1. Welcome to OBVAM Overview

Welcome to the Oracle Banking Virtual Account Management (OBVAM) Overview User Guide. It provides an overview to the module and takes you through the various steps involved setting up and maintaining a virtual account.

This document is intended for Back Office Data Entry Clerk, Back Office Managers/Officers, Product Managers, End of Day Operators and Financial Controller users.

OBVAM is a single integrated platform which enables your corporate customers to create and manage multiple virtual accounts for their liquidity, receivable and payable management needs. These virtual accounts are used to make and receive payments on behalf of few real accounts. This service model helps the corporates to monitor their cash inflow and outflow in an organized manner by reconciling the payments in real time and also consolidating the cash in few centralized real accounts.

With OBVAM, corporates who wants to hold multiple bank accounts across locations can create any number of virtual accounts that can be backed by a few real centralized accounts. Corporates with multiple dealers and suppliers can assign a unique virtual account to each of them for payer and receiver identification, hence, enabling higher reconciliation rate.

Varying from the traditional approach of the banks setting up and administering numerous physical bank ledger accounts, OBVAM offers the corporate to create, control and manage any number of virtual accounts for them or their clients. The corporate can customize the virtual account numbers and allocate different numbers to their clients for easy identification through the virtual account number. For example, a mobile service provider company can advice their customers to pay the bills to a customer specific virtual account. The customer specific virtual account may contain the mobile number or can be the mobile number itself. When the payments are done through the virtual account numbers, the real account of the mobile service provider is credited. At the same time, the mobile service provider will have the details of customers who have made the payments thus making it easy for the company to reconcile the dues with payments received.

1.0.1 Benefits

OBVAM application provides service for the customers of financial institutions. This service helps the corporate clients to manage and control multiple virtual accounts with different currencies. These virtual accounts can be used to manage and track high transaction volumes towards the master bank account. The corporate customer can open and close these virtual accounts without any intervention from the banks. OBVAM allows you to:

- Create customized virtual account numbers and structures irrespective of regions with multiple currencies

- Create configurable virtual CIF and IBAN mask at bank and branch level for a real CIF and IBAN

- Link multiple virtual account structures to a single CASA

- Debit and credit transactions for virtual accounts with shadow accounting

- Track the balance and transfer the balance amount between the virtual accounts

- Amount block support for virtual account and structure

- Set up negative balance limits for virtual accounts

- Generate the transaction statement for virtual account transactions

1.0.2 Key Features

- Comprehensive solution for OBVAM

- Stand-alone architecture requires very little change to bank’s existing core systems

- Faster time to market

- Capability to interface with corporate ERP

- Highly configurable based on corporate specific needs

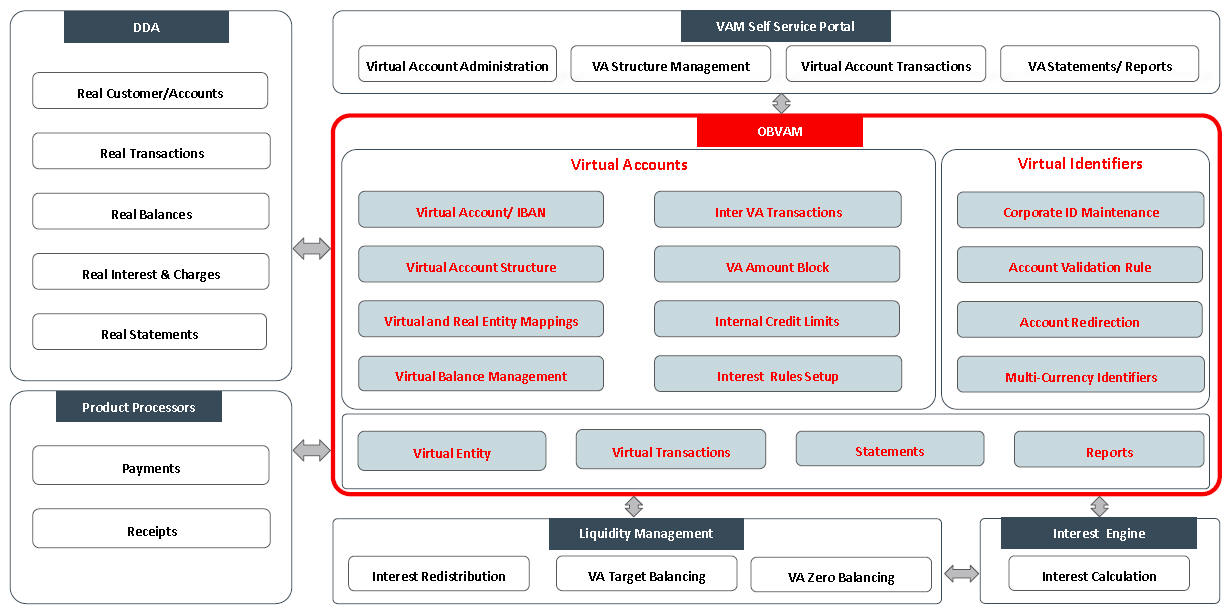

1.1 Architecture

An illustration of the OBVAM architecture.

1.2 Dashboard

The dashboard is an information tool that visually tracks, analyses and displays key data points to monitor the health of the application.

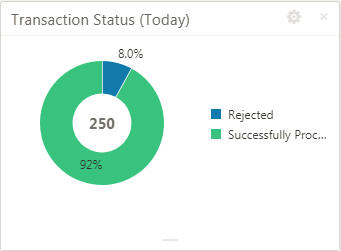

1.2.1 Transaction Status

Displays all transaction status that is sorted on a daily, weekly, monthly, quarterly and annually in a doughnut chart format. Using this dashboard, you can analyse how many transactions are successful, rejected and processed with exceptions. A sample of the transaction status is illustrated:

1.2.2 Rejection Reasons

Displays the reasons for all the rejected transactions that is sorted on a daily, weekly, monthly, quarterly and annually in a Pareto Chart format. Using this dashboard, you can analyse the reasons for rejection and resolve the transaction issues. A sample of the rejected reason is illustrated:

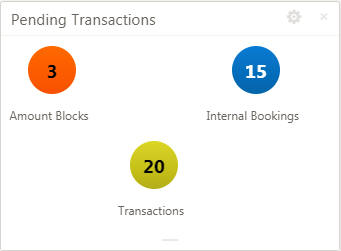

1.2.3 Pending Transactions

Displays all pending transaction that is sorted by all the transactional screens and their unauthorized record count in a tabular format. Using this dashboard, you can view the number of pending transaction for transaction screen. A sample of the pending transaction is illustrated:

1.2.4 Pending Maintenance

Displays all pending maintenance that is sorted by all the maintenance screens and their unauthorized record count in a tabular format. Using this dashboard, you can view the number of pending transaction for maintenance screen. A sample of the pending maintenance is illustrated:

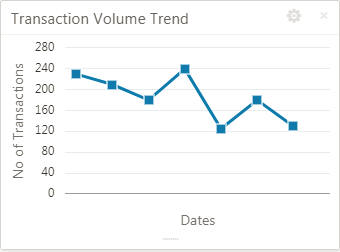

1.2.5 Transaction Volume Trend

Displays the number transactions for the selected duration in a line chart format. Using this dashboard, you can view the number of transactions that have taken place for the selected duration. A sample of the transaction volume trend is illustrated:

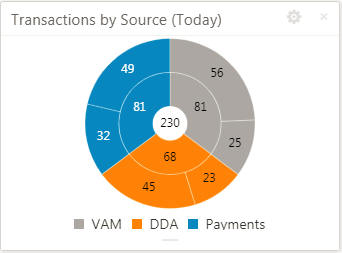

1.2.6 Transaction by Source

Displays a hierarchical form of data of the total number of transaction, types of transactions and their sources in a Sunburst Chart format. Using this dashboard, you can view the number of transactions for each type and their sources <require more information>. A sample of the transaction source and type is illustrated:

1.2.7 Actions

You can preform the following actions:

Action |

Description |

Configure Tile |

Modify the dashboard tile based on the user preference. |

Close |

Remove the dashboard widget from the dashboard landing page. |

Drag to Reorder |

Rearrange the dashboard widget on the dashboard landing page. |

Expand Tile |

Expand the dashboard widget to view more details of the widget. |

Add Tile |

Add the dashboard widget to the dashboard landing page. |

You can view the common features/procedures in the Getting Started User Guide.

1.3 Forget Customer for Entity

You can configure the forget customer for entity.

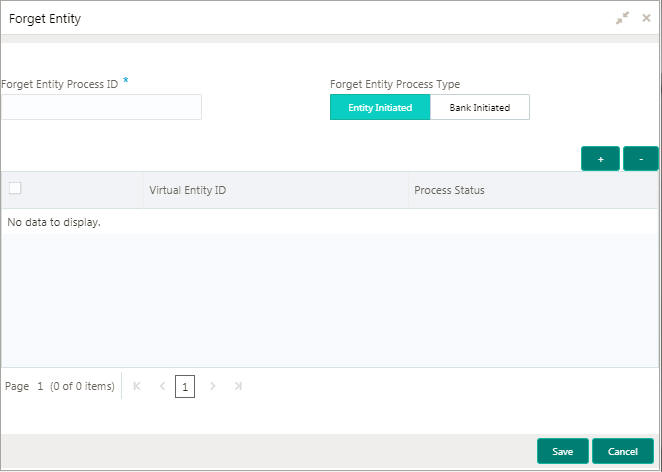

1.3.1 Forget Entity Maintenance

The maintenance screen allows you to configure forget customer for entity.

1.3.1.1 How to reach here:

Virtual Account Management > Forget Process > Forget Entity

1.3.1.2 How to add forget entity:

- In the Forget Entity screen, provide the required details:

- Forget Entity Process ID: Enter the forget customer process ID.

- Forget Entity Process Type: Select one of the options:

- Entity Initiated: If selected, you can initiate the forget option for the entity.

- Bank Initiated: If selected, you can initiate the forget option for the bank.

Note

Depending on the options selected, the grid options appear.

- Click + to add a row and provide the entity/bank details.

- Click Save.