicing > Servicing > Transaction Authorization > Authorization History.

- In the Authorization History screen’s Search Criteria section, use the Comparison Operator and Value columns to enter the search criteria you want to use to locate an account.

- Click Search. The system displays the result of the search in the Results section at the bottom of the screen. You can click Reset Criteria at any time to clear the Comparison Operator and Values columns on the Search screen.

- In the Results section, view the following information:

Field:

View this:

Account #

The account number.

Transaction

The transaction.

Status

The status of the transaction.

Maker

View the user Id of the person who entered the transaction on the Customer Service screen.

Initiated Dt

View the date and time the transaction was initially posted on the Customer Service screen.

Checker

View the user Id of the person who validated the transaction on the Authorization screen.

Authorized Dt

The authorized date.

Comments

Any comment attached to the transaction.

Start Date

The transaction start date.

End Date

The transaction end date.

Elapsed Time

The elapsed time of the transaction.

End of Day (EOD) processing

The Transaction Authorization screen’s Authorization screen employs the 24 x 7 accessibility feature. You can continue working with the Authorization screen and post transactions even when end of day (EOD) batch process is running. When you post a transaction on the Transaction Authorization screen’s Authorization screen and the transaction posting is deferred or cannot be posted at the present time, “System Under Maintenance. Transaction Posting Deferred” appears in the Results section. If transaction posting is deferred, the system automatically posts the transactions once it completes batch processing.

7.3 Review Request Tab

The Review Requests screen allows for effective communication between the Maker and Checker. The Transaction Authorization screen’s Review Request screen operates the same way as the existing Review Request screen in Customer Service screen. One difference is that the Transaction Authorization screen’s Review Request screen contains the Transaction field.

Review requests created on the Transaction Authorization screen can be viewed in the Customer Service screen’s Review Request screen. However, the Transaction Authorization screen’s Review Request screen will only display transaction authorization requests.

To view the Review Request screen

- On the Oracle Financial Services Lending and Leasing home screen, click the Servicing > Servicing > Transaction Authorization > Review Request tab.

7.4 Review Request

The Review Requests screen is primarily a work flow tool used to flag an Account for the attention of another Oracle Financial Services Lending and Leasing user and ask for review / feedback. It allows the system users to send and receive requests (including e-mail) commenting on a specific Account. The Review Request tab supports iterative review of selected Account and also to process the review with multiple reviewers.

In this chapter, you will learn how to compete the following tasks:

- Filter and View Review Requests

- Create and Send Review Request

- Reviewing a Request

- Responding to Review Request

- Reassign Review Request

- E-mailing Review Request

- Closing Review Request

- Complete Review Request

Note

You can complete the above tasks for an Account Review Request using Review Request tab in the Customer Servicing screen.

7.4.1 Filter and View Review Requests

The Review Requests tab contains the following sections:

- Query Section

- Action Section

- Email Section

- Comment History Section

Query Section

The Query section enables you to filter records based on User and type of review requests using any of the following options:

The ‘User’ drop-down lists your User ID along with your Supervisor ID if the same has been defined in User Definition screen (Setup > Administration > User > Users). If you are the supervisor, you can view all your subordinates User ID’s along with yours for selection.

On selecting a particular User ID from the list, system displays all the requests which are created, reviewed, closed and completed by that user.

You can further filter the review request based on the following:

Query Options |

Descriptions |

Originator |

Displays the records of all the active review requests created by the selected User. |

Receiver |

Displays the records of all the active review requests received by the selected User. |

Both |

Displays all the review requests records created as well as reviewed by the selected User with the status other than ‘CLOSED’ and ‘COMPLETED’. |

View All |

Displays all the review requests records created as well as reviewed by the selected User with all the statuses. |

Forwarded Only |

Displays all the review requests records which are forwarded by the selected User to another user for review. |

Action Section

The Action section enables you to Send (create), Respond, Close, or Complete the review request.

Action Options |

Descriptions |

Open Account |

Displays the Customer Service screen with the Account details assigned for review. |

Send Request |

Sends a review request to another Oracle Financial Services Lending and Leasing user. |

Send Response |

Sends a response to a review request received from another Oracle Financial Services Lending and Leasing user. |

Close Request |

Changes the status of review request to CLOSED and can be viewed by selecting ‘View All’ option in the ‘Query’ section. |

Complete Request |

Changes the status of review request to COMPLETED and can be viewed by selecting ‘View All’ option in the ‘Query’ section. |

Remove Filter |

Removes the selected filters applied to narrow the view of review request. The option is available when a review request is accessed from DashBoard > My Pending Review Requests section. |

Email Section

The Email section enables you to send an email to either originator or receiver of the review request if an email setup is configured. However, note that a review request cannot be responded or replied back from email recipient.

Email Options |

Descriptions |

Originator |

Sends an email of review request information to the person listed in the Originator column on Review Request page. |

Receiver |

Sends an email of review request to the person listed in the Receiver column on Review Request page. |

The ‘Review Requests’ section in Customer Service screen displays the following information for each record:

Fields |

Descriptions |

Request # |

View the system generated review request number. The same can be used to query and track the review requests. |

Originator |

The user id of the review request originator. |

Priority |

The request priority: HIGH, NORMAL, or LOW. |

Receiver |

The recipient of the review request. |

Phone |

Applicant’s phone number in the review request. |

Address |

Applicant’s address in the review request. |

Applicant’s email in the review request. |

|

Status |

The current status of review request. Following status are tracked in this column: WAITING FOR RESPONSE - when request is sent to reviewer RETURN TO ORIGINATOR - when reviewer has responded to request CLOSED - when the request is closed COMPLETED - when the request is completed |

Date |

The date and time when the review request was created. |

Account # |

The Account number which needs review. |

Days Past Due |

Total number of days elapsed past the due date. |

Total Outstanding Balance |

Displays either ‘Account outstanding principal balance’ for active accounts, or ‘Deficiency balance’ for charge-off accounts. |

Customer |

Primary / Secondary (spouse) name associated to the account. |

Comment History

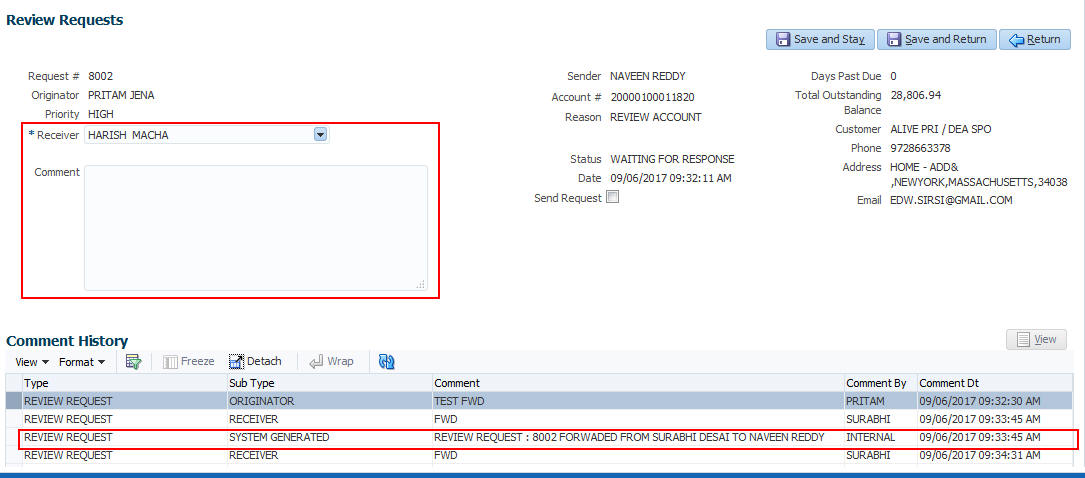

The ‘Comment History’ section displays the log of comments or additional information added by originator or receiver while creating or reviewing a request.

During an iterative review, where there are multiple trails of communication exchanged between originator and receiver, the ‘Comment History’ section tracks all the updates as individual records for reference.

The Comment History section also allows you to know the actually reviewer when an Account review request is forwarded to multiple reviewers and is reviewed or completed by second or third person other than the one assigned by originator.

In the Comment History section, you can view the following details of the selected review request:

Comments From |

Descriptions |

Type |

View the type of request and is indicated as REVIEW REQUEST by default as maintained in ‘COMMENT_TYPE_CD’ lookup code. |

Sub Type |

View the sub type of request which can be ORIGINATOR, RECEIVER, or SYSTEM GENERATED as maintained in COMMENT_SUB_TYPE_CD lookup code. Note: The sub type ‘SYSTEM GENERATED’ is automatically posted by the system when the review request is forwarded to another user by the assigned reviewer. The same is also updated with a comment in the next column. |

Comment |

View the Originator’s or Reviewer’s comment. SYSTEM GENERATED comments are posted in the format - REVIEW REQUEST: <Request #> FORWADED FROM <first assigned user id> TO <next assigned user id>. |

Comment By |

View the user who has posted the comment. SYSTEM GENERATED comments are marked as ‘INTERNAL’. |

Comment Dt |

View the Date and time when the comment was posted. |

7.4.2 Create and Send Review Request

The review request tab primarily allows you to flag an Account for the attention of another OFSLL user through a request asking for review / feedback. While doing so, you can either choose to send it to the reviewer immediately on creating the request or only create the request and later send for review.

To Create and Send Review Request

- On the Oracle Financial Services Lending and Leasing Application home page, click Servicing > Customer Service screen and select ‘Review Requests’ tab.

- In the Review Requests section, select ‘Originator’.

- Click ‘ADD’. You can also perform any of the Basic Operations mentioned in Navigation chapter. A brief description of the fields are given below:

In this field:

View this:

Request #

View the system generated request number.

Originator

View the requester’s user ID auto generated by system upon creating the request.

Priority

Select the priority of review request as High, Normal, or Low from the drop-down list. This helps the reviewer to prioritize the request while responding but does not affect the order in which messages are sent or received.

Receiver

Select the user ID of the reviewer from the drop-down list.

Comment

Specify additional details for review (if any) which can be sent to the reviewer along with the review request.

Sender

View the user ID of previous reviewer, if a request has been forwarded to another reviewer.

Note: A forwarded review request can only be viewed in the review request tab by filtering user ID of previous reviewer and selecting ‘Forwarded only’ check box.

Account #

Select the Account to be reviewed from the drop-down list. The following fields are auto-populated based on selection:

Days Past Due

Total Outstanding Balance

Customer

Phone

Address

Email

Reason

Select the purpose for request from drop-down list.

Status

View the status of review request auto updated by system upon creating the request.

Date

View the date and time when the request was created. System appends the current date by default.

Send Request

(Optional) Select this check box to send it to reviewer immediately on creating the request.

However, if the request still need changes, retain the check box unselected and proceed to create the request. The same can later be sent for review by selecting ‘Send Request’ option from the action section.

- Perform any of the Basic Actions mentioned in Navigation chapter.

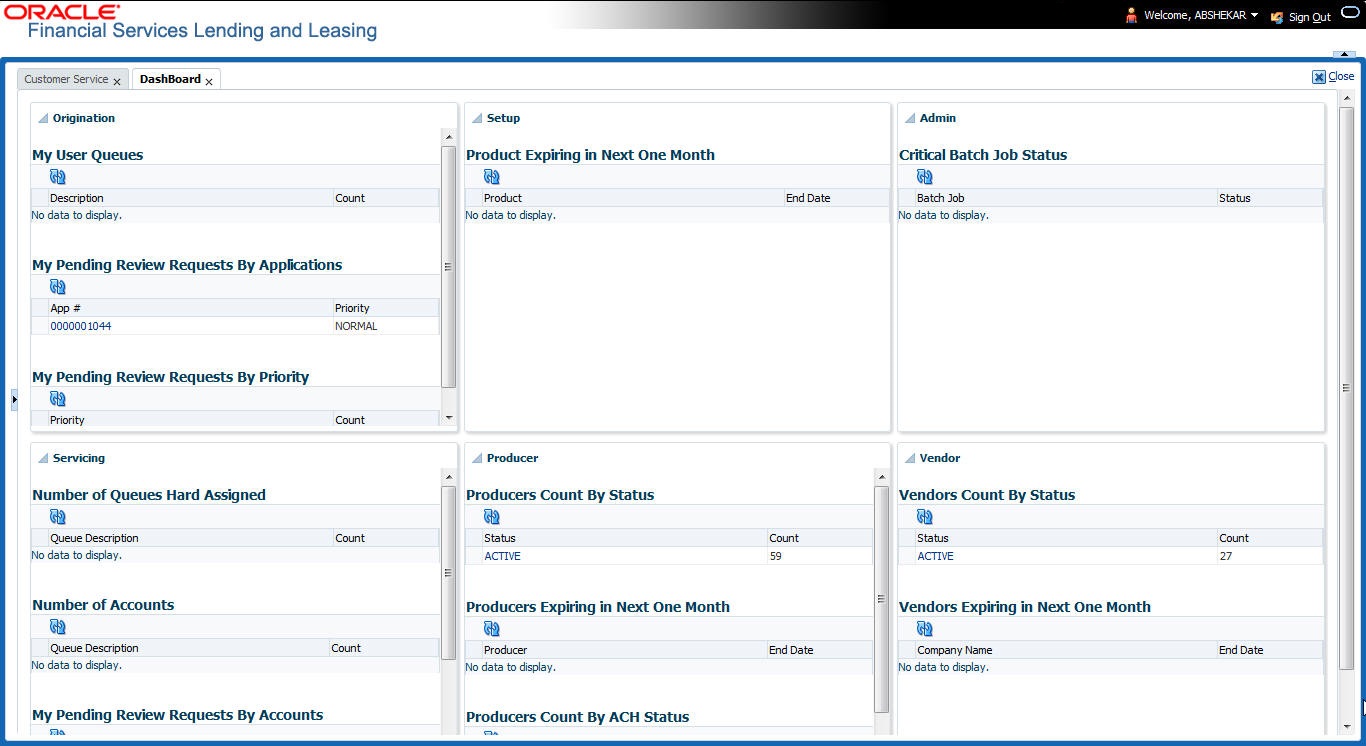

The review request(s) appear on the recipient’s ‘My Pending Review Request’ window in DashBoard and also on the ‘Review Request’ tab header with (Pending: <count of unseen requests>). The status of request is updated as WAITING FOR RESPONSE.

7.4.3 Reviewing a Request

When you receive a review request, the system notifies you by creating an entry in ‘My Pending Review Requests By Priority’ section in DashBoard with the number of unseen messages. Clicking on the Account # link opens the Review Request tab.

To review requests

- On the Oracle Financial Services Lending and Leasing Application home page, click Servicing > Customer Service screen and select ‘Review Requests’ tab.

- In the Query section, click ‘Receiver’. System displays all open review request you have received.

- Click ‘Open Account’. The Account details are displayed in Customer Service > Summary tab.

- Review the details in particular to the details specified in the comment (if any).

7.4.4 Responding to Review Request

On completing the review, you can Send Response detailing the feedback of your review. It is ideally recommended to send a response back to the originator by providing your views on the review as a comment. The details are recorded in the ‘Comment History’ section as reference.

However, system also allows your forward the same request to another reviewer in case of additional clarifications.

To respond to review request

- On the Oracle Financial Services Lending and Leasing Application home page, click Servicing > Customer Service screen and select ‘Review Requests’ tab.

- In the Query section, click ‘Receiver’. System displays all open review request you have received.

- In the Review Request section, select the record that you have reviewed.Click ‘Edit’. Specify your review response in the ‘Comment’ field. Select the ‘Send Request’ check box to send the review response immediately to originator. In case of any further changes, retain the check box unselected and save the details. The response is not sent and the same can later be sent to originator by selecting the record and clicking on ‘Send Response’ option from the action section.

The details are updated in Review Request tab and status of request is updated as RETURN TO ORIGINATOR.

7.4.5 Reassign Review Request

While reviewing a request, system also facilitates you to reassign (i.e. forward) the review request to another user for review. In such a case, you become the ‘Sender’ and the assigned user will be the reviewer of the request. The request can further move to other reviewers if required.

When the request is reassigned or forwarded to another reviewer, the actual originator can still track the status of request by selecting user ID in Query section. As a ‘Sender’, you can view the reassigned review requests by selecting the ‘Forwarded Only’ check box in Query section. Also, on reassigning or forwarding a review request, system automatically posts a comment in ‘Comment History’ section in the format - REVIEW REQUEST: <Request #> FORWADED FROM <first assigned user id> TO <next assigned user id> with Sub Type as ‘SYSTEM GENERATED’ and Comment By as ‘INTERNAL’.

Note

It is recommended to limit the reassignment of review request since tracking the request status becomes difficult.

To reassign review request

- On the Oracle Financial Services Lending and Leasing Application home page, click Servicing > Customer Service screen and select ‘Review Requests’ tab.

- In the Query section, click ‘Receiver’. System displays all open review request you have received.

- In the Review Request section, select the record that you have reviewed and click Edit.

- Select the required reviewer from ‘Receiver’ drop down list.

- (Optional) Specify the reason for reassignment in the ‘Comment’ field. The same is tracked in ‘Comment History’ section.

- Select the ‘Send Request’ check box to reassign review request immediately on update. In case of any further changes, retain the check box unselected and save the details. The reassignment can later be completed by selecting the record and clicking on ‘Send Response’ option from the action section.

The details are updated in Review Request tab and status of request is updated as WAITING FOR RESPONSE.

7.4.6 E-mailing Review Request

While system updates ‘My Pending Review Requests By Priority ‘section in the DashBoard to notify you about the new requests, you can also e-mail a review request to both the originator and a receiver, as applicable. The system will use e-mail address recorded for both the originator and receiver in Setup > Administration > User > User Definition section.

To e-mail a review request

- On the Oracle Financial Services Lending and Leasing Application home page, click Servicing > Customer Service screen and select ‘Review Requests’ tab.

- In ‘Email’ section, click ‘Originator’ to send the message to the person listed in Originator field.

-or-

- Click ‘Receiver’ to send it to the person listed in the Receiver field.

The system emails the details of selected record to e-mail address recorded in user setup.

7.4.7 Closing Review Request

You can close a review request you created at anytime, regardless of status. However, you can only close review requests that have your user id in the Originator field. When you close a review request, the system removes it from Review Request tab.

To close a review request

- On the Oracle Financial Services Lending and Leasing Application home page, click Servicing > Customer Service screen and select ‘Review Requests’ tab.

- Select the request you want to close in the Review Request section.

- In the Action section, click ‘Close Request’.

The system assigns the request as Closed and removes it from your Review Request record. The closed review requests can be reviewed anytime by selecting ‘View All’ in the Query section.

7.4.8 Complete Review Request

When a particular review request has completed the review process from reviewer with required changes and confirmation, the same can be marked as ‘COMPLETE’ in the Review Request tab. However, you can complete a request only if you are the originator of the request. When you complete a review request, system removes it from Review Request tab.

To complete a review request

- On the Oracle Financial Services Lending and Leasing Application home page, click Servicing > Customer Service screen and select ‘Review Requests’ tab.

- Select the request you want to close in the Review Request section.

- In the Action section, click ‘Complete Request’.

The system assigns the request as ‘COMPLETED’ and removes it from your Review Request record. The completed review requests can be reviewed anytime by selecting ‘View All’ in the Query section.