2. Limits

The functions and actions provided by the Oracle Banking Enterprise Limits and Collateral Management are explained below. All functions explained below, come under Limits in the Menu Browser.

This chapter contains the following sections:

- Section 2.1, "Maintaining Line Code details"

- Section 2.2, "Facilities Maintenance"

- Section 2.3, "Account/Contract Balance Maintenance for Netting"

- Section 2.4, "Ear Marking Maintenance"

- Section 2.5, "Queue Maintenance"

- Section 2.6, "Breach Tracking for Main Line Facility Utilization Transactions"

- Section 2.8, "About Approval By Email"

- Section 2.9, "Facilities Amount Transfer Maintenance"

- Section 2.9, "Facilities Amount Transfer Maintenance"

- Section 2.10, "Dual Authorization of Utilization Transaction"

- Section 2.10, "Dual Authorization of Utilization Transaction"

2.1 Maintaining Line Code details

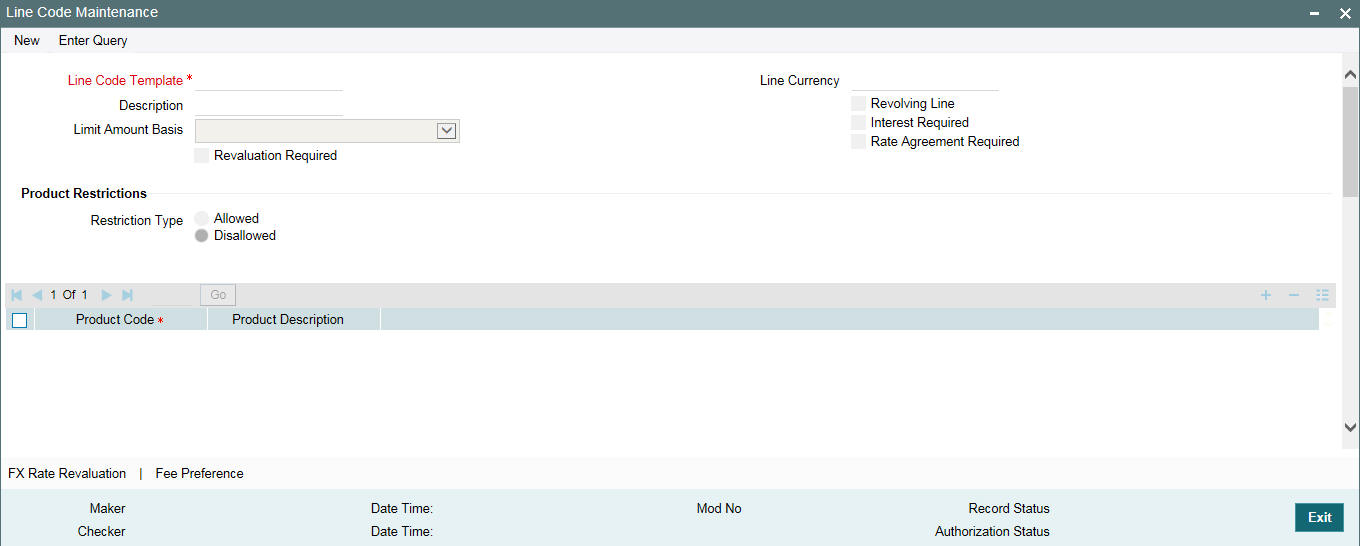

You can create and maintain line codes in the ‘Line Code Maintenance’ screen. Using this screen you can maintain line code details. These details are populated to ‘Facilities Maintenance screen’ (GEDFACLT).You can invoke the ‘Line Code Maintenance’ screen by typing ‘GEDLNCOD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Line Code Template

Specify a unique code for the Line Code Template.

Description

Specify the description of the Line Code.

Limit Amount Basis

The value for Limit Amount can be maintained as the following:

- Limit Amount Basis

- Limit Amount + Collateral Contribution Limit Amount

- Min(Limit Amount, Collateral Contribution)

Line Currency

Specify the currency in which the Line Code is to be defined.

Revolving Line

Select this check box to indicate that the credit line is Revolving. A revolving credit line indicates that a repayment of the utilized credit should reinstate the credit limit of the customer.

Interest Required

Select this check box to indicate the facility is applicable for interest calculation.

Revaluation Required

Identifies if the facility has to revalued or not.

Rate Agreement Required

If this check box is selected, then rates are taken based on FX rate fixing. If this check box is not selected, then rates are taken from 'Currency Exchange Rates Input' screen based on the maintenance done in ‘Global Exposure Parameter’ screen.

The system picks the rate/rate code and updates the utilization across the facility linked to the contracts.

Product Restriction type

You can restrict the limit available under this line to a specific product by selecting allowed/ disallowed option.

If you choose the restriction type as 'Allowed', click the button and select the Product code from the

list to indicate that they are allowed to use the line.

If you choose the restriction type as 'Disallowed', click the button and select the Product code from the

list to indicate that they are not allowed to use the line.

Product Code

Specify the product code from the LOV for the Product Restriction.

Product Description

The product code description is displayed.

Branch Restriction type

You can restrict the limit available under this line to a specific branch by selecting allowed / disallowed option.

If you choose the restriction type as 'Allowed', click the button and select the Branch code from the

list to indicate that they are allowed to use the line.

If you choose the restriction type as 'Disallowed', click the button and select the Branch code from the

list to indicate that they are not allowed to use the line.

Branch

Specify the branch code from the LOV for the Branch Restriction.

Branch Description

Branch Code description is displayed.

Tenor Restrictions

You can define the limits based on the tenor of the contracts that utilize the limit.

Tenor

Specify the Tenor Name.

Days

Number of days corresponding to the tenor.

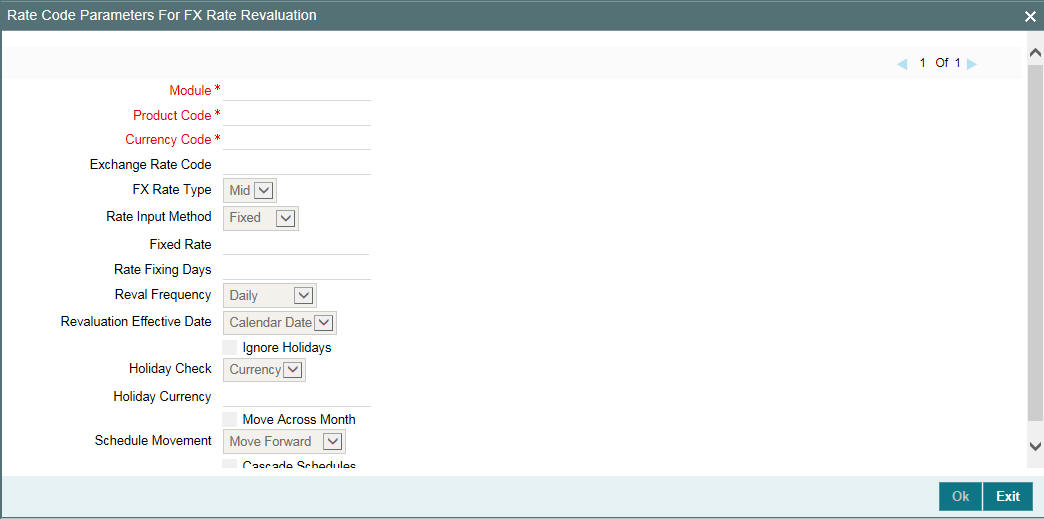

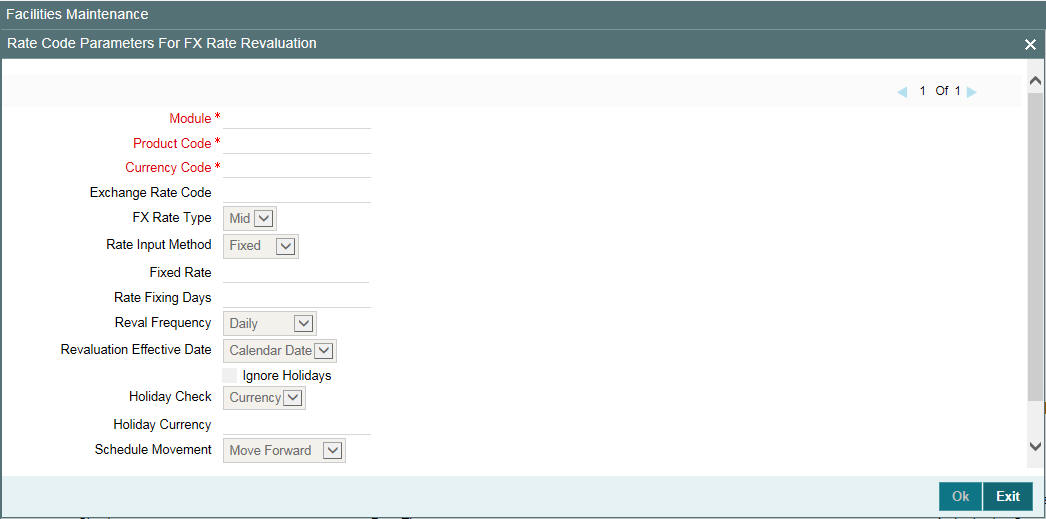

2.1.1 FX Rate Fixing

Provision to fix a rate between a 'Transaction Currency' and 'Facility Currency'.

Currently, system picks the rates for utilization transaction based on the maintenance at Parameter level in 'Global Exposure Parameter Detail’ screen.

A fixed rate can be provided or a set of parameters like rate type and rate indicators can be maintained, and the rate pick up is derived based on these parameters.

Module

Specify the associated module from the adjoining option list.

Product Code

Based on the module, the product code appears accordingly.

Currency Code

Specify the valid currency code. The ‘Currency Code’ cannot be same as ‘Line Currency’.

Exchange Rate Code

Specify the exchange rate code. These rate codes are picked from the Currency Rate Type Definition screen (CYDCRATY).

‘Exchange Rate Code’ field entry is required if the Rate Input Method is ‘Derived’. An error appears if 'Exchange Rate Code’ has a value and ‘Rate Input Method’ is ‘Fixed’.

FX Rate Type

You can either select ‘Mid’, or ‘Sell’ or ‘Buy’.

Rate Input Method

You can either select ‘Fixed’ or ‘Derived’.

- Fixed- Fixed rate provided at the FX level would be picked up.

- Derived- Based on Exchange Rate Code, FX Rate Type, and Rate Fixing Days provided, Rate would be derived.

The system revaluates only those contracts for which ‘Rate Agreement Required' and 'Revaluation Required' are selected.

The Next Reval Date is updated for each of the contracts created based on these FX Maintenances.

- Derived Rate Input Method Type -'Revaluation Frequency', 'Revaluation Effective Date' and ‘Holiday Treatment’ chosen at the facility level.

- Fixed Rate Input Method Type- Today’s Date.

After the End Of Day process, the facility would be revaluated with the modified values for Fixed and Derived Rate Input Method Type.

Fixed Rate

Specify the fixed rate.

‘Fixed Rate’ field entry is required if the ‘Rate Input Method’ is ‘Fixed’. An error appears if 'Fixed Rate' has a value and ‘Rate Input Method’ is ‘Derived’.

Rate Fixing Days

Specify the rate fixing days. The allowed values are 0-5.

In case of 'Derived', rate fixing days as T-0, Rate maintained at the 'Currency Exchange Rates Input' screen is taken.

Rate fixing days as T-1 to T-5, rate would be picked up from the History of 'Currency Exchange Rates Input' screen for the respective date.

Reval Frequency

You can either select ‘Daily’, ‘Weekly’, ‘Monthly’, ‘Quarterly’, ‘Half Yearly’, ‘Yearly’, ‘Ad Hoc’ or ‘None’.

Ensure to select 'Reval Frequency' if you have selected 'Revaluation Required' and 'Rate Agreement Required' check box in the 'Line Code Maintenance' screen.

Adhoc - Fixed rates are revaluated only on modification of rate at facility level. So, the frequency for fixed rates are maintained as ‘Ad Hoc’

None - If you need to suppress currency revaluation for a certain combination of ‘Module’, ‘Product Code’ and ‘Currency Code’, the ‘None’ can be selected as the Frequency.

For ‘Daily’, ‘Weekly’, ‘Monthly’, ‘Quarterly’, ‘Half Yearly’ and ‘Yearly’, next revaluation date is computed based on the Frequency selected.

Note

Reval frequency supported for 'Fixed' rate input method are 'ADHOC' and 'NONE'. For 'Derived' reval frequency except 'ADHOC' rate input method all other are supported.

Revaluation Effective Date

You can either select ‘Calendar Date’ or ‘Value Date’.

Calendar Date – For example, Revaluation date is 15th July, and Frequency is monthly, Next Reval Date would be 1st August.

Value Date - For Example, Revaluation date is 15th July, and Frequency is monthly, Next Reval Date would be 15th August.

Holiday Treatment

Ignore Holidays

If this check box is selected, then holiday treatment is not applied to calculate the next date. If this check box is not selected, then ‘Holiday Preferences’ settings are validated.

Move Across Month

If this check box is selected, then the system moves the date to next month. If this check box is unselected, then the system moves the date to next date.

Example

Working Day |

30-Aug |

1-Sep |

Holiday |

31-Aug |

|

Schedule Movement |

Move Forward |

|

Calculated Next Date |

31-Aug |

|

In above mentioned example, if ‘Move Across Month’ is selected, then the system moves next date to 1-Sep. If ‘Move Across Month’ is not selected, then the system changes next date to 30-Aug.

Schedule Movement

Move Forward

In case calculated next date is holiday then date should be moved forward. In this case fee liquidation moves to 1st Sep which is next working date

Move Backward

In case calculated next date is holiday then date should be moved backward. In this case, fee liquidation moves to 30th Aug which is previous working date

Cascade Schedules

If cascade schedules is selected, then the next date is calculated on based on previous schedule date instead of start date.

Holiday Check

If holiday treatment is applicable, then you can select ‘Local’, ‘Currency’ or ‘Both’ based on your holiday maintenance.

If 'Both' is selected and 'Branch' or 'Currency' is holiday, then holiday processing setting is considered.

Holiday Currency

If holiday check is maintained as ‘Currency’ or ‘Both’ then currency code to be maintained here.

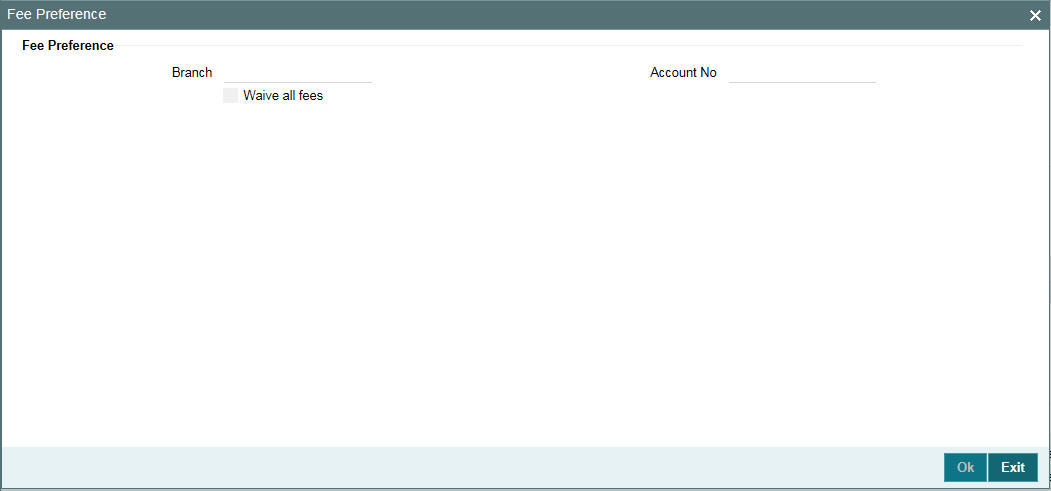

2.1.2 Fee Preference

Branch

You can maintain branch code in this screen and this value gets defaulted in ‘Facilities Maintenance’ screen.

Account No

You can maintain account number in this screen and this value gets defaulted in ‘Facilities Maintenance’ screen.

Waive all fees

Select this check box if you want to waive all the fees.

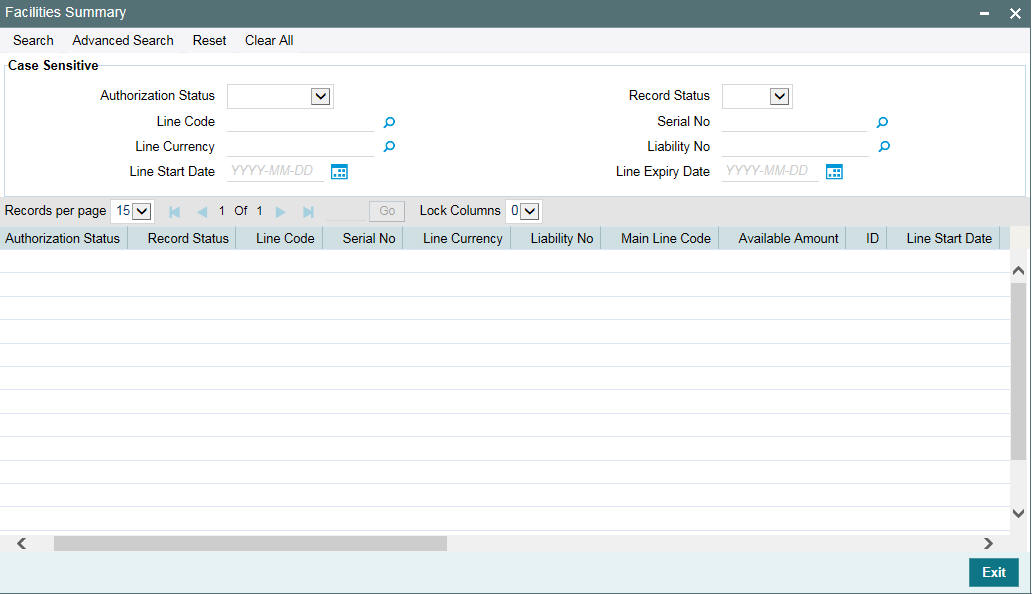

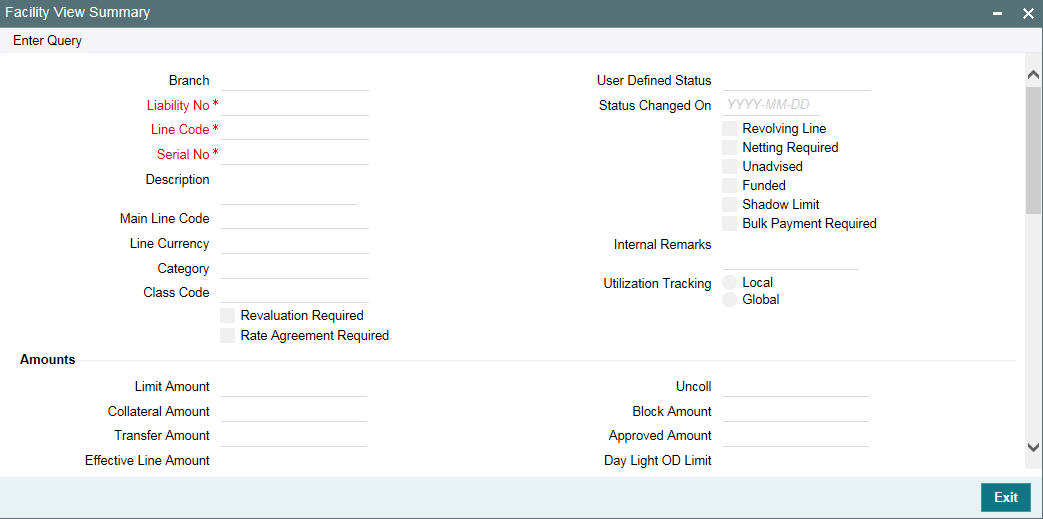

2.2 Facilities Maintenance

You can maintain credit limits for a Line Code - Liability Code combination in the ‘Facilities Maintenance’ screen. You can invoke the ‘Facilities Maintenance’ screen by typing ‘GEDFACLT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details:

Facility Branch

By default, the system displays the branch code in which facility has been created.

Liability Number

Specify the Liability number here.

Line Code

Specify the Line Code to which the liability ID is to be associated with. Allocating credit limits for the Line-Liability combination can be done. The customer(s) who fall under this Liability Code avails credit facilities under this Credit line.

By linking a Credit Line to a Liability code the customer also gets linked to the Credit Line. This is true because a Liability code has been assigned to every credit seeking customer and the credit facilities granted to the customer are defined and tracked with this code.

You can either enter the Line Code or take from a LOV which picks the Line Code details maintained in the ‘GEDLNCOD’ screen.

Serial Number

Each time a Liability - line code combination is specified, Oracle Banking ELM system always defaults 1 as serial number. Thus, for every new record entered for a Liability No-Line Code combination, a serial number is defaulted to 1. The Liability - Line- Serial number forms a unique combination for facility identification.

Note

If a second facility is created with the same line code then an error appears on save. To create multiple facilities, you can also select the line code from the LOV and default the values by clicking on ‘Populate’ button. Then value of line code can then be changed and save.

Description

Give a brief description of the facility here.

Main Line Code

Specify the main line code if the created facility is a sub line.

If the main line code is not specified, then the system defaults the line code as the main line code.

Line Currency

Specify the currency in which the facility is defined. The currency that has been selected have the following implications:

- The limit amount that has been specified for this Line-Liability combination is taken to be in this currency.

- The line that has been defined is available for Utilization only in the line currency, unless specified otherwise under Currency Restrictions in this screen.

Once the entry is authorized you cannot change the currency.

If the limit allotted to this Line-Liability combination can be utilized by accounts and transactions in currencies other than the limit currency, the limit utilization is arrived at by using the mid-rate for the currency pair as of that day.

Category

Select the facility category from the list available here.The list displayed here is based on maintenance done in 'Category Maintenance' screen.

Class Code

Select fee class from class code adjoining option list.

Revaluation Required

Identifies if the facility has to revalued or not.

Rate Agreement Required

If this check box is selected, then rates are taken based on FX rate fixing. If this check box is not selected, then rates are taken from 'Currency Exchange Rates Input' screen based on the maintenance done in ‘Global Exposure Parameter’ screen.

The system picks the rate/rate code and updates the utilization across the facility linked to the contracts.

Revolving Line

Select this check box to indicate that the credit line is Revolving. A revolving credit line indicates that a repayment of the utilized credit should reinstate the credit limit of the customer. You can modify the preference, as required.

Netting Required

This check box is deselected by default, indicating that netting is not required for the facility. You can select this check box to enable netting for the facility.

Unadvised

Select this check box to indicate that the facility is unadvised.

Note

Charges can be collected on the utilization transactions for facilities that are unadvised. For this purpose SDEs ADVISED_LINE and COMMITMENT_CUR_UTIL can be used while setting up the charge rule at the CL product creation level.

Funded

Indicate whether the line is fund based or non fund based.

Shadow Limit

Select this check box to indicate that utilization amounts should be updated only for the facility and mainlines for the facility. Thus, when a utilization request is processed, the system updates the utilization amount only at the facility level and leaves the utilization amount at the liability level untouched.

The mainline and sub-lines of a facility need to have the same preference. This implies that you can enable this option for a sub-line only if the mainline has this option already enabled. Similarly, you cannot create a sub-line as a ‘Shadow Limit’ if the mainline does not have this facility.

Note

You cannot modify this option after you authorize the facility.

Bulk Payment Required

Select this check box to indicate if bulk payment is required. If you specify here that bulk payment is required for the liner, then the same is maintained at the ‘Bulk Payments’ screen.

For more information about the ‘Bulk Payments’ screen, refer to the section, ‘Making Bulk Payments against loan or commitment’ under the Chapter ‘Operations’ of the ‘Retail Lending’ user manual.

Note

You can use this feature if ELCM standalone has FCUBS as the product processor.

User Defined Status

Specify status of the facility (For example, NORM for normal, BLOCKED, and so on) from the list available here The list displayed here is based on maintenance done in 'User Define Status Summary' screen.

Status Changed Date

Specify the date on which you want to change the status. You can specify a date before the line start date to block the line till the specified date. In addition, you can set a date prior to the application date.

Internal Remarks

Specify the internal remarks as limits terms and conditions.

Utilization Tracking

It signifies if the utilization tracking of the facility is done locally or globally.

Amounts

Specify the following details:

Limit Amount

Specify the limit for the facility. If you have maintained schedules for limits, the system automatically updates the limit amount here on the dates specified for each limit in the schedule.

Collateral Amount

System defaults the Collateral Amount on save, based on the pools linked in the 'Pool Links' sub screen.

Transfer Amount

System displays the transfer amount resulting from 'Facilities Amount Transfer' transactions. The value displayed has either the sign "-" or "+", indicating whether the amount is transferred from or to the line. If the sign is "-", then the amount is transferred from the line and if it is "+", then the amount is transferred to the line.

Effective Line Amount

The system displays the effective line amount.

Effective Line Amount Basis

For defining drawing power of line the elements mentioned below are treated as the basis for the effective line amount calculation.

- Line Amount + Collateral

- Line Amount

- Minimum of Line Amount and Collateral

Note

EFF_LIMIT_AMOUNT can be used while setting up the IC rule for interest calculation based on facility effective limit amount.

Maintenance Value date

The value date on which facility amount is modified. That is, the date on which facility amount modified is earlier than ‘Line Start Date’ for an active credit line.

When an amendment is done on a facility like limit amount, basis, and so on, if maintenance value date is given as a back value date, modification takes effect from the given maintenance value date and appropriately value dated balance is updated. If maintenance value date is not entered during amendment, processing date is default updated. However, maintenance value date cannot be prior to line start date.

In case of future dated lines, any amendment done between the booking date and line start date, maintenance value date is updated as 'Line Start Date'.

Uncollected Amount

The system displays the uncollected amount.

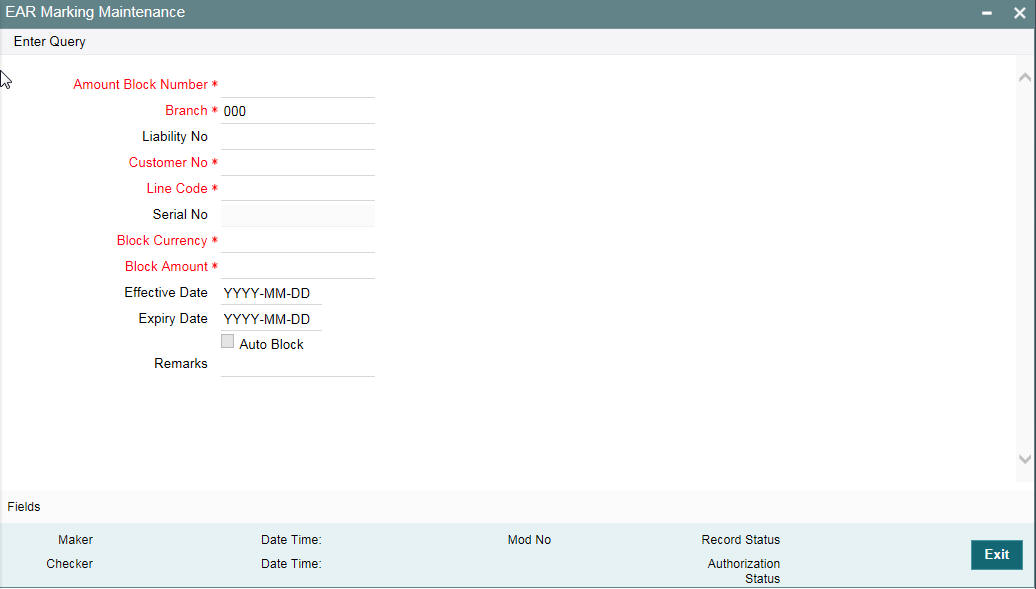

Block Amount

Specify the block amount.

Approved Limit Amount

This is the maximum limit amount allowed for the facility and must be specified whenever you maintain schedule limits. System ensures that neither the ‘Limit Amount’ maintained here nor the schedule ‘Limit Amount’, maintained as part of the limits schedule is greater than the limit specified here".

Max Daily Limit

Specify the maximum daily limit.

Daily Light Limit

Specify the daily light limit.

Utilization

This section contains the following details:

Available Amount

The system displays the available amount.

Date of First OD

The system displays the date of first OD.

Date of Last OD

The system displays the date of last OD.

Netting Contribution

The system displays the netting amount in GEDACCNT screen.

The system displays the netting contribution if:

- The facility is linked in the ‘Netting Account’ screen.

- ‘Netting Required’ is checked at Liability level, Facility level, and Netting Account level.

Last New Utilized Date

The system displays the last new utilized date.

Amount Utilized Today

The system displays the amount utilized on the current date.

Utilization Amount

The system displays the utilization amount.

Tanked Utilization

The system computes and displays the utilization amount that can be set in the 'Tanked Utilization' field.

As part of EOD process, the utilization amount is set in the 'Tanked Utilization' field.

During EOD process, this utilization amount is updated as indicated below:

- Based on the liability which is linked to the transaction as per the contract

- Based on the collaterals that is linked to the transaction.

- Based on the collaterals pool which is linked to the transaction.

After BOD process, the amount is cleared from the 'Tanked Utilization' field and it is updated in the utilization amount.

Processing future dated credit line

A future dated credit line is a credit line that has a value date later than the date on which it is booked. You can create credit line with value date as future date for the following lines.

- Main-Lines

- Sub-Lines

You can create future dated sub-lines only for active main-lines. Both main-line and sub-line cannot be created with future value date.

System validates that only active main lines can be linked to a future dated sub-line and only active lines are list in LOV against main line.

Availability

Specify the following details:

Line Start Date

Specify the line start date. If not specified, system defaults the line start date as the current application date. In case ‘Line Start Date’ is not specified line start date takes current application date. Once such a record is authorized, line start date cannot be edited.

However, if a line is created with future date, this ‘Line Start Date’ can be modified after authorization. However, modified date cannot be prior to current business date.

You can book a future dated credit line using ‘Line Start Date’.From this date the credit line becomes active. You cannot enter the back date, that is, the date prior to system date. If line start date falls on a holiday, an override message appears.Initiation event of the future dated facility is triggered on ‘Line Start Date’ with contingent entries.

Expiry Date

Specify the expiry date for the facility. If the limit amount assigned to the facility is not utilized within the specified expiry date then the Available check box remains deselected. This freezes the line for the respective liability.

The freezing of the line code is part of the Oracle Banking ELCM EOD Batch.

The Oracle Banking ELCM system does not allow the expiry date of a facility to exceed the expiry date of linked collateral(s).

When a Facility record is saved, the system compares the expiry date of all the collaterals in the Pool which is linked to the Facility. An error message is shown if any expiry dates are less than the expiry date of the Facility.

If the expiry date falls on a holiday maintained in the branch, then system displays the error message ‘Facility Expiry Date falls on a branch Holiday’.

The facility shall not be available on the maturity/expiry but you can modify the facility on the expiry date if required.

Available

If the Line facility is available then this check box is selected.

The Oracle Banking ELCM system tracks the status of both the Contract and the Facility. When the status of the Contract changes to PDO, then the Facility becomes unavailable.

This check box is disabled if the ‘Line Start Date’ is provided as future date, that is the credit line is in inactive state. It is enabled on the date when the credit line becomes active.

The product processor gives an ASCII file including all the facilities which need to be frozen. Oracle Banking ELCM initiates an amendment event and then deselects the 'Available' check box.

Book Date

Specify the date on which the credit line is booked in the system. The system date is defaulted. You cannot modify this date.

Note

Amendments to facility between booking date and line start date is considered at the time of initiation of contract on line start date

Available check box gets automatically selected on line start date BOD and facility is available for utilization.

Availment Date

Specify the availment date on which the first utilization should take place. If the limit amount assigned to the facility is not utilized within the specified availment date then the available check box is disabled. This freezes the line for the respective liability.

Exception

Specify the following details:

Exception Transaction Amount

Specify the Exception transaction amount. During utilization transaction when the utilization amount crosses the specified exception transaction amount, there is a breach of the limit amount. This is a credit exception in the transaction. You can use the ‘Multi-authorisation’ screen for authorising such a transaction.

Note

The utilization transaction can also be authorized or rejected using the "Multi Authorization Maintenance screen based on the system configuration.

Exception Breach Percentage

Specify the Exception Breach Percentage. During utilization transaction when utilization amount crosses the specified Exception Breach Percentage, there is a breach of the limit amount. This is a credit exception in the transaction. You can use the ‘Multi-authorisation’ screen for authorising such a transaction.

Note

The utilization transaction can also be authorized or rejected using the ‘Multi Authorization

Maintenance’ screen based on the system configuration.

Limit Status

Select the status of the limit from the adjoining drop-down list. The options available are:

- Active

- Closed

- Frozen

Next Review Date

Based on the review frequency, the system displays the next limit review date. This date is derived by adding the frequency days to the current date.

If you do not select any of the provided review frequency and set it to blank, then you need to manually enter the next review date.

The next review date must always be before the facility expiry date.

Review Frequency

Select the frequency at which the limit should be reviewed. The options available are:

- Monthly

- Quarterly

- Half yearly

- Yearly

- Blank - if you select this, you need to specify the next review date.

Closure Reason

Specify the reason for limit closure. The system also displays the closure reason based on CAM process flow.

Freeze Reason

Specify the freeze reason of the limit. The system displays this based on CAM process flow.

Note

The following SDEs are not applicable for ELCM based interest calculation.

- ELCM based interest calculation SDEs,

- Limit_Amount, Eff_Limit_Amount

- Matured_Amount - If you repay the already utilized amount, then the repay credit will update on the Matured_Util field of the 'Getm_facility' table.

Note

In case of granular access, facility details maintained for allowed list of customers are allowed to view, query, modify, authorize, re-open, copy, delete, and so on based on the user/users preferences selected in ‘Access Group Restriction’ tab available in the ‘User Maintenance’ screen. For more information, refer to Common Core - Security Management System User Guide.

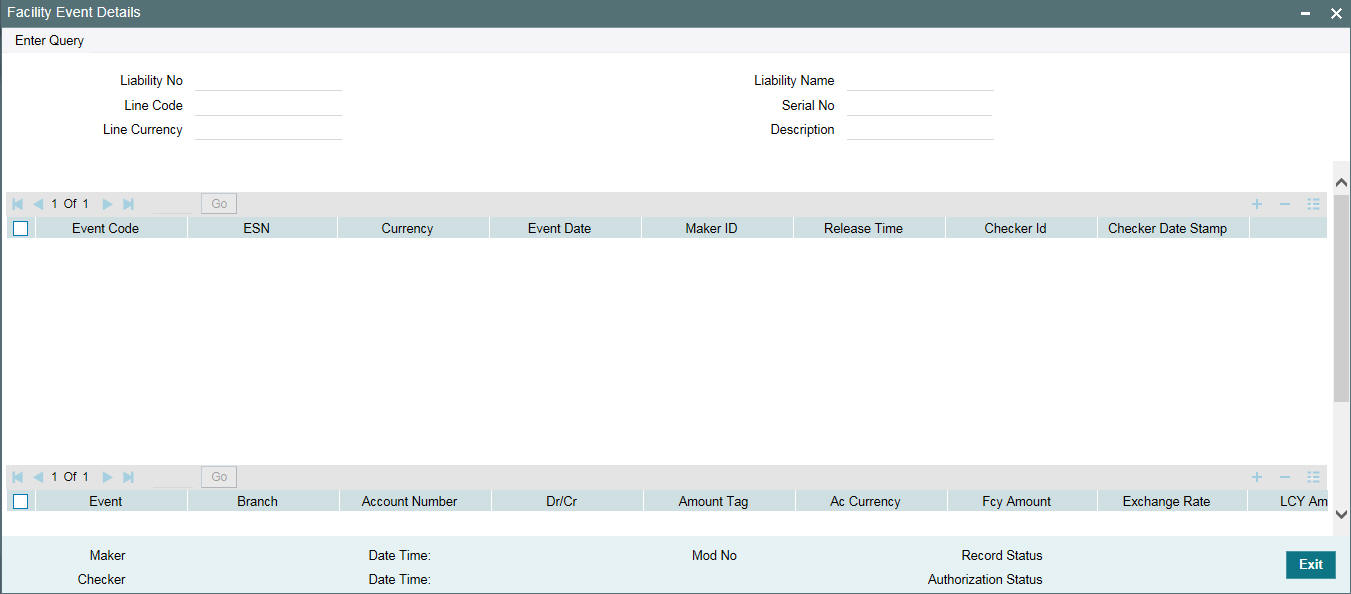

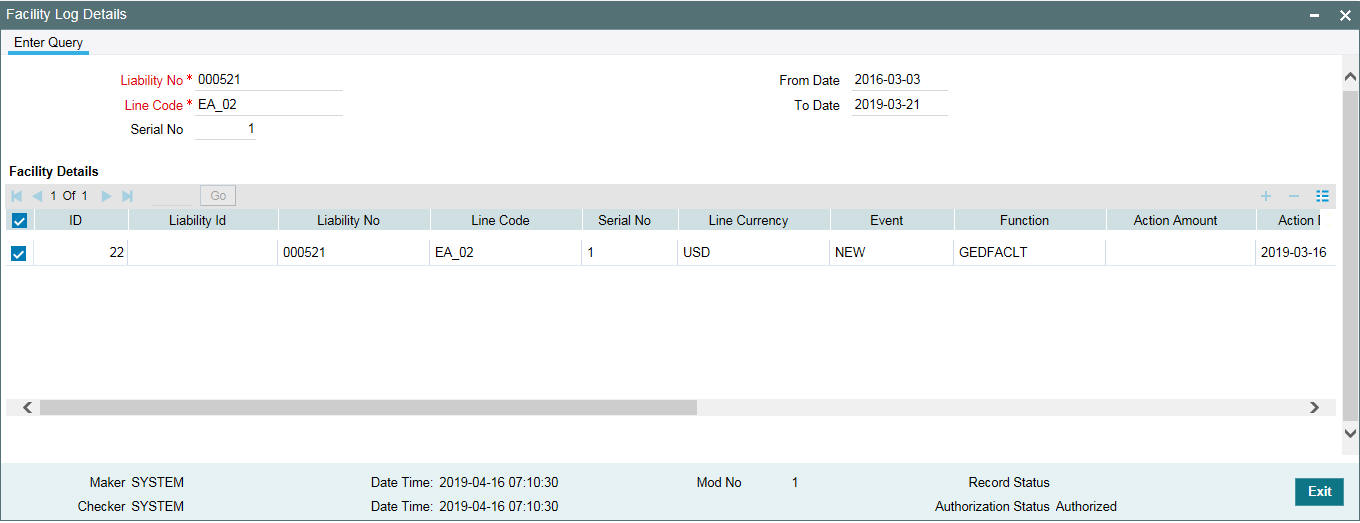

2.2.1 Maintaining Facility Event Details

The 'Facility Event Details' screen is used to view the event details related to the facility online.

You can click ‘Events’ button or type’ GEDFEVNT’ in the field at the top right corner of the application toolbar and click the adjoining arrow button to invoke this screen.

Liability No

Facilities have to be linked to a liability. Specify the liability number for which the facility is linked.

Liability Name

Specify the liability name.

Line Code

Specify the line code to be used for facility. If a line code is linked to a facility then it is required to track the limits of the linked line.

Serial No

Indicates the ELCM generated unique identifier for the facility. The ‘Serial No’ field is disabled and it gets defaulted from the ‘Facilities Maintenance’ screen.

Line Currency

Specify the currency in which the facility is defined. The currency that has been selected have the following implications:

- The limit amount that has been specified for this Line-Liability combination is taken to be in this currency.

- The line that has been defined is available for Utilization only in the line currency, unless specified otherwise under Currency Restrictions in this screen.

Once the entry is authorized you cannot change the currency.

If the limit allotted to this Line-Liability combination can be utilized by accounts and transactions in currencies other than the limit currency, the limit utilization is arrived at by using the mid-rate for the currency pair as of that day.

Description

Specify the facility description.

Event details can be fetched based on the following filter conditions.

- Liability Number

- Line Code

- Serial Number

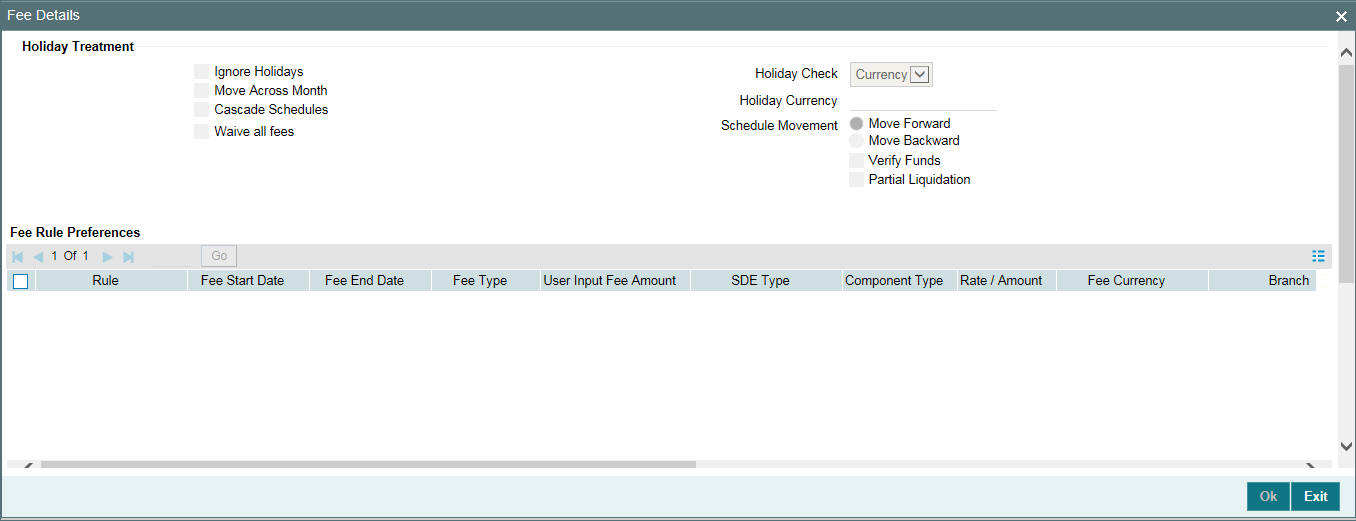

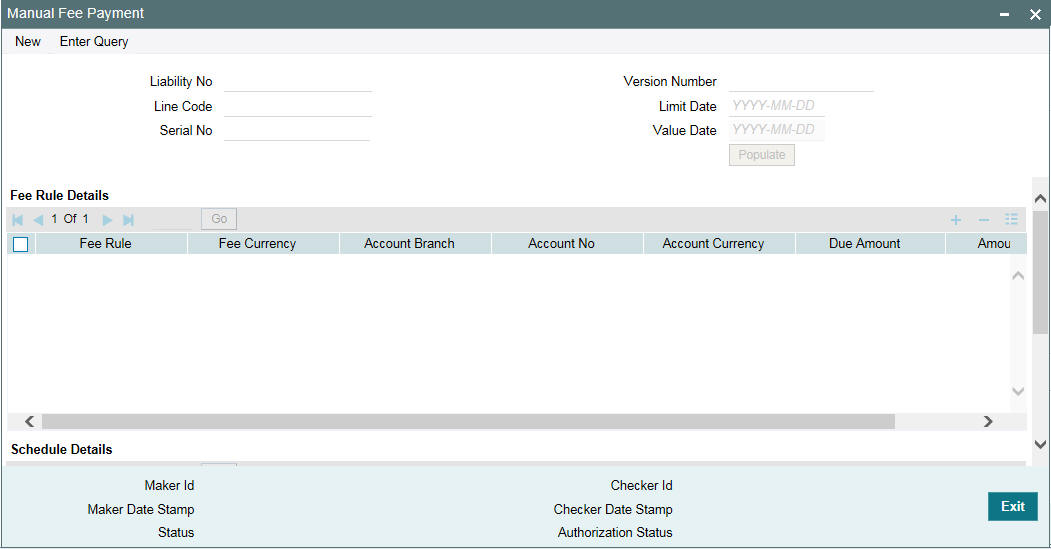

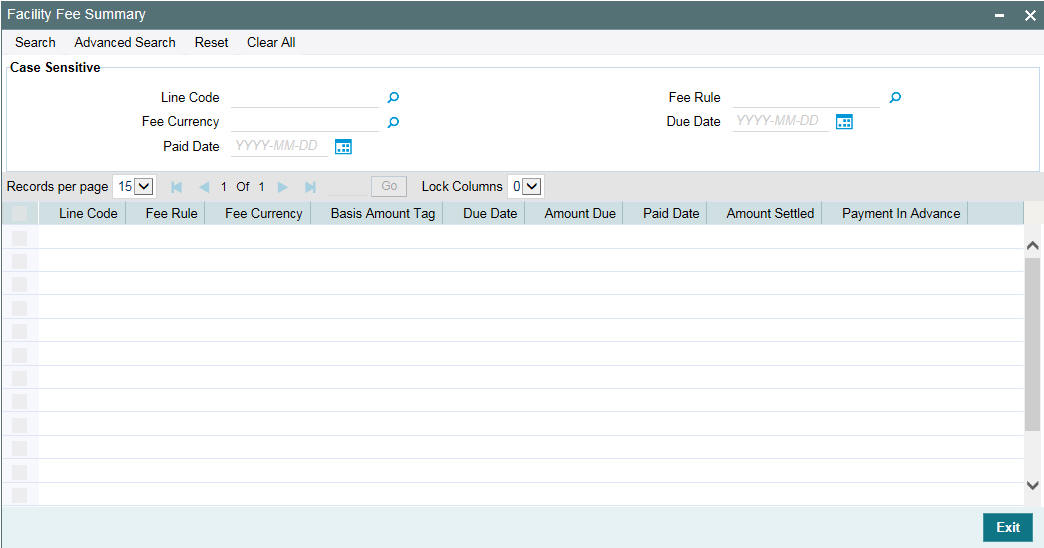

2.2.2 Maintaining Fee Details

You can add fee details on the facility maintenance using ‘Fee Details’ screen. To invoke this screen, click ‘Fee Preference’ button on the ‘Facility Maintenance’ screen.

Fee Rule Preferences

Specify the following:

Holiday Treatment

Ignore Holidays

If this check box is selected, then holiday treatment is not applied to calculate the next date. If this check box is not selected, then ‘Holiday Preferences’ settings are validated.

Move Across Month

If this check box is selected, then the system moves the date to next month. If this check box is unselected, then the system moves the date to next date.

Example

Working Day |

30-Aug |

1-Sep |

Holiday |

31-Aug |

|

Schedule Movement |

Move Forward |

|

Calculated Next Date |

31-Aug |

|

In above mentioned example, if ‘Move Across Month’ is selected, then the system moves next date to 1-Sep. If ‘Move Across Month’ is not selected, then the system changes next date to 30-Aug.

Schedule Movement

Move Forward

In case calculated next date is holiday then date should be moved forward. In this case fee liquidation moves to 1st Sep which is next working date.

Move Backward

In case calculated next date is holiday then date should be moved backward. In this case, fee liquidation moves to 30th Aug which is previous working date.

Verify Funds

You can select this check box if ECA check is required. If this check box is selected, then liquidation of fees follows the ECA process (as opted for full or partial liquidation). If this check box is not selected, then the system does a force post for all fees components.

Partial Liquidation

If this check box is selected, then partial liquidation/recovery is allowed based on the balance amount of fees available in CASA. If this check box is not selected, then system will opt to recover full amount of fees and will not try for partial liquidation/recovery in case of insufficient CASA balance.

Note

If this check box is selected and ‘Verify Funds’ check box is not selected, then an error appears on save of facility. If this check box is not selected and ‘Verify Funds’ check box is selected an override appears on save of facility and then full liquidation happens. Only if both the check boxes are selected then partial liquidation is allowed.

Cascade Schedules

If cascade schedules is selected, then the next date is calculated on based on previous schedule date instead of start date.

If fee liquidation date for one of the liquidation cycle is changed based on holiday processing setting and if cascade schedule is selected future liquidation dates of corresponding fee gets modified as per the newly arrived liquidation date.

Holiday Check

If holiday treatment is applicable, then you can select ‘Local’, ‘Currency Holiday’ or ‘Both’ based on your holiday maintenance.

If 'Both' is selected and 'Branch' or 'Currency' is holiday, then holiday processing setting is considered.

Holiday Currency

If holiday check is maintained as ‘Currency’ or ‘Both’ then currency code to be maintained here.

Rule

Click 'Populate' of the 'Facility Maintenance' screen to display the fee rules linked to the fee classes in the 'Fee Preference' sub-screen.

Fee Start Date

Specify the date from which the fee needs to be calculated. If fee start date is left blank, then 'Line Start Date' is defaulted. The fee start date cannot be before 'Line Start Date'.

Fee End Date

Specify the date, till the fee needs to be calculated. If it is blank, on save system defaults the 'Line Expiry Date' as 'Fee End Date'.

Fee Type

Displays whether the 'Fee Type' is 'Rate' or 'Amount'. These values get defaulted from the 'Fee Rule Maintenance' screen.

User Input Fee Amount

The fee amount is entered if the fee is of ‘User Input Fee’.

SDE Type

If the fee is based on any SDEs, the SDE which is linked to that fee is displayed.

Component Type

Indicates the ‘Slab’ or ‘Tier’ fee component type. This value is fetched from the GEDRULES.

Rate Amount

Specify the applicable fee rate or amount. For ‘Slab’ component type both fee rate and amount are applicable whereas for ‘Tier’ component type only fee rate is applicable.

Fee Currency

The system defaults the fee currency as line currency on facility creation. It is a read -only field.

Branch

Indicates the Branch code. You can either enter the branch code or select the branch code from the adjoining option list.

Account Number

Account number configured in 'Fee Class Maintenance' screen (customer debit) for the corresponding fee rule which gets defaulted in this field. If required you can modify.

Select the account number from the adjoining option list. A list of all valid accounts related to customer linked to liability are displayed here.

Account Currency

Once you select the account number, the account currency is defaulted.

Liquidate Method

The liquidation method of fee maintained in 'Fee and Accounting Class Maintenance' screen, whether it is 'Arrears' or 'Advance' is displayed here.

Liquidation Preference

The liquidation preference of fee maintained in 'Fee and Accounting Class Maintenance' screen whether it is 'Auto' or 'Manual' is displayed here.

Start Date

The date in which the fee has to be liquidated is defaulted from 'Fee and Accounting Class Maintenance' screen.

Start Month

The month in which the fee has to be liquidated is defaulted from 'Fee and Accounting Class Maintenance' screen.

Waived

While maintaining a facility, we can waive the specific fee linked to class in the fee preference.

Defer Liquidation

If an individual fee in a facility is to be deferred for a fee liquidation cycle, then this check box allows you to defer liquidation of fees attached to a credit line.

Defer check box is not selected by default at the time of facility creation. If defer check box is selected during facility creation, entering defer liquidation days is mandatory.

Likewise for a fee which is attached during facility creation, defer check box is available for selected as part of amendment for the particular liquidation cycle.Fee which is marked as deferred gets liquidated on the deferred liquidation date after that the defer check box gets cleared and defer liquidation days field is blank which gets enabled if you mark the fee of next liquidation cycle as defer.

Defer Liquidation Days

The number of days fee liquidation is to be deferred. That is, number of days after which fee is liquidated from its original liquidation date.

Note

- Defer fee liquidation is applicable for all fees with 'Liquidate Method' as ‘Arrears’ and 'Liquidation Preference' as ‘Auto’.

- Defer fee liquidation is not applicable if the fee 'Liquidation Frequency' is ‘One time’ or ‘Daily’. If liquidation frequency is ‘Monthly’/’Quarterly’/’Half Yearly’/’Yearly’, then the maximum number of days deferred can be 30.

- Defer fee liquidation is not applicable for fees with 'Liquidate Method' as ‘Arrears’ and 'Liquidation Preference' as ‘Manual'.

- Deferment of fee liquidation is applicable only for the current fee cycle. Not applicable for future or previous fee cycles.

- Fee liquidation event and entries are triggered on the new liquidation date.

- Backdated utilizations triggers fee re-calculations only for the current cycle. It does not affect the previous cycle fees (both fee calculations and accruals). The fees, which have been liquidated (non-deferred) or are to be liquidated on new deferred date is not recalculated.

- For fees with holiday processing applicable, new deferred liquidation date is arrived at by adding the defer number of days to the original liquidation date calculated based on applicable holiday processing rule. However, if the deferred liquidation date falls again on a holiday, fee liquidation event is triggered on the same day with accounting.

- ECA processing considers the new fee liquidation date as a result of deferred fee liquidation.

Effective Dates

Specify the dates from which the fee rate details are applicable for the specific fee linked in the ‘Fee Rule Preference’ screen.

Fee Rate Details

Specify the following:

Basis Amount

Specify the fee basis amount.

Rate

Specify the fee rate in percentage

Amount

Specify the fee amount.

External Pricing Required

This value is defaulted based on the class selected in 'Fee and Accounting Class Maintenance' screen and you cannot modify this value.

Compute Ext Pricing

This button is enabled only if ‘External Pricing Required’ check box is selected in ‘Fee Rule Maintenance’ screen. You need to provide the effective date for fee component and click ‘Compute Ext Pricing’ button. The system fetches the pricing value for the date selected from the external pricing and billing system.

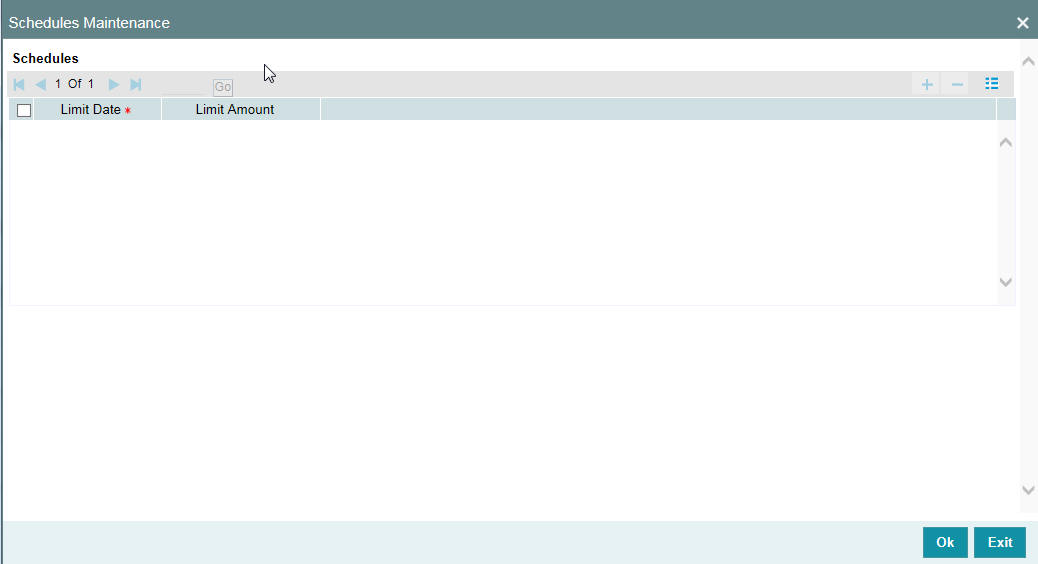

2.2.3 Maintaining Limit Schedules

The limit assigned to a customer under a revolving line can be reduced. You can define these details while maintaining limits for a customer. From the Facilities Maintenance screen, click ‘Schedules’ button.

For a liability code and credit line combination, you can define limit schedules and indicate the limit that is applicable for the period. You can enter a negative limit amount. However, the ‘Limit Date’ should not be earlier than the ‘Limit start date’ and later than the ‘Limit Expiry Date’.

The Facility batch which runs at BOD checks the limits schedule for a facility and if a schedule is due on the current date in the branch. If so, it updates the limit amount for the facility for which the schedule is due with the schedule limit amount.

Limit Date

Specify the limit date. The limit date cannot be earlier than current business date.

The limit date cannot be earlier than 'Line Start Date'. It should be future date of 'Line Start Date'.

Schedules Limit Amount

Specify the limit amount for the specific limit date.

You need to enter details in this screen only for transactions that involve a Tenor (Example, Loans, Money market transactions, and so on). Through this screen you can specify a list of Tenors and the associated limit that tenor based transactions can utilize under this line.

For example, you have defined a limit schedule for a facility for your client ABC Corporation where the Limit Amount initially is USD 1 million and the start date for the facility is Jan 01,2009. The schedule is as shown below:

Limit Date |

Limit Amount |

February 01, 2009 |

500000 |

March 02, 2009 |

800000 |

April 03, 2009 |

400000 |

May 04, 2009 |

900000 |

In this case, during BOD on Feb 01, 200r, the limit mount is updated to USD 500,000 and on Mar 02, 2009 it is modified again to USD 800,000. If the batch does not run on Mar 02, 2009, it will be run on Mar 03, 2009. Accordingly, the ‘Scheduled Limit Amount’ defined for Mar 02, 2009 Schedule is updated as Facility Limit Amount.

During EOD, the system processes limits schedules and revision process takes place for the facilities as per the scheduled date. It processes the limit schedules till next working day and marks all the schedules till date as processed.

When the Facility Start Date and Schedule Date falls on the same day, then on save of Facility record, you get an override message for confirmation on updating the limit amount of Facility as per the schedule amount.

While processing, if there are any errors or overrides, it should be logged. The following are the possible errors:

- Available amount is negative for the facility.

- The Tenor Limit Amount exceeds the Line Approved Limit Amount as the validation of the Tenor Limit Amount is against the Approved Limit Amount.

- The amount cannot exceed the overall limit specified for the liability id.

- The Main Line Limit cannot be less than any of its Sub Line Limit.

- The Sub Line Limit cannot exceed the Main Line Limit.

Example

Assume the following:

- Liability - GROUPLIAB

- Line - SHTLLIMIT

- Serial - 1

- Start Date - 01-Jul-2009

- Limit Currency - USD

- Limit Amount - 50000

Schedules:

Limit Date |

Limit Amount |

15-July-2009 |

60000 |

28-July-2009 |

65000 |

30-July-2009 |

75000 |

15-Aug-2009 |

80000 |

- System Date - 14-Jul-2009

- Limit Amount - 50000

- On 14-Jul-2009 EOD, limit revision process takes the 15-Jul-2009 schedule and update 60000 as limit amount. The revised limit is enforced or effective on 15-Jul-2009.

- System Date - 15-Jul-2009

- Limit Amount - 60000

Schedules:

Limit Date |

Limit Amount |

15-July-2009 |

60000 |

28-July-2009 |

65000 |

30-July-2009 |

75000 |

15-Aug-2009 |

80000 |

- System Date - 27-Jul-2009

- Limit Amount - 60000

- Next working Day - 30-Jul-2009

On 27-Jul-2009 EOD, the limit revision process picks 28-Jul-2009 and 30-Jul-2009 schedules and update 75000 as limit amount. The revised limit is enforced / effective on 30-Jul-2009.

- System Date - 30-Jul-2009

- Limit Amount - 75000

Schedules:

Limit Date |

Limit Amount |

15-July-2009 |

60000 |

28-July-2009 |

65000 |

30-July-2009 |

75000 |

15-Aug-2009 |

80000 |

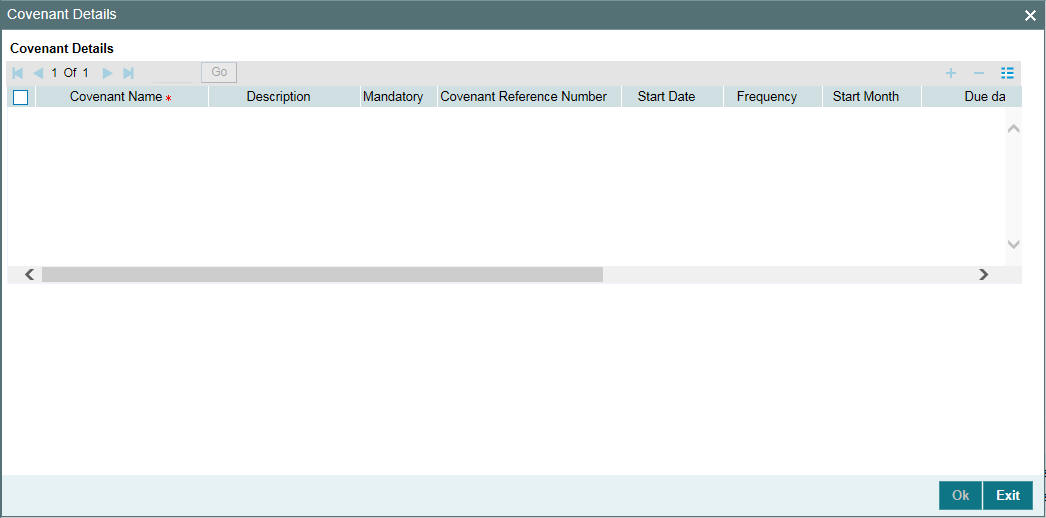

2.2.4 Specifying Covenant Details

The covenant details can be captured for facility in the ‘Covenant Details’ screen. Click ‘Covenants’ to invoke this screen.

Multiple covenants can be entered in the screen shown below. You can customize the details of each covenant recorded here.

Covenant Name

Select the covenant name from the list available here. The list displays the covenant names maintained in Covenant Maintenance screen. Based on the covenant selected, all other details of the covenant maintenance will be brought here.

Mandatory

Mandatory/Non mandatory details are shown on choosing a covenant name. You may change this.

Covenant Reference Number

Indicates the covenant reference number.

Start Date

Start date is defaulted to current business date when covenant is linked to a facility and you cannot modify it.

Frequency

Frequency of the specified covenant is defaulted here based on the details maintained at ‘Covenant Maintenance’ screen.You may change the frequency shown here on choosing a covenant name.

Start Month

Start month of the specified covenant is defaulted here based on the details maintained at ‘Covenant Maintenance’ screen. You may change the 'Start Month' shown here on choosing a covenant name. Start month is mandatory when frequency is quarterly and above.

Due date

Due date of the specified covenant is defaulted here based on the details maintained at ‘Covenant Maintenance’ screen. You may change the Due Date shown here on choosing a covenant name. Due date is mandatory when frequency is monthly and above.

Revision Date

Indicates the date on which covenant has to be revisited for review.

Revision date is derived by system and updated when covenant is saved – based on combination of start date + (combination of frequency and due date and start month).

Examples for the revision date calculation of different frequencies.

System date -5th April 2019

- Daily-6th April 2019

- Weekly-12th April 2019

- Monthly-10th May 2019 (Due date provided-10)

- Quarterly-2nd June 2019 (Due date provided-2, Start month- June)

- Half yearly-1st Feb 2020 (Due date provided-1, Start month-Feb)

- Yearly- 10th July 2020 (Due date provided-10,Start month-July)

System date -5th August 2019

- Daily-6th August 2019

- Weekly-12th August 2019

- Monthly-10th September 2019 (Due date provided-10)

- Quarterly-2nd June 2020 (Due date provided-2, Start month- June)

- Half yearly-1st Feb 2020 (Due date provided-1, Start month-Feb)

Yearly- 10th July 2020 (Due date provided-10,Start month-July)

Notice Days

Specify the notice days, that is, the number of days prior to revision date of the covenant. The period during the notice days are the notice period. Notice days are mandatory when frequency is weekly and above. You can change the Notice Days details which are displayed here on choosing a covenant name

Grace Days

Specify the grace days, that is, the number of days after the revision date of the covenant that the covenant will be available for tracking. You can change the Grace Days details which are displayed here on choosing a covenant name.

Remarks

Remarks if any specified for the covenant at the ‘Covenant Maintenance’ screen are defaulted here. It can also be changed here.

Covenant Reference Number

Indicates the covenant reference number.

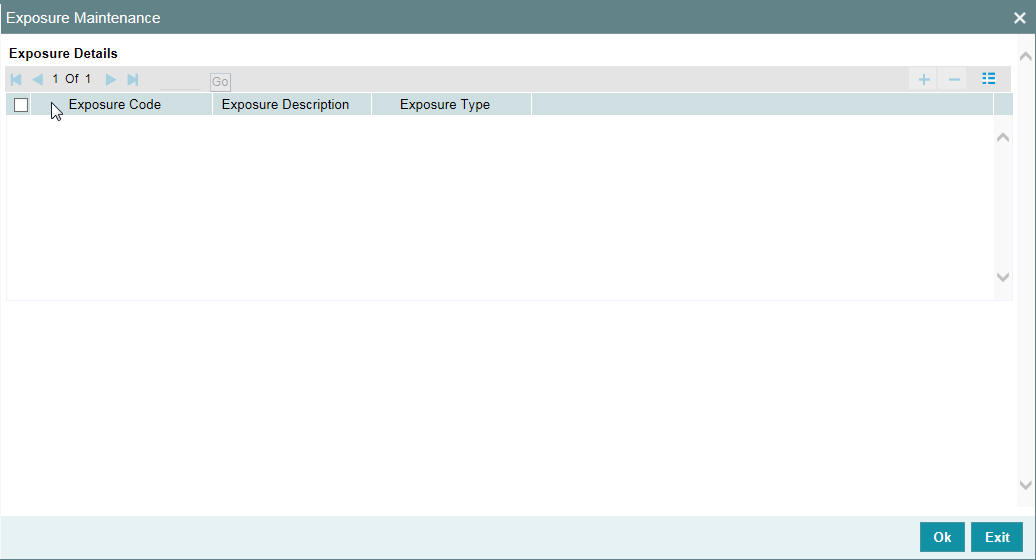

2.2.5 Tracking Exposure for a Line

The facility defined can be tracked for particular exposures.

The exposure details can be captured for facility in the ‘Exposure Details’ screen. Click ‘Exposure’ to invoke this screen.

Exposure Code

Select the exposure code from the option list available here. The list displays the exposure codes maintained in Exposure Maintenance screen. Based on the exposure selected, all other details of the exposure maintenance is displayed here.

Description

The system displays the description of the selected exposure code.

Exposure Type

The system displays the exposure type to which the selected exposure code is associated.

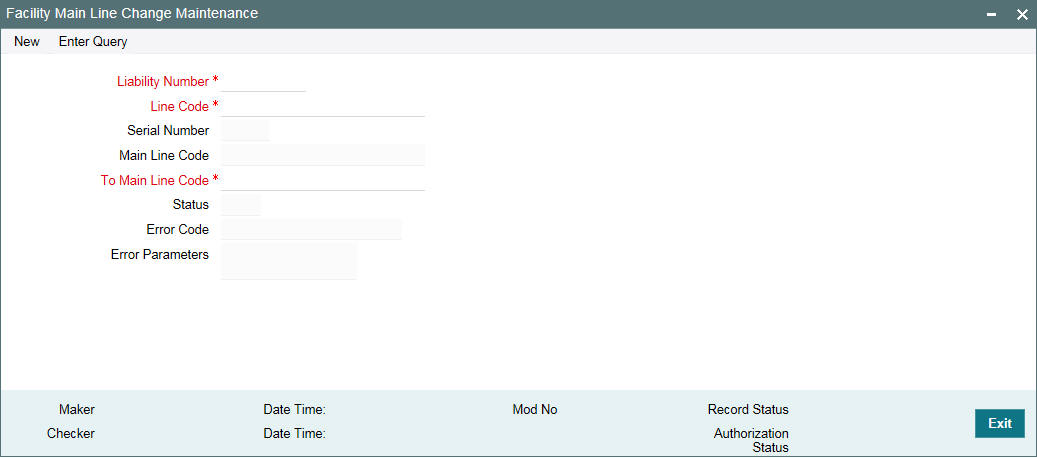

2.2.6 Capturing Facility Main Line Change Maintenance Details

In case, if the main line has been changed, the utilization transactions linked to the sub-line also needs to be changed. Using this screen, all the utilization transactions done in facility which has a main-line change, would reflect the utilization transaction changes in the new main line. These changes happen after processing EOD.

You can invoke the ‘Facility Main Line Change Maintenance’ screen by typing ‘GEDFMLCG' in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Liability Number

Specifies the liability number of the utilization transaction. Specify the valid liability number available in the ELCM system.

Line Code

Specify the Line Code to which the liability ID is to be associated with.

Serial Number

Each time a customer - line code combination is specified, ELCM module assigns a unique serial number to the combination. This serial number is unique to the line-liability code combination. Thus, for every new record entered for a Line-Liability combination, a new serial number is generated. The Line - Liability - Serial number forms a unique combination.

Main Line Code

Specify the main line code if the created facility is a sub line. If the main line code is not specified, then the system defaults the facility code as the main line code.

To Main Line Code

The new main line code to which the utilized amount is transferred.

Status

The status of the line is displayed.

Error Code

Specifies the error code of the transaction.

Error Parameters

Specifies the error parameters associated to the transaction.

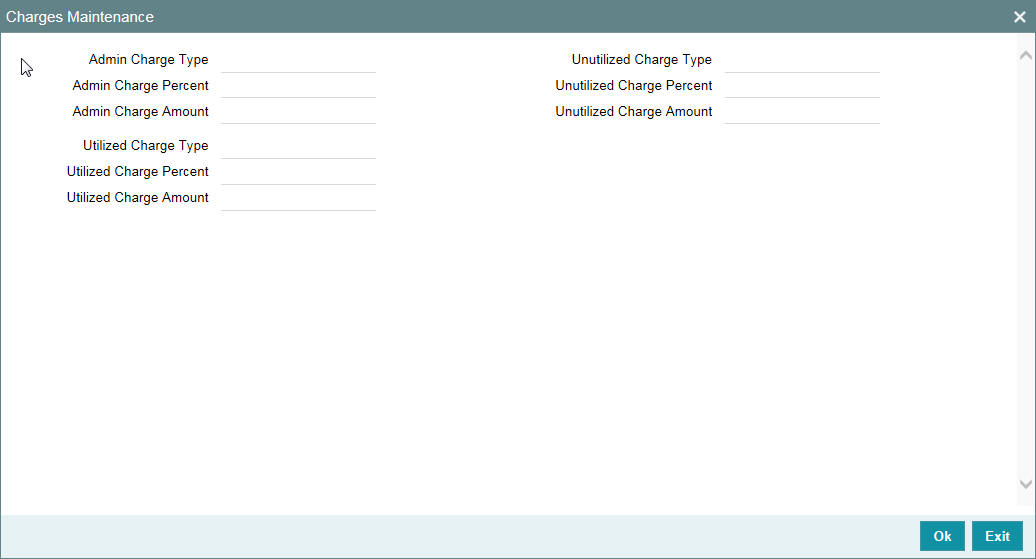

2.2.7 Capturing Facility Maintenance Charges Details

To capture facility maintenance charge details, click ‘Charges’ button.

Admin Charge Type

Administrations charges as a part of creation of new line can be specified here. Charge can be a fixed amount or a percentage of the Limits amount.

Unutilized Charge Amount

Specify the charge amount that has to be collected on a certain frequency (daily, monthly, and so non) based on the unutilized amount. Charge can be a fixed amount or a percentage of the unutilized amount.

Utilized Charge Amount

Specify the charge amount that has to be collected on a certain frequency (daily, monthly, and so on) based on the utilized amount. Charge can be a fixed amount or a percentage of the utilized amount.

Note

‘Charge’ sub-screen captures the details and stores it. However, this information does not have any impact on the processing of charges in the application.

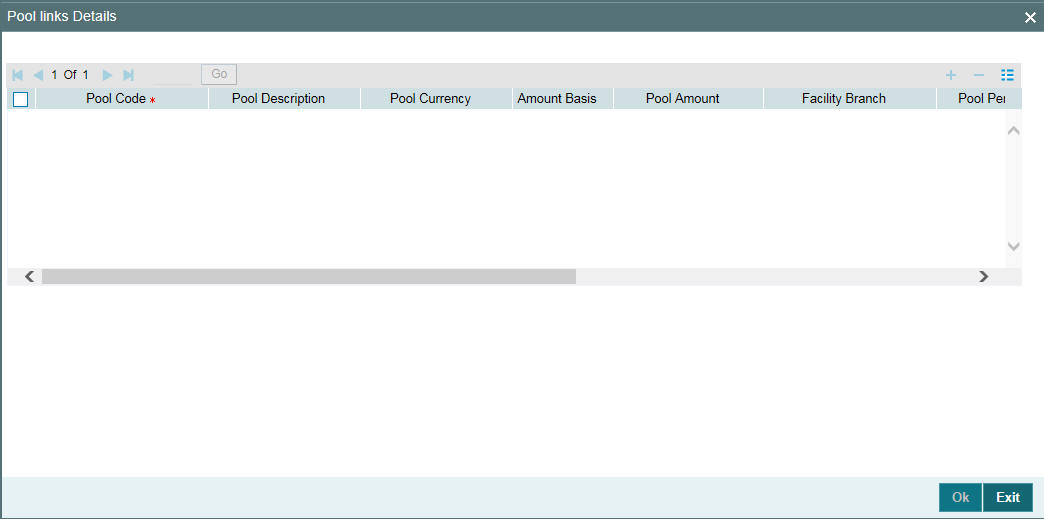

2.2.8 Maintaining Collateral Pool Linkages

For collateral Contribution in Total Effective line amount, the pool code maintained for that particular Liability ID has to been linked, which can be achieved using this sub-screen. From the Facilities Maintenance screen, click on the ‘Pool Links’ button.

Pool Code

Select the pool code from the adjoining list. The list displays all the pool codes associated for that liability ID.

Pool Description

System displays the pool description based on the selected pool code.

Pool Currency

System displays the pool currency based on the selected pool code.

Amount Basis

You can either select ‘Percentage’ or ‘Amount’

If 'Percentage' is selected, then system allows you to enter the percentage only and not the 'Linked Amount'. The 'Linked Amount' is appropriately calculated by the system and it is not editable. The value of the percentage must be from range 0 to 100.

If 'Amount' is selected, then the system allows you to enter the amount only and not percentage. When amount is entered, the system appropriately calculates the percentage. Ensure to maintain amount in positive.

If the 'Amount Basis' is selected as ‘Amount’ and 'Collateral Pool Value' is modified, then the percentage linked gets recalculated based on the modified 'Collateral Pool Value'.

You can modify the linkage at facility level from percentage to amount and vice-versa.

The system ensures that total of pool value linked to one or multiple facilities is not more than the collateral pool value.

Pool Amount

System displays the pool amount based on the selected pool code.

Facility Branch

Select the branch code from the adjoining list.

Pool Percentage

System displays the pool %.

Linked Amount

System displays the facility amount In Pool currency.

Pool Percentage and Linked Amount

In case 'Collateral Pool Value' is increased in 'Collateral Pool Maintenance' screen, then the 'Linked Amount' is modified only if the 'Amount Basis' is 'Percentage'.

If the 'Amount Basis' is 'Amount', then the 'Linked Amount' is retained as is. However based on the changed 'Collateral Pool Value', the 'Pool Percentage' is re-calculated considering the retained amount.

In case 'Collateral Pool Value' is decreased, modified amount of collateral pool is validated with all the 'Linked Amount' in various facilities (either percentage or amount) and if the total amount linked is less than modified amount then modification of collateral pool value is to be allowed. Wherever 'Percentage' is considered for linking collateral pool value to facility

If the 'Collateral Pool Value' decreased amount is less than the total 'Linked Amount' in various facilities, then an appropriate error message appears.

Facility Currency

System displays the facility currency

Linked amount in Facility Ccy

System displays the facility amount.

Percentage Of Contract

System displays the percentage of contract.

Pool Linkages multi entry block does two functions:

Firstly, on clicking ‘Plus’ button you can link one row of the available pool amount (that is, Pool amount – Pool Utilized) to that Line code for which the collateral contribution is required. Secondly, it displays at any point in time the pool amount (in percentage terms) utilized by various Line Codes and Contracts.

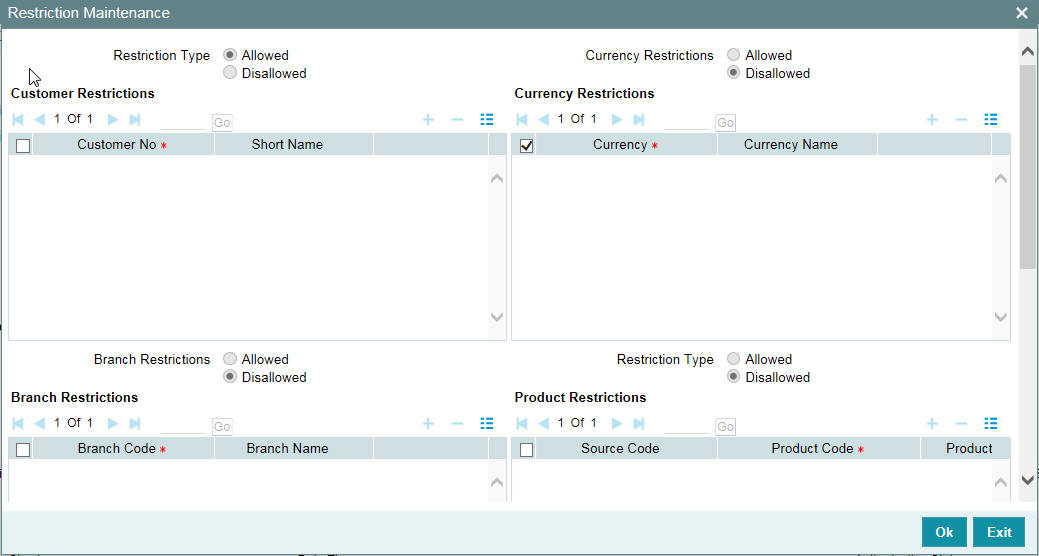

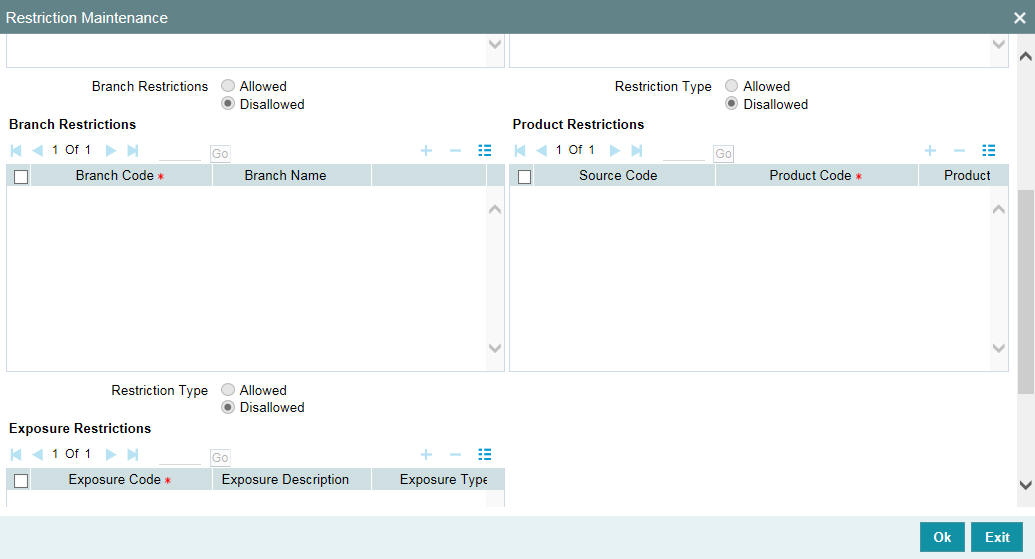

2.2.9 Maintaining Restrictions for a Line

By default, all customers, branches, and products maintained in your bank can utilize the limit defined for a credit line. You can also define the limit for a line in any currency. However, you can opt to restrict the limit available under a credit line to specific customers, branches, products and currencies.

You can define these restrictions in the Limits Restrictions screen. To invoke this screen, click ‘Limit Restrictions’ button from the Facilities Maintenance screen.

Restriction Type

Select the restriction type for each restrictions defined for the facility from the following options:

- Allowed

- Disallowed

Customer Restrictions

Customer No

Select the customer number from the adjoining option list.

Short Name

Specify the short name for the customer.

Currency Restrictions

Currency Code

Specify the currency code for the Currency Restriction.

Currency Name

System displays the currency name for the currency, as maintained in the 'Currency Definition' screen based on the selected 'Currency Code’.

Branch Restrictions

Branch Code

Specify the branch code for the Branch Restriction.

Branch Name

System displays the branch name for the branch, as maintained in the 'Branch Parameters Maintenance' screen based on the selected 'Branch Code’.

Ext System Restrictions

External System

Specify the external system for the External System Restriction.

Description

System displays the description for the external system, as maintained in the 'External System Maintenance' screen based on the selected 'External System' chosen Exposure Restrictions

Exposure Name

Specify the exposure name for the Exposure Restriction.

Exposure Description

System displays the description for the exposure, as maintained in the 'Track Exposure Maintenance' screen based on the selected 'Exposure Name'.

Product Restrictions

Product Code

Specify the product code for the Product Restriction.

Product Description

System displays the description for the product based on the selected 'Product Code'

2.2.10 Maintaining Customer Restrictions for a Line

To recall, you can assign a limit to a Line - Liability combination. A liability code can have several customers linked to it. By default, the line that you define is available to all customers linked to the liability code.

You can restrict the limit available under this line-liability combination to specific customers. If you choose the restriction type as 'Allowed', click on the ‘Plus’ button and select the customer code from the list to indicate that they are allowed to use the line. If you choose the restriction type as 'Disallowed', click on the ‘Plus’ button and select the customer code from the list to indicate that they are not allowed to use the line. Once you choose restriction type as 'Allowed', you can restrict a customer(s), from using the credit under a line by highlighting the code that identifies the customer and clicking on the ‘Minus’ button". You can remove the restrictions earlier imposed on a customer, that is, (allow a restricted customer usage of the limit under a line). To allow a restricted customer usage of a line, select the customer code from the list and click on the ‘Plus’ button.

2.2.10.1 Maintaining Branch Restrictions for a Line

You can restrict the usage of a credit line that you have defined to certain branches of your bank. If you choose the restriction type as 'Allowed', click on the ‘Plus’ button and select the branch code from the list to indicate that those branches of your bank can use the line.If you are choose the restriction type as 'Disallowed', click on the ‘Plus’ button and select the branch code from the list to indicate that those branches of your bank are not allowed to use the line.

Once you choose restriction type as 'Allowed', you can disallow a branch(s) from using this line by selecting code that identifies the branch and clicking on the ‘Minus’ button. You can remove the restrictions earlier imposed on a branch that is, to allow a restricted branch usage of the limit under this line. To allow a restricted branch usage of a line, select the code that identifies the branch from the option list and click on the ‘Plus’ button.

2.2.10.2 Maintaining Currency Restrictions for a Line

Just as you can restrict the limit defined for a line to specific customers, branches, and products, you can restrict it to specific currencies. Once you choose the restriction type as 'Allowed', select the currencies to which you would like to restrict application from the available option list.The list of currency codes you choose in this field is described in the adjacent column.

To remove a currency from the list of allowed currencies, highlight the currency code and click on the ‘Minus’ button. To add a currency to the list of allowed currencies, click on the ‘Plus’ button, and choose the currency from the option list available.

2.2.10.3 Currency Restrictions at Facility Level

- Sub-line currency is one of the currencies allowed at main line level and the system does not allow you to create sub-line in any other currency.

- Allowed currencies at the sub-line level should be equal to or a sub set of the allowed currencies at the main line level.

- Once a utilization is linked to the sub-line or main line in a certain currency, you are restricted from removing the respective currency from the facility. The system throw an error that “Utilization Exist with the Currency. Hence it cannot be removed from the allowed currencies”.

- For a utilization attached to either the sub-line or the main-line directly, the system should check that the utilization currency is among the allowed currencies at the facility level, including that of the main-line. The same should be applicable for Block transaction. If it is different, system throws an error that “Utilization Currency is not an Allowed Currency at the Facility Level”.

- During block transaction, the system converts the currency in the block amount if Block and Facility (GEDFACLT) are in different currencies after considering the rate maintained at GEDPARAM

- If you provide the fixed/derived rate at the facility level (GEDFACLT), the same is picked up during the utilization for the currency conversion.

- When the main-line and sub-line are in different currencies, rate for conversion between sub-line and main-line is to be picked from GEDPARAM.

- The system checks the consistency of currency of the sub-line and allowed currencies at the main-line.

- The system ensures that the utilization currency is among the allowed currencies of the facility(ies) attached, including that of the main-line, in case the utilization is attached to sub-line.

2.2.10.4 Maintaining Exposure Restrictions for a Line

You can also define the types of exposures that should be allowed (or disallowed) for a line. Based on the list you maintain, the system displays an error message if a utilization request with a transaction exposure is received where the exposure for the facility is either disallowed or not maintained as part of the allowed exposures.

Indicate if the exposure codes that you are specifying should be allowed or disallowed. From the option list available, select the exposure codes. The system defaults the description of the chosen exposure codes. To remove an exposure code from the list, highlight the code and click on the ‘Minus’ button. To add to the list, click on the ‘Plus’ button, and choose the exposure code from the option list available.

While saving the record, if the exposures disallowed here are found to be linked to existing Facility Exposures or Customer Liability Exposures, the system displays an error message and does not save the details.

2.2.10.5 Maintaining Product Restrictions for a Line

You can define the types of products that should be allowed or disallowed for a line. To add a product to the list of allowed products, click on the ‘Plus’ button and select the Source and Product Code from the adjoining option lists. The system defaults the description of the chosen source and product code.

To remove a product from the list of Allowed Products, select the Product Code and click the ‘Minus’ button.

Note

System considers both the source and the product code to validate the restriction.

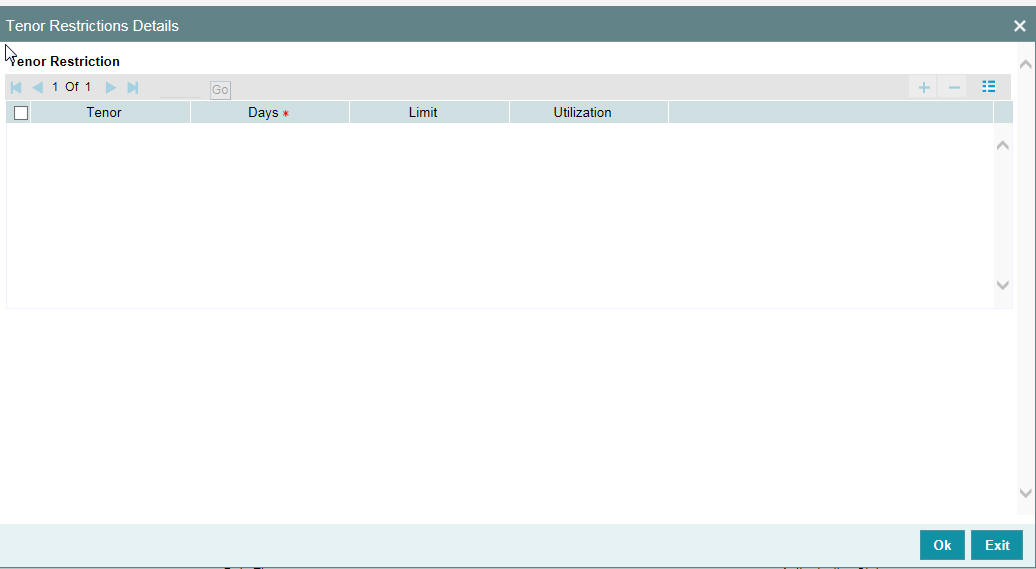

2.2.11 Defining Tenor Based Restrictions

You can define Limits based on the tenor of the contracts that utilize the limit.

Click ‘Tenor Restrictions’ button from the Facilities Maintenance screen to maintain Tenor restrictions for the limit you have specified for the Line-Liability combination.

Tenor

Specify the name of the tenor.

Tenor (Days)

Specify the number of days.

Limit

Specify the limit for the tenor in days.

Utilization

System displays the utilization amount for the specific tenor in days, based on the utilization of the facility in 'Schedules' sub-screen.

2.2.11.1 Maintaining Tenor Restrictions for a Main Line

For a main line, you can:

- Specify the list of tenor restrictions for which you would like to limit your exposure.

- Assign limits for the Tenor restrictions.

2.2.11.2 Maintaining Tenor Restrictions for a Sub-Line

You can define a sub-line tenor list and also define limits for each of them. To recall, a sub- line falls under the umbrella of the Main Line to which it is linked. Therefore, the maximum tenor that you define for a sub-line should not exceed the maximum tenor defined for the main line to which it is linked. The limit amount that you define for each sub-line tenor cannot be higher than the tenor limit defined for the main line to which it is linked.

Tenors and limits can be placed at both the sub-line and main-line levels. But the maximum tenor of a sub-line cannot exceed the maximum tenor defined for the main-line to which it is linked.

Example

You define a Line LOANS and link it to the Liability Code CREATIVITY INC. (the Liability and the Customer Code in this case are the same). The limit set for this line - LOANS is $ 1million.

- Main Line Code

- Loans

You define a credit limit of $ 1 million for Creativity Inc. under this Credit Line. You also specify the tenor Restrictions for the line to be the following 30D, 60D, and 90D.

Main Line Tenor List |

Limit |

30D |

0.5M |

60D |

0.3M |

90D |

0.25M |

The loans that this customer can avail can be further classified into Short, Medium, and Long

Term Loans.

For our example we shall make Short Term, Medium Term and Long Term loans as sub-lines under the Main Line Loans. It is only when you link these credit lines to the Credit Line Loans that it becomes a Main line.

Sub-line code

- STLOANS

- MTLOANS

- LTLOANS

You can define a tenor list and have tenor based limits for both the Main Line and Sub-lines. So we shall also maintain tenor based limits for the sub-line STLOANS (as shown in the table below):

Sub- line Tenor List |

Limit |

30D |

0.3M |

60D |

0.2M |

90D |

0.1M |

You can add to the list of tenors maintained for a Main Line by specifying the Tenor restriction under the head Tenor and clicking on the ‘Plus’ button. If you want to remove a tenor restriction from the list of tenor restrictions highlight it and click the ‘Minus’ button.

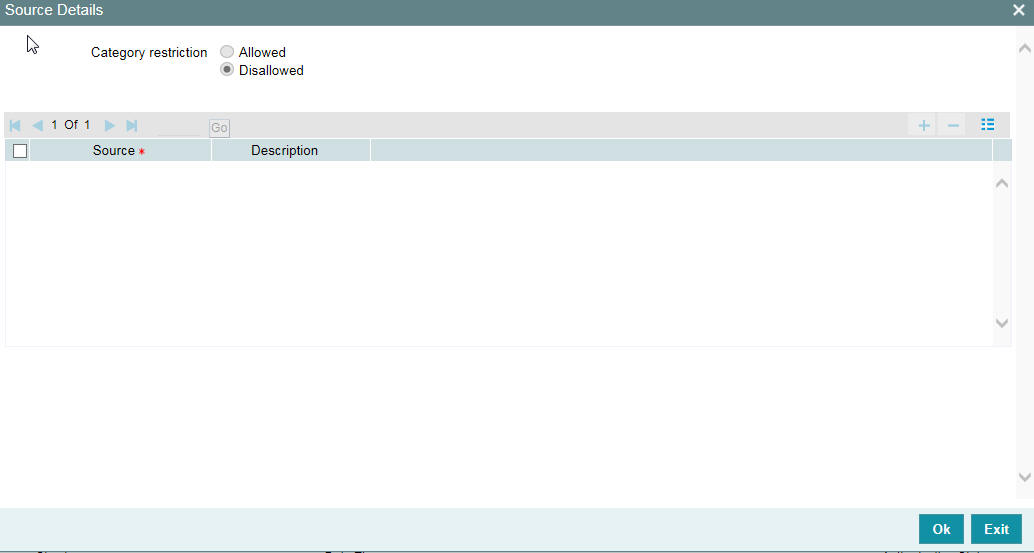

2.2.12 Maintaining Source Restrictions

You can specify which sources are allowed or restricted to access the facility in ‘Source Restrictions’ screen. Click on ‘Source Restrictions’ button in ‘Facilities Maintenance’ screen to invoke this screen.

Restriction Type

To maintain an allowed list of liability restrictions choose the ‘Allowed’, option. To maintain a disallowed list of liability restrictions, choose the ‘Disallowed’ option.

Default value of this field will be’ Disallowed’. If you select restriction type as ‘allowed’, then you have to input at least one record.

Source

Specify the source from the adjoining option list.

Description

Give a brief description about the System restriction here.

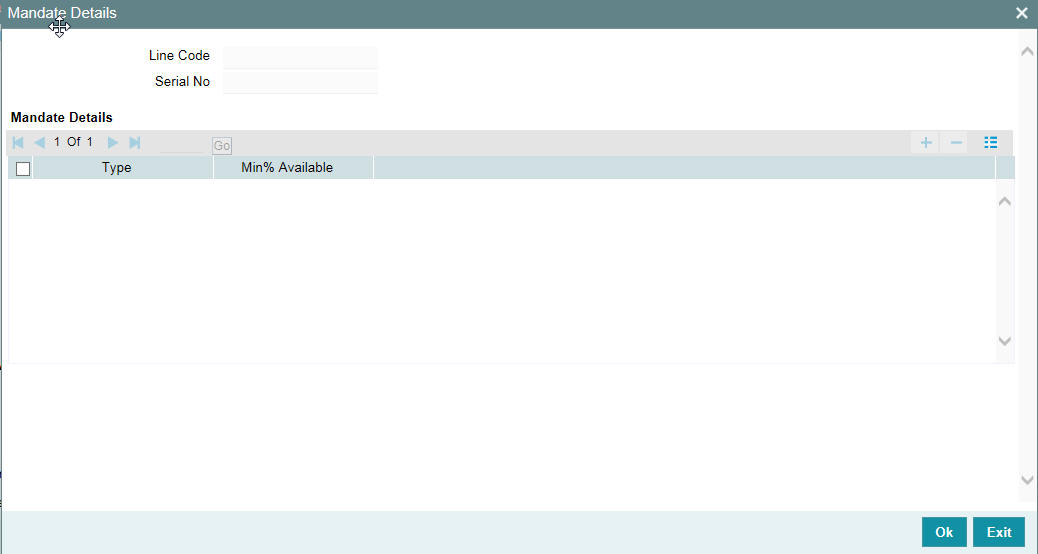

2.2.13 Maintaining Mandate Details

You can maintain mandate information for specific line codes using ‘Mandate’ screen. Click ‘Mandate’ button on ‘Facility Maintenance’ screen.

You can specify the following details here:

Line Code

Specify the line code for which the mandate has to be maintained. The system displays the line code from the main screen of facility.

Serial Number

The system displays the line serial number of the line code maintained.

Mandate Details

Collateral Type

Specify the collateral type required for validating mandate for the utilization transaction. The option list displays all valid collateral types maintained in the system. Choose the appropriate one.

You can add more rows to the list using add button.

Min % Available

Specify the minimum percentage of the specific collateral type to be collected while processing the utilization transaction against the line code specified. The system verifies whether the mandate percentage of the line utilization amount is greater than the collateral limit contribution. If the mandate percentage is higher, the system displays an override message. You may choose to continue or cancel the maintenance.

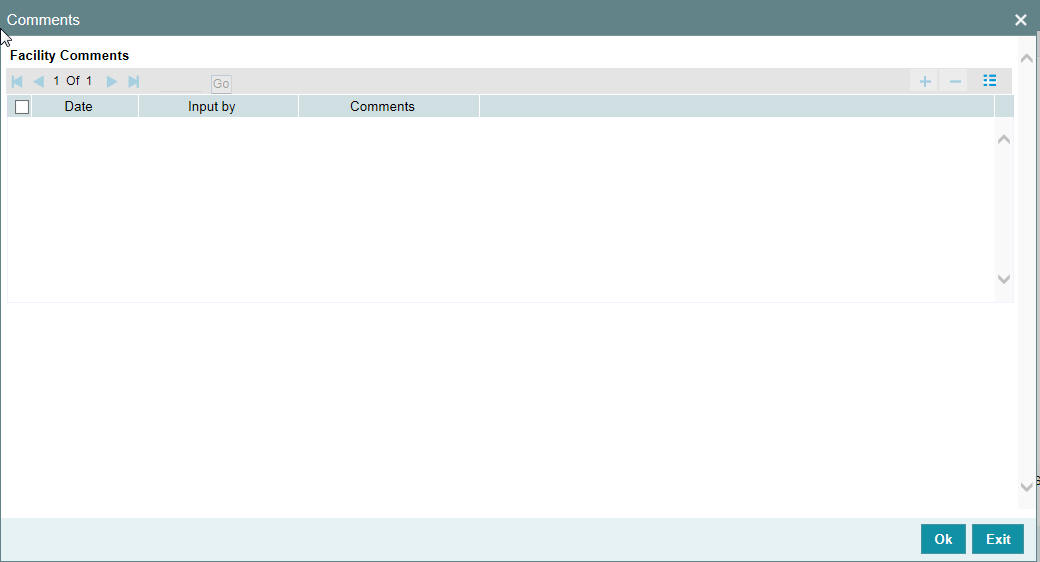

2.2.14 Comments on Facility

You can add your comments on the facility maintenance using ‘Comments’ screen. To invoke this screen, click ‘Comments’ button on the ‘Facility Maintenance’ screen.

Following fields are available for capturing the comments.

Date

The system displays the current system date.

Input by

The system displays the user ID of the user of the current session.

Comments

Type in the comments that you wish save. This is a free text field where you can type in your comments.

The comments that you maintain here is displayed in the Credit Desktop also. For details, refer to the chapter ‘Credit Desktop’ in this user manual.

Once you have captured the above details, click ‘OK’ button to navigate to the ‘Facilities Maintenance’ screen.

2.2.15 FX Rate Revaluation

You can access this screen by clicking ‘FX Rate Revaluation’ in ‘Facilities Maintenance’ screen.

The values in this screen gets defaulted from ‘Line Code Maintenance’ screen on providing the 'Line Code' which is saved in ‘Line Code Maintenance’ screen and clicking 'Populate'.

Or

You can enter the ‘Line Code’ in ‘Facilities Maintenance’ screen and provide the ‘FX Rate Revaluation’ details.

You can change these values. On saving a facility with the ‘Module’, ‘Product Code’ and ‘Currency Code’ combination, it cannot be modified further.

For more information about this screen, refer to ‘Maintaining Line Code details’ section.

2.2.16 Facility Credit Rating and History

You can access this screen by clicking ‘Credit Rating’ in ‘Facilities Maintenance’ screen.

Facility Credit Ratings

Agency Name

Select the credit rating agency name from the adjoining option list.

Credit Rating

Select the credit rating from the adjoining option list. You can maintain multiple external credit rating agencies for a single facility.

However, you can maintain only one internal credit rating agency for a single facility.

Primary

Select one of the Credit ratings as the primary rating for facility

The ratings from multiple agencies of external type can be assigned to a facility of which one should be marked as primary.

Only one internal credit rating can be maintained which by default is considered 'Primary'.

The internal credit rating marked as 'Primary' is shown in 'Internal Credit Rating' field of 'Facilities Maintenance' screen. Similarly, external credit rating marked as 'Primary' is shown in 'External Credit Rating' field of 'Facilities Maintenance' screen.

The modification of primary from one agency to another is allowed.

Note

When a primary credit rating at facility level is modified to a rating with a lower priority, then an alert is triggered. The alert of such facilities is displayed in the dashboard.

Effective Date

Specify the effective date while associating a credit rating to a facility.

It is mandatory to select the effective date while associating the credit rating. Effective date can be backdated and not future dated. For the same agency, multiple ratings cannot be assigned for the same effective date.

If multiple modifications are done for a particular agency with the same effective date, then the last modification is taken into consideration

Credit Rating Agency Type

Select the agency type as “Internal’ or External’. These values get defaulted from the ‘Credit Rating Agency Maintenance’ screen.

Facility Credit Rating History

Credit Rating and Effective Date

If the credit rating for a specific agency is modified along with the Effective date at a facility level, then the existing is recorded in the ‘Facility Credit Ratings History’ section.

2.2.17 Notifications

Notification sub-system enables the particular facility record to be a candidate for notification whenever the record is amended. At least one of the out of box supplied fields in notification sub-system to be enabled to bring this facility under the purview of generating notification. When values in field/s enabled for notification are modified as part of direct updating or as part of batch updating, all details of the facility is sent in the notification message along with old and new value details of the fields enabled for notification.

Notification messages are logged in a table with unique reference number. A new quartz job is required to read notification messages and publish it on configured queue/topic.

To configure the fields for notification message, click ‘Notification’ subsystem.

Field name |

Screen |

Modification |

Old value relevance |

Notification triggered when |

Limit amount |

GCDFACLT - main screen |

Direct/Batch |

Yes |

When limit amount changes |

Effective line amount basis |

GCDFACLT - main screen |

Direct |

Yes |

When effective line amount is changed |

Collateral amount |

GCDFACLT - main screen/Pool links |

Direct/Batch |

Yes |

When changes done in pool links screen or when collateral value changes |

Revolving to non-revolving |

GCDFACLT - main screen |

Direct |

Yes |

When revolving check box is selected/cleared |

Available amount |

GCDFACLT - main screen |

Derived value in screen when base value gets modified Direct/Batch |

Yes |

When available amount changes based on changes on account of utilization, blocking, limit amount changes, so on |

Utilization amount |

GCDFACLT - main screen |

Direct |

Yes |

Overall utilization amount changes |

Limit expiry date |

GCDFACLT - main screen |

Batch |

No |

When limit expiry date cross application date |

Limit date |

GEDFACLT - Schedules sub-screen |

Batch |

No |

On reaching the Limit date maintained at the Limit Schedule |

Covenant revision date |

GEDFACLT - covenants sub-screen |

Batch |

No |

When revision date is crossed and covenant expires |

Credit rating change |

GEDFACLT - credit rating |

Direct |

Yes |

When credit rating changes for an existing record. |

2.2.18 Change Log

You can see the history of all the facility changes that have happened for a selected facility. For each facility, you can view the record details, remarks, warnings, fields that are modified.

You should be able to view the details of particular record of that screen by using the change log button. The result should list all the modifications on the particular record.

In 'Change Log View' subsystem, you can only view the old and new values of the following fields and the dependent fields that are modified.

Records section

- Modification Number

- Modification Status

- First Authorization Status

- Authorization Status

- Maker Id

- Maker Date Stamp

- First Checker Id

- First Checker Date

- Checker Id

- Checker Date Stamp

- View Change

Remarks

- Maker Remarks

- Maker Override Remarks

- First Checker Remarks

- Checker Remarks

Warnings Section

- Warning Code

- Warning Description

Fields Section

- Field Name

- Old Value

- New Value

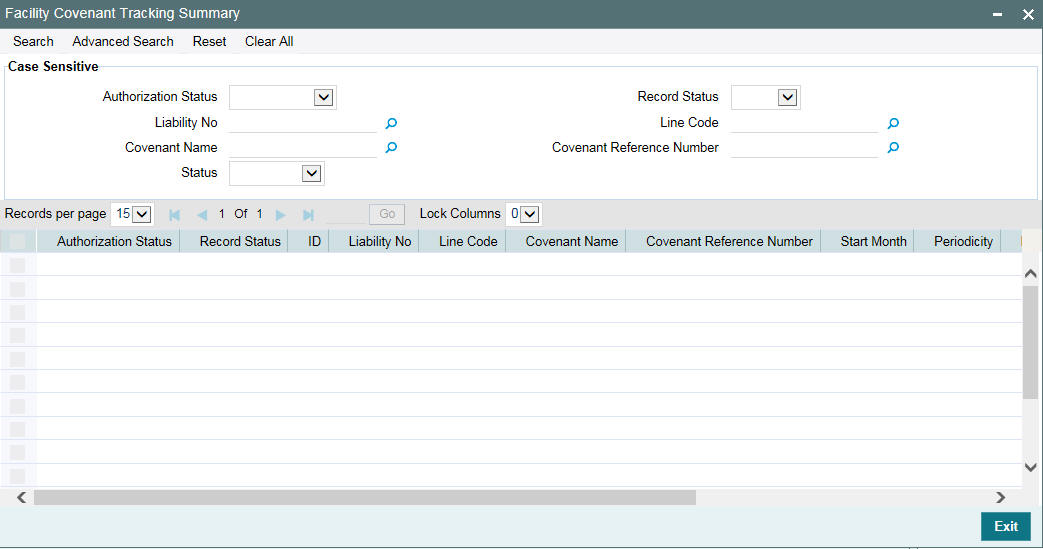

2.2.19 Viewing Facility Covenant Tracking Summary

You can view summary of covenants attached to the facility for tracking using the ‘Facility Covenant Tracking Summary’ screen. You can view applicable covenants for a particular facility from the list of covenants maintained in the system.

You can open detailed screen using this screen. You can query the records based on the search criteria.

You can invoke this screen by typing ‘GESCOVTR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

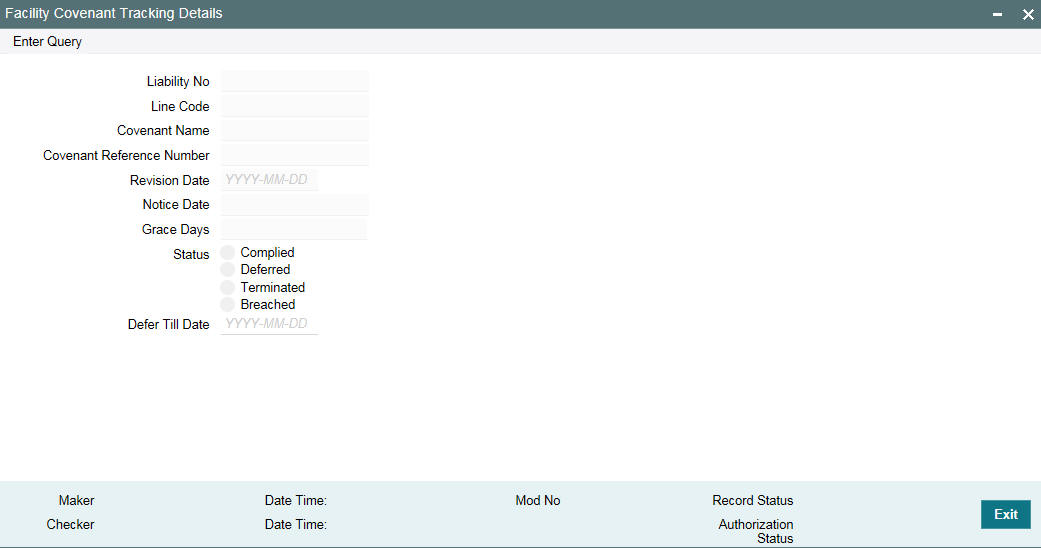

2.2.20 Tracking Facility Covenant Details

The captured covenants as part of facilities can be tracked using 'Facility Covenant Tracking Details' screen.

You can invoke the ‘Facility Covenant Tracking Details’ screen by typing ‘GESCOVTR’ (Facility Covenant Tracking Summary) and on clicking the queried record ‘GEDCOVTR’ (‘Facility Covenant Tracking Details’) is opened with the details of the covenant.

You can unlock and update the status of the covenant here.

Liability Number

Indicates the liability number for which the facility is linked.

Line Code

Indicates the line code.

Covenant Name

Indicates the covenant name.

Covenant Reference Number

Indicates the covenant reference number for the facility being maintained.

Revision Date

Indicates the date on which covenant has to be revisited for review.

Revision date is arrived by the system for a particular facility covenant based on start date + (combination of frequency & due date & start month) at the time of save.

Notice Date

Indicates the date on which covenants can be tracked for compliance before revision date in advance based on notice days configured.

Grace Days

Indicates the grace days for the next due/revision date allowed for facility covenant.Status

You can select the covenant status as the following:

- Complied

- If the status of the covenant is not compiled on or before revision date, then the status is updated as breached by batch process immediately after revision date.

- If the covenant has the grace days configured, compliance can be marked till the grace period end date. The status gets updated as breached only after grace period end date if compliance is not marked by then.

- Compliance on the breached covenant can be marked after which the covenant for next frequency is enabled with the next revision date duly considering the original revision date + frequency.

- Once compliance is marked for a particular frequency, record for the next frequency with blank status is available in DB and accordingly revision date get updated in collateral/facility

- Deferred

- Covenants can be deferred for a defined period during which time covenants are not available for tracking. When covenants are breached, it cannot be deferred. Deferment can be done before the covenant becomes breached.

- Terminated -

- Covenants can be stopped from further tracking by updating the status as 'Terminated'. Only covenants which are either complied or deferred status can be terminated. Breached covenants cannot be terminated.

- Breached

- Covenants which are not complied within next revision date is marked as breached.

- When covenants pertaining to multiple frequency are breached, all of them are available for tracking

Defer Till Date

In case the status is ‘Deferred’, then you need to specify this date

You need to specify the date so that covenants falling during this period are not tracked. After end of deferment date, covenants are applicable and available for tracking.

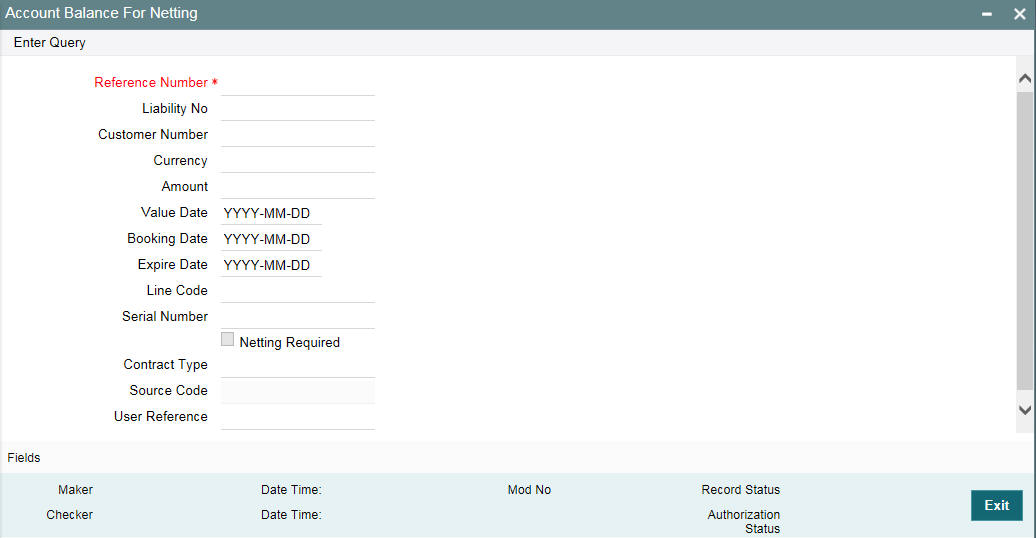

2.2.20.1 Including Netting Amount in Facility’s Netting Contribution

You can set the available amount under a Facility to include the Netting Amount too. To enable this feature you must check the ‘Netting Required’ check box in the following levels:

- Account Netting level

- Liability level

- Facility level

Once the netting option is enabled in the above levels the Netting amount maintained as a part of Account Netting screen is added to the available amount of the facility in facility currency. The netting amount field in the facility screen is displayed in the Netting Contribution field for the facility in facility currency.

Account Netting

When you authorize an account netting transaction with contract type ‘AC’ and netting enabled, then the netting amount is included in the facility in facility currency after netting has been enabled in Liability level & Facility level. Here the Netting Amount is updated accordingly.

When you modify an Account Netting Record and deselect the Netting check box, then the system automatically subtract the netting amount from the Available Amount and the Netting Amount for the corresponding facility

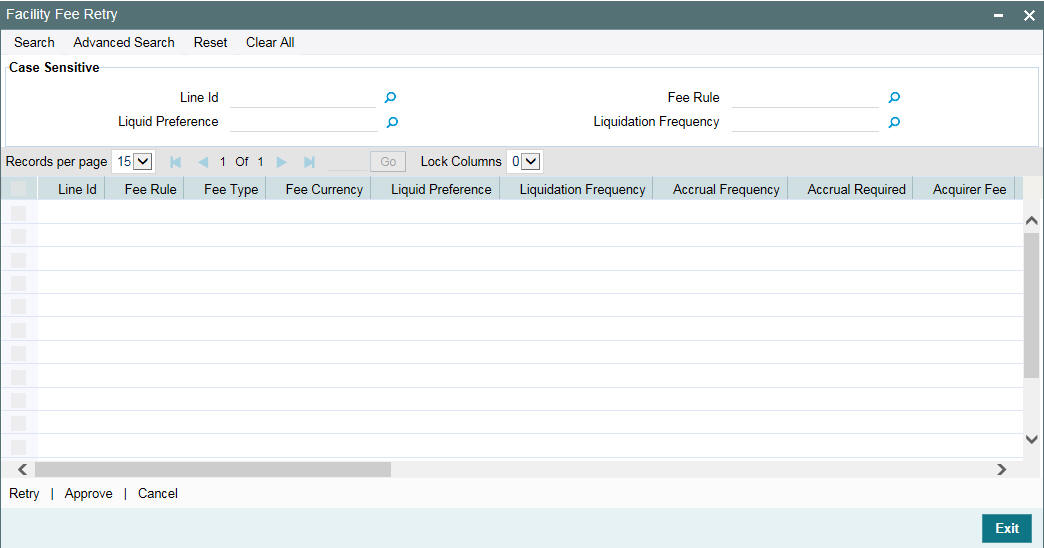

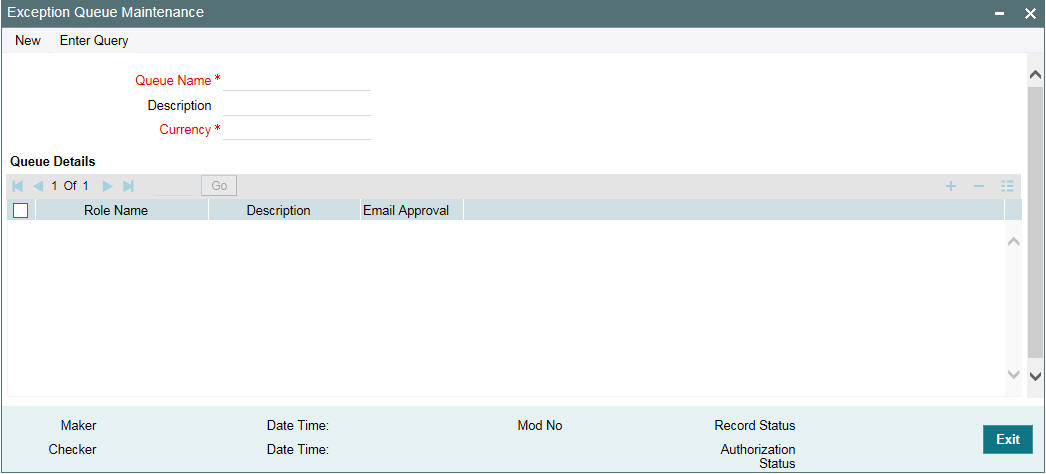

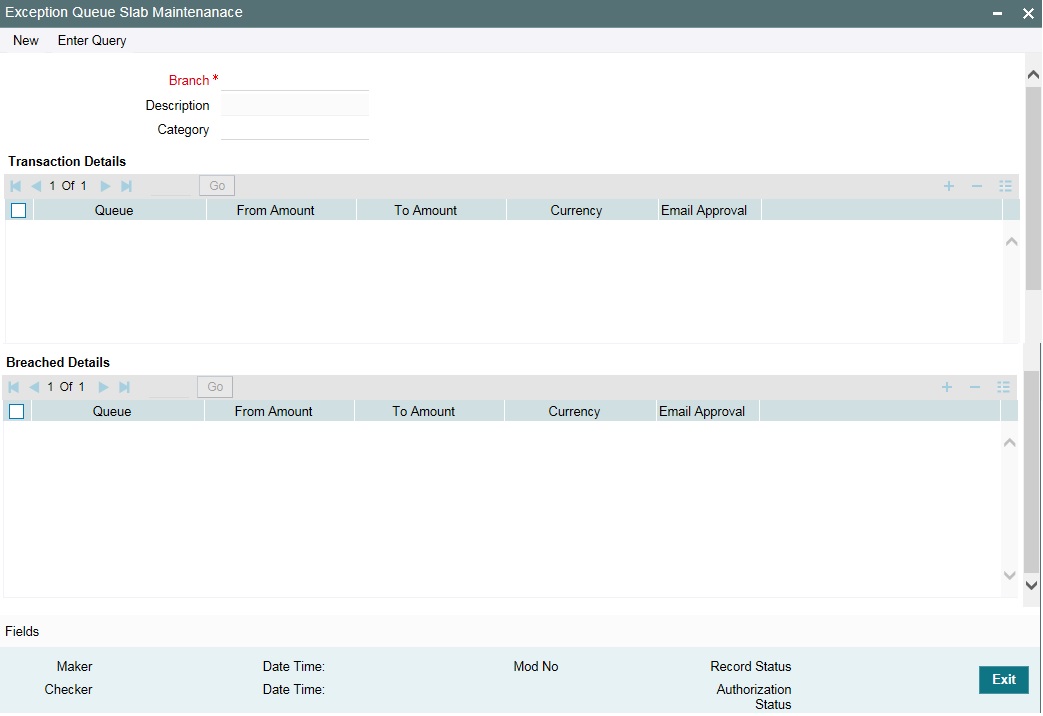

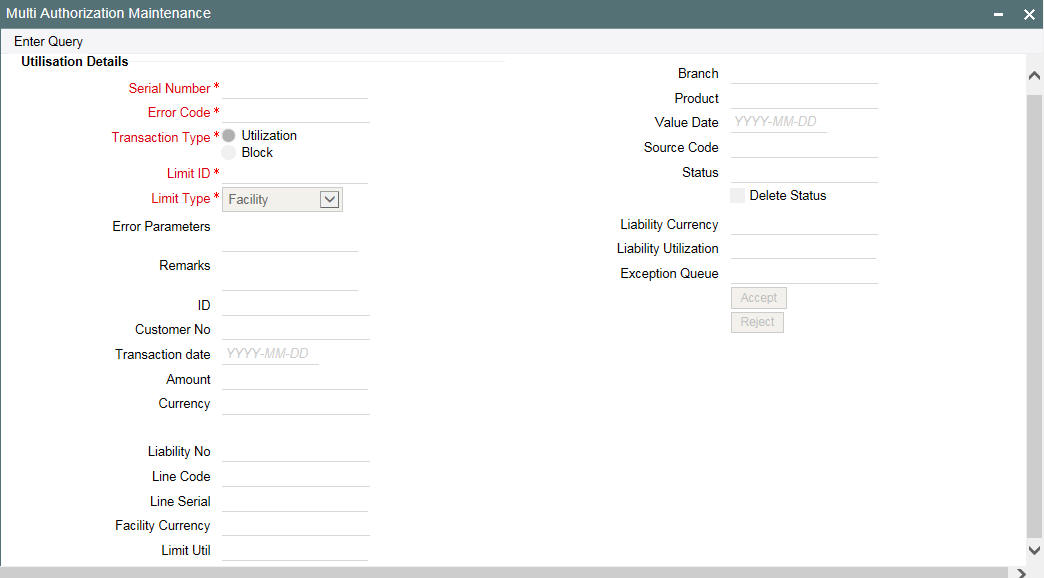

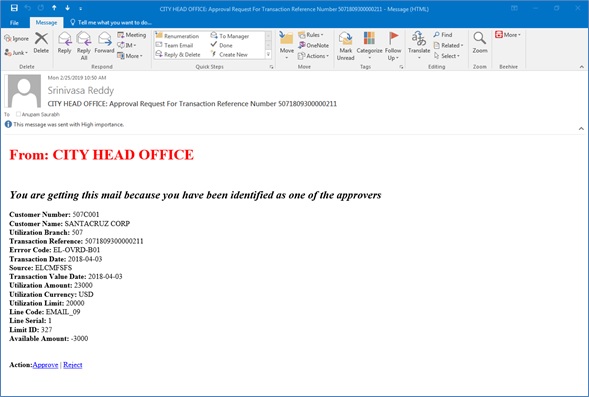

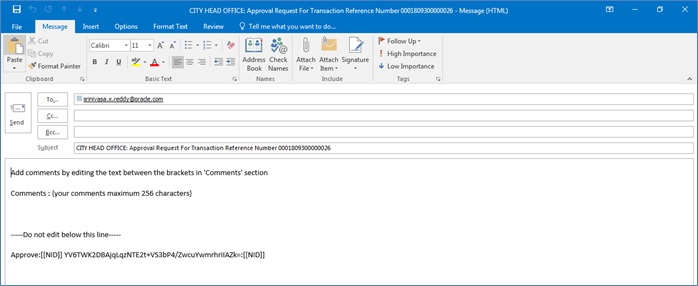

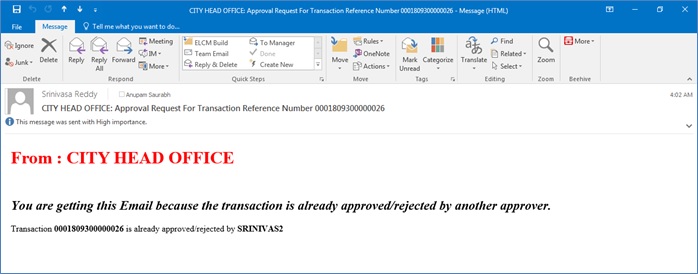

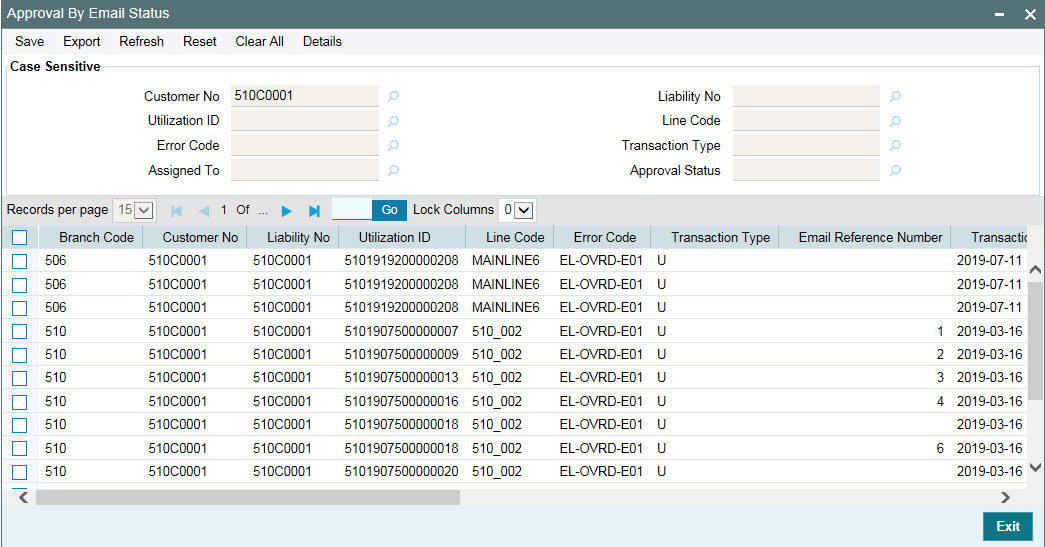

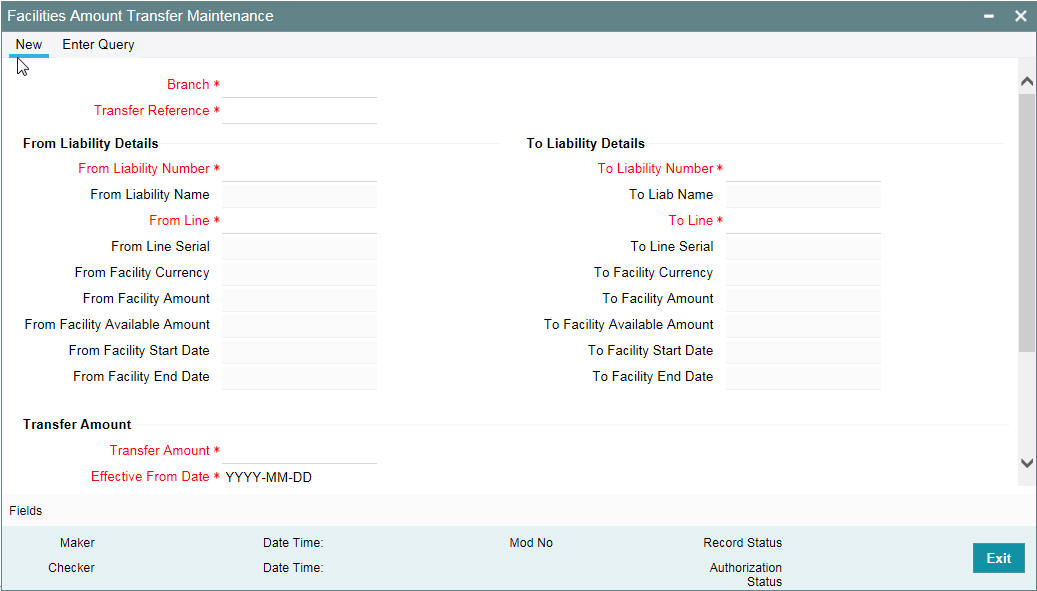

When you modify an Account Netting Record and select the Netting check box, then the system automatically add the netting amount to the Available Amount and the Netting amount for the corresponding facility.