1. Welcome to Oracle Banking Corporate Lending Process Management

Welcome to the Oracle Banking Corporate Lending Process Management (OBCLMO) process management User Manual. It provides an overview to the middle office module and takes you through the various steps involved in handling all the necessary activities in the life cycle of a corporate loan process. This manual is designed to help you create all types of corporate loan. This manual is intended for the Relationship Managers (RMs) and other loan executive staffs in charge of maintaining the loan accounts in the bank.

Corporate Lending Process Management is a single integrated platform which enables to create and manage corporate loan accounts and focus on the corporate lending operations of a middle office branch. Corporate Lending Middle Office module supports the following lifecycle.

- Loan Origination

- Loan Restructuring

- In-Principal Approval

OBCLMO uses Oracle BPMN framework for defining the business process. The capture and enrichment of information in multiple steps can be dynamically assigned to different user profiles or roles. The Platform provide capability to associate different business process-flow definitions to different category of Applications and also enables.

- Advice Generation

- Map Documents and Checklist for Various stages

The Platform also aids to enhance the productivity through queries and dashboard widgets providing a quick insight into the Application process stage and the status of the existing Loans.

1.1 Loan Origination

Loan Origination process provides a facility to create Corporate Loan taking the application through various stages of the business process flow commencing from loan request initiation till loan account creation/handoff and disbursement based on the Application Category.

The process of corporate loan origination is initiated by the Relationship Manager (RM) (or users with relevant rights) on behalf of an existing or a prospective customer. Based on the nature of the financing requirement the system can be configured to initiate the relevant Business process flow. For instance the Corporate Customer/Company may approach the bank for its credit needs related to working capital, expansion or for Trade financing through various channels like branch, mail or through external agents. The platform also enables the initiation of a Loan Request via Customer direct Banking channel through the REST based Service APIs. The Platform has a predefined BPMN process flow following a typical corporate loan initiation process. However this can be modified to suite the Bank's requirements. The list of stages that are required for a Loan origination process will be pre-defined in BPMN process and the data segments that are applicable for every stage can be configured in Application Category maintenance. Based on this setup, system derives the process flow for every loan application.

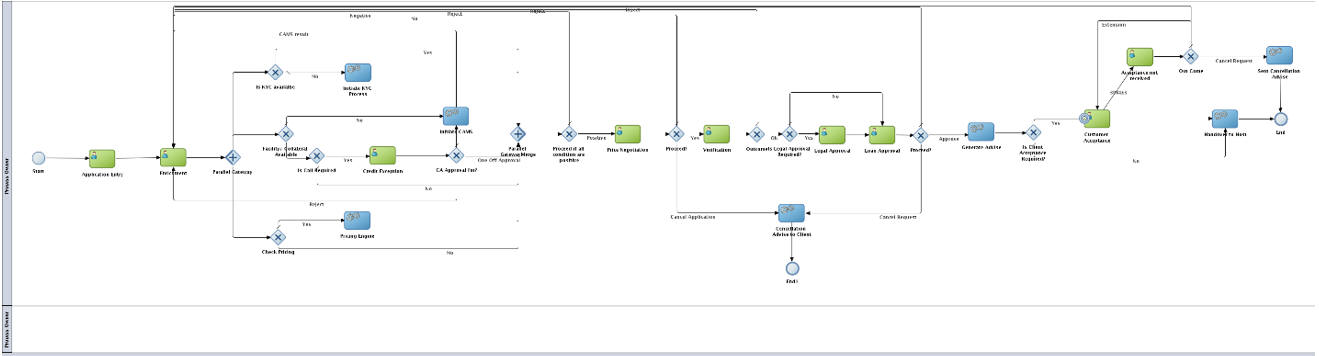

The process flow pre-defined for Loan Origination is provided for quick reference:

- Application Entry

- Application Enrichment

- Credit Exception

- Price Negotiation

- Application Verification

- Legal Verification

- Loan Approval

- Customer Acceptance

BPMN process will drive the flow from one stage to another based on the combination of attribute value and process outcome combination. Following attributes are validated as part of BPMN process for Loan origination life cycle:

- KYC Required

- CAMS Initiation Required

- Credit Appraisal Required

- Facility Creation Required

- Price Negotiation Required

- Legal Approval Required

- Customer Acceptance Required

- Loan Amount

- Loan Currency

1.1.1 Initiating Loan Origination

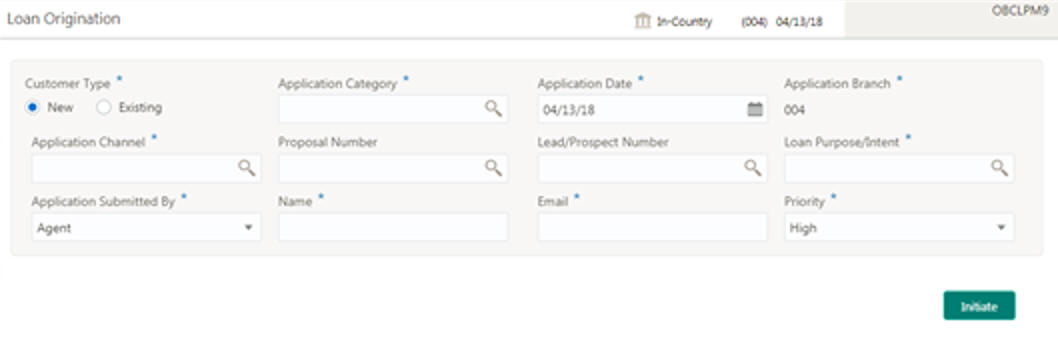

The basic registration details to create a corporate loan for a prospective borrower can be initiated using this initiation screen, provided the user has the required access rights.

1.1.1.1 How to reach here:

Corporate Lending > Operations > Loan Origination

1.1.1.2 How to initiate a loan origination:

- In the Loan Origination screen, provide the required details:

- Customer Type: Select one of the options:

- New: If selected, applicant details can be captured as part of loan creation.

- Existing: If selected, system defaults the applicant related details in the respective data segments.

- Application Category: Click Search to view and select the required

application category. Based on the application category, system derives

the following details to process the loan application:

- Applicable stages and its data segments

- Required documents and checklists

- Stage level advices

- Application Date: Select an effective application date from the dropdown calendar. The system defaults the current system date as the application initiation date.

- Application Branch: Displays the Branch where the application is captured.

- Application Channel: Click Search to view and select the required application channel.

- Proposal Number: Click Search to view and select the required proposal number. The list displays all valid reference number created as part of In-Principle Approval. System has to fetch and populate the details such as Tenor, Amount, Interest, Charges as agreed in the draft approval request.

- Lead/Prospect Number: Click Search to view and select the required lead/prospect number for the applications that are received through agents or channels.

- Loan Purpose/Intent: Click Search to view and select the required loan purpose/intent.

- Application Submitted By: Select the details of the Agent/Customer who has submitted the application from the dropdown list.

- Name: Enter the name of the Agent/Customer who has submitted the application.

- Email: Enter the Email ID of the Agent/Customer who has submitted the application.

- Priority: Select a priority from the dropdown list.

- Click Initiate to begin the process.

On submit of the screen, a unique Application Registration number will be auto generated by the system, which are used throughout the process and for further tracking. For an application, based on application category viz. Term Loan, Pre-shipment Finance, Post-shipment Finance, Project Financing, Working Capital and so on. system will derive the process flow for Loan Origination and the process will get instantiated.

Based on the user rights the system will navigate the user to the first manual stage of the process flow.

1.2 In-Principle Approval

In Principle Approval process facilitate to create a prospect or lead Corporate Loan which a customer may want by for the various financing requirements. A customer would like to check his eligibility, basic details and the structure of the loan which can be catered via In Principle Approval. This process also defines the basic terms and condition on which a customer can avail loan from bank or a draft version of loan details. This process commence from In Principle Approval initiation till the draft advice is sent to customer for various Application Category.

The process of In-principle Approval can be initiated by the Relationship Manager (RM) (or users with relevant rights) on behalf of an existing or a prospective customer. Based on the nature of the financing requirement the system can be configured to initiate the relevant Business process flow. For instance the Corporate Customer / Company may approach the bank for its credit needs related to working capital, expansion or for Trade financing through various channels like branch, mail or through external agents. The platform also enables the initiation of this process via Customer direct Banking channel through the REST based Service APIs. The Platform has a predefined BPMN process flow following a typical corporate loan process. However this can be modified to suite the Bank's requirements.

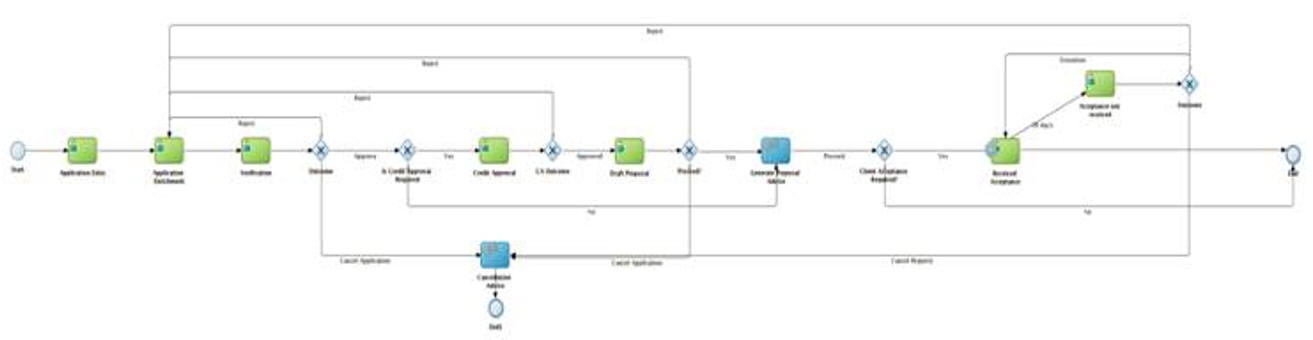

The list of stages pre-defined for the In-principle Approval are:

- Application Entry

- Application Enrichment

- Verification

- Credit Appraisal

- Draft Approval

- Customer Acceptance

BPMN process will drive the flow from one stage to another based on the combination of attribute value and process outcome combination. Following attributes are validated as part of BPMN process for In-principle Approval life cycle:

- Credit Appraisal Required

- Customer Agreement Required

- Loan Amount

- Loan Currency

1.2.1 Initiating In-Principle Approval

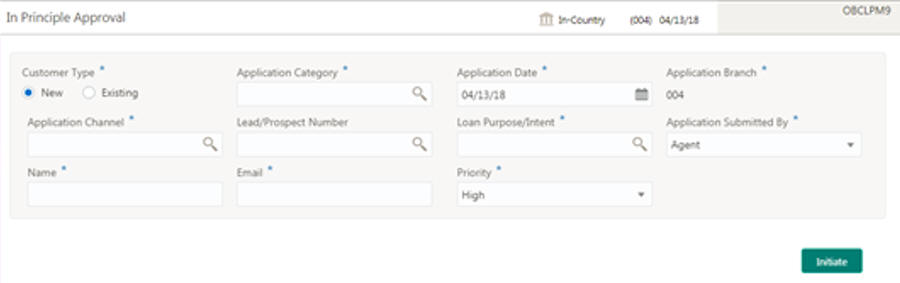

The basic registration details to create a draft Approval for a prospective borrower can be initiated using this Initiation Screen, provided the user has the required access rights.

1.2.1.1 How to reach here:

Corporate Lending > Operations > In-Principle Approval

1.2.1.2 How to Initiate an in-principle approval:

- In the In-Principle Approval screen, provide the required details:

- Customer Type: Select one of the options:

- New: If selected, applicant details can be captured as part of this segment.

- Existing: If selected, system defaults the applicant related details in the respective data segments.

- Application Category: Click Search to view and select the required

application category. Based on the application category, system derives

the following details to process the loan application:

- Applicable stages and its data segments

- Required documents and checklists

- Stage level advices

- Application Date: Select an effective application date from the dropdown calendar. The system defaults the current system date as the application initiation date.

- Application Branch: Displays the Branch where the application is captured.

- Application Channel: Click Search to view and select the required application channel.

- Proposal Number: Click Search to view and select the required proposal number. The list displays all valid reference number created as part of In-Principle Approval. System has to fetch and populate the details such as Tenor, Amount, Interest, Charges as agreed in the draft approval request.

- Lead/Prospect Number: Click Search to view and select the required lead/prospect number for the applications that are received through agents or channels.

- Loan Purpose/Intent: Click Search to view and select the required loan purpose/intent.

- Application Submitted By: Select the details of the Agent/Customer who has submitted the application from the dropdown list.

- Name: Enter the name of the Agent/Customer who has submitted the application.

- Email: Enter the Email ID of the Agent/Customer who has submitted the application.

- Priority: Select a priority from the dropdown list.

- Click Initiate to begin the process.

On submit of the screen, a unique Application Registration number will be auto generated by the system, which are used throughout the process and for further tracking. Based on application category viz. Term Loan, Pre-shipment Finance, Post-shipment Finance, Project Financing, Working Capital and so on. system will derive the process flow for In Principal Approval and the process will get instantiated.

Based on the user rights the system will navigate the user to the first manual stage of the process flow.

1.3 Loan Restructuring

Loan Restructuring provides a facility to manage corporate loan account through various stages of process flow commencing from restructuring entry till loan restructuring handoff based on the Application Category. Loan restructuring may either request for a financial or non-financial amendment or for rollover. Financial amendments include changes to various components of a loan such as:

- Additional disbursement of Principal

- Interest rate or amount

- Fees and Charges

- Maturity Date

Non-financial amendments include changes to various components of a loan such as:

- Credit line and Collaterals

- Payment Schedule

Rollover denotes the renewal of a loan. The outstanding principal of the loan is rolled over with or without outstanding interest for an extended maturity date.

The process of Corporate loan restructuring gets initiated when the bank RM approaches a prospective customer to improve his loan status or when the prospective customer approaches the bank requesting for an amendment or rollover based on his corporate needs. The loan restructuring process moves forward only based on the customer interest.

List of stages and corresponding data segments can be configured using for every Application Category and Life cycle combination. Based on the defined application category, system will derive the process flow for Loan Restructuring.

The list of stages pre-defined for the Loan restructuring are:

- Amendment Entry

- Enrichment

- Credit Exception

- Price Negotiation

- Loan Approval

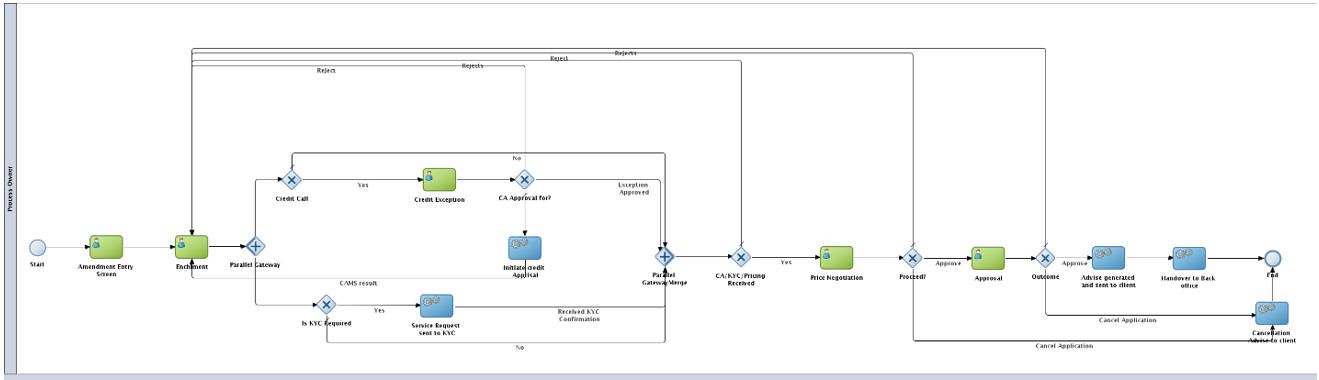

BPMN process will drive the flow from one stage to another based on the combination of attribute value and process outcome combination. Following attributes are validated as part of BPMN process for Loan restructuring lifecycle:

- KYC Required

- Credit Appraisal Required

- Restructuring Type

- Amendment Type

- Loan Amount

- Loan Currency

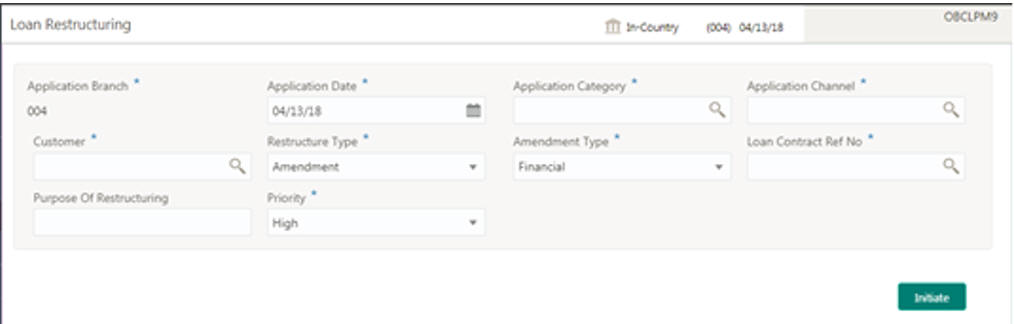

1.3.1 Initiating Loan Restructuring

The basic registration details to request for a restructuring of a corporate loan for a prospective borrower can be initiated using this Restructuring Initiation Screen, provided the user has the required access rights.

1.3.1.1 How to reach here:

Corporate Lending > Operations > Loan Restructuring

1.3.1.2 How to restructure a loan:

- In the Loan Restructure screen, provide the required details:

- Application Branch: Displays the Branch where the application is captured.

- Application Date: Select an effective application date from the dropdown calendar. The system defaults the current system date as the application initiation date.

- Application Category: Click Search to view and select the required

application category. Based on the application category, system derives

the following details to process the loan application:

- Applicable stages and its data segments

- Required documents and checklists

- Stage level advices

- Application Channel: Click Search to view and select the required application channel.

- Customer: Click Search to view and select the required customer.

- Restructure Type: Select a type of restructuring for the loan from the dropdown list.

- Amendment Type: Select an amendment type from the dropdown list. It is mandatory if you select the Restructure Type field as Amendment.

- Loan Contract Reference Number: Click Search to view and select the required loan contract reference number. The adjoining list displays all active loan contracts that are maintained in the back office system.

- Purpose of Restructuring: Enter a reason/addition information for restructuring the loan details.

- Priority: Select a priority from the dropdown list.

- Click Initiate to begin the process.

On submit of the screen, a unique Application Registration number will be auto generated by the system, which are used throughout the process and for further tracking. Based on restructuring type selected, system will derive the process flow for Loan restructuring with the configured list of data segments and the process will get instantiated.

Based on the user rights the system will navigate the user to the first manual stage of the restructuring process flow.